-

@ 6a6be47b:3e74e3e1

2025-05-27 16:36:21

@ 6a6be47b:3e74e3e1

2025-05-27 16:36:21🔍 Today was one of those days where I dove deeper into the world of Stacker News, exploring how wallets work and all that jazz. If you have any tips or tricks, please send them my way—I’m still figuring it all out!

After my tech adventures, I turned to drawing. Usually, I have a lineup of ideas ready to go, but none of them quite fit my mood today. Then I remembered the butterflies from my upcoming blog entry—can you guess what I’m writing and painting about? 👀

🦋Even though I’ve painted butterflies before here’s one on Instagram, I felt like revisiting them.

This one I posted on Nostr, a while ago

Lately, I’ve been seeing butterflies everywhere on my walks with my dog, and they just felt right for today’s art session. So here’s to butterflies and their beautiful symbolism!

In Celtic mythology, there’s an old Irish saying:

“Butterflies are souls of the dead waiting to pass through Purgatory.” From mindbodygreen.com

It’s no wonder butterflies are often seen as symbols of rebirth. Even Aristotle named the butterfly:

“Psyche,” the Greek word for “soul.” From learnreligions.com

☀️With the weather warming up, days growing longer, and the air full of new scents (and butterfly sightings!🦋), I invite you to really enjoy this season. After drawing today’s butterfly, I realized how freeing it is to just let go and create—no pressure, just fun. Sometimes, taking even a few mindful minutes to do something you love can work wonders—maybe even a little magic.

Hope to catch you on the next one, frens. Godspeed! ✨

Today's butterfly. I drew it on Procreate.

https://stacker.news/items/990470

-

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06Star Wars is often viewed as a myth of rebellion, freedom, and resistance to tyranny. The iconography—scrappy rebels, totalitarian stormtroopers, lone smugglers—suggests a deep anti-authoritarian ethos. Yet, beneath the surface, the narrative arc of Star Wars consistently affirms the necessity, even sanctity, of central authority. This blog entry introduces the question: Is Star Wars fundamentally a celebration of statism?

Rebellion as Restoration, Not Revolution

The Rebel Alliance’s mission is not to dismantle centralized power, but to restore the Galactic Republic—a bureaucratic, centrally governed institution. Characters like Mon Mothma and Bail Organa are high-ranking senators, not populist revolutionaries. The goal is to remove the corrupt Empire and reinstall a previous central authority, presumed to be just.

- Rebels are loyalists to a prior state structure.

- Power is not questioned, only who wields it.

Jedi as Centralized Moral Elites

The Jedi, often idealized as protectors of peace, are unelected, extra-legal enforcers of moral and military order. Their authority stems from esoteric metaphysical abilities rather than democratic legitimacy.

- They answer only to their internal Council.

- They are deployed by the Senate, but act independently of civil law.

- Their collapse is depicted as tragic not because they were unaccountable, but because they were betrayed.

This positions them as a theocratic elite, not spiritual anarchists.

Chaos and the Frontier: The Case of the Cantina

The Mos Eisley cantina, often viewed as a symbol of frontier freedom, reveals something darker. It is: - Lawless - Violent - Culturally fragmented

Conflict resolution occurs through murder, not mediation. Obi-Wan slices off a limb; Han shoots first—both without legal consequence. There is no evidence of property rights, dispute resolution, or voluntary order.

This is not libertarian pluralism—it’s moral entropy. The message: without centralized governance, barbarism reigns.

The Mythic Arc: Restoration of the Just State

Every trilogy in the saga returns to a single theme: the fall and redemption of legitimate authority.

- Prequels: Republic collapses into tyranny.

- Originals: Rebels fight to restore legitimate order.

- Sequels: Weak governance leads to resurgence of authoritarianism; heroes must reestablish moral centralism.

The story is not anti-state—it’s anti-bad state. The solution is never decentralization; it’s the return of the right ruler or order.

Conclusion: The Hidden Statism of a Rebel Myth

Star Wars wears the costume of rebellion, but tells the story of centralized salvation. It: - Validates elite moral authority (Jedi) - Romanticizes restoration of fallen governments (Republic) - Portrays decentralized zones as corrupt and savage (outer rim worlds)

It is not an anarchist parable, nor a libertarian fable. It is a statist mythology, clothed in the spectacle of rebellion. Its core message is not that power should be abolished, but that power belongs to the virtuous few.

Question to Consider:

If the Star Wars universe consistently affirms the need for centralized moral and political authority, should we continue to see it as a myth of freedom? Or is it time to recognize it as a narrative of benevolent empire? -

@ 5d4b6c8d:8a1c1ee3

2025-05-27 13:34:45

@ 5d4b6c8d:8a1c1ee3

2025-05-27 13:34:45Is the housing market going to crash for real this time?

https://primal.net/e/nevent1qvzqqqqqqypzp6dtxy5uz5yu5vzxdtcv7du9qm9574u5kqcqha58efshkkwz6zmdqqs8dqr35dc0npsc8cuulqm4m7gxrgqq3ytphtja9nx534a592gztzsuzsrja

https://stacker.news/items/990316

-

@ cefb08d1:f419beff

2025-05-27 09:36:52

@ cefb08d1:f419beff

2025-05-27 09:36:52Gabriela Bryan vs Caitlin Simmers | Western Australia Margaret River Pro 2025 - Final

https://www.youtube.com/watch?v=2GK8l3RPqmE

Jordy Smith vs Griffin Colapinto | Western Australia Margaret River Pro 2025 - Final

https://www.youtube.com/watch?v=zGWMVDwU_is

Highlights: Western Australia Margaret River Pro 2025 - All the Highlights

https://www.youtube.com/watch?v=32055IXrtnU

Ranking WSL Women:

Ranking WSL Men:

Source: https://www.worldsurfleague.com/athletes/tour/wct?year=2025

https://stacker.news/items/990198

-

@ 39cc53c9:27168656

2025-05-27 09:21:53

@ 39cc53c9:27168656

2025-05-27 09:21:53The new website is finally live! I put in a lot of hard work over the past months on it. I'm proud to say that it's out now and it looks pretty cool, at least to me!

Why rewrite it all?

The old kycnot.me site was built using Python with Flask about two years ago. Since then, I've gained a lot more experience with Golang and coding in general. Trying to update that old codebase, which had a lot of design flaws, would have been a bad idea. It would have been like building on an unstable foundation.

That's why I made the decision to rewrite the entire application. Initially, I chose to use SvelteKit with JavaScript. I did manage to create a stable site that looked similar to the new one, but it required Jav aScript to work. As I kept coding, I started feeling like I was repeating "the Python mistake". I was writing the app in a language I wasn't very familiar with (just like when I was learning Python at that mom ent), and I wasn't happy with the code. It felt like spaghetti code all the time.

So, I made a complete U-turn and started over, this time using Golang. While I'm not as proficient in Golang as I am in Python now, I find it to be a very enjoyable language to code with. Most aof my recent pr ojects have been written in Golang, and I'm getting the hang of it. I tried to make the best decisions I could and structure the code as well as possible. Of course, there's still room for improvement, which I'll address in future updates.

Now I have a more maintainable website that can scale much better. It uses a real database instead of a JSON file like the old site, and I can add many more features. Since I chose to go with Golang, I mad e the "tradeoff" of not using JavaScript at all, so all the rendering load falls on the server. But I believe it's a tradeoff that's worth it.

What's new

- UI/UX - I've designed a new logo and color palette for kycnot.me. I think it looks pretty cool and cypherpunk. I am not a graphic designer, but I think I did a decent work and I put a lot of thinking on it to make it pleasant!

- Point system - The new point system provides more detailed information about the listings, and can be expanded to cover additional features across all services. Anyone can request a new point!

- ToS Scrapper: I've implemented a powerful automated terms-of-service scrapper that collects all the ToS pages from the listings. It saves you from the hassle of reading the ToS by listing the lines that are suspiciously related to KYC/AML practices. This is still in development and it will improve for sure, but it works pretty fine right now!

- Search bar - The new search bar allows you to easily filter services. It performs a full-text search on the Title, Description, Category, and Tags of all the services. Looking for VPN services? Just search for "vpn"!

- Transparency - To be more transparent, all discussions about services now take place publicly on GitLab. I won't be answering any e-mails (an auto-reply will prompt to write to the corresponding Gitlab issue). This ensures that all service-related matters are publicly accessible and recorded. Additionally, there's a real-time audits page that displays database changes.

- Listing Requests - I have upgraded the request system. The new form allows you to directly request services or points without any extra steps. In the future, I plan to enable requests for specific changes to parts of the website.

- Lightweight and fast - The new site is lighter and faster than its predecessor!

- Tor and I2P - At last! kycnot.me is now officially on Tor and I2P!

How?

This rewrite has been a labor of love, in the end, I've been working on this for more than 3 months now. I don't have a team, so I work by myself on my free time, but I find great joy in helping people on their private journey with cryptocurrencies. Making it easier for individuals to use cryptocurrencies without KYC is a goal I am proud of!

If you appreciate my work, you can support me through the methods listed here. Alternatively, feel free to send me an email with a kind message!

Technical details

All the code is written in Golang, the website makes use of the chi router for the routing part. I also make use of BigCache for caching database requests. There is 0 JavaScript, so all the rendering load falls on the server, this means it needed to be efficient enough to not drawn with a few users since the old site was reporting about 2M requests per month on average (note that this are not unique users).

The database is running with mariadb, using gorm as the ORM. This is more than enough for this project. I started working with an

sqlitedatabase, but I ended up migrating to mariadb since it works better with JSON.The scraper is using chromedp combined with a series of keywords, regex and other logic. It runs every 24h and scraps all the services. You can find the scraper code here.

The frontend is written using Golang Templates for the HTML, and TailwindCSS plus DaisyUI for the CSS classes framework. I also use some plain CSS, but it's minimal.

The requests forms is the only part of the project that requires JavaScript to be enabled. It is needed for parsing some from fields that are a bit complex and for the "captcha", which is a simple Proof of Work that runs on your browser, destinated to avoid spam. For this, I use mCaptcha.

