-

@ 32e18276:5c68e245

2023-12-06 15:29:43

@ 32e18276:5c68e245

2023-12-06 15:29:43I’m going to be on an ordinals panels as one of the people who is counter arguing the claim that they are good for bitcoin. I decided to brush up on the technicals on how inscriptions work. I am starting to see luke’s perspective on how it is exploiting a loophole in bitcoin’s anti-data-spam mechanisms.

Storing data in Bitcoin, the “standard” way

The standard way you add “data” to bitcoin is by calling the OP_RETURN opcode. Bitcoin devs noticed that people were storing data (like the bitcoin whitepaper) in the utxo set via large multisig transactions. The problem with this is that this set is unprunable and could grow over time. OP_RETURN outputs on the other-hand are provably prunable and don’t add to utxo bloat.

Here’s an excerpt from the march 2014 0.9.0 release notes that talks about this:

On OP_RETURN: There was been some confusion and misunderstanding in the community, regarding the OP_RETURN feature in 0.9 and data in the blockchain. This change is not an endorsement of storing data in the blockchain. The OP_RETURN change creates a provably-prunable output, to avoid data storage schemes – some of which were already deployed – that were storing arbitrary data such as images as forever-unspendable TX outputs, bloating bitcoin’s UTXO database. Storing arbitrary data in the blockchain is still a bad idea; it is less costly and far more efficient to store non-currency data elsewhere.

Much of the work on bitcoin core has been focused on making sure the system continues to function in a decentralized way for its intended purpose in the presence of people trying to abuse it for things like storing data. Bitcoin core has always discouraged this, as it is not designed for storage of images and data, it is meant for moving digital coins around in cyberspace.

To help incentive-align people to not do stupid things, OP_RETURN transactions were not made non-standard, so that they are relayable by peers and miners, but with the caveat:

- They can only push 40 bytes (later increased to 80,83, I’m guessing to support larger root merkle hashes since that is the only sane usecase for op_return)

Bitcoin also added an option called -datacarriersize which limits the total number of bytes from these outputs that you will relay or mine.

Why inscriptions are technically an exploit

Inscriptions get around the datacarriersize limit by disguising data as bitcoin script program data via OP_PUSH inside OP_IF blocks. Ordinals do not use OP_RETURN and are not subjected to datacarriersize limits, so noderunners and miners currently have limited control over the total size of this data that they wish to relay and include in blocks. Luke’s fork of bitcoin-core has some options to fight this spam, so hopefully we will see this in core sometime soon as well.

Inscriptions are also taking advantage of features in segwit v1 (witness discount) and v2/taproot (no arbitrary script size limit). Each of these features have interesting and well-justified reasons why they were introduced.

The purpose of the witness discount was to make it cheaper to spend many outputs which helps the reduction of the utxo set size. Inscriptions took advantage of this discount to store monke jpegs disguised as bitcoin scripts. Remember, bitcoin is not for storing data, so anytime bitcoin-devs accidentally make it cheap and easy to relay data then this should be viewed as an exploit. Expect it to be fixed, or at least provide tools to noderunners for fighting this spam.

Where do we go from here

The interesting part of this story is that people seem to attach value to images stored on the bitcoin blockchain, and they are willing to pay the fee to get it in the block, so non-ideologic miners and people who don’t care about the health and decentralization of bitcoin are happy to pay or collect the fee and move on.

Data should not get a discount, people should pay full price if they want to store data. They should just use op_return and hashes like opentimestamps or any other reasonable protocol storing data in bitcoin.

After going through this analysis I’ve come to the opinion that this is a pretty bad data-spam exploit and bitcoin devs should be working on solutions. Ideological devs like luke who actually care about the health and decentralization of the network are and I’m glad to see it.

-

@ 23b0e2f8:d8af76fc

2025-01-08 18:17:52

@ 23b0e2f8:d8af76fc

2025-01-08 18:17:52Necessário

- Um Android que você não use mais (a câmera deve estar funcionando).

- Um cartão microSD (opcional, usado apenas uma vez).

- Um dispositivo para acompanhar seus fundos (provavelmente você já tem um).

Algumas coisas que você precisa saber

- O dispositivo servirá como um assinador. Qualquer movimentação só será efetuada após ser assinada por ele.

- O cartão microSD será usado para transferir o APK do Electrum e garantir que o aparelho não terá contato com outras fontes de dados externas após sua formatação. Contudo, é possível usar um cabo USB para o mesmo propósito.

- A ideia é deixar sua chave privada em um dispositivo offline, que ficará desligado em 99% do tempo. Você poderá acompanhar seus fundos em outro dispositivo conectado à internet, como seu celular ou computador pessoal.

O tutorial será dividido em dois módulos:

- Módulo 1 - Criando uma carteira fria/assinador.

- Módulo 2 - Configurando um dispositivo para visualizar seus fundos e assinando transações com o assinador.

No final, teremos:

- Uma carteira fria que também servirá como assinador.

- Um dispositivo para acompanhar os fundos da carteira.

Módulo 1 - Criando uma carteira fria/assinador

-

Baixe o APK do Electrum na aba de downloads em https://electrum.org/. Fique à vontade para verificar as assinaturas do software, garantindo sua autenticidade.

-

Formate o cartão microSD e coloque o APK do Electrum nele. Caso não tenha um cartão microSD, pule este passo.

- Retire os chips e acessórios do aparelho que será usado como assinador, formate-o e aguarde a inicialização.

- Durante a inicialização, pule a etapa de conexão ao Wi-Fi e rejeite todas as solicitações de conexão. Após isso, você pode desinstalar aplicativos desnecessários, pois precisará apenas do Electrum. Certifique-se de que Wi-Fi, Bluetooth e dados móveis estejam desligados. Você também pode ativar o modo avião.\ (Curiosidade: algumas pessoas optam por abrir o aparelho e danificar a antena do Wi-Fi/Bluetooth, impossibilitando essas funcionalidades.)

- Insira o cartão microSD com o APK do Electrum no dispositivo e instale-o. Será necessário permitir instalações de fontes não oficiais.

- No Electrum, crie uma carteira padrão e gere suas palavras-chave (seed). Anote-as em um local seguro. Caso algo aconteça com seu assinador, essas palavras permitirão o acesso aos seus fundos novamente. (Aqui entra seu método pessoal de backup.)

Módulo 2 - Configurando um dispositivo para visualizar seus fundos e assinando transações com o assinador.

-

Criar uma carteira somente leitura em outro dispositivo, como seu celular ou computador pessoal, é uma etapa bastante simples. Para este tutorial, usaremos outro smartphone Android com Electrum. Instale o Electrum a partir da aba de downloads em https://electrum.org/ ou da própria Play Store. (ATENÇÃO: O Electrum não existe oficialmente para iPhone. Desconfie se encontrar algum.)

-

Após instalar o Electrum, crie uma carteira padrão, mas desta vez escolha a opção Usar uma chave mestra.

- Agora, no assinador que criamos no primeiro módulo, exporte sua chave pública: vá em Carteira > Detalhes da carteira > Compartilhar chave mestra pública.

-

Escaneie o QR gerado da chave pública com o dispositivo de consulta. Assim, ele poderá acompanhar seus fundos, mas sem permissão para movimentá-los.

-

Para receber fundos, envie Bitcoin para um dos endereços gerados pela sua carteira: Carteira > Addresses/Coins.

-

Para movimentar fundos, crie uma transação no dispositivo de consulta. Como ele não possui a chave privada, será necessário assiná-la com o dispositivo assinador.

- No assinador, escaneie a transação não assinada, confirme os detalhes, assine e compartilhe. Será gerado outro QR, desta vez com a transação já assinada.

- No dispositivo de consulta, escaneie o QR da transação assinada e transmita-a para a rede.

Conclusão

Pontos positivos do setup:

- Simplicidade: Basta um dispositivo Android antigo.

- Flexibilidade: Funciona como uma ótima carteira fria, ideal para holders.

Pontos negativos do setup:

- Padronização: Não utiliza seeds no padrão BIP-39, você sempre precisará usar o electrum.

- Interface: A aparência do Electrum pode parecer antiquada para alguns usuários.

Nesse ponto, temos uma carteira fria que também serve para assinar transações. O fluxo de assinar uma transação se torna: Gerar uma transação não assinada > Escanear o QR da transação não assinada > Conferir e assinar essa transação com o assinador > Gerar QR da transação assinada > Escanear a transação assinada com qualquer outro dispositivo que possa transmiti-la para a rede.

Como alguns devem saber, uma transação assinada de Bitcoin é praticamente impossível de ser fraudada. Em um cenário catastrófico, você pode mesmo que sem internet, repassar essa transação assinada para alguém que tenha acesso à rede por qualquer meio de comunicação. Mesmo que não queiramos que isso aconteça um dia, esse setup acaba por tornar essa prática possível.

-

@ f9c0ea75:44e849f4

2025-01-08 18:15:47

@ f9c0ea75:44e849f4

2025-01-08 18:15:47Nos anos 80, o Brasil testemunhou um dos momentos mais patéticos da sua história econômica: os "Fiscais do Sarney". Movidos por um decreto inútil, cidadãos foram incentivados a denunciar comerciantes que não seguissem o tabelamento de preços imposto pelo governo. O resultado? Um fracasso absoluto, prateleiras vazias, inflação descontrolada e a certeza de que a mentalidade fiscalizadora não gera valor para ninguém – apenas sufoca a economia e reforça o atraso.

Agora, décadas depois, vemos a mesma mentalidade derrotada ressurgir na Receita Federal com a fiscalização automática sobre transações acima de R$ 5.000 via PIX. Em vez de buscar um ambiente mais produtivo e inovador, o governo se empenha em monitorar cada centavo que circula, tratando qualquer movimentação um pouco maior como suspeita. Quem ganha com isso? Certamente não é o cidadão honesto, nem a economia real.

E quem são os protagonistas dessa história? Os novos fiscais da Receita Federal, que assumem um papel tão irrelevante quanto o dos fiscais de Sarney. Um trabalho de baixo valor agregado, que não contribui para a criação de riqueza ou inovação. São apenas burocratas modernos, presos na mentalidade de que controlar e punir é mais importante do que fomentar o crescimento e a liberdade financeira.

A história já provou que o fiscalismo estatal é um modelo falido, seja tabelando preços ou perseguindo transações financeiras. Enquanto alguns criam, inovam e geram valor, outros se ocupam apenas de vigiar e tributar. O tempo sempre mostrou quem estava certo.

Nos anos 80, o Brasil testemunhou um dos momentos mais patéticos da sua história econômica: os "Fiscais do Sarney". Movidos por um decreto inútil, cidadãos foram incentivados a denunciar comerciantes que não seguissem o tabelamento de preços imposto pelo governo. O resultado? Um fracasso absoluto, prateleiras vazias, inflação descontrolada e a certeza de que a mentalidade fiscalizadora não gera valor para ninguém – apenas sufoca a economia e reforça o atraso.

Agora, décadas depois, vemos a mesma mentalidade derrotada ressurgir na Receita Federal com a fiscalização automática sobre transações acima de R$ 5.000 via PIX. Em vez de buscar um ambiente mais produtivo e inovador, o governo se empenha em monitorar cada centavo que circula, tratando qualquer movimentação um pouco maior como suspeita. Quem ganha com isso? Certamente não é o cidadão honesto, nem a economia real.

E quem são os protagonistas dessa história? Os novos fiscais da Receita Federal, que assumem um papel tão irrelevante quanto o dos fiscais de Sarney. Um trabalho de baixo valor agregado, que não contribui para a criação de riqueza ou inovação. São apenas burocratas modernos, presos na mentalidade de que controlar e punir é mais importante do que fomentar o crescimento e a liberdade financeira.

A história já provou que o fiscalismo estatal é um modelo falido, seja tabelando preços ou perseguindo transações financeiras. Enquanto alguns criam, inovam e geram valor, outros se ocupam apenas de vigiar e tributar. O tempo sempre mostrou quem estava certo.

-

@ c11cf5f8:4928464d

2025-01-08 14:31:14

@ c11cf5f8:4928464d

2025-01-08 14:31:14Here we are again with our monthly Magnificent Seven, the summary giving you a hit of what you missed in the ~AGORA territory.

Top-Performing Ads

This month, the most engaging ones are:

00[SELL] STACKER NEWS Merch: T-Shirts & Cap [32100 sats + shipping] by me :)01Beeswax Dinner Candles For Sale by @kr02I'd Buy ~bitcoin Territory At The Right Price by @0xbitcoiner03Bitcoin Watches by @jakoyoh62904SN merch live on amazon by @stack_harder05A couple programming bounties payable in BTC (Javascript/Typescript, C++) by @springfield_data_recovery06[SELL] Accepting SATs ~ Genuine Authentic SHAQ (Shaquille O'Neal) Autograph by @watchmancbiz07PlebBook 📖 - (Update: Jan 2025 - Earn Sats in AGORA) by @PlebLab08HereComes Bitcoin SATSCARD™ - Summer of Bitcoin by @Design_r09[OFFER] 12K sats for any item in The Bullish Shop (BOLT12 only) by @thebullishbitcoiner10Bitcoin Shirt on Walmart 👀 by @96dffdc39e

Cowboys Credits Buyers

Yes, this Jan 3rd CCs have been deployed, a unique SN feature that enable everyone to play around and upvote/reward interesting contents and stackers. Has been an interesting number of stackers enetring the market and setting the rate

- @siggy47 Will Pay Sats For Cowboy Credits https://stacker.news/items/837713/r/AG Make him an offer. His territories rent are due.

- @ek [BUY] 100 cowboy credits for one satoshi https://stacker.news/items/837469/r/AG Sender must pay the 30% sybil fee, so the sender has to pay 100/0.7=142 CCs to get 1 sat

- @Darth first ever CCs offer, and always with his third eye looking at the future, want too [SWAP] SN Cowboy credits https://stacker.news/items/723069/r/AG PS: posted in October 2024

Professional Services accepting Bitcoin

Ihttps://stacker.news/items/813013/r/AG @gpvansat's [OFFER][Graphic Design]

From the paste editions (It's important to keep these offers available) *

IIhttps://stacker.news/items/775383/r/AG @TinstrMedia - Color Grading (Styling) Your Pictures as a Service *IIIhttps://stacker.news/items/773557/r/AG @MamaHodl, MATHS TUTOR 50K SATS/hour English global *IVhttps://stacker.news/items/684163/r/AG @BTCLNAT's OFFER HEALTH COUNSELING [21 SAT/ consultation *Vhttps://stacker.news/items/689268/r/AG @mathswithtess [SELL] MATHS TUTOR ONLINE, 90k sats per hour. Global but English only.In case you missed

Here some interesting post, opening conversations and free speech about markets and business on the bitcoin circular economy:

- Buy Kratum With Bitcoin https://stacker.news/items/806578/r/AG by @siggy47

- How Is Shipping Handled? https://stacker.news/items/832303/r/AG by @siggy47

- Building a List of 'Buy It For Life' Products https://stacker.news/items/809655/r/AG by @kr

- Sender must pay the 30% sybil fee, so the sender has to pay 100/0.7=142 CCs to get 1 sat https://stacker.news/items/811292/r/AG by @Fabs

- How to (Ethically) Get Rid of Your Unwanted Stuff https://stacker.news/items/829228/r/AG by @mo

- The Calgary Sat Market - A driven community of Bitcoiners, making magic together https://stacker.news/items/811666/r/AG by @supratic

- ɅGOᏒɅ 🏜️ First Year Recap: A Thriving 2024 for Stacker News P2P Marketplace https://stacker.news/items/821255/r/AG by @AGORA

🏷️ Spending Sunday is back!

