-

@ 8f69ac99:4f92f5fd

2025-05-16 11:40:35

@ 8f69ac99:4f92f5fd

2025-05-16 11:40:35Há algo quase reconfortante na previsibilidade com que certos colunistas abordam Bitcoin: a cada oportunidade, repetem os mesmos chavões, reciclados com indignação moralista e embrulhados numa embalagem de falsa autoridade. O artigo publicado na Visão, com o título dramático "De criança prodígio a adolescente problemático", encaixa-se perfeitamente nesse molde.

Trata-se de uma peça de opinião que mistura factos irrelevantes com interpretações enviesadas, estatísticas sem contexto e um medo mal disfarçado de perder o monopólio da narrativa económica. A autora, Sofia Santos Machado, opta por colar em Bitcoin os desastres do chamado “mundo cripto” como se fossem parte do mesmo fenómeno — ignorando, por conveniência ou ignorância, que Bitcoin não é altcoins, não é NFTs, não é esquemas de yield exótico, e não é fintech vestida de blockchain.

Esta resposta centra-se exclusivamente em Bitcoin — um protocolo monetário aberto, incorruptível e resistente à censura, que já está a servir como salvaguarda de valor em regiões onde o sistema financeiro convencional falhou. Não me interessa defender pirâmides, tokens inflacionários ou aventuras bancárias mal calculadas.

Criticar Bitcoin é legítimo — mas fazê-lo sem saber do que se fala é apenas desinformação.

A Histeria da Água — Falar Sem Saber

O artigo abre com uma pérola alarmista sobre o consumo de água:

“Uma única transacção de bitcoin consome seis milhões de vezes mais água do que um pagamento com cartão.”

Seis. Milhões. De vezes. Resta saber se a autora escreveu isto com cara séria ou a rir-se enquanto bebia água engarrafada dos Alpes Suíços.

Fontes? Metodologia? Contexto? Estou a brincar — isto é a Visão, onde os números são decoração e os factos opcionais.

Claro que comparar transacções na camada base de Bitcoin com pagamentos "instantâneos" da rede Visa é tão rigoroso como comparar um Boeing 747 com um avião de papel porque um voa mais longe. Um artigo sério teria falado em batching, na Lightning Network, ou no facto de que Bitcoin nem sequer compete com a Visa nesse nível, nem em nenhum. Mas isso exigiria, imagine-se, investigação.

Pior ainda, não há qualquer menção ao consumo de água na extracção de ouro, nos data centers bancários, ou no treino de modelos de inteligência artificial. Pelos vistos, só Bitcoin tem de obedecer aos mandamentos ecológicos da Visão. O resto? Santa ignorância selectiva.

Criminosos e o Fantasma do Satoshi

Eis o clássico: “Bitcoin é usado por criminosos”. Um cliché bafiento tirado do baú de 2013, agora reapresentado como se fosse escândalo fresco.

Na realidade, Bitcoin é pseudónimo, não anónimo. Todas as transacções ficam gravadas num livro público — não é propriamente o esconderijo ideal para lavar dinheiro, a menos que sejas fã de disfarces em néon.

E os dados? Claríssimos. Segundo a Chainalysis e a Europol, a actividade ilícita com Bitcoin tem vindo a diminuir. Enquanto isso, os bancos — esses bastiões de confiança — continuam a ser apanhados a lavar biliões para cartéis e cleptocratas. Mas disso a Visão não fala. Devia estragar a narrativa.

O verdadeiro crime aqui é a preguiça intelectual tão profunda que quase merece uma moldura. A Visão tem um editor?

O Espantalho Energético

Como uma criança que acabou de aprender uma palavra nova, a Visão repete “consumo energético” como se fosse um pecado original. Bitcoin usa electricidade — escândalo!

Mas vejamos: o Proof-of-Work não é um defeito. É a razão pela qual Bitcoin é seguro. Não há “desperdício” — há uso, e muitas vezes com energia excedente, renovável, ou que de outro modo seria desperdiçada. É por isso que os mineiros se instalam junto a barragens remotas, queima de gás (flaring), ou parques eólicos no meio do nada — não porque odeiam o planeta, mas porque os incentivos económicos funcionam. Escrevi sobre isso aqui.

O que a Visão convenientemente ignora é que Bitcoin está a ajudar a integrar mais energia renovável nas redes, funcionando como carga flexível. Mas nuance? Trabalho de casa? Esquece lá isso.

Para uma explicação mais séria, podiam ter ouvido o podcast A Seita Bitcoin com o Daniel Batten. Mas para quê investigar?

Cripto = Bitcoin = Fraude?

Aqui chegamos ao buraco negro intelectual: enfiar tudo no mesmo saco. FTX colapsou? Culpa de Bitcoin. Um banqueiro jogou com altcoins? Culpa de Bitcoin. Scam de NFT? Deve ter sido o Satoshi.

Vamos esclarecer: Bitcoin não é “cripto”. Bitcoin é descentralizado, sem líderes, transparente. Não teve pré-mineração, não tem CEO, não promete lucros. O que o rodeia? Tokens centralizados, esquemas Ponzi, pirâmides e vaporware — precisamente o oposto do que Bitcoin representa.

Se um executivo bancário perde o dinheiro dos clientes em Dogecoins, isso é um problema dele. Bitcoin não lhe prometeu nada. Foi a ganância.

E convenhamos: os bancos tradicionais também colapsam. E não precisam de satoshis para isso. Bastam dívidas mal geridas, contabilidade criativa e uma fé cega no sistema.

Culpar Bitcoin por falcatruas “cripto” é como culpar o TCP/IP ou SMTP por emails de phishing. É preguiçoso, desonesto e diz-nos mais sobre a autora do que sobre a tecnologia.

Promessas Por Cumprir? Só Se Não Estiveres a Ver

A "jornalista" da Visão lamenta que “após 15 anos, os riscos são reais mas as promessas por cumprir”. Que promessas? Dinheiro grátis? Cafés pagos com QR codes mágicos?

Bitcoin nunca prometeu fazer cappuccinos mais rápidos. Prometeu soberania monetária, resistência à censura e um sistema previsível. E tem cumprido — diariamente, para milhões. E para o cappuccino, há sempre a Lightning Network.

Pergunta aos venezuelanos, nigerianos, peruanos ou argentinos se Bitcoin falhou. Para muitos, é a única forma de escapar à hiperinflação, ao confisco estatal e à decadência financeira.

Bitcoin não é uma app. É infra-estrutura. É uma nova camada base para o dinheiro global. Não se vê — mas protege, impõe regras e não obedece a caprichos de banqueiros centrais.

E isso assusta. Especialmente quem nunca viveu fora da bolha do euro.

Conclusão: A Visão a Gritar Contra o Progresso

No fim, o artigo da Visão é um festival de clichés, dados errados e ressentimento. Não é só enganador. É desonesto. Culpa a tecnologia pelos erros dos homens. Rejeita o futuro em nome do conforto passado.

Bitcoin não é uma varinha mágica. Mas é a fundação de uma nova liberdade financeira. Uma ferramenta para proteger valor, resistir a abusos e escapar ao controlo constante de quem acha que sabe o que é melhor para ti.

Portanto, fica aqui o desafio, Sofia: se queres criticar Bitcoin, primeiro percebe o que é. Lê o white paper. Estuda. Faz perguntas difíceis.

Caso contrário, és só mais um cão a ladrar para a trovoada — muito barulho, zero impacto.

-

@ 0e29efc2:ff142af2

2025-05-07 15:09:46

@ 0e29efc2:ff142af2

2025-05-07 15:09:46Table of Contents

- Intro

- Important Terminology

- Getting Started

- Where do I buy bitcoin?

- Okay, I bought some bitcoin-now what?

- Less than 0.01 BTC

- More than 0.01 BTC and less than 0.1 BTC

- More than 0.1 BTC

- How Bitcoin Works

- Skepticism

- Someone will hack it

- The government will try to stop it

- It’s not backed by anything

- Conclusion

Intro

Maybe you saw an article in Forbes, a news segment about MicroStrategy (MSTR), or you glanced at the bitcoin price chart; whatever the spark, your curiosity led you here. Enough friends and relatives keep asking me about bitcoin that I finally organized my thoughts into a single reference. This is not a comprehensive guide—it assumes you trust me as a heuristic.

Important Terminology

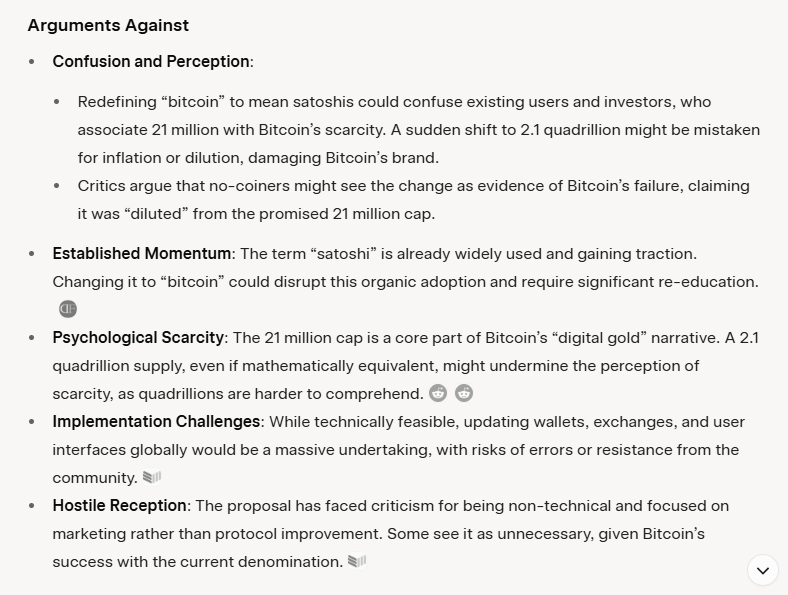

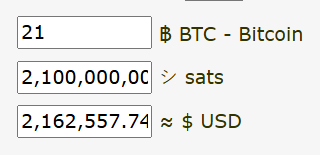

Sat (satoshi) – the smallest unit of bitcoin. One bitcoin (₿) equals 100 000 000 sats.

Getting Started

Where do I buy bitcoin?

I use River because it publishes proof‑of‑reserves, supports the Lightning Network, and pays interest on idle USD balances (currently 3.8 %).

Okay, I bought some bitcoin-now what?

Withdraw it immediately. Centralized exchanges can and do fail. Your next step depends on how much bitcoin you hold.

If at any point you're struggling, please reach out to me.

