-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

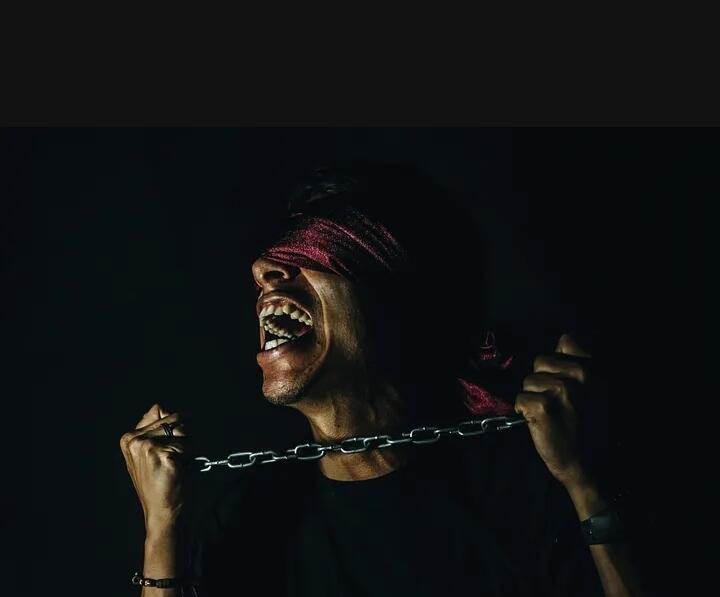

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

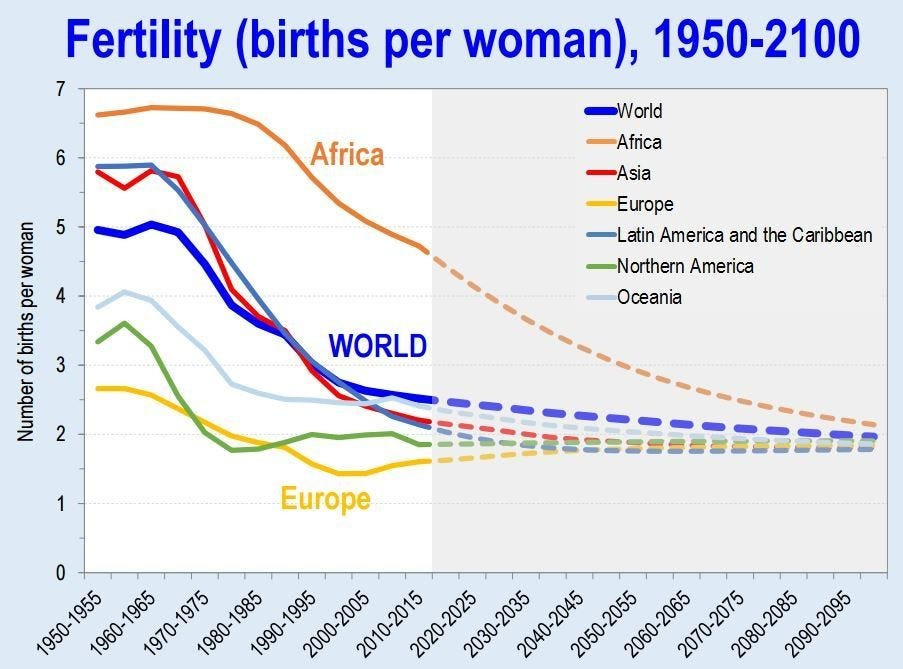

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 3f770d65:7a745b24

2025-05-19 18:09:52

@ 3f770d65:7a745b24

2025-05-19 18:09:52🏌️ Monday, May 26 – Bitcoin Golf Championship & Kickoff Party

Location: Las Vegas, Nevada\ Event: 2nd Annual Bitcoin Golf Championship & Kick Off Party"\ Where: Bali Hai Golf Clubhouse, 5160 S Las Vegas Blvd, Las Vegas, NV 89119\ 🎟️ Get Tickets!

Details:

-

The week tees off in style with the Bitcoin Golf Championship. Swing clubs by day and swing to music by night.

-

Live performances from Nostr-powered acts courtesy of Tunestr, including Ainsley Costello and others.

-

Stop by the Purple Pill Booth hosted by Derek and Tanja, who will be on-boarding golfers and attendees to the decentralized social future with Nostr.

💬 May 27–29 – Bitcoin 2025 Conference at the Las Vegas Convention Center

Location: The Venetian Resort\ Main Attraction for Nostr Fans: The Nostr Lounge\ When: All day, Tuesday through Thursday\ Where: Right outside the Open Source Stage\ 🎟️ Get Tickets!

Come chill at the Nostr Lounge, your home base for all things decentralized social. With seating for \~50, comfy couches, high-tops, and good vibes, it’s the perfect space to meet developers, community leaders, and curious newcomers building the future of censorship-resistant communication.

Bonus: Right across the aisle, you’ll find Shopstr, a decentralized marketplace app built on Nostr. Stop by their booth to explore how peer-to-peer commerce works in a truly open ecosystem.

Daily Highlights at the Lounge:

-

☕️ Hang out casually or sit down for a deeper conversation about the Nostr protocol

-

🔧 1:1 demos from app teams

-

🛍️ Merch available onsite

-

🧠 Impromptu lightning talks

-

🎤 Scheduled Meetups (details below)

🎯 Nostr Lounge Meetups

Wednesday, May 28 @ 1:00 PM

- Damus Meetup: Come meet the team behind Damus, the OG Nostr app for iOS that helped kickstart the social revolution. They'll also be showcasing their new cross-platform app, Notedeck, designed for a more unified Nostr experience across devices. Grab some merch, get a demo, and connect directly with the developers.

Thursday, May 29 @ 1:00 PM

- Primal Meetup: Dive into Primal, the slickest Nostr experience available on web, Android, and iOS. With a built-in wallet, zapping your favorite creators and friends has never been easier. The team will be on-site for hands-on demos, Q\&A, merch giveaways, and deeper discussions on building the social layer of Bitcoin.

🎙️ Nostr Talks at Bitcoin 2025

If you want to hear from the minds building decentralized social, make sure you attend these two official conference sessions:

1. FROSTR Workshop: Multisig Nostr Signing

-

🕚 Time: 11:30 AM – 12:00 PM

-

📅 Date: Wednesday, May 28

-

📍 Location: Developer Zone

-

🎤 Speaker: nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpqs9etjgzjglwlaxdhsveq0qksxyh6xpdpn8ajh69ruetrug957r3qf4ggfm (Austin Kelsay) @ Voltage\ A deep-dive into FROST-based multisig key management for Nostr. Geared toward devs and power users interested in key security.

