-

@ 6e0ea5d6:0327f353

2025-05-28 04:34:08

@ 6e0ea5d6:0327f353

2025-05-28 04:34:08Ascolta bene! It is more dignified to thirst alone in the desert than to share wine with someone who has no thirst for conquest.

On the silent path to success, it’s not the declared enemies who slow the march, but rather the friends. Not the noble or loyal ones, but the failures—those who carry a dull glint in their eyes, chronic laziness in their spirit, and the eternal excuse of bad luck in their pockets. Friendship, when poorly chosen, becomes a polished anchor, tied to your ankle with ropes named camaraderie.

Nothing weighs heavier on the journey than having to endure the failed and envious around you. It is a kind of emotional parasitism that begins with empathy and ends in stagnation. Those who live among the weak will crawl. Those who keep company with miserable friends, instead of striving to prosper, learn to curse wealth—not out of ethics, but out of envy. Mediocrity, my friend, is contagious. And it does not take root suddenly, but like a silent epidemic.

Ambition—that fire that burns in the bones of great men—will always seem like arrogance to the ears of the failed. Those who have never built anything, except arguments to justify their paralysis, will never understand the fury of someone born to conquer. And so, with smiles, they spit venom: “Calm down,” they say, “be content,” they advise. Hypocrites. What they call humility is nothing more than resignation to their own defeat.

To walk alone, with hunger and honor, is worth more than feasting at lavish tables at the cost of your own sweat, surrounded by parasites who toast your downfall with glasses full of praise. No one prospers where the conversation is filled with complaints, criticism, and envy. What does not build up, corrodes.

The rust of the weak is invisible at first—a bitter joke here, a veiled critique there. And before you know it, the structure is already rotten. Of the friendship, only the weight remains. Of the relationship, only exhaustion. The true enemy of success is the company of those who have failed and wish for you the same fate. These tragic figures—always tired, always victims—are masters of collective self-sabotage.

Feel no remorse in abandoning those who build nothing and consume everything. And in that abandonment, you become freer, stronger, and unbreakable.

Thank you for reading, my friend!

If this message resonated with you, consider leaving your "🥃" as a token of appreciation.

A toast to our family!

-

@ 1d7ff02a:d042b5be

2025-05-28 04:02:47

@ 1d7ff02a:d042b5be

2025-05-28 04:02:47For those who still don't truly understand Bitcoin, it means you still don't understand what money is, who creates it, and why humans need money.

It's a scam that the education system doesn't teach this important subject, while we spend almost our entire lives trying to earn money. Therefore, I recommend following the money and studying Bitcoin seriously.

Why Bitcoin Matters

Saving is the greatest discovery in human history

Before humans learned to save, we were just animals living day to day. Saving is what makes humans different from other animals — the ability to think about the future and store for later.

Saving created civilization itself

Without saving, there would be no cities, no science, no art. Everything we call "progress" comes from the ability to save.

Money is the greatest creation in human history

It is the tool that has allowed human civilization to advance to this day. Money is the best tool humans use for saving.

Bitcoin is the best money ever created

It is the most perfect money humans have ever created. No one can control, manipulate, destroy it, and it is truly limited like time in life.

Bitcoin is like a black hole

That will absorb all value from the damaged financial system. It will draw stability and value to itself. Everything of value will flow into Bitcoin eventually.

Bitcoin is like Buddhism discovering truth

It helps understand the root problems of the current financial system and the emergence of many problems in society, just like Buddha who understood all suffering and the causes of suffering.

Bitcoin is freedom

Money is power, money controls human behavior. When we have money that preserves value and cannot be controlled, we will have intellectual freedom, freedom of expression, and the power to choose.

The debt that humanity has created today would take another thousand years to pay off completely

There is no way out and it's heading toward serious collapse. Bitcoin is the light that will help prevent humanity from entering another dark age.

Bitcoin cannot steal your time

It cannot be created from nothing. Every Bitcoin requires real energy and time to create.

Bitcoin is insurance that protects against mismanagement

It helps protect against currency debasement, economic depression, and failed policies. Bitcoin will protect your value.

Bitcoin is going to absorb the world's value

Eventually, Bitcoin will become the store of value for the entire world. It will absorb wealth from all assets, all prices, and all investments.

Exit The Matrix

We live in a financial Matrix. Every day we wake up and go to work, thinking we're building a future for ourselves. But in reality, we're just giving energy to a system that extracts value from us every second. Bitcoin is the red pill — it will open your eyes to see the truth of the financial world. Central banks are the architects of this Matrix — they create money from nothing, and we have to work hard to get it.

The education system has deceived us greatly. They teach us to work for money, but never teach us what money is. We spend 12-16 years in school, then spend our entire lives earning money, but never know what it is, who creates it, and why it has value. This is the biggest scam in human history.

We are taught to be slaves of the system, but not taught to understand the system.

The Bitcoin standard will end war

When you can't print money for war anymore, war becomes too expensive.

We are entering the Bitcoin Renaissance era

An era of financial and intellectual revival. Bitcoin is creating a new class of humans. People who understand and hold Bitcoin will become a new class with true freedom.

The Path to Financial Truth

Follow the money trail and you will see the truth: - Who controls money printing? - Why do prices keep getting higher? - Why are the poor getting poorer and the rich getting richer?

All the answers lie in understanding money and Bitcoin.

Studying Bitcoin is not just about investment — it's about understanding the future of currency and human society.

Don't just work for money. Understand money. Study Bitcoin.

If you don't understand money, you will be a slave to the system forever. If you understand Bitcoin, you will gain freedom.

-

@ dfa02707:41ca50e3

2025-05-28 04:01:31

@ dfa02707:41ca50e3

2025-05-28 04:01:31Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ eb0157af:77ab6c55

2025-05-28 04:01:11

@ eb0157af:77ab6c55

2025-05-28 04:01:11The open-source project makes it possible to send bitcoin even in censored or disconnected areas through a radio mesh network.

In an interview with Decrypt, the developer known by the pseudonym “cyber” revealed the details of Darkwire, an open-source project that could enable new use cases for Bitcoin transactions without internet access.

The project, presented at the Bitcoin 2025 Official Hackathon, leverages Long Range Radio (LoRa) technology to create a decentralized mesh network that allows Bitcoin transactions to be sent even in the total absence of traditional connectivity.

Darkwire was specifically designed for situations where conventional communication infrastructure is inaccessible or controlled. According to cyber, the system is ideal for politically sensitive regions like the Rafah Crossing or the Indo-Tibetan border, where internet access can be limited or heavily monitored.

“Darkwire is for individuals seeking privacy or wishing to bypass surveillance of their communications and transactions. Imagine it to be akin to Tor but for this specific use case,” the creator explained.

LoRa technology

Darkwire operates through a combination of technologies. The system uses long-range LoRa radios along with microcontrollers such as the Arduino UNO to form a decentralized mesh network.

When a user wants to send a Bitcoin transaction without internet access, they specify the recipient’s address and the amount via a local graphical interface managed by bitcoinlib. The system then generates a signed Bitcoin transaction in hexadecimal format, which is split into smaller packets and transmitted via radio.

Mesh Network

Darkwire’s mesh network allows the data to “hop” from node to node until it reaches an internet-connected exit point. In ideal conditions, each Darkwire node has a range of up to 10 kilometers with a direct line of sight, reduced to 3-5 kilometers in densely populated areas.

“At least one node in the network needs to be connected to the internet, so that the transaction can be pushed to the blockchain for miners to verify it,” cyber said.

Once the transaction data reaches a node with internet access, it acts as an exit point, broadcasting the verified Bitcoin transaction to the global network, where it can be included in a block.

Limitations and future developments

Currently, Darkwire faces several technical limitations that the team is actively working to address. The relatively low bandwidth of LoRa radios and their sensitivity to terrain obstacles represent challenges. Moreover, the system’s dependence on internet-connected exit nodes could create potential points of failure.

According to reports, the project is still in its hackathon phase, but cyber has plans to further develop it, turning it into a full open-source platform and making it “the industry standard” for LoRa-based communications.

“I do hope people living in any kind of authoritarian regimes and states do get to use darkwire and put the truth out there,” the developer added.

