-

@ 5d4b6c8d:8a1c1ee3

2025-05-23 19:32:28

@ 5d4b6c8d:8a1c1ee3

2025-05-23 19:32:28https://primal.net/e/nevent1qvzqqqqqqypzp6dtxy5uz5yu5vzxdtcv7du9qm9574u5kqcqha58efshkkwz6zmdqqszj207pl0eqkgld9vxknxamged64ch2x2zwhszupkut5v46vafuhg9833px

Some of my colleagues were talking about how they're even more scared of RFK Jr. than they are of Trump. I hope he earns it.

https://stacker.news/items/987685

-

@ 56f27915:5fee3024

2025-05-23 18:51:08

@ 56f27915:5fee3024

2025-05-23 18:51:08Ralph Boes – Menschenrechtsaktivist, Philosoph, Vorstandsmitglied im Verein Unsere Verfassung e.V.

Ralph Boes zeigt in dem Buch auf, wie wir uns von der Übermacht des Parteienwesens, die zur Entmündigung des Volkes führt, befreien können. Er zeigt, dass schon im Grundgesetz selbst höchst gegenläufige, an seinen freiheitlich-demokratischen Idealen bemessen sogar als verfassungswidrig zu bezeichnende Tendenzen wirken. Und dass diese es sind, die heute in seine Zerstörung führen. Er weist aber auch die Ansatzpunkte auf, durch die der Zerstörung des Grundgesetzes wirkungsvoll begegnet werden kann.

Eintritt frei, Spendentopf

Ralph Boes hat u.a. dafür gesorgt, dass die unmäßigen Sanktionen in Hartz IV 2019 vom Bundesverfassungsgericht für menschenrechts- und verfassungswidrig erklärt wurden. Aktuell setzt er sich für eine Ur-Abstimmung des Volkes über seine Verfassung ein.

-

@ 3c389c8f:7a2eff7f

2025-05-23 18:23:28

@ 3c389c8f:7a2eff7f

2025-05-23 18:23:28I've sporadically been trying to spend some time familiarizing myself with Nostr marketplace listings and the clients that support them. I have been pleased with what I have encountered. The clients are simple to use, and people have been receptive to transacting with me. I've sold items to both people whom I consider to be close contacts, as well as to people that I barely know.

My first attempt was close to 2 years ago, when I listed one pound bags of coffee for sale. If I remember correctly, there was only one marketplace client then, and it only had support for extension signing. At the time, my old laptop had just died so I couldn't really interact with my listings through that client. (I have never had much luck with extensions on mobile browsers, so I have never attempted to use one for Nostr.) Instead, I used Amethyst to list my product and exchange messages with potential buyers. The Amethyst approach to handling different Nostr events is brilliant to me. You can do some part of each thing but not all. I view it as great introduction to what Nostr is capable of doing and a gateway to discovering other clients. Marketplace listings on Amethyst are handled in that fashion. You can list products for sale. You can browse and inquire about products listed by your contacts or by a more "global" view, which in the case of Nostr, would be products listed by anyone who publishes their listings to any of the relays that I connect with to read. There is no delete option, should a product sell out, and there is no direct purchase option. All sales need to be negotiated through direct messages. Though it has limited functionality, the system works great for items that will be listed for repeated sale, such as my coffee. If one were to list a one-off item and sell it, the flow to delete the listing would be easy enough. Copy the event ID, visit delete.nostr.com , and remove the product. Should there be a price change, it would be necessary to visit a full marketplace client to edit the listing, though one could easily delete and start over as well. Anyway, much to my surprise I sold more coffee than I had anticipated through that listing. People were eager to try out the feature and support a small business. This was an awesome experience and I see no reason to avoid buying or selling products on Nostr, even if the only client available to you is Amethyst. (Which I think might be the only mobile app with marketplace support.) It is completely manageable.

Later, I tried to list a pair of nearly new shoes. Those did not sell. I have a sneaking suspicion that there were very few people that wore size USw6 shoes using Nostr at the time. Even though no one wanted my shoes, I still ended up having some interesting conversations about different styles of running shoes, boots, and other footwear talk. I can't call the listing a total bust, even though I ended up deleting the listing and donating those shoes to the YWCA. After some number of months watching and reading about development in the Nostr marketplace space, I decided to try again.

This second approach, I started with niche rubber duckies that, for reasons unbeknownst to most, I just happen to have an abundance of. It occurred to me that day that I would most likely be creating most of my listings via mobile app since that is also my main method of taking pictures these days. I could sync or send them, but realistically it's just adding extra steps for me. I listed my ducks with Amethyst (all of which are currently still available, surprise, surprise.). I immediately went to check how the listing renders in the marketplace clients. There are 2 where I can view it, and the listing looks nice, clean, organized in both places. That alone is reason enough to get excited about selling on Nostr. Gone are the days of "this item is cross-posted to blah, blah, blah" lest risk being kicked out of the seller groups on silo'd platforms.

Knowing I can't take it personally that literally no one else on Nostr has an affinity for obscure rubber ducks (that they are willing to admit), I leave my duckies listed and move on. My next listing is for artisan bracelets. Ones that I love to make. I made my mobile listing, checked it across clients and this time I noticed that shopstr.store is collecting my listings into a personal seller profile, like a little shop. I spent some time setting up the description and banner, and now it looks really nice. This is great, since the current site acts as an open and categorized market for all sellers. Maybe someone will see the bracelets while browsing the clothing category and stumble upon the rubber ducky of their dreams in the process. That hasn't happened yet, but I was pretty jazzed to sell a few bracelets right away. Most of the sale and exchange happened via DM, for which I switched to Flotilla because it just handles messaging solidly for me. I made some bracelets, waited a few weeks, then visited Shopstr again to adjust the price. That worked out super well. I noticed that a seller can also list in their preferred currency, which is very cool. Meanwhile, back to my social feed, I can see my listing posted again since there was an edit. While not always the best thing to happen with edits, it is great that it happens with marketplace listings. It removes all the steps of announcing a price reduction, which would be handy for any serious seller. I am very happy with the bracelet experience, and I will keep that listing active and reasonably up to date for as long as any interest arises. Since this has all gone so well, I've opted to continue listing saleable items to Nostr first for a few days to a few weeks prior to marketing them anywhere else.

Looking at my listings on cypher.space, I can see that this client is tailored more towards people who are very passionate about a particular set of things. I might not fall into this category but my listings still look very nice displayed with my writing, transposed poetry, and recipes. I could see this being a great space for truly devotional hobbyists or sellers who are both deeply knowledgeable about their craft and also actively selling. My experience with all 3 of these marketplace-integrated clients had been positive and I would say that if you are considering selling on Nostr, it is worth the effort.

As some sidenotes:

-

I am aware that Shopstr has been built to be self-hosted and anyone interested in selling for the long term should at least consider doing so. This will help reduce the chances of Nostr marketplaces centralizing into just another seller-silo.

-

Plebeian Market is out there, too. From the best I could tell, even though this is a Nostr client, those listings are a different kind than listings made from the other clients referenced here. I like the layout and responsiveness of the site but I opted not to try it out for now. Cross-posting has been the bane of online selling for me for quite some time. If they should migrate to an interoperable listing type (which I think I read may happen in the future), I will happily take that for a spin, too.

-

My only purchase over Nostr marketplaces so far was some vinyls, right around the time I had listed my coffee. It went well, the seller was great to work with, everything arrived in good shape. I have made some other purchases through Nostr contacts, but those were conversations that lead to non-Nostr seller sites. I check the marketplace often, though, for things I may want/need. The listings are changing and expanding rapidly, and I foresee more purchases becoming a part of my regular Nostr experience soon enough.

-

I thought about including screenshots for this, but I would much rather you go check these clients out for yourself.

