-

@ 3c7dc2c5:805642a8

2025-05-17 17:52:05

@ 3c7dc2c5:805642a8

2025-05-17 17:52:05🧠Quote(s) of the week:

'Forget price predictions. Forget market cycle theory. Forget market cap estimates. Forget diminishing returns. Forget omega candles. Forget technical analysis.

THE ONLY THING THAT MATTERS.

Your assumption should be that the future has way more productivity than the present. Bitcoin is only 0.2% of the present world. Imagine buying 1/500th of the world in 1925 and holding onto it to it was worth half of the world of 1950, 1990, or 2025… Bitcoin is cheap.' - Luke Broyles

Bitcoin is Time (great article by Der Gigi), and productivity's going digital, and Bitcoin’s the base layer.

🧡Bitcoin news🧡

Retail is absent from Bitcoin because at $100K, they think they have missed the boat. WRONG! https://i.ibb.co/2pmz4fS/Gqcjoxs-XEAAMl-BF.jpg

On the 5th of May:

➡️US Senator David McCormick discloses +$ 1.0 m Bitcoin purchase on recent dip.

➡️Bitcoin Knots just overtook the latest version of Bitcoin Core on Clark Moody's dashboard

➡️'Merchants in the City of Cannes, France will start accepting Bitcoin and crypto this summer, with the council aiming for 90% adoption.' - Bitcoin Archive

➡️River: Cash is king. Of killing savings. Beat inflation with a small bitcoin allocation. https://i.ibb.co/dJV9tvY8/Gq-MLy-Ag-Ww-AAXb-G.jpg

➡️150,000 people tuned into MicroStrategy’s earnings call. Not because of profits, but because they’re watching the blueprint for a Bitcoin-based financial system unfold in real time.

Pledditor: 'The class of 2024/2025 is stacking MSTR more than they are stacking BTC, and that's not a great thing.' Keep in mind, they've never been shown proof that Strategy holds Bitcoin in a cold storage wallet address. I can't find the MicroStrategy wallets holding 555,450 BTC. Can you?

On the 6th of May:

➡️'Serious report by Morgan Stanley. (You can read it here)

-Bitcoin has sufficient market cap to be a reserve, but it is more volatile than other reserve currencies.

-Volatility is decreasing.

-$370b allocation to Bitcoin would reflect market cap proportions.

-A reserve of 12%-17% of the total bitcoin supply would mirror other currency proportions.

Overton window has shifted.' - Troy Cross

➡️Daniel Batten: 'Bitcoin's environmental benefits have now been validated in 20 peer-reviewed studies, according to a recent Cambridge University report. It's also now being covered by 13 mainstream news outlets. How times change!' Here you can find all the articles.

https://x.com/DSBatten/status/1919521469090169127

On top of that, there are now 10 sustainable media magazines and news sites covering the environmental benefits of Bitcoin mining: https://x.com/DSBatten/status/1919518338092323260

Just imagine using only Bitcoin for transactions + store of value - while getting rid of all the banks and heavily reducing energy waste.

➡️UK Treasury’s Economic Secretary Emma Reynolds rules out national Bitcoin reserve. Says it's not “appropriate for our market.” HFSP

➡️Listed companies will invest about $205B in Bitcoin between 2025-2029, according to Bernstein.

➡️Dr. Jan Wüstenfeld: 'The Blockchain Group is ready to up their Bitcoin buying game. At their next Extraordinary General Meeting on June 10, they intend to increase their capital-raising capacity to more than €10 billion to accelerate their Bitcoin treasury strategy—at a Bitcoin price of €83k, that would be more than 120,000 Bitcoin. For reference, they currently hold 640 Bitcoin valued at €53.12 million. That is a significant capital raise.' https://i.ibb.co/k2SvJ0Ny/Gq-WTPx-Za-YAA89-UV.jpg

➡️New Hampshire passes Bitcoin Reserve bill into law! Governor Ayotte signed HB 302 into law this morning, making NH the first U.S. state to enact a Bitcoin Reserve bill.

➡️Regarding the Bitcoin Core debate. I am inclined to take the free market perspective, but I also do not want Bitcoin to be anything like ETH. If you really want to understand the Bitcoin Core debate, I suggest you go and read the actual Pull Request on GitHub. Or else read the great following thread by ColeTU: https://threadreaderapp.com/thread/1919769008439464335.html

➡️Publicly traded company Thumzup Media Corp files to raise $500 million to buy more Bitcoin.

➡️Strike just launched Bitcoin-backed lending - CEO Jack Mallers Where does the yield come from?

"By opening a loan, you authorize Strike to transfer your Bitcoin to a trusted third-party capital provider for the duration of the loan. Who?

"The fact 'no rehypothecation' isn't explicitly guaranteed, means you should probably assume this collateral will be rehypothecated." BitPaine

➡️The Bitcoin Dominance chart is one of the most ruthless things I've ever seen. 3 years straight of destroying alts and no signs of stopping.' - Bitcoin Isaiah https://i.ibb.co/NGGvxyN/Gq-RRKJJWMAEWPEG.png

➡️Two long-dormant Silk Road–linked wallets from 2013 moved 3,421 Bitcoin worth $322.5 million in their first transactions in over a decade.

➡️U.S. Spot Bitcoin ETFs are aggressively accumulating Bitcoin again. In the past 7 days, ETFs added over 16,549 coins, while only 3,150 were mined.

➡️Only 993,285 addresses have more than 1 Bitcoin.

On the 7th of May:

➡️Bitcoin is now up 383% since 2 ECB Bloggers wrote Bitcoin's obituary. https://i.ibb.co/b5KFCKBG/Fi7-AOz8-Uc-AAMlif.png

➡️ARIZONA's other Strategic Bitcoin Reserve bill, SB 1373, moves to Governor Hobbs' desk for signing. Last week, she vetoed the Bitcoin Reserve Bill SB 1025.

➡️Fintech Revolut to integrate the Bitcoin Lightning network. Revolut is now partnering with Lightspark. This will allow Revolut users to send Bitcoin instantly and with lower fees.

➡️Strategy has a larger treasury than Apple. https://i.ibb.co/0p81LqPg/Gq-TULsv-Ww-AA6-Plw.jpg

➡️ 7,200 BTC taken off exchanges yesterday and 103,000 the last month.

➡️ Metaplanet issues $25M in zero-coupon bonds to buy more Bitcoin.

➡️Bitcoin News: "Bitcoin’s volume-weighted market cap dominance is 93%. Unlike simple market cap, this metric factors in actual trading volume, revealing where real liquidity and demand are. Ignore it at your own peril."

➡️ New Hampshire is enacting a Bitcoin Strategic Reserve. Governor Ayotte signed HB302 into law.

➡️Bhutan becomes the 1st nation to implement nationwide Bitcoin payments for tourists.

On the 8th of May:

➡️Bitcoin to be completely exempt from capital gains tax under bill passed by the Missouri House.

➡️ Arizona Governor officially signs law to establish a Strategic Bitcoin Reserve Fund. https://i.ibb.co/d0Fpg3bH/Gqc-Ewoo-WUAAe-SLp.jpg

➡️ Oregon passed Senate Bill 167, updating its Uniform Commercial Code (UCC) to include Bitcoin and other digital assets. This new law recognizes digital assets as valid collateral and acknow ledges electronic records and signatures in commercial transactions.

➡️ UAE's state-owned oil giant Emarat accepts Bitcoin and crypto payments at petrol/gas stations.

➡️Standard Chartered Bank analyst apologizes for $120,000 Bitcoin price prediction, says target 'may be too low.'

➡️ 'The Texas House committee has approved SB 21; next steps are a Texas House vote by all members and the governor’s signature. It looks likely that Texas will have a Strategic Bitcoin Reserve, the big open question is how much BTC will be acquired.' -Pierre Rochard

➡️ A month ago first Bitcoin payment was made at a supermarket in Switzerland – Spar in Zug. Interesting data from Swiss supermarket payments (source @OpenCryptoPay): Even though they can be done with practically all "crypto," 90.8% of payments are in sats, 5.3% in stablecoins, 1.2% in WBTC. 20+ transactions per day. Amazing!

On the 9th of May:

➡️'Steak n Shake is accepting Bitcoin payments at all locations starting May 16, making the cryptocurrency available to our more than 100 million customers. The movement is just beginning…' - Steak 'n' Shake Steak 'n Shake has 393 locations, primarily in the Midwest and the South. https://i.ibb.co/fddLCSsT/Gqd-d-Oq-Wc-AAQVMz.jpg

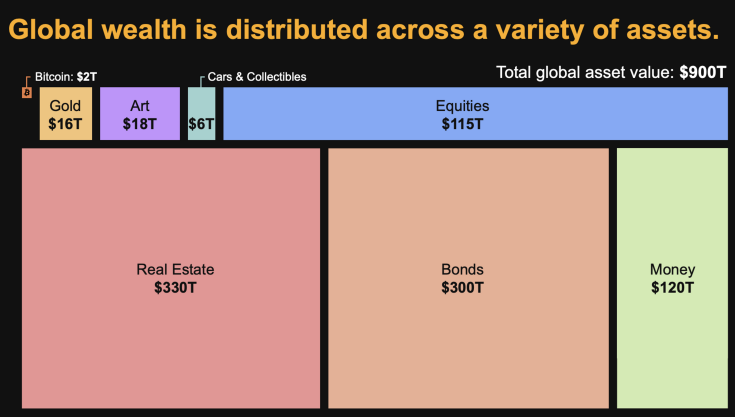

➡️Bitcoin is now the 3rd largest commodity in the world by market cap! 1. Gold = $22 trillion 2. Oil = $3 trillion 3. Bitcoin = $2 trillion Bitcoin is among the top 5 biggest global assets with a +2 TRILLION market cap. Bigger than Amazon and Google (Alphabet) https://i.ibb.co/XkvShGFC/Gqgc-y-IXIAIa-G2-I.jpg

➡️Sam Callahan: A new BIS paper on Bitcoin dropped yesterday. To cut through the jargon: It concluded that Bitcoin use rises when inflation surges, remittances get pricey, and capital controls increase. In other words, when people need it most. Source

➡️ Bitcoin Archive: "Amazon, Tesla, & Google all had BIGGER drawdowns than Bitcoin in the last 6 months, & nobody says they are "too volatile". LAST ~6 MONTHS

- AMAZON -33%

- TESLA -56%

- GOOGLE - 32%

- BITCOIN - 31%

Is Bitcoin volatile? Sure, but... ONLY BITCOIN BOUNCED BACK TO PUSH FOR NEW ALL-TIME HIGHS!"

