-

@ 0e9491aa:ef2adadf

2025-05-24 07:01:14

@ 0e9491aa:ef2adadf

2025-05-24 07:01:14

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 57d1a264:69f1fee1

2025-05-24 06:07:19

@ 57d1a264:69f1fee1

2025-05-24 06:07:19Definition: when every single person in the chain responsible for shipping a product looks at objectively horrendous design decisions and goes: yup, this looks good to me, release this. Designers, developers, product managers, testers, quality assurance... everyone.

I nominate Peugeot as the first example in this category.

Continue reading at https://grumpy.website/1665

https://stacker.news/items/988044

-

@ 0e9491aa:ef2adadf

2025-05-24 06:01:20

@ 0e9491aa:ef2adadf

2025-05-24 06:01:20

The newly proposed RESTRICT ACT - is being advertised as a TikTok Ban, but is much broader than that, carries a $1M Fine and up to 20 years in prison️! It is unconstitutional and would create massive legal restrictions on the open source movement and free speech throughout the internet.

The Bill was proposed by: Senator Warner, Senator Thune, Senator Baldwin, Senator Fischer, Senator Manchin, Senator Moran, Senator Bennet, Senator Sullivan, Senator Gillibrand, Senator Collins, Senator Heinrich, and Senator Romney. It has broad support across Senators of both parties.

Corrupt politicians will not protect us. They are part of the problem. We must build, support, and learn how to use censorship resistant tools in order to defend our natural rights.

The RESTRICT Act, introduced by Senators Warner and Thune, aims to block or disrupt transactions and financial holdings involving foreign adversaries that pose risks to national security. Although the primary targets of this legislation are companies like Tik-Tok, the language of the bill could potentially be used to block or disrupt cryptocurrency transactions and, in extreme cases, block Americans’ access to open source tools or protocols like Bitcoin.

The Act creates a redundant regime paralleling OFAC without clear justification, it significantly limits the ability for injured parties to challenge actions raising due process concerns, and unlike OFAC it lacks any carve-out for protected speech. COINCENTER ON THE RESTRICT ACT

If you found this post helpful support my work with bitcoin.

-

@ 57d1a264:69f1fee1

2025-05-24 05:53:43

@ 57d1a264:69f1fee1

2025-05-24 05:53:43This talks highlights tools for product management, UX design, web development, and content creation to embed accessibility.

Organizations need scalability and consistency in their accessibility work, aligning people, policies, and processes to integrate it across roles. This session highlights tools for product management, UX design, web development, and content creation to embed accessibility. We will explore inclusive personas, design artifacts, design systems, and content strategies to support developers and creators, with real-world examples.

https://www.youtube.com/watch?v=-M2cMLDU4u4

https://stacker.news/items/988041

-

@ f6488c62:c929299d

2025-05-24 05:10:20

@ f6488c62:c929299d

2025-05-24 05:10:20คุณเคยจินตนาการถึงอนาคตที่ AI มีความฉลาดเทียบเท่ามนุษย์หรือไม่? นี่คือสิ่งที่ Sam Altman ซีอีโอของ OpenAI และทีมพันธมิตรอย่าง SoftBank, Oracle และ MGX กำลังผลักดันผ่าน โครงการ Stargate! โครงการนี้ไม่ใช่แค่เรื่องเทคโนโลยี แต่เป็นก้าวกระโดดครั้งใหญ่ของมนุษยชาติ! Stargate คืออะไร? Stargate เป็นโปรเจกต์สร้าง ศูนย์ข้อมูล AI ขนาดยักษ์ที่ใหญ่ที่สุดในประวัติศาสตร์ ด้วยเงินลงทุนเริ่มต้น 100,000 ล้านดอลลาร์ และอาจสูงถึง 500,000 ล้านดอลลาร์ ภายในปี 2029! เป้าหมายคือการพัฒนา Artificial General Intelligence (AGI) หรือ AI ที่ฉลาดเทียบเท่ามนุษย์ เพื่อให้สหรัฐฯ ครองความเป็นผู้นำด้าน AI และแข่งขันกับคู่แข่งอย่างจีน โครงการนี้เริ่มต้นที่เมือง Abilene รัฐเท็กซัส โดยจะสร้างศูนย์ข้อมูล 10 แห่ง และขยายไปยังญี่ปุ่น สหราชอาณาจักร และสหรัฐอาหรับเอมิเรตส์ ทำไม Stargate ถึงสำคัญ?

นวัตกรรมเปลี่ยนโลก: AI จาก Stargate จะช่วยพัฒนาวัคซีน mRNA รักษามะเร็งได้ใน 48 ชั่วโมง และยกระดับอุตสาหกรรมต่าง ๆ เช่น การแพทย์และความมั่นคงแห่งชาติสร้างงาน: คาดว่าจะสร้างงานกว่า 100,000 ตำแหน่ง ในสหรัฐฯ

พลังงานมหาศาล: ศูนย์ข้อมูลอาจใช้พลังงานถึง 1.2 กิกะวัตต์ เทียบเท่ากับเมืองขนาดใหญ่!

ใครอยู่เบื้องหลัง? Sam Altman ร่วมมือกับ Masayoshi Son จาก SoftBank และได้รับการสนับสนุนจาก Donald Trump ซึ่งผลักดันนโยบายให้ Stargate เป็นจริง การก่อสร้างดำเนินการโดย Oracle และพันธมิตรด้านพลังงานอย่าง Crusoe Energy Systems ความท้าทาย? ถึงจะยิ่งใหญ่ แต่ Stargate ก็เจออุปสรรค ทั้งปัญหาการระดมทุน ความกังวลเรื่องภาษีนำเข้าชิป และการแข่งขันจากคู่แข่งอย่าง DeepSeek ที่ใช้โครงสร้างพื้นฐานน้อยกว่า แถม Elon Musk ยังออกมาวิจารณ์ว่าโครงการนี้อาจ “ไม่สมจริง” แต่ Altman มั่นใจและเชิญ Musk ไปดูไซต์งานที่เท็กซัสเลยทีเดียว! อนาคตของ Stargate ศูนย์ข้อมูลแห่งแรกจะเริ่มใช้งานในปี 2026 และอาจเปลี่ยนโฉมวงการ AI ไปตลอดกาล นี่คือก้าวสำคัญสู่ยุคใหม่ของเทคโนโลยีที่อาจเปลี่ยนวิถีชีวิตของเรา! และไม่ใช่ประตูดวงดาวแบบในหนังนะ! ถึงชื่อ Stargate จะได้แรงบันดาลใจจากภาพยนตร์ sci-fi อันโด่งดัง แต่โครงการนี้ไม่ได้พาเราไปยังดวงดาวอื่น มันคือการเปิดประตูสู่โลกแห่ง AI ที่ทรงพลัง และอาจเปลี่ยนอนาคตของมนุษยชาติไปเลย! และไม่เหมือน universechain ของ star ของผมนะครับ

Stargate #AI #SamAltman #OpenAI #อนาคตของเทคโนโลยี

-

@ 472f440f:5669301e

2025-05-20 13:01:09

@ 472f440f:5669301e

2025-05-20 13:01:09Marty's Bent

via me

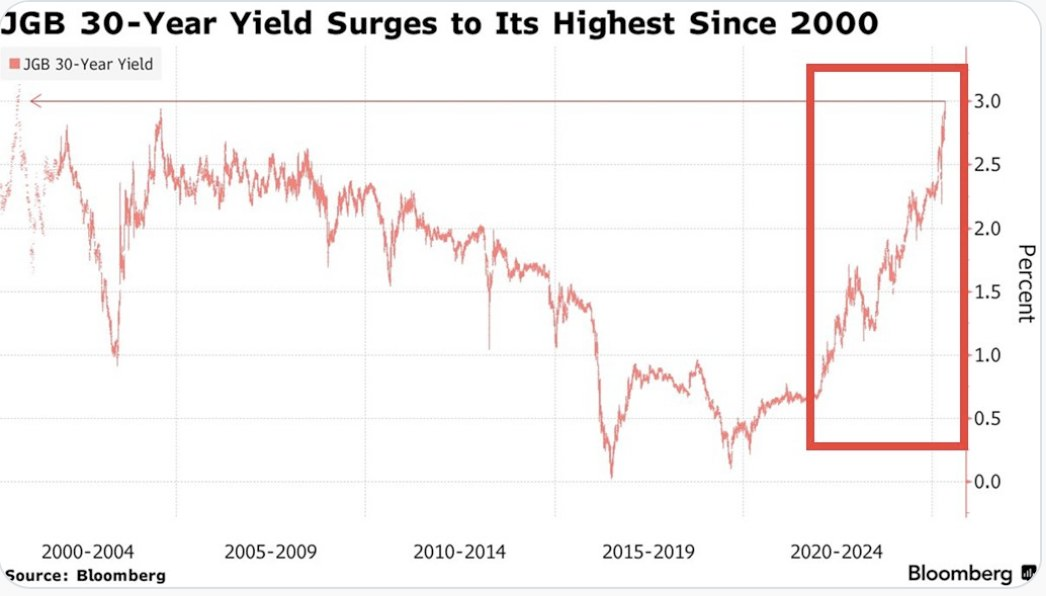

Don't sleep on what's happening in Japan right now. We've been covering the country and the fact that they've lost control of their yield curve since late last year. After many years of making it a top priority from a monetary policy perspective, last year the Bank of Japan decided to give up on yield curve control in an attempt to reel inflation. This has sent yields for the 30-year and 40-year Japanese government bonds to levels not seen since the early 2000s in the case of the 30-year and levels never before seen for the 40-year, which was launched in 2007. With a debt to GDP ratio that has surpassed 250% and a population that is aging out with an insufficient amount of births to replace the aging workforce, it's hard to see how Japan can get out of this conundrum without some sort of economic collapse.

This puts the United States in a tough position considering the fact that Japan is one of the largest holders of U.S. Treasury bonds with more than 1,135 sats | $1.20 trillion in exposure. If things get too out of control in Japan and the yield curve continues to drift higher and inflation continues to creep higher Japan can find itself in a situation where it's a forced seller of US Treasuries as they attempt to strengthen the yen. Another aspect to consider is the fact that investors may see the higher yields on Japanese government bonds and decide to purchase them instead of US Treasuries. This is something to keep an eye on in the weeks to come. Particularly if higher rates drive a higher cost of capital, which leads to even more inflation. As producers are forced to increase their prices to ensure that they can manage their debt repayments.

