-

@ ece127e2:745bab9c

2025-05-20 18:59:11

@ ece127e2:745bab9c

2025-05-20 18:59:11vamos a ver que tal

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:22

@ 04c915da:3dfbecc9

2025-05-20 15:50:22There is something quietly rebellious about stacking sats. In a world obsessed with instant gratification, choosing to patiently accumulate Bitcoin, one sat at a time, feels like a middle finger to the hype machine. But to do it right, you have got to stay humble. Stack too hard with your head in the clouds, and you will trip over your own ego before the next halving even hits.

Small Wins

Stacking sats is not glamorous. Discipline. Stacking every day, week, or month, no matter the price, and letting time do the heavy lifting. Humility lives in that consistency. You are not trying to outsmart the market or prove you are the next "crypto" prophet. Just a regular person, betting on a system you believe in, one humble stack at a time. Folks get rekt chasing the highs. They ape into some shitcoin pump, shout about it online, then go silent when they inevitably get rekt. The ones who last? They stack. Just keep showing up. Consistency. Humility in action. Know the game is long, and you are not bigger than it.

Ego is Volatile

Bitcoin’s swings can mess with your head. One day you are up 20%, feeling like a genius and the next down 30%, questioning everything. Ego will have you panic selling at the bottom or over leveraging the top. Staying humble means patience, a true bitcoin zen. Do not try to "beat” Bitcoin. Ride it. Stack what you can afford, live your life, and let compounding work its magic.

Simplicity

There is a beauty in how stacking sats forces you to rethink value. A sat is worth less than a penny today, but every time you grab a few thousand, you plant a seed. It is not about flaunting wealth but rather building it, quietly, without fanfare. That mindset spills over. Cut out the noise: the overpriced coffee, fancy watches, the status games that drain your wallet. Humility is good for your soul and your stack. I have a buddy who has been stacking since 2015. Never talks about it unless you ask. Lives in a decent place, drives an old truck, and just keeps stacking. He is not chasing clout, he is chasing freedom. That is the vibe: less ego, more sats, all grounded in life.

The Big Picture

Stack those sats. Do it quietly, do it consistently, and do not let the green days puff you up or the red days break you down. Humility is the secret sauce, it keeps you grounded while the world spins wild. In a decade, when you look back and smile, it will not be because you shouted the loudest. It will be because you stayed the course, one sat at a time. \ \ Stay Humble and Stack Sats. 🫡

-

@ 04c915da:3dfbecc9

2025-05-16 17:12:05

@ 04c915da:3dfbecc9

2025-05-16 17:12:05One of the most common criticisms leveled against nostr is the perceived lack of assurance when it comes to data storage. Critics argue that without a centralized authority guaranteeing that all data is preserved, important information will be lost. They also claim that running a relay will become prohibitively expensive. While there is truth to these concerns, they miss the mark. The genius of nostr lies in its flexibility, resilience, and the way it harnesses human incentives to ensure data availability in practice.

A nostr relay is simply a server that holds cryptographically verifiable signed data and makes it available to others. Relays are simple, flexible, open, and require no permission to run. Critics are right that operating a relay attempting to store all nostr data will be costly. What they miss is that most will not run all encompassing archive relays. Nostr does not rely on massive archive relays. Instead, anyone can run a relay and choose to store whatever subset of data they want. This keeps costs low and operations flexible, making relay operation accessible to all sorts of individuals and entities with varying use cases.

Critics are correct that there is no ironclad guarantee that every piece of data will always be available. Unlike bitcoin where data permanence is baked into the system at a steep cost, nostr does not promise that every random note or meme will be preserved forever. That said, in practice, any data perceived as valuable by someone will likely be stored and distributed by multiple entities. If something matters to someone, they will keep a signed copy.

Nostr is the Streisand Effect in protocol form. The Streisand effect is when an attempt to suppress information backfires, causing it to spread even further. With nostr, anyone can broadcast signed data, anyone can store it, and anyone can distribute it. Try to censor something important? Good luck. The moment it catches attention, it will be stored on relays across the globe, copied, and shared by those who find it worth keeping. Data deemed important will be replicated across servers by individuals acting in their own interest.

Nostr’s distributed nature ensures that the system does not rely on a single point of failure or a corporate overlord. Instead, it leans on the collective will of its users. The result is a network where costs stay manageable, participation is open to all, and valuable verifiable data is stored and distributed forever.

-

@ 08f96856:ffe59a09

2025-05-15 01:22:34

@ 08f96856:ffe59a09

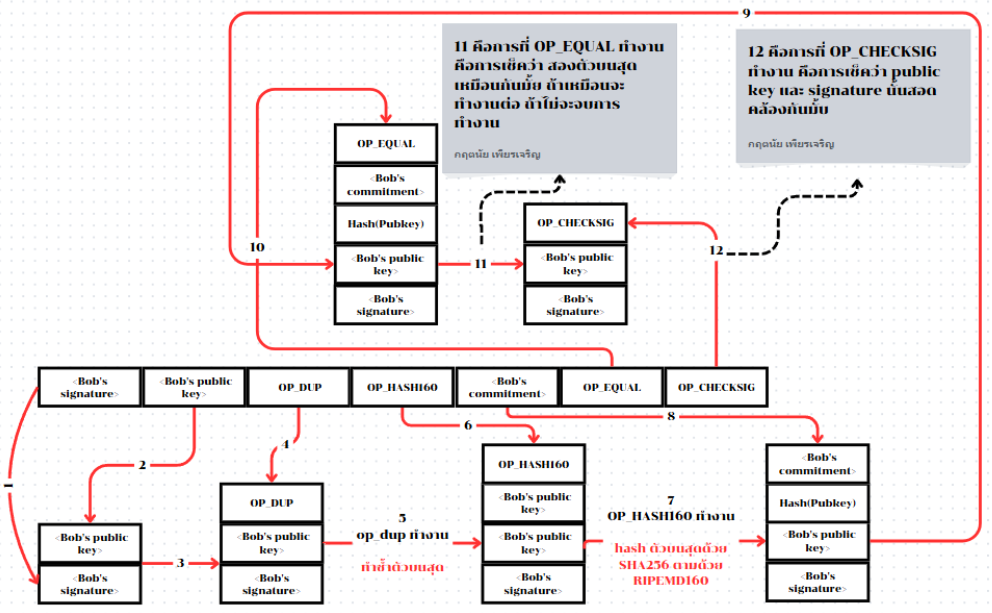

2025-05-15 01:22:34เมื่อพูดถึง Bitcoin Standard หลายคนมักนึกถึงภาพโลกอนาคตที่ทุกคนใช้บิตคอยน์ซื้อกาแฟหรือของใช้ในชีวิตประจำวัน ภาพแบบนั้นดูเหมือนไกลตัวและเป็นไปไม่ได้ในความเป็นจริง หลายคนถึงกับพูดว่า “คงไม่ทันเห็นในช่วงชีวิตนี้หรอก” แต่ในมุมมองของผม Bitcoin Standard อาจไม่ได้เริ่มต้นจากการที่เราจ่ายบิตคอยน์โดยตรงในร้านค้า แต่อาจเริ่มจากบางสิ่งที่เงียบกว่า ลึกกว่า และเกิดขึ้นแล้วในขณะนี้ นั่นคือ การล่มสลายทีละน้อยของระบบเฟียตที่เราใช้กันอยู่

ระบบเงินที่อิงกับอำนาจรัฐกำลังเข้าสู่ช่วงขาลง รัฐบาลทั่วโลกกำลังจมอยู่ในภาระหนี้ระดับประวัติการณ์ แม้แต่ประเทศมหาอำนาจก็เริ่มแสดงสัญญาณของภาวะเสี่ยงผิดนัดชำระหนี้ อัตราเงินเฟ้อกลายเป็นปัญหาเรื้อรังที่ไม่มีท่าทีจะหายไป ธนาคารที่เคยโอนฟรีเริ่มกลับมาคิดค่าธรรมเนียม และประชาชนก็เริ่มรู้สึกถึงการเสื่อมศรัทธาในระบบการเงินดั้งเดิม แม้จะยังพูดกันไม่เต็มเสียงก็ตาม

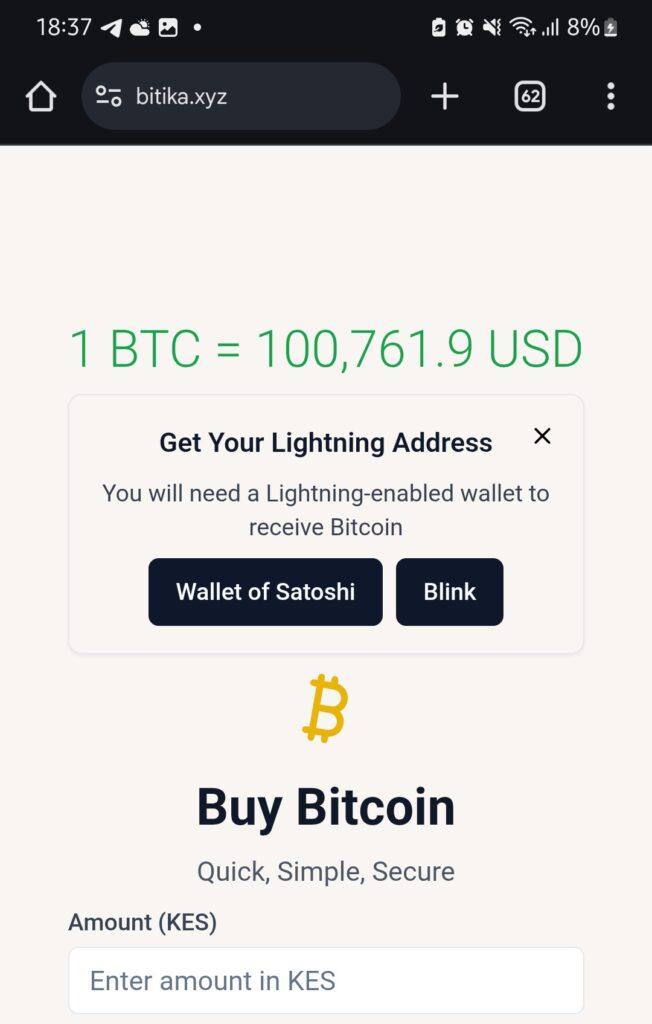

ในขณะเดียวกัน บิตคอยน์เองก็กำลังพัฒนาแบบเงียบ ๆ เงียบ... แต่ไม่เคยหยุด โดยเฉพาะในระดับ Layer 2 ที่เริ่มแสดงศักยภาพอย่างจริงจัง Lightning Network เป็น Layer 2 ที่เปิดใช้งานมาได้ระยะเวลสหนึ่ง และยังคงมีบทบาทสำคัญที่สุดในระบบนิเวศของบิตคอยน์ มันทำให้การชำระเงินเร็วขึ้น มีต้นทุนต่ำ และไม่ต้องบันทึกทุกธุรกรรมลงบล็อกเชน เครือข่ายนี้กำลังขยายตัวทั้งในแง่ของโหนดและการใช้งานจริงทั่วโลก

