-

@ 9ca447d2:fbf5a36d

2025-06-07 12:02:04

@ 9ca447d2:fbf5a36d

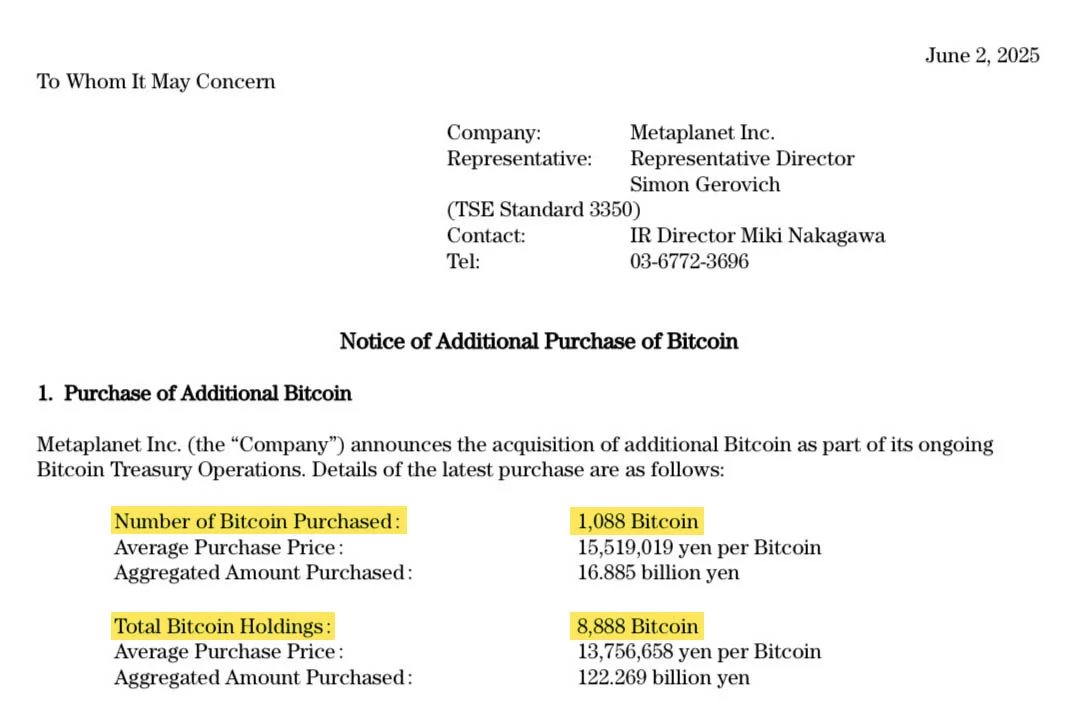

2025-06-07 12:02:04Metaplanet Inc. has bought 1,088 more bitcoin (BTC), and now holds 8,888 BTC worth over $930 million. This puts Metaplanet in the top 10 corporate bitcoin holders, ahead of Galaxy Digital and Block Inc.

Metaplanet Inc. on X

The company’s CEO Simon Gerovich announced the purchase on X on June 2, 2025. The company bought the new BTC at an average price of around $107,771 per coin, costing the company approximately $117.3 million.

The company said this purchase brings them 90% of the way to their 2025 goal of 10,000 BTC.

Metaplanet only started its bitcoin treasury policy in April 2024 but has been moving fast. At the start of 2025, it had less than 2,000 BTC, and now it has over 8,800.

This has been done through a combination of stock rights exercises and bond issuances, raising capital without diluting existing shareholders. In May 2025 alone, Metaplanet issued zero-coupon, non-interest-bearing bonds for a combined value of $71 million.

According to the filings, the company recently completed its “21 Million Plan” which was a program that involved the full exercise of 210 million stock acquisition rights.

These stock rights allowed Metaplanet to raise capital through equity sales while limiting dilution risk.

Metaplanet’s Bitcoin strategist, Dylan LeClair, said the company views bitcoin as a core part of its financial strategy and is all in, not just making small allocations.

Metaplanet’s buying has paid off in more ways than one.

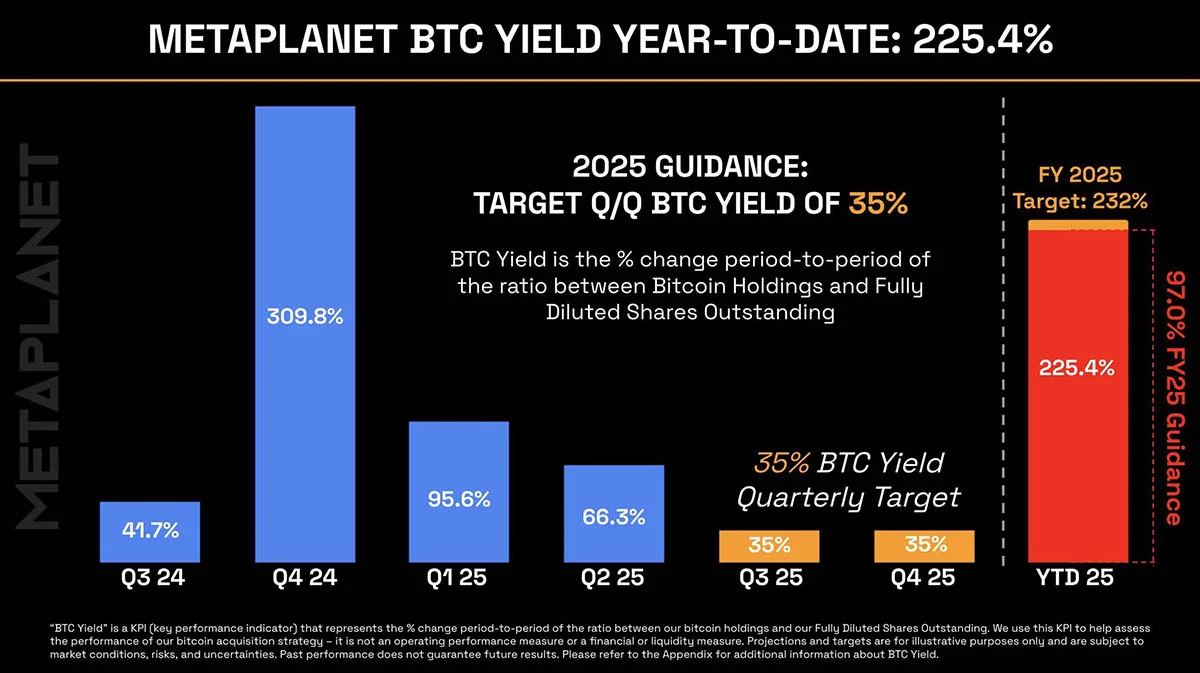

Its BTC Yield, a company metric that compares bitcoin holdings to total shares, has impressed investors. In Q2 2025 it had a 66.3% BTC Yield, year-to-date it has a 225% BTC Yield.

Metaplanet BTC Yield over time — Vincent on X

The stock is up 155% in the last month and is currently trading at 1,149 JPY, despite the overall volatility in the Tokyo Stock Exchange—where many other companies are under pressure due to the rising Japanese bond yields.

Analysts say the company still has more room to run.

Analysts say the company’s mNAV is back to 4.75 and the stock is undervalued compared to Strategy.

mNAV is short for “multiple of Net Asset Value” and is a metric used to compare the market’s valuation of a company to the actual value of its assets, primarily its bitcoin holdings.

Metaplanet is called “Japan’s Strategy”, a reference to Michael Saylor’s Strategy, the U.S.-based company that holds over 580,000 BTC—the most of any company in the world.

The corporate bitcoin boom isn’t stopping with Strategy and Metaplanet. On May 28, 2025 GameStop announced it had bought 4,710 BTC, worth over $512 million, its first foray into bitcoin after updating its investment policy this year.

-

@ 6a6be47b:3e74e3e1

2025-06-07 09:28:14

@ 6a6be47b:3e74e3e1

2025-06-07 09:28:14Hi frens! 📕

How are you today? How’s your weekend going? I hope you’ve found a moment to rest and recharge—even just for a few minutes. If you’re on the hunt for your next great read, I’ve got something exciting to share!

I just found out that the new book from Robert Galbraith (aka J.K. Rowling) "The Hallmarked Man" has finally been announced! It’s coming out this September, and I’ll admit—I screamed and did a little happy dance. The last book ended on such a major cliffhanger!

🕵️♂️ If you’re not familiar, Robert Galbraith is Rowling’s pen name for her detective series featuring the duo Cormoran Strike and Robin Ellacott. Strike is the founder of their private investigation agency, and Robin, who started as a temp secretary, quickly proved she’s a natural-born detective (and it’s been her dream job for years).

If you’re wondering whether you need to read the earlier books first, I get it. The story of Robin and Strike definitely makes more sense if you start from the beginning, but Rowling is clever—she avoids major spoilers, so you can jump in out of order if you want (like I did!). Just be warned: you’ll get hooked and want to know what happens next.

Each book centers on a new crime for Strike and Robin to solve, so you’re pulled into the mystery first—and then deeper into their lives. That’s part of what makes the series so addictive.

📖 Why am I so hyped for the new release? The last book, The Running Grave, was a wild ride: tense, heart-wrenching, and impossible to put down. I was on the edge of my seat the whole time! For me, it’s the best in the series so far. By the end, I was fully invested in all the characters—even the secondary ones. I just had to know what would happen to them.

Of course, not everyone is a fan of Rowling’s style, and some say her books could use a bit of editing. But I think she weaves tension, character development, and mystery together brilliantly. To each their own, though!

❤️ I have really high hopes for the next book this fall. If you love mysteries with complex characters and dark twists, I hope you’ll give this series a shot. Sometimes the truth is even darker than you expect!

Let me know what you think if you’ve read them—or if you’re planning to start.

🌟 Enjoy your weekend and godspeed!

https://stacker.news/items/999611

-

@ 044da344:073a8a0e

2025-06-07 07:49:53

@ 044da344:073a8a0e

2025-06-07 07:49:53Es ist merkwürdig, wie sich die Dinge manchmal fügen. Himmelfahrt bin ich mit den beiden größeren Enkeln, 2 und 4, in einen Zirkus gegangen. Wir mussten ein wenig suchen, okay, haben das Zelt aber irgendwann entdeckt am Ufer des Regen. Ich könnte schreiben: klein, aber fein, so richtig trifft es das jedoch nicht. Klein schon. Ich will hier auch nicht schimpfen, weil sich die Zirkusfamilie alle Mühe gegeben hat, einen preisgekrönten Artisten dabeihatte (Silberner Clown in Monte Carlo) und sogar reichlich Tiere in die Manege brachte. Vier Araberpferde, zwei Dromedare, einen Esel und Ziegen.

