-

@ 09d5c0a0:2ebbe260

2025-05-12 17:08:20

@ 09d5c0a0:2ebbe260

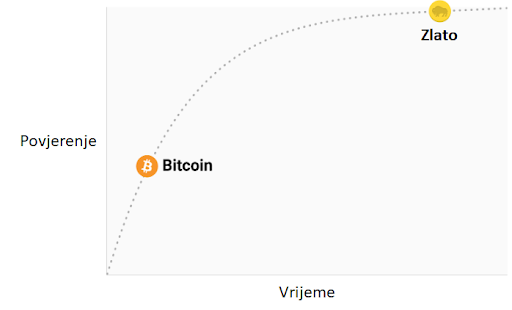

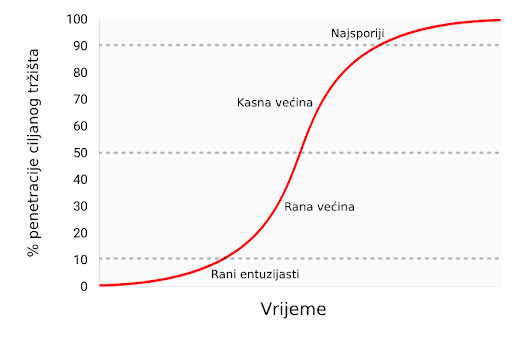

2025-05-12 17:08:20*For some people, Bitcoin is about saving for retirement. For others, it’s about eating tomorrow. __I first shared the idea of a “Bitcoin Privilege Curve” at the Plan B Forum 2025 in El Salvador. And it still guides how I see Bitcoin today—especially here in Uganda. __Bitcoin shows up differently depending on where you are in life. What it gives you depends on what you need most. __In Uganda, Bitcoin shows up as survival and uphill battle towards financial empowerment to the largely financially illiterate community. __Sometimes it’s food. Sometimes it’s school fees. Or even a skill. We receive Bitcoin donations that allow us to feed orphans, support teachers, and build small projects that teach these children how to farm, save, and think differently about money, __They’re learning how to live better. A child who knows how to grow food and save in sats is building wealth from the ground up. That’s what the lower end of the curve looks like: *Cheap transactions: Many of the people we work with don’t have bank accounts and the cost of accessing, setting up and maintaining a bank account is just unnecessary. Bitcoin lets them send and receive money within themselves almost at no fees, a better option than the exploitative fee structure by mobile money service providers and most banks. Cross-border remittances: We’ve seen Bitcoin move across borders in minutes with no forms, no gatekeepers. I can instantly and cheaply pay for a friend's grocery shopping in Kenya by sending Kenyan shillings into a Grocery Vendor's Mpesa straight from my Bitcoin wallet via Tando. Wealth multiplication: Even saving one sat creates a shift. It teaches patience. It grows over time. Bitcoin is a wealth multiplier for most underprivileged or privileged people, we taught Bitcoin and its principles to former students at Makerere University that have now entered the job market, from testimonials Bitcoin is helping them achieve their savings goals faster than their colleagues.

__Now go higher up the curve, and Bitcoin looks different. ****Wealth preservation: For someone with savings, Bitcoin protects that value over time, especially in regions with unstable currencies, the Argentina, Zimbabwe and Venezuala currency devaluation scandals always remind me that, you can do everything right and still end up losing all your hard earned value to mediocre goverment policies. Inflation hedge: Where governments keep printing money, Bitcoin holds its ground. It offers a stable alternative. The fallacy that inflation is a necessary evil no longer holds water, having a currency with a 21 Million coin hard cap enforceable by millions of Bitcoin network participants across the world guarantees no governement intervention. Censorship resistance: No one can freeze, reject or interfere with your Bitcoin and respective transactions. It's easy to assume because its a public ledger, you sacrifice privacy hence transaction integrity but this is far from the case, Bitcoin gives people freedom to transact without interference privately. Choice: Bitcoin doesn’t lock you into one system. You can move in and out of, save, or spend it however you see fit as long as your transactions obey the globally agreed upon, never changing network rules since 2009.

__So no, it’s not fair to compare someone struggling for a meal to someone saving for their retirement. But that’s the point. Bitcoin doesn’t need to be the same thing for everyone.

__With Gorilla Sats , our tourism project, we’re linking both ends of the curve. Bitcoiners from around the world visit our communities and spend their Bitcoin with local vendors. It’s not charity—it’s a circular economy. The people higher up the curve get meaningful experiences. Locals get income, exposure, and proof that their sats are valuable.

__In traditional finance, someone without a Visa machine can’t do business with someone carrying a card. The tourist who can't easily use mobile money and is hesistant because of exchange rates will spend comparably less but with Bitcoin, all you need is a phone even a basic button one because with now Machankura 8333, Bitcoin moves via USSD.

__Bitcoin offers privilege—but not the kind that excludes. It offers access, ownership, and freedom based on where you are in life. So no, it’s not fair to compare someone struggling for a meal with someone protecting their portfolio. But that’s the point.

__And if we build for everyone on the curve, we all move forward.

__If you’re building for Bitcoin adoption, think about the full curve. What’s it solving where you live? And who still needs a way in?

-

@ c9badfea:610f861a

2025-05-12 16:29:32

@ c9badfea:610f861a

2025-05-12 16:29:32- Install Organic Maps

- Launch the app and download the World Map first

- Tap the ☰ at the bottom, then select Download Maps, and tap the + icon

- Download maps by tapping ⤓ next to your desired region

- Return to the main screen and tap 🔍 to search for your destination

- Enjoy navigating offline

ℹ️ Note that Organic Maps does not provide live traffic updates

-

@ a3c6f928:d45494fb

2025-05-12 15:30:48

@ a3c6f928:d45494fb

2025-05-12 15:30:48Financial freedom is a powerful concept—one that goes beyond simply having money in the bank. It is the ability to live the life you desire, free from the constraints of financial worry. Achieving financial freedom requires planning, discipline, and a clear understanding of your financial goals.

What Is Financial Freedom?

Financial freedom means having enough income, savings, and investments to support the lifestyle you want for yourself and your family. It is about being in control of your finances, instead of your finances controlling you. When you are financially free, you have choices—you can travel, start a business, or retire comfortably without constant stress about money.

Steps to Achieving Financial Freedom

-

Set Clear Financial Goals: Understand what financial freedom means to you and set measurable goals to achieve it.

-

Create a Budget and Stick to It: Track your income and expenses to identify areas where you can save more.

-

Invest Wisely: Grow your wealth by investing in assets like stocks, real estate, or mutual funds.

-

Build an Emergency Fund: Save at least 3-6 months’ worth of living expenses to protect against unexpected events.

-

Eliminate Debt: High-interest debt can be a major barrier to financial freedom. Prioritize paying it off.

Why Financial Freedom Matters

Financial freedom gives you the power to make decisions without being bound by financial constraints. It allows for greater life flexibility, reduces stress, and opens up opportunities that would otherwise be unreachable. Most importantly, it provides peace of mind and the ability to focus on what truly matters.

Start Your Journey Today

The path to financial freedom is not a quick fix—it is a lifelong commitment to smart financial choices. But with perseverance and planning, it is achievable. Begin today, and take control of your financial future.

“Financial freedom is available to those who learn about it and work for it.” — Robert Kiyosaki

Plan wisely. Invest smartly. Live freely.

-

-

@ 6be5cc06:5259daf0

2025-05-12 14:50:36

@ 6be5cc06:5259daf0

2025-05-12 14:50:36A posição do libertário que rejeita o cristianismo padece de sérias incoerências lógicas, históricas e filosóficas. Ao renegar as bases espirituais e culturais que tornaram possível o próprio ideal libertário, tal posição demonstra ser, ao mesmo tempo, autofágica e irracional. É o caso de alguém que se gloria dos frutos de uma árvore que corta pela raiz.

I. Fundamento histórico: a civilização da liberdade é cristã

Não foi o secularismo moderno, nem o paganismo antigo, que ergueram as instituições que protegem a dignidade da pessoa humana e os limites ao poder. Desde os primeiros séculos, a Igreja resistiu ao culto estatal romano, afirmando a soberania de Deus sobre os Césares — "Mais importa obedecer a Deus que aos homens" (Atos 5,29).

Foi o cristianismo que:

-

Fundou universidades livres, onde o saber era buscado sob o primado da verdade;

-

Defendeu a lei natural como fundamento do direito — uma doutrina que protege o indivíduo contra tiranias;

-

Resgatou e aprofundou o conceito de pessoa, dotada de razão e livre-arbítrio, imagem de Deus, e, portanto, inalienavelmente digna e responsável.

Em momentos-chave da história, como nas disputas entre papado e império, nas resistências contra absolutismos, e na fundação do direito internacional por Francisco de Vitoria e a Escola de Salamanca, foi o cristianismo quem freou o poder estatal em nome de princípios superiores. A tradição cristã foi frequentemente o principal obstáculo à tirania, não seu aliado.

Negar isso é amputar a própria genealogia da liberdade ocidental.

Uma das chaves do cristianismo para a construção dessa civilização da liberdade foi a exaltação do individualismo. Ao afirmar que o ser humano é feito à imagem de Deus e que sua salvação é uma escolha pessoal, o cristianismo colocou o indivíduo no centro da moralidade e da liberdade. Diferente dos gregos, cuja ética era voltada para a polis e a cidade-estado, o cristianismo reafirma a suprema importância do indivíduo, com sua capacidade de escolha moral, responsabilidade pessoal e dignidade intrínseca. Esse princípio, mais do que qualquer outra religião, foi o alicerce do desenvolvimento da liberdade individual e da autonomia, valores que sustentam a civilização ocidental.

A ética grega, na melhor das hipóteses, descreve a ordem natural — mas não consegue justificar por que essa ordem deveria obrigar a vontade humana. Um Logos impessoal não tem autoridade moral. Uma ordem cósmica sem um Legislador é apenas um dado de fato, não uma norma vinculante. A vontade pode rebelar-se contra o telos — e sem um Deus justo, que ordena a natureza à perfeição, não há razão última para não o fazer.

A cultura grega teve uma influência indiscutível sobre o desenvolvimento da civilização ocidental, mas o cristianismo não só absorveu o que havia de bom na cultura grega, como também elevou e completou esses aspectos. O cristianismo, ao afirmar que todos os homens são feitos à imagem e semelhança de Deus e têm dignidade intrínseca, levou a uma noção de igualdade moral e liberdade que transcende as limitações da pólis grega.

II. Falsa dicotomia: fé e liberdade não são opostas

Com frequência equiparam a religião à coerção e à obediência cega. Mas isso é um equívoco: o cristianismo não se impõe pela força, mas apela à consciência. O próprio Deus, em sua relação com a criatura racional, respeita sua liberdade. Como ensina a Escritura:

"Se alguém quiser vir após mim..." (Mt 16,24);

"Eis que estou à porta e bato. Se alguém ouvir a minha voz e abrir a porta, entrarei em sua casa e cearei com ele." (Ap 3,20);

"Assim falai, e assim procedei, como devendo ser julgados pela lei da liberdade." (Tiago 2,12).A adesão à fé deve ser livre, voluntária e racional, pois sem liberdade não há verdadeiro mérito, nem amor genuíno. Isso é mais compatível com o princípio de não agressão do que qualquer utopia secular. Ora, o núcleo do evangelho é voluntarista: salvação pessoal, conversão interior, caridade.

Ninguém deve ser forçado, contra sua vontade, a abraçar a fé, pois o ato de fé é por sua natureza voluntário (Dignitatis Humanae; CDC, cân. 748,2)

Se algum Estado usa da força para impor o cristianismo, afirmar que o cristianismo causou as coerções é tão equivocado quanto dizer que a propriedade privada causa o comunismo; é uma inversão da realidade, pois o comunismo surge precisamente da violação da propriedade. Portanto, a fé forçada é inválida em si mesma, pois viola a natureza do ato de crer, que deve ser livre.

III. Fundamento moral: sem transcendência, o libertarianismo flutua no vácuo

O libertário anticristão busca defender princípios objetivos — como a inviolabilidade do indivíduo e a ilegitimidade da agressão — sem um fundamento transcendente que lhes dê validade universal. Por que a agressão é errada? Por que alguém tem direito à vida, à liberdade, à propriedade? Sem uma explicação transcendental, as respostas para tais perguntas se tornam apenas opiniões ou convenções, não obrigações morais vinculantes. Se a moralidade é puramente humana, então os direitos podem ser modificados ou ignorados conforme a vontade da sociedade. O conceito de direitos naturais, tão caro ao libertarianismo, precisa de um solo metafísico que justifique sua universalidade e imutabilidade. Caso contrário, eles podem ser tratados apenas como acordos utilitários temporários ou preferências culturais, sem qualquer obrigatoriedade para todos os seres humanos em todas as circunstâncias.

Pensadores libertários seculares, como Ayn Rand e Murray Rothbard, tentaram ancorar os direitos naturais na razão humana ou na natureza do homem. Rand baseia sua ética no egoísmo racional, enquanto Rothbard apela à lei natural. Embora essas abordagens busquem objetividade, elas carecem de uma resposta definitiva para por que a razão ou a natureza humana obrigam moralmente todos os indivíduos. Sem um fundamento transcendente, suas concepções permanecem vulneráveis a interpretações subjetivas ou a cálculos utilitários.

