-

@ 8fb140b4:f948000c

2023-11-21 21:37:48

@ 8fb140b4:f948000c

2023-11-21 21:37:48Embarking on the journey of operating your own Lightning node on the Bitcoin Layer 2 network is more than just a tech-savvy endeavor; it's a step into a realm of financial autonomy and cutting-edge innovation. By running a node, you become a vital part of a revolutionary movement that's reshaping how we think about money and digital transactions. This role not only offers a unique perspective on blockchain technology but also places you at the heart of a community dedicated to decentralization and network resilience. Beyond the technicalities, it's about embracing a new era of digital finance, where you contribute directly to the network's security, efficiency, and growth, all while gaining personal satisfaction and potentially lucrative rewards.

In essence, running your own Lightning node is a powerful way to engage with the forefront of blockchain technology, assert financial independence, and contribute to a more decentralized and efficient Bitcoin network. It's an adventure that offers both personal and communal benefits, from gaining in-depth tech knowledge to earning a place in the evolving landscape of cryptocurrency.

Running your own Lightning node for the Bitcoin Layer 2 network can be an empowering and beneficial endeavor. Here are 10 reasons why you might consider taking on this task:

-

Direct Contribution to Decentralization: Operating a node is a direct action towards decentralizing the Bitcoin network, crucial for its security and resistance to control or censorship by any single entity.

-

Financial Autonomy: Owning a node gives you complete control over your financial transactions on the network, free from reliance on third-party services, which can be subject to fees, restrictions, or outages.

-

Advanced Network Participation: As a node operator, you're not just a passive participant but an active player in shaping the network, influencing its efficiency and scalability through direct involvement.

-

Potential for Higher Revenue: With strategic management and optimal channel funding, your node can become a preferred route for transactions, potentially increasing the routing fees you can earn.

-

Cutting-Edge Technological Engagement: Running a node puts you at the forefront of blockchain and bitcoin technology, offering insights into future developments and innovations.

-

Strengthened Network Security: Each new node adds to the robustness of the Bitcoin network, making it more resilient against attacks and failures, thus contributing to the overall security of the ecosystem.

-

Personalized Fee Structures: You have the flexibility to set your own fee policies, which can balance earning potential with the service you provide to the network.

-

Empowerment Through Knowledge: The process of setting up and managing a node provides deep learning opportunities, empowering you with knowledge that can be applied in various areas of blockchain and fintech.

-

Boosting Transaction Capacity: By running a node, you help to increase the overall capacity of the Lightning Network, enabling more transactions to be processed quickly and at lower costs.

-

Community Leadership and Reputation: As an active node operator, you gain recognition within the Bitcoin community, which can lead to collaborative opportunities and a position of thought leadership in the space.

These reasons demonstrate the impactful and transformative nature of running a Lightning node, appealing to those who are deeply invested in the principles of bitcoin and wish to actively shape its future. Jump aboard, and embrace the journey toward full independence. 🐶🐾🫡🚀🚀🚀

-

-

@ 8fb140b4:f948000c

2023-11-18 23:28:31

@ 8fb140b4:f948000c

2023-11-18 23:28:31Chef's notes

Serving these two dishes together will create a delightful centerpiece for your Thanksgiving meal, offering a perfect blend of traditional flavors with a homemade touch.

Details

- ⏲️ Prep time: 30 min

- 🍳 Cook time: 1 - 2 hours

- 🍽️ Servings: 4-6

Ingredients

- 1 whole turkey (about 12-14 lbs), thawed and ready to cook

- 1 cup unsalted butter, softened

- 2 tablespoons fresh thyme, chopped

- 2 tablespoons fresh rosemary, chopped

- 2 tablespoons fresh sage, chopped

- Salt and freshly ground black pepper

- 1 onion, quartered

- 1 lemon, halved

- 2-3 cloves of garlic

- Apple and Sage Stuffing

- 1 loaf of crusty bread, cut into cubes

- 2 apples, cored and chopped

- 1 onion, diced

- 2 stalks celery, diced

- 3 cloves garlic, minced

- 1/4 cup fresh sage, chopped

- 1/2 cup unsalted butter

- 2 cups chicken broth

- Salt and pepper, to taste

Directions

- Preheat the Oven: Set your oven to 325°F (165°C).

- Prepare the Herb Butter: Mix the softened butter with the chopped thyme, rosemary, and sage. Season with salt and pepper.

- Prepare the Turkey: Remove any giblets from the turkey and pat it dry. Loosen the skin and spread a generous amount of herb butter under and over the skin.

- Add Aromatics: Inside the turkey cavity, place the quartered onion, lemon halves, and garlic cloves.

- Roast: Place the turkey in a roasting pan. Tent with aluminum foil and roast. A general guideline is about 15 minutes per pound, or until the internal temperature reaches 165°F (74°C) at the thickest part of the thigh.

- Rest and Serve: Let the turkey rest for at least 20 minutes before carving.

- Next: Apple and Sage Stuffing

- Dry the Bread: Spread the bread cubes on a baking sheet and let them dry overnight, or toast them in the oven.

- Cook the Vegetables: In a large skillet, melt the butter and cook the onion, celery, and garlic until soft.

- Combine Ingredients: Add the apples, sage, and bread cubes to the skillet. Stir in the chicken broth until the mixture is moist. Season with salt and pepper.

- Bake: Transfer the stuffing to a baking dish and bake at 350°F (175°C) for about 30-40 minutes, until golden brown on top.

-

@ 8fb140b4:f948000c

2023-11-02 01:13:01

@ 8fb140b4:f948000c

2023-11-02 01:13:01Testing a brand new YakiHonne native client for iOS. Smooth as butter (not penis butter 🤣🍆🧈) with great visual experience and intuitive navigation. Amazing work by the team behind it! * lists * work

Bold text work!

Images could have used nostr.build instead of raw S3 from us-east-1 region.

Very impressive! You can even save the draft and continue later, before posting the long-form note!

🐶🐾🤯🤯🤯🫂💜

-

@ 8fb140b4:f948000c

2023-08-22 12:14:34

@ 8fb140b4:f948000c

2023-08-22 12:14:34As the title states, scratch behind my ear and you get it. 🐶🐾🫡

-

@ 8fb140b4:f948000c

2023-07-30 00:35:01

@ 8fb140b4:f948000c

2023-07-30 00:35:01Test Bounty Note

-

@ 8fb140b4:f948000c

2023-07-22 09:39:48

@ 8fb140b4:f948000c

2023-07-22 09:39:48Intro

This short tutorial will help you set up your own Nostr Wallet Connect (NWC) on your own LND Node that is not using Umbrel. If you are a user of Umbrel, you should use their version of NWC.

Requirements

You need to have a working installation of LND with established channels and connectivity to the internet. NWC in itself is fairly light and will not consume a lot of resources. You will also want to ensure that you have a working installation of Docker, since we will use a docker image to run NWC.

- Working installation of LND (and all of its required components)

- Docker (with Docker compose)

Installation

For the purpose of this tutorial, we will assume that you have your lnd/bitcoind running under user bitcoin with home directory /home/bitcoin. We will also assume that you already have a running installation of Docker (or docker.io).

Prepare and verify

git version - we will need git to get the latest version of NWC. docker version - should execute successfully and show the currently installed version of Docker. docker compose version - same as before, but the version will be different. ss -tupln | grep 10009- should produce the following output: tcp LISTEN 0 4096 0.0.0.0:10009 0.0.0.0: tcp LISTEN 0 4096 [::]:10009 [::]:**

For things to work correctly, your Docker should be version 20.10.0 or later. If you have an older version, consider installing a new one using instructions here: https://docs.docker.com/engine/install/

Create folders & download NWC

In the home directory of your LND/bitcoind user, create a new folder, e.g., "nwc" mkdir /home/bitcoin/nwc. Change to that directory cd /home/bitcoin/nwc and clone the NWC repository: git clone https://github.com/getAlby/nostr-wallet-connect.git

Creating the Docker image

In this step, we will create a Docker image that you will use to run NWC.

- Change directory to

nostr-wallet-connect:cd nostr-wallet-connect - Run command to build Docker image:

docker build -t nwc:$(date +'%Y%m%d%H%M') -t nwc:latest .(there is a dot at the end) - The last line of the output (after a few minutes) should look like

=> => naming to docker.io/library/nwc:latest nwc:latestis the name of the Docker image with a tag which you should note for use later.

Creating docker-compose.yml and necessary data directories

- Let's create a directory that will hold your non-volatile data (DB):

mkdir data - In

docker-compose.ymlfile, there are fields that you want to replace (<> comments) and port “4321” that you want to make sure is open (check withss -tupln | grep 4321which should return nothing). - Create

docker-compose.ymlfile with the following content, and make sure to update fields that have <> comment:

version: "3.8" services: nwc: image: nwc:latest volumes: - ./data:/data - ~/.lnd:/lnd:ro ports: - "4321:8080" extra_hosts: - "localhost:host-gateway" environment: NOSTR_PRIVKEY: <use "openssl rand -hex 32" to generate a fresh key and place it inside ""> LN_BACKEND_TYPE: "LND" LND_ADDRESS: localhost:10009 LND_CERT_FILE: "/lnd/tls.cert" LND_MACAROON_FILE: "/lnd/data/chain/bitcoin/mainnet/admin.macaroon" DATABASE_URI: "/data/nostr-wallet-connect.db" COOKIE_SECRET: <use "openssl rand -hex 32" to generate fresh secret and place it inside ""> PORT: 8080 restart: always stop_grace_period: 1mStarting and testing

Now that you have everything ready, it is time to start the container and test.

- While you are in the

nwcdirectory (important), execute the following command and check the log output,docker compose up - You should see container logs while it is starting, and it should not exit if everything went well.

- At this point, you should be able to go to

http://<ip of the host where nwc is running>:4321and get to the interface of NWC - To stop the test run of NWC, simply press

Ctrl-C, and it will shut the container down. - To start NWC permanently, you should execute

docker compose up -d, “-d” tells Docker to detach from the session. - To check currently running NWC logs, execute

docker compose logsto run it in tail mode add-fto the end. - To stop the container, execute

docker compose down

That's all, just follow the instructions in the web interface to get started.

Updating

As with any software, you should expect fixes and updates that you would need to perform periodically. You could automate this, but it falls outside of the scope of this tutorial. Since we already have all of the necessary configuration in place, the update execution is fairly simple.

- Change directory to the clone of the git repository,

cd /home/bitcoin/nwc/nostr-wallet-connect - Run command to build Docker image:

docker build -t nwc:$(date +'%Y%m%d%H%M') -t nwc:latest .(there is a dot at the end) - Change directory back one level

cd .. - Restart (stop and start) the docker compose config

docker compose down && docker compose up -d - Done! Optionally you may want to check the logs:

docker compose logs

-

@ 7ed7d5c3:6927e200

2025-01-08 17:10:00

@ 7ed7d5c3:6927e200

2025-01-08 17:10:00Can't decide if the terrible book you just read is a 1 or 1.5 star book? Look no further than this chart. Was it Shit or just Bad? Was that movie you watched Very Good or just Decent? How many things out there are really Life Changing?

Finally, a rating scale for humans. Use it for anything in your life that needs a rating out of 5 stars.

Rating / Description

0.5 – The worst 1.0 – Shit 1.5 – Bad 2.0 – Eh 2.5 – Entertaining, but not great 3.0 – Neutral 3.5 – Alright 4.0 – Decent 4.5 – Very good 5.0 – Life Changing

P.S. Do not use it to rate your wife's cooking. The author is not liable for any damages.

-

@ 8d34bd24:414be32b

2025-01-08 14:34:15

@ 8d34bd24:414be32b

2025-01-08 14:34:15I’ve known that there are references to Jesus in the Old Testament. They just don’t use the name Jesus.

Then God said, “Let Us make man in Our image, according to Our likeness; and let them rule over the fish of the sea and over the birds of the sky and over the cattle and over all the earth, and over every creeping thing that creeps on the earth.” (Genesis 1:26) {emphasis mine}

Notice the references to God in the plural. These are clues to the trinitarian (3 persons in one God) nature of God.

There are also examples of theophanies (preincarnate Jesus) in the Old Testament. These theophanies are frequently referred to as “the angel of the Lord” or “the angel of God.”

But the angel of the Lord called to him from heaven and said, “Abraham, Abraham!” And he said, “Here I am.” He said, “Do not stretch out your hand against the lad, and do nothing to him; for now I know that you fear God, since you have not withheld your son, your only son, from Me.” (Genesis 22:11-12) {emphasis mine}

In this case we know that the “angel of the Lord” is not just an angel because he says, “I know that you fear God, since you have not withheld your son, your only son, from Me,” equating Himself, “Me,” with God. In most cases when an angel appears, the people drop face down in worship, but the angel corrects them and tells them not to worship. When the angel is Jesus, He accepts the worship and in many cases sacrifices as well.

