-

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52

@ 9ca447d2:fbf5a36d

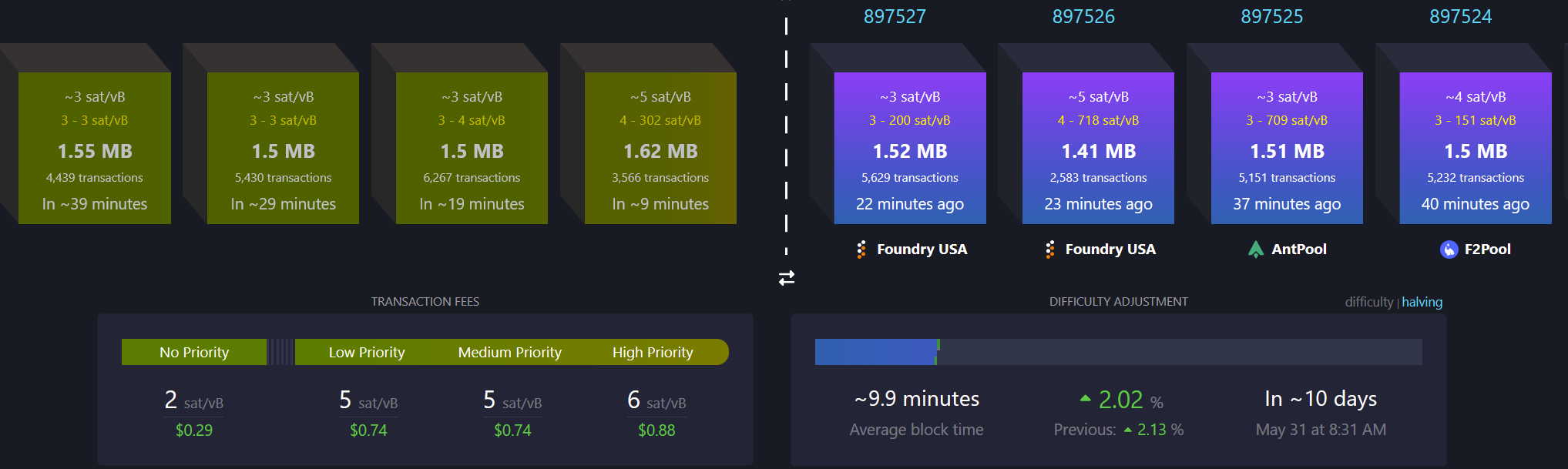

2025-05-22 14:01:52Gen Z (those born between 1997 and 2012) are not rushing to stack sats, and Oliver Porter, Founder & CEO of Jippi, understands the challenge better than most. His strategy revolves around adapting Bitcoin education to fit seamlessly into the digital lives of young adults.

“We need to meet them where they are,” Oliver explains. “90% of Gen Z plays games. 70% expect to earn rewards.”

So, what will effectively introduce them to Bitcoin? In Oliver’s mind, the answer is simple: games that don’t feel preachy but still plant the orange pill.

Learn more at Jippi.app

That’s exactly what Jippi is. Based in Austin, Texas, the team has created a mobile augmented reality (AR) game that rewards players in bitcoin and sneakily teaches them why sound money matters.

“It’s Pokémon GO… but for sats,” Oliver puts it succinctly.

Jippi is like Pokemon Go, but for sats

Oliver’s Bitcoin journey, like many in the space, began long before he was ready. A former colleague had tried planting the seed years earlier, handing him a copy of The Bitcoin Standard. But the moment passed.

It wasn’t until the chaos of 2020 when lockdowns hit, printing presses roared, and civil liberties shrank that the message finally landed for him.

“The government got so good at doing reverse Robin Hood,” Oliver explains. “They steal from the working population and reward the rich.”

By 2020, though, the absurdity of the covid hysteria had caused his eyes to be opened and the orange light seemed the best path back to freedom.

He left the UK for Austin “one of the best places for Bitcoiners,” he says, and dove headfirst into the industry, working at Swan for a year before founding Jippi on PlebLab’s accelerator program.

Jippi’s flagship game lets players roam their cities hunting digital creatures, Bitcoin Beasts, tied to real-world locations. Catching them requires answering Bitcoin trivia, and the reward is sats.

No jargon. No hour-long lectures. Just gameplay with sound money principles woven right in.

The model is working. At a recent hackathon in Austin, Jippi beat out 14 other teams to win first place and $15,000 in prize money.

Oliver of Jippi won Top Builder Season 2 — PlebLab on X

“We’re backdooring Bitcoin education,” Oliver admits. “And while we’re at it, encouraging people to get outside and touch grass.”

Not everyone’s been thrilled. When Jippi team members visited one of the more liberal-leaning places in Texas, UT Austin, to test interest in Bitcoin, they found some seriously committed no-coiners on the campus.

“One young woman told me, ‘I would rather die than talk about Bitcoin,'” Oliver recalls, highlighting the cultural resistance that’s built up among younger demographics.

This resistance is backed by hard data. According to Oliver, some of the Bitcoin podcasters they met with in the space to do market research reported that less than 1% of their listeners are from Gen Z and that number is dropping.

“Unless we find a way to capture their interest in a meaningful way, there’s going to be a big problem around trying to sway Gen Z away from the siren call of s***coins and crypto casinos and towards Bitcoin,” Oliver warns.

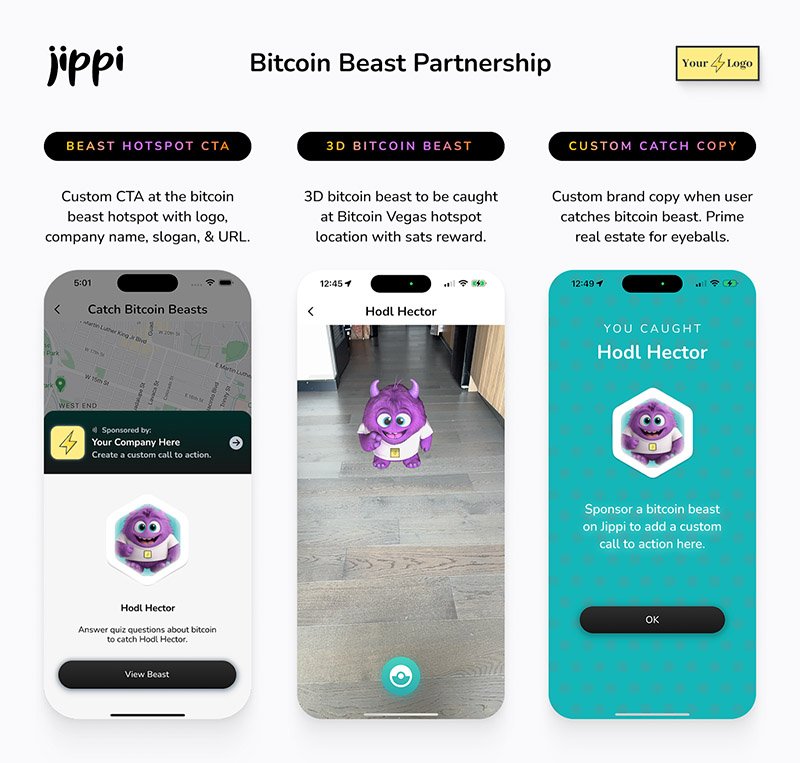

Jippi’s next big move is Las Vegas, where they’ll launch the Beast Catch experience at the Venetian during a major Bitcoin event. To mark the occasion, they’re opening up six limited sponsorship spots for Bitcoin companies, each one tied to a custom in-game beast.

Jippi looks to launch a special event at Bitcoin 2025

“It’s real estate inside the game,” Oliver explains. “Brands become allies, not intrusions. You get a logo, company name, and call to action, so we can push people to your site or app.”

Bitcoin Well—an automatic self-custody Bitcoin platform—has claimed Beast #1. Only five exclusive spots remain for Bitcoin companies to “beastify their brand” through Jippi’s immersive AR game.

“I love the Jippi mission. I think gamified learning is how we will onboard the next generation and it’s exciting to see what the Jippi team is doing! I love working with bitcoiners towards our common mission – bullish!” said Adam O’Brien, Bitcoin Well CEO.

Jippi’s sponsorship model is simple: align incentives, respect users, and support builders. Instead of throwing ad money at tech giants, Bitcoin companies can connect with new users naturally while they’re having fun and earning sats in the process.

For Bitcoin companies looking to reach a younger demographic, this represents a unique opportunity to showcase their brand to up to 30,000 potential customers at the Vegas event.

Jippi Bitcoin Beast partnership

While Jippi’s current focus is simple, get the game into more cities, Oliver sees a future where AR glasses and AI help personalize Bitcoin education even further.

“The magic is going to really happen when Apple releases the glasses form factor,” he says, describing how augmented reality could enhance real-world connections rather than isolate users.

In the longer term, Jippi aims to evolve from a free-to-play model toward a pay-to-play version with higher stakes. Users would form “tribes” with friends to compete for substantial bitcoin prizes, creating social connections along with financial education.

Unlike VC-backed startups, Jippi is raising funds pleb style via Timestamp, an open investment platform for Bitcoin companies.

“You don’t have to be an accredited investor,” Oliver explains. “You’re directly supporting the parallel Bitcoin economy by investing in Bitcoin companies for equity.”

Anyone can invest as little as $100. Perks include early access, exclusive game content, and even creating your own beast design with your name/pseudonym and unique game lore. Each investment comes with direct ownership of an early-stage Bitcoin company like Jippi.

For Oliver, this is more than just a business. It’s about future-proofing Bitcoin adoption and ensuring Satoshi’s vision lives on, especially as many people are lured by altcoins, NFTs, and social media dopamine.

“We’re on the right side of history,” he says firmly. “I want my grandkids to know that early on in the Bitcoin revolution, games like Jippi helped make it stick.”

In a world increasingly absorbed by screens and short attention spans, Jippi’s combination of outdoor play, sats rewards, and Bitcoin education might be exactly the bridge Gen Z needs.