Aqui, o cristianismo oferece uma explicação sólida e transcendental que fundamenta os direitos naturais. A visão cristã de que o ser humano foi criado à imagem e semelhança de Deus confere à pessoa uma dignidade intrínseca, imutável e universal. Essa dignidade não depende de fatores externos, como consenso social ou poder político, mas é uma característica inerente ao ser humano pela sua criação divina. A partir dessa perspectiva teológica, torna-se possível afirmar com base sólida que os direitos naturais são dados por Deus e, portanto, são universais e vinculantes.

O cristianismo também é a base de um sistema moral que distingue claramente justiça de legalidade. O Estado pode criar leis, mas isso não significa que essas leis sejam justas. A justiça, sob a ótica cristã, é uma expressão da ordem moral objetiva, algo que transcende as leis humanas e é definido pela vontade divina. Por isso, o libertarianismo cristão vê a agressão como uma violação de uma ordem moral objetiva, e não apenas uma violação de uma convenção social ou de um acordo utilitário.

Se a moralidade e os direitos naturais não forem fundamentados em um Logos criador e legislador, o que acontece é que o conceito de direito natural degenera para algo mais frágil, como um simples acordo utilitário. Nesse cenário, os direitos do indivíduo se tornam algo acordado entre os membros de uma sociedade, em vez de princípios imutáveis e universais. Os direitos podem ser negociados, alterados ou ignorados conforme o interesse do momento.

IV. Fundamento científico: a racionalidade moderna é filha da fé cristã

A ciência moderna só foi possível no contexto cultural cristão. Nenhuma outra civilização — nem a grega, nem a islâmica, nem a chinesa — produziu o método científico como o Ocidente cristão o fez.

Isso se deve a quatro premissas teológicas:

-

Criação racional: O mundo é ordenado por um Deus racional.

-

Distinção entre Criador e criatura: A natureza não é divina e pode ser estudada sem sacrilégio.

-

Valor do trabalho e da observação empírica, herdado do monaquismo.

-

Autonomia institucional, presente nas universidades medievais.

A doutrina cristã da Criação ex nihilo ensina que o mundo foi criado por um Deus racional, sábio e pessoal. Portanto, o cosmos é ordenado, possui leis, e pode ser compreendido pela razão humana — que é imagem do Criador. Isso contrasta fortemente com as cosmovisões panteístas ou mitológicas, onde o mundo é cíclico, arbitrário ou habitado por forças caprichosas.

Sem essa fé no Logos criador, não há razão para crer que a natureza tenha uma ordem inteligível universal e constante, que pode ser descoberta por observação e dedução. A ciência moderna só é possível porque, antes de investigar a natureza, pressupôs-se que ela era investigável — e isso foi uma herança direta do pensamento cristão.

Homens como Bacon, Newton, Kepler e Galileu viam na ciência um modo de glorificar o Criador. O ateísmo cientificista é, portanto, parasitário da teologia cristã, pois toma seus frutos e rejeita suas raízes. A ciência moderna nasceu como filha legítima da fé cristã. E os que hoje a usam contra sua mãe, ou são ingratos, ou ignorantes.

V. O cristianismo como barreira à revolução cultural

O cristianismo é a barreira mais sólida contra a infiltração revolucionária. A chamada "marcha gramsciana", que visa corroer os fundamentos morais da sociedade para subjugar o indivíduo ao coletivo, encontra sua resistência mais firme nos princípios cristãos. A fé cristã, ao proclamar a existência de uma verdade objetiva, de uma lei moral imutável e de uma dignidade humana que transcende o Estado e o consenso social, imuniza a civilização contra o relativismo e o igualitarismo nivelador do marxismo cultural.

Além disso, o cristianismo é uma tradição milenar, profundamente enraizada no cotidiano das pessoas, não sendo uma novidade a ser imposta ou implementada, mas uma força presente há séculos, que permeia a estrutura social, moral e cultural da sociedade. Sua presença constante nas comunidades, desde os tempos mais antigos, oferece uma resistência robusta contra qualquer tentativa de subverter a ordem natural e moral estabelecida.

Não por acaso, tanto Karl Marx quanto Antonio Gramsci identificaram no cristianismo o principal obstáculo à realização de seus projetos revolucionários. Marx chamou a religião de "ópio do povo" porque sabia que uma alma ancorada em Deus não se submete facilmente ao poder terreno; Gramsci, mais sutil, propôs a destruição da cultura cristã como pré-condição para o triunfo do socialismo. Sem essa âncora transcendente, a sociedade torna-se presa fácil das engenharias sociais que pretendem redefinir arbitrariamente o homem, a família e a liberdade.

Conclusão

O libertário anticristão, consciente ou não, nega as fundações mesmas do edifício que habita. Ao rejeitar o cristianismo, cava o abismo sob os próprios pés, privando o ideal libertário de sua base moral, cultural e racional. Ele defende a ética voluntária, a liberdade individual e a ordem espontânea, mas sem o solo metafísico e histórico que torna esses princípios inteligíveis e possíveis. É um erro tentar preservar a liberdade em termos absolutos sem reconhecer as raízes cristãs que a sustentam, pois o cristianismo é a única tradição que a legitima e a viabiliza.

Negar o cristianismo é racionalmente insustentável. A liberdade, como a conhecemos, é filha da fé cristã, que oferece a base moral e metafísica que torna a liberdade tanto desejável quanto possível. Mesmo que ateu, o libertário que ama a liberdade deveria, no mínimo, respeitar — e, idealmente, redescobrir — essas raízes cristãs. Pois sem fé, restam apenas o niilismo e o relativismo, que, eventualmente, desaguam na servidão.

Como nos ensina a tradição: Ubi fides ibi libertas — onde há fé, há liberdade.

-

-

@ eabee230:17fc7576

2025-05-12 14:38:11

@ eabee230:17fc7576

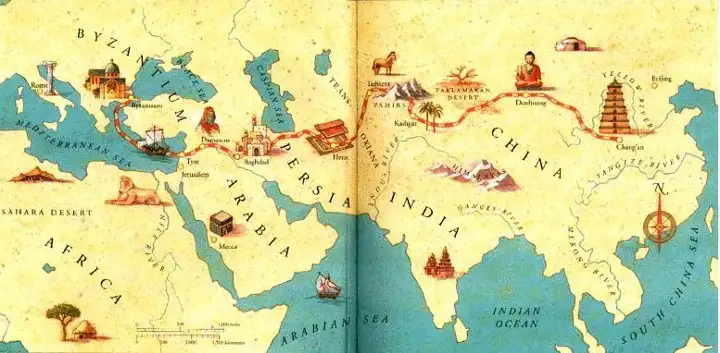

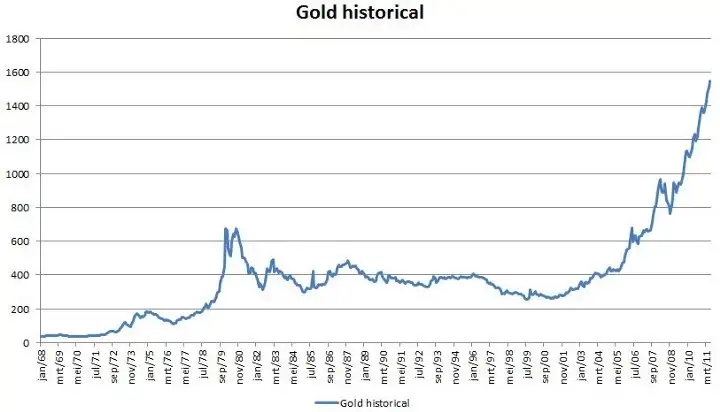

2025-05-12 14:38:11⚖️ຢ່າລືມສິ່ງທີ່ເຄີຍເກີດຂຶ້ນ ຮອດຊ່ວງທີ່ມີການປ່ຽນແປງລະບົບການເງິນຈາກລະບົບເງິນເກົ່າ ສູ່ລະບົບເງິນໃໝ່ມັນເຮັດໃຫ້ຄົນທີ່ລວຍກາຍເປັນຄົນທຸກໄດ້ເລີຍ ນ້ຳພັກນ້ຳແຮງທີ່ສະສົມມາດ້ວຍຄວາມເມື່ອຍແຕ່ບໍ່ສາມາດແລກເປັນເງິນລະບົບໃໝ່ໄດ້ທັງໝົດ ຖືກຈຳກັດຈຳນວນທີ່ກົດໝາຍວາງອອກມາໃຫ້ແລກ ເງິນທີ່ເຫຼືອນັ້ນປຽບຄືດັ່ງເສດເຈ້ຍ ເພາະມັນບໍ່ມີຢູ່ໃສຮັບອີກຕໍ່ໄປເພາະກົດໝາຍຈະນຳໃຊ້ສະກຸນໃໝ່ ປະຫວັດສາດເຮົາມີໃຫ້ເຫັນວ່າ ແລະ ເຄີຍຜ່ານມາແລ້ວຢ່າໃຫ້ຄົນລຸ້ນເຮົາຊຳ້ຮອຍເກົ່າ.

🕰️ຄົນທີ່ມີຄວາມຮູ້ ຫຼື ໃກ້ຊິດກັບແຫຼ່ງຂໍ້ມູນຂ່າວສານກໍຈະປ່ຽນເງິນທີ່ມີຢູ່ເປັນສິນສັບບໍ່ວ່າຈະເປັນທີ່ດິນ ແລະ ທອງຄຳທີ່ສາມາດຮັກສາມູນລະຄ່າໄດ້ເຮັດໃຫ້ເຂົາຍັງຮັກສາຄວາມມັ້ງຄັ້ງໃນລະບົບໃໝ່ໄດ້.

🕰️ໃຜທີ່ຕ້ອງການຈະຍ້າຍປະເທດກໍ່ຈະໃຊ້ສິ່ງທີ່ເປັນຊື່ກາງໃນການແລກປ່ຽນເປັນທີ່ຍ້ອມຮັບຫຼາຍນັ້ນກໍຄືທອງຄຳ ປ່ຽນຈາກເງິນລະບົບເກົ່າເປັນທອງຄຳເພື່ອທີ່ສາມາດປ່ຽນທອງຄຳເປັນສະກຸນເງິນທ້ອງຖິ່ນຢູ່ປະເທດປາຍທາງໄດ້.

🕰️ຈາກຜູ້ດີເມື່ອກ່ອນກາຍເປັນຄົນທຳມະດາຍ້ອນສັບສິນທີ່ມີ ບໍ່ສາມາດສົ່ງຕໍ່ສູ່ລູກຫຼານໄດ້. ການເກັບອອມເປັນສິ່ງທີ່ດີ ແຕ່ຖ້າໃຫ້ດີຕ້ອງເກັບອອມໃຫ້ຖືກບ່ອນ ຄົນທີ່ຮູ້ທັນປ່ຽນເງິນທີ່ມີຈາກລະບົບເກົ່າໄປສູ່ທອງຄຳ ເພາະທອງຄຳມັນເປັນສາກົນ.

ໃຜທີ່ເຂົ້າໃຈ ແລະ ມອງການໄກກວ່າກໍ່ສາມາດຮັກສາສິນສັບສູ່ລູກຫຼານໄດ້ ເກັບເຈ້ຍໃນປະລິມານທີ່ພໍໃຊ້ຈ່າຍ ປ່ຽນເຈ້ຍໃຫ້ເປັນສິ່ງທີ່ຮັກສາມູນລະຄ່າໄດ້ແທ້ຈິງ.🕰️ເຮົາໂຊກດີທີ່ເຄີຍມີບົດຮຽນມາແລ້ວ ເກີດຂຶ້ນຈິງໃນປະເທດເຮົາບໍ່ໄດ້ຢາກໃຫ້ທັງໝົດແຕ່ຢາກໃຫ້ສຶກສາ ແລະ ຕັ້ງຄຳຖາມວ່າທີ່ຜ່ານມາມັນເປັນແບບນີ້ແທ້ບໍ່ ເງິນທີ່ລັດຄວາມຄຸມ ເງິນປະລິມານບໍ່ຈຳກັດ ການໃຊ້ກົດໝາຍແບບບັງຄັບ. ຖ້າຄອບຄົວຫຼືຄົນໃກ້ໂຕທີ່ຍູ່ໃນຊ່ວງເຫດການນັ້ນແຕ່ຕັດສິນໃຈຜິດພາດທີ່ບໍ່ປ່ຽນເຈ້ຍເປັນສິນສັບ. ນີ້ແມ່ນໂອກາດທີ່ຈະແກ້ໄຂຂໍ້ຜິດພາດນັ້ນໂດຍຫັນມາສຶກສາເງິນແທ້ຈິງແລ້ວແມ່ນຍັງກັນແທ້ ເວລາມີຄ່າສຶກສາບິດຄອຍ.

