-

@ 2cde0e02:180a96b9

2025-06-05 15:13:03

@ 2cde0e02:180a96b9

2025-06-05 15:13:03pen & ink; monochromized

Magdalena Carmen Frida Kahlo y Calderón[a] (Spanish pronunciation: [ˈfɾiða ˈkalo]; 6 July 1907 – 13 July 1954[1]) was a Mexican painter known for her many portraits, self-portraits, and works inspired by the nature and artifacts of Mexico. Inspired by the country's popular culture, she employed a naïve folk art style to explore questions of identity, postcolonialism, gender, class, and race in Mexican society.[2] Her paintings often had strong autobiographical elements and mixed realism with fantasy. In addition to belonging to the post-revolutionary Mexicayotl movement, which sought to define a Mexican identity, Kahlo has been described as a surrealist or magical realist.[3] She is also known for painting about her experience of chronic pain.[4]

https://stacker.news/items/997980

-

@ 7f6db517:a4931eda

2025-06-05 15:02:24

@ 7f6db517:a4931eda

2025-06-05 15:02:24

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-05 15:02:23

@ 7f6db517:a4931eda

2025-06-05 15:02:23

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-05 15:02:22

@ dfa02707:41ca50e3

2025-06-05 15:02:22News

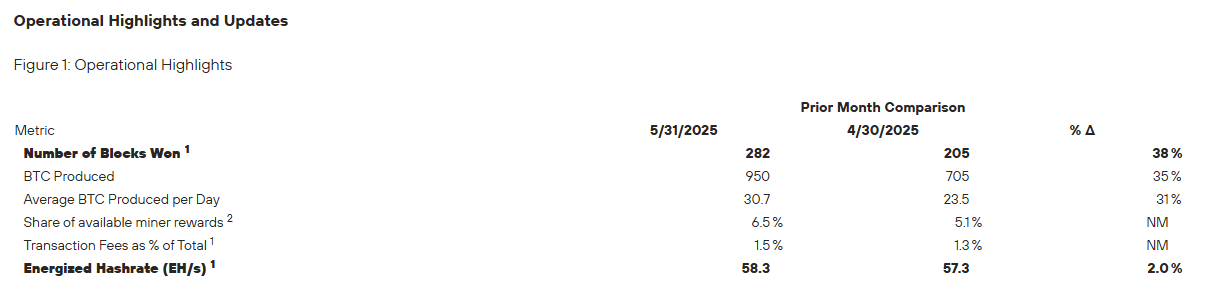

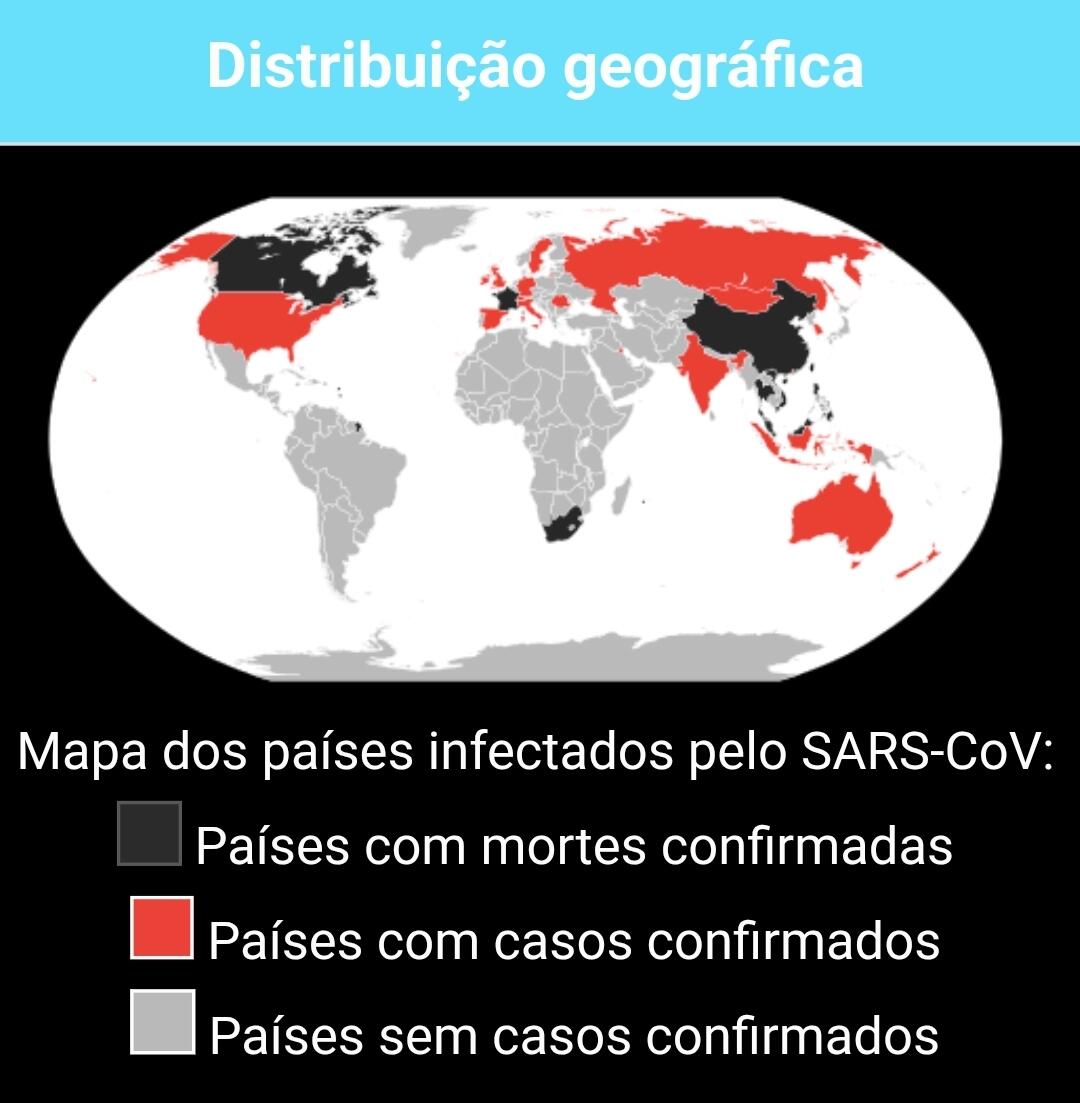

- Bitcoin mining centralization in 2025. According to a blog post by b10c, Bitcoin mining was at its most decentralized in May 2017, with another favorable period from 2019 to 2022. However, starting in 2023, mining has become increasingly centralized, particularly due to the influence of large pools like Foundry and the use of proxy pooling by entities such as AntPool.

Source: b10c's blog.

- OpenSats announces the eleventh wave of Nostr grants. The five projects in this wave are the mobile live-streaming app Swae, the Nostr-over-ham-radio project HAMSTR, Vertex—a Web-of-Trust (WOT) service for Nostr developers, Nostr Double Ratchet for end-to-end encrypted messaging, and the Nostr Game Engine for building games and applications integrated with the Nostr ecosystem.

- New Spiral grantee: l0rinc. In February 2024, l0rinc transitioned to full-time work on Bitcoin Core. His efforts focus on performance benchmarking and optimizations, enhancing code quality, conducting code reviews, reducing block download times, optimizing memory usage, and refactoring code.

- Project Eleven offers 1 BTC to break Bitcoin's cryptography with a quantum computer. The quantum computing research organization has introduced the Q-Day Prize, a global challenge that offers 1 BTC to the first team capable of breaking an elliptic curve cryptographic (ECC) key using Shor’s algorithm on a quantum computer. The prize will be awarded to the first team to successfully accomplish this breakthrough by April 5, 2026.

- Unchained has launched the Bitcoin Legacy Project. The initiative seeks to advance the Bitcoin ecosystem through a bitcoin-native donor-advised fund platform (DAF), investments in community hubs, support for education and open-source development, and a commitment to long-term sustainability with transparent annual reporting.

- In its first year, the program will provide support to Bitcoin hubs in Nashville, Austin, and Denver.

- Support also includes $50,000 to the Bitcoin Policy Institute, a $150,000 commitment at the University of Austin, and up to $250,000 in research grants through the Bitcoin Scholars program.