-

-

@ ecda4328:1278f072

2025-05-23 18:16:24

@ ecda4328:1278f072

2025-05-23 18:16:24And what does it mean to withdraw back to Bitcoin Layer 1?

Disclaimer: This post was written with help from ChatGPT-4o. If you spot any mistakes or have suggestions — feel free to reply or zap in feedback!

Let’s break it down — using three popular setups:

1. Wallet of Satoshi (WoS)

Custodial — you don’t touch Lightning directly

Sending sats:

- You open WoS, paste a Lightning invoice, hit send.

- WoS handles the payment entirely within their system.

- If recipient uses WoS: internal balance update.

- If external: routed via their node.

- You never open channels, construct routes, or sign anything.

Withdrawing to L1:

- You paste a Bitcoin address.

- WoS sends a regular on-chain transaction from their custodial wallet.

- You pay a fee. It’s like a bank withdrawal.

You don’t interact with Lightning directly. Think of it as a trusted 3rd party Lightning “bank”.

2. Phoenix Wallet

Non-custodial — you own keys, Phoenix handles channels

Sending sats:

- You scan a Lightning invoice and hit send.

- Phoenix uses its backend node (ACINQ) to route the payment.

- If needed, it opens a real 2-of-2 multisig channel on-chain automatically.

- You own your keys (12-word seed), Phoenix abstracts the technical parts.

Withdrawing to L1:

- You enter your Bitcoin address.

- Phoenix closes your Lightning channel (cooperatively, if possible).

- Your sats are sent as a real Bitcoin transaction to your address.

You’re using Lightning “for real,” with real Bitcoin channels — but Phoenix smooths out the UX.

3. Your Own Lightning Node

Self-hosted — you control everything

Sending sats:

- You manage your channels manually (or via automation).

- Your node:

- Reads the invoice

- Builds a route using HTLCs

- Sends the payment using conditional logic (preimages, time locks).

- If routing fails: retry or adjust liquidity.

Withdrawing to L1:

- You select and close a channel.

- A channel closing transaction is broadcast:

- Cooperative = fast and cheap

- Force-close = slower, more expensive, and time-locked

- Funds land in your on-chain wallet.

You have full sovereignty — but also full responsibility (liquidity, fees, backups, monitoring).

Core Tech Behind It: HTLCs, Multisig — and No Sidechain

- Lightning channels = 2-of-2 multisig Bitcoin addresses

- Payments = routed via HTLCs (Hashed Time-Locked Contracts)

- HTLCs are off-chain, but enforceable on-chain if needed

- Important:

- The Lightning Network is not a sidechain.

- It doesn't use its own token, consensus, or separate blockchain.

- Every Lightning channel is secured by real Bitcoin on L1.

Lightning = fast, private, off-chain Bitcoin — secured by Bitcoin itself.

Summary Table

| Wallet | Custody | Channel Handling | L1 Withdrawal | HTLC Visibility | User Effort | |--------------------|--------------|------------------------|---------------------|------------------|--------------| | Wallet of Satoshi | Custodial | None | Internal to external| Hidden | Easiest | | Phoenix Wallet | Non-custodial| Auto-managed real LN | Channel close | Abstracted | Low effort | | Own Node | You | Manual | Manual channel close| Full control | High effort |

Bonus: Withdrawing from LN to On-Chain

- WoS: sends sats from their wallet — like PayPal.

- Phoenix: closes a real channel and sends your UTXO on-chain.

- Own node: closes your multisig contract and broadcasts your pre-signed tx.

Bitcoin + Lightning = Sovereign money + Instant payments.

Choose the setup that fits your needs — and remember, you can always level up later.P.S. What happens in Lightning... usually stays in Lightning.

-

@ 472f440f:5669301e

2025-05-20 13:01:09

@ 472f440f:5669301e

2025-05-20 13:01:09Marty's Bent

via me

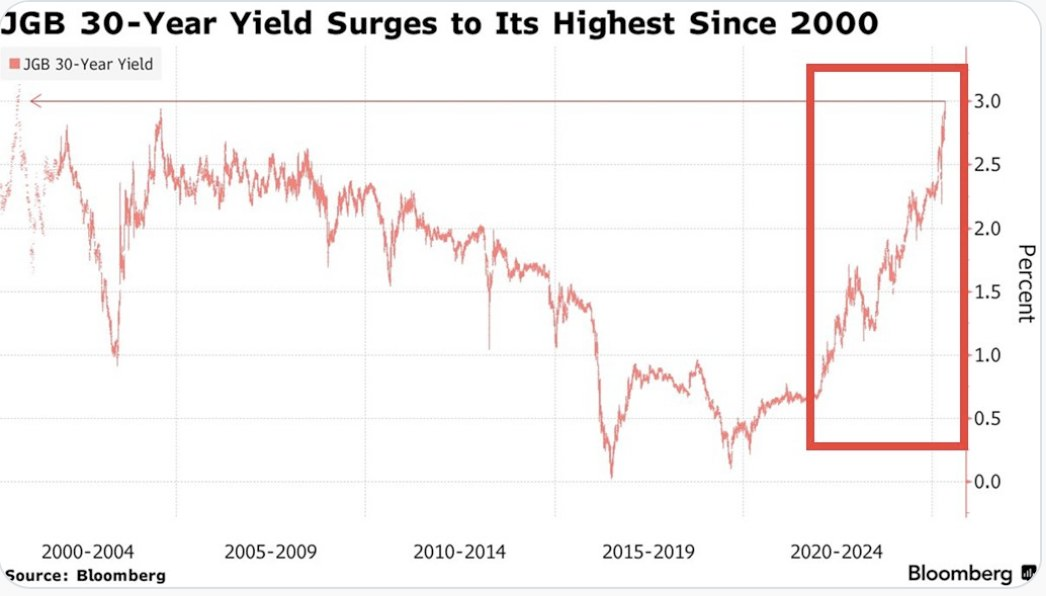

Don't sleep on what's happening in Japan right now. We've been covering the country and the fact that they've lost control of their yield curve since late last year. After many years of making it a top priority from a monetary policy perspective, last year the Bank of Japan decided to give up on yield curve control in an attempt to reel inflation. This has sent yields for the 30-year and 40-year Japanese government bonds to levels not seen since the early 2000s in the case of the 30-year and levels never before seen for the 40-year, which was launched in 2007. With a debt to GDP ratio that has surpassed 250% and a population that is aging out with an insufficient amount of births to replace the aging workforce, it's hard to see how Japan can get out of this conundrum without some sort of economic collapse.

This puts the United States in a tough position considering the fact that Japan is one of the largest holders of U.S. Treasury bonds with more than 1,135 sats | $1.20 trillion in exposure. If things get too out of control in Japan and the yield curve continues to drift higher and inflation continues to creep higher Japan can find itself in a situation where it's a forced seller of US Treasuries as they attempt to strengthen the yen. Another aspect to consider is the fact that investors may see the higher yields on Japanese government bonds and decide to purchase them instead of US Treasuries. This is something to keep an eye on in the weeks to come. Particularly if higher rates drive a higher cost of capital, which leads to even more inflation. As producers are forced to increase their prices to ensure that they can manage their debt repayments.

It's never a good sign when the Japanese Prime Minister is coming out to proclaim that his country's financial situation is worse than Greece's, which has been a laughing stock of Europe for the better part of three decades. Japan is a very proud nation, and the fact that its Prime Minister made a statement like this should not be underappreciated.

As we noted last week, the 10-year and 30-year U.S. Treasury bonds are drifting higher as well. Earlier today, the 30-year bond yield surpassed 5%, which has been a psychological level that many have been pointed to as a critical tipping point. When you take a step back and look around the world it seems pretty clear that bond markets are sending a very strong signal. And that signal is that something is not well in the back end of the financial system.