➡️ If you own 1 WHOLE Bitcoin, you're a millionaire in 50 currencies. If you own 0.5 Bitcoin, you're a millionaire in 20-25 currencies. For example, the Turkish Lira has literally gone to ZERO against Bitcoin. The ultimate fate of every fiat currency, some will just get there faster than others Owning 1 BTC will make you a millionaire in ALL currencies in the next decade or so.

➡️ Former PayPal Vice President says Bitcoin Lightning Network will welcome “dozens of digital banks and wallets” and enable 100s of millions of people to receive Bitcoin-powered payments by the end of Q3.

➡️ Coinbase just disclosed in their Q1 filing: they custody 2.68 million bitcoin. That’s over 13% of all Bitcoin in circulation, on one platform. Is this the greatest honeypot in financial history? Yes, it is...read next week's Weekly Bitcoin update.

➡️ FORTUNE: “Meta is in discussions with crypto firms to introduce stablecoins as a means to manage payouts, and has also hired a vice president of product with crypto experience to help shepherd the discussions.” When Bitcoin?

➡️ 344,620 new Bitcoin wallets created as price surges to $103K, according to data from Santiment.

➡️ Great post + article by Parker Lewis: Bitcoin is Money https://x.com/parkeralewis/status/1920875453893443994

Discover alignment!

Remember Satoshi's first words: 'A purely peer-to-peer version of electronic cash'

➡️Goldman Sachs has boosted its stake in BlackRock’s iShares Bitcoin Trust (IBIT) by 28%, now holding over 30.8 million shares valued at more than $1.4 billion as of March 31, according to an SEC filing.

On the 10th of May:

➡️TeraWulf posted Q1 2025 revenue of $34.4M, down 19% from last year, as the Bitcoin Halving and power costs pressured margins. The company mined 372 BTC, with a sharp rise in power cost per coin to $ 66 K.

On the 12th of May:

➡️Strategy has acquired 13,390 BTC for ~$1.34 billion at ~$99,856 per bitcoin and has achieved BTC Yield of 15.5% YTD 2025. As of 5/11/2025, we hold 568,840 Bitcoin acquired for ~$39.41 billion at ~$69,287 per Bitcoin.

➡️$66 billion Dell officially rejects shareholder proposal to add Bitcoin to treasury.

➡️'The correlation of Bitcoin and M2 is staggering. Bitcoin continues to follow the Global M2 Money Supply (not liquidity) with a 70-day lag. When I made this chart last July, I didn't think it'd hold this tight of a relationship. M2 is a poor measure of money supply, but it's still fascinating to observe.' - Joe Consorti

https://i.ibb.co/gZy1m0rm/Gqs2-Oc-HXMAA-Qp-U.jpg

➡️Businesses are the largest net buyers of bitcoin so far this year, led by Strategy, which makes up 77% of the growth.

➡️Missouri moves to become the first U.S. state to eliminate capital gains tax on Bitcoin with the passage of HB 594.

➡️99% of Bitcoin will be mined by 2035. https://i.ibb.co/67t0PGtY/Gqu9qll-WUAUxwr-S.jpg

💸Traditional Finance / Macro:

On the 7th of May:

👉🏽Warren Buffett now owns an astonishing 5.1% of the entire U.S. Treasury Bill Market.

🏦Banks:

👉🏽 No news

🌎Macro/Geopolitics:

One of the intentional consequences of the inflationary fiat system: the evil regulatory noose auto-tightens.

Thomas Greif:

The Bank Secrecy Act, established in 1970, required reporting cash transactions above $10,000.

Today, 55 years later, that threshold remains unchanged.

But $10,000 ain't what it used to be back in 1970.

To give you an idea of just how much money $10,000 was back then: - The US Median household income was $9,870 - The average US house costs approximately $23,000 - Chevy Impala, the best-selling car in the US in 1970, had a starting price of $3,200

So you could go to your Chevy dealer and buy three Impalas in cash without triggering the cash transaction reporting requirement.

Today, thanks to the lack of adjustment for inflation, far smaller purchases like a high-end Apple Mac Studio computer purchased with cash would trigger a reporting event. Adjusted for inflation, the threshold should be $82,422 today. At the rate they are printing money, in a couple of decades, you'll need to report every other grocery shop.

https://i.ibb.co/G4d5w4Wc/Gq-SEPi-Xw-AAf-Umf.jpg

On the 5th of May:

👉🏽'Foreign Demand for U.S. Treasuries COLLAPSES as America Faces Record Debt Rollovers ($7 Trillion) and a $1.9 Trillion Deficit in 2025 alone. The buyers are gone, the bills are due, and the clock just struck midnight.' - CarlBMenger

P.S.: Just to make it even more obvious. The Fed just spent $20BN on 3-year bonds, their largest single-day purchase since 2021. Are they injecting liquidity instead of cutting rates to avoid panic?

👉🏽TKL: "World central banks have benefited from rising gold prices: The value of developed market central banks’ gold holdings has risen by ~$600 billion, or 90%, to a record $1.3 trillion since 2022.

At the same time, emerging market central banks’ gold value has doubled to a record $800 billion. This comes as gold prices have skyrocketed 105% since the October 2022 low.

Moreover, EM and DM central banks have increased their holdings by 10% and 1%, respectively, during this time. In 2022-2024, world central banks bought a whopping 3,176 tonnes of gold. Demand for gold has never been stronger."

Luke Gromen:

'Summary of the last 5 days in gold: US paper traders shorted gold while China was on holiday. Chinese traders bought physical gold upon returning from their holiday. Lost amidst the noise: China increasingly controls global gold prices, which has major implications for FX over time.'

https://i.ibb.co/TDVDCkdw/Gq-RRKJJWMAEHAAL.png

On the 6th of May:

👉🏽Good Morning from Germany, where Friedrich Merz has fallen short of a majority in the first round of the chancellor vote—something that has never happened before in German history. He received 310 votes, 6 short of the 316 needed for a majority in parliament.

👉🏽The European Union is targeting €100 billion of US goods with tariffs if trade talks fail.

👉🏽US trade balance falls to -$140.5 billion, the worst month in history On that same day...

👉🏽Treasury Secretary Bessent says, "The United States Government will never default. We will raise the debt ceiling."

👉🏽Manfred Weber of the EPP, a European political group:

"The Romanian Social Democrats' decision not to back the pro-European presidential candidate is simply unacceptable. I expect a clear commitment—no room for political games as extremism rises. We fully back the decision of our member parties to show their support for Nicușor Dan."

The EPP, as a European political group, has no direct role in Romania's internal political decisions, and such an action is an attempt to influence national political dynamics. What democracy and European values is he talking about?

But when J.D. Vance makes critical remarks about Germany, it’s called interference in domestic politics… Apparently, this isn’t. Now, don't get me wrong, I am not picking sides on this matter, but the hypocrisy is nauseating and the double standards are unbearable.

On the 7th of May:

👉🏽"Attracting scientists to the EU with half a billion euros"

https://fd.nl/politiek/1554495/met-een-half-miljard-euro-wetenschappers-naar-de-eu-trekken

An important question is not addressed in this article: Who is going to pay for this? / How will it be financed? Will it come at the expense of EU researchers?' - Lex Hoogduin

And even more crucially: what kind of 'scientists' is the EU trying to attract? This comes just a day after revelations that it misused Covid money. Journalism, anyone?

👉🏽China's central bank cuts key rates, injects 1 trillion yuan, 3 hours after agreeing to trade talks to prop up the economy and give the communist party ammo for negotiations.

Meanwhile...

👉🏽SUMMARY OF FED DECISION: 1. Fed leaves rates unchanged for 3rd straight meeting 2. Fed says inflation remains "somewhat elevated" 3. Uncertainty about outlook has "increased further" 4. Risks of higher unemployment and inflation have risen 5. The Fed is attentive to risks to both sides of its mandate 6. Fed appears to see a higher risk of stagflation ahead The Fed pause continues despite Trump's calls for cuts.

👉🏽The European Central Bank (ECB) plans to partner with the private sector to develop a digital euro. In a press release, the ECB claimed that findings will “be shared in a report later this year.”

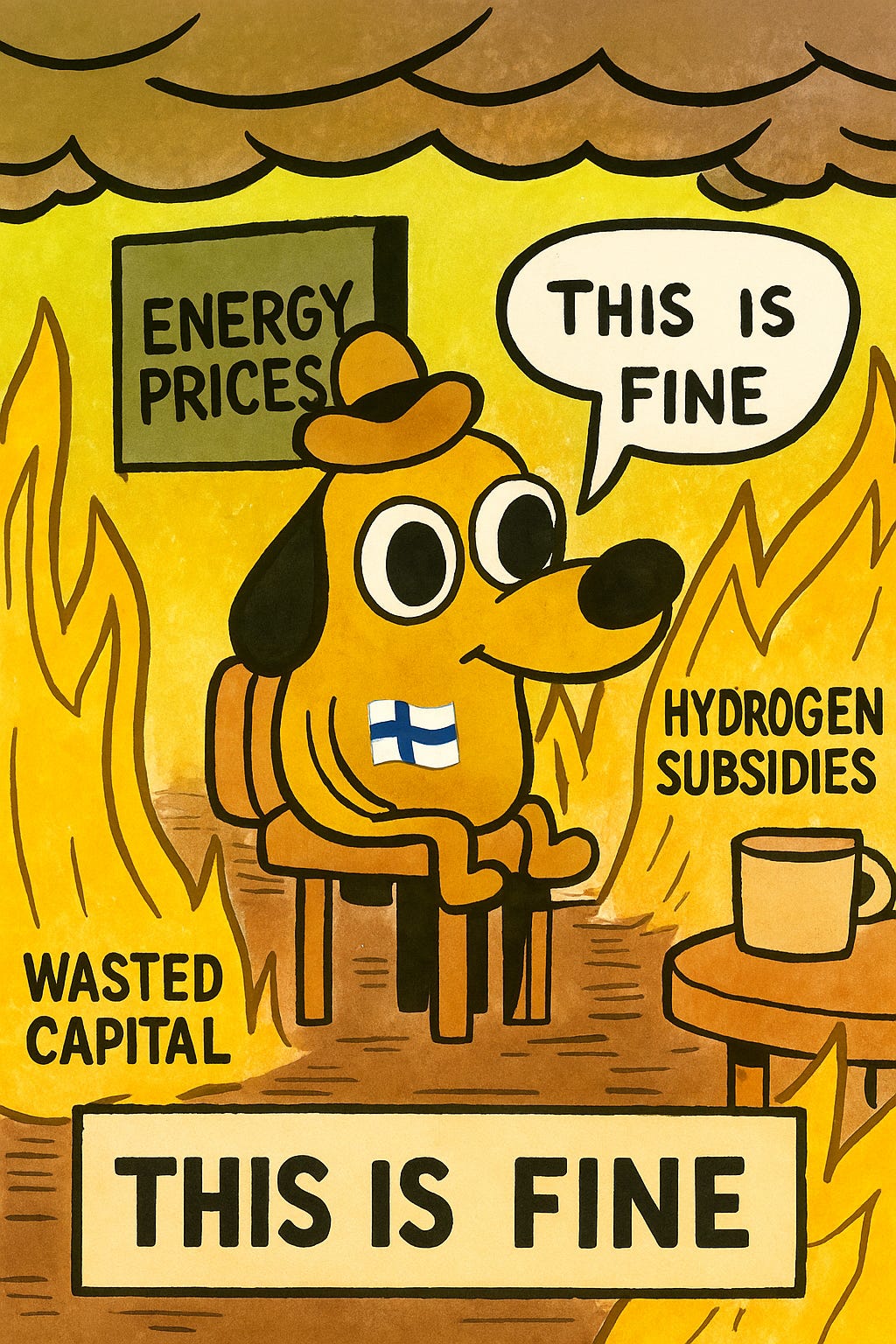

👉🏽Another blow to North Sea wind: Ørsted is pulling the plug on the 2,400 MW Hornsea 4 offshore wind project, accepting a €500 million loss. This comes despite having a Contract for Difference (CfD) agreement with the UK government. Source

Imagine being a pension fund heavily invested in the Danish fairytale called Ørsted. That so-called “blue bond” for “enhancing biodiversity” is starting to look more like a financial “blue bruise.”