ขณะเดียวกัน Layer 2 ทางเลือกอื่นอย่าง Ark Protocol ก็กำลังพัฒนาเพื่อตอบโจทย์ด้านความเป็นส่วนตัวและประสบการณ์ใช้งานที่ง่าย BitVM เปิดแนวทางใหม่ให้บิตคอยน์รองรับ smart contract ได้ในระดับ Turing-complete ซึ่งทำให้เกิดความเป็นไปได้ในกรณีใช้งานอีกมากมาย และเทคโนโลยีที่น่าสนใจอย่าง Taproot Assets, Cashu และ Fedimint ก็ทำให้การออกโทเคนหรือสกุลเงินที่อิงกับบิตคอยน์เป็นจริงได้บนโครงสร้างของบิตคอยน์เอง

เทคโนโลยีเหล่านี้ไม่ใช่การเติบโตแบบปาฏิหาริย์ แต่มันคืบหน้าอย่างต่อเนื่องและมั่นคง และนั่นคือเหตุผลที่มันจะ “อยู่รอด” ได้ในระยะยาว เมื่อฐานของความน่าเชื่อถือไม่ใช่บริษัท รัฐบาล หรือทุน แต่คือสิ่งที่ตรวจสอบได้และเปลี่ยนกฎไม่ได้

แน่นอนว่าบิตคอยน์ต้องแข่งขันกับ stable coin, เงินดิจิทัลของรัฐ และ cryptocurrency อื่น ๆ แต่สิ่งที่ทำให้มันเหนือกว่านั้นไม่ใช่ฟีเจอร์ หากแต่เป็นความทนทาน และความมั่นคงของกฎที่ไม่มีใครเปลี่ยนได้ ไม่มีทีมพัฒนา ไม่มีบริษัท ไม่มีประตูปิด หรือการยึดบัญชี มันยืนอยู่บนคณิตศาสตร์ พลังงาน และเวลา

หลายกรณีใช้งานที่เคยถูกทดลองในโลกคริปโตจะค่อย ๆ เคลื่อนเข้ามาสู่บิตคอยน์ เพราะโครงสร้างของมันแข็งแกร่งกว่า ไม่ต้องการทีมพัฒนาแกนกลาง ไม่ต้องพึ่งกลไกเสี่ยงต่อการผูกขาด และไม่ต้องการ “ความเชื่อใจ” จากใครเลย

Bitcoin Standard ที่ผมพูดถึงจึงไม่ใช่การเปลี่ยนแปลงแบบพลิกหน้ามือเป็นหลังมือ แต่คือการ “เปลี่ยนฐานของระบบ” ทีละชั้น ระบบการเงินใหม่ที่อิงอยู่กับบิตคอยน์กำลังเกิดขึ้นแล้ว มันไม่ใช่โลกที่ทุกคนถือเหรียญบิตคอยน์ แต่มันคือโลกที่คนใช้อาจไม่รู้ตัวด้วยซ้ำว่า “สิ่งที่เขาใช้นั้นอิงอยู่กับบิตคอยน์”

ผู้คนอาจใช้เงินดิจิทัลที่สร้างบน Layer 3 หรือ Layer 4 ผ่านแอป ผ่านแพลตฟอร์ม หรือผ่านสกุลเงินใหม่ที่ดูไม่ต่างจากเดิม แต่เบื้องหลังของระบบจะผูกไว้กับบิตคอยน์

และถ้ามองในเชิงพัฒนาการ บิตคอยน์ก็เหมือนกับอินเทอร์เน็ต ครั้งหนึ่งอินเทอร์เน็ตก็ถูกมองว่าเข้าใจยาก ต้องพิมพ์ http ต้องรู้จัก TCP/IP ต้องตั้ง proxy เอง แต่ปัจจุบันผู้คนใช้งานอินเทอร์เน็ตโดยไม่รู้ว่าเบื้องหลังมีอะไรเลย บิตคอยน์กำลังเดินตามเส้นทางเดียวกัน โปรโตคอลกำลังถอยออกจากสายตา และวันหนึ่งเราจะ “ใช้มัน” โดยไม่ต้องรู้ว่ามันคืออะไร

หากนับจากช่วงเริ่มต้นของอินเทอร์เน็ตในยุค 1990 จนกลายเป็นโครงสร้างหลักของโลกในสองทศวรรษ เส้นเวลาของบิตคอยน์ก็กำลังเดินตามรอยเท้าของอินเทอร์เน็ต และถ้าเราเชื่อว่าวัฏจักรของเทคโนโลยีมีจังหวะของมันเอง เราก็จะรู้ว่า Bitcoin Standard นั้นไม่ใช่เรื่องของอนาคตไกลโพ้น แต่มันเกิดขึ้นแล้ว

siamstr

-

@ 57d1a264:69f1fee1

2025-05-24 06:07:19

@ 57d1a264:69f1fee1

2025-05-24 06:07:19Definition: when every single person in the chain responsible for shipping a product looks at objectively horrendous design decisions and goes: yup, this looks good to me, release this. Designers, developers, product managers, testers, quality assurance... everyone.

I nominate Peugeot as the first example in this category.

Continue reading at https://grumpy.website/1665

https://stacker.news/items/988044

-

@ 57d1a264:69f1fee1

2025-05-24 05:53:43

@ 57d1a264:69f1fee1

2025-05-24 05:53:43This talks highlights tools for product management, UX design, web development, and content creation to embed accessibility.

Organizations need scalability and consistency in their accessibility work, aligning people, policies, and processes to integrate it across roles. This session highlights tools for product management, UX design, web development, and content creation to embed accessibility. We will explore inclusive personas, design artifacts, design systems, and content strategies to support developers and creators, with real-world examples.

https://www.youtube.com/watch?v=-M2cMLDU4u4

https://stacker.news/items/988041

-

@ eb0157af:77ab6c55

2025-05-24 18:01:14

@ eb0157af:77ab6c55

2025-05-24 18:01:14Vivek Ramaswamy’s company bets on distressed bitcoin claims as its Bitcoin treasury strategy moves forward.

Strive Enterprises, an asset management firm co-founded by Vivek Ramaswamy, is exploring the acquisition of distressed bitcoin claims, with particular interest in around 75,000 BTC tied to the Mt. Gox bankruptcy estate. This move is part of the company’s broader strategy to build a Bitcoin treasury ahead of its planned merger with Asset Entities.

According to a document filed on May 20 with the Securities and Exchange Commission, Strive has partnered with 117 Castell Advisory Group to “identify and evaluate” distressed Bitcoin claims with confirmed legal judgments. Among these are approximately 75,000 BTC connected to Mt. Gox, with an estimated market value of $8 billion at current prices.

Essentially, Strive aims to acquire rights to bitcoins currently tied up in legal disputes, which can be purchased at a discount by those willing to take on the risk and wait for eventual recovery.

In a post on X, Strive’s CFO, Ben Pham, stated:

“Strive intends to use all available mechanisms, including novel financial strategies not used by other Bitcoin treasury companies, to maximize its exposure to the asset.”

The company also plans to buy cash at a discount by merging with publicly traded companies holding more cash than their stock value, using the excess funds to purchase additional Bitcoin.

Mt. Gox, the exchange that collapsed in 2014, is currently in the process of repaying creditors, with a deadline set for October 31, 2025.

In its SEC filing, Strive declared:

“This strategy is intended to allow Strive the opportunity to purchase Bitcoin exposure at a discount to market price, enhancing Bitcoin per share and supporting its goal of outperforming Bitcoin over the long run.”

At the beginning of May, Strive announced its merger plan with Asset Entities, a deal that would create the first publicly listed asset management firm focused on Bitcoin. The resulting company aims to join the growing number of firms adopting a Bitcoin treasury strategy.

The corporate treasury trend

Strive’s initiative to accumulate bitcoin mirrors that of other companies like Strategy and Japan’s Metaplanet. On May 19, Strategy, led by Michael Saylor, announced the purchase of an additional 7,390 BTC for $764.9 million, raising its total holdings to 576,230 BTC. On the same day, Metaplanet revealed it had acquired another 1,004 BTC, increasing its total to 7,800 BTC.

The post Bitcoin in Strive’s sights: 75,000 BTC from Mt. Gox among its targets appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-05-24 18:01:13

@ eb0157af:77ab6c55

2025-05-24 18:01:13According to the ECB Executive Board member, the launch of the digital euro depends on the timing of the EU regulation.

