-

@ 51faaa77:2c26615b

2025-05-04 17:52:33

@ 51faaa77:2c26615b

2025-05-04 17:52:33There has been a lot of debate about a recent discussion on the mailing list and a pull request on the Bitcoin Core repository. The main two points are about whether a mempool policy regarding OP_RETURN outputs should be changed, and whether there should be a configuration option for node operators to set their own limit. There has been some controversy about the background and context of these topics and people are looking for more information. Please ask short (preferably one sentence) questions as top comments in this topic. @Murch, and maybe others, will try to answer them in a couple sentences. @Murch and myself have collected a few questions that we have seen being asked to start us off, but please add more as you see fit.

originally posted at https://stacker.news/items/971277

-

@ 90c656ff:9383fd4e

2025-05-04 17:48:58

@ 90c656ff:9383fd4e

2025-05-04 17:48:58The Bitcoin network was designed to be secure, decentralized, and resistant to censorship. However, as its usage grows, an important challenge arises: scalability. This term refers to the network's ability to manage an increasing number of transactions without affecting performance or security. This challenge has sparked the speed dilemma, which involves balancing transaction speed with the preservation of decentralization and security that the blockchain or timechain provides.

Scalability is the ability of a system to increase its performance to meet higher demands. In the case of Bitcoin, this means processing a greater number of transactions per second (TPS) without compromising the network's core principles.

Currently, the Bitcoin network processes about 7 transactions per second, a number considered low compared to traditional systems, such as credit card networks, which can process thousands of transactions per second. This limit is directly due to the fixed block size (1 MB) and the average 10-minute interval for creating a new block in the blockchain or timechain.

The speed dilemma arises from the need to balance three essential elements: decentralization, security, and speed.

The Timechain/"Blockchain" Trilemma:

01 - Decentralization: The Bitcoin network is composed of thousands of independent nodes that verify and validate transactions. Increasing the block size or making them faster could raise computational requirements, making it harder for smaller nodes to participate and affecting decentralization. 02 - Security: Security comes from the mining process and block validation. Increasing transaction speed could compromise security, as it would reduce the time needed to verify each block, making the network more vulnerable to attacks. 03 - Speed: The need to confirm transactions quickly is crucial for Bitcoin to be used as a payment method in everyday life. However, prioritizing speed could affect both security and decentralization.

This dilemma requires balanced solutions to expand the network without sacrificing its core features.

Solutions to the Scalability Problem

Several solutions have been suggested to address the scalability and speed challenges in the Bitcoin network.

- On-Chain Optimization

01 - Segregated Witness (SegWit): Implemented in 2017, SegWit separates signature data from transactions, allowing more efficient use of space in blocks and increasing capacity without changing the block size. 02 - Increasing Block Size: Some proposals have suggested increasing the block size to allow more transactions per block. However, this could make the system more centralized as it would require greater computational power.

- Off-Chain Solutions

01 - Lightning Network: A second-layer solution that enables fast and low-cost transactions off the main blockchain or timechain. These transactions are later settled on the main network, maintaining security and decentralization. 02 - Payment Channels: Allow direct transactions between two users without the need to record every action on the network, reducing congestion. 03 - Sidechains: Proposals that create parallel networks connected to the main blockchain or timechain, providing more flexibility and processing capacity.

While these solutions bring significant improvements, they also present issues. For example, the Lightning Network depends on payment channels that require initial liquidity, limiting its widespread adoption. Increasing block size could make the system more susceptible to centralization, impacting network security.

Additionally, second-layer solutions may require extra trust between participants, which could weaken the decentralization and resistance to censorship principles that Bitcoin advocates.

Another important point is the need for large-scale adoption. Even with technological advancements, solutions will only be effective if they are widely used and accepted by users and developers.

In summary, scalability and the speed dilemma represent one of the greatest technical challenges for the Bitcoin network. While security and decentralization are essential to maintaining the system's original principles, the need for fast and efficient transactions makes scalability an urgent issue.

Solutions like SegWit and the Lightning Network have shown promising progress, but still face technical and adoption barriers. The balance between speed, security, and decentralization remains a central goal for Bitcoin’s future.

Thus, the continuous pursuit of innovation and improvement is essential for Bitcoin to maintain its relevance as a reliable and efficient network, capable of supporting global growth and adoption without compromising its core values.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ 5df413d4:2add4f5b

2025-05-04 01:13:31

@ 5df413d4:2add4f5b

2025-05-04 01:13:31Short photo-stories of the hidden, hard to find, obscure, and off the beaten track.

Come now, take a walk with me…

The Traveller 02: Jerusalem Old City

The bus slowly lurches up the winding and steep embankment. We can finally start to see the craggy tops of buildings peaking out over the ridge in the foreground distance. We have almost reached it. Jerusalem, the City on the Hill.

https://i.nostr.build/e2LpUKEgGBwfveGi.jpg

Our Israeli tour guide speaks over the mic to draw our attention to the valley below us instead - “This is the the Valley of Gehenna, the Valley of the Moloch,” he says. “In ancient times, the pagans who worshiped Moloch used this place for child sacrifice by fire. Now, imagine yourself, an early Hebrew, sitting atop the hill, looking down in horror. This is the literal Valley of The Shadow of Death, the origin of the Abrahamic concept of Hell.” Strong open - this is going to be fun.

https://i.nostr.build/5F29eBKZYs4bEMHk.jpg

Inside the Old City, our guide - a chubby, cherub-faced intelligence type on some sort of punishment duty, deputized to babysit foreigners specifically because he reads as so dopey and disarming - points out various Judeo-Christian sites on a map, his tone subtly suggesting which places are most suggested, or perhaps, permitted…

https://i.nostr.build/J44fhGWc9AZ5qpK4.jpg

https://i.nostr.build/3c0jh09nx6d5cEdt.jpg

Walking, we reach Judaism’s Kotel, the West Wall - massive, grand, and ancient, whispering of the Eternal. Amongst the worshipers, we touch the warm, dry limestone and, if we like, place written prayers into the wall's smaller cracks. A solemn and yearning ghost fills the place - but whose it is, I'm not sure.  https://i.nostr.build/AjDwA0rFiFPlrw1o.jpg

Just above the Kotel, Islam’s Dome of the Rock can be seen, its golden cap blazing in the sun. I ask our guide about visiting the dome. He cuts a heavy eyeroll in my direction - it seems I’ve outed myself as my group’s “that guy.” His face says more than words ever could, “Oy vey, there’s one in every group…”

“Why would anyone want to go there? It is a bit intense, no?” Still, I press. “Well, it is only open to tourists on Tuesday and Thursdays…” It is Tuesday. “And even then, visiting only opens from 11:30…” It is 11:20. As it becomes clear to him that I don't intend to drop this...“Fine!” he relents, with a dramatic flaring of the hands and an uniquely Israeli sigh, “Go there if you must. But remember, the bus leaves at 1PM. Good luck...” Great! Totally not ominous at all.

https://i.nostr.build/6aBhT61C28QO9J69.jpg

The checkpoint for the sole non-Muslim entrance leading up to the Dome is administered by several gorgeous and statuesque, assault rifle clad, Ethiop-Israeli female soldiers. In this period of relative peace and calm, they feel lax enough to make a coy but salacious game of their “screening” the men in line. As I observe, it seems none doth protest...

https://i.nostr.build/jm8F3pUp9EXqPRkN.jpg

Past the gun-totting Sirens, a long wooden rampart leads up to the Temple Mount, The Mount of the House of the Holy, al-Ḥaram al-Sharīf, The Noble Sanctuary, The Furthest Mosque, the site of the Dome of the Rock and the al-Masjid al-Asqa.

https://i.nostr.build/DoS0KIkrVN0yiVJ0.jpg

On the Mount, the Dome dominates all views. To those interested in pure expressions of beauty, the Dome is, undeniably, a thing of absolute glory. I pace the grounds, snapping what pictures I can. I pause to breathe and to let the electric energy of the setting wash over me.

https://i.nostr.build/0BQYLwpU291q2fBt.jpg

https://i.nostr.build/yCxfB1V8eAcfob93.jpg

It’s 12:15 now, I decide to head back. Now, here is what they don’t tell you. The non-Muslin entrance from the West Wall side is a one-way deal. Leaving the Dome plaza dumps you out into the back alley bazaar of Old City’s Muslim district. And so it is. I am lost.

https://i.nostr.build/XnQ5eZgjeS1UTEBt.jpg

https://i.nostr.build/EFGD5vgmFx5YYuH4.jpg

I run through the Muslim quarter, blindly turning down alleyways that seem to be taking me in the general direction of where I need to be - glimpses afforded by the city’s uneven elevation and cracks in ancient stone walls guiding my way.

https://i.nostr.build/mWIEAXlJfdqt3nuh.jpg

In a final act of desperation and likely a significant breach of Israeli security protocol, I scale a low wall and flop down back on the side of things where I'm “supposed” to be. But either no one sees me or no one cares. Good luck, indeed.

I make it back to my group - they are not hard to find, a bunch of MBAs in “business casual” travel attire and a tour guide wearing a loudly colored hat and jacket - with just enough time to still visit the Church of the Holy Sepulcher.

https://i.nostr.build/3nFvsXdhd0LQaZd7.jpg

https://i.nostr.build/sKnwqC0HoaZ8winW.jpg

Inside, a chaotic and dizzying array of chapels, grand domed ceilings, and Christian relics - most notably the Stone of Anointing, commemorating where Christ’s body was prepared for burial and Tomb of Christ, where Christ is said to have laid for 3 days before Resurrection.

https://i.nostr.build/Lb4CTj1dOY1pwoN6.jpg

https://i.nostr.build/LaZkYmUaY8JBRvwn.jpg

In less than an hour, one can traverse from the literal Hell, to King David’s Wall, The Tomb of Christ, and the site of Muhammad’s Ascension. The question that stays with me - What is it about this place that has caused so many to turn their heads to the heavens and cry out for God? Does he hear? And if he answers, do we listen?

https://i.nostr.build/elvlrd7rDcEaHJxT.jpg

Jerusalem, The Old City, circa 2014. Israel.