2. Panel: Decentralizing Social Media

-

🕑 Time: 2:00 PM – 2:30 PM

-

📅 Date: Thursday, May 29

-

📍 Location: Genesis Stage

-

🎙️ Moderator: nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqy08wumn8ghj7mn0wd68yttjv4kxz7fwv3jhyettwfhhxuewd4jsqgxnqajr23msx5malhhcz8paa2t0r70gfjpyncsqx56ztyj2nyyvlq00heps - Bitcoin Strategy @ Roxom TV

-

👥 Speakers:

-

nostr:nprofile1qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcppemhxue69uhkummn9ekx7mp0qqsy2ga7trfetvd3j65m3jptqw9k39wtq2mg85xz2w542p5dhg06e5qmhlpep – Early Bitcoin dev, CEO @ Sirius Business Ltd

-

nostr:nprofile1qy2hwumn8ghj7mn0wd68ytndv9kxjm3wdahxcqg5waehxw309ahx7um5wfekzarkvyhxuet5qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncdhu7e3 – Analyst & Partner @ Ego Death Capital

Get the big-picture perspective on why decentralized social matters and how Nostr fits into the future of digital communication.

🌃 NOS VEGAS Meetup & Afterparty

Date: Wednesday, May 28\ Time: 7:00 PM – 1:00 AM\ Location: We All Scream Nightclub, 517 Fremont St., Las Vegas, NV 89101\ 🎟️ Get Tickets!

What to Expect:

-

🎶 Live Music Stage – Featuring Ainsley Costello, Sara Jade, Able James, Martin Groom, Bobby Shell, Jessie Lark, and other V4V artists

-

🪩 DJ Party Deck – With sets by nostr:nprofile1qy0hwumn8ghj7cmgdae82uewd45kketyd9kxwetj9e3k7mf6xs6rgqgcwaehxw309ahx7um5wgh85mm694ek2unk9ehhyecqyq7hpmq75krx2zsywntgtpz5yzwjyg2c7sreardcqmcp0m67xrnkwylzzk4 , nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgkwaehxw309anx2etywvhxummnw3ezucnpdejqqg967faye3x6fxgnul77ej23l5aew8yj0x2e4a3tq2mkrgzrcvecfsk8xlu3 , and more DJs throwing down

-

🛰️ Live-streamed via Tunestr

-

🧠 Nostr Education – Talks by nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq37amnwvaz7tmwdaehgu3dwfjkccte9ejx2un9ddex7umn9ekk2tcqyqlhwrt96wnkf2w9edgr4cfruchvwkv26q6asdhz4qg08pm6w3djg3c8m4j , nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqg7waehxw309anx2etywvhxummnw3ezucnpdejz7ur0wp6kcctjqqspywh6ulgc0w3k6mwum97m7jkvtxh0lcjr77p9jtlc7f0d27wlxpslwvhau , nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq3vamnwvaz7tmwdaehgu3wd33xgetk9en82m30qqsgqke57uygxl0m8elstq26c4mq2erz3dvdtgxwswwvhdh0xcs04sc4u9p7d , nostr:nprofile1q9z8wumn8ghj7erzx3jkvmmzw4eny6tvw368wdt8da4kxamrdvek76mrwg6rwdngw94k67t3v36k77tev3kx7vn2xa5kjem9dp4hjepwd3hkxctvqyg8wumn8ghj7mn0wd68ytnhd9hx2qpqyaul8k059377u9lsu67de7y637w4jtgeuwcmh5n7788l6xnlnrgssuy4zk , nostr:nprofile1qy28wue69uhnzvpwxqhrqt33xgmn5dfsx5cqz9thwden5te0v4jx2m3wdehhxarj9ekxzmnyqqswavgevxe9gs43vwylumr7h656mu9vxmw4j6qkafc3nefphzpph8ssvcgf8 , and more.

-

🧾 Vendors & Project Booths – Explore new tools and services

-

🔐 Onboarding Stations – Learn how to use Nostr hands-on

-

🐦 Nostrich Flocking – Meet your favorite nyms IRL

-

🍸 Three Full Bars – Two floors of socializing overlooking vibrant Fremont Street

| | | | | ----------- | -------------------- | ------------------- | | Time | Name | Topic | | 7:30-7:50 | Derek | Nostr for Beginners | | 8:00-8:20 | Mark & Paul | Primal | | 8:30-8:50 | Terry | Damus | | 9:00-9:20 | OpenMike and Ainsley | V4V | | 09:30-09:50 | The Space | Space |

This is the after-party of the year for those who love freedom technology and decentralized social community. Don’t miss it.

Final Thoughts

Whether you're there to learn, network, party, or build, Bitcoin 2025 in Las Vegas has a packed week of Nostr-friendly programming. Be sure to catch all the events, visit the Nostr Lounge, and experience the growing decentralized social revolution.

🟣 Find us. Flock with us. Purple pill someone.

-

-

@ b83a28b7:35919450

2025-05-16 19:26:56

@ b83a28b7:35919450

2025-05-16 19:26:56This article was originally part of the sermon of Plebchain Radio Episode 111 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ 04c915da:3dfbecc9

2025-05-16 18:06:46

@ 04c915da:3dfbecc9

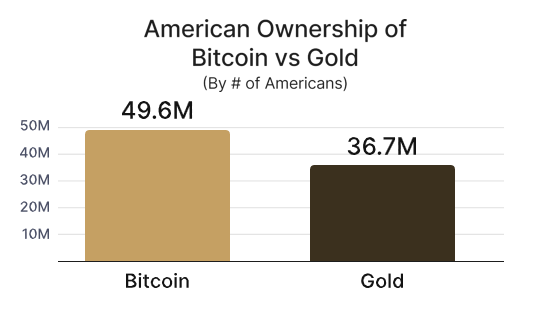

2025-05-16 18:06:46Bitcoin has always been rooted in freedom and resistance to authority. I get that many of you are conflicted about the US Government stacking but by design we cannot stop anyone from using bitcoin. Many have asked me for my thoughts on the matter, so let’s rip it.

Concern

One of the most glaring issues with the strategic bitcoin reserve is its foundation, built on stolen bitcoin. For those of us who value private property this is an obvious betrayal of our core principles. Rather than proof of work, the bitcoin that seeds this reserve has been taken by force. The US Government should return the bitcoin stolen from Bitfinex and the Silk Road.

Using stolen bitcoin for the reserve creates a perverse incentive. If governments see bitcoin as a valuable asset, they will ramp up efforts to confiscate more bitcoin. The precedent is a major concern, and I stand strongly against it, but it should be also noted that governments were already seizing coin before the reserve so this is not really a change in policy.