The angel of the Lord appeared to him and said to him, “The Lord is with you, O valiant warrior.” Then Gideon said to him, “O my lord, if the Lord is with us, why then has all this happened to us? … So Gideon said to Him, “If now I have found favor in Your sight, then show me a sign that it is You who speak with me. Please do not depart from here, until I come back to You, and bring out my offering and lay it before You.” And He said, “I will remain until you return.”

Then Gideon went in and prepared a young goat and unleavened bread from an ephah of flour; he put the meat in a basket and the broth in a pot, and brought them out to him under the oak and presented them. The angel of God said to him, “Take the meat and the unleavened bread and lay them on this rock, and pour out the broth.” And he did so. Then the angel of the Lord put out the end of the staff that was in his hand and touched the meat and the unleavened bread; and fire sprang up from the rock and consumed the meat and the unleavened bread. Then the angel of the Lord vanished from his sight. When Gideon saw that he was the angel of the Lord, he said, “Alas, O Lord God! For now I have seen the angel of the Lord face to face.” (Judges 6:12=13a, 17-22) {emphasis mine}

As you can see, Gideon offered an offering. An offering to anyone other than God would be idolatry. Gideon offers a “a young goat and unleavened bread from an ephah of flour,” which is a proper sin offering to God. The angel did not eat the offering, but told Gideon to “Take the meat and the unleavened bread and lay them on this rock … Then the angel of the Lord put out the end of the staff that was in his hand and touched the meat and the unleavened bread; and fire sprang up from the rock and consumed the meat and the unleavened bread. Then the angel of the Lord vanished from his sight.” Gideon’s offering was taken as a burnt offering to God and to angel of the Lord, who is Jesus.

With all of this, look at the verse I read last night:

Who has ascended into heaven and descended?\ Who has gathered the wind in His fists?\ Who has wrapped the waters in His garment?\ Who has established all the ends of the earth?\ What is His name or His son’s name?\ Surely you know! (Proverbs 30:4) {emphasis mine}

Surely this is a passage about Jesus.

This verse says, “Who has ascended into heaven and descended?” The New Testament says about Jesus, “No one has ascended into heaven, but He who descended from heaven: the Son of Man.” (John 3:13)

This verse says, “Who has gathered the wind in His fists?” The New Testament says about Jesus,

And there arose a fierce gale of wind, and the waves were breaking over the boat so much that the boat was already filling up. Jesus Himself was in the stern, asleep on the cushion; and they woke Him and said to Him, “Teacher, do You not care that we are perishing?” And He got up and rebuked the wind and said to the sea, “Hush, be still.” And the wind died down and it became perfectly calm. (Mark 4:37-39) {emphasis mine}

This verse says, “Who has wrapped the waters in His garment?” The New Testament says about Jesus,

And in the fourth watch of the night He came to them, walking on the sea. When the disciples saw Him walking on the sea, they were terrified, and said, “It is a ghost!” And they cried out in fear. But immediately Jesus spoke to them, saying, “Take courage, it is I; do not be afraid.”

Peter said to Him, “Lord, if it is You, command me to come to You on the water.” And He said, “Come!” And Peter got out of the boat, and walked on the water and came toward Jesus. (Matthew 14:25-29) {emphasis mine}

This verse says, “Who has established all the ends of the earth?” The New Testament says about Jesus,

In the beginning was the Word, and the Word was with God, and the Word was God. He was in the beginning with God. All things came into being through Him, and apart from Him nothing came into being that has come into being. (John 1:1-3) {emphasis mine}

This verse says, “What is His name or His son’s name?” The New Testament says about Jesus,

After being baptized, Jesus came up immediately from the water; and behold, the heavens were opened, and he saw the Spirit of God descending as a dove and lighting on Him, and behold, a voice out of the heavens said, “This is My beloved Son, in whom I am well-pleased. (Matthew 3:16-17) {emphasis mine}

This verse says, “Surely you know!” As New Testament believers we know the Son of God, Jesus Christ. The Bible was pointing to the Son of God long before He came to earth as a baby.

Who has ascended into heaven and descended?\ Who has gathered the wind in His fists?\ Who has wrapped the waters in His garment?\ Who has established all the ends of the earth?\ What is His name or His son’s name?\ Surely you know! (Proverbs 30:4) {emphasis mine}

It doesn’t matter how many times we have already read the Bible. Every time we read it, we can discover new insight and knowledge of God, His eternal plans, and His commands for our lives. God is good.

Trust Jesus.

-

@ ed84ce10:cccf4c2a

2025-01-08 12:33:06

@ ed84ce10:cccf4c2a

2025-01-08 12:33:06Hackathon Summary

The YQuantum 2024 Hackathon concluded with significant participation and numerous project submissions, establishing itself as a vibrant platform for innovation. Out of 300 registrants, the on-site participants formed teams and worked on developing 28 BUIDLs, engaging in challenges across diverse tracks sponsored by prominent quantum computing organizations, such as QuEra Computing, IBM Quantum, Classiq, DoraHacks, SandboxAQ, and Capgemini/The Hartford/Quantinuum.

Participants developed groundbreaking solutions in quantum computing, driven by prize incentives, including quantum cloud credits, internships, networking opportunities, and potential speaking engagements. The grand prizes recognized exceptional projects, with the first place receiving $2000, presentation opportunities before Yale researchers, and participation in the Yale Innovation Summit.

The hackathon successfully fostered a collaborative environment that encouraged the exploration of cutting-edge technologies and ideas, advancing the quantum computing field. YQuantum 2024 underscored the potential of quantum technologies and promoted knowledge exchange among participants and sponsors.

Hackathon Winners

Held on April 13, 2024, YQuantum's inaugural event attracted 300 participants from 10 countries, featuring six industry-sponsored challenges that culminated in a series of prestigious awards.

Institute Grand Prizes Winners

-

1st Place: Quantum Consortium: Case-Duke-Lehigh-Vandy Nexus This project employs adiabatic methods to prepare antiferromagnetic energy eigenstates, with a focus on quantum many-body scarring and enhancing error correction in computing.

-

2nd Place: Sparse Quantum State Preparation The team developed efficient algorithms using Classiq APIs for sparse quantum state preparation, optimizing execution for scalability and efficiency in managing quantum data.

-

3rd Place: QuBruin This project optimizes algorithms using dynamic quantum circuits and enhances error correction. The team improved user accessibility through Qiskit-based models for better circuit performance under noise conditions.

IBM Quantum Prize Winners

- Modified IBM Challenge

This project delves into foundational linear algebra concepts, emphasizing core principles and mastery.

QuEra Computing Prize Winners

- 3D Quantum Scars on 2D Tweezer Arrays

The team investigates quantum scar states on a 3D lattice projected into 2D, using Julia and QuEra's Bloqade to simulate quantum dynamics.

Classiq Technologies Prize Winners

- YQuantum2024 Classiq Team 34 Wavefunction Wizards

Focusing on optimizing sparse quantum state preparation, this project enhances algorithmic efficiency in quantum data processing.

DoraHacks Prize Winners

- Spooner_QRNG_Classifier

The project employs Python scripts and a gradient booster classifier to predict quantum device origins of random binary data, surpassing baseline prediction accuracy.

Capgemini // Quantinuum // The Hartford Prize Winners

-

Skittlez

This partnership addresses quantum computing challenges through interdisciplinary expertise, designing innovative quantum solutions. -

Honorable Mention: BB24 - Yale Quantum Monte Carlo The project enhances Quantum Monte Carlo techniques via novel sampling and encoding schemes, improving parallel processing and computational efficiency.

SandboxAQ Prize Winners

-

QuantumQuails

This project improves solar cell efficiency through quantum chemistry, utilizing VQE to model solar energy absorption for enhanced conversion effectiveness. -

Honorable Mention: mRNA Sequence Design via Quantum Approximate Optimization Algorithm This project optimizes mRNA sequence design using QAOA, enhancing protein expression and structural stability through codon and nucleotide parameters.

Explore all projects at DoraHacks.

About the Organizer:

YQuantum

YQuantum is a prominent entity within the technology and blockchain sectors, recognized for its innovative approach and strategic initiatives. Specializing in utilizing quantum computing capabilities, YQuantum is committed to advancing the technological frontier. Though specific projects are not highlighted, YQuantum's role in shaping industry standards positions it as a leader in the field. Through dedication to cutting-edge research and development, YQuantum continues to drive progress in quantum technologies, aligning with its mission to propel scientific and technological advancements globally.

-

-

@ 2355757c:5ad3e04d

2025-01-08 17:00:53

@ 2355757c:5ad3e04d

2025-01-08 17:00:53Non-Native Electromagnetic Fields (nnEMFs) are in my opinion, the least discussed and most pervasive environmental toxin in modern society that is negatively affecting our health. We live in a toxic soup world, where we are being attacked from every angle. Polluted air, water, plastics, chemicals in our food/clothes, endocrine disruptors in our personal care and cooking products…the list goes on and on. It is the unfortunate reality of living in a modern fiat world, where all big companies cut corners with cheap, toxic ingredients just so you can have a $20 cooking pan and a $15 t-shirt.

On the bright side of things, most of those toxins are pretty easily avoidable by just swapping for higher quality or more natural alternatives. You can also filter or buy better water and eat real food that was raised locally without toxic herbicides (to a pretty easy degree). Enter nnEMFs, something that is IMPOSSIBLE to fully avoid and MUCH more challenging to mitigate exposure to. That is because technology is so ubiquitous in our modern society. Cell phones and wifi routers in every house, smart appliances, cell towers on every block, power distribution and transmission lines, 5G rollout…we are surrounded by nnEMFs on a daily basis.

What are nnEMFs and why are they bad for my health?

A nnEMF is any EMF generated from a non-native source AKA a result of modern human technology. The three most common sources of nnEMFs are from our electrical power grid, radiofrequency (RF) communication, and microwave frequencies. These three sources differ by function and frequency.

-

Electrical Power Grid - 60Hz Frequency - In “Extremely Low Frequency Range (ELF)”

-

Radio Frequency (RF) - 3kHz to 300GHz - Mobile/Societal Communication/TV/Radio

-

Microwave (MW) - 300MHz to 300GHz - Radar/Satellite/Space Communication

It gets a bit confusing in the nomenclature between RF and MW, but in reality the only difference is the type of application above 300MHz. Below 300MHz and it is distinctly an RF frequency. All transmission and distribution of power to industry/homes/businesses is occurring at 60Hz. Vast differences in frequency, both turn out to be pretty detrimental for our health. Here’s a few reasons why:

- Classified as a possible carcinogen by the IARC (Group 2B)

RF-EMFs and ELF EMFs have been classified by the IARC as possibly carcinogenic based on the current scientific evidence. Now this is still a lower classification than red meat, so does this carry any merit? I say yes. Many researchers agree, such as in THIS study where researchers looked at mobile phone radiation and risk of brain tumors and concluded that RF fields should be classified as a probable carcinogenunder the criteria used by the IARC.

- RF and ELF Fields Increase Oxidative Stress

Oxidative stress. If you are a regular here in the health space you know how much comes down to maintaining redox homeostasis in our mitochondria (the supplier of ATP in our cells). Dysfunctional mitochondria = dysfunctional health and it just so happens that nnEMFs can significantly increase oxidative stress in our cells, with review studies like THIS one documenting how the most electromagnetic organs (brain, heart) as well as reproductive organs (testes, ovaries) were the MOST affected. (I wrote a recent substack post on declining sperm count and nnEMFs was the star of the show). Increased oxidative stress is consistent with OG findings from the likes of Dr. Robert Becker and Dr. Andrew Marino in their research. It is high level, but increased levels of oxidative stress predisposes you to increased risk of ALL KNOWN CHRONIC DISEASES. Because of this, nnEMFs have been strongly linked to increased risk of the following:

-

Neurodegenerative diseases

-

Reproductive issues

-

Cancer

-

Cardiovascular disease

-

Diabetes

-

Disturbed Sleep

We live in a toxic soup world. Achieving restorative sleep is the only way our body is able to fight back and restore our health from all of these toxic exposures. ANYTHING that impedes sleep restoration is a premature nail in the coffin in my eyes. Don’t believe me on the importance and power of melatonin and our circadian rhythm? Check out THIS thread I wrote on melatonin (anti-cancer, potent anti-oxidant, mitochondrial composer, etc.). Exposure to nnEMFs during the day AND at night disturb our sleep and prevent the ability to have that highly restorative sleep needed to detoxify and replenish our cells. Lose quality sleep, lose the ability to handle stressors that you are exposed to daily.