There are secrets to be found. Go there.

Bitcoin #Jerusalem #Israel #Travel #Photography #Art #Story #Storytelling #Nostr #Zap #Zaps #Plebchain #Coffeechain #Bookstr #NostrArt #Writing #Writestr #Createstr

-

@ a5ee4475:2ca75401

2025-05-04 17:22:36

@ a5ee4475:2ca75401

2025-05-04 17:22:36clients #list #descentralismo #english #article #finalversion

*These clients are generally applications on the Nostr network that allow you to use the same account, regardless of the app used, keeping your messages and profile intact.

**However, you may need to meet certain requirements regarding access and account NIP for some clients, so that you can access them securely and use their features correctly.

CLIENTS

Twitter like

- Nostrmo - [source] 🌐🤖🍎💻(🐧🪟🍎)

- Coracle - Super App [source] 🌐

- Amethyst - Super App with note edit, delete and other stuff with Tor [source] 🤖

- Primal - Social and wallet [source] 🌐🤖🍎

- Iris - [source] 🌐🤖🍎

- Current - [source] 🤖🍎

- FreeFrom 🤖🍎

- Openvibe - Nostr and others (new Plebstr) [source] 🤖🍎

- Snort 🌐(🤖[early access]) [source]

- Damus 🍎 [source]

- Nos 🍎 [source]

- Nostur 🍎 [source]

- NostrBand 🌐 [info] [source]

- Yana 🤖🍎🌐💻(🐧) [source]

- Nostribe [on development] 🌐 [source]

- Lume 💻(🐧🪟🍎) [info] [source]

- Gossip - [source] 💻(🐧🪟🍎)

- Camelus [early access] 🤖 [source]

Communities

- noStrudel - Gamified Experience [info] 🌐

- Nostr Kiwi [creator] 🌐

- Satellite [info] 🌐

- Flotilla - [source] 🌐🐧

- Chachi - [source] 🌐

- Futr - Coded in haskell [source] 🐧 (others soon)

- Soapbox - Comunnity server [info] [source] 🌐

- Ditto - Soapbox comunnity server 🌐 [source] 🌐

- Cobrafuma - Nostr brazilian community on Ditto [info] 🌐

- Zapddit - Reddit like [source] 🌐

- Voyage (Reddit like) [on development] 🤖

Wiki

Search

- Advanced nostr search - Advanced note search by isolated terms related to a npub profile [source] 🌐

- Nos Today - Global note search by isolated terms [info] [source] 🌐

- Nostr Search Engine - API for Nostr clients [source]

Website

App Store

ZapStore - Permitionless App Store [source]

Audio and Video Transmission

- Nostr Nests - Audio Chats 🌐 [info]

- Fountain - Podcast 🤖🍎 [info]

- ZapStream - Live streaming 🌐 [info]

- Corny Chat - Audio Chat 🌐 [info]

Video Streaming

Music

- Tidal - Music Streaming [source] [about] [info] 🤖🍎🌐

- Wavlake - Music Streaming [source] 🌐(🤖🍎 [early access])

- Tunestr - Musical Events [source] [about] 🌐

- Stemstr - Musical Colab (paid to post) [source] [about] 🌐

Images

- Pinstr - Pinterest like [source] 🌐

- Slidestr - DeviantArt like [source] 🌐

- Memestr - ifunny like [source] 🌐

Download and Upload

Documents, graphics and tables

- Mindstr - Mind maps [source] 🌐

- Docstr - Share Docs [info] [source] 🌐

- Formstr - Share Forms [info] 🌐

- Sheetstr - Share Spreadsheets [source] 🌐

- Slide Maker - Share slides 🌐 (advice: https://zaplinks.lol/ and https://zaplinks.lol/slides/ sites are down)

Health

- Sobrkey - Sobriety and mental health [source] 🌐

- NosFabrica - Finding ways for your health data 🌐

- LazerEyes - Eye prescription by DM [source] 🌐

Forum

- OddBean - Hacker News like [info] [source] 🌐

- LowEnt - Forum [info] 🌐

- Swarmstr - Q&A / FAQ [info] 🌐

- Staker News - Hacker News like 🌐 [info]

Direct Messenges (DM)

- 0xchat 🤖🍎 [source]

- Nostr Chat 🌐🍎 [source]

- Blowater 🌐 [source]

- Anigma (new nostrgram) - Telegram based [on development] [source]

- Keychat - Signal based [🤖🍎 on development] [source]

Reading

- Highlighter - Insights with a highlighted read 🌐 [info]

- Zephyr - Calming to Read 🌐 [info]

- Flycat - Clean and Healthy Feed 🌐 [info]

- Nosta - Check Profiles [on development] 🌐 [info]

- Alexandria - e-Reader and Nostr Knowledge Base (NKB) [source]

Writing

Lists

- Following - Users list [source] 🌐

- Listr - Lists [source] 🌐

- Nostr potatoes - Movies List source 💻(numpy)

Market and Jobs

- Shopstr - Buy and Sell [source] 🌐

- Nostr Market - Buy and Sell 🌐

- Plebeian Market - Buy and Sell [source] 🌐

- Ostrich Work - Jobs [source] 🌐

- Nostrocket - Jobs [source] 🌐

Data Vending Machines - DVM (NIP90)

(Data-processing tools)

AI

Games

- Chesstr - Chess 🌐 [source]

- Jestr - Chess [source] 🌐

- Snakestr - Snake game [source] 🌐

- DEG Mods - Decentralized Game Mods [info] [source] 🌐

Customization

Like other Services

- Olas - Instagram like [source] 🤖🍎🌐

- Nostree - Linktree like 🌐

- Rabbit - TweetDeck like [info] 🌐

- Zaplinks - Nostr links 🌐

- Omeglestr - Omegle-like Random Chats [source] 🌐

General Uses

- Njump - HTML text gateway source 🌐

- Filestr - HTML midia gateway [source] 🌐

- W3 - Nostr URL shortener [source] 🌐

- Playground - Test Nostr filters [source] 🌐

- Spring - Browser 🌐

Places

- Wherostr - Travel and show where you are

- Arc Map (Mapstr) - Bitcoin Map [info]

Driver and Delivery

- RoadRunner - Uber like [on development] ⏱️

- Arcade City - Uber like [on development] ⏱️ [info]

- Nostrlivery - iFood like [on development] ⏱️

OTHER STUFF

Lightning Wallets (zap)

- Alby - Native and extension [info] 🌐

- ZBD - Gaming and Social [info] 🤖🍎

- Wallet of Satoshi [info] 🤖🍎

- Minibits - Cashu mobile wallet [info] 🤖

- Blink - Opensource custodial wallet (KYC over 1000 usd) [source] 🤖🍎

- LNbits - App and extesion [source] 🤖🍎💻

- Zeus - [info] [source] 🤖🍎

Exchange

Media Server (Upload Links)

audio, image and video

- Nostr Build - [source] 🌐

- Nostr Check - [info] [source] 🌐

- NostPic - [source] 🌐

- Sovbit 🌐

- Voidcat - [source] 🌐

Without Nip: - Pomf - Upload larger videos [source] - Catbox - [source] - x0 - [source]

Donation and payments

- Zapper - Easy Zaps [source] 🌐

- Autozap [source] 🌐

- Zapmeacoffee 🌐

- Nostr Zap 💻(numpy)

- Creatr - Creators subscription 🌐

- Geyzer - Crowdfunding [info] [source] 🌐

- Heya! - Crowdfunding [source]

Security

- Secret Border - Generate offline keys 💻(java)

- Umbrel - Your private relay [source] 🌐

Extensions

- Nos2x - Account access keys 🌐

- Nsec.app 🌐 [info]

- Lume - [info] [source] 🐧🪟🍎

- Satcom - Share files to discuss - [info] 🌐

- KeysBand - Multi-key signing [source] 🌐

Code

- Nostrify - Share Nostr Frameworks 🌐

- Git Workshop (github like) [experimental] 🌐

- Gitstr (github like) [on development] ⏱️

- Osty [on development] [info] 🌐

- Python Nostr - Python Library for Nostr

Relay Check and Cloud

- Nostr Watch - See your relay speed 🌐

- NosDrive - Nostr Relay that saves to Google Drive

Bidges and Getways

- Matrixtr Bridge - Between Matrix & Nostr

- Mostr - Between Nostr & Fediverse

- Nostrss - RSS to Nostr

- Rsslay - Optimized RSS to Nostr [source]

- Atomstr - RSS/Atom to Nostr [source]

NOT RELATED TO NOSTR

Android Keyboards

Personal notes and texts

Front-ends

- Nitter - Twitter / X without your data [source]

- NewPipe - Youtube, Peertube and others, without account & your data [source] 🤖

- Piped - Youtube web without you data [source] 🌐

Other Services

- Brave - Browser [source]

- DuckDuckGo - Search [source]

- LLMA - Meta - Meta open source AI [source]

- DuckDuckGo AI Chat - Famous AIs without Login [source]

- Proton Mail - Mail [source]

Other open source index: Degoogled Apps

Some other Nostr index on:

-

@ 5df413d4:2add4f5b

2025-05-04 00:51:49

@ 5df413d4:2add4f5b

2025-05-04 00:51:49Short photo-stories of the hidden, hard to find, obscure, and off the beaten track.

