-

@ 20e7c953:3b8bcb21

2025-06-05 10:46:07

@ 20e7c953:3b8bcb21

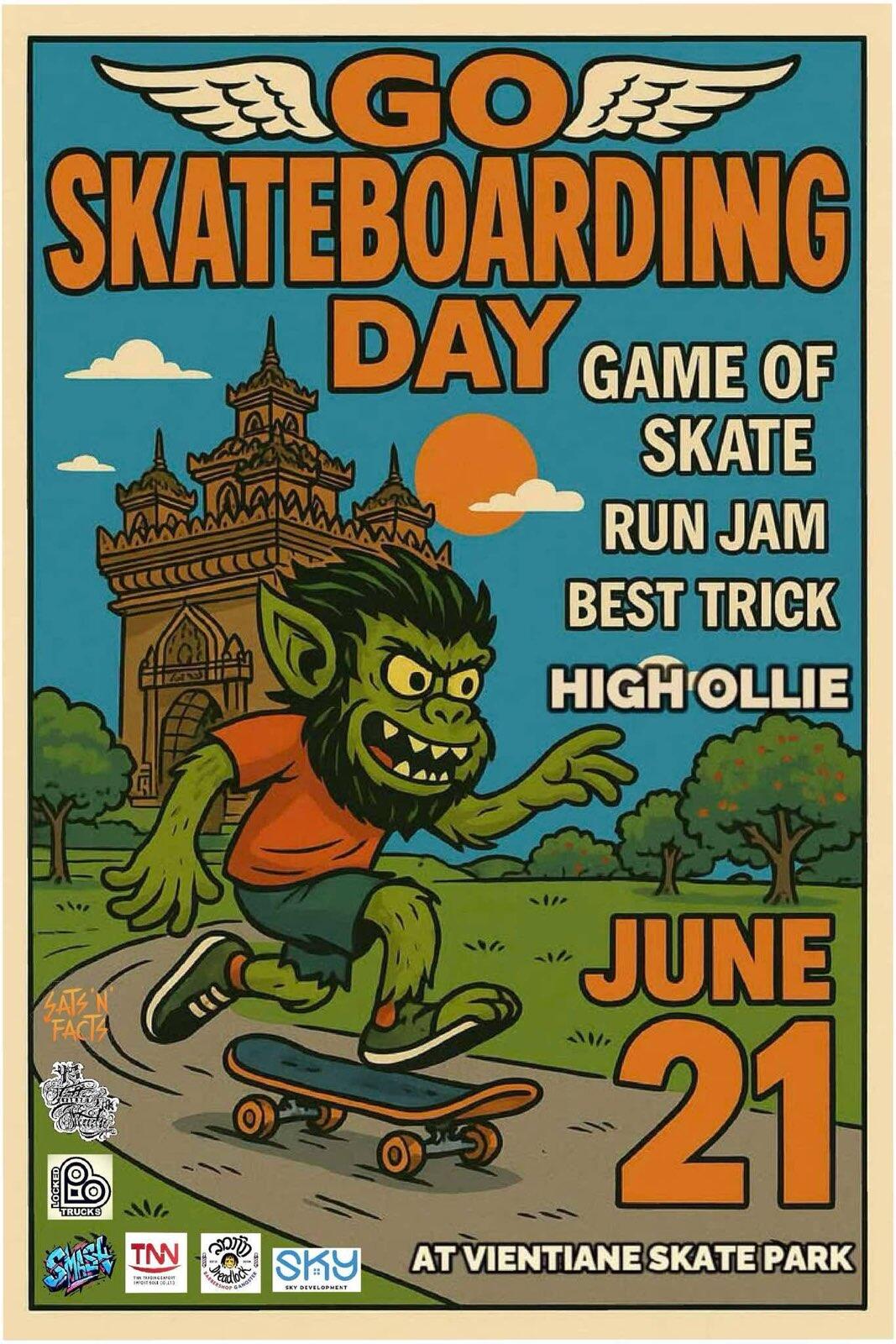

2025-06-05 10:46:0721… That number means something. A reminder that limits create value - both in Bitcoin and in life.

Every June 21st, skaters around the world remind us that freedom is something you make yourself - one push at a time only constrained by your own limitations.

This year in Vientiane, we’re proud to support one of the few real skate spots in Laos. A place built and held together by skaters for skaters.

Expect around 50 locals - from young kids to older heads - showing up not just to skate, but to hold space for each other. No ego, no filters, just boards, fun and respect.

Bircoiners have lots to learn from these communities on this regard. Go skate and you'll find out.

SnF

Laostr

Skateboardingisfun

Skate4Fun

Skatestr

-

@ a5142938:0ef19da3

2025-06-05 10:24:37

@ a5142938:0ef19da3

2025-06-05 10:24:37Brands

Nordkidz is a German brand that creates made-to-order clothing and linens for babies, children, and a little bit for their parents.

Natural materials used in products

⚠️ Warning: some products from this brand contain non-natural materials, including:

Categories of products offered

This brand offers products made entirely from natural materials in the following categories:

Clothing

- Clothing fits : babies, children, unisex

- Tops : sweaters, t-shirts

- Bottoms : pants-trousers, shorts, sweatpants

- Head & handwear : hats, scarves

Home

- Linen : bath ponchos, bean bag covers, muslin squares

Other information

👉 Learn more on the brand website

Where to find their products?

- Nordkidz (in German, delivery area: Germany and the European Union) 💚 Via this link, you directly support the brand.

📝 You can contribute to this entry by suggesting edits in comments.

🗣️ Do you use this brand's products? Share your opinion in the comments.

⚡ Happy to have found this information? Support the project by making a donation to thank the contributors.

-

@ e4950c93:1b99eccd

2025-06-05 10:23:39

@ e4950c93:1b99eccd

2025-06-05 10:23:39Marques

Nordkidz est une marque allemande qui crée à la demande des vêtements et linges pour les bébés, les enfants, et un peu pour leurs parents.

Matières naturelles utilisées dans les produits

⚠️ Attention, certains produits de cette marque contiennent des matières non naturelles, dont :

Catégories de produits proposés

Cette marque propose des produits intégralement en matière naturelle dans les catégories suivantes :

Vêtements

- Tailles vêtements : bébés, enfants, unisexe

- Hauts : pulls, t-shirts

- Bas : pantalons, pantalons de survêtement, shorts

- Tête et mains : bonnets, écharpes

Maison

- Linge : housses de pouf, langes, ponchos de bain

Autres informations

👉 En savoir plus sur le site de la marque

Où trouver leurs produits ?

- Nordkidz (en allemand, zone de livraison : Allemagne et Union Européenne) 💚 Via ce lien vous soutenez directement la marque.

📝 Tu peux contribuer à cette fiche en suggérant une modification en commentaire.

🗣️ Tu utilises des produits de cette marque ? Partage ton avis en commentaire.

⚡ Heureu-x-se de trouver cette information ? Soutiens le projet en faisant un don pour remercier les contribut-eur-ice-s.

-

@ dfa02707:41ca50e3

2025-06-05 10:01:29

@ dfa02707:41ca50e3

2025-06-05 10:01:29Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-06-05 10:01:27

@ dfa02707:41ca50e3

2025-06-05 10:01:27Contribute to keep No Bullshit Bitcoin news going.

News

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- Spiral renews support for Dan Gould and Joschisan. The organization has renewed support for Dan Gould, who is developing the Payjoin Dev Kit (PDK), and Joschisan, a Fedimint developer focused on simplifying federations.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- The European Central Bank is pushing for amendments to the European Union's Markets in Crypto Assets legislation (MiCA), just months after its implementation. According to Politico's report on Tuesday, the ECB is concerned that U.S. support for cryptocurrency, particularly stablecoins, could cause economic harm to the 27-nation bloc.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- The Virtual Asset Service Providers (VASP) Bill 2025 introduced in Kenya. The new legislation aims to establish a comprehensive legal framework for licensing, regulating, and supervising virtual asset service providers (VASPs), with strict penalties for non-compliant entities.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Paul Atkins has officially assumed the role of the 34th Chairman of the US Securities and Exchange Commission (SEC). This is a return to the agency for Atkins, who previously served as an SEC Commissioner from 2002 to 2008 under the George W. Bush administration. He has committed to advancing the SEC’s mission of fostering capital formation, safeguarding investors, and ensuring fair and efficient markets.

- Federal Reserve retracts guidance discouraging banks from engaging in 'crypto.' The U.S. Federal Reserve withdrew guidance that discouraged banks from crypto and stablecoin activities, as announced by its Board of Governors on Thursday. This includes rescinding a 2022 supervisory letter requiring prior notification of crypto activities and 2023 stablecoin requirements.

"As a result, the Board will no longer expect banks to provide notification and will instead monitor banks' crypto-asset activities through the normal supervisory process," reads the FED statement.