fiatcurrency #bitcoin #gold #history #paymentsolutions #laokip #laostr

-

@ 4bc7982c:4cb5c39d

2025-05-12 14:21:38

@ 4bc7982c:4cb5c39d

2025-05-12 14:21:38-----BEGIN PGP PUBLIC KEY BLOCK----- mQINBFav2jMBEADPCRsFp9Vtw0vlkeho2v8lIPblVNNeW43HLNXeEGvgn+gaK5sW 9H5mbp6ZLEjbdEr7zc3eu7iLFudw9IdJCLKYcqkXWBpAQF7JF6l4J18oOQK1Tfzc QyU5jWuAcc+Ds8REW91X/N9Ae/QF+dtRyuv1ILFKZ88G2za/TdV06PuNdyi3qTlD 5HPVhd5YrZyY7GVG1gTi7Wtj6tONGjjQARR6T1LDuN75QmoDvw3m68U5QnoECGg4 BFAdPrnFxYpTCl6SyV9AsCfzTwP2mIkLKZi7X/wSubt4b+nhPMuFeZ/6XFCfHCD4 mEcQudyXByi7FgAXmX+UPS1iFtaXG8UJHM4Fq2k5FcjdLXW2s0kKk915XVEE9Q4Y wWQpTonr9FwgT+aSbV7UX8ihNhNCSQAv1RnIIt8t9hncztfZD7g/FMj4FfZ8GkI0 gmn3DliSlswBZbr1rN0HTitAzYKNUsiinIxwICfj9yRTcQ92F0ML+zwQB5UOXjEJ ra+D3tGjyVCNKO940rbjvj/QAvakoNBdCnbaZDKf26Hc0qpcn3DvGei0QLFJ2gmz EnK1dW4kftcJE8piibvq35EEptqkDiCMlI0Eq819vtJBumF3ZSBjMeEB1IPfSvDG 1OoUXXS0TGwCGstjMTRQ1S2D8fDb0ENBrbdhyWXZVQFzxi/YMwkNGswDoQARAQAB tBpzaGlub2hhaSA8YnRjaW5mb0BzZGYub3JnPokCNwQTAQgAIQIbAwIeAQIXgAUC Y+g7QQYLCQgHAwIGFQgCCQoLAxYCAQAKCRBKdYg8wbHTTG6OD/wJ9V3tjvaerA6Y GViWU6h0Nrvjs6/NWq48K3hP9eqy9n7CKVOviCjglF/yf1FEfEDg7LKYtFYLs1pf MFzNolynfGearK7HQeOXRoNFfkDqQWcjPWeVWhkEgxrqq9AMg+7gHMMtKnHWezJT E4NaAui7uW7rTiOvS8PT8+Y3uATermzJ0Cmb1c0su/s9in3bPwnmxJpbj9EruOWg MVY8Hov5fEJTwghIwoVBR2D4nWObQMWQsiNrEG/XdPeE1XzHGLrSmH64o6T2vWK2 XkQU6TVDBKhsIy0EjX9B36Hx+MmFx1pfHfxtGpAgZKwnEnMIoNc2vvrkjJhnRCUQ 1MfMoPDnn01mOT/kNkijyTUlh4rYeqa/A5JuqLbQ6qWz4e9rodu9C6/drn7Ivk/D ipRyMihNKbWq1PkAr7I9YQ/1NAM8ZmUE/bFL7/t6rDsa5IinwUeu/WGqNmKHIo0o u5vQD9zwmYOqeZLo2vzmmr/NkaRD7/3j5pb81MTjZzqTh/BGI31TEbjWpJ4StJ4g 2QNcXamGa/7/TpgI5u2EQojdvUojzSg7V3/ZNsNaJnDnqtZNzY7n2q4qvE2H/xJq z5y0SsTgpMPktt+ljg/T3po/LGQIcCPE4EBpSBKSpi0VWvkGVM2sraUCzP82c/X+ ztr12YwcckdET9SWDtSloE942tXKO4kCOQQTAQgAIwUCVq/aMwIbAwcLCQgHAwIB BhUIAgkKCwQWAgMBAh4BAheAAAoJEEp1iDzBsdNMrLMP/1pQZUXNzG9FlhBBGA8X ko+ObEvuVUvtZzTu8DXrQGDp/DYQq+O7YWhZ8WwyxYJx718bkIemHP5IbXbzmeS3 Nijf1mszrCbmw7QZ496YTihoZxyeb8MHYECPAiUbz9Ie2S6/isF45LZX3SbkwlYc M5UfV4iaXqvKSuydRJ8Xk68rn+AiEXFrv1vcGy7cqDz4PBOd9ZJwiAWhr0m9hMZT uDqYPI8choUh3uhpMIEf9YLD77ru1xl0Uba8e34qrOs+Secfv81ItbFION9z0A17 W2/q01dQfojpcoC+YS3CXXCJGm5TwYniIWVUmtL4eIfg6T/ZX5o5Am3aj4pQxr+E y/NNkUvplXZ+nG3fG4mthY4r+NV4E/RSsZJDU55BAWhZj3fHVhu7Q40yVMHLJNP9 KKCdacd/WWJtUX3Z1X/mQplJcMCYwhvdPNCctDpHrEyuIlvDvJuqbCY5eBa0hk8z jRNA9IghWW7JMzcnQR5u6FXWiqmcfFOEJwDUu8hM057Q6e6/FRPjlmua6SzcMK+k ERS+AwAIX4BIaLCnE7ndizQ/y6ek2hpKFXzPBLmxLyID91/wlA6NzbtyZkgZvJ7X g/7Rtt4FyZwKZqbfBFrjzLIyFTkmJ0lSPCSuWna5vaSg1HXPfc05wOUXsGV8xA8D zrolAoj4OIo//H2YMvLy5Giz0f8AACeO/wAAJ4kBEAABAQAAAAAAAAAAAAAAAP/Y /+AAEEpGSUYAAQEAAAAAAAAA/9sAQwAIBgYHBgUIBwcHCQkICgwUDQwLCwwZEhMP FB0aHx4dGhwcICQuJyAiLCMcHCg3KSwwMTQ0NB8nOT04MjwuMzQy/9sAQwEJCQkM CwwYDQ0YMiEcITIyMjIyMjIyMjIyMjIyMjIyMjIyMjIyMjIyMjIyMjIyMjIyMjIy MjIyMjIyMjIyMjIy/8AAEQgAyADIAwEiAAIRAQMRAf/EABwAAAIDAQEBAQAAAAAA AAAAAAYHAAQFAwIIAf/EAEkQAAEDAwIDBAcFAwgIBwAAAAECAwQABREGEgchMRNB kaEUIjJRcYGxFSNCYcEIUtEWFyQlM1OSohg0YmNzgpPSQ1RVcpTC4f/EABkBAAMB AQEAAAAAAAAAAAAAAAABAgMEBf/EACIRAAICAgIDAQEBAQAAAAAAAAABAhEDEiFB EzFRBCJhgf/aAAwDAQACEQMRAD8AAbvwd1NZkuKf9GWhH4miog/5aEpOn50UkLQC R7s/rX0K1xpmuEJk6RW4g9exloX5GuMvibpeY2U3TRFxCVclH0dKh4irpfBWfOog P4yUgVyMdwHG2n8q8cGZQw/CfiLV3dk4nH58q/E2Pg/NwpjUaWCT0W4QfMUUgEN6 C9tzgAfnX43DdcHq4p/p4XaLnpzA1iypJ6BTqD+teU8CkryYd/jOJ7iBn6UUg5EM LbII9kVbg6emTpAZSppsnvcJApxyOBd/59nNiLx05kVjyeEesYSj2cL0gD+6dHOi ogZ8DgVqO4xw8zcbVgjOC8rPkmhu8cO7zZXFokKZVsOCUbv1FFyLBru0glqLdI5/ 2Mn6VbTf+IEMhMiRJUnG3ZIjBWfmRRURWxPrirQspJTkcq/RDdV0xTYe1Jc3QW7h YLPKHeVxSlXiDWQ87ZXlZd0p2ZByr0WUpvPjmqSiDbMDTWg7nqdakxZENnb3vubc +Ao1T+zvqpYym4Wkj3h1f/bWIpzTvLbbb3BXn2mZKXCPHFbdvviIiQImr79EGOQe ZCgPjg0nFdMSk+z9/wBHXVf/AKhaf+ov/tqf6Ouq/wDz9p/6q/8Atrft2v782/ln XMGU2kY7OdAUgH/mAzW9B4lanW+cq01NQPwNSy2o+NTqyrFPO4Oaht7qm3JEFRBx lKl8/wDLVNPC29KyPSYQI961fwp9t6/vTqgqToztmu9Uae04fkDiuL2tbSFf0/Q1 8ZCj6znogUB80mjVlKhDq4ZXhPWTC/xq/hVJ/Qs+ODvlw+XuUr+FPh3UfDt93Y8u 4QlH+9YWgDxFeC3w5lqAZ1THCjyw4sfrRqPg+endOyWjjtmD+YJ/hXH7Ekf3jXia +j/5C6amDETUNvcUroN6D+tVX+D6lt5iy4iyf3TVJR7Jkn0Ii26Rm3KSlhuRFbUr oXVkD6Uao4CamcY7VE+1KTt3eq8o/wD1oqk8HryzktJS57tjnOqY0jra0J+4Vcmw ByKCVAU6gZtyFvdNAXa0qUl9xhRT12bv1FSmC7c9dQhskPreQOqZEYHPzxUqtYBc hTtKlME7FOIPfg4q43ebnGQezlvpJ9yzX0C3qrhFfiS8iEy4eoejls/TFezw/wCG moGyqDMaST0LEkcvkaj0aUINrUl1BClvhwjudbSr9KujUvapPptmtkjPXDZQfKnH J4B2p5sGDeHkH3qbCgfCh2ZwEvUcqMSdGkp7gfUNPZCoXyZumHkff2F1pZ6lh7p8 M1aaNkSE+gX26wFk9FlRCfA1rT+Eeq4gUr7OLgH90QrND0jSN9hubH7dJQT72zTt DQSQp2qY53WniAh0p9lt50pz/izW7D1lxVgrKu1hXJHuOwj5EEUrXYLrR2rScjuK ajfpjQ+7cWgZ/CsilaHSHQ1xo1Tb1BF20gVH8RacI/Q1qxOPWnpDgbn2qbG7iVIC wKSsW/32IrLdwlJ/LfkedXV6wmrAEuJCkj8RcjgE/MU6iNJD0b4gcNLsrD0uElau X37JSfpV1myaBvCCYbkFee9h8Z+tfPxv9ikIKZOnGUk/iYcKT51G2NHvthYfuNue V1ASFpHzHOp1XQOI/JHCyyyMqjvLQD05BQrIkcH0bVFmSws9yVNkedLCEJUcZsev XAB7KHXFtjwPKiOFqbiVCSFsTY9zR0GVIXn4YOaWrJ1NWRwkmZ5R2T+bazWa7w3m RchcV/HvCc1bb4u6yty9l20yhZ7i2FDNacXj/ZgsN3O0Toa+8gpWKlwbGkD8TSzl tkJc7HtOfNDoIzTLtsOxPxWk9q/EexzDT6gM/PlVeJxU0NdkpC57aNwyBIaKa2oz +lryN8OVDd/4TgBHyqanH0Pj4fjmnS+3hi7OLQR7LzaHUnyofuOhj2brztrs8wJS TybUyo+HKi9uysJAUw+4kdxCs1+O2l9aFIEtSkqGCFE01kl2SJF3T+m5MdyQ7ZJ8 FaTgvRF9okfOqH2NBSlRt+sZcRwD1Q+laPMGm1O0YVRlMI7TslHJS2vA8KE7joV3 CkbnkoHetGRTWV9oaBuIeIkUA2nV7E9tPQGQlXyIUK2GNc8U7V61wsUe4N95bTt8 01hSNBPtKKmZSASe7Kaz1QdVWlRMSfJCEnklt448KayRfspJBwzxtW24W73pKQxj qpCgryIqUEHV2qYQxMaTJSe6QylVSrTgS0gPTcdJSifSbDJYUe+NI5eBqzHiaSc3 GPerhbz/AL9rI8RXiZw91RbiRJsspPLOQncPKsR61SWSQ/FeQR3LQRVbDDCDDuzL gcsevGlbT6qTKUg+BokjX/i3bAC1KbuKCeXrodz4EHFKURdp9nmPfXdrtmFb2XHW le9Cyk+VCkuxUN1rjVre2L23XTbS0jkT2S2/MZFbET9oO2LA+1LFJZ7tyCFjzpOx tU6ggoKGbtKCP3VnePOryddT3AlM6DbZqU9zsYDPzFH8MKHVG4m8NL/lEtpppajj EmKAfEVcTYOGV/GIjsEKHXsXtp86Rwv2mLgpX2npdltSvxRHijFeVQdCSQOyk3SA 4T1JStIH1o0j0w5Ha9wcsEpBXBuDwz09ZKh5VhTOB0oEmNcGFjuCwU0vIlljtrSq x6/bjlPMB9xbWfh3URx5fFC2JSYOoGrkjPIIfQ/kfDrih430w5Okvg9fWNxTDQ8B 0U26Dn5UPv6AuUdakvQZKVJ6jYaLY/FTiFaXdl50+2+kDqhhST5ZFakX9oCGghFz skhgj2lJUD4A1Gkh2K13TTycpSopx1Cga8N2O5x/WjukEc/VUU074nFTh/eloakY aUsZHbsY8xWu0xoK8hJjTIJUegbkBKvDNS4zQWIhi46nt3NMuT+e5W8edXUajub4 2zIcCUOn38VP1FO9egrQ+gmNIWM9MLChVNXDlAJKZDax3BScUtmh2KiDFh3p9UY6 SjOOhO4+iu7CfgDWo7w+s4b3+g3mAo+0EtbgPCj9Oi34D/pEaMjtE9FNq51stXO7 w0BD0RagnvUmluwsVsW0XOAMWjWLzIT7LcgLRjx5VdTduJ8L14syFcmx1wpCvLka ZLt6Yfb2yrelYPUKGfrQLqq12iWtDsCCYbuPWUydufCrU49jtMzEcWNcWtzF2000 