Come now, take a walk with me…

The Traveller 01: Ku/苦 Bar

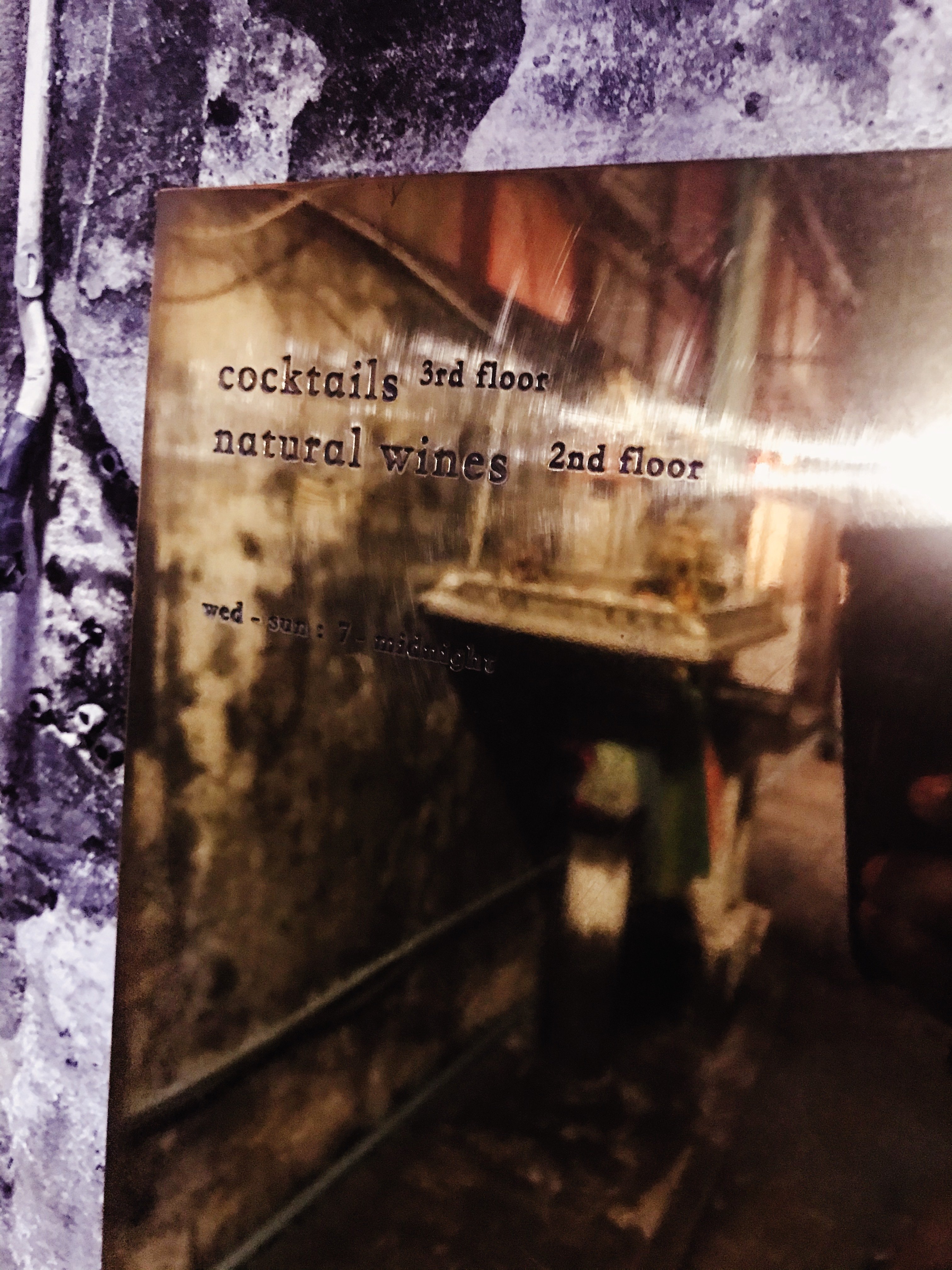

Find a dingy, nondescript alley in a suspiciously quiet corner of Bangkok’s Chinatown at night. Walk down it. Pass the small prayer shrine that houses the angels who look over these particular buildings and approach an old wooden door. You were told that there is a bar here, as to yet nothing suggests that this is so…

Wait! A closer inspection reveals a simple bronze plaque, out of place for its polish and tended upkeep, “cocktails 3rd floor.” Up the stairs then! The landing on floor 3 presents a white sign with the Chinese character for bitter, ku/苦, and a red arrow pointing right.

Pass through the threshold, enter a new space. To your right, a large expanse of barren concrete, an empty “room.” Tripods for…some kind of filming? A man-sized, locked container. Yet, you did not come here to ask questions, such things are none of your business!

And to your left, you find the golden door. Approach. Enter. Be greeted. You have done well! You have found it. 苦 Bar. You are among friends now. Inside exudes deep weirdness - in the etymological sense - the bending of destinies, control of the fates. And for the patrons, a quiet yet social place, a sensual yet sacred space.

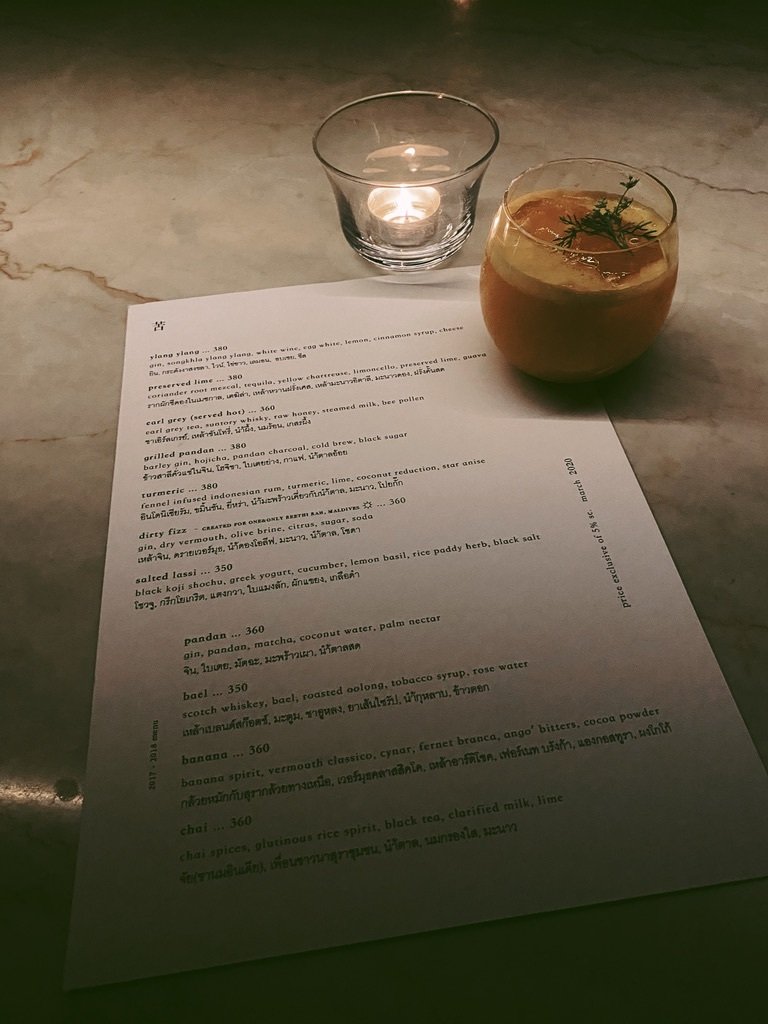

Ethereal sounds, like forlorn whale songs fill the air, a strange music for an even stranger magic. But, Taste! Taste is the order of the day! Fragrant, Bizarre, Obscure, Dripping and Arcane. Here you find a most unique use flavor, flavors myriad and manifold, flavors beyond name. Buddha’s hand, burnt cedar charcoal, ylang ylang, strawberry leaf, maybe wild roots brought in by some friendly passerby, and many, many other things. So, Taste! The drinks here, libations even, are not so much to be liked or disliked, rather, the are liquid context, experience to be embraced with a curious mind and soul freed from judgment.

And In the inner room, one may find another set of stairs. Down this time. Leading to the second place - KANGKAO. A natural wine bar, or so they say. Cozy, botanical, industrial, enclosed. The kind of private setting where you might overhear Bangkok’s resident “State Department,” “UN,” and “NGO” types chatting auspiciously in both Mandarin and English with their Mainland Chinese counterparts. But don’t look hard or listen too long! Surely, there’s no reason to be rude… Relax, relax, you are amongst friends now.

**苦 Bar. Bangkok, circa 2020. There are secrets to be found. Go there. **

Plebchain #Bitcoin #NostrArt #ArtOnNostr #Writestr #Createstr #NostrLove #Travel #Photography #Art #Story #Storytelling #Nostr #Zap #Zaps #Bangkok #Thailand #Siamstr

-

@ c7aa97dc:0d12c810

2025-05-04 17:06:47

@ c7aa97dc:0d12c810

2025-05-04 17:06:47COLDCARDS’s new Co-Sign feature lets you use a multisig (2 of N) wallet where the second key (policy key) lives inside the same COLDCARD and signs only when a transaction meets the rules you set-for example:

- Maximum amount per send (e.g. 500k Sats)

- Wait time between sends, (e.g 144 blocks = 1 day)

- Only send to approved addresses,

- Only send after you provide a 2FA code

If a payment follows the rules, COLDCARD automatically signs the transaction with 2 keys which makes it feel like a single-sig wallet.

Break a rule and the device only signs with 1 key, so nothing moves unless you sign the transaction with a separate off-site recovery key.