This is even made clear when you look at the private sector, particularly at consumer debt. In late March, we warned of the growing trend of buy now, pay later schemes drifting down market as major credit card companies released charge-off data which showed charge-off rates reaching levels not seen since the 2008 great financial crisis. At the time, we could only surmise that Klarna was experiencing similar charge-off rates on the bigger-ticket items they financed and started doing deals with companies like DoorDash to finance burrito deliveries in an attempt to move down market to finance smaller ticket items with a higher potential of getting paid back. It seems like that inclination was correct as Klarna released data earlier today showing more losses on their book as consumers find it extremely hard to pay back their debts.

via NewsWire

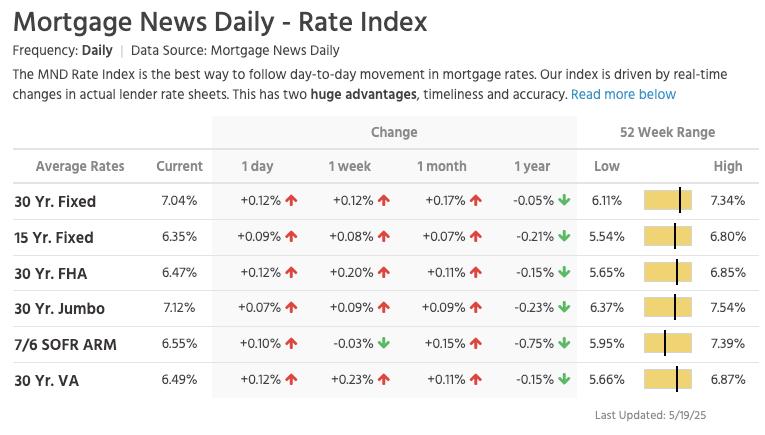

This news hit the markets on the same day as the average rate of the 30-year mortgage in the United States rose to 7.04%. I'm not sure if you've checked lately, but real estate prices are still relatively elevated outside of a few big cities who expanded supply significantly during the COVID era as people flooded out of blue states towards red states. It's hard to imagine that many people can afford a house based off of sticker price alone, but with a 7% 30-year mortgage rate it's becoming clear that the ability of the Common Man to buy a house is simply becoming impossible.

via Lance Lambert

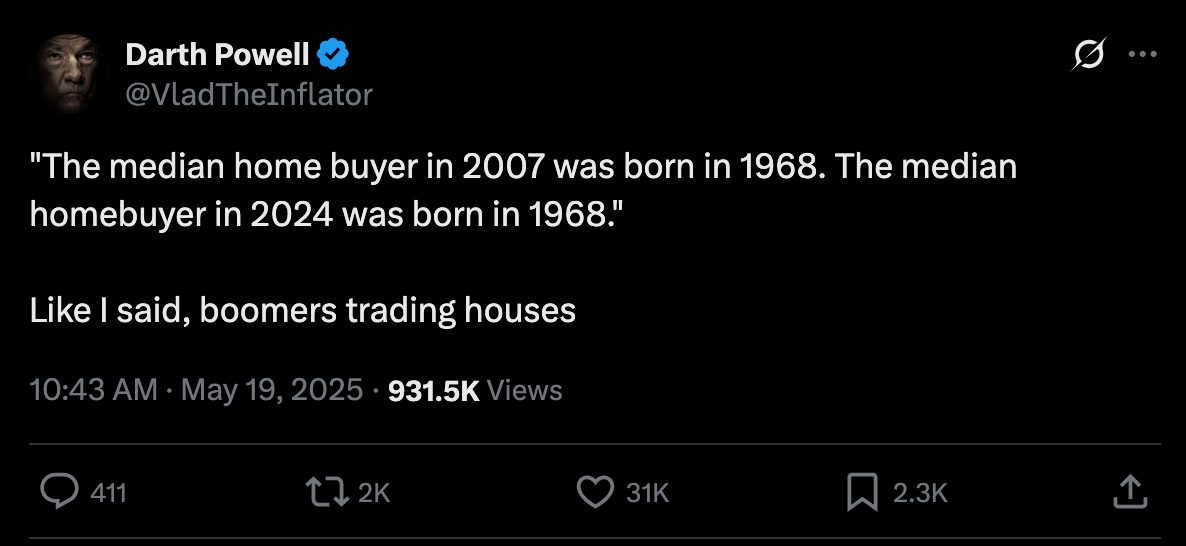

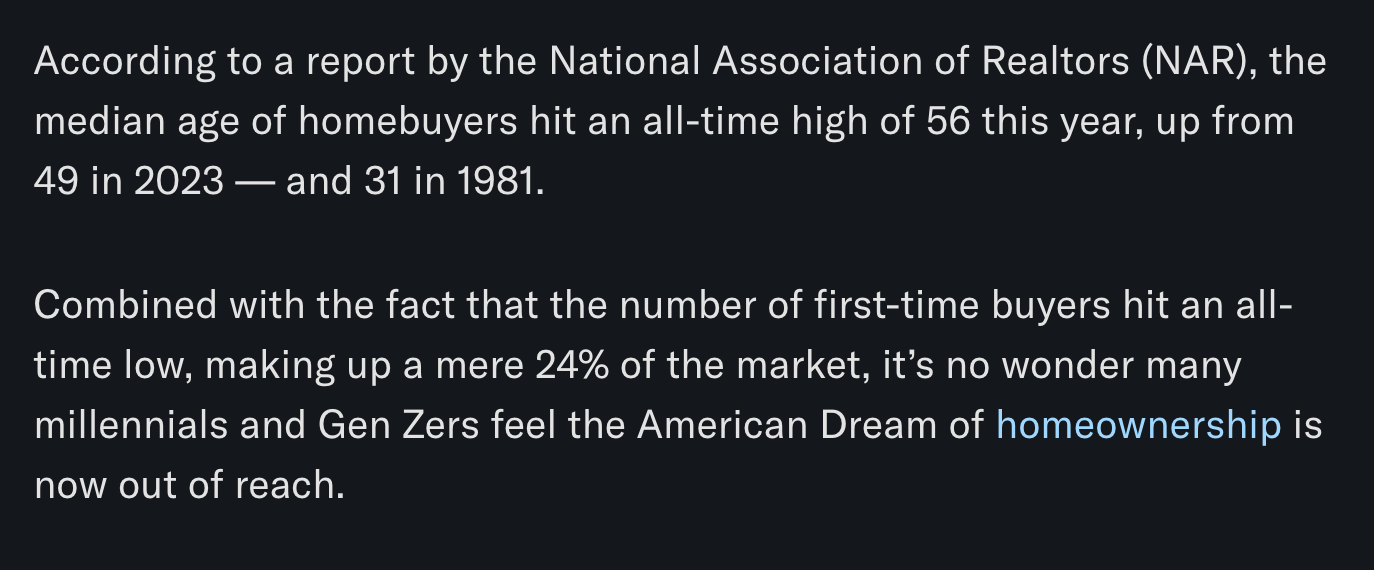

The mortgage rate data is not the only thing you need to look at to understand that it's becoming impossible for the Common Man of working age to buy a house. New data has recently been released that highlights That the median home buyer in 2007 was born in 1968, and the median home buyer in 2024 was born in 1968. Truly wild when you think of it. As our friend Darth Powell cheekily highlights below, we find ourselves in a situation where boomers are simply trading houses and the younger generations are becoming indentured slaves. Forever destined to rent because of the complete inability to afford to buy a house.

via Darth Powell

via Yahoo Finance

Meanwhile, Bitcoin re-approached all-time highs late this evening and looks primed for another breakout to the upside. This makes sense if you're paying attention. The high-velocity trash economy running on an obscene amount of debt in both the public and private sectors seems to be breaking at the seams. All the alarm bells are signaling that another big print is coming. And if you hope to preserve your purchasing power or, ideally, increase it as the big print approaches, the only thing that makes sense is to funnel your money into the hardest asset in the world, which is Bitcoin.

via Bitbo

Buckle up, freaks. It's gonna be a bumpy ride. Stay humble, Stack Sats.

