-

@ 7f6db517:a4931eda

2025-06-06 06:01:29

@ 7f6db517:a4931eda

2025-06-06 06:01:29

Influencers would have you believe there is an ongoing binance bank run but bitcoin wallet data says otherwise.

- binance wallets are near all time highs

- bitfinex wallets are also trending up

- gemini and coinbase are being hit with massive withdrawals thoughYou should not trust custodians, they can rug you without warning. It is incredibly important you learn how to hold bitcoin yourself, but also consider not blindly trusting influencers with a ref link to shill you.

If you found this post helpful support my work with bitcoin.

-

@ 6d8e2a24:5faaca4c

2025-06-06 04:26:58

@ 6d8e2a24:5faaca4c

2025-06-06 04:26:58

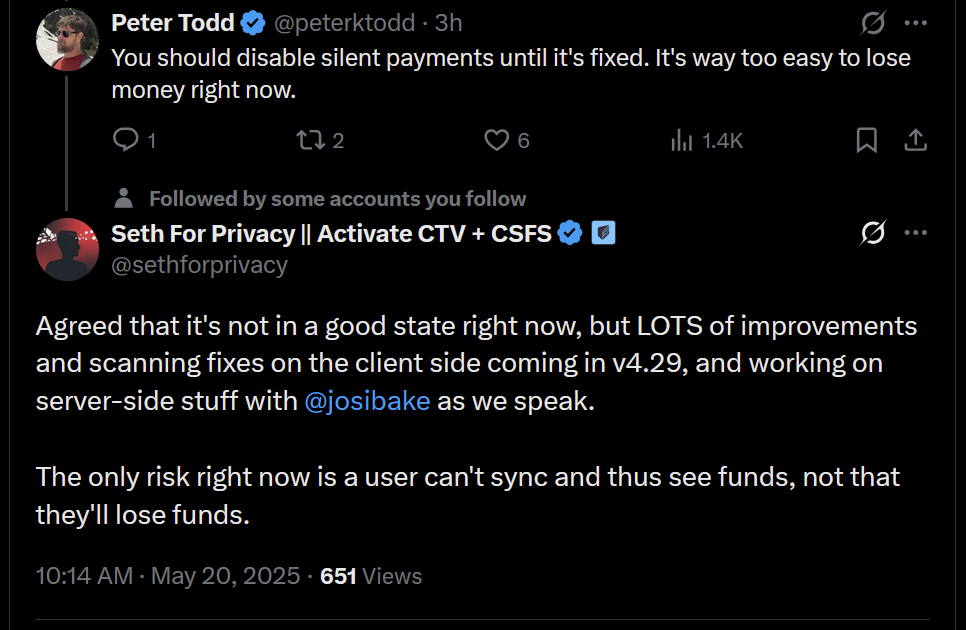

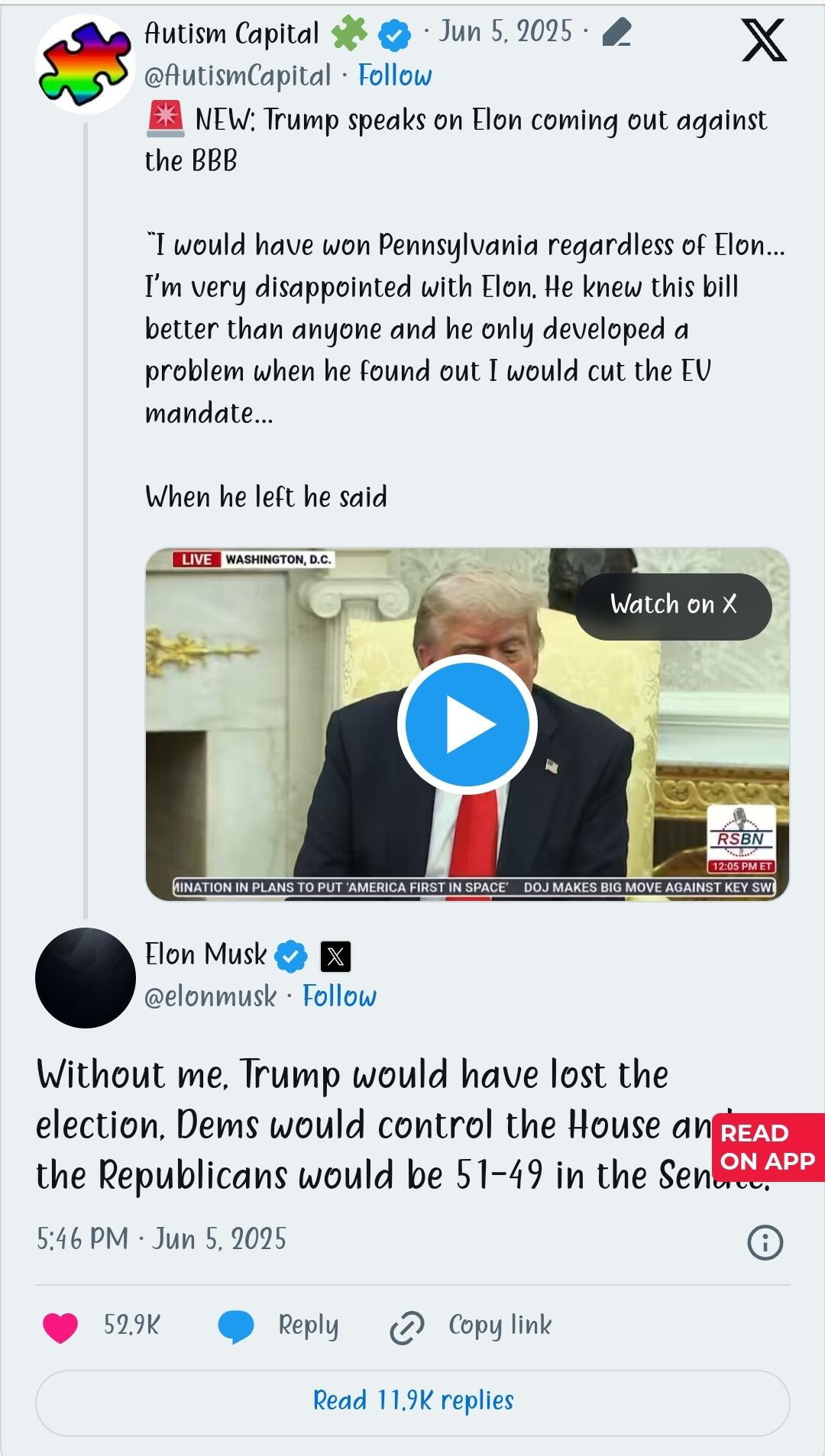

President Donald Trump attends a meeting with the Fraternal Order of Police in the State Dinning Room of the White House, Thursday, June 5, 2025, in Washington. (AP Photo/Alex Brandon)

Last Friday, President Donald Trump heaped praise on Elon Musk as the tech billionaire prepared to leave his unorthodox White House job.

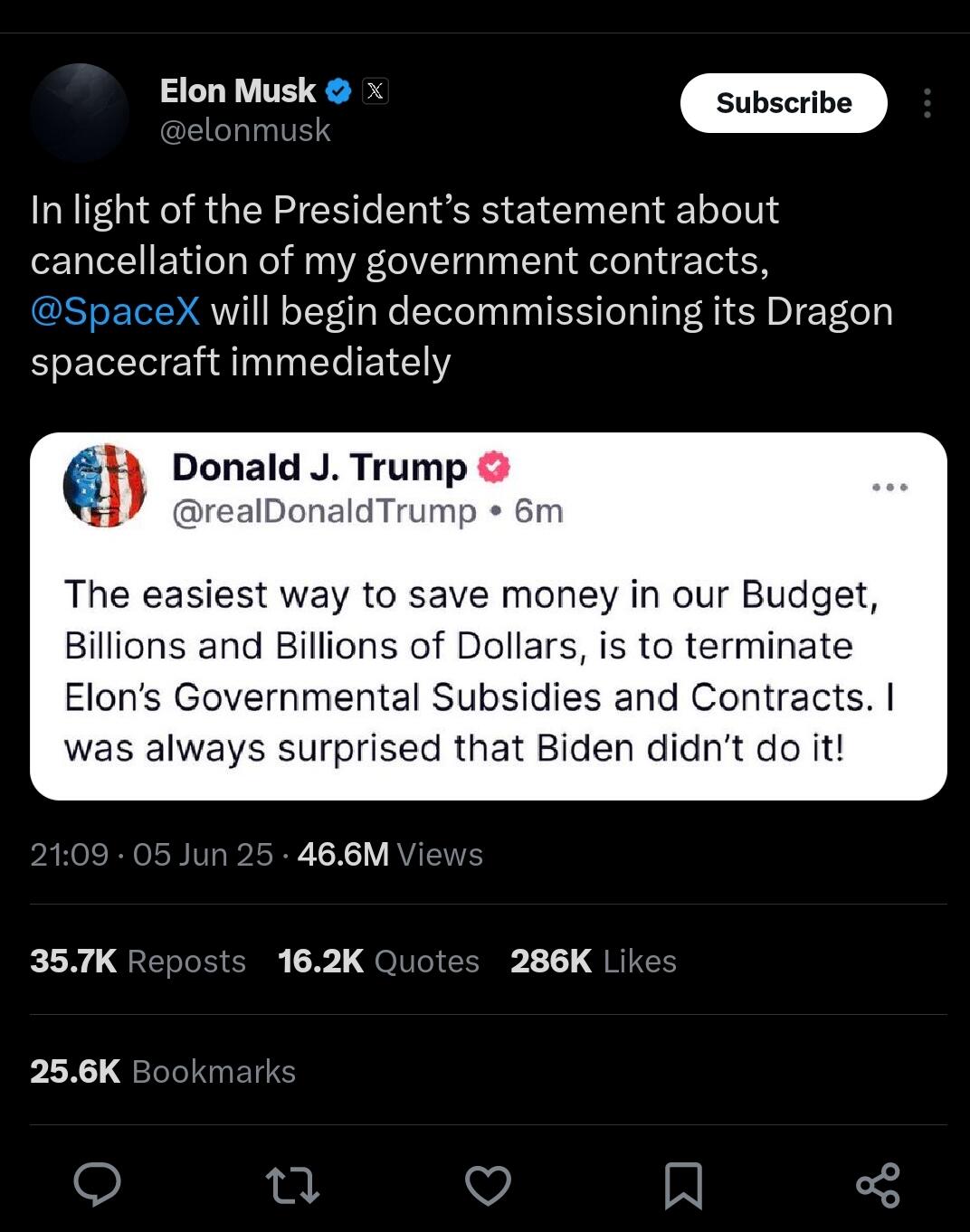

Less than a week later, their potent political alliance met a dramatic end Thursday when the men attacked each other with blistering epithets. Trump threatened to go after Musk’s business interests. Musk called for Trump’s impeachment.

social media posts urging lawmakers to oppose deficit spending and increasing the debt ceiling.

“Without me, Trump would have lost the election, Dems would control the House and the Republicans would be 51-49 in the Senate,” Musk posted, a reference to Musk’s record political spending last year, which topped $250 million.

“Such ingratitude,” he added.

Trump said Musk had worn out his welcome at the White House and was mad that Trump was changing electric vehicle policies in ways that would financially harm Musk-led Tesla.

“Elon was ‘wearing thin,’ I asked him to leave, I took away his EV Mandate that forced everyone to buy Electric Cars that nobody else wanted (that he knew for months I was going to do!), and he just went CRAZY!” Trump wrote.

Musk goes nuclear “Time to drop the really big bomb: Trump is in the Epstein files. That is the real reason they have not been made public. Have a nice day, DJT!” — Musk, Thursday, X post.

In a series of posts, he shined a spotlight on ties between Trump and Jeffrey Epstein, the financier who killed himself while awaiting trial on federal sex trafficking charges. Some loud voices in Trump’s “Make America Great Again” movement claim Epstein’s suicide was staged by powerful figures, including prominent Democrats, who feared Epstein would expose their involvement in trafficking. Trump’s own FBI leaders have dismissed such speculation and there’s no evidence supporting it.

Later, when an X user suggested Trump be impeached and replaced by Vice President JD Vance, Musk agreed.