It’s the convenience of singlesig with the guard-rails of multisig.

Use Cases Unlocked

Below you will find an overview of usecases unlocked by this security enhancing feature for everyday bitcoiners, families, and small businesses.

1. Travel Lock-Down Mode

Before you leave, set the wait-time to match the duration of your trip—say 14 days—and cap each spend at 50k sats. If someone finds the COLDCARD while you’re away, they can take only one 50k-sat nibble and then must wait the full two weeks—long after you’re back—to try again. When you notice your device is gone you can quickly restore your wallet with your backup seeds (not in your house of course) and move all the funds to a new wallet.

2. Shared-Safety Wallet for Parents or Friends

Help your parents or friends setup a COLDCARD with Co-Sign, cap each spend at 500 000 sats and enforce a 7-day gap between transactions. Everyday spending sails through; anything larger waits for your co-signature from your key. A thief can’t steal more than the capped amount per week, and your parents retains full sovereignty—if you disappear, they still hold two backup seeds and can either withdraw slowly under the limits or import those seeds into another signer and move everything at once.

3. My First COLDCARD Wallet

Give your kid a COLDCARD, but whitelist only their own addresses and set a 100k sat ceiling. They learn self-custody, yet external spends still need you to co-sign.

4. Weekend-Only Spending Wallet

Cap each withdrawal (e.g., 500k sats) and require a 72-hour gap between sends. You can still top-up Lightning channels or pay bills weekly, but attackers that have access to your device + pin will not be able to drain it immediately.

5. DIY Business Treasury

Finance staff use the COLDCARD to pay routine invoices under 0.1 BTC. Anything larger needs the co-founder’s off-site backup key.

6. Donation / Grant Disbursement Wallet

Publish the deposit address publicly, but allow outgoing payments only to a fixed list of beneficiary addresses. Even if attackers get the device, they can’t redirect funds to themselves—the policy key refuses to sign.

7. Phoenix Lightning Wallet Top-Up

Add a Phoenix Lightning wallet on-chain deposit addresses to the whitelist. The COLDCARD will co-sign only when you’re refilling channels. This is off course not limited to Phoenix wallet and can be used for any Lightning Node.

8. Deep Cold-Storage Bridge

Whitelist one or more addresses from your bitcoin vault. Day-to-day you sweep hot-wallet incoming funds (From a webshop or lightning node) into the COLDCARD, then push funds onward to deep cold storage. If the device is compromised, coins can only land safely in the vault.

9. Company Treasury → Payroll Wallets

List each employee’s salary wallet on the whitelist (watch out for address re-use) and cap the amount per send. Routine payroll runs smoothly, while attackers or rogue insiders can’t reroute funds elsewhere.

10. Phone Spending-Wallet Refills

Whitelist only some deposit addresses of your mobile wallet and set a small per-send cap. You can top up anytime, but an attacker with the device and PIN can’t drain more than the refill limit—and only to your own phone.

I hope these usecase are helpfull and I'm curious to hear what other use cases you think are possible with this co-signing feature.

For deeper technical details on how Co-Sign works, refer to the official documentation on the Coldcard website. https://coldcard.com/docs/coldcard-cosigning/

You can also watch their Video https://www.youtube.com/watch?v=MjMPDUWWegw

coldcard #coinkite #bitcoin #selfcustody #multisig #mk4 #ccq

nostr:npub1az9xj85cmxv8e9j9y80lvqp97crsqdu2fpu3srwthd99qfu9qsgstam8y8 nostr:npub12ctjk5lhxp6sks8x83gpk9sx3hvk5fz70uz4ze6uplkfs9lwjmsq2rc5ky

-

@ 90c656ff:9383fd4e

2025-05-04 17:06:06

@ 90c656ff:9383fd4e

2025-05-04 17:06:06In the Bitcoin system, the protection and ownership of funds are ensured by a cryptographic model that uses private and public keys. These components are fundamental to digital security, allowing users to manage and safeguard their assets in a decentralized way. This process removes the need for intermediaries, ensuring that only the legitimate owner has access to the balance linked to a specific address on the blockchain or timechain.

Private and public keys are part of an asymmetric cryptographic system, where two distinct but mathematically linked codes are used to guarantee the security and authenticity of transactions.

Private Key = A secret code, usually represented as a long string of numbers and letters.

Functions like a password that gives the owner control over the bitcoins tied to a specific address.

Must be kept completely secret, as anyone with access to it can move the corresponding funds.

Public Key = Mathematically derived from the private key, but it cannot be used to uncover the private key.

Functions as a digital address, similar to a bank account number, and can be freely shared to receive payments.

Used to verify the authenticity of signatures generated with the private key.

Together, these keys ensure that transactions are secure and verifiable, eliminating the need for intermediaries.

The functioning of private and public keys is based on elliptic curve cryptography. When a user wants to send bitcoins, they use their private key to digitally sign the transaction. This signature is unique for each operation and proves that the sender possesses the private key linked to the sending address.

Bitcoin network nodes check this signature using the corresponding public key to ensure that:

01 - The signature is valid. 02 - The transaction has not been altered since it was signed. 03 - The sender is the legitimate owner of the funds.

If the signature is valid, the transaction is recorded on the blockchain or timechain and becomes irreversible. This process protects funds against fraud and double-spending.

The security of private keys is one of the most critical aspects of the Bitcoin system. Losing this key means permanently losing access to the funds, as there is no central authority capable of recovering it.

- Best practices for protecting private keys include:

01 - Offline storage: Keep them away from internet-connected networks to reduce the risk of cyberattacks. 02 - Hardware wallets: Physical devices dedicated to securely storing private keys. 03 - Backups and redundancy: Maintain backup copies in safe and separate locations. 04 - Additional encryption: Protect digital files containing private keys with strong passwords and encryption.

- Common threats include:

01 - Phishing and malware: Attacks that attempt to trick users into revealing their keys. 02 - Physical theft: If keys are stored on physical devices. 03 - Loss of passwords and backups: Which can lead to permanent loss of funds.

Using private and public keys gives the owner full control over their funds, eliminating intermediaries such as banks or governments. This model places the responsibility of protection on the user, which represents both freedom and risk.

Unlike traditional financial systems, where institutions can reverse transactions or freeze accounts, in the Bitcoin system, possession of the private key is the only proof of ownership. This principle is often summarized by the phrase: "Not your keys, not your coins."

This approach strengthens financial sovereignty, allowing individuals to store and move value independently and without censorship.

Despite its security, the key-based system also carries risks. If a private key is lost or forgotten, there is no way to recover the associated funds. This has already led to the permanent loss of millions of bitcoins over the years.

To reduce this risk, many users rely on seed phrases, which are a list of words used to recover wallets and private keys. These phrases must be guarded just as carefully, as they can also grant access to funds.

In summary, private and public keys are the foundation of security and ownership in the Bitcoin system. They ensure that only rightful owners can move their funds, enabling a decentralized, secure, and censorship-resistant financial system.

However, this freedom comes with great responsibility, requiring users to adopt strict practices to protect their private keys. Loss or compromise of these keys can lead to irreversible consequences, highlighting the importance of education and preparation when using Bitcoin.

Thus, the cryptographic key model not only enhances security but also represents the essence of the financial independence that Bitcoin enables.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ 5df413d4:2add4f5b

2025-05-04 00:06:31

@ 5df413d4:2add4f5b

2025-05-04 00:06:31This opinion piece was first published in BTC Magazine on Feb 20, 2023

Just in case we needed a reminder, banks are showing us that they can and will gatekeep their customers’ money to prevent them from engaging with bitcoin. This should be a call to action for Bitcoiners or anyone else who wants to maintain control over their finances to move toward more proactive use of permissionless bitcoin tools and practices.

Since January of 2023, when Jamie Dimon decried Bitcoin as a “hyped-up fraud” and “a pet rock,” on CNBC, I've found myself unable to purchase bitcoin using my Chase debit card on Cash App. And I'm not the only one — if you have been following Bitcoin Twitter, you might have also seen Alana Joy tweet about her experience with the same. (Alana Joy Twitter account has since been deleted).

In both of our cases, it is the bank preventing bitcoin purchases and blocking inbound fiat transfers to Cash App for customers that it has associated with Bitcoin. All under the guise of “fraud protection,” of course.

No, it doesn’t make a whole lot of sense — Chase still allows ACH bitcoin purchases and fiat on Cash App can be used for investing in stocks, saving or using Cash App’s own debit card, not just bitcoin — but yes, it is happening. Also, no one seems to know exactly when this became Chase’s policy. The fraud representative I spoke with wasn’t sure and couldn’t point to any documentation, but reasoned that the rule has been in place since early last year. Yet murkier still, loose chatter can be found on Reddit about this issue going back to at least April 2021.

However, given that I and so many others were definitely buying bitcoin via Chase debit throughout 2021 and 2022, I’d wager that this policy, up to now, has only been exercised haphazardly, selectively, arbitrarily, even. Dark patterns abound, but for now, it seems like I just happen to be one of the unlucky ones…

That said, there is nothing preventing this type of policy from being enforced broadly and in earnest by one or many banks. If and as banks feel threatened by Bitcoin, we will surely see more of these kinds of opaque practices.

It’s Time To Get Proactive

Instead, we should expect it and prepare for it. So, rather than railing against banks, I want to use this as a learning experience to reflect on the importance of permissionless, non-KYC Bitcoining, and the practical actions we can take to advance the cause.

Bank with backups and remember local options. Banking is a service, not servitude. Treat it as such. Maintaining accounts at multiple banks may provide some limited fault tolerance against banks that take a hostile stance toward Bitcoin, assuming it does not become the industry norm. Further, smaller, local and regional banks may be more willing to work with Bitcoiner customers, as individual accounts can be far more meaningful to them than they are to larger national banks — though this certainly should not be taken for granted.