-

@ 39cc53c9:27168656

2025-05-27 09:21:51

@ 39cc53c9:27168656

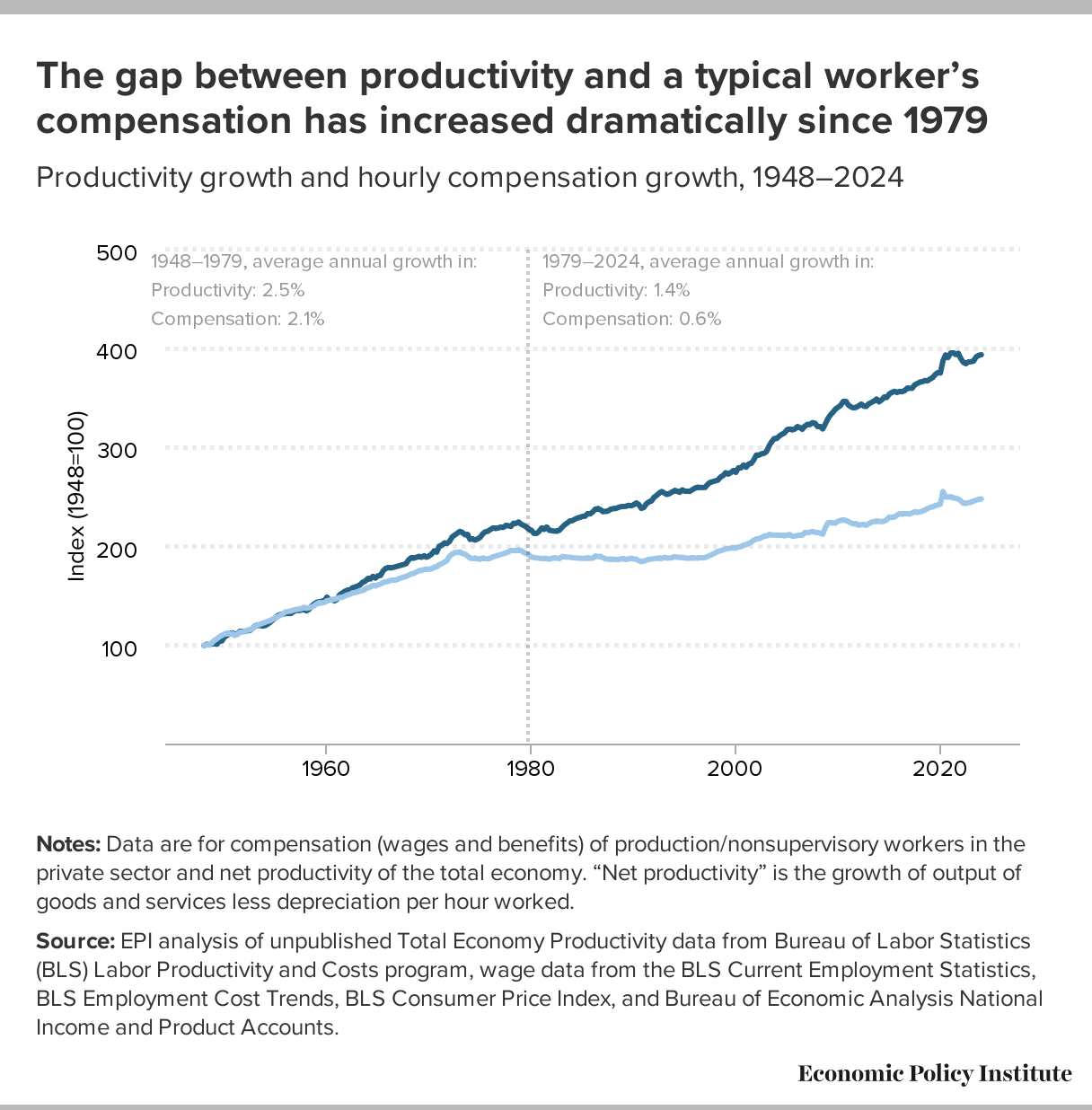

2025-05-27 09:21:51Know Your Customer is a regulation that requires companies of all sizes to verify the identity, suitability, and risks involved with maintaining a business relationship with a customer. Such procedures fit within the broader scope of anti-money laundering (AML) and counterterrorism financing (CTF) regulations.

Banks, exchanges, online business, mail providers, domain registrars... Everyone wants to know who you are before you can even opt for their service. Your personal information is flowing around the internet in the hands of "god-knows-who" and secured by "trust-me-bro military-grade encryption". Once your account is linked to your personal (and verified) identity, tracking you is just as easy as keeping logs on all these platforms.

Rights for Illusions

KYC processes aim to combat terrorist financing, money laundering, and other illicit activities. On the surface, KYC seems like a commendable initiative. I mean, who wouldn't want to halt terrorists and criminals in their tracks?

The logic behind KYC is: "If we mandate every financial service provider to identify their users, it becomes easier to pinpoint and apprehend the malicious actors."

However, terrorists and criminals are not precisely lining up to be identified. They're crafty. They may adopt false identities or find alternative strategies to continue their operations. Far from being outwitted, many times they're several steps ahead of regulations. Realistically, KYC might deter a small fraction – let's say about 1% ^1 – of these malefactors. Yet, the cost? All of us are saddled with the inconvenient process of identification just to use a service.

Under the rhetoric of "ensuring our safety", governments and institutions enact regulations that seem more out of a dystopian novel, gradually taking away our right to privacy.

To illustrate, consider a city where the mayor has rolled out facial recognition cameras in every nook and cranny. A band of criminals, intent on robbing a local store, rolls in with a stolen car, their faces obscured by masks and their bodies cloaked in all-black clothes. Once they've committed the crime and exited the city's boundaries, they switch vehicles and clothes out of the cameras' watchful eyes. The high-tech surveillance? It didn’t manage to identify or trace them. Yet, for every law-abiding citizen who merely wants to drive through the city or do some shopping, their movements and identities are constantly logged. The irony? This invasive tracking impacts all of us, just to catch the 1% ^1 of less-than-careful criminals.

KYC? Not you.

KYC creates barriers to participation in normal economic activity, to supposedly stop criminals. ^2

KYC puts barriers between many users and businesses. One of these comes from the fact that the process often requires multiple forms of identification, proof of address, and sometimes even financial records. For individuals in areas with poor record-keeping, non-recognized legal documents, or those who are unbanked, homeless or transient, obtaining these documents can be challenging, if not impossible.

For people who are not skilled with technology or just don't have access to it, there's also a barrier since KYC procedures are mostly online, leaving them inadvertently excluded.

Another barrier goes for the casual or one-time user, where they might not see the value in undergoing a rigorous KYC process, and these requirements can deter them from using the service altogether.

It also wipes some businesses out of the equation, since for smaller businesses, the costs associated with complying with KYC norms—from the actual process of gathering and submitting documents to potential delays in operations—can be prohibitive in economical and/or technical terms.

You're not welcome

Imagine a swanky new club in town with a strict "members only" sign. You hear the music, you see the lights, and you want in. You step up, ready to join, but suddenly there's a long list of criteria you must meet. After some time, you are finally checking all the boxes. But then the club rejects your membership with no clear reason why. You just weren't accepted. Frustrating, right?

This club scenario isn't too different from the fact that KYC is being used by many businesses as a convenient gatekeeping tool. A perfect excuse based on a "legal" procedure they are obliged to.

Even some exchanges may randomly use this to freeze and block funds from users, claiming these were "flagged" by a cryptic system that inspects the transactions. You are left hostage to their arbitrary decision to let you successfully pass the KYC procedure. If you choose to sidestep their invasive process, they might just hold onto your funds indefinitely.

Your identity has been stolen

KYC data has been found to be for sale on many dark net markets^3. Exchanges may have leaks or hacks, and such leaks contain very sensitive data. We're talking about the full monty: passport or ID scans, proof of address, and even those awkward selfies where you're holding up your ID next to your face. All this data is being left to the mercy of the (mostly) "trust-me-bro" security systems of such companies. Quite scary, isn't it?

As cheap as $10 for 100 documents, with discounts applying for those who buy in bulk, the personal identities of innocent users who passed KYC procedures are for sale. ^3

In short, if you have ever passed the KYC/AML process of a crypto exchange, your privacy is at risk of being compromised, or it might even have already been compromised.

(they) Know Your Coins

You may already know that Bitcoin and most cryptocurrencies have a transparent public blockchain, meaning that all data is shown unencrypted for everyone to see and recorded forever. If you link an address you own to your identity through KYC, for example, by sending an amount from a KYC exchange to it, your Bitcoin is no longer pseudonymous and can then be traced.

If, for instance, you send Bitcoin from such an identified address to another KYC'ed address (say, from a friend), everyone having access to that address-identity link information (exchanges, governments, hackers, etc.) will be able to associate that transaction and know who you are transacting with.

Conclusions

To sum up, KYC does not protect individuals; rather, it's a threat to our privacy, freedom, security and integrity. Sensible information flowing through the internet is thrown into chaos by dubious security measures. It puts borders between many potential customers and businesses, and it helps governments and companies track innocent users. That's the chaos KYC has stirred.

The criminals are using stolen identities from companies that gathered them thanks to these very same regulations that were supposed to combat them. Criminals always know how to circumvent such regulations. In the end, normal people are the most affected by these policies.

The threat that KYC poses to individuals in terms of privacy, security and freedom is not to be neglected. And if we don’t start challenging these systems and questioning their efficacy, we are just one step closer to the dystopian future that is now foreseeable.

Edited 20/03/2024 * Add reference to the 1% statement on Rights for Illusions section to an article where Chainalysis found that only 0.34% of the transaction volume with cryptocurrencies in 2023 was attributable to criminal activity ^1

-

@ 491afeba:8b64834e

2025-05-27 21:02:29

@ 491afeba:8b64834e

2025-05-27 21:02:29Quando adolescente eu acreditava na coerência da teoria de "amor líquido" do polonês, sociólogo, Zygmunt Bauman, apresentada no livro "Amor Líquido: Sobre a Fragilidade dos Laços Humanos", qual no meu amadurecimento em estudos, sejam eles no meio acadêmico ou fora, percebo como uma das formas mais rasas de explicar as mudanças e transformações dos padrões de relações sócio-afetivas dos humanos. A seguir colocar-me-ei na minha juventude não tanto recente, direi então que nós, se adolescentes e conservadores, ou mesmo jovens adultos mais conservadores, costumamos levar como dogma uma óptica decadentista generalizada de todos os avanços de eras dos homens, universalizamos por nos ser comum a indistinção entre humanidade e humanidades, ou mesmo "humanity" e "humankind" ("humanidade" como espécime e "humanidade" como um universal), compreendemos toda "essas" como "essa" e indistinguimos as sociedades para com os homens, ou seja, a incapacidade de definir os seres dentro de suas respectivas singularidades e especificidades nos leva ao decadentismo generalista (a crença de que de forma geral, e universal, a "civilização universal" decai moralmente, éticamente, materialmente e espiritualmente), que aparente à nós determinadas mudanças nas relações humanas quanto ao caráter sócio-afetivo, por falta de profundidade e critérios ainda sobre questões alinhadas aos métodos e coerências, ou incoerências, lógicas, nós se jovens e conservadores somos levados ao engodo de concordar com a teoria do amor líquido de Bauman, que devo cá explicar de antemão: trata ela, a teoria, o padrão de "amor" dos tempos presentes como frágil, de prazo (curto e médio) e diferente em grau comparativamente ao amor comum das eras passadas.