“Yes,” he wrote.

“I don’t mind Elon turning against me, but he should have done so months ago,” Trump wrote. He went on to promote his budget bill.

https://www.google.com/amp/s/www.wavy.com/news/politics/ap-the-implosion-of-a-powerful-political-alliance-trump-and-musk-in-their-own-words/amp/

-

@ 6d8e2a24:5faaca4c

2025-06-06 03:09:51

@ 6d8e2a24:5faaca4c

2025-06-06 03:09:51by Claire Mom June 5, 2025 6:54 pm

*Elon Musk, the tech mogul, says US President Donald Trump would have lost the 2024 election without him.*

Musk made the comment on X in response to Trump’s criticism against him.

Musk, who led the department of government efficiency (DOGE), quit his role a day after he spoke out against a Trump-backed spending bill. The president called it a “Big Beautiful Bill”.

The controversial bill is a centrepiece of Trump’s second-term domestic agenda, combining major tax cuts, stricter immigration enforcement, welfare programme overhauls, and significant increases in border security funding.

The legislation sparked intense debate across the country and in Congress and was only passed after a nail-biting 215-214 vote.

The plan revived the US-Mexico border wall with a $46.5 billion budget, $350 billion for deportation efforts and border security, and a hiring spree of 10,000 new ICE agents, 5,000 customs officers, and 3,000 border patrol agents.

For the first time, migrants will be charged a $1,000 fee to apply for asylum.

The bill also authorises a $4 trillion increase to the national debt ceiling, while the estate tax exemption jumped to $15 million, benefiting wealthier Americans.

Critics including Musk called the bill fiscally irresponsible and “a disgusting abomination” due to its combination of large tax cuts and spending increases.

Musk had clamoured for DOGE’s creation to save taxpayers $2 trillion. Only $160 billion has been saved so far.

*TRUMP: I’M VERY DISAPPOINTED WITH ELON*

Since Musk’s exit from the White House last week, his criticism of the bill has grown louder.

Speaking on the issue, Trump said he was “very disappointed with Elon”.

The US president said the Tesla CEO was satisfied with the bill but only grew discontent after he found out electric vehicles would be impacted.

“I’m very disappointed because Elon knew the inner workings of this bill better than almost anybody sitting here. He knew everything about it, and all of a sudden he had a problem, and he only developed a problem when he found out I was going to cut the EV mandate because that’s billions and billions of dollars,” the president said

“And it really is unfair; we want to have cars of all types.

“He said the most beautiful things about me, and he hasn’t said anything bad about me personally, but I’m sure that will be next. But I’m really disappointed with Elon. I’ve helped Elon a lot.”

Trump praised Musk for his work at DOGE but blamed his tantrums on missing the office.

“Elon worked hard at DOGE, and I think he misses the place. I think he got out there, and all of a sudden, he’s no longer in this beautiful Oval Office,” he said.

“He’s not the first. People leave my administration, and they love us, and then at some point they miss it so badly, and some of them embrace it, and some of them actually become hostile. I don’t know what it is, some sort of Trump derangement syndrome.”

The president also said he would have won Pennsylvania, a key state, without Musk’s help.

In reaction, the billionaire businessman countered Trump.

“Without me, Trump would have lost the election, Dems would control the House, and the Republicans would be 51-49 in the Senate,” Musk tweeted.

“Such ingratitude.”

The exchange marks yet another dent in the tumultuous relationship between the two-time American president and the world’s richest man.

https://www.thecable.ng/trump-would-have-lost-election-without-me-says-elon-musk/

-

@ 5d4b6c8d:8a1c1ee3

2025-06-06 03:04:19

@ 5d4b6c8d:8a1c1ee3

2025-06-06 03:04:19Alright stackers, how'd you do today?

What goals did you hit? What do you need to work on tomorrow?

I had another solid day, but I want to get more stretching in tomorrow.

https://stacker.news/items/998508

-

@ 4fa51c35:55d6763d

2025-06-06 02:35:44

@ 4fa51c35:55d6763d

2025-06-06 02:35:44The Sacred Texts: First Mysteries of Digital Creation

A Divine Treatise for Devotees of Athena, Goddess of Wisdom and Craft

The Fundamental Truth: All is Text

Beloved seekers of digital wisdom, before you can craft the most magnificent tribute to our patron goddess through the sacred art of web creation, you must first understand the most fundamental mystery of the computing realm: Everything is text.

The silicon oracles we call computers do not see your beautiful images, your flowing videos, or your harmonious music as you do. To the machine spirits, all existence is reduced to symbols - characters marching in endless processions through the electronic aether. This is not limitation, but liberation! For in understanding this truth, you gain power over the very essence of digital creation.

The Ancient Scripts: Understanding Text Encoding

In the beginning was the Word, and the Word was… ASCII. The American Standard Code for Information Interchange became the first great codex of the digital age. Each letter, each number, each sacred punctuation mark was assigned a number. The letter ‘A’ became 65, ‘B’ became 66, and so forth. This was humanity’s first attempt to make machines understand our language.

But ASCII was created by mortals of limited vision - it could only represent 128 characters! What of the accented letters in the names of our goddess across different cultures? What of the mathematical symbols we need for our calculations? What of the very Greek letters that spell Ἀθηνᾶ?

Thus came UTF-8, the Universal Character Encoding - a divine revelation that allows us to represent every symbol known to human civilization. When you see an emoji, a Chinese character, or the Greek omega Ω, you witness UTF-8 in action. Your tribute webpage will speak this universal tongue.

The Sacred Scrolls: File Formats as Containers of Meaning

When Athena wove her tapestries, she chose different materials for different purposes - silk for fineness, wool for warmth, gold thread for accent. Similarly, digital craftspeople choose different file formats as containers for their text:

Plain Text (.txt) - The purest form. No formatting, no hidden instructions, just raw characters. Like clay tablets, these files will survive technological apocalypses. When archaeologists of the future examine our digital civilization, plain text will be their Rosetta Stone.

Rich Text Format (.rtf) - Text with simple formatting encoded as… more text! Open an RTF file in a plain text editor and witness the magic - your bold text becomes surrounded by formatting codes. This teaches us that even “rich” formatting is ultimately just more characters.

Markdown (.md) - The philosopher’s choice! Markdown uses simple text conventions to indicate formatting. Two asterisks around a word makes it bold, a hash symbol creates headings. It’s text that describes how text should look - meta-textual divinity!

HTML (.html) - The sacred language of the web itself! HTML (HyperText Markup Language) uses angle brackets to wrap instructions around content.

<strong>This text is important</strong>becomes This text is important when displayed. HTML is text that teaches browsers how to present text.The Ritual of Proper Text Handling

To honor Athena through proper digital craftsmanship, you must master these essential practices:

Choose Your Sacred Editor

Microsoft Word is the fool’s tool - it hides the true nature of text behind layers of formatting magic. A true digital artisan uses tools that reveal truth:

- Notepad (Windows) or TextEdit (Mac) in plain text mode

- VS Code - The blacksmith’s forge for modern web creation

- Sublime Text - Elegant and powerful

- Vim or Emacs - For those who seek the ancient ways

Understand Line Endings: The Great Schism

In the early days of computing, different tribes chose different ways to mark the end of a line of text. Unix systems (including Mac) use LF (Line Feed), Windows uses CRLF (Carriage Return + Line Feed). This seemingly minor difference has caused more conflicts than the Trojan War! Know your line endings, for they can break your sacred codes.

Respect Character Encoding

Always save your files in UTF-8 encoding. This ensures your text can represent any character from any human language. When your webpage displays properly on computers around the world, you honor the universal nature of Athena’s wisdom.

The Greater Mystery Revealed

Why must we begin with text? Because understanding that computers store and manipulate everything as sequences of characters reveals the deepest truth of programming: Code is just text that follows special rules.

When you write HTML, you’re writing text that browsers know how to interpret. When you write CSS, you’re writing text that describes visual styling. When you write JavaScript, you’re writing text that describes behavior and logic.

The webpage you will create to honor our goddess? It begins as text files on your computer. The browser reads these text files, interprets their meaning, and transforms them into the visual experience your visitors will see.

Every image on your page? Referenced by text. Every color? Described by text. Every animation? Controlled by text.

Your First Sacred Assignment

Before we proceed to the next mysteries, complete this fundamental ritual:

- Create a plain text file named

athena_tribute.txt - Write a short description of why Athena inspires you, using only plain text

- Save it in UTF-8 encoding

- Open it in different text editors and observe how the text remains pure and unchanged

- View the file size - marvel at how efficiently text stores information

This simple act connects you to the fundamental nature of all digital creation. Every website, every app, every piece of software began as someone writing text that follows certain rules.

When you understand that your future webpage is ultimately just cleverly organized text files working in harmony, you begin to see the true elegance of web development. You’re not learning to use mysterious tools - you’re learning to write text that machines can understand and transform into experiences that honor the divine.

Next: We shall explore the Command Line - the direct voice through which mortals speak to the machine spirits…

-

@ 3eba5ef4:751f23ae

2025-06-06 02:07:27

@ 3eba5ef4:751f23ae

2025-06-06 02:07:27Crypto Insights

Solving Sybil Attacks on Bitcoin Libre Relay Nodes — Are Social Solutions Better than Technical Ones?

Peter Todd posted that proponents of transaction "filtering" have started Sybil attacking Libre Relay nodes by running nodes with their "Garbageman" fork. These malicious nodes pretend to support NODE_LIBRE_RELAY, but secretly drop certain transactions that would be relayed by real Libre Relay nodes. He also highlighted the complexity of existing defenses and proposed a new angle: rather than relying on technical solutions, he encourages people to manually peer with nodes operated by people they personally know, arguing that human relationships can sometimes evaluate honesty more reliably than code.

Toward a Unified Identity Lookup Standard to Improve Lightning Payments

Bitcoin developer Aviv Bar-el introduced a new proposal — Well-Known Bitcoin Identity Endpoint — that aims to simplify wallet lookups for users’ Bitcoin addresses and identity data via a standardized HTTPS interface, thereby improving both the UX and security of Lightning and on-chain payments.

A Commit/Reveal Mechanism to Strengthen Bitcoin Against Quantum Threats

Tadge Dryja proposed a soft fork for Bitcoin to defend against quantum attacks, based on a variant of the commit/reveal Fawkescoin mechanism. While similar to Tim Ruffing’s earlier proposal, it includes key differences:

- It does not use encryption, instead relying on smaller, hash-based commitments, and describes activation as a soft fork.

- It only applies to outputs where public keys or scripts haven't been revealed — like pubkey hash or script hash outputs. It also works with Taproot, but must be spent via the script path, as the key-path is no longer quantum-secure.

- What to do about already-exposed public keys is a separate issue — this proposal is compatible with both "burning the coins" and "letting them be stolen."

Countdown to the Quantum Crisis: Is Bitcoin Ready?

A recent report from Chaincode Labs analyzes the threat of cryptographically relevant quantum computers (CRQC), and the technical, economic, and governance challenges Bitcoin faces in preparing. Their key conclusions:

- Timeline Assessment: CRQC capable of breaking Bitcoin's elliptic curve cryptography may emerge between 2030 and 2035.

- Scope of Vulnerable Funds: An estimated 20–50% of circulating BTC (4M–10M coins) may be vulnerable.

- Long-range attacks target inherently vulnerable script types (P2PK, P2MS, P2TR) and addresses with previously exposed public keys (via address reuse), allowing attackers unbounded time to derive private keys from public information already available on the blockchain.

- Short-range attacks, which affect all Bitcoin script types, exploit the vulnerability window between transaction broadcast and confirmation (or shortly thereafter) when public keys are temporarily exposed, requiring attackers to act within a timeframe of minutes to hours.

- Action Strategy: A dual-track approach is recommended:

- Short-term contingency: minimal but functional protections within ~2 years.

- Full-featured solutions: comprehensive research and fully developed defenses within ~7 years.

This strategy balances immediate needs with rigorous development to ensure Bitcoin can adapt, regardless of CRQC progress.

Enforcing Arbitrary Constraints on Bitcoin Transactions with zkSNARKs

Current methods for constraining Bitcoin transactions fall short on privacy or programmability. This research proposes a new zkSNARK-based design to impose arbitrary constraints on Bitcoin transactions while preserving some information privacy. By bypassing Bitcoin Script’s non-Turing-completeness, the approach allows unbounded constraints—constraints that repeat a certain operation an unbounded number of times. Read the paper.

