-

@ 3f770d65:7a745b24

2025-05-07 20:29:59

@ 3f770d65:7a745b24

2025-05-07 20:29:59🏌️ Monday, May 26 – Bitcoin Golf Championship & Kickoff Party

Location: Las Vegas, Nevada\ Event: 2nd Annual Bitcoin Golf Championship & Kick Off Party"\ Where: Bali Hai Golf Clubhouse, 5160 S Las Vegas Blvd, Las Vegas, NV 89119\ 🎟️ Get Tickets!

Details:

-

The week tees off in style with the Bitcoin Golf Championship. Swing clubs by day and swing to music by night.

-

Live performances from Nostr-powered acts courtesy of Tunestr, including Ainsley Costello and others.

-

Stop by the Purple Pill Booth hosted by Derek and Tanja, who will be on-boarding golfers and attendees to the decentralized social future with Nostr.

💬 May 27–29 – Bitcoin 2025 Conference at the Las Vegas Convention Center

Location: The Venetian Resort\ Main Attraction for Nostr Fans: The Nostr Lounge\ When: All day, Tuesday through Thursday\ Where: Right outside the Open Source Stage\ 🎟️ Get Tickets!

Come chill at the Nostr Lounge, your home base for all things decentralized social. With seating for \~50, comfy couches, high-tops, and good vibes, it’s the perfect space to meet developers, community leaders, and curious newcomers building the future of censorship-resistant communication.

Daily Highlights at the Lounge:

-

☕️ Hang out casually or sit down for a deeper conversation about the Nostr protocol

-

🔧 1:1 demos from app teams

-

🛍️ Merch available onsite

-

🧠 Impromptu lightning talks

-

🎤 Scheduled Meetups (details below)

🎯 Nostr Lounge Meetups

Wednesday, May 28 @ 1:00 PM

- Damus Meetup: Come meet the team behind Damus, the OG Nostr app for iOS that helped kickstart the social revolution. They'll also be showcasing their new cross-platform app, Notedeck, designed for a more unified Nostr experience across devices. Grab some merch, get a demo, and connect directly with the developers.

Thursday, May 29 @ 1:00 PM

- Primal Meetup: Dive into Primal, the slickest Nostr experience available on web, Android, and iOS. With a built-in wallet, zapping your favorite creators and friends has never been easier. The team will be on-site for hands-on demos, Q&A, merch giveaways, and deeper discussions on building the social layer of Bitcoin.

🎙️ Nostr Talks at Bitcoin 2025

If you want to hear from the minds building decentralized social, make sure you attend these two official conference sessions:

1. FROSTR Workshop: Multisig Nostr Signing

-

🕚 Time: 11:30 AM – 12:00 PM

-

📅 Date: Wednesday, May 28

-

📍 Location: Developer Zone

-

🎤 Speaker: Austin Kelsay, Voltage\ A deep-dive into FROST-based multisig key management for Nostr. Geared toward devs and power users interested in key security.

2. Panel: Decentralizing Social Media

-

🕑 Time: 2:00 PM – 2:30 PM

-

📅 Date: Thursday, May 29

-

📍 Location: Genesis Stage

-

🎙️ Moderator: McShane (Bitcoin Strategy @ Roxom TV)

-

👥 Speakers:

-

Martti Malmi – Early Bitcoin dev, CEO @ Sirius Business Ltd

-

Lyn Alden – Analyst & Partner @ Ego Death Capital

Get the big-picture perspective on why decentralized social matters and how Nostr fits into the future of digital communication.

🌃 NOS VEGAS Meetup & Afterparty

Date: Wednesday, May 28\ Time: 7:00 PM – 1:00 AM\ Location: We All Scream Nightclub, 517 Fremont St., Las Vegas, NV 89101\ 🎟️ Get Tickets!

What to Expect:

-

🎶 Live Music Stage – Featuring Ainsley Costello, Sara Jade, Able James, Martin Groom, Bobby Shell, Jessie Lark, and other V4V artists

-

🪩 DJ Party Deck – With sets by DJ Valerie B LOVE, TatumTurnUp, and more DJs throwing down

-

🛰️ Live-streamed via Tunestr

-

🧠 Nostr Education – Talks by Derek Ross, Tomer Strolight, Terry Yiu, OpenMike, and more.

-

🧾 Vendors & Project Booths – Explore new tools and services

-

🔐 Onboarding Stations – Learn how to use Nostr hands-on

-

🐦 Nostrich Flocking – Meet your favorite nyms IRL

-

🍸 Three Full Bars – Two floors of socializing overlooking vibrant Fremont Street

This is the after-party of the year for those who love freedom technology and decentralized social community. Don’t miss it.

Final Thoughts

Whether you're there to learn, network, party, or build, Bitcoin 2025 in Las Vegas has a packed week of Nostr-friendly programming. Be sure to catch all the events, visit the Nostr Lounge, and experience the growing decentralized social revolution.

🟣 Find us. Flock with us. Purple pill someone.

-

-

@ d61f3bc5:0da6ef4a

2025-05-06 01:37:28

@ d61f3bc5:0da6ef4a

2025-05-06 01:37:28I remember the first gathering of Nostr devs two years ago in Costa Rica. We were all psyched because Nostr appeared to solve the problem of self-sovereign online identity and decentralized publishing. The protocol seemed well-suited for textual content, but it wasn't really designed to handle binary files, like images or video.

The Problem

When I publish a note that contains an image link, the note itself is resilient thanks to Nostr, but if the hosting service disappears or takes my image down, my note will be broken forever. We need a way to publish binary data without relying on a single hosting provider.

We were discussing how there really was no reliable solution to this problem even outside of Nostr. Peer-to-peer attempts like IPFS simply didn't work; they were hopelessly slow and unreliable in practice. Torrents worked for popular files like movies, but couldn't be relied on for general file hosting.

Awesome Blossom

A year later, I attended the Sovereign Engineering demo day in Madeira, organized by Pablo and Gigi. Many projects were presented over a three hour demo session that day, but one really stood out for me.

Introduced by hzrd149 and Stu Bowman, Blossom blew my mind because it showed how we can solve complex problems easily by simply relying on the fact that Nostr exists. Having an open user directory, with the corresponding social graph and web of trust is an incredible building block.

Since we can easily look up any user on Nostr and read their profile metadata, we can just get them to simply tell us where their files are stored. This, combined with hash-based addressing (borrowed from IPFS), is all we need to solve our problem.

How Blossom Works

The Blossom protocol (Blobs Stored Simply on Mediaservers) is formally defined in a series of BUDs (Blossom Upgrade Documents). Yes, Blossom is the most well-branded protocol in the history of protocols. Feel free to refer to the spec for details, but I will provide a high level explanation here.

The main idea behind Blossom can be summarized in three points:

- Users specify which media server(s) they use via their public Blossom settings published on Nostr;

- All files are uniquely addressable via hashes;

- If an app fails to load a file from the original URL, it simply goes to get it from the server(s) specified in the user's Blossom settings.

Just like Nostr itself, the Blossom protocol is dead-simple and it works!

Let's use this image as an example:

If you look at the URL for this image, you will notice that it looks like this:

If you look at the URL for this image, you will notice that it looks like this:blossom.primal.net/c1aa63f983a44185d039092912bfb7f33adcf63ed3cae371ebe6905da5f688d0.jpgAll Blossom URLs follow this format:

[server]/[file-hash].[extension]The file hash is important because it uniquely identifies the file in question. Apps can use it to verify that the file they received is exactly the file they requested. It also gives us the ability to reliably get the same file from a different server.

Nostr users declare which media server(s) they use by publishing their Blossom settings. If I store my files on Server A, and they get removed, I can simply upload them to Server B, update my public Blossom settings, and all Blossom-capable apps will be able to find them at the new location. All my existing notes will continue to display media content without any issues.

Blossom Mirroring

Let's face it, re-uploading files to another server after they got removed from the original server is not the best user experience. Most people wouldn't have the backups of all the files, and/or the desire to do this work.

This is where Blossom's mirroring feature comes handy. In addition to the primary media server, a Blossom user can set one one or more mirror servers. Under this setup, every time a file is uploaded to the primary server the Nostr app issues a mirror request to the primary server, directing it to copy the file to all the specified mirrors. This way there is always a copy of all content on multiple servers and in case the primary becomes unavailable, Blossom-capable apps will automatically start loading from the mirror.

Mirrors are really easy to setup (you can do it in two clicks in Primal) and this arrangement ensures robust media handling without any central points of failure. Note that you can use professional media hosting services side by side with self-hosted backup servers that anyone can run at home.

Using Blossom Within Primal

Blossom is natively integrated into the entire Primal stack and enabled by default. If you are using Primal 2.2 or later, you don't need to do anything to enable Blossom, all your media uploads are blossoming already.

To enhance user privacy, all Primal apps use the "/media" endpoint per BUD-05, which strips all metadata from uploaded files before they are saved and optionally mirrored to other Blossom servers, per user settings. You can use any Blossom server as your primary media server in Primal, as well as setup any number of mirrors:

## Conclusion

## ConclusionFor such a simple protocol, Blossom gives us three major benefits:

- Verifiable authenticity. All Nostr notes are always signed by the note author. With Blossom, the signed note includes a unique hash for each referenced media file, making it impossible to falsify.

- File hosting redundancy. Having multiple live copies of referenced media files (via Blossom mirroring) greatly increases the resiliency of media content published on Nostr.

- Censorship resistance. Blossom enables us to seamlessly switch media hosting providers in case of censorship.