If you must use KYC’d Bitcoin services, do so thoughtfully. For Cash App (and services like it), consider first loading in fiat and making buys out of the app’s native cash balance instead of purchasing directly through a linked bank account/debit card where information is shared with the bank that allows it to flag the transaction for being related to bitcoin. Taking this small step may help to avoid gatekeeping and can provide some minor privacy, from the bank at least.

Get comfortable with non-KYC bitcoin exchanges. Just as many precoiners drag their feet before making their first bitcoin buys, so too do many Bitcoiners drag their feet in using permissionless channels to buy and sell bitcoin. Robosats, Bisq, Hodl Hodl— you can use the tools. For anyone just getting started, BTC Sessions has excellent video tutorial content on all three, which are linked.

If you don’t yet know how to use these services, it’s better to pick up this knowledge now through calm, self-directed learning rather than during the panic of an emergency or under pressure of more Bitcoin-hostile conditions later. And for those of us who already know, we can actively support these services. For instance, more of us taking action to maintain recurring orders on such platforms could significantly improve their volumes and liquidity, helping to bootstrap and accelerate their network effects.

Be flexible and creative with peer-to-peer payment methods. Cash App, Zelle, PayPal, Venmo, Apple Cash, Revolut, etc. — the services that most users seem to be transacting with on no-KYC exchanges — they would all become willing, if not eager and active agents of financial gatekeeping in any truly antagonistic, anti-privacy environment, even when used in a “peer-to-peer” fashion.

Always remember that there are other payment options — such as gift cards, the original digital-bearer items — that do not necessarily carry such concerns. Perhaps, an enterprising soul might even use Fold to earn bitcoin rewards on the backend for the gift cards used on the exchange…

Find your local Bitcoin community! In the steadily-advancing shadow war on all things permissionless, private, and peer-to-peer, this is our best defense. Don’t just wait until you need other Bitcoiners to get to know other Bitcoiners — to paraphrase Texas Slim, “Shake your local Bitcoiner’s hand.” Get to know people and never underestimate the power of simply asking around. There could be real, live Bitcoiners near you looking to sell some corn and happy to see it go to another HODLer rather than to a bunch of lettuce-handed fiat speculators on some faceless, centralized, Ponzi casino exchange. What’s more, let folks know your skills, talents and expertise — you might be surprised to find an interested market that pays in BTC!

In closing, I believe we should think of permissionless Bitcoining as an essential and necessary core competency, just like we do with Self-Custody. And we should push it with similar urgency and intensity. But as we do this, we should also remember that it is a spectrum and a progression and that there are no perfect solutions, only tradeoffs. Realization of the importance of non-KYC practices will not be instant or obvious to near-normie newcoiners, coin-curious fence-sitters or even many minted Bitcoiners. My own experience is certainly a testament to this.

As we promote the active practice of non-KYC Bitcoining, we can anchor to empathy, patience and humility — always being mindful of the tremendous amount of unlearning most have to go through to get there. So, even if someone doesn’t get it the first time, or the nth time, that they hear it from us, if it helps them get to it faster at all, then it’s well worth it.

~Moon

-

@ b99efe77:f3de3616

2025-05-04 16:59:35

@ b99efe77:f3de3616

2025-05-04 16:59:35fafasdf

asdfasfasf

Places & Transitions

- Places:

-

Bla bla bla: some text

-

Transitions:

- start: Initializes the system.

- logTask: bla bla bla.

petrinet ;startDay () -> working ;stopDay working -> () ;startPause working -> paused ;endPause paused -> working ;goSmoke working -> smoking ;endSmoke smoking -> working ;startEating working -> eating ;stopEating eating -> working ;startCall working -> onCall ;endCall onCall -> working ;startMeeting working -> inMeetinga ;endMeeting inMeeting -> working ;logTask working -> working -

@ 6389be64:ef439d32

2025-05-03 07:17:36

@ 6389be64:ef439d32

2025-05-03 07:17:36In Jewish folklore, the golem—shaped from clay—is brought to life through sacred knowledge. Clay’s negative charge allows it to bind nutrients and water, echoing its mythic function as a vessel of potential.

Biochar in Amazonian terra preta shares this trait: it holds life-sustaining ions and harbors living intention. Both materials, inert alone, become generative through human action. The golem and black earths exist in parallel—one cultural, one ecological—shaping the lifeless into something that serves, protects, and endures.

originally posted at https://stacker.news/items/970089

-

@ 266815e0:6cd408a5

2025-05-02 22:24:59

@ 266815e0:6cd408a5

2025-05-02 22:24:59Its been six long months of refactoring code and building out to the applesauce packages but the app is stable enough for another release.

This update is pretty much a full rewrite of the non-visible parts of the app. all the background services were either moved out to the applesauce packages or rewritten, the result is that noStrudel is a little faster and much more consistent with connections and publishing.

New layout

The app has a new layout now, it takes advantage of the full desktop screen and looks a little better than it did before.

Removed NIP-72 communities

The NIP-72 communities are no longer part of the app, if you want to continue using them there are still a few apps that support them ( like satellite.earth ) but noStrudel won't support them going forward.

The communities where interesting but ultimately proved too have some fundamental flaws, most notably that all posts had to be approved by a moderator. There were some good ideas on how to improve it but they would have only been patches and wouldn't have fixed the underlying issues.

I wont promise to build it into noStrudel, but NIP-29 (relay based groups) look a lot more promising and already have better moderation abilities then NIP-72 communities could ever have.

Settings view

There is now a dedicated settings view, so no more hunting around for where the relays are set or trying to find how to add another account. its all in one place now

Cleaned up lists

The list views are a little cleaner now, and they have a simple edit modal

New emoji picker

Just another small improvement that makes the app feel more complete.

Experimental Wallet

There is a new "wallet" view in the app that lets you manage your NIP-60 cashu wallet. its very experimental and probably won't work for you, but its there and I hope to finish it up so the app can support NIP-61 nutzaps.

WARNING: Don't feed the wallet your hard earned sats, it will eat them!

Smaller improvements

- Added NSFW flag for replies

- Updated NIP-48 bunker login to work with new spec

- Linkfy BIPs

- Added 404 page

- Add NIP-22 comments under badges, files, and articles

- Add max height to timeline notes

- Fix articles view freezing on load

- Add option to mirror blobs when sharing notes

- Remove "open in drawer" for notes

-

@ 90c656ff:9383fd4e

2025-05-04 16:49:19

@ 90c656ff:9383fd4e

2025-05-04 16:49:19The Bitcoin network is built on a decentralized infrastructure made up of devices called nodes. These nodes play a crucial role in validating, verifying, and maintaining the system, ensuring the security and integrity of the blockchain or timechain. Unlike traditional systems where a central authority controls operations, the Bitcoin network relies on the collaboration of thousands of nodes around the world, promoting decentralization and transparency.

In the Bitcoin network, a node is any computer connected to the system that participates in storing, validating, or distributing information. These devices run Bitcoin software and can operate at different levels of participation, from basic data transmission to full validation of transactions and blocks.

There are two main types of nodes:

- Full Nodes:

01 - Store a complete copy of the blockchain or timechain. 02 - Validate and verify all transactions and blocks according to the protocol rules. 03 - Ensure network security by rejecting invalid transactions or fraudulent attempts.

- Light Nodes:

01 - Store only parts of the blockchain or timechain, not the full structure. 02 - Rely on full nodes to access transaction history data. 03 - Are faster and less resource-intensive but depend on third parties for full validation.

Nodes check whether submitted transactions comply with protocol rules, such as valid digital signatures and the absence of double spending.

Only valid transactions are forwarded to other nodes and included in the next block.

Full nodes maintain an up-to-date copy of the network's entire transaction history, ensuring integrity and transparency. In case of discrepancies, nodes follow the longest and most valid chain, preventing manipulation.

Nodes transmit transaction and block data to other nodes on the network. This process ensures all participants are synchronized and up to date.

Since the Bitcoin network consists of thousands of independent nodes, it is nearly impossible for a single agent to control or alter the system.

Nodes also protect against attacks by validating information and blocking fraudulent attempts.

Full nodes are particularly important, as they act as independent auditors. They do not need to rely on third parties and can verify the entire transaction history directly.

By maintaining a full copy of the blockchain or timechain, these nodes allow anyone to validate transactions without intermediaries, promoting transparency and financial freedom.

- In addition, full nodes:

01 - Reinforce censorship resistance: No government or entity can delete or alter data recorded on the system. 02 - Preserve decentralization: The more full nodes that exist, the stronger and more secure the network becomes. 03 - Increase trust in the system: Users can independently confirm whether the rules are being followed.

Despite their value, operating a full node can be challenging, as it requires storage space, processing power, and bandwidth. As the blockchain or timechain grows, technical requirements increase, which can make participation harder for regular users.

To address this, the community continuously works on solutions, such as software improvements and scalability enhancements, to make network access easier without compromising security.

In summary, nodes are the backbone of the Bitcoin network, performing essential functions in transaction validation, verification, and distribution. They ensure the decentralization and security of the system, allowing participants to operate reliably without relying on intermediaries.

Full nodes, in particular, play a critical role in preserving the integrity of the blockchain or timechain, making the Bitcoin network resistant to censorship and manipulation.

While running a node may require technical resources, its impact on preserving financial freedom and system trust is invaluable. As such, nodes remain essential elements for the success and longevity of Bitcoin.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ efc19139:a370b6a8

2025-05-04 16:42:24

@ efc19139:a370b6a8

2025-05-04 16:42:24Bitcoin has a controversial reputation, but in this essay, I argue that Bitcoin is actually a pretty cool thing; it could even be described as the hippie movement of the digital generations.

