-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

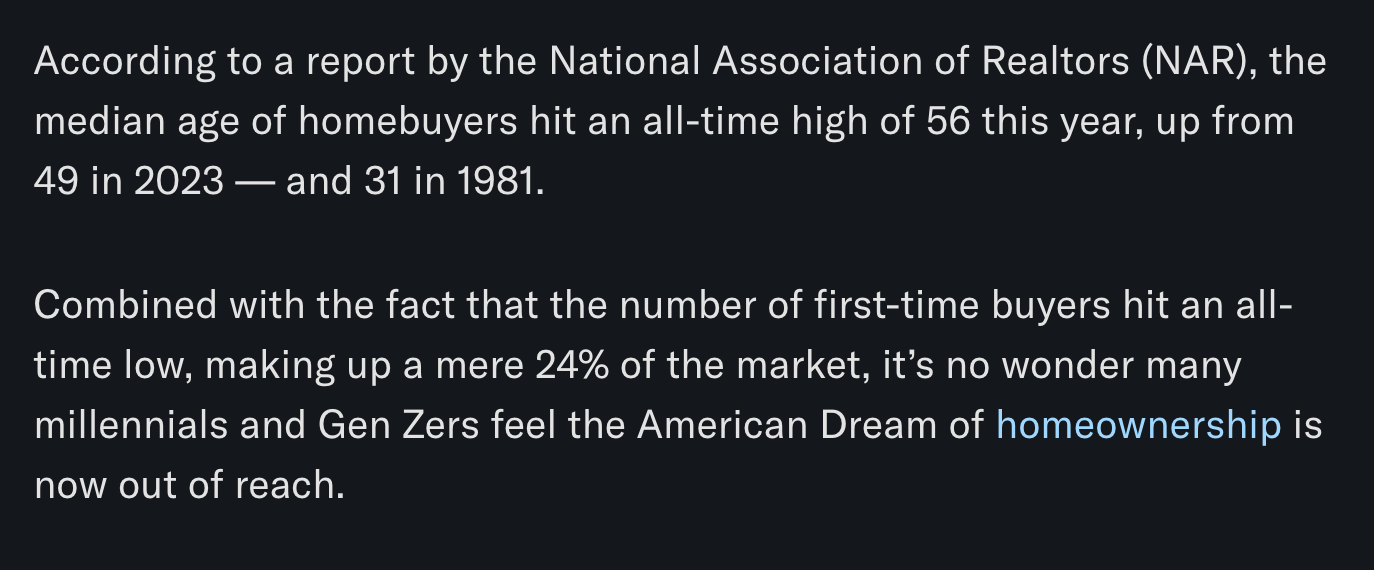

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 2b998b04:86727e47

2025-05-20 22:15:45

@ 2b998b04:86727e47

2025-05-20 22:15:45I didn’t take a course on “prompt engineering.” I didn’t memorize secret formulas or chase viral hacks.

What I did do was treat it like a system.

Just like in software:

Write → Compile → Test → Debug → Repeat

With AI, the loop feels just as familiar:

Prompt → Output → Edit → Re-prompt

That’s not magic. That’s engineering.

When someone asked me, “How can you trust AI for anything serious?”\ I told them: “Same way we trust the internet — not because the network’s reliable, but because the protocol is.”

AI is no different. The key is building systems around it:

-

Multiple models if needed

-

Human-in-the-loop verification

-

Layered editing and real discernment

It’s Not That Different From Other Engineering

Once you stop treating AI like a black box and start treating it like a tool, the whole experience changes.

The prompt isn’t a spell. It’s a spec.\ The response isn’t a prophecy. It’s a build.\ And your discernment? That’s your QA layer.

What I Actually Use It For

-

Brainstorming titles and refining headlines

-

Drafting posts that I shape and filter

-

Running content through for edge cases

-

Exploring theological or philosophical questions

And yes — I want it to be useful. I am building to make a living, not just to make noise. But I don’t lead with monetization. I lead with clarity — and build toward sustainability.

Final Thought

If you’re waiting for a course to teach you how to “do AI,” maybe just start by building something real. Test it. Edit it. Use it again. That’s engineering.

Shoutout to Dr. C (ChatGPT) for helping me articulate this.

If this post sparked anything for you, zap a few sats ⚡ — every bit helps me keep building with conviction.

-

-

@ 3f770d65:7a745b24

2025-05-20 21:14:28

@ 3f770d65:7a745b24

2025-05-20 21:14:28I’m Derek Ross, and I’m all-in on Nostr.

I started the Grow Nostr Initiative to help more people discover what makes Nostr so powerful: ✅ You own your identity ✅ You choose your social graph and algorithms ✅ You aren't locked into any single app or platform ✅ You can post, stream, chat, and build, all without gatekeepers

What we’re doing with Grow Nostr Initiative: 🌱 Hosting local meetups and mini-conferences to onboard people face-to-face 📚 Creating educational materials and guides to demystify how Nostr works 🧩 Helping businesses and creators understand how they can plug into Nostr (running media servers, relays, and using key management tools)

I believe Nostr is the foundation of a more open internet. It’s still early, but we’re already seeing incredible apps for social, blogging, podcasting, livestreaming, and more. And the best part is that they're all interoperable, censorship-resistant, and built on open standards. Nostr is the world's largest bitcoin economy by transaction volume and I truly believe that the purple pill helps the orange pill go down. Meaning, growing Nostr will also grow Bitcoin adoption.

If you’ve been curious about Nostr or are building something on it, or let’s talk. Whether you're just getting started or you're already deep in the ecosystem, I'm here to answer questions, share what I’ve learned, and hear your ideas. Check out https://nostrapps.com to find your next social decentralized experience.

Ask Me Anything about GNI, Nostr, Bitcoin, the upcoming #NosVegas event at the Bitcoin Conference next week, etc.!

– Derek Ross 🌐 https://grownostr.org npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424

https://stacker.news/items/984689

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:22

@ 04c915da:3dfbecc9

2025-05-20 15:50:22There is something quietly rebellious about stacking sats. In a world obsessed with instant gratification, choosing to patiently accumulate Bitcoin, one sat at a time, feels like a middle finger to the hype machine. But to do it right, you have got to stay humble. Stack too hard with your head in the clouds, and you will trip over your own ego before the next halving even hits.

Small Wins

Stacking sats is not glamorous. Discipline. Stacking every day, week, or month, no matter the price, and letting time do the heavy lifting. Humility lives in that consistency. You are not trying to outsmart the market or prove you are the next "crypto" prophet. Just a regular person, betting on a system you believe in, one humble stack at a time. Folks get rekt chasing the highs. They ape into some shitcoin pump, shout about it online, then go silent when they inevitably get rekt. The ones who last? They stack. Just keep showing up. Consistency. Humility in action. Know the game is long, and you are not bigger than it.

Ego is Volatile

Bitcoin’s swings can mess with your head. One day you are up 20%, feeling like a genius and the next down 30%, questioning everything. Ego will have you panic selling at the bottom or over leveraging the top. Staying humble means patience, a true bitcoin zen. Do not try to "beat” Bitcoin. Ride it. Stack what you can afford, live your life, and let compounding work its magic.

Simplicity

There is a beauty in how stacking sats forces you to rethink value. A sat is worth less than a penny today, but every time you grab a few thousand, you plant a seed. It is not about flaunting wealth but rather building it, quietly, without fanfare. That mindset spills over. Cut out the noise: the overpriced coffee, fancy watches, the status games that drain your wallet. Humility is good for your soul and your stack. I have a buddy who has been stacking since 2015. Never talks about it unless you ask. Lives in a decent place, drives an old truck, and just keeps stacking. He is not chasing clout, he is chasing freedom. That is the vibe: less ego, more sats, all grounded in life.

The Big Picture

Stack those sats. Do it quietly, do it consistently, and do not let the green days puff you up or the red days break you down. Humility is the secret sauce, it keeps you grounded while the world spins wild. In a decade, when you look back and smile, it will not be because you shouted the loudest. It will be because you stayed the course, one sat at a time. \ \ Stay Humble and Stack Sats. 🫡

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50

@ 6ad3e2a3:c90b7740

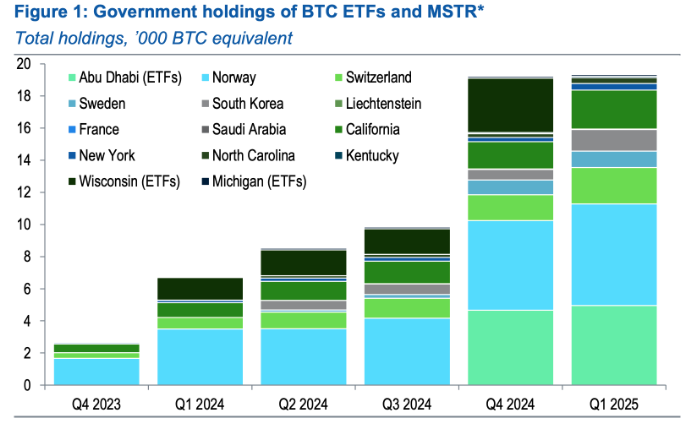

2025-05-20 13:49:50I’ve written about MSTR twice already, https://www.chrisliss.com/p/mstr and https://www.chrisliss.com/p/mstr-part-2, but I want to focus on legendary short seller James Chanos’ current trade wherein he buys bitcoin (via ETF) and shorts MSTR, in essence to “be like Mike” Saylor who sells MSTR shares at the market and uses them to add bitcoin to the company’s balance sheet. After all, if it’s good enough for Saylor, why shouldn’t everyone be doing it — shorting a company whose stock price is more than 2x its bitcoin holdings and using the proceeds to buy the bitcoin itself?

