-

@ 7f6db517:a4931eda

2025-06-02 09:01:29

@ 7f6db517:a4931eda

2025-06-02 09:01:29

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ eb0157af:77ab6c55

2025-06-02 09:01:08

@ eb0157af:77ab6c55

2025-06-02 09:01:08The blockchain analytics firm claims to have identified the Bitcoin addresses held by the company led by Saylor.

Arkham Intelligence announced it had identified addresses linked to Strategy. According to Arkham’s statements, an additional 70,816 BTC connected to the company have been identified, with an estimated value of around $7.6 billion at current prices. This discovery would bring the total amount of Strategy’s identified holdings to $54.5 billion.

SAYLOR SAID HE WOULD NEVER REVEAL HIS ADDRESSES … SO WE DID

We have identified an additional 70,816 BTC belonging to Strategy, bringing our total identified MSTR BTC holdings to $54.5 Billion. We are the first to publicly identify these holdings.

This represents 87.5% of… pic.twitter.com/P3OVdVrhQL

— Arkham (@arkham) May 28, 2025

The analytics firm claims to have mapped 87.5% of Strategy’s total holdings. In a provocative post on X, Arkham wrote:

“Saylor said he would never reveal his addresses. So, we did it for him.

Previously, we tagged:

– 107,000 BTC sent to MSTR’s Fidelity deposits (Fidelity does not segregate custody, so these BTC do not appear in the MSTR entity)

– Over 327,000 BTC held in segregated custody, including Coinbase Prime, in our MSTR entity.”Arkham’s revelations directly clash with Michael Saylor’s public statements on wallet security. During the Bitcoin 2025 conference in Las Vegas, the Strategy chairman explicitly warned against publishing corporate wallet addresses.

“No institutional or enterprise security analyst would ever think it’s a good idea to publish all the wallet addresses so you can be tracked back and forth,” Saylor said during the event.

The executive chairman of Strategy added:

“The current, conventional way to publish proof-of-reserves is an insecure proof of reserves… It’s not a good idea, it’s a bad idea.”

He compared publishing wallet addresses to “publishing the addresses, bank accounts, and phone numbers of your kids hoping it will protect them — when in fact it makes them more vulnerable.”

Finally, the executive chairman suggested using artificial intelligence to explore the security implications of such a practice, claiming that in-depth research could produce “50 pages” of potential security risks.

The post Arkham reveals 87% of Strategy’s Bitcoin addresses appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-06-02 09:00:48

@ 9ca447d2:fbf5a36d

2025-06-02 09:00:48Meta Platforms Inc., the parent company of Facebook and Instagram, has voted down a shareholder proposal to add bitcoin to its treasury. The vote took place at the company’s annual shareholder meeting on May 30, 2025.

The proposal, known as Proposal 13, was submitted by investor Ethan Peck on behalf of the National Center for Public Policy Research (NCPPR).

It asked Meta to convert a portion of its $72 billion in cash, cash equivalents, and marketable securities into bitcoin. The idea was to hedge against inflation and low returns from traditional bond investments.

But the company’s shareholders said no.

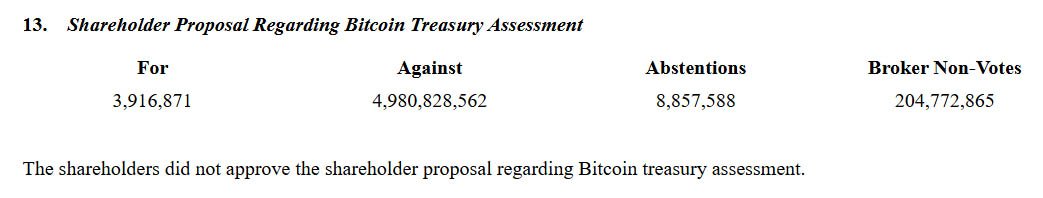

According to the official count, more than 4.98 billion shares were voted against the proposal, while 3.92 million shares were for it—less than 0.1% of total votes. 8.86 million shares were abstentions and over 204 million were broker non-votes.

Meta shareholders rejected bitcoin reserve proposal — SEC

So now, Meta joins Microsoft and Amazon in rejecting calls to add bitcoin to their balance sheets.

Related: Microsoft Shareholders Reject Bitcoin Investment Proposal

Proponents of the proposal argued that bitcoin would help protect Meta’s reserves from inflation and weak bond returns. Peck and others pointed to bitcoin’s strong performance in 2024 and growing institutional interest in the scarce digital asset.

The proposal said bitcoin’s fixed supply and track record make it a long-term store of value.

High-profile supporters, including Matt Cole, CEO of Strive Asset Management, brought the issue to the forefront. At the Bitcoin 2025 conference in Las Vegas, Cole addressed Meta CEO Mark Zuckerberg directly:

“You have already done step one. You have named your goat Bitcoin,” he said. “My ask is that you take step two and adopt a bold corporate bitcoin treasury strategy.”

Others, like Bloomberg ETF analyst Eric Balchunas, said if Meta added bitcoin to its balance sheet it would be a big deal. “If Meta or Microsoft adds BTC to the balance sheet, it will be like when Tom Hanks got COVID—suddenly, it feels real,” Balchunas said.

Despite all the hype and arguments for Bitcoin, the tech giant’s board of directors opposed the measure. The board said the company already has a treasury management process in place that prioritizes capital preservation and liquidity.

“While we are not opining on the merits of cryptocurrency investments compared to other assets, we believe the requested assessment is unnecessary given our existing processes to manage our corporate treasury,” Meta’s board noted.

The board also noted that it reviews many investment options and sees no need for a separate review process specific to Bitcoin.

Meta’s decision shows the broader hesitation of large-cap companies to get into bitcoin as part of their financial strategy.

While companies like Michael Saylor’s Strategy are adding bitcoin to their treasuries every chance they get, companies like Microsoft, Amazon and now Meta, are taking a more cautious approach.

According to recent reports, Meta is exploring ways to integrate stablecoins into its platforms to enable global payouts.

This would be a re-entry into the digital asset space after the company shelved its Diem project due to regulatory issues—a step that bitcoin advocates deem unnecessary, insufficient, and irrelevant to protecting the company’s finances.

-

@ cae03c48:2a7d6671

2025-06-02 09:00:28

@ cae03c48:2a7d6671

2025-06-02 09:00:28Bitcoin Magazine

Panama City Mayor Mizrachi: “Bitcoin Is Not Just Safe, It’s Prosperous”At the 2025 Bitcoin Conference in Las Vegas, the Director of Bitcoin Beach Mike Peterson, the Presidential Advisors of Building Bitcoin Country El Salvador Max & Stacy and the Mayor City of Panama Mayer Mizrachi discussed Bitcoins future in Panama.

At the beginning of the panel, Is Panama Next? El Salvador Leading The Region For Bitcoin Adoption, Mayor Mizrachi started by mentioning, “We accept Bitcoin. The city gets paid in Bitcoin, but it receives in dollars through an intermediary processing, payments processor. Bitcoin is not just safe. It’s prosperous.”

Max commented about the scammers in crypto and how El Salvador is managing it.

“We did a couple of things early on, one was to create The Bitcoin Office which will be directly reporting to the President, and then also we passed a law which will say bitcoin is money and everything else is an unregistered security,” said Max.

Mike Peterson stated, “the access of Bitcoin in Central America to do battle against the globalists that have always looked at the regionist back yard. This is intolerable and this is going to change right now.” After Mizrachi commented, “Imagine yourself in an economic block powered by El Salvador, supported by Panama and the rest will come.”

Stacy reminded everybody about El Salvador’s School system.

“El Salvador is the first country in the world to have a comprehensive public school financial literacy education program from 7 years old,” mentioned Stacy. “These are little kids, learning financial literacy.”

Max ended the panel by saying, “the US game theory right? Because the US wants to buy a lot of Bitcoin, so if Panama wants to buy a lot of bitcoin then it helps everybody in the US. This is the beautiful expression of game theory perfectly aligned in the protocol that is changing the world that we live in. And on the street level what bitcoin does to the population is to go from a spending mentality to a saving mentality.”

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Day 3 below:

This post Panama City Mayor Mizrachi: “Bitcoin Is Not Just Safe, It’s Prosperous” first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-02 09:00:27