Dann aber kamen die Katzen. Richtig gelesen. Katzen dort, wo es Tiger, Löwen, Bären gegeben hat, als ich selbst noch ein Kind war. Ich meine gar nicht die großen Zelte in der DDR, Berolina, Busch oder Aeros. Diese Riesen verirrten sich nicht in einen Badeort auf Rügen. Die Wiese gleich hinter unserem Haus gehörte ab Anfang der 1980er Rüdiger Probst, alle paar Jahre wieder. Ein junger Mann, der gar nicht so viel älter war als ich, keine Angst vor großen Tieren hatte und mit einem Salto von Pferd zu Pferd sprang. In einem kleinen Zirkus wie gesagt, für ein paar Groschen und meist vor vollem Haus. Mit den Enkeln hatte ich jetzt allen Platz der Welt und hinterher ein leeres Portemonnaie. Sieben Euro allein für Popcorn (es gab nur eine Tütengröße) und fünf (freiwillig) für ein paar Möhrenstücke, damit die Kinder in der Pause was zum Füttern in der Hand hatten.

Am Abend dann das neue Buch von Matthias Krauß. „Die falschen Fragen gestellt“. Ich habe mich ein wenig gewundert, als das Paket im Kasten lag, weil der Autor vor gar nicht allzu langer Zeit einen „einseitigen Waffenstillstand“ ausgerufen hatte und Schluss machen wollte mit seinem Kampf gegen die „Aufarbeitungsindustrie“ und mit der Verteidigung der DDR. Ich zitiere einfach aus meiner Rezension von 2019:

Matthias Krauß, 1960 in Hennigsdorf geboren, weiß natürlich, was da alles im Argen lag. Er hat selbst an der Sektion Journalistik studiert und in den späten 1980ern noch ein wenig für die Parteipresse gearbeitet. „Apologetisch“, sagt er. Vor allem Innen- und Wirtschaftspolitik. Sein Aber: erstens die Kultur. Begegnungen vor allem mit dem, was in Osteuropa so an Filmen, Serien, Kunst produziert wurde. Punkt zwei: „der einfache Mensch“. „Ungleich häufiger“ im Bild als heute. Und drittens „gab es eine prinzipielle und grundsätzliche Kritik“ am Westen und am Kapitalismus.

Der Zirkus am Ufer des Regen. Ein totes Pferd soll man nicht reiten. Deshalb tauche ich ein in ein Buch, das etwas schafft, was selbst ich nicht für möglich gehalten habe. Matthias Krauß singt ein Loblied auf den DDR-Journalismus, ohne dass es peinlich wird. Er bleibt dabei ganz bei sich – bei der Mappe mit Zeitungsausschnitten, die er als Schüler angelegt hat, bei den Aktbildern im Magazin, das sein Vater abonniert hatte und das dem Sohn auch jenseits der Erotik ganze Welten öffnete, bei einem Porträt, das ihm die Lokalzeitung 1977 widmete.

Das Schöne ist: Matthias Krauß hat das alles aufgehoben und darf jetzt als reifer Mann zurückschauen – als Journalist, der später auch die andere Seite erlebt hat, folglich vergleichen kann und vor allem niemandem mehr nach dem Mund reden muss. Die „Qualität der Bilder“, okay. Eher „Kartoffeldruck“ als Zeitung. Die immer gleichen alten Männer, klar. Die Grenzen, die jedes Parteiorgan hat und die auch ein junger Mann wie Krauß schon zu spüren bekam. Aber eben auch Texte, die nah dran waren am Leben (vor allem an der Arbeit) und ihre Leser ernst nahmen. Matthias Krauß ist nach dem Studium 1986 Redakteur der Jugendseite des Potsdamer SED-Blatts geworden und ruft den Journalismusforschern heute zu: Vergleicht doch einfach die Bravo mit dem Neuen Leben, einer Zeitschrift, die damals sein Leitstern war und immer ausverkauft. These von Matthias Krauß: Das Neue Leben

war vielseitiger, anspruchsvoller und in jeder Hinsicht höherwertiger als die Bravo-Post, mit dem endlos einfältigen Star-Rummel, den auf Kauf und Konsum orientierten Modetipps, dem Klatsch und Abklatsch und den klischeehaften Rollenbildern – Ausdruck des insgesamt unpolitischen Grundanspruchs. Nun gut, aus exakt diesem Grund wird dieser Vergleich wohl niemals stattfinden. (S. 103)

Matthias Krauß hat ein kaum zu schlagendes Argument auf seiner Seite: Er, der SED-Propagandist, hatte nach 1990 schnell wieder das Vertrauen des Publikums, das er „bei Lichte besehen“ vielleicht gar nicht verdiente, aber allein wegen seiner Herkunft bekam (S. 116). Und: Er kann sogar jemanden zitieren, der die Ernte-Berichterstattung vermisst, Hassobjekt von Lesern wie von Journalisten – einen Landwirt aus dem Westen, der dort sehen konnte, wie weit die Kollegen waren, was sie wie machten und wie sie auf das Wetter reagierten (S. 166).

Ich gebe zu: Ich habe eine Schwäche für autobiografische Texte. Solche Bücher erlauben mir, all das mit Leben zu füllen, was in den Akten bald zu Staub zerfällt. Ich habe ein Fußballregal (gleich zweimal Lothar Matthäus!), eine DDR-Abteilung, Erinnerungen von Wissenschaftlern und natürlich Journalisten. Da längst nicht jeder schreibt, der etwas zu sagen hat, helfe ich immer wieder nach und sammle als Interviewer Lebensgeschichten ein. Matthias Krauß dürfte einer der ersten ostdeutschen Medienmenschen aus der Geburtskohorte um 1960 sein, der sich öffentlich äußert und dabei nicht einfach das nachbetet, was ohnehin schon überall steht.

Das gilt auch jenseits des Themas Journalismus. Der Wehrdienst, für mich bis heute ein Albtraum, wird von Matthias Krauß als „Entscheidung für eine Art persönlicher Freiheit“ interpretiert (S. 43). Mit 18 unabhängig sein von den Eltern und dann auch ohne Geldsorgen studieren können. Leipzig war für ihn in den 1980ern nicht nur Uni-Standort, sondern auch „Messestadt“ und damit „Weltstadt“ (S. 50). Und der Aufregung um jede DDR-Exmatrikulation, die er keineswegs schönredet, werden „die Millionen Opfer der Demokratisierung“ gegenübergestellt und das laute gesamtdeutsche Schweigen nicht nur in diesem Punkt (S. 58).

Was das alles mit dem Zirkus zu tun hat? Matthias Krauß hat in der DDR das Motto für sein Leben als Journalist gefunden – bei der Arbeit mit einem Parteisoldaten, der einfach nicht rauswollte aus dem Korsett, das die Genossen über sein Leben geworfen hatten.

Ja, sagte ich mir, stelle immer die falschen Fragen. (S. 153)

In Sachen Zirkus liegen alle Antworten auf dem Tisch. Meine Trauer habe ich schon vor mehr als zehn Jahren verarbeitet. Mal schauen, was die Enkel eines Tages dazu sagen.

Matthias Krauß: Die falschen Fragen gestellt. Journalist in zwei deutschen Staaten. Berlin: Das Neue Berlin 2025, 189 Seiten, 18 Euro.

-

@ 57d1a264:69f1fee1

2025-06-07 05:38:49

@ 57d1a264:69f1fee1

2025-06-07 05:38:49Every purchase we make ties us to a vast, hidden network of people, machines, and resources — whether we see it or not.

Supply chains are large industrial systems. They are composed of heterogeneous elements, such as ships, aircraft, trains, and trucks, but also systems of labor, information, and finance that build them and connect them together. Usually the goods flow in one direction and money flows in the opposite direction. Their physical substrates are themselves industrial products, relying on ships, trucks, cranes, fossil fuels, and electric power, tied together by skilled human operators, supervisors, managers, and other industrial roles.

Few of us would likely condone every moment of every supply chain for every product we consume.

Consider any product in your home. Where was it made? (That should be written on the label somewhere.) Where were the parts made? Who put them all together? How did it get to your doorstep?

Continue reading at https://thereader.mitpress.mit.edu/supply-chains-are-us/

https://stacker.news/items/999509

-

@ 9ca447d2:fbf5a36d

2025-06-07 11:01:31

@ 9ca447d2:fbf5a36d

2025-06-07 11:01:31LAS VEGAS, May 28 2025 — Blockstream, the global leader in Bitcoin-powered financial infrastructure, has today revealed its strategic vision to support Bitcoin’s next pivotal phase of growth, building on over a decade of pioneering work at the forefront of Bitcoin innovation.

Unveiled in a keynote by Blockstream Co-Founder and CEO Dr. Adam Back at Bitcoin 2025 in Las Vegas and anchored by a bold new tagline, The Future of Finance Runs on Bitcoin, the vision introduces a clear framework based on three core business units—Consumer, Enterprise and Blockstream Asset Management (BAM).

This framework represents a unified approach to onboarding users across the rapidly growing Bitcoin economy, from individuals to institutions.

“The past year has shown clearly that Bitcoin no longer sits on the margins of the global financial system—it is rapidly becoming the foundation,” said Dr. Back.

“Our vision is simple: The Future of Finance Runs on Bitcoin. Guided by this idea, Blockstream is working hard to build the vertically integrated platform to support that transition, from individual self-custody to enterprise-scale asset issuance and regulated investment products.”

A New Era for Bitcoin-Native Finance

According to crypto ETF analytics platform SoSoValue, Bitcoin has attracted over $41 billion in net ETF inflows alone since the launch of U.S. spot ETFs in early 2024, led by major institutions such as BlackRock, Fidelity, and Franklin Templeton.

At the same time, New Hampshire and Arizona have become the first U.S. states to pursue Strategic Bitcoin Reserves and the number of corporate treasuries holding bitcoin continues to climb.

With a market cap of just over $2 trillion and trillions settled annually on-chain, Bitcoin’s role as a legitimate financial layer is becoming increasingly clear, hastening the need for scalable infrastructure.

Blockstream has been building that infrastructure for over a decade.

Founded in 2014 by Dr. Adam Back—inventor of Bitcoin’s proof-of-work (PoW) mechanism—the company has focused from the outset on expanding Bitcoin’s functionality without compromising its foundational principles.