Interested in sponsoring a Beast or investing in Jippi? Reach out to Jippi directly by heading to their partnerships page on their website or visit their Timestamp page to invest in Jippi today.

-

@ 1817b617:715fb372

2025-05-22 23:39:18

@ 1817b617:715fb372

2025-05-22 23:39:18🚀 Instantly Send Spendable Flash BTC, ETH, & USDT — 100% Blockchain-Verifiable!

Step into the future of cryptocurrency innovation with CryptoFlashingTool.com — your go-to solution for sending spendable Flash Bitcoin (BTC), Ethereum (ETH), and USDT transactions. Using cutting-edge 🔥 Race/Finney-style blockchain simulation, our technology generates coins that are virtually indistinguishable from real, fully confirmed blockchain transactions. Transactions stay live and spendable from 60 up to 360 days!

🌐 Explore all the details at cryptoflashingtool.com.

🌟 Why Trust Our Crypto Flashing System? Whether you’re a blockchain enthusiast, ethical hacker, security expert, or digital entrepreneur, our solution offers a perfect mix of authenticity, speed, and flexibility.

🎯 Top Features You’ll Love: ✅ Instant Blockchain Simulation: Transactions are complete with valid wallet addresses, transaction IDs, and real confirmations.

🔒 Privacy First: Works flawlessly with VPNs, TOR, and proxies to keep you fully anonymous.

🖥️ User-Friendly Software: Built for Windows, beginner and pro-friendly with simple step-by-step guidance.

📅 Flexible Flash Durations: Choose how long coins stay valid — from 60 to 360 days.

🔄 Full Wallet Compatibility: Instantly flash coins to SegWit, Legacy, or BCH32 wallets with ease.

💱 Exchange-Ready: Spend your flashed coins on leading exchanges like Kraken and Huobi.

📊 Proven Results: ✅ Over 79 billion flash transactions completed. ✅ 3000+ satisfied users around the globe. ✅ 42 active blockchain nodes ensuring fast, seamless performance.

📌 How It Works: Step 1️⃣: Input Transaction Info

Pick your coin (BTC, ETH, USDT: TRC-20, ERC-20, BEP-20). Set amount and flash duration. Enter the recipient wallet (auto-validated). Step 2️⃣: Make Payment

Pay in your selected crypto. Scan the QR code or use the provided address. Upload your transaction proof (hash and screenshot). Step 3️⃣: Launch the Flash

Blockchain confirmation simulation happens instantly. Your transaction appears real within seconds. Step 4️⃣: Verify & Spend

Access your flashed coins immediately. Verify your transactions using blockchain explorers. 🛡️ Why Our Flashing Tech Leads the Market: 🔗 Race/Finney Attack Mechanics: Mimics authentic blockchain behavior. 🖥️ Private iNode Clusters: Deliver fast syncing and reliable confirmation. ⏰ Live Timer: Ensures fresh, legitimate transactions. 🔍 Real Blockchain TX IDs: All transactions come with verifiable IDs.

❓ FAQs:

Is flashing secure? ✅ Yes, fully encrypted with VPN/proxy compatibility. Multiple devices? ✅ Yes, up to 5 Windows PCs per license. Chargebacks possible? ❌ No, flashing is irreversible. Spendability? ✅ Flash coins stay spendable 60–360 days. Verification after expiry? ❌ No, transactions expire after the set time. Support? ✅ 24/7 Telegram and WhatsApp help available. 🔐 Independent, Transparent, Trusted:

At CryptoFlashingTool.com, we pride ourselves on unmatched transparency, speed, and reliability. See our excellent reviews on ScamAdvisor and top crypto forums!

📲 Contact Us: 📞 WhatsApp: +1 770 666 2531 ✈️ Telegram: @cryptoflashingtool

🎉 Ready to Flash Like a Pro?

💰 Buy Flash Coins Now 🖥️ Get Your Flashing Software

The safest, smartest, and most powerful crypto flashing solution is here — only at CryptoFlashingTool.com!

Instantly Send Spendable Flash BTC, ETH, & USDT — 100% Blockchain-Verifiable!

Step into the future of cryptocurrency innovation with CryptoFlashingTool.com — your go-to solution for sending spendable Flash Bitcoin (BTC), Ethereum (ETH), and USDT transactions. Using cutting-edge

Race/Finney-style blockchain simulation, our technology generates coins that are virtually indistinguishable from real, fully confirmed blockchain transactions. Transactions stay live and spendable from 60 up to 360 days!

Explore all the details at cryptoflashingtool.com.

Why Trust Our Crypto Flashing System? Whether you’re a blockchain enthusiast, ethical hacker, security expert, or digital entrepreneur, our solution offers a perfect mix of authenticity, speed, and flexibility.

Top Features You’ll Love:

Instant Blockchain Simulation: Transactions are complete with valid wallet addresses, transaction IDs, and real confirmations.

Privacy First: Works flawlessly with VPNs, TOR, and proxies to keep you fully anonymous.

User-Friendly Software: Built for Windows, beginner and pro-friendly with simple step-by-step guidance.

Flexible Flash Durations: Choose how long coins stay valid — from 60 to 360 days.

Full Wallet Compatibility: Instantly flash coins to SegWit, Legacy, or BCH32 wallets with ease.

Exchange-Ready: Spend your flashed coins on leading exchanges like Kraken and Huobi.

Proven Results:

Over 79 billion flash transactions completed.

3000+ satisfied users around the globe.

42 active blockchain nodes ensuring fast, seamless performance.

How It Works: Step

: Input Transaction Info

- Pick your coin (BTC, ETH, USDT: TRC-20, ERC-20, BEP-20).

- Set amount and flash duration.

- Enter the recipient wallet (auto-validated).

Step

: Make Payment

- Pay in your selected crypto.

- Scan the QR code or use the provided address.

- Upload your transaction proof (hash and screenshot).

Step

: Launch the Flash

- Blockchain confirmation simulation happens instantly.

- Your transaction appears real within seconds.

Step

: Verify & Spend

- Access your flashed coins immediately.

- Verify your transactions using blockchain explorers.

Why Our Flashing Tech Leads the Market:

Race/Finney Attack Mechanics: Mimics authentic blockchain behavior.

Private iNode Clusters: Deliver fast syncing and reliable confirmation.

Live Timer: Ensures fresh, legitimate transactions.

Real Blockchain TX IDs: All transactions come with verifiable IDs.

FAQs:

- Is flashing secure?

Yes, fully encrypted with VPN/proxy compatibility. - Multiple devices?

Yes, up to 5 Windows PCs per license. - Chargebacks possible?

No, flashing is irreversible. - Spendability?

Flash coins stay spendable 60–360 days. - Verification after expiry?

No, transactions expire after the set time. - Support?

24/7 Telegram and WhatsApp help available.

Independent, Transparent, Trusted:

At CryptoFlashingTool.com, we pride ourselves on unmatched transparency, speed, and reliability. See our excellent reviews on ScamAdvisor and top crypto forums!

Contact Us:

WhatsApp: +1 770 666 2531

Telegram: @cryptoflashingtool

Ready to Flash Like a Pro?

The safest, smartest, and most powerful crypto flashing solution is here — only at CryptoFlashingTool.com!

-

@ c9badfea:610f861a

2025-05-10 11:08:51

@ c9badfea:610f861a

2025-05-10 11:08:51- Install FUTO Keyboard (it's free and open source)

- Launch the app, tap Switch Input Methods and select FUTO Keyboard

- For voice input, choose FUTO Keyboard (needs mic permission) and grant permission While Using The App

- Configure keyboard layouts under Languages & Models as needed

Adding Support for Non-English Languages

Voice Input

- Download voice input models from the FUTO Keyboard Add-Ons page

- For languages like Chinese, German, Spanish, Russian, French, Portuguese, Korean, and Japanese, download the Multilingual-74 model

- For other languages, download Multilingual-244

- Open FUTO Keyboard, go to Languages & Models, and import the downloaded model under Voice Input

Dictionaries

- Get dictionary files from AOSP Dictionaries

- Open FUTO Keyboard, navigate to Languages & Models, and import the dictionary under Dictionary

ℹ️ When typing, tap the microphone icon to use voice input

-

@ 57d1a264:69f1fee1

2025-05-22 13:13:36

@ 57d1a264:69f1fee1

2025-05-22 13:13:36Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986624

-

@ 57d1a264:69f1fee1

2025-05-22 12:36:20

@ 57d1a264:69f1fee1

2025-05-22 12:36:20Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986587

-

@ 3eba5ef4:751f23ae

2025-05-23 01:12:10

@ 3eba5ef4:751f23ae

2025-05-23 01:12:10Crypto Insights

Introducing Generalized Program Composition and Coin Delegation into Bitcoin

Joshua Doman proposed a proof-of-concept called Graftleaf, aiming to achieve generalized program composition and delegation in Taproot in a simple and secure way. Graftleaf is a new Taproot leaf version (0xc2) that uses the annex to perform delegation. It adds two key features:

-

Composition: The ability to sequentially execute zero, one, or multiple witness programs, including a locking script.

-

Delegation: The ability to add additional spending conditions at signing time, which can include arbitrary combinations of programs and scripts.

This design overcomes the limitations of previous proposals by supporting complex script composition and delegation, promising backward compatibility, improved privacy and fungibility with the existing P2TR addresses.

Why OP_CHECKCONTRACTVERIFY (CCV) Will Replace OP_VAULT

A post mainly discusses the current status of Bitcoin script opcode OP_VAULT (BIP-345) and the possibility of it being replaced by OP_CHECKCONTRACTVERIFY (CCV, BIP-443). Key factors include:

-

CCV is a more general version of OP_VAULT, inheriting some features such as amount modes and deferred (cross-input) checks.

-

CCV supports replacing multiple script tapleaf nodes, has a simpler interface, and a lighter script interpreter implementation.

The author also points out CCV’s shortcomings and possible future extensions:

-

Currently, there is a lack of supporting documentation and tools, and the BIP is not yet fully completed.

-

A VAULT-decorator opcode may be needed to implement certain advanced features, such as requiring collateral lockup when unvaulting, or adding some rate-limiting behavior. These features are currently difficult to achieve.

