-

There was a catch—there was always a catch. The fiat businesses had built empires on sand, parading as indestructible titans while their foundations crumbled beneath them. They were too big to fail, they said, as if saying it loud enough could stop the tide. But the tide didn’t care, and the tide had a name: Bitcoin.

Bitcoin wasn’t the currency of criminals anymore, as the talking heads on television liked to parrot. No, it was the currency of mathematicians, engineers, and anyone else who figured out that trusting a bank to keep your money safe was like trusting a fox to guard your chickens. And while the fiat war machine churned along, chewing up lives with merciless efficiency, its disembodied body was writhing and bleeding out like a wounded ouroboros—an ancient snake devouring its own tail, too consumed by its gluttony to notice its inevitable demise.

The ouroboros wasn’t just dying. It was rotting.

The "Warscape of Disruption" was not kind.

---

The Ouroboros of Fiat

The fiat war machine, that hungry mouth, had always feasted on the lifeblood of ordinary people—wages diluted by inflation, savings eroded by fees, debts stretched out for eternity. The machine’s appetite was insatiable, gnashing and grinding through entire generations. Yet, the tail it chewed wasn’t just a metaphor; it was its own lifeline. Each bite it took to sustain itself weakened the system further, draining liquidity, trust, and time.

The result? A writhing, bleeding beast—a grotesque spectacle of a financial system that couldn’t stop destroying itself even as its days were clearly numbered. Bitcoin, like a sword forged from cryptographic steel, struck at the head of the ouroboros, severing the illusion that the system was sustainable.

---

The Fall of Fiat Empires

Imagine a city under siege. The walls are high, the defenses robust—or so they seem. Inside, the merchants continue their trade as if the invaders outside will simply get bored and leave. But Bitcoin does not leave. Bitcoin is a battering ram, each transaction a blow to the gates. It doesn’t stop, doesn’t sleep, doesn’t even care if it’s raining. The merchants inside—your Fortune 500s, your too-big-to-fails—sit around arguing over their spreadsheets, wondering why their liquidity is drying up.

And liquidity does dry up when your currency is no longer trusted. Why would anyone hold onto a rapidly devaluing asset when Bitcoin offers a deflationary alternative? Why leave wealth in the hands of a financial system designed to siphon it away? Fiat businesses scramble for answers, only to find themselves priced out of relevance.

---

DeFi: The Siege Engines

If Bitcoin is the battering ram, DeFi is the trebuchet, hurling innovations like smart contracts and yield farming over the walls of traditional finance. What once required entire armies of lawyers and brokers can now be executed in seconds on a blockchain. Borrowing, lending, insuring—these were the sacred pillars of fiat finance, and DeFi is smashing them to pieces with algorithms.

But the beauty—or terror, depending on which side you’re on—is that DeFi doesn’t even need to storm the gates. It builds new cities outside the walls, cities without kings or tax collectors, where every transaction is voluntary and transparent. These new cities—protocols like Aave, Uniswap, and MakerDAO—are thriving. Meanwhile, the old cities burn.

---

Critical Analysis: The End of Complacency

The fall of fiat businesses is not just a matter of technological disruption; it is a reckoning. They thrived for decades on inefficiency and opacity, extracting rents from consumers who had no other choice. But now there is a choice, and it is brutally efficient.

Yet, the decimation of fiat businesses raises questions:

1. Regulatory Resistance: Governments will not surrender their economic dominance without a fight. Will they embrace Bitcoin and DeFi, or attempt to stifle it through draconian regulation?

2. Inclusion or Exclusion: While Bitcoin and DeFi promise financial inclusion, their adoption requires technical literacy and access to the internet. Will the transition leave the less fortunate behind?

3. Moral Hazard: As DeFi dismantles gatekeepers, it also removes the safety nets. If everyone becomes their own bank, who will rescue those who make poor financial decisions?

---

The Fiat Future: A Ghost Town

The ouroboros is dying. Its mouth still chews, trying to wring out a few last drops of life from a system that no longer works. Its tail, now bitten to the bone, hangs limp. Fiat businesses are already on life support, relying on bailouts, artificial liquidity injections, and consumer apathy. But this system, like all empires, will fall.

Bitcoin does not care about your quarterly earnings. DeFi does not care about your brand equity. The warscape of the technology landscape will be leveled, and those who fail to adapt will be left behind as relics of a bygone era.

To paraphrase an old soldier, “If we don’t end fiat, fiat will end us.” But maybe that’s not such a bad thing. After all, the only businesses that will truly disappear are the ones that deserve to.

So, as the siege continues, the merchants of fiat have a choice: reinvent or die. But as anyone in DeFi will tell you, the smart money is already on the other side of the wall.

-

I have had the same network setup for a long time now. Unifi stuff just works most of the time. I didn't really pick it. Its not open source and now that I have fiber and have been having some issues with some of the Unifi hardware its time to make the call.

Do I just upgrade with Unifi or start migrating to something more in line with what I value.

So I've been chatting with my very helpful colleges at Red Hat and after mentioning PfSense to them I was told to check out Opnsense instead.

1. I want to slowly move to 10g network gear

2. I need PoE switches that are 10g

3. I want a robust firewall / router

4. I don't really wanna build my router due to time

Currently looking at [Protectli Buyer’s Guide](https://kb.protectli.com/buyers-guide/) who sell hardware that is pre-installed with many options. I haven't decided which one to get yet. I wanna buy with the future in mind though so 10g connections are a must and support for two WAN connection is as well. I'm glad I ran CAT6 in my house years ago instead of cheaping out.

After I replace my router / firewall I will want to replace my Unifi switches. I'm considering buying used Cisco switches from eBay.

Anyone have any advice on this plan or advice?

originally posted at https://stacker.news/items/851922

-

# Changes

## Daniel Saxton (5):

- Add t tags for hashtags

- Use HashSet, lowercase, and add emoji tests

- Add test and format

- Fix emoji hashtags

- Handle punctuation better

## William Casarin (3):

- grip: show pointer cursor on grip

- adjust context menu/grip circle sizes

- grip: fix double frame border

## kernelkind (10):

- extract timing from AppSizeHandler to TimedSerializer

- use TimedSerializer in AppSizeHandler

- introduce ZoomHandler

- integrate ZoomHandler

- move columns ui

- move column

- integrate column moving

- use replace move icon with grab

- toggle move tooltip on button press

- update colors

pushed to [notedeck:refs/heads/master](http://git.jb55.com/notedeck/commit/e4732f5112ad7688e4159be9e2cb9869ca851aae.html)

-

Deleted

-

By a Humble Admirer of Reason and Revelation

In an age where the digital and metaphysical intertwine, Bitcoin emerges as more than a mere technological marvel; it beckons us to contemplate the profound relationship between faith and truth. This inquiry, inspired by the works of great philosophers such as Immanuel Kant and Thomas Aquinas, seeks to explore the interplay between Bitcoin, faith, and the divine truth.

---

Faith and Rational Certainty

Faith, in its essence, is often misunderstood. It is not mere blind belief but a rational assent to truths that transcend empirical verification. Immanuel Kant argued that reason sets the boundaries of what we can know, yet it also reveals the necessity of postulating certain truths—God, freedom, and immortality—for the coherence of our moral universe. In Bitcoin, we find a parallel. The network operates on cryptographic principles, open source code, and decentralized consensus mechanisms. Its participants, however, exhibit a form of faith—not in a centralized authority, but in the immutability of its mathematical foundation.

This faith is not irrational but deeply rooted in trust. The nodes and miners who uphold Bitcoin's ledger act in fidelity to its rules, a collective acknowledgment of truth beyond subjective influence. Bitcoin, therefore, embodies a kind of secular faith, where trust in a system replaces reliance on human arbiters.

---

The Immutable Ledger and the Divine Truth

Thomas Aquinas viewed God as the ultimate source of truth, whose divine law orders the cosmos. In Bitcoin, one might see a reflection of this divine order—a man-made system aspiring to transcend corruption, deceit, and centralization. The blockchain is immutable, a ledger where each transaction is sealed in time, immune to revision or manipulation. This echoes the divine truth: unchanging, eternal, and knowable through reason.

Yet Bitcoin also confronts us with a humbling realization. It is not divine; it is a human construct. Its immutability is contingent, not absolute. But in its operation, Bitcoin mirrors humanity's yearning for divine justice—a world where truth cannot be falsified, where accountability is woven into the fabric of existence.

---

The Role of Freedom

Freedom is a cornerstone of both faith and Bitcoin. Kant posited that moral law requires the freedom to act according to reason. Bitcoin, too, is a system predicated on individual freedom: freedom to transact without intermediaries, to store wealth beyond the reach of coercion, and to participate in a global economy unshackled by geographic or political constraints.

This freedom, however, is not anarchic. It is bounded by Bitcoin's rules, much like moral freedom is bound by divine law. The protocol demands adherence to its principles; deviation leads to exclusion. Here, Bitcoin becomes a microcosm of the moral universe, where freedom and law coexist in a delicate balance.

---

Bitcoin as a Test of Faith

Bitcoin also demands faith in the unseen. Its cryptographic foundations are abstract and inaccessible to most. To trust Bitcoin, one must trust the mathematics and the consensus that govern it—a faith akin to the theologian's trust in the coherence of divine revelation. This faith is tested by volatility, uncertainty, and the constant threat of human error or malice. Yet, like the pilgrim who endures trials to affirm their belief, Bitcoin participants persevere, drawn by a vision of a more just and truthful economic order.

---

The Eschatological Impulse

Finally, Bitcoin invites us to consider the eschatological—the end of things and the ultimate fulfillment of truth. In Christian theology, history moves toward a final reconciliation of all things in God. Bitcoin, while temporal, shares an eschatological impulse: it envisions a world where financial systems are no longer instruments of oppression but tools of liberation.

This vision is imperfect, as all human endeavors are. But it gestures toward the divine truth that undergirds all creation: that justice, transparency, and freedom are not merely human aspirations but reflections of a higher order.

---

Conclusion: Faith in the Age of Bitcoin

Bitcoin is not divine, yet it draws us toward the divine truth. It is a testament to human ingenuity and our unrelenting quest for systems that reflect the eternal values of justice and truth. To place faith in Bitcoin is not to worship it but to acknowledge its potential as a tool—a reminder of what humanity can achieve when it aligns its efforts with principles of truth and freedom.

In the end, faith and Bitcoin converge in their reliance on truth. One points us to the heavens, the other to the blockchain, yet both call us to live in fidelity to what is unchanging, just, and true. Thus, Bitcoin becomes not merely a technology but a philosophical and spiritual phenomenon, challenging us to reflect on the relationship between faith, reason, and the divine.

-

[Originalni tekst na ecd.rs](https://ecd.rs/blog/istorija-rudarenja-bitkoina-od-nastanka-blokcejna-do-danas/)

###### 25.08.2020 / Autor: Marko Matanović

---

Istorija rudarenja bitkoina počinje ne toliko davne 2009. godine nastankom Bitkoin-a, odnosno od nastanka blokčejna kao tehnologije. U Satošijevom *[whitepaper-u](https://bitcoin.org/bitcoin.pdf)* spominje se pojam *[Proof-of-Work](https://ecd.rs/faqs/proof-of-work-pow/)* (PoW). U ovom sada već istorijskom dokumentu koji objašnjava funkcionisanje Bitkoin-a navodi se da će se Proof-of-Work sistem koristiti za validaciju blokova u Bitkoin blokčejnu (procesuiranje transakcija), a da bi [blok](https://ecd.rs/faqs/blok/) bio “potvrđen” potrebno je da se izdvoji određena procesorska snaga. U suštini *Proof-of-Work* obezbeđuje sigurnost blokčejna tako što zahteva od korisnika da uloži odredjenu količinu rada kako bi bio nagradjen i omogućava dodavanje novih validnih transakcija u blok.