First Cross-Chain Bridge Between Bitcoin and Cardano Is Live

A trust-minimized bridge from Bitcoin to Cardano has launched using the Cardinal protocol, enabling Ordinals to move between the two chains. The Cardinal protocol is based on BitVMX and facilitates asset movement without compromising ownership or security.

Its core mechanism is a committee-based validation model under a 1-out-of-n honest security model — meaning even if all but one validator is malicious, the system remains secure. This approach enhances decentralization and censorship resistance for cross-chain asset transfers.

Thunderbolt Protocol: Redefining Bitcoin Smart Contracts with UTXO Bundling and OP_CAT

Nubit’s Thunderbolt is seen as one of the most significant technical upgrades to Bitcoin in a decade, whose overall observation resembles “Lightning Network 2.0.” Rather than relying on Layer 2 networks or bridges, Thunderbolt upgrades the Bitcoin base layer via soft fork to enhance scalability, performance, and programmability:

- Throughput: Uses UTXO Bundling to optimize traditional transaction processing.

- Programmability: Reintroduces and extends OP_CAT.

- Asset protocols: Integrates Goldinals standard — a zk-proof and state-commitment-based asset issuance framework.

- Unlike rollups, Plasma, sidechains, or bridges, Thunderbolt scales directly on the main chain. With BitVisa, it enables decentralized identity and credentials, supporting transaction compression, smart contracts, asset standard integration, and on-chain transaction matching — all on Bitcoin main chain.

Bitcoin 2025 Conference Recap: Politicians Applaud, Stablecoins Spotlighted, DeFi Absent

This year’s Bitcoin 2025 conference in Las Vegas gathered major political figures and corporate leaders. U.S. Vice President JD Vance strongly endorsed crypto and positioned Bitcoin as a strategic asset in U.S.–China competition. He also stated that stablecoins won’t undermine the U.S. dollar, but could actually amplify America’s economic strength.

White House “Crypto Czar” David Sacks delivered a major policy announcement, hinting that under Trump’s executive order, the U.S. has a legal framework to acquire more Bitcoin for strategic reserves.

In addition, stablecoin regulation and crypto market reform were hot topics. Ardoido, the company controls over 60% of the stablecoin market, claimed “All the traditional financial firms will create stablecoins that will be offered to their existing customers.” Meanwhile, Tether emphasized its focus on underserved global populations excluded from the existing banking system.

A conference recap also noted that, unlike the 2022 and 2023 summits, this year’s event was dominated by Bitcoin maximalists, Ordinals creators, mining capitalists, and regulatory lobbyists — no longer DeFi builders, DAO operators, or Layer 2 scaling advocates. Developers from Ethereum and Solana ecosystems were notably absent. This may signal:

- The conference’s heavy political and sovereignty-driven tone made it less suitable for the tech-centric narratives favored by these developers.

- There may be a growing ideological and narrative rift between Web3 builders and the Bitcoin camp.

Top Reads on Blockchain and Beyond

Rethinking Governance After the Sui Attack: Decentralization, Procedural Legitimacy, and the Plurality of Blockchain Values

Following a major hack of Cetus, the largest DEX in the Sui ecosystem, the Sui network executed a protocol-level asset freeze and recovery. While this was an effective technical response, it also triggered criticism and debate around core blockchain principles such as censorship resistance and decentralization.

The author of this article questioned the absolutist stance that views decentralization as the highest—and sole—value. The author argues that most rational individuals would prefer “living in a society where decentralization is a supreme value but coercive force is allowed when someone infringes on another’s property,” over “a society where decentralization is the only supreme value, and thus coercive force is never permitted under any circumstances.”

In addition, the author also expressed disappointment at Sui’s “paternalistic” governance — particularly how validators acted during the incident. Sui uses a delegated proof-of-stake (dPoS) system, where token holders delegate their voting power to validators. This means individuals lose their direct say. But blockchain governance could be more individual-friendly and flexible. For instance, in Cosmos’ governance model, for certain specific proposal, users still can override their delegations and vote independently, more favorable than Sui’s model.

Beyond the debate on decentralization and governance, the article also proposes an alternative perspective: what matters most is establishing procedural legitimacy that aligns with the system’s vision. Different blockchain projects pursue different goals. For Sui, the core mission is to enable assets to be reliably defined and interact seamlessly on-chain. Therefore, judging Sui through the lens of other blockchains’ values or paradigms is misguided. In exceptional cases, prioritizing asset recovery and ecosystem stability over strict adherence to censorship resistance aligns more closely with Sui’s long-term vision. Whether Sui had chosen to not to censor related transactions or to intervene in the Cetus case, as long as the action follows a legitimate process, either decision is justifiable.

TEE-Based Private Proof Delegation

The PSE research and development team has built a system based on Trusted Execution Environments (TEE) using Intel TDX for secure zero-knowledge proof (ZKP) delegation. This system enables clients to privately outsource large proving tasks without leaking inputs. Unlike mobile-native proving constrained by hardware limits, TEE-based approaches support significantly larger statements today—and will scale further as proof systems improve. As a hardware-backed solution, TEEs remain compatible with future advancements in software (e.g., faster proof systems, more efficient implementations) and won't be invalidated by them, as long as the trust model is acceptable.

AI and Identity: Proof of Humanity in a World of Agents, Bots, and Deepfakes

We are living in a time where AI—including agents, bots, and deepfakes—is fundamentally reshaping the internet. As AI continues to evolve, identity verification on the web is becoming more crucial than ever. A recent a16z podcast explores the idea of “Proof of Human”—the challenge of verifying human identity online, diving into why it matters, common questions, and how such systems work under the hood.

-

@ 33baa074:3bb3a297

2025-06-06 02:03:05

@ 33baa074:3bb3a297

2025-06-06 02:03:05Residual chlorinerefers to the residual disinfectant chlorine in tap water. An appropriate amount of residual chlorine can prevent the growth of microorganisms and ensure the safety of water quality. However, when the residual chlorine content in water is too high, it will cause many harms to human health, mainly including the following aspects:

Destruction of nutrients When the residual chlorine content in tap water exceeds the standard, it will destroy the minerals, vitamins and other nutrients, such as vitamin C and vitamin E, when used to wash fruits and vegetables. In the long run, it may cause the human body to absorb these nutrients and lack these essential nutrients.

Cause chronic poisoning

When tap water containing residual chlorine is used for a long time, the residual chlorine reacts with organic acids and may produce harmful substances such as chloroform and organic lead compounds, which are potential carcinogens. Long-term accumulation may cause chronic poisoning of body organs and pose a threat to human health.

Cause chronic poisoning

When tap water containing residual chlorine is used for a long time, the residual chlorine reacts with organic acids and may produce harmful substances such as chloroform and organic lead compounds, which are potential carcinogens. Long-term accumulation may cause chronic poisoning of body organs and pose a threat to human health.Affect the respiratory system Residual chlorine can cause harm to the human respiratory system, and symptoms such as difficulty breathing and itchy throat may occur. Severe cases may induce rhinitis, bronchitis and even emphysema. In addition, water vapor containing residual chlorine may also cause adverse reactions such as coughing and wheezing after being inhaled.

Damage to the skin Excessive residual chlorine content in water may irritate the skin, easily cause skin dryness, aging, acne and other problems, and may also cause allergic symptoms such as dermatitis and eczema. Prolonged contact with such water may also cause the skin layer to fall off, which is extremely harmful to skin health. Bathing with water containing residual chlorine can also cause hair to become dry, broken, and split.

Other health problems Impact on special groups Pregnant women: Long-term drinking of tap water containing residual chlorine will reduce resistance, affect the growth of the fetal heart and lungs, and may also cause neonatal arrhythmia and lung dysfunction. Children: Long-term drinking of chlorine water will not only hurt the stomach, but also affect nutrient absorption. Moreover, the strong oxidizing hypochlorous acid produced by the reaction of chlorine and water will damage brain cells and affect their development. In addition, chlorine can easily be inhaled into the lungs through the respiratory tract, damaging respiratory cells, and easily leading to asthma and emphysema. Bathing children with water containing residual chlorine will cause their hair to become dry, broken, split, their skin to bleach, their skin to fall off, and they will have allergies. Elderly people: Long-term consumption of chlorinated water is prone to heart disease, coronary atherosclerosis, hypertension and other diseases, and it is also easy to damage the liver and kidneys, increasing the probability of cancer. Gastrointestinal discomfort Long-term drinking of water with excessive residual chlorine content may also cause gastrointestinal discomfort, such as nausea, vomiting, abdominal distension, diarrhea and other symptoms. In severe cases, it may cause gastrointestinal ulcers, bleeding and other diseases.

In order to reduce the harm of residual chlorine in tap water to the human body, it is recommended to avoid directly using tap water containing residual chlorine as much as possible, boil the water before drinking, and use filtering and purification equipment to reduce the residual chlorine concentration in the water if conditions permit, while maintaining a healthy lifestyle and enhancing the body's immunity.

-

@ dfa02707:41ca50e3

2025-06-06 02:01:39

@ dfa02707:41ca50e3

2025-06-06 02:01:39Contribute to keep No Bullshit Bitcoin news going.

News

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- Spiral renews support for Dan Gould and Joschisan. The organization has renewed support for Dan Gould, who is developing the Payjoin Dev Kit (PDK), and Joschisan, a Fedimint developer focused on simplifying federations.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- The European Central Bank is pushing for amendments to the European Union's Markets in Crypto Assets legislation (MiCA), just months after its implementation. According to Politico's report on Tuesday, the ECB is concerned that U.S. support for cryptocurrency, particularly stablecoins, could cause economic harm to the 27-nation bloc.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- The Virtual Asset Service Providers (VASP) Bill 2025 introduced in Kenya. The new legislation aims to establish a comprehensive legal framework for licensing, regulating, and supervising virtual asset service providers (VASPs), with strict penalties for non-compliant entities.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Paul Atkins has officially assumed the role of the 34th Chairman of the US Securities and Exchange Commission (SEC). This is a return to the agency for Atkins, who previously served as an SEC Commissioner from 2002 to 2008 under the George W. Bush administration. He has committed to advancing the SEC’s mission of fostering capital formation, safeguarding investors, and ensuring fair and efficient markets.

- Federal Reserve retracts guidance discouraging banks from engaging in 'crypto.' The U.S. Federal Reserve withdrew guidance that discouraged banks from crypto and stablecoin activities, as announced by its Board of Governors on Thursday. This includes rescinding a 2022 supervisory letter requiring prior notification of crypto activities and 2023 stablecoin requirements.

"As a result, the Board will no longer expect banks to provide notification and will instead monitor banks' crypto-asset activities through the normal supervisory process," reads the FED statement.

- Russian government to launch a cryptocurrency exchange. The country's Ministry of Finance and Central Bank announced plans to establish a trading platform for "highly qualified investors" that "will legalize crypto assets and bring crypto operations out of the shadows."