- Russian government to launch a cryptocurrency exchange. The country's Ministry of Finance and Central Bank announced plans to establish a trading platform for "highly qualified investors" that "will legalize crypto assets and bring crypto operations out of the shadows."

- Twenty One Capital is set to launch with over 42,000 BTC in its treasury. This new Bitcoin-native firm, backed by Tether and SoftBank, is planned to go public via a SPAC merger with Cantor Equity Partners and will be led by Jack Mallers, co-founder and CEO of Strike. According to a report by the Financial Times, the company aims to replicate the model of Michael Saylor with his company, MicroStrategy.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Metaplanet buys another 145 BTC. The Tokyo-listed company has purchased an additional 145 BTC for $13.6 million. Their total bitcoin holdings now stand at 5,000 coins, worth around $428.1 million.

- Semler Scientific has increased its bitcoin holdings to 3,303 BTC. The company acquired an additional 111 BTC at an average price of $90,124. The purchase was funded through proceeds from an at-the-market offering and cash reserves, as stated in a press release.

- Tesla still holds nearly $1 billion in bitcoin. According to the automaker's latest earnings report, the firm reported digital asset holdings worth $951 million as of March 31.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

- Arch Labs has secured $13 million to develop "ArchVM" and integrate smart-contract functionality with Bitcoin. The funding round, valuing the company at $200 million, was led by Pantera Capital, as announced on Tuesday.

- Citrea deployed its Clementine Bridge on the Bitcoin testnet. The bridge utilizes the BitVM2 programming language to inherit validity from Bitcoin, allegedly providing "the safest and most trust-minimized way to use BTC in decentralized finance."

- UAE-based Islamic bank ruya launches Shari’ah-compliant bitcoin investing. The bank has become the world’s first Islamic bank to provide direct access to virtual asset investments, including Bitcoin, via its mobile app, per Bitcoin Magazine.

- Solosatoshi.com has sold over 10,000 open-source miners, adding more than 10 PH of hashpower to the Bitcoin network.

"Thank you, Bitaxe community. OSMU developers, your brilliance built this. Supporters, your belief drives us. Customers, your trust powers 10,000+ miners and 10PH globally. Together, we’re decentralizing Bitcoin’s future. Last but certainly not least, thank you@skot9000 for not only creating a freedom tool, but instilling the idea into thousands of people, that Bitcoin mining can be for everyone again," said the firm on X.

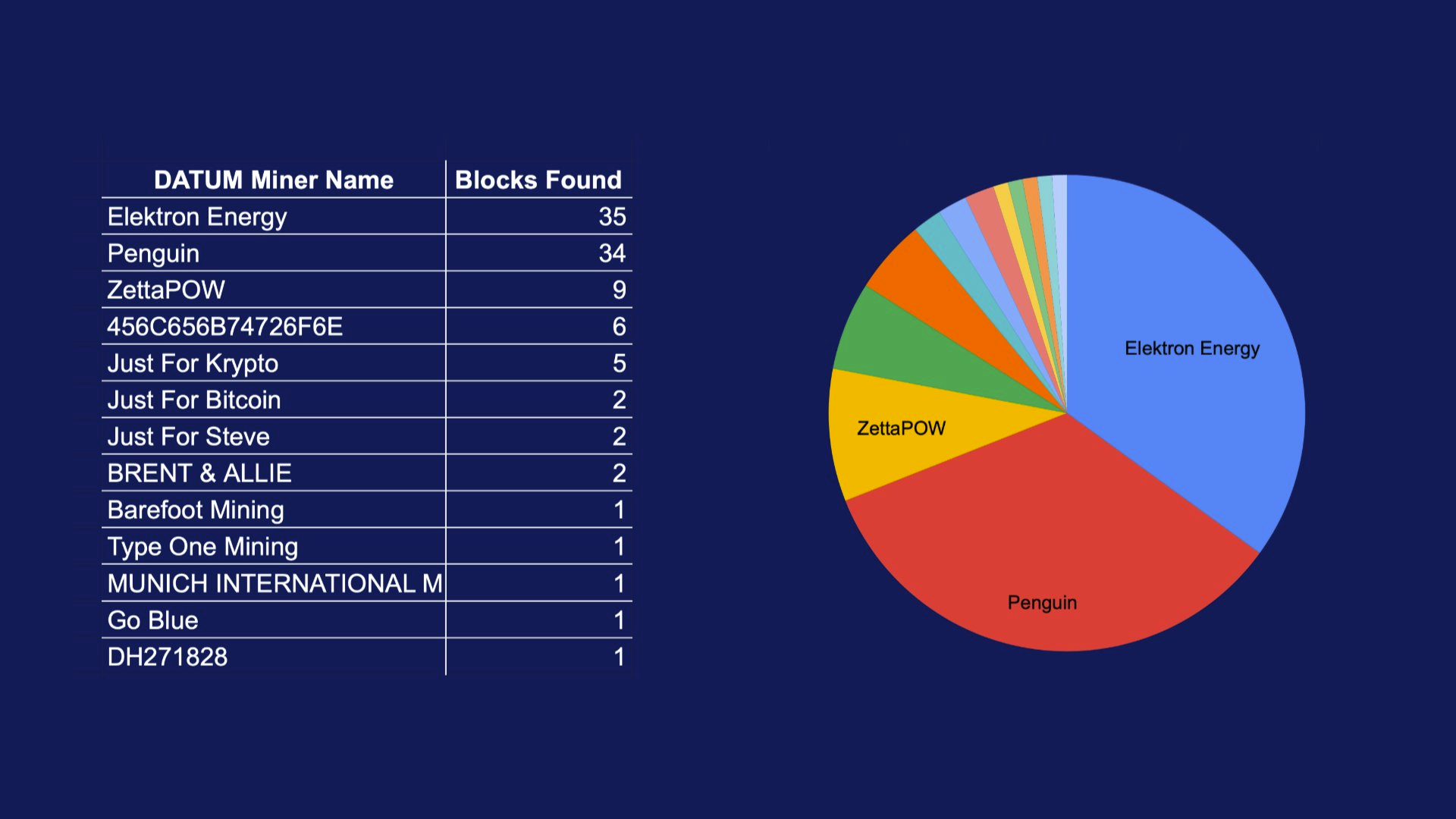

- OCEAN's DATUM has found 100 blocks. "Over 65% of OCEAN’s miners are using DATUM, and that number is growing every day. This means block template construction is making its way back into the hands of the miners, which is not only the most profitable

-

@ dfa02707:41ca50e3

2025-06-05 10:01:24

@ dfa02707:41ca50e3

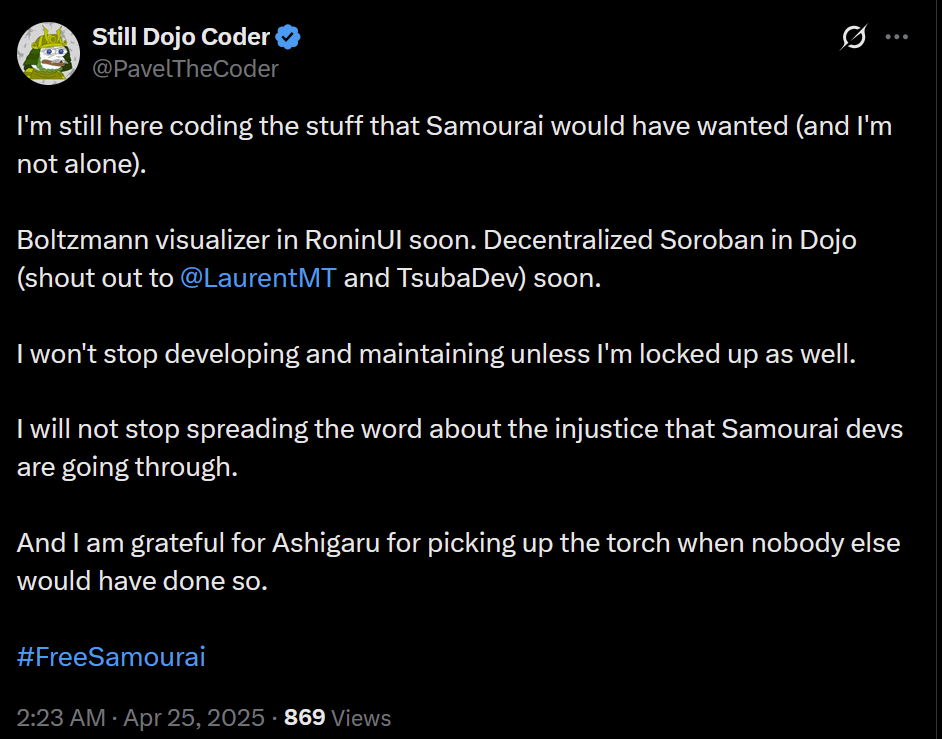

2025-06-05 10:01:24- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ eb0157af:77ab6c55

2025-06-05 10:01:07

@ eb0157af:77ab6c55

2025-06-05 10:01:07French authorities have identified a 24-year-old Franco-Moroccan man as the mastermind behind a series of attacks targeting crypto entrepreneurs, including the co-founder of Ledger.