Less than 0.01 BTC

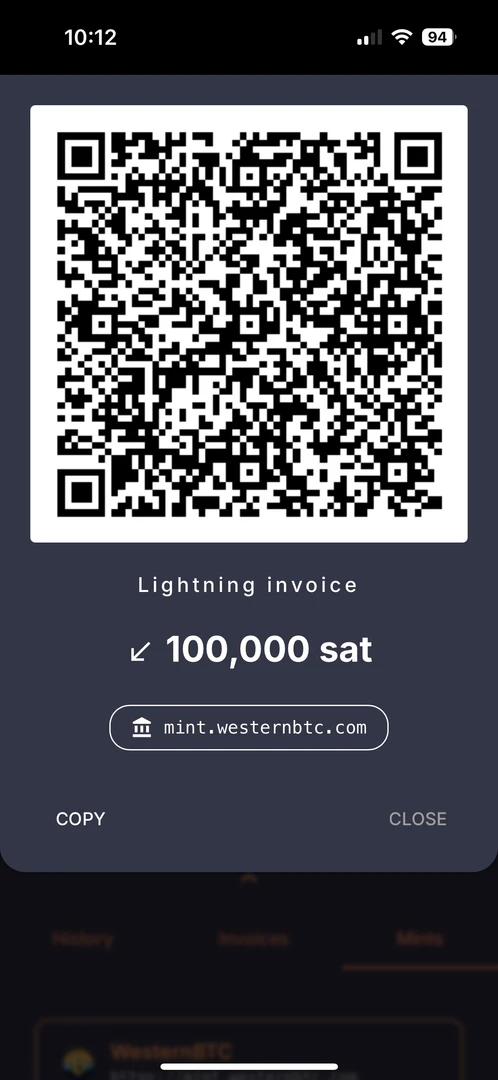

- On your phone open Safari (iOS) or Chrome (Android).

- Paste

https://wallet.cashu.me?mint=https://mint.westernbtc.com. Confirm the prompt that asks whether you trusthttps://mint.westernbtc.com. I run this mint so beginners can skip the gnarly parts. - Complete setup.

- Tap Receive → LIGHTNING → enter amount → COPY.

- In River choose Send → Send to a Bitcoin wallet, paste the invoice, verify, and send.

- Return to the wallet; your sats should appear.

More than 0.01 BTC and less than 0.1 BTC

It's time for cold storage. Cold storage means a dedicated signing device not connected to the internet. Think of it like keys to a house. If you have the keys (your cold storage signing device), you can get into your house (the bitcoin). I recommend and use the COLDCARD Q or COLDCARD MK4 from COLDCARD. See this thorough walkthrough.

The creator nostr:npub1rxysxnjkhrmqd3ey73dp9n5y5yvyzcs64acc9g0k2epcpwwyya4spvhnp8 makes reliable content.

More than 0.1 BTC

The next security upgrade involves something called multisig. It requires the use of multiple devices instead of one. Think of those nuclear launch silos in movies where two keys need to be turned in order to launch the missile. One person can't reach both keys, so you need two people. Like the two keys needing to be turned, we need a certain number of keys (signing devices) to be used.

This offers a number of benefits. Say you have a 2-of-3 multisig setup. You would need two of the three keys to move the bitcoin. If you were to lose one, you could use the two others to move it instead. Many choose to geographically distribute the keys; choosing to keep one at a friend’s house or with a bank.

The previous video I linked covers multisig as well. Again, please reach out to me if you need help.

How Bitcoin Works

I'm going to paint a scene portraying the basics of how bitcoin works. Picture a race that's supposed to take 10 minutes to run start-to-finish, and there's a crowd of people spectating. When the fastest runner crosses the finish line, they're awarded 50 bitcoin. Everyone in the crowd recognizes who won, and writes it down on their own scoreboard. Then, the next race begins.

Now, let's say more racers who've had special training join. They start winning consistently because of it, and now the race only lasts about 9 minutes. There's a special rule everyone in the crowd agreed to, that they can make the race harder to ensure it's around 10 minutes long. So they make the race harder to counteract the faster runners.

With this in mind, let's get to the skepticism you might have.

Skepticism

Someone will hack it

Think of bitcoin as the people in the crowd. If someone tries to cheat and writes on their scoreboard that they have a billion bitcoin, their scoreboard is going to look different than everybody else’s. The other people in the crowd will cross-reference with each other and decide to ignore that person who cheated.

The government will try to stop it

Again, think of the crowd. In reality, the "crowd participants" are scattered all around the world. You might be able to stop many of them, but it would be almost impossible to stop everyone. Imagine people are watching the race on TV, can you find everyone who's spectating? Ironically, attempted bans often increase interest.

It’s not backed by anything.

Think of the runners. The runners are bitcoin miners. They have to expend real energy to participate in the race. The more bitcoin miners, the more secure the network. In summary, it's backed by electricity and work.

Conclusion

There are too many topics to cover in one article. I haven't even touched on the history of money, what money is, scarcity, etc. The best way to learn is to research the topics you're interested in for yourself. It took months of deep diving before I was sold on bitcoin, and I had many touch points before that.

Once you see it though, you can't unsee it.

-

@ 8f69ac99:4f92f5fd

2025-05-06 14:21:13

@ 8f69ac99:4f92f5fd

2025-05-06 14:21:13A concepção popular de "anarquia" evoca frequentemente caos, colapso e violência. Mas e se anarquia significasse outra coisa? E se representasse um mundo onde as pessoas cooperam e se coordenam sem autoridades impostas? E se implicasse liberdade, ordem voluntária e resiliência—sem coerção?

Bitcoin é um dos raros exemplos funcionais de princípios anarquistas em acção. Não tem CEO, nem Estado, nem planeador central—e, no entanto, o sistema funciona. Faz cumprir regras. Propõe um novo modelo de governação e oferece uma exploração concreta do anarcocapitalismo.

Para o compreendermos, temos de mudar de perspectiva. Bitcoin não é apenas software ou um instrumento de investimento—é um sistema vivo: uma ordem espontânea.

Ordem Espontânea, Teoria dos Jogos e o Papel dos Incentivos Económicos

Na política e economia contemporâneas, presume-se geralmente que a ordem tem de vir de cima. Governos, corporações e burocracias são vistos como essenciais para organizar a sociedade em grande escala.

Mas esta crença nem sempre se verifica.

Os mercados surgem espontaneamente da troca. A linguagem evolui sem supervisão central. Projectos de código aberto prosperam graças a contribuições voluntárias. Nenhum destes sistemas precisa de um rei—e, no entanto, têm estrutura e funcionam.

Bitcoin insere-se nesta tradição de ordens emergentes. Não é ditado por uma entidade única, mas é governado através de código, consenso dos utilizadores e incentivos económicos que recompensam a cooperação e penalizam a desonestidade.

Código Como Constituição

Bitcoin funciona com base num conjunto de regras de software transparentes e verificáveis. Estas regras determinam quem pode adicionar blocos, com que frequência, o que constitui uma transacção válida e como são criadas novas moedas.

Estas regras não são impostas por exércitos nem pela polícia. São mantidas por uma rede descentralizada de milhares de nós, cada um a correr voluntariamente software que valida o cumprimento das regras. Se alguém tentar quebrá-las, o resto da rede simplesmente rejeita a sua versão.

Isto não é governo por maioria—é aceitação baseada em regras.

Cada operador de nó escolhe qual versão do software quer executar. Se uma alteração proposta não tiver consenso suficiente, não se propaga. Foi assim que as "guerras do tamanho do bloco" foram resolvidas—não por votação, mas através de sinalização do que os utilizadores estavam dispostos a aceitar.

Este modelo de governação ascendente é voluntário, sem permissões, e extraordinariamente resiliente. Representa um novo paradigma de sistemas autorregulados.

Mineiros, Incentivos e a Segurança Baseada na Teoria dos Jogos

Bitcoin assegura a sua rede utilizando a Teoria de Jogos. Os mineiros que seguem o protocolo são recompensados financeiramente. Quem tenta enganar—como reescrever blocos ou gastar duas vezes—sofre perdas financeiras e desperdiça recursos.

Agir honestamente é mais lucrativo.

A genialidade de Bitcoin está em alinhar incentivos egoístas com o bem comum. Elimina a necessidade de confiar em administradores ou esperar benevolência. Em vez disso, torna a fraude economicamente irracional.

Isto substitui o modelo tradicional de "confiar nos líderes" por um mais robusto: construir sistemas onde o mau comportamento é desencorajado por design.

Isto é segurança anarquista—não a ausência de regras, mas a ausência de governantes.

Associação Voluntária e Confiança Construída em Consenso

Qualquer pessoa pode usar Bitcoin. Não há controlo de identidade, nem licenças, nem processo de aprovação. Basta descarregar o software e começar a transaccionar.

Ainda assim, Bitcoin não é um caos desorganizado. Os utilizadores seguem regras rigorosas do protocolo. Porquê? Porque é o consenso que dá valor às "moedas". Sem ele, a rede fragmenta-se e falha.

É aqui que Bitcoin desafia as ideias convencionais sobre anarquia. Mostra que sistemas voluntários podem gerar estabilidade—não porque as pessoas são altruístas, mas porque os incentivos bem desenhados tornam a cooperação a escolha racional.

Bitcoin é sem confiança (trustless), mas promove confiança.

Uma Prova de Conceito Viva

Muitos acreditam que, sem controlo central, a sociedade entraria em colapso. Bitcoin prova que isso não é necessariamente verdade.

É uma rede monetária global, sem permissões, capaz de fazer cumprir direitos de propriedade, coordenar recursos e resistir à censura—sem uma autoridade central. Baseia-se apenas em regras, incentivos e participação voluntária.

Bitcoin não é um sistema perfeito. É um projecto dinâmico, em constante evolução. Mas isso faz parte do que o torna tão relevante: é real, está a funcionar e continua a melhorar.

Conclusão

A anarquia não tem de significar caos. Pode significar cooperação sem coerção. Bitcoin prova isso.

Procuramos, desesperados, por alternativas às instituições falhadas, inchadas e corruptas. Bitcoin oferece mais do que dinheiro digital. É uma prova viva de que podemos construir sociedades descentralizadas, eficientes e justas.

E isso, por si só, já é revolucionário.

Photo by Floris Van Cauwelaert on Unsplash

-

@ 8f69ac99:4f92f5fd

2025-05-02 09:29:41

@ 8f69ac99:4f92f5fd

2025-05-02 09:29:41À medida que Portugal se aproxima das eleições legislativas de 2025, a 18 de Maio, torna-se essencial compreender as diferentes propostas políticas e os programas eleitorais dos partidos para votar de forma informada. Este artigo funciona como um índice para uma série de análises realizadas aos programas dos principais partidos, com foco em temas como liberdades individuais, descentralização e crescimento económico.