Trump's Middle East Peace Strategy: Redefining U.S. Foreign Policy

In his recent Middle East tour, President Trump signaled what our guest Dr. Anas Alhajji calls "a major change in US policy." Trump explicitly rejected the nation-building strategies of his predecessors, contrasting the devastation in Afghanistan and Iraq with the prosperity of countries like Saudi Arabia and UAE. This marks a profound shift from both Republican and Democratic foreign policy orthodoxy. As Alhajji noted, Trump's willingness to meet with Syrian President Assad follows a historical pattern where former adversaries eventually become diplomatic partners.

"This is really one of the most important shifts in US foreign policy to say, look, sorry, we destroyed those countries because we tried to rebuild them and it was a big mistake." - Dr. Anas Alhajji

The administration's new approach emphasizes negotiation over intervention. Rather than military solutions, Trump is engaging with groups previously considered off-limits, including the Houthis, Hamas, and Iran. This pragmatic stance prioritizes economic cooperation and regional stability over ideological confrontation. The focus on trade deals and investment rather than regime change represents a fundamental reimagining of America's role in the Middle East.

Check out the full podcast here for more on the Iran nuclear situation, energy market predictions, and why AI development could create power grid challenges. Only on TFTC Studio.

Headlines of the Day

Bitcoin Soars to 100,217 sats | $106.00K While Bonds Lose 40% Since 2020 - via X

US Senate Advances Stablecoin Bill As America Embraces Bitcoin - via X

Get our new STACK SATS hat - via tftcmerch.io

Texas House Debates Bill For State-Run Bitcoin Reserve - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Don't let the noise consume you. Focus on making your life 1% better every day.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ 472f440f:5669301e

2025-05-20 02:00:54

@ 472f440f:5669301e

2025-05-20 02:00:54Marty's Bent

https://www.youtube.com/watch?v=p0Sj1sG05VQ

Here's a great presentation from our good friend nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpp4mhxue69uhkummn9ekx7mqqyz2hj3zg2g3pqwxuhg69zgjhke4pcmjmmdpnndnefqndgqjt8exwj6ee8v7 , President of The Nakamoto Institute titled Hodl for Good. He gave it earlier this year at the BitBlockBoom Conference, and I think it's something everyone reading this should take 25 minutes to watch. Especially if you find yourself wondering whether or not it's a good idea to spend bitcoin at any given point in time. Michael gives an incredible Austrian Economics 101 lesson on the importance of lowering one's time preference and fully understanding the importance of hodling bitcoin. For the uninitiated, it may seem that the hodl meme is nothing more than a call to hoard bitcoins in hopes of getting rich eventually. However, as Michael points out, there's layers to the hodl meme and the good that hodling can bring individuals and the economy overall.

The first thing one needs to do to better understand the hodl meme is to completely flip the framing that is typically thrust on bitcoiners who encourage others to hodl. Instead of ceding that hodling is a greedy or selfish action, remind people that hodling, or better known as saving, is the foundation of capital formation, from which all productive and efficient economic activity stems. Number go up technology is great and it really matters. It matters because it enables anybody leveraging that technology to accumulate capital that can then be allocated toward productive endeavors that bring value to the individual who creates them and the individual who buys them.

When one internalizes this, it enables them to turn to personal praxis and focus on minimizing present consumption while thinking of ways to maximize long-term value creation. Live below your means, stack sats, and use the time that you're buying to think about things that you want in the future. By lowering your time preference and saving in a harder money you will have the luxury of demanding higher quality goods in the future. Another way of saying this is that you will be able to reshape production by voting with your sats. Initially when you hold them off the market by saving them - signaling that the market doesn't have goods worthy of your sats - and ultimately by redeploying them into the market when you find higher quality goods that meet the standards desire.

The first part of this equation is extremely important because it sends a signal to producers that they need to increase the quality of their work. As more and more individuals decide to use bitcoin as their savings technology, the signal gets stronger. And over many cycles we should begin to see low quality cheap goods exit the market in favor of higher quality goods that provide more value and lasts longer and, therefore, make it easier for an individual to depart with their hard-earned and hard-saved sats. This is only but one aspect that Michael tries to imbue throughout his presentation.

The other is the ability to buy yourself leisure time when you lower your time preference and save more than you spend. When your savings hit a critical tipping point that gives you the luxury to sit back and experience true leisure, which Michael explains is not idleness, but the contemplative space to study, create art, refine taste, and to find what "better goods" actually are. Those who can experience true leisure while reaping the benefits of saving in a hard asset that is increasing in purchasing power significantly over the long term are those who build truly great things. Things that outlast those who build them. Great art, great monuments, great institutions were all built by men who were afforded the time to experience leisure. Partly because they were leveraging hard money as their savings and the place they stored the profits reaped from their entrepreneurial endeavors.

If you squint and look into the future a couple of decades, it isn't hard to see a reality like this manifesting. As more people begin to save in Bitcoin, the forces of supply and demand will continue to come into play. There will only ever be 21 million bitcoin, there are around 8 billion people on this planet, and as more of those 8 billion individuals decide that bitcoin is the best savings vehicle, the price of bitcoin will rise.

When the price of bitcoin rises, it makes all other goods cheaper in bitcoin terms and, again, expands the entrepreneurial opportunity. The best part about this feedback loop is that even non-holders of bitcoin benefit through higher real wages and faster tech diffusion. The individuals and business owners who decide to hodl bitcoin will bring these benefits to the world whether you decide to use bitcoin or not.

This is why it is virtuous to hodl bitcoin. The potential for good things to manifest throughout the world increase when more individuals decide to hodl bitcoin. And as Michael very eloquently points out, this does not mean that people will not spend their bitcoin. It simply means that they have standards for the things that they will spend their bitcoin on. And those standards are higher than most who are fully engrossed in the high velocity trash economy have today.

In my opinion, one of those higher causes worthy of a sats donation is nostr:nprofile1qyfhwumn8ghj7enjv4jhyetvv9uju7re0gq3uamnwvaz7tmfdemxjmrvv9nk2tt0w468v6tvd3skwefwvdhk6qpqwzc9lz2f40azl98shkjewx3pywg5e5alwqxg09ew2mdyeey0c2rqcfecft . Consider donating so they can preserve and disseminate vital information about bitcoin and its foundations.

The Shell Game: How Health Narratives May Distract from Vaccine Risks

In our recent podcast, Dr. Jack Kruse presented a concerning theory about public health messaging. He argues that figures like Casey and Callie Means are promoting food and exercise narratives as a deliberate distraction from urgent vaccine issues. While no one disputes healthy eating matters, Dr. Kruse insists that focusing on "Froot Loops and Red Dye" diverts attention from what he sees as immediate dangers of mRNA vaccines, particularly for children.

"It's gonna take you 50 years to die from processed food. But the messenger jab can drop you like Damar Hamlin." - Dr Jack Kruse

Dr. Kruse emphasized that approximately 25,000 children per month are still receiving COVID vaccines despite concerns, with 3 million doses administered since Trump's election. This "shell game," as he describes it, allows vaccines to remain on childhood schedules while public attention fixates on less immediate health threats. As host, I believe this pattern deserves our heightened scrutiny given the potential stakes for our children's wellbeing.