The suspect, Badiss Mohamed Amide Bajjou, was captured in Tangier by Moroccan authorities following an international arrest warrant issued by Interpol.

The arrest marks a major breakthrough in the investigations into a wave of kidnappings that targeted several figures in the French crypto sector. According to Le Parisien, the suspect was wanted for multiple crimes, including armed extortion and kidnapping.

Bajjou is accused of remotely orchestrating a sophisticated criminal network specializing in targeting wealthy individuals in the crypto world. His alleged criminal activity dates back to July 2023, when he began coordinating abductions and extortion attempts against industry entrepreneurs.

The Ledger case and a wave of kidnappings

Among the most shocking incidents was the attack on David Balland, co-founder of Ledger. The kidnappers subjected him to extreme torture, amputating one of his fingers to increase psychological pressure while demanding a €10 million ransom in cryptocurrency. Investigations suggest a direct link between Bajjou and this case.

Another high-profile incident involved an attempted abduction of the family of Pierre Noizat, CEO of Paymium. In May, masked men tried to kidnap Noizat’s daughter, her husband, and their child in broad daylight. Subsequent investigations led to the indictment of 25 suspects, including teenagers and minors.

Capture operation and seizure of evidence

During Bajjou’s arrest, Moroccan authorities seized materials connected to the kidnappings. According to local media, multiple bladed weapons, dozens of mobile phones, and a substantial amount of cash allegedly linked to the criminal activities were confiscated.

International cooperation and the search for accomplices

French Interior Minister Gérald Darmanin publicly thanked Moroccan authorities for their cooperation in the arrest. However, investigations remain ongoing as another Franco-Moroccan man, believed to be the leader of the group and around 40 years old, is still at large. Interior Minister Bruno Retailleau has vowed to track down all those responsible and protect crypto entrepreneurs during meetings with industry leaders.

The post Suspected organizer of France’s crypto kidnapping spree arrested in Morocco appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-06-05 10:00:46

@ 9ca447d2:fbf5a36d

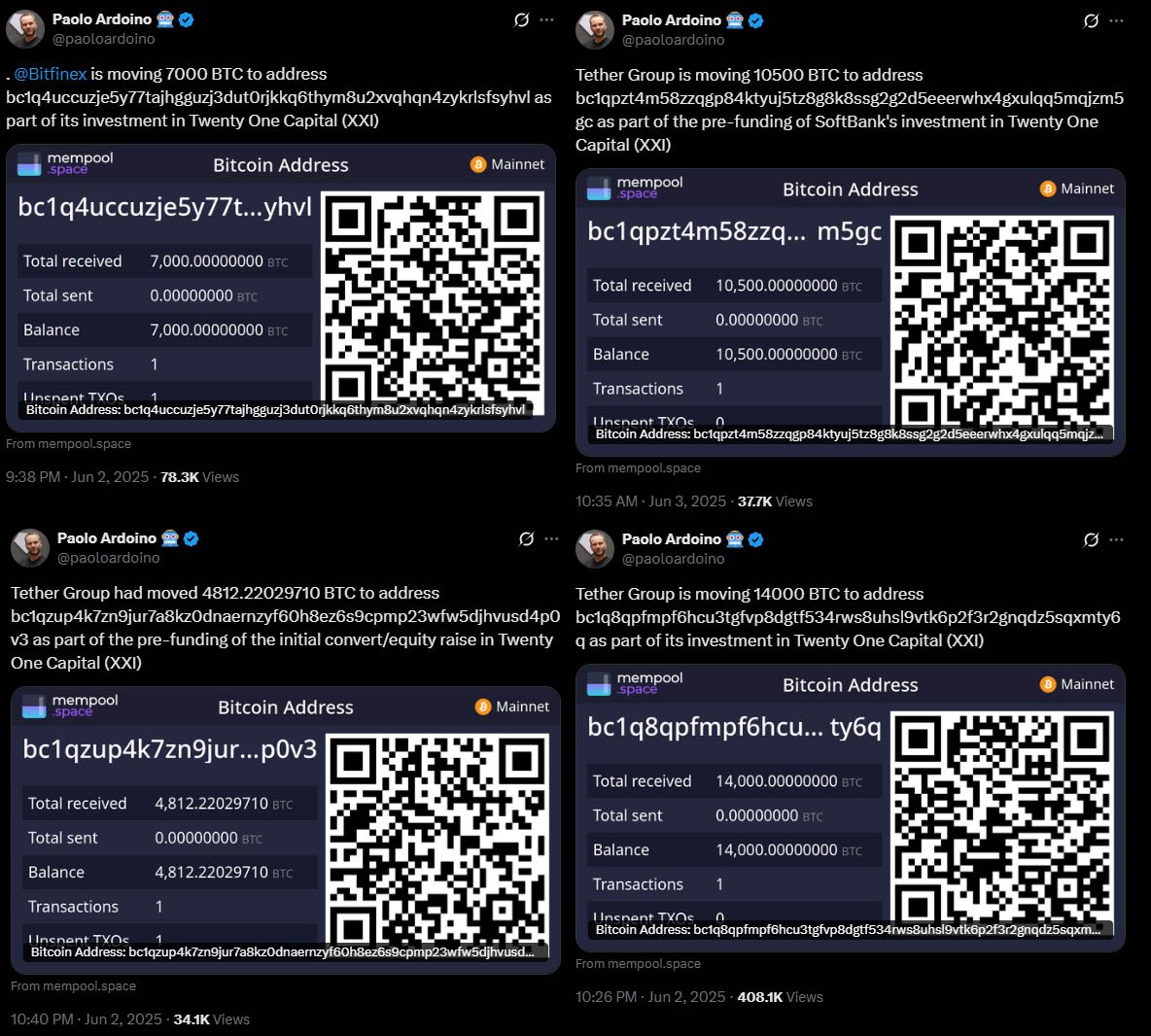

2025-06-05 10:00:46In a massive vote of confidence for a new bitcoin-focused company, Tether and Bitfinex have moved over 37,000 BTC—worth $3.9 billion—to digital treasury firm Twenty One Capital. This is one of the largest Bitcoin transactions in recent history.

The announcement came from Paolo Ardoino, CEO of Tether and CTO of Bitfinex, through multiple posts on X. According to Ardoino, the transfers were part of a pre-funding round for the launch of Twenty One Capital, a new company that will lead the bitcoin treasury space.

Ardoino announced several transfers on X — Sources 1, 2, 3, 4, and 5

“Tether Group is moving 10,500 BTC to address bc1qpzt4m58zzqgp84ktyuj5tz8g8k8ssg2g2d5eeerwhx4gxulqq5mqjzm5gc as part of the pre-funding of SoftBank’s investment in Twenty One Capital (XXI)” Ardoino said.

Twenty One Capital is a new bitcoin treasury firm led by Jack Mallers, CEO of Strike and founder of Zap. The company is backed by Tether, Bitfinex, SoftBank and Cantor Fitzgerald.

The company will go public via a SPAC merger with Cantor Equity Partners (CEP) and will trade under the ticker XXI on Nasdaq. After the merger was announced CEP’s stock price skyrocketed from $11 to $59.75.

Cantor Equity Partners’ stock price jumped on news of the merger — TradingView

Mallers says the company’s mission is bold and clear: accumulate bitcoin and provide full transparency through public wallet disclosures, also known as providing “proof-of-reserves“.

Total bitcoin moved to Twenty One Capital so far include:

- 10,500 BTC from Tether on behalf of SoftBank (worth about $1.1 billion)

- 19,729.69 BTC from Tether (worth around $2 billion)

- 7,000 BTC from Bitfinex (valued at roughly $740 million)

The amounts sum up to 37,229.69 BTC, worth around $3.9 billion at current prices. These were verified on public blockchain explorers.

The Twenty One Capital wallets now show large balances. They have already confirmed they have 31,500 BTC. That makes them the 3rd largest corporate bitcoin holder behind Strategy and Marathon Digital Holdings.

Once these new transfers are confirmed, the company will take over Marathon to become the second-largest corporate holder of the scarce digital asset globally.

Related: Twenty One Capital Becomes 3rd-Largest Corporate Holder of Bitcoin

Unlike companies that add bitcoin to their balance sheet, Twenty One Capital exists solely to accumulate and manage bitcoin. It follows a model similar to Strategy but is more transparent.