Ideally all seized bitcoin should be burned, by law. This would align incentives properly and make it less likely for the government to actively increase coin seizures. Due to the truly scarce properties of bitcoin, all burned bitcoin helps existing holders through increased purchasing power regardless. This change would be unlikely but those of us in policy circles should push for it regardless. It would be best case scenario for American bitcoiners and would create a strong foundation for the next century of American leadership.

Optimism

The entire point of bitcoin is that we can spend or save it without permission. That said, it is a massive benefit to not have one of the strongest governments in human history actively trying to ruin our lives.

Since the beginning, bitcoiners have faced horrible regulatory trends. KYC, surveillance, and legal cases have made using bitcoin and building bitcoin businesses incredibly difficult. It is incredibly important to note that over the past year that trend has reversed for the first time in a decade. A strategic bitcoin reserve is a key driver of this shift. By holding bitcoin, the strongest government in the world has signaled that it is not just a fringe technology but rather truly valuable, legitimate, and worth stacking.

This alignment of incentives changes everything. The US Government stacking proves bitcoin’s worth. The resulting purchasing power appreciation helps all of us who are holding coin and as bitcoin succeeds our government receives direct benefit. A beautiful positive feedback loop.

Realism

We are trending in the right direction. A strategic bitcoin reserve is a sign that the state sees bitcoin as an asset worth embracing rather than destroying. That said, there is a lot of work left to be done. We cannot be lulled into complacency, the time to push forward is now, and we cannot take our foot off the gas. We have a seat at the table for the first time ever. Let's make it worth it.

We must protect the right to free usage of bitcoin and other digital technologies. Freedom in the digital age must be taken and defended, through both technical and political avenues. Multiple privacy focused developers are facing long jail sentences for building tools that protect our freedom. These cases are not just legal battles. They are attacks on the soul of bitcoin. We need to rally behind them, fight for their freedom, and ensure the ethos of bitcoin survives this new era of government interest. The strategic reserve is a step in the right direction, but it is up to us to hold the line and shape the future.

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ 04c915da:3dfbecc9

2025-05-16 17:51:54

@ 04c915da:3dfbecc9

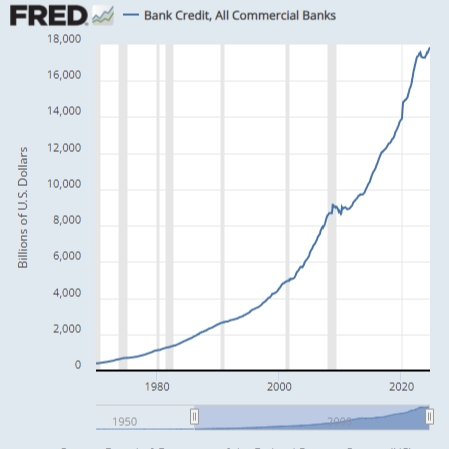

2025-05-16 17:51:54In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ 04c915da:3dfbecc9

2025-05-16 17:12:05

@ 04c915da:3dfbecc9

2025-05-16 17:12:05One of the most common criticisms leveled against nostr is the perceived lack of assurance when it comes to data storage. Critics argue that without a centralized authority guaranteeing that all data is preserved, important information will be lost. They also claim that running a relay will become prohibitively expensive. While there is truth to these concerns, they miss the mark. The genius of nostr lies in its flexibility, resilience, and the way it harnesses human incentives to ensure data availability in practice.

A nostr relay is simply a server that holds cryptographically verifiable signed data and makes it available to others. Relays are simple, flexible, open, and require no permission to run. Critics are right that operating a relay attempting to store all nostr data will be costly. What they miss is that most will not run all encompassing archive relays. Nostr does not rely on massive archive relays. Instead, anyone can run a relay and choose to store whatever subset of data they want. This keeps costs low and operations flexible, making relay operation accessible to all sorts of individuals and entities with varying use cases.

Critics are correct that there is no ironclad guarantee that every piece of data will always be available. Unlike bitcoin where data permanence is baked into the system at a steep cost, nostr does not promise that every random note or meme will be preserved forever. That said, in practice, any data perceived as valuable by someone will likely be stored and distributed by multiple entities. If something matters to someone, they will keep a signed copy.

Nostr is the Streisand Effect in protocol form. The Streisand effect is when an attempt to suppress information backfires, causing it to spread even further. With nostr, anyone can broadcast signed data, anyone can store it, and anyone can distribute it. Try to censor something important? Good luck. The moment it catches attention, it will be stored on relays across the globe, copied, and shared by those who find it worth keeping. Data deemed important will be replicated across servers by individuals acting in their own interest.

Nostr’s distributed nature ensures that the system does not rely on a single point of failure or a corporate overlord. Instead, it leans on the collective will of its users. The result is a network where costs stay manageable, participation is open to all, and valuable verifiable data is stored and distributed forever.

-

@ 04c915da:3dfbecc9

2025-05-15 15:31:45

@ 04c915da:3dfbecc9

2025-05-15 15:31:45Capitalism is the most effective system for scaling innovation. The pursuit of profit is an incredibly powerful human incentive. Most major improvements to human society and quality of life have resulted from this base incentive. Market competition often results in the best outcomes for all.

That said, some projects can never be monetized. They are open in nature and a business model would centralize control. Open protocols like bitcoin and nostr are not owned by anyone and if they were it would destroy the key value propositions they provide. No single entity can or should control their use. Anyone can build on them without permission.

As a result, open protocols must depend on donation based grant funding from the people and organizations that rely on them. This model works but it is slow and uncertain, a grind where sustainability is never fully reached but rather constantly sought. As someone who has been incredibly active in the open source grant funding space, I do not think people truly appreciate how difficult it is to raise charitable money and deploy it efficiently.

Projects that can be monetized should be. Profitability is a super power. When a business can generate revenue, it taps into a self sustaining cycle. Profit fuels growth and development while providing projects independence and agency. This flywheel effect is why companies like Google, Amazon, and Apple have scaled to global dominance. The profit incentive aligns human effort with efficiency. Businesses must innovate, cut waste, and deliver value to survive.

Contrast this with non monetized projects. Without profit, they lean on external support, which can dry up or shift with donor priorities. A profit driven model, on the other hand, is inherently leaner and more adaptable. It is not charity but survival. When survival is tied to delivering what people want, scale follows naturally.

The real magic happens when profitable, sustainable businesses are built on top of open protocols and software. Consider the many startups building on open source software stacks, such as Start9, Mempool, and Primal, offering premium services on top of the open source software they build out and maintain. Think of companies like Block or Strike, which leverage bitcoin’s open protocol to offer their services on top. These businesses amplify the open software and protocols they build on, driving adoption and improvement at a pace donations alone could never match.

When you combine open software and protocols with profit driven business the result are lean, sustainable companies that grow faster and serve more people than either could alone. Bitcoin’s network, for instance, benefits from businesses that profit off its existence, while nostr will expand as developers monetize apps built on the protocol.