"Unchained will match grants 1:1 made to partner organizations who support Bitcoin Core development when made through the Unchained-powered bitcoin DAF, up to 1 BTC," was stated in a blog post.

- Block launched open-source tools for Bitcoin treasury management. These include a dashboard for managing corporate bitcoin holdings and provides a real-time BTC-to-USD price quote API, released as part of the Block Open Source initiative. The company’s own instance of the bitcoin holdings dashboard is available here.

Source: block.xyz

- Bull Bitcoin expands to Mexico, enabling anyone in the country to receive pesos from anywhere in the world straight from a Bitcoin wallet. Additionally, users can now buy Bitcoin with a Mexican bank account.

"Bull Bitcoin strongly believes in Bitcoin’s economic potential in Mexico, not only for international remittances and tourism, but also for Mexican individuals and companies to reclaim their financial sovereignty and protect their wealth from inflation and the fragility of traditional financial markets," said Francis Pouliot, Founder and CEO of Bull Bitcoin.

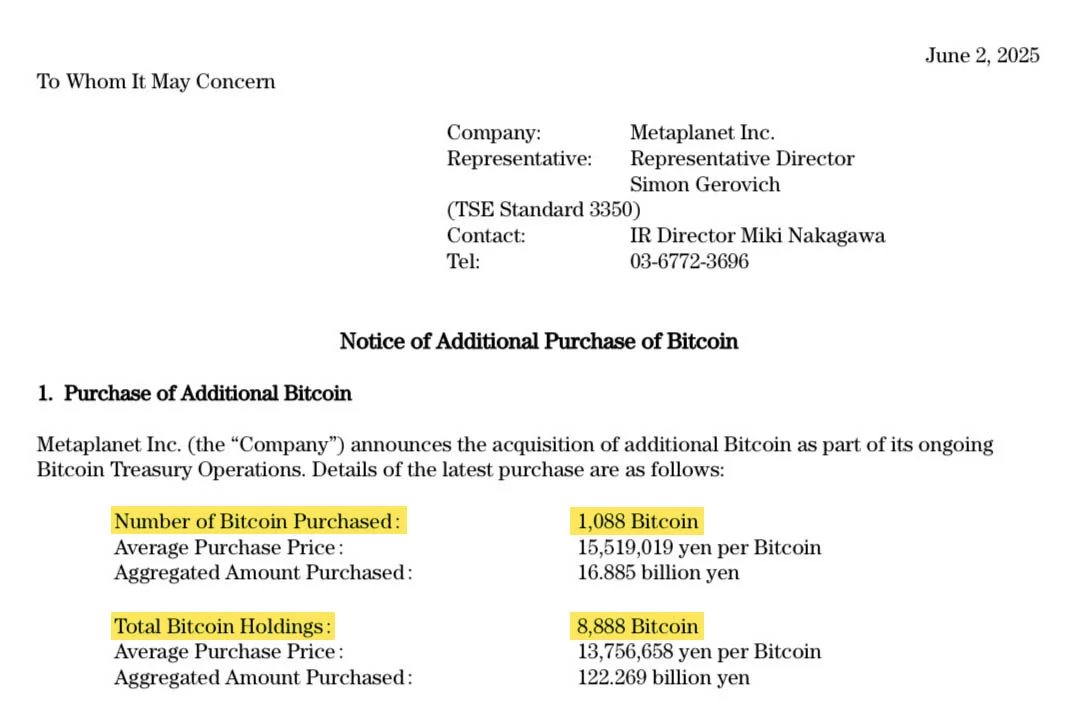

- Corporate bitcoin holdings hit a record high in Q1 2025. According to Bitwise, public companies' adoption of Bitcoin has hit an all-time high. In Q1 2025, these firms collectively hold over 688,000 BTC, marking a 16.11% increase from the previous quarter. This amount represents 3.28% of Bitcoin's fixed 21 million supply.

Source: Bitwise.

- The Bitcoin Bond Company for institutions has launched with the aim of acquiring $1 trillion in Bitcoin over 21 years. It utilizes secure, transparent, and compliant bond-like products backed by Bitcoin.

- The U.S. Senate confirmed Paul Atkins as Chair of the Securities and Exchange Commission (SEC). At his confirmation hearing, Atkins emphasized the need for a clear framework for digital assets. He aims to collaborate with the CFTC and Congress to address jurisdiction and rulemaking gaps, aligning with the Trump administration's goal to position the U.S. as a leader in Bitcoin and blockchain finance.

- Ethereum developer Virgil Griffith has been released from custody. Griffith, whose sentence was reduced to 56 months, is now seeking a pardon. He was initially sentenced to 63 months for allegedly violating international sanctions laws by providing technical advice on using cryptocurrencies and blockchain technology to evade sanctions during a presentation titled 'Blockchains for Peace' in North Korea.

- No-KYC exchange eXch to close down under money laundering scrutiny. The privacy-focused cryptocurrency trading platform said it will cease operations on May 1. This decision follows allegations that the platform was used by North Korea's Lazarus Group for money laundering. eXch revealed it is the subject of an active "transatlantic operation" aimed at shutting down the platform and prosecuting its team for "money laundering and terrorism."

- Blockstream combats ESP32 FUD concerning Jade signers. The company stated that after reviewing the vulnerability disclosed in early March, Jade was found to be secure. Espressif Systems, the designer of the ESP32, has since clarified that the "undocumented commands" do not constitute a "backdoor."

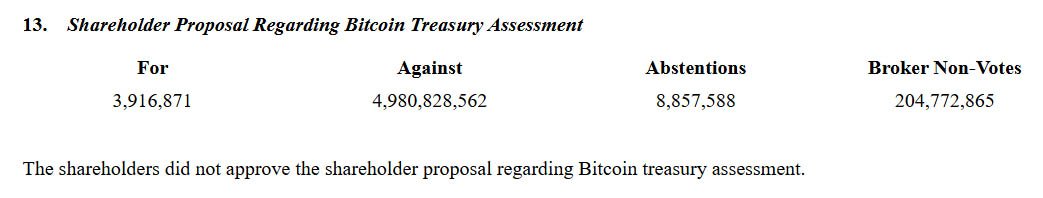

- Bank of America is lobbying for regulations that favor banks over tech firms in stablecoin issuance. The bank's CEO Brian Moynihan is working with groups such as the American Bankers Association to advance the issuance of a fully reserved, 1:1 backed "Bank of America coin." If successful, this could limit stablecoin efforts by non-banks like Tether, Circle, and others, reports The Block.

- Tether to back OCEAN Pool with its hashrate. "As a company committed to financial freedom and open access, we see supporting decentralization in Bitcoin mining as essential to the network’s long-term integrity," said Tether CEO Paolo Ardoino.

- Bitdeer to expand its self-mining operations to navigate tariffs. The Singapore-based mining company is advancing plans to produce machines in the U.S. while reducing its mining hardware sales. This response is in light of increasing uncertainties related to U.S. trade policy, as reported by Bloomberg.

- Tether acquires $32M in Bitdeer shares. The firm has boosted its investment in Bitdeer during a wider market sell-off, with purchases in early to mid-April amounting to about $32 million, regulatory filings reveal.

- US Bitcoin miner manufacturer Auradine has raised $153 million in a Series C funding round as it expands into AI infrastructure. The round was led by StepStone Group and included participation from Maverick Silicon, Premji Invest, Samsung Catalyst Fund, Qualcomm Ventures, Mayfield, MARA Holdings, GSBackers, and other existing investors. The firm raised to over $300 million since its inception in 2022.

- Voltage has partnered with BitGo to [enable](https://www.voltage.cloud/blog/bitgo-and-voltage-team-up-to-deliver-instant-bitcoin-and-stabl

-

@ dfa02707:41ca50e3

2025-06-05 15:02:22

@ dfa02707:41ca50e3

2025-06-05 15:02:22

Good morning (good night?)! The No Bullshit Bitcoin news feed is now available on Moody's Dashboard! A huge shoutout to sir Clark Moody for integrating our feed.

