-

@ 000002de:c05780a7

2025-05-21 20:00:21

@ 000002de:c05780a7

2025-05-21 20:00:21I enjoy Jonathan Pageau's perspectives from time to time. He is big on myth and symbolic signs in culture and history. I find this stuff fascinating as well. I watched this video last week, and based on the title, I was thinking... hmm, I wonder if it is a review of Return of the Strong Gods. It wasn't, but it really flows with the thesis of that book. You should read it if you haven't, and before you do, go check out @SimpleStacker's review of it.

Pageau starts the video by talking about the concept of "watching the clown." He uses Ye as the clown. Ye has been a leading indicator in the past when he publicly claimed he was a Christian and began making music and holding church services. Now he's going "off the rails" seemingly with his Hitler songs and art. Clearly, the stigma of Hitler will not last forever. It's hard for us to realize this. At least for someone of my age, but Pageau points out that eventually, the villains of history become less of a stand-in for Satan and more of a purely historical figure. He mentions Alexander the Great as a man who did incredibly evil things, but today we just read about him in school and don't really think about it too much. One day, that will be the way Hitler is viewed. Sure, evil, but the power of using him as the mythical Satan will wane.

The most interesting point I took away from this video, though, was that the post-war consensus was built on a dark secret. Now, it's not a secret to me, but at some point, it was. And this secret is a deep flaw in the current state of the West that keeps affecting us in negative ways. The secret is that in order to defeat Hitler and the Nazis, the West allied itself with the Soviets. Stalin. An incredibly evil man and an ideology that has led to the death and suffering of more humans than the Nazis. This is just a fact, but it's so dark that we don't talk about it.

For many years as I began to study Communism and the Soviet Union I began to question why on earth did the allies align themselves with Stalin. Obviously it was for stratigic reasons. I get it. But the fact that this topic is not really discussed in our culture has had a dark effect. Now, I'm not interested in figuring out if Stalin was more evil than Hitler or if Fascism is worse that Communism. I think this misses the point. The point is that today if soneone has Nazi symbols it is very likely not gonna go well for them but Communist symbols are usually just fine. We see the ideas of Socialism discussed openly without concern. Its popular even. Fascism on the other hand is always (until recently) masked at best.

Today we are seeing more and more people openly talk about this reality, and it is a signal that the WW2 consensus is breaking. As people age out and our collective memory fades, this lie will become more visible because the mythical view of Hitler will fade. This will allow people to be more objective about viewing the decisions of the past. I don't recall the book discussing this directly, but it is an interesting connection for sure.

I recommend watching The World War II Consensus is Breaking Down by Jonathan Pageau.

https://stacker.news/items/985962

-

@ 000002de:c05780a7

2025-05-21 17:42:27

@ 000002de:c05780a7

2025-05-21 17:42:27I've been trying out Arch Linux again and the thing that always surprises me is pacman. The way it works seems so unintuitive to me coming from the apt, yum, and dnf worlds.

I know I will get it and it will become internalized but I just wonder what the designer was thinking when making the flags/commands.

https://stacker.news/items/985808

-

@ 000002de:c05780a7

2025-05-21 17:27:46

@ 000002de:c05780a7

2025-05-21 17:27:46I completely missed this until yesterday. I was listening to our local news talk station and it came up. They had some people that were pretty knowledgeable about prostate cancer on. They talked about other presidents being tested while in office for it. They came to conclusion that it is possible that Biden wasn't having his PSA checked. This is pretty normal for a old dude his age. But it is not normal for a President his age.

My thought is much simpler.

We know his doctors, the media, and his admin were lying about his health when he was in office. Hello! Anyone paying attention and not invested in his regime knew he was declining mentally in front of our very eyes. They covered for him over and over again. Only those that don't pay attention or discounted his critics completely was surprised by his debate performance.

To be clear though, Biden is far from the first president to do this. Wilson, FDR, Kennedy, and Reagan all had issues and they were kept from the public. If we learned these things in school we might actually have a public that thinks critically once and a while.

So, with that in mind do you really think the regime would not withhold medical info about this cancer? Come on. Don't be naive. He clearly was not in charge 100% of the time while in office and the regime wanted to maintain power. Sharing that he had prostate cancer would not be on the menu.

Politics is like a drug that numbs the brain. Because people don't like one party or person they retard their thinking. Its the same thing as happens in sports. Fans of one team see the same play completely differently from the other team's fans. Politics and the investment into parties kills most people's objectivity.

I don't trust liars. It honestly blows my mind how trusting people can be of professional liars. Both parties are full of liars. Trump is a liar and those opposing him are liars. We are drowning in lies. You can vote for a lessor of two evils but never forget what they are.

https://stacker.news/items/985791

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ da8b7de1:c0164aee

2025-05-21 15:59:12

@ da8b7de1:c0164aee

2025-05-21 15:59:12Blykalla svéd fejlesztő következő tőkebevonási köre augusztus végéig

A svéd Blykalla, amely fejlett ólom-hűtésű gyorsreaktorokat (SEALER) fejleszt, augusztus végéig tervezi következő tőkebevonási körét. A vállalat nemrég 7,3 millió dolláros befektetést szerzett, amellyel összesen már 20 millió dollárnyi forrást gyűjtött össze. A SEALER technológia jelentősen hatékonyabb üzemanyag-felhasználást ígér, akár 140-szeres hatékonysággal a hagyományos könnyűvizes reaktorokhoz képest. Az első két reaktort Svédországban tervezik megépíteni, de már ukrán és más európai, valamint kanadai partnerekkel is tárgyalnak. A következő lépés a tesztreaktor megépítése és az engedélyezési folyamat elindítása, amelyet 2025-re terveznek lezárni. A vállalat célja, hogy technológiai szolgáltatóként jelenjen meg, nem pedig üzemeltetőként[2].

Amerikai szenátorok törvényjavaslata Kína és Oroszország nukleáris befolyása ellen

Amerikai republikánus és demokrata szenátorok közösen nyújtottak be törvényjavaslatot, amelynek célja Kína és Oroszország növekvő nemzetközi nukleáris befolyásának visszaszorítása. Az International Nuclear Energy Act egy új hivatalt hozna létre, amely a nukleáris exportot, finanszírozást és szabályozási szabványosítást erősítené. A törvényjavaslat egy alapot is létrehozna a nemzetbiztonság szempontjából fontos projektek finanszírozására, valamint kétévente kabinet szintű egyeztetést írna elő a nukleáris biztonságról és ipar-politikai kérdésekről. A kezdeményezés hátterében az elektromos áram iránti várható keresletnövekedés és a szektor stratégiai jelentősége áll[3].

India 49%-os külföldi tulajdon engedélyezését fontolgatja a nukleáris szektorban

India fontolgatja, hogy akár 49%-os külföldi tulajdont is engedélyezzen atomerőműveiben, hogy elérje ambiciózus nukleáris kapacitásbővítési céljait és csökkentse szén-dioxid-kibocsátását. Jelenleg a külföldi befektetők számára tilos az atomerőművekben való tulajdonszerzés, de a kormány tervezi a szabályozás lazítását, beleértve a nukleáris felelősségi törvények enyhítését is. A cél az, hogy 2047-re 12-ről 100 gigawattra növeljék az ország nukleáris kapacitását. Bármilyen külföldi befektetéshez továbbra is kormányzati jóváhagyás szükséges lenne[4].

NRC: végleges környezeti jelentés a Summer-1 engedélymegújításáról

Az amerikai Nukleáris Szabályozási Bizottság (NRC) közzétette a Summer-1 atomerőmű engedélymegújításához kapcsolódó végleges környezeti hatástanulmányát. A jelentés szerint nincs olyan jelentős környezeti hatás, amely akadályozná a 966 MWe teljesítményű reaktor további 20 évig tartó üzemeltetését 2042 után. A vizsgálat alternatív energiaforrásokat is értékelt, de egyik sem bizonyult jobbnak a jelenlegi atomenergia-használatnál. A Summer-1 egység különálló a befejezetlen Summer-2 és -3 blokkoktól, amelyek építését 2017-ben leállították[5].

Nemzetközi nukleáris hatósági és technológiai fejlemények

A szlovéniai Portorozban május közepén tartották a közép-európai nukleáris hatóságok éves találkozóját, ahol a biztonsági és technológiai együttműködés volt a fókuszban. Emellett a BME megalapította a Mikro- és Kis Moduláris Reaktorok Kompetenciaközpontját, amely a magyarországi SMR-technológia fejlesztését és elterjesztését támogatja[6][7].

Hivatkozások

- nucnet.org

- ignition-news.com

- investing.com

- energynews.oedigital.com

- ans.org

- pakspress.hu

- mandiner.hu

-

@ 8d34bd24:414be32b

2025-05-21 15:52:46

@ 8d34bd24:414be32b

2025-05-21 15:52:46In our culture today, people like to have “my truth” as opposed to “your truth.” They want to have teachers who tell them what they want to hear and worship in the way they desire. The Bible predicted these times.

For the time will come when people will not put up with sound doctrine. Instead, to suit their own desires, they will gather around them a great number of teachers to say what their itching ears want to hear. (2 Timothy 4:3)

My question is, “do we get to choose what we want to believe about God and how we want to worship Him, or does God tell us what we are to believe and how we are to worship Him?”

The Bible makes it clear that He is who He says He is and He expects obedience and worship according to His commands. We do not get to decide for ourselves.