Saylor himself has said selling shares at 2x NAV (net asset value) to buy bitcoin is like selling dollars for two dollars each, and Chanos has apparently decided to get in while the getting (market cap more than 2x net asset value) is good. If the price of bitcoin moons, sending MSTR’s shares up, you are more than hedged in that event, too. At least that’s the theory.

The problem with this bet against MSTR’s mNAV, i.e., you are betting MSTR’s market cap will converge 1:1 toward its NAV in the short and medium term is this trade does not exist in a vacuum. Saylor has described how his ATM’s (at the market) sales of shares are accretive in BTC per share because of this very premium they carry. Yes, we’ll dilute your shares of the company, but because we’re getting you 2x the bitcoin per share, you are getting an ever smaller slice of an ever bigger overall pie, and the pie is growing 2x faster than your slice is reducing. (I https://www.chrisliss.com/p/mstr how this works in my first post.)

But for this accretion to continue, there must be a constant supply of “greater fools” to pony up for the infinitely printable shares which contain only half their value in underlying bitcoin. Yes, those shares will continue to accrete more BTC per share, but only if there are more fools willing to make this trade in the future. So will there be a constant supply of such “fools” to keep fueling MSTR’s mNAV multiple indefinitely?

Yes, there will be in my opinion because you have to look at the trade from the prospective fools’ perspective. Those “fools” are not trading bitcoin for MSTR, they are trading their dollars, selling other equities to raise them maybe, but in the end it’s a dollars for shares trade. They are not selling bitcoin for them.

You might object that those same dollars could buy bitcoin instead, so they are surely trading the opportunity cost of buying bitcoin for them, but if only 5-10 percent of the market (or less) is buying bitcoin itself, the bucket in which which those “fools” reside is the entire non-bitcoin-buying equity market. (And this is not considering the even larger debt market which Saylor has yet to tap in earnest.)

So for those 90-95 percent who do not and are not presently planning to own bitcoin itself, is buying MSTR a fool’s errand, so to speak? Not remotely. If MSTR shares are infinitely printable ATM, they are still less so than the dollar and other fiat currencies. And MSTR shares are backed 2:1 by bitcoin itself, while the fiat currencies are backed by absolutely nothing. So if you hold dollars or euros, trading them for MSTR shares is an errand more sage than foolish.

That’s why this trade (buying BTC and shorting MSTR) is so dangerous. Not only are there many people who won’t buy BTC buying MSTR, there are many funds and other investment entities who are only able to buy MSTR.

Do you want to get BTC at 1:1 with the 5-10 percent or MSTR backed 2:1 with the 90-95 percent. This is a bit like medical tests that have a 95 percent accuracy rate for an asymptomatic disease that only one percent of the population has. If someone tests positive, it’s more likely to be a false one than an indication he has the disease*. The accuracy rate, even at 19:1, is subservient to the size of the respective populations.

At some point this will no longer be the case, but so long as the understanding of bitcoin is not widespread, so long as the dollar is still the unit of account, the “greater fools” buying MSTR are still miles ahead of the greatest fools buying neither, and the stock price and mNAV should only increase.

. . .

One other thought: it’s more work to play defense than offense because the person on offense knows where he’s going, and the defender can only react to him once he moves. Similarly, Saylor by virtue of being the issuer of the shares knows when more will come online while Chanos and other short sellers are borrowing them to sell in reaction to Saylor’s strategy. At any given moment, Saylor can pause anytime, choosing to issue convertible debt or preferred shares with which to buy more bitcoin, and the shorts will not be given advance notice.

If the price runs, and there is no ATM that week because Saylor has stopped on a dime, so to speak, the shorts will be left having to scramble to change directions and buy the shares back to cover. Their momentum might be in the wrong direction, though, and like Allen Iverson breaking ankles with a crossover, Saylor might trigger a massive short squeeze, rocketing the share price ever higher. That’s why he actually welcomes Chanos et al trying this copycat strategy — it becomes the fuel for outsized gains.

For that reason, news that Chanos is shorting MSTR has not shaken my conviction, though there are other more pertinent https://www.chrisliss.com/p/mstr-part-2 with MSTR, of which one should be aware. And as always, do your own due diligence before investing in anything.

* To understand this, consider a population of 100,000, with one percent having a disease. That means 1,000 have it, 99,000 do not. If the test is 95 percent accurate, and everyone is tested, 950 of the 1,000 will test positive (true positives), 50 who have it will test negative (false negatives.) Of the positives, 95 percent of 99,000 (94,050) will test negative (true negatives) and five percent (4,950) will test positive (false positives). That means 4,950 out of 5,900 positives (84%) will be false.

-

@ df9150e8:4b224b13

2025-05-20 19:16:06

@ df9150e8:4b224b13

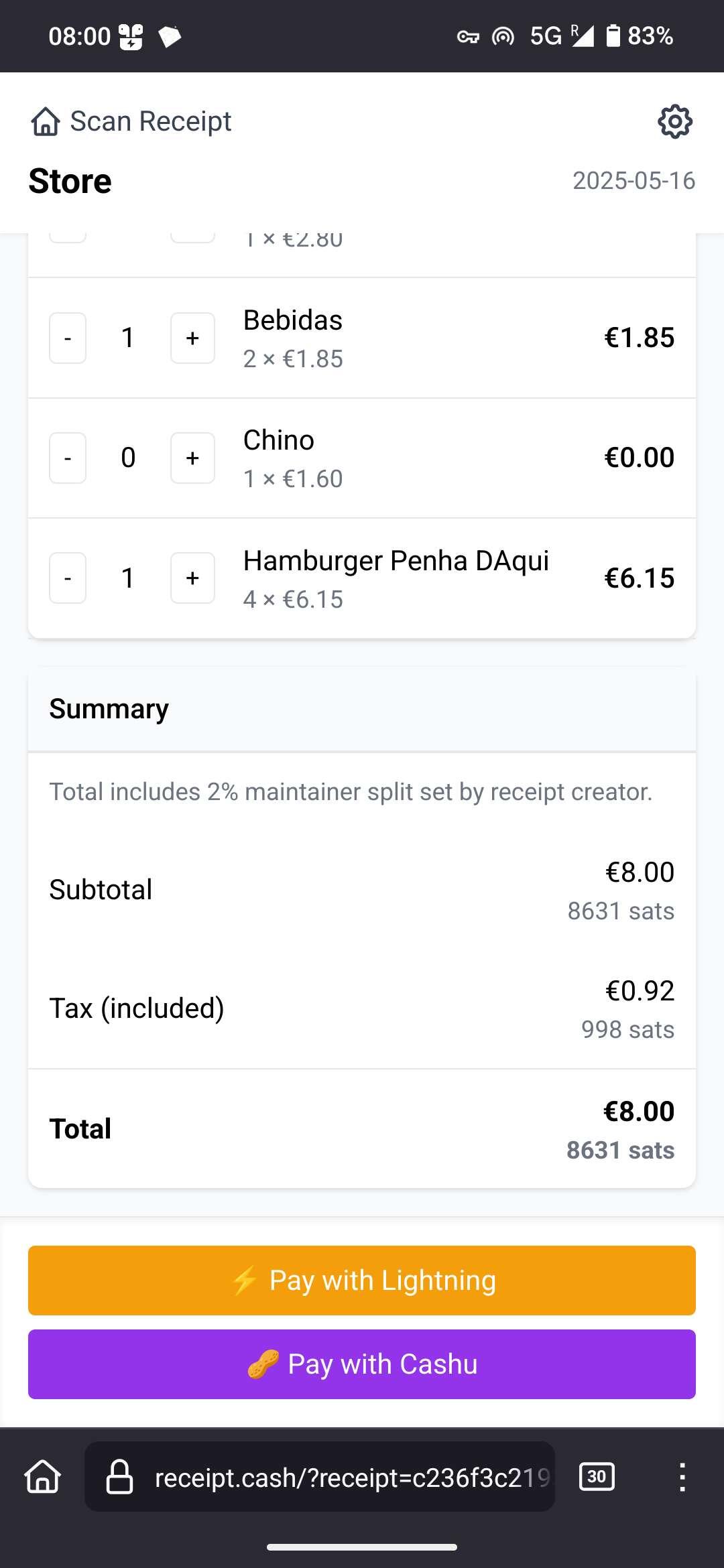

2025-05-20 19:16:06Small Business & Bitcoin - Month 1 - April Update

This letter is meant to be a month by month reflection and live interaction of starting and building a bitcoin treasury for your small business. It is my belief that a bitcoin treasury will expand the runway and viability of any profitable cash flowing small business. It is a stealthy and discrete way to extend the value and worth of your small business.