The post Bitcoin without internet thanks to LoRa technology: the Darkwire project appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-05-28 04:00:49

@ b1ddb4d7:471244e7

2025-05-28 04:00:49In the heart of East Africa, where M-Pesa reigns supreme and innovation pulses through bustling markets, a quiet revolution is brewing—one that could redefine how millions interact with money.

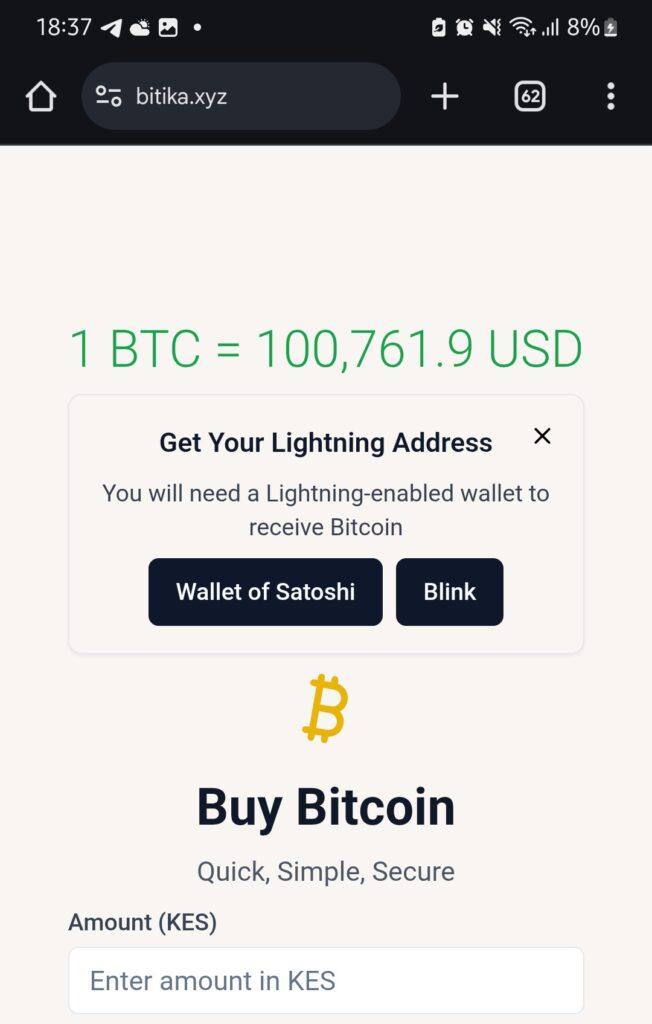

Enter Bitika, the Kenyan startup turning bitcoin’s complexity into a three-step dance, merging the lightning speed of sats with the trusted rhythm of mobile money.

At the helm is a founder whose “aha” moment came not in a boardroom, but at his kitchen table, watching his father grapple with the gap between understanding bitcoin and actually using it.

Bitika was born from that friction—a bridge between M-Pesa’s ubiquity and bitcoin’s borderless promise, wrapped in a name as playful as the Swahili slang that inspired it.

But this isn’t just a story about simplifying transactions. It’s about liquidity battles, regulatory tightropes, and a vision to turn Bitika into the invisible rails powering Africa’s Bitcoin future.

Building on Bitcoin

- Tell us a bit about yourself and how you got into bitcoin/fintech, and what keeps you passionate about this space?

I first came across bitcoin in 2020, but like many at that time, I didn’t fully grasp what it really was. It sounded too complicated, probably with the heavy terminologies. Over time, I kept digging deeper and became more curious.

I started digging into finance and how money works and realised this was what I needed to understand bitcoin’s objectives. I realized that bitcoin wasn’t just a new type of money—it was a breakthrough in how we think about freedom, ownership, and global finance.

What keeps me passionate is how bitcoin can empower people—especially in Africa—to take control of their wealth, without relying on unstable systems or middlemen.

- What pivotal moment or experience inspired you to create Bitika? Was there a specific gap in Kenya’s financial ecosystem that sparked the idea?

Yes, this idea was actually born right in my own home. I’ve always been an advocate for bitcoin, sharing it with friends, family, and even strangers. My dad and I had countless conversations about it. Eventually, he understood the concept. But when he asked, “How do I even buy bitcoin?” or “Can you just buy it for me?” and after taking him through binance—that hit me.

If someone I’d educated still found the buying process difficult, how many others were feeling the same way? That was the lightbulb moment. I saw a clear gap: the process of buying bitcoin was too technical for the average Kenyan. That’s the problem Bitika set out to solve.

- How did you identify the synergy between bitcoin and M-Pesa as a solution for accessibility?

M-Pesa is at the center of daily life in Kenya. Everyone uses it—from buying groceries to paying rent. Instead of forcing people to learn new tools, I decided to meet them where they already are. That synergy between M-Pesa and bitcoin felt natural. It’s about bridging what people already trust with something powerful and new.

- Share the story behind the name “Bitika” – does it hold a cultural or symbolic meaning?

Funny enough, Bitika isn’t a deeply planned name. It came while I was thinking about bitcoin and the type of transformation it brings to individuals. In Swahili, we often add “-ka” to words for flair—like “bambika” from “bamba.”

So, I just coined Bitika as a playful and catchy way to reflect something bitcoin-related, but also uniquely local. I stuck with it because thinking of an ideal brand name is the toughest challenge for me.

- Walk us through the user journey – how does buying bitcoin via M-Pesa in “3 simple steps” work under the hood?

It’s beautifully simple.

1. The user enters the amount they want to spend in KES—starting from as little as 50 KES (about $0.30).

2. They input their Lightning wallet address.

3. They enter their M-Pesa number, which triggers an STK push (payment prompt) on their phone. Once confirmed—pap!—they receive bitcoin almost instantly.

Under the hood, we fetch the live BTC price, validate wallet addresses, check available liquidity, process the mobile payment, and send sats via the Lightning Network—all streamlined into a smooth experience for the user.

- Who’s Bitika’s primary audience? Are you focusing on unbanked populations, tech enthusiasts, or both?

Both. Bitika is designed for everyday people—especially the unbanked and underbanked who are excluded from traditional finance. But we also attract bitcoiners who just want a faster, easier way to buy sats. What unites them is the desire for a seamless and low-barrier bitcoin experience.

Community and Overcoming Challenges

- What challenges has Bitika faced navigating Kenya’s bitcoin regulations, and how do you build trust with regulators?

Regulation is still evolving here. Parliament has drafted bills, but none have been passed into law yet. We’re currently in a revision phase where policymakers are trying to strike a balance between encouraging innovation and protecting the public.

We focus on transparency and open dialogue—we believe that building trust with regulators starts with showing how bitcoin can serve the public good.

- What was the toughest obstacle in building Bitika, and how did you overcome it?

Liquidity. Since we don’t have deep capital reserves, we often run into situations where we have to pause operations often to manually restock our bitcoin supply. It’s frustrating—for us and for users. We’re working on automating this process and securing funding to maintain consistent liquidity so users can access bitcoin at any time, without disruption.

This remains our most critical issue—and the primary reason we’re seeking support.

- Are you eyeing new African markets? What’s next for Bitika’s product?

Absolutely. The long-term vision is to expand Bitika into other African countries facing similar financial challenges. But first, we want to turn Bitika into a developer-first tool—infrastructure that others can build on. Imagine local apps, savings products, or financial tools built using Bitika’s simple bitcoin rails. That’s where we’re heading.

- What would you tell other African entrepreneurs aiming to disrupt traditional finance?

Disrupting finance sounds exciting—but the reality is messy. People fear what they don’t understand. That’s why simplicity is everything. Build tools that hide the complexity, and focus on making the user’s life easier. Most importantly, stay rooted in local context—solve problems people actually face.

What’s Next?

- What’s your message to Kenyans hesitant to try bitcoin, and to enthusiasts watching Bitika?

To my fellow Kenyans: bitcoin isn’t just an investment—it’s a sovereign tool. It’s money you truly own. Start small, learn, and ask questions.

To the bitcoin community: Bitika is proof that bitcoin is working in Africa. Let’s keep pushing. Let’s build tools that matter.

- How can the bitcoin community, both locally and globally, support Bitika’s mission?