The woman said to Him, “Sir, I perceive that You are a prophet. Our fathers worshiped in this mountain, and you people say that in Jerusalem is the place where men ought to worship.” Jesus said to her, “Woman, believe Me, an hour is coming when neither in this mountain nor in Jerusalem will you worship the Father. You worship what you do not know; we worship what we know, for salvation is from the Jews. But an hour is coming, and now is, when the true worshipers will worship the Father in spirit and truth; for such people the Father seeks to be His worshipers. God is spirit, and those who worship Him must worship in spirit and truth.” (John 4:19-24) {emphasis mine}

In this passage, Jesus gently corrects the woman for worshipping what she does not know. He also says, “God is spirit, and those who worship Him must worship in spirit and truth.” He states what God is (spirit) and how He must be worshipped “in spirit and truth.” We don’t get to define God however we wish, and we don’t get to worship Him any way we wish. God is who He has revealed Himself to be and we must obey Him and worship Him the way He has commanded.

In this next passage, God makes clear that He is holy and we do not get to worship Him any way we wish. We are to interact with Him in the prescribed manner.

Now Nadab and Abihu, the sons of Aaron, took their respective firepans, and after putting fire in them, placed incense on it and offered strange fire before the Lord, which He had not commanded them. And fire came out from the presence of the Lord and consumed them, and they died before the Lord. Then Moses said to Aaron, “It is what the Lord spoke, saying,

‘By those who come near Me I will be treated as holy,\ And before all the people I will be honored.’ ”

So Aaron, therefore, kept silent. (Leviticus 10:1-3) {emphasis mine}

God had prescribed a particular way to approach Him and only those whom He had chosen (priests of the lineage of Aaron). Nadab and Abihu chose to “do it their way” and paid the price for ignoring God’s command. God set an example with them.

God has been gracious enough to reveal Himself, His character, His power, and His commands to us. If we have truly submitted ourselves to His rule, we should hunger for God’s words so we can know Him better and honor Him in obedience.

But now I come to You; and these things I speak in the world so that they may have My joy made full in themselves. I have given them Your word; and the world has hated them, because they are not of the world, even as I am not of the world. I do not ask You to take them out of the world, but to keep them from the evil one. They are not of the world, even as I am not of the world. Sanctify them in the truth; Your word is truth. (John 17:13-17) {emphasis mine}

In today’s culture, everybody likes to claim their own personal truth, but that isn’t how truth works. The truth is not determined by an individual for themselves. It isn’t even determined by a consensus or majority vote. The truth is the truth even if not one person on earth believes it. God speaks truth and God is truth. Our belief or lack thereof doesn’t change the truth, but our lack of belief in the truth, especially the truth as revealed by God in His word, can negatively affect our relationship with God.

God expects us to study His word so we can obey His commands.

For I did not speak to your fathers, or command them in the day that I brought them out of the land of Egypt, concerning burnt offerings and sacrifices. But this is what I commanded them, saying, ‘Obey My voice, and I will be your God, and you will be My people; and you will walk in all the way which I command you, that it may be well with you.’ Yet they did not obey or incline their ear, but walked in their own counsels and in the stubbornness of their evil heart, and went backward and not forward. Since the day that your fathers came out of the land of Egypt until this day, I have sent you all My servants the prophets, daily rising early and sending them. Yet they did not listen to Me or incline their ear, but stiffened their neck; they did more evil than their fathers. (Jeremiah 7:22-26) {emphasis mine}

Today you rarely see someone bowing down to a golden idol, but that doesn’t mean that we are any better at obeying God’s commands or submitting to His will. We still try to make God in our own image so He is a convenience to us and how we want to live our lives. We still put other things ahead of God — family, work, entertainment, fame, etc. Most of us aren’t any more faithful to God than the Israelites were. Just like the Israelites, we put on the trappings of faith but don’t live according to faith and faithfulness.

And He said to them, “Rightly did Isaiah prophesy of you hypocrites, as it is written:

‘This people honors Me with their lips,\ But their heart is far away from Me.\ **But in vain do they worship Me,\ Teaching as doctrines the precepts of men.’\ Neglecting the commandment of God, you hold to the tradition of men.”

He was also saying to them, “You are experts at setting aside the commandment of God in order to keep your tradition. (Mark 7:6-9) {emphasis mine}

How many “churches” and “Christian” leaders teach people according to the culture instead of according to the Word of God? How many tell people what they want to hear and what makes them feel good instead of what they need to hear — the truth as spoken through the Bible? How many church attenders follow a “Christian” leader more than they follow their Creator, Savior, and God? How many church attenders can recite the words of their leaders better than the Holy Scriptures?

I solemnly charge you in the presence of God and of Christ Jesus, who is to judge the living and the dead, and by His appearing and His kingdom: preach the word; be ready in season and out of season; reprove, rebuke, exhort, with great patience and instruction. For the time will come when they will not endure sound doctrine; but wanting to have their ears tickled, they will accumulate for themselves teachers in accordance to their own desires, and will turn away their ears from the truth and will turn aside to myths. But you, be sober in all things, endure hardship, do the work of an evangelist, fulfill your ministry. (2 Timothy 4:1-5) {emphasis mine}

How can we know if a church leader is rightly preaching God’s word? We can only know if we have read the Bible and studied it. We should be like the Bereans:

Now these were more noble-minded than those in Thessalonica, for they received the word with great eagerness, examining the Scriptures daily to see whether these things were so. (Acts 17:11)

Honestly, I don’t trust any spiritual leader who doesn’t encourage me to search the Scriptures to see whether their words are true. Any leader who puts their own word above the Scriptures is a false teacher. Sadly there are many, maybe more than faithful teachers. Some false teachers are intentionally so, but many have been misled by other false teachers. Their guilt is less, but they don’t do any less harm than those who intentionally mislead.

We need to seek trustworthy teachers who speak according to the Word of God, who quote the Bible to support their opinions, and who seek the good of their followers rather than the submission of their followers.

Do not harden your hearts, as at Meribah,\ As in the day of Massah in the wilderness,

“When your fathers tested Me,\ They tried Me, though they had seen My work.\ For forty years I loathed that generation,\ And said they are a people who err in their heart,\ And they do not know My ways.\ Therefore I swore in My anger,\ Truly they shall not enter into My rest.” (Psalm 95:8-11) {emphasis mine} *Teach me good discernment and knowledge,\ For I believe in Your commandments*.\ Before I was afflicted I went astray,\ But now I keep Your word.\ You are good and do good;\ Teach me Your statutes.\ The arrogant have forged a lie against me;\ *With all my heart I will observe Your precepts*.\ Their heart is covered with fat,\ But I delight in Your law.\ It is good for me that I was afflicted,\ That I may learn Your statutes.\ The law of Your mouth is better to me\ Than thousands of gold and silver pieces. (Psalm 119:66-72) {emphasis mine}

May our Creator God teach us the truth. May He fill our hearts with the desire to be in His word daily and to seek His will. May He do what is necessary to get our attention and turn our hearts and minds fully to Him, so we can learn His statutes and serve Him faithfully, so one day we are blessed to hear, “Well done! Good and faithful servant.”

Trust Jesus.

FYI, I see lack of knowledge of truth and God’s word as one of the biggest problems in the church today; however, it is possible to know the Bible in depth, but not know God. As important as knowledge of Scriptures is, this knowledge (without faith, submission, obedience, and love) is meaningless. Knowledge doesn’t get us to heaven. Even obedience doesn’t get us to heaven. Only faith and submission to our creator God leads to salvation and heaven. That being said, we can’t faithfully serve our God without knowledge of Him and His commands. Out of gratefulness for who He is and what He has done for us, we should seek to know and please Him.

-

@ 9c3a0089:c6f201fb

2025-05-21 13:51:11

@ 9c3a0089:c6f201fb

2025-05-21 13:51:11What allows one person to engage in cruel acts more easily than another?

What allows one person to engage in any activity more easily than another?

Inclination vs. Aversion.

To what extent are inclinations and aversions an expression of an individuals biology/genetics vs. social conditioning?

If inclination toward cruelty is a result of social conditioning why is it present so consistently across time and location? Why do attempts to condition people away from cruelty and toward kindness ultimately fail when stress tested by simple opportunity?

Humans have a fairly consistent history of cruelty with comically varied excuses for the behavior which are sometimes near opposites. I suspect the details of circumstance and varying excuses are not the cause of cruelty.

Biology/genetics seems to be the answer but as with all traits there must be outliers. It seems inclination toward cruelty is the norm with aversion rarer and aversion along with the courage to stand against cruel acts very rare.

I fear we have been telling false tales of why we engage in cruelty on both small and large scale because the truth is unpleasant. Particularity when outliers with a strong aversion to cruelty see cruel acts and must tell themselves a story that accounts for how a human like themselves could do such things so easily(not realizing they are an outlier) leading to all kinds of creativity in both Religious Myth and fiction.

I think for 1000s of years we have placed blame on evil supernatural forces, gods, demons, devils etc. And more recently on religion, mind virus, mass psychosis, bad leaders or an evil few among the otherwise good majority etc.

I fear the truth is simply that the reason people throughout history so easily engage in cruel acts when the opportunity arises is because the large majority of humans are inclined to do so and are fairly comfortable with inflicting suffering on others. Particularly when they feel safe from consequence and they perceive that doing so strengthens their social standing or that not doing so would weaken it(survival for a social creature).

Unfortunately this makes good sense from a survival standpoint. And fortunately or unfortunately the rule of law and threat of consequence keeps this inclination hidden allowing any society to always believe maybe they and the people around them are the good guys when in truth it is fear that keeps them in check until it doesn’t time and time again.

Do we choose to go forward like this?

Will the meek ever inherit the Earth? Do we need to give it to them?