Blockstream Research, led by renowned cryptographer Andrew Poelstra, is a key contributor to Bitcoin Core and drives advances in applied cryptography and protocol development.

On the product side, Blockstream maintains Core Lightning (CLN) for scalable payments, the Liquid Network and Blocksteam Asset Management Platform (AMP) for tokenized asset issuance and settlement, as well as self-custody tools including the open-source Jade hardware wallet.

The All-New Blockstream App—Self Custody on Your Terms

Headlining today’s keynote was the launch of the all-new Blockstream app—a streamlined, self-custodial experience that lets users buy bitcoin and secure it immediately in their own wallet.

Built on the foundation of the trusted Blockstream Green wallet, the updated app offers seamless support for managing bitcoin and Liquid assets within a redesigned interface tailored to both new and experienced users.

The Blockstream app is designed to make onboarding intuitive from day one, minimizing friction while staying true to the principles of self-custody.

Users can begin simply and gradually adopt more advanced features at their own pace—including hardware signing and air-gapped transactions with the Blockstream Jade.

Current Blockstream Green users will find all existing functionality preserved within the redesigned interface.

With support for 31 languages, the app makes Bitcoin accessible to anyone with a smartphone, opening the door to secure, sovereign finance worldwide

“The new Blockstream app isn’t just a wallet,” said Peter Bain, VP of Consumer Products at Blockstream.

“It’s a gateway to the full power of Bitcoin—enabling secure savings, fast payments, and seamless management of tokenized assets, all within an intuitive interface designed for both newcomers and hardcore bitcoiners.”

Blockstream Enterprise: Bitcoin-Native Financial Infrastructure

Dr. Back also used his keynote to highlight the growing importance of Blockstream Enterprise, the company’s evolving platform for corporations, governments and participants across the broader financial sector.

Underpinned by the Liquid Network and Blockstream AMP, the platform enables secure asset issuance, as well as treasury and balance sheet management.

It also facilitates integration with custodians, exchanges and core financial systems via industry-standard FIX and REST APIs.

With the first iteration of AMP already available and additional features rolling out over time, the platform builds on Liquid’s momentum, which recently surpassed $3.27 billion in total value locked (TVL).

In doing so, it provides a Bitcoin-native foundation for tokenization and institutional settlement focused on regulated custody, compliant off-exchange settlement, and programmable financial instruments.

“As capital markets evolve, businesses, institutions, and governments will need infrastructure that is secure, programmable and built directly on Bitcoin’s rapidly growing network,” said Dr. Back.

“Blockstream Enterprise brings that infrastructure together—enabling asset issuance, management, and settlement on Liquid, Bitcoin’s first and most battle-tested sidechain.”

Unifying Consumer, Enterprise, and Institutional Products

Today’s keynote marks a strategic inflection point, aligning Blockstream’s efforts across the three market segments it serves.

In 2024, the company raised $210 million to accelerate development and launched Blockstream Asset Management (BAM), a dedicated division focused on institutional-grade Bitcoin investment products.

The company has also deepened collaborations with regulated custodians, corporate treasuries and financial service providers to support the integration of Liquid and AMP into existing financial infrastructure.

The Future of Finance Runs on Bitcoin

The vision laid out by Dr. Back reflects Blockstream’s conviction that Bitcoin is no longer just a $2 trillion asset class but a settlement layer, a development platform, and the most credible foundation for building the next financial system.

“The financial world is waking up to what we’ve known for years,” said Dr. Back. “Bitcoin is here to stay —and it’s never been easier to build on it.”

“From first-time users to trillion-dollar institutions, our aim is to give everyone the tools to participate in this new economy, with the transparency, security and resilience that only Bitcoin can provide.”

To learn more visit Booth 2121 at Bitcoin 2025 or visit www.blockstream.com.

Download the new Blockstream app today and take control of your bitcoin—on your terms.

Institutions, enterprises, and governments interested in building on Bitcoin with Liquid and AMP can connect with the Blockstream team directly at business@blockstream.com.

Media contact:

Edward Moore – Head of PR, Blockstream

emoore@blockstream.comAbout Blockstream

Founded in 2014, Blockstream is a global leader in Bitcoin and blockchain infrastructure, with offices and team members distributed around the world.

Serving as the technology provider for the Liquid Network, Blockstream offers a sidechain solution that enables secure, trustless Bitcoin swap settlements and robust smart contracts, empowering financial institutions to tokenize assets efficiently.

The company’s Core Lightning is a leading implementation of the open Lightning Network protocol, widely adopted for enterprise Bitcoin Lightning Network deployments.

Blockstream Jade, an open-source hardware wallet, delivers advanced security for Bitcoin and Liquid assets in an easy-to-use form factor.

For consumers, Blockstream app is a highly secure and user-friendly Bitcoin wallet.

Disclaimer

This press release contains forward-looking statements, including but not limited to statements regarding the expected launch timeline of the Blockstream Enterprise platform and time to market of Blockstream Asset Management products.

Other “forward looking statements” may, without limitation, include statements that are preceded by, followed by, or include the words “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “foresees,” or similar expressions, and other statements concerning anticipated future events and expectations that are not historical facts.

_Actual results may differ materially due to regulatory developments, competition from other hardware and technology services providers (in the case of Jade and the app) and both traditional finance and crypto native managers (in the case of BAM), market conditions and other risks. Actual results may differ materially. Blockstream undertakes no oblig

-

@ b1ddb4d7:471244e7

2025-06-07 11:01:14

@ b1ddb4d7:471244e7

2025-06-07 11:01:14Breez, a leader in Lightning Network infrastructure, and Spark, a bitcoin-native Layer 2 (L2) platform, today announced a groundbreaking collaboration to empower developers with tools to seamlessly integrate self-custodial bitcoin payments into everyday applications.

The partnership introduces a new implementation of the Breez SDK built on Spark’s bitcoin-native infrastructure, accelerating the evolution of bitcoin from “digital gold” to a global, permissionless currency.

The Breez SDK is expanding

We’re joining forces with @buildonspark to release a new nodeless implementation of the Breez SDK — giving developers the tools they need to bring Bitcoin payments to everyday apps.

Bitcoin-Native

Powered by Spark’s…— Breez

(@Breez_Tech) May 22, 2025

(@Breez_Tech) May 22, 2025A Bitcoin-Native Leap for Developers

The updated Breez SDK leverages Spark’s L2 architecture to deliver a frictionless, bitcoin-native experience for developers.

Key features include:

- Universal Compatibility: Bindings for all major programming languages and frameworks.

- LNURL & Lightning Address Support: Streamlined integration for peer-to-peer transactions.

- Real-Time Interaction: Instant mobile notifications for payment confirmations.

- No External Reliance: Built directly on bitcoin via Spark, eliminating bridges or third-party consensus.

This implementation unlocks use cases such as streaming content payments, social app monetization, in-game currencies, cross-border remittances, and AI micro-settlements—all powered by Bitcoin’s decentralized network.

Quotes from Leadership

Roy Sheinfeld, CEO of Breez:

“Developers are critical to bringing bitcoin into daily life. By building the Breez SDK on Spark’s revolutionary architecture, we’re giving builders a bitcoin-native toolkit to strengthen Lightning as the universal language of bitcoin payments.”Kevin Hurley, Creator of Spark:

“This collaboration sets the standard for global peer-to-peer transactions. Fast, open, and embedded in everyday apps—this is bitcoin’s future. Together, we’re equipping developers to create next-generation payment experiences.”David Marcus, Co-Founder and CEO of Lightspark:

“We’re thrilled to see developers harness Spark’s potential. This partnership marks an exciting milestone for the ecosystem.”Collaboration Details

As part of the agreement, Breez will operate as a Spark Service Provider (SSP), joining Lightspark in facilitating payments and expanding Spark’s ecosystem. Technical specifications for the SDK will be released later this year, with the full implementation slated for launch in 2025.About Breez

Breez pioneers Lightning Network solutions, enabling developers to embed self-custodial bitcoin payments into apps. Its SDK powers seamless, secure, and decentralized financial interactions.About Spark

Spark is a bitcoin-native Layer 2 infrastructure designed for payments and settlement, allowing developers to build directly on Bitcoin’s base layer without compromises. -

@ 57d1a264:69f1fee1

2025-06-07 05:28:26

@ 57d1a264:69f1fee1

2025-06-07 05:28:26In the early days of computer vision, when memory was scarce and every byte counted, innovation thrived under constraint. “An Efficient Chain-Linking Algorithm,” developed at Inria in the late 1980s, is a brilliant example of this spirit. Now preserved and shared by Software Heritage, this compact yet powerful piece of C code showcases how elegance and efficiency went hand in hand in outlining the future of image processing—one pixel chain at a time.

The code resulted from research work carried out between 1985 and 1991 at Inria, by Gérard Giraudon (research and principal investigator), Philippe Garnesson (a PhD student), and Patrick Cipière (software engineer). Down in sunny Sophia Antipolis, a tech park 20 minutes inland from Antibes, the team tackled computer vision with a distinctly local flavor. They called themselves PASTIS, a playful nod to the anise drink. Still, the acronym – Scene Analysis and Symbolic Image Processing Project (Projet d’Analyse de Scène et de Traitement d’Image Symbolique) – hinted at their serious mission.

Continue reading at https://www.softwareheritage.org/2025/06/04/history_computer_vision/

https://stacker.news/items/999507

-

@ 57d1a264:69f1fee1

2025-06-07 06:08:19

@ 57d1a264:69f1fee1

2025-06-07 06:08:19In the rural areas of Vietnam, people tend to give the land plot next to their house to their grown up children to build a new home – thus a new family. This poses many interesting problems about the two generation’s living spaces. In the case of Ai Nghia House, we pay close attention to the connection and privacy between the two families.

The skylit courtyard

Learning from the structure of traditional houses in Hoi An, we create a courtyard in the middle of the house, connecting the parents’ house and the children’s new house. The courtyard plays its role as a funnel collecting sunlight and natural wind, also, it’s a place for sharing daily stories, common or private. It’s a place where parents watch over the house and the kids, where families pass over a little spice in cooking time, or simply a place where the sky is only one perk away. The courtyard is thus shared naturally between the families as a continuation between generations.

The framed garden

The front garden is framed into a red brick facade, making the greenery stand out. Voids are boldly cut to allow sunlight to reach the plants, making the garden comes to life. Altogether that frame becomes a lively picture of nature and many daily moments of each member in the family.

Read more about Naqi & Partners at https://naqipartners.com/project/ai-nghia-house-quang-nam/

https://stacker.news/items/999526

-

@ 57d1a264:69f1fee1

2025-06-07 05:48:57

@ 57d1a264:69f1fee1

2025-06-07 05:48:57There is only one item on my CSS wishlist for 2025: a slower pace!