Aos jovens mais progressistas opera uma compreensão dialética sobre as eras dos homens nos seu tempo presente, na qual ao tempo que o ser progride ele também regride simultaneamente, ou seja, a medida que aparecem contradições advindas de transformações materiais da realidade humana o ser supera essas contradições e progride em meio as transformações, ainda fazendo parte da lógica dessa indissociavelmente, assim constantemente progredindo e regredindo, havendo para esses dois vetores de distinção: o primeiro é o que releva questões espirituais como ao caráter do pensamento "new age", o segundo ignora essas questões por negar a existência da alma, seguem ao materialismo. Cedem em crer na teoria baumaninana como dogma, pois não encontram outros meios para explicar as transformações da sociedade na esfera sócio-afetiva sem que haja confrontamento direto com determinadas premissas assim pertinemente presentes, ou por não conciliarem com análises relativamente superiores, como a de Anthony Giddens sobre a "relação pura" em "A Transformação da Intimidade" e de François de Singly apresentada em "Sociologie du Couple".

!(image)[https://i.pinimg.com/736x/6f/b4/9e/6fb49eda2c8cf6dc837a0abfc7e108e6.jpg]

Há um problema quando uma teoria deixa de assim ser para vir a tornar-se mais um elemento desconexo da ciência, agora dentro da cultura pop, se assim podemos dizer, ou da cultura de massa, ou se preferirem mesmo "anticultura", esse problema é a sua deformização teórica, tornando-se essa rasa para sua palatabilidade massiva, somada a incapacidade de partes da sociedade civil em compreender as falhas daquilo que já foi massificado. Tive surpresa ao entender que muitos outros compartilham da mesma opinião, a exemplo, possuo um amigo na faculdade, marxista, que ao falarmos sobre nossos projetos de pesquisa, citou ele o projeto de um de nossos colegas, no qual esse referido um de nossos colegas faria seu projeto com base na teoria do amor líquido de Bauman, então alí demos risada disso, ora, para nós a teoria baumaniana é furada, passamos a falar sobre Bauman e o motivo pelo qual não gostávamos, lá fiquei até surpreso em saber que mais gente além de mim não gostava da teoria de Bauman, pois ao que eu via na internet era rede de enaltecimentos à figura e à sua teoria, tal como fosse uma revelação partindo de alguma divindade da Idade do Bronze. Pouco tempo depois tive em aula de teoria política uma citação de Bauman partindo do professor que ministrava a disciplina, no entanto, ao citar o nome de Bauman o mesmo fez uma feição na qual aparentava segurar risada, provavelmente ele também não levava Bauman à sério. Não devo negar que todas as vezes que vejo o sociólogo sendo citado em alguma nota no X, no Instagram ou qualquer outra rede social, tal como fosse um referencial teórico bom, sinto uma vergonha alheia pois alí tenho uma impressão de que a pessoa não leu Bauman e usa o referencial teórico como um fato já assim provado e comprovado.

Há pontos positivos na teoria baumaniana, como a capacidade de perceber o problema e correlacioná-lo à modernidade, assim como sucitar a influência do que há de material no fenômeno, porém os erros são pertinentes: o primeiro problema é de categoria. Não há, por parte de Bauman noção alguma entre as dissociações dos amores, não há atenção sobre o amor como estrutura ou ele como um sentimento, todo ele é compreendido uniformemente como "amor", partindo do pressuposto que todas as relações, todas elas, são firmadas com base no amor. Essa crença tem uma origem: Hegel. Nos Escritos Teológicos Hegel partia da crença que o amor ligava os seres relacionalmente como uma força de superação e alienação, mas há de compreendermos que esse Friedrich Hegel é o jovem ainda pouco maduro em suas ideias e seu sistema de pensamento, mais a frente, em "Fenomenologia do Espírito e na Filosofia do Direito", Hegel compreende a institucionalidade do direito no amor e a institucionalização dessa força, assim aproxima-se da realidade a respeito da inserção do amor nas esferas práticas do humano, porém essa ideia, apesar de imperfeita, pois ao que sabemos não é o amor que consolida a relação, mas sim a Verdade (Alétheia), conforme apontado por Heidegger em "Ser e Tempo", essa ideia do amor como a fundamento das relações humanas influenciou, e até hoje influencia, qualquer análise sobre as relações humanas fora da esfera materialista, fora dessa pois, melhormente explicado em exemplo, os marxistas (em exemplo), assim como Marx, consideram como base primordial das relações as condições materiais.

Por certo, não é de todo amor a base para a solidificação, ora, erram aqueles que creem que somente essa força, assim apontada por Hegel, constituiam todos os relacionamentos formais como pilares fundamentais, pois em prática as famílias eram até a fiduciarização dessas, por mais paradoxal que seja, compreendidas melhor como instituições orgânicas de caráter legal do que conluios de afetividades. A família outrora tinha consigo aparelhos de hierarquia bem estabelicidos, quais prezavam pela ordem interna e externa, que acima dessa instituição estava somente a Igreja (outra instituição), com sua fiduciarização [da família] após o movimento tomado pelos Estados nacionais em aplicação do casamento civil mudou-se a lógica das partes que a compõe, findou-se o princípio da subsidiariedade (não intervenção de determinadas instituições nas decisões quais podem ser exercidas em resuluções de problemas nas competências de quaisquer instituições), foi-se então, contudo, também a autoridade, e nisso revela-se um outro problema não apontado na teoria de Bauman: qual o padrão do amor "sólido"? Pois, ora, sociedades tradicionais não abdicavam do relevar dos amores para tornar seus filhos em ativos nas práticas de trocas (dádivas)? É notório que esse padrão se dissocia do padrão de sentimento apontado por Bauman, encontramos esse fato em estudo nos trabalhos "Ensaio Sobre a Dádiva", do Marcel Mauss, e "As Estruturas Elementares do Parentesco", do Claude Levi-Strauss, quais expõem que nas sociedades "sólidas", tradicionais, relevava-se mais questões institucionais que as sentimentais para a formação de laços (teoria da aliança). Muitas das relações passadas não eram baseadas no amor, não significando assim que as de hoje, em oposição, sejam, mas que permanecem-se semelhantes em base, diferentemente em grau e forma.

!(image)[https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F748b94c3-f882-45db-8333-09260ef15cfe_615x413.jpeg]

Ora, ainda existem casamentos motivados pela política, pelo status, pelo prestígio, pelos bens, pelo poder, pela influência familiar e assim sucetivamente, tal como no passado, ocorre que essa prática tornou-se oculta, não mais explícita e aparente, devo dizer ainda que em partes, pois prepondera em nosso tempo uma epidemia de adultérios, fornicações, práticas lascivas e demais práticas libertinosas explicitamente, em contraposição às práticas ocultas em vergonhas de sociedades sem declínio moral e espiritual, o que nos leva a questionar o método comparativo em dicotomia temporal "presente x passado" aplicado por Bauman, no qual segue-se da seguinte forma:

Transformação Passado = *sólido* | Presente = *líquido* Categorias Padrão de amor: tradicional (*sólido*) moderno (*líquido*) *Sólido* = estável, prazo (médio-grande), profundo, determinado. *Líquido* = instável, prazo (curto-médio), raso, indeterminado.O que penso é: Zygmunt Bauman buscou uma explicação material e laical para desviar ao fato de que há uma notória correlação entre espiritualização da sociedade, se voltada à Verdade, com a estabilidade das instituições, o que é já reduzido à moral religiosa, somente, não à mística, como por pensadores da linha de Tocqueville, ou em abordagens também mais laical (positivista) porém ainda relevantes, como Émile Durkheim em "As Formas Elementares da Vida Religiosa" e Max Weber em "A Ética Protestante e o Espírito do Capitalismo", contrapondo uma abordage mais voltada, de fato, a espiritualidade, como Christopher Dawnson, que defende essa teoria em "Religião e o Surgimento da Cultura Ocidental", e Eric Voegelin, principalmente nas obras "A Nova Ciência da Política" e "Ordem e História".