It's never a good sign when the Japanese Prime Minister is coming out to proclaim that his country's financial situation is worse than Greece's, which has been a laughing stock of Europe for the better part of three decades. Japan is a very proud nation, and the fact that its Prime Minister made a statement like this should not be underappreciated.

As we noted last week, the 10-year and 30-year U.S. Treasury bonds are drifting higher as well. Earlier today, the 30-year bond yield surpassed 5%, which has been a psychological level that many have been pointed to as a critical tipping point. When you take a step back and look around the world it seems pretty clear that bond markets are sending a very strong signal. And that signal is that something is not well in the back end of the financial system.

This is even made clear when you look at the private sector, particularly at consumer debt. In late March, we warned of the growing trend of buy now, pay later schemes drifting down market as major credit card companies released charge-off data which showed charge-off rates reaching levels not seen since the 2008 great financial crisis. At the time, we could only surmise that Klarna was experiencing similar charge-off rates on the bigger-ticket items they financed and started doing deals with companies like DoorDash to finance burrito deliveries in an attempt to move down market to finance smaller ticket items with a higher potential of getting paid back. It seems like that inclination was correct as Klarna released data earlier today showing more losses on their book as consumers find it extremely hard to pay back their debts.

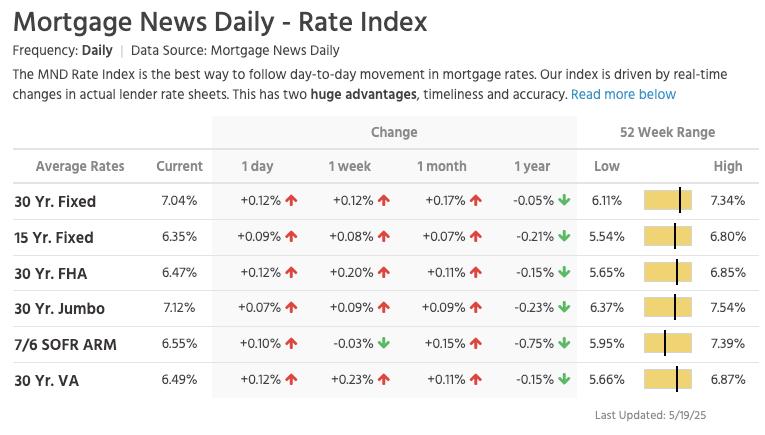

via NewsWire

This news hit the markets on the same day as the average rate of the 30-year mortgage in the United States rose to 7.04%. I'm not sure if you've checked lately, but real estate prices are still relatively elevated outside of a few big cities who expanded supply significantly during the COVID era as people flooded out of blue states towards red states. It's hard to imagine that many people can afford a house based off of sticker price alone, but with a 7% 30-year mortgage rate it's becoming clear that the ability of the Common Man to buy a house is simply becoming impossible.

via Lance Lambert

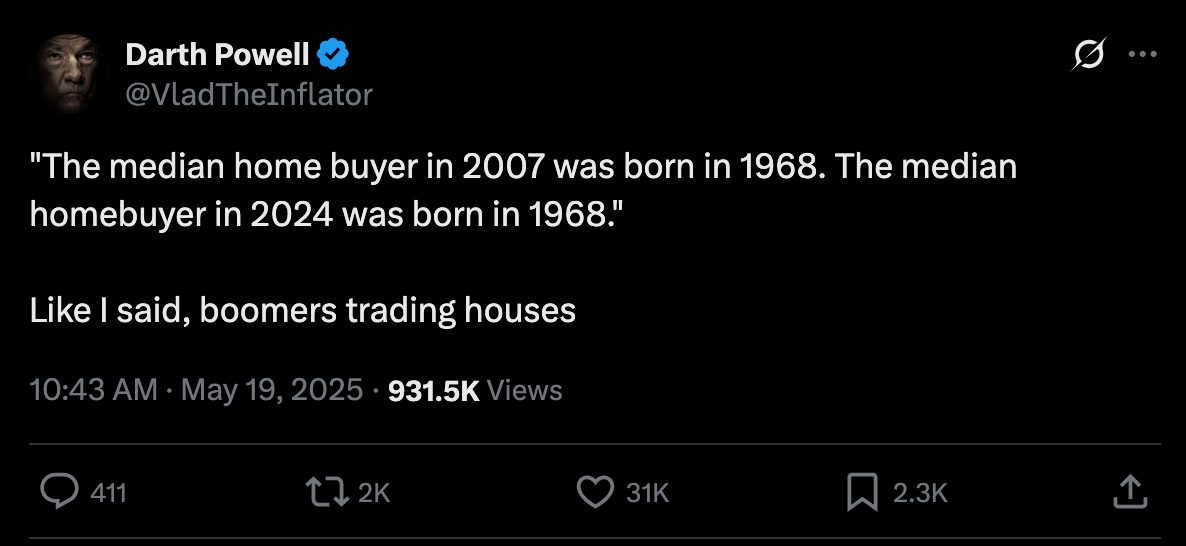

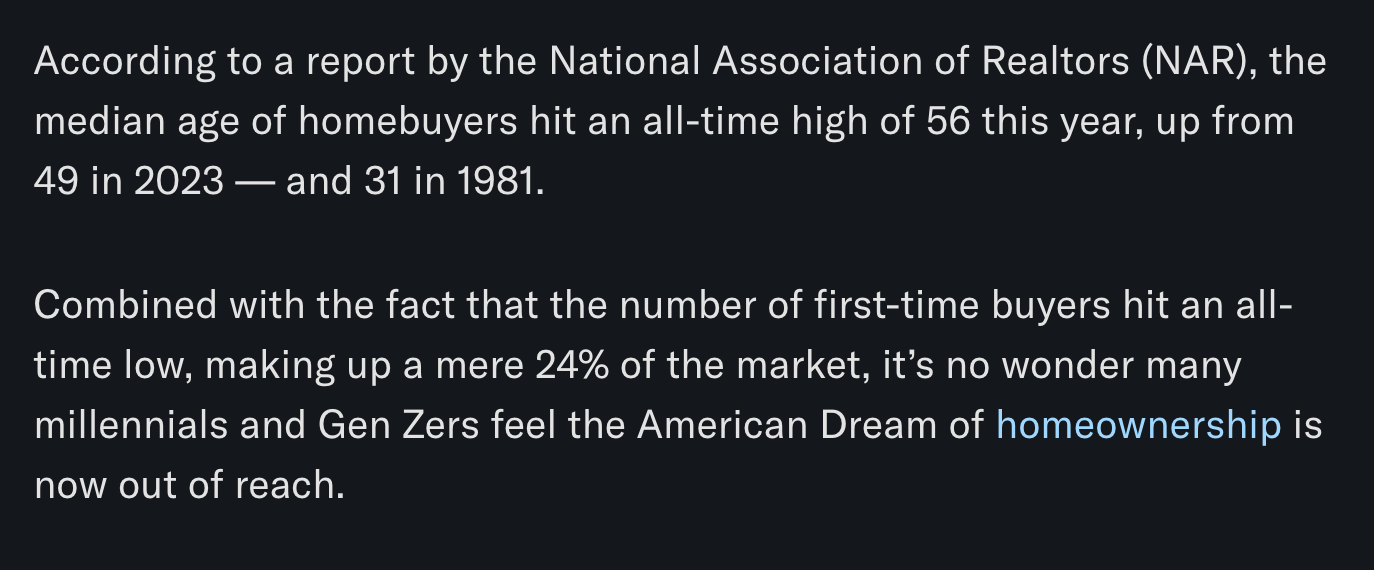

The mortgage rate data is not the only thing you need to look at to understand that it's becoming impossible for the Common Man of working age to buy a house. New data has recently been released that highlights That the median home buyer in 2007 was born in 1968, and the median home buyer in 2024 was born in 1968. Truly wild when you think of it. As our friend Darth Powell cheekily highlights below, we find ourselves in a situation where boomers are simply trading houses and the younger generations are becoming indentured slaves. Forever destined to rent because of the complete inability to afford to buy a house.

via Darth Powell

via Yahoo Finance

Meanwhile, Bitcoin re-approached all-time highs late this evening and looks primed for another breakout to the upside. This makes sense if you're paying attention. The high-velocity trash economy running on an obscene amount of debt in both the public and private sectors seems to be breaking at the seams. All the alarm bells are signaling that another big print is coming. And if you hope to preserve your purchasing power or, ideally, increase it as the big print approaches, the only thing that makes sense is to funnel your money into the hardest asset in the world, which is Bitcoin.

via Bitbo

Buckle up, freaks. It's gonna be a bumpy ride. Stay humble, Stack Sats.

Trump's Middle East Peace Strategy: Redefining U.S. Foreign Policy

In his recent Middle East tour, President Trump signaled what our guest Dr. Anas Alhajji calls "a major change in US policy." Trump explicitly rejected the nation-building strategies of his predecessors, contrasting the devastation in Afghanistan and Iraq with the prosperity of countries like Saudi Arabia and UAE. This marks a profound shift from both Republican and Democratic foreign policy orthodoxy. As Alhajji noted, Trump's willingness to meet with Syrian President Assad follows a historical pattern where former adversaries eventually become diplomatic partners.

"This is really one of the most important shifts in US foreign policy to say, look, sorry, we destroyed those countries because we tried to rebuild them and it was a big mistake." - Dr. Anas Alhajji

The administration's new approach emphasizes negotiation over intervention. Rather than military solutions, Trump is engaging with groups previously considered off-limits, including the Houthis, Hamas, and Iran. This pragmatic stance prioritizes economic cooperation and regional stability over ideological confrontation. The focus on trade deals and investment rather than regime change represents a fundamental reimagining of America's role in the Middle East.

Check out the full podcast here for more on the Iran nuclear situation, energy market predictions, and why AI development could create power grid challenges. Only on TFTC Studio.

Headlines of the Day

Bitcoin Soars to 100,217 sats | $106.00K While Bonds Lose 40% Since 2020 - via X

US Senate Advances Stablecoin Bill As America Embraces Bitcoin - via X

Get our new STACK SATS hat - via tftcmerch.io

Texas House Debates Bill For State-Run Bitcoin Reserve - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Don't let the noise consume you. Focus on making your life 1% better every day.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ c1d77557:bf04ec8b

2025-05-24 05:02:26

@ c1d77557:bf04ec8b

2025-05-24 05:02:26O 567br é uma plataforma de entretenimento online que tem se destacado pela sua inovação, variedade de jogos e foco na experiência do jogador. Com uma interface amigável e recursos de alta qualidade, a plataforma oferece uma jornada divertida e segura para os seus usuários. Neste artigo, vamos explorar os principais aspectos do 567br, incluindo a introdução da plataforma, os jogos que ela oferece e como a experiência do jogador é aprimorada em cada detalhe.