Da bismo poslali transakciju na Bitkoin mreži potrebno je da platimo određeni transaction fee, tj. naknadu za obradu i [potvrđivanje](https://ecd.rs/faqs/konfirmacijaconfirmation/) same transakcije. Upravo ovaj transaction fee se distribuira rudarima kao podsticaj da rade svoj posao u najboljem interesu i po utvrđenim pravilima sistema, odnosno da koriste svoj hardver radi potvrđivanja (naših) transakcija na mreži. Transakcije sa većim izdvojenim transaction fee-jem će biti brže potvrđene na mreži jer će baš ta transakcija rudarima biti isplativija za potvrđivanje. Osim ove vrste transakcija rudari dobijaju i određenu [nagradu za svaki potvrđeni blok](https://ecd.rs/faqs/blok-nagrada/).

Trenutni block reward je 6.25 BTC-a po potvrđenom bloku. Ovaj iznos se deli među svim rudarima na mreži proporcionalno njihovom učinku, što znači da što je više rudara na mreži to je njihova pojedinačna nagrada manja jer je veća konkurencija. Sem toga što se nagrada smanjuje sa većom konkurencijom povećava se i težina rudarenja. Nagrada za Bitkoin se smanjuje na određenom broju izrudarenih blokova i svaki put je nova nagrada dva puta manja od prethodne. Ovo je u kripto zajednici poznatije kao “*[Bitcoin halving](https://ecd.rs/faqs/halving/)*” koji se odigrava otprilike na svake četiri godine, sa ciljem da svaki put upola umanji inflaciju samog bitkoina kako bi održao/povećao svoju vrednost.

*Cene Bitkoina i nagrade po bloku*

Istorija rudarenja bitkoina se može podeliti u nekoliko era koje prate razvoj kripto industrije kao celine. Ove ere se razlikuju po hardveru koji se koristio za rudarenja. Ukoliko se pitate zašto je uopšte bilo potrebno menjati, odnosno pojačavati hardver koji se koristi – razlog je povećanje težine kopanja usled popularizacije kriptovaluta i rudarenja kriptovaluta tokom vremena. Svake godine bio je potreban sve jači i bolji hardver kako bi se rudarenje isplatilo, prvenstveno jer je konkurencija (bila) sve veća, i samim tim više učesnika deli nagradu koja je posledično manja. To uglavnom znači da nam treba jači hardver kako bismo, kao rudari, uradili što veći deo posla na validaciji svakog bloka i maksimalno povećali nagradu koja sledi.

Istorija rudarenja bitkoina uopšteno se može podeliti na nekoliko celina:

– **Era procesora** (2009 – 2010)

– **Era grafičkih kartica** (2010 – 2011)

– **Era FPGA kartica** (2011 – 2013)

– **Era ASIC uređaja** (2013 – 2020)

#### Era procesora (2009 – 2010)

Ovo je početna era rudarenja koju karateriše korišćenje procesora koji se mogu naći u bilo kom laptopu ili desktop računaru. [Prvobitna Satošijeva ideja](https://ecd.rs/blog/idejni-tvorac-bitkoina-misteriozni-satosi-nakamoto/) je bila da svako na mreži koristi svoj procesor za [rudarenje](https://ecd.rs/faqs/kripto-rudarenje/). Na početku ove ere rudarenje je pre svega bio veoma neobičan hobi. Satoši je želeo na taj način da bolje osigura stabilnost i sigurnost mreže. Prvi bitkoini koji su bili iskopani, bili su iskopani upravo pomoću procesora. Korišćen je sličan program kao program za mrežno otključavanje Nokia telefona zbog sličnog principa korišćenja SHA-256 funkcije za enkripciju. Svako ko je želeo je mogao da rudari bitkoin uz pomoć svog laptopa ili desktop računara.

Kako se sve više rudara priključivalo na mrežu i kako je postalo moguće zameniti prve bitkoine za [fiat novac](https://ecd.rs/faqs/fiat-novac/), javio se interesantan problem – procesori koji su u to vreme imali bolje performanse su mogli da izrudare više bitkoina, što ujedno znači da su bili profitabilniji. Sve više rudara je koristilo procesore jačih performansi što je rezultovalo povećanjem težine kopanja. Povećanje težine kopanja je značilo da su procesori slabijih performansi postali još manje isplativi, odnosno da će dobiti proporcionalno manje bitkoina. Ljudi koji su u ovo vreme rudarili na Bitkoin mreži su mogli na mesečnom nivou da zarade i više hiljada bitkoina u zavisnosti od tipa i broja procesora koji su koristili.

Naravno, tada je cena bitkoina bila višestruko manja nego što je sada. Bez obzira na malu cenu, određeni ljudi su uvideli potencijal u rudarenju i krenuli su sa nabavkom sve boljih i boljih procesora. Cilj je bio što isplativije rudarenje bitkoina sa što manjim ulaganjima. Na ovaj način smo dobili prve rudare i potpuno funkcionalnu Bitkoin mrežu.

*AMD Phenom II procesor iz 2008. godine*

#### Era grafičkih kartica (2010 – 2011)

Kako je potražnja za bitkoinom porasla, a on dostigao cenu od 10 centi u oktobru 2010. godine, pojavili su se prvi rudari koji su koristili grafičke kartice (GPU) za rudarenje umesto procesora. Pojedinci su otkrili da je ovaj način rudarenja mnogo efikasniji od rudarenja procesorom, a vest se brzo raširila. Za relativno kratko vreme težina kopanja je toliko porasla da se uopšte nije isplatilo kopati procesorom. Računari sa dobrom diskretnom grafičkom karticom koja se može koristiti za igranje video igara su ubrzo postale mašine za zaradu nove vrste digitalnog novca.

Tada je u svetu računarstva bila popularna opcija korišćenja dve grafičke kartice za bolje performanse u video igrama i programima koji su bili veoma zahtevni (npr. video produkcija ili 3D modelovanje), tako da je već postojala potrebna infrastruktura za rudarenje sa više grafičkih kartica. Što više grafičkih kartica u računaru to je zarada bila bolja. Ubrzo su se pojavili *[miningrig](https://ecd.rs/faqs/mining-rig/)*-ovi (računari specijalizovani za rudarenje) koji su imali od 4 do 8 grafičkih kartica. U početku ovo su bile po izgledu jako amaterski sklopljene mašine, ali su kasnije poprimile poseban i donekle standardizovan oblik.

*Primer izgleda prvih mining rig-ova*

#### Era FPGA kartica (2011 – 2013)

FPGA je skraćeno od field-programmable gate array. Konkretan hardver je dizajniran tako da korisnik može naknadno da ga prilagodi za određeni zadatak. Karakteristika ovih uređaja je brzo izvršavanje konkretne vrste zadataka koje može biti i do dva puta efikasnije od izvršavanja istog zadatka pomoću grafičke kartice. Ovaj potencijal zaintrigirao je rudare tog doba i sredinom 2011. godine otpočelo je korišćenje ovog hardvera za potrebe rudarenja. Obzirom na to da FPGA uređaji nisu toliko jednostavni za korišćenje za razliku od grafičkih kartica i procesora, u početku nije bilo puno ljudi koji su rudarili pomoću ovih uređaja. Kako je softver za rudarenje uz pomoć FPGA uređaja postajao sve dostupniji, rastao je i broj ljudi koji su na ovaj način zarađivali svoje bitkoine.

Naravno, velika efikasnost ovih uređaja i činjenica da daju dva puta bolje rezultate od grafičkih kartica samo je dodatno doprinela povećanju težine kopanja bitkoina, ali nisu FPGA uređaji doveli do toga da [GPU](https://ecd.rs/faqs/gpu/) rudarenje postane istorija rudarenja bitkoina. Do toga su doveli [ASIC](https://ecd.rs/faqs/asic/) uređaji koji su stupili na scenu 2013. godine.

*FPGA uređaj*

#### Era ASIC uređaja (2013 – 2020)

ASIC uređaji su se prvi put pojavili 2013. godine i potpuno su preuzeli scenu rudarenja. Naime, ASIC je skraćeno od application-specific integrated circuit što znači da su ASIC uređaji posebno pravljeni za rešavanje jedne vrste zadatka. Mana ovog pristupa je to što se ASIC uređaji ne mogu koristiti ni za šta drugo osim za rudarenje uz pomoć određenog algoritma. Prednosti ovih uređaja su višestruko bolje performanse i veoma laka instalacija. Nije bilo potrebno razumeti se u hardver za korišćenje ASIC uređaja. Rudari bi samo naručili ove mašine i uključili ih. Odjednom svako je mogao da rudari na Bitkoin mreži uz minimalan trud. To je rezultiralo povećanjem težine kopanja do te mere da su svi prethodno navedeni načini rudarenja postali (skoro) potpuno neisplativi za kopanje bitkoina.

Istorija rudarenja bitkoina pamti nekoliko firmi koje su se bavile prozvodnjom ASIC uređaja među kojima je i današnji gigant Bitmain. Trka za najboljim ASIC uređajem je dovela do gašenja velikog broja firmi jer su samo firme sa kompetentim proizvodom mogle da opstanu na tržištu. Što je veći broj određenog modela bio proizveden, to su troškovi njegove proizvodnje bili manji, tako da manje firme nisu imale puno šanse da opstanu kao ozbiljni konkurenti u ponudi uređaja rudarima.

Prvi ASIC-i su bili u obliku USB uređaja. Bili su bez ventilatora, bez buke i uz minimalnu potrošnju struje. Rudari su ubrzo krenuli da prave prve farme za rudarenje uz pomoć ovih malih uređaja – nekoliko desetina njih povezanih na isti računar uz pomoć USB hub-ova davali su maksimalne performanse. Sa porastom težine kopanja, sve bolji i bolji ASIC-i su zauzimali svoja mesta u garažama i skladištima rudara dok su stari bili prodavani po znatno manjim cenama.

*Prve ASIC farme*

ASIC uređaji su se razvijali kako je potreba za sve jačim mašinama rasla. Ova era i dalje traje, a ASIC uređaji danas pružaju nekoliko hiljada puta bolje performanse od prvih procesora koji su bili korišćeni 2009. godine. Nove generacije ASIC-a su uvek veoma isplative, ali treba uzeti u obzir i veoma veliku cenu novih ASIC uređaja kao i činjenicu da novi modeli izlaze na svakih nekoliko meseci što smanjuje profitabilnost starih modela.

*Izgled današnjeg ASIC uređaja*

Ovi uređaji će ostati dominantni na sceni Bitkoin rudarenja i nema naznaka da će se to promeniti u skorije vreme. U sledećem blogu o rudarenju bitkoina i kriptovaluta uopšte ćemo proći kroz način(e) za postavljanje rig-a za rudarenje i trenutno dostupne opcije na domaćem tržištu. Takođe ćemo pokriti određene modele i procene profitabilnosti rudarenja bitkoina u 2020-oj godini.

-

I know with the hype around Trump's election victory and the pro-Bitcoin people that he has surrounded himself with as of late, the idea of a Bitcoin Strategy Reserve or BSR is an intoxicating idea among many Bitcoiners.

I don't blame Bitcoiners from being happy about it, how can you not be? After enduring the last 4 years of vicious crackdown, arbitrary rules from the SEC and outright hostility to the Bitcoin community in general it is nice to have an administration that is simply nice to us and wants to leave the community alone to do it own thing.

While I am excited to see what a new Trump administration looks like for Bitcoin over the next four years, I am not onboard with a BSR. I think that the BSR is bad policy and supports the system that we are trying escape from in the first place.

In my opinion I believe a BSR signals to the world that the government doesn't believe in its own currency or its ability to reign their spending problem. Even the mere signaling that America is going to create a BSR has sent other countries scrambling to create one of their own. This is incredibly bad news for the US bond market.

[Who are the buyers of US bonds right now?](https://www.reuters.com/markets/rates-bonds/bond-vigilante-pimco-trims-long-term-us-sovereign-debt-holdings-2024-12-09/) A huge component of the market is foreign governments.[ Even though they have been less willing to buy US bonds over the last couple of decades most governments are still in the market buying up US debt. ](https://wolfstreet.com/2024/10/19/which-foreign-countries-bought-the-recklessly-ballooning-us-debt-increasingly-crucial-question-many-piled-it-up-cleanest-dirty-shirt/)

Now imagine of these foreign buyers start buying Bitcoin in small amounts at first and slowly scale into Bitcoin in a big way once they see the insane price action. They will FINALLY get it and once that happens its over the dollar. This is a gradually then suddenly like moment that no one is ready for at the moment.

