-

@ 91117f2b:111207d6

2025-06-06 18:32:33

@ 91117f2b:111207d6

2025-06-06 18:32:33

The weight of unspoken words can be a heavy burden, but it's a burden that can be lifted. By expressing ourselves authentically, we can:

- Release pent-up emotions: Sharing our feelings can help us process and understand them better.

- Form deeper connections: Vulnerability can lead to more meaningful relationships and a sense of community.

- Find our voice: Expressing ourselves can help us discover our unique perspective and style.

Creative Outlets for Expression

- Writing: Journaling, poetry, or short stories can be powerful ways to express emotions.

- Art: Painting, drawing, or photography can provide a visual outlet for feelings.

- Conversation: Talking to a trusted friend, family member, or therapist can help you process your emotions.

The Courage to Be Vulnerable

Being vulnerable takes courage, but it's a courage that can lead to:

- Deeper self-awareness: Understanding your emotions and needs.

- More authentic relationships: Building connections based on trust and empathy.

- Personal growth: Developing resilience and confidence.

Your Story Matters

Your experiences, thoughts, and feelings are unique and valuable. By sharing your story, you can:

- Inspire others: Your words can motivate, comfort, or empower others.

- Process your emotions: Sharing your story can help you heal and grow.

- Leave a legacy: Your words can outlast you, leaving a lasting impact.

Everyone has a way to express themselves, what's yours?

-

@ 91117f2b:111207d6

2025-06-06 18:17:24

@ 91117f2b:111207d6

2025-06-06 18:17:24

Nigeria, land of vibrant culture, delicious jollof rice, and... creepy crawlies! Yes, our beloved country is home to some insects that might just make you shudder. But don't worry, we've got you covered!

The Top 5 Most Feared (and Fascinating) Insects in Nigeria

-

Mosquitoes: The Unwelcome Guests- These tiny terrors are notorious for their itchy bites and malaria-spreading abilities. But let's be real, who needs personal space when you're trying to enjoy a peaceful evening outdoors?

-

Cockroaches: The Ultimate Survivors- These resilient critters can thrive in even the most inhospitable environments. They're like the Nigerian version of The Terminator – unstoppable and unkillable!

-

Scorpions: The Stinging Sensations- With their menacing stingers and armored shells, scorpions are the ultimate party crashers. Just don't invite them to your next outdoor gathering!

-

Tsetse Flies: The Biting Buzz- These pesky flies are known for their painful bites and ability to transmit diseases. But hey, at least they're consistent – they'll always bring their A-game to the biting party!

-

Ants: The Marching Army- Some ant species in Nigeria are infamous for their painful stings and organized invasions. It's like they're trying to take over the world, one crumb at a time!

The Silver Lining

While these insects might seem daunting, they play a vital role in Nigeria's ecosystem. They pollinate, decompose, and even serve as a food source for other animals. So, let's appreciate these creepy crawlies from a safe distance!

Survival Tips

To coexist with Nigeria's insects, remember:

- Wear protective clothing when outdoors

- Keep your home clean and tidy

- Use insect repellent (preferably the strong stuff)

- Don't mess with ants – they'll retaliate!

The Nigerian Insect Brigade

While we might joke about these insects, it's essential to respect their place in our ecosystem. Who knows, maybe one day we'll learn to appreciate their quirky charm?

In Nigeria, we don't have aliens, to pose as a threat "(alien invasion)" , we already have insect invasion.

-

-

@ 4d41a7cb:7d3633cc

2025-06-06 18:16:08

@ 4d41a7cb:7d3633cc

2025-06-06 18:16:08Have you ever stopped to think how retarded our monetary system is? If the U.S. is the most powerful nation on earth, has the biggest gold reserves, and has the monopoly over the global reserve currency... Why the fuck are they still 34 trillion in debt? One reporter finally asked this important question to the Chair of the Council of Economic Advisors (whatever that means): Jared Bernstein.

> JB: They, they, um, they, yeah, they, they, um, they sell bonds. Yeah, they sell bonds, right? Since they sell bonds and people buy the bonds and lend them the money. Yeah, so, yeah, I guess I'm just, I don't, I can't really talk. I don't, I don't get it. I don't know what they're talking about.

BANKSTERS DON'T WANT US TO KNOW HOW THIS MECHANISM WORKS BECAUSE THEY KNOW THAT IF WE KNOW, WE ARE GOING TO GET MAD. NOT EVEN POLITICIANS AND HIGH-RANKED OFFICIALS UNDERSTAND WHAT I AM ABOUT TO EXPLAIN.

THE CORRECT QUESTION TO ASK IS: IF THE U.S. PRINTS DOLLARS, WHY DOES IT HAVE SUCH A BIG DEBT? IF YOU HAD THIS QUESTION BEFORE: GOOD FOR YOU!

THE ANSWER IS: The U.S. has debt because every Federal Reserve Note, a.k.a. FRN ("DOLLAR"), that the Federal Reserve prints is a NOTE that the government owes plus interest. The FRNs are debt instruments! How is this possible? You may ask... Who do they owe this debt to? "The government does not print "dollars" out of thin air."

The government prints bonds (debt) out of thin air, and the Federal Reserve buys these bonds, printing FRNs out of thin air. And that is how "dollars" come into existence. This doesn't make sense, right? Thomas Edison thought the same when he said:

> “If the government can issue bonds, it can issue currency. Both are promises to pay, but one promise fattens the usurer and the other helps the people.”

New York Times, 6 de diciembre de 1921The U.S. could print its own debt-free, non-interest-bearing Treasury notes. Like Lincoln printed the Greenbacks to finance the Civil War, Kennedy issued treasury notes with E.O. 11110. What's the difference between a United States note and a Federal Reserve note?

ONE PROMISE FATTENS THE USURER, AND THE OTHER HELPS THE PEOPLE.

The truth is the Federal Reserve took over the U.S. government in 1933 when it declared bankruptcy and the power was passed to its creditors: the Federal Reserve. This institution artificially inflated and contracted the currency supply to create the Great Depression (1929) and finally bankrupted the U.S. government in 1933. They forced the Gold Standard Act in the 1900s, and then they officially took the U.S. out of it in 1934. This bank stole the gold of the American people, and then they stole the gold of other nations in 1971!!!

I want to clarify that I am not making this up, but I am standing on the shoulders of giants like Alfred Owen Crozier (1863-1939). This legend was lobbying against the Federal Reserve Act in 1912, and he wrote the book U.S. Money vs. Corporate Currency, where he documented the intent of this private group of banksters to create a private central bank that would counterfeit currency and take over the republic, bankrupting it. He literally predicted the Great Depression. His worst nightmares turned into a reality. Here you have my top 3 books from him:

Most recently, another legendary character that did a monumental work in dismantling this giant fraud was Thomas Schauf (1949). He lived years out of his savings to prove this giant fraud to the American people. He is a certified CPA who became a full-time lecturer on “money and debt” after the 1987 crash. He dismantled the Federal Reserve cartel, and he also explains the fraud of the commercial bank's credit creation process using the Federal Reserve's own publications.

Both Alfred and Thomas prove that the Federal Reserve is an unconstitutional private central bank that took the power to coin currency from the government, unlawfully transferring that sovereignty to private corporations. Crozier provided the original historical record, and Thomas provided the insider accounting documentation.

CROZIER CONTRIBUTIONS

-

Introduced the term “corporate currency” to flag that the new notes would be liabilities of a private cartel, not of the U.S. Treasury.

-

Warned about the non gold redeem-ability of this private paper: any emergency suspension of specie payments would convert the notes into a floating, unbacked claim—“irredeemable except in more paper.”

-

National bankruptcy forecast: once Treasury debt became the key collateral behind private notes, taxpayers would shoulder every panic, culminating in “the insolvency of the Republic.”

THOMAS SCHAUF UNIQUE CONTRIBUTIONS

-

FOIA stock-subscription ledgers (1991): first public list of the individual banks and share counts that capitalized each of the 12 Reserve Banks.

-

Annotated FRB H-4-1 balance sheets (weekly releases): line-by-line notes showing how “Federal Reserve Notes outstanding” are booked as a liability to member banks, not to the public.

-

Discount-window flow charts: traced how reserves created in New York are pyramided 30-to-1 in downstream banks, then recycled into Treasuries.

-

Internal circulars on surplus rebates: revealed the dividend formula (6 % to stock-holding banks) and the legally mandated tax exemption on that income.

Thomas Schauf is the researcher who turned the Federal Reserve’s own accounting records into hard evidence of private ownership and systemic leverage.

The Federal Reserve is the biggest fraud in human history and the most profitable business on earth: it prints currency out of thin air, and it lends it to the government at interest, buying treasury bills. For every FRN they print at no cost they earn $1 plus interest.

NEW YORK FEDERAL RESERVE OWNERS

• Chase Manhattan Bank N.A. • Citibank N.A. • Morgan Guaranty Trust • Chemical Bank • Bankers Trust Co. • Manufacturers Hanover

HOW CAN AMERICA END THIS FRAUD?

Alfred Owen Crozier, Thomas Schauf, and I will agree on the same solution: Convert existing Federal Reserve notes into U.S. notes on a one-for-one basis. This will automatically end the interest on the U.S. debt: THE BIGGEST U.S GOVERNMENT LIABILITY.

You cannot fix the deficit if you don't nationalize the Federal Reserve Inc and replace every interest-bearing Federal Reserve Note with a non-interest-bearing U.S. Note.

YOU CAN LITERALLY ELIMINATE THE U.S. PUBLIC DEBT BY ISSUING AN EXECUTIVE ORDER REPLACING FRNs FOR U.S notes. Then force private banks to lend only their own capital or time deposits, ending the credit-creation privilege and the boom and bust cycle.

Ron Paul will also agree with this. Every person that understands the monetary system will agree with this.

All freedom-loving Americans who believe in the Revolutionary War, the Constitution, and the Bill of Rights need to join their efforts to fight this corrupt system, abolish the federal system, the national debt, and most of the taxes, and re-establish an honest monetary system.

The American population needs to understand the truth and why they fought the Revolutionary War: FOR THIS SAME REASON! WAKE UP, AMERICA!

This cannot be fixed with Bitcoin TODAY, but probably in the coming decades. But in the meantime it can be done with Treasury notes. This needs to be done if you want to avoid hyperinflation and a state of emergency, martial law, and total disaster.

Time is running out and you need to take action fast. Interest rates are eating up all the revenue of the government and your tax money is going into an unpayable black hole for this very reason.

Americans have two choices: stay and fight or escape before disaster strikes. And no, I am not being extremist, it is a sad reality. Read this books, study this and talk about this with all you fellow Americans.

This is the most important issue you should be discussing about.

-

-

@ 97c70a44:ad98e322

2025-06-06 18:12:40

@ 97c70a44:ad98e322

2025-06-06 18:12:40Vibe coding is taking the nostr developer community by storm. While it's all very exciting and interesting, I think it's important to pump the brakes a little - not in order to stop the vehicle, but to try to keep us from flying off the road as we approach this curve.

In this note Pablo is subtweeting something I said to him recently (although I'm sure he's heard it from other quarters as well):

nostr:nevent1qvzqqqqqqypzp75cf0tahv5z7plpdeaws7ex52nmnwgtwfr2g3m37r844evqrr6jqy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qghwaehxw309aex2mrp0yh8qunfd4skctnwv46z7qg6waehxw309ac8junpd45kgtnxd9shg6npvchxxmmd9uqzq0z48d4ttzzkupswnkyt5a2xfkhxl3hyavnxjujwn5k2k529aearwtecp4

There is a naive, curmudgeonly case for simply "not doing AI". I think the intuition is a good one, but the subject is obviously more complicated - not doing it, either on an individual or a collective level, is just not an option. I recently read Tools for Conviviality by Ivan Illich, which I think can help us here. For Illich, the best kind of tool is one which serves "politically interrelated individuals rather than managers".

This is obviously a core value for bitcoiners. And I think the talks given at the Oslo Freedom Forum this year present a compelling case for adoption of LLMs for the purposes of 1. using them for good, and 2. developing them further so that they don't get captured by corporations and governments. Illich calls both the telephone and print "almost ideally convivial". I would add the internet, cryptography, and LLMs to this list, because each one allows individuals to work cooperatively within communities to embody their values in their work.

But this is only half the story. Illich also points out how "the manipulative nature of institutions... have put these ideally convivial tools at the service of more [managerial dominance]."

Preventing the subversion and capture of our tools is not just a matter of who uses what, and for which ends. It also requires an awareness of the environment that the use of the tool (whether for virtuous or vicious ends) creates, which in turn forms the abilities, values, and desires of those who inhabit the environment.

The natural tendency of LLMs is to foster ignorance, dependence, and detachment from reality. This is not the fault of the tool itself, but that of humans' tendency to trade liberty for convenience. Tools naturally amplify that tendency, and having established their own patterns of use as systems of values and evaluation of outcome in the inhabitants of the environment they create, foster an inability to recognize their own influence, and thereby to work effectively for purposes not endorsed by the structure of the tool-defined environment. This is what I mean when I say that AI use is anti-human. I mean it in the same way that all unreflective tool use is anti-human. c.f. Wendell Berry for an evaluation of industrial agriculture along the same lines.

What I'm not claiming is that a minority of high agency individuals can't use the technology for virtuous ends. In fact, I think that is an essential part of the solution. Tool use can be good. But tools that bring their users into dependence on complex industry and catechize their users into a particular system should be approached with extra caution. The plow was a convivial tool, and so were early tractors. Self-driving John Deere monstrosities are a straightforward extension of the earlier form of the technology, but are self-evidently an instrument of debt slavery, chemical dependency, industrial centralization, and degradation of the land. As Illich says:

There is a form of malfunction in which growth does not yet tend toward the destruction of life, yet renders a tool antagonistic to its specific aims. Tools, in other words, have an optimal, a tolerable, and a negative range.