Check out the full podcast here for more on Big Pharma's alleged bioweapons program, the "Time Bank Account" concept, and how Bitcoin principles apply to health sovereignty.

Headlines of the Day

Aussie Judge: Bitcoin is Money, Possibly CGT-Exempt - via X

JPMorgan to Let Clients Buy Bitcoin Without Direct Custody - via X

Get our new STACK SATS hat - via tftcmerch.io

Mubadala Acquires 384,239 sats | $408.50M Stake in BlackRock Bitcoin ETF - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I've been walking from my house around Town Lake in Austin in the mornings and taking calls on the walk. Big fan of a walking call.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 5144fe88:9587d5af

2025-05-23 17:01:37

@ 5144fe88:9587d5af

2025-05-23 17:01:37The recent anomalies in the financial market and the frequent occurrence of world trade wars and hot wars have caused the world's political and economic landscape to fluctuate violently. It always feels like the financial crisis is getting closer and closer.

This is a systematic analysis of the possibility of the current global financial crisis by Manus based on Ray Dalio's latest views, US and Japanese economic and financial data, Buffett's investment behavior, and historical financial crises.

Research shows that the current financial system has many preconditions for a crisis, especially debt levels, market valuations, and investor behavior, which show obvious crisis signals. The probability of a financial crisis in the short term (within 6-12 months) is 30%-40%,

in the medium term (within 1-2 years) is 50%-60%,

in the long term (within 2-3 years) is 60%-70%.

Japan's role as the world's largest holder of overseas assets and the largest creditor of the United States is particularly critical. The sharp appreciation of the yen may be a signal of the return of global safe-haven funds, which will become an important precursor to the outbreak of a financial crisis.

Potential conditions for triggering a financial crisis Conditions that have been met 1. High debt levels: The debt-to-GDP ratio of the United States and Japan has reached a record high. 2. Market overvaluation: The ratio of stock market to GDP hits a record high 3. Abnormal investor behavior: Buffett's cash holdings hit a record high, with net selling for 10 consecutive quarters 4. Monetary policy shift: Japan ends negative interest rates, and the Fed ends the rate hike cycle 5. Market concentration is too high: a few technology stocks dominate market performance

Potential trigger points 1. The Bank of Japan further tightens monetary policy, leading to a sharp appreciation of the yen and the return of overseas funds 2. The US debt crisis worsens, and the proportion of interest expenses continues to rise to unsustainable levels 3. The bursting of the technology bubble leads to a collapse in market confidence 4. The trade war further escalates, disrupting global supply chains and economic growth 5. Japan, as the largest creditor of the United States, reduces its holdings of US debt, causing US debt yields to soar

Analysis of the similarities and differences between the current economic environment and the historical financial crisis Debt level comparison Current debt situation • US government debt to GDP ratio: 124.0% (December 2024) • Japanese government debt to GDP ratio: 216.2% (December 2024), historical high 225.8% (March 2021) • US total debt: 36.21 trillion US dollars (May 2025) • Japanese debt/GDP ratio: more than 250%-263% (Japanese Prime Minister’s statement)

Before the 2008 financial crisis • US government debt to GDP ratio: about 64% (2007) • Japanese government debt to GDP ratio: about 175% (2007)

Before the Internet bubble in 2000 • US government debt to GDP ratio: about 55% (1999) • Japanese government debt to GDP ratio: about 130% (1999)

Key differences • The current US debt-to-GDP ratio is nearly twice that before the 2008 crisis • The current Japanese debt-to-GDP ratio is more than 1.2 times that before the 2008 crisis • Global debt levels are generally higher than historical pre-crisis levels • US interest payments are expected to devour 30% of fiscal revenue (Moody's warning)

Monetary policy and interest rate environment

Current situation • US 10-year Treasury yield: about 4.6% (May 2025) • Bank of Japan policy: end negative interest rates and start a rate hike cycle • Bank of Japan's holdings of government bonds: 52%, plans to reduce purchases to 3 trillion yen per month by January-March 2026 • Fed policy: end the rate hike cycle and prepare to cut interest rates

Before the 2008 financial crisis • US 10-year Treasury yield: about 4.5%-5% (2007) • Fed policy: continuous rate hikes from 2004 to 2006, and rate cuts began in 2007 • Bank of Japan policy: maintain ultra-low interest rates

Key differences • Current US interest rates are similar to those before the 2008 crisis, but debt levels are much higher than then • Japan is in the early stages of ending its loose monetary policy, unlike before historical crises • The size of global central bank balance sheets is far greater than at any time in history

Market valuations and investor behavior Current situation • The ratio of stock market value to the size of the US economy: a record high • Buffett's cash holdings: $347 billion (28% of assets), a record high • Market concentration: US stock growth mainly relies on a few technology giants • Investor sentiment: Technology stocks are enthusiastic, but institutional investors are beginning to be cautious

Before the 2008 financial crisis • Buffett's cash holdings: 25% of assets (2005) • Market concentration: Financial and real estate-related stocks performed strongly • Investor sentiment: The real estate market was overheated and subprime products were widely popular

Before the 2000 Internet bubble • Buffett's cash holdings: increased from 1% to 13% (1998) • Market concentration: Internet stocks were extremely highly valued • Investor sentiment: Tech stocks are in a frenzy

Key differences • Buffett's current cash holdings exceed any pre-crisis level in history • Market valuation indicators have reached a record high, exceeding the levels before the 2000 bubble and the 2008 crisis • The current market concentration is higher than any period in history, and a few technology stocks dominate market performance

Safe-haven fund flows and international relations Current situation • The status of the yen: As a safe-haven currency, the appreciation of the yen may indicate a rise in global risk aversion • Trade relations: The United States has imposed tariffs on Japan, which is expected to reduce Japan's GDP growth by 0.3 percentage points in fiscal 2025 • International debt: Japan is one of the largest creditors of the United States

Before historical crises • Before the 2008 crisis: International capital flows to US real estate and financial products • Before the 2000 bubble: International capital flows to US technology stocks

Key differences • Current trade frictions have intensified and the trend of globalization has weakened • Japan's role as the world's largest holder of overseas assets has become more prominent • International debt dependence is higher than any period in history

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ b83a28b7:35919450

2025-05-16 19:23:58

@ b83a28b7:35919450

2025-05-16 19:23:58This article was originally part of the sermon of Plebchain Radio Episode 110 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ 3f770d65:7a745b24

2025-05-20 21:14:28

@ 3f770d65:7a745b24

2025-05-20 21:14:28I’m Derek Ross, and I’m all-in on Nostr.

I started the Grow Nostr Initiative to help more people discover what makes Nostr so powerful: ✅ You own your identity ✅ You choose your social graph and algorithms ✅ You aren't locked into any single app or platform ✅ You can post, stream, chat, and build, all without gatekeepers

What we’re doing with Grow Nostr Initiative: 🌱 Hosting local meetups and mini-conferences to onboard people face-to-face 📚 Creating educational materials and guides to demystify how Nostr works 🧩 Helping businesses and creators understand how they can plug into Nostr (running media servers, relays, and using key management tools)

I believe Nostr is the foundation of a more open internet. It’s still early, but we’re already seeing incredible apps for social, blogging, podcasting, livestreaming, and more. And the best part is that they're all interoperable, censorship-resistant, and built on open standards. Nostr is the world's largest bitcoin economy by transaction volume and I truly believe that the purple pill helps the orange pill go down. Meaning, growing Nostr will also grow Bitcoin adoption.

If you’ve been curious about Nostr or are building something on it, or let’s talk. Whether you're just getting started or you're already deep in the ecosystem, I'm here to answer questions, share what I’ve learned, and hear your ideas. Check out https://nostrapps.com to find your next social decentralized experience.