@ cae03c48:2a7d6671

2025-06-02 09:00:27Bitcoin Magazine

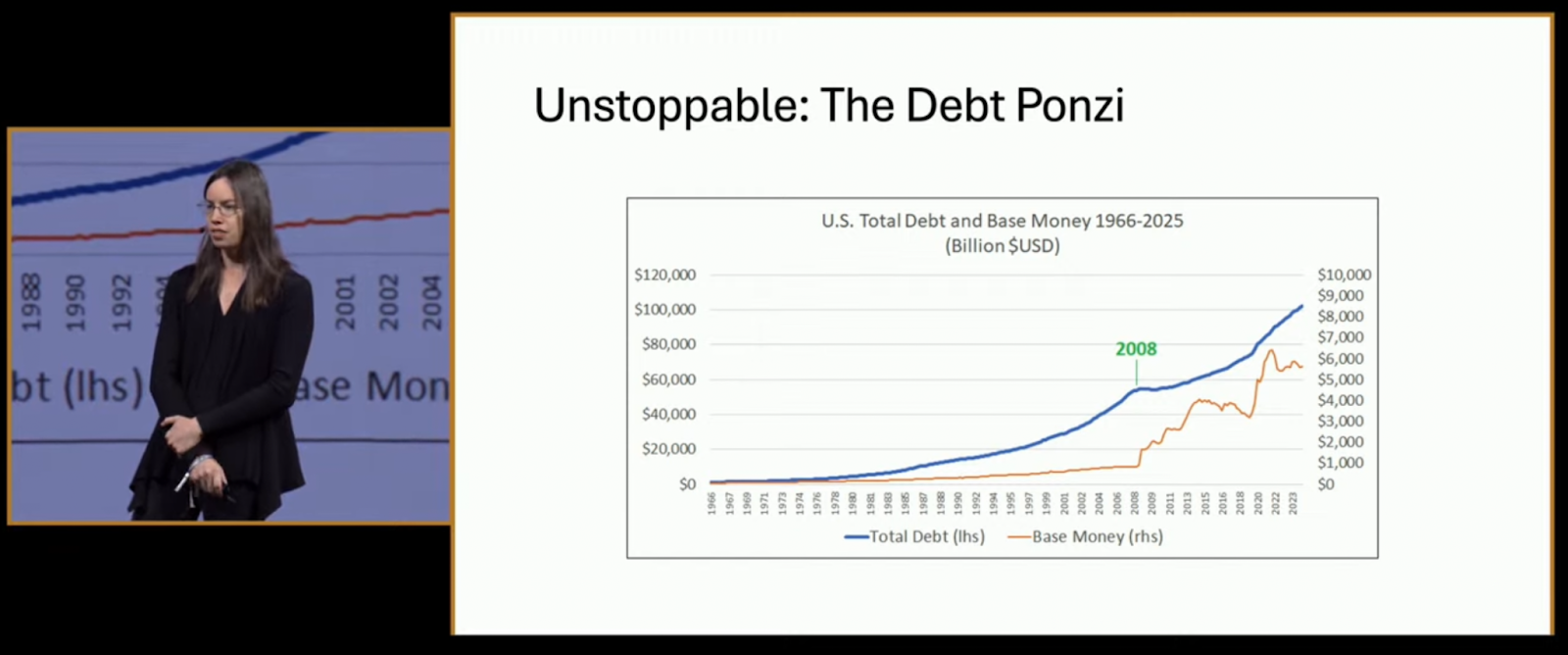

The Debt Train Has No Brakes: Lyn Alden Makes the Case for BTC at Bitcoin 2025“Nothing stops this train,” Lyn Alden initially stated at Bitcoin 2025, walking the audience through a data-rich presentation that made one thing clear: the U.S. fiscal system is out of control—and Bitcoin is more necessary than ever.

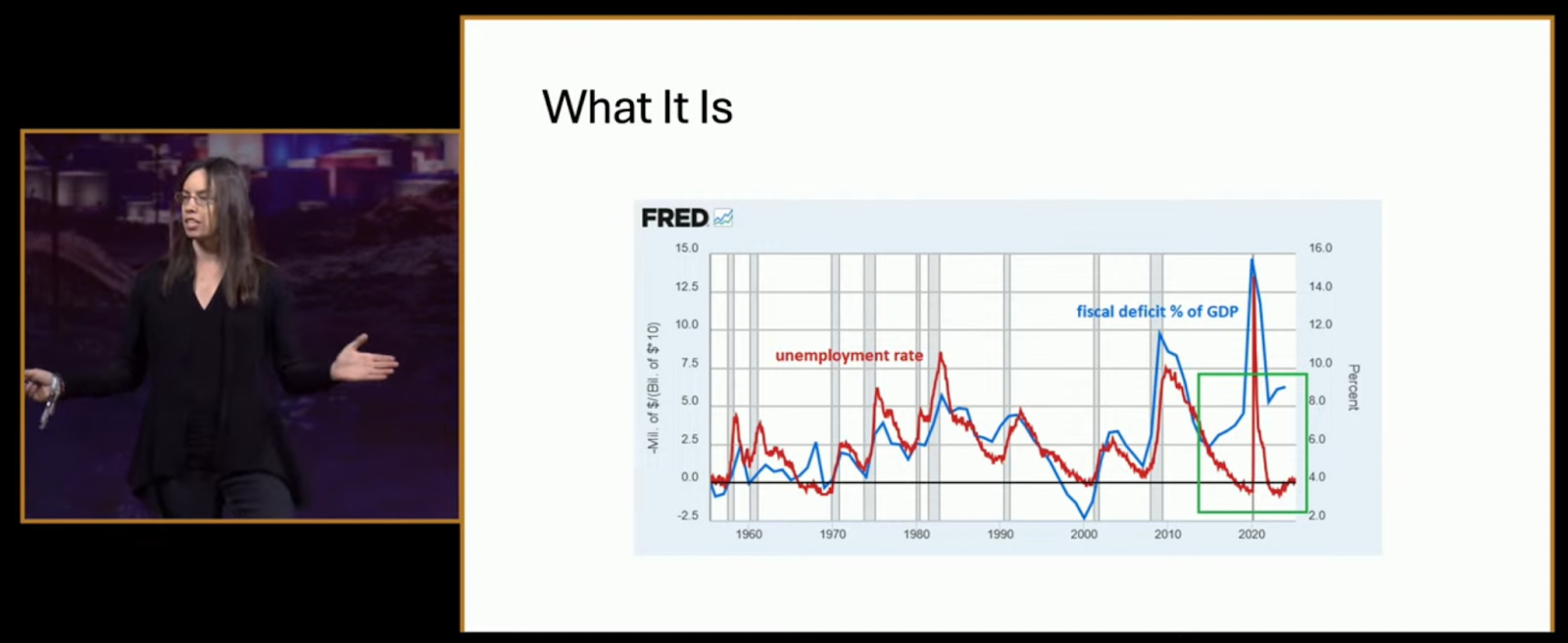

Her first chart, sourced from the Federal Reserve’s FRED database, displayed a stark decoupling: the unemployment rate is down, yet the fiscal deficit has surged past 7% of GDP. “This started around 2017, went into overdrive during the pandemic, and hasn’t corrected,” Alden said. “That’s not normal. We’re in a new era.”

She didn’t mince words. “Nothing stops this train because there are no brakes attached to it anymore. The brakes are heavily impaired.

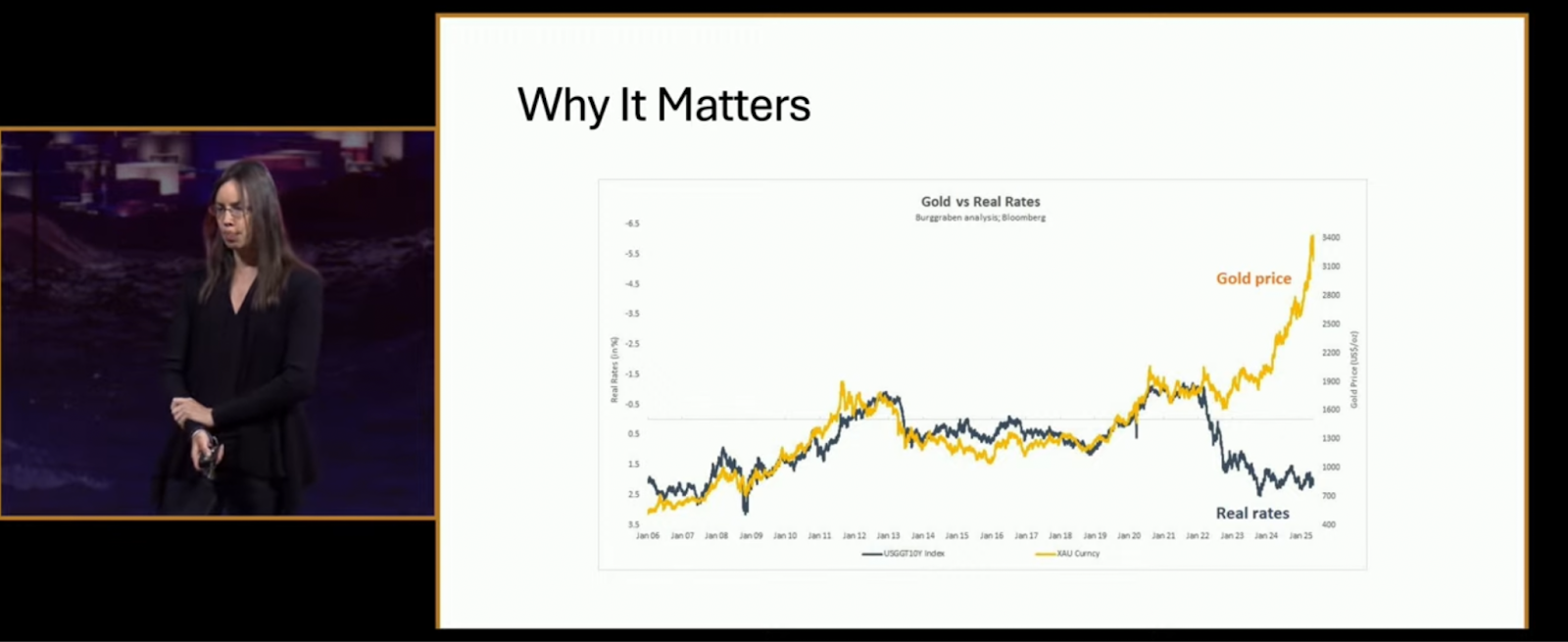

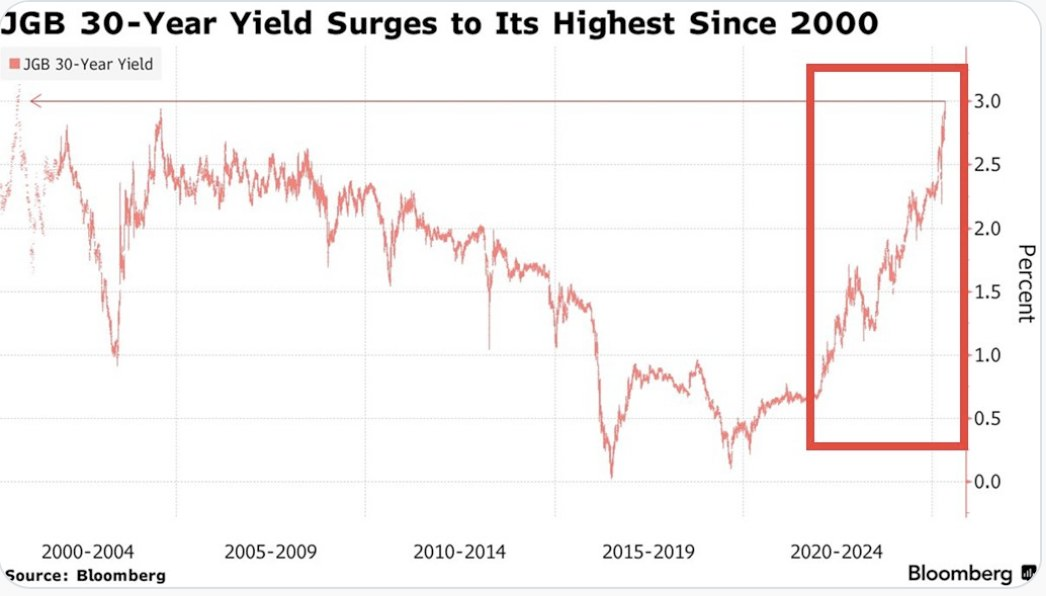

Why should Bitcoiners care? Because, as Alden explained, “it matters for asset prices—especially anything scarce.” She displayed a gold vs. real rates chart that showed gold soaring as real interest rates plunged. “Five years ago, most would have said Bitcoin couldn’t thrive in a high-rate environment. Yet here we are—Bitcoin over $100K, gold at new highs, and banks breaking under pressure.”