Mallers introduced new financial metrics like Bitcoin Per Share (BPS) and Bitcoin Return Rate (BRR) to value the company in bitcoin terms, not fiat.

He thinks economic value in the future will not be measured in dollars but in satoshis—the smallest unit of bitcoin. The company is not just about guarding against fiat collapse, but about completely opting out of the system.

A key part of the firm’s strategy is proof of reserves. Unlike some other big bitcoin holders, Twenty One Capital has already published its public wallet addresses so anyone can verify its holdings in real time.

Ardoino called this approach “Bitcoin Treasury Transparency (BTT)” and said it’s a response to recent industry scandals that showed the dangers of financial opacity in digital assets.

Mallers added openness is the only way to build long-term trust in a bitcoin-native financial system.

Twenty One Capital wants to reshape financial infrastructure, build native bitcoin lending models and promote global Bitcoin adoption.

-

@ cae03c48:2a7d6671

2025-06-05 10:00:26

@ cae03c48:2a7d6671

2025-06-05 10:00:26Bitcoin Magazine

Semler Scientific Acquires 185 Bitcoin, Increasing Total Holdings to 4,449 BTCToday, Semler Scientific announced it has increased its Bitcoin holdings. The company acquired 185 Bitcoin between May 23 and June 3 for $20 million with an average purchase price of $107,974 per Bitcoin, using proceeds from its at-the-market (ATM) offering program.

JUST IN:

Public company Semler Scientific purchases an additional 185 #bitcoin for $20 million. pic.twitter.com/Iir6NiNzc8

Public company Semler Scientific purchases an additional 185 #bitcoin for $20 million. pic.twitter.com/Iir6NiNzc8— Bitcoin Magazine (@BitcoinMagazine) June 4, 2025

“We continue to accretively grow our bitcoin arsenal using operating cash flow and proceeds from debt and equity financings,” said the chairman of Semler Scientific Eric Semler. “And we are excited to launch the Semler Scientific dashboard today on our website to provide the public with regularly updated information on our bitcoin holdings and other key metrics.”

Since launching the ATM program in April 2025, Semler has raised approximately $136.2 million under the sales agreement of over 3.6 million shares of its common stock.

As of June 3, 2025, Semler holds 4,449 Bitcoin which were acquired for an amount of $410.0 million, with an average purchase price of $92,158 per Bitcoin. At the time of writing, the market value of these holdings is around $446.2 million.

Eric Semler on X posted, “SMLR acquires 185 Bitcoins for $20 million and has generated BTC Yield of 26.7% YTD. Now holding 4,449 $BTC.”

$SMLR acquires 185 #Bitcoins for $20 million and has generated BTC Yield of 26.7% YTD. Now holding 4,449 $BTC.

— Eric Semler (@SemlerEric) June 4, 2025

Semler Scientific uses the BTC Yield as a key performance indicator (KPI) to help assess the performance of its strategy of acquiring Bitcoin. As of year-to-date, the company has achieved a BTC Yield of 26.7%.

“Semler Scientific believes this KPI can be used to supplement an investor’s understanding of Semler Scientific’s decision to fund the purchase of Bitcoin by issuing additional shares of its common stock or instruments convertible to common stock,” stated the 8-K form.

In Q1 FY2025, Semler Scientific reported a difficult quarter. Revenue came in at $8.8 million, a 44% decrease year-over-year. Operating expenses jumped to $39.9 million from $8.9 million last year, mainly due to a $29.8 million contingent liability tied to the potential settlement with the DOJ. This led to a $31.1 million operating loss, compared to a $7.0 million profit in Q1 2024.

“Our healthcare business is seeing green shoots from the cardiovascular product line that we introduced to our large enterprise customer base this year,” said the CEO of Semler Scientific Doug Murphy-Chutorian. “We are expecting growth and cash generation from these FDA-cleared products and services, which will add to our bitcoin treasury strategy.”

This post Semler Scientific Acquires 185 Bitcoin, Increasing Total Holdings to 4,449 BTC first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-05 10:00:25

@ cae03c48:2a7d6671

2025-06-05 10:00:25Bitcoin Magazine

BTCPay Server: The Backbone of Bitcoin Commerce, 2025The genesis story of BTCPay Server is without a doubt one of the most iconic moments in Bitcoin history. A single developer, feeling betrayed by Bitpay, a bitcoin payments processing giant and its attempt at co-opting Bitcoin, declared economic war on the company in a tweet that will never be forgotten by the Bitcoin industry; “This is lies, my trust in you is broken, I will make you obsolete.”

Nicolas Dorier went on to create one of the most widely distributed open source projects in the Bitcoin industry and perhaps the invoicing and payments industry as a whole: BTCPay Server. Much has been written about the context and motivation behind Dorier’s founding of the project — there’s even a documentary about it.

What’s seldom highlighted is how ambitious a project BTCPay Server is, how feature-rich it has become and how deeply integrated it is with the industry. In fact, it is easy to forget that as an open source project with no centralized database of users, BTCPay Server is both a massive privacy upgrade for its users and represents the removal of a fundamental middleman processing payments. As a result, Dorier and the BTCPay Server community have created a public goods infrastructure — a kind of commons of payment processing — that provides users real value by saving them fees, and providing them a much smoother user experience given that no personal information is required for the payments to flow.

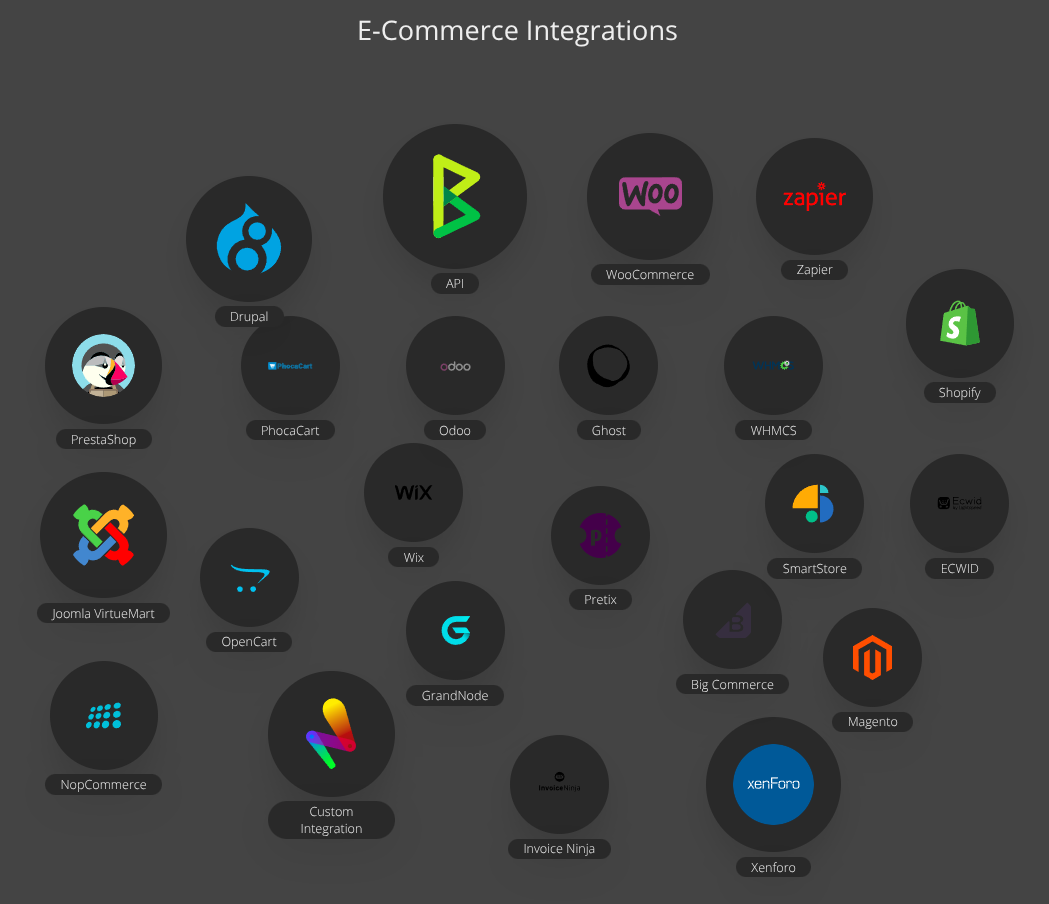

Humbly described on their website as “a self-hosted, open-source cryptocurrency payment processor,” BTCPay Server is an invoicing and accounting system for merchants, a fully featured Bitcoin wallet with full node capabilities; on-chain, Lightning Network and Liquid Network support; hardware wallet support; and a modular plugin system. The plugins in particular extend the core of BTCPay Server into a wide range of niches. They also integrate into e-commerce giants such as WooCommerce and Shopify.