Encerrrando, minha cosmovisão é a católica, o sistema de crença e religião qual sigo é do Deus que se fez homem por amor aos seus filhos, não posso negar ou mesmo omitir o fato de que, por trás de toda a minha crítica estão meus pensamentos e minhas convicções alinhadas àquilo que mais tenho amor em toda minha vida: a Verdade, e a Verdade é Deus, pois Cristo é a Verdade, o Caminho e a Vida, ninguém vai ao Pai se não por Ele, e pois bem, seria incoerência de minha parte não relevar o fato de crença como um dos motivos pelos quais eu rejeito a teoria do amor líquido de Zygmunt Bauman, pois os amores são todos eles praticados por formas, existem por diferentes formas e assim são desde sua tradicionalidade até o predomínio das distorções de declínio espiritual das eras presentes (e também antigas pré-Era Axial), estão esses preservados pelo alinhamento à verdade, assim são indistorcíveis, imutáveis, ou seja, amor é amor, não releva-se o falso amor como um, simplesmente não o é, assim o interesse, a sanha por bens, o egoísmo e a egolatria ("cupiditas", para Santo Agostinho de Hipona, em oposição ao que o santo e filósofo trata por "caritas") não são formas do amor, são autoenganos, não bons, se não são bons logo não são de Deus, ora, se Deus é amor, se ele nos ama, determino como amor (e suas formas) o que está de acordo com a Verdade. Aprofundando, a Teologia do Corpo, do Papa São João Paulo II, rejeita a "liquidez" apresentada por Bauman, pois o amor é, em suma, sacríficio, parte da entrega total de si ao próximo, e se não há logo não é amor. A Teologia do Corpo rejeita não os fundamentos de mentira no "líquido", mas também no "sólido", pois a tradicionalidade não é sinônimo de bom e pleno acordo com o amor que Deus pede de nós, não são as coerções, as violências, as imposições e demais vontades em oposição às de Deus que determinam os amores -- fatos em oposição ao ideário romanticizado. Claro, nem todas as coerções são por si inválidas do amor, ou mesmo as escolhas em trocas racionalizadas, a exemplo do autruísmo em vista da chance da família ter êxito e sucesso, ou seja, pelo bem dos próximos haver a necessidade de submissão a, em exemplo, um casamento forjado, ou algo do gênero, reconhece-se o amor no ato se feito por bem da família, porém o amor incutido, nesse caso, explicita o caráter sacrificial, no qual uma vontade e um amor genuinamente potencial em prazeres e alegrias são anulados, ou seja, mesmo nesse modelo tradicional na "solidez" há possibilidade do amor, não nas formas romanticizadas em critérios, como "estabilidade" e "durabilidade", mas no caráter do sacríficio exercido. Conforme nos ensina São Tomás de Aquino, o amor não é uma "força", tal como ensina Hegel, mas sim uma virtude teologal conforme na "Suma Teológica" (II-II Q. 26-28), não devemos reduzir o amor e os amores em análises simplórias (não simples) de falsa complexidade extraídas em métodos questionáveis e pouco competentes à real diensão de crise espiritual das eras, por esse motivo não concordo com a teoria do amor líquido de Zygmunt Bauman.

-

@ 7f6db517:a4931eda

2025-05-27 20:01:40

@ 7f6db517:a4931eda

2025-05-27 20:01:40

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 5391098c:74403a0e

2025-05-27 18:20:42

@ 5391098c:74403a0e

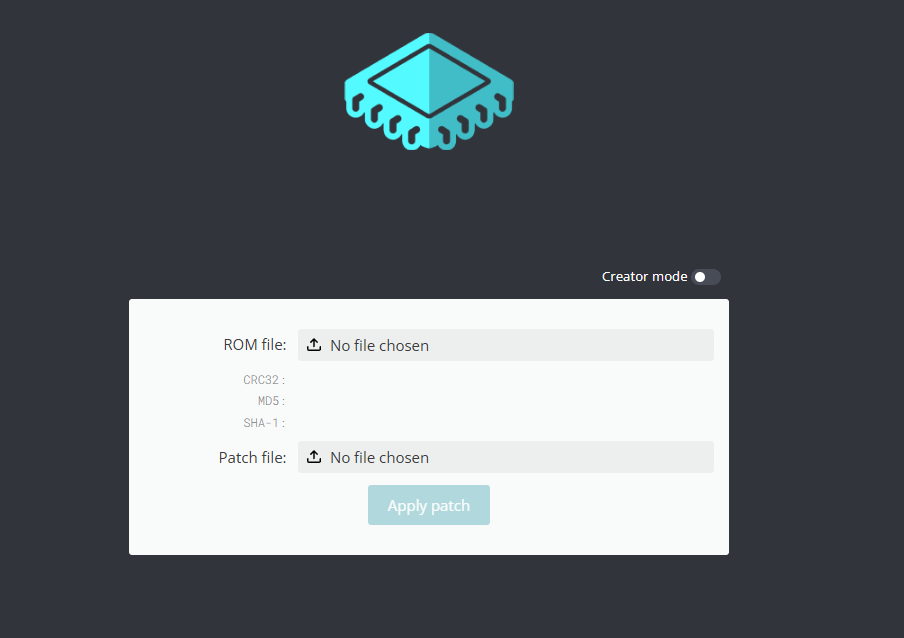

2025-05-27 18:20:42Você trabalha 5 meses do ano somente para pagar impostos. Ou seja, 42% da sua renda serve para bancar serviços públicos de péssima qualidade. Mesmo que você tivesse a liberdade de usar esses 42% da sua renda para contratar serviços privados de qualidade (saúde, segurança e ensino), ainda assim você seria um escravo porque você recebe dinheiro em troca do seu trabalho, e o dinheiro perde cerca de 10% do valor a cada ano. Em outras palavras todo seu dinheiro que sobra depois de comprar comida, vestuário e moradia perde 100% do valor a cada 10 anos. Isso acontece porque o Estado imprime dinheiro do nada e joga na economia de propósito para gerar INFLAÇÃO e manter todos nós escravizados. Você pode deixar seu dinheiro investido em qualquer aplicação que imaginar e ainda assim nunca terá uma rentabilidade superior a inflação real. No final, acaba perdendo tudo do mesmo jeito. Caso você se ache esperto por investir o que sobra da sua renda em bens duráveis como imóveis ou veículos, sabia que esses bens também não são seus, porque se deixar de pagar os impostos desses bens (iptu, itr, ipva) você também perde tudo. Além disso, o custo de manutenção desses bens deve ser levado em consideração na conta das novas dívidas que você assumiu. No caso dos imóveis urbanos é impossível alugá-lo por mais de 0,38% do seu valor mensalmente. Em outras palavras, a cada ano você recebe menos de 5% do que investiu, tem que pagar o custo de manutenção, mais impostos e a valorização do bem nunca será superior a inflação real, também fazendo você perder quase tudo em cerca de 15 anos. A situação é ainda pior com os imóveis rurais e veículos, basta fazer as contas. Caso o dinheiro que você receba em troca do seu trabalho seja suficiente apenas para comprar comida, vestuário e moradia, você já sabe que é um escravo né?… Precisamos entender que a escravidão não acabou, apenas foi democratizada. Hoje a escravidão é financeira, nós somos os castiços e os donos do dinheiro são o senhorio. Os donos do dinheiro são os Globalistas e os Estados seus fantoches. O esquema é simples: fazer todo mundo trabalhar em troca de algo que perde 100% do valor a cada 10 anos, ou seja o dinheiro. Se você pudesse trabalhar em troca de algo que aumentasse de valor acima da inflação real a cada 10 anos você finalmente conquistaria sua liberdade financeira e deixaria de ser escravo. Pois bem, isso já é possível, e não se trata de ouro ou imóveis e sim sobre o Bitcoin, que sobe de valor mais de 100% a cada 10 anos, com a vantagem de ser inconfiscável e de fácil transferência para seus herdeiros quando você morrer, através de uma simples transação LockTime feita em vida. Portanto, mesmo que você não tenha dinheiro para comprar Bitcoin, passar a aceitar Bitcoin em troca de seus produtos e serviços é a única forma de se libertar da escravidão financeira. A carta de alforria financeira proporcionada pelo Bitcoin não é imediata, pois a velocidade da sua libertação depende do quanto você está disposto a aprender sobre o assunto. Eu estou aqui para te ajudar, caso queira. No futuro o Bitcoin estará tão presente na sua vida quanto o pix e o cartão de crédito, você querendo ou não. Assim como o cartão de crédito foi a evolução do cheque pós-datado e o pix a evolução do cartão, o Bitcoin e outras criptomoedas serão a evolução de todos esses meios de pagamento. O que te ofereço é a oportunidade de abolição da sua escravatura antes dos demais escravos acordarem para a realidade, afinal a história sempre se repete: desde o ano de 1300 a.c. a escravidão era defendida pelos próprios escravos, que mais cedo ou mais tarde, foram libertados por Moisés em êxodo 11 da Bíblia Sagrada e hoje o povo de israel se tornou a nação mais rica do mundo. A mesma história se repetiu na Roma Antiga: com o pão e circo. Da mesma forma todo esse império escravocrata ruiu porque mais cedo ou mais tarde os escravos se revoltam, bastam as coisas piorarem bastante. O atual regime de escravidão teve início com a queda do padrão-ouro para impressão do dinheiro no ano de 1944. A escravidão apenas ficou mais sofisticada, pois em vez de pagar os escravos com cerveja como no Egito Antigo ou com pão e circo como na Roma Antiga, passou-se a pagar os escravos com dinheiro sem lastro, ou seja dinheiro inventado, criado do nada, sem qualquer representação com a riqueza real da economia. Mesmo sendo a escravidão atual mais sofisticada, que deixou de ser física para ser financeira, o que torna a mentira mais bem contada, mais cedo ou mais tarde os escravos modernos irão acordar, basta as coisas piorarem mais ou perceberem que todos os bens e serviços do mundo não representam nem 1% de todo o dinheiro que impresso sem lastro. Em outras palavras, se os donos de todo o dinheiro do mundo resolvessem utilizá-lo para comprar tudo o que existe à venda, o preço do quilo do café subiria para R$ 297.306,00 e o preço médio dos imóveis subiria para um número tão grande que sequer caberia nesta folha de papel. Hoje, o dinheiro não vale nada, seus donos sabem disso e optam por entregar o dinheiro aos poucos para os escravos em troca do seu trabalho, para manter o atual regime o máximo de tempo possível. Mesmo assim, o atual regime de escravidão financeira está com os dias contados e depende de você se posicionar antes do efeito manada. Nunca é tarde para entrar no Bitcoin, mesmo ele tendo uma quantidade de emissão limitada, seu valor subirá infinitamente. A menor unidade do Bitcoin é o satoshi, cuja abreviação é sats. Diferente do centavo, cada sat vale um centésimo milionésimo de bitcoin. Hoje (25/05/25), cada unidade de Bitcoin equivale a setecentos mil reais. Logo, cada R$ 0,01 equivale à 0,007 sats. Lembrando que o centavo é um real dividido por cem e o sat é um bitcoin dividido por cem milhões, por isso ainda não existe a paridade entre 1 centavo de real e 1 sat. Essa paridade será alcançada quando um Bitcoin passar a valer um milhão de reais. Com a velocidade que nosso dinheiro está perdendo valor isso não irá demorar muito. Utilizando dados econômicos avançados, prevejo que cada unidade de Bitcoin passará a valer hum milhão de reais até o ano de 2029, assim equiparando 1 sat para cada R$ 0,01. Nesse momento, certamente muitos empresários, comerciantes e profissionais liberais passarão a aceitar o Bitcoin como forma de pagamento pelos seus produtos e serviços, assim como o cheque foi substituído pelo cartão de crédito e o cartão pelo pix. Sabendo disso, você pode entrar na onda de transição no futuro junto com a manada e perder essa alta valorização, ou passar a aceitar Bitcoin agora pelos seus produtos e serviços, assinando assim, a própria carta de alforria da sua escravidão financeira. É importante dizer que os próprios globalistas e governos estão trocando dinheiro por Bitcoin como nunca na história e mesmo que eles adquiram todos os bitcoins disponíveis, ainda assim não será mais possível manter seu regime de escravidão financeira funcionando porque a emissão de Bitcoin é limitada, sendo impossível criar Bitcoin sem lastro, como é feito com o dinheiro hoje. Com o presente artigo, te ofereço a oportunidade de conquistar seus primeiros sats agora, de forma segura e independente, sem precisar de corretoras, bancos, intermediários ou terceiros, basta você querer pois toda a informação necessária está disponível na internet gratuitamente. Se ainda assim você quiser continuar sendo escravo financeiro, depois não adiantar se arrepender quando as janelas de oportunidade se fecharem, o Drex for implantado, papel moeda restringido e sua vida piorar bastante. Importante mencionar que a Lei Brasileira ainda permite a movimentação de até R$ 30.000,00 em Bitcoin por mês sem a necessidade de declaração à Receita Federal e que esse direito pode deixar de existir a qualquer momento, e que quando o Drex for implantado você perderá diversos outros direitos, dentre ele a liberdade de gastar seu dinheiro como quiser e o sigilo. Ofereço ainda, a oportunidade de você baixar uma carteira de Bitcoin gratuita e segura no seu aparelho de celular que funciona de forma semelhante a um banco digital como Nubank e Pagseguro por exemplo, para poder começar à receber Bitcoin pelos seus produtos e serviços agora, de forma fácil e gratuita. Utilizando o qrcode abaixo você ainda ganha alguns sats de graça, promoção válida até o dia 29/05/25 e patrocinada pela Corretora Blink de El Salvador, onde o Bitcoin já é moeda oficial do país, basta acessar o link e instalar o aplicativo: https://get.blink.sv/btcvale