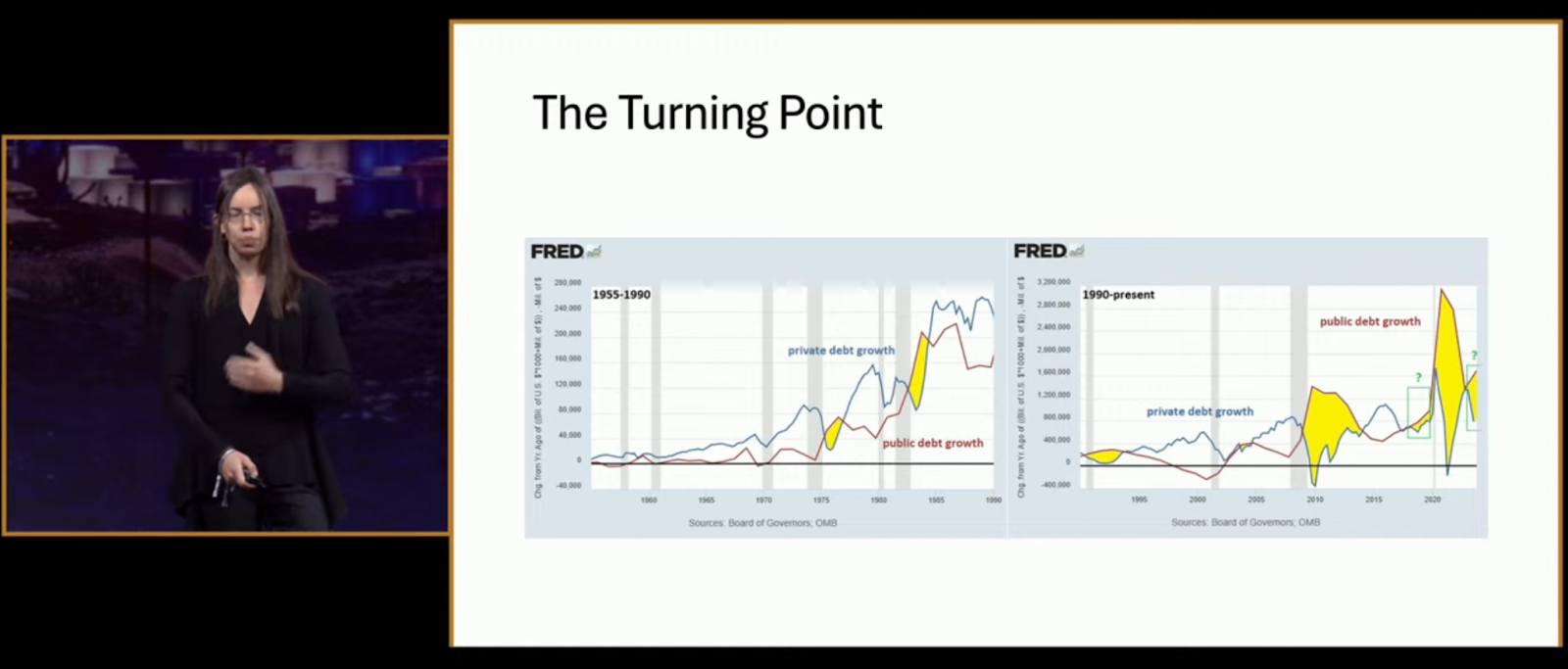

Next came what she called “The Turning Point”—a side-by-side showing how public debt growth overtook private sector debt post-2008, flipping a decades-long norm. “This is inflationary, persistent, and it means the Fed can’t slow things down anymore.”

Another chart revealed why rising interest rates are now accelerating the deficit. “They’ve lost their brakes. Raising rates just makes the federal interest bill explode faster than it slows bank lending.”

Alden called it a ponzi: “The system is built on constant growth. Like a shark, it dies if it stops swimming.”

Her slide showed a relentless rise in total debt versus base money—except for a jolt in 2008, and again after 2020. “This isn’t going backward. Ever.”

So why Bitcoin? “Because it’s the opposite. Scarce, decentralized, and mathematically capped,” Alden concluded. “There are two reasons nothing stops this train: math and human nature. Bitcoin is the mirror of this system—and the best protection from it.”

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Day 3 below:

This post The Debt Train Has No Brakes: Lyn Alden Makes the Case for BTC at Bitcoin 2025 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-02 09:00:26

@ cae03c48:2a7d6671

2025-06-02 09:00:26Bitcoin Magazine

Jack Mallers Announced A New System of Bitcoin Backed Loans at StrikeThe Founder and CEO of Strike, Jack Mallers, at the 2025 Bitcoin Conference in Las Vegas, announced a new system of Bitcoin backed loans at Strike with one digit interest rate.

Jack Mallers began his keynote by pointing at the biggest problem. Fiat currency.

“The best time to go to Whole Foods and buy eggs with your dollars was 1913,” said Mallers. “Every other time after, you are getting screwed.”

What’s the solution?

“The solution is Bitcoin,” stated Mallers. “Bitcoin is the money that we coincide that nobody can print. You can’t print, you can’t debase my time and energy, you cannot deprive me of owning assets, of getting out of debt, of living sovereignly and protecting my future, my family, my priced possessions. Bitcoin is what we invented to do that.”

Mallers gave a power message to the audience by explaining that people should HODL every dollar they have in Bitcoin. People should also spend a little of it to have a nice life.

“You can’t HODL forever,” said Jack.

While talking about loans that people borrow against their Bitcoin. He explained why he thinks banks putting 20% in interest for loans backed with Bitcoin is outrageous.

“All these professional economists, they are like Bitcoin is risky and volatile,” stated Mallers. “No it’s not. This is the magnificent 7 one year volatility and the orange one in the middle is Bitcoin. It’s no more risky and volatile. It’s a little bit more volatile than Apple, but is far less more volatile than Tesla.”

“As Bitcoin matures, its volatility goes down,” continued Jack. “Bitcoin volatility is at a point where it is no more risky than a Tesla Stock. We should not be paying double digits rates for a loan.”

Mallers announced his new system of loans at Strike of 9-13% in interest rates. It will allow people to get loans from $10,000 to $1 billion.

Mallers closed by saying, “please be responsible. This is debt. Debt is like fire in my opinion. It can heat a civilization. It can warm your home, but if you go too crazy it can burn your house down.”

“Life is short,” said Jack. “Take the trip, but with bitcoin you just get to take a better one.”

This post Jack Mallers Announced A New System of Bitcoin Backed Loans at Strike first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-02 09:00:25

@ cae03c48:2a7d6671

2025-06-02 09:00:25Bitcoin Magazine

Michael Saylor Presents The 21 Ways to Wealth at Bitcoin 2025Michael Saylor, Executive Chairman of Strategy, took the stage at Bitcoin 2025 delivering a keynote titled “21 Ways to Wealth.” He stated: “This speech is for you. I’ve traveled the world and told countries, institutional investors, and even the disembodied spirits of our children’s children why they need Bitcoin. This is for every individual, every family, every small business. It’s for everybody.”

He began with clarity. “The first way to wealth is clarity,” he said. “Clarity comes the moment you realize Bitcoin is capital—perfected capital, programmable capital, incorruptible capital.” For Saylor, every thoughtful individual on Earth will ultimately seek such pristine capital, and every AI system will prefer it as well.

The second path is conviction. Bitcoin, he said, will appreciate faster than every other asset, because it’s engineered for performance. “It’s going to grow faster than real estate or collectibles. It is the most efficient store of value in human history.”

The third way is courage. “If you’re going to get rich on Bitcoin, you need courage,” he warned. “Wealth favors those who embrace intelligent monetary risk. Some people will get left behind. Others will juggle it. But the bold will feed the fire—sell your bonds, buy Bitcoin. An extraordinary explosion of value is coming.”

Fourth comes cooperation. “You are more powerful if you have the full support of your family. Your children have time and potential. The secret is transferring capital into their hands. Families that move in unity are unstoppable.”

The fifth is capability. “Master AI,” he said. “In 2025, everything you can imagine is at your fingertips—wisdom, analysis, creativity. Ask AI, argue with it, use it. You can become a super genius. Don’t put your ego first—put your interests first. Your family will thank you.”

Saylor’s sixth way to wealth is composition: construct legal entities that scale your strategy and protect your assets. “Ask the AI and figure it out. You can work hard, or you can work smart. This year, everyone should be operating like the most sophisticated millionaire family office.”