So if you take way the foreign buyer of US bonds, who are you left with? The Federal Reserve. Having the Federal Reserve directly buying up government debt is huge sign of monetization of the debt to the world and doesn't bode well for the future of America or the world.

As you can see setting up a BSR would be highly destabilizing in the short term and could create a whole slew of knock on effects that no one is prepared or equipped to deal with.

In addition to destabilizing an already fragile economic environment, why do we want this big ass government to have Bitcoin in the first place? So they can keep on oppressing the working man/woman, crushing innovation and generally being a tick on the back of the private sector? How about we not empower them to keep spying on us and the world.

I want to live in a world where war impose heavy costs on leaders and governments and peace is the default setting of the world. Governments using Bitcoin to prop up their tyrannical ways is not why Bitcoin was created. You know that. I know that. The rest of the world should know that.

Bitcoin was created as an electronic p2p system that allows anyone to transact regardless of artificial borders or political differences. Bitcoin allows anyone to transact globally without the grubby hands of the government trying to take a cut. We need less government, not more.

I'm personally not a fan of governments or big money institutions getting into Bitcoin as I feel its like letting the fox into the hen house but that ship has sailed. The best we can hope for now is to create enough individual adoption that it makes it hard for governments to get a large amount of Bitcoin so they can act as a check on the accumulation of Bitcoin.

HODL culture is needed now more than ever. Don't hand over your Bitcoin to tyrants. Stack sats. HODL. Create the change you want to see in the world.

-

Hello everyone, as part of the nostr:npub10pensatlcfwktnvjjw2dtem38n6rvw8g6fv73h84cuacxn4c28eqyfn34f grant I have to write a progress report for Formstr, I thought I'll use this opportunity to do a nostr blog! , Something I've been meaning to do for sometime, hopefully I don't bore you.

## Introduction

There was a lot of work ahead of us even before we got the grant, and we tried to tackle it heads on.

We completely changed the underlying mechanism of storing and fetching forms. Whereas previously a form was a kind 0 event, same as a profile event. The form is now created and responded to in the mechanism as outlined in the [Forms NIP](https://github.com/nostr-protocol/nips/pull/1190/files). This had to be done while making sure that none of the older forms broke during the process. The new specification helps streamline the forms usecase to expand to access control, private forms, upgrade to nip44 encryption.

Some of these features existed as Proofs of Concepts prior to this quarters work, the major tasks were to streamline and production-ize them, to be able to release it to the public. We were also joined by nostr:npub1vf6wyw9j38sm96vwfekwvqxucr9jutqrmwdc2qnql79a66al9fzsuvt9ys who along with nostr:npub15gkmu50rcuv6mzevmslyllppwmeqxulnqfak0gwud3hfwmau6mvqqnpfvg helped move the project along.

## How did we spend our time.

Released a major Formstr Update (16/12/204): - [Release PR](https://github.com/abhay-raizada/nostr-forms/pull/157):

This Release Contained The Following Changelog:

- Move Form Creation and Rendering to New Event

- Upgrade Response Encryption to NIP-44.

- Add Ability to create private forms.

- Add ability to send private form access as Gift Wraps.

- Create a new dashboard UI to incorporate new form types.

- Add ability to login to formstr

- Use naddr to encode form Urls instead of pubkey(centralized).

Work done to production-ize these features can be found in the following PRs:

1. [Save forms to local device automatically](https://github.com/abhay-raizada/nostr-forms/pull/176)

2. [Ability to remove participants in Access Control UI](https://github.com/abhay-raizada/nostr-forms/pull/178)

3. [Revamp Responses Page according to NIP-101](https://github.com/abhay-raizada/nostr-forms/pull/181/files)

4. [Add a "My Forms" Section on the dashboard](https://github.com/abhay-raizada/nostr-forms/pull/188)

5. [Add UI for Inserting Images](https://github.com/abhay-raizada/nostr-forms/pull/183)

6. [Using Naddr Instead of pubkey as formId](https://github.com/abhay-raizada/nostr-forms/pull/180)

In addition to these there were multiple bugfixes and patches that I've excluded for brevity.

## Major Challenges

We were in "beta hell" for a long time, even though I had finished rudimentary versions of each of the features in advance (some to test the viability of the forms NIP). Incorporating them into the running version proved to be a challenge. We realized that some of the features required major UI changes, and a lot of new features broke previously working desirable features such as NIP-04 Notifications. A lot of [work](https://github.com/abhay-raizada/nostr-forms/pull/157/commits/4ce6970b09e7728004ccdeb058efb2b58dd96ef0) like this had to be done to ensure formstr brought in new features while continuing to work exactly as old users liked it.

## What's left and what's coming?

From the wish-list items I had committed during the application a few major ones remain:

- Edit Past Forms.

- Paid Surveys.

- Support for NIP-42 Private Relays.

- Conditional Rendering of form fields

- Sections

Of these I'm happy to report that we've already begun work on conditional rendering of fields (https://github.com/abhay-raizada/nostr-forms/pull/199)

## What is de-prioritized?

Going with experiences from quarter 1, we are de-prioritizing Formstr Integrations with 3rd party services like Ollama (Self Sovereign AI) and business tools like Slack, Notion etc. We'll try to get to it, but it's less of a priority compared to other features!

## How the funds were used.

- Paying Individual Contributors for PRs submitted.

- Living Expenses

-

As men age, maintaining optimal vitality becomes essential for a fulfilling life. At TESTO - Herbal Vitality, we offer a range of natural solutions designed to help men maintain energy, confidence, and balance. From vitamins that support testosterone to libido supplements in NZ and horny goat weed for men, our products offer natural ways to support male health. In this article, we’ll explore how these supplements can help enhance your well-being.

**How Can Vitamins That Support Testosterone Improve Men’s Health**?

Testosterone is a key hormone that influences many aspects of men’s health, including muscle mass, energy levels, and sexual wellness. As men age, their testosterone levels naturally decrease, which can lead to reduced vitality and performance. To combat this, it’s important to include vitamins that help maintain testosterone levels.

Vitamins such as Vitamin D, Zinc, and Magnesium are crucial for supporting testosterone production. Vitamin D, for example, has been linked to better testosterone levels, while Zinc and Magnesium play important roles in hormone regulation. Our herbal formulations combine these essential nutrients to help men naturally maintain their testosterone levels, supporting long-term vitality and a better quality of life.

Incorporating vitamins that support testosterone into your daily routine can help you feel more energised, maintain physical strength, and improve overall wellness.

**What Are Libido Supplements in NZ and How Can They Benefit You**?

Libido plays a crucial role in maintaining healthy relationships and personal well-being. As men age, their libido can decline due to hormonal changes or stress. This is where libido supplements in NZ come into play. At TESTO, our libido supplements are crafted to naturally support sexual health, enhance performance, and boost energy levels.

Our supplements are made from powerful herbs traditionally used to support male sexual health. These ingredients help improve blood circulation, support hormone balance, and provide a natural energy boost. By choosing libido supplements in NZ, you can promote better sexual health and confidence.

In addition, our libido supplements are safe, effective, and made with high-quality, natural ingredients. They offer an ideal solution for those looking to support their overall well-being and improve performance naturally.

**Why Is Horny Goat Weed for Men So Effective**?

Known for its long history in traditional medicine, horny goat weed is a powerful herb used to enhance stamina, support sexual health, and boost energy levels. It contains icariin, a compound believed to improve blood flow and enhance endurance.

Horny goat weed has been widely used for centuries in Chinese medicine to promote vitality. This herb works by supporting circulation, which helps men feel more energised, both physically and mentally. Whether you're looking to increase stamina during workouts or improve performance in the bedroom, horny goat weed for men offers a natural solution to support your health.

**Why Choose Natural Supplements for Your Health**?

At TESTO - Herbal Vitality, we believe in the power of natural ingredients to support men’s wellness. Our products, including [vitamins that support testosterone](https://www.testo.co.nz/), libido supplements in NZ, and horny goat weed for men, are designed to provide safe, effective solutions for boosting vitality, energy, and sexual health.

By integrating these supplements into your routine, you’re taking steps toward improved wellness and a healthier lifestyle. We use high-quality, natural ingredients to ensure you receive the best possible results without harmful side effects.

Start your journey toward revitalisation with TESTO and enjoy the benefits of natural, holistic wellness. Whether you're aiming to boost your testosterone levels, support your libido, or enhance your overall vitality, we have the right solutions for you.

-

I feel like I'm just full of newbie questions for stacker news this week. Sorry.

I recently took the killer [pleb devs courses](https://plebdevs.com/) and now confidently feel like I have some programming skills kinda-sorta (the classes are great, but I was starting from 0) under my belt. My end goal was to stick it to the man and be a part of the bitcoin revolution. That said, I've made a couple of projects that I really want to share with more folks, but would like to actually make them into cooler sites.

For my actual long-term business, I've been renting a domain name for decades and never thought too much about it since it was a business expense and I really didn't care what happened to it after I was gone. However, for these fun coding projects, I wanted to get a domain so that everything doesn't end in .onrender or .vercel.app and I assumed that since I was using a more silly name, it'd be cheap to just by something forever. But that doesn't seem to be the case. In fact...as most of you know...but which is news to me, you can't actually buy domains forever at all. Am I correct about this? If so, doesn't that mean the whole decentralized nature of the internet is a sham? I'm feeling very confused and not finding much helpful info.

My goal is to buy a landing page for a bunch of bitcoin-themed games I've built (something like bitcoingames.stupid) and my [nostrminusnostr](https://nostrminusnostr.vercel.app/) client, something like nostrminusnostr.nostr. Anyway, I found some stuff in the range I'd be willing to spend on Vercel, but am just a little confused how domain hosting actually works.

originally posted at https://stacker.news/items/851425

-

First off, big shoutout to Coinos for having support for adding a memo to BOLT12 offers. This provides a solid alternative for the pleb who wants to support mining decentralization but doesn’t want to set up a CLN node and pay thousands of sats for a channel only to get little rewards. This is the case for most of us who only have a miner or two (e.g. a Bitaxe and/or an S9).

Before we get into setting up Lightning payouts, you’ll want to have your miner configured to mine with OCEAN of course. You’ll also want to make sure that the bitcoin address you use is from a wallet that supports signing messages.

These are the ones listed in the OCEAN docs[^1]:

[^1]: https://ocean.xyz/docs/lightning

* Bitcoin Knots/Bitcoin Core

* Coldcard

* Electrum

* LND (Command Line)