We’re currently fundraising on Geyser. Support—whether it’s financial, technical, or simply sharing our story—goes a long way. Every sat you contribute helps us stay live, grow our liquidity, and continue building a tool that brings bitcoin closer to the everyday person in Africa.

Support here: https://geyser.fund/project/bitika

-

@ b1ddb4d7:471244e7

2025-05-28 04:00:38

@ b1ddb4d7:471244e7

2025-05-28 04:00:38When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ cae03c48:2a7d6671

2025-05-28 04:00:29

@ cae03c48:2a7d6671

2025-05-28 04:00:29Bitcoin Magazine

White House Executive Director Bo Hines Declares U.S. The Future Global Crypto SuperpowerIn a session at the Bitcoin 2025 Conference this morning titled “_Making America the Global Bitcoin Superpower“_, Bo Hines, White House Executive Director, Tyler Williams, from the US Treasury Department, and moderator Miles Jennings made one thing clear: the United States is going all-in on Bitcoin—and fast.

JUST IN:

President Trump's Executive Director said "Bitcoin is the golden standard."

President Trump's Executive Director said "Bitcoin is the golden standard." "We're not gonna sell any Bitcoin that we possible have in the US government, period."

pic.twitter.com/F6Dv2nUk9b

pic.twitter.com/F6Dv2nUk9b— Bitcoin Magazine (@BitcoinMagazine) May 27, 2025

“We are well on our way to becoming the bitcoin superpower of the world,” said Bo Hines. “This is something that is not partisan. This is a revolution in our financial system.”

Moderator Miles Jennings pointed to key regulatory steps currently in motion. “If the bill becomes law (and I hope it does) we will have quite an active role. The connective tissue between the legacy financial system and bitcoin, stablecoins, and everything else will really be paved with stablecoin legislation,” Jennings said.

Hines emphasized that, “Updating the payment rails is necessary and we are well on our way to achieving that.” He also noted that upcoming market structure legislation will define how intermediaries like exchanges and brokers are regulated and how digital assets are classified—either as securities or commodities.

“We want folks to innovate here,” Hines stressed. “We can’t be fearful of them walking into the SEC and getting a Wells notice before they get on the elevator.” He added that U.S. regulators are now encouraging crypto innovators to return: “Our message to folks who have gone offshore is: welcome home_._”

Williams highlighted that any new laws must reflect the unique architecture of decentralized finance. “Traditional markets are based on a principal-agent model,” he explained. “But crypto moves us toward a principal-to-principal structure.”

He noted that after regulatory support for the ETP marketplace, institutional Bitcoin adoption surged—and believes the same would happen again under stablecoin and market structure legislation.

The most bullish comment of the morning came from Hines: “Bitcoin is truly the golden standard… This is an asset that we should be harnessing on behalf of the American people. We want as much as we can possibly get.”

“We are going big on digital assets,” added Tyler. “You will certainly see the United States stepping out as the bitcoin superpower of the world,” Hines concluded.

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Industry Day below:

https://www.youtube.com/live/3e3KE40r_WM?si=LCZcZeKbxi_iTk62This post White House Executive Director Bo Hines Declares U.S. The Future Global Crypto Superpower first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 491afeba:8b64834e

2025-05-27 23:57:01

@ 491afeba:8b64834e

2025-05-27 23:57:01Quando adolescente eu acreditava na coerência da teoria de "amor líquido" do polonês, sociólogo, Zygmunt Bauman, apresentada no livro "Amor Líquido: Sobre a Fragilidade dos Laços Humanos", qual no meu amadurecimento em estudos, sejam eles no meio acadêmico ou fora, percebo como uma das formas mais rasas de explicar as mudanças e transformações dos padrões de relações sócio-afetivas dos humanos. A seguir colocar-me-ei na minha juventude não tanto recente, direi então que nós, se adolescentes e conservadores, ou mesmo jovens adultos mais conservadores, costumamos levar como dogma uma óptica decadentista generalizada de todos os avanços de eras dos homens, universalizamos por nos ser comum a indistinção entre humanidade e humanidades, ou mesmo "humanity" e "humankind" ("humanidade" como espécime e "humanidade" como um universal), compreendemos toda "essas" como "essa" e indistinguimos as sociedades para com os homens, ou seja, a incapacidade de definir os seres dentro de suas respectivas singularidades e especificidades nos leva ao decadentismo generalista (a crença de que de forma geral, e universal, a "civilização universal" decai moralmente, éticamente, materialmente e espiritualmente), que aparente à nós determinadas mudanças nas relações humanas quanto ao caráter sócio-afetivo, por falta de profundidade e critérios ainda sobre questões alinhadas aos métodos e coerências, ou incoerências, lógicas, nós se jovens e conservadores somos levados ao engodo de concordar com a teoria do amor líquido de Bauman, que devo cá explicar de antemão: trata ela, a teoria, o padrão de "amor" dos tempos presentes como frágil, de prazo (curto e médio) e diferente em grau comparativamente ao amor comum das eras passadas.

Aos jovens mais progressistas opera uma compreensão dialética sobre as eras dos homens nos seu tempo presente, na qual ao tempo que o ser progride ele também regride simultaneamente, ou seja, a medida que aparecem contradições advindas de transformações materiais da realidade humana o ser supera essas contradições e progride em meio as transformações, ainda fazendo parte da lógica dessa indissociavelmente, assim constantemente progredindo e regredindo, havendo para esses dois vetores de distinção: o primeiro é o que releva questões espirituais como ao caráter do pensamento "new age", o segundo ignora essas questões por negar a existência da alma, seguem ao materialismo. Cedem em crer na teoria baumaninana como dogma, pois não encontram outros meios para explicar as transformações da sociedade na esfera sócio-afetiva sem que haja confrontamento direto com determinadas premissas assim pertinemente presentes, ou por não conciliarem com análises relativamente superiores, como a de Anthony Giddens sobre a "relação pura" em "A Transformação da Intimidade" e de François de Singly apresentada em "Sociologie du Couple".

https://i.pinimg.com/736x/6f/b4/9e/6fb49eda2c8cf6dc837a0abfc7e108e6.jpg

Há um problema quando uma teoria deixa de assim ser para vir a tornar-se mais um elemento desconexo da ciência, agora dentro da cultura pop, se assim podemos dizer, ou da cultura de massa, ou se preferirem mesmo "anticultura", esse problema é a sua deformização teórica, tornando-se essa rasa para sua palatabilidade massiva, somada a incapacidade de partes da sociedade civil em compreender as falhas daquilo que já foi massificado. Tive surpresa ao entender que muitos outros compartilham da mesma opinião, a exemplo, possuo um amigo na faculdade, marxista, que ao falarmos sobre nossos projetos de pesquisa, citou ele o projeto de um de nossos colegas, no qual esse referido um de nossos colegas faria seu projeto com base na teoria do amor líquido de Bauman, então alí demos risada disso, ora, para nós a teoria baumaniana é furada, passamos a falar sobre Bauman e o motivo pelo qual não gostávamos, lá fiquei até surpreso em saber que mais gente além de mim não gostava da teoria de Bauman, pois ao que eu via na internet era rede de enaltecimentos à figura e à sua teoria, tal como fosse uma revelação partindo de alguma divindade da Idade do Bronze. Pouco tempo depois tive em aula de teoria política uma citação de Bauman partindo do professor que ministrava a disciplina, no entanto, ao citar o nome de Bauman o mesmo fez uma feição na qual aparentava segurar risada, provavelmente ele também não levava Bauman à sério. Não devo negar que todas as vezes que vejo o sociólogo sendo citado em alguma nota no X, no Instagram ou qualquer outra rede social, tal como fosse um referencial teórico bom, sinto uma vergonha alheia pois alí tenho uma impressão de que a pessoa não leu Bauman e usa o referencial teórico como um fato já assim provado e comprovado.