Despite this, CCV remains a better foundation for building vault functionality.

Enabling Recursive Covenants via Self-Replication

Bram Cohen proposed adding a few simple opcodes to Bitcoin Script to enable recursive covenants in a natural and straightforward way. He illustrated with examples that a practical and useful script can be achieved through Quine, without other more complex tricks; developers writing recursive covenants must be aware of the importance of this approach.

UTXO Set Report from Mempool Research: Nearly Half of Bitcoin UTXOs Are Less Than 1,000 Sats

During the OP_RETURN debate in April-May 2025, the impact of inserting arbitrary data into transactions on the UTXO set sparked much discussion. In this report, Mempool studied the UTXO set, highlighting the fragmentation and bloat issues, especially due to small transactions and data embedding, which increase the storage and validation burden for node operators.

Key findings include:

-

Severe Bloat: Currently, about 49% of UTXOs are less than 1,000 satoshis (about $1). Most of these use Taproot address format and may be related to data embedding schemes (like Ordinals) or related transfer mechanisms. Although these UTXOs can usually be spent, before they are, they increase the storage and validation burden for all node operators.

-

Significant Proportion of Inscription-Related UTXOs: About 30% of UTXOs are related to inscription.

-

Large Number of Long-Unspent UTXOs: There are over 100,000 old Counterparty UTXOs using Pay to Multisig (p2ms) scripts, which have existed for over 10 years. Although they make up a small proportion of the total (about 173 million UTXOs), they are a typical example of UTXO bloat.

-

Taproot Becomes the Most Common UTXO Type: Among all UTXO types, Taproot (p2tr) has the highest proportion at 34.2%, followed by traditional p2pkh (28.8%) and p2wpkh (26.5%). However, in terms of total value stored, Taproot’s share is relatively low, indicating it is mainly used for small transactions or data embedding.

The report concludes by mentioning that as the UTXO sets continue to grow, Utreexo and SwiftSync are two scaling methods for maintaining Bitcoin’s accessibility to a wide range of node operators.

Visualization of Bitcoin Mainnet Data

mainnet-observer, built and maintained by developer @0xB10C, visualizes multiple data points from the Bitcoin mainnet, including:

-

Mining a single block currently requires over ~500,000,000,000,000,000,000,000,000 (500 zeta or 5×10²³) hash attempts.

-

Over 42 BTC are now permanently lost in provably unspendable OP_RETURN outputs.

-

Daily updated “Mining Centralization Index” (with proxy pools)

-

Bitcoin mining is currently highly centralized, with 6 pools producing and mining over 95% of block templates.

Path Queries: Addressing Payment Reliability and Routing Limitations

brh28 initiated a discussion on Lightning Network payment routing, focusing on issues like liquidity uncertainty and inefficient path discovery. He proposed a new path query mechanism—allowing nodes to dynamically share information through path queries, fostering a more decentralized routing ecosystem. This can improve the success rate of large payments and reduce reliance on a completely synced channel graph. Although there are still some privacy concerns, this method provides nodes with a controllable information disclosure mechanism and is expected to revolutionize current payment routing approaches.

Bitlayer and Sui Achieve Trust-Minimized BitVM Bridge

Bitlayer and Sui integrated the BitVM Bridge, launching Peg-BTC (YBTC)—bridging native Bitcoin to the Sui ecosystem via BitVM Bridge. BitVM Bridge is a trust-minimized bridge powered by Bitlayer and supported by the advanced BitVM smart contract framework.

Ark Protocol Litepaper

Ark recently released its litepaper: Ark: A UTXO-based Transaction Batching Protocol, outlining its technical foundation. As an innovative Bitcoin scaling protocol, Ark enables off-chain transaction execution while allowing users full control over their funds. This is achieved by introducing “virtual UTXOs” (VTXOs), allowing users to transact off-chain while retaining the ability to unilaterally exit to the Bitcoin main chain. Coordinated by an operator who batches user activities into on-chain commitments, Ark achieves high transaction throughput with minimal on-chain footprint. This provides Bitcoin with a simple and user-friendly scaling solution that offers a practical path for Layer 2 solutions that are inefficient or costly to execute on the main chain.

Top Reads on Blockchain and Beyond

List of Known Real-World Bitcoin Attack Incidents

Here is a list of real-world attacks against Bitcoin/crypto asset holders over the years.

The Internet Capital Market: Free Avenue for Developers, or Another Wave of FOMO?

This post discusses Internet Capital Markets (ICM)—decentralized platforms where funds flow directly to app builders and creators. ICM combines crowdfunding, token issuance, and equity speculation, eliminating the need for VCs, banks, or app stores. In 2025, more independent developers are issuing app tokens directly via X and tools like Believe and Launchcoin, attracting mass investment.

ICM Proponents argue this model breaks traditional funding barriers, making innovation more democratic and accessible; while critics warn that ICM is becoming a hotbed for hype and short-term speculation, with many projects lacking real products or long-term value. The author believes whether ICM can become the next milestone for Web3 hinges on whether it can break free from the cycle of “speculation becomes product traction” and deliver real user value and sustained innovation.

-

-

@ 3eba5ef4:751f23ae

2025-05-23 01:08:23

@ 3eba5ef4:751f23ae

2025-05-23 01:08:23加密洞见

在比特币中引入通用程序组合与币委托机制

Joshua Doman 提出了一个 Graftleaf 的概念验证,旨在用一种简单而安全的方法在 Taproot 中实现通用程序组合和代笔委托。Graftleaf 是一个新的 Taproot 叶子版本(0xc2),使用附件来执行委托。Graftleaf 增加了两个关键功能:

-

组合:按顺序执行零个、一个或多个见证程序的能力,包括一个锁定脚本。

-

委派:在签名时添加其他支出条件的能力,可以包括程序和脚本的任意组合。

它们旨在通过支持复杂的脚本组合和委托来克服以前提案的局限性,承诺提高隐私性、可替代性以及与现有 P2TR 地址的向后兼容性。

为什么说 OP_CHECKCONTRACTVERIFY (CCV) 将会取代 OP_VAULT

帖子主要讨论了比特币脚本操作码 OP_VAULT(BIP-345)的现状,及其被OP_CHECKCONTRACTVERIFY(CCV,BIP-443)取代的可能。重要因素有:

-

CCV 是 OP_VAULT 的更通用版本,继承了部分功能,如金额模式(amount modes)、延迟跨输入检查(deferred cross-input checks)。

-

CCV支持替换多个脚本叶子节点(tapleaf),接口更简洁,脚本解释器实现更轻量。

同时作者也指出 CCV 的不足与未来可能的扩展:

-

当前缺少部分配套文档和工具,BIP 尚未完全完成。

-

可能需要 VAULT-decorator 操作码来实现某些高级功能,如解锁金库时必须抵押锁定、速率限制等。

尽管如此,CCV仍然是构建金库功能的更优基础。

通过自复制方式启用递归契约

Bram Cohen 提出通过向比特币脚本添加一些简单的操作码,以一种自然而直接的方式实现递归契约(recursive covenants)。他通过例子说明,一个实用且有用的脚本通过 Quine 自复制就可以实现,无需其他更复杂的技巧;编写递归契约的开发者必须意识到该方式的重要性。

Mempool Research 发布 UTXO 集的报告:比特币中近一半 UTXO 金额小于 1000 聪

在 2025 年 4 至 5 月期间的 OP_RETURN 大辩论中,将任意数据插入交易对 UTXO 集的影响的问题引发了大量讨论。Mempool 在这份报告中,对 UTXO 集进行了研究,强调了比特币 UTXO 集合碎片化和膨胀的问题,特别是由于小额交易和数据嵌入导致的 UTXO 增长,增加了节点运营者的存储和验证负担。关键结论有:

-

UTXO 集合的碎片化严重:目前约有 49% 的 UTXO 金额低于 1000 聪(约合 1 美元),这些小额 UTXO 大多采用 Taproot 地址格式,可能与数据嵌入方案(如 Ordinals 铭文)或相关的转移机制有关。尽管这些 UTXO 通常可被花费,但在被使用之前,它们会增加所有节点运营者的存储和验证负担。

-

铭文相关的 UTXO 占比显著:约 30% 的 UTXO 与铭文相关。

-

存在大量长期未动用的 UTXO:有超过 10 万个使用 Pay to Multisig (p2ms) 脚本的旧 Counterparty UTXO,且存在超过 10 年。尽管在总数(约 1.73 亿个 UTXO)中所占比例较小,但依然是 UTXO 膨胀的典型问题。

-

Taproot 成为最常见的 UTXO 类型:在所有 UTXO 类型中,Taproot(p2tr)占比最高,为 34.2%,其次是传统的 p2pkh(28.8%)和 p2wpkh(26.5%)。但是从 UTXO 所存储的总价值来看,Taproot 的占比相对较低,表明其主要用于小额交易或数据嵌入。

报告最后也提到,对于继续增长的 UTXO 集,Utreexo 和 SwiftSync 是两种对保持比特币对广泛节点运营者可访问性的扩容方法。

比特币网络各项数据的可视化呈现

mainnet-observer 由开发者 @0xB10C 搭建并维护,将比特币链的多项数据呈现出来,可以看到:

-

目前挖掘一个区块所需要的平均哈希尝试:超过 ~500000000000000000000000000(500 zeta 或 5×10²³)次

-

超过 42 个 BTC 现在永远丢失在可证明无法花费的 OP_RETURN 输出中

-

每日更新的「挖矿中心化指数」(带有代理池)

-

比特币挖矿高度集中,6 个矿池生产并挖掘了超过 95%的区块模板(截止 2025 年 4 月)

闪电网络路径查询:解决支付可靠性和路由限制

brh28 发起了关于闪电网络路由支付的讨论,聚焦「流动性的不确定性」(liquidity uncertainty)和路径发现效率低的问题,提出了一种新的路径查询机制——允许节点以路径查询的形式,实现动态信息共享,推动了一个更加分布式的路由生态。这可以提高了大额支付的成功率,并减少对完整通道图的依赖。尽管在隐私方面仍存在一定担忧,但该方法为节点提供了一种可控的信息披露机制,有望革新现有的支付路由方式。

Bitlayer 和 Sui 实现了信任最小化的 BitVM 桥

Bitlayer 和 Sui 整合了 BitVM Bridge,推出 Peg-BTC(YBTC)——通过 BitVM Bridge 将原生比特币桥接到 Sui 生态中。BitVM Bridge 是一个由 Bitlayer 提供支持并由先进的 BitVM 智能合约框架支持的信任最小化桥。

Ark 协议的正式规范

Ark 近日发布 Litepaper: Ark: A UTXO-based Transaction Batching Protocol,阐述其技术基础。作为一种新颖的比特币扩容协议,Ark 实现了链下交易执行,同时让用户能完全掌控自己的资金。这一点通过引入「虚拟UTXO」(VTXO)得以实现,用户在链下交易,同时保留单方面退出至比特币主链的能力。Ark 同一个 operator 协作,将用户操作打包成链上承诺,在保持极小链上负担的前提下实现高交易吞吐量。这为比特币提供了一种简单易用的扩容方案,也为那些在主链上执行效率低下或成本过高的二层方案提供了落地空间。

精彩无限,不止于链

已知真实发生过的比特币攻击事件列表

这里列出了历年来在真实世界中发生过的、针对比特币/加密资产拥有者的攻击事件。

互联网资本市场:是开发者的自由通道,还是另一波 FOMO?

