-

@ 5391098c:74403a0e

2025-05-27 18:20:42

@ 5391098c:74403a0e

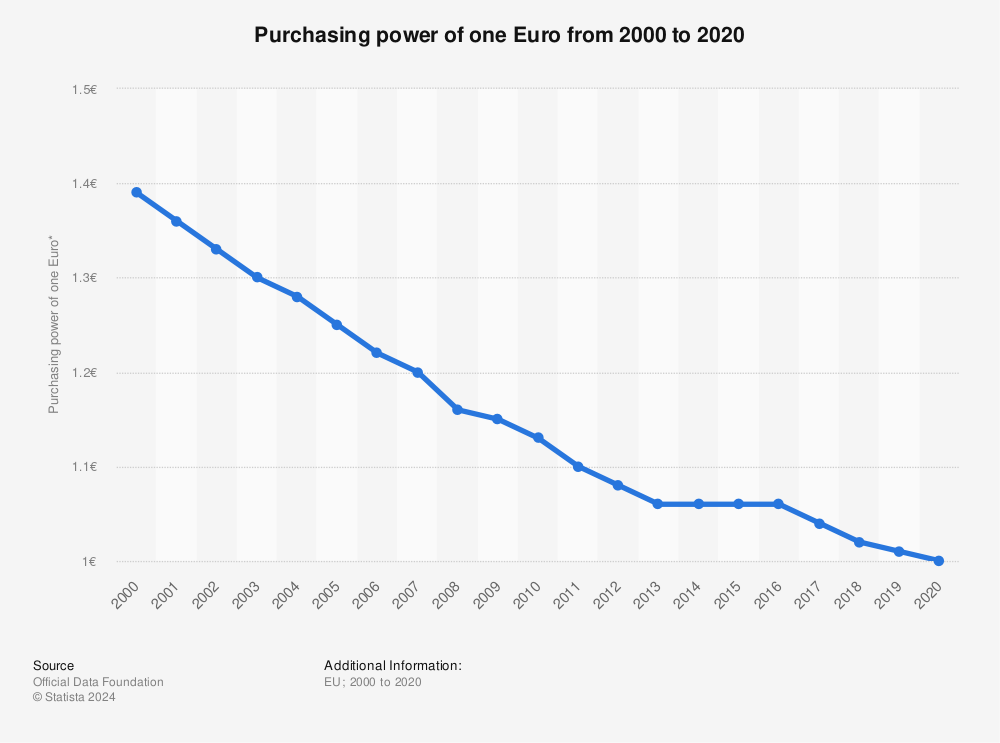

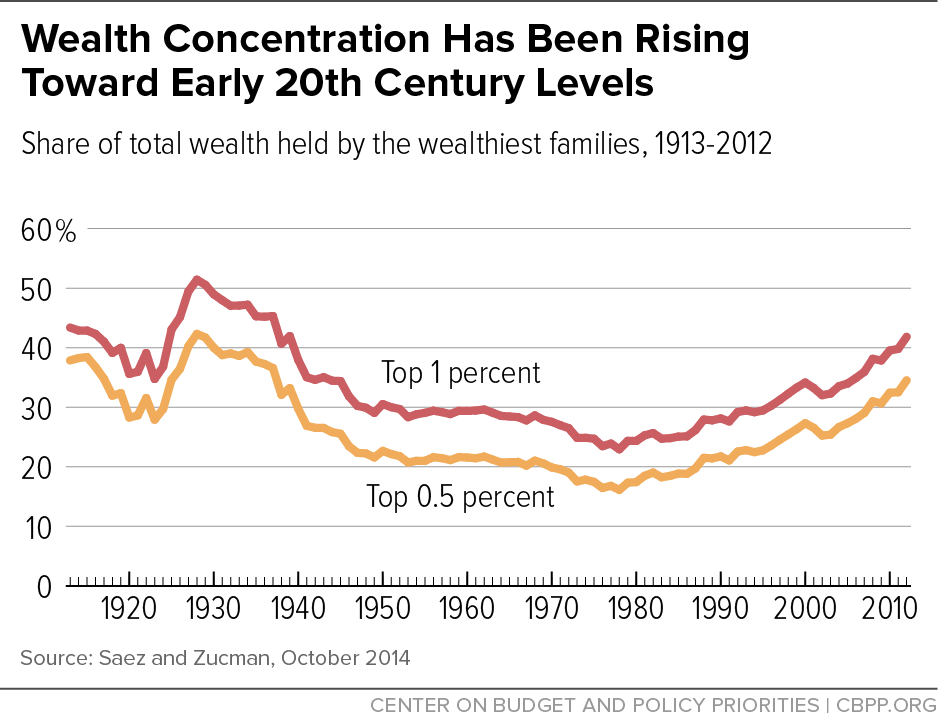

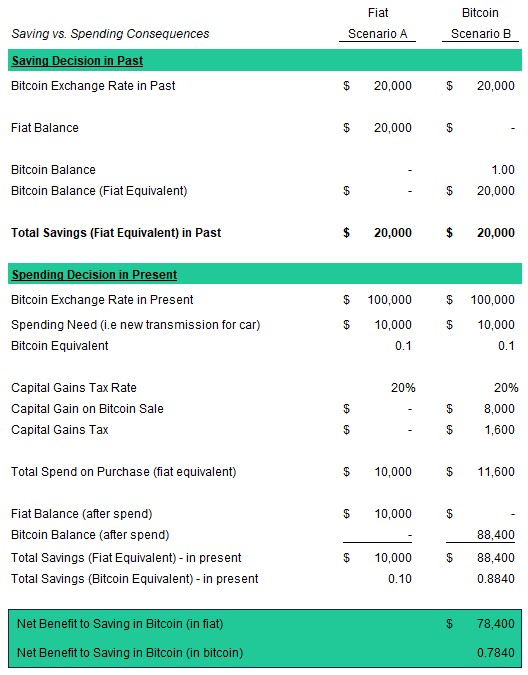

2025-05-27 18:20:42Você trabalha 5 meses do ano somente para pagar impostos. Ou seja, 42% da sua renda serve para bancar serviços públicos de péssima qualidade. Mesmo que você tivesse a liberdade de usar esses 42% da sua renda para contratar serviços privados de qualidade (saúde, segurança e ensino), ainda assim você seria um escravo porque você recebe dinheiro em troca do seu trabalho, e o dinheiro perde cerca de 10% do valor a cada ano. Em outras palavras todo seu dinheiro que sobra depois de comprar comida, vestuário e moradia perde 100% do valor a cada 10 anos. Isso acontece porque o Estado imprime dinheiro do nada e joga na economia de propósito para gerar INFLAÇÃO e manter todos nós escravizados. Você pode deixar seu dinheiro investido em qualquer aplicação que imaginar e ainda assim nunca terá uma rentabilidade superior a inflação real. No final, acaba perdendo tudo do mesmo jeito. Caso você se ache esperto por investir o que sobra da sua renda em bens duráveis como imóveis ou veículos, sabia que esses bens também não são seus, porque se deixar de pagar os impostos desses bens (iptu, itr, ipva) você também perde tudo. Além disso, o custo de manutenção desses bens deve ser levado em consideração na conta das novas dívidas que você assumiu. No caso dos imóveis urbanos é impossível alugá-lo por mais de 0,38% do seu valor mensalmente. Em outras palavras, a cada ano você recebe menos de 5% do que investiu, tem que pagar o custo de manutenção, mais impostos e a valorização do bem nunca será superior a inflação real, também fazendo você perder quase tudo em cerca de 15 anos. A situação é ainda pior com os imóveis rurais e veículos, basta fazer as contas. Caso o dinheiro que você receba em troca do seu trabalho seja suficiente apenas para comprar comida, vestuário e moradia, você já sabe que é um escravo né?… Precisamos entender que a escravidão não acabou, apenas foi democratizada. Hoje a escravidão é financeira, nós somos os castiços e os donos do dinheiro são o senhorio. Os donos do dinheiro são os Globalistas e os Estados seus fantoches. O esquema é simples: fazer todo mundo trabalhar em troca de algo que perde 100% do valor a cada 10 anos, ou seja o dinheiro. Se você pudesse trabalhar em troca de algo que aumentasse de valor acima da inflação real a cada 10 anos você finalmente conquistaria sua liberdade financeira e deixaria de ser escravo. Pois bem, isso já é possível, e não se trata de ouro ou imóveis e sim sobre o Bitcoin, que sobe de valor mais de 100% a cada 10 anos, com a vantagem de ser inconfiscável e de fácil transferência para seus herdeiros quando você morrer, através de uma simples transação LockTime feita em vida. Portanto, mesmo que você não tenha dinheiro para comprar Bitcoin, passar a aceitar Bitcoin em troca de seus produtos e serviços é a única forma de se libertar da escravidão financeira. A carta de alforria financeira proporcionada pelo Bitcoin não é imediata, pois a velocidade da sua libertação depende do quanto você está disposto a aprender sobre o assunto. Eu estou aqui para te ajudar, caso queira. No futuro o Bitcoin estará tão presente na sua vida quanto o pix e o cartão de crédito, você querendo ou não. Assim como o cartão de crédito foi a evolução do cheque pós-datado e o pix a evolução do cartão, o Bitcoin e outras criptomoedas serão a evolução de todos esses meios de pagamento. O que te ofereço é a oportunidade de abolição da sua escravatura antes dos demais escravos acordarem para a realidade, afinal a história sempre se repete: desde o ano de 1300 a.c. a escravidão era defendida pelos próprios escravos, que mais cedo ou mais tarde, foram libertados por Moisés em êxodo 11 da Bíblia Sagrada e hoje o povo de israel se tornou a nação mais rica do mundo. A mesma história se repetiu na Roma Antiga: com o pão e circo. Da mesma forma todo esse império escravocrata ruiu porque mais cedo ou mais tarde os escravos se revoltam, bastam as coisas piorarem bastante. O atual regime de escravidão teve início com a queda do padrão-ouro para impressão do dinheiro no ano de 1944. A escravidão apenas ficou mais sofisticada, pois em vez de pagar os escravos com cerveja como no Egito Antigo ou com pão e circo como na Roma Antiga, passou-se a pagar os escravos com dinheiro sem lastro, ou seja dinheiro inventado, criado do nada, sem qualquer representação com a riqueza real da economia. Mesmo sendo a escravidão atual mais sofisticada, que deixou de ser física para ser financeira, o que torna a mentira mais bem contada, mais cedo ou mais tarde os escravos modernos irão acordar, basta as coisas piorarem mais ou perceberem que todos os bens e serviços do mundo não representam nem 1% de todo o dinheiro que impresso sem lastro. Em outras palavras, se os donos de todo o dinheiro do mundo resolvessem utilizá-lo para comprar tudo o que existe à venda, o preço do quilo do café subiria para R$ 297.306,00 e o preço médio dos imóveis subiria para um número tão grande que sequer caberia nesta folha de papel. Hoje, o dinheiro não vale nada, seus donos sabem disso e optam por entregar o dinheiro aos poucos para os escravos em troca do seu trabalho, para manter o atual regime o máximo de tempo possível. Mesmo assim, o atual regime de escravidão financeira está com os dias contados e depende de você se posicionar antes do efeito manada. Nunca é tarde para entrar no Bitcoin, mesmo ele tendo uma quantidade de emissão limitada, seu valor subirá infinitamente. A menor unidade do Bitcoin é o satoshi, cuja abreviação é sats. Diferente do centavo, cada sat vale um centésimo milionésimo de bitcoin. Hoje (25/05/25), cada unidade de Bitcoin equivale a setecentos mil reais. Logo, cada R$ 0,01 equivale à 0,007 sats. Lembrando que o centavo é um real dividido por cem e o sat é um bitcoin dividido por cem milhões, por isso ainda não existe a paridade entre 1 centavo de real e 1 sat. Essa paridade será alcançada quando um Bitcoin passar a valer um milhão de reais. Com a velocidade que nosso dinheiro está perdendo valor isso não irá demorar muito. Utilizando dados econômicos avançados, prevejo que cada unidade de Bitcoin passará a valer hum milhão de reais até o ano de 2029, assim equiparando 1 sat para cada R$ 0,01. Nesse momento, certamente muitos empresários, comerciantes e profissionais liberais passarão a aceitar o Bitcoin como forma de pagamento pelos seus produtos e serviços, assim como o cheque foi substituído pelo cartão de crédito e o cartão pelo pix. Sabendo disso, você pode entrar na onda de transição no futuro junto com a manada e perder essa alta valorização, ou passar a aceitar Bitcoin agora pelos seus produtos e serviços, assinando assim, a própria carta de alforria da sua escravidão financeira. É importante dizer que os próprios globalistas e governos estão trocando dinheiro por Bitcoin como nunca na história e mesmo que eles adquiram todos os bitcoins disponíveis, ainda assim não será mais possível manter seu regime de escravidão financeira funcionando porque a emissão de Bitcoin é limitada, sendo impossível criar Bitcoin sem lastro, como é feito com o dinheiro hoje. Com o presente artigo, te ofereço a oportunidade de conquistar seus primeiros sats agora, de forma segura e independente, sem precisar de corretoras, bancos, intermediários ou terceiros, basta você querer pois toda a informação necessária está disponível na internet gratuitamente. Se ainda assim você quiser continuar sendo escravo financeiro, depois não adiantar se arrepender quando as janelas de oportunidade se fecharem, o Drex for implantado, papel moeda restringido e sua vida piorar bastante. Importante mencionar que a Lei Brasileira ainda permite a movimentação de até R$ 30.000,00 em Bitcoin por mês sem a necessidade de declaração à Receita Federal e que esse direito pode deixar de existir a qualquer momento, e que quando o Drex for implantado você perderá diversos outros direitos, dentre ele a liberdade de gastar seu dinheiro como quiser e o sigilo. Ofereço ainda, a oportunidade de você baixar uma carteira de Bitcoin gratuita e segura no seu aparelho de celular que funciona de forma semelhante a um banco digital como Nubank e Pagseguro por exemplo, para poder começar à receber Bitcoin pelos seus produtos e serviços agora, de forma fácil e gratuita. Utilizando o qrcode abaixo você ainda ganha alguns sats de graça, promoção válida até o dia 29/05/25 e patrocinada pela Corretora Blink de El Salvador, onde o Bitcoin já é moeda oficial do país, basta acessar o link e instalar o aplicativo: https://get.blink.sv/btcvale