Há pontos positivos na teoria baumaniana, como a capacidade de perceber o problema e correlacioná-lo à modernidade, assim como sucitar a influência do que há de material no fenômeno, porém os erros são pertinentes: o primeiro problema é de categoria. Não há, por parte de Bauman noção alguma entre as dissociações dos amores, não há atenção sobre o amor como estrutura ou ele como um sentimento, todo ele é compreendido uniformemente como "amor", partindo do pressuposto que todas as relações, todas elas, são firmadas com base no amor. Essa crença tem uma origem: Hegel. Nos Escritos Teológicos Hegel partia da crença que o amor ligava os seres relacionalmente como uma força de superação e alienação, mas há de compreendermos que esse Friedrich Hegel é o jovem ainda pouco maduro em suas ideias e seu sistema de pensamento, mais a frente, em "Fenomenologia do Espírito e na Filosofia do Direito", Hegel compreende a institucionalidade do direito no amor e a institucionalização dessa força, assim aproxima-se da realidade a respeito da inserção do amor nas esferas práticas do humano, porém essa ideia, apesar de imperfeita, pois ao que sabemos não é o amor que consolida a relação, mas sim a Verdade (Alétheia), conforme apontado por Heidegger em "Ser e Tempo", essa ideia do amor como a fundamento das relações humanas influenciou, e até hoje influencia, qualquer análise sobre as relações humanas fora da esfera materialista, fora dessa pois, melhormente explicado em exemplo, os marxistas (em exemplo), assim como Marx, consideram como base primordial das relações as condições materiais.

Por certo, não é de todo amor a base para a solidificação, ora, erram aqueles que creem que somente essa força, assim apontada por Hegel, constituiam todos os relacionamentos formais como pilares fundamentais, pois em prática as famílias eram até a fiduciarização dessas, por mais paradoxal que seja, compreendidas melhor como instituições orgânicas de caráter legal do que conluios de afetividades. A família outrora tinha consigo aparelhos de hierarquia bem estabelicidos, quais prezavam pela ordem interna e externa, que acima dessa instituição estava somente a Igreja (outra instituição), com sua fiduciarização [da família] após o movimento tomado pelos Estados nacionais em aplicação do casamento civil mudou-se a lógica das partes que a compõe, findou-se o princípio da subsidiariedade (não intervenção de determinadas instituições nas decisões quais podem ser exercidas em resuluções de problemas nas competências de quaisquer instituições), foi-se então, contudo, também a autoridade, e nisso revela-se um outro problema não apontado na teoria de Bauman: qual o padrão do amor "sólido"? Pois, ora, sociedades tradicionais não abdicavam do relevar dos amores para tornar seus filhos em ativos nas práticas de trocas (dádivas)? É notório que esse padrão se dissocia do padrão de sentimento apontado por Bauman, encontramos esse fato em estudo nos trabalhos "Ensaio Sobre a Dádiva", do Marcel Mauss, e "As Estruturas Elementares do Parentesco", do Claude Levi-Strauss, quais expõem que nas sociedades "sólidas", tradicionais, relevava-se mais questões institucionais que as sentimentais para a formação de laços (teoria da aliança). Muitas das relações passadas não eram baseadas no amor, não significando assim que as de hoje, em oposição, sejam, mas que permanecem-se semelhantes em base, diferentemente em grau e forma.

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F748b94c3-f882-45db-8333-09260ef15cfe_615x413.jpeg

Ora, ainda existem casamentos motivados pela política, pelo status, pelo prestígio, pelos bens, pelo poder, pela influência familiar e assim sucetivamente, tal como no passado, ocorre que essa prática tornou-se oculta, não mais explícita e aparente, devo dizer ainda que em partes, pois prepondera em nosso tempo uma epidemia de adultérios, fornicações, práticas lascivas e demais práticas libertinosas explicitamente, em contraposição às práticas ocultas em vergonhas de sociedades sem declínio moral e espiritual, o que nos leva a questionar o método comparativo em dicotomia temporal "presente x passado" aplicado por Bauman, no qual segue-se da seguinte forma:

Transformação Passado = *sólido* | Presente = *líquido* Categorias Padrão de amor: tradicional (*sólido*) moderno (*líquido*) *Sólido* = estável, prazo (médio-grande), profundo, determinado. *Líquido* = instável, prazo (curto-médio), raso, indeterminado.O que penso é: Zygmunt Bauman buscou uma explicação material e laical para desviar ao fato de que há uma notória correlação entre espiritualização da sociedade, se voltada à Verdade, com a estabilidade das instituições, o que é já reduzido à moral religiosa, somente, não à mística, como por pensadores da linha de Tocqueville, ou em abordagens também mais laical (positivista) porém ainda relevantes, como Émile Durkheim em "As Formas Elementares da Vida Religiosa" e Max Weber em "A Ética Protestante e o Espírito do Capitalismo", contrapondo uma abordage mais voltada, de fato, a espiritualidade, como Christopher Dawnson, que defende essa teoria em "Religião e o Surgimento da Cultura Ocidental", e Eric Voegelin, principalmente nas obras "A Nova Ciência da Política" e "Ordem e História".

Encerrando, minha cosmovisão é a católica, o sistema de crença e religião qual sigo é do Deus que se fez homem por amor aos seus filhos, não posso negar ou mesmo omitir o fato de que, por trás de toda a minha crítica estão meus pensamentos e minhas convicções alinhadas àquilo que mais tenho amor em toda minha vida: a Verdade, e a Verdade é Deus, pois Cristo é a Verdade, o Caminho e a Vida, ninguém vai ao Pai se não por Ele, e pois bem, seria incoerência de minha parte não relevar o fato de crença como um dos motivos pelos quais eu rejeito a teoria do amor líquido de Zygmunt Bauman, pois os amores são todos eles praticados por formas, existem por diferentes formas e assim são desde sua tradicionalidade até o predomínio das distorções de declínio espiritual das eras presentes (e também antigas pré-Era Axial), estão esses preservados pelo alinhamento à verdade, assim são indistorcíveis, imutáveis, ou seja, amor é amor, não releva-se o falso amor como um, simplesmente não o é, assim o interesse, a sanha por bens, o egoísmo e a egolatria ("cupiditas", para Santo Agostinho de Hipona, em oposição ao que o santo e filósofo trata por "caritas") não são formas do amor, são autoenganos, não bons, se não são bons logo não são de Deus, ora, se Deus é amor, se ele nos ama, determino como amor (e suas formas) o que está de acordo com a Verdade. Aprofundando, a Teologia do Corpo, do Papa São João Paulo II, rejeita a "liquidez" apresentada por Bauman, pois o amor é, em suma, sacríficio, parte da entrega total de si ao próximo, e se não há logo não é amor. A Teologia do Corpo rejeita não os fundamentos de mentira no "líquido", mas também no "sólido", pois a tradicionalidade não é sinônimo de bom e pleno acordo com o amor que Deus pede de nós, não são as coerções, as violências, as imposições e demais vontades em oposição às de Deus que determinam os amores -- fatos em oposição ao ideário romanticizado. Claro, nem todas as coerções são por si inválidas do amor, ou mesmo as escolhas em trocas racionalizadas, a exemplo do autruísmo em vista da chance da família ter êxito e sucesso, ou seja, pelo bem dos próximos haver a necessidade de submissão a, em exemplo, um casamento forjado, ou algo do gênero, reconhece-se o amor no ato se feito por bem da família, porém o amor incutido, nesse caso, explicita o caráter sacrificial, no qual uma vontade e um amor genuinamente potencial em prazeres e alegrias são anulados, ou seja, mesmo nesse modelo tradicional na "solidez" há possibilidade do amor, não nas formas romanticizadas em critérios, como "estabilidade" e "durabilidade", mas no caráter do sacríficio exercido. Conforme nos ensina São Tomás de Aquino, o amor não é uma "força", tal como ensina Hegel, mas sim uma virtude teologal conforme na "Suma Teológica" (II-II Q. 26-28), não devemos reduzir o amor e os amores em análises simplórias (não simples) de falsa complexidade extraídas em métodos questionáveis e pouco competentes à real diensão de crise espiritual das eras, por esse motivo não concordo com a teoria do amor líquido de Zygmunt Bauman.

-

@ cae03c48:2a7d6671

2025-05-28 04:00:28

@ cae03c48:2a7d6671

2025-05-28 04:00:28Bitcoin Magazine

Bitcoin Enters a New Era: Industry Leaders Predict Trillions in Institutional InflowsAt the 2025 Bitcoin Conference in Las Vegas, the Founder and CEO of Kelly Intelligence Kevin Kelly, the Chief Executive Officer of Bitwise Asset Management Hunter Horsley, the CEO of BitGo Mike Belshe and the Advisor of WBTC Justin Sun talked about the future of financial products in the globe.