DON’T BELIEVE ME THAT nnEMFs are harmful to human health? You are not alone. Many mainstream media outlets, researchers, and industry “experts” dismiss the level of non-ionizing radiation coming from things like cell phones as dangerous to human health. This is has been ongoing since the 1970s. However, if you are subscribed to this newsletter you may have more of an open mind to believing everything you read from CNN, Forbes, or the WHO. I know you all question things more than the average member of society. So if you question the efficacy and morality of the vaccine, why would you not also question the potential health hazards of nnEMF exposure? Even Presidential Nominee RFK is on board. Big Tech, Big Pharma, Big Food…there is no difference! Centralized industry will do anything it takes to cover up research that is sound and not funded by themselves. Here is an example…

Dr. Henry Lai from University of Washington Emeritus has compiled the most comprehensive set of research articles regarding nnEMFs and biological impacts. He has reviewed OVER 2,500 studies. His conclusion?

Dr. Lai reports concluded from his research that exposure to RFR or ELF EMF produces oxidative effects or free radicals, and damages DNA. Downstream effects of studies examined include significant effects on genetic, neurological and reproductive functions. Among hundreds of studies of Radio Frequency Radiation (RFR), 70% to 89% reported significant biological effects. Among hundreds of studies of Extremely Low Frequency (ELF) and static fields, 74% to 91% reported significant biological effects.

Still don’t believe me, read the book Going Somewhere by Dr. Andrew Marino. It will blow your mind on how much effort has gone to cover up research on the biological effects of nnEMFs since the 1970s. Or Google Russia’s stance on nnEMFs.

You can also listen to one of our latest Decentralized Radio episodes with Anthony Smith, COO of EMF Safe. EMF Safe is a fantastic company that offers, in my opinion, the MOST effective nnEMF mitigation technology for your house. Hint: it’s not a f*cking pendant or harmonizer. YouTube link or Spotify link HERE.

Now that we got through the depressing side of the story, let's talk about WHAT YOU CAN DO to protect yourself from the harmful effects of nnEMFs without having to live in the woods-not a perfect solution either ;)

HOW TO MITIGATE nnEMF detrimental health effects: DURATION + DISTANCE \

\ TIME/DURATION. Your worst enemy in being exposed to nnEMFs is the duration of exposure. Nearly all of the negative studies showed that after 48-72hrs of exposure (chronic), detrimental health effects were seen. HOWEVER, the same studies showed less conclusive negative health effects for exposures less than 24-48hrs (with variance). For me that means the following action items:

-

Turn off the wifi-router at night

-

Turn phone on airplane mode when not using for >10 min

-

Turn appliances OFF when not in use in your home

-

Create a sleep sanctuary with minimal/no electronics in the bedroom

-

Do not move to an area right next to High Voltage Transmission Lines, Substation, Airport, Hospital, etc. (any area with high powered communication/RF equipment or power distribution equipment)

DISTANCE. Distance is your best friend in mitigating nnEMFs. Why? Inverse square law. Inverse square law is the fact that the magnitude of the EMF is calculated with the square of the distance in the denominator of the equation. This means that for every doubling of distance you have between you and the EMF source, the magnitude weakens by a factor of FOUR. Triple the distance, EMF magnitude goes down by a factor of NINE (and so forth). For me that results in the following action items:

-

Do not keep your cell phone ON your body when ON & receiving calls/texts

-

Do NOT hold your cell phone up to your ear when making calls (use headphones/speaker)

-

Move your bed 6-12 inches AWAY from any electrical outlets in your bedroom (especially near your head)

-

Do not stand immediately next to high powered appliances when ON & in use (microwave, washer, dryer, blender, etc.)

There exists a lot of other nnEMF “mitigating/harmonizing” technologies, however I would be highly suspect of anyone trying to sell you something. EMFs are extremely complex. The angle of incidence, power level, and frequency matter tremendously. Most folks who aren’t engineers or have a deep knowledge of physics likely won’t be able to have the baseline knowledge to know what is a scam and what is not. OR what to prioritize from an nnEMF mitigation perspective. I gave a pretty good starting point above for what actionable steps you can take. THis does not mean all products are a scam. nnEMF shielding has its place and I use some of these products…but whenever a topic is extremely complex to the layperson, it is easy for someone to convince you that a product works. Especially when proof is challenging to come up with (EMF readers are an okay tool at best).

As someone who holds a M.S. in Electrical Engineering, I never thought that my degree would come in handy for health optimization. Now in 2023, here I am realizing how electromagnetism is likely the MOST important topic to conceptualize to really crack the optimal health code. We are electromagnetic beings, and the research in this space has only just begun to scratch the surface.

If you want to learn more in depth about nnEMFs, mitigation tactics, what products work and do not, etc…subscribe to stay up to date on the latest. I am directly working with some renowned EMF experts on developing more educational content/courses that I will be launching in the near future to help practitioners and fellow esoteric health connoisseurs better understand nnEMFs more in depth to help themselves and their clients live a more optimal life.

Here on Decentralized Health, I will be writing in depth about the electromagnetic aspects of health alongside other topics I am passionate about such as environmental toxins, regenerative agriculture, decentralization, Bitcoin and more. I want as many people as possible to become empowered through education so that they can escape the dependencies of the centralized systems that are tarnishing our quality of life.

This is just the tip of the nnEMF iceberg.

Stay Sovereign,

Tristan

Originally published Sep 25. 2023

-

-

@ f96073dc:5951c7c2

2025-01-08 16:54:42

@ f96073dc:5951c7c2

2025-01-08 16:54:42Introduction

The food we consume plays an obvious yet undervalued role in not just sustaining us, but also in shaping who we become.

The phrase "You are what you eat" transcends cliché to embody a profound truth: our diet directly influences our life experience.

Debates continue about the optimal food sources for human health and longevity.

These discussions often involve emotionally charged arguments influenced by faith, traditions, economic interests, and political opinions concerning the global climate crisis and sustainability.

My goal isn’t to delve into the weeds of this emotional & political debate, but instead to strip things back and provide a birds eye view on nutrition, whilst offering alternative lenses through which we can view food.

## Understanding Food as Information

## Understanding Food as Information More than mere fuel, food serves as crucial information for our bodies.

This concept may sound strange, as much of our nutritional understanding has been dumbed down to ‘energy in, energy out’, or ‘calories in, calories out’.

This perspective bypasses the importance of micro nutrients—the vitamins & minerals our bodies interrelate with, or don’t.

Food information determines how our cells function and regenerate, impacting everything from energy levels to cognitive ability.

The challenge lies in deciphering what constitutes "good information."

For centuries, nature provided a simple guide.

Our ancestors thrived on a diet of organ meats, plants, seafood, fruit, muscle meats, bones, and eggs—foods naturally rich in nutrients and absent of modern chemicals.

The question remains: If our forebears thrived on these natural foods, why have we deviated so drastically?

## The Shift in Food Paradigms

## The Shift in Food Paradigms The introduction of heavily processed "Frankenfoods" laden with chemicals represents a stark departure from the diets of our grandparents and great-grandparents.

They consumed what we now coin "organic" food out of necessity rather than choice.

Food is pleasure, but it’s also a tool for a healthy self.

This ratio has been disproportionally thrown out of alignment.

The modern supermarket, with its aisles dominated by hyper palatable and processed products, reflects a concerning shift in our eating habits.

On the periphery of supermarkets lie fruits, vegetables, dairy, and animal based products, many of which have been sprayed with chemicals like glyphosate, or raised under inhumane conditions.

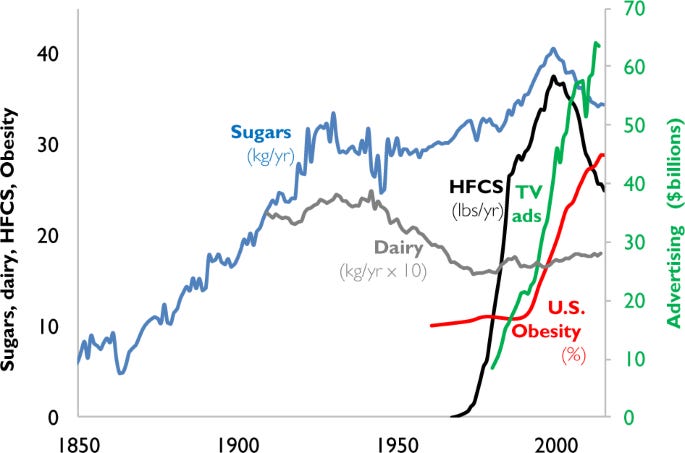

This brings us to the troubling paradox: while some parts of the world suffer from over-consumption and associated health issues like obesity and metabolic diseases, others face malnutrition and starvation due to food scarcity. (See red line below)

*HFCS: High fructose corn syrup

*HFCS: High fructose corn syrupQuestioning Current Food Paradigms

Our current food systems are broken.

A hard truth and pill to swallow, but if you look around, people have never been this unwell and overweight.

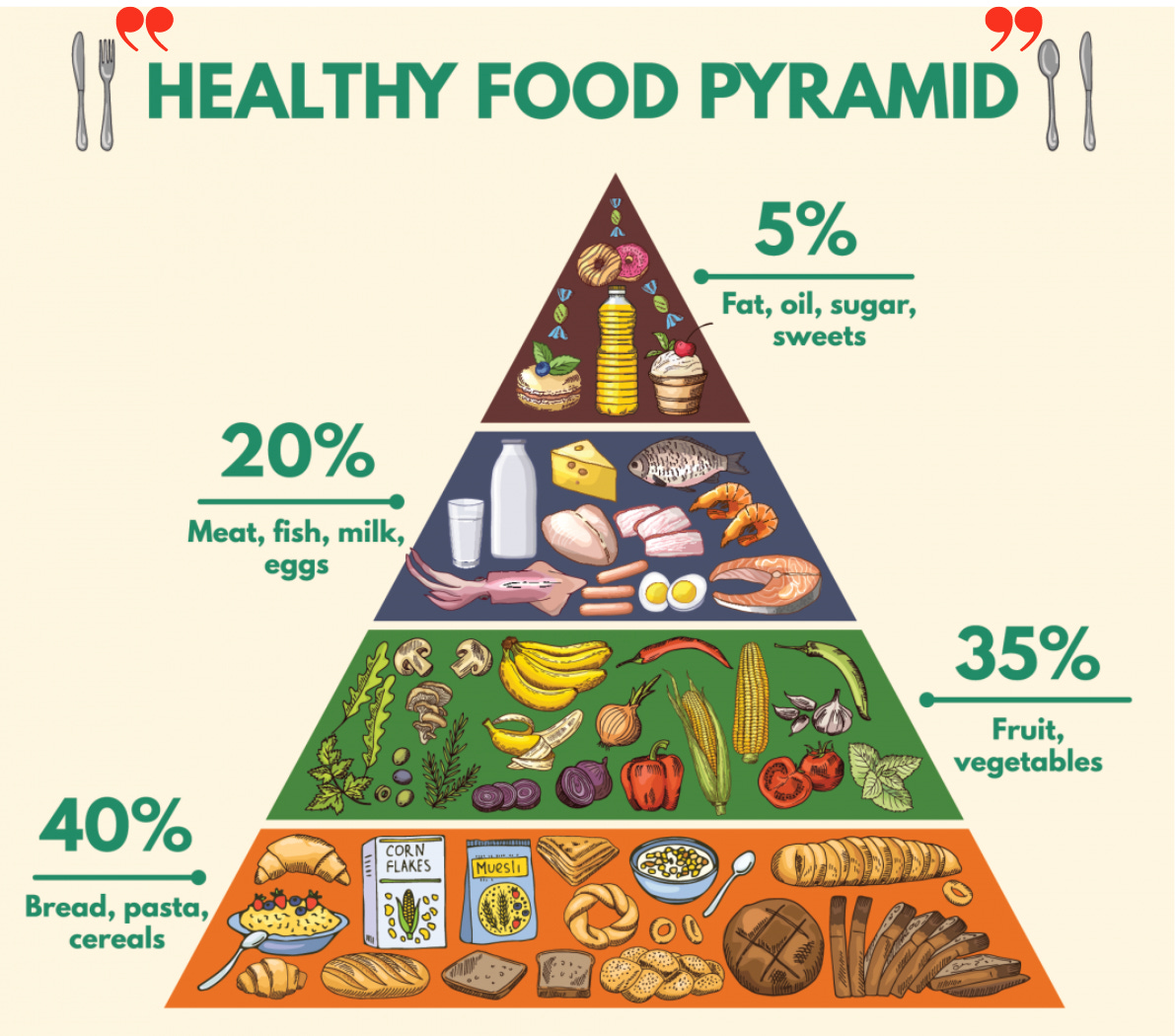

Misleading ‘Health Star Ratings’ and a flawed food pyramid, reflect a deeper societal malaise.

These systems often promote products that are not conducive to health, with processed carbohydrate forms serving as our staple, while nutrient and caloric dense foods like meat, fish, dairy, and natural fats have been marginalised.

## Whole Foods and Balanced Nutrients

## Whole Foods and Balanced Nutrients So, what’s the ideal diet?

There is no universal diet that fits everybody.

The journey to finding the right diet involves personal experimentation.

However, a diet emphasising whole foods, which humans have consumed for millennia, remains a sound choice.