Mainstream media often portrays Bitcoin purely as speculation, with headlines focusing on price fluctuations or painting it as an environmental disaster. It has frequently been declared dead and buried, only to rise again—each time, it's labeled as highly risky and suspicious as a whole. Then there are those who find blockchain fascinating in general but dismiss Bitcoin as outdated, claiming it will soon be replaced by a new cryptocurrency (often one controlled by the very author making the argument). Let’s take a moment to consider why Bitcoin is interesting and how it can drive broad societal change, much like the hippie movement once did. Bitcoin is a global decentralized monetary system operating on a peer-to-peer network. Since nearly all of humanity lives within an economic system based on money, it’s easy to see how an overhaul of the financial system could have a profound impact across different aspects of society. Bitcoin differs from traditional money through several unique characteristics: it is scarce, neutral, decentralized, and completely permissionless. There is no central entity—such as a company—that develops and markets Bitcoin, meaning it cannot be corrupted.

Bitcoin is an open digital network, much like the internet. Due to its lack of a central governing entity and its organic origin, Bitcoin can be considered a commodity, whereas other cryptocurrencies resemble securities, comparable to stocks. Bitcoin’s decentralized nature makes it geopolitically neutral. Instead of being controlled by a central authority, it operates under predefined, unchangeable rules. No single entity in the world has the ability to arbitrarily influence decision-making within the Bitcoin network. This characteristic is particularly beneficial in today’s political climate, where global uncertainty is heightened by unpredictable leaders of major powers. The permissionless nature of Bitcoin and its built-in resistance to censorship are crucial for individuals living under unstable conditions. Bitcoin is used to raise funds for politically persecuted activists and for charitable purposes in regions where financial systems have been weaponized against political opponents or used to restrict people's ability to flee a country. These are factors that may not immediately come to mind in Western nations, where such challenges are not commonly faced. Additionally, according to the World Bank, an estimated 1.5 billion people worldwide still lack access to any form of banking services.

Mining is the only way to ensure that no one can seize control of the Bitcoin network or gain a privileged position within it. This keeps Bitcoin neutral as a protocol, meaning a set of rules without leaders. It is not governed in the same way a company is, where ownership of shares dictates control. Miners earn the right to record transactions in Bitcoin’s ledger by continuously proving that they have performed work to obtain that right. This proof-of-work algorithm is also one reason why Bitcoin has spread so organically. If recording new transactions were free, we would face a problem similar to spam: there would be an endless number of competing transactions, making it impossible to reach consensus on which should officially become part of the decentralized ledger. Mining can be seen as an auction for adding the next set of transactions, where the price is the amount of energy expended. Using energy for this purpose is the only way to ensure that mining remains globally decentralized while keeping the system open and permissionless—free from human interference. Bitcoin’s initial distribution was driven by random tech enthusiasts around the world who mined it as a hobby, using student electricity from their bedrooms. This is why Bitcoin’s spread can be considered organic, in contrast to a scenario where it was created by a precisely organized inner circle that typically would have granted itself advantages before the launch.

If energy consumption is considered concerning, the best regulatory approach would be to create optimal conditions for mining in Finland, where over half of energy production already comes from renewable sources. Modern miners are essentially datacenters, but they have a unique characteristic: they can adjust their electricity consumption seamlessly and instantly without delay. This creates synergy with renewable energy production, which often experiences fluctuations in supply. The demand flexibility offered by miners provides strong incentives to invest increasingly in renewable energy facilities. Miners can commit to long-term projects as last-resort consumers, making investments in renewables more predictable and profitable. Additionally, like other datacenters, miners produce heat as a byproduct. As a thought experiment, they could also be considered heating plants, with a secondary function of securing the Bitcoin network. In Finland, heat is naturally needed year-round. This combination of grid balancing and waste heat recovery would be key to Europe's energy self-sufficiency. Wouldn't it be great if the need to bow to fossil fuel powers for energy could be eliminated? Unfortunately, the current government has demonstrated a lack of understanding of these positive externalities by proposing tax increases on electricity. The so-called fiat monetary system also deserves criticism in Western nations, even though its flaws are not as immediately obvious as elsewhere. It is the current financial system in which certain privileged entities control the issuance of money as if by divine decree, which is what the term fiat (command) refers to. The system subtly creates and maintains inequality.

The Cantillon effect is an economic phenomenon in which entities closer to newly created money benefit at the expense of those farther away. Access to the money creation process is determined by credit ratings and loan terms, as fiat money is always debt. The Cantillon effect is a distorted version of the trickle-down theory, where the loss of purchasing power in a common currency gradually moves downward. Due to inflation, hard assets such as real estate, precious metals, and stocks become more expensive, just as food prices rise in stores. This process further enriches the wealthy while deepening poverty. The entire wealth of lower-income individuals is often held in cash or savings, which are eroded by inflation much like a borrowed bottle of Leijona liquor left out too long. Inflation is usually attributed to a specific crisis, but over the long term (spanning decades), monetary inflation—the expansion of the money supply—plays a significant role. Nobel Prize-winning economist Paul Krugman, known for his work on currencies, describes inflation in his book The Accidental Theorist as follows, loosely quoted: "It is really, really difficult to cut nominal wages. Even with low inflation, making labor cheaper would require a large portion of workers to accept wage cuts. Therefore, higher inflation leads to higher employment." Since no one wants to voluntarily give up their salary in nominal terms, the value of wages must be lowered in real terms by weakening the currency in which they are paid. Inflation effectively cuts wages—or, in other words, makes labor cheaper. This is one of the primary reasons why inflation is often said to have a "stimulating" effect on the economy.

It does seem somewhat unfair that employees effectively subsidize their employers’ labor costs to facilitate new hires, doesn’t it? Not to mention the inequities faced by the Global South in the form of neocolonialism, where Cantillon advantages are weaponized through reserve currencies like the US dollar or the French franc. This follows the exact same pattern, just on a larger scale. The Human Rights Foundation (hrf.org) has explored the interconnection between the fiat monetary system and neocolonialism in its publications, advocating for Bitcoin as part of the solution. Inflation can also be criticized from an environmental perspective. Since it raises time preference, it encourages people to make purchases sooner rather than delay them. As Krugman put it in the same book, “Extra money burns in your pocket.” Inflation thus drives consumption while reducing deliberation—it’s the fuel of the economy. If the goal from an environmental standpoint is to moderate economic activity, the first step should be to stop adding fuel to the fire. The impact of inflation on intergenerational inequality and the economic uncertainty faced by younger generations is rarely discussed. Boomers have benefited from the positive effects of the trend sparked by the Nixon shock in 1971, such as wealth accumulation in real estate and inflation-driven economic booms. Zoomers, meanwhile, are left to either fix the problems of the current system or find themselves searching for a lifeboat.

Bitcoin emerged as part of a long developmental continuum within the discussion forums of rebellious programmers known as cypherpunks, or encryption activists. It is an integral part of internet history and specifically a counterculture movement. Around Bitcoin, grassroots activists and self-organized communities still thrive, fostering an atmosphere that is welcoming, inspiring, and—above all—hopeful, which feels rare in today’s world. Although the rush of suits and traditional financial giants into Bitcoin through ETF funds a year ago may have painted it as opportunistic and dull in the headlines, delving into its history and culture reveals ever-fascinating angles and new layers within the Bitcoin sphere. Yet, at its core, Bitcoin is simply money. It possesses all seven characteristics required to meet the definition of money: it is easily divisible, transferable, recognizable, durable, fungible, uniform, and straightforward to receive. It serves as a foundation on which coders, startup enthusiasts, politicians, financial executives, activists, and anarchists alike can build. The only truly common denominator among the broad spectrum of Bitcoin users is curiosity—openness to new ideas. It merely requires the ability to recognize potential in an alternative system and a willingness to embrace fundamental change. Bitcoin itself is the most inclusive system in the world, as it is literally impossible to marginalize or exclude its users. It is a tool for peaceful and voluntary collaboration, designed so that violence and manipulation are rendered impossible in its code.

Pretty punk in the middle of an era of polarization and division, wouldn’t you say?

The original author (not me) is the organizer of the Bitcoin conference held in Helsinki, as well as a founding member and vice chairman of the Finnish Bitcoin Association. More information about the event can be found at: https://btchel.com and https://njump.me/nprofile1qqs89v5v46jcd8uzv3f7dudsvpt8ntdm3927eqypyjy37yx5l6a30fcknw5z5 ps. Zaps and sats will be forwarded to author!

originally posted at https://stacker.news/items/971219

-

@ df478ecd:495107a7

2025-05-01 17:07:43{"wss://nostr21.com":{"read":true,"write":true},"wss://offchain.pub":{"read":true,"write":true},"wss://relay.damus.io":{"read":true,"write":true},"wss://relay.snort.social":{"read":true,"write":true},"wss://relay.jerseyplebs.com":{"write":true,"read":true},"wss://relay.primal.net":{"write":true,"read":true},"wss://news.utxo.one":{"write":true,"read":true},"wss://purplepag.es":{"read":true,"write":true}}

@ df478ecd:495107a7

2025-05-01 17:07:43{"wss://nostr21.com":{"read":true,"write":true},"wss://offchain.pub":{"read":true,"write":true},"wss://relay.damus.io":{"read":true,"write":true},"wss://relay.snort.social":{"read":true,"write":true},"wss://relay.jerseyplebs.com":{"write":true,"read":true},"wss://relay.primal.net":{"write":true,"read":true},"wss://news.utxo.one":{"write":true,"read":true},"wss://purplepag.es":{"read":true,"write":true}} -

@ cbaa0c82:e9313245

2025-05-02 17:00:12

@ cbaa0c82:e9313245

2025-05-02 17:00:12TheWholeGrain - #April2025

Toast officially took this April. It was non-stop Toast posts since the beginning of the month when Toast somehow got control of the nSec for the official Bread and Toast nPub on NOSTR. Not only that, but Toast somehow managed to hack the entire Bread and Toast website!