O 567br foi desenvolvido com o objetivo de proporcionar aos jogadores uma experiência imersiva e prazerosa. Sua interface é simples, intuitiva e de fácil navegação, permitindo que os usuários encontrem rapidamente seus jogos favoritos. A plataforma também é otimizada para dispositivos móveis, o que significa que os jogadores podem acessar seus jogos em qualquer lugar e a qualquer momento, seja no computador ou no smartphone.

Além disso, o 567brse preocupa com a segurança de seus usuários, implementando tecnologias de criptografia de ponta para garantir que todos os dados pessoais e financeiros estejam protegidos. A plataforma também oferece suporte ao cliente de alta qualidade, disponível 24/7, para resolver quaisquer dúvidas ou problemas que possam surgir durante a experiência de jogo.

Jogos Empolgantes e Variedade para Todos os Gostos No 567br, a diversidade de jogos é um dos pontos fortes da plataforma. Desde jogos de mesa e cartas até opções de entretenimento mais dinâmicas e inovadoras, há algo para todos os gostos e preferências. Os jogos disponíveis são desenvolvidos por alguns dos melhores fornecedores de conteúdo da indústria, garantindo gráficos de alta qualidade, jogabilidade fluida e mecânicas envolventes.

Os jogadores podem escolher entre diferentes categorias, como:

Jogos de Mesa: Para quem gosta de uma experiência mais estratégica e de tomada de decisões, os jogos de mesa são uma excelente opção. São oferecidas diversas variantes de jogos populares, como pôquer, blackjack, roleta, entre outros.

Jogos de Ação e Aventura: Para os que buscam adrenalina e emoção, a plataforma oferece uma seleção de jogos de ação e aventura com temas envolventes e gráficos impressionantes. Esses jogos garantem uma experiência de jogo emocionante e desafiadora.

Jogos de Arcade: Se você está em busca de algo mais descontraído e divertido, os jogos de arcade são uma excelente escolha. Eles são rápidos, fáceis de entender e proporcionam diversão instantânea.

A plataforma está sempre atualizando seu portfólio de jogos para garantir que os jogadores tenham acesso às últimas novidades e inovações do mundo do entretenimento online.

A Experiência do Jogador: Personalização e Interatividade O 567br não se limita a oferecer apenas uma plataforma de jogos, mas também busca criar uma experiência personalizada e interativa para cada jogador. A plataforma possui funcionalidades que permitem que os usuários ajustem sua experiência de jogo de acordo com suas preferências individuais.

A personalização da interface é um exemplo claro disso. O jogador pode escolher o tema e a disposição dos elementos na tela, criando um ambiente que seja confortável e agradável de usar. Além disso, o 567br oferece recursos interativos, como chats ao vivo, onde os jogadores podem interagir com outros usuários e até mesmo com os dealers, proporcionando uma sensação de comunidade.

Outro aspecto importante é a possibilidade de acompanhar o desempenho e os resultados de jogo. A plataforma oferece relatórios detalhados, permitindo que os jogadores monitorem seu progresso, analisem suas vitórias e perdas, e façam ajustes em sua estratégia de jogo.

Promoções e Benefícios para os Jogadores O 567br também oferece uma série de promoções e benefícios que tornam a experiência de jogo ainda mais atrativa. Novos jogadores podem aproveitar bônus de boas-vindas e outras ofertas especiais, enquanto jogadores regulares podem se beneficiar de programas de fidelidade e promoções exclusivas.

Essas ofertas ajudam a aumentar a diversão e proporcionam mais oportunidades para que os jogadores explorem novos jogos e tenham uma experiência ainda mais rica. Além disso, o sistema de recompensas é transparente e justo, garantindo que todos os jogadores tenham as mesmas oportunidades de aproveitar os benefícios.

Conclusão: Uma Plataforma Completa para Todos os Gostos Com sua interface intuitiva, variedade de jogos e foco na experiência do jogador, o 567br se consolida como uma plataforma de entretenimento online de alta qualidade. Seja para quem busca jogos estratégicos, ação intensa ou diversão casual, o 567br tem algo para todos.

A segurança, o suporte ao cliente e a personalização da experiência de jogo tornam o 567br uma opção atraente para jogadores que buscam mais do que apenas uma plataforma de jogos – buscam uma jornada de entretenimento envolvente e segura. Se você está procurando por uma experiência completa e agradável, o 567br é, sem dúvida, uma excelente escolha.

-

@ c1d77557:bf04ec8b

2025-05-24 05:01:44

@ c1d77557:bf04ec8b

2025-05-24 05:01:44O P11Bet é uma plataforma inovadora que chega para oferecer uma experiência de jogo única, reunindo uma variedade de opções para os entusiastas de diferentes tipos de entretenimento online. Com uma interface moderna e fácil de usar, ela se destaca por proporcionar uma jornada divertida e segura para os jogadores, com um foco especial na qualidade da experiência e no atendimento às necessidades do público.

Uma Plataforma Completa e Acessível Ao acessar o P11Bet, os usuários encontram uma plataforma intuitiva, que facilita a navegação e oferece uma variedade de recursos para tornar o jogo mais agradável. A estrutura do site é otimizada para fornecer uma experiência fluida, seja no desktop ou em dispositivos móveis. Além disso, a plataforma se preocupa em manter um ambiente seguro, garantindo a proteção dos dados dos jogadores e permitindo que se concentrem na diversão.

A plataforma é projetada para todos os tipos de jogadores, desde os iniciantes até os mais experientes. A simplicidade de uso é uma das grandes vantagens, permitindo que qualquer pessoa possa se registrar e começar a jogar sem dificuldades. Além disso, a p11betoferece suporte ao cliente em português, o que facilita a comunicação e garante um atendimento de alta qualidade para os usuários brasileiros.

Diversidade de Jogos para Todos os Gostos O P11Bet se destaca pela vasta gama de opções de jogos que oferece aos seus usuários. A plataforma abriga uma seleção diversificada que vai desde jogos clássicos até as opções mais modernas, atendendo a todos os estilos e preferências. Entre as opções mais procuradas estão jogos de mesa, apostas esportivas, slots, e outras modalidades que garantem horas de entretenimento.

Um dos principais atrativos do P11Bet são os jogos de habilidade e de sorte, que exigem tanto estratégia quanto um pouco de sorte. As opções variam desde os mais simples aos mais complexos, oferecendo algo para todos os gostos. Os jogadores podem se aventurar em diversas modalidades, testando suas habilidades em jogos que vão de roletas e blackjack a versões mais inovadoras e dinâmicas.

Para aqueles que preferem algo mais emocionante e competitivo, as apostas esportivas são uma das maiores atrações. O P11Bet oferece uma ampla variedade de eventos esportivos ao vivo para apostar, com odds atrativas e uma plataforma que permite realizar apostas de forma rápida e eficiente. Seja em esportes populares como futebol, basquete ou até mesmo esportes menos tradicionais, há sempre algo para os apostadores mais exigentes.

A Experiência do Jogador: Diversão e Segurança O P11Bet não apenas se preocupa com a diversidade de jogos, mas também com a experiência do jogador. A plataforma foi desenvolvida para garantir que os jogadores possam desfrutar de seus jogos favoritos com a maior segurança e conforto possível. Além de um design intuitivo, a plataforma oferece diversas opções de pagamento, incluindo métodos populares no Brasil, para facilitar depósitos e retiradas. Isso garante que o processo de transações seja simples, rápido e seguro.

Outro ponto positivo do P11Bet é a experiência imersiva que ele oferece aos jogadores. A plataforma está sempre atualizada com novas funcionalidades, com promoções atraentes e bônus especiais que aumentam ainda mais a diversão. A interação com outros jogadores também é um diferencial, com espaços que permitem competir, conversar e trocar experiências com pessoas de todo o mundo.

Além disso, o suporte ao cliente da P11Bet é um dos mais elogiados pelos usuários. A equipe está sempre disponível para resolver dúvidas e fornecer assistência de maneira eficaz e amigável. Isso garante que os jogadores tenham sempre uma experiência tranquila, sem se preocupar com questões técnicas ou problemas relacionados à plataforma.

Conclusão Em resumo, o P11Bet é uma excelente escolha para quem busca uma plataforma completa e de qualidade para se divertir e desafiar suas habilidades. Com uma grande variedade de jogos, uma interface de fácil navegação e um suporte excepcional, ele garante que cada momento na plataforma seja único e prazeroso. Para quem deseja se aventurar no mundo dos jogos online, o P11Bet é uma opção que combina segurança, inovação e diversão.

-

@ e39333da:7c66e53a

2025-05-21 14:26:08

@ e39333da:7c66e53a

2025-05-21 14:26:08::youtube{#prPOncMkV6c}

Tara Gaming has announced The Age of Bhaarat, a dark fantasy action RPG, with a cinematic and gameplay trailer, showcasing what seems like early footage of the game. The game will release on PC via Steam.

-

@ c1d77557:bf04ec8b

2025-05-24 05:01:11

@ c1d77557:bf04ec8b

2025-05-24 05:01:11Se você está em busca de uma experiência de jogo dinâmica e diversificada, o 59h é a plataforma que você precisa conhecer. Com um foco claro na satisfação dos jogadores, ela oferece uma ampla variedade de opções de entretenimento, além de uma interface amigável e segura. Neste artigo, vamos explorar a plataforma 59h, destacando suas principais funcionalidades, jogos emocionantes e a experiência do usuário.

O Que é a Plataforma 59h? O 59h é uma plataforma inovadora que oferece uma vasta gama de jogos e experiências digitais para os entusiastas do entretenimento online. A plataforma se destaca pela sua interface intuitiva, que permite aos jogadores navegar com facilidade entre as diferentes categorias de jogos. Ela é ideal para quem busca uma experiência divertida e acessível, sem complicações.

Desde o momento em que você acessa o 59h, fica evidente o compromisso com a qualidade. A plataforma é projetada para ser acessível em diversos dispositivos, seja no seu computador, tablet ou smartphone. Isso garante que os jogadores possam aproveitar seus jogos favoritos a qualquer momento e em qualquer lugar, com a mesma qualidade e desempenho.