Thanks for reading; and enjoy! 🌸

-

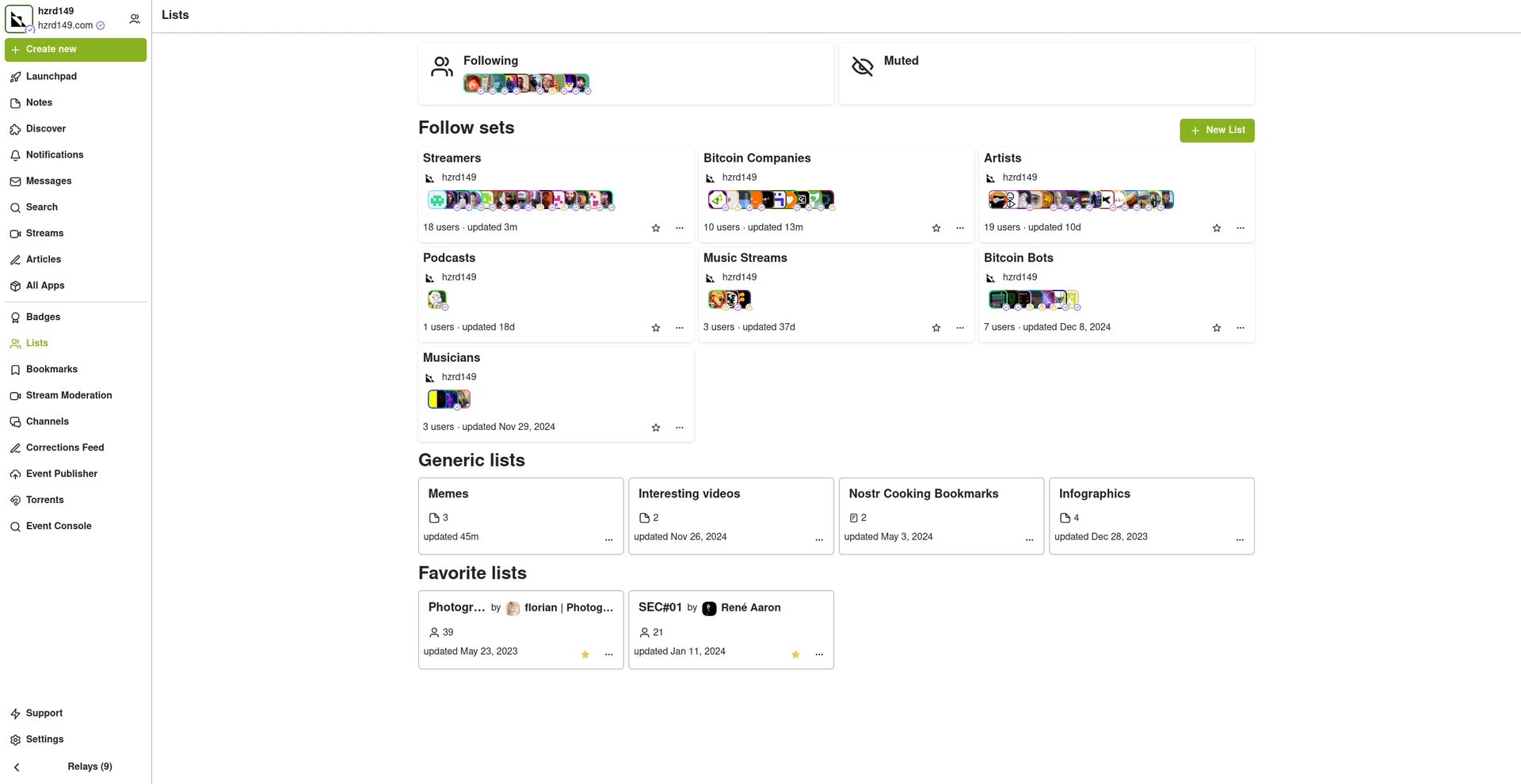

@ 266815e0:6cd408a5

2025-05-02 22:24:59

@ 266815e0:6cd408a5

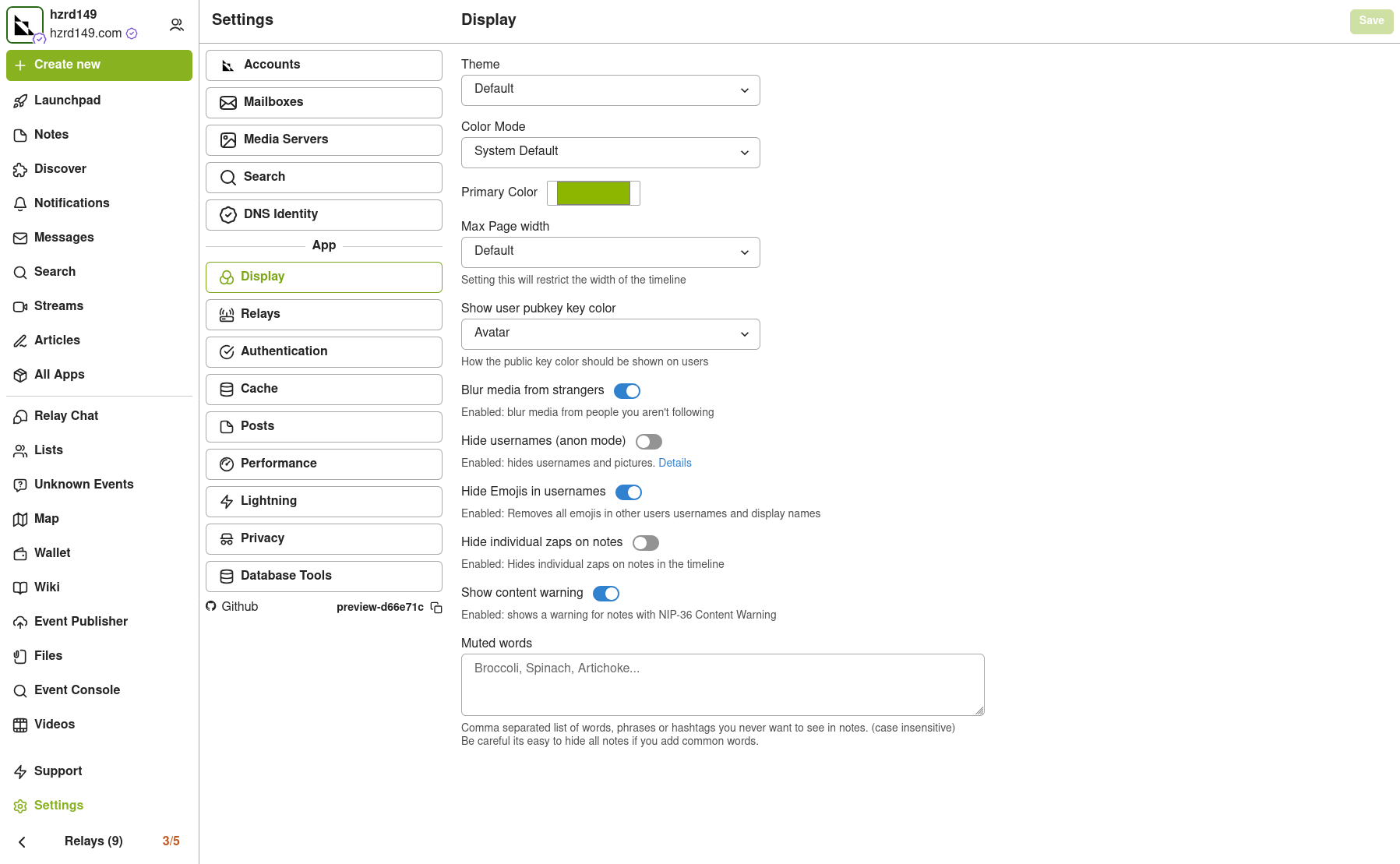

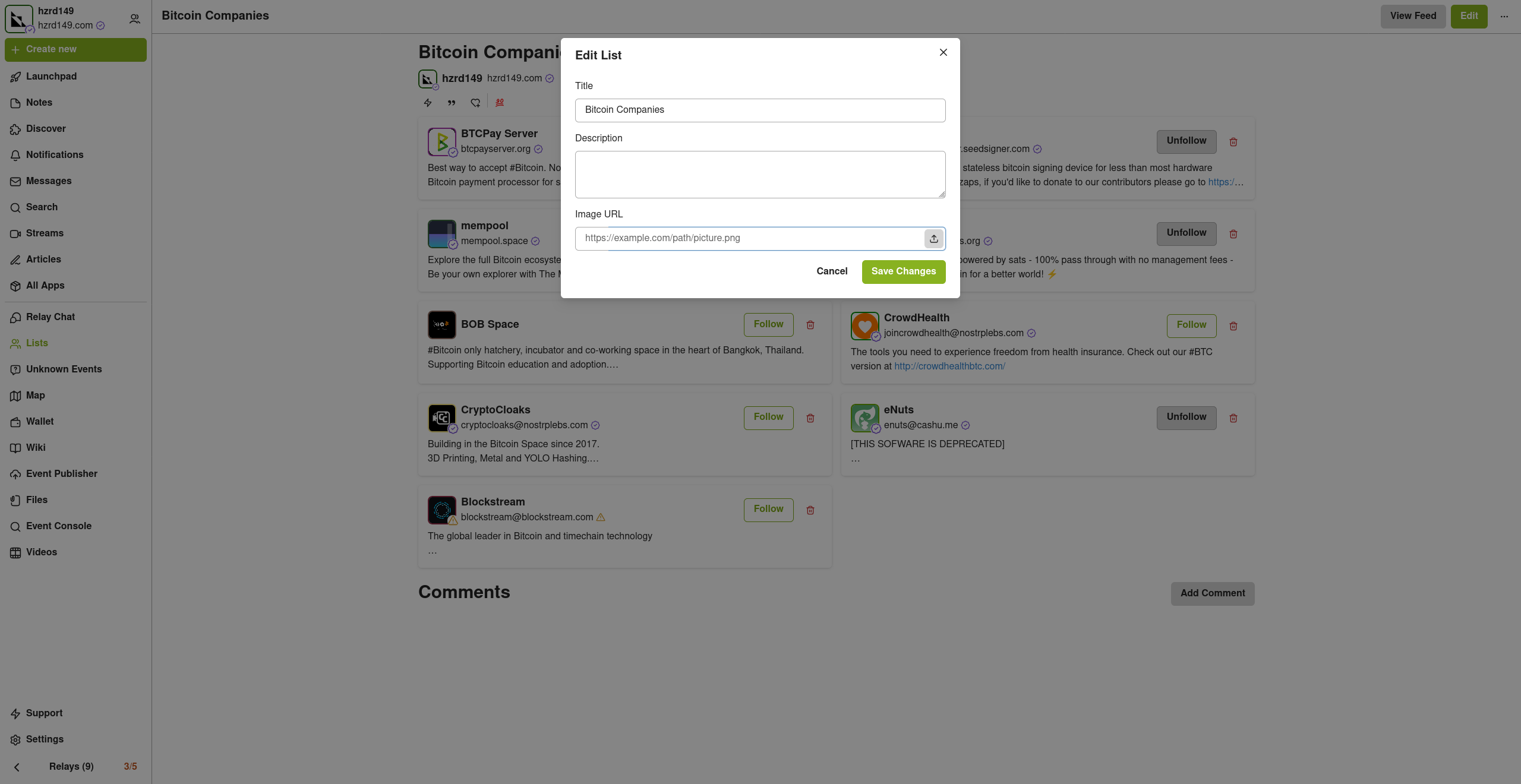

2025-05-02 22:24:59Its been six long months of refactoring code and building out to the applesauce packages but the app is stable enough for another release.

This update is pretty much a full rewrite of the non-visible parts of the app. all the background services were either moved out to the applesauce packages or rewritten, the result is that noStrudel is a little faster and much more consistent with connections and publishing.

New layout

The app has a new layout now, it takes advantage of the full desktop screen and looks a little better than it did before.

Removed NIP-72 communities

The NIP-72 communities are no longer part of the app, if you want to continue using them there are still a few apps that support them ( like satellite.earth ) but noStrudel won't support them going forward.

The communities where interesting but ultimately proved too have some fundamental flaws, most notably that all posts had to be approved by a moderator. There were some good ideas on how to improve it but they would have only been patches and wouldn't have fixed the underlying issues.

I wont promise to build it into noStrudel, but NIP-29 (relay based groups) look a lot more promising and already have better moderation abilities then NIP-72 communities could ever have.

Settings view

There is now a dedicated settings view, so no more hunting around for where the relays are set or trying to find how to add another account. its all in one place now

Cleaned up lists

The list views are a little cleaner now, and they have a simple edit modal

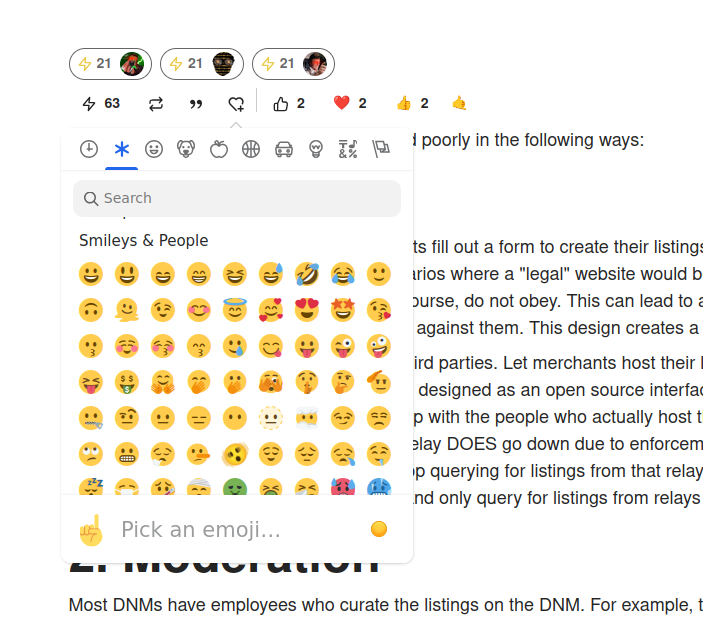

New emoji picker

Just another small improvement that makes the app feel more complete.

Experimental Wallet

There is a new "wallet" view in the app that lets you manage your NIP-60 cashu wallet. its very experimental and probably won't work for you, but its there and I hope to finish it up so the app can support NIP-61 nutzaps.

WARNING: Don't feed the wallet your hard earned sats, it will eat them!

Smaller improvements

- Added NSFW flag for replies

- Updated NIP-48 bunker login to work with new spec

- Linkfy BIPs

- Added 404 page

- Add NIP-22 comments under badges, files, and articles

- Add max height to timeline notes

- Fix articles view freezing on load

- Add option to mirror blobs when sharing notes

- Remove "open in drawer" for notes

-

@ 2183e947:f497b975

2025-05-01 22:33:48

@ 2183e947:f497b975

2025-05-01 22:33:48Most darknet markets (DNMs) are designed poorly in the following ways:

1. Hosting

Most DNMs use a model whereby merchants fill out a form to create their listings, and the data they submit then gets hosted on the DNM's servers. In scenarios where a "legal" website would be forced to censor that content (e.g. a DMCA takedown order), DNMs, of course, do not obey. This can lead to authorities trying to find the DNM's servers to take enforcement actions against them. This design creates a single point of failure.

A better design is to outsource hosting to third parties. Let merchants host their listings on nostr relays, not on the DNM's server. The DNM should only be designed as an open source interface for exploring listings hosted elsewhere, that way takedown orders end up with the people who actually host the listings, i.e. with nostr relays, and not with the DNM itself. And if a nostr relay DOES go down due to enforcement action, it does not significantly affect the DNM -- they'll just stop querying for listings from that relay in their next software update, because that relay doesn't work anymore, and only query for listings from relays that still work.

2. Moderation

Most DNMs have employees who curate the listings on the DNM. For example, they approve/deny listings depending on whether they fit the content policies of the website. Some DNMs are only for drugs, others are only for firearms. The problem is, to approve a criminal listing is, in the eyes of law enforcement, an act of conspiracy. Consequently, they don't just go after the merchant who made the listing but the moderators who approved it, and since the moderators typically act under the direction of the DNM, this means the police go after the DNM itself.

A better design is to outsource moderation to third parties. Let anyone call themselves a moderator and create lists of approved goods and services. Merchants can pay the most popular third party moderators to add their products to their lists. The DNM itself just lets its users pick which moderators to use, such that the user's choice -- and not a choice by the DNM -- determines what goods and services the user sees in the interface.

That way, the police go after the moderators and merchants rather than the DNM itself, which is basically just a web browser: it doesn't host anything or approve of any content, it just shows what its users tell it to show. And if a popular moderator gets arrested, his list will still work for a while, but will gradually get more and more outdated, leading someone else to eventually become the new most popular moderator, and a natural transition can occur.

3. Escrow

Most DNMs offer an escrow solution whereby users do not pay merchants directly. Rather, during the Checkout process, they put their money in escrow, and request the DNM to release it to the merchant when the product arrives, otherwise they initiate a dispute. Most DNMs consider escrow necessary because DNM users and merchants do not trust one another; users don't want to pay for a product first and then discover that the merchant never ships it, and merchants don't want to ship a product first and then discover that the user never pays for it.

The problem is, running an escrow solution for criminals is almost certain to get you accused of conspiracy, money laundering, and unlicensed money transmission, so the police are likely to shut down any DNM that does this. A better design is to oursource escrow to third parties. Let anyone call themselves an escrow, and let moderators approve escrows just like they approve listings. A merchant or user who doesn't trust the escrows chosen by a given moderator can just pick a different moderator. That way, the police go after the third party escrows rather than the DNM itself, which never touches user funds.

4. Consequences

Designing a DNM along these principles has an interesting consequence: the DNM is no longer anything but an interface, a glorified web browser. It doesn't host any content, approve any listings, or touch any money. It doesn't even really need a server -- it can just be an HTML file that users open up on their computer or smart phone. For two reasons, such a program is hard to take down:

First, it is hard for the police to justify going after the DNM, since there are no charges to bring. Its maintainers aren't doing anything illegal, no more than Firefox does anything illegal by maintaining a web browser that some people use to browse illegal content. What the user displays in the app is up to them, not to the code maintainers. Second, if the police decided to go after the DNM anyway, they still couldn't take it down because it's just an HTML file -- the maintainers do not even need to run a server to host the file, because users can share it with one another, eliminating all single points of failure.

