-

@ bf47c19e:c3d2573b

2025-05-11 18:12:00

@ bf47c19e:c3d2573b

2025-05-11 18:12:00Originalni članak na politika.rs.

06.12.2014 / Autor: Istok Pavlović

Pre nekoliko godina, pojavila se digitalna valuta – bitkoin. Isprva, delovalo je kao utopija šačice sanjara ideja da ova valuta jednog dana postane glavno sredstvo plaćanja među ljudima, i da se potpuno ukine bankarski sistem i posrednici u finansijskim transakcijama. Međutim, san polako postaje realnost. Sve više ozbiljnih kompanija prima bitkoin kao sredstvo plaćanja, i njegovo usvajanje se povećava iz meseca u mesec.

Kako zapravo radi bitkoin? Da bismo odgovorili na ovo pitanje, pođimo od jednog starijeg problema u matematici, koji se zove „problem vizantijskih generala”.

Vizantijski generali opkolili su neprijateljski grad. Svaki od generala nalazi se sa svojom vojskom negde oko grada, i generali su geografski razdvojeni. Komunikacija među generalima ide preko kurira, koji prenose poruke. Da bi napad uspeo, generali moraju da se dogovore oko zajedničkog nastupa – da krenu svi odjednom u dogovoreno vreme. Međutim, problem je što među generalima, pa i među kuririma mogu da postoje izdajnici – ljudi koji rade za neprijatelja i koji će namerno preneti pogrešnu poruku kako bi sabotirali napad. Kako organizovati prenošenje poruka među generalima tako da akcija uspe, bez obzira na izdajnike?

Rešenje ovog problema postoji, i u pitanju je veoma kompleksan matematički algoritam koji se razvio početkom 21. veka. Pojavom bržih kompjutera, ovaj problem postao je rešiv za kraće vreme. U praksi, ovo je značilo da smo dobili način da se uspostavi potpuno poverenje između dve osobe na internetu koje se uopšte ne poznaju. To je otvorilo čitav novi spektar mogućnosti – a jedna od tih mogućnosti je digitalni novac.

Bitkoin sistem je zapravo kao jedna velika finansijska knjiga na internetu. Vi kupujete prostor u toj knjizi, u zamenu za klasičan novac ili prodajom neke robe ili usluga, i tada postajete vlasnik određene sume bitkoina. Taj svoj prostor zatim možete prodati nekom drugom ko hoće da ga kupi. Sve transakcije su potpuno sigurne i niko na svetu ne može da ospori da su se desile.Transakcije automatski beleži mreža kompjutera širom sveta prema „algoritmu vizantijskih generala”, bez ikakvog upliva živih ljudi, i tako dobijamo maksimalno poverenje. S obzirom na to da su ljudi eliminisani iz jednačine, najvažnija posledica ovog sistema je to što sada sve transakcije mogu da budu bez posrednika, bez banaka i nema provizije.

Ova poslednja činjenica je jedan od ključnih razloga što je bitkoin uveden kao sredstvo plaćanja u mnogim prodavnicama. Koliko god opskurno delovao, bitkoin je zapravo mnogo povoljniji za prodavce od klasičnog novca. Recimo da prodajete elektronske uređaje, gde je uobičajena margina profita oko pet procenata. Banke za procesiranje kartice uzimaju 2,5 odsto. Vi, dakle dajete polovinu svog profita banci, samo zato što banke kao sistem imaju monopol nad plaćanjem i nemate izbora. Tačnije, niste imali izbora do pojave bitkoina.

Za velike kompanije, kojima ne smetaju bankarske provizije, bitkoin je više stvar prestiža i mode. „Hej, pogledajte kako smo mi moderna kompanija, primamo bitkoine.” Međutim, za male porodične biznise bitkoini bukvalno mogu da znače opstanak.

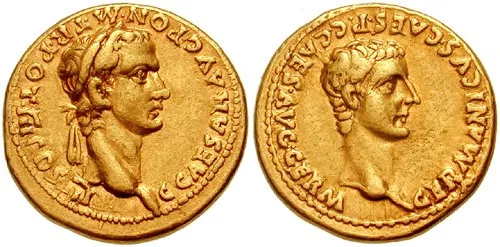

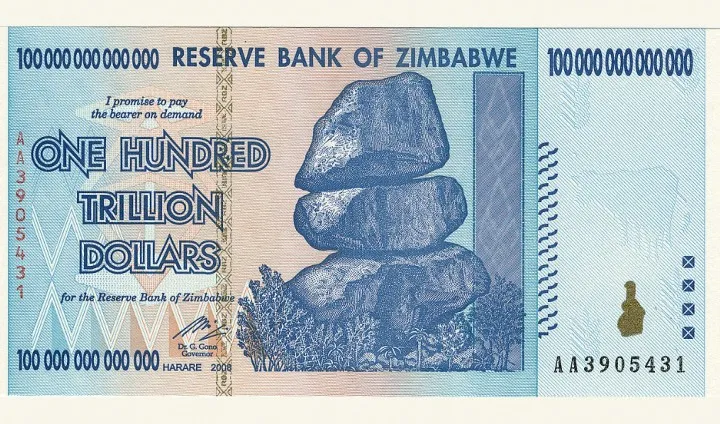

Postavlja se logično pitanje, šta je to što bitkoinima daje vrednost? Odgovor na ovo pitanje zapravo leži u pitanju „šta je to što daje vrednost klasičnom novcu”. Ako pogledamo istoriju novca, u početnom trenutku za ljude je to bilo neko parče papira, ali su uvedene zlatne rezerve kao garancija da taj papir vredi. Ova garancija stvorila je kod ljudi veru u novac, i ta vera čini njegovu vrednost. Kasnije, ove zlatne rezerve su davno prevaziđene i nemaju veze s količinom novca u opticaju, ali ono što je ostalo jeste vera u novac, i samo zahvaljujući toj veri novac ima vrednost.

Ista stvar je i sa bitkoinima. Njegovu vrednost zapravo čini vera. Milionima ljudi širom sveta krv uzavri od sreće kada čuju za ideju da se konačno iskoreni bankarski sistem. Oni vide bankare kao „krvopije koji žive na tuđoj grbači”, i podržaće svaku ideju u tom pravcu. Počeće pasionirano da koriste bitkoine kao sredstvo plaćanja gde god je to moguće, sanjajući da dožive tokom svog života naslov u novinama „Bankari ostali bez posla”, da bi tog dana mogli da kažu: „I ja sam u ovome učestvovao, ja sam jedan od oslobodilaca čovečanstva.”

Naravno, kao i svaka tehnologija u svojoj ranoj fazi, bitkoin ima svoje propuste koji se sređuju. Ako pogledate internet komentare, ima ljudi koji će naći sto mana bitkoinima. Ipak, da smo slušali kritizere koji kritikuju tehnologije u ranoj fazi, nikada ne bismo imali avione, električnu struju, ili bilo koje inovacije koje su u početku delovale nesigurno, a bez kojih nam je današnji život nezamisliv.

-

@ bf47c19e:c3d2573b

2025-05-11 18:11:21

@ bf47c19e:c3d2573b

2025-05-11 18:11:21Originalni tekst na trzisnoresenje.blogspot.com

06.10.2014 / Autor: Slaviša Tasić

Od kako je bitcoin postao popularan vodi se rasprava među zagovornicima slobodnog tržišta oko njegovo gpravog statusa: da li je to budući novac, efikasan sistem zaobilaženja državne kontrole i garant slobode pojedinca, ili pak fikcija i pomodarstvo iza koje nema ničeg stvarnog?

Teorijski centar debate je pitanje da li je bitcoin "zapravo" novac ili ne. Jedna grupa tvrdi da jeste, pozivajući se na to da je nastao hiljadama dobrovoljnih akata potrošača na tržištu i time uspostavljen kao konvencija. Ko ste vi, teoretičari iz fotelje, da u ime naroda koji prihvata bitcoin definišete šte je "pravi" novac a šta nije? Druga škola tvrdi da je to irelevantno, da je takozvana vrednost bitcoina fiktivna i naduvana, i da će uskoro pući, jer nema nikakve realne pozadine: svaki novac kroz istoriju je uvek morao da ima podlogu nećeg realnog, najčešće plemenitog metala neke vrste, novac nikad ne nastaje nečijom naredbom ili proizvoljnom odlukom.

Vrlo često se u ovom kontekstu pominje Misesova čuena "teorema regresije". Ona kaže da je novac univerzalno razmensko sredstvo koje svoju vrednost crpe iz prethodne upotrebne vrednosti materijala od kojeg je sačinjeno. Recimo, zlato i srebro imaju vrednost kao nakit i luksuzna roba koju ljudi traže iz ne-monetarnih razloga, a njihova vrednost kao novca se onda izvodi iz te prethodne evaluacije njegove ne monetarne upotrebne "vrednosti". Tehnički rečeno, tražnja za zlatom kao monetarnim dobrom izvedena je iz tražnje za zlatom kao nemonetarnim dobrom.

Problem sa bitcoinom je što na prvi pogled on nema nikakvu ne-monetarnu vrednost. Nije zasnovan ni na kakvom fizičkom materijalu ili robi, već predstavlja kompjuterski algoritam. Bitcoin je beskoristan za bilo šta drugo osim kao sredstvo plaćanja. Ako je tome tako, onda postoje samo dve mogućnosti: ili bitcoin ne može da bude novac, ili je teorija o realnoj, nemonetarnoj osnovi novca netačna.

Izgleda da ni jedno ni drugo nije slučaj. Bitcoin jeste sredstvo razmene, iako još uvek nije novac, budući da nije univerzalno prihvaćen (što ne znači da ne može ili da neće biti prihvaćen), ali bitcoin istovremeno JESTE zasnovan na nečem realnom, tj ima vrednost i mimo svoje uloge kao novca. Ta prethodna vrednost bitcoina je njegova uloga kao efikasnog sistema plaćanja. Kao što Jeffrey Tucker naglašava u svom novom tekstu, Bitcoin je 2008 uveden kao sistem plaćanja koji bi omogućio efikasni transfer resursa između pojedinaca u raznim delovima sveta uz potpuno zaobilaženje zvaničnog finansijskog sistema. Programski dokument osnivača Bitcoina nije uopšte spominjao novac nego samo sistem plaćanja koji omogućava pouzdanost, anonimonst i operisanje izvan zvaničnih finansijkih tokova. Tehnički detalji su ovde.

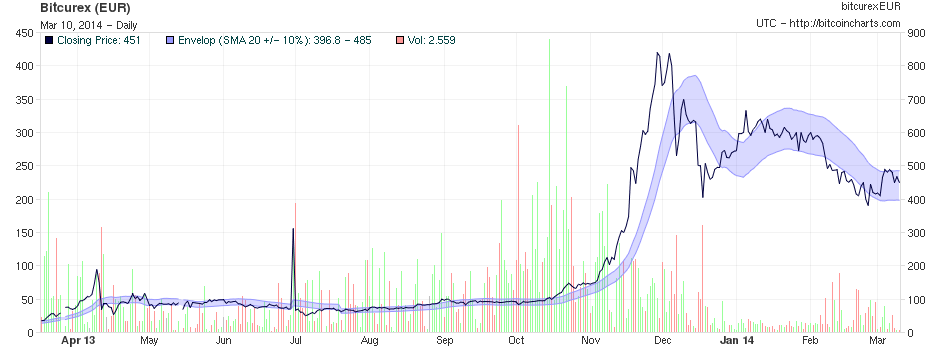

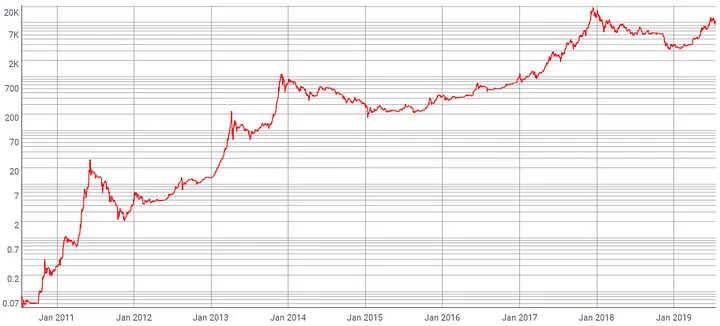

Bitcoin kao sistem je lansiran 9 januara 2009, ali u tom trenutku njegova vrednost je bila nula! Sve do oktobra 2009 potenicjalni klijenti su mogli da dobiju besplatno koliko god hoće bitcoina da eksperimentišu. Ljudi su vršili prve transakcije, proveravali da li je sistem pouzdan, da li radi onako kako je obećano itd. Taj proces eksperminetisanja je trajao oko deset meseci. U tom periodu Bitcoin kao novac nije imao nikakvu tržišnu vrednost. Pre tačno pet godina, 5 oktobra 2009 postavljena je prva tržišna cena. Ona je bila 1390 bitcoina za jedan američki dolar, odnosno jedan bitcoin je vredeo manje od desetog dela penija. U tom trenutku publika je bila još uvek skeptična, što se pokazalo u vrlo niskoj ceni, ali kako je vreme prolazilo cena je rasla jer je evaluacija sistema, sa protokom vremena i daljim potvrđivanjem njegove vrednosti i pouzdanosti, kao i ulaskom mnogo šireg kurga ljudi u igru, postajala sve viša. Međutim, to je sve sa teorijske tačke gledišta irelevantno; ključna stvar je da je početna evaluacija bitcoina, prva tržišna cena objavljena 5 oktobra 2009 bila zapravo izraz evaluacije sistema plaćanja koja je vršena mesecima nezavisno od samog novca (tj njegove potencijalne vrednosti). Bitcoin kao novac "regresira" u mizesovskom smislu na bitcoin kao sistem plaćanja.