It is somewhat difficult to gauge the success and scope of BTCPay Server. Because it is a self-hosted platform that does not capture customer data of any kind — it has no central cloud service as other payment processors do — our view into its success is somewhat limited.

However, we can get a sense of their reach by proxy of other metrics, for example, their primary software repository has had over 170 open source contributors, with 8,393 commits at the time of writing.

As of 2025, BTCPay Server has had one million downloads directly from its GitHub repository, which does not account for cloud providers of the software as hosted by companies like Voltage or Lunanode. It is also often the case that one instance of BTCPay Server serves multiple merchants and hosts multiple stores simultaneously.

R0ckstardev, one of the top contributors to the project, told Bitcoin Magazine that there could be hundreds of thousands of instances of BTCPay Server running throughout the world. Tobe Chileta, a contributor to the project, also told Bitcoin Magazine that “of the seven continents of the world, I think it is only Antarctica that I haven’t seen someone run BTCPay server.” He added, “I’m certain we have merchants running in Asia, Africa, North America, South America, Europe and Australia.”

Companies

BTCPay Server’s website business directory, while far from exhaustive, covers hundreds of merchants onboarded. The BTCPay Server community also does regular case studies of user cohorts or major merchants that use the software, documenting their integration and story in their case studies page. It gives fantastic insights into a variety of Bitcoin communities throughout the world and includes useful guides on how to replicate various results and implementations.

Namecheap, for example, boasted over 70 million dollars’ of bitcoin volume since their integration of BTCPay Server. From May 18, 2020, to October 2024 they clocked in 1.1m transactions in total with over 500,000 users paying in bitcoin, resulting in over $73 million in revenue through payments made from over 200 countries.

BTC Inc, the parent company of the biggest Bitcoin conference in the world, has for years been setting up BTCPay Server for its merchants, and even has a one-hour behind-the-scenes documentary on the complexities of setting up dozens of merchants at a conference (filmed during the Nashville 2024 Bitcoin conference). The event saw over 25,000 attendees, including the 47th president of the U.S., Donald J. Trump.

In this most recent Bitcoin 2025 conference in Las Vegas, BTCPay Server was used to process a new world record of Bitcoin transactions within an eight-hour period, with 4,187 transactions in total. The initial target was 4,000 transactions and was set by the Guinness World Records organization.

Integrations and Plugins

One of the most important dimensions of BTCPay Server is its plugin system. Given the wide variety of ways companies can interact with Bitcoin, the developer community has optimized the BTCPay Server code toward a plugin model that developers can build for with a well-documented set of GitHub repos and an API. Today there are over 30 plugins available on BTCPay Server. Here are some of the greatest hits:

Boltz Swap Exchange Plugin

Boltz is an atomic swap exchange focused on the various Bitcoin layers such as Liquid, Lightning, Rootstock and of course Bitcoin on-chain. It has gained prominence of late as a very simple solution to the channel rebalancing challenges Lightning wallets face. R0ckstardev told Bitcoin Magazine that he is particularly impressed with the Boltz integration, and even tweeted as much earlier this year.

I've recently been going through the code of @Boltzhq plugin for @BtcpayServer, what jackstar12 & @kilrau have done there is an absolutely l33t engineering.

It's a literal crime against humanity that what they've done was not featured more in Bitcoin media.

— Uncle Rockstar Developer (@r0ckstardev) April 24, 2025

Branded as a noncustodial Bitcoin Bridge, Boltz allows users to swap between different Bitcoin layers while retaining maximum control of their funds, using atomic swap technology that eliminates third-party trust across crypto-native payments. For example, you can use Boltz via BTCPay Server to make a Lightning payment, where the sats are initially held at rest in a Liquid network wallet and are pulled from that balance by the Boltz plugin. The L-BTC is atomically swapped for sats on the Lightning Network via the Boltz exchange and the satoshis flow to the end recipient. This whole process is effectively noncustodial.

This is the same type of “lightning service provider” style infrastructure with which Breez wallet recently announced integration. While it is not quite as cheap as a user-operated Lightning node can be in the best of cases, it is far easier to set up and run — only demanding a few clicks on the BTCPay Server interface. As far as BTCPay Server is concerned, this Boltz plugin represents a full Lightning node, integrating natively with the invoicing and accounting layers.

This tech also scales quite well: One BTCPay Server admin can support many different merchants and not even have to run or manage a standard Lightning node, since the plugin supports automated liquidity management.

The Bolt Cards Plugin

The Bolt card, a company and product created by the Coincenter exchange, has come into prominence recently thanks to its unique graphics and the laser-eyes that light up on tap-to-pay. They, too, have a BTCPay Server plugin that lets users manage and connect these cool NFC cards to their wallets via the plugin.

BITCOIN IS MONEY.

AND AT @THEBITCOINCONF WE WILL PAY IN STYLE, WITH @JACK LASER-EYES BOLT CARDS.

ONLY 1,000 AVAILABLE, GET YOURS ON MAY 28TH. [pic.twitter.com/fDrZW5TGCv](https:

-

@ 3eab247c:1d80aeed

2025-06-05 08:51:39

@ 3eab247c:1d80aeed

2025-06-05 08:51:39Global Metrics

Here are the top stats from the last period:

- Total Bitcoin-accepting merchants: 15,306 → 16,284

- Recently verified (1y): 7,540 → 7,803 (the rest of our dataset is slowly rotting; help us before it's too late!)

- Avg. days since last verification: 398 → 405 (more mappers, please)

- Merchants boosted: 22 (for a total of 4,325 days, someone is feeling generous)

- Comments posted: 34

Find current stats over at the 👉 BTC Map Dashboard.

Merchant Adoption

Steak n’ Shake

The US 🇺🇸 is a massive country, yet its BTC Map footprint has been lagging relative to other countries ... that is until now!

In what came as a nice surprise to our Shadowy Supertaggers 🫠, the Steak ’n Shake chain began accepting Bitcoin payments across hundreds of its locations nationwide (with some international locations too).

According to CoinDesk, the rollout has been smooth, with users reporting seamless transactions powered by Speed.

This marks a significant step towards broader Bitcoin adoption in the US. Now to drop the capital gains tax on cheesburgers!

SPAR Switzerland

In other chain/franchise adoption news, the first SPAR supermarket in Switzerland 🇨🇭 to begin accepting Bitcoin was this one in Zug. It was quickly followed by this one in Rossrüti and this one in Kreuzlingen, in what is believed to be part of a wider roll-out plan within the country powered by DFX's Open CryptoPay.

That said, we believe the OG SPAR crown goes to SPAR City in Arnhem Bitcoin City!

New Features

Merchant Comments in the Web App

Web App users are now on par with Android users in that they can both see and make comments on merchants.

This is powered by our tweaked API that enables anyone to make a comment as long as they pass the satswall fee of 500 sats. This helps keep spam manageable and ensure quality comments.

And just in case you were wondering what the number count was on the merchant pins - yep, they're comments!

Here is an 👉 Example merchant page with comments.

Merchant Page Design Tweaks

To support the now trio of actions (Verify, Boost & Comment) on the merchant page, we've re-jigged the design a little to make things a little clearer.

What do you think?

Technical

Codebase Refactoring

Thanks to Hannes’s contributions, we’ve made progress in cleaning-up the Web App's codebase and completing long overdue maintenance. Whilst often thankless tasks, these caretaking activities help immensely with long-term maintainability enabling us to confidently build new features.

Auth System Upgrades

The old auth system was held together with duct tape and prayers, and we’re working on a more robust authentication system to support future public API access. Updates include:

- Password hashing

- Bearer token support

- Improved security practices

More enhancements are in progress and we'll update you in the next blog post.

Better API Documentation

Instead of relying on tribal knowledge, we're finally getting around to writing actual docs (with the help/hindrance of LLMs). The "move fast, break everything" era is over; now we move slightly slower and break slightly less. Progress!

Database Improvements

We use SQLite, which works well but it requires careful handling in async Rust environments. So now we're untangling this mess to avoid accidental blocking queries (and the ensuing dumpster fires).

Backup System Enhancements

BTC Map data comes in three layers of fragility:

- Merchants (backed up by OS - the big boys handle this)

- Non-OSM stuff (areas, users, etc. - currently stored on a napkin)

- External systems (Lightning node, submission tickets - pray to Satoshi)

We're now forcing two core members to backup everything, because redundancy is good.

Credits

Thanks to everyone who directly contributed to the project this period:

- Comino

- descubrebitcoin

- Hannes

- Igor Bubelov

- Nathan Day

- Rockedf

- Saunter

- SiriusBig

- vv01f

Support Us

There are many ways in which you can support us:

-

Become a Shadowy Supertagger and help maintain your local area or pitch-in with the never-ending global effort.

-

Consider a zapping this note or make a donation to the to the project here.