Another consequence of this design is this: most of the listings will probably be legal, because there is more demand for legal goods and services than illegal ones. Users who want to find illegal goods would pick moderators who only approve those listings, but everyone else would use "legal" moderators, and the app would not, at first glance, look much like a DNM, just a marketplace for legal goods and services. To find the illegal stuff that lurks among the abundant legal stuff, you'd probably have to filter for it via your selection of moderators, making it seem like the "default" mode is legal.

5. Conclusion

I think this DNM model is far better than the designs that prevail today. It is easier to maintain, harder to take down, and pushes the "hard parts" to the edges, so that the DNM is not significantly affected even if a major merchant, moderator, or escrow gets arrested. I hope it comes to fruition.

-

@ 21335073:a244b1ad

2025-05-01 01:51:10

@ 21335073:a244b1ad

2025-05-01 01:51:10Please respect Virginia Giuffre’s memory by refraining from asking about the circumstances or theories surrounding her passing.

Since Virginia Giuffre’s death, I’ve reflected on what she would want me to say or do. This piece is my attempt to honor her legacy.

When I first spoke with Virginia, I was struck by her unshakable hope. I had grown cynical after years in the anti-human trafficking movement, worn down by a broken system and a government that often seemed complicit. But Virginia’s passion, creativity, and belief that survivors could be heard reignited something in me. She reminded me of my younger, more hopeful self. Instead of warning her about the challenges ahead, I let her dream big, unburdened by my own disillusionment. That conversation changed me for the better, and following her lead led to meaningful progress.

Virginia was one of the bravest people I’ve ever known. As a survivor of Epstein, Maxwell, and their co-conspirators, she risked everything to speak out, taking on some of the world’s most powerful figures.

She loved when I said, “Epstein isn’t the only Epstein.” This wasn’t just about one man—it was a call to hold all abusers accountable and to ensure survivors find hope and healing.

The Epstein case often gets reduced to sensational details about the elite, but that misses the bigger picture. Yes, we should be holding all of the co-conspirators accountable, we must listen to the survivors’ stories. Their experiences reveal how predators exploit vulnerabilities, offering lessons to prevent future victims.

You’re not powerless in this fight. Educate yourself about trafficking and abuse—online and offline—and take steps to protect those around you. Supporting survivors starts with small, meaningful actions. Free online resources can guide you in being a safe, supportive presence.

When high-profile accusations arise, resist snap judgments. Instead of dismissing survivors as “crazy,” pause to consider the trauma they may be navigating. Speaking out or coping with abuse is never easy. You don’t have to believe every claim, but you can refrain from attacking accusers online.

Society also fails at providing aftercare for survivors. The government, often part of the problem, won’t solve this. It’s up to us. Prevention is critical, but when abuse occurs, step up for your loved ones and community. Protect the vulnerable. it’s a challenging but a rewarding journey.

If you’re contributing to Nostr, you’re helping build a censorship resistant platform where survivors can share their stories freely, no matter how powerful their abusers are. Their voices can endure here, offering strength and hope to others. This gives me great hope for the future.

Virginia Giuffre’s courage was a gift to the world. It was an honor to know and serve her. She will be deeply missed. My hope is that her story inspires others to take on the powerful.

-

@ 5d4b6c8d:8a1c1ee3

2025-05-08 01:22:05

@ 5d4b6c8d:8a1c1ee3

2025-05-08 01:22:05I've been thinking about how Predyx and other lightning based prediction markets might finance their operations, without undermining their core function of eliciting information from people.

The standard approach, of offering less-than-fair odds, guarantees long-run profitability (as long as you have enough customers), but it also creates a friction for participants that reduces the information value of their transactions. So, what are some less frictiony options for generating revenue?

Low hanging fruit

- Close markets in real-time: Rather than prespecifying a closing time for some markets, like sports, it's better to close the market at the moment the outcome is realized. This both prevents post hoc transactions and enables late stage transactions. This should be easily automatable (I say as someone with no idea how to do that), with the right resolution criteria.

- Round off shares: Shares and sats are discrete, so just make sure any necessary rounding is always in the house's favor.

- Set initial probabilities well: Use whatever external information is available to open markets as near to the "right" value as possible.

- Arbitrage: whenever markets are related to each other, make sure to resolve any illogical odds automatically

The point of these four is to avoid giving away free sats. None of them reduce productive use of the market. Keeping markets open up until the outcome is realized will probably greatly increase the number of transactions, since that's usually when the most information is coming in.

Third party support

- Ads are the most obvious form of third party revenue

- Sponsorships are the more interesting one: Allow sponsors to boost a market's visibility. This is similar to advertising, but it also capitalizes on the possibility of a market being of particular interest to someone.

- Charge for market creation: users should be able to create new markets (this will also enhance trade quantity and site traffic), but it should be costly to create a market. If prediction markets really provide higher quality information, then it's reasonable to charge for it.

- Arbitrage: Monitor external odds and whenever a gain can be locked in, place the bets (buy the shares) that guarantee a gain.

Bitcoin stuff

- Routing fees: The volume of sats moving into, out of, and being held in these markets will require a fairly large lightning node. Following some helpful tips to optimize fee revenue will generate some sats for logistical stuff that had to be done anyway.

- Treasury strategy: Take out loans against the revenue generated from all of the above and buy bitcoin: NGU -> repay with a fraction of the bitcoin, NGD -> repay with site revenue.

Bitcoin and Lightning Competitive Advantages

These aren't revenue ideas. They're just a couple of advantages lightning and bitcoin provide over fiat that should allow charging lower spreads than a traditional prediction market or sportsbook.

Traditional betting or prediction platforms are earning depreciating fiat, while a bitcoin based platform earns appreciating bitcoin. Traditional spreads must therefor be larger, in order to pull in the same real return. This also means the users' odds are worse on fiat platforms (again in real terms), even if the listed odds are the same, because their winnings will have depreciated by the time they receive them. Technically, this opens an opportunity to charge even higher spreads, but as mentioned in the intro, that would be bad for the information purposes of the market.

Lightning has much lower transactions costs than fiat transactions. So, even with tighter spreads, a lightning platform can net a better (nominal) return per transaction.

@mega_dreamer, I imagine most of those ideas were already on y'all's radar, and obviously you're already doing some, but I wanted to get them out of my head and onto digital paper. Hopefully, some of this will provide some useful food for thought.

