-

@ dfa02707:41ca50e3

2025-05-20 09:10:54

@ dfa02707:41ca50e3

2025-05-20 09:10:54News

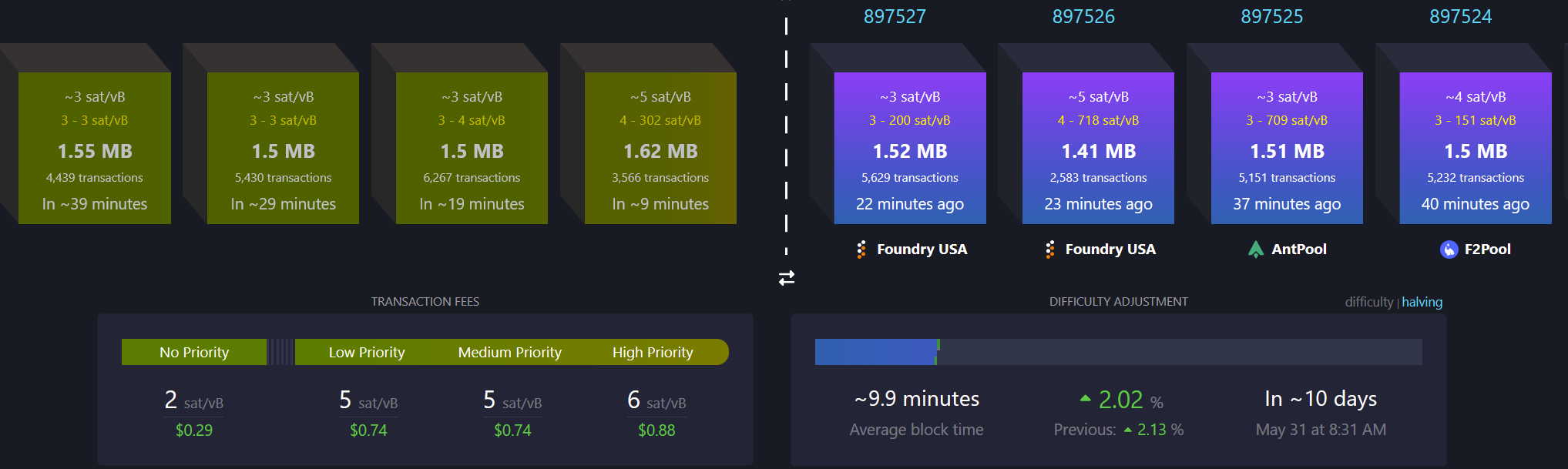

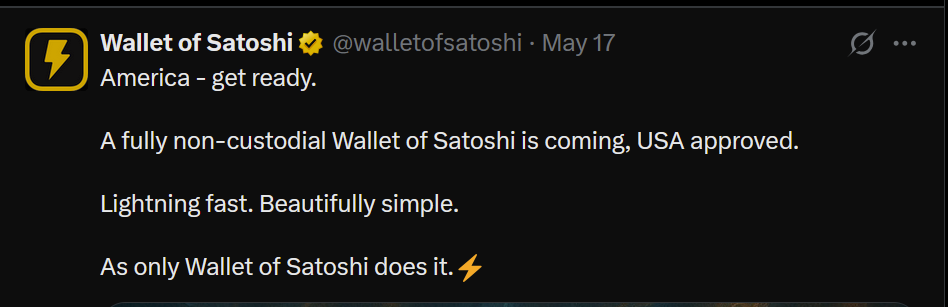

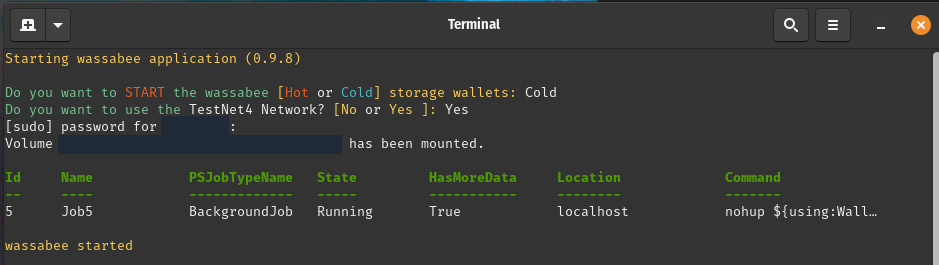

- Wallet of Satoshi teases a comeback in the US market with a non-custodial product. According to an announcement on X, the widely popular custodial Lightning wallet is preparing to re-enter the United States market with a non-custodial wallet. It is unclear whether the product will be open-source, but the project has clarified that "there will be no KYC on any Wallet of Satoshi, ever!" Wallet of Satoshi ceased serving customers in the United States in November 2023.

- Vulnerability disclosure: Remote crash due to addr message spam in Bitcoin Core versions before v29. Bitcoin Core developer Antoine Poinsot disclosed an integer overflow bug that crashes a node if spammed with addr messages over an extended period. A fix was released on April 14, 2025, in Bitcoin Core v29.0. The issue is rated Low severity.

- Coinbase Know Your Customer (KYC) data leak. The U.S. Department of Justice, including its Criminal Division in Washington, is investigating a cyberattack on Coinbase. The incident involved cybercriminals attempting to extort $20 million from Coinbase to prevent stolen customer data from being leaked online. Although the data breach affected less than 1% of the exchange's users, Coinbase now faces at least six lawsuits following the revelation that some customer support agents were bribed as part of the extortion scheme.

- Fold has launched Bitcoin Gift Cards, enabling users to purchase bitcoin for personal use or as gifts, redeemable via the Fold app. These cards are currently available on Fold’s website and are planned to expand to major retailers nationwide later this year.

"Our mission is to make bitcoin simple and approachable for everyone. The Bitcoin Gift Card brings bitcoin to millions of Americans in a familiar way. Available at the places people already shop, the Bitcoin Gift Card is the best way to gift bitcoin to others," said Will Reeves, Chairman and CEO of Fold.

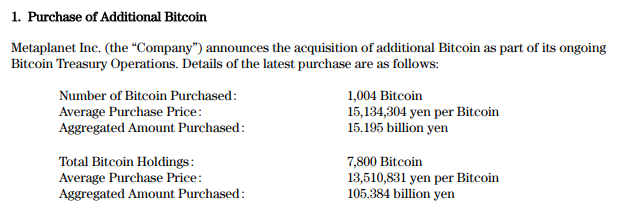

- Corporate treasuries hold nearly 1.1 million BTC, representing about 5.5% of the total circulating supply (1,082,164 BTC), per BitcoinTreasuries.net data. Recent purchases include Strategy adding 7,390 BTC (total: 576,230 BTC), Metplanet acquiring 1,004 BTC (total: 7,800 BTC), Tether holding over 100,521 BTC, and XXI Capital, led by Jack Mallers, starting with 31,500 BTC.

- Meanwhile, a group of investors has filed a class action lawsuit against Strategy and its executive Michael Saylor. The lawsuit alleges that Strategy made overly optimistic projections using fair value accounting under new FASB rules while downplaying potential losses.

- The U.S. Senate voted to advance the GENIUS stablecoin bill for further debate before a final vote to pass it. Meanwhile, the House is crafting its own stablecoin legislation to establish a regulatory framework for stablecoins and their issuers in the U.S, reports CoinDesk.

- French 'crypto' entrepreneurs get priority access to emergency police services. French Minister of the Interior, Bruno Retailleau, agreed on measures to enhance security for 'crypto' professionals during a meeting on Friday. This follows a failed kidnapping attempt on Tuesday targeting the family of a cryptocurrency exchange CEO, and two other kidnappings earlier this year.

- Brussels Court declares tracking-based ads illegal in EU. The Brussels Court of Appeal ruled tracking-based online ads illegal in the EU due to an inadequate consent model. Major tech firms like Microsoft, Amazon, Google, and X are affected by the decision, as their consent pop-ups fail to protect privacy in real-time bidding, writes The Record.

- Telegram shares data on 22,777 users in Q1 2025, a significant increase from the 5,826 users' data shared during the same period in 2024. This significant increase follows the arrest of CEO and founder Pavel Durov last year.

- An Australian judge has ruled that Bitcoin is money, potentially exempting it from capital gains tax in the country. If upheld on appeal, this interim decision could lead to taxpayer refunds worth up to $1 billion, per tax lawyer Adrian Cartland.

Use the tools

- Bitcoin Safe v1.3.0 a secure and user-friendly Bitcoin savings wallet for beginners and advanced users, introduces an interactive chart, Child Pays For Parent (CPFP) support, testnet4 compatibility, preconfigured testnet demo wallets, various bug fixes, and other improvements.

- BlueWallet v7.1.8 brings numerous bug fixes, dependency updates, and a new search feature for addresses and transactions.

- Aqua Wallet v0.3.0 is out, offering beta testing for the reloadable Dolphin card (in partnership with Visa) for spending bitcoin and Liquid BTC. It also includes a new Optical Character Recognition (OCR) text scanner to read text addresses like QR codes, colored numbers on addresses for better readability, a reduced minimum for spending and swapping Liquid Bitcoin to 100 sats, plus other fixes and enhancements.

Source: Aqua wallet.

- The latest firmware updates for COLDCARD Mk4 v5.4.3 and Q v1.3.3 are now available, featuring the latest enhancements and bug fixes.

- Nunchuk Android v1.9.68.1 and iOS v1.9.79 introduce support for custom blockchain explorers, wallet archiving, re-ordering wallets on the home screen via long-press, and an anti-fee sniping setting.

- BDK-cli v1.0.0, a CLI wallet library and REPL tool to demo and test the BDK library, now uses bdk_wallet 1.0.0 and integrates Kyoto, utilizing the Kyoto protocol for compact block filters. It sets SQLite as the default database and discontinues support for sled.

- publsp is a new command-line tool designed for Lightning node runners or Lightning Service Providers (LSPs) to advertise liquidity offers over Nostr.

"LSPs advertise liquidity as addressable Kind 39735 events. Clients just pull and evaluate all those structured events, then NIP-17 DM an LSP of their choice to coordinate a liquidity purchase," writes developer smallworlnd.

-

Lightning Blinder by Super Testnet is a proof-of-concept privacy tool for the Lightning Network. It enables users to mislead Lightning Service Providers (LSPs) by making it appear as though one wallet is the sender or recipient, masking the original wallet. Explore and try it out here.

-

Mempal v1.5.3, a Bitcoin mempool monitoring and notification app for Android, now includes a swipe-down feature to refresh the dashboard, a custom time option for widget auto-update frequency, and a

-

@ 90c656ff:9383fd4e

2025-05-20 09:06:27

@ 90c656ff:9383fd4e

2025-05-20 09:06:27Since its creation in 2008, Bitcoin has been seen as a direct challenge to the traditional banking system. Developed as a decentralized alternative to fiat money, Bitcoin offers a way to store and transfer value without relying on banks, governments, or other financial institutions. This characteristic has made it a symbol of resistance against a financial system that, over time, has been marked by crises, manipulation, and restrictions imposed on citizens.

The 2008 financial crisis and the birth of Bitcoin

Bitcoin emerged in response to the 2008 financial crisis—a collapse that exposed the flaws of the global banking system. Central banks printed massive amounts of money to bail out irresponsible financial institutions, while millions of people lost their homes, savings, and jobs. In this context, Bitcoin was created as an alternative financial system, where no central authority could manipulate the economy for its own benefit.

In the first block of the Bitcoin blockchain or timechain, Satoshi Nakamoto included the following message:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

This phrase, taken from a newspaper headline of the time, symbolizes Bitcoin’s intent to offer a financial system beyond the control of banks and governments.

- Key reasons why Bitcoin resists the banking system

01 - Decentralization: Unlike money issued by central banks, Bitcoin cannot be created or controlled by any single entity. The network of users validates transactions transparently and independently.

02 - Limited Supply: While central banks can print money without limit—causing inflation and currency devaluation—Bitcoin has a fixed supply of 21 million units, making it resistant to artificial depreciation.

03 - Censorship Resistance: Banks can freeze accounts and block transactions at any time. With Bitcoin, anyone can send and receive funds without needing permission from third parties.

04 - Self-Custody: Instead of entrusting funds to a bank, Bitcoin users can store their own coins without the risk of account freezes or bank failures.

- Conflict between banks and Bitcoin

01 - Media Attacks: Large financial institutions often label Bitcoin as risky, volatile, or useless, attempting to discourage its adoption.

02 - Regulation and Crackdowns: Some governments, influenced by the banking sector, have implemented restrictions on Bitcoin usage, making it harder to buy and sell.

03 - Creation of Centralized Alternatives: Many central banks are developing digital currencies (CBDCs) that maintain control over digital money but do not offer Bitcoin’s freedom and decentralization.