Aviso: disponibilizei o link da carteira de Bitcoin da Corretora Blink apenas como exemplo de como é fácil aceitar Bitcoin como forma de pagamento pelos seus produtos e serviços. Não recomento depender de qualquer corretora para guardar seus valores em Bitcoin. A melhor forma de fazer isso é mantendo dois computadores ou notebook em casa, um conectado à internet com memória em disco disponível de 1 terabyte ou mais para armazenar e visualizar suas transações e outro computador ou notebook desconectado da internet para armazenar suas senhas e chaves privadas para assinar as transações via pendrive. Somente assim você estará 100% livre e seguro. Importante ainda fazer backup em vários CDs com criptografia do seu computador ou notebook que assina as transações, assim também ficando 100% livre e seguro para restaurar sua carteira em qualquer outro computador caso necessário. Todas as instruções de como fazer isso já estão disponíveis gratuitamente na internet. Caso deseje contratar uma consultoria pessoal que inclui aulas particulares por vídeo conferência, onde você aprenderá:

→ Tudo o que precisa saber sobre Bitcoin e demais criptomoedas; → Sistema operacional Linux; → Como instalar sua carteira de Bitcoin em dois computadores para assinaturas air gapped; → Se manter 100% livre e seguro. → Com carga horária à combinar conforme sua disponibilidade.

O custo do investimento pelo meu serviço individual para esse tipo de consultoria é de 204.000 sats (R$ 1.543,46 na cotação atual) valor válido até 31/07/25, interessados entrar em contato por aqui ou através da Matrix: @davipinheiro:matrix.org https://davipinheiro.com/voce-e-escravo-e-nem-sabe-eu-vou-te-provar-agora/

-

@ 5391098c:74403a0e

2025-05-27 18:15:38

@ 5391098c:74403a0e

2025-05-27 18:15:38Você trabalha 5 meses do ano somente para pagar impostos. Ou seja, 42% da sua renda serve para bancar serviços públicos de péssima qualidade. Mesmo que você tivesse a liberdade de usar esses 42% da sua renda para contratar serviços privados de qualidade (saúde, segurança e ensino), ainda assim você seria um escravo porque você recebe dinheiro em troca do seu trabalho, e o dinheiro perde cerca de 10% do valor a cada ano. Em outras palavras todo seu dinheiro que sobra depois de comprar comida, vestuário e moradia perde 100% do valor a cada 10 anos. Isso acontece porque o Estado imprime dinheiro do nada e joga na economia de propósito para gerar INFLAÇÃO e manter todos nós escravizados. Você pode deixar seu dinheiro investido em qualquer aplicação que imaginar e ainda assim nunca terá uma rentabilidade superior a inflação real. No final, acaba perdendo tudo do mesmo jeito. Caso você se ache esperto por investir o que sobra da sua renda em bens duráveis como imóveis ou veículos, sabia que esses bens também não são seus, porque se deixar de pagar os impostos desses bens (iptu, itr, ipva) você também perde tudo. Além disso, o custo de manutenção desses bens deve ser levado em consideração na conta das novas dívidas que você assumiu. No caso dos imóveis urbanos é impossível alugá-lo por mais de 0,38% do seu valor mensalmente. Em outras palavras, a cada ano você recebe menos de 5% do que investiu, tem que pagar o custo de manutenção, mais impostos e a valorização do bem nunca será superior a inflação real, também fazendo você perder quase tudo em cerca de 15 anos. A situação é ainda pior com os imóveis rurais e veículos, basta fazer as contas. Caso o dinheiro que você receba em troca do seu trabalho seja suficiente apenas para comprar comida, vestuário e moradia, você já sabe que é um escravo né?… Precisamos entender que a escravidão não acabou, apenas foi democratizada. Hoje a escravidão é financeira, nós somos os castiços e os donos do dinheiro são o senhorio. Os donos do dinheiro são os Globalistas e os Estados seus fantoches. O esquema é simples: fazer todo mundo trabalhar em troca de algo que perde 100% do valor a cada 10 anos, ou seja o dinheiro. Se você pudesse trabalhar em troca de algo que aumentasse de valor acima da inflação real a cada 10 anos você finalmente conquistaria sua liberdade financeira e deixaria de ser escravo. Pois bem, isso já é possível, e não se trata de ouro ou imóveis e sim sobre o Bitcoin, que sobe de valor mais de 100% a cada 10 anos, com a vantagem de ser inconfiscável e de fácil transferência para seus herdeiros quando você morrer, através de uma simples transação LockTime feita em vida. Portanto, mesmo que você não tenha dinheiro para comprar Bitcoin, passar a aceitar Bitcoin em troca de seus produtos e serviços é a única forma de se libertar da escravidão financeira. A carta de alforria financeira proporcionada pelo Bitcoin não é imediata, pois a velocidade da sua libertação depende do quanto você está disposto a aprender sobre o assunto. Eu estou aqui para te ajudar, caso queira. No futuro o Bitcoin estará tão presente na sua vida quanto o pix e o cartão de crédito, você querendo ou não. Assim como o cartão de crédito foi a evolução do cheque pós-datado e o pix a evolução do cartão, o Bitcoin e outras criptomoedas serão a evolução de todos esses meios de pagamento. O que te ofereço é a oportunidade de abolição da sua escravatura antes dos demais escravos acordarem para a realidade, afinal a história sempre se repete: desde o ano de 1300 a.c. a escravidão era defendida pelos próprios escravos, que mais cedo ou mais tarde, foram libertados por Moisés em êxodo 11 da Bíblia Sagrada e hoje o povo de israel se tornou a nação mais rica do mundo. A mesma história se repetiu na Roma Antiga: com o pão e circo. Da mesma forma todo esse império escravocrata ruiu porque mais cedo ou mais tarde os escravos se revoltam, bastam as coisas piorarem bastante. O atual regime de escravidão teve início com a queda do padrão-ouro para impressão do dinheiro no ano de 1944. A escravidão apenas ficou mais sofisticada, pois em vez de pagar os escravos com cerveja como no Egito Antigo ou com pão e circo como na Roma Antiga, passou-se a pagar os escravos com dinheiro sem lastro, ou seja dinheiro inventado, criado do nada, sem qualquer representação com a riqueza real da economia. Mesmo sendo a escravidão atual mais sofisticada, que deixou de ser física para ser financeira, o que torna a mentira mais bem contada, mais cedo ou mais tarde os escravos modernos irão acordar, basta as coisas piorarem mais ou perceberem que todos os bens e serviços do mundo não representam nem 1% de todo o dinheiro que impresso sem lastro. Em outras palavras, se os donos de todo o dinheiro do mundo resolvessem utilizá-lo para comprar tudo o que existe à venda, o preço do quilo do café subiria para R$ 297.306,00 e o preço médio dos imóveis subiria para um número tão grande que sequer caberia nesta folha de papel. Hoje, o dinheiro não vale nada, seus donos sabem disso e optam por entregar o dinheiro aos poucos para os escravos em troca do seu trabalho, para manter o atual regime o máximo de tempo possível. Mesmo assim, o atual regime de escravidão financeira está com os dias contados e depende de você se posicionar antes do efeito manada. Nunca é tarde para entrar no Bitcoin, mesmo ele tendo uma quantidade de emissão limitada, seu valor subirá infinitamente. A menor unidade do Bitcoin é o satoshi, cuja abreviação é sats. Diferente do centavo, cada sat vale um centésimo milionésimo de bitcoin. Hoje (25/05/25), cada unidade de Bitcoin equivale a setecentos mil reais. Logo, cada R$ 0,01 equivale à 0,007 sats. Lembrando que o centavo é um real dividido por cem e o sat é um bitcoin dividido por cem milhões, por isso ainda não existe a paridade entre 1 centavo de real e 1 sat. Essa paridade será alcançada quando um Bitcoin passar a valer um milhão de reais. Com a velocidade que nosso dinheiro está perdendo valor isso não irá demorar muito. Utilizando dados econômicos avançados, prevejo que cada unidade de Bitcoin passará a valer hum milhão de reais até o ano de 2029, assim equiparando 1 sat para cada R$ 0,01. Nesse momento, certamente muitos empresários, comerciantes e profissionais liberais passarão a aceitar o Bitcoin como forma de pagamento pelos seus produtos e serviços, assim como o cheque foi substituído pelo cartão de crédito e o cartão pelo pix. Sabendo disso, você pode entrar na onda de transição no futuro junto com a manada e perder essa alta valorização, ou passar a aceitar Bitcoin agora pelos seus produtos e serviços, assinando assim, a própria carta de alforria da sua escravidão financeira. É importante dizer que os próprios globalistas e governos estão trocando dinheiro por Bitcoin como nunca na história e mesmo que eles adquiram todos os bitcoins disponíveis, ainda assim não será mais possível manter seu regime de escravidão financeira funcionando porque a emissão de Bitcoin é limitada, sendo impossível criar Bitcoin sem lastro, como é feito com o dinheiro hoje. Com o presente artigo, te ofereço a oportunidade de conquistar seus primeiros sats agora, de forma segura e independente, sem precisar de corretoras, bancos, intermediários ou terceiros, basta você querer pois toda a informação necessária está disponível na internet gratuitamente. Se ainda assim você quiser continuar sendo escravo financeiro, depois não adiantar se arrepender quando as janelas de oportunidade se fecharem, o Drex for implantado, papel moeda restringido e sua vida piorar bastante. Importante mencionar que a Lei Brasileira ainda permite a movimentação de até R$ 30.000,00 em Bitcoin por mês sem a necessidade de declaração à Receita Federal e que esse direito pode deixar de existir a qualquer momento, e que quando o Drex for implantado você perderá diversos outros direitos, dentre ele a liberdade de gastar seu dinheiro como quiser e o sigilo. Ofereço ainda, a oportunidade de você baixar uma carteira de Bitcoin gratuita e segura no seu aparelho de celular que funciona de forma semelhante a um banco digital como Nubank e Pagseguro por exemplo, para poder começar à receber Bitcoin pelos seus produtos e serviços agora, de forma fácil e gratuita. Utilizando o qrcode abaixo você ainda ganha alguns sats de graça, promoção válida até o dia 29/05/25 e patrocinada pela Corretora Blink de El Salvador, onde o Bitcoin já é moeda oficial do país, basta acessar o link e instalar o aplicativo: https://get.blink.sv/btcvale

Aviso: disponibilizei o link da carteira de Bitcoin da Corretora Blink apenas como exemplo de como é fácil aceitar Bitcoin como forma de pagamento pelos seus produtos e serviços. Não recomento depender de qualquer corretora para guardar seus valores em Bitcoin. A melhor forma de fazer isso é mantendo dois computadores ou notebook em casa, um conectado à internet com memória em disco disponível de 1 terabyte ou mais para armazenar e visualizar suas transações e outro computador ou notebook desconectado da internet para armazenar suas senhas e chaves privadas para assinar as transações via pendrive. Somente assim você estará 100% livre e seguro. Importante ainda fazer backup em vários CDs com criptografia do seu computador ou notebook que assina as transações, assim também ficando 100% livre e seguro para restaurar sua carteira em qualquer outro computador caso necessário. Todas as instruções de como fazer isso já estão disponíveis gratuitamente na internet. Caso deseje contratar uma consultoria pessoal que inclui aulas particulares por vídeo conferência, onde você aprenderá:

→ Tudo o que precisa saber sobre Bitcoin e demais criptomoedas; → Sistema operacional Linux; → Como instalar sua carteira de Bitcoin em dois computadores para assinaturas air gapped; → Se manter 100% livre e seguro. → Com carga horária à combinar conforme sua disponibilidade.