Dakle, bitcoin nije fiat novac. On predstavlja potencijalnu valutu koja je izvedena iz tržišne vrednosti specifičnog sistema plaćanja koji klijentima omogućava značajne prednosti koje drugi sistemi ne pružaju. I stoga oza njega stoji "realna vrednost" u istom smislu u kome nešto "realno" stoji iza zlata i srebra kao novca, ili iza modernih fiat valuta izvedenih iz zlata i srebra. Ja ne verujem da bi bitcoin imao velike šanse protiv zlata i srebra na slobodnom tržištu valuta, ali u ovom trenutku ne postoji slobodno tržište valuta, tj onaj ko pokuša da trguje u zlatu završiće u zatvoru. U takvim okolnostima, virtuelnost bitcoina predstavlja komparativnu prednost u odnosu na svaku vrstu robnog novca uključujući i zlato: vlasnik ne poseduje nikakvu fizičku supstancu koju vlada može da mu konfiskuje. Naravno, to bi moglo da se promeni ukoliko vlade ocene da je bitcoin značajna opasnost i krene u tehnološki rat protiv njega. U tom slučaju bi i cena verovatno pala.

-

@ bf47c19e:c3d2573b

2025-05-11 18:10:39

@ bf47c19e:c3d2573b

2025-05-11 18:10:39Originalni tekst na trzisnoresenje.blogspot.com

15.12.2023 / Autor: Slaviša Tasić

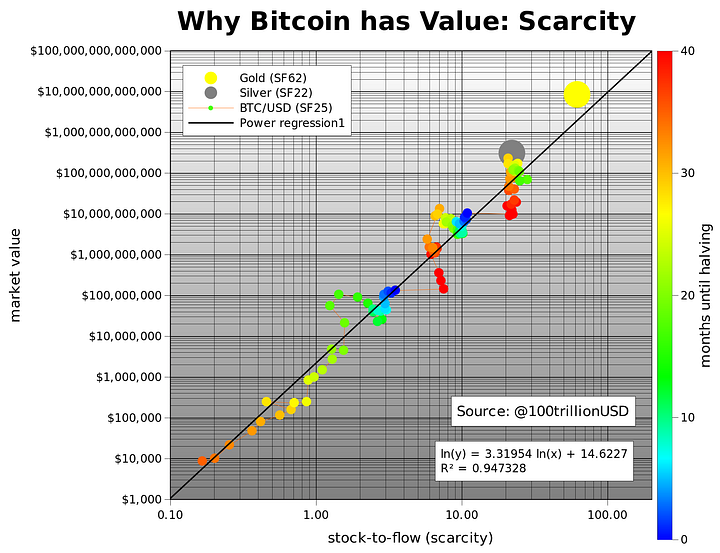

Ovako sam pisao u aprilu kad je Bitcoin vredeo $50-100 dolara:

"Koja je budućnost Bitcoina? Većina mu predviđa propast, ali već smo videli da ima neprijatelje sa obeju strana i obe imaju svoje razloge. ... Ali ekonomski gledano, sada kad je Bitcoin došao dovde, meni se čini da može još mnogo rasti."

...

"Zato mislim da ekonomski Bitcoin više nema problem. Sa ovako ograničenom ponudom, a uz održanje sadašnje tražnje ili njen rast, njegove vrednost može i još mnogo da poraste."

U međuvremenu je otišao na preko $1,000. Ali mislite da sam kupio neki Bitcoin? Nisam, teško je baviti se takvim sitnicama kad morate da pišete blog.

Evo šta sada mislim o Bitcoinu.

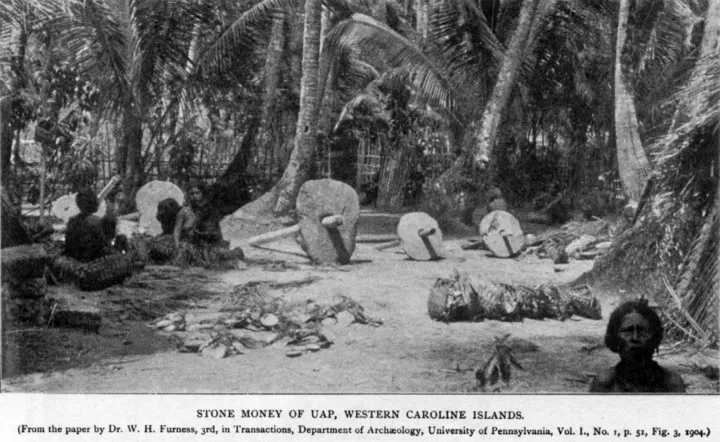

Najvažnije je razumeti zašto Bitcoin uopšte ima vrednost. To što ima neku vrednost i nije tako iznenađujuće. Valute su istorijski spontano nastajale najčešće od nečega što ima istinsku vrednost, bronze, srebra ili zlata. Ali nije neviđeno ni da novac bez intristične vrednosti bude široko prihvaćen. Poznat je slučaj ostrva kamenog novca, gde je novac bilo kamenje, neka vrsta krečnjaka (vidi sliku ispod). Stanovnici jednog polinezijskog ostrva su koristili ovaj kamen kao novac zbog samo jedne osobine -- zato što nije postojao na ostrvu. Da biste nabavili takvo kamenje morali ste ići na drugo ostrvo, što je bilo skupo i naporno. I to je jedina osobina koja je krečnjak činila novcem, nisu ga koristili ni za šta drugo.

Štaviše, da ne bi kotrljali kamenje pri svakoj kupovini, trgovali su samo pravima na odrđeni kamen, a da se kamen uopšte nije morao pomeriti s mesta. To je suštinski isto kao današnje elektronsko bankarstvo, ali to je druga priča.

Bitcoin je nešto najbliže tome. Kad se uspostavi konvencija, onda novac ne mora imati imanentnu vrednost. Konvencija je, iz garantovanu retkost dovoljan uslov da nešto uspe kao novac. Kao i krečnjak na tom ostrvu, Bitcoin je suštinski bezvredan, ali 1) ne može se naći lako (ima retkost) i 2) postoji konvencija da se prihvata kao novac -- prihvatate ga jer znate da će ga i drugi prihvatiti.

Ali koliko je Bitcoin zaista redak? Sam Bitcoin jeste, jer mu je ponuda programski ograničena. Ali sada vidimo uspon drugih kripto valuta -- Litecoin, Peercoin, i drugi. Bitcoin je redak, ali svako može da napravi nešto jako slično bitcoinu i zvati ga drugačije. To se uveliko i dešava, za sada bez efekta na vrednost Bitcoina.

Za sada Bitcoin ima rastuću snagu konvencije, ili ekonomskim rečnikom, za njega radi efekat mreže. Efekat mreže postoji kada svaki dodatni korisnik povećava vrednost dobra -- vi koristite tastaturu sa početnim slovima QWERTY zato što svi drugi koriste istu tastaturu pa je glupo da počinjete nešto drugo; otvorili ste Facebook nalog ne zato što je Facebook tehnološki najbolje urađen nego zato što svi drugi imaju Facebook pa se tako nalkaše povezujete; nemate Google Plus jer niko drugi nema Google Plus što ga čini beskorisnim, i tako dalje. Uspostavljene mreže je jako teško srušiti, one se perpetuiraju i rastu na principu začaranog kruga.

Kad se jednom uspostave, mreže kao Facebook ili Bitcoin imaju ugrađenu prednost i teško ih je srušiti. Ali znate li ko je još imao efekat mreže u svoju korist? Imao je Windows i imao je MySpace. Windows se još drži ali nije ni blizu moći od pre desetak godina, a MySpace je potpuno propao -- a ljudi su 2008. MySpaceu predviđali večni monopol zbog efekta mreže. Poenta je, efekat mreže je prednost ali nikome ne garantuje monopol, pa čak ni opstanak.

Situacija sa Bitcoinom je ovakva. Sa pojavom drugih valuta retkost je izgubio. Nije bitno što nema Bitcoina, Bitcoin je samo ime. Ima ili može biti neograničeno mnogo kriptovaluta istog tipa i to je ono što je važno. Konvenciju odnosno efekat mreže Bitcoin još uvek ima, štaviše tu je i dalje u usponu. Ali to mu ne garantuje dugoročni uspeh. Kad se ta dva saberu, mislim da Bitcoin nema dobrih dugoročnih izgleda. Da sam onda u aprilu kupio Bitcoine, sada bih prodao.

-

@ bf47c19e:c3d2573b

2025-05-11 18:10:19

@ bf47c19e:c3d2573b

2025-05-11 18:10:19Originalni tekst na trzisnoresenje.blogspot.com

03.04.2013 / Autor: Slaviša Tasić

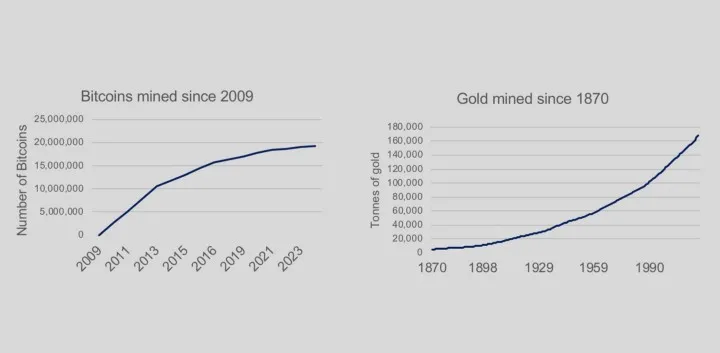

Posle kiparske epizode naglo je došlo do rasta njegove vrednosti. Bitcoin je virtuelna valuta koju ne kontroliše niko. Umesto toga, emitovanje Bitcoina ograničeno je komplikovanim programom. Kao i kod zlata, svako može da iskopa novčiće, ali kopanje je naporno i neizvesno -- jedina je razlika što se posao ne obavlja fizički već kompjuterski. Program je postavljen tako da količina iskopanih Bitcoina raste po stalno opadajućoj stopi, dok se na kraju, za nekih stotinak godina, asimptotski ne približi konačnom nivou.

Za bliže objašnjenje Bitcoina i više o tekućim dešavanima pročešljajte Nedeljni komentar, a meni ceo fenomen postaje vrlo interesantan iz nekoliko razloga.

Prvo, Bitcoin ima mnogo neprijatelja. Neprijatelji su pristalice državnog novca, jer je ovo privatni, decentralizovani novac, čije štampanje ne kontrolišu stručnjaci za monetarnu politiku već se obavlja po automatskom programu. Tokovi novca se teško kontrolišu i neke centralne banke su već "izrazile zabrinutost" zbog rastuće uloge ove valute.

Ali, neprijatelji su i libertarijanski ekonomisti kojima je bliži zlatni standard. U njihovu viziju se ne uklapa to što Bitcoin očigledno nema pravu materijalnu vrednost. Bitcoin je nešto kao privatni fiat novac -- dosada neviđeni fenomen. Po njima tako nešto ne može da postoji i zato mu od samog početka predviđaju propast, ali ih bar za ovih par godina njegovog postojanja stvarnost demantuje.

Dalje, nastanak i dosadašnji uspeh Bitcoina se kosi sa bilo kojom postojećom teorijom i štaviše, za njegov uspeh gotovo da uopšte nema racionalnog objašnjenja. Najveća tajna slobodne razmene, bilo da je to tržište ili drugi oblici slobodne i dobrovoljne saradnje, je to što iz neorganizovane akcije slobodnih pojedinaca može doći do ishoda kojima se ne možemo unapred nadati, koji prevazilaze našu moć imaginacije i koje čak i ex post teško možemo racionalno objasniti. (To je Hayekova najvažnija ideja, a ne njegov libertarijanizam po sebi).