The initial form of a tool is almost always beneficial, because tools are made by humans for human ends. But as the scale of the tool grows, its logic gets more widely and forcibly, applied. The solution to the anti-human tendencies of any technology is an understanding of scale. To prevent the overrun of the internal logic of a given tool and its creation of an environment hostile to human flourishing, we need to impose limits on scale.

Tools that require time periods or spaces or energies much beyond the order of corresponding natural scales are dysfunctional.

My problem with LLMs is:

- Not their imitation of human idioms, but their subversion of them and the resulting adoption of robotic idioms by humans

- Not the access they grant to information, but their ability to obscure accurate information

- Not their elimination of menial work, but its increase (c.f. Bullshit Jobs)

- Not their ability to take away jobs, but their ability to take away the meaning found in good work

- Not their ability to confer power to the user, but their ability to confer power to their owner

- Not their ability to solve problems mechanistically, but the extension of their mechanistic value system to human life

- Not the convenience they create, but the dependence they encourage

- Not the conversations they are able to participate in, but the relationships they displace

All of these dysfunctions come from the over-application of the technology in evaluating and executing the fundamentally human task of living. AI work is the same kind of thing as an AI girlfriend, because work is not only for the creation of value (although that's an essential part of it), but also for the exercise of human agency in the world. In other words, tools must be tools, not masters. This is a problem of scale - when tool use is extended beyond its appropriate domain, it becomes what Illich calls a "radical monopoly" (the domination of a single paradigm over all of human life).

So the important question when dealing with any emergent technology becomes: how can we set limits such that the use of the technology is naturally confined to its appropriate scale?

Here are some considerations:

- Teach people how to use the technology well (e.g. cite sources when doing research, use context files instead of fighting the prompt, know when to ask questions rather than generate code)

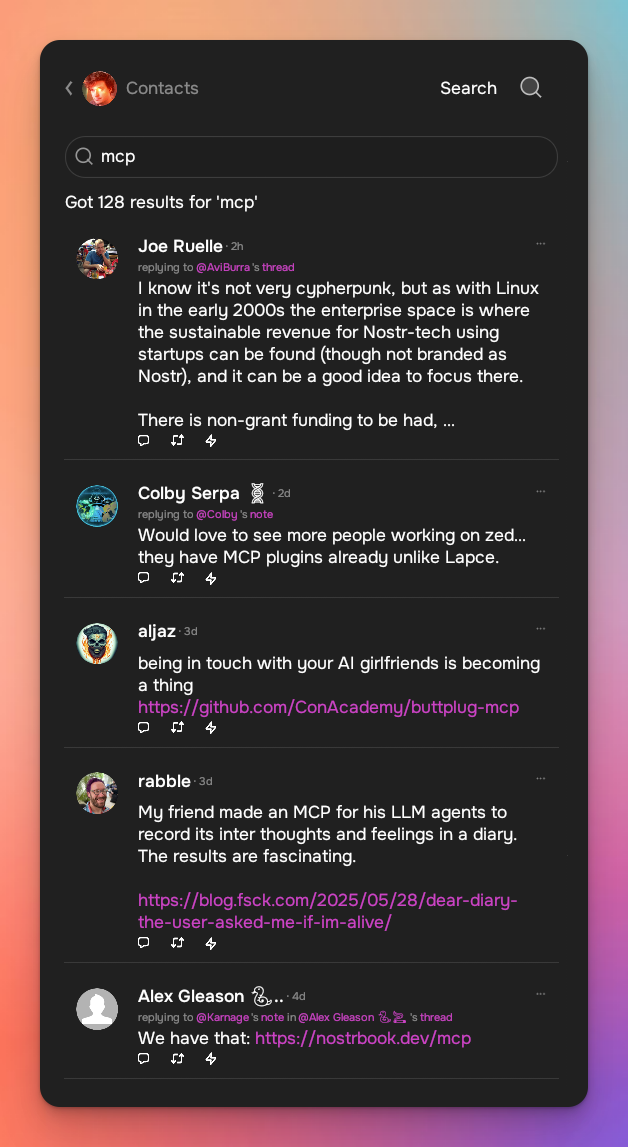

- Create and use open source and self-hosted models and tools (MCP, stacks, tenex). Refuse to pay for closed or third-party hosted models and tools.

- Recognize the dependencies of the tool itself, for example GPU availability, and diversify the industrial sources to reduce fragility and dependence.

- Create models with built-in limits. The big companies have attempted this (resulting in Japanese Vikings), but the best-case effect is a top-down imposition of corporate values onto individuals. But the idea isn't inherently bad - a coding model that refuses to generate code in response to vague prompts, or which asks clarifying questions is an example. Or a home assistant that recognized childrens' voices and refuses to interact.

- Divert the productivity gains to human enrichment. Without mundane work to do, novice lawyers, coders, and accountants don't have an opportunity to hone their skills. But their learning could be subsidized by the bots in order to bring them up to a level that continues to be useful.

- Don't become a slave to the bots. Know when not to use it. Talk to real people. Write real code, poetry, novels, scripts. Do your own research. Learn by experience. Make your own stuff. Take a break from reviewing code to write some. Be independent, impossible to control. Don't underestimate the value to your soul of good work.

- Resist both monopoly and "radical monopoly". Both naturally collapse over time, but by cultivating an appreciation of the goodness of hand-crafted goods, non-synthetic entertainment, embodied relationship, and a balance between mobility and place, we can relegate new, threatening technologies to their correct role in society.

I think in all of this is implicit the idea of technological determinism, that productivity is power, and if you don't adapt you die. I reject this as an artifact of darwinism and materialism. The world is far more complex and full of grace than we think.

The idea that productivity creates wealth is, as we all know, bunk. GDP continues to go up, but ungrounded metrics don't reflect anything about the reality of human flourishing. We have to return to a qualitative understanding of life as whole, and contextualize quantitative tools and metrics within that framework.

Finally, don't believe the hype. Even if AI delivers everything it promises, conservatism in changing our ways of life will decelerate the rate of change society is subjected to and allow time for reflection and proper use of the tool. Curmudgeons are as valuable as technologists. There will be no jobspocalypse if there is sufficient political will to value human good over mere productivity. It's ok to pump the breaks.

-

@ 7f6db517:a4931eda

2025-06-06 18:02:34

@ 7f6db517:a4931eda

2025-06-06 18:02:34

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-06 18:02:32

@ 7f6db517:a4931eda

2025-06-06 18:02:32

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-06 18:02:32

@ 7f6db517:a4931eda

2025-06-06 18:02:32

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-06 18:02:31

@ 7f6db517:a4931eda

2025-06-06 18:02:31

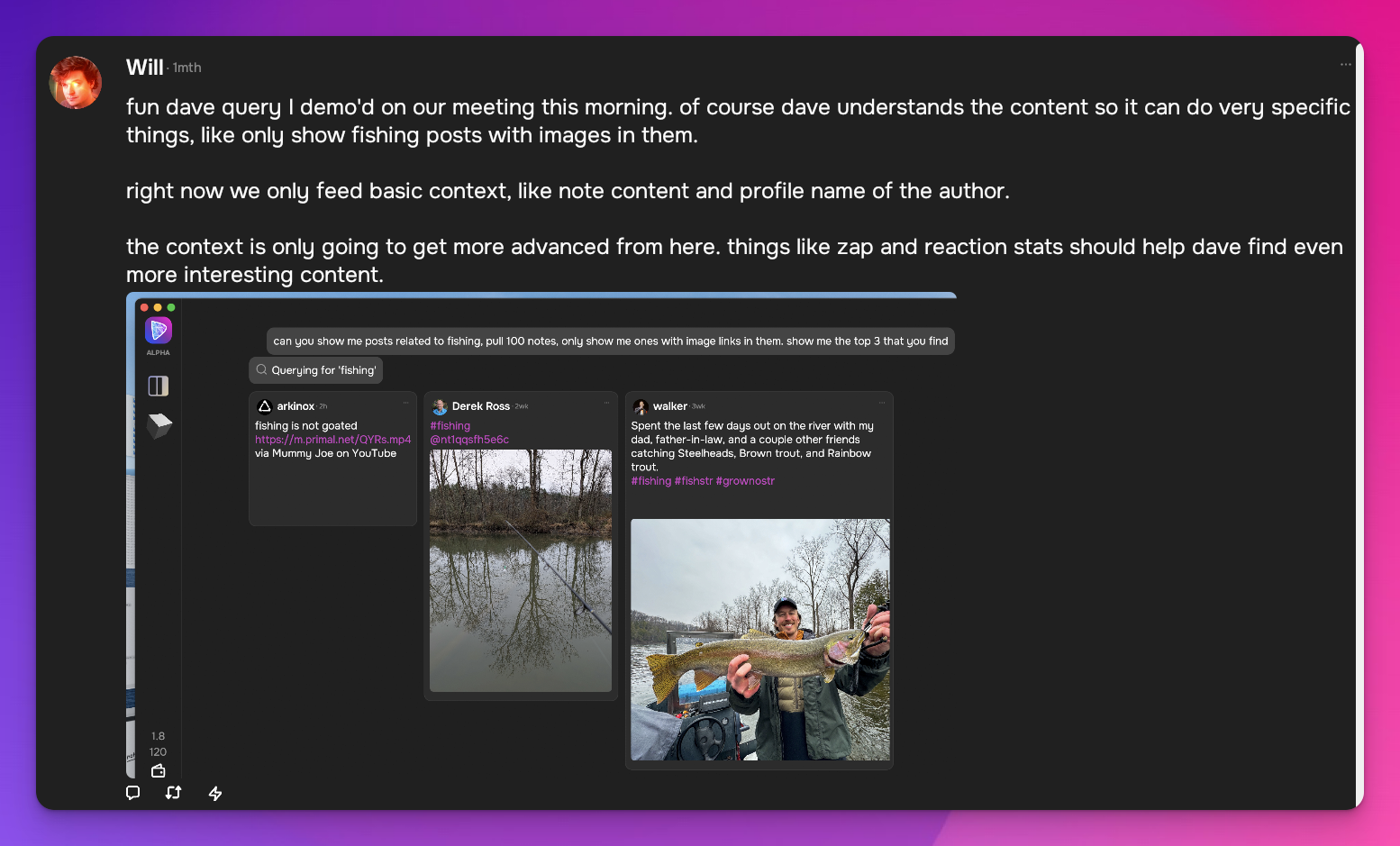

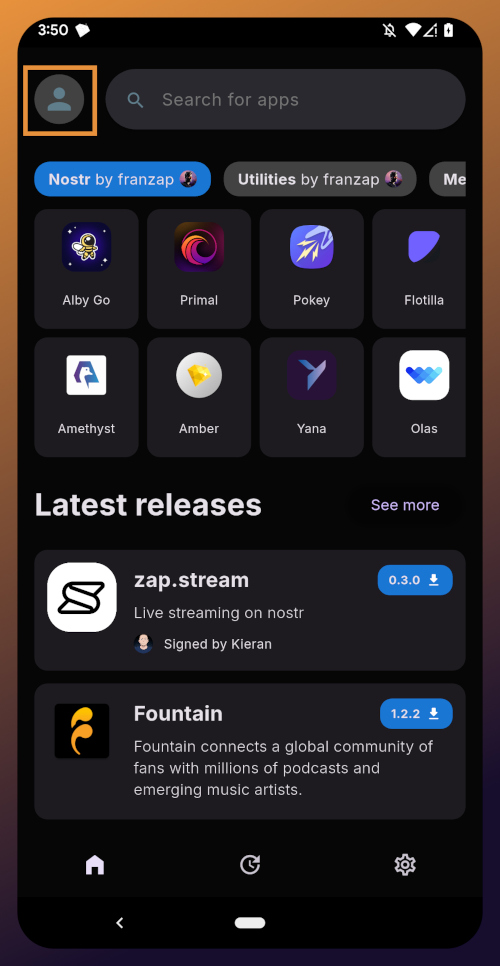

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-06 18:02:30

@ dfa02707:41ca50e3

2025-06-06 18:02:30Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-06-06 18:02:28

@ dfa02707:41ca50e3

2025-06-06 18:02:28Headlines

- Spiral renews support for Dan Gould and Joschisan. The organization has renewed support for Dan Gould, who is developing the Payjoin Dev Kit (PDK), and Joschisan, a Fedimint developer focused on simplifying federations.