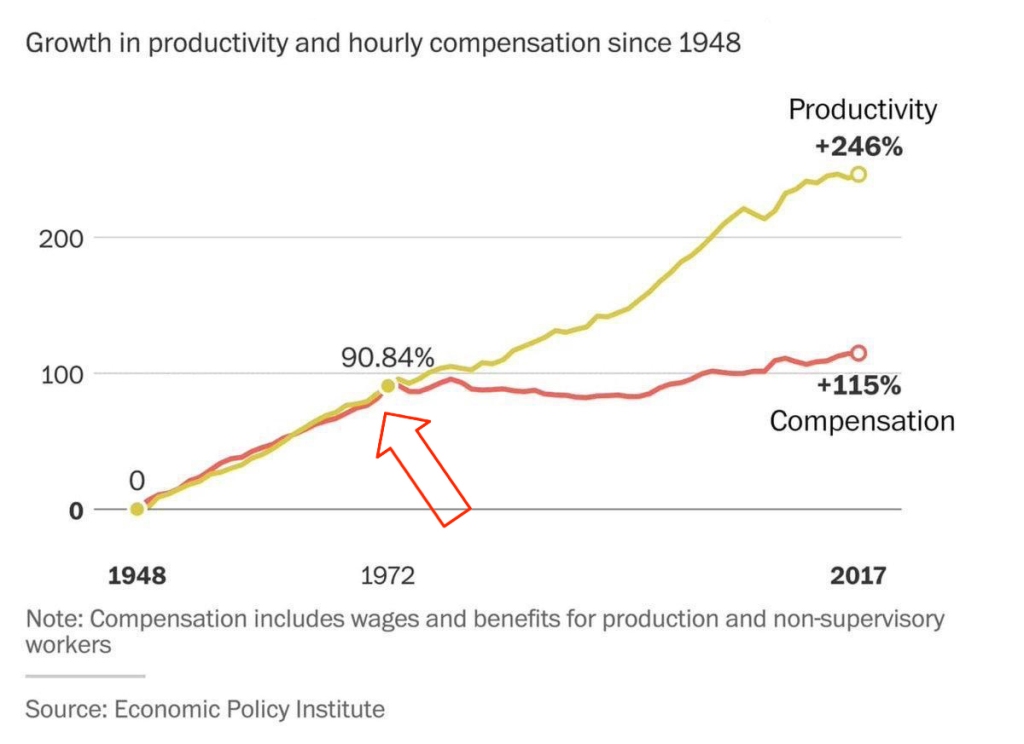

It is becoming more and more obvious that cash on a balance sheet is melting away due to record high inflation rates. A bitcoin treasury is your best weapon against high inflation and it has consistently and reliably outpaced inflation since inception.

Another benefit to a bitcoin treasury is reshaping your mindset around bitcoin being the hurdle rate for your small business. Bitcoin has a 10 year CAGR of 84%. And while that is likely to shrink over the coming 10 years, we still expect it to exceptionally outperform any other treasury asset. With that in mind, you need to look at the outgoing dollar within your business. Any dollar spent that can’t return you better than 84% may be likely best served in your bitcoin treasury.

So the goal of this letter is simple: I will be building an outline and example in real time and month by month on how to build your bitcoin treasury within a small business. I will be detailing the process in these monthly essays for my reflection and your consumption. If you are reading this, you’ve probably seen what Michael Saylor and Strategy have done in the public markets. They have created the playbook for public bitcoin treasury. We are going to detail the process for your average mom and pop business.

The Playbook

To start this writing, I am going to give you the exact methods we will be taking to acquire our bitcoin as well as the exact % and amounts of bitcoin added to the treasury. We are starting on zero. What I mean by that is that as of now we will not be lump summing any cash into bitcoin from our balance sheet. We will likely do that down the road, but not something we are doing today. We are going to start by averaging 10% of monthly profit into bitcoin.

You may think this amount is too conservative. I tend to agree. My plan is to put something together that is repeatable and conservative at the start. We are going to add 10% of profits to a bitcoin balance each month for a few months and evaluate. Our goal is to increase the % allocation after the first few months. We are starting conservative because other businesses (and ours) need to operate without that 10% and make sure we can adapt. Once we’ve done that we slowly continue to increase the allocation until we reach optimal % allocations.

In addition to simply purchasing bitcoin, we’ve switched to a bitcoin back debit card. This means that every transaction (marketing, bill pay) I am getting anywhere from 1% to 1.5% back in bitcoin. While this will be a marginal way to stack bitcoin, every little bit counts and this helps us add to our stack. If we believe that bitcoin has another 10X increase in fiat price over the coming years then this will prove to make everything cheaper in the long run as the bitcoin back we collect will be increasing in value for years to come. What 1.5% is now could end up being 15% off in a few short years. Any small business owner knows that your margins are everything and giving us this edge in our margin is a huge thing for business owners.

Our Treasury

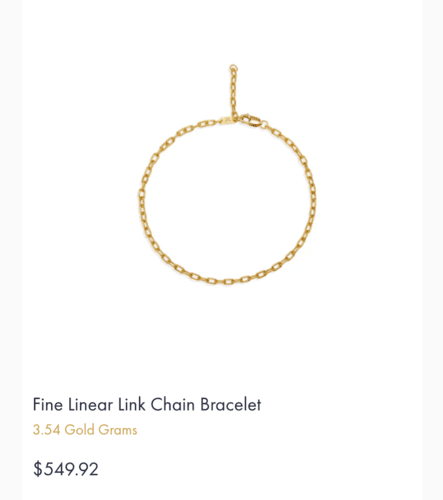

We began stacking mid April so we don’t have a full month of stacking yet. Based on our few weeks of stacking our current treasury as of May 12, 2025 looks like this:

Stacked through purchasing: 905,336 sats = $918

Stacked through bitcoin back card = 183,281 sats = $190.72

Total Bitcoin = 1,088,617 sats = $1,108.72

Important To Note:

Current price of bitcoin when writing = $101,871.10 per coin.

“Sat” is the smallest unit of a bitcoin.

1 million sats = 1% of owning a whole bitcoin

Our Treasury Strategy (Expanded):

Purchasing Bitcoin via business profits

We are starting at what we believe will be the most conservative allocation towards bitcoin that we will have. 10% should affect our (and hopefully most) operating business very little. We are starting in the most conservative way so that other small businesses can see this and hopefully make these very minor but achievable allocations into bitcoin.

Each month I will look at our net profit and then take 10% of it and purchase bitcoin. We will store all of our bitcoin on a multi sig hardware wallet and continue to track the proceeds here publicly.

In the future (as mentioned above) we will continue to raise the % of net profit allocated towards bitcoin. We want to acquire bitcoin as rapidly and violently as possible. We will need a much greater than 10% allocation to do that. We will likely reevaluate after month 3 and see if it is time to increase the % allocation.

This is also a great encouragement to all small businesses to get creative with sales and marketing to boost your bottom line. Since the % allocation is fixed, we have to earn more profit in order to purchase more bitcoin. Obviously, the best way to maximize bitcoin stacked each month is eventually getting to peak % allocation and continuously maximizing and setting new monthly highs with profit in the business.

As much as we love bitcoin, this allows us to spend the bulk of our time focused inward on our business. The more improvements we can make then, in theory, the more bitcoin we should be able to put in our reserves. This is also a great encouragement to business owners to really dig in and slash all waste within the business. What are we paying for/spending money on that is a waste or at the very least non essential to operations. It can also allow us to audit our way of doing things to ensure everything we do is being done in the most efficient way possible. A lean and profitable business is one that can stack more bitcoin.

Getting bitcoin via a bitcoin back debit card:

This is the 2nd way that we will add bitcoin to our balance sheet as a treasury asset. This debit card works just like a reward credit card. We spend money on it and are instantly rewarded with 1% to 1.5% bitcoin back. This bitcoin is added directly to a wallet linked to our debit card and can be withdrawn to the main wallet.

While this will not be our most powerful driver in stacking bitcoin, It will certainly increase our bitcoin holdings over time as opposed to not using it. It kind of works from the opposite end of the spectrum. Purchasing bitcoin through our profits is a great offensive way to buy bitcoin. Getting bitcoin back from our debit card purchase is a great defensive way to stack bitcoin as it decreases our cost of goods sold with every purchase. As we spend on marketing, pay our taxes, upgrade equipment, or sign up for a new subscription that will help the business, we will be earning bitcoin back on all of those purchases making them cheaper than the listed price.

As the bitcoin we get back via debit card rewards goes up in value over the years, everything we purchase using that card is, in theory, getting cheaper.

Borrowed Money

There is also the option of taking on debt for bitcoin which we’ve seen happen rapidly in public markets. Currently, we are not taking on any kind of debt to add to our bitcoin treasury, but that is something we can and will consider as time moves on. It is important to me to begin stacking with our cashflows first. Once we have built up a decent hoard of BTC on our treasury, we would consider taking a loan to purchase bitcoin,

Think of this as an arbitrage opportunity. If you can secure a loan at 6% for an asset that might have a CAGR of 40+% then it would likely be a good move to make as long as you have sufficient cashflows to cover the principal and interest payments on the loan.

As a small business, we don’t have access to the same tools and products that public companies do. So it’s important to ensure we keep a low time preference with any time of borrowing that we may do. While it is always ideal to stack as much bitcoin as possible, ensuring that you are doing so in a responsible and sustainable way is key. You should be able to cover the payments on the loan very easily. If it’s going to constrain cashflow and increase stress and pressure in the business then you are probably borrowing too much. Loan amounts should be in that sweet spot of impactful enough to really boost your bitcoin treasury, but not so heavy that it puts your business in danger.

It’s also important to note that borrowing money isn’t for everyone. If the thought of a loan to purchase bitcoin causes stress, you may be better off just focusing on stacking from your cashflow and improving your bitcoin treasury month in and month out. Just because this has been popularized in the public markets, doesn’t mean that it has to be done on a smaller scale with your small business. It’s simply something to consider when evaluating your bitcoin treasury and how you can increase it’s value in the most accretive ways possible.

For example, Let’s say your company has a net profit of $10,000 per month. You’ve already got a bitcoin treasury valued at $100,000 and you have the opportunity to take on a $30,000 loan at 6% interest. This would automatically boost your treasury by 30% and should be a debt note that is simple and sustainable to pay each month out of your net profits. You would also be able to continue stacking your % allocation each month from your net profit.

The danger of this loan is low in a number of ways. First, the note would be for $30,000 and you have a bitcoin treasury of $130,000. In a worst case scenario, you could liquidate enough bitcoin to payoff the loan and move on. The other substantial way that it’s safe is that you have sufficient cashflow to cover what is likely to be a payment in the $500-$700 range each month depending on the terms. You are only eating into your net profit by 5-7% monthly to begin to pay down the loan.

I'm surely coming from the conservative side when it comes to being a bitcoiner in small business, but I would feel much more comfortable taking a loan once I have a pre established treasury. I would also like for the size of that loan to be smaller than the overall value of my current treasury. So with those parameters set, I’m probably a few months away from even considering a loan to expand the bitcoin on my balance sheet. However, It will be something that I maintain a watchful eye on and would consider it when terms and market conditions seem favorable to make a lump sum buy into bitcoin.

