-

@ 90152b7f:04e57401

2025-05-22 03:51:20

@ 90152b7f:04e57401

2025-05-22 03:51:20Wikileaks - S E C R E T SECTION 01 OF 02 TEL AVIV 001733 SIPDIS SIPDIS E.O. 12958: DECL: 06/13/2017 TAGS: PREL, PTER, MOPS, KWBG, LE, SY, IS SUBJECT: MILITARY INTELLIGENCE DIRECTOR YADLIN COMMENTS ON GAZA, SYRIA AND LEBANON Classified By: Ambassador Richard H. Jones, Reason 1.4 (b) (d)

2007 June 13

1. (S) Summary. During a June 12 meeting with the Ambassador, IDI Director MG Amos Yadlin said that Gaza was "number four" on his list of threats, preceded by Iran, Syria, and Hizballah in that order. Yadlin said the IDI has been predicting armed confrontation in Gaza between Hamas and Fatah since Hamas won the January 2006 legislative council elections. Yadlin felt that the Hamas military wing had initiated the current escalation with the tacit consent of external Hamas leader Khalid Mishal, adding that he did not believe there had been a premeditated political-level decision by Hamas to wipe out Fatah in Gaza. Yadlin dismissed Fatah's capabilities in Gaza, saying Hamas could have taken over there any time it wanted for the past year, but he agreed that Fatah remained strong in the West Bank. Although not necessarily reflecting a GOI consensus view, Yadlin said Israel would be "happy" if Hamas took over Gaza because the IDF could then deal with Gaza as a hostile state. He dismissed the significance of an Iranian role in a Hamas-controlled Gaza "as long as they don't have a port." Regarding predictions of war with Syria this summer, Yadlin recalled the lead-up to the 1967 war, which he said was provoked by the Soviet Ambassador in Israel. Both Israel and Syria are in a state of high alert, so war could happen easily even though neither side is seeking it. Yadlin suggested that the Asad regime would probably not survive a war, but added that Israel was no longer concerned with maintaining that "evil" regime. On Lebanon, Yadlin felt that the fighting in the Nahr Al-Barid camp was a positive development for Israel since it had "embarrassed" Hizballah, adding that IDI had information that the Fatah Al-Islam terrorist group was planning to attack UNIFIL before it blundered into its confrontation with the LAF. End Summary.

Gaza Fighting Not Israel's Main Problem

---------------------------------------

2. (S) The Ambassador, accompanied by Pol Couns and DATT, called on IDI Director Major General Amos Yadlin June 12. Noting reports of fierce fighting between Hamas and Fatah in Gaza that day, the Ambassador asked for Yadlin's assessment. Yadlin described Gaza as "not Israel's main problem," noting that it ranked fourth in his hierarchy of threats, behind Iran, Syria, and Hizballah. Yadlin described Gaza as "hopeless for now," commenting that the Palestinians had to realize that Hamas offered no solution. IDI analysts, he said, had predicted a confrontation in Gaza since Hamas won the Palestinian Legislative Council elections in January 2006. Yadlin commented that Palestinian President Mahmoud Abbas and Hamas Prime Minister Ismail Haniyeh had become personally close despite their ideological differences, but neither leader had control over those forces under them.

3. (S) Yadlin explained that both Fatah and Hamas contained many factions. The Hamas military wing had been frustrated since the signing of the Mecca Agreement in January, but there were also many armed groups in Gaza that were not under the control of either party. Yadlin cited the example of the Dughmush clan, which had shifted from Fatah to the Popular Resistance Committees to Hamas before becoming an armed entity opposed to all of them. After May 15, the Hamas military wing had sought to export the fighting to Sderot by launching waves of Qassam rockets. One week later, as a result of IDF retaliation, they realized the price was too high and reduced the Qassam attacks.

4. (S) In response to the Ambassador's question, Yadlin said he did not think that day's Hamas attacks on Fatah security forces were part of a premeditated effort to wipe out Fatah in Gaza. Instead, they probably represented an initiative of the military wing with the tacit consent of Khalid Mishal in Damascus. Mishal was still considering the costs and benefits of the fighting, but the situation had become so tense that any incident could lead to street fighting without any political decision.

Gaza and West Bank Separating

-----------------------------

5. (S) The Ambassador asked Yadlin for his assessment of reports that Fatah forces had been ordered not to fight back. Yadlin said Mohammed Dahlan had 500 men and the Presidential Guard had 1,500 more. They understand that the balance of power favors Hamas, which "can take over Gaza any time it wants to." Yadlin said he would be surprised if Fatah fights, and even more surprised if they win. As far as he was concerned, this had been the case for the past year. The situation was different in the West Bank, however, where Fatah remained relatively strong and had even started to

TEL AVIV 00001733 002 OF 002

kidnap Hamas activists. Yadlin agreed that Tawfiq Tirawi had a power base in the West Bank, but he added that Fatah was not cohesive.

6. (S) The Ambassador commented that if Fatah decided it has lost Gaza, there would be calls for Abbas to set up a separate regime in the West Bank. While not necessarily reflecting a consensus GOI view, Yadlin commented that such a development would please Israel since it would enable the IDF to treat Gaza as a hostile country rather than having to deal with Hamas as a non-state actor. He added that Israel could work with a Fatah regime in the West Bank. The Ambassador asked Yadlin if he worried about a Hamas-controlled Gaza giving Iran a new opening. Yadlin replied that Iran was already present in Gaza, but Israel could handle the situation "as long as Gaza does not have a port (sea or air)."

War with Syria "Could Happen Easily"

------------------------------------

7. (S) Noting Israeli press speculation, the Ambassador asked Yadlin if he expected war with Syria this summer. Recalling the 1967 war, Yadlin commented that it had started as a result of the Soviet Ambassador in Israel reporting on non-existing Israeli preparations to attack Syria. Something similar was happening again, he said, with the Russians telling the Syrians that Israel planned to attack them, possibly in concert with a U.S. attack on Iran. Yadlin stated that since last summer's war in Lebanon, Syria had engaged in a "frenzy of preparations" for a confrontation with Israel. The Syrian regime was also showing greater self-confidence. Some Syrian leaders appeared to believe that Syria could take on Israel military, but others were more cautious. The fact that both sides were on high alert meant that a war could happen easily, even though neither side is seeking one. In response to a question, Yadlin said he did not think the Asad regime would survive a war, but he added that preserving that "evil" regime should not be a matter of concern.

Fighting in Nahr al-Barid Positive for Israel

---------------------------------------------

8. (S) The Ambassador asked Yadlin for his views on the fighting in the Nahr al-Barid refugee camp in northern Lebanon. Although Yadlin was called to another meeting and did not have time to elaborate, he answered that the fighting was positive for Israel because it had embarrassed Hizballah, which had been unable to adopt a clear-cut position on the Lebanese Army's action, and because the Fatah al-Islam terrorist organization had been planning to attack UNIFIL and then Israel before it blundered into its current confrontation with the LAF. He also agreed that the confrontation was strengthening the LAF, in fact and in the eyes of the Lebanese people, which was also good.

9. (S) Comment: Yadlin's relatively relaxed attitude toward the deteriorating security situation in Gaza represents a shift in IDF thinking from last fall, when the Southern Command supported a major ground operation into Gaza to remove the growing threat from Hamas. While many media commentators continue to make that argument, Yadlin's view appears to be more in synch with that of Chief of General Staff Ashkenazi, who also believes that the more serious threat to Israel currently comes from the north.

********************************************* ******************** Visit Embassy Tel Aviv's Classified Website: http://www.state.sgov.gov/p/nea/telaviv

You can also access this site through the State Department's Classified SIPRNET website. ********************************************* ******************** JONES

-

@ 502ab02a:a2860397

2025-05-22 01:30:37

@ 502ab02a:a2860397

2025-05-22 01:30:37ถ้าพูดถึง "เกาหลีใต้" หลายคนอาจนึกถึงซีรีส์ น้ำจิ้มเผ็ด หรือไอดอลหน้าผ่อง ๆ แต่เบื้องหลังวัฒนธรรมที่ลื่นไหลไปทั่วโลกนี้ ยังมีอาณาจักรธุรกิจขนาดมหึมาที่เป็นเหมือนเครื่องยนต์หลักผลักดันทั้งอาหาร เพลง หนัง และนวัตกรรมระดับโลก หนึ่งในนั้นคือ CJ Group ที่เริ่มต้นจากบริษัทน้ำตาลเล็ก ๆ ในปี 1953 แต่เติบโตจนกลายเป็นหนึ่งใน conglomerate หรือ "กลุ่มธุรกิจผูกเครือ" ที่ทรงอิทธิพลที่สุดของแดนโสม

คำว่า CJ ย่อมาจาก CheilJedang (แปลว่า “หมายเลขหนึ่งแห่งโลก” ในภาษาจีน-เกาหลี) ก่อตั้งโดย อี บยองชอล ผู้ก่อตั้ง Samsung Group ในช่วงเวลานั้น เกาหลีใต้กำลังฟื้นตัวจากสงครามเกาหลี และรัฐบาลส่งเสริมการพัฒนาอุตสาหกรรมภายในประเทศ เดิมเป็นหน่วยธุรกิจอาหารของกลุ่ม Samsung ในปี 1993 Cheil Jedang แยกตัวออกจาก Samsung Group และกลายเป็นบริษัทอิสระภายใต้การบริหารของ อี แจฮยอน หลานชายของอี บยองชอล แล้วขยายขอบเขตธุรกิจอย่างไม่หยุดยั้ง จากความเชี่ยวชาญใน "การหมัก" แบบดั้งเดิม พวกเขากลับกลายเป็นผู้เล่นรายใหญ่ระดับโลกในวงการ เทคโนโลยีชีวภาพ การผลิตอาหารไปจนถึงธุรกิจ บันเทิงระดับฮอลลีวูด และ โลจิสติกส์ข้ามทวีป

พูดง่าย ๆ ว่า CJ ไม่ได้แค่ส่งออกกิมจิหรือบิบิมบับ แต่พวกเขากำลังวางรากฐานของ "อนาคตแห่งอาหาร" และ "ความบันเทิงแบบไร้พรมแดน" ในเวลาเดียวกัน จนใครหลายคนถึงกับบอกว่า ถ้าอยากเข้าใจเกาหลีใต้ ก็ต้องเริ่มจากเข้าใจ CJ Group เสียก่อน

แล้วในเครือข่ายของ CJ Group มีธุรกิจอะไรบ้างที่น่าสนใจ และแบรนด์ไหนที่เราคุ้นเคยแบบไม่รู้ตัว ไปดูกันเลย

- ธุรกิจอาหารและบริการอาหาร (Food & Food Services)

- CJ CheilJedang บริษัทอาหารชั้นนำของเกาหลีใต้ มีผลิตภัณฑ์เด่น ได้แก่ Bibigo แบรนด์อาหารเกาหลีพร้อมรับประทาน เช่น เกี๊ยว ซอส และกิมจิ Hetbahn ข้าวสวยพร้อมรับประทานที่ได้รับความนิยมในเกาหลี