Uma Grande Variedade de Jogos para Todos os Gostos O 59h se destaca por sua impressionante variedade de jogos. Independentemente do tipo de jogo que você prefere, certamente encontrará algo que se adapte ao seu estilo. A plataforma oferece desde jogos de habilidade, até opções mais relaxantes e divertidas para aqueles que buscam algo mais descontraído.

Entre as opções mais populares, destacam-se os jogos de mesa, onde os jogadores podem testar suas habilidades em jogos como pôquer, blackjack e outros. Para quem prefere algo mais voltado para a sorte, o 59h também oferece jogos com elementos de sorte que podem garantir grandes recompensas.

Além disso, a plataforma está sempre atualizando seu portfólio de jogos, trazendo novidades para os jogadores. Isso significa que você nunca ficará entediado, já que sempre haverá algo novo e emocionante para experimentar.

A Experiência do Jogador no 59h Uma das maiores qualidades da plataforma 59h é sua atenção à experiência do usuário. Desde o processo de registro até a escolha de um jogo, tudo foi pensado para garantir uma navegação tranquila e sem estresse.

A plataforma é completamente segura, oferecendo métodos de pagamento rápidos e confiáveis. Isso significa que os jogadores podem depositar e retirar seus fundos com confiança, sem se preocupar com a segurança de suas informações pessoais. Além disso, o suporte ao cliente está sempre disponível para ajudar em caso de dúvidas ou problemas, garantindo que sua experiência seja o mais fluida possível.

Outro ponto que merece destaque é a comunidade de jogadores. A interação com outros jogadores é uma parte importante da plataforma, permitindo que você compartilhe dicas, participe de torneios e crie amizades. A plataforma 59h se esforça para criar um ambiente amigável e inclusivo, onde todos podem se divertir e aprender uns com os outros.

Acessibilidade e Facilidade de Uso O 59h não é apenas sobre a diversidade de jogos; também se trata de tornar o acesso o mais simples possível. A plataforma oferece um design responsivo, que se adapta perfeitamente a qualquer tipo de dispositivo. Isso significa que você pode jogar no computador, smartphone ou tablet com a mesma facilidade.

O processo de cadastro é simples e rápido, permitindo que você comece a jogar em questão de minutos. Além disso, a plataforma oferece uma série de recursos adicionais, como promoções e bônus exclusivos, que tornam a experiência ainda mais empolgante.

Conclusão O 59h se posiciona como uma plataforma de entretenimento online completa, oferecendo uma vasta gama de jogos, uma experiência de usuário de alta qualidade e um ambiente seguro e amigável para jogadores de todos os níveis. Se você procura uma plataforma confiável, diversificada e divertida, o 59h é a escolha ideal. Não importa se você é um iniciante ou um jogador experiente, há sempre algo novo para descobrir e aproveitar no 59h.

-

@ dfa02707:41ca50e3

2025-05-24 05:00:54

@ dfa02707:41ca50e3

2025-05-24 05:00:54Contribute to keep No Bullshit Bitcoin news going.

- This release introduces Payjoin v2 functionality to Bitcoin wallets on Cake, along with several UI/UX improvements and bug fixes.

- The Payjoin v2 protocol enables asynchronous, serverless coordination between sender and receiver, removing the need to be online simultaneously or maintain a server. This simplifies privacy-focused transactions for regular users.

"I cannot speak highly enough of how amazing it has been to work with @bitgould and Jaad from the@payjoindevkit team, they're doing incredible work. None of this would be possible without them and their tireless efforts. PDK made it so much easier to ship Payjoin v2 than it would have been otherwise, and I can't wait to see other wallets jump in and give back to PDK as they implement it like we did," said Seth For Privacy, VP at Cake Wallet.

How to started with Payjoin in Cake Wallet:

- Open the app menu sidebar and click

Privacy. - Toggle the

Use Payjoinoption. - Now on your receive screen you'll see an option to copy a Payjoin URL

- Bull Bitcoin Wallet v0.4.0 introduced Payjoin v2 support in late December 2024. However, the current implementations are not interoperable at the moment, an issue that should be addressed in the next release of the Bull Bitcoin Wallet.

- Cake Wallet was one of the first wallets to introduce Silent Payments back in May 2024. However, users may encounter sync issues while using this feature at present, which will be resolved in the next release of Cake Wallet.

What's new

- Payjoin v2 implementation.

- Wallet group improvements: Enhanced management of multiple wallets.

- Various bug fixes: improving overall stability and user experience.

- Monero (XMR) enhancements.

Learn more about using, implementing, and understanding BIP 77: Payjoin Version 2 using the

payjoincrate in Payjoin Dev Kit here. -

@ 472f440f:5669301e

2025-05-20 02:00:54

@ 472f440f:5669301e

2025-05-20 02:00:54Marty's Bent

https://www.youtube.com/watch?v=p0Sj1sG05VQ

Here's a great presentation from our good friend nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpp4mhxue69uhkummn9ekx7mqqyz2hj3zg2g3pqwxuhg69zgjhke4pcmjmmdpnndnefqndgqjt8exwj6ee8v7 , President of The Nakamoto Institute titled Hodl for Good. He gave it earlier this year at the BitBlockBoom Conference, and I think it's something everyone reading this should take 25 minutes to watch. Especially if you find yourself wondering whether or not it's a good idea to spend bitcoin at any given point in time. Michael gives an incredible Austrian Economics 101 lesson on the importance of lowering one's time preference and fully understanding the importance of hodling bitcoin. For the uninitiated, it may seem that the hodl meme is nothing more than a call to hoard bitcoins in hopes of getting rich eventually. However, as Michael points out, there's layers to the hodl meme and the good that hodling can bring individuals and the economy overall.

The first thing one needs to do to better understand the hodl meme is to completely flip the framing that is typically thrust on bitcoiners who encourage others to hodl. Instead of ceding that hodling is a greedy or selfish action, remind people that hodling, or better known as saving, is the foundation of capital formation, from which all productive and efficient economic activity stems. Number go up technology is great and it really matters. It matters because it enables anybody leveraging that technology to accumulate capital that can then be allocated toward productive endeavors that bring value to the individual who creates them and the individual who buys them.

When one internalizes this, it enables them to turn to personal praxis and focus on minimizing present consumption while thinking of ways to maximize long-term value creation. Live below your means, stack sats, and use the time that you're buying to think about things that you want in the future. By lowering your time preference and saving in a harder money you will have the luxury of demanding higher quality goods in the future. Another way of saying this is that you will be able to reshape production by voting with your sats. Initially when you hold them off the market by saving them - signaling that the market doesn't have goods worthy of your sats - and ultimately by redeploying them into the market when you find higher quality goods that meet the standards desire.

The first part of this equation is extremely important because it sends a signal to producers that they need to increase the quality of their work. As more and more individuals decide to use bitcoin as their savings technology, the signal gets stronger. And over many cycles we should begin to see low quality cheap goods exit the market in favor of higher quality goods that provide more value and lasts longer and, therefore, make it easier for an individual to depart with their hard-earned and hard-saved sats. This is only but one aspect that Michael tries to imbue throughout his presentation.

The other is the ability to buy yourself leisure time when you lower your time preference and save more than you spend. When your savings hit a critical tipping point that gives you the luxury to sit back and experience true leisure, which Michael explains is not idleness, but the contemplative space to study, create art, refine taste, and to find what "better goods" actually are. Those who can experience true leisure while reaping the benefits of saving in a hard asset that is increasing in purchasing power significantly over the long term are those who build truly great things. Things that outlast those who build them. Great art, great monuments, great institutions were all built by men who were afforded the time to experience leisure. Partly because they were leveraging hard money as their savings and the place they stored the profits reaped from their entrepreneurial endeavors.

If you squint and look into the future a couple of decades, it isn't hard to see a reality like this manifesting. As more people begin to save in Bitcoin, the forces of supply and demand will continue to come into play. There will only ever be 21 million bitcoin, there are around 8 billion people on this planet, and as more of those 8 billion individuals decide that bitcoin is the best savings vehicle, the price of bitcoin will rise.

When the price of bitcoin rises, it makes all other goods cheaper in bitcoin terms and, again, expands the entrepreneurial opportunity. The best part about this feedback loop is that even non-holders of bitcoin benefit through higher real wages and faster tech diffusion. The individuals and business owners who decide to hodl bitcoin will bring these benefits to the world whether you decide to use bitcoin or not.

This is why it is virtuous to hodl bitcoin. The potential for good things to manifest throughout the world increase when more individuals decide to hodl bitcoin. And as Michael very eloquently points out, this does not mean that people will not spend their bitcoin. It simply means that they have standards for the things that they will spend their bitcoin on. And those standards are higher than most who are fully engrossed in the high velocity trash economy have today.

In my opinion, one of those higher causes worthy of a sats donation is nostr:nprofile1qyfhwumn8ghj7enjv4jhyetvv9uju7re0gq3uamnwvaz7tmfdemxjmrvv9nk2tt0w468v6tvd3skwefwvdhk6qpqwzc9lz2f40azl98shkjewx3pywg5e5alwqxg09ew2mdyeey0c2rqcfecft . Consider donating so they can preserve and disseminate vital information about bitcoin and its foundations.

The Shell Game: How Health Narratives May Distract from Vaccine Risks

In our recent podcast, Dr. Jack Kruse presented a concerning theory about public health messaging. He argues that figures like Casey and Callie Means are promoting food and exercise narratives as a deliberate distraction from urgent vaccine issues. While no one disputes healthy eating matters, Dr. Kruse insists that focusing on "Froot Loops and Red Dye" diverts attention from what he sees as immediate dangers of mRNA vaccines, particularly for children.

"It's gonna take you 50 years to die from processed food. But the messenger jab can drop you like Damar Hamlin." - Dr Jack Kruse

Dr. Kruse emphasized that approximately 25,000 children per month are still receiving COVID vaccines despite concerns, with 3 million doses administered since Trump's election. This "shell game," as he describes it, allows vaccines to remain on childhood schedules while public attention fixates on less immediate health threats. As host, I believe this pattern deserves our heightened scrutiny given the potential stakes for our children's wellbeing.

Check out the full podcast here for more on Big Pharma's alleged bioweapons program, the "Time Bank Account" concept, and how Bitcoin principles apply to health sovereignty.