I believe this to be an opportunity within a limited time frame. I think we see bitcoin increase in value by a multiple of 10 over the coming decade. I do think that as time marches on that bitcoin’s CAGR will continue to decrease. It’ll still be attractive, but this is a natural occurrence as an asset matures and becomes larger. Will borrowing money responsibly to purchase bitcoin be a good idea when it is priced at $1,000,000 per coin? Only Time will tell. Until we see more of that price maturation, I tend to think it’s a fairly solid trade off when done responsibly.

In Conclusion:

This writing had a lot of technicality to it to explain what we are doing. In future writings I will continue to share our bitcoin stacking results and thoughts behind how we feel about the previous month. I’ll also get into some more of the business aspects of it and what we are doing to increase efficiency. At the end of the day, everything we do will be in an effort to stack more bitcoin into our treasury.

We will provide an ongoing monthly update and will update again once May has ended.

Talk Soon.

-Caleb Gregory

-

@ c9badfea:610f861a

2025-05-20 17:05:41

@ c9badfea:610f861a

2025-05-20 17:05:41- Install YTDLnis (it's free and open source)

- Launch the app and allow notifications and storage access if prompted

- Go to any supported website or use the YouTube, Instagram, X, or Facebook app

- Tap Share on the post or website URL and select YTDLnis as the sharing destination

- Adjust the settings if desired and tap Download

- You'll be notified when the download finishes

- Enjoy uninterrupted watching!

ℹ️ This app uses

yt-dlpinternally and it's also available as a standalone CLI tool -

@ 57d1a264:69f1fee1

2025-05-20 06:15:51

@ 57d1a264:69f1fee1

2025-05-20 06:15:51Deliberate (?) trade-offs we make for the sake of output speed.

... By sacrificing depth in my learning, I can produce substantially more work. I’m unsure if I’m at the correct balance between output quantity and depth of learning. This uncertainty is mainly fueled by a sense of urgency due to rapidly improving AI models. I don’t have time to learn everything deeply. I love learning, but given current trends, I want to maximize immediate output. I’m sacrificing some learning in classes for more time doing outside work. From a teacher’s perspective, this is obviously bad, but from my subjective standpoint, it’s unclear.

Finding the balance between learning and productivity. By trade, one cannot be productive in specific areas without first acquire the knowledge to define the processes needed to deliver. Designing the process often come on a try and fail dynamic that force us to learn from previous mistakes.

I found this little journal story fun but also little sad. Vincent's realization, one of us trading his learnings to be more productive, asking what is productivity without quality assurance?

Inevitably, parts of my brain will degenerate and fade away, so I need to consciously decide what I want to preserve or my entire brain will be gone. What skills am I NOT okay with offloading? What do I want to do myself?

Read Vincent's journal https://vvvincent.me/llms-are-making-me-dumber/

https://stacker.news/items/984361

-

@ 57d1a264:69f1fee1

2025-05-20 06:02:26

@ 57d1a264:69f1fee1

2025-05-20 06:02:26Digital Psychology ↗Wall of impact website showcase a collection of success metrics and micro case studies to create a clear, impactful visual of your brand's achievements. It also displays a Wall of love with an abundance of testimonials in one place, letting the sheer volume highlight your brand's popularity and customer satisfaction.

And like these, many others collections like Testimonial mashup that combine multiple testimonials into a fast-paced, engaging reel that highlights key moments of impact in an attention-grabbing format.

Awards and certifications of websites highlighting third-party ratings and verification to signal trust and quality through industry-recognized achievements and standards.

View them all at https://socialproofexamples.com/

https://stacker.news/items/984357

-

@ 554ab6fe:c6cbc27e

2025-05-20 15:51:33

@ 554ab6fe:c6cbc27e

2025-05-20 15:51:33Introduction

It is becoming increasingly evident that sunlight is an essential nutrient for the body. To be more precise, the various wavelengths coming from the sun provide different benefits to the body, and each play a vital role in human health. Even more so, they work in concert with one another, as one wavelength may help reduce the potentially harmful effects of another. Benefits are maximized and harm reduced when we are exposed to the full breadth of this rainbow. This article will attempt to shed light on these various benefits and synergies.

To put this discussion into context, it is important to consider the overall health benefits of sunlight exposure. In a Swedish study that followed 29,000 women over 20 years, it was found that the mortality rate was doubled in those who avoided sun exposure when compared to those that didn’t (Lindqvist et al. 2016). Women who avoided the sun were twice as likely to die, primarily from cardiovascular disease, and there was no difference between death from malignant melanoma between the two groups (Lindqvist et al. 2016).

To understand why sunlight is so beneficial to health, it is important to make clear the diverse range of wavelengths that come from the sun. We typically think of the sun as a provider of both visible light and warmth. However, the spectrum of light visible to the human eye is a narrow band of the wavelengths actually emitted by the sun.

As wavelengths become shorter, visible light becomes more blue. Beyond the visible spectrum on the blue end, we arrive at ultraviolet (UV) light. On the other end of the spectrum are the longer red wavelengths. Outside of the visible window on the red side is infrared (IR) light, which provides heat. For helpful context, consider how shorter wavelengths have a harder time penetrating our atmosphere. So, the skies of dawn and dusk are predominately filled with red and near-infrared (NIR) light, while the middle of the day contains more blue and UV light. The bulk of wavelengths from the sun throughout the day are on the NIR end. The entire spectrum of visible and non-visible light between UV and IR plays critical roles in human health, especially towards mitochondrial health and metabolism. To summarize these benefits and provide a general overview for the following article, the benefits are as follows:

- UV – aids in the production of vitamin D and melanin, but also causes DNA damage

- Vitamin D improves immune system function and can repair DNA damage

- Melanin stores electrons for use within mitochondria

- Blue – involved in our circadian rhythm as the absence of blue light triggers the production of melatonin, an important antioxidant.

- Near-infrared (NIR) – improves mitochondria function and energy production while also protecting us from the harms of blue and UV light.

Ultraviolet Light

Let’s begin with a discussion around the widely misunderstood light of UV. UV is often viewed as a dangerous form of light, given that it can cause DNA damage and lead to cancer. While true, this myopic point of view ignores the crucial benefits of UV light. UV light produces vitamin D, which counteracts the DNA damage caused by UV while providing many other benefits. Additionally, UV light triggers the production of melanin, which aids in mitochondrial function. Like all physiological processes in the body that are vital to survival, there is a release of POMC-derived endorphins when skin comes into contact with UV light (Fell et al. 2014). Any person likely reading this article can agree that sitting under the sun simply feels amazing. We are drawn to it in a deeply meaningful sense.

Vitamin D is one of the most important chemicals regarding health, and it is poorly named. The term ‘vitamin’ refers to a compound that is important for health but cannot be adequately made within the body and must be retrieved externally. Peoples of the Northern and Southern hemisphere who are exposed to less UV light during winter would, for example, historically retrieve their vitamin D from foods such as oily fish, seal blubber, whale blubber, and polar bear liver (Wacker and Holick 2013). In a similar way, vitamin D was given its name 100 years ago when it was found that cod-liver oil was capable of curing rickets, when it was found that the so-called vitamin could promote calcium deposition in bones (McCollum et al. 1922). It was only until much later, in 1981, when scientists discovered that human skin could also synthesize vitamin D (M. F. Holick 1981). A majority of human vitamin D is produced by the skin when exposed to UVB (280 – 315 nm), while a minor amount is gained through food (Prietl et al. 2013; Wacker and Holick 2013). Most cells and organs in the human body have vitamin D receptors and many organs also have the ability to produce it, this speaks to the incredibly important nature of this compound towards our health (Prietl et al. 2013; Wacker and Holick 2013). Vitamin D deficiency has been associated with various types of cancer, autoimmune disorders, type 1 diabetes mellitus, multiple sclerosis (MS), cardiovascular disease, and even schizophrenia (Michael F. Holick 2007; Wacker and Holick 2013). Multiple studies have also found that vitamin D deficiency increases all-cause mortality (Garland et al. 2014; Yang et al. 2011; Chowdhury et al. 2014).

Though the historical benefits to vitamin D were attributed mainly to bone health, it is far more important. Vitamin D plays a critical role in protecting against invasive pathogens, reducing autoimmunity, and maintaining overall health (Wimalawansa 2023). Regarding immunity, one way it does this is by causing a shift away from proinflammatory responses to one more centered around T cell activation (Prietl et al. 2013). Vitamin D has therefore been shown to benefit other disorders that are related to immunity, such as a study that found vitamin D supplementation during pregnancy reduced asthmatic symptoms in children (Litonjua et al. 2016). That being said, it is important to highlight how there is no substitution for natural sunlight as a means of getting vitamin D. Naturally produced vitamin D from the skin lasts 2-3 times longer in the body (Wacker and Holick 2013). This is one of many likely reasons why the natural avenue should always be preferred over the supplemental. A similar line of reasoning follows in methods of getting UV light, as natural sun exposure leads to a decrease of all-cause mortality while the use of artificial tanning beds has been shown to increase all-cause and cancer mortality (Yang et al. 2011). More on why this likely occurs later.

Beyond vitamin D’s benefits to the immune system, it is important to focus on the compound’s role in mitochondrial health. In a previous article I wrote titled “Sunlight and Health”, I delve deeper into the importance of mitochondria and the science of how they work. In simplicity, imagine how all life on earth centers around energy. The sun provides energy to the earth, and the plethora of life on earth harness and facilitate the flow of that energy. Plants and animals share a symbiotic relationship within this system. Plants, through photosynthesis, take in sunlight, CO2, and water and create a glucose precursor and oxygen. This occurs within the chloroplast of plant cells. Within human cells, we have mitochondria. Our mitochondria, in turn, take in oxygen and glucose and produce CO2, water, and energy for our bodies in the form of ATP. What the plant breathes out, we breathe in, and vice versa. Mitochondria are central to all animal life on earth, and the ATP produced is central to all physiologic function. If your mitochondria are unhealthy, you are unhealthy and will experience disease.