O custo do investimento pelo meu serviço individual para esse tipo de consultoria é de 204.000 sats (R$ 1.543,46 na cotação atual) valor válido até 31/07/25, interessados entrar em contato por aqui ou através da Matrix: @davipinheiro:matrix.org https://davipinheiro.com/voce-e-escravo-e-nem-sabe-eu-vou-te-provar-agora/

-

@ 7f6db517:a4931eda

2025-05-27 18:02:40

@ 7f6db517:a4931eda

2025-05-27 18:02:40

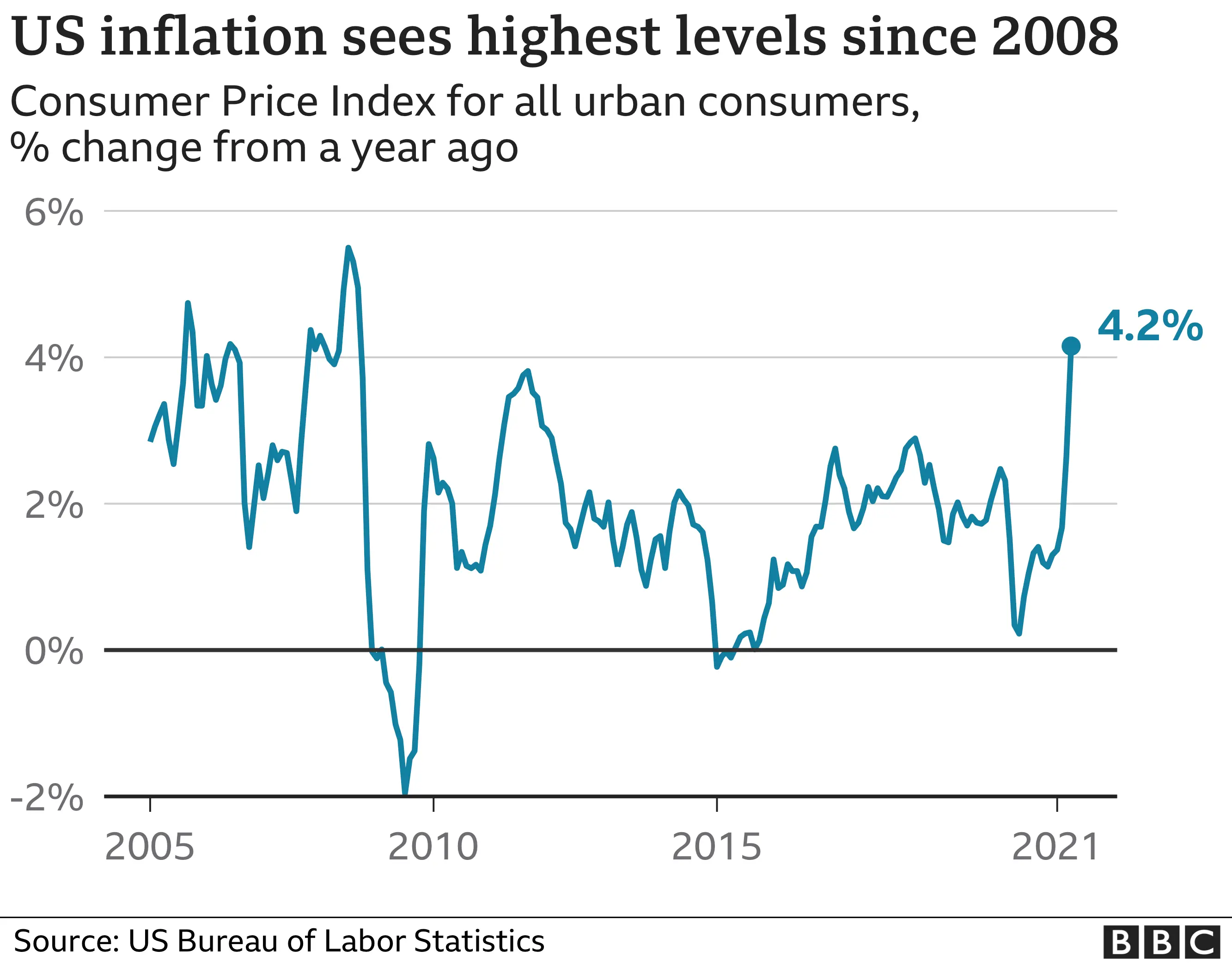

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-27 18:02:39

@ 7f6db517:a4931eda

2025-05-27 18:02:39

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 491afeba:8b64834e

2025-05-27 16:48:45

@ 491afeba:8b64834e

2025-05-27 16:48:45Quando adolescente eu acreditava na coerência da teoria de "amor líquido" do polonês, sociólogo, Zygmunt Bauman, apresentada no livro "Amor Líquido: Sobre a Fragilidade dos Laços Humanos", qual no meu amadurecimento em estudos, sejam eles no meio acadêmico ou fora, percebo como uma das formas mais rasas de explicar as mudanças e transformações dos padrões de relações sócio-afetivas dos humanos. A seguir colocar-me-ei na minha juventude não tanto recente, direi então que nós, se adolescentes e conservadores, ou mesmo jovens adultos mais conservadores, costumamos levar como dogma uma óptica decadentista generalizada de todos os avanços de eras dos homens, universalizamos por nos ser comum a indistinção entre humanidade e humanidades, ou mesmo "humanity" e "humankind" ("humanidade" como espécime e "humanidade" como um universal), compreendemos toda "essas" como "essa" e indistinguimos as sociedades para com os homens, ou seja, a incapacidade de definir os seres dentro de suas respectivas singularidades e especificidades nos leva ao decadentismo generalista (a crença de que de forma geral, e universal, a "civilização universal" decai moralmente, éticamente, materialmente e espiritualmente), que aparente à nós determinadas mudanças nas relações humanas quanto ao caráter sócio-afetivo, por falta de profundidade e critérios ainda sobre questões alinhadas aos métodos e coerências, ou incoerências, lógicas, nós se jovens e conservadores somos levados ao engodo de concordar com a teoria do amor líquido de Bauman, que devo cá explicar de antemão: trata ela, a teoria, o padrão de "amor" dos tempos presentes como frágil, de prazo (curto e médio) e diferente em grau comparativamente ao amor comum das eras passadas.

Aos jovens mais progressistas opera uma compreensão dialética sobre as eras dos homens nos seu tempo presente, na qual ao tempo que o ser progride ele também regride simultaneamente, ou seja, a medida que aparecem contradições advindas de transformações materiais da realidade humana o ser supera essas contradições e progride em meio as transformações, ainda fazendo parte da lógica dessa indissociavelmente, assim constantemente progredindo e regredindo, havendo para esses dois vetores de distinção: o primeiro é o que releva questões espirituais como ao caráter do pensamento "new age", o segundo ignora essas questões por negar a existência da alma, seguem ao materialismo. Cedem em crer na teoria baumaninana como dogma, pois não encontram outros meios para explicar as transformações da sociedade na esfera sócio-afetiva sem que haja confrontamento direto com determinadas premissas assim pertinemente presentes, ou por não conciliarem com análises relativamente superiores, como a de Anthony Giddens sobre a "relação pura" em "A Transformação da Intimidade" e de François de Singly apresentada em "Sociologie du Couple".

!(image)[https://i.pinimg.com/736x/6f/b4/9e/6fb49eda2c8cf6dc837a0abfc7e108e6.jpg]

Há um problema quando uma teoria deixa de assim ser para vir a tornar-se mais um elemento desconexo da ciência, agora dentro da cultura pop, se assim podemos dizer, ou da cultura de massa, ou se preferirem mesmo "anticultura", esse problema é a sua deformização teórica, tornando-se essa rasa para sua palatabilidade massiva, somada a incapacidade de partes da sociedade civil em compreender as falhas daquilo que já foi massificado. Tive surpresa ao entender que muitos outros compartilham da mesma opinião, a exemplo, possuo um amigo na faculdade, marxista, que ao falarmos sobre nossos projetos de pesquisa, citou ele o projeto de um de nossos colegas, no qual esse referido um de nossos colegas faria seu projeto com base na teoria do amor líquido de Bauman, então alí demos risada disso, ora, para nós a teoria baumaniana é furada, passamos a falar sobre Bauman e o motivo pelo qual não gostávamos, lá fiquei até surpreso em saber que mais gente além de mim não gostava da teoria de Bauman, pois ao que eu via na internet era rede de enaltecimentos à figura e à sua teoria, tal como fosse uma revelação partindo de alguma divindade da Idade do Bronze. Pouco tempo depois tive em aula de teoria política uma citação de Bauman partindo do professor que ministrava a disciplina, no entanto, ao citar o nome de Bauman o mesmo fez uma feição na qual aparentava segurar risada, provavelmente ele também não levava Bauman à sério. Não devo negar que todas as vezes que vejo o sociólogo sendo citado em alguma nota no X, no Instagram ou qualquer outra rede social, tal como fosse um referencial teórico bom, sinto uma vergonha alheia pois alí tenho uma impressão de que a pessoa não leu Bauman e usa o referencial teórico como um fato já assim provado e comprovado.

Há pontos positivos na teoria baumaniana, como a capacidade de perceber o problema e correlacioná-lo à modernidade, assim como sucitar a influência do que há de material no fenômeno, porém os erros são pertinentes: o primeiro problema é de categoria. Não há, por parte de Bauman noção alguma entre as dissociações dos amores, não há atenção sobre o amor como estrutura ou ele como um sentimento, todo ele é compreendido uniformemente como "amor", partindo do pressuposto que todas as relações, todas elas, são firmadas com base no amor. Essa crença tem uma origem: Hegel. Nos Escritos Teológicos Hegel partia da crença que o amor ligava os seres relacionalmente como uma força de superação e alienação, mas há de compreendermos que esse Friedrich Hegel é o jovem ainda pouco maduro em suas ideias e seu sistema de pensamento, mais a frente, em "Fenomenologia do Espírito e na Filosofia do Direito", Hegel compreende a institucionalidade do direito no amor e a institucionalização dessa força, assim aproxima-se da realidade a respeito da inserção do amor nas esferas práticas do humano, porém essa ideia, apesar de imperfeita, pois ao que sabemos não é o amor que consolida a relação, mas sim a Verdade (Alétheia), conforme apontado por Heidegger em "Ser e Tempo", essa ideia do amor como a fundamento das relações humanas influenciou, e até hoje influencia, qualquer análise sobre as relações humanas fora da esfera materialista, fora dessa pois, melhormente explicado em exemplo, os marxistas (em exemplo), assim como Marx, consideram como base primordial das relações as condições materiais.