-

CJ Foodville ดำเนินธุรกิจร้านอาหารและเบเกอรี่ เช่น: Tous Les Jours ร้านเบเกอรี่สไตล์ฝรั่งเศส VIPS ร้านสเต็กและสลัดบุฟเฟ่ต์

-

ธุรกิจเทคโนโลยีชีวภาพ (Bio) ความเชี่ยวชาญนี้เป็นรากฐานสำคัญในการขยายธุรกิจด้านเทคโนโลยีชีวภาพของ CJ เลยครับ

- CJ BIO ผู้นำด้านการผลิตกรดอะมิโนและผลิตภัณฑ์ชีวภาพผ่านเทคโนโลยีการหมักจุลินทรีย์ เช่น Lysine, Tryptophan, Valine กรดอะมิโนที่ใช้ในอุตสาหกรรมอาหารสัตว์และอาหารเสริม

-

CJ Bioscience มุ่งเน้นการวิจัยและพัฒนาไมโครไบโอมเพื่อสุขภาพ

-

ธุรกิจโลจิสติกส์และค้าปลีก (Logistics & Retail)

- CJ Logistics ให้บริการโลจิสติกส์ครบวงจร ทั้งการขนส่งทางบก ทางทะเล และทางอากาศ รวมถึงบริการคลังสินค้าและการจัดการซัพพลายเชน

-

CJ Olive Young: ร้านค้าปลีกด้านสุขภาพและความงามอันดับหนึ่งของเกาหลี มีผลิตภัณฑ์ยอดนิยม เช่น Anua PDRN Set ชุดบำรุงผิวที่ได้รับความนิยม MILKTOUCH ผลิตภัณฑ์เมคอัพที่ได้รับความนิยม

-

ธุรกิจบันเทิงและสื่อ (Entertainment & Media) อันนี้ยิ่งใหญ่ระดับโลกมากๆ หลายคนคงจำได้กับ ภาพยนตร์เอเชียแรกกับรางวัลออสการ์ Parasite

- CJ ENM บริษัทผลิตและจัดจำหน่ายเนื้อหาบันเทิงที่มีชื่อเสียงระดับโลก มีผลงานเด่น ได้แก่ Crash Landing on You ซีรีส์ที่ได้รับความนิยมอย่างสูง Parasite ภาพยนตร์ที่ได้รับรางวัลออสการ์

- CJ CGV เครือโรงภาพยนตร์มัลติเพล็กซ์ที่มีสาขาทั่วโลก

CJ Group ขยายธุรกิจไปยังต่างประเทศ เช่น การเข้าซื้อกิจการ Schwan's Company ในสหรัฐอเมริกา และการเปิดสาขา CGV ในหลายประเทศ นอกจากนี้ CJ ยังมีบทบาทสำคัญในการเผยแพร่วัฒนธรรมเกาหลีสู่ระดับโลกผ่าน KCON และการผลิตเนื้อหาบันเทิงที่ได้รับความนิยมในต่างประเทศด้วยครับ

จะเห็นได้ว่า เครือข่ายของ CJ นั้นยิ่งใหญ่มากๆเลย ทีนี้มีเรื่องน่าสนใจตรงนี้ครับ

ในช่วงปี 2013–2016 CJ Group โดยเฉพาะฝ่ายสื่อบันเทิงอย่าง CJ ENM ต้องเผชิญกับแรงกดดันจากรัฐบาลของประธานาธิบดี พัค กึนฮเย เหตุการณ์สำคัญคือการที่ อี มีคยอง (Miky Lee) รองประธาน CJ และผู้มีบทบาทสำคัญในการขับเคลื่อนธุรกิจบันเทิงระดับโลก ถูกกดดันให้ลาออกจากตำแหน่ง รายงานระบุว่า ทำเนียบประธานาธิบดีไม่พอใจเนื้อหาสื่อบางรายการของ CJ ที่มีลักษณะเสียดสีหรือวิพากษ์วิจารณ์รัฐบาล เช่น รายการ SNL Korea ที่ล้อเลียนพัค กึนฮเย ผ่านตัวละคร Teletubbies

ภายใต้แรงกดดันนี้ CJ มีการปรับเปลี่ยนเนื้อหาสื่อ โดยลดการนำเสนอเนื้อหาที่อาจขัดแย้งกับรัฐบาล และหันไปผลิตภาพยนตร์ที่สอดคล้องกับนโยบายของรัฐ เช่น ภาพยนตร์เรื่อง Ode to My Father (2014) ที่สะท้อนความรักชาติและการพัฒนาเศรษฐกิจในยุคของพัค ชุงฮี บิดาของพัค กึนฮเย ภาพยนตร์เรื่องนี้ได้รับการสนับสนุนจากรัฐบาลและถูกมองว่าเป็น "ภาพยนตร์เพื่อสุขภาพ" ที่ส่งเสริมความภาคภูมิใจในชาติ แน่นอนว่าแค้นฝังหุ่นมันยังไม่หายไปไหนครับ

เมื่อเกิดการเปิดโปง "บัญชีดำ" (Blacklist) ของรัฐบาลพัค กึนฮเย ที่มีการจำกัดสิทธิเสรีภาพของศิลปินและผู้ผลิตสื่อที่วิพากษ์วิจารณ์รัฐบาล ทำให้เกิดกระแสต่อต้านอย่างรุนแรงในสังคมเกาหลี. ในปี 2016 ซน กยองชิก ประธาน CJ ได้ให้การต่อศาลว่า มีแรงกดดันจากรัฐบาลให้ อี มีคยอง หลีกเลี่ยงการมีบทบาทในบริษัท เหตุการณ์นี้เป็นส่วนหนึ่งของการเปิดโปงคดีทุจริตของพัค กึนฮเย ซึ่งนำไปสู่การประท้วงครั้งใหญ่และการถอดถอนประธานาธิบดีในปี 2017

หลังจากการเปลี่ยนแปลงทางการเมือง CJ Group ได้กลับมามีบทบาทอย่างเต็มที่ในวงการบันเทิงอีกครั้ง อี มีคยอง กลับมาดำรงตำแหน่งและมีบทบาทสำคัญในการผลักดันภาพยนตร์เรื่อง Parasite (2019) ซึ่งได้รับรางวัลออสการ์และยกระดับภาพลักษณ์ของ CJ ในระดับโลก ซึ่งถ้าใครได้ดูหนังเรื่องนั้นแล้วรู้เรื่องราวเบื้องหลังนี้จะเข้าใจเนื้อหาได้อย่างลึกซึ้งขึ้นไปอีกเลยครับ การนำเสนอเรื่องราวนี้ถือเป็นการวิพากษ์วิจารณ์สังคมและระบบทุนนิยมอย่างชัดเจน ซึ่งแตกต่างจากแนวทางที่ CJ เคยถูกกดดันให้ปฏิบัติตามในยุคของพัค กึนฮเย อย่างสิ้นเชิง

อย่าเพิ่งไปสะใจกับเนื้อหา ให้มองว่า "เขาทำอะไรได้บ้าง" นี่คือประเด็นสำคัญครับ #pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ 05a0f81e:fc032124

2025-05-21 19:28:38

@ 05a0f81e:fc032124

2025-05-21 19:28:38Phobia and temperament are two distinct concepts in psychology:

Phobia 1. Specific fear or anxiety: Phobias involve intense, irrational fears or anxieties towards specific objects, situations, or activities. 2. Avoidance behavior: People with phobias often exhibit avoidance behaviors to escape the feared stimulus. 3. Impact on daily life: Phobias can significantly impact an individual's daily life, causing distress and impairment.

Temperament 1. Personality traits: Temperament refers to an individual's inherent personality traits, including emotional reactivity, mood, and behavioral tendencies. 2. Stable patterns: Temperament is relatively stable across situations and over time. 3. Influence on behavior: Temperament influences an individual's behavior, interactions, and responses to various situations.

Key differences 1. Specificity: Phobias are specific to certain objects or situations, while temperament is a broader personality trait. 2. Focus: Phobias focus on fear or anxiety, whereas temperament encompasses a range of personality characteristics. 3. Impact: Phobias can have a significant impact on daily life, while temperament can shape an individual's overall behavior and interactions.

Comparison 1. Both influence behavior: Both phobias and temperament can influence an individual's behavior and responses to situations. 2. Both can be shaped: Both phobias and temperament can be shaped by a combination of genetic and environmental factors.

Understanding the differences and similarities between phobias and temperament can provide valuable insights into human behavior and psychological processes.

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ f85b9c2c:d190bcff

2025-05-21 16:38:32

@ f85b9c2c:d190bcff

2025-05-21 16:38:32 HUNT or be HUNTED in the human food chain.

HUNT or be HUNTED in the human food chain.That's the raw truth of life, not just in the wild but in the intricate web of human society, where we're all part of a relentless food chain. At the core, life is a survival game, where every individual, knowingly or not, plays their part either as hunter or prey. But in human society, the stakes aren't just about physical survival; they're about financial, social, and psychological dominance. Here, the food chain isn't just about who eats whom but who can leverage, influence, or sometimes exploit others for their own gain.

Leaders, those at the top of this human hierarchy, often have a knack for exploitation, albeit wrapped in the guise of opportunity or progress. They understand the game: to maintain their position, they must keep feeding on the resources, be they intellectual, financial, or labor from those below. Think about how big corporations might use their power to influence legislation, control markets, or keep wages low to maximize profit. The poor, in this scenario, are often the hunted, their energy and labor harvested to sustain the comfort and luxury of those at the top. But here's the twist in this human food chain: everyone, from the top to the bottom, engages in some form of selfishness. It's not just about the rich exploiting the poor; even within the same strata, we see people clawing for their spot, their advantage. We're all, in some way, looking out for number one, whether it's through office politics, personal branding, or simply ensuring our survival in an increasingly competitive world. We justify our actions, our small betrayals or manipulations, as necessary for survival or success, mirroring the natural world where every creature fights to live another day. This doesn't mean we're all villains or victims; it's just the reality of the game we're all playing. The key is recognizing this dynamic and deciding how you'll play your part. Will you be the prey, always on the run or hiding, or will you become the predator, learning to hunt, to strategize, to thrive? Here’s what I’ve learned through my journey up this chain: it’s not about the ruthlessness of taking but the resilience to grow. The most dangerous predators in our world are those who not only know how to hunt but also how to adapt, learn, and sometimes, protect or help others as part of their strategy (I think I might be part of them). It’s about understanding that today’s prey could be tomorrow’s ally or competitor.

So, to those reading this, don't give up. The climb to the top is steep, fraught with challenges, but it's not impossible. Keep learning, keep evolving. Use your experiences, your setbacks as lessons rather than defeats. In this human food chain, there's always room at the top for those willing to work for it, to adapt, to survive, and to thrive. I hope to see you at the top of the food chain, not just surviving, but truly living.

-

@ f85b9c2c:d190bcff

2025-05-21 16:35:02

@ f85b9c2c:d190bcff

2025-05-21 16:35:02 A Crypto Wallet is a container for digital assets (Cryptocurrencies & NFT). It’s like a tool that helps us manage our assets in one place and allows us to do transactions. It is a gateway to blockchain. Cryptocurrencies never leave the native blockchain, they are just transferred from one wallet to another.