Bitcoin je izgledao a i dalje većini ekonomista i medija izgleda nemoguće, jer iako je njegova ponuda ograničena programom, tražnja za njim je stvar pukog verovanja. Kod zlata i srebra, tražnja postoji jer ti metali imaju i stvarnu vrednost. Kod državnog novca, tražnja postoji jer vam država kaže da morate da koristite taj novac, ali i svojim autoritetom garantuje da će svi ostali prihvatati taj novac. Kod Bitcoina vam niko ne garantuje ništa. Kako je to počelo da se koristi, kako su ljudi, posebno oni u početku, prihvatali da prodaju stvari za Bitcoine, ili da razmenjuju svoje evre i dolare za Bitcoine, meni uopšte nije jasno. Sada je lakše, valuta je donekle uspostavljena, više je prodavaca koji je prihvataju, znate da ima dovoljno onih koji je koriste i zato ima nekih osnova za verovanje da će se to nastaviti. Ali da je tako nešto moglo da počne, da nastane ni iz čega, je gotovo neshvatljivo.

Koja je budućnost Bitcoina? Većina mu predviđa propast, ali već smo videli da ima neprijatelje sa obeju strana i obe imaju svoje razloge. Propast je pre svega moguća usled državne intervencije. Možda će tako nešto jednostavno biti zabranjeno i proganjano. Kad je američka Komisija za hartije od vrednosti mogla da ugasi jako korisnu onlajn kladionicu Intrade (čije smo kvote na razne događaje u svetu ovde često linkovali), navodno iz razloga finansijske sigurnosti, onda je vrlo moguće da i Bitcoin dođe na red.

Ali ekonomski gledano, sada kad je Bitcoin došao dovde, meni se čini da može još mnogo rasti. Tačno je da tražnja za njim počiva na cikličnom verovanju, na verovanju svakog korisnika da će svi drugi nastaviti da primaju Bitcoin, ali: prvo, već nas je jednom iznanadilo da je Bitcoin samo na osnovu tog verovanja došao od nule do današnjih preko 100$ za Bitcoin. Drugo, ne zaboravite da ni ostale valute nisu baš toliko drugačije. Tražnja za državnim novcen se, bez obzira na državne garancije, dobrim delom zasniva na istoj slobodnoj veri da će i drugi prihvatati taj novac. Zlato ima materijalnu vrednost, ali ta vrednost, za industrijsku upotrebu ili nakit, je obično dosta manja od njegove sadašnje cene. Nisu se u poslenjih nekoliko godina industrijska upotreba i atraktivnost zlatnog nakita promenili, već su se promenila očekivanja vrednosti zlata, koja takođe zavise od vaše pretpostavke da će i ostali nastaviti da kupuju i drže zlato.

Zato mislim da ekonomski Bitcoin više nema problem. Sa ovako ograničenom ponudom, a uz održanje sadašnje tražnje ili njen rast, njegove vrednost može i još mnogo da poraste. Mnogo realniji scenario raspada je panika posle najave država da će zabraniti njegovu upotrebu uz neki izgovor kao što su finansijska stabilnost ili sprečavanje pranja novca. Ali čak i ako se to dogodi ostaće fascinantno da je ovakva inicijativa uopšte uspela -- protivno zakonima slabašne ljudske logike.

-

@ bf47c19e:c3d2573b

2025-05-11 18:07:57

@ bf47c19e:c3d2573b

2025-05-11 18:07:57Časopis studenata Ekonomskog fakulteta - "Monopolist", oktobar 2013. / Autor: Nikola Nikitović

Da li ćemo, uz pomoć interneta, uspeti da zaobiđemo banke u procesu novčanih transakcija i tako učinimo sebe bogatijim?

Slobodno tržište tera svakog učesnika da popravi performanse svog proizvoda ili usluge, smanji troškove, eliminiše nepotrebne aktivnosti i sve to u cilju profi ta. Zato ne čudi što zbog pojave savremenih tehnologija mnoga zanimanja nestaju. Tako danas skoro da više i nemamo daktilografe, limare, časovničare i slično. Međutim, delatnost koja je izložena konkurenciji, ali vekovima opstaje i tradicionalno pravi velike profi te je bankarstvo. Iste godine kad je svet zahvatila svetska ekonomska kriza, te čuvene 2008, osoba ili grupa ljudi pod pseudonimom „Satoši Nakamoto” izbacuje „bitkoin protokol”. Idejni tvorac bitkoina izabrao je da ostane anoniman, što je otvorilo prostor za istražitelje koji su pokušali da otkriju identitet Satoši Nakamota. Izneti su i dokazi koji povezuju troje ljudi sa identitetom Nakamota, ali ništa više od onoga što obični demanti ne mogu osporiti.

ŠTA JE, U STVARI, „BITKOIN”?

Jedna od ideja tvoraca bitkoina je da se dizajnira nova ekonomija u kojoj digitalni domen ima primarnu ulogu. Bitkoin je prva decentralizovana digitalna valuta. Za razliku od evra, dolara, dinara ili bilo koje druge valute, bitkoinom ne upravlja nijedna institucija - ni centralna banka, ni vlada, niti bilo ko drugi. To su digitalni novčići koji se mogu slati putem interneta. Šaljemo ih neposredno, dakle, bez učešća banaka, što znači da su troškovi slanja, ako ne nulti, onda svakako manji nego do sada. Geografski faktori ne predstavljaju ograničenje, pa, na kojoj god lokaciji da se nalazimo, moći ćemo da primamo ili šaljemo ovaj digitalni novac. Takođe, jedna od važnih osobina bitkoina je ta da nam račun ni u jednom trenutku ne može biti zamrznut.

Urednik „Bitkoin magazina” kaže da je bitkoin upravo ono što bi novac trebalo da bude. Ove transakcije ne liče na klasične novčane transakcije. Kako njima ne upravlja centralna banka, infl acija nije moguća, što u slučaju Srbije, zemlje s tradicionalno visokom infl acijom i drugom najvećom hiperinfl acijom, dosta znači. Bitkoini se generišu u procesu zvanom „mining”. Kompjuter nam zadaje kompleksan matematički problem, a cilj je šezdesetčetvorocifreni broj. Ukoliko kompjuter uspešno reši ovaj algoritam, postajemo vlasnici pedeset bitkoina. Mreža je programirana tako da povećava ponudu novca prema predodređenom rasporedu sve dok ukupan broj bitkoina ne dostigne 21 milion. Trenutno se u proseku izbacuje oko dvadeset pet novčića na svakih deset minuta. Ovaj broj biće prepolovljen do 2017, i tako svake četiri godine dok ne dostigne limit. Novembra 2012. kreirana je polovina ukupne ponude bitkoina od 21 milion, a oko 2140. bi trebalo i cela ponuda.

Vrednost bitkoina u odnosu na dolar rapidno se uvećava - od svega trideset centi januara 2011. do 125 dolara marta 2013. Iz tog razloga ljudi koriste bitkoin radije kao investiciju, nego kao sredstvo plaćanja.

Mt.Gox je najveća svetska bitkoin berza (eng. exchange) gde ljudi mogu da trguju bitkoinima bilo s kim u svetu, mogu da ih kupuju lokalnom valutom, a mogu čak i da ih skladište. Ipak, ni ovo nije bez rizika: hakeri mogu da upadnu u sistem i da ga ozbiljno ugroze. Bitkoin je, takođe, poznat po tome što je moguće, uz određeni softver, kupovati nelegalne proizvode poput droge, što skeptici vide kao negativnu stranu ove valute. Ali, ako znamo da nož može da ubije čoveka, ali i da iseče hleb, da li to onda znači da treba da zabranimo proizvodnju noževa?

Najveći interes za novu digitalnu valutu pokazuju zemlje koje nemaju tako jak bankarski sektor kao Kina, Rusija, zemlje Latinske Amerike i Afrika. Postoje dva aspekta bitkoina koja izazivaju sumnju u naše razumevanje novca: on je istovremeno i valuta i način plaćanja (nešto kao „pejpal” sa svojom valutom). Svakako da se vladama i ostalim regulatornim telima ovaj koncept ne sviđa. Oni vole kad akademci razmišljaju o monetarnoj politici, pišu radove i predaju svoje ideje nadležnima, koji ih prihvate ili odbace. Satoši Nakamoto, tvorac bitkoina, nije tako razmišljao: on je napravio valutu i pustio je u upotrebu, pa ko hoće, može da je koristi. Ovo je prvi put u istoriji da jedan čovek može da šalje i prima novac bez učešća ijedne druge osobe, bilo gde na planeti. Nije bitno da li ima bankovni račun, nije bitno da li ima kreditne kartice, ako ima kompjuter i pristup internetu, može da šalje novac odakle god želi i niko ga ne može sprečiti u tome. Neki idu i toliko daleko da kažu da je ovo i najveći izum posle interneta. Ako je tako, to znači da će tražnja rasti, a kako je ponuda predvidiva i ograničena, znači da će i cena da raste. Ako je zaista tako, hajdemo onda svi po bitkoine.

-

@ bf47c19e:c3d2573b

2025-05-11 18:02:25

@ bf47c19e:c3d2573b

2025-05-11 18:02:25Bitcoin: Peer-to-peer sistem elektronskog novca

Satoshi Nakamoto

satoshin@gmx.com

Translated in Serbian from bitcoin.org/bitcoin.pdf by ECD

Sažetak. Potpuna peer-to-peer verzija elektronskog novca omogućila bi slanje uplata putem interneta direktno od jedne strane ka drugoj bez posredovanja finansijskih institucija. Digitalni potpisi pružaju deo rešenja, ali se glavni benefiti gube ako je i dalje potrebna pouzdana treća strana za sprečavanje dvostruke potrošnje. Predlažemo rešenje problema dvostruke potrošnje korišćenjem peer-to-peer mreže. Mreža vremenski označava transakcije tako što ih hešuje u tekući lanac dokaza o radu (proof of work) temeljen na hešu, formirajući zapis koji se ne može promeniti bez ponovnog rada i objavljivanja dokaza o tom radu. Najduži lanac ne služi samo kao dokaz niza događaja, nego i kao dokaz da je taj niz događaja potvrđen od strane dela peer-to-peer mreže koja poseduju najveću zbirnu procesorsku snagu (CPU). Sve dok većinu procesorske snage kontrolišu čvorovi (nodes) koji ne sarađuju u napadu na mrežu, oni će generisati najduži lanac i nadmašiti napadače. Sama mreža zahteva minimalnu strukturu. Poruke kroz mrežu se prenose uz pretpostavku da svaki čvor čini maksimalan napor da poruku prenese u svom izvornom obliku i na optimalan način, a čvorovi mogu napustiti mrežu i ponovo joj se pridružiti po želji, prihvatajući najduži lanac dokaza o radu kao dokaz onoga što se dogodilo dok ih nije bilo.

1. Uvod

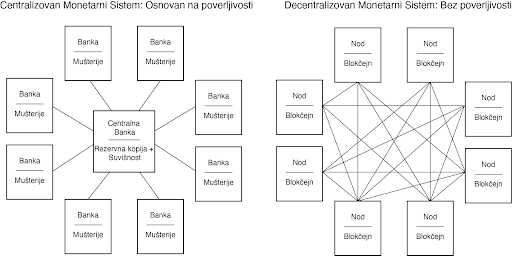

Trgovina na Internetu počela je da se oslanja skoro isključivo na finansijske institucije koje služe kao pouzdani posrednici pri obradi elektronskih plaćanja. Iako sistem radi dovoljno dobro za većinu transakcija i dalje trpi od inherentnih slabosti modela utemeljenog na poverenju.

Potpuno nepovratne transakcije zapravo nisu moguće, jer finansijske institucije ne mogu izbeći posredovanje u rešavanju eventualnih sporova. Troškovi posredovanja povećavaju troškove transakcija, ograničavaju minimalnu praktičnu veličinu transakcija i onemogućuju male, povremene transakcije jer postoji velika šteta zbog gubitka mogućnosti da se izvrše nepovratna plaćanja za nepovratne usluge. Uz mogućnost povraćaja transakcije, potreba za poverenjem raste. Trgovci moraju biti oprezni prema svojim kupcima i tražiti im više informacija nego što bi inače bilo neophodno. Određeni procenat prevara prihvaćen je kao neizbežan. Ovi troškovi i nepouzdanost plaćanja mogu se izbeći korišćenjem gotovine, ali ne postoji mehanizam za elektronsko plaćanje bez pouzdane treće strane.

Ono što je potrebno je elektronski sistem plaćanja zasnovan na kriptografskom dokazu umesto na poverenju, koji omogućava da bilo koje dve strane direktno i dobrovoljno međusobno trguju bez potrebe za posrednikom. Transakcije koje su nepovratne bi zaštitile prodavce od prevara, a escrow mehanizmi mogli bi se lako implementirati radi zaštite kupaca. U ovom dokumentu predlažemo rešenje problema dvostruke potrošnje korišćenjem peer-to-peer distribuiranog servera vremenskih oznaka (timestamp) za generisanje računarskog dokaza o hronološkom redosledu transakcija. Sistem je siguran sve dok pošteni čvorovi zajedno kontrolišu više procesorske snage procesora nego bilo koja udružena grupa napadačkih čvorova.