Share your most recent Bitcoin purchases of just check what other stackers are buying with their sats! Read more https://stacker.news/items/837629/r/AG

Just a reminder for you all

This territory aims to connect stackers and curious buyers for IRL P2P Bitcoin deals. Have fun checking what else stackers are shilling globally in the ~AGORA. This is a great time for you to make some space un-dusting some stuff that has been sitting there for too long and get some sats for it!

Create your Ads now!

Looking to start something new? Hit one of the links below to free your mind:

- 💬 TOPIC for conversation,

- [⚖️ SELL] anything! or,

- if you're looking for something, hit the [🛒 BUY]!

- [🧑💻 HIRE] any bitcoiner skill or stuff from bitcoiners

- [🖇 OFFER] any product or service and stack more sats

- [🧑⚖️ AUCTION] to let stackers decide a fair price for your item

- [🤝 SWAP] if you're looking to exchange anything with anything else

- [🆓 FREE] your space, make a gift!

- [⭐ REVIEW] any bitcoin product or LN service you recently bought or subscribed to

Or contact @AGORA team on nostr DM and we can help you publish a personalized post.

.

#nostr#stuff4sats#sell#buy#plebchain#grownostr#asknostroriginally posted at https://stacker.news/items/842103

-

@ ed84ce10:cccf4c2a

2025-01-08 12:33:06

@ ed84ce10:cccf4c2a

2025-01-08 12:33:06Hackathon Summary

The YQuantum 2024 Hackathon concluded with significant participation and numerous project submissions, establishing itself as a vibrant platform for innovation. Out of 300 registrants, the on-site participants formed teams and worked on developing 28 BUIDLs, engaging in challenges across diverse tracks sponsored by prominent quantum computing organizations, such as QuEra Computing, IBM Quantum, Classiq, DoraHacks, SandboxAQ, and Capgemini/The Hartford/Quantinuum.

Participants developed groundbreaking solutions in quantum computing, driven by prize incentives, including quantum cloud credits, internships, networking opportunities, and potential speaking engagements. The grand prizes recognized exceptional projects, with the first place receiving $2000, presentation opportunities before Yale researchers, and participation in the Yale Innovation Summit.

The hackathon successfully fostered a collaborative environment that encouraged the exploration of cutting-edge technologies and ideas, advancing the quantum computing field. YQuantum 2024 underscored the potential of quantum technologies and promoted knowledge exchange among participants and sponsors.

Hackathon Winners

Held on April 13, 2024, YQuantum's inaugural event attracted 300 participants from 10 countries, featuring six industry-sponsored challenges that culminated in a series of prestigious awards.

Institute Grand Prizes Winners

-

1st Place: Quantum Consortium: Case-Duke-Lehigh-Vandy Nexus This project employs adiabatic methods to prepare antiferromagnetic energy eigenstates, with a focus on quantum many-body scarring and enhancing error correction in computing.

-

2nd Place: Sparse Quantum State Preparation The team developed efficient algorithms using Classiq APIs for sparse quantum state preparation, optimizing execution for scalability and efficiency in managing quantum data.

-

3rd Place: QuBruin This project optimizes algorithms using dynamic quantum circuits and enhances error correction. The team improved user accessibility through Qiskit-based models for better circuit performance under noise conditions.

IBM Quantum Prize Winners

- Modified IBM Challenge

This project delves into foundational linear algebra concepts, emphasizing core principles and mastery.

QuEra Computing Prize Winners

- 3D Quantum Scars on 2D Tweezer Arrays

The team investigates quantum scar states on a 3D lattice projected into 2D, using Julia and QuEra's Bloqade to simulate quantum dynamics.

Classiq Technologies Prize Winners

- YQuantum2024 Classiq Team 34 Wavefunction Wizards

Focusing on optimizing sparse quantum state preparation, this project enhances algorithmic efficiency in quantum data processing.

DoraHacks Prize Winners

- Spooner_QRNG_Classifier

The project employs Python scripts and a gradient booster classifier to predict quantum device origins of random binary data, surpassing baseline prediction accuracy.

Capgemini // Quantinuum // The Hartford Prize Winners

-

Skittlez

This partnership addresses quantum computing challenges through interdisciplinary expertise, designing innovative quantum solutions. -

Honorable Mention: BB24 - Yale Quantum Monte Carlo The project enhances Quantum Monte Carlo techniques via novel sampling and encoding schemes, improving parallel processing and computational efficiency.

SandboxAQ Prize Winners

-

QuantumQuails

This project improves solar cell efficiency through quantum chemistry, utilizing VQE to model solar energy absorption for enhanced conversion effectiveness. -

Honorable Mention: mRNA Sequence Design via Quantum Approximate Optimization Algorithm This project optimizes mRNA sequence design using QAOA, enhancing protein expression and structural stability through codon and nucleotide parameters.

Explore all projects at DoraHacks.

About the Organizer:

YQuantum

YQuantum is a prominent entity within the technology and blockchain sectors, recognized for its innovative approach and strategic initiatives. Specializing in utilizing quantum computing capabilities, YQuantum is committed to advancing the technological frontier. Though specific projects are not highlighted, YQuantum's role in shaping industry standards positions it as a leader in the field. Through dedication to cutting-edge research and development, YQuantum continues to drive progress in quantum technologies, aligning with its mission to propel scientific and technological advancements globally.

-

-

@ d830ee7b:4e61cd62

2025-01-08 07:56:25

@ d830ee7b:4e61cd62

2025-01-08 07:56:25การเผชิญหน้า (The Collision Point)

กลางปี 2017 ที่ร้านคราฟท์เบียร์เล็ก ๆ ในย่านเกาะเกร็ด นนทบุรี อากาศร้อนจนเครื่องปรับอากาศ (ที่ยังไม่มี) ในร้านทำงานหนักแทบไหม้ "แจ๊ก กู้ดเดย์" (Jakk Goodday) นั่งลงบนเก้าอี้ไม้ที่เจ้าของร้านกันไว้ให้เป็นประจำ ราวกับเขาเป็นลูกค้าขาประจำระดับวีไอพี

กลิ่นกาแฟคั่ว ลอยผสมกับไอความร้อนจากนอกหน้าต่าง (ผิดร้านหรือเปล่า?) เกิดเป็นบรรยากาศขมติดปลายลิ้นชวนให้คนจิบแล้วอยากถอนใจ

เขาเหลือบมองออกไปนอกหน้าต่าง.. เห็นแสงแดดแผดเผาราวกับมันรู้ว่าสงคราม Blocksize กำลังคุกรุ่นขึ้นอีกครั้ง

บรรยากาศนอกหน้าต่างกับใน ฟอรัม Bitcointalk ช่างเหมือนกันจนน่าขนลุก มันร้อนแรง ไร้ความปรานี

แจ๊กเปิดแล็ปท็อป กดเข้าเว็บฟอรัม พอเสียงแจ้งเตือน “—ติ๊ง” ดังขึ้น คิ้วของเขาก็ขมวดเล็กน้อย คล้ายได้กลิ่นดินปืนกลางสนามรบ

“โรเจอร์ แวร์ (Roger Ver) ไลฟ์เดือดลั่นเวที!” “ปีเตอร์ วูเล (Pieter Wuille) โต้กลับเรื่อง SegWit!” “Hard Fork ใกล้ถึงจุดปะทะแล้ว!”

แจ๊กคลิกเข้าไปในลิงก์ของไลฟ์ทันที เหมือนมือของเขาไม่ต้องการคำสั่งจากสมอง ความคุ้นเคยกับเหตุการณ์แบบนี้บอกเขาว่า นี่ไม่ใช่ดีเบตธรรมดา แต่มันอาจเปลี่ยนอนาคตของ Bitcoin ได้จริง ๆ

เห็นแค่พาดหัวสั้น ๆ แต่ความตึงเครียดก็ชัดเจนขึ้นเรื่อย ๆ ทุกข้อความเหมือนสุมไฟใส่ใจกองหนึ่งที่พร้อมระเบิดได้ทุกเมื่อ

โทรศัพท์ของแจ๊กดังพร้อมปรากฏชื่อ แชมป์ ‘PIGROCK’ ลอยขึ้นมา เขาหยิบขึ้นมารับทันที

“ว่าไงวะแชมป์… มีอะไรด่วนหรือเปล่า?” น้ำเสียงแจ๊กฟังดูเหมือนง่วง ๆ แต่จริง ๆ เขาพร้อมจะลุกมาวิเคราะห์สถานการณ์ให้ฟังทุกเมื่อ

“พี่แจ๊ก.. ผมอ่านดีเบตเรื่อง SegWit ในฟอรัมอยู่ครับ บางคนด่าว่ามันไม่ได้แก้ปัญหาจริง ๆ บ้างก็บอกถ้าเพิ่ม Blocksize ไปเลยจะง่ายกว่า... ผมเลยสงสัยว่า Hard Fork ที่เค้าพูดถึงกันนี่คืออะไร ใครคิดอะไรก็ Fork กันได้ง่าย ๆ เลยเหรอ"

"แล้วถ้า Fork ไปหลายสาย สุดท้ายเหรียญไหนจะเป็น ‘Bitcoin ที่แท้จริง’ ล่ะพี่?”

“แล้วการ Fork มันส่งผลกับนักลงทุนยังไงครับ? คนทั่วไปอย่างผมควรถือไว้หรือขายหนีตายดีล่ะเนี่ย?”

แจ๊กยิ้มมุมปาก ชอบใจที่น้องถามจี้จุด

“เอางี้… การ Fork มันเหมือนแบ่งถนนออกเป็นสองสาย ใครชอบกติกาเก่าก็วิ่งถนนเส้นเก่า ใครอยากแก้กติกาใหม่ก็ไปถนนเส้นใหม่"

"แต่ประเด็นคือ... นี่ไม่ใช่เรื่องเล็ก ๆ เพราะมีผลต่ออัตลักษณ์ของ Bitcoin ทั้งหมดเลยนะมึง—ใครจะยอมปล่อยผ่านง่าย ๆ”

"คิดดูสิ ถ้าครั้งนี้พวกเขา Fork จริง มันอาจไม่ได้เปลี่ยนแค่เครือข่าย แต่เปลี่ยนวิธีที่คนมอง Bitcoin ไปตลอดกาลเลยนะ"

"แล้วใครมันจะอยากลงทุนในระบบที่แตกแยกซ้ำแล้วซ้ำเล่าวะ?"

“งั้นหมายความว่าตอนนี้ก็มีสองแนวใหญ่ ๆ ชัวร์ใช่ไหมครับ?” แชมป์ถามต่อ

“ฝั่ง โรเจอร์ แวร์ ที่บอกว่าต้องเพิ่ม Blocksize ให้ใหญ่จุใจ กับฝั่งทีม Core อย่าง ปีเตอร์ วูเล ที่ยืนยันต้องใช้ SegWit ทำให้บล็อกเบา ไม่กระทบการกระจายอำนาจ?”

“ใช่เลย” แจ๊กจิบกาแฟดำเข้ม ๆ ผสมน้ำผึ้งไปหนึ่งอึก

“โรเจอร์นี่เขาเชื่อว่า Bitcoin ต้องเป็นเงินสดดิจิทัลที่ใช้จ่ายไว ค่าธรรมเนียมไม่แพง ส่วนปีเตอร์กับ Bitcoin Core มองว่าการเพิ่มบล็อกเยอะ ๆ มันจะไปฆ่า Node รายย่อย คนไม่มีทุนก็รัน Node ไม่ไหว สุดท้าย Bitcoin จะกลายเป็นระบบกึ่งรวมศูนย์ ซึ่งมันผิดหลักการเดิมของ ซาโตชิ ไงล่ะ”

“ฟังแล้วก็ไม่ใช่เรื่องง่ายนะพี่… งั้นที่ผมได้ยินว่า จิฮั่น อู๋ (Jihan Wu) เจ้าของ Bitmain ที่ถือ Hashrate เกินครึ่งนี่ก็มาอยู่ฝั่งเดียวกับโรเจอร์ใช่ไหม?"

"เพราะยิ่งบล็อกใหญ่ ค่าธรรมเนียมยิ่งเพิ่ม นักขุดก็ได้กำไรสูงขึ้นใช่ป่ะ?”

“ไอ้เรื่องกำไรก็ส่วนหนึ่ง...” แจ๊กถอนหายใจ

“แต่ที่สำคัญกว่านั้นคืออำนาจต่อรอง… ตอนประชุมลับที่ฮ่องกงเมื่อปีที่แล้ว พี่เองก็ถูกชวนให้เข้าไปในฐานะคนกลาง เลยเห็นภาพน่าขนลุกอยู่หน่อย ๆ"

"จิฮั่นนั่งไขว่ห้างด้วยสีหน้ามั่นใจมาก ด้วย Hashrate ราว 60% ของโลก สั่งซ้ายหันขวาหันเหมือนเป็นแม่ทัพใหญ่ได้เลย พอโรเจอร์ก็ไฟแรงอยู่แล้ว อยากให้ Bitcoin ครองโลกด้วยวิธีของเขา สองคนนี่จับมือกันทีจะเขย่าชุมชน Bitcoin ได้ทั้งกระดาน”

"พี่รู้สึกเหมือนนั่งอยู่ในศึกชิงบัลลังก์ยุคใหม่ คนหนึ่งยึดพลังขุด คนหนึ่งยึดความศรัทธาในชื่อ Bitcoin แต่สิ่งที่พี่สงสัยในตอนนั้นคือ… พวกเขาสู้เพื่อใครกันแน่?"

แชมป์เงียบไปครู่เหมือนกำลังประมวลผล “แล้วตอนนั้นพี่คิดยังไงบ้างครับ? รู้สึกกลัวหรือว่ายังไง?”