The European Central Bank (ECB) is making progress in preparing for the digital euro. According to Piero Cipollone, ECB Executive Board member and coordinator of the project, the technical phase “is proceeding quickly and on schedule,” but moving to operational implementation still requires political approval of the regulation at the European level.

Speaking at the ‘Voices on the Future’ event organized by Ansa and Asvis, Cipollone outlined a possible timeline:

“If the regulation is approved at the start of 2026 — in the best-case scenario for the European legislative process — we could see the first transactions with the digital euro by mid-2028.”

Cipollone also highlighted Europe’s current dependence on electronic payment systems managed by non-European companies:

“Today in Europe, whenever we don’t use cash, any transaction online or at the supermarket has to go through credit cards, with their fees. The payment system relies on companies that aren’t based in Europe. You can see why it would make sense to have a system fully under our control.”

For the ECB board member, the digital euro would act as a direct alternative to cash in the digital world, working like “a banknote you can spend anywhere in Europe for any purpose.”

The digital euro project is part of the ECB’s broader strategy to strengthen the independence of Europe’s financial system. According to Cipollone and the Central Bank, Europe’s digital currency would be a key step toward greater autonomy in electronic payments, reducing reliance on infrastructure and services outside the European Union.

The post ECB: digital euro by mid-2028, says Cipollone appeared first on Atlas21.

-

@ d360efec:14907b5f

2025-05-13 00:39:56

@ d360efec:14907b5f

2025-05-13 00:39:56🚀📉 #BTC วิเคราะห์ H2! พุ่งชน 105K แล้วเจอแรงขาย... จับตา FVG 100.5K เป็นจุดวัดใจ! 👀📊

จากากรวิเคราะห์ทางเทคนิคสำหรับ #Bitcoin ในกรอบเวลา H2:

สัปดาห์ที่แล้ว #BTC ได้เบรคและพุ่งขึ้นอย่างแข็งแกร่งค่ะ 📈⚡ แต่เมื่อวันจันทร์ที่ผ่านมา ราคาได้ขึ้นไปชนแนวต้านบริเวณ 105,000 ดอลลาร์ แล้วเจอแรงขายย่อตัวลงมาตลอดทั้งวันค่ะ 🧱📉

ตอนนี้ ระดับที่น่าจับตาอย่างยิ่งคือโซน H4 FVG (Fair Value Gap ในกราฟ 4 ชั่วโมง) ที่ 100,500 ดอลลาร์ ค่ะ 🎯 (FVG คือโซนที่ราคาวิ่งผ่านไปเร็วๆ และมักเป็นบริเวณที่ราคามีโอกาสกลับมาทดสอบ/เติมเต็ม)

👇 โซน FVG ที่ 100.5K นี้ ยังคงเป็น Area of Interest ที่น่าสนใจสำหรับมองหาจังหวะ Long เพื่อลุ้นการขึ้นในคลื่นลูกถัดไปค่ะ!

🤔💡 อย่างไรก็ตาม การตัดสินใจเข้า Long หรือเทรดที่บริเวณนี้ ขึ้นอยู่กับว่าราคา แสดงปฏิกิริยาอย่างไรเมื่อมาถึงโซน 100.5K นี้ เพื่อยืนยันสัญญาณสำหรับการเคลื่อนไหวที่จะขึ้นสูงกว่าเดิมค่ะ!

เฝ้าดู Price Action ที่ระดับนี้อย่างใกล้ชิดนะคะ! 📍

BTC #Bitcoin #Crypto #คริปโต #TechnicalAnalysis #Trading #FVG #FairValueGap #PriceAction #MarketAnalysis #ลงทุนคริปโต #วิเคราะห์กราฟ #TradeSetup #ข่าวคริปโต #ตลาดคริปโต

-

@ eb0157af:77ab6c55

2025-05-24 18:01:12

@ eb0157af:77ab6c55

2025-05-24 18:01:12A new study reveals: 4 out of 5 Americans would like the US to convert some of its gold into Bitcoin.

A recent survey conducted by the Nakamoto Project revealed that a majority of Americans support converting a portion of the United States’ gold reserves into Bitcoin. The survey, carried out online by Qualtrics between February and March 2025, involved 3,345 participants with demographic characteristics representative of US census standards. Most respondents expressed a desire to convert between 1% and 30% of the gold reserves into BTC.

Troy Cross, co-founder of the Nakamoto Project, stated:

“When given a slider and asked to advise the US government on the right proportion of Bitcoin and gold, subjects were very reluctant to put that slider on 0% Bitcoin and 100% gold. Instead, they settled around 10% Bitcoin.”

One significant finding from the research is the correlation between age and openness to Bitcoin: younger respondents showed a greater inclination toward the cryptocurrency compared to older generations.

A potential US strategy

Bo Hines, a White House advisor, is promoting an initiative for the Treasury Department to acquire Bitcoin by selling off a portion of its gold. Under the proposed plan, the government could acquire up to 1 million BTC over the next five years.

To finance these purchases, the government plans to sell Federal Reserve gold certificates. The proposal aligns with Senator Cynthia Lummis’ 2025 Bitcoin Act, which aims to declare Bitcoin a critical national strategic asset.

Currently, the United States holds 8,133 metric tons of gold, valued at over $830 billion, and about 200,000 BTC, valued at $21 billion.

The post The majority in the US wants to convert part of the gold reserves into Bitcoin appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52

@ 9ca447d2:fbf5a36d

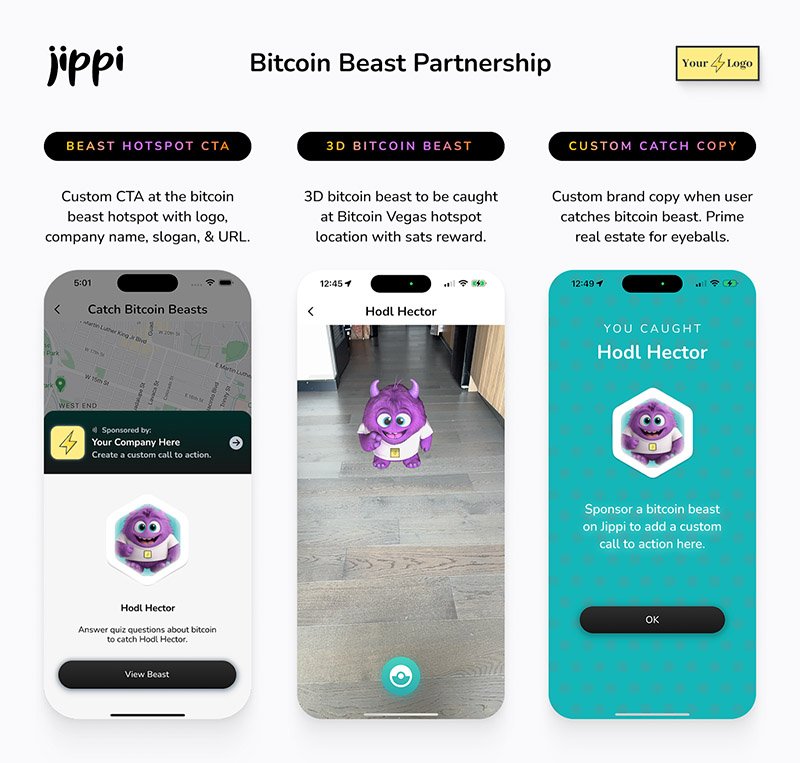

2025-05-22 14:01:52Gen Z (those born between 1997 and 2012) are not rushing to stack sats, and Oliver Porter, Founder & CEO of Jippi, understands the challenge better than most. His strategy revolves around adapting Bitcoin education to fit seamlessly into the digital lives of young adults.

“We need to meet them where they are,” Oliver explains. “90% of Gen Z plays games. 70% expect to earn rewards.”

So, what will effectively introduce them to Bitcoin? In Oliver’s mind, the answer is simple: games that don’t feel preachy but still plant the orange pill.

Learn more at Jippi.app

That’s exactly what Jippi is. Based in Austin, Texas, the team has created a mobile augmented reality (AR) game that rewards players in bitcoin and sneakily teaches them why sound money matters.

“It’s Pokémon GO… but for sats,” Oliver puts it succinctly.

Jippi is like Pokemon Go, but for sats

Oliver’s Bitcoin journey, like many in the space, began long before he was ready. A former colleague had tried planting the seed years earlier, handing him a copy of The Bitcoin Standard. But the moment passed.

It wasn’t until the chaos of 2020 when lockdowns hit, printing presses roared, and civil liberties shrank that the message finally landed for him.

