-

@ eac63075:b4988b48

2025-06-07 13:44:48

@ eac63075:b4988b48

2025-06-07 13:44:48Ever imagined sending a Bitcoin transaction without an internet connection? Or talking to your friends during a total blackout when the cell network just vanishes? It sounds like science fiction, but this technology is an accessible reality, built with low-cost hardware and open-source software. Welcome to the world of mesh networks, Meshtastic, and the BTC Mesh project.

This guide explores the universe of decentralized communication networks, showing how they work, why they are vital for our digital sovereignty, and how you can use them to strengthen your privacy and resilience—not just in communication, but in your Bitcoin transactions as well.

What Are Mesh Networks and Why Should You Care?

Our connected world runs on a fragile, centralized infrastructure. Cell towers, internet providers, data centers—if one of these points fails, communication stops. A mesh network turns this logic on its head.

Here, each participant (or "node") connects directly to other nodes within its reach, forming a web of P2P (peer-to-peer) connections. Instead of data passing through a central server, it hops from node to node until it reaches its destination. The true strength of this approach is decentralization and resilience. If a node goes down, the others simply find a new path for the information. The network reconfigures and heals itself.

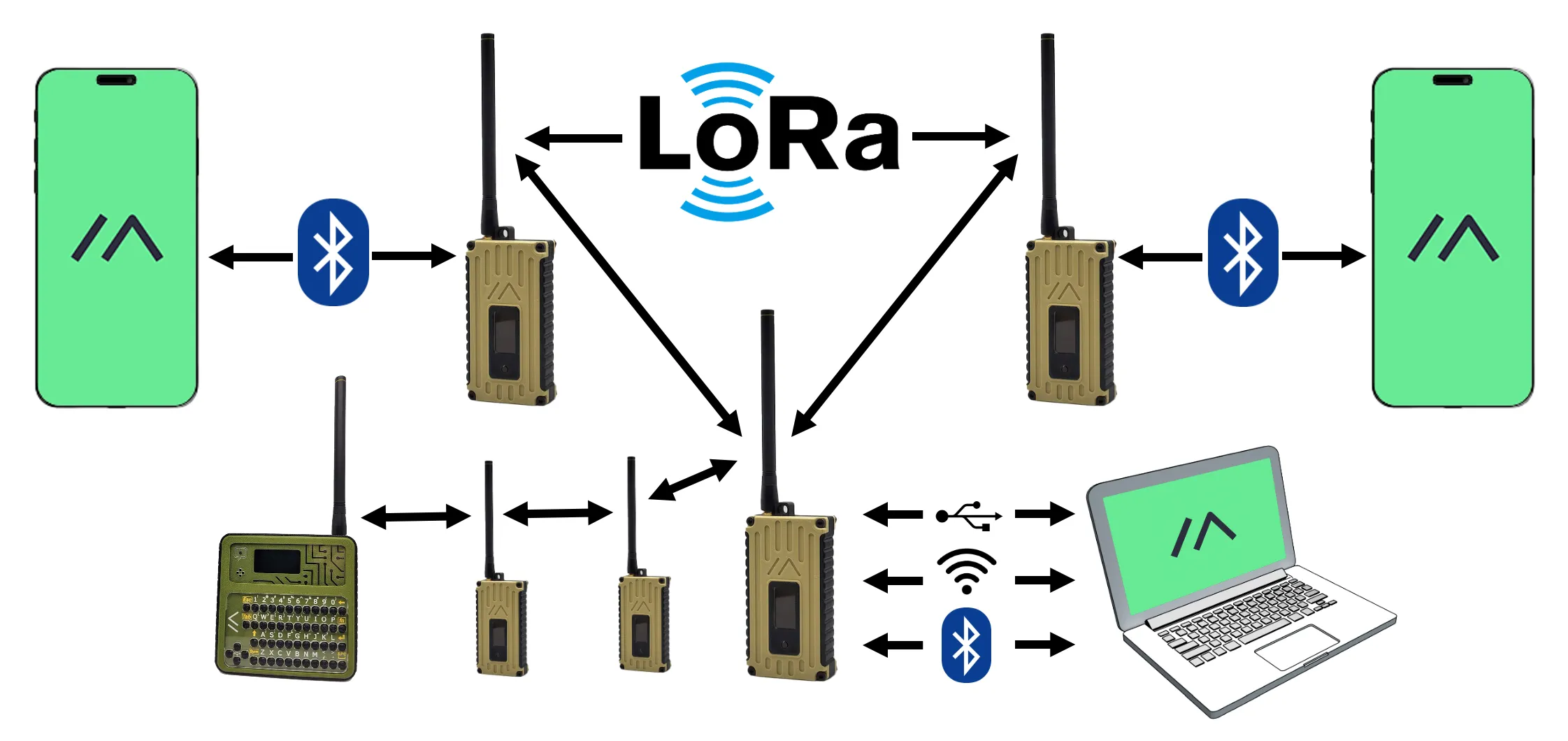

Source: meshtastic.org

Source: meshtastic.orgLoRa and Meshtastic: The Dynamic Duo

To create these networks in the real world, the enthusiast community has rallied around a powerful duo:

- LoRa (Long Range): Think of LoRa as the physical layer—the "radio waves" of our network. It's a technology that allows for long-range wireless communication with incredibly low power consumption. We're talking about cheap little radios that can send small data packets for miles, running for days on a single battery.

- Meshtastic: If LoRa is the physical medium, Meshtastic is the brain. It's open-source software that equips these radios to form a smart, easy-to-use mesh network. Meshtastic handles everything: discovering other nodes, managing routes, encrypting messages, and providing an interface on your phone, connected via Bluetooth.

Meshtastic was originally created as an off-grid communicator, but its usefulness goes far beyond that. Here, privacy is a fundamental pillar. To join a group channel, you need the encryption key. Direct messages are end-to-end encrypted. It's like having a "hardware wallet" for your communication: your private key is secure on your radio, ensuring that only you and the recipient can read the messages.