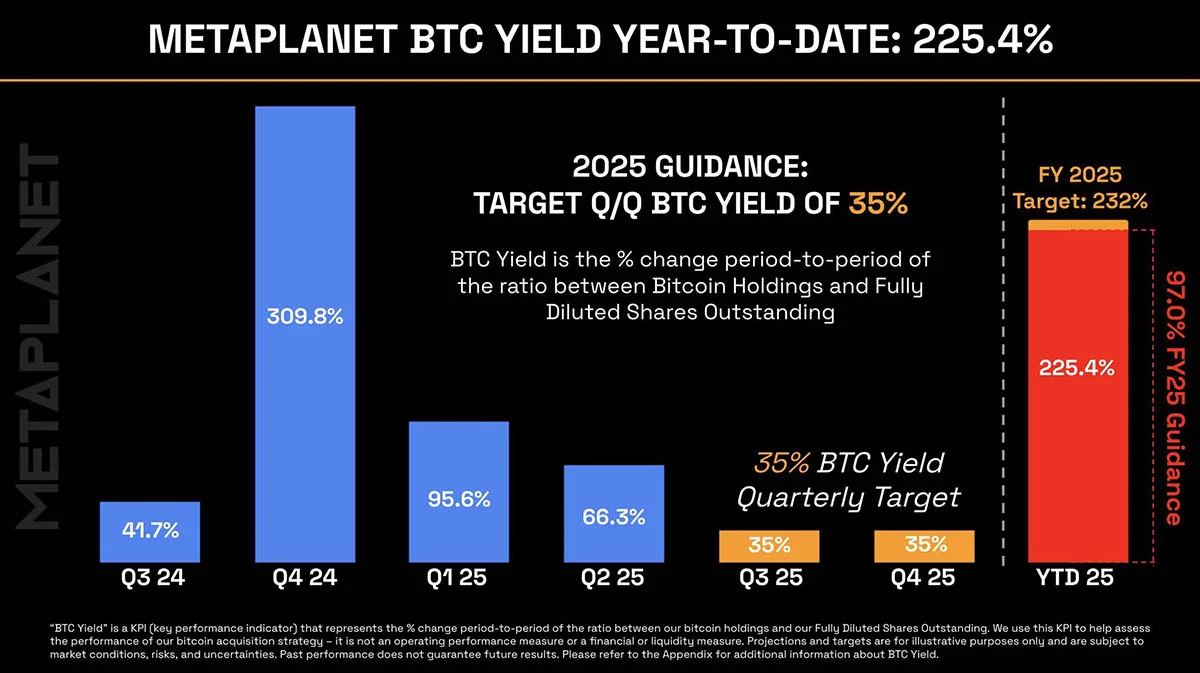

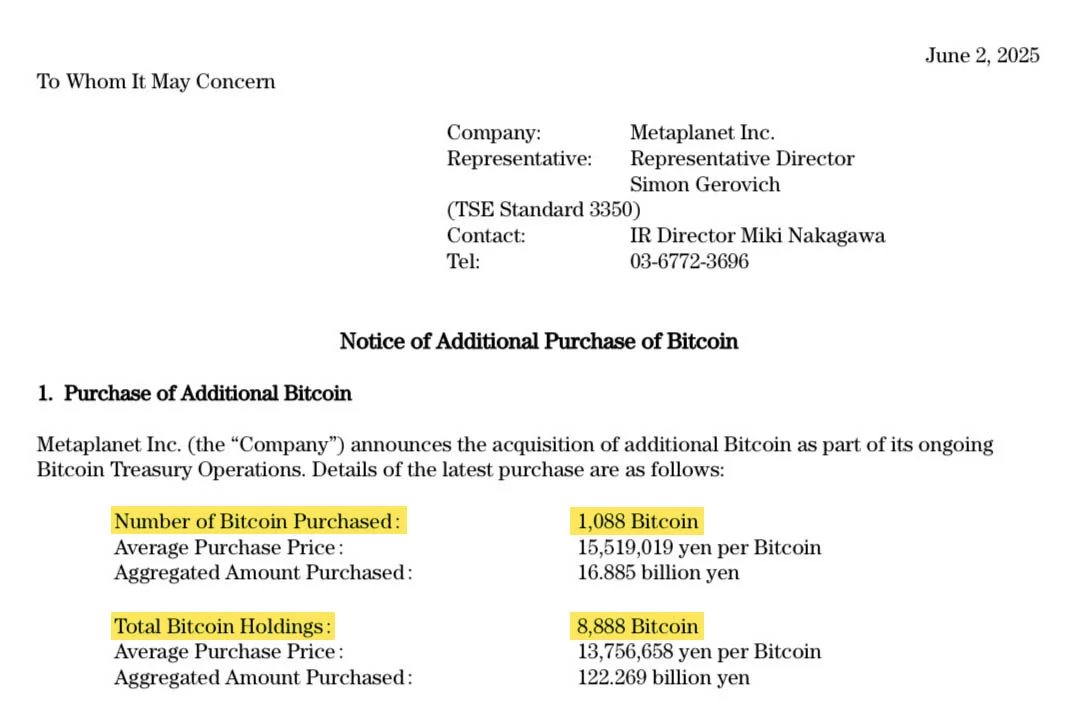

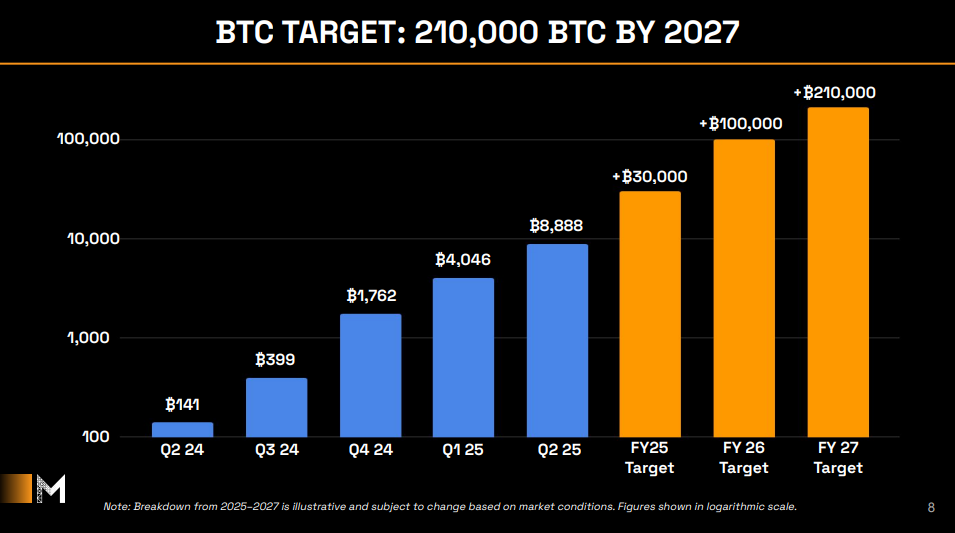

- Metaplanet buys another 145 BTC. The Tokyo-listed company has purchased an additional 145 BTC for $13.6 million. Their total bitcoin holdings now stand at 5,000 coins, worth around $428.1 million.

- Semler Scientific has increased its bitcoin holdings to 3,303 BTC. The company acquired an additional 111 BTC at an average price of $90,124. The purchase was funded through proceeds from an at-the-market offering and cash reserves, as stated in a press release.

- The Virtual Asset Service Providers (VASP) Bill 2025 introduced in Kenya. The new legislation aims to establish a comprehensive legal framework for licensing, regulating, and supervising virtual asset service providers (VASPs), with strict penalties for non-compliant entities.

- Russian government to launch a cryptocurrency exchange. The country's Ministry of Finance and Central Bank announced plans to establish a trading platform for "highly qualified investors" that "will legalize crypto assets and bring crypto operations out of the shadows."

- All virtual asset service providers expect to be fully compliant with the Travel Rule by the end of 2025. A survey by financial surveillance specialist Notabene reveals that 90% of virtual asset service providers (VASPs) expect full Travel Rule compliance by mid-2025, with all aiming for compliance by year-end. The survey also shows a significant rise in VASPs blocking withdrawals until beneficiary information is confirmed, increasing from 2.9% in 2024 to 15.4% now. Additionally, about 20% of VASPs return deposits if originator data is missing.

- UN claims Bitcoin mining is a "powerful tool" for money laundering. The Rage's analysis suggests that the recent United Nations Office on Drugs and Crime report on crime in South-East Asia makes little sense and hints at the potential introduction of Anti-Money Laundering (AML) measures at the mining level.

- Riot Platforms has obtained a $100 million credit facility from Coinbase Credit, using bitcoin as collateral for short-term funding to support its expansion. The firm's CEO, Jason Les, stated that this facility is crucial for diversifying financing sources and driving long-term stockholder value through strategic growth initiatives.

- Bitdeer raises $179M in loans and equity amid Bitcoin chip push. The Miner Mag reports that Bitdeer entered into a loan agreement with its affiliate Matrixport for up to $200 million in April, as disclosed in its annual report filed on Monday.

- Federal Reserve retracts guidance discouraging banks from engaging in 'crypto.' The U.S. Federal Reserve withdrew guidance that discouraged banks from crypto and stablecoin activities, as announced by its Board of Governors on Thursday. This includes rescinding a 2022 supervisory letter requiring prior notification of crypto activities and 2023 stablecoin requirements.

"As a result, the Board will no longer expect banks to provide notification and will instead monitor banks' crypto-asset activities through the normal supervisory process," reads the FED statement.

- UAE-based Islamic bank ruya launches Shari’ah-compliant bitcoin investing. The bank has become the world’s first Islamic bank to provide direct access to virtual asset investments, including Bitcoin, via its mobile app, per Bitcoin Magazine.

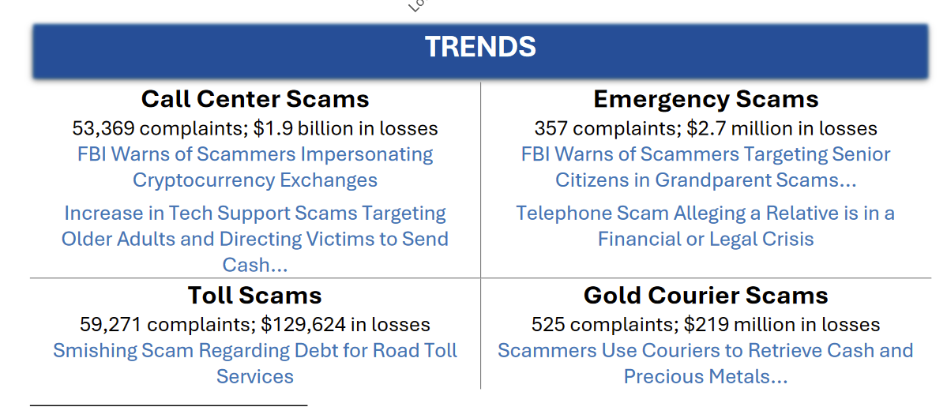

- U.S. 'crypto' scam losses amounted to $9.3B in 2024. The US The Federal Bureau of Investigation (FBI) has reported $9.3 billion losses in cryptocurrency-related scams in 2024, noting a troubling trend of scams targeting older Americans, which accounted for over $2.8 billion of those losses.

Source: FBI.

- North Korean hackers establish fake companies to target 'crypto' developers. Silent Push researchers reported that hackers linked to the Lazarus Group created three shell companies, two of which are based in the U.S., with the objective of spreading malware through deceptive job interview scams aimed at individuals seeking jobs in cryptocurrency companies.

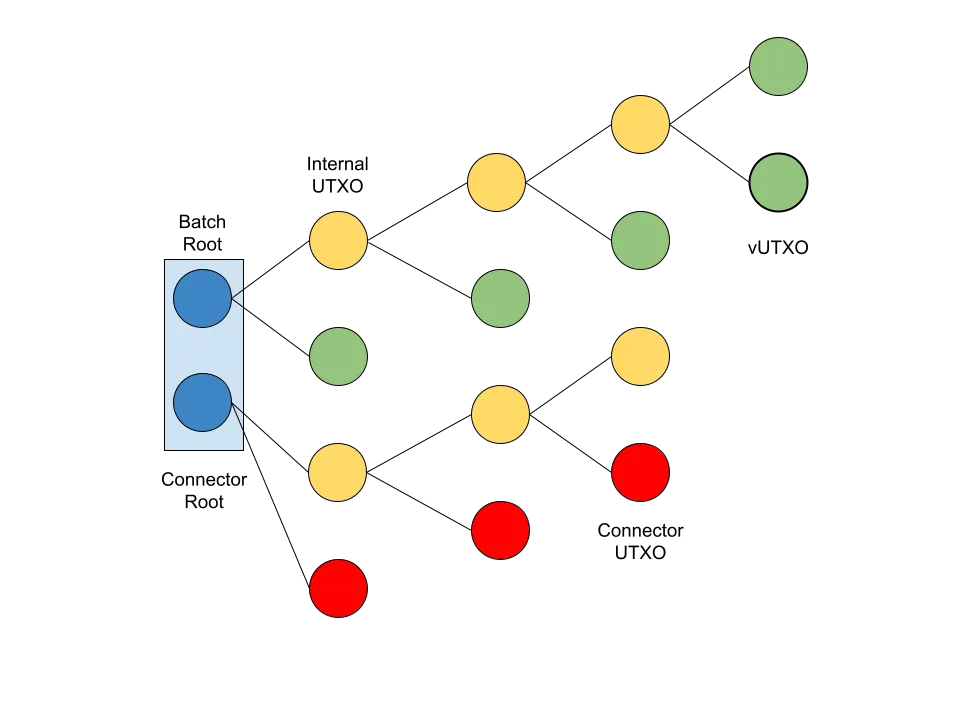

- Citrea deployed its Clementine Bridge on the Bitcoin testnet. The bridge utilizes the BitVM2 programming language to inherit validity from Bitcoin, allegedly providing "the safest and most trust-minimized way to use BTC in decentralized finance."

- Hesperides University offers a Master’s degree in Bitcoin. Bitcoin Magazine reports the launch of the first-ever Spanish-language Master’s program dedicated exclusively to Bitcoin. Starting April 28, 2025, this fully online program will equip professionals with technical, economic, legal, and philosophical skills to excel in the Bitcoin era.

- BTC in D.C. event is set to take place on September 30 - October 1 in Washington, D.C. Learn more about this initiative here.

Use the tools

- Bitcoin Keeper just got a new look. Version 2.2.0 of the mobile multisig app brought a new branding design, along with a Keeper Private tier, testnet support, ability to import and export BIP-329 labels, and the option to use a Server Key with multiple users.