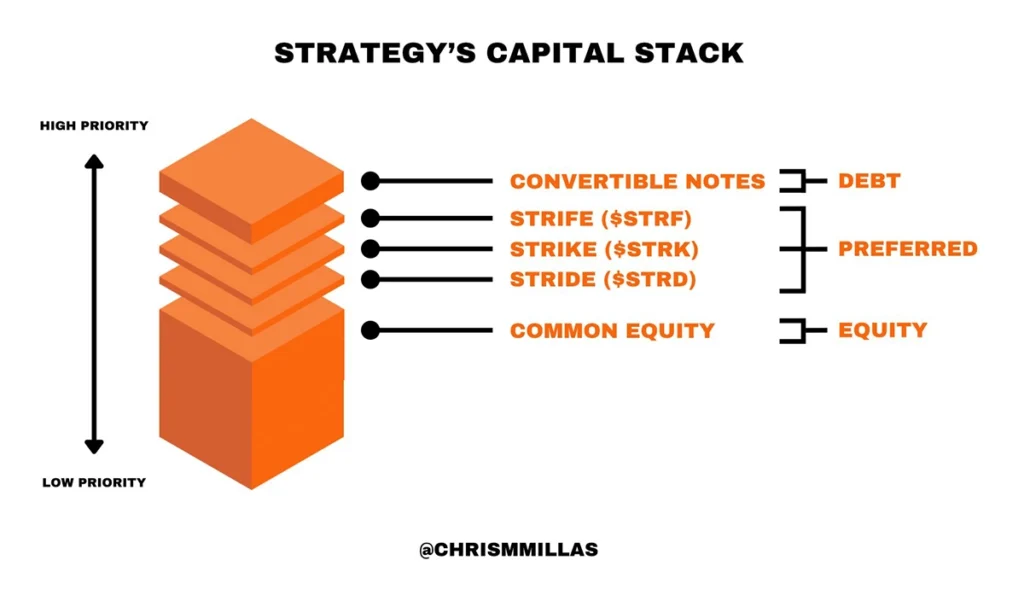

- Twenty One Capital is set to launch with over 42,000 BTC in its treasury. This new Bitcoin-native firm, backed by Tether and SoftBank, is planned to go public via a SPAC merger with Cantor Equity Partners and will be led by Jack Mallers, co-founder and CEO of Strike. According to a report by the Financial Times, the company aims to replicate the model of Michael Saylor with his company, MicroStrategy.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Metaplanet buys another 145 BTC. The Tokyo-listed company has purchased an additional 145 BTC for $13.6 million. Their total bitcoin holdings now stand at 5,000 coins, worth around $428.1 million.

- Semler Scientific has increased its bitcoin holdings to 3,303 BTC. The company acquired an additional 111 BTC at an average price of $90,124. The purchase was funded through proceeds from an at-the-market offering and cash reserves, as stated in a press release.

- Tesla still holds nearly $1 billion in bitcoin. According to the automaker's latest earnings report, the firm reported digital asset holdings worth $951 million as of March 31.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

- Arch Labs has secured $13 million to develop "ArchVM" and integrate smart-contract functionality with Bitcoin. The funding round, valuing the company at $200 million, was led by Pantera Capital, as announced on Tuesday.

- Citrea deployed its Clementine Bridge on the Bitcoin testnet. The bridge utilizes the BitVM2 programming language to inherit validity from Bitcoin, allegedly providing "the safest and most trust-minimized way to use BTC in decentralized finance."

- UAE-based Islamic bank ruya launches Shari’ah-compliant bitcoin investing. The bank has become the world’s first Islamic bank to provide direct access to virtual asset investments, including Bitcoin, via its mobile app, per Bitcoin Magazine.

- Solosatoshi.com has sold over 10,000 open-source miners, adding more than 10 PH of hashpower to the Bitcoin network.

"Thank you, Bitaxe community. OSMU developers, your brilliance built this. Supporters, your belief drives us. Customers, your trust powers 10,000+ miners and 10PH globally. Together, we’re decentralizing Bitcoin’s future. Last but certainly not least, thank you@skot9000 for not only creating a freedom tool, but instilling the idea into thousands of people, that Bitcoin mining can be for everyone again," said the firm on X.

- OCEAN's DATUM has found 100 blocks. "Over 65% of OCEAN’s miners are using DATUM, and that number is growing every day. This means block template construction is making its way back into the hands of the miners, which is not only the most profitable

-

@ e2c72a5a:bfacb2ee

2025-06-06 02:55:03

@ e2c72a5a:bfacb2ee

2025-06-06 02:55:03Your crypto wallet is probably leaking money right now. While everyone obsesses over price charts, the silent killer is gas fees – those tiny transactions add up to thousands wasted annually. Smart traders aren't just buying dips, they're timing their transactions when network congestion drops. The difference? Up to 80% savings on every move you make. Next time before hitting "confirm," check the gas tracker. Is it worth paying 3x more just to move your assets right this second? Patience isn't just a virtue in crypto – it's literally profitable. What's your strategy for minimizing transaction costs while maximizing gains?

-

@ 374ee93a:36623347

2025-06-05 22:42:00

@ 374ee93a:36623347

2025-06-05 22:42:00Chef's notes

Start your day the self sovereign way

Details

- ⏲️ Prep time: 10 mins

- 🍳 Cook time: 15 mins

- 🍽️ Servings: 4

Ingredients

- 1lb Jar Bottled Rhubarb https://jimblesjumble.netlify.app/item/a0c35618722834ac714d0a47058a2adc76ee7485a6b74f5da5f9eb2d3fb5d879

- 1pt Homemade Custard (3/4pt cream, 3 large eggs, 100g honey, 1/2 tbspn vanilla extract)

- 4 Handfuls Granola

- 1 Node https://plebeian.market/products/huxley@nostrplebs.com/start-9-node-y22zfjp8x6

Directions

- Whisk together the cream, eggs, honey and vanilla

- Chill overnight or serve warm with 1/4 jar of stewed rhubarb and a large handful of granola per person

- Consolidate some UTXOs on your node

- Have a Good Morning

-

@ dfa02707:41ca50e3

2025-06-06 02:01:36

@ dfa02707:41ca50e3

2025-06-06 02:01:36Contribute to keep No Bullshit Bitcoin news going.

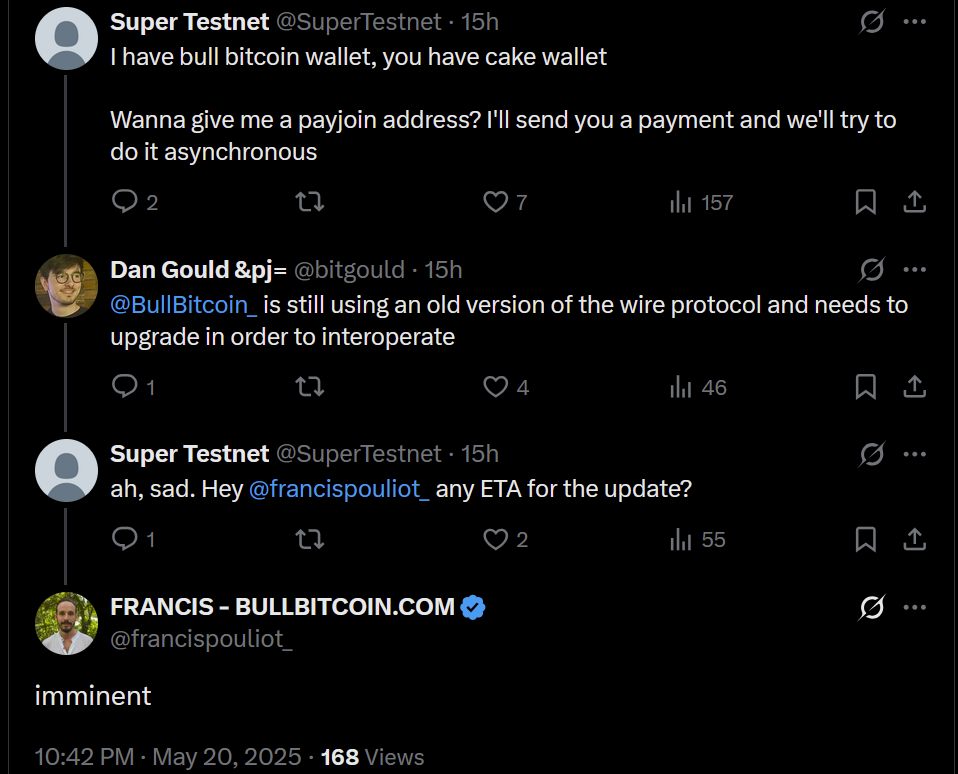

- This release introduces Payjoin v2 functionality to Bitcoin wallets on Cake, along with several UI/UX improvements and bug fixes.

- The Payjoin v2 protocol enables asynchronous, serverless coordination between sender and receiver, removing the need to be online simultaneously or maintain a server. This simplifies privacy-focused transactions for regular users.

"I cannot speak highly enough of how amazing it has been to work with @bitgould and Jaad from the@payjoindevkit team, they're doing incredible work. None of this would be possible without them and their tireless efforts. PDK made it so much easier to ship Payjoin v2 than it would have been otherwise, and I can't wait to see other wallets jump in and give back to PDK as they implement it like we did," said Seth For Privacy, VP at Cake Wallet.

How to started with Payjoin in Cake Wallet:

- Open the app menu sidebar and click

Privacy. - Toggle the

Use Payjoinoption. - Now on your receive screen you'll see an option to copy a Payjoin URL

- Bull Bitcoin Wallet v0.4.0 introduced Payjoin v2 support in late December 2024. However, the current implementations are not interoperable at the moment, an issue that should be addressed in the next release of the Bull Bitcoin Wallet.

- Cake Wallet was one of the first wallets to introduce Silent Payments back in May 2024. However, users may encounter sync issues while using this feature at present, which will be resolved in the next release of Cake Wallet.

What's new

- Payjoin v2 implementation.

- Wallet group improvements: Enhanced management of multiple wallets.

- Various bug fixes: improving overall stability and user experience.

- Monero (XMR) enhancements.

Learn more about using, implementing, and understanding BIP 77: Payjoin Version 2 using the

payjoincrate in Payjoin Dev Kit here. -

@ 3eba5ef4:751f23ae

2025-06-06 01:59:47

@ 3eba5ef4:751f23ae

2025-06-06 01:59:47加密洞见

解决比特币抗审查交易中继的女巫攻击,社交方案好于技术方案?

Peter Todd 发帖指出,针对比特币抗审查交易中继的攻击行为正在发生——一个名为 garbageman 的节点正在对 Libre Relay 节点采取女巫攻击。这些攻击节点假装支持抗审查交易中继(NODE_LIBRE_RELAY),但实际在暗中丢弃某些交易,目的是阻止特定交易被打包进入区块。作者还介绍了现有防御方法的难度和复杂性,并提出新思路——与其用技术方案解决,不用通过社交解决。他鼓励人们手动与跟他们有个人关系的节点进行连接,原因很简单,人与人的关系可以比任何代码都更有力地评估诚实。

打造统一身份查询标准,提升闪电网络付款体验

比特币开发者 Aviv Bar-el 发表了一项新提案「知名比特币身份端点」(Well-Known Bitcoin Identity Endpoint),旨在通过 HTTPS 标准接口,简化钱包查询用户比特币地址和身份信息的流程,提升链上支付——尤其是闪电网络付款的用户体验和安全性。

通过「承诺/揭示」机制,帮助加强比特币抵御量子计算威胁

Tadge Dryja 提出一种抵御量子计算攻击的比特币软分叉方案。它是「承诺/揭示」(commit / reveal)Fawkescoin 机制的变体,大部分内容与 Tim Ruffing 几年前的方案类似,但也有以下重要区别:

- 该方案不使用加密,而是用更小的基于哈希的承诺,并且描述了如何通过软分叉激活此机制。

- 这个方案仅适用于公钥(或脚本)在链上未公开的输出,例如 pubkey hash 或 script hash 类型;也适用于 Taproot,但必须通过脚本路径花费,因为 Taproot 的 key-path 花费在量子攻击下将不再安全。

- 至于那些公钥已经在链上暴露的输出该如何处理,是另一个独立问题(本方案与「销毁这些币」或「任其被盗」这两种做法都兼容)。

量子危机倒计时:比特币准备好了吗?