tsdVNoWk/qK04vHu1ZCLjZprHvKBvA+VBjzmpbVziXOZs7krVvHga5K1fektlFxt 8Cck/wB9FAPiKr+GHA1YnFLQN3TtXMbbJ6pfZKSK0UM6NvIBjTYpUvmOzeAPgaRr 100pcF/1hpUMrPNTkV4p5/Cqi7doOSCUXS629WeSXWwseI7qXjRLHtK4ew5SMxpq v+YBQ8qlJqJp6S2oL09r5sHqltUlTZ8DyqUtCbCdj9oZ6PtTdNMPN9ylIc2+AUK1 Y/G7Qt0XsuFueY3cip5hKx4ikO1rK+oTtcmJfT7nmkrz413VqqNISBNsNve95bQW yfz5VVREP9M7hFqFeN1p7VfLJHZK/SvbnCnQd1QVQZGzd+KPKChXz8zcNJyEkSLX Lik/iZWFgeNWGY2nspNu1JMiEnmHmSkD5pNUoJ9hY4pvAKK4k+hXhaPd2re6sGZw GvLWfR5cSQPiUnzoZgz9WRQr7J1yxJS2PVT6Xjl8FVuQtfcU7ad7rCbi2ocgW0q+ YKTmh430w2MeZwh1TEWoC2LdA72lBQNY0jRN4hJK5NtktJHUqaVgeVMSNx8vURQR dtLnlyKmypJ8CK34nH/S0lGyfCmxieRCmwsUtZ/B2ItVtWkHLasD8uVeEQnmnAtj e2pPRTZKSPCvpJGtOGt7ZSl2bbcHmEvI2Hn8qso0joS7JPogiKKu9h8Z+tS7XtDs +eoeotR2zIj3GWkHkQpRUD41oDXt6cQlubHgzUp7noqefzxTlf4PWlxRVHnPoSeg UAqsqRwceTvMeYw4PwhSSCaFOgFZ9uaemhRuekY6VE+1CcU0fCvwsaCmJTtTc7Y5 nmtWHQKNZPCq8MZxCS4P92rNZEnh9OY5vW19H57CRV+ZhwVYdtZbVm0a+Q2ceql4 qbJPjiiCHP4lWxKfRLzFuSP3Q6lz686FpGkFt81JUkjplJFWYukpTyUGA3K7Ue0p vOKXkT9lew1Y4ka7tqwLppzt0e9tsjPzHKtqDxqtDig1cbdMhu9FDbuANZ1u0Lq1 phsxL9KYUQCUvHcBRBbtGX5RP21cLdNST+KICfGmnjftCo0mtf6QnJAXcY6c9zo2 1aSNLXU7mpUNwn9x4fxqo7w103Kyp+A1vPXsxtHhWLK4MWN1RVGmTIx7tqs4qWsX ViCd3SNteR90tQ9xBzWZI0Il1JAdaUO4KRQ0vhVqKEsm06vkIA6Bzdy86prj8WbE 6sNSftJpA9pSUqCvh31Gi6YFqdw4J3g24LH7yKD7loJqOSDHfZwe8GiBfFTWlpWB c9Ndoke1htSD+oq/E47WZ4bLnZZsdXfyCxT1kArZelQ2vDCxu6jNSnOzxA4bXgf0 iTEZcUMESWigj51Kf9fA4AJ7gVCmK32jU0V5s+yFYyfCsSfwM1VEBMZliUO7Y6Af OqMXQCXiF2HW0FZz6oLqmlA+NaybDxaszZVCurkloDOWZiXPI1pp8JBGbw31VA5S bLJSfcgBf0rEesU6J6r8V9o+5bZFM1HEfipp9vNwt632/Zy/EKh4pruzx8lEhq+a XhvD8W0FJ8FA1Li0AozDdTzwg/GvbD9wiEKjyH2SnoW3VDHnTqHFDhld0g3PTTjL g/cjpI/ymu7cXg7enMR7kYi1dEbijHiKLYCki6t1DDX6lzecHudAWPOrR1rLcA9M tdtk+/cyEk/MU1jwf09PQpdo1Aw+SeilJOPCsuZwLvCSTGfiPo6jCsGhTaFQvkXb Tcn/AFrTamCfxRX+/wCBro1H0knK412usJ0nkCjIH+GiCXwm1JEb3/Zi3Eg4+7IN DcnSc6M4UPRJDax+Etqp+VhRuxHLzHATZeIJIRzCHZC2/lhWaJ4+suKEBKCpUKeg DokoXn5g5pWOWN9Jxg/AivKLbLjqy2txtQORtUU0t0/aDkcrfGjU1vQn7W0oTk81 NbkjzogsnGu1XWSmNItc2K6r99ORSLF61JCRsRcpe33FW4edEFplajvcRSloZcKe RcUhKFeNZ5JRSui0mfRd5b9KtHbQ4jL7hAUlK09RVfS90RPhlBiojPNnattIxg0v NE64lRZP2TdXANpwhSj5UWq/qzVLclC8Rpg7jy3V5j/X/R2Q/PcWn/wORUrw2oKT kHOa913xdqziJUqVKoCVKlSgDMvVukXCIUxZRjvgeqcApP5EUir/AHq522a/Eudp tkotqKSpTACj8xX0RQXqnQqL7LMxhxpt0jCkrTyJ99VGTQ0rEM5e9LSjtn6YW2rv VGexj88GpR1cOEd3JUppuM7+SV4NStlkJ1PnssOIJ949xq5Eud2g84s2S1/7XCKf Kb7wYvwHbxWobqh1U2ps/MjlXQcPeGt7VttOoGmlEZShEhKvrzqbChRwuJGtICQl q8vlA/C4kKB8a22uMN3eTtulotNwHQl1gA0aucBC8lS4N/YdT3ZRnzFDdy4H6pjl QYZjyQOikOYz8jSjIXJnfy40TPUBc9EMIOea4ju3Fd1ROEl1JLU262tXuV66fOsG bw31PABVItMkJHUpbJFYrlkmxiQ8y4z/AMRBTWmwWHTHDuxy2+1sOuooKj6iZH3a j51oxdD8TLatK7Rf25aUjKTGnhXkaVqoKx1KVfCvcd+fb1bosmQwR/duFNG4WNlO quMVh3plQpEhKTzU7EDg8U1ficd7sw52V504hIHIq9ZB8CKW8LiFrCApJavcshPR KyFDzrdY4x34p2XOHAuCfc8wmio9oLDxHF3QV1SEXWyONKzzPYpXj5irTM7hRfHE lqUIzh7juR9eVAC9f6MuaNt30MzvPVyIsI8K5B7hTczhDV5tThHUq3p86lRiykM2 Rw70tMjOyLfe0hKU7v7VKkj40obxIVbZyo0aSF4OAWz1q1cNO6ft9tcmWTVqZueS o+wpX88cqG4gV6YHCd2D31z5Uki4vkNrboLUF9hpmRpLaHMggOKwaMYydQW+xrg3 iMrtGPXYfHMZFEOh7g09bmUpGCU0fpbafa2rSlQ9xFeeoQzcPg7vP4kuAQ0fq9u7 wQh1QS+3yWk8jmjJl5LqeRrMOmLR6QX0RENunqpHKtJmKhgYRnArqxRnBU/RzZp4 p8xVM71KlStznJXCUh9xgpjuJbWfxEZxXepSasCi08phxEd0qWsjO/HWulwVITb3 1RNvpAQS3u6ZqzgZ6VWnNregvtNr2LUggK91SkoIq7Yo5nEvWlrcWJGn23kIOCpK Fc/CpS4vVzv0O4SG2rjIRsWQNquXWpWycaLaSfop/bXDe4rPpWnLhbt34or+8J/P BrsjTXDua4fQdZPw1H2BJjHzIrMuHCzVVu/t7TI+KE7h5UPv6euEUqEiM82E9dyC P0rbYxGDC0VfY33mmtbwH8H1ENTS2T8jyrUEzjVY0qSn0uY2nHrhKHx4jnSe7Bxo +qohSe8HBFaMS+3+CoLi3Wc2R02vq/jRsn0A1muNmt7Q2EXjT7bhT7S1tLbz4cq0 4/Hqy3BopvGmOROFBKkuE/IgUtovFfWENnsH5qZaM5xLaDn1rQHFZmY8F3bR9jmH GCoNbDSqFgMVvVHB+9oSJMVqE4T+NktqHzFdTo3hjfDm23xpsjqEvg+RpcN3/hlc 1lM7TMy3qPMuRniQD+QrqNN8Mrg4pcHWEqBuHJqTHyEn409Y/RB5J4GMPtqVbb00 4M8t6MjxBrAncD7+wD2BjSfdsVj61SicPru20XdM68hyVZyhtmYpoq88ZrWjReMd lRvafkzUA8gXkPj60tfjGCEvhxqGCCX7VIAH7qM/SsV7T8mOr76O42fcpGKZo4ta 7tGEXXT5dCT6yzGWnl39OVaUfjjZJaki5WAJKjzPqq8iKThJAhN+hejoVjIJ7q7Q jho7k86ZWu9VaTvFrBs8FtuQTlbgZ2KH5UuYxL4CWk5JPLArmyJ1yXAN9EasRa5H YyFbUjkCTypw2/U0Z4Aodzn86REPRl0lFLiWFEnmAKMrfDm2wpakMrbIA5mvNnHV 3FnfBbKmOFq6trAIUOdWhJSWyoEUCW5x1zaAVEZ76JkJU3EcWonATWmPPJ8MWT88 F6LibiO0wcYq2iShY5GhyG0qSjeFdTWo1GWhIwauGSbIy4ca4RqhQPQ1+1mffJOB muyPSCK6I5P8Od467LRcSDjPOuEl1DbKlOLCEAc1E9K/EsKCtyqwb867IivtFh0R dhC3Ep9YfAd9Ty3yOEE37BeVoPTN4eccYvqO0USojck4J+dSgKdprSL0laWtXOQn 1cyh9kpwfjUrpWPgJWnVnNPFDidYNybpae1Sn2i9EVjxSauxf2gAslu96YYWk9S2 efgoUurfxT1nbUpQ3dluIT3PIC8+NbbPGKdJSRebDaLjnluUyEHFbLV+0YBt/OTw vvKOxuVgXFB5lYjjr8U10TYeEV+UHYd5MRahhLfbbQD+aSKCFas4cXEBM7Rb0VR9 pcV6vQs/Cm6JJYvVztiz+F9veB86NF0Abv8ABG1z/XtN+ZeBHRWD5isGfwKv7IJj iLIA/cXtJ+RrOZ4asuJDundeQVZPqIcdLSvrWkzZOL2n2wm2XRU5nqCxJS8B/io1 f0YMXDhZqa3p3O2d8pJwC2N/0oak6fmRFlMmI+0r3LbIppfzncUrGB9qWMutpICl uRFDPzTyrQa4+srXsu2lTuxhW0jP+YUtJCEiILzSt7RUkjoQcGtC33W/2xQXEukx kg5wl9WPDNO0cROGF6aH2jaFs9/rxwcH4pNdUWPhPfWyqBdGI7ixkDttpT8lUv6X QCxh8V9bQm9i5/pKc8w+gKz+VXlcW3ZrJbu+k7PMUU47QN7VD86PVcGLPNZ322/N ug9FHaoeVYczgde2t3o70aQnPIhW3I+dTswFu1NRc5y0IYSyHPZQjoPyo10ppeZC mpkOsF1gjKeVDdx01O01dyxLZUy8363vGPfW/H4wXexx0xWI8RaW04BW3k+NY5E5 8GsHQ97IWvR0Es9mQMEEVqSYsJ1re8hvA71V88tftCagQrLltgLHuwRV1P7Qjr6Q idp5hxPfscP61gvztL2W8lu/Q4lOQ2l4aU3/AMtS7TOysElxJ5hOBSxh8WND3I4l xZ9ucx1QcpzRaxedOXiyuRI2omtq+eXhhQH51g/zZEzbzRdWddLXhtxBZU764/Oj qM4laMgilM7/ACOsCVPzL4p1XujpzWavjFpW0PKEO3XSSQPVK3AEn5ZqsX58idiy zjMeYSnrgV7HKkAP2iWAMDTrn/yK0Lf+0Lb3SBIs7zIzgntAcV2RtezlodpUAoJ7 zVVNwjLdW0Fex7RPQUHQOKNmucVUlhK9oTnJ91D1413Gt0pLyoy3Ybg3KCe/NTtz SLjjsGuLV5ts67IjwUNZbT67iUj1jUrVXrvhhdUhNwtrjKz1UWenzFSt0pUJmPK4 ATVEqgXaC+nHILBHmKHp3BXVMXeUwG3gnvZczmtiNw01TCy7pvV8aSUc0pZmKST8 skVcFx412HAXFdmoTyJKEugj5Vpr/pkLeXoK+wl7ZNrlNHuy0TWS9YpjCiCFJI7l JINN1HGvWEBWy7aYbXg4JUhaP/ytNnjTpG4rUL5ptTCiMFWxLufAZp6yXQxDGA8k gkjd7wK7xp11gYTFly2ADn7pwp50+0XPg3qDs0lxiI4rkEqC2jn6V1PC7Rd0bWq2 39vnzTtdSoDzqNmApoPFHXUHalN4cdbSMBMhtKwfjW03xiuTxAvNjtE8YwoqY2qP zovlcCpJG6FdmHUnoFNkedDdx4M6kjlSkRUvpT3tKBz8qakBW/llw+uSiq6aJcZW faciO4HhmuiLXwmu5zHvFxtS180pko3JT+XPNDszQV+hnDtpmo/MtEjyrHVZJbZI U2tOOoKcVW7AYbPDeK/td03r23LIVkJcUWz5H9K3Y9q4sWkqMSe3cWRjapD4Wk/A Gk63bJCFHswoK/2eVXI03UFrXui3Gaxg5wh0gZ+FS5X7A29WzNTO3dbt/Zdbkq6h SMDH5UET23CorUORrduV8u10eS7cpjshxIwFOHNVJBS5GOR176zbGgaPKvIJFXHm U5O0g1x7E9MVLYHlt3CvW5imhw90FO1hH9IRI9GYScBRGcigi0afduDiSpJDYPXH