Por certo, não é de todo amor a base para a solidificação, ora, erram aqueles que creem que somente essa força, assim apontada por Hegel, constituiam todos os relacionamentos formais como pilares fundamentais, pois em prática as famílias eram até a fiduciarização dessas, por mais paradoxal que seja, compreendidas melhor como instituições orgânicas de caráter legal do que conluios de afetividades. A família outrora tinha consigo aparelhos de hierarquia bem estabelicidos, quais prezavam pela ordem interna e externa, que acima dessa instituição estava somente a Igreja (outra instituição), com sua fiduciarização [da família] após o movimento tomado pelos Estados nacionais em aplicação do casamento civil mudou-se a lógica das partes que a compõe, findou-se o princípio da subsidiariedade (não intervenção de determinadas instituições nas decisões quais podem ser exercidas em resuluções de problemas nas competências de quaisquer instituições), foi-se então, contudo, também a autoridade, e nisso revela-se um outro problema não apontado na teoria de Bauman: qual o padrão do amor "sólido"? Pois, ora, sociedades tradicionais não abdicavam do relevar dos amores para tornar seus filhos em ativos nas práticas de trocas (dádivas)? É notório que esse padrão se dissocia do padrão de sentimento apontado por Bauman, encontramos esse fato em estudo nos trabalhos "Ensaio Sobre a Dádiva", do Marcel Mauss, e "As Estruturas Elementares do Parentesco", do Claude Levi-Strauss, quais expõem que nas sociedades "sólidas", tradicionais, relevava-se mais questões institucionais que as sentimentais para a formação de laços (teoria da aliança). Muitas das relações passadas não eram baseadas no amor, não significando assim que as de hoje, em oposição, sejam, mas que permanecem-se semelhantes em base, diferentemente em grau e forma.

!(image)[https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F748b94c3-f882-45db-8333-09260ef15cfe_615x413.jpeg]

Ora, ainda existem casamentos motivados pela política, pelo status, pelo prestígio, pelos bens, pelo poder, pela influência familiar e assim sucetivamente, tal como no passado, ocorre que essa prática tornou-se oculta, não mais explícita e aparente, devo dizer ainda que em partes, pois prepondera em nosso tempo uma epidemia de adultérios, fornicações, práticas lascivas e demais práticas libertinosas explicitamente, em contraposição às práticas ocultas em vergonhas de sociedades sem declínio moral e espiritual, o que nos leva a questionar o método comparativo em dicotomia temporal "presente x passado" aplicado por Bauman, no qual segue-se da seguinte forma:

Transformação Passado = *sólido* | Presente = *líquido* Categorias Padrão de amor: tradicional (*sólido*) moderno (*líquido*) *Sólido* = estável, prazo (médio-grande), profundo, determinado. *Líquido* = instável, prazo (curto-médio), raso, indeterminado.O que penso é: Zygmunt Bauman buscou uma explicação material e laical para desviar ao fato de que há uma notória correlação entre espiritualização da sociedade, se voltada à Verdade, com a estabilidade das instituições, o que é já reduzido à moral religiosa, somente, não à mística, como por pensadores da linha de Tocqueville, ou em abordagens também mais laical (positivista) porém ainda relevantes, como Émile Durkheim em "As Formas Elementares da Vida Religiosa" e Max Weber em "A Ética Protestante e o Espírito do Capitalismo", contrapondo uma abordage mais voltada, de fato, a espiritualidade, como Christopher Dawnson, que defende essa teoria em "Religião e o Surgimento da Cultura Ocidental", e Eric Voegelin, principalmente nas obras "A Nova Ciência da Política" e "Ordem e História".

Encerrrando, minha cosmovisão é a católica, o sistema de crença e religião qual sigo é do Deus que se fez homem por amor aos seus filhos, não posso negar ou mesmo omitir o fato de que, por trás de toda a minha crítica estão meus pensamentos e minhas convicções alinhadas àquilo que mais tenho amor em toda minha vida: a Verdade, e a Verdade é Deus, pois Cristo é a Verdade, o Caminho e a Vida, ninguém vai ao Pai se não por Ele, e pois bem, seria incoerência de minha parte não relevar o fato de crença como um dos motivos pelos quais eu rejeito a teoria do amor líquido de Zygmunt Bauman, pois os amores são todos eles praticados por formas, existem por diferentes formas e assim são desde sua tradicionalidade até o predomínio das distorções de declínio espiritual das eras presentes (e também antigas pré-Era Axial), estão esses preservados pelo alinhamento à verdade, assim são indistorcíveis, imutáveis, ou seja, amor é amor, não releva-se o falso amor como um, simplesmente não o é, assim o interesse, a sanha por bens, o egoísmo e a egolatria ("cupiditas", para Santo Agostinho de Hipona, em oposição ao que o santo e filósofo trata por "caritas") não são formas do amor, são autoenganos, não bons, se não são bons logo não são de Deus, ora, se Deus é amor, se ele nos ama, determino como amor (e suas formas) o que está de acordo com a Verdade. Aprofundando, a Teologia do Corpo, do Papa São João Paulo II, rejeita a "liquidez" apresentada por Bauman, pois o amor é, em suma, sacríficio, parte da entrega total de si ao próximo, e se não há logo não é amor. A Teologia do Corpo rejeita não os fundamentos de mentira no "líquido", mas também no "sólido", pois a tradicionalidade não é sinônimo de bom e pleno acordo com o amor que Deus pede de nós, não são as coerções, as violências, as imposições e demais vontades em oposição às de Deus que determinam os amores -- fatos em oposição ao ideário romanticizado. Claro, nem todas as coerções são por si inválidas do amor, ou mesmo as escolhas em trocas racionalizadas, a exemplo do autruísmo em vista da chance da família ter êxito e sucesso, ou seja, pelo bem dos próximos haver a necessidade de submissão a, em exemplo, um casamento forjado, ou algo do gênero, reconhece-se o amor no ato se feito por bem da família, porém o amor incutido, nesse caso, explicita o caráter sacrificial, no qual uma vontade e um amor genuinamente potencial em prazeres e alegrias são anulados, ou seja, mesmo nesse modelo tradicional na "solidez" há possibilidade do amor, não nas formas romanticizadas em critérios, como "estabilidade" e "durabilidade", mas no caráter do sacríficio exercido. Conforme nos ensina São Tomás de Aquino, o amor não é uma "força", tal como ensina Hegel, mas sim uma virtude teologal conforme postas na "Suma Teológica" (II-II Q. 26-28), não devemos reduzir o amor e os amores em análises simplórias (não simples) de falsa complexidade extraídas em métodos questionáveis e pouco competentes à real diensão de crise espiritual das eras, por esse motivo não concordo com a teoria do amor líquido de Zygmunt Bauman.

-

@ d360efec:14907b5f

2025-05-27 15:46:26

@ d360efec:14907b5f

2025-05-27 15:46:26 -

@ b7274d28:c99628cb

2025-05-27 07:07:33

@ b7274d28:c99628cb

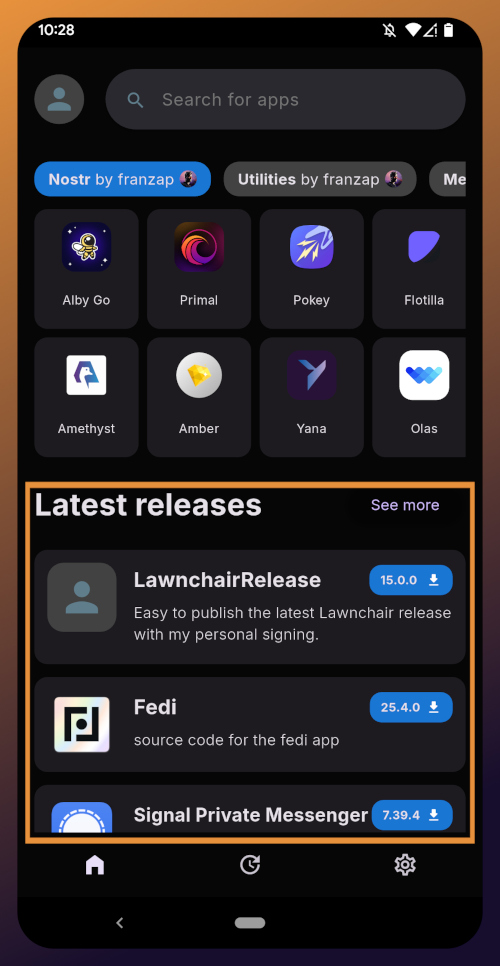

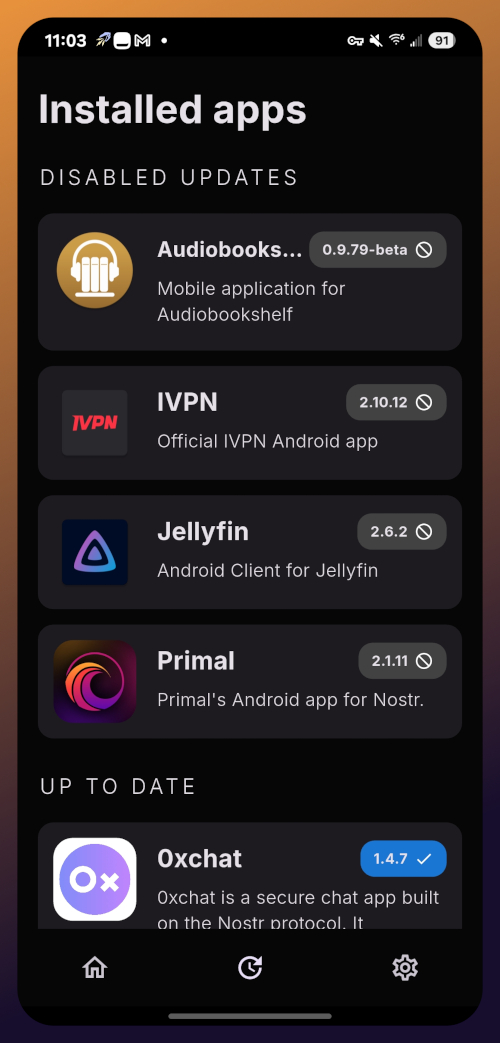

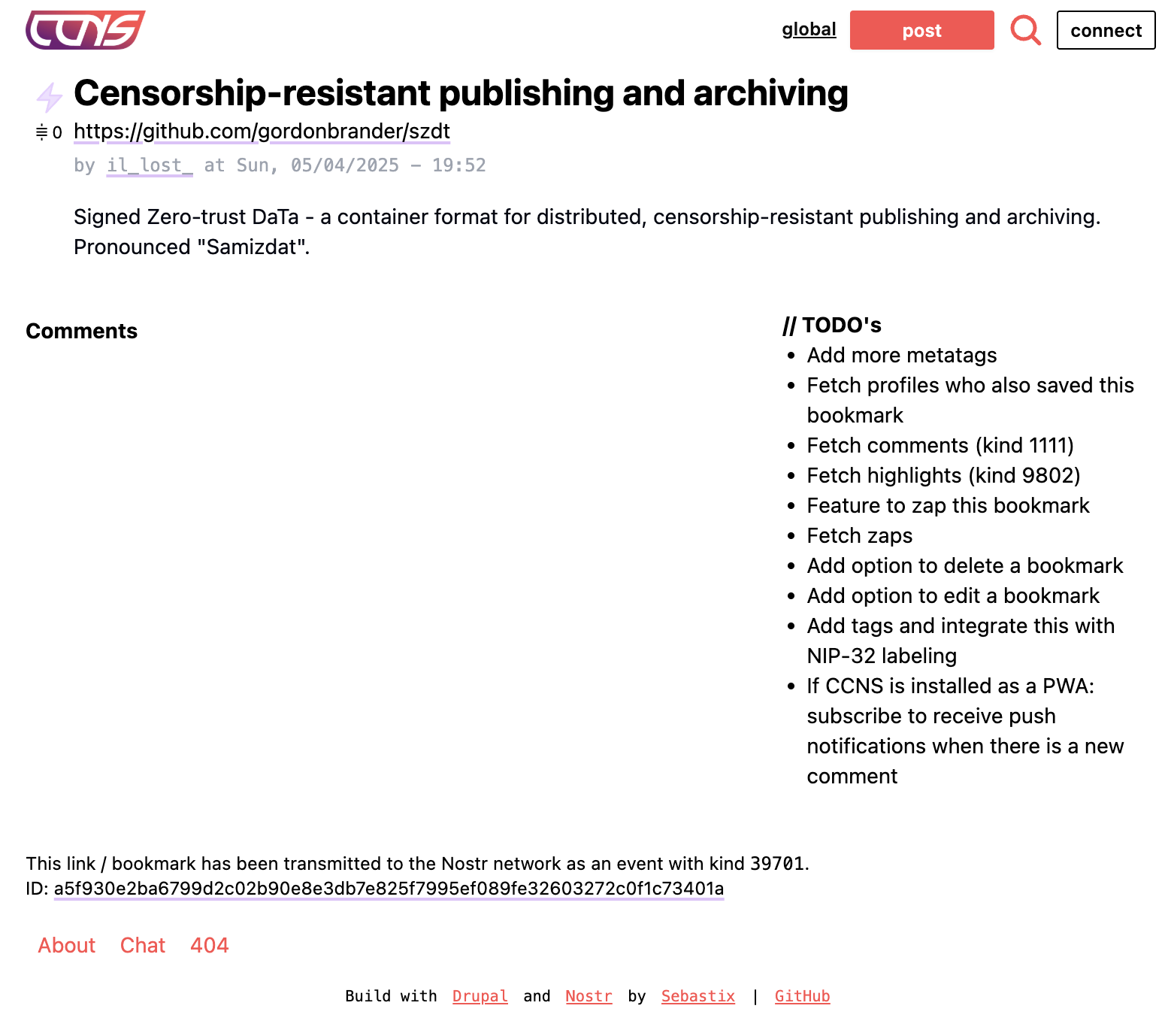

2025-05-27 07:07:33A few months ago, a nostrich was switching from iOS to Android and asked for suggestions for #Nostr apps to try out. nostr:npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424 offered the following as his response:

nostr:nevent1qvzqqqqqqypzq0mhp4ja8fmy48zuk5p6uy37vtk8tx9dqdwcxm32sy8nsaa8gkeyqydhwumn8ghj7un9d3shjtnwdaehgunsd3jkyuewvdhk6tcpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhszythwden5te0dehhxarj9emkjmn99uqzpwwts6n28eyvjpcwvu5akkwu85eg92dpvgw7cgmpe4czdadqvnv984rl0z