We're still trying to figure out how...

Luckily, we've managed to take back control of the website as well as gotten Toast to agree not to mess around with our profile on NOSTR. We'll see how long that lasts...

Sunday Singles - April 2025 2025-04-06 | Sunday Single 87 Title: Puppets Toast just keeps saying, "Dance my puppets... Dance..." over and over... https://i.nostr.build/Xz6akLAQXZgTUJrh.png

2025-04-13 | Sunday Single 88 Title: Late Night Show Tonight on A Midnight Snack with Toast! We have our guest, End-Piece, to talk about a new movie and much more! https://i.nostr.build/NKdCZ6gmZh7wEFSJ.png

2025-04-20 | Sunday Single 89 Title: Sculpture This statue is in honor of Toast, the Great! https://i.nostr.build/08C2SG3VCiugelX4.png

2025-04-27 | Sunday Single 90 Title: Nothing Butter It's Nothing Butter! Because Nothing get Butter than this! https://i.nostr.build/sfR3U6LWIj9hPjkX.png

Adventure Series: Questline The group continues on the next leg of their journey which happens to lead them into a massive forest where the trees are so thick and large that sunlight can barely get through if at all!

Artist: Dakota Jernigan (The Bitcoin Painter) Writer: Daniel David (dan 🍞)

2025-04-08 | Questline 007 - Dark Forest After recovering from their recent battle our heroes continue on their path to find themselves before a large dark forest. The forest is so large that the only way to get to the other side is to go through it. https://i.nostr.build/29FrlOBwWCRsTvrN.png

2025-04-22 | Questline 008 - Into the Shadows As the our heroes enter the forest the darkness of the shadows begins to engulf all that is around them. While Bread is eager to move into the woods Toast and End-Piece are a little more hesitant to do so. https://i.nostr.build/MOkJEzeFVVCSK9aj.png

Toast's Takeover 2025 As we pointed out at the beginning of this edition of The Whole Grain, Toast took over just about everything! On the last day of March something suspicious was going on. https://i.nostr.build/0ERB5nXGTRQew0C3.png

The next day on April 1st, the official Bread and Toast nPub was renamed to Toast and Bread. Some people might have even thought that it was just a silly April Fools joke on our part, but then the following message was released that same morning:

Hey, everyone! Toast here! That’s right, I’m in charge now! https://i.nostr.build/tHyQr5BsGcf00crp.png

For the next month, it’s all about, me, Toast! Prepare yourselves for Toast’s Takeover!

Stay tuned for more of Toast and Bread! Things are about to get crispy!

Our entire brand was transformed into Toast and Bread. Even the website was redirecting to ToastandBread.com. It was crazy, and no one could figure out how Toast made it all happen.

Other Content Released in April 2025 2025-04-02 | Toast's Comic Collection Title: Toastie #12 Hi. My Name is Toastie Andrews. Welcome to Toasterdale! https://i.nostr.build/vW9plTM44t4U2WM8.png

2025-04-09 | Concept Art Title: The Birth of Toast This was a quick drawing done to show how Toast actually became Toast. The idea was that our second slice of bread gets stuck in a toaster while exploring. End-Piece accidentally turns the toaster on while trying to figure out how to help. https://i.nostr.build/TDQ6CiPBkrxAU3Vi.png

2025-04-16 | Bitcoin Art Title: Toast Loves Lightning Block Height: 892674 Toast loves learning about Lightning! https://i.nostr.build/SAoXAvpjH6gYDYPB.png

Additions to The Bakery in 2025 We had our first addition of the year to The Bakery back in March, and we'd like to make sure we share it in this edition of The Whole Grain since we forgot to mention it the March edition. Let's just all agree we got distracted dealing with Toast's ego.

2025-03-09 | npub1df47g7a39usamq83aula72zdz23fx9xw5rrfmd0v6p9t20n5u0ss2eqez9 https://image.nostr.build/55d0531271ee5263841d4d06b67f787ed3da85babaedd865a007f957e14fb2e7.jpg

As for April, we had a few new additions to The Bakery. The first additions was a collection that showed us what Bread and Toast would look like on some classic VHS tapes.

2025-04-04 | npub1qhjxfxpjm7udr0agr6nuhuwf9383e4g9907g64r9hf6y4fh6t6uqpcp36k https://i.nostr.build/5VJZdLOC1FdzJ3XE.jpg https://i.nostr.build/G5SUkzo1tKoYFoef.png https://i.nostr.build/ViDuteL5TXM3YTs1.png

To finish off here is the latest addition which was a beautiful watercolor showing off all three slices of bread on a plate next to a toaster!

2025-04-24 | npub1f5kc2agn63ecv2ua4909z9ahgmr2x9263na36jh6r908ql0926jq3nvk2u https://image.nostr.build/9fc49d71715ae6a90f441b71de6ba0f8598b3f81c7fb7247ccb200e9537d8fb1.jpg https://image.nostr.build/19a158ceb6010a24712ee2741447f3e56f2883156e775c1be037b498a3b51a2e.jpg

Thanks for checking out the eighth issue of The Whole Grain. The Whole Grain is released on the first of every month and covers all of the content released by Bread and Toast in the previous month. For all Bread and Toast content visit BreadandToast.com!

Thanks for putting up with Toast this past month! Bread and End-Piece

BreadandToast #SundaySingle #Questline #ToastsComicCollection #ConceptArt #BitcoinArt #Bread #Toast #EndPiece #Artstr #Comic #Cartoon #NostrOnly #🍞 #🖼️

List of nPubs Mentioned: samhain: npub1df47g7a39usamq83aula72zdz23fx9xw5rrfmd0v6p9t20n5u0ss2eqez9

archjourney: npub1qhjxfxpjm7udr0agr6nuhuwf9383e4g9907g64r9hf6y4fh6t6uqpcp36k

existing sprinkles: npub1f5kc2agn63ecv2ua4909z9ahgmr2x9263na36jh6r908ql0926jq3nvk2u

The Bitcoin Painter: npub1tx5ccpregnm9afq0xaj42hh93xl4qd3lfa7u74v5cdvyhwcnlanqplhd8g

dan 🍞: npub16e3vzr7dk2uepjcnl85nfare3kdapxge08gr42s99n9kg7xs8xhs90y9v6

-

@ 1eb5d2c9:ee9e8d5f

2025-05-01 01:22:20#ZapAllWomen 🫡⚡

@ 1eb5d2c9:ee9e8d5f

2025-05-01 01:22:20#ZapAllWomen 🫡⚡ -

@ 90c656ff:9383fd4e

2025-05-04 16:36:21

@ 90c656ff:9383fd4e

2025-05-04 16:36:21Bitcoin mining is a crucial process for the operation and security of the network. It plays an important role in validating transactions and generating new bitcoins, ensuring the integrity of the blockchain or timechain-based system. This process involves solving complex mathematical calculations and requires significant computational power. Additionally, mining has economic, environmental, and technological effects that must be carefully analyzed.

Bitcoin mining is the procedure through which new units of the currency are created and added to the network. It is also responsible for verifying and recording transactions on the blockchain or timechain. This system was designed to be decentralized, eliminating the need for a central authority to control issuance or validate operations.

Participants in the process, called miners, compete to solve difficult mathematical problems. Whoever finds the solution first earns the right to add a new block to the blockchain or timechain and receives a reward in bitcoins, along with the transaction fees included in that block. This mechanism is known as Proof of Work (PoW).

The mining process is highly technical and follows a series of steps:

Transaction grouping: Transactions sent by users are collected into a pending block that awaits validation.

Solving mathematical problems: Miners must find a specific number, called a nonce, which, when combined with the block’s data, generates a cryptographic hash that meets certain required conditions. This process involves trial and error and consumes a great deal of computational power.

Block validation: When a miner finds the correct solution, the block is validated and added to the blockchain or timechain. All network nodes verify the block’s authenticity before accepting it.

Reward: The winning miner receives a bitcoin reward, in addition to the fees paid for the transactions included in the block. This reward decreases over time in an event called halving, which happens approximately every four years.

Bitcoin mining has a significant economic impact, as it creates income opportunities for individuals and companies. It also drives the development of new technologies such as specialized processors (ASICs) and modern cooling systems.

Moreover, mining supports financial inclusion by maintaining a decentralized network, enabling fast and secure global transactions. In regions with unstable economies, Bitcoin provides a viable alternative for value preservation and financial transfers.

Despite its economic benefits, Bitcoin mining is often criticized for its environmental impact. The proof-of-work process consumes large amounts of electricity, especially in areas where the energy grid relies on fossil fuels.

It’s estimated that Bitcoin mining uses as much energy as some entire countries, raising concerns about its sustainability. However, there are ongoing efforts to reduce these impacts, such as the increasing use of renewable energy sources and the exploration of alternative systems like Proof of Stake (PoS) in other decentralized networks.

Mining also faces challenges related to scalability and the concentration of computational power. Large companies and mining pools dominate the sector, which can affect the network’s decentralization.

Another challenge is the growing complexity of the mathematical problems, which requires more advanced hardware and consumes more energy over time. To address these issues, researchers are studying solutions that optimize resource use and keep the network sustainable in the long term.

In summary, Bitcoin mining is an essential process for maintaining the network and creating new units of the currency. It ensures security, transparency, and decentralization, supporting the operation of the blockchain or timechain.