-

@ cae03c48:2a7d6671

2025-06-05 10:00:25

@ cae03c48:2a7d6671

2025-06-05 10:00:25Bitcoin Magazine

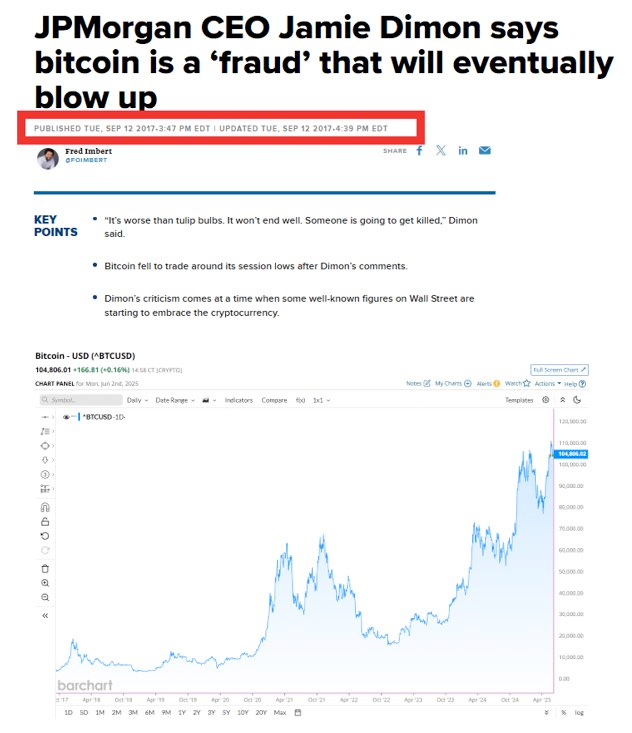

JPMorgan to Offer Clients Financing Against Bitcoin & Crypto ETFsJPMorgan Chase & Co. plans to allow its trading and wealth-management clients to use cryptocurrency-linked assets, including spot Bitcoin exchange-traded funds (ETFs), as collateral for loans, according to Bloomberg.

JPMorgan Plans to Offer Clients Financing Against Crypto ETFs pic.twitter.com/QpausRiHxM

JPMorgan Plans to Offer Clients Financing Against Crypto ETFs pic.twitter.com/QpausRiHxM— matthew sigel, recovering CFA (@matthew_sigel) June 4, 2025

The bank will begin with BlackRock’s iShares Bitcoin Trust (IBIT), and additional ETFs are expected to be added over time. The policy will apply globally, spanning all client segments—from individual retail accounts to investors.

In addition to the lending change, JPMorgan will begin factoring crypto holdings into overall net worth and liquid asset evaluations, placing them on par with stocks, vehicles, or fine art when determining loan eligibility, according to those familiar with the matter.

This development marks a formal expansion of what had previously been permitted on a limited, case-by-case basis. The bank’s new approach comes as other major financial institutions, including Morgan Stanley, explore ways to integrate crypto offerings more broadly. Last month, Bloomberg also reported that Morgan Stanley plans to bring crypto trading to its E*Trade platform.

The shift also reflects changes in the U.S. regulatory environment. Since returning to office, President Donald Trump’s administration has taken a more favorable stance toward digital assets. Spot Bitcoin ETFs, first introduced in January 2024, have seen rapid growth and now manage a combined $128 billion in assets, making them among the most successful ETF launches to date.

Bitcoin’s price has also risen significantly in recent months, reaching a record $111,980 in May 2025.

JPMorgan was among the first large U.S. banks to experiment with blockchain technology and maintains relationships with firms such as Coinbase. This latest decision allows more digital assets into the bank’s lending framework.

While JPMorgan CEO Jamie Dimon has remained publicly skeptical of Bitcoin, he has consistently emphasized clients’ right to access the asset. Speaking at the firm’s investor day in May, Dimon stated, “I’m not a fan of Bitcoin.” He went on to say, “I don’t think we should smoke, but I defend your right to smoke. I defend your right to buy Bitcoin, go at it.”

This post JPMorgan to Offer Clients Financing Against Bitcoin & Crypto ETFs first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-05 10:00:24

@ cae03c48:2a7d6671

2025-06-05 10:00:24Bitcoin Magazine

Bitcoin Layer 2: The Key To Scaling BitcoinBitcoin, and for that matter all blockchains, do not scale. It is a fundamental limitation of blockchain based systems that they are incapable of facilitating transactional use at a truly global scale without completely sacrificing the decentralization and verifiability that make them valuable in the first place.

This has been an existential issue that Bitcoiners have grappled with from the very beginning of Bitcoin. This is a comment from James A. Donald, a Canadian cypherpunk who was the first person to reply to Satoshi’s original post on the cryptography mailing list:

Satoshi Nakamoto wrote:

“The bandwidth might not be as prohibitive as you

think. A typical transaction would be about 400 bytes

(ECC is nicely compact). Each transaction has to be

broadcast twice, so lets say 1KB per transaction.

Visa processed 37 billion transactions in FY2008, or

an average of 100 million transactions per day. That

many transactions would take 100GB of bandwidth, or

the size of 12 DVD or 2 HD quality movies, or about

$18 worth of bandwidth at current prices.”The trouble is, you are comparing with the Bankcard

network.But a new currency cannot compete directly with an old,

because network effects favor the old.You have to go where Bankcard does not go.

At present, file sharing works by barter for bits. This,

however requires the double coincidence of wants. People

only upload files they are downloading, and once the

download is complete, stop seeding. So only active

files, files that quite a lot of people want at the same

time, are available.File sharing requires extremely cheap transactions,

several transactions per second per client, day in and

day out, with monthly transaction costs being very small

per client, so to support file sharing on bitcoins, we

will need a layer of account money on top of the

bitcoins, supporting transactions of a hundred

thousandth the size of the smallest coin, and to support

anonymity, chaumian money on top of the account money.Let us call a bitcoin bank a bink. The bitcoins stand

in the same relation to account money as gold stood in

the days of the gold standard. The binks, not trusting

each other to be liquid when liquidity is most needed,

settle out any net discrepancies with each other by

moving bit coins around once every hundred thousand

seconds or so, so bitcoins do not change owners that

often, Most transactions cancel out at the account

level. The binks demand bitcoins of each other only

because they don’t want to hold account money for too

long. So a relatively small amount of bitcoins

infrequently transacted can support a somewhat larger

amount of account money frequently transacted.Despite the era of the Blocksize Wars, the big blockers, and the naive assumptions by many early Bitcoiners that simply raising the blocksize was a viable solution to scale the system, it has been understood by competent observers and engineers from the very beginning that this would undermine the core value proposition of that made it useful in the first place. Hal Finney also spoke of the need for such a settlement layer on top.

Scaling in layers has always been the only rational plan to make Bitcoin work in the long term, but for a long period of Bitcoin’s early history how to do so without relying on trusted third parties was an elusive problem.

One of the first ideas on how to do this was sidechains, independent blockchains with a peg to facilitate locking bitcoin on the mainchain to utilize on the sidechain, and at any point unlocking funds on the mainchain to move them back by proving legitimate control of bitcoin on the sidechain. These systems however have yet to achieve a way to operate a peg without either 1) introducing some form of trusted third party, no matter how well mitigated, or 2) creating centralization pressure for the primary Bitcoin network.

Since those early days there have been many more ideas developed that have found better ways to peg into second layer systems, specifically schemes like the Lightning Network and Ark which allow end users to unilaterally exit back to the mainchain without needing the permission or approval of some operator.

Scaling Bitcoin in a way that facilitates higher transactional volumes without degrading the security properties of Bitcoin to the point of being indistinguishable from third party operated custodians is one of the most critical problems to solve in order for Bitcoin to truly succeed in the long term.

This article series will explore the architectures of different Layer 2 systems for Bitcoin, both those deployed live on the network right now and those that are simply design proposals at this point.

Listed below are the systems I will be covering. The design space of Layer 2s is much more expansive than many people are familiar with, so this list should not be taken as comprehensive and complete, and will be updated over time to reflect additional Layer 2s that are covered.

- Ark

- Statechains

- Lightning Network

- Sidechains

- Clique

- Rollups

- Client Side Validated Systems

- Ecash

- Custodial Systems

- Physical Bearer Instruments

This post Bitcoin Layer 2: The Key To Scaling Bitcoin first appeared on Bitcoin Magazine and is written by Shinobi.

-

@ cae03c48:2a7d6671

2025-06-05 10:00:23

@ cae03c48:2a7d6671

2025-06-05 10:00:23Bitcoin Magazine

Support The Blockchain Regulatory Certainty Act (BRCA) To Protect Noncustodial ServicesWith a lot of regulatory talk centered around The GENIUS Act and The CLARITY Act (the market structure bill) right now, it’s important that Bitcoin enthusiasts also pay attention to and support The Blockchain Regulatory Certainty Act (BRCA) — H.R. 1747.