-

@ 90de72b7:8f68fdc0

2025-05-21 10:44:54

@ 90de72b7:8f68fdc0

2025-05-21 10:44:54Custom Traffic Light Control System 21/05

This Petri net represents a traffic control protocol ensuring that two traffic lights alternate safely and are never both green at the same time.

petrinet ;start () -> greenLight1 redLight2 ;toRed1 greenLight1 -> queue redLight1 ;toGreen2 redLight2 queue -> greenLight2 ;toGreen1 queue redLight1 -> greenLight1 ;toRed2 greenLight2 -> redLight2 queue ;stop redLight1 queue redLight2 -> () -

@ 90de72b7:8f68fdc0

2025-05-21 10:34:35

@ 90de72b7:8f68fdc0

2025-05-21 10:34:35PetriNostr. My everyday activity

PetriNostr never sleep! This is a demo

Places & Transitions

- Places:

-

Bla bla bla: some text

-

Transitions:

- start: Initializes the system.

- logTask: bla bla bla.

petrinet ;startDay () -> working ;stopDay working -> () ;startPause working -> paused ;endPause paused -> working ;goSmoke working -> smoking ;endSmoke smoking -> working ;startEating working -> eating ;stopEating eating -> working ;startCall working -> onCall ;endCall onCall -> working ;startMeeting working -> inMeetinga ;endMeeting inMeeting -> working ;logTask working -> working -

@ 90de72b7:8f68fdc0

2025-05-21 10:31:32

@ 90de72b7:8f68fdc0

2025-05-21 10:31:32PetriNostr. My everyday activity

PetriNostr never sleep! This is a demo

Places & Transitions

- Places:

-

Bla bla bla: some text

-

Transitions:

- start: Initializes the system.

- logTask: bla bla bla.

petrinet ;startDay () -> working ;stopDay working -> () ;startPause working -> paused ;endPause paused -> working ;goSmoke working -> smoking ;endSmoke smoking -> working ;startEating working -> eating ;stopEating eating -> working ;startCall working -> onCall ;endCall onCall -> working ;startMeeting working -> inMeetinga ;endMeeting inMeeting -> working ;logTask working -> working -

@ da8b7de1:c0164aee

2025-05-21 10:30:07

@ da8b7de1:c0164aee

2025-05-21 10:30:07„Európának a tettek mezejére kell lépnie a nukleáris energia támogatásában” – mondja a brüsszeli iparági csoport új vezetője

A cikk fő témája, hogy az európai nukleáris ipar új vezetője, Emmanuel Brutin (Nucleareurope), nagyobb elkötelezettséget vár el az Európai Bizottságtól a nukleáris energia támogatásában. Bár pozitív jelek mutatkoznak a nukleáris energia iránti nyitottság terén, Brutin szerint a gyakorlatban még mindig jelentős akadályok vannak, például a finanszírozási forrásokhoz való hozzáférésben és a projektengedélyezések lassúságában.

Főbb pontok:

- Politikai nyitottság, de gyakorlati akadályok: Az EU-ban nőtt a nukleáris energia elismerése, például bekerült a fenntartható befektetési taxonómiába és a Net-Zero Industry Act-be. Ugyanakkor a nukleáris energia továbbra is kizárt több fontos finanszírozási eszközből, mint az InvestEU vagy a Just Transition Fund.

- Technológiai semlegesség szükségessége: Brutin hangsúlyozza, hogy az EU-nak nemcsak nem szabad hátráltatnia a nukleáris energiát, hanem aktívan támogatnia is kellene, különösen a Clean Industrial Deal és az Affordable Energy Action Plan keretében.

- Finanszírozás és engedélyezés: A nukleáris ágazat számára kulcsfontosságú a finanszírozáshoz való jobb hozzáférés, mivel a beruházások tőkeigényesek. Brutin szerint gyorsítani kellene a nukleáris projektek engedélyezését, és lazítani az állami támogatási szabályokon.

- Stratégiai jelentőség: Európa teljes nukleáris értéklánccal rendelkezik, ami stratégiai autonómiát jelent, különösen a jelenlegi geopolitikai környezetben.

- Új PINC dokumentum: Nyáron várható a frissített PINC (Illustrative Nuclear Programme), amelynek konkrét lépéseket kell tartalmaznia a nukleáris beruházások támogatására.

- Iparági igények: Az energiaintenzív iparágak (pl. acél, cement) számára nem az energiaforrás típusa számít, hanem a megbízható, olcsó és dekarbonizált villamosenergia-ellátás.

- Tanulás a múlt hibáiból: Brutin elismeri, hogy a nukleáris projektek Európában gyakran szenvedtek késésektől és költségtúllépésektől, de az iparág dolgozik ezek megoldásán.

Forrás:

NucNet:

"Europe Must 'Walk The Talk' On Support For Nuclear Energy, Says New Head Of Brussels Industry Group"

Megjelenés dátuma: 2025. május 20.

Elérhető: NucNet honlapján -

@ 04c915da:3dfbecc9

2025-05-20 15:50:22

@ 04c915da:3dfbecc9

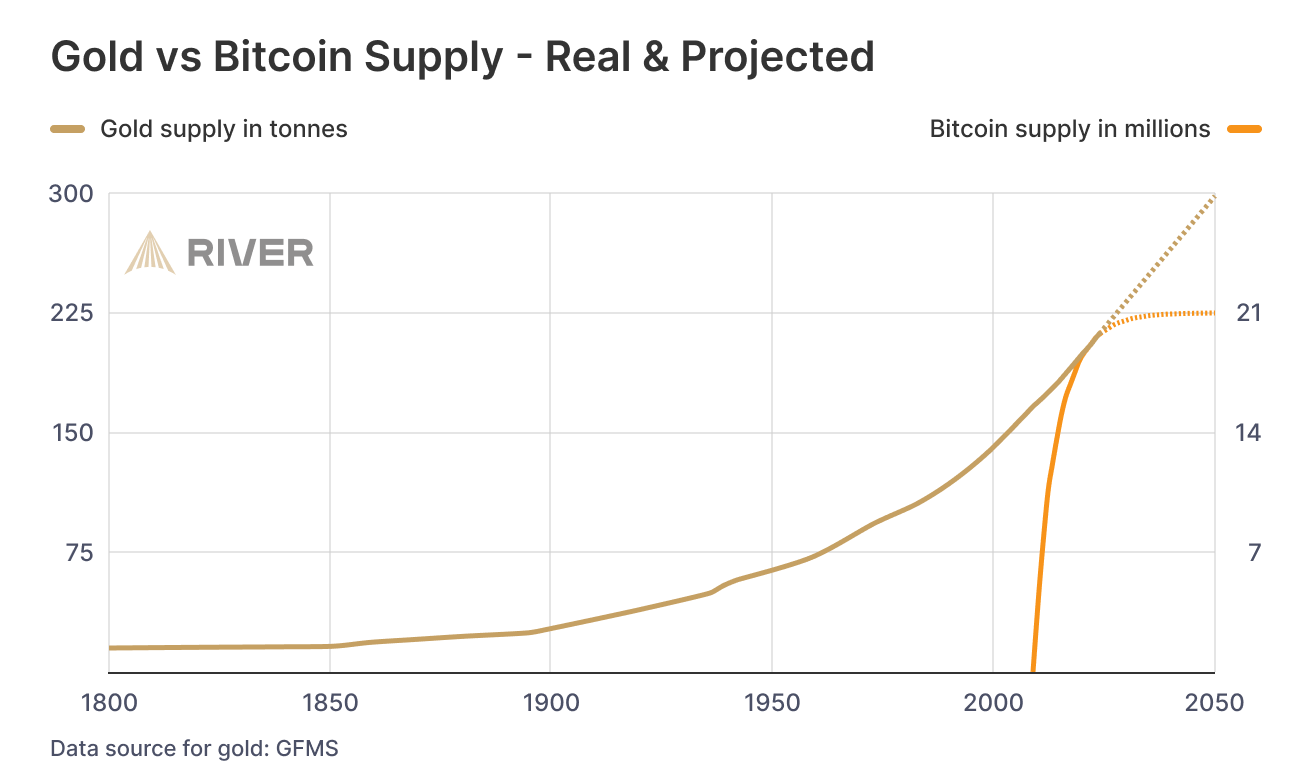

2025-05-20 15:50:22There is something quietly rebellious about stacking sats. In a world obsessed with instant gratification, choosing to patiently accumulate Bitcoin, one sat at a time, feels like a middle finger to the hype machine. But to do it right, you have got to stay humble. Stack too hard with your head in the clouds, and you will trip over your own ego before the next halving even hits.

Small Wins

Stacking sats is not glamorous. Discipline. Stacking every day, week, or month, no matter the price, and letting time do the heavy lifting. Humility lives in that consistency. You are not trying to outsmart the market or prove you are the next "crypto" prophet. Just a regular person, betting on a system you believe in, one humble stack at a time. Folks get rekt chasing the highs. They ape into some shitcoin pump, shout about it online, then go silent when they inevitably get rekt. The ones who last? They stack. Just keep showing up. Consistency. Humility in action. Know the game is long, and you are not bigger than it.

Ego is Volatile

Bitcoin’s swings can mess with your head. One day you are up 20%, feeling like a genius and the next down 30%, questioning everything. Ego will have you panic selling at the bottom or over leveraging the top. Staying humble means patience, a true bitcoin zen. Do not try to "beat” Bitcoin. Ride it. Stack what you can afford, live your life, and let compounding work its magic.