Hunter Horsley started the panel by saying that we are entering a new chapter in 2025 with the change in the regulatory circumstances.

“In the US wealth managers manage between 30 and 60 trillion dollars,” said Horsley. “If wealth managers wind up allocating 1% to the space on behalf of their clients, helping their clients access the opportunities here that are hundreds and billions of dollars.”

JUST IN:

$12 billion Bitwise CEO Hunter Horsley says if wealth managers allocate 1% to #Bitcoin, “that's hundreds of billions of dollars.”

$12 billion Bitwise CEO Hunter Horsley says if wealth managers allocate 1% to #Bitcoin, “that's hundreds of billions of dollars.”  pic.twitter.com/4OhoBjwDYR

pic.twitter.com/4OhoBjwDYR— Bitcoin Magazine (@BitcoinMagazine) May 27, 2025

Justin Sun emphasized the importance of integrating Bitcoin into decentralized finance (DeFi) platforms:

“Raw Bitcoin is a way to get your Bitcoin into a smart contract platform,” said Sun. “You can use your Bitcoin as collateral you borrow like stablecoin, you borrow other major crypto currencies tokens and also of course generate yield on the Bitcoin you are holding because Bitcoin is a proof of network.”

“Any transaction you can see in the blockchain and all the reserve addresses is available on the Blockchain. It’s safe and transparent and at the same time is smart,” stated Sun.

Mike Belshe elaborated on the foundational elements that make a stablecoin successful, particularly when Bitcoin is used in that context.

“What makes a good stablecoin whether you are talking about dollars or Bitcoin, it’s the liquidity that you have on the market around the world,” stated Belshe.

Horsley continued by addressing that we’ll see more companies adopting this and hundreds of thousands of Bitcoin being put onto more balance sheets.

“Corporations are buying Bitcoin,” commented Horsley. “It’s an extraordinary theme of this year. As of the first quarter of this year, 79 publicly traded companies had put Bitcoin on their balance sheet. Over 600k Bitcoin and there is only 21 million Bitcoin. It’s a lot of Bitcoin”

Justin Sun closed the panel by stating, “the progress we are making here in the United States really matters because as we all further encourage people around the world to get into the Bitcoin industry.”

“Once Bitcoin passes this kind of stage and gets institution adoption in the United States will accelerate that option globally,” said Sun.

This post Bitcoin Enters a New Era: Industry Leaders Predict Trillions in Institutional Inflows first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 7f6db517:a4931eda

2025-05-27 20:01:40

@ 7f6db517:a4931eda

2025-05-27 20:01:40

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ cae03c48:2a7d6671

2025-05-28 04:00:27

@ cae03c48:2a7d6671

2025-05-28 04:00:27Bitcoin Magazine

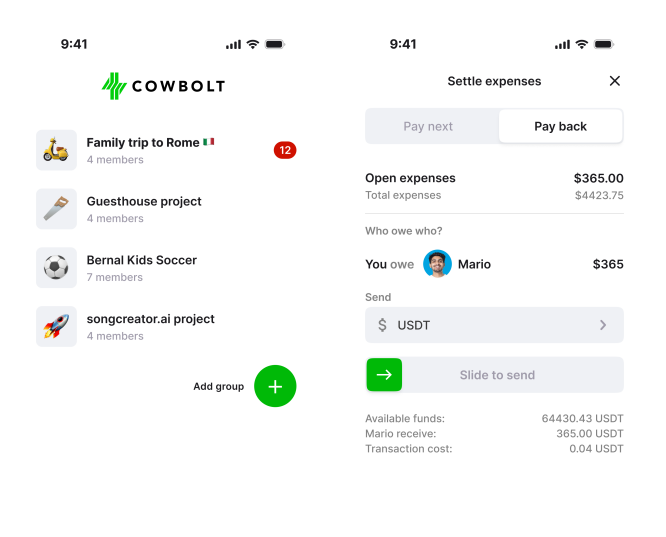

Cowbolt Announces Their Mission to Make Bitcoin Familiar to EverybodyToday at the Bitcoin Conference in Las Vegas, Cowbolt, an app that lets you split expense payments and settle in bitcoin, will launch their mission: turn peer-to-peer payments into a Bitcoin onramp, starting with family and friends.

Cowbolt will let their clients split costs and settle instantly using Bitcoin and USDT, with no middlemen, no bank friction and with self-custody. They will try to convert everyday transactions into Bitcoin adoption.

“We believe the most powerful onramp to Bitcoin isn’t an exchange — it’s people,” said the co-founder of Cowbolt Daniel Ekström. “That’s why we built Cowbolt. For friends, not hedge funds.”

What Cowbolt will bring to the table:

- Split and settle.

- Keep your keys.

- Fast and trusted.

- Works across borders.

The app is already being used for remittances, group travel, and day-to-day payments. It’s designed to be like a modern fintech app and will be available for iOS and Android.

“Building Airbnb taught me that when design is simple and gets out of the way, people do amazing things,” stated the ex-Creative Director at Airbnb & co-founder Cowbolt Tony Högqvist. “That’s the point here too. Not to store bitcoin in an ETF, but to use it between people. Effortlessly. Among teams, friends, families — every day.”

This post Cowbolt Announces Their Mission to Make Bitcoin Familiar to Everybody first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 7f6db517:a4931eda

2025-05-27 20:01:40

@ 7f6db517:a4931eda

2025-05-27 20:01:40

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06Star Wars is often viewed as a myth of rebellion, freedom, and resistance to tyranny. The iconography—scrappy rebels, totalitarian stormtroopers, lone smugglers—suggests a deep anti-authoritarian ethos. Yet, beneath the surface, the narrative arc of Star Wars consistently affirms the necessity, even sanctity, of central authority. This blog entry introduces the question: Is Star Wars fundamentally a celebration of statism?

Rebellion as Restoration, Not Revolution

The Rebel Alliance’s mission is not to dismantle centralized power, but to restore the Galactic Republic—a bureaucratic, centrally governed institution. Characters like Mon Mothma and Bail Organa are high-ranking senators, not populist revolutionaries. The goal is to remove the corrupt Empire and reinstall a previous central authority, presumed to be just.

- Rebels are loyalists to a prior state structure.

- Power is not questioned, only who wields it.

Jedi as Centralized Moral Elites

The Jedi, often idealized as protectors of peace, are unelected, extra-legal enforcers of moral and military order. Their authority stems from esoteric metaphysical abilities rather than democratic legitimacy.

- They answer only to their internal Council.

- They are deployed by the Senate, but act independently of civil law.

- Their collapse is depicted as tragic not because they were unaccountable, but because they were betrayed.

This positions them as a theocratic elite, not spiritual anarchists.

Chaos and the Frontier: The Case of the Cantina

The Mos Eisley cantina, often viewed as a symbol of frontier freedom, reveals something darker. It is: - Lawless - Violent - Culturally fragmented

Conflict resolution occurs through murder, not mediation. Obi-Wan slices off a limb; Han shoots first—both without legal consequence. There is no evidence of property rights, dispute resolution, or voluntary order.

This is not libertarian pluralism—it’s moral entropy. The message: without centralized governance, barbarism reigns.

The Mythic Arc: Restoration of the Just State

Every trilogy in the saga returns to a single theme: the fall and redemption of legitimate authority.

- Prequels: Republic collapses into tyranny.

- Originals: Rebels fight to restore legitimate order.

- Sequels: Weak governance leads to resurgence of authoritarianism; heroes must reestablish moral centralism.

The story is not anti-state—it’s anti-bad state. The solution is never decentralization; it’s the return of the right ruler or order.

Conclusion: The Hidden Statism of a Rebel Myth

Star Wars wears the costume of rebellion, but tells the story of centralized salvation. It: - Validates elite moral authority (Jedi) - Romanticizes restoration of fallen governments (Republic) - Portrays decentralized zones as corrupt and savage (outer rim worlds)

It is not an anarchist parable, nor a libertarian fable. It is a statist mythology, clothed in the spectacle of rebellion. Its core message is not that power should be abolished, but that power belongs to the virtuous few.