Eating natural foods avoids the pitfalls of ultra-processed foods and provides a balanced array of nutrients.

Side note: historically, meat was always the prized resource.

## Beyond Pesticides

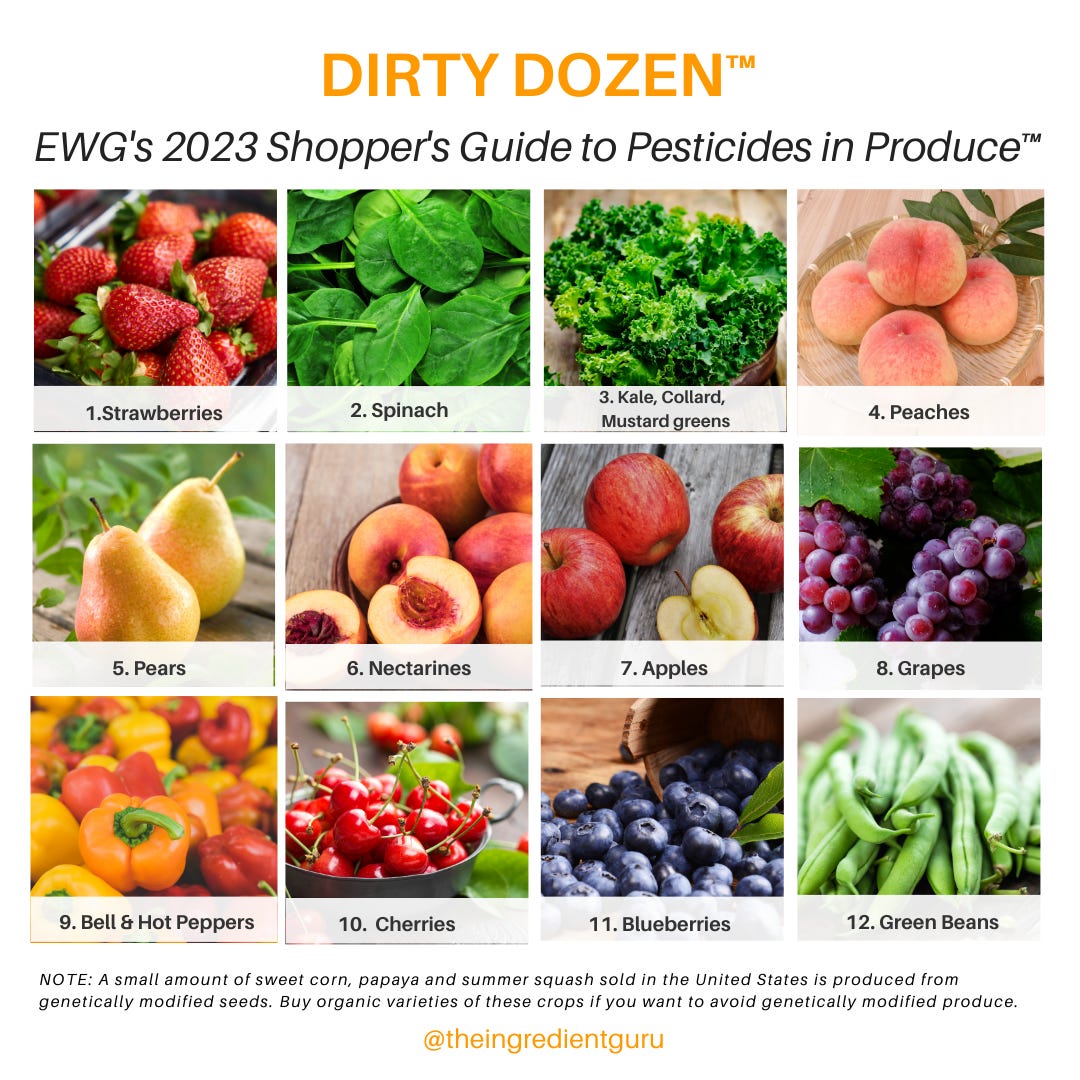

## Beyond Pesticides Every year, the Environmental Working Group (EWG) puts together a list of 15 foods with the lowest amounts of pesticide residues, and conversely, 12 of the most contaminated foods with pesticides.

This is known as the ‘Clean Fifteen’ and ‘Dirty Dozen’.

When financially feasible, it’s advised to consume organic and pasture raised products.

If buying organic isn’t possible, one strategy to reduce pesticides is to soak the produce in water and a teaspoon of baking soda or a splash of apple cider vinegar for a few minutes.

## Nutritional Strategies for Specific Needs

## Nutritional Strategies for Specific Needs Strategies like the elimination diet can help individuals identify how specific foods affect their bodies, allowing them to make informed choices that resonate with their unique physiological needs.

Tracking macronutrients and particularly protein intake can be crucial for specific health goals like muscle growth or weight loss.

Gaining a baseline understanding of the macros in your food can be an important piece of the puzzle, but should not become an obsessive practice.

Many diets serve a purpose, and depending on your goals as well as physiology, can be leveraged for great benefit.

This broad concept has been developed into a growing area of research called Nutrigenomics, defined as the study of how different foods may interact with specific genes to modify the risk of common chronic diseases, such as heart disease, stroke, and certain cancers.

For example, a ketogenic diet can help those with neurological disorders such as epilepsy or Alzheimer's disease, intermittent fasting can facilitate weight loss, and a carnivore diet can heal chronic skin or gut issues.

## Conclusion

## ConclusionIn an era where diet-related health issues are rampant, returning to a more natural, informed way of eating is not just beneficial; it is necessary.

The prevalence of heavily processed "Frankenfoods" deviates from the nutrient-rich diets of our ancestors, contributing to a paradox of overconsumption and malnutrition.

Challenging current food paradigms is necessary to address misleading nutritional guidelines and flawed food systems.

Empower yourself to explore food in a deeper fashion, seeking a diet that not only nourishes your body but also aligns with your lifestyle goals and fosters a sense of vitality and well-being.

Eating well is a form of a self respect, and while we get the chance to inhabit this physical form, it should be our duty to make the most of this life and embody our fullest potential.

-

@ bf47c19e:c3d2573b

2025-01-08 16:43:01

@ bf47c19e:c3d2573b

2025-01-08 16:43:01Originalni tekst na danas.rs

11.01.2021 / Autor: Aleksandar Milošević

Ima više od osam godina otkako sam prvi put čuo za to nešto što se zvalo bitkoin.

Libertarijanski san: „Decentralizovana“ valuta koju ne kontroliše nijedna država; na koju nijedna centralna banka ne može da utiče; koju je zahvaljujući „blokčejn“ tehnologiji nemoguće falsifikovati i koja nudi anonimnost kakvu poznaje samo keš.

Valuta čija je ukupna količina unapred fiksirana pa joj je rast vrednosti usađen u DNK.

I to još valuta koju je moguće dobiti besplatno, ali po zasluzi, jer bitkoini nastaju tako što vaš kompjuter reši komplikovani matematički zadatak iza kojeg se „krije“ jedan od ovih magičnih novčića.

To što je čitav sistem osmislio misteriozni matematički genije poznat kao Satoši Nakamoto, koji možda postoji, a možda i ne postoji i što se ceo finansijski establišment obrušio na čitavu bitkoin-maniju kombinacijom podsmeha i represivnih pretnji, moglo je samo da ubrza moju tadašnju odluku da kupim XFX ATI RADEON HD 5870 grafičku karticu za nekih 200 evra (maksimum koji sam od skromne novinarske plate mogao sebi da oprostim) i priključim se drugoj velikoj zlatnoj groznici, nekih 150 godina nakon one originalne, kalifornijske.

Ipak, kao što se da pretpostaviti iz činjenice da danas pišem ovaj tekst umesto da na nekom tropskom ostrvu vežbam skokove u vodu, sudbina nije htela da se obogatim rudareći bitkoine.

Ispostavilo se, naime, da moja moćna grafička karta ne odgovara mojoj dosta nesposobnoj matičnoj ploči, pa sam uz pomoć najgore „cost-benefit“ analize u istoriji biznisa zaključio da je bolje da prodam grafičku sa 20 evra gubitka i zaboravim na sve, nego da zarad svoje igrarije menjam čitav kompjuter.

Ta greška koštala me je nekih 700.000 dolara.

Toliko bih, žalosno je, danas imao da sam propalu investiciju u pogrešan hardver pretvorio u novotariju zvanu kriptovaluta, po tadašnjem kursu od 10 dolara za novčić, umesto što sam „zaboravio na sve“.

Bitkoin je, ispostavilo se, postao prilično velika stvar.

S kursom od 40.000 dolara za jedan bitkoin, s međunarodnim bankama koje spekulišu ovom valutom, s nuklearnim naučnicima hapšenim jer su ruski državni superkompjuter upregli da za njih rudari bitkoin, sa novinskim izveštajima o ljudima koji idu u zemlje s jeftinom strujom da u njima instaliraju čitava skladišta puna računara za traženje bitkoina, pa čak i sa poslednjim pričama koje krive upravo bitkoin za to što je u Pakistanu pao napon struje za 200 miliona ljudi i što je 500 miliona Evropljana zamalo ostalo bez svetla, nema nikakve sumnje da je bitkoin nešto veliko.

A opet, to nešto veliko i dalje uporno ostaje – ništa.

Ma koliko neverovatna cena od 40.000 dolara delovala zavodljivo, bitkoin entuzijasti su već jednom, pre tačno dve godine, sve to već doživeli, kada je ova valuta prvi put u meteorskom usponu za samo par nedelja dostigla 20.000 dolara, da bi se onda jednako naglo i jednako neobjašnjivo survala nazad, ostavljajući mnoge sa velikom i nimalo virtuelnom rupom u džepu.

Osnovni problem bitkoina, uzrok njegove karakteristične nestabilnosti – ogromnih skokova i jednako spektakularnih padova – jeste to što niko ne zna za šta je on koristan.

Ma kako uzbudljivo delovala čitava priča o novcu koji je van kontrole vlade, koji nudi anonimnost transakcija i koji je navodno nemoguće falsifikovati, činjenica je da prosečnoj osobi ništa od toga nije potrebno.

Tačnije, bitkoin – sem u uskom krugu slučajeva – ne nudi ništa što već ne možete da dobijete sa svojom valutom, a da vam je potrebno.

Za anonimnost je većini dovoljan keš, rizik od falsifikata je dovoljno mali da je zanemarljiv, a kontrola države i nezavisnost od monetarnih vlasti su priče koje su ljudima eventualno intelektualno zanimljive, ali nikog neće naterati da u praksi krene da koristi neku virtuelnu valutu.

Zato je bitkoin ostao novac ponajviše upotrebljavan za nezakonite transakcije – otkup podataka od hakera, prodaju droge i tome slično – gde su anonimnost i elektronski transfer novca bitniji od svega.

Zašto onda raste cena bitkoinu?

Zato što svi kupuju bitkoine nadajući se da će im cena skočiti i da će zaraditi.

Kako raste tražnja tako raste cena i očekivanje se ispunjava.

Onda kad tražnja nestane, a to će se desiti kad svi koji su upravo sad čuli za bitkoin pokupuju virtuelne novčiće videvši koliki je rast cene u poslednjim danima, cena će krenuti da pada.

Jer – bitkoini nikom nisu potrebni i niko ne želi da ih zadrži. Sve što svi žele je da ih kupe, da im cena „iz nekog razloga skoči“ i da ih onda zamene za „pravi novac“.

U toj igri, koja se stalno ponavlja kako naiđe novi talas publiciteta, neko naravno mora i da izgubi.

Bitkoin neće postići stabilnost i neće uspeti da iskaže svoju „deflatornu“ prirodu u koju se svi uzdaju da im trajno podiže vrednost novčića koje poseduju, sve dok se ne bude pronašla njegova svrha kao valute.

Dok dovoljno veliki broj ljudi ne bude hteo da drži i koristi bitkoine za ono za šta je svaka valuta namenjena – za kupovinu roba i usluga.

Droga, oružje, ucene i ostale oblasti kriminalne ekonomije nisu dovoljni da bi se takva stabilnost postigla.

Glavni problem bitkoina je zato njegova praznina.

Bitkoin nije zlato našeg doba. Pre je blato.