* Seedsigner

* Sparrow

* Specter

* Trezor

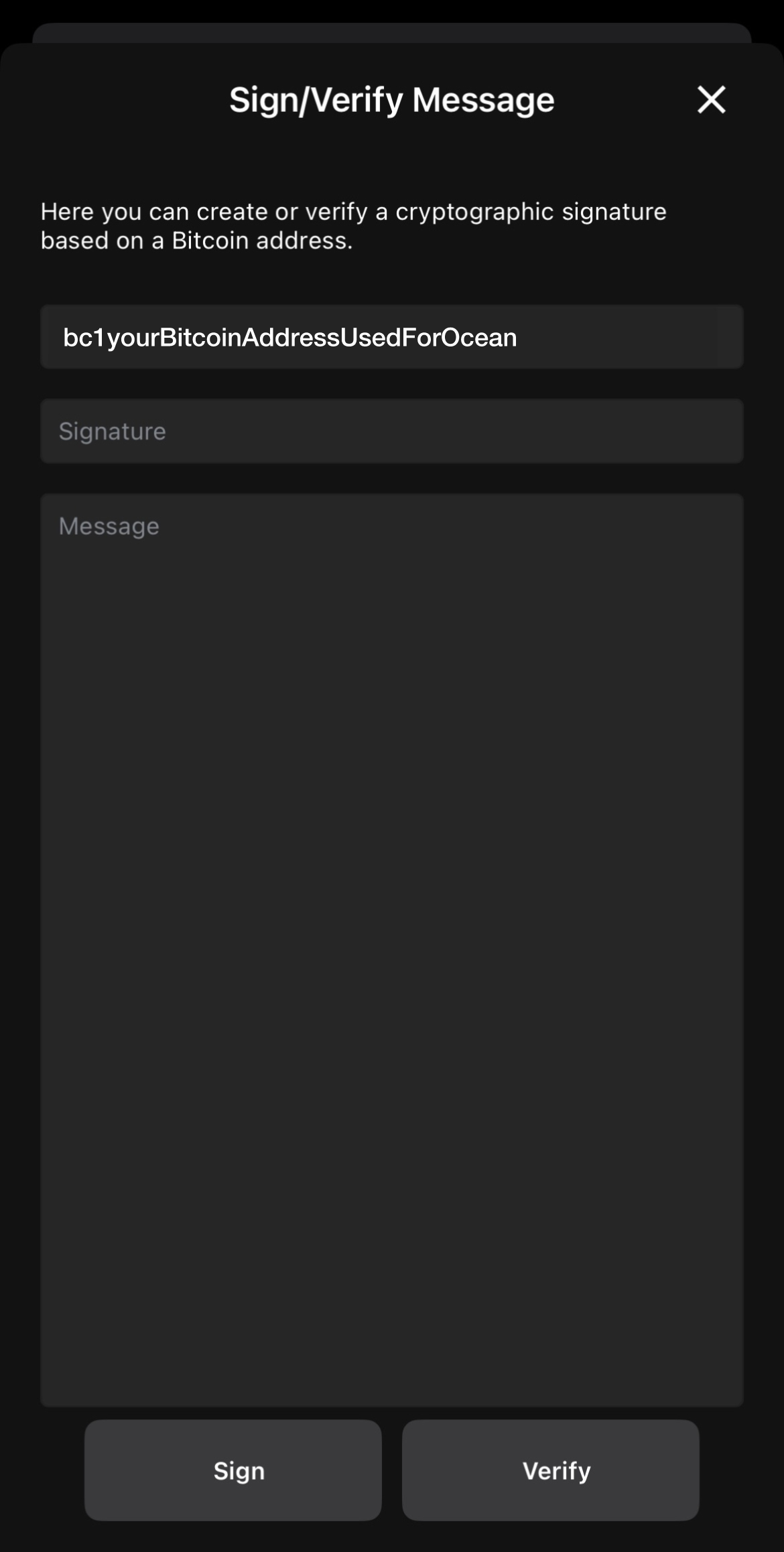

I checked one of my favorite, user-friendly wallets — Blue Wallet — and it happens to support signing messages as well.

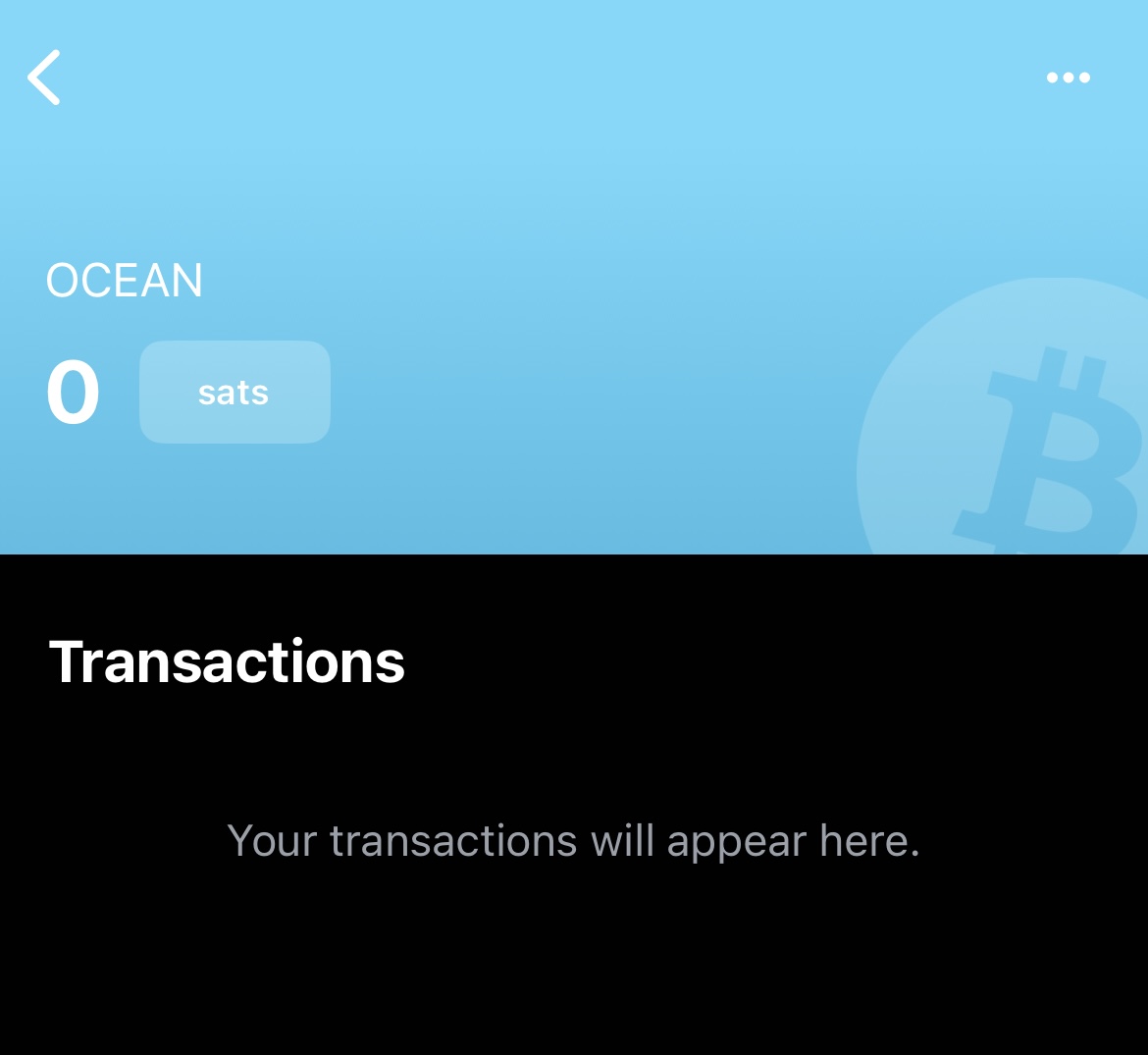

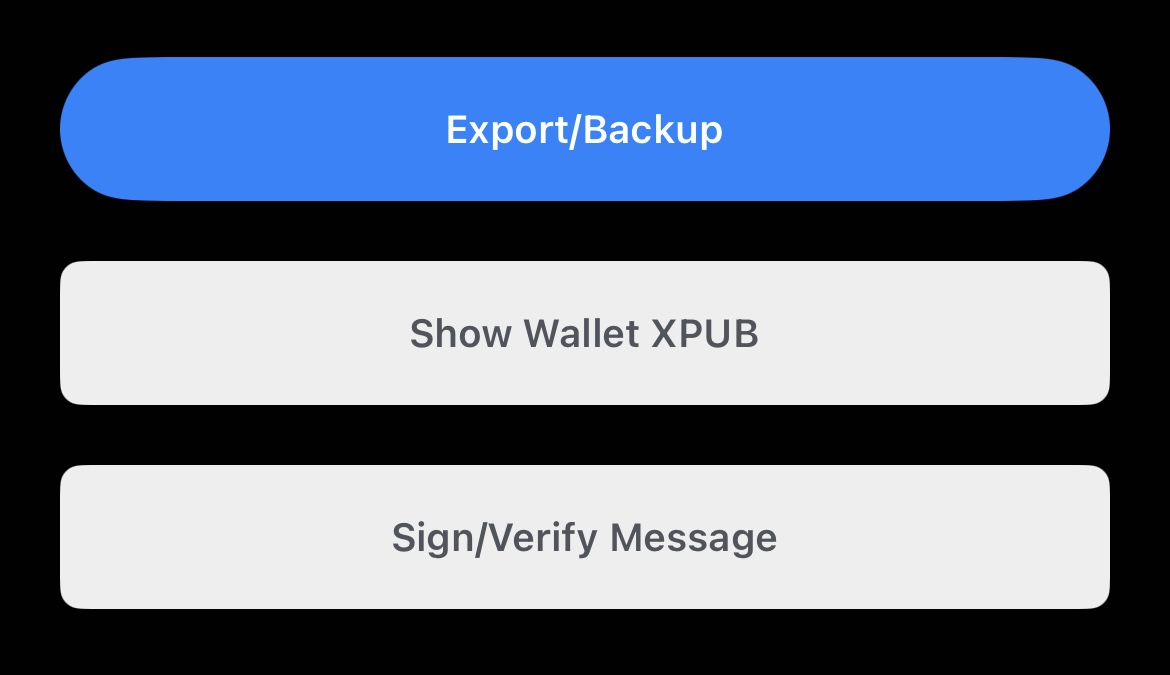

Just tap the three dots on the upper right and you’ll see the “Sign/Verify Message” button at the bottom.

Whichever wallet you choose, generate a receive address to use when configuring your miner (it’ll also be your OCEAN username).

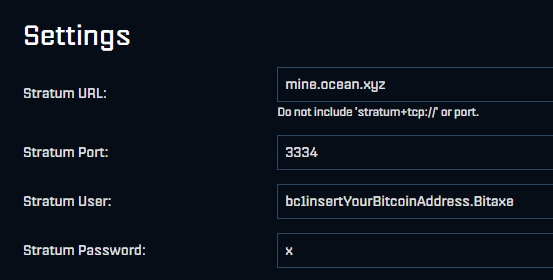

Here’s how it looks on the Bitaxe (AxeOS)…

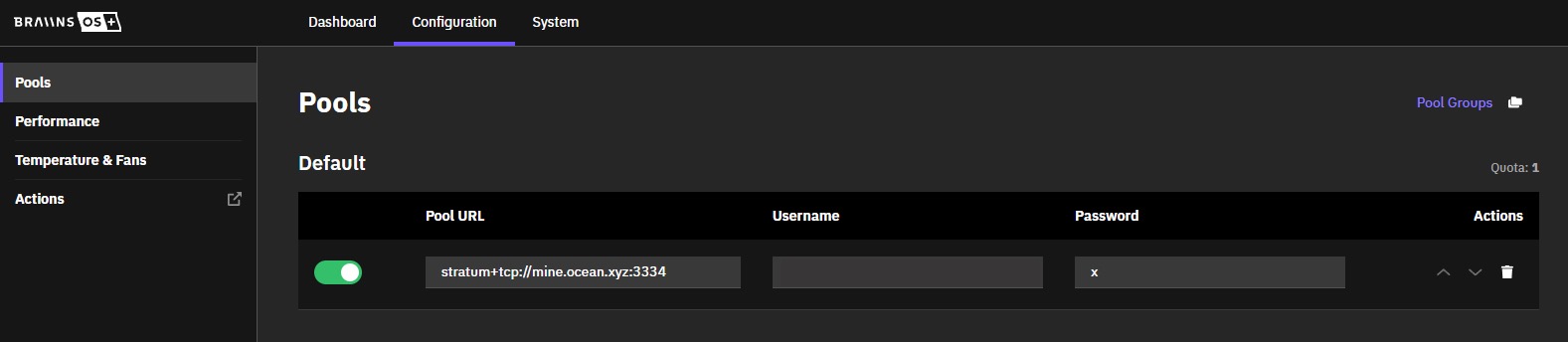

And the Antminer S9 (Braiins OS).

NOTE: There’s a slight difference in the URL format between the two apps. Other than that, the username will be your bitcoin address followed by the optional “.” + the nickname for your machine.

You can find more details on OCEAN’s get started page[^2].

[^2]: https://ocean.xyz/getstarted

---

Alright, now that your miner is pointed at OCEAN. Let’s configure Lightning payouts!