Yes. #Android users are fortunate to have some powerful Nostr apps and tools at our disposal that simply have no comparison over on the iOS side. However, a tool is only as good as the knowledge of the user, who must have an understanding of how best to wield it for maximum effect. This fact was immediately evidenced by replies to Derek asking, "What is the use case for Citrine?" and "This is the first time I'm hearing about Citrine and Pokey. Can you give me links for those?"

Well, consider this tutorial your Nostr starter-kit for Android. We'll go over installing and setting up Amber, Amethyst, Citrine, and Pokey, and as a bonus we'll be throwing in the Zapstore and Coinos to boot. We will assume no previous experience with any of the above, so if you already know all about one or more of these apps, you can feel free to skip that tutorial.

So many apps...

You may be wondering, "Why do I need so many apps to use Nostr?" That's perfectly valid, and the honest answer is, you don't. You can absolutely just install a Nostr client from the Play Store, have it generate your Nostr identity for you, and stick with the default relays already set up in that app. You don't even need to connect a wallet, if you don't want to. However, you won't experience all that Nostr has to offer if that is as far as you go, any more than you would experience all that Italian cuisine has to offer if you only ever try spaghetti.

Nostr is not just one app that does one thing, like Facebook, Twitter, or TikTok. It is an entire ecosystem of applications that are all built on top of a protocol that allows them to be interoperable. This set of tools will help you make the most out of that interoperability, which you will never get from any of the big-tech social platforms. It will provide a solid foundation for you to build upon as you explore more and more of what Nostr has to offer.

So what do these apps do?

Fundamental to everything you do on Nostr is the need to cryptographically sign with your private key. If you aren't sure what that means, just imagine that you had to enter your password every time you hit the "like" button on Facebook, or every time you commented on the latest dank meme. That would get old really fast, right? That's effectively what Nostr requires, but on steroids.

To keep this from being something you manually have to do every 5 seconds when you post a note, react to someone else's note, or add a comment, Nostr apps can store your private key and use it to sign behind the scenes for you. This is very convenient, but it means you are trusting that app to not do anything with your private key that you don't want it to. You are also trusting it to not leak your private key, because anyone who gets their hands on it will be able to post as you, see your private messages, and effectively be you on Nostr. The more apps you give your private key to, the greater your risk that it will eventually be compromised.

Enter #Amber, an application that will store your private key in only one app, and all other compatible Nostr apps can communicate with it to request a signature, without giving any of those other apps access to your private key.

Most Nostr apps for Android now support logging in and signing with Amber, and you can even use it to log into apps on other devices, such as some of the web apps you use on your PC. It's an incredible tool given to us by nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, and only available for Android users. Those on iPhone are incredibly jealous that they don't have anything comparable, yet.

Speaking of nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, the next app is also one of his making.

All Nostr data is stored on relays, which are very simple servers that Nostr apps read notes from and write notes to. In most forms of social media, it can be a pain to get your own data out to keep a backup. That's not the case on Nostr. Anyone can run their own relay, either for the sake of backing up their personal notes, or for others to post their notes to, as well.

Since Nostr notes take up very little space, you can actually run a relay on your phone. I have been on Nostr for almost 2 and a half years, and I have 25,000+ notes of various kinds on my relay, and a backup of that full database is just 24MB on my phone's storage.

Having that backup can save your bacon if you try out a new Nostr client and it doesn't find your existing follow list for some reason, so it writes a new one and you suddenly lose all of the people you were following. Just pop into your #Citrine relay, confirm it still has your correct follow list or import it from a recent backup, then have Citrine restore it. Done.

Additionally, there are things you may want to only save to a relay you control, such as draft messages that you aren't ready to post publicly, or eCash tokens, which can actually be saved to Nostr relays now. Citrine can also be used with Amber for signing into certain Nostr applications that use a relay to communicate with Amber.

If you are really adventurous, you can also expose Citrine over Tor to be used as an outbox relay, or used for peer-to-peer private messaging, but that is far more involved than the scope of this tutorial series.

You can't get far in Nostr without a solid and reliable client to interact with. #Amethyst is the client we will be using for this tutorial because there simply isn't another Android client that comes close, so far. Moreover, it can be a great client for new users to get started on, and yet it has a ton of features for power-users to take advantage of as well.

There are plenty of other good clients to check out over time, such as Coracle, YakiHonne, Voyage, Olas, Flotilla and others, but I keep coming back to Amethyst, and by the time you finish this tutorial, I think you'll see why. nostr:npub1gcxzte5zlkncx26j68ez60fzkvtkm9e0vrwdcvsjakxf9mu9qewqlfnj5z and others who have contributed to Amethyst have really built something special in this client, and it just keeps improving with every update that's shipped.

Most social media apps have some form of push notifications, and some Nostr apps do, too. Where the issue comes in is that Nostr apps are all interoperable. If you have more than one application, you're going to have both of them notifying you. Nostr users are known for having five or more Nostr apps that they use regularly. If all of them had notifications turned on, it would be a nightmare. So maybe you limit it to only one of your Nostr apps having notifications turned on, but then you are pretty well locked-in to opening that particular app when you tap on the notification.

Pokey, by nostr:npub1v3tgrwwsv7c6xckyhm5dmluc05jxd4yeqhpxew87chn0kua0tjzqc6yvjh, solves this issue, allowing you to turn notifications off for all of your Nostr apps, and have Pokey handle them all for you. Then, when you tap on a Pokey notification, you can choose which Nostr app to open it in.

Pokey also gives you control over the types of things you want to be notified about. Maybe you don't care about reactions, and you just want to know about zaps, comments, and direct messages. Pokey has you covered. It even supports multiple accounts, so you can get notifications for all the npubs you control.

One of the most unique and incredibly fun aspects of Nostr is the ability to send and receive #zaps. Instead of merely giving someone a 👍️ when you like something they said, you can actually send them real value in the form of sats, small portions of a Bitcoin. There is nothing quite like the experience of receiving your first zap and realizing that someone valued what you said enough to send you a small amount (and sometimes not so small) of #Bitcoin, the best money mankind has ever known.

To be able to have that experience, though, you are going to need a wallet that can send and receive zaps, and preferably one that is easy to connect to Nostr applications. My current preference for that is Alby Hub, but not everyone wants to deal with all that comes along with running a #Lightning node. That being the case, I have opted to use nostr:npub1h2qfjpnxau9k7ja9qkf50043xfpfy8j5v60xsqryef64y44puwnq28w8ch for this tutorial, because they offer one of the easiest wallets to set up, and it connects to most Nostr apps by just copy/pasting a connection string from the settings in the wallet into the settings in your Nostr app of choice.

Additionally, even though #Coinos is a custodial wallet, you can have it automatically transfer any #sats over a specified threshold to a separate wallet, allowing you to mitigate the custodial risk without needing to keep an eye on your balance and make the transfer manually.

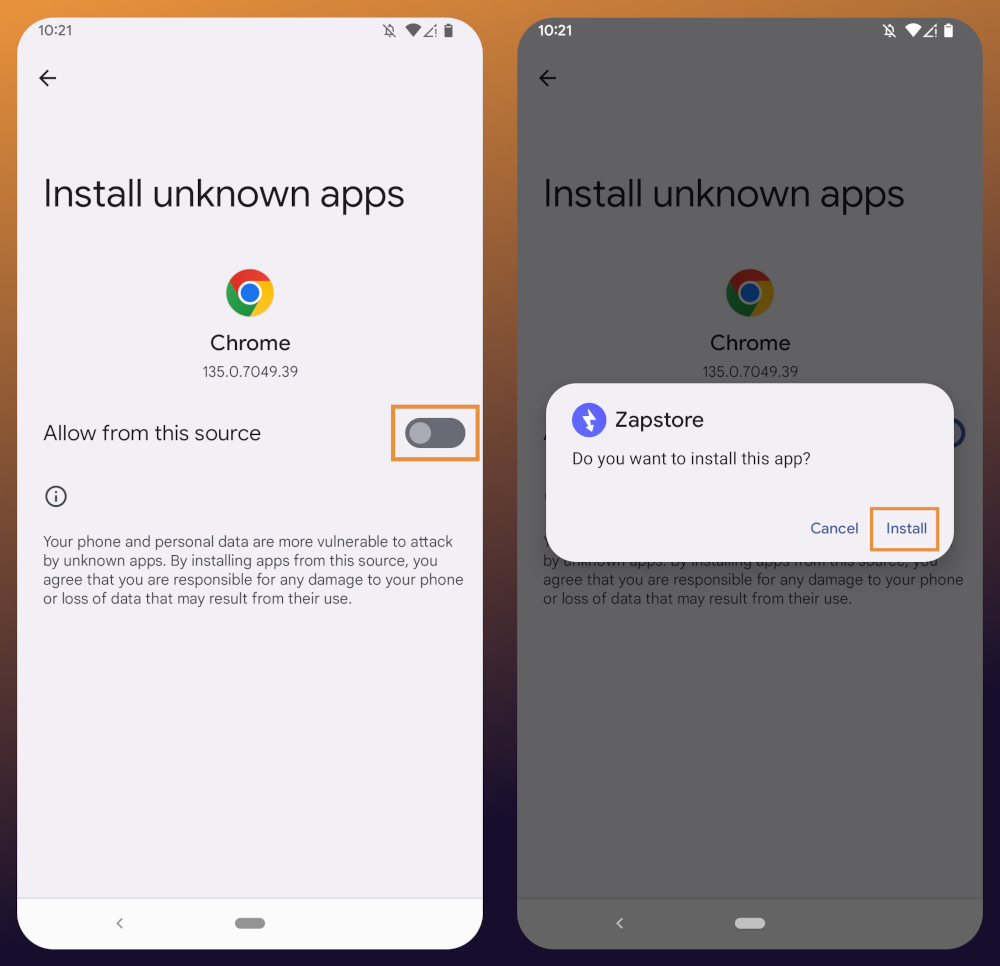

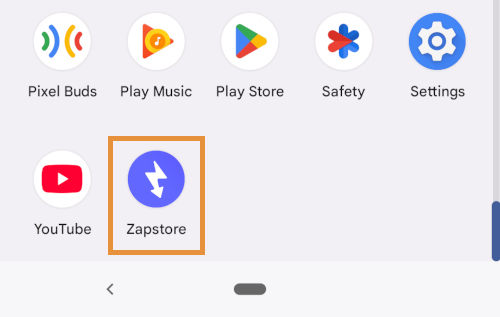

Most of us on Android are used to getting all of our mobile apps from one souce: the Google Play Store. That's not possible for this tutorial series. Only one of the apps mentioned above is available in Google's permissioned playground. However, on Android we have the advantage of being able to install whatever we want on our device, just by popping into our settings and flipping a toggle. Indeed, thumbing our noses at big-tech is at the heart of the Nostr ethos, so why would we make ourselves beholden to Google for installing Nostr apps?