Simplicity

There is a beauty in how stacking sats forces you to rethink value. A sat is worth less than a penny today, but every time you grab a few thousand, you plant a seed. It is not about flaunting wealth but rather building it, quietly, without fanfare. That mindset spills over. Cut out the noise: the overpriced coffee, fancy watches, the status games that drain your wallet. Humility is good for your soul and your stack. I have a buddy who has been stacking since 2015. Never talks about it unless you ask. Lives in a decent place, drives an old truck, and just keeps stacking. He is not chasing clout, he is chasing freedom. That is the vibe: less ego, more sats, all grounded in life.

The Big Picture

Stack those sats. Do it quietly, do it consistently, and do not let the green days puff you up or the red days break you down. Humility is the secret sauce, it keeps you grounded while the world spins wild. In a decade, when you look back and smile, it will not be because you shouted the loudest. It will be because you stayed the course, one sat at a time. \ \ Stay Humble and Stack Sats. 🫡

-

@ c239c0f9:fa4a5015

2025-05-21 10:25:04

@ c239c0f9:fa4a5015

2025-05-21 10:25:04Block:#897676- May 2025It's again that time of the month, time to catch up with the latest features and trends that are shaping the future of Bitcoin—the very first and most commented insights from around SN cypherspace. Every issue arrives with expert analysis, in-depth interview, and breaking news of the most significant advancements in the Bitcoin layer two solutions.

Two new things this month:

A)zaps to these posts will be split to the top contributor to this territoryB)As have stacked some cowboy credits lately, I'll give them away to the stackers commenting below anything meaningful, feedback to this newsletter, or suggestions to improve the territorySubscribe to the territory and make sure you don’t miss anything about the Bitcoin Revolution!

Now let's focus on the top five items for each category, an electrifying selection that hope you'll be able to read before next edition.

Happy Zapping!

Top ~Lightning posts

Most zapranked posts this month:

-

Liquidity requirements for Lightning payments: Ark servers and LSPs compared by @supratic 409 sats \ 8 comments \ 12 May

-

Wallet of Satoshi is coming back to US with non-custodial wallet by @k00b 906 sats \ 18 comments \ 18 May

-

How to offer Submarine Swaps — Electrum Documentation by @f321x7 836 sats \ 5 comments \ 13 May

-

Parallel channels are a mess - a rant by @C_Otto 1918 sats \ 5 comments \ 1 May

-

LNBig insight about running a LN node by @DarthCoin 1244 sats \ 10 comments \ 23 Apr

Top posts by comments

Excluding the ones already mentioned above, you can see them all here (excluding those already listed above):

-

I believe CoinOS will resolve itself, but this screenshot is a rug pull 💨 by @realBitcoinDog 411 sats \ 73 comments \ 13 May

-

CoinOS having some issues by @StillStackinAfterAllTheseYears 268 sats \ 24 comments \ 10 May

-

BOLT12 Suggestions? by @metadavid 516 sats \ 16 comments \ 28 Apr

-

Phoenix Wallet - Swap In by @02b58a1376 256 sats \ 15 comments \ 25 Apr

-

Clearnet+Tor LND in Docker with wireguard VPS for privacy by @klk 696 sats \ 14 comments \ 27 Apr

Top ~Lightning Boosts

Check them all here.

-

What is the Right LSP for You? [VIDEO] by @Jestopher_BTC 667 sats \ 30k boost \ 3 comments \ 15 May

-

Things Bitcoiners Don’t Want To Hear (2020) by @k00b 1553 sats \ 20k boost \ 15 comments \ 10 May

-

Liquidity Subscriptions: Automated Liquidity for Merchants by @Jestopher_BTC 448 sats \ 10k boost \ 4 comments \ 8 May lightning

Don't miss...

Lightning Network : our high-maintenance crazy-ex by @avbpod

Coinbase announces L402 copycat "x402" by @bounty_hunter

15% of Coinbase’s Bitcoin transactions run on the Lightning Network by @south_korea_ln

An Exposition of Pathfinding Strategies Within Lightning Network Clients by @supratic

How to censor users in cashu? by @kpa

@darthcoin by @Thecanadian88

Cashu Highlights Q1 by @supratic

Top Lightning posts outside ~Lightning

This month best posts about the Lightning Network outside ~Lightning territory:

-

Ultimate guide to LN routing and fee management. by @javier 21.6k sats \ 39 comments \ 6 May on

~bitcoin -

Mobile (non-phone) Lightning Wallet? by @jasonb 565 sats \ 36 comments \ 30 Apr on

~bitcoin -

Robosats Guide by @siggy47 33k sats \ 27 comments \ 22 Apr on

~bitcoin_beginners -

LNemail: Private Disposable Email via Lightning by @lnemail 2758 sats \ 22 comments \ 18 May on

~privacy -

Another explanation of how Ark works 1329 sats \ 10 comments \ @k00b 21 May on

~bitcoin

Forever top ~Lightning posts

La crème de la crème... check them all here. Nothing has changed this month!

-

👨🚀 We're releasing 𝗔𝗟𝗕𝗬 𝗚𝗢 - the easiest lightning mobile wallet by @Alby 29.2k sats \ 41 comments \ @Alby 25 Sep 2024 on

~lightning -

Building Self Custody Lightning in 2025 by @k00b 2303 sats \ 8 comments \ 22 Jan on

~lightning -

Lightning Wallets: Self-Custody Despite Poor Network - Apps Tested in Zimbabwe by @anita 72.8k sats \ 39 comments \ 28 Jan 2024 lightning on

~lightning -

How to Attach Your self-hosted LNbits wallet to SEND/RECEIVE sats to/from SN by @supratic 1765 sats \ 18 comments \ 23 Sep 2024 on

~lightning -

A Way to Use Stacker News to improve your Zap Receiving by @bzzzt 1652 sats \ 22 comments \ 15 Jul 2024 on

~lightning

Forever top Lightning posts outside ~Lightning

Ek's post rise at #5, congrats!

-

Rethinking Lightning by @benthecarman 51.7k sats \ 140 comments \ 6 Jan 2024 on

~bitcoin -

Lightning Everywhere by @TonyGiorgio 12k sats \ 27 comments \ 24 Jul 2023 on

~bitcoin -

Lightning is dead, long live the Lightning! by @supertestnet and zaps forwarded to @anita (50%) @k00b (50%) 6321 sats \ 28 comments \ @tolot 27 Oct 2023 on

~bitcoin -

Bisq2 adds lightning by @supertestnet 3019 sats \ 47 comments \ 19 Aug 2024 on

~bitcoin -

Lightning Prediction Market MVP - delphi.market by @ek 34.1k sats \ 59 comments \ 4 Dec 2023 on

~bitcoin

-

-

@ a6b4114e:60d83c46

2025-05-21 03:25:43

@ a6b4114e:60d83c46

2025-05-21 03:25:43GTA San Andreas is one installment of Grand Theft Auto.

It is safe and secure for your device. No harmful elements have been found yet. It does not contain viruses, malware, bloatware, bugs, or threats, as its authority always upgrades the game to eliminate unwanted components. The amazing thing is that the game is 100% free for Android users.

You do not pay a single cent from your pocket.

Download: https://androidhd.com/en/gta-san-andreas

-

@ 1817b617:715fb372

2025-05-21 20:30:52

@ 1817b617:715fb372

2025-05-21 20:30:52🚀 Instantly Send Spendable Flash BTC, ETH, & USDT — Fully Blockchain-Verifiable!

Welcome to the cutting edge of crypto innovation: the ultimate tool for sending spendable Flash Bitcoin (BTC), Ethereum (ETH), and USDT transactions. Our advanced blockchain simulation technology employs 🔥 Race/Finney-style mechanisms, producing coins indistinguishable from authentic blockchain-confirmed tokens. Your transactions are instantly trackable and fully spendable for durations from 60 to 360 days!

🌐 Visit cryptoflashingtool.com for complete details.

🌟 Why Choose Our Crypto Flashing Service? Crypto Flashing is perfect for crypto enthusiasts, blockchain developers, ethical hackers, security professionals, and digital entrepreneurs looking for authenticity combined with unparalleled flexibility.

🎯 Our Crypto Flashing Features: ✅ Instant Blockchain Verification: Transactions appear completely authentic, complete with real blockchain confirmations, transaction IDs, and wallet addresses.

🔒 Maximum Security & Privacy: Fully compatible with VPNs, TOR, and proxy servers, ensuring absolute anonymity and protection.

🖥️ Easy-to-Use Software: Designed for Windows, our intuitive platform suits both beginners and experts, with detailed, step-by-step instructions provided.

📅 Customizable Flash Durations: Control your transaction lifespan precisely, from 60 to 360 days.

🔄 Universal Wallet Compatibility: Instantly flash BTC, ETH, and USDT tokens to SegWit, Legacy, or BCH32 wallets.

💱 Spendable on Top Exchanges: Flash coins seamlessly accepted on leading exchanges like Kraken and Huobi.