Headlines of the Day

Aussie Judge: Bitcoin is Money, Possibly CGT-Exempt - via X

JPMorgan to Let Clients Buy Bitcoin Without Direct Custody - via X

Get our new STACK SATS hat - via tftcmerch.io

Mubadala Acquires 384,239 sats | $408.50M Stake in BlackRock Bitcoin ETF - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I've been walking from my house around Town Lake in Austin in the mornings and taking calls on the walk. Big fan of a walking call.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 348e7eb2:3b0b9790

2025-05-24 05:00:33

@ 348e7eb2:3b0b9790

2025-05-24 05:00:33Nostr-Konto erstellen - funktioniert mit Hex

Was der Button macht

Der folgende Code fügt einen Button hinzu, der per Klick einen Nostr-Anmeldedialog öffnet. Alle Schritte sind im Code selbst ausführlich kommentiert.

```html

```

Erläuterungen:

- Dynamisches Nachladen: Das Script

modal.jswird nur bei Klick nachgeladen, um Fehlermeldungen beim Initial-Load zu vermeiden. -

Parameter im Überblick:

-

baseUrl: Quelle für API und Assets. an: App-Name für den Modal-Header.aa: Farbakzent (Foerbico-Farbe als Hex).al: Sprache des Interfaces.am: Licht- oder Dunkelmodus.afb/asb: Bunker-Modi für erhöhten Datenschutz.aan/aac: Steuerung der Rückgabe privater Schlüssel.arr/awr: Primal Relay als Lese- und Schreib-Relay.-

Callbacks:

-

onComplete: Schließt das Modal, zeigt eine Bestätigung und bietet die Weiterleitung zu Primal an. onCancel: Schließt das Modal und protokolliert den Abbruch.

Damit ist der gesamte Code sichtbar, kommentiert und erklärt.

- Dynamisches Nachladen: Das Script

-

@ 472f440f:5669301e

2025-05-16 00:18:45

@ 472f440f:5669301e

2025-05-16 00:18:45Marty's Bent

It's been a pretty historic week for the United States as it pertains to geopolitical relations in the Middle East. President Trump and many members of his administration, including AI and Crypto Czar David Sacks and Treasury Secretary Scott Bessent, traveled across the Middle East making deals with countries like Qatar, Saudi Arabia, the United Arab Emirates, Syria, and others. Many are speculating that Iran may be included in some behind the scenes deal as well. This trip to the Middle East makes sense considering the fact that China is also vying for favorable relationships with those countries. The Middle East is a power player in the world, and it seems pretty clear that Donald Trump is dead set on ensuring that they choose the United States over China as the world moves towards a more multi-polar reality.

Many are calling the events of this week the Riyadh Accords. There were many deals that were struck in relation to artificial intelligence, defense, energy and direct investments in the United States. A truly prolific power play and demonstration of deal-making ability of Donald Trump, if you ask me. Though I will admit some of the numbers that were thrown out by some of the countries were a bit egregious. We shall see how everything plays out in the coming years. It will be interesting to see how China reacts to this power move by the United States.

While all this was going on, there was something happening back in the United States that many people outside of fringe corners of FinTwit are not talking about, which is the fact that the 10-year and 30-year U.S. Treasury bond yields are back on the rise. Yesterday, they surpassed the levels of mid-April that caused a market panic and are hovering back around levels that have not been seen since right before Donald Trump's inauguration.

I imagine that there isn't as much of an uproar right now because I'm pretty confident the media freakouts we were experiencing in mid-April were driven by the fact that many large hedge funds found themselves off sides of large levered basis trades. I wouldn't be surprised if those funds have decreased their leverage in those trades and bond yields being back to mid-April levels is not affecting those funds as much as they were last month. But the point stands, the 10-year and 30-year yields are significantly elevated with the 30-year approaching 5%. Regardless of the deals that are currently being made in the Middle East, the Treasury has a big problem on its hands. It still has to roll over many trillions worth of debt over over the next few years and doing so at these rates is going to be massively detrimental to fiscal deficits over the next decade. The interest expense on the debt is set to explode in the coming years.

On that note, data from the first quarter of 2025 has been released by the government and despite all the posturing by the Trump administration around DOGE and how tariffs are going to be beneficial for the U.S. economy, deficits are continuing to explode while the interest expense on the debt has definitively surpassed our annual defense budget.

via Charlie Bilello

via Mohamed Al-Erian

To make matters worse, as things are deteriorating on the fiscal side of things, the U.S. consumer is getting crushed by credit. The 90-plus day delinquency rates for credit card and auto loans are screaming higher right now.

via TXMC

One has to wonder how long all this can continue without some sort of liquidity crunch. Even though equities markets have recovered from their post-Liberation Day month long bear market, I would not be surprised if what we're witnessing is a dead cat bounce that can only be continued if the money printers are turned back on. Something's got to give, both on the fiscal side and in the private markets where the Common Man is getting crushed because he's been forced to take on insane amounts of debt to stay afloat after years of elevated levels of inflation. Add on the fact that AI has reached a state of maturity that will enable companies to replace their current meat suit workers with an army of cheap, efficient and fast digital workers and it isn't hard to see that some sort of employment crisis could be on the horizon as well.

Now is not the time to get complacent. While I do believe that the deals that are currently being made in the Middle East are probably in the best interest of the United States as the world, again, moves toward a more multi-polar reality, we are facing problems that one cannot simply wish away. They will need to be confronted. And as we've seen throughout the 21st century, the problems are usually met head-on with a money printer.

I take no pleasure in saying this because it is a bit uncouth to be gleeful to benefit from the strife of others, but it is pretty clear to me that all signs are pointing to bitcoin benefiting massively from everything that is going on. The shift towards a more multi-polar world, the runaway debt situation here in the United States, the increasing deficits, the AI job replacements and the consumer credit crisis that is currently unfolding, All will need to be "solved" by turning on the money printers to levels they've never been pushed to before.

Weird times we're living in.

China's Manufacturing Dominance: Why It Matters for the U.S.

In my recent conversation with Lyn Alden, she highlighted how China has rapidly ascended the manufacturing value chain. As Lyn pointed out, China transformed from making "sneakers and plastic trinkets" to becoming the world's largest auto exporter in just four years. This dramatic shift represents more than economic success—it's a strategic power play. China now dominates solar panel production with greater market control than OPEC has over oil and maintains near-monopoly control of rare earth elements crucial for modern technology.

"China makes like 10 times more steel than the United States does... which is relevant in ship making. It's relevant in all sorts of stuff." - Lyn Alden

Perhaps most concerning, as Lyn emphasized, is China's financial leverage. They hold substantial U.S. assets that could be strategically sold to disrupt U.S. treasury market functioning. This combination of manufacturing dominance, resource control, and financial leverage gives China significant negotiating power in any trade disputes, making our attempts to reshoring manufacturing all the more challenging.

Check out the full podcast here for more on Triffin's dilemma, Bitcoin's role in monetary transition, and the energy requirements for rebuilding America's industrial base.

Headlines of the Day

Financial Times Under Fire Over MicroStrategy Bitcoin Coverage - via X

Trump in Qatar: Historic Boeing Deal Signed - via X

Get our new STACK SATS hat - via tftcmerch.io

Johnson Backs Stock Trading Ban; Passage Chances Slim - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Building things of value is satisfying.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 82a7a1ff:2c1e9cdf

2025-05-19 18:18:31

@ 82a7a1ff:2c1e9cdf

2025-05-19 18:18:31Whatever

-

@ 06830f6c:34da40c5

2025-05-24 04:21:03

@ 06830f6c:34da40c5

2025-05-24 04:21:03The evolution of development environments is incredibly rich and complex and reflects a continuous drive towards greater efficiency, consistency, isolation, and collaboration. It's a story of abstracting away complexity and standardizing workflows.

Phase 1: The Bare Metal & Manual Era (Early 1970s - Late 1990s)

-

Direct OS Interaction / Bare Metal Development:

- Description: Developers worked directly on the operating system's command line or a basic text editor. Installation of compilers, interpreters, and libraries was a manual, often arcane process involving downloading archives, compiling from source, and setting environment variables. "Configuration drift" (differences between developer machines) was the norm.

- Tools: Text editors (Vi, Emacs), command-line compilers (GCC), Makefiles.

- Challenges: Extremely high setup time, dependency hell, "works on my machine" syndrome, difficult onboarding for new developers, lack of reproducibility. Version control was primitive (e.g., RCS, SCCS).

-

Integrated Development Environments (IDEs) - Initial Emergence:

- Description: Early IDEs (like Turbo Pascal, Microsoft Visual Basic) began to integrate editors, compilers, debuggers, and sometimes GUI builders into a single application. This was a massive leap in developer convenience.

- Tools: Turbo Pascal, Visual Basic, early Visual Studio versions.

- Advancement: Improved developer productivity, streamlined common tasks. Still relied on local system dependencies.

Phase 2: Towards Dependency Management & Local Reproducibility (Late 1990s - Mid-2000s)

-

Basic Build Tools & Dependency Resolvers (Pre-Package Managers):

- Description: As projects grew, manual dependency tracking became impossible. Tools like Ant (Java) and early versions of

autoconf/makefor C/C++ helped automate the compilation and linking process, managing some dependencies. - Tools: Apache Ant, GNU Autotools.

- Advancement: Automated build processes, rudimentary dependency linking. Still not comprehensive environment management.

- Description: As projects grew, manual dependency tracking became impossible. Tools like Ant (Java) and early versions of

-

Language-Specific Package Managers:

- Description: A significant leap was the emergence of language-specific package managers that could fetch, install, and manage libraries and frameworks declared in a project's manifest file. Examples include Maven (Java), npm (Node.js), pip (Python), RubyGems (Ruby), Composer (PHP).

- Tools: Maven, npm, pip, RubyGems, Composer.

- Advancement: Dramatically simplified dependency resolution, improved intra-project reproducibility.

- Limitation: Managed language-level dependencies, but not system-level dependencies or the underlying OS environment. Conflicts between projects on the same machine (e.g., Project A needs Python 2.7, Project B needs Python 3.9) were common.

Phase 3: Environment Isolation & Portability (Mid-2000s - Early 2010s)

-

Virtual Machines (VMs) for Development:

- Description: To address the "it works on my machine" problem stemming from OS-level and system-level differences, developers started using VMs. Tools like VMware Workstation, VirtualBox, and later Vagrant (which automated VM provisioning) allowed developers to encapsulate an entire OS and its dependencies for a project.