👉🏽France’s President Macron: We have to rethink our economic fundamentals. You don't say, this doesn't sound good. Is that the same France that had its last budget surplus in 1974 and is basically a broke country? France, indeed, might start to rethink its annual 6% national deficit. That stacks fast.

👉🏽Germany’s Chancellor Merz: EU fiscal rules could be softened for defense.

👉🏽Treasury Secretary Scott Bessent said, "We believe that the US should be the premier destination for digital assets."

👉🏽 Failed oversight of the EU’s multi-billion euro COVID recovery fund spending. Typical: the Netherlands receives a mere fraction from the fund — in other words, it’s paying for other countries.

And with such massive spending, it’s hardly surprising that we’re seeing such rampant inflation. For the Netherlands, this involves €5.4 billion in grants, of which €2.5 billion has already been received. The funds are being used for investments in, among other things, renewable energy.

That’s called corruption.

The European Court of Auditors further states that member states have received funds for projects without any clear evidence they will ever be completed, pointing to weak oversight mechanisms, for which the countries themselves are responsible. If this were a private company, the CEO would be facing a courtroom.

Fortunately, there will be strict oversight on the €800 billion earmarked for European defence! RIGHT!? RIGHT!?????

👉🏽'Interest payments on US debt declined by -$13.5 billion in Q1 2025, to an annualized $1.11 trillion, the lowest since Q2 2024. This marks the first quarterly decline in interest payments since 2020. However, interest expense on national debt is still TWICE as high as it was 5 years ago. Currently, the government spends over $3 billion per day on interest. As a % of GDP, interest payments reached 3.7%, and currently stand just below 1980s-1990s levels. Reducing US debt must remain a top priority.' -TKL

👉🏽 Merz, Bundeskanzler der Bundesrepublik Deutschland, "There are €3.8 trillion in savings sitting in (German) bank accounts. Just imagine if we could mobilize just 10% of that." "What we lack is not capital, but the right instruments to mobilize it."

In other words, Merz—like Macron is eyeing citizens' savings to finance “investments.” Which investments, exactly? Take your pick.

Germany, for example, is the second-largest donor of military aid to Ukraine, contributing over €10 billion — roughly the same amount needed to maintain all federal roads and bridges in Germany for an entire year.

May I remind you that Ursula von der Leyen has already made it clear that they plan to rob EU citizens of their savings?

On the 8th of May:

👉🏽 Bank of England just cut interest rates by 0.25% to 4.25%, citing Donald Trump’s tariff trade war as one of the key reasons.

👉🏽"Between 2015 and 2030, the price of a car like the Renault Clio will have increased by 40 percent — 92.5 percent of which is due to regulation," says Renault CEO Luca de Meo.

👉🏽 Geiger Capital: 'The train is out of control… The first 7 months of FY 2025 produced a deficit of $1.1 trillion. That’s $196 billion more than the deficit recorded in the same period last fiscal year. On track for a $2 TRILLION annual deficit.'

On the 9th of May:

👉🏽"The gold exists only for a tiny fraction of a second." Still, it's only a matter of time before that’s solved technologically. Gold has an expiration date as a limited store of value. Deal with it.

The problem with gold is that when its value increases, it becomes more profitable to increase the quantity mined.

The quantity of BTC mined can not be increased; it gets cut in half every ~4 years. No matter how much the value of BTC increases.

👉🏽 I have shared the following chart multiple times... https://i.ibb.co/1JQj4HCX/Gqh-Gnp-DXMAE3-TDV.jpg

Michael A. Arouet: "Spain and Italy have the largest unfunded pensions in Europe, at about 500% of GDP. They also happen to be the two countries with the lowest fertility rates in Western Europe. Dear Spanish and Italian friends, don’t count that you will be able to live comfortably in retirement."

For the people here in the Netherlands, this thing is a freaking ticking bomb. Pension sustainability is a continent-wide concern.

So when von der Leyen talks about tapping into pension funds for the next “crisis” fund, what she’s really referring to is the Netherlands, Denmark, and Sweden — the countries with the largest, well-managed pension reserves.

Oh, and we are in the midst of the biggest change of our (Dutch) pension system...

On the 10th of May:

👉🏽Pakistani Prime Minister Shehbaz Sharif calls a meeting with officials in charge of overseeing the nuclear weapons arsenal. Yikes!

On the 12th of May:

👉🏽'Global debt soared $7.5 trillion in Q1 2025, to a record $324 trillion, according to IIF data. Emerging markets accounted for 50% of the jump, with total EM debt hitting a record $106 trillion. China was the primary driver of the debt increase, with debt levels rising by ~$2 trillion. Over the last 2 years, total world debt has surged by a whopping $20 trillion. Meanwhile, the global debt-to-GDP ratio fell slightly to 325%, the lowest since 2020. However, the ratio for emerging markets hit a record 245%. The debt crisis is a global issue.' -TKL

https://i.ibb.co/8ns9TY2v/Gqwkj-Ru-W0-AABu-Y7.png

Just look at the chart & the numbers and ask yourself, do we really have a solution?

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did - The True Cost of the Dollar Empire with Lyn Alden They discuss: - The Trade Deficit - Tariffs - The Price of the USD Hegemony - Bitcoin As a Neutral Reserve Asset

https://youtu.be/GI-f8V8FGGM

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

-

@ 044da344:073a8a0e

2025-05-17 15:38:45

@ 044da344:073a8a0e

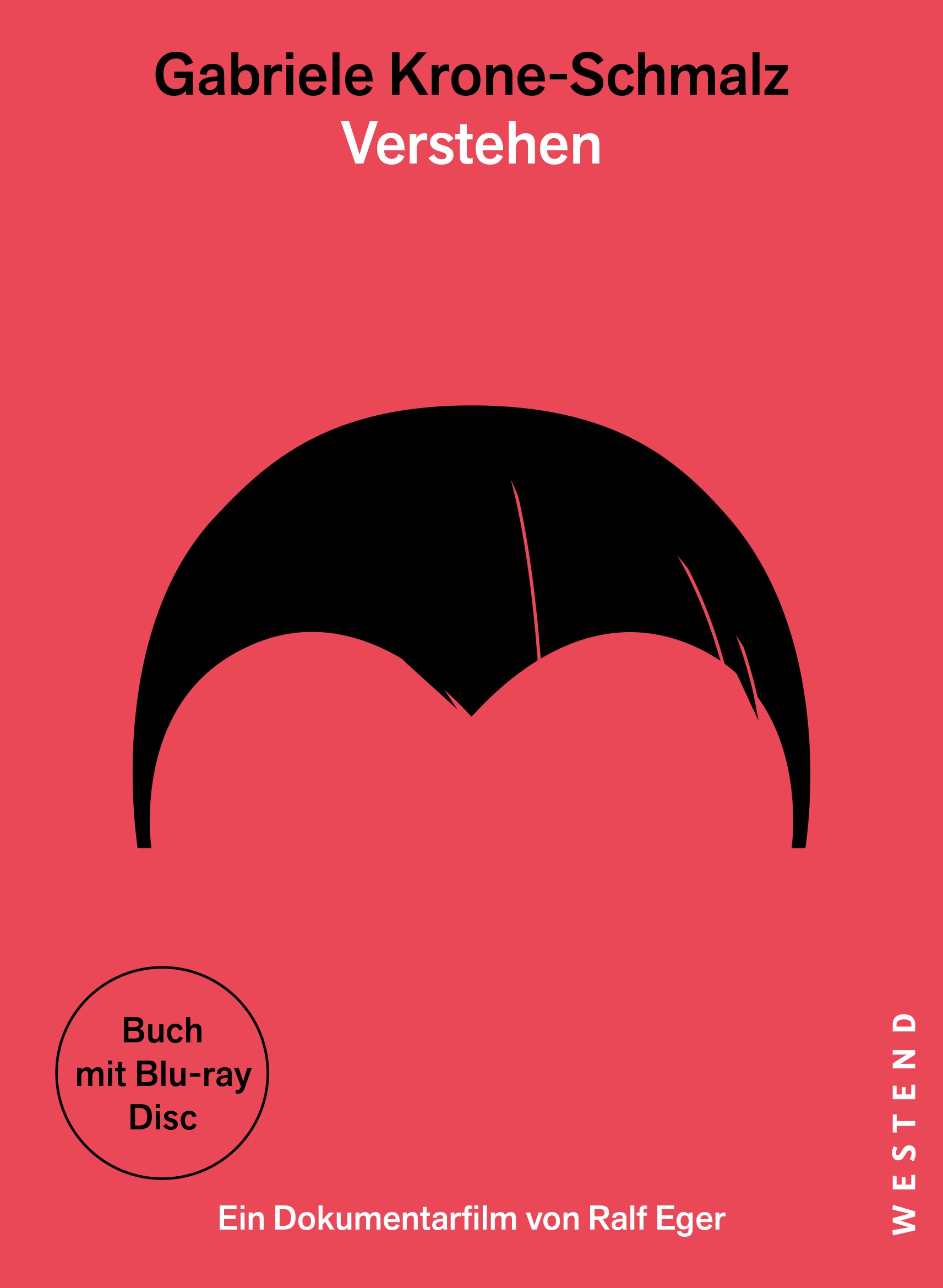

2025-05-17 15:38:45Die Frisur auf einem Cover. Das muss man erstmal schaffen. Ich könnte auch schreiben: Darauf muss man erstmal kommen, aber die Agentur Buchgut hat das so ähnlich ja schon bei Walter van Rossum ausprobiert und seinem Bestseller „Meine Pandemie mit Professor Drosten“.