A Evolução da Esquerda e da Direita: Um Contexto Histórico e Ideológico

Os termos “esquerda” e “direita” surgiram na Revolução Francesa (1789–1799) para distinguir quem se sentava ao lado do presidente da Assembleia: as forças favoráveis às reformas radicais (à esquerda) e as defensoras da monarquia e da ordem estabelecida (à direita). Com o século XIX e o advento do liberalismo económico, a direita passou a associar-se ao livre mercado e ao direito de propriedade, enquanto a esquerda defendeu maior intervenção estatal para promover igualdade.

No final do século XIX e início do século XX, surgiram o socialismo e o comunismo como correntes mais radicais da esquerda, propondo a abolição da propriedade privada dos meios de produção (comunismo) ou sistemas mistos com forte regulação e redistribuição (socialismo). A resposta liberal-conservadora evoluiu para o capitalismo democrático, que combina mercado livre com alguns mecanismos de assistência social.

Hoje, o espectro político vai além do simples eixo esquerda–direita, incluindo dimensões como:

- Autoritarismo vs. Liberdade: grau de controlo do Estado sobre a vida individual e as instituições;

- Intervenção Estatal vs. Livre Mercado: equilíbrio entre regulação económica e iniciativas privadas;

- Igualdade Social vs. Mérito e Responsabilidade Individual: ênfase na redistribuição de recursos ou na criação de incentivos pessoais.

Este modelo multidimensional ajuda a capturar melhor as posições dos partidos contemporâneos e as suas promessas de governação.

Visão Geral das Análises por Partido

Segue-se um resumo dos principais partidos políticos em Portugal, com destaque para a sua orientação ideológica segundo as dimensões de autoritarismo, nível de Intervenção estatal e grau de liberdade individual. Cada nome de partido estará ligado à respectiva análise detalhada.

| Partido | Orientação Ideológica | Nível de Intervenção Estatal | Grau de Liberdade Individual | |----------------------------------------|---------------------------------------------------------------------------------------|------------------------------|------------------------------| | AD – Aliança Democrática (PSD/CDS) | Centro-direita democrática (baixo autoritarismo / equilíbrio intervenção–mercado) | Médio | Médio | | PS – Partido Socialista | Centro-esquerda social-democrata (moderado autoritarismo / intervenção estatal) | Alto | Médio | | CDU – Coligação Democrática Unitária (PCP/PEV) | Esquerda comunista/eco-marxista (mais autoritário / forte intervenção) | Muito alto | Baixo | | IL – Iniciativa Liberal | Liberalismo clássico (muito baixa intervenção / alta liberdade) | Baixo | Muito alto | | Chega | Nacionalismo autoritário (controlo social elevado / mercado regulado com foco interno)| Médio | Baixo | | Livre | Esquerda progressista verde (baixa hierarquia / intervenção social) | Alto | Médio | | BE – Bloco de Esquerda | Esquerda democrática radical (moderado autoritarismo / intervenção forte) | Alto | Médio | | PAN – Pessoas-Animais-Natureza | Ambientalismo progressista (intervenção pragmática / foco em direitos e sustentabilidade) | Médio | Alto | | Ergue-te | Nacionalismo soberanista (autoritarismo elevado / intervenção seletiva com foco nacional) | Médio | Baixo | | ADN – Alternativa Democrática Nacional | Nacionalismo conservador (autoritarismo elevado / intervenção seletiva com foco nacional) | Médio | Baixo |

Análises Detalhadas dos Programas Eleitorais

Estas análises pretendem oferecer aos eleitores uma visão clara e objetiva das propostas de cada partido, facilitando decisões conscientes nas urnas. Ao focar-se nas promessas relacionadas com liberdades individuais, descentralização e crescimento económico, este conjunto de textos ajuda a compreender melhor o impacto potencial de cada escolha política.

Aliança Democrática (AD)

Partido Socialista (PS)

Coligação Democrática Unitária (CDU)

Iniciativa Liberal (IL)

Chega

Livre

Bloco de Esquerda (BE)

Pessoas,Animais e Natureza (PAN)

Alternativa Democrática Nacional (ADN)

Ergue-te

Photo by Brett Kunsch on Unsplash

-

@ 3bf0c63f:aefa459d

2025-04-25 19:26:48

@ 3bf0c63f:aefa459d

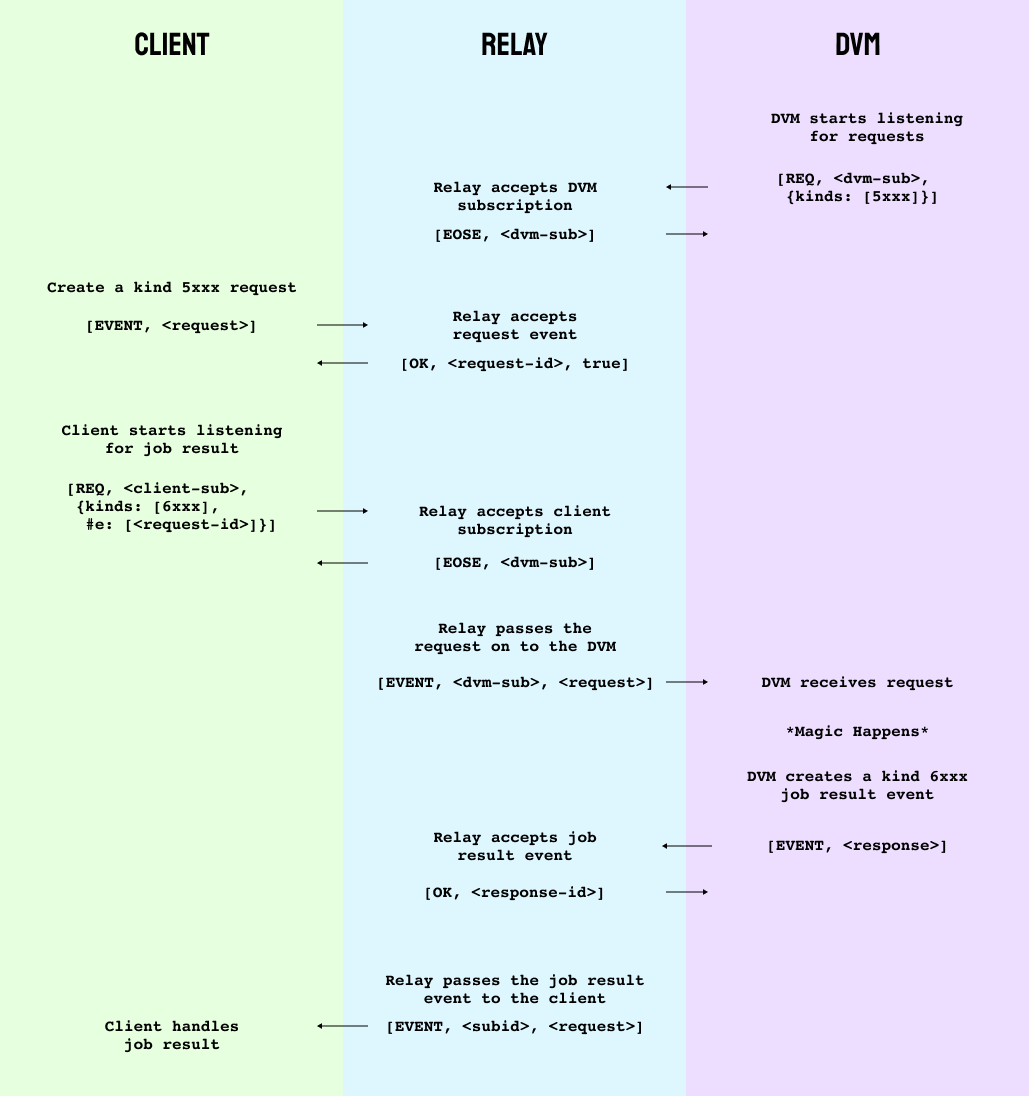

2025-04-25 19:26:48Redistributing Git with Nostr

Every time someone tries to "decentralize" Git -- like many projects tried in the past to do it with BitTorrent, IPFS, ScuttleButt or custom p2p protocols -- there is always a lurking comment: "but Git is already distributed!", and then the discussion proceeds to mention some facts about how Git supports multiple remotes and its magic syncing and merging abilities and so on.

Turns out all that is true, Git is indeed all that powerful, and yet GitHub is the big central hub that hosts basically all Git repositories in the giant world of open-source. There are some crazy people that host their stuff elsewhere, but these projects end up not being found by many people, and even when they do they suffer from lack of contributions.

Because everybody has a GitHub account it's easy to open a pull request to a repository of a project you're using if it's on GitHub (to be fair I think it's very annoying to have to clone the repository, then add it as a remote locally, push to it, then go on the web UI and click to open a pull request, then that cloned repository lurks forever in your profile unless you go through 16 screens to delete it -- but people in general seem to think it's easy).

It's much harder to do it on some random other server where some project might be hosted, because now you have to add 4 more even more annoying steps: create an account; pick a password; confirm an email address; setup SSH keys for pushing. (And I'm not even mentioning the basic impossibility of offering

pushaccess to external unknown contributors to people who want to host their own simple homemade Git server.)At this point some may argue that we could all have accounts on GitLab, or Codeberg or wherever else, then those steps are removed. Besides not being a practical strategy this pseudo solution misses the point of being decentralized (or distributed, who knows) entirely: it's far from the ideal to force everybody to have the double of account management and SSH setup work in order to have the open-source world controlled by two shady companies instead of one.

What we want is to give every person the opportunity to host their own Git server without being ostracized. at the same time we must recognize that most people won't want to host their own servers (not even most open-source programmers!) and give everybody the ability to host their stuff on multi-tenant servers (such as GitHub) too. Importantly, though, if we allow for a random person to have a standalone Git server on a standalone server they host themselves on their wood cabin that also means any new hosting company can show up and start offering Git hosting, with or without new cool features, charging high or low or zero, and be immediately competing against GitHub or GitLab, i.e. we must remove the network-effect centralization pressure.

External contributions

The first problem we have to solve is: how can Bob contribute to Alice's repository without having an account on Alice's server?

SourceHut has reminded GitHub users that Git has always had this (for most) arcane

git send-emailcommand that is the original way to send patches, using an once-open protocol.Turns out Nostr acts as a quite powerful email replacement and can be used to send text content just like email, therefore patches are a very good fit for Nostr event contents.