After years of rapid innovation, now feels like the right time for browser vendors to take a beat to consolidate, fix browser inconsistencies, and let the rest of us catch up.

After all, we might've heard about

subgrid, :has(), scroll-drivenanimations, and all the other recent CSS improvements – but how many of us can say that we've actually used all these features, let alone mastered them?This is why this year's survey will be so interesting. It'll be a chance to see which of the past few year's new CSS additions have already been adopted by the community, and which ones are still on our to-do list.

So once again, please join me for this year's State of CSS!

Take the survey at https://survey.devographics.com/en-US/survey/state-of-css/2025

https://stacker.news/items/999510

-

@ 523a8281:fc94329a

2025-06-07 05:11:07

@ 523a8281:fc94329a

2025-06-07 05:11:07The Darkest Hour of the GameFi Market and the Glimmer of Hope Amid the prolonged downturn of the cryptocurrency market, the GameFi sector is undergoing an unprecedented trial. According to CoinGecko data, the total market capitalization of the GameFi sector shrank by 35% from its peak in the first half of 2024. DappRadar statistics further confirm the industry's decline—numerous projects have struggled to maintain sustainable economic models, leading to severe user attrition. Although the number of daily active users has grown by 18%, this "volume up, price down" phenomenon reflects the market's painful transition from speculation-driven to value-driven development.

Even more alarming is that 93% of projects in the industry have either stagnated or perished, with the average project lifespan lasting a mere four months. Token prices have fallen more than 95% from their historical highs, extinguishing the enthusiasm of countless investors and players. The once-glorious "Play-to-Earn" and "X to Earn" models collapsed after the profit bubbles burst, exposing the fatal flaws of over-reliance on financial speculation while neglecting the essence of gaming.

However, crises often breed opportunities. The GameFi sector has not been crushed by the bear market but has instead started to clarify its future direction amid the turbulence. This deep market adjustment acts as a brutal filter, leaving only those projects that abandon token speculation, focus on player experience, and build sustainable economic systems to stand out during this industry-wide reshuffle.

- Neo Fantasy: A Game-Changer Breaking the Deadlock Neo Fantasy is not just a blockchain game; it is a gateway to the ACGN metaverse. In the mysterious land of Loren, players become brave adventurers tasked with reclaiming wealth from the forces of darkness. The game seamlessly integrates compelling storylines with cutting-edge blockchain technology, allowing players to immerse themselves in epic adventures while earning significant rewards through diverse gameplay. From the moment players step into the game, they are captivated by its unique charm—whether it's the vividly designed characters or the grand battle scenes, everything reflects Neo Fantasy's relentless pursuit of quality.

Looking back at the development trajectory of the GameFi industry, its collapse was no accident. Many past projects focused entirely on speculative financial incentives, neglecting the refinement of game content and the construction of community ecosystems. Complex and obscure tokenomics and flashy but impractical DeFi concepts attracted attention in the short term but failed to mask the lack of gameplay. Once token rewards diminished, users quickly scattered, leading to the project's rapid decline. This blind pursuit of short-term gains ultimately triggered a full-blown industry crisis, serving as a wake-up call for future projects.

Neo Fantasy has keenly identified these industry pitfalls and introduced a series of innovative measures to break the deadlock:

Enhancing User Experience: The team accurately addressed traditional gamers' aversion to complex blockchain interfaces by developing an independent application that combines the seamless operation of traditional games with the "play-to-earn" features of Web3. New players can easily get started without deep knowledge of blockchain technology. This low-barrier design significantly broadens the user base, attracting many players who were previously deterred by blockchain games.

Community and Market Expansion: Neo Fantasy has demonstrated strong strategic foresight by establishing deep collaborations with renowned platforms like Nextype, quickly amassing a large user base. Moreover, its plan to launch on mainstream app stores such as Google Play and the App Store aims to tap into the billion-user Web2 gaming market. This move will undoubtedly break the barriers of blockchain gaming, allowing more ordinary players to experience Neo Fantasy's unique charm and paving the way for broader growth.

Innovative Gameplay: Sustained innovation in gameplay is key to Neo Fantasy's vitality. The team has abandoned the outdated model of solely relying on token-driven user engagement and continuously introduces new features. PvE dungeons are filled with challenges and surprises, requiring strategic cooperation to overcome; the PvP arena is packed with skilled players, offering intense real-time battles; auto chess combines strategy and luck, making each match unpredictable; and guild tournaments emphasize teamwork, fostering strong bonds among players. Future plans for open-world and virtual-world experiences will further expand the game's boundaries, delivering unprecedented immersive experiences.

Sustainable Tokenomics: The construction of the token economy showcases the team's wisdom and vision. Centered around the ERT token, the system serves as both a governance tool and a utility token. Through a carefully designed economic cycle model, every in-game action—whether upgrading heroes, enhancing equipment, or participating in events—is closely tied to ERT. This design ensures the token's utility while avoiding unsustainable high-yield promises, achieving self-sufficient and healthy economic circulation. Additionally, offering free hero characters to new players lowers the participation barrier, attracting a diverse and loyal community of traditional gamers.

-

Breaking Through the Bear Market: Neo Fantasy's Keys to Success and Industry Insights Under the severe challenges of the bear market, Neo Fantasy's development strategy has pointed the way forward for GameFi projects. Gameplay is the foundation of survival; only with outstanding fun and playability can players truly immerse themselves. A strong community is the cornerstone of development; an active player community not only enhances user retention but also injects continuous vitality into the project. Leveraging mainstream platforms to expand the market is the necessary path to breaking through barriers and achieving large-scale growth. Meanwhile, a sustainable and transparent tokenomics model is the core element to ensure the long-term stability of the project. Continuous innovation is the key to standing out in a fiercely competitive market; only by consistently introducing new features can a project retain players' attention and maintain its competitiveness.

-

Looking Ahead: Concrete Actions to Lead the Next GameFi Revolution While the GameFi sector has suffered significant losses during the bear market, Neo Fantasy's rise offers hope for the industry's recovery. In the future, Neo Fantasy will take a series of practical actions to solidify its strengths and drive industry transformation:

Expanding Community Collaboration and Listening to Players: Neo Fantasy will broaden its community partnerships, working with global gaming forums, blockchain communities, and player groups. By hosting regular online and offline events and conducting surveys, the project will gather feedback on gameplay, economic systems, and social features. These insights will guide targeted improvements to ensure the game aligns with player needs, enhancing satisfaction and loyalty.

Optimizing Game Content for Premium Experiences: Resources will continue to be invested in developing and refining game content. This includes enriching storylines for immersive narratives, fine-tuning PvE dungeon difficulty curves and reward mechanisms, and improving PvP balance and fairness. The development of open-world and virtual-world features will also be accelerated, introducing innovative gameplay and interaction elements to provide players with more opportunities for exploration and creativity.

Strengthening Guild Systems to Promote Ecosystem Prosperity: Neo Fantasy will actively support in-game guild development by offering exclusive benefits and activities such as guild quests and rewards. A guild ranking system will incentivize growth, while cross-game and cross-platform collaborations will encourage interaction among players from different communities, expanding the game's influence and ecosystem.

Expanding the Ecosystem and Exploring New Possibilities: Beyond core gameplay, Neo Fantasy will actively expand its ecosystem. On the technical side, it will accelerate cross-chain compatibility to enable seamless flow of $ERT tokens and game assets across networks, attracting more external resources and users. In content creation, the project will support an ACGN creator program, encouraging community members to produce comics, novels, animations, and other content related to Neo Fantasy, enriching the game's cultural value and building a diverse ecosystem.

By focusing on player experience, community building, and sustainable development, Neo Fantasy has proven that GameFi can thrive even in a bear market. The future belongs to projects that prioritize high-quality gaming content and earn players' trust. Neo Fantasy not only survives but actively positions itself as a leader, driving the next GameFi revolution. For the GameFi industry, abandoning hype and focusing on quality is the key to standing out in a fiercely competitive market. Neo Fantasy is steadfastly walking this path, writing its own legend.