Ask Me Anything about GNI, Nostr, Bitcoin, the upcoming #NosVegas event at the Bitcoin Conference next week, etc.!

– Derek Ross 🌐 https://grownostr.org npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424

https://stacker.news/items/984689

-

@ 1c5ff3ca:efe9c0f6

2025-05-23 10:13:57

@ 1c5ff3ca:efe9c0f6

2025-05-23 10:13:57Auto-Deployment on a VPS with GitHub Actions

Introduction

This tutorial describes how you can deploy an application on a VPS using GitHub Actions. This way, changes in your GitHub repository are automatically deployed to your VPS.

Prerequisites

- GitHub Account

- GitHub Repository

- Server + SSH access to the server

Step 1 - SSH Login to Server

Open a terminal and log in via SSH. Then navigate to the

.sshdirectoryssh user@hostname cd ~/.sshStep 2 - Create an SSH Key

Now create a new SSH key that we will use for auto-deployment. In the following dialog, simply press "Enter" repeatedly until the key is created.

ssh-keygen -t ed25519 -C "service-name-deploy-github"Step 3 - Add the Key to the

authorized_keysFilecat id_ed25519.pub >> authorized_keys(If you named the key file differently, change this accordingly)

Step 4 - GitHub Secrets

In order for the GitHub Action to perform the deployment later, some secrets must be stored in the repository. Open the repository on GitHub. Navigate to "Settings" -> "Secrets And Variables" -> "Actions". Add the following variables:

HOST: Hostname or IP address of the serverUSERNAME: Username you use to log in via SSHSSHKEY: The private key (copy the content fromcat ~/.ssh/id_ed25519)PORT: 22

Step 5 - Create the GitHub Action

Now create the GitHub Action for auto-deployment. The following GitHub Action will be used: https://github.com/appleboy/scp-action In your local repository, create the file

.github/workflows/deploy.yml:```yaml name: Deploy on: [push] jobs: build: runs-on: ubuntu-latest steps: - uses: actions/checkout@v1 - name: Copy repository content via scp uses: appleboy/scp-action@master with: host: ${{ secrets.HOST }} username: ${{ secrets.USERNAME }} port: ${{ secrets.PORT }} key: ${{ secrets.SSHKEY }} source: "." target: "/your-target-directory"

- name: Executing a remote command uses: appleboy/ssh-action@master with: host: ${{ secrets.HOST }} username: ${{ secrets.USERNAME }} port: ${{ secrets.PORT }} key: ${{ secrets.SSHKEY }} script: | ls```

This action copies the repository files to your server using

scp. Afterwards, thelscommand is executed. Here you can add appropriate commands that rebuild your service or similar. To rebuild and start a docker service you could use something like this or similar:docker compose -f target-dir/docker-compose.yml up --build -dNow commit this file and in the "Actions" tab of your repository, the newly created action should now be visible and executed. With every future change, the git repository will now be automatically copied to your server.Sources

I read this when trying out, but it did not work and I adapted the

deploy.ymlfile: https://dev.to/knowbee/how-to-setup-continuous-deployment-of-a-website-on-a-vps-using-github-actions-54im -

@ 8d34bd24:414be32b

2025-05-21 15:52:46

@ 8d34bd24:414be32b

2025-05-21 15:52:46In our culture today, people like to have “my truth” as opposed to “your truth.” They want to have teachers who tell them what they want to hear and worship in the way they desire. The Bible predicted these times.

For the time will come when people will not put up with sound doctrine. Instead, to suit their own desires, they will gather around them a great number of teachers to say what their itching ears want to hear. (2 Timothy 4:3)

My question is, “do we get to choose what we want to believe about God and how we want to worship Him, or does God tell us what we are to believe and how we are to worship Him?”

The Bible makes it clear that He is who He says He is and He expects obedience and worship according to His commands. We do not get to decide for ourselves.

The woman said to Him, “Sir, I perceive that You are a prophet. Our fathers worshiped in this mountain, and you people say that in Jerusalem is the place where men ought to worship.” Jesus said to her, “Woman, believe Me, an hour is coming when neither in this mountain nor in Jerusalem will you worship the Father. You worship what you do not know; we worship what we know, for salvation is from the Jews. But an hour is coming, and now is, when the true worshipers will worship the Father in spirit and truth; for such people the Father seeks to be His worshipers. God is spirit, and those who worship Him must worship in spirit and truth.” (John 4:19-24) {emphasis mine}

In this passage, Jesus gently corrects the woman for worshipping what she does not know. He also says, “God is spirit, and those who worship Him must worship in spirit and truth.” He states what God is (spirit) and how He must be worshipped “in spirit and truth.” We don’t get to define God however we wish, and we don’t get to worship Him any way we wish. God is who He has revealed Himself to be and we must obey Him and worship Him the way He has commanded.

In this next passage, God makes clear that He is holy and we do not get to worship Him any way we wish. We are to interact with Him in the prescribed manner.

Now Nadab and Abihu, the sons of Aaron, took their respective firepans, and after putting fire in them, placed incense on it and offered strange fire before the Lord, which He had not commanded them. And fire came out from the presence of the Lord and consumed them, and they died before the Lord. Then Moses said to Aaron, “It is what the Lord spoke, saying,

‘By those who come near Me I will be treated as holy,\ And before all the people I will be honored.’ ”

So Aaron, therefore, kept silent. (Leviticus 10:1-3) {emphasis mine}

God had prescribed a particular way to approach Him and only those whom He had chosen (priests of the lineage of Aaron). Nadab and Abihu chose to “do it their way” and paid the price for ignoring God’s command. God set an example with them.

God has been gracious enough to reveal Himself, His character, His power, and His commands to us. If we have truly submitted ourselves to His rule, we should hunger for God’s words so we can know Him better and honor Him in obedience.

But now I come to You; and these things I speak in the world so that they may have My joy made full in themselves. I have given them Your word; and the world has hated them, because they are not of the world, even as I am not of the world. I do not ask You to take them out of the world, but to keep them from the evil one. They are not of the world, even as I am not of the world. Sanctify them in the truth; Your word is truth. (John 17:13-17) {emphasis mine}

In today’s culture, everybody likes to claim their own personal truth, but that isn’t how truth works. The truth is not determined by an individual for themselves. It isn’t even determined by a consensus or majority vote. The truth is the truth even if not one person on earth believes it. God speaks truth and God is truth. Our belief or lack thereof doesn’t change the truth, but our lack of belief in the truth, especially the truth as revealed by God in His word, can negatively affect our relationship with God.

God expects us to study His word so we can obey His commands.

For I did not speak to your fathers, or command them in the day that I brought them out of the land of Egypt, concerning burnt offerings and sacrifices. But this is what I commanded them, saying, ‘Obey My voice, and I will be your God, and you will be My people; and you will walk in all the way which I command you, that it may be well with you.’ Yet they did not obey or incline their ear, but walked in their own counsels and in the stubbornness of their evil heart, and went backward and not forward. Since the day that your fathers came out of the land of Egypt until this day, I have sent you all My servants the prophets, daily rising early and sending them. Yet they did not listen to Me or incline their ear, but stiffened their neck; they did more evil than their fathers. (Jeremiah 7:22-26) {emphasis mine}

Today you rarely see someone bowing down to a golden idol, but that doesn’t mean that we are any better at obeying God’s commands or submitting to His will. We still try to make God in our own image so He is a convenience to us and how we want to live our lives. We still put other things ahead of God — family, work, entertainment, fame, etc. Most of us aren’t any more faithful to God than the Israelites were. Just like the Israelites, we put on the trappings of faith but don’t live according to faith and faithfulness.