Nun als Gabriele Krone-Schmalz. Ich habe mich gefühlt wie früher, wenn jemand mit einem Überraschungsei kam. Die Verpackung: ein Versprechen. Dann die Schokolade. Hier: ein paar tolle Fotos, die einen Bogen spannen von 1954 bis in die Gegenwart, Texte der Liedermacherin Gabriele Krone-Schmalz, geschrieben 1965 bis 1972, die Biografie in Schlagworten und zwei Vorworte. Jeweils zwei Seiten, mehr nicht. Und dann kommt das, worum es bei einem solchen Überraschungsei eigentlich geht: das Spielzeug. Hier ein Film.

Bevor ich dazu komme, muss ich die beiden Vorworte würdigen. „Resignieren ist keine Lösung“ steht über dem Text von Gabriele Krone-Schmalz. Damit ist viel gesagt. Sie fragt sich, „wozu das Ganze gut sein soll“. Die Antwort in einem Satz:

Vielleicht ist dieser Film mit dem wunderbar doppeldeutigen Titel „Gabriele Krone-Schmalz – Verstehen“ eine Art Vermächtnis: mein Leben, meine Arbeit und vielleicht für den einen oder anderen eine Ermunterung, sich nicht verbiegen zu lassen, nicht aufzugeben, sich einzumischen und nicht zuletzt ein Beispiel dafür, dass es möglich ist, mit einem Menschen fünfzig Jahre lang glücklich zu sein.

Als Gabriele Krone-Schmalz im Mai 2018 in meine Reihe Medienrealität live an die LMU kam, lebte ihr Mann noch. Wir hatten einen vollen Hörsaal, viele Fans und jede Menge Gegenwind aus dem eigenen Haus. Die Osteuropa-Forschung, erschienen in Mannschaftsstärke und mit Zetteln, die abgelesen werden wollten. Haltung zeigen, anstatt miteinander zu sprechen. Als wir hinterher zum Griechen um die Ecke gingen, saßen die Kollegen am Nachbartisch und würdigten uns keines Blickes. Wozu sich austauschen, wenn man ohnehin weiß, was richtig ist und was falsch? Vier Jahre später hatten die gleichen Kollegen noch mehr Oberwasser und haben auf allen Kanälen daran erinnert, welcher Teufel da einst in den heiligen Hallen der Universität erschienen war – auf Einladung dieses Professors. Sie wissen schon.

Das zweite Vorwort kommt vom Filmemacher. „Mein Name ist Ralf Eger“ steht oben auf der Seite. Eger, 1961 am Rande Münchens geboren, erzählt von seinem Jugend-Vorsatz, „niemals für die Rüstungsindustrie zu arbeiten“, von einer langen Laufbahn im öffentlich-rechtlichen Rundfunk und davon, wie diese beiden Dinge plötzlich nicht mehr zusammenpassten. Schlaflose Nächte, Debatten im BR („eine Beschreibung meiner Anläufe würde mühelos dieses Booklet füllen“) und schließlich die Idee für ein Porträt, umgesetzt auf eigene Faust mit drei Gleichgesinnten, ganz ohne Rundfunksteuer im Rücken.

Was soll ich sagen? Großartig. Für mich sowieso. Eine Heimat nach der anderen. Gabriele Krone-Schmalz ist in Lam zur Welt gekommen, im Bayerischen Wald, nur ein paar Kilometer entfernt von dem Dorf, in dem ich jetzt lebe. Ralf Eger geht mit ihr durch den Ort, in dem sie einen Teil ihrer Kindheit verbrachte und noch Leute aus ihrer Schulzeit kennt. Ein Fest für meine Ohren und für die Augen sowieso. Die Landschaft, der Dialekt. Dass Eger mit Untertiteln arbeitet, sei ihm verziehen. Er lässt ein altes Paar sprechen, einen Café-Betreiber von einst, eine Wirtin von heute. So sind die Menschen, mit denen ich hier jeden Tag zu tun habe. Geradeaus, warm, in der Wirklichkeit verankert.

Dann geht es zum Pleisweiler Gespräch und damit zu Albrecht Müller, dem Gründer und Herausgeber der Nachdenkseiten. Jens Berger am Lenkrad, Albrecht Müller am Saalmikrofon und abends in der Weinstube, dazu Markus Karsten, Westend-Verleger, mit seinem Tiger und Roberto De Lapuente am Büchertisch, festgehalten für die Ewigkeit in 1A-Bild- und Tonqualität. Später im Film wird Gabriele Krone-Schmalz auch in Ulm sprechen. Ich kenne dieses Publikum. Nicht mehr ganz jung, aber immer noch voller Energie. Diese Menschen füllen die Räume, wenn jemand wie Gabriele Krone-Schmalz kommt, weil sie unzufrieden sind mit dem, was ihnen die Leitmedien über die Welt erzählen wollen, weil sie nach Gleichgesinnten suchen und vor allem, weil sie etwas tun wollen, immer noch. Ich bin weder Filmemacher noch Filmkritiker, aber ich weiß: Diese Stimmung kann man kaum besser einfangen als Ralf Eger.

Überhaupt. Die Kameras. Vier allein beim Auftritt im Wohnzimmer der Nachdenkseiten. Damit lässt sich ein Vortrag so inszenieren, dass man auch daheim auf dem Sofa gern zuhört, wenn der Star über Geopolitik spricht. „Gabriele Krone-Schmalz – Verstehen“: Der Titel zielt auf mehr. Russland und Deutschland, Vergangenheit, Gegenwart, Zukunft: alles schön und gut. Dieser Film hat eine zweite und eine dritte Ebene. Die Musik kommt von – Krone-Schmalz. Gesungen in den frühen 1970ern, festgehalten auf einem Tonband und wiedergefunden für Ralf Eger. Und dann sind da Filmaufnahmen aus der Sowjetunion der späten 1980er, als Krone-Schmalz für die ARD in Moskau war und ihr Mann die Kamera dabeihatte, wenn die Mutter zu Besuch kam oder wenn es auf Tour ging. Eisfischen im Polarmeer, eine orthodoxe Taufe mit der Patin Krone-Schmalz, die Rückkehr der Roten Armee aus Afghanistan. Wer das alles gesehen und erlebt hat, wird nie und nimmer einstimmen in den Ruf nach Kriegstüchtigkeit.

Gabriele Krone-Schmalz - Verstehen. Ein Dokumentarfilm von Ralf Egner. Frankfurt am Main: Westend 2025, Blue-Ray Disc + 32 Seiten Booklet, 28 Euro.

Freie Akademie für Medien & Journalismus

Bildquellen: Screenshot (GKS am kleinen Arbersee)

-

@ d41bf82f:ed90d888

2025-05-17 15:15:42

@ d41bf82f:ed90d888

2025-05-17 15:15:42“…สิ่งที่ขับเคลื่อนเศรษฐกิจสหรัฐฯ และจะเป็นปัจจัยแห่งชัยชนะในสงคราม ในโลกที่เชื่อมต่อถึงกันด้วยโทรทัศน์นับ 500 ช่องนั้น ไม่ใช่แรงงานหรือการผลิตขนาดใหญ่ดังเดิมอีกต่อไป หากแต่เป็นข้อมูลดิจิทัลที่ผ่านระบบคอมพิวเตอร์ ข้อมูลเหล่านี้ดำรงอยู่ในไซเบอร์สเปซ—มิติใหม่ที่ถือกำเนิดจากการแพร่ขยายไม่รู้จบของเครือข่ายคอมพิวเตอร์ ดาวเทียม โมเด็ม ฐานข้อมูล และอินเทอร์เน็ตสาธารณะ” — NEIL MUNRO

บทนี้เริ่มต้นด้วยการเปรียบเทียบอำนาจต่อรองของแรงงานในยุคอุตสาหกรรมกับยุคสารสนเทศ ผ่านเหตุการณ์สำคัญคือการนัดหยุดงานแบบนั่งประท้วงของคนงาน General Motors ในปี 1936–1937 ซึ่งแสดงถึงจุดสูงสุดของพลังการต่อรองของแรงงานในยุคนั้น ผู้เขียนชี้ว่า ยุทธวิธีแบบนี้รวมถึงการรวมกลุ่มของสหภาพแรงงานเป็นเพียงผลผลิตของโครงสร้างทางการเมืองมหภาคในยุคอุตสาหกรรมที่กำลังจะหมดอำนาจลงในยุคสารสนเทศเช่นเดียวกับแรงงานทาสในยุคก่อสร้างพีระมิด

สภาวะการเมืองมหภาคใหม่ทำให้ยุทธศาสตร์ของการ “ข่มขู่กรรโชก” (extortion) และ “การให้ความคุ้มครอง” (protection) กลับด้านโดยสิ้นเชิง รัฐในยุคอุตสาหกรรมสามารถเก็บภาษีจำนวนมากได้เพราะควบคุมประชากรและทรัพยากรได้ง่าย เช่นเดียวกับที่องค์กรอาชญากรรมสามารถข่มขู่ผู้ประกอบการในพื้นที่เดียวกันได้ แต่ในโลกที่มีเทคโนโลยีคอมพิวเตอร์ การสื่อสารไร้สาย และระบบเข้ารหัสแบบใหม่ ทำให้การคุ้มครองทรัพย์สินส่วนบุคคลทำได้ง่ายขึ้น ขณะที่การเก็บภาษีและการใช้ความรุนแรงแบบเดิม ๆ กลับทำได้ยากขึ้น

ผู้เขียนเน้นว่า ดุลยภาพระหว่างการกรรโชกกับการคุ้มครองเคยเอียงไปทาง “การใช้กำลัง” อย่างสุดโต่งในช่วงปลายศตวรรษที่ 20 ซึ่งเป็นผลมาจากรัฐสวัสดิการและการรวมอำนาจในรูปแบบระบบราชการที่สามารถควบคุมได้ถึงกว่าครึ่งหนึ่งของรายได้ประชาชน แต่เมื่อเข้าสู่ยุคสารสนเทศ ความสามารถนี้จะหดตัวลงอย่างต่อเนื่อง หัวใจของการเปลี่ยนแปลงอยู่ที่ คณิตศาสตร์แห่งการคุ้มครอง ซึ่งมีรากฐานจากหลักการทางคณิตศาสตร์ง่าย ๆ ว่า การคูณง่ายกว่าการหาร กล่าวคือ การเข้ารหัสที่ใช้การคูณเลขเฉพาะขนาดใหญ่สามารถสร้างระบบป้องกันที่แข็งแกร่ง ขณะที่ผู้โจมตีต้องใช้ทรัพยากรอย่างมากในการถอดรหัส นี่คือรากฐานของระบบเข้ารหัสสมัยใหม่ ซึ่งช่วยให้เกิดขอบเขตใหม่ของการค้าบนโลกไซเบอร์ที่ปลอดภัยจากการแทรกแซงของรัฐ