-

@ 00cfe60d:2819cc65

2025-01-08 16:36:40

@ 00cfe60d:2819cc65

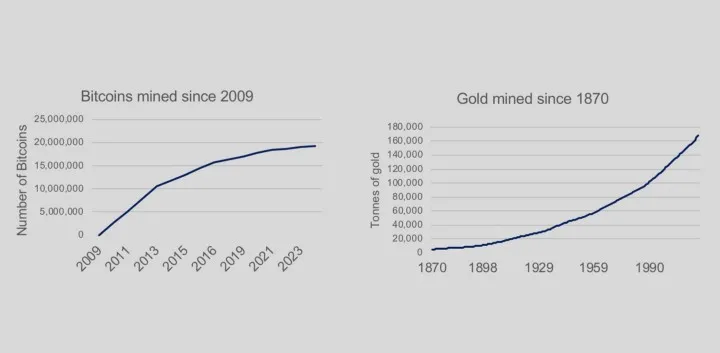

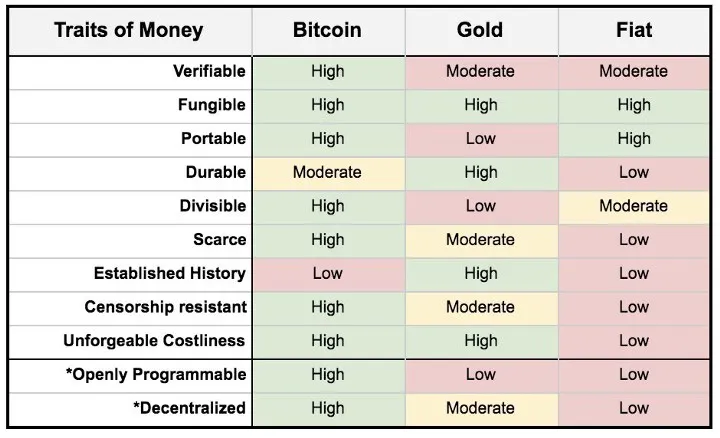

2025-01-08 16:36:40Lets start with the money talk, at its core, a good form of money is created from two key ingredients: time and energy.

**Money = Time + Energy ** This simple idea explains why money has value. Time is something we can never get back, and energy is what powers everything we do, both mentally and physically. Together, they create value.

Why Energy is So Important Energy is what keeps life going. It’s essential for everything we use and do every day. For example:

- Food without energy to cook is raw and not very tasty.

- A car without energy doesn’t go anywhere.

- A person without energy feels tired and can’t work or play.

- Your work without energy gets nothing done.

- Football without energy means no running, no cheering, and no fun.

- A phone without energy is just a useless object.

- A house without energy is cold, dark, and uncomfortable.

- Transportation without energy means no moving buses, trains, or planes.

- The internet without energy means no websites, no games, and no communication.

- Nature without energy means plants don’t grow and animals can’t survive.

And what about money without energy? ** We often hear that “time is money” but if money is created without any time or energy, it becomes worthless. That’s why energy is so important in giving money its value.

Why Bitcoin is Different

Bitcoin is special because it follows the equation of money perfectly. It’s the best kind of money because it requires both time and energy to exist. Here’s how:

-

Time: Bitcoin’s network is designed to create new bitcoins at regular intervals, so time is built into the system.

-

Energy: Bitcoin is made using a process called Proof-of-Work, which uses real-world energy to produce and secure it. This ties its value to effort and cost.

Thanks to this process, Bitcoin is:

-

Scarce: There will only ever be 21 million bitcoins. It can’t be copied or faked.

-

Reliable: Its value is tied to real-world energy, making it solid and trustworthy.

-

Effort-Based: No one can create bitcoins out of thin air. It takes real work.

This makes Bitcoin an honest form of money, free from manipulation or shortcuts. It connects the digital and physical worlds through energy, just like gold was in the past, requiring time and energy to extract and maintain its value.

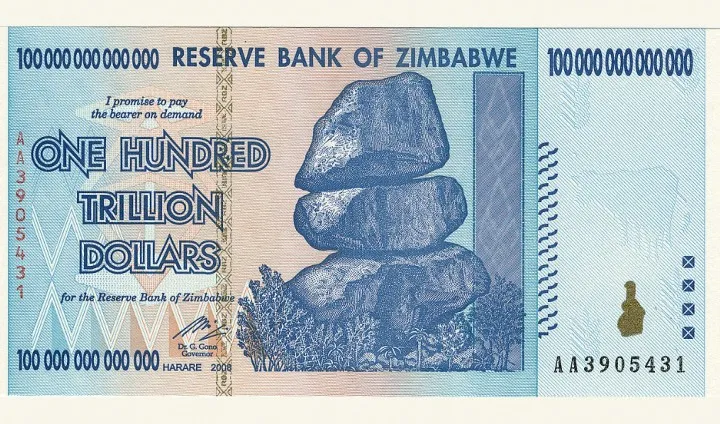

The Problem with Regular Money (Fiat Money)

On the other hand, fiat money, the kind printed by governments, doesn’t follow the same rules. It’s made without effort, just by pressing a button. This leads to big problems:

-

Inflation: More money is printed, making the money you already have worth less.

-

Manipulation: Governments and banks can change the rules whenever they want.

-

Unfairness: People closest to the money printers benefit the most, while everyone else pays the price.

-

Fiat money breaks the rule of time and energy. It’s just a symbol, not a true store of value.

**Henry Ford’s Energy Currency Idea ** Over 100 years ago, Henry Ford had a bold idea: What if money was based on energy? He believed energy was the ultimate resource because it’s measurable and valuable to everyone.

Bitcoin brings Ford’s vision to life. Its Proof-of-Work system ties money directly to energy. Bitcoin acts as a global, incorruptible energy currency that rewards effort and aligns money with real-world value.

Why Energy-Based Money Matters

Money that’s rooted in time and energy isn’t just an idea, it’s a principle we live by every day. To truly understand the value of energy and effort, let me share a personal story.

Every single day of the week, I train. I pour my energy and effort into CrossFit, pushing my body and mind to their limits. Last year, during a competition, I achieved something I’d never done before: 12 ring muscle-ups. Before that, my maximum was just three. Through consistent training, spending my time and energy at the gym, I earned that reward. It wasn’t easy, but it was worth it.

This is Proof-of-Work in action. Just like my training required time and energy to achieve results, Bitcoin requires time and energy to exist. Its

Proof-of-Work mechanism ensures:

- It can’t be faked or inflated.

- It rewards hard work and energy, not shortcuts or manipulation.

- It restores trust by linking value to real-world effort.

In a world where fiat money can be printed without effort, Bitcoin shines as a clear and honest form of money. Like the work I put into my training, Bitcoin ties time and energy to value, creating a system that’s fair, transparent, and built to last.

-

@ bf47c19e:c3d2573b

2025-01-08 16:26:02

@ bf47c19e:c3d2573b

2025-01-08 16:26:02Originalni tekst na politika.rs

13.09.2021 / Autor: Aleksandar Apostolovski

Za svet virtuelne banalnosti u koji smo umarširali potrebna je i njegova moneta. Kakav svet takvo i sredstvo plaćanja.

Ni četnički jataci nisu kao što su nekada bili. Ne skrivaju se u zemunicama, ne spremaju masnu gibanicu – prste da poližeš – ne čekaju zapadne saveznike da se iskrcaju na Jadranu. Verovatno nemaju ni brade modne linije starog američkog benda „Zi Zi Top”.

Nepoznata sajber ilegalna grupa upala je u podrum kuće čiča Draže u Ivanjici. Zaista, prvorazredna vest. Instalirali su snažne procesore i mašine za rudarenje bitkoinima i daljinskim sistemom. Ko zna odakle. Možda sa Kariba, možda iz Kosjerića, možda iz Jajca – ako su ipak partizani. Trgovali su kriptovalutama. Umalo da tako rasture uličnu rasvetu tokom „Nušićijade”, pa su čelnici opštine sproveli internu istragu, tražeći ilegalce koji vrše diverziju nad elektroenergetskim sistemom grada i festivalom satire.

Upali su u Dražin dom, sišli u podrum i zatekli sofisticiranu opremu, snažne procesore i nekakve mašine za rudarenje po internetu. Kompjuterski komandosi, naravno, nisu bili prisutni. Sada ih juri policija. Potrošili su oko 55.000 kilovat-sati struje. Verovatno se skrivaju pod stripovskim kodnim imenima, poput hakera iz Niša koji su ojadili Teksašane, pa im je doakao FBI, jer Ameri možda trpe svoje prevarante koji muzu kockare na globalnom groblju kriptovaluta, ali ne dozvoljavaju da se u međunarodnu spekulativnu igru ubace mozgovi sa južne pruge, gde je dozvoljeno da se prži paprika, pravi ajvar i sluša melanholični džez na „Nišvilu”.

Jedan od članova niške hakerske grupe je Antonije Stojiljković, koji se krio iza lažnih imena „Toni Rivas” i „Džejkob Gold”, a u slobodno vreme bio je reper poznatiji kao „Zli Toni”. Stojiljković je izručen Americi zbog računarskih prevara. Dobrovoljno se prijavio kako bi se sklonio u Ameriku.

Ti momci su nudili bitkoin upola cene i stvorili takvu virtuelnu međunarodnu mrežu lažnih kompanija, menadžera, uz organizaciju video-konferencija, da su omađijali dobar deo internet investitora iz Teksasa, te je Federalni istražni biro morao da spasava čast kauboja koje su izradile Nišlije. Njihov vođa, izvesni Kristijan Krstić, prestao je da se javlja policiji, nestao je sa suprugom i ortakom Markom Pavlovićem bez traga, iako su pod istragom, što može da poremeti i diplomatske odnose između Srbije i SAD.

Taj Kristijan, ne onaj Kristijan koji se seli iz rijalitija u rijaliti, koristio je nadimke poput „Feliksa Logana” ili „Maršala Grahama” i na internet prevarama zaradio je više desetina miliona evra. Priča nije nimalo bezazlena. Veze „Zlog Tonija” dosežu, bar po dosadašnjem toku istrage, sve do klana Belivuka.

Ali, to će rešavati sudovi i policija, mada i podaci koji su procurili otkrivaju suštinu fame bitkoin i na hiljade kriptovaluta koje može stvoriti bilo koji maher, avanturista, šaljivdžija, klinac, multimilioner, tajne službe, trgovci oružjem, narko-bosovi, plaćene ubice ili Del Bojevi koji će iduće godine postati milioneri.

Virtuelni svet ne može postojati bez virtuelnih valuta, s tim što one nisu opipljive, iza njih ne stoje centralne banke i vlade. Dakle, nemate pojma ko ih je stvorio, nemate pojma s kime trgujete i ko su brokeri.

Vidim da na „Jutjubu”, u motelu „Stari Hrast” na Koridoru 10, neki momci plaćaju prebranac i vešalice bitkoinima, preko mobilnih telefona. U kafani primaju i etereume, digitalni novčić u usponu, odmah iza bitkoina. I za to čudo je potreban digitalni novčanik... Ovde ću se zaustaviti jer je za svet banalnosti u koji smo umarširali potrebna i njegova moneta. Kakav svet takvo i sredstvo plaćanja.

Kako su kompjuterski podaci svih vrsta, od pretraživača, društvenih mreža, aplikacija, do podataka kompanija, državnih i međunarodnih organizacija, i onih ličnih, koje upravo vi posedujete, postali nezamislivo ogromna baza koju je nemoguće uskladištiti, otvorena je berza za internet magacionere koji će, rudareći na internetu, postati kandidati za potencijalne šefove skladišta. Teoretski, možete izrudariti deo arhive CIA. Preporuka – ako saznate ko je ukokao Kenedija, ćutite ko zaliveni!

(Dragan Stojanović)

Da je Alija Sirotanović kojim slučajem rudario kao specijalci iz Dražinog podruma, postao bi Bil Gejts. Alija je znao da nema ’leba bez motike, odnosno krampa. Zato je ostao Sirotanović. Ovo je novo doba. Mašina krampuje u simuliranoj stvarnosti, a virtuelni homo sapijens upravlja procesorima. Bitkoin vrti gde burgija neće! Stvar ipak nije tako idilična. Te skalamerije troše ogromne količine električne energije i strahovito zagrevaju prostorije, pa je u Dražinom podrumu bilo nešto vrelije nego u sauni. Priča se da su najveći mešetari otperjali na Island da se prirodno rashlade. Sledeće stanište im je Grenland.

Kome god je stalo do računarskog kriptovalutnog avanturizma može da formira svoj mali rudnik, gde nema zlata ni dijamanata, ali ima koina, odnosno stotog dela bitkoina. Jedan trenutno vredi 50.000 dolara. Pitam se, ovako zastareo, gde su banke i menjačnice?

Sa ono malo informatičkog znanja – valjda ću uspeti nekako imejlom da pošaljem ovaj tekst – saznao sam da vrednost bitkoina vrtoglavo skače i pada na dnevnom nivou, a kako je njegov broj ograničen na globalnom nivou, a neformalni šef Federalnih rezervi bitkoina je donedavno bio jedan od najbogatijih ljudi sveta Ilon Mask, koji je na svom tviter nalogu svakodnevno formirao grafikon rasta i pada svojim opaskama, tu već naslućujem elemente bondovskog zapleta. Harizmatični superbogataš koji leti u svemir, poseduje kompaniju električnih automobila „Tesla”, upravljao je donedavno imaginarnom berzom i valutom, ali je nedavno odustao. Možda zato emigrira u kosmos?