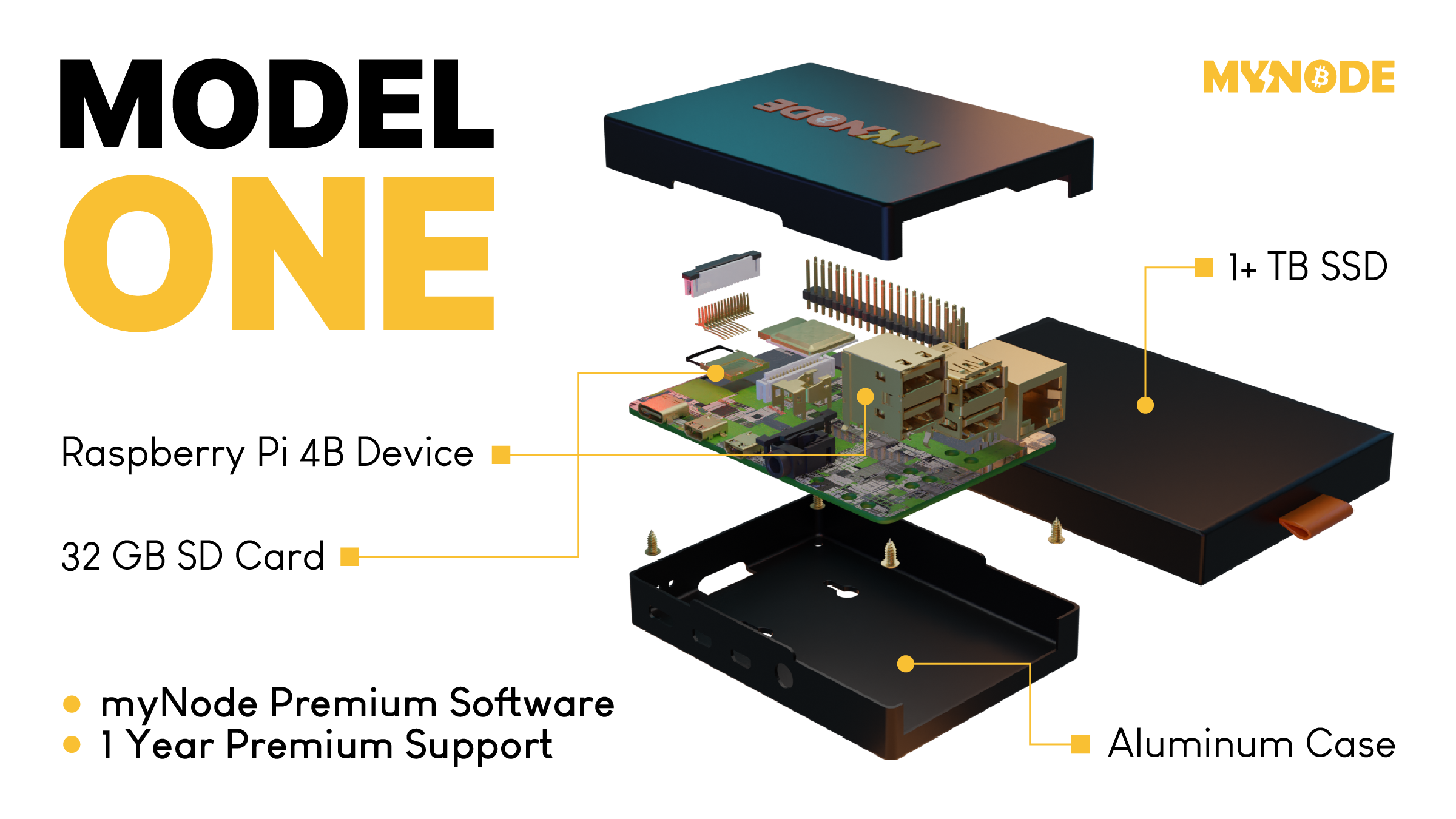

Aviso: disponibilizei o link da carteira de Bitcoin da Corretora Blink apenas como exemplo de como é fácil aceitar Bitcoin como forma de pagamento pelos seus produtos e serviços. Não recomento depender de qualquer corretora para guardar seus valores em Bitcoin. A melhor forma de fazer isso é mantendo dois computadores ou notebook em casa, um conectado à internet com memória em disco disponível de 1 terabyte ou mais para armazenar e visualizar suas transações e outro computador ou notebook desconectado da internet para armazenar suas senhas e chaves privadas para assinar as transações via pendrive. Somente assim você estará 100% livre e seguro. Importante ainda fazer backup em vários CDs com criptografia do seu computador ou notebook que assina as transações, assim também ficando 100% livre e seguro para restaurar sua carteira em qualquer outro computador caso necessário. Todas as instruções de como fazer isso já estão disponíveis gratuitamente na internet. Caso deseje contratar uma consultoria pessoal que inclui aulas particulares por vídeo conferência, onde você aprenderá:

→ Tudo o que precisa saber sobre Bitcoin e demais criptomoedas; → Sistema operacional Linux; → Como instalar sua carteira de Bitcoin em dois computadores para assinaturas air gapped; → Se manter 100% livre e seguro. → Com carga horária à combinar conforme sua disponibilidade.

O custo do investimento pelo meu serviço individual para esse tipo de consultoria é de 204.000 sats (R$ 1.543,46 na cotação atual) valor válido até 31/07/25, interessados entrar em contato por aqui ou através da Matrix: @davipinheiro:matrix.org https://davipinheiro.com/voce-e-escravo-e-nem-sabe-eu-vou-te-provar-agora/

-

@ 39cc53c9:27168656

2025-05-27 09:21:50

@ 39cc53c9:27168656

2025-05-27 09:21:50Over the past few months, I've dedicated my time to a complete rewrite of the kycnot.me website. The technology stack remains unchanged; Golang paired with TailwindCSS. However, I've made some design choices in this iteration that I believe significantly enhance the site. Particularly to backend code.

UI Improvements

You'll notice a refreshed UI that retains the original concept but has some notable enhancements. The service list view is now more visually engaging, it displays additional information in a more aesthetically pleasing manner. Both filtering and searching functionalities have been optimized for speed and user experience.

Service pages have been also redesigned to highlight key information at the top, with the KYC Level box always accessible. The display of service attributes is now more visually intuitive.

The request form, especially the Captcha, has undergone substantial improvements. The new self-made Captcha is robust, addressing the reliability issues encountered with the previous version.

Terms of Service Summarizer

A significant upgrade is the Terms of Service summarizer/reviewer, now powered by AI (GPT-4-turbo). It efficiently condenses each service's ToS, extracting and presenting critical points, including any warnings. Summaries are updated monthly, processing over 40 ToS pages via the OpenAI API using a self-crafted and thoroughly tested prompt.

Nostr Comments

I've integrated a comment section for each service using Nostr. For guidance on using this feature, visit the dedicated how-to page.

Database

The backend database has transitioned to pocketbase, an open-source Golang backend that has been a pleasure to work with. I maintain an updated fork of the Golang SDK for pocketbase at pluja/pocketbase.

Scoring

The scoring algorithm has also been refined to be more fair. Despite I had considered its removal due to the complexity it adds (it is very difficult to design a fair scoring system), some users highlighted its value, so I kept it. The updated algorithm is available open source.

Listings

Each listing has been re-evaluated, and the ones that were no longer operational were removed. New additions are included, and the backlog of pending services will be addressed progressively, since I still have access to the old database.

API

The API now offers more comprehensive data. For more details, check here.

About Page

The About page has been restructured for brevity and clarity.

Other Changes

Extensive changes have been implemented in the server-side logic, since the whole code base was re-written from the ground up. I may discuss these in a future post, but for now, I consider the current version to be just a bit beyond beta, and additional updates are planned in the coming weeks.