- Earlier this month the project also announced Keeper Learn service, offering clear and guided Bitcoin learning sessions for both groups and individuals.

- Keeper Desktop v0.2.2, a companion desktop app for Bitcoin Keeper mobile app, received a renewed branding update, too.

The evolution of Bitcoin Keeper logo. Source: BitHyve blog.

- Blockstream Green Desktop v2.0.25 updates GDK to v0.75.1 and fixes amount parsing issues when switching from fiat denomination to Liquid asset.

- Lightning Loop v0.31.0-beta enhances the

loop listswapscommand by improving the ability to filter the response. - Lightning-kmp v1.10.0, an implementation of the Lightning Network in Kotlin, is now available.

- LND v0.19.0-beta.rc3, the latest beta release candidate of LND is now ready for testing.

- ZEUS v0.11.0-alpha2 is now available for testing, too. It's nuts.

- JoinMarket Fidelity Bond Simulator helps potential JoinMarket makers evaluate their competitive position in the market based on fidelity bonds.

- UTXOscope is a text-only Bitcoin blockchain analysis tool that visualizes price dynamics using only on-chain data. The

-

@ e2c72a5a:bfacb2ee

2025-06-06 18:01:32

@ e2c72a5a:bfacb2ee

2025-06-06 18:01:32The 8-Month Prison Sentence That Changed Crypto's Security Landscape

Freedom comes at a price. Just ask Tigran Gambaryan, who finally resigned from Binance after spending 8 months in a Nigerian prison for doing his job.

While headlines focus on Bitcoin's price swings and Trump-Musk feuds, the real story is how vulnerable crypto executives have become on the global stage. Gambaryan's detention wasn't random – it was a warning shot to compliance officers worldwide.

The former IRS investigator joined Binance to strengthen their compliance, only to be detained while traveling for work. His crime? Being too good at his job in an industry where borders mean nothing but local governments still control everything.

This pattern repeats across jurisdictions: executives detained, exchanges pressured, and compliance officers caught in geopolitical crosshairs. Meanwhile, companies like Uber quietly explore stablecoins to move money globally while avoiding similar risks.

What security measures are you implementing to protect your crypto assets and identity when traveling internationally? The next detention story could impact your investments more than any market dip.

-

@ dfa02707:41ca50e3

2025-06-06 18:02:27

@ dfa02707:41ca50e3

2025-06-06 18:02:27Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ a5ee4475:2ca75401

2025-06-06 14:13:27

@ a5ee4475:2ca75401

2025-06-06 14:13:27[EM ATUALIZAÇÃO]

vacina #saude #politica #manipulacao #mundial #genocidio #pandemia #conspiracao

Este artigo reúne algumas menções e evidências mais antigas que vim registrando durante alguns anos em relação a Covid-19, vacinas obrigatórias e a ação de agências de governo, fundações, políticos, mídia tradicional, celebridades, influenciadores, cientistas, redes sociais e laboratórios, em envolvimento com genocídio e restrições de liberdades em escala mundial causado por decisões em várias esferas relativas ao covid e as vacinas obrigatórias em geral.

Porém, alguns links podem não estar mais disponiveis, foram que ainda faltam ser registradas muitas informações já divulgadas nos últimos anos e que muitos não tiveram contato pela escassez de meios para a obtenção dessas informações de forma organizada.

Portanto, o presente artigo ainda passará por atualizações de conteúdo e formatação. Logo, se possível, ajudem sugerindo complementos ou alterações, ou com doações.

"Aqueles que não conseguem lembrar o passado estão condenados a repeti-lo." - George Satayana

Noções iniciais:

- O termo 'Coronavírus' (COVID) é na verdade um nome genérico para vários vírus de gripes já comuns, dado para o tipo corona (com uma "coroa", 'espetos' ao redor dele), o Sars-Cov-2 (que passou a ser chamado erroneamente só de Covid), é só um deles.

- SARS-CoV-2 é que é nome do vírus. Ele que causa a doença Covid-19;

- O coronavírus SARS-CoV-2 é o segundo tipo de SARS-CoV documentado, o primeiro ocorreu entre 2002 e 2003, se originando também da China e também dito como tendo origem animal;

- SARS (Severe Acute Respiratory Syndrome) - Síndrome Respiratória Aguda Grave (SRAG) é a uma doença respiratória viral, relatada ser de origem zoonótica (animal), causada pelos coronavírus SARS-CoV (2002) e SARS-CoV-2 (2019), ambos de origem chinesa;

1. Vacinas Obrigatórias em Geral

23/01/2025 - [Pesquisa] Vacinas causando autismo em crianças https://publichealthpolicyjournal.com/vaccination-and-neurodevelopmental-disorders-a-study-of-nine-year-old-children-enrolled-in-medicaid/