Headlines

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

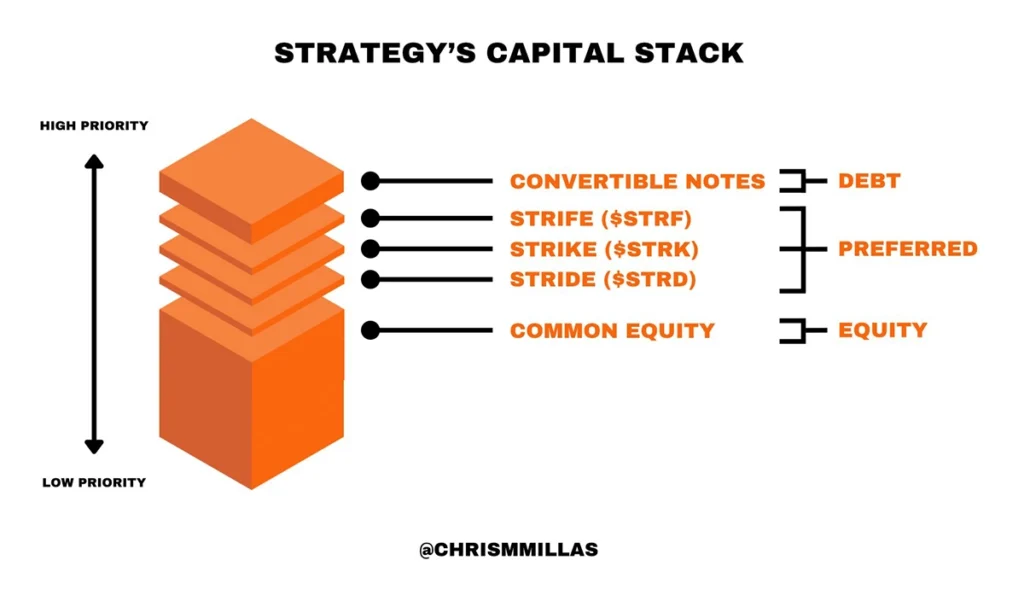

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- The Bank for International Settlements (BIS) wants to contain 'crypto' risks. A report titled "Cryptocurrencies and Decentralised Finance: Functions and Financial Stability Implications" calls for expanding research into "how new forms of central bank money, capital controls, and taxation policies can counter the risks of widespread crypto adoption while still fostering technological innovation."

- "Global Implications of Scam Centres, Underground Banking, and Illicit Online Marketplaces in Southeast Asia." According to the United Nations Office on Drugs and Crime (UNODC) report, criminal organizations from East and Southeast Asia are swiftly extending their global reach. These groups are moving beyond traditional scams and trafficking, creating sophisticated online networks that include unlicensed cryptocurrency exchanges, encrypted communication platforms, and stablecoins, fueling a massive fraud economy on an industrial scale.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

Use the tools

- Bitcoin Safe v1.2.3 expands QR SignMessage compatibility for all QR-UR-compatible hardware signers (SpecterDIY, KeyStone, Passport, Jade; already supported COLDCARD Q). It also adds the ability to import wallets via QR, ensuring compatibility with Keystone's latest firmware (2.0.6), alongside other improvements.

- Minibits v0.2.2-beta, an ecash wallet for Android devices, packages many changes to align the project with the planned iOS app release. New features and improvements include the ability to lock ecash to a receiver's pubkey, faster confirmations of ecash minting and payments thanks to WebSockets, UI-related fixes, and more.

- Zeus v0.11.0-alpha1 introduces Cashu wallets tied to embedded LND wallets. Navigate to Settings > Ecash to enable it. Other wallet types can still sweep funds from Cashu tokens. Zeus Pay now supports Cashu address types in Zaplocker, Cashu, and NWC modes.

- LNDg v1.10.0, an advanced web interface designed for analyzing Lightning Network Daemon (LND) data and automating node management tasks, introduces performance improvements, adds a new metrics page for unprofitable and stuck channels, and displays warnings for batch openings. The Profit and Loss Chart has been updated to include on-chain costs. Advanced settings have been added for users who would like their channel database size to be read remotely (the default remains local). Additionally, the AutoFees tool now uses aggregated pubkey metrics for multiple channels with the same peer.

- Nunchuk Desktop v1.9.45 release brings the latest bug fixes and improvements.

- Blockstream Green iOS v4.1.8 has renamed L-BTC to LBTC, and improves translations of notifications, login time, and background payments.

- Blockstream Green Android v4.1.8 has added language preference in App Settings and enables an Android data backup option for disaster recovery. Additionally, it fixes issues with Jade entry point PIN timeout and Trezor passphrase input.

- Torq v2.2.2, an advanced Lightning node management software designed to handle large nodes with over 1000 channels, fixes bugs that caused channel balance to not be updated in some cases and channel "peer total local balance" not getting updated.

- Stack Wallet v2.1.12, a multicoin wallet by Cypher Stack, fixes an issue with Xelis introduced in the latest release for Windows.

- ESP-Miner-NerdQAxePlus v1.0.29.1, a forked version from the NerdAxe miner that was modified for use on the NerdQAxe+, is now available.

- Zark enables sending sats to an npub using Bark.

- Erk is a novel variation of the Ark protocol that completely removes the need for user interactivity in rounds, addressing one of Ark's key limitations: the requirement for users to come online before their VTXOs expire.

- Aegis v0.1.1 is now available. It is a Nostr event signer app for iOS devices.

- Nostash is a NIP-07 Nostr signing extension for Safari. It is a fork of Nostore and is maintained by Terry Yiu. Available on iOS TestFlight.

- Amber v3.2.8, a Nostr event signer for Android, delivers the latest fixes and improvements.

- Nostur v1.20.0, a Nostr client for iOS, adds

-

@ dfa02707:41ca50e3

2025-06-05 15:02:22

@ dfa02707:41ca50e3

2025-06-05 15:02:22Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-06-05 15:02:21

@ dfa02707:41ca50e3

2025-06-05 15:02:21Contribute to keep No Bullshit Bitcoin news going.

News

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- Spiral renews support for Dan Gould and Joschisan. The organization has renewed support for Dan Gould, who is developing the Payjoin Dev Kit (PDK), and Joschisan, a Fedimint developer focused on simplifying federations.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- The European Central Bank is pushing for amendments to the European Union's Markets in Crypto Assets legislation (MiCA), just months after its implementation. According to Politico's report on Tuesday, the ECB is concerned that U.S. support for cryptocurrency, particularly stablecoins, could cause economic harm to the 27-nation bloc.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- The Virtual Asset Service Providers (VASP) Bill 2025 introduced in Kenya. The new legislation aims to establish a comprehensive legal framework for licensing, regulating, and supervising virtual asset service providers (VASPs), with strict penalties for non-compliant entities.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Paul Atkins has officially assumed the role of the 34th Chairman of the US Securities and Exchange Commission (SEC). This is a return to the agency for Atkins, who previously served as an SEC Commissioner from 2002 to 2008 under the George W. Bush administration. He has committed to advancing the SEC’s mission of fostering capital formation, safeguarding investors, and ensuring fair and efficient markets.

- Federal Reserve retracts guidance discouraging banks from engaging in 'crypto.' The U.S. Federal Reserve withdrew guidance that discouraged banks from crypto and stablecoin activities, as announced by its Board of Governors on Thursday. This includes rescinding a 2022 supervisory letter requiring prior notification of crypto activities and 2023 stablecoin requirements.

"As a result, the Board will no longer expect banks to provide notification and will instead monitor banks' crypto-asset activities through the normal supervisory process," reads the FED statement.

- Russian government to launch a cryptocurrency exchange. The country's Ministry of Finance and Central Bank announced plans to establish a trading platform for "highly qualified investors" that "will legalize crypto assets and bring crypto operations out of the shadows."