The seventh is citizenship. Choose your economic nexus carefully—“domicile where sovereignty respects your freedom,” he said. “This isn’t just about this year—it’s about this century.”

Eighth is civility. “Respect the natural power structures of the world. Respect the force of nature,” he explained. “If you want to generate wealth in the Bitcoin universe, don’t fight unnecessarily. Find common ground. Inflation and distraction are your enemies.”

Ninth is corporation. “A well-structured corporation is the most powerful wealth engine on Earth. Families are powerful. Partnerships are even more powerful. But corporations can scale globally. What is your vehicle? What is your path?”

The tenth way is focus. “Just because you can do a thing doesn’t mean you should,” he warned. “If you invest in Bitcoin, there’s a 90% chance it will succeed over five years. Don’t confuse ambition with accomplishment. Come up with a strategy—and stick to it.”

The eleventh is equity. “Share your opportunities with investors who will share your risk,” he said, pointing to MicroStrategy’s own rise from $10 million to a $5 billion market cap by aligning with equity partners who believed in the Bitcoin mission.

The twelfth is credit. “There are people in the world who are afraid of the future—they want small yield, certainty. Offer that. Give creditors security in return for capital. Convert their fear into fuel and turn risk into yield by investing in Bitcoin.”

The thirteenth is compliance. “Create the best company you can within the rules of your market. Learn the rules of the road. If you know them, you can drive faster. You can scale legally and sustainably.”

The fourteenth way is capitalization. “Velocity compounds wealth,” Saylor said. “Raise and reinvest capital as fast and as often as you can. The faster your money moves into productive Bitcoin strategies, the more it multiplies.”

Fifteenth is communication. “Speak with candor. Act with transparency. And repeat your message often,” he urged. “Creating wealth with Bitcoin is simple—but only if people understand what you’re doing and why you’re doing it.”

Sixteenth is commitment. “Don’t allow yourself to be distracted,” he said. “Don’t chase your own ideas. Don’t feed the trolls. Stay committed to Bitcoin. It’s the greatest idea in the world. The world probably doesn’t care what you think—but it will care when you win.”

The Seventeenth way is competence. “You’re not competing with noise—you’re competing with someone who is laser-focused, who executes flawlessly,” he said. “You must deliver consistent, precise, and reliable performance. That’s how you win.”

The Eighteenth is adaptation. “Circumstances change. Every structure you trust today will eventually fail. A wise person is prepared to abandon their baggage and adjust plans when needed. Rigidity is ruin.”

Nineteenth is evolution. “Build on your core strengths. You don’t need to start over—you need to level up. Leverage what you already do best, and expand it through Bitcoin and advanced technologies.”

Twentieth is advocacy. “Inspire others to walk the Bitcoin path,” he said. “Become an evangelist for economic freedom. Show others what this revolution really means. Show them the way.”

Finally, the twenty-first way is generosity. “When you’re successful—and you will be successful—spread happiness. Share security. Deliver hope. That light inside you will shine. And others will be drawn to it.”

As he ended, Saylor smiled and quoted the very origin of it all:

“It might make sense to get some, in case it catches on.” – Satoshi.

In Michael Saylor’s worldview, Bitcoin is not a get-rich-quick scheme—it’s the ultimate long-term play. It is the foundation of generational wealth, the engine of personal and institutional freedom, and the tool for those bold enough to lead humanity into a more sovereign, secure future.

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Day 3 below:

This post Michael Saylor Presents The 21 Ways to Wealth at Bitcoin 2025 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-02 09:00:25

@ cae03c48:2a7d6671

2025-06-02 09:00:25Bitcoin Magazine

Bitcoin Builders Exist Because Of UsersBuilder: Nicholas Gregory

Language(s): C++, Rust

Contribute(s/ed) To: Ocean Sidechain, Mainstay, Mercury Wallet, Mercury Layer

Work(s/ed) At: CommerceBlock (formerly)

Prior to Bitcoin, Nicholas was a software developer working in the financial system for banking firms developing trading and derivatives platforms. After the 2008 financial crisis he began to consider alternatives to the legacy financial system in the fallout.

Like many from that time, he completely ignored the original Slashdot article featuring the Bitcoin whitepaper due to the apparent focus on Windows as an application platform (Nicholas was a UNIX/Linux developer). Thankfully someone he knew introduced him to Bitcoin later on.

The thing that captured his interest about Bitcoin rather than other alternatives at the time was its specific architecture as a distributed computer network.

“The fact that it was like an alternative way. It was all based around [a] kind of […] network. And what I mean by that, building financial systems, people always wanted a system that was 24-7.

And how do you deal with someone interacting [with] it in different geographical parts of the world without it being centralized?

And I’d seen various ways of people solving that problem, but it never had been done, you know, in a kind of […] scalable solution. And using […] cryptography and proof of work to solve that issue was just weird, to be honest. It was totally weird for me.”

All of the other systems he had designed, and some that he built, were systems distributed across multiple parts of the world. Unlike Bitcoin however, these systems were permissioned and restricted who could update the relevant database(s) despite that fact that copies of them were redundantly distributed globally.

“The fact that in Bitcoin you had everyone kind of doing this proof of work game, which is what it is. And whoever wins does the [database] write. That mess[ed] with my head. That was […] very unique.”

Beginning To Build

Nicholas’s path to building in the space was an organic one. At the time he was living in New York City, and being a developer he of course found the original Bitdevs founded in NYC. Back then meetups were incredibly small, sometimes even less than a dozen people, so the environment was much more conducive to in-depth conversations than some larger meetups these days.

He first began building a “hobbyist” Over The Counter (OTC) trading software stack for some people (back then a very significant volume of bitcoin was traded OTC for cash or other fiat mediums). From here Nicholas and Omar Shibli, whom he met at Bitdevs, worked together on Pay To Contract (BIP 175).

BIP 175 specifies a scheme where a customer purchasing a good participates in generating the address the merchant provides. This is done by the two first agreeing on a contract describing what is being paid for, afterwards the merchant sends a master public key to the consumer, who uses the hash of that description of the item or service to generate an individual address using the hash and master public key.

This allows the customer to prove what the merchant agreed to sell them, and that the payment for the good or service has been made. Simply publishing the master public key and contract allows any third party to generate the address that was paid, and verify that the appropriate amount of funds were sent there.

Ocean and Mainstay

Nicholas and Omar went on to found CommerceBlock, a Bitcoin infrastructure company. Commerceblock took a similar approach to business as Blockstream, building technological platforms to facilitate the use of Bitcoin and blockchains in general in commerce and finance. Shortly afterwards Nicholas met Tom Trevethan who came on board.

“I met Tom via, yeah, a mutual friend, happy to say who it is. There’s a guy called, who, new people probably don’t know who he is, but OGs do, John Matonis. John Matonis was a good friend of mine, [I’d] known him for a while. He introduced me to Tom, who was, you know, kind of more on the cryptography side. And it kind of went from there.”

The first major project they worked on was Ocean, a fork of the Elements sidechain platform developed by Blockstream that the Liquid sidechain was based on. The companies CoinShares and Blockchain in partnership with others launched an Ocean based sidechain in 2019 to issue DGLD, a gold backed digital token.

“So we, you know, we were working on forks of Elements, doing bespoke sidechains. […] Tom had some ideas around cryptography. And I think one of our first ideas was about how to bolt on these forks of Elements onto […] the Bitcoin main chain. […] We thought the cleanest way to do that was […] using some sort of, I can’t remember, but it was something [based on] single-use sealed sets, which was an invention by Peter Todd. And I think we implemented that fairly well with Mainstay.”

The main distinction between Ocean and Liquid as a sidechain platform is Ocean’s use of a protocol designed at Commerceblock called Mainstay. Mainstay is a timestamping protocol that, unlike Opentimestamps, strictly orders the merkle tree it builds instead of randomly adding items in whatever order they are submitted in. This allows each sidechain to timestamp its current blockheight into the Bitcoin blockchain everytime mainchain miners find a block.

While this is useless for any bitcoin pegged into the sidechain, for regulated real world assets (RWA), this provides a singular history of ownership that even the federation operating the sidechain cannot change. This removes ambiguity of ownership during legal disputes.

When asked about the eventually shuttering of the project, Nicholas had this to say:

“I don’t know if we were early, but we had a few clients. But it was, yeah, there wasn’t much adoption. I mean, Liquid wasn’t doing amazing. And, you know, being based in London/Europe, whenever we met clients to do POCs, we were competing against other well-funded projects.

It shows how many years ago they’d either received money from people like IBM or some of the big consultancies and were promoting Hyperledger. Or it was the days when we would be competing against EOS and Tezos. So because we were like a company that needed money to build prototypes or build sidechains, it kind of made it very hard. And back then there wasn’t much adoption.”

Mercury Wallet and Mercury Layer

After shutting down Ocean, Nicholas and Tom eventually began working on a statechain implementation, though the path to this was not straightforward.

“[T]here were a few things happening at the same time that led to it. So the two things were we were involved in a [proof of concept], a very small […]POC for like a potential client. But this rolled around Discreet Log Contracts. And one of the challenges of Discreet Log Contracts, they’re very capital inefficient. So we wanted a way to novate those contracts. And it just so happened that Ruben Sampson, you know, wrote this kind of white paper/Medium post about statechains. And […] those two ideas, that kind of solved potentially that issue around DLCs.”

In the end they did not wind up deploying a statechain solution for managing DLCs, but went in a different direction.

Well, there was another thing happening at the same time, coinswaps. And, yeah, bear in mind, in those days, everyone worried that by […] 2024/2025 […] network fees could be pretty high. And to do […] coin swaps, you kind of want to do multiple rounds. So […] state chains felt perfect because […] you basically take a UTXO, you put it off the chain, and then you can swap it as much as you want.”