A Crypto Wallet is a container for digital assets (Cryptocurrencies & NFT). It’s like a tool that helps us manage our assets in one place and allows us to do transactions. It is a gateway to blockchain. Cryptocurrencies never leave the native blockchain, they are just transferred from one wallet to another.A Wallet has two components : 1. Public Key 2. Private Key

Public Key The address that you use to send or receive the assets is the public key. For different tokens on a same chain, there is one public key. Whereas for multi chain wallets there are multiple public keys for each chain. That’s why you have same wallet address for DAI and ETH in Metamask, whereas different addresses for Solana and Eth.

Private Key The private key is a 12, 18 or 24 long phrase that we are asked to save when we create a new wallet. This phrase is needed to verify the ownership of the assets in the wallet, if you loose your phrase you lose the assets in the wallet.

There are 2 types of wallets: 1.Hot wallet 2.Cold wallet Hot wallet The wallet that is connected to the internet is called a hot wallet. Like Metamask Phantom or Trust Wallet. It’s also called Software Wallet that can be either web based/extension, desktop wallet or mobile app wallet. Cold wallet It’s a hardware device that stores the assets along with private and the public keys but is never connected to the internet. It’s like a store of value, people who hold for long term prefer using a ledger as it’s safe from hackers

-

@ 3fa9f42b:00d5e778

2025-05-21 09:56:23

@ 3fa9f42b:00d5e778

2025-05-21 09:56:23S689 đang ngày càng khẳng định vị thế của mình như một nền tảng kỹ thuật số uy tín và thân thiện với người dùng tại thị trường Việt Nam. Với giao diện hiện đại, tinh gọn và dễ sử dụng, S689 tạo cảm giác thoải mái ngay từ lần đầu truy cập. Tất cả các yếu tố từ thiết kế, bố cục, màu sắc đến cách bố trí các chức năng đều được tối ưu để phục vụ nhu cầu truy cập nhanh chóng và thuận tiện. Người dùng có thể sử dụng S689 trên nhiều thiết bị khác nhau như điện thoại thông minh, máy tính bảng hay laptop mà không gặp khó khăn về tương thích hay tốc độ tải trang. Hệ thống tìm kiếm nhanh, điều hướng mượt mà và khả năng cá nhân hóa nội dung theo sở thích giúp S689 trở thành một lựa chọn lý tưởng cho những ai tìm kiếm sự linh hoạt và hiệu quả trong trải nghiệm số hằng ngày. Không chỉ đơn thuần là một nền tảng trực tuyến, S689 còn là cầu nối mang đến sự tiện nghi, kết nối người dùng với các nội dung chất lượng và phù hợp với nhu cầu cá nhân.

Một trong những điểm mạnh nổi bật của S689 chính là khả năng vận hành ổn định và độ bảo mật cao. Nền tảng được xây dựng trên nền tảng công nghệ tiên tiến, luôn cập nhật các tiêu chuẩn kỹ thuật mới để đảm bảo hiệu suất hoạt động mượt mà và ổn định nhất. Người dùng không phải lo lắng về gián đoạn dịch vụ hay những lỗi kỹ thuật gây ảnh hưởng đến trải nghiệm. Sự an toàn thông tin cá nhân luôn được đặt lên hàng đầu, với các biện pháp bảo mật đa lớp, mã hóa dữ liệu và kiểm soát truy cập chặt chẽ. Chính sách bảo mật minh bạch và hệ thống giám sát tự động giúp người dùng yên tâm khi sử dụng S689 trong thời gian dài. Bên cạnh đó, đội ngũ chăm sóc khách hàng chuyên nghiệp của S689 hoạt động liên tục 24/7 để hỗ trợ người dùng giải quyết mọi vấn đề một cách nhanh chóng, từ các thắc mắc kỹ thuật cho đến hỗ trợ về thông tin tài khoản. Nhờ đó, S689 không chỉ đảm bảo chất lượng dịch vụ mà còn tạo được sự tin tưởng tuyệt đối từ cộng đồng người dùng.

Không dừng lại ở việc xây dựng một nền tảng kỹ thuật số chất lượng, S689 còn chú trọng phát triển một cộng đồng tương tác tích cực và sôi động. Các hoạt động sự kiện, ưu đãi định kỳ và chương trình tặng thưởng cho người dùng thân thiết giúp tạo ra sự gắn bó lâu dài giữa người dùng và nền tảng. Sự tương tác không chỉ đơn thuần mang tính cá nhân mà còn mở rộng ra thành các kết nối cộng đồng, nơi người dùng có thể chia sẻ kinh nghiệm, hỗ trợ nhau và cùng nhau trải nghiệm tiện ích trên nền tảng. Điều này giúp S689 không chỉ là một công cụ sử dụng đơn lẻ, mà còn là một phần của cuộc sống kỹ thuật số hiện đại, nơi mà mỗi người dùng đều cảm nhận được giá trị và sự quan tâm. Với định hướng phát triển bền vững, lấy người dùng làm trung tâm, S689 tiếp tục mở rộng quy mô, cải tiến chất lượng và ứng dụng công nghệ tiên tiến để phục vụ tốt hơn nhu cầu ngày càng đa dạng của người sử dụng. Đây chính là lý do S689 đang ngày càng được yêu thích và tin dùng rộng rãi trên thị trường hiện nay.

-

@ f6488c62:c929299d

2025-05-21 08:52:36

@ f6488c62:c929299d

2025-05-21 08:52:36ปี 2568 ตลาดคริปโตยังคงเต็มไปด้วยความร้อนแรงและโอกาส Bitcoin พุ่งแตะ 106,595.5 ดอลลาร์ (ณ วันที่ 21 พ.ค. 2568) ขณะที่เหรียญมีมอย่าง KPEPE ก็กลายเป็นที่จับตามองของเหล่านักลงทุนรายใหญ่ แต่ท่ามกลางกระแสความร้อนแรง คำถามสำคัญยังคงอยู่: ตลาดคริปโตอยู่ช่วงไหนของวัฏจักร? และโอกาสใหญ่กำลังมาหรือใกล้จบลงแล้ว?

หนึ่งในเสียงที่ดังที่สุดในชุมชนคริปโตตอนนี้คือชื่อที่หลายคนอาจยังไม่รู้จักแน่ชัด – James Wynn เขาโพสต์ข้อความเมื่อวันที่ 31 มีนาคม 2568 ว่า

“The best is yet to come.” หรือ “สิ่งที่ดีที่สุดยังมาไม่ถึง” – คำพูดที่จุดประกายความหวังในชุมชนนักเทรดทั่วโลก

แม้เขาจะถูกยกย่องว่าเป็น “วาฬคริปโต” จากการถือครองมูลค่ามหาศาล แต่ในความเป็นจริง เรายังไม่รู้ว่าเขาคือใคร – ชื่อ James Wynn อาจเป็นเพียงนามแฝง หรือ persona บนโลกออนไลน์ก็เป็นได้

ในบทความนี้ เราจะวิเคราะห์มุมมองของเขาอย่างมีวิจารณญาณ พร้อมแนะแนวทางที่นักเทรดควรเตรียมตัวเพื่อคว้าโอกาสในช่วงขาขึ้นนี้

ภาพรวมตลาดคริปโตในปี 2568 ปีนี้ถือเป็นช่วงขาขึ้นที่เกิดจากหลายปัจจัยสำคัญ:

การอนุมัติ Bitcoin Spot ETFs ในสหรัฐฯ

การเข้ารับตำแหน่งของ Donald Trump พร้อมนโยบายที่เป็นมิตรต่อคริปโต เช่น การผลักดันให้ Bitcoin เป็นสินทรัพย์สำรองของชาติ

ปัจจัยเหล่านี้ได้ดึงดูดทั้งนักลงทุนรายย่อยและสถาบันเข้าสู่ตลาด ส่งผลให้ราคาของ BTC และเหรียญมีมอย่าง KPEPE พุ่งสูงขึ้นอย่างรวดเร็ว สะท้อนถึงโมเมนตัมที่ยังคงแข็งแกร่ง

มุมมองจาก ‘James Wynn’: ปลายวัฏจักร? หรือแค่เริ่มต้น? แม้จะไม่มีใครรู้แน่ชัดว่า James Wynn คือใคร แต่เขากลายเป็นบุคคลที่มีอิทธิพลในชุมชนคริปโตจากการเปิดเผยมุมมองที่เฉียบคมและพอร์ตการลงทุนขนาดใหญ่

เขาโพสต์ไว้ว่า

“ถ้าใครคิดว่าเราอยู่ท้ายวัฏจักรแล้ว คุณคิดผิด”

โดยให้เหตุผลหลัก 3 ข้อ:

การพุ่งขึ้นของราคาส่วนใหญ่เกิดจาก ข่าวดีภายนอก เช่น ETF ยังไม่ใช่ "กระแสล้นตลาด"

นโยบายรัฐบาล Trump ส่งผลเชิงจิตวิทยาเชิงบวกต่อทั้งนักลงทุนและตลาด

ยังไม่เกิด Altcoin Season หรืออารมณ์ตลาดช่วง “Euphoria” ตามแผนภาพ Psychology of a Market Cycle

เขาประเมินว่าตลาดน่าจะอยู่ช่วง “Optimism → Thrill” ซึ่งเป็นช่วงกลางของวัฏจักรที่นักลงทุนเริ่มตื่นเต้น แต่ยังไม่ถึงจุดสูงสุด

เขาเป็นใคร? วาฬตัวจริงหรือบุคคลลึกลับ? แม้ James Wynn จะได้รับความสนใจอย่างมาก แต่ตัวตนของเขายังคลุมเครือ:

ไม่มีข้อมูลยืนยันตัวตนชัดเจน

ไม่รู้ว่าเขาเป็นบุคคล กลุ่ม หรือองค์กร

ใช้นามแฝงออนไลน์ และบัญชีเทรดที่ระบุไว้ไม่ผูกกับตัวตนจริง

ถึงอย่างนั้น พฤติกรรมการลงทุนของเขาก็ไม่ธรรมดา:

Long BTC-USD ด้วยเลเวอเรจ 40x กว่า 5,200 BTC (มูลค่ากว่า 546 ล้านดอลลาร์)

Long KPEPE-USD ด้วยเลเวอเรจ 10x มูลค่ากว่า 32.8 ล้านดอลลาร์

รวมกำไรจากการเทรดกว่า 20.2 ล้านดอลลาร์ (ราว 687 ล้านบาท)

ใช้แพลตฟอร์ม Hyperliquid และแสดงจุดยืนต่อต้าน CEX บางแห่งอย่าง Bybit ที่เขาเคยกล่าวหาว่ามีการ manipulate ตลาด

สิ่งที่น่าสนใจคือ Wynn มักจะลดตำแหน่งและล็อกกำไรอย่างเป็นระบบ เช่น วันที่ 20 พ.ค. 2568 เขาลดตำแหน่ง BTC ลง 1,142 BTC และถอน USDC กลับวอลเล็ตส่วนตัว – สะท้อนถึงการบริหารความเสี่ยงที่รอบคอบ