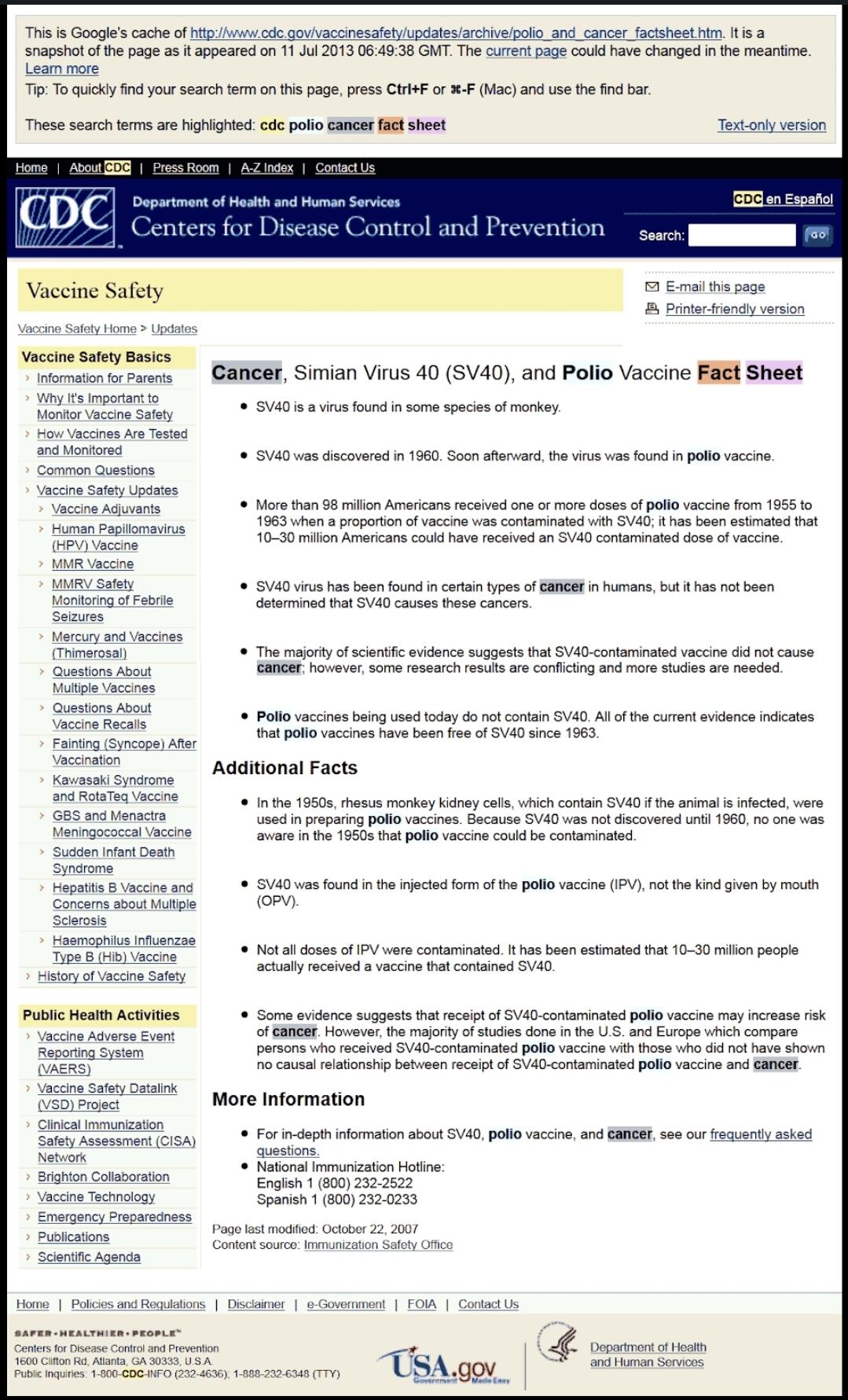

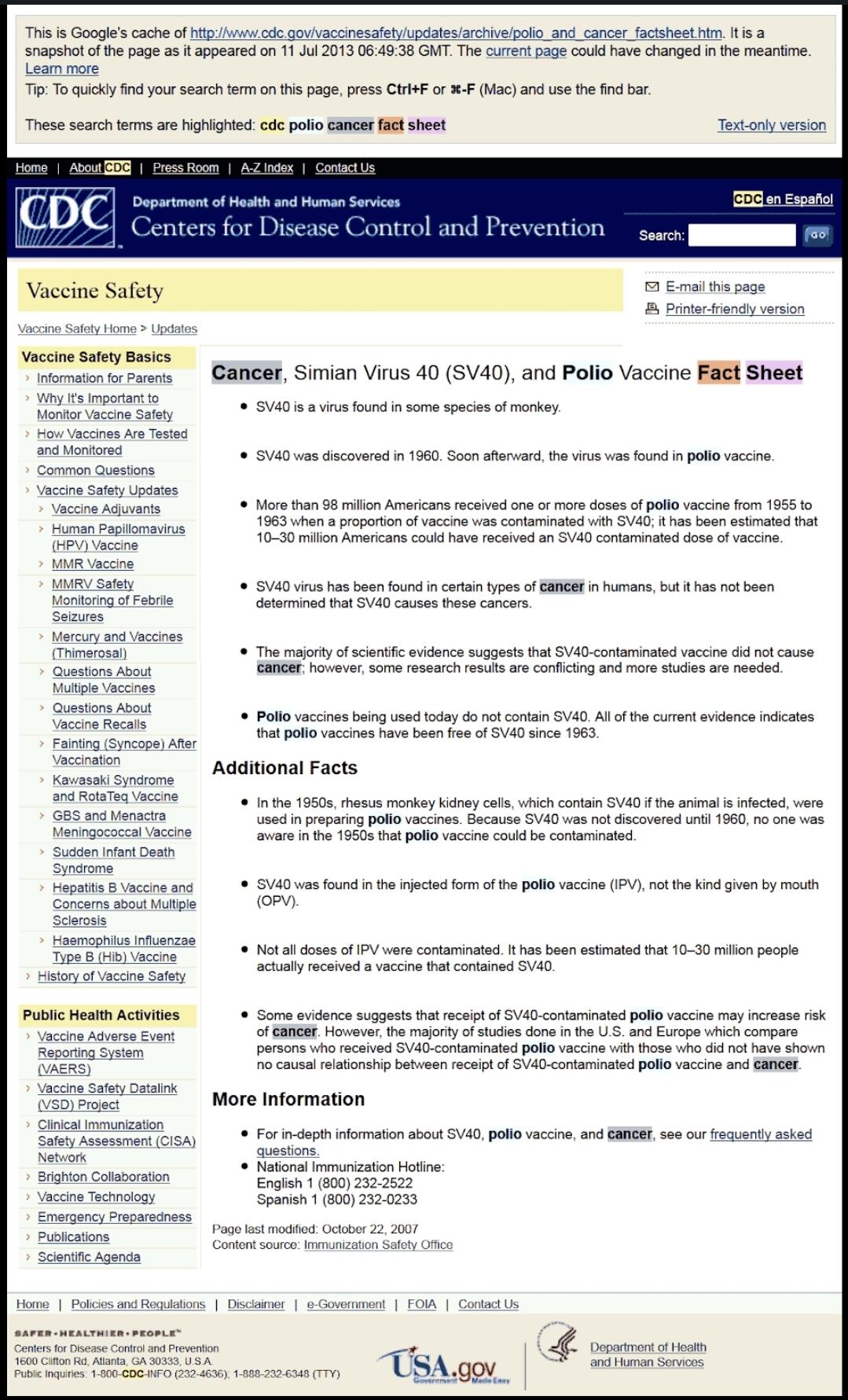

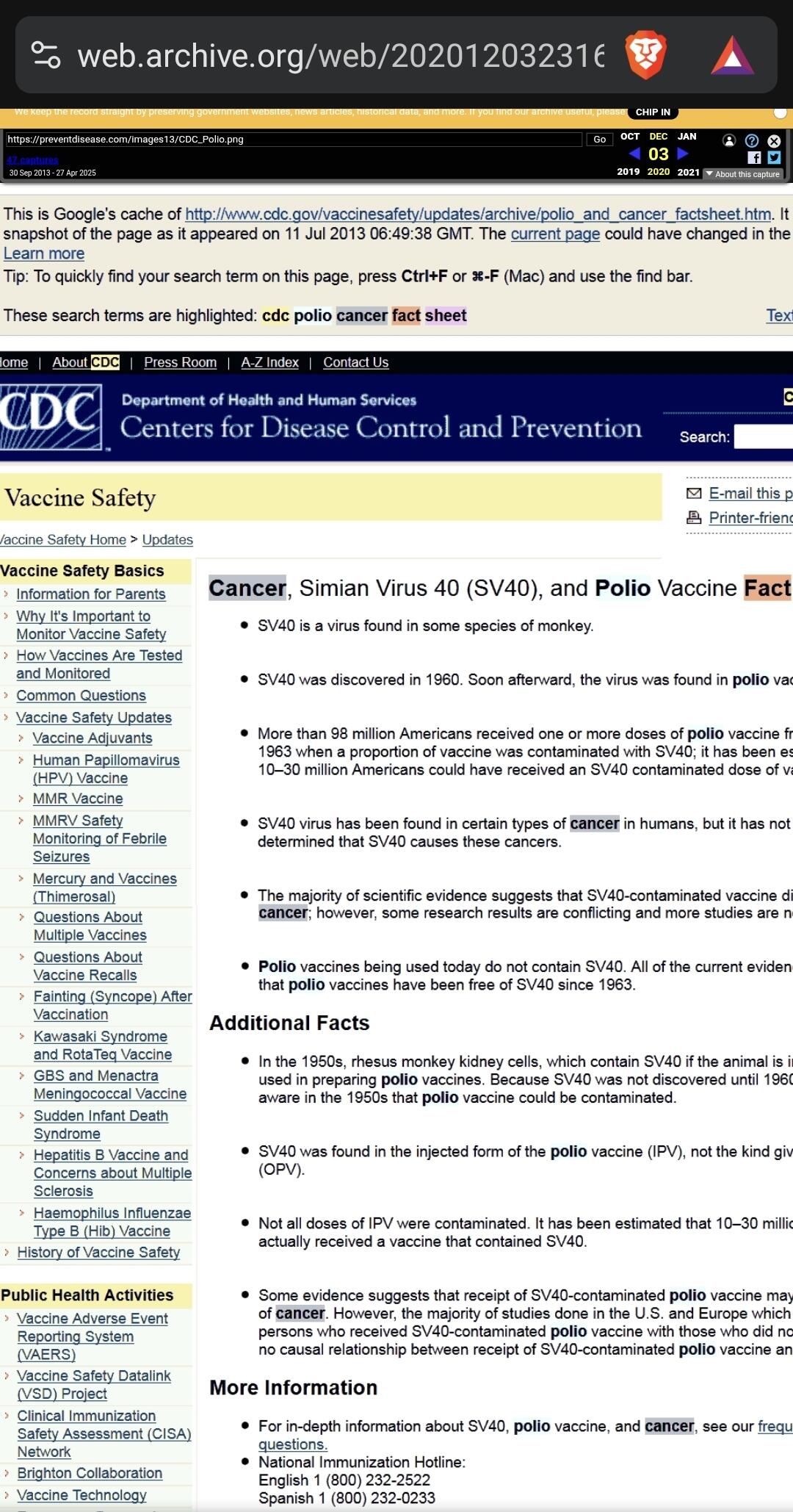

- O CDC admite que 98 milhões de pessoas receberam o vírus do câncer através da vacina da Poliomielite https://medicinanews.com.br/frente/frente_1/o-cdc-admite-que-98-milhoes-de-pessoas-receberam-o-virus-do-cancer-atraves-da-vacina-poliomielite/

"O CDC (Os Centros de Controle e Prevenção de Doenças dos Estados Unidos) removeu rapidamente uma página do seu site, que estava em cache no Google, como você pode ver logo abaixo, admitindo que mais de 98 milhões de americanos receberam uma ou mais doses de vacina contra pólio dentro de 8 período entre 1955 e 1963, quando uma proporção da vacina foi contaminada com um poliomavírus causador de câncer chamado SV40."

Fonte original da imagem: https://preventdisease.com/images13/CDC_Polio.png [indisponível] - A imagem foi trocada por outra de menor qualidade e em outro link, mas eu já tinha a imagem original salva.

Fonte original da imagem: https://preventdisease.com/images13/CDC_Polio.png [indisponível] - A imagem foi trocada por outra de menor qualidade e em outro link, mas eu já tinha a imagem original salva. Imagem arquivada em: https://web.archive.org/web/20201203231640/

Imagem arquivada em: https://web.archive.org/web/20201203231640/27/02/2021 - Por que o Japão demorou para vacinar, mesmo com Olimpíada se aproximando https://www.cnnbrasil.com.br/internacional/2021/02/27/por-que-o-japao-demorou-para-vacinar-mesmo-com-olimpiada-se-aproximando

"Desconfiança da população japonesa em relação a vacinas, ligada a casos ocorridos no passado, está entre razões que atrasaram imunização no país.

A resistência à vacina do Japão remonta à década de 1970, quando duas crianças morreram dentro de 24 horas após receberem a vacina combinada contra difteria, tétano e coqueluche (coqueluche). A vacina foi temporariamente suspensa, mas a confiança já havia sido abalada. Por vários anos, as taxas de vacinação infantil caíram, levando a um aumento nos casos de tosse convulsa.

No final dos anos 1980, houve outro susto com a introdução da vacina tripla contra sarampo, caxumba e rubéola produzida no Japão. As primeiras versões do imunizante foram associadas à meningite asséptica, ou inchaço das membranas ao redor do cérebro e da medula espinhal. O problema foi rastreado até o componente caxumba da vacina tripla, o que levou a uma ação judicial e a indenização por danos pesados.

O Instituto Nacional de Ciências da Saúde interrompeu a dose combinada em 1993 e a substituiu por vacinas individuais. Após o escândalo, Shibuya disse que o governo japonês se tornou "ciente dos riscos" e seu programa nacional de vacinação tornou-se voluntário.

O Dr. Yuho Horikoshi, especialista em doenças infecciosas, diz que os processos levaram a uma "lacuna de vacinação", em que nenhuma vacina foi aprovada no Japão por cerca de 15 anos.

Mais recentemente, em 2013, o Japão adicionou a vacina contra o papilomavírus humano (HPV) ao calendário nacional para proteger as meninas contra o vírus sexualmente transmissível, que é conhecido por causar câncer cervical. No entanto, vídeos de meninas supostamente sofrendo de reações adversas começaram a circular no YouTube, levando o governo a retirá-los da programação nacional."

2. PRIMEIRAS OCORRÊNCIAS PREDITIVAS AO COVID-19

2002 - Síndrome respiratória aguda grave (SARS) Brenda L. Tesini (setembro de 2018). Síndrome respiratória aguda grave (SARS) [indisponível]. Manual Merck. Consultado em 23 de janeiro de 2020, citado no Wikipedia

SARS - Wikipédia: "A SARS [doença do vírus SARS-CoV] foi detectada pela primeira vez no fim de 2002 na China. Entre 2002 e 2003, um surto da doença resultou em mais de 8 000 casos e cerca de 800 mortes em todo o mundo."

2010 - Fundação Rockfeller, Lockstep. https://www.rockefellerfoundation.org/wp-content/uploads/Annual-Report-2010-1.pdf

Neste PDF da fundação Rockfeller, em seu próprio site, a fundação deixou claro o seu envolvimento em casos de ‘contenção’ de pandemias juntamente com a USAID (agência americana com nome ambíguo, como formalmente ‘United States Agency for International Development’, mas soando como ‘US Socorre’, mas sendo um braço do governo democrata que financiava interferências políticas diretas em vários países, como em intervenções no Brasil ), inclusive em relacionadas ao SARS, o mesmo sintoma dos coronavírus Sars-Cov e Sars-Cov-2 (o vírus propagado em 2019) e que causa o COVID-19.

Segundo eles:

“Integração entre Regiões e Países

A Fundação Rockefeler investiu US$ 22 milhões em sua Iniciativa de Redes de Vigilância de Doenças para ajudar a conter a disseminação de doenças infecciosas e pandemias, fortalecendo os sistemas nacionais, regionais e globais de vigilância e resposta a doenças. Dois programas-chave da Rockefeler — a Rede de Vigilância de Doenças da Bacia do Mekong e a Rede Integrada de Vigilância de Doenças da África Oriental — conectaram e capacitaram profissionais de saúde, epidemiologistas e autoridades de saúde pública em toda a região, levando a um aumento de seis vezes nos locais de vigilância de doenças transfronteiriças somente nos últimos três anos. Em 2010, a Rockefeler expandiu a bem-sucedida campanha transdisciplinar One Health, que a USAID e o Banco Asiático de Desenvolvimento adotaram como modelos. One Health refere-se à integração da ciência médica e veterinária para combater essas novas variedades de doenças zoonóticas que se movem e sofrem mutações rapidamente de animais para humanos. Essas colaborações criaram e fortaleceram uma rede regional crítica de saúde pública, enquanto as lições aprendidas foram exportadas entre disciplinas e países. Além de fortalecer os laços globais em saúde pública, a Rockefeler ajudou a elevar o nível de especialização e treinamento em campo. O Programa de Treinamento em Epidemiologia de Campo coloca graduados nos mais altos escalões do governo no Laos e no Vietnã, enquanto as bolsas da Rockefeler transformaram as ferramentas disponíveis para os médicos, permitindo-lhes utilizar o poder da internet para se comunicar e monitorar eventos, compreender contextos locais e analisar novos problemas. Finalmente, estamos aplicando ferramentas do século XXI para combater os desafios de saúde do século XXI.”