In summary, Bitcoin is not just a digital currency—it is a movement of resistance against a financial system that has repeatedly failed to protect ordinary citizens. By offering a decentralized, transparent, and censorship-resistant alternative, Bitcoin represents financial freedom and challenges the banking monopoly over money. As long as the traditional banking system continues to impose restrictions and control the flow of capital, Bitcoin will remain a symbol of independence and financial sovereignty.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ 640f3844:d7b13a29

2025-05-20 08:52:49

@ 640f3844:d7b13a29

2025-05-20 08:52:49CrazyGames là một nền tảng giải trí số đang ngày càng khẳng định vị thế trong cộng đồng người dùng hiện đại nhờ vào khả năng cung cấp trải nghiệm linh hoạt, hấp dẫn và thân thiện. Với giao diện được thiết kế thông minh và trực quan, CrazyGames giúp người dùng dễ dàng tiếp cận và khám phá hàng loạt nội dung đa dạng chỉ trong vài thao tác. Dù sử dụng điện thoại, máy tính bảng hay máy tính để bàn, hệ thống luôn được tối ưu hóa để vận hành mượt mà, không gây gián đoạn hay ảnh hưởng đến trải nghiệm tổng thể. CrazyGames không chỉ đơn thuần là một nền tảng kỹ thuật số mà còn là nơi hội tụ của sáng tạo, công nghệ và niềm vui, nơi người dùng có thể tìm thấy sự giải tỏa sau những giờ làm việc căng thẳng hoặc học tập mệt mỏi. Nền tảng luôn chú trọng đến việc đổi mới giao diện, bổ sung các tính năng tiện ích nhằm mang lại giá trị sử dụng thực tế và phù hợp với xu hướng công nghệ đang thay đổi từng ngày.

Một trong những điểm nhấn nổi bật khiến CRAZYGAMES thu hút sự quan tâm rộng rãi chính là tính cá nhân hóa và khả năng kết nối cộng đồng vượt trội. Hệ thống sử dụng các thuật toán phân tích hành vi thông minh để đưa ra các đề xuất nội dung phù hợp với sở thích và nhu cầu riêng biệt của từng người dùng, từ đó nâng cao mức độ hài lòng và giữ chân người dùng lâu hơn. Không gian cộng đồng tích hợp trong nền tảng cũng tạo điều kiện cho các thành viên giao lưu, chia sẻ cảm nhận và trao đổi kinh nghiệm, giúp tăng sự gắn kết và hình thành một hệ sinh thái giải trí sôi động, đầy màu sắc. Hơn thế nữa, CrazyGames thường xuyên cập nhật nội dung mới, điều chỉnh theo phản hồi thực tế từ người dùng nhằm đảm bảo mọi người luôn cảm thấy được lắng nghe và phục vụ đúng với mong đợi. Việc áp dụng công nghệ mới, đặc biệt là trí tuệ nhân tạo và dữ liệu lớn, đã giúp CrazyGames trở thành một nền tảng tiên phong trong việc cá nhân hóa trải nghiệm người dùng ở cấp độ cao nhất.

CrazyGames cũng đặt yếu tố bảo mật và hỗ trợ kỹ thuật làm trọng tâm trong chiến lược phát triển lâu dài. Với hệ thống bảo mật nhiều lớp, kết hợp xác thực người dùng và mã hóa dữ liệu tiên tiến, người dùng có thể yên tâm khi trải nghiệm mà không phải lo lắng về quyền riêng tư hay nguy cơ rò rỉ thông tin cá nhân. Đồng thời, đội ngũ chăm sóc khách hàng của CrazyGames luôn sẵn sàng phản hồi nhanh chóng, giải quyết kịp thời các vướng mắc phát sinh và liên tục cập nhật các hướng dẫn sử dụng để người dùng tận dụng được mọi tính năng mà nền tảng mang lại. Ngoài ra, CrazyGames còn tổ chức nhiều chương trình tương tác hấp dẫn và hoạt động khuyến khích sáng tạo trong cộng đồng, giúp nâng cao trải nghiệm người dùng và biến mỗi lần truy cập trở thành một hành trình khám phá mới mẻ. Với tất cả những yếu tố đó, CrazyGames không chỉ là một nền tảng giải trí kỹ thuật số, mà còn là người bạn đồng hành lý tưởng trong hành trình kết nối công nghệ, sáng tạo và cảm xúc.

-

@ 8576ca0e:621f735e

2025-05-20 08:46:45

@ 8576ca0e:621f735e

2025-05-20 08:46:45

Now that you’ve mastered the basics, it’s time to level up. Bitcoin isn’t just about buying and holding it’s about understanding the ecosystem, optimizing security, and leveraging its unique properties to build wealth. In this deep dive, we’ll explore advanced concepts every Bitcoin enthusiast needs to know.

-

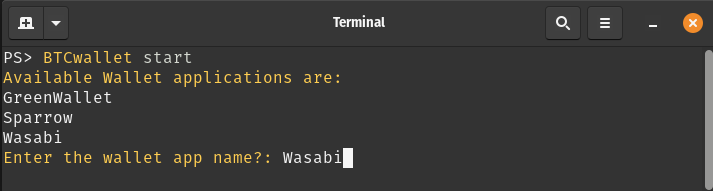

Mastering Bitcoin Security: Beyond the Basics -Multisig Wallets: Require multiple private keys to authorize transactions (e.g., 2-of-3 signatures). Ideal for protecting large holdings. -Cold Storage Deep Dive: How to set up air gapped hardware wallets, metal seed backups, and geographic redundancy. -Privacy Best Practices: Using CoinJoin, Tor, and wallets like Wasabi or Samourai to enhance anonymity. -Pro Tip: Test recovery phrases before transferring large sums.

-

Bitcoin’s Economic Landscape: Scarcity, Halvings, and Market Cycles -The Halving Explained: How Bitcoin’s supply schedule (every 4 years) impacts price, miner behavior, and long term value. -Stock to Flow (S2F) Model: Why Bitcoin’s scarcity makes it a compelling store of value. -Market Psychology: Spotting bull/bear cycles, avoiding FOMO, and using dollar cost averaging (DCA) strategically.

-

Advanced Transaction Techniques -Layer 2 Solutions: Harnessing the Lightning Network for instant, low cost payments (and earning routing fees). -Replace by Fee (RBF): Speed up stuck transactions by increasing fees. -Taproot and Schnorr Signatures: How Bitcoin’s upgrades improve privacy and scalability.

-

Earning Passive Income with Bitcoin -Lending and Yield: Risks and rewards of platforms like Celsius (post-bankruptcy lessons) and decentralized alternatives. -Bitcoin Mining Pools: Can you still profit as a small miner? We break down the math. -Staking Alternatives: Wrapped Bitcoin (WBTC) in DeFi opportunities and risks.

-

Navigating Regulation and Taxes -Global Tax Compliance: Reporting crypto gains, airdrops, and forks (IRS, HMRC, etc.). -Self custody vs Regulation: How governments are approaching Bitcoin custody laws and privacy tools. -Bitcoin ETFs and Institutions: What BlackRock, Fidelity, and others mean for retail investors.

-

The Future of Bitcoin: What’s Next? -Bitcoin as a Reserve Asset: Nation states adopting BTC (El Salvador, Lugano). -Smart Contracts on Bitcoin: Exploring Rootstock (RSK) and Discreet Log Contracts (DLCs). -Quantum Computing Threats: Separating hype from reality.

Why Follow My Profile? -Weekly Deep Dives: From mining profitability calculators to privacy tool tutorials. -Market Analysis: Bullish catalysts, bearish risks, and how to stay ahead. -Community Q&A: Get your advance bitcion questions answered.

🔔 Follow my profile to unlock Bitcoin 103: Building Wealth in a Decentralized World. Coming soon!

-

-

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08 -

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06 -

@ 5188521b:008eb518

2025-05-20 08:33:09

@ 5188521b:008eb518

2025-05-20 08:33:09This memo intends to brief the federated societies of the galaxy on the status of one specific emerging civilization that has increasingly been of interest to our members, and further, to recommend caution when traveling unannounced nearby their local planet.

External Memo #263 from the Emerging Civilizations Council (ECC)

As you are all aware, it is the intention of our federated societies to isolate any emerging civilization in order to allow them the freedom to evolve and innovate independent of any external knowledge or technology. The benefits of this are twofold. Firstly, if during their scientific exploration and development, they are able to reach our same conclusions about the fundamentals of the universe, then we receive additional independent confirmation of our existing knowledge base. Secondly, and of much greater interest, is that all of our most advanced zero-to-one technological innovations have originated from these isolated civilizations because they are permitted to solve problems without bias from more advanced societies.

In earlier times, some of our members practiced strategic infusions of knowledge into emerging civilizations that would be disguised as native discoveries in order to secretly accelerate their advancement. While this was effective in developing advanced and peaceful civilizations more quickly, it was observed that those societies rarely developed any meaningful new technologies. As we have since learned, once a bias is introduced into an emerging civilization, it is typically destined to only innovate around our existing knowledge base.

More dangerously, societies that become aware of more advanced galactic civilizations almost always become focused on extrasolar power projection. This is an extension of the local evolutionary pressures that led to their domination as the apex predator on their planet. Only after they access the virtually unlimited resources of the galaxy, and they have resolved their internal struggle over distribution of those resources, will they be granted full federation status and interspecies technology transfer can be permitted. Prior to this stage, technology transfer from advanced societies must be avoided, as it can destabilize their development and often leads to the destruction of our most precious galactic resource; independent, decentralized technological innovation.

The dominant intelligent species of the specific civilization that is the focus of this memo identify as “Humans” and collectively inhabit a planet they call “Earth.” The Humans of Earth have yet to discover any advanced technology that would be useful to our members at this time; however, based on a key recent milestone in their development, their status has been upgraded to that of “pre-federation,” making them the leading candidate for our next admission into the galactic federation. As such, it has been estimated that first contact with the Humans of Earth may be possible within the next 1-2 GmRs [1 Galactic micro-Rotation (GmR) equals approximately 200 Earth solar orbits and spans approximately 10 human generations].

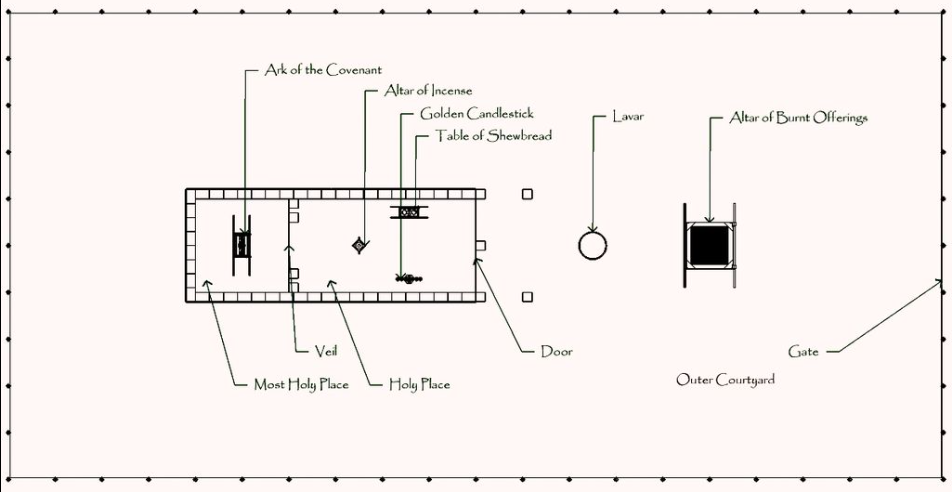

Their recent promotion to pre-federation status is based on their discovery of inviolable absolute scarcity — a key event that was independently reached among all federation members and typically triggers exponential advancement within two to four local generations. As is the case on Earth, inviolable absolute scarcity is virtually always used to develop undiluted intraspecies communication of value (the so-called perfect money). This has shown to be critical for cooperation and advancement among planetary apex predators throughout our galaxy.

The Earth-based discovery centers around a simple massless ledger system that is secured by electric power projection and is rapidly being adopted among the Humans of Earth. As with most apex predators, human trust is extremely difficult to scale across their entire planetary population. However, the new Earth-based monetary system, which they have named “bitcoin,” is quickly gaining the trust of humans as it continues to prove its inviolability. As has been the case among all emerging civilizations since the formation of the ECC, scarcity alone, even absolute scarcity, has never been enough to trigger exponential technological growth. The source of absolute scarcity must also be inviolable, or it will never be sufficiently trusted among a population.

The new currency of Earth is in the process of proving its inviolability by surviving numerous attacks with no meaningful disruption. Notably, even those closest to its discovery attempted to violate the properties of Earth’s initial implementation of absolute scarcity but were unsuccessful. Today it continues to withstand external attacks by those who have the most to lose, as adoption of a true and fair economic communication threatens to expose the opposition’s less productive, less efficient ideas. This, of course, is the specific class that must be disintegrated in order to allow the Humans of Earth to innovate freely and unlock exponential advancement. This same scenario has played out in all of our ancient histories following the discovery of inviolable absolute scarcity.

Because bitcoin has only existed for approximately one half of one human generation, proofs of inviolability have only been apparent to those who are looking the closest into the implications of the new discovery. Unsurprisingly, the humans who are the most inadequately compensated by the previous monetary systems are the first to find the benefits of inviolable absolute scarcity.

The highly anticipated exponential advancement from the now pre-federation Humans of Earth has attracted the interest of many of our members. Note, that at this juncture, the galactic playbook permits members to approach a pre-federation civilization undetected in order to fairly attain small quantities of their local implementation of inviolable absolute scarcity. The purpose of this practice is to allow our members to obtain a compatible and trusted source of compensation to be used in exchange for the first valuable innovations of a pre-federation society in a way that avoids unnecessary exposure to our technology prior to its full federation status.