Mercury Wallet was fully built out and functional, but sadly never gained any user adoption. Samourai Wallet and Wasabi Wallet at the time dominated the privacy tool ecosystem, and Mercury Wallet was never able to successfully take a bite out of the market.

Rather than completely give up, they went back to the drawing board to build a statechain variant using Schnorr with the coordinator server blind signing, meaning it could not see what it was signing. When asked why those changes were made, he had this to say: “That would give us a lot more flexibility to do other things in Bitcoin with L2s. You know, the moment you have a blinded solution, we thought, well, this could start having interoperability with Lightning.”

Rather than building a user facing wallet this time, they built out a Software Development Kit (SDK) that could be integrated with other wallets.

“{…] I guess with Mercury Layer, it was very much building a kind of […] full-fledged Layer 2 that anyone could use. So we [built] it as an SDK. We did have a default wallet that people could run. But we were hoping that other people would integrate it.”

The End of CommerceBlock

In the end, CommerceBlock shuttered its doors after many years of brilliant engineering work. Nicholas and the rest of the team built numerous systems and protocols that were very well engineered, but at the end of the day they seemed to always be one step ahead of the curve. That’s not necessarily a good thing when it comes to building systems for end users.

If your work is too far ahead of the demand from users, then in the end that isn’t a sustainable strategy.

“…being in the UK, which is not doing that well from a regulatory point of view, played into it. If I

-

@ bf95e1a4:ebdcc848

2025-06-02 05:47:40

@ bf95e1a4:ebdcc848

2025-06-02 05:47:40This is a part of the Bitcoin Infinity Academy course on Knut Svanholm's book Bitcoin: Sovereignty Through Mathematics. For more information, check out our Geyser page!

A New Form of Life

It’s not easy to define the properties that would deem an entity a new form of life. There’s no consensus among scientists or nations regarding the definition of what a life form is. This is one of the main hurdles when it comes to defining artificial or synthetic life. How does one know when life has been created if there’s no clear definition of what life actually is? One popular definition of life is that a living organism is an open system that maintains homeostasis, is composed of cells, has a life cycle, undergoes metabolism, can grow, adapt to its environment, respond to stimuli, reproduce, and evolve. Could Bitcoin fit into this description? In order to find out, we need to dissect both this definition of life and the basic properties of the Bitcoin network.

Bitcoin is quite clearly an open system, but what does it mean for an organism to maintain homeostasis? Homeostasis is the tendency towards a relatively stable equilibrium between interdependent elements, especially (but not limited to) as maintained by physiological processes. The first part of that sentence perfectly describes what Bitcoin does. The equilibrium is the consensus between the nodes, which act as interdependent elements. One could even argue that they actually are maintained by physiological processes since each node’s decisions are ultimately made by human brains and not software, but for now, we’ll examine Bitcoin as a life form from a non-meta-argument perspective. The next part of the definition is that life is made up of cells, which the Bitcoin network also arguably is, especially if you count nodes as cells.

A life cycle is defined as a “series of changes in form that an organism undergoes, returning to the starting state,” according to Wikipedia. The life cycle of the Bitcoin network is still unclear, but it seems unlikely that it will ever return to its starting state. What is more likely is that while we have witnessed its birth, it is highly unlikely that any human alive today will outlive the network, so we won’t have any way of knowing. This is not unheard of in nature either however. A species of fungi called Armillaria Ostoyae, or the Humongous Fungus, in the Blue Mountains of Oregon, is one of the largest and oldest organisms ever known to man. This mushroom network is estimated to be between 2500 and 8500 years old based on its current growth rate. No one knows what its life cycle looks like in perfect detail.

The three main purposes of metabolism in a living body are the conversion of food to energy to run cellular processes, the conversion of food into bodily building blocks, and the elimination of nitrogenous wastes. Bitcoin’s metabolism works in a similar manner. Bitcoin feeds on electricity, and its cellular processes are its transactions. Its body has its own building blocks, literal blocks, that are added to its body, the blockchain, roughly every ten minutes. Malicious blocks are considered waste and are thus eliminated by the system. Bitcoin grows and adapts to its environment organically, exemplified lately by the development of the Lightning Network and other Layer 2 scaling solutions. It responds to external stimuli by showing a more and more ironclad resistance to change while still responding well to sufficiently clever improvement proposals. Like the Armillaria Ostoyae, Bitcoin grows rather than reproduces, and it evolves over time by adopting good ideas and rejecting bad ones.

The notion of Bitcoin as a life form may sound far-fetched and even a bit silly, even though a lot of its properties fit the bill. What we do know about it is that it is very unlikely to go away or stop functioning in the foreseeable future. Whether or not Bitcoin is alive is up for debate, but it can’t be killed, and that ought to mean something. We should study it carefully and try to be as unbiased and humble as possible when drawing conclusions about it.

Speaking of fungi, one of the most important aspects of money is its fungibility. Fungibility goes hand-in-hand with privacy and censorship resistance. If certain Bitcoin addresses were to end up on a government's blacklist, they’d end up becoming less valuable than their not yet blacklisted neighbors. Look at what happened to the Indian Rupee bills that were banned overnight by the Indian government in late 2017 in order to “fight corruption.” They’re still in use, but only worth about 70% of the value they held when they were considered “legal tender”. If Bitcoin transactions can’t be private, they won’t be fungible. This would reduce Bitcoin’s monetary capability. We’re at a point in history where Bitcoin transactions can be completely private, but only a select few people know how to ensure that they really are. This is arguably Bitcoin’s greatest flaw and a very real hurdle on the way to mainstream adoption.

So, how many privacy measures does the average user need to take? Just as when it comes to storage, it depends on the user’s knowledge level. Most users should probably be more careful than they are right now, but there’s little reason to be paranoid. It’s still very hard to prove that a specific transaction was made by a specific user. The whole ordeal is somewhat akin to the fight against the BitTorrent network ten years ago. The copyright lobby found different means of scaring off users in different parts of the world, banning websites, prosecuting providers, and so on, but the network itself is still thriving, and torrent files are as accessible as they ever were. A lot of heads will probably have to roll before Bitcoin is accepted everywhere, but just like they couldn’t fight filesharing, governments won’t be able to fight Bitcoin. Even the policymakers will understand the advantages of Bitcoin usage sooner or later. The word later is key here. If you want to be absolutely sure that what you do with your Bitcoin is legal, private, or worthwhile, just wait. Wait out the storm, and don’t use them until they’re fully acceptable everywhere. They’ll be worth a lot more, and you’ll have a lot more options in general. Remember, HODLing is using.

One of the greatest hidden perks of Bitcoin adoption is that it forces people to think for themselves. First, it forces the user to think about computer security. In order to store your Bitcoins safely, you have to know what you’re doing, what software and hardware you can trust, etc. It is virtually impossible to do anything online without trusting any third party. Every piece of hardware and software inside and in between each of the two computers communicating could potentially be corrupt. In Bitcoin, the cautious user will be rewarded, and the reckless user will be punished eventually. This is also true for Bitcoin’s on- and off-ramps, and the less cautious user is always more likely to end up in legal trouble. The coming tsunami that is hyperbitcoinization is scary, but a skilled surfer can expect the ride of his lifetime.

About the Bitcoin Infinity Academy

The Bitcoin Infinity Academy is an educational project built around Knut Svanholm’s books about Bitcoin and Austrian Economics. Each week, a whole chapter from one of the books is released for free on Highlighter, accompanied by a video in which Knut and Luke de Wolf discuss that chapter’s ideas. You can join the discussions by signing up for one of the courses on our Geyser page. Signed books, monthly calls, and lots of other benefits are also available.

-

@ b1ddb4d7:471244e7

2025-06-02 04:00:40

@ b1ddb4d7:471244e7

2025-06-02 04:00:40Bitcoin FilmFest (BFF25) returns to Warsaw for its third edition, blending independent cinema—from feature films and commercials to AI-driven experimental visuals—with education and entertainment.

Hundreds of attendees from around the world will gather for three days of screenings, discussions, workshops, and networking at the iconic Kinoteka Cinema (PKiN), the same venue that hosted the festival’s first two editions in March 2023 and April 2024.

This year’s festival, themed “Beyond the Frame,” introduces new dimensions to its program, including an extra day on May 22 to celebrate Bitcoin Pizza Day, the first real-world bitcoin transaction, with what promises to be one of Europe’s largest commemorations of this milestone.

BFF25 bridges independent film, culture, and technology, with a bold focus on decentralized storytelling and creative expression. As a community-driven cultural experience with a slightly rebellious spirit, Bitcoin FilmFest goes beyond movies, yet cinema remains at its heart.

Here’s a sneak peek at the lineup, specially curated for movie buffs:

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money.

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money. Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative).

Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative). Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.

Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.To get an idea of what might come up at the event, here, you can preview 6 selected ads combined into two 2 videos:

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships.

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships. Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.

Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.BFF25 Main Screenings

Sample titles from BFF25’s Official Selection:

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director.

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director. UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year.

UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year. HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.

HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.Check out trailers for this year’s BFF25 and past editions on YouTube.

Tickets & Info:

- Detailed program and tickets are available at bitcoinfilmfest.com/bff25.

- Stay updated via the festival’s official channels (links provided on the website).