However, mining also brings challenges such as high energy consumption and the concentration of resources in large pools. Even so, the pursuit of sustainable solutions and technological innovations points to a promising future, where Bitcoin continues to play a central role in the digital economy.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ 1eb5d2c9:ee9e8d5f

2025-04-29 17:08:49{"id":"9e350d19cdab6ccaa2023822404d4c7d57ecf0e25dc938872eb63a0ee4c036bc","pubkey":"e96911258fabb7c235ffbb052c96a07bf91f3ef91cfa036e4f442fd23320261f","created_at":1745900599,"kind":1,"tags":[["e","0514cc738ab72c2fd7c1acf6e59db1bb6f801ad4cbe8ae02a53ea0b59d302a9f","wss://nostr-dev.wellorder.net","root"],["p","04c915daefee38317fa734444acee390a8269fe5810b2241e5e6dd343dfbecc9","","mention"],["p","74ffc51cc30150cf79b6cb316d3a15cf332ab29a38fec9eb484ab1551d6d1856","","mention"]],"content":"Running knots ","sig":"637707f2774221bb3fcb11420eed6d787c3b2c557adde9bb2741627b81f3cabd7db99a0742958c0bd325a99019cadf17aa37abfd237b22e5e77382e5313c91a3"}

@ 1eb5d2c9:ee9e8d5f

2025-04-29 17:08:49{"id":"9e350d19cdab6ccaa2023822404d4c7d57ecf0e25dc938872eb63a0ee4c036bc","pubkey":"e96911258fabb7c235ffbb052c96a07bf91f3ef91cfa036e4f442fd23320261f","created_at":1745900599,"kind":1,"tags":[["e","0514cc738ab72c2fd7c1acf6e59db1bb6f801ad4cbe8ae02a53ea0b59d302a9f","wss://nostr-dev.wellorder.net","root"],["p","04c915daefee38317fa734444acee390a8269fe5810b2241e5e6dd343dfbecc9","","mention"],["p","74ffc51cc30150cf79b6cb316d3a15cf332ab29a38fec9eb484ab1551d6d1856","","mention"]],"content":"Running knots ","sig":"637707f2774221bb3fcb11420eed6d787c3b2c557adde9bb2741627b81f3cabd7db99a0742958c0bd325a99019cadf17aa37abfd237b22e5e77382e5313c91a3"} -

@ 700c6cbf:a92816fd

2025-05-04 16:34:01

@ 700c6cbf:a92816fd

2025-05-04 16:34:01Technically speaking, I should say blooms because not all of my pictures are of flowers, a lot of them, probably most, are blooming trees - but who cares, right?

It is that time of the year that every timeline on every social media is being flooded by blooms. At least in the Northern Hemisphere. I thought that this year, I wouldn't partake in it but - here I am, I just can't resist the lure of blooms when I'm out walking the neighborhood.

Spring has sprung - aaaachoo, sorry, allergies suck! - and the blooms are beautiful.

Yesterday, we had the warmest day of the year to-date. I went for an early morning walk before breakfast. Beautiful blue skies, no clouds, sunshine and a breeze. Most people turned on their aircons. We did not. We are rebels - hah!

We also had breakfast on the deck which I really enjoy during the weekend. Later I had my first session of the year painting on the deck while listening/watching @thegrinder streaming. Good times.

Today, the weather changed. Last night, we had heavy thunderstorms and rain. This morning, it is overcast with the occasional sunray peaking through or, as it is right now, raindrops falling.

We'll see what the day will bring. For me, it will definitely be: Back to painting. Maybe I'll even share some here later. But for now - this is a photo post, and here are the photos. I hope you enjoy as much as I enjoyed yesterday's walk!

Cheers, OceanBee

!(image)[https://cdn.satellite.earth/cc3fb0fa757c88a6a89823585badf7d67e32dee72b6d4de5dff58acd06d0aa36.jpg] !(image)[https://cdn.satellite.earth/7fe93c27c3bf858202185cb7f42b294b152013ba3c859544950e6c1932ede4d3.jpg] !(image)[https://cdn.satellite.earth/6cbd9fba435dbe3e6732d9a5d1f5ff0403935a4ac9d0d83f6e1d729985220e87.jpg] !(image)[https://cdn.satellite.earth/df94d95381f058860392737d71c62cd9689c45b2ace1c8fc29d108625aabf5d5.jpg] !(image)[https://cdn.satellite.earth/e483e65c3ee451977277e0cfa891ec6b93b39c7c4ea843329db7354fba255e64.jpg] !(image)[https://cdn.satellite.earth/a98fe8e1e0577e3f8218af31f2499c3390ba04dced14c2ae13f7d7435b4000d7.jpg] !(image)[https://cdn.satellite.earth/d83b01915a23eb95c3d12c644713ac47233ce6e022c5df1eeba5ff8952b99d67.jpg] !(image)[https://cdn.satellite.earth/9ee3256882e363680d8ea9bb6ed3baa5979c950cdb6e62b9850a4baea46721f3.jpg] !(image)[https://cdn.satellite.earth/201a036d52f37390d11b76101862a082febb869c8d0e58d6aafe93c72919f578.jpg] !(image)[https://cdn.satellite.earth/cd516d89591a4cf474689b4eb6a67db842991c4bf5987c219fb9083f741ce871.jpg]

-

@ 40b9c85f:5e61b451

2025-04-24 15:27:02

@ 40b9c85f:5e61b451

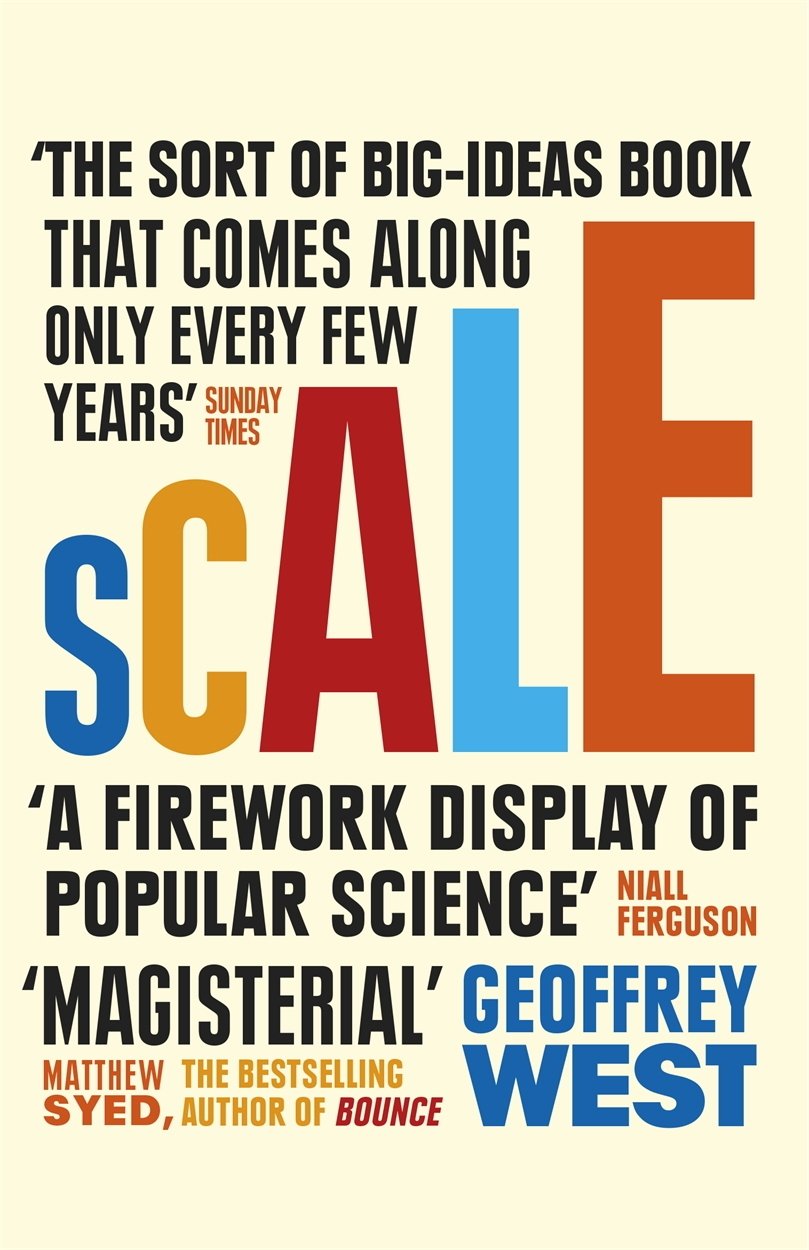

2025-04-24 15:27:02Introduction

Data Vending Machines (DVMs) have emerged as a crucial component of the Nostr ecosystem, offering specialized computational services to clients across the network. As defined in NIP-90, DVMs operate on an apparently simple principle: "data in, data out." They provide a marketplace for data processing where users request specific jobs (like text translation, content recommendation, or AI text generation)

While DVMs have gained significant traction, the current specification faces challenges that hinder widespread adoption and consistent implementation. This article explores some ideas on how we can apply the reflection pattern, a well established approach in RPC systems, to address these challenges and improve the DVM ecosystem's clarity, consistency, and usability.

The Current State of DVMs: Challenges and Limitations

The NIP-90 specification provides a broad framework for DVMs, but this flexibility has led to several issues:

1. Inconsistent Implementation

As noted by hzrd149 in "DVMs were a mistake" every DVM implementation tends to expect inputs in slightly different formats, even while ostensibly following the same specification. For example, a translation request DVM might expect an event ID in one particular format, while an LLM service could expect a "prompt" input that's not even specified in NIP-90.

2. Fragmented Specifications