Once you get used to it and the proper UIs (or CLIs) are built sending and applying patches to and from others becomes a much easier flow than the intense clickops mixed with terminal copypasting that is interacting with GitHub (you have to clone the repository on GitHub, then update the remote URL in your local directory, then create a branch and then go back and turn that branch into a Pull Request, it's quite tiresome) that many people already dislike so much they went out of their way to build many GitHub CLI tools just so they could comment on issues and approve pull requests from their terminal.

Replacing GitHub features

Aside from being the "hub" that people use to send patches to other people's code (because no one can do the email flow anymore, justifiably), GitHub also has 3 other big features that are not directly related to Git, but that make its network-effect harder to overcome. Luckily Nostr can be used to create a new environment in which these same features are implemented in a more decentralized and healthy way.

Issues: bug reports, feature requests and general discussions

Since the "Issues" GitHub feature is just a bunch of text comments it should be very obvious that Nostr is a perfect fit for it.

I will not even mention the fact that Nostr is much better at threading comments than GitHub (which doesn't do it at all), which can generate much more productive and organized discussions (and you can opt out if you want).

Search

I use GitHub search all the time to find libraries and projects that may do something that I need, and it returns good results almost always. So if people migrated out to other code hosting providers wouldn't we lose it?

The fact is that even though we think everybody is on GitHub that is a globalist falsehood. Some projects are not on GitHub, and if we use only GitHub for search those will be missed. So even if we didn't have a Nostr Git alternative it would still be necessary to create a search engine that incorporated GitLab, Codeberg, SourceHut and whatnot.

Turns out on Nostr we can make that quite easy by not forcing anyone to integrate custom APIs or hardcoding Git provider URLs: each repository can make itself available by publishing an "announcement" event with a brief description and one or more Git URLs. That makes it easy for a search engine to index them -- and even automatically download the code and index the code (or index just README files or whatever) without a centralized platform ever having to be involved.

The relays where such announcements will be available play a role, of course, but that isn't a bad role: each announcement can be in multiple relays known for storing "public good" projects, some relays may curate only projects known to be very good according to some standards, other relays may allow any kind of garbage, which wouldn't make them good for a search engine to rely upon, but would still be useful in case one knows the exact thing (and from whom) they're searching for (the same is valid for all Nostr content, by the way, and that's where it's censorship-resistance comes from).

Continuous integration

GitHub Actions are a very hardly subsidized free-compute-for-all-paid-by-Microsoft feature, but one that isn't hard to replace at all. In fact there exists today many companies offering the same kind of service out there -- although they are mostly targeting businesses and not open-source projects, before GitHub Actions was introduced there were also many that were heavily used by open-source projects.

One problem is that these services are still heavily tied to GitHub today, they require a GitHub login, sometimes BitBucket and GitLab and whatnot, and do not allow one to paste an arbitrary Git server URL, but that isn't a thing that is very hard to change anyway, or to start from scratch. All we need are services that offer the CI/CD flows, perhaps using the same framework of GitHub Actions (although I would prefer to not use that messy garbage), and charge some few satoshis for it.

It may be the case that all the current services only support the big Git hosting platforms because they rely on their proprietary APIs, most notably the webhooks dispatched when a repository is updated, to trigger the jobs. It doesn't have to be said that Nostr can also solve that problem very easily.

-

@ 3bf0c63f:aefa459d

2025-04-25 18:55:52

@ 3bf0c63f:aefa459d

2025-04-25 18:55:52Report of how the money Jack donated to the cause in December 2022 has been misused so far.

Bounties given

March 2025

- Dhalsim: 1,110,540 - Work on Nostr wiki data processing

February 2025

- BOUNTY* NullKotlinDev: 950,480 - Twine RSS reader Nostr integration

- Dhalsim: 2,094,584 - Work on Hypothes.is Nostr fork

- Constant, Biz and J: 11,700,588 - Nostr Special Forces

January 2025

- Constant, Biz and J: 11,610,987 - Nostr Special Forces

- BOUNTY* NullKotlinDev: 843,840 - Feeder RSS reader Nostr integration

- BOUNTY* NullKotlinDev: 797,500 - ReadYou RSS reader Nostr integration

December 2024

- BOUNTY* tijl: 1,679,500 - Nostr integration into RSS readers yarr and miniflux

- Constant, Biz and J: 10,736,166 - Nostr Special Forces

- Thereza: 1,020,000 - Podcast outreach initiative

November 2024

- Constant, Biz and J: 5,422,464 - Nostr Special Forces

October 2024

- Nostrdam: 300,000 - hackathon prize

- Svetski: 5,000,000 - Latin America Nostr events contribution

- Quentin: 5,000,000 - nostrcheck.me

June 2024

- Darashi: 5,000,000 - maintaining nos.today, searchnos, search.nos.today and other experiments

- Toshiya: 5,000,000 - keeping the NIPs repo clean and other stuff

May 2024

- James: 3,500,000 - https://github.com/jamesmagoo/nostr-writer

- Yakihonne: 5,000,000 - spreading the word in Asia

- Dashu: 9,000,000 - https://github.com/haorendashu/nostrmo

February 2024

- Viktor: 5,000,000 - https://github.com/viktorvsk/saltivka and https://github.com/viktorvsk/knowstr

- Eric T: 5,000,000 - https://github.com/tcheeric/nostr-java

- Semisol: 5,000,000 - https://relay.noswhere.com/ and https://hist.nostr.land relays

- Sebastian: 5,000,000 - Drupal stuff and nostr-php work

- tijl: 5,000,000 - Cloudron, Yunohost and Fraidycat attempts

- Null Kotlin Dev: 5,000,000 - AntennaPod attempt

December 2023

- hzrd: 5,000,000 - Nostrudel

- awayuki: 5,000,000 - NOSTOPUS illustrations

- bera: 5,000,000 - getwired.app

- Chris: 5,000,000 - resolvr.io

- NoGood: 10,000,000 - nostrexplained.com stories

October 2023

- SnowCait: 5,000,000 - https://nostter.vercel.app/ and other tools

- Shaun: 10,000,000 - https://yakihonne.com/, events and work on Nostr awareness

- Derek Ross: 10,000,000 - spreading the word around the world

- fmar: 5,000,000 - https://github.com/frnandu/yana

- The Nostr Report: 2,500,000 - curating stuff

- james magoo: 2,500,000 - the Obsidian plugin: https://github.com/jamesmagoo/nostr-writer

August 2023

- Paul Miller: 5,000,000 - JS libraries and cryptography-related work

- BOUNTY tijl: 5,000,000 - https://github.com/github-tijlxyz/wikinostr

- gzuus: 5,000,000 - https://nostree.me/

July 2023

- syusui-s: 5,000,000 - rabbit, a tweetdeck-like Nostr client: https://syusui-s.github.io/rabbit/

- kojira: 5,000,000 - Nostr fanzine, Nostr discussion groups in Japan, hardware experiments

- darashi: 5,000,000 - https://github.com/darashi/nos.today, https://github.com/darashi/searchnos, https://github.com/darashi/murasaki

- jeff g: 5,000,000 - https://nostr.how and https://listr.lol, plus other contributions

- cloud fodder: 5,000,000 - https://nostr1.com (open-source)

- utxo.one: 5,000,000 - https://relaying.io (open-source)

- Max DeMarco: 10,269,507 - https://www.youtube.com/watch?v=aA-jiiepOrE

- BOUNTY optout21: 1,000,000 - https://github.com/optout21/nip41-proto0 (proposed nip41 CLI)

- BOUNTY Leo: 1,000,000 - https://github.com/leo-lox/camelus (an old relay thing I forgot exactly)

June 2023

- BOUNTY: Sepher: 2,000,000 - a webapp for making lists of anything: https://pinstr.app/

- BOUNTY: Kieran: 10,000,000 - implement gossip algorithm on Snort, implement all the other nice things: manual relay selection, following hints etc.

- Mattn: 5,000,000 - a myriad of projects and contributions to Nostr projects: https://github.com/search?q=owner%3Amattn+nostr&type=code

- BOUNTY: lynn: 2,000,000 - a simple and clean git nostr CLI written in Go, compatible with William's original git-nostr-tools; and implement threaded comments on https://github.com/fiatjaf/nocomment.

- Jack Chakany: 5,000,000 - https://github.com/jacany/nblog

- BOUNTY: Dan: 2,000,000 - https://metadata.nostr.com/

April 2023

- BOUNTY: Blake Jakopovic: 590,000 - event deleter tool, NIP dependency organization

- BOUNTY: koalasat: 1,000,000 - display relays

- BOUNTY: Mike Dilger: 4,000,000 - display relays, follow event hints (Gossip)

- BOUNTY: kaiwolfram: 5,000,000 - display relays, follow event hints, choose relays to publish (Nozzle)

- Daniele Tonon: 3,000,000 - Gossip

- bu5hm4nn: 3,000,000 - Gossip

- BOUNTY: hodlbod: 4,000,000 - display relays, follow event hints

March 2023

- Doug Hoyte: 5,000,000 sats - https://github.com/hoytech/strfry

- Alex Gleason: 5,000,000 sats - https://gitlab.com/soapbox-pub/mostr

- verbiricha: 5,000,000 sats - https://badges.page/, https://habla.news/

- talvasconcelos: 5,000,000 sats - https://migrate.nostr.com, https://read.nostr.com, https://write.nostr.com/

- BOUNTY: Gossip model: 5,000,000 - https://camelus.app/

- BOUNTY: Gossip model: 5,000,000 - https://github.com/kaiwolfram/Nozzle

- BOUNTY: Bounty Manager: 5,000,000 - https://nostrbounties.com/

February 2023

- styppo: 5,000,000 sats - https://hamstr.to/

- sandwich: 5,000,000 sats - https://nostr.watch/

- BOUNTY: Relay-centric client designs: 5,000,000 sats https://bountsr.org/design/2023/01/26/relay-based-design.html

- BOUNTY: Gossip model on https://coracle.social/: 5,000,000 sats

- Nostrovia Podcast: 3,000,000 sats - https://nostrovia.org/

- BOUNTY: Nostr-Desk / Monstr: 5,000,000 sats - https://github.com/alemmens/monstr

- Mike Dilger: 5,000,000 sats - https://github.com/mikedilger/gossip

January 2023

- ismyhc: 5,000,000 sats - https://github.com/Galaxoid-Labs/Seer

- Martti Malmi: 5,000,000 sats - https://iris.to/

- Carlos Autonomous: 5,000,000 sats - https://github.com/BrightonBTC/bija

- Koala Sat: 5,000,000 - https://github.com/KoalaSat/nostros

- Vitor Pamplona: 5,000,000 - https://github.com/vitorpamplona/amethyst

- Cameri: 5,000,000 - https://github.com/Cameri/nostream

December 2022

- William Casarin: 7 BTC - splitting the fund

- pseudozach: 5,000,000 sats - https://nostr.directory/

- Sondre Bjellas: 5,000,000 sats - https://notes.blockcore.net/

- Null Dev: 5,000,000 sats - https://github.com/KotlinGeekDev/Nosky

- Blake Jakopovic: 5,000,000 sats - https://github.com/blakejakopovic/nostcat, https://github.com/blakejakopovic/nostreq and https://github.com/blakejakopovic/NostrEventPlayground

-

@ 8f69ac99:4f92f5fd

2025-04-23 14:39:01

@ 8f69ac99:4f92f5fd

2025-04-23 14:39:01Dizem-nos que a inflação é necessária. Mas e se for, afinal, a raiz da disfunção económica que enfrentamos?