Vitamin D plays a role in mitochondrial health at a DNA level. Our cells have DNA, which we inherited from our mother and father. On top of that, the mitochondria within our cells have their own set of DNA (mtDNA). Our mitochondria come from our mother’s egg, and therefore our mtDNA always is inherited from our mother. UV light can cause damage to both our DNA and mtDNA (Birch-Machin, Russell, and Latimer 2013). This is what gives UV light the ability to cause cancer. Additionally, damage to the mtDNA within our mitochondria can lead to mitochondrial dysfunction. The more poorly our mitochondria function, the less energy we produce for our cells, and the less healthy our cells become. There is research being developed that suggests the role of vitamin D is to counterbalance this danger by regulating gene transcription and reducing mtDNA damage. A mouse study conducted in 2011, for example, found that different shapes of vitamin D reduce the development of tumors in mice following UV exposure (Dixon et al. 2011). It is not unlike nature to create a system of checks and balances, to ensure that the damaging effects of UV light are counterbalanced by a compound produced by the body when exposure to that same light.

While vitamin D may be important for mitochondrial health by protecting against mtDNA damage, melanin potentially plays a much larger role. Melanin is the pigment in our skin that make us darker. Not only is the diversity in skin tones across humans due to variations in melanin content, but a tan is also the creation of more melanin. To be more specific, the skin’s exposure to UVA (315-400nm) leads to the creation of melanin (Wicks et al. 2011). The most obvious benefit to the production of melanin, which most people could appreciate, is that the darker or tanner our skin is, the less damage we will receive from UV light. In this way, melanin shares a similar responsibility to vitamin D, where both are protecting the body against the very thing that forms them. Even more crucially however, melanin acts as a battery for the mitochondria.

During cellular respiration, where mitochondria turn oxygen and glucose into energy, electrons are stripped from the glucose for use. In other words, what our mitochondria really need are oxygen and electrons, and the glucose is simply a means to an end. If the mitochondria are the engine, then the electrons are the fuel (assuming you are still breathing). Due to its chemical structure, melanin is a natural reversible oxidation-reduction system (Figge 1939). In other words, it can both store and release electrons. Melanin is therefore a kind of battery, retrieving electrons from various sources, and storing them for future use in our mitochondria as a substitute for food. When stated this way, and considering how food is important because both fats and carbohydrates fuel the body by providing electrons to our mitochondria, one can imagine how vitally important melanin is. Melanin is central towards the availability of electrons for use in our body to produce the energy to live. Without adequate melanin, your mitochondria will starve for fuel and not provide your body with the energy it needs to thrive.

Blue Light

To contextualize the role blue light plays in human health, it is important to revisit an important byproduct of cellular respiration within mitochondria. When mitochondria turn electrons and oxygen into energy, there is a byproduct formed known as reactive oxygen species (ROS). ROS play important roles in the body, but in excess they can cause DNA damage and disrupt various cellular processes. For example, UV light causes cancer due to the ROS generated, and studies have found that blue light does the same in both the skin and eyes (Nakashima, Ohta, and Wolf 2017; Abdouh et al. 2024). This research suggests that excess blue light or blue light in isolation can damage the eyes and cause harm like UV light.

Blue and UV light are predominant during the middle of the day. Though both may cause oxidative stress on the body, the body simultaneously counteracts this damage through melatonin. Think of melatonin as the junk remover for mitochondria. Throughout the day mitochondria produce energy, and ROS is formed. During our nighttime sleep, melatonin plays an important role as an antioxidant and removes the excess ROS (Leon et al. 2004).

The relationship between blue light and melatonin is important. During the day, when blue light is present, our body suppresses the production of melatonin (West et al. 2011). When the sun sets and there is no longer a heavy presence of blue light, our body begins to produce melatonin for sleep. This is a central function for how our body gets tired at night and gets ready for sleep. This is also why artificial light at night, from our modern technology, is harmful to human health because it tricks the body into the continual suppression of melatonin production. Without proper melatonin production, our cells buildup too much ROS and this can cause mitochondrial dysfunction and other sleep related issues.

Beyond the importance of getting good sleep and producing melatonin to remove excess ROS from our cells, the existence of artificial light and excess blue light is problematic during the day as well. As stated previously, blue light causes ROS buildup in both the skin and eyes (Nakashima, Ohta, and Wolf 2017; Abdouh et al. 2024). As with most harms from sunlight, our body has adapted with a backup plan. During the day, when blue and UV light is present, there is simultaneous exposure to NIR light (650-1200nm). Recent research suggests that NIR also counterbalances the harm of blue light by increasing melatonin synthesis in the mitochondria (Tan et al. 2023). This highlights the importance of receiving the full spectrum of light from the sun, as one wavelength counterbalances the damages of the other.

Near-Infrared Light

While indoor living has been commonplace for humans across generations, and modern technology has over saturated our bodies with blue light, some recent changes to our technology have made things worse. Incandescent light bulbs emit NIR light, this is why they got warm. However, LED lights do not emit NIR light. Therefore, where people of past generations were potentially exposed to a lot of artificial light at night, this was counterbalanced by the NIR emitted by those same lightbulbs. Now, modern humans use LEDs and spend 93% of our time indoors with zero exposure to NIR, which is 90% of the light emitted by the sun (Tan et al. 2023).

Not only does NIR light protect our bodies from the damaging consequences of blue light, but it similarly protects us against UV light. As stated previously, NIR may result in the production of melatonin within mitochondria during the day, helping protect against the ROS buildup and mtDNA damage. Additionally, research has also found that NIR light protects from UV light in other ways. For example, a study in 2008 found that pretreating skin with NIR light (660nm) prevented sunburns (Barolet and Boucher 2008). Another study found that red and NIR light (620-690nm) altered gene expression and upregulated DNA repair (Kim et al. 2019). Again, this highlights the theme that the body has produced the means to protect itself from the harms of the sun via other rays emitted. However, the protection from harmful rays is best achieved when exposed to the full spectrum of light wavelengths as they change throughout the day. The light of dawn and dusk is predominately red and NIR. Therefore, this research suggests that being exposed to morning light will protect the body from the potentially cancer-causing effects of the UV light later in the day. A human being who lived outside would naturally be exposed to this spectrum of light every day. However, modern humans may be inside in the morning, go to the beach during the middle of the day, and get sunburned because they do not properly receive the full spectrum of light as nature intended every day.

Lastly, it is important to explore the ways NIR improves mitochondrial function. If electrons are the fuel source for this engine, and melatonin is the junk removal, then NIR is the lubricant. NIR improves the energy output of mitochondria, and there are various hypotheses for how this occurs. One hypothesis is that NIR boosts the functionality of cytochrome c oxidase, one of the chromophores used in the electron transport chain (ETC) of cellular respiration within mitochondria (De Freitas and Hamblin 2016). Another involves NIR light’s ability to modify the viscosity of water which increases the efficiency of the final step in the ETC, the ATP synthase (Sommer, Haddad, and Fecht 2015). ATP synthase can be thought of as a kind of pump that produces ATP, in this way NIR can be thought of almost literally as a lubricant for this pump.

Summary

In summary, the research involving how sunlight affects mitochondrial health highlights the importance of the full spectrum of wavelengths, each of which plays a vital role in human health throughout the day. Having exposure to one, without the other, can lead to imbalances and mitochondrial disease. The red and NIR light in the morning helps our mitochondria produce more energy throughout the day, while also preparing our bodies for the beneficial yet dangerous wavelengths to come. In the middle of the day, we receive much more UV and blue light, which help us produce vitamin D and melanin, both central to health and wellness. Once the sun sets, and blue light is absent, we produce melatonin for sleep. During our sleep, the melatonin removes the dangerous byproducts of our energy-producing day, protecting us from disease and preparing us for the following day. Mitochondria are central to human health and life on earth, and the rays from the sun are central to mitochondrial health.

Respecting nature and its cycles is vital for us humans who are increasingly immersing ourselves in a world dominated by technology. Our ancestors did not have to reconcile with these ideas, because life forced these exposures upon them. If we wish to maintain health in our modern world, we must be able to find balance. Even though some might think they can escape into the virtual world, our bodies will always and forever be connected and reliant upon the natural one.

References

Abdouh, Mohamed, Yunxi Chen, Alicia Goyeneche, and Miguel N. Burnier. 2024. “Blue Light-Induced Mitochondrial Oxidative Damage Underlay Retinal Pigment Epithelial Cell Apoptosis.” International Journal of Molecular Sciences 25 (23): 12619.

Barolet, Daniel, and Annie Boucher. 2008. “LED Photoprevention: Reduced MED Response Following Multiple LED Exposures.” Lasers in Surgery and Medicine 40 (2): 106–12.

Birch-Machin, M. A., E. V. Russell, and J. A. Latimer. 2013. “Mitochondrial DNA Damage as a Biomarker for Ultraviolet Radiation Exposure and Oxidative Stress.” The British Journal of Dermatology 169 (s2): 9–14.

Chowdhury, Rajiv, Setor Kunutsor, Anna Vitezova, Clare Oliver-Williams, Susmita Chowdhury, Jessica C. Kiefte-de-Jong, Hassan Khan, et al. 2014. “Vitamin D and Risk of Cause Specific Death: Systematic Review and Meta-Analysis of Observational Cohort and Randomised Intervention Studies.” BMJ (Clinical Research Ed.) 348 (apr01 2): g1903.