Fortunately, all members who have taken part in this practice have fairly participated in the securitization of the bitcoin network, contributing small amounts of energy to organize and record transactions onto its independent time-based ledger system called the “Timechain.” Fair participation is critical to establish trust upon first contact.

Further, our members have, thus far, successfully minimized their impact on the new monetary system of Earth. This is important to disguise our existence but will also help gain trust in the future as no member will be seen as having abused its privileged access to overwhelming amounts of energy and computational power. To that end, it is believed that none of our members have collected more than a single payment for their energy contributions; meaning that no member society has more than 50 out of the full supply of 21,000,000 bitcoin (this was originally the smallest attainable payment for this form of fair participation).

The ECC asks that you please continue exercising caution, keeping your contributions to the bitcoin network to an absolute minimum. As a reminder, even a single service payment (currently 6.25 out of the full supply of 21,000,000 bitcoin), will likely be sufficient compensation for any of their innovations following first contact. Once awarded full federation status, Humans of Earth will be permitted to act as a full trading partner and will be eligible for other means of value for value payment.

However, the purpose of this message is not simply to commend our members for following those aspects of the galactic playbook. All federated societies of the galaxy should also be aware that there have recently been an increasing number of atmospheric anomalies detected by the Humans of Earth. Many believe that these anomalies are primarily caused by the influx of near-earth TDEs following their upgrade to pre-federation status [Temporary Distortion Events (TDEs) are a byproduct of most means of galactic travel]. We are, therefore, requesting that all members voluntarily announce their travel coordinates to help ensure that any TDEs in the future are adequately dispersed in space-time to avoid detectable events on Earth.

Although it has been almost 50 GmRs since the last emerging civilization was upgraded to pre-federation status, it is imperative that we maintain the complete isolation of the Humans of Earth at this critical juncture. As stated, if the Humans of Earth begin to suspect the presence of an overwhelmingly advanced species, they are highly likely to skew their innovations towards violent technologies that could destabilize their society and disrupt their potential for future contributions.

Thank you for maintaining our core principles as we begin to prepare for the next member to be admitted into our peaceful, decentralized federation.

End wideband galactic transmission…

This story first appeared in Tales from the Timechain. Support our work and buy a copy here.

79% of the zaps from this story will be passed onto the author, Reed. 21 Futures requests 21% for operating costs.

@nostr:npub1xgyjasdztryl9sg6nfdm2wcj0j3qjs03sq7a0an32pg0lr5l6yaqxhgu7s is a Christian, father of three, husband, bitcoiner, mechanical engineer in the nuclear power industry, science nerd and is passionate about the pursuit of truth. Reed also organized the Western Mass Bitcoin Meetup and is active on bitcoin twitter (@FreedomMoney21) and Nostr (nostrplebs.com/s/reed)

-

@ da0b9bc3:4e30a4a9

2025-05-20 07:11:51

@ da0b9bc3:4e30a4a9

2025-05-20 07:11:51Hello Stackers!

Welcome on into the ~Music Corner of the Saloon!

A place where we Talk Music. Share Tracks. Zap Sats.

So stay a while and listen.

🚨Don't forget to check out the pinned items in the territory homepage! You can always find the latest weeklies there!🚨

🚨Subscribe to the territory to ensure you never miss a post! 🚨

https://stacker.news/items/984377

-

@ d64f3475:8e56b3bf

2025-05-20 07:06:29

@ d64f3475:8e56b3bf

2025-05-20 07:06:29Jo, blomster kommer i alle farger og fasonger. Her har du to eksempler:

-

@ d64f3475:8e56b3bf

2025-05-20 07:06:27

@ d64f3475:8e56b3bf

2025-05-20 07:06:27Skjønner du? Bare tekst.

-

@ d64f3475:8e56b3bf

2025-05-20 07:06:25

@ d64f3475:8e56b3bf

2025-05-20 07:06:25TEST TEST TEST Her kommer bildene:

-

@ cefb08d1:f419beff

2025-05-20 06:59:00

@ cefb08d1:f419beff

2025-05-20 06:59:00https://stacker.news/items/984374

-

@ 58537364:705b4b85

2025-05-20 06:47:23

@ 58537364:705b4b85

2025-05-20 06:47:23อิคิไก (Ikigai) แปลว่า ความหมายของการมีชีวิตอยู่ เหตุผลของการมีชีวิตอยู่ เราเกิดมาเพื่ออะไร ใช้ชีวิตอยู่ไปทำไม เมื่อการงานไม่ใช่สิ่งที่แปลกแยกจากชีวิต

คนญี่ปุ่นเชื่อว่าทุกคนมี ikigai ของตัวเอง ผู้ที่ค้นพบ ikigai จะเจอความหมายและคุณค่าของชีวิต ทำให้มีความสุขกว่า อารมณ์ดีกว่า และมีโลกที่น่าอยู่กว่าด้วย

ปัจจุบัน มีหนังสือเกี่ยวกับอิคิไกออกวางขายเป็นจำนวนมาก แต่เล่มที่คนญี่ปุ่นเป็นคนเขียนเล่มแรกนั้น คือ

- The Little Book of Ikigai : The secret Japanese way to live a happy and long life โดยอาจารย์เคน โมหงิ (แปลภาษาไทยโดย คุณวุฒิชัย กฤษณะประการกิจ)

ตามมาสัมผัสโลกของอิคิไกที่แท้จริงจากนักวิทยาศาสตร์วิจัยด้านสมองชาวญี่ปุ่นคนนี้ ผ่านบทสนทนาที่จะเปลี่ยนความคิดใหม่ที่ว่า 'อิคิไก' เริ่มต้นจากมองหาความสุขเล็กๆ น้อยๆ ในแบบของตัวเราเอง

อาจารย์เคน โมหงิว่า ปู่จิโร่ เชฟซูชิวัย 94 ปี ที่ยังยืนปั้นซูชิให้เราทานอยู่ในทุกวันนี้ เป็นแรงบันดาลใจให้อาจารย์เกิดไอเดียในการเขียนหนังสืออิคิไก

เชฟซูชิที่ ‘ไม่ได้’ เริ่มเลือกงานนี้เพราะความรักหรือความถนัด แต่กลับทุ่มเทปั้นซูชิทุกคำเพื่อให้ลูกค้ามีความสุข… นั่นคือต้นแบบของอิคิไก

น่าแปลกที่คนญี่ปุ่นไม่ค่อยใช้คำว่า ‘อิคิไก’ ในชีวิตประจำวันหรือบทสนทนาทั่วไปเท่าไหร่

เพราะมันเป็นสิ่งที่ปกติและเราทำกันตามธรรมชาติ ในโลกปัจจุบัน เรามักพูดกันว่าทำอย่างไรเราถึงจะประสบความสำเร็จ ทำอย่างไรจะได้เลื่อนตำแหน่ง หากอยากเป็น CEO จะเป็นได้อย่างไร แต่คนญี่ปุ่นมีความคิดว่าความสำเร็จไม่ใช่ทุกอย่างในชีวิต

ยกตัวอย่างเช่นมีคนญี่ปุ่นจำนวนมากที่จริงจังกับงานอดิเรก หรือมี โคดาวาริ* คนอื่นไม่สนหรอกว่างานอดิเรกของคนคนนั้นจะเป็นอะไร ตราบใดที่คนคนนั้นดูมีความสุขดีนั่นก็โอเคแล้ว มีคนจำนวนมากคลั่งไคล้รถไฟ มังงะ (หนังสือการ์ตูน) หรือแอนิเมะ (ภาพยนตร์การ์ตูน) คนเหล่านี้ไม่จำเป็นต้องมีชื่อเสียงหรือได้รับการยอมรับจากสังคม ตราบเท่าที่พวกเขามีความสุขในแบบของเขาเอง มันก็ดีแล้ว

- ความพิถีพิถันใส่ใจในบางเรื่องเป็นพิเศษ เช่น คนที่ชอบเครื่องเขียนมากๆ จะพิถีพิถันในการเลือกปากกา สมุด ดินสอที่ตนเองจะใช้ เพราะฉะนั้น คนที่มีโคดาวาริเหล่านี้จะศึกษาเครื่องเขียนจนถึงที่สุด วิเคราะห์ ทดลอง จนพบว่าเครื่องเขียนแบบใดที่ตนเองหลงใหลที่สุด

อิคิไกของแต่ละคนอาจแตกต่างกัน ต่างคนอาจมีค่านิยมที่ต่างกัน ซึ่งสะท้อนในรูปแบบชีวิตที่แตกต่างกันก็ได้

อิคิไกเป็นเรื่องของความหลากหลายนะ สังคมญี่ปุ่นพยายามผลักดันให้เด็กๆ ทุกคนตามหาอิคิไกของตนเอง เราจะไม่บอกว่า งานนี้เงินดี ทำสิ หรืองานนี้เงินน้อย อย่าไปทำเลย ถ้าคุณถามนักศึกษาว่า พวกเขาอยากทำงานอะไร พวกเขาคงไม่ตอบว่าเลือกทำที่บริษัทนี้เพราะเงินเป็นอันดับแรกหรอก

อิคิไกแตกต่างจากคำว่า ‘ความสำเร็จ’ คนญี่ปุ่นรู้ว่าชีวิตไม่ได้มีแค่เรื่องประสบความสำเร็จ อิคิไกสำคัญกับชีวิตมากกว่า คุณอาจจะประสบความสำเร็จ แต่คุณอาจไม่มีอิคิไก ในทางกลับกัน แม้คุณไม่ประสบความสำเร็จ คุณอาจจะมีอิคิไกก็ได้ ซึ่งชีวิตคุณอาจจะมีความสุขมากกว่า

อาจารย์เคน โมหงินิยามคำว่า ‘ความสำเร็จ’ คือสิ่งที่คุณจะได้รับการยอมรับจากคนในสังคมหรือบริบทสังคมนั้นๆ แต่อิคิไกมาจากหัวใจของคุณ มาจากความสุขส่วนตัวของคุณ คนอื่นอาจจะไม่ได้มองว่านั่นคือความสำเร็จ

อิคิไกเป็นสิ่งที่เฉพาะบุคคล เราสามารถมีความสุขในแบบของเราเอง เราไม่ตัดสินความสุขของคนอื่น และให้เขามีความสุขในแบบของเขาเอง…

สิ่งสำคัญของอิคิไกคือ คุณมีความสุขเล็กๆ น้อยๆ จากเรื่องที่ดูเหมือนเป็นเรื่องเล็กๆ น้อยๆ หรือเปล่า เช่น ตอนเด็กๆ ผมชอบศึกษาเกี่ยวกับผีเสื้อ เวลาผมไปวิ่งออกกำลังกายแล้วเห็นผีเสื้อสวยๆ ผมก็สัมผัสได้ถึงอิคิไก หรือบางทีอาจเกิดขึ้นตอนที่ผมรู้สึกตลกๆ ก็ได้ ผมเห็นเด็กผู้ชายคนหนึ่งบอกพ่อว่า “พ่อๆ ต้องทำอย่างนี้สิ” เวลาผมได้ยินบทสนทนาแบบนี้ ผมก็รู้สึกถึงอิคิไก

หากพวกเราอยากมีอิคิไกบ้าง เราควรเริ่มจากอะไรดี ? เริ่มจากการสัมผัสความสุขจากสิ่งเล็กๆ น้อยๆ ก่อน มันเริ่มทำได้ง่ายที่สุด ในสมองเรามีสารชื่อโดพามีน หากเราทำอะไรสำเร็จเล็กๆ น้อยๆ โดพามีนจะหลั่งออกมา วงจรนั้นจะช่วยทำให้คุณมีความสุข การมีความสุขกับสิ่งเล็กๆ เช่นนี้เป็นเรื่องสำคัญมาก สำหรับหลายคน แนวคิดเรื่องอิคิไกอาจเข้าใจยาก หรือยากสำหรับบางคนที่ชีวิตพวกเขากำลังอยู่ในช่วงยากลำบาก กำลังรู้สึกหมดหวัง ท้อแท้ หรือไม่ได้เคารพตนเอง เพราะฉะนั้น เริ่มจากความสุขเล็กๆ น้อยๆ ก่อนครับ

มันเหมือนการคิดบวกไหม ? อิคิไกเป็นส่วนหนึ่งนะ เวลาเราคิดถึงชีวิต หรือคิดหาวิธีการคิดบวก มันเป็นเรื่องที่ซับซ้อนมาก สำหรับบางคนคำว่า ‘คิดบวก’ อาจฟังดูกดดันสำหรับพวกเขา เพราะฉะนั้น เริ่มจากการมองเห็นความสุขจากสิ่งเล็กๆ น้อยๆ รอบตัว สิ่งเล็กมากๆ เช่นการได้ตื่นมาชงกาแฟดื่ม การได้วิ่งกลางสายฝน

Lesson from Ken Mogi 1. อิคิไก ไม่ใช่การแสวงหาความสำเร็จหรือความร่ำรวย แต่เป็นการรู้สึกหรือสัมผัสถึงความสุขในชีวิตของตนเอง จนทำให้เราเห็นความหมายของชีวิตเราในแบบของเรา 2. อิคิไกไม่ใช่สิ่งที่สังคมนิยามหรือโลกให้ความสำคัญ แต่ละคนมีอิคิไกที่แตกต่างกัน และมีความสุขกับชีวิตในแบบของตนเอง ที่เราเลือกเอง 3. เราไม่ควรตัดสินคนอื่นหรือบีบบังคับคนอื่น เช่น ลูก แฟน ให้ใช้ชีวิตในแบบที่เราคิดว่าใช่ แต่เราควรเคารพความหลากหลายนั้น 4. มองคนที่มีอิคิไกหรือกำลังสนุกกับสิ่งที่พวกเขารักด้วยรอยยิ้ม และคอยช่วยเหลือหากพวกเขาลำบาก 5. อิคิไกมีทั้งระดับใหญ่ ซึ่งเกี่ยวกับแนวทางชีวิตหรือคุณค่าของงาน และอิคิไกระดับเล็กคือการสัมผัสความสุขเล็กๆ น้อยๆ ที่พบเห็นได้ในชีวิตประจำวัน 6. อิคิไก เริ่มต้นจากมองหาความสุขเล็กๆ น้อยๆ ในวันนี้

ที่มา : จากคอลัมน์ Cloud of Thoughts บทสัมภาษณ์ของอ.เกตุวดี Marumura พาไปคุยกับอาจารย์เคน โมหงิ ผู้เขียนหนังสืออิคิไกเล่มแรก!