-

@ 162b4b08:9f7d278c

2025-05-27 10:12:53

@ 162b4b08:9f7d278c

2025-05-27 10:12:53Trong thời đại mà công nghệ số trở thành trụ cột không thể thiếu trong mọi lĩnh vực, từ công việc đến giải trí, việc sở hữu một nền tảng số toàn diện như PUM88 đóng vai trò vô cùng quan trọng đối với người dùng hiện đại. Không chỉ là nơi cung cấp các công cụ tiện ích, PUM88 còn tạo nên một hệ sinh thái linh hoạt, đáp ứng mọi nhu cầu trong một môi trường trực tuyến đầy năng động. Từ những bước đầu như đăng ký, đăng nhập, cho đến trải nghiệm thực tế, tất cả đều được tối ưu nhằm mang lại sự thuận tiện tối đa. Giao diện thiết kế thông minh, bố cục rõ ràng, thao tác nhanh gọn giúp người dùng dễ dàng tiếp cận và sử dụng mà không cần kiến thức kỹ thuật chuyên sâu. Bên cạnh đó, hệ thống xử lý tốc độ cao và khả năng tương thích đa nền tảng (từ smartphone đến laptop) giúp người dùng duy trì kết nối mọi lúc mọi nơi, không bị giới hạn bởi thiết bị hay không gian sử dụng. Không dừng lại ở đó, PUM88 còn liên tục nâng cấp công nghệ như tích hợp trí tuệ nhân tạo để gợi ý nội dung cá nhân hóa theo hành vi và sở thích, giúp mỗi trải nghiệm trở nên sống động, gần gũi và mang tính cá nhân cao hơn bao giờ hết. Đây chính là điểm cộng lớn giúp PUM88 tạo nên dấu ấn trong lòng người dùng yêu thích sự tiện lợi và linh hoạt trong đời sống số.

Ngoài ra, yếu tố khiến PUM88 trở nên đáng tin cậy chính là khả năng bảo mật vượt trội và chính sách hỗ trợ khách hàng tận tâm. Dữ liệu cá nhân và các hoạt động của người dùng luôn được bảo vệ nghiêm ngặt bằng các chuẩn mã hóa quốc tế, hệ thống tường lửa, xác thực hai lớp và giám sát bảo mật liên tục. Nhờ vậy, người dùng hoàn toàn yên tâm khi sử dụng mà không lo bị lộ thông tin hay rò rỉ dữ liệu. Thêm vào đó, đội ngũ chăm sóc khách hàng hoạt động 24/7 với thái độ chuyên nghiệp và phản hồi nhanh chóng giúp giải quyết mọi thắc mắc hoặc sự cố kỹ thuật một cách hiệu quả. Không những thế, PUM88 còn thường xuyên lắng nghe ý kiến người dùng để cải tiến giao diện, bổ sung tính năng mới, đảm bảo rằng nền tảng luôn bắt kịp xu hướng công nghệ và đáp ứng đúng nhu cầu thực tế. Việc cập nhật liên tục không chỉ giúp người dùng có được trải nghiệm mượt mà hơn mà còn giữ cho nền tảng luôn mới mẻ, sáng tạo và không ngừng phát triển. Trong bối cảnh chuyển đổi số đang diễn ra mạnh mẽ tại Việt Nam, PUM88 không chỉ đơn thuần là một ứng dụng tiện ích mà còn là một trợ thủ đắc lực cho cuộc sống hiện đại – nơi mà người dùng có thể tận dụng công nghệ để nâng cao hiệu suất cá nhân, tối ưu hóa thời gian và tận hưởng trải nghiệm số trọn vẹn nhất mỗi ngày.

-

@ 7f6db517:a4931eda

2025-05-27 20:01:40

@ 7f6db517:a4931eda

2025-05-27 20:01:40

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 39cc53c9:27168656

2025-05-27 09:21:48

@ 39cc53c9:27168656

2025-05-27 09:21:48I'm launching a new service review section on this blog in collaboration with OrangeFren. These reviews are sponsored, yet the sponsorship does not influence the outcome of the evaluations. Reviews are done in advance, then, the service provider has the discretion to approve publication without modifications.

Sponsored reviews are independent from the kycnot.me list, being only part of the blog. The reviews have no impact on the scores of the listings or their continued presence on the list. Should any issues arise, I will not hesitate to remove any listing.

The review

WizardSwap is an instant exchange centred around privacy coins. It was launched in 2020 making it old enough to have weathered the 2021 bull run and the subsequent bearish year.

| Pros | Cons | |------|------| | Tor-friendly | Limited liquidity | | Guarantee of no KYC | Overly simplistic design | | Earn by providing liquidity | |

Rating: ★★★★★ Service Website: wizardswap.io

Liquidity

Right off the bat, we'll start off by pointing out that WizardSwap relies on its own liquidity reserves, meaning they aren't just a reseller of Binance or another exchange. They're also committed to a no-KYC policy, when asking them, they even promised they would rather refund a user their original coins, than force them to undergo any sort of verification.

On the one hand, full control over all their infrastructure gives users the most privacy and conviction about the KYC policies remaining in place.

On the other hand, this means the liquidity available for swapping isn't huge. At the time of testing we could only purchase at most about 0.73 BTC with XMR.

It's clear the team behind WizardSwap is aware of this shortfall and so they've come up with a solution unique among instant exchanges. They let you, the user, deposit any of the currencies they support into your account and earn a profit on the trades made using your liquidity.

Trading

Fees on WizardSwap are middle-of-the-pack. The normal fee is 2.2%. That's more than some exchanges that reserve the right to suddenly demand you undergo verification, yet less than half the fees on some other privacy-first exchanges. However as we mentioned in the section above you can earn almost all of that fee (2%) if you provide liquidity to WizardSwap.

It's good that with the current Bitcoin fee market their fees are constant regardless of how much, or how little, you send. This is in stark contrast with some of the alternative swap providers that will charge you a massive premium when attempting to swap small amounts of BTC away.

Test trades

Test trades are always performed without previous notice to the service provider.

During our testing we performed a few test trades and found that every single time WizardSwap immediately detected the incoming transaction and the amount we received was exactly what was quoted before depositing. The fees were inline with what WizardSwap advertises.

- Monero payment proof

- Bitcoin received

- Wizardswap TX link - it's possible that this link may cease to be valid at some point in the future.

ToS and KYC

WizardSwap does not have a Terms of Service or a Privacy Policy page, at least none that can be found by users. Instead, they offer a FAQ section where they addresses some basic questions.

The site does not mention any KYC or AML practices. It also does not specify how refunds are handled in case of failure. However, based on the FAQ section "What if I send funds after the offer expires?" it can be inferred that contacting support is necessary and network fees will be deducted from any refund.

UI & Tor

WizardSwap can be visited both via your usual browser and Tor Browser. Should you decide on the latter you'll find that the website works even with the most strict settings available in the Tor Browser (meaning no JavaScript).

However, when disabling Javascript you'll miss the live support chat, as well as automatic refreshing of the trade page. The lack of the first means that you will have no way to contact support from the trade page if anything goes wrong during your swap, although you can do so by mail.

One important thing to have in mind is that if you were to accidentally close the browser during the swap, and you did not save the swap ID or your browser history is disabled, you'll have no easy way to return to the trade. For this reason we suggest when you begin a trade to copy the url or ID to someplace safe, before sending any coins to WizardSwap.

The UI you'll be greeted by is simple, minimalist, and easy to navigate. It works well not just across browsers, but also across devices. You won't have any issues using this exchange on your phone.

Getting in touch

The team behind WizardSwap appears to be most active on X (formerly Twitter): https://twitter.com/WizardSwap_io

If you have any comments or suggestions about the exchange make sure to reach out to them. In the past they've been very receptive to user feedback, for instance a few months back WizardSwap was planning on removing DeepOnion, but the community behind that project got together ^1 and after reaching out WizardSwap reversed their decision ^2.

You can also contact them via email at:

support @ wizardswap . ioDisclaimer

None of the above should be understood as investment or financial advice. The views are our own only and constitute a faithful representation of our experience in using and investigating this exchange. This review is not a guarantee of any kind on the services rendered by the exchange. Do your own research before using any service.