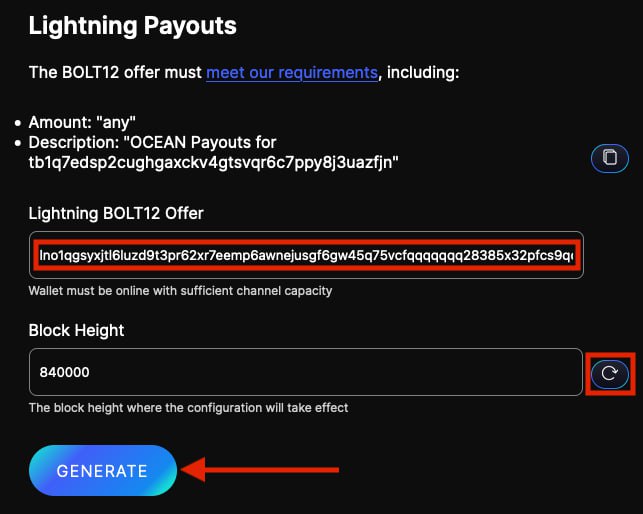

### Generating the BOLT12 Offer

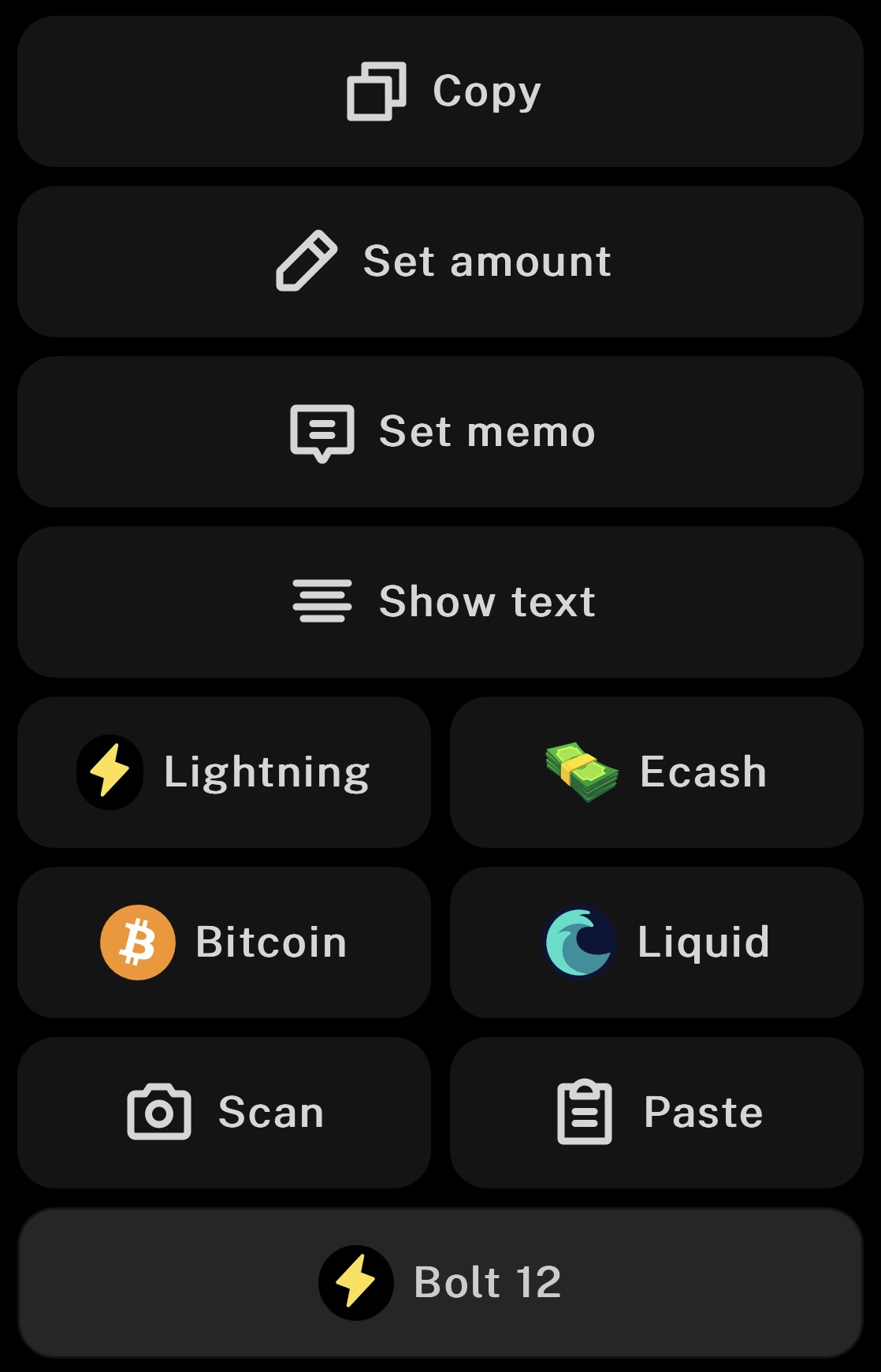

In the Coinos app, go to Receive > Bolt 12.

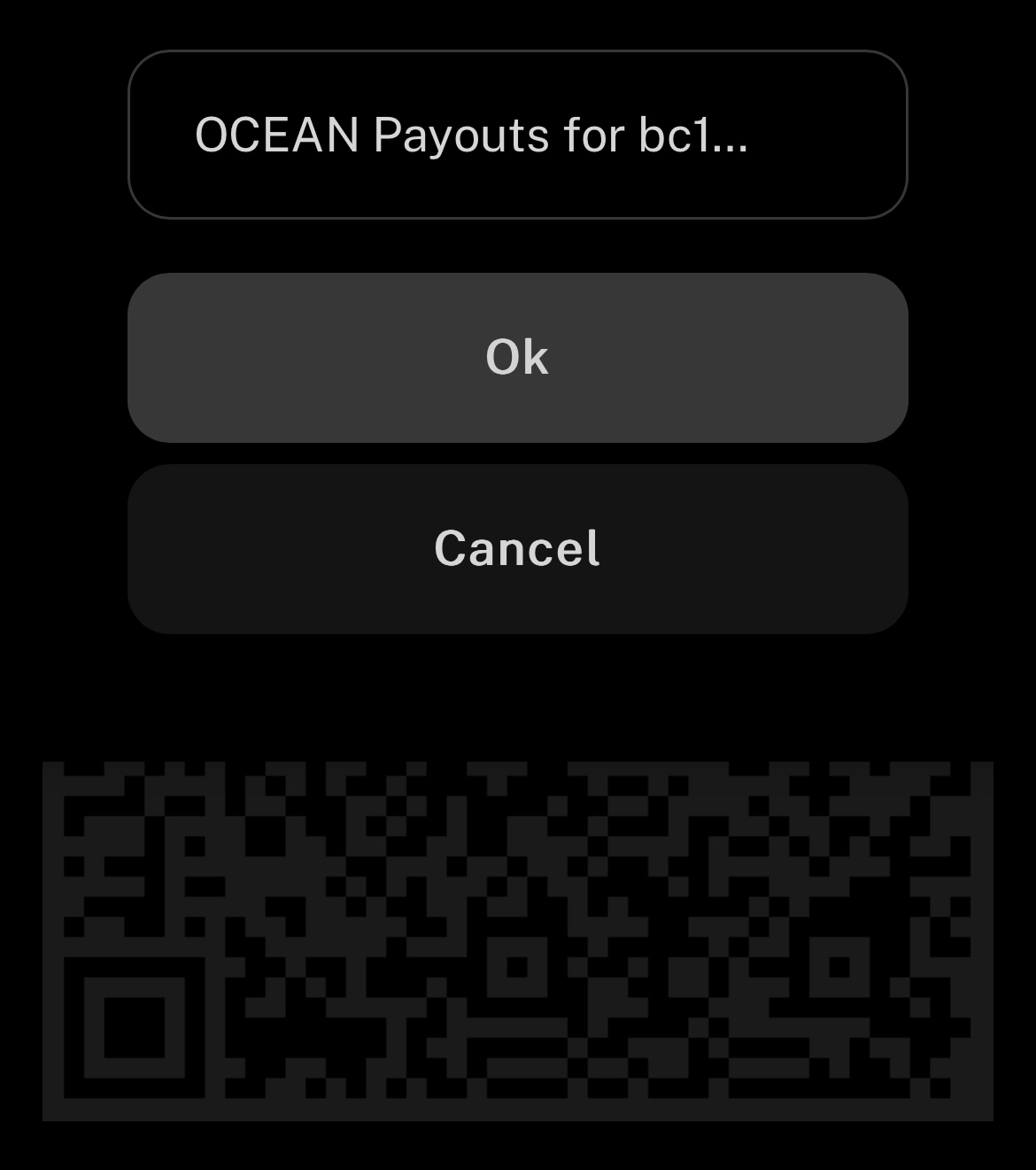

Tap “Set memo” and set it to “OCEAN Payouts for [insert your bitcoin address]” (this text is case-sensitive). Use the same bitcoin address you used above to configure your miner(s).

After tapping OK, copy the BOLT12 offer (it should start with “lno”) and proceed to the next step.

### Generating the Configuration Message

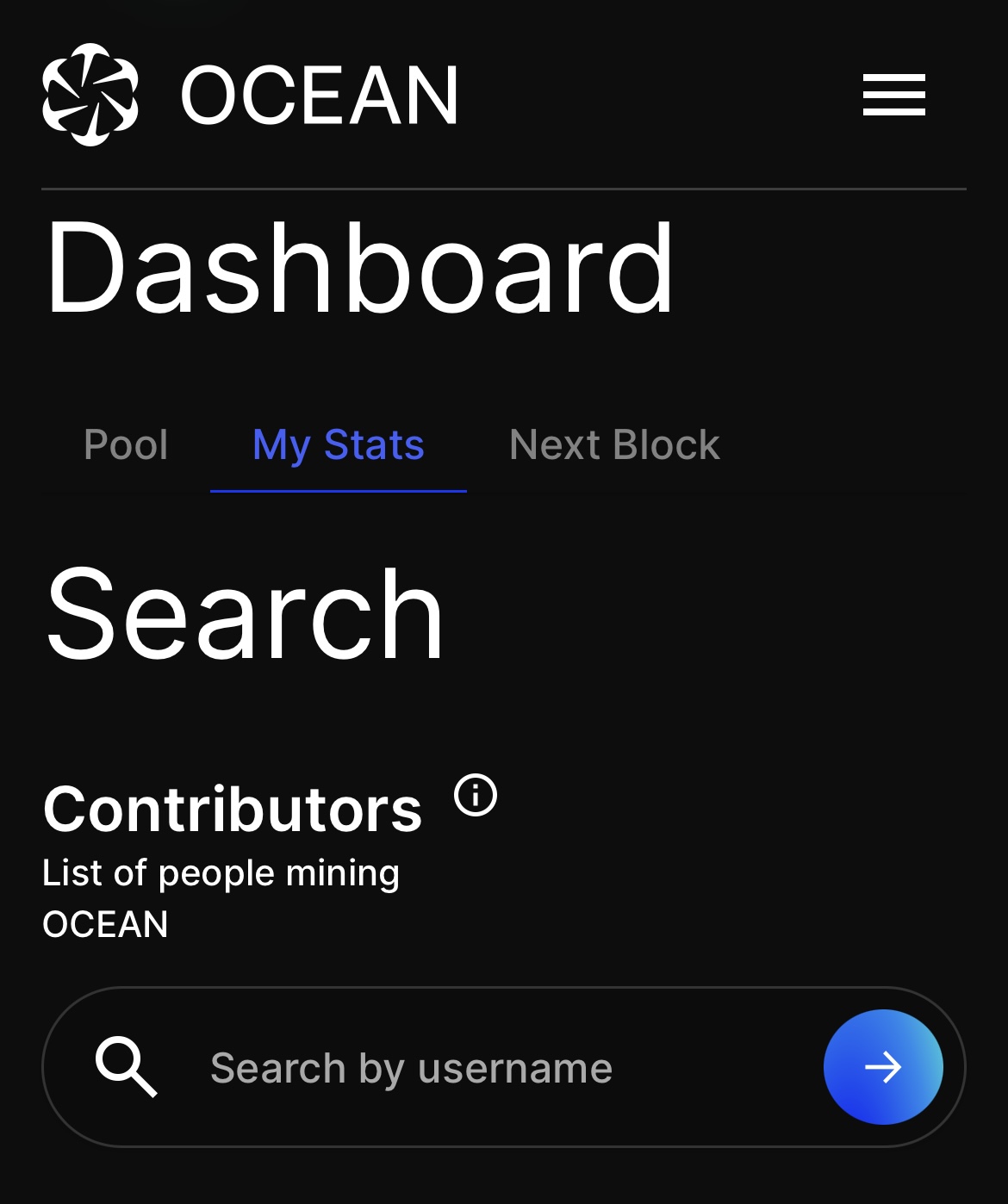

Navigate to the [My Stats](https://ocean.xyz/stats) page by searching for your OCEAN Bitcoin address.