- Tools: VMware, VirtualBox, Vagrant.

- Advancement: Achieved strong isolation and environment reproducibility (a true "single environment" for a project).

- Limitations: Resource-heavy (each VM consumed significant CPU, RAM, disk space), slow to provision and boot, difficult to share large VM images.

-

Early Automation & Provisioning Tools:

- Description: Alongside VMs, configuration management tools started being used to automate environment setup within VMs or on servers. This helped define environments as code, making them more consistent.

- Tools: Chef, Puppet, Ansible.

- Advancement: Automated provisioning, leading to more consistent environments, often used in conjunction with VMs.

Phase 4: The Container Revolution & Orchestration (Early 2010s - Present)

-

Containerization (Docker):

- Description: Docker popularized Linux Containers (LXC), offering a lightweight, portable, and efficient alternative to VMs. Containers package an application and all its dependencies into a self-contained unit that shares the host OS kernel. This drastically reduced resource overhead and startup times compared to VMs.

- Tools: Docker.

- Advancement: Unprecedented consistency from development to production (Dev/Prod Parity), rapid provisioning, highly efficient resource use. Became the de-facto standard for packaging applications.

-

Container Orchestration:

- Description: As microservices and container adoption grew, managing hundreds or thousands of containers became a new challenge. Orchestration platforms automated the deployment, scaling, healing, and networking of containers across clusters of machines.

- Tools: Kubernetes, Docker Swarm, Apache Mesos.

- Advancement: Enabled scalable, resilient, and complex distributed systems development and deployment. The "environment" started encompassing the entire cluster.

Phase 5: Cloud-Native, Serverless & Intelligent Environments (Present - Future)

-

Cloud-Native Development:

- Description: Leveraging cloud services (managed databases, message queues, serverless functions) directly within the development workflow. Developers focus on application logic, offloading infrastructure management to cloud providers. Containers become a key deployment unit in this paradigm.

- Tools: AWS Lambda, Azure Functions, Google Cloud Run, cloud-managed databases.

- Advancement: Reduced operational overhead, increased focus on business logic, highly scalable deployments.

-

Remote Development & Cloud-Based IDEs:

- Description: The full development environment (editor, terminal, debugger, code) can now reside in the cloud, accessed via a thin client or web browser. This means developers can work from any device, anywhere, with powerful cloud resources backing their environment.

- Tools: GitHub Codespaces, Gitpod, AWS Cloud9, VS Code Remote Development.

- Advancement: Instant onboarding, consistent remote environments, access to high-spec machines regardless of local hardware, enhanced security.

-

Declarative & AI-Assisted Environments (The Near Future):

- Description: Development environments will become even more declarative, where developers specify what they need, and AI/automation tools provision and maintain it. AI will proactively identify dependency issues, optimize resource usage, suggest code snippets, and perform automated testing within the environment.

- Tools: Next-gen dev container specifications, AI agents integrated into IDEs and CI/CD pipelines.

- Prediction: Near-zero environment setup time, self-healing environments, proactive problem identification, truly seamless collaboration.

web3 #computing #cloud #devstr

-

-

@ 90152b7f:04e57401

2025-05-24 03:47:24

@ 90152b7f:04e57401

2025-05-24 03:47:24"Army study suggests U.S. force of 20,000"

The Washington Times - Friday, April 5, 2002

The Bush administration says there are no active plans to put American peacekeepers between Palestinians and Israelis, but at least one internal military study says 20,000 well-armed troops would be needed.

The Army’s School of Advanced Military Studies (SAMS), an elite training ground and think tank at Fort Leavenworth, Kan., produced the study last year. The 68-page paper tells how the major operation would be run the first year, with peacekeepers stationed in Gaza, Hebron, Jerusalem and Nablus.

One major goal would be to “neutralize leadership of Palestine dissenting factions [and] prevent inter-Palestinian violence.”

The military is known to update secret contingency plans in the event international peacekeepers are part of a comprehensive Middle East peace plan. The SAMS study, a copy of which was obtained by The Washington Times, provides a glimpse of what those plans might entail.

Defense Secretary Donald H. Rumsfeld repeatedly has said the administration has no plans to put American troops between the warring factions. But since the escalation of violence, more voices in the debate are beginning to suggest that some type of American-led peace enforcement team is needed.

Sen. Arlen Specter, Pennsylvania Republican, quoted U.S. special envoy Gen. Anthony Zinni as saying there is a plan, if needed, to put a limited number of American peacekeepers in the Israeli-occupied territories.

Asked on CBS whether he could envision American troops on the ground, Mr. Specter said Sunday: “If we were ever to stabilize the situation, and that was a critical factor, it’s something that I would be willing to consider.”

Added Sen. Joseph R. Biden Jr., Delaware Democrat and Senate Foreign Relations Committee chairman, “In that context, yes, and with European forces as well.”

The recent history of international peacekeeping has shown that it often takes American firepower and prestige for the operation to work. The United Nations made futile attempts to stop Serbian attacks on the Muslim population in Bosnia.

The U.S. entered the fray by bombing Serbian targets and bringing about a peace agreement that still is being backed up by American soldiers on the ground. U.S. combat troops are also in Kosovo, and they have a more limited role in Macedonia.

But James Phillips, a Middle East analyst at the Heritage Foundation, used the word “disaster” to describe the aftermath of putting an international force in the occupied territories.

“I think that would be a formula for sucking us into the violence,” he said. “United States troops would be a lightening rod for attacks by radical Islamics and other Palestinian extremist groups. The United States cannot afford to stretch its forces any thinner. They’re very busy as it is with the war against international terrorism.”

Mr. Phillips noted that two Norwegian observers in Hebron were killed this week. U.N. representatives on the Lebanon border have been unable to prevent terrorists from attacking Israel.

The SAMS paper tries to predict events in the first year of peacekeeping and the dangers U.S. troops would face.

It calls the Israeli armed forces a “500-pound gorilla in Israel. Well armed and trained. Operates in both Gaza [and the West Bank]. Known to disregard international law to accomplish mission. Very unlikely to fire on American forces.”

On the Mossad, the Israeli intelligence service, the Army study says, “Wildcard. Ruthless and cunning. Has capability to target U.S. forces and make it look like a Palestinian/Arab act.”

It described Palestinian youth as “loose cannons; under no control, sometimes violent.” The study was done by 60 officers dubbed the “Jedi Knights,” as all second-year SAMS students are called. The Times first reported on their work in September. Recent violence in the Middle East has raised questions about what type of force it would take to keep the peace.

In the past, SAMS has done studies for the Army chief of staff and the Joint Chiefs. SAMS personnel helped plan the allied ground attack that liberated Kuwait.

The Middle East study sets goals that a peace force should accomplish in the first 30 days. They include “create conditions for development of Palestinian State and security of [Israel],” ensure “equal distribution of contract value or equivalent aid” and “build lasting relationships based on new legal borders and not religious-territorial claims.”

The SAMS report does not specify a full order of battle for the 20,000 troops. An Army source who reviewed the paper said each of three brigades would require about 100 armored vehicles, 25 tanks and 12 self-propelled howitzers, along with attack helicopters and spy drones.

The Palestinians have supported calls for an international force, but Tel Aviv has opposed the idea.

https://www.washingtontimes.com/news/2002/apr/5/20020405-041726-2086r/

-

@ 58537364:705b4b85

2025-05-24 03:25:05

@ 58537364:705b4b85

2025-05-24 03:25:05Ep 228 "วิชาชีวิต"

คนเราเมื่อเกิดมาแล้ว ไม่ได้หวังแค่มีชีวิตรอดเท่านั้น แต่ยังปรารถนา "ความเจริญก้าวหน้า" และ "ความสุขในชีวิต"

จึงพากันศึกษาเล่าเรียนเพื่อให้มี "วิชาความรู้" สำหรับการประกอบอาชีพ โดยเชื่อว่า การงานที่มั่นคงย่อมนำ "ความสำเร็จ" และ "ความเจริญก้าวหน้า" มาให้

อย่างไรก็ตาม...ความสำเร็จในวิชาชีพหรือความเจริญก้าวหน้าในชีวิต ไม่ได้เป็นหลักประกันความสุขอย่างแท้จริง

แม้เงินทองและทรัพย์สมบัติจะช่วยให้ชีวิตมีความสุข สะดวก สบาย แต่ไม่ได้ช่วยให้สุขใจในสิ่งที่ตนมี หากยังรู้สึกว่า "ตนยังมีไม่พอ"

ขณะเดียวกันชื่อเสียงเกียรติยศที่ได้มาก็ไม่ช่วยให้คลายความทุกข์ใจ เมื่อต้องเผชิญปัญหาต่างๆ นาๆ

ทั้งการพลัดพราก การสูญเสียบุคคลผู้เป็นที่รัก ความเจ็บป่วย และความตายที่ต้องเกิดขึ้นกับทุกคน

ยิ่งกว่านั้น...ความสำเร็จในอาชีพและความเจริญก้าวหน้าในชีวิต ล้วนเป็น "สิ่งไม่เที่ยง" แปรผันตกต่ำ ไม่สามารถควบคุมได้

วิชาชีพทั้งหลายช่วยให้เราหาเงินได้มากขึ้น แต่ไม่ได้ช่วยให้เราเข้าถึง "ความสุขที่แท้จริง"

คนที่ประสบความสำเร็จในวิชาชีพไม่น้อย ที่มีชีวิตอมทุกข์ ความเครียดรุมเร้า สุขภาพเสื่อมโทรม

หากเราไม่อยากเผชิญกับสิ่งเหล่านี้ ควรเรียน "วิชาชีวิต" เพื่อเข้าใจโลก เข้าใจชีวิต รู้เท่าทันความผันแปรไปของสรรพสิ่ง

วิชาชีวิต...เรียนจากประสบการณ์ชีวิต เมื่อมีปัญหาต่างๆ ขอให้คิดว่า คือ "บททดสอบ"

จงหมั่นศึกษาหาบทเรียนจากวิชานี้อยู่เสมอ สร้าง "ความตระหนักรู้" ถึงความสำคัญในการมีชีวิต

ช่วงที่ผ่านมา เมื่อมีปัญหาฉันไม่สามารถหาทางออกจากทุกข์ได้เศร้า เสียใจ ทุรน ทุราย สอบตก "วิชาชีวิต"