-

@ 5391098c:74403a0e

2025-05-27 18:15:38

@ 5391098c:74403a0e

2025-05-27 18:15:38Você trabalha 5 meses do ano somente para pagar impostos. Ou seja, 42% da sua renda serve para bancar serviços públicos de péssima qualidade. Mesmo que você tivesse a liberdade de usar esses 42% da sua renda para contratar serviços privados de qualidade (saúde, segurança e ensino), ainda assim você seria um escravo porque você recebe dinheiro em troca do seu trabalho, e o dinheiro perde cerca de 10% do valor a cada ano. Em outras palavras todo seu dinheiro que sobra depois de comprar comida, vestuário e moradia perde 100% do valor a cada 10 anos. Isso acontece porque o Estado imprime dinheiro do nada e joga na economia de propósito para gerar INFLAÇÃO e manter todos nós escravizados. Você pode deixar seu dinheiro investido em qualquer aplicação que imaginar e ainda assim nunca terá uma rentabilidade superior a inflação real. No final, acaba perdendo tudo do mesmo jeito. Caso você se ache esperto por investir o que sobra da sua renda em bens duráveis como imóveis ou veículos, sabia que esses bens também não são seus, porque se deixar de pagar os impostos desses bens (iptu, itr, ipva) você também perde tudo. Além disso, o custo de manutenção desses bens deve ser levado em consideração na conta das novas dívidas que você assumiu. No caso dos imóveis urbanos é impossível alugá-lo por mais de 0,38% do seu valor mensalmente. Em outras palavras, a cada ano você recebe menos de 5% do que investiu, tem que pagar o custo de manutenção, mais impostos e a valorização do bem nunca será superior a inflação real, também fazendo você perder quase tudo em cerca de 15 anos. A situação é ainda pior com os imóveis rurais e veículos, basta fazer as contas. Caso o dinheiro que você receba em troca do seu trabalho seja suficiente apenas para comprar comida, vestuário e moradia, você já sabe que é um escravo né?… Precisamos entender que a escravidão não acabou, apenas foi democratizada. Hoje a escravidão é financeira, nós somos os castiços e os donos do dinheiro são o senhorio. Os donos do dinheiro são os Globalistas e os Estados seus fantoches. O esquema é simples: fazer todo mundo trabalhar em troca de algo que perde 100% do valor a cada 10 anos, ou seja o dinheiro. Se você pudesse trabalhar em troca de algo que aumentasse de valor acima da inflação real a cada 10 anos você finalmente conquistaria sua liberdade financeira e deixaria de ser escravo. Pois bem, isso já é possível, e não se trata de ouro ou imóveis e sim sobre o Bitcoin, que sobe de valor mais de 100% a cada 10 anos, com a vantagem de ser inconfiscável e de fácil transferência para seus herdeiros quando você morrer, através de uma simples transação LockTime feita em vida. Portanto, mesmo que você não tenha dinheiro para comprar Bitcoin, passar a aceitar Bitcoin em troca de seus produtos e serviços é a única forma de se libertar da escravidão financeira. A carta de alforria financeira proporcionada pelo Bitcoin não é imediata, pois a velocidade da sua libertação depende do quanto você está disposto a aprender sobre o assunto. Eu estou aqui para te ajudar, caso queira. No futuro o Bitcoin estará tão presente na sua vida quanto o pix e o cartão de crédito, você querendo ou não. Assim como o cartão de crédito foi a evolução do cheque pós-datado e o pix a evolução do cartão, o Bitcoin e outras criptomoedas serão a evolução de todos esses meios de pagamento. O que te ofereço é a oportunidade de abolição da sua escravatura antes dos demais escravos acordarem para a realidade, afinal a história sempre se repete: desde o ano de 1300 a.c. a escravidão era defendida pelos próprios escravos, que mais cedo ou mais tarde, foram libertados por Moisés em êxodo 11 da Bíblia Sagrada e hoje o povo de israel se tornou a nação mais rica do mundo. A mesma história se repetiu na Roma Antiga: com o pão e circo. Da mesma forma todo esse império escravocrata ruiu porque mais cedo ou mais tarde os escravos se revoltam, bastam as coisas piorarem bastante. O atual regime de escravidão teve início com a queda do padrão-ouro para impressão do dinheiro no ano de 1944. A escravidão apenas ficou mais sofisticada, pois em vez de pagar os escravos com cerveja como no Egito Antigo ou com pão e circo como na Roma Antiga, passou-se a pagar os escravos com dinheiro sem lastro, ou seja dinheiro inventado, criado do nada, sem qualquer representação com a riqueza real da economia. Mesmo sendo a escravidão atual mais sofisticada, que deixou de ser física para ser financeira, o que torna a mentira mais bem contada, mais cedo ou mais tarde os escravos modernos irão acordar, basta as coisas piorarem mais ou perceberem que todos os bens e serviços do mundo não representam nem 1% de todo o dinheiro que impresso sem lastro. Em outras palavras, se os donos de todo o dinheiro do mundo resolvessem utilizá-lo para comprar tudo o que existe à venda, o preço do quilo do café subiria para R$ 297.306,00 e o preço médio dos imóveis subiria para um número tão grande que sequer caberia nesta folha de papel. Hoje, o dinheiro não vale nada, seus donos sabem disso e optam por entregar o dinheiro aos poucos para os escravos em troca do seu trabalho, para manter o atual regime o máximo de tempo possível. Mesmo assim, o atual regime de escravidão financeira está com os dias contados e depende de você se posicionar antes do efeito manada. Nunca é tarde para entrar no Bitcoin, mesmo ele tendo uma quantidade de emissão limitada, seu valor subirá infinitamente. A menor unidade do Bitcoin é o satoshi, cuja abreviação é sats. Diferente do centavo, cada sat vale um centésimo milionésimo de bitcoin. Hoje (25/05/25), cada unidade de Bitcoin equivale a setecentos mil reais. Logo, cada R$ 0,01 equivale à 0,007 sats. Lembrando que o centavo é um real dividido por cem e o sat é um bitcoin dividido por cem milhões, por isso ainda não existe a paridade entre 1 centavo de real e 1 sat. Essa paridade será alcançada quando um Bitcoin passar a valer um milhão de reais. Com a velocidade que nosso dinheiro está perdendo valor isso não irá demorar muito. Utilizando dados econômicos avançados, prevejo que cada unidade de Bitcoin passará a valer hum milhão de reais até o ano de 2029, assim equiparando 1 sat para cada R$ 0,01. Nesse momento, certamente muitos empresários, comerciantes e profissionais liberais passarão a aceitar o Bitcoin como forma de pagamento pelos seus produtos e serviços, assim como o cheque foi substituído pelo cartão de crédito e o cartão pelo pix. Sabendo disso, você pode entrar na onda de transição no futuro junto com a manada e perder essa alta valorização, ou passar a aceitar Bitcoin agora pelos seus produtos e serviços, assinando assim, a própria carta de alforria da sua escravidão financeira. É importante dizer que os próprios globalistas e governos estão trocando dinheiro por Bitcoin como nunca na história e mesmo que eles adquiram todos os bitcoins disponíveis, ainda assim não será mais possível manter seu regime de escravidão financeira funcionando porque a emissão de Bitcoin é limitada, sendo impossível criar Bitcoin sem lastro, como é feito com o dinheiro hoje. Com o presente artigo, te ofereço a oportunidade de conquistar seus primeiros sats agora, de forma segura e independente, sem precisar de corretoras, bancos, intermediários ou terceiros, basta você querer pois toda a informação necessária está disponível na internet gratuitamente. Se ainda assim você quiser continuar sendo escravo financeiro, depois não adiantar se arrepender quando as janelas de oportunidade se fecharem, o Drex for implantado, papel moeda restringido e sua vida piorar bastante. Importante mencionar que a Lei Brasileira ainda permite a movimentação de até R$ 30.000,00 em Bitcoin por mês sem a necessidade de declaração à Receita Federal e que esse direito pode deixar de existir a qualquer momento, e que quando o Drex for implantado você perderá diversos outros direitos, dentre ele a liberdade de gastar seu dinheiro como quiser e o sigilo. Ofereço ainda, a oportunidade de você baixar uma carteira de Bitcoin gratuita e segura no seu aparelho de celular que funciona de forma semelhante a um banco digital como Nubank e Pagseguro por exemplo, para poder começar à receber Bitcoin pelos seus produtos e serviços agora, de forma fácil e gratuita. Utilizando o qrcode abaixo você ainda ganha alguns sats de graça, promoção válida até o dia 29/05/25 e patrocinada pela Corretora Blink de El Salvador, onde o Bitcoin já é moeda oficial do país, basta acessar o link e instalar o aplicativo: https://get.blink.sv/btcvale

Aviso: disponibilizei o link da carteira de Bitcoin da Corretora Blink apenas como exemplo de como é fácil aceitar Bitcoin como forma de pagamento pelos seus produtos e serviços. Não recomento depender de qualquer corretora para guardar seus valores em Bitcoin. A melhor forma de fazer isso é mantendo dois computadores ou notebook em casa, um conectado à internet com memória em disco disponível de 1 terabyte ou mais para armazenar e visualizar suas transações e outro computador ou notebook desconectado da internet para armazenar suas senhas e chaves privadas para assinar as transações via pendrive. Somente assim você estará 100% livre e seguro. Importante ainda fazer backup em vários CDs com criptografia do seu computador ou notebook que assina as transações, assim também ficando 100% livre e seguro para restaurar sua carteira em qualquer outro computador caso necessário. Todas as instruções de como fazer isso já estão disponíveis gratuitamente na internet. Caso deseje contratar uma consultoria pessoal que inclui aulas particulares por vídeo conferência, onde você aprenderá:

→ Tudo o que precisa saber sobre Bitcoin e demais criptomoedas; → Sistema operacional Linux; → Como instalar sua carteira de Bitcoin em dois computadores para assinaturas air gapped; → Se manter 100% livre e seguro. → Com carga horária à combinar conforme sua disponibilidade.

O custo do investimento pelo meu serviço individual para esse tipo de consultoria é de 204.000 sats (R$ 1.543,46 na cotação atual) valor válido até 31/07/25, interessados entrar em contato por aqui ou através da Matrix: @davipinheiro:matrix.org https://davipinheiro.com/voce-e-escravo-e-nem-sabe-eu-vou-te-provar-agora/

-

@ 611021ea:089a7d0f

2025-05-26 18:28:46

@ 611021ea:089a7d0f

2025-05-26 18:28:46Imagine a world where your favorite health and fitness apps—diet trackers, meditation tools, cardio and strength training platforms, even therapy apps—can all work together seamlessly. Not because they're owned by the same company, but because they speak a common, open language. That's the future NIP-101h is building on Nostr.

A Modular, Privacy-First Health Data Framework

NIP-101h defines a modular, privacy-first framework for sharing granular health and fitness metrics on the decentralized Nostr protocol. The core idea is simple but powerful: every health metric (weight, steps, calories, mood, and so on) gets its own unique Nostr event kind. Apps can implement only the metrics they care about, and users can choose exactly what to share, with whom, and how.

This modular approach means true interoperability. A meditation app can log mindfulness sessions, a running app can record your daily mileage, and a diet tracker can keep tabs on your nutrition—all using the same underlying standard. Each app remains independent, but your data becomes portable, composable, and, most importantly, under your control.

Why NIP-101h Matters

Interoperability

Today's health and fitness apps are walled gardens. Data is locked away in proprietary formats, making it hard to move, analyze, or combine. NIP-101h breaks down these barriers by providing a common, open standard for health metrics on Nostr. Apps can collaborate, users can migrate, and new services can emerge—without permission or lock-in.

User Control & Privacy

Health data is deeply personal. That's why NIP-101h is privacy-first: all metric values are encrypted by default using NIP-44, unless the user explicitly opts out. You decide what's public, what's private, and who gets access. Even if you want to keep everything local, that's supported too.

Extensibility

The world of health and fitness is always evolving. NIP-101h is designed to grow with it. New metrics can be added at any time via the

-

@ bf47c19e:c3d2573b

2025-05-27 21:19:32

@ bf47c19e:c3d2573b

2025-05-27 21:19:32Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Procena vrednosti

- Većina Bitcoin-ovih pozitivnih strana opstaje

- Broj ljudi koji su prihvatili Bitcoin

- Zaključak

Prošlo je trinaest godina od nastanka Bitcoina i lako je poverovati da je većina njegovog rasta iza njega. Deo ovoga je rezultat predrasude koju svi delimo i što nas navodi da zamislimo trenutno stanje stvari kao završni stepen njegovog razvoja. Svaki bitcoiner je nekad mislio da je prekasan sa Bitcoin-om. Međutim, kada primenjujemo kritičko razmišljanje da bismo procenili gde je Bitcoin u svojoj putanji rasta, otkrivamo da je suprotno u stvari tačno: još uvek je vrlo, vrlo rano.