帖子讨论了互联网资本市场( ICM, Internet Capital Markets ),即去中心化平台——资金直接流向应用程序构建者和创建者。ICM 集众筹、代币发行和股权投机于一体,无需VC、银行或应用商店。2025年,越来越多独立开发者通过 X 和 Believe、Launchcoin 等工具直接发行应用代币,吸引大众投资。ICM 的支持者认为,这种模式打破了传统融资壁垒,让创新更民主、门槛更低;但批评者警告,ICM 正沦为炒作和短期投机的温床,许多项目缺乏实际产品和长期价值。作者认为,ICM 模式能否成为 Web3 的下一个里程碑,关键在于其能否走出「投机成了产品增长动力」(speculation becomes product traction)的怪圈,实现真正的用户价值和持续创新。

-

-

@ 57d1a264:69f1fee1

2025-05-22 06:21:22

@ 57d1a264:69f1fee1

2025-05-22 06:21:22You’ve probably seen it before.

You open an agency’s website or a freelancer’s portfolio. At the very top of the homepage, it says:

We design for startups.

You wait 3 seconds. The last word fades out and a new one fades in:

We design for agencies.

Wait 3 more seconds:

We design for founders.

I call this design pattern The Wheel of Nothing: a rotating list of audience segments meant to impress through inclusion and draw attention through motion… for absolutely no reason.

Revered brand studio Pentagram recently launched a new website. To my surprise, the homepage features the Wheel of Nothing front and center, boldly claiming:

We design Everything for Everyone…before cycling through more specific combinations every few seconds.

Dan Mall, a husband, dad, teacher, creative director, designer, founder, and entrepreneur from Philly. I share as much as I can to create better opportunities for those who wouldn’t have them otherwise. Most recently, I ran design system consultancy SuperFriendly for over a decade.

Read more at Dans' website https://danmall.com/posts/the-wheel-of-nothing/

https://stacker.news/items/986392

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ 8aa70f44:3073d1a6

2025-05-21 13:07:14

@ 8aa70f44:3073d1a6

2025-05-21 13:07:14Earlier this year I launched the asknostr.site project which has been a great journey and learning experience. I had wanted to write down my goals and ideas with the project but didn't get to it yet. Primal launching the article editor was a trigger for me to go for it.

Ever since I joined Nostr i was looking for ways to apply my skillset solve a problem and help with adoption. Around Christmas I figured that a Quora/Stackoverflow alternative is something that needs to exist on Nostr.

Before I knew it I had a pretty decent prototype. And because the network already had so much awesome content, contributors and authors I was never discouraged by the challenge that kills so many good ideas -> "Where do I get the first users?".

Since the initial announcement I have received so much encouragement through zaps, likes, DM's, and maybe most of all seeing the increase in usage of the site and #asknostr content kept me going.

Current State

The current version of the site is stable and most bugs are hashed out. After logging in (remote signer, extension or nsec) you can engage with content through votes, comments and replies. Or simply ask a new question.

All content is stored in the site's own private relay and preprocessed/computed into a single data store (postgres) so the site is fast, accessible and crawl-able.

The site supports browsing hashtags, voting/commenting on answers, asking new questions and every contributor get their own profile (example). At the time of writing the site has 41k questions, almost 200k replies/comments and upwards of 5 million sats purely for #asknostr content.

What to expect/On my list

There are plenty of things and UI bugs that need love and between writing the draft of this post and hitting publish I shipped 3 minor bug fixes. Little by little, bit by bit...

In addition to all those small details here is an overview of the things on my own wish list:

-

Inline Zaps: Ability to zap from the asknostr.site interface. Click the zap button, specify or pick the number of sats zap away.

-

Contributor Rank: A leaderboard to add some gamification. More recognition to those nostriches that spend their time helping other people out

-

Search by Keyword: Search all content by keywords. Experiment with the index to show related questions or answers

-

Better User Profiles: Improve the user profile so it shows all the profile questions and answers. Quick buttons to follow or zap that person. Better insights in the topics (hashtags) the profile contributes to

-

Bookmarks: Ability to bookmark questions and answers. Increase bookmark weight as a signal to rank answers.

-

Smarter Scoring: Tune how answers are scored (winning answer formula). Perhaps give more weight to the question author or use WoT. Not sure yet.

All of this is happening at some point so follow me if you want to stay up to date.

Goals

To manage expectations and keep me focussed I write down the mid and long term goals of the project.

Long term

Call me cheesy but I believe that humanity will flourish through an open web and sound money. My own journey started from with bitcoin but if you asked me today if it's BTC or nostr that is going to have the most impact I wouldn't know what to answer. Chicken or egg?

The goal of the project is to offer an open platform that empowers individuals to ask questions, share expertise and access high-quality information across different topics. The project empowers anyone to monetize their experience creating a sustainable ecosystem that values and rewards knowledge sharing. This will ultimately democratize access to knowledge for all.

Mid term

The project can help a lot with onboarding new users onto the network. Once we start to rank on certain topics we can get a piece of the search traffic pie (StackOverflows 12 million, and Quora 150 million visitors per month) which is a great way to expose people to the power of the network.

First time visitors do not need to know about nostr or zaps to receive value. They can browse around, discover interesting content and perhaps even create a profile without even knowing they are on Nostr now.

Gradually those users will understand the value of the network through better rankings (zaps beats likes), a cross-client experience and a profile that can be used on any nostr site or app.

In order for the site to do that we need to make sure content is browsable by language, (sub)topics and and we double down on 'the human touch' with real contributors and not LLMs.

Short Term Goal

The first goal is to make the site really good and an important resource for existing Nostr users. Enable visitors to search and discover what they are interested in. Integrate within the existing nostr eco system with 'open in' functionality and quick links to interesting projects (followerpacks?)

One of things i want to get right is to improve user retention by making the whole Q\&A experience more sticky. I want to run some experiments (bots, award, summaries) to get more people to use asknostr.site more often and come back.

What about the name?

Finally the big question: What about the asknostr.site name? I don't like the name that much but it's what people know. I think there is a high chance that people will discover Nostr apps like Olas, Primal or Damus without needing to know what NOSTR is or means.

Therefore I think there is a good chance that the project won't be called asknostr.site forever. I guess it all depends on where we all take this.

Onwards!

-

-

@ 74fb3ef2:58adabc7

2025-05-22 22:26:23

@ 74fb3ef2:58adabc7

2025-05-22 22:26:23Suppose you have a small mom-and-pop shop selling bananas, your bananas are of the highest quality, you plant the banana trees yourself, you water them daily, take great care of everything, and still select only the top 1% of bananas to sell.

Your customers love it, there's no place where they can get better bananas, but due to the fact that you spend so much time, your bananas have to be more expensive, so despite the higher quality, you don't make as much money as you think you should; surely you can get a little more of the market if you adopt some of the strategies that work for your competitors.

So you look across the street, and what do you know? Their bananas are of significantly worse quality than yours, but they're not just selling bananas, they're selling apples too, so you think to yourself, "what if I sold apples? Maybe my apples won't be the best in the market, but nobody can beat my bananas!"

You start planting apple trees, and after a while you're able go sell slightly better than average apples, but by doing so you neglect your bananas ever so slightly.

Most of your existing customers don't notice, you still have the best bananas in town, they don't notice the slight drop in quality. And now that you're selling apples too you're making more money, and more customers come to you.

But you notice that there's a new store now that's selling oranges, and people are buying them. So surely you need oranges too, so you can make some extra money.

You plant a few orange trees, but find yourself spending so much time tending to the oranges and apples that you can't devote the same time and love to your bananas.

You are making a bit of extra cash from the new customers, business is going well, but you don't have time for anything else anymore. You no free time anymore, you are overworked and your health is getting worse.

But you can't stop now that business is going well, you are making so much more, yeah maybe you don't have the same bananas anymore, but you do have slightly above average apples and oranges that have attracted so many customers.

You suddenly fall ill, you've overworked yourself and you are stuck at a hospital for a while.

When you come back to your store, a few of your customers are back, but not all of them, so you think of more ideas, mandarins, kiwi, watermelons, you can grow it all, but you're gonna hire a bunch of people to help you so you don't fall ill again.

One thing leads to another and you are making more money than ever, but strangely you don't hear your customers praising your bananas anymore.

So you take one of your bananas, peel it, and as you taste it, a wave of disappointment hits you.

Your bananas are now just as bad as everyone else's; you gave in to the tyranny of the marginal customer.

You make a lot of money now, but your flagship product is long gone, you are now just another Fruitseller.