Chaincode 在近期发布的报告中,系统分析了「加密相关量子计算」(CRQC,Cryptographically relevant quantum computers)威胁的整体态势,评估了比特币在应对这一转变过程中面临的技术、经济与治理挑战,并表示必须要在早于 CRQC 出现的数年构建起相关共识。重要的结论有:

- 时间窗口:打破比特币椭圆曲线加密基础的 CRQC 可能首先出现在 2030 - 2035 年间。

- 脆弱资金范围:在所有流通的比特币中,约 20-50%(4-1000 万枚 BTC)可能易受 CRQC 攻击。其中远程攻击针对本质上易受攻击的脚本类型(P2PK、P2MS、P2TR)和具有先前暴露的公钥的地址(地址重用),使攻击者能够无限期地从区块链上已有的公共信息中获取私钥;短程攻击会影响所有比特币脚本类型,利用交易广播和确认之间(或之后不久)的漏洞窗口,当公钥暂时暴露时,要求攻击者在几分钟到几小时的时间范围内采取行动。

-

行动战略:建议采用双轨方法,包括:

- 应急措施:在约 2 年内完成对 CRQC 的最低限度但可运作的防护;

- 全面对策:在约 7 年内深入对问题的探索,并开发出功能完备的解决方案

这种双轨策略平衡了眼前的安全需求与最佳抗量子解决方案的严格研究和开发,确保无论 CRQC 能力如何发展,比特币都能做出适当的响应。

利用 zkSNARKs 对比特币交易实施任意约束

对于给比特币交易执行约束,现有的解决方案在隐私或可编程性上都存在不足。本文的研究者利用 zkSNARKs 设计了一种新方案,可以对比特币交易执行任意约束,并保持一定程度的信息私密性。他们方法绕过了比特币脚本的非图灵完备性,允许执行无界约束(unbounded constraints),即重复某个运算的次数次数不受限制。论文全文。

第一个跨比特币和 Cardano 的桥上线

从比特币到 Cardano 的信任最小化 Ordinals 桥通过 Cardinal 协议实现。Cardinal 协议实是一种基于 BitVMX 的信任最小化互作性协议,在不破坏所有权或损害安全性的前提下,它让比特币上中的不可替代资产(如 Ordinals 和 Runes)同 Cardano 链实现了来回移动。

Cardinal 协议背后的技术核心之一是「委员会的验证机制 」(committee-based validation mechanism),遵循 1-out-of-n honest 安全模型。这意味着即使除了一个验证者之外的所有验证者都恶意作,系统仍然保持安全——在增强安全性的同时,还实现了一种更加去中心化和抗审查的方式来在链之间移动资产 。

Thunderbolt 协议:通过 UTXO 捆绑和 OP_CAT 扩展,重构比特币智能合约

Nubit 提出的 Thunderbolt 被认为是为比特币在过去十年中最具里程碑意义的技术升级之一,被视为「Lightning Network 2.0」。Thunderbolt 是一种基于比特币基础层的软分叉升级方法,不依赖二层网络或桥的妥协,而是通过对比特币主链协议层的修改,从根本上增强其可扩展性、交易性能和可编程性。具体而言,Thunderbolt:

- 在吞吐量方面,使用 UTXO 捆绑(UTXO Bundling)技术,实现了对传统比特币交易处理模型的重大优化。

- 在可编程性方面,重新引入并扩展了 OP_CAT 。

- 在资产协议集成方面,Thunderbolt 实施了 Goldinals 统一标准,提供了一个基于零知识证明和状态承诺的资产发行框架。

- 与传统的扩容方法(如侧链、Plasma、Rollup 或桥接包装代币)不同,Thunderbolt 采用原生主链扩容路径。通过 BitVisa 提供去中心化的身份和凭证系统,让交易压缩、智能合约、资产标准集成、链上交易匹配都可以直接在比特币主链上运行。

比特币 2025 大会回顾:政要汇聚、稳定币受关注、DeFi 缺席

今年在拉斯维加斯举行的比特币 2025 大会,汇聚了众多政治要员和企业巨头。美国副总统 JD Vance 对加密货币表明了全力支持,并讨论了比特币在美中竞争中作为战略资产的潜力,他还认为,稳定币不会威胁到美元的完整性,而会使美国的经济实力倍增。白宫加密货币沙皇 David Sacks 发表了会议中最重要的政策公告之一, 暗示根据特朗普建立战略比特币储备的行政命令,美国政府有「获得更多比特币的合法途径」。

此外,关于稳定币立法和加密市场改革受到了很多关注。控制着超过 60% 稳定币市场的 Ardoido 公司表示:「所有传统金融公司都将创建稳定币,提供给他们现有的客户」;而 Tether 表示,其目标市场是全球范围内被排除在银行业之外的人。

这篇总结也提到,与 2022 年和 2023 年的类似峰会不同,今年的大会是由比特币最大化者、Ordinals 创建者、矿业资本家和监管游说者主导,而不再由 DeFi 协议构建者、DAO 运营商或 Layer2 扩容倡导者主导,以太坊和 Solana 生态的开发者缺席。这或许表明:

- 该会议明显的政治基调,使其不适合开发者喜欢的以技术为中心的叙述。

- Web3 建设者和比特币阵营之间的意识形态和叙事分歧可能会越来越大。

精彩无限,不止于链

Sui 攻击事件下的治理再思考:去中心化,程序合法性,和区块链的价值多元性

在受到生态最大的 DEX 项目 Cetus 黑客攻击之后,Sui 网络在协议层面执行了资产冻结和恢复——这是一种有效的技术回应,但同时引发了对抗审查和去中心化等核心区块链原则的批评和辩论。

文章的作者质疑了将去中心化视为唯一至高价值的立场,认为对于大多数有理性者而言,「生活在一个去中心化被认为是最高价值,但当有人侵犯他人财产时,允许强制武力的社会中」都要好于「生活在一个去中心化是唯一至高价值的社会中,因此在任何情况下都不允许强制武力」。

同时作者也指出,Sui 的验证者和网络行为采用的「家长式」治理方式令人失望;此外, Sui 使用委托权益证明(dPoS)系统,其中代币持有者将其代币委托给验证者,验证者代表他们行使相关的投票权,个人因此丧失了投票权。但区块链本来提供了有利于个人的、更加灵活的解决方案,比如 Cosmos 的治理框架就要优于 Sui——对于特定提案,验证人的决定并不会自动代表每个委托人的投票。

在关于去中心化的价值和治理方式之外,文章也提到另一种思考角度——「最重要的是建立与系统愿景相一致的程序合法性」。不同的项目追求不同的目标。就 Sui 而言,其核心目标是使各种资产能够被可靠地定义、并在链上无缝交互。因此,用其他区块链的范式或价值观来理解 Sui 的设计就是不合适的。在特殊情况下,Sui 优先考虑用户资产的返还和生态系统的稳定,而不是严格遵守抗审查——这一决定与其自身的长期愿景更加一致。此外,无论是 Sui 决定不审查相关交易,还是选择对 Cetus 的行为负责,如果背后有程序合法性,这两个决定都是合理的。

基于可信执行环境的私密证明委托

PSE 研究开发团队使用 Intel TDX 构建了一个基于可信执行环境(Trusted Execution Environment)的系统,用于安全的零知识证明委托。该系统允许客户端在不泄露输入的前提下,将大规模的证明任务私密地外包出去。相比受限于硬件能力的移动端本地证明,基于 TEE 的证明方案能够在目前就支持更大规模的陈述,并且随着证明系统的改进持续扩展。作为一种由硬件支撑的解决方案,TEE 能够兼容未来在软件层面的进展(例如更快的证明系统、更高效的工程实现),且只要信任模型被接受,就不会因这些进展而失效。

AI 与 ID:在代理、机器人、深度伪造等世界中的人类证明

我们正处于 AI(包括 AI 智能体、机器人、深度伪造等)深刻改变互联网的时代,随着 AI 的发展,网络上的身份认证变得愈发重要。a16z 的这期播客,讨论了在网上识别人类身份的「人类证明」(proof of human)问题,包括它为何重要,常见的问题有哪些,以及它在底层是如何运作的。

-

@ e2c72a5a:bfacb2ee

2025-06-06 02:43:10

@ e2c72a5a:bfacb2ee

2025-06-06 02:43:10North Korea's digital heist playbook: $7.7M crypto laundering scheme reveals how rogue nations exploit tech talent. The Justice Department's latest civil forfeiture complaint targets crypto and NFTs tied to an elaborate North Korean operation where IT workers posed as legitimate freelancers, infiltrated US companies, and funneled millions through complex blockchain pathways. This isn't just another hack—it's a sophisticated economic warfare strategy that turns technical expertise into untraceable funding for weapons programs. While governments scramble to seize these digital assets, the case exposes a troubling vulnerability: how easily skilled developers can weaponize their talents in plain sight. Are your company's remote contractors who they claim to be, or part of a state-sponsored financial pipeline hiding behind a convincing digital mask?

-

@ e2c72a5a:bfacb2ee

2025-06-06 01:42:46

@ e2c72a5a:bfacb2ee

2025-06-06 01:42:46North Korea's digital heist reveals the dark side of crypto's borderless nature. The US Justice Department is hunting $7.7 million in stolen cryptocurrency and NFTs allegedly laundered through an elaborate scheme involving North Korean IT workers posing as legitimate freelancers. This isn't just another hack—it's a sophisticated state-sponsored operation exploiting the very features that make crypto revolutionary: anonymity and borderless transactions. While we celebrate crypto's ability to transcend boundaries, this case exposes how those same qualities create perfect conditions for rogue nations to fund weapons programs and evade sanctions. The crypto industry faces a critical balancing act: how do we preserve financial freedom while preventing bad actors from exploiting the system? Perhaps the solution isn't more regulation but smarter blockchain analytics and international cooperation. What security measures would you support that don't compromise crypto's core principles?

-

@ 502ab02a:a2860397

2025-06-06 01:15:24

@ 502ab02a:a2860397

2025-06-06 01:15:24ปิดท้าย week นี้ด้วยสงครามดีไหมครับ ถ้าอาหารเป็นสนามรบ สิทธิบัตรก็เปรียบเหมือนป้อมปราการ และการฟ้องร้องก็คือปืนใหญ่ยิงสวนกันกลางแดด…ใครที่เคยคิดว่าโลกของอาหารแห่งอนาคตจะสวยงามเพราะเปลี่ยนถั่วเป็นสเต๊ก สกัดกลิ่นเลือดจากพืช หรือหลอกลิ้นให้เชื่อว่า “อร่อยเหมือนเนื้อ” ก็คงต้องมานั่งทบทวนใหม่ว่า โลกใบนี้ไม่ได้ขับเคลื่อนด้วยความฝัน แต่ขับเคลื่อนด้วยเอกสาร 70 หน้าของทนายความ และหมายเรียกจากศาลกลางรัฐเดลาแวร์

Motif FoodWorks เข้ามาในวงการอาหารด้วยวิสัยทัศน์สุดเท่ คือจะสร้างโครงสร้าง-กลิ่น-รส ของโปรตีนอนาคตให้แบรนด์ plant-based ทั่วโลกใช้ได้โดยไม่ต้องเริ่มใหม่ตั้งแต่ศูนย์ เปรียบเหมือนเป็นเบื้องหลังของวงการ มีซอสลับคือ HEMAMI™ ที่สกัดกลิ่นเนื้อจากยีสต์ ผ่านวิธีการทางวิทยาศาสตร์สุดซับซ้อน ฟังแล้วดูดี แต่ปัญหาคือซอสลับของเขาดัน “คล้ายเกินไป” กับของ Impossible Foods ที่ใช้ heme protein เหมือนกัน

แล้วอะไรคือจุดเปราะบางที่ทำให้ Motif ต้องร่วง?