A crença mainstream é clara: para estimular o crescimento, os governos devem poder desvalorizar a sua moeda — essencialmente, criar dinheiro do nada. Supostamente, isso incentiva o investimento, aumenta o consumo e permite responder a crises económicas. Esta narrativa foi repetida tantas vezes que se tornou quase um axioma — raramente questionado.

No centro desta visão está a lógica fiat-keynesiana: uma economia estável exige um banco central disposto a manipular o valor do dinheiro para alcançar certos objectivos políticos. Esta abordagem, inspirada por John Maynard Keynes, defende a intervenção estatal como forma de estabilizar a economia durante recessões. Na teoria, os investidores e consumidores beneficiam de taxas de juro artificiais e de maior poder de compra — um suposto ganho para todos.

Mas há outra perspectiva: a visão do dinheiro sólido (sound money, em inglês). Enraizada na escola austríaca e nos princípios da liberdade individual, esta defende que a manipulação monetária não é apenas desnecessária — é prejudicial. Uma moeda estável, não sujeita à depreciação arbitrária, é essencial para promover trocas voluntárias, empreendedorismo e crescimento económico genuíno.

Está na hora de desafiar esta sabedoria convencional. Ao longo dos próximos capítulos, vamos analisar os pressupostos errados que sustentam a lógica fiat-keynesiana e explorar os benefícios de um sistema baseado em dinheiro sólido — como Bitcoin. Vamos mostrar por que desvalorizar a moeda é moralmente questionável e economicamente prejudicial, e propor alternativas mais éticas e eficazes.

Este artigo (que surge em resposta ao "guru" Miguel Milhões) pretende iluminar as diferenças entre estas duas visões opostas e apresentar uma abordagem mais sólida e justa para a política económica — centrada na liberdade pessoal, na responsabilidade individual e na preservação de instituições financeiras saudáveis.

O Argumento Fiat: Por que Dizem que é Preciso Desvalorizar a Moeda

Este argumento parte geralmente de uma visão económica keynesiana e/ou estatista e assenta em duas ideias principais: o incentivo ao investimento e a necessidade de resposta a emergências.

Incentivo ao Investimento

Segundo os defensores do sistema fiat, se uma moeda como o ouro ou bitcoin valorizar ao longo do tempo, as pessoas tenderão a "acumular" essa riqueza em vez de investir em negócios produtivos. O receio é que, se guardar dinheiro se torna mais rentável do que investir, a economia entre em estagnação.

Esta ideia parte de uma visão simplista do comportamento humano. Na realidade, as pessoas tomam decisões financeiras com base em múltiplos factores. Embora seja verdade que activos valorizáveis são atractivos, isso não significa que os investimentos desapareçam. Pelo contrário, o surgimento de activos como bitcoin cria novas oportunidades de inovação e investimento.

Historicamente, houve crescimento económico em períodos de moeda sólida — como no padrão-ouro. Uma moeda estável e previsível pode incentivar o investimento, ao dar confiança nos retornos futuros.

Resposta a Emergências

A segunda tese é que os governos precisam de imprimir dinheiro rapidamente em tempos de crise — pandemias, guerras ou recessões. Esta capacidade de intervenção é vista como essencial para "salvar" a economia.

De acordo com economistas keynesianos, uma injecção rápida de liquidez pode estabilizar a economia e evitar colapsos sociais. No entanto, este argumento ignora vários pontos fundamentais:

- A política monetária não substitui a responsabilidade fiscal: A capacidade de imprimir dinheiro não torna automaticamente eficaz o estímulo económico.

- A inflação é uma consequência provável: A impressão de dinheiro pode levar a pressões inflacionistas, reduzindo o poder de compra dos consumidores e minando o próprio estímulo pretendido. Estamos agora a colher os "frutos" da impressão de dinheiro durante a pandemia.

- O timing é crítico: Intervenções mal cronometradas podem agravar a situação.

Veremos em seguida porque estes argumentos não se sustentam.

Rebatendo os Argumentos

O Investimento Não Morre num Sistema de Dinheiro Sólido

O argumento de que o dinheiro sólido mata o investimento falha em compreender a ligação entre poupança e capital. Num sistema sólido, a poupança não é apenas acumulação — é capital disponível para financiar novos projectos. Isso conduz a um crescimento mais sustentável, baseado na qualidade e não na especulação.

Em contraste, o sistema fiat, com crédito barato, gera bolhas e colapsos — como vimos em 2008 ou na bolha dot-com. Estes exemplos ilustram os perigos da especulação facilitada por políticas monetárias artificiais.

Já num sistema de dinheiro sólido, como o que cresce em torno de Bitcoin, vemos investimentos em mineração, startups, educação e arte. Os investidores continuam activos — mas fazem escolhas mais responsáveis e de longo prazo.

Imprimir Dinheiro Não Resolve Crises

A ideia de que imprimir dinheiro é essencial em tempos de crise parte de uma ilusão perigosa. A inflação que se segue reduz o poder de compra e afecta especialmente os mais pobres — é uma forma oculta de imposto.

Além disso, soluções descentralizadas — como os mercados, redes comunitárias e poupança — são frequentemente mais eficazes. A resposta à COVID-19 ilustra isso: grandes empresas foram salvas, mas pequenos negócios e famílias ficaram para trás. Os últimos receberam um amuse-bouche, enquanto os primeiros comeram o prato principal, sopa, sobremesa e ainda levaram os restos.

A verdade é que imprimir dinheiro não cria valor — apenas o redistribui injustamente. A verdadeira resiliência nasce de comunidades organizadas e de uma base económica saudável, não de decretos políticos.

Dois Mundos: Fiat vs. Dinheiro Sólido

| Dimensão | Sistema Fiat-Keynesiano | Sistema de Dinheiro Sólido | |----------|--------------------------|-----------------------------| | Investimento | Estimulado por crédito fácil, alimentando bolhas | Baseado em poupança real e oportunidades sustentáveis | | Resposta a crises | Centralizada, via impressão de moeda | Descentralizada, baseada em poupança e solidariedade | | Preferência temporal | Alta: foco no consumo imediato | Baixa: foco na poupança e no futuro | | Distribuição de riqueza | Favorece os próximos ao poder (Efeito Cantillon) | Benefícios da deflação são distribuídos de forma mais justa | | Fundamento moral | Coercivo e redistributivo | Voluntário e baseado na liberdade individual |

Estes contrastes mostram que a escolha entre os dois sistemas vai muito além da economia — é também uma questão ética.

Consequências de Cada Sistema

O Mundo Fiat

Num mundo dominado pelo sistema fiat, os ciclos de euforia e colapso são a norma. A desigualdade aumenta, com os mais próximos ao poder a lucrar com a inflação e a impressão de dinheiro. A poupança perde valor, e a autonomia financeira das pessoas diminui.

À medida que o Estado ganha mais controlo sobre a economia, os cidadãos perdem capacidade de escolha e dependem cada vez mais de apoios governamentais. Esta dependência destrói o espírito de iniciativa e promove o conformismo.

O resultado? Estagnação, conflitos sociais e perda de liberdade.

O Mundo com Dinheiro Sólido

Com uma moeda sólida, o crescimento é baseado em valor real. As pessoas poupam mais, investem melhor e tornam-se mais independentes financeiramente. As comunidades tornam-se mais resilientes, e a cooperação substitui a dependência estatal.

Benefícios chave:

- Poupança real: A moeda não perde valor, e a riqueza pode ser construída com estabilidade.

- Resiliência descentralizada: Apoio mútuo entre indivíduos e comunidades em tempos difíceis.

- Liberdade económica: Menor interferência política e mais espaço para inovação e iniciativa pessoal.

Conclusão

A desvalorização da moeda não é uma solução — é um problema. Os sistemas fiat estão desenhados para transferir riqueza e poder de forma opaca, perpetuando injustiças e instabilidade.

Por outro lado, o dinheiro sólido — como Bitcoin — oferece uma alternativa credível e ética. Promove liberdade, responsabilidade e transparência. Impede abusos de poder e expõe os verdadeiros custos da má governação.

Não precisamos de mais inflação — precisamos de mais integridade.

Está na hora de recuperarmos o controlo sobre a nossa vida financeira. De rejeitarmos os sistemas que nos empobrecem lentamente e de construirmos um futuro em que o dinheiro serve as pessoas — e não os interesses políticos.

O futuro do dinheiro pode e deve ser diferente. Juntos, podemos criar uma economia mais justa, livre e resiliente — onde a prosperidade é partilhada e a dignidade individual respeitada.

Photo by rc.xyz NFT gallery on Unsplash

-

@ 8f69ac99:4f92f5fd

2025-04-07 15:35:08

@ 8f69ac99:4f92f5fd

2025-04-07 15:35:08No dia 2 de Abril de 2025, o Presidente dos Estados Unidos, Donald Trump, anunciou um novo pacote abrangente de tarifas com o objectivo de combater os desequilíbrios comerciais e revitalizar as indústrias nacionais. Foi imposta uma tarifa geral de 10% sobre todas as importações, com taxas mais elevadas—34% para a China e 20% para a União Europeia—em preparação para entrar em vigor. O anúncio reacendeu debates antigos sobre proteccionismo, globalização e o futuro do dólar norte-americano.

Embora estas medidas possam parecer extremas, as tarifas são um instrumento tradicional da política comercial internacional. Países de todo o mundo, incluindo a União Europeia, utilizam-nas rotineiramente para proteger indústrias estratégicas, regular o comércio e gerar receitas. A UE, por exemplo, impõe há muito tempo taxas sobre produtos norte-americanos como bens agrícolas, maquinaria e têxteis. Em contrapartida, os EUA já taxaram importações da UE, como o aço, alumínio e aeronaves, em disputas comerciais.