Wvqjhrafs3TrXqbAUjAxisZZFeqKUeLEZrrR0/TcoRJEsSGsbkLAxS6eBQo5JJr6 14kaOOpLX20dOZTI5JH4hXzNeLC/EdWgpIUk4IPLFa3RV2uAdCj76/CskGva2nEK IKTW5oywnUGo48ReOyCgpefdUuVK2Qk7GDoO1lOl2nnRgOZAyOoouu8iHZLE1Ldj IfVySltaeShWnJhNx/RbXFKGylshAPTlXjUWiblqK0R/RZDTrzKdqkhWEn4Vhjbl Kzr1UY8i5kar0ZIBVcdIlKj7S4zxHlUqrdeFuqGSr+qH1Ad7RCh5VK9JTdHI/Yvm PtGGvfGffaPeW3Cn6VuQtcaytikmNe5wSnolbm8eBpvN6i4P6jUEPMphOYz67ZbH j0rsOHXD6+c7RqFKFK6JS+lXkedSpfSQChcbNUobDc+PAnI70yGPa8Kufzp6enE/ begrc44eRXHwOXzFEczgPIUlXoV0YfR1G8YPlWBO4H6iYaK2mmnsdzboJPyp7IDw ZXCK8NntoFyta/e2Sa/EaG4f3FzFo14uOo/+HIRg/pQ7P4eX23qUl+3yUKAycIzy +IoedsMhtRJSsE/vJxRsA12uG+tYjXbab1smUhP9mluYRkeOK7tu8bbCFBxDtwTy O4lDoH0NJ9uPOhncw680R0LThT9DWvC1rrC1KBZvU5KQMAKc3fWmqAaX88GtLaQL rpVBQOSlFK0HPmKtM8YtMXBRRddMraCvaUUJVzoFicadXsYTIciS2x1S+wDn5itV njBap7iUXnRlvfCuSlM4B86VR+AHUa9cLbutLhSzGdP4VIUjHhyrsrhvpC+b3bfd FErORsdCgPlQEq+8JLmkofs1ygKUea2ugPyPSvEqw8Pm4SpNq1rcoihzCOavIAEU qXQBVN4FbwDGuqSf943j6UudXaPf006uHIUhSwMhSDyIri1rrUFhfP2XqeTJabOE CQNwI+BrNuurbvqZ0v3J1DjqhglKdo8KhqgBchIcKVHlXpbiUABASa8SGiFkg86r hKietZsY0NMaxtLEWNBehobXkJ7THfX0dp2THdtMcMrScIGcV8SJ3JOQa24Gr7/a 0Yh3WQ0ByACsgVzeNqWyLTTVM+yLpe7bZY/bXCY0wju3HmflSh1wizypibgYoehy RuQ4gFOT30B6JtV11texOu0519hshR7RRO8/Cnvd9Nxpuk3oKQMto3NnHskDupTy NvU0jFJWJZuw6QuCFeu8y73I3VZsFtt2kpEia06Fkp5KUeYoLuYdiy1DJSpJ54rO aemTpbcdLzhSpYB592azqXb4LVJjcWtepoyFuT24EhQJbW4raCPjVVvTXEi2KC7H fWpTQOQhuWOfyNc9S6alSocdERxvLbQHZ5x3UuZdovVrfUnMhtSeeW3VAeVdX55Q SoWTkaCtYcXbIf6balPJHeqPvHik1KWcLWeqbdj0e/T07fwqc3DzqV2rU5Q1buvB 27/61ZZ1seUeZQSUjwNdmdB8Or3lVo1euKR0S+ACD8Tg0LXDhhqSAD2lskJA6lKd w8qwXdNTWge0bdSR3qQRUJsY02eF+q4Z7TT+tmnwPYCZZTy8xXcucbbA0rITNab5 5IS6VD60oEQrlDI7JTiccxsUR9K3ImutZ24jsL1OTt5AKIUB8iKL+gMVjjDri1DF 70uHUj2trS0H6EVoNcbtLTQGLzpp5onkr1EOJH0NBcfjdq5hARKEGYMYIeYxnwq5 /O1ZZ5AvGh4MknkVtYSfMUcPoQaNXbhJqJ1RHZsLCeYKVNj+GawdRWrhkwyosXl1 C8cg0O0FC98uWjZbW+xWR+3LUMrC1ZBPwzQJOeKlHCuVLgZoT3bMy4oRHFuozyUp OKzFzImSEIPhVI868EcqmwLReRjlyriXjzAUarkV+YxStiOoWrPWr8d9SU4x1rMS o5ruw8UHnSsCy8oEnNVuSTXVSt9cVc81AzwtQFeAoEYr8Uk13jWybLGWI61j3imA ZaZ15frRFTFtMOOpLY5nYSfnRAnjRqhsqZejRVFQKSkJINBMDTV7RkMvNR9/tZdA 8a37NplMO4tvXCZGddChgBeR86ylGF2bwUgcuF4fmyVuPNFC1nOMUccN9NremouU xshA5oCh1o/i6J07dlJlLDQdT7iMGtdyK1a2ihpaNgGBisZyVcGqg75Mma4hUlY6 AHArLkutYUlaQoHkcjNWXlJWpSveay5Ccg1y92dCjFoxpOl7XOJKNzSj+7Uq+kba lbLLNL2T4ofAgPGq82xYZvOj5QVj11NhScfIir0fjVoa5fdzobrGR6weYBxS5h8b dVsL/pkeFNT0wtvBHzrRHFTTN1bS1e9FRSScrW1jr7x316NnmjBRO4UaiSdki3Nu dM7i0oV7PDHR1yRmDPPPoW30rpdF7g/d3Cl6JKtqnBjcknamu0bQujpCkqsGvFsn PJLi8YPlQARTOBSVFRj3Ftz3BaMGhu4cGr1CSVtxkyAATlpYOPlWn/JLiNbQfsPW SJrecpSqRzPyOfrXh3U/F/T8VX2lbWZDOMF8pB2/nlJpgLG4xXoC1NOoKFJ5EK7q HJCiSTmiG83GXcHXHpLaUuKOVbffQw6SQakDzvIr938q2NFNtv63sjT7aHWlzWgp CxlKhuHIjvpt37R9tsFj1/cXbew416cwYqSkDa0VJUoIP4QdxTy91ACL3ipuB76Y XEfTundNW6Gm1t7pFxeXLZX2hV2cQgbE4z1yTz68qM5llYnTNGWiRbLOLJOaih4t JQiWtzsio5I9bacde+mIRYFegnnTAl6Xs7T2hEojKAurq0zPvD64D+wfD1fdRL/I 6wp1zNtcjTAjFmOtVviLuCv6wIcxuznIO0EhPfSATyT+dRQpjapg2iDw4kqtcUoQ jUbrLTj7W14NhAwhRPPkc8jS3S4D1ooZ4UMV0ZmSWB906pIHurQtdqN1e2B1Lae9 Ro4h6D0+ljfLnOKPeQqpbSGrvgXv2lKOSt5XPrRBYrNerwntokd1TY/FjkaY1k0x ouK+hSWRJcTz+9Oc/KmfBuVqjMJS00y0hI5JSkACsJzXRunJdiqtFm1LD2FSFNtj qSegrbkzZO7sXcnbyye+u2stdNP3GLZba6kekLCVrT3flWlqKGiMY45EloEn3nFZ ODfJe/0wd+U1VfOBX4t7aoiuEiW20yVLIz3CsXFmsZ8HNaxipWSJDqySrlk1KFFj 2C248IYTx322YUj91xOfMUNS+Et5aUezaafT70LA+tSpXrHmmHK4fXdhtRVbpHLq Nmaw5GmpzRG6G8g92Wz/AAqVKQzmY11iOhSXZjSxzBQtSavjU+qWoS4artNVHUMK QslWR8TUqUwMeRIedQd6VEn/AGTWWpClE5Qv/CalSpAu2KabNqC33Mx1upiSEPFs ct205xnuo0vnE2TfNPy7U7bnEh5jsQsuZ2ntu0yRjnywn5VKlAApqK8rvwtYERbP oMBuHzOd+0n1unLr0rZTrYjWNiv32a5i1RmWC1v5ubElOc45ZzUqUxFlOt4C4FjT JsUlybZ1lTDyZG1PN3tDlO3n7q6J1tZRqOZczpqUUTgVPhUnc4hztN4U2op9Tpj4 GpUoAydR6rGooUxCre+zIk3Fc0kPKLaQRjbs6Z5e1QqELH4Ff4TUqUAdG1vtf2fa JP5A13E+4AFPbPEe7nUqUmkB2j3a5RXN7bjoPwNao1TdHWihal59+DUqVOqKtmjo uFJumrGH1hZDZzkg9c06dXysPMN7cqDfM4qVKJJAm7AKU+pJOEq8KznXVOe0lRx+ VSpXM0joi2cys4xtOfhUqVKii7P/2YkCNgQTAQoAIAUCZ0teqgIbAwULCQgHAwUV CgkICwQWAgEAAh4BAheAAAoJEEp1iDzBsdNMxsoP/2amun27Yf9/9lXVZJUagfkm 5M4dBPDoC5YfR7IQ1kFjvexC5vSEQRcD8w/hxyrAlqdYOZqZ8K30S8DS5XFlo0DV O/UXSiglaaTHpZIBkiZwutB5BJA1BzGdj0CsQZnOc2lVaJQoZg29k1TBFvinO1tQ t5o2ue4GMg20CjNjDG7QmQ+Dex1rNSIlbusEPeNybyLZVoRsAEAWirwZ2khAwuxo S+EUs3hTRTXVuhg0Ed9zL4nvV3f8WiUoK0fTHLj5Esx8DBiB/IXZCGGRZziORupe xeugX7kOx5eRpmok7rxZIPIUEfBpC5Zr0EysVa6lh9b6U11eDPFZfNkIUAYJboj7 MvvvJkviA8kg8xEo4oe2eMrwOvMKnpPq0xtsOesmdT4iXREEAbndlnOm9L7o1lIn ZvH7fk3K+myDryh/JejgUNiz/Vk8s8JBCsD8vb9P0TdkG8Jy07VoiTcKdDjaNj9T dqjXq280OYwb8KprhdQmfSMfVhqOa3X0N5xFxIPutOZHYILenAbLQ9GXpNVhCshm ApW8F0cHqoPJXLyIyAQQRgib2zmUfY8aZCgxd5C08HOZMfnY2vdoYZ+tchVoHGIR mpo4RlLFY9ZF6NQW9c+bXJqVXpFNJqtRc2O7YZCs2HzisaudBnx1aFbz2HLDzSU3 ybKi93/CIASzyBkzVpLtuQINBFav2jMBEACxwOSaz5YrOdJ2pp3L/8454ACGhRGX YzKtNgj9gPNT6GyJDHW+x61TN1AeR13MqM5UaIvMrjhE17bh62LhkpBEvg2cRrYB Ge7r8J/8E0Q1i/FeFnjS7PeAGOmT32krDtz0GhcRYoTh6uWBIb3aiYYyU5dufit5 ObSjS3qWHRBdIr2Pie6/ppLOVXdeDsbtscU63HkujRMljYd4uPR6oJwFgdQbySK9 tKU/HUS3qhX8SJ6hEN6rfuzEONWynN36ofDS74W2srZxXF5rz7XxYMUe27+9sZd0 zlgTmXL+3wcUfyCTfr3ZxZdx0FL8GY53OrZDQmSCyY667133O/EzVdBLH5vY1I9u d1H2PxoDPQacjl36/mRCpKNGs2Oh52B3NbJ5U7YeEG4OMcA1zC2blih9ExRhi3gD KFcpTXklvJPPS4ffIurdYFTkcWa8Ko+Ck+RHEOl3qXAINrQk9B5M2+eK3SBt5vC8 L/+Ke0ah3vpkuLUV2Piimtgw38eoDw/H/3v+vQ6O5mYLTCqY59c84HZw2NWGaJdX gHZpr2DlwuEMCQkwPWUt53r+8/Sru4LaDjsJv2V6MNTTeYB9e4LfWwZhHA1Us3SU 4A47B5MpNmTXmBxVLfX0qVJfrs0c5726F16cuAqpL8pOQ5+O/UPQ9+F2l/1h3lxK w0I0ZBq4tOqhzQARAQABiQIfBBgBCAAJBQJWr9ozAhsMAAoJEEp1iDzBsdNMGugP /05GhajYg4ES54fn8lcbvnkGm1w5NVP7OS9wzGY/6nDTHX8rmMvVFBYQXerCBZEo IihXPBTuvQ3vYfXnfwglyRw6QvepLM3oez0iLLJPjQU25SgXutl2EIjVbzYtcmkX DGhUGi7IHSqmjIQumrTQWbHzyUAA58otUh4aPYl4aAKxCOMSJlqzUnOmkZRFIynC 6zxHZvh68G2bv503w7R0S867fjO7qnckRMQI7+MYRfWvTdiwqtw+0dKUkTDhkHIz 4sHHZmWISUXhC1kIA9BoxxVXddL5GoAde0L/62cSXL7HDt1tkA0hhO17is1wu3sm lLUeTvsL7LfXI3bOIQjY1CdlNyf65utFnvFsNNVav2ZEXGYcZH2uvKgY/quIa1+y Cbf8w/aYt+ahoi54NAldvoXE6EPs+bZuDviGLHXCLfQLuMu7NfJyJEkPbxLMf+58 k/bkZ8r7vC+x3EpRSI7oHaYYtoQDsRN2NIrRYwuCXlLt26dIGmmdbzLT5bribw7Q CZYkhjd9jnV7+dpAcVTVrE+A7AXb46JVvFaKrhl6rPIlcB81+XoSg4hvAJOWPvcZ CfWrtHVGvPzOJpNxBQteoYUc1SrVi/1j5WR+FnVDA68pY5QdK3fNSDXIhctNxMxC Yv5/cxSTVRCsTbtFg8tRHkJHhq4FVIk0O8o+TSVrfxzs =JPry -----END PGP PUBLIC KEY BLOCK-----