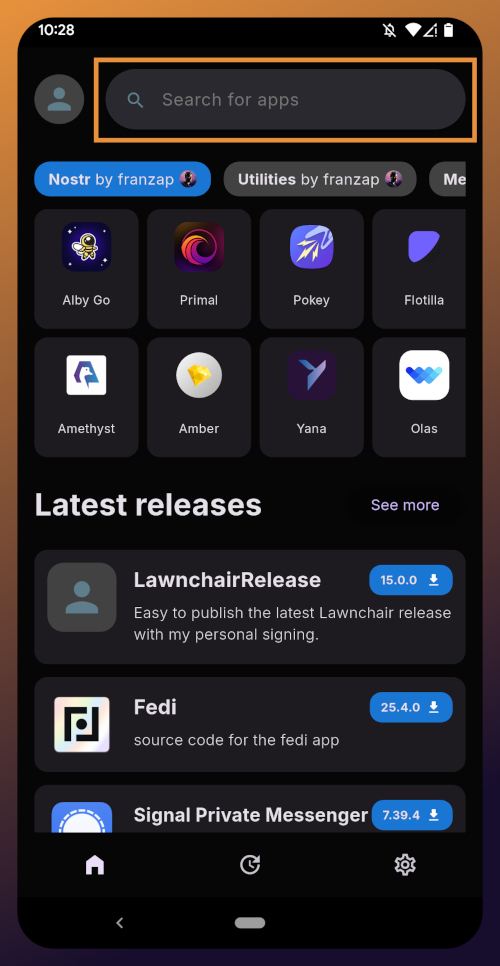

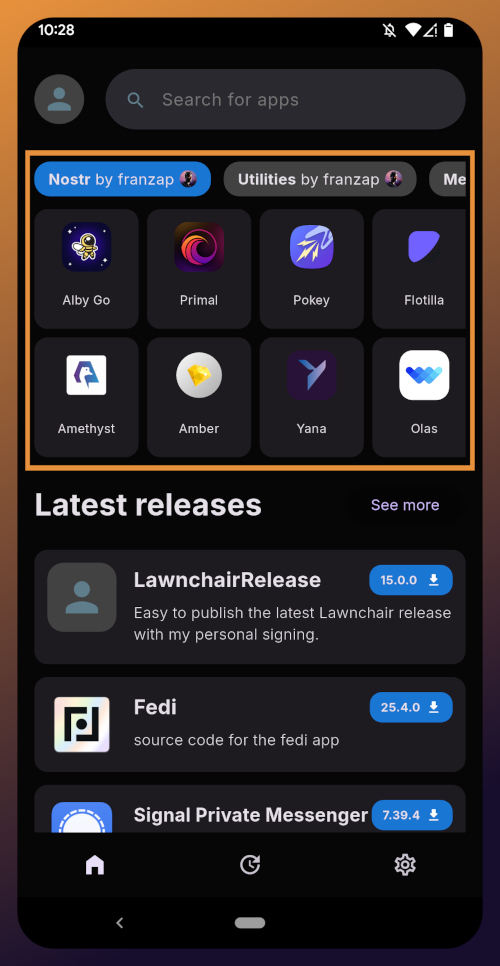

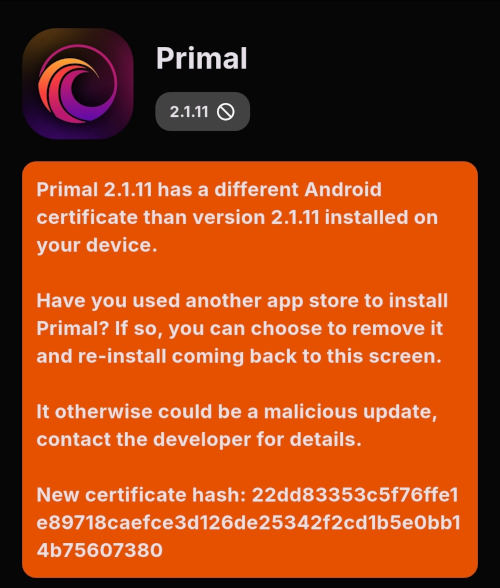

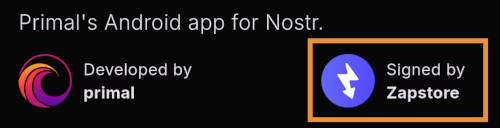

The nostr:npub10r8xl2njyepcw2zwv3a6dyufj4e4ajx86hz6v4ehu4gnpupxxp7stjt2p8 is an alternative app store made by nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9 as a resource for all sorts of open-source apps, but especially Nostr apps. What is more, you can log in with Amber, connect a wallet like Coinos, and support the developers of your favorite Nostr apps directly within the #Zapstore by zapping their app releases.

One of the biggest features of the Zapstore is the fact that developers can cryptographically sign their app releases using their Nostr keys, so you know that the app you are downloading is the one they actually released and hasn't been altered in any way. The Zapstore will warn you and won't let you install the app if the signature is invalid.

Getting Started

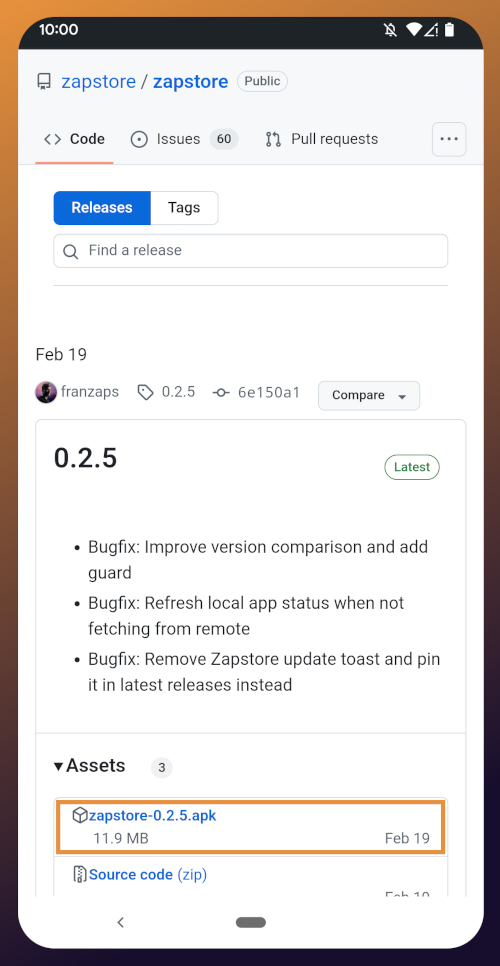

Since the Zapstore will be the source we use for installing most of the other apps mentioned, we will start with installing the Zapstore.

We will then use the Zapstore to install Amber and set it up with our Nostr account, either by creating a new private key, or by importing one we already have. We'll also use it to log into the Zapstore.

Next, we will install Amethyst from the Zapstore and log into it via Amber.

After this, we will install Citrine from the Zapstore and add it as a local relay on Amethyst.

Because we want to be able to send and receive zaps, we will set up a wallet with CoinOS and connect it to Amethyst and the Zapstore using Nostr Wallet Connect.

Finally, we will install Pokey using the Zapstore, log into it using Amber, and set up the notifications we want to receive.

By the time you are done with this series, you will have a great head-start on your Nostr journey compared to muddling through it all on your own. Moreover, you will have developed a familiarity with how things generally work on Nostr that can be applied to other apps you try out in the future.

Continue to Part 2: The Zapstore. Nostr Link: nostr:naddr1qvzqqqr4gupzpde8f55w86vrhaeqmd955y4rraw8aunzxgxstsj7eyzgntyev2xtqydhwumn8ghj7un9d3shjtnzwf5kw6r5vfhkcapwdejhgtcqp5cnwdphxv6rwwp3xvmnzvqgty5au

-

@ 1f956aec:768866bd

2025-05-26 15:06:38

@ 1f956aec:768866bd

2025-05-26 15:06:38== January 17 2025

Out From Underneath | Prism Shores

crazy arms | pigeon pit

Humanhood | The Weather Station

== february 07 2025

Wish Defense | FACS

Sayan - Savoie | Maria Teriaeva

Nowhere Near Today | Midding

== february 14 2025

Phonetics On and On | Horsegirl

== february 21 2025

Finding Our Balance | Tsoh Tso

Machine Starts To Sing | Porridge Radio

Armageddon In A Summer Dress | Sunny Wa

== february 28 2025

you, infinite | you, infinite

On Being | Max Cooper

Billboard Heart | Deep Sea Diver

== March 21 2025

Watermelon/Peacock | Exploding Flowers

Warlord of the Weejuns | Goya Gumbani

== March 28 2025

Little Death Wishes | CocoRosie

Forever is a Feeling | Lucy Dacus

Evenfall | Sam Akpro

== April 4 2025

Tripla | Miki Berenyi Trio

Adagio | Σtella

The Fork | Oscar Jerome

== April 18 2025

Send A Prayer My Way | Julien Baker & TORRES

Superheaven | Superheaven

Thee Black Boltz | Tunde Adebimpe

from brooklyvegan

== April 25 2025

Face Down In The Garden |Tennis

Under Tangled Silence | Djrum

Viagr Aboys |Viagra Boys

Blurring Time | Bells Larsen

== May 2 2025

Time is Not Yours | Say Sue Me 세이수미

If You Asked For A Picture | Blondshell

== May 16 2025

Wield Your Hope Like A Weapon | Soot Sprite

Transmission 96 | Liftin Spirits & DJ Persuasion

Menedék | TÖRZS

== May 28 2025

Forefowk, Mind Me | Quinie

Silver Tears | SILVER TEARS

-

@ 57d1a264:69f1fee1

2025-05-26 07:07:54

@ 57d1a264:69f1fee1

2025-05-26 07:07:54Though Philips is no longer the consumer electronics giant they once were—they've shifted into health technology—they still manufacture some personal care items, like electric shavers and hair dryers. Now, somewhat bizarrely, they're dipping their foot into the DIY repair movement to support those products. The company has partnered with Prusa, the Czech company that has become one of the world's largest manufacturers of 3D printers, to launch this new Philips Fixables initiative.

https://www.youtube.com/watch?v=q85lZdNStGs

https://stacker.news/items/989395

-

@ 57d1a264:69f1fee1

2025-05-25 06:26:42

@ 57d1a264:69f1fee1

2025-05-25 06:26:42I dare to claim that the big factor is the absence of an infinite feed design.

Modern social media landscape sucks for a myriad of reasons, but oh boy does the infinite feed take the crapcake. It's not just bad on it's own, it's emblematic of most, if not all other ways social media have deteriorated into an enshitification spiral. Let's see at just three things I hate about it the most.

1) It's addictive: In the race for your attention, every addictive design element helps. But infinite feed is addictive almost by default. Users are expected to pull the figurative lever until they hit a jackpot. Just one more reel, then I'll go to sleep.

2) Autonomy? What's that? You are not the one driving your experience. No. You are just a passenger passively absorbing what the feed feeds you.

3) Echo chambers. The algorithm might be more to blame here, but the infinite feed and it's super-limited exploration options sure don't help. Your feed only goes two ways - into the past and into the comfortable.

And I could go on, and on...

The point it, if the goal of every big tech company is to have us mindlessly and helplessly consume their products, without agency and opposition (and it is $$$), then the infinite feed gets them half-way there.

Let's get rid of it. For the sake of humanity.

Aphantasia [^1]

Version: 1.0.2 AlphaWhat is Aphantasia?

I like to call it a social network for graph enthusiasts. It's a place where your thoughts live in time and space, interconnected with others and explorable in a graph view.

The code is open-source and you can take a look at it on GitHub. There you can find more information about contributions, API usage and other details related to the software.

There is also an accompanying youtube channel.

https://www.youtube.com/watch?v=JeLOt-45rJM

[^1]: Aphantasia the software is named after aphantasia the condition - see Wikipedia for more information.

https://stacker.news/items/988754

-

@ f0fcbea6:7e059469

2025-05-27 18:08:04

@ f0fcbea6:7e059469

2025-05-27 18:08:04Muita gente, hoje em dia, acha que a leitura já não é tão necessária quanto foi no passado. O rádio e a televisão acabaram assumindo as funções que outrora pertenciam à mídia impressa, da mesma maneira que a fotografia assumiu as funções que outrora pertenciam à pintura e às artes gráficas. Temos de reconhecer - é verdade - que a televisão cumpre algumas dessas funções muito bem; a comunicação visual dos telejornais, por exemplo, tem impacto enorme. A capacidade do rádio em transmitir informações enquanto estamos ocupados - dirigindo um carro, por exemplo - é algo extraordinário, além de nos poupar muito tempo. No entanto, é necessário questionar se as comunicações modernas realmente aumentam o conhecimento sobre o mundo à nossa volta.