2. Transakcije

Elektronski novčić definišemo kao lanac digitalnih potpisa. Svaki vlasnik prenosi novčić na sledećeg digitalnim potpisivanjem heša prethodne transakcije i javnog ključa sledećeg vlasnika, dodajući ih potom na kraj novčića. Primalac transakcije može da verifikuje potpise, a time i lanac vlasništva.

Problem je naravno u tome što primalac ne može potvrditi da jedan od prethodnih vlasnika nije dva puta poslao isti novčić. Uobičajeno rešenje je uvođenje pouzdanog centralizovanog posrednika, kreatora novčića koji proverava sve transakcije. Nakon svake transakcije, novčić se mora vratiti kreatoru kako bi se izdao novi novčić i veruje se da samo za novčiće izdate direktno od kreatora možemo biti sigurni da nisu dva puta potrošeni. Problem sa ovim rešenjem je što sudbina čitavog novčanog sistema zavisi od kompanije koja kreira novčiće, jer svaka transakcija mora da prođe kroz nju, baš kao što je slučaj sa bankom.

Treba nam način da primalac bude siguran da prethodni vlasnici nisu potpisali nikakve ranije transakcije kojim bi potrošili taj novčić. Za naše potrebe, računamo transakciju koja se prva desila i ne zanimaju nas naredni pokušaji da se isti novčić ponovo pošalje. Jedini način da sa sigurnošću potvrdimo da taj novčić nije prethodno bio poslat je da imamo informacije o svim transakcijama koje su se ikada desile. U modelu baziranom na centalizovan kreatoru, taj kreator je imao informacije o svim transakcijama i odlučivao koja transakcija je prva stigla. Da bismo to postigli bez pouzdanog posrednika, transakcije moraju biti javno objavljene [1] i potreban nam je sistem u kojem učesnici mogu da se dogovore o jedinstvenoj istoriji redosleda kojim su transakcije primljene. Primaocu je potreban dokaz da se u trenutku dešavanja svake od transakcija većina čvorova složila oko toga da je baš ta transakcija bila ona koja je prva primljena.

3. Server vremenskih oznaka

Rešenje koje predlažemo počinje serverom vremenskih oznaka. Server vremenske oznake radi tako što uzima heš bloka podataka kojem će se dodeliti vremenska oznaka i objavi taj heš svima u mreži, slično kao u novinama ili kao post na Usenet mreži [2-5]. Vremenska oznaka očigledno dokazuje da su podaci morali postojati u to vreme kako bi ušli u haš. Svaka vremenska oznaka sadrži prethodnu vremensku oznaku u svom hešu, formirajući tako lanac, pri čemu svaka dodatna vremenska oznaka pojačava potvrde onih pre nje.

4. Dokaz o radu (Proof-of-Work)

Da bismo implementirali distribuirani server vremenskih oznaka na peer-to-peer principu, moraćemo da koristimo sistem dokaza o radu sličan Hashcash-u Adama Back-a [6], umesto Uneset postova ili novinskih objava. Dokaz o radu uključuje traženje vrednosti koja će, kada se hešuje, na primer pomoću SHA-256 heš funkcije, stvarati heš čiji binarni zapis započinje određenim brojem nula. Prosečna količina potrebnog rada eksponencijalno raste sa brojem potrebnih početnih nula, a može se proveriti izvršavanjem samo jedne heš fuknkcije.

Za našu mrežu vremenskih oznaka implementiramo dokaz o radu povećavajući nonce broja u bloku sve dok se ne pronađe ona vrednost nonce-a koja daje hešu bloka potreban broj početnih nula. Jednom kada se procesorska snaga utroši kako bi se zadovoljio dokaz o radu, blok se ne može izmeniti bez ponovljenog rada. Kako se kasniji blokovi vežu na taj blok, rad potreban da se on izmeni uključivao bi i ponovno obrađivanje svih blokova nakon njega.

Dokaz o radu takođe rešava problem utvrđivanja većine pri odlučivanju. Ako bi se većina zasnivala na principu jednog glasa po IP adresi, mogao bi je narušiti svako ko je u stanju da glasa sa više IP adresa odjednom. Dokaz o radu u osnovi predstavlja jedan glas po jedinici procesorske snage. Većinska odluka je predstavljena najdužim lancem u čije je stvaranje zapravo investirano najviše rada prilikom dokazivanja. Ako većinu procesorske snage kontrolišu pošteni čvorovi, pošten lanac će rasti najbrže i nadmašiće sve konkurentske lance. Da bi izmenio neki od prethodnih blokova, napadač bi morao da ponovi dokaz o radu za taj blok i sve blokove nakon njega, a zatim da sustigne i nadmaši količinu rada poštenih čvorova. Kasnije ćemo pokazati da se dodavanjem novih blokova eksponencijalno smanjuje verovatnoća da će sporiji napadač uspeti da sustigne pošteni lanac.

Da bi se kompenzovalo povećanje brzine hardvera i promenljivo interesovanje ljudi za vođenje čvorova tokom vremena, težina obavljanja dokaza o radu (proof-of-work difficulty) određuje se prema prosečnom broju blokova krairanih za sat vremena. Ako se blokovi stvaraju prebrzo, težina se povećava.

5. Mreža

Koraci za vođenje mreže su sledeći:

1) Nove transakcije se prosleđuju svim čvorovima u mreži. 2) Svaki čvor prikuplja nove transakcije u blok. 3) Svaki čvor radi na pronalaženju dokaza o radu dovoljnog nivoa težine za svoj blok. 4) Kada čvor pronađe dokaz o radu, on emituje taj blok ka svim čvorovima. 5) Čvorovi prihvataju blok samo ako su sve transakcije u njemu ispravne i nisu već potrošene. 6) Čvorovi izražavaju prihvatanje bloka radeći na stvaranju sledećeg bloka u lancu, koristeći heš prihvaćenog bloka kao prethodni heš.

Čvorovi uvek smatraju da je najduži lanac ispravan i nastaviće da rade na njegovom produžavanju. Ako dva čvora istovremeno emituju različite verzije sledećeg bloka, neki čvorovi prvo mogu primiti jedan ili drugi blok. U tom slučaju svaki čvor radi na prvom koji je dobio, ali čuvaju drugu kariku lanca u slučaju da ona postane duža. Dilema će biti rešena kada se pronađe sledeći dokaz o radu i jedna karika postane duža; čvorovi koji su radili na drugoj karici lanca će se prebaciti na dužu kariku.

Emitovanje novih transakcija ne mora nužno doći do svih čvorova. Sve dok stižu do velikog broja čvorova, te transakcije će ući u blok. Slično važi i za blokove, ni oni ne moraju doći odmah do svih čvorova. Ako neki čvor propusti da primi informaciju o bloku, kada mu stigne sledeći blok,primetiće da je propustio jedan, pa će ga tražiti naknadno.

6. Podsticaj

Po pravilu, prva transakcija u bloku je posebna transakcija koja kreira novi novčić u vlasništvu kreatora bloka. Ovo daje podsticaj čvorovima da podrže mrežu i pruža način za početnu ubacivanje novčića u opticaj, budući da ne postoji centralno telo koje ih izdaje. Stalno dodavanje konstantne količine novih novčića liči na rudarenje zlata, gde rudari ulažu resurse kako bi izrudarili nove količine zlata i ubacili ih u opticaj. U našem slučaju ulaže se procesorsko vreme i električna energija.

Podsticaj se takođe može finansirati i transakcionim naknadama. Ako je iznos izlaznog dela transakcije manji od ulaznog, razliku čini naknada za transakciju koja se dodaje iznosu nagrade za kreatora bloka koji sadrži tu transakciju. Nakon što predefinisani broj novčića uđe u opticaj, podsticaj mogu u potpunosti činiti transakcione naknade, čime se sistem oslobađa inflacije.

Čvorovi su na ovaj način podstaknuti da ostanu pošteni. Ako je pohlepni napadač u stanju da angažuje više procesorske snage od svih poštenih čvorova zajedno, morao bi da bira između toga da poništi svoje izvršene transakcije i time prevari ljude ili da procesorsku snagu koristi za stvaranje novih novčića. On bi trebalo bi uvidi da je isplativije igrati po pravilima koja ga nagrađuju sa više novih novčića od svi drugi zajedno, nego da potkopava sistem i vrednost sopstvenog bogatstva.

7. Oslobađanje prostora na hard disku

Kada je dovoljno blokova dodato nakon poslednje transakcije novčića, prethodne transakcije tog novčića se mogu odbaciti kako bi se uštedeo prostor na hard disku. Kako bi se to ostvarilo bez razbijanja heša bloka, transakcije su hešovane u Merkleovo stablo (Merkle Tree) [7] [2] [5], gde je samo koren uključen u heš bloka. Stari blokovi se tada mogu sabiti uklanjanjem nepotrebnih grana drveta. Unutrašnji heševi ne moraju biti skladišteni.

Zaglavlje bloka bez transakcija bilo bi oko 80 bajtova. Ako pretpostavimo da su blokovi generisani svakih 10 minuta, 80 bajtova * 6 * 24 * 365 = 4,2 MB godišnje. Imajući u vidu činjenicu da se u 2008. godini računari uglavnom prodaju sa oko 2 GB RAM-a i Murov zakon koji predviđa trenutni rast od 1,2 GB godišnje, skladištenje ne bi trebalo da predstavlja problem čak i ako se zaglavlja bloka moraju čuvati u memoriji.

8. Pojednostavljena verifikacija plaćanja

Moguće je verifikovati plaćanja bez vođenja čitavog mrežnog čvora. Korisnik samo treba da sačuva kopiju zaglavlja blokova najdužeg lanca dokaza o radu, do koje može doći upitom ka mrežnim čvorovima dok se ne uveri da je dobio najduži lanac i dobije Merkleova granu

koja povezuje transakciju sa blokom u koji je uneta vremenska oznaka za tu transakciju. Ne može samostalno proveriti transakciju, ali povezujući je sa mestom u lancu može videti da je prihvaćena od strane čvora mreže i da su na njen blok dodati naknadni blokovi što dalje potvrđuje da ju je mreža prihvatila.

Kao takva, verifikacija je pouzdana sve dok pošteni čvorovi kontrolišu mrežu, ali je ranjiva ako napadač nadjača ostatak mreže. Čvorovi mreže mogu sami proveriti transakcije, ali napadačeve lažne transakcije mogu zavarati one koji koriste pojednostavljenu metodu verifikacije transakcija sve dok je on u stanju da nadjačava ostatak mreže. Jedna od strategija zaštite bila bi prihvatanje upozorenja čvorova mreže kada otkriju nevažeći blok, pri čemu bi korisnikov softver morao da preuzme ceo blok i sporne transakcije kako bi potvrdio nepravilnost. Biznisi koji primaju česte uplate će verovatno želeti da pokrenu i vode sopstvene čvorove radi brže verifikacije i potrebe da im sigurnost ne zavisi od drugih.

9. Kombinovanje i deljenje vrednosti

Iako bi bilo moguće pojedinačno rukovati novčićima, bilo bi nezgrapno kreirati zasebnu transakciju za svaki cent u toj transferu. Da biste dozvolili podelu i kombinovanje vrednosti, transakcije sadrže više ulaza i izlaza. Obično će postojati ili jedan ulaz iz veće prethodne transakcije ili više unosa koji kombinuju manje iznose, a najviše dva izlaza: jedan za samo plaćanje, a jedan koji vraća kusur, ako ga ima, nazad pošiljaocu.

Treba napomenuti da situacija u kojoj transakcija zavisi od nekoliko drugih transakcija, a te transakcije zavise od još mnogo više, ovde nije problem. Nikada ne postoji potreba za izdvajanjem istorije pojedinačne transakcije.

10. Privatnost

Tradicionalni bankarski model postiže odgovarajući nivo privatnosti ograničavanjem pristupa informacijama na strane uključene u transakciju i posrednika. Neophodnost javnog objavljivanja svih transakcija isključuje mogućnost primene pomenutog modela, ali privatnost se i dalje može zadržati na drugi način: čuvanjem javnih ključeva (public keys) anonimnim. Javnost može videti da neko šalje iznos nekom drugom, ali bez informacija koje povezuju transakciju sa bilo kim. Ovo je slično količini informacija koje objavljuju berze, gde se vreme i veličina pojedinačnih trgovina čine javnim, ali bez navođenja ko su stranke uključene u tu trgovinu.