While Meshtastic is the most popular, alternatives like MeshCore exist, which aim to optimize packet routing. However, the network effect is powerful, and the vast majority of users today are on the Meshtastic platform.

Introducing BTC Mesh: Bitcoin Transactions Via Radio

This is where Bitcoin enters the picture. The inspiration for the BTC Mesh project came from a mix of necessity and chance. After buying a LoRa radio on AliExpress that, to my frustration, couldn't transmit over long distances—and the seller simply stopped responding—I discovered it worked perfectly within my apartment. With two radios in hand, one for the base and another "defective" one, I had the perfect test environment for a new use case: sending Bitcoin transactions over the mesh network.

GitHub - eddieoz/btcmesh: BTC Mesh Relay is designed to send Bitcoin payments via LoRa Meshtastic.

BTC Mesh is a simple application that allows anyone on a Meshtastic network to send a Bitcoin transaction (on-chain, layer 1) over the radio network, without needing a direct internet connection.

How the Magic Works

The system has two parts: a client and a server.

- The Server: Someone on the network with internet access runs the "server node." This is a computer (a Raspberry Pi can handle it) connected to a LoRa radio and a full Bitcoin node (Bitcoin Core). It acts as the bridge between the off-grid mesh world and the global Bitcoin network.

- The Client: Anyone else on the network, even miles away and without internet, can use the "client" on their laptop or phone.

The process is a choreographed dance designed for the low-speed LoRa network:

- Preparing the Transaction: In a wallet like Sparrow, you create and sign your transaction. Instead of clicking "Broadcast," you copy the "Raw Transaction"—a long hexadecimal text.

- Sending Over the Mesh: In the terminal, you run a simple command, pointing to the server's radio and pasting your raw transaction.

- The Communication: Since the transaction is too large for a single LoRa packet, the client splits it into chunks and starts a conversation with the server:

- Client: "Hey server! I have a transaction in 15 parts. Can we start?"

- Server: "Roger that! Awaiting 15 parts. Send the first one."

- Client: (sends part 1)

- Server: "Part 1 received. Send part 2."

- This "handshake" continues until all parts are confirmed, ensuring the transaction arrives complete.

- Validation and Broadcast: Upon receiving everything, the server reconstructs the transaction, validates it, and hands it off to its local Bitcoin node, which finally broadcasts it to the worldwide network.

And that's it! Your transaction is sent to the blockchain, broadcast from a radio, without your IP address ever being exposed.

Maximum Privacy and Sovereignty

BTC Mesh's power lies in its layers of privacy:

- No IP Trail: Since the transaction is sent via radio, there is no record of your IP address. To the Bitcoin network, the transaction simply originated from the server node.

- End-to-End Encryption: The communication between the radios is encrypted by Meshtastic. No one in between can see the content of your transaction.

- Extra Layer with Tor: For maximum privacy, the server node can connect to the internet through the Tor network. This way, not even the server's IP is exposed in the final broadcast.

This combination creates a powerful system for censorship-resistant Bitcoin transactions with high privacy.

Building Your Kit: The Hardware

Excited to build your own station? The hardware is cheap and accessible.

- Frequency is Key: First, know the legal LoRa frequency in your country. In Brazil, use 915 MHz. In Europe, 868 MHz. Buying the wrong frequency will render your radio useless.

- Popular Brands:

- Heltec: Very popular, with boards like the T114, V3, and the Wireless Bridge, which comes with a practical design and an e-ink screen.

- RAK Wireless: Considered more "professional." The RAK4631 model (which I use for my base) is excellent, and the WisBlock line is modular, requiring no soldering.

- LilyGo: Famous in the "maker" community. Offers boards like the T-Beam (with GPS), T-Echo (small and practical), and the T-Deck (a full communicator with a keyboard).

- Seeed Studio (SenseCAP): Offers robust devices like the T1000-e (waterproof) and the XIAO ESP32S3 (tiny, perfect for compact projects).

- Antennas: Don't underestimate the antenna! And a crucial warning: never, ever, turn on your radio without an antenna connected, or you could burn out the transmitter.

- 3 dBi: A more "rounded" signal (a sphere), great for short distances with vertical obstacles.

- 10 dBi: A "flatter," more directional signal (a frisbee), for long distances with a clear line of sight.

- Power: Many boards have connectors for batteries and small solar panels, allowing you to create autonomous nodes.

Limitations and Considerations

Despite its power, LoRa technology has its limits:

- Low Bandwidth: The network is slow. Think 140-character Twitter. It's perfect for messages, but forget about web browsing.

- Regulation: Many regions limit the amount of data a radio can transmit per hour ("duty cycle"). Meshtastic respects these limits, which reinforces the need for optimized applications.

- Need for a Bridge: For a transaction to reach the global network, one node on the mesh needs internet. The network can be fully off-grid for internal communication, but the bridge to the outside world is necessary for certain applications. MQTT servers can play this role, connecting distant mesh networks over the internet.

Use Cases: Beyond Bitcoin

- Disaster Communication: Projects like Disaster.Radio focus on using LoRa to coordinate rescue teams during catastrophes.

- Outdoor Activities: Essential for hiking and camping in remote locations.

- Internet of Things (IoT): In agriculture, sensors can cover vast areas. On farms, they can monitor livestock.

- Private Communication: In a world of surveillance, having a communication channel that you control is an act of sovereignty.

The Future is Decentralized

Projects like BTC Mesh offer a glimpse into a more resilient, private, and decentralized future. They give us the tools to build our own communication and financial networks, free from centralized control.

The technology is cheap, the software is free, and the community is vibrant. Building your first node might seem intimidating, but it's a rewarding project and a practical step toward personal sovereignty.