Follow Neo Fantasy on: Twitter: https://x.com/NeoFantasy_Game

Telegram: https://t.me/NeoFantasy2024

Youtube: https://www.youtube.com/@NeoFantasy2024

Medium: https://medium.com/@neofantasy419

-

@ 523a8281:fc94329a

2025-06-07 04:53:12

@ 523a8281:fc94329a

2025-06-07 04:53:12As the global financial landscape continues to evolve, the interaction between the cryptocurrency market and traditional financial systems is becoming increasingly intertwined. Crypto payment cards, serving as a critical bridge between the two, are emerging as a new force in the payments sector. According to a report by The Brainy Insights, the global crypto credit card market was valued at $25 billion in 2023 and is projected to surpass $400 billion by 2033, showcasing astonishing growth potential. Behind this rapid development is the relentless effort of payment providers to bridge the gap between crypto and traditional payment methods, striving to meet users' diverse payment needs. Currently, crypto payment card products are springing up like mushrooms after a rain and have already integrated with mainstream payment methods like Google Pay, Apple Pay, and Alipay, greatly enhancing their usability. Products like the Crypto. com Visa Card, Binance Card, Bybit Card, and Bitget Card, mostly launched by major cryptocurrency exchanges, hold significant influence in the market. In terms of technological innovation, some card issuers have even integrated DeFi protocols such as Ethena, Morpho, and USUAL, offering asset appreciation services to users and successfully building a comprehensive financial service ecosystem that extends from payments to wealth management. This further expands the application scope and value of crypto payment cards. Despite the unique advantages of cryptocurrency payments in terms of speed (46% of users choose it), cross-border cost efficiency (37% value low fees), and financial autonomy (32% pursue decentralization), a survey by Bitget Wallet reveals that their actual application scale still lags significantly behind traditional payment systems. The traditional payment market, worth trillions of dollars, covers the vast majority of daily transactions globally, while crypto payments occupy only a small share, mainly concentrated in niche scenarios like cross-border remittances and digital asset transactions. Users' preference for traditional payment methods primarily stems from concerns about trust and security. The security risks of crypto payments (e.g., hacking and fraud) leave users apprehensive, while traditional payments, backed by mature banking systems, legal protections, and dispute resolution mechanisms, significantly reduce transaction risks. Additionally, the price volatility of cryptocurrencies makes them unsuitable as stable transaction mediums, whereas the stability of traditional fiat currencies better aligns with daily consumer needs. Traditional payments also achieve seamless coverage through extensive POS terminals and online integrations, whereas the limited merchant acceptance of crypto payments restricts their practicality. Furthermore, the low operational barriers of traditional payment tools and the habitual usage formed over time, combined with the complexity and technical barriers of crypto wallets, pose challenges to the widespread adoption of crypto payments. Against this market backdrop, the VooPay digital asset card stands out, showcasing core advantages such as multi-chain technology integration, global compliance frameworks, and real-time payment innovations, redefining the crypto payment experience: 1. Breaking Efficiency Barriers with Multi-Chain Interoperability and Real-Time Payment Technology The VooPay digital asset card supports major cryptocurrencies like Bitcoin, Ethereum, USDT, and BNB (compatible with multi-chain protocols such as BEP-20 and TRC-20). Through an integrated cross-chain bridge, users can freely transfer assets across major blockchains like Ethereum, BNB Chain, and TRON without manual conversion. For instance, a freelancer in the UK receiving USDT payments from a U.S. client can directly convert it to GBP for consumption via the card, with the entire process settling in minutes and fees as low as 1.8%-2%. This represents a more than 90% improvement in efficiency and a 60%-80% reduction in costs compared to traditional bank cross-border transfers (5%-10% fees + 3-5 days settlement). The platform employs Layer 2 scaling technologies (e.g., zk-Rollups) to further optimize transaction throughput, supporting high-frequency, low-value payment scenarios. Additionally, its dynamic exchange rate locking feature helps users mitigate cryptocurrency price volatility risks, ensuring payment amount stability—for example, even if Bitcoin drops from $101,867 in January 2025 to $94,500 in February, users can still settle payments at the real-time exchange rate during consumption without needing to pre-convert to fiat currency. 2. Building Trust with a Global Payment Network and Compliance System Leveraging deep collaborations with Visa and MasterCard, the VooPay digital asset card covers 210 countries/regions and 150 million merchants (including offline retail, online e-commerce, and ATM networks). It supports integration with third-party platforms like Alipay, WeChat Pay, and Apple Pay, enabling seamless transitions between "crypto-to-fiat" payment scenarios. For instance, in the $20.5 billion spent by Canadians in the U.S. in 2024, using the VooPay card could bypass traditional bank exchange rate losses (averaging about 3%) and high fees, requiring only a fixed rate of 1.8%-2%. In terms of compliance, VooPay holds financial licenses in Europe and North America, strictly adhering to KYC (Know Your Customer) and AML (Anti-Money Laundering) standards. Users must complete identity verification to activate their cards. The digital asset cards are issued by banks in Hong Kong and the U.S., with funds segregated from platform operating assets and regularly audited by third-party institutions to ensure security. This ensures that every transaction complies with global regulatory requirements, especially under the backdrop of tightened financial regulations driven by Trump-era policies, providing users with reliable safeguards. 3. Revolutionizing User Experience and Extending the Ecosystem to Make Crypto Payments Mainstream The VooPay card is designed to balance high spending limits and operational convenience: the Gold Card has a daily spending limit of $7,500 and a monthly limit of $50,000, while the virtual card can be activated with as little as 10 USDT. It supports instant card issuance and multilingual interfaces (including Chinese). Users can view multi-chain asset distributions, transaction records, and real-time exchange rates via the app, significantly lowering the operational barriers compared to traditional crypto wallets. Moreover, the card integrates Zero-Knowledge Proof (ZKP) technology, protecting transaction privacy while meeting compliance requirements, allowing users to complete payment verification without disclosing sensitive information. On the ecosystem front, VooPay's native token, VOO, has diverse use cases, including payment fee discounts (20%), participation in liquidity mining, and community governance voting. Future plans include deep integration with DeFi protocols, enabling users to directly participate in staking, lending, and other financial activities via the card, building an integrated ecosystem of "payments-wealth management-governance." As a core project incubated by M3 DAO, VooPay is deeply embedded in its community ecosystem, which spans over 100 countries and includes more than 200,000 members. It serves as the designated payment hub for incubated projects like Rocket and MetaMars. Rocket, an IDO platform in the DeFi space, collaborates with VooPay to achieve seamless integration of crypto asset subscriptions and payments. Users can invest in Rocket projects using the VooPay card and enjoy VOO token fee discounts and priority benefits. MetaMars, on the other hand, extends VooPay's practical applications in metaverse scenarios, enabling users to purchase NFTs or virtual services with cryptocurrencies stored in their cards, with the system automatically converting to platform tokens at low fees. Together, the three entities drive VooPay's construction of an integrated ecosystem of "payments + investments + applications," promoting the adoption of cryptocurrencies in diverse scenarios. 4. Differentiated Competitiveness to Address Market Challenges Compared to traditional payments and competitors, VooPay's core advantages lie in: ●Dual-Driven by Technology and Compliance: Enhancing efficiency through cross-chain interoperability and Layer 2 technologies while building trust with financial licenses in Europe and North America and segregated fund custody. ●Deep Integration of Scenarios and Ecosystems: Covering diverse scenarios such as personal consumption, enterprise cross-border acquiring, and DeFi finance, rather than being limited to single-use transaction functions. ●Accurate Matching of User Needs: Addressing pain points in cross-border payments (low cost, real-time), privacy and security demands (ZKP technology), and operational barriers (one-click integration with mainstream payments) with systematic solutions. Looking ahead, as blockchain technology matures and global regulatory environments gradually open up, VooPay is poised to carve out a larger space in the crypto payment card market with its triple advantages of "technological innovation + compliance framework + ecosystem expansion." It aims to drive cryptocurrencies from "marginal payments" to "daily necessities," becoming a mainstream gateway connecting Web3 and the real economy.

-

@ da8b7de1:c0164aee

2025-06-07 04:42:05

@ da8b7de1:c0164aee

2025-06-07 04:42:05Nukleáris technológiai és projektfejlesztési hírek

Több jelentős nemzetközi fejlemény történt a nukleáris energia területén. A Westinghouse Electric Company megkapta az amerikai Energiaügyi Minisztériumtól a kulcsfontosságú biztonsági jóváhagyást az eVinci mikroreaktorához, ami fontos lépés ennek az innovatív nukleáris technológiának a bevezetése felé. A vállalat Idaho államban tervezi egy tesztreaktor létesítését, ami jól mutatja, hogy a mikroreaktorok piaca egyre nagyobb lendületet kap.

Eközben a nukleáris kapacitás gyors bővítéséhez szükséges ellátási lánc felkészültsége volt a fő témája a World Nuclear Association első konferenciájának. Jelentős projektfrissítések között szerepel a kritikus turbinakomponensek beszerelése a kínai Haiyang atomerőműben, az indiai Mahi Banswara Rajasthan Atomerőmű négy blokkjára vonatkozó szabályozói engedély, valamint egy új olaszországi partnerség, a Nuclitalia, amely fejlett nukleáris technológiákra fókuszál. Belgiumban a Nukleáris Kutatóközpont hivatalos konzultációkat indított egy ólom-hűtésű kis moduláris reaktor (SMR) ügyében, Brazília pedig bejelentette, hogy Oroszországgal közösen fejleszt SMR-projektet.

Szabályozási és biztonsági aktualitások

A Nemzetközi Atomenergia-ügynökség (IAEA) meghosszabbította a tanulmányok benyújtási határidejét a közelgő, nukleáris létesítmények ellenállóképességéről szóló konferenciájára, hangsúlyozva a nukleáris létesítmények alkalmazkodásának fontosságát a klímaváltozás jelentette növekvő kockázatokhoz. A konferenciát 2025 októberében rendezik Bécsben, és fő témája a nukleáris létesítmények biztonságának és ellenállóképességének növelése lesz, különös tekintettel a külső eseményekre, mint az árvizek és földrengések.

Kanadában a Nukleáris Biztonsági Bizottság engedélyezte az Ontario Power Generation számára, hogy megkezdje egy BWRX-300 típusú reaktor építését a Darlington New Nuclear Project helyszínén, ami a nukleáris építkezések folyamatos szabályozói támogatását mutatja. Az Egyesült Államokban a Nukleáris Szabályozási Bizottság további 20 évvel meghosszabbította a Duke Energy Oconee atomerőművi blokkjainak üzemeltetési engedélyét, valamint támogatást nyújtott a michigani Palisades atomerőmű újraindításához.

Iparági és gazdasági trendek

Az iparági vezetők optimistán nyilatkoztak a nukleáris energia jelenlegi helyzetéről, kiemelve az Egyesült Államokban zajló aktív projekteket (például a TerraPower Wyomingban és az X-energy együttműködése a Dow vállalattal), valamint a fejlett nukleáris üzemanyaggyártásba irányuló magánbefektetések növekedését. Felmerült az is, hogy a Világbank nukleáris projekteket is finanszírozhatna, ami tovább ösztönözhetné a globális beruházásokat, és megerősítené a nukleáris energia szerepét az energetikai átmenetben.

Belgiumban a kormány és az Engie közüzemi vállalat végleges megállapodást kötött a Tihange 3 és Doel 4 reaktorok üzemidejének tíz évvel történő meghosszabbításáról, amely az energiabiztonságot és a radioaktív hulladék kezelését is szolgálja. Németországban a nukleáris technológiai szövetség hangsúlyozta, hogy akár hat, nemrégiben leállított reaktor újraindítása technikailag megvalósítható, és a nukleáris energia biztonságos, gazdaságos, valamint klímabarát alternatívát jelent.

Nemzetközi együttműködés és kutatás

Kanadában a Prodigy Clean Energy és a Serco közel jár a szállítható atomerőművek tesztprogramjának befejezéséhez, amelynek középpontjában a biztonság és az extrém helyzetekben való ellenállóképesség áll. Az EnergySolutions és a WEC Energy Group új nukleáris kapacitás létesítését vizsgálja a wisconsini Kewaunee helyszínen, és előzetes engedélyeket kívánnak szerezni a jövőbeni telepítéshez.

Az IAEA ismételten hangsúlyozta, hogy kész támogatni a Zaporizzsjai Atomerőműre vonatkozó megállapodásokat, amely továbbra is orosz katonai ellenőrzés alatt áll, kiemelve a térségben fennálló geopolitikai és biztonsági kihívásokat.

Források:

world-nuclear-news.org

nucnet.org

iaea.org

ans.org -

@ 5d4b6c8d:8a1c1ee3

2025-06-07 02:18:51

@ 5d4b6c8d:8a1c1ee3

2025-06-07 02:18:51This is the place to reflect on how well you met your ~HealthAndFitness goals today.

Where did you succeed? What do you need to keep working on?