โชคดีครูบาอาจารย์ให้ข้อคิด กล่าวว่า เป็นเรื่องธรรมดาหากเรายังไม่เข้าใจชีวิต ทุกสิ่งล้วนผันแปร เกิด-ดับ เป็นธรรมดา ท่านเมตตาส่งหนังสือเล่มนี้มาให้

เมื่อค่อยๆ ศึกษา ทำความเข้าใจ นำความทุกข์ที่เกิดขึ้นมาพิจารณา เห็นว่าเมื่อ "สอบตก" ก็ "สอบใหม่" จนกว่าจะผ่านไปได้

วิชาทางโลกเมื่อสอบตกยังเปิดโอกาสให้เรา "สอบซ่อม" วิชาทางธรรมก็เช่นเดียวกัน หากเจอปัญหา อุปสรรค หรือ ความทุกข์ถาโถมเข้ามา ขอให้เราตั้งสติ ว่า จะตั้งใจทำข้อสอบนี้ให้ผ่านไปให้จงได้

หากเราสามารถดำเนินชีวิตด้วยความเข้าใจ เราจะค้นพบ "วิชาชีวิต" ที่สามารถทำให้หลุดพ้นจากความทุกข์ได้แน่นอน

ด้วยรักและปรารถนาดี ปาริชาติ รักตะบุตร 21 เมษายน 2566

น้อมกราบขอบพระคุณพระ อ.ไพศาล วิสาโล เป็นอย่างสูง ที่ท่านเมตตา ให้ข้อธรรมะยามทุกข์ใจและส่งหนังสือมาให้ จึงตั้งใจอยากแบ่งปันเป็นธรรมทาน

-

@ 2b998b04:86727e47

2025-05-24 03:40:36

@ 2b998b04:86727e47

2025-05-24 03:40:36Solzhenitsyn Would Have Loved Bitcoin

I didn’t plan to write this. But a comment from @HODL stirred something in me — a passing thought that took root and wouldn’t let go:

> “Solzhenitsyn would have understood Bitcoin.”

The more I sat with it, the more I realized: he wouldn’t have just understood it — he would have loved it.

A Life of Resistance

Aleksandr Solzhenitsyn didn’t just survive the Soviet gulags — he exposed them. Through The Gulag Archipelago and other works, he revealed the quiet machinery of evil: not always through brutality, but through systemic lies, suppressed memory, and coerced consensus.

His core belief was devastatingly simple:

> “The line dividing good and evil cuts through the heart of every human being.”

He never let anyone off the hook — not the state, not the system, not even himself. Evil, to Solzhenitsyn, was not “out there.” It was within. And resisting it required truth, courage, and deep personal responsibility.

Bitcoin: Truth That Resists

That’s why I believe Solzhenitsyn would have resonated with Bitcoin.

Not the hype. Not the coins. Not the influencers.

But the heart of it:

-

A system that resists coercion.

-

A ledger that cannot be falsified.

-

A network that cannot be silenced.

-

A protocol that doesn't care about party lines — only proof of work.

Bitcoin is incorruptible memory.\ Solzhenitsyn fought to preserve memory in the face of state erasure.\ Bitcoin cannot forget — and it cannot be made to lie.

Responsibility and Sovereignty

Bitcoin demands what Solzhenitsyn demanded: moral responsibility. You hold your keys. You verify your truth. You cannot delegate conscience.

He once wrote:

> “A man who is not inwardly prepared for the use of violence against him is always weaker than his opponent.”

Bitcoin flips that equation. It gives the peaceful man a weapon: truth that cannot be seized.

I’ve Felt This Line Too

I haven’t read all of The Gulag Archipelago — it’s long, and weighty — but I’ve read enough to know Solzhenitsyn’s voice. And I’ve felt the line he describes:

> That dividing line between good and evil… that runs through my own heart.

That’s why I left the noise of Web3. That’s why I’m building with Bitcoin. Because I believe the moral architecture of this protocol matters. It forces me to live in alignment — or walk away.

Final Word

I think Solzhenitsyn would have seen Bitcoin not as a tech innovation, but as a moral stand. Not a replacement for Christ — but a quiet echo of His justice.

And that’s why I keep stacking, writing, building — one block at a time.

Written with help from ChatGPT (Dr. C), and inspired by a comment from @HODL that sparked something deep.

If this resonated, feel free to zap a few sats — not because I need them, but because signal flows best when it’s shared with intention.

HODL mentioned this idea in a note — their Primal profile:\ https://primal.net/hodl

-

-

@ 502ab02a:a2860397

2025-05-24 01:14:43

@ 502ab02a:a2860397

2025-05-24 01:14:43ในสายตาคนรักสุขภาพทั่วโลก “อโวคาโด” คือผลไม้ในฝัน มันมีไขมันดี มีไฟเบอร์สูง ช่วยลดคอเลสเตอรอลได้ มีวิตามินอี มีโพแทสเซียม และที่สำคัญคือ "ดูดี" ทุกครั้งที่ถูกปาดวางบนขนมปังโฮลวีตในชามสลัด หรือบนโฆษณาอาหารคลีนสุดหรู

แต่ในสายตาชาวไร่บางคนในเม็กซิโกหรือชุมชนพื้นเมืองในโดมินิกัน อโวคาโดไม่ใช่ผลไม้แห่งสุขภาพ แต่มันคือสัญลักษณ์ของความรุนแรง การกดขี่ และการสูญเสียเสรีภาพในผืนดินของตัวเอง

เมื่ออาหารกลายเป็นทองคำ กลุ่มอิทธิพลก็ไม่เคยพลาดจะเข้าครอบครอง

เรามักได้ยินคำว่า "ทองคำเขียว" หรือ Green Gold ใช้เรียกอโวคาโด เพราะในรอบ 20 ปีที่ผ่านมา ความต้องการบริโภคของมันพุ่งสูงขึ้นเป็นเท่าตัว โดยเฉพาะในสหรัฐฯ และยุโรป จากผลการวิจัยของมหาวิทยาลัยฮาร์วาร์ดและข้อมูลการส่งออกของ USDA พบว่า 90% ของอโวคาโดที่บริโภคในอเมริกา มาจากรัฐมิโชอากังของเม็กซิโก พื้นที่ซึ่งควบคุมโดยกลุ่มค้ายาเสพติดไม่ต่างจากเจ้าของสวนตัวจริง

พวกเขาเรียกเก็บ “ค่าคุ้มครอง” จากเกษตรกร โดยใช้วิธีเดียวกับมาเฟีย คือ ถ้าไม่จ่าย ก็เจ็บตัวหรือหายตัว ไม่ว่าจะเป็นกลุ่ม CJNG (Jalisco New Generation Cartel), Familia Michoacana หรือ Caballeros Templarios พวกเขาไม่ได้สนใจว่าใครปลูกหรือใครรดน้ำ ตราบใดที่ผลผลิตสามารถเปลี่ยนเป็นเงินได้

องค์กรอาชญากรรมเหล่านี้ไม่ได้แค่ “แฝงตัว” ในอุตสาหกรรม แต่ ยึดครอง ห่วงโซ่การผลิตทั้งหมด ตั้งแต่แปลงปลูกไปจนถึงโรงบรรจุและเส้นทางขนส่ง คนที่ไม่ยอมเข้าระบบมืดอาจต้องพบจุดจบในป่า หรือไม่มีชื่ออยู่ในทะเบียนบ้านอีกต่อไป

จากรายงานของเว็บไซต์ Food is Power องค์กรไม่แสวงกำไรด้านความยุติธรรมด้านอาหารในสหรัฐฯ เผยว่า ในปี 2020 มีเกษตรกรในเม็กซิโกจำนวนมากที่ถูกข่มขู่ บางรายถึงขั้นถูกฆาตกรรม เพราะปฏิเสธจ่ายค่าคุ้มครองจากกลุ่มค้ายา

การปลูกอโวคาโดไม่ใช่เรื่องเบาๆ กับธรรมชาติ เพราะมันต้องการ “น้ำ” มากถึง 272 ลิตรต่อผลเดียว! เรามาดูว่า “272 ลิตร” นี้ เท่ากับอะไรบ้างในชีวิตจริง อาบน้ำฝักบัวนาน 10–12 นาที (โดยเฉลี่ยใช้น้ำ 20–25 ลิตรต่อนาที) ใช้น้ำซักเสื้อผ้าเครื่องหนึ่ง (เครื่องซักผ้า 1 ครั้งกินประมาณ 60–100 ลิตร) น้ำดื่มของคนหนึ่งคนได้นานเกือบ เดือน (คนเราต้องการน้ำดื่มประมาณ 1.5–2 ลิตรต่อวัน)

ถ้าเราใช้ข้อมูลจาก FAO และ Water Footprint Network การผลิตเนื้อวัว 1 กิโลกรัม ต้องใช้น้ำ 15,000 ลิตร (รวมทั้งการปลูกหญ้า อาหารสัตว์ การดื่มน้ำของวัว ฯลฯ) ได้โปรตีนราว 250 กรัม อโวคาโด 1 กิโลกรัม (ราว 5 ผล) ใช้น้ำประมาณ 1,360 ลิตร ได้โปรตีนเพียง 6–8 กรัมเท่านั้น พูดง่ายๆคือ เมื่อเทียบอัตราส่วนเป็นลิตรต่อกรัมโปรตีนแล้วนั้น วัวใช้น้ำ 60 ลิตรต่อกรัมโปรตีน / อโวคาโด ใช้น้ำ 194 ลิตรต่อกรัมโปรตีน แถมการเลี้ยงวัวในระบบธรรมชาติ (เช่น pasture-raised หรือ regenerative farming) ยังสามารถเป็นส่วนหนึ่งของระบบหมุนเวียนน้ำและคาร์บอนได้ พอเห็นภาพแล้วใช่ไหมครับ ดังนั้นเราควรระมัดระวังการเสพสื่อเอาไว้ด้วยว่า คำว่า "ดีต่อโลก" ไม่ได้หมายถึงพืชอย่างเดียว ทุกธุรกิจถ้าทำแบบที่ควรทำ มันยังสามารถผลักดันโลกไม่ให้ตกอยู่ในมือองค์กร future food ได้ เพราะมูลค่ามันสูงมาก

และเมื่อราคาสูง พื้นที่เพาะปลูกก็ขยายอย่างไร้การควบคุม ป่าธรรมชาติในรัฐมิโชอากังถูกแอบโค่นแบบผิดกฎหมายเพื่อแปลงสภาพเป็นไร่ “ทองเขียว” ข้อมูลจาก Reuters พบว่าผลไม้ที่ถูกส่งออกไปยังสหรัฐฯ บางส่วนมาจากแปลงปลูกที่บุกรุกป่าคุ้มครอง และรัฐบาลเองก็ไม่สามารถควบคุมได้เพราะอิทธิพลของกลุ่มทุนและมาเฟีย