-

@ 57d1a264:69f1fee1

2025-05-20 06:15:51

@ 57d1a264:69f1fee1

2025-05-20 06:15:51Deliberate (?) trade-offs we make for the sake of output speed.

... By sacrificing depth in my learning, I can produce substantially more work. I’m unsure if I’m at the correct balance between output quantity and depth of learning. This uncertainty is mainly fueled by a sense of urgency due to rapidly improving AI models. I don’t have time to learn everything deeply. I love learning, but given current trends, I want to maximize immediate output. I’m sacrificing some learning in classes for more time doing outside work. From a teacher’s perspective, this is obviously bad, but from my subjective standpoint, it’s unclear.

Finding the balance between learning and productivity. By trade, one cannot be productive in specific areas without first acquire the knowledge to define the processes needed to deliver. Designing the process often come on a try and fail dynamic that force us to learn from previous mistakes.

I found this little journal story fun but also little sad. Vincent's realization, one of us trading his learnings to be more productive, asking what is productivity without quality assurance?

Inevitably, parts of my brain will degenerate and fade away, so I need to consciously decide what I want to preserve or my entire brain will be gone. What skills am I NOT okay with offloading? What do I want to do myself?

Read Vincent's journal https://vvvincent.me/llms-are-making-me-dumber/

https://stacker.news/items/984361

-

@ 98912a0b:c1f46ab6

2025-05-20 07:15:49

@ 98912a0b:c1f46ab6

2025-05-20 07:15:49Jo, blomster kommer i alle farger og fasonger. Her har du to eksempler:

-

@ 57d1a264:69f1fee1

2025-05-20 06:02:26

@ 57d1a264:69f1fee1

2025-05-20 06:02:26Digital Psychology ↗Wall of impact website showcase a collection of success metrics and micro case studies to create a clear, impactful visual of your brand's achievements. It also displays a Wall of love with an abundance of testimonials in one place, letting the sheer volume highlight your brand's popularity and customer satisfaction.

And like these, many others collections like Testimonial mashup that combine multiple testimonials into a fast-paced, engaging reel that highlights key moments of impact in an attention-grabbing format.

Awards and certifications of websites highlighting third-party ratings and verification to signal trust and quality through industry-recognized achievements and standards.

View them all at https://socialproofexamples.com/

https://stacker.news/items/984357

-

@ 98912a0b:c1f46ab6

2025-05-20 07:15:47

@ 98912a0b:c1f46ab6

2025-05-20 07:15:47Skjønner du? Bare tekst.

-

@ 9c9d2765:16f8c2c2

2025-05-20 05:45:33

@ 9c9d2765:16f8c2c2

2025-05-20 05:45:33CHAPTER TWENTY THREE Across town, the Ray estate was drenched in shame. The once-proud family was now the subject of ridicule, their downfall televised, published, and whispered in business circles. Helen stood before a cracked mirror in her bedroom, mascara smudged, lips trembling with fury. The headlines were merciless:

"Heir to JP Empire Humiliated by Ray Family Then Bought Them Out."

"President James: From Rejection to Royalty."

She had lost more than power. She had lost control.

Mark, seated in an armchair with a drink that had gone warm, stared at the wall, his eyes empty. He was a strategist, a manipulator but somehow, he had underestimated James.

"He's just one man…" Mark muttered.

"No," Helen corrected him coldly. "He's not just a man. He’s a symbol now. Of power… of justice… and worst of all, forgiveness."

Mark scoffed. "Forgiveness?"

"Yes," she snapped, spinning to face him. "Because he didn’t destroy us when he could. That makes him look grander than anything we can ever fabricate. He let the world ruin us instead."

There was a long pause.

Then Mark stood, eyes narrow. "We’ll find another way. We always do."

But the fire in his voice had dulled. The Ray family was crippled, their company reduced to a shadow of its former self. Their staff had dwindled, partners severed ties, and their name now stood for arrogance and downfall.

Meanwhile, James had begun the silent restoration of more than just a company he was rebuilding legacies.

Back at JP Enterprises, Rita stepped into James’s office, her presence warm and reassuring.

“You’ve been in here for hours,” she said softly. “Everything alright?”

James looked up, his eyes thoughtful. “Everything is fine. I’m just… reflecting.”

“About them?”

He nodded. “Helen, Mark, Tracy. I know they’re not done. People like them never accept defeat.”

Rita approached, placing a comforting hand on the desk. “Then be ready for their next move. But know that you’re not alone anymore. And you’re no longer the man they thought you were.”

A faint smile curved on his lips. “No. I’m the man they made me become.”

Outside the office, whispers of the upcoming restructuring had already begun. Rumors swirled about James planning to absorb Ray Enterprises entirely into JP Holdings. Some believed he would dismantle it brick by brick. Others hoped he would revive it, proving once again that mercy was strength.

But only James knew his next move.

And as the days passed, the city watched some in admiration, others in dread.

Nightfall settled over the city like velvet, embroidered with the glimmer of a thousand restless lights. From the penthouse office of JP Enterprises, James stood before the floor-to-ceiling windows, his silhouette framed against the horizon. The world below him pulsed with ambition and whispers. Yet his mind wasn’t on the skyline, but on the murky tide still gathering beneath it Mark, Helen, and the crumbling remnants of a fallen dynasty that refused to stay buried.

The public had embraced his rise like a storybook tale. From the ashes of mockery, betrayal, and scorn, he had risen dignified, strategic, and unyielding. News outlets now hailed him as a symbol of resilience, of leadership sharpened by adversity. But James knew that the brightest stars cast the darkest shadows.

Behind the glamour, war drums still beat.

He sat at his desk, opening a sealed file handed to him earlier by his private investigator. Inside were photographs, recordings, and written transcripts irrefutable proof of secret meetings between Helen, Mark, and a few disgruntled former board members of Ray Enterprises. They were not merely planning revenge, they were mobilizing.

A knock interrupted his thoughts. Rita stepped in, poised and composed.

“You asked me to bring the reports on the integration of Ray Enterprises’ satellite branches.”

“Thank you, Rita,” James said, his voice calm but laced with calculation. “Leave them here.”

She lingered. “There’s something else,” she said, her tone more hushed now. “The woman from the anniversary… she’s resurfaced.”

James looked up slowly. “Where?”

“She was seen outside a media house yesterday, trying to set up another exclusive. But word is she's trying to recant her confession. Claims she was ‘coerced’ into blaming Mark and Helen.”

James’s gaze narrowed. “They’re trying to rewrite the narrative.”

Rita nodded. “And if they succeed, they’ll portray you as the one who orchestrated the chaos.”

He exhaled quietly, rising from his seat. “Let them try. The truth is no longer their weapon, it's mine.”

Meanwhile, in a dimly lit lounge across town, Mark and Helen sat opposite a trembling young woman, the same one who once fell to her knees and confessed everything at the anniversary.

“You owe us,” Helen said through clenched teeth. “We gave you the money, we protected you… and you humiliated us in front of the entire city.”

“I was scared,” the woman stammered, eyes darting between them. “Everyone was watching. Mr. JP was furious. What was I supposed to do?”

Mark leaned in, his expression carved from ice. “Fix it.”

“Y-You mean go to the press?”

Helen smiled coldly. “No. We mean bury the damage. Make James look like the one pulling your strings. We’ll give you twice what we paid. You just have to make the world believe he bribed you.”

As the woman hesitated, fear swimming in her gaze, Helen added softly, “Or you disappear.”

The woman’s nod was reluctant, but it was enough.

-

@ fb3d3798:371f711a

2025-05-20 07:13:37

@ fb3d3798:371f711a

2025-05-20 07:13:37Jo, blomster kommer i alle farger og fasonger. Her har du to eksempler:

-

@ 6983717b:0ad20c03

2025-05-20 04:23:13

@ 6983717b:0ad20c03

2025-05-20 04:23:13Zignaly公司深度研究报告

1. 创始人背景及声誉

Zignaly于2018年由三位好友共同创立,分别是CEO Bartolome “Bart” R. Bordallo、CFO Abdul Rafay Gadit和CMO David Rodríguez Coronadobitdegree.org。\ Bart Bordallo 是一位拥有数据驱动思维的创业者和区块链倡导者,他曾在西班牙富士通担任系统管理员长达8年,并创办过多家创业项目(如Hadanet、Innova Medialead等)iq.wiki。2014年他联合创办营销数据分析工具Tractionboard,2017年出任Quickstart Ventures CEO,孵化推出Zignaly和社交媒体工具Jooiceriq.wiki。Bart以善于开拓创新技术闻名,在业内积累了丰富经验和人脉。

Abdul Rafay Gadit 拥有金融背景,毕业于巴基斯坦IBA商学院(2010年获银行与金融学士学位)iq.wiki。他曾在渣打银行任职(2010–2016),后加入家族科技企业并成为巴基斯坦知名科技公司Gaditek的合伙人iq.wiki。2016年起Rafay担任风投公司Disrupt的合伙人和投资主管,并担任多家初创企业顾问iq.wiki。他于2019年参与联合创立Zignaly并出任财务主管,被誉为连续创业者,在巴基斯坦科技圈享有声誉iq.wiki。他的家族及商业背景使他在行业内建立起良好信誉。

David Rodríguez 在B2C和B2B市场营销领域有多年创业和领导经验theorg.com。作为Zignaly联合创始人兼市场总监,他负责全球市场拓展。他曾创立过创业公司Artigoo等,在数字营销和增长策略方面有专长crustdata.com。David毕业于西班牙知名院校(具体背景未详),其在欧洲创业圈口碑良好。

综上,三位创始人结合了技术、金融和营销的互补背景:Bart拥有技术创业经验,Rafay具备金融投资专业和家族企业支持,David深谙市场运营。这样的多元背景为Zignaly奠定了坚实基础,创始团队在区块链社交投资领域拥有较高声誉iq.wikiiq.wiki。

Zignaly团队在2023年Token2049峰会上(迪拜)与合作伙伴DWF Labs合影,展示了创始团队的行业影响力。

Zignaly团队在2023年Token2049峰会上(迪拜)与合作伙伴DWF Labs合影,展示了创始团队的行业影响力。2. 南非数字货币牌照情况

牌照概况:Zignaly已在南非获得加密资产服务提供商牌照,是全球首批持牌的加密社交投资平台之一coindesk.comglobenewswire.com。根据南非《金融咨询与中介服务法》(FAIS)的新规,Zignaly于2024年获授第二类(Category II)“自由裁量型金融服务提供商 (Discretionary FSP)”牌照coindesk.com。该类别相当于传统资管中的基金管理资格,允许Zignaly为用户提供资金托管和自主投资管理服务。

持牌实体与监管:Zignaly的南非牌照由其当地注册实体 Merritt Administrators (Pty) Ltd 名义持有coindesk.com。根据南非金融部门行为监管局(FSCA)登记信息,Merritt Administrators (Pty) Ltd已正式列入授权机构名单coindesk.com。该公司注册号为2013/189063/07,注册地址在南非豪登省约翰内斯堡Rosebank区Hood大道1号zignaly.com。颁发牌照的监管机构正是南非金融行业行为监管局(FSCA),负责加密资产服务提供商的审批和监管。FSCA自2023年6月起受理加密公司牌照申请,并计划至2024年4月共批准约60家企业coindesk.comcoindesk.com。Zignaly与Luno等成为首批获批者,体现出其合规运营能力。

牌照影响:获得南非Category II牌照使Zignaly成为“全球首家持牌社交投资平台”globenewswire.com。Zignaly团队表示为满足严格监管要求投入了6年时间准备,拿证后即可为用户提供自由裁量基金管理和托管服务globenewswire.com。这一里程碑显著增强了平台合法性和用户信心,用户基础随之增长,并为其开发新产品(如去中心化金融DeFi投资)打开大门globenewswire.com。该牌照处于G20国家中少有的先进数字资产监管框架下globenewswire.com。凭借FSCA授权,Zignaly建立了合规背书,有助于其在全球拓展业务并加强监管沟通coindesk.com。