Stvar zaista može izmaći kontroli ili će, možda, bitkoin postati naša sudbina, a mi rudari iz sauna? Salvador je pre nekoliko dana postao prva zemlja na svetu koja je usvojila bitkoin kao zakonsko sredstvo plaćanja, uz američki dolar, s planovima korišćenja vulkanske geotermalne energije za napajanje rudarenja digitalne valute. Postavili su i bankomate. Tamošnjem narodu, kao i meni, ništa nije jasno.

Međutim, broj bitkoina je ograničen i zato pomalo podseća na zlato. Ali kod zlata ipak ponešto razumem. Recimo, ako imam zlatnu polugu i neko me napadne, mogu da je koristim u samoodbrani, a onda je sklonim u trezor banke.

Mogu da učinim i nešto drugo, jednako glupo. Da stvorim sopstvenu kriptovalutu. Nazvaću je „Ser Oliver koin”. Cijena će joj, logično, biti prava sitnica. Trebaju mi saradnici. Kruži fama da se popriličan broj klinaca, mahom dvadesetogodišnjaka, pridružio kultu bitkoina. Tokom korone izgubili su poverenje u sve, naročito u nas matore. Optužuju nas za izdaju i predviđaju propast država i zvaničnih valuta, uz uspon dvoglave aždaje – saveza bogataša i političara.

Delimično su u pravu, ali nisu ukapirali ključnu stvar. Aždaja raste, a oni rudare. Na kraju će završiti još gore nego Alija Sirotanović. Likovi im neće biti na novčanicama, a kablovima će biti priključeni za superkompjuter. Njihov novi vlasnik, s kodnim imenom „Procesor”, plaćaće ih idiot-koinima. Tražili smo, gledaćemo.

-

@ bf47c19e:c3d2573b

2025-01-08 16:03:01

@ bf47c19e:c3d2573b

2025-01-08 16:03:01Originalni tekst na trzisnoresenje.blogspot.com

22.12.2017 / Autor: Slaviša Tasić

Ovoliki uspon Bitcoina neobjašnjiv je za ekonomiste. Ne znam da li je to problem za bitcoin ili za ekonomiste, ali činjenica je da se uspeh bitcoina ne uklapa u postojeće ekonomske koncepte bar kada se radi o njemu kao valuti (blockchain kao tehnološka podloga je druga stvar). Možda su tinejdžeri koji su kupovali bitcoin 2010. i sada postali milioneri ispali pametniji od ekonomista, ali ja i dalje ne vidim odgovor bitcoina na neka standardna konceptualna pitanja. Postoji apokrifna izjava pripisana nekom profesoru ekonomije: "OK, vidim da to radi u praksi -- ali čik da vidim da li radi u teoriji?" Ovo je nešto tog tipa.

O poreklu novca, od Aristotela nasuprot Platonu pa sve do danas, postoje dve teorije. Jedna je teorija robnog novca i po njoj je novac nastao kada su neke vredne stvari počele da se češće koriste u razmeni. Plemeniti metali, naročito srebro i zlato, najpogodniji za čuvanje, oblikovanje i seckanje tako su postali novac. Kada se kasnije pojavio papirni novac on je sve do prvih decenija 20. veka bio samo hartija od vrednosti koja donosiocu daje pravo na propisanu količinu zlata.

Druga teorija je kartalizam, po kojoj neku robu novcem ne čini njena unutrašnja vrednost ili robna podloga, već država onda kada odluči da tu robu prihvata za naplatu poreza. Zbog toga je prelaz na papirni novac tokom 20. veka bio tako bezbolan i papirne valute se danas bez problema prihvataju. Današnji papirni novac nije više sertifikat koji vam daje pravo na zlato, ali vrednost ima jer u krajnjoj liniji znate da njime uvek možete platiti državi za porez ili usluge.

Bitcoin se ne uklapa ni u jednu od ovih teorija. On nema imanentnu vrednost kao robni novac, niti se može koristiti za plaćanje državi. Jedini način za bitcoin da ima neku vrednost je da ga prihvataju druge privatne strane u transakcijama. To je potpuni novitet u istoriji novca, jer se po prvi put radi o privatnom dekretnom (proklamovanom ili fiat) novcu. Postojao je privatni novac sa robnom podlogom; postoji državni dekretni novac; ali nikad privatni dekretni novac.

Najveći problem sa bitcoinom kao valutom je nestabilnost. To što njegova vrednost vrtoglavo raste nikako nije argument u prilog njemu jer nestabilnost valute isključuje mogućnost smislenog ugovaranja u njoj. Pristalice bitcoina dobro znaju da je njegova ponuda automatski ograničena i to je čest argument u odbranu bitcoina kao valute i navodno u prilog njegove stabilnosti. Ja nisam siguran da ograničenost ponude igra tako veliku ulogu.

Prvo, iako je količina bitcoina ograničena, može se napraviti neograničeno mnogo kopija bitcoina ili boljih kripto valuta. Već sada postoji na hiljade njih. Šta ograničenost ponude bitcoina uopšte znači kada ima neograničeno mnogo alternativa?

Drugo, iako je ponuda ograničena, cenu novca, kao i svega drugog, određuju ponuda i tražnja. A tražnja je kao što vidimo veoma varijabilna. Tako na jednoj strani imamo kvaziograničenost ponude a na drugoj veliku neizvesnost tražnje. To sve ukazuje na ogromnu nestabilnost.

Kod klasičnih valuta, poput evra ili dinara, ponuda je ograničena politikom centralne banke. Mnogi će reći da to nije nikakva garancija, ali zapadne valute već 30 godina nemaju nikakvu inflaciju, a u proteklih desetak godina veći problem bila je deflacija. Tražnja - želja za držanjem novca - je kod državnih valuta takođe varijabilna, ali mnogo manje jer monopolski karakter ovih valuta i naplata poreza u njima garantuju njihovu upotrebu. I kod tradicionalnih valuta ne samo da je tražnja novca relativno stabilna, već u situacijama kada tražnja novca bude nestabilna, fleksibilnost njegove ponude postaje prednost a ne mana. Na primer, tražnja za švajcarskim francima je negde oko 2009. naglo porasla. Švajcarska centralna banka je na to reagovala ogromnim povećanjem ponude, tako da je franak sačuvao bazičnu stabilnost. Jeste ojačao ali u razumnoj meri - ne desetostruko ili stostruko kao što rade kriptovalute.

Zato ne vidim kako se oscilacije bitcoina mogu zaustaviti. Jasno je da kriptovalute imaju neku korisnost u transakcijama, makar to bilo i za ilegalne aktivnosti, ali kada je ponuda neograničena a tražnja neizvesna onda nema nikakvih smernica buduće vrednosti. Ne znam koliko se to čak i može nazvati balonom jer se uopšte nemamo na šta osloniti u proceni nekakve prave vrednosti -- nema nikakvog fundamentalnog razloga ni da cena bitcoina poraste na $19,000 niti da danas padne na $12,500. Jedina vrednost koja u teoriji ima smisla je nula ili vrlo blizu nule.

-

@ d830ee7b:4e61cd62

2025-01-08 07:56:25

@ d830ee7b:4e61cd62

2025-01-08 07:56:25การเผชิญหน้า (The Collision Point)

กลางปี 2017 ที่ร้านคราฟท์เบียร์เล็ก ๆ ในย่านเกาะเกร็ด นนทบุรี อากาศร้อนจนเครื่องปรับอากาศ (ที่ยังไม่มี) ในร้านทำงานหนักแทบไหม้ "แจ๊ก กู้ดเดย์" (Jakk Goodday) นั่งลงบนเก้าอี้ไม้ที่เจ้าของร้านกันไว้ให้เป็นประจำ ราวกับเขาเป็นลูกค้าขาประจำระดับวีไอพี

กลิ่นกาแฟคั่ว ลอยผสมกับไอความร้อนจากนอกหน้าต่าง (ผิดร้านหรือเปล่า?) เกิดเป็นบรรยากาศขมติดปลายลิ้นชวนให้คนจิบแล้วอยากถอนใจ

เขาเหลือบมองออกไปนอกหน้าต่าง.. เห็นแสงแดดแผดเผาราวกับมันรู้ว่าสงคราม Blocksize กำลังคุกรุ่นขึ้นอีกครั้ง

บรรยากาศนอกหน้าต่างกับใน ฟอรัม Bitcointalk ช่างเหมือนกันจนน่าขนลุก มันร้อนแรง ไร้ความปรานี

แจ๊กเปิดแล็ปท็อป กดเข้าเว็บฟอรัม พอเสียงแจ้งเตือน “—ติ๊ง” ดังขึ้น คิ้วของเขาก็ขมวดเล็กน้อย คล้ายได้กลิ่นดินปืนกลางสนามรบ

“โรเจอร์ แวร์ (Roger Ver) ไลฟ์เดือดลั่นเวที!” “ปีเตอร์ วูเล (Pieter Wuille) โต้กลับเรื่อง SegWit!” “Hard Fork ใกล้ถึงจุดปะทะแล้ว!”

แจ๊กคลิกเข้าไปในลิงก์ของไลฟ์ทันที เหมือนมือของเขาไม่ต้องการคำสั่งจากสมอง ความคุ้นเคยกับเหตุการณ์แบบนี้บอกเขาว่า นี่ไม่ใช่ดีเบตธรรมดา แต่มันอาจเปลี่ยนอนาคตของ Bitcoin ได้จริง ๆ

เห็นแค่พาดหัวสั้น ๆ แต่ความตึงเครียดก็ชัดเจนขึ้นเรื่อย ๆ ทุกข้อความเหมือนสุมไฟใส่ใจกองหนึ่งที่พร้อมระเบิดได้ทุกเมื่อ

โทรศัพท์ของแจ๊กดังพร้อมปรากฏชื่อ แชมป์ ‘PIGROCK’ ลอยขึ้นมา เขาหยิบขึ้นมารับทันที

“ว่าไงวะแชมป์… มีอะไรด่วนหรือเปล่า?” น้ำเสียงแจ๊กฟังดูเหมือนง่วง ๆ แต่จริง ๆ เขาพร้อมจะลุกมาวิเคราะห์สถานการณ์ให้ฟังทุกเมื่อ

“พี่แจ๊ก.. ผมอ่านดีเบตเรื่อง SegWit ในฟอรัมอยู่ครับ บางคนด่าว่ามันไม่ได้แก้ปัญหาจริง ๆ บ้างก็บอกถ้าเพิ่ม Blocksize ไปเลยจะง่ายกว่า... ผมเลยสงสัยว่า Hard Fork ที่เค้าพูดถึงกันนี่คืออะไร ใครคิดอะไรก็ Fork กันได้ง่าย ๆ เลยเหรอ"

"แล้วถ้า Fork ไปหลายสาย สุดท้ายเหรียญไหนจะเป็น ‘Bitcoin ที่แท้จริง’ ล่ะพี่?”

“แล้วการ Fork มันส่งผลกับนักลงทุนยังไงครับ? คนทั่วไปอย่างผมควรถือไว้หรือขายหนีตายดีล่ะเนี่ย?”

แจ๊กยิ้มมุมปาก ชอบใจที่น้องถามจี้จุด

“เอางี้… การ Fork มันเหมือนแบ่งถนนออกเป็นสองสาย ใครชอบกติกาเก่าก็วิ่งถนนเส้นเก่า ใครอยากแก้กติกาใหม่ก็ไปถนนเส้นใหม่"

"แต่ประเด็นคือ... นี่ไม่ใช่เรื่องเล็ก ๆ เพราะมีผลต่ออัตลักษณ์ของ Bitcoin ทั้งหมดเลยนะมึง—ใครจะยอมปล่อยผ่านง่าย ๆ”

"คิดดูสิ ถ้าครั้งนี้พวกเขา Fork จริง มันอาจไม่ได้เปลี่ยนแค่เครือข่าย แต่เปลี่ยนวิธีที่คนมอง Bitcoin ไปตลอดกาลเลยนะ"

"แล้วใครมันจะอยากลงทุนในระบบที่แตกแยกซ้ำแล้วซ้ำเล่าวะ?"

“งั้นหมายความว่าตอนนี้ก็มีสองแนวใหญ่ ๆ ชัวร์ใช่ไหมครับ?” แชมป์ถามต่อ

“ฝั่ง โรเจอร์ แวร์ ที่บอกว่าต้องเพิ่ม Blocksize ให้ใหญ่จุใจ กับฝั่งทีม Core อย่าง ปีเตอร์ วูเล ที่ยืนยันต้องใช้ SegWit ทำให้บล็อกเบา ไม่กระทบการกระจายอำนาจ?”