I probably didn't get enough sleep and overcompensated with caffeine. Otherwise, today was pretty solid. Other than a big cookie, I ate well and kept it within a decent window. Activity level was good, not great.

I meant to stretch more today, which I didn't really do, but I suppose I can do now.

https://stacker.news/items/999453

-

@ b1ddb4d7:471244e7

2025-06-07 12:01:52

@ b1ddb4d7:471244e7

2025-06-07 12:01:52Breez, a leader in Lightning Network infrastructure, and Spark, a bitcoin-native Layer 2 (L2) platform, today announced a groundbreaking collaboration to empower developers with tools to seamlessly integrate self-custodial bitcoin payments into everyday applications.

The partnership introduces a new implementation of the Breez SDK built on Spark’s bitcoin-native infrastructure, accelerating the evolution of bitcoin from “digital gold” to a global, permissionless currency.

The Breez SDK is expanding

We’re joining forces with @buildonspark to release a new nodeless implementation of the Breez SDK — giving developers the tools they need to bring Bitcoin payments to everyday apps.

Bitcoin-Native

Powered by Spark’s…— Breez

(@Breez_Tech) May 22, 2025

(@Breez_Tech) May 22, 2025A Bitcoin-Native Leap for Developers

The updated Breez SDK leverages Spark’s L2 architecture to deliver a frictionless, bitcoin-native experience for developers.

Key features include:

- Universal Compatibility: Bindings for all major programming languages and frameworks.

- LNURL & Lightning Address Support: Streamlined integration for peer-to-peer transactions.

- Real-Time Interaction: Instant mobile notifications for payment confirmations.

- No External Reliance: Built directly on bitcoin via Spark, eliminating bridges or third-party consensus.

This implementation unlocks use cases such as streaming content payments, social app monetization, in-game currencies, cross-border remittances, and AI micro-settlements—all powered by Bitcoin’s decentralized network.

Quotes from Leadership

Roy Sheinfeld, CEO of Breez:

“Developers are critical to bringing bitcoin into daily life. By building the Breez SDK on Spark’s revolutionary architecture, we’re giving builders a bitcoin-native toolkit to strengthen Lightning as the universal language of bitcoin payments.”Kevin Hurley, Creator of Spark:

“This collaboration sets the standard for global peer-to-peer transactions. Fast, open, and embedded in everyday apps—this is bitcoin’s future. Together, we’re equipping developers to create next-generation payment experiences.”David Marcus, Co-Founder and CEO of Lightspark:

“We’re thrilled to see developers harness Spark’s potential. This partnership marks an exciting milestone for the ecosystem.”Collaboration Details

As part of the agreement, Breez will operate as a Spark Service Provider (SSP), joining Lightspark in facilitating payments and expanding Spark’s ecosystem. Technical specifications for the SDK will be released later this year, with the full implementation slated for launch in 2025.About Breez

Breez pioneers Lightning Network solutions, enabling developers to embed self-custodial bitcoin payments into apps. Its SDK powers seamless, secure, and decentralized financial interactions.About Spark

Spark is a bitcoin-native Layer 2 infrastructure designed for payments and settlement, allowing developers to build directly on Bitcoin’s base layer without compromises. -

@ 8bad92c3:ca714aa5

2025-06-07 11:01:49

@ 8bad92c3:ca714aa5

2025-06-07 11:01:49Marty's Bent

If you do one thing today, take the time to spend an hour to watch this YouTube video. As someone creating content who has become very cognizant of the effects of the algorithm and the pressures to cater to it, this video was unexpectedly and incredibly satisfying. We're coming up on the eight year anniversary of this newsletter and the podcast that accompanies it and over that eight year period, the pressures to compete in the world of ever increasing digital soy slop grow at an accelerating rate.

If you've seen our YouTube channel recently, you'll probably notice that we've bent the knee to the thumbnail and title clickbait game in an attempt to get our content out to a wider audience. This is something I've held out on for many years now at this point, but recently became convinced that it's something we simply have to do if we want to get our message out to a wider audience. As I write this, I'm thinking that maybe the fact that we have to do that in the first place says something about the content we're putting out there and whether or not it is actually valuable. But I do think the high velocity trash economy becoming completely saturated with digital soy slop has made it so people who truly want to get their message out have to play that game.

I want to make one thing clear. I certainly do not think I'm an artist, but I do like to think that over the last eight years we've been putting out information via content mediums that is valuable to you, dear reader. However, the informational content we put out there, particularly the audio and video content, is put on platforms where it is forced to compete with others who cater to the lowest common denominators of dopamine hijacking and in-group signaling that draws the masses like moths to a flame.

If you haven't watched the YouTube video yet, which I'm assuming 99.9% of you haven't, this may seem like a nonsensical ramble. So, I'll keep this one short and urge you to go watch the social commentary from comedian Jarrett Moore about the state of art, "content" and its effect on culture as it stands today. I'm assuming this isn't too much of a spoiler alert, but the situation is pretty dire. The world needs better art and people who are willing to support artists who are truly creative and take risks. This has nothing to do with bitcoin. But I think it highlights an interesting part of our society that is deteriorating at a rapid clip. And it's something that all of us should feel compelled to attend to lest we speed run into Idiocracy.

It made me feel uneasy about parts of my approach to this business, and that's a good thing.

Don't forget to buy a Bitkey!

Iran's Nuclear Ambitions Create a "Never-Ending Crisis"

In our latest discussion, energy expert Dr. Anas Alhajji described what he called Iran's "never-ending crisis" – a thesis he first published over 20 years ago that has proven remarkably accurate. As Alhajji explained, this crisis persists because of a fundamental contradiction: the U.S. sees any Iranian nuclear program (even peaceful) as strengthening a hostile regime, while Iran views nuclear energy as essential for domestic stability and economic survival.

"Iran is not going to negotiate over the bomb. They want to drag everything for the longest period until they get the bomb." - Dr. Anas Alhajji

What's particularly concerning is Iran's resilience against sanctions. Alhajji detailed how Iran has masterfully circumvented oil export restrictions through China, using a dedicated Chinese bank to process payments outside the international system. Iran's leadership appears willing to endure temporary geopolitical losses in Syria, Lebanon, and potentially Yemen, calculating that obtaining nuclear weapons will fundamentally transform regional politics and their treatment by the United States.

Check out the full podcast here for more on Trump's Middle East strategy, the future of BRICS, and critical challenges facing global energy infrastructure.

Headlines of the Day

Standard Chartered Predicts Bitcoin Will Reach $500K by 2028 - via X

Lummis: Genius Act Makes US Leader in Digital Asset Policy - via X

Get our new STACK SATS hat - via tftcmerch.io

Jake Tapper's Admission on Biden's Decline Sparks Media Ethics Debate - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code *“TFTC20”* during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

My oldest is already at the "faking sick to get out of school" stage and I'm extremely proud.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ 5d4b6c8d:8a1c1ee3

2025-06-07 00:40:06

@ 5d4b6c8d:8a1c1ee3

2025-06-07 00:40:06https://youtu.be/YA1Lkl3h9AQ

"...and then, like so many Pacers games, things just happened."

I think that's about as well as any of us understand what's going on.

https://stacker.news/items/999389

-

@ cae03c48:2a7d6671

2025-06-06 22:00:31

@ cae03c48:2a7d6671

2025-06-06 22:00:31Bitcoin Magazine

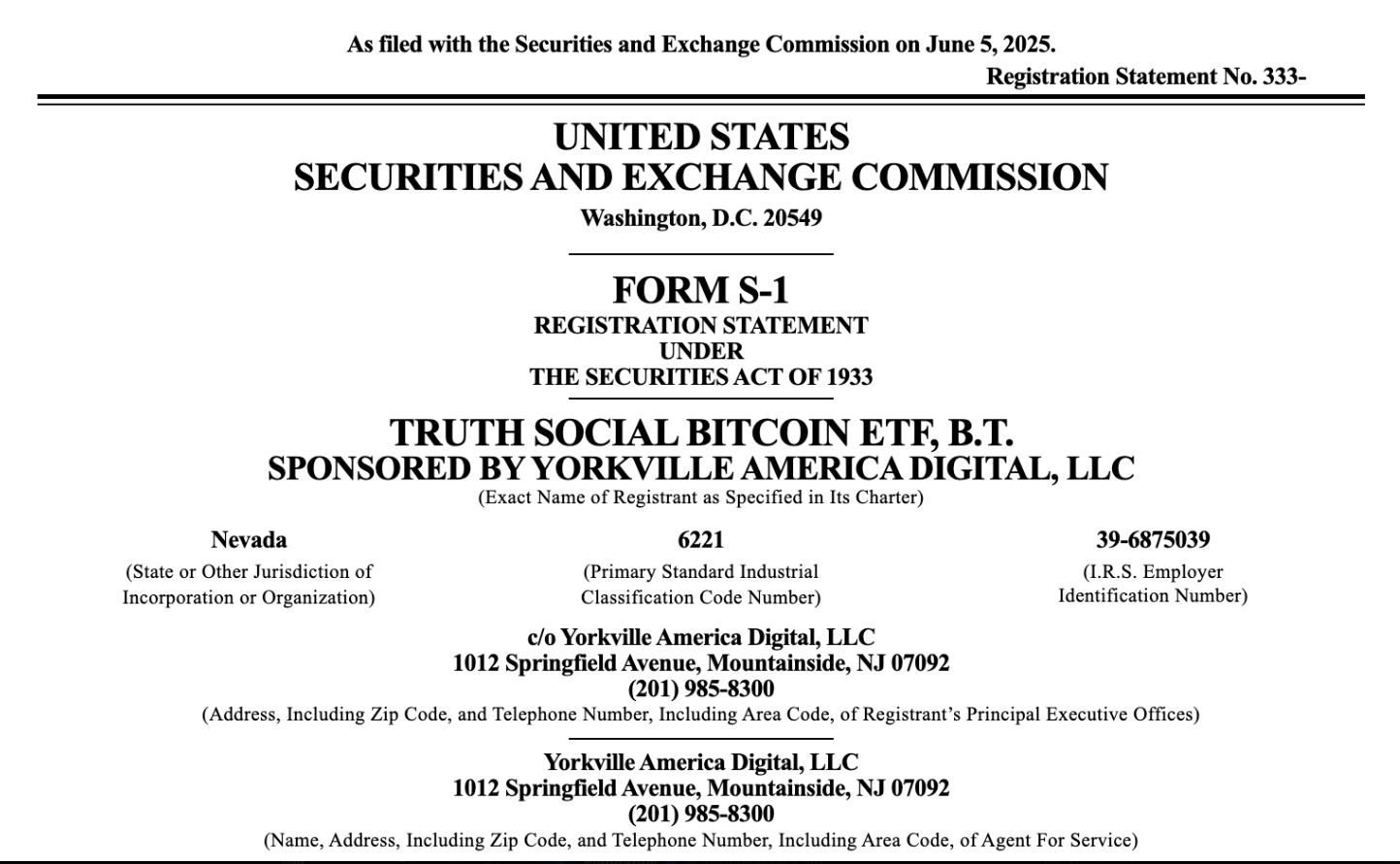

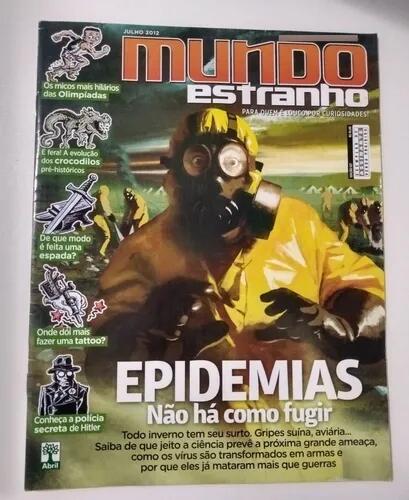

President Trump’s Truth Social Files S-1 Form For Bitcoin ETFToday, Trump Media and Technology Group Corp. (Nasdaq, NYSE Texas: DJT) filed with the US Securities and Exchange Commission (SEC) a Form S-1 for their upcoming Truth Social Bitcoin ETF.