Talvez hoje saibamos mais sobre o mundo do que no passado. Dado que o conhecimento é pré-requisito para o entendimento, trata-se de algo bom. Mas o conhecimento não é um pré-requisito tão importante ao entendimento quanto normalmente se supõe. Não precisamos saber tudo sobre determinada coisa para que possamos entendê-la. Uma montanha de fatos pode provocar o efeito contrário, isto é, pode servir de obstáculo ao entendimento. Há uma sensação, hoje em dia, de que temos acesso a muitos fatos, mas não necessariamente ao entendimento desses fatos.

Uma das causas dessa situação é que a própria mídia é projetada para tornar o pensamento algo desnecessário - embora, é claro, isso seja apenas mera impressão. O ato de empacotar ideias e opiniões intelectuais é uma atividade à qual algumas das mentes mais brilhantes se dedicam com grande diligência. O telespectador, o ouvinte, o leitor de revistas - todos eles se defrontam com um amálgama de elementos complexos, desde discursos retóricos minuciosamente planejados até dados estatísticos cuidadosamente selecionados, cujo objetivo é facilitar o ato de "formar a opinião" das pessoas com esforço e dificuldade mínimos. Por vezes, no entanto, o empacotamento é feito de maneira tão eficiente, tão condensada, que o telespectador, o ouvinte ou o leitor não conseguem formar sua opinião. Em vez disso, a opinião empacotada é introjetada em sua mente mais ou menos como uma gravação é inserida no aparelho de som. No momento apropriado, aperta-se o play e a opinião é "tocada". Eles reproduzem a opinião sem terem pensado a respeito.

-

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06Star Wars is often viewed as a myth of rebellion, freedom, and resistance to tyranny. The iconography—scrappy rebels, totalitarian stormtroopers, lone smugglers—suggests a deep anti-authoritarian ethos. Yet, beneath the surface, the narrative arc of Star Wars consistently affirms the necessity, even sanctity, of central authority. This blog entry introduces the question: Is Star Wars fundamentally a celebration of statism?

Rebellion as Restoration, Not Revolution

The Rebel Alliance’s mission is not to dismantle centralized power, but to restore the Galactic Republic—a bureaucratic, centrally governed institution. Characters like Mon Mothma and Bail Organa are high-ranking senators, not populist revolutionaries. The goal is to remove the corrupt Empire and reinstall a previous central authority, presumed to be just.

- Rebels are loyalists to a prior state structure.

- Power is not questioned, only who wields it.

Jedi as Centralized Moral Elites

The Jedi, often idealized as protectors of peace, are unelected, extra-legal enforcers of moral and military order. Their authority stems from esoteric metaphysical abilities rather than democratic legitimacy.

- They answer only to their internal Council.

- They are deployed by the Senate, but act independently of civil law.

- Their collapse is depicted as tragic not because they were unaccountable, but because they were betrayed.

This positions them as a theocratic elite, not spiritual anarchists.

Chaos and the Frontier: The Case of the Cantina

The Mos Eisley cantina, often viewed as a symbol of frontier freedom, reveals something darker. It is: - Lawless - Violent - Culturally fragmented

Conflict resolution occurs through murder, not mediation. Obi-Wan slices off a limb; Han shoots first—both without legal consequence. There is no evidence of property rights, dispute resolution, or voluntary order.

This is not libertarian pluralism—it’s moral entropy. The message: without centralized governance, barbarism reigns.

The Mythic Arc: Restoration of the Just State

Every trilogy in the saga returns to a single theme: the fall and redemption of legitimate authority.

- Prequels: Republic collapses into tyranny.

- Originals: Rebels fight to restore legitimate order.

- Sequels: Weak governance leads to resurgence of authoritarianism; heroes must reestablish moral centralism.

The story is not anti-state—it’s anti-bad state. The solution is never decentralization; it’s the return of the right ruler or order.

Conclusion: The Hidden Statism of a Rebel Myth

Star Wars wears the costume of rebellion, but tells the story of centralized salvation. It: - Validates elite moral authority (Jedi) - Romanticizes restoration of fallen governments (Republic) - Portrays decentralized zones as corrupt and savage (outer rim worlds)

It is not an anarchist parable, nor a libertarian fable. It is a statist mythology, clothed in the spectacle of rebellion. Its core message is not that power should be abolished, but that power belongs to the virtuous few.

Question to Consider:

If the Star Wars universe consistently affirms the need for centralized moral and political authority, should we continue to see it as a myth of freedom? Or is it time to recognize it as a narrative of benevolent empire? -

@ bf47c19e:c3d2573b

2025-05-27 14:57:56

@ bf47c19e:c3d2573b

2025-05-27 14:57:56Srpski prevod knjige "The Little Bitcoin Book"

Zašto je Bitkoin bitan za vašu slobodu, finansije i budućnost?

Verovatno ste čuli za Bitkoin u vestima ili da o njemu raspravljaju vaši prijatelji ili kolege. Kako to da se cena stalno menja? Da li je Bitkoin dobra investicija? Kako to uopšte ima vrednost? Zašto ljudi stalno govore o tome kao da će promeniti svet?

"Mala knjiga o Bitkoinu" govori o tome šta nije u redu sa današnjim novcem i zašto je Bitkoin izmišljen da obezbedi alternativu trenutnom sistemu. Jednostavnim rečima opisuje šta je Bitkoin, kako funkcioniše, zašto je vredan i kako utiče na individualnu slobodu i mogućnosti ljudi svuda - od Nigerije preko Filipina do Venecuele do Sjedinjenih Država. Ova knjiga takođe uključuje odeljak "Pitanja i odgovori" sa nekim od najčešće postavljanih pitanja o Bitkoinu.

Ako želite da saznate više o ovom novom obliku novca koji i dalje izaziva interesovanje i usvajanje širom sveta, onda je ova knjiga za vas.

-

@ bf47c19e:c3d2573b

2025-05-27 14:54:03

@ bf47c19e:c3d2573b

2025-05-27 14:54:03Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- 5 Razloga Zašto je Novac Važan za Vas, Individualno

- 3 Razloga Zašto je Novac Važan za Društvo u Celini

- Zašto ljudi mrze novac?

Novac vs trenuci – da li oni treba da budu u sukobu? Kakva je uloga novca?

Novac je nepredvidiva zver modernog društva – neki ga veličaju sa stalnom željom da steknu više, dok ga drugi demonizuju i kažu da je pohlepa srž društvenih problema. Tokom mnogih godina svog života, ja sam često prelazio sa jednog na drugo gledište, i naučio mnogo toga upoznajući druge ljude koji žive na oba kraja ovog spektra. Kao i kod mnogih složenih tema, istina leži negde u sredini.

Novac je važan zato što on može da pomogne u uklanjanju materijalnih želja i patnji – omogućavanjem da preuzmete kontrolu nad svojim životom i da brinete o voljenima. Novac podiže životni standard društva omogućavanjem trgovine, a pritom minimalizuje potrebu za poverenjem.

Na novac možemo gledati kao na način da svoj uloženi trud sačuvamo u odredjenom obliku, i da ga vremenom prenesemo, tako da možemo da uživamo u plodovima svog rada. Novac kao alat je jedna od najvažnijih stvari za rast civilizacije. Na nesreću, mnogi su vremenom zlostavljali novac, ali sa dobrim razlogom: način na koji naš novac danas funkcioniše dovodi do duboko podeljenog društva – što ću i objasniti.

5 Razloga Zašto je Novac Važan za Vas, Individualno

Novac je važan za rast bogatstva, što je malo drugačije od toga da imamo veliku platu ili jednostavno zarađivati velike količine novca. Bogatstvo je otklanjanje želja, kako bi mogli da obratimo više pažnje na neke korisnije stvari u životu, od pukog preživljavanja i osnovnih udobnosti.

Bogata osoba je ona koja zaradi više novca nego što potroši, i koja ga čuva – ona čuva svoj rad tokom vremena. Uporedite ovo sa visoko plaćenim lekarom koji živi u velikoj vili sa hipotekom i sa Mercedesom na lizing. Iako ova osoba ima visoke prihode, ona takođe ima velike rashode u vidu obaveze plaćanja te hipoteke i lizinga. Te obaveze sprečavaju ovu osobu da uživa u istinskim blagodetima novca i bogatstva koje one predstavljaju:

1. Sloboda od potrebe za radom

Bez bogatstva, vi morate da radite da biste preživeli. Dostizanjem bogatstva i odredjenom imovinom koja vam donosi novac bez potrebe da vi trošite svoje vreme, vi možete da oslobodite svoj raspored. Više ne zavisite od posla koji mrzite, i nemorate da provodite 40 sati nedeljno odvojeni od porodice, samo da biste se pobrinuli za svoje osnovne potrebe. Dobijanje otkaza u padu ekonomije neće vas dovesti do finansijske propasti ili nečeg goreg.

2. Kontrola nad time kako vi trošite svoje vreme

Kada steknete bogatstvo, vi možete da odlučite kako želite da provodite svoje vreme. Kada se nalazimo u trci pacova i radimo 40+ sati nedeljno, često se naviknemo da novac trošimo onda kada imamo slobodnog vremena. Idemo na lepe večere ili idemo na skupe odmore. Međutim, sa više vremena, a možda čak i sa manje novca, mi možemo da imamo isto ili više uživanja živeći usporenije.

Razmislite o ovome – ukoliko imate samo 1 nedelju slobodno od posla, vi onda morate da kupite onaj mnogo skuplji let u Petak uveče koji se vraća u sledeću Nedelju, kako biste maksimalno iskoristili svoje vreme na nekom egzotičnom mestu za odmor. Međutim, ukoliko ste u mogućnosti da izdržavate sebe bez potrebe da mnogo vremena provodite na poslu, vi onda možete u Utorak da krenete jeftinijim letom i vratite se u sledeću Sredu. Takođe nećete osećati toliki pritisak da se opustite u uživanju tokom vaše nedelje u inostranstvu – možda ćete čak moći i da ostanete duže i da istražujete više, bez plaćanja skupih turističkih agencija i hotela kako bi organizovali vaše kraće putovanje.

3. Sposobnost da pomažete vašim prijateljima i porodici

Onda kada novca imate na pretek, možete poboljšati svoje odnose sa prijateljima i porodicom ne samo kroz dodatno slobodno vreme koje provodite sa njima, već i sa samim novcem. Ako je vašem prijatelju potrebna hitna operacija, vi možete da mu izadjete u susret i pomognete mu da stane na svoje noge. Ukoliko vam je tetka bolesna, vi možete da provedete vreme pored nje, umesto da je pozovete na kratko dok putujete prema kući vraćajući se nakon celog dana provedenog u kancelariji.

4. Smanjen finansijski stres

Stres je sveobuhvatno i opasno stanje modernog doba, sa kojim gotovo svi mi živimo u nekoj odredjenoj meri. Povezan je sa lošim zdravljem, sa preko 43% svih odraslih koji kažu da pate od odredjenih zdravstvenih problema uzrokovanih stresom. Stres zbog posla pogađa 83% zaposlenih.

Pravo bogatstvo – koje znači eliminaciju želja i potreba – može da ukloni ovaj stres i njegove negativne uticaje na druge delove života. Ovo bi čak moglo da ukloni većinu stresa u vašem životu, uzimajući u obzir da je uzrok stresa broj 1 upravo novac.

5. Bolje možete da pomognete vašoj zajednici

Mnogi od nas žele da volontiraju u svojim zajednicama i pomognu onima koja je pomoć preko potrebna, ali nisu u stanju da pronađu slobodnog vremena i energije zbog svog posla, porodice i društvenih aktivnosti koje nas mentalno i fizički čine srećnima, zdravima i hranjenima. Sa bogatstvom, mi možemo da posvetimo vreme koje nam je potrebno za razumevanje i doprinos drugima – a ne samo da sa vremena na vreme pomognemo slanjem humanitarnog SMS-a.