“ใช่เลย” แจ๊กจิบกาแฟดำเข้ม ๆ ผสมน้ำผึ้งไปหนึ่งอึก

“โรเจอร์นี่เขาเชื่อว่า Bitcoin ต้องเป็นเงินสดดิจิทัลที่ใช้จ่ายไว ค่าธรรมเนียมไม่แพง ส่วนปีเตอร์กับ Bitcoin Core มองว่าการเพิ่มบล็อกเยอะ ๆ มันจะไปฆ่า Node รายย่อย คนไม่มีทุนก็รัน Node ไม่ไหว สุดท้าย Bitcoin จะกลายเป็นระบบกึ่งรวมศูนย์ ซึ่งมันผิดหลักการเดิมของ ซาโตชิ ไงล่ะ”

“ฟังแล้วก็ไม่ใช่เรื่องง่ายนะพี่… งั้นที่ผมได้ยินว่า จิฮั่น อู๋ (Jihan Wu) เจ้าของ Bitmain ที่ถือ Hashrate เกินครึ่งนี่ก็มาอยู่ฝั่งเดียวกับโรเจอร์ใช่ไหม?"

"เพราะยิ่งบล็อกใหญ่ ค่าธรรมเนียมยิ่งเพิ่ม นักขุดก็ได้กำไรสูงขึ้นใช่ป่ะ?”

“ไอ้เรื่องกำไรก็ส่วนหนึ่ง...” แจ๊กถอนหายใจ

“แต่ที่สำคัญกว่านั้นคืออำนาจต่อรอง… ตอนประชุมลับที่ฮ่องกงเมื่อปีที่แล้ว พี่เองก็ถูกชวนให้เข้าไปในฐานะคนกลาง เลยเห็นภาพน่าขนลุกอยู่หน่อย ๆ"

"จิฮั่นนั่งไขว่ห้างด้วยสีหน้ามั่นใจมาก ด้วย Hashrate ราว 60% ของโลก สั่งซ้ายหันขวาหันเหมือนเป็นแม่ทัพใหญ่ได้เลย พอโรเจอร์ก็ไฟแรงอยู่แล้ว อยากให้ Bitcoin ครองโลกด้วยวิธีของเขา สองคนนี่จับมือกันทีจะเขย่าชุมชน Bitcoin ได้ทั้งกระดาน”

"พี่รู้สึกเหมือนนั่งอยู่ในศึกชิงบัลลังก์ยุคใหม่ คนหนึ่งยึดพลังขุด คนหนึ่งยึดความศรัทธาในชื่อ Bitcoin แต่สิ่งที่พี่สงสัยในตอนนั้นคือ… พวกเขาสู้เพื่อใครกันแน่?"

แชมป์เงียบไปครู่เหมือนกำลังประมวลผล “แล้วตอนนั้นพี่คิดยังไงบ้างครับ? รู้สึกกลัวหรือว่ายังไง?”

“จะไม่กลัวได้ไง!” แจ๊กหัวเราะแห้ง ๆ แวบหนึ่งก็นึกถึงสีหน้าที่ยิ้มเยาะของทั้งคู่ตอนประกาศความพร้อมจะ Fork

“พี่อดคิดไม่ได้ว่าถ้า Core ยังไม่ยอมขยายบล็อก พวกนั้นจะลากนักขุดทั้งกองทัพแฮชเรตไปทำเครือข่ายใหม่ให้เป็น ‘Bitcoin สายใหญ่’ แล้วทิ้งเครือข่ายเดิมให้ซวนเซ"

"แค่คิดก็นึกถึงสงครามกลางเมืองในหนังประวัติศาสตร์แล้วน่ะ.. แตกเป็นสองฝ่าย สุดท้ายใครแพ้ใครชนะ ไม่มีใครทำนายได้จริง ๆ”

พูดจบ.. เขาเปิดฟอรัมดูไลฟ์ดีเบตจากงานในปี 2017 ต่อ โรเจอร์ แวร์ กำลังพูดในโทนร้อนแรง

“Bitcoin ไม่ใช่ของคนรวย! ถ้าคุณไม่เพิ่ม Blocksize คุณก็ทำให้ค่าธรรมเนียมพุ่งจนคนธรรมดาใช้ไม่ได้!”

ขณะเดียวกัน ปีเตอร์ วูเล่ ยืนอยู่ฝั่งตรงข้าม สีหน้าเยือกเย็นราวกับตั้งรับมานาน “การเพิ่มบล็อกคือการทำลายโครงสร้าง Node รายย่อยในระยะยาว แล้วมันจะยังเรียกว่ากระจายอำนาจได้หรือ?”

"ถ้าคุณอยากให้ Bitcoin เป็นของคนรวยเพียงไม่กี่คน ก็เชิญขยายบล็อกไปเถอะนะ แต่ถ้าอยากให้มันเป็นระบบที่คนทุกระดับมีส่วนร่วมจริง ๆ ..คุณต้องฟังเสียง Node รายเล็กด้วย" ปีเตอร์กล่าว

เสียงผู้คนในงานโห่ฮากันอย่างแตกเป็นสองฝ่าย บ้างก็เชียร์ความตรงไปตรงมาของโรเจอร์ บ้างก็เคารพเหตุผลเชิงเทคนิคของปีเตอร์

ข้อความจำนวนมหาศาลในฟอรัมต่างโหมกระพือไปต่าง ๆ นานา มีทั้งคำด่าหยาบคายจนแจ๊กต้องเบือนหน้า ตลอดจนการวิเคราะห์ลึก ๆ ถึงอนาคตของ Bitcoin ที่อาจไม่เหมือนเดิม

ในระหว่างนั้น.. แชมป์ส่งข้อความ Discord กลับมาอีก

“พี่ ถ้า Fork จริง ราคาจะป่วนแค่ไหน? ที่เขาว่าคนถือ BTC จะได้เหรียญใหม่ฟรี ๆ จริงไหม? ผมกลัวว่าถ้าเกิดแบ่งเครือข่ายไม่รู้กี่สาย ตลาดอาจมั่วจนคนหายหมดก็ได้ ใช่ไหมครับ?”

"แล้วถ้าเครือข่ายใหม่ล้มเหลวล่ะครับ? จะส่งผลอะไรต่อชุมชน Bitcoin เดิม?"

"ไอ้แชมป์มึงถามรัวจังวะ!?" แจ๊กสบถเพราะเริ่มตั้งรับไม่ทัน

“ก็ขึ้นกับตลาดจะเชื่อว่าสายไหนเป็น ‘ของจริง’ อีกนั่นแหละ” แจ๊กพิมพ์กลับ

“บางคนถือไว้เผื่อได้เหรียญใหม่ฟรี บางคนขายหนีตายก่อน"

"พี่เองก็ยังไม่กล้าการันตีเลย แต่ที่แน่ ๆ สงครามนี้ไม่ได้มีแค่ผลกำไร มันกระทบศรัทธาของชุมชน Bitcoin ทั้งหมดด้วย"

"ถ้าชาวเน็ตเลิกเชื่อมั่น หรือคนนอกมองว่าพวกเราทะเลาะกันเองเหมือนเด็กแย่งของเล่น ต่อให้ฝั่งไหนชนะ ก็อาจไม่มีผู้ใช้เหลือให้ฉลอง”

แล้วสายตาแจ๊กก็ปะทะกับกระทู้ใหม่ที่เด้งขึ้นมาบนหน้าฟอรัม

“โรเจอร์ แวร์ ประกาศ: ถ้าไม่เพิ่ม Blocksize เราจะฟอร์กเป็น Bitcoin ที่แท้จริง!”

ตัวหนังสือหนาแปะอยู่ตรงนั้นส่งแรงสั่นสะเทือนราวกับจะดึงคนในวงการให้ต้องเลือกข้างกันแบบไม่อาจกลับหลังได้

แจ๊กเอื้อมมือปิดแล็ปท็อปช้า ๆ คล้ายยอมรับความจริงว่าหนทางประนีประนอมอาจไม่มีอีกแล้ว..

“สงครามนี่คงใกล้ระเบิดเต็มทีล่ะนะ” เขาลุกจากเก้าอี้ สะพายเป้ พึมพำกับตัวเองขณะมองกาแฟดำที่เหลือครึ่งแก้ว “ถ้าพวกเขาฟอร์กจริง โลกคริปโตฯ ที่เราเคยรู้จักอาจไม่มีวันเหมือนเดิมอีกต่อไป”

เขามองออกไปนอกหน้าต่าง แสงแดดที่แผดเผาราวกับกำลังบอกว่า.. อนาคตของ Bitcoin อยู่ในจุดที่เส้นแบ่งระหว่างชัยชนะกับความล่มสลายเริ่มพร่าเลือน... และอาจไม่มีทางย้อนกลับ

ก่อนเดินออกจากร้าน เขากดส่งข้อความสั้น ๆ ถึงแชมป์

“เตรียมใจกับความปั่นป่วนไว้ให้ดี ไม่แน่ว่าเราอาจจะได้เห็น Bitcoin แตกเป็นหลายสาย.. ใครจะอยู่ใครจะไปไม่รู้เหมือนกัน แต่เรื่องนี้คงไม่จบง่าย ๆ แน่”

แจ๊กผลักประตูออกไปพบกับแดดจัดที่เหมือนแผดเผากว่าเดิม พายุร้อนไม่ได้มาแค่ในรูปความร้อนกลางกรุง แต่มาในรูป “สงคราม Blocksize” ที่พร้อมจะฉีกชุมชนคริปโตออกเป็นฝักฝ่าย และอาจลามบานปลายจนกลายเป็นศึกประวัติศาสตร์

ทว่าสิ่งที่ค้างคาใจกลับเป็นคำถามนั้น…

เมื่อเครือข่ายแบ่งเป็นหลายสายแล้ว เหรียญไหนจะเป็น Bitcoin จริง?

หรือบางที... ในโลกที่ใครก็ Fork ได้ตามใจ เราจะไม่มีวันได้เห็น “Bitcoin หนึ่งเดียว” อีกต่อไป?

คำถามที่ไม่มีใครตอบได้ชัดนี้ส่องประกายอยู่ตรงปลายทาง ราวกับป้ายเตือนว่า “อันตรายข้างหน้า” และคนในชุมชนทั้งหมดกำลังจะต้องเผชิญ…

โดยไม่มีใครมั่นใจเลยว่าจะรอด หรือจะแตกสลายไปก่อนกันแน่...

สองเส้นทาง (The Forked Path)

กลางปี 2017 ท้องฟ้าเหนือบุรีรัมย์ยังคงคุกรุ่นด้วยไอแดดและความร้อนแรงของสงคราม Blocksize แจ๊ก กู้ดเดย์ ก้าวเข้ามาในคาเฟ่เล็ก ๆ แห่งหนึ่งในย่านเทศบาลด้วยสีหน้าครุ่นคิด เขาพยายามมองหามุมสงบสำหรับนั่งตั้งหลักในโลกความเป็นจริง ก่อนจะจมดิ่งสู่สงครามในโลกดิจิทัลบนฟอรัม Bitcointalk อีกครั้ง

กลิ่นกาแฟคั่วเข้มลอยกระทบจมูก แจ๊กสั่งกาแฟดำแก้วโปรดแล้วปลีกตัวมาที่โต๊ะริมกระจก กระจกบานนั้นสะท้อนแสงอาทิตย์จัดจ้า ราวกับจะบอกว่าวันนี้คงไม่มีใครหนีความร้อนที่กำลังแผดเผา ทั้งในอากาศและในชุมชน Bitcoin ได้พ้น

เขาเปิดแล็ปท็อปขึ้น ล็อกอินเข้า Bitcointalk.org ตามเคย ข้อความและกระทู้มากมายกระหน่ำแจ้งเตือน ไม่ต่างอะไรจากสมรภูมิคำพูดที่ไม่มีวันหลับ “Hong Kong Agreement ล้มเหลวจริงหรือ?” “UASF คือปฏิวัติโดย Node?” เหล่านี้ล้วนสะท้อนความไม่แน่นอนในชุมชน Bitcoin ที่ตอนนี้ ดูคล้ายจะถึงจุดแตกหักเต็มที...

“ทั้งที่ตอนนั้นเราก็พยายามกันแทบตาย…” แจ๊กพึมพำ มองจอด้วยสายตาเหนื่อยใจพร้อมภาพความทรงจำย้อนกลับเข้าในหัว เขายังจำการประชุมที่ฮ่องกงเมื่อต้นปี 2016 ได้แม่น ยามนั้นความหวังในการประนีประนอมระหว่าง Big Block และ Small Block ดูเป็นไปได้ หากแต่กลายเป็นละครฉากใหญ่ที่จบลงโดยไม่มีใครยอมถอย...