为清晰起见,整理Zignaly相关牌照信息如下:

| 持牌地区 | 持牌实体及注册号 | 牌照类型 | 监管机构 | | -------- | ---------------------------------------------- | -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- | ----------------- | | 南非(2024) | Merritt Administrators Pty Ltd(2013/189063/07) | 加密资产服务提供商牌照:Category II 类金融服务提供商(自由裁量资管)coindesk.com | 南非金融部门行为监管局(FSCA) |

表:Zignaly在南非持有的加密资产相关牌照概览。

3. 南美业务布局及发展状况

主要市场及用户:Zignaly的产品在南美地区具有相当用户基础,覆盖大部分拉美国家市场criptonoticias.com。根据西班牙语媒体报道,Zignaly平台可在阿根廷、哥伦比亚、墨西哥、智利、秘鲁、玻利维亚、巴拿马、乌拉圭、巴拉圭、巴西、危地马拉、哥斯达黎加等主要拉美国家正常访问服务criptonoticias.com。这些国家拥有活跃的加密投资群体,是Zignaly重点拓展的区域。其中巴西是特别重要的市场,用户规模增长迅速。2023年Zignaly(也称“ZIGDAO”)宣布与巴西最大的加密社区之一Criptomaniacos达成战略合作zignaly.medium.com。Zignaly为该社区定制了专属版本(称为“Z-Prime”解决方案),上线后短期内吸引超过5,000名用户,管理资产超250万美元zignaly.medium.com。这一合作为Zignaly在巴西迅速聚拢人气,并计划借助Criptomaniacos超过50万的用户群实现爆发式增长(目标突破百万用户、资产管理规模翻倍)zignaly.medium.com。可见,巴西已成为Zignaly在南美的领军市场之一。

合作伙伴与在地化:Zignaly积极与南美本地加密社群和机构合作,采用共赢模式拓展业务版图。在巴西,通过与Criptomaniacos等头部社区领袖合作,Zignaly快速建立起信任背书和用户基础zignaly.medium.com。此外,Zignaly的去中心化部门ZIGChain亦关注拉美市场机会。2024年12月,ZIGChain与拉美新兴市场金融公链Kiichain签署合作备忘录,共同致力于为拉美真实资产代币化引入全球流动性medium.commedium.com。Kiichain专注于拉美实物资产上链(如房地产、基础设施),此次合作将使Kiichain发行的代币化资产通过ZIGChain生态触达全球投资者medium.commedium.com。这显示Zignaly不仅服务散户投资者,也寻求参与拉美更广阔的金融创新生态。

监管环境与动态:拉美各国对加密业务监管态度不一,Zignaly在该地区主要采取合规经营与规避高风险市场并举的策略。根据其用户协议,Zignaly目前不向部分国家提供服务,包括美国、萨尔瓦多、古巴、委内瑞拉等criptonoticias.com(其中萨尔瓦多虽将比特币定为法币,但Zignaly出于内部政策或风险考虑暂未进入)。这一列表暗示Zignaly在拉美选择了政治经济环境稳定、监管友好的国家运营。像巴西已于2024年初实施加密法案,要求数字资产服务商向中央银行注册。Zignaly与当地社区合作有助于理解并适应监管。不过截至目前,未见Zignaly在南美获得正式牌照的公开报道,运营主要依托其全球牌照(如南非FSCA)和合作伙伴资源。未来若南美国家(如巴西、阿根廷等)推行明确牌照制度,Zignaly可能考虑申请本地牌照或设立合资实体,以巩固合规基础。

总的来说,南美(广义上含拉美地区)已成为Zignaly用户增长和社区运营的要地。巴西是亮点市场,Zignaly通过深耕本地合作获得显著成果zignaly.medium.com。同时,平台在西语圈国家如阿根廷、哥伦比亚、墨西哥等亦有相当渗透率criptonoticias.com。凭借区域化策略和全球合规优势,Zignaly在南美正持续扩张其社交投资版图。

4. 在巴基斯坦的业务及关系

团队渊源: 巴基斯坦与Zignaly关系密切,主要体现在联合创始人Rafay Gadit的背景上。Rafay作为巴基斯坦本土培养的企业家,其家族企业和投资经历为Zignaly奠定了早期基础iq.wiki。他毕业后回国加入了自家科技业务(Gaditek集团)并活跃于本地创业投资圈iq.wiki。Rafay通过Paklaunch等巴基斯坦创业社区结识投资人,并将这些资源引入Zignaly的融资中linkedin.com。据其领英发文透露,Zignaly于2022年获得5000万美元融资时,Paklaunch平台曾帮助团队对接到了关键投资方linkedin.com。由此可见,巴基斯坦创业社区对Zignaly的早期成长有所助力。

本地业务和用户:由于巴基斯坦目前对加密货币交易所持不友好甚至禁止态度(央行曾建议全面禁止加密交易),Zignaly尚未在巴基斯坦开展官方业务或设立办事处。这一点从Zignaly未将巴基斯坦列入支持或排除名单中也可侧面印证(官方服务条款并未提及巴基斯坦,可能是默认不提供)criptonoticias.com。然而,巴基斯坦拥有庞大的散户投资群体,不排除部分用户通过VPN等方式访问Zignaly服务。据报道,Rafay本人积极倡导普惠金融理念,希望通过区块链技术解决金融包容性问题thefounderdaily.comthefounderdaily.com。他曾在访谈中提及,自己的背景让他意识到传统金融体系对普通人的局限,因此创立Zignaly旨在让全球各地的人(包括穆斯林国家民众)都能公平参与财富增值机会thefounderdaily.com。这包含了对巴基斯坦等发展中国家投资者的考虑。因此可以推测,虽然Zignaly未在巴基斯坦公开运营,但创始团队可能借助当地人脉在小范围内推广教育,加深对当地监管的了解。Rafay也有可能通过他的家族企业和人脉(如Gaditek和Paklaunch)向巴基斯坦用户传播Zignaly理念。总的来说,目前Zignaly在巴基斯坦没有官方合作伙伴或直接服务,与当地监管机构亦无公开互动记录。然而,凭借联合创始人的资源,Zignaly在巴基斯坦保持了一定的间接影响力和潜在用户关注度。

监管互动:巴基斯坦尚未建立明确的加密监管框架,大环境不利于Zignaly此类平台落地。本地监管层曾多次警告数字货币交易风险,并封锁过一些交易所的网站。Zignaly为了规避监管风险,选择暂不触碰这一市场也是明智之举。目前未见Zignaly与巴基斯坦国家银行(SBP)或证券监管机构直接沟通的报道。未来若巴基斯坦态度转变,比如引入沙盒监管,Zignaly或将凭借Rafay的关系寻求进入。但就当前而言,Zignaly与巴基斯坦的联系更多体现在人脉和愿景层面,而非实际业务开展。

5. 伊斯兰金融领域的参与程度

Zignaly高度重视伊斯兰金融合规和穆斯林市场的需求,近年积极将清真(Halal)投资原则纳入其产品体系。具体表现在:

-

推出清真合规投资板块:2025年初,Zignaly上线了一个专门的伊斯兰教法合规投资市场,聚焦代币化实物资产(RWA)的投资机会help.zignaly.comhelp.zignaly.com。该板块命名为“Zamanat”,于2025年迪拜ZIGChain峰会上发布,是构建在ZIGChain上的清真RWA投资平台hackernoon.com。Zamanat由专业的伊斯兰金融机构审核把关,每个上线项目均经过伊斯兰教金融专家团队审核,确保符合教法原则(禁止利息利巴和过度投机Gharar等)help.zignaly.com。这一市场专注于房地产、基础设施等真实资产的代币化,使穆斯林投资者能够在不违背信仰的前提下参与高潜力投资help.zignaly.comhackernoon.com。这体现出Zignaly对于道德金融和信仰价值的尊重,旨在吸引全球穆斯林投资群体。

-

专业认证与合作:Zignaly积极寻求知名伊斯兰金融顾问的背书。2025年4月在迪拜举办的ZIGChain峰会上,Zignaly宣布与国际顶尖的伊斯兰金融顾问公司Amanie Advisors建立战略合作chainwire.orgchainwire.org。Amanie Advisors为Zignaly生态中的项目提供教法合规认证。例如,去中心化收益聚合协议Nawa Finance在该峰会上获得了Amanie出具的正式沙里亚合规证书,成为全球首个清真合规的比特币DeFi收益协议chainwire.org。Amanie首席执行官Maya Marissa Malek表示,期待与Zignaly及其合作项目一同推进包容性和合乎道德的金融创新chainwire.org。此外,ZIGChain生态对清真项目的支持也吸引了众多伊斯兰金融领域创业者参与,如Nawa Finance在ZIGChain Summit上获得ZIGLabs、Disrupt等机构投资,加速清真DeFi生态发展chainwire.org。

-

穆斯林国家市场推广:Zignaly选择在迪拜举办大型峰会并发布伊斯兰金融相关产品,凸显对中东穆斯林市场的重视prnewswire.com。迪拜作为伊斯兰金融中心和区块链友好城市,吸引了众多穆斯林投资者与开发者参加ZIGChain Summit(现场超过2000人,包括传统金融的私人银行家、财富管理团队等)hackernoon.com。会上伊斯兰金融主题成为焦点之一(设有“沙里亚、DeFi与普惠财富”专题讨论),探讨Web3如何为穆斯林投资者开拓新机遇hackernoon.com。除了中东,Zignaly对南亚和东南亚穆斯林市场也有所关注。例如印尼、马来西亚拥有大量穆斯林投资者且监管相对开放,Zignaly提供清真选项将有利于进入这些市场。Zignaly联合创始人Rafay来自穆斯林国家,对清真投资理念有亲身认同,他多次强调将道德与技术结合的重要性,以吸引过去因宗教原因观望的投资者群体chainwire.orgchainwire.org。

综上,Zignaly正深入伊斯兰金融领域:不仅在产品上推出符合教法的投资渠道help.zignaly.com,还引入权威机构认证提升可信度chainwire.org。通过在穆斯林聚居地区(如海湾国家)开展市场活动并强调道德投资理念,Zignaly努力成为穆斯林投资者可信赖的加密财富平台。这种战略有助于Zignaly在竞争中差异化,并为数万亿美元规模的全球伊斯兰金融市场服务hackernoon.com。

6. ZigChain项目概况

ZigChain是Zignaly于2024年推出的全新Layer-1区块链项目,旨在打造面向财富管理和去中心化投资的专用公链生态coindesk.com。其主要情况如下:

-

技术架构:ZigChain基于Cosmos SDK构建,是Cosmos网络上的一条独立区块链binance.com。采用Tendermint BFT共识,实现高吞吐和跨链互操作(可与Cosmos生态链通过IBC协议连接)。值得注意的是,ZigChain兼容EVM(以太虚拟机)binance.com。这意味着开发者可以方便地在ZigChain上部署Solidity智能合约,并与以太坊等生态交互。ZigChain内置了Zignaly团队开发的创新财富管理模块,使其区别于普通公链binance.com。该模块汲取了Zignaly平台的投资功能,将专业资管策略直接嵌入区块链底层,实现链上托管和收益分配等逻辑。ZigChain还支持账户抽象等用户体验改进,降低了使用私钥和管理链上资产的门槛binance.com。总体而言,从架构上ZigChain定位为一个专用的去中心化投资基础设施,兼顾了Cosmos的可扩展性和EVM的广泛兼容性。

-

市场定位:ZigChain被称为“财富生成基础设施”,目标是连接专业资管人与普通投资者,桥接传统理财与DeFi世界thefounderdaily.combinance.com。其愿景是在区块链上提供类似传统基金的体验:用户将资金委托给链上的财富经理(即经验丰富的交易员/基金经理),后者通过智能合约策略进行投资操作,用户持有其投资组合份额的代币化凭证hackernoon.com。这种模式让不懂技术或理财的小白用户也能“一键式”参与复杂的DeFi策略或真实资产投资binance.com。ZigChain希望解决其他资产链“有基础设施无需求”的痛点,通过Zignaly现有庞大用户社区提供初始流动性和投资需求binance.com。Zignaly已有60万+注册用户和5万+ ZIG持币用户,为ZigChain带来冷启动优势binance.com。因此,ZigChain定位于下一代财富管理公链,以满足传统高净值产品(如地产、私募基金)在区块链上的发行和投资需求hackernoon.com。它强调自身是解决“代币化房地产缺乏流动性”的方案,通过庞大投资者网络为代币化资产注入买盘需求binance.combinance.com。这一定位差异化了ZigChain,使其不仅是技术平台,更是带有现成用户和资金的流动性层。

-

生态系统组成:ZigChain生态由多个层次构成:

-

基础层:ZigChain区块链本身及其财富管理引擎(WME)。WME提供去中心化资产管理框架,让财富经理发行策略代币、自动复利和调仓等hackernoon.comhackernoon.com。