De Freitas, Lucas Freitas, and Michael R. Hamblin. 2016. “Proposed Mechanisms of Photobiomodulation or Low-Level Light Therapy.” IEEE Journal of Selected Topics in Quantum Electronics: A Publication of the IEEE Lasers and Electro-Optics Society 22 (3): 348–64.

Dixon, Katie M., Anthony W. Norman, Vanessa B. Sequeira, Ritu Mohan, Mark S. Rybchyn, Vivienne E. Reeve, Gary M. Halliday, and Rebecca S. Mason. 2011. “1α,25(OH)₂-Vitamin D and a Nongenomic Vitamin D Analogue Inhibit Ultraviolet Radiation-Induced Skin Carcinogenesis.” Cancer Prevention Research (Philadelphia, Pa.) 4 (9): 1485–94.

Fell, Gillian L., Kathleen C. Robinson, Jianren Mao, Clifford J. Woolf, and David E. Fisher. 2014. “Skin β-Endorphin Mediates Addiction to UV Light.” Cell 157 (7): 1527–34.

Figge, Frank H. J. 1939. “Melanin: A Natural Reversible Oxidation-Reduction System and Indicator.” Experimental Biology and Medicine (Maywood, N.J.) 41 (1): 127.

Garland, Cedric F., June Jiwon Kim, Sharif Burgette Mohr, Edward Doerr Gorham, William B. Grant, Edward L. Giovannucci, Leo Baggerly, et al. 2014. “Meta-Analysis of All-Cause Mortality According to Serum 25-Hydroxyvitamin D.” American Journal of Public Health 104 (8): e43-50.

Holick, M. F. 1981. “The Cutaneous Photosynthesis of Previtamin D3: A Unique Photoendocrine System.” The Journal of Investigative Dermatology 77 (1): 51–58.

Holick, Michael F. 2007. “Vitamin D Deficiency.” The New England Journal of Medicine 357 (3): 266–81.

Kim, Hyun Soo, Yeo Jin Kim, Su Ji Kim, Doo Seok Kang, Tae Ryong Lee, Dong Wook Shin, Hyoung-June Kim, and Young Rok Seo. 2019. “Transcriptomic Analysis of Human Dermal Fibroblast Cells Reveals Potential Mechanisms Underlying the Protective Effects of Visible Red Light against Damage from Ultraviolet B Light.” Journal of Dermatological Science 94 (2): 276–83.

Leon, Josefa, Dario Acuña-Castroviejo, Rosa M. Sainz, Juan C. Mayo, Dun Xian Tan, and Russel J. Reiter. 2004. “Melatonin and Mitochondrial Function.” Life Sciences. Elsevier Inc. https://doi.org/10.1016/j.lfs.2004.03.003.

Lindqvist, P. G., E. Epstein, K. Nielsen, M. Landin-Olsson, C. Ingvar, and H. Olsson. 2016. “Avoidance of Sun Exposure as a Risk Factor for Major Causes of Death: A Competing Risk Analysis of the Melanoma in Southern Sweden Cohort.” Journal of Internal Medicine 280 (4): 375–87.

Litonjua, Augusto A., Vincent J. Carey, Nancy Laranjo, Benjamin J. Harshfield, Thomas F. McElrath, George T. O’Connor, Megan Sandel, et al. 2016. “Effect of Prenatal Supplementation with Vitamin D on Asthma or Recurrent Wheezing in Offspring by Age 3 Years: The VDAART Randomized Clinical Trial.” JAMA: The Journal of the American Medical Association 315 (4): 362–70.

McCollum, E. V., Nina Simmonds, J. Ernestine Becker, and P. G. Shipley. 1922. “Studies on Experimental Rickets.” The Journal of Biological Chemistry 53 (2): 293–312.

Nakashima, Yuya, Shigeo Ohta, and Alexander M. Wolf. 2017. “Blue Light-Induced Oxidative Stress in Live Skin.” Free Radical Biology & Medicine 108 (July): 300–310.

Prietl, Barbara, Gerlies Treiber, Thomas R. Pieber, and Karin Amrein. 2013. “Vitamin D and Immune Function.” Nutrients 5 (7): 2502–21.

Sommer, Andrei P., Mike Kh Haddad, and Hans Jörg Fecht. 2015. “Light Effect on Water Viscosity: Implication for ATP Biosynthesis.” Scientific Reports 5 (July). https://doi.org/10.1038/srep12029.

Tan, Dun-Xian, Russel J. Reiter, Scott Zimmerman, and Ruediger Hardeland. 2023. “Melatonin: Both a Messenger of Darkness and a Participant in the Cellular Actions of Non-Visible Solar Radiation of near Infrared Light.” Biology 12 (1): 89.

Wacker, Matthias, and Michael F. Holick. 2013. “Sunlight and Vitamin D: A Global Perspective for Health: A Global Perspective for Health.” Dermato-Endocrinology 5 (1): 51–108.

West, Kathleen E., Michael R. Jablonski, Benjamin Warfield, Kate S. Cecil, Mary James, Melissa A. Ayers, James Maida, et al. 2011. “Blue Light from Light-Emitting Diodes Elicits a Dose-Dependent Suppression of Melatonin in Humans.” Journal of Applied Physiology (Bethesda, Md.: 1985) 110 (3): 619–26.

Wicks, Nadine L., Jason W. Chan, Julia A. Najera, Jonathan M. Ciriello, and Elena Oancea. 2011. “UVA Phototransduction Drives Early Melanin Synthesis in Human Melanocytes.” Current Biology: CB 21 (22): 1906.

Wimalawansa, Sunil J. 2023. “Infections and Autoimmunity-the Immune System and Vitamin D: A Systematic Review.” Nutrients 15 (17): 3842.

Yang, Ling, Marie Lof, Marit Bragelien Veierød, Sven Sandin, Hans-Olov Adami, and Elisabete Weiderpass. 2011. “Ultraviolet Exposure and Mortality among Women in Sweden.” Cancer Epidemiology, Biomarkers & Prevention: A Publication of the American Association for Cancer Research, Cosponsored by the American Society of Preventive Oncology 20 (4): 683–90.

- UV – aids in the production of vitamin D and melanin, but also causes DNA damage

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:48

@ 04c915da:3dfbecc9

2025-05-20 15:50:48For years American bitcoin miners have argued for more efficient and free energy markets. It benefits everyone if our energy infrastructure is as efficient and robust as possible. Unfortunately, broken incentives have led to increased regulation throughout the sector, incentivizing less efficient energy sources such as solar and wind at the detriment of more efficient alternatives.

The result has been less reliable energy infrastructure for all Americans and increased energy costs across the board. This naturally has a direct impact on bitcoin miners: increased energy costs make them less competitive globally.

Bitcoin mining represents a global energy market that does not require permission to participate. Anyone can plug a mining computer into power and internet to get paid the current dynamic market price for their work in bitcoin. Using cellphone or satellite internet, these mines can be located anywhere in the world, sourcing the cheapest power available.

Absent of regulation, bitcoin mining naturally incentivizes the build out of highly efficient and robust energy infrastructure. Unfortunately that world does not exist and burdensome regulations remain the biggest threat for US based mining businesses. Jurisdictional arbitrage gives miners the option of moving to a friendlier country but that naturally comes with its own costs.

Enter AI. With the rapid development and release of AI tools comes the requirement of running massive datacenters for their models. Major tech companies are scrambling to secure machines, rack space, and cheap energy to run full suites of AI enabled tools and services. The most valuable and powerful tech companies in America have stumbled into an accidental alliance with bitcoin miners: THE NEED FOR CHEAP AND RELIABLE ENERGY.

Our government is corrupt. Money talks. These companies will push for energy freedom and it will greatly benefit us all.