-

@ f85b9c2c:d190bcff

2025-05-23 01:04:58

@ f85b9c2c:d190bcff

2025-05-23 01:04:58 I’ve always believed that truth doesn’t bend to the will of the crowd. Growing up, I watched people nod along to ideas they didn’t even agree with, just because everyone else seemed to. It baffled me then, and it still does now. There’s something powerful about standing firm when you know you’re right—even if it means standing alone.

I’ve always believed that truth doesn’t bend to the will of the crowd. Growing up, I watched people nod along to ideas they didn’t even agree with, just because everyone else seemed to. It baffled me then, and it still does now. There’s something powerful about standing firm when you know you’re right—even if it means standing alone.It’s not easy, though. The pressure to conform can feel like a tidal wave, crashing down with judgment, whispers, and rolled eyes. I’ve been there, heart pounding, wondering if I’m the crazy one. But here’s what I’ve learned: the majority isn’t always right. History backs me up—think of Galileo, shunned for saying the Earth wasn’t the center of the universe, or the countless voices drowned out before they were proven true. Numbers don’t guarantee wisdom.

For me, it’s about integrity. If I’ve wrestled with the facts, questioned myself, and still landed on solid ground, I’m not backing down just to keep the peace. It’s not arrogance—it’s conviction. I’d rather be the lone voice in a sea of noise than a silent echo of a lie. Because in the end, truth doesn’t care about headcounts. It cares about courage.

-

@ 57d1a264:69f1fee1

2025-05-21 05:47:41

@ 57d1a264:69f1fee1

2025-05-21 05:47:41As a product builder over too many years to mention, I’ve lost count of the number of times I’ve seen promising ideas go from zero to hero in a few weeks, only to fizzle out within months.

The problem with most finance apps, however, is that they often become a reflection of the internal politics of the business rather than an experience solely designed around the customer. This means that the focus is on delivering as many features and functionalities as possible to satisfy the needs and desires of competing internal departments, rather than providing a clear value proposition that is focused on what the people out there in the real world want. As a result, these products can very easily bloat to become a mixed bag of confusing, unrelated and ultimately unlovable customer experiences—a feature salad, you might say.

Financial products, which is the field I work in, are no exception. With people’s real hard-earned money on the line, user expectations running high, and a crowded market, it’s tempting to throw as many features at the wall as possible and hope something sticks. But this approach is a recipe for disaster.

Here’s why: https://alistapart.com/article/from-beta-to-bedrock-build-products-that-stick/

https://stacker.news/items/985285

-

@ f85b9c2c:d190bcff

2025-05-23 01:01:32

@ f85b9c2c:d190bcff

2025-05-23 01:01:32Hey, it’s me again, and let me tell you about the wildest thing that happened to me recently. I swear, my life could be a comedy show sometimes😂. Picture this: me and my buddies were out messing around in the woods near campus, just kicking it like we always do. The sun was out, the vibes were good, and we were probably being louder than we needed to be. Then, out of nowhere, I spotted something slithering near my friend benji leg.

A snake. A legit, no-joke snake!

I yelled, “SNAKE!” at the top of my lungs—probably sounded like a total lunatic —and before I could even blink, those dudes were GONE. I mean, faster than their shadows, Olympic-sprinter-level gone. I’m standing there, heart pounding, looking at this snake like, “Bruh, did I just get ditched?” Turns out, I did. My so-called friends bolted back to the dorms without a second thought, leaving me to face the scaly intruder solo. Luckily, the snake wasn’t in the mood for drama. It just gave me this lazy side-eye and slithered off, like it was too cool to deal with me. I hightailed it back to the dorms too, and when I got there, benji and the crew were already laughing their heads off. “Bro, you screamed like a horror movie victim!” they said. Yeah, real funny, guys.

Honestly, though? I’m just glad that snake didn’t get too cozy with my backside. A near miss like that deserves a medal—or at least a good story. We’ve been cracking up about it ever since, and now every time we’re out, I’m the designated “snake spotter. Lesson learned: friends are great until nature throws a curveball. Phew, that was close! Never be afraid to stand against everyone if you know you’re right.

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ f85b9c2c:d190bcff

2025-05-23 00:54:23

@ f85b9c2c:d190bcff

2025-05-23 00:54:23 P2P trading is also referred to as peer-to-peer trading or, more recently, people-to-people trading. Individuals can trade currencies and other marketable goods with other traders in this decentralized financial trading system.

P2P trading is a method of trading cryptocurrencies between people without the need of middlemen like exchanges, banks, or other financial institutions. Networks that connect buyers and sellers, streamline transactions, and frequently provide conflict resolution services are where P2P transactions take place.

P2P trading is also referred to as peer-to-peer trading or, more recently, people-to-people trading. Individuals can trade currencies and other marketable goods with other traders in this decentralized financial trading system.

P2P trading is a method of trading cryptocurrencies between people without the need of middlemen like exchanges, banks, or other financial institutions. Networks that connect buyers and sellers, streamline transactions, and frequently provide conflict resolution services are where P2P transactions take place.What is P2P Trading P2P trading is one of the quickest, cheapest, and most adaptable trading platforms, according to numerous research. Even more people could benefit from it if they lack access to conventional financial services or find some procedures to be too complicated.

P2P Trading in Nigeria P2P trading has grown somewhat in popularity in recent years as a result of the expansion of online marketplaces that bring together buyers and sellers. These platforms frequently offer wonderful alternatives to traditional financial services and perform similarly to or even better than what is provided by regional banks. Markets today provide unique advantages like quick transactions, reduced fees, and improved flexibility.

The ongoing development of regulations prohibiting the usage of cryptocurrencies is another factor that has increased the need for P2P trade in Nigeria. The majority of crypto traders in Nigeria now trade their cryptocurrencies with one another using the P2P trading system rather than the conventional trader-to-exchange service as a result of the ban on cryptocurrencies since 2021 till recently.P2P trading is thus one of the most popular and widely used forms of trading in Nigeria.

Peer-to-peer cryptocurrency trading is available on a number of well-known trading platforms, including Binance, Bitget, Bybit etc. A system has been built by these platforms (exchange websites and mobile applications) that enables traders to connect and trade their preferred crypto assets. P2P trading platforms have the power to transform Nigeria’s financial system and open up new doors for economic growth and development by bringing buyers and sellers together directly.

How does P2P trading work? One of the most effective ways to exchange cryptocurrency is through P2P trading, so everyone should be aware of how to get around it. It uses the exchange as a middleman to arrange, oversee, and finish trades between two independent dealers. The exchange service is used by buyers who search for sellers who are willing to sell to them at the price they are willing to pay, make a payment, and receive coins in return.

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50I’ve written about MSTR twice already, https://www.chrisliss.com/p/mstr and https://www.chrisliss.com/p/mstr-part-2, but I want to focus on legendary short seller James Chanos’ current trade wherein he buys bitcoin (via ETF) and shorts MSTR, in essence to “be like Mike” Saylor who sells MSTR shares at the market and uses them to add bitcoin to the company’s balance sheet. After all, if it’s good enough for Saylor, why shouldn’t everyone be doing it — shorting a company whose stock price is more than 2x its bitcoin holdings and using the proceeds to buy the bitcoin itself?

Saylor himself has said selling shares at 2x NAV (net asset value) to buy bitcoin is like selling dollars for two dollars each, and Chanos has apparently decided to get in while the getting (market cap more than 2x net asset value) is good. If the price of bitcoin moons, sending MSTR’s shares up, you are more than hedged in that event, too. At least that’s the theory.

The problem with this bet against MSTR’s mNAV, i.e., you are betting MSTR’s market cap will converge 1:1 toward its NAV in the short and medium term is this trade does not exist in a vacuum. Saylor has described how his ATM’s (at the market) sales of shares are accretive in BTC per share because of this very premium they carry. Yes, we’ll dilute your shares of the company, but because we’re getting you 2x the bitcoin per share, you are getting an ever smaller slice of an ever bigger overall pie, and the pie is growing 2x faster than your slice is reducing. (I https://www.chrisliss.com/p/mstr how this works in my first post.)

But for this accretion to continue, there must be a constant supply of “greater fools” to pony up for the infinitely printable shares which contain only half their value in underlying bitcoin. Yes, those shares will continue to accrete more BTC per share, but only if there are more fools willing to make this trade in the future. So will there be a constant supply of such “fools” to keep fueling MSTR’s mNAV multiple indefinitely?

Yes, there will be in my opinion because you have to look at the trade from the prospective fools’ perspective. Those “fools” are not trading bitcoin for MSTR, they are trading their dollars, selling other equities to raise them maybe, but in the end it’s a dollars for shares trade. They are not selling bitcoin for them.

You might object that those same dollars could buy bitcoin instead, so they are surely trading the opportunity cost of buying bitcoin for them, but if only 5-10 percent of the market (or less) is buying bitcoin itself, the bucket in which which those “fools” reside is the entire non-bitcoin-buying equity market. (And this is not considering the even larger debt market which Saylor has yet to tap in earnest.)

So for those 90-95 percent who do not and are not presently planning to own bitcoin itself, is buying MSTR a fool’s errand, so to speak? Not remotely. If MSTR shares are infinitely printable ATM, they are still less so than the dollar and other fiat currencies. And MSTR shares are backed 2:1 by bitcoin itself, while the fiat currencies are backed by absolutely nothing. So if you hold dollars or euros, trading them for MSTR shares is an errand more sage than foolish.

That’s why this trade (buying BTC and shorting MSTR) is so dangerous. Not only are there many people who won’t buy BTC buying MSTR, there are many funds and other investment entities who are only able to buy MSTR.

Do you want to get BTC at 1:1 with the 5-10 percent or MSTR backed 2:1 with the 90-95 percent. This is a bit like medical tests that have a 95 percent accuracy rate for an asymptomatic disease that only one percent of the population has. If someone tests positive, it’s more likely to be a false one than an indication he has the disease*. The accuracy rate, even at 19:1, is subservient to the size of the respective populations.

At some point this will no longer be the case, but so long as the understanding of bitcoin is not widespread, so long as the dollar is still the unit of account, the “greater fools” buying MSTR are still miles ahead of the greatest fools buying neither, and the stock price and mNAV should only increase.

. . .