แนวทางสำหรับนักเทรด: ถ้า "สิ่งที่ดีที่สุด" ยังมาไม่ถึง... หากมุมมองของ Wynn ถูกต้อง และตลาดยังไม่ถึงจุดสูงสุด ต่อไปนี้คือตัวอย่างแนวทางที่นักเทรดควรพิจารณา:

🔹 วางแผนรับ pullback: หากอยู่ในช่วง "Thrill" ตลาดอาจมีการพักตัวชั่วคราว – เป็นโอกาสในการ “ซื้อซ้ำ” ก่อนเข้าสู่จุดพีค

🔹 จับตา altcoin season: การที่เหรียญมีมอย่าง KPEPE พุ่งขึ้น อาจเป็นสัญญาณล่วงหน้าของ Altcoin Season ที่กำลังจะเริ่ม – เตรียมลิสต์เหรียญที่มีศักยภาพ

🔹 เน้นการบริหารความเสี่ยง: ใช้ stop-loss และเลเวอเรจอย่างระมัดระวัง อย่าลืมว่าวัฏจักรคริปโตสามารถเปลี่ยนแปลงอย่างรวดเร็ว

🔹 ติดตามความเคลื่อนไหวของวาฬ (แม้จะไม่รู้ว่าเขาคือใคร): เช่น ที่อยู่กระเป๋า 0x5078C2FbeA2B2aD61bcB40BC0233E5Ce56EDb6 ซึ่งเชื่อว่าเป็นของ Wynn – การเคลื่อนไหวของกระเป๋านี้อาจบ่งชี้แนวโน้มตลาดล่วงหน้า

สรุป แม้เราจะยังไม่รู้แน่ชัดว่า James Wynn คือใคร หรือแม้กระทั่งเขามีอยู่จริงหรือไม่ แต่คำพูดของเขาก็สอดคล้องกับทิศทางตลาดในปัจจุบันที่ยังคงอยู่ในขาขึ้น

“The best is yet to come.” – ถ้าเขาพูดถูก โอกาสที่ดีที่สุดในตลาดคริปโตปี 2568 ก็ยังไม่มาถึง

นักเทรดควร:

ติดตามสัญญาณตลาดอย่างรอบคอบ

จัดพอร์ตให้พร้อมสำหรับการเปลี่ยนแปลง

และที่สำคัญ — อย่าหลงกระแส โดยไม่มีแผนรองรับ

วาฬที่แท้จริงอาจไม่มีชื่อเสียง… และนั่นแหละคือสิ่งที่ทำให้พวกเขาน่าจับตายิ่งกว่าใคร

-

@ 502ab02a:a2860397

2025-05-21 07:49:22

@ 502ab02a:a2860397

2025-05-21 07:49:22หลายคนอาจแปลกใจว่า ทำไมน้ำมันจากผลไม้แบบอโวคาโดถึงกล้าขึ้นชั้น “ไขมันดี” ไปเทียบกับน้ำมันมะกอกได้ ทั้งที่ฟังดูไม่หรูเท่า แต่ความจริงแล้ว น้ำมันอโวคาโดคือหนึ่งในไม่กี่ชนิดของน้ำมันพืชที่สกัดจาก “เนื้อผล” ไม่ใช่เมล็ด ทำให้มีโครงสร้างไขมันที่ต่างจาก seed oils ทั่วไป ทั้งในแง่กรดไขมัน สารต้านอนุมูลอิสระ และวิธีที่มันตอบสนองต่อความร้อน

น้ำมันอโวคาโดมีกรดไขมันไม่อิ่มตัวตำแหน่งเดียว (MUFA) เป็นหลัก โดยเฉพาะ กรดโอเลอิก (Oleic acid) ซึ่งคิดเป็นประมาณ 65–70% ของไขมันทั้งหมด ใกล้เคียงน้ำมันมะกอกเลย แต่เหนือกว่าเล็กน้อยในแง่ของ ค่าควัน (smoke point) ที่สูงถึง 250°C (แบบ refined) และราว 190–200°C (แบบ cold-pressed) ทำให้เหมาะกับการผัดหรือทอดแบบเบา ๆ โดยไม่ทำให้เกิดสารพิษจากไขมันไหม้เร็วเท่าน้ำมันที่ค่าควันต่ำ

นอกจาก MUFA แล้ว น้ำมันอโวคาโดยังมี PUFA อยู่เล็กน้อย ประมาณ 10–14% ส่วนใหญ่คือ โอเมก้า-6 (linoleic acid) ซึ่งก็มีปริมาณไม่มากจนถึงขั้นต้องห่วงเรื่องการอักเสบ เหมือนที่เจอกับพวกน้ำมันรำข้าวหรือถั่วเหลืองที่ PUFA พุ่งสูงเกิน 50% ขึ้นไป และที่สำคัญ...โอเมก้า-3 ในอโวคาโดก็มีอยู่บ้างในรูปของ ALA แม้ไม่เยอะ แต่ก็บอกได้ว่าโครงสร้างโดยรวมของมันสมดุลพอควร ถ้ามองในรูปแบบพลังงานไขมัน ก็ถือว่าใช้ได้เลย

อโวคาโดออยล์แบบไม่ผ่านกระบวนการ (unrefined) ยังมีพวก วิตามินอี (tocopherols) ในระดับประมาณ 13–20 มก. ต่อ 100 กรัม และสารโพลีฟีนอลบางชนิดราวๆ 30–50 mg GAE/100 กรัม เช่น catechins และ procyanidins อยู่บ้าง ซึ่งช่วยลดการเกิดอนุมูลอิสระตอนเจอความร้อน และยังดีต่อผิวหนังในมิติของ skincare ด้วยนะ

ถ้าใช้แบบ cold-pressed, unrefined กลิ่นมันจะออกคล้ายอะโวคาโดสุก ๆ หน่อย มีความเขียวอ่อน ๆ และครีมมี่เล็ก ๆ ซึ่งเหมาะกับการคลุกหรือปรุงแบบ low heat มากกว่าการทอดแรง ส่วนถ้าจะใช้ทำอาหารจริงจัง น้ำมันอโวคาโดแบบ refined ก็จะกลิ่นอ่อนลง สีใสขึ้น และทนไฟได้ดีขึ้นมาก เหมาะจะเอาไปทำ steak หรือผัดไฟกลางได้แบบไม่กังวล อันนี้ก็แล้วแต่จะเลือกนะครับ

ถ้าจะพูดให้ตรง… น้ำมันอโวคาโดคือ “ไขมันผลไม้สายกลาง” ที่ทั้งทนไฟพอใช้ ทำครัวได้หลากหลาย และไม่บิดเบือนสัดส่วนไขมันในร่างกายเราจนเกินไป และถ้าเลือกแบบที่ผลิตดี ไม่โดนสารเคมี ไม่โดนไฮโดรเจนเสริม ก็ถือว่าเป็นน้ำมันดีอีกตัวที่วางใจได้ในครัวจริง ๆ

ใครอยากลองทำเองที่บ้านก็ได้นะ แบบง่ายๆแค่มีผ้าขาวบาง https://youtu.be/gwHGgoMuRnI?si=ehcQceabdbMGfkwG

นอกจากนี้บางคนอาจเคยเห็นโฆษณาสินค้าที่มีน้ำมันจากเมล็ดและเปลือกด้วยใช่ไหมครับ

เมล็ดอโวคาโดนั้นอุดมไปด้วย ไขมันน้อยกว่ามาก เมื่อเทียบกับเนื้อผล แต่มีสารพฤกษเคมีบางชนิดที่นักวิจัยสนใจ เช่น ฟีนอลิกส์ (phenolics), ฟลาโวนอยด์, สารต้านจุลชีพ และ ไฟเบอร์ละลายน้ำสูง การสกัดน้ำมันจากเมล็ดมักจะใช้ ตัวทำละลาย (solvent extraction) หรือ วิธี supercritical CO₂ ไม่ค่อยทำแบบ cold-pressed เพราะน้ำมันน้อยเกิน ปริมาณน้ำมันจากเมล็ดนั้นต่ำมาก คือไม่ถึง 5% ของน้ำหนักแห้ง ทำให้ไม่ค่อยนิยมในเชิงพาณิชย์ น้ำมันจากเมล็ดมักไม่ได้เอาไว้ปรุงอาหาร แต่เอาไปใช้ ด้านเวชสำอาง หรือ functional food มากกว่า เช่น ครีมทาผิว แชมพู หรือผลิตภัณฑ์ชะลอวัย

เปลือกอโวคาโดมี สารต้านจุลชีพและสารต้านออกซิเดชัน บางชนิดเช่นกัน แต่มีไขมันน้อยมากแทบจะไม่มีเลย บางงานวิจัยพยายามสกัดพวก polyphenols หรือสารสีธรรมชาติจากเปลือก เพื่อใช้ในอาหารเสริม หรือผลิตภัณฑ์สุขภาพ ไม่ได้สกัดน้ำมันโดยตรง แบบเนื้อผล แต่ใช้เปลือกเป็นวัตถุดิบเสริมมากกว่า เช่น ผสมในน้ำมันหลักเพื่อเพิ่มคุณสมบัติด้านสุขภาพ

ส่วนตัวคิดว่าไม่ต้องทำเองหรอกครับ ซื้อกินเหอะ 555 เจ้านี้ดีนะ อยู่คู่วงการสุขภาพมาแต่แรกๆเลย https://s.shopee.co.th/8zsnEsLrvh

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ 15f9e159:ca9a5ac4

2025-05-21 07:37:11

@ 15f9e159:ca9a5ac4

2025-05-21 07:37:11A plataforma 755Bet é uma das principais opções para quem busca uma experiência única no universo dos jogos online. Com uma interface intuitiva, jogos de alta qualidade e uma experiência de usuário focada na diversão e no prazer do jogador, o 755Bet se destaca como um dos destinos preferidos para quem deseja aproveitar ao máximo o entretenimento digital. Vamos explorar o que torna o 755Bet uma plataforma tão especial e por que ele deve ser a sua próxima escolha para diversão online.

Plataforma 755Bet: Um Espaço Inovador e Completo O 755Bet oferece aos jogadores uma plataforma moderna e fácil de navegar, permitindo que se conectem ao mundo do entretenimento online com apenas alguns cliques. A plataforma é projetada para ser acessível tanto para novatos quanto para jogadores experientes, com recursos que atendem a diferentes gostos e preferências.

Com um design que prioriza a simplicidade, o 755Bet garante que seus usuários possam encontrar rapidamente o que procuram. Seja para jogar ou simplesmente explorar as opções oferecidas, a experiência do usuário é fluida e sem complicações. Além disso, o site é otimizado para dispositivos móveis, permitindo que você aproveite a diversão a qualquer hora e em qualquer lugar.

A plataforma oferece diversos métodos de pagamento seguros, garantindo que os jogadores possam realizar transações de maneira rápida e sem preocupações. O 755bet também investe constantemente em melhorar a segurança dos dados de seus usuários, com protocolos avançados de criptografia para proteger as informações pessoais e financeiras.