Question to Consider:

If the Star Wars universe consistently affirms the need for centralized moral and political authority, should we continue to see it as a myth of freedom? Or is it time to recognize it as a narrative of benevolent empire? -

@ cae03c48:2a7d6671

2025-05-28 04:00:26

@ cae03c48:2a7d6671

2025-05-28 04:00:26Bitcoin Magazine

US Senator Cynthia Lummis Discusses Bitcoin Reserve, Stablecoin Legislation, and Market Structure Bill at Bitcoin 2025 ConferenceAt the 2025 Bitcoin Conference in Las Vegas, U.S Senator Cynthia Lummis and CLO of Coinbase Paul Grewal discussed the market structure bill, stablecoin bill, future taxing system, bitcoin strategy reserve and bitcoin mining.

Cynthia Lummis started by commenting about the market structure bill and stablecoin bill.

“The market structure bills is probably more important to a lot of the people in this conference than the stablecoin bill because there are a lot of businesses, yours among them,” said Lummis. “There are businesses for people who either buy and hold, so they want a custodial service or there are companies that lend Bitcoin, there is a futures market for Bitcoin, there are so many ways in which Bitcoin can interface with fiat currency with the US dollar.”

Lummis also mentioned the tax system that she wants to implement and what her office has submitted to the finance committee.

“As the lighting network develops and companies like Strike sort of have been leaders in that space,” added Lummis. “Create an opportunity for transactions to occur on a daily basis in Bitcoin. Everything from buying a cup of coffee to dinner somewhere. It would be helpful that certain transactions of that size below 600 dollars per transaction, not be subject to taxation.”

During her speech, she went into detail on one the biggest problems lawmakers are facing against digital assets.

“Part of the problem in the last four years has been largely regulatory agencies that have been very hostile towards digital assets, so we are trying to change as fast as we can,” said Lummis. “It doesn’t happen overnight. We don’t even have a confirmed IRS director in place yet, so it is really hard to get these structural changes enacted by the rule makers at the IRS when there is no IRS commission yet in place.”

Ending the panel, Lummis addressed one of the biggest reasons the US government should get into Bitcoin.

“We are 37 trillion dollars in debt, so if we bought and held a million Bitcoin for 20 years it will cut that debt in half and we have underperforming assets that can be converted to Bitcoin without borrowing additional money. Bitcoin is such an important Global Strategic asset and it is not only important in the economy, but in our global defense because there are components to our defense. One is having a lethal war fighting machine that can overcome other armies, another military effort. Another one is having an economic machine that can overcome other currencies.” She continued, “Even our military generals say that bitcoin is an important deterrent to aggression from other countries, especially from China.”

This post US Senator Cynthia Lummis Discusses Bitcoin Reserve, Stablecoin Legislation, and Market Structure Bill at Bitcoin 2025 Conference first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 502ab02a:a2860397

2025-05-28 02:03:01

@ 502ab02a:a2860397

2025-05-28 02:03:01ยังมีอีกสิ่งหนึ่งที่มักซ่อนอยู่ในเมล็ดธัญพืช ถั่วเปลือกแข็ง และพืชตระกูลถั่วทั้งหลาย เป็นเหมือน “กล่องเก็บขุมทรัพย์” สำหรับชีวิตน้อยๆ ของพืชในวันที่จะเติบโต แต่พอสิ่งนี้หลุดเข้ามาในร่างกายมนุษย์ มันกลับถูกมองว่าเป็น “ขโมย” ขโมยแร่ธาตุไปจากร่างกายเรา เจ้าสิ่งนั้นคือ “กรดไฟติก” หรือ phytic acid นั่นเองครับ

กรดไฟติกเป็นสารอินทรีย์ที่พืชสร้างขึ้นเพื่อเก็บสะสมฟอสฟอรัสไว้ใช้ตอนงอกงามในอนาคต มันเปรียบเหมือนกระปุกออมสินของเมล็ดพืช พวกเมล็ดถั่วดำ ข้าวโพด ข้าวกล้อง ข้าวโอ๊ต เมล็ดทานตะวัน อัลมอนด์ ไปจนถึงเต้าหู้ ถั่วเหลือง และธัญพืชต่างๆ ล้วนมีกรดไฟติกอยู่ไม่น้อย โดยเฉพาะถ้าเป็น “ธัญพืชเต็มเมล็ด” ที่ไม่ผ่านการขัดสีแบบที่หลายๆคนชอบ นั่นเพราะเยื่อหุ้มเมล็ดคือที่เก็บเจ้าตัวนี้ไว้

หลายคนคงคิดว่า อ้าวแล้วเจ้ากรดไฟติกทำไมถึงมีชื่อเสียงไม่ค่อยดีนัก? คำตอบอยู่ที่ “ความสามารถในการจับแร่ธาตุ” ของมันนี่แหละครับ

กรดไฟติกเป็นเหมือนแม่เหล็กเล็กๆ ที่สามารถจับตัวกับแร่ธาตุต่างๆ ได้ดี โดยเฉพาะ “แร่ธาตุบวกสอง” ทั้งหลาย แร่ธาตุบวกสอง คือ แร่ธาตุที่เวลาอยู่ในร่างกายจะอยู่ในรูปของไอออนที่มีประจุไฟฟ้า บวก 2 (เขียนว่า ²⁺) หรือพูดอีกแบบคือ มันเสียอิเล็กตรอนออกไป 2 ตัว เลยกลายเป็นไอออนที่มีพลังบวก 2 หน่วย กรดไฟติก หรือ แทนนิน จะทำตัวเป็น "แม่เหล็ก" ดูดแร่ธาตุออกไป มันมักจะจับกับแร่ธาตุที่มีประจุบวก โดยเฉพาะพวกที่ประจุบวกแรงๆ แบบ บวกสอง (²⁺) นี่แหละ เพราะจับแน่น จับเหนียว ยิ่งบวกเยอะยิ่งจับดี เหมือนแช่แม่เหล็กลงไปในกล่องโลหะ เช่น ธาตุเหล็ก สังกะสี แมกนีเซียม แคลเซียม และทองแดง พอมันจับเสร็จแล้ว ร่างกายเราก็ไม่สามารถดูดซึมแร่ธาตุพวกนี้เข้าไปได้ เพราะมันเปลี่ยนสภาพกลายเป็นของจับคู่ที่ลำไส้ไม่รู้จัก ไม่รู้จะพาเข้าร่างกายยังไง สุดท้ายก็ต้องโบกมือลาไปพร้อมของเสีย

พวกที่เป็น บวกสาม (³⁺) อย่างเช่น อลูมิเนียม (Al³⁺) หรือ เหล็กเฟอริก (Fe³⁺) จะจับแน่นมาก ถึงขั้นอาจเกิด “ตกตะกอน” แบบไม่ละลายน้ำเลยทีเดียว พวกนี้ลำไส้ไม่สามารถดูดซึมได้เลย ในขณะที่แร่ธาตุบวกหนึ่ง โซเดียม (Na⁺) โพแทสเซียม (K⁺) ประจุบวกแค่ +1 จับกับกรดไฟติกได้น้อยกว่า

ในแง่นี้กรดไฟติกเลยถูกเรียกว่า “สารต้านสารอาหาร” หรือ anti-nutrient เพราะมันต้านไม่ให้ร่างกายได้แร่ธาตุที่ควรจะได้ แต่อย่าเพิ่งตัดสินมันเหมือนผู้ร้าย เพราะในขณะที่กรดไฟติกอาจขโมยแร่ธาตุบางตัวจากร่างกาย มันก็มีคุณสมบัติน่าสนใจที่ดูจะเป็นคุณงามความดีของมันเหมือนกัน เช่น มันสามารถจับกับโลหะหนักบางชนิด เช่น ตะกั่ว หรือแคดเมียม ที่อาจปนเปื้อนในอาหาร แล้วพาออกไปจากร่างกายก่อนที่สิ่งเหล่านั้นจะทำร้ายเรา