Capitalism scales best because competition results in efficiency. Donation funded protocols and software lay the groundwork, while market driven businesses build on top. The profit incentive acts as a filter, ensuring resources flow to what works, while open systems keep the playing field accessible, empowering users and builders. Together, they create a flywheel of innovation, growth, and global benefit.

-

@ efe5d120:1fc51981

2025-05-15 12:53:31

@ efe5d120:1fc51981

2025-05-15 12:53:31It’s not big government programs or powerful institutions that make a society strong. It’s something much simpler: everyday people trading and working together.

Think about the local hardware store owner. He helps his neighbors, gives people jobs, and provides useful tools. But when the government taxes him too much to fund its programs, it takes away money he could have used to hire someone or visit his family. That hurts both him and the people around him.

This happens all over. Small business owners, tradesmen, inventors and entrepreneurs are the ones who really build up a society. They create value by trading things people want, and both sides benefit. Free trade gives people more choices and helps them live better lives.

But from a young age, we’re told to obey authority without question. We’re taught that without rulers, there would be chaos. But what if that’s not true?

Look around the world: even when governments try to control trade, people still find ways to work together and exchange goods. It’s natural. People want to cooperate and help each other—especially when they’re free to do so.

Here’s the hard truth: if someone can take your money, control your property, and punish you without your agreement, isn’t that a kind of control—or even servitude?

True prosperity doesn’t come from the top down. It comes from people freely working together—farmers, builders, cooks, coders—offering their skills to others who need them.

When trade is free, people do well. When it’s blocked by too many rules or taxes, everyone loses—especially the ones who need help the most.

The answer isn’t more laws or more control. It’s more freedom. Next time someone says we need more government to fix things, ask yourself: wouldn’t free people solve those problems better on their own?

Real civilization isn’t about being ruled. It’s about choosing to work together, trade fairly, and respect each other’s rights. That’s not chaos—that’s freedom.

-

@ 21335073:a244b1ad

2025-05-09 13:56:57

@ 21335073:a244b1ad

2025-05-09 13:56:57Someone asked for my thoughts, so I’ll share them thoughtfully. I’m not here to dictate how to promote Nostr—I’m still learning about it myself. While I’m not new to Nostr, freedom tech is a newer space for me. I’m skilled at advocating for topics I deeply understand, but freedom tech isn’t my expertise, so take my words with a grain of salt. Nothing I say is set in stone.

Those who need Nostr the most are the ones most vulnerable to censorship on other platforms right now. Reaching them requires real-time awareness of global issues and the dynamic relationships between governments and tech providers, which can shift suddenly. Effective Nostr promoters must grasp this and adapt quickly.

The best messengers are people from or closely tied to these at-risk regions—those who truly understand the local political and cultural dynamics. They can connect with those in need when tensions rise. Ideal promoters are rational, trustworthy, passionate about Nostr, but above all, dedicated to amplifying people’s voices when it matters most.

Forget influencers, corporate-backed figures, or traditional online PR—it comes off as inauthentic, corny, desperate and forced. Nostr’s promotion should be grassroots and organic, driven by a few passionate individuals who believe in Nostr and the communities they serve.

The idea that “people won’t join Nostr due to lack of reach” is nonsense. Everyone knows X’s “reach” is mostly with bots. If humans want real conversations, Nostr is the place. X is great for propaganda, but Nostr is for the authentic voices of the people.

Those spreading Nostr must be so passionate they’re willing to onboard others, which is time-consuming but rewarding for the right person. They’ll need to make Nostr and onboarding a core part of who they are. I see no issue with that level of dedication. I’ve been known to get that way myself at times. It’s fun for some folks.

With love, I suggest not adding Bitcoin promotion with Nostr outreach. Zaps already integrate that element naturally. (Still promote within the Bitcoin ecosystem, but this is about reaching vulnerable voices who needed Nostr yesterday.)

To promote Nostr, forget conventional strategies. “Influencers” aren’t the answer. “Influencers” are not the future. A trusted local community member has real influence—reach them. Connect with people seeking Nostr’s benefits but lacking the technical language to express it. This means some in the Nostr community might need to step outside of the Bitcoin bubble, which is uncomfortable but necessary. Thank you in advance to those who are willing to do that.

I don’t know who is paid to promote Nostr, if anyone. This piece isn’t shade. But it’s exhausting to see innocent voices globally silenced on corporate platforms like X while Nostr exists. Last night, I wondered: how many more voices must be censored before the Nostr community gets uncomfortable and thinks creatively to reach the vulnerable?

A warning: the global need for censorship-resistant social media is undeniable. If Nostr doesn’t make itself known, something else will fill that void. Let’s start this conversation.

-

@ d61f3bc5:0da6ef4a

2025-05-06 01:37:28

@ d61f3bc5:0da6ef4a

2025-05-06 01:37:28I remember the first gathering of Nostr devs two years ago in Costa Rica. We were all psyched because Nostr appeared to solve the problem of self-sovereign online identity and decentralized publishing. The protocol seemed well-suited for textual content, but it wasn't really designed to handle binary files, like images or video.

The Problem

When I publish a note that contains an image link, the note itself is resilient thanks to Nostr, but if the hosting service disappears or takes my image down, my note will be broken forever. We need a way to publish binary data without relying on a single hosting provider.

We were discussing how there really was no reliable solution to this problem even outside of Nostr. Peer-to-peer attempts like IPFS simply didn't work; they were hopelessly slow and unreliable in practice. Torrents worked for popular files like movies, but couldn't be relied on for general file hosting.

Awesome Blossom

A year later, I attended the Sovereign Engineering demo day in Madeira, organized by Pablo and Gigi. Many projects were presented over a three hour demo session that day, but one really stood out for me.

Introduced by hzrd149 and Stu Bowman, Blossom blew my mind because it showed how we can solve complex problems easily by simply relying on the fact that Nostr exists. Having an open user directory, with the corresponding social graph and web of trust is an incredible building block.

Since we can easily look up any user on Nostr and read their profile metadata, we can just get them to simply tell us where their files are stored. This, combined with hash-based addressing (borrowed from IPFS), is all we need to solve our problem.

How Blossom Works

The Blossom protocol (Blobs Stored Simply on Mediaservers) is formally defined in a series of BUDs (Blossom Upgrade Documents). Yes, Blossom is the most well-branded protocol in the history of protocols. Feel free to refer to the spec for details, but I will provide a high level explanation here.

The main idea behind Blossom can be summarized in three points:

- Users specify which media server(s) they use via their public Blossom settings published on Nostr;

- All files are uniquely addressable via hashes;

- If an app fails to load a file from the original URL, it simply goes to get it from the server(s) specified in the user's Blossom settings.