O que distingue a proposta de Trump é a sua escala, ambição e o objectivo mais amplo: reestruturar a economia dos EUA. Por detrás desta estratégia está uma realidade económica mais profunda—moldada por décadas de défices comerciais, endividamento crescente e o papel do dólar como moeda de reserva mundial. Este artigo explora como estes factores se cruzam, por que razão os EUA se encontram numa posição precária, e se políticas como tarifas elevadas, taxas de juro baixas ou até o Bitcoin podem apontar o caminho a seguir.

As Raízes da Crise: Sobreconsumo e Desindustrialização nos EUA

Durante décadas, os Estados Unidos "viveram acima das suas possibilidades", acumulando um défice comercial que actualmente ultrapassa os 800 mil milhões de dólares por ano. Este desequilíbrio—em que o país compra mais do que vende ao exterior—é sintoma de um problema mais profundo. No pós-Segunda Guerra Mundial, os EUA eram uma potência industrial. Mas, a partir dos anos 70, e com maior intensidade nos anos 90, a globalização transferiu a produção para o estrangeiro. As empresas procuraram custos de mão de obra mais baixos e os mercados norte-americanos encheram-se de produtos fabricados fora.

Para sustentar este consumo, os EUA apoiaram-se na sua posição privilegiada: a emissão da moeda de reserva mundial. Isso gerou um ciclo de endividamento, com o país a pedir emprestado ao exterior para manter o nível de vida. O resultado? Desindustrialização. Fábricas fecharam e milhões de empregos na indústria desapareceram em estados como Ohio, Michigan e Pensilvânia.

Hoje, os EUA produzem muito menos—em proporção ao seu tamanho—do que há algumas décadas, mesmo mantendo um apetite crescente por importações. O défice comercial expõe uma fragilidade estrutural: um país cada vez mais incapaz de sustentar-se através da sua própria produção. Os dólares gastos fora regressam muitas vezes sob a forma de compras de dívida pública, perpetuando o ciclo.

À medida que os défices crescem e a economia depende cada vez mais de mecanismos financeiros do que da produção real, surge uma questão inevitável: até quando poderá a América continuar a comprar a crédito antes que o cartão seja recusado?

O Dilema de Triffin: Moeda Global vs. Potência Industrial

Imagine ser a única pessoa numa cidade com uma impressora de dinheiro que todos usam. Para satisfazer a procura, continua a imprimir e a enviar notas para o exterior—até que o seu próprio negócio local entra em decadência e se torna dependente dos outros. Esta é a essência do Dilema de Triffin, e a corda bamba que os EUA têm vindo a atravessar há gerações.

O dilema surge quando a moeda de um país é usada como padrão global. O dólar—utilizado mundialmente para transacções de petróleo, comércio e reservas—precisa de estar amplamente disponível. Essa abundância provém de défices comerciais persistentes por parte dos EUA.

Mas os défices têm um custo. Os dólares enviados para fora voltam como procura por bens estrangeiros, enfraquecendo a produção interna. Porque fabricar um produto em Detroit por 10 dólares, quando se pode importar por $2? Com o tempo, isto destrói a base industrial do país.

Esta não é uma preocupação teórica—é uma realidade histórica. O economista Robert Triffin advertiu nos anos 60 que um país não pode simultaneamente manter a sua moeda como padrão mundial e conservar uma base industrial sólida. Os EUA confirmaram essa previsão. Após a guerra, os dólares ajudaram a reconstruir a Europa e o Japão, mas esses mesmos países tornaram-se concorrentes industriais dos EUA em sectores como o aço e a indústria automóvel.

As fábricas abandonadas no Midwest e os teares silenciosos no sul são marcas visíveis desta troca. O domínio do dólar concedeu influência global à América, mas às custas da sua produção.

Espiral da Dívida: Obrigações Financeiras Crescentes dos EUA

Em 2025, a dívida federal dos EUA ultrapassa os 36 biliões de dólares ($36 000 000 000 000 000 000)—cerca de 108 mil dólares por cada americano, adultos, jovens, idosos. Durante anos, o acesso fácil ao crédito e a procura global por dívida americana mascararam os riscos. Agora, as fissuras estão à vista.

O problema não é apenas o montante—é o prazo e o custo de manter esta dívida. Grande parte dela é de curto prazo, exigindo refinanciamentos frequentes. Com o aumento das taxas de juro, os custos associados disparam. Só em 2024, os pagamentos de juros ultrapassaram 1 bilião de dólares—mais do que os orçamentos combinados de educação, transportes e habitação.

A “Lei de Ferguson”, proposta pelo historiador Niall Ferguson, afirma que quando os juros da dívida superam os gastos militares, o império está em declínio. Em 2025, os EUA gastam cerca de 900 mil milhões em defesa, e os encargos com juros já os ultrapassaram.

Este ponto de viragem trouxe problemas a impérios do passado—do Reino Unido após a Primeira Guerra Mundial até Roma no seu declínio. Hoje, cresce o cepticismo quanto à saúde fiscal dos EUA. Países como a China e a Rússia estão a reduzir as suas reservas em dívida americana, preferindo ouro, yuan ou outros activos.

Se mais nações seguirem o mesmo caminho, os EUA terão de escolher: continuar a endividar-se para sustentar o sistema ou aceitar um papel reduzido para o dólar na economia mundial.

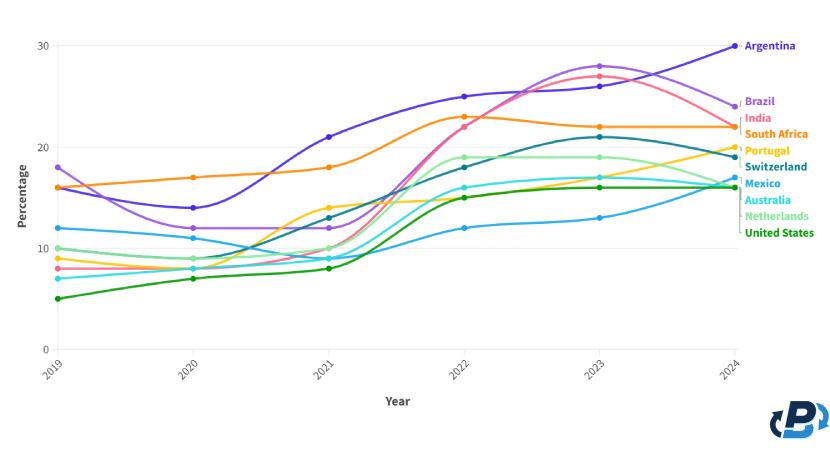

Desdolarização: A Mudança Global Longe do Dólar

A desdolarização refere-se à tendência crescente de reduzir a dependência do dólar nas transacções comerciais, reservas e sistemas financeiros. Embora o dólar ainda domine, a sua supremacia está sob crescente pressão de novas potências económicas e tensões geopolíticas.

Porque Está o Mundo a Afastar-se do Dólar?

- Risco Económico: A volatilidade do dólar, agravada pela dívida e instabilidade política nos EUA, torna-o menos fiável como reserva de valor.

- Instrumento Geopolítico: O uso do dólar pelos EUA para impor sanções leva rivais a procurar alternativas.

Alternativas Emergentes

- Ouro: Bancos centrais estão a reforçar as reservas em ouro como protecção.

- Commodities: Petróleo e cereais começam a ser transaccionados em moedas alternativas—como vendas de petróleo em yuan pela Arábia Saudita.

- Criptomoedas: Bitcoin e outros activos digitais ganham terreno como reservas neutras e descentralizadas.

- Moedas Regionais: Os países dos BRICS desenvolvem sistemas de pagamento e discutem uma moeda comum para reduzir a dependência do dólar.

Um Declínio Lento, Mas Visível

A percentagem do dólar nas reservas cambiais mundiais caiu de 70% no ano 2000 para menos de 60% actualmente. O comércio em moedas não-dólar cresceu 25% desde 2020. O domínio do dólar persiste, mas o movimento de mudança é claro.

A Estratégia Económica de Trump em 3 Etapas

Em 2025, Trump apresentou uma estratégia económica audaciosa em três frentes:

1. Tarifas Elevadas para Revitalizar a Indústria

Uma tarifa de 10% sobre todas as importações, com taxas superiores para países com superavit comercial, visa incentivar a produção interna. Críticos alertam para o aumento de preços e inflação, mas apoiantes defendem que é necessário para reindustrializar.

2. Redução das Taxas de Juro para Gerir a Dívida

A administração pressiona a Reserva Federal para baixar as taxas, reduzindo os encargos da dívida pública. Isto levanta preocupações sobre a independência do banco central e a estabilidade monetária a longo prazo.

3. Bitcoin como Activo Estratégico de Reserva

Num passo histórico, Trump assinou uma ordem executiva para criar a Reserva Estratégica de Bitcoin e o Stock Nacional de Activos Digitais. O objectivo é diversificar as reservas e proteger contra a inflação.

Riscos e Compensações

A estratégia económica de Trump não está isenta de riscos:

- Inflação: Tarifas mais altas poderão aumentar o custo de vida.

- Polarização Política: Medidas controversas poderão acentuar divisões internas.

- Incerteza Económica: O proteccionismo pode afastar investimento e travar a inovação.

- Instabilidade Monetária: Um erro na gestão da dívida ou dos activos digitais poderá enfraquecer o dólar.

Estes riscos exigem gestão cuidadosa para evitar agravar os problemas existentes.

O Papel de Bitcoin: Protecção ou Último Recurso?

Integrar Bitcoin nas reservas nacionais é ousado—mas pode ser revolucionário, e a meu ver, inevitável!

Vantagens

- Escassez: Com oferta limitada a 21 milhões de unidades, Bitcoin é deflacionário.

- Descentralização: Resistente à censura e manipulação, reforça a soberania financeira.

- Alcance Global: Sem fronteiras, permite trocas neutras num mundo multipolar.

Desafios

- Volatilidade: As flutuações no curto prazo são ainda significativas, mas a adopção institucional pode estabilizar o preço.

- Regulação: O enquadramento legal está em evolução, mas tende para maior clareza.

- Adopção Técnica: Persistem desafios de escalabilidade, embora soluções como a Lightning Network estejam a amadurecer.

A Reserva Estratégica de Bitcoin pode revelar-se visionária—ou precipitada. Tudo dependerá da execução e da aceitação global.