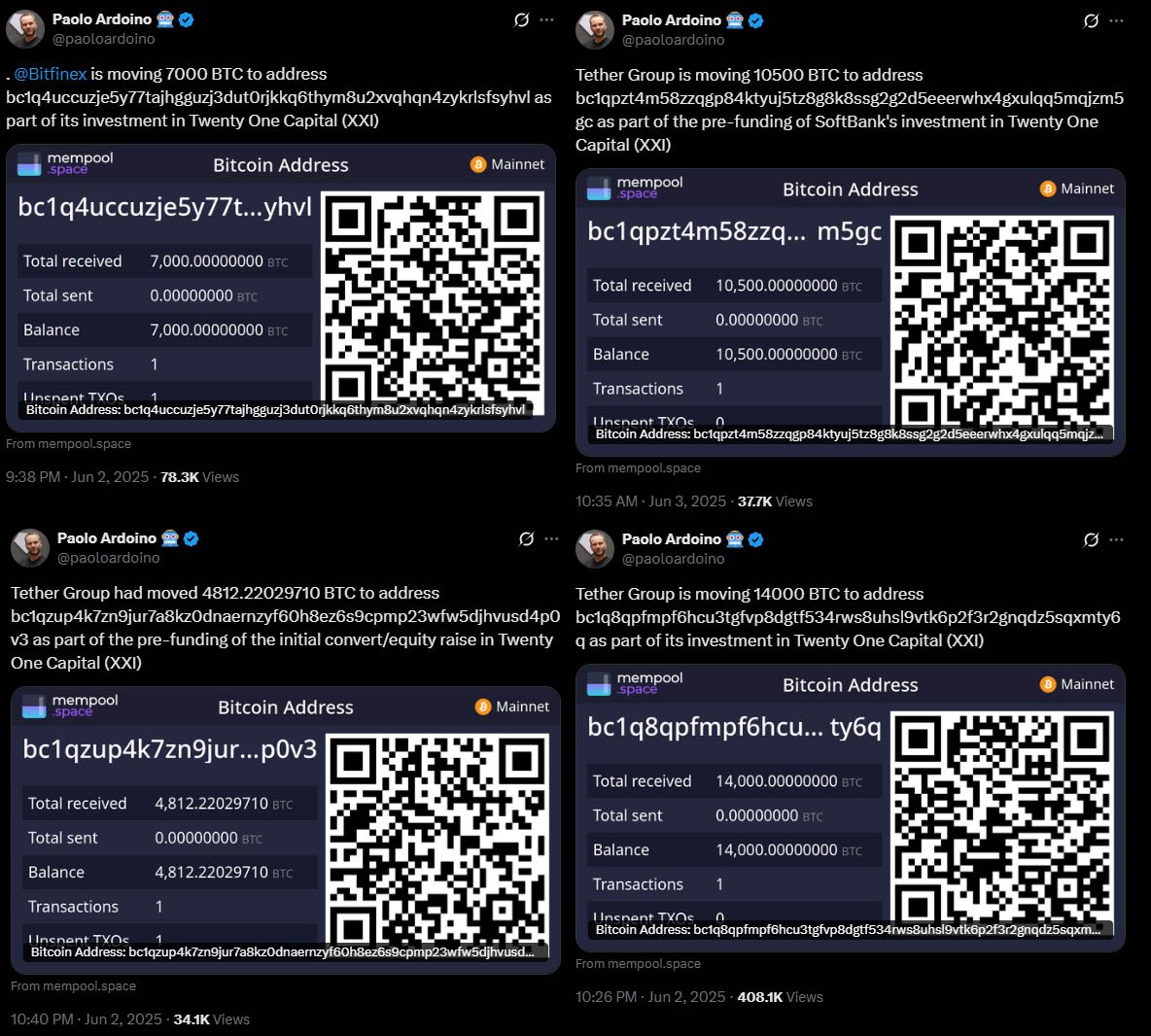

- Twenty One Capital is set to launch with over 42,000 BTC in its treasury. This new Bitcoin-native firm, backed by Tether and SoftBank, is planned to go public via a SPAC merger with Cantor Equity Partners and will be led by Jack Mallers, co-founder and CEO of Strike. According to a report by the Financial Times, the company aims to replicate the model of Michael Saylor with his company, MicroStrategy.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

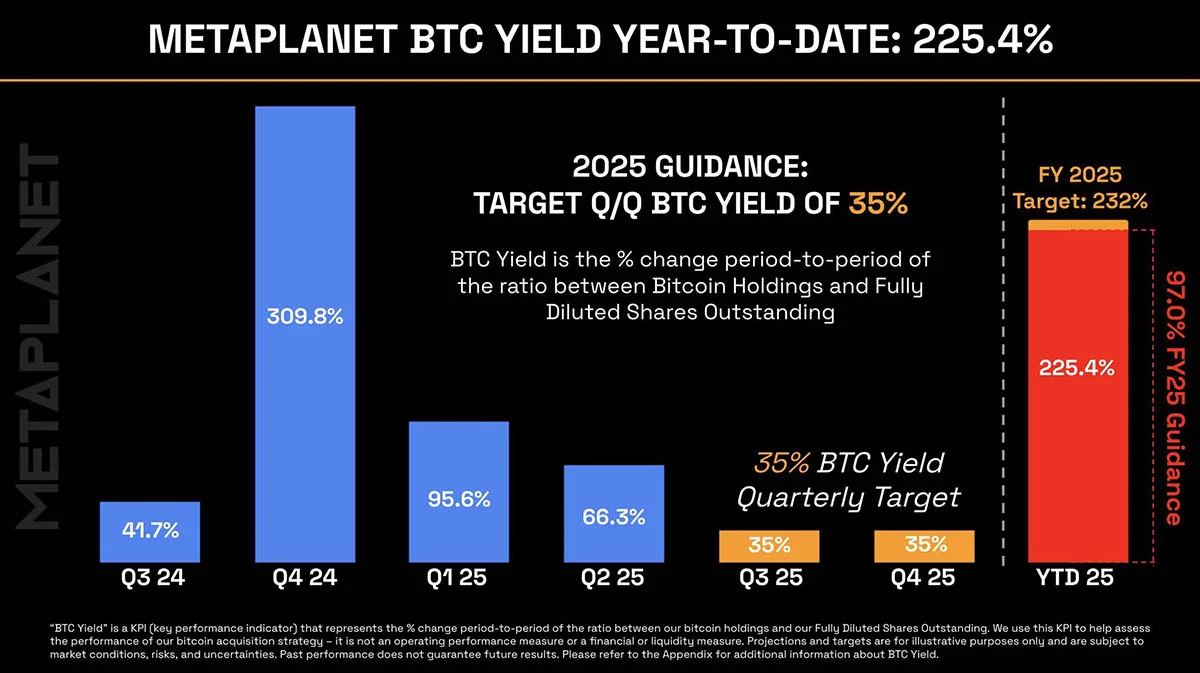

- Metaplanet buys another 145 BTC. The Tokyo-listed company has purchased an additional 145 BTC for $13.6 million. Their total bitcoin holdings now stand at 5,000 coins, worth around $428.1 million.

- Semler Scientific has increased its bitcoin holdings to 3,303 BTC. The company acquired an additional 111 BTC at an average price of $90,124. The purchase was funded through proceeds from an at-the-market offering and cash reserves, as stated in a press release.

- Tesla still holds nearly $1 billion in bitcoin. According to the automaker's latest earnings report, the firm reported digital asset holdings worth $951 million as of March 31.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

- Arch Labs has secured $13 million to develop "ArchVM" and integrate smart-contract functionality with Bitcoin. The funding round, valuing the company at $200 million, was led by Pantera Capital, as announced on Tuesday.

- Citrea deployed its Clementine Bridge on the Bitcoin testnet. The bridge utilizes the BitVM2 programming language to inherit validity from Bitcoin, allegedly providing "the safest and most trust-minimized way to use BTC in decentralized finance."

- UAE-based Islamic bank ruya launches Shari’ah-compliant bitcoin investing. The bank has become the world’s first Islamic bank to provide direct access to virtual asset investments, including Bitcoin, via its mobile app, per Bitcoin Magazine.

- Solosatoshi.com has sold over 10,000 open-source miners, adding more than 10 PH of hashpower to the Bitcoin network.

"Thank you, Bitaxe community. OSMU developers, your brilliance built this. Supporters, your belief drives us. Customers, your trust powers 10,000+ miners and 10PH globally. Together, we’re decentralizing Bitcoin’s future. Last but certainly not least, thank you@skot9000 for not only creating a freedom tool, but instilling the idea into thousands of people, that Bitcoin mining can be for everyone again," said the firm on X.