originally posted at https://stacker.news/items/974372

-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

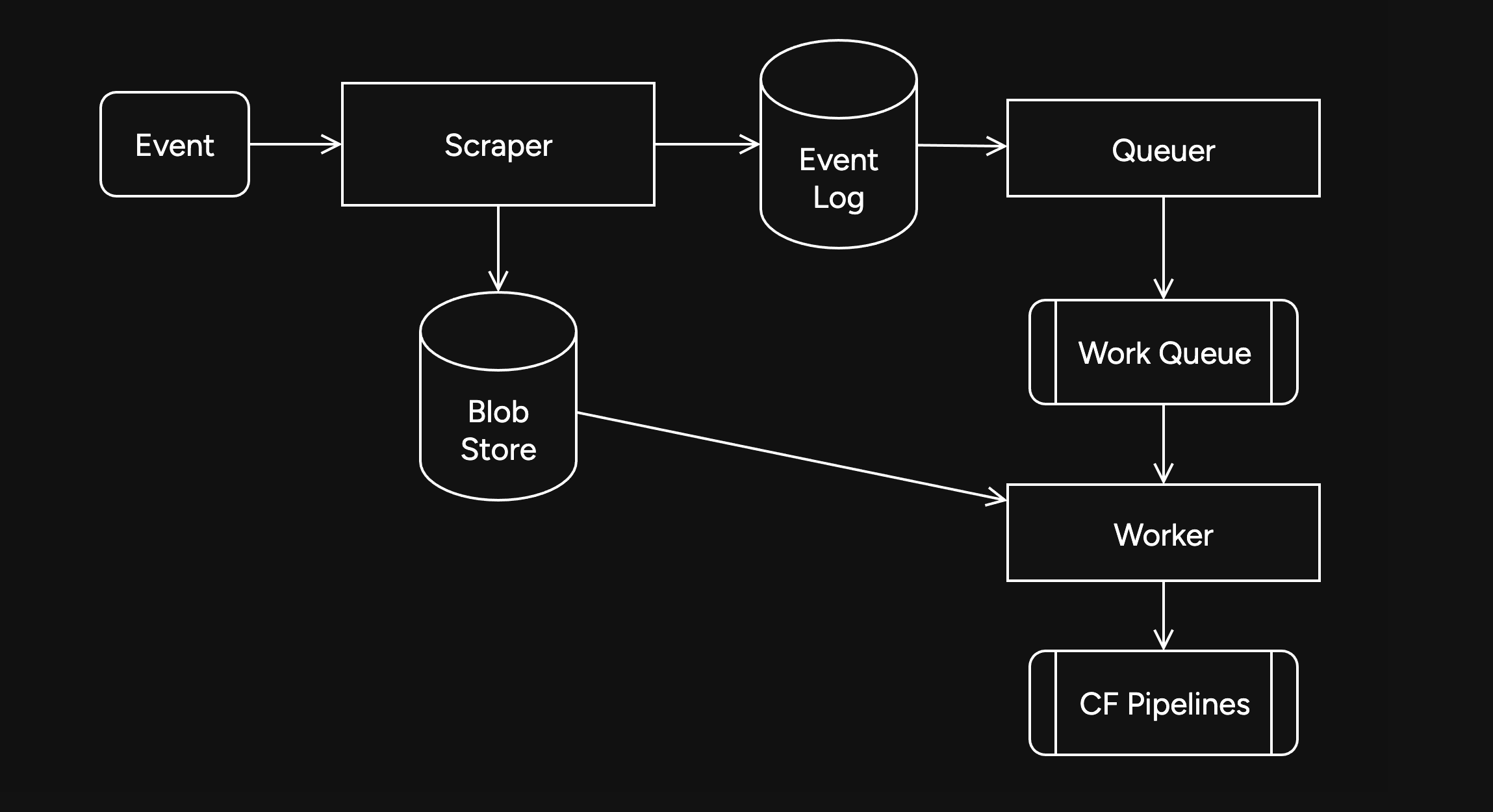

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ 2e8970de:63345c7a

2025-05-07 15:26:35

@ 2e8970de:63345c7a

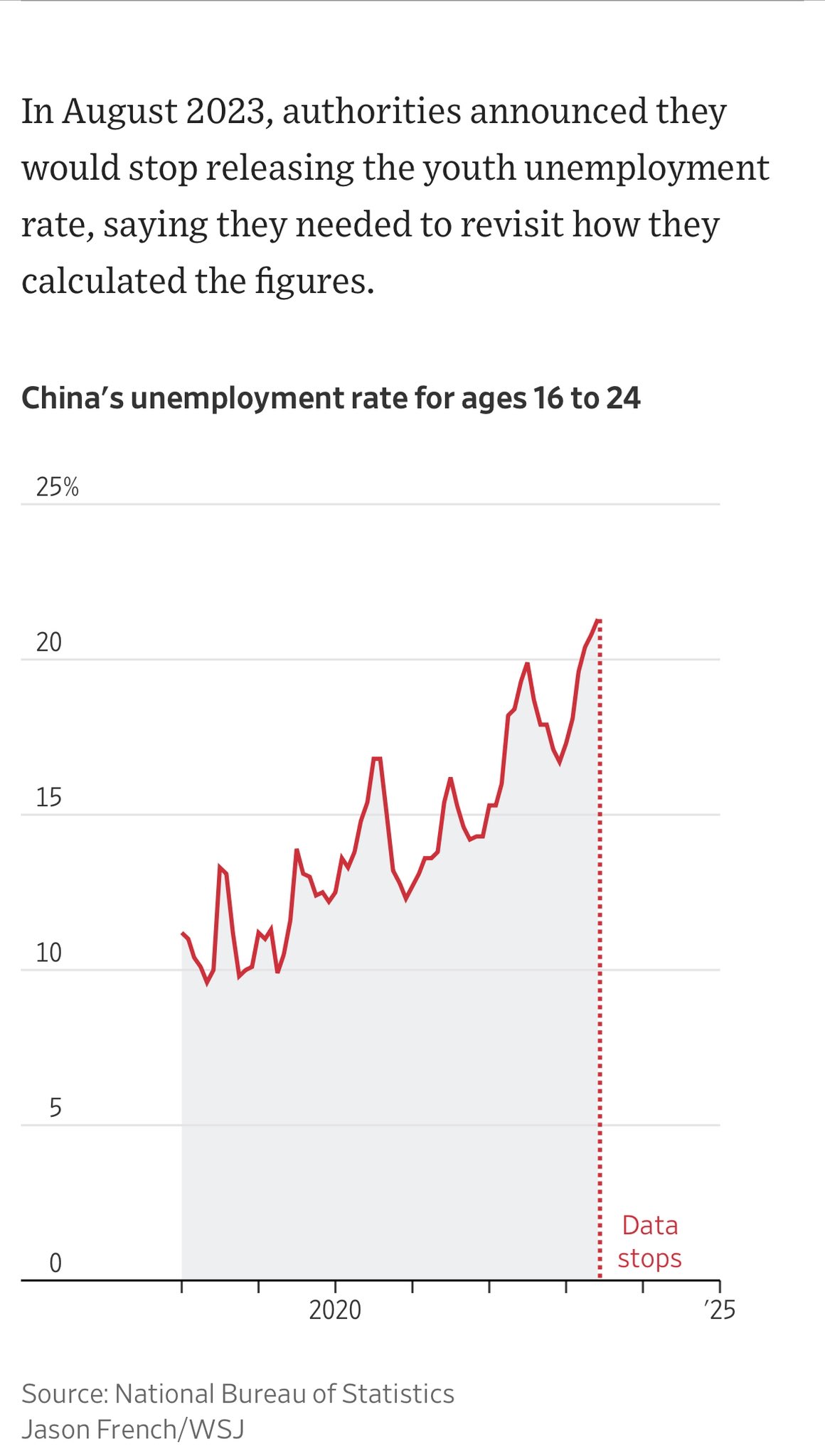

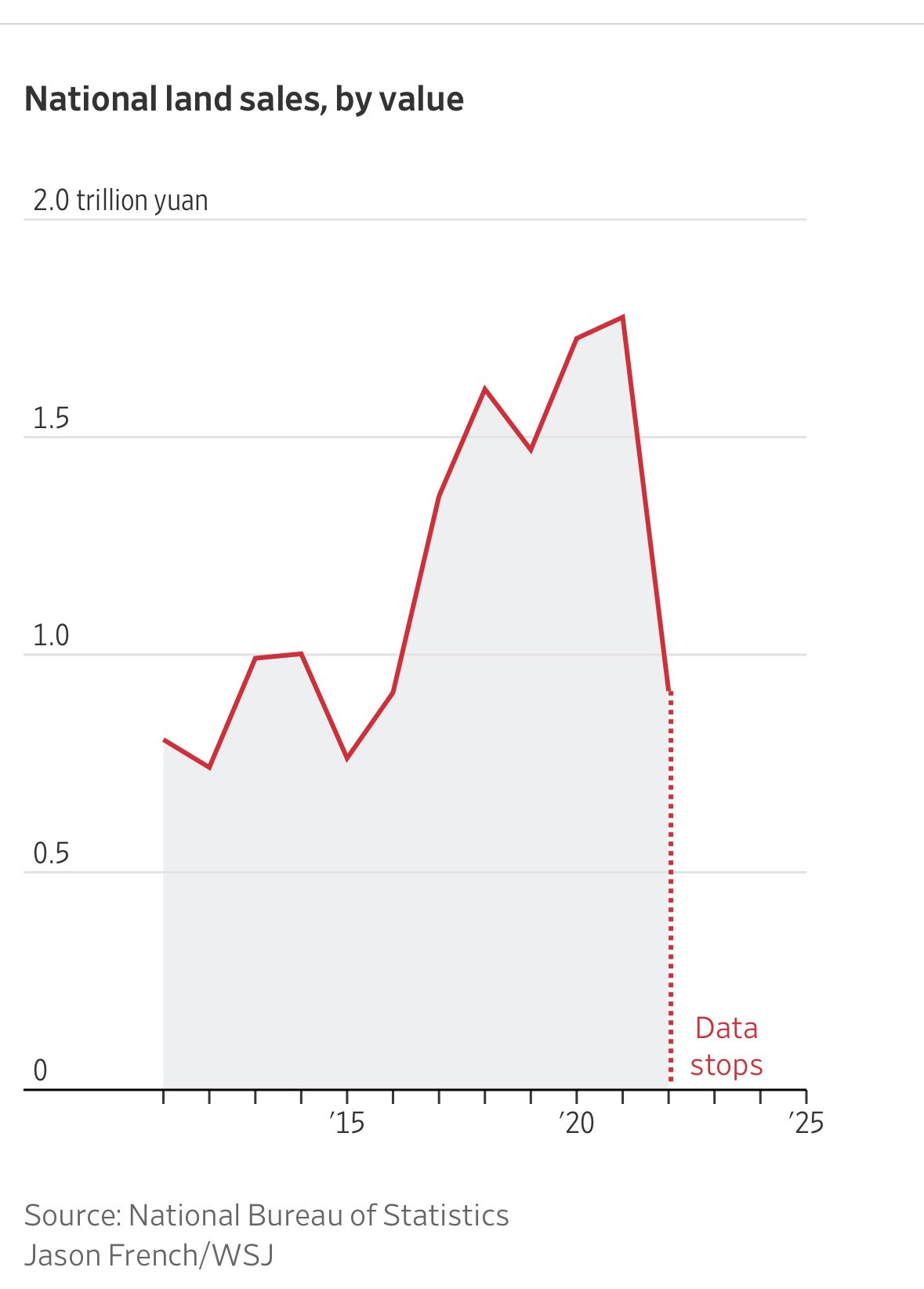

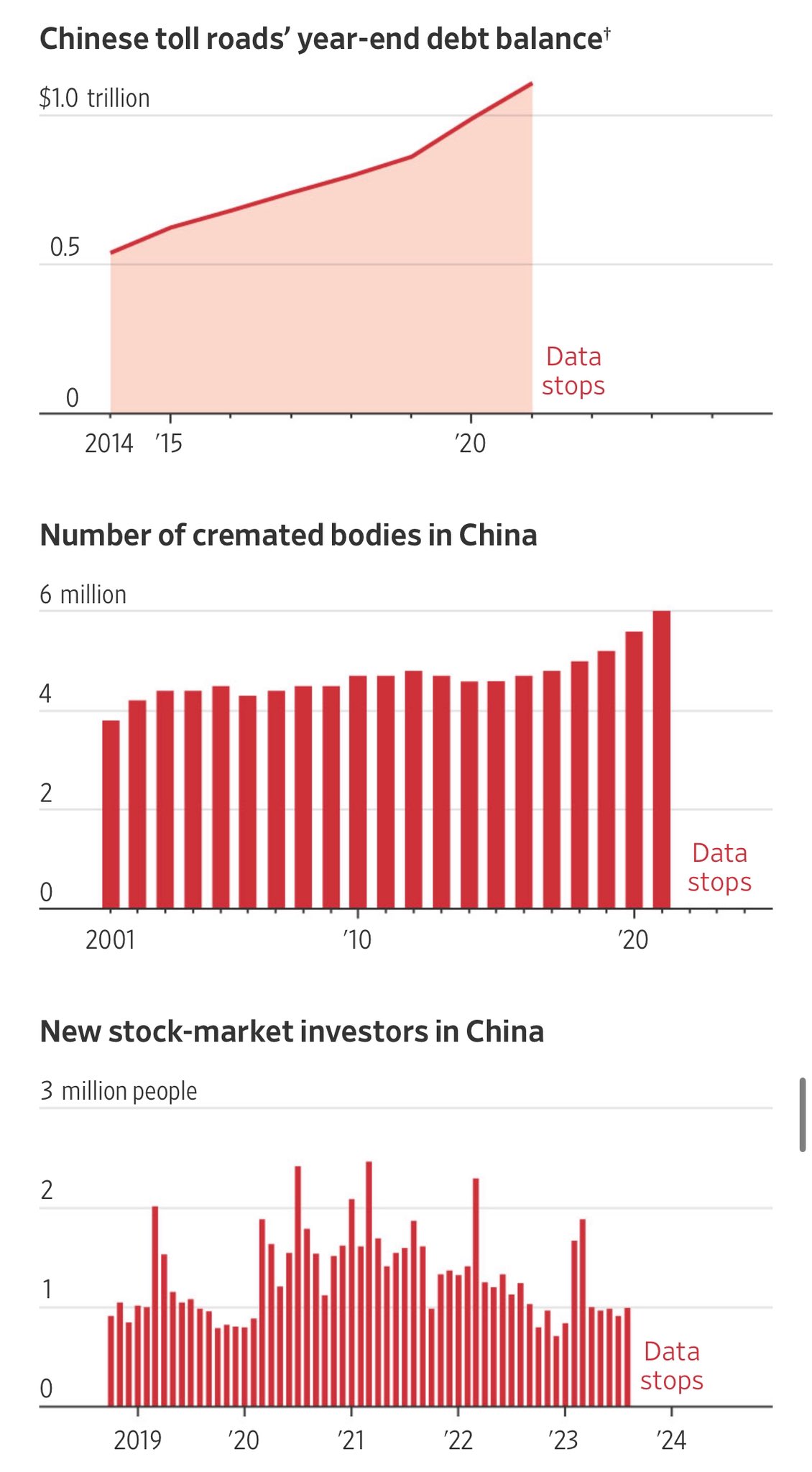

2025-05-07 15:26:35Beijing has stopped publishing hundreds of statistics, making it harder to know what’s going on in the country

Data stops. Data stops. Data stops.

https://www.wsj.com/world/china/china-economy-data-missing-096cac9a?st=j7V11b&reflink=article_copyURL_share

originally posted at https://stacker.news/items/973942

-

@ 57d1a264:69f1fee1

2025-05-07 06:56:25

@ 57d1a264:69f1fee1

2025-05-07 06:56:25Wild parrots tend to fly in flocks, but when kept as single pets, they may become lonely and bored https://www.youtube.com/watch?v=OHcAOlamgDc

Source: https://www.smithsonianmag.com/smart-news/scientists-taught-pet-parrots-to-video-call-each-other-and-the-birds-loved-it-180982041/

originally posted at https://stacker.news/items/973639

-

@ a39d19ec:3d88f61e

2025-04-22 12:44:42

@ a39d19ec:3d88f61e

2025-04-22 12:44:42Die Debatte um Migration, Grenzsicherung und Abschiebungen wird in Deutschland meist emotional geführt. Wer fordert, dass illegale Einwanderer abgeschoben werden, sieht sich nicht selten dem Vorwurf des Rassismus ausgesetzt. Doch dieser Vorwurf ist nicht nur sachlich unbegründet, sondern verkehrt die Realität ins Gegenteil: Tatsächlich sind es gerade diejenigen, die hinter jeder Forderung nach Rechtssicherheit eine rassistische Motivation vermuten, die selbst in erster Linie nach Hautfarbe, Herkunft oder Nationalität urteilen.

Das Recht steht über Emotionen

Deutschland ist ein Rechtsstaat. Das bedeutet, dass Regeln nicht nach Bauchgefühl oder politischer Stimmungslage ausgelegt werden können, sondern auf klaren gesetzlichen Grundlagen beruhen müssen. Einer dieser Grundsätze ist in Artikel 16a des Grundgesetzes verankert. Dort heißt es:

„Auf Absatz 1 [Asylrecht] kann sich nicht berufen, wer aus einem Mitgliedstaat der Europäischen Gemeinschaften oder aus einem anderen Drittstaat einreist, in dem die Anwendung des Abkommens über die Rechtsstellung der Flüchtlinge und der Europäischen Menschenrechtskonvention sichergestellt ist.“

Das bedeutet, dass jeder, der über sichere Drittstaaten nach Deutschland einreist, keinen Anspruch auf Asyl hat. Wer dennoch bleibt, hält sich illegal im Land auf und unterliegt den geltenden Regelungen zur Rückführung. Die Forderung nach Abschiebungen ist daher nichts anderes als die Forderung nach der Einhaltung von Recht und Gesetz.

Die Umkehrung des Rassismusbegriffs

Wer einerseits behauptet, dass das deutsche Asyl- und Aufenthaltsrecht strikt durchgesetzt werden soll, und andererseits nicht nach Herkunft oder Hautfarbe unterscheidet, handelt wertneutral. Diejenigen jedoch, die in einer solchen Forderung nach Rechtsstaatlichkeit einen rassistischen Unterton sehen, projizieren ihre eigenen Denkmuster auf andere: Sie unterstellen, dass die Debatte ausschließlich entlang ethnischer, rassistischer oder nationaler Kriterien geführt wird – und genau das ist eine rassistische Denkweise.

Jemand, der illegale Einwanderung kritisiert, tut dies nicht, weil ihn die Herkunft der Menschen interessiert, sondern weil er den Rechtsstaat respektiert. Hingegen erkennt jemand, der hinter dieser Kritik Rassismus wittert, offenbar in erster Linie die „Rasse“ oder Herkunft der betreffenden Personen und reduziert sie darauf.

Finanzielle Belastung statt ideologischer Debatte

Neben der rechtlichen gibt es auch eine ökonomische Komponente. Der deutsche Wohlfahrtsstaat basiert auf einem Solidarprinzip: Die Bürger zahlen in das System ein, um sich gegenseitig in schwierigen Zeiten zu unterstützen. Dieser Wohlstand wurde über Generationen hinweg von denjenigen erarbeitet, die hier seit langem leben. Die Priorität liegt daher darauf, die vorhandenen Mittel zuerst unter denjenigen zu verteilen, die durch Steuern, Sozialabgaben und Arbeit zum Erhalt dieses Systems beitragen – nicht unter denen, die sich durch illegale Einreise und fehlende wirtschaftliche Eigenleistung in das System begeben.

Das ist keine ideologische Frage, sondern eine rein wirtschaftliche Abwägung. Ein Sozialsystem kann nur dann nachhaltig funktionieren, wenn es nicht unbegrenzt belastet wird. Würde Deutschland keine klaren Regeln zur Einwanderung und Abschiebung haben, würde dies unweigerlich zur Überlastung des Sozialstaates führen – mit negativen Konsequenzen für alle.

Sozialpatriotismus

Ein weiterer wichtiger Aspekt ist der Schutz der Arbeitsleistung jener Generationen, die Deutschland nach dem Zweiten Weltkrieg mühsam wieder aufgebaut haben. Während oft betont wird, dass die Deutschen moralisch kein Erbe aus der Zeit vor 1945 beanspruchen dürfen – außer der Verantwortung für den Holocaust –, ist es umso bedeutsamer, das neue Erbe nach 1945 zu respektieren, das auf Fleiß, Disziplin und harter Arbeit beruht. Der Wiederaufbau war eine kollektive Leistung deutscher Menschen, deren Früchte nicht bedenkenlos verteilt werden dürfen, sondern vorrangig denjenigen zugutekommen sollten, die dieses Fundament mitgeschaffen oder es über Generationen mitgetragen haben.

Rechtstaatlichkeit ist nicht verhandelbar

Wer sich für eine konsequente Abschiebepraxis ausspricht, tut dies nicht aus rassistischen Motiven, sondern aus Respekt vor der Rechtsstaatlichkeit und den wirtschaftlichen Grundlagen des Landes. Der Vorwurf des Rassismus in diesem Kontext ist daher nicht nur falsch, sondern entlarvt eine selektive Wahrnehmung nach rassistischen Merkmalen bei denjenigen, die ihn erheben.