Just like Nostr itself, the Blossom protocol is dead-simple and it works!

Let's use this image as an example:

If you look at the URL for this image, you will notice that it looks like this:

If you look at the URL for this image, you will notice that it looks like this:blossom.primal.net/c1aa63f983a44185d039092912bfb7f33adcf63ed3cae371ebe6905da5f688d0.jpgAll Blossom URLs follow this format:

[server]/[file-hash].[extension]The file hash is important because it uniquely identifies the file in question. Apps can use it to verify that the file they received is exactly the file they requested. It also gives us the ability to reliably get the same file from a different server.

Nostr users declare which media server(s) they use by publishing their Blossom settings. If I store my files on Server A, and they get removed, I can simply upload them to Server B, update my public Blossom settings, and all Blossom-capable apps will be able to find them at the new location. All my existing notes will continue to display media content without any issues.

Blossom Mirroring

Let's face it, re-uploading files to another server after they got removed from the original server is not the best user experience. Most people wouldn't have the backups of all the files, and/or the desire to do this work.

This is where Blossom's mirroring feature comes handy. In addition to the primary media server, a Blossom user can set one one or more mirror servers. Under this setup, every time a file is uploaded to the primary server the Nostr app issues a mirror request to the primary server, directing it to copy the file to all the specified mirrors. This way there is always a copy of all content on multiple servers and in case the primary becomes unavailable, Blossom-capable apps will automatically start loading from the mirror.

Mirrors are really easy to setup (you can do it in two clicks in Primal) and this arrangement ensures robust media handling without any central points of failure. Note that you can use professional media hosting services side by side with self-hosted backup servers that anyone can run at home.

Using Blossom Within Primal

Blossom is natively integrated into the entire Primal stack and enabled by default. If you are using Primal 2.2 or later, you don't need to do anything to enable Blossom, all your media uploads are blossoming already.

To enhance user privacy, all Primal apps use the "/media" endpoint per BUD-05, which strips all metadata from uploaded files before they are saved and optionally mirrored to other Blossom servers, per user settings. You can use any Blossom server as your primary media server in Primal, as well as setup any number of mirrors:

## Conclusion

## ConclusionFor such a simple protocol, Blossom gives us three major benefits:

- Verifiable authenticity. All Nostr notes are always signed by the note author. With Blossom, the signed note includes a unique hash for each referenced media file, making it impossible to falsify.

- File hosting redundancy. Having multiple live copies of referenced media files (via Blossom mirroring) greatly increases the resiliency of media content published on Nostr.

- Censorship resistance. Blossom enables us to seamlessly switch media hosting providers in case of censorship.

Thanks for reading; and enjoy! 🌸

-

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08 -

@ 266815e0:6cd408a5

2025-05-02 22:24:59

@ 266815e0:6cd408a5

2025-05-02 22:24:59Its been six long months of refactoring code and building out to the applesauce packages but the app is stable enough for another release.

This update is pretty much a full rewrite of the non-visible parts of the app. all the background services were either moved out to the applesauce packages or rewritten, the result is that noStrudel is a little faster and much more consistent with connections and publishing.

New layout

The app has a new layout now, it takes advantage of the full desktop screen and looks a little better than it did before.

Removed NIP-72 communities

The NIP-72 communities are no longer part of the app, if you want to continue using them there are still a few apps that support them ( like satellite.earth ) but noStrudel won't support them going forward.

The communities where interesting but ultimately proved too have some fundamental flaws, most notably that all posts had to be approved by a moderator. There were some good ideas on how to improve it but they would have only been patches and wouldn't have fixed the underlying issues.

I wont promise to build it into noStrudel, but NIP-29 (relay based groups) look a lot more promising and already have better moderation abilities then NIP-72 communities could ever have.

Settings view

There is now a dedicated settings view, so no more hunting around for where the relays are set or trying to find how to add another account. its all in one place now

Cleaned up lists

The list views are a little cleaner now, and they have a simple edit modal

New emoji picker

Just another small improvement that makes the app feel more complete.

Experimental Wallet

There is a new "wallet" view in the app that lets you manage your NIP-60 cashu wallet. its very experimental and probably won't work for you, but its there and I hope to finish it up so the app can support NIP-61 nutzaps.

WARNING: Don't feed the wallet your hard earned sats, it will eat them!

Smaller improvements

- Added NSFW flag for replies

- Updated NIP-48 bunker login to work with new spec

- Linkfy BIPs

- Added 404 page

- Add NIP-22 comments under badges, files, and articles

- Add max height to timeline notes

- Fix articles view freezing on load

- Add option to mirror blobs when sharing notes

- Remove "open in drawer" for notes

-

@ 2183e947:f497b975

2025-05-01 22:33:48

@ 2183e947:f497b975

2025-05-01 22:33:48Most darknet markets (DNMs) are designed poorly in the following ways:

1. Hosting

Most DNMs use a model whereby merchants fill out a form to create their listings, and the data they submit then gets hosted on the DNM's servers. In scenarios where a "legal" website would be forced to censor that content (e.g. a DMCA takedown order), DNMs, of course, do not obey. This can lead to authorities trying to find the DNM's servers to take enforcement actions against them. This design creates a single point of failure.

A better design is to outsource hosting to third parties. Let merchants host their listings on nostr relays, not on the DNM's server. The DNM should only be designed as an open source interface for exploring listings hosted elsewhere, that way takedown orders end up with the people who actually host the listings, i.e. with nostr relays, and not with the DNM itself. And if a nostr relay DOES go down due to enforcement action, it does not significantly affect the DNM -- they'll just stop querying for listings from that relay in their next software update, because that relay doesn't work anymore, and only query for listings from relays that still work.

2. Moderation

Most DNMs have employees who curate the listings on the DNM. For example, they approve/deny listings depending on whether they fit the content policies of the website. Some DNMs are only for drugs, others are only for firearms. The problem is, to approve a criminal listing is, in the eyes of law enforcement, an act of conspiracy. Consequently, they don't just go after the merchant who made the listing but the moderators who approved it, and since the moderators typically act under the direction of the DNM, this means the police go after the DNM itself.

A better design is to outsource moderation to third parties. Let anyone call themselves a moderator and create lists of approved goods and services. Merchants can pay the most popular third party moderators to add their products to their lists. The DNM itself just lets its users pick which moderators to use, such that the user's choice -- and not a choice by the DNM -- determines what goods and services the user sees in the interface.

That way, the police go after the moderators and merchants rather than the DNM itself, which is basically just a web browser: it doesn't host anything or approve of any content, it just shows what its users tell it to show. And if a popular moderator gets arrested, his list will still work for a while, but will gradually get more and more outdated, leading someone else to eventually become the new most popular moderator, and a natural transition can occur.