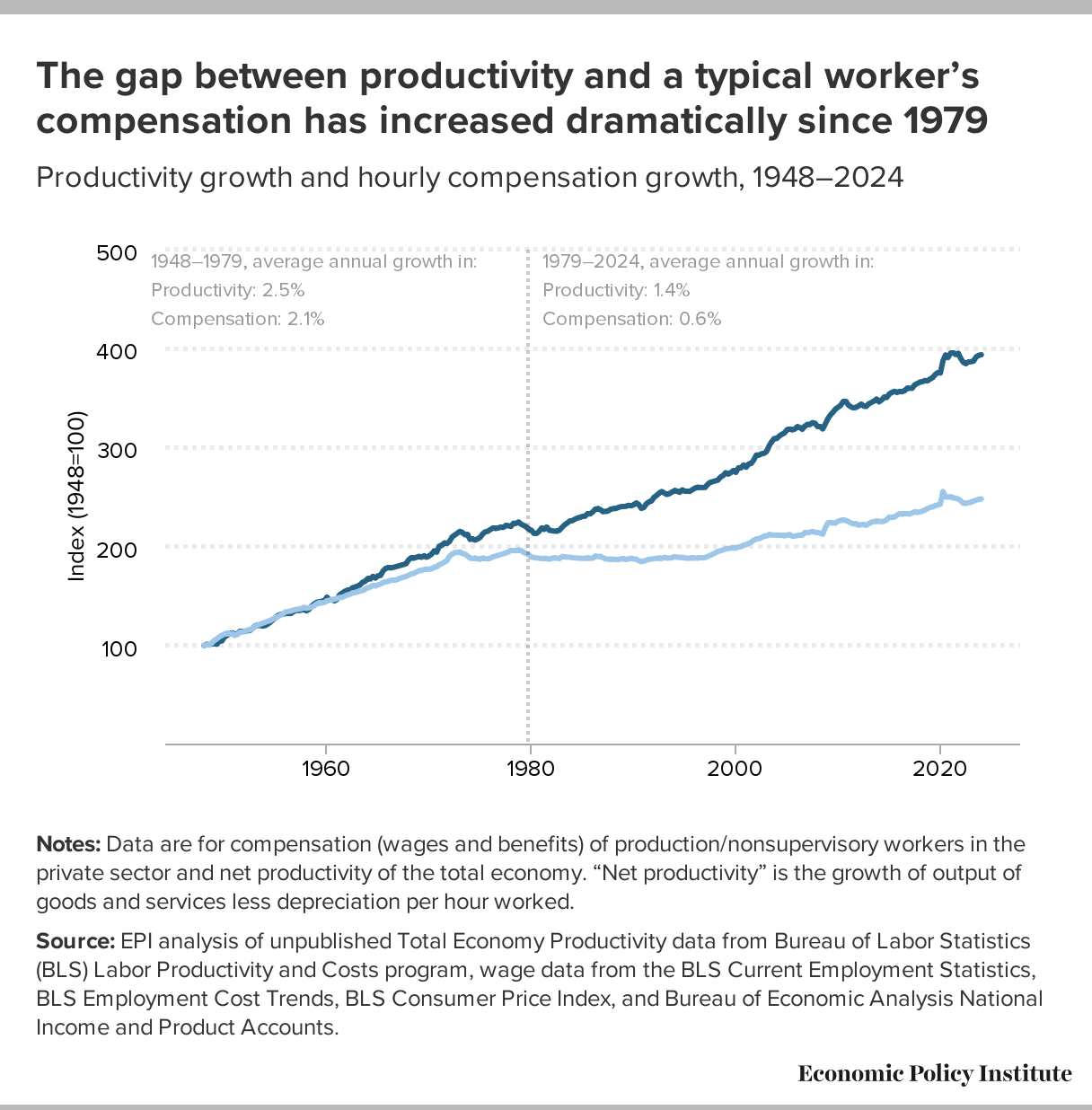

“The government got so good at doing reverse Robin Hood,” Oliver explains. “They steal from the working population and reward the rich.”

By 2020, though, the absurdity of the covid hysteria had caused his eyes to be opened and the orange light seemed the best path back to freedom.

He left the UK for Austin “one of the best places for Bitcoiners,” he says, and dove headfirst into the industry, working at Swan for a year before founding Jippi on PlebLab’s accelerator program.

Jippi’s flagship game lets players roam their cities hunting digital creatures, Bitcoin Beasts, tied to real-world locations. Catching them requires answering Bitcoin trivia, and the reward is sats.

No jargon. No hour-long lectures. Just gameplay with sound money principles woven right in.

The model is working. At a recent hackathon in Austin, Jippi beat out 14 other teams to win first place and $15,000 in prize money.

Oliver of Jippi won Top Builder Season 2 — PlebLab on X

“We’re backdooring Bitcoin education,” Oliver admits. “And while we’re at it, encouraging people to get outside and touch grass.”

Not everyone’s been thrilled. When Jippi team members visited one of the more liberal-leaning places in Texas, UT Austin, to test interest in Bitcoin, they found some seriously committed no-coiners on the campus.

“One young woman told me, ‘I would rather die than talk about Bitcoin,'” Oliver recalls, highlighting the cultural resistance that’s built up among younger demographics.

This resistance is backed by hard data. According to Oliver, some of the Bitcoin podcasters they met with in the space to do market research reported that less than 1% of their listeners are from Gen Z and that number is dropping.

“Unless we find a way to capture their interest in a meaningful way, there’s going to be a big problem around trying to sway Gen Z away from the siren call of s***coins and crypto casinos and towards Bitcoin,” Oliver warns.

Jippi’s next big move is Las Vegas, where they’ll launch the Beast Catch experience at the Venetian during a major Bitcoin event. To mark the occasion, they’re opening up six limited sponsorship spots for Bitcoin companies, each one tied to a custom in-game beast.

Jippi looks to launch a special event at Bitcoin 2025

“It’s real estate inside the game,” Oliver explains. “Brands become allies, not intrusions. You get a logo, company name, and call to action, so we can push people to your site or app.”

Bitcoin Well—an automatic self-custody Bitcoin platform—has claimed Beast #1. Only five exclusive spots remain for Bitcoin companies to “beastify their brand” through Jippi’s immersive AR game.

“I love the Jippi mission. I think gamified learning is how we will onboard the next generation and it’s exciting to see what the Jippi team is doing! I love working with bitcoiners towards our common mission – bullish!” said Adam O’Brien, Bitcoin Well CEO.

Jippi’s sponsorship model is simple: align incentives, respect users, and support builders. Instead of throwing ad money at tech giants, Bitcoin companies can connect with new users naturally while they’re having fun and earning sats in the process.

For Bitcoin companies looking to reach a younger demographic, this represents a unique opportunity to showcase their brand to up to 30,000 potential customers at the Vegas event.

Jippi Bitcoin Beast partnership

While Jippi’s current focus is simple, get the game into more cities, Oliver sees a future where AR glasses and AI help personalize Bitcoin education even further.

“The magic is going to really happen when Apple releases the glasses form factor,” he says, describing how augmented reality could enhance real-world connections rather than isolate users.

In the longer term, Jippi aims to evolve from a free-to-play model toward a pay-to-play version with higher stakes. Users would form “tribes” with friends to compete for substantial bitcoin prizes, creating social connections along with financial education.

Unlike VC-backed startups, Jippi is raising funds pleb style via Timestamp, an open investment platform for Bitcoin companies.

“You don’t have to be an accredited investor,” Oliver explains. “You’re directly supporting the parallel Bitcoin economy by investing in Bitcoin companies for equity.”

Anyone can invest as little as $100. Perks include early access, exclusive game content, and even creating your own beast design with your name/pseudonym and unique game lore. Each investment comes with direct ownership of an early-stage Bitcoin company like Jippi.

For Oliver, this is more than just a business. It’s about future-proofing Bitcoin adoption and ensuring Satoshi’s vision lives on, especially as many people are lured by altcoins, NFTs, and social media dopamine.

“We’re on the right side of history,” he says firmly. “I want my grandkids to know that early on in the Bitcoin revolution, games like Jippi helped make it stick.”

In a world increasingly absorbed by screens and short attention spans, Jippi’s combination of outdoor play, sats rewards, and Bitcoin education might be exactly the bridge Gen Z needs.

Interested in sponsoring a Beast or investing in Jippi? Reach out to Jippi directly by heading to their partnerships page on their website or visit their Timestamp page to invest in Jippi today.

-

@ 57d1a264:69f1fee1

2025-05-22 13:13:36

@ 57d1a264:69f1fee1

2025-05-22 13:13:36Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986624

-

@ d360efec:14907b5f

2025-05-12 04:01:23

@ d360efec:14907b5f

2025-05-12 04:01:23 -

@ eb0157af:77ab6c55

2025-05-24 18:01:11

@ eb0157af:77ab6c55

2025-05-24 18:01:11The exchange reveals the extent of the breach that occurred last December as federal authorities investigate the recent data leak.

Coinbase has disclosed that the personal data of 69,461 users was compromised during the breach in December 2024, according to documentation filed with the Maine Attorney General’s Office.

The disclosure comes after Coinbase announced last week that a group of hackers had demanded a $20 million ransom, threatening to publish the stolen data on the dark web. The attackers allegedly bribed overseas customer service agents to extract information from the company’s systems.

Coinbase had previously stated that the breach affected less than 1% of its user base, compromising KYC (Know Your Customer) data such as names, addresses, and email addresses. In a filing with the U.S. Securities and Exchange Commission (SEC), the company clarified that passwords, private keys, and user funds were not affected.

Following the reports, the SEC has reportedly opened an official investigation to verify whether Coinbase may have inflated user metrics ahead of its 2021 IPO. Separately, the Department of Justice is investigating the breach at Coinbase’s request, according to CEO Brian Armstrong.

Meanwhile, Coinbase has faced criticism for its delayed response to the data breach. Michael Arrington, founder of TechCrunch, stated that the stolen data could cause irreparable harm. In a post on X, Arrington wrote:

“The human cost, denominated in misery, is much larger than the $400m or so they think it will actually cost the company to reimburse people. The consequences to companies who do not adequately protect their customer information should include, without limitation, prison time for executives.”

Coinbase estimates the incident could cost between $180 million and $400 million in remediation expenses and customer reimbursements.

Arrington also condemned KYC laws as ineffective and dangerous, calling on both regulators and companies to better protect user data:

“Combining these KYC laws with corporate profit maximization and lax laws on penalties for hacks like these means these issues will continue to happen. Both governments and corporations need to step up to stop this. As I said, the cost can only be measured in human suffering.”

The post Coinbase: 69,461 users affected by December 2024 data breach appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-05-24 18:01:10

@ eb0157af:77ab6c55

2025-05-24 18:01:10Bitcoin adoption will come through businesses: neither governments nor banks will lead the revolution.

In recent years, it’s undeniable that Bitcoin has ceased to be just a radical idea born from the minds of cypherpunks. It is now recognized across the board as a global asset, discussed in the upper echelons of finance, accepted even on Wall Street, purchased by banking groups and included as a “strategic reserve” by some nations.