Kao dodatni zaštitni zid, preporučljivo je koristiti novi par ključeva za svaku transakciju, kako ne bi bili povezane sa zajedničkim vlasnikom. Neka povezivanja su i dalje neizbežna kod transakcija sa više ulaza, koje nužno otkrivaju da su njihovi ulazi bili u vlasništvu istog vlasnika. Rizik je taj da bi se otkrivanjem vlasnik ključa mogle otkriti i ostale transakcije koje su pripadale tom vlasniku.

11. Proračuni

Razmatramo scenario u kome napadač pokušava da generiše alternativni lanac brže od poštenog lanca. Čak i ako se to postigne, to ne omogućuje proizvoljne promene u sistemu, poput stvaranje vrednosti ni iz čega ili uzimanje novca koji nikada nije pripadao napadaču. Pošteni čvorovi neće prihvatiti nevažeće transakcije kao uplatu i nikada neće prihvatiti blok koji ih sadrži. Napadač može samo pokušati da promeni jednu od svojih transakcija kako bi vratio novac koji je nedavno potrošio.

Trka između poštenog lanca i lanca napadača može se predstaviti kao binomska distribucija slučajne diskretne varijable (Binomial Random Walk). Uspešni ishod je da se pošten lanac produži za jedan blok, povećavajući svoje vođstvo za +1, a neuspešni ishod je da se napadačev lanac produži za jedan blok, smanjujući zaostatak za -1.

Verovatnoću da napadač nadoknadi određeni deficit možemo izraziti kroz problem kockareve propasti (Gambler’s Ruin Problem). Pretpostavimo da kockar sa neograničenim iznosom novca počinje sa zaostatkom i igra potencijalno beskonačan broj ponovljenih igara u pokušaju da nadoknadi zaostatak. Možemo izračunati verovatnoću za nadoknađivanje zaostatka ili da će napadač stići pošten lanac, na sledeći način [8]:

p= verovatnoća da pošten čvor pronađe sledeći blok q= verovatnoća da napadač pronađe sledeći blok qz= verovatnoća da će napadač ikada dostići z blokova zaostatka

S obzirom na našu pretpostavku da je p > q, verovatnoća pada eksponencijalno kako se povećava broj blokova koje napadač mora da nadoknadi. Sa šansama protiv njega, ako mu se u početku ne posreći, njegove šanse postaju manje i manje sa povećanjem zaostatka.

Sada razmatramo koliko primalac nove transakcije treba da čeka pre nego što postane

dovoljno siguran da pošiljalac ne može promeniti transakciju. Pretpostavljamo da je pošiljalac napadač koji želi da natera primaoca da veruje da mu je platio, a zatim nakon nekog vremena tu transakciju preusmeri ka sebi. Primalac će primetiti kada se to dogodi, ali pošiljalac se nada da će tad već biti prekasno.

Primalac generiše novi par ključeva i daje javni ključ pošiljaocu neposredno pre potpisivanja transakcije. Ovo sprečava pošiljaoca da unapred pripremi lanac blokova radeći na njemu neprekidno dok mu se ne posreći da stekne dovoljnu prednost i u tom trenutku izvrši transakciju. Kada se transakcija pošalje, nepošteni pošiljalac počinje tajno da radi na paralelnom lancu koji sadrži alternativnu verziju njegove transakcije.

Primalac čeka dok transakcija ne bude dodata u blok, i dok z blokova nije dodato nakon tog bloka. On ne zna tačno koliko je napadač napredovao, ali pod pretpostavkom da su pošteni blokovi kreirani očekivanom dinamikom, potencijalni napredak napadača će biti prikazan kao Poasonova distribucija sa očekivanom vrednošću:

Kako bismo izračunali verovatnoću da napadač ipak može da nadoknadi zaostatak, množimo gustinu verovatnoće za svaki nivo napretka koji je mogao da ostvari sa verovatnoćom da od tog trenutka može da potpuno nadoknadi zaostatak:

Preuređujemo formulu kako bismo izbegli sabiranje beskonačnog broja sabiraka zbog repa distribucije:

I konvertujemo u programski kod u programskom jeziku C…

Kroz par primera, vidimo da verovatnoća opada eksponencijalno sa porastom z.

Rešavanje za P < 0.1%…

12. Zaključak

Predložili smo sistem za elektronske transakcije bez oslanjanja na poverenje. Počeli smo sa uobičajenim šablonom i novčićima nastalim iz digitalnih potpisa, koji pruža snažnu kontrolu nad vlasništvom, ali je nepotpun bez načina da se spreči dvostruka potrošnja. Kako bismo ovo rešili, predložili smo peer-to-peer mrežu koja koristi dokaz o radu za čuvanje javne istorije transakcija čija izmena napadačima brzo postaje računski nepraktična ako pošteni čvorovi kontrolišu većinu procesorske snage. Mreža je robusna u svojoj nestrukturiranoj jednostavnosti. Svi čvorovi rade istovremeno uz malo koordinacije. Ne treba ih identifikovati, jer se poruke ne usmeravaju na jedno određeno mesto nego samo trebaju biti prenete uz maksimalan napor od strane čvorova da se taj prenos odradi na predviđen način. Čvorovi mogu da napuste i ponovo se pridruže mreži po želji, prihvatajući lanac dokaza o radu kao dokaz onoga što se dogodilo dok ih nije bilo. Oni glasaju svojom procesorskom snagom, izražavajući svoje prihvatanje validnih blokova time što pokušavaju da ih nadgrade novim blokovima i odbacuju nevažeće blokove odbijanjem ih nadgrađuju. Sva potrebna pravila i podsticaji mogu se nametnuti ovim mehanizmom postizanja konsenzusa.

Reference:

[1] W. Dai, „b-money,“ http://www.weidai.com/bmoney.txt, 1998. [2] H. Massias, X.S. Avila, and J.-J. Quisquater, „Design of a secure timestamping service with minimal trust requirements,“ In 20th Symposium on Information Theory in the Benelux, May 1999. [3] S. Haber, W.S. Stornetta, „How to time-stamp a digital document,“ In Journal of Cryptology, vol 3, no 2, pages 99-111, 1991. [4] D. Bayer, S. Haber, W.S. Stornetta, „Improving the efficiency and reliability of digital time-stamping,“ In Sequences II: Methods in Communication, Security and Computer Science, pages 329-334, 1993. [5] S. Haber, W.S. Stornetta, „Secure names for bit-strings,“ In Proceedings of the 4th ACM Conference on Computer and Communications Security, pages 28-35, April 1997. [6] A. Back, „Hashcash – a denial of service counter-measure,“ http://www.hashcash.org/papers/hashcash.pdf, 2002. [7] R.C. Merkle, „Protocols for public key cryptosystems,“ In Proc. 1980 Symposium on Security and Privacy, IEEE Computer Society, pages 122-133, April 1980. [8] W. Feller, „An introduction to probability theory and its applications,“ 1957.

-

@ bf47c19e:c3d2573b

2025-05-11 17:58:59

@ bf47c19e:c3d2573b

2025-05-11 17:58:59Originalni tekst na thebitcoinmanual.com

Lightning Network (eng. lightning - munja, network - mreža) je jedno od primarnih rešenja za skaliranje Bitkoin mreže sa ciljem da je više ljudi može koristiti na različite načine čime bi se zaobišla ograničenja glavnog blokčejna. Lightning mreža deluje kao "drugi sloj" koji je dodat Bitkoin (BTC) blokčejnu koji omogućava transakcije van glavnog lanca (blokčejna) pošto se transakcije između korisnika ne registruju na samoj blokčejn mreži.

Lightning kao "sloj-2 (layer-2)" pojačava skalabilnost blokčejn aplikacija tako što upravlja transakcijama van glavnog blokčejna ("sloj-1" / layer-1), dok istovremeno uživa benefite moćne decentralizovane sigurnosti glavnog blokčejna, tako da korisnici mogu ulaziti i izlaziti iz Lightning mreže koristeći custodial ili non-custodial servise u zavisnosti od sopstvene sposobnosti i znanja da koriste glavni blokčejn.

Kao što i samo ime govori Lightning Network je dizajnirana za brza, instant i jeftina plaćanja u svrhu sredstva razmene i druga programabilna plaćanja kojima nije potrebna instant konačnost (finality) ali ni sigurnost glavnog lanca. Lightning je najbolje uporediti sa vašom omiljenom aplikacijom za plaćanja ili debitnom karticom.

Šta je Lightning mreža?

Lightning mreža vuče svoje poreklo još od tvorca Bitkoina, Satošija Nakamota, ali je formalizovana od strane istraživača Joseph Poon-a i Thaddeus Dryja-a koji su 14. januara 2016. godine objavili beli papir o Lightning Network-u.

Radilo se o predlogu alternativnog rešenja za skaliranje Bitkoina da bi se izbeglo proširenje kapaciteta bloka Bitkoin mreže i smanjio rizik od centralizacije blokčejna. Dalje, skaliranje van glavnog lanca znači zadržavanje integriteta samog blokčejna što omogućuje više eksperimentalnog rada na Bitkoinu bez ograničenja koja su postavljena na glavnom blokčejnu.

Lightning Labs, kompanija za blokčejn inženjering, pomogla je pokretanje beta verzije Lightning mreže u martu 2018. - pored dve druge popularne implementacije od strane kompanija kao što su ACINQ i Blockstream.

- Lightning Labs – LND

- Blockstream – Core Lightning (implementacija nekada poznata kao c-lightning)

- ACINQ – Eclair

Svaka verzija protokola ima svoje poglede i načine kako rešava određene probleme ali ostaje interoperabilna sa ostalim implementacijama u smislu korišćenja novčanika, tako da za krajnjeg korisnika nije bitno kojom verzijom se služi kada upravlja svojim čvororom (node-om).

Lightning Network je protokol koji svako može koristiti i razvijati ga, proširivati i unapređivati i koji kreira posebno i odvojeno okruženje za korišćenje Bitkoina kroz seriju pametnih ugovora (smart contracts) koji zaključavaju BTC na Lightning-u radi izbegavanja dvostruke potrošnje (double-spending). Lightning Network nije blokčejn ali živi i funkcioniše na samom Bitkoinu i koristi glavni lanac kao sloj za konačno, finalno poravnanje.

Lightning mreža ima sopstvene čvorove koji pokreću ovaj dodatni protokol i zaključavaju likvidnost Bitkoina u njemu sa ciljem olakšavanja plaćanja.

Lightning omogućava svakom korisniku da kreira p2p (peer-to-peer) platni kanal (payment channel) između dve strane, kao npr. između mušterije i trgovca. Kada je uspostavljen, ovaj kanal im omogućava da međusobno šalju neograničen broj transakcija koje su istovremeno gotovo instant i veoma jeftine. Ponaša se kao svojevrsna mala "knjiga" (ledger) koja omogućava korisnicima da plaćaju još manje proizvode i usluge poput kafe i to bez uticaja na glavnu Bitkoin mrežu.

Kako radi Lightning Network?

Lightning Network se zasniva na pametnim ugovorima koji su poznati kao hashed time lock contracts koji između dve strane kreiraju platne kanale van glavnog blokčejna (off-chain payment channels). Kada zaključate BTC na glavnom lancu u ovim posebnim pametnim ugovorima, ova sredstva se otključavaju na Lightning mreži.

Ova sredstva zatim možete koristiti da biste napravili platne kanale sa ostalim korisnicima Lightning mreže, aplikacijama i menjačnicama.

Ovo su direktne platne linije koje se dešavaju na vrhu, odnosno izvan glavnog blokčejna. Kada je platni kanal otvoren, možete izvršiti neograničen broj plaćanja sve dok ne potrošite sva sredstva.

Korišćenje Lightning sredstava nije ograničeno pravilima glavnog Bitkoin lanca i ova plaćanja se vrše gotovo trenutno i za samo delić onoga što bi koštalo na glavnom blokčejnu.

Vaš platni kanal ima svoj sopstveni zapisnik (ledger) u koji se beleže transakcije izvan glavnog BTC blokčejna. Svaka strana ima mogućnost da ga zatvori ili obnovi po svom nahođenju i vrati sredstva nazad na glavni Bitkoin lanac objavljivanjem transakcije kojom se zatvara kanal.

Kada dve strane odluče da zatvore platni kanal, sve transakcije koje su se desile unutar njega se objedinjuju i zatim objavljuju na glavni blokčejn "registar".

Zašto biste želeli da koristite Lightning mrežu?

Trenutno slanje satošija

Lightning Network je "sloj-2" izgrađen na vrhu glavnog Bitkoin lanca koji omogućava instant i veoma jeftine transakcije između lightning novčanika. Ova mreža se nalazi u interakciji sa glavnim blokčejnom ali se plaćanja pre svega sprovode off-chain, van glavnog lanca, pošto koristi sopstvenu evidenciju plaćanja na lightning mreži.