The act, which was reintroduced to Congress on May 21, 2025 by Rep. Tom Emmer (R-MN) and Rep. Ritchie Torres (D-NY), provides “safe harbor from licensing and registration for certain non-controlling blockchain developers and providers of blockchain services.”

Critical Bitcoin legislation was introduced last week & it needs our support

The Blockchain Regulatory Certainty Act (BRCA) by @GOPMajorityWhip and @RitchieTorres protects self-custody developers, miners, and nodes from being classified as money transmitters.

Thread

pic.twitter.com/cJ8Ogno3h5

pic.twitter.com/cJ8Ogno3h5— Nick Neuman (@Nneuman) May 30, 2025

It also stipulates that no blockchain developer or provider of a blockchain service shall be treated as a money transmitter unless the developers or providers behind the project have control over user funds.

This bill is relevant because the developers for both Samourai Wallet and Tornado Cash are currently facing charges for operating unlicensed money transmitter businesses, despite the fact that the developers for neither of these technologies ever had control over user funds.

It’s also important because, under the Biden administration, the U.S. Department of Justice (DoJ) didn’t just classify privacy services as money transmitters, but ancillary services such as Lightning nodes, rollup sequencers, and other Bitcoin and blockchain technology, as well.

If the BRCA isn’t enacted into law, there is a risk that all Bitcoin and crypto wallets as well as other noncustodial services and technologies will be made illegal and/or subject to KYC/AML laws.

While Rep. Emmer and Rep. Torres’ reintroducing this bill is a positive step, the congressmen need our help in making the BRCA a priority for this current Congress.

To help, go to SaveOurWallets.org and follow the directions on the website to contact the elected officials that represent your district and state in the federal government and tell them that you would like to see them support the BRCA.

But they need our help, we need to make clear that the Blockchain Regulatory Certainty Act is *the* priority this Congress for our space. Go to https://t.co/fXVqSQ2nUv, put in your ZIP code, and make a quick call. It works.

— saveourwallets (@saveourwalets) June 3, 2025

If this act doesn’t pass, we will face significant hurdles regarding the scaling of Bitcoin and other blockchains as well as around privacy.

Yes, yes, I know some of you are saying to yourselves Bitcoin will win regardless of our actions (or that it’s already won) and that we don’t need to engage with politicians in the process.

I’m here to say 1.) this isn’t necessarily true, 2.) there are four developers currently facing trial (the Samourai and Tornado Cash developers) and pushing to get this bill passed may help them, 3.) if this bill doesn’t pass, scaling Bitcoin may be much more difficult, and 4.) there’s a reality in which we give up a lot of our legal right to privacy when using Bitcoin if the bill doesn’t pass.

So, with these points in mind, pick up the phone and/or send an email to your elected representatives and tell them you’d like to see them support the BRCA.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This post Support The Blockchain Regulatory Certainty Act (BRCA) To Protect Noncustodial Services first appeared on Bitcoin Magazine and is written by Frank Corva.

-

@ cae03c48:2a7d6671

2025-06-05 10:00:22

@ cae03c48:2a7d6671

2025-06-05 10:00:22Bitcoin Magazine

Matador Technologies Raises C$1.64M To Invest in Their Bitcoin ReserveMatador Technologies Inc. (TSXV: MATA, OTCQB: MATAF), a Bitcoin-focused tech company, announced that it has closed the second tranche of its non-brokered private placement, raising C$1,644,300 through the issuance of 2,652,097 units at a price of $0.62 per unit, with the proceeds going towards investing in their Bitcoin reserve.

Matador (TSXV: MATA | OTCQB: MATAF | FSE: IU3) closes $1.64M second tranche at $0.62/unit

Matador (TSXV: MATA | OTCQB: MATAF | FSE: IU3) closes $1.64M second tranche at $0.62/unit

Each unit: 1 share + ½ warrant @ $0.77

Each unit: 1 share + ½ warrant @ $0.77

Proceeds:

Buy more Bitcoin

Buy more Bitcoin

Expand gold & Grammies

Expand gold & Grammies

General corporate growth

General corporate growth  https://t.co/nUm0bFWtO0#Bitcoin #TreasuryStrategy…

https://t.co/nUm0bFWtO0#Bitcoin #TreasuryStrategy…— Matador Technologies (@buymatador) June 4, 2025

“Each Unit consists of one common share and one-half of one common share purchase warrant,” stated in the press release. “Each Warrant entitles the holder to acquire one additional common share of the Company at a price of $0.77 for a period of twelve months from the date of issuance.”

The warrants are subject to acceleration if Matador’s shares trade at or above $1.15 for five consecutive trading days at any time following the date which is four months and one day after the closing date.

The securities from the second tranche are under a hold period that lasts until October 5, 2025. As part of the deal, the company also paid finder’s fees totaling $95,582 and issued 152,165 broker warrants on the same terms.

This follows the first tranche of the offering, announced on May 30, 2025, which included a CAD$1.5 million investment from Arrington Capital, a digital asset management firm co-founded by Michael Arrington.

“We’re thrilled to welcome Arrington Capital as a strategic investor,” said the CEO of Matador Technologies Inc. Deven Soni. “Their deep conviction in the Bitcoin ecosystem and global perspective on digital assets align perfectly with Matador’s vision. This investment enhances our ability to accelerate development of Bitcoin-native financial products and scale our platform globally.”

In that tranche, Matador issued 2,419,354 units under the same terms. Each including one common share and one-half warrant, with full warrants exercisable at $0.77 for one year. Like the second tranche, those warrants are also subject to acceleration if the share price hits $1.15 for five consecutive trading days following the initial four-month period.

“This is more than just a capital raise—it’s a signal that the world’s top digital asset investors see the same future we do,” said the Chief Visionary Officer of Matador Mark Moss.

“At Matador, we believe the next wave of global financial infrastructure will be built on digital assets,” commented Moss. “By aligning with HODL, we’re not just expanding geographically—we’re expanding the reach of the digital assets’ ecosystem into a key innovation hub.”

This post Matador Technologies Raises C$1.64M To Invest in Their Bitcoin Reserve first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 7f6db517:a4931eda

2025-06-05 09:02:04

@ 7f6db517:a4931eda

2025-06-05 09:02:04

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 42a071ab:3391e086

2025-06-05 09:31:56

@ 42a071ab:3391e086

2025-06-05 09:31:56Trong một thế giới mà sự cạnh tranh ngày càng khốc liệt, yếu tố tạo nên sự khác biệt không chỉ nằm ở chất lượng sản phẩm mà còn ở cách một thương hiệu chăm sóc và kết nối với khách hàng. AV88 hiểu rõ điều đó và đã không ngừng đầu tư vào trải nghiệm người dùng như một chiến lược cốt lõi để xây dựng lòng tin và sự trung thành. Ngay từ những bước đầu tiên khi khách hàng tiếp cận AV88, họ được đón nhận bởi một giao diện thân thiện, dễ sử dụng và được thiết kế dựa trên hành vi sử dụng thực tế. Tất cả các chức năng, từ đăng ký tài khoản, quản lý thông tin cá nhân cho đến các bước tương tác hằng ngày đều được tối ưu để đảm bảo sự liền mạch và thuận tiện. Hơn thế, AV88 còn xây dựng một hệ thống chăm sóc khách hàng luôn sẵn sàng hỗ trợ 24/7, cung cấp thông tin kịp thời và giải quyết mọi thắc mắc nhanh chóng, mang lại cảm giác yên tâm tuyệt đối cho người sử dụng. Không chỉ dừng lại ở mức độ phản hồi, đội ngũ tại AV88 còn chủ động thu thập ý kiến, khảo sát nhu cầu và cải tiến dịch vụ theo thời gian thực, từ đó đảm bảo rằng mỗi sự đổi mới đều xuất phát từ chính kỳ vọng của người dùng. Nhờ vậy, AV88 không đơn thuần là một nền tảng dịch vụ mà còn là một người bạn đồng hành đáng tin cậy trong hành trình số hóa của mỗi khách hàng.

av88 cũng đặt ra một tiêu chuẩn mới cho sự minh bạch và bảo mật – hai yếu tố then chốt trong việc xây dựng niềm tin lâu dài. Mọi quy trình đều được thiết lập rõ ràng, dễ theo dõi và có hướng dẫn chi tiết, từ quy trình giao dịch cho đến các chính sách bảo vệ thông tin cá nhân. Các công nghệ mã hóa tiên tiến và lớp xác thực đa tầng giúp bảo đảm an toàn tuyệt đối trong mọi hoạt động. Không dừng lại ở việc duy trì chất lượng dịch vụ, AV88 còn tiên phong trong việc tích hợp công nghệ nhằm tối ưu hóa hiệu suất và giảm thiểu thời gian chờ đợi của người dùng. Các thao tác nạp – rút nhanh chóng, hệ thống thông báo thông minh và tính cá nhân hóa trong trải nghiệm giúp người dùng cảm nhận được sự linh hoạt và chuyên nghiệp. Chính sự kết hợp giữa công nghệ, con người và tầm nhìn chiến lược đã giúp AV88 không chỉ duy trì vị thế trên thị trường mà còn định hình chuẩn mực mới cho ngành dịch vụ lấy khách hàng làm trung tâm. Dù trong bối cảnh nào, AV88 vẫn luôn giữ vững cam kết: lắng nghe, thấu hiểu và đồng hành cùng khách hàng trên mọi hành trình. Điều này không chỉ tạo dựng giá trị bền vững cho thương hiệu mà còn góp phần nâng cao tiêu chuẩn chung của ngành, thúc đẩy sự phát triển toàn diện và dài lâu.