- Use ‘LN-NEWS’ to get 10% of tickets

-

@ cefb08d1:f419beff

2025-06-02 08:59:16

@ cefb08d1:f419beff

2025-06-02 08:59:16https://stacker.news/items/995022

-

@ 58537364:705b4b85

2025-06-01 16:46:42

@ 58537364:705b4b85

2025-06-01 16:46:42ความสุขทางโลก ลัทธิสุขนิยมยกย่อง แต่ลัทธิทรมานตนประณาม หากไม่มองว่ากามสุขเป็นพรจากพระผู้เป็นเจ้า คนก็มักมองว่ากามสุขเป็นเครื่องลวงล่อของซาตาน ในเรื่องนี้พระพุทธศาสนาเลือกเดินสายกลาง โดยสอนว่าเราควรทำความเข้าใจกามสุขให้แจ่มแจ้ง ทั้งในแง่เสน่ห์เย้ายวน ข้อจำกัดและข้อบกพร่องทั้งหลาย

เพื่อให้เข้าใจกามสุขอย่างแจ่มแจ้ง เราอาจตั้งคำถามดังนี้: กามสุขสนองตอบความต้องการทางจิตใจแบบใดได้บ้าง และไม่อาจตอบสนองความต้องการแบบใดได้ เพราะเหตุใด

ความต้องการในส่วนที่กามสุขไม่อาจตอบสนองได้ เราควรปฏิบัติอย่างไร

เราหลงเพลิดเพลินและยึดติดในกามสุขมากเพียงใด และกามสุขมีอิทธิพลเหนือจิตใจเราเพียงใด

เราเคยทำหรือพูดสิ่งที่ไม่ถูกต้องเนื่องด้วยปรารถนาในกามสุขหรือไม่

เราเคยเบียดเบียนผู้อื่นเนื่องด้วยปรารถนาในกามสุขหรือไม่

บ่อยครั้งเพียงใดที่สุขทางโลกสร้างความผิดหวังให้เรา

ความคาดหวังมีผลกระทบอย่างไรต่อความสุขทางโลก การทำอะไรซ้ำๆ และความเคยชินส่งผลต่อความสุขทางโลกอย่างไร

เรารู้สึกอย่างไร ยามไม่ได้กามสุขที่เราปรารถนา

กามสุขมีความเกี่ยวข้องกับความซึมเศร้าหรือไม่ กับความวิตกกังวลด้วยหรือไม่

เรารู้สึกอย่างไร เมื่อนึกถึงอนาคตว่า จะต้องพลัดพรากจากสุขทางโลก เนื่องด้วยความเจ็บไข้ ความแก่ และความตาย

การพลัดพรากจากความสุขทางโลกรู้สึกอย่างไรบ้าง

เราตั้งคำถามได้มากมาย และยังตั้งคำถามได้มากไปกว่านี้

หลักสำคัญ คือ ยิ่งเห็นชัดแจ้งในกามสุข เราจะยิ่งเกิดปัญญาและเข้าถึงความสงบมากขึ้นธรรมะคำสอน โดย พระอาจารย์ชยสาโร แปลถอดความ โดย ปิยสีโลภิกขุ

-

@ b1ddb4d7:471244e7

2025-06-02 08:01:09

@ b1ddb4d7:471244e7

2025-06-02 08:01:09Bitcoin FilmFest (BFF25) returns to Warsaw for its third edition, blending independent cinema—from feature films and commercials to AI-driven experimental visuals—with education and entertainment.

Hundreds of attendees from around the world will gather for three days of screenings, discussions, workshops, and networking at the iconic Kinoteka Cinema (PKiN), the same venue that hosted the festival’s first two editions in March 2023 and April 2024.

This year’s festival, themed “Beyond the Frame,” introduces new dimensions to its program, including an extra day on May 22 to celebrate Bitcoin Pizza Day, the first real-world bitcoin transaction, with what promises to be one of Europe’s largest commemorations of this milestone.

BFF25 bridges independent film, culture, and technology, with a bold focus on decentralized storytelling and creative expression. As a community-driven cultural experience with a slightly rebellious spirit, Bitcoin FilmFest goes beyond movies, yet cinema remains at its heart.

Here’s a sneak peek at the lineup, specially curated for movie buffs:

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money.

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money. Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative).

Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative). Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.

Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.To get an idea of what might come up at the event, here, you can preview 6 selected ads combined into two 2 videos:

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships.

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships. Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.

Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.BFF25 Main Screenings

Sample titles from BFF25’s Official Selection:

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director.

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director. UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year.

UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year. HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.

HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.Check out trailers for this year’s BFF25 and past editions on YouTube.

Tickets & Info:

- Detailed program and tickets are available at bitcoinfilmfest.com/bff25.

- Stay updated via the festival’s official channels (links provided on the website).