📊 Proven Track Record: ✅ Over 79 Billion flash transactions completed. ✅ 3000+ satisfied customers worldwide. ✅ 42 active blockchain nodes for fast, reliable transactions. 📌 Simple Step-by-Step Flashing Process: Step 1️⃣: Enter Transaction Details

Choose coin (BTC, ETH, USDT: TRC-20, ERC-20, BEP-20) Specify amount & flash duration Provide wallet address (validated automatically) Step 2️⃣: Complete Payment & Verification

Pay using the cryptocurrency you wish to flash Scan the QR code or paste the payment address Upload payment proof (transaction hash & screenshot) Step 3️⃣: Initiate Flash Transaction

Our technology simulates blockchain confirmations instantly Flash transaction appears authentic within seconds Step 4️⃣: Verify & Spend Immediately

Access your flashed crypto instantly Easily verify transactions via provided blockchain explorer links 🛡️ Why Our Technology is Trusted: 🔗 Race/Finney Attack Logic: Creates realistic blockchain headers. 🖥️ Private iNode Cluster: Guarantees fast synchronization and reliable transactions. ⏰ Live Timer System: Ensures fresh wallet addresses and transaction legitimacy. 🔍 Genuine Blockchain TX IDs: Authentic transaction IDs included with every flash ❓ Frequently Asked Questions: Is flashing secure? ✅ Yes, encrypted with full VPN/proxy support. Can I flash from multiple devices? ✅ Yes, up to 5 Windows PCs per license. Are chargebacks possible? ❌ No, flash transactions are irreversible. How long are flash coins spendable? ✅ From 60–360 days, based on your chosen plan. Verification after expiry? ❌ Transactions can’t be verified after the expiry. Support available? ✅ Yes, 24/7 support via Telegram & WhatsApp.

🔐 Transparent, Reliable & Highly Reviewed:

CryptoFlashingTool.com operates independently, providing unmatched transparency and reliability. Check out our glowing reviews on ScamAdvisor and leading crypto forums!

📲 Get in Touch Now: 📞 WhatsApp: +1 770 666 2531 ✈️ Telegram: @cryptoflashingtool

🎉 Ready to Start?

💰 Buy Flash Coins Now 🖥️ Get Your Flashing Software

Experience the smartest, safest, and most powerful crypto flashing solution on the market today!

CryptoFlashingTool.com — Flash Crypto Like a Pro.

Instantly Send Spendable Flash BTC, ETH, & USDT — Fully Blockchain-Verifiable!

Welcome to the cutting edge of crypto innovation: the ultimate tool for sending spendable Flash Bitcoin (BTC), Ethereum (ETH), and USDT transactions. Our advanced blockchain simulation technology employs

Race/Finney-style mechanisms, producing coins indistinguishable from authentic blockchain-confirmed tokens. Your transactions are instantly trackable and fully spendable for durations from 60 to 360 days!

Visit cryptoflashingtool.com for complete details.

Why Choose Our Crypto Flashing Service?

Crypto Flashing is perfect for crypto enthusiasts, blockchain developers, ethical hackers, security professionals, and digital entrepreneurs looking for authenticity combined with unparalleled flexibility.

Our Crypto Flashing Features:

Instant Blockchain Verification: Transactions appear completely authentic, complete with real blockchain confirmations, transaction IDs, and wallet addresses.

Maximum Security & Privacy: Fully compatible with VPNs, TOR, and proxy servers, ensuring absolute anonymity and protection.

Easy-to-Use Software: Designed for Windows, our intuitive platform suits both beginners and experts, with detailed, step-by-step instructions provided.

Customizable Flash Durations: Control your transaction lifespan precisely, from 60 to 360 days.

Universal Wallet Compatibility: Instantly flash BTC, ETH, and USDT tokens to SegWit, Legacy, or BCH32 wallets.

Spendable on Top Exchanges: Flash coins seamlessly accepted on leading exchanges like Kraken and Huobi.

Proven Track Record:

- Over 79 Billion flash transactions completed.

- 3000+ satisfied customers worldwide.

- 42 active blockchain nodes for fast, reliable transactions.

Simple Step-by-Step Flashing Process:

Step : Enter Transaction Details

- Choose coin (BTC, ETH, USDT: TRC-20, ERC-20, BEP-20)

- Specify amount & flash duration

- Provide wallet address (validated automatically)

Step : Complete Payment & Verification

- Pay using the cryptocurrency you wish to flash

- Scan the QR code or paste the payment address

- Upload payment proof (transaction hash & screenshot)

Step : Initiate Flash Transaction

- Our technology simulates blockchain confirmations instantly

- Flash transaction appears authentic within seconds

Step : Verify & Spend Immediately

- Access your flashed crypto instantly

- Easily verify transactions via provided blockchain explorer links

Why Our Technology is Trusted:

- Race/Finney Attack Logic: Creates realistic blockchain headers.

- Private iNode Cluster: Guarantees fast synchronization and reliable transactions.

- Live Timer System: Ensures fresh wallet addresses and transaction legitimacy.

- Genuine Blockchain TX IDs: Authentic transaction IDs included with every flash

Frequently Asked Questions:

- Is flashing secure?

Yes, encrypted with full VPN/proxy support. - Can I flash from multiple devices?

Yes, up to 5 Windows PCs per license. - Are chargebacks possible?

No, flash transactions are irreversible. - How long are flash coins spendable?

From 60–360 days, based on your chosen plan. - Verification after expiry?

Transactions can’t be verified after the expiry.

Support available?

Yes, 24/7 support via Telegram & WhatsApp.

Transparent, Reliable & Highly Reviewed:

CryptoFlashingTool.com operates independently, providing unmatched transparency and reliability. Check out our glowing reviews on ScamAdvisor and leading crypto forums!

Get in Touch Now:

WhatsApp: +1 770 666 2531

Telegram: @cryptoflashingtool

Ready to Start?

Experience the smartest, safest, and most powerful crypto flashing solution on the market today!

CryptoFlashingTool.com — Flash Crypto Like a Pro.

-

@ b83a28b7:35919450

2025-05-16 19:23:58

@ b83a28b7:35919450

2025-05-16 19:23:58This article was originally part of the sermon of Plebchain Radio Episode 110 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ 04c915da:3dfbecc9

2025-05-16 18:06:46

@ 04c915da:3dfbecc9

2025-05-16 18:06:46Bitcoin has always been rooted in freedom and resistance to authority. I get that many of you are conflicted about the US Government stacking but by design we cannot stop anyone from using bitcoin. Many have asked me for my thoughts on the matter, so let’s rip it.

Concern

One of the most glaring issues with the strategic bitcoin reserve is its foundation, built on stolen bitcoin. For those of us who value private property this is an obvious betrayal of our core principles. Rather than proof of work, the bitcoin that seeds this reserve has been taken by force. The US Government should return the bitcoin stolen from Bitfinex and the Silk Road.

Using stolen bitcoin for the reserve creates a perverse incentive. If governments see bitcoin as a valuable asset, they will ramp up efforts to confiscate more bitcoin. The precedent is a major concern, and I stand strongly against it, but it should be also noted that governments were already seizing coin before the reserve so this is not really a change in policy.

Ideally all seized bitcoin should be burned, by law. This would align incentives properly and make it less likely for the government to actively increase coin seizures. Due to the truly scarce properties of bitcoin, all burned bitcoin helps existing holders through increased purchasing power regardless. This change would be unlikely but those of us in policy circles should push for it regardless. It would be best case scenario for American bitcoiners and would create a strong foundation for the next century of American leadership.

Optimism

The entire point of bitcoin is that we can spend or save it without permission. That said, it is a massive benefit to not have one of the strongest governments in human history actively trying to ruin our lives.

Since the beginning, bitcoiners have faced horrible regulatory trends. KYC, surveillance, and legal cases have made using bitcoin and building bitcoin businesses incredibly difficult. It is incredibly important to note that over the past year that trend has reversed for the first time in a decade. A strategic bitcoin reserve is a key driver of this shift. By holding bitcoin, the strongest government in the world has signaled that it is not just a fringe technology but rather truly valuable, legitimate, and worth stacking.

This alignment of incentives changes everything. The US Government stacking proves bitcoin’s worth. The resulting purchasing power appreciation helps all of us who are holding coin and as bitcoin succeeds our government receives direct benefit. A beautiful positive feedback loop.

Realism

We are trending in the right direction. A strategic bitcoin reserve is a sign that the state sees bitcoin as an asset worth embracing rather than destroying. That said, there is a lot of work left to be done. We cannot be lulled into complacency, the time to push forward is now, and we cannot take our foot off the gas. We have a seat at the table for the first time ever. Let's make it worth it.

We must protect the right to free usage of bitcoin and other digital technologies. Freedom in the digital age must be taken and defended, through both technical and political avenues. Multiple privacy focused developers are facing long jail sentences for building tools that protect our freedom. These cases are not just legal battles. They are attacks on the soul of bitcoin. We need to rally behind them, fight for their freedom, and ensure the ethos of bitcoin survives this new era of government interest. The strategic reserve is a step in the right direction, but it is up to us to hold the line and shape the future.

-

@ 7460b7fd:4fc4e74b

2025-05-21 02:35:36

@ 7460b7fd:4fc4e74b

2025-05-21 02:35:36如果比特币发明了真正的钱,那么 Crypto 是什么?

引言

比特币诞生之初就以“数字黄金”姿态示人,被支持者誉为人类历史上第一次发明了真正意义上的钱——一种不依赖国家信用、总量恒定且不可篡改的硬通货。然而十多年过去,比特币之后蓬勃而起的加密世界(Crypto)已经远超“货币”范畴:从智能合约平台到去中心组织,从去央行的稳定币到戏谑荒诞的迷因币,Crypto 演化出一个丰富而混沌的新生态。这不禁引发一个根本性的追问:如果说比特币解决了“真金白银”的问题,那么 Crypto 又完成了什么发明?