- OCEAN's DATUM has found 100 blocks. "Over 65% of OCEAN’s miners are using DATUM, and that number is growing every day. This means block template construction is making its way back into the hands of the miners, which is not only the most profitable

-

@ dfa02707:41ca50e3

2025-06-05 15:02:19

@ dfa02707:41ca50e3

2025-06-05 15:02:19Contribute to keep No Bullshit Bitcoin news going.

- This release introduces Payjoin v2 functionality to Bitcoin wallets on Cake, along with several UI/UX improvements and bug fixes.

- The Payjoin v2 protocol enables asynchronous, serverless coordination between sender and receiver, removing the need to be online simultaneously or maintain a server. This simplifies privacy-focused transactions for regular users.

"I cannot speak highly enough of how amazing it has been to work with @bitgould and Jaad from the@payjoindevkit team, they're doing incredible work. None of this would be possible without them and their tireless efforts. PDK made it so much easier to ship Payjoin v2 than it would have been otherwise, and I can't wait to see other wallets jump in and give back to PDK as they implement it like we did," said Seth For Privacy, VP at Cake Wallet.

How to started with Payjoin in Cake Wallet:

- Open the app menu sidebar and click

Privacy. - Toggle the

Use Payjoinoption. - Now on your receive screen you'll see an option to copy a Payjoin URL

- Bull Bitcoin Wallet v0.4.0 introduced Payjoin v2 support in late December 2024. However, the current implementations are not interoperable at the moment, an issue that should be addressed in the next release of the Bull Bitcoin Wallet.

- Cake Wallet was one of the first wallets to introduce Silent Payments back in May 2024. However, users may encounter sync issues while using this feature at present, which will be resolved in the next release of Cake Wallet.

What's new

- Payjoin v2 implementation.

- Wallet group improvements: Enhanced management of multiple wallets.

- Various bug fixes: improving overall stability and user experience.

- Monero (XMR) enhancements.

Learn more about using, implementing, and understanding BIP 77: Payjoin Version 2 using the

payjoincrate in Payjoin Dev Kit here. -

@ dfa02707:41ca50e3

2025-06-05 15:02:19

@ dfa02707:41ca50e3

2025-06-05 15:02:19Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ 7f6db517:a4931eda

2025-06-05 15:02:26

@ 7f6db517:a4931eda

2025-06-05 15:02:26

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-05 15:02:18

@ dfa02707:41ca50e3

2025-06-05 15:02:18- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ fbf0e434:e1be6a39

2025-06-05 14:08:24

@ fbf0e434:e1be6a39

2025-06-05 14:08:24Hackathon 概要

ETHBratislava Hackathon Vol.2 汇聚 54 名开发者并审核通过 11 个项目,成为以太坊社区的重要盛事。此次黑客马拉松在斯洛伐克技术大学举办,参与者可免费参与 ETHBratislava 大会,这一安排助力开发者探索区块链技术的前沿进展。

项目在解决以太坊可扩展性与互操作性问题上成果显著,尤其在 “World Computer” 赛道表现突出。“Zircuit Restaking Track” 赛道也带来重要创新,聚焦通过 AI 驱动的 zk rollups 技术提升安全性与扩展性。“European Stablecoin EURØP Challenge” 则致力于开发欧元背书的稳定币,推动欧洲监管数字货币概念落地。

参与者不仅获得资深导师指导、与行业领袖建立连接的机会,现场更有招聘方挖掘技术人才。活动在兼具庆祝与社交属性的派对中落幕。总计 4,000 欧元奖金的设置,营造了开发者之间竞争与合作并存的创新氛围。ETHBratislava Vol.2 成功孵化出影响以太坊未来的创新构想,同时强化了社区联结。

Hackathon 获奖者

World Computer 奖项获奖者

此类别着重于利用以太坊能力的面向消费者的应用程序。开发者创建了解决方案,旨在增强包容性、金融工具和教育平台。获奖者包括:

- Zhar: 该去中心化平台使用AI和以太坊区块链来管理、执行和激励使用智能合约和代币的链上挑战。

- Ledger Lens: 一个Web应用程序,促进对以太坊多层生态系统的可视化和分析,强调代币流动和跨链桥使用等指标。

现实世界代币化奖项获奖者

此类别集中于在欧洲利用EUR锚定的稳定币EURØP构建效用。项目目标是在此数字货币之上部署初步技术增强。

- dEST: 一个去中心化平台,利用NFTs和智能合约来促进无中介的代币化房地产交易。

- EnergyHub: 一个提供去中心化平台以货币化多余绿色能源并通过智能合约和用户友好的仪表板实现能源捐赠的应用程序。

Restaking 奖项获奖者

此类别鼓励团队在Zircuit生态系统内的AI驱动zkEVM上进行构建,着重于支持AI增强安全性和创新zk rollup技术的项目。

- RestakerX: 一个仪表板应用程序,设计用于跟踪Zircuit网络上的数字资产,提供算法建议以最大化收益。

有关所有项目的更多详细信息和此次黑客马拉松中展示的创新理念的进一步见解,请访问 ETHBratislava Hackathon页面。

关于组织者

Ethereum Bratislava

Ethereum Bratislava 是中欧和东欧地区区块链和技术领域的一个重要社区,致力于推进以太坊的开发和整合。由一支专家团队支持,该组织在增强以太坊在中欧和东欧地区的可扩展性和安全性的项目中作出了重大贡献。积极参与社区活动和教育活动强调了他们在区块链领域促进技术创新和知识共享的承诺。Ethereum Bratislava 继续支持技术改进和生态系统增长,旨在增强以太坊的能力和跨各行业的采用。

-

@ dfa02707:41ca50e3

2025-06-05 15:02:18

@ dfa02707:41ca50e3

2025-06-05 15:02:18Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ 8bad92c3:ca714aa5

2025-06-05 15:02:17

@ 8bad92c3:ca714aa5

2025-06-05 15:02:17Key Takeaways

In this episode, Bitcoin Core veteran James O’Beirne delivers a sharp critique of Bitcoin’s developmental stagnation, attributing it to political dysfunction, post-fork trauma, and resistance within Bitcoin Core to critical upgrades like CheckTemplateVerify (CTV). He argues that while institutional adoption accelerates, internal innovation is being stifled by misplaced controversies—such as the OP_RETURN policy debate—and a bottlenecked governance model. O’Beirne warns that without urgent progress on scaling solutions like CTV, congestion control, and vaulting systems, Bitcoin risks ossifying and becoming vulnerable to institutional capture. Advocating a more adversarial posture, he suggests forking or building alternative clients to pressure progress but remains hopeful, seeing rising momentum for protocol upgrades from developers outside the Core elite.

Best Quotes

“Everybody has mempool derangement syndrome… it’s such a small issue in the grand scheme of challenges Bitcoin is facing.”

“Bitcoin is as much an experiment in technical human organization as it is a pure technology.”

“If we don’t figure out how to scale trustless Bitcoin self-custody, we’re toast. Right now, only about 2.5% of Americans could actually use Bitcoin monthly in a meaningful way.”

“CTV isn’t sexy—it just works. It keeps getting reinvented because it's so useful. At this point, it’s essential.”

“If Core isn’t going to evaluate these proposals, someone has to. Otherwise, we need to build the social justification for forking.”

“Lightning didn’t scale Bitcoin the way we expected. Let’s stop assuming a silver bullet is coming and start building the bridges ourselves.”

“You could onboard someone with just a phone and a vault… and give them more security than most hardware wallets.”

Conclusion

While Bitcoin gains traction with institutions and governments, its internal development is stalling under political inertia and misplaced focus. James O’Beirne urges the community to prioritize impactful upgrades like CTV and CCV, challenge the bottleneck of Bitcoin Core if needed, and recommit to Bitcoin’s foundational principles. This episode underscores the urgent need to bridge technical and social divides to ensure Bitcoin remains a decentralized, censorship-resistant tool for global value transfer.