Razvijene su različite aplikacije koje su kompatibilne sa Lightning mrežom, koje su veoma lake za korišćenje i ne zahtevaju više od QR koda za primanje i slanje prekograničnih transakcija.

Možete deponovati BTC na vaše lightning novčanike tako što ćete slati satošije sa menjačnica ili ih kupovati direktno unutar ovih aplikacija. Većina ovih novčanika ima ograničenje od nekoliko miliona satošija (iako će se ovaj limit povećavati kako više biznisa i država bude prihvatalo Bitkoin) koje možete poslati po transakciji što ima smisla budući da je za slanje većih iznosa bolje korišćenje glavnog blokčejna.

Pokretanje sopstvenog čvora

Kako se više ljudi bude povezivalo sa lightning mrežom i koristilo njene mogućnosti, sve više ljudi pokreće svoje čvorove radi verifikacije transakcija putem svojih lightning platnih kanala. Kroz ove kanale je moguće bezbedno poslati različite iznose satošija, a takođe je moguće zarađivati i male naknade za svaku transakciju koja prolazi kroz vaš kanal.

Transakcione naknade

Uprkos trenutnim transakcijama, još uvek postoje transakcione naknade povezane sa otvaranjem i zatvaranjem platnih kanala koje se moraju platiti rudarima na glavnom blokčejnu prilikom finalizacije lightning platnih kanala. Takođe postoje i naknade za rutiranje (routing fees) koje idu lightning čvorovima (i njihovim platnim kanalima) koji su uspostavljeni da bi se omogućila plaćanja.

Sa daljim napredovanjem razvoja Bitkoina i novim nadogradnjama, imaćemo sve veći rast i razvoj layer-2 aplikacija kao što je lightning.

Više izvora o Lightning mreži

Ukoliko želite da naučite više o Lightning mreži, najbolje je da pročitate dodatne tekstove na sajtu thebitcoinmanual.com.

-

@ bf47c19e:c3d2573b

2025-05-11 17:50:31

@ bf47c19e:c3d2573b

2025-05-11 17:50:31Originalni tekst na dvadesetjedan.com

Autor: Parker Lewis / Prevod na srpski: Plumsky

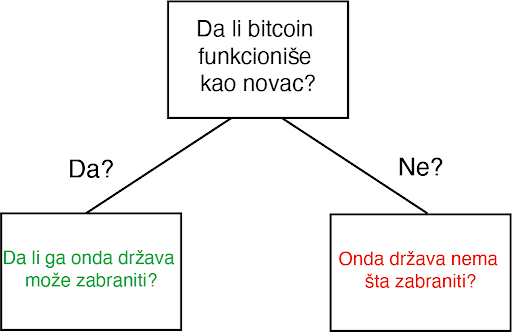

Ideja da država može nekako zabraniti bitcoin je jedna od poslednjih faza tuge, tačno pred prihvatanje realnosti. Posledica ove rečenice je priznanje da bitcoin “funkcioniše”. U stvari, ona predstavlja činjenicu da bitcoin funkcioniše toliko dobro da on preti postojećim državnim monopolima nad novcem i da će zbog toga države da ga unište kroz regulativne prepreke da bi eliminisale tu pretnju. Gledajte na tvrdnju da će države zabraniti bitcoin kao kondicionalnu logiku. Da li bitcoin funkcioniše kao novac? Ako je odgovor „ne“, onda države nemaju šta da zabrane. Ako je odgovor „da“, onda će države da probaju da ga zabrane. Znači, glavna poenta ovog razmišljanja je pretpostavka da bitcoin funkcioiniše kao novac. Onda je sledeće logično pitanje da li intervencija od strane države može uspešno da uništi upravo taj funkcionalan bitcoin.

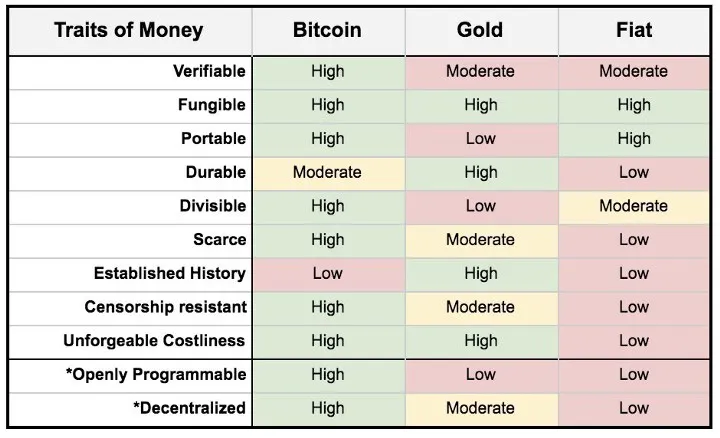

Za početak, svako ko pokušava da razume kako, zašto, ili da li bitcoin funkcioniše mora da proceni ta pitanja potpuno nezavisno od prouzrekovanja državne regulacije ili intervencije. Iako je nesumnjivo da bitcoin mora da postoji uzgred državnih regulativa, zamislite na momenat da države ne postoje. Sam od sebe, da li bi bitcoin funkcionisao kao novac, kad bi se prepustio slobodnom tržištu? Ovo pitanje se širi u dodatna pitanja i ubrzo se pretvara u bunar bez dna. Šta je novac? Šta su svojstva koja čine jednu vrstu novca bolje od druge? Da li bitcoin poseduje ta svojstva? Da li je bitcoin bolja verzija novca po takvim osobinama? Ako je finalni zaključak da bitcoin ne funkcioniše kao novac, implikacije državne intervencije su nebitne. Ali, ako je bitcoin funkcionalan kao novac, ta pitanja onda postaju bitna u ovoj debati, i svako ko o tome razmišlja bi morao imati taj početnički kontekst da bi mogao proceniti da li je uopšte moguće zabraniti. Po svom dizajnu, bitcoin postoji van države. Ali bitcoin nije samo van kontrole države, on u stvari funkcioniše bez bilo kakve saradnje centralizovanih identiteta. On je globalan i decentralizovan. Svako može pristupiti bitcoinu bez potrebe saglasnosti bilo koga i što se više širi sve je teže cenzurisati celokupnu mrežu. Arhitektura bitcoina je namerno izmišljena da bude otporna na bilo koje pokušaje države da ga zabrane. Ovo ne znači da države širom sveta neće pokušavati da ga regulišu, oporezuju ili čak da potpuno zabrane njegovo korišćenje. Naravno da će biti puno bitki i otpora protiv usvajanja bitcoina među građanima. Federal Reserve i Američki Treasury (i njihovi globalni suparnici) se neće ležeći predati dok bitcoin sve više i više ugrožava njihove monopole prihvatljivog novca. Doduše, pre nego što se odbaci ideja da države mogu potpuno zabraniti bitcoin, mora se prvo razumeti posledice tog stava i njegovog glasnika.

Progresija poricanja i stepeni tuge

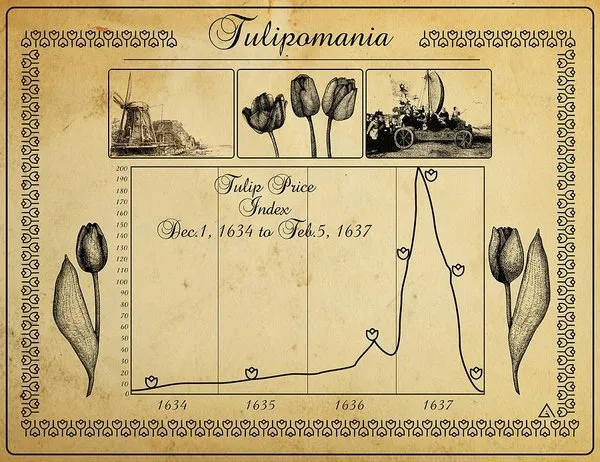

Pripovesti skeptičara se neprestano menjaju kroz vreme. Prvi stepen tuge: bitcoin nikad ne može funkcionisati-njegova vrednost je osnovana ni na čemu. On je moderna verzija tulip manije. Sa svakim ciklusom uzbuđenja, vrednost bitcoina skače i onda vrlo brzo se vraća na dole. Često nazvano kao kraj njegove vrednosti, bitcoin svaki put odbija da umre i njegova vrednost pronađe nivo koji je uvek viši od prethodnih ciklusa globalne usvajanja. Tulip pripovetka postaje stara i dosadna i skeptičari pređu na više nijansirane teme, i time menjaju bazu debate. Drugi stepen tuge predstoji: bitcoin je manjkav kao novac. On je previše volatilan da bi bio valuta, ili je suviše spor da bi se koristio kao sistem plaćanja, ili se ne može proširiti dovoljno da zadovolji sve promete plaćanja na svetu, ili troši isuviše struje. Taj niz kritike ide sve dalje i dalje. Ovaj drugi stepen je progresija poricanja i dosta je udaljen od ideje da je bitcoin ništa više od bukvalno bezvrednog ničega.

Uprkos tim pretpostavnim manjcima, vrednost bitcoin mreže nastavje da raste vremenom. Svaki put, ona ne umire, nasuprot, ona postaje sve veća i jača. Dok se skeptičari bave ukazivanjem na manjke, bitcoin ne prestaje. Rast u vrednosti je prouzrokovan jednostavnom dinamikom tržišta: postoji više kupca nego prodavca. To je sve i to je razlog rasta u adopciji. Sve više i više ljudi shvata zašto postoji fundamentalna potražnja za bitcoinom i zašto/kako on funkcioniše. To je razlog njegovog dugotrajnog rasta. Dokle god ga sve više ljudi koristi za čuvanje vrednosti, neće pasti cena snabdevanja. Zauvek će postojati samo 21 milion bitcoina. Nebitno je koliko ljudi zahtevaju bitcoin, njegova cela količina je uvek ista i neelastična. Dok skeptičari nastavljaju sa svojom starom pričom, mase ljudi nastavljaju da eliminišu zabludu i zahtevaju bitcoin zbog njegovih prednosti u smislu novčanih svojstva. Između ostalog, ne postoji grupa ljudi koja je više upoznata sa svim argumentima protiv bitcoina od samih bitcoinera.

Očajanje počinje da se stvara i onda se debata još jedanput pomera. Sada nije više činjenica je vrednost bitcoina osnovana ni na čemu niti da ima manjke kao valuta; sada se debata centrira na regulaciji državnih autoriteta. U ovom zadnjem stepenu tuge, bitcoin se predstavlja kao u stvari isuviše uspešnom alatkom i zbog toga države ne smeju dozvoliti da on postoji. Zaista? Znači da je genijalnost čoveka ponovo ostvarila funkcionalan novac u tehnološko superiornoj formi, čije su posledice zaista neshvatljive, i da će države upravo taj izum nekako zabraniti. Primetite da tom izjavom skeptičari praktično priznaju svoj poraz. Ovo su poslednji pokušaji u seriji promašenih argumenata. Skeptičari u isto vreme prihvataju da postoji fundamentalna potražnja za bitcoinom a onda se premeštaju na neosnovan stav da ga države mogu zabraniti.

Ajde da se poigramo i tim pitanjem. Kada bih zapravo razvijene države nastupile na scenu i pokušale da zabrane bitcoin? Trenutno, Federal Reserve i Treasury ne smatraju bitcoin kao ozbiljnu pretnju superiornosti dolara. Po njihovom celokupnom mišljenju, bitcoin je slatka mala igračka i ne može da funkcioniše kao novac. Sadašnja kompletna kupovna moć bitcoina je manja od $200 milijardi. Sa druge strane, zlato ima celokupnu vrednost od $8 triliona (40X veću od bitcoina) i količina odštampanog novca (M2) je otprilike 15 triliona (75X veličine bitcoinove vrednosti). Kada će Federal Reserve i Treasury da počne da smatra bitcoin kao ozbiljnu pretnju? Kad bitcoin poraste na $1, $2 ili $3 triliona? Možete i sami da izaberete nivo, ali implikacija je da će bitcoin biti mnogo vredniji, i posedovaće ga sve više ljudi širom sveta, pre nego što će ga državne vlasti shvatiti kao obiljnog protivnika.