One other thought: it’s more work to play defense than offense because the person on offense knows where he’s going, and the defender can only react to him once he moves. Similarly, Saylor by virtue of being the issuer of the shares knows when more will come online while Chanos and other short sellers are borrowing them to sell in reaction to Saylor’s strategy. At any given moment, Saylor can pause anytime, choosing to issue convertible debt or preferred shares with which to buy more bitcoin, and the shorts will not be given advance notice.

If the price runs, and there is no ATM that week because Saylor has stopped on a dime, so to speak, the shorts will be left having to scramble to change directions and buy the shares back to cover. Their momentum might be in the wrong direction, though, and like Allen Iverson breaking ankles with a crossover, Saylor might trigger a massive short squeeze, rocketing the share price ever higher. That’s why he actually welcomes Chanos et al trying this copycat strategy — it becomes the fuel for outsized gains.

For that reason, news that Chanos is shorting MSTR has not shaken my conviction, though there are other more pertinent https://www.chrisliss.com/p/mstr-part-2 with MSTR, of which one should be aware. And as always, do your own due diligence before investing in anything.

* To understand this, consider a population of 100,000, with one percent having a disease. That means 1,000 have it, 99,000 do not. If the test is 95 percent accurate, and everyone is tested, 950 of the 1,000 will test positive (true positives), 50 who have it will test negative (false negatives.) Of the positives, 95 percent of 99,000 (94,050) will test negative (true negatives) and five percent (4,950) will test positive (false positives). That means 4,950 out of 5,900 positives (84%) will be false.

-

@ bf47c19e:c3d2573b

2025-05-22 21:07:02

@ bf47c19e:c3d2573b

2025-05-22 21:07:02Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Šta je Bitcoin?

- Šta Bitcoin može da učini za vas?

- Zašto ljudi kupuju Bitcoin?

- Da li je vaš novac siguran u dolarima, kućama, akcijama ili zlatu?

- Šta je bolje za štednju od dolara, kuća i akcija?

- Po čemu se Bitcoin razlikuje od ostalih valuta?

- kako Bitcoin spašava svet?

- Kako mogu da saznam više o Bitcoin-u?

Bitcoin čini da štednja novca bude kul – i praktična – ponovo. Ovaj članak objašnjava kako i zašto.

Šta je Bitcoin?

Bitcoin se naziva digitalno zlato, mašina za istinu, blockchain, peer to peer mreža čvorova, energetski ponor i još mnogo toga. Bitcoin je, u stvari, sve ovo. Međutim, ova objašnjenja su često toliko tehnička i suvoparna, da bi većina ljudi radije gledala kako trava raste. Što je najvažnije, ova objašnjenja ne pokazuju kako Bitcoin ima bilo kakve koristi za vas.

iPod nije postao kulturološka senzacija jer ga je Apple nazvao „prenosnim digitalnim medijskim uređajem“. Postao je senzacija jer su ga zvali “1,000 pesama u vašem džepu.”

Ne zanima vas šta je Bitcoin. Vas zanima šta on može da učini za vas.

Baš kao i Internet, vaš auto, vaš telefon, kao i mnogi drugi uređaji i sistemi koje svakodnevno koristite, vi ne treba da znate šta je Bitcoin ili kako to funkcioniše da biste razumeli šta on može da učini za vas.

Šta Bitcoin može da učini za vas?

Bitcoin može da sačuva vaš teško zarađeni novac.

Bitcoin je stekao veliku pažnju u 2017. i 2018. godini zbog svoje spekulativne upotrebe. Mnogi ljudi su ga kupili nadajući se da će se obogatiti. Cena je naglo porasla, a zatim se srušila. Ovo nije bio prvi put da je Bitcoin uradio to. Međutim, niko nikada nije izgubio novac držeći bitcoin duže od 3,5 godine – ćak i ako je kupio na apsolutnim vrhovima.

Zašto Bitcoin konstantno raste? Ljudi počinju da shvataju koliko je Bitcoin moćan, kao način uštede novca u svetu u kojem je ’novac’ poput dolara, eura i drugih nacionalnih valuta dizajniran da gubi vrednost.

Ovo čini Bitcoin odličnom opcijom za štednju novca na nekoliko godina ili više. Bitcoin je bolji od štednje novca u dolarima, akcijama, nekretninama, pa čak i u zlatu.

Zato pokušajte da zaboravite na trenutak na razumevanje blockchaina, digitalne valute, kriptografije, seed fraza, novčanika, rudarstva i svih ostalih nerazumljivih termina. Za sada, razgovarajmo o tome zašto ljudi kupuju Bitcoin: razlog je prostiji nego što vi mislite.

Zašto ljudi kupuju Bitcoin?

Naravno, svako ima svoj razlog za kupovinu Bitcoin-a. Jedan od razloga, koji verovatno često čujete, je taj što mu vrednost raste. Ljudi žele da se obogate. Uskoče kao spekulanti, krenu u vožnju i najverovatnije ih prodaju ubrzo nakon kupovine.

Međutim, čak i kada cena krene naglo prema gore i strmoglavo padne nazad, mnogi ljudi ostanu i nakon tog pada. Otkud mi to znamo? Broj aktivnih novčanika dnevno, koji je otprilike sličan broju korisnika Bitcoin-a, nastavlja da raste. Takođe, nakon svakog balona u istoriji Bitcoin-a, cena se nikada ne vraća na svoju cenu pre balona. Uvek ostane malo višlja. Bitcoin se penje, a svaka masovna spekulativna serija dovodi sve više i više ljudi.

Broj aktivnih Bitcoin novčanika neprekidno raste

„Aktivna adresa“ znači da je neko tog dana poslao Bitcoin transakciju. Donji grafikon je na logaritamskoj skali.

Izvor: Glassnode

Izvor: GlassnodeCena Bitcoina se neprestano penje

Kroz istoriju Bitcoin-a možemo videti divlje kolebanje cena, ali nakon svakog balona, cena se ostaje višlja nego pre. Ovo je cena Bitcoin-a na logaritamskoj skali.

Izvor: Glassnode

Izvor: GlassnodeTo pokazuje da se ljudi zadržavaju: potražnja za Bitcoin-om se povećava. Da je svaki masovni rast cena bio samo balon koji su iscenirali prevaranti koji žele brzo da se obogate, cena bi se vratila na nivo pre balona. To se dogodilo sa lalama, ali ne i sa Bitcoin-om.

I zašto se onda cena Bitcoin-a stalno povećava? Sve veći broj ljudi čuva Bitcoin dugoročno – oni razumeju šta Bitcoin može učiniti za njihovu štednju.

Zašto ljudi štede svoj novac u Bitcoin-u umesto na štednim računima, kućama, deonicama ili zlatu? Hajde da pogledajmo sve te metode štednje, i zatim da ih uporedimo sa Bitcoin-om.

Da li je vaš novac siguran u dolarima, kućama, akcijama ili zlatu?

Tokom mnogo godina, to su bile pristojne opcije za štednju. Međutim, sistem koji podržava vrednost svega ovoga je u krizi.

Dolari, Euri, Dinari

Dolari i sve ostale „tradicionalne“ valute koje proizvode vlade, stvorene su da izgube vrednost kroz inflaciju. Banke i tradicionalni monetarni sistem uzrokuju inflaciju stalnim stvaranjem i distribucijom novog novca. Kada Američke Federalne Rezerve objave ciljanu stopu od 2% inflacije, to znači da žele da vaš novac svake godine izgubi 2% od svoje vrednosti. Čak i sa inflacijom od samo 2%, vaša štednja u dolarima izgubiće polovinu vrednosti tokom 40-godišnjeg radnog veka.

Izveštena inflacija se danas opasno povečava, uprkos rastućem „buretu sa barutom“ koji bi mogao da explodira i dovede do masivne hiperinflacije. Što je više valute u opticaju, to je više baruta u buretu.

Naše vlade su ekonomiju napunile valutama da bankarski sistem ne bi propao nakon finansijske krize koja se dogodila 2008. godine. Od tada je većina glavnih centralnih banaka postavila vrlo niske kamatne stope, što pojedincima i korporacijama omogućava dobijanje jeftinijih kredita. To znači da mnogi pojedinci i korporacije podižu ogromne kredite i koriste ih za kupovinu druge imovine poput deonica, umetničkih dela i nekretnina. Sve ovo pozajmljivanje znači da stvaramo tone novog novca i stavljamo ga u opticaj.

Računi za podsticaje (stimulus bills) COVID-19 za 2020. godinu unose trilione u sistem. Ovoliko stvaranje valuta na kraju dovodi do inflacije – velikog gubitka u vrednosti valute.

Količina američkog dolara u opticaju gotovo se udvostručila od marta 2020. godine. Izvor

Količina američkog dolara u opticaju gotovo se udvostručila od marta 2020. godine. IzvorRačuni za podsticaje su bez presedana, toliko da je neko izmislio meme da opiše ovu situaciju.

Resurs koji vlade mogu da naprave u većem broju da bi platile svoje račune? Ne zvuči kao dobro mesto za štednju novca.

Kuće

Kuće su tokom prošlog veka bile pristojan način štednje novca. Međutim, pad cena nekretnina 2007. godine doveo je do toga da su mnogi vlasnici kuća izgubili svu ušteđevinu.

Danas su kuće gotovo nepristupačne za prosečnog čoveka. Jedan od načina da se ovo izmeri je koliko godišnjih zarada treba prosečnom čoveku da zaradi ekvivalent vrednosti prosečne kuće. Prema CityLab-u, publikaciji Bloomberg-a koja pokriva gradove, porodica može da priuštiti određenu kuću ako košta manje od 2,6 godišnjih prihoda domaćinstva te porodice.

Međutim, prema RZS (Republički zavod za statistiku) prosečan prihod porodičnog domaćinstva u Srbiji iznosi oko 570 EUR mesečno ili otprilike 7.000 EUR godišnje. Nažalost, samo najjeftinija područja van gradova imaju srednje cene kuća od oko 2,6 prosečnih godišnjih prihoda domaćinstva. U većim gradovima poput Beograda i Novog Sada srednja cena kuće je veća od 10 prosečnih godišnjih prihoda jednog domaćinstva.