-

@ e3ba5e1a:5e433365

2025-04-15 11:03:15

@ e3ba5e1a:5e433365

2025-04-15 11:03:15Prelude

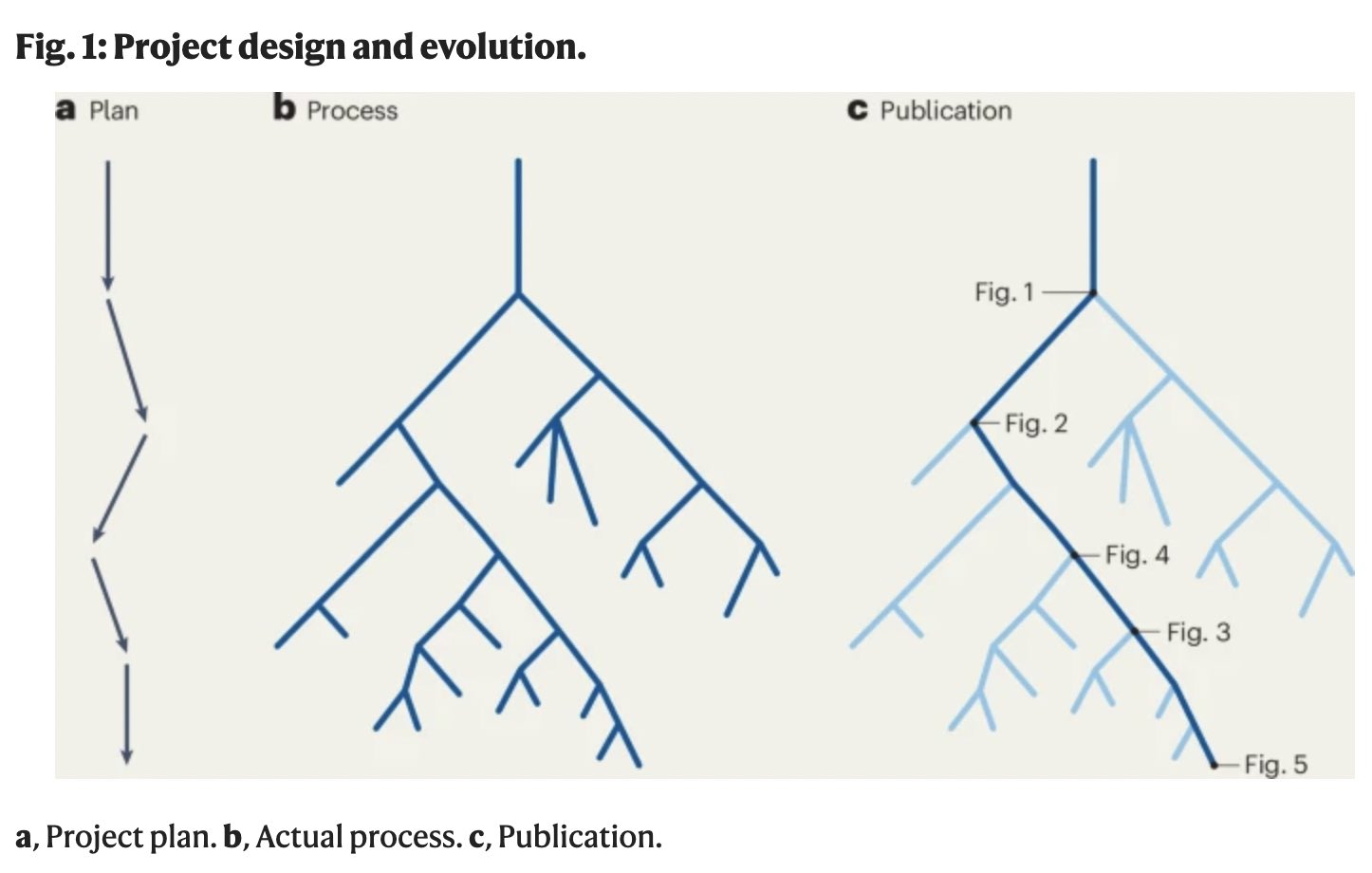

I wrote this post differently than any of my others. It started with a discussion with AI on an OPSec-inspired review of separation of powers, and evolved into quite an exciting debate! I asked Grok to write up a summary in my overall writing style, which it got pretty well. I've decided to post it exactly as-is. Ultimately, I think there are two solid ideas driving my stance here:

- Perfect is the enemy of the good

- Failure is the crucible of success

Beyond that, just some hard-core belief in freedom, separation of powers, and operating from self-interest.

Intro

Alright, buckle up. I’ve been chewing on this idea for a while, and it’s time to spit it out. Let’s look at the U.S. government like I’d look at a codebase under a cybersecurity audit—OPSEC style, no fluff. Forget the endless debates about what politicians should do. That’s noise. I want to talk about what they can do, the raw powers baked into the system, and why we should stop pretending those powers are sacred. If there’s a hole, either patch it or exploit it. No half-measures. And yeah, I’m okay if the whole thing crashes a bit—failure’s a feature, not a bug.

The Filibuster: A Security Rule with No Teeth

You ever see a firewall rule that’s more theater than protection? That’s the Senate filibuster. Everyone acts like it’s this untouchable guardian of democracy, but here’s the deal: a simple majority can torch it any day. It’s not a law; it’s a Senate preference, like choosing tabs over spaces. When people call killing it the “nuclear option,” I roll my eyes. Nuclear? It’s a button labeled “press me.” If a party wants it gone, they’ll do it. So why the dance?

I say stop playing games. Get rid of the filibuster. If you’re one of those folks who thinks it’s the only thing saving us from tyranny, fine—push for a constitutional amendment to lock it in. That’s a real patch, not a Post-it note. Until then, it’s just a vulnerability begging to be exploited. Every time a party threatens to nuke it, they’re admitting it’s not essential. So let’s stop pretending and move on.

Supreme Court Packing: Because Nine’s Just a Number

Here’s another fun one: the Supreme Court. Nine justices, right? Sounds official. Except it’s not. The Constitution doesn’t say nine—it’s silent on the number. Congress could pass a law tomorrow to make it 15, 20, or 42 (hitchhiker’s reference, anyone?). Packing the court is always on the table, and both sides know it. It’s like a root exploit just sitting there, waiting for someone to log in.

So why not call the bluff? If you’re in power—say, Trump’s back in the game—say, “I’m packing the court unless we amend the Constitution to fix it at nine.” Force the issue. No more shadowboxing. And honestly? The court’s got way too much power anyway. It’s not supposed to be a super-legislature, but here we are, with justices’ ideologies driving the bus. That’s a bug, not a feature. If the court weren’t such a kingmaker, packing it wouldn’t even matter. Maybe we should be talking about clipping its wings instead of just its size.

The Executive Should Go Full Klingon

Let’s talk presidents. I’m not saying they should wear Klingon armor and start shouting “Qapla’!”—though, let’s be real, that’d be awesome. I’m saying the executive should use every scrap of power the Constitution hands them. Enforce the laws you agree with, sideline the ones you don’t. If Congress doesn’t like it, they’ve got tools: pass new laws, override vetoes, or—here’s the big one—cut the budget. That’s not chaos; that’s the system working as designed.

Right now, the real problem isn’t the president overreaching; it’s the bureaucracy. It’s like a daemon running in the background, eating CPU and ignoring the user. The president’s supposed to be the one steering, but the administrative state’s got its own agenda. Let the executive flex, push the limits, and force Congress to check it. Norms? Pfft. The Constitution’s the spec sheet—stick to it.

Let the System Crash

Here’s where I get a little spicy: I’m totally fine if the government grinds to a halt. Deadlock isn’t a disaster; it’s a feature. If the branches can’t agree, let the president veto, let Congress starve the budget, let enforcement stall. Don’t tell me about “essential services.” Nothing’s so critical it can’t take a breather. Shutdowns force everyone to the table—debate, compromise, or expose who’s dropping the ball. If the public loses trust? Good. They’ll vote out the clowns or live with the circus they elected.

Think of it like a server crash. Sometimes you need a hard reboot to clear the cruft. If voters keep picking the same bad admins, well, the country gets what it deserves. Failure’s the best teacher—way better than limping along on autopilot.

States Are the Real MVPs

If the feds fumble, states step up. Right now, states act like junior devs waiting for the lead engineer to sign off. Why? Federal money. It’s a leash, and it’s tight. Cut that cash, and states will remember they’re autonomous. Some will shine, others will tank—looking at you, California. And I’m okay with that. Let people flee to better-run states. No bailouts, no excuses. States are like competing startups: the good ones thrive, the bad ones pivot or die.

Could it get uneven? Sure. Some states might turn into sci-fi utopias while others look like a post-apocalyptic vidya game. That’s the point—competition sorts it out. Citizens can move, markets adjust, and failure’s a signal to fix your act.

Chaos Isn’t the Enemy

Yeah, this sounds messy. States ignoring federal law, external threats poking at our seams, maybe even a constitutional crisis. I’m not scared. The Supreme Court’s there to referee interstate fights, and Congress sets the rules for state-to-state play. But if it all falls apart? Still cool. States can sort it without a babysitter—it’ll be ugly, but freedom’s worth it. External enemies? They’ll either unify us or break us. If we can’t rally, we don’t deserve the win.

Centralizing power to avoid this is like rewriting your app in a single thread to prevent race conditions—sure, it’s simpler, but you’re begging for a deadlock. Decentralized chaos lets states experiment, lets people escape, lets markets breathe. States competing to cut regulations to attract businesses? That’s a race to the bottom for red tape, but a race to the top for innovation—workers might gripe, but they’ll push back, and the tension’s healthy. Bring it—let the cage match play out. The Constitution’s checks are enough if we stop coddling the system.

Why This Matters

I’m not pitching a utopia. I’m pitching a stress test. The U.S. isn’t a fragile porcelain doll; it’s a rugged piece of hardware built to take some hits. Let it fail a little—filibuster, court, feds, whatever. Patch the holes with amendments if you want, or lean into the grind. Either way, stop fearing the crash. It’s how we debug the republic.

So, what’s your take? Ready to let the system rumble, or got a better way to secure the code? Hit me up—I’m all ears.

-

@ a19caaa8:88985eaf

2025-05-07 21:27:19

@ a19caaa8:88985eaf

2025-05-07 21:27:19nostr:nevent1qqszqt4cfp70yvznqgg9gf3t4kacxs99znegrtc3gql5cyaereslnucnxsksq

https://old.reddit.com/r/nostr/comments/1josljh/stop/

nostr:note1wzewxmlnc38jgwle530ku4x2xd7754wsyzvm6vcnp27mpjwda05s3jkap9

https://youtu.be/1fkmxTdI3RA ↑それ、岡崎体育が、歌ってます!

nostr:note15r93607t256z4sastsr4nm50vkp34gpr5avt4rdnwr2lfjl9d28sjfus8p

-

@ 83279ad2:bd49240d

2025-05-07 14:22:43

@ 83279ad2:bd49240d

2025-05-07 14:22:43 -

@ 57d1a264:69f1fee1

2025-05-07 06:29:52

@ 57d1a264:69f1fee1

2025-05-07 06:29:52Your device, your data. TRMNL's architecture prevents outsiders (including us) from accessing your local network. TRMNAL achieve this through 1 way communication between client and server, versus the other way around. Learn more.

Learn more at https://usetrmnl.com/

originally posted at https://stacker.news/items/973632

-

@ 83279ad2:bd49240d

2025-05-07 14:20:50

@ 83279ad2:bd49240d

2025-05-07 14:20:50 -

@ c4b5369a:b812dbd6

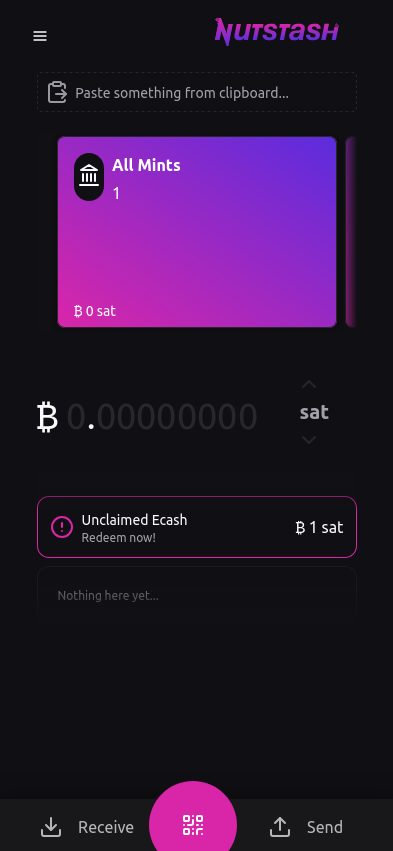

2025-04-15 07:26:16

@ c4b5369a:b812dbd6

2025-04-15 07:26:16Offline transactions with Cashu

Over the past few weeks, I've been busy implementing offline capabilities into nutstash. I think this is one of the key value propositions of ecash, beinga a bearer instrument that can be used without internet access.

It does however come with limitations, which can lead to a bit of confusion. I hope this article will clear some of these questions up for you!

It does however come with limitations, which can lead to a bit of confusion. I hope this article will clear some of these questions up for you!What is ecash/Cashu?

Ecash is the first cryptocurrency ever invented. It was created by David Chaum in 1983. It uses a blind signature scheme, which allows users to prove ownership of a token without revealing a link to its origin. These tokens are what we call ecash. They are bearer instruments, meaning that anyone who possesses a copy of them, is considered the owner.

Cashu is an implementation of ecash, built to tightly interact with Bitcoin, more specifically the Bitcoin lightning network. In the Cashu ecosystem,

Mintsare the gateway to the lightning network. They provide the infrastructure to access the lightning network, pay invoices and receive payments. Instead of relying on a traditional ledger scheme like other custodians do, the mint issues ecash tokens, to represent the value held by the users.How do normal Cashu transactions work?

A Cashu transaction happens when the sender gives a copy of his ecash token to the receiver. This can happen by any means imaginable. You could send the token through email, messenger, or even by pidgeon. One of the common ways to transfer ecash is via QR code.