Predsednik Tramp & Treasury Sekretar Mnučin o Bitcoinu (2019):

„Ja neću pričati o bitcoinu za 10 godina, u to možete biti sigurni {…} Ja bi se kladio da čak za 5 ili 6 godina neću više pričati o bitcoinu kao sekretar Trusury-a. Imaću preča posla {…} Mogu vam obećati da ja lično neću biti pun bitcoina.“ – Sekretar Treasury-a Stiv Mnučin

„Ja nisam ljubitelj bitcoina {…}, koji nije novac i čija vrednost je jako volatilna i osnovana na praznom vazduhu.“ – Predsednik Donald J. Tramp

Znači, logika skeptika ide ovako: bitcoin ne funkcioniše, ali ako funkcioniše, onda će ga država zabraniti. Ali, države slobodnog sveta neće pokušati da ga zabrane dokle god se on ne pokaže kao ozbiljna pretnja. U tom trenutku, bitcoin će biti vredniji i sigurno teži da se zabrani, pošto će ga više ljudi posedovati na mnogo širem geografskom prostoru. Ignorišite fundamentalne činjenice i asimetriju koja je urođena u globalnom dešavanju monetizacije zato što u slučaju da ste u pravu, države će taj proces zabraniti. Na kojoj strani tog argumenta bi radije stajao racionalan ekonomski učesnik? Posedovanje finansijske imovine kojoj vrednost toliko raste da preti globalnoj rezervnoj valuti, ili nasuprot – nemati tu imovinu? Sa pretpostavkom da individualci razumeju zašto je mogućnost (a sve više i verovatnoća) ove realnosti, koji stav je logičniji u ovom scenariju? Asimetrija dve strane ovog argumenta sama od sebe zahteva da je prvi stav onaj istinit i da fundamentalno razumevanje potražnje bitcoina samo još više ojačava to mišljenje.

Niko ne moze zabraniti bitcoin

Razmislite šta bitcoin u stvari predstavlja pa onda šta bi predstavljala njegova zabrana. Bitcoin je konverzija subjektivne vrednosti, stvorena i razmenjena u realnošću, u digitalne potpise. Jednostavno rečeno, to je konverzija ljudskog vremena u novac. Kad neko zahteva bitcoin, oni u isto vreme ne zahtevaju neki drugi posed, nek to bio dolar, kuća, auto ili hrana itd. Bitcoin predstavlja novčanu štednju koja sa sobom žrtvuje druge imovine i servise. Zabrana bitcoina bi bio napad na najosnovnije ljudske slobode koje je on upravo stvoren da brani. Zamislite reakciju svih onih koji su prihvatili bitcoin: „Bilo je zabavno, alatka za koju su svi eksperti tvrdili da neće nikad funkcionisati, sada toliko dobro radi i sad ti isti eksperti i autoriteti kažu da mi to nemožemo koristiti. Svi idite kući, predstava je gotova.“verovanje da će svi ljudi koji su učestvovali u bitcoin usvajanju, suverenitetu koji nudi i finansiskoj slobodi, odjednom samo da se predaju osnovnom rušenju njihovih prava je potpuno iracionalna pozicija.

Novac je jedan od najbitnijih instrumenata za slobodu koji je ikad izmišljen. Novac je to što u postojećem društvu ostvaruje mogućnosti siromašnom čoveku – čiji je domet veći nego onaj koji je bio dostižan bogatim ljudima pre ne toliko puno generacija.“ – F. A. Hajek

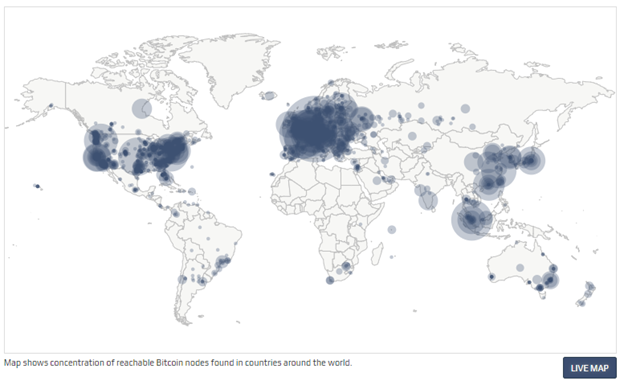

Države nisu uspele da zabrane konzumiranje alkohola, droga, kupovinu vatrenog oružja, pa ni posedovanje zlata. Država može samo pomalo da uspori pristup ili da deklariše posedovanje ilegalnim, ali ne može da uništi nešto što veliki broj raznovrsnih ljudi smatra vrednim. Kada je SAD zabranila privatno posedovanje zlata 1933., zlato nije palo u vrednosti ili nestalo sa finansijskog tržišta. Ono je u stvari poraslo u vrednosti u poređenju sa dolarom, i samo trideset godina kasnije, zabrana je bila ukinuta. Ne samo da bitcoin nudi veću vrednosno obećanje od bilo kog drugog dobra koje su države pokušale da zabrane (uključujući i zlato); nego po svojim osobinama, njega je mnogo teže zabraniti. Bitcoin je globalan i decentralizovan. On ne poštuje granice i osiguran je mnoštvom nodova i kriptografskim potpisima. Sam postupak zabrane bi zahtevao da se u isto vreme zaustavi „open source“ softver koji emituje i izvršava slanje i potvrđivanje digitalno enkriptovanih ključeva i potpisa. Ta zabrana bi morala biti koordinisana između velikog broja zemalja, sa tim da je nemoguće znati gde se ti nodovi i softver nalazi ili da se zaustavi instaliranje novih nodova u drugim pravnim nadležnostima. Da ne pominjemo i ustavske pitanja, bilo bi tehnički neizvodljivo da se takva zabrana primeni na bilo kakav značajan način.

Čak kada bih sve zemlje iz G-20 grupe koordinisale takvu zabranu u isto vreme, to ne bi uništilo bitcoin. U stvari, to bi bilo samoubistvo za fiat novčani sistem. To bi još više prikazalo masama da je bitcoin u stvari novac koji treba shvatiti ozbiljno, i to bi samo od sebe započelo globalnu igru vatanje mačke za rep. Bitcoin nema centralnu tačku za napad; bitcoin rudari, nodovi i digitalni potpisi su rasejani po celom svetu. Svaki aspekt bitcoina je decentralizovan, zato su glavni stubovi njegove arhitekture da učesnici uvek treba kontrolisati svoje potpise i upravljati svojim nodom. Što više digitalnih potpisa i nodova koji postoje, to je više bitcoin decentralizovan, i to je više odbranjiva njegova mreža od strane neprijatelja. Što je više zemalja gde rudari izvršavaju svoj posao, to je manji rizik da jedan nadležni identitet može uticati na njegov bezbednosni sistem. Koordinisan internacionalni napad na bitcoin bi samo koristio da bitcoin još više ojača svoj imuni sistem. Na kraju krajeva, to bi ubrzalo seobu iz tradicionalnog finansijskog sistema (i njegovih valuta) a i inovaciju koja postoji u bitcoin ekosistemu. Sa svakom bivšom pretnjom, bitcoin je maštovito pronalazio način da ih neutrališe pa i koordinisan napad od strane država ne bi bio ništa drugačiji.

Inovacija u ovoj oblasti koja se odlikuje svojom „permissionless“ (bez dozvole centralnih identiteta) osobinom, omogućava odbranu od svakojakih napada. Sve varijante napada koje su bile predvidjene je upravo to što zahteva konstantnu inovaciju bitcoina. To je ona Adam Smitova nevidljiva ruka, ali dopingovana. Pojedinačni učesnici mogu da veruju da su motivisani nekim većim uzrokom, ali u stvari, korisnost kaja je ugrađena u bitcoin stvara kod učesnika dovoljno snažan podsticaj da omogući svoje preživljavanje. Sopstveni interes milione, ako ne milijarde, nekoordinisanih ljudi koji se jedino slažu u svojom međusobnom potrebom za funkcionalnim novcem podstiče inovacije u bitcoinu. Danas, možda to izgleda kao neka kul nova tehnologija ili neki dobar investment u finansijskom portfoliju, ali čak i ako to mnogi ne razumeju, bitcoin je apsolutna nužnost u svetu. To je tako zato što je novac nužnost a historijski priznate valute se fundamentalno raspadaju. Pre dva meseca, tržište američkih državnih obveznica je doživeo kolaps na šta je Federal Reserve reagovao time što je povećao celokupnu količinu dolara u postojanju za $250 milijardi, a još više u bliskoj budućnosti. Tačno ovo je razlog zašto je bitcoin nužnost a ne samo luksuzni dodatak. Kada inovacija omogućava bazično funkcionisanje ekonomije ne postoji ni jedna država na svetu koja može da zaustavi njenu adopciju i rast. Novac je nužnost a bitcoin znatno poboljšava sistem novca koji je ikada postojao pre njega.

Sa više praktične strane, pokušaj zabranjivanja bitcoina ili njegove velike regulacije od nadležnosti bi direktno bilo u korist susedne nadležnih organa. Podsticaj da se odustane od koordinisanog napada na bitcoin bi bio isuviše veliki da bi takvi dogovori bili uspešni. Kada bi SAD deklarisovale posed bitcoina ilegalnim sutra, da li bi to zaustavilo njegov rast, razvoj i adopciji i da li bi to smanjilo vrednost celokupne mreže? Verovatno. Da li bi to uništilo bitcoin? Ne bi. Bitcoin predstavlja najpokretljivije kapitalno sredstvo na svetu. Zemlje i nadležne strukture koje kreiraju regulativnu strukturu koja najmanje ustručava korišćenje bitcoina će biti dobitnici velike količine uliva kapitala u svoje države.

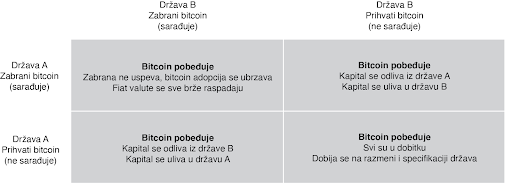

Zabrana Bitcoinove Zatvoreničke Dileme

U praksi, zatvorenička dilema nije igra jedan na jedan. Ona je multidimenzijska i uključuje mnoštvo nadležnosti, čiji se interesi nadmeću međusobno, i to uskraćuje mogućnosti bilo kakve mogućnosti zabrane. Ljudski kapital, fizički kapital i novčani kapital će sav ići u pravcu država i nadležnosti koje najmanje ustručuju bitcoin. To se možda neće desiti sve odjednom, ali pokušaji zabrane su isto za badava koliko bi bilo odseći sebi nos u inat svom licu. To ne znači da države to neće pokušati. India je već probala da zabrani bitcoin. Kina je uvela puno restrikcija. Drugi će da prate njihove tragove. Ali svaki put kada država preduzme takve korake, to ima nepredvidljive efekte povećanja bitcoin adopcije. Pokušaji zabranjivanja bitcoina su jako efektivne marketing kampanje. Bitcoin postoji kao sistem nevezan za jednu suverenu državu i kao novac je otporan na cenzuru. On je dizajniran da postoji van državne kontrole. Pokušaji da se taj koncept zabrani samo još više daje njemu razlog i logiku za postojanje.

Jedini Pobednički Potez je da se Uključiš u Igru

Zabrana bitcoina je trošenje vremena. Neki će to pokušati; ali svi će biti neuspešni. Sami ti pokušaji će još više ubrzati njegovu adopciju i širenje. Biće to vetar od 100 km/h koji raspaljuje vatru. To će ojačati bitcoin sve više i doprineće njegovoj pouzdanosti. U svakom slučaju, verovanje da će države zabraniti bitcoin u momentu kada on postane dovoljno velika pretnja rezervnim valutam sveta, je iracionalan razlog da se on no poseduje kao instrument štednje novca. To ne samo da podrazumeva da je bitcoin novac, ali u isto vreme i ignoriše glavne razloge zašto je to tako: on je decentralizovan i otporan na cenzure. Zamislite da razumete jednu od nojvećih tajni današnjice i da u isto vreme tu tajnu asimetrije koju bitcoin nudi ne primenjujete u svoju korist zbog straha od države. Pre će biti, neko ko razume zašto bitcoin funkcioniše i da ga država ne može zaustaviti, ili nepuno znanje postoji u razumevanju kako bitcoin uopšte funckioniše. Počnite sa razmatranjem fundamentalnih pitanja, a onda primenite to kao temelj da bi procenili bilo koji potencijalan rizik od strane budućih regulacija ili restrikcija državnih organa. I nikad nemojte da zaboravite na vrednost asimetrije između dve strane ovde prezentiranih argumenata. Jedini pobednički potez je da se uključite u igru.

Stavovi ovde prezentirani su samo moji i ne predstavljaju Unchained Capital ili moje kolege. Zahvaljujem se Fil Gajgeru za razmatranje teksta i primedbe.

-

@ bf47c19e:c3d2573b

2025-05-11 17:48:52

@ bf47c19e:c3d2573b

2025-05-11 17:48:52Originalni tekst na medium.com.

Autor: Aleksandar Svetski / Prevod: ₿itcoin Serbia

Nemojte kupovati Bitkoin!

Ni danas, ni kasnije, nikada!

Posvećeno skepticima, neznalicama, arogantnima i nezainteresovanima.

NE TREBA vam Bitkoin.

Molim vas. Nemojte ga kupovati.

Lično me ne zanima "masovna adopcija".

Draža mi je selektivna adopcija.