-

@ 005bc4de:ef11e1a2

2025-05-12 14:00:42

@ 005bc4de:ef11e1a2

2025-05-12 14:00:42Hostr

Hive + Nostr = Hostr, a bidirectional bridge.

Hostr is a bidirectional bridge between Nostr and Hive. What you post on one is automatically cross-posted to the other. (See SETUP.md if you want to jump right in and run it.)

This is experimental. Expect that there will be glitches, errors, and corrections to be made. So, consider it very beta, with no guarantees, and use at your own risk.

Nostr and Hive have differences, mainly, Nostr is a protocol and Hive is a blockchain. Nostr does not have a token, although bitcoin is much-loved and used across Nostr. Hive has two main tokens: HIVE and the HBD stablecoin. More importantly, Nostr and Hive have similarities. Both are decentralized and censorship resistant thanks to users owning and controlling their own private keys.

Nostr users - why you might want to bridge to Hive

I feel the #1 reason a Nostr user might wish to use this bridge is to permanently store and chronicle your Nostr notes.

-

Immutability for your Nostr notes. Your notes on Nostr are held on relays; if they go away, your notes go away. (There was a “nosdrive.app” backup, however I do not believe it’s still working.) Hive is immutable. There is no "delete" and even an “edit” on Hive does not erase the original. Like with a wiki page, a Hive edit shows the most recent version, but the original still remains historically. This would give Nostr users a permanent record of their notes in chronological order.

-

Hive is an excellent long form blogging platform with stable and persistent links. Finding old Nostr notes can be difficult.

-

Increase your reach and potentially gain followers. Your content will bridge off of the Nostr island and be opened to 10-30,000 daily Hive users. Go to https://peakd.com/c/hive-133987 and look for “Hive statistics” to see numbers.

-

Earn rewards in HIVE and HBD. “Likes” on Nostr do not reward you monetarily, but every upvote on Hive yields rewards. For bitcoin maxis, these tokens can easily be swapped into sats with tools like the https://v4v.app web app, or others.

-

Help grow Nostr. Every note that bridges over to Hive will have a footer saying something like, “This note originated on Nostr,” with a link back to your Nostr note on njump.me. On that page, a "Join Nostr" button is prominent.

Hive users - why you might want to bridge to Nostr

-

Increase your reach and potentially gain followers. Your content will be bridged off the Hive island and be opened to 17-18,000 daily users. See https://stats.nostr.band for Nostr stats.

-

Earn bitcoin sats in the form of “zaps.” Nostr does not have a token. But, it has a strong culture of zapping (tipping) bitcoin satoshis to other users to reward quality content. Memes are loved and often zapped too.

-

Unlimited posting. Nostr is not held back by posting or activity limitations, such as with Resource Credits or community norms that frown on posting too often.

-

Even more censorship resistance. Hive is truly censorship-free in that posted content, no matter the content, does indeed posted. However, front ends can choose to show or not show content that the community has downvoted. Nostr is more free speech or censorship resistant...you post it, it's posted. (Relays can choose to relay it or not, accept it or reject it, but you could run your own relay.)

-

Help grow Hive. Every post that bridges over to Nostr will have a footer saying something like, “This post originated on Hive,” with a link back to your Hive blockchain post. This brings wider exposure to Hive.

Quirks about Nostr and Hive

If you’re unfamiliar with Nostr, it has a few quirks:

-

You have one private key, called an “nsec”. It goes along with your “npub”, your public key. Your npub is your username, your nsec IS your account.

-

You simply need an nsec, then a “client” which is a front end.

- You need to add “relays” to your client in order to connect. This is very easy, but how to do it depends on the client. Client's usually walk you through this when you start.

- Short form content (like the old "Tweets") are called kind 1 notes. Long form notes, like most Hive posts, are called kind 30023.

If you’re unfamiliar with Hive, it has more quirks:

-

Hive has five private keys, yes, five. Each has a specific purpose. From least powerful to most powerful, they are: posting key (to post), active key (to move tokens), owner key (to do anything), memo key (to dm/pm), and backup/master private key (to totally restore all keys). Don’t worry about all the keys. For Hostr, we only deal with posting notes/posts, so the posting key is all we deal with.

-

Hive has a culture of frowning on posting too often. Doing so can be seen as trying to milk the HIVE/HBD rewards that you gain from upvotes. Too much posting can be viewed as spamming and result in downvotes (this hurts your Web-of-Trust score, called “reputation” on Hive, and is shown alongside your username; you want to grow and keep your reputation up). The chain also has a 5-minute cool-down rule coded in: after posting, you cannot post for another five minutes.

-

Additionally, to avoid spam, Hive actions burn “Resource Credits” or RCs. Think of RCs as the charge % in your phone battery. Every action on Hive uses RCs, so they dwindle with every use. Posting is high in RC cost. Bad news: if you run out of RCs, you’re unable to do things on Hive. Good news: RCs also recharge. If out of RCs, you can wait and then do things later. For the Hostr script, over-posting means the script will post until RCs are exhausted, then it will stall until RCs are recharged, post again, stall, etc. You can check your RCs in many places, such as a Hive explorer like https://hivescan.info and entering your Hive username. If you have RC issues, reach out for help.

You don't want to over-post on Hive. To avoid over-posting, Hostr has two versions of the script:

-

bidirectional-longform30023.js

- Nostr ➡️ Hive - Listens only for kind 30023 (long form) Nostr notes to bridge over to Hive. Kind 1 short form notes are ignored.

- Hive ➡️ Nostr - Any Hive post over 380 characters gets truncated as a kind 1 (short form) Nostr note (with a link back to the full Hive post).

-

bidirectional-bridge.js

- Nostr➡️Hive - This script listens for both kind 1 (short form) and kind 30023 (long form) Nostr notes and bridges both over to Hive.

- Hive ➡️ Nostr - Same as above (380+ is truncated).

Which script version should I use?

- If you post frequently on Nostr (more than 2 times per day?), the bidirectional-longform30023.js script is likely best. Per Hive community norms, you don't want to post too often on there. With this script version, only long form notes will bridge over from Nostr to Hive.

- For newcomers to Hive, I would start with this script to be safe.

-

If in doubt, use this script.

-

If you post infrequently on Nostr (2 times per day or fewer?), the bidirectional-bridge.js (both kinds 1 and 30023) might work fine for you.

Nostr users - how to begin

You’ll need a Hive account. You can see sign-up options at https://signup.hive.io. Some options are free, others are not. I (crrdlx) have some free “VIP tickets” to sign up with and you are welcome to use one if you wish, see https://crrdlx.vercel.app/hive-vip-ticket.html. If the tickets there are already spent, contact me and I'll get you set up.

As with Nostr, the critical thing with a Hive account is saving your keys. Hive has multiple keys, just save them all. We’ll only use the “posting key” for the Hostr bridge, however. The other keys can be used on Hive if you wish. (For instance, the "active key" is used to handle your HIVE/HBD rewards earned, the "memo key" for private messages.)

Once signed up (and keys are safe), you can adjust your Hive account/profile using any Hive front end like https://peakd.com/username, https://ecency.com/username, or https://hive.blog/username. Just remember, every action on Hive burns RCs, keep an eye on that.

You can learn more about Hive at https://hivewiki.vercel.app if you wish.

See the "Setting up..." section below to set up the bridge.

Hive users - how to begin

You’ll need a Nostr account. Getting a Nostr "account" is nothing more than generating keys. A simple way to do this is at https://nstart.me If you wish to dig into details, take a look at http://nostrwiki.crrdlx.infinityfreeapp.com/doku.php?id=wiki:get-started

As with Hive, you simply need to safely store your private keys. On Nostr, your private key is called your “nsec” (sec, as in “secret”). Your public key is your “npub” (pub, as in "public"). Your nsec is all you need, but just so you know, your private key comes in two formats: (a) your nsec, and (b) the “hex” form (same key, just different forms). With the Hostr bridge, we’ll use the hex private key. Depending on how you join Nostr, your hex key may be given to you at sign up. But, even if it's not, you can always check back-and-forth between nsec and hex keys using a tool like https://nostrtool.com and choosing "Load a privkey from nsec/hex".

Again, just save your nsec and/or hex private key and you’re set.

You can learn more about Nostr at https://nostrwiki.vercel.app if you wish.

See the "Setting up..." section below to set up the bridge.

Setting up the Hostr bridge

To set up the bridge, see SETUP.md in the repo below. The Hostr bridge has a bit of technicals behind it, but don't get intimidated. Because technical things change, I’ll keep the technical how-to instructions housed at https://github.com/crrdlx/hostr

Disclaimer

This is an experimental bridge. Expect that there will be glitches, errors, and corrections to be made. So, consider it very beta, with no guarantees, and use at your own risk. Source code: https://github.com/crrdlx/hostr

Built with ❤️ by crrdlx

Connect on Hive: @crrdlx

Connect on Nostr: nostr:npub1qpdufhjpel94srm3ett2azgf49m9dp3n5nm2j0rt0l2mlmc3ux3qza082j

All contacts: https://linktr.ee/crrdlx

-

-

@ 5383d895:7b141166

2025-05-12 13:02:58

@ 5383d895:7b141166

2025-05-12 13:02:58LOVE678 là một nền tảng giải trí trực tuyến hiện đại, được thiết kế để mang đến cho người dùng những trải nghiệm thú vị, an toàn và dễ dàng tiếp cận. Giao diện của nền tảng này rất thân thiện với người dùng, giúp mọi người có thể dễ dàng tìm kiếm các dịch vụ mà mình cần một cách nhanh chóng và thuận tiện. Từ việc truy cập vào các tính năng giải trí cho đến việc quản lý tài khoản, mọi thao tác trên LOVE678 đều được tối ưu hóa để đảm bảo người dùng không gặp phải bất kỳ sự phức tạp nào. Bên cạnh đó, LOVE678 cũng cung cấp tốc độ truy cập nhanh chóng, ổn định trên nhiều thiết bị, từ máy tính để bàn đến điện thoại di động, giúp người dùng có thể tận hưởng dịch vụ mọi lúc, mọi nơi mà không gặp phải sự gián đoạn. Nền tảng này đặc biệt chú trọng đến bảo mật thông tin, với các công nghệ mã hóa tiên tiến giúp bảo vệ dữ liệu người dùng một cách tối ưu. Chính nhờ vào những tính năng vượt trội này, LOVE678 đã và đang trở thành lựa chọn ưu tiên của nhiều người dùng hiện đại.

Không chỉ chú trọng đến sự tiện lợi và bảo mật, LOVE678 còn đặc biệt quan tâm đến việc nâng cao trải nghiệm người dùng thông qua việc cung cấp dịch vụ khách hàng chất lượng cao. Đội ngũ hỗ trợ khách hàng của LOVE678 luôn túc trực 24/7, sẵn sàng giải đáp mọi thắc mắc và xử lý các vấn đề mà người dùng gặp phải trong suốt quá trình sử dụng nền tảng. Người dùng có thể dễ dàng liên hệ với đội ngũ hỗ trợ qua các kênh chat trực tuyến, email hay điện thoại để được giúp đỡ kịp thời. Điều này không chỉ giúp người dùng cảm thấy yên tâm mà còn tạo ra một mối liên kết bền chặt giữa LOVE678 và cộng đồng người sử dụng. Bên cạnh đó, LOVE678 cũng thường xuyên tổ chức các chương trình khuyến mãi, sự kiện và hoạt động giao lưu cộng đồng, tạo cơ hội để người dùng trải nghiệm thêm nhiều dịch vụ hấp dẫn và thú vị. Từ đó, nền tảng này không chỉ là một công cụ giải trí mà còn là một không gian kết nối, giúp người dùng giao lưu, học hỏi và chia sẻ những giá trị hữu ích.