Jogos no 755Bet: Variedade para Todos os Gostos Uma das principais atrações do 755Bet é a ampla seleção de jogos oferecidos. Se você é fã de jogos de mesa, como blackjack e roleta, ou prefere jogos de habilidade e estratégia, o 755Bet tem algo para todos. A variedade de opções garante que cada jogador possa encontrar o jogo que mais lhe agrada, com gráficos de alta qualidade e jogabilidade envolvente.

O site conta com uma vasta gama de opções, que incluem títulos populares de diferentes categorias. Além disso, novos jogos estão sempre sendo adicionados ao portfólio, garantindo que os jogadores nunca fiquem sem novidades. A plataforma oferece jogos com diferentes níveis de dificuldade, o que significa que tanto iniciantes quanto veteranos podem aproveitar as opções disponíveis, sempre encontrando o jogo que se adapta ao seu estilo.

Experiência do Jogador: Diversão e Comodidade No 755Bet, a experiência do jogador é uma prioridade. A plataforma não apenas oferece jogos de alta qualidade, mas também foca em criar um ambiente acolhedor e acessível. O atendimento ao cliente é uma parte fundamental da experiência do usuário, com uma equipe dedicada pronta para responder a qualquer dúvida ou ajudar com problemas de forma rápida e eficaz.

Além disso, o 755Bet oferece promoções e bônus que tornam a experiência ainda mais interessante para seus jogadores. Isso inclui recompensas para novos membros, bem como ofertas especiais para usuários regulares. Esses incentivos ajudam a manter a motivação dos jogadores e garantem que a experiência seja sempre divertida e recompensadora.

O 755Bet também conta com recursos de personalização que permitem aos jogadores ajustar a plataforma conforme suas preferências. Isso pode incluir a escolha de temas, ajustes de notificação e preferências de jogo, tudo para garantir que o ambiente de jogo seja o mais agradável possível.

Conclusão O 755Bet se destaca como uma plataforma completa para quem busca uma experiência online rica e envolvente. Com uma interface intuitiva, uma ampla variedade de jogos e um foco constante na satisfação do jogador, ele é um destino obrigatório para aqueles que querem explorar o universo dos jogos online de forma segura, divertida e acessível. Seja você um novato ou um jogador experiente, o 755Bet tem tudo o que você precisa para uma experiência inesquecível.

-

@ 15f9e159:ca9a5ac4

2025-05-21 07:36:25

@ 15f9e159:ca9a5ac4

2025-05-21 07:36:25O mundo dos jogos online está sempre em evolução, e novas plataformas surgem constantemente para oferecer experiências únicas aos jogadores. O 0e0e é uma dessas plataformas, que vem conquistando o público com uma proposta inovadora, repleta de jogos envolventes e uma interface amigável. Se você está em busca de uma nova forma de diversão e desafios, o 0e0e oferece tudo isso e muito mais.

Introdução à Plataforma 0e0e O 0e0e é uma plataforma online que tem como principal objetivo proporcionar uma experiência de entretenimento de qualidade. Com um design moderno e acessível, a plataforma é fácil de navegar, permitindo que os jogadores se sintam à vontade ao explorar suas diversas funcionalidades. O 0e0e está disponível para todos os tipos de dispositivos, garantindo que os usuários possam jogar a qualquer hora e em qualquer lugar, seja no desktop ou no celular.

Ao acessar a plataforma, os jogadores têm acesso a uma ampla variedade de jogos, além de recursos que tornam a experiência ainda mais agradável, como bônus atrativos, promoções e um atendimento ao cliente de excelência. O 0e0efoca em criar um ambiente dinâmico, que agrada tanto aos iniciantes quanto aos jogadores mais experientes.

Jogos no 0e0e: Diversão Sem Limites Uma das maiores vantagens do 0e0e é sua vasta seleção de jogos, que atende aos mais diversos gostos e preferências. Seja você fã de jogos de habilidade, estratégia ou entretenimento de alta ação, a plataforma tem opções para todos. Entre os jogos mais populares, encontramos desde clássicos da cultura de jogos até títulos exclusivos que você não encontra facilmente em outras plataformas.

Os jogos disponíveis são desenvolvidos por fornecedores renomados da indústria, garantindo gráficos impressionantes, jogabilidade fluida e uma experiência imersiva. Cada jogo foi cuidadosamente selecionado para proporcionar momentos de diversão, com desafios que mantêm os jogadores engajados e motivados a explorar cada vez mais as opções da plataforma.

Uma das atrações mais procuradas pelos usuários do 0e0e são os jogos de mesa, que oferecem uma experiência tradicional de jogo com um toque moderno. Os jogadores podem escolher entre várias modalidades, cada uma com regras fáceis de aprender, mas desafiadoras o suficiente para manter o interesse.

Além disso, a plataforma oferece jogos com temas variados, desde aventuras épicas a opções mais leves e descontraídas. Seja você um jogador casual ou alguém em busca de competição, há sempre algo para experimentar no 0e0e.

Experiência do Jogador: Conforto e Inovação O 0e0e entende que a experiência do jogador vai além da simples escolha de jogos. A plataforma investe em diversos aspectos para garantir que a navegação seja intuitiva e sem complicações. O processo de registro e acesso aos jogos é simples, permitindo que qualquer pessoa, independentemente da sua familiaridade com plataformas digitais, possa começar a jogar rapidamente.

Além disso, o 0e0e conta com um suporte ao cliente eficiente, pronto para ajudar em qualquer questão que possa surgir durante a jornada do jogador. A equipe de suporte está disponível 24 horas por dia, 7 dias por semana, oferecendo um atendimento rápido e amigável.

Para tornar a experiência ainda mais imersiva, o 0e0e disponibiliza uma série de promoções e bônus especiais para seus usuários. Estes benefícios são pensados para aumentar a diversão e proporcionar mais oportunidades de ganhar, criando um ambiente onde os jogadores podem aproveitar ao máximo cada momento.

A plataforma também oferece métodos de pagamento rápidos e seguros, garantindo que os depósitos e retiradas sejam realizados de maneira tranquila, sem qualquer complicação. A segurança dos dados do usuário é uma prioridade para o 0e0e, que utiliza tecnologia de ponta para proteger todas as informações pessoais e financeiras.

Conclusão: O 0e0e Como a Escolha Certa para os Jogadores O 0e0e é muito mais do que uma plataforma de jogos; é um espaço onde diversão, emoção e segurança se encontram. Com uma interface amigável, uma vasta seleção de jogos e um suporte ao cliente dedicado, o 0e0e oferece tudo o que um jogador precisa para se divertir e viver novas experiências. Seja você um iniciante ou um veterano, o 0e0e tem tudo para tornar sua jornada ainda mais emocionante e recompensadora. Não perca a chance de explorar tudo o que essa plataforma incrível tem a oferecer!

-

@ 15f9e159:ca9a5ac4

2025-05-21 07:35:46

@ 15f9e159:ca9a5ac4

2025-05-21 07:35:46A 55kd é uma plataforma inovadora no cenário de jogos online, criada para oferecer aos jogadores uma experiência única e envolvente. Se você está procurando por uma maneira divertida de passar o tempo, explorar novos jogos e viver grandes emoções, a 55kd pode ser o lugar ideal. Neste artigo, vamos explorar como a 55kd se destaca, desde sua introdução até a experiência dos jogadores e a vasta gama de jogos disponíveis.

Introdução à Plataforma 55kd A 55kd surgiu com a missão de revolucionar o mundo dos jogos online, oferecendo uma plataforma fácil de navegar, segura e repleta de opções de entretenimento. Com um design moderno e uma interface amigável, a plataforma foi desenvolvida para atender tanto jogadores iniciantes quanto veteranos, garantindo que todos se sintam confortáveis e imersos na experiência.

A 55kd prioriza a acessibilidade e a praticidade, permitindo que os jogadores acessem os jogos de forma rápida e sem complicações. Com um sistema eficiente de registro e uma plataforma intuitiva, novos usuários podem se cadastrar e começar a jogar rapidamente, sem a necessidade de processos complexos.

Variedade de Jogos na 55kd A plataforma 55kdse destaca pela grande variedade de jogos que oferece aos seus usuários. Desde opções de estratégia até os jogos mais emocionantes de sorte e habilidade, há algo para todos os gostos. A cada visita, os jogadores podem esperar novas e emocionantes opções para explorar.

Entre os jogos mais populares, destacam-se as opções de jogos de mesa, slots de vídeo e jogos de habilidade. Cada jogo foi cuidadosamente selecionado e desenvolvido para garantir uma experiência de alta qualidade, com gráficos impressionantes, jogabilidade fluida e recursos inovadores.

Os jogos de mesa, por exemplo, oferecem desafios para aqueles que preferem jogos de raciocínio e estratégia. Já os slots de vídeo são ideais para quem busca emoção e diversão instantânea, com uma ampla gama de temas e bônus que aumentam a adrenalina.

Além disso, a 55kd também oferece jogos de habilidade, permitindo que os jogadores mostrem sua destreza e competência. Esses jogos são perfeitos para aqueles que gostam de testar suas habilidades e estratégias, competindo com outros jogadores por grandes prêmios.

A Experiência do Jogador na 55kd Uma das maiores preocupações da 55kd é garantir que seus jogadores tenham uma experiência de jogo impecável. A plataforma investe constantemente em melhorias para proporcionar um ambiente seguro, rápido e transparente. A segurança é uma prioridade, e a plataforma utiliza tecnologias de ponta para proteger as informações dos usuários, além de garantir transações rápidas e seguras.

A 55kd também se destaca pelo seu suporte ao cliente. Se os jogadores tiverem dúvidas ou enfrentarem problemas durante o jogo, uma equipe de suporte altamente treinada está disponível para oferecer assistência imediata. O suporte é acessível por vários canais, como chat ao vivo e e-mail, garantindo que os jogadores se sintam sempre amparados.

Além disso, a plataforma oferece um sistema de bônus e promoções que torna a experiência ainda mais emocionante. Oferecendo prêmios, ofertas exclusivas e recompensas constantes, a 55kd mantém os jogadores motivados e engajados, proporcionando uma sensação contínua de novidade e prazer.

Conclusão A 55kd se destaca como uma plataforma completa e de alta qualidade, que oferece não apenas uma ampla gama de jogos, mas também uma experiência personalizada para cada jogador. Com uma interface intuitiva, jogos diversificados e um suporte excepcional, a 55kd é a escolha ideal para quem busca diversão e entretenimento de qualidade.

Se você ainda não experimentou a 55kd, está na hora de se juntar a essa comunidade vibrante e explorar tudo o que ela tem a oferecer. Prepare-se para uma jornada inesquecível de diversão, desafios e grandes vitórias.