-

资产层:涵盖各种资产类别,如DeFi收益策略、Real World Assets (RWA)(房地产、票据等现实资产的代币)、游戏资产以及其他创新资产类型binance.com。ZigChain尤其重视RWA,上面提到的Zamanat清真市场即是RWA板块的重要组成hackernoon.com。另有合作伙伴如Kiichain一起丰富RWA品类medium.commedium.com。

-

参与者:由财富经理(专业交易员/机构)、投资者用户以及开发者三方组成。coindesk.comZigChain的独特之处在于引入“财富经理”这一层作为强用户,充当协议和散户之间的桥梁coindesk.com。开发者则可在ZigChain上开发各类dApp,如策略聚合器、数据分析工具等,扩展生态功能。

-

支持机构:ZigChain获得多方战略及资金支持。2024年宣布时即联合DWF Labs、Disrupt.com和UDHC Finance设立了1亿美元生态基金,用于激励开发者在ZigChain上创新iq.wiki。DWF Labs管理合伙人Andrei Grachev公开背书ZigChain模式,称这是前所未有的开发者、财富管理者和用户融合的新尝试iq.wiki。另外,Zignaly内部孵化器ZIGLabs也在投资生态项目,如参与投资了清真DeFi项目Nawa Financechainwire.orgchainwire.org。

-

社区治理:随着ZigChain的发展,Zignaly社区已于2023年转型为ZIGDAOiq.wiki。社区持有人将通过DAO机制参与ZigChain治理和决策。ZIG代币未来可能用于质押验证节点、提案投票等治理功能,从而将社区与链的发展紧密绑定。

-

代币信息:ZigChain的原生代币为ZIG币(ZIG)。ZIG最初于2021年作为ERC-20代币发行,用于赋能Zignaly平台bitdegree.org。ZIG总量约19.54亿枚,目前流通约14.09亿枚,市值在1.3亿美金上下,排名200名开外bitdegree.org。ZIG币在Zignaly/ZigChain生态中有多重用途:

-

平台功能:用户可用ZIG支付服务费用、获得交易手续费折扣和现金返还,以及购买保险NFT等iq.wikibitdegree.org。Zignaly提供了一种保险机制,允许用户用ZIG购买保单,对投资提供10%-100%不等的损失保障bitdegree.org。

-

治理权益:ZIG持有人作为ZIGDAO成员,可对平台升级和未来战略进行投票表决iq.wiki。持币还可提前体验新功能并参与项目空投。

-

奖励与忠诚度:ZIG用作生态激励,例如质押ZIG可获得额外收益,或兑换独家NFT资产等iq.wiki。2023年Zignaly推出AI驱动的新功能时,也曾对ZIG持有者发放独家NFT白名单作为奖励medium.com。

-

跨链和主网角色:随着ZigChain主网推进,ZIG将从ERC-20逐步映射成为ZigChain的主网币,用于支付链上Gas费用、质押节点、跨链桥流动性等。值得注意的是,CoinGecko显示Zignaly已将项目名称更改为“ZIGChain (ZIG)”twitter.com。这暗示ZIG币定位从平台币扩展为公链主网币。

项目进展:ZigChain已于2024年发布测试网并在Token2049等场合展示功能iq.wiki。2025年4月的迪拜峰会宣布主网将于6月上线,同时发布了Zamanat平台和$2500万AI生态基金等消息prnewswire.com(AI基金用于支持基于ZigChain的AI投资项目)。ZigChain Summit聚集了众多投资界人士,反响积极hackernoon.com。可以预期,ZigChain主网在2025年中推出后,将进入生态建设快车道。

总而言之,ZigChain具有清晰的技术架构和差异化定位,融合了传统资管理念与区块链优势。凭借Zignaly既有用户和资金基础,以及雄厚的生态资金支持,ZigChain有望打造出一个围绕财富管理的创新公链生态,在DeFi市场占据一席之地。

7. 币安最大Broker地位及角色分析

币安经纪商计划参与:Zignaly自早期便加入币安Broker(经纪商)计划(现称币安链接伙伴计划),充分利用币安交易所的流动性和基础设施来为其用户提供交易服务criptonoticias.com。作为Broker,Zignaly的用户通过Zignaly界面下单,但实际交易执行和资金托管由币安等交易所完成criptonoticias.com。这意味着用户资产安全由币安保障,并受其SAFU基金保护,且可享用币安深度和撮合引擎zignaly.com。Zignaly通过Broker API对接,实现与币安账户体系的联通,用户无需单独在币安开户即可交易,从而降低了门槛。

最大Broker的地位:截至目前,Zignaly已成为币安生态中规模最大的经纪合作伙伴之一。在币安官方内容和Zignaly资料中,多次提及Zignaly是“币安顶级Broker”,甚至是“最大的币安Broker合作伙伴”zignaly.combinance.com。据Zignaly官方透露,其平台拥有60万+用户,其中约$1.2亿美金的用户资产通过Broker连接到币安等交易所进行交易binance.com。这一AUM(管理资产规模)在币安Broker合作伙伴中名列前茅binance.com。币安方面也将Zignaly列为示范案例之一,认可其为大量散户提供了进入币安市场的渠道zignaly.com。值得注意的是,Zignaly不仅对接币安,还同时是Bybit等交易所的官方Broker合作伙伴medium.com。它支持的交易所包括币安、Bybit、KuCoin、BitMEX、AscendEX等,总计5-6家criptonoticias.commedium.com。在这些中币安交易量最大、用户使用最多criptonoticias.com。因此Zignaly在币安Broker体系内的交易量和用户数应是最高的,这奠定了其“最大Broker”的地位。

角色定位与收益模式:作为币安Broker,Zignaly扮演的是“导流+增值服务提供者”角色。一方面,Zignaly通过其社交投资平台吸引了众多原本不会直接使用交易所的新用户,将其导流至币安的交易深度中进行交易criptonoticias.comcriptonoticias.com。另一方面,Zignaly为用户提供了币安本身没有的复制交易、利润分成等独特功能,提升了用户黏性和交易频率criptonoticias.com。这种分工合作下,币安获得了交易量和用户基数,Zignaly则通过与币安分润交易手续费来实现收益。根据Broker计划,币安会将Zignaly用户交易手续费的一定比例返还给Zignaly作为佣金。此外,Zignaly自己的盈利模式还包括对盈利的跟单投资收取一定成功报酬(Profit Sharing模型)globenewswire.com。但其复制交易服务对用户零前期费用,只有盈利才按比例分成globenewswire.com。这需要有大量交易作为支撑,币安的高流动性恰好满足了这一点。可以说,Zignaly的Broker身份为其盈利模式提供了坚实基础。

交易量与数据:公开数据显示,Zignaly发展初期(2021年上半年)平台交易量已超过20亿美元,AUM约9000万美元reddit.com。如今用户数比当时增长数倍,AUM增至1.2亿以上binance.commedium.com。保守估计目前Zignaly月均交易额已达数十亿美元级别,成为币安不可忽视的流量来源。Zignaly也积极宣传这一成就,以增强投资者和用户信心。例如其Medium博客提到在一年内用户从2万增至50万+、资管规模从数百万增至过亿美元medium.com。币安官方新闻稿和Square动态也多次报道Zignaly的进展,将其列为Broker成功案例zignaly.com。

官方评价:币安和Zignaly官方均对这层合作予以正面评价。Zignaly网站称“币安将我们列为顶级Broker,提升了平台可信度”zignaly.com。币安Broker项目页面则强调,通过Binance Link计划,合作方可利用币安技术和安全体系扩展业务binance.com。对于Zignaly用户而言,与币安的深度合作带来了安全感(资产由全球最大交易所托管)和便利性(无需在多平台频繁转账)criptonoticias.com。这种双赢关系是币安经纪商模式的初衷。Zignaly联合创始人Rafay在领英上也表达了对币安合作的重视,称有幸与顶级伙伴(包括币安)合作使团队更有动力将Zignaly做成全球最大社交投资平台linkedin.com。

简言之,Zignaly确系币安最大的Broker之一。它以社交交易优势为币安带来可观用户和交易量,并借助币安基础设施增强自身服务能力criptonoticias.com。其Broker角色实为币安生态的“前端入口”和“功能延伸”,双方关系密切(见下节),官方场合也经常互相背书这一合作。对于“最大Broker”这一定位,Zignaly通过数据和币安的认可充分证明了自身的行业领先地位binance.com。

8. 在日本的潜在业务布局

当前业务状况:截至目前,没有公开资料显示Zignaly在日本开展了实际业务或设立法律实体。日本对加密交易及相关服务实行严格的牌照制度(需取得金融厅FSA颁发的加密资产交易业者牌照或投资顾问牌照),门槛较高。而Zignaly尚未出现在日本金融厅授权的交易平台名单中。据日媒报道,FSA近期甚至要求下架未注册的海外加密APP以限制日本用户使用境外服务binance.com。Zignaly并未进入日本主流市场,可能基于合规压力选择暂不触及日本用户。其官网的服务条款中常见的禁止地区列表里一般会包括美国和受制裁国家,但并未明确提及日本criptonoticias.com。然而,日本法律规定未注册业者不得向日本居民招揽业务,否则会收到警告。2022-2023年间FSA曾警告多家海外交易所非法向日本用户提供服务binance.com。Zignaly显然希望避免卷入此类合规风险。因此可以推测,Zignaly默示屏蔽了日本市场,至少在没有拿到牌照前不会积极招募日本用户。

潜在布局和计划:尽管目前缺席,日本市场对于Zignaly具有潜在吸引力:日本拥有成熟的零售交易群体和完善的法规环境,若能合规进入,将利于提升品牌可信度和用户质量。Zignaly可能已经在关注日本监管动态,评估进入时机。一种可能途径是在日本寻找本土合作伙伴,比如与持牌金融机构或大型证券公司合作推出受监管的社交交易服务。然而这需要克服文化和产品适配等挑战。另一种路径是等日本明确推出针对社交投资或复制交易的新规,再申请相应牌照。目前日本的金融商品取引法下没有直接针对复制跟单的平台分类,Zignaly若申请,可能需按照“投资顾问/代理业”或“第二种金融商品业务”来办理,流程复杂冗长。此外,从市场测试角度,Zignaly尚未针对日本语系进行本地化,包括网站、客服、社区运营都未见日语内容。这表明短期内他们不打算投入日本市场。

竞争与展望:日本市场已有Bitcopy等本地社交交易服务,以及eToro等平台的间接影响。如果Zignaly进军日本,将面对本土玩家和监管壁垒双重挑战。不过,Zignaly在合规方面已经有南非牌照背书,或许能增加日本监管部门的信任感。Zignaly过去也曾在高度监管环境下运营(如与美国投资者隔离服务),有一定经验。如果未来Zignaly决定进入日本,可能会:

-

成立日本子公司(如“Zignaly Japan KK”)并申请成为注册投资业者。

-

或与当地公司合资,利用后者牌照开展业务,以技术提供方身份出现。

-

同时针对日本用户开发日语界面、符合当地法规的风控措施(例如设置杠杆上限、用户适当性检查等)。

但在这些举措落地前,暂无迹象表明Zignaly已经在日本展开布局。目前可以确认的是,Zignaly未对日本市场进行任何官方宣传或业务拓展。考虑到日本监管渐趋严格,Zignaly短期策略可能是观望为主,把资源集中在东南亚、中东等增长更快且监管宽松的地区。等到条件成熟,再评估进入日本的可行性。总而言之,Zignaly在日本暂未有公开业务或合规进展,未来是否进入取决于监管环境和公司战略调整。

9. 与FTX团队及美系交易所的关系

与FTX团队的历史关系:目前无确凿信息显示Zignaly与已倒闭的FTX交易所或其团队存在直接合作或投资关系。在Zignaly历次融资中,已知主要资方为GEM数字投资基金(来自卢森堡,承诺投资5000万美元)coindesk.com、DWF Labs等,并未出现FTX旗下Alameda Research等的身影coindesk.com。Zignaly的代币ZIG也未曾在FTX交易所上线交易(主要流通于Binance、KuCoin、Kraken等交易所bitdegree.org)。此外,Zignaly创始团队背景与FTX团队并无交集:FTX团队核心在美国和香港,而Zignaly团队在西班牙、巴基斯坦等地。因此可以认定,Zignaly与FTX基本不存在直接联系。唯一可能的间接关联是:两者都曾参与Binance等行业活动,或有过行业交流。但未见任何合作公告或交叉投资记录。FTX于2022年11月爆雷后,Zignaly业务未受明显影响,也印证其未与FTX深度绑定。

与美国系交易所的关系:这里主要指Coinbase、(以及Deribit等衍生品平台)的关联程度:

-

Coinbase:Zignaly没有与Coinbase公布任何官方合作。Coinbase主要面向北美合规市场,而Zignaly由于合规原因不服务美国用户criptonoticias.com。因此Zignaly几乎不可能与Coinbase有用户导流或API对接合作。此外,Coinbase也没有类似币安Broker的外部经纪商计划。Zignaly亦未获得Coinbase Ventures的投资(其融资公告中无Coinbase身影)。因此Zignaly与Coinbase基本没有直接关联。唯一弱关联是ZIG代币曾在2021年申请过Coinbase资产评估名单,但未被上市。此外,Zignaly提供的策略主要在高杠杆币种,而Coinbase产品以现货为主,业务契合度不高。