3. Escrow

Most DNMs offer an escrow solution whereby users do not pay merchants directly. Rather, during the Checkout process, they put their money in escrow, and request the DNM to release it to the merchant when the product arrives, otherwise they initiate a dispute. Most DNMs consider escrow necessary because DNM users and merchants do not trust one another; users don't want to pay for a product first and then discover that the merchant never ships it, and merchants don't want to ship a product first and then discover that the user never pays for it.

The problem is, running an escrow solution for criminals is almost certain to get you accused of conspiracy, money laundering, and unlicensed money transmission, so the police are likely to shut down any DNM that does this. A better design is to oursource escrow to third parties. Let anyone call themselves an escrow, and let moderators approve escrows just like they approve listings. A merchant or user who doesn't trust the escrows chosen by a given moderator can just pick a different moderator. That way, the police go after the third party escrows rather than the DNM itself, which never touches user funds.

4. Consequences

Designing a DNM along these principles has an interesting consequence: the DNM is no longer anything but an interface, a glorified web browser. It doesn't host any content, approve any listings, or touch any money. It doesn't even really need a server -- it can just be an HTML file that users open up on their computer or smart phone. For two reasons, such a program is hard to take down:

First, it is hard for the police to justify going after the DNM, since there are no charges to bring. Its maintainers aren't doing anything illegal, no more than Firefox does anything illegal by maintaining a web browser that some people use to browse illegal content. What the user displays in the app is up to them, not to the code maintainers. Second, if the police decided to go after the DNM anyway, they still couldn't take it down because it's just an HTML file -- the maintainers do not even need to run a server to host the file, because users can share it with one another, eliminating all single points of failure.

Another consequence of this design is this: most of the listings will probably be legal, because there is more demand for legal goods and services than illegal ones. Users who want to find illegal goods would pick moderators who only approve those listings, but everyone else would use "legal" moderators, and the app would not, at first glance, look much like a DNM, just a marketplace for legal goods and services. To find the illegal stuff that lurks among the abundant legal stuff, you'd probably have to filter for it via your selection of moderators, making it seem like the "default" mode is legal.

5. Conclusion

I think this DNM model is far better than the designs that prevail today. It is easier to maintain, harder to take down, and pushes the "hard parts" to the edges, so that the DNM is not significantly affected even if a major merchant, moderator, or escrow gets arrested. I hope it comes to fruition.

-

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06 -

@ 58537364:705b4b85

2025-05-22 05:42:27

@ 58537364:705b4b85

2025-05-22 05:42:27คนเรามักจะเห็นคุณค่าของสิ่งใด ส่วนใหญ่ก็ใน ๒ สถานการณ์คือ หนึ่ง ตอนที่ยังไม่ได้มา หรือ สอง ตอนที่เสียไปแล้ว

อันนี้มันเป็นโศกนาฏกรรม ที่เกิดขึ้นกับผู้คนจำนวนมาก การที่คนเรามีสิ่งดีๆ แต่ว่าเราไม่เห็นคุณค่า เพราะว่าเรามองออกไปนอกตัว ไปเห็นแต่สิ่งที่ตัวเองไม่มี อยากจะได้มา

คล้ายๆ กับเรื่อง หมาคาบเนื้อในนิทานอีสป ตอนเด็กๆ เราคงจำได้ มีหมาตัวหนึ่งคาบเนื้อมา เนื้อชิ้นใหญ่เลย มันดีใจมากแล้วมันก็วิ่งไปยังที่ที่ มันจะได้กินเนื้ออย่างมีความสุข มีช่วงหนึ่งก็ต้องเดินข้ามสะพาน มันก็ชะโงกหน้าไปมองที่ลำธารหรือลำคลอง

ก็เห็นเงาตัวเอง เงานั่นมันก็ใหญ่ แล้วมันก็พบว่าในเงานั้น เนื้อในเงามันใหญ่กว่าเนื้อที่ตัวเองคาบ มันอยากได้เนื้อก้อนนั้นมากเลย เพราะว่ามันเป็นก้อนที่ใหญ่กว่า

มันก็เลยอ้าปาก เพื่อที่จะไปงับเนื้อในเงานั้น พอมันอ้าปาก ก็ปรากฏว่าเนื้อในปาก ก็หลุดตกลงแม่น้ำ แล้วเนื้อในเงานั้นก็หายไป เป็นอันว่าหมดเลย อดทั้ง 2 อย่าง .

ฉะนั้น คนเราถ้าหากเรา กลับมาเห็นคุณค่าของสิ่งที่เรามีอยู่ เราจะมีความสุขได้ง่าย อาจจะไม่ใช่สิ่งของ อาจจะไม่ใช่ผู้คน แต่อาจจะเป็นสุขภาพของเรา

อาจจะได้แก่ ลมหายใจของเรา ที่ยังหายใจได้ปกติ รวมถึงการที่ เรายังเดินเหินไปไหนมาไหนได้ การที่เรายังมองเห็น การที่เรายังได้ยิน

หลายคนมีสิ่งนี้อยู่ในตัว แต่กลับไม่เห็นค่า และไม่รู้สึกว่าตัวเองโชคดี กลับไปมองว่า ฉันยังไม่มีโน่นยังไม่มีนี่ ไม่มีบ้าน ไม่มีรถ ไม่มีเงิน

รู้สึกว่าทุกข์ระทมเหลือเกิน

ทำไมฉันจึงลำบากแบบนี้ ทั้งที่ตัวเองก็มีสิ่งดีๆ ในตัว สุขภาพ ความปกติสุข อิสรภาพที่เดินไปไหนมาไหนได้

แต่กลับไม่เห็นค่า เพราะว่ามัวแต่ไปสนใจสิ่งที่ตัวเองยังไม่มี

ซึ่งเป็นอนาคต

ถ้าเราหันกลับมาเห็นคุณค่าของสิ่งที่เรามีอยู่ แล้วก็ไม่ไปพะวงหรือให้ความสนใจกับสิ่งที่ยังไม่มี เราจะมีความสุขได้ง่าย อันนี้คือ ความหมายหนึ่งของการทำปัจจุบันให้ดีที่สุด

…

การทำปัจจุบันให้ดีที่สุด พระอาจารย์ไพศาล วิสาโล

-

@ c230edd3:8ad4a712

2025-04-11 16:02:15

@ c230edd3:8ad4a712

2025-04-11 16:02:15Chef's notes

Wildly enough, this is delicious. It's sweet and savory.

(I copied this recipe off of a commercial cheese maker's site, just FYI)

I hadn't fully froze the ice cream when I took the picture shown. This is fresh out of the churner.