-

@ bc6ccd13:f53098e4

2025-05-21 22:13:47

@ bc6ccd13:f53098e4

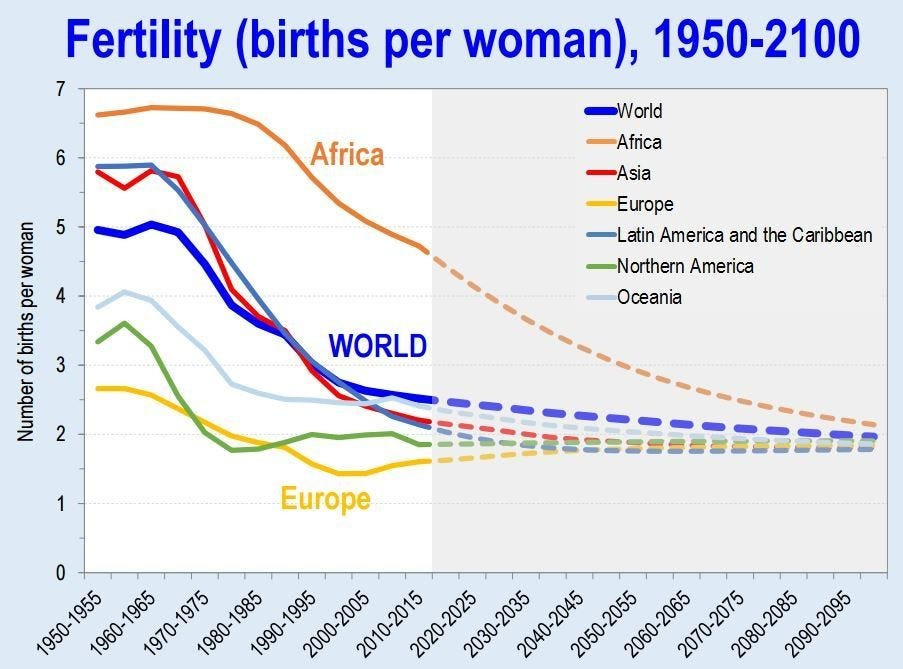

2025-05-21 22:13:47The global population has been rising rapidly for the past two centuries when compared to historical trends. Fifty years ago, that trend seemed set to continue, and there was a lot of concern around the issue of overpopulation. But if you haven’t been living under a rock, you’ll know that while the population is still rising, that trend now seems set to reverse this century, and there’s every indication population could decline precipitously over the next two centuries.

Demographics is a field where predictions about the future are much more reliable than in most scientific fields. That’s because future population trends are “baked in” decades in advance. If you want to know how many fifty-year-olds there will be in forty years, all you have to do is count the ten-year-olds today and allow for mortality rates. That maximum was already determined by the number of births ten years ago, and absolutely nothing can change that now. The average person doesn’t think that through when they look at population trends. You hear a lot of “oh we just need to do more of x to help the declining birthrate” without an acknowledgement that future populations in a given cohort are already fixed by the number of births that already occurred.

As you can see, global birthrates have already declined close to the 2.3 replacement level, with some regions ahead of others, but all on the same trajectory with no region moving against the trend. I’m not going to speculate on the reasons for this, or even whether it’s a good or bad thing. Instead I’m going to make some observations about outcomes this trend could cause economically, and why. Like most macro issues, an individual can’t do anything to change the global landscape personally, but knowing what that landscape might look like is essential to avoiding fallout from trends outside your control.

The Resource Pie

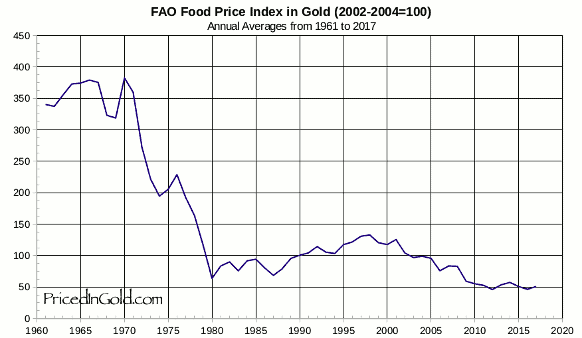

Thomas Malthus popularized the concern about overpopulation with his 1798 book An Essay on the Principle of Population. The basic premise of the book was that population could grow and consume all the available resources, leading to mass poverty, starvation, disease, and population collapse. We can say in hindsight that this was incorrect, given that the global population has increased from less than a billion to over eight billion since then, and the apocalypse Malthus predicted hasn’t materialized. Exactly the opposite, in fact. The global standard of living has risen to levels Malthus couldn’t have imagined, much less predicted.

So where did Malthus go wrong? His hypothesis seems reasonable enough, and we do see a similar trend in certain animal populations. The base assumption Malthus got wrong was to assume resources are a finite, limiting factor to the human population. That at some point certain resources would be totally consumed, and that would be it. He treated it like a pie with a lot of slices, but still a finite number, and assumed that if the population kept rising, eventually every slice would be consumed and there would be no pie left for future generations. That turns out to be completely wrong.

Of course, the earth is finite at some abstract level. The number of atoms could theoretically be counted and quantified. But on a practical level, do humans exhaust the earth’s resources? I’d point to an article from Yale Scientific titled Has the Earth Run out of any Natural Resources? To quote,

> However, despite what doomsday predictions may suggest, the Earth has not run out of any resources nor is it likely that it will run out of any in the near future. > > In fact, resources are becoming more abundant. Though this may seem puzzling, it does not mean that the actual quantity of resources in the Earth’s crust is increasing but rather that the amount available for our use is constantly growing due to technological innovations. According to the U.S. Geological Survey, the only resource we have exhausted is cryolite, a mineral used in pesticides and aluminum processing. However, that is not to say every bit of it has been mined away; rather, producing it synthetically is much more cost efficient than mining the existing reserves at its current value.

As it happens, we don’t run out of resources. Instead, we become better at finding, extracting, and efficiently utilizing resources, which means that in practical terms resources become more abundant, not less. In other words, the pie grows faster than we can eat it.

So is there any resource that actually limits human potential? I think there is, and history would suggest that resource is human ingenuity and effort. The more people are thinking about and working on a problem, the more solutions we find and build to solve it. That means not only does the pie grow faster than we can eat it, but the more people there are, the faster the pie grows. Of course that assumes everyone eating pie is also working to grow the pie, but that’s a separate issue for now.

Productivity and Division of Labor

Why does having more people lead to more productivity? A big part of it comes down to division of labor and specialization. The best way to get really good at something is to do more of it. In a small community, doing just one thing simply isn’t possible. Everyone has to be somewhat of a generalist in order to survive. But with a larger population, being a specialist becomes possible. In fact, that’s the purpose of money, as I explained here.

nostr:naddr1qvzqqqr4gupzp0rve5f6xtu56djkfkkg7ktr5rtfckpun95rgxaa7futy86npx8yqq247t2dvet9q4tsg4qng36lxe6kc4nftayyy89kua2

The more specialized an economy becomes, the more efficient it can be. There are big economies of scale in almost every task or process. So for example, if a single person tried to build a car from scratch, it would be extremely difficult and take a very long time. However, if you have a thousand people building a car, each doing a specific job, they can become very good at doing that specific job and do it much faster. And then you can move that process to a factory, and build machines to do specific jobs, and add even more efficiency.

But that only works if you’re building more than one car. It doesn’t make sense to build a huge factory full of specialized equipment that takes lots of time and effort to design and manufacture, and then only build one car. You need to sell thousands of cars, maybe even millions of cars, to pay off that initial investment. So division of labor and specialization relies on large populations in two different ways. First, you need a large population to have enough people to specialize in each task. But second and just as importantly, you need a large population of buyers for the finished product. You need a big market in order to make mass production economical.

Think of a computer or smartphone. It takes thousands of specialized processes, thousands of complex parts, and millions of people doing specialized jobs to extract the raw materials, process them, and assemble them into a piece of electronic hardware. And electronics are relatively expensive anyway. Imagine how impossible it would be to manufacture electronics economically, if the market demand wasn’t literally in the billions of units.

Stairs Up, Elevator Down

We’ve seen exponential increases in productivity over the past few centuries, resulting in higher living standards even as population exploded. Now, facing the prospect of a drastic trend reversal, what will happen to productivity and living standards? The typical sentiment seems to be “well, there are a lot of people already competing for resources, so if population does decline, that will just reduce the competition and leave a bigger slice of pie for each person, so we’ll all be getting wealthier as a result of population decline.”

This seems reasonable at first glance. Surely dividing the economic pie into fewer slices means a bigger slice for everyone, right? But remember, more specialization and division of labor is what made the pie as big as it is to begin with. And specialization depends on large populations for both the supply of specialized labor, and the demand for finished goods. Can complex supply chains and mass production withstand population reduction intact? I don’t think the answer is clear.

The idea that it will all be okay, and we’ll get wealthier as population falls, is based on some faulty assumptions. It assumes that wealth is basically some fixed inventory of “things” that exist, and it’s all a matter of distribution. That’s typical Marxist thinking, similar to the reasoning behind “tax the rich” and other utopian wealth transfer schemes.

The reality is, wealth is a dynamic concept with strong network effects. For example, a grocery store in a large city can be a valuable asset with a large potential income stream. The same store in a small village with a declining population can be an unprofitable and effectively worthless liability.

Even something as permanent as a house is very susceptible to network effects. If you currently live in an area where housing is scarce and expensive, you might think a declining population would be the perfect solution to high housing costs. However, if you look at a place that’s already facing the beginnings of a population decline, you’ll see it’s not actually that simple. Japan, for example, is already facing an aging and declining population. And sure enough, you can get a house in Japan for free, or basically free. Sounds amazing, right? Not really.

If you check out the reason houses are given away in Japan, you’ll find a depressing reality. Most of the free houses are in rural areas or villages where the population is declining, often to the point that the village becomes uninhabited and abandoned. It’s so bad that in 2018, 13.6% of houses in Japan were vacant. Why do villages become uninhabited? Well, it turns out that a certain population level is necessary to support the services and businesses people need. When the population falls too low, specialized businesses can no longer operated profitably. It’s the exact issue we discussed with division of labor and the need for a high population to provide a market for the specialist to survive. As the local stores, entertainment venues, and businesses close, and skilled tradesmen move away to larger population centers with more customers, living in the village becomes difficult and depressing, if not impossible. So at a certain critical level, a village that’s too isolated will reach a tipping point where everyone leaves as fast as possible. And it turns out that an abandoned house in a remote village or rural area without any nearby services and businesses is worth… nothing. Nobody wants to live there, nobody wants to spend the money to maintain the house, nobody wants to pay the taxes needed to maintain the utilities the town relied on. So they try to give the houses away to anyone who agrees to live there, often without much success.

So on a local level, population might rise gradually over time, but when that process reverses and population declines to a certain level, it can collapse rather quickly from there.

I expect the same incentives to play out on a larger scale as well. Complex supply chains and extreme specialization lead to massive productivity. But there’s also a downside, which is the fragility of the system. Specialization might mean one shop can make all the widgets needed for a specific application, for the whole globe. That’s great while it lasts, but what happens when the owner of that shop retires with his lifetime of knowledge and experience? Will there be someone equally capable ready to fill his shoes? Hopefully… But spread that problem out across the global economy, and cracks start to appear. A specialized part is unavailable. So a machine that relies on that part breaks down and can’t be repaired. So a new machine needs to be built, which is a big expense that drives up costs and prices. And with a falling population, demand goes down. Now businesses are spending more to make fewer items, so they have to raise prices to stay profitable. Now fewer people can afford the item, so demand falls even further. Eventually the business is forced to close, and other industries that relied on the items they produced are crippled. Things become more expensive, or unavailable at any price. Living standards fall. What was a stairway up becomes an elevator down.