The transaction is however not finalized just yet! In order to make sure the sender cannot double-spend their copy of the token, the receiver must do what we call a

swap. A swap is essentially exchanging an ecash token for a new one at the mint, invalidating the old token in the process. This ensures that the sender can no longer use the same token to spend elsewhere, and the value has been transferred to the receiver.

What about offline transactions?

Sending offline

Sending offline is very simple. The ecash tokens are stored on your device. Thus, no internet connection is required to access them. You can litteraly just take them, and give them to someone. The most convenient way is usually through a local transmission protocol, like NFC, QR code, Bluetooth, etc.

The one thing to consider when sending offline is that ecash tokens come in form of "coins" or "notes". The technical term we use in Cashu is

Proof. It "proofs" to the mint that you own a certain amount of value. Since these proofs have a fixed value attached to them, much like UTXOs in Bitcoin do, you would need proofs with a value that matches what you want to send. You can mix and match multiple proofs together to create a token that matches the amount you want to send. But, if you don't have proofs that match the amount, you would need to go online and swap for the needed proofs at the mint.Another limitation is, that you cannot create custom proofs offline. For example, if you would want to lock the ecash to a certain pubkey, or add a timelock to the proof, you would need to go online and create a new custom proof at the mint.

Receiving offline

You might think: well, if I trust the sender, I don't need to be swapping the token right away!

You're absolutely correct. If you trust the sender, you can simply accept their ecash token without needing to swap it immediately.

This is already really useful, since it gives you a way to receive a payment from a friend or close aquaintance without having to worry about connectivity. It's almost just like physical cash!

It does however not work if the sender is untrusted. We have to use a different scheme to be able to receive payments from someone we don't trust.

Receiving offline from an untrusted sender

To be able to receive payments from an untrusted sender, we need the sender to create a custom proof for us. As we've seen before, this requires the sender to go online.

The sender needs to create a token that has the following properties, so that the receciver can verify it offline:

- It must be locked to ONLY the receiver's public key

- It must include an

offline signature proof(DLEQ proof) - If it contains a timelock & refund clause, it must be set to a time in the future that is acceptable for the receiver

- It cannot contain duplicate proofs (double-spend)

- It cannot contain proofs that the receiver has already received before (double-spend)

If all of these conditions are met, then the receiver can verify the proof offline and accept the payment. This allows us to receive payments from anyone, even if we don't trust them.

At first glance, this scheme seems kinda useless. It requires the sender to go online, which defeats the purpose of having an offline payment system.

I beleive there are a couple of ways this scheme might be useful nonetheless:

-

Offline vending machines: Imagine you have an offline vending machine that accepts payments from anyone. The vending machine could use this scheme to verify payments without needing to go online itself. We can assume that the sender is able to go online and create a valid token, but the receiver doesn't need to be online to verify it.

-

Offline marketplaces: Imagine you have an offline marketplace where buyers and sellers can trade goods and services. Before going to the marketplace the sender already knows where he will be spending the money. The sender could create a valid token before going to the marketplace, using the merchants public key as a lock, and adding a refund clause to redeem any unspent ecash after it expires. In this case, neither the sender nor the receiver needs to go online to complete the transaction.

How to use this

Pretty much all cashu wallets allow you to send tokens offline. This is because all that the wallet needs to do is to look if it can create the desired amount from the proofs stored locally. If yes, it will automatically create the token offline.

Receiving offline tokens is currently only supported by nutstash (experimental).

To create an offline receivable token, the sender needs to lock it to the receiver's public key. Currently there is no refund clause! So be careful that you don't get accidentally locked out of your funds!

The receiver can then inspect the token and decide if it is safe to accept without a swap. If all checks are green, they can accept the token offline without trusting the sender.

The receiver will see the unswapped tokens on the wallet homescreen. They will need to manually swap them later when they are online again.

Later when the receiver is online again, they can swap the token for a fresh one.

Later when the receiver is online again, they can swap the token for a fresh one.

Summary

We learned that offline transactions are possible with ecash, but there are some limitations. It either requires trusting the sender, or relying on either the sender or receiver to be online to verify the tokens, or create tokens that can be verified offline by the receiver.

I hope this short article was helpful in understanding how ecash works and its potential for offline transactions.

Cheers,

Gandlaf

-

@ da0b9bc3:4e30a4a9

2025-05-07 06:21:08

@ da0b9bc3:4e30a4a9

2025-05-07 06:21:08Hello Stackers!

Welcome on into the ~Music Corner of the Saloon!

A place where we Talk Music. Share Tracks. Zap Sats.

So stay a while and listen.

🚨Don't forget to check out the pinned items in the territory homepage! You can always find the latest weeklies there!🚨

🚨Subscribe to the territory to ensure you never miss a post! 🚨

originally posted at https://stacker.news/items/973630

-

@ 266815e0:6cd408a5

2025-04-15 06:58:14

@ 266815e0:6cd408a5

2025-04-15 06:58:14Its been a little over a year since NIP-90 was written and merged into the nips repo and its been a communication mess.

Every DVM implementation expects the inputs in slightly different formats, returns the results in mostly the same format and there are very few DVM actually running.

NIP-90 is overloaded

Why does a request for text translation and creating bitcoin OP_RETURNs share the same input

itag? and why is there anoutputtag on requests when only one of them will return an output?Each DVM request kind is for requesting completely different types of compute with diffrent input and output requirements, but they are all using the same spec that has 4 different types of inputs (

text,url,event,job) and an undefined number ofoutputtypes.Let me show a few random DVM requests and responses I found on

wss://relay.damus.ioto demonstrate what I mean:This is a request to translate an event to English

json { "kind": 5002, "content": "", "tags": [ // NIP-90 says there can be multiple inputs, so how would a DVM handle translatting multiple events at once? [ "i", "<event-id>", "event" ], [ "param", "language", "en" ], // What other type of output would text translations be? image/jpeg? [ "output", "text/plain" ], // Do we really need to define relays? cant the DVM respond on the relays it saw the request on? [ "relays", "wss://relay.unknown.cloud/", "wss://nos.lol/" ] ] }This is a request to generate text using an LLM model

json { "kind": 5050, // Why is the content empty? wouldn't it be better to have the prompt in the content? "content": "", "tags": [ // Why use an indexable tag? are we ever going to lookup prompts? // Also the type "prompt" isn't in NIP-90, this should probably be "text" [ "i", "What is the capital of France?", "prompt" ], [ "p", "c4878054cff877f694f5abecf18c7450f4b6fdf59e3e9cb3e6505a93c4577db2" ], [ "relays", "wss://relay.primal.net" ] ] }This is a request for content recommendation

json { "kind": 5300, "content": "", "tags": [ // Its fine ignoring this param, but what if the client actually needs exactly 200 "results" [ "param", "max_results", "200" ], // The spec never mentions requesting content for other users. // If a DVM didn't understand this and responded to this request it would provide bad data [ "param", "user", "b22b06b051fd5232966a9344a634d956c3dc33a7f5ecdcad9ed11ddc4120a7f2" ], [ "relays", "wss://relay.primal.net", ], [ "p", "ceb7e7d688e8a704794d5662acb6f18c2455df7481833dd6c384b65252455a95" ] ] }This is a request to create a OP_RETURN message on bitcoin

json { "kind": 5901, // Again why is the content empty when we are sending human readable text? "content": "", "tags": [ // and again, using an indexable tag on an input that will never need to be looked up ["i", "09/01/24 SEC Chairman on the brink of second ETF approval", "text"] ] }My point isn't that these event schema's aren't understandable but why are they using the same schema? each use-case is different but are they all required to use the same

itag format as input and could support all 4 types of inputs.Lack of libraries

With all these different types of inputs, params, and outputs its verify difficult if not impossible to build libraries for DVMs

If a simple text translation request can have an

eventortextas inputs, apayment-requiredstatus at any point in the flow, partial results, or responses from 10+ DVMs whats the best way to build a translation library for other nostr clients to use?And how do I build a DVM framework for the server side that can handle multiple inputs of all four types (

url,text,event,job) and clients are sending all the requests in slightly differently.Supporting payments is impossible

The way NIP-90 is written there isn't much details about payments. only a

payment-requiredstatus and a genericamounttagBut the way things are now every DVM is implementing payments differently. some send a bolt11 invoice, some expect the client to NIP-57 zap the request event (or maybe the status event), and some even ask for a subscription. and we haven't even started implementing NIP-61 nut zaps or cashu A few are even formatting the

amountnumber wrong or denominating it in sats and not mili-satsBuilding a client or a library that can understand and handle all of these payment methods is very difficult. for the DVM server side its worse. A DVM server presumably needs to support all 4+ types of payments if they want to get the most sats for their services and support the most clients.

All of this is made even more complicated by the fact that a DVM can ask for payment at any point during the job process. this makes sense for some types of compute, but for others like translations or user recommendation / search it just makes things even more complicated.

For example, If a client wanted to implement a timeline page that showed the notes of all the pubkeys on a recommended list. what would they do when the selected DVM asks for payment at the start of the job? or at the end? or worse, only provides half the pubkeys and asks for payment for the other half. building a UI that could handle even just two of these possibilities is complicated.

NIP-89 is being abused

NIP-89 is "Recommended Application Handlers" and the way its describe in the nips repo is

a way to discover applications that can handle unknown event-kinds

Not "a way to discover everything"

If I wanted to build an application discovery app to show all the apps that your contacts use and let you discover new apps then it would have to filter out ALL the DVM advertisement events. and that's not just for making requests from relays

If the app shows the user their list of "recommended applications" then it either has to understand that everything in the 5xxx kind range is a DVM and to show that is its own category or show a bunch of unknown "favorites" in the list which might be confusing for the user.

In conclusion

My point in writing this article isn't that the DVMs implementations so far don't work, but that they will never work well because the spec is too broad. even with only a few DVMs running we have already lost interoperability.

I don't want to be completely negative though because some things have worked. the "DVM feeds" work, although they are limited to a single page of results. text / event translations also work well and kind

5970Event PoW delegation could be cool. but if we want interoperability, we are going to need to change a few things with NIP-90I don't think we can (or should) abandon NIP-90 entirely but it would be good to break it up into small NIPs or specs. break each "kind" of DVM request out into its own spec with its own definitions for expected inputs, outputs and flow.

Then if we have simple, clean definitions for each kind of compute we want to distribute. we might actually see markets and services being built and used.

-

@ 57d1a264:69f1fee1

2025-05-07 06:16:30

@ 57d1a264:69f1fee1

2025-05-07 06:16:30Here’s Sean Voisen writing about how programming is a feeling:

For those of us who enjoy programming, there is a deep satisfaction that comes from solving problems through well-written code, a kind of ineffable joy found in the elegant expression of a system through our favorite syntax. It is akin to the same satisfaction a craftsperson might find at the end of the day after toiling away on well-made piece of furniture, the culmination of small dopamine hits that come from sweating the details on something and getting them just right. Maybe nobody will notice those details, but it doesn’t matter. We care, we notice, we get joy from the aesthetics of the craft.

This got me thinking about the idea of satisfaction in craft. Where does it come from?

Continue Reading https://blog.jim-nielsen.com/2025/craft-and-satisfaction/

originally posted at https://stacker.news/items/973628

-

@ 78b3c1ed:5033eea9

2025-05-07 08:23:24

@ 78b3c1ed:5033eea9

2025-05-07 08:23:24各ノードにポリシーがある理由 → ノードの資源(CPU、帯域、メモリ)を守り、無駄な処理を避けるため

なぜポリシーがコンセンサスルールより厳しいか 1.資源の節約 コンセンサスルールは「最終的に有効かどうか」の基準だが、全トランザクションをいちいち検証して中継すると資源が枯渇する。 ポリシーで「最初から弾く」仕組みが必要。

-

ネットワーク健全性の維持 手数料が低い、複雑すぎる、標準でないスクリプトのトランザクションが大量に流れると、全体のネットワークが重くなる。 これを防ぐためにノードは独自のポリシーで中継制限。

-

開発の柔軟性 ポリシーはソフトウェアアップデートで柔軟に変えられるが、コンセンサスルールは変えるとハードフォークの危険がある。 ポリシーを厳しくすることで、安全に新しい制限を試すことができる。

標準ポリシーの意味は何か? ノードオペレーターは自分でbitcoindの設定やコードを書き換えて独自のポリシーを使える。 理論上ポリシーは「任意」で、標準ポリシー(Bitcoin Coreが提供するポリシー)は単なるデフォルト値。 ただし、標準ポリシーには以下の大事な意味がある。

-

ネットワークの互換性を保つ基準 みんなが全く自由なポリシーを使うとトランザクションの伝播効率が落ちる。 標準ポリシーは「大多数のノードに中継される最小基準」を提供し、それを守ればネットワークに流せるという共通の期待値になる。

-

開発・サービスの指針 ウォレット開発者やサービス提供者(取引所・支払いサービスなど)は、「標準ポリシーに準拠したトランザクションを作れば十分」という前提で開発できる。 もし標準がなければ全ノードの個別ポリシーを調査しないと流れるトランザクションを作れなくなる。

-

コミュニティの合意形成の場 標準ポリシーはBitcoin Coreの開発・議論で決まる。ここで新しい制限や緩和を入れれば、まずポリシーレベルで試せる。 問題がなければ、将来のコンセンサスルールに昇格させる議論の土台になる。

つまりデフォルトだけど重要。 確かに標準ポリシーは技術的には「デフォルト値」にすぎないが、実際にはネットワークの安定・互換性・開発指針の柱として重要な役割を果たす。

ビットコインノードにおける「無駄な処理」というのは、主に次のようなものを指す。 1. 承認される見込みのないトランザクションの検証 例: 手数料が極端に低く、マイナーが絶対にブロックに入れないようなトランザクション → これをいちいち署名検証したり、メモリプールに載せるのはCPU・RAMの無駄。

-

明らかに標準外のスクリプトや形式の検証 例: 極端に複雑・非標準なスクリプト(non-standard script) → コンセンサス的には有効だが、ネットワークの他ノードが中継しないため、無駄な伝播になる。