Details

- ⏲️ Prep time: 15 min

- 🍳 Cook time: 30 min

- 🍽️ Servings: 4

Ingredients

- 12 oz blue cheese

- 3 Tbsp lemon juice

- 1 c sugar

- 1 tsp salt

- 1 qt heavy cream

- 3/4 c chopped dark chocolate

Directions

- Put the blue cheese, lemon juice, sugar, and salt into a bowl

- Bring heavy cream to a boil, stirring occasionally

- Pour heavy cream over the blue cheese mix and stir until melted

- Pour into prepared ice cream maker, follow unit instructions

- Add dark chocolate halfway through the churning cycle

- Freeze until firm. Enjoy.

-

@ 21335073:a244b1ad

2025-05-01 01:51:10

@ 21335073:a244b1ad

2025-05-01 01:51:10Please respect Virginia Giuffre’s memory by refraining from asking about the circumstances or theories surrounding her passing.

Since Virginia Giuffre’s death, I’ve reflected on what she would want me to say or do. This piece is my attempt to honor her legacy.

When I first spoke with Virginia, I was struck by her unshakable hope. I had grown cynical after years in the anti-human trafficking movement, worn down by a broken system and a government that often seemed complicit. But Virginia’s passion, creativity, and belief that survivors could be heard reignited something in me. She reminded me of my younger, more hopeful self. Instead of warning her about the challenges ahead, I let her dream big, unburdened by my own disillusionment. That conversation changed me for the better, and following her lead led to meaningful progress.

Virginia was one of the bravest people I’ve ever known. As a survivor of Epstein, Maxwell, and their co-conspirators, she risked everything to speak out, taking on some of the world’s most powerful figures.

She loved when I said, “Epstein isn’t the only Epstein.” This wasn’t just about one man—it was a call to hold all abusers accountable and to ensure survivors find hope and healing.

The Epstein case often gets reduced to sensational details about the elite, but that misses the bigger picture. Yes, we should be holding all of the co-conspirators accountable, we must listen to the survivors’ stories. Their experiences reveal how predators exploit vulnerabilities, offering lessons to prevent future victims.

You’re not powerless in this fight. Educate yourself about trafficking and abuse—online and offline—and take steps to protect those around you. Supporting survivors starts with small, meaningful actions. Free online resources can guide you in being a safe, supportive presence.

When high-profile accusations arise, resist snap judgments. Instead of dismissing survivors as “crazy,” pause to consider the trauma they may be navigating. Speaking out or coping with abuse is never easy. You don’t have to believe every claim, but you can refrain from attacking accusers online.

Society also fails at providing aftercare for survivors. The government, often part of the problem, won’t solve this. It’s up to us. Prevention is critical, but when abuse occurs, step up for your loved ones and community. Protect the vulnerable. it’s a challenging but a rewarding journey.

If you’re contributing to Nostr, you’re helping build a censorship resistant platform where survivors can share their stories freely, no matter how powerful their abusers are. Their voices can endure here, offering strength and hope to others. This gives me great hope for the future.

Virginia Giuffre’s courage was a gift to the world. It was an honor to know and serve her. She will be deeply missed. My hope is that her story inspires others to take on the powerful.

-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ c230edd3:8ad4a712

2025-04-09 00:33:31

@ c230edd3:8ad4a712

2025-04-09 00:33:31Chef's notes

I found this recipe a couple years ago and have been addicted to it since. Its incredibly easy, and cheap to prep. Freeze the sausage in flat, single serving portions. That way it can be cooked from frozen for a fast, flavorful, and healthy lunch or dinner. I took inspiration from the video that contained this recipe, and almost always pan fry the frozen sausage with some baby broccoli. The steam cooks the broccoli and the fats from the sausage help it to sear, while infusing the vibrant flavors. Serve with some rice, if desired. I often use serrano peppers, due to limited produce availability. They work well for a little heat and nice flavor that is not overpowering.

Details

- ⏲️ Prep time: 25 min

- 🍳 Cook time: 15 min (only needed if cooking at time of prep)

- 🍽️ Servings: 10

Ingredients

- 4 lbs ground pork

- 12-15 cloves garlic, minced

- 6 Thai or Serrano peppers, rough chopped

- 1/4 c. lime juice

- 4 Tbsp fish sauce

- 1 Tbsp brown sugar

- 1/2 c. chopped cilantro

Directions

- Mix all ingredients in a large bowl.

- Portion and freeze, as desired.

- Sautè frozen portions in hot frying pan, with broccoli or other fresh veggies.

- Serve with rice or alone.

-

@ 00000001:b0c77eb9

2025-02-14 21:24:24

@ 00000001:b0c77eb9

2025-02-14 21:24:24مواقع التواصل الإجتماعي العامة هي التي تتحكم بك، تتحكم بك بفرض أجندتها وتجبرك على اتباعها وتحظر وتحذف كل ما يخالفها، وحرية التعبير تنحصر في أجندتها تلك!

وخوارزمياتها الخبيثة التي لا حاجة لها، تعرض لك مايريدون منك أن تراه وتحجب ما لا يريدونك أن تراه.

في نوستر انت المتحكم، انت الذي تحدد من تتابع و انت الذي تحدد المرحلات التي تنشر منشوراتك بها.

نوستر لامركزي، بمعنى عدم وجود سلطة تتحكم ببياناتك، بياناتك موجودة في المرحلات، ولا احد يستطيع حذفها او تعديلها او حظر ظهورها.

و هذا لا ينطبق فقط على مواقع التواصل الإجتماعي العامة، بل ينطبق أيضاً على الـfediverse، في الـfediverse انت لست حر، انت تتبع الخادم الذي تستخدمه ويستطيع هذا الخادم حظر ما لا يريد ظهوره لك، لأنك لا تتواصل مع بقية الخوادم بنفسك، بل خادمك من يقوم بذلك بالنيابة عنك.

وحتى إذا كنت تمتلك خادم في شبكة الـfediverse، إذا خالفت اجندة بقية الخوادم ونظرتهم عن حرية الرأي و التعبير سوف يندرج خادمك في القائمة السوداء fediblock ولن يتمكن خادمك من التواصل مع بقية خوادم الشبكة، ستكون محصوراً بالخوادم الأخرى المحظورة كخادمك، بالتالي انت في الشبكة الأخرى من الـfediverse!

نعم، يوجد شبكتان في الكون الفدرالي fediverse شبكة الصالحين التابعين للأجندة الغربية وشبكة الطالحين الذين لا يتبعون لها، إذا تم إدراج خادمك في قائمة fediblock سوف تذهب للشبكة الأخرى!