Postoje dva načina da razmišljate o tome koliko je rano za Bitcoin kao zalihu vrednosti neke imovine:

-

Procena vrednosti kao procenat od njegovog punog potencijala

-

Prihvatanje kao procenat od njegovog punog potencijala (na čemu je fokus u ovom članku).

Procena vrednosti

Prvi i najčešći način da se proceni koliko je rano za Bitcoin je da se pogleda njegova ukupna vrednost (trenutno oko 900B USD) i uporedi sa njegovim punim potencijalom. Izazov sa ovim je očigledno da je puni potencijal Bitcoin-a stvar nagađanja. Oni koji duboko razumeju Bitcoin imaju tendenciju da njegov potencijal posmatraju barem kao potencijal zlata (oko 13T USD), ali teoretski više poput 200T USD (oko polovine ukupne vrednosti sveta).

Za brzi pregled ovog potencijala od 200T USD, pogledajmo ukupno raspoloživo tržište Bitcoin-a. Radi jednostavnosti, samo ćemo razmotriti njegovu ulogu zalihe vrednosti i zanemariti njegov potencijal da pojede tržišni udeo od oko 100T USD ukupne vrednosti u različitim svetskim valutama. Uzimajući u obzir različite zalihe vrednosne imovine i grubom procenom koliki bi % Bitcoin mogao da uzme od njih, dobili smo ovakav rezultat:

Iako put do 200T USD nije veliko rastezanje, u stvarnoj vrednosti čini se previše dobrim da bi bio istinit. Sa obzirom da je bez presedana da zaliha vrednosti neke robe postigne vrednost veću od zlata, to jednostavno predstavlja neistraženu teritoriju. Ali čak i ako se jednostavno pridržavamo targetiranja niže ciljne vrednosti zlata od 13T USD, Bitcoin još uvek tendenciju velikog porasta svoje cene u budućnosti.

Većina Bitcoin-ovih pozitivnih strana opstaje

Svako ko razmišlja da nešto svog teško zarađenog novca uskladišti u Bitcoin pita se „da li sam poranio ili zakasnio?“ Nepisano je pravilo da se svako oseća kao da je zakasnio kad stigne. Brojni su primeri ljudi koji žale kako su zakasnili 2011. ili 2013. ili 2016. godine, kada je cena Bitcoin-a bila 5, 100, odnosno 600 USD.

Kao i u bilo kojoj zajednici koja se razvija i raste i u kojoj ima manjka nekretninama, pridošlice zavide ljudima koji su već obezbedili sebi nekretninu, ne sluteći da će njima zavideti ljudi koji tek treba da dođu. Ovaj fenomen je primenjiv i na velikom broju drugih primera. Na primer, zakasneli u Kalifornijskoj zlatnoj groznici bili su razočarani kada su došli, a bogata zlatna polja su već bila iscrpljena, i umesto toga su se naseliti na nekoliko stotina hektara zemljišta, a koje sada vrede bogatstvo.

U srcu ovog osećanja je strah da više nema uspona, da više nema novca koji se može zaraditi uzimajući ono što je još uvek ostalo dostupno. Da li smo dostigli tu tačku sa Bitcoin-om?

Pa ne. Čini se da je zapravo suprotno. Na osnovu punog potencijalnog opsega procene koji smo utvrdili gore, čak i u ishodu niskog nivoa (13T USD), velika većina bogatstva koje će steći vlasnici Bitcoin-a, tek treba da se stekne (96%). Da bi parirao proceni zlata, Bitcoin i dalje mora da poraste 26 puta.

A ako se desi vrhunski ishod, punih 99,7% ukupnog stvaranja bogatstva Bitcoin-a ostaje pred nama. To bi značilo da Bitcoin još uvek treba da poraste 400 puta, zanemarujući pariranje zlatu.

Stavljanjem trenutne vrednosti Bitcoin-a u perspektivu, postaje jasno da je za Bitcoin još uvek vrlo rano.

Iako ova analiza sugeriše da za Bitcoin-u ostaje od 26x do 400x rasta, korisno je proveriti ovaj zaključak kroz drugo razumno objašnjenje, a tamo gde je poznat puni potencijal…

Broj ljudi koji su prihvatili Bitcoin

Procene broja vlasnika Bitcoin-a širom sveta se veoma razlikuju. To je dovelo do prilične količine dvosmislenosti i nesigurnosti u vezi sa stvarnim brojevima i određenog stepena odustajanja i mišljenja da je taj broj jednostavno preteško precizno proceniti. Iako je teško utvrditi konačan broj, glavni razlog za odstupanje u procenama je nedostatak standardizovanih definicija šta znači prihvatanje Bitcoin-a.

Istina je da postoje različiti nivoi prihvatanja Bitcoin-a. Podelom na segmente prihvatanja Bitcoin-a lakše je uvideti ne samo zašto postoji širok opseg procena, već i još važnije, koliko je još uvek rano za prihvatanje Bitcoin-a kao preferirane zalihe vrednosti.

U ove svrhe, hajde da podelimo u segmente prihvatanje Bitcoin-a na četiri različita „nivoa“:

1. Kežual amateri (prstom u vodi)

2. Alokatori 1% (stopalima u vodi)

3. Značajni vernici (do pojasa u vodi)

4. Bitcoin maximalisti (u vodi preko glave)

Pre nego što počnemo, potreban nam je imenilac. Mogli bismo da koristimo globalno stanovništvo, ali po mom mišljenju ovo daje loše rezultate. Ono što mi zaista procenjujemo je koji procenat sveta koji poseduje odredjeno bogatstvo za skladištenje u Bitcoin-u, je to i učinio. Prema podacima sa sajta Statista, 2,2 biliona ljudi na svetu poseduje najmanje 10k USD u neto vrednosti, što se čini kao razumna granica za zalihu koju žele da uskladište. Činjenica je da će siromašne zajednice takođe koristiti Bitcoin kao zalihu vrednosti i verovatno će iz njega izvući veću korist kao rezultat marginalnog pristupa tradicionalnoj bankarskoj infrastrukturi kao klijenti banaka sa „niskom vrednošću“. Međutim, u naše svrhe, jednostavno gledamo koliko je ljudi usvojilo Bitcoin među grupama sa značajnim bogatstvom za skladištenje, tako da će 2.2 biliona služiti kao naša puna potencijalna veličina tržišta.

1. Kežual amateri

Ovaj segment ljudi koji su prihvatili Bitcoin uključuje sve one koji imaju bilo koju količinu Bitcoin-a – vašeg prijatelja sa 20 USD BTC-a negde u nekom novčaniku ili vašu tetku koja se ne seća svoje Coinbase lozinke iz 2017. Po mom mišljenju, najveća zabuna oko broja ljudi koji su prihvatili Bitcoin nastaje zbog poistovećivanja „kežual amatera“ sa ljudima koji su u potpunosti prihvatili Bitcoin. Realnost je takva da ljudi ovog segmenta uglavnom samo eksperimentišu, bilo da bi stekli osećaj za ono o čemu svi pričaju, ili samo uložu nekoliko dolara u Bitcoin u nadi da će možda dobiti džekpot, kao što je slučaj sa greb-greb nagradnim igrama.

Zbog toga, „kežual amateri“ su razlog dovodjenja u zabludu pravog broja ljudi koji su u potpunosti prihvatili Bitcoin. Njihovo ponašanje zapravo ne predstavlja prihvatanje u pravom smislu te reči i stoga se ne bi trebalo smatrati ljudima koji su u potpunosti prihvatili Bitcoin. Istina je da, kada kežual amateri shvate da je Bitcoin najbolja zaliha vrednosti neke imovine u istoriji, neće ostati na samo 20 USD u Bitcoin-ima. Umesto toga, oni će svoju štednju prebaciti u mnogo većim iznosima.

Što se tiče odredjivanja veličine ovog segmenta, Willy Woo je sastavio razumno iscrpnu i sveobuhvatnu procenu od oko 187 miliona ljudi koji su prihvatili Bitcoin, što znači da su oni u najmanju ruku „kežual amateri“.

Koristeći ovaj i naš puni potencijal od 2,2 biliona ljudi kao imenioca, 8,5% potencijalnih ljudi koji su prihvatili Bitcoin-e dostiglo je nivo „kežual amatera“. Ovo je prilično velik broj i potpuno obmanjuje stvarni obim potpunog prihvatanja, a što će pokazati sledeći segmenti.

2. Alokatori 1%

Za preostale potkategorije, tačni podaci su manje dostupni. Kao takvi, sve što možemo je da smislimo razumne procene putem triangulacije.

Po mom mišljenju, „alokatori 1%“ se mogu okarakterisati kao ljudi koji su prihvatili Bitcoin, i koji žele da imaju mali, ali ne i zanemarljivi deo u Bitcoin-u. Za naše svrhu, mislim da je pristojan prag za ovu grupu svako ko ima najmanje 0,1 Bitcoin, i može se smatrati da imaju malu, ali ne i zanemarljivu poziciju u Bitcoin-u.

Gledajući Bitcoin blockchain, postoji oko 3 miliona adresa koje imaju najmanje 0,1 BTC. Pored ovih brojeva na blockchain-u, moramo da uzmemo u obzir i znatan broj ljudi koji imaju ovaj iznos na berzi ili GBTC-u. Kombinovanjem, mislim da je razumno proceniti da je 10 miliona ljudi dostiglo nivo „alokatora 1%“ ili veći.

Na osnovu ovih brojeva, samo 1⁄17 „kežual amatera“ dostiglo je nivo prihvatanja „alokatora 1%“, što znači da je ovaj nivo prihvatanja Bitcoin-a do danas postigao samo 0,5% penetracije. Ovaj strmi pad je razlog zašto je došlo do zablude da veliki broj „kežual amatera“ bude označeno kao grupa koja je u potpunosti prihvatila Bitcoin.

3. Značajni vernici

U ovu kategoriju spada svako ko je dostigao nivo razumevanja Bitcoin-a da alokacija od 1% ili čak 5% više ne izgleda dovoljna.

Uopšteno govoreći, ova grupa se kreće u rasponu od 5 – 50%. Išao bih toliko daleko da bih rekao da je većina ljudi koji sebe smatraju vernicima u Bitcoin-e, uključujući većinu Bitcoin Twitter-a, negde u ovoj grupi.

Procena veličine ove grupe postaje mnogo nejasnija, ali možemo se osloniti na podatke iz blockchain-a da bismo došli do razumne procene.