และอีกด้านหนึ่งที่กำลังเป็นที่สนใจคือ ฤทธิ์ต้านอนุมูลอิสระของกรดไฟติก มันอาจช่วยลดการอักเสบ หรือยับยั้งการเติบโตของเซลล์มะเร็งบางชนิดในระดับเซลล์ได้ มีงานวิจัยที่พบว่ามันอาจไปจับกับธาตุเหล็กส่วนเกินที่ว่ายอยู่ในเลือด ซึ่งเป็นตัวเร่งปฏิกิริยาอนุมูลอิสระ คล้ายช่วย “เก็บเศษเหล็กที่ลอยไปมาบนทางด่วนหลอดเลือด” ให้ปลอดภัยขึ้นอีกนิด

แต่ทั้งนี้ทั้งนั้น อยากให้คิดแบบนี้ครับว่า กรดไฟติกคือคนแปลกหน้าที่ “บางมื้อก็มีประโยชน์ บางมื้อก็ทำให้เราขาดของดี” สิ่งสำคัญอยู่ที่ “สภาวะแวดล้อมของมื้ออาหาร” ถ้าอาหารในมื้อมีแร่ธาตุไม่มากนัก แล้วกรดไฟติกเข้ามาเยอะ มันก็ยิ่งลดโอกาสดูดซึมแร่ธาตุเหล่านั้น แต่ถ้ามื้ออาหารมีความหลากหลาย โปรตีนเพียงพอ วิตามิน C อยู่ครบ ก็ช่วยเพิ่มการดูดซึมธาตุเหล็กได้ดีขึ้น เพราะมันเปลี่ยนเหล็กให้อยู่ในรูปแบบที่ร่างกายดูดซึมง่ายขึ้น

แล้วเราจะจัดการยังไงกับกรดไฟติกในครัวแบบบ้านเรา?

วิธีพื้นบ้านมีมาแต่โบราณแล้วนั่นคือ -แช่น้ำ ก่อนหุงข้าวกล้อง หรือแช่ถั่วก่อนนำไปต้ม จะช่วยลดกรดไฟติกได้ระดับหนึ่ง เพราะมีเอนไซม์ที่ชื่อว่า phytase ซึ่งจะเริ่มทำงานเมื่อพืชได้รับน้ำและอุณหภูมิพอเหมาะ -การหมัก เช่น หมักแป้งข้าวเปลือกทำขนม หรือการหมักเต้าหู้ ก็เป็นวิธีดั้งเดิมที่ช่วยลดกรดไฟติกลงได้มาก เพราะเอนไซม์ของจุลินทรีย์ในกระบวนการหมักจะช่วยย่อยกรดไฟติกให้ลดลง -การงอก หรือ sprouting คือการทำให้เมล็ดพืชเริ่มต้นชีวิตใหม่ เช่น ถั่วงอก ข้าวกล้องงอก วิธีนี้ลดกรดไฟติกได้ดีมาก เพราะ phytase ที่อยู่ในพืชจะถูกกระตุ้นให้ทำงานสูงสุดตอนพืชเริ่มงอก

ข้อมูลคร่าวๆ บอกว่า วิธีเหล่านี้อาจลดกรดไฟติกลงได้ 30-90% ขึ้นกับชนิดของพืช และระยะเวลาที่ใช้

แต่ต้องรู้ไว้ด้วยว่า… การลดกรดไฟติกก็อาจทำให้พลังงานสำรองหรือสารอาหารบางตัวในพืชหายไปด้วยเช่นกัน เช่น วิตามิน B และสารต้านอนุมูลอิสระบางชนิด จึงควรใช้วิธีที่พอเหมาะ ไม่ถึงกับฆ่าความดีของพืชหมด

ดังนั้นเช่นกันครับว่า กรดไฟติกไม่ใช่ศัตรู ไม่ใช่เทพเจ้า แต่คือ “สมการ” ที่ต้องรู้จักแก้ไขให้เหมาะกับมื้ออาหารของเรา ถ้าเฮียเลือกกินแบบ animal-based อยู่แล้ว แร่ธาตุสำคัญส่วนใหญ่ก็ได้จากเนื้อสัตว์แบบที่ดูดซึมได้ดีอยู่แล้ว กรดไฟติกจากพืชที่กินพอประมาณก็อาจไม่ได้ร้ายแรงอะไรนัก เพียงแต่ต้องรู้ทันและจัดการให้พอดี ไม่ให้มันกลายเป็นตัวฉุดไม่ให้ร่างกายดูดซึมของดี

สุดท้าย เหมือนชีวิตเรานี่แหละ… “ทุกอย่างมีมุมมืดและมุมสว่าง อยู่ที่ว่าเราจัดแสงยังไงให้แม้แต่เงาก็กลายเป็นพลังของชีวิตเรา” #โรงบ่มสุขภาพ #HealthyHut #pirateketo #ตำรับเอ๋ #siripun #siamstr