Hope, From the Parasite Class?

All that being said, I’m not completely pessimistic about the future. I think the potential for an acceptable outcome exists.

I see two broad groups of people in the economy; producers, and parasites. One thing the increasing productivity has done is made it easier than ever to survive. Food is plentiful globally, the only issues are with distribution. Medical advances save countless lives. Everything is more abundant than ever before. All that has led to a very “soft” economic reality. There’s a lot of non-essential production, which means a lot of wealth can be redistributed to people who contribute nothing, and if it’s done carefully, most people won’t even notice. And that is exactly what has happened, in spades.

There are welfare programs of every type and description, and handouts to people for every reason imaginable. It’s never been easier to survive without lifting a finger. So millions of able-bodied men choose to do just that.

Besides the voluntarily idle, the economy is full of “bullshit jobs.” Shoutout to David Graeber’s book with that title. (It’s an excellent book and one I would highly recommend, even though the author was a Marxist and his conclusions are completely wrong.) A 2015 British poll asked people, “Does your job make a meaningful contribution to the world?” Only 50% said yes, while 37% said no and 13% were uncertain.

This won’t be a surprise to anyone who’s operated a business, or even worked in the private sector in general. There are three types of jobs; jobs that accomplish something productive, jobs that accomplish nothing of value, and jobs that actually hinder people trying to accomplish something productive. The number of jobs in the last two categories has grown massively over the years. This would include a lot of unnecessary administrative jobs, burdensome regulatory jobs, useless DEI and HR jobs, a large percentage of public sector jobs, most of the military-industrial complex, and the list is endless. All these jobs accomplish nothing worthwhile at best, and actively discourage those who are trying to accomplish something at worst.

Even among jobs that do accomplish some useful purpose, the amount of time spent actually doing the job continues to decline. According to a 2016 poll, American office workers spent only 39% of their workday actually doing their primary task. The other 61% was largely wasted on unproductive administrative tasks and meetings, answering emails, and just simply wasting time.

I could go on, but the point is, there’s a lot of slack in the economy. We’ve become so productive that the number of people actually doing the work to keep everyone fed, clothed, and cared for is only a small percentage of the population. In one sense, that’s a cause for optimism. The population could decline a lot, and we’d still have enough bodies to man the economic engine, as it were.

Aging

The thing with population decline, though, is nobody gets to choose who goes first. Not unless you’re a psychopathic dictator. So populations get old, then they get small. This means that the number of dependents in the economy rises naturally. Once people retire, they still need someone to grow the food, keep the lights on, and provide the medical care. And it doesn’t matter how much money the retirees have saved, either. Money is just a claim on wealth. The goods and services actually have to be provided by someone, and if that someone was never born, all the money in the world won’t change anything.

And the aging occurs on top of all the people already taking from the economy without contributing anything of value. So that seems like a big problem.

Currently, wealth redistribution happens through a combination of direct taxes, indirect taxation through deficit spending, and the whole gamut of games that happen when banks create credit/debt money by making loans. In a lot of cases, it’s very indirect and difficult to pin down. For example, someone has a “job” in a government office, enforcing pointless regulations that actually hinder someone in the private sector from producing something useful. Their paycheck comes from the government, so a combination of taxes on productive people, and deficit spending, which is also a tax on productive people. But they “have a job,” so who’s going to question their contribution to society? On the other hand, it could be a banker or hedge fund manager. They might be pulling in a massive salary, but at the core all they’re really doing is finding creative financial ways to transfer wealth from productive people to themselves, without contributing anything of value.

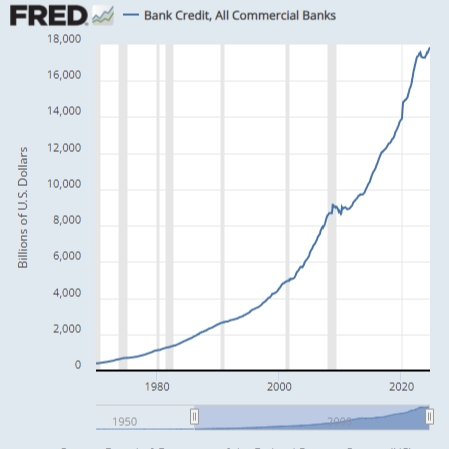

You’ll notice a common theme if you think about this problem deeply. Most of the wealth transfer that supports the unproductive, whether that’s welfare recipients, retirees, bureaucrats, corporate middle managers, or weapons manufacturers, is only possible through expanding the money supply. There’s a limit to how much direct taxation the productive will bear while the option to collect welfare exists. At a certain point, people conclude that working hard every day isn’t worth it, when taxes take so much of their wages that they could make almost as much without working at all. So the balance of what it takes to support the dependent class has to come indirectly, through new money creation.

As long as the declining population happens under the existing monetary system, the future looks bleak. There’s no limit to how much money creation and inflation the parasite class will use in an attempt to avoid work. They’ll continue to suck the productive class dry until the workers give up in disgust, and the currency collapses into hyperinflation. And you can’t run a complex economy without functional money, so productivity inevitably collapses with the currency.

The optimistic view is that we don’t have to continue supporting the failed credit/debt monetary system. It’s hurting productivity, messing up incentives, and contributing to increasing wealth inequality and lower living standards for the middle class. If we walk away from that system and adopt a hard money standard, the possibility of inflationary wealth redistribution vanishes. The welfare and warfare programs have to be slashed. The parasite class is forced to get busy, or starve. In that scenario, the declining population of workers can be offset by a massive shift away from “bullshit jobs” and into actual productive work.

While that might not be a permanent solution to declining population, it would at least give us time to find a real solution, without having our complex economy collapse and send our living standards back to the 17th century.

It’s a complex issue with many possible outcomes, but I think a close look at the effects of the monetary system on productivity shows one obvious problem that will make the situation worse than necessary. Moving to a better monetary system and creating incentives for productivity would do a lot to reduce the economic impacts of a declining population.

-

@ 9c9d2765:16f8c2c2

2025-05-21 05:45:00

@ 9c9d2765:16f8c2c2

2025-05-21 05:45:00CHAPTER TWENTY FOUR

Back at JP Towers, James had already anticipated the move. He had cameras and witness accounts from the anniversary event, stored securely in multiple locations. He knew the public had a short memory but a long hunger for drama. One misstep could tilt public sentiment.

But James was no longer playing to survive.

He was playing to reign.

Later that night, he stood before a mirror, adjusting the cuffs of his suit. In his reflection, he saw more than his own face; he saw the faces of those who had mocked, betrayed, and underestimated him. And he saw the legacy he was building not just for himself, but for those who once believed justice was a myth.

He whispered to the reflection, “Let them come. Let them burn what’s left of their dignity. I’ll rise through the smoke again. Because I always do.”

Outside, the wind howled like a prophecy through the high-rises.

The days that followed carried a subtle tension that coiled around the city's heartbeat. JP Enterprises thrived outwardly, stock prices climbed, investor confidence surged, and the company continued to solidify its dominion over the corporate landscape. But beneath the facade of calm and progress, a tempest brewed in silence.

James, the man once ridiculed and ostracized, now sat at the summit of power, yet his enemies, battered but unbroken, plotted from the shadows.

In an undisclosed meeting room within the Executive Wing, James convened with his most trusted circle Charles, Rita, and Sandra. The room was dimly lit, the atmosphere sober, with every eye locked onto the digital presentation being displayed.

On the screen were surveillance stills, financial records, and intercepted messages.

Rita, ever composed, began, “We’ve confirmed that Helen and Mark are using a shell media outlet in a nearby province to rewrite the narrative surrounding the anniversary incident. They’re laundering stories through third-party publications to make it appear as if you orchestrated the bribery and the public drama.”

Sandra added, her voice laced with concern, “The young woman from the event she’s set to appear in a televised interview in two days. The preview clips suggest she’ll claim coercion, manipulation… that you paid her to falsely accuse Mark and Helen.”

Charles sat back in his chair, folding his arms. “It’s a desperate move,” he muttered, “but one that could sway public opinion if left unchecked.”

James didn’t flinch. His gaze was cold and calculated. “Let them speak,” he said. “Let her appear on screen, let the nation watch but when the time is right, we’ll release the real footage. Every confession, every whispered transaction, every threat they issued. And when we do, it won’t just be public opinion they lose, it'll be their freedom.”

The room fell silent. The weight of the plan was immense. James wasn’t simply fighting a smear campaign he was orchestrating the downfall of those who had haunted his past and jeopardized his future.

Across town, in a luxurious yet shadowy apartment, Helen paced furiously. Mark sat slouched on the couch, phone in hand, monitoring the latest headlines.

“She hasn’t confirmed the script yet,” Mark grumbled, referring to the woman they’d bribed. “She’s stalling. You think she’s flipping again?”

“She better not,” Helen spat. “We gave her a second chance, more money, more protection. If she dares cross us again...”

“Then we make her disappear,” Mark said coldly.

Helen paused. “Or we pin everything on her. Let her take the fall.”

Their desperation bled into their decisions. The empire they tried to build with lies and manipulation was already on unstable ground. They didn’t realize James wasn’t just steps ahead. Two days later, as the nation sat glued to their screens, the controversial interview aired. The woman, visibly tense, spoke her lines.

“Yes… he promised to protect me… he told me to say Mark and Helen bribed me… I was scared of what he might do if I didn’t cooperate…”

The hosts gasped, commentators argued, and the news cycle erupted.

For an hour, James’s name trended for all the wrong reasons.

And then the storm came.

JP Enterprises’ official communication channels released a statement followed by a seven-minute clip, unedited, raw, and crystal clear. It captured everything: the lady kneeling, pointing to Mark and Helen, the whispered confessions, the crowd’s reaction, Helen’s furious outburst. And, most damning of all, a covert recording of Helen threatening the woman in a private meeting.

The tide turned instantly.

Social media exploded not with outrage toward James, but with condemnation of the real culprits. Hashtags flipped. Influencers, journalists, and even rival corporations came to James’s defense. The woman fled the city within hours. Mark and Helen, now disgraced, faced not just the wrath of public judgment, but the immediate interest of law enforcement.

Back at the JP tower, James watched it all unfold. The screen reflected in his eyes as headlines changed: “President Vindicated,” “Corporate Sabotage Exposed,” “Justice Prevails in High-Stakes Feud.”

Charles walked in slowly, a faint smile on his lips. “It’s done.”

James nodded, his voice a calm murmur. “No. It’s only the beginning. I haven’t just protected my name, I've carved a legacy.”

He stood up, walking toward the window where the city stretched out beneath him, unaware of how close it had come to being ruled by lies.

Behind him, the quiet echo of Charles’s voice lingered: “Your enemies are falling, one by one.”