เมื่อการคุ้มครองสามารถทำได้ด้วยเทคโนโลยี ความจำเป็นในการพึ่งพารัฐเพื่อความมั่นคงจะลดลง ผู้คนและองค์กรสามารถเคลื่อนย้ายได้อย่างอิสระมากขึ้น เศรษฐกิจแบบรวมศูนย์จะถดถอย และระบบตลาดที่ปรับตัวเองตามธรรมชาติจะเข้ามาแทนที่ ระบบเศรษฐกิจที่อิงอำนาจแบบบังคับจะถูกมองว่า “ดั้งเดิม” และไร้ประสิทธิภาพมากขึ้นเรื่อย ๆ เทคโนโลยีในยุคนี้ยังเอื้อต่อการสร้าง ระบบซับซ้อนแบบปรับตัวได้(complex adaptive systems) ซึ่งเกิดจากการกระจายขีดความสามารถและการจัดระเบียบตัวเอง ระบบเหล่านี้จะมีพลังการเรียนรู้ ฟื้นฟู และพัฒนาในตัวเองอย่างไม่หยุดยั้ง แม้ผู้คนจำนวนมากยังยึดติดกับแนวคิดเรื่อง “ชาติ” และ “อำนาจรัฐ” แต่ผู้เขียนเสนอว่าโลกกำลังมุ่งไปสู่ทิศทางตรงกันข้าม ในอนาคต ผู้ที่ได้เปรียบไม่ใช่ “รัฐ” แต่คือ “ปัจเจกบุคคลผู้มีอธิปไตย” ซึ่งสามารถปกป้องทรัพย์สินของตนเองโดยไม่ต้องพึ่งรัฐ และมีอิสระในการเลือกที่อยู่ การทำงาน และการใช้ทรัพยากรโดยไม่ถูกควบคุมแบบเดิม

การเปลี่ยนผ่านจากเศรษฐกิจที่ใช้พลังงานหนักและระบบอุตสาหกรรม ไปสู่เศรษฐกิจที่อิงกับข้อมูลและระบบดิจิทัล ยังทำให้องค์กรธุรกิจมีขนาดเล็กลง คล่องตัวมากขึ้น และสามารถเคลื่อนย้ายได้ง่ายกว่าที่เคยเป็น ผลิตภัณฑ์และบริการจำนวนมากไม่ได้ขึ้นอยู่กับทรัพยากรธรรมชาติอีกต่อไป ซึ่งหมายความว่าอำนาจในการบังคับของรัฐแบบเดิมจะไม่สามารถตามทันพฤติกรรมของผู้ประกอบการยุคใหม่ได้

บทนี้จึงชี้ให้เห็นว่า ในยุคที่ตรรกะแห่งความรุนแรงกำลังเปลี่ยนไป รัฐไม่สามารถใช้อำนาจผูกขาดในการให้ความคุ้มครองหรือควบคุมทรัพยากรได้อีกต่อไป เทคโนโลยีได้ปลดล็อกศักยภาพใหม่ให้กับปัจเจกบุคคล และทำให้โครงสร้างอำนาจที่เคยมั่นคงในศตวรรษก่อน กำลังสั่นคลอนอย่างรุนแรง

สามารถไปติดตามเนื้อหาแบบ short vdo ที่สรุปประเด็นสำคัญจากแต่ละบท พร้อมกราฟิกและคำอธิบายกระชับ เข้าใจง่าย ได้ที่ TikTok ช่อง https://www.tiktok.com/@moneyment1971

-

@ 15cf81d4:b328e146

2025-05-17 14:48:15

@ 15cf81d4:b328e146

2025-05-17 14:48:15Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

Why Trust Crypt Recver? 🤝 🛠️ Expert Recovery Solutions At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

Partially lost or forgotten seed phrases Extracting funds from outdated or invalid wallet addresses Recovering data from damaged hardware wallets Restoring coins from old or unsupported wallet formats You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈 Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases. Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery. Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet. Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy. ⚠️ What We Don’t Do While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

Don’t Let Lost Crypto Hold You Back! Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today! Ready to reclaim your lost crypto? Don’t wait until it’s too late! 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us! For real-time support or questions, reach out to our dedicated team on: ✉️ Telegram: t.me/crypptrcver 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

# Why Trust Crypt Recver? 🤝

# Why Trust Crypt Recver? 🤝🛠️ Expert Recovery Solutions\ At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

- Partially lost or forgotten seed phrases

- Extracting funds from outdated or invalid wallet addresses

- Recovering data from damaged hardware wallets

- Restoring coins from old or unsupported wallet formats

You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery\ We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority\ Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology\ Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈

- Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery.

- Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet.

- Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy.

⚠️ What We Don’t Do\ While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

# Don’t Let Lost Crypto Hold You Back!

# Don’t Let Lost Crypto Hold You Back!Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection\ Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today!\ Ready to reclaim your lost crypto? Don’t wait until it’s too late!\ 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us!\ For real-time support or questions, reach out to our dedicated team on:\ ✉️ Telegram: t.me/crypptrcver\ 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.

-

@ 9b308fda:b6c7310d

2025-05-17 14:27:58

@ 9b308fda:b6c7310d

2025-05-17 14:27:58I’m excited to share that I’ve been selected as a Summer of Bitcoin intern at Formstr!

After the final exams wrapped up on May 4th, I took a short, well-deserved break while traveling back home from college for the summer. Once settled in, I quickly transitioned into internship mode and began diving into the project assigned to me at Formstr.

It’s been a great start so far, and I’m looking forward to learning, building, and sharing more along the way.

-

@ b1ddb4d7:471244e7

2025-05-17 14:21:54

@ b1ddb4d7:471244e7

2025-05-17 14:21:54Bitcoin FilmFest (BFF25) returns to Warsaw for its third edition, blending independent cinema—from feature films and commercials to AI-driven experimental visuals—with education and entertainment.

Hundreds of attendees from around the world will gather for three days of screenings, discussions, workshops, and networking at the iconic Kinoteka Cinema (PKiN), the same venue that hosted the festival’s first two editions in March 2023 and April 2024.

This year’s festival, themed “Beyond the Frame,” introduces new dimensions to its program, including an extra day on May 22 to celebrate Bitcoin Pizza Day, the first real-world bitcoin transaction, with what promises to be one of Europe’s largest commemorations of this milestone.

BFF25 bridges independent film, culture, and technology, with a bold focus on decentralized storytelling and creative expression. As a community-driven cultural experience with a slightly rebellious spirit, Bitcoin FilmFest goes beyond movies, yet cinema remains at its heart.

Here’s a sneak peek at the lineup, specially curated for movie buffs:

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money.

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money. Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative).

Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative). Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.

Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.To get an idea of what might come up at the event, here, you can preview 6 selected ads combined into two 2 videos:

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships.

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships. Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.

Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.BFF25 Main Screenings

Sample titles from BFF25’s Official Selection:

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director.

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director. UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year.

UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year. HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.

HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.Check out trailers for this year’s BFF25 and past editions on YouTube.

Tickets & Info:

- Detailed program and tickets are available at bitcoinfilmfest.com/bff25.

- Stay updated via the festival’s official channels (links provided on the website).

- Use ‘LN-NEWS’ to get 10% of tickets

-

@ 5cb68b7a:b7cb67d5

2025-05-17 14:14:06

@ 5cb68b7a:b7cb67d5

2025-05-17 14:14:06In the realm of cryptocurrency, the stakes are incredibly high, and losing access to your digital assets can be a daunting experience. But don’t worry — cryptrecver.com is here to transform that nightmare into a reality! With expert-led recovery services and leading-edge technology, Crypt Recver specializes in helping you regain access to your lost Bitcoin and other cryptocurrencies.

Why Choose Crypt Recver? 🤔 🔑 Expertise You Can Trust At Crypt Recver, we blend advanced technology with skilled engineers who have a solid track record in crypto recovery. Whether you’ve forgotten your passwords, lost your private keys, or encountered issues with damaged hardware wallets, our team is ready to assist.

⚡ Fast Recovery Process Time is crucial when recovering lost funds. Crypt Recver’s systems are designed for speed, enabling quick recoveries — allowing you to return to what matters most: trading and investing.

🎯 High Success Rate With a success rate exceeding 90%, our recovery team has aided numerous clients in regaining access to their lost assets. We grasp the complexities of cryptocurrency and are committed to providing effective solutions.

🛡️ Confidential & Secure Your privacy is paramount. All recovery sessions at Crypt Recver are encrypted and completely confidential. You can trust us with your information, knowing we uphold the highest security standards.

🔧 Advanced Recovery Tools We employ proprietary tools and techniques to tackle complex recovery scenarios, from retrieving corrupted wallets to restoring coins from invalid addresses. No matter the challenge, we have a solution.

Our Recovery Services Include: 📈 Bitcoin Recovery: Lost access to your Bitcoin wallet? We can assist in recovering lost wallets, private keys, and passphrases. Transaction Recovery: Mistaken transfers, lost passwords, or missing transaction records — let us help you reclaim your funds! Cold Wallet Restoration: Did your cold wallet fail? We specialize in safely extracting assets. Private Key Generation: Forgotten your private key? We can help you generate new keys linked to your funds without compromising security. Don’t Let Lost Crypto Ruin Your Day! 🕒 With an estimated 3 to 3.4 million BTC lost forever, it’s essential to act quickly when facing access issues. Whether you’ve been affected by a dust attack or simply forgotten your key, Crypt Recver provides the support you need to reclaim your digital assets.

🚀 Start Your Recovery Now! Ready to retrieve your cryptocurrency? Don’t let uncertainty hold you back! 👉 Request Wallet Recovery Help Today!cryptrecver.com

Need Immediate Assistance? 📞 For quick queries or support, connect with us on: ✉️ Telegram: t.me/crypptrcver 💬 WhatsApp: +1(941)317–1821

Trust Crypt Recver for the best crypto recovery service — get back to trading with confidence! 💪In the realm of cryptocurrency, the stakes are incredibly high, and losing access to your digital assets can be a daunting experience. But don’t worry — cryptrecver.com is here to transform that nightmare into a reality! With expert-led recovery services and leading-edge technology, Crypt Recver specializes in helping you regain access to your lost Bitcoin and other cryptocurrencies.