“จะไม่กลัวได้ไง!” แจ๊กหัวเราะแห้ง ๆ แวบหนึ่งก็นึกถึงสีหน้าที่ยิ้มเยาะของทั้งคู่ตอนประกาศความพร้อมจะ Fork

“พี่อดคิดไม่ได้ว่าถ้า Core ยังไม่ยอมขยายบล็อก พวกนั้นจะลากนักขุดทั้งกองทัพแฮชเรตไปทำเครือข่ายใหม่ให้เป็น ‘Bitcoin สายใหญ่’ แล้วทิ้งเครือข่ายเดิมให้ซวนเซ"

"แค่คิดก็นึกถึงสงครามกลางเมืองในหนังประวัติศาสตร์แล้วน่ะ.. แตกเป็นสองฝ่าย สุดท้ายใครแพ้ใครชนะ ไม่มีใครทำนายได้จริง ๆ”

พูดจบ.. เขาเปิดฟอรัมดูไลฟ์ดีเบตจากงานในปี 2017 ต่อ โรเจอร์ แวร์ กำลังพูดในโทนร้อนแรง

“Bitcoin ไม่ใช่ของคนรวย! ถ้าคุณไม่เพิ่ม Blocksize คุณก็ทำให้ค่าธรรมเนียมพุ่งจนคนธรรมดาใช้ไม่ได้!”

ขณะเดียวกัน ปีเตอร์ วูเล่ ยืนอยู่ฝั่งตรงข้าม สีหน้าเยือกเย็นราวกับตั้งรับมานาน “การเพิ่มบล็อกคือการทำลายโครงสร้าง Node รายย่อยในระยะยาว แล้วมันจะยังเรียกว่ากระจายอำนาจได้หรือ?”

"ถ้าคุณอยากให้ Bitcoin เป็นของคนรวยเพียงไม่กี่คน ก็เชิญขยายบล็อกไปเถอะนะ แต่ถ้าอยากให้มันเป็นระบบที่คนทุกระดับมีส่วนร่วมจริง ๆ ..คุณต้องฟังเสียง Node รายเล็กด้วย" ปีเตอร์กล่าว

เสียงผู้คนในงานโห่ฮากันอย่างแตกเป็นสองฝ่าย บ้างก็เชียร์ความตรงไปตรงมาของโรเจอร์ บ้างก็เคารพเหตุผลเชิงเทคนิคของปีเตอร์

ข้อความจำนวนมหาศาลในฟอรัมต่างโหมกระพือไปต่าง ๆ นานา มีทั้งคำด่าหยาบคายจนแจ๊กต้องเบือนหน้า ตลอดจนการวิเคราะห์ลึก ๆ ถึงอนาคตของ Bitcoin ที่อาจไม่เหมือนเดิม

ในระหว่างนั้น.. แชมป์ส่งข้อความ Discord กลับมาอีก

“พี่ ถ้า Fork จริง ราคาจะป่วนแค่ไหน? ที่เขาว่าคนถือ BTC จะได้เหรียญใหม่ฟรี ๆ จริงไหม? ผมกลัวว่าถ้าเกิดแบ่งเครือข่ายไม่รู้กี่สาย ตลาดอาจมั่วจนคนหายหมดก็ได้ ใช่ไหมครับ?”

"แล้วถ้าเครือข่ายใหม่ล้มเหลวล่ะครับ? จะส่งผลอะไรต่อชุมชน Bitcoin เดิม?"

"ไอ้แชมป์มึงถามรัวจังวะ!?" แจ๊กสบถเพราะเริ่มตั้งรับไม่ทัน

“ก็ขึ้นกับตลาดจะเชื่อว่าสายไหนเป็น ‘ของจริง’ อีกนั่นแหละ” แจ๊กพิมพ์กลับ

“บางคนถือไว้เผื่อได้เหรียญใหม่ฟรี บางคนขายหนีตายก่อน"

"พี่เองก็ยังไม่กล้าการันตีเลย แต่ที่แน่ ๆ สงครามนี้ไม่ได้มีแค่ผลกำไร มันกระทบศรัทธาของชุมชน Bitcoin ทั้งหมดด้วย"

"ถ้าชาวเน็ตเลิกเชื่อมั่น หรือคนนอกมองว่าพวกเราทะเลาะกันเองเหมือนเด็กแย่งของเล่น ต่อให้ฝั่งไหนชนะ ก็อาจไม่มีผู้ใช้เหลือให้ฉลอง”

แล้วสายตาแจ๊กก็ปะทะกับกระทู้ใหม่ที่เด้งขึ้นมาบนหน้าฟอรัม

“โรเจอร์ แวร์ ประกาศ: ถ้าไม่เพิ่ม Blocksize เราจะฟอร์กเป็น Bitcoin ที่แท้จริง!”

ตัวหนังสือหนาแปะอยู่ตรงนั้นส่งแรงสั่นสะเทือนราวกับจะดึงคนในวงการให้ต้องเลือกข้างกันแบบไม่อาจกลับหลังได้

แจ๊กเอื้อมมือปิดแล็ปท็อปช้า ๆ คล้ายยอมรับความจริงว่าหนทางประนีประนอมอาจไม่มีอีกแล้ว..

“สงครามนี่คงใกล้ระเบิดเต็มทีล่ะนะ” เขาลุกจากเก้าอี้ สะพายเป้ พึมพำกับตัวเองขณะมองกาแฟดำที่เหลือครึ่งแก้ว “ถ้าพวกเขาฟอร์กจริง โลกคริปโตฯ ที่เราเคยรู้จักอาจไม่มีวันเหมือนเดิมอีกต่อไป”

เขามองออกไปนอกหน้าต่าง แสงแดดที่แผดเผาราวกับกำลังบอกว่า.. อนาคตของ Bitcoin อยู่ในจุดที่เส้นแบ่งระหว่างชัยชนะกับความล่มสลายเริ่มพร่าเลือน... และอาจไม่มีทางย้อนกลับ

ก่อนเดินออกจากร้าน เขากดส่งข้อความสั้น ๆ ถึงแชมป์

“เตรียมใจกับความปั่นป่วนไว้ให้ดี ไม่แน่ว่าเราอาจจะได้เห็น Bitcoin แตกเป็นหลายสาย.. ใครจะอยู่ใครจะไปไม่รู้เหมือนกัน แต่เรื่องนี้คงไม่จบง่าย ๆ แน่”

แจ๊กผลักประตูออกไปพบกับแดดจัดที่เหมือนแผดเผากว่าเดิม พายุร้อนไม่ได้มาแค่ในรูปความร้อนกลางกรุง แต่มาในรูป “สงคราม Blocksize” ที่พร้อมจะฉีกชุมชนคริปโตออกเป็นฝักฝ่าย และอาจลามบานปลายจนกลายเป็นศึกประวัติศาสตร์

ทว่าสิ่งที่ค้างคาใจกลับเป็นคำถามนั้น…

เมื่อเครือข่ายแบ่งเป็นหลายสายแล้ว เหรียญไหนจะเป็น Bitcoin จริง?

หรือบางที... ในโลกที่ใครก็ Fork ได้ตามใจ เราจะไม่มีวันได้เห็น “Bitcoin หนึ่งเดียว” อีกต่อไป?

คำถามที่ไม่มีใครตอบได้ชัดนี้ส่องประกายอยู่ตรงปลายทาง ราวกับป้ายเตือนว่า “อันตรายข้างหน้า” และคนในชุมชนทั้งหมดกำลังจะต้องเผชิญ…

โดยไม่มีใครมั่นใจเลยว่าจะรอด หรือจะแตกสลายไปก่อนกันแน่...

สองเส้นทาง (The Forked Path)

กลางปี 2017 ท้องฟ้าเหนือบุรีรัมย์ยังคงคุกรุ่นด้วยไอแดดและความร้อนแรงของสงคราม Blocksize แจ๊ก กู้ดเดย์ ก้าวเข้ามาในคาเฟ่เล็ก ๆ แห่งหนึ่งในย่านเทศบาลด้วยสีหน้าครุ่นคิด เขาพยายามมองหามุมสงบสำหรับนั่งตั้งหลักในโลกความเป็นจริง ก่อนจะจมดิ่งสู่สงครามในโลกดิจิทัลบนฟอรัม Bitcointalk อีกครั้ง

กลิ่นกาแฟคั่วเข้มลอยกระทบจมูก แจ๊กสั่งกาแฟดำแก้วโปรดแล้วปลีกตัวมาที่โต๊ะริมกระจก กระจกบานนั้นสะท้อนแสงอาทิตย์จัดจ้า ราวกับจะบอกว่าวันนี้คงไม่มีใครหนีความร้อนที่กำลังแผดเผา ทั้งในอากาศและในชุมชน Bitcoin ได้พ้น

เขาเปิดแล็ปท็อปขึ้น ล็อกอินเข้า Bitcointalk.org ตามเคย ข้อความและกระทู้มากมายกระหน่ำแจ้งเตือน ไม่ต่างอะไรจากสมรภูมิคำพูดที่ไม่มีวันหลับ “Hong Kong Agreement ล้มเหลวจริงหรือ?” “UASF คือปฏิวัติโดย Node?” เหล่านี้ล้วนสะท้อนความไม่แน่นอนในชุมชน Bitcoin ที่ตอนนี้ ดูคล้ายจะถึงจุดแตกหักเต็มที...

“ทั้งที่ตอนนั้นเราก็พยายามกันแทบตาย…” แจ๊กพึมพำ มองจอด้วยสายตาเหนื่อยใจพร้อมภาพความทรงจำย้อนกลับเข้าในหัว เขายังจำการประชุมที่ฮ่องกงเมื่อต้นปี 2016 ได้แม่น ยามนั้นความหวังในการประนีประนอมระหว่าง Big Block และ Small Block ดูเป็นไปได้ หากแต่กลายเป็นละครฉากใหญ่ที่จบลงโดยไม่มีใครยอมถอย...

...การประชุม Hong Kong Agreement (2016)

ภายในห้องประชุมหรูของโรงแรมใจกลางย่านธุรกิจฮ่องกง บรรยากาศตึงเครียดยิ่งกว่าการเจรจาสงบศึกในสมัยโบราณ

โรเจอร์ แวร์ ยืนเสนอว่า “การเพิ่ม Blocksize สำคัญต่ออนาคตของ Bitcoin — เราอยากให้คนทั่วไปเข้าถึงได้โดยไม่ต้องจ่ายค่าธรรมเนียมแพง ๆ”

“จิฮั่น อู๋ (Jihan Wu)” จาก Bitmain นั่งฝั่งเดียวกับโรเจอร์ คอยเสริมว่าการเพิ่มบล็อกคือโอกาสสำหรับนักขุด และหากทีม Core ไม่ยอม พวกเขาก็พร้อม “ดัน Fork” ขึ้นได้ทุกเมื่อ ด้วย Hashrate มหาศาลที่พวกเขาคุมไว้

ฝั่ง ปีเตอร์ วูเล (Pieter Wuille) กับ เกร็ก แมกซ์เวลล์ (Greg Maxwell) จาก Bitcoin Core เถียงกลับอย่างใจเย็นว่า “การขยายบล็อกอาจดึงดูดทุนใหญ่ ๆ แล้วไล่ Node รายย่อยออกไป ชุมชนอาจไม่เหลือความกระจายอำนาจอย่างที่ Satoshi ตั้งใจ”

สุดท้าย บทสรุปที่เรียกว่า Hong Kong Agreement ลงนามได้ก็จริง แต่มันกลับเป็นแค่ลายเซ็นบนกระดาษที่ไม่มีฝ่ายไหนเชื่อใจใคร

แจ๊กเบือนสายตาออกนอกหน้าต่าง สังเกตเห็นผู้คนเดินขวักไขว่ บ้างก็ดูรีบร้อน บ้างเดินทอดน่องเหมือนว่างเปล่า นี่คงไม่ต่างอะไรกับชาวเน็ตในฟอรัมที่แบ่งฝ่ายกันใน “สงคราม Blocksize” อย่างไม่มีทีท่าจะหยุด

แค่ไม่กี่นาที... เสียงโทรศัพท์ก็ดังขึ้น ชื่อ แชมป์ ‘PIGROCK’ โชว์หราเต็มจออีกครั้ง

“ว่าไงเจ้าแชมป์?” แจ๊กกรอกเสียงในสายด้วยอารมณ์เหนื่อย ๆ ทว่าพร้อมจะอธิบายเหตุการณ์ตามสไตล์คนที่ชอบครุ่นคิด

“พี่แจ๊ก.. ผมเข้าใจแล้วว่าการประชุมฮ่องกงมันล้มเหลว ตอนนี้ก็มีคนแยกเป็นสองขั้ว Big Block กับ SegWit แต่ผมเจออีกกลุ่มในฟอรัมเรียกว่า UASF (User-Activated Soft Fork) ที่เหมือนจะกดดันพวกนักขุดให้ยอมรับ SegWit..."

"อยากรู้ว่าตกลง UASF มันสำคัญยังไงครับ? ทำไมใคร ๆ ถึงเรียกว่าเป็น การปฏิวัติโดย Node กัน?”

แจ๊กอมยิ้มก่อนจะวางแก้วกาแฟลง พูดด้วยน้ำเสียงจริงจังกว่าเดิม “UASF น่ะหรือ? มันเปรียบได้กับการที่ ‘ชาวนา’ หรือ ‘ประชาชนตัวเล็ก ๆ’ ออกมาประกาศว่า ‘ฉันจะไม่รับบล็อกของนักขุดที่ไม่รองรับ SegWit นะ ถ้าแกไม่ทำตาม ฉันก็จะตัดบล็อกแกทิ้ง!’ เสมือนเป็นการปฏิวัติที่บอกว่าแรงขุดมากแค่ไหนก็ไม่สำคัญ ถ้าคนรัน Node ไม่ยอม… เชนก็เดินต่อไม่ได้”

“โห… ฟังดูแรงจริง ๆ พี่ แล้วถ้านักขุดไม่ร่วมมือ UASF จะเกิดอะไรขึ้น?” แชมป์ถามต่อเสียงสั่นนิด ๆ

“ก็อาจเกิด ‘Chain Split’ ยังไงล่ะ"

"แยกเครือข่ายเป็นสองสาย สุดท้ายเครือข่ายเดิม กับเครือข่ายใหม่ที่รองรับ SegWit ไม่ตรงกัน คนอาจสับสนหนักยิ่งกว่า Hard Fork ปกติด้วยซ้ำ"

"แต่นั่นแหละ... มันแสดงพลังว่าผู้ใช้ทั่วไปก็มีสิทธิ์กำหนดทิศทาง Bitcoin ไม่ได้น้อยไปกว่านักขุดเลย”

“เข้าใจแล้วครับพี่… เหมือน การปฏิวัติโดยประชาชนตาดำ ๆ ที่จับมือกันค้านอำนาจทุนใหญ่ใช่ไหม?” แชมป์หยุดครู่หนึ่ง “ผมเคยคิดว่า Node รายย่อยน้อยรายจะไปสู้อะไรไหว แต่ตอนนี้ดูท่าจะเปลี่ยนเกมได้จริงว่ะพี่…”

“ใช่เลย” แจ๊กตอบ

“นี่เป็นความพิเศษของ Bitcoin ที่บอกว่า ‘เราคุมเครือข่ายร่วมกัน’ แม้แต่ Bitmain ที่มี Hashrate มากกว่า 50% ก็หนาวได้ถ้าผู้ใช้หรือ Node รายย่อยรวมพลังกันมากพอ”

แชมป์ฟังด้วยความตื่นเต้นปนกังวล “แล้วแบบนี้ เรื่อง SegWit กับ Blocksize จะจบยังไงครับ? เห็นข่าวว่าถ้านักขุดโดนกดดันมาก ๆ คนอย่าง จิฮั่น อู๋ อาจออกไปสนับสนุน Bitcoin Cash ที่จะเปิดบล็อกใหญ่”

แจ๊กเลื่อนดูฟีดข่าวในฟอรัม Bitcointalk อีกครั้ง ก็เห็นพาดหัวชัด ๆ

“Bitmain ประกาศกร้าวพร้อมหนุน BCH เต็มพิกัด!”