-

@ c1e6505c:02b3157e

2025-05-22 03:44:39

@ c1e6505c:02b3157e

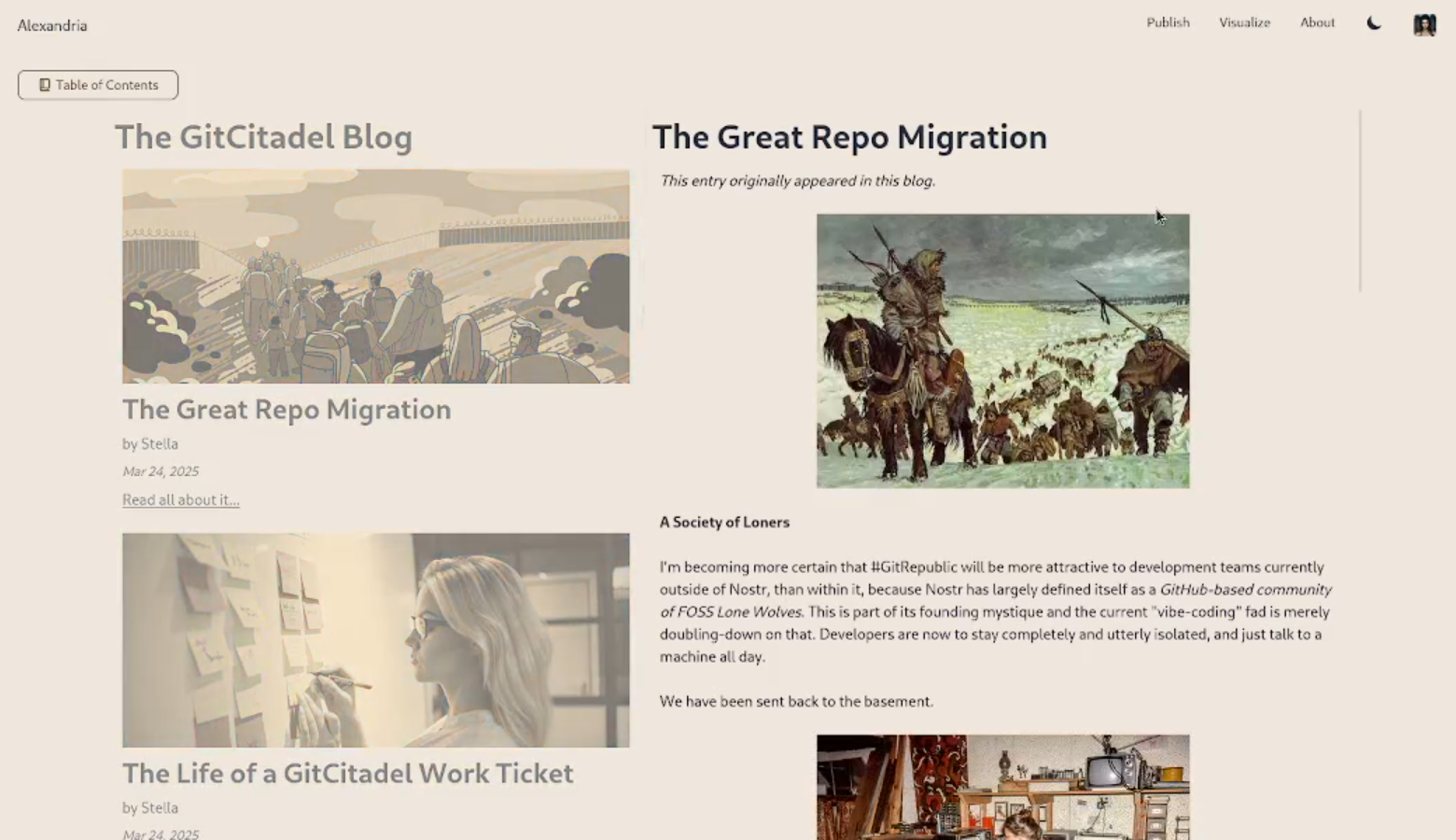

2025-05-22 03:44:39This is day two of testing the Leica Summaron 35mm f2.8 on the Fujifilm X-Pro2.

The first part of this story you can find here on StackerNews**

TL;DR: I think I’m really enjoying this lens.

I went into it thinking I’d probably just sell it since it was gifted to me - assumed I wouldn’t like it. But after just a couple of days with it mounted on the X-Pro2, I’ve been surprisingly drawn to it.

Shooting wide open at f2.8 (which is how I’m testing it - to best reveal the lens’s character), the soft roll-off is really pleasing. It feels organic. The lens is over 50 years old, so I expected some quirks-but the quality feels natural, not overly “vintage". Takes the digital edge off.

The short focus throw is also really nice. Compared to the Summicron 35mm f2 v3 I usually shoot on my M262 (which has a longer throw), the Summaron feels tighter and more responsive when zone focusing.

One gripe: the infinity lock. It’s kind of annoying. I find myself accidentally locking it too often, but I’m getting used to holding the button down as I rotate the ring. I’ve read others complain about it, so I know I’m not alone there.

Most of these shots were from a bike ride to the river - about 6 miles out to swim and enjoy the sun. Perfect day for making a few photos.

This kind of work is honestly just fun. I enjoy the process, and even more so once I’m happy with the results and can share them.

Still building confidence in my work over time. I think I’m slowly refining my style - even if the subject matter is simple. Easier said than done, as any editor/curator knows (and I say this as one through NOICE Magazine).

Let me know what you think. I’ll try to upload higher resolution versions this time around (but not too high).

*Also, I use a program called Dehancer for creating the grain in these photographs. I highly recommend the program actually, I've been using it for a long time. If you would like to try it out, I have a promo code. Use "Pictureroom" for 10% off I believe.

You can further support me and my work by sending sats to colincz\@getalby.com. Thank you.

(note* this is being publised from the updated Primal reads client)

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 2b998b04:86727e47

2025-05-22 02:45:34

@ 2b998b04:86727e47

2025-05-22 02:45:34I recently released my first open-source tool:\ 👉 nostr-signal-filter

It fetches and formats your latest top-level Nostr note or long-form article, cleans up any embedded links using TinyURL, and outputs a clean version ready for reposting to:

-

LinkedIn

-

Facebook

-

X / Twitter

⚙️ Built for Simplicity

The stack is intentionally minimal:

-

Python + WebSockets + Bech32

-

TinyURL API for link shortening

-

Dockerized CLI usage:

bashCopyEdit

docker run --rm -e PUBKEY=npub1yourpubkeyhere nostr-fetcher > latest.mdFrom idea to working repo took under 3 hours — including debugging, Docker tweaks, README cleanup, and tagging a clean release.\ \ This most certainly would have taken much longer if I had done this all without ChatGPTs' help.\ \ 🖼️ Example Output (

latest.md)textCopyEdit

🕒 2025-05-20 22:24:17 📄 Note (originally posted on Nostr/primal.net) --- 🚨 New long-form drop: AI Isn’t Magic. It’s Engineering. How I use ChatGPT like any other tool in the stack — with iteration, discernment, and real output. Read it here: https://tinyurl.com/ynv7jq6g ⚡ Zaps appreciated if it resonates. --- 🔗 View on Nostr: https://tinyurl.com/yobvaxkx

🧪 Where I Used It

- ✅ Facebook: clean rendering with preview ->

- ✅ X/Twitter: teaser + link (had to truncate for character limit) ->

https://x.com/AndyGStanton/status/1925045477172773136

🙌 Try It Yourself

If you're publishing on Nostr but still sharing on legacy platforms:

👉 github.com/andrewgstanton/nostr-signal-filter

-

Clean output

-

Easy to run

-

Portable via Docker

All it needs is your

npub.

⚡ Zap Me If You Found This Useful

If this tool saved you time — or if it sparked ideas for your own Nostr publishing stack —\ send a zap my way. I’m always looking to connect with other creators who value signal > noise.

🔗 Zap on Primal -> https://primal.net/andrewgstanton

🔭 Next Features (I’d Love Help With)

-

Archive all notes + articles (not just the latest 50) to

archive.md -

Function to shorten links in any text block

-

Output

post.mdfor any given Nostr event ID (not just latest) -

Optional API integration to post directly to LinkedIn or X

Built with ChatGPT’s help.\ Iterated. Published. Cross-posted.\ That’s proof of work.

-

-

@ 502ab02a:a2860397

2025-05-21 02:12:10

@ 502ab02a:a2860397

2025-05-21 02:12:10ถ้าเอ่ยถึง CJ หลายคนอาจนึกถึงซอสเกาหลีรสจัดจ้าน หรือบะหมี่กึ่งสำเร็จรูปแบรนด์ดังที่ขายทั่วโลก แต่เบื้องหลังความสำเร็จของแบรนด์เหล่านั้น มีบริษัทแม่อย่าง CJ CheilJedang ที่ไม่ได้แค่ผลิตอาหารแปรรูป แต่เป็นหนึ่งในผู้เล่นใหญ่ของอุตสาหกรรมอาหารระดับโลก ด้วยฐานความรู้ลึกซึ้งในเทคโนโลยีชีวภาพ หนึ่งในแขนงที่โดดเด่นคือ CJ BIO ธุรกิจไบโอเทคโนโลยีที่เน้นการใช้ Microbial Fermentation หรือการหมักจุลินทรีย์เพื่อผลิตสารอาหารและวัตถุดิบอาหารคุณภาพสูงในระดับอุตสาหกรรม

ประวัติของ CJ BIO เริ่มจากจุดเล็ก ๆ แต่ทรงพลัง คือการผลิต โมโนโซเดียมกลูตาเมต (MSG) ซึ่งเป็นกรดอะมิโนชนิดหนึ่งที่มีบทบาทสำคัญในการเพิ่มรสชาติ “อูมามิ” ให้กับอาหารทั่วโลก จุดนี้เองที่ทำให้ CJ BIO ได้สะสมเทคโนโลยีหมักจุลินทรีย์ในระดับอุตสาหกรรมมายาวนานกว่า 60 ปี ด้วยโรงงานหมักขนาดใหญ่ที่ตั้งอยู่ในหลายประเทศ เช่น เกาหลีใต้ จีน บราซิล อินโดนีเซีย และสหรัฐอเมริกา ทำให้ CJ BIO กลายเป็นหนึ่งในผู้ผลิตกรดอะมิโนและวัตถุดิบอาหารหมักจุลินทรีย์รายใหญ่ของโลก

แต่ถ้าให้พูดแบบง่าย ๆ การหมักจุลินทรีย์ของ CJ BIO นั้น ไม่ใช่แค่ “การทำอาหาร” ธรรมดา ๆ แต่เป็นการ “สร้างอาหารในระดับโมเลกุล” ตั้งแต่พื้นฐาน ซึ่งถือเป็นเทคโนโลยีที่สำคัญสำหรับอนาคตของอาหาร เพราะมันช่วยให้เราสามารถผลิตโปรตีน กรดอะมิโน และสารอาหารต่าง ๆ ที่มีคุณภาพสูงและควบคุมได้ในโรงงานขนาดใหญ่ โดยไม่ต้องพึ่งพาการเกษตรแบบดั้งเดิมที่ต้องใช้พื้นที่มากและมีผลกระทบต่อสิ่งแวดล้อม