-

@ 7e538978:a5987ab6

2025-05-20 14:10:38

@ 7e538978:a5987ab6

2025-05-20 14:10:38🧑💻🚀 This bounty has now been claimed - Read more here 🧑💻🚀🧑💻🚀

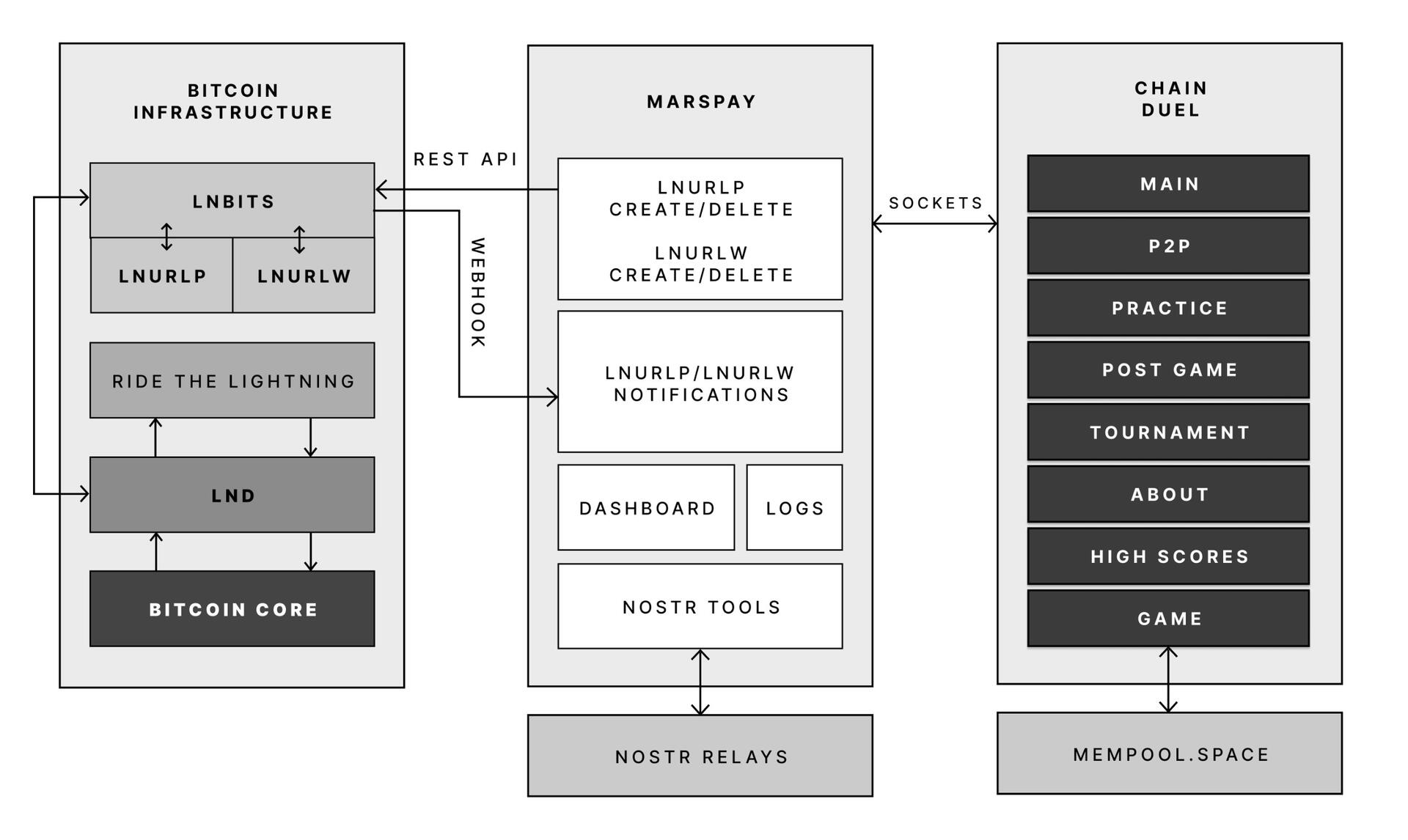

Bounty Specification: Implement a Nostr Wallet Connect Funding Source for LNbits

Project Overview

This project involves the development of a funding source within LNbits that can use a remote NWC wallet service.

Objective

To create a NWC funding source for LNbits that allows for lightning network operations using a remote Nostr Wallet Connect wallet service. This funding source should implement all funding source functions using NWC as defined in the Void funding source stub - https://github.com/lnbits/lnbits/blob/dev/lnbits/wallets/void.py

Deliverables

- NWC Funding Source: Robust funding source for LNbits that implements all funding source functions using NIP-47.

- Documentation: Comprehensive guide including:

- Installation and configuration processes.

- Configuration guidelines to connect with various NWC wallet services.

- Test Suite: Complete set of tests ensuring the functionality works under various scenarios and adheres to the NIP-47 protocol.

- Demonstration: A working demonstration of LNbits acting as a NWC client, performing transactions using a NWC wallet service.

Requirements

- The extension should be implemented in Python to align with the existing LNbits platform.

- Follow the NIP-47 protocol.

- Integration should support asynchronous operations to handle real-time transaction confirmations.

Budget

- Total Bounty: 750,000 sats

- Payment will be made upon final delivery, after successful testing and documentation review.

Evaluation Criteria

- Adherence to the NIP-47 specifications and LNbits integration requirements.

- Security and efficiency of the implementation.

- Quality of documentation and ease of use.

How to Apply

Get in touch with us in the LNbits Telegram channel

-

@ bd32f268:22b33966

2025-05-20 14:07:47

@ bd32f268:22b33966

2025-05-20 14:07:47Recentemente tive conhecimento do mais recente flagelo cuja popularidade espelha bem o estado avançado de degeneração da nossa sociedade, o bebé reborn. Há uns anos certamente não passaria de uma piada de mau gosto quando alguém nos dissesse que decidiu adquirir um boneco para criar como se se tratasse de um filho, infelizmente em 2025 deixou de ser uma piada para se tornar algo assombroso.

Depois de fazer alguma pesquisa sobre o tema percebi que há pessoas que têm em curso processos litigantes judiciais relativos à, note-se com pasmo, guarda da boneca. A insanidade não fica por aqui uma vez que, algumas "mães" procuram atendimento médico para os seus bonecos. No Brasil, a câmara dos deputados recebeu três projetos destinados à criação de políticas públicas relacionadas com estes bonecos. As notícias sobre este fenómeno surreal multiplicam-se à medida que a insanidade se alastra como vírus pelas redes sociais.

Vivemos numa sociedade que há muito se divorciou da realidade, uma sociedade de pós-verdade, por isso de alguma forma não choca que este tipo de coisa possa acontecer. Podemos dizer que de alguma forma existe um primado do sentimento face à razão, preferimos, por vezes com consequências catastróficas, uma mentira "empática" do que uma verdade salvífica. Esta nossa tibieza em afirmar a verdade leva-nos consequentemente a uma crendice insustentável que é esta de, cada um tem a sua verdade. Graças a essa filosofia permitimos que um certo discurso lunático tenha mais alcance no espaço público. Por vezes ingenuamente podemos pensar que se trata de algo inofensivo, sem consequências de maior, contudo a experiência mostra-nos precisamente o contrário. Há por detrás destes fenómenos uma índole corrosiva que funciona como aguilhão para a disseminação das agendas políticas e ideológicas que visam a destruição da família. Considerando a excecional vulnerabilidade psíquica que observamos em cada vez mais pessoas neste tempo e a ampla disseminação destes fenómenos temos razão mais que suficientes para estarmos preocupados.

Uma outra elação que podemos retirar é que a nossa sociedade com as alegadas gerações "mais bem preparadas de sempre" está claramente a produzir um excesso de adultos que se comporta e, a todos os títulos são, crianças funcionais.

Com tudo isto fica cada vez mais difícil viver uma vida harmoniosa com a lei natural, pois vivemos em harmonia com algo considerado opressor pelos apologetas destes produtos do marxismo cultural. Com a pretensa igualdade que se pretende alcançar, equiparando inclusive um boneco a uma bebé, as famílias no sentido próprio do termo ficam em segundo plano relativamente a estes "novos" e esotéricos conceitos de família.

Importa perguntar, no meio de todas essas novas formas de se pensar uma família, qual é o ideal ?

Provavelmente os apologetas destas bizarrices ficarão em silêncio uma vez que coerentemente consideram que todas as formas são iguais e válidas.

Isto é apenas mais um sinal que nos é dado do declínio palpável dos valores que construíram a nossa sociedade e civilização. Façamos algo para que estas nocivas ideologias não entrem no nosso coração e em nossas casas, sob pena da corrupção dos nossos princípios e dos daqueles que nos são queridos. Estes fenómenos são de tal forma doentios que nos levam a crer que vivemos numa época tragicómica, o que me fez lembrar de uma história contada por Kierkgaard e que partilho de seguida.

“Certa vez, houve um incêndio num circo ambulante na Dinamarca. O director mandou imediatamente o palhaço, que já se encontrava vestido e maquilhado a preceito, para a vila mais próxima, à procura de ajuda, advertindo-o de que existia o perigo de o fogo se espalhar pelos campos ceifados e ressequidos, com risco iminente para as casas do próprio povoado. O palhaço correu até à vila e pediu aos moradores que viessem ajudar a apagar o incêndio que estava a destruir o circo. Mas os habitantes viram nos gritos do palhaço apenas um belo truque de publicidade que visaria levá-los a acorrer em grande número às sessões do circo; aplaudiam e desatavam a rir. Diante dessa reacção, o palhaço sentiu mais vontade de chorar do que de rir. Fez de tudo para convencer as pessoas de que não estava a representar, de que não se tratava de um truque e sim de um apelo da maior seriedade: estava realmente em causa um incêndio. Mas a sua insistência só fazia aumentar os risos; eles achavam que a performance estava excelente – até que o fogo alcançou de facto aquela vila. Aí já foi tarde, e o fogo acabou por destruir não só o circo, mas também a povoação”.

Soren Kierkgaard - Filósofo dinamarquês

-

@ 7e538978:a5987ab6

2025-05-20 13:45:12

@ 7e538978:a5987ab6

2025-05-20 13:45:12LNbits now has full NWC support thanks to the work of contributor @riccardobl, who has claimed two LNbits bounties for implementing Nostr Wallet Connect (NWC) support in LNbits.

LNbits can now act both as a wallet service and as a funding source using the Nostr NWC protocol (NIP-47). This opens the door to new integrations with a growing ecosystem of Nostr clients and Lightning wallets.

Two Sides of NWC Integration

The work delivered by Riccardo B comprises two separate peices of work that together implement full support for NWC:

1. LNbits as a Wallet Service

This extension allows LNbits to operate as an always-on wallet service compatible with Nostr Wallet Connect clients such as Damus, Amethyst, or any app supporting NIP-47. Users can connect these Nostr clients to their LNbits instance and create and pay Lightning invoices through it.

This turns your LNbits wallet into a backend Lightning provider for your favourite Nostr app all self-hosted.

2. NWC as a Funding Source

The second piece of work flips the relationship. With this in place, LNbits can now act as an NWC client, meaning it can be funded from any NWC wallet service. This could be another LNbits, Alby, Minibits and more.

Why This Is a Big Deal for LNbits Users

These two bounties make LNbits one of the first applications in the Lightning ecosystem to offer bidirectional NWC support — as both a service and a client. This brings benefits such as:

-

Fund any NWC-compatible app using your LNbits wallet.

-

Fund LNbits using any wallet that supports Nostr Wallet Connect.

-

Build NWC-native apps with LNbits as a backend, or power your own LNbits server using existing wallet infrastructure.

For developers, it’s a chance to build in flexible, interoperable ways. For users, it means more choice, more control, and less friction when managing Lightning payments across apps and devices.