เขาถอนหายใจเฮือกหนึ่ง “ก็ใกล้เป็นจริงแล้วล่ะ… โรเจอร์ แวร์ เองก็ผลักดัน BCH ว่าคือ Bitcoin แท้ที่ค่าธรรมเนียมถูก ใช้งานได้จริง ส่วนฝั่ง BTC ที่ยึดเอา SegWit เป็นหลัก ก็ไม่ยอมให้ Blocksize เพิ่มใหญ่เกินจำเป็น.."

"ต่างคนต่างมีเหตุผล... แต่อุดมการณ์นี่คนละทางเลย”

“แล้วพี่คิดว่าใครจะเป็นฝ่ายชนะครับ?”

“เฮ้ย.. มึงถามยากไปหรือเปล่า” แจ๊กหัวเราะหึ ๆ “ทุกคนมีโอกาสได้หมด และก็มีโอกาสพังหมดเหมือนกัน ถ้า UASF กดดันนักขุดให้อยู่กับ Core ได้ พวกเขาอาจยอมแพ้ แต่ถ้า Bitmain เทใจไป BCH นักขุดรายใหญ่คนอื่น ๆ ก็คงตาม"

"แล้วถ้าฝั่ง BCH เริ่มได้เปรียบ... อาจดึงคนไปเรื่อย ๆ สุดท้ายจะเหลือไหมล่ะฝั่ง SegWit ตัวจริง?”

“งั้น Node รายย่อยจะยืนอยู่ตรงไหนล่ะครับพี่?” แชมป์ถามอย่างหนักใจ

“Node รายย่อยและชุมชนผู้ใช้นี่แหละ คือ ตัวแปรชี้ขาด ทุกวันนี้คนกลุ่ม UASF พยายามโชว์พลังว่าตัวเองมีสิทธิ์ตั้งกติกาเหมือนกัน ไม่ใช่แค่นักขุด"

"อย่างที่บอก.. มันคือการ ‘ลุกขึ้นปฏิวัติ’ โดยชาวนา ต่อสู้กับเจ้าที่ที่ถือ ‘แฮชเรต’ เป็นอาวุธ”

แจ๊กตบบ่าตัวเองเบา ๆ ก่อนจะหัวเราะเล็กน้อย

“นี่แหละความมันของ Bitcoin ไม่มีเจ้าไหนสั่งได้เบ็ดเสร็จจริง ๆ ทุกฝั่งต่างถือไพ่คนละใบ สงครามยังไม่รู้จะจบยังไง ถึงอย่างนั้นมันก็สะท้อนวิญญาณ ‘decentralization’ ที่แท้จริง กล้ายอมรับสิทธิ์ทุกฝ่ายเพื่อแข่งขันกันตามกติกา”

จู่ ๆ ในหน้าฟอรัมก็มีกระทู้ใหม่เด้งเด่น “Bitmain หนุน Bitcoin Cash ด้วย Hashrate กว่า 50%! สงครามเริ่มแล้ว?” ข้อความนั้นดังโครมครามเหมือนระเบิดลงกลางวง

แจ๊กนิ่งไปชั่วขณะ สัมผัสได้ถึงความปั่นป่วนที่กำลังปะทุขึ้นอีกครั้ง เหงื่อบางเบาซึมบนหน้าผากแม้อากาศในคาเฟ่จะเย็นฉ่ำ เขาหันมองโทรศัพท์ที่ยังค้างสายกับแชมป์ แล้วเอ่ยด้วยน้ำเสียงจริงจัง

“นี่ล่ะ.. จุดเริ่มของสองเส้นทางอย่างชัดเจน… บล็อกใหญ่จะไปกับ BCH ส่วน SegWit ก็อยู่กับ BTC แน่นอนว่าทั้งสองฝ่ายไม่คิดถอยง่าย ๆ นักขุดจะเลือกข้างไหน? Node รายย่อยจะยอมใคร?"

"เมื่อสงครามครั้งนี้นำไปสู่การแบ่งเครือข่าย ใครกันแน่จะเป็นผู้ชนะตัวจริง? หรืออาจไม่มีผู้ชนะเลยก็เป็นได้”

ปลายสายเงียบงัน มีแต่เสียงหายใจของแชมป์ที่สะท้อนความกังวลปนอยากรู้อย่างแรง

“พี่… สุดท้ายแล้วเรากำลังยืนอยู่บนรอยแยกที่พร้อมจะฉีกทุกอย่างออกเป็นชิ้น ๆ ใช่ไหมครับ?”

“อาจจะใช่ก็ได้... หรือถ้ามองอีกมุม อาจเป็นวัฏจักรที่ Bitcoin ต้องเจอเป็นระยะ ทุกคนมีสิทธิ์ Fork ได้ตามใจใช่ไหมล่ะ? ก็ขอให้โลกได้เห็นกันว่าชุมชนไหนแน่จริง” แจ๊กพูดทิ้งท้ายก่อนจะแย้มยิ้มเจือรอยอ่อนล้า

ภาพบนจอคอมพิวเตอร์ฉายกระทู้ถกเถียงกันไม่หยุด ประหนึ่งเวทีดีเบตที่ไม่มีวันปิดไฟ แจ๊กจิบกาแฟอึกสุดท้ายเหมือนจะเตรียมพร้อมใจก่อนเข้าสู่สนามรบครั้งใหม่ สงครามยังไม่จบ.. ซ้ำยังดูหนักข้อยิ่งขึ้นเรื่อย ๆ

เขาลุกขึ้นจากโต๊ะ ชำเลืองมองแสงแดดจัดจ้าที่สาดลงมาไม่หยุด เปรียบเหมือนไฟแห่งข้อขัดแย้งที่เผาผลาญทั้งชุมชน Bitcoin ไม่ว่าใครจะเลือกอยู่ฝั่งไหน กลุ่ม UASF, กลุ่ม Big Block, หรือ กลุ่ม SegWit ทางเดินข้างหน้าล้วนเต็มไปด้วยความไม่แน่นอน

“สุดท้ายแล้ว… เมื่อกระดานแบ่งเป็นสองเส้นทางอย่างเด่นชัด สงคราม Blocksize จะจบลงด้วยใครได้บทผู้ชนะ?"

"หรือบางที… มันอาจไม่มีผู้ชนะที่แท้จริงในระบบที่ใครก็ Fork ได้ตลอดเวลา”

คำถามนี้ลอยติดค้างอยู่ในบรรยากาศยามบ่ายที่ร้อนระอุ ชวนให้ใครก็ตามที่จับตาดูสงคราม Blocksize ต้องฉุกคิด

เมื่อไม่มีใครเป็นเจ้าของ Bitcoin อย่างสมบูรณ์ ทุกคนจึงมีสิทธิ์บงการและเสี่ยงต่อการแตกแยกได้ทุกเมื่อ แล้วท้ายที่สุด ชัยชนะ–ความพ่ายแพ้ อาจไม่ใช่จุดสิ้นสุดของโลกคริปโตฯ

แต่เป็นเพียงจุดเริ่มต้นของการวิวัฒน์ที่ไม่มีวันจบสิ้น…

เมาท์แถมเรื่อง UASF (User-Activated Soft Fork)

นี่สนามรบยุคกลางที่ดูเหมือนในหนังแฟนตาซี ทุกคนมีดาบ มีโล่ แต่จู่ ๆ คนตัวเล็กที่เราไม่เคยสังเกต—พวกชาวนา ช่างไม้ คนแบกน้ำ—กลับรวมตัวกันยกดาบบุกวังเจ้าเมือง พร้อมตะโกนว่า “พอเถอะ! เราก็มีสิทธิ์เหมือนกัน!”

มันอาจจะดูเวอร์ ๆ หน่อยใช่ไหมครับ?

แต่ในโลก Bitcoin ปี 2017 นี่คือสิ่งที่เกิดขึ้นในรูปแบบ “User-Activated Soft Fork” หรือ UASF การปฏิวัติด้วยพลังโหนด ซึ่งทำให้นักขุดยักษ์ใหญ่ตัวสั่นงันงกันมาแล้ว!

แล้ว UASF มันคืออะไรล่ะ?

“User-Activated Soft Fork” หรือเรียกย่อ ๆ ว่า “UASF” ไม่ใช่อัปเกรดซอฟต์แวร์สวย ๆ แต่เป็น “ดาบเล่มใหม่” ที่คนตัวเล็ก—หมายถึง โหนด รายย่อย—ใช้ต่อรองกับนักขุดรายใหญ่ โดยกติกาคือ.. ถ้านักขุดไม่ทำตาม (เช่น ไม่รองรับ SegWit) โหนดก็จะปฏิเสธบล็อกของพวกเขาอย่างไม่เกรงใจใคร

สมมุติว่าคุณคือโหนด..

คุณรันซอฟต์แวร์ Bitcoin คอยตรวจสอบธุรกรรม วันดีคืนดี คุณประกาศ “ต่อไปถ้าใครไม่รองรับ SegWit ฉันไม่ยอมรับบล็อกนะ!” นี่ล่ะครับ “UASF” ตัวเป็น ๆ

คำขวัญสุดฮิตของ UASF

“No SegWit, No Block”

หรือแปลว่าถ้าบล็อกไม่รองรับ SegWit ก็เชิญออกไปเลยจ้า..

มันเหมือนการที่ชาวนาโผล่มาตบโต๊ะอาหารท่านขุนว่า “นายใหญ่จะปลูกอะไรก็ปลูกไป แต่ไม่งั้นฉันไม่รับผลผลิตนายนะ!”

ความเชื่อมโยงกับ BIP 148

ถ้าจะพูดถึง UASF ต้องรู้จัก BIP 148 ไว้นิดนึง มันเปรียบเหมือน “ธงปฏิวัติ” ที่ตีตราว่าวันที่ 1 สิงหาคม 2017 คือเส้นตาย!

BIP 148 บอกไว้ว่า.. ถ้าถึงวันนั้นแล้วยังมีนักขุดหน้าไหนไม่รองรับ SegWit บล็อกที่ขุดออกมาก็จะถูกโหนดที่ใช้ UASF “แบน” หมด

ผลลัพธ์ที่ตั้งใจ นักขุดไม่อยากโดนแบนก็ต้องทำตาม UASF กล่าวคือ “นายต้องรองรับ SegWit นะ ไม่งั้นอด!”

หลายคนกลัวกันว่า “อ้าว ถ้านักขุดใหญ่ ๆ ไม่ยอมแล้วหันไปขุดสายอื่น จะไม่กลายเป็นแยกเครือข่าย (Chain Split) หรือ?”

ใช่ครับ.. มันอาจเกิดสงครามสายใหม่ทันทีไงล่ะ

ทำไม UASF ถึงสำคัญ?

ย้อนกลับไปก่อนปี 2017 Bitcoin มีปัญหาโลกแตกทั้งค่าธรรมเนียมแพง ธุรกรรมหน่วง บวกกับความขัดแย้งเรื่อง “จะเพิ่ม Blocksize ดีไหม?” ทางกลุ่มนักขุดรายใหญ่ (นำโดย Bitmain, Roger Ver ฯลฯ) รู้สึกว่า “SegWit ไม่ใช่ทางออกที่แท้จริง” แต่อีกฝั่ง (ทีม Core) ชี้ว่า “Blocksize ใหญ่มากไปจะรวมศูนย์นะ โหนดรายย่อยตายหมด”

UASF เลยโผล่มา เหมือนชาวนาตะโกนว่า

“หุบปากได้แล้วไอ้พวกที่สู้กัน! ถ้าพวกแกไม่รองรับ SegWit พวกข้า (โหนด) ก็จะไม่เอาบล็อกแก”

สาระก็คือ.. มันคือตัวบ่งชี้ว่าคนตัวเล็กอย่างโหนดรายย่อยก็มีพลังต่อรอง เป็นกลไกที่ดึงอำนาจจากมือทุนใหญ่กลับสู่มือชุมชน (Decentralization ที่แท้ทรู)

วิธีการทำงานของ UASF

ลองจินตนาการตาม..

-

การกำหนดเส้นตาย BIP 148 ประกาศไว้ “ถึงวันที่ 1 สิงหาคม 2017 ถ้านายยังไม่รองรับ SegWit โหนด UASF จะไม่รับบล็อกนาย”

-

ถ้าคุณเป็นนักขุด… คุณขุดบล็อกออกมา แต่ไม่ได้ตีธง “ฉันรองรับ SegWit” UASF โหนดเห็นปุ๊บ พวกเขาจะจับโยนทิ้งไปเลย

-

ผลกระทบ? นักขุดที่ไม่ยอมทำตามจะเจอปัญหา บล็อกที่ขุดออกมาไม่มีใครรับ—เสียแรงขุดฟรี

อาจเกิด Chain Split คือ แยกเครือข่ายเลย ถ้านักขุดเหล่านั้นไปตั้งสายใหม่

ความสำเร็จและความท้าทายของ UASF

ความสำเร็จ.. หลังการรวมพลังผู้ใช้ โหนดรายย่อยกดดันนักขุดได้ไม่น้อย จนกระทั่ง SegWit เปิดใช้งานจริงใน Bitcoin วันที่ 24 สิงหาคม 2017 ช่วยให้ธุรกรรมเร็วขึ้น แก้ Transaction Malleability และเปิดทางสู่ Lightning Network ในอนาคต

ความท้าทาย.. นักขุดบางค่ายไม่โอเค.. โดยเฉพาะ Bitmain ซึ่งคาดว่าจะสูญรายได้บางส่วน ก็นำไปสู่การสนับสนุน “Bitcoin Cash (BCH)” แยกสาย (Hard Fork) ของตัวเองตั้งแต่วันที่ 1 สิงหาคม 2017 นั่นเอง

ว่าแล้วก็เปรียบง่าย ๆ

UASF เหมือนปฏิบัติการยึดคฤหาสน์เจ้าเมืองมาเปิดให้ชาวบ้านเข้าอยู่ฟรี.. แต่อีกฝ่ายบอก

“งั้นฉันออกไปตั้งคฤหาสน์ใหม่ดีกว่า!”