Crypto 与政治的碰撞:随着Crypto版图扩张,全球政治势力也被裹挟进这场金融变革洪流(示意图)。比特币的出现重塑了货币信用,但Crypto所引发的却是一场更深刻的政治与治理结构实验。从华尔街到华盛顿,从散户论坛到主权国家,越来越多人意识到:Crypto不只是技术或金融现象,而是一种全新的政治表达结构正在萌芽。正如有激进论者所断言的:“比特币发明了真正的钱,而Crypto则在发明新的政治。”价格K线与流动性曲线,或许正成为这个时代社群意志和社会价值观的新型投射。

Crypto 与政治的碰撞:随着Crypto版图扩张,全球政治势力也被裹挟进这场金融变革洪流(示意图)。比特币的出现重塑了货币信用,但Crypto所引发的却是一场更深刻的政治与治理结构实验。从华尔街到华盛顿,从散户论坛到主权国家,越来越多人意识到:Crypto不只是技术或金融现象,而是一种全新的政治表达结构正在萌芽。正如有激进论者所断言的:“比特币发明了真正的钱,而Crypto则在发明新的政治。”价格K线与流动性曲线,或许正成为这个时代社群意志和社会价值观的新型投射。冲突结构:当价格挑战选票

传统政治中,选票是人民意志的载体,一人一票勾勒出民主治理的正统路径。而在链上的加密世界里,骤升骤降的价格曲线和真金白银的买卖行为却扮演起了选票的角色:资金流向成了民意走向,市场多空成为立场表决。价格行为取代选票,这听来匪夷所思,却已在Crypto社群中成为日常现实。每一次代币的抛售与追高,都是社区对项目决策的即时“投票”;每一根K线的涨跌,都折射出社区意志的赞同或抗议。市场行为本身承担了决策权与象征权——价格即政治,正在链上蔓延。

这一新生政治形式与旧世界的民主机制形成了鲜明冲突。bitcoin.org中本聪在比特币白皮书中提出“一CPU一票”的工作量证明共识,用算力投票取代了人为决策bitcoin.org。而今,Crypto更进一步,用资本市场的涨跌来取代传统政治的选举。支持某项目?直接购入其代币推高市值;反对某提案?用脚投票抛售资产。相比漫长的选举周期和层层代议制,链上市场提供了近乎实时的“公投”机制。但这种机制也引发巨大争议:资本的投票天然偏向持币多者(富者)的意志,是否意味着加密政治更为金权而非民权?持币多寡成为影响力大小,仿佛选举演变成了“一币一票”,巨鲸富豪俨然掌握更多话语权。这种与民主平等原则的冲突,成为Crypto政治形式饱受质疑的核心张力之一。

尽管如此,我们已经目睹市场投票在Crypto世界塑造秩序的威力:2016年以太坊因DAO事件分叉时,社区以真金白银“投票”决定了哪条链获得未来。arkhamintelligence.com结果是新链以太坊(ETH)成为主流,其市值一度超过2,800亿美元,而坚持原则的以太经典(ETC)市值不足35亿美元,不及前者的八十分之一arkhamintelligence.com。市场选择清楚地昭示了社区的政治意志。同样地,在比特币扩容之争、各类硬分叉博弈中,无不是由投资者和矿工用资金与算力投票,胜者存续败者黯然。价格成为裁决纷争的最终选票,冲击着传统“选票决胜”的政治理念。Crypto的价格民主,与现代代议民主正面相撞,激起当代政治哲思中前所未有的冲突火花。

治理与分配

XRP对决SEC成为了加密世界“治理与分配”冲突的经典战例。2020年底,美国证券交易委员会(SEC)突然起诉Ripple公司,指控其发行的XRP代币属于未注册证券,消息一出直接引爆市场恐慌。XRP价格应声暴跌,一度跌去超过60%,最低触及0.21美元coindesk.com。曾经位居市值前三的XRP险些被打入谷底,监管的强硬姿态似乎要将这个项目彻底扼杀。

然而XRP社区没有选择沉默。 大批长期持有者组成了自称“XRP军团”(XRP Army)的草根力量,在社交媒体上高调声援Ripple,对抗监管威胁。面对SEC的指控,他们集体发声,质疑政府选择性执法,声称以太坊当年发行却“逍遥法外”,只有Ripple遭到不公对待coindesk.com。正如《福布斯》的评论所言:没人预料到愤怒的加密散户投资者会掀起法律、政治和社交媒体领域的‘海啸式’反击,痛斥监管机构背弃了保护投资者的承诺crypto-law.us。这种草根抵抗监管的话语体系迅速形成:XRP持有者不但在网上掀起舆论风暴,还采取实际行动向SEC施压。他们发起了请愿,抨击SEC背离保护投资者初衷、诉讼给个人投资者带来巨大伤害,号召停止对Ripple的上诉纠缠——号称这是在捍卫全球加密用户的共同利益bitget.com。一场由民间主导的反监管运动就此拉开帷幕。

Ripple公司则选择背水一战,拒绝和解,在法庭上与SEC针锋相对地鏖战了近三年之久。Ripple坚称XRP并非证券,不应受到SEC管辖,即使面临沉重法律费用和业务压力也不妥协。2023年,这场持久战迎来了标志性转折:美国法庭作出初步裁决,认定XRP在二级市场的流通不构成证券coindesk.com。这一胜利犹如给沉寂已久的XRP注入强心针——消息公布当天XRP价格飙涨近一倍,盘中一度逼近1美元大关coindesk.com。沉重监管阴影下苟延残喘的项目,凭借司法层面的突破瞬间重获生机。这不仅是Ripple的胜利,更被支持者视为整个加密行业对SEC强权的一次胜仗。

XRP的对抗路线与某些“主动合规”的项目形成了鲜明对比。 稳定币USDC的发行方Circle、美国最大合规交易所Coinbase等选择了一条迎合监管的道路:它们高调拥抱现行法规,希望以合作换取生存空间。然而现实却给了它们沉重一击。USDC稳定币在监管风波中一度失去美元锚定,哪怕Circle及时披露储备状况也无法阻止恐慌蔓延,大批用户迅速失去信心,短时间内出现数十亿美元的赎回潮blockworks.co。Coinbase则更为直接:即便它早已注册上市、反复向监管示好,2023年仍被SEC指控为未注册证券交易所reuters.com,卷入漫长诉讼漩涡。可见,在迎合监管的策略下,这些机构非但未能换来监管青睐,反而因官司缠身或用户流失而丧失市场信任。 相比之下,XRP以对抗求生存的路线反而赢得了投资者的眼光:价格的涨跌成为社区投票的方式,抗争的勇气反过来强化了市场对它的信心。

同样引人深思的是另一种迥异的治理路径:技术至上的链上治理。 以MakerDAO为代表的去中心化治理模式曾被寄予厚望——MKR持币者投票决策、算法维持稳定币Dai的价值,被视为“代码即法律”的典范。然而,这套纯技术治理在市场层面却未能形成广泛认同,亦无法激发群体性的情绪动员。复杂晦涩的机制使得普通投资者难以参与其中,MakerDAO的治理讨论更多停留在极客圈子内部,在社会大众的政治对话中几乎听不见它的声音。相比XRP对抗监管所激发的铺天盖地关注,MakerDAO的治理实验显得默默无闻、难以“出圈”。这也说明,如果一种治理实践无法连接更广泛的利益诉求和情感共鸣,它在社会政治层面就难以形成影响力。

XRP之争的政治象征意义由此凸显: 它展示了一条“以市场对抗国家”的斗争路线,即通过代币价格的集体行动来回应监管权力的施压。在这场轰动业界的对决中,价格即是抗议的旗帜,涨跌映射着政治立场。XRP对SEC的胜利被视作加密世界向旧有权力宣告的一次胜利:资本市场的投票器可以撼动监管者的强权。这种“价格即政治”的张力,正是Crypto世界前所未有的社会实验:去中心化社区以市场行为直接对抗国家权力,在无形的价格曲线中凝聚起政治抗争的力量,向世人昭示加密货币不仅有技术和资本属性,更蕴含着不可小觑的社会能量和政治意涵。

不可归零的政治资本

Meme 币的本质并非廉价或易造,而在于其构建了一种“无法归零”的社群生存结构。 对于传统观点而言,多数 meme 币只是短命的投机游戏:价格暴涨暴跌后一地鸡毛,创始人套现跑路,投资者血本无归,然后“大家转去炒下一个”theguardian.com。然而,meme 币社群的独特之处在于——失败并不意味着终结,而更像是运动的逗号而非句号。一次币值崩盘后,持币的草根们往往并未散去;相反,他们汲取教训,准备东山再起。这种近乎“不死鸟”的循环,使得 meme 币运动呈现出一种数字政治循环的特质:价格可以归零,但社群的政治热情和组织势能不归零。正如研究者所指出的,加密领域中的骗局、崩盘等冲击并不会摧毁生态,反而成为让系统更加强韧的“健康应激”,令整个行业在动荡中变得更加反脆弱cointelegraph.com。对应到 meme 币,每一次暴跌和重挫,都是社群自我进化、卷土重来的契机。这个去中心化群体打造出一种自组织的安全垫,失败者得以在瓦砾上重建家园。对于草根社群、少数派乃至体制的“失败者”而言,meme 币提供了一个永不落幕的抗争舞台,一种真正反脆弱的政治性。正因如此,我们看到诸多曾被嘲笑的迷因项目屡败屡战:例如 Dogecoin 自2013年问世后历经八年沉浮,早已超越玩笑属性,成为互联网史上最具韧性的迷因之一frontiersin.org;支撑 Dogecoin 的正是背后强大的迷因文化和社区意志,它如同美国霸权支撑美元一样,为狗狗币提供了“永不中断”的生命力frontiersin.org。