Timestamps

0:00 - Intro

0:41 - Multi axis issue

5:12 - Core governance

9:41 - Derailing productive discussions

17:05 - Fold & Bitkey

18:32 - CTV

29:24 - Unchained

29:53 - Magnitude of change

41:45 - Covenant proposals

50:16 - CTV benefits

57:56 - Institutional ownership

1:05:26 - Moving forwardTranscript

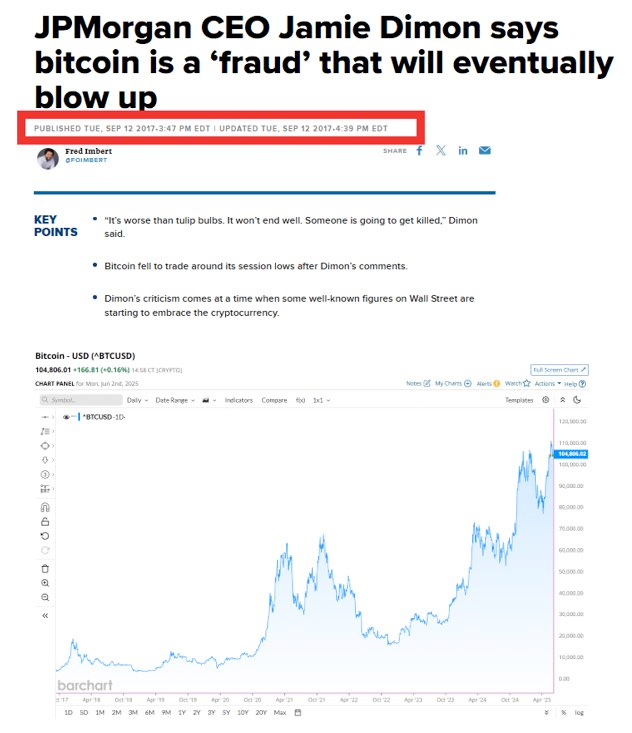

(00:00) I think I have a somewhat different take than 99% of the people in the discussion. What freaks me out is if you've got Sailor owning half million coins or whatever and Black Rockck owning however many, people forget that Bitcoin is as much an experiment in technical human organization as it is, you know, as a sort of pure technology.

(00:17) The undernowledged reality is I'm actually interested to see if we have like a black swan adoption event from the machines. the risk given the increased scrutiny that things like the strategic Bitcoin reserve introduce there's a shot clock on getting to trustless decentralized value storage technology and I think we really have to be thinking about that combination of physically tired and mentally tired it's also tiresome James it's it's I was looking at that picture today and I was actually going to tweet it absent any caption just because it's

(00:52) a really good Uh yeah, it's a really good epitome of uh of a lot of stuff. But I'm with you, man. I'm tired. It's Friday. Who is it? Is that a just some random Japanese guy? I think it's it's I actually think it's from a documentary about I don't know if it's Africa, but Oh, yes. Yes.

(01:13) It's there's a little bit of a kind of like racy connotation there. Um yeah, the uh it's been long. It was interesting for me. We had Texas Energy Mining Summit here in Austin the beginning of the week. It sort of blended with Bitcoin plus I was over at Bitcoin++ Wednesday and yesterday doing the live desk and obviously topic of conversation is OP return this policy decision and this policy change that that core wants to make and many people are uh angry about and it's just again it's also tiresome.

(01:52) spoke with people on both sides over the two days and I I think I came away more confused than than I entered entered the week like what is the optimal path and somebody who's worked on Bitcoin core worked on Bitcoin core for for many years I've seen you tweeting about it seems like I won't put words in your mouth I'll let you say like what is your perspective on this whole policy debate around op return yeah so in general I think I have a somewhat different take than um 99% of the people in in the discussion which is basically that this

(02:25) is a really stupid discussion um everybody has mempool derangement syndrome like at every layer um and uh what what frustrates me a little bit about the conversation not not to not to uh get like um grumpy right off the bat but it's just it's it's such a small issue in the in the grand scheme of challenges that are being presented to Bitcoin that like spending all this drama on it um is is really a silly use of time and uh kind of emotion, but I can break it down for you.

(03:02) I mean, I think I think like largely the argument is happening on a few layers. Um the change itself technically I'm totally in favor of it. It makes sense. you know, basically the rationale is like, well, you know, um, people want to include exogenous data into the chain. Um, you can't really stop them from doing that.

(03:23) Um and so let's basically minimize the damage by saying hey you know we're going to make it easier for people to actually make use of op return as a data carrier which uh lets us avoid bloat in the UTXO set which is like one of the precious resources we have to take care of for the node.

(03:44) Um, so that's all good and the and the other thing too is that as we've seen with the ordinal stuff is um, you know, data is going to wait make its way into the chain and actually it hurts the whole network when um, there are transactions that most nodes haven't seen yet but they come through a block. Basically that slows down block propagation time.

(04:06) And so the whole idea is if you bring policy closer to the actual consensus rules, closer to the actual transactions that are going to come through and be mined, then you're going to have better network performance. You're going to have lower latency when it comes to actually broadcasting a new block around. So that's like the the sort of technical layer of the discussion.

(04:25) It's it's really a minute non-controversial change if you kind of have fluency with the the technical end of the mempool. Um, but I think there's this this higher layer to the conversation which is sort of a readjudication of spam in Bitcoin. And it's, you know, I think a lot of the the old animal spirits and sentiments are emerging about like, well, we don't like spam.

(04:49) And I think for a lot of people who kind of get lost in the technical details, it's very easy to latch on to the sentiment of I don't like spam. Um and so uh so that makes the sort of ocean knots camp maybe more appealing. Uh so that's yeah that's I guess a summary if you want to jump in anything in particular we can that's what I was saying I came out more confused than I went in.

(05:20) So last week on RHR, hey, I agree. You want policy to be aligned with consensus. Like whether we like it or not, these transactions are getting into blocks. They're non-standard, but they are valid within consensus rules and policy just isn't aligning with that. And like you said, this is disrupting the P2P layer and potentially the fee uh estimation process that that many nodes use, many applications use.

(05:49) And it makes sense to me to align policy with consensus. These things are happening. And if you can make it so Bitcoin full nodes are operating as efficiently and optimally as possible by changing this, it makes sense to me. I think my one like push back was like makes sense to me. However, I think how it was communicated to people and the whole mess with the PR.

(06:12) I think it's I think it's it was it's it's just a tactical error. Like even if this change gets in the the the real benefit of is is not material. You know, nobody was really clamoring for it. um this stuff always, you know, gets the hackles up of everybody who cares at all about, you know, spamming Bitcoin. So, it was a real tactical error.

(06:36) And I think that's that's one place where I mean it's kind of I had a little bit of shot in Freud seeing it because I'm fairly critical of core as a project along you know a variety of axes at this point and it was just kind of a demonstration of the the disconnection and kind of ineptitude of um publicity management kind of on on their end.

(06:58) Um, and so like there's part of me that enjoys seeing that because I I'm kind of convinced that that group has a lot less efficacy than they have credibility. And so to to see that kind of catch up was was interesting. The uh let's dive into that like what you said multiple axes you have a problem. I think we've throughout the years like we've been discussing the issues that Bitcoin like yourself particularly as a Bitcoin core developer for many years trying to get things through not only in the context of the way core works from a governance

(07:35) structure but just the way Bitcoin works as a distributed open source protocol like trying to get changes in and I will say like -

@ 8bad92c3:ca714aa5

2025-06-05 15:02:17

@ 8bad92c3:ca714aa5

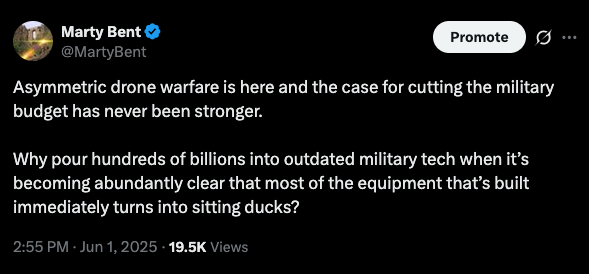

2025-06-05 15:02:17Marty's Bent

If you do one thing today, take the time to spend an hour to watch this YouTube video. As someone creating content who has become very cognizant of the effects of the algorithm and the pressures to cater to it, this video was unexpectedly and incredibly satisfying. We're coming up on the eight year anniversary of this newsletter and the podcast that accompanies it and over that eight year period, the pressures to compete in the world of ever increasing digital soy slop grow at an accelerating rate.