- Use ‘LN-NEWS’ to get 10% of tickets

-

@ cae03c48:2a7d6671

2025-06-02 09:00:24

@ cae03c48:2a7d6671

2025-06-02 09:00:24Bitcoin Magazine

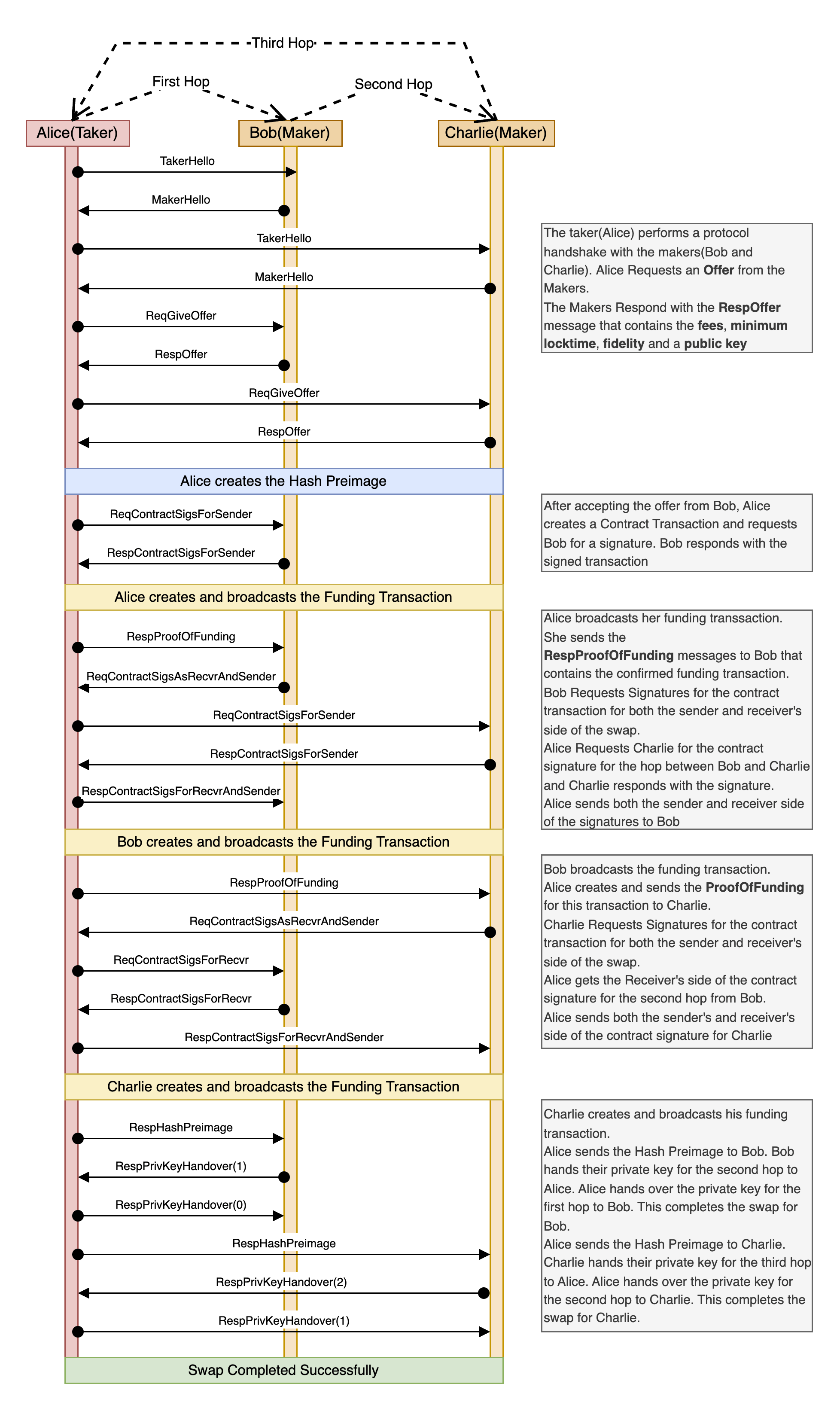

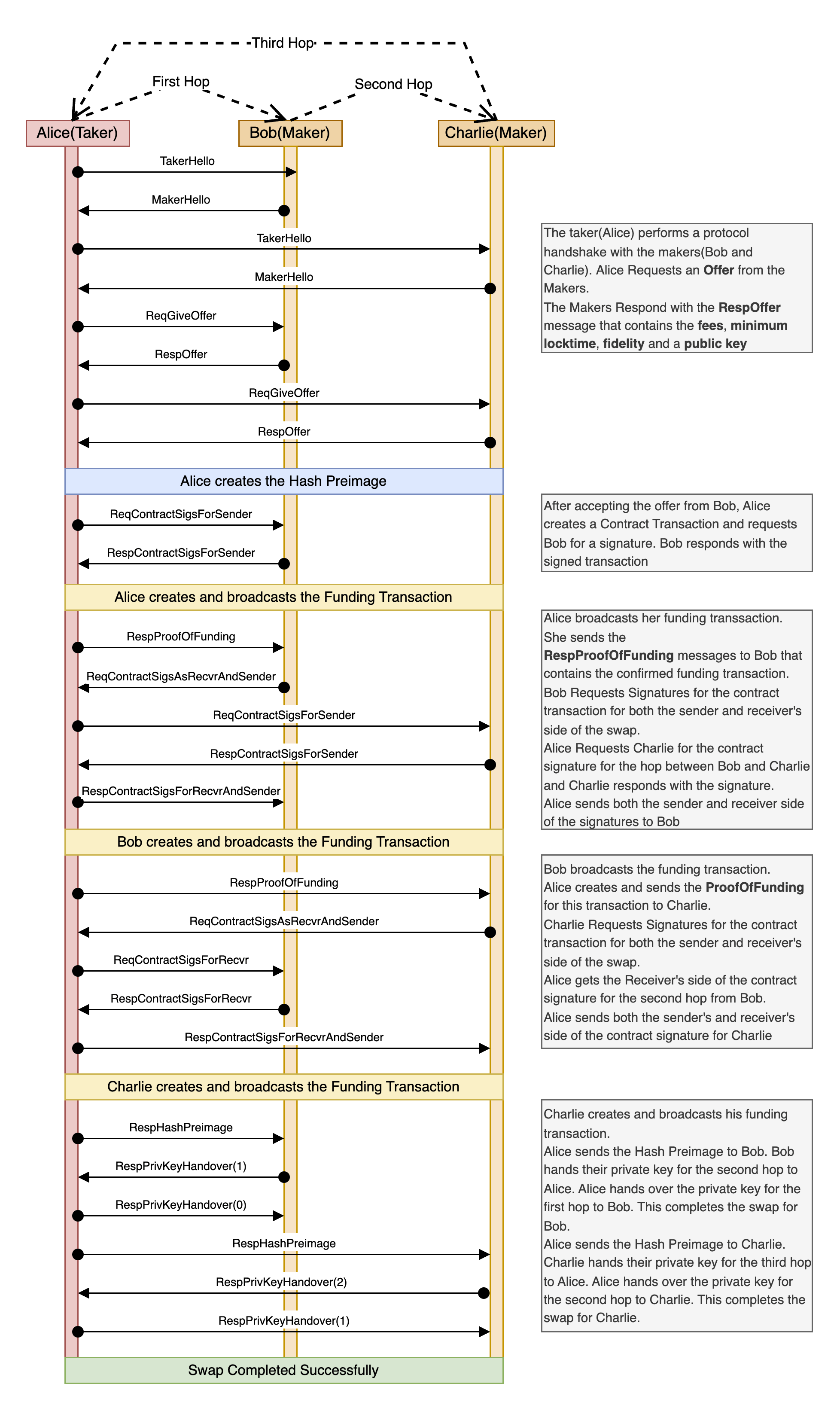

Amboss Launches Rails, a Self-Custodial Bitcoin Yield ServiceAmboss, a leader in AI-driven solutions for the Bitcoin Lightning Network, today announced Rails, a groundbreaking self-custodial Bitcoin yield service. According to a press release sent to Bitcoin Magazine, it’s designed to empower companies, custodians, and high net worth individuals. This allows participants to earn a yield on their Bitcoin.

Big news from @TheBitcoinConf !

We’re thrilled to announce Rails—a self-custodial Bitcoin yield service that empowers you to earn on your BTC while supercharging the Lightning Network.Let’s bring Bitcoin to the World.https://t.co/3WYYvB95hP

— AMBOSS

(@ambosstech) May 29, 2025

(@ambosstech) May 29, 2025Rails also launched a secure way for Liquidity Providers (LPs) to hold all custody of their Bitcoin while generating returns from liquidity leases and payment routing, although they are not guaranteed. The implementation of Amboss’ AI technology, Rails strengthened their Lighting Network with more dependable transactions and larger payment volumes.

“Rails is a transformative force for the Lightning Network,” said the CEO and Co-Founder of Amboss Jesse Shrader. “It’s not just about yield—it’s about enabling businesses to strengthen the network while earning on their Bitcoin. This is a critical step in Bitcoin’s evolution as a global medium of exchange.”

The service offers two options:

- Rails LP is designed for high net worth individuals, custodians, and companies with Bitcoin treasuries, requiring a minimum commitment of 1 BTC for one year.

- Liquidity subscriptions are designed for businesses that receive Bitcoin payments, with fees starting at 0.5%.

Amboss partnered with CoinCorner and Flux (a joint venture between Axiom and CoinCorner), to bring Rails to the market. CoinCorner has incorporated it into both its exchange platform and daily payment services in the Isle of Man. Flux is jointly focused on advancing the Lightning Network’s presence in global payments. Their participation highlights growing industry trust in Rails as a tool to scale Bitcoin effectively.

“Rails offers a practical way for businesses like ours to participate in the Lightning Network’s growth,” said the CFO of CoinCorner David Boylan. “We’ve been using the Lightning Network for years, and Rails provides a structured approach to engaging with its economy, particularly through liquidity leasing and payment routing. This aligns with our goal of making Bitcoin more accessible and practical for everyday use.”

This post Amboss Launches Rails, a Self-Custodial Bitcoin Yield Service first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ c3b2802b:4850599c

2025-06-02 08:57:13

@ c3b2802b:4850599c

2025-06-02 08:57:13Die Befragten erzählen, wie sie den Zusammenbruch des Vertrauens vieler Menschen im Land in das mechanistische Muster von Heilung durch Medikamente und Injektionen erlebt haben. Und sie lassen uns teilhaben an ihrem Erfahrungsschatz mit Heilverfahren, welche über mechanistische Verfahren des klassischen Gesundheitswesens hinausweisen. Verfahren, welche dazu beitragen, dass wir Menschen unsere Balance, unser Wohlbefinden erhalten oder wiederfinden. Verfahren, die uns in unsere volle Kraft und Energie bringen, um unsere Möglichkeiten und Potentiale zur Entfaltung zu bringen.

Das Buch erscheint zu einem passenden Zeitpunkt. Zum einen haben viele Menschen seit 2021 am eigenen Körper die Folgen der mRNA Injektionen erlebt und dramatische Schicksale von Angehörigen und Freunden miterlebt.

Zum anderen kommen derzeit vermehrt Informationen in Umlauf, welche die Motive von global agierenden Pharmaziekartellen und von ihnen gesponserten Organisationen wie der Welt-Gesundheits-Organisation WHO offenlegen.

Worum geht es der WHO, die zu 84% von privaten Geldgebern unterhalten wird? Im Jahr 2022 hat die WHO eine Bittschrift für potentielle Sponsoren veröffentlicht, welche den denkwürdigen Titel hat: „A healthy return“. Gemeint ist ein „gesunder“ Geldrückfluß für Geldgeber, welcher eine 3.500 (dreitausendfünfhundert!!!) prozentige Steigerung des Wertes des eingezahlten Geldes in Aussicht stellt. Hier finden Sie Details.

Wieviel Zinsen zahlt Ihre Bank, falls Sie mal Geld übrig haben? Ein, zwei – oder gar drei Prozent? Darf man solch einer Vereinigung das Vertrauen schenken, die Gesundheit der Weltbevölkerung sicherzustellen? Mögen Sie Ihre Zukunft einer Organisation anvertrauen, welche nicht demokratisch legitimiert ist, die unbekümmert mit Genmanipulationen umgeht und die exorbitante Gewinne für ihre Sponsoren im Auge hat?

Die Zeit scheint reif zu sein, uns in Erinnerung zu rufen: Wir Menschen sind komplexe Wesen mit Körper und Seele. Uns zeichnen zauberhafte Potentiale aus. Wir verfügen über ein Gewissen, Achtsamkeit, Dankbarkeit, Demut, Liebe.

Hier schließt sich der Kreis zum Buch von Laurens Dillmann: Die Experten für Gesundheit, Wohlbefinden und Potentialentfaltung wurden nach ihrem Werdegang, ihren Überzeugungen, ihrer konkreten Heilarbeit, ihren Erfolgen und teils auch zu ihrer Position in der globalen aktuellen Krise befragt.

Was das Buch charmant macht, ist die große Buntheit an zusammengetragenen Perspektiven, welche sich durch die Vielfalt der Berufsschwerpunkte der Befragten ergibt. Ein Wildnispädagoge und eine Hebamme, Traumatherapeuten und klassische Ärzte, Medizinwissenschaftler und -ethiker, ein Wildpflanzenexperte und ein Anti-Gewalt-Trainer, eine Gesangs- und Musiktherapeutin, eine Sex-Forscherin und mehrere Psychologen geben sich ein Stelldichein zwischen den Buchdeckeln. Auch wenig verbreitete Aspekte wie Astrologie oder Schamanismus kommen zur Sprache.

In einem Schlusskapitel stellt Sozialarbeiter, Naturpädagoge und Heilpraktiker Mattheo Pfleger in einem Manifest „Pro Leben und Gesundheit 2030“ eine Reihe von sehr weitreichenden Leitlinien für ein Gesundheitswesen der Zukunft vor. Besonders eindrücklich für mich ist sein Vorschlag einer Grundgesetzänderung, in der die Würde des Lebens für unantastbar erklärt wird. Hier kann das Buch erworben werden.

-

@ 9c9d2765:16f8c2c2

2025-06-02 08:21:08

@ 9c9d2765:16f8c2c2

2025-06-02 08:21:08CHAPTER THIRTY FIVE

“Ladies and gentlemen,” James began, his voice firm but serene, “we have reached a stage where the name JP Enterprises must stand not only for affluence and innovation but also for responsibility and reinvention.”

The team leaned in, captivated by his tone.

“I’ve given this much thought,” he continued, “and it’s time we invested not just in profitable ventures but in communities especially those that raised men like me.”

Whispers of approval circled the room. James unfolded a series of blueprints and documents, revealing a new initiative named The Phoenix Foundation, a massive philanthropic wing of JP Enterprises aimed at funding education, rebuilding impoverished neighborhoods, and providing mentorship for underprivileged youth.

“This isn’t charity,” James clarified. “This is legacy.”

Meanwhile, on the other side of the city, Mark and Helen were dealing with the crushing weight of public disgrace. Their failed scheme had made headlines. Investors withdrew, associates distanced themselves, and even loyal allies now whispered behind their backs.

Helen slammed a newspaper onto the glass table in frustration. “They’ve blacklisted us from another tender. Mark, we’re becoming irrelevant!”

Mark, who had been pacing the room like a caged animal, finally stopped. “It’s not over. We still have leverage somewhere. James isn’t invincible.”

Helen scoffed. “Tell that to the world. They worship the ground he walks on. You think you can bring down a man who rose from being a street outcast to owning the city’s largest enterprise?”