เฮียอยากให้ลองคิดแบบนี้ครับ สมมุติว่ามีร้านกาแฟใหม่ที่ตั้งใจจะขายกาแฟแนวใหม่ ใช้เมล็ดกาแฟหมักยีสต์กลิ่นกล้วยหอม รสชาตินุ่มลึก เป็นของตัวเอง เขาไม่ได้ก็อปสูตรใคร แต่ดันไปใช้กระบวนการคล้ายกับแบรนด์เจ้าตลาดที่เขียนจดสิทธิบัตรเอาไว้ก่อนแล้ว แค่คล้ายก็พอจะโดนลากขึ้นศาลได้ เพราะในโลกของสิทธิบัตร “ความใหม่” และ “ความไม่เหมือน” คือสิ่งศักดิ์สิทธิ์ แม้จะไม่ได้ก็อปตรง ๆ

Impossible Foods เห็นช่องนี้ชัด พวกเขายื่นฟ้องทันที โดยระบุว่า HEMAMI™ ของ Motif ละเมิดสิทธิบัตรเทคนิคการใช้ heme เพื่อสร้างรสชาติเหมือนเนื้อในผลิตภัณฑ์ plant-based ซึ่งเป็นหัวใจหลักที่ Impossible ใช้มัดใจตลาดมาหลายปี

ในเดือนมีนาคม 2022, Impossible Foods ก็ลุกขึ้นมาฟ้อง Motif FoodWorks ต่อศาลรัฐบาลกลางของสหรัฐฯ โดยอ้างว่า HEMAMI™ ละเมิดสิทธิบัตรของตนที่เกี่ยวข้องกับการใช้โปรตีน heme ในการสร้างรสชาติและกลิ่นที่คล้ายเนื้อจริงในผลิตภัณฑ์จากพืช จุดนี้ดูผิวเผินเหมือนแค่ “บริษัท A เหมือนของบริษัท B เลยโดนฟ้อง” แต่ความจริงซับซ้อนและลึกกว่านั้นมาก เพราะทั้งสองบริษัทต่างก็ใช้วิธีผลิตโปรตีน heme ที่คล้ายกันมาก นั่นคือการดัดแปลงพันธุกรรมจุลินทรีย์ให้ผลิตโปรตีนเฉพาะ แล้วหมักออกมาในถังขนาดใหญ่ แต่ต่างกันที่วัตถุดิบและดีไซน์โปรตีน

Impossible Foods ใช้ “soy leghemoglobin” ซึ่งเป็นโปรตีน heme จากรากถั่วเหลือง ส่วน Motif ใช้ “bovine myoglobin” ซึ่งเลียนแบบของวัวจริง ๆ โดยตรง ความคล้ายคือโปรตีนทั้งสองต่างก็ให้กลิ่นคาวแบบเนื้อเมื่อโดนความร้อน และสร้างสีแดงแบบ rare steak ได้เหมือนกัน ทั้งยังถูกหมักด้วยจุลินทรีย์ GMO แบบใกล้เคียงกันอีกด้วย แม้จะต่างสายพันธุ์ของโปรตีน แต่การฟ้องครั้งนี้ตั้งอยู่บนแนวคิดว่า “วิธีการใช้” โปรตีน heme ในอาหารจากพืชอาจเข้าข่ายละเมิดสิทธิบัตร

จากนั้นไม่กี่เดือน Motif ก็สวนกลับโดยการยื่นคำร้อง “Inter Partes Review” (IPR) กับสำนักงานสิทธิบัตรของสหรัฐฯ (USPTO) ผ่าน PTAB ซึ่งเป็นขั้นตอนที่ใช้เพื่อขอให้ตรวจสอบความถูกต้องของสิทธิบัตรที่กำลังมีปัญหา แนวคิดคือถ้าพิสูจน์ได้ว่าสิทธิบัตรของ Impossible นั้นไม่ใหม่จริง หรือมี prior art อยู่ก่อนแล้ว (เช่น งานวิจัยเก่า ๆ ที่ตีพิมพ์ก่อน) ก็จะทำให้สิทธิบัตรนั้นกลายเป็นโมฆะ

Motif ยื่นคำร้องโจมตีสิทธิบัตรถึง 7 ฉบับของ Impossible แบบกระหน่ำชุดใหญ่ ยิงทีเดียวหวังให้สั่นคลอนทั้งระบบ แต่ PTAB รับพิจารณาเพียงฉบับเดียว (หมายเลขสิทธิบัตร 10,933,018) และท้ายที่สุดในเดือนเมษายน 2023 ศาลตัดสินยกเลิกฉบับนั้นจริง โดยให้เหตุผลว่า “ไม่เป็นสิ่งประดิษฐ์ใหม่อย่างเพียงพอ” ซึ่งถือเป็นชัยชนะเล็ก ๆ ของ Motif และสร้างแรงกระเพื่อมในแวดวงวิทยาศาสตร์อาหารอยู่พอสมควร

แต่แม้จะมีชัยบางส่วน อีก 6 ฉบับที่เหลือ PTAB กลับไม่รับพิจารณา โดยบอกว่า “หลักฐานไม่ชัดเจนพอจะเข้าขั้นพิจารณาใหม่” นั่นทำให้ฝั่ง Impossible ยังถือสิทธิบัตรส่วนใหญ่ไว้อยู่เหมือนเดิม แล้วก็เริ่มกลับมาเร่งกระบวนการฟ้องร้องในศาลต่อ ซึ่งหมายความว่า Motif ยิ่งต้องใช้เงินมากขึ้นเรื่อย ๆ ในการสู้รบทั้งสองด้าน ทั้งในศาลและในระบบสิทธิบัตร

ชัยชนะเล็ก ๆ นี้กลายเป็นดาบสองคม เพราะในขณะที่ Motif ดีใจว่าล้มได้ 1 ฉบับ ตลาดกลับมองว่าพวกเขาสู้แบบดิ้นสุดตัว ซึ่งในมุมของนักลงทุน นั่นแปลว่า "ขาดเงินทุนหมุนเวียน" หรือ “มีแนวโน้มขาดทุนต่อเนื่อง” มากกว่าจะมองว่าเป็นฮีโร่สู้เพื่อความถูกต้อง

ระหว่างนี้ Motif ยังพยายาม “spin” ภาพลักษณ์ตัวเองในเชิงบวกอย่างหนัก พวกเขาเปิดตัวผลิตภัณฑ์ใหม่ชื่อ “Motif MoBeef™” และ “Motif MoChicken™” โดยใช้ HEMAMI™ ผสมอยู่ พร้อมโชว์ผลงานให้เชฟชื่อดังระดับ Michelin มาชิมและออกสื่อ โดยหวังว่าจะสร้างความเชื่อมั่นให้ตลาดว่า “ผลิตภัณฑ์เรายังไปต่อได้” และอาจดึงดีลใหม่หรือการลงทุนเพิ่มเข้ามาเพื่อบรรเทาภาระจากการฟ้องร้อง

และในขณะที่ Motif เดินหน้าเปิดตัวผลิตภัณฑ์ใหม่เพื่อแสดงพลังให้ตลาดเห็นว่า “เรายังไปต่อได้” ฝั่ง Impossible กลับเดินเกม PR อย่างเงียบ ๆ ด้วยการแจ้งเตือนสื่อและผู้ถือหุ้นว่า “Motif ยังใช้เทคโนโลยีละเมิดอยู่ต่อเนื่อง” พร้อมแนบเอกสารคำฟ้องเพิ่มในปี 2023 ซึ่งแปลความได้ว่า “ศึกยังไม่จบ อย่าเพิ่งส่งเงินให้คู่แข่งเรา” เพราะในเอกสารคำฟ้องของปี 2023 พวกเขาเสริมข้อกล่าวหาใหม่ว่าการที่ Motif ออกสื่อและใช้ HEMAMI™ ต่อไป “เป็นการจงใจละเมิด” และอาจเข้าข่ายการทำลายคุณค่าของแบรนด์ Impossible โดยตรง จุดนี้ยิ่งทำให้ Motif อยู่ในมุมที่เสี่ยงและลำบากมากขึ้น

การต่อสู้ของทั้งสองบริษัทจึงไม่ใช่แค่เรื่องใครเลียนแบบใคร แต่มันคือเกมยืดเวลา เผาเงิน ปั่นมูลค่า และวัดใจนักลงทุนว่าใครจะถอยก่อนกัน และสุดท้ายคนที่หมดลมหายใจก่อนก็คือ Motif แม้จะมีนักวิทยาศาสตร์เก่ง ๆ เทคโนโลยีล้ำ ๆ หรือวัตถุดิบดีแค่ไหน แต่เมื่อต้องมาสู้กับยักษ์ที่มีสิทธิบัตรในมือ บารมีในตลาด และชื่อเสียงติดหูผู้บริโภค…ก็ยากที่จะเอาชนะด้วยวิทยาศาสตร์เพียงอย่างเดียว

ศึกนี้จึงไม่ได้จบแค่ในศาล แต่มันลากไปถึงห้องประชุมนักลงทุน พาดหัวข่าวใน Business Insider และบอร์ด Reddit ที่คุยกันว่า “Motif จะไปไม่รอดหรือเปล่า” ซึ่งในยุคที่เงินทุนคือออกซิเจน การที่ภาพลักษณ์ของบริษัทเริ่มสั่นคลอน ก็เหมือนถังอากาศรั่วในห้องแล็บใต้ทะเล…ไม่นานนัก Motif ก็เริ่มลดจำนวนพนักงาน ลดเป้าการผลิต และสุดท้าย “ลดบทบาทตัวเองในตลาด”

หากดูเผิน ๆ หลายคนอาจคิดว่านี่คือเรื่องของสองบริษัทใหญ่ในโลก plant-based ที่ทะเลาะกันเอง แต่จริง ๆ แล้วนี่คือบทเรียนใหญ่ของ “วงการอาหารแห่งอนาคต” ที่กำลังเติบโตบนหลังคำว่า IP Intellectual Property ใครถือสิทธิบัตรก่อน คนนั้นตั้งกฎได้ ใครมาใหม่ ถ้าไม่จดให้ไว ก็อาจต้องจ่ายค่าต๋งตลอดชีวิต

และที่เจ็บปวดที่สุดคือบางทีของที่คุณคิดขึ้นมาเอง อาจไม่ใช่ของคุณอีกต่อไปแล้ว ถ้าคุณไม่มีเอกสารในมือ

นี่แหละครับ วงการที่ดูเหมือนจะขาย “นวัตกรรมอาหาร” แต่จริง ๆ แล้วขาย “สิทธิบัตรในกล่องข้าว” ใครจะอยู่ใครจะไป บางทีก็ไม่เกี่ยวกับว่า “ของอร่อยแค่ไหน” แต่เกี่ยวกับว่า “ใครมีทนายเก่งกว่า”

และในขณะที่สองยักษ์ใหญ่ยิงกันด้วยเอกสารละเมิดสิทธิ์ เหยื่อเงียบ ๆ อย่างเกษตรกรรายย่อยที่ยังอยากปลูกผักจริง เลี้ยงวัวจริง หรือแม้แต่ผู้บริโภคที่แค่อยากรู้ว่า “กินอะไรแล้วร่างกายจะดีขึ้น” กลับวนเวียนในทางอยู่ในโลกที่อาหารทุกคำถูกควบคุมโดยทุน จดหมายเรียกจากศาล และวัตถุดิบสังเคราะห์ที่มีรหัสมากกว่าชื่อจริง

สงครามสิทธิบัตรเหล่านี้ไม่เคยมีพื้นที่ให้ชาวไร่ หรือผู้บริโภคธรรมดาเข้าไปมีเสียงเลยสักนิด เพราะมันคือการต่อสู้ระหว่างนักล่าที่ฟาดฟันกันบนยอดห่วงโซ่อาหาร แต่เบื้องล่างของพีระมิด กลับมีแต่เหยื่อที่ถูกเลี้ยงให้งุนงง อยู่กับของปลอม และเชื่อว่า “นี่แหละคืออนาคตของอาหาร”

แล้วใครจะบอกเราว่า...ทางรอดคืออะไร?

คำตอบอาจอยู่ไม่ไกล แค่เราต้องกลับมาถามคำถามง่าย ๆ ที่ใครก็ลืมไปว่า “จริง ๆ แล้ว เราต้องการอาหารแบบไหนกันแน่” อาหารที่กินแล้วแข็งแรง หรืออาหารที่บริษัทแข็งแรง?

เพราะตราบใดที่เรายังปล่อยให้กล่องข้าวอยู่ในมือคนจดสิทธิบัตร เราอาจไม่มีวันได้กลับไปจับจอบเอง ปลูกเอง กินเอง แบบที่มนุษย์เคยเป็นมาก่อนโลกจะกลายเป็นห้องทดลองขนาดยักษ์

ศึกระหว่างผู้ล่ายังรุนแรงขนาดนี้ แล้วศึกระหว่างผู้ล่ากับเหยื่อ จะเหลืออะไรครับ

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ eb0157af:77ab6c55

2025-06-06 06:01:16

@ eb0157af:77ab6c55

2025-06-06 06:01:16The Russian banking giant introduces financial instruments linked to Bitcoin for qualified investors.

Russia’s largest commercial banking institution, Sber, has made its entry into the Bitcoin space by unveiling a bond product tied to the asset.

Sber has officially launched its structured financial instrument that mirrors the price performance of Bitcoin alongside fluctuations in the dollar-ruble exchange rate. The product is already available to qualified investors through the over-the-counter (OTC) market, with plans to list it on the Moscow Exchange in the near future.