The ETF, which will hold bitcoin directly, is designed to track the bitcoin’s price performance.

“Truth Social Bitcoin ETF, B.T. is a Nevada business trust that issues beneficial interests in its net assets,” stated the Form S-1. “The assets of the Trust consist primarily of bitcoin held by a custodian on behalf of the Trust. The Trust seeks to reflect generally the performance of the price of bitcoin.”

The ETF is sponsored by Yorkville America Digital, LLC and will trade under NYSE Arca. The Trust’s assets primarily consist of bitcoin held by Foris DAX Trust Company, LLC, the designated bitcoin custodian. Crypto.com will act as the ETF’s prime execution agent and liquidity provider.

“Shares will be offered to the public from time to time at varying prices that will reflect the price of bitcoin and the trading price of the Shares on New York Stock Exchange Arca, Inc. at the time of the offer,” mentioned the Form S-1.

While the ETF offers investors a regulated avenue for bitcoin exposure, the Trust warned of several risks related to digital assets:

- Loss, theft, or compromise of private keys could result in permanent loss of bitcoin.

- Bitcoin’s reliance on blockchain and Internet technologies makes it vulnerable to disruptions and cyber threats.

- Environmental and regulatory pressures tied to high electricity use in bitcoin mining could impact market stability.

- Potential forks or protocol failures in the Bitcoin Network may lead to volatility and uncertainty in asset value.

Last week, during an interview at the 2025 Bitcoin Conference, Donald Trump Jr. announced that TMTG and Truth Social were forming a Bitcoin treasury with $2.5 billion. “We’re seriously on crypto—we’re seriously on Bitcoin,” said Trump Jr. “We’re in three major deals. I believe we’re at the beginning of what will be the future of finance. And the opportunity is massive.”

The day after that interview, Eric Trump and Donald Trump Jr., joined by American Bitcoin Executive Chairman and Board Member Mike Ho, CEO Matt Prusak, and Altcoin Daily founder Aaron Arnold, discussed the future of Bitcoin.

“The whole system is broken and now all of the sudden you have crypto which solves all the problems,” commented Eric Trump. “It makes everything cheaper, it makes everything faster, it makes it safer, it makes it more transparent. It makes the whole system more functional.“

“Everybody wants Bitcoin. Everybody is buying Bitcoin,” Eric added.

This post President Trump’s Truth Social Files S-1 Form For Bitcoin ETF first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 3c7dc2c5:805642a8

2025-06-06 21:32:46

@ 3c7dc2c5:805642a8

2025-06-06 21:32:46🧠Quote(s) of the week:

"The real Bitcoin Strategic Reserve is the Bitcoin held in the wallets of individual citizens. A strong nation of citizens who have strong Bitcoin reserves is going to be okay." - Marty Bent https://i.ibb.co/rRNJWsJX/Gr4-W7-ZEXc-AAZ4i-U.jpg

🧡Bitcoin news🧡

"The premise required for the universe to function is the conservation of energy. A person without energy is a ghost. An object without energy is an image. Money without energy is credit." —Michael Saylor https://i.ibb.co/N61ZL8sv/Gr4-Xcwg-XQAI5m-Hz.png

On the 26th of May:

➡️'Bitcoin capital flows could exceed $120B by the end of 2025 and reach $300B in 2026, per Bitwise. U.S. spot Bitcoin ETFs attracted over $36.2B in net inflows during 2024, outperforming expectations and exceeding early SPDR Gold Shares (GLD) performance by 20x.' -Bitcoin News

https://i.ibb.co/TMx3mbV6/Gr3kg-LZW8-AAj-TN3.jpg

➡️Michael Saylor's STRATEGY becomes the first company to hold over 500,000 Bitcoin on its balance sheet. Over the last 64 days, Saylor has purchased approximately 80,000 Bitcoin.

➡️River: '2-3% inflation per year sounds harmless... until you zoom out. Every line on this chart is a reason Bitcoin exists.'

https://i.ibb.co/fYPW6RRh/Gr6-LXts-Ww-AEj4no.jpg

➡️State Street Corporation has bought 1.13 million Strategy₿ $MSTR stocks for 344.78 million dollars at an average price of $304.41 per share in Q1 2025. Their total holdings are 4.98 million shares worth over 1.84 billion dollars.

On the 27th of May:

➡️Cantor Fitzgerald officially launches $2 BILLION Bitcoin-backed lending with first loans, partnering with Anchorage Digital and Copper. - Bloomberg

➡️Trump Media Announces Approximately $2.5 Billion Bitcoin Treasury Deal. Trump Media is following the MSTR playbook. With that amount, you can now buy over 22,500 BTC. TMTG would then enter the list of largest corporate Bitcoin holders in fourth place.

Pledditor: "Trump just sabotaged Cynthia Lummis's BITCOIN ACT by doing this I see no future where Trump buys billions of dollars of bitcoin and then Congress codifies SBR into law. The corruption is just too brazen." Spot on! Considering the brazen corruption so far this actually makes it more likely.

➡️'Jack Dorsey’s Block to launch Bitcoin Lightning Payments on all Square terminals!' -Bitcoin Archive

Jack Dorsey’s Block is launching Bitcoin payments on Square at the Bitcoin Conference. Merchants can choose to hold the BTC or automatically convert it to fiat. The feature will expand to more sellers later this year.

➡️Sminston With: "But yes, I'm sure this cycle has peaked."

'Bitcoin cycles @ power law fit, a la 365-day SMA At ~$110,000/coin today, the 365-dSMA is only touching the trendline; History shows each cycle moving 2-3x higher than this. Have a nice day!'

https://i.ibb.co/gMHhq3FP/Gr9rka-ZXg-AAI5-Ck.jpg

➡️Whales have shifted to net distribution with a score around 0.3, reversing their earlier accumulation pattern during this year's price rallies, according to data from Glassnode.

➡️Fast food giant Steak 'n Shake announced they're saving 50% in processing fees accepting Bitcoin payments '#Bitcoin is faster than credit cards'

➡️BlackRock increases Bitcoin exposure for their own funds. The Strategic Income Opportunities Portfolio now holds 2,123,592 shares of IBIT as of March 31 (worth $99.4M) up from 1,691,143 shares on December 31.

➡️Interesting, so Michael Saylor is refusing to publish on-chain proof of Bitcoin reserves...

If Metaplanet and El Salvador can do proof of reserves, why not Strategy? At the end of the day, it's investors' money that is being used to buy Bitcoin. What am I missing?

Arkham: 'SAYLOR SAID HE WOULD NEVER REVEAL HIS ADDRESSES ... SO WE DID We have identified an additional 70,816 BTC belonging to Strategy, bringing our total identified MSTR BTC holdings to $54.5 Billion. We are the first to identify these holdings publicly. This represents 87.5% of total MSTR holdings (including assets in Fidelity Digital’s omnibus custody).'

https://intel.arkm.com/explorer/entity/microstrategy

Don't Trust, Verify!

On the 28th of May:

➡️GameStop CEO says the company bought 4,700 #Bitcoin because it's better than gold. "It has asymmetric upside."

Parker Lewis: Gamestop bought 4,710 Bitcoin (or 471 billion bitcoins) and the CEO says things like "if the thesis is correct." That is a scary place to be, relying on some thesis. "But, we'll see what happens."

Zero vision, great. This pretty much sums up the Bitcoin conference from last week: a repetitive parroting of Bitcoin fundamentals with zero substance beyond “buy Bitcoin, it’s the future.”

Most of the time these people will do the following thing. Sell low after buying high. Anyway, Gamestop is up 4.20% in pre-market after announcing a purchase of 4,710 Bitcoin. They're now the 13th largest public company holder of BTC in the world.

➡️IMF says "efforts will continue" to prevent El Salvador from acquiring more Bitcoin.

➡️The U.S. Department of Labor has officially reversed its 2022 guidance on Bitcoin and crypto in retirement plans.