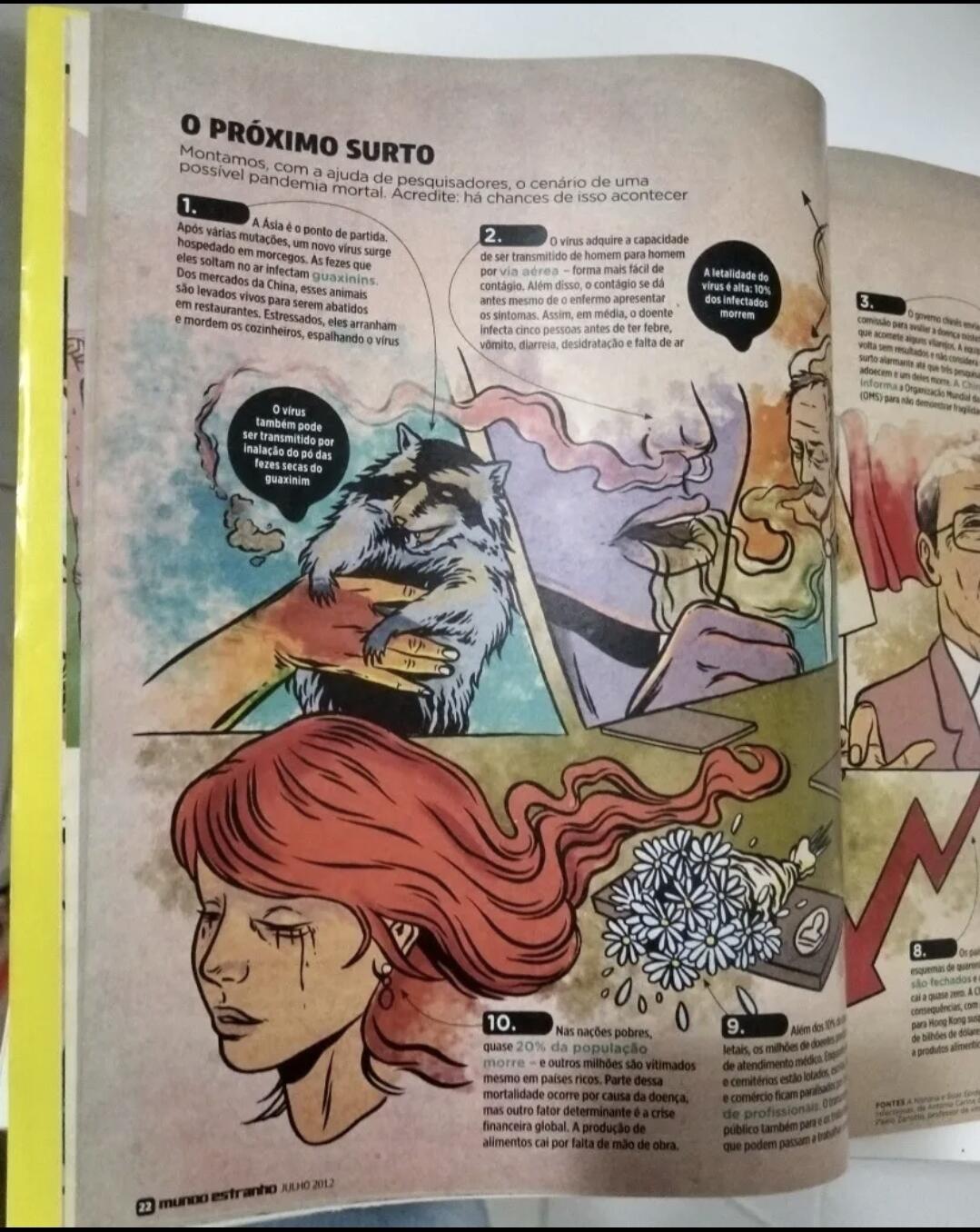

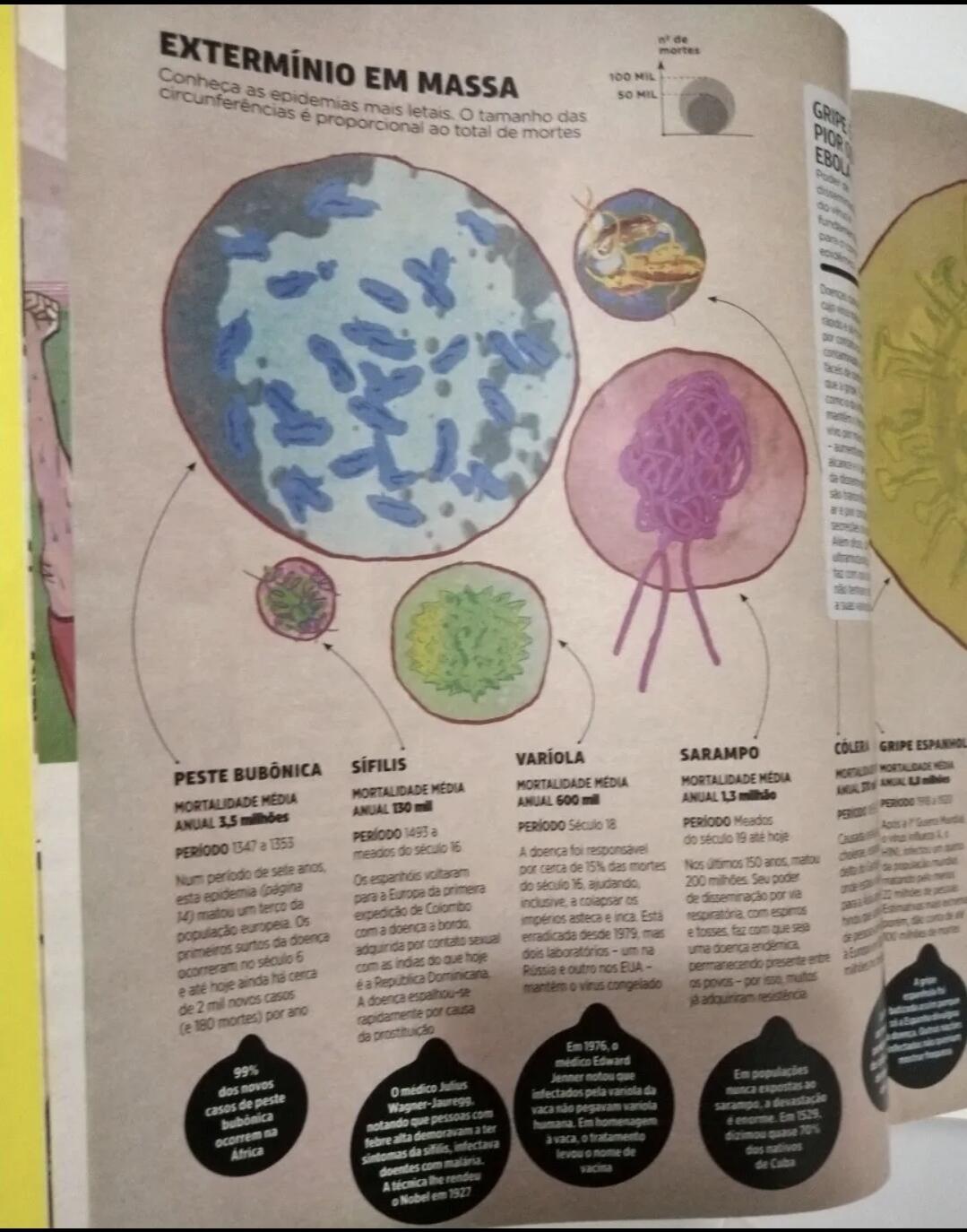

Julho de 2012 - Revista Mundo Estranho - Epidemias Citada em: https://super.abril.com.br/especiais/epidemia-o-risco-invisivel/

Houve uma grande 'coincidência'. A revista Mundo Estranho em julho de 2012, requisitou o até então doutorando em virologia, Átila Iamarino (do canal Nerdologia no Youtube - O mesmo cientista que fez diversas propagandas das vacinas no Brasil), para descrever um possível cenário de propagação de uma epidemia viral, a revista descreve com grande precisão os eventos de 2020, mas apontando o oposto da China, em que, na realidade, sua economia cresceu vertiginosamente.

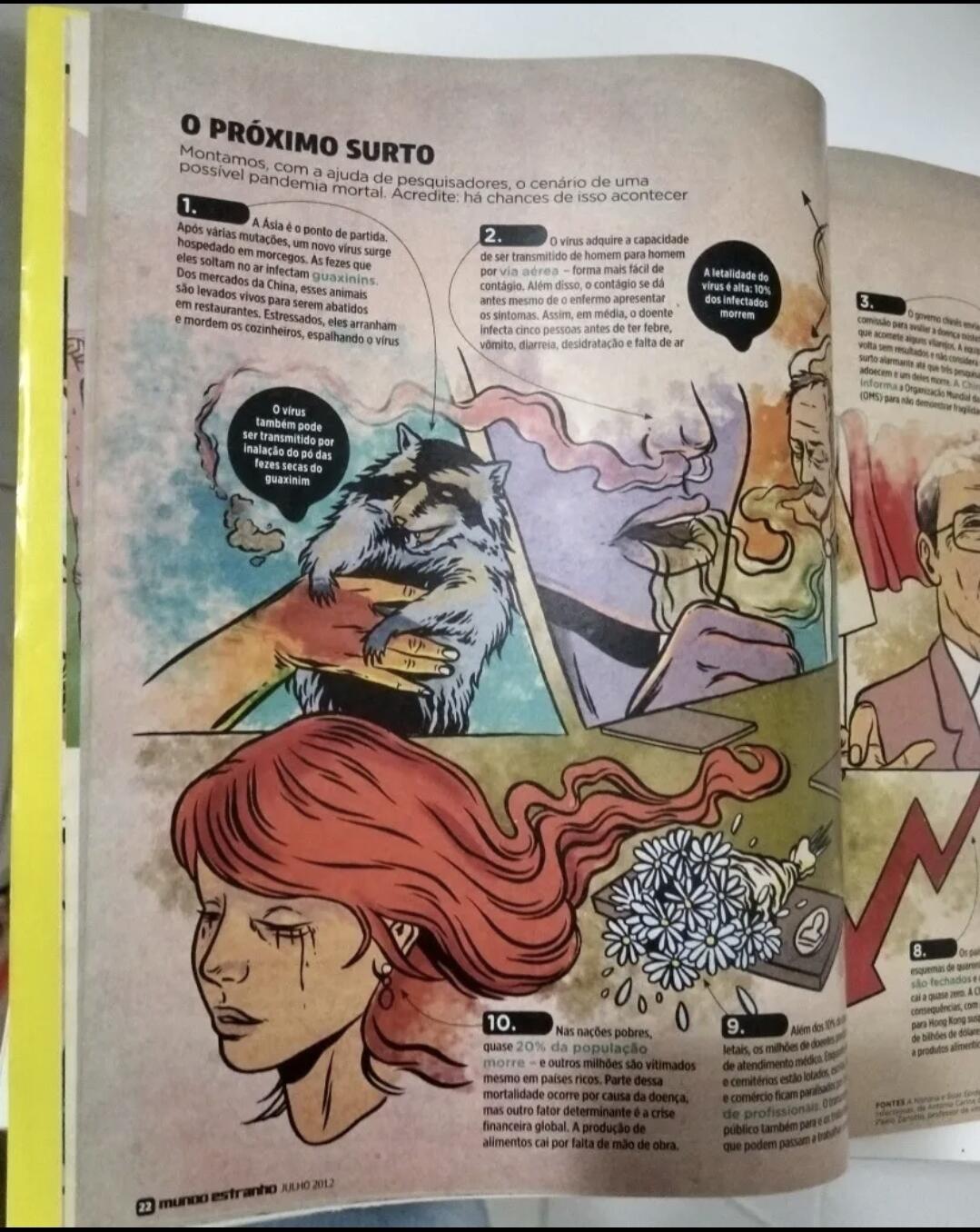

Segundo eles:

"1 – A Ásia é o ponto de partida. Após várias mutações, um novo vírus surge hospedado em morcegos. As fezes que eles soltam no ar infectam guaxinins. Dos mercados da China, esses animais são levados vivos para serem abatidos em restaurantes. Estressados, eles arranham e mordem os cozinheiros, espalhando o vírus.

2 – O vírus adquire a capacidade de ser transmitido de homem para homem por via aérea – forma mais fácil de contágio. Além disso, o contágio se dá antes mesmo de o enfermo apresentar os sintomas. Assim, em média, o doente infecta cinco pessoas antes de ter febre, vômito, diarreia, desidratação e falta de ar.

3 – O governo chinês envia uma comissão para avaliar a doença misteriosa que acomete alguns vilarejos. A equipe volta sem resultados e não considera o surto alarmante até que três pesquisadores adoecem e um deles morre. A China não informa a Organização Mundial da Saúde (OMS) para não demonstrar fragilidade.

4 – Os sintomas são comuns e a doença só chama a atenção quando muita gente começa a morrer na mesma região. Ainda assim, demora para que médicos e enfermeiros percebam a ineficiência de antibióticos na cura – o que exclui a maioria das bactérias como agente causador. Testes com vírus comuns também dão negativo.

5 – O governo isola comunidades em que há focos da doença. Ninguém entra nas cidades e nenhum doente pode sair. Mas, como a misteriosa enfermidade demora quatro dias para mostrar seus sintomas, muitos doentes saem dos vilarejos sem saber que estão infectados, alastrando a epidemia.

6 – Doentes viajam de avião para grandes cidades, como Hong Kong. O fervilhante centro comercial, que atrai gente do mundo todo, é um polo de contágio e disseminação. Sem imaginar o risco que correm, pessoas são contaminadas e, ao voltar para seu local de origem, carregam o vírus para todos os continentes.

7 – Com a doença já fora de controle, começa uma corrida entre laboratórios e cientistas de grandes universidades para descobrir o agente causador. Mesmo com o vírus isolado, as vacinas demoram para ser feitas em larga escala, tornando impossível o atendimento à demanda mundial.

8 – Os países se isolam, mantendo esquemas de quarentena. Aeroportos são fechados e o turismo mundial cai a quase zero. A China sofre as piores consequências, com o fluxo de empresários para Hong Kong suspenso – gerando prejuízos de bilhões de dólares – e com o boicote a produtos alimentícios vindos da Ásia.

9 – Além dos 10% de casos letais, os milhões de doentes precisam de atendimento médico. Enquanto hospitais e cemitérios estão lotados, escolas, indústrias e comércio ficam paralisados por falta de profissionais. O transporte público também para e os trabalhadores que podem passam a trabalhar em casa.

10 – Nas nações pobres, quase 20% da população morre – e outros milhões são vitimados mesmo em países ricos. Parte dessa mortalidade ocorre por causa da doença, mas outro fator determinante é a crise financeira global. A produção de alimentos cai por falta de mão de obra.

Fontes: A História e Suas Epidemias e Pandemias – A Humanidade em Risco, de Stefan Cunha Ujvari; Pragas e Epidemias – Histórias de Doenças Infecciosas, de Antonio Carlos de Castro Toledo Jr. Consultoria: Stefan Ujvari Cunha, infectologista do Hospital Alemão Oswaldo Cruz; Paolo Zanotto, professor de virologia do Instituto de Ciências Biológicas (ICB) da USP; Átila Iamarino, doutorando em HIV-1 no ICB da USP."

3. PRIMEIROS INDÍCIOS

10/2019 - Evento 201 - Durante os Jogos Militares Internacionais na China https://www.centerforhealthsecurity.org/event201/

Promovido por: - Bill & Melinda Gates Foundation - John Hopkins Institute - Fórum econômico mundial

"O evento simula a liberação de um coronavírus novo do tipo zoonótico transmitido por morcegos para porcos e por fim para humanos. Eventualmente ele se torna muito transmissível entre humanos levando a uma pandemia severa. O vírus é muito parecido com o vírus da SARS, mas se transmite muito mais facilmente entre pessoas devido a sintomas muito mais leves destas."

Também mencionado por: Jornal Estadão

Sobre o "Movimento antivacina"

05/12/2017 - Movimento antivacina: como surgiu e quais consequências ele pode trazer? https://www.uol.com.br/universa/noticias/redacao/2017/12/05/o-que-o-movimento-antivacina-pode-causar.htm?cmpid=copiaecola

23/03/2019 - "Instagram bloqueia hashtags e conteúdo antivacinação" https://canaltech.com.br/redes-sociais/instagram-bloqueia-hashtags-e-conteudo-antivacinacao-135411/

23/05/2021 - Novos dados sobre pesquisadores de Wuhan aumentam debate sobre origens da Covid https://www.cnnbrasil.com.br/saude/novos-dados-sobre-pesquisadores-de-wuhan-aumentam-debate-sobre-origens-da-covid/

"A China relatou à Organização Mundial da Saúde que o primeiro paciente com sintomas semelhantes aos de Covid-19 foi registrado em Wuhan em 8 de dezembro de 2019"

01/02/2020 - O que aconteceu desde que o novo coronavírus foi descoberto na China https://exame.com/ciencia/o-que-aconteceu-desde-que-o-novo-coronavirus-foi-descoberto-na-china/

"O primeiro alerta foi recebido pela Organização Mundial da Saúde (OMS) em 31 de dezembro de 2019"

15/09/2020 - YouTube diz que vai remover vídeos com mentiras sobre vacina contra COVID-19 https://gizmodo.uol.com.br/youtube-remover-videos-mentiras-vacina-covid-19/

"O YouTube anunciou na quarta-feira (14) que estenderá as regras atuais sobre mentiras, propaganda e teorias da conspiração sobre a pandemia do coronavírus para incluir desinformação sobre as vacinas contra a doença.

De acordo com a Reuters, a gigante do vídeo diz que agora vai proibir conteúdos sobre vacinas contra o coronavírus que contradizem “o consenso de especialistas das autoridades de saúde locais ou da OMS”, como afirmações falsas de que a vacina é um pretexto para colocar chips de rastreamento nas pessoas ou que irá matar ou esterilizar quem tomar."