And He said to them, “Rightly did Isaiah prophesy of you hypocrites, as it is written:

‘This people honors Me with their lips,\ But their heart is far away from Me.\ **But in vain do they worship Me,\ Teaching as doctrines the precepts of men.’\ Neglecting the commandment of God, you hold to the tradition of men.”

He was also saying to them, “You are experts at setting aside the commandment of God in order to keep your tradition. (Mark 7:6-9) {emphasis mine}

How many “churches” and “Christian” leaders teach people according to the culture instead of according to the Word of God? How many tell people what they want to hear and what makes them feel good instead of what they need to hear — the truth as spoken through the Bible? How many church attenders follow a “Christian” leader more than they follow their Creator, Savior, and God? How many church attenders can recite the words of their leaders better than the Holy Scriptures?

I solemnly charge you in the presence of God and of Christ Jesus, who is to judge the living and the dead, and by His appearing and His kingdom: preach the word; be ready in season and out of season; reprove, rebuke, exhort, with great patience and instruction. For the time will come when they will not endure sound doctrine; but wanting to have their ears tickled, they will accumulate for themselves teachers in accordance to their own desires, and will turn away their ears from the truth and will turn aside to myths. But you, be sober in all things, endure hardship, do the work of an evangelist, fulfill your ministry. (2 Timothy 4:1-5) {emphasis mine}

How can we know if a church leader is rightly preaching God’s word? We can only know if we have read the Bible and studied it. We should be like the Bereans:

Now these were more noble-minded than those in Thessalonica, for they received the word with great eagerness, examining the Scriptures daily to see whether these things were so. (Acts 17:11)

Honestly, I don’t trust any spiritual leader who doesn’t encourage me to search the Scriptures to see whether their words are true. Any leader who puts their own word above the Scriptures is a false teacher. Sadly there are many, maybe more than faithful teachers. Some false teachers are intentionally so, but many have been misled by other false teachers. Their guilt is less, but they don’t do any less harm than those who intentionally mislead.

We need to seek trustworthy teachers who speak according to the Word of God, who quote the Bible to support their opinions, and who seek the good of their followers rather than the submission of their followers.

Do not harden your hearts, as at Meribah,\ As in the day of Massah in the wilderness,

“When your fathers tested Me,\ They tried Me, though they had seen My work.\ For forty years I loathed that generation,\ And said they are a people who err in their heart,\ And they do not know My ways.\ Therefore I swore in My anger,\ Truly they shall not enter into My rest.” (Psalm 95:8-11) {emphasis mine} *Teach me good discernment and knowledge,\ For I believe in Your commandments*.\ Before I was afflicted I went astray,\ But now I keep Your word.\ You are good and do good;\ Teach me Your statutes.\ The arrogant have forged a lie against me;\ *With all my heart I will observe Your precepts*.\ Their heart is covered with fat,\ But I delight in Your law.\ It is good for me that I was afflicted,\ That I may learn Your statutes.\ The law of Your mouth is better to me\ Than thousands of gold and silver pieces. (Psalm 119:66-72) {emphasis mine}

May our Creator God teach us the truth. May He fill our hearts with the desire to be in His word daily and to seek His will. May He do what is necessary to get our attention and turn our hearts and minds fully to Him, so we can learn His statutes and serve Him faithfully, so one day we are blessed to hear, “Well done! Good and faithful servant.”

Trust Jesus.

FYI, I see lack of knowledge of truth and God’s word as one of the biggest problems in the church today; however, it is possible to know the Bible in depth, but not know God. As important as knowledge of Scriptures is, this knowledge (without faith, submission, obedience, and love) is meaningless. Knowledge doesn’t get us to heaven. Even obedience doesn’t get us to heaven. Only faith and submission to our creator God leads to salvation and heaven. That being said, we can’t faithfully serve our God without knowledge of Him and His commands. Out of gratefulness for who He is and what He has done for us, we should seek to know and please Him.

-

@ 472f440f:5669301e

2025-05-16 00:18:45

@ 472f440f:5669301e

2025-05-16 00:18:45Marty's Bent

It's been a pretty historic week for the United States as it pertains to geopolitical relations in the Middle East. President Trump and many members of his administration, including AI and Crypto Czar David Sacks and Treasury Secretary Scott Bessent, traveled across the Middle East making deals with countries like Qatar, Saudi Arabia, the United Arab Emirates, Syria, and others. Many are speculating that Iran may be included in some behind the scenes deal as well. This trip to the Middle East makes sense considering the fact that China is also vying for favorable relationships with those countries. The Middle East is a power player in the world, and it seems pretty clear that Donald Trump is dead set on ensuring that they choose the United States over China as the world moves towards a more multi-polar reality.

Many are calling the events of this week the Riyadh Accords. There were many deals that were struck in relation to artificial intelligence, defense, energy and direct investments in the United States. A truly prolific power play and demonstration of deal-making ability of Donald Trump, if you ask me. Though I will admit some of the numbers that were thrown out by some of the countries were a bit egregious. We shall see how everything plays out in the coming years. It will be interesting to see how China reacts to this power move by the United States.

While all this was going on, there was something happening back in the United States that many people outside of fringe corners of FinTwit are not talking about, which is the fact that the 10-year and 30-year U.S. Treasury bond yields are back on the rise. Yesterday, they surpassed the levels of mid-April that caused a market panic and are hovering back around levels that have not been seen since right before Donald Trump's inauguration.

I imagine that there isn't as much of an uproar right now because I'm pretty confident the media freakouts we were experiencing in mid-April were driven by the fact that many large hedge funds found themselves off sides of large levered basis trades. I wouldn't be surprised if those funds have decreased their leverage in those trades and bond yields being back to mid-April levels is not affecting those funds as much as they were last month. But the point stands, the 10-year and 30-year yields are significantly elevated with the 30-year approaching 5%. Regardless of the deals that are currently being made in the Middle East, the Treasury has a big problem on its hands. It still has to roll over many trillions worth of debt over over the next few years and doing so at these rates is going to be massively detrimental to fiscal deficits over the next decade. The interest expense on the debt is set to explode in the coming years.

On that note, data from the first quarter of 2025 has been released by the government and despite all the posturing by the Trump administration around DOGE and how tariffs are going to be beneficial for the U.S. economy, deficits are continuing to explode while the interest expense on the debt has definitively surpassed our annual defense budget.

via Charlie Bilello

via Mohamed Al-Erian

To make matters worse, as things are deteriorating on the fiscal side of things, the U.S. consumer is getting crushed by credit. The 90-plus day delinquency rates for credit card and auto loans are screaming higher right now.

via TXMC

One has to wonder how long all this can continue without some sort of liquidity crunch. Even though equities markets have recovered from their post-Liberation Day month long bear market, I would not be surprised if what we're witnessing is a dead cat bounce that can only be continued if the money printers are turned back on. Something's got to give, both on the fiscal side and in the private markets where the Common Man is getting crushed because he's been forced to take on insane amounts of debt to stay afloat after years of elevated levels of inflation. Add on the fact that AI has reached a state of maturity that will enable companies to replace their current meat suit workers with an army of cheap, efficient and fast digital workers and it isn't hard to see that some sort of employment crisis could be on the horizon as well.

Now is not the time to get complacent. While I do believe that the deals that are currently being made in the Middle East are probably in the best interest of the United States as the world, again, moves toward a more multi-polar reality, we are facing problems that one cannot simply wish away. They will need to be confronted. And as we've seen throughout the 21st century, the problems are usually met head-on with a money printer.

I take no pleasure in saying this because it is a bit uncouth to be gleeful to benefit from the strife of others, but it is pretty clear to me that all signs are pointing to bitcoin benefiting massively from everything that is going on. The shift towards a more multi-polar world, the runaway debt situation here in the United States, the increasing deficits, the AI job replacements and the consumer credit crisis that is currently unfolding, All will need to be "solved" by turning on the money printers to levels they've never been pushed to before.