Mark’s eyes darkened. “He bleeds, Helen. Everyone has a weak spot. We just haven’t found him yet.”

But even as their desperation festered, James was rising even higher. A televised interview had been scheduled where he would unveil The Phoenix Foundation. The nation watched eagerly. Sitting on a minimalist stage, flanked by banners of the foundation’s vision, James spoke from the heart.

“I know what it means to be invisible,” he said. “I know what hunger, shame, and rejection feel like. I’ve lived it. But I also know the power of one opportunity, one person who believes in you. Through this foundation, I want to be that person for thousands.”

The applause was thunderous, not only from the live audience but from homes, offices, and schools where people were inspired by his journey.

The days following the televised launch of The Phoenix Foundation brought waves of admiration and support from across the country. Letters of gratitude flooded JP Enterprises from parents whose children now had access to scholarships, to small business owners revitalized by community grants. James, once shunned and dismissed, was now a symbol of unshakable strength, resilience, and grace under fire.

But in the shadows, the remnants of Mark and Helen’s influence continued to decay.

With the media fixated on James’s rise and the overwhelming success of the foundation, Helen had become a recluse, seldom leaving her estate. The curtains were always drawn, the halls eerily quiet, and every incoming call was a potential threat to her already-battered reputation. Her once-prized social invitations had vanished, and even her closest acquaintances now found convenient excuses to avoid her.

One afternoon, as she sat on her leather chaise, surrounded by unopened letters and wilting orchids, her phone buzzed. It was Mark.

"We need to talk," his voice came through, rough and urgent.

"Unless you’ve figured out a way to reverse time or erase James from existence, I’m not interested," she replied dryly, her voice thick with exhaustion.

"I’ve been digging into his foundation. There might be something," he said, the faintest glimmer of his former arrogance returning.

Helen raised a skeptical brow. "You mean the only project that has made him a national hero overnight? Do enlighten me."

Mark hesitated for a moment, then spoke. "I have a contact. Someone who worked closely with James during his street days. She claims there's more to his story, something about a deal gone wrong before Ray Enterprises even noticed him."

Helen’s eyes narrowed. "You better not be chasing another ghost story, Mark. We’ve lost everything playing that game."

Meanwhile, back at JP Enterprises, James was unaware of the new whispers trailing behind him. His focus remained undivided, channeling his efforts into real progress. He visited schools sponsored by the foundation, shook hands with young entrepreneurs, and held intimate town hall meetings to listen to citizens’ concerns. His sincerity was unmistakable.

One evening, as he stood at the balcony of his high-rise office, looking over the city he once roamed as a stranger, his uncle Charles joined him.

"You’ve come a long way, James," Charles said, resting a firm hand on his shoulder. "Your father may have doubted you once, but now he sees what we always knew: you're more than capable of carrying this legacy."

James nodded slowly. "It’s not about the legacy anymore, Uncle. It’s about changing lives. If we succeed, JP Enterprises won’t just be remembered for profit margins, it'll be remembered for its heart."

And indeed, that heart had begun to beat in places once forgotten.

"Sir, there's something you might want to take a look at," James's personal assistant said as she stepped into his office, holding a manila folder with both hands.

James looked up from his tablet, where he had been reviewing the upcoming development plans for The Phoenix Foundation outreach program in rural districts. "Is it urgent?"

Tracy’s expression was uneasy. "I believe so. It slipped into the front reception without a name. Just labeled ‘To the President, Personal.’ We scanned the documents. They’re… sensitive."

James gestured for her to bring it over. He leaned back in his chair as she placed the folder before him and stepped away. Slowly, he opened it, revealing a series of photographs, transcripts, and one shocking email thread. His eyes narrowed as he scanned the contents. There it was detailed records of recent communications between Mark and a former government contractor, outlining a clandestine attempt to discredit The Phoenix Foundation by faking embezzlement allegations.

"So they haven’t learned their lesson," James muttered to himself, his jaw tightening.

Tracy, standing silently nearby, asked cautiously, "Should I inform legal?"

"Not yet," he replied, standing and pacing toward the window. "Let them think they still have the upper hand. We’ll collect more. I want this to be their final mistake, not just another slap on the wrist."

From the 39th floor, the skyline shimmered in the twilight. But beneath the golden hues of the sunset, darkness moved silently, calculating its next step.

Across town, in an upscale but dimly lit lounge, Mark and Helen sat across from each other, their faces drawn and wary. They were meeting a woman known only as "Seraphina," a discreet broker of information and, when needed, scandal.

-

@ b1ddb4d7:471244e7

2025-06-02 08:01:07

@ b1ddb4d7:471244e7

2025-06-02 08:01:07Starting January 1, 2026, the United Kingdom will impose some of the world’s most stringent reporting requirements on cryptocurrency firms.

All platforms operating in or serving UK customers-domestic and foreign alike-must collect and disclose extensive personal and transactional data for every user, including individuals, companies, trusts, and charities.

This regulatory drive marks the UK’s formal adoption of the OECD’s Crypto-Asset Reporting Framework (CARF), a global initiative designed to bring crypto oversight in line with traditional banking and to curb tax evasion in the rapidly expanding digital asset sector.

What Will Be Reported?

Crypto firms must gather and submit the following for each transaction:

- User’s full legal name, home address, and taxpayer identification number

- Detailed data on every trade or transfer: type of cryptocurrency, amount, and nature of the transaction

- Identifying information for corporate, trust, and charitable clients

The obligation extends to all digital asset activities, including crypto-to-crypto and crypto-to-fiat trades, and applies to both UK residents and non-residents using UK-based platforms. The first annual reports covering 2026 activity are due by May 31, 2027.

Enforcement and Penalties

Non-compliance will carry stiff financial penalties, with fines of up to £300 per user account for inaccurate or missing data-a potentially enormous liability for large exchanges. The UK government has urged crypto firms to begin collecting this information immediately to ensure operational readiness.

Regulatory Context and Market Impact

This move is part of a broader UK strategy to position itself as a global fintech hub while clamping down on fraud and illicit finance. UK Chancellor Rachel Reeves has championed these measures, stating, “Britain is open for business – but closed to fraud, abuse, and instability”. The regulatory expansion comes amid a surge in crypto adoption: the UK’s Financial Conduct Authority reported that 12% of UK adults owned crypto in 2024, up from just 4% in 2021.

Enormous Risks for Consumers: Lessons from the Coinbase Data Breach

While the new framework aims to enhance transparency and protect consumers, it also dramatically increases the volume of sensitive personal data held by crypto firms-raising the stakes for cybersecurity.

The risks are underscored by the recent high-profile breach at Coinbase, one of the world’s largest exchanges.

In May 2025, Coinbase disclosed that cybercriminals, aided by bribed offshore contractors, accessed and exfiltrated customer data including names, addresses, government IDs, and partial bank details.

The attackers then used this information for sophisticated phishing campaigns, successfully deceiving some customers into surrendering account credentials and funds.

“While private encryption keys remained secure, sufficient customer information was exposed to enable sophisticated phishing attacks by criminals posing as Coinbase personnel.”

Coinbase now faces up to $400 million in compensation costs and has pledged to reimburse affected users, but the incident highlights the systemic vulnerability created when large troves of personal data are centralized-even if passwords and private keys are not directly compromised. The breach also triggered a notable drop in Coinbase’s share price and prompted a $20 million bounty for information leading to the attackers’ capture.

The Bottom Line

The UK’s forthcoming crypto reporting regime represents a landmark in financial regulation, promising greater transparency and tax compliance. However, as the Coinbase episode demonstrates, the aggregation of sensitive user data at scale poses a significant cybersecurity risk.

As regulators push for more oversight, the challenge will be ensuring that consumer protection does not become a double-edged sword-exposing users to new threats even as it seeks to shield them from old ones.

-

@ 7f6db517:a4931eda

2025-06-02 04:01:30

@ 7f6db517:a4931eda

2025-06-02 04:01:30

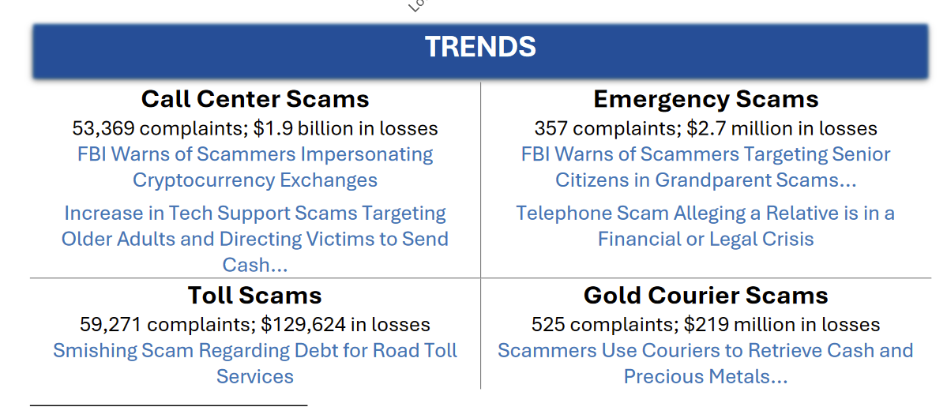

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-02 04:01:29

@ 7f6db517:a4931eda

2025-06-02 04:01:29

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ da0b9bc3:4e30a4a9

2025-06-02 08:20:19

@ da0b9bc3:4e30a4a9

2025-06-02 08:20:19Hello Stackers!

Welcome on into the ~Music Corner of the Saloon!

A place where we Talk Music. Share Tracks. Zap Sats.

So stay a while and listen.

🚨Don't forget to check out the pinned items in the territory homepage! You can always find the latest weeklies there!🚨

🚨Subscribe to the territory to ensure you never miss a post!

https://stacker.news/items/995015

-

@ dfa02707:41ca50e3

2025-06-02 08:01:53

@ dfa02707:41ca50e3

2025-06-02 08:01:53Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.