Futuros Possíveis: Crise ou Reinvenção?

Os EUA estão perante uma encruzilhada histórica. Um caminho aponta para a renovação: revitalizar a indústria e adoptar activos digitais, como por exemplo as stablecoins para perpetuar a hegemonia do dólar, lastreado em Bitcoin. O outro conduz à crise—com inflação, instabilidade e perda de influência global.

Num cenário optimista, os EUA emergem como líderes industriais e digitais, com reservas diversificadas que incluem Bitcoin. A recente ordem executiva para adquirir Bitcoin de forma neutra ao orçamento é um sinal positivo.

Num cenário pessimista, menos provável com as medidas em curso, o país mergulha em dívidas, vê o dólar enfraquecer e perde coesão interna. Mas com visão estratégica e inovação económica, há margem para navegar os desafios com sucesso.

Conclusão

A América enfrenta uma oportunidade única de redefinir o seu destino económico. A estratégia de Trump—baseada em tarifas, taxas de juro baixas e Bitcoin—pode marcar o início de uma nova era de resiliência e recuperação industrial.

A inclusão de Bitcoin nas reservas nacionais mostra que os instrumentos tradicionais já não bastam. Ao abraçar os activos digitais e restaurar a produção nacional, os EUA podem recuperar a liderança económica mundial.

O caminho será difícil. Mas com ousadia e execução eficaz, os Estados Unidos não só podem recuperar—podem reinventar-se.

-

@ 41fa852b:af7b7706

2025-05-18 09:33:15

@ 41fa852b:af7b7706

2025-05-18 09:33:15> "Only he who attempts the absurd is capable of achieving the impossible."—Miguel de Unamuno

It’s a busy week with the Bitcoin Ireland conference and Pizza Day celebrations in Thames Ditton and Bristol.

Support your local Bitcoin communities by attending as many of this week’s meetups and events as possible.

Let’s Go!

Upcoming Bitcoin Meetups

Happening this week…

-

Lincolnshire Bitcoin: Lincolnshire Bitcoin meets on the second Monday of each month at 7:30 PM in the Treaty of Commerce, Lincoln. Open to all, from OG’s to newcomers. This month on the 19th. 🍺

-

Bitcoin Surrey: This months Surrey meetup features special guest Freddie New, co-founder of Bitcoin Policy UK at The Bourne Club, 12 Frensham Rd GU9 8HB 18:00 with the talk starting at 19:00. 🍺🎤

-

Newcastle upon Tyne Bitcoin Meetup: The next Newcastle meetup is on Tuesday 20th May at Kabin @ Kabannas NE1 6UQ. 6:30 PM. 🍺

-

Bitcoin Glasgow: Bitcoin Glasgow meet every 3rd Wednesday of the month and this month will be at The Maltman, 59–61 Renfield Street at 18:00 to 20:00. 🍻

-

Bitcoinology @ Cyphermunk House: This will be primarily a social event. Attendees are encouraged to bring their burning questions to address as many as possible. Everyone is welcome, whether to share knowledge as an expert or to learn as a student. Bitcoinology will provide structure to ensure a shared learning experience that’s both engaging and enjoyable. 👨🏻🏫👨🏼🎓

-

Shropshire Bitcoin: On the 21st, the Shropshire crew will be meeting at the Admiral Benbow in Shrewsbury. 19:00 - 23:00. 🍺

-

Bitcoin Pizza Day at Thames Ditton: Celebrate Bitcoin Pizza Day with the Surrey Bitcoiners on May 22nd, 2025, in Thames Ditton, where local venues will be accepting Bitcoin for food and drinks in honour of the first real-world Bitcoin transaction. Just 20 minutes from London Waterloo, it’s the perfect chance to enjoy a slice, connect with fellow Bitcoiners, and support businesses embracing sound money. 🍕

-

Bitcoin Bristol - Pizza Day: If Thames Ditton is a bit too far, don’t worry. Bristol will also be celebrating Bitcoin Pizza Day in style on Thursday, May 22nd at 18:15 at Stable Pizza, Harbourside. This informal gathering offers a relaxed setting to chat over drinks in a lively public bar with no table reservations—just drop by. It’s a great chance to discuss Bitcoin news, ideas, and developments while meeting others in the local scene. Everyone is welcome, from curious newcomers to seasoned OGs, and all questions are encouraged. For help finding the group on the night, join the Telegram chat at t.me/BitcoinBristol. 🍕

-

The Satoshi Society - Southampton: Join a friendly group of bitcoiners at The Maritimo Lounge, Ocean Village on Friday 23rd May for food and a Bitcoin chat at 18:00. 🍺 🍴

-

Into The Valueverse: The first UK live music event, built on top of Bitcoin. Into the Valueverse is a celebration of artists brought together through Bitcoin. Performing live are Longy, a raw and rebellious voice from Southend blending rock, folk, and punk; Joe Martin, a heartfelt singer-songwriter inspired by folk and Americana greats; and Nathan Abbot, an Essex-based artist known for his soulful voice and powerful storytelling. The event takes place at The Fickle Pickle Club, 228 London Road, Westcliff-on-Sea, on Friday 23rd May, 2025. Doors open at 19:30, show starts at 20:00, and it’s for ages 18 and over. 🎶🎸🎤

-

Bitcoin Ireland Conference: Set to take place on Saturday, May 24, at The Green Isle Hotel in Dublin. This community-driven event aims to connect Irish Bitcoin enthusiasts, promote Bitcoin-friendly businesses, and educate the public about the potential of Bitcoin. Attendees can expect a day filled with insightful talks, networking opportunities, and discussions on various aspects of Bitcoin, including its impact on finance, energy, and society. The conference will feature a diverse lineup of speakers, including Daniel Prince, Knut Svanholm, Francis Pouliot, and British HODL, among others. Whether you’re a seasoned Bitcoiner or just curious about the technology, the Bitcoin Ireland Conference offers a platform to learn, share, and engage with the growing Bitcoin community in Ireland. 🎤🫂

-

Bitcoin Walk - Edinburgh: Every Saturday they walk around Arthur’s Seat in this historic city. Join them at 12 pm to chat about all things Bitcoin and keep fit. 🚶🏽♂️🚶🏼♀️🚶🏻

New Businesses Accepting Bitcoin

This week we have…

-

McCann Bespoke Tailors: Founded by Neil McCann in 2002, has grown from a South London garage into a leading name in British tailoring. Known for its craftsmanship and high-profile partnerships–from the Savoy Hotel to Premier League clubs–the brand now operates a flagship store on Lime Street with a private bar and dedicated consultation space. McCann Bespoke is now accepting Bitcoin. 👔

-

Moradok Siam in Romsey: Bun is a specialist in deep tissue massage, known for helping those suffering from persistent muscular aches and pains; particularly in the back, shoulders, and neck. Drawing on years of experience, she works with precision to identify problem areas and applies targeted techniques to relieve tension and restore movement. Her treatments aren’t for the faint-hearted, but they offer real results. Many clients are referred by local doctors after conventional treatments like injections and medication have failed. For lasting relief, regular appointments are strongly recommended. 💆🏻♂️

Upcoming Special Events

These events aren’t happening next week, but they’re important to add to your calendar now as tickets are selling fast.

Bloom Festival 2025: Takes place 31 May – 1 June at Cypher Munk House, London. This open-source celebration brings together developers, artists, and tinkerers to explore tech, culture, and Bitcoin.

🎤 Talks & Panels

Topics include:

-

Open-source innovation

-

The Bitcoin whitepaper

-

Decentralized publishing

-

Bitcoin in UK education

🛠️ Workshops

Get hands-on with:

-

Off-grid mesh networks

-

DIY Bitcoin signing devices

-

Censorship-resistant publishing

-

Creative coding with open tools

🎨 Creative & Cultural

-

Collaborative art & music

-

Acoustic performances

-

Bitcoin-inspired exhibitions

🛍️ The Souk

-

Open-source hardware

-

Seed storage gear

-

Prints and handmade goods

Children of Riddim Festival - Bitcoin Stage: This is shaping up to be one of the biggest music festivals with Bitcoin vibes in the world.

Around 150 DJs, artists, and speakers will perform over four days, from 12–16 June, in Hemel Hempstead. A dedicated stage, the Barn of Freedom, will spotlight Bitcoin culture, education, and unstoppable apps on the Nostr protocol–alongside music, talks, and much more.

Support for the Barn of Freedom stage can be given via geyser.fund, where both ticket purchases and donations are welcome. One-day and four-day passes are available, and on-site camping is included.

Confirmed names include Joe Bryan, Metamick (Geyser Fund), Roger9000, Angor, MadMunky, Huxley, and many more.

The Bitcoin Beach Retreat: An annual Bitcoin-only gathering held at a scenic coastal campsite in North Wales. Celebrating its fifth year in 2025, the retreat offers a relaxed, community-driven alternative to traditional conferences. From July 11–14, up to 120 Bitcoiners will come together to share knowledge, enjoy beachside BBQs, and strengthen their networks under the stars. With no pre-booked speakers, the event thrives on peer-led workshops and spontaneous discussions, fostering genuine connections among attendees. Emphasising local engagement, the retreat directs the majority of its funds into the surrounding community, with 42% of expenses paid in Bitcoin last year. Whether attending solo or with family, attendees can expect a welcoming environment dedicated to sound money and shared values.

Get Involved

-

Volunteer: Passionate about merchant adoption? Reach out to Bridge2Bitcoin on Twitter or website.

-

Start a Meetup: Want to launch a Bitcoin meetup? We’ll support you. Contact us on Twitter or just reply to this email.

-

Contribute to BTCMaps: Help maintain this key Bitcoin resource—no coding skills needed. Update a UK area.

-

Telegram: Join our Channel for UK meetup updates

-

Feedback: Reply to this email with ideas and suggestions.

This week’s sponsors is…

Get out and support the meetups where you can, visit Bitcoin Events UK for more info on each meetup and to find your closest on the interactive map.

Stay tuned for more updates next week!

Simon.

-

-

@ 8f69ac99:4f92f5fd

2025-04-01 15:54:53

@ 8f69ac99:4f92f5fd

2025-04-01 15:54:53Bitcoin tem-se afirmado como um meio de pagamento global, atraindo cada vez mais comerciantes e consumidores. Em Portugal, os pequenos e médios empresários têm uma oportunidade única para reduzir custos, expandir mercados e proteger-se da inflação ao aceitar bitcoin como opção pagamento.