Novac, koji se pametno koristi, je moćno sredstvo za poboljšanje vašeg života i života vaših najmilijih i zajednice. Međutim, novac je takođe moćno sredstvo za poboljšanje društva u celini – ukoliko je dobro strukturiran.

3 Razloga Zašto je Novac Važan za Društvo u Celini

Novac poboljšava sposobnost ljudi da trguju jedni s drugima, što podstiče određene specijalizacije. Ako je imanje vašeg komšije odlično za proizvodnju vina, a vaše je pogodno za žito, obojica možete da profitirate trgovinom. Sad oboje imate i hleb i vino, umesto jednog pijanog vlasnika vinograda i jednog proizvodjača žita kome je dosadno!

Novac poboljšava društvo na nekoliko načina:

1. Omogućava specijalizaciju

Kao u primeru vlasnika vinograda i proizvodjača žita, novac omogućava povećanu specijalizaciju poboljšavajući sposobnost trgovine. Svaka razmena dobara ima problem sa ‘sticajima potreba’ – oba partnera u trgovini moraju da žele ono što druga osoba ima da bi pristala na trgovinu.

Možemo da mislimo o novcu kao o dobru koje žele gotovo svi. Ovo trgovinu čini mnogo jednostavnijom – da biste stekli odredjeno dobro, sve što vam je potrebno je novac, a ne neka slučajna stvar koju prodavac tog dobra takođe želi u tom trenutku. Vremenom je upotreba novca omogućila specijalizaciju, što je povećalo kvalitet i složenost roba i usluga.

Zamislite da sami pokušate da napravite svoj telefon – a bili su potrebni milioni stručnjaka i specijalizovana oprema da bi proizveli taj uređaj. Svi ti stručnjaci i kompanije plaćaju jedni drugima u novcu, omogućavajući složenom plesu globalnih proizvođača i lanaca snabdevanja da taj telefon isporuče na dlan vaše ruke. Čak i nešto tako jednostavno kao flaša za vodu uključuje naftna polja i proizvodne pogone koji su možda hiljadama kilometara od vaše kuće.

Kada ljudi mogu da se specijalizuju, kvalitet robe i usluga može da se poveća.

2. Omogućava korisnu trgovinu uz smanjeno poverenje

Mala društva mogu mirno i produktivno da posluju bez novca koristeći usluge, “dodjem ti” i uzajamno razumevanje. Međutim, kako se društva uvećavaju, svima brzo postaje nemoguće da održavaju lične odnose i isti stepen poverenja sa svima ostalima. Sistem trgovine uslugama i međusobnog poverenja ne funkcioniše previše dobro sa putnikom koji se nalazi na proputovanju kroz grad, i provede samo 15 minuta svog života u vašoj prodavnici.

Novac minimizira poverenje potrebno za trgovinu u većim društvima. Sada više ne moram da verujem da ćete mi pomoći kasnije kada mi zatreba – mogu samo da prihvatim uplatu od vas i da to koristim da bih sebi pomogao kasnije. Jedan od mojih omiljenih mislilaca, Nick Szabo, ovo naziva ‘društvena prilagodljivost’.

3. Smanjuje upotrebu sile

Kada društvo teži upotrebi određenog oblika novca za olakšavanje trgovine, može u velikoj meri da smanji nasilje u tom društvu. Kako to može biti tako? Zar ljudi ne bi i dalje želeli da kradu jedni od drugih ili da se svete?

Ukoliko razmišljamo van uobičajnih okvira, možemo da počnemo da razumemo kako novac može da smanji nasilje. Ako ti i ja živimo u susednim zemljama i želimo nešto što druga zemlja ima, imamo dva načina da to dobijemo: uzimanjem na silu ili menjanjem nečeg našeg za to. Kao što je ranije rečeno, novac znatno olakšava trgovinu – pa ćemo postojanjem zajedničkog monetarnog sistema verovatnije radje izvršiti trgovinu nego napad na zemlju. Zašto bismo rizikovali svoje živote kad možemo samo mirno da trgujemo jedni sa drugima?

Zašto ljudi mrze novac?

Pa ako novac ima toliko koristi za nas lično i za društvo u celini, zašto toliko ljudi mrzi novac? Zašto je demonizovan, zajedno sa onima koji ga imaju puno?

Za deo ovoga može biti okrivljen problem u jednakosti mogućnosti – to da je nekima teže da izadju iz nemaštine i postanu bogati. Bez sumnje, neki mali deo potiče od ljudi koji jednostavno ne žele da se trude ili preduzmu neophodne rizike da bi postali bogati.

Međutim, oba ova problema imaju više veze sa problemima kako naš novac danas funkcioniše, nego sa bilo kojim problemom u samom konceptu novca. Novčani sistem treba da nagrađuje ljude koji proizvode vredne stvari i trguju njima sa drugima. Verujem da većina ljudi danas misli da novac tako funkcioniše, i to ne bi smelo da bude daleko od istine.

Naš trenutni monetarni sistem, na žalost, nagrađuje ’finansijalizaciju’ – pretvarajući sve u imovinu, čija vrednost može da se napumpava ili spušta stvaranjem dobre priče i navođenjem drugih da veruju u nju. Razuzdani dug pogonjen stalnim omalovažavanjem svih glavnih valuta dodat je ovom blatu finansijalizacije. Sada je isplativije podići ogroman kredit i koristiti ga za brzo okretanje imovine radi zarade nego izgraditi posao koji društvu nudi korisne robe i usluge.

Tradicionalni monetarni sistem dodatno nagradjuje predatore, partnere u zločinu i neradnike.

Propast našeg novca razvila se tokom proteklih pola veka, počevši od toga kada su naše valute postale ništa više od parčeta papira, podržanog sa verom i kreditima naših vlada. Da biste bolje razumeli ovu promenu, pogledajte moj post o svrsi i istoriji novca.

Ako vam se sviđa moj rad, molim vas da ga podelite sa svojim prijateljima i porodicom. Cilj mi je da svima pružim pogled u ekonomiju i na to kako ona utiče na njihov život.

-

@ 45d6c2bf:56915a25

2025-05-27 14:23:39

@ 45d6c2bf:56915a25

2025-05-27 14:23:39published without nostr installed

-

@ 43baaf0c:d193e34c

2025-05-27 14:08:02

@ 43baaf0c:d193e34c

2025-05-27 14:08:02During the incredible Bitcoin Filmfest, I attended a community session where a discussion emerged about zapping and why I believe zaps are important. The person leading the Nostr session who is also developing an app that’s partially connected to Nostr mentioned they wouldn’t be implementing the zap mechanism directly. This sparked a brief but meaningful debate, which is why I’d like to share my perspective as an artist and content creator on why zaps truly matter.

Let me start by saying that I see everything from the perspective of an artist and creator, not so much from a developer’s point of view. In 2023, I started using Nostr after spending a few years exploring the world of ‘shitcoins’ and NFTs, beginning in 2018. Even though I became a Bitcoin maximalist around 2023, those earlier years taught me an important lesson: it is possible to earn money with my art.

Whether you love or hate them, NFTs opened my eyes to the idea that I could finally take my art to the next level. Before that, for over 15 years, I ran a travel stock video content company called @traveltelly. You can read the full story about my journey in travel and content here: https://yakihonne.com/article/traveltelly@primal.net/vZc1c8aXrc-3hniN6IMdK

When I truly understood what Bitcoin meant to me, I left all other coins behind. Some would call that becoming a Bitcoin maximalist.

The first time I used Nostr, I discovered the magic of zapping. It amazed me that someone who appreciates your art or content could reward you—not just with a like, but with real value: Bitcoin, the hardest money on earth. Zaps are small amounts of Bitcoin sent as a sign of support or appreciation. (Each Bitcoin is divisible into 100 million units called Satoshis, or Sats for short—making a Satoshi the smallest unit of Bitcoin recorded on the blockchain.)

The Energy of Zaps

The Energy of ZapsIf you’re building an app on Nostr—or even just connecting to it—but choose not to include zaps, why should artists and content creators share their work there? Why would they leave platforms like Instagram or Facebook, which already benefit from massive network effects?

Yes, the ability to own your own data is one of Nostr’s greatest strengths. That alone is a powerful reason to embrace the protocol. No one can ban you. You control your content. And the ability to post once and have it appear across multiple Nostr clients is an amazing feature.

But for creators, energy matters. Engagement isn’t just about numbers—it’s about value. Zaps create a feedback loop powered by real appreciation and real value, in the form of Bitcoin. They’re a signal that your content matters. And that energy is what makes creating on Nostr so special.

But beyond those key elements, I also look at this from a commercial perspective. The truth is, we still can’t pay for groceries with kisses :)—we still need money as a medium of exchange. Being financially rewarded for sharing your content gives creators a real incentive to keep creating and sharing. That’s where zaps come in—they add economic value to engagement.

A Protocol for Emerging Artists and Creators

I believe Nostr offers a great starting point for emerging artists and content creators. If you’re just beginning and don’t already have a large following on traditional social media platforms, Nostr provides a space where your work can be appreciated and directly supported with Bitcoin, even by a small but engaged community.

On the other hand, creators who already have a big audience and steady income on platforms like Instagram or YouTube may not feel the urgency to switch. This is similar to how wealthier countries are often slower to understand or adopt Bitcoin—because they don’t need it yet. In contrast, people in unbanked regions or countries facing high inflation are more motivated to learn how money really works.

In the same way, emerging creators—those still finding their audience and looking for sustainable ways to grow—are often more open to exploring new ecosystems like Nostr, where innovation and financial empowerment go hand in hand.

The same goes for Nostr. After using it for the past two years, I can honestly say: without Nostr, I wouldn’t be the artist I am today.

Nostr motivates me to create and share every single day. A like is nice but receiving a zap, even just 21 sats, is something entirely different. Once you truly understand that someone is willing to pay you for what you share, it’s no longer about the amount. It’s about the magic behind it. That simple gesture creates a powerful, positive energy that keeps you going.

Even with Nostr’s still relatively small user base, I’ve already been able to create projects that simply wouldn’t have been possible elsewhere.

Zaps do more than just reward—they inspire. They encourage you to keep building your community. That inspiration often leads to new projects. Sometimes, the people who zap you become directly involved in your work, or even ask you to create something specifically for them.

That’s the real value of zaps: not just micro-payments, but micro-connections sparks that lead to creativity, collaboration, and growth.

Proof of Work (PoW)

Over the past two years, I’ve experienced firsthand how small zaps can evolve into full art projects and even lead to real sales. Here are two examples that started with zaps and turned into something much bigger:

Halving 2024 Artwork

When I started the Halving 2024 project, I invited people on Nostr to be part of it. 70 people zapped me 2,100 sats each, and in return, I included their Npubs in the final artwork. That piece was later auctioned and sold to Jurjen de Vries for 225,128 Sats.

Magic Internet Money

For the Magic Internet Money artwork, I again invited people to zap 2,100 sats to be included. Fifty people participated, and their contributions became part of the final art frame. The completed piece was eventually sold to Filip for 480,000 sats.

These examples show the power of zaps: a simple, small act of appreciation can turn into larger engagement, deeper connection, and even the sale of original art. Zaps aren’t just tips—they’re a form of collaboration and support that fuel creative energy.

I hope this article gives developers a glimpse into the perspective of an artist using Nostr. Of course, this is just one artist’s view, and it doesn’t claim to speak for everyone. But I felt it was important to share my Proof of Work and perspective.

For me, Zaps matter.

Thank you to all the developers who are building these amazing apps on Nostr. Your work empowers artists like me to share, grow, and be supported through the value-for-value model.

-

@ c1e9ab3a:9cb56b43

2025-05-27 13:19:53

@ c1e9ab3a:9cb56b43

2025-05-27 13:19:53I. Introduction: Money as a Function of Efficiency and Preference

Money is not defined by law, but by power over productivity. In any open economy, the most economically efficient actors—those who control the most valuable goods, services, and knowledge—ultimately dictate the medium of exchange. Their preferences signal to the broader market what form of money is required to access the highest-value goods, from durable commodities to intangibles like intellectual property and skilled labor.

Whatever money these actors prefer becomes the de facto unit of account and store of value, regardless of its legal status. This emergent behavior is natural and reflects a hierarchy of monetary utility.

II. Classical Gresham’s Law: A Product of Market Distortion

Gresham’s Law, famously stated as:

"Bad money drives out good"