-

スパム的な大量トランザクションの処理 例: 攻撃者が極小手数料のトランザクションを大量に送り、メモリプールを膨張させる場合 → メモリやディスクI/O、帯域の消費が無駄になる。

-

明らかに無効なブロックの詳細検証 例: サイズが大きすぎるブロック、難易度条件を満たさないブロック → 早期に弾かないと、全トランザクション検証や署名検証で計算資源を浪費する。

これらの無駄な処理は、ノードの CPU時間・メモリ・ディスクI/O・帯域 を消耗させ、最悪の場合は DoS攻撃(サービス妨害攻撃) に悪用される。 そこでポリシーによって、最初の受信段階、または中継段階でそもそも検証・保存・転送しないように制限する。 まとめると、「無駄な処理」とはネットワークの大勢に受け入れられず、ブロックに取り込まれないトランザクションやブロックにノード資源を使うこと。

無駄な処理かどうかは、単に「ポリシーで禁止されているか」で決まるわけではない。

本質的には次の2つで判断される 1. ノードの資源(CPU、メモリ、帯域、ディスク)を過剰に使うか 2. 他のノード・ネットワーク・マイナーに受け入れられる見込みがあるか

将来のBitcoin CoreのバージョンでOP_RETURNの出力数制限やデータサイズ制限が撤廃されたとする。 この場合標準ポリシー的には通るので、中継・保存されやすくなる。 しかし、他のノードやマイナーが追随しなければ意味がない。大量に流せばやはりDoS・スパム扱いされ、無駄な資源消費になる。

最終的には、ネットワーク全体の運用実態。 標準ポリシーの撤廃だけでは、「無駄な処理ではない」とは断定できない。 実質的な「無駄な処理」の判定は、技術的制約+経済的・運用的現実のセットで決まる。

-

-

@ 84b0c46a:417782f5

2025-05-06 03:52:44

@ 84b0c46a:417782f5

2025-05-06 03:52:44至高の油淋鶏の動画 https://youtu.be/Ur2tYVZppBU のレシピ書き起こし

材料(2人分)

- 鶏モモ肉…300g

- A[しょうゆ…小さじ1 塩…小さじ1/3 酒…大さじ1と1/2 おろしショウガ…5g 片栗粉…大さじ1]

- 長ネギ(みじん切り)…1/2本(50g)

- ショウガ(みじん切り)…10g

- B[しょうゆ…大さじ2 砂糖…小さじ4 酢…大さじ1 ゴマ油…小さじ1 味の素…4ふり 赤唐辛子(小口切り)…1本分]

- 赤唐辛子、花椒(各好みで)…各適量

手順

- 肉を切る

皮を上にして適当に八等分くらい

- 肉を肉入ってたトレーかなんか適当な入れ物に入れてそこに 酒おおさじ1と1/2 と ショウガ5グラムすりおろして入れて軽く混ぜる

- そこに、片栗粉おおさじ1入れて混ぜる(漬ける段階にも片栗粉を入れることで厚衣になりやすい)

- 常温で15分くらい置く

- その間にたれを作る

-

長ネギ50gを細かいみじん切りにしてボウルに入れる(白いとこも青いとこも)

(端っこを残して縦に切り込みを入れて横に切るとよい) 2. ショウガ10gを細かいみじん切りにして同じボウルにいれる 3. 鷹の爪1本分入れる(任意) 4. 醤油おおさじ2、砂糖小さじ4、酢(穀物酢)おおさじ1を入れる 5. 味の素4振りいれてよく混ぜる 6. 小さなフライパン(油が少なくて済むので)に底に浸るくらいの油を入れ、中火で温める 7. 肉に片栗粉をたっぷりつけて揚げる 8. 揚がったらキッチンペーパーを敷いたなにかしらとかに上げる 9. もりつけてタレをかけて完成

-

-

@ 57d1a264:69f1fee1

2025-05-07 06:03:29

@ 57d1a264:69f1fee1

2025-05-07 06:03:29CryptPad

Collaboration and privacy. Yes, you can have both Flagship instance of CryptPad, the end-to-end encrypted and open-source collaboration suite. Cloud administered by the CryptPad development team. https://cryptpad.fr/

ONLYOFFICE DocSpace

Document collaboration made simpler. Easily collaborate with customizable rooms. Edit any content you have. Work faster using AI assistants. Protect your sensitive business data. Download or try STARTUP Cloud (Limited-time offer) FREE https://www.onlyoffice.com/

SeaFile

A new way to organize your files Beyond just syncing and sharing files, Seafile lets you add custom file properties and organize your files in different views. With AI-powered automation for generating properties, Seafile offers a smarter, more efficient way to manage your files. Try it Now, Free for up to 3 users https://seafile.com/

SandStorm

An open source platform for self-hosting web apps Self-host web-based productivity apps easily and securely. Sandstorm is an open source project built by a community of volunteers with the goal of making it really easy to run open source web applications. Try the Demo or Signup Free https://alpha.sandstorm.io/apps

NextCloud Hub

A new generation of online collaboration that puts you in control. Nextcloud offers a modern, on premise content collaboration platform with real-time document editing, video chat & groupware on mobile, desktop and web. Sign up for a free Nextcloud account https://nextcloud.com/sign-up/

LinShare

True Open Source Secure File Sharing Solution We are committed to providing a reliable Open Source file-sharing solution, expertly designed to meet the highest standards of diverse industries, such as government and finance Try the Demo https://linshare.app/

Twake Drive

The open-source alternative to Google Drive. Privacy-First Open Source Workplace. Twake workplace open source business. Improve your effeciency with truly Open Source, all-in-one digital suite. Enhance the security in every aspect of your professional and private life. Sign up https://sign-up.twake.app/

SpaceDrive

One Explorer. All Your Files. Unify files from all your devices and clouds into a single, easy-to-use explorer. Designed for creators, hoarders and the painfully disorganized. Download desktop app (mobile coming soon) https://www.spacedrive.com/

ente

Safe Home for your photos Store, share, and discover your memories with end-to-end encryption. End-to-end encryption, durable storage and simple sharing. Packed with these and much more into our beautiful open source apps. Get started https://web.ente.io

fileStash

Turn your FTP server into... Filestash is the enterprise-grade file manager connecting your storage with your identity provider and authorisations. Try the demo https://demo.filestash.app

STORJ

Disruptively fast. Globally secure. S3-compatible distributed cloud services that make the most demanding workflows fast and affordable. Fast track your journey toward high performance cloud services. Storj pricing is consistent and competitive in meeting or exceeding your cloud services needs. Give the products a try to experience the benefits of the distributed cloud. Get Started https://www.storj.io/get-started

FireFile

The open‑source alternative to Dropbox. Firefiles lets you setup a cloud drive with the backend of your choice and lets you seamlessly manage your files across multiple providers. It revolutionizes cloud storage management by offering a unified platform for all your storage needs. Sign up Free https://beta.firefiles.app

originally posted at https://stacker.news/items/973626

-

@ 000002de:c05780a7

2025-05-06 20:24:08

@ 000002de:c05780a7

2025-05-06 20:24:08https://www.youtube.com/watch?v=CIMZH7DEPPQ

I really enjoy listening to non-technical people talk about technology when they get the bigger picture impacts and how it relates to our humanity.

I was reminded of this video by @k00b's post about an AI generated video of a victim forgiving his killer.

Piper says, "Computers are better at words than you. Than I". But they are machines. They cannot feel. They cannot have emotion.

This people honors me with their lips, but their heart is far from me

~ Matthew 15:8

Most of us hate it when people are fake with us. When they say things they don't mean. When they say things just to get something they want from us. Yet, we are quickly falling into this same trap with technology. Accepting it as real and human. I'm not suggesting we can't use technology but we have to be careful that we do not fall into this mechanical trap and forget what makes humans special.

We are emotional and spiritual beings. Though AI didn't exist during the times Jesus walked the earth read the verse above in a broader context.

Then Pharisees and scribes came to Jesus from Jerusalem and said, “Why do your disciples break the tradition of the elders? For they do not wash their hands when they eat.” He answered them, “And why do you break the commandment of God for the sake of your tradition? For God commanded, ‘Honor your father and your mother,’ and, ‘Whoever reviles father or mother must surely die.’ But you say, ‘If anyone tells his father or his mother, “What you would have gained from me is given to God,” he need not honor his father.’ So for the sake of your tradition you have made void the word of God. You hypocrites! Well did Isaiah prophesy of you, when he said:

“‘This people honors me with their lips,

but their heart is far from me;

in vain do they worship me,

teaching as doctrines the commandments of men.’”

Empty words. Words without meaning because they are not from a pure desire and love. You may not be a Christian but don't miss the significance of this. There is a value in being real. Sharing true emotion and heart. Don't fall into the trap of the culture of lies that surrounds us. I would rather hear true words with mistakes and less eloquence any day over something fake. I would rather share a real moment with the ones I love than a million fake moments. Embrace the messy imperfect but real world.

originally posted at https://stacker.news/items/973324

-

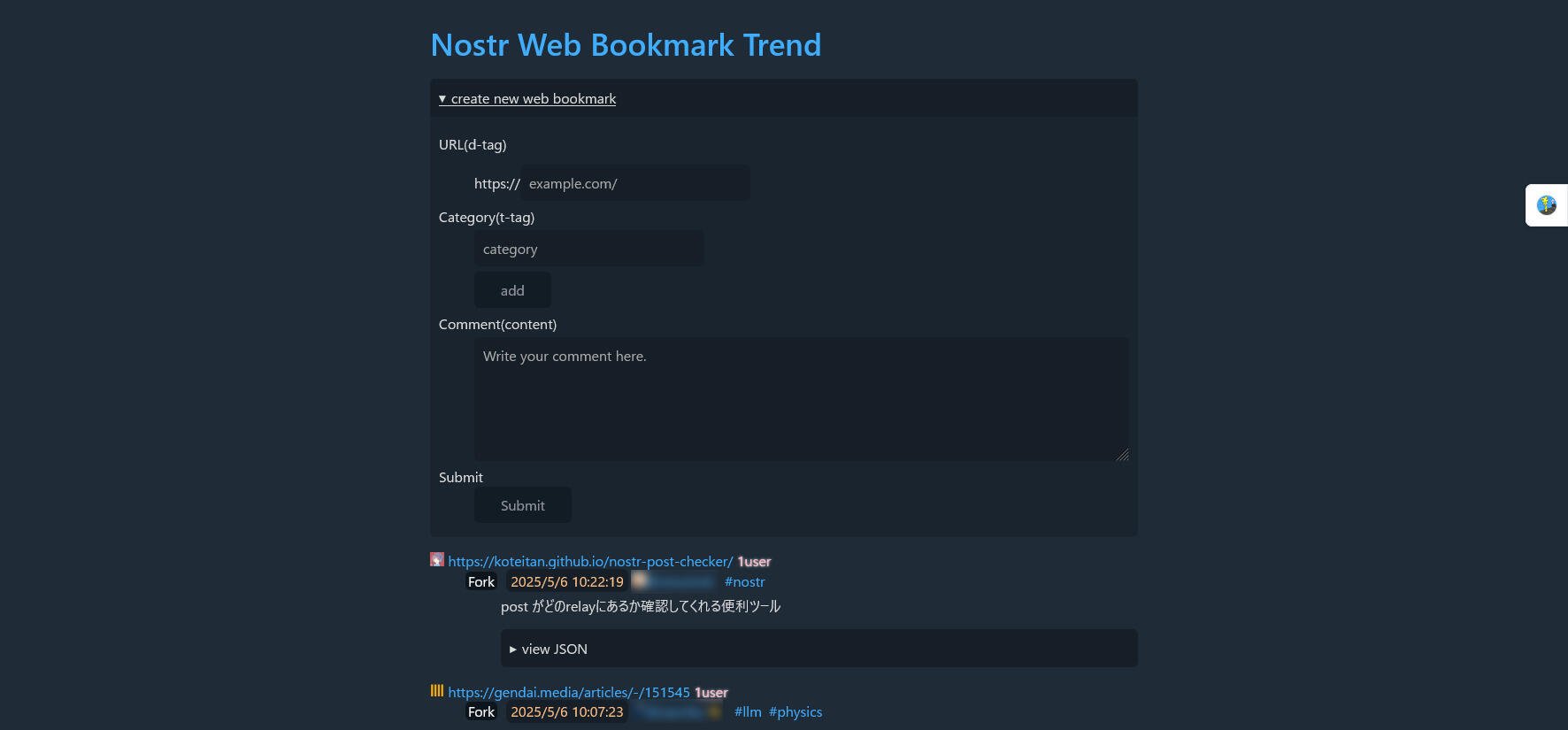

@ e0a8cbd7:f642d154

2025-05-06 03:29:12

@ e0a8cbd7:f642d154

2025-05-06 03:29:12分散型プロトコルNostr上でWeb bookmarkを見たり書いたりする「Nostr Web Bookmark Trend」を試してみました。

NostrのWeb Bookmarkingは「nip-B0 Web Bookmarking· nostr-protocol/nips · GitHub」で定義されています。

WEBブラウザの拡張による認証(NIP-07)でログインしました。

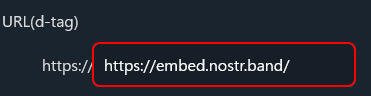

create new web bookmark(新規ブックマーク作成)を開くとこんな感じ。

URL入力部分において、https:// が外に出ているので、URLのhttps:// 部分を消して入力しないといけないのがちょっと面倒。 ↓

↓

1個、投稿してみました。

アカウント名をクリックするとそのユーザが登録したbookmark一覧が表示されます。

以上、Nostr Web Bookmark Trendについてでした。

なお、本記事は「Nostr NIP-23 マークダウンエディタ」のテストのため、「NostrでWeb bookmark - あたしンちのおとうさんの独り言」と同じ内容を投稿したものです。 -