...การประชุม Hong Kong Agreement (2016)

ภายในห้องประชุมหรูของโรงแรมใจกลางย่านธุรกิจฮ่องกง บรรยากาศตึงเครียดยิ่งกว่าการเจรจาสงบศึกในสมัยโบราณ

โรเจอร์ แวร์ ยืนเสนอว่า “การเพิ่ม Blocksize สำคัญต่ออนาคตของ Bitcoin — เราอยากให้คนทั่วไปเข้าถึงได้โดยไม่ต้องจ่ายค่าธรรมเนียมแพง ๆ”

“จิฮั่น อู๋ (Jihan Wu)” จาก Bitmain นั่งฝั่งเดียวกับโรเจอร์ คอยเสริมว่าการเพิ่มบล็อกคือโอกาสสำหรับนักขุด และหากทีม Core ไม่ยอม พวกเขาก็พร้อม “ดัน Fork” ขึ้นได้ทุกเมื่อ ด้วย Hashrate มหาศาลที่พวกเขาคุมไว้

ฝั่ง ปีเตอร์ วูเล (Pieter Wuille) กับ เกร็ก แมกซ์เวลล์ (Greg Maxwell) จาก Bitcoin Core เถียงกลับอย่างใจเย็นว่า “การขยายบล็อกอาจดึงดูดทุนใหญ่ ๆ แล้วไล่ Node รายย่อยออกไป ชุมชนอาจไม่เหลือความกระจายอำนาจอย่างที่ Satoshi ตั้งใจ”

สุดท้าย บทสรุปที่เรียกว่า Hong Kong Agreement ลงนามได้ก็จริง แต่มันกลับเป็นแค่ลายเซ็นบนกระดาษที่ไม่มีฝ่ายไหนเชื่อใจใคร

แจ๊กเบือนสายตาออกนอกหน้าต่าง สังเกตเห็นผู้คนเดินขวักไขว่ บ้างก็ดูรีบร้อน บ้างเดินทอดน่องเหมือนว่างเปล่า นี่คงไม่ต่างอะไรกับชาวเน็ตในฟอรัมที่แบ่งฝ่ายกันใน “สงคราม Blocksize” อย่างไม่มีทีท่าจะหยุด

แค่ไม่กี่นาที... เสียงโทรศัพท์ก็ดังขึ้น ชื่อ แชมป์ ‘PIGROCK’ โชว์หราเต็มจออีกครั้ง

“ว่าไงเจ้าแชมป์?” แจ๊กกรอกเสียงในสายด้วยอารมณ์เหนื่อย ๆ ทว่าพร้อมจะอธิบายเหตุการณ์ตามสไตล์คนที่ชอบครุ่นคิด

“พี่แจ๊ก.. ผมเข้าใจแล้วว่าการประชุมฮ่องกงมันล้มเหลว ตอนนี้ก็มีคนแยกเป็นสองขั้ว Big Block กับ SegWit แต่ผมเจออีกกลุ่มในฟอรัมเรียกว่า UASF (User-Activated Soft Fork) ที่เหมือนจะกดดันพวกนักขุดให้ยอมรับ SegWit..."

"อยากรู้ว่าตกลง UASF มันสำคัญยังไงครับ? ทำไมใคร ๆ ถึงเรียกว่าเป็น การปฏิวัติโดย Node กัน?”

แจ๊กอมยิ้มก่อนจะวางแก้วกาแฟลง พูดด้วยน้ำเสียงจริงจังกว่าเดิม “UASF น่ะหรือ? มันเปรียบได้กับการที่ ‘ชาวนา’ หรือ ‘ประชาชนตัวเล็ก ๆ’ ออกมาประกาศว่า ‘ฉันจะไม่รับบล็อกของนักขุดที่ไม่รองรับ SegWit นะ ถ้าแกไม่ทำตาม ฉันก็จะตัดบล็อกแกทิ้ง!’ เสมือนเป็นการปฏิวัติที่บอกว่าแรงขุดมากแค่ไหนก็ไม่สำคัญ ถ้าคนรัน Node ไม่ยอม… เชนก็เดินต่อไม่ได้”

“โห… ฟังดูแรงจริง ๆ พี่ แล้วถ้านักขุดไม่ร่วมมือ UASF จะเกิดอะไรขึ้น?” แชมป์ถามต่อเสียงสั่นนิด ๆ

“ก็อาจเกิด ‘Chain Split’ ยังไงล่ะ"

"แยกเครือข่ายเป็นสองสาย สุดท้ายเครือข่ายเดิม กับเครือข่ายใหม่ที่รองรับ SegWit ไม่ตรงกัน คนอาจสับสนหนักยิ่งกว่า Hard Fork ปกติด้วยซ้ำ"

"แต่นั่นแหละ... มันแสดงพลังว่าผู้ใช้ทั่วไปก็มีสิทธิ์กำหนดทิศทาง Bitcoin ไม่ได้น้อยไปกว่านักขุดเลย”

“เข้าใจแล้วครับพี่… เหมือน การปฏิวัติโดยประชาชนตาดำ ๆ ที่จับมือกันค้านอำนาจทุนใหญ่ใช่ไหม?” แชมป์หยุดครู่หนึ่ง “ผมเคยคิดว่า Node รายย่อยน้อยรายจะไปสู้อะไรไหว แต่ตอนนี้ดูท่าจะเปลี่ยนเกมได้จริงว่ะพี่…”

“ใช่เลย” แจ๊กตอบ

“นี่เป็นความพิเศษของ Bitcoin ที่บอกว่า ‘เราคุมเครือข่ายร่วมกัน’ แม้แต่ Bitmain ที่มี Hashrate มากกว่า 50% ก็หนาวได้ถ้าผู้ใช้หรือ Node รายย่อยรวมพลังกันมากพอ”

แชมป์ฟังด้วยความตื่นเต้นปนกังวล “แล้วแบบนี้ เรื่อง SegWit กับ Blocksize จะจบยังไงครับ? เห็นข่าวว่าถ้านักขุดโดนกดดันมาก ๆ คนอย่าง จิฮั่น อู๋ อาจออกไปสนับสนุน Bitcoin Cash ที่จะเปิดบล็อกใหญ่”

แจ๊กเลื่อนดูฟีดข่าวในฟอรัม Bitcointalk อีกครั้ง ก็เห็นพาดหัวชัด ๆ

“Bitmain ประกาศกร้าวพร้อมหนุน BCH เต็มพิกัด!”

เขาถอนหายใจเฮือกหนึ่ง “ก็ใกล้เป็นจริงแล้วล่ะ… โรเจอร์ แวร์ เองก็ผลักดัน BCH ว่าคือ Bitcoin แท้ที่ค่าธรรมเนียมถูก ใช้งานได้จริง ส่วนฝั่ง BTC ที่ยึดเอา SegWit เป็นหลัก ก็ไม่ยอมให้ Blocksize เพิ่มใหญ่เกินจำเป็น.."

"ต่างคนต่างมีเหตุผล... แต่อุดมการณ์นี่คนละทางเลย”

“แล้วพี่คิดว่าใครจะเป็นฝ่ายชนะครับ?”

“เฮ้ย.. มึงถามยากไปหรือเปล่า” แจ๊กหัวเราะหึ ๆ “ทุกคนมีโอกาสได้หมด และก็มีโอกาสพังหมดเหมือนกัน ถ้า UASF กดดันนักขุดให้อยู่กับ Core ได้ พวกเขาอาจยอมแพ้ แต่ถ้า Bitmain เทใจไป BCH นักขุดรายใหญ่คนอื่น ๆ ก็คงตาม"

"แล้วถ้าฝั่ง BCH เริ่มได้เปรียบ... อาจดึงคนไปเรื่อย ๆ สุดท้ายจะเหลือไหมล่ะฝั่ง SegWit ตัวจริง?”

“งั้น Node รายย่อยจะยืนอยู่ตรงไหนล่ะครับพี่?” แชมป์ถามอย่างหนักใจ

“Node รายย่อยและชุมชนผู้ใช้นี่แหละ คือ ตัวแปรชี้ขาด ทุกวันนี้คนกลุ่ม UASF พยายามโชว์พลังว่าตัวเองมีสิทธิ์ตั้งกติกาเหมือนกัน ไม่ใช่แค่นักขุด"

"อย่างที่บอก.. มันคือการ ‘ลุกขึ้นปฏิวัติ’ โดยชาวนา ต่อสู้กับเจ้าที่ที่ถือ ‘แฮชเรต’ เป็นอาวุธ”

แจ๊กตบบ่าตัวเองเบา ๆ ก่อนจะหัวเราะเล็กน้อย

“นี่แหละความมันของ Bitcoin ไม่มีเจ้าไหนสั่งได้เบ็ดเสร็จจริง ๆ ทุกฝั่งต่างถือไพ่คนละใบ สงครามยังไม่รู้จะจบยังไง ถึงอย่างนั้นมันก็สะท้อนวิญญาณ ‘decentralization’ ที่แท้จริง กล้ายอมรับสิทธิ์ทุกฝ่ายเพื่อแข่งขันกันตามกติกา”

จู่ ๆ ในหน้าฟอรัมก็มีกระทู้ใหม่เด้งเด่น “Bitmain หนุน Bitcoin Cash ด้วย Hashrate กว่า 50%! สงครามเริ่มแล้ว?” ข้อความนั้นดังโครมครามเหมือนระเบิดลงกลางวง

แจ๊กนิ่งไปชั่วขณะ สัมผัสได้ถึงความปั่นป่วนที่กำลังปะทุขึ้นอีกครั้ง เหงื่อบางเบาซึมบนหน้าผากแม้อากาศในคาเฟ่จะเย็นฉ่ำ เขาหันมองโทรศัพท์ที่ยังค้างสายกับแชมป์ แล้วเอ่ยด้วยน้ำเสียงจริงจัง

“นี่ล่ะ.. จุดเริ่มของสองเส้นทางอย่างชัดเจน… บล็อกใหญ่จะไปกับ BCH ส่วน SegWit ก็อยู่กับ BTC แน่นอนว่าทั้งสองฝ่ายไม่คิดถอยง่าย ๆ นักขุดจะเลือกข้างไหน? Node รายย่อยจะยอมใคร?"

"เมื่อสงครามครั้งนี้นำไปสู่การแบ่งเครือข่าย ใครกันแน่จะเป็นผู้ชนะตัวจริง? หรืออาจไม่มีผู้ชนะเลยก็เป็นได้”

ปลายสายเงียบงัน มีแต่เสียงหายใจของแชมป์ที่สะท้อนความกังวลปนอยากรู้อย่างแรง

“พี่… สุดท้ายแล้วเรากำลังยืนอยู่บนรอยแยกที่พร้อมจะฉีกทุกอย่างออกเป็นชิ้น ๆ ใช่ไหมครับ?”

“อาจจะใช่ก็ได้... หรือถ้ามองอีกมุม อาจเป็นวัฏจักรที่ Bitcoin ต้องเจอเป็นระยะ ทุกคนมีสิทธิ์ Fork ได้ตามใจใช่ไหมล่ะ? ก็ขอให้โลกได้เห็นกันว่าชุมชนไหนแน่จริง” แจ๊กพูดทิ้งท้ายก่อนจะแย้มยิ้มเจือรอยอ่อนล้า

ภาพบนจอคอมพิวเตอร์ฉายกระทู้ถกเถียงกันไม่หยุด ประหนึ่งเวทีดีเบตที่ไม่มีวันปิดไฟ แจ๊กจิบกาแฟอึกสุดท้ายเหมือนจะเตรียมพร้อมใจก่อนเข้าสู่สนามรบครั้งใหม่ สงครามยังไม่จบ.. ซ้ำยังดูหนักข้อยิ่งขึ้นเรื่อย ๆ

เขาลุกขึ้นจากโต๊ะ ชำเลืองมองแสงแดดจัดจ้าที่สาดลงมาไม่หยุด เปรียบเหมือนไฟแห่งข้อขัดแย้งที่เผาผลาญทั้งชุมชน Bitcoin ไม่ว่าใครจะเลือกอยู่ฝั่งไหน กลุ่ม UASF, กลุ่ม Big Block, หรือ กลุ่ม SegWit ทางเดินข้างหน้าล้วนเต็มไปด้วยความไม่แน่นอน

“สุดท้ายแล้ว… เมื่อกระดานแบ่งเป็นสองเส้นทางอย่างเด่นชัด สงคราม Blocksize จะจบลงด้วยใครได้บทผู้ชนะ?"

"หรือบางที… มันอาจไม่มีผู้ชนะที่แท้จริงในระบบที่ใครก็ Fork ได้ตลอดเวลา”

คำถามนี้ลอยติดค้างอยู่ในบรรยากาศยามบ่ายที่ร้อนระอุ ชวนให้ใครก็ตามที่จับตาดูสงคราม Blocksize ต้องฉุกคิด

เมื่อไม่มีใครเป็นเจ้าของ Bitcoin อย่างสมบูรณ์ ทุกคนจึงมีสิทธิ์บงการและเสี่ยงต่อการแตกแยกได้ทุกเมื่อ แล้วท้ายที่สุด ชัยชนะ–ความพ่ายแพ้ อาจไม่ใช่จุดสิ้นสุดของโลกคริปโตฯ

แต่เป็นเพียงจุดเริ่มต้นของการวิวัฒน์ที่ไม่มีวันจบสิ้น…

เมาท์แถมเรื่อง UASF (User-Activated Soft Fork)