Svinja ne zaslužuje bisere.

Na vama je da platite cenu neznanja.

Kao i cenu glupavosti.

Kada dođe vreme, sa zadovoljstvom ću vam platiti hiljadu satošija mesečno za vaše vreme i smejati se usput.

Najbitnija odluka koju ćete ikada doneti

NEMA važnije odluke za vašu finansijsku, ekonomsku i suverenu budućnost koju danas možete doneti nego da kupite Bitkoin.

A ako ne želite da izdvojite malo vremena da ga dalje proučite, JEDINA osoba koju treba da krivite kasnije ste vi sami.

Danas, Bitkoin se nalazi u svojoj ranoj, početnoj fazi. O ovome možete više pročitati ovde (hvala ObiWan Kenobit):

Hiperbitkoinizacija: pobednik uzima sve

Ovo JE prilika ne samo vašeg života, već verovatno i najveći mogući transfer bogatstva u istoriji, a najluđa stvar je što će se najveći deo toga odigrati u narednih nekoliko decenija.

Nalazimo se tek u prvih 12 godina ove promene, a već smo videlo kako je Bitkoin eksplodirao sa $0.008c (kada su za 10.000 BTC kupljene dve pice) na trenutnu cenu od oko $11.500.

Ovo je tek početak. Tek 0.001% svetskog bogatstva je denominirano u Bitkoinu.

Ako sada izdvojite samo trenutak da razumete novac, njegovu ulogu u društvu i kako će ekonomski darvinizam voditi ceo svet prema najrobusnijem, najčvršćem i najsigurnijem obliku očuvanja bogatstva, možete odlučiti da kupite neki deo pre nego što se ostatak sveta priključi.

Čitajući ovo, vi ste poput drevnog pojedinca koji je pronašao zlato, dok svi ostali koriste školjke. Razlika je u tome što živite u digitalnom dobu tokom kojeg će se ovaj novac pojaviti i sazreti za vreme vašeg života. Taj drevni pojedinac bi bio u pravu ali mrtav zato što je zlatu bilo potrebno nekoliko hiljada godina da uradi ono za šta će Bitkoinu biti potrebne decenije.

Zamislite. Se. Nad. Tim.

I naučite dalje o nastanku Bitkoina ovde:

I za ime ljubavi prema sopstvenoj budućnosti, preuzmite ovu kratku elektronsku knjigu i jebeno se edukujte!!

Preuzmite "Investiranje u Bitkoin"

I eto, dajem vam izvore.. jbt.. Svejedno...

Danas, imate izbor da kupite Bitkoin; najoskudniji novac u univerzumu, za siću!! Bukvalno možete kupiti hiljade satošija (najmanju jedinicu Bitkoina gde je 100.000.000 satošija = 1 BTC) za $1!!!

Danas ne postoji veća prilika, kao što sutradan neće postojati veće žaljenje kada više ne budete imali "izbor" da ga kupite.

Kada taj dan bude došao i kada budete to morali da prihvatite, setićete se ovih reči, ali avaj, biće prekasno, a vreme ne možete vratiti.

Više nije 2012

Tada ste imali izgovor. Sada je 2020...

Apsolutno NEMA razloga zašto neko sa malo radoznalosti i relativno funkcionalnim mozgom ne može da prouči šta je Bitkoin, zašto postoji, zašto je važan i zašto bi trebalo da u njega prebaci malo ličnog bogatstva.

Naročito ako ima prijatelja poput mene ili mnoštvo Bitkoinera negde tamo.

Ja više neću smarati ljude sa porukama "zašto treba kupiti Bitkoin".

Više nije 2012. godina.

Danas imamo toliko puno informacija od toliko mnogo dobrih ljudi na svim mogućim medijima, tako da NEMATE IZGOVORA da ga ignorišete ili kažete: "ali niko mi nije rekao".

Ukoliko nemate da izdvojite bar malo vremena od vašeg Netflix rasporeda da biste istražili šta je ova stvar i zašto je bitna za vašu ličnu ekonomsku budućnost, onda zaslužujete to što imate.

Deluje okrutno ali dobrodošao u život, mladi žutokljunče.

Sada... Ako ste izdvojili malo vremena ali ste i dalje nezainteresovani ili dovoljno glupi da ga odbacite, onda zaista zaslužujete to što dolazi i ostatak ovog članka je definitivno za vas.

Ne želim da uopšte kupite Bitkoin!

Ok Aleks, ali šta ćemo sa "masovnom adopcijom"???

Pažljivo me slušajte:

Zabole me kurac da li će masovna adopcija doći za 10, 20, 50 ili 100 godina!

Ja sam skroz za selektivnu adopciju i potpuno za dugačku igru. Tako da sam spreman da čekam.

Kao u SVIM prirodnim, evolutivno funkcionalnim sistemima, oni koji seju i pomažu u izgradnji temelja bi trebalo da budu i nesrazmerno nagrađeni.

Ovo je 100% fer i predivno nejednako (neki od vas koji me znate ste upoznati sa mojim stavom o nejednakosti kao najprezrenijem od svih ljudskih ideala. Radi se o odvratnom idealu koji nagrađuje najgore među nama).

Tako da za skeptike i "neverne Tome" imam jednostavnu poruku:

Nadam se da nećete uopšte kupiti Bitkoin. Ni danas ni bilo kada. Nadam se da će jedini put kada budete stupili u dodir sa Bitkoinom to biti jedini način da za nešto budete isplaćeni; npr. kada budete morali da ga zaradite.

Jedva čekam dan kada će mojih nekoliko hiljada satošija moći da kupi tri, četiri ili pet meseci vašeg vremena.

A u međuvremenu...

Molim vas, držite se vašeg fiat novca. Molim vas, držite se vaših šitkoina.

Ne želim nikoga od vas "blokčejnera", šitkoinera, fiat nokoinera i vas svih ostalih klovnova koji mislite da znate bolje.

Ovaj rolerkoster je specijalan, tako da zašto bih želeo da ga delim sa vama glupanderima? Zašto bih bacao bisere pred svinje?

Ja verujem u principe isključivosti.

Ovo nije "kumbaya" ili "svi smo jedno". Jebite se.

Sa razlogom smo drugačiji.

Napraviću sam svoj krevet i ležati u njemu. Vi napravite svoje.

Kada bude došlo vreme, ja ću vam za vaše vreme plaćati satošijima zato što onda nećete imati izbora.

Tada ja pobeđujem, a vi gubite.

Kako sejete, tako žanjete

Razlika između mene i vas je ta što ja kupujem Bitkoin sada zato što tako želim. Vi ćete morati da radite za Bitkoin sutra zato što tako morate.

To je cena neznanja. To je cena arogancije.

To je cena gluposti koju ćete platiti i, koliko god ovo zvuči okrutno, istina je da zaslužujete svaki delić toga.

Svi ležimo u krevetu koji sami pravimo, a vi svoj krevet pravite sada.

Neće vam samouvereni Bitkoiner reći: "lepo sam vam rekao". Nova ekonomska realnost će vam to reći umesto njega.

"Lepo sam vam rekao" će vas udariti poput tone cigle kada shvatite razliku između vas i onih koji su bili razboriti, koji su marljivo štedeli, koji su uložili vreme i trud da otkriju šta je zapravo Bitkoin dok su ih svi nazivali ludacima.

Neće biti sažaljenja.

Nema više bacanja bisera pred svinje

Oni koji imaju priliku da kupe nešto Bitkoina sada, a odluče da to ne urade zahvaljujući neznanju, aroganciji ili gluposti, zaslužuju da plate sa kamatom.

Zaslužuju da trguju svoje sutrašnje dragoceno vreme i energiju za ono što su mogli da nabave danas i to bukvalno "za kikiriki".

Ovde nema greške: nismo jednaki. Mi smo veoma, veoma različiti ljudi.

Ja sam uložio vreme, trud i energiju sada, ne samo zbog sebe samog, već i da bih posadio seme i pomogao mreži.

Uradio sam svoj deo.

Vi ćete doći kasnije i pomoći mi da žanjem nagrade svog truda. Postojaćete da biste mi pomogli da uživam u plodovima.

To će biti vaša uloga.

Izabrao sam da rizikujem i steknem deo onoga zbog čega su me svi nazivali ludim zato što sam učio, verovao i shvatio danas, sa nadom da se izgradi bolja, poštenija i pravičnija budućnost za sve.

Radeći to, neki od nas će postati džinovi i nesrazmerno bogati. I vi imate tu šansu ali je mnogi od vas neće iskoristiti.

I ja sam skroz ok sa tim. Više neću bacati bisere pred svinje.

Ovaj članak može zvučati neprijatno ali više me zabole kurac. Sada je na vama da sami istražujete.

Ovo se događa bez obzira sviđalo vam se to ili ne. Ja i hiljade drugih Bitkoinera smo pisali eseje i eseje o ovome.

Neka imena sa kvalitetnim materijalom kojih se mogu setiti iz glave su:

- Naravno ja

- Gigi

- Robert Breedlove

- Saifedean Ammous

Ako ste radoznali možete ih pratiti. A ovo je sjajno mesto gde možete preuzeti nekoliko odličnih radova:

I za kraj, ako si Bitkoiner koji ovo čita, nikada nećeš znati da li sam zloban ili samo igram 4D šah.

Iskreno, nije ni bitno.

Ovo se dešava. Bitkoin osvaja svet. Ekonomski darvinizam je činjenica.

Sakupljajte vaše satošije, ponudite maslinovu grančicu, obratite pažnju na njihovu radoznalost ili iskru u njihovom oku kao znak da nastavite. Ukoliko toga nema ili naiđete na odbijanje, ostavite ih da se igraju kao svinje u govnima sa njihovim fiatom, deonicama ili šitkoinima.

Biće nam potrebni čistači za naše citadele.

-

@ 95543309:196c540e

2025-05-11 12:42:09

@ 95543309:196c540e

2025-05-11 12:42:09Lets see if this works with the blossom upload and without markdown hassle.

:cat:

https://blossom.primal.net/73a099f931366732c18dd60da82db6ef65bb368eb96756f07d9fa7a8a3644009.mp4

-

@ d360efec:14907b5f

2025-05-10 03:57:17

@ d360efec:14907b5f

2025-05-10 03:57:17Disclaimer: * การวิเคราะห์นี้เป็นเพียงแนวทาง ไม่ใช่คำแนะนำในการซื้อขาย * การลงทุนมีความเสี่ยง ผู้ลงทุนควรตัดสินใจด้วยตนเอง

-

@ c1e9ab3a:9cb56b43

2025-05-09 23:10:14

@ c1e9ab3a:9cb56b43

2025-05-09 23:10:14I. Historical Foundations of U.S. Monetary Architecture

The early monetary system of the United States was built atop inherited commodity money conventions from Europe’s maritime economies. Silver and gold coins—primarily Spanish pieces of eight, Dutch guilders, and other foreign specie—formed the basis of colonial commerce. These units were already integrated into international trade and piracy networks and functioned with natural compatibility across England, France, Spain, and Denmark. Lacking a centralized mint or formal currency, the U.S. adopted these forms de facto.

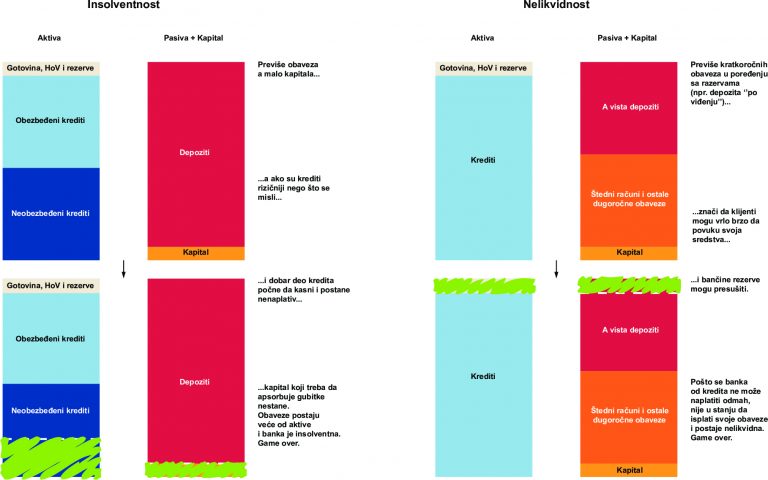

As security risks and the practical constraints of physical coinage mounted, banks emerged to warehouse specie and issue redeemable certificates. These certificates evolved into fiduciary media—claims on specie not actually in hand. Banks observed over time that substantial portions of reserves remained unclaimed for years. This enabled fractional reserve banking: issuing more claims than reserves held, so long as redemption demand stayed low. The practice was inherently unstable, prone to panics and bank runs, prompting eventual centralization through the formation of the Federal Reserve in 1913.