If you've seen our YouTube channel recently, you'll probably notice that we've bent the knee to the thumbnail and title clickbait game in an attempt to get our content out to a wider audience. This is something I've held out on for many years now at this point, but recently became convinced that it's something we simply have to do if we want to get our message out to a wider audience. As I write this, I'm thinking that maybe the fact that we have to do that in the first place says something about the content we're putting out there and whether or not it is actually valuable. But I do think the high velocity trash economy becoming completely saturated with digital soy slop has made it so people who truly want to get their message out have to play that game.

I want to make one thing clear. I certainly do not think I'm an artist, but I do like to think that over the last eight years we've been putting out information via content mediums that is valuable to you, dear reader. However, the informational content we put out there, particularly the audio and video content, is put on platforms where it is forced to compete with others who cater to the lowest common denominators of dopamine hijacking and in-group signaling that draws the masses like moths to a flame.

If you haven't watched the YouTube video yet, which I'm assuming 99.9% of you haven't, this may seem like a nonsensical ramble. So, I'll keep this one short and urge you to go watch the social commentary from comedian Jarrett Moore about the state of art, "content" and its effect on culture as it stands today. I'm assuming this isn't too much of a spoiler alert, but the situation is pretty dire. The world needs better art and people who are willing to support artists who are truly creative and take risks. This has nothing to do with bitcoin. But I think it highlights an interesting part of our society that is deteriorating at a rapid clip. And it's something that all of us should feel compelled to attend to lest we speed run into Idiocracy.

It made me feel uneasy about parts of my approach to this business, and that's a good thing.

Don't forget to buy a Bitkey!

Iran's Nuclear Ambitions Create a "Never-Ending Crisis"

In our latest discussion, energy expert Dr. Anas Alhajji described what he called Iran's "never-ending crisis" – a thesis he first published over 20 years ago that has proven remarkably accurate. As Alhajji explained, this crisis persists because of a fundamental contradiction: the U.S. sees any Iranian nuclear program (even peaceful) as strengthening a hostile regime, while Iran views nuclear energy as essential for domestic stability and economic survival.

"Iran is not going to negotiate over the bomb. They want to drag everything for the longest period until they get the bomb." - Dr. Anas Alhajji

What's particularly concerning is Iran's resilience against sanctions. Alhajji detailed how Iran has masterfully circumvented oil export restrictions through China, using a dedicated Chinese bank to process payments outside the international system. Iran's leadership appears willing to endure temporary geopolitical losses in Syria, Lebanon, and potentially Yemen, calculating that obtaining nuclear weapons will fundamentally transform regional politics and their treatment by the United States.

Check out the full podcast here for more on Trump's Middle East strategy, the future of BRICS, and critical challenges facing global energy infrastructure.

Headlines of the Day

Standard Chartered Predicts Bitcoin Will Reach $500K by 2028 - via X

Lummis: Genius Act Makes US Leader in Digital Asset Policy - via X

Get our new STACK SATS hat - via tftcmerch.io

Jake Tapper's Admission on Biden's Decline Sparks Media Ethics Debate - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code *“TFTC20”* during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

My oldest is already at the "faking sick to get out of school" stage and I'm extremely proud.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ 8bad92c3:ca714aa5

2025-06-05 15:02:16

@ 8bad92c3:ca714aa5

2025-06-05 15:02:16

Another week of conversations with sharp minds thinking about Bitcoin's future and the broader economic landscape. Here are the three most compelling predictions from recent episodes.

Bitcoin Core Will Face a Major Governance Crisis Over Covenant Proposals in 2025 - James O'Beirne

James made a prediction that sent chills through the Bitcoin development community - he believes Bitcoin Core's current governance structure will reach a breaking point this year over covenant proposals like CTV. After working as a Core developer for nearly a decade, he's convinced that the organization's inability to make progress on scaling solutions will force alternative implementations.

His timeline is specific and urgent. James believes that if Core doesn't show "substantive review discussion about how we get this stuff in" within six months, credible developers will start building alternate activation clients. The technical argument is compelling: covenants like CheckTemplateVerify have been thoroughly reviewed for seven years, with a 5 BTC bounty (worth over $500,000) still unclaimed for finding material bugs.

The stakes couldn't be higher for Bitcoin's future. James noted that currently "just over two and a half percent of Americans would be able to, on a monthly basis, buy Bitcoin on an exchange, withdraw it to self-custody, and then maybe make a spend." Without scaling solutions, this number won't improve meaningfully. His prediction reflects growing frustration with Core's de facto monopoly over protocol development. "You simply can't ignore that there is a social reality to being in that world," he said, referring to the concentrated funding and decision-making power that has created what he sees as an unsustainable bottleneck for Bitcoin's evolution.

The U.S. Will See Widespread Energy Blackouts as AI Data Centers Strain the Grid - Anas Alhajji

Dr. Anas delivered a sobering prediction about America's energy infrastructure failing to keep pace with exploding AI demand. He expects we'll see significant blackouts in major cities within the next few years, with a particularly concerning scenario where AI facilities maintain power while residential areas go dark. "I will not be surprised if we end up with a situation like this in some states and some cities," he warned.

The mathematics behind his prediction are stark. Energy consumption is skyrocketing due to multiple factors: urbanization, AI data centers, and simple population growth. When migrants move from rural areas to U.S. cities, their energy consumption increases by 30-70 times. Meanwhile, AI facilities require massive baseload power that renewable sources simply cannot provide reliably.

The infrastructure problems run deeper than just generation capacity. Anas explained that America's electrical grid is aging and wasn't designed for this level of demand. Even worse, we lack the manufacturing capacity to produce enough natural gas turbines - the only realistic solution for reliable baseload power at scale. He predicts this will create a dangerous political dynamic where tech companies with guaranteed power contracts maintain operations during blackouts while regular citizens lose electricity. "We might see a backlash from the population, and we will see politicians basically being forced to fight them because of that."

AI Will Force Millennials Into Career Reinvention Within the Next Decade - Bram Kanstein

Bram made a stark prediction about the collision between artificial intelligence and millennial career paths. He believes that traditional knowledge-based jobs will become obsolete much faster than people expect, forcing an entire generation to completely rethink their working lives. "If you think you're going to work for the next 30 years of your life, think again," he warned during our conversation.

His argument centers on the rapid advancement of AI capabilities that he's witnessed firsthand. After spending just 12 hours working with AI tools, Bram claims he developed what could be "a top 10 cybersecurity invention" - despite having no cybersecurity background. This experience convinced him that jobs requiring strict knowledge and logic are already dead. The implications are massive for millennials who built their careers around expertise that AI can now replicate instantly.

The timing couldn't be worse, as Bram notes that this technological disruption is happening precisely when millennials need stable income to support families and prepare for retirement. His solution? Use Bitcoin to create the time and space needed to figure out how to function in an AI-dominated world. "You need to be aware of that. This is where it's going. So how do you protect yourself in an age of AI? Bitcoin is the perfect way to do that."

Blockspace conducts cutting-edge proprietary research for investors.

New Bitcoin Mining Pool Flips Industry Model: "Plebs Eat First" Could Threaten Corporate Dominance

Parasite Pool's radical zero-fee structure challenges mining giants by guaranteeing payouts to small miners while rewarding block finders with instant Bitcoin. It disrupts traditional mining with a hybrid payout model that gives block discoverers 1 BTC immediately, while distributing remaining rewards (~2.125 BTC plus fees) among all pool participants. This "plebs eat first" approach targets the 22% discount miners typically accept in exchange for guaranteed income.

Key innovations that matter:

- Lightning Network integration bypasses Bitcoin's 100-block maturity rule, delivering instant payouts to Lightning wallets

- 10-sat minimum withdrawal eliminates traditional barriers for small miners

- Block withholding protection through substantial honest-miner rewards reduces pool attacks

The pool currently commands just 5 PH/s (0.000006% of Bitcoin's network), meaning an expected 3+ years before hitting a block. But this represents a growing counterculture against Full Pay Per Share (FPPS) pools that dominate corporate mining.