➡️ UK MP @EmmaforWycombe writes that the “UK government currently has no plans to adopt a strategic bitcoin reserve.” She believes Bitcoin’s “properties as an asset nonetheless remain inconsistent with the objectives and investment principles that govern the Government's foreign exchange reserves.” The UK government appears dead set on fumbling a bag of 61,000 BTC. HFSP! https://i.ibb.co/1tMHmqKw/Gs-C3-D54-Wc-AAdg0d.jpg

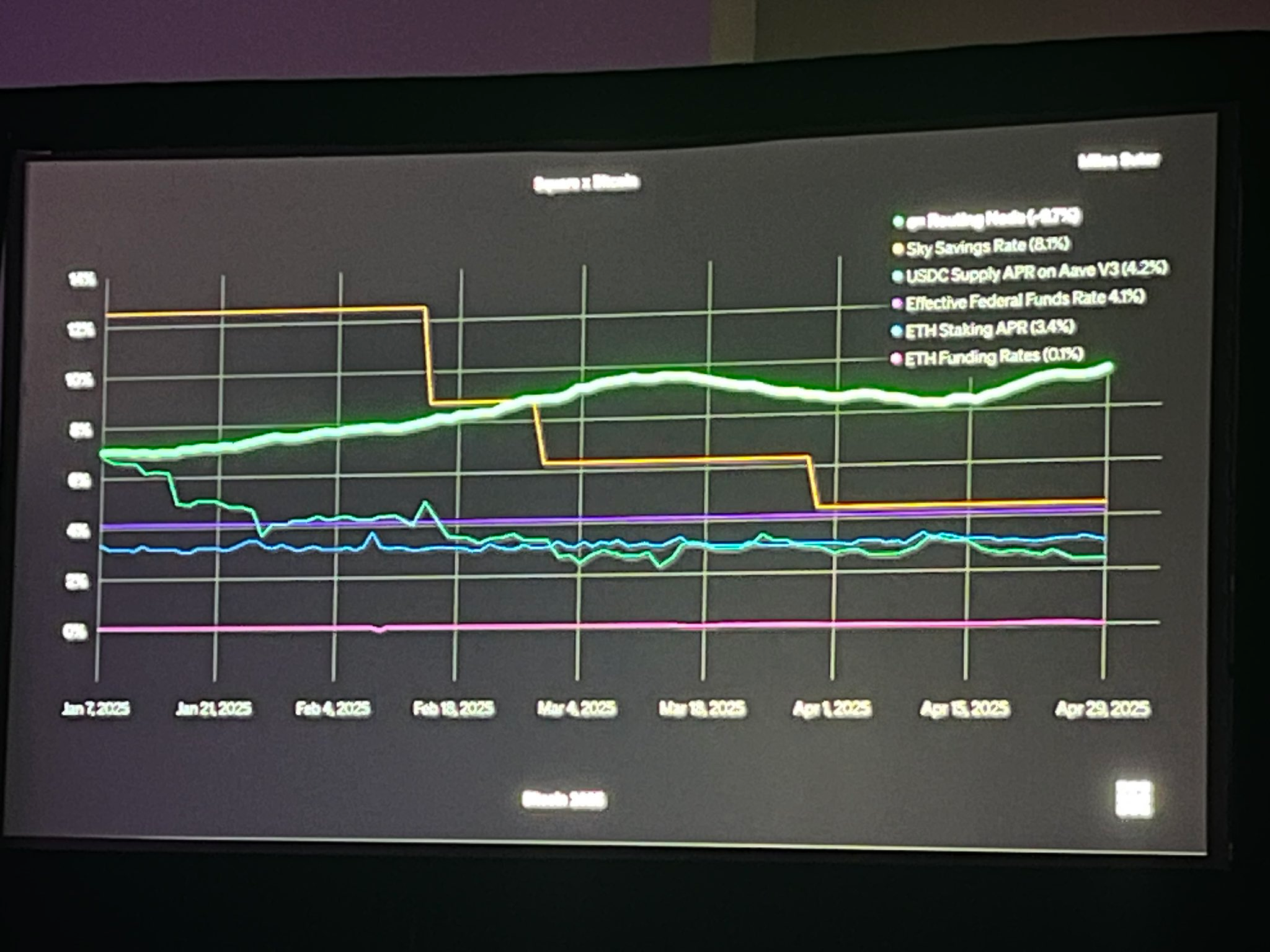

➡️Ryan Gentry: 'The biggest news at @TheBitcoinConf just dropped. @milessuter shared that the c= routing node is earning 9.7% APR on its bitcoin liquidity (which I’d estimate at ~$10M, 50% of its 184 BTC of public capacity). True non-custodial yield based on the utility of bitcoin payments.'

Great response on the matter by Sam Callahan: "Imagine a treasury company with 1,000 BTC earning ~10% annual yield. Sovereign, Bitcoin-native yield without counterparty risk that’s tied to the economic activity of Lightning instead of interest rate policy. At $1M per BTC, that’s $100M in annual recurring revenue."

9.7% REAL yield on a payment network while holding the keys to their BTC the entire time!! Madness! The constant claims that no one uses lightning are ridiculous.

On the 29th of May:

➡️ Investors are selling gold for Bitcoin - Bloomberg Gold ETF outflows: -$2.8 billion Bitcoin ETF inflows: +$9 billion.

➡️'Spanish banking giant Banco Santander looking to make Bitcoin and stablecoins available to retail clients. Santander has 175 million customers worldwide and is the BIGGEST lender in the Eurozone.' - Bitcoin Archive

➡️The U.S. Department of Labor rescinded 2022 guidance discouraging 401(k) plans from including Bitcoin and cryptocurrency, allowing retirement plans to potentially include Bitcoin and other digital assets. If just 1% of the $8 trillion in 401k funds flows into Bitcoin, that’s $80 billion of new demand, and 2x more than what’s flowed into Bitcoin ETFs.

➡️ Blockstream launches the Blockstream App, enabling users to buy Bitcoin directly and store it in a self-custodial wallet, eliminating the need for third-party custodians.

➡️$550 billion DBS bank says Bitcoin mining could help stabilize the grid and reduce emissions.

➡️Tether reveals that it owns over 100,000 Bitcoin & +50 tons of gold.

➡️Paris Saint Germain adopts Bitcoin as a Treasury Reserve asset.

➡️'The supply of BTC held by long-term holders has now increased by OVER 1.4 MILLION in under 3 months! The market's most experienced participants are refusing to sell Bitcoin at these prices, and soon there won't be enough $BTC left for those late to the party...' - Bitcoin Magazine Pro

On the 30th of May:

➡️Joe Consorti:

It was foretold. Should Bitcoin follow global M2 all the way down on this correction, we may see $97,500. May not happen, may see lower, nobody knows. The only certainty is that the global aggregate of fiat denominated in USD will rise, and so too will BTC follow it in time.

https://i.ibb.co/5gpq4c53/Gs-Pp-SWua-MAUwzj-T.jpg

➡️Buy Real Bitcoin, and NOT:

⇒ BTC Companies,

⇒ Wrapped BTC

⇒ BTC IOU's

⇒ ...

Bitcoin in self-custody is the only way you get all the benefits of BTC.

https://i.ibb.co/0pZgdQjP/Gs-ND795-Xs-AA23-Yx.jpg

And please, as Wicked described it perfectly: 'Don’t run a node for Bitcoin, run and use it for yourself. Your humble little node isn’t saving the network, but it can protect your privacy and verify that the coins you receive are legit…if you’re actually using it.'

On the 31st of May:

➡️The Texas legislature has passed the Strategic Bitcoin Reserve bill. It now goes to Governor Abbott who is expected to sign it into law. This is a historic moment for Bitcoin and Texas, one of the largest (8th largest) economies in the world.

➡️Bitcoin News: 'Norwegian digital asset firm K33 has raised 60 million SEK (about $5.6 million) to expand its Bitcoin treasury. The funds were secured from insiders and strategic investors, including Klein Group and Modiola AS. CEO Torbjørn Bull Jenssen said the move reflects K33’s belief in Bitcoin’s long-term role in global finance and strengthens the company’s balance sheet as it grows its presence as a leading crypto broker in Europe.'

➡️ IMF raises concern over Pakistan‘s Bitcoin mining power plans. They want everyone under their control. They can't do it with Bitcoin. They might be losing another 'customer'. The IMF sees all the debt slaves becoming financially sovereign and independent by embracing Bitcoin.

https://i.ibb.co/BV0V1c6S/Gs-Sj-NP5-WIAAZv-Fo.jpg

I have rewritten Daniel Batten's quote/post on this matter:

**

'Why Pakistan’s Bitcoin Plans May Not Survive the IMF"

**

While I’m an optimist by nature—and I truly hope I’m wrong—I believe Pakistan will struggle to follow through on its Bitcoin and Bitcoin mining ambitions.

Short Answer: The IMF

Mid-Length Explanation:

- Bitcoin poses a significant threat to the IMF’s influence—on at least five fronts.

- Pakistan is heavily indebted to the IMF, and history shows a clear pattern: the IMF has already derailed or scaled back Bitcoin initiatives in all of the three countries that attempted adoption—El Salvador, Argentina, and the Central African Republic.

- Pakistan will likely face similar pushback.

- And given Pakistan’s economic vulnerabilities, it’s equally likely that the IMF will succeed.

What the IMF’s Next Steps Might Look Like

-

Manufacturing Doubt and Delay The IMF will likely begin by generating fear, uncertainty, and doubt (FUD) around the viability of Pakistan’s Bitcoin program. Expect references to:

-

“Energy shortages”

- “High electricity costs”

- “Unclear regulatory frameworks”

- “Anti-money laundering (AML) concerns”

These will be framed as responsible concerns by a seasoned financial guardian. The IMF may also imply that Pakistan acted prematurely, noting the country did not consult the IMF before announcing its Bitcoin initiative—suggesting a lack of due diligence. However, these objections are highly debatable. Multiple peer-reviewed studies show that Bitcoin mining can improve grid stability and lower electricity costs. Moreover, examples like Bhutan and El Salvador demonstrate how Bitcoin can enhance economic sovereignty. But that’s precisely the issue: economic sovereignty reduces the IMF’s lending relevance, and that’s not in the IMF’s institutional interest.

- Weaponizing Debt and Conditionality

Under its $7 billion Extended Fund Facility program, the IMF is likely to:

- Demand FATF-compliant crypto regulation

- Prohibit state-level Bitcoin accumulation

- Tie loan disbursements to rollbacks on Bitcoin and mining-related policies

This approach exploits Pakistan’s financial dependence on IMF loans to meet external debt obligations and maintain its foreign exchange reserves.

- Enforcing Compliance Through Vulnerability

Pakistan’s financial position leaves little room for defiance:

- It faces $12.7 billion in debt repayments in FY 2025.

- Without IMF support, reserves could fall below $4 billion, covering less than one month of imports—far below the threshold needed for macroeconomic stability.

- A repeat of early 2023, when reserves fell to $2.92 billion, would likely trigger another balance-of-payments crisis.

This would pressure the Pakistani rupee, already having depreciated from PKR 100 to over 330 per USD since 2017, and could push the country closer to default. Given its past FATF grey-listing, Pakistan cannot afford another multilateral funding freeze.

So What Does This All Mean?

It means the gloves are off.

The IMF is no longer merely advising—it’s actively resisting. Bitcoin threatens its long-standing monopoly over financially vulnerable nations, and Pakistan is shaping up to be the fourth test case of this resistance. If the IMF pressures Pakistan into reversing course, it will mark a 4-for-4 track record in blocking Bitcoin adoption efforts by countries under its financial umbrella.

The Bigger Picture