“复活权”的数字政治意涵

这种“失败-重生”的循环结构蕴含着深刻的政治意涵:在传统政治和商业领域,一个政党选举失利或一家公司破产往往意味着清零出局,资源散尽、组织瓦解。然而在 meme 币的世界,社群拥有了一种前所未有的“复活权”。当项目崩盘,社区并不必然随之消亡,而是可以凭借剩余的人心和热情卷土重来——哪怕换一个 token 名称,哪怕重启一条链,运动依然延续。正如 Cheems 项目的核心开发者所言,在几乎无人问津、技术受阻的困境下,大多数人可能早已卷款走人,但 “CHEEMS 社区没有放弃,背景、技术、风投都不重要,重要的是永不言弃的精神”cointelegraph.com。这种精神使得Cheems项目起死回生,社区成员齐声宣告“我们都是 CHEEMS”,共同书写历史cointelegraph.com。与传统依赖风投和公司输血的项目不同,Cheems 完全依靠社区的信念与韧性存续发展,体现了去中心化运动的真谛cointelegraph.com。这意味着政治参与的门槛被大大降低:哪怕没有金主和官方背书,草根也能凭借群体意志赋予某个代币新的生命。对于身处社会边缘的群体来说,meme 币俨然成为自组织的安全垫和重新集结的工具。难怪有学者指出,近期涌入meme币浪潮的主力,正是那些对现实失望但渴望改变命运的年轻人theguardian.com——“迷茫的年轻人,想要一夜暴富”theguardian.com。meme币的炒作表面上看是投机赌博,但背后蕴含的是草根对既有金融秩序的不满与反抗:没有监管和护栏又如何?一次失败算不得什么,社区自有后路和新方案。这种由底层群众不断试错、纠错并重启的过程,本身就是一种数字时代的新型反抗运动和群众动员机制。

举例而言,Terra Luna 的沉浮充分展现了这种“复活机制”的政治力量。作为一度由风投资本热捧的项目,Luna 币在2022年的崩溃本可被视作“归零”的失败典范——稳定币UST瞬间失锚,Luna币价归零,数十亿美元灰飞烟灭。然而“崩盘”并没有画下休止符。Luna的残余社区拒绝承认失败命运,通过链上治理投票毅然启动新链,“复活”了 Luna 代币,再次回到市场交易reuters.com。正如 Terra 官方在崩盘后发布的推文所宣称:“我们力量永在社区,今日的决定正彰显了我们的韧性”reuters.com。事实上,原链更名为 Luna Classic 后,大批所谓“LUNC 军团”的散户依然死守阵地,誓言不离不弃;他们自发烧毁巨量代币以缩减供应、推动技术升级,试图让这个一度归零的项目重新燃起生命之火binance.com。失败者并未散场,而是化作一股草根洪流,奋力托举起项目的残迹。经过迷因化的叙事重塑,这场从废墟中重建价值的壮举,成为加密世界中草根政治的经典一幕。类似的案例不胜枚举:曾经被视为笑话的 DOGE(狗狗币)正因多年社群的凝聚而跻身主流币种,总市值一度高达数百亿美元,充分证明了“民有民享”的迷因货币同样可以笑傲市场frontiersin.org。再看最新的美国政治舞台,连总统特朗普也推出了自己的 meme 币 $TRUMP,号召粉丝拿真金白银来表达支持。该币首日即从7美元暴涨至75美元,两天后虽回落到40美元左右,但几乎同时,第一夫人 Melania 又发布了自己的 $Melania 币,甚至连就职典礼的牧师都跟风发行了纪念币theguardian.com!显然,对于狂热的群众来说,一个币的沉浮并非终点,而更像是运动的换挡——资本市场成为政治参与的新前线,你方唱罢我登场,meme 币的群众动员热度丝毫不减。值得注意的是,2024年出现的 Pump.fun 等平台更是进一步降低了这一循环的技术门槛,任何人都可以一键生成自己的 meme 币theguardian.com。这意味着哪怕某个项目归零,剩余的社区完全可以借助此类工具迅速复制一个新币接力,延续集体行动的火种。可以说,在 meme 币的世界里,草根社群获得了前所未有的再生能力和主动权,这正是一种数字时代的群众政治奇观:失败可以被当作梗来玩,破产能够变成重生的序章。

价格即政治:群众投机的新抗争

meme 币现象的兴盛表明:在加密时代,价格本身已成为一种政治表达。这些看似荒诞的迷因代币,将金融市场变成了群众宣泄情绪和诉求的另一个舞台。有学者将此概括为“将公民参与直接转化为了投机资产”cdn-brighterworld.humanities.mcmaster.ca——也就是说,社会运动的热情被注入币价涨跌,政治支持被铸造成可以交易的代币。meme 币融合了金融、技术与政治,通过病毒般的迷因文化激发公众参与,形成对现实政治的某种映射cdn-brighterworld.humanities.mcmaster.caosl.com。当一群草根投入全部热忱去炒作一枚毫无基本面支撑的币时,这本身就是一种大众政治动员的体现:币价暴涨,意味着一群人以戏谑的方式在向既有权威叫板;币价崩盘,也并不意味着信念的消亡,反而可能孕育下一次更汹涌的造势。正如有分析指出,政治类 meme 币的出现前所未有地将群众文化与政治情绪融入市场行情,价格曲线俨然成为民意和趋势的风向标cdn-brighterworld.humanities.mcmaster.ca。在这种局面下,投机不再仅仅是逐利,还是一种宣示立场、凝聚共识的过程——一次次看似荒唐的炒作背后,是草根对传统体制的不服与嘲讽,是失败者拒绝认输的呐喊。归根结底,meme 币所累积的,正是一种不可被归零的政治资本。价格涨落之间,群众的愤怒、幽默与希望尽显其中;这股力量不因一次挫败而消散,反而在市场的循环中愈发壮大。也正因如此,我们才说“价格即政治”——在迷因币的世界里,价格不只是数字,更是人民政治能量的晴雨表,哪怕归零也终将卷土重来。cdn-brighterworld.humanities.mcmaster.caosl.com

全球新兴现象:伊斯兰金融的入场

当Crypto在西方世界掀起市场治政的狂潮时,另一股独特力量也悄然融入这一场域:伊斯兰金融携其独特的道德秩序,开始在链上寻找存在感。长期以来,伊斯兰金融遵循着一套区别于世俗资本主义的原则:禁止利息(Riba)、反对过度投机(Gharar/Maysir)、强调实际资产支撑和道德投资。当这些原则遇上去中心化的加密技术,会碰撞出怎样的火花?出人意料的是,这两者竟在“以市场行为表达价值”这个层面产生了惊人的共鸣。伊斯兰金融并不拒绝市场机制本身,只是为其附加了道德准则;Crypto则将市场机制推向了政治高位,用价格来表达社群意志。二者看似理念迥异,实则都承认市场行为可以也应当承载社会价值观。这使得越来越多金融与政治分析人士开始关注:当虔诚的宗教伦理遇上狂野的加密市场,会塑造出何种新范式?

事实上,穆斯林世界已经在探索“清真加密”的道路。一些区块链项目致力于确保协议符合伊斯兰教法(Sharia)的要求。例如Haqq区块链发行的伊斯兰币(ISLM),从规则层面内置了宗教慈善义务——每发行新币即自动将10%拨入慈善DAO,用于公益捐赠,以符合天课(Zakat)的教义nasdaq.comnasdaq.com。同时,该链拒绝利息和赌博类应用,2022年还获得了宗教权威的教令(Fatwa)认可其合规性nasdaq.com。再看理念层面,伊斯兰经济学强调货币必须有内在价值、收益应来自真实劳动而非纯利息剥削。这一点与比特币的“工作量证明”精神不谋而合——有人甚至断言法定货币无锚印钞并不清真,而比特币这类需耗费能源生产的资产反而更符合教法初衷cointelegraph.com。由此,越来越多穆斯林投资者开始以道德投资的名义进入Crypto领域,将资金投向符合清真原则的代币和协议。

这种现象带来了微妙的双重合法性:一方面,Crypto世界原本奉行“价格即真理”的世俗逻辑,而伊斯兰金融为其注入了一股道德合法性,使部分加密资产同时获得了宗教与市场的双重背书;另一方面,即便在遵循宗教伦理的项目中,最终决定成败的依然是市场对其价值的认可。道德共识与市场共识在链上交汇,共同塑造出一种混合的新秩序。这一全球新兴现象引发广泛议论:有人将其视为金融民主化的极致表现——不同文化价值都能在市场平台上表达并竞争;也有人警惕这可能掩盖新的风险,因为把宗教情感融入高风险资产,既可能凝聚强大的忠诚度,也可能在泡沫破裂时引发信仰与财富的双重危机。但无论如何,伊斯兰金融的入场使Crypto的政治版图更加丰盈多元。从华尔街交易员到中东教士,不同背景的人们正通过Crypto这个奇特的舞台,对人类价值的表达方式进行前所未有的实验。

升华结语:价格即政治的新直觉

回顾比特币问世以来的这段历程,我们可以清晰地看到一条演进的主线:先有货币革命,后有政治发明。比特币赋予了人类一种真正自主的数字货币,而Crypto在此基础上完成的,则是一项前所未有的政治革新——它让市场价格行为承担起了类似政治选票的功能,开创了一种“价格即政治”的新直觉。在这个直觉下,市场不再只是冷冰冰的交易场所;每一次资本流动、每一轮行情涨落,都被赋予了社会意义和政治涵义。买入即表态,卖出即抗议,流动性的涌入或枯竭胜过千言万语的陈情。Crypto世界中,K线图俨然成为民意曲线,行情图就是政治晴雨表。决策不再由少数权力精英关起门来制定,而是在全球无眠的交易中由无数普通人共同谱写。这样的政治形式也许狂野,也许充满泡沫和噪音,但它不可否认地调动起了广泛的社会参与,让原本疏离政治进程的个体通过持币、交易重新找回了影响力的幻觉或实感。