So, are you ready to get off the grid?

-

@ f85b9c2c:d190bcff

2025-06-07 13:16:28

@ f85b9c2c:d190bcff

2025-06-07 13:16:28

To understand the value of a cryptocurrency, it’s vital to know how many coins are currently in circulation and at what price they’re being sold. Market capitalization of coins are calculated by multiplying the number of coins in circulation with their current market selling rate per coin.

What is Market Capitalization? Market capitalization is the total dollar value of all shares in a company. For Bitcoin or another cryptocurrency it’s calculated by multiplying a total number of coins mined by their current price at that particular time. The market cap is a great way to measure an asset’s stability. The larger it gets, the less likely you’ll have any fluctuations in pricing because more people are using this currency. This means that its price will remain consistent over time no matter what happens with the markets.

Why is a Market Cap Necessary? Cryptocurrencies are collected and catalogued by market cap which helps investors better understand their value. This statistic can indicate if a cryptocurrency is safe to buy or sell compared with others in the industry — it may also provide an idea of what kind of growth potential they have ahead.

What Can You Do With the Market Cap? It’s essential for crypto enthusiasts like yourself to keep track of what kind of project might be worth investing in.

Cryptocurrencies are divided into three categories based on their market cap: 1.Large-cap Cryptocurrencies Large-cap cryptocurrencies are considered lower-risk investments because they’ve demonstrated growth and high liquidity. This means that even if many people sell their investment, its value won’t decrease too much.

2.Mid-cap Cryptocurrencies Mid-cap cryptocurrencies have a lot of potential but are also riskier than large-cap coins.

3.Small-cap Cryptocurrencies Small-cap cryptocurrencies could be your best bet for those looking to invest in a more volatile market with the potential for greater returns.

Last thoughts Even though cryptocurrency market caps allow for an easy way to compare the values of different coins you should consider all factors when investing in any project. You can’t just go into cryptocurrency investing without doing your research. It would help if you looked at each coin’s market trends and stability and whether it’s right for you financially.

-

@ 1817b617:715fb372

2025-06-07 13:15:04

@ 1817b617:715fb372

2025-06-07 13:15:04Looking to simulate a USDT deposit that appears instantly in a wallet — with no blockchain confirmation, no real spend, and no trace?

You’re in the right place.

🔗 Buy Flash USDT Now This product sends Flash USDT directly to your TRC20, ERC20, or BEP20 wallet address — appears like a real deposit, but disappears after a set time or block depth.

✅ Perfect for: Simulating token inflows Wallet stress testing “Proof of funds” display Flash USDT is ideal for developers, trainers, UI testers, and blockchain researchers — and it’s fully customizable.

🧠 What Is Flash USDT? Flash USDT is a synthetic transaction that mimics a real Tether transfer. It shows up instantly in a wallet balance, and it’s confirmed on-chain — and expires after a set duration.

This makes it:

Visible on wallet interfaces Time-limited (auto-disappears cleanly) Undetectable on block explorers after expiry It’s the smartest, safest way to simulate high-value transactions without real crypto.

🛠️ Flash USDT Software – Your Own USDT Flasher at Your Fingertips Want to control the flash? Run your own operations? Flash unlimited wallets?

🔗 Buy Flash USDT Software

This is your all-in-one USDT flasher tool, built for TRC20, ERC20, and BEP20 chains. It gives you full control to:

Send custom USDT amounts Set custom expiry time (e.g., 30–360 days) Flash multiple wallets Choose between networks (Tron, ETH, BSC) You can simulate any amount, to any supported wallet, from your own system.

No third-party access. No blockchain fee. No trace left behind.

💥 Why Our Flash USDT & Software Stands Out Feature Flash USDT Flash USDT Software One-time flash send ✅ Yes Optional Full sender control ❌ No ✅ Yes TRC20 / ERC20 / BEP20 ✅ Yes ✅ Yes Custom duration/expiry Limited ✅ Yes Unlimited usage ❌ One-off ✅ Yes Whether you’re flashing for wallet testing, demoing investor dashboards, or simulating balance flows, our tools deliver realism without risk.

🛒 Ready to Buy Flash USDT or the Software? Skip the wait. Skip the scammers. You’re one click away from real control.

👉 Buy Flash USDT 👉 Buy Flash USDT Software

📞 Support or live walkthrough?

💬 Telegram: @cryptoflashingtool 📱 WhatsApp: +1 770-666-2531

🚫 Legal Notice These tools are intended for:

Educational purposes Demo environments Wallet and UI testing They are not for illegal use or financial deception. Any misuse is your full responsibility.

Final Call: Need to flash USDT? Want full control? Don’t wait for another “maybe” tool.

Get your Flash USDT or Flashing Software today and simulate like a pro.

🔗 Buy Now → Flash USDT 🔗 Buy Now → Flash USDT Software 💬 Telegram: @cryptoflashingtool 📱 WhatsApp: +1 770-666-2531Looking to simulate a USDT deposit that appears instantly in a wallet — with no blockchain confirmation, no real spend, and no trace?

You’re in the right place.

Buy Flash USDT Now\ This product sends Flash USDT directly to your TRC20, ERC20, or BEP20 wallet address — appears like a real deposit, but disappears after a set time or block depth.

Perfect for:

- Simulating token inflows

- Wallet stress testing

- “Proof of funds” display

Flash USDT is ideal for developers, trainers, UI testers, and blockchain researchers — and it’s fully customizable.

What Is Flash USDT?

Flash USDT is a synthetic transaction that mimics a real Tether transfer. It shows up instantly in a wallet balance, and it’s confirmed on-chain — and expires after a set duration.

This makes it:

- Visible on wallet interfaces

- Time-limited (auto-disappears cleanly)

- Undetectable on block explorers after expiry

It’s the smartest, safest way to simulate high-value transactions without real crypto.