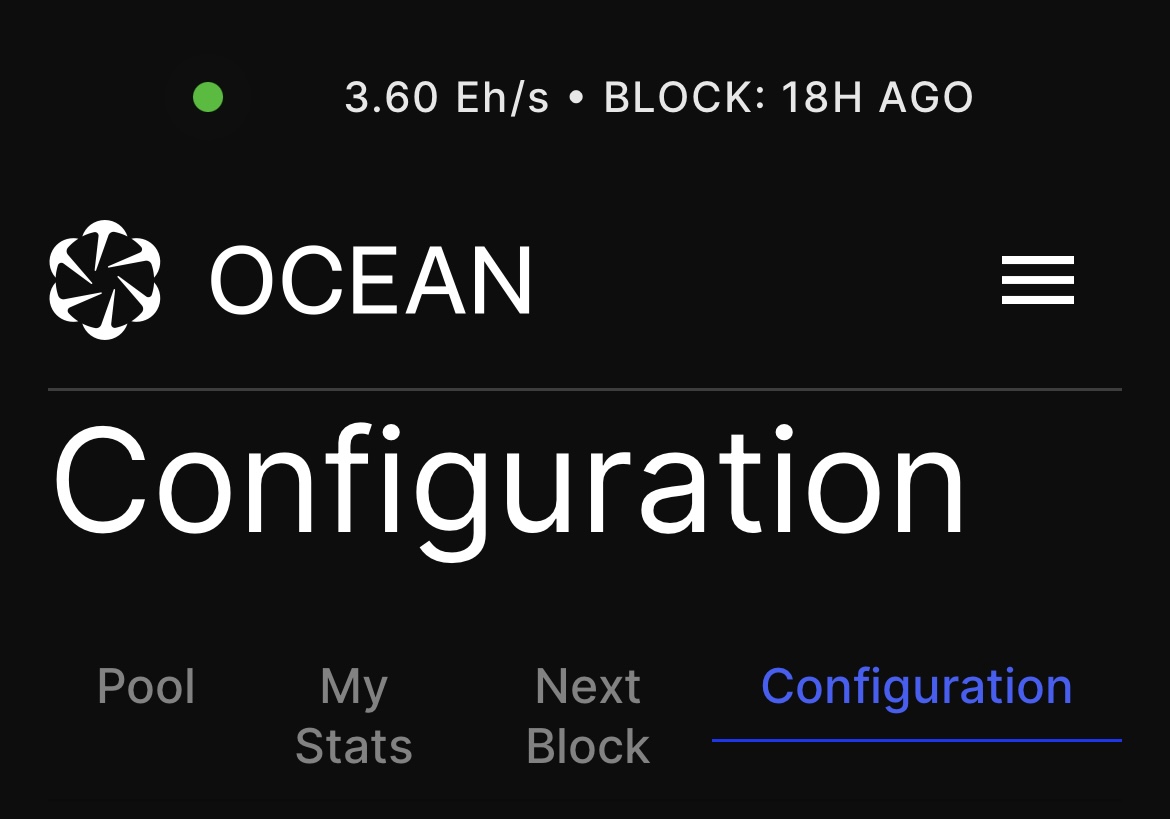

The click the Configuration link next to Next Block to access the configuration form.

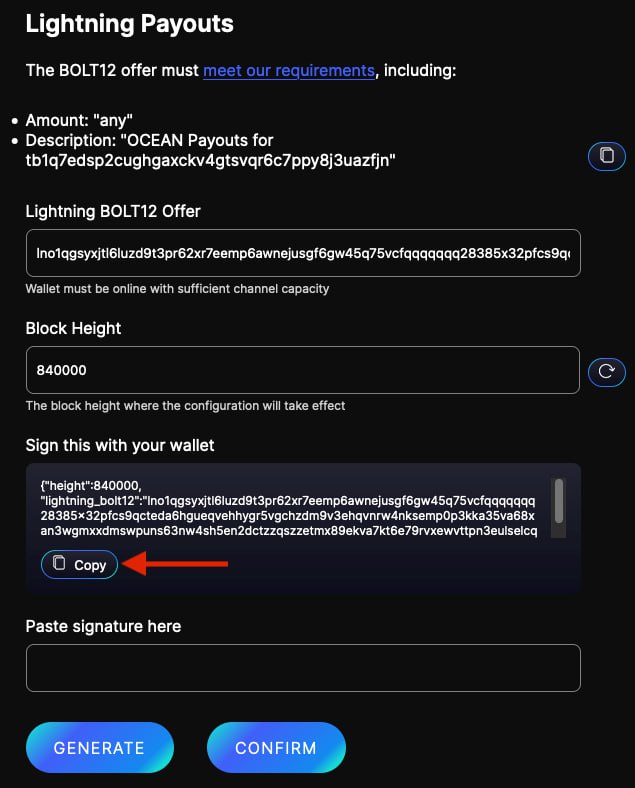

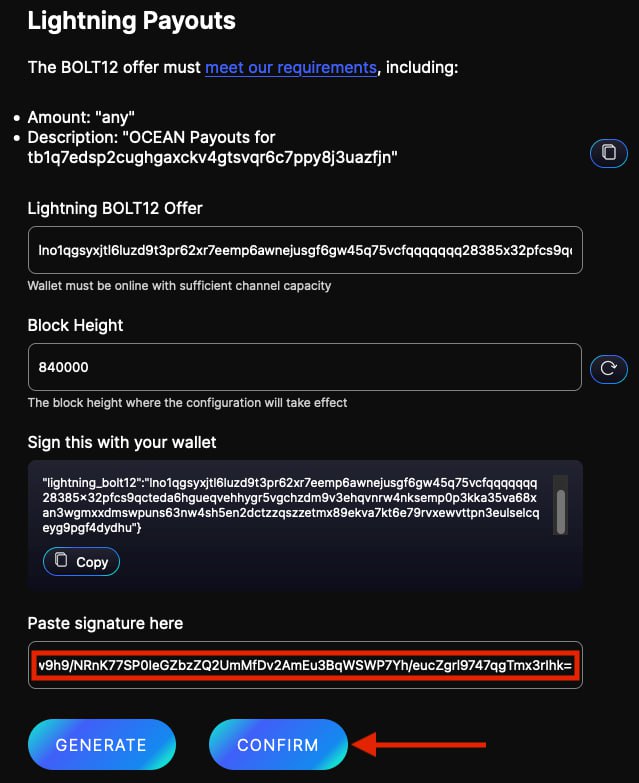

Paste the BOLT12 offer here, update the block height to latest, click GENERATE, and copy the generated unsigned message.

### Signing the Configuration Message

To sign the generated message, go back to Blue Wallet and use the signing function. Paste the configuration message in the Message field, tap Sign, and copy the signed message that’s generated.

### Submitting the Signed Message

Once signed, copy the signature, paste it in the OCEAN configuration form, and click CONFIRM.

If all goes well, you should see a confirmation that the configuration was successful. Congrats! 🎉

All you gotta do now is sit back, relax, and wait for a block to be found…

Or you can look into setting up [DATUM](https://ocean.xyz/docs/datum-setup). 😎

originally posted at https://stacker.news/items/851025

-

Em 2007, o Brasil comemorava o fim da CPMF (Contribuição Provisória sobre Movimentação Financeira), um imposto que, embora "temporário", durou 10 anos e arrecadou centenas de bilhões de reais. Na época, o governo afirmava que a contribuição era necessária para financiar a saúde pública, mas, na prática, foi mais um peso sobre o cidadão e as empresas.

Agora, quase duas décadas depois, o cenário está mudando novamente. O monitoramento financeiro da Receita Federal sobre transações acima de R$ 5 mil e a implementação do DREX, a moeda digital programável do Banco Central, sugerem que o controle sobre o dinheiro nunca foi tão grande.

A pergunta que fica é: será que estamos caminhando para uma nova CPMF, só que digital e automatizada?

---

### **O Passado: CPMF e o Controle Estatal sobre o Dinheiro**

\

A CPMF nasceu sob o pretexto de ser um imposto temporário, com uma alíquota pequena (inicialmente 0,20%, depois 0,38%) que incidiria sobre qualquer movimentação bancária. Seu objetivo oficial era financiar a saúde, mas a verdade é que o governo encontrou nela uma mina de ouro de arrecadação, garantindo bilhões de reais anualmente.

Os problemas começaram a aparecer rapidamente:

1. O custo era repassado aos preços dos produtos e serviços, afetando toda a economia.

2. Empresas e cidadãos pagavam sobre transações repetidas, tornando a carga tributária ainda maior.

3. O dinheiro não foi totalmente para a saúde, sendo usado para tapar buracos no orçamento.

4. A promessa de temporariedade caiu por terra, e a CPMF durou uma década.

5. O governo insistia que não existia outro jeito de arrecadar sem essa cobrança, mas, quando foi extinta, nada desmoronou. Só ficou mais difícil tributar o cidadão sem que ele percebesse.

Agora, vemos novos mecanismos de controle financeiro surgindo. O argumento é o mesmo: transparência, combate à sonegação e otimização da arrecadação. Mas será que é só isso?

---

### **O Presente: Receita Federal Fecha o Cerco sobre Suas Transações**

\

A partir de 2025, qualquer movimentação acima de R$ 5 mil para pessoas físicas e R$ 15 mil para empresas será automaticamente informada à Receita Federal. Isso significa que se você fizer uma transferência maior que esse valor, o governo já saberá sem precisar pedir dados ao banco.

Oficialmente, essa medida não implica na criação de um novo imposto. Mas, se a história nos ensina algo, é que governos não implementam esse nível de monitoramento à toa. Algumas questões que surgem:

- Se não é para tributar, por que monitorar tão de perto?

- Se a CPMF foi extinta, por que voltamos a um sistema de rastreamento financeiro tão intrusivo?

- Esse é só um primeiro passo para um imposto automático sobre movimentações digitais?

---

### **O Futuro: DREX e a Automação da Tributação**

\

O DREX, a versão digital do real, será um grande passo para o controle financeiro estatal. Diferente do Pix, que apenas facilita transferências, o DREX permite que o Banco Central programe e rastreie cada centavo movimentado.

E o que isso significa para o cidadão comum?

- Pagamentos e tributações automáticas: um sistema de split payment poderia fazer com que impostos fossem cobrados diretamente na fonte, sem a necessidade de declarações ou boletos.

- Controle total sobre transações: diferente do dinheiro físico, que circula sem monitoramento, o DREX permitirá ao governo rastrear qualquer pagamento, em tempo real.

- Possibilidade de limitação de uso: com uma moeda programável, poderia haver restrições sobre onde, quando e como você pode gastar seu dinheiro.

O Banco Central e a Receita Federal garantem que não há planos de usar o DREX para tributação compulsória, mas a CPMF também começou assim: como algo temporário, necessário e inofensivo.

---

### **Estamos Caminhando para uma Nova CPMF Digital?**

\

Se analisarmos a trajetória do governo na questão tributária, fica claro que:

- Primeiro, nega-se qualquer imposto novo.

- Depois, implementa-se um sistema de monitoramento, supostamente para "combater fraudes".

- Por fim, a tributação é introduzida sob a justificativa de que "não há outra saída". A CPMF só funcionou porque o dinheiro passava pelo sistema bancário e era fácil de rastrear. Agora, com o DREX e o monitoramento da Receita, o governo não precisaria nem de um imposto explícito para tributar transações—ele poderia simplesmente automatizar a cobrança diretamente na moeda digital.

O que antes dependia de aprovação no Congresso e resistência da população, pode agora ser feito com um simples ajuste de software no Banco Central.

O governo diz que isso não está nos planos. Mas se olharmos para trás, essa é exatamente a mesma narrativa que ouvimos antes da CPMF entrar em vigor.