However, the general perception that hovers today regarding Bitcoin’s diffusion is still that of minimal adoption, almost insignificant. Bitcoin exists, certainly, but in fact it is not being used. It is rarely possible to pay in satoshis in commercial establishments. Demand is still extremely low.

Furthermore, the debate on Bitcoin is still practically absent: excluding some local events, some niche media outlets or some timid discussion, today Bitcoin is in fact excluded from general interest. The level of understanding and knowledge of the phenomenon is certainly still very low.

Yet, Bitcoin represents an unprecedented technological improvement, capable of solving many problems inherent in the fiat system in which we live. What could facilitate its diffusion?

Bitcoin becomes familiar when businesses adopt it

When talking about Bitcoin adoption, many look to States. They imagine governments that legislate or accumulate Bitcoin as a “strategic reserve,” or banks perceived as forward-thinking that would lead technological change, opening up to innovation. But the reality is different: bureaucracy, political constraints, and fear of losing control inherently prevent States and central banks from being pioneers.

What really drives Bitcoin adoption are not States, but businesses. It is the forward-looking entrepreneurs, innovative startups and – eventually – even large multinational companies that decide to integrate Bitcoin into their operating systems that drive adoption. Indeed, the business world has always played a key role in the adoption of new technologies. This was the case, for example, with the internet, e-commerce, mobile telephony, and the cloud. It will also be the case with Bitcoin.

Unlike a State, when a company adopts Bitcoin, it does so for concrete reasons: efficiency, savings, protection, access to new markets, independence from traditional banking circuits, or bureaucratic streamlining. It is a rational choice, not an ideological one, dictated by the intent to improve one’s competitiveness against the competition to survive in the market.

What is currently missing to facilitate adoption is, in all likelihood, a significant number of businesses that have decided to integrate Bitcoin into their company systems.

Bitcoin becomes “normal” when it is integrated into the operational flow of businesses. Holding and framing bitcoin on the balance sheet, paying an invoice, paying salaries to employees in satoshis, making value transfers globally thanks to the blockchain, allowing customers to pay via Lightning Network… when all this becomes possible with the same simplicity with which we use the euro or the dollar, Bitcoin stops being alternative and becomes the standard.

Businesses are not just users. They are adoption multipliers. When a company chooses Bitcoin, it is automatically proposing it to customers, employees, suppliers, and institutional stakeholders. Each business adoption equals tens, hundreds, or thousands of new eyes on Bitcoin.

People, after all, trust what they see every day: if your trusted restaurant accepts bitcoin, or if your favorite e-commerce platform uses it to receive international payments, or if your colleague receives it as a salary, then Bitcoin no longer appears to be a mysterious object. It finally begins to be perceived as a real, useful, and functioning tool.

The integration of a technology in companies helps make it understandable, accessible, and legitimate in the eyes of the public. This is how distrust is overcome: by making Bitcoin visible in daily life.

Bitcoin and businesses today

A River Financial report estimates that as of May 2025, only 5% of bitcoin is currently owned by private businesses. A still very small number.

According to research by River, in May 2025 businesses hold just over a million btc (about 5% of available monetary units). More than two-thirds of bitcoin (68.2%) are in the hands of private individuals.

To promote Bitcoin adoption, it is necessary today to support businesses in integrating this standard, leveraging all its enormous opportunities. Among others, this technology allows for fast, economical, and global payments. It eliminates intermediaries, increases transparency and security in value transfers. It removes bureaucratic frictions and allows opening up to a new global market.

Every sector can benefit from Bitcoin: e-commerce, tourism, industry, restaurants, professional services, or any other business. Bitcoin revolutionizes the concept of money, and money is a transversal working tool.

We are still at the beginning, but several signals are encouraging. According to a study by Bitwise and reported by Atlas21, in the first quarter of 2025, a growing number of US companies (+16.11% compared to the previous one) are including Bitcoin in their balance sheets, not just as a financial bet, but as a long-term strategy to protect their assets and access a decentralized monetary system to transfer value worldwide without resorting to financial intermediaries.

Who is driving the change?

Echoing the words of Roy Sheinfeld, CEO of Breez, the true potential of Bitcoin will be unleashed first and foremost from the work of developers, the true architects in designing and refining tools that are increasingly simple and intuitive to use for anyone, regardless of level of expertise. It is the developers – Roy rightly argued – who will enable us to “conquer the world.”

But probably that’s not enough: the next step is to make Bitcoin a globally accepted technological standard, changing its perception towards the general public. And this is where businesses come into play.

Guided by the market, technological innovation, and the desire to meet user demands, entrepreneurs today represent the fulcrum to accelerate the monetary transition from the current fiat system towards the Bitcoin standard. It is entrepreneurs who transform innovations from opportunities for a few to a reality shared by many.

The adoption of Bitcoin will therefore not arise from a sudden event, nor from the exclusive fruit of enthusiasts’ enthusiasm or from arbitrary political choices decreed by States or regulators.

The future of Bitcoin is built in the places where value is created every day: in companies, in their systems, and in their strategic decisions.

“If we conquer developers, we conquer the world. If we conquer businesses, we conquer adoption.”

The post The key to Bitcoin adoption is businesses appeared first on Atlas21.

-

@ 57d1a264:69f1fee1

2025-05-22 12:36:20

@ 57d1a264:69f1fee1

2025-05-22 12:36:20Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986587

-

@ 57d1a264:69f1fee1

2025-05-22 06:21:22

@ 57d1a264:69f1fee1

2025-05-22 06:21:22You’ve probably seen it before.

You open an agency’s website or a freelancer’s portfolio. At the very top of the homepage, it says:

We design for startups.

You wait 3 seconds. The last word fades out and a new one fades in:

We design for agencies.

Wait 3 more seconds:

We design for founders.

I call this design pattern The Wheel of Nothing: a rotating list of audience segments meant to impress through inclusion and draw attention through motion… for absolutely no reason.

Revered brand studio Pentagram recently launched a new website. To my surprise, the homepage features the Wheel of Nothing front and center, boldly claiming:

We design Everything for Everyone…before cycling through more specific combinations every few seconds.

Dan Mall, a husband, dad, teacher, creative director, designer, founder, and entrepreneur from Philly. I share as much as I can to create better opportunities for those who wouldn’t have them otherwise. Most recently, I ran design system consultancy SuperFriendly for over a decade.

Read more at Dans' website https://danmall.com/posts/the-wheel-of-nothing/

https://stacker.news/items/986392

-

@ eb0157af:77ab6c55

2025-05-24 18:01:09

@ eb0157af:77ab6c55

2025-05-24 18:01:09Governor Abbott will have to decide whether to sign the bill establishing a bitcoin reserve for the state.

Texas could become the third U.S. state to set up a strategic bitcoin reserve, following the approval of Senate Bill 21 by the state House, with 101 votes in favor and 42 against.

Lee Bratcher, founder and president of the Texas Blockchain Council, expressed confidence that Governor Greg Abbott will sign the legislative measure. In an interview with The Block, Bratcher said:

“I’ve talked to the governor about this personally, and I think he wants to see Texas lead in this way.”

The bill is expected to reach the governor’s desk within a week or two, according to Bratcher’s projections. If signed, Texas would follow in the footsteps of New Hampshire and Arizona in creating a state-held bitcoin reserve.

Despite Texas ranking as the world’s eighth-largest economy — ahead of many nations — the initial approach to the reserve will be cautious. Bratcher estimates the starting investment will be in the “tens of millions of dollars,” an amount he describes as “modest” for an economy the size of Texas. The responsibility for operational decisions would fall to the state comptroller, who acts as an executive accountant in charge of managing and investing public funds.

“My sense is that it will be in the tens of millions of dollars, which, while it sounds significant, is a very modest amount, for a state the size of Texas.” explained the president of the Texas Blockchain Council.

The road to approval

According to Bratcher, the idea of creating a state bitcoin reserve dates back to 2022 and represents the culmination of years of work by the Texas Blockchain Council. The organization has worked closely with lawmakers who shared the vision of seeing the state accumulate the world’s leading cryptocurrency. Additionally, Texas has long been home to numerous bitcoin mining companies.

The post Texas one step away from a bitcoin reserve: only the governor’s signature is missing appeared first on Atlas21.

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ 8aa70f44:3073d1a6

2025-05-21 13:07:14

@ 8aa70f44:3073d1a6

2025-05-21 13:07:14Earlier this year I launched the asknostr.site project which has been a great journey and learning experience. I had wanted to write down my goals and ideas with the project but didn't get to it yet. Primal launching the article editor was a trigger for me to go for it.

Ever since I joined Nostr i was looking for ways to apply my skillset solve a problem and help with adoption. Around Christmas I figured that a Quora/Stackoverflow alternative is something that needs to exist on Nostr.

Before I knew it I had a pretty decent prototype. And because the network already had so much awesome content, contributors and authors I was never discouraged by the challenge that kills so many good ideas -> "Where do I get the first users?".

Since the initial announcement I have received so much encouragement through zaps, likes, DM's, and maybe most of all seeing the increase in usage of the site and #asknostr content kept me going.

Current State

The current version of the site is stable and most bugs are hashed out. After logging in (remote signer, extension or nsec) you can engage with content through votes, comments and replies. Or simply ask a new question.

All content is stored in the site's own private relay and preprocessed/computed into a single data store (postgres) so the site is fast, accessible and crawl-able.

The site supports browsing hashtags, voting/commenting on answers, asking new questions and every contributor get their own profile (example). At the time of writing the site has 41k questions, almost 200k replies/comments and upwards of 5 million sats purely for #asknostr content.