บทเรียนสำคัญ UASF เป็นตัวอย่างชัดว่า “ผู้ใช้” หรือ โหนดรายย่อย สามารถสร้างแรงกดดันให้นักขุดต้องยอมเปลี่ยนได้จริง ๆ ไม่ใช่แค่ยอมรับเงื่อนไขที่ขุดกันมา

ผลกระทบระยะยาวหลังจากนั้นล่ะ?

SegWit ถูกใช้งาน ทำให้ค่าธรรมเนียมธุรกรรมลดลง (ช่วงหนึ่ง) เกิด Lightning Network เป็น Layer 2 สุเฟี้ยวของ Bitcoin เกิด BCH (Bitcoin Cash) เป็นสายแยกที่อ้างว่า Blocksize ใหญ่คือทางออก

สรุปแล้ว UASF ทำให้โลกได้รู้ว่า..

Bitcoin ไม่ใช่ของนักขุด หรือของฝ่ายพัฒนาใดฝ่ายเดียว แต่มันเป็นของทุกคน!

“Bitcoin เป็นของทุกคน”

ไม่มีใครมีอำนาจเบ็ดเสร็จ ไม่ว่าคุณจะถือ Hashrate มากแค่ไหน ถ้า Node ทั่วโลกไม่เอา ก็จบ!

“แรงขุดใหญ่แค่ไหน ก็แพ้ใจมวลชน!”

(น่าจะมีตอนต่อไปนะ.. ถ้าชอบก็ Zap โหด ๆ เป็นกำลังใจให้ด้วยนะครับ)

-

-

@ a012dc82:6458a70d

2025-01-08 02:56:16

@ a012dc82:6458a70d

2025-01-08 02:56:16Table Of Content

-

Rollercoaster Rides

-

The Impact of Macroeconomic Forces

-

Short-term Projections

-

Ethereum's Steady Stance

-

Week-on-week Comparisons

-

Altcoins in Focus

-

The Laggards

-

Market Overview

-

Conclusion

-

FAQ

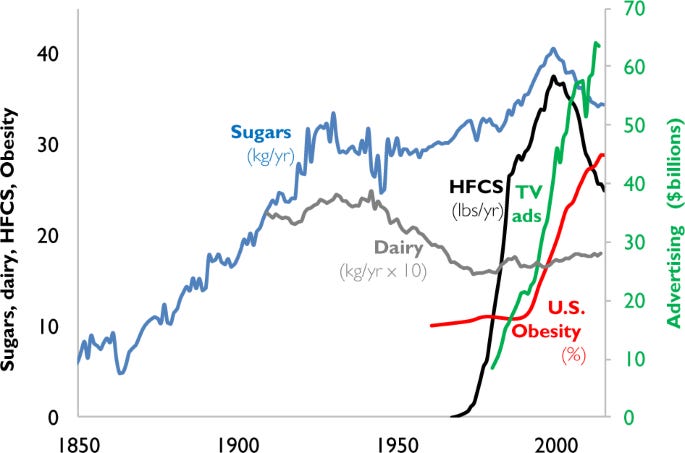

September has once again proven itself to be a tumultuous month for the world's most prominent cryptocurrency, Bitcoin (BTC). This month-long rollercoaster ride has historical roots, as September has historically been a challenging period for Bitcoin. However, the first two-thirds of the month showcased remarkable progress, raising expectations. But the recent resurgence of the US dollar has cast a shadow over the entire crypto market, leading to uncertainty among investors and traders.

Rollercoaster Rides

As the calendar pages flipped through September, Bitcoin embarked on a rollercoaster ride that left many in the crypto community holding their breath. Over the weekend, Bitcoin witnessed a significant dip, eroding a substantial portion of its gains for the month. Sunday's trading session saw the BTC/USDT pair drop by 1.2%, closing at $26,250. Monday's early trades further exacerbated the bearish trend, pushing the pair below $26,150. These rapid fluctuations in Bitcoin's value have been a hallmark of its journey in recent weeks.

The Impact of Macroeconomic Forces

In addition to its internal dynamics, Bitcoin has been significantly influenced by macroeconomic factors, particularly the policies and guidance provided by the Federal Reserve and other central banks. Last week, the Fed's unexpected hawkish stance sent shockwaves through financial markets, including the crypto sphere. This policy shift had an adverse effect on risk-on trading sentiment, causing investors to reevaluate their strategies. As the month approaches its conclusion, a less eventful macroeconomic calendar might imply reduced volatility in the coming days. However, the lingering impact of the Fed's decisions remains a source of uncertainty.

Short-term Projections

To gain insights into Bitcoin's short-term trajectory, market analysts have turned to Binance's order book analysis. According to their assessment, a support line appears to be forming at the $25,000 mark, providing some stability in the face of recent turbulence. Conversely, selling resistance has been identified at $27,500, indicating a significant challenge for Bitcoin's upward momentum. These levels are likely to play a crucial role in determining Bitcoin's path in the immediate future, with traders closely monitoring any breaches or rebounds.

Ethereum's Steady Stance

In contrast to Bitcoin's rollercoaster performance, Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has demonstrated a more stable trajectory over the past few days. While Saturday saw minimal fluctuations, Sunday's trades witnessed a modest 0.8% dip, settling at $1,580. As of Monday, Ethereum has maintained this position, indicating resilience in the face of market turbulence. Ethereum's stability, as compared to Bitcoin's wild swings, underscores the unique dynamics at play within the broader cryptocurrency market.

Week-on-week Comparisons

Examining the performance of these two leading cryptocurrencies over the course of the week reveals intriguing trends. Bitcoin has experienced a 2% decline in its value, signaling the challenges it faced amid a shifting financial landscape. Meanwhile, Ethereum has faced a slightly more significant drop of over 3%. These fluctuations underscore the inherent volatility of the crypto market, even among its most prominent players.

Altcoins in Focus

Beyond Bitcoin and Ethereum, the broader altcoin spectrum presents a diverse set of performances. One standout performer has been Solana (SOL), which surged ahead by an impressive 1.75% in the past seven days. This remarkable growth has garnered the attention of investors and enthusiasts alike. Additionally, Ripple (XRP) has maintained positive momentum, adding approximately 0.8% to its value. These altcoins' resilience serves as a testament to the unique dynamics within the cryptocurrency ecosystem.

The Laggards

However, not all altcoins have been able to escape the gravitational pull of Bitcoin's performance. Prominent digital assets such as Binance's BNB token, Dogecoin (DOGE), Cardano (ADA), Polkadot (DOT), and Polygon (MATIC) have mirrored Bitcoin's downward trend. These digital assets have seen marginal losses in terms of their respective market capitalizations, underscoring the interconnectedness of the cryptocurrency market.

Market Overview

At present, the global cryptocurrency market cap stands at an impressive $1.04 trillion, signifying the substantial size and influence of the digital asset market. Bitcoin continues to command a dominant position, with a market dominance of 49.9%. This reaffirms Bitcoin's status as the undisputed leader in the digital asset space, despite the challenges it faces in September.

Conclusion

As September draws to a close, the battle between Bitcoin and the resurgent US dollar remains uncertain. The interplay between internal dynamics, macroeconomic factors, and market sentiment will continue to shape the crypto landscape in the days ahead. Traders and enthusiasts alike will be watching closely to discern the next moves in this high-stakes confrontation. As the dust settles, the cryptocurrency market will likely reveal new trends and opportunities for those who can navigate these uncertain waters with agility and insight.

FAQ

Why is September historically challenging for Bitcoin? September has traditionally been a tough month for Bitcoin, with factors like market sentiment and macroeconomic forces contributing to its volatility during this period.

How is the US dollar impacting Bitcoin's recent performance? The resurgence of the US dollar has cast a shadow over the crypto market, leading to uncertainty and impacting Bitcoin's value.

What are the short-term projections for Bitcoin and Ethereum? Short-term projections for Bitcoin suggest a support line at $25,000 and resistance at $27,500, while Ethereum has maintained relative stability.

Which altcoins have performed well recently? Solana (SOL) and Ripple (XRP) have shown positive momentum, but some prominent altcoins have followed Bitcoin's downward trend.

That's all for today

If you want more, be sure to follow us on:

NOSTR: croxroad@getalby.com

Instagram: @croxroadnews.co

Youtube: @croxroadnews

Store: https://croxroad.store

Subscribe to CROX ROAD Bitcoin Only Daily Newsletter

https://www.croxroad.co/subscribe

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

-

-

@ fbf0e434:e1be6a39

2025-01-07 14:38:31

@ fbf0e434:e1be6a39

2025-01-07 14:38:31Hackathon 总结

HackPrinceton Fall 2024 Hackathon 于 11 月 8 日至 10 日在普林斯顿大学举行。活动吸引了 238 名开发人员,他们注册了 99 个项目,参与者在为期 36 小时的活动中参与了研讨会、指导会议和展示。Hackathon 设有四个主要方向:教育 + 互动、医疗保健、金融和可持续性,鼓励多样化和创新的想法。

除了主要方向外,还提供了十七个由赞助商提供的挑战作为赏金,为活动增添了竞争元素。参与者通过公开的 GitHub 存储库提交他们的项目,并在最后一天向评委展示了两分钟展示。其中一个亮点是有效的项目"demo",在时间限制下展示了不同行业的重大创意,提升了项目的可见度。

奖品是一个重要的激励因素,整体冠军奖是一套 AirPod Max,将颁发给获胜团队的每位成员,第二名团队将获得 Xbox Series S 游戏机。HackPrinceton Fall 2024 在技能发展、协作和创造性解决方案方面发挥了重要作用,展示了经验丰富和新手参与者的积极参与。

Hackathon 获奖者

Healthcare Prize Winners

-

Bartimaeus: Stealing Vision Back - 该项目通过使用智能手机摄像头、YOLO 和 OpenCV 提供音频导航,帮助盲人进行空间导航,创新性地利用 AI 实现精准路径规划和物体识别。

-

PillPal Pro - 一款智能盒子解决方案,通过 ESP32 微控制器确保老年患者遵循用药习惯,实现跟踪和通知功能,整合了 3D 打印外壳和 Firebase 功能。

-

ReCall.ai - 该项目利用 AI 和可穿戴技术为认知障碍人士识别人脸,支持社交互动,并提供跨多种设施的认知健康洞察。

-

HealthSync - 通过分配患者紧急程度评分并利用点对点网络和高级数据安全进行安全的实时信息交换,增强医院协调。

-

Medbank - 提供个性化健康钱包,实现医疗信息和保险详情的管理,利用 AI 进行智能保险处理和地理空间分析实现供应商匹配。

-

HormoniQ - 通过一款机器学习工具分析健康记录中的激素模式,解决 PCOS 诊断挑战,为医疗保健提供者提供早期干预可能性。

-

World Translationator 5000 - 使用量子自然语言处理技术进行准确翻译,以解决医疗中的语言障碍。

Education and Interaction Prize Winners

- CrystalMath - 一个通过分步动画和语音解说可视化数学问题的 AI 驱动平台,使用 Claude 模型计算和 AWS 托管。

Finance Prize Winners

-

Stratify - 提供一个 AI 驱动的股票回溯测试工具,通过详细分析和用户友好的模拟优化投资策略。

-

Asteroid Audit - 通过游戏化的体验提供税务教育,整合 Unity 进行游戏开发,并使用自定义算法进行视觉税务估算。

-

Orbital Finance - 使用 AI 语音助手技术进行实时客户互动,通过 MATLAB 和 NLP 提供深入的数据分析,助力业务增长。

Sustainability Prize Winners

-

WasteWise - 使用计算机视觉和 GPT-4 API 分析垃圾数据,通过品牌和可回收性评价引导可持续的消费者习惯。

-

SustainAI - 一个 AI 驱动的平台,根据用户数据提供个性化的可持续生活方式建议,利用 MATLAB 进行上下文数据个性化。

Developer Tool Prize Winners

- Scraply - 提供一个拖放界面简化深度学习教育,用于构建神经网络,具有算法建议和游戏化学习功能。

Financial Innovation Prize Winners

-

Chama - 提供实时洞察平台,通过情感分析和可操作建议促进加密货币教育,整合 OnChainKit 进行安全交易。

-

HackAwards - 通过项目所有权和贡献跟踪,使用 VerbWire API 和 Base Blockchain 实现高效处理,促进 Hackathon 参与。

浏览所有项目及更多详情请访问 HackPrinceton Fall 2024。

关于主办方:

HackPrinceton

HackPrinceton 将全球的黑客聚集在一起进行合作和创新。以沉浸式活动闻名,该组织提供研讨会、讲座和指导项目,促进技能发展和创新思维。这些活动为参与者提供了创造有影响力项目的必要工具,即使对那些没有初步团队或项目想法的人也是如此。HackPrinceton 致力于培养创造力,通过其全面支持为有抱负的创新者提供帮助,其使命是激发有影响力和创新性想法的生成。更多信息请访问 HackPrinceton 的网站。

-

-

@ b9af65f8:443fbde5

2025-01-07 10:49:10

@ b9af65f8:443fbde5

2025-01-07 10:49:10AE789 là một trong những nền tảng giải trí trực tuyến được ưa chuộng, mang đến cho người tham gia một không gian giải trí đầy hấp dẫn và thú vị. Với giao diện dễ sử dụng, dễ tiếp cận, AE789 nhanh chóng chiếm được lòng tin của người tham gia nhờ vào sự đa dạng trong các trò chơi cũng như cam kết bảo mật tuyệt đối. Nền tảng này không chỉ cung cấp các trò chơi phong phú mà còn tạo ra một môi trường an toàn và bảo mật cho người dùng.

Một trong những điểm mạnh lớn nhất của AE789 chính là sự đa dạng trong các trò chơi mà nền tảng này cung cấp. Người tham gia có thể dễ dàng tìm thấy một loạt các trò chơi từ đơn giản đến phức tạp, đáp ứng nhu cầu giải trí của nhiều đối tượng khác nhau. Các trò chơi trên AE789 không chỉ về mặt thể loại mà còn có sự đầu tư mạnh mẽ vào đồ họa và âm thanh. Những trò chơi được thiết kế đẹp mắt và có gameplay mượt mà, mang lại cảm giác chân thực, như thể người chơi đang tham gia vào một thế giới thực tế. Điều này tạo nên một trải nghiệm thú vị và không thể thiếu đối với những ai tìm kiếm một nền tảng giải trí chất lượng.