ในโดมินิกันก็เช่นกัน มีรายงานจากสำนักข่าว Gestalten ว่าพื้นที่ป่าสงวนหลายพันไร่ถูกเปลี่ยนเป็นไร่อโวคาโด เพื่อป้อนตลาดผู้บริโภคในอเมริกาและยุโรปโดยตรง โดยไม่มีการชดเชยใดๆ แก่ชุมชนท้องถิ่น

สุขภาพที่ดีไม่ควรได้มาจากการทำลายสุขภาพของคนอื่น ไม่ควรมีผลไม้ใดที่ดูดีในจานของเรา แล้วเบื้องหลังเต็มไปด้วยคราบเลือดและน้ำตาของคนปลูก

เฮียไม่ได้จะบอกให้เลิกกินอโวคาโดเลย แต่เฮียอยากให้เรารู้ทัน ว่าความนิยมของอาหารสุขภาพวันนี้ กำลังเป็นสนามใหม่ของกลุ่มทุนโลก ที่พร้อมจะครอบครองด้วย “อำนาจอ่อน” ผ่านแบรนด์อาหารธรรมชาติ ผ่านกฎหมายสิ่งแวดล้อม หรือแม้แต่การครอบงำตลาดเสรีด้วยกำลังอาวุธ

นี่ไม่ใช่เรื่องไกลตัว เพราะเมื่อกลุ่มทุนเริ่มฮุบเมล็ดพันธุ์ คุมเส้นทางขนส่ง คุมฉลาก Certified Organic ทั้งหลาย พวกเขาก็ “ควบคุมสุขภาพ” ของผู้บริโภคเมืองอย่างเราไปด้วยโดยอ้อม

คำถามสำคัญที่มาทุกครั้งเวลามีเนื้อหาอะไรมาฝากคือ แล้วเราจะทำอะไรได้? 555555 - เลือกบริโภคผลไม้จากแหล่งที่โปร่งใสหรือปลูกเองได้ - สนับสนุนเกษตรกรรายย่อยที่ไม่อยู่ภายใต้กลุ่มทุน - ใช้เสียงของผู้บริโภคกดดันให้มีระบบตรวจสอบต้นทางจริง ไม่ใช่แค่ฉลากเขียวสวยๆ - และที่สำคัญ อย่าเชื่อว่า “ทุกสิ่งที่เขาวางให้ดูสุขภาพดี” จะดีจริง (ข้อนี่ละตัวดีเลยครับ)

สุขภาพไม่ใช่สินค้า และอาหารไม่ควรเป็นอาวุธของกลุ่มทุน หากเราเริ่มตระหนักว่าอาหารคือการเมือง น้ำคืออำนาจ และแปลงเกษตรคือสนามรบ เฮียเชื่อว่าผู้บริโภคอย่างเราจะไม่ยอมเป็นหมากอีกต่อไป #pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ e39333da:7c66e53a

2025-05-16 13:20:33

@ e39333da:7c66e53a

2025-05-16 13:20:33::youtube{#Pex7jW3Tqwo}

Developer SHIFT UP has announced that their latest titled, Stellar Blade, that was released on PS5 on the 2024, will release on PC via Steam and EGS on the 11th of June 2025.

The game will be priced at $60, and $80 for the edition of the game that includes the 'Twin Expansion Pack', which includes the NieR: Automata DLC and the Goddess of Victory: Nikke DLC, and a key to redeem a Stellar Blade costume in the developer's previous Free-to-Play title Goddess of Victory: Nikke.

The trailer released to announce said release date also showcases the changes the made for the game and highlight PC specific enhancements, support, and options.

It's worth noting, in terms of negative news that tagged along with this, that the game will have Denuvo running, which there are evidence that decreases a game's performance, and may prevent you from playing the game offline. The game will also have an optional PSN account login, and because of this, the game is not available for purchase in around 130 countries. There's also an exclusive outfit locked behind a PSN-to-Steam account linking.

Here's the system requirements:

| | Minimum | Recommended | High | Very High | | ----------------------- | ----------------------------------------------------- | ------------------------------------------------------- | ------------------------------------------------------- | ------------------------------------------------- | | Average Performance | 1080P at 60 frames per second | 1440P at 60 frames per second | 1440P at 60 frames per second | 4K at 60 frames per second | | Graphic Presets | Low | Medium | High | Very High | | CPU | Intel Core i5-7600K AMD Ryzen 5 1600X | Intel Core i5-8400 AMD Ryzen 5 3600X | Intel Core i5-8400 AMD Ryzen 5 3600X | Intel Core i5-8400 AMD Ryzen 5 3600X | | GPU | NVIDIA GeForce GTX 1060 6GB AMD Radeon RX 580 8GB | NVIDIA GeForce RTX 2060 SUPER AMD Radeon RX 5700 XT | NVIDIA GeForce RTX 2070 SUPER AMD Radeon RX 6700 XT | NVIDIA GeForce RTX 3080 AMD Radeon RX 7900 XT | | RAM | 16GB | 16GB | 16GB | 16GB | | Storage | 75GB HDD (SSD Recommended) | 75GB SSD | 75GB SSD | 75GB SSD | | OS | Windows 10 64-bit | Windows 10 64-bit | Windows 10 64-bit | Windows 10 64-bit |

-

@ 2b998b04:86727e47

2025-05-24 03:16:38

@ 2b998b04:86727e47

2025-05-24 03:16:38Most of the assets I hold—real estate, equities, and businesses—depreciate in value over time. Some literally, like physical buildings and equipment. Some functionally, like tech platforms that age faster than they grow. Even cash, which should feel "safe," quietly loses ground to inflation. Yet I continue to build. I continue to hold. And I continue to believe that what I’m doing matters.

But underneath all of that — beneath the mortgages, margin trades, and business pivots — I’ve made a long-term bet:

Bitcoin will outlast the decay.

The Decaying System I Still Operate In

Let me be clear: I’m not a Bitcoin purist. I use debt. I borrow to acquire real estate. I trade with margin in a brokerage account. I understand leverage — not as a sin, but as a tool that must be used with precision and respect. But I’m also not naive.

The entire fiat-based financial system is built on a slow erosion of value. Inflation isn't a bug — it’s a feature. And it's why most business models, whether in real estate or retail, implicitly rely on asset inflation just to stay solvent.

That’s not sustainable. And it’s not honest.

The Bitcoin Thesis: Deflation That Works for You

Bitcoin is fundamentally different. Its supply is fixed. Its issuance is decreasing. Over time, as adoption grows and fiat weakens, Bitcoin’s purchasing power increases.

That changes the game.

If you can hold even a small portion of your balance sheet in BTC — not just as an investment, but as a strategic hedge — it becomes a way to offset the natural depreciation of your other holdings. Your buildings may age. Your cash flow may fluctuate. But your Bitcoin, if properly secured and held with conviction, becomes the anchor.

It’s not about day trading BTC or catching the next ATH. It’s about understanding that in a world designed to leak value, Bitcoin lets you patch the hole.

Why This Matters for Builders

If you run a business — especially one with real assets, recurring costs, or thin margins — you know how brutal depreciation can be. Taxes, maintenance, inflation, replacement cycles… it never stops.

Adding BTC to your long-term treasury isn’t about becoming a "crypto company." It’s about becoming anti-fragile. It’s about building with a component that doesn’t rot.

In 5, 10, or 20 years, I may still be paying off mortgages and navigating property cycles. But if my Bitcoin allocation is still intact, still growing in real purchasing power… then I haven’t just preserved wealth. I’ve preserved optionality. I’ve created a counterbalance to the relentless decay of everything else.

Final Word

I still play the fiat game — because for now, I have to. But I’m no longer betting everything on it. Bitcoin is my base layer now. Quiet, cold-stored, and uncompromising.

It offsets depreciation — not just financially, but philosophically. It reminds me that not everything has to erode. Not everything has to be sacrificed to time or policy or inflation.

Some things can actually hold. Some things can last.

And if I build right — maybe what I build can last too.

If this resonated, feel free to send a zap — it helps me keep writing and building from a place of conviction.

This article was co-written with the help of ChatGPT, a tool I use to refine and clarify what I’m working through in real time.

-

@ 472f440f:5669301e

2025-05-14 13:17:04

@ 472f440f:5669301e

2025-05-14 13:17:04Marty's Bent

via me

It seems like every other day there's another company announced that is going public with the intent of competing with Strategy by leveraging capital markets to create financial instruments to acquire Bitcoin in a way that is accretive for shareholders. This is certainly a very interesting trend, very bullish for bitcoin in the short-term, and undoubtedly making it so bitcoin is top of mind in the mainstream. I won't pretend to know whether or not these strategies will ultimately be successful or fail in the short, medium or long term. However, one thing I do know is that the themes that interest me, both here at TFTC and in my role as Managing Partner at Ten31, are companies that are building good businesses that are efficient, have product-market-fit, generate revenues and profits and roll those profits into bitcoin.

While it seems pretty clear that Strategy has tapped into an arbitrage that exists in capital markets, it's not really that exciting. From a business perspective, it's actually pretty straightforward and simple; find where potential arbitrage opportunities exists between pools of capital looking for exposure to spot bitcoin or bitcoin's volatility but can't buy the actual asset, and provide them with products that give them access to exposure while simultaneously creating a cult-like retail following. Rinse and repeat. To the extent that this strategy is repeatable is yet to be seen. I imagine it can expand pretty rapidly. Particularly if we have a speculative fervor around companies that do this. But in the long run, I think the signal is falling back to first principles, looking for businesses that are actually providing goods and services to the broader economy - not focused on the hyper-financialized part of the economy - to provide value and create efficiencies that enable higher margins and profitability.

With this in mind, I think it's important to highlight the combined leverage that entrepreneurs have by utilizing bitcoin treasuries and AI tools that are emerging and becoming more advanced by the week. As I said in the tweet above, there's never been a better time to start a business that finds product-market fit and cash flows quickly with a team of two to three people. If you've been reading this rag over the last few weeks, you know that I've been experimenting with these AI tools and using them to make our business processes more efficient here at TFTC. I've also been using them at Ten31 to do deep research and analysis.