What to expect/On my list

There are plenty of things and UI bugs that need love and between writing the draft of this post and hitting publish I shipped 3 minor bug fixes. Little by little, bit by bit...

In addition to all those small details here is an overview of the things on my own wish list:

-

Inline Zaps: Ability to zap from the asknostr.site interface. Click the zap button, specify or pick the number of sats zap away.

-

Contributor Rank: A leaderboard to add some gamification. More recognition to those nostriches that spend their time helping other people out

-

Search by Keyword: Search all content by keywords. Experiment with the index to show related questions or answers

-

Better User Profiles: Improve the user profile so it shows all the profile questions and answers. Quick buttons to follow or zap that person. Better insights in the topics (hashtags) the profile contributes to

-

Bookmarks: Ability to bookmark questions and answers. Increase bookmark weight as a signal to rank answers.

-

Smarter Scoring: Tune how answers are scored (winning answer formula). Perhaps give more weight to the question author or use WoT. Not sure yet.

All of this is happening at some point so follow me if you want to stay up to date.

Goals

To manage expectations and keep me focussed I write down the mid and long term goals of the project.

Long term

Call me cheesy but I believe that humanity will flourish through an open web and sound money. My own journey started from with bitcoin but if you asked me today if it's BTC or nostr that is going to have the most impact I wouldn't know what to answer. Chicken or egg?

The goal of the project is to offer an open platform that empowers individuals to ask questions, share expertise and access high-quality information across different topics. The project empowers anyone to monetize their experience creating a sustainable ecosystem that values and rewards knowledge sharing. This will ultimately democratize access to knowledge for all.

Mid term

The project can help a lot with onboarding new users onto the network. Once we start to rank on certain topics we can get a piece of the search traffic pie (StackOverflows 12 million, and Quora 150 million visitors per month) which is a great way to expose people to the power of the network.

First time visitors do not need to know about nostr or zaps to receive value. They can browse around, discover interesting content and perhaps even create a profile without even knowing they are on Nostr now.

Gradually those users will understand the value of the network through better rankings (zaps beats likes), a cross-client experience and a profile that can be used on any nostr site or app.

In order for the site to do that we need to make sure content is browsable by language, (sub)topics and and we double down on 'the human touch' with real contributors and not LLMs.

Short Term Goal

The first goal is to make the site really good and an important resource for existing Nostr users. Enable visitors to search and discover what they are interested in. Integrate within the existing nostr eco system with 'open in' functionality and quick links to interesting projects (followerpacks?)

One of things i want to get right is to improve user retention by making the whole Q\&A experience more sticky. I want to run some experiments (bots, award, summaries) to get more people to use asknostr.site more often and come back.

What about the name?

Finally the big question: What about the asknostr.site name? I don't like the name that much but it's what people know. I think there is a high chance that people will discover Nostr apps like Olas, Primal or Damus without needing to know what NOSTR is or means.

Therefore I think there is a good chance that the project won't be called asknostr.site forever. I guess it all depends on where we all take this.

Onwards!

-

-

@ 57d1a264:69f1fee1

2025-05-21 05:47:41

@ 57d1a264:69f1fee1

2025-05-21 05:47:41As a product builder over too many years to mention, I’ve lost count of the number of times I’ve seen promising ideas go from zero to hero in a few weeks, only to fizzle out within months.

The problem with most finance apps, however, is that they often become a reflection of the internal politics of the business rather than an experience solely designed around the customer. This means that the focus is on delivering as many features and functionalities as possible to satisfy the needs and desires of competing internal departments, rather than providing a clear value proposition that is focused on what the people out there in the real world want. As a result, these products can very easily bloat to become a mixed bag of confusing, unrelated and ultimately unlovable customer experiences—a feature salad, you might say.

Financial products, which is the field I work in, are no exception. With people’s real hard-earned money on the line, user expectations running high, and a crowded market, it’s tempting to throw as many features at the wall as possible and hope something sticks. But this approach is a recipe for disaster.

Here’s why: https://alistapart.com/article/from-beta-to-bedrock-build-products-that-stick/

https://stacker.news/items/985285

-

@ d360efec:14907b5f

2025-05-10 03:57:17

@ d360efec:14907b5f

2025-05-10 03:57:17Disclaimer: * การวิเคราะห์นี้เป็นเพียงแนวทาง ไม่ใช่คำแนะนำในการซื้อขาย * การลงทุนมีความเสี่ยง ผู้ลงทุนควรตัดสินใจด้วยตนเอง

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ eb0157af:77ab6c55

2025-05-24 18:01:08

@ eb0157af:77ab6c55

2025-05-24 18:01:08Bitcoin surpasses gold in the United States: 50 million holders and a dominant role in the global market.

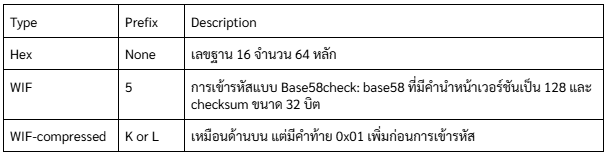

According to a new report by River, for the first time in history, the number of Americans owning bitcoin has surpassed that of gold holders. The analysis reveals that approximately 50 million U.S. citizens currently own the cryptocurrency, while gold owners number 37 million. In fact, 14.3% of Americans own bitcoin, the highest percentage of holders worldwide.

Source: River

The report highlights that 40% of all Bitcoin-focused companies are based in the United States, consolidating America’s dominant position in the sector. Additionally, 40.5% of Bitcoin holders are men aged 31 to 35, followed by 35.9% of men aged 41 to 45. In contrast, only 13.4% of holders are women.

Source: River

Notably, U.S. companies hold 94.8% of all bitcoins owned by publicly traded companies worldwide. According to the report, recent regulatory changes in the U.S. have made the asset more accessible through financial products such as spot ETFs.

The document also shows that American investors increasingly view the cryptocurrency as protection against fiscal instability and inflation, appreciating its limited supply and decentralized governance model.

For River, Bitcoin offers significant practical advantages over gold in the modern digital era. Its ease of custody, cross-border transfer, and liquidity make the cryptocurrency an attractive option for both individual and institutional investors, the report suggests.

The post USA: 50 million Americans own bitcoin appeared first on Atlas21.

-

@ 3bf0c63f:aefa459d

2025-04-25 18:55:52

@ 3bf0c63f:aefa459d

2025-04-25 18:55:52Report of how the money Jack donated to the cause in December 2022 has been misused so far.

Bounties given

March 2025

- Dhalsim: 1,110,540 - Work on Nostr wiki data processing

February 2025

- BOUNTY* NullKotlinDev: 950,480 - Twine RSS reader Nostr integration

- Dhalsim: 2,094,584 - Work on Hypothes.is Nostr fork

- Constant, Biz and J: 11,700,588 - Nostr Special Forces

January 2025

- Constant, Biz and J: 11,610,987 - Nostr Special Forces

- BOUNTY* NullKotlinDev: 843,840 - Feeder RSS reader Nostr integration

- BOUNTY* NullKotlinDev: 797,500 - ReadYou RSS reader Nostr integration

December 2024

- BOUNTY* tijl: 1,679,500 - Nostr integration into RSS readers yarr and miniflux

- Constant, Biz and J: 10,736,166 - Nostr Special Forces

- Thereza: 1,020,000 - Podcast outreach initiative

November 2024

- Constant, Biz and J: 5,422,464 - Nostr Special Forces

October 2024

- Nostrdam: 300,000 - hackathon prize

- Svetski: 5,000,000 - Latin America Nostr events contribution

- Quentin: 5,000,000 - nostrcheck.me

June 2024

- Darashi: 5,000,000 - maintaining nos.today, searchnos, search.nos.today and other experiments

- Toshiya: 5,000,000 - keeping the NIPs repo clean and other stuff

May 2024

- James: 3,500,000 - https://github.com/jamesmagoo/nostr-writer

- Yakihonne: 5,000,000 - spreading the word in Asia

- Dashu: 9,000,000 - https://github.com/haorendashu/nostrmo

February 2024

- Viktor: 5,000,000 - https://github.com/viktorvsk/saltivka and https://github.com/viktorvsk/knowstr

- Eric T: 5,000,000 - https://github.com/tcheeric/nostr-java

- Semisol: 5,000,000 - https://relay.noswhere.com/ and https://hist.nostr.land relays

- Sebastian: 5,000,000 - Drupal stuff and nostr-php work

- tijl: 5,000,000 - Cloudron, Yunohost and Fraidycat attempts

- Null Kotlin Dev: 5,000,000 - AntennaPod attempt

December 2023

- hzrd: 5,000,000 - Nostrudel

- awayuki: 5,000,000 - NOSTOPUS illustrations

- bera: 5,000,000 - getwired.app

- Chris: 5,000,000 - resolvr.io

- NoGood: 10,000,000 - nostrexplained.com stories

October 2023

- SnowCait: 5,000,000 - https://nostter.vercel.app/ and other tools

- Shaun: 10,000,000 - https://yakihonne.com/, events and work on Nostr awareness

- Derek Ross: 10,000,000 - spreading the word around the world

- fmar: 5,000,000 - https://github.com/frnandu/yana

- The Nostr Report: 2,500,000 - curating stuff

- james magoo: 2,500,000 - the Obsidian plugin: https://github.com/jamesmagoo/nostr-writer

August 2023

- Paul Miller: 5,000,000 - JS libraries and cryptography-related work

- BOUNTY tijl: 5,000,000 - https://github.com/github-tijlxyz/wikinostr

- gzuus: 5,000,000 - https://nostree.me/

July 2023

- syusui-s: 5,000,000 - rabbit, a tweetdeck-like Nostr client: https://syusui-s.github.io/rabbit/

- kojira: 5,000,000 - Nostr fanzine, Nostr discussion groups in Japan, hardware experiments

- darashi: 5,000,000 - https://github.com/darashi/nos.today, https://github.com/darashi/searchnos, https://github.com/darashi/murasaki

- jeff g: 5,000,000 - https://nostr.how and https://listr.lol, plus other contributions

- cloud fodder: 5,000,000 - https://nostr1.com (open-source)

- utxo.one: 5,000,000 - https://relaying.io (open-source)

- Max DeMarco: 10,269,507 - https://www.youtube.com/watch?v=aA-jiiepOrE

- BOUNTY optout21: 1,000,000 - https://github.com/optout21/nip41-proto0 (proposed nip41 CLI)

- BOUNTY Leo: 1,000,000 - https://github.com/leo-lox/camelus (an old relay thing I forgot exactly)

June 2023

- BOUNTY: Sepher: 2,000,000 - a webapp for making lists of anything: https://pinstr.app/

- BOUNTY: Kieran: 10,000,000 - implement gossip algorithm on Snort, implement all the other nice things: manual relay selection, following hints etc.