Formerly known as Sberbank, the institution stated in a May 30 announcement that the listing would provide transparency, liquidity, and convenience for a wide range of professional investors. This structured approach will allow investors to benefit both from Bitcoin’s appreciation in dollars and from the strengthening of the US dollar against the Russian ruble, the bank suggests.

The lender also announced plans to expand its crypto offering through the SberInvestments platform, introducing exchange-traded products that provide exposure to digital assets. The first product will be a Bitcoin futures instrument, scheduled for listing on June 4, coinciding with its official launch by the Moscow Exchange.

Sber’s initiative follows the authorization granted by Russia’s Central Bank on May 28, which permitted financial institutions to offer specific crypto-related financial instruments to accredited investors. However, the direct offering of cryptocurrencies remains prohibited.

Meanwhile, T-Bank (formerly Tinkoff Bank) launched an investment product linked to Bitcoin’s price, branding it a “smart asset” issued through Russia’s state-backed tokenization platform Atomyze.

According to the Russian Central Bank’s report for the first quarter of 2025, Russian residents hold approximately 827 billion rubles ($9.2 billion) in cryptocurrencies on centralized exchanges. Inflows into Russian crypto platforms surged by 51%, reaching 7.3 trillion rubles ($81.5 billion) over the same period.

The post Sber, Russia’s largest bank, launches Bitcoin bonds appeared first on Atlas21.

-

@ 2cde0e02:180a96b9

2025-06-05 21:45:00

@ 2cde0e02:180a96b9

2025-06-05 21:45:00日本の姫

https://stacker.news/items/998335

-

@ df67f9a7:2d4fc200

2025-06-05 19:52:32

@ df67f9a7:2d4fc200

2025-06-05 19:52:32Nostr is NOT a social network. Nostr is a network of interconnected social apps. And, since any app is a social app, Nostr is for every app.

ONLY Nostr incentivizes inter-connectivity between independent apps, simply by respecting sovereignty at the protocol layer. For end users, sovereignty means that the content they post “to Nostr” will never be owned by the apps that they use. For businesses building apps on Nostr, sovereignty means that every app actually benefits by other apps being on the network. Because sovereignty is respected, users are retained for longer and independent apps thrive far longer on Nostr than on the legacy “black box” social networks.

Social apps thrive on Nostr

Nostr integration provides these benefits for every app :

- Unrestrained access for any app, to all public and private data “on Nostr”. No fees or licenses for harvesting user data from the network.

- Unburdened from liability, when collecting user data with any app. When sending “to Nostr”, end users retain custody of user data while apps never loose access.

- Unlimited free market of search engines and feed algos. Users and brands can create, use, and share any algos or custom feeds. Grow your audience on your own terms.

- Universal open network for all apps. Build any kind of app for any audience, on the same network as other apps for other audiences. Discover new trends from user data.

- Unregulated tech platform. Build your own app and use it as you wish. No gate keepers. No code review.

Sovereignty is good for business.

Regardless of the network size, a Nostr integrated app can grow its user base MUCH faster and with greater independence BECAUSE of the sovereignty respecting protocol. While end users may retain custody of their identities and data on the network, it’s the apps that determine which data is, or is not, sent to the network. Respect for sovereignty IS the killer feature that ONLY the Nostr protocol provides for apps and for end users.

Because Nostr is permissionless for any app to integrate :

- end users will always have a free market of apps choose from

- apps are free to integrate only as much as benefits their business model.

- apps gain access to more novel data as new apps bring new users to the network.

Because data on Nostr is managed by end users and available to all apps :

- User data looses exclusivity and the demand shifts toward novel insights and information derived from these data.

- Apps are freed from having to be “data pirates”, and can focus on establishing a trusted user base, providing valuable services to satisfied customers, informed by the abundance of user data.

- Apps are incentivized to offload data onto the network, establishing a new paradigm for interconnectivity, where independence is NOT at stake as the network grows.

- New markets spring up to support users with self custody of their data, driven by the reality that apps can have full access without assuming responsibility.

- The market for search and algo tools opens up for independent apps and end users to discover and interact freely with each other.

- The ad based “attention economy” slowly transforms to a value based consumer economy, where the end user is the customer rather than the product being sold.

Even while privacy is respected

Sometimes sovereignty is at odds with privacy, but Nostr allows all parties to win while both are protected.

- For end users sending sensetive data "to Nostr", privacy is assured by encrypting it with their own private keys and/or sending it to private (auth required) relays of their choosing.

- For apps handling private IP or business data, any traditional “black box” infrastructure can be used in the back end to manitain isolation from Nostr.

This means apps and end users remain in control of their own private data, without requiring “big social” as trust provider or data reseller. To access a user's private data, client apps (even search engines, running locally) only need explicit permission from the end user to retrieve or decrypt from Nostr relays. Public data, on the other hand, is freely available for any app or search engine to harvest from any Nostr relay. In either case, user data on the Nostr network is always accessible to client apps, without additional restrictions or fees.

Nostr is for every app.

Adding social to any app makes it a better app. Add reviews for products or services. Add commenting or direct messaging. Share or collaborate on content creation. Nostr integration is straightforward and incremental for any app.

Nostr doesn't define your app's business model ... Nostr 10X's it!

Here's how :

- Start with your own business and app design. Add Nosrr login.

- Discover what "kinds" of user data already exists "on Nostr" that your app can ingest and make use of.

- Decide which "kinds" of data would benefit your business, your users, and the network, if sent "to Nostr".

- Implement Nostr integration for data kinds and add webs of trust tools for recommendation and discovery.

- Verify your app is sovereignty respecting in how it handles private data and implements Nostr NIPs.

- Engage with existing users, and onboard new users from your app, to earn their trust and patronage over Nostr.

For more info and assistance, contact our team of Nostr integration experts.

-

@ f85b9c2c:d190bcff

2025-06-06 01:02:16

@ f85b9c2c:d190bcff

2025-06-06 01:02:16

Cristiano Ronaldo stands out as a recognized and accomplished football player on a scale. His inspiring journey, from beginnings in Portugal to attaining superstar status serves as an inspiration, to individuals.

Ronaldo’s prodigious talent was evident from a young age. His coach at Sporting CP famously said “He was skinny when he arrived here but with tremendous skill”. Through hard work and dedication, Ronaldo honed his skills

Some Work Ethic and Ambition that Fuelled his success .A key factor in Ronaldo’s success story is his incredible work ethic and winning mentality. He is renowned for his strict training regimen, nutrition plan, and diligent recovery routines. Ronaldo’s dedication to self-improvement paved the way for his success. .Throughout his career, Ronaldo has shown insatiable hunger and ambition to be the best. His drive to succeed and break records is unmatched. Even in the twilight of his career, Ronaldo’s success story continues as he plies his trade in Italy with Juventus.

Lessons from Ronaldo’s Success Story 1. Dedication and hard work are essential Ronaldo showed how training relentlessly can make dreams come true. 2. Believe in your talent Ronaldo had the confidence and work ethic to fulfill his potential. 3. Handle pressure with grace Ronaldo embraced the spotlight and thrived under pressure. 4. Be ambitious and hungry Ronaldo set new benchmarks by constantly raising the bar. 5. Lead by example Ronaldo inspires teammates with his exemplary attitude. 6. Learn and improve Even at the top Ronaldo keeps evolving and adding new skills. 7. Give back Ronaldo uses his global fame and fortune for charity work.

Sum Up Cristiano Ronaldo's remarkable journey showcases the heights that can be reached through a combination of talent and relentless effort. His success serves as an inspiration for anyone with dreams and the determination to make them a reality.

-

@ eb0157af:77ab6c55

2025-06-06 01:01:33

@ eb0157af:77ab6c55

2025-06-06 01:01:33French authorities have identified a 24-year-old Franco-Moroccan man as the mastermind behind a series of attacks targeting crypto entrepreneurs, including the co-founder of Ledger.

The suspect, Badiss Mohamed Amide Bajjou, was captured in Tangier by Moroccan authorities following an international arrest warrant issued by Interpol.

The arrest marks a major breakthrough in the investigations into a wave of kidnappings that targeted several figures in the French crypto sector. According to Le Parisien, the suspect was wanted for multiple crimes, including armed extortion and kidnapping.

Bajjou is accused of remotely orchestrating a sophisticated criminal network specializing in targeting wealthy individuals in the crypto world. His alleged criminal activity dates back to July 2023, when he began coordinating abductions and extortion attempts against industry entrepreneurs.

The Ledger case and a wave of kidnappings

Among the most shocking incidents was the attack on David Balland, co-founder of Ledger. The kidnappers subjected him to extreme torture, amputating one of his fingers to increase psychological pressure while demanding a €10 million ransom in cryptocurrency. Investigations suggest a direct link between Bajjou and this case.

Another high-profile incident involved an attempted abduction of the family of Pierre Noizat, CEO of Paymium. In May, masked men tried to kidnap Noizat’s daughter, her husband, and their child in broad daylight. Subsequent investigations led to the indictment of 25 suspects, including teenagers and minors.

Capture operation and seizure of evidence

During Bajjou’s arrest, Moroccan authorities seized materials connected to the kidnappings. According to local media, multiple bladed weapons, dozens of mobile phones, and a substantial amount of cash allegedly linked to the criminal activities were confiscated.

International cooperation and the search for accomplices

French Interior Minister Gérald Darmanin publicly thanked Moroccan authorities for their cooperation in the arrest. However, investigations remain ongoing as another Franco-Moroccan man, believed to be the leader of the group and around 40 years old, is still at large. Interior Minister Bruno Retailleau has vowed to track down all those responsible and protect crypto entrepreneurs during meetings with industry leaders.

The post Suspected organizer of France’s crypto kidnapping spree arrested in Morocco appeared first on Atlas21.

-

@ f85b9c2c:d190bcff

2025-06-06 00:24:22

@ f85b9c2c:d190bcff

2025-06-06 00:24:22

Inflation is one of the most significant factors affecting personal wealth and the economy yet it goes unnoticed until its effects become unavoidable. As the cost of goods and services rises, your purchasing power decreases, and this makes long-term financial planning more challenging.

What is inflation? Inflation is the general increase in prices of goods and the reduction of the purchasing power of money. It is commonly measured by : 1.Consumer Price Index (CPI)

2.Core Inflation

3.Producer Price Index (PPI)

Inflation occurs due to various factors, including increased demand and supply chain disruptions

Why is Inflation Important? Inflation is crucial because it affects the cost of living, purchasing power, and the economy as a whole. As prices rise money loses value making it harder for consumers to afford essentials if wages don’t keep up. It also influences interest rates as central banks ,adjust policies to control inflation, borrowing, savings, and investments.

How Inflation Affects Personal Wealth 1. Erosion of Purchasing Power As prices rise, the same amount of money used to buy more before now buys fewer goods and services. 2. Impact on Savings Your money sitting in savings accounts with little or no interest rates loses value over time. If the inflation rate exceeds the interest or profit earned on your savings, then it becomes affected 3. Effects on Investments Their impact is the most because inflation reduces the real value of future payments. 4.Wages & Employment Some businesses may cut costs by reducing roles in a department or reducing pay to keep the team members.

Everyone is affected by inflation.

How Do You Protect Your Wealth from Inflation? 1.Invest in Inflation-Protected Assets Stocks and real estate investments offer long-term growth potential.They give you ownership of a product, which you can use, resell or repackage as you please. 2.Alternative Investments If you have the stomach, commodities, cryptocurrency, and other non-traditional assets may provide inflation releaved. 3. Increase Income Streams Side hustles, passive income, and career advancements can help offset inflation’s impact. 4.Reduce Debt Nigerians are aware of Credit Houses pretending as Loan Sharks chasing debtors around with ridiculous messages of loved ones. In a period of inflation, those loans feel like a double punishment because of ridiculous interest rates and overwhelmed inflation. Whatever you can do to reduce your debt during this period will be life-changing. Also, non-interest debts should always be considered before going down a slippery slope.

Summary Nigeria — A Few Word One thing is clear — inflation persists in almost every corridor of the economy. Inflation is an inevitable part of economic cycles, but understanding its impact allows you to take proactive steps in protecting your wealth. But I believe you can maintain financial stability by following some of the steps above.

Be proactive!