*07/01/2021 - YouTube vai punir canais que promovem mentiras sobre eleições – incluindo os de Trump https://olhardigital.com.br/2021/01/07/noticias/youtube-vai-punir-canais-que-promovem-mentiras-sobre-eleicoes-incluindo-os-de-trump/

"O YouTube anunciou que vai punir canais que promovem mentiras sobre as eleições, removendo sumariamente qualquer vídeo que contenha desinformação e, ao mesmo tempo, advertindo com um “strike” o canal que o veicular. A medida já está valendo e a primeira “vítima” é ninguém menos que o ex-presidente americano, Donald Trump.

A medida não é exatamente nova, mas foi novamente comunicada e reforçada pelo YouTube na quarta-feira (6), após os eventos de invasão do Capitólio, em Washington, onde o presidente eleito Joe Biden participava da cerimônia que confirmava a sua vitória nas eleições de novembro de 2020. A ocasião ficou marcada pela tentativa de invasão de correligionários de Trump, que entraram no edifício em oposição à nomeação do novo presidente. Uma mulher acabou sendo morta pela polícia que protegia o local.

O ex-presidente Donald Trump teve vídeos banidos de seu canal no YouTube após os eventos de ontem (6) no capitólio."

4. FIGURAS CENTRAIS

Bill Gates

- Bill Gates diz 'não' a abrir patentes de vacinas https://www.frontliner.com.br/bill-gates-diz-nao-a-abrir-patentes-de-vacinas/

"Bill Gates, um dos homens mais ricos do mundo, cuja fundação tem participação na farmacêutica alemã CureVac, produtora de vacina mRNA para prevenção de covid-19, disse não acreditar que a propriedade intelectual tenha algo a ver com o longo esforço global para controlar a pandemia."

João Doria e São Paulo

26/07/2017 - João Dória vai a China conhecer drones para ampliar segurança eletrônica na capital paulista https://jc.ne10.uol.com.br/blogs/jamildo/2017/07/26/joao-doria-vai-china-conhecer-drones-para-ampliar-seguranca-eletronica-na-capital-paulista/

02/08/2019 - Governo de SP fará Missão China para ampliar cooperação e atrair investimentos https://www.saopaulo.sp.gov.br/spnoticias/governo-de-sao-paulo-detalha-objetivos-da-missao-china/

20/11/2019 - Doria se encontra com chineses das gigantes CREC e CRCC e oferece concessões de rodovia, metrô e ferrovia https://diariodotransporte.com.br/2019/11/20/doria-se-encontra-com-chineses-das-gigantes-crec-e-crcc-e-oferece-concessoes-de-rodovia-metro-e-ferrovia/

25/01/2020 - "Chineses serão agressivos" nas privatizações em SP até 2022, afirma Dória https://noticias.uol.com.br/colunas/jamil-chade/2020/01/25/entrevista-joao-doria-privatizacoes-sao-paulo-china.htm

O governador de São Paulo, João Doria, afirma que vai acelerar os programas de desestatização no estado em 2020 e acredita que concessões e vendas poderão permitir uma arrecadação de pelo menos R$ 40 bilhões. Nesse processo, o governador avalia que a China deve atuar de forma agressiva e que aprofundará sua posição de maior parceira comercial do estado, se distanciando de americanos e argentinos.

29/06/2020 - Doria estabelece multa para quem estiver sem máscara na rua em SP https://veja.abril.com.br/saude/doria-estabelece-multa-para-quem-estiver-sem-mascara-na-rua/

24/12/2020 - Doria é flagrado sem máscara e fazendo compras em Miami https://pleno.news/brasil/politica-nacional/doria-e-flagrado-sem-mascara-e-fazendo-compras-em-miami.html

"Foto do governador de São Paulo sem o item de proteção viralizou nas redes"

07/06/2021 - Doria é criticado na internet por tomar sol sem máscara em hotel no Rio https://vejasp.abril.com.br/cidades/doria-e-criticado-na-internet-por-tomar-sol-sem-mascara-em-hotel-no-rio/

30/09/2020 - Governo de SP assina contrato com Sinovac e prevê vacina para dezembro https://agenciabrasil.ebc.com.br/saude/noticia/2020-09/governo-de-sp-assina-contrato-com-sinovac-e-preve-vacina-para-dezembro

O governador de São Paulo, João Doria, e o vice-presidente da laboratório chinês Sinovac, Weining Meng, assinaram hoje (30), um contrato que prevê o fornecimento de 46 milhões de doses da vacina CoronaVac para o governo paulista até dezembro deste ano.

O contrato também prevê a transferência tecnológica da vacina da Sinovac para o Instituto Butantan, o que significa que, o instituto brasileiro poderá começar a fabricar doses dessa vacina contra o novo coronavírus. O valor do contrato, segundo o governador João Doria é de US$ 90 milhões.

20/10/2020 - Coronavac terá mais de 90% de eficácia, afirmam integrantes do governo paulista https://www.cnnbrasil.com.br/saude/2020/12/20/coronavac-tera-mais-de-90-de-eficacia-afirmam-integrantes-do-governo

24/10/2020 - Não esperamos 90% de eficácia da Coronavac’, diz secretário de saúde de SP https://www.cnnbrasil.com.br/saude/2020/12/24/nao-esperamos-90-de-eficacia-da-coronavac-diz-secretario-de-saude-de-sp

07/01/2021 - Vacina do Butantan: eficácia é de 78% em casos leves e 100% em graves https://www.cnnbrasil.com.br/saude/2021/01/07/vacina-do-butantan-eficacia-e-de-78-em-casos-leves-e-100-em-graves

09/01/2021 - Não é hora de sermos tão cientistas como estamos sendo agora https://g1.globo.com/sp/sao-paulo/video/nao-e-hora-de-sermos-tao-cientistas-como-estamos-sendo-agora-diz-secretario-de-saude-de-sp-9166405.ghtml

10/01/2021 - Dados da Coronavac relatados à Anvisa não estão claros, diz médico https://www.cnnbrasil.com.br/saude/2021/01/10/dados-da-coronavac-relatados-a-anvisa-nao-estao-claros-diz-medico

"O diretor do Laboratório de Imunologia do Incor, Jorge Kalil, reforçou que faltaram informações sobre a Coronavac nos dados divulgados à Anvisa"

12/01/2021 - New Brazil data shows disappointing 50,4% efficacy for China’s Coronavac vaccine [Novos dados do Brasil mostram eficácia decepcionante de 50,4% para a vacina CoronaVac da China] https://www.reuters.com/article/us-health-coronavirus-brazil-coronavirus/new-brazil-data-shows-disappointing-504-efficacy-for-chinas-coronavac-vaccine-idUSKBN29H2CE

13/01/2021 - Eficácia da Coronavac: 50,38%, 78% ou 100%? https://blogs.oglobo.globo.com/lauro-jardim/post/5038-78-ou-100.html

“De acordo com interlocutores que participaram tanto do anúncio de ontem como da semana passada, quem pressionou para que os dados de 78% e 100% fossem liberados foi João Dória.”

07/05/2021 - Covid-19: Doria toma primeira dose da vacina CoronaVac https://veja.abril.com.br/saude/covid-19-doria-toma-primeira-dose-da-vacina-coronavac/

04/06/2021 - Doria é vacinado com a segunda dose da CoronaVac em São Paulo https://noticias.uol.com.br/politica/ultimas-noticias/2021/06/04/doria-e-vacinado-com-a-segunda-dose-da-coronavac-em-sao-paulo.htm

15/07/2021 - Doria testa positivo para a Covid-19 pela 2ª vez https://www.correiobraziliense.com.br/politica/2021/07/4937833-doria-testa-positivo-para-covid-19-pela-segunda-vez.html

"Governador de São Paulo já havia sido diagnosticado com a doença no ano passado. Ele diz que, apesar da infecção, se sente bem, o que atribui ao fato de ter sido vacinado com duas doses da Coronavac"

06/08/2021 - CPI recebe investigação contra Doria por compra de máscara sem licitação https://www.conexaopoder.com.br/nacional/cpi-recebe-investigacao-contra-doria-por-compra-de-mascara-sem-licitacao/150827

"Empresa teria usado o nome de Alexandre Frota para vender máscaras ao governo de SP. Doria nega informação"

Renan Filho

(filho do Renan Calheiros)

25/07/2019 - Governador Renan Filho vai à China em busca de investimentos para o estado https://www.tnh1.com.br/videos/vid/governador-renan-filho-vai-a-china-em-busca-de-investimentos-para-o-estado/

20/03/2020 - Governadores do NE consultam China e pedem material para tratar covid-19 https://noticias.uol.com.br/saude/ultimas-noticias/redacao/2020/03/20/governadores-do-ne-consultam-china-e-pedem-material-para-tratar-covid-19.htm

5. Narrativas, restrições e proibições

17/12/2020 - STF decide que vacina contra a covid pode ser obrigatória, mas não forçada https://noticias.uol.com.br/saude/ultimas-noticias/redacao/2020/12/17/stf-julga-vacinacao-obrigatoria.htm?cmpid=copiaecola

"O STF (Supremo Tribunal Federal) decidiu, em julgamento hoje, que o Estado pode determinar a obrigatoriedade da vacinação contra a covid-19. Porém fica proibido o uso da força para exigir a vacinação, ainda que possam ser aplicadas restrições a direitos de quem recusar a imunização.

Dez ministros foram favoráveis a obrigatoriedade da vacinação, que poderá ser determinada pelo governo federal, estados ou municípios. As penalidades a quem não cumprir a obrigação deverão ser definidas em lei."

27/07/2021 - Saiba que países estão adotando 'passaporte da vacina' para suspender restrições https://www.cnnbrasil.com.br/internacional/2021/07/27/saiba-que-paises-estao-adotando-passaporte-da-vacina-para-suspender-restricoes

" - Israel - Uniao Europeia - Áustria - Dinamarca - Eslovênia - França - Grécia - Irlanda - Itália - Letônia - Lituânia - Luxemburgo - Holanda - Portugal - Japão - Coreia do sul"

18/06/2021 - O que é o passaporte da vacina que Bolsonaro quer vetar? https://noticias.uol.com.br/politica/ultimas-noticias/2021/06/18/uol-explica-o-que-e-o-passaporte-da-vacina-que-opoe-bolsonaro-e-damares.htm

"O Brasil poderá ter um certificado de imunização futuramente. Aprovado no Senado na semana passada, o "passaporte da vacina", como é chamado, prevê identificar pessoas vacinadas para que entrem em locais públicos ou privados com possíveis restrições."

6. Vacinas

Alegações iniciais

- CoronaVac, Oxford e Pfizer: veja diferenças entre as vacinas contra covid noticias.uol.com.br/saude/ultimas-noticias/redacao/2021/05/11/diferencas-vacinas-covid-brasil.htm

" - CoronaVac (Butantan/Sinovac - Chinesa) Com virus inativo 50,38% de eficácia 2 doses

-

Covishield - 'AstraZeneca' (Fiocruz/Astrazenica/Oxford - Britânica) Com virus não replicante 67% de eficácia 2 doses

-

ComiRNAty - 'Pfizer' (Pfizer - Americana / BioNTech - Alemã) Com RNA mensageiro 96% de eficácia 2 doses"

Riscos diretos

15/06/2021 - Trombose após vacinação com AstraZeneca: Quais os sintomas e como se deve atuar? https://www.istoedinheiro.com.br/trombose-apos-vacinacao-com-astrazeneca-quais-os-sintomas-e-como-se-deve-atuar/

"Agências europeias estão reticentes com a vacina da AstraZeneca. Ela chegou a ser desaconselhada a pessoas com idade inferior a 60 anos, e um alto funcionário da Agência Europeia de Medicamentos declarou que era melhor deixar de administrar a vacina deste laboratório em qualquer idade quando há alternativas disponíveis, devido aos relatos de trombose após a primeira dose, apesar de raros."

11/05/2021 - CoronaVac, Oxford e Pfizer: veja diferenças entre as vacinas contra covid https://noticias.uol.com.br/saude/ultimas-noticias/redacao/2021/05/11/diferencas-vacinas-covid-brasil.htm

"Na terça-feira (12), o Ministério da Saúde determinou a suspensão da aplicação da vacina de Oxford/AstraZeneca para gestantes e puérperas com comorbidades. A decisão segue recomendação da Anvisa, que apura a morte de uma grávida de 35 anos que tomou o imunizante e teve um AVC (acidente vascular cerebral)."

30/07/2021 - Pfizer representa o mesmo risco de trombose que a Astrazeneca, aponta levantamento https://panoramafarmaceutico.com.br/pfizer-representa-o-mesmo-risco-de-trombose-que-a-astrazeneca-aponta-levantamento/

7. CRIMES

Crimes da Pfizer

18/11/2020 Não listado no google - Os Crimes documentados da produtora de vacinas de Covid - Pfizer [INGLÊS] https://www.dmlawfirm.com/crimes-of-covid-vaccine-maker-pfizer-well-documented/

"A velocidade com que a vacina Covid da Pfizer foi produzida, a ausência de estudos em animais, testes de controle randomizados e outros testes e procedimentos padrão usuais para um novo medicamento são, no mínimo, preocupantes. Além disso, todos os fabricantes de vacinas Covid receberam imunidade legal para quaisquer ferimentos ou mortes que possam causar. Se essas vacinas são tão seguras quanto promovidas, por que seus fabricantes precisam de imunidade geral?"