Weird times we're living in.

China's Manufacturing Dominance: Why It Matters for the U.S.

In my recent conversation with Lyn Alden, she highlighted how China has rapidly ascended the manufacturing value chain. As Lyn pointed out, China transformed from making "sneakers and plastic trinkets" to becoming the world's largest auto exporter in just four years. This dramatic shift represents more than economic success—it's a strategic power play. China now dominates solar panel production with greater market control than OPEC has over oil and maintains near-monopoly control of rare earth elements crucial for modern technology.

"China makes like 10 times more steel than the United States does... which is relevant in ship making. It's relevant in all sorts of stuff." - Lyn Alden

Perhaps most concerning, as Lyn emphasized, is China's financial leverage. They hold substantial U.S. assets that could be strategically sold to disrupt U.S. treasury market functioning. This combination of manufacturing dominance, resource control, and financial leverage gives China significant negotiating power in any trade disputes, making our attempts to reshoring manufacturing all the more challenging.

Check out the full podcast here for more on Triffin's dilemma, Bitcoin's role in monetary transition, and the energy requirements for rebuilding America's industrial base.

Headlines of the Day

Financial Times Under Fire Over MicroStrategy Bitcoin Coverage - via X

Trump in Qatar: Historic Boeing Deal Signed - via X

Get our new STACK SATS hat - via tftcmerch.io

Johnson Backs Stock Trading Ban; Passage Chances Slim - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Building things of value is satisfying.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ e0a24c5c:fa44b1e7

2025-05-23 19:21:04

@ e0a24c5c:fa44b1e7

2025-05-23 19:21:04Ralph Boes – Menschenrechtsaktivist, Philosoph

Ralph Boes zeigt in dem Buch auf, wie wir uns von der Übermacht des Parteienwesens, die zur Entmündigung des Volkes führt, befreien können. Er zeigt, dass schon im Grundgesetz selbst höchst gegenläufige, an seinen freiheitlich-demokratischen Idealen bemessen sogar als verfassungswidrig zu bezeichnende Tendenzen wirken. Und dass diese es sind, die heute in seine Zerstörung führen. Er weist aber auch die Ansatzpunkte auf, durch die der Zerstörung des Grundgesetzes wirkungsvoll begegnet werden kann.

Eintritt frei, Spendentopf

Ralph Boes hat u.a. dafür gesorgt, dass die unmäßigen Sanktionen in Hartz IV 2019 vom Bundesverfassungsgericht für menschenrechts- und verfassungswidrig erklärt wurden. Aktuell setzt er sich für eine Ur-Abstimmung des Volkes über seine Verfassung ein.

-

@ e39333da:7c66e53a

2025-05-21 14:26:08

@ e39333da:7c66e53a

2025-05-21 14:26:08::youtube{#prPOncMkV6c}

Tara Gaming has announced The Age of Bhaarat, a dark fantasy action RPG, with a cinematic and gameplay trailer, showcasing what seems like early footage of the game. The game will release on PC via Steam.

-

@ b0a838f2:34ed3f19

2025-05-23 18:11:34

@ b0a838f2:34ed3f19

2025-05-23 18:11:34- AmuseWiki - Amusewiki is based on the Emacs Muse markup, remaining mostly compatible with the original implementation. It can work as a read-only site, as a moderated wiki, or as a fully open wiki or even as a private site. (Demo, Source Code)

GPL-1.0Perl/Docker - BookStack - Organize and store information. Stores documentation in a book like fashion. (Demo, Source Code)

MITPHP/Docker - django-wiki - Wiki system with complex functionality for simple integration and a superb interface. Store your knowledge with style: Use django models. (Demo)

GPL-3.0Python - docmost - Collaborative wiki and documentation software (alternative to Confluence, Notion). (Source Code)

AGPL-3.0Docker/Nodejs - Documize - Modern Docs + Wiki software with built-in workflow, single binary executable, just bring MySQL/Percona. (Source Code)

AGPL-3.0Go - Dokuwiki - Easy to use, lightweight, standards-compliant wiki engine with a simple syntax allowing reading the data outside the wiki. All data is stored in plain text files, therefore no database is required. (Source Code)

GPL-2.0PHP - Feather Wiki - A lightning fast and infinitely extensible tool for creating personal non-linear notebooks, databases, and wikis that is entirely self-contained, runs in your browser, and is only 58 kilobytes in size. (Demo, Source Code, Clients)

AGPL-3.0Javascript - Gitit - Wiki program that stores pages and uploaded files in a git repository, which can then be modified using the VCS command line tools or the wiki's web interface.

GPL-2.0Haskell - Gollum - Simple, Git-powered wiki with a sweet API and local frontend.

MITRuby - Mediawiki - Wiki software package that powers Wikipedia and all other Wikimedia projects, serving hundreds of millions of users each month. (Demo, Source Code)

GPL-2.0PHP - Mycorrhiza Wiki - Filesystem and git-based wiki engine written in Go using Mycomarkup as its primary markup language. (Source Code)

AGPL-3.0Go - Otter Wiki - Simple, easy to use wiki software using markdown. (Source Code)

MITDocker - Pepperminty Wiki - Complete markdown-powered wiki contained in a single PHP file. (Demo)

MPL-2.0PHP - PmWiki - Wiki-based system for collaborative creation and maintenance of websites.

GPL-3.0PHP - Raneto - Raneto is an open source Knowledgebase platform that uses static Markdown files to power your Knowledgebase. (Source Code)

MITNodejs - TiddlyWiki - Reusable non-linear personal web notebook. (Source Code)

BSD-3-ClauseNodejs - Tiki - Wiki CMS Groupware with the most built-in features. (Demo, Source Code)

LGPL-2.1PHP - W - Lightweight, mutli-user, flat-file-database Wiki engine. Create pages quickly and edit them in your Web browser using Mardown/HTML/CSS/JS. The main difference with other wiki is that you are encouraged to customize each page style individually. (Source Code)

AGPL-3.0PHP - WackoWiki - WackoWiki is a light and easy to install multilingual Wiki-engine. (Source Code)

BSD-3-ClausePHP - Wiki.js - Modern, lightweight and powerful wiki app using Git and Markdown. (Demo, Source Code)

AGPL-3.0Nodejs/Docker/K8S - WikiDocs - A databaseless markdown flat-file wiki engine. (Source Code)

MITPHP/Docker - WiKiss - Wiki, simple to use and install. (Source Code)

GPL-2.0PHP - Wikmd - Modern and simple file based wiki that uses Markdown and Git.

MITPython/Docker - XWiki - Second generation wiki that allows the user to extend its functionalities with a powerful extension-based architecture. (Demo, Source Code)

LGPL-2.1Java/Docker/deb - Zim - Graphical text editor used to maintain a collection of wiki pages. Each page can contain links to other pages, simple formatting and images. (Source Code)

GPL-2.0Python/deb

- AmuseWiki - Amusewiki is based on the Emacs Muse markup, remaining mostly compatible with the original implementation. It can work as a read-only site, as a moderated wiki, or as a fully open wiki or even as a private site. (Demo, Source Code)

-

@ 04c915da:3dfbecc9

2025-05-16 17:51:54

@ 04c915da:3dfbecc9

2025-05-16 17:51:54In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:22

@ 04c915da:3dfbecc9

2025-05-20 15:50:22There is something quietly rebellious about stacking sats. In a world obsessed with instant gratification, choosing to patiently accumulate Bitcoin, one sat at a time, feels like a middle finger to the hype machine. But to do it right, you have got to stay humble. Stack too hard with your head in the clouds, and you will trip over your own ego before the next halving even hits.

Small Wins