-

@ 8bad92c3:ca714aa5

2025-06-05 09:01:45

@ 8bad92c3:ca714aa5

2025-06-05 09:01:45Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ 7f6db517:a4931eda

2025-06-05 09:02:03

@ 7f6db517:a4931eda

2025-06-05 09:02:03

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-05 09:02:02

@ 7f6db517:a4931eda

2025-06-05 09:02:02

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 9ca447d2:fbf5a36d

2025-06-05 09:01:24

@ 9ca447d2:fbf5a36d

2025-06-05 09:01:24Trump Media & Technology Group (TMTG), the company behind Truth Social and other Trump-branded digital platforms, is planning to raise $2.5 billion to build one of the largest bitcoin treasuries among public companies.

The deal involves the sale of approximately $1.5 billion in common stock and $1.0 billion in convertible senior secured notes.

According to the company, the offering is expected to close by the end of May, pending standard closing conditions.

Devin Nunes, CEO of Trump Media, said the investment in bitcoin is a big part of the company’s long-term plan.

“We view Bitcoin as an apex instrument of financial freedom,” Nunes said.

“This investment will help defend our Company against harassment and discrimination by financial institutions, which plague many Americans and U.S. firms.”

He added that the bitcoin treasury will be used to create new synergies across the company’s platforms including Truth Social, Truth+, and the upcoming financial tech brand Truth.Fi.

“It’s a big step forward in the company’s plans to evolve into a holding company by acquiring additional profit-generating, crown jewel assets consistent with America First principles,” Nunes said.

The $2.5 billion raise will come from about 50 institutional investors. The $1 billion in convertible notes will have 0% interest and be convertible into shares at a 35% premium.

TMTG’s current liquid assets, including cash and short-term investments, are $759 million as of the end of the first quarter of 2025. With this new funding, the company’s liquid assets will be over $3 billion.

Custody of the bitcoin treasury will be handled by Crypto.com and Anchorage Digital. They will manage and store the digital assets.

Earlier this week The Financial Times reported Trump Media was planning to raise $3 billion for digital assets acquisitions.

The article said the funds would be used to buy bitcoin and other digital assets, and an announcement could come before a major related event in Las Vegas.

Related: Bitcoin 2025 Conference Kicks off in Las Vegas Today

Trump Media denied the FT report. In a statement, the company said, “Apparently the Financial Times has dumb writers listening to even dumber sources.”

There was no further comment. However, the official $2.5 billion figure, which was announced shortly after by Trump Media through a press release, aligns with its actual filing and investor communication.

Trump Media’s official announcement

This comes at a time when the Trump family and political allies are showing renewed interest in Bitcoin.

President Donald Trump who is now back in office since the 2025 election, has said he wants to make the U.S. the “crypto capital of the world.”

Trump Media is also working on retail bitcoin investment products including ETFs aligned with America First policies.

These products will make bitcoin more accessible to retail investors and support pro-Trump financial initiatives.

But not everyone is happy.

Democratic Senator Elizabeth Warren recently expressed concerns about Trump Media’s Bitcoin plans. She asked U.S. regulators to clarify their oversight of digital-asset ETFs, warning of investor risk.

Industry insiders are comparing Trump Media’s plans to Strategy (MSTR) which has built a multi-billion dollar bitcoin treasury over the last year. They used stock and bond sales to fund their bitcoin purchases.

-

@ dfa02707:41ca50e3

2025-06-05 10:01:29

@ dfa02707:41ca50e3

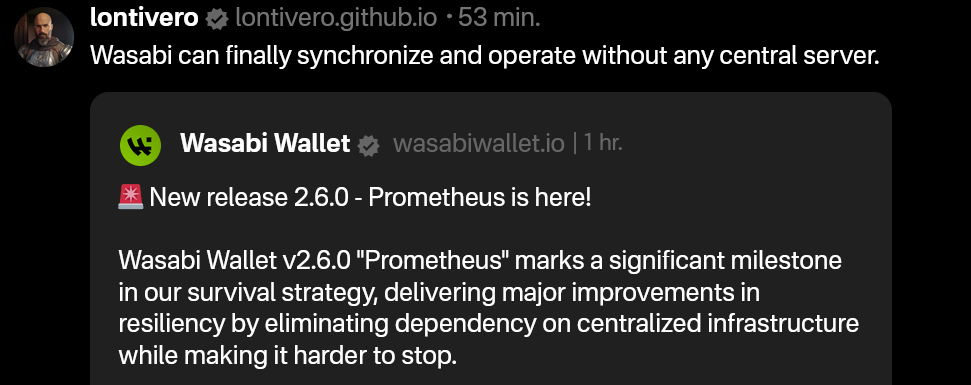

2025-06-05 10:01:29News

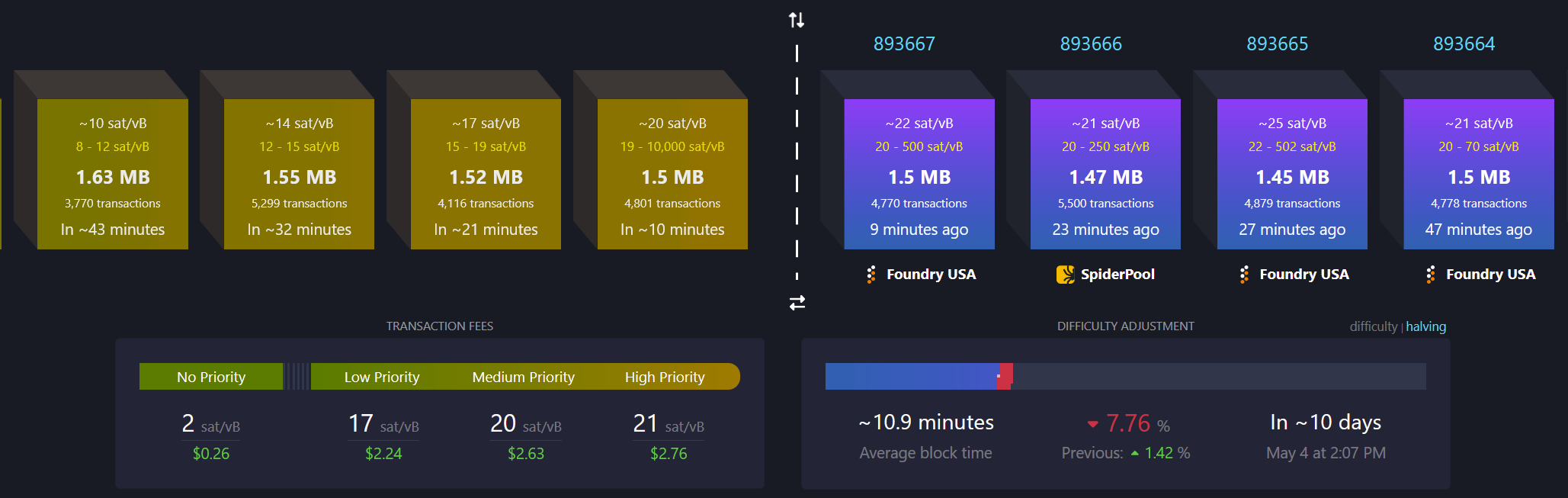

- Bitcoin mining centralization in 2025. According to a blog post by b10c, Bitcoin mining was at its most decentralized in May 2017, with another favorable period from 2019 to 2022. However, starting in 2023, mining has become increasingly centralized, particularly due to the influence of large pools like Foundry and the use of proxy pooling by entities such as AntPool.

Source: b10c's blog.

- OpenSats announces the eleventh wave of Nostr grants. The five projects in this wave are the mobile live-streaming app Swae, the Nostr-over-ham-radio project HAMSTR, Vertex—a Web-of-Trust (WOT) service for Nostr developers, Nostr Double Ratchet for end-to-end encrypted messaging, and the Nostr Game Engine for building games and applications integrated with the Nostr ecosystem.