"A Pfizer, uma empresa farmacêutica que parece ter ganhado na loteria para produzir a primeira vacina Covid-19, está atualmente lutando contra centenas de ações judiciais sobre o Zantac, um popular medicamento contra azia. Os processos da Zantac afirmam que a droga popular pode estar contaminada com uma substância cancerígena chamada N-nitrosodimetilamina (NDMA). Os processos Zantac são em aberto e em andamento, já que a farmacêutica está lutando contra eles; mas a Pfizer, sabemos, cometeu vários crimes ou transgressões pelos quais foi punida nos últimos anos. As falhas da empresa estão bem documentadas e vale a pena revisá-las neste momento crítico da história da humanidade, enquanto todos nós buscamos respostas."

A Pfizer recebeu a maior multa da história dos Estados Unidos como parte de um acordo judicial de US $ 2,3 bilhões com promotores federais por promover medicamentos erroneamente (Bextra, Celebrex) e pagar propinas a médicos complacentes. A Pfizer se confessou culpada de falsificar a marca do analgésico Bextra, promovendo o medicamento para usos para os quais não foi aprovado.

Na década de 1990, a Pfizer estava envolvida em válvulas cardíacas defeituosas que causaram a morte de mais de 100 pessoas. A Pfizer enganou deliberadamente os reguladores sobre os perigos. A empresa concordou em pagar US $ 10,75 milhões para acertar as acusações do departamento de justiça por enganar reguladores.

A Pfizer pagou mais de US $ 60 milhões para resolver um processo sobre o Rezulin, um medicamento para diabetes que causou a morte de pacientes de insuficiência hepática aguda.

No Reino Unido, a Pfizer foi multada em quase € 90 milhões por sobrecarregar o NHS, o Serviço Nacional de Saúde. A Pfizer cobrou do contribuinte um adicional de € 48 milhões por ano, pelo que deveria custar € 2 milhões por ano.

A Pfizer concordou em pagar US $ 430 milhões em 2004 para resolver acusações criminais de que havia subornado médicos para prescrever seu medicamento para epilepsia Neurontin para indicações para as quais não foi aprovado. Em 2011, um júri concluiu que a Pfizer cometeu fraude em sua comercialização do medicamento Neurontin. A Pfizer concordou em pagar $ 142,1 milhões para liquidar as despesas.

A Pfizer revelou que pagou quase 4.500 médicos e outros profissionais médicos cerca de US $ 20 milhões por falar em nome da Pfizer.

Em 2012, a Comissão de Valores Mobiliários dos Estados Unidos - anunciou que havia chegado a um acordo de US $ 45 milhões com a Pfizer para resolver acusações de que suas subsidiárias haviam subornado médicos e outros profissionais de saúde no exterior para aumentar as vendas no exterior.

A Pfizer foi processada em um tribunal federal dos Estados Unidos por usar crianças nigerianas como cobaias humanas, sem o consentimento dos pais das crianças. A Pfizer pagou US $ 75 milhões para entrar em acordo no tribunal nigeriano pelo uso de um antibiótico experimental, o Trovan, nas crianças. A empresa pagou um valor adicional não divulgado nos Estados Unidos para liquidar as despesas aqui. A Pfizer violou o direito internacional, incluindo a Convenção de Nuremberg estabelecida após a Segunda Guerra Mundial, devido aos experimentos nazistas em prisioneiros relutantes.

Em meio a críticas generalizadas de roubar os países pobres em busca de drogas, a Pfizer prometeu dar US $ 50 milhões para um medicamento para a AIDS para a África do Sul. Mais tarde, no entanto, a Pfizer falhou em honrar essa promessa.

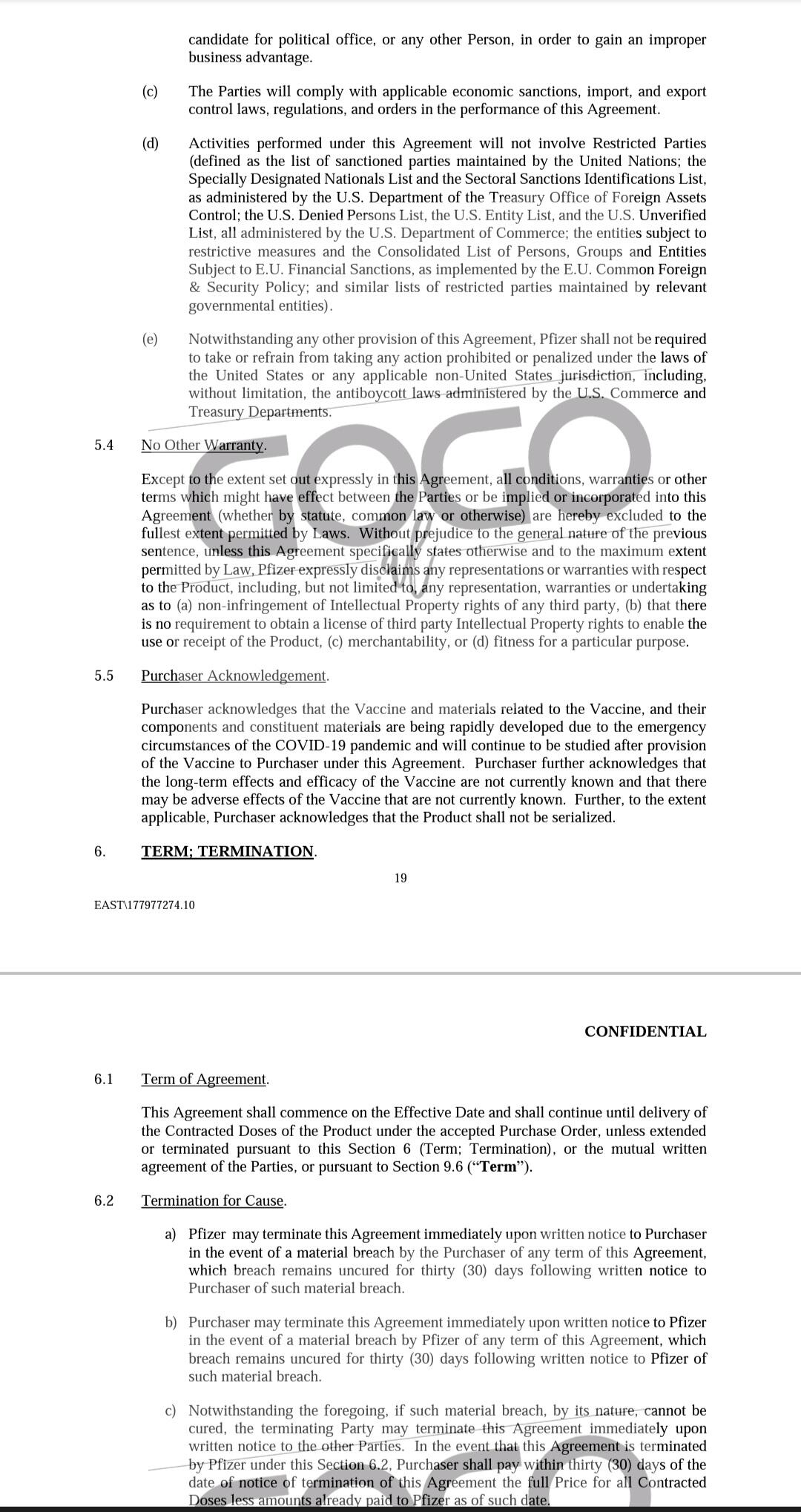

- Pfizer contract leaked!

[Contrato da Pfizer vazado]

http://sanjeev.sabhlokcity.com/Misc/LEXO-KONTRATEN-E-PLOTE.pdf

http://sanjeev.sabhlokcity.com/Misc/LEXO-KONTRATEN-E-PLOTE.pdf

Segundo o contrato "o produto não deve ser serializado":

"5.5 Reconhecimento do comprador.

O Comprador reconhece que a Vacina e os materiais relacionados à Vacina, e seus componentes e materiais constituintes estão sendo desenvolvidos rapidamente devido às circunstâncias de emergência da pandemia de COVID-19 e continuarão a ser estudados após o fornecimento da Vacina ao Comprador nos termos deste Contrato. O Comprador reconhece ainda que os efeitos de longo prazo e eficácia da Vacina não são atualmente conhecidos e que pode haver efeitos adversos da Vacina que não são atualmente conhecidos. Além disso, na medida do aplicável, o Comprador reconhece que o Produto não deve ser serializado."

Crimes da AstraZeneca

21/06/2003 - AstraZeneca se declara culpada no esquema de médico de câncer https://www.nytimes.com/2003/06/21/business/astrazeneca-pleads-guilty-in-cancer-medicine-scheme.html

"A AstraZeneca, a grande empresa farmacêutica, se declarou culpada hoje de uma acusação de crime de fraude no sistema de saúde e concordou em pagar $ 355 milhões para resolver as acusações criminais e civis de que se envolveu em um esquema nacional para comercializar ilegalmente um medicamento contra o câncer de próstata.

O governo disse que os funcionários da empresa deram incentivos financeiros ilegais a cerca de 400 médicos em todo o país para persuadi-los a prescrever o medicamento Zoladex. Esses incentivos incluíram milhares de amostras grátis de Zoladex [...]"

27/04/2010 - Farmacêutica gigante AstraZeneca pagará US $ 520 milhões pelo marketing de medicamentos off-label https://www.justice.gov/opa/pr/pharmaceutical-giant-astrazeneca-pay-520-million-label-drug-marketing

"AstraZeneca LP e AstraZeneca Pharmaceuticals LP vão pagar $ 520 milhões para resolver as alegações de que a AstraZeneca comercializou ilegalmente o medicamento antipsicótico Seroquel para usos não aprovados como seguros e eficazes pela Food and Drug Administration (FDA), os Departamentos de Justiça e Saúde e Serviços Humanos A Equipe de Ação de Fiscalização de Fraudes em Saúde (HEAT) anunciou hoje. Esses usos não aprovados também são conhecidos como usos "off-label" porque não estão incluídos no rótulo do medicamento aprovado pela FDA."

- List of largest pharmaceutical settlements [Lista dos maiores acordos farmaceuticos] https://en.m.wikipedia.org/wiki/List_of_largest_pharmaceutical_settlements

8. CIENTISTAS

- Máscara Provoca Insuficiência Respiratória E Contaminação Microbiana… [Canal deletado] https://youtube.com/watch?v=eHu-pydSvDI

Não lembro mais a quem pertencia, mas provavelmente era de um médico falando do assunto. Creio ter sido do Dr. Paulo Sato, por essa temática ter sido abordada por ele, mas ao abrir o site aparece somente:

"Este vídeo foi removido por violar as diretrizes da comunidade do YouTube"

Dr. Paulo Sato

- USAR ou NÃO USAR a CUECA do seu governador no rosto https://fb.watch/7NPP_7rS5S/ https://www.facebook.com/AdoniasSoaresBR/videos/1347904292291481/ Adonias Soares entrevista ao Dr. Paulo Sato sobre as máscaras, em que é simulado o efeito da respiração prolongada das máscaras no organismo com o uso de águas de torneira, natural, gaseificada (com gás carbônico) e antioxidante, em que a com gás carbônico (PH 4 - Ácido) representa o organismo humano, e na prática representa lesão corporal e iniciação de doenças.

Dr. Kary Mullis

(Criador do teste PCR)

- PCR nas palavras do seu inventor - Dr. Kary Mullis (legendado) https://www.youtube.com/watch?v=W1O52uTygk8

"Qualquer um pode testar positivo para quase qualquer coisa com um teste de PCR, se você executá-lo por tempo suficiente… Com PCR, se voce fizer isso bem, você pode encontrar quase tudo em qualquer pessoa… Isso não te diz que você está doente."

- Kary Mullis DESTRUYE a Anthony Fauci lbry://@CapitalistChile#0/Kary-Mullis---Fauci#5

"Ele [...] não entende de medicina e não deveria estar onde está. A maioria dos que estão acima são só administrativos e não têm nem ideia do que ocorre aqui em baixo e essas pessoas tem uma agenda que não é a que gostaríamos que tivessem, dado que somos nós os que pagamos a eles para que cuidem da nossa saúde. Têm uma agenda pessoal."

Dra. Li-Meng Yan

- Dra. Li-Meng Yan: O vírus foi criado em laboratório com um objetivo: Causar dano. https://youtu.be/pSXp3CZnvOc

Dr. Joe Roseman

- Cientista Phd Dr Joe Roseman faz seríssimas advertencias sobre a picada https://youtu.be/0PIXVFqJ_h8

Dr. Robert Malone

- As vacinas podem estar causando ADE - Dr. Robert Malone https://odysee.com/@AkashaComunidad:f/Las_vacunas_pueden_estar_causando_ADE_magnificaci%C3%B3n_mediada_por:f lbry://@Información.#b/Drrm#9

Dr. Robert Malone, um dos três inventores da tecnologia de RNAm que se usa de forma farmacêutica. No vídeo fala sobre os efeitos de ADE (realce dependente de anticorpos) que estão ocorrendo com as vacinas. Nas palavras do Dr. Malone, já não é somente uma hipótese, mas baseada nos conhecimentos gerados nas provas e ensaios pré clínicos, com as vacinas contra o primeiro vírus da SARS.

Dr. Luc Montagnier

- Dr. Luc Montagnier, virologista, prêmio Nobel de medicina, um dos descobridores do vírus HIV, afirma: "a vacinação em massa está criando as novas variantes' (@medicospelavida , telegram)

CASOS DOCUMENTADOS

13 de setembro de 2021 - 13/09/2021 - Carta aberta ao Ministro da Saúde por Arlene Ferrari Graf, mãe de Bruno Oscar Graf https://telegra.ph/Carta-aberta-ao-Ministro-da-Sa%C3%BAde-09-13

Também em: Gazeta do Povo