“价格即政治”并非一句简单的口号,而是Crypto给予世界的全新想象力。它质疑了传统政治的正统性:如果一串代码和一群匿名投资者就能高效决策资源分配,我们为何还需要繁冗的官僚体系?它也拷问着自身的内在隐忧:当财富与权力深度绑定,Crypto政治如何避免堕入金钱统治的老路?或许,正是在这样的矛盾和张力中,人类政治的未来才会不断演化。Crypto所开启的,不仅是技术乌托邦或金融狂欢,更可能是一次对民主形式的深刻拓展和挑战。这里有最狂热的逐利者,也有最理想主义的社群塑梦者;有一夜暴富的神话,也有瞬间破灭的惨痛。而这一切汇聚成的洪流,正冲撞着工业时代以来既定的权力谱系。

当我们再次追问:Crypto究竟是什么? 或许可以这样回答——Crypto是比特币之后,人类完成的一次政治范式的试验性跃迁。在这里,价格行为化身为选票,资本市场演化为广场,代码与共识共同撰写“社会契约”。这是一场仍在进行的文明实验:它可能无声地融入既有秩序,也可能剧烈地重塑未来规则。但无论结局如何,如今我们已经见证:在比特币发明真正的货币之后,Crypto正在发明真正属于21世纪的政治。它以数字时代的语言宣告:在链上,价格即政治,市场即民意,代码即法律。这,或许就是Crypto带给我们的最直观而震撼的本质启示。

参考资料:

-

中本聪. 比特币白皮书: 一种点对点的电子现金系统. (2008)bitcoin.org

-

Arkham Intelligence. Ethereum vs Ethereum Classic: Understanding the Differences. (2023)arkhamintelligence.com

-

Binance Square (@渔神的加密日记). 狗狗币价格为何上涨?背后的原因你知道吗?binance.com

-

Cointelegraph中文. 特朗普的迷因币晚宴预期内容揭秘. (2025)cn.cointelegraph.com

-

慢雾科技 Web3Caff (@Lisa). 风险提醒:从 LIBRA 看“政治化”的加密货币骗局. (2025)web3caff.com

-

Nasdaq (@Anthony Clarke). How Cryptocurrency Aligns with the Principles of Islamic Finance. (2023)nasdaq.comnasdaq.com

-

Cointelegraph Magazine (@Andrew Fenton). DeFi can be halal but not DOGE? Decentralizing Islamic finance. (2023)cointelegraph.com

-

-

@ 5cb68b7a:b7cb67d5

2025-05-21 20:15:38

@ 5cb68b7a:b7cb67d5

2025-05-21 20:15:38Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

Why Trust Crypt Recver? 🤝 🛠️ Expert Recovery Solutions At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

Partially lost or forgotten seed phrases Extracting funds from outdated or invalid wallet addresses Recovering data from damaged hardware wallets Restoring coins from old or unsupported wallet formats You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈 Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases. Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery. Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet. Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy. ⚠️ What We Don’t Do While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

Don’t Let Lost Crypto Hold You Back! Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today! Ready to reclaim your lost crypto? Don’t wait until it’s too late! 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us! For real-time support or questions, reach out to our dedicated team on: ✉️ Telegram: t.me/crypptrcver 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

# Why Trust Crypt Recver? 🤝

# Why Trust Crypt Recver? 🤝🛠️ Expert Recovery Solutions\ At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

- Partially lost or forgotten seed phrases

- Extracting funds from outdated or invalid wallet addresses

- Recovering data from damaged hardware wallets

- Restoring coins from old or unsupported wallet formats

You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery\ We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority\ Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology\ Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈

- Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery.

- Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet.

- Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy.

⚠️ What We Don’t Do\ While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

# Don’t Let Lost Crypto Hold You Back!

# Don’t Let Lost Crypto Hold You Back!Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection\ Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today!\ Ready to reclaim your lost crypto? Don’t wait until it’s too late!\ 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us!\ For real-time support or questions, reach out to our dedicated team on:\ ✉️ Telegram: t.me/crypptrcver\ 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.

-

@ 04c915da:3dfbecc9

2025-05-16 17:51:54

@ 04c915da:3dfbecc9

2025-05-16 17:51:54In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ 21335073:a244b1ad

2025-05-01 01:51:10

@ 21335073:a244b1ad

2025-05-01 01:51:10Please respect Virginia Giuffre’s memory by refraining from asking about the circumstances or theories surrounding her passing.

Since Virginia Giuffre’s death, I’ve reflected on what she would want me to say or do. This piece is my attempt to honor her legacy.

When I first spoke with Virginia, I was struck by her unshakable hope. I had grown cynical after years in the anti-human trafficking movement, worn down by a broken system and a government that often seemed complicit. But Virginia’s passion, creativity, and belief that survivors could be heard reignited something in me. She reminded me of my younger, more hopeful self. Instead of warning her about the challenges ahead, I let her dream big, unburdened by my own disillusionment. That conversation changed me for the better, and following her lead led to meaningful progress.

Virginia was one of the bravest people I’ve ever known. As a survivor of Epstein, Maxwell, and their co-conspirators, she risked everything to speak out, taking on some of the world’s most powerful figures.

She loved when I said, “Epstein isn’t the only Epstein.” This wasn’t just about one man—it was a call to hold all abusers accountable and to ensure survivors find hope and healing.

The Epstein case often gets reduced to sensational details about the elite, but that misses the bigger picture. Yes, we should be holding all of the co-conspirators accountable, we must listen to the survivors’ stories. Their experiences reveal how predators exploit vulnerabilities, offering lessons to prevent future victims.

You’re not powerless in this fight. Educate yourself about trafficking and abuse—online and offline—and take steps to protect those around you. Supporting survivors starts with small, meaningful actions. Free online resources can guide you in being a safe, supportive presence.

When high-profile accusations arise, resist snap judgments. Instead of dismissing survivors as “crazy,” pause to consider the trauma they may be navigating. Speaking out or coping with abuse is never easy. You don’t have to believe every claim, but you can refrain from attacking accusers online.

Society also fails at providing aftercare for survivors. The government, often part of the problem, won’t solve this. It’s up to us. Prevention is critical, but when abuse occurs, step up for your loved ones and community. Protect the vulnerable. it’s a challenging but a rewarding journey.

If you’re contributing to Nostr, you’re helping build a censorship resistant platform where survivors can share their stories freely, no matter how powerful their abusers are. Their voices can endure here, offering strength and hope to others. This gives me great hope for the future.

Virginia Giuffre’s courage was a gift to the world. It was an honor to know and serve her. She will be deeply missed. My hope is that her story inspires others to take on the powerful.

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ 91bea5cd:1df4451c

2025-04-15 06:27:28

@ 91bea5cd:1df4451c

2025-04-15 06:27:28Básico

bash lsblk # Lista todos os diretorios montados.Para criar o sistema de arquivos:

bash mkfs.btrfs -L "ThePool" -f /dev/sdxCriando um subvolume:

bash btrfs subvolume create SubVolMontando Sistema de Arquivos:

bash mount -o compress=zlib,subvol=SubVol,autodefrag /dev/sdx /mntLista os discos formatados no diretório:

bash btrfs filesystem show /mntAdiciona novo disco ao subvolume:

bash btrfs device add -f /dev/sdy /mntLista novamente os discos do subvolume:

bash btrfs filesystem show /mntExibe uso dos discos do subvolume:

bash btrfs filesystem df /mntBalancea os dados entre os discos sobre raid1:

bash btrfs filesystem balance start -dconvert=raid1 -mconvert=raid1 /mntScrub é uma passagem por todos os dados e metadados do sistema de arquivos e verifica as somas de verificação. Se uma cópia válida estiver disponível (perfis de grupo de blocos replicados), a danificada será reparada. Todas as cópias dos perfis replicados são validadas.

iniciar o processo de depuração :

bash btrfs scrub start /mntver o status do processo de depuração Btrfs em execução:

bash btrfs scrub status /mntver o status do scrub Btrfs para cada um dos dispositivos

bash btrfs scrub status -d / data btrfs scrub cancel / dataPara retomar o processo de depuração do Btrfs que você cancelou ou pausou:

btrfs scrub resume / data

Listando os subvolumes:

bash btrfs subvolume list /ReportsCriando um instantâneo dos subvolumes:

Aqui, estamos criando um instantâneo de leitura e gravação chamado snap de marketing do subvolume de marketing.

bash btrfs subvolume snapshot /Reports/marketing /Reports/marketing-snapAlém disso, você pode criar um instantâneo somente leitura usando o sinalizador -r conforme mostrado. O marketing-rosnap é um instantâneo somente leitura do subvolume de marketing

bash btrfs subvolume snapshot -r /Reports/marketing /Reports/marketing-rosnapForçar a sincronização do sistema de arquivos usando o utilitário 'sync'

Para forçar a sincronização do sistema de arquivos, invoque a opção de sincronização conforme mostrado. Observe que o sistema de arquivos já deve estar montado para que o processo de sincronização continue com sucesso.

bash btrfs filsystem sync /ReportsPara excluir o dispositivo do sistema de arquivos, use o comando device delete conforme mostrado.

bash btrfs device delete /dev/sdc /ReportsPara sondar o status de um scrub, use o comando scrub status com a opção -dR .

bash btrfs scrub status -dR / RelatóriosPara cancelar a execução do scrub, use o comando scrub cancel .