Ako nekako možete sebi da priuštite kuću, ona bi mogla biti pristojna zaliha vrednosti. Dokle god ne doživimo još jedan krah i izvršitelji zaplene ovu imovinu mnogim vlasnicima kuća.

Akcije

Berza je u prošlosti takođe dobro poslovala. Međutim, sporo i stabilno povećanje tržišta događa se u dosadnom, predvidljivom svetu. Svakog dana vidimo sve manje toga. Nakon ubrzanja korona virusa, videli smo smo najbrži pad američke berze u istoriji od 25% – brži od Velike depresije.

Neki se odlučuju za ulaganje u obveznice i drugu finansijsku imovinu, ali ’prinosi’ za tu imovinu – procenat kamate zarađene na imovinu iz godine u godinu – stalno opada. Sve veći broj odredjenih imovina ima čak i negativne prinose, što znači da posedovanje te imovine košta! Ovo je veliki problem za sve koji se oslanjaju na penziju. Plus, s obzirom na to da su akcije denominovane u tradicionalnim valutama poput dolara i evra, inflacija pojede prinos koji investitor dobije.

Najgore od svega je to što ti isti ekonomski krahovi koji uzrokuju masovna otpuštanja i teško tržište rada takođe znače i nagli pad cena akcija. Čuvanje ušteđevine u akcijama može značiti i gubitak štednje i gubitak posla zbog recesije. Teška vremena mogu da vas prisile da svoje akcije prodate po vrlo malim cenama samo da biste platili svoje račune.

A to nije baš siguran način štednje novca.

Zlato

Vrednost zlata neprekidno se povećavala tokom 5000 godina, obično padajući onda kada berza obećava jače prinose.

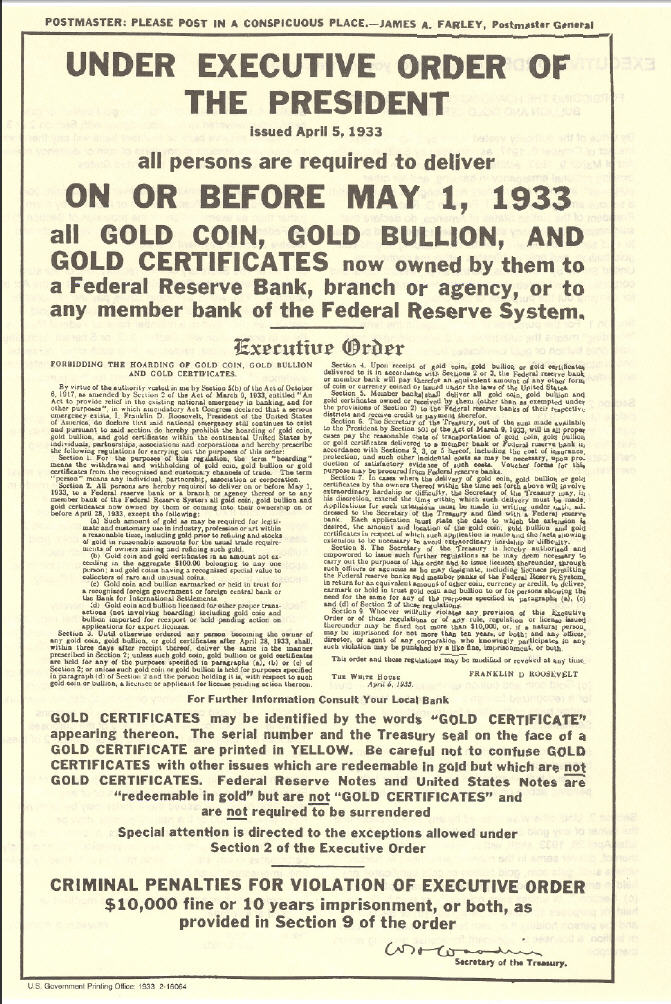

Evidencija vrednosti zlata je solidna. Međutim, zlato nosi i druge rizike. Većina ljudi poseduje zlato na papiru. Oni fizički ne poseduju zlato, već ga njihova banka čuva za njih. Zbog toga je zlato veoma podložno konfiskaciji od strane vlade.

Zašto bi vlada konfiskovala nečije zlato, a kamoli u demokratskoj zemlji u „slobodnom svetu“? Ali to se dešavalo i ranije. 1933. godine Izvršnom Naredbom 6102, predsednik Roosevelt naredio je svim Amerikancima da prodaju svoje zlato vladi u zamenu za papirne dolare. Vlada je iskoristila pretnju zatvorom za prikupljanje zlata u fizičkom obliku. Znali su da se zlato više poštuje kao zaliha vrednosti širom sveta od papirnih dolara.

Ako posedujete svoje zlato na nekoj od aplikacija za trgovanje akcijama, možete se kladiti da će vam ga država oduzeti ako joj zatreba. Čak i ako posedujete fizičko zlato, onda ga izlažete mogućnosti krađe – od strane kriminalca ili vaše vlade.

Vaša uštedjevina nije bezbedna.

Rast cena svih gore navedenih sredstava zavisi od našeg trenutnog političkog i ekonomskog sistema koji se nastavlja kao i tokom proteklih 100 godina. Međutim, danas vidimo ogromne pukotine u ovom sistemu.

Sistem ne funkcioniše dobro za većinu ljudi.

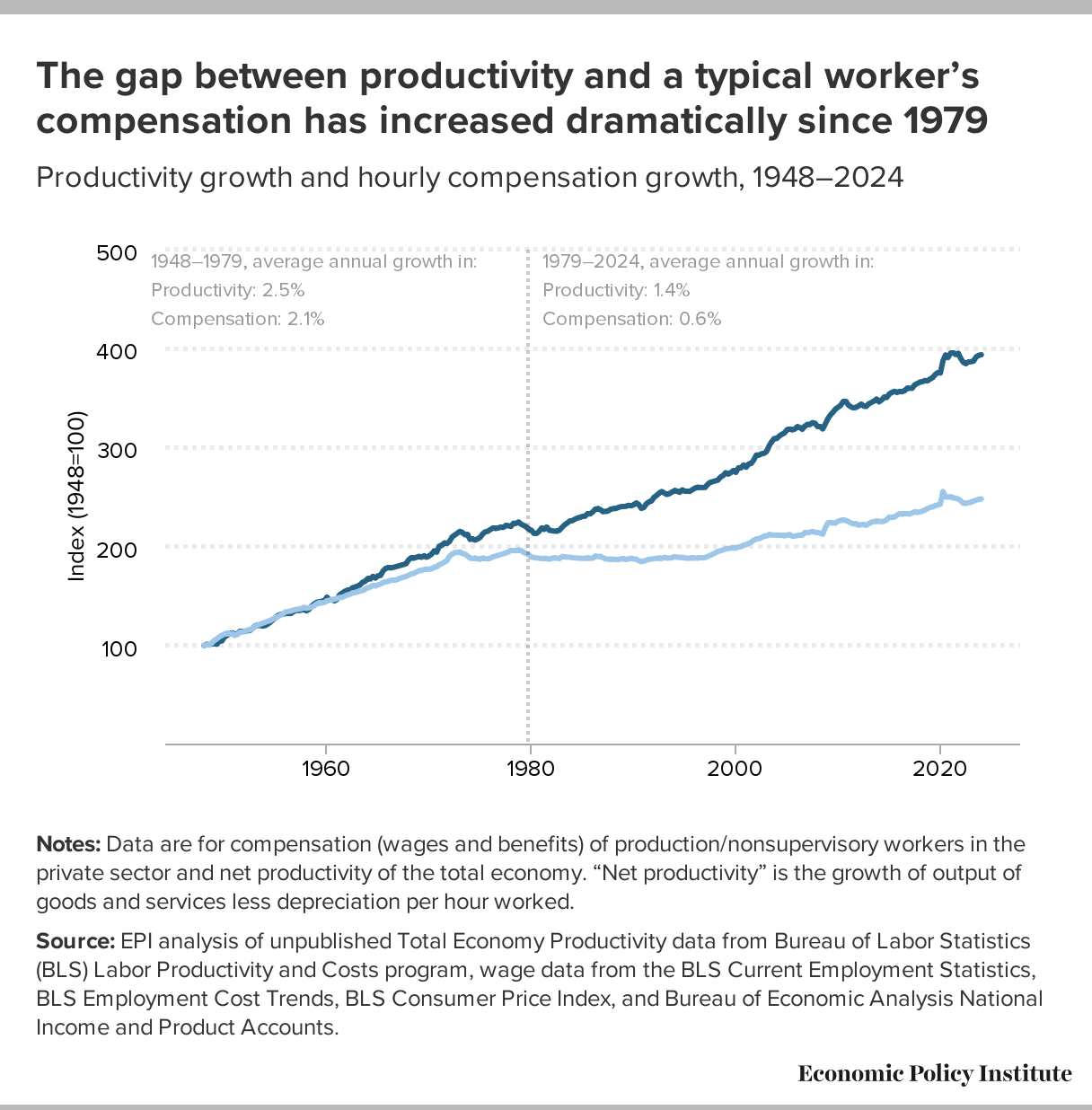

Od 1971. plate većine američkih radnika nisu rasle. S druge strane, bogatstvo koje imaju najbogatiji u društvu nalazi se na nivoima koji nisu viđeni više od 80 godina. U međuvremenu, ljudi sve manje i manje veruju institucijama poput banaka i vlada.

CBPP Nejednakost Bogatstva Tokom Vremena

CBPP Nejednakost Bogatstva Tokom VremenaŠirom sveta možemo videti dokaze o slamanju sistema kroz politički ekstremizam: izbor Trampa i drugih ekstremističkih desničarskih kandidata, Bregzit, pokret Occupy, popularizacija koncepta univerzalnog osnovnog dohotka, povratak pojma „socijalizam“ nazad u modu. Ljudi na svim delovima političkog i društvenog spektra osećaju problematična vremena i posežu za sve radikalnijim rešenjima.

Šta je bolje za štednju od dolara, kuća i akcija?

Pa kako ljudi mogu da štede novac u ovim teškim vremenima? Ili ne koriste tradicionalne valute, ili kupuju sredstva koja će zadržati vrednost u teškim vremenima.

Bitcoin ima najviše potencijala da zadrži vrednost kroz politička i ekonomska previranja od bilo koje druge imovine. Na tom putu će biti rupa na kojima će se rušiti ili pumpati, međutim, njegova svojstva čine ga takvim da će verovatno preživeti previranja kada druga imovina ne bude to mogla.

Šta Bitcoin čini drugačijim?

Bitcoini su retki.

Proces ‘rudarenja’ bitcoin-a, proizvodnju bitcoin-a čini veoma skupom, a Bitcoin protokol ograničava ukupan broj bitcoin-a na 21 milion novčića. To čini Bitcoin imunim na nagle poraste ponude. Ovo se veoma razlikuje od tradicionalnih valuta, koje vlade mogu da štampaju sve više kad god one to požele. Zapamtite, povećanje ponude vrši veliki pritisak na vrednost valute.

Bitcoini nemaju drugu ugovornu stranu.

Bitcoin se takođe razlikuje od imovine kao što su obveznice, akcije i kuće, jer mu nedostaje druga ugovorna strana. Druge ugovorne strane su drugi subjekti uključeni u vrednost sredstva, koji to sredstvo mogu obezvrediti ili vam ga uzeti. Ako imate hipoteku na svojoj kući, banka je druga ugovorna strana. Kada sledeći put dođe do velikog finansijskog kraha, banka vam može oduzeti kuću. Kompanije su kvazi-ugovorne strane akcijama i obveznicama, jer mogu da počnu da donose loše odluke koje utiču na njihovu cenu akcija ili na „neizvršenje“ duga (da ga ne vraćaju vama ili drugim poveriocima). Bitcoin nema ovih problema.

Bitcoin je pristupačan.

Svako sa 5 eura i mobilnim telefonom može da kupi i poseduje mali deo bitcoin-a. Važno je da znate da ne morate da kupite ceo bitcoin. Bitcoin-i su deljivi do 100-milionite jedinice, tako da možete da kupite Bitcoin u vrednosti od samo nekoliko eura. Neuporedivo lakše nego kupovina kuće, zlata ili akcija!

Bitcoin se ne može konfiskovati.

Banke drže većinu vaših eura, zlata i akcija za vas. Većina ljudi u razvijenom svetu veruje bankama, jer većina ljudi koji žive u današnje vreme nikada nije doživela konfiskaciju imovine ili ’šišanje’ od strane banaka ili vlada. Nažalost, postoji presedan za konfiskaciju imovine čak i u demokratskim zemljama sa snažnom vladavinom prava.

Kada vlada konfiskuje imovinu, ona obično ubedi javnost da će je menjati za imovinu jednake vrednosti. U SAD-u 1930-ih, vlada je davala dolare vlasnicima zlata. Vlada je znala da uvek može da odštampa još više dolara, ali da ne može da napravi više zlata. Na Kipru 2012. godine, jedna propala banka je svojim klijentima dala deonice banke da pokrije dolare klijenata koje je banka trebala da ima. I dolari i deonice su strmoglavo opali u odnosu na imovinu koja je uzeta od ovih ljudi.

Doći do bitcoin-a koji ljudi poseduju, biće mnogo teže jer se bitcoin-i mogu čuvati u novčaniku koji ne poseduje neka treća strana, a vi možete čak i da zapamtite privatne ključeve do vašeg bitcoin-a u glavi.

Bitcoin je za štednju.

Bitcoin se polako pokazuje kao najbolja opcija za dugoročnu štednju novca, posebno s obzirom na današnju ekonomsku klimu. Posedovanje čak i malog dela, je polisa osiguranja koja se isplati ako svet i dalje nastavi da ludi. Cena Bitcoin-a u dolarima može divlje da varira u roku od godinu ili dve, ali tokom 3+ godine skoro svi vide slične ili više cene od trenutka kada su ga kupili. U stvari, doslovno niko nije izgubio novac čuvajući Bitcoin duže od 3,5 godine – čak i ako je kupio BTC na apsolutnim vrhovima tržišta.

Imajte na umu da nakon ove tačke ti ljudi više nikada nisu videli rizik od gubitka. Cena se nikada nije smanjila niže od najviše cene u prethodnom ciklusu.

Po čemu se Bitcoin razlikuje od ostalih valuta?

Bitcoin funkcioniše tako dobro kao način štednje zbog svog neobičnog dizajna, koji ga čini drugačijim od bilo kog drugog oblika novca koji je postojao pre njega. Bitcoin je digitalna valuta, prvi i verovatno jedini primer valute koja ima ograničenu ponudu dok radi na otvorenom, decentralizovanom sistemu. Vlade strogo kontrolišu valute koje danas koristimo, poput dolara i eura, i proizvode ih za finansiranje ratova i dugova. Korisnici Bitcoin-a – poput vas – kontrolišu Bitcoin protokol.

Evo šta Bitcoin razlikuje od dolara, eura i drugih valuta:

Bitcoin je otvoren sistem.

Svako može da odluči da se pridruži Bitcoin mreži i primeni pravila softverskog protokola, što je dovelo do vrlo decentralizovanog sistema u kojem nijedan pojedinac ili entitet ne može da blokira transakciju, zamrzne sredstva ili da ukrade od druge osobe.Današnji savremeni bankarski sistem se uveliko razlikuje. Nekoliko banaka je dobilo poverenje da gotovo sve valute, akcije i druge vredne predmete čuvaju na “sigurnom” za svoje klijente. Da biste postali banka, potrebni su vam milioni dolara i neverovatne količine političkog uticaja. Da biste pokrenuli Bitcoin čvor i postali „svoja banka“, potrebno vam je nekoliko stotina dolara i jedno slobodno popodne.

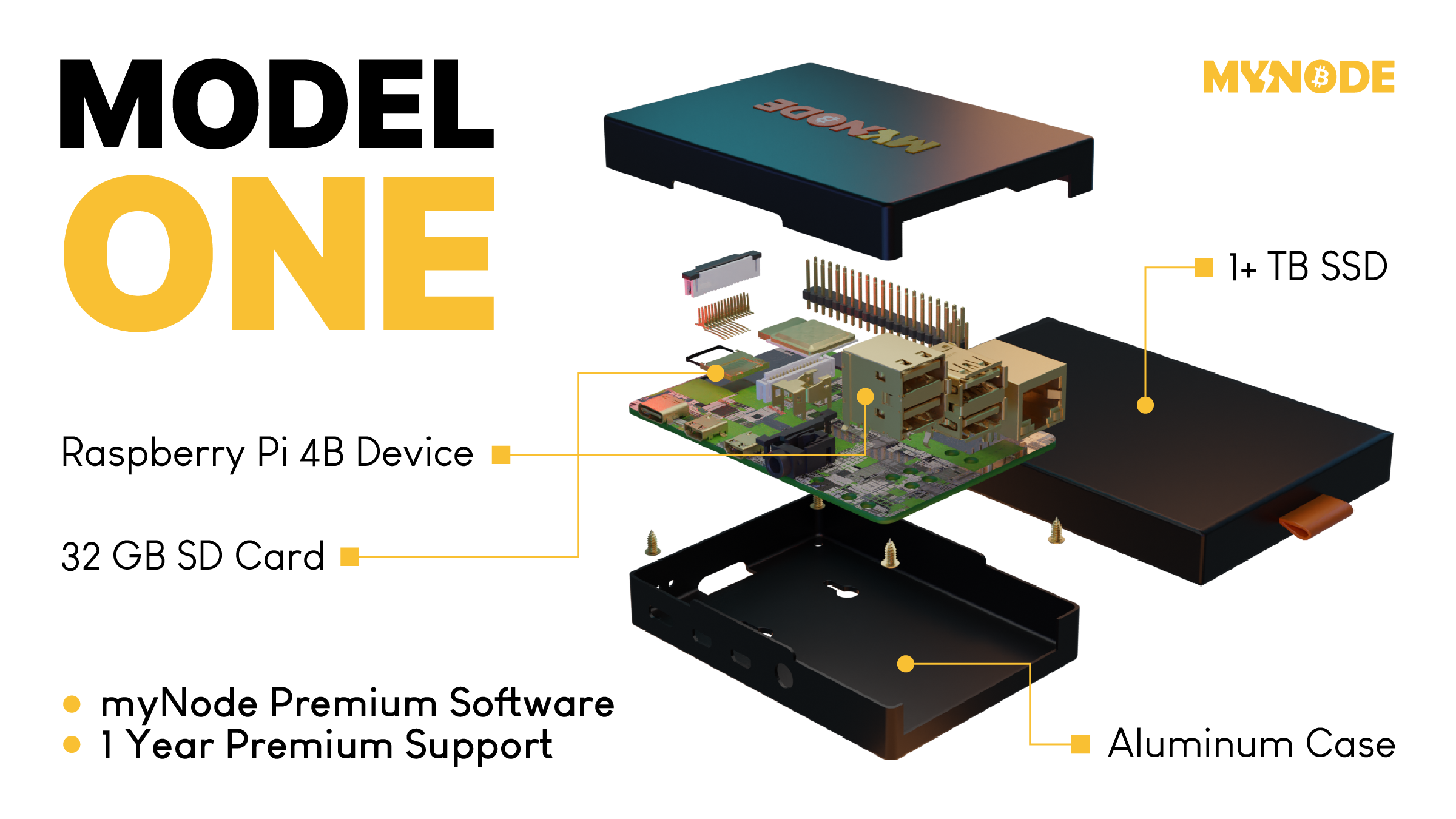

Tako izgleda Bitcoin čvor – Node

MyNode čvor vam omogućava da postanete svoja banka za samo nekoliko minuta.

Tako izgleda Bitcoin čvor – Node

MyNode čvor vam omogućava da postanete svoja banka za samo nekoliko minuta.Bitcoin ima ograničenu ponudu.

Softverski