---

### **Seu Dinheiro, Seu Controle?**

\

O Brasil está entrando em uma nova era financeira. O monitoramento de grandes transações e a implementação do DREX podem representar um avanço na transparência e na eficiência econômica, mas também criam um risco real de perda de liberdade financeira e tributação automatizada.

O que aconteceu com a CPMF deve servir de lição: o que começa como uma simples ferramenta de arrecadação pode se transformar em um peso permanente sobre o cidadão.

Se o governo tiver a tecnologia e a infraestrutura para tributar automaticamente, quanto tempo levará até que eles resolvam usá-la?

-

Many times people wonder “Why do we have to obey God?” or “Why should we submit to Jesus’s lordship?” or “Why is Jesus the only way to Heaven?” Although there are many reasons, they can all be summarized in Him being our creator.

Today, I was listening to “The End Times” podcast with Mark Hitchcock and he was discussing Revelation chapter 4. Among other things, he read this passage:

> And the four living creatures, each one of them having six wings, are full of eyes around and within; and day and night they do not cease to say,

>

> “**Holy, holy, holy is the Lord God, the Almighty, who was and who is and who is to come**.”

>

> And when the living creatures give glory and honor and thanks to Him who sits on the throne, to Him who lives forever and ever, the twenty-four elders will fall down before Him who sits on the throne, and will worship Him who lives forever and ever, and will cast their crowns before the throne, saying,

>

> “**Worthy are You, our Lord and our God, to receive glory and honor and power; for You created all things, and because of Your will they existed, and were created**.” (Revelation 4:8-11) {emphasis mine}

God deserves our worship and our obedience because He is our creator. As creator, He has the right to command us to obey. Also as creator, He knows what is best for us because He created us and everything around us. He created us with a purpose and we will never know complete joy and peace until we obey Him and work according to the purpose He created us to fulfill.

If God was just a superhero type God, who was stronger and smarter than us, then He wouldn’t have a right to authority over us. Because He created us, He does. People questioning God’s authority to define right and wrong has existed throughout history. Isaiah addressed this complaint in the Old Testament:

> “Woe to the one who quarrels with his Maker—\

> An earthenware vessel among the vessels of earth!\

> Will the clay say to the potter, ‘What are you doing?’\

> Or the thing you are making say, ‘He has no hands’? (Isaiah 45:9)

In the New Testament, Paul goes into even more details on God’s right and authority:

> On the contrary, who are you, O man, who answers back to God? The thing molded will not say to the molder, “Why did you make me like this,” will it? Or does not the potter have a right over the clay, to make from the same lump one vessel for honorable use and another for common use? What if God, although willing to demonstrate His wrath and to make His power known, endured with much patience vessels of wrath prepared for destruction? And He did so to make known the riches of His glory upon vessels of mercy, which He prepared beforehand for glory, even us, whom He also called, not from among Jews only, but also from among Gentiles. (Romans 9:20-24)

The one who creates something has the right to do what he wants with his creation, whether using it for honor, for dishonor, or for destruction. The creator has the right to say how his creation will be used and for what purpose it will be used. No one, especially the created creature, has a right to question that authority. We question God’s authority and His truth because we do not have nearly a high enough view of God.

> **You turn things around!**\

> Shall the potter be considered as equal with the clay,\

> That what is made would say to its maker, “He did not make me”;\

> Or what is formed say to him who formed it, “He has no understanding”? (Isaiah 29:16) {emphasis mine}

Read this verse again. Anyone who is formed, who says to the one who formed it, “*He has not understanding*,” has completely turned their thinking upside down. This is foolish thinking.

God deserves our thanks, our worship, and our obedience because He created us. Without Him we would never have existed. God is good! All of the time!

> “**Worthy are You, our Lord and our God, to receive glory and honor and power; for You created all things, and because of Your will they existed, and were created**.” (Revelation 4:11) {emphasis mine}

Because I see so many people treat God in such a low manner, I tend to accentuate His holiness and His authority. That doesn’t mean that the God of the Bible is a distant taskmaster far away sitting waiting to punish anyone who strays from the exact path He has called them to walk. He is loving, kind, and merciful, too.

God is referred to as Father for a reason. A father of a youngster is feared by the child, but that child also leans on his father for protection, love, and direction. Although the father has the authority and the power to punish or make demands, a loving father does what is best for the child. The best may be a punishment for doing wrong or just allowing the child to fail, but the father’s protecting hand is always there preventing any major harm. The discomfort that is allowed is for the good of the child. It guides the child in the path that will most benefit the child in the long run even if the child is very unhappy with the father’s actions at the moment. Most of the time, when the child grows up, they come to understand and appreciate their parents’ actions. The God of the Bible is the heavenly Father of each and every believer and so much more loving, more wise, and more powerful than any earthly father.

Trust Jesus.\

\

your sister in Christ,

Christy

FYI, Right after writing this post, I read this article on a related subject. It is a hard truth, like the one I shared, but worth embracing, if you have time, check it out

[The Not So Political Protestant](https://thenotsopoliticalprotestant.substack.com/p/could-oppression-be-gods-wonderful?utm_source=substack&utm_campaign=post_embed&utm_medium=web)

[Could Oppression Be God's Wonderful Plan for Your Life?](https://thenotsopoliticalprotestant.substack.com/p/could-oppression-be-gods-wonderful?utm_source=substack&utm_campaign=post_embed&utm_medium=web)

[Hey guys, it's Lee. Thanks for stopping by The Not So Political Protestant, a publication dedicated to correcting the course of the American church in regard to politics and its place in the lives of Christians. The Not So Political Protestant is here to call God's people back to sanity and repentance because, as citizens of another world, we should liv…](https://thenotsopoliticalprotestant.substack.com/p/could-oppression-be-gods-wonderful?utm_source=substack&utm_campaign=post_embed&utm_medium=web)

[Read more](https://thenotsopoliticalprotestant.substack.com/p/could-oppression-be-gods-wonderful?utm_source=substack&utm_campaign=post_embed&utm_medium=web)

[a month ago · 3 likes · 3 comments · Lee Lumley](https://thenotsopoliticalprotestant.substack.com/p/could-oppression-be-gods-wonderful?utm_source=substack&utm_campaign=post_embed&utm_medium=web)

Bible verses are NASB (New American Standard Bible) 1995 edition unless otherwise stated

-

Few days back this track get on Top of list on #wavlake.

It's nice , but not a point. at all.

> The message is clear. like Real Talk should be !

We know, specialy on #nostr, that solutions are available. However, the world is not yet aware of them.

100% of the donations for this remix will be sent to my friend [Yusef]( https://x.com/Yusef_Mahmoud1) who is on the ground and has been providing food, water, and shelter for children in Gaza even before or the psyop with October 07 took a place. Israel has enforced a blockade on Gaza for over decade. And Just past year completly destroyed 90% of land.

Like to the ground , no schools , no hospitals ... hard to find anything what surrvived those daily airstrikes without 1h of pause since 350 days. WTF

It's heartbreaking to see children dying daily in houreds and the lack of action from the public and authorities of other nations. The statistics are alarming, and it's essential to address this issue and find ways to make progress. it's crucial to raise awareness and take action to prevent further tragedies. Let's remember that every child's life is precious and deserves our attention and support.

In most apocaliptic condition , where is-real controling all money supply (check lastest news about banknotes in there) , the #Bitcoin is one and only solution can help them in daily bases. It was helping them before with great succes. Why you ask ? becuse even if they close all platforms You can still send them some sats.

> How fookin cool is that !!

I know it doesn't sound funny.

Those People pushed to the limit , now they have a tool that fulfills exactly what was created for A Peer-to-Peer Electronic Cash System.

```

No Middle man .

```

```

On the middle is only a finger whitch **WE the PEOPLE**

can give to those Scumbagz in Goverments and Banks, Full stop.

```

Many people are only recently realizing the truth about Gaza being an open-air prison from like 75 years. Not 3, not 5 or even 20 ..... but ***seventy five fookin years***.

This music mix was created to share the truth and provoke to critical thinking, which has been lacking for the past decade. and even more.

I wonder why we can watch live streams of the ongoing genocide in 4K HD and stil be silent. not all but many.

Why are we surprised that normies don't understand ***Bitcoin*** and still use **fiat** shit currency? Whitch is fudament of All war crimes. We should ask ourselves.

> Our own ignorance and the banking system are the cancers of this world.

### If we lose Palestine, we will lose much more than we think.

You will be next - One way or another

Thank you for your support, not for me but for those in need who can gain hope from our efforts.

Respect to you all.

[LISTEN HERE]( https://wavlake.com/album/c980c860-9102-49bb-9fef-bdf0a270486d) and suport directly in upper links

#FreePalestine

Thanks

be blessed

MadMunky

-

I am a huge fan of Flatpak applications on Linux. I like how they work. I like how easy they are to install. I like how you can control their permissions with such granularity. Etc.

Well now, I have yet another reason to love Flatpaks: easy installation reproducibility. Let me show you what I mean.

---

Let's say you have been using Flatpaks for a while, and you have all the apps you could want installed on your system.

Then, for whatever reason, you have to set up an OS on a new machine. For example, it could be that a new version of Ubuntu is about to drop, and you want to install it from scratch on your laptop.

Well, now you can easily install all the Flatpaks that you use and love on that new OS with just a few commands.

First, on your current machine, we want to list out all the installed Flatpaks. But, we don't want to just do it with a `flatpak list`, because that gives us too much information.

All we want right now is a list of the Application IDs. We can do that with the following command:

```

flatpak list --app --columns application

```

Now, this is great, and we can just manually copy and paste this list into a text file if we want.

Instead, what we are going to do is take that output and redirect it to a file with the output redirection operator. We are going to call that output something like "flatpaks.txt" or something else unimportant, because we need to rename the file in the next step.

```

flatpak list --app --columns application > flatpaks.txt

```

Great! Now, we have a text file of every Flatpak we currently have installed on our system. Next, we need to format it, so we can easily input the contents of the text file into the command line for install at a later time.

We can easily format this file appropriately with the next command and output the contents into a new text file. In my experience, if we try to overwrite the contents of the first file, the command won't work. Here's how to do it:

```

cat flatpaks.txt | tr '\n' ' ' | sed 's/ $/\n/' > flatpakinstalls.txt

```

Now, this is technically a few commands, and when broken down they simply say "take this file's contents, replace the new lines with spaces, remove the trailing space at the end of the line, and write this new output to a new file." Regular expressions are wild.

The last thing you'll want to do is delete the original file, since now you have two:

```

rm flatpaks.txt

```

With that, you have a clean text file containing all the Flatpaks installed on your system that you can reference on any other machine. But, we can actually do this a little better.

With all of that out of the way, we can take that three or four-step process and boil it down to one simple copy pasta command thanks to the and operator, `&&`:

```

flatpak list --app --columns application > flatpaks.txt && cat flatpaks.txt | tr '\n' ' ' | sed 's/ $/\n/' > flatpakinstalls.txt && rm flatpaks.txt

```

That's it! Easy as pie.

Just keep this file backed up and safe. Then, after you are done installing your new OS, you'll need to make sure Flatpak is set up and ready by following the official Flatpak documentation.

After that, you can move this text file over to that machine, copy the contents, and paste them after the `flatpak install` command to quickly and effortlessly reproduce the Flatpak setup you had on your old installation.

Hope you find this as helpful as I do.

-

In infosec, there is a seemingly never ending list of acronyms any cyber professional must be familiar with in order to work efficiently and effectively. One of those is a common vulnerability known as IDOR.

IDOR stands for Insecure Direct Object Reference, and it's a type of vulnerability that can have serious implications for the security of web applications if not properly addressed. But what is it exactly?

## What is IDOR?

---

IDOR is a security vulnerability that occurs when an application exposes internal implementation objects to users without proper authorization checks. In simpler terms, it means that an attacker can manipulate parameters in the application's URL or form fields to access unauthorized data or functionality.

Ok, that's a mouthful, so let's break it down further.

## How Does IDOR Work?

---

To understand how IDOR works, consider a scenario where a web application reveals information about what you're accessing or viewing via the URL. For example, a user profile page may have a URL like the following: `https://example.com/profile?id=123`.