Để đáp ứng nhu cầu ngày càng cao của người dùng, LOVE678 luôn cải tiến và phát triển các tính năng mới, đồng thời không ngừng nâng cấp hệ thống để duy trì sự ổn định và hiệu suất hoạt động. Nền tảng này luôn đặt mục tiêu tạo ra một môi trường trực tuyến an toàn, thú vị và chất lượng, nhằm mang đến những trải nghiệm giải trí tuyệt vời nhất cho người sử dụng. Các tính năng của LOVE678 được thiết kế không chỉ để đáp ứng nhu cầu giải trí mà còn nhằm cung cấp những công cụ tiện ích, giúp người dùng có thể dễ dàng quản lý tài khoản và tối ưu hóa quá trình sử dụng. Với sự cam kết không ngừng phát triển và nâng cao chất lượng dịch vụ, LOVE678 đang từng bước khẳng định vị thế của mình trong ngành giải trí trực tuyến, đồng thời tiếp tục xây dựng niềm tin vững chắc trong lòng người dùng. Nền tảng này không chỉ là nơi để thư giãn, mà còn là nơi để kết nối và phát triển, giúp mọi người trải nghiệm những phút giây giải trí đích thực trong một không gian trực tuyến an toàn và tiện lợi.

-

@ d360efec:14907b5f

2025-05-12 04:01:23

@ d360efec:14907b5f

2025-05-12 04:01:23 -

@ c3e23eb5:03d7caa9

2025-05-12 13:00:36

@ c3e23eb5:03d7caa9

2025-05-12 13:00:36The issue I have with the term "mesh networks" is that it is associated with a flat network topology. While I love the idea of avoiding hierarchy, this simply doesn't scale. Data Plane: How the Internet Scales

The internet on the scales because it has a tree like structure. As you can see in the diagram below, global (tier 1) ISPs branch out to national (tier 2) ISPs who in turn branch out to local (tier 3) ISPs.

``` ,-[ Tier 1 ISP (Global) ]─-───────[ Tier 1 ISP (Global) ] / |

/ ▼

[IXP (Global)]═══╦═══[IXP (Global)]

║

Tier 2 ISP (National)◄──────────╗

/ \ ║

▼ ▼ ║

[IXP (Regional)]════╬══[IXP (Regional)] ║

/ \ ║

▼ ▼ ║

Tier 3 ISP (Local) Tier 3 ISP (Local) ║

| | ║

▼ ▼ ▼

[User] [User] [Enterprise]▲ IXPs are physical switch fabrics - members peer directly ▲ Tier 1/2 ISPs provide transit through IXPs but don't control them ```

This structure also reflects in IP addresses, where regional traffic gets routed by regional tiers and global traffic keeps getting passed up through gateways till it reaches the root of the tree. The global ISP then routes the traffic into the correct branch so that it can trickle down to the destination IP at the bottom.

12.0.0.0/8 - Tier 1 manages routing (IANA-allocated) └─12.34.0.0/16 - Tier 2 allocated block (through RIR) └─12.34.56.0/24 - Tier 3 subnet via upstream provider ├─12.34.56.1 Public IP (CGNAT pool) └─192.168.1.1 Private IP (local NAT reuse)Balancing idealism with pragmatism

This approach to scaling is much less idealistic than a flat hierarchy, because it relies on an authority (IANA) to assign the IP ranges to ISPs through Regional Internet Registries (RIRs). Even if this authority wasn't required, the fact that many users rely on few Tier 1 ISPs means that the system is inherently susceptible to sabotage (see 2019 BGP leak incident).

Control Plane: the internet is still described as decentralised

The internet is still described as decentralised because there is a flat hierarchy between

tier 1ISPs at the root of the tree. ``` INTERNET CORE (Tier 1 ISPs)AT&T (AS7018) <══════════> Deutsche Telekom (AS3320) ║ ╔════════════════════╗ ║ ║ ║ ║ ║ ╚══>║ NTT (AS2914) ║<══╝ ║ ║ ║ ║ ║ ║ ╚═══════> Lumen (AS3356) ║ ║ ╚════╩════════════> Telia (AS1299)

```

The border gateway protocol (BGP) is used to exchange routing information between autonomous systems (ISPs). Each autonomous system is a branch of the "internet tree" and each autonomous system advertises routes to downstream autonomous systems (branches). However, the autonomous systems at the root of the tree also maintain a record of their piers, so that they can forward traffic to the correct peer. Hence, the following is a more complete diagram of the internet: ```

INTERNET CORE (TIER 1 MESH) ╔══════════════╦═════════════╦════════╦═════════════╗ ║ ║ ║ ║ ║ AT&T (AS7018) <══╬══> Lumen (AS3356) <══╬══> NTT (AS2914) ║ ║ ║ ║ ║ ║ ║ ╚══> Telia (AS1299) <══╝ ║ ║ ╚═══════════════════════════════╝ ║ ║ ╚═> Deutsche Telekom (AS3320) <═╝ ║ TREE HIERARCHY BELOW - MESH ABOVE ║ ▼ [ Tier 1 ISP ]───────────────────┐ / | | / ▼ ▼ [IXP]═══╦═══[IXP] [IXP] ║ ║ ▼ ▼ Tier 2 ISP◄──────────╗ Tier 2 ISP◄───────╗ / \ ║ / \ ║ ▼ ▼ ║ ▼ ▼ ║ [IXP]═╦[IXP] ║ [IXP]═╦[IXP] ║ / \ ║ / \ ║ ▼ ▼ ▼ ▼ ▼ ▼ Tier 3 ISP User Tier 3 ISP Enterprise```

So its a mesh network - whats wrong with that?

In the example above, NTT can only send traffic to Deutsche Telekom via Lumen or AT&T. NTT relies on its peers to maintain a correct record of the IP range that they are responsible for, so that traffic that was intended for Deutsche Telekom doesn't end up in the wrong network. An intentional or even accidental error in an autonomous system's routing tables can be detrimental to the flow of traffic through the network.

Hence, mesh networks require: * Reliability: peers rely on each-other not to fail (e.g., 2019 AWS US-East-1 availability) * Trust: peers must be honest about address ranges (e.g., 2018 BGP hijacking incident) * Central planning: BGP traffic engineering determines which route a packet takes

Application Layer Innovations

Now that we have a rough overview of how the internet is broken, lets think about what can still be done. The flat hierarchy that we associate with mesh networks sounds beautiful, but it doesn't scale. However, the tree-like structure assumes that most participants in the network rely on an authority to give them an address or a range of addresses so that they can communicate.

Overlay networks

Fortunately all it takes to interact with someone on nostr is their public key. The recipients client will render your signed and/or encrypted event no matter how it reaches them. Whether your note reaches them over the internet, over some other network or via a carrier pigeon doesn't matter. nostr:npub1hw6amg8p24ne08c9gdq8hhpqx0t0pwanpae9z25crn7m9uy7yarse465gr is working on a NIP for that and I'm sure he will share an explanation of how it works.

Bitcoin Instead of a Routing Algorithm

Now that we have digital bearer assets (e-cash), users can pay their internet gateway (TollGate) for access to the internet even though they are still offline. Once the TollGate has redeemed the e-cash, it gives the user access to the internet.

Frictionless Switching between ISPs (TollGates)

Legacy internet service providers use KYC money (fiat) to transfer the cost of the infrastructure to their users. However, this means that they are able to identify which packet belongs to which user. The KYC nature of their interaction with the users also makes it difficult for users to switch ISPs when service providers undercut each-other. Internet users who are on e-cash rails can hop between ISPs frictionlessly since they buy small amounts of data frequently in a granular manner.

Users that have access to independent competing TollGates can switch between them freely, so its impossible for any one TollGate to prevent a user from connecting to the internet. The only thing a TollGate can do is attract traffic by providing cheaper and/or faster internet access.

Anyone can arbitrage connectivity

Now that users have non KYC internet, there is nothing stopping them from reselling access to their internet connection. Anyone who has a WiFi router and access to a cheap internet connection can act as a range extender by re-selling access to that gateway for people who aren't able to connect directly.

Now the route that the traffic takes through the network is determined dynamically by the markets. The individual TollGate operators select their gateways and set their prices when they create a business model. The customers select the route that best meets their needs by selecting a gateway for their next purchase.

-

@ 57d1a264:69f1fee1

2025-05-11 06:23:03

@ 57d1a264:69f1fee1

2025-05-11 06:23:03Past week summary

From a Self Custody for Organizations perspective, after analyzing the existing protocols (Cerberus, 10xSecurityBTCguide and Glacier) and reading a bunch of relates articles and guides, have wrapped to the conclusion that this format it is good to have as reference. However, something else is needed. For example, a summary or a map of the whole process to provide an overview, plus a way to deliver all the information and the multy-process in a more enjoyable way. Not a job for this hackathon, but with the right collaborations I assume it's possible to: - build something that might introduce a bit more quests and gamification - provide a learning environment (with testnet funds) could also be crucial on educating those unfamiliar with bitcoin onchain dynamics.

Have been learning more and playing around practicing best accessibility practices and how it could be applied to a desktop software like Bitcoin Safe. Thanks to @johnjherzog for providing a screen recording of his first experience and @jasonb for suggesting the tools to be used. (in this case tested/testing on Windows with the Accessibility Insights app). Some insight shared have been also applied to the website, running a full accessibility check (under WCAG 2.2 ADA, and Section 508 standards) with 4 different plugins and two online tools. I recognize that not all of them works and analyze the same parameters, indeed they complement each other providing a more accurate review.

For Bitcoin Safe interface improvements, many suggestions have been shared with @andreasgriffin , including: - a new iconset, including a micro-set to display the number of confirmed blocs for each transaction - a redesigned History/Dashboard - small refinements like adding missing columns on the tables - allow the user to select which columns to be displayed - sorting of unconfirmed transactions - Defining a new style for design elements like mempool blocks and quick receive boxes You can find below some screenshots with my proposals that hopefully will be included in the next release.

Last achievement this week was to prepare the website https://Safe.BTC.pub, the container where all the outcomes f this experiment will be published. You can have a look, just consider it still WIP. Branding for the project has also been finalized and available in this penpot file https://design.penpot.app/#/workspace?team-id=cec80257-5021-8137-8005-eab60c043dd6&project-id=cec80257-5021-8137-8005-eab60c043dd8&file-id=95aea877-d515-80ac-8006-23a251886db3&page-id=132f519a-39f4-80db-8006-2a41c364a545

What's for next week

After spending most of the time learning and reading material, this coming week will be focused on deliverables. The goal as planned will be to provide: - Finalized Safe₿its brand and improve overall desktop app experience, including categorization of transactions and addresses - An accessibility report or guide for Bitcoin Safe and support to implement best practices - A first draft of the Self-Custody for Organizations guide/framework/protocol, ideally delivered through the website http://Safe.BTC.pub in written format, but also as FlowChart to help have an overview of the whole resources needed and the process itself. This will clearly define preparations and tools/hardwares needed to successfully complete the process.

To learn more about the project, you can visit: Designathon website: https://event.bitcoin.design/#project-recj4SVNLLkuWHpKq Discord channel: https://discord.com/channels/903125802726596648/1369200271632236574 Previous SN posts: https://stacker.news/items/974489/r/DeSign_r and https://stacker.news/items/974488/r/DeSign_r

Stay tuned, more will be happening this coming week

originally posted at https://stacker.news/items/977190

-

@ 57d1a264:69f1fee1

2025-05-11 05:52:56

@ 57d1a264:69f1fee1

2025-05-11 05:52:56Past week summary

From a Self Custody for Organizations perspective, after analyzing the existing protocols (Cerberus, 10xSecurityBTCguide and Glacier) and reading a bunch of relates articles and guides, have wrapped to the conclusion that this format it is good to have as reference. However, something else is needed. For example, a summary or a map of the whole process to provide an overview, plus a way to deliver all the information and the multy-process in a more enjoyable way. Not a job for this hackathon, but with the right collaborations I assume it's possible to: - build something that might introduce a bit more quests and gamification - provide a learning environment (with testnet funds) could also be crucial on educating those unfamiliar with bitcoin onchain dynamics.

Have been learning more and playing around practicing best accessibility practices and how it could be applied to a desktop software like Bitcoin Safe. Thanks to @johnjherzog for providing a screen recording of his first experience and @jasonbohio for suggesting the tools to be used. (in this case tested/testing on Windows with the Accessibility Insights app). Some insight shared have been also applied to the website, running a full accessibility check (under WCAG 2.2 ADA, and Section 508 standards) with 4 different plugins and two online tools. I recognize that not all of them works and analyze the same parameters, indeed they complement each other providing a more accurate review.

For Bitcoin Safe interface improvements, many suggestions have been shared with @andreasgriffin , including: - a new iconset, including a micro-set to display the number of confirmed blocs for each transaction - a redesigned History/Dashboard - small refinements like adding missing columns on the tables - allow the user to select which columns to be displayed - sorting of unconfirmed transactions - Defining a new style for design elements like mempool blocks and quick receive boxes You can find below some screenshots with my proposals that hopefully will be included in the next release.