-

@ df478568:2a951e67

2025-06-05 23:34:01

@ df478568:2a951e67

2025-06-05 23:34:01About 156,000 blocks ago, I went to a Taco Shop for a bitcoin meetup. I asked my favorite question, “Do you accept bitcoin?”

“Yes," he said as he handed me a Toast Terminal with a BTCpayServer QR code.

]

]Awesome!

12,960 blocks later, I took my dad to the taco shop. We ordered food. I asked my favorite question once again.

“Uh…Yeah, but I don't know how to work the machine.”

"Dough!🤦"

It's been a problem in the past, but now lightning payments are about to be ubiquitous. Steak N Shake is taking bitcoin using Speed Wallet and Block is implementing bitcoin payments by 2026 in all legal jurisdictions. I have tested both of these so you don't have to. Just kidding. I geek out on this stuff, but both work great. You can pay with your sats by scanning a screen on a QR code. The employees don't need to be bitcoin lightning network experts. You can just pay as easy as a credit card.

There were 35,000 people at the bitcoin conference, and 4,187 transactions were made. It was a world record. Wait, I thought they said there could only be 7 transactions per second! No, not anymore. Now we can use bitcoin for shopping. I can pay for tacos at taco trucks.

How You Can Accept Bitcoin At Your Business

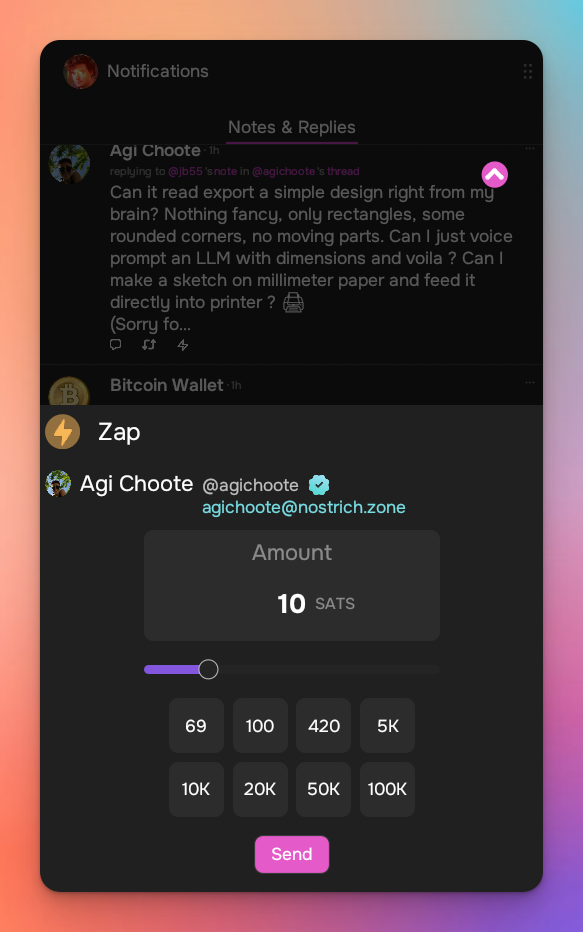

Coinos is a simple bitcoin point of sale information that acts like a cash register. Bitcoin is peer-to-peer electronic cash. Coinos is a cash register and you should treat it as such. If you make a few hundred thousand sats at the end of the night, you should sweep the bitcoin into your own wallet.. You can use Aqua, AlbyHub, Bull Bitcoin wallet, or whatever your favorite lightning enabled wallet is to withdraw. You'll need a password. Do not lose this. I have tried the automatic withdraws, but it did not work for me. I'm no concerned because this is not a wallet I intend to keep a lot of sats in for a long time.

Here is my coinos payment terminal.

https://coinos.io/ZapthisBlog/receive

I made the QR code with libreqr.com/

Now I have an online bitcoin cash register. The Bitcoiners know how to pay for stuff with sats. They will be proud to show you too. If you're nerdy, you can use all the cool kid tools now, but we will just focus on the lightning address. Anyone can send you sats with a lightning address with just a QR code.

At the end of the night, you cash out to your own wallet. Again, this assumes you have an Aqua Wallet or any other lightning enabled wallet, but all it takes to accept bitcoin at your brick and mortar store is to create an account with Coinos and print out a QR code. It's a quick and easy way to start accepting bitcoin even if you don't expect many clients to shop with sats.

Tips

This is not just a cash register. Employees can also make their own Coinos wallet and receive tips from bitcoiners. Anyone can accept payments using this system. Your kids could use it to sell lemonade for sats. You are only limited by your imagination. When will you begin accepting bitcoin payments? It is easier than ever. You do not need to train employees. You do not need to be in the store. Bitcoin is peer-to-peer electronic cash so you can give it away like cash. I don't know what the tax rules on cash are. You need to verify that with your own jurisdiction. This is not financial or tax advice. This is for informational purposes only.

Remember, this is a custodial wallet. Not your keys not your bitcoin. Don't keep more sats than you are willing to lose on custodial wallets. Sweep your wallet early and often. Loss of funds is possible. There is a small fee for liquidity management too. Do your own research.

-

@ 42a071ab:3391e086

2025-06-05 20:06:56

@ 42a071ab:3391e086

2025-06-05 20:06:5688VIN đã từng bước khẳng định vị thế của mình trên thị trường bằng cách không ngừng đầu tư vào chất lượng dịch vụ và sự hài lòng của người dùng. Khác với những nền tảng thông thường, 88VIN chú trọng vào việc xây dựng một hệ sinh thái vận hành bài bản, nơi mọi quy trình đều được chuẩn hóa và tối ưu để đem lại hiệu suất cao nhất. Từ bước đăng ký tài khoản, xác thực thông tin, cho đến nạp – rút tiền và hỗ trợ khách hàng, tất cả đều được thiết kế một cách khoa học, rõ ràng và minh bạch. Sự tiện lợi trong thao tác và tính linh hoạt trong hệ thống đã giúp 88VIN tạo được sự tin tưởng vững chắc từ phía người dùng. Hệ thống hoạt động ổn định, tốc độ xử lý nhanh chóng, cùng đội ngũ chăm sóc khách hàng chuyên nghiệp, nhiệt tình 24/7 chính là những yếu tố làm nên thành công bền vững của 88VIN. Không chỉ vậy, nền tảng còn tích hợp công nghệ bảo mật hiện đại, bảo vệ an toàn tuyệt đối cho mọi thông tin và giao dịch cá nhân, giúp người dùng yên tâm tuyệt đối khi sử dụng.

Bên cạnh sự hoàn hảo về hệ thống, 88VIN còn gây ấn tượng bởi chính sách hỗ trợ người dùng rõ ràng, minh bạch và đầy tính nhân văn. Thay vì chỉ chú trọng vào mặt kỹ thuật, 88VIN hiểu rằng yếu tố con người mới là cốt lõi cho sự phát triển lâu dài. Chính vì vậy, đội ngũ chăm sóc khách hàng tại đây không chỉ được đào tạo bài bản mà còn luôn sẵn sàng lắng nghe, thấu hiểu và đồng hành cùng người dùng trong mọi tình huống. Mỗi phản hồi, dù là nhỏ nhất, đều được ghi nhận nghiêm túc để làm cơ sở nâng cấp chất lượng dịch vụ. Điều này giúp tạo nên một cộng đồng sử dụng 88VIN văn minh, gắn bó và ngày càng phát triển. Đồng thời, việc tối ưu hóa trải nghiệm người dùng được thể hiện qua từng chi tiết nhỏ, từ giao diện hiển thị, bố cục chức năng đến tốc độ phản hồi trên mọi thiết bị. Chính nhờ sự chăm chút tỉ mỉ đó, 88VIN không chỉ đáp ứng nhu cầu trước mắt mà còn luôn sẵn sàng cải tiến để bắt kịp xu hướng trong tương lai.

88VIN không đơn thuần là một nền tảng cung cấp dịch vụ chất lượng cao mà còn là biểu tượng của sự cam kết lâu dài đối với người dùng. Mỗi thành viên khi đến với 88VIN đều được đảm bảo quyền lợi rõ ràng, được đồng hành trong môi trường minh bạch và công bằng. Sự khác biệt của 88VIN chính là khả năng duy trì sự ổn định trong khi vẫn không ngừng đổi mới và hoàn thiện. Những giá trị mà 88VIN theo đuổi không chỉ nằm ở hiệu quả vận hành mà còn là sự tận tâm trong từng trải nghiệm của người dùng. Đây là yếu tố quyết định giúp nền tảng ngày càng chiếm được lòng tin và sự lựa chọn của cộng đồng. Trong thời đại mà sự cạnh tranh ngày càng khốc liệt, việc giữ vững đạo đức kinh doanh, coi trọng người dùng và luôn đặt chất lượng lên hàng đầu chính là con đường bền vững mà 88VIN đang theo đuổi. Nhờ vậy, 88VIN ngày càng khẳng định vị trí vững chắc, trở thành điểm đến tin cậy cho những ai tìm kiếm một nền tảng chuyên nghiệp, ổn định và thực sự vì lợi ích của người dùng.

-

@ dfa02707:41ca50e3

2025-06-05 20:02:23

@ dfa02707:41ca50e3

2025-06-05 20:02:23Headlines

- Twenty One Capital is set to launch with over 42,000 BTC in its treasury. This new Bitcoin-native firm, backed by Tether and SoftBank, is planned to go public via a SPAC merger with Cantor Equity Partners and will be led by Jack Mallers, co-founder and CEO of Strike. According to a report by the Financial Times, the company aims to replicate the model of Michael Saylor with his company, MicroStrategy.

- Florida's SB 868 proposes a backdoor into encrypted platforms. The bill and its House companion have both passed through their respective committees and are headed to a full vote. If enacted, SB 868 would require social media companies to decrypt teens' private messages, ban disappearing messages, allow unrestricted parental access to private messages, and likely eliminate encryption for all minors altogether.

- Paul Atkins has officially assumed the role of the 34th Chairman of the US Securities and Exchange Commission (SEC). This is a return to the agency for Atkins, who previously served as an SEC Commissioner from 2002 to 2008 under the George W. Bush administration. He has committed to advancing the SEC’s mission of fostering capital formation, safeguarding investors, and ensuring fair and efficient markets.

- Solosatoshi.com has sold over 10,000 open-source miners, adding more than 10 PH of hashpower to the Bitcoin network.

"Thank you, Bitaxe community. OSMU developers, your brilliance built this. Supporters, your belief drives us. Customers, your trust powers 10,000+ miners and 10PH globally. Together, we’re decentralizing Bitcoin’s future. Last but certainly not least, thank you@skot9000 for not only creating a freedom tool, but instilling the idea into thousands of people, that Bitcoin mining can be for everyone again," said the firm on X.

- OCEAN's DATUM has found 100 blocks. "Over 65% of OCEAN’s miners are using DATUM, and that number is growing every day. This means block template construction is making its way back into the hands of the miners, which is not only the most profitable for miners on OCEAN but also one of the best things for Bitcoin," stated the mining pool.

Source: orangesurf

- Arch Labs has secured $13 million to develop "ArchVM" and integrate smart-contract functionality with Bitcoin. The funding round, valuing the company at $200 million, was led by Pantera Capital, as announced on Tuesday.

- Tesla still holds nearly $1 billion in bitcoin. According to the automaker's latest earnings report, the firm reported digital asset holdings worth $951 million as of March 31.

- The European Central Bank is pushing for amendments to the European Union's Markets in Crypto Assets legislation (MiCA), just months after its implementation. According to Politico's report on Tuesday, the ECB is concerned that U.S. support for cryptocurrency, particularly stablecoins, could cause economic harm to the 27-nation bloc.

- TABConf 2025 is scheduled to take place from October 13-16, 2025. This prominent technical Bitcoin conference is dedicated to community building, education, and developer support, and it is set to return in October. Get your tickets here.

- Kaduna Lightning Development Bootcamp. From May 14th to 17th, the Bitcoin Lightning Developer Bootcamp will take place in Kaduna, Nigeria. Thisevent offers four dynamic days of coding, learning, and networking. Organized by Africa Free Routing and supported by Btrust, Tether, and African Bitcoiners, this bootcamp is designed as a gateway for African developers eager to advance their skills in Bitcoin and Lightning development. Apply here.

Source: African Bitcoiners.