Bên cạnh các trò chơi phong phú, ae666 còn thu hút người tham gia với các chương trình khuyến mãi và sự kiện đặc biệt. Các sự kiện này mang đến cơ hội cho người tham gia nhận được những phần thưởng hấp dẫn và khám phá thêm nhiều tính năng mới của nền tảng. Đặc biệt, những chương trình khuyến mãi của AE789 không chỉ dành cho người tham gia mới mà còn áp dụng cho người chơi lâu dài, giúp duy trì sự hào hứng và thúc đẩy người chơi quay lại với nền tảng này. Các sự kiện này không chỉ tạo ra những cơ hội mới mẻ mà còn giúp người tham gia kết nối và giao lưu với cộng đồng giải trí sôi động trên AE789.

Bảo mật là yếu tố quan trọng được AE789 đặt lên hàng đầu. Nền tảng này sử dụng các công nghệ bảo mật tiên tiến nhất để bảo vệ thông tin cá nhân và giao dịch của người tham gia. Mọi dữ liệu đều được mã hóa và lưu trữ an toàn, giúp người tham gia hoàn toàn yên tâm khi sử dụng dịch vụ. AE789 cam kết cung cấp một môi trường bảo mật tuyệt đối, giúp người dùng không phải lo lắng về các rủi ro về thông tin cá nhân. Điều này tạo ra niềm tin vững chắc cho người tham gia, từ đó tăng cường sự trung thành và mức độ hài lòng với nền tảng.

Cuối cùng, AE789 cũng nổi bật với dịch vụ chăm sóc khách hàng tận tâm và chuyên nghiệp. Đội ngũ hỗ trợ khách hàng của nền tảng luôn sẵn sàng giải đáp mọi thắc mắc và hỗ trợ người tham gia trong suốt quá trình sử dụng dịch vụ. Với sự nhiệt tình và chuyên nghiệp, đội ngũ chăm sóc khách hàng của AE789 giúp người tham gia giải quyết nhanh chóng các vấn đề phát sinh, từ đó nâng cao trải nghiệm sử dụng nền tảng. Sự hỗ trợ chu đáo này cũng là một trong những yếu tố quan trọng giúp AE789 trở thành một nền tảng giải trí trực tuyến được yêu thích và tin tưởng.

Với tất cả những yếu tố trên, AE789 xứng đáng là lựa chọn hàng đầu cho những ai tìm kiếm một không gian giải trí trực tuyến chất lượng và an toàn. Với sự đa dạng trong các trò chơi, chương trình khuyến mãi hấp dẫn, bảo mật tuyệt đối và dịch vụ hỗ trợ khách hàng tận tâm, AE789 cam kết mang đến cho người tham gia một trải nghiệm giải trí trọn vẹn và tuyệt vời.

-

@ 1cb14ab3:95d52462

2025-01-08 18:11:43

@ 1cb14ab3:95d52462

2025-01-08 18:11:43

Previous Works in the Series:

More from Hes:

All images are credit of Hes, but you are free to download and use for any purpose. If you find joy from these photos, please feel free to send a zap. Enjoy life on a Bitcoin standard.

-

@ b9af65f8:443fbde5

2025-01-07 10:48:15

@ b9af65f8:443fbde5

2025-01-07 10:48:1588Club là một nền tảng giải trí trực tuyến đang ngày càng thu hút sự chú ý của người dùng nhờ vào những dịch vụ đa dạng, chất lượng cao và tính bảo mật tuyệt đối. Với giao diện thân thiện, dễ sử dụng và các trò chơi phong phú, 88Club mang đến một không gian giải trí lý tưởng cho tất cả mọi người. Nền tảng này cam kết mang lại trải nghiệm tuyệt vời, từ các trò chơi giải trí đơn giản đến những trò chơi đòi hỏi kỹ năng cao, luôn đáp ứng nhu cầu đa dạng của người tham gia.

Điều làm nên sự khác biệt của 88Club chính là sự đa dạng trong các trò chơi và dịch vụ mà nó cung cấp. Người tham gia có thể dễ dàng tìm thấy một loạt các trò chơi hấp dẫn, từ những trò chơi giải trí nhẹ nhàng đến những trò chơi yêu cầu sự tính toán và chiến lược. Các trò chơi trên 88Club đều được thiết kế với đồ họa đẹp mắt, âm thanh sống động và gameplay mượt mà, mang đến cho người chơi những trải nghiệm chân thực và đầy hấp dẫn. Đặc biệt, 88Club không ngừng cập nhật các trò chơi mới, tạo ra một không gian giải trí không bao giờ bị nhàm chán.

Bên cạnh các trò chơi thú vị, 88club còn tổ chức các sự kiện và chương trình khuyến mãi hấp dẫn, mang đến cho người tham gia cơ hội nhận được những phần thưởng giá trị. Những sự kiện này không chỉ tạo cơ hội để người tham gia thể hiện tài năng mà còn giúp họ giao lưu và kết nối với cộng đồng. Với những chương trình khuyến mãi đặc biệt, người tham gia sẽ có cơ hội trải nghiệm những trò chơi mới mẻ và nhận những phần thưởng hấp dẫn, tạo nên một môi trường giải trí sôi động và phong phú.

Bảo mật là yếu tố mà 88Club đặc biệt chú trọng. Nền tảng này sử dụng các công nghệ bảo mật tiên tiến để bảo vệ thông tin cá nhân và các giao dịch của người tham gia. Mọi thông tin người dùng được mã hóa và bảo vệ an toàn tuyệt đối. Với hệ thống bảo mật mạnh mẽ, người tham gia có thể yên tâm khi tham gia vào các trò chơi và sự kiện mà không lo ngại về các vấn đề bảo mật. Điều này giúp 88Club xây dựng được lòng tin vững chắc trong cộng đồng người tham gia.

Một yếu tố quan trọng khác giúp 88Club trở thành lựa chọn hàng đầu chính là dịch vụ hỗ trợ khách hàng tận tình và chuyên nghiệp. Nền tảng này có đội ngũ hỗ trợ khách hàng luôn sẵn sàng giải đáp mọi thắc mắc và hỗ trợ người tham gia trong quá trình sử dụng dịch vụ. Với thái độ thân thiện, nhiệt tình và chuyên môn cao, đội ngũ hỗ trợ khách hàng của 88Club cam kết mang lại dịch vụ hỗ trợ tốt nhất, giúp người tham gia có thể tận hưởng những trải nghiệm giải trí tuyệt vời nhất mà không gặp phải bất kỳ rào cản nào.

Với tất cả những yếu tố trên, 88Club xứng đáng là một trong những nền tảng giải trí trực tuyến hàng đầu hiện nay. Không chỉ cung cấp các trò chơi hấp dẫn và đa dạng, 88Club còn tạo ra một không gian giải trí an toàn và bảo mật cho người tham gia. Với sự phát triển không ngừng và cam kết mang lại trải nghiệm giải trí chất lượng, 88Club chắc chắn sẽ tiếp tục là lựa chọn lý tưởng cho những ai yêu thích không gian giải trí trực tuyến đầy thú vị và sáng tạo.

-

@ 68ce44e4:ecd5f574

2025-01-07 10:11:16

@ 68ce44e4:ecd5f574

2025-01-07 10:11:16Another Depin project... In early stage.. Backed by Solana and Hostinger.. ✅🔥

https://app.mygate.network/login?code=BMT47j

Join now in early stage n earn good rewards.. 🔥💯

mygate #cryptoairdrops #cryptocurrency #bitcoin #earnfreecrypto

-

@ bf47c19e:c3d2573b

2025-01-08 18:06:36

@ bf47c19e:c3d2573b

2025-01-08 18:06:36Originalni tekst na danas.rs

22.09.2024 / Autor: Marko Matanović

Bitkoin je 2009. godine zamišljen da bude digitalni keš. Zvučalo je revolucionarno zbog toga što je mnoge dovelo u dilemu: kako nešto potpuno digitalno može da ima vrednost i bude valuta.

Pre 15 godina smo živeli u društvu u kome je preko 95 odsto ukupnog novca u opticaju već potpuno digitalno i virtuelno.

Danas je još više izražena digitalizacija novca. Bitkoin je bio deo procesa evolucije više nego revolucije kada je u pitanju barem forma “novca”.

Petnaest godina kasnije bitkoin nije zamenio tradicionalne valute: dolare, evre, dinare. I verovatno to neće uraditi. Nije ispunio početnu zamisao, digitalni novac.

Ali se nametnuo kao čuvar vrednosti. Jedan od razloga je jednostavan. Kada posedujemo bilo koji oblik imovine, uvek ćemo za plaćanje (čemu novac većini ljudi i služi) koristiti najmanje kvalitetan novac, onaj koji vremenom ne dobija na vrednosti ili je gubi čak.

Veći deo vlasnika bitkoina veruje da će njegova vrednost rasti vremenom. Dok s druge strane imamo dinar, evro ili dolar koji će 100 odsto za godinu dana vredeti dva odsto ili 15 odsto manje. Zbog toga većina vlasnika bitkoina ga neće koristiti da kupuje hleb ili plaća račune za telefon, tj. kao sredstvo plaćanja.

Za razliku od fizičkog zlata, svima poznatog, jedna od prednosti bitkoina je prenosivost. Bitkoin infrastruktura funkcioniše tako da se svaka transakcija prenosa bitkoina obavlja u proseku za 10-ak minuta, 24/7/365.

Ta transakcija će se realizovati 100 odsto ako je usklađena sa pravilima Bitkoin ekosistema. Pravila su pritom transparentna, ista, lako primenljiva za sve. Iz ovoga se nameće i druga i treća potencijalna prednost bitkoina u odnosu na zlato. Bez obzira na količinu i vrednost bitkoina koji se kroz transakciju prenose, vreme tog prenosa je oko 10 minuta. A cena obrade transakcije zanemarljiva. Par dolara ili manje. Na dan pisanja teksta, kilogram zlata je vredeo oko 84.000 dolara ili 10 kilograma oko 840.000 dolara itd. Slične vrednosti je 1,4 bitkoin, tj. 14 bitkoina…

Postoje ozbiljni regulatorni, sigurnosni, vremenski, troškovni izazovi prenosa pomenutih količina zlata s jedne lokacije na drugu ili u drugu državu. Za prenos 0.0001 btc-a (bitkoina), vrednosti oko šest dolara ili za prenos 1.000 btc, vrednosti oko 60 miliona dolara trebaće vam 10 minuta. Transakcije vas mogu koštati i manje od jednog dolara!

I ne postoji bezbednosni rizik. Neuporedivo brže, sigurnije, jeftinije. Neki kažu da je bitkoin „digitalno zlato“ i pouzdana mreža za prenos vrednosti.

Bitkoin su u početku koristili samo pojedinci, fizička lica. Danas ga koriste i kompanije i neke države. Pojedinci deo sredstava prebacuju u bitkoine, kako bi se sačuvali od inflacije koja je u skoro svim ekonomijama prisutna i obezvređuje novac koji posedujemo.

Neki u njemu vide potencijal rasta vrednosti. Neki se bave “trading-om”, špekulisanjem u nadi da će kratkoročno zaraditi. Neki ga koriste da bi preneli vrednost brže i lakše.

U ratom zahvaćenih delovima sveta, deo populacije je kroz bitkoin i kriptovalute imao jedinu mogućnost da spase svoju do tada stečenu imovinu. U tim situacijama ne možete nekretninu, zlato, umetnička dela, automobile lako preneti ili sačuvati. Često su tada blokirani bankarski računi ili rad banaka. Ali, deo sredstava se može prebaciti u kriptovalute.

Zbog toga u Srbiji puno ljudi koji su se sklonili iz Rusije i Ukrajine zapravo koristi kriptovalute. Globalno, kompanije kupuju bitkoine, jer imaju investiciono usmerenje ili usmerenje ka diversifikaciji sredstava. I takođe bitkoin ili neke druge kriptovalute koriste kao sredstvo plaćanja u internacionalnom poslovanju. Neuporedivo je veća brzina realizacije transakcija kritpovaluta u poređenju sa transakcijama koje idu kroz bankarski sistem.

Postoje jurisdikcije koje nisu integrisane u globalne finansijske sisteme i ne postoji način naplate i saradnje dve kompanije iz dve države. Sve dok se kripto nije pojavio. Države imaju različite stavove po pitanju kripta. Neke ga kupuju. Neke ga rudare čak.

Ali većina je donela regulatorne okvire koji definišu zakonske mogućnosti i načine korišćenja kriptovaluta. I za građane i za kompanije. I za firme koje pružaju usluge povezane za kriptovalutama u tim državama. U Srbiji se primenjuje Zakon o digitalnoj imovini od 2021. godine i time su postavljeni dodatni regulatorni okviri.

SPLET konferencija koja se 8. oktobra održava u Beogradu je deo svog programa posvetila temama povezanim sa kriptovalutama, tokenizacijom, pravnim aspektima tog sveta.

ECD.rs, prva kriptomenjačnica u Srbiji, će imati svoje predstavnike i paneliste na SPLET-u. Cilj je da još dublje zaronimo u ove teme. Želimo da ponudimo dodatne uvide, odgovore. Delićemo iskustvo od 12 i više godina bavljenja kriptovalutama. Vidimo se na SPLET-u!

Splet konferenciju zajednički organizuju projekti „Preduzmi ideju“ u realizaciji Inicijative „Digitalna Srbija“ i „Srbija Inovira“, koje sprovodi ICT HUB, u saradnji sa Američkom agencijom za međunarodni razvoj (USAID). Ovogodišnju konferenciju realizuju i uz podršku i pokroviteljstvo Ministarstva nauke, tehnološkog razvoja i inovacija.

-

@ bf47c19e:c3d2573b

2025-01-08 17:55:06

@ bf47c19e:c3d2573b

2025-01-08 17:55:06Originalni tekst za nin.rs.

09.10.2024 / Autor: Marko Matanović

Najveći deo stvari merimo zajedničkim imeniteljem – novcem. Fantastični izum društva. Olakšava komunikaciju, saradnju i napredak civilizacije. Trenutna novčana vrednost mnogih stvari ne mora biti pokazatelj realne ili vrednosti na duge staze.

Bitkoin kao kriptovaluta ima svojih uspona i padova. U ceni. Kada nešto vredi nula pa krene od par mesta desno iza decimalnog zareza u $ protivvrednosti i završi na 50.000 ili 70.000$, može se reći da je bilo više uspona nego padova.

Zamišljen i najavljen je kao digitalni keš 2008. godine. Preskačući prvu godinu ili dve, rezervisane skoro isključivo za uzak krug programera, sledi poistovećivanje bitkoina sa sredstvom za plaćanja ilegalnih usluga i proizvoda. Zbog delimične zablude da su transakcije bitkoinom anonimne.

Godine 2013. godine pada Silk Road platforma, online marketplace, na kome se za bitkoin moglo kupiti puno toga ilegalnog. Po nekima to je i konačni pad bitkoina. Iz današnje perspektive, neupućena osoba može i dalje ostati pri stavu da je bitkoin pretežno tu za izvršenje ilegalnih transakcija. Bitkoin i danas postoji, Silk Road ne.