- Mattn: 5,000,000 - a myriad of projects and contributions to Nostr projects: https://github.com/search?q=owner%3Amattn+nostr&type=code

- BOUNTY: lynn: 2,000,000 - a simple and clean git nostr CLI written in Go, compatible with William's original git-nostr-tools; and implement threaded comments on https://github.com/fiatjaf/nocomment.

- Jack Chakany: 5,000,000 - https://github.com/jacany/nblog

- BOUNTY: Dan: 2,000,000 - https://metadata.nostr.com/

April 2023

- BOUNTY: Blake Jakopovic: 590,000 - event deleter tool, NIP dependency organization

- BOUNTY: koalasat: 1,000,000 - display relays

- BOUNTY: Mike Dilger: 4,000,000 - display relays, follow event hints (Gossip)

- BOUNTY: kaiwolfram: 5,000,000 - display relays, follow event hints, choose relays to publish (Nozzle)

- Daniele Tonon: 3,000,000 - Gossip

- bu5hm4nn: 3,000,000 - Gossip

- BOUNTY: hodlbod: 4,000,000 - display relays, follow event hints

March 2023

- Doug Hoyte: 5,000,000 sats - https://github.com/hoytech/strfry

- Alex Gleason: 5,000,000 sats - https://gitlab.com/soapbox-pub/mostr

- verbiricha: 5,000,000 sats - https://badges.page/, https://habla.news/

- talvasconcelos: 5,000,000 sats - https://migrate.nostr.com, https://read.nostr.com, https://write.nostr.com/

- BOUNTY: Gossip model: 5,000,000 - https://camelus.app/

- BOUNTY: Gossip model: 5,000,000 - https://github.com/kaiwolfram/Nozzle

- BOUNTY: Bounty Manager: 5,000,000 - https://nostrbounties.com/

February 2023

- styppo: 5,000,000 sats - https://hamstr.to/

- sandwich: 5,000,000 sats - https://nostr.watch/

- BOUNTY: Relay-centric client designs: 5,000,000 sats https://bountsr.org/design/2023/01/26/relay-based-design.html

- BOUNTY: Gossip model on https://coracle.social/: 5,000,000 sats

- Nostrovia Podcast: 3,000,000 sats - https://nostrovia.org/

- BOUNTY: Nostr-Desk / Monstr: 5,000,000 sats - https://github.com/alemmens/monstr

- Mike Dilger: 5,000,000 sats - https://github.com/mikedilger/gossip

January 2023

- ismyhc: 5,000,000 sats - https://github.com/Galaxoid-Labs/Seer

- Martti Malmi: 5,000,000 sats - https://iris.to/

- Carlos Autonomous: 5,000,000 sats - https://github.com/BrightonBTC/bija

- Koala Sat: 5,000,000 - https://github.com/KoalaSat/nostros

- Vitor Pamplona: 5,000,000 - https://github.com/vitorpamplona/amethyst

- Cameri: 5,000,000 - https://github.com/Cameri/nostream

December 2022

- William Casarin: 7 BTC - splitting the fund

- pseudozach: 5,000,000 sats - https://nostr.directory/

- Sondre Bjellas: 5,000,000 sats - https://notes.blockcore.net/

- Null Dev: 5,000,000 sats - https://github.com/KotlinGeekDev/Nosky

- Blake Jakopovic: 5,000,000 sats - https://github.com/blakejakopovic/nostcat, https://github.com/blakejakopovic/nostreq and https://github.com/blakejakopovic/NostrEventPlayground

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 91bea5cd:1df4451c

2025-04-15 06:27:28

@ 91bea5cd:1df4451c

2025-04-15 06:27:28Básico

bash lsblk # Lista todos os diretorios montados.Para criar o sistema de arquivos:

bash mkfs.btrfs -L "ThePool" -f /dev/sdxCriando um subvolume:

bash btrfs subvolume create SubVolMontando Sistema de Arquivos:

bash mount -o compress=zlib,subvol=SubVol,autodefrag /dev/sdx /mntLista os discos formatados no diretório:

bash btrfs filesystem show /mntAdiciona novo disco ao subvolume:

bash btrfs device add -f /dev/sdy /mntLista novamente os discos do subvolume:

bash btrfs filesystem show /mntExibe uso dos discos do subvolume:

bash btrfs filesystem df /mntBalancea os dados entre os discos sobre raid1:

bash btrfs filesystem balance start -dconvert=raid1 -mconvert=raid1 /mntScrub é uma passagem por todos os dados e metadados do sistema de arquivos e verifica as somas de verificação. Se uma cópia válida estiver disponível (perfis de grupo de blocos replicados), a danificada será reparada. Todas as cópias dos perfis replicados são validadas.

iniciar o processo de depuração :

bash btrfs scrub start /mntver o status do processo de depuração Btrfs em execução:

bash btrfs scrub status /mntver o status do scrub Btrfs para cada um dos dispositivos

bash btrfs scrub status -d / data btrfs scrub cancel / dataPara retomar o processo de depuração do Btrfs que você cancelou ou pausou:

btrfs scrub resume / data

Listando os subvolumes:

bash btrfs subvolume list /ReportsCriando um instantâneo dos subvolumes:

Aqui, estamos criando um instantâneo de leitura e gravação chamado snap de marketing do subvolume de marketing.

bash btrfs subvolume snapshot /Reports/marketing /Reports/marketing-snapAlém disso, você pode criar um instantâneo somente leitura usando o sinalizador -r conforme mostrado. O marketing-rosnap é um instantâneo somente leitura do subvolume de marketing

bash btrfs subvolume snapshot -r /Reports/marketing /Reports/marketing-rosnapForçar a sincronização do sistema de arquivos usando o utilitário 'sync'

Para forçar a sincronização do sistema de arquivos, invoque a opção de sincronização conforme mostrado. Observe que o sistema de arquivos já deve estar montado para que o processo de sincronização continue com sucesso.

bash btrfs filsystem sync /ReportsPara excluir o dispositivo do sistema de arquivos, use o comando device delete conforme mostrado.

bash btrfs device delete /dev/sdc /ReportsPara sondar o status de um scrub, use o comando scrub status com a opção -dR .

bash btrfs scrub status -dR / RelatóriosPara cancelar a execução do scrub, use o comando scrub cancel .

bash $ sudo btrfs scrub cancel / ReportsPara retomar ou continuar com uma depuração interrompida anteriormente, execute o comando de cancelamento de depuração

bash sudo btrfs scrub resume /Reportsmostra o uso do dispositivo de armazenamento:

btrfs filesystem usage /data

Para distribuir os dados, metadados e dados do sistema em todos os dispositivos de armazenamento do RAID (incluindo o dispositivo de armazenamento recém-adicionado) montados no diretório /data , execute o seguinte comando:

sudo btrfs balance start --full-balance /data

Pode demorar um pouco para espalhar os dados, metadados e dados do sistema em todos os dispositivos de armazenamento do RAID se ele contiver muitos dados.

Opções importantes de montagem Btrfs

Nesta seção, vou explicar algumas das importantes opções de montagem do Btrfs. Então vamos começar.

As opções de montagem Btrfs mais importantes são:

**1. acl e noacl

**ACL gerencia permissões de usuários e grupos para os arquivos/diretórios do sistema de arquivos Btrfs.

A opção de montagem acl Btrfs habilita ACL. Para desabilitar a ACL, você pode usar a opção de montagem noacl .

Por padrão, a ACL está habilitada. Portanto, o sistema de arquivos Btrfs usa a opção de montagem acl por padrão.

**2. autodefrag e noautodefrag

**Desfragmentar um sistema de arquivos Btrfs melhorará o desempenho do sistema de arquivos reduzindo a fragmentação de dados.

A opção de montagem autodefrag permite a desfragmentação automática do sistema de arquivos Btrfs.

A opção de montagem noautodefrag desativa a desfragmentação automática do sistema de arquivos Btrfs.

Por padrão, a desfragmentação automática está desabilitada. Portanto, o sistema de arquivos Btrfs usa a opção de montagem noautodefrag por padrão.

**3. compactar e compactar-forçar

**Controla a compactação de dados no nível do sistema de arquivos do sistema de arquivos Btrfs.

A opção compactar compacta apenas os arquivos que valem a pena compactar (se compactar o arquivo economizar espaço em disco).

A opção compress-force compacta todos os arquivos do sistema de arquivos Btrfs, mesmo que a compactação do arquivo aumente seu tamanho.

O sistema de arquivos Btrfs suporta muitos algoritmos de compactação e cada um dos algoritmos de compactação possui diferentes níveis de compactação.

Os algoritmos de compactação suportados pelo Btrfs são: lzo , zlib (nível 1 a 9) e zstd (nível 1 a 15).