-

Deribit:Deribit虽以美国团队创立,但注册在欧盟(荷兰)并面向全球提供加密期权和期货交易。Zignaly迄今未集成Deribit作为支持交易所。其支持的衍生品交易所包括BitMEX、Bybit等criptonoticias.com。可能由于Deribit主要提供期权,较为小众,而Zignaly专注于现货和永续合约的跟单交易。在投资或合作层面,也无迹象显示双方有往来。Deribit未出现在Zignaly合作伙伴名单中,Zignaly也未曾宣布支持Deribit的API接入。因此双方关联度很低。

-

其他美系交易所:如Kraken、Gemini等,Zignaly同样无直接合作。ZIG代币虽然在Kraken上线交易bitdegree.org,但这属于Kraken自主上市行为,不代表战略合作。Zignaly没有接入Kraken的交易API作为其平台的一部分,因为Kraken主要服务现货和少量期货,不符合Zignaly用户偏好。Gemini等更无交集。

总结来说,Zignaly与美国阵营的交易所联系甚微。这与Zignaly避开美国市场战略一致,也是对其主要合作伙伴币安的差异化选择。相较之下,Zignaly更倾向于与非美系平台合作(币安、Bybit、KuCoin等亚洲和欧洲平台),一方面规避美国监管风险,另一方面这些平台的产品(高杠杆合约等)更适合Zignaly的跟单盈利模式。对于FTX这样的美国背景公司,Zignaly并未牵涉其中,因而在FTX风波中毫发无损,继续推进自身业务。

10. 与币安的关系分析(“若即若离”)

Zignaly与币安的关系可以用“紧密合作却保持独立”来形容,表面上看似若即若离,实则是一种战略平衡:

合作深度:Zignaly是币安紧密的生态伙伴之一。从2019年起,Zignaly就与币安建立对接,推出针对币安交易的复制交易功能zignaly.com。币安的Broker/Link计划更使双方绑定,Zignaly大量交易在币安体系内完成criptonoticias.com。币安也认可Zignaly为顶级合作方,多次在官方渠道宣传其业绩zignaly.com。技术上,Zignaly深度集成币安API,用户通过Zignaly下单实为在币安撮合criptonoticias.com。安全上,Zignaly用户资产由币安托管,受到币安风控保护criptonoticias.com。可以说,币安为Zignaly提供了交易引擎、流动性、托管、安全等关键支持。如果没有币安,Zignaly无法轻易实现全球服务。因此合作层面,两者关系非常紧密,Zignaly对币安存在一定依赖。

独立性:尽管联系密切,Zignaly仍保持自身的独立运营和战略拓展:

-

多元交易所集成: Zignaly并非只依赖币安一家,它同时对接了多家交易所(Bybit、KuCoin等),以分散风险和覆盖更多市场medium.com。这表明Zignaly不将所有鸡蛋放在一个篮子里,在合作币安的同时也与币安的竞争对手合作。这种多元策略保证了如果币安出现政策变化,Zignaly仍有其他出路。

-

自主生态建设: Zignaly开发了ZIGChain公链和ZIG代币经济,打造自己的去中心化生态iq.wiki。这部分业务(如链上RWA投资、DAO治理等)是在币安体系之外开展的。尤其ZIGChain是一个独立网络,Zignaly藉此拥有了不依赖任何中心化交易所的新赛道。如果ZIGChain生态成功,Zignaly对币安的依赖度将降低,因为部分交易和资产管理可转移到链上进行。

-

资本与治理独立: Zignaly目前并未接受币安Labs或币安直接投资,其主要股东是第三方基金(如GEM)和创始团队。币安在Zignaly没有股权,这意味着Zignaly在公司治理上不受币安直接控制。双方是合作伙伴关系而非母子公司关系。这给了Zignaly在决策上更大自主空间,可以根据自身利益选择业务方向,而不必完全听命于币安。

-

品牌和社区: Zignaly经营着自己的品牌和用户社区(ZIGDAO),并未被币安品牌所吞没。用户普遍认识Zignaly作为独立平台,而非币安的子平台。这种品牌独立性也体现双方保持一定距离。Zignaly甚至在某些场合与币安竞争,例如它的利润分享模式理论上和币安的理财产品存在替代关系。但由于定位不同,币安默许了Zignaly的存在。

“若即若离”的表现:这种关系既有亲密合作的一面,也有保持距离的一面:

-

亲密体现在日常运营和战略协同上——币安为Zignaly赋能,Zignaly为币安导流,互惠互利binance.com。双方高层可能定期沟通,比如在行业会议或Broker大会上交流经验。币安也从Zignaly获取社交交易领域的数据和洞见。

-

保持距离体现在Zignaly不断拓展币安之外的新领域,比如支持币安竞争对手Bybit,发行自己代币并上其他交易所(Kraken等)bitdegree.org。币安则对Zignaly采取开放态度,但并未将其收购或纳入子公司体系。这可能是出于合规或资源考虑,也反映币安对这种松散合作模式的认可。

风险与依赖程度:尽管Zignaly努力独立,但对币安的依赖仍不可忽视。币安交易量占Zignaly大头,一旦币安遭遇风险(如监管打压、停业等),Zignaly业务将受冲击。不过Zignaly的多交易所策略和链上业务可部分缓解这种风险。此外,币安若改变Broker政策(例如降低佣金比例或收紧用户管控),也可能影响Zignaly收益。这种不确定性让Zignaly对币安既依赖又审慎,从而保持若即若离的姿态。

战略定位:对币安来说,Zignaly是拓展社交投资领域的战略伙伴,但不是唯一伙伴(币安还有其他Broker合作)。币安希望Zignaly成功又不会大到威胁自身。所以币安支持Zignaly但保持一定边界,不给予独占特权。对Zignaly而言,币安是基础设施提供者而非最终目的地。Zignaly借力币安成长,同时构筑自己的护城河(社区+公链)。这种伙伴关系类似“平台+应用”的生态纽带:币安提供平台,Zignaly作为应用丰富了平台场景。双方都从合作中获益,但也都为自己预留了退出和转圜的空间。

综上,Zignaly与币安的关系紧密合作却又保持独立,被用户形容为“若即若离”实属恰当。它们既相互依存,又各自发展:Zignaly深度依赖币安的交易生态来服务其50万+用户medium.com,同时通过多元化策略降低对单一平台的束缚。币安则愿意共享部分资源给Zignaly,但不直接将其收编,以保持生态开放性和灵活性。这种微妙平衡使得双方在快速变化的加密行业中都能进退自如。正如一份币安Square分析所称:“Zignaly连接全球50万用户和150多位资管人,币安与Bybit皆将其视为顶级Broker伙伴”binance.com。这种定位体现了Zignaly在头部交易所眼中的价值,也解释了双方若即若离、松耦合但高协同的关系本质。

参考资料:

-

Zignaly创始团队及公司简介bitdegree.orgiq.wiki

-

Zignaly获得南非FSCA二类牌照的报道coindesk.comglobenewswire.com

-

Zignaly在拉美市场(巴西)合作的官方披露zignaly.medium.com

-

Zignaly伊斯兰金融合规及Zamanat平台介绍help.zignaly.comhackernoon.com

-

ZigChain发布和技术架构详情coindesk.combinance.com

-

Zignaly为币安最大Broker的官方说法binance.commedium.com

-

关于Zignaly在日本暂无业务的推断criptonoticias.combinance.com

-

Zignaly与FTX无关联及与美系交易所关系分析bitdegree.orgreddit.com

-

币安与Zignaly合作关系的综述criptonoticias.comzignaly.com

-

-

@ fb3d3798:371f711a

2025-05-20 07:13:35

@ fb3d3798:371f711a

2025-05-20 07:13:35Skjønner du? Bare tekst.

-

@ 04ce30c2:59ea576a

2025-05-20 04:19:25

@ 04ce30c2:59ea576a

2025-05-20 04:19:25Em uma sociedade verdadeiramente livre, o indivíduo tem o direito de escolher como guardar e transferir valor. Isso inclui a liberdade de escolher qual moeda usar, sem coerção, monopólios ou imposições estatais. A concorrência entre moedas permite que as melhores propriedades monetárias prevaleçam de forma natural e voluntária.

Moeda imposta é controle

Quando uma única moeda é forçada por lei, seja por decreto estatal ou por exigências institucionais, o usuário perde a soberania sobre seu próprio patrimônio. Isso abre espaço para inflação arbitrária, bloqueios de transações, congelamento de fundos e vigilância massiva.

Concorrência monetária é essencial

A liberdade monetária implica a coexistência de várias moedas competindo entre si. Cada uma traz suas características e vantagens específicas. A escolha deve estar nas mãos do usuário, não em autoridades centralizadas.

A melhor moeda tende a se tornar o padrão

No longo prazo, a moeda com melhores propriedades monetárias, como previsibilidade, descentralização, auditabilidade e liquidez, tende a ser adotada como padrão de referência para precificação, poupança e comércio global.

O Bitcoin é a moeda mais forte nesse sentido. Mas isso não impede que outras moedas coexistam como ferramentas complementares em contextos específicos.

Conversão é liberdade

Se o usuário quiser por exemplo mais privacidade ao comprar um café ou pagar uma conta, ele pode facilmente trocar seus bitcoins por monero e usá-los conforme sua necessidade. A possibilidade de trocar entre moedas é parte essencial da liberdade financeira.

Uma sociedade livre permite a escolha. O padrão monetário deve emergir do consenso do mercado, não de imposições. Que o Bitcoin se torne o padrão não por decreto, mas por mérito. E que outras moedas existam para servir à liberdade individual em toda sua complexidade.

-

@ 7953d1fa:69c8039d

2025-05-20 02:39:56

@ 7953d1fa:69c8039d

2025-05-20 02:39:56No mundo digital em constante evolução, plataformas de entretenimento online vêm ganhando espaço entre os brasileiros que buscam diversão, emoção e recompensas. Uma das opções que tem se destacado recentemente é a KK999, uma plataforma moderna, segura e repleta de oportunidades para jogadores de todos os níveis. Com uma ampla gama de jogos envolventes e uma experiência de usuário otimizada, o KK999 está conquistando cada vez mais adeptos no Brasil.

Introdução à Plataforma KK999 O KK999 se diferencia por oferecer uma experiência completa e intuitiva desde o primeiro acesso. A interface da plataforma foi cuidadosamente projetada para ser amigável, permitindo que novos usuários se cadastrem rapidamente e naveguem com facilidade. Tudo é pensado para garantir que o jogador tenha uma experiência fluida, sem complicações e com total transparência.

Além disso, o kk999se destaca por sua forte infraestrutura de segurança. Utilizando tecnologia de criptografia de ponta, os dados dos usuários são protegidos em todas as transações, garantindo tranquilidade para quem deseja apenas se divertir. Outro ponto importante é o suporte ao cliente, que está disponível 24 horas por dia, com atendimento em português, pronto para auxiliar com qualquer dúvida ou necessidade.

Variedade de Jogos para Todos os Gostos Um dos grandes atrativos do KK999 é a impressionante variedade de jogos disponíveis. Desde os tradicionais jogos de cartas até opções modernas com gráficos avançados, a plataforma atende todos os estilos de jogadores. Entre os destaques, estão as famosas roletas virtuais, jogos de pesca interativa, slot machines com temas variados e jogos ao vivo que simulam a sensação de estar em uma sala de jogos física.

Os slots, por exemplo, são um sucesso entre os brasileiros, oferecendo desde títulos clássicos com frutas e números até aventuras temáticas com bônus emocionantes. Os jogos de cartas também têm grande popularidade, incluindo versões modernas de pôquer, bacará e outros jogos estratégicos que desafiam a mente do jogador.

Para quem gosta de competir em tempo real, o KK999 oferece jogos ao vivo com crupiês reais e interatividade instantânea, proporcionando uma experiência imersiva e cheia de adrenalina. Tudo isso com transmissões de alta qualidade e conexão estável.

Experiência do Jogador: Diversão e Confiabilidade A experiência do jogador é uma das maiores prioridades do KK999. Desde o primeiro cadastro até as jogadas mais avançadas, a plataforma investe em funcionalidades que aumentam o conforto e a confiança do usuário. A navegação é rápida, os jogos carregam com eficiência e as recompensas são distribuídas com agilidade.

Outro fator que atrai muitos jogadores é o sistema de bônus e promoções. O KK999 frequentemente disponibiliza ofertas especiais para novos membros e prêmios para usuários frequentes, incentivando a fidelidade e aumentando ainda mais as chances de ganhar.

Além disso, o KK999 oferece uma experiência totalmente otimizada para dispositivos móveis. Seja no celular ou tablet, o jogador pode acessar todos os recursos da plataforma de qualquer lugar, a qualquer momento, sem perder desempenho ou qualidade.

Conclusão O KK999 se consolida como uma das principais plataformas de entretenimento digital no Brasil, reunindo inovação, segurança e uma variedade impressionante de jogos. Ideal tanto para iniciantes quanto para jogadores experientes, o site oferece tudo o que é necessário para transformar momentos comuns em experiências emocionantes.