Par meseci posle Silk Road-a, pada i tada pratkično jedina “ozbiljna” kripto berza Mt. Gox. U to vreme odgovorna za 70%+ svih bitkoin transakcija. Tačno 10 godina kasnije, svedoci smo vraćanja dela izgubljenih sredstava (oko 25%) tadašnjim vlasnicima naloga na Mt. Gox berzi. Bitkoin je danas 100 puta vredniji nego pre 2014. Taj vraćeni “delić” izgubljenih bitkoina njegovim vlasnicima je danas “samo” 25 puta vredniji.

Bilo je još dosta propalih kripto projekata. I biće ih. Među poznatijim, prevara iza OneCoin-a. Sunovrat UST-a i Lune, Celsius i FTX bankroti. Svaki odogovoran za gubitke koji prelaze milijarde dolara. Bitkoin je i dalje tu. Bitkoin je imao i konkurente iz redova kriptovaluta. Poslednji pravi je iz 2017. godine i “Bitcoin Cash”. Danas kada se pogleda gde je jedan a gde drugi sve je jasno.

Satoshi Nakamoto, ime iza ideje bitkoina i njegovog lansiranja, je postavio fascinantne postulate na kojima će prva kriptovaluta funkcionisati. A inspirisan manjkavostima globalnog finansijskog sistema. Bitkoin je baziran na transparentnom, decentralizovanom sistemu. Dostupan svima, sa jednakim i izuzetno niskim barijerama ulaska i izlaska iz tog ekosistema. Funkcioniše po setu pravila koja su ista za sve. Ukoliko se poštuju, transakciju bitkoinom niko ne može osporiti i ne može se retroaktivno manipulisati.

Prvi put imamo digitalni sadržaj koji se ne može kopirati. Bitkoin ekosistem funkcioniše 15 godina pratkično bez down-time-a. Usko je shvatanje reći da je rudarenje bitkoina proces koji bespotrebno troši previše energije. Ili da bitkoin nema uporište u nekoj opipljivoj vrednosti. Ta skupa reč je poverenje. Ničijom svesnom namerom, već organski, bitkoin je od digitalnog keša postao prepoznat kao čuvar vrednosti, digitalno zlato. Jer zašto da koristiš za svakodnevna plaćanja nešto što može vredeti za godinu ili godine 5%,10%, 50% više, ako imaš RSD, EUR ili $ koji će 100% za godinu dana vredeti 2% ili 15% manje?

Danas bitkoin koriste obični ljudi, kompanije i države.

Satoshi je svakako imao drugačiju viziju ove kriptovalute – digitalni keš i pošteniji novac. Kreirajući ekosistem na koji svi mi možemo vršiti uticaj barem podjednako koliko i Satoshi, ostavljena su otvorena vrata da se vizija promeni. Vizija je prilagođena, prepuštena našim prethodnim i budućim postupcima i društvenim okolnostima. Važno je da su postulati i dalje tu. Sa njima i Bitkoin.

-

@ d830ee7b:4e61cd62

2025-01-07 09:14:17

@ d830ee7b:4e61cd62

2025-01-07 09:14:17จุดเริ่มต้นของสงครามบล็อกไซส์

ลองนึกภาพร้านอาหารเล็ก ๆ ที่มีแค่สิบโต๊ะ แต่ลูกค้ากลับล้นหลามจนพนักงานวิ่งวุ่นตลอดวัน เราอาจเห็นภาพชัดว่าปัญหาต้องตามมาแน่ ๆ ถ้าจำนวนโต๊ะไม่พอกับลูกค้าที่ต่อแถวกันยาวเหยียด

บางคนหัวเสียจนยอมจ่ายเงินเพิ่มเพื่อรีบได้โต๊ะนั่ง ในขณะที่อีกหลายคนก็ยืนรอจนหมดอารมณ์กิน สุดท้ายก็ต้องถามกันว่า

“จะทำยังไงดี ถึงจะไม่เสียเอกลักษณ์ร้าน และไม่ปล่อยให้ลูกค้าต้องหงุดหงิดมากมายขนาดนี้?”

บรรยากาศตรงนี้เปรียบได้กับสภาพของบิตคอยน์ช่วงราวปี 2015 ซึ่งเดิมทีเคยรองรับธุรกรรมได้สบาย ๆ แต่จู่ ๆ ก็ต้องแบกรับภาระธุรกรรมมหาศาลจน “คิวยาวเป็นหางว่าว”

ทั้งหมดนี้มาจากข้อกำหนดตั้งต้นว่า แต่ละบล็อกมีขนาดเพียง 1 เมกะไบต์ และบล็อกจะถูกสร้างทุก ๆ ประมาณ 10 นาที ทีนี้พอผู้ใช้หลั่งไหลเข้ามาไม่หยุด พื้นที่เล็ก ๆ ที่ว่าเลยเอาไม่อยู่ ใครอยากให้ธุรกรรมติดบล็อกก่อนก็ควักกระเป๋าจ่ายค่าธรรมเนียมเพิ่ม ถ้าไม่จ่าย ธุรกรรมอาจรอข้ามวันข้ามคืน แถมยังเสี่ยงค้างเติ่งไปเลย

ความไม่พอใจจึงปะทุขึ้นเป็นเสียงดังลั่นว่า

“แก้ปัญหานี้ยังไงดี จะขยายบล็อกกันเลยไหม หรือปรับซอฟต์แวร์ให้ฉลาดขึ้นโดยไม่เพิ่มขนาดจริง ๆ?”

เมื่อสองแนวคิดนี้ตั้งฉากกัน คนในแวดวงบิตคอยน์จึงแตกเป็นสองฝั่งหลัก ๆ

ฝั่งแรกเสนอ “เพิ่ม Blocksize” โดยบอกว่าต้องแก้ให้จบตรงจุด เหมือนเพิ่มโต๊ะเข้าไปในร้าน จะได้รองรับลูกค้าได้มากขึ้น เพราะเชื่อว่า Bitcoin ต้องพร้อมสำหรับการใช้งานทั่วโลก การขยายจาก 1 MB เป็น 2 MB หรือ 4 MB หรือมากกว่านั้น จึงตอบโจทย์ผู้ใช้หลากหลายตั้งแต่รายเล็กไปจนถึงธุรกิจใหญ่

แกนนำฝ่ายนี้คือ Roger Ver หรือ “Bitcoin Jesus” ที่ผลักดันแนวคิดนี้สุดตัวร่วมกับทีมขุดอย่าง Bitmain ซึ่งไม่อยากเห็นใครต้องยืนรอนานหรือจ่ายแพงเวอร์

อีกฝ่ายคือทีมพัฒนา “Bitcoin Core” ที่มี Greg Maxwell และ Peter Wuille เป็นหัวขบวน พวกเขายืนยันว่าถ้ายิ่งเพิ่มขนาดบล็อกให้ใหญ่โต ก็จะยิ่งเก็บข้อมูลมากจนโหนดรายเล็ก ๆ ต้องใช้ทรัพยากรสูงขึ้น สุดท้ายอาจเหลือแค่รายใหญ่ที่รันโหนดไหว แล้ว Decentralization ก็จะถูกบั่นทอน

ฝ่ายบิตคอยน์คอร์จึงเสนอทางแก้แบบ Segregated Witness (SegWit) ซึ่งเปรียบได้กับการจัดโต๊ะใหม่ให้แยบยล—ย้ายข้อมูลลายเซ็นธุรกรรมไปไว้นอกบล็อกหลัก ทำให้ในบล็อกมีพื้นที่ใส่ธุรกรรมได้อีกเยอะขึ้นโดยไม่ต้องทุบผนังขยายร้าน

ความขัดแย้งไม่ได้จำกัดอยู่ในเว็บบอร์ดหรือฟอรัม แต่ลุกลามไปจนถึงเวทีระดับโลกอย่าง Consensus Conference ปี 2016 และ 2017 ฝ่ายหนุนเพิ่มขนาดบล็อกก็โหวกเหวกว่า “นี่แหละถูกจุดที่สุด”

ส่วนทีมบิตคอยน์คอร์ก็โต้กลับว่า “ขืนบล็อกใหญ่ไป ระบบก็เสี่ยงรวมศูนย์ เพราะใครจะมีทุนซื้ออุปกรณ์แพง ๆ และเน็ตแรง ๆ ตลอด” จึงไม่ใช่แค่ถกเถียงทางเทคนิค แต่สะท้อนมุมมองปรัชญาด้วยว่าบิตคอยน์ควรเป็นระบบ “กระจาย” หรือ “รวมศูนย์” กันแน่

ยิ่งถกก็ยิ่งมองไม่เห็นทางออก.. บ้างก็เสนอให้ Fork แยกเครือข่ายไปเลย เหมือนเปิดสาขาร้านใหม่ ใครไม่โอเคแนวไหนก็ไปอีกสาขาหนึ่ง

Roger Ver กับสายขุดยักษ์ใหญ่ก็บอกว่าถ้าไม่เพิ่ม Blocksize ต่อไปค่าธรรมเนียมสูง และคนจะเข้าถึงยากขึ้น เหมือนร้านที่โต๊ะแน่นจนคนล้น

ฝั่งบิตคอยน์คอร์ย้ำว่าจะพัฒนา SegWit กับ Lightning Network เพื่อขนธุรกรรมส่วนใหญ่ไปทำงานนอกบล็อกหลัก แม้อาจต้องรอให้เทคโนโลยีสุกงอม แต่คงไม่กระทบโหนดรายเล็กมากนัก

ในโลกออนไลน์ สงครามโซเชียลก็เริ่มเดือด ตั้งกระทู้กันทุกวัน บางคนต่อว่านักขุดว่าเอากำไรเป็นหลัก บ้างบอกทีมบิตคอยน์คอร์ไม่เข้าใจปัญหาฝั่งธุรกิจจนชาวเน็ตแบ่งเป็นหลายค่าย คำถามใหญ่จึงดังขึ้น

“ตกลงบิตคอยน์จะเป็น ‘อาวุธทางการเงิน’ ของคนหมู่มากได้จริงเหรอ ถ้าไม่มีพื้นที่ในบล็อกมากพอ?”

หรือ..

“ถ้าผลุนผลันขยายบล็อกไปเรื่อย ๆ จนเหลือแต่รายใหญ่ที่รันโหนดได้ แบบนั้นยังถือว่าเป็น บิตคอยน์ในอุดมการณ์ของ Satoshi Nakamoto ไหม?”

พอหลายฝ่ายพยายามประนีประนอมกันหลายเวที สุดท้ายก็ไม่ประสบผล Roger Ver มั่นใจว่าต้องเพิ่ม Blocksize เท่านั้นจึงพาบิตคอยน์รอด

ส่วนทีม Core ไม่ยอมเปิดทางง่าย ๆ เพราะกลัวระบบเสียหลักการกระจายอำนาจไป

ด้วยเหตุผลทั้งคู่จึงทำให้สงครามนี้ยืดเยื้อ กลุ่มขุดและพัฒนาในแวดวงเริ่มจับตากันเครียด บ้างเสนอทางผสม เช่น เพิ่ม Blocksize นิดหน่อย แล้วเปิด SegWit ควบคู่ บ้างเสนอว่าให้เลื่อนตัดสินใจออกไปก่อนก็ยังดี

ไม่มีใครรู้ว่าจะลงเอยอย่างไร.. และหากเรื่องนี้พลั้งพลาดบิตคอยน์อาจแตกเป็นสองสายจนผู้ใช้หรือนักลงทุนสับสน

สถานการณ์ช่วงแรกเหมือน “ไฟที่กำลังคุ” เพราะยังไม่ปะทุเต็มที่แต่ก็แรงพอจะยกครัวไปตลอดทั้งวงการ คนพัฒนาก็ทำ SegWit และ Lightning Network ไป ฝ่ายหนุน Blocksize ก็เดินสายผลักดันให้เต็มที่ ถึงขั้นยอมเสี่ยง Fork ถ้าจำเป็นจริง ๆ

นี่แหละคือจุดเริ่มต้นของความตึงเครียดที่ไม่ใช่แค่ “ขนาดบล็อก” แต่หมายถึงอนาคตของบิตคอยน์ที่อาจพลิกโฉมไปตลอดกาล..

คิดง่าย ๆ ก็เหมือนร้านอาหารเล็ก ๆ ที่กำลังจะก้าวสู่ภัตตาคารใหญ่ระดับท็อป เมื่อแขกเหรื่อมาไม่หยุดหย่อน แน่นอนว่าเสียงเรียกร้องให้ทุบกำแพงขยายร้านย่อมมีบ้าง แต่บางคนอาจบอก “เปลี่ยนวิธีจัดโต๊ะแทนได้ไหม?” ทุกแนวทางต่างมีทั้งโอกาสและความเสี่ยง

ที่สำคัญคือ บิตคอยน์เป็นสินทรัพย์อันดับหนึ่งของโลกคริปโตฯ หากก้าวพลาดเพียงเล็กน้อย อาจสะเทือนไปทั่วโลกด้วย

เนื้อหาถัดไปผมจะชวนมาดูว่า ใครกันแน่ที่อยู่เบื้องหลังการขับเคลื่อนสงคราม Blocksize ครั้งนี้?

พวกเขามีแรงจูงใจอะไรกันบ้าง? และจะนำพาบิตคอยน์ไปในทิศทางใด?

ขอทิ้งท้ายส่วนนี้ให้คิดเล่น ๆ

“ถ้าเพิ่ม Blocksize สุด ๆ แต่โหนดรายเล็กหายหมด สุดท้ายยังเรียกว่ากระจายอำนาจอยู่ไหม?”

“หรือจะรักษาบล็อกขนาดเล็กไว้อย่างเดิม แล้วปรับเทคโนโลยีเสริมให้ฉลาดขึ้นดีกว่า?”

ทั้งหมดที่เล่ามายังเป็นแค่บทโหมโรงนะครับ สงครามนี้เพิ่งปะทุเท่านั้น ยังมีอะไรเข้มข้นอีกมาก ติดตามต่อว่าฝั่งไหนจะงัดไม้เด็ดอะไรออกมาเพื่อรักษา “ร้านอาหาร” แห่งนี้ให้เดินหน้าต่อไปได้โดยไม่เสียตัวตน..

ใครคือผู้ขับเคลื่อนสงคราม Blocksize?

พาร์ทที่แล้ว เราได้เห็นภาพรวมของปัญหาที่ดูเหมือนจะเล็กนิดเดียวอย่าง “บล็อกใหญ่หรือเล็ก?” แต่กลับแผ่ขยายจนกลายเป็นมหากาพย์ความขัดแย้งในชุมชนบิตคอยน์ เสมือนเดิมพันอนาคตของสกุลเงินดิจิทัลอันดับหนึ่งบนโลกใบนี้

พอตอนนี้ถึงเวลาแล้วที่เราจะก้าวลึกลงไปในเบื้องหลังของสงครามอันร้อนแรงนี้ ใครอยู่ในเงามืด? ใครลากสายอยู่หลังเวที? และใครโดดขึ้นมาเดินลุยบนสนามเปิดเพื่อต่อสู้แย่งชิงฉันทามติของเครือข่าย?

มีคนชอบเปรียบเทียบว่าศึก Blocksize ครั้งนี้คือ “สนามรบดิจิทัล” ซึ่งไม่ได้ยิงกระสุนห้ำหั่นแต่ใช้โค้ดแทน ขับเคลื่อนด้วย “Hashrate” ที่เปรียบเสมือนอาวุธหนัก ฝ่ายไหนถือกำลังขุดสูงกว่าก็เหมือนมีกองทัพเบิ้ม ๆ อยู่ในมือ

ด้านนักพัฒนาและผู้ใช้ทั่วไปก็คล้ายประชากรพลเรือนที่บางทีก็ต้องยอมรับชะตา แต่บางทีก็รวมตัวประท้วงสร้างพลังของตัวเองให้โลกได้เห็น ทุกฝีก้าวมีคนจ้องดูว่าจะเกิด “Hard Fork” หรือ “Soft Fork” เมื่อไหร่ และกฎใดจะถูกประกาศเป็น “กฎใหม่” ให้ทุกคนต้องปฏิบัติตาม

ในมุมของคนอยาก “เพิ่ม Blocksize” เห็นชื่อของ Roger Ver โผล่โดดเด่นสุด ๆ เขาคือ “Bitcoin Jesus” แห่งยุคบุกเบิก ที่ครั้งหนึ่งทุ่มทุนโปรโมตบิตคอยน์แบบไม่กลัวเจ๊ง ด้วยความเชื่อว่าบิตคอยน์ควรเป็น “เงินสดดิจิทัล” ลื่นไหลจ่ายคล่อง สลัดค่าธรรมเนียมแพง ๆ ทิ้งไปให้หมด

ในสายตาเขา การคงบล็อกเล็กแค่ 1 MB ยิ่งทำให้คนใช้แล้วปวดหัว ค่าธรรมเนียมสูงปรี๊ด ธุรกรรมอืดอาดเกินจะทน เลยต้องขยายขนาดบล็อกแบบจัดเต็ม เหมือนขยายถนนให้รถวิ่งง่าย ไม่งั้นก็ต้องมุดเข้าอุโมงค์แคบ ๆ จอดติดกันยาว

และ “Bitmain” บริษัทเครื่องขุดเบอร์ใหญ่สุดในโลกก็เข้ามาเสริมพลังแบบเต็มขั้น ขับเคลื่อนโดย Jihan Wu ที่เล็งเห็นว่าพอยิ่งขยายบล็อก ธุรกรรมก็จะยิ่งทะลัก ค่าธรรมเนียมก็จะเพิ่มขึ้น นักขุดจะได้เงินดี สร้างแรงดึงดูดให้คนหันมาหาบิตคอยน์มากขึ้นไปอีก

Bitmain ถือ Hashrate มหาศาล จึงไม่ต่างจากมีทัพใหญ่พร้อมยกพลบุก เพื่อดันแนวคิด “Fork” ได้ตลอดเวลา ถ้าฝั่งเพิ่ม Blocksize อยากจะเล่นเกมสายไหนก็เดินได้เลย

อีกฟากสนาม คือทีม “Bitcoin Core” ถือเป็นแกนกลางที่คุมซอฟต์แวร์หลัก

นำโดย *Greg Maxwell, Peter Wuille และ Wladimir van der Laan***

พวกเขาห่วงว่าถ้าบล็อกใหญ่ขึ้นมาก คงจะมีแค่นายทุนใหญ่เท่านั้นที่รันโหนดไหว ประชาชนตัวเล็ก ๆ หรือคนไม่มีทรัพยากรเยอะก็ยิ่งถูกกันออกจากเครือข่าย กลายเป็นระบบกึ่งรวมศูนย์ ซึ่งสวนกับหลักการเดิมที่ Satoshi Nakamoto เคยวางไว้

พวกเขาจึงเสนอ Segregated Witness (SegWit) เพื่อตัดข้อมูลลายเซ็น (Witness Data) ทิ้งไปนอกบล็อก ทำให้มีพื้นที่รองรับธุรกรรมได้เยอะขึ้นแบบไม่ต้องขยาย “เลนหลัก” และจะต่อยอดด้วย Lightning Network เพื่อยกธุรกรรมส่วนใหญ่ไปอยู่นอกบล็อกอีกชั้น

ฝั่งนักพัฒนาเหล่านี้ไม่ได้สู้อย่างโดดเดี่ยว แต่มีผู้ใช้รวมพลังกันในนาม UASF (User-Activated Soft Fork) มองว่า

“ใครว่าขุดเยอะแล้วสั่งการได้หมด? ผู้ใช้ทั่ว ๆ ไปก็ออกแบบกติกาได้เหมือนกัน?”

พวกเขาบอกเลยว่า “ถ้าไม่หนุน SegWit พวกฉันไม่เอาด้วยนะ”

การเคลื่อนไหวแบบนี้สร้างแรงกดดันให้นักขุดต้องรีบตามน้ำ ไม่งั้นเสี่ยงโดนผู้ใช้ปฏิเสธบล็อกกันถ้วนหน้า

ปี 2016-2017 กลายเป็นช่วงร้อนระอุสุด ๆ Roger Ver ลุกขึ้นพูดเมื่อไหร่ มักกล่าวหาทีม Core ว่าปิดประตูโอกาสทองของบิตคอยน์

ส่วนทีม Core ก็ตีโต้กลับว่า “ถ้าเพิ่มบล็อกเร็วไป มีแต่จะทำให้บิ๊กทุนไม่กี่เจ้าเข้ามาผูกขาด!”

พอยิ่งเถียงกันในงานใหญ่ เช่น Consensus Conference 2017 ประเด็นก็ยิ่งเดือด บางฝ่ายอยาก “Fork” แตกสายไปเลย บางฝ่ายยังคอยประนีประนอม แต่ก็ไม่มีใครลงรอยกันได้

Roger Ver และ Bitmain เร่งเครื่องดัน Hard Fork

ทีม Core ไม่ยอมถอย ยืนกราน SegWit ก่อน แล้วใช้ Lightning Network ปิดเกม

ผลคือ...

ทุกคนเริ่มกลัวว่า “Bitcoin จะแตกเป็นสองสายจริง ๆ หรือ?”

จะเป็นบล็อกใหญ่ หรือจะอยู่ 1 MB พร้อม SegWit?

กลางปี 2017 สงครามนี้จึงคลอด “Bitcoin Cash” เครือข่ายใหม่ที่กลุ่ม Roger Ver ผลักดัน บอกว่านี่คือ “Bitcoin ตัวจริง” ที่ค่าธรรมเนียมถูกกว่า ธุรกรรมไวกว่า รองรับคนจำนวนมากได้

ในขณะเดียวกัน เครือข่ายหลัก BTC ก็เปิดใช้ SegWit ไป พร้อมมุ่งหน้าเปิดทาง Lightning Network ทำให้ครึ่งหนึ่งของชุมชนยังเชื่อมั่นว่าการรักษาบล็อกเล็ก คือหัวใจสำคัญของกระจายอำนาจ

Blocksize War ครั้งนี้ เกินกว่าจะเรียกว่า “ดีเบตเชิงเทคนิค”

มันคล้ายการปะทะอุดมการณ์ของ “กระจายอำนาจอย่างเคร่งครัด” ปะทะ “ขยายบล็อกให้ใช้งานจริงในชีวิตประจำวัน”

ทั้งสองฝ่ายต่างยิงวาทะกันเดือดในโซเชียลมีเดีย คนฝ่ายหนึ่งบอกอีกฝ่าย “ล้าหลังไม่รู้จักปรับตัว” อีกฝ่ายก็ยันกลับว่า “คิดแค่กำไรระยะสั้น ไม่รักษาอัตลักษณ์บิตคอยน์” บน Reddit, Twitter, ฟอรัมต่าง ๆ เหล่าผู้เคยเป็นเพื่อนร่วมทางต้องแยกค่ายกันเพราะมองต่างว่าควรเพิ่มบล็อกหรือเปล่า

ที่สุดแล้ว...

เมื่อสองอุดมการณ์สวนทางกันระดับราก แทบไม่มีพื้นที่ประนีประนอม บ้างเชื่อว่าถ้าไม่เพิ่มบล็อกบิตคอยน์จะใช้งานลำบากเกิน บ้างยึดมั่นว่าถ้าบล็อกใหญ่มากโหนดเล็ก ๆ ก็จะหายไปหมด ระบบจะตกในมือไม่กี่คน.. ซึ่งขัดเจตนารมณ์ตั้งต้นของ Satoshi แบบสุด ๆ

ผลลัพธ์จึงลงเอยด้วยการเกิด “Bitcoin Cash” (BCH) แยกเครือข่าย และเปิดศึกโฆษณาว่า “ตนต่างหากที่เป็นผู้สืบทอดแนวคิด Satoshi ของจริง”

เมื่อ Bitcoin Cash ถือกำเนิดพร้อมขนาดบล็อกใหญ่ “มหาศึก” ครั้งนี้ก็ไม่ได้จบลง แต่เปลี่ยนหน้าฉากไปสู่การตลาดและความชอบธรรม

ใคร ๆ ก็ตั้งคำถามว่า “Bitcoin Cash ต่างจาก Bitcoin ยังไง?” หรือ “ใครสืบทอดเจตนารมณ์ Satoshi อย่างแท้จริงกันแน่?”

นักพัฒนา ฝั่ง BTC ยังเหนียวแน่นว่ารักษาเครือข่ายให้เบา ๆ แล้วใช้ทริคอย่าง SegWit, Lightning Network เสริม คือทางออกป้องกันการรวมศูนย์

ฝ่าย BCH ก็บอกว่าบล็อกใหญ่เลยดีกว่า ทุกคนจะได้เทรดกันเพลินโดยไม่ต้องแย่งพื้นที่

ในภาพใหญ่.. สงครามครั้งนี้ส่งคลื่นกระเพื่อมไปทั่วโลกคริปโตฯ หลายคนกลัวว่าถ้ายังแยกแตกกันแบบนี้ต่อ ราคาจะผันผวนจนคนขยาด แต่ก็มีอีกฝ่ายที่มองว่า

“ดีสิ มีการแข่งขันแล้วเกิดนวัตกรรมใหม่ ๆ”

เพราะในโลกโอเพนซอร์ส ไม่มีใครหยุดการแยกตัวได้ถ้าคนบางกลุ่มอยากลองแนวทางใหม่

คำถามสำคัญคือ..

“ใครขับเคลื่อนสงคราม Blocksize?”

คำตอบก็หนีไม่พ้น Roger Ver, Bitmain และทีม Bitcoin Core รวมถึงกลุ่ม UASF

พวกเขาต่างมีพลังในมิติต่าง ๆ

Roger Ver มีแรงสนับสนุนจากนักขุดสายทุนจัด Bitmain มีกองทัพ Hashrate มหาศาล ทีม Bitcoin Core คุมซอฟต์แวร์ และ UASF ก็มีอำนาจ ‘No Node, No Vote’ ที่ปัดบล็อกไม่พอใจทิ้งได้หมด

นี่ไม่ใช่การรบระหว่าง “อำนาจกับผู้อ่อนแอ” แต่เป็นสมรภูมิที่ทุกขั้วมี “พลัง” อยู่คนละแบบ ทำให้การประนีประนอมเป็นเพียงอุดมคติ

จนที่สุดจึงแตกเป็นสองสาย เหมือนเป็นสปิริตของโอเพนซอร์สที่แค่ Fork ก็พาเดินไปคนละทิศ ใครอยากกดเครื่องขุดก็ขุด ใครอยากตามซอฟต์แวร์ Core ก็จัดไป

นึกภาพอนาคตสิครับ.. ถ้ามีเทคโนโลยีใหม่เข้ามาอีก จะมีสงคราม “Blocksize 2.0” หรือเปล่า? ถ้าเจอเงื่อนไขใหญ่ ๆ ในการเปลี่ยนระบบ ย่อมต้องเข้าสู่วงจรดีเบตเดือดปุดเหมือนเคย

เพราะบิตคอยน์เป็นระบบไร้ผู้นำสูงสุด ทุกฝ่ายจึงมีสิทธิชูมือคัดค้านหรือสนับสนุนอย่างอิสระ

ฉากในเนื้อหาส่วนนี้คือด้านหน้าฉากของสงคราม Blocksize และเหล่าคนขับเคลื่อนที่ทำให้เกิดการแตกแยกครั้งประวัติศาสตร์ในโลกบิตคอยน์ ส่วนต่อไปเราจะได้เห็นเทคนิคล้ำ ๆ และจุดชนวนสุดเฉพาะหน้าที่ทำให้สองฝ่ายยิ่งปะทะกันอีก

แต่ก่อนจะไปรอนั้น..

ขอสรุปให้คิดกันแบบง่าย ๆ ว่า… ในโลกอันไร้ศูนย์กลางที่ต่างคนต่างตะโกนว่า

“ฉันคือเจ้าของบิตคอยน์!”

สุดท้าย “ใครกันแน่เป็นผู้ตัดสินทิศทาง?” หรือแท้จริง “ชัยชนะ–ความพ่ายแพ้” ก็ไม่มีอยู่จริงในสงครามแบบนี้...

เอาจริง ๆ การตัดสินใจของไม่กี่คน หรือการร่วมตัวของยูสเซอร์กระจัดกระจาย ก็ล้วนมีสิทธิเปลี่ยนอนาคตของเงินดิจิทัลได้ทั้งสิ้น จึงเป็นเสน่ห์และความโกลาหลของ “decentralization” ที่น่าหลงใหล

ไม่มีใครสั่งใครได้เต็มร้อย แต่ก็ไม่มีใครจะหยุดคนอื่นได้หมดเช่นกัน

เมื่อมองย้อนกลับไป.. นี่แหละเป็นบทเรียนสำคัญว่าบิตคอยน์ไม่ได้เป็นของใครคนเดียว และถ้าวันหนึ่งไฟสงครามลุกลามขึ้นอีกรอบ เราทุกคนจะรับมือกันยังไง?

ตอนนี้สงครามอาจดูเงียบ ๆ แต่ก็ไม่ได้ปิดฉากสนิท เพราะคลื่นใต้น้ำยังพร้อมระอุขึ้นได้ตลอด

เวลาเท่านั้นที่จะบอกว่า SegWit จะพิสูจน์ตัวเองได้ไหม หรือฝ่าย Hard Fork จะกลับมาโดดเด่นอีกครั้ง