Last achievement this week was to prepare the website https://Safe.BTC.pub, the container where all the outcomes f this experiment will be published. You can have a look, just consider it still WIP. Branding for the project has also been finalized and available in this penpot file https://design.penpot.app/#/workspace?team-id=cec80257-5021-8137-8005-eab60c043dd6&project-id=cec80257-5021-8137-8005-eab60c043dd8&file-id=95aea877-d515-80ac-8006-23a251886db3&page-id=132f519a-39f4-80db-8006-2a41c364a545

What's for next week

After spending most of the time learning and reading material, this coming week will be focused on deliverables. The goal as planned will be to provide: - Finalized Safe₿its brand and improve overall desktop app experience, including categorization of transactions and addresses - An accessibility report or guide for Bitcoin Safe and support to implement best practices - A first draft of the Self-Custody for Organizations guide/framework/protocol, ideally delivered through the website http://Safe.BTC.pub in written format, but also as FlowChart to help have an overview of the whole resources needed and the process itself. This will clearly define preparations and tools/hardwares needed to successfully complete the process.

To learn more about the project, you can visit: Designathon website: https://event.bitcoin.design/#project-recj4SVNLLkuWHpKq Discord channel: https://discord.com/channels/903125802726596648/1369200271632236574 Previous SN posts: https://stacker.news/items/974489/r/DeSign_r and https://stacker.news/items/974488/r/DeSign_r

Stay tuned, more will be happening this coming week

originally posted at https://stacker.news/items/977180

-

@ 3c389c8f:7a2eff7f

2025-05-11 22:53:30

@ 3c389c8f:7a2eff7f

2025-05-11 22:53:30As I'm sitting here trying to hone in on what might be important to write about in this moment, my mind keeps swirling around through all the things that have me sitting here to begin with. Nostr found me in a time when my life needed a change. The discovery of something that provided the light of hope to an otherwise dark, dystopian future was more powerful than I could have ever predicted. Timing is everything, they say. I believe that to be half true, as timing alone means nothing if the will is non-existent. The intersection of opportunity and preparedness, and all that. I know how I found my way here, but I do not fully understand the things that have drawn my curiosity and kept my attention so strongly. My will ached for change, simplicity, and meaning. I found it, in what seem to me, simultaneously the most likely and the most unlikely of places. There's a magic to that, and its probably better to leave some questions unanswered, lest they lose their mystic power.

My experiences are my own but theme of them resonates through most of the people with whom I interact. It's been very clear that I wasn't alone in these feelings. A movement of highly inspired, hopeful people have continued to support this digital freedom movement since my arrival, in varying ways. Some people have highly technical skills ranging from network systems to design to cybersecurity. Others, like myself, have little to offer in the realms of functionality and we do what we can to breathe life into the systems built to provide digital freedom of speech for all. It's a humbling experience. We are reminded. sometimes directly and sometimes indirectly, that none of Nostr would matter if there were no one using it. We know this to be true, but it is no less humbling to be surrounded by constant innovation and a thriving desire to bring this experience to the entire world.

Now here I sit, tapping out these words, in the midst of another massive life change, stressful but chosen. I could sign off, go read a book in the garden, and go about my world as I would have in my pre-Nostr times. I don't want to do that, though. Hope is here. If there is a place to dwell, in hope is where I will always choose.

I find it important to acknowledge, though, that Nostr and the people using it are in a constant state of flux, too. This isn't my rock nor harbor nor shelter. It's the chaotic good, reminding me both to keep an appreciation for how far this ecosystem has come in such a short amount of time and a realistic set of expectations for where this all can go. The same applies for how well things work at any given moment...And equally so in missing my some of my early Nostr friends that have come and gone, while remaining open to the possibility of meeting new ones... Experiences had and experiences yet to come. I don't know if I have ever been so coaxed outside of my mind by a group of strangers on the internet. But here I am, looking back and looking forward, surrounded by awe in all directions, sharing thoughts that would otherwise be scribbled in pen to be burned in a random evening fire. I've long felt that the core of social media should be just this. Spaces for people to connect, above all else, in the ways that create meaning in our lives. I suppose in some ways that did exist before, but it was twisted, and obscured, and slowly pulled away.

Now its here and super-charged by possibility. What this looks like for any individual will not be the same as my own view. That's part of what makes this so beautiful to me. We need to be able to speak freely. Just as importantly we need to be able to surround ourselves with the things and people that makes us want to do more, that make us want to feel humbled. Or not, if we so choose... but I choose hope.

-

@ a296b972:e5a7a2e8

2025-05-12 16:52:30

@ a296b972:e5a7a2e8

2025-05-12 16:52:30Wo sind der 1. Stock, das Erdgeschoss und der Keller? Das Dach ist noch zu bauen. Das Haus zum unerklärlichen Krieg ist unfertig. Der Bau wurde schon viel früher begonnen, aber die westlichen Medien behaupten das Gegenteil oder verschweigen es. Eine Vorgeschichte darf es nicht geben.

Am Ukraine-Krieg sieht man, dass ein Konflikt, der entgegen den Behauptungen der Propaganda-Maschine nicht erst im Februar 2022 angefangen hat, wie lange es dauert, bis wieder Verhältnisse zustande kommen, die eine Befriedung ermöglichen. Das Ringen darum ist hoffentlich endlich in die Zielgerade eingelaufen und man findet besser gestern als heute eine Lösung. So viele Menschenleben auf beiden Seiten hat dieser Wahnsinn bislang gekostet. Am Ende, wofür? Die Verwirrung bleibt bis zuletzt, denn einerseits treibt der US-amerikanische Präsident die Friedensbemühungen maßgeblich voran, andererseits werden von US-amerikanischer Seite mutmaßlich die Waffenlieferungen fortgesetzt und Starlink nicht abgeschaltet, was erheblich zum abrupten Beenden des sinnlosen Sterbens beitragen würde.

Verträge sind zu erfüllen? Sicherung der US-amerikanischen Interessen? Druckmittel auf Russland? Und Europa? Europa, vor allem Deutschland, Frankreich und Großbritannien geben weiterhin den Geisterfahrer und haben immer noch nicht mitbekommen, dass sie in der Beilegung des Ukraine-Kriegs nicht das geringste zu sagen haben. Sie spielen sich aber auf, als hätten sie und machen „einen auf dicke Hose“. Murmeln werden als Eier verkauft.

Etwas aus dem Fokus der Neuen Medien gerät dabei der immer noch wütende Krieg im Gaza-Streifen mit einer israelischen Planier-Raupe, dessen Vorgeschichte noch länger ist, als die, die zum Ukraine-Krieg geführt hat. Rund 80 Jahre, aber auch hier eigentlich noch länger. Man kann sich vorstellen, wie lange es hier dauern wird, bis sich sichere, friedliche Verhältnisse einstellen können.

Wer kann sicher sein, wer nimmt sich das Recht heraus zu behaupten, wer entscheidet darüber, dass sich Zustände, wie im 3. Reich, die Verfolgung und Vernichtung einer Minderheit, damals die Juden, nicht wiederholen kann? Seitdem das geschehen ist, hat sich der Großteil der Menschheit keinen Millimeter weiterentwickelt.

Wenn gerade Deutsche Anzeichen für eine Wiederholung dieser tief-dunklen Zeit zu erkennen glauben, derzeit in dem, wie der israelische Staat mit dem Gaza-Streifen verfährt, dann ist das keine Verharmlosung der Gräueltaten im 3. Reich, sondern der Beweis dafür, dass es doch einige gibt, die aus der Geschichte gelernt haben, und die der Meinung sind, dass sich so etwas niemals mehr wiederholen darf.

Um auf einen Genozid hinzuweisen, muss jeder Vergleich möglich und erlaubt sein. Es geht um eine Mehrzahl von Menschen, von Familien, die einfach nur in Frieden leben wollen! Ungeachtet der Tatsache, dass es auf beiden Seiten Kräfte gibt, die das nicht interessiert.

Besonders tragisch wird es, wenn dieser Genozid augenscheinlich ausgerechnet von denen ausgeht, die selbst so schrecklich davon betroffen waren.

Wie kann sich der deutsche Staat erdreisten, diejenigen als Anti-Semiten zu bezeichnen, die hier Merkmale eines Genozids zu erkennen glauben und versuchen, diese kritischen Stimmen zu unterdrücken, „nur“, weil es sich um den Staat Israel handelt, der hier als Täter infrage kommt. Auch der Staat Israel hat keinen Freibrief, die Bevölkerung im Gaza-Streifen nach seinen Vorstellungen und Überzeugungen abzurasieren.

Ein Genozid ist ein Genozid, egal von welcher Regierung eines Landes er begangen wird.

Der Staat Israel ist keine Ausnahme! Im Gegenteil. Aufgrund der Erfahrung seines Volkes müsste es die Menschlichkeit gebieten, dass derartiger Völkermord nie wieder geschieht.

Weiter müsste der Begriff Anti-Semitismus einmal genau unter die Lupe genommen werden, was wer aus welchen Gründen darunter versteht. Man kann den Eindruck gewinnen, dass dieser Begriff vor allem als Totschlagargument verwendet wird, um kritische Stimmen mundtot zu machen. Besonders bei diesem heiklen Thema wäre absolute Akkuratesse dringend notwendig.

Es ist die Pflicht eines jeden, der Kritik an den Zuständen üben will, nicht zu verallgemeinern.

Nicht alle israelischen Staatsbürger sind Netanjahu-Anhänger (das zeigen die Demonstrationen), nicht alle Juden sind Zionisten, nicht einmal alle Zionisten sind Juden.

Und sicher sind auf der Gaza-Seite ebenfalls nicht nur „Engel“ unterwegs!

Beide Lager haben rund 80 Jahre Zeit gehabt, den gegenseitigen Hass durch gegenseitige Provokationen aufzubauen und ihn immer wieder sich entladen zu lassen.

Dieser unermessliche Hass kann nur über Generationen hinweg wieder abgebaut werden.

Wenn es jemals eine ernste Absicht gegeben hätte, eine 2-Staaten-Lösung zu realisieren, wäre diese schon längst in die Tat umgesetzt worden. Wenn jedoch der politische Wille dazu fehlt, vor allem auf der Seite des Stärkeren, passiert gar nichts. Und der fehlt jetzt schon seit rund 80 Jahren.

Maßgeblich durch die Briten ist der Staat Israel künstlich entstanden. Die Ableitung der Nutznießer auf einen Gebietsanspruch aus einem Glauben heraus, ist einmalig.

In dem nicht natürlich entstandenen, sondern künstlich geschaffenen Staatsgebilde liegt möglicherweise die Wurzel allen Übels, die von langer Hand, spätestens durch die Balfour-Deklaration im Jahre 1917 ihren Anfang genommen hat.

Man hat nun Jahrzehnte lang Zeit gehabt, zu beobachten, dass dieses Konstrukt ein sicheres Leben und eine Garantie für friedliche Verhältnisse aller nicht zustande gebracht hat. Schmerzliche Erfahrungen auf beiden Seiten haben bislang nicht dazu geführt, dass man zu der Einsicht gekommen wäre, dass man sich möglicherweise auf dem Holzweg befindet.

Die verfeindeten Lager müssten sich, neutral moderiert (welcher Staat, welcher Mensch ist heute noch neutral, oder zumindest kein Interessenvertreter?), zusammensetzen und sich in sicher nicht einfachen, langwierigen, zähen Gesprächen und Verhandlungen über die Neugründung eines gemeinsamen Staates für alle Beteiligten ernsthaft nachdenken, solange, bis es zu einer Einigung gekommen wäre, die für alle Beteiligten akzeptabel ist. Das Ergebnis, eine gemeinsame Staatenlösung, müsste das erklärte Ziel sein und wenn es noch so lange dauern würde.

Das Mitspracherecht müsste nach Bevölkerungsanteil in einem gerechten Verhältnis festgelegt werden. So müssten kleinere Anteile verhältnismäßig mehr Stimmanteile haben, als der größere Anteil, um zu möglichst für alle gerechten Entscheidungen zu gelangen, die alle Beteiligten mittragen könnten. Ein Vorankommen wäre nur durch Vernunft, nicht durch Starrsinn möglich.

Aufgrund der hitzigen Mentalität aller Beteiligten müssten beide Lager auf Gedeih und Verderb voneinander abhängig gemacht werden, sodass ein friedliches Zusammenraufen immer wieder nötig wäre, weil niemand in der Lage wäre, die Oberhand zu gewinnen.

Es müssten gegenseitige Abhängigkeiten geschaffen werden. So könnten zum Beispiel Lieferungen von Lebensmitteln, Wasser, Energie (Israel) usw. mit der Hoheit über die noch zu erschließenden Gasfelder (Gaza) vor Gaza „verrechnet“ werden, ohne, dass die USA oder sonst wer die Finger im Spiel haben.

Bei derartigen gegenseitigen Abhängigkeiten würde man sich schon zusammenraufen.

Das alles setzt voraus, dass der Mensch an sich seine menschlichen Schwächen unter Kontrolle bringen würde. Hierzu können Machtstreben, Geldgier, Rechthaberei, Überheblichkeit, Ideologien, Ansprüche aus einem Glauben heraus usw. gezählt werden.