-

@ a39d19ec:3d88f61e

2025-04-22 12:44:42

@ a39d19ec:3d88f61e

2025-04-22 12:44:42Die Debatte um Migration, Grenzsicherung und Abschiebungen wird in Deutschland meist emotional geführt. Wer fordert, dass illegale Einwanderer abgeschoben werden, sieht sich nicht selten dem Vorwurf des Rassismus ausgesetzt. Doch dieser Vorwurf ist nicht nur sachlich unbegründet, sondern verkehrt die Realität ins Gegenteil: Tatsächlich sind es gerade diejenigen, die hinter jeder Forderung nach Rechtssicherheit eine rassistische Motivation vermuten, die selbst in erster Linie nach Hautfarbe, Herkunft oder Nationalität urteilen.

Das Recht steht über Emotionen

Deutschland ist ein Rechtsstaat. Das bedeutet, dass Regeln nicht nach Bauchgefühl oder politischer Stimmungslage ausgelegt werden können, sondern auf klaren gesetzlichen Grundlagen beruhen müssen. Einer dieser Grundsätze ist in Artikel 16a des Grundgesetzes verankert. Dort heißt es:

„Auf Absatz 1 [Asylrecht] kann sich nicht berufen, wer aus einem Mitgliedstaat der Europäischen Gemeinschaften oder aus einem anderen Drittstaat einreist, in dem die Anwendung des Abkommens über die Rechtsstellung der Flüchtlinge und der Europäischen Menschenrechtskonvention sichergestellt ist.“

Das bedeutet, dass jeder, der über sichere Drittstaaten nach Deutschland einreist, keinen Anspruch auf Asyl hat. Wer dennoch bleibt, hält sich illegal im Land auf und unterliegt den geltenden Regelungen zur Rückführung. Die Forderung nach Abschiebungen ist daher nichts anderes als die Forderung nach der Einhaltung von Recht und Gesetz.

Die Umkehrung des Rassismusbegriffs

Wer einerseits behauptet, dass das deutsche Asyl- und Aufenthaltsrecht strikt durchgesetzt werden soll, und andererseits nicht nach Herkunft oder Hautfarbe unterscheidet, handelt wertneutral. Diejenigen jedoch, die in einer solchen Forderung nach Rechtsstaatlichkeit einen rassistischen Unterton sehen, projizieren ihre eigenen Denkmuster auf andere: Sie unterstellen, dass die Debatte ausschließlich entlang ethnischer, rassistischer oder nationaler Kriterien geführt wird – und genau das ist eine rassistische Denkweise.

Jemand, der illegale Einwanderung kritisiert, tut dies nicht, weil ihn die Herkunft der Menschen interessiert, sondern weil er den Rechtsstaat respektiert. Hingegen erkennt jemand, der hinter dieser Kritik Rassismus wittert, offenbar in erster Linie die „Rasse“ oder Herkunft der betreffenden Personen und reduziert sie darauf.

Finanzielle Belastung statt ideologischer Debatte

Neben der rechtlichen gibt es auch eine ökonomische Komponente. Der deutsche Wohlfahrtsstaat basiert auf einem Solidarprinzip: Die Bürger zahlen in das System ein, um sich gegenseitig in schwierigen Zeiten zu unterstützen. Dieser Wohlstand wurde über Generationen hinweg von denjenigen erarbeitet, die hier seit langem leben. Die Priorität liegt daher darauf, die vorhandenen Mittel zuerst unter denjenigen zu verteilen, die durch Steuern, Sozialabgaben und Arbeit zum Erhalt dieses Systems beitragen – nicht unter denen, die sich durch illegale Einreise und fehlende wirtschaftliche Eigenleistung in das System begeben.

Das ist keine ideologische Frage, sondern eine rein wirtschaftliche Abwägung. Ein Sozialsystem kann nur dann nachhaltig funktionieren, wenn es nicht unbegrenzt belastet wird. Würde Deutschland keine klaren Regeln zur Einwanderung und Abschiebung haben, würde dies unweigerlich zur Überlastung des Sozialstaates führen – mit negativen Konsequenzen für alle.

Sozialpatriotismus

Ein weiterer wichtiger Aspekt ist der Schutz der Arbeitsleistung jener Generationen, die Deutschland nach dem Zweiten Weltkrieg mühsam wieder aufgebaut haben. Während oft betont wird, dass die Deutschen moralisch kein Erbe aus der Zeit vor 1945 beanspruchen dürfen – außer der Verantwortung für den Holocaust –, ist es umso bedeutsamer, das neue Erbe nach 1945 zu respektieren, das auf Fleiß, Disziplin und harter Arbeit beruht. Der Wiederaufbau war eine kollektive Leistung deutscher Menschen, deren Früchte nicht bedenkenlos verteilt werden dürfen, sondern vorrangig denjenigen zugutekommen sollten, die dieses Fundament mitgeschaffen oder es über Generationen mitgetragen haben.

Rechtstaatlichkeit ist nicht verhandelbar

Wer sich für eine konsequente Abschiebepraxis ausspricht, tut dies nicht aus rassistischen Motiven, sondern aus Respekt vor der Rechtsstaatlichkeit und den wirtschaftlichen Grundlagen des Landes. Der Vorwurf des Rassismus in diesem Kontext ist daher nicht nur falsch, sondern entlarvt eine selektive Wahrnehmung nach rassistischen Merkmalen bei denjenigen, die ihn erheben.

-

@ e3ba5e1a:5e433365

2025-04-15 11:03:15

@ e3ba5e1a:5e433365

2025-04-15 11:03:15Prelude

I wrote this post differently than any of my others. It started with a discussion with AI on an OPSec-inspired review of separation of powers, and evolved into quite an exciting debate! I asked Grok to write up a summary in my overall writing style, which it got pretty well. I've decided to post it exactly as-is. Ultimately, I think there are two solid ideas driving my stance here:

- Perfect is the enemy of the good

- Failure is the crucible of success

Beyond that, just some hard-core belief in freedom, separation of powers, and operating from self-interest.

Intro

Alright, buckle up. I’ve been chewing on this idea for a while, and it’s time to spit it out. Let’s look at the U.S. government like I’d look at a codebase under a cybersecurity audit—OPSEC style, no fluff. Forget the endless debates about what politicians should do. That’s noise. I want to talk about what they can do, the raw powers baked into the system, and why we should stop pretending those powers are sacred. If there’s a hole, either patch it or exploit it. No half-measures. And yeah, I’m okay if the whole thing crashes a bit—failure’s a feature, not a bug.

The Filibuster: A Security Rule with No Teeth

You ever see a firewall rule that’s more theater than protection? That’s the Senate filibuster. Everyone acts like it’s this untouchable guardian of democracy, but here’s the deal: a simple majority can torch it any day. It’s not a law; it’s a Senate preference, like choosing tabs over spaces. When people call killing it the “nuclear option,” I roll my eyes. Nuclear? It’s a button labeled “press me.” If a party wants it gone, they’ll do it. So why the dance?