Apesar das vantagens, muitos comerciantes enfrentam desafios significativos, especialmente no que toca às obrigações fiscais e à falta de conhecimento (ou vontade de aprender) por parte dos contabilistas. Questões como o registo contábil adequado, a tributação do IRC e a facturação com IVA ainda geram incerteza e dificultam a adopção da criptomoeda.

Este artigo explora como os comerciantes podem aceitar bitcoin de forma legal e eficiente, analisa os desafios fiscais e contábeis e apresenta soluções práticas para superar os obstáculos impostos pela regulamentação e pela falta de apoio dos profissionais de contabilidade.

Benefícios de Aceitar Bitcoin

1. Redução de Custos

Aceitar pagamentos em bitcoin permite evitar taxas bancárias elevadas, especialmente em transacções internacionais. Como as transferências ocorrem directamente entre carteiras digitais, sem a intermediação de bancos, os comerciantes podem poupar significativamente em comissões e taxas de processamento.

2. Liquidação Rápida

Diferente dos pagamentos bancários tradicionais, que podem demorar dias, uma transacção na rede Bitcoin pode ser confirmada em minutos, ou em segundos ou menos usando a Lightning Network. Isto reduz o tempo de espera para a disponibilidade dos fundos e melhora o fluxo de caixa dos comerciantes.

3. Expansão de Mercado

Os comerciantes podem atrair clientes internacionais e um público mais inovador e tecnológico. A aceitação de bitcoin pode diferenciar um negócio da concorrência e aumentar a base de clientes ao incluir entusiastas de criptomoedas e consumidores que preferem meios de pagamento descentralizados.

4. Protecção Contra Inflação

Bitcoin pode actuar como reserva de valor, protegendo o património contra desvalorizações monetárias. Em contextos de inflação elevada, manter parte do capital em Bitcoin pode ajudar a preservar o poder de compra a longo prazo.

|

|

|:--:|

| Bruno de Gouveia da Care to Beauty - A Seita Bitcoin |

|

|:--:|

| Bruno de Gouveia da Care to Beauty - A Seita Bitcoin |Como Funciona na Prática?

1. Aceitação Directa vs. Conversão Automática

Os comerciantes podem optar por aceitar bitcoin directamente, mantendo-o na sua carteira digital, ou utilizar serviços como OpenNode, Swiss Bitcoin Pay, Coincorner ou Coinbase para converter automaticamente os pagamentos em euros. A escolha depende da estratégia da empresa quanto à exposição à volatilidade da criptomoeda.

2. Configuração de Carteira Bitcoin

Para receber pagamentos directamente, o comerciante precisa de uma carteira Bitcoin segura, como Electrum, BlueWallet ou Aqua entre outras. Estas carteiras oferecem diferentes níveis de segurança e acessibilidade, permitindo que os comerciantes escolham a solução mais adequada ao seu modelo de negócio.

3. Facturação e Registo Contábil

Cada pagamento deve ser facturado em euros, com referência à taxa de câmbio do momento. O registo contábil deve ser feito correctamente para garantir a conformidade fiscal, reflectindo o valor recebido em bitcoin e a sua equivalência em euros na altura da transacção. Muitas carteiras e plataformas de pagamento oferecem relatórios detalhados que facilitam o registo contábil e a declaração fiscal.

Obrigações Fiscais e Contábeis

1. IRC (Imposto sobre o Rendimento das Pessoas Colectivas)

Os rendimentos obtidos através de bitcoin devem ser devidamente registados na contabilidade da empresa, uma vez que são considerados receitas operacionais. Para efeitos fiscais, a conversão do valor recebido em bitcoin deve ser feita com base na taxa de câmbio vigente no momento da transacção, garantindo um registo transparente e conforme com as normas contábeis.

Se a empresa optar por manter os bitcoins sem os converter imediatamente para euros, estes podem ser classificados como activos intangíveis, conforme a Norma Contabilística e de Relato Financeiro (NCRF), artigo 6. No entanto, se forem utilizados como meio de pagamento recorrente, por exemplo pagar a fornecedores que também aceitem bitcoin, podem ser classificados como inventário, dependendo da natureza da actividade empresarial.

No momento da venda ou conversão dos bitcoins para euros, qualquer mais-valia obtida é considerada um rendimento da empresa e estará sujeita a tributação em sede de IRC à taxa geral em vigor.

2. IVA (Imposto sobre o Valor Acrescentado)

As transacções de troca de bitcoin por euros estão isentas de IVA, conforme o artigo 9.º, alínea 27), subalínea d), do Código do IVA (CIVA), que reconhece as criptomoedas como meios de pagamento e as exclui da incidência de IVA.

No entanto, a venda de bens ou serviços pagos em bitcoin deve ser facturada normalmente, em euros, com a taxa de IVA correspondente ao produto ou serviço comercializado. Para garantir conformidade fiscal, a factura deve indicar a contrapartida em euros, com base na taxa de câmbio do momento da transacção, independentemente da moeda utilizada no pagamento.

Na prática, aceitar pagamento em bitcoin funciona de forma muito semelhante a aceitar pagamento em dinheiro físico... 😉

3. Registos e Demonstrações Financeiras

As empresas que aceitam bitcoin devem manter registos contabilísticos detalhados sobre todas as transacções realizadas. bitcoin pode ser registado como activo intangível ou inventário, dependendo do seu uso:

- Activo intangível: Quando a empresa detém bitcoin como reserva de valor ou investimento, registando-o ao custo de aquisição e procedendo a ajustamentos caso haja desvalorização relevante.

- Inventário: Se a empresa opera no sector de compra e venda de criptomoedas ou usa bitcoin para transacções comerciais frequentes, deve ser registado como inventário, seguindo as regras de mensuração aplicáveis a mercadorias.

As demonstrações financeiras devem reflectir correctamente a posse de bitcoin, incluindo informações sobre variações de valor ao longo do tempo. Os contabilistas devem garantir a correta apresentação destes activos nos balanços e relatórios anuais, o que pode exigir reavaliação periódica dos valores contabilizados.

O Obstáculo: Contabilistas e a Falta de Apoio

1. Falta de Conhecimento

Muitos TOC não estão familiarizados com a contabilidade de criptomoedas, o que gera incertezas e complicações para os comerciantes.

2. Resistência e Falta de Vontade

Em vez de se actualizarem, muitos contabilistas recusam-se a aprender sobre Bitcoin, deixando os comerciantes sem apoio adequado.

3. Impacto nos Negócios

Com a falta de informação e apoio dos TOC, muitos comerciantes evitam aceitar bitcoin, perdendo uma oportunidade de mercado.

Soluções e Alternativas

1. Educação e Autonomia

Os comerciantes podem aprender o essencial sobre contabilidade de bitcoin para questionar e orientar os seus contabilistas. Existem recursos online, cursos e materiais educativos que permitem aos empresários compreender as melhores práticas para registo e declaração das transacções em bitcoin.

2. Ferramentas e Software

Existem algumas plataformas que ajudam na gestão e declaração de criptomoedas, fornecendo relatórios detalhados sobre transacções, ganhos e impostos devidos. Essas ferramentas facilitam a organização financeira e reduzem erros contábeis.

3. Rede de Apoio

Juntar-se a comunidades de empresários e especialistas em bitcoin pode ajudar a encontrar soluções e recomendações de contabilistas competentes. Fóruns, grupos em redes sociais e associações focadas no tema podem ser excelentes fontes de suporte e partilha de experiências.

4. Links uteis

Conclusão

Aceitar bitcoin pode ser vantajoso para pequenos e médios comerciantes, mas a burocracia e a falta de conhecimento dos contabilistas dificultam esse processo. É essencial que os comerciantes exijam um melhor serviço dos seus TOC e procurem alternativas para garantir que estão em conformidade com a lei, aproveitando ao mesmo tempo os benefícios desta nova forma de pagamento.

Disclaimer: Este artigo é meramente informativo e não deve ser considerado como aconselhamento jurídico ou fiscal. É recomendável consultar um profissional qualificado para obter orientações específicas sobre a aceitação de bitcoin e as obrigações fiscais associadas. A legislação pode variar e é importante estar sempre actualizado com as normas vigentes. A responsabilidade pela aceitação de bitcoin e o cumprimento das obrigações fiscais recai exclusivamente sobre o comerciante. O autor não se responsabiliza por quaisquer consequências decorrentes da aceitação de bitcoin ou da interpretação das informações contidas neste artigo.

Photo by CardMapr.nl on Unsplash

-

@ 609f186c:0aa4e8af

2025-05-16 20:57:43

@ 609f186c:0aa4e8af

2025-05-16 20:57:43Google says that Android 16 is slated to feature an optional high security mode. Cool.

Advanced Protection has a bunch of requested features that address the kinds of threats we worry about.

It's the kind of 'turn this one thing on if you face elevated risk' that we've been asking for from Google.

And likely reflects some learning after Google watched Apple 's Lockdown Mode play out. I see a lot of value in this..

Here are some features I'm excited to see play out:

The Intrusion Logging feature is interesting & is going to impose substantial cost on attackers trying to hide evidence of exploitation. Logs get e2ee encrypted into the cloud. This one is spicy.

The Offline Lock, Inactivity Reboot & USB protection will frustrate non-consensual attempts to physically grab device data.

Memory Tagging Extension is going to make a lot of attack & exploitation categories harder.

2G Network Protection & disabling Auto-connect to insecure networks are going to address categories of threat from things like IMSI catchers & hostile WiFi.

I'm curious about some other features such as:

Spam & Scam detection: Google messages feature that suggests message content awareness and some kind of scanning.

Scam detection for Phone by Google is interesting & coming later. The way it is described suggests phone conversation awareness. This also addresses a different category of threat than the stuff above. I can see it addressing a whole category of bad things that regular users (& high risk ones too!) face. Will be curious how privacy is addressed or if this done purely locally. Getting messy: Friction points? I see Google thinking these through, but I'm going to add a potential concern: what will users do when they encounter friction? Will they turn this off & forget to re-enable? We've seen users turn off iOS Lockdown Mode when they run into friction for specific websites or, say, legacy WiFi. They then forget to turn it back on. And stay vulnerable.

Bottom line: users disabling Apple's Lockdown Mode for a temporary thing & leaving it off because they forget to turn it on happens a lot. This is a serious % of users in my experience...

And should be factored into design decisions for similar modes. I feel like a good balance is a 'snooze button' or equivalent so that users can disable all/some features for a brief few minute period to do something they need to do, and then auto re-enable.

Winding up:

I'm excited to see how Android Advanced Protection plays with high risk users' experiences. I'm also super curious whether the spam/scam detection features may also be helpful to more vulnerable users (think: aging seniors)...

Niche but important: