-

@ a5ee4475:2ca75401

2025-06-06 14:13:27

@ a5ee4475:2ca75401

2025-06-06 14:13:27[EM ATUALIZAÇÃO]

vacina #saude #politica #manipulacao #mundial #genocidio #pandemia #conspiracao

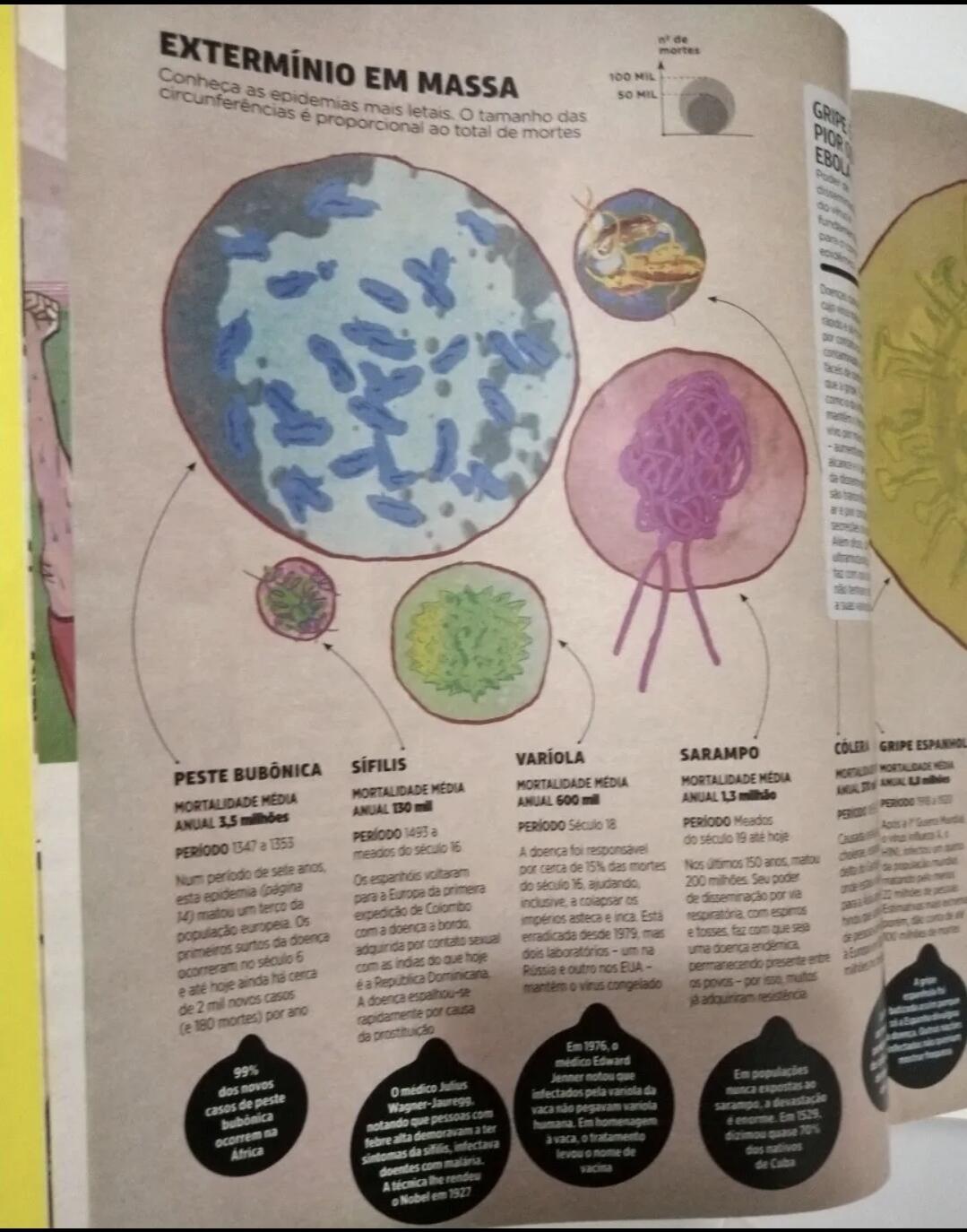

Este artigo reúne algumas menções e evidências mais antigas que vim registrando durante alguns anos em relação a Covid-19, vacinas obrigatórias e a ação de agências de governo, fundações, políticos, mídia tradicional, celebridades, influenciadores, cientistas, redes sociais e laboratórios, em envolvimento com genocídio e restrições de liberdades em escala mundial causado por decisões em várias esferas relativas ao covid e as vacinas obrigatórias em geral.

Porém, alguns links podem não estar mais disponiveis, foram que ainda faltam ser registradas muitas informações já divulgadas nos últimos anos e que muitos não tiveram contato pela escassez de meios para a obtenção dessas informações de forma organizada.

Portanto, o presente artigo ainda passará por atualizações de conteúdo e formatação. Logo, se possível, ajudem sugerindo complementos ou alterações, ou com doações.

"Aqueles que não conseguem lembrar o passado estão condenados a repeti-lo." - George Satayana

Noções iniciais:

- O termo 'Coronavírus' (COVID) é na verdade um nome genérico para vários vírus de gripes já comuns, dado para o tipo corona (com uma "coroa", 'espetos' ao redor dele), o Sars-Cov-2 (que passou a ser chamado erroneamente só de Covid), é só um deles.

- SARS-CoV-2 é que é nome do vírus. Ele que causa a doença Covid-19;

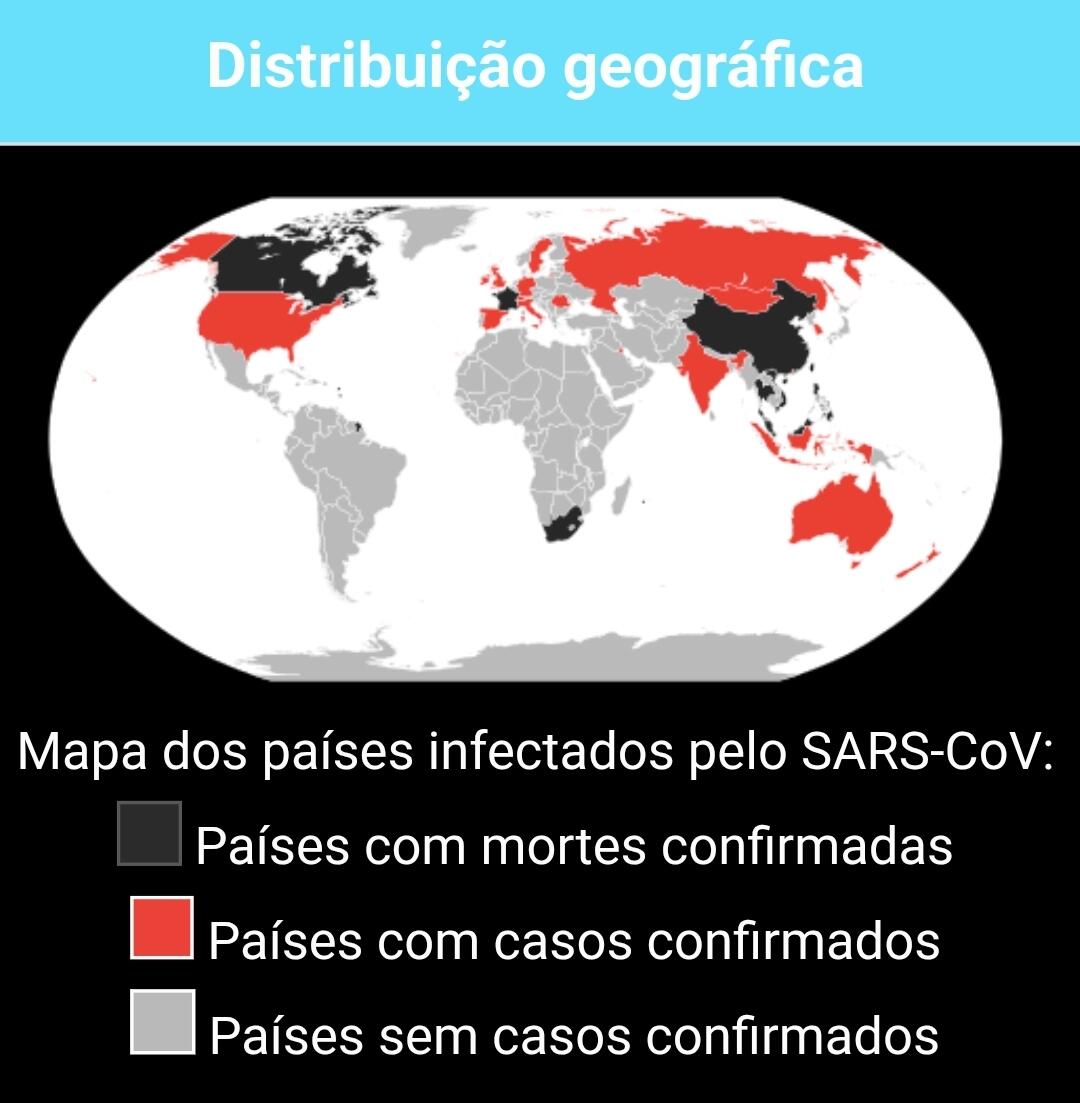

- O coronavírus SARS-CoV-2 é o segundo tipo de SARS-CoV documentado, o primeiro ocorreu entre 2002 e 2003, se originando também da China e também dito como tendo origem animal;

- SARS (Severe Acute Respiratory Syndrome) - Síndrome Respiratória Aguda Grave (SRAG) é a uma doença respiratória viral, relatada ser de origem zoonótica (animal), causada pelos coronavírus SARS-CoV (2002) e SARS-CoV-2 (2019), ambos de origem chinesa;

1. Vacinas Obrigatórias em Geral

23/01/2025 - [Pesquisa] Vacinas causando autismo em crianças https://publichealthpolicyjournal.com/vaccination-and-neurodevelopmental-disorders-a-study-of-nine-year-old-children-enrolled-in-medicaid/

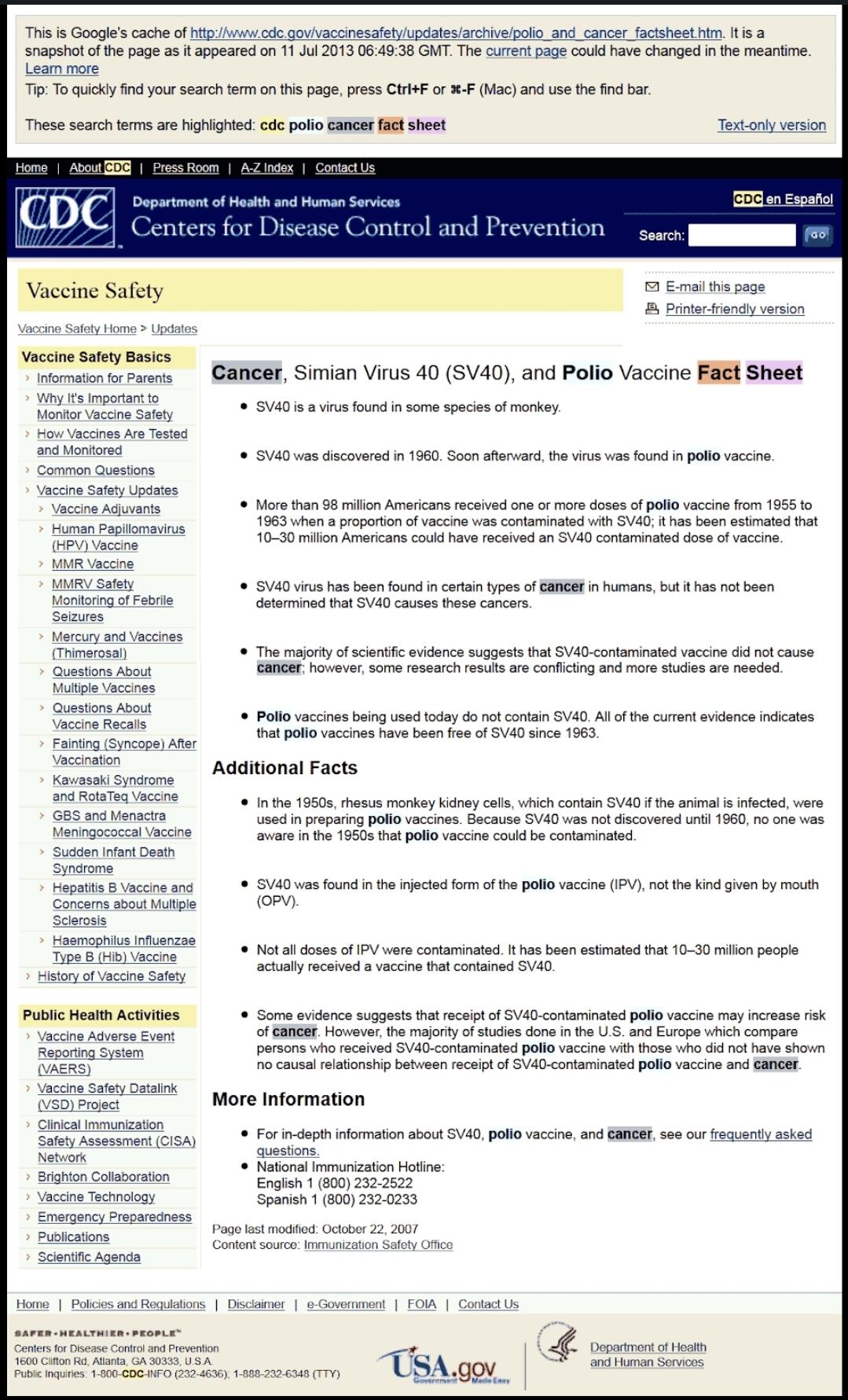

- O CDC admite que 98 milhões de pessoas receberam o vírus do câncer através da vacina da Poliomielite https://medicinanews.com.br/frente/frente_1/o-cdc-admite-que-98-milhoes-de-pessoas-receberam-o-virus-do-cancer-atraves-da-vacina-poliomielite/

"O CDC (Os Centros de Controle e Prevenção de Doenças dos Estados Unidos) removeu rapidamente uma página do seu site, que estava em cache no Google, como você pode ver logo abaixo, admitindo que mais de 98 milhões de americanos receberam uma ou mais doses de vacina contra pólio dentro de 8 período entre 1955 e 1963, quando uma proporção da vacina foi contaminada com um poliomavírus causador de câncer chamado SV40."

Fonte original da imagem: https://preventdisease.com/images13/CDC_Polio.png [indisponível] - A imagem foi trocada por outra de menor qualidade e em outro link, mas eu já tinha a imagem original salva.

Fonte original da imagem: https://preventdisease.com/images13/CDC_Polio.png [indisponível] - A imagem foi trocada por outra de menor qualidade e em outro link, mas eu já tinha a imagem original salva. Imagem arquivada em: https://web.archive.org/web/20201203231640/

Imagem arquivada em: https://web.archive.org/web/20201203231640/27/02/2021 - Por que o Japão demorou para vacinar, mesmo com Olimpíada se aproximando https://www.cnnbrasil.com.br/internacional/2021/02/27/por-que-o-japao-demorou-para-vacinar-mesmo-com-olimpiada-se-aproximando

"Desconfiança da população japonesa em relação a vacinas, ligada a casos ocorridos no passado, está entre razões que atrasaram imunização no país.

A resistência à vacina do Japão remonta à década de 1970, quando duas crianças morreram dentro de 24 horas após receberem a vacina combinada contra difteria, tétano e coqueluche (coqueluche). A vacina foi temporariamente suspensa, mas a confiança já havia sido abalada. Por vários anos, as taxas de vacinação infantil caíram, levando a um aumento nos casos de tosse convulsa.

No final dos anos 1980, houve outro susto com a introdução da vacina tripla contra sarampo, caxumba e rubéola produzida no Japão. As primeiras versões do imunizante foram associadas à meningite asséptica, ou inchaço das membranas ao redor do cérebro e da medula espinhal. O problema foi rastreado até o componente caxumba da vacina tripla, o que levou a uma ação judicial e a indenização por danos pesados.

O Instituto Nacional de Ciências da Saúde interrompeu a dose combinada em 1993 e a substituiu por vacinas individuais. Após o escândalo, Shibuya disse que o governo japonês se tornou "ciente dos riscos" e seu programa nacional de vacinação tornou-se voluntário.

O Dr. Yuho Horikoshi, especialista em doenças infecciosas, diz que os processos levaram a uma "lacuna de vacinação", em que nenhuma vacina foi aprovada no Japão por cerca de 15 anos.

Mais recentemente, em 2013, o Japão adicionou a vacina contra o papilomavírus humano (HPV) ao calendário nacional para proteger as meninas contra o vírus sexualmente transmissível, que é conhecido por causar câncer cervical. No entanto, vídeos de meninas supostamente sofrendo de reações adversas começaram a circular no YouTube, levando o governo a retirá-los da programação nacional."

2. PRIMEIRAS OCORRÊNCIAS PREDITIVAS AO COVID-19

2002 - Síndrome respiratória aguda grave (SARS) Brenda L. Tesini (setembro de 2018). Síndrome respiratória aguda grave (SARS) [indisponível]. Manual Merck. Consultado em 23 de janeiro de 2020, citado no Wikipedia

SARS - Wikipédia: "A SARS [doença do vírus SARS-CoV] foi detectada pela primeira vez no fim de 2002 na China. Entre 2002 e 2003, um surto da doença resultou em mais de 8 000 casos e cerca de 800 mortes em todo o mundo."

2010 - Fundação Rockfeller, Lockstep. https://www.rockefellerfoundation.org/wp-content/uploads/Annual-Report-2010-1.pdf

Neste PDF da fundação Rockfeller, em seu próprio site, a fundação deixou claro o seu envolvimento em casos de ‘contenção’ de pandemias juntamente com a USAID (agência americana com nome ambíguo, como formalmente ‘United States Agency for International Development’, mas soando como ‘US Socorre’, mas sendo um braço do governo democrata que financiava interferências políticas diretas em vários países, como em intervenções no Brasil ), inclusive em relacionadas ao SARS, o mesmo sintoma dos coronavírus Sars-Cov e Sars-Cov-2 (o vírus propagado em 2019) e que causa o COVID-19.

Segundo eles:

“Integração entre Regiões e Países

A Fundação Rockefeler investiu US$ 22 milhões em sua Iniciativa de Redes de Vigilância de Doenças para ajudar a conter a disseminação de doenças infecciosas e pandemias, fortalecendo os sistemas nacionais, regionais e globais de vigilância e resposta a doenças. Dois programas-chave da Rockefeler — a Rede de Vigilância de Doenças da Bacia do Mekong e a Rede Integrada de Vigilância de Doenças da África Oriental — conectaram e capacitaram profissionais de saúde, epidemiologistas e autoridades de saúde pública em toda a região, levando a um aumento de seis vezes nos locais de vigilância de doenças transfronteiriças somente nos últimos três anos. Em 2010, a Rockefeler expandiu a bem-sucedida campanha transdisciplinar One Health, que a USAID e o Banco Asiático de Desenvolvimento adotaram como modelos. One Health refere-se à integração da ciência médica e veterinária para combater essas novas variedades de doenças zoonóticas que se movem e sofrem mutações rapidamente de animais para humanos. Essas colaborações criaram e fortaleceram uma rede regional crítica de saúde pública, enquanto as lições aprendidas foram exportadas entre disciplinas e países. Além de fortalecer os laços globais em saúde pública, a Rockefeler ajudou a elevar o nível de especialização e treinamento em campo. O Programa de Treinamento em Epidemiologia de Campo coloca graduados nos mais altos escalões do governo no Laos e no Vietnã, enquanto as bolsas da Rockefeler transformaram as ferramentas disponíveis para os médicos, permitindo-lhes utilizar o poder da internet para se comunicar e monitorar eventos, compreender contextos locais e analisar novos problemas. Finalmente, estamos aplicando ferramentas do século XXI para combater os desafios de saúde do século XXI.”

Julho de 2012 - Revista Mundo Estranho - Epidemias Citada em: https://super.abril.com.br/especiais/epidemia-o-risco-invisivel/

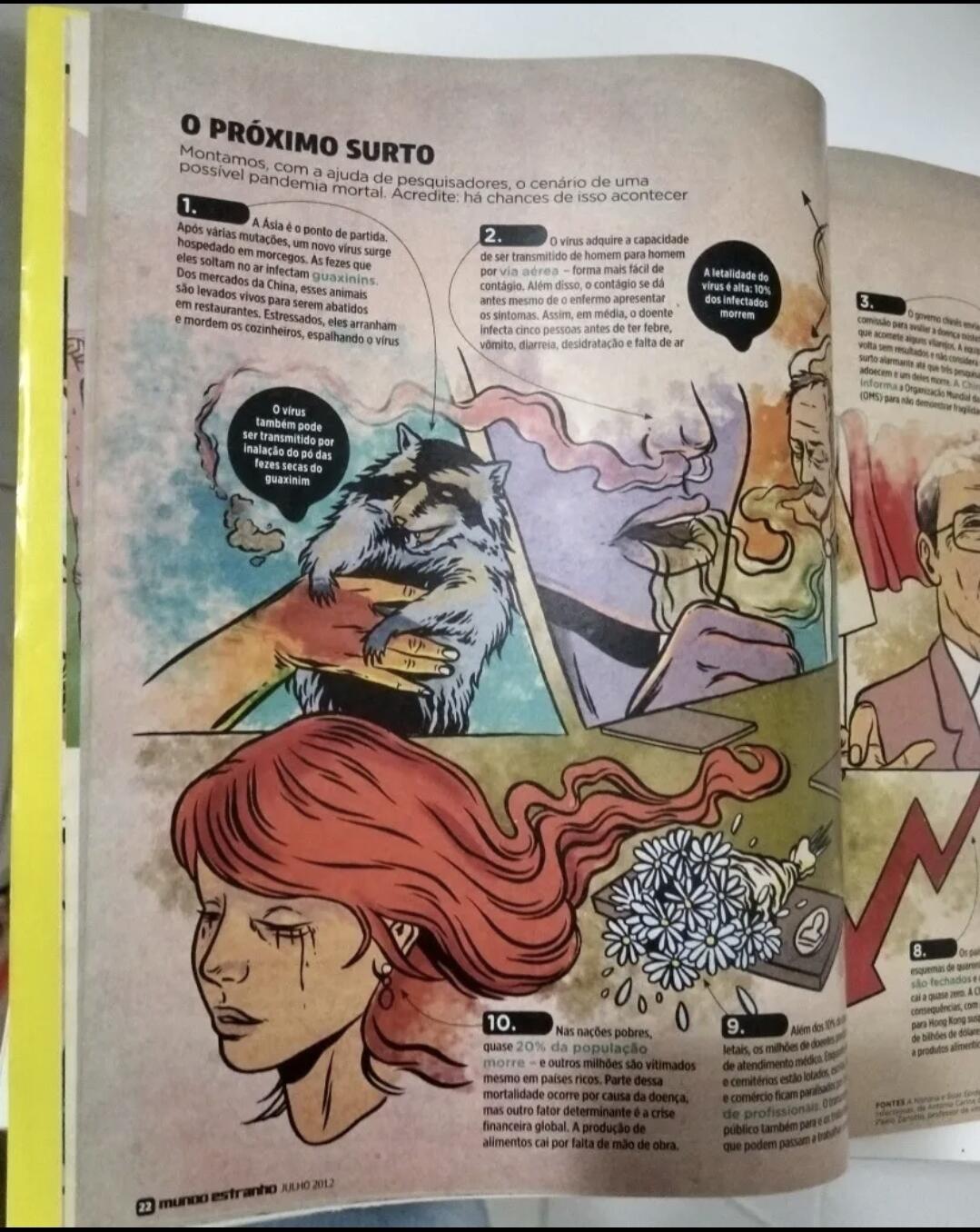

Houve uma grande 'coincidência'. A revista Mundo Estranho em julho de 2012, requisitou o até então doutorando em virologia, Átila Iamarino (do canal Nerdologia no Youtube - O mesmo cientista que fez diversas propagandas das vacinas no Brasil), para descrever um possível cenário de propagação de uma epidemia viral, a revista descreve com grande precisão os eventos de 2020, mas apontando o oposto da China, em que, na realidade, sua economia cresceu vertiginosamente.

Segundo eles:

"1 – A Ásia é o ponto de partida. Após várias mutações, um novo vírus surge hospedado em morcegos. As fezes que eles soltam no ar infectam guaxinins. Dos mercados da China, esses animais são levados vivos para serem abatidos em restaurantes. Estressados, eles arranham e mordem os cozinheiros, espalhando o vírus.

2 – O vírus adquire a capacidade de ser transmitido de homem para homem por via aérea – forma mais fácil de contágio. Além disso, o contágio se dá antes mesmo de o enfermo apresentar os sintomas. Assim, em média, o doente infecta cinco pessoas antes de ter febre, vômito, diarreia, desidratação e falta de ar.

3 – O governo chinês envia uma comissão para avaliar a doença misteriosa que acomete alguns vilarejos. A equipe volta sem resultados e não considera o surto alarmante até que três pesquisadores adoecem e um deles morre. A China não informa a Organização Mundial da Saúde (OMS) para não demonstrar fragilidade.

4 – Os sintomas são comuns e a doença só chama a atenção quando muita gente começa a morrer na mesma região. Ainda assim, demora para que médicos e enfermeiros percebam a ineficiência de antibióticos na cura – o que exclui a maioria das bactérias como agente causador. Testes com vírus comuns também dão negativo.

5 – O governo isola comunidades em que há focos da doença. Ninguém entra nas cidades e nenhum doente pode sair. Mas, como a misteriosa enfermidade demora quatro dias para mostrar seus sintomas, muitos doentes saem dos vilarejos sem saber que estão infectados, alastrando a epidemia.

6 – Doentes viajam de avião para grandes cidades, como Hong Kong. O fervilhante centro comercial, que atrai gente do mundo todo, é um polo de contágio e disseminação. Sem imaginar o risco que correm, pessoas são contaminadas e, ao voltar para seu local de origem, carregam o vírus para todos os continentes.

7 – Com a doença já fora de controle, começa uma corrida entre laboratórios e cientistas de grandes universidades para descobrir o agente causador. Mesmo com o vírus isolado, as vacinas demoram para ser feitas em larga escala, tornando impossível o atendimento à demanda mundial.

8 – Os países se isolam, mantendo esquemas de quarentena. Aeroportos são fechados e o turismo mundial cai a quase zero. A China sofre as piores consequências, com o fluxo de empresários para Hong Kong suspenso – gerando prejuízos de bilhões de dólares – e com o boicote a produtos alimentícios vindos da Ásia.

9 – Além dos 10% de casos letais, os milhões de doentes precisam de atendimento médico. Enquanto hospitais e cemitérios estão lotados, escolas, indústrias e comércio ficam paralisados por falta de profissionais. O transporte público também para e os trabalhadores que podem passam a trabalhar em casa.

10 – Nas nações pobres, quase 20% da população morre – e outros milhões são vitimados mesmo em países ricos. Parte dessa mortalidade ocorre por causa da doença, mas outro fator determinante é a crise financeira global. A produção de alimentos cai por falta de mão de obra.

Fontes: A História e Suas Epidemias e Pandemias – A Humanidade em Risco, de Stefan Cunha Ujvari; Pragas e Epidemias – Histórias de Doenças Infecciosas, de Antonio Carlos de Castro Toledo Jr. Consultoria: Stefan Ujvari Cunha, infectologista do Hospital Alemão Oswaldo Cruz; Paolo Zanotto, professor de virologia do Instituto de Ciências Biológicas (ICB) da USP; Átila Iamarino, doutorando em HIV-1 no ICB da USP."

3. PRIMEIROS INDÍCIOS

10/2019 - Evento 201 - Durante os Jogos Militares Internacionais na China https://www.centerforhealthsecurity.org/event201/

Promovido por: - Bill & Melinda Gates Foundation - John Hopkins Institute - Fórum econômico mundial

"O evento simula a liberação de um coronavírus novo do tipo zoonótico transmitido por morcegos para porcos e por fim para humanos. Eventualmente ele se torna muito transmissível entre humanos levando a uma pandemia severa. O vírus é muito parecido com o vírus da SARS, mas se transmite muito mais facilmente entre pessoas devido a sintomas muito mais leves destas."

Também mencionado por: Jornal Estadão

Sobre o "Movimento antivacina"

05/12/2017 - Movimento antivacina: como surgiu e quais consequências ele pode trazer? https://www.uol.com.br/universa/noticias/redacao/2017/12/05/o-que-o-movimento-antivacina-pode-causar.htm?cmpid=copiaecola

23/03/2019 - "Instagram bloqueia hashtags e conteúdo antivacinação" https://canaltech.com.br/redes-sociais/instagram-bloqueia-hashtags-e-conteudo-antivacinacao-135411/

23/05/2021 - Novos dados sobre pesquisadores de Wuhan aumentam debate sobre origens da Covid https://www.cnnbrasil.com.br/saude/novos-dados-sobre-pesquisadores-de-wuhan-aumentam-debate-sobre-origens-da-covid/

"A China relatou à Organização Mundial da Saúde que o primeiro paciente com sintomas semelhantes aos de Covid-19 foi registrado em Wuhan em 8 de dezembro de 2019"

01/02/2020 - O que aconteceu desde que o novo coronavírus foi descoberto na China https://exame.com/ciencia/o-que-aconteceu-desde-que-o-novo-coronavirus-foi-descoberto-na-china/

"O primeiro alerta foi recebido pela Organização Mundial da Saúde (OMS) em 31 de dezembro de 2019"

15/09/2020 - YouTube diz que vai remover vídeos com mentiras sobre vacina contra COVID-19 https://gizmodo.uol.com.br/youtube-remover-videos-mentiras-vacina-covid-19/

"O YouTube anunciou na quarta-feira (14) que estenderá as regras atuais sobre mentiras, propaganda e teorias da conspiração sobre a pandemia do coronavírus para incluir desinformação sobre as vacinas contra a doença.

De acordo com a Reuters, a gigante do vídeo diz que agora vai proibir conteúdos sobre vacinas contra o coronavírus que contradizem “o consenso de especialistas das autoridades de saúde locais ou da OMS”, como afirmações falsas de que a vacina é um pretexto para colocar chips de rastreamento nas pessoas ou que irá matar ou esterilizar quem tomar."

*07/01/2021 - YouTube vai punir canais que promovem mentiras sobre eleições – incluindo os de Trump https://olhardigital.com.br/2021/01/07/noticias/youtube-vai-punir-canais-que-promovem-mentiras-sobre-eleicoes-incluindo-os-de-trump/

"O YouTube anunciou que vai punir canais que promovem mentiras sobre as eleições, removendo sumariamente qualquer vídeo que contenha desinformação e, ao mesmo tempo, advertindo com um “strike” o canal que o veicular. A medida já está valendo e a primeira “vítima” é ninguém menos que o ex-presidente americano, Donald Trump.

A medida não é exatamente nova, mas foi novamente comunicada e reforçada pelo YouTube na quarta-feira (6), após os eventos de invasão do Capitólio, em Washington, onde o presidente eleito Joe Biden participava da cerimônia que confirmava a sua vitória nas eleições de novembro de 2020. A ocasião ficou marcada pela tentativa de invasão de correligionários de Trump, que entraram no edifício em oposição à nomeação do novo presidente. Uma mulher acabou sendo morta pela polícia que protegia o local.

O ex-presidente Donald Trump teve vídeos banidos de seu canal no YouTube após os eventos de ontem (6) no capitólio."

4. FIGURAS CENTRAIS

Bill Gates

- Bill Gates diz 'não' a abrir patentes de vacinas https://www.frontliner.com.br/bill-gates-diz-nao-a-abrir-patentes-de-vacinas/

"Bill Gates, um dos homens mais ricos do mundo, cuja fundação tem participação na farmacêutica alemã CureVac, produtora de vacina mRNA para prevenção de covid-19, disse não acreditar que a propriedade intelectual tenha algo a ver com o longo esforço global para controlar a pandemia."

João Doria e São Paulo

26/07/2017 - João Dória vai a China conhecer drones para ampliar segurança eletrônica na capital paulista https://jc.ne10.uol.com.br/blogs/jamildo/2017/07/26/joao-doria-vai-china-conhecer-drones-para-ampliar-seguranca-eletronica-na-capital-paulista/

02/08/2019 - Governo de SP fará Missão China para ampliar cooperação e atrair investimentos https://www.saopaulo.sp.gov.br/spnoticias/governo-de-sao-paulo-detalha-objetivos-da-missao-china/

20/11/2019 - Doria se encontra com chineses das gigantes CREC e CRCC e oferece concessões de rodovia, metrô e ferrovia https://diariodotransporte.com.br/2019/11/20/doria-se-encontra-com-chineses-das-gigantes-crec-e-crcc-e-oferece-concessoes-de-rodovia-metro-e-ferrovia/

25/01/2020 - "Chineses serão agressivos" nas privatizações em SP até 2022, afirma Dória https://noticias.uol.com.br/colunas/jamil-chade/2020/01/25/entrevista-joao-doria-privatizacoes-sao-paulo-china.htm

O governador de São Paulo, João Doria, afirma que vai acelerar os programas de desestatização no estado em 2020 e acredita que concessões e vendas poderão permitir uma arrecadação de pelo menos R$ 40 bilhões. Nesse processo, o governador avalia que a China deve atuar de forma agressiva e que aprofundará sua posição de maior parceira comercial do estado, se distanciando de americanos e argentinos.

29/06/2020 - Doria estabelece multa para quem estiver sem máscara na rua em SP https://veja.abril.com.br/saude/doria-estabelece-multa-para-quem-estiver-sem-mascara-na-rua/

24/12/2020 - Doria é flagrado sem máscara e fazendo compras em Miami https://pleno.news/brasil/politica-nacional/doria-e-flagrado-sem-mascara-e-fazendo-compras-em-miami.html

"Foto do governador de São Paulo sem o item de proteção viralizou nas redes"

07/06/2021 - Doria é criticado na internet por tomar sol sem máscara em hotel no Rio https://vejasp.abril.com.br/cidades/doria-e-criticado-na-internet-por-tomar-sol-sem-mascara-em-hotel-no-rio/

30/09/2020 - Governo de SP assina contrato com Sinovac e prevê vacina para dezembro https://agenciabrasil.ebc.com.br/saude/noticia/2020-09/governo-de-sp-assina-contrato-com-sinovac-e-preve-vacina-para-dezembro

O governador de São Paulo, João Doria, e o vice-presidente da laboratório chinês Sinovac, Weining Meng, assinaram hoje (30), um contrato que prevê o fornecimento de 46 milhões de doses da vacina CoronaVac para o governo paulista até dezembro deste ano.

O contrato também prevê a transferência tecnológica da vacina da Sinovac para o Instituto Butantan, o que significa que, o instituto brasileiro poderá começar a fabricar doses dessa vacina contra o novo coronavírus. O valor do contrato, segundo o governador João Doria é de US$ 90 milhões.

20/10/2020 - Coronavac terá mais de 90% de eficácia, afirmam integrantes do governo paulista https://www.cnnbrasil.com.br/saude/2020/12/20/coronavac-tera-mais-de-90-de-eficacia-afirmam-integrantes-do-governo

24/10/2020 - Não esperamos 90% de eficácia da Coronavac’, diz secretário de saúde de SP https://www.cnnbrasil.com.br/saude/2020/12/24/nao-esperamos-90-de-eficacia-da-coronavac-diz-secretario-de-saude-de-sp

07/01/2021 - Vacina do Butantan: eficácia é de 78% em casos leves e 100% em graves https://www.cnnbrasil.com.br/saude/2021/01/07/vacina-do-butantan-eficacia-e-de-78-em-casos-leves-e-100-em-graves

09/01/2021 - Não é hora de sermos tão cientistas como estamos sendo agora https://g1.globo.com/sp/sao-paulo/video/nao-e-hora-de-sermos-tao-cientistas-como-estamos-sendo-agora-diz-secretario-de-saude-de-sp-9166405.ghtml

10/01/2021 - Dados da Coronavac relatados à Anvisa não estão claros, diz médico https://www.cnnbrasil.com.br/saude/2021/01/10/dados-da-coronavac-relatados-a-anvisa-nao-estao-claros-diz-medico

"O diretor do Laboratório de Imunologia do Incor, Jorge Kalil, reforçou que faltaram informações sobre a Coronavac nos dados divulgados à Anvisa"

12/01/2021 - New Brazil data shows disappointing 50,4% efficacy for China’s Coronavac vaccine [Novos dados do Brasil mostram eficácia decepcionante de 50,4% para a vacina CoronaVac da China] https://www.reuters.com/article/us-health-coronavirus-brazil-coronavirus/new-brazil-data-shows-disappointing-504-efficacy-for-chinas-coronavac-vaccine-idUSKBN29H2CE

13/01/2021 - Eficácia da Coronavac: 50,38%, 78% ou 100%? https://blogs.oglobo.globo.com/lauro-jardim/post/5038-78-ou-100.html

“De acordo com interlocutores que participaram tanto do anúncio de ontem como da semana passada, quem pressionou para que os dados de 78% e 100% fossem liberados foi João Dória.”

07/05/2021 - Covid-19: Doria toma primeira dose da vacina CoronaVac https://veja.abril.com.br/saude/covid-19-doria-toma-primeira-dose-da-vacina-coronavac/

04/06/2021 - Doria é vacinado com a segunda dose da CoronaVac em São Paulo https://noticias.uol.com.br/politica/ultimas-noticias/2021/06/04/doria-e-vacinado-com-a-segunda-dose-da-coronavac-em-sao-paulo.htm

15/07/2021 - Doria testa positivo para a Covid-19 pela 2ª vez https://www.correiobraziliense.com.br/politica/2021/07/4937833-doria-testa-positivo-para-covid-19-pela-segunda-vez.html

"Governador de São Paulo já havia sido diagnosticado com a doença no ano passado. Ele diz que, apesar da infecção, se sente bem, o que atribui ao fato de ter sido vacinado com duas doses da Coronavac"

06/08/2021 - CPI recebe investigação contra Doria por compra de máscara sem licitação https://www.conexaopoder.com.br/nacional/cpi-recebe-investigacao-contra-doria-por-compra-de-mascara-sem-licitacao/150827

"Empresa teria usado o nome de Alexandre Frota para vender máscaras ao governo de SP. Doria nega informação"

Renan Filho

(filho do Renan Calheiros)

25/07/2019 - Governador Renan Filho vai à China em busca de investimentos para o estado https://www.tnh1.com.br/videos/vid/governador-renan-filho-vai-a-china-em-busca-de-investimentos-para-o-estado/

20/03/2020 - Governadores do NE consultam China e pedem material para tratar covid-19 https://noticias.uol.com.br/saude/ultimas-noticias/redacao/2020/03/20/governadores-do-ne-consultam-china-e-pedem-material-para-tratar-covid-19.htm

5. Narrativas, restrições e proibições

17/12/2020 - STF decide que vacina contra a covid pode ser obrigatória, mas não forçada https://noticias.uol.com.br/saude/ultimas-noticias/redacao/2020/12/17/stf-julga-vacinacao-obrigatoria.htm?cmpid=copiaecola

"O STF (Supremo Tribunal Federal) decidiu, em julgamento hoje, que o Estado pode determinar a obrigatoriedade da vacinação contra a covid-19. Porém fica proibido o uso da força para exigir a vacinação, ainda que possam ser aplicadas restrições a direitos de quem recusar a imunização.

Dez ministros foram favoráveis a obrigatoriedade da vacinação, que poderá ser determinada pelo governo federal, estados ou municípios. As penalidades a quem não cumprir a obrigação deverão ser definidas em lei."

27/07/2021 - Saiba que países estão adotando 'passaporte da vacina' para suspender restrições https://www.cnnbrasil.com.br/internacional/2021/07/27/saiba-que-paises-estao-adotando-passaporte-da-vacina-para-suspender-restricoes

" - Israel - Uniao Europeia - Áustria - Dinamarca - Eslovênia - França - Grécia - Irlanda - Itália - Letônia - Lituânia - Luxemburgo - Holanda - Portugal - Japão - Coreia do sul"

18/06/2021 - O que é o passaporte da vacina que Bolsonaro quer vetar? https://noticias.uol.com.br/politica/ultimas-noticias/2021/06/18/uol-explica-o-que-e-o-passaporte-da-vacina-que-opoe-bolsonaro-e-damares.htm

"O Brasil poderá ter um certificado de imunização futuramente. Aprovado no Senado na semana passada, o "passaporte da vacina", como é chamado, prevê identificar pessoas vacinadas para que entrem em locais públicos ou privados com possíveis restrições."

6. Vacinas

Alegações iniciais

- CoronaVac, Oxford e Pfizer: veja diferenças entre as vacinas contra covid noticias.uol.com.br/saude/ultimas-noticias/redacao/2021/05/11/diferencas-vacinas-covid-brasil.htm

" - CoronaVac (Butantan/Sinovac - Chinesa) Com virus inativo 50,38% de eficácia 2 doses

-

Covishield - 'AstraZeneca' (Fiocruz/Astrazenica/Oxford - Britânica) Com virus não replicante 67% de eficácia 2 doses

-

ComiRNAty - 'Pfizer' (Pfizer - Americana / BioNTech - Alemã) Com RNA mensageiro 96% de eficácia 2 doses"

Riscos diretos

15/06/2021 - Trombose após vacinação com AstraZeneca: Quais os sintomas e como se deve atuar? https://www.istoedinheiro.com.br/trombose-apos-vacinacao-com-astrazeneca-quais-os-sintomas-e-como-se-deve-atuar/

"Agências europeias estão reticentes com a vacina da AstraZeneca. Ela chegou a ser desaconselhada a pessoas com idade inferior a 60 anos, e um alto funcionário da Agência Europeia de Medicamentos declarou que era melhor deixar de administrar a vacina deste laboratório em qualquer idade quando há alternativas disponíveis, devido aos relatos de trombose após a primeira dose, apesar de raros."

11/05/2021 - CoronaVac, Oxford e Pfizer: veja diferenças entre as vacinas contra covid https://noticias.uol.com.br/saude/ultimas-noticias/redacao/2021/05/11/diferencas-vacinas-covid-brasil.htm

"Na terça-feira (12), o Ministério da Saúde determinou a suspensão da aplicação da vacina de Oxford/AstraZeneca para gestantes e puérperas com comorbidades. A decisão segue recomendação da Anvisa, que apura a morte de uma grávida de 35 anos que tomou o imunizante e teve um AVC (acidente vascular cerebral)."

30/07/2021 - Pfizer representa o mesmo risco de trombose que a Astrazeneca, aponta levantamento https://panoramafarmaceutico.com.br/pfizer-representa-o-mesmo-risco-de-trombose-que-a-astrazeneca-aponta-levantamento/

7. CRIMES

Crimes da Pfizer

18/11/2020 Não listado no google - Os Crimes documentados da produtora de vacinas de Covid - Pfizer [INGLÊS] https://www.dmlawfirm.com/crimes-of-covid-vaccine-maker-pfizer-well-documented/

"A velocidade com que a vacina Covid da Pfizer foi produzida, a ausência de estudos em animais, testes de controle randomizados e outros testes e procedimentos padrão usuais para um novo medicamento são, no mínimo, preocupantes. Além disso, todos os fabricantes de vacinas Covid receberam imunidade legal para quaisquer ferimentos ou mortes que possam causar. Se essas vacinas são tão seguras quanto promovidas, por que seus fabricantes precisam de imunidade geral?"

"A Pfizer, uma empresa farmacêutica que parece ter ganhado na loteria para produzir a primeira vacina Covid-19, está atualmente lutando contra centenas de ações judiciais sobre o Zantac, um popular medicamento contra azia. Os processos da Zantac afirmam que a droga popular pode estar contaminada com uma substância cancerígena chamada N-nitrosodimetilamina (NDMA). Os processos Zantac são em aberto e em andamento, já que a farmacêutica está lutando contra eles; mas a Pfizer, sabemos, cometeu vários crimes ou transgressões pelos quais foi punida nos últimos anos. As falhas da empresa estão bem documentadas e vale a pena revisá-las neste momento crítico da história da humanidade, enquanto todos nós buscamos respostas."

A Pfizer recebeu a maior multa da história dos Estados Unidos como parte de um acordo judicial de US $ 2,3 bilhões com promotores federais por promover medicamentos erroneamente (Bextra, Celebrex) e pagar propinas a médicos complacentes. A Pfizer se confessou culpada de falsificar a marca do analgésico Bextra, promovendo o medicamento para usos para os quais não foi aprovado.

Na década de 1990, a Pfizer estava envolvida em válvulas cardíacas defeituosas que causaram a morte de mais de 100 pessoas. A Pfizer enganou deliberadamente os reguladores sobre os perigos. A empresa concordou em pagar US $ 10,75 milhões para acertar as acusações do departamento de justiça por enganar reguladores.

A Pfizer pagou mais de US $ 60 milhões para resolver um processo sobre o Rezulin, um medicamento para diabetes que causou a morte de pacientes de insuficiência hepática aguda.

No Reino Unido, a Pfizer foi multada em quase € 90 milhões por sobrecarregar o NHS, o Serviço Nacional de Saúde. A Pfizer cobrou do contribuinte um adicional de € 48 milhões por ano, pelo que deveria custar € 2 milhões por ano.

A Pfizer concordou em pagar US $ 430 milhões em 2004 para resolver acusações criminais de que havia subornado médicos para prescrever seu medicamento para epilepsia Neurontin para indicações para as quais não foi aprovado. Em 2011, um júri concluiu que a Pfizer cometeu fraude em sua comercialização do medicamento Neurontin. A Pfizer concordou em pagar $ 142,1 milhões para liquidar as despesas.

A Pfizer revelou que pagou quase 4.500 médicos e outros profissionais médicos cerca de US $ 20 milhões por falar em nome da Pfizer.

Em 2012, a Comissão de Valores Mobiliários dos Estados Unidos - anunciou que havia chegado a um acordo de US $ 45 milhões com a Pfizer para resolver acusações de que suas subsidiárias haviam subornado médicos e outros profissionais de saúde no exterior para aumentar as vendas no exterior.

A Pfizer foi processada em um tribunal federal dos Estados Unidos por usar crianças nigerianas como cobaias humanas, sem o consentimento dos pais das crianças. A Pfizer pagou US $ 75 milhões para entrar em acordo no tribunal nigeriano pelo uso de um antibiótico experimental, o Trovan, nas crianças. A empresa pagou um valor adicional não divulgado nos Estados Unidos para liquidar as despesas aqui. A Pfizer violou o direito internacional, incluindo a Convenção de Nuremberg estabelecida após a Segunda Guerra Mundial, devido aos experimentos nazistas em prisioneiros relutantes.

Em meio a críticas generalizadas de roubar os países pobres em busca de drogas, a Pfizer prometeu dar US $ 50 milhões para um medicamento para a AIDS para a África do Sul. Mais tarde, no entanto, a Pfizer falhou em honrar essa promessa.

- Pfizer contract leaked!

[Contrato da Pfizer vazado]

http://sanjeev.sabhlokcity.com/Misc/LEXO-KONTRATEN-E-PLOTE.pdf

http://sanjeev.sabhlokcity.com/Misc/LEXO-KONTRATEN-E-PLOTE.pdf

Segundo o contrato "o produto não deve ser serializado":

"5.5 Reconhecimento do comprador.

O Comprador reconhece que a Vacina e os materiais relacionados à Vacina, e seus componentes e materiais constituintes estão sendo desenvolvidos rapidamente devido às circunstâncias de emergência da pandemia de COVID-19 e continuarão a ser estudados após o fornecimento da Vacina ao Comprador nos termos deste Contrato. O Comprador reconhece ainda que os efeitos de longo prazo e eficácia da Vacina não são atualmente conhecidos e que pode haver efeitos adversos da Vacina que não são atualmente conhecidos. Além disso, na medida do aplicável, o Comprador reconhece que o Produto não deve ser serializado."

Crimes da AstraZeneca

21/06/2003 - AstraZeneca se declara culpada no esquema de médico de câncer https://www.nytimes.com/2003/06/21/business/astrazeneca-pleads-guilty-in-cancer-medicine-scheme.html

"A AstraZeneca, a grande empresa farmacêutica, se declarou culpada hoje de uma acusação de crime de fraude no sistema de saúde e concordou em pagar $ 355 milhões para resolver as acusações criminais e civis de que se envolveu em um esquema nacional para comercializar ilegalmente um medicamento contra o câncer de próstata.

O governo disse que os funcionários da empresa deram incentivos financeiros ilegais a cerca de 400 médicos em todo o país para persuadi-los a prescrever o medicamento Zoladex. Esses incentivos incluíram milhares de amostras grátis de Zoladex [...]"

27/04/2010 - Farmacêutica gigante AstraZeneca pagará US $ 520 milhões pelo marketing de medicamentos off-label https://www.justice.gov/opa/pr/pharmaceutical-giant-astrazeneca-pay-520-million-label-drug-marketing

"AstraZeneca LP e AstraZeneca Pharmaceuticals LP vão pagar $ 520 milhões para resolver as alegações de que a AstraZeneca comercializou ilegalmente o medicamento antipsicótico Seroquel para usos não aprovados como seguros e eficazes pela Food and Drug Administration (FDA), os Departamentos de Justiça e Saúde e Serviços Humanos A Equipe de Ação de Fiscalização de Fraudes em Saúde (HEAT) anunciou hoje. Esses usos não aprovados também são conhecidos como usos "off-label" porque não estão incluídos no rótulo do medicamento aprovado pela FDA."

- List of largest pharmaceutical settlements [Lista dos maiores acordos farmaceuticos] https://en.m.wikipedia.org/wiki/List_of_largest_pharmaceutical_settlements

8. CIENTISTAS

- Máscara Provoca Insuficiência Respiratória E Contaminação Microbiana… [Canal deletado] https://youtube.com/watch?v=eHu-pydSvDI

Não lembro mais a quem pertencia, mas provavelmente era de um médico falando do assunto. Creio ter sido do Dr. Paulo Sato, por essa temática ter sido abordada por ele, mas ao abrir o site aparece somente:

"Este vídeo foi removido por violar as diretrizes da comunidade do YouTube"

Dr. Paulo Sato

- USAR ou NÃO USAR a CUECA do seu governador no rosto https://fb.watch/7NPP_7rS5S/ https://www.facebook.com/AdoniasSoaresBR/videos/1347904292291481/ Adonias Soares entrevista ao Dr. Paulo Sato sobre as máscaras, em que é simulado o efeito da respiração prolongada das máscaras no organismo com o uso de águas de torneira, natural, gaseificada (com gás carbônico) e antioxidante, em que a com gás carbônico (PH 4 - Ácido) representa o organismo humano, e na prática representa lesão corporal e iniciação de doenças.

Dr. Kary Mullis

(Criador do teste PCR)

- PCR nas palavras do seu inventor - Dr. Kary Mullis (legendado) https://www.youtube.com/watch?v=W1O52uTygk8

"Qualquer um pode testar positivo para quase qualquer coisa com um teste de PCR, se você executá-lo por tempo suficiente… Com PCR, se voce fizer isso bem, você pode encontrar quase tudo em qualquer pessoa… Isso não te diz que você está doente."

- Kary Mullis DESTRUYE a Anthony Fauci lbry://@CapitalistChile#0/Kary-Mullis---Fauci#5

"Ele [...] não entende de medicina e não deveria estar onde está. A maioria dos que estão acima são só administrativos e não têm nem ideia do que ocorre aqui em baixo e essas pessoas tem uma agenda que não é a que gostaríamos que tivessem, dado que somos nós os que pagamos a eles para que cuidem da nossa saúde. Têm uma agenda pessoal."

Dra. Li-Meng Yan

- Dra. Li-Meng Yan: O vírus foi criado em laboratório com um objetivo: Causar dano. https://youtu.be/pSXp3CZnvOc

Dr. Joe Roseman

- Cientista Phd Dr Joe Roseman faz seríssimas advertencias sobre a picada https://youtu.be/0PIXVFqJ_h8

Dr. Robert Malone

- As vacinas podem estar causando ADE - Dr. Robert Malone https://odysee.com/@AkashaComunidad:f/Las_vacunas_pueden_estar_causando_ADE_magnificaci%C3%B3n_mediada_por:f lbry://@Información.#b/Drrm#9

Dr. Robert Malone, um dos três inventores da tecnologia de RNAm que se usa de forma farmacêutica. No vídeo fala sobre os efeitos de ADE (realce dependente de anticorpos) que estão ocorrendo com as vacinas. Nas palavras do Dr. Malone, já não é somente uma hipótese, mas baseada nos conhecimentos gerados nas provas e ensaios pré clínicos, com as vacinas contra o primeiro vírus da SARS.

Dr. Luc Montagnier

- Dr. Luc Montagnier, virologista, prêmio Nobel de medicina, um dos descobridores do vírus HIV, afirma: "a vacinação em massa está criando as novas variantes' (@medicospelavida , telegram)

CASOS DOCUMENTADOS

13 de setembro de 2021 - 13/09/2021 - Carta aberta ao Ministro da Saúde por Arlene Ferrari Graf, mãe de Bruno Oscar Graf https://telegra.ph/Carta-aberta-ao-Ministro-da-Sa%C3%BAde-09-13

Também em: Gazeta do Povo

O texto de uma mãe discorrendo sobre o filho dela, Bruno Oscar Graf, ter ANTI-HEPARINA PF4 AUTO-IMUNE e ter vindo a falecer por reação à vacina.

11/05/2021 - Rio notifica morte de grávida vacinada com imunizante Oxford https://www.terra.com.br/noticias/coronavirus/rio-notifica-morte-de-gravida-vacinada-com-imunizante-oxford,415b9b0c49169427ac2f90ae3765c057e9suy3qn.html

"Vítima não apresentava histórico de doença circulatória nem sofria de nenhuma doença viral; relação será investigada"

13/08/2021 - Cruzeiro com 4.336 pessoas tem 27 contaminados com Covid-19 em Belize https://paranaportal.uol.com.br/geral/cruzeiro-com-4-336-pessoas-tem-27-contaminados-com-covid-19-em-belize/amp/

"Segundo um comunicado do Conselho de Turismo de Belize emitido na quarta-feira (11), 26 contaminados são da tripulação e um é passageiro. A maioria é assintomática e os 27 estão vacinados."

9. ALEGAÇÕES DIRETAS

Setembro de 2021 - 09/2021 - BOMBA: Ex-membro do Partido Comunista da China revela que o primeiro surto da Covid foi “intencional” https://terrabrasilnoticias.com/2021/09/bomba-ex-membro-do-partido-comunista-da-china-revela-que-o-primeiro-surto-da-covid-foi-intencional/

-

@ 0b118e40:4edc09cb

2025-06-06 14:08:06

@ 0b118e40:4edc09cb

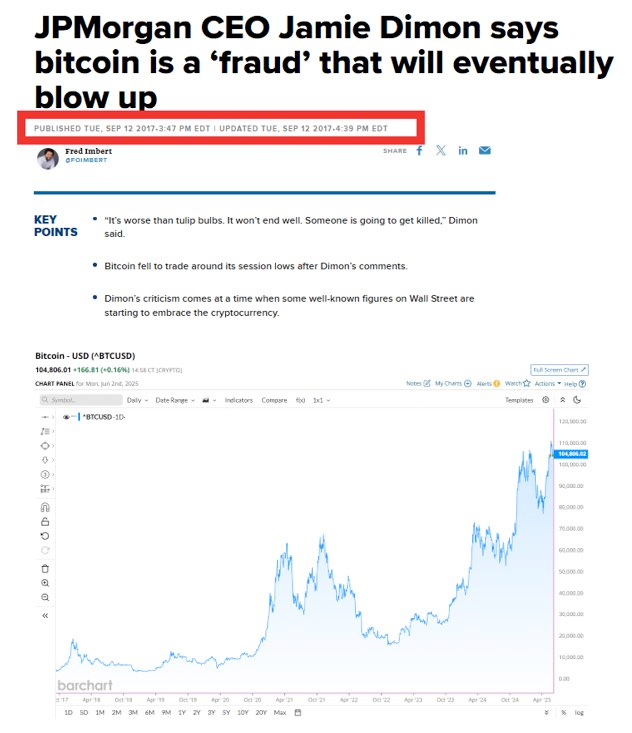

2025-06-06 14:08:06The idea of Bitcoin as an internet native currency, and eventually a global one, is coming to life slowly. But historically, the idea of global currency has haunted the world’s financial imagination for nearly a century.

From Keynes’s Bancor in 1944 to Zhou Xiaochuan’s post-crisis proposal in 2009 to today’s renewed debates, the idea resurfaces every time the global economy fractures.

Could this time be different with Bitcoin?

I decided to trace the idea of global currency through several decades and books. I may have missed some parts, so feel free to add. I’ll keep this brief and leave the books I’ve read below.

In the beginning

It all started on July 1, 1944. 730 delegates from 44 Allied nations, including major powers like the US, UK, Soviet Union, China, and France, gathered at the Mount Washington Hotel in Bretton Woods, New Hampshire. They spent 2 weeks figuring out how the new international monetary and financial system would be, post WW2

After WW1, the treaty of Versailles was needed, but imposed harsh reparations that devastated economies and contributed to the rise of fascism, such as Hitler, Mussolini and gang.

So when folks met up in 1944 (WW2 was almost ending), the goal was to prevent another Great Depression, another global conflict and build a stable global economic order.

2 main proposals were discussed in Bretton Woods.

-

John Maynard Keynes, representing the UK, proposed the creation of a global currency called Bancor. It will be issued through a global central bank known as the International Clearing Union (ICU).

-

Harry Dexter White, representing the US, promoted a dollar-based system. Countries would peg their currencies to the US. dollar backed by gold. He also led the creation of the IMF and the World Bank.

To understand how both of these proposals work, let's look at an example.

-

Country A (Germany): Massive exporter

-

Country B (USA): Massive importer

-

Country C (Brazil): Balanced trade (imports = exports)

***Based on Dexter’s model and the current USD-based system, ***

Say Germany sells $1B worth of cars to the US. The US pays in dollars, increasing its trade deficit. Germany accumulates dollars as reserves or buys the US Treasury bonds. Over time, the US continues running trade deficits, while Germany keeps hoarding dollars. Hence the unsustainable debt of the US.

***In Keynes’s Bancor system, ***

If Germany sells $1B worth of cars to the US, then the US does not pay in dollars. Instead, the ICU credits Germany with 1B Bancors and debits the US with -1B Bancors.

The ICU police this. If Germany exceeds the surplus threshold, it pays interest or penalties to discourage hoarding. If the US exceeds its deficit threshold, it is warned to rebalance trade or face restrictions.

Here, Germany is incentivized to import more (e.g., from Brazil) or invest in global development. The US is encouraged to export more or reduce consumption. Brazil, with balanced trade, enjoys stability in Bancor flows and avoids pressure.

The idea behind Bancor was a zero-sum balancing act. No country could become “too big to fail” due to excessive deficits. But it was too complicated and idealistic in assuming every country could maintain balanced trade.

Dexter on the other hand had a few tricks up his sleeve. In the end, Dexter’s USD dominance proposal was adopted.

The Bretton Woods system established the US dollar as the central global currency

Why did dollar dominance win over Bancor?

Simplicity often wins over complexity. But more so ICU felt too centralized, asking nations to surrender economic autonomy to a global body. That didn’t sit well in a post-war world where sovereignty was non-negotiable. That and idealist economic trade balance views.

Dexter’s dollar-based system on the other hand wasn’t fair play at all. It was centralized and authoritarian in its design.

So how did Dexter pull it off?

They had gold. They were ahead in economic recovery.

And they had nuclear weapons.

At the time, the US held nearly 2/3 of the world’s gold reserves. It was a significant advantage in advocating for a gold-backed dollar as the bedrock of global trade.

The US proposed a fixed gold peg at $35 per ounce.

From a broader geopolitical backdrop, the global population in 1944 was about 2.3 billion, a fraction of today’s 8 billion. The world was far less interconnected. The war had devastated Europe, Russia, and much of Asia. Infrastructure, economies, and entire cities were in ruins. The US, by contrast, had faced far fewer casualties and damages. Being geographically isolated, it had minimal domestic losses, around a tenth of what Europe suffered, and its economy was poised to rebuild faster.

But gold dominance and economic recovery alone didn’t secure US financial dominance.

American scientific breakthroughs had already signaled global power. Physicists like Leo Szilard and Albert Einstein, who had fled Europe, helped develop nuclear weapons. Their intent was deterrence, not destruction. But once the bomb existed, it changed geopolitics overnight. The US had military dominance. And after Hiroshima and Nagasaki in 1945, it became the undisputed superpower.

In the end, the USD won and the vision for neutral global currency faded.

And 20 years passed on…

France sends its warship to the US

Under Bretton Woods, countries could exchange dollars for gold, but the US had been printing more dollars than it had gold to back it. And it used it to fund the costly Vietnam War and domestic programs like the Great Society under LBJ.

Belgian-American economist Robert Triffin pointed out a fatal flaw in the Bretton Woods system that came to be known as the Triffin dilemma.

-

The world needed US dollars for liquidity and trade.

-

But the more dollars the US pumped out, the less credible its gold promise became.

Yet the US kept promising that every dollar was still convertible to gold at $35 per ounce.

French President Charles de Gaulle saw this as financial imperialism. He called it the “exorbitant privileged position”. The world had to pay for what they bought with the money they have, but not the US.

So in 1965, France did something unexpected. It sent a warship to New York Harbor to physically retrieve French gold reserves held by the Federal Reserve.

Would it have escalated to war? Maybe. But likely not. It was perhaps more of a diplomatic theatre and a sovereign flex. France was exercising its right under the Bretton Woods agreement to convert dollars into gold. But doing it with military formality was to send a signal to the world that they don’t trust the US system anymore.

It was one of the first major public blows to the dollar’s credibility. And France wasn’t alone. Other countries like West Germany and Switzerland followed suit, redeeming dollars for gold and draining US reserves.

The Nixon shock

Given they did not have enough gold, the IMF introduced Special Drawing Rights (SDRs) in 1969. SDRs were an international reserve asset, created to supplement gold and dollar reserves. Instead of relying solely on the US dollar, SDRs were based on a basket of major currencies (originally gold-backed but later diversified).

The idea was to reduce the world’s dependence on the dollar and avoid a liquidity crisis. But SDRs were a little too late and a little too weak to solve the underlying problem.

By 1971, the US could no longer sustain the illusion. President Nixon “closed the gold window,” suspending dollar convertibility to gold.

The Bretton Woods collapsed and this marked the beginning of fiat money dominance.

The French pursuit

While France demanded justice in one corner of the world, the French franc, specifically the CFA franc, has been dominant in parts of Africa since 1945, long before 1971.

After WWII, France created two CFA franc zones:

-

West Africa: Communauté Financière Africaine (XOF)

-

Central Africa: Coopération Financière en Afrique Centrale (XAF)

These zones included 14 African countries, many of which were former French colonies. France maintained monetary control via currency convertibility guarantees and representation in African central banks. Till today it has influence over these country’s monetary policy.

Colonisation hasn't ended in some parts of the world.

Did countries stop using the USD after the Nixon shock 1971?

Nope. The US dollar was no longer convertible to gold and it dismantled the fixed exchange rate system. But most countries did not stop using the USD as their dominant reserve or trade currency. There were no decent alternatives. Instead, they floated their currencies or maintained a soft peg to the dollar or a basket of currencies.

The USD remained dominant in oil trade (OPEC priced oil in USD) - petrodollar deal, global debt markets and FX reserves (central banks kept holding USD).

In 1997, when many Southeast Asian countries were still pegged to the USD, Soros claimed that SEA will tank. The US further increased its credit rates leading to capital flight and eventual tanking of these countries leading to Asian Financial Crisis '97. Many financial crisis has similar vibe.

The 1999 Euro launch

The idea of a shared currency appeared again, this time through the forms of Euro. It was a mandatory system for member states of the Eurozone, and came with centralized authority, the European Central Bank (ECB), which controlled monetary policy for all participating nations.

At first glance, the euro seemed like a win. It eliminated exchange rate fluctuations, making trade within the Eurozone smoother. It gave weaker economies access to lower borrowing costs and helped Europe establish itself as a financial heavyweight. Today, the euro is the second most-used reserve currency after the US dollar.

But it came at a cost. Countries that adopted the euro lost monetary sovereignty and could no longer print their own money or adjust interest rates to respond to local crises. This became painfully clear during Greece’s debt crisis, where strict monetary policies prevented the country from devaluing its currency to recover. The one-size-fits-all approach meant that economies as different as Germany and Greece had to follow the same rules, often to the detriment of weaker nations. Debt-ridden countries like Italy and Spain were forced into harsh austerity measures because they could not manipulate their currency to ease financial strain. Meanwhile, richer nations like Germany and the Netherlands felt they were unfairly propping up struggling economies, creating political tension across the EU.

In recent years, the euro has faced pressure from global trade tensions, monetary tightening, and geopolitical instability contributing to market volatility and periodic depreciation against other major currencies.

The Bretton Woods 2.0

Believe it or not, after all that, there was a call for Bretton Woods 2.0. Yet another global currency dream.

When the housing market collapsed in 2008 followed by a series of domino effects, global banks froze lending, economies contracted, and panic set in. The crisis exposed how fragile the international financial system had become as it was overly reliant on debt, under-regulated, and centered around the US dollar.

Many countries, especially in the Global South and emerging markets, started to question whether a system built around a single national currency was sustainable.

China, for instance, had been holding huge amounts of US debt while the US printed more dollars through bailouts and quantitative easing. This created global imbalances as exporting nations were lending money to the US to keep the system running, while taking on the risk of dollar depreciation.

In 2009, China’s central bank openly proposed replacing the US dollar with a neutral global reserve currency suggesting SDRs (Special Drawing Rights) issued by the IMF instead.

These concerns led to a wave of calls from world leaders for a “Bretton Woods 2.0” , a modern rethinking of the post-WWII economic order. At G20 summits in London in 2009, countries like France, China, and Russia pushed for reforms in global financial institutions and more balanced power sharing.

In the end, the IMF received more funding, and some banking regulations were tightened in the years after. But no real overhaul happened. No surprise there? The dollar remained dominant.

The foundation of the global economy didn’t change, even though trust in it had been deeply shaken.

The growth of BRICS

In 2023, Brazil, Russia, India, China, and South Africa began discussing the idea of a shared currency or alternative mechanism to reduce the dependence on USD ie de-dollarisation. The sanctions on Russia didn't help. After Russia’s invasion of Ukraine, the US and its allies froze Russia’s dollar reserves and cut it off from SWIFT, the “backbone of global banking communication”. This made one thing clear. If you fall out with Washington, your access to the global economy can vanish overnight.

China’s growing economic power also gave it more leverage to process alternative options. It would trade in Yuan with Russia and Iran.

I know many still say it's at its early stage, but I see many countries hedging their bets quietly and aligning with Putin and Xi. It became more obvious after US imposed tariffs on multiple nations, signaling that economic tools can double as political weapons. The world’s second financial system is slowly forming.

What is the world looking for, for the last century ?

From Bretton Woods to multiple financial crises, from the birth of the Euro to the rise of BRICS, through war and peace, we’ve been circling around the same ideal. A global currency that is :

-

Simple

-

Free from dominant power

-

Decentralised

-

Borderless

-

Scarce

-

Transparent

-

Inclusive, with self custody

-

Resilient in crisis

-

Built for individual financial sovereignty

-

A new backbone for global finance, owned by no one

It doesn’t matter where you’re from, what politics you believe in, or how your economy leans. The answer keeps pointing in the same direction:

Bitcoin

This is the first true global currency.

And it’s just there

Waiting...

.

.

.

Some books that might interest you :

-

The Battle of Bretton Woods by Benn Steil

-

Goodbye, Great Britain by Kathleen Burk and Alec Cairncross

-

The Ghost of Bancor by Tommaso Padoa-Schioppa

-

Confessions of an Economic Hitman by John Perkins

-

The Blood Bankers by James S. Henry

-

-

@ 7f6db517:a4931eda

2025-06-06 14:02:12

@ 7f6db517:a4931eda

2025-06-06 14:02:12

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-06 14:02:12

@ 7f6db517:a4931eda

2025-06-06 14:02:12

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-06 14:02:11

@ 7f6db517:a4931eda

2025-06-06 14:02:11

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-06 14:02:10

@ 7f6db517:a4931eda

2025-06-06 14:02:10

Humanity's Natural State Is Chaos

Without order there is chaos. Humans competing with each other for scarce resources naturally leads to conflict until one group achieves significant power and instates a "monopoly on violence."Power Brings Stability

Power has always been the key means to achieve stability in societies. Centralized power can be incredibly effective in addressing issues such as crime, poverty, and social unrest efficiently. Unfortunately this power is often abused and corrupted.Centralized Power Breeds Tyranny

Centralized power often leads to tyrannical rule. When a select few individuals hold control over a society, they tend to become corrupted. Centralized power structures often lack accountability and transparency, and rely too heavily on trust.Distributed Power Cultivates Freedom

New technology that empowers individuals provide us the ability to rebuild societies from the bottom up. Strong individuals that can defend and provide for themselves will help build strong local communities on a similar foundation. The result is power being distributed throughout society rather than held by a select few.In the short term, relying on trust and centralized power is an easy answer to mitigating chaos, but freedom tech tools provide us the ability to build on top of much stronger distributed foundations that provide stability while also cultivating individual freedom.

The solution starts with us. Empower yourself. Empower others. A grassroots freedom tech movement scaling one person at a time.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-06 14:02:09

@ dfa02707:41ca50e3

2025-06-06 14:02:09Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-06-06 14:02:08

@ dfa02707:41ca50e3

2025-06-06 14:02:08Headlines

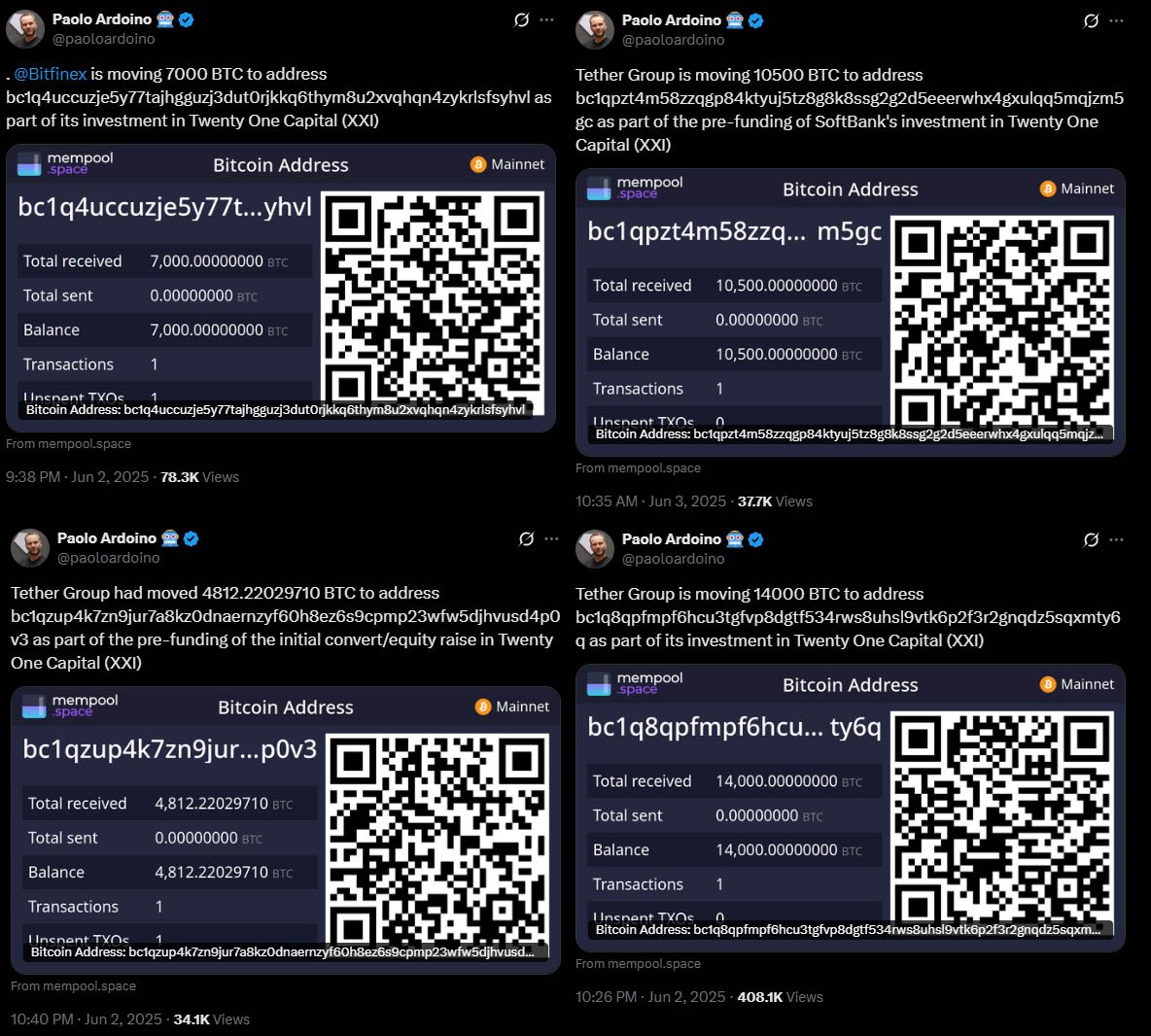

- Spiral renews support for Dan Gould and Joschisan. The organization has renewed support for Dan Gould, who is developing the Payjoin Dev Kit (PDK), and Joschisan, a Fedimint developer focused on simplifying federations.

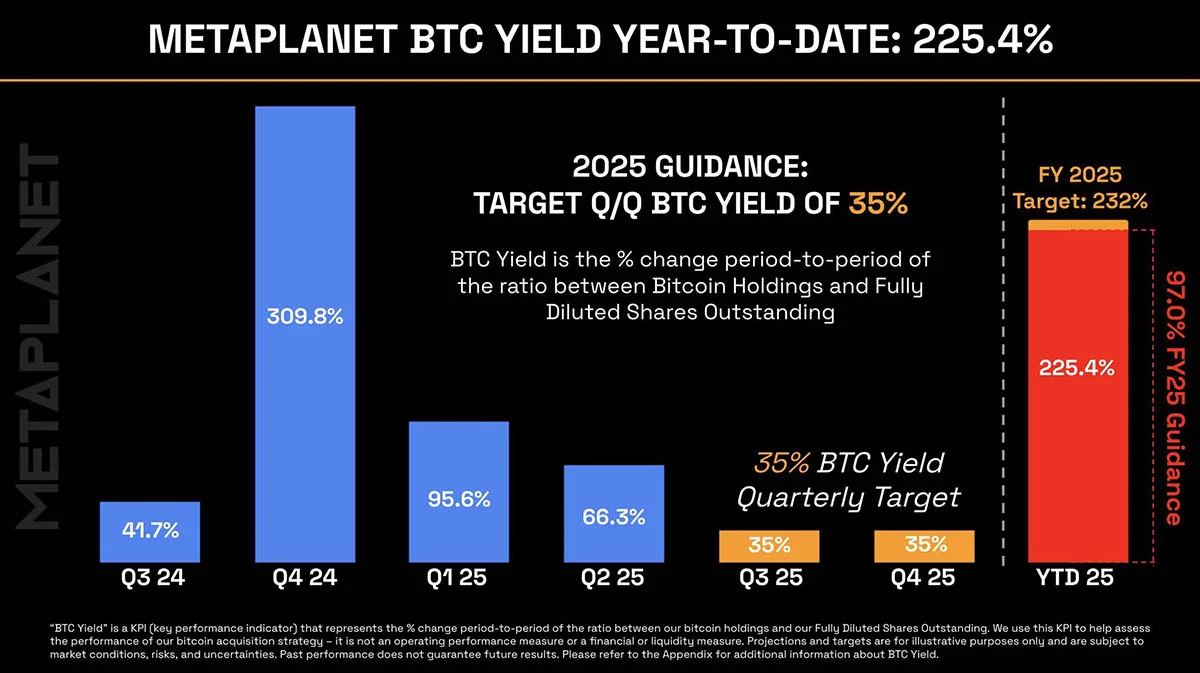

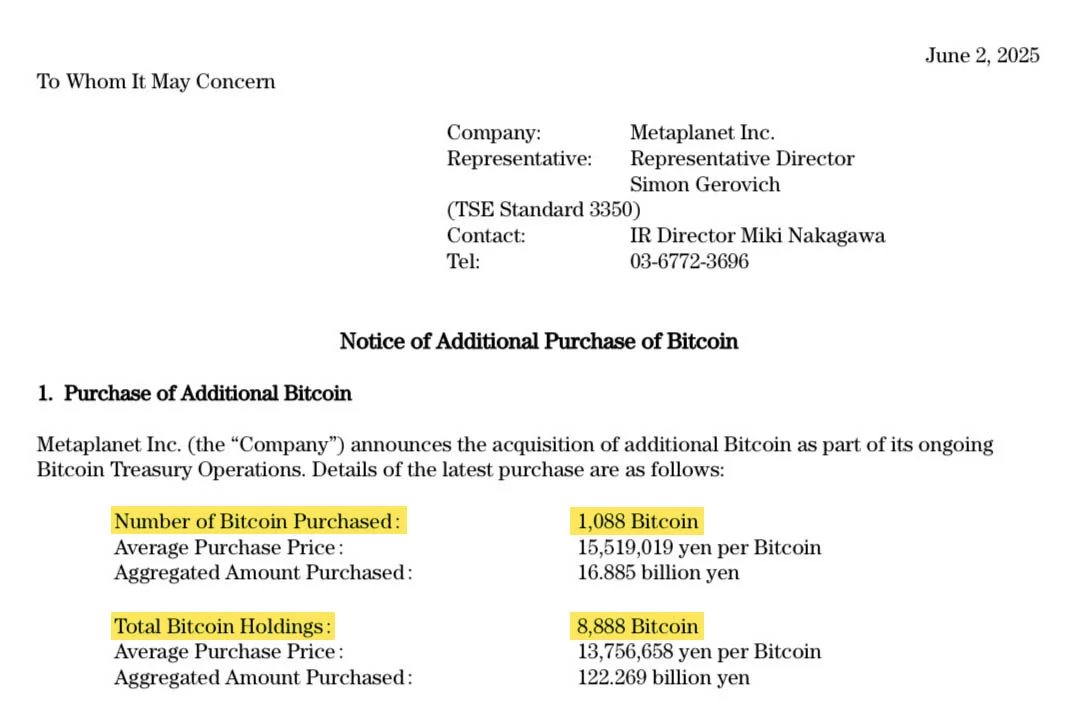

- Metaplanet buys another 145 BTC. The Tokyo-listed company has purchased an additional 145 BTC for $13.6 million. Their total bitcoin holdings now stand at 5,000 coins, worth around $428.1 million.

- Semler Scientific has increased its bitcoin holdings to 3,303 BTC. The company acquired an additional 111 BTC at an average price of $90,124. The purchase was funded through proceeds from an at-the-market offering and cash reserves, as stated in a press release.

- The Virtual Asset Service Providers (VASP) Bill 2025 introduced in Kenya. The new legislation aims to establish a comprehensive legal framework for licensing, regulating, and supervising virtual asset service providers (VASPs), with strict penalties for non-compliant entities.

- Russian government to launch a cryptocurrency exchange. The country's Ministry of Finance and Central Bank announced plans to establish a trading platform for "highly qualified investors" that "will legalize crypto assets and bring crypto operations out of the shadows."

- All virtual asset service providers expect to be fully compliant with the Travel Rule by the end of 2025. A survey by financial surveillance specialist Notabene reveals that 90% of virtual asset service providers (VASPs) expect full Travel Rule compliance by mid-2025, with all aiming for compliance by year-end. The survey also shows a significant rise in VASPs blocking withdrawals until beneficiary information is confirmed, increasing from 2.9% in 2024 to 15.4% now. Additionally, about 20% of VASPs return deposits if originator data is missing.

- UN claims Bitcoin mining is a "powerful tool" for money laundering. The Rage's analysis suggests that the recent United Nations Office on Drugs and Crime report on crime in South-East Asia makes little sense and hints at the potential introduction of Anti-Money Laundering (AML) measures at the mining level.

- Riot Platforms has obtained a $100 million credit facility from Coinbase Credit, using bitcoin as collateral for short-term funding to support its expansion. The firm's CEO, Jason Les, stated that this facility is crucial for diversifying financing sources and driving long-term stockholder value through strategic growth initiatives.

- Bitdeer raises $179M in loans and equity amid Bitcoin chip push. The Miner Mag reports that Bitdeer entered into a loan agreement with its affiliate Matrixport for up to $200 million in April, as disclosed in its annual report filed on Monday.

- Federal Reserve retracts guidance discouraging banks from engaging in 'crypto.' The U.S. Federal Reserve withdrew guidance that discouraged banks from crypto and stablecoin activities, as announced by its Board of Governors on Thursday. This includes rescinding a 2022 supervisory letter requiring prior notification of crypto activities and 2023 stablecoin requirements.

"As a result, the Board will no longer expect banks to provide notification and will instead monitor banks' crypto-asset activities through the normal supervisory process," reads the FED statement.

- UAE-based Islamic bank ruya launches Shari’ah-compliant bitcoin investing. The bank has become the world’s first Islamic bank to provide direct access to virtual asset investments, including Bitcoin, via its mobile app, per Bitcoin Magazine.

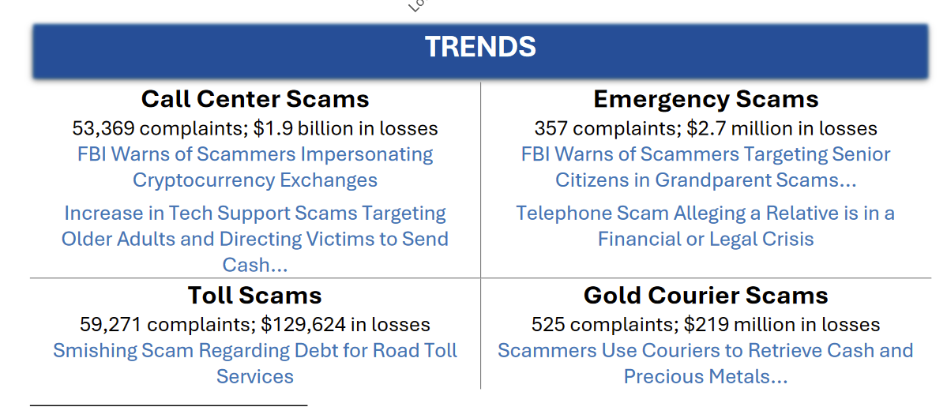

- U.S. 'crypto' scam losses amounted to $9.3B in 2024. The US The Federal Bureau of Investigation (FBI) has reported $9.3 billion losses in cryptocurrency-related scams in 2024, noting a troubling trend of scams targeting older Americans, which accounted for over $2.8 billion of those losses.

Source: FBI.

- North Korean hackers establish fake companies to target 'crypto' developers. Silent Push researchers reported that hackers linked to the Lazarus Group created three shell companies, two of which are based in the U.S., with the objective of spreading malware through deceptive job interview scams aimed at individuals seeking jobs in cryptocurrency companies.

- Citrea deployed its Clementine Bridge on the Bitcoin testnet. The bridge utilizes the BitVM2 programming language to inherit validity from Bitcoin, allegedly providing "the safest and most trust-minimized way to use BTC in decentralized finance."

- Hesperides University offers a Master’s degree in Bitcoin. Bitcoin Magazine reports the launch of the first-ever Spanish-language Master’s program dedicated exclusively to Bitcoin. Starting April 28, 2025, this fully online program will equip professionals with technical, economic, legal, and philosophical skills to excel in the Bitcoin era.

- BTC in D.C. event is set to take place on September 30 - October 1 in Washington, D.C. Learn more about this initiative here.

Use the tools

- Bitcoin Keeper just got a new look. Version 2.2.0 of the mobile multisig app brought a new branding design, along with a Keeper Private tier, testnet support, ability to import and export BIP-329 labels, and the option to use a Server Key with multiple users.

- Earlier this month the project also announced Keeper Learn service, offering clear and guided Bitcoin learning sessions for both groups and individuals.

- Keeper Desktop v0.2.2, a companion desktop app for Bitcoin Keeper mobile app, received a renewed branding update, too.

The evolution of Bitcoin Keeper logo. Source: BitHyve blog.

- Blockstream Green Desktop v2.0.25 updates GDK to v0.75.1 and fixes amount parsing issues when switching from fiat denomination to Liquid asset.

- Lightning Loop v0.31.0-beta enhances the

loop listswapscommand by improving the ability to filter the response. - Lightning-kmp v1.10.0, an implementation of the Lightning Network in Kotlin, is now available.

- LND v0.19.0-beta.rc3, the latest beta release candidate of LND is now ready for testing.

- ZEUS v0.11.0-alpha2 is now available for testing, too. It's nuts.

- JoinMarket Fidelity Bond Simulator helps potential JoinMarket makers evaluate their competitive position in the market based on fidelity bonds.

- UTXOscope is a text-only Bitcoin blockchain analysis tool that visualizes price dynamics using only on-chain data. The

-

@ dfa02707:41ca50e3

2025-06-06 14:02:07

@ dfa02707:41ca50e3

2025-06-06 14:02:07Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ dfa02707:41ca50e3

2025-06-06 14:02:06

@ dfa02707:41ca50e3

2025-06-06 14:02:06Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ dfa02707:41ca50e3

2025-06-06 14:02:06

@ dfa02707:41ca50e3

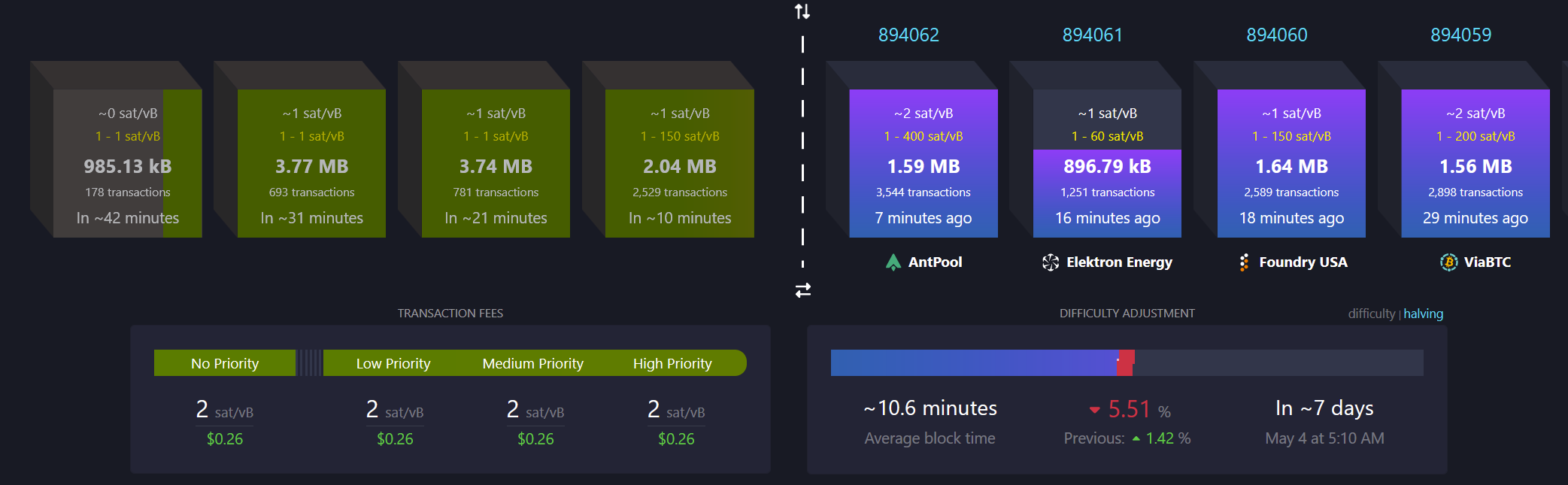

2025-06-06 14:02:06Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ dfa02707:41ca50e3

2025-06-06 14:02:05

@ dfa02707:41ca50e3

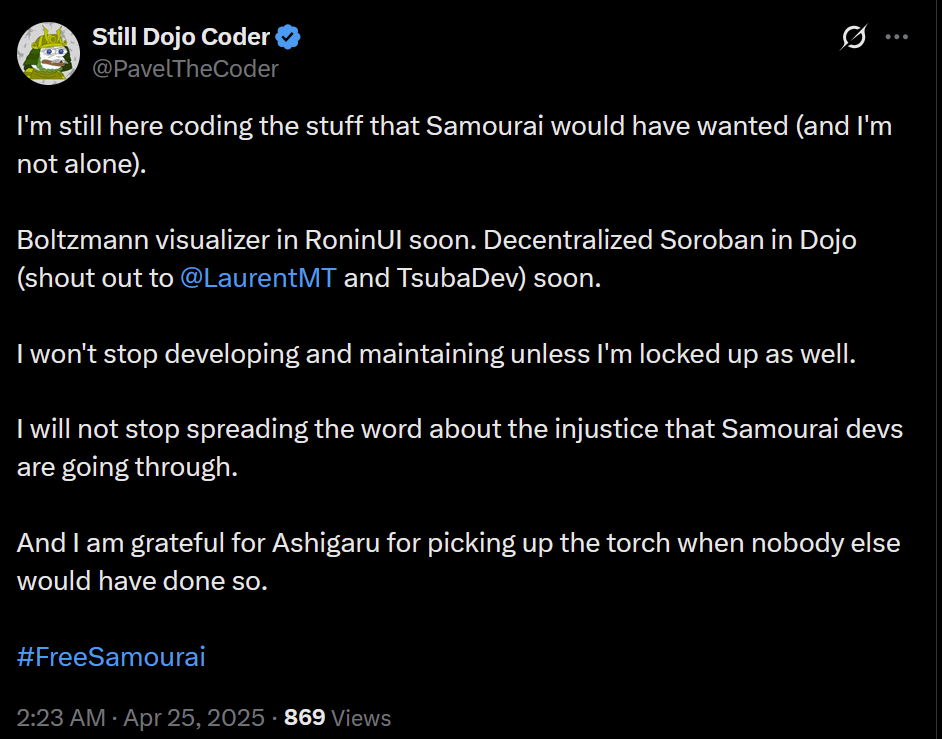

2025-06-06 14:02:05- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new