In a secure application, the server would verify that the user has the necessary permissions to access the profile with ID 123. However, in the case of an IDOR vulnerability, an attacker could change the ID parameter in the URL to something like `https://example.com/profile?id=456` to access a different user's profile, potentially exposing sensitive customer information.

The consequences of an IDOR vulnerability go beyond unauthorized access to customer information as well. Attackers could gain access to other sensitive data, such as financial records, administrative functions, or other business related data. This can lead to data breaches, privacy violations, and reputational damage to the organization.

## Preventing IDOR Attacks

---

Preventing IDOR attacks requires a proactive approach to security. Here are some basic best practices to mitigate theses attacks:

1. Implement Proper Access Controls: Ensure that all user requests are properly authenticated and authorized before granting access to resources.

2. Use Indirect Object References: Instead of exposing internal object references directly in URLs, use indirect references that are mapped to internal objects on the server side.

3. Validate User Input: Sanitize and validate all user input to prevent malicious manipulation of parameters.

4. Employ Role-Based Access Control: Implement role-based access control to restrict users' access to only the resources they are authorized to view or modify.

5. Regular Security Audits: Conduct regular security audits and penetration testing to identify and remediate potential IDOR vulnerabilities.

IDOR is a critical security issue that requires proactive measures to mitigate. By understanding how IDOR works and implementing various security controls, organizations can safeguard their web applications against potential threats and ensure the confidentiality, integrity, and availability of their data.

-

In cybersecurity, there is a buzzword I've seen some confusion about online recently. It's called zero trust, and though it sounds like vague corporate-ese at first, it actually represents a necessary approach to digital security.

Cyber threats are constantly evolving, and IT professionals need to be prepared for the worst at all times. Zero trust is a valid part of defense in depth and the principle of least privilege within a network or series of networks. But what exactly does that mean?

Well, historically, cyber professionals relied on perimeter defenses like firewalls to determine trust, assuming that everything inside the network was trustworthy. Zero trust challenges this notion by requiring strict identity verification for every user and device trying to access resources, regardless of their location.

You'll often hear the term "never trust, always verify" when talking about zero trust. Practically, this means that every user and device must authenticate their identity before accessing the resources on the network, ensuring that only authorized individuals can access sensitive data.

It also means users are granted the minimum level of access required to perform their tasks (the principle of least privilege I mentioned a second ago). This not only limits the potential damage that can be caused in case of a security breach, but it impedes insider threats from doing even more damage than would be possible otherwise.

Zero trust also makes it harder for attackers to move laterally within a network by implementing network segmentation. This divides larger networks up into smaller pieces, isolating each segment, and protecting them from threats in other segments.

Effectively implementing these steps is not a set it and forget it kind of thing either. Zero trust requires continuous monitoring of user and device behavior to detect anomalies or suspicious activities that may indicate security threats. Proper implementation takes the "never trust" part to the extreme.

In other words, zero trust means that organizations don't blindly trust their employees and internal networks. Threats can come from anywhere, including within, and implementing various controls to mitigate these risks can significantly enhance an organization's security posture and enable them to better protect all constituents involved.

-

The internet is a dangerous place, full of vulnerabilities attackers leverage to malicious ends. One of the more common vulnerabilities that websites face is cross-site scripting (XSS) attacks. XSS attacks can have serious consequences, ranging from stealing sensitive information to defacing websites. Without wasting any time, let's jump into what XSS is, how it works, and how to mitigate it on your websites.

## What is Cross-Site Scripting (XSS)?

---

XSS is a type of injection security vulnerability typically found in web applications, and it exploits the trust users have in websites. It occurs when an attacker injects malicious scripts into web pages via input fields, URLs, or even cookies.

When a user visits a compromised page, the injected script is executed in the user's browser, allowing the attacker to carry out various malicious activities. This works because the scripts are assumed to have come from a trusted source. When executed, they can steal sensitive information, hijack user sessions, or deface the website.

## Types of XSS Attacks

---

There are three types of XSS:

1. **Stored XSS**: The malicious script is stored on the server and executed whenever a user accesses the compromised page.

2. **Reflected XSS**: The malicious script is reflected off a web server and executed in the user's browser.

3. **DOM-based XSS**: The attack occurs in the Document Object Model (DOM) of the web page, allowing the attacker to manipulate the page's content.

## Preventing XSS Attacks

---

There are several ways to mitigate XSS, some examples include the following:

1. **Input Validation**: Validate and sanitize all user input to prevent the injection of malicious scripts.

2. **Output Encoding**: Encode user input before displaying it on the web page to prevent script execution.

3. **Content Security Policy (CSP)**: Implement a CSP to restrict the sources from which scripts can be loaded on your website.

4. **Use HTTPS**: Ensure that your website uses HTTPS to encrypt data transmitted between the server and the user's browser.

## Conclusion

---

Cross-site scripting attacks pose a significant threat to web security. By understanding how XSS works and implementing best practices to prevent such attacks, you can safeguard your website and protect your users' sensitive information. Stay vigilant, stay informed, and stay secure in the ever-evolving landscape of web security.

-

https://www.pewresearch.org/short-reads/2025/01/08/share-of-us-adults-living-without-a-romantic-partner-has-ticked-down-in-recent-years/

> he share of U.S. adults who are not living with a spouse or partner has modestly declined since 2019. In 2023, 42% of adults were unpartnered, down from 44% in 2019, according to a new Pew Research Center analysis of Census Bureau data.

> However, certain demographic groups are more likely than others to be unpartnered, as of 2023

originally posted at https://stacker.news/items/851235

-

In the ever-evolving world of cybersecurity, understanding the various vulnerabilities that can be exploited by attackers is crucial for maintaining robust defenses. One such vulnerability that poses a significant risk is Local File Inclusion (LFI). This blog post aims to demystify LFI, explaining what it is, how it can be exploited, and what measures can be taken to prevent it.

## What is Local File Inclusion (LFI)?

---

Local File Inclusion is a type of web application vulnerability that allows an attacker to access files from the server where the application is hosted. This can be achieved by exploiting poorly written code in the web application that processes user input. Essentially, if an application allows users to specify a file to be included, and it doesn't properly sanitize the input, attackers can manipulate this input to include arbitrary files from the server.

LFI vulnerabilities often arise in applications that use scripts like PHP, where the `include`, `require`, `include_once`, and `require_once` functions are used to include files dynamically. When these functions are used improperly, they can become a gateway for attackers.

## How Does LFI Work?

---

To understand how LFI works, let's consider a simple example. Here we see a PHP script that uses user input to include different page templates:

```php

<?php

$page = $_GET['page'];

include("pages/" . $page . ".php");

?>

```

If the application fails to properly validate the `page` parameter from user input, an attacker could manipulate it by inserting paths that lead to unintended files:

```

http://example.com/index.php?page=../../etc/passwd

```

In this scenario, if not properly secured, the attacker could potentially read sensitive system files like `/etc/passwd` on Unix-based systems.

## Impacts of LFI Vulnerabilities

---

LFI vulnerabilities can have severe consequences, including but not limited to the following:

1\. **Information Disclosure**: Attackers can gain access to sensitive files, such as configuration files, passwords, and application source code.\

2. **Remote Code Execution**: In some cases, attackers can leverage LFI to execute arbitrary code on the server, especially if they can upload malicious files to the server.\

3. **Access to Internal Systems**: Attackers may use LFI to pivot and access other systems within the network, potentially leading to broader compromises.

## Preventing LFI Vulnerabilities

---

Preventing LFI vulnerabilities requires a combination of secure coding practices and proper input validation. Here are some key measures to take:

1\. **Input Validation**: Always validate and sanitize user inputs. Ensure that the input corresponds to the expected format and type, and reject any suspicious or malformed input.\

\

2. **Whitelist Files**: Instead of allowing arbitrary file inclusion, use a whitelist of allowable files that can be included. This restricts the files that can be included to a predefined set.\

\

3. **Avoid User-Controlled File Paths**: Where possible, avoid using user input directly in file paths. If it is necessary, use predefined directories and filenames.\

\

4. **Use Built-In Functions**: Utilize built-in functions and libraries that handle file inclusions more securely. For example, PHP’s `filter_input()` can help sanitize input data.\

\

5. **Principle of Least Privilege**: Ensure that the web server and application run with the least privileges necessary, minimizing the impact of a potential compromise.\

\

6. **Security Testing**: Regularly conduct security testing, including code reviews and penetration testing, to identify and fix vulnerabilities.

## Conclusion

---

Local File Inclusion is a potent vulnerability that can lead to significant security breaches if left unchecked. By understanding how LFI works and implementing robust security measures, developers and administrators can protect their applications from being exploited.

Ensuring that user inputs are properly validated and sanitized, using whitelists, and adhering to the principle of least privilege are fundamental steps in safeguarding against LFI attacks. Regular security assessments and staying informed about the latest security practices will further bolster defenses against this and other vulnerabilities.

-

A river must have two banks. A day has no meaning without a night. Even a narrative manifests amidst the story of a hero and a villain. Science is the study of the dualities - to put them to a greater use. Every time we get a better appreciation of a duality, we expound a new branch of science. For example Chemistry is built on the idea of "charge" duality. Particle physics is an outcome of magnetic duality (also called spin). The digital duality (0 and 1) is the basis for the computer science. Not only proven science, every thought has a dualistic outlook - a yes or a no - to be or not to be!

Our own anatomy is a mirror image as if two halves are sealed together - one on left and another on the right - two hands, two legs, two ears. Even the brains are split into left and right lobes. Leonardo da Vinci was trying to find the code of life in the parity symmetry of the Vitruvian Man. The physical duality of our anatomy led to most discoveries in ancient medicine of Suśruta and Charka - long before Leonardo. It is believed they were looking for a singularity amidst the duality of every other aspect of human body - an island in the river of life. And since they found only one heart in every mammal, they assumed god must live on this island.

In Vedic science , the study of dualities is known as Dwait. On the other hand, Vaidik philosophy believes the observer that sits amidst dualities is same across all of them - a singular observer - Adwait - an island between two banks of a river. The island underscores the nature, shape and the existence of that "perpetual" that dualities bind for conscious[^consciousness] experience? That Avykta (inexpressible knowledge) that dualities bind, is known as Tattva[^Tattva]. It binds itself into the knots (of evolving dualities) to gain answer to just one question - who am I? What is my own true shape (Swa-roopa). If one could know the answer to this question, dualities automatically shatter. They vanish because they are rendered unnecessary!

[^consciousness]: Conscious experience: is summation of Dwait and Adwait. In our geometric perception, it is easier to visualize a duality as a dimension - a one-dimensional line that goes from the object to its mirror image. The images may be merged in each other - as in case of atomic particles; or at perceived distances as in case of our reflection in a mirror. The important thing, however, is the one that sits at the surface of the mirror - in the middle - to see two images - one on the left and another on the right - one up and another down and infinite other angles. Millions of dimensions may intersect at this focal point. More intersections - greater the resolution of perception -> higher degree of conscious experience. A computer is lower in consciousness because it has only one dimension to resolve - from digital zero to a digital one. In Vaidik Science, the fifty significant traits (Vritties) are considered the prime dimensions of human experience measured through five senses. If digital duality enabled experiences such as internet, it is not hard to imagine how evolved conscious experience could be based on five senses playing with fifty traits. Yes, it can render the experience of our physical world, the seasons, the green expanses, rivers, buildings, gadgets - but that is only a fraction of what we are capable of. There are infinitely many more experiences that lie hidden in the realm of emotions. Yet senses only observe the chiral imagery. They find it hard to navigate the emotions, besides being grossly unaware of the observer that sits amidst this chaos. What is it that creates this beautiful tapestry? - sometimes layered over each other's like an onion; and other times existing on the same plane of conscious experience, and who is the observer? What is that "one" that sits within inseparable dipoles of a magnet? What exactly is that "unseen" that runs between an anode and a cathode ? Spirituality (Nyaan), is the careful study of that "one" staying put amidst the dualities always shuttling like a ping pong ball. Can it ever get to the rest? Or the idea of conscious life is to merely lock this incessant rhythm ? If so, to what avail?