Você pode especificar qual algoritmo de compactação usar para o sistema de arquivos Btrfs com uma das seguintes opções de montagem:

- compress=algoritmo:nível

- compress-force=algoritmo:nível

Para obter mais informações, consulte meu artigo Como habilitar a compactação do sistema de arquivos Btrfs .

**4. subvol e subvolid

**Estas opções de montagem são usadas para montar separadamente um subvolume específico de um sistema de arquivos Btrfs.

A opção de montagem subvol é usada para montar o subvolume de um sistema de arquivos Btrfs usando seu caminho relativo.

A opção de montagem subvolid é usada para montar o subvolume de um sistema de arquivos Btrfs usando o ID do subvolume.

Para obter mais informações, consulte meu artigo Como criar e montar subvolumes Btrfs .

**5. dispositivo

A opção de montagem de dispositivo** é usada no sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs.

Em alguns casos, o sistema operacional pode falhar ao detectar os dispositivos de armazenamento usados em um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs. Nesses casos, você pode usar a opção de montagem do dispositivo para especificar os dispositivos que deseja usar para o sistema de arquivos de vários dispositivos Btrfs ou RAID.

Você pode usar a opção de montagem de dispositivo várias vezes para carregar diferentes dispositivos de armazenamento para o sistema de arquivos de vários dispositivos Btrfs ou RAID.

Você pode usar o nome do dispositivo (ou seja, sdb , sdc ) ou UUID , UUID_SUB ou PARTUUID do dispositivo de armazenamento com a opção de montagem do dispositivo para identificar o dispositivo de armazenamento.

Por exemplo,

- dispositivo=/dev/sdb

- dispositivo=/dev/sdb,dispositivo=/dev/sdc

- dispositivo=UUID_SUB=490a263d-eb9a-4558-931e-998d4d080c5d

- device=UUID_SUB=490a263d-eb9a-4558-931e-998d4d080c5d,device=UUID_SUB=f7ce4875-0874-436a-b47d-3edef66d3424

**6. degraded

A opção de montagem degradada** permite que um RAID Btrfs seja montado com menos dispositivos de armazenamento do que o perfil RAID requer.

Por exemplo, o perfil raid1 requer a presença de 2 dispositivos de armazenamento. Se um dos dispositivos de armazenamento não estiver disponível em qualquer caso, você usa a opção de montagem degradada para montar o RAID mesmo que 1 de 2 dispositivos de armazenamento esteja disponível.

**7. commit

A opção commit** mount é usada para definir o intervalo (em segundos) dentro do qual os dados serão gravados no dispositivo de armazenamento.

O padrão é definido como 30 segundos.

Para definir o intervalo de confirmação para 15 segundos, você pode usar a opção de montagem commit=15 (digamos).

**8. ssd e nossd

A opção de montagem ssd** informa ao sistema de arquivos Btrfs que o sistema de arquivos está usando um dispositivo de armazenamento SSD, e o sistema de arquivos Btrfs faz a otimização SSD necessária.

A opção de montagem nossd desativa a otimização do SSD.

O sistema de arquivos Btrfs detecta automaticamente se um SSD é usado para o sistema de arquivos Btrfs. Se um SSD for usado, a opção de montagem de SSD será habilitada. Caso contrário, a opção de montagem nossd é habilitada.

**9. ssd_spread e nossd_spread

A opção de montagem ssd_spread** tenta alocar grandes blocos contínuos de espaço não utilizado do SSD. Esse recurso melhora o desempenho de SSDs de baixo custo (baratos).

A opção de montagem nossd_spread desativa o recurso ssd_spread .

O sistema de arquivos Btrfs detecta automaticamente se um SSD é usado para o sistema de arquivos Btrfs. Se um SSD for usado, a opção de montagem ssd_spread será habilitada. Caso contrário, a opção de montagem nossd_spread é habilitada.

**10. descarte e nodiscard

Se você estiver usando um SSD que suporte TRIM enfileirado assíncrono (SATA rev3.1), a opção de montagem de descarte** permitirá o descarte de blocos de arquivos liberados. Isso melhorará o desempenho do SSD.

Se o SSD não suportar TRIM enfileirado assíncrono, a opção de montagem de descarte prejudicará o desempenho do SSD. Nesse caso, a opção de montagem nodiscard deve ser usada.

Por padrão, a opção de montagem nodiscard é usada.

**11. norecovery

Se a opção de montagem norecovery** for usada, o sistema de arquivos Btrfs não tentará executar a operação de recuperação de dados no momento da montagem.

**12. usebackuproot e nousebackuproot

Se a opção de montagem usebackuproot for usada, o sistema de arquivos Btrfs tentará recuperar qualquer raiz de árvore ruim/corrompida no momento da montagem. O sistema de arquivos Btrfs pode armazenar várias raízes de árvore no sistema de arquivos. A opção de montagem usebackuproot** procurará uma boa raiz de árvore e usará a primeira boa que encontrar.

A opção de montagem nousebackuproot não verificará ou recuperará raízes de árvore inválidas/corrompidas no momento da montagem. Este é o comportamento padrão do sistema de arquivos Btrfs.

**13. space_cache, space_cache=version, nospace_cache e clear_cache

A opção de montagem space_cache** é usada para controlar o cache de espaço livre. O cache de espaço livre é usado para melhorar o desempenho da leitura do espaço livre do grupo de blocos do sistema de arquivos Btrfs na memória (RAM).

O sistema de arquivos Btrfs suporta 2 versões do cache de espaço livre: v1 (padrão) e v2

O mecanismo de cache de espaço livre v2 melhora o desempenho de sistemas de arquivos grandes (tamanho de vários terabytes).

Você pode usar a opção de montagem space_cache=v1 para definir a v1 do cache de espaço livre e a opção de montagem space_cache=v2 para definir a v2 do cache de espaço livre.

A opção de montagem clear_cache é usada para limpar o cache de espaço livre.

Quando o cache de espaço livre v2 é criado, o cache deve ser limpo para criar um cache de espaço livre v1 .

Portanto, para usar o cache de espaço livre v1 após a criação do cache de espaço livre v2 , as opções de montagem clear_cache e space_cache=v1 devem ser combinadas: clear_cache,space_cache=v1

A opção de montagem nospace_cache é usada para desabilitar o cache de espaço livre.

Para desabilitar o cache de espaço livre após a criação do cache v1 ou v2 , as opções de montagem nospace_cache e clear_cache devem ser combinadas: clear_cache,nosapce_cache

**14. skip_balance

Por padrão, a operação de balanceamento interrompida/pausada de um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs será retomada automaticamente assim que o sistema de arquivos Btrfs for montado. Para desabilitar a retomada automática da operação de equilíbrio interrompido/pausado em um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs, você pode usar a opção de montagem skip_balance .**

**15. datacow e nodatacow

A opção datacow** mount habilita o recurso Copy-on-Write (CoW) do sistema de arquivos Btrfs. É o comportamento padrão.

Se você deseja desabilitar o recurso Copy-on-Write (CoW) do sistema de arquivos Btrfs para os arquivos recém-criados, monte o sistema de arquivos Btrfs com a opção de montagem nodatacow .

**16. datasum e nodatasum

A opção datasum** mount habilita a soma de verificação de dados para arquivos recém-criados do sistema de arquivos Btrfs. Este é o comportamento padrão.

Se você não quiser que o sistema de arquivos Btrfs faça a soma de verificação dos dados dos arquivos recém-criados, monte o sistema de arquivos Btrfs com a opção de montagem nodatasum .

Perfis Btrfs

Um perfil Btrfs é usado para informar ao sistema de arquivos Btrfs quantas cópias dos dados/metadados devem ser mantidas e quais níveis de RAID devem ser usados para os dados/metadados. O sistema de arquivos Btrfs contém muitos perfis. Entendê-los o ajudará a configurar um RAID Btrfs da maneira que você deseja.

Os perfis Btrfs disponíveis são os seguintes:

single : Se o perfil único for usado para os dados/metadados, apenas uma cópia dos dados/metadados será armazenada no sistema de arquivos, mesmo se você adicionar vários dispositivos de armazenamento ao sistema de arquivos. Assim, 100% do espaço em disco de cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos pode ser utilizado.

dup : Se o perfil dup for usado para os dados/metadados, cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos manterá duas cópias dos dados/metadados. Assim, 50% do espaço em disco de cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos pode ser utilizado.

raid0 : No perfil raid0 , os dados/metadados serão divididos igualmente em todos os dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, não haverá dados/metadados redundantes (duplicados). Assim, 100% do espaço em disco de cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos pode ser usado. Se, em qualquer caso, um dos dispositivos de armazenamento falhar, todo o sistema de arquivos será corrompido. Você precisará de pelo menos dois dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid0 .

raid1 : No perfil raid1 , duas cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, a matriz RAID pode sobreviver a uma falha de unidade. Mas você pode usar apenas 50% do espaço total em disco. Você precisará de pelo menos dois dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid1 .

raid1c3 : No perfil raid1c3 , três cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, a matriz RAID pode sobreviver a duas falhas de unidade, mas você pode usar apenas 33% do espaço total em disco. Você precisará de pelo menos três dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid1c3 .

raid1c4 : No perfil raid1c4 , quatro cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, a matriz RAID pode sobreviver a três falhas de unidade, mas você pode usar apenas 25% do espaço total em disco. Você precisará de pelo menos quatro dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid1c4 .

raid10 : No perfil raid10 , duas cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos, como no perfil raid1 . Além disso, os dados/metadados serão divididos entre os dispositivos de armazenamento, como no perfil raid0 .

O perfil raid10 é um híbrido dos perfis raid1 e raid0 . Alguns dos dispositivos de armazenamento formam arrays raid1 e alguns desses arrays raid1 são usados para formar um array raid0 . Em uma configuração raid10 , o sistema de arquivos pode sobreviver a uma única falha de unidade em cada uma das matrizes raid1 .