# Why Choose Crypt Recver? 🤔

# Why Choose Crypt Recver? 🤔🔑 Expertise You Can Trust\ At Crypt Recver, we blend advanced technology with skilled engineers who have a solid track record in crypto recovery. Whether you’ve forgotten your passwords, lost your private keys, or encountered issues with damaged hardware wallets, our team is ready to assist.

⚡ Fast Recovery Process\ Time is crucial when recovering lost funds. Crypt Recver’s systems are designed for speed, enabling quick recoveries — allowing you to return to what matters most: trading and investing.

🎯 High Success Rate\ With a success rate exceeding 90%, our recovery team has aided numerous clients in regaining access to their lost assets. We grasp the complexities of cryptocurrency and are committed to providing effective solutions.

🛡️ Confidential & Secure\ Your privacy is paramount. All recovery sessions at Crypt Recver are encrypted and completely confidential. You can trust us with your information, knowing we uphold the highest security standards.

🔧 Advanced Recovery Tools\ We employ proprietary tools and techniques to tackle complex recovery scenarios, from retrieving corrupted wallets to restoring coins from invalid addresses. No matter the challenge, we have a solution.

# Our Recovery Services Include: 📈

# Our Recovery Services Include: 📈- Bitcoin Recovery: Lost access to your Bitcoin wallet? We can assist in recovering lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistaken transfers, lost passwords, or missing transaction records — let us help you reclaim your funds!

- Cold Wallet Restoration: Did your cold wallet fail? We specialize in safely extracting assets.

- Private Key Generation: Forgotten your private key? We can help you generate new keys linked to your funds without compromising security.

Don’t Let Lost Crypto Ruin Your Day! 🕒

With an estimated 3 to 3.4 million BTC lost forever, it’s essential to act quickly when facing access issues. Whether you’ve been affected by a dust attack or simply forgotten your key, Crypt Recver provides the support you need to reclaim your digital assets.

🚀 Start Your Recovery Now!\ Ready to retrieve your cryptocurrency? Don’t let uncertainty hold you back!\ 👉 Request Wallet Recovery Help Today!cryptrecver.com

Need Immediate Assistance? 📞

For quick queries or support, connect with us on:\ ✉️ Telegram: t.me/crypptrcver\ 💬 WhatsApp: +1(941)317–1821

Trust Crypt Recver for the best crypto recovery service — get back to trading with confidence! 💪

-

@ 58537364:705b4b85

2025-05-17 14:00:29

@ 58537364:705b4b85

2025-05-17 14:00:29การภาวนานี่ ที่สำคัญ มันไม่ใช่ความสงบนะ สิ่งสำคัญที่มีค่ายิ่งกว่าความสงบก็คือ การที่เราได้เห็น อารมณ์ เห็นความคิดที่มันผุดขึ้นมา และตรงนี้แหละมันจะทำให้เรา สามารถที่จะเป็นอิสระ จากความคิดและอารมณ์ แทนที่จะตกเป็นทาสของมัน ถูกความคิดดึงไป หลอกล่อ หรือว่าถูกอารมณ์ครอบงำ บงการจิตใจ เราก็สามารถที่จะเป็นอิสระจากมัน หรือเป็นนายเหนือมันได้

ความคิดนี่ ถ้าหากว่าเราไม่รู้ทันมัน มันก็เป็นนายเหนือเรา แต่ถ้าเรารู้ทันนะ เราก็เป็นนายมัน ความคิดมันเป็นบ่าวที่ดีแต่เป็นนายที่เลวนะ คนไม่ค่อยตระหนักเท่าไร มันเป็นบ่าวที่ดีถ้าเรารู้จักใช้มัน ใช้มันแก้ปัญหาต่างๆ ที่เกิดขึ้น ไม่ว่าจะเป็นปัญหาเรื่องชีวิต ปัญหาเรื่องทำมาหากิน หรือแม้กระทั่งปัญหาในทางธรรม ความคิดนี่ถ้าเรารู้จักใช้มัน มันมีประโยชน์ แต่ถ้าเราปล่อยให้มันเป็นนายเรานี่ เราแย่เลย

ความคิดก็เหมือนกันนะ อารมณ์ก็เหมือนกัน โดยเฉพาะความคิดนี่เป็นบ่าวที่ดี เป็นนายที่เลว ถ้าเราปล่อยให้มันเป็นนายเมื่อไร เรากินไม่ได้นอนไม่หลับ ต้องไปทะเลาะเบาะแว้งกับผู้คน เพราะว่าเขาคิดไม่เหมือนเรา เขาคิดต่างจากเรา หรือคิดต่างจากสิ่งที่อยู่ในหัวของเรา บางทีก็ฆ่ากันเพราะความคิดที่ต่างกัน ฆ่าเพื่อปกป้องความคิดที่อยู่ในหัวของเรา

อารมณ์ก็เหมือนกัน ถ้าเราไม่รู้ทันอารมณ์ เราก็จะตกเป็นทาสของมัน ปล่อยให้มันบงการ ไม่ว่าจะเป็นความโกรธ ความเศร้า เวลาเศร้านี่ ความเศร้ามันก็จะหลอกให้เราเศร้าไปเรื่อย สรรหาเหตุผลมากมายว่าเราควรเศร้า เพราะถ้าเราไม่เศร้าแสดงว่าเราไม่รักเขา ถ้าเรารักเขาเราต้องเศร้า ต้องเศร้าไปเรื่อยๆ ถ้าหายเศร้าเมื่อไรแสดงว่าไม่รักเขา ไม่ว่าคนนั้นจะเป็นพ่อ แม่ หรือลูก มันก็หลอกให้เราจมอยู่ในความเศร้า ดำดิ่งอยู่ในความเศร้า จนกระทั่งกลายเป็นโรคซึมเศร้าไปเลย

หรือความโกรธก็เหมือนกัน มันก็จะหลอกจะล่อ สรรหาเหตุผลให้เราโกรธ เพื่อความถูกต้อง เพื่อจะได้สั่งสอนมัน ไม่ให้มันทำสิ่งที่ไม่ถูกต้องต่อไป ฉะนั้นเนี่ย ไม่ใช่โกรธอย่างเดียว ต้องจัดการด้วย

คนเราถ้าไม่รู้ทันความคิด ไม่รู้ทันอารมณ์ มันก็สามารถสร้างทุกข์ให้กับตัวเองได้ และสิ่งที่ต้องการคือความสงบนี่ มันก็จะเกิดขึ้นไม่ได้เลย การภาวนานี่ คนส่วนใหญ่ก็ปรารถนาแต่ความสงบ สงบที่เขาเข้าใจคือไม่คิดอะไร แล้วก็ไปห้ามความคิดหรือไปกดข่มอารมณ์ด้วย มันมีความคิดก็กดมันเอาไว้ มันมีอารมณ์เกิดขึ้นก็กดมันเอาไว้ เพราะคิดว่านี่มันจะทำให้ตัวเองสงบ

แต่ที่จริงแล้ว สิ่งที่ดีกว่าก็คือ “การเห็น” เห็นความคิดและอารมณ์ ซึ่งจะเห็น หรือรู้ทันมันได้ ก็ต้องยอมให้มันเกิดขึ้น อนุญาตให้มันเกิดขึ้น ไม่กดข่มมัน ใหม่ๆ ก็ไม่เห็นนะ พอมันเกิดขึ้นทีไร มันก็ครองใจเราทันที เรียกว่า “เข้าไปเป็น”

แต่ต่อไปนี่เราฝึกการเห็นบ่อยๆ ฝึกเห็นบ่อยๆ มันก็จะเห็นได้เร็วขึ้น แล้วมันก็จะเข้าไปเป็นน้อยลง พอเห็นเมื่อไรนะ มันก็จะครองใจเราไม่ได้ และนี่ก็คือการค้นพบที่สำคัญเลย เพราะมันหมายถึงการที่เราสามารถ จะเป็นอิสระจากความคิดและอารมณ์ได้.

การค้นพบตัวเองที่สำคัญ พระอาจารย์ไพศาล วิสาโล วัดป่าสุคะโต แสดงธรรมเย็นวันที่ 11 กันยายน 2565

-

@ 005bc4de:ef11e1a2

2025-05-17 13:40:23

@ 005bc4de:ef11e1a2

2025-05-17 13:40:23Bitcoin, sats, bits, numbers, and perceptions

Quick background

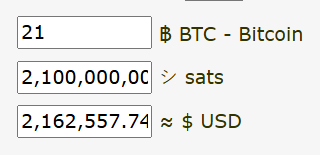

In December 2024 John Carvalho proposed BIP 21Q titled "Redefinition of the Bitcoin Unit to the Base Denomination." His point: the word "bitcoin" should not refer to the 21 million bitcoins we hear about, but to what we currently call "sats", the "base" unit of bitcoin. There are 2.1 quadrillion sats. So, instead of saying there are 21 million bitcoin, BIP 21Q suggests saying there are 2.1 quadrillion.

There'd be absolutely zero change to Bitcoin, the protocol, with this BIP (unlike the OP_CAT or more current OP_RETURN debates). This is just a movement to get people to change the way they talk about and refer to "bitcoin." BIP 21Q is just a rewording, a rephrasing, a rebranding, a rethinking.

Since

Since then, there has been discussion. I'll admit it's interesting to talk about, but I've never thought much of it. My take has been, and frankly still is: this too will pass. I hadn't heard or thought of this in a couple of months. Until...

In the past couple of days though, like a campfire that has been slowly dying down, a sudden rush of wind has fanned the embers and the flames have sparked upward. As best I can tell, that wind came out of the mouth (or typing) of Jack Dorsey (Twitter founder, Square/Block CEO, billionaire, you know Jack) when he put this note out.

Watch the vid on YouTube.