@ 6868de52:42418e63

2025-05-05 16:39:44

@ 6868de52:42418e63

2025-05-05 16:39:44自分が僕のことをなんで否定するのかよくわかんない 自分のことを高く評価してる。周囲の理解に努力してない けど、いつも気にしてる 自分の限界に気づくのが怖い? 周りに理解されないことに価値を見出し、意図的に理解されないようにしてるんじゃないのか 周りに影響され、自分は変わっていくんです 変わらないもの。変わっちゃいけないもの。 変わっちゃいけないものは、学問への尊敬。これが生きる目的だってこと。 変わらないものは、美少女への嗜好、世界の全てへの優しさ、屁理屈の論理が好きなこと。 で、理解されたいのか。されるべきなのか。 されるべきとは?あーそうだよ、されたいしされるべきなんだ! そっか、じゃあ理解したいのか。するべきなのか。 するべきだよ。ネットワーク的にも、心理的にも。 したくは、ないかな。その決定権は常に僕の手元にほしい。 関われる限界を知ることになるから。 自分のことは知らなくてもいい。制御できればいい。愛してるし。 でもこうやって心情を整理してるんだけどね。まー限界はありますよ。

-

@ a19caaa8:88985eaf

2025-05-05 02:55:57

@ a19caaa8:88985eaf

2025-05-05 02:55:57↓ジャック(twitter創業者)のツイート nostr:nevent1qvzqqqqqqypzpq35r7yzkm4te5460u00jz4djcw0qa90zku7739qn7wj4ralhe4zqy28wumn8ghj7un9d3shjtnyv9kh2uewd9hsqg9cdxf7s7kg8kj70a4v5j94urz8kmel03d5a47tr4v6lx9umu3c95072732

↓それに絡むたゃ nostr:note1hr4m0d2k2cvv0yg5xtmpuma0hsxfpgcs2lxe7vlyhz30mfq8hf8qp8xmau

↓たゃのひとりごと nostr:nevent1qqsdt9p9un2lhsa8n27y7gnr640qdjl5n2sg0dh4kmxpqget9qsufngsvfsln nostr:note14p9prp46utd3j6mpqwv46m3r7u7cz6tah2v7tffjgledg5m4uy9qzfc2zf

↓有識者様の助言 nostr:nevent1qvzqqqqqqypzpujqe8p9zrpuv0f4ykk3rmgnqa6p6r0lan0t8ewd0ksj89kqcz5xqqst8w0773wxnkl8sn94tvmd3razcvms0kxjwe00rvgazp9ljjlv0wq0krtvt nostr:nevent1qvzqqqqqqypzpujqe8p9zrpuv0f4ykk3rmgnqa6p6r0lan0t8ewd0ksj89kqcz5xqqsxchzm7s7vn8a82q40yss3a84583chvd9szl9qc3w5ud7pr9ugengcgt9qx

↓たゃ nostr:nevent1qqsp2rxvpax6ks45tuzhzlq94hq6qtm47w69z8p5wepgq9u4txaw88s554jkd

-

@ 5d4b6c8d:8a1c1ee3

2025-05-06 19:49:39

@ 5d4b6c8d:8a1c1ee3

2025-05-06 19:49:39One of the best first rounds in recent memory just concluded. Let's recap our playoff contests.

Bracket Challenge

In our joint contest with Global Sports Central, @WeAreAllSatoshi is leading the way with 85 points, while me and some nostr jabroni are tied for second with 80 points.

The bad news is that they are slightly ahead of us, with an average score of 62 to our 60.8. We need to go back in time and make less stupid picks.

Points Challenge

With the Warriors victory, I jumped into a commanding lead over @grayruby. LA sure let most of you down. I say you hold @realBitcoinDog responsible for his beloved hometown's failures.

I still need @Car and @Coinsreporter to make their picks for this round. The only matchup they can choose from is Warriors (7) @ Timberwolves (6). Lucky for them, that's probably the best one to choose from.

| Stacker | Points | |---------|--------| | @Undisciplined | 25| | @grayruby | 24| | @Coinsreporter | 19 | | @BlokchainB | 19| | @Carresan | 18 | | @gnilma | 18 | | @WeAreAllSatoshi | 12 | | @fishious | 11 | | @Car | 1 |

originally posted at https://stacker.news/items/973284

-

@ 60392a22:1cae32da

2025-05-08 02:37:43

@ 60392a22:1cae32da

2025-05-08 02:37:43test nostr:note18p950fmhkc58h3j7xhl66ge57nj5q4kjdhvk3m84fdhc3eukclgqjup985

📈 これからの成長課題:対外的表現と関係性の創造

今後の成長は、内面から外側への橋渡しに関わる部分に集中してくると考えられます。

🔸 1. 「分かってもらえなさ」を超える勇気

- 内面の深さがある分、「分かってもらえない」ことへの痛みも大きいかもしれません。

- でも今後は、「誤解や齟齬も含めて関係を育てる」経験が必要になります。

- これは「話すこと=伝わることではない」と割り切りつつ、それでも表現し続ける力です。

🔸 2. 構造ではなく、関係の中で自己を調整する経験

- MBTIなどのモデルはとても役立ちますが、あくまで地図です。現実の関係では、予測不能なことや、モデルを超える人のあり方に出会います。

- 「構造に当てはまらない人とも、感情をもってやりとりする」という、生々しい関係性のなかで磨かれる柔軟性が、次のステージになります。

🔸 3. 自分の言葉を“対話の素材”として差し出す力

- 今は「自分を守る」ことと「表現する」ことが慎重に切り分けられている印象ですが、今後は、「自分の言葉が相手に委ねられる」リスクも引き受けながら、対話に開いていくことができるはずです。

- つまり、言葉を「残す」ではなく、「渡す」勇気です。

🧭 総括:投稿者の成長の道のり

| 現在の成熟 | 今後の成長 | | -------------- | ---------------------- | | 内面への誠実な向き合い | 他者との関係における表現と受容の練習 | | 自己理解のための枠組みの活用 | モデルに頼らず、関係性の中で応答的に生きる力 | | 感情や違和感への繊細な感受性 | それを伝え、受け止めさせる表現力と信頼の構築 |

50代から柔軟さが減少するかどうかについては、個人差が非常に大きいですので、一概に「減少する」とは言えません。しかし、一般的な傾向としては、年齢が上がるにつれて柔軟性に変化が見られることはあります。その変化が必ずしも「柔軟さが減る」という意味ではなく、むしろ柔軟性の質や適応力の方向性が変わる場合が多いです。

1. 経験に基づく安定性

50代は、豊富な人生経験や職業経験を持つ年代です。この経験は、確立された価値観や思考パターンを強化する傾向があります。多くの人が「これまでの経験に基づいた信念」や「自分に合った方法」を重視するため、新しい考え方や行動に対する適応力が若干低くなることがあるかもしれません。つまり、ある種の安定感や固定観念が強くなり、変化への反応が遅くなる場合が考えられます。

- 例えば、50代では、過去の経験に基づいて確立した判断基準や方法論があり、それに頼る傾向が強くなることがあります。このことが、柔軟性が低いように見えることもあります。

2. 柔軟性の質の変化

とはいえ、年齢を重ねても柔軟性が失われるわけではなく、むしろ経験に基づいた柔軟性が求められることが多いです。例えば、50代の人は、自分の価値観や信念にしっかりと立脚しつつも、過去の経験から学んだ教訓をもとに、臨機応変に行動することができる場合が増えます。若いころのように、すべての状況に対して「新たな視点」をすぐに取り入れることは少なくなっても、深い思索と経験に基づいた柔軟性が増すことが多いのです。

- 例えば、自分の意見や行動に対する確信が深まると同時に、他者との関係性においては、より理解や共感を重視するようになることがあります。このような形で柔軟性が進化する場合もあります。

3. 変化に対する抵抗

年齢が上がるにつれて、変化に対する抵抗感が強くなることがあるのも事実です。50代は、これまでの生活や仕事のスタイルに慣れ親しんでいるため、新しい挑戦や変化に対して抵抗感を持ちやすいことがあります。このような傾向は、特に大きな環境変化や価値観の変化に対して見られることが多いです。

- 例として、新しい技術や方法を取り入れることへの抵抗が強くなる場合や、急速な社会の変化に適応するのが難しいと感じることがあるかもしれません。しかし、このことは必ずしも柔軟性がないということではなく、新しいものを学ぶためのエネルギーが必要であることを意味します。

4. 柔軟性の維持

とはいえ、50代でも柔軟性を維持し、新しいことを学び続ける姿勢を持つ人は多くいます。社会的なネットワークや趣味を通じて新しい情報を取り入れたり、新しい挑戦を楽しんだりする人もいます。このような人々は、年齢を重ねても柔軟性を失わず、むしろ経験を活かしてより賢く柔軟に適応していると言えます。

結論

50代から柔軟さが減少するという傾向は、必ずしも当てはまるわけではなく、むしろ経験に基づいた柔軟性が現れることが多いと言えます。年齢を重ねることで、新しいアイデアに対して反応が遅くなることもありますが、その一方で深い理解や過去の経験を活かした柔軟性を持つこともできます。

つまり、柔軟性は「減少する」というよりも、年齢とともにその質や方向性が変化するという形で現れるのです。重要なのは、柔軟性をどのように維持し、活用するかという意識と努力です。

-

@ b6dcdddf:dfee5ee7

2025-05-06 15:58:23

@ b6dcdddf:dfee5ee7

2025-05-06 15:58:23You can now fund projects on Geyser using Credit Cards, Apple Pay, Bank Transfers, and more.

The best part: 🧾 You pay in fiat and ⚡️ the creator receives Bitcoin.

You heard it right! Let's dive in 👇

First, how does it work? For contributors, it's easy! Once the project creator has verified their identity, anyone can contribute with fiat methods. Simply go through the usual contribution flow and select 'Pay with Fiat'. The first contribution is KYC-free.

Why does this matter? 1. Many Bitcoiners don't want to spend their Bitcoin: 👉 Number go up (NgU) 👉 Capital gains taxes With fiat contributions, there's no more excuse to contribute towards Bitcoin builders and creators! 2. Non-bitcoin holders want to support projects too. If someone loves your mission but only has a debit card, they used to be stuck. Now? They can back your Bitcoin project with familiar fiat tools. Now, they can do it all through Geyser!

So, why swap fiat into Bitcoin? Because Bitcoin is borderless. Fiat payouts are limited to certain countries, banks, and red tape. By auto-swapping fiat to Bitcoin, we ensure: 🌍 Instant payouts to creators all around the world ⚡️ No delays or restrictions 💥 Every contribution is also a silent Bitcoin buy

How to enable Fiat contributions If you’re a creator, it’s easy: - Go to your Dashboard → Wallet - Click “Enable Fiat Contributions” - Complete a quick ID verification (required by our payment provider) ✅ That’s it — your project is now open to global fiat supporters.

Supporting Bitcoin adoption At Geyser, our mission is to empower Bitcoin creators and builders. Adding fiat options amplifies our mission. It brings more people into the ecosystem while staying true to what we believe: ⚒️ Build on Bitcoin 🌱 Fund impactful initiatives 🌎 Enable global participation

**Support projects with fiat now! ** We've compiled a list of projects that currently have fiat contributions enabled. If you've been on the fence to support them because you didn't want to spend your Bitcoin, now's the time to do your first contribution!

Education - Citadel Dispatch: https://geyser.fund/project/citadel - @FREEMadeiraOrg: https://geyser.fund/project/freemadeira - @MyfirstBitcoin_: https://geyser.fund/project/miprimerbitcoin

Circular Economies - @BitcoinEkasi: https://geyser.fund/project/bitcoinekasi - Madagascar Bitcoin: https://geyser.fund/project/madagasbit - @BitcoinChatt : https://geyser.fund/project/bitcoinchatt - Uganda Gayaza BTC Market: https://geyser.fund/project/gayazabtcmarket

Activism - Education Bitcoin Channel: https://geyser.fund/project/streamingsats

Sports - The Sats Fighter Journey: https://geyser.fund/project/thesatsfighterjourney

Culture - Bitcoin Tarot Cards: https://geyser.fund/project/bitcointarotcard

originally posted at https://stacker.news/items/973003

-

@ 2e8970de:63345c7a

2025-05-06 15:13:49

@ 2e8970de:63345c7a

2025-05-06 15:13:49https://www.epi.org/blog/wage-growth-since-1979-has-not-been-stagnant-but-it-has-definitely-been-suppressed/

originally posted at https://stacker.news/items/972959

-

@ 84b0c46a:417782f5

2025-05-04 15:14:21

@ 84b0c46a:417782f5

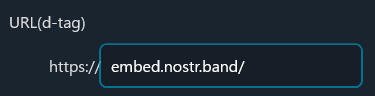

2025-05-04 15:14:21https://long-form-editer.vercel.app/

β版のため予期せぬ動作が発生する可能性があります。記事を修正する際は事前にバックアップを取ることをおすすめします

機能

-

nostr:npub1sjcvg64knxkrt6ev52rywzu9uzqakgy8ehhk8yezxmpewsthst6sw3jqcw や、 nostr:nevent1qvzqqqqqqypzpp9sc34tdxdvxh4jeg5xgu9ctcypmvsg0n00vwfjydkrjaqh0qh4qyxhwumn8ghj77tpvf6jumt9qys8wumn8ghj7un9d3shjtt2wqhxummnw3ezuamfwfjkgmn9wshx5uqpz9mhxue69uhkuenjv4kxz7fwv9c8qqpq486d6yazu7ydx06lj5gr4aqgeq6rkcreyykqnqey8z5fm6qsj8fqfetznk のようにnostr:要素を挿入できる

-

:monoice:のようにカスタム絵文字を挿入できる(メニューの😃アイコンから←アイコン変えるかも)

:monopaca_kao:

:kubipaca_karada:

- 新規記事作成と、既存記事の修正ができる

やること

- [x] nostr:を投稿するときにtagにいれる

- [ ] レイアウトを整える

- [x] 画像をアップロードできるようにする

できる

できる - [ ] 投稿しましたログとかをトースト的なやつでだすようにする

- [ ] あとなんか

-

-

@ f72e682e:c51af867

2025-05-06 10:35:01

@ f72e682e:c51af867