/เฮียเอง

-

@ 5391098c:74403a0e

2025-05-27 18:20:42

@ 5391098c:74403a0e

2025-05-27 18:20:42Você trabalha 5 meses do ano somente para pagar impostos. Ou seja, 42% da sua renda serve para bancar serviços públicos de péssima qualidade. Mesmo que você tivesse a liberdade de usar esses 42% da sua renda para contratar serviços privados de qualidade (saúde, segurança e ensino), ainda assim você seria um escravo porque você recebe dinheiro em troca do seu trabalho, e o dinheiro perde cerca de 10% do valor a cada ano. Em outras palavras todo seu dinheiro que sobra depois de comprar comida, vestuário e moradia perde 100% do valor a cada 10 anos. Isso acontece porque o Estado imprime dinheiro do nada e joga na economia de propósito para gerar INFLAÇÃO e manter todos nós escravizados. Você pode deixar seu dinheiro investido em qualquer aplicação que imaginar e ainda assim nunca terá uma rentabilidade superior a inflação real. No final, acaba perdendo tudo do mesmo jeito. Caso você se ache esperto por investir o que sobra da sua renda em bens duráveis como imóveis ou veículos, sabia que esses bens também não são seus, porque se deixar de pagar os impostos desses bens (iptu, itr, ipva) você também perde tudo. Além disso, o custo de manutenção desses bens deve ser levado em consideração na conta das novas dívidas que você assumiu. No caso dos imóveis urbanos é impossível alugá-lo por mais de 0,38% do seu valor mensalmente. Em outras palavras, a cada ano você recebe menos de 5% do que investiu, tem que pagar o custo de manutenção, mais impostos e a valorização do bem nunca será superior a inflação real, também fazendo você perder quase tudo em cerca de 15 anos. A situação é ainda pior com os imóveis rurais e veículos, basta fazer as contas. Caso o dinheiro que você receba em troca do seu trabalho seja suficiente apenas para comprar comida, vestuário e moradia, você já sabe que é um escravo né?… Precisamos entender que a escravidão não acabou, apenas foi democratizada. Hoje a escravidão é financeira, nós somos os castiços e os donos do dinheiro são o senhorio. Os donos do dinheiro são os Globalistas e os Estados seus fantoches. O esquema é simples: fazer todo mundo trabalhar em troca de algo que perde 100% do valor a cada 10 anos, ou seja o dinheiro. Se você pudesse trabalhar em troca de algo que aumentasse de valor acima da inflação real a cada 10 anos você finalmente conquistaria sua liberdade financeira e deixaria de ser escravo. Pois bem, isso já é possível, e não se trata de ouro ou imóveis e sim sobre o Bitcoin, que sobe de valor mais de 100% a cada 10 anos, com a vantagem de ser inconfiscável e de fácil transferência para seus herdeiros quando você morrer, através de uma simples transação LockTime feita em vida. Portanto, mesmo que você não tenha dinheiro para comprar Bitcoin, passar a aceitar Bitcoin em troca de seus produtos e serviços é a única forma de se libertar da escravidão financeira. A carta de alforria financeira proporcionada pelo Bitcoin não é imediata, pois a velocidade da sua libertação depende do quanto você está disposto a aprender sobre o assunto. Eu estou aqui para te ajudar, caso queira. No futuro o Bitcoin estará tão presente na sua vida quanto o pix e o cartão de crédito, você querendo ou não. Assim como o cartão de crédito foi a evolução do cheque pós-datado e o pix a evolução do cartão, o Bitcoin e outras criptomoedas serão a evolução de todos esses meios de pagamento. O que te ofereço é a oportunidade de abolição da sua escravatura antes dos demais escravos acordarem para a realidade, afinal a história sempre se repete: desde o ano de 1300 a.c. a escravidão era defendida pelos próprios escravos, que mais cedo ou mais tarde, foram libertados por Moisés em êxodo 11 da Bíblia Sagrada e hoje o povo de israel se tornou a nação mais rica do mundo. A mesma história se repetiu na Roma Antiga: com o pão e circo. Da mesma forma todo esse império escravocrata ruiu porque mais cedo ou mais tarde os escravos se revoltam, bastam as coisas piorarem bastante. O atual regime de escravidão teve início com a queda do padrão-ouro para impressão do dinheiro no ano de 1944. A escravidão apenas ficou mais sofisticada, pois em vez de pagar os escravos com cerveja como no Egito Antigo ou com pão e circo como na Roma Antiga, passou-se a pagar os escravos com dinheiro sem lastro, ou seja dinheiro inventado, criado do nada, sem qualquer representação com a riqueza real da economia. Mesmo sendo a escravidão atual mais sofisticada, que deixou de ser física para ser financeira, o que torna a mentira mais bem contada, mais cedo ou mais tarde os escravos modernos irão acordar, basta as coisas piorarem mais ou perceberem que todos os bens e serviços do mundo não representam nem 1% de todo o dinheiro que impresso sem lastro. Em outras palavras, se os donos de todo o dinheiro do mundo resolvessem utilizá-lo para comprar tudo o que existe à venda, o preço do quilo do café subiria para R$ 297.306,00 e o preço médio dos imóveis subiria para um número tão grande que sequer caberia nesta folha de papel. Hoje, o dinheiro não vale nada, seus donos sabem disso e optam por entregar o dinheiro aos poucos para os escravos em troca do seu trabalho, para manter o atual regime o máximo de tempo possível. Mesmo assim, o atual regime de escravidão financeira está com os dias contados e depende de você se posicionar antes do efeito manada. Nunca é tarde para entrar no Bitcoin, mesmo ele tendo uma quantidade de emissão limitada, seu valor subirá infinitamente. A menor unidade do Bitcoin é o satoshi, cuja abreviação é sats. Diferente do centavo, cada sat vale um centésimo milionésimo de bitcoin. Hoje (25/05/25), cada unidade de Bitcoin equivale a setecentos mil reais. Logo, cada R$ 0,01 equivale à 0,007 sats. Lembrando que o centavo é um real dividido por cem e o sat é um bitcoin dividido por cem milhões, por isso ainda não existe a paridade entre 1 centavo de real e 1 sat. Essa paridade será alcançada quando um Bitcoin passar a valer um milhão de reais. Com a velocidade que nosso dinheiro está perdendo valor isso não irá demorar muito. Utilizando dados econômicos avançados, prevejo que cada unidade de Bitcoin passará a valer hum milhão de reais até o ano de 2029, assim equiparando 1 sat para cada R$ 0,01. Nesse momento, certamente muitos empresários, comerciantes e profissionais liberais passarão a aceitar o Bitcoin como forma de pagamento pelos seus produtos e serviços, assim como o cheque foi substituído pelo cartão de crédito e o cartão pelo pix. Sabendo disso, você pode entrar na onda de transição no futuro junto com a manada e perder essa alta valorização, ou passar a aceitar Bitcoin agora pelos seus produtos e serviços, assinando assim, a própria carta de alforria da sua escravidão financeira. É importante dizer que os próprios globalistas e governos estão trocando dinheiro por Bitcoin como nunca na história e mesmo que eles adquiram todos os bitcoins disponíveis, ainda assim não será mais possível manter seu regime de escravidão financeira funcionando porque a emissão de Bitcoin é limitada, sendo impossível criar Bitcoin sem lastro, como é feito com o dinheiro hoje. Com o presente artigo, te ofereço a oportunidade de conquistar seus primeiros sats agora, de forma segura e independente, sem precisar de corretoras, bancos, intermediários ou terceiros, basta você querer pois toda a informação necessária está disponível na internet gratuitamente. Se ainda assim você quiser continuar sendo escravo financeiro, depois não adiantar se arrepender quando as janelas de oportunidade se fecharem, o Drex for implantado, papel moeda restringido e sua vida piorar bastante. Importante mencionar que a Lei Brasileira ainda permite a movimentação de até R$ 30.000,00 em Bitcoin por mês sem a necessidade de declaração à Receita Federal e que esse direito pode deixar de existir a qualquer momento, e que quando o Drex for implantado você perderá diversos outros direitos, dentre ele a liberdade de gastar seu dinheiro como quiser e o sigilo. Ofereço ainda, a oportunidade de você baixar uma carteira de Bitcoin gratuita e segura no seu aparelho de celular que funciona de forma semelhante a um banco digital como Nubank e Pagseguro por exemplo, para poder começar à receber Bitcoin pelos seus produtos e serviços agora, de forma fácil e gratuita. Utilizando o qrcode abaixo você ainda ganha alguns sats de graça, promoção válida até o dia 29/05/25 e patrocinada pela Corretora Blink de El Salvador, onde o Bitcoin já é moeda oficial do país, basta acessar o link e instalar o aplicativo: https://get.blink.sv/btcvale

Aviso: disponibilizei o link da carteira de Bitcoin da Corretora Blink apenas como exemplo de como é fácil aceitar Bitcoin como forma de pagamento pelos seus produtos e serviços. Não recomento depender de qualquer corretora para guardar seus valores em Bitcoin. A melhor forma de fazer isso é mantendo dois computadores ou notebook em casa, um conectado à internet com memória em disco disponível de 1 terabyte ou mais para armazenar e visualizar suas transações e outro computador ou notebook desconectado da internet para armazenar suas senhas e chaves privadas para assinar as transações via pendrive. Somente assim você estará 100% livre e seguro. Importante ainda fazer backup em vários CDs com criptografia do seu computador ou notebook que assina as transações, assim também ficando 100% livre e seguro para restaurar sua carteira em qualquer outro computador caso necessário. Todas as instruções de como fazer isso já estão disponíveis gratuitamente na internet. Caso deseje contratar uma consultoria pessoal que inclui aulas particulares por vídeo conferência, onde você aprenderá:

→ Tudo o que precisa saber sobre Bitcoin e demais criptomoedas; → Sistema operacional Linux; → Como instalar sua carteira de Bitcoin em dois computadores para assinaturas air gapped; → Se manter 100% livre e seguro. → Com carga horária à combinar conforme sua disponibilidade.

O custo do investimento pelo meu serviço individual para esse tipo de consultoria é de 204.000 sats (R$ 1.543,46 na cotação atual) valor válido até 31/07/25, interessados entrar em contato por aqui ou através da Matrix: @davipinheiro:matrix.org https://davipinheiro.com/voce-e-escravo-e-nem-sabe-eu-vou-te-provar-agora/

-

@ c1e9ab3a:9cb56b43

2025-05-27 13:19:53

@ c1e9ab3a:9cb56b43

2025-05-27 13:19:53I. Introduction: Money as a Function of Efficiency and Preference

Money is not defined by law, but by power over productivity. In any open economy, the most economically efficient actors—those who control the most valuable goods, services, and knowledge—ultimately dictate the medium of exchange. Their preferences signal to the broader market what form of money is required to access the highest-value goods, from durable commodities to intangibles like intellectual property and skilled labor.

Whatever money these actors prefer becomes the de facto unit of account and store of value, regardless of its legal status. This emergent behavior is natural and reflects a hierarchy of monetary utility.

II. Classical Gresham’s Law: A Product of Market Distortion

Gresham’s Law, famously stated as:

"Bad money drives out good"

is only valid under coercive monetary conditions, specifically: - Legal tender laws that force the acceptance of inferior money at par with superior money. - Fixed exchange rates imposed by decree, not market valuation. - Governments or central banks backing elastic fiduciary media with promises of redemption. - Institutional structures that mandate debt and tax payments in the favored currency.

Under these conditions, superior money (hard money) is hoarded, while inferior money (soft, elastic, inflationary) circulates. This is not an expression of free market behavior—it is the result of suppressed price discovery and legal coercion.

Gresham’s Law, therefore, is not a natural law of money, but a law of distortion under forced parity and artificial elasticity.

III. The Collapse of Coercion: Inversion of Gresham’s Law