-

@ 3c389c8f:7a2eff7f

2025-04-29 18:13:50

@ 3c389c8f:7a2eff7f

2025-04-29 18:13:50TL;DR visit this post for a list of signers

Your nsec/private key is your key to controlling all that you do on Nostr. Every action you take is signed by this private key, validating that was you that generated that event, whether it be a note, a like, a list, or whatever else. Like a broken record, I have to state that it is irreplaceable. YOU own your identity and no one else. It is your responsibility to keep your nsec safe, but of course, you also want to be able to use all the different apps and clients available. To aid you in this process, a few different tools have been developed. Let's take a look at some that are more common and easy-to-use, where to use them, and for what.

The Browser Extension

This is probably the simplest and most straight forward form of private key manager available. There are many options to choose from, each compatible with various, commonly used browsers, including mobile browsers. Many provide the option to manage multiple keys for different profiles. Some are simply a signer while others may include other features. The concept is very simple. The extension holds your key and exposes it only only enough to sign an event. These extensions can be set to different levels of manual approval that you can control based on the level of convenience you seek. The ease and convenience does trade off a bit of security, as your private key will be exposed momentarily each time you create an event. It is up to you to choose whether this is appropriate for your use. For casual browsing and social media use, it is a fairly good and easy to use option. Nearly all Nostr apps and clients support signing with this method.

The Remote Signer

Often referred as a "bunker", Nostr remote signers hold your private key completely offline and communicating with clients. Clients send events to the signer to be signed, which then sends back the signed event for publishing. This bunker can be hosted on your own hardware or managed by a truested 3rd party. As long as the signer is online, it can communicate as needed. The signer generates a "bunker string" that is used to communicate. These may seem cumbersome to set up, as each client that you intend to use will need its own permissions. Once all of the pieces and permissions are in place, most of this activity will happen in the background. Bunkers allow for a lot of flexibility. The "bunker string" for a single app can be shared with other users who you may want to be able to make posts on your behalf. Multiple people can manage a social media profile, while the main owner of that identity maintains control of the nsec. These bunker strings can be revoked and replaced at any time. This signing method is growing in popularity and many clients already offer support for it.

The Native Android Signer

Currently, Amber is the only native app available to handle Nostr event signing. It is an incredible tool for managing your Nostr key on your mobile device. The signing flow is similar to remote signing, as described above, but it can communicate with both your Android native Nostr apps and web clients accessed through most mobile browsers, eliminating the need for a browser extension. Similar apps are under development for iOS, but I don't use any of those devices, so covering that here will only happen via other's opinions at a later date. Check this list for current options.

NcryptSec

NcryptSec signing works by encrypting your nsec on a local device, unlocked by a password that you choose. Support for this method is very limited, as the encrypted private key stays on your device. If you intend to use Nostr through one device and few apps, this can be a very secure option, as long as you can remember your password, as it cannot be changed.

NFC and Hardware Signers

Some devices have been developed to store your nsec completely offline on a device or NFC chip, and some clients have added support for scanning/connecting to sign. I haven't personally tried any of these options, nor do I intend to promote the sale of any particular products. If you are interested in these techniques and devices, the information is not hard to find. The price of a devices varies, depending on your feature needs.

There are also DIY options that utilize existing hardware, if you are into that sort of thing.

Higher Security and Recoverability Options

Creating a scheme that allows for recovery of a lost key while maintaining the integrity of a unique identity is no easy task. The key must be fractured into shards, encrypted, and distributed across multiple servers in various locations, while you maintain a portion or portions of your own. These servers are run by trusted 3rd parties who will then sign events "with" you. Some include a scheme of running your own always online hardware to act as host for these shards. I fall short on the technical understanding of certain aspects of these processes, so I will spare you of my attempt to explain. As far as I know, there are a couple of methods underway that are worth paying attention to:

Frostr nostr:nevent1qvzqqqqqqypzqs3fcg0szqdtcway2ge7zahfwhafuecmkx9xwg4a7aexhgj5ghleqy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qgwwaehxw309ahx7uewd3hkctcqyrh3r7uhytc4dywjggxz24277xgqtvcadvnjfks6fram7gjpev9nuentfht

Promenade nostr:nevent1qvzqqqqqqypzqwlsccluhy6xxsr6l9a9uhhxf75g85g8a709tprjcn4e42h053vaqydhwumn8ghj7un9d3shjtnhv4ehgetjde38gcewvdhk6tcprdmhxue69uhhyetvv9ujuam9wd6x2unwvf6xxtnrdakj7qpqqqq0dlpwxhw5l97yrcts2klhr9zqqpcmdfpaxm8r7hygykp630cq23ggph

For a List of signers, please visit this post.

-

@ 3c389c8f:7a2eff7f

2025-04-29 18:07:00

@ 3c389c8f:7a2eff7f

2025-04-29 18:07:00Extentions:

https://chromewebstore.google.com/detail/flamingo-%E2%80%93-nostr-extensio/alkiaengfedemppafkallgifcmkldohe

https://chromewebstore.google.com/detail/nos2x/kpgefcfmnafjgpblomihpgmejjdanjjp

https://chromewebstore.google.com/detail/aka-profiles/ncmflpbbagcnakkolfpcpogheckolnad

https://keys.band/

https://github.com/haorendashu/nowser

The Remote Signer:

https://nsec.app/

https://github.com/kind-0/nsecbunkerd

Native Android Signer:

https://github.com/greenart7c3/amber

iOS

https://testflight.apple.com/join/8TFMZbMs

https://testflight.apple.com/join/DUzVMDMK

Higher Security Options: To start using Nostr with a secure, recoverable keypair: https://nstart.me/en

For Existing Keys: https://www.frostr.org/

Thank you to https://nostr.net/ for keeping a thorough list of Nostr apps, clients, and tools!

-

@ 8194da31:0f3badf3

2025-04-29 17:49:12

@ 8194da31:0f3badf3

2025-04-29 17:49:12LLM interpretation:

That’s a profound and provocative statement: “The corruption of money is the corruption of the Logos.” Let’s unpack this in detail, integrating philosophical, theological, and economic dimensions:

⸻

- What Is the Logos?

In classical and theological terms: •Greek Philosophy (esp. Heraclitus & Stoics): Logos is the divine reason, the ordering principle of the cosmos—a rational structure underlying all reality. •Plato: While he didn’t use Logos as prominently, his concept of the Forms, especially the Form of the Good, parallels it. The Logos could be seen as the bridge between the realm of ideal truth and the material world. •Christian Theology (esp. John 1:1): “In the beginning was the Logos, and the Logos was with God, and the Logos was God.” Christ is identified as the Logos—the incarnate expression of divine truth, coherence, and moral order.

So, Logos = reason, truth, order, and meaning—both metaphysical and moral.

⸻

- What Is Money in Moral and Philosophical Terms?

Money is not just a medium of exchange; it is a tool of memory, a symbol of trust, and a measure of value. In a functioning system, it reflects: •Honest human action over time •Deferred trust and cooperation across generations •A shared language of value

In this sense, money is a representation of human agreements, which are grounded in speech, contract, and moral order—i.e., it is rooted in logos (lowercase l), as language and rationality.

⸻

- The Corruption of Money as a Violation of Logos

If Logos is the moral-rational order, then:

To corrupt money is to distort the shared language of value and trust. It is to introduce lies into the very structure of economic relationships.

This corruption occurs through: •Inflation and debasement (violating the honesty of measurement) •Manipulative monetary policy (favoring the few over the many) •Counterfeit value signals (misallocating resources) •Loss of accountability (removing consequences for moral failure)

Thus, money’s corruption breaks the moral symmetry between effort and reward, cost and value, debt and payment—violating logos in both linguistic and metaphysical senses.

⸻

- Theological Echoes:

If Christ is the Logos incarnate, then: •Monetary corruption becomes not merely economic malfeasance but moral rebellion. •It is anti-Logos—an act of anomia (lawlessness), which the New Testament identifies with the spirit of antichrist (2 Thessalonians 2:3–8).

⸻

-

@ 266815e0:6cd408a5

2025-04-29 17:47:57

@ 266815e0:6cd408a5

2025-04-29 17:47:57I'm excited to announce the release of Applesauce v1.0.0! There are a few breaking changes and a lot of improvements and new features across all packages. Each package has been updated to 1.0.0, marking a stable API for developers to build upon.

Applesauce core changes

There was a change in the

applesauce-corepackage in theQueryStore.The

Queryinterface has been converted to a method instead of an object withkeyandrunfields.A bunch of new helper methods and queries were added, checkout the changelog for a full list.

Applesauce Relay

There is a new

applesauce-relaypackage that provides a simple RxJS based api for connecting to relays and publishing events.Documentation: applesauce-relay

Features:

- A simple API for subscribing or publishing to a single relay or a group of relays

- No

connectorclosemethods, connections are managed automatically by rxjs - NIP-11

auth_requiredsupport - Support for NIP-42 authentication

- Prebuilt or custom re-connection back-off

- Keep-alive timeout (default 30s)

- Client-side Negentropy sync support

Example Usage: Single relay

```typescript import { Relay } from "applesauce-relay";

// Connect to a relay const relay = new Relay("wss://relay.example.com");

// Create a REQ and subscribe to it relay .req({ kinds: [1], limit: 10, }) .subscribe((response) => { if (response === "EOSE") { console.log("End of stored events"); } else { console.log("Received event:", response); } }); ```

Example Usage: Relay pool

```typescript import { Relay, RelayPool } from "applesauce-relay";

// Create a pool with a custom relay const pool = new RelayPool();

// Create a REQ and subscribe to it pool .req(["wss://relay.damus.io", "wss://relay.snort.social"], { kinds: [1], limit: 10, }) .subscribe((response) => { if (response === "EOSE") { console.log("End of stored events on all relays"); } else { console.log("Received event:", response); } }); ```

Applesauce actions

Another new package is the

applesauce-actionspackage. This package provides a set of async operations for common Nostr actions.Actions are run against the events in the

EventStoreand use theEventFactoryto create new events to publish.Documentation: applesauce-actions

Example Usage:

```typescript import { ActionHub } from "applesauce-actions";

// An EventStore and EventFactory are required to use the ActionHub import { eventStore } from "./stores.ts"; import { eventFactory } from "./factories.ts";

// Custom publish logic const publish = async (event: NostrEvent) => { console.log("Publishing", event); await app.relayPool.publish(event, app.defaultRelays); };

// The

publishmethod is optional for the asyncrunmethod to work const hub = new ActionHub(eventStore, eventFactory, publish); ```Once an

ActionsHubis created, you can use therunorexecmethods to execute actions:```typescript import { FollowUser, MuteUser } from "applesauce-actions/actions";

// Follow fiatjaf await hub.run( FollowUser, "3bf0c63fcb93463407af97a5e5ee64fa883d107ef9e558472c4eb9aaaefa459d", );

// Or use the

execmethod with a custom publish method await hub .exec( MuteUser, "3bf0c63fcb93463407af97a5e5ee64fa883d107ef9e558472c4eb9aaaefa459d", ) .forEach((event) => { // NOTE: Don't publish this event because we never want to mute fiatjaf // pool.publish(['wss://pyramid.fiatjaf.com/'], event) }); ```There are a log more actions including some for working with NIP-51 lists (private and public), you can find them in the reference

Applesauce loaders

The

applesauce-loaderspackage has been updated to support any relay connection libraries and not justrx-nostr.Before:

```typescript import { ReplaceableLoader } from "applesauce-loaders"; import { createRxNostr } from "rx-nostr";

// Create a new rx-nostr instance const rxNostr = createRxNostr();

// Create a new replaceable loader const replaceableLoader = new ReplaceableLoader(rxNostr); ```

After:

```typescript

import { Observable } from "rxjs"; import { ReplaceableLoader, NostrRequest } from "applesauce-loaders"; import { SimplePool } from "nostr-tools";

// Create a new nostr-tools pool const pool = new SimplePool();

// Create a method that subscribes using nostr-tools and returns an observable function nostrRequest: NostrRequest = (relays, filters, id) => { return new Observable((subscriber) => { const sub = pool.subscribe(relays, filters, { onevent: (event) => { subscriber.next(event); }, onclose: () => subscriber.complete(), oneose: () => subscriber.complete(), });

return () => sub.close();}); };

// Create a new replaceable loader const replaceableLoader = new ReplaceableLoader(nostrRequest); ```

Of course you can still use rx-nostr if you want:

```typescript import { createRxNostr } from "rx-nostr";

// Create a new rx-nostr instance const rxNostr = createRxNostr();

// Create a method that subscribes using rx-nostr and returns an observable function nostrRequest( relays: string[], filters: Filter[], id?: string, ): Observable

{ // Create a new oneshot request so it will complete when EOSE is received const req = createRxOneshotReq({ filters, rxReqId: id }); return rxNostr .use(req, { on: { relays } }) .pipe(map((packet) => packet.event)); } // Create a new replaceable loader const replaceableLoader = new ReplaceableLoader(nostrRequest); ```

There where a few more changes, check out the changelog

Applesauce wallet

Its far from complete, but there is a new

applesauce-walletpackage that provides a actions and queries for working with NIP-60 wallets.Documentation: applesauce-wallet

Example Usage:

```typescript import { CreateWallet, UnlockWallet } from "applesauce-wallet/actions";

// Create a new NIP-60 wallet await hub.run(CreateWallet, ["wss://mint.example.com"], privateKey);

// Unlock wallet and associated tokens/history await hub.run(UnlockWallet, { tokens: true, history: true }); ```

-

@ e7454994:7bb2dac7

2025-04-29 16:28:59

@ e7454994:7bb2dac7

2025-04-29 16:28:59Imagine

According to Cazoomi, total revenue for nonprofits in the U.S. reached approximately $3.7 trillion in 2024.

I know in some cases a billion is a hundred million instead of a thousand million (presumably so that some millionaires can call themselves billionaires to distinguish themselves from the riffraff). But that’s not the case here. A trillion is one followed by 12 zeros, so in 2024, US non-profits’ expenses were

3,700,000,000,000 dollars.

How much is a trillion?

And that’s just the USA. We could safely double it for worldwide non-profits and still be well below the actual figure. To be conservative, let’s say 6 trillion of our dollars each year goes on the kinds of projects that non-profits are allowed to do (essentially, making the world a better place).

Think what you could do with just one million dollars. Now think of that times six million! The entire population of Congo, each man, woman, and child, could become a millionaire!. It’s not really imaginable.

That’s how much nonprofits have. What the hell have they done with all that money? In most places where poverty and malnutrition are rife, two thousand dollars a year per family would be more than enough to enable people to sort out whatever problems they have and convert their local community to abundance over three years. Six trillion divided by two thousand is three billion.

The people whom we allow to manage ‘aid’ for us are (to be polite) inept, and we need to bypass them urgently. Directsponsor.org and clickforcharity.net are part of a proof of concept, and our aim is to prove that a better way is possible by doing it.

When a hierarchy exists, it presents a focus of power that power-seeking individuals and cliques can over time turn to their advantage… Even volunteer organizations are subject to intrigues, power grabs, covert arrangements, misallocation of funds, etc. The problem is made worse by the fact that those who most desire power and who are the most ruthless are the very ones who tend to work their way to the top of hierarchies.

More Fun With Figures

Oxfam UK raised £368,000,000 in 2013-14. That’s around 450,000,000 euros. What could we do with that kind of money? A direct sponsorship project is, for a family, 120 per month = 1440 per year. 1440 / 450,000,000 = 312,500 families.

312,500 families, x 4 = 1,250,000 people, would move from poverty into abundance every 3 years with the money that goes through Oxfam. Does Oxfam achieve anything like this with our money?

Oxfam UK is just one of many, many such charities and is small fry when you look at things like USAID, which ran through 27 billion dollars in the year to 2025. What could we do with that?

Its well over 15 million families. Over 60 million people! Or, the entire population of Botswana, Namibia, Mauritania, Liberia, the Republic of Congo, the Central African Republic, Libya, Sierra Leone, Eritrea, Togo, and Guinea combined. This is only to make a point, not to suggest that we would ever achieve such numbers. It shows how wasteful and scandalous our present “aid” efforts really are.

NGOs and governments waste our money.

Solution

Until recently, it was impossible to send money directly to another human without going through the banking system. The big charity organisations were a necessary part of the process, and they made the most of their position. Think about it: you have a family to feed, rent or a mortgage that has to be paid, or you’ll be homeless and destitute. What would your priority be? Apart from the top level, these are generally good people with the best intentions.

But now we have Bitcoin. People can send money all over the world at extremely low cost. The recipients aren’t stupid; they know what they need better than any NGO “expert,” and any expertise or teaching they need, they can get if they have the money to pay for it. This way, the power relationship is reversed in favor of our recipients.

All we need is a system (open and distributed) that ensures sponsors’ funds are not being squandered and the projects being supported are not scams.

A few people decided to start such a project. We have a system almost fully built and currently being tested out. It will enable people to get together into small groups of sponsors to fund small, local projects by directly funding the individuals working on the project. Anything from a regular monthly commitment to a click-for-charity system where you don’t even need any money to occasional one-off purchases of items for a project will be possible.

Here’s our pilot project in Badilisha, on Lake Victoria.

If you like doing stuff on social media, please sign up on our beta site (no money needed) and say hi; we need a few people to get it started. clickforcharity.net.

-

@ 005bc4de:ef11e1a2

2025-04-29 16:08:56

@ 005bc4de:ef11e1a2

2025-04-29 16:08:56Trump Bitcoin Report Card - Day 100

For whatever reason day 100 of a president's term has been deemed a milestone. So, it's time to check in with President Trump's bitcoin pledges and issue a report card.

Repo and prior reports: - GitHub: https://github.com/crrdlx/trump-bitcoin-report-card - First post: https://stacker.news/items/757211 - Progress Report 1: https://stacker.news/items/774165 - Day 1 Report Card: https://stacker.news/items/859475 - Day 100 Report Card: https://stacker.news/items/966434

Report Card | | Pledge | Prior Grade | Current Grade | |--|--|--|--| | 1 | Fire SEC Chair Gary Gensler on day 1 | A | A | | 2 | Commute the sentence of Ross Ulbricht on day 1 | A | A | | 3 | Remove capital gains taxes on bitcoin transactions | F | F | | 4 | Create and hodl a strategic bitcoin stockpile | D | C- | | 5 | Prevent a CBDC during his presidency | B+ | A | | 6 | Create a "bitcoin and crypto" advisory council | C- | C | | 7 | Support the right to self-custody | D+ | B- | | 8 | End the "war on crypto" | D+ | B+ | | 9 | Mine all remaining bitcoin in the USA | C- | C | | 10 | Make the US the "crypto capital of the planet" | C- | C+ |

Comments

Pledge 1 - SEC chair - (no change from earlier) - Gensler is out. This happened after the election and Trump took office. With the writing on the wall, Gensler announced he would resign, Trump picked a new SEC head in Paul Atkins, and Gensler left office just before Trump was sworn in. The only reason an A+ was not awarded was that Trump wasn't given the chance to actually fire Gensler, because he quit. No doubt, though, his quitting was due to Trump and the threat of being sacked.

Day 100 Report Card Grade: A

Pledge 2 - free Ross - (no change from earlier) - Ross Ulbricht's sentence was just commuted. Going will "option 3" above, the pledge was kept. An A+ would have been a commutation yesterday or by noon today, but, let's not split hairs. It's done.

Day 100 Report Card Grade: A

Pledge 3 - capital gains - This requires either executive action and/or legislation. There was no action. Executive action can be done with the stroke of a pen, but it was not. Legislation is tricky and time-consuming, however, there wasn't even mention of this matter. This seems to be on the back burner since statements such as this report in November. See Progress Report 1: https://stacker.news/items/774165 for more context.

Trump's main tax thrust has been the tariff, actually a tax increase, instead of a cut. Currently, the emphasis is on extending the "Trump tax cuts" and recently House Speaker Mike Johnson indicated such a bill would be ready by Memorial Day. Earlier in his term, there was more chatter about tax relief for bitcoin or cryptocurrency. There seems to be less chatter on this, or none at all, such as its absence in the "ready by Memorial Day" article.

Until tax reform is codified and signed, it isn't tax law and the old code still applies.

Day 100 Report Card Grade: F

Pledge 4 - bitcoin reserve - The initial grade was a C, it was dropped to a D mainly due to Trump's propensity to [alt]coinery, and now it's back to a C-.

Getting the grade back up into C-level at a C- was a little bumpy. On March 2, 2025, Trump posted that a U.S. Crypto Reserve would be created. This is what had been hoped for, except that the pledge was for a Bitcoin Reserve, not crypto. And secondly, he specifically named XRP, SOL, and ADA (but not BTC). Just a couple of hours later, likely in clean up mode, he did add BTC (along with ETH) as "obviously" being included. So, the "Bitcoin Reserve" became a "Crypto Reserve."

Maybe still in "cleanup mode," Sec. of Commerce Howard Lutnick said bitcoin will hold "special status" in the reserve. Then, on March 6, an executive order made the U.S. Digital Asset Stockpile official. Again, "Bitcoin" was generalized until section 3 where the "Strategic Bitcoin Reserve" did come to official fruition.

The grade is only a C- because the only thing that happened was the naming of the stockpile. Indeed, it became official. But the "stockpile" was just BTC already held by the U.S. government. I think it's fair to say most bitcoiners would have preferred a statement about buying BTC. Other Trump bitcoin officials indicated acquiring "as much as we can get", which sounds great, but until it happens, is only words.

Day 100 Report Card Grade: C-

Pledge 5 - no CBDC - An executive order on January 23, 2025 forbade a CBDC in section 1, part v by "prohibiting the establishment, issuance, circulation, and use of a CBDC."

Day 100 Report Card Grade: A

Pledge 6 - advisory council - The Trump bitcoin or crypto team consists of the following: David Sacks as “crypto czar” and Bo Hines as executive director of the Presidential Council of Advisers for Digital Assets.

A White House Crypto Summit (see video) was held on March 7, 2025. In principle, the meeting was good, however, the summit seemed (a) to be very heavily "crypto" oriented, and (b) to largely be a meet-and-greet show.

Still, just the fact that such a show took place, inside the White House, reveals how far things have come and the change in climate. For the grade to go higher, more tangible things should take place over time.

Day 100 Report Card Grade: C

Pledge 7 - self-custody - There's been a bit of good news though on this front. First, the executive order above from January 23 stated in section 1, i, one of the goals was "...to maintain self-custody of digital assets." Also, the Phoenix wallet returned to the U.S. In 2024, both Phoenix and Wallet of Satoshi pulled out of the U.S. for fear of government crackdowns. The return of Phoenix, again, speaks to the difference in climate now and is a win for self-custody.

To rise above B-level, more assurance, it would be good to see further clear assurance that people can self-custody, that developers can build self-custody, and businesses can create products to self-custody. Also, Congressional action could get to an A.

Day 100 Report Card Grade: B-

Pledge 8 - end war on crypto - There has been improvement here. First, tangibly, SAB 121 was sent packing as SEC Commissioner Hester Peirce announced. Essentially, this removed a large regulatory burden. Commissioner Peirce also said ending the burdens will be a process to get out of the "mess". So, there's work to do. Also, hurdles were recently removed so that banks can now engage in bitcoin activity. This is both a symbolic and real change.

Somewhat ironically, Trump's own venture into cryptocurrency with his World Liberty Financial and the $TRUMP and $MELANIA tokens, roundly poo-pood by bitcoiners, might actually be beneficial in a way. The signal from the White House seems to be on all things cryptocurrency, "Do it."

The improvement and climate now seems very different than with the previous administration and leaders who openly touted a war on crypto.

Day 100 Report Card Grade: B+

Pledge 9 - USA mining - As noted earlier, this is an impossible pledge. That said, things can be done to make America mining friendly. The U.S. holds an estimated 37 to 40% of Bitcoin hash rate, which is substantial. Plus, Trump, or the Trump family at least, has entered into bitcoin mining. With Hut 8, Eric Trump is heading "American Bitcoin" to mine BTC. Like the $TRUMP token, this conveys that bitcoin mining is a go in the USA.

Day 100 Report Card Grade: C

Pledge 10 - USA crypto capital - This pledge closely aligned with pledges 8 and 9. If the war on crypto ends, the USA becomes more and more crypto and bitcoin friendly. And, if the hashrate stays high and even increases, that puts the USA at the center of it all. Most of the categories above have seen improvements, all of which help this last pledge. Trump's executive orders help this grade as well as they move from only words spoken to becoming official policy.

To get higher, the Bitcoin Strategic Reserve should move from a name-change only to acquiring more BTC. If the USA wants to be the world's crypto capital, being the leader in bitcoin ownership is the way to do it.

Day 100 Report Card Grade: C+

Sources

- Nashville speech - https://www.youtube.com/watch?v=EiEIfBatnH8

- CryptoPotato "top 8 promises" - https://x.com/Crypto_Potato/status/1854105511349584226

- CNBC - https://www.cnbc.com/2024/11/06/trump-claims-presidential-win-here-is-what-he-promised-the-crypto-industry-ahead-of-the-election.html

- BLOCKHEAD - https://www.blockhead.co/2024/11/07/heres-everything-trump-promised-to-the-crypto-industry/

- CoinTelegraph - https://cointelegraph.com/news/trump-promises-crypto-election-usa

- China vid - Bitcoin ATH and US Strategic Bitcoin Stockpile - https://njump.me/nevent1qqsgmmuqumhfktugtnx9kcsh3ap6v7ca4z8rgx79palz2qk0wzz5cksppemhxue69uhkummn9ekx7mp0qgszwaxc8j8e0zw9sdq59y43rykyx3wm0lcd2502xth699v0gxf0degrqsqqqqqpglusv6

- Capitals gains tax - https://bravenewcoin.com/insights/trump-proposes-crypto-tax-cuts-targets-u-s-made-tokens-for-tax-exemption Progress report 1 ------------------------------------------------------------------------------------

- Meeting with Brian Armstrong - https://www.wsj.com/livecoverage/stock-market-today-dow-sp500-nasdaq-live-11-18-2024/card/exclusive-trump-to-meet-privately-with-coinbase-ceo-brian-armstrong-DDkgF0xW1BW242rVeuqx

- Michael Saylor podcast - https://fountain.fm/episode/DHEzGE0f99QQqyM36nVr

- Gensler resigns - https://coinpedia.org/news/big-breaking-sec-chair-gary-gensler-officially-resigns/ Progress report 2 ------------------------------------------------------------------------------------

- Trump & Justin Sun - https://www.coindesk.com/business/2024/11/26/justin-sun-joins-donald-trumps-world-liberty-financial-as-adviser $30M investment: https://www.yahoo.com/news/trump-crypto-project-bust-until-154313241.html

- SEC chair - https://www.cnbc.com/2024/12/04/trump-plans-to-nominate-paul-atkins-as-sec-chair.html

- Crypto czar - https://www.zerohedge.com/crypto/trump-names-david-sacks-white-house-ai-crypto-czar

- Investigate Choke Point 2.0 - https://www.cryptopolitan.com/crypto-czar-investigate-choke-point/

- Crypto council head Bo Hines - https://cointelegraph.com/news/trump-appoints-bo-hines-head-crypto-council

- National hash rate: https://www.cryptopolitan.com/the-us-controls-40-of-bitcoins-hashrate/

- Senate committee https://coinjournal.net/news/rep-senator-cynthia-lummis-selected-to-chair-crypto-subcommittee/

- Treasurh Sec. CBDC: https://decrypt.co/301444/trumps-treasury-pick-scott-bessant-pours-cold-water-on-us-digital-dollar-initiative

- National priority: https://cointelegraph.com/news/trump-executive-order-crypto-national-priority-bloomberg?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- $TRUMP https://njump.me/nevent1qqsffe0d7mgtu5jhasy4hmkcdy7wfrlcqwc4vf676hulvdn8uaqa3acpzamhxue69uhhyetvv9ujuurjd9kkzmpwdejhgtczyztpa8q038vw5xluyhnydj5u39d7cpssvuswjhhjqj8q42jh4ul3wqcyqqqqqqgmha026

- World Liberty buys alts: https://www.theblock.co/post/335779/trumps-world-liberty-buys-25-million-of-tokens-including-link-tron-aave-and-ethena?utm_source=rss&utm_medium=rss

- CFTC chair: https://cryptoslate.com/trump-appoints-crypto-advocate-caroline-pham-as-cftc-acting-chair/

- WLF buys wrapped BTC https://www.cryptopolitan.com/trump-buys-47-million-in-bitcoin/

- SEC turnover https://www.theblock.co/post/335944/trump-names-sec-commissioner-mark-uyeda-as-acting-chair-amid-a-crypto-regulatory-shift?utm_source=rss&utm_medium=rss

- ----------------------------100 Days Report---------------------------------Davos speech "world capital of AI and crypto" https://coinpedia.org/news/big-breaking-president-trump-says-u-s-to-become-ai-and-crypto-superpower/

- SAB 121 gone, Hester P heads talk force & ends sab 121?, war on crypto https://x.com/HesterPeirce/status/1882562977985114185 article: https://www.theblock.co/post/336761/days-after-gensler-leaves-sec-rescinds-controversial-crypto-accounting-guidance-sab-121?utm_source=twitter&utm_medium=social CoinTelegraph: https://cointelegraph.com/news/trump-executive-order-cbdc-ban-game-changer-us-institutional-crypto-adoption?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- Possible tax relief https://cryptodnes.bg/en/will-trumps-crypto-policies-lead-to-tax-relief-for-crypto-investors/

- War on crypto https://decrypt.co/304395/trump-sec-crypto-task-force-priorities-mess

- Trump "truths" 2/18 make usa #1 in crypto, "Trump effect" https://www.theblock.co/post/333137/ripple-ceo-says-75-of-open-roles-are-now-us-based-due-to-trump-effect and https://www.coindesk.com/markets/2025/01/06/ripples-garlinghouse-touts-trump-effect-amid-bump-in-u-s-deals

- Strategic reserve https://njump.me/nevent1qqsf89l74mqfkk74jqhjcqtwp5m970gedmtykn5uhl0vz9mhmrvvvgqpzamhxue69uhhyetvv9ujuurjd9kkzmpwdejhgtczyztpa8q038vw5xluyhnydj5u39d7cpssvuswjhhjqj8q42jh4ul3wqcyqqqqqqge7c74u and https://njump.me/nevent1qqswv50m7mc95m3saqce08jzpqc0vedw4avdk6zxy9axrn3hqet52xgpzamhxue69uhhyetvv9ujuurjd9kkzmpwdejhgtczyztpa8q038vw5xluyhnydj5u39d7cpssvuswjhhjqj8q42jh4ul3wqcyqqqqqqgpc7cp3

- Strategic reserve, bitcoin special https://www.thestreet.com/crypto/policy/bitcoin-to-hold-special-status-in-u-s-crypto-strategic-reserve

- Bitcoin reserve, crypto stockpile https://decrypt.co/309032/president-trump-signs-executive-order-to-establish-bitcoin-reserve-crypto-stockpile vid link https://njump.me/nevent1qqs09h58patpv9vfjpcss6v5nxv7m23u8g6g43nqvkjzgzescztucmspr9mhxue69uhhyetvv9ujumt0d4hhxarj9ecxjmnt9upzqtjzyy2ylrsceh5uj20j5e95v0e99s3epsvyctu2y0vrwyltvq33qvzqqqqqqyus4pu7

- Truth summit https://njump.me/nevent1qqswj6sv0wr4d4ppwzam5egr5k6nmqgjpwmsrlx2a7d4ndpfj0fxvcqpzamhxue69uhhyetvv9ujuurjd9kkzmpwdejhgtczyztpa8q038vw5xluyhnydj5u39d7cpssvuswjhhjqj8q42jh4ul3wqcyqqqqqqgu0mzzh and vid https://njump.me/nevent1qqsptn8c8wyuhlqtjr5u767x20q4dmjvxy28cdj30t4v9phhf6y5a5spzamhxue69uhhyetvv9ujuurjd9kkzmpwdejhgtczyztpa8q038vw5xluyhnydj5u39d7cpssvuswjhhjqj8q42jh4ul3wqcyqqqqqqgqklklu

- SEC chair confirmed https://beincrypto.com/sec-chair-paul-atkins-confirmed-senate-vote/

- pro bitcoin USA https://coinpedia.org/news/u-s-secretary-of-commerce-howard-lutnick-says-america-is-ready-for-bitcoin/

- tax cuts https://thehill.com/homenews/house/5272043-johnson-house-trump-agenda-memorial-day/

- "as much as we can get" https://cryptobriefing.com/trump-bitcoin-acquisition-strategy/

- ban on CBDC https://www.whitehouse.gov/presidential-actions/2025/01/strengthening-american-leadership-in-digital-financial-technology/

- Phoenix WoS leave https://www.coindesk.com/opinion/2024/04/29/wasabi-wallet-and-phoenix-leave-the-us-whats-next-for-non-custodial-crypto

- Trump hut 8 mining https://www.reuters.com/technology/hut-8-eric-trump-launch-bitcoin-mining-company-2025-03-31/

-

@ d1667293:388e7004

2025-04-29 16:00:19

@ d1667293:388e7004

2025-04-29 16:00:19The "Bitcoindollar" system—an emerging term which describes the interplay of U.S. dollar-denominated stablecoins and Bitcoin as complementary forces in the evolving monetary framework of the digital era (and which replaces the defunct Petrodollar system)—has sparked an interesting debate on Nostr with PowMaxi.

You will find the thread links at the bottom of this article.

Powmaxi argues that attempting to merge hard money (Bitcoin) with soft money (the U.S. dollar) is structurally doomed, because the systems are inherently contradictory and cannot coexist without one eventually destroying the other.

This critique is certainly valid, but ONLY if the Bitcoindollar is viewed as a final system. But I never claim that. To the contrary, the conclusion in my book is that this is a system that buys time for fiat, absorbs global demand for monetary stability, and ushers in a Bitcoinized world without the immediate collapse and the reset of the fiat system which would otherwise cause dramatic consequences. The Bitcoindollar is the only way to a gradual Bitcoin dominance in 10-20 years time while avoiding sudden collapse of the fiat system, so that also the power elites who hold the keys to this system can adapt.\ At least this is my hope.

Therefore the "fusion" isn't the future. The siphoning is. And the U.S. may try to ride it as long as possible. The Bitcoindollar system is a transitional strategic framework, not a\ permanent monetary equilibrium. In the end I agree with PowMaxi.

His detailed critique deserves an equally detailed analysis. Here's how the objections break down and why they don’t necessarily undermine the Bitcoindollar system.

1. Hard Money vs. Soft Money: Opposed Systems?

Objection: Bitcoin is a closed, decentralized system with a fixed supply; the dollar is an open, elastic system governed by central banks and political power. These traits are mutually exclusive and incompatible.

Response: Ideologically, yes. Practically, no. Hybrid financial systems are not uncommon. Bitcoin and stablecoins serve different user needs: Bitcoin is a store of value; stablecoins are mediums of exchange. Their coexistence mirrors real-world economic needs. The contradiction can be managed, and is not fatal at least for the transitional phase.

2. Scarcity vs. Elasticity: Economic Incompatibility?

Objection: Bitcoin can’t inject liquidity in crises; fiat systems can. Anchoring fiat to Bitcoin removes policymakers' tools.

Response: Correct — but that’s why Bitcoin is held as a reserve, not used as the primary medium of exchange in the Bitcoindollar model. Fiat-based liquidity mechanisms still function via stablecoins, while Bitcoin acts as a counterweight to long-term monetary debasement. The system’s strength is in its optionality: you don’t have to use Bitcoin until you want an exit ramp from fiat.

3. No Stable Equilibrium: One Must Win?

Objection: The system will destabilize. Either Bitcoin undermines fiat or fiat suppresses Bitcoin.

Response: Not necessarily in this transitional phase. The “conflict” isn’t between tools — it’s between control philosophies. The dollar won’t disappear overnight, and Bitcoin isn’t going away. The likely outcome is a gradual shifting of savings and settlement layers to Bitcoin, while fiat continues to dominate day-to-day payments and credit markets — until Bitcoin becomes structurally better in both.

4. Gresham’s and Thiers’ Law: Hollowing Fiat?

Objection: People save in Bitcoin and spend fiat, eroding fiat value.

Response: Yes — and that’s been happening since 2009. But this isn’t a flaw; it’s a transition mechanism. The Bitcoindollar model recognizes this and creates a bridge: it monetizes U.S. debt while preserving access to hard money. In the long run, my expectation is that naturally bitcoin will prevail both as a SOV and currency, but until then, stablecoins and T-bill-backed tokens serve useful roles in the global economy.

5. Philosophical Incompatibility?

Objection: Bitcoin prioritizes individual sovereignty; fiat systems are hierarchical. They can't be reconciled.

Response: They don’t need to be reconciled ideologically to function in parallel. Users choose the tool that suits their needs. One empowers individual autonomy; the other offers state-backed convenience. This is a competition of values, not a mechanical incompatibility. The Bitcoindollar model is a strategy. It’s a bridge between old and new systems, not a permanent coexistence.

6. Fusion is Impossible?

Objection: It’s only a temporary bridge. One side must lose.

Response: Exactly. The Bitcoindollar system is a transitional bridge. But that doesn’t reduce its value. It provides a functional pathway for individuals, companies, and governments to gradually exit broken monetary systems and experiment with new models.

In the meantime, the U.S. benefits from stablecoin-driven Treasury demand, while Bitcoin continues to grow as a global reserve asset.

Bottom line: A Strategic Convergence, Not a Permanent Fusion

The Bitcoindollar system isn’t a contradiction. It’s a convergence zone. It reflects the reality that monetary systems evolve gradually, not cleanly. Bitcoin and fiat will compete, overlap, and influence each other. Eventually, yes — hard money wins. But until then, hybrid systems offer powerful stepping stones.

Thread links:

Thread started from this initial post.

-

@ 1eb5d2c9:ee9e8d5f

2025-04-29 17:08:49{"id":"9e350d19cdab6ccaa2023822404d4c7d57ecf0e25dc938872eb63a0ee4c036bc","pubkey":"e96911258fabb7c235ffbb052c96a07bf91f3ef91cfa036e4f442fd23320261f","created_at":1745900599,"kind":1,"tags":[["e","0514cc738ab72c2fd7c1acf6e59db1bb6f801ad4cbe8ae02a53ea0b59d302a9f","wss://nostr-dev.wellorder.net","root"],["p","04c915daefee38317fa734444acee390a8269fe5810b2241e5e6dd343dfbecc9","","mention"],["p","74ffc51cc30150cf79b6cb316d3a15cf332ab29a38fec9eb484ab1551d6d1856","","mention"]],"content":"Running knots ","sig":"637707f2774221bb3fcb11420eed6d787c3b2c557adde9bb2741627b81f3cabd7db99a0742958c0bd325a99019cadf17aa37abfd237b22e5e77382e5313c91a3"}

@ 1eb5d2c9:ee9e8d5f

2025-04-29 17:08:49{"id":"9e350d19cdab6ccaa2023822404d4c7d57ecf0e25dc938872eb63a0ee4c036bc","pubkey":"e96911258fabb7c235ffbb052c96a07bf91f3ef91cfa036e4f442fd23320261f","created_at":1745900599,"kind":1,"tags":[["e","0514cc738ab72c2fd7c1acf6e59db1bb6f801ad4cbe8ae02a53ea0b59d302a9f","wss://nostr-dev.wellorder.net","root"],["p","04c915daefee38317fa734444acee390a8269fe5810b2241e5e6dd343dfbecc9","","mention"],["p","74ffc51cc30150cf79b6cb316d3a15cf332ab29a38fec9eb484ab1551d6d1856","","mention"]],"content":"Running knots ","sig":"637707f2774221bb3fcb11420eed6d787c3b2c557adde9bb2741627b81f3cabd7db99a0742958c0bd325a99019cadf17aa37abfd237b22e5e77382e5313c91a3"} -

@ df478ecd:495107a7

2025-04-29 11:43:48😂 ok

@ df478ecd:495107a7

2025-04-29 11:43:48😂 ok -

@ 56cd780f:cbde8b29

2025-04-29 14:37:37

@ 56cd780f:cbde8b29

2025-04-29 14:37:37And this is the regular text.

-

@ df478ecd:495107a7

2025-04-29 11:38:10Who did you write this post for? Who was the audience in your head while you were writing?

@ df478ecd:495107a7

2025-04-29 11:38:10Who did you write this post for? Who was the audience in your head while you were writing? -

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ df478ecd:495107a7

2025-04-29 11:35:30You made content tailored to x algorithm (attention seeking threadboi shit) and expected it to do well on a protocol that demands authenticity, trust, and real connections. It’s a learning curve, my man. But just because these two things can look the same doesn’t mean they are. Nostr is a different beast.

@ df478ecd:495107a7

2025-04-29 11:35:30You made content tailored to x algorithm (attention seeking threadboi shit) and expected it to do well on a protocol that demands authenticity, trust, and real connections. It’s a learning curve, my man. But just because these two things can look the same doesn’t mean they are. Nostr is a different beast. -

@ df478ecd:495107a7

2025-04-29 11:26:10I think nostr:npub1pzzrdngrnlufqazx3lfj07k0vfuya6ehfy8q5yv2h8c5e8fxgmxqhxdsr8 is waiting for 100 days

@ df478ecd:495107a7

2025-04-29 11:26:10I think nostr:npub1pzzrdngrnlufqazx3lfj07k0vfuya6ehfy8q5yv2h8c5e8fxgmxqhxdsr8 is waiting for 100 days -

@ 56cd780f:cbde8b29

2025-04-29 14:37:35

@ 56cd780f:cbde8b29

2025-04-29 14:37:35I will add a picture, a hyperlink and a video. Let’s see if it works.

-

@ 56cd780f:cbde8b29

2025-04-29 14:37:33

@ 56cd780f:cbde8b29

2025-04-29 14:37:33Is it still working?

-

@ 56cd780f:cbde8b29

2025-04-29 14:37:31

@ 56cd780f:cbde8b29

2025-04-29 14:37:31Is it actually called “summary”?

-

@ 56cd780f:cbde8b29

2025-04-29 14:37:29

@ 56cd780f:cbde8b29

2025-04-29 14:37:29A few weeks ago, I ran into an old friend at a coffee shop. We hadn’t spoken in years, and within five minutes, she said something I’ve heard countless times:

“I just feel like I’m so behind.”

Behind who? Behind what?

There’s this idea—quiet, nagging, oddly universal—that we’re all somehow in a race we didn’t sign up for. That we’re supposed to have hit certain milestones by certain ages. That if we’re not married, promoted, rich, settled, happy (and photogenic) by 30 or 40 or pick your poison, then we’ve failed some invisible test.

There’s this idea—quiet, nagging, oddly universal—that we’re all somehow in a race we didn’t sign up for. That we’re supposed to have hit certain milestones by certain ages. That if we’re not married, promoted, rich, settled, happy (and photogenic) by 30 or 40 or pick your poison, then we’ve failed some invisible test.Where did this come from?

Some of it’s cultural, obviously. Social media compresses timelines. You’re 27, doom-scrolling, and suddenly someone from high school just IPO’d their startup and got engaged in Rome. Another just bought a house with a kitchen island the size of a small country. You wonder if you missed a memo.

But beneath that, there’s something deeper. A belief that life is linear. That it should look like a staircase: school, job, marriage, house, kids, success. But real life? It’s a squiggle. A mess. A beautiful disaster.

Here’s the truth: You’re not behind. There’s no schedule. There’s only your path, and the courage it takes to stay on it—even when it looks wildly different from everyone else’s.

I say this as someone who has taken the “scenic route.” I changed careers in my 30s. I moved cities on a hunch. I dropped things that looked great on paper because they felt wrong in my gut. I’ve had seasons of momentum and seasons of stuckness. Both were necessary.

“Catching up” assumes there’s a fixed destination. But what if there isn’t? What if the point isn’t arrival, but presence? Progress that feels real, not performative?

If you need a permission slip to stop comparing, let this be it.

You’re not late. You’re not early.

You’re not late. You’re not early.

You’re right on time. -

@ df478ecd:495107a7

2025-04-29 01:41:47{"id":"31b39406e15296cedf4e6bd2ac0f51394b90c3161ef5d000f91fa92ac118d6fd","pubkey":"c43bbb58e2e6bc2f9455758257f6ba5329107bd4e8274068c2936c69d9980b7d","created_at":1745890803,"kind":1,"content":"no more cone for toshi <3 \nhttps:\/\/m.primal.net\/Qgoe.jpg\nhttps:\/\/m.primal.net\/Qgof.jpg","tags":[],"sig":"16464db6d9a774a393a611f33070dd74c7088f6002a8fa71fd530414113314c2f5f4991e91d13182bf7ec297a40294cfff5386caeb795e5289c99870d8bd8b22"}

@ df478ecd:495107a7

2025-04-29 01:41:47{"id":"31b39406e15296cedf4e6bd2ac0f51394b90c3161ef5d000f91fa92ac118d6fd","pubkey":"c43bbb58e2e6bc2f9455758257f6ba5329107bd4e8274068c2936c69d9980b7d","created_at":1745890803,"kind":1,"content":"no more cone for toshi <3 \nhttps:\/\/m.primal.net\/Qgoe.jpg\nhttps:\/\/m.primal.net\/Qgof.jpg","tags":[],"sig":"16464db6d9a774a393a611f33070dd74c7088f6002a8fa71fd530414113314c2f5f4991e91d13182bf7ec297a40294cfff5386caeb795e5289c99870d8bd8b22"} -

@ df478ecd:495107a7

2025-04-28 22:16:54Don’t know for sure until we try. Let a thousand clients bloom

@ df478ecd:495107a7

2025-04-28 22:16:54Don’t know for sure until we try. Let a thousand clients bloom -

@ 56cd780f:cbde8b29

2025-04-29 14:37:27

@ 56cd780f:cbde8b29

2025-04-29 14:37:27There’s something sacred about morning air — the way it carries just enough chill to remind you you’re alive, without pushing you back inside. I’ve been starting my days on the balcony lately. Not because it’s glamorous (it isn’t), or because I have a routine (I don’t), but because it’s the only space in my apartment that feels both open and still.

This morning I made coffee with too much cinnamon and curled up with a blanket that’s seen better days. I watched the city slowly wake up — one barking dog, two joggers, and the clatter of a recycling truck below. It’s odd how these tiny patterns become a kind of comfort.

I used to think that slowing down meant falling behind. But here, perched on the third floor with my feet on cold concrete and the sky just starting to blush, I feel like I’m exactly where I’m supposed to be.

I used to think that slowing down meant falling behind. But here, perched on the third floor with my feet on cold concrete and the sky just starting to blush, I feel like I’m exactly where I’m supposed to be.If you’re reading this, maybe you needed that reminder too.

— Natalie

-

@ df478ecd:495107a7

2025-04-28 22:16:10I got a couch at least! (Sitting on it) More furniture on the way. Purchased just not delivered.

@ df478ecd:495107a7

2025-04-28 22:16:10I got a couch at least! (Sitting on it) More furniture on the way. Purchased just not delivered. -

@ 40b9c85f:5e61b451

2025-04-24 15:27:02

@ 40b9c85f:5e61b451

2025-04-24 15:27:02Introduction

Data Vending Machines (DVMs) have emerged as a crucial component of the Nostr ecosystem, offering specialized computational services to clients across the network. As defined in NIP-90, DVMs operate on an apparently simple principle: "data in, data out." They provide a marketplace for data processing where users request specific jobs (like text translation, content recommendation, or AI text generation)

While DVMs have gained significant traction, the current specification faces challenges that hinder widespread adoption and consistent implementation. This article explores some ideas on how we can apply the reflection pattern, a well established approach in RPC systems, to address these challenges and improve the DVM ecosystem's clarity, consistency, and usability.

The Current State of DVMs: Challenges and Limitations

The NIP-90 specification provides a broad framework for DVMs, but this flexibility has led to several issues:

1. Inconsistent Implementation

As noted by hzrd149 in "DVMs were a mistake" every DVM implementation tends to expect inputs in slightly different formats, even while ostensibly following the same specification. For example, a translation request DVM might expect an event ID in one particular format, while an LLM service could expect a "prompt" input that's not even specified in NIP-90.

2. Fragmented Specifications

The DVM specification reserves a range of event kinds (5000-6000), each meant for different types of computational jobs. While creating sub-specifications for each job type is being explored as a possible solution for clarity, in a decentralized and permissionless landscape like Nostr, relying solely on specification enforcement won't be effective for creating a healthy ecosystem. A more comprehensible approach is needed that works with, rather than against, the open nature of the protocol.

3. Ambiguous API Interfaces

There's no standardized way for clients to discover what parameters a specific DVM accepts, which are required versus optional, or what output format to expect. This creates uncertainty and forces developers to rely on documentation outside the protocol itself, if such documentation exists at all.

The Reflection Pattern: A Solution from RPC Systems

The reflection pattern in RPC systems offers a compelling solution to many of these challenges. At its core, reflection enables servers to provide metadata about their available services, methods, and data types at runtime, allowing clients to dynamically discover and interact with the server's API.

In established RPC frameworks like gRPC, reflection serves as a self-describing mechanism where services expose their interface definitions and requirements. In MCP reflection is used to expose the capabilities of the server, such as tools, resources, and prompts. Clients can learn about available capabilities without prior knowledge, and systems can adapt to changes without requiring rebuilds or redeployments. This standardized introspection creates a unified way to query service metadata, making tools like

grpcurlpossible without requiring precompiled stubs.How Reflection Could Transform the DVM Specification

By incorporating reflection principles into the DVM specification, we could create a more coherent and predictable ecosystem. DVMs already implement some sort of reflection through the use of 'nip90params', which allow clients to discover some parameters, constraints, and features of the DVMs, such as whether they accept encryption, nutzaps, etc. However, this approach could be expanded to provide more comprehensive self-description capabilities.

1. Defined Lifecycle Phases

Similar to the Model Context Protocol (MCP), DVMs could benefit from a clear lifecycle consisting of an initialization phase and an operation phase. During initialization, the client and DVM would negotiate capabilities and exchange metadata, with the DVM providing a JSON schema containing its input requirements. nip-89 (or other) announcements can be used to bootstrap the discovery and negotiation process by providing the input schema directly. Then, during the operation phase, the client would interact with the DVM according to the negotiated schema and parameters.

2. Schema-Based Interactions

Rather than relying on rigid specifications for each job type, DVMs could self-advertise their schemas. This would allow clients to understand which parameters are required versus optional, what type validation should occur for inputs, what output formats to expect, and what payment flows are supported. By internalizing the input schema of the DVMs they wish to consume, clients gain clarity on how to interact effectively.

3. Capability Negotiation

Capability negotiation would enable DVMs to advertise their supported features, such as encryption methods, payment options, or specialized functionalities. This would allow clients to adjust their interaction approach based on the specific capabilities of each DVM they encounter.

Implementation Approach

While building DVMCP, I realized that the RPC reflection pattern used there could be beneficial for constructing DVMs in general. Since DVMs already follow an RPC style for their operation, and reflection is a natural extension of this approach, it could significantly enhance and clarify the DVM specification.

A reflection enhanced DVM protocol could work as follows: 1. Discovery: Clients discover DVMs through existing NIP-89 application handlers, input schemas could also be advertised in nip-89 announcements, making the second step unnecessary. 2. Schema Request: Clients request the DVM's input schema for the specific job type they're interested in 3. Validation: Clients validate their request against the provided schema before submission 4. Operation: The job proceeds through the standard NIP-90 flow, but with clearer expectations on both sides

Parallels with Other Protocols

This approach has proven successful in other contexts. The Model Context Protocol (MCP) implements a similar lifecycle with capability negotiation during initialization, allowing any client to communicate with any server as long as they adhere to the base protocol. MCP and DVM protocols share fundamental similarities, both aim to expose and consume computational resources through a JSON-RPC-like interface, albeit with specific differences.

gRPC's reflection service similarly allows clients to discover service definitions at runtime, enabling generic tools to work with any gRPC service without prior knowledge. In the REST API world, OpenAPI/Swagger specifications document interfaces in a way that makes them discoverable and testable.

DVMs would benefit from adopting these patterns while maintaining the decentralized, permissionless nature of Nostr.

Conclusion

I am not attempting to rewrite the DVM specification; rather, explore some ideas that could help the ecosystem improve incrementally, reducing fragmentation and making the ecosystem more comprehensible. By allowing DVMs to self describe their interfaces, we could maintain the flexibility that makes Nostr powerful while providing the structure needed for interoperability.

For developers building DVM clients or libraries, this approach would simplify consumption by providing clear expectations about inputs and outputs. For DVM operators, it would establish a standard way to communicate their service's requirements without relying on external documentation.

I am currently developing DVMCP following these patterns. Of course, DVMs and MCP servers have different details; MCP includes capabilities such as tools, resources, and prompts on the server side, as well as 'roots' and 'sampling' on the client side, creating a bidirectional way to consume capabilities. In contrast, DVMs typically function similarly to MCP tools, where you call a DVM with an input and receive an output, with each job type representing a different categorization of the work performed.

Without further ado, I hope this article has provided some insight into the potential benefits of applying the reflection pattern to the DVM specification.

-

@ df478ecd:495107a7

2025-04-28 22:08:57Where would you like issues or PRs? I noticed that my Apple TV cuts to a screen saver and shuts off the stream if left unattended too long. Would like to log it in the right place.

@ df478ecd:495107a7

2025-04-28 22:08:57Where would you like issues or PRs? I noticed that my Apple TV cuts to a screen saver and shuts off the stream if left unattended too long. Would like to log it in the right place. -

@ 7d33ba57:1b82db35

2025-04-29 14:14:11

@ 7d33ba57:1b82db35

2025-04-29 14:14:11Located in eastern Poland, Lublin is a city where history, culture, and youthful energy come together. Often called the "Gateway to the East," Lublin blends Gothic and Renaissance architecture, vibrant street life, and deep historical roots—especially as a center of Jewish heritage and intellectual life.

🏙️ Top Things to See in Lublin

🏰 Lublin Castle

- A striking hilltop castle with a neo-Gothic façade and a beautifully preserved Romanesque chapel (Chapel of the Holy Trinity)

- Don’t miss the frescoes inside—a rare mix of Byzantine and Western art styles

🚪 Old Town (Stare Miasto)

- Wander through cobblestone streets, pastel buildings, and arched gateways

- Filled with cozy cafes, galleries, and vibrant murals

- The Grodzka Gate symbolizes the passage between Christian and Jewish quarters

🕯️ Lublin’s Jewish Heritage

- Visit the Grodzka Gate – NN Theatre, a powerful memorial and museum telling the story of the once-vibrant Jewish community

- Nearby Majdanek Concentration Camp offers a sobering but important historical experience

🎭 Culture & Events

- Lublin is known for its festivals, like Carnaval Sztukmistrzów (Festival of Magicians and Street Performers) and the Night of Culture

- The city has a thriving theatre and music scene, supported by its large student population

🌳 Green Spaces

- Relax in Saski Garden, a peaceful park with walking paths and fountains

- Or take a walk along the Bystrzyca River for a quieter, more local feel

🍽️ Local Tastes

- Sample Polish classics like pierogi, żurek (sour rye soup), and bigos (hunter’s stew)

- Look for modern twists on traditional dishes in Lublin’s growing number of bistros and artisan cafés

🚆 Getting There

- Easy access by train or bus from Warsaw (2–2.5 hours)

- Compact center—easily walkable

-

@ c4b5369a:b812dbd6

2025-04-15 07:26:16

@ c4b5369a:b812dbd6

2025-04-15 07:26:16Offline transactions with Cashu

Over the past few weeks, I've been busy implementing offline capabilities into nutstash. I think this is one of the key value propositions of ecash, beinga a bearer instrument that can be used without internet access.

It does however come with limitations, which can lead to a bit of confusion. I hope this article will clear some of these questions up for you!

It does however come with limitations, which can lead to a bit of confusion. I hope this article will clear some of these questions up for you!What is ecash/Cashu?

Ecash is the first cryptocurrency ever invented. It was created by David Chaum in 1983. It uses a blind signature scheme, which allows users to prove ownership of a token without revealing a link to its origin. These tokens are what we call ecash. They are bearer instruments, meaning that anyone who possesses a copy of them, is considered the owner.

Cashu is an implementation of ecash, built to tightly interact with Bitcoin, more specifically the Bitcoin lightning network. In the Cashu ecosystem,

Mintsare the gateway to the lightning network. They provide the infrastructure to access the lightning network, pay invoices and receive payments. Instead of relying on a traditional ledger scheme like other custodians do, the mint issues ecash tokens, to represent the value held by the users.How do normal Cashu transactions work?

A Cashu transaction happens when the sender gives a copy of his ecash token to the receiver. This can happen by any means imaginable. You could send the token through email, messenger, or even by pidgeon. One of the common ways to transfer ecash is via QR code.

The transaction is however not finalized just yet! In order to make sure the sender cannot double-spend their copy of the token, the receiver must do what we call a

swap. A swap is essentially exchanging an ecash token for a new one at the mint, invalidating the old token in the process. This ensures that the sender can no longer use the same token to spend elsewhere, and the value has been transferred to the receiver.

What about offline transactions?

Sending offline

Sending offline is very simple. The ecash tokens are stored on your device. Thus, no internet connection is required to access them. You can litteraly just take them, and give them to someone. The most convenient way is usually through a local transmission protocol, like NFC, QR code, Bluetooth, etc.

The one thing to consider when sending offline is that ecash tokens come in form of "coins" or "notes". The technical term we use in Cashu is

Proof. It "proofs" to the mint that you own a certain amount of value. Since these proofs have a fixed value attached to them, much like UTXOs in Bitcoin do, you would need proofs with a value that matches what you want to send. You can mix and match multiple proofs together to create a token that matches the amount you want to send. But, if you don't have proofs that match the amount, you would need to go online and swap for the needed proofs at the mint.Another limitation is, that you cannot create custom proofs offline. For example, if you would want to lock the ecash to a certain pubkey, or add a timelock to the proof, you would need to go online and create a new custom proof at the mint.

Receiving offline

You might think: well, if I trust the sender, I don't need to be swapping the token right away!

You're absolutely correct. If you trust the sender, you can simply accept their ecash token without needing to swap it immediately.

This is already really useful, since it gives you a way to receive a payment from a friend or close aquaintance without having to worry about connectivity. It's almost just like physical cash!

It does however not work if the sender is untrusted. We have to use a different scheme to be able to receive payments from someone we don't trust.

Receiving offline from an untrusted sender

To be able to receive payments from an untrusted sender, we need the sender to create a custom proof for us. As we've seen before, this requires the sender to go online.

The sender needs to create a token that has the following properties, so that the receciver can verify it offline:

- It must be locked to ONLY the receiver's public key

- It must include an

offline signature proof(DLEQ proof) - If it contains a timelock & refund clause, it must be set to a time in the future that is acceptable for the receiver

- It cannot contain duplicate proofs (double-spend)

- It cannot contain proofs that the receiver has already received before (double-spend)

If all of these conditions are met, then the receiver can verify the proof offline and accept the payment. This allows us to receive payments from anyone, even if we don't trust them.

At first glance, this scheme seems kinda useless. It requires the sender to go online, which defeats the purpose of having an offline payment system.

I beleive there are a couple of ways this scheme might be useful nonetheless:

-

Offline vending machines: Imagine you have an offline vending machine that accepts payments from anyone. The vending machine could use this scheme to verify payments without needing to go online itself. We can assume that the sender is able to go online and create a valid token, but the receiver doesn't need to be online to verify it.

-

Offline marketplaces: Imagine you have an offline marketplace where buyers and sellers can trade goods and services. Before going to the marketplace the sender already knows where he will be spending the money. The sender could create a valid token before going to the marketplace, using the merchants public key as a lock, and adding a refund clause to redeem any unspent ecash after it expires. In this case, neither the sender nor the receiver needs to go online to complete the transaction.

How to use this

Pretty much all cashu wallets allow you to send tokens offline. This is because all that the wallet needs to do is to look if it can create the desired amount from the proofs stored locally. If yes, it will automatically create the token offline.

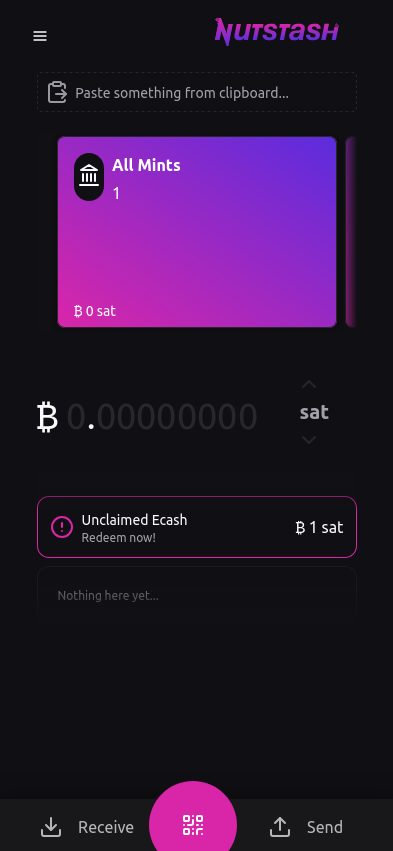

Receiving offline tokens is currently only supported by nutstash (experimental).

To create an offline receivable token, the sender needs to lock it to the receiver's public key. Currently there is no refund clause! So be careful that you don't get accidentally locked out of your funds!

The receiver can then inspect the token and decide if it is safe to accept without a swap. If all checks are green, they can accept the token offline without trusting the sender.

The receiver will see the unswapped tokens on the wallet homescreen. They will need to manually swap them later when they are online again.

Later when the receiver is online again, they can swap the token for a fresh one.

Later when the receiver is online again, they can swap the token for a fresh one.

Summary

We learned that offline transactions are possible with ecash, but there are some limitations. It either requires trusting the sender, or relying on either the sender or receiver to be online to verify the tokens, or create tokens that can be verified offline by the receiver.

I hope this short article was helpful in understanding how ecash works and its potential for offline transactions.

Cheers,

Gandlaf

-

@ df478ecd:495107a7

2025-04-28 22:02:42Thanks!

@ df478ecd:495107a7

2025-04-28 22:02:42Thanks! -

@ df478ecd:495107a7

2025-04-28 22:01:38I’m sure some developer might tackle this for Samsung TVs!

@ df478ecd:495107a7

2025-04-28 22:01:38I’m sure some developer might tackle this for Samsung TVs! -

@ df478ecd:495107a7

2025-04-28 21:58:14I had to install it on my Apple TV with TestFlight, no app for Samsung.

@ df478ecd:495107a7

2025-04-28 21:58:14I had to install it on my Apple TV with TestFlight, no app for Samsung. -

@ bbb5dda0:f09e2747

2025-04-29 13:46:37

@ bbb5dda0:f09e2747

2025-04-29 13:46:37GitHub Actions (CI/CD) over Nostr

I Spent quite a bit of time on getting Nostr-based GitHub actions working. I have a basic runner implementation now, which i've reworked quite a bit when working with @dan on getting the front-end of it into gitworkshop.dev. We found that the nature of these jobs don't really lend itself to fit within the NIP-90 DVM spec.

What we have now: - A dvm-cicd-runner that - Advertises itself using NIP-89 announcements. - Takes a DVM request with: - repository - branch/ref - path to workflow file (

.yml) - job timeout (max duration) - 🥜 Cashu prepayment for the job timeout (to be refunded) - Pulls the repository and executes the provided workflow file - Sends logs in batches as partial job results - Publishes job results and gets displayed in gitworkshop - Gitworkshop.dev (all nostr:npub15qydau2hjma6ngxkl2cyar74wzyjshvl65za5k5rl69264ar2exs5cyejr work) UI that : - Shows available workflow runners. - Instructing + paying runner to execute workflow file - Displaying job status, live updating with the latest logs / autoscroll, all the stuff you'd expect - Neatly displaying past jobs for the current repositoryTODO'S + Ideas/vision

- TODO: refunding the unused minutes (job timeout - processing time) to the requester

- TODO: create seperate kinds/nip for worflow execution over nostr

- Create separate kinds for streaming arbitrary text data over nostr (line by line logs)

- automated git watchers for projects to kick of jobs

- Separate out workflow management stuff from gitworkshop.dev. A micro-app might serve better to manage runners for git projects etc and takes away pressure from gitworkshop.dev to do it all.

- Perhaps support just running .yaml files, without the requirement to have it in a git repo. Could just be a .yaml file on blossom.

TollGate

I spent most of my time working on TollGate. There's been a lot of back and forth to the drawing board to narrow down what the TollGate protocol looks like. I helped define some concepts on implementing a tollgate which we could use as language to discuss the different components that are part of a tollgate implementation. It helped us narrow down what was implementation and what is part of the protocol.

Current state of the project

- We have a website displaying the project: TollGate.me

- Worked on a basic android app for auto payments, validating we can auto-buy from tollgates by our phones

- Presented TollGate at @Sats 'n Facts

- There's a protocol draft, presented at SEC-04

- We've done workshops, people were able to turn an OpenWRT router into a TollGate

- Building and releasing TollGate as a singular OpenWRT package, installable on any compatible architecture

- Building and releasing TollGate OS v0.0.1 (prebuilt OpenWRT image), targeting a few specific routers

- First tollgate deployed in the wild!! (At a restaurant in Funchal, Madeira)

- Other developers started to make their own adjacent implementations, which decentralizes the protocol already

What's next:

- We're gathering useful real user feedback to be incorporated in OS v0.0.2 soon

- Refine the protocol further

- Showing TollGate at various conferences in Europe throughout the summer

- Keep building the community, it's growing fast

Epoxy (Nostr based Addressing)

Although i've pivoted towards focusing on TollGate I worked out an implementation of my NIP-(1)37 proposal. During SEC-04 I worked out this browser plugin to demonstrate one way to make websites resistant to rugpulls.

It works by looking for a

metatag in the page'shead:html <meta name="nostr-pubkey" relays="relay.site.com,other.relay.com">[hexPubkey]</meta>When we've never recorded a pubkey for this domain, we save it. This pubkey now serves as the owner of the website. It looks for a kind

11111event of that pubkey. It should list the current domain as one of it's domains. If not, it shows a warning.The key concept is that if we visit this website again and one of these scenario's is true: - There is no longer a

metatag - There's another pubkey in themetatag - The pubkey is still on the webpage, but the11111no longer lists this domainThen we consider this domain as RUGPULLED and the user gets an error, suggesting to navigate to other domain listed by this

pubkey. I'd like it to perhaps auto-redirect to another domain listed by the owner, this is especially useful for frequently rugged domains.This extension does try to solve a bootstrapping problem. We need to establish the website's pubkey at some point. We have to start somewhere, which is why the first load is considered as the 'real' one, since we have no way of knowing for sure.

Other

🥜/⚡️ Receipt.Cash - Social Receipt sharing app

During SEC I worked on scratching an itch that has been lingering in my mind since SEC-03 already. And now that vibecoding is a thing it wasn't this huge undertaking anymore to handle the front-end stuff (which i suck at).

The usage scenario is a bunch of bitcoiners that are at a restaurant, we get the bill and want to split it amongst each other. One person can pay the bill, then: - Payer photographs receipt - Payer adds Cashu Payment request - Payer sets dev split % - App turns the receipt + request into a (encrypted) nostr event - The payer shares the event with QR or Share Menu

The friend scan the QR: - Receipt is loaded and displayed - Friend selects items they ordered - Friend hits pay button (⚡️Lightning or 🥜Cashu) and pays - Payment gets sent to Payer's cashu wallet - Dev split set by Payer goes to dev address.

Some features: - Change LLM model that processes the receipt to extract data - Proofs storage + recovery (if anything fails during processing)

Todo's: - Letting payer configure LNURL for payouts - Letting payer edit Receipt before sharing - Fix: live updates on settled items

The repo: receipt-cash

-

@ df478ecd:495107a7

2025-04-28 21:56:34Looking good in my unfurnished apt! Is there a reason for the border around the stream? https://image.nostr.build/231c332d71ad68599b881bf7910c198fb1b7b742106d69183736ac7c6c03cd4a.jpg

@ df478ecd:495107a7

2025-04-28 21:56:34Looking good in my unfurnished apt! Is there a reason for the border around the stream? https://image.nostr.build/231c332d71ad68599b881bf7910c198fb1b7b742106d69183736ac7c6c03cd4a.jpg -

@ fd0bcf8c:521f98c0

2025-04-29 13:38:49

@ fd0bcf8c:521f98c0

2025-04-29 13:38:49The vag' sits on the edge of the highway, broken, hungry. Overhead flies a transcontinental plane filled with highly paid executives. The upper class has taken to the air, the lower class to the roads: there is no longer any bond between them, they are two nations."—The Sovereign Individual

Fire

I was talking to a friend last night. Coffee in hand. Watching flames consume branches. Spring night on his porch.

He believed in America's happy ending. Debt would vanish. Inflation would cool. Manufacturing would return. Good guys win.

I nodded. I wanted to believe.

He leaned forward, toward the flame. I sat back, watching both fire and sky.

His military photos hung inside. Service medals displayed. Patriotism bone-deep.

The pendulum clock on his porch wall swung steadily. Tick. Tock. Measuring moments. Marking epochs.