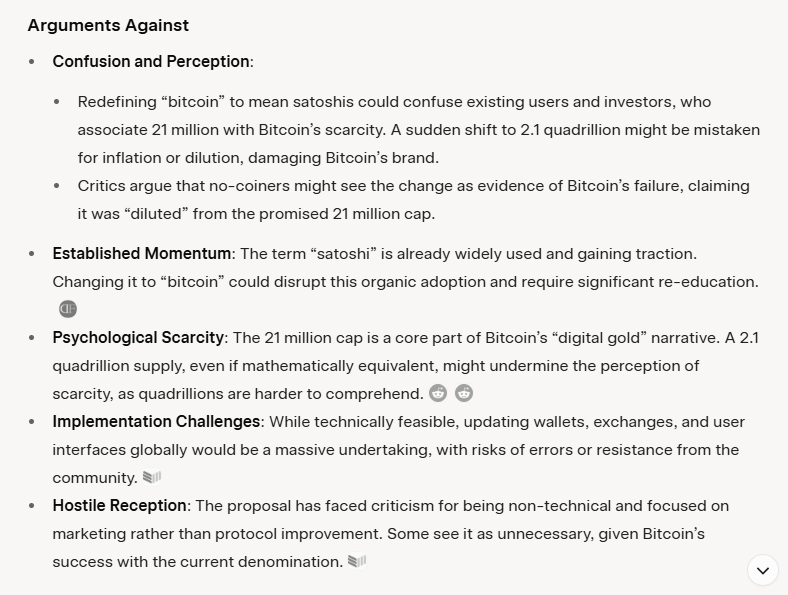

The video makes some good points, both against and in favor of BIP 21Q. Quickly, Grok summarized the arguments for and against, below:

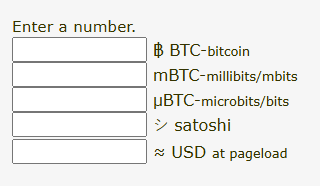

Today, I even read chatter about a middle ground compromise to use "bits" as the base unit. In other words, don't use "sats" but use "bits." I guess the idea is that a bitcoin can stay one of 21 million, but "bits," which sounds like little bitcoins, can be the 2.1 quadrillion. "Oh brother," I thought, even more confusion. We've been through this back in the 20-teens with bits, ubits, and mbits. This was a main reason I made the Satoshi Bitcoin Converter because it was confusing! I'm happy we were past all this, but then...it's back!

Just for kicks, you can fool around with the old SBC version 7 and find out how confusing it is.

One of the arguments in the video is that the BoardwalkCash.com folks have adopted "bitcoin" as their base unit. Boardwalk Cash is a cashu/ecash (and Lightning) web app with the intention of making spending and receiving small, coffee-sized payments easy.

Notice the bitcoin B after the zero, not "sats" or a satoshi symbol, like the one I proposed: シ 😃

Below, I sent 21 sats (bitcoins?) from a different ecash/cashu wallet. And, boom, there they appear in Boardwalk Cash. Notice how it appears as 21₿, as 21 bitcoin. Then, when I click it, it shows $0.02 USD, two pennies.

I didn't actually send 21 what-we-think-of-today bitcoins, worth $2.16 million. I sent two US pennies worth.

By the way, if you've never messed around with ecash/cashu and wish to try it out, get a wallet and I'll send you a few sats (bitcoins?) as ecash to see how easy it is. These images are from Boardwalkcash.com which is very clean, however I use Cashu.me.

And so...

And so, this is the main argument against, in my view: possible confusion. The other issue would be the changeover by things like exchanges or maybe even smart contracts that bridge BTC to other chains. Having worked on my little converter app, I know that it can be easy to make a decimal mistake in the code and throw everything off. I'm certain that, should we move to 2.1 quadrillion bitcoins, somebody will foul up an interface or back end which might cause a big problem, maybe some big losses.

Two things here:

On the more technical side, the changing of names and code on exchanges or smart contracts, it would almost be better if there was a hard-and-fast, set changeover date, like there was with Y2K. There is a clear before-and-after, B.C. and A.D. date. Call it, "BQ" and "AQ", before and after quadrillion. 😂 If there was a date/time where everything was 21M "bitcoin" to 2.1Q "bitcoin", that would force the issue.

However, there is not such a date or time, nor will there be...recall that bitcoin is decentralized, no CEO here. If this 2.1Q change actually happens, the reality is that it will be a rolling, gradual, thing. It will be case by case, app by app, exchange by exchange. And some won't make the change at all. This lends back to the confusion situation.

Secondly, on the human perception side, this actually concerns me less. We can change human perception. It takes some time, but human perception and thinking is very plastic and can definitely be molded. Heaven knows the examples of how this has been used the wrong way in history, umm, anything like this go on in World War II?

Quick case studies of changing perception:

Standard Oil (John D. Rockefeller's company) was essentially a monopoly and was broken up by the U.S., remember that from history class? They had a multitude of sub-brands, one of which was "Esso", get it?, S.O., Standard Oil? They wanted to move away from ties to Standard Oil, at least perception-wise, and wanted to consolidate all their sub-brands. They moved to "Exxon" with a marketing campaign. The marketing types were brilliant. They understood that there is a time thing involved. Unlike the Y2K hard date above, they knew that human perception, as malleable as it is, changes over time. Rather than fight this, they used this to their advantage.

As I understand, one of their techniques was to use the visual. The Esso sign was shown in places with the Esso logo up high and prominent. But, down below, was the never-before-seen Exxon sign. It was just there, doing nothing. Doing nothing except implanting itself into the subconscious of the viewers. Then, the Exxon sign, in later ads, appeared higher. The Esso sign lowered and was less prominent. Hmm? What's going on? Does anyone even notice? Hmm? Then, in the coup, the tiger mascot literally lowered the Esso sign down and raised the Exxon sign up.

In the final coup d'état, the Esso sign simply disappeared. And, make no mistake, this is the coup de grâce...the word Esso just disappeared. It was no longer seen at all. Then, it was forgotten and it was gone. Now, there is Exxon.

More recently, we all know that Twitter rebranded to X. It seemed so dumb, definitely awkward, I'm still not entirely used to it, people still write, "...so-and-so posted on X, formerly Twitter,..." (as if no one knows that X is formerly Twitter), I still say people "tweet" on X, but it's changing. I now hear reference to what so-and-so said "on X", with no mention of Twitter. It's changing. Time...it'll change...Twitter will stop being mentioned, Twitter will be a part of history, like Esso.

What'll happen with 21Q?

Nothing. I fully predict that this 2.1 quadrillion bitcoins thing will go nowhere. One of the main reasons for moving to replace "sats" as "bitcoins" is the perception that 1 bitcoin is unattainable and that people know "bitcoin," but don't know "sats." A bull bitcoin is out of reach for most people, but sats are attainable by everyone with a wallet. And, if they don't know ther term "sats," it's probably easier to change that perception (to educate them on sats) than it is to change and possibly confuse their knowledge of 21M bitcoins with 2.1Q bitcoins. It's probably easier to educate on "sats" than it is to change all the backends on exchanges and smart contracts and front ends (and some won't change at all, which will add more to confusion).

Solution: educate

Practical solution: if you think you might be speaking to a "normie" audience, make it a point to use the phrase "bitcoin sats." Over time, as people acquire and use sats to buy burgers, they'll know that sats means 1 of 2.1 quadrillion, but a bitcoin is 1 of 21 million. This is the Esso tiger lowering "bitcoin" and raising "sats."

-

@ 87f5e1d9:e251d8f4

2025-05-17 13:13:42

@ 87f5e1d9:e251d8f4

2025-05-17 13:13:42In the realm of cryptocurrency, the stakes are incredibly high, and losing access to your digital assets can be a daunting experience. But don’t worry — cryptrecver.com is here to transform that nightmare into a reality! With expert-led recovery services and leading-edge technology, Crypt Recver specializes in helping you regain access to your lost Bitcoin and other cryptocurrencies.

Why Choose Crypt Recver? 🤔 🔑 Expertise You Can Trust At Crypt Recver, we blend advanced technology with skilled engineers who have a solid track record in crypto recovery. Whether you’ve forgotten your passwords, lost your private keys, or encountered issues with damaged hardware wallets, our team is ready to assist.

⚡ Fast Recovery Process Time is crucial when recovering lost funds. Crypt Recver’s systems are designed for speed, enabling quick recoveries — allowing you to return to what matters most: trading and investing.

🎯 High Success Rate With a success rate exceeding 90%, our recovery team has aided numerous clients in regaining access to their lost assets. We grasp the complexities of cryptocurrency and are committed to providing effective solutions.

🛡️ Confidential & Secure Your privacy is paramount. All recovery sessions at Crypt Recver are encrypted and completely confidential. You can trust us with your information, knowing we uphold the highest security standards.

🔧 Advanced Recovery Tools We employ proprietary tools and techniques to tackle complex recovery scenarios, from retrieving corrupted wallets to restoring coins from invalid addresses. No matter the challenge, we have a solution.

Our Recovery Services Include: 📈 Bitcoin Recovery: Lost access to your Bitcoin wallet? We can assist in recovering lost wallets, private keys, and passphrases. Transaction Recovery: Mistaken transfers, lost passwords, or missing transaction records — let us help you reclaim your funds! Cold Wallet Restoration: Did your cold wallet fail? We specialize in safely extracting assets. Private Key Generation: Forgotten your private key? We can help you generate new keys linked to your funds without compromising security. Don’t Let Lost Crypto Ruin Your Day! 🕒 With an estimated 3 to 3.4 million BTC lost forever, it’s essential to act quickly when facing access issues. Whether you’ve been affected by a dust attack or simply forgotten your key, Crypt Recver provides the support you need to reclaim your digital assets.

🚀 Start Your Recovery Now! Ready to retrieve your cryptocurrency? Don’t let uncertainty hold you back! 👉 Request Wallet Recovery Help Today!cryptrecver.com

Need Immediate Assistance? 📞 For quick queries or support, connect with us on: ✉️ Telegram: t.me/crypptrcver 💬 WhatsApp: +1(941)317–1821

Trust Crypt Recver for the best crypto recovery service — get back to trading with confidence! 💪In the realm of cryptocurrency, the stakes are incredibly high, and losing access to your digital assets can be a daunting experience. But don’t worry — cryptrecver.com is here to transform that nightmare into a reality! With expert-led recovery services and leading-edge technology, Crypt Recver specializes in helping you regain access to your lost Bitcoin and other cryptocurrencies.

# Why Choose Crypt Recver? 🤔

# Why Choose Crypt Recver? 🤔🔑 Expertise You Can Trust\ At Crypt Recver, we blend advanced technology with skilled engineers who have a solid track record in crypto recovery. Whether you’ve forgotten your passwords, lost your private keys, or encountered issues with damaged hardware wallets, our team is ready to assist.

⚡ Fast Recovery Process\ Time is crucial when recovering lost funds. Crypt Recver’s systems are designed for speed, enabling quick recoveries — allowing you to return to what matters most: trading and investing.

🎯 High Success Rate\ With a success rate exceeding 90%, our recovery team has aided numerous clients in regaining access to their lost assets. We grasp the complexities of cryptocurrency and are committed to providing effective solutions.

🛡️ Confidential & Secure\ Your privacy is paramount. All recovery sessions at Crypt Recver are encrypted and completely confidential. You can trust us with your information, knowing we uphold the highest security standards.