Both of these features were developed and delivered by Riccardo B (@riccardobl), an contributor who took on and completed both LNbits bounties and was extremely helpful during the PR review process. We owe a huge thanks to Riccardo for his work here.

To try them out, read the full article detailing how NWC works with LNbits.

-

-

@ cae03c48:2a7d6671

2025-05-20 21:04:08

@ cae03c48:2a7d6671

2025-05-20 21:04:08Bitcoin Magazine

The Blockchain Group Secures €8.6 Million to Boost Bitcoin StrategyThe Blockchain Group (ALTBG), listed on Euronext Growth Paris and known as Europe’s first Bitcoin Treasury Company, has announced a capital increase of approximately €8.6 million as it pushes forward with its Bitcoin Treasury Company strategy. The funding was raised through two operations, a Reserved Capital Increase and a Private Placement, with both priced at €1.279 per share.

JUST IN:

French company The Blockchain Group raises €8.6 million to buy more #Bitcoin pic.twitter.com/VjTKyFSS6w

French company The Blockchain Group raises €8.6 million to buy more #Bitcoin pic.twitter.com/VjTKyFSS6w— Bitcoin Magazine (@BitcoinMagazine) May 20, 2025

This price represents a 20.18% premium over the 20-day volume-weighted average share price but a 46.26% discount compared to the closing price on May 19, 2025, reflecting recent high share price volatility.

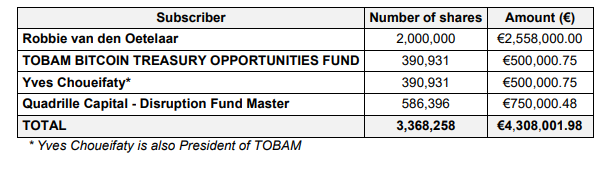

“The Company’s Board of Directors decided on May 19, 2025, using the delegated authority granted by the shareholders’ meeting held on February 21, 2025, under the terms of its 5th resolution, on an issuance, without pre-emptive rights for shareholders, of 3,368,258 new ordinary shares of the Company at a price of €1.2790 per share, including an issuance premium, representing a premium of approximately 20.18% compared to the weighted average of the twenty closing prices of ALTBG shares on Euronext Growth Paris preceding the decision of the Company’s Board of Directors, corresponding to a total subscription amount of €4,308,001.98,” said the press release.

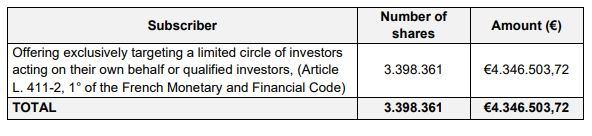

In the Reserved Capital Increase, 3.37 million shares were issued to selected investors, including Robbie van den Oetelaar, TOBAM Bitcoin Treasury Opportunities Fund, and Quadrille Capital, raising over €4.3 million. The Private Placement raised another €4.35 million via the issuance of 3.4 million shares, targeting qualified investors.

“The Board of Directors also decided on a capital increase without pre-emptive rights for shareholders through an offering exclusively targeting a limited circle of investors acting on their own behalf or qualified investor, ” stated the press release.

The funds will support The Blockchain Group’s ongoing strategy of accumulating Bitcoin and expanding its subsidiaries in data intelligence, AI, and decentralized tech. Following this capital increase, the company’s share capital stands at €4.37 million, divided into over 109 million shares.

“The funds raised through the Capital Increase will enable the Company to strengthen its Bitcoin Treasury Company strategy, consisting in the accumulation of Bitcoin, while continuing to develop the operational activities of its subsidiaries,” said the press release.

Additionally, on May 12, The Blockchain Group announced it secured approximately €12.1 million through a convertible bond issuance reserved for Adam Back, CEO of Blockstream.

This post The Blockchain Group Secures €8.6 Million to Boost Bitcoin Strategy first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:44:28

@ 6ad3e2a3:c90b7740

2025-05-20 13:44:28I https://www.chrisliss.com/p/mstr a few months ago with the subtitle “The Only Stock,” and I’m starting to regret it. Now, it was trading at 396 on January 20 when I posted it and 404 now (even if it dipped 40 percent to 230 or so in between), but that’s not why I regret it. I pointed out it was not investable unless you’re willing to stomach large drawdowns, and anyone who bought then could exit with a small profit now had they not panic-sold along the way.

The reason I regret it is I don’t want to make public stock predictions because it adds stress to my life. I have not sold any of my shares yet, but something I’ve noticed recently has got me thinking about it, and stock tips are like a game of telephone wherein whoever is last in the chain might find out the wrong information and too late. And while every adult has agency and is responsible for his own financial decisions, I don’t want my readers losing money on account of anything I write.

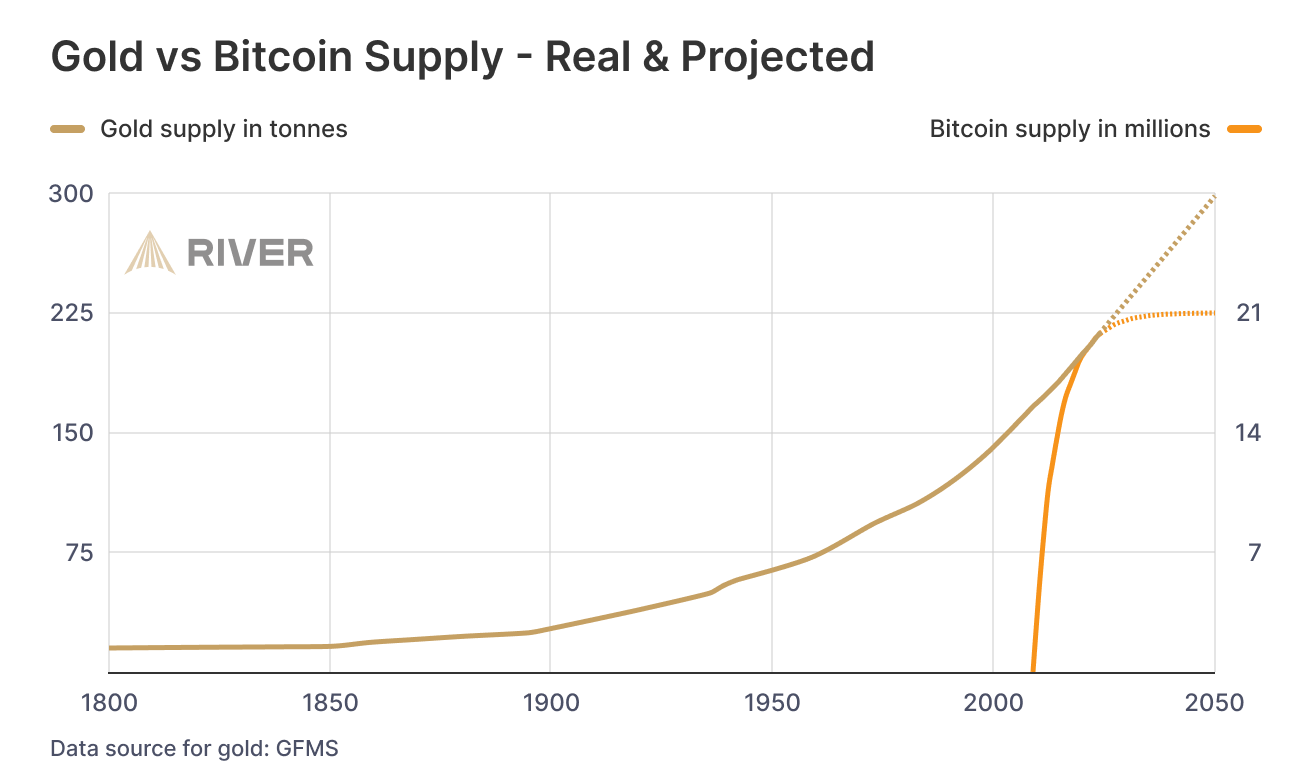

My base case is still that MSTR becomes a trillion-dollar company, destroys the performance of the S&P, the Mag-7 and virtually any other equity portfolio most people would assemble. Michael Saylor is trading an infinitely-printable asset (his shares) for humanity’s best-ever, finite-supply digital gold, and that trade should be profitable for him and his shareholders in perpetuity.

I don’t know exactly what he plans to do when that trade is no longer available to him — either because no one takes fiat currency for bitcoin anymore or because his mNAV (market-cap-to-bitcoin-holding ratio) goes below one — but that’s not my main concern, either. At that point he’ll have so much bitcoin, he’ll probably become the world’s first and largest bitcoin bank and profit by making his pristine collateral available to individuals and institutions. Even at five percent interest, half a trillion in bitcoin would yield $25B in profits every year. Even at a modest 10x valuation, the stock would more than double from here.

I am also not overly concerned with Saylor’s present amount of convertible debt which is at low or zero rates and is only https://www.strategy.com/. He’s been conservative on that front and only issuing on favorable terms. I don’t doubt Saylor’s prescience, intelligence or business sense one bit.

What got me thinking were some Twitter posts by a former Salomon Brothers trader/prophet Josh Mandell https://x.com/JoshMandell6/status/1921597739458339193 recently. In November when bitcoin was mooning after the election, he predicted that on March 14th it would close at $84,000, and if it did it would then go on an epic run up to $444,000 this cycle.

A lot of people make predictions, a few of them come true, but rarely do they come true on the dot (it closed at exactly $84K according to some exchanges) and on such a specific timeframe. Now, maybe he just got lucky, or maybe he is a skilled trader who made one good prediction, but the reason he gave for his prediction, insofar as he gave one, was not some technical chart or quantitative analysis, but a memory he had from 30 years ago that got into his mind that he couldn’t shake. He didn’t get much more specific than that, other than that he was tuned into something that if he explained fully would make too many people think he had gone insane. And then the prediction came true on the dot months later.