Industry impact: If successful, Parasite Pool could attract commercial miners seeking downside protection while maintaining the lottery appeal that drives pleb participation. The model challenges the structural advantages of corporate mining pools.

What's next: ZK Shark plans to open-source components over time, with the current beta suggesting this is just "V1" of a broader disruption strategy.

Subscribe to them here (seriously, you should): https://newsletter.blockspacemedia.com/

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

STACK SATS hat: https://tftcmerch.io/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ 8bad92c3:ca714aa5

2025-06-05 15:02:16

@ 8bad92c3:ca714aa5

2025-06-05 15:02:16Key Takeaways

In this episode, Bram Kanstein delivers a powerful exploration of how studying money for thousands of hours led him to a single, life-changing conclusion: Bitcoin is the key to preserving value and reclaiming personal agency in an increasingly unstable world. Through the lens of a disillusioned millennial generation—raised with technological optimism but betrayed by economic reality—Bram exposes the fiat system as one built on illusion, debt, and diminishing returns. He explains how Bitcoin’s transparent, rule-based design offers a principled alternative, especially for those wired to question systems and seek truth. Describing the fiat economy as a “high-velocity trash system” that undermines innovation and long-term planning, he argues Bitcoin creates the time and space to think, build, and live freely. As AI reshapes the labor market, Bram sees Bitcoin as a vital foundation for individuals to adapt, maintain sovereignty, and thrive in a future defined by rapid technological disruption.

Best Quotes

“Anything that you would want to fix in the world is broken because the money is broken.”

“You’re stacking nothing. Literal paper.”

“You have to red pill before you orange pill.”

“The only thing you need to do is move to the other money that they cannot mess with.”

“One Bitcoin is one Bitcoin. That’s the whole point.”

“Millennials are primed to understand Bitcoin.”

“Bitcoin lets you get out of the rat race and start walking your own path.”

“The fiat mindset is a zero-sum game. In Bitcoin, value is created.”

“We should stop asking how to value Bitcoin—and start asking how to value everything else in Bitcoin.”

“Even with a master’s in economics, people still don’t understand what money is.”

Conclusion

This episode delivers a powerful call to rethink everything we assume about money, arguing that understanding Bitcoin is less about profit and more about reclaiming personal agency in a world defined by uncertainty. Bram Kanstein shows how asking fundamental questions—like “What is money?”—can lead to a deeper sense of purpose and autonomy. As AI and systemic instability accelerate, Bitcoin emerges not just as sound money, but as a life tool for intentional living, long-term thinking, and individual sovereignty.

Timestamps

0:00 - Intro

0:36 - INTJ bitcoiners

4:58 - The millennial headspace is primed for bitcoin

7:25 - Bitcoin gives time and space to build

15:29 - Fold & Bitkey

17:05 - Seeing systemic problems

26:25 - Bitcoin’s positive feedback loop

33:55 - Recognize your agency

37:58 - Unchained

38:27 - Fiat money creates uncertainty

44:41 - What is money?

54:04 - Money and energy

1:03:43 - Bitcoin allows growth

1:09:02 - Bitcoin/AI

1:31:34 - Optimistic noteTranscript

(00:00) Let's say you're a millennial and mid-30s and you want to retire in 30 years. If you calculate the amount of dollar, pound the euro, yen units. You need way more units of that money than you think right now. They are funding pension funds, but the pension funds are using that money for the people that are actually retiring.

(00:17) No one knows about money. They don't know how debt works, how finance works. But that's kind of how it's designed, right? Like that's what eventually keeps the Ponzi alive. And I just started with the question, what do you think happens if you call the bank and say like, hey, can I get 100 or 200k in cash? Man, you got an editor like in house.

(00:39) That's That's pro. That's uh it's because this setup I'm so far away from the computer. I just need somebody to hit the button. Okay. Okay. the extent the extent of of Logan's job extends far beyond just hitting the button. But yeah, INTJ I think uh I think it was as we rear into what looks to be another bull market.

(01:05) I think getting back to first principles and discussing the challenges of studying and understanding Bitcoin, it's important to to highlight the archetype of individuals who have studied fallen down the rabbit hole and really dedicated their lives to Bitcoin. And this INTJ cohort that exists within Bitcoin seems pretty material apparently. Yeah.

(01:35) I mean, I have many moments where I just realize that I'm lucky that my brain is wired in a certain way, you know. I feel like crazy blessed that I figured out this Bitcoin thing, you know, and that when I ran into certain realizations along the way in my Bitcoin journey that I was like, hm, you know, how does this actually work? you know, do I actually understand the systems I'm participating in, the things that I believe, you know, the the the the people that I abstracted um or or outsourced certain responsibilities to to take care of, for example, my money

(02:10) in the bank. You know, I I think um being wired in a certain way definitely helps in grasping Bitcoin to a degree where you're like, okay, this is the only thing I need to pay attention to, you know, in my life. And yeah, we we jokingly started talking about this because I have the hat here, but there was this um I think it was like like a Twitter poll actually or someone shared it on Twitter and this is already like two or three years old where where someone investigated these MyersBriggs um personality types and I think there's

(02:42) only like 2% of people that have INTJ but like 20% of Bitcoiners have that personality type. So it um it apparently helps. So yeah, I just I just quickly Googled it actually. It says uh the INTJ is the architect. It's a personality type with the introverted intuitive thinking and judging traits. These thoughtful tacticians love perfecting the details of life, applying creativity and rationality to everything they do.

(03:09) I think the rationality part here is what um what uh I think helps you to to gro Bitcoin eventually. Yeah, it reminds me of I forget what the study was, but postco it was a similar distribution of just like 2% of people were highly skeptical of what was going on with the lockdowns and the attack on bodily autonomy.

(03:38) And there was a study that was done about I forget it was bees or some type of fly that they they have like the horde of um the horde of the particular fly I think it was bees has like 2% act as these sort of alarm bells that are on the outside the outskirts of the community and they'll start communicating like hey something's wrong here and people the other flies or bees will be skeptical at first but then eventually uh the alarm bells will be proven to be right that there was some sort of danger around the corner. That's fascinating.

(04:09) Yeah. Yeah, that's fascinating. I I think we're not that special eventually, you know, like we think we have all this autonomy, but but um yeah, we're we're just wired in a certain way. And I think I don't know where you want to take this conversation, but I think, you know, part of growing up and being an adult is figuring out, you know, how do I actually work and how do I work with how I work, you know? Yeah. No, it is.

(04:36) And as I get older, creep into my mid-30s, which is hard hard to come to grips with, it is uh really falling back on like, all right, I I feel like I have a good perspective on the world and my place in it, and how do I just optimize to make sure I'm aligning my my work and my career, I guess, if you call it that, with what I'm passionate about. Yeah.

(05:00) Well, I also think that is actually why our generation, you know, my my podcast is Bitcoin for millennials. I think uh the millennials are primed to understand Bitcoin. You know, we are in this life phase where big things happen, you know, starting a family or settling somewhere or or making big career moves or decide Yeah.

(05:25) like deciding what am I going to spend like the next 10 20 years on and uh I think it's an interesting phase actually I I don't know how that was for you but but for me like the the 30s were really where I dove more and more into Bitcoin like got got that stronger conviction and also yeah kind of was invited to go further down that that rabbit hole you know and like how I see it now is that that Bitcoin is really the foundation for the rest of my life, you know, like it it gives me time and space to look forward and enthusiasm, you know, like I sometimes lurk on the

(06:01) millennial subreddit, you know, or the finance sub subreddit. And many people in our generation are very nihilistic, you know, they're very unsure about the future. Like some people aren't even having kids because they think they cannot afford it, you know. And uh whenever I read that, I just think like, yeah, I I don't really have those things.

(06:22) But I know it's because of Bitcoin, you know. I I know that Bitcoin gives me, yeah, like I said, the time and space to figure out what's next, like what should I focus on? Like it gives time and space to to try out stuff, to build something, you know, to to to really attempt at at doing something. Where I see many people that don't see that, they are more in the consumer type, you know, like they they just spend the money that's worth the most today, you know, like that's what they're incentivized to do. Yeah.