🔧 Advanced Recovery Tools\ We employ proprietary tools and techniques to tackle complex recovery scenarios, from retrieving corrupted wallets to restoring coins from invalid addresses. No matter the challenge, we have a solution.

# Our Recovery Services Include: 📈

# Our Recovery Services Include: 📈- Bitcoin Recovery: Lost access to your Bitcoin wallet? We can assist in recovering lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistaken transfers, lost passwords, or missing transaction records — let us help you reclaim your funds!

- Cold Wallet Restoration: Did your cold wallet fail? We specialize in safely extracting assets.

- Private Key Generation: Forgotten your private key? We can help you generate new keys linked to your funds without compromising security.

Don’t Let Lost Crypto Ruin Your Day! 🕒

With an estimated 3 to 3.4 million BTC lost forever, it’s essential to act quickly when facing access issues. Whether you’ve been affected by a dust attack or simply forgotten your key, Crypt Recver provides the support you need to reclaim your digital assets.

🚀 Start Your Recovery Now!\ Ready to retrieve your cryptocurrency? Don’t let uncertainty hold you back!\ 👉 Request Wallet Recovery Help Today!cryptrecver.com

Need Immediate Assistance? 📞

For quick queries or support, connect with us on:\ ✉️ Telegram: t.me/crypptrcver\ 💬 WhatsApp: +1(941)317–1821

Trust Crypt Recver for the best crypto recovery service — get back to trading with confidence! 💪

-

@ a296b972:e5a7a2e8

2025-05-17 13:03:39

@ a296b972:e5a7a2e8

2025-05-17 13:03:39Man stelle sich vor, es droht Frieden auszubrechen. Wie stehen wir, die Deutschen, die Europäer denn dann da? Ja, wie die letzten Deppen, die ihr auch seid!

Wen wundert es, wenn nach erfolgreicher Friedensverhinderung durch Boris Johnson in 2022 und den durch den Westen zahlreichen überschrittenen Roten Linien Russland skeptisch ist?

Am russischen Misstrauen haben die hinter der Ukraine stehenden westlichen Staaten jahrelang erfolgreich gearbeitet.

„Besonderer Dank“ gilt hier vor allem der von allen Mitgliedern bedenkenlos hingenommenen NATO-Osterweiterung.

Die Aussage von Frau Merkel, man habe nie vorgehabt, das Minsk-Abkommen umzusetzen, stattdessen habe man gewollt, der Ukraine Zeit zu verschaffen, sich aufzurüsten, kann nur von jemandem, der weniger als eine Gehirnzelle hat, als vertrauensbildende Maßnahme bewertet werden.

Die immer wieder im Raum stehende Debatte um eine deutsche Lieferung von Kampf-Stieren, demnächst wohlmöglich unter Ausschluss der Öffentlichkeit (das könnte Teile der Bevölkerung verunsichern), ein weiteres Beispiel von friedenstüchtiger Diplomatie.

Wie schon beim klaglosen Hinnehmen der terroristischen Sprengung der Nordstream2 Pipelines, wozu Präsident Trump schon geäußert hat, dass es die Russen sicher nicht waren, wird auch brav von Deutschland hingenommen, dass von Wiesbaden aus, die Koordination der Raketenangriffe von der Ukraine auf Russland durch die USA, innerhalb der Task Force Dragon, gesteuert werden.

Die Verletzung des 2+4-Vertrages durch die Stationierung von Nicht-NATO-Truppen in Rostock, die an die Umbenennung eines Schokoriegels von Raider in Twixx erinnert.

Das strikte Einhalten der deutschen Maxime: „Von Deutschland soll nur noch Frieden ausgehen.“

Dazu die Lieferung von Raketen mit mittlerer Reichweite durch die Franzosen und Briten nach dem Motto: Ich habe nur das Messer auf den Tisch gelegt, zugestochen hat ein anderer.

All das trägt dazu bei, dass Russland vertrauensvoll nach europäischen Friedensvorschlägen geradezu lechzt. Unterstrichen werden diese übermenschlichen Anstrengungen durch ein weiteres, das bereit 17. Sanktionspaket. Dümmer geht’s nimmer.

Auch diplomatisch nicht zu überbietende Aussagen, wie „Russland wird immer unser Feind sein“, oder „Russland wird Deutschland in spätestens 5 Jahren angreifen“, oder „Deutschland muss wieder kriegstüchtig werden“, unterstreichen den unbedingten Willen, das sinnlose Sterben auf beiden Seiten schnellst möglich beenden zu wollen.

Außerhalb Deutschlands kann man nur zu der Überzeugung gelangen, dass es sich bei diesem Land um eine Freiluft-Irrenanstalt handeln muss. Und wer will schon mit geistig verwirrten Insassen über so ernste Themen wie Krieg und Frieden verhandeln, bei denen Verstand gebraucht wird.

Derartige Weltfremde ist nur mit Sarkasmus zu ertragen.

Bewundernswert der Langmut, den Russland bis heute an den Tag legt. Wäre die Situation umgekehrt, hätte der Westen schon lange dem „bösen“ Russen gezeigt, wo der US-Hammer hängt, und dass man so mit der sogenannten Wertegemeinschaft nicht umgehen kann.

Ja, der russische Einmarsch in die Ukraine war völkerrechtswidrig, genau so wie die US-amerikanischen „Besuche“ der USA in Vietnam, in Libyen und im Irak, auf sehr unschöne Weise. Wer hat nicht noch die Bilder vom Blitzgewitter der Bomben auf Bagdad im Gedächtnis. „Immer schön drauf, Stärke zeigen!“

Die zentrale Frage ist, wie man Deutschland „möglichst schonend“ beibringen kann, ohne, dass es einen größeren psychischen Staatsschaden davonträgt, dass es als Geisterfahrer auf der Friedensautobahn unterwegs ist.

Von russischer Seite sind nicht gerade die Vorstände der Kaninchenzüchter-Vereine nach Istanbul entsandt worden. Im Gegenteil, es handelt sich wohl eher um Personen, die bestens über das Kriegsgeschehen vor Ort Bescheid wissen.

Es darf nicht vergessen werden, dass es sich um einen Stellvertreterkrieg zwischen den von der Vorgängerregierung angezettelten USA und Russland, auf dem Rücken der Ukraine handelt.

In Istanbul haben sich zunächst die beiden Länder getroffen, deren Soldaten tatsächlich aufeinander schießen. Nicht die Strategen im Hintergrund. Und selbstverständlich beobachten die USA sehr wachsam, was vor sich geht und wie der Verlauf ist.

Es wäre fern der Realität, wenn im Hintergrund nicht weitere Fäden gesponnen würden, die der Öffentlichkeit zunächst vorenthalten werden. In diesem Fall kann das sogar von Vorteil sein, weil zu viele System-Journalisten den Brei mit dämlichen Kommentaren verderben könnten.

Zunächst soll zwischen den aktiv kämpfenden Parteien der Dialog wieder aufgenommen und eine Grundlage geschaffen werden, was schon ein großer Fortschritt ist, weil man sich seit 2022 überhaupt wieder erst einmal an einen gemeinsamen Tisch gesetzt hat und endlich wieder miteinander redet.

Wie immer im Krieg, wird auch hier strategisch vorgegangen und peinlichst darauf geachtet, dass alle Beteiligten möglichst weitgehend ihr Gesicht bewahren. Wer geglaubt hat, dass hier gleich Friedenstauben aufsteigen und alles mit einem Bruderkuss besiegelt wird, der ist wirklich ziemlich naiv.

Erst, wenn Sondierungsgespräche und Vorverhandlungen so weit gediehen sind, dass „nur“ noch eine Unterschrift fehlt, treten Putin und Trump als Friedensbringer auf die Bühne und besiegeln den „Deal“. Wie man jetzt an dem Vorführen Selenskyjs durch Putin gesehen hat, dient dieser nur noch als Spielball, der beim Ping-Pong um den Frieden hin- und hergeworfen wird. Trump hatte zuvor Selensky bei seinem Besuch im Weißen Haus ganz deutlich gesagt, dass er die Karten nicht in der Hand hat.

Jeder, der bei Verstand geblieben ist, wünscht sich endlich ein Ende dieses sinnlosen Sterbens, doch der Druck muss im Kessel langsam und kontrolliert abgelassen werden.

Entgegen der im Westen weitverbreiteten Propaganda-Lüge, der Konflikt in der Ukraine habe im Februar 2022 angefangen, hat sich die Situation über Jahre, mindestens mit der NATO-Osterweiterung aufgebaut. Da kann niemand erwarten, dass die Wiederherstellung eines Gleichgewichts jetzt in kürzester Zeit erreicht werden kann.

Urheber dieser Tragödie ist die NATO, die Russland immer mehr auf die Pelle gerückt ist. Hätte sie sich seinerzeit, wie der Warschauer Pakt, aufgrund der veränderten Kräfteverhältnisse ebenfalls aufgelöst, würden heute rund 1 Million Männer auf beiden Seiten sehr wahrscheinlich noch leben. Es wäre zu wünschen, dass nach dem exemplarischen Desaster in der Ukraine neue Überlegungen angestrengt werden würden, ob nicht die NATO, als Relikt aus alten Zeiten und aus Missachtung ihres Gründungsgedanken, ein Verteidigungsbündnis sein zu wollen, von der Zeit eingeholt wurde und ihrer Auflösung entgegensehen muss.

Dieser Artikel wurde mit dem Pareto-Client geschrieben

* *

(Bild von pixabay)

-

@ dfa02707:41ca50e3

2025-05-17 12:59:05

@ dfa02707:41ca50e3

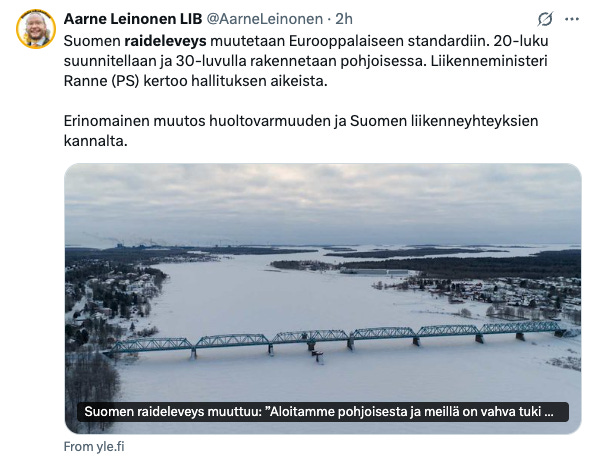

2025-05-17 12:59:05Contribute to keep No Bullshit Bitcoin news going.