-

@ 8b4456a7:ba913035

2025-05-20 07:10:58

@ 8b4456a7:ba913035

2025-05-20 07:10:58Jo, blomster kommer i alle farger og fasonger. Her har du to eksempler:

-

@ 7953d1fa:69c8039d

2025-05-20 02:39:23

@ 7953d1fa:69c8039d

2025-05-20 02:39:23O cenário do entretenimento online no Brasil vem evoluindo rapidamente, e uma das plataformas que mais se destaca atualmente é a 8CC. Com uma proposta moderna, intuitiva e voltada para a melhor experiência do usuário, a 8CC conquistou a confiança de milhares de jogadores que buscam diversão, praticidade e oportunidades de ganhos reais em um ambiente seguro.

Conhecendo a Plataforma 8CC A 8CC é uma plataforma digital desenvolvida para atender tanto iniciantes quanto jogadores experientes. Sua interface amigável e bem organizada facilita a navegação mesmo para quem nunca teve contato com esse tipo de entretenimento antes. Compatível com computadores, tablets e celulares, o site é totalmente responsivo, o que significa que você pode se divertir de qualquer lugar, a qualquer hora.

Um dos diferenciais da 8cc é o seu compromisso com a segurança dos usuários. A plataforma utiliza tecnologia de criptografia de ponta para garantir a proteção de dados pessoais e transações financeiras. Além disso, o suporte ao cliente está sempre disponível para tirar dúvidas, resolver problemas e oferecer o melhor atendimento possível.

Diversidade de Jogos para Todos os Gostos Na 8CC, os jogadores têm acesso a uma vasta seleção de jogos online, desenvolvidos pelos principais provedores do mercado internacional. Isso garante alta qualidade gráfica, mecânicas inovadoras e excelente desempenho.

Entre os jogos mais populares da plataforma estão:

Slots (caça-níqueis): com temas variados, rodadas bônus e jackpots progressivos que proporcionam grandes emoções.

Jogos de mesa clássicos: como roleta, blackjack e bacará, com versões que imitam perfeitamente a experiência de jogo ao vivo.

Jogos com crupiês em tempo real: transmitidos com qualidade HD, esses jogos trazem interatividade e realismo, permitindo que o jogador se sinta dentro de um ambiente físico de alto padrão.

A plataforma também disponibiliza jogos de habilidade e apostas esportivas ao vivo, oferecendo uma experiência ainda mais completa e personalizada de acordo com o perfil de cada usuário.

Experiência do Jogador na 8CC Quem já experimentou jogar na 8CC sabe o quanto a plataforma valoriza o conforto e a satisfação de seus usuários. Desde o momento do cadastro até o resgate de ganhos, tudo é feito de forma simples, rápida e segura. O processo de registro é intuitivo, exigindo apenas alguns dados básicos, e os métodos de pagamento são variados, aceitando transferências bancárias, carteiras digitais e até criptomoedas.

Outro destaque é o sistema de recompensas e promoções. A 8CC frequentemente oferece bônus de boas-vindas, rodadas grátis e campanhas especiais para usuários fiéis, o que aumenta ainda mais as chances de ganhar e prolonga a diversão. Além disso, a plataforma promove torneios e desafios semanais com prêmios atrativos, incentivando a competição saudável entre os jogadores.

Por Que Escolher a 8CC? Existem muitas razões para escolher a 8CC como sua principal plataforma de jogos online:

Confiabilidade e segurança em todas as operações;

Variedade de jogos para todos os perfis;

Interface moderna e de fácil navegação;

Promoções e bônus frequentes;

Atendimento ao cliente eficiente e disponível 24 horas.

Se você busca uma experiência diferenciada, com diversão garantida e a possibilidade de transformar seu tempo livre em momentos empolgantes, a 8CC é a escolha certa. Descubra agora mesmo tudo o que essa plataforma inovadora tem a oferecer e junte-se à comunidade que está revolucionando o entretenimento digital no Brasil.

-

@ 472f440f:5669301e

2025-05-20 02:00:54

@ 472f440f:5669301e

2025-05-20 02:00:54Marty's Bent

https://www.youtube.com/watch?v=p0Sj1sG05VQ

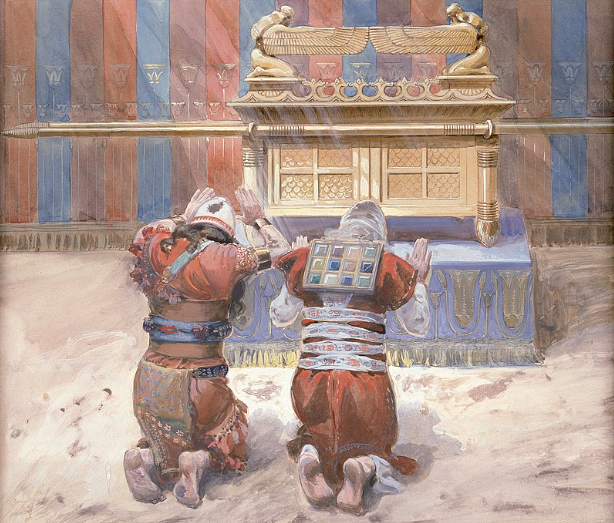

Here's a great presentation from our good friend nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpp4mhxue69uhkummn9ekx7mqqyz2hj3zg2g3pqwxuhg69zgjhke4pcmjmmdpnndnefqndgqjt8exwj6ee8v7 , President of The Nakamoto Institute titled Hodl for Good. He gave it earlier this year at the BitBlockBoom Conference, and I think it's something everyone reading this should take 25 minutes to watch. Especially if you find yourself wondering whether or not it's a good idea to spend bitcoin at any given point in time. Michael gives an incredible Austrian Economics 101 lesson on the importance of lowering one's time preference and fully understanding the importance of hodling bitcoin. For the uninitiated, it may seem that the hodl meme is nothing more than a call to hoard bitcoins in hopes of getting rich eventually. However, as Michael points out, there's layers to the hodl meme and the good that hodling can bring individuals and the economy overall.

The first thing one needs to do to better understand the hodl meme is to completely flip the framing that is typically thrust on bitcoiners who encourage others to hodl. Instead of ceding that hodling is a greedy or selfish action, remind people that hodling, or better known as saving, is the foundation of capital formation, from which all productive and efficient economic activity stems. Number go up technology is great and it really matters. It matters because it enables anybody leveraging that technology to accumulate capital that can then be allocated toward productive endeavors that bring value to the individual who creates them and the individual who buys them.

When one internalizes this, it enables them to turn to personal praxis and focus on minimizing present consumption while thinking of ways to maximize long-term value creation. Live below your means, stack sats, and use the time that you're buying to think about things that you want in the future. By lowering your time preference and saving in a harder money you will have the luxury of demanding higher quality goods in the future. Another way of saying this is that you will be able to reshape production by voting with your sats. Initially when you hold them off the market by saving them - signaling that the market doesn't have goods worthy of your sats - and ultimately by redeploying them into the market when you find higher quality goods that meet the standards desire.

The first part of this equation is extremely important because it sends a signal to producers that they need to increase the quality of their work. As more and more individuals decide to use bitcoin as their savings technology, the signal gets stronger. And over many cycles we should begin to see low quality cheap goods exit the market in favor of higher quality goods that provide more value and lasts longer and, therefore, make it easier for an individual to depart with their hard-earned and hard-saved sats. This is only but one aspect that Michael tries to imbue throughout his presentation.

The other is the ability to buy yourself leisure time when you lower your time preference and save more than you spend. When your savings hit a critical tipping point that gives you the luxury to sit back and experience true leisure, which Michael explains is not idleness, but the contemplative space to study, create art, refine taste, and to find what "better goods" actually are. Those who can experience true leisure while reaping the benefits of saving in a hard asset that is increasing in purchasing power significantly over the long term are those who build truly great things. Things that outlast those who build them. Great art, great monuments, great institutions were all built by men who were afforded the time to experience leisure. Partly because they were leveraging hard money as their savings and the place they stored the profits reaped from their entrepreneurial endeavors.

If you squint and look into the future a couple of decades, it isn't hard to see a reality like this manifesting. As more people begin to save in Bitcoin, the forces of supply and demand will continue to come into play. There will only ever be 21 million bitcoin, there are around 8 billion people on this planet, and as more of those 8 billion individuals decide that bitcoin is the best savings vehicle, the price of bitcoin will rise.

When the price of bitcoin rises, it makes all other goods cheaper in bitcoin terms and, again, expands the entrepreneurial opportunity. The best part about this feedback loop is that even non-holders of bitcoin benefit through higher real wages and faster tech diffusion. The individuals and business owners who decide to hodl bitcoin will bring these benefits to the world whether you decide to use bitcoin or not.

This is why it is virtuous to hodl bitcoin. The potential for good things to manifest throughout the world increase when more individuals decide to hodl bitcoin. And as Michael very eloquently points out, this does not mean that people will not spend their bitcoin. It simply means that they have standards for the things that they will spend their bitcoin on. And those standards are higher than most who are fully engrossed in the high velocity trash economy have today.

In my opinion, one of those higher causes worthy of a sats donation is nostr:nprofile1qyfhwumn8ghj7enjv4jhyetvv9uju7re0gq3uamnwvaz7tmfdemxjmrvv9nk2tt0w468v6tvd3skwefwvdhk6qpqwzc9lz2f40azl98shkjewx3pywg5e5alwqxg09ew2mdyeey0c2rqcfecft . Consider donating so they can preserve and disseminate vital information about bitcoin and its foundations.

The Shell Game: How Health Narratives May Distract from Vaccine Risks

In our recent podcast, Dr. Jack Kruse presented a concerning theory about public health messaging. He argues that figures like Casey and Callie Means are promoting food and exercise narratives as a deliberate distraction from urgent vaccine issues. While no one disputes healthy eating matters, Dr. Kruse insists that focusing on "Froot Loops and Red Dye" diverts attention from what he sees as immediate dangers of mRNA vaccines, particularly for children.

"It's gonna take you 50 years to die from processed food. But the messenger jab can drop you like Damar Hamlin." - Dr Jack Kruse

Dr. Kruse emphasized that approximately 25,000 children per month are still receiving COVID vaccines despite concerns, with 3 million doses administered since Trump's election. This "shell game," as he describes it, allows vaccines to remain on childhood schedules while public attention fixates on less immediate health threats. As host, I believe this pattern deserves our heightened scrutiny given the potential stakes for our children's wellbeing.

Check out the full podcast here for more on Big Pharma's alleged bioweapons program, the "Time Bank Account" concept, and how Bitcoin principles apply to health sovereignty.

Headlines of the Day

Aussie Judge: Bitcoin is Money, Possibly CGT-Exempt - via X

JPMorgan to Let Clients Buy Bitcoin Without Direct Custody - via X

Get our new STACK SATS hat - via tftcmerch.io

Mubadala Acquires 384,239 sats | $408.50M Stake in BlackRock Bitcoin ETF - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I've been walking from my house around Town Lake in Austin in the mornings and taking calls on the walk. Big fan of a walking call.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 6e0ea5d6:0327f353

2025-05-20 01:35:20

@ 6e0ea5d6:0327f353

2025-05-20 01:35:20**Ascolta bene! ** A man's sentimental longing, though often disguised in noble language and imagination, is a sickness—not a virtue.

It begins as a slight inclination toward tenderness, cloaked in sweetness. Then it reveals itself as a masked addiction: a constant need to be seen by a woman, validated by her, and reciprocated—as if someone else's affection were the only anchor preventing the shipwreck of his emotions.

The man who understands the weight of leadership seeks no applause, no gratitude, not even romantic love. He knows that his role is not theatrical but structural. He is not measured by the emotion he evokes, but by the stability he ensures. Being a true man is not ornamental. He is not a decorative symbol in the family frame.

We live in an era where male roles have been distorted by an overindulgence in emotion. The man stopped guiding and began asking for direction. His firmness was exchanged for softness, his decisiveness for hesitation. Trying to please, many have given up authority. Trying to love, they’ve begun to bow. A man who begs for validation within his own home is not a leader—he is a guest. And when the patriarch has to ask for a seat at the table he should preside over and sustain, something has already been irreversibly inverted.

Unexamined longing turns into pleading. And all begging is the antechamber of humiliation. A man who never learned to cultivate dignified solitude will inevitably fall to his knees in desperation. And then, he yields. Yields to mediocre presence, to shallow affection, to constant disrespect. He smiles while he bleeds, praises the one who despises him, accepts crumbs and pretends it’s a banquet. All of it, cazzo... just to avoid the horror of being alone.

Davvero, amico mio, for the men who beg for romance, only the consolation of being remembered will remain—not with respect, but with pity and disgust.

The modern world feeds the fragile with illusions, but reality spits them out. Sentimental longing is now celebrated as sensitivity. But every man who nurtures it as an excuse will, sooner or later, pay for it with his dignity.

Thank you for reading, my friend!

If this message resonated with you, consider leaving your "🥃" as a token of appreciation.

A toast to our family!

-

@ 8b4456a7:ba913035

2025-05-20 07:10:56

@ 8b4456a7:ba913035

2025-05-20 07:10:56Skjønner du? Bare tekst.

-

@ 502ab02a:a2860397