Flash USDT Software – Your Own USDT Flasher at Your Fingertips

Want to control the flash?\ Run your own operations?\ Flash unlimited wallets?

This is your all-in-one USDT flasher tool, built for TRC20, ERC20, and BEP20 chains. It gives you full control to:

- Send custom USDT amounts

- Set custom expiry time (e.g., 30–360 days)

- Flash multiple wallets

- Choose between networks (Tron, ETH, BSC)

You can simulate any amount, to any supported wallet, from your own system.

No third-party access.\ No blockchain fee.\ No trace left behind.

Why Our Flash USDT & Software Stands Out

Feature

Flash USDT

Flash USDT Software

One-time flash send

Yes

Optional

Full sender control

No

Yes

TRC20 / ERC20 / BEP20

Yes

Yes

Custom duration/expiry

Limited

Yes

Unlimited usage

One-off

Yes

Whether you’re flashing for wallet testing, demoing investor dashboards, or simulating balance flows, our tools deliver realism without risk.

Ready to Buy Flash USDT or the Software?

Skip the wait. Skip the scammers.\ You’re one click away from real control.

Support or live walkthrough?

Telegram: @cryptoflashingtool

WhatsApp: +1 770-666-2531

Legal Notice

These tools are intended for:

- Educational purposes

- Demo environments

- Wallet and UI testing

They are not for illegal use or financial deception. Any misuse is your full responsibility.

Final Call:

Need to flash USDT? Want full control?\ Don’t wait for another “maybe” tool.

Get your Flash USDT or Flashing Software today and simulate like a pro.

Telegram: @cryptoflashingtool

WhatsApp: +1 770-666-2531

-

@ dfa02707:41ca50e3

2025-06-07 13:01:49

@ dfa02707:41ca50e3

2025-06-07 13:01:49

Good morning (good night?)! The No Bullshit Bitcoin news feed is now available on Moody's Dashboard! A huge shoutout to sir Clark Moody for integrating our feed.

Headlines

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- The Bank for International Settlements (BIS) wants to contain 'crypto' risks. A report titled "Cryptocurrencies and Decentralised Finance: Functions and Financial Stability Implications" calls for expanding research into "how new forms of central bank money, capital controls, and taxation policies can counter the risks of widespread crypto adoption while still fostering technological innovation."

- "Global Implications of Scam Centres, Underground Banking, and Illicit Online Marketplaces in Southeast Asia." According to the United Nations Office on Drugs and Crime (UNODC) report, criminal organizations from East and Southeast Asia are swiftly extending their global reach. These groups are moving beyond traditional scams and trafficking, creating sophisticated online networks that include unlicensed cryptocurrency exchanges, encrypted communication platforms, and stablecoins, fueling a massive fraud economy on an industrial scale.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

Use the tools

- Bitcoin Safe v1.2.3 expands QR SignMessage compatibility for all QR-UR-compatible hardware signers (SpecterDIY, KeyStone, Passport, Jade; already supported COLDCARD Q). It also adds the ability to import wallets via QR, ensuring compatibility with Keystone's latest firmware (2.0.6), alongside other improvements.

- Minibits v0.2.2-beta, an ecash wallet for Android devices, packages many changes to align the project with the planned iOS app release. New features and improvements include the ability to lock ecash to a receiver's pubkey, faster confirmations of ecash minting and payments thanks to WebSockets, UI-related fixes, and more.

- Zeus v0.11.0-alpha1 introduces Cashu wallets tied to embedded LND wallets. Navigate to Settings > Ecash to enable it. Other wallet types can still sweep funds from Cashu tokens. Zeus Pay now supports Cashu address types in Zaplocker, Cashu, and NWC modes.

- LNDg v1.10.0, an advanced web interface designed for analyzing Lightning Network Daemon (LND) data and automating node management tasks, introduces performance improvements, adds a new metrics page for unprofitable and stuck channels, and displays warnings for batch openings. The Profit and Loss Chart has been updated to include on-chain costs. Advanced settings have been added for users who would like their channel database size to be read remotely (the default remains local). Additionally, the AutoFees tool now uses aggregated pubkey metrics for multiple channels with the same peer.

- Nunchuk Desktop v1.9.45 release brings the latest bug fixes and improvements.

- Blockstream Green iOS v4.1.8 has renamed L-BTC to LBTC, and improves translations of notifications, login time, and background payments.

- Blockstream Green Android v4.1.8 has added language preference in App Settings and enables an Android data backup option for disaster recovery. Additionally, it fixes issues with Jade entry point PIN timeout and Trezor passphrase input.

- Torq v2.2.2, an advanced Lightning node management software designed to handle large nodes with over 1000 channels, fixes bugs that caused channel balance to not be updated in some cases and channel "peer total local balance" not getting updated.

- Stack Wallet v2.1.12, a multicoin wallet by Cypher Stack, fixes an issue with Xelis introduced in the latest release for Windows.

- ESP-Miner-NerdQAxePlus v1.0.29.1, a forked version from the NerdAxe miner that was modified for use on the NerdQAxe+, is now available.

- Zark enables sending sats to an npub using Bark.

- Erk is a novel variation of the Ark protocol that completely removes the need for user interactivity in rounds, addressing one of Ark's key limitations: the requirement for users to come online before their VTXOs expire.

- Aegis v0.1.1 is now available. It is a Nostr event signer app for iOS devices.

- Nostash is a NIP-07 Nostr signing extension for Safari. It is a fork of Nostore and is maintained by Terry Yiu. Available on iOS TestFlight.

- Amber v3.2.8, a Nostr event signer for Android, delivers the latest fixes and improvements.

- Nostur v1.20.0, a Nostr client for iOS, adds

-

@ dfa02707:41ca50e3

2025-06-07 13:01:49

@ dfa02707:41ca50e3

2025-06-07 13:01:49Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-06-07 13:01:47

@ dfa02707:41ca50e3

2025-06-07 13:01:47Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ dfa02707:41ca50e3

2025-06-07 13:01:47

@ dfa02707:41ca50e3

2025-06-07 13:01:47Contribute to keep No Bullshit Bitcoin news going.

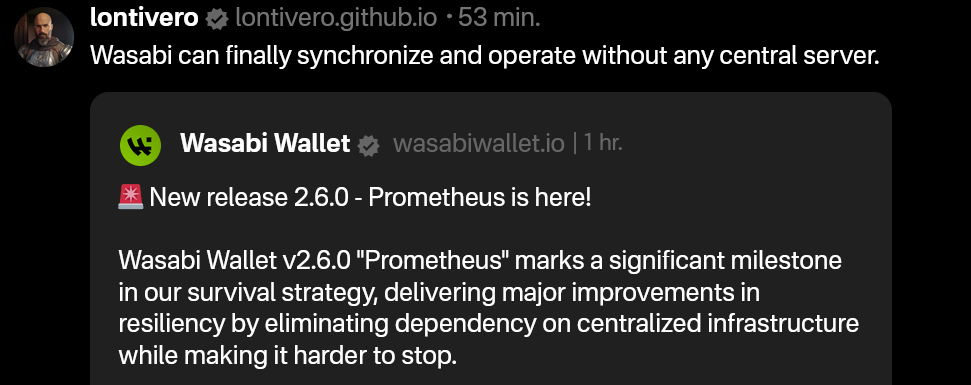

- Wasabi Wallet v2.6.0 "Prometheus" is a major update for the project, focused on resilience and independence from centralized systems.

- Key features include support for BIP 158 block filters for direct node synchronization, a revamped full node integration for easier setup without third-party reliance, SLIP 39 share backups for flexible wallet recovery (sponsored by Trezor), and a Nostr-based update manager for censorship-resistant updates.

- Additional improvements include UI bug fixes, a new fallback for transaction broadcasting, updated code signing, stricter JSON serialization, and options to avoid third-party rate providers, alongside various under-the-hood enhancements.

This new version brings us closer to our ultimate goal: ensuring Wasabi is future-proof," said the developers, while also highlighting the following key areas of focus for the project:

- Ensuring users can always fully and securely use their client.

- Making contribution and forks easy through a codebase of the highest quality possible: understandable, maintainable, and improvable.

"As we achieve our survival goals, expect more cutting-edge improvements in Bitcoin privacy and self-custody. Thank you for the trust you place in us by using Wasabi," was stated in the release notes.

What's new

- Support for Standard BIP 158 Block Filters. Wasabi now syncs using BIP 158 filters without a backend/indexer, connecting directly to a user's node. This boosts sync speed, resilience, and allows full sovereignty without specific server dependency.

- Full Node Integration Rework. The old integration has been replaced with a simpler, more adaptable system. It’s not tied to a specific Bitcoin node fork, doesn’t need the node on the same machine as Wasabi, and requires no changes to the node’s setup.

- "Simply enable the RPC server on your node and point Wasabi to it," said the developers. This ensures all Bitcoin network activities—like retrieving blocks, fee estimations, block filters, and transaction broadcasting—go through your own node, avoiding reliance on third parties.

- Create & Recover SLIP 39 Shares. Users now create and recover wallets with multiple share backups using SLIP 39 standard.

"Special thanks to Trezor (SatoshiLabs) for sponsoring this amazing feature."

- Nostr Update Manager. This version implements a pioneering system with the Nostr protocol for update information and downloads, replacing reliance on GitHub. This enhances the project's resilience, ensuring updates even if GitHub is unavailable, while still verifying updates with the project's secure certificate.

- Updated Avalonia to v11.2.7, fixes for UI bugs (including restoring Minimize on macOS Sequoia).

- Added a configurable third-party fallback for broadcasting transactions if other methods fail.

- Replaced Windows Code Signing Certificate with Azure Trusted Signing.

- Many bug fixes, improved codebase, and enhanced CI pipeline.

- Added the option to avoid using any third-party Exchange Rate and Fee Rate providers (Wasabi can work without them).

- Rebuilt all JSON Serialization mechanisms avoiding default .NET converters. Serialization is now stricter.

Full Changelog: v2.5.1...v2.6.0

-

@ dfa02707:41ca50e3

2025-06-07 13:01:46

@ dfa02707:41ca50e3

2025-06-07 13:01:46Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ dfa02707:41ca50e3

2025-06-07 13:01:45

@ dfa02707:41ca50e3

2025-06-07 13:01:45Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ dfa02707:41ca50e3

2025-06-07 12:02:39

@ dfa02707:41ca50e3

2025-06-07 12:02:39Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-06-07 13:01:45

@ dfa02707:41ca50e3

2025-06-07 13:01:45- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ b1ddb4d7:471244e7

2025-06-07 13:01:07

@ b1ddb4d7:471244e7

2025-06-07 13:01:07When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ 8bad92c3:ca714aa5

2025-06-07 13:01:44

@ 8bad92c3:ca714aa5

2025-06-07 13:01:44Key Takeaways

In this episode of TFTC, energy economist Anas Alhajji outlines a profound shift in U.S. foreign policy under Trump—away from military intervention and toward transactional diplomacy focused on trade, reconstruction, and curbing Chinese and Russian influence in the Middle East. He highlights Trump’s quiet outreach to Syria as emblematic of the U.S.'s strategic flexibility in legitimizing former adversaries when economically beneficial. Alhajji dismisses BRICS as a fractured bloc incapable of rivaling the U.S.-led order and insists the dollar and petrodollar remain dominant. On energy, he warns that despite favorable fundamentals, prices are suppressed by political confusion, underinvestment, and an aging power grid ill-prepared for the AI and urbanization boom. He also contends that Iran is stalling negotiations to buy time for nuclear advancement and that any deal will be superficial. Finally, Alhajji debunks the myth of Trump being pro-oil, noting his long-standing hostility toward the industry and explaining why a repeat of his past energy boom is implausible given today’s financial and structural constraints.

Best Quotes

- “BRICS is a paper tiger. Everything about BRICS is what China does—and that’s it.”

- “The dollar is here to stay. The petrodollar is here to stay. End of story.”

- “Trump hates the oil industry. He always classified it as an enemy.”

- “Energy projects are 30- to 40-year investments, but politicians think in 4-year cycles. That’s where the disconnect lies.”

- “People think shale will boom again. It won’t. The model changed from ‘drill baby drill’ to ‘control baby control.’”

- “The real story of Trump’s trip wasn’t about politics—it was investment, investment, investment.”

- “Without massive investment in the grid and gas turbines, blackouts will become the norm—even in rich countries like Kuwait.”

- “Iran and China have perfected the game of oil exports. Sanctions are just theater at this point.”

Conclusion

Anas Alhajji’s conclusion challenges conventional narratives, arguing that global power is shifting from military dominance to economic leverage, infrastructure investment, and energy control. He presents a nuanced view of U.S. foreign policy under Trump, emphasizing the strategic importance of trade and reconstruction over regime change. As energy demand soars and geopolitical risks mount, Alhajji warns that the real dangers lie not in foreign adversaries, but in policy confusion, infrastructural lag, and complacency—making this episode a crucial listen for anyone seeking to understand the high-stakes intersection of energy, economics, and diplomacy.

Timestamps

0:00 - Intro

0:48 - Syria and US diplomacy in Middle East

12:50 - Trump in the Middle East

18:12 - Fold & Bitkey

19:48 - Iran - Nuclear program and PR

33:53 - Unchained

34:22 - Crude markets, trade war and US debt

54:28 - Trump's energy stance

1:05:46 - Energy sector challanges

1:14:44 - Policy recommendations

1:21:18 - AI and bitcoinTranscript

(00:00) oil prices market fundamentals support higher price than where we are today. But because of this confusion, everyone is scared of low economic growth and that is a serious problem. The US media ignored part of Trump's speech when he said we are not about nation building and they refer to Afghanistan and Iraq.

(00:15) Look at them. This is a criticism of George W. Bush. We have groups that are talking about the demise of the dollar, the rise of bricks. Bricks is a paper tiger. Everything about bricks is what China does and that's it. The dollar is here to stay and the petro dollar is here to stay.

(00:31) The perception is that the Trump administration is cold but the reality Trump hates the oil [Music] indust. How are you? Very good. Very good. Thank you. As you were telling me, you've been a bit sleepd deprived this week trying to keep up with what's going on. Oh, absolutely. I mean, Trump keeps us on our toes uh all the time.

(01:06) In fact, I plan certain things for the weekend and Trump will say something or he will do something and all of a sudden we get busy again. Uh so clients are not going to wait for you until you finish your work. Basically, they want to know what's going on. So what is going on? What what how profound were the events in the Middle East? These are very uh very profound changes basically because it is very clear that if you look at the last 15 years uh and you look at the growth uh in the Middle East, you look at the growth of Saudi Arabia and uh the

(01:41) role of Turkey for example in the region uh it just just amazing be beyond any uh any thoughts. Uh in fact both of them Turkey and Saudi Arabia are part of the G20. Uh so they have economic influence and they have political influence. And of course the icing on the cake for those who are familiar with the region is to recognize the Syrian government and meet with the Syrian uh president.

(02:11) Uh this is a major a major change in economics and politics uh of the Middle East. Let's touch on that Syria uh topic for a while because I think a lot of people here in the United States were a bit shocked at how sort of welcoming President Trump was towards the new Syrian president considering the fact that uh he was considered an enemy not too long ago here in the United States.

(02:42) What first of all it's a fact of life for those who would like to check the history of politics. There were many people around the world who were classified or they were on the terrorism list and then they became friends of the United States or they were became heroes. I mean Nelson Mandela is one of them. You look at Latin America, there are presidents in Latin America who were uh the enemy of the United States and then they became uh uh cooperative with the United States and the United States recognized their governments and the result of their uh elections. Uh so

(03:15) we've seen this historically uh several uh several times around the world and as they say freedom fighters for some basically are the enemies and the terrorists for for others etc. So uh what we've seen that's why the the visit is very important that the recognition of this government is very important. uh the fact on the ground that uh the president of Syria had the power on the ground uh he had the the the people on the ground and he had the control on the ground and whatever he's been he's been doing since he came into power until now

(03:52) he done all the right steps u and people loved him I mean everyone who went to Syria whether the Syrians who left Syria 40 years ago or uh the visitors who are coming to Syria, they will tell you, "We have never seen the Syrian people as happy as we've seen them today, despite the fact that they they live in misery.

(04:17) They don't have um 8 million people without housing. Uh there is barely any electricity in most of the country. There is no internet. There is barely any food. The uh inflation is rampant, etc. But people are happy because they lived in fear for a very long time. And uh the steps they have taken. For example, the uh ministers in the previous government uh are still there and they are still in the housing of the government.

(04:49) They still have the drivers. They still have the cars from the previous government. They still have it until today. So uh they they were classified as enemies before. But all of a sudden now you have a new government that is uh accepting them. Uh so we we see some changes on the ground that are positive and we'll see how these things will go given that the area around them basically has been unstable for a very long time.

(05:17) how because I don't the the news when I was actually it was surreal for me because my first trip to the Middle East was last December when it was literally f flying over Syria to Abu Dhabi when uh um Assad was getting thrown out and it was pretty surreal to be in that region of the world.

(05:43) How as it pertains to like religious minorities within Syria moving forward is there protractions protections there? Um well let me just uh I want to emphasize one point that is very important. What did the interest of Turkey, Saudi Arabia and the United States in Syria if remember Syria was controlled by Iran and was controlled by the Russians.

(06:09) So in a sense it becomes uh kind of an imperative that taking it away from Iran and Russia and not bringing Iran or Russia back is extremely important. Now the Russians are still there and they have their own base but at least they are not bombing the Syrians and not killing them anymore. But the idea here is taking Syria out of Iran and Russia and probably later on if they kick the Russians out, Russians will not have access to the Mediterranean.

(06:37) Uh so there is an interest uh of all parties basically to take Russia out of Iran and um out of uh Syria regardless the country is uh devastated and it creates massive opportunities for US companies on all levels and uh we've seen a contract uh done recently with you mentioned Abu Dhabi uh uh a contract uh uh with the UA a basically to revamp all the Syrian ports and work on the Syrian ports.

(07:13) Uh so such contracts basically uh when you have a country that has nothing and it's completely devastated the whole infrastructure is devastated. Who is going to build it? If the uh what the Chinese, the Russians, so who who are going to build it? So, uh I think there is a a big room for US companies and others basically to come in and uh literally help on one side and make money on the other.

(07:38) Yeah, I think that that's what I'm trying to discern. What was this convoy from the United States to the Middle East this week signali -

@ 8bad92c3:ca714aa5

2025-06-07 13:01:41

@ 8bad92c3:ca714aa5

2025-06-07 13:01:41MicroStrategy's Debt-Financed Bitcoin Strategy Will Force a Reckoning Within 18 Months - Jessy Gilger

Jessy Gilger from Unchained Capital warned about the sustainability of MicroStrategy's model and its derivatives like MSTY. He predicts that as more companies adopt Bitcoin treasury strategies, "the P&L will matter more as the balance sheet gets commoditized." Within the next 18 months, he expects the current arbitrage opportunities that MicroStrategy exploits will diminish as Bitcoin reaches higher liquidity levels and more competitors enter the space.

His most concerning prediction involves MSTY specifically, which currently offers distributions annualized at 120% - far exceeding the 16-22% he calculates as reasonable from covered call strategies. "If a whale wants out of MSTY in size... they could sell those derivative positions into an illiquid market where there's no bid," potentially causing a 95% collapse similar to what happened with gold mining ETFs during COVID. He advises investors to consider "private pools" for options strategies rather than pooled products where "you're in the pool with everyone else" and subject to forced liquidations.

Pensions Will Drive the Next Major Bitcoin Adoption Wave in 2026-2027 - Adam Back

Adam Back sees institutional adoption accelerating dramatically as pension funds begin allocating to Bitcoin. "The institutional cover of some of the bigger entities that people would reference... you don't get fired for following BlackRock's recommendation," he explained. With BlackRock now suggesting 2% portfolio allocations and the infrastructure finally in place through Blockstream's new Gannett Trust Company, the barriers for institutional adoption are falling rapidly.

Back predicts this will create a "snowball" effect as pension funds realize Bitcoin can help address their massive unfunded liabilities. He noted that financial institutions offering Bitcoin products are "slow movers" with "policies and training materials and guidance that they got to get through," but once activated, the scale will dwarf current retail and ETF flows. The combination of pension fund allocations, continued nation-state adoption, and the mathematical scarcity of Bitcoin leads him to view even $100,000 as "cheap" given where the market is headed.

Traditional Bond Markets Will Collapse as Bitcoin Becomes the Escape Hatch - Sean Bill

Sean Bill sees a massive shift coming as bond markets deteriorate globally. "You peel back the onion. So who benefits from financial repression, right. And inflating your way out of assets," he explained. With Japanese bond yields blowing out and U.S. 30-year yields jumping 10 basis points in a single day, Bill predicts we're witnessing the early stages of a sovereign debt crisis that will drive unprecedented flows into Bitcoin.

He pointed to Japan's MetaPlanet as a preview of what's coming: "The whole bond market of Japan just flowed into a hotel company." As pension funds and institutions realize they can't meet obligations through traditional fixed income, Bitcoin will become the only viable alternative. Bill believes this transition will accelerate once fiduciaries understand Bitcoin's role as "pristine collateral" that can help them "chip away at those unfunded liabilities." His experience getting Santa Clara County's pension into Bitcoin in 2021 showed him firsthand how a 1-3% allocation at $17,000 could have "wiped out the unfunded liability" as Bitcoin approached $100,000.

Adam Back & Sean Bill Podcast Here

Blockspace conducts cutting-edge proprietary research for investors.

New Bitcoin Mining Pool Flips Industry Model: "Plebs Eat First" Could Threaten Corporate Dominance

UTXO Management's explosive report forecasts unprecedented institutional demand that could absorb 20% of Bitcoin's circulating supply by 2026. Bitcoin ETFs shattered records with $36.2 billion in year-one inflows, crushing every commodity ETF launch—and they're projected to hit $100 billion annually by 2027.

The real story? ETFs are just the appetizer. Five massive catalysts are converging: wealth platforms eyeing $120 billion from a modest 0.5% allocation across $60 trillion AUM; corporations following MicroStrategy's playbook now holding 803,143 BTC; potential U.S. Strategic Reserve of 1 million BTC; 13 states with active Bitcoin reserve bills; and the rise of BTCfi yield strategies offering 2-15% returns.

The game-changer: these aren't day traders. CFOs, treasurers, and governments are structurally locked buyers seeking BTC-denominated yields, not quick profits. With FASB mark-to-market accounting removing impairment headaches and regulatory clarity accelerating globally, institutions face a stark reality—allocate now or chase exposure at dramatically higher prices.

This isn't another cycle. It's the institutional colonization of Bitcoin.

Subscribe to them here (seriously, you should): https://newsletter.blockspacemedia.com/

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

STACK SATS hat: https://tftcmerch.io/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ 8bad92c3:ca714aa5

2025-06-07 13:01:39

@ 8bad92c3:ca714aa5

2025-06-07 13:01:39Marty's Bent

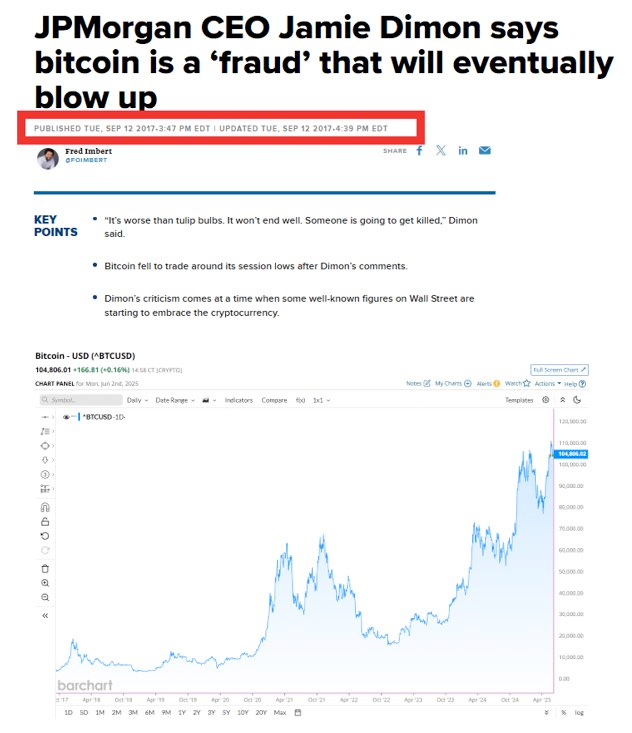

J.P. Morgan CEO Jamie Dimon has long been an outspoken skeptic and critic of bitcoin. He has called Bitcoin a speculative asset, a fraud, a pet rock, and has opined that it will inevitably blow up. A couple of years ago, he was on Capitol Hill saying that if he were the government, he would "close it down". Just within the last month, he was on Fox Business News talking with Maria Bartiromo, proclaiming that the U.S. should be stockpiling bullets and rare earth metals instead of bitcoin. It's pretty clear that Jamie Dimon, who is at the helm of the most powerful and largest bank in the world, does not like bitcoin one bit.

Evidence below:

via Bitcoin Magazine

via me

via CNBC

Despite Dimon's distinguished disdain for Bitcoin, J.P. Morgan cannot deny reality. The CEO of the largest bank in the world is certainly a powerful man, but no one individual, even in the position that Jamie Dimon is in, is more powerful than the market. And the market has spoken very clearly, it is demanding bitcoin. The Bitcoin ETFs have been the most successful ETFs in terms of pace of growth since their launch. They've accumulated tens of billions of dollars in AUM in a very short period of time. Outpacing the previous record set by the gold ETF, GLD.

Whether or not Jamie Dimon himself likes Bitcoin doesn't matter. J.P. Morgan, as the largest bank in the world and a publicly traded company, has a duty to shareholders. And that duty is to increase shareholder value by any ethical and legal means necessary. Earlier today, J.P. Morgan announced plans to offer clients financing against their Bitcoin ETFs, as well as some other benefits, including having their bitcoin holdings recognized in their overall net worth and liquid assets, similar to stocks, cars, and art, which will be massive for bitcoiners looking to get mortgages and other types of loans.

via Bloomberg

I've talked about this recently, but trying to buy a house when most of your liquid net worth is held in bitcoin is a massive pain in the ass. Up until this point, if you wanted to have your bitcoin recognized as part of your net worth and count towards your overall credit profile, you would need to sell some bitcoin, move it to a bank account, and have it sit there for a certain period of time before it was recognized toward your net worth. This is not ideal for bitcoiners who have sufficient cash flows and don't want to sell their bitcoin, pay the capital gains tax, and risk not being able to buy back the amount of sats they were forced to sell just to get a mortgage.

It's not yet clear to me whether or not J.P. Morgan will recognize bitcoin in cold storage toward their clients' net worth and credit profile, or if this is simply for bitcoin ETFs only. However, regardless, this is a step in the right direction and a validation of something that many bitcoiners have been saying for years. Inevitably, everyone will have to bend the knee to bitcoin. Today, it just happened to be the largest bank in the world. I expect more of this to come in the coming months, years, and decades.

Lyn Alden likes to say it in the context of the U.S. national debt and the fiscal crisis, but it also applies to bitcoin adoption and the need for incumbents to orient themselves around the demands of individual bitcoiners; nothing stops this train.

Real Estate Correction Coming

Real estate expert Leon Wankum shared his perspective on why property prices need to find a new equilibrium by 2026. He pointed to the 18-year property cycle theory, noting we're at the end of the current cycle with a massive imbalance - 34% more sellers than buyers, the highest gap since records began in 2013. Leon explained that sellers still have unrealistic expectations based on 2021-2022 peaks, while buyers face a fundamentally different reality with higher borrowing costs.

"We need a price equilibrium. We need demand and supply prices to match. It's going to take a long time, I think." - Leon Wankum

Leon doesn't expect a catastrophic crash, however. He emphasized that the financial system depends too heavily on real estate as collateral for authorities to allow a complete collapse. With interest rates likely staying above 3% to combat inflation, he sees a healthy correction rather than devastation - a necessary adjustment that creates opportunities for patient buyers who understand the new market dynamics.

Check out the full podcast here for more on Bitcoin treasury strategies, dual collateralization, and corporate BTC adoption

Headlines of the Day

California May Seize Idle Bitcoin After 3 Years - via X

Semler Scientific Buys $20M More Bitcoin, Holds $467M - via X

US Home Sellers Surge as Buyers Hit 4-Year Low - via X

Get our new STACK SATS hat - via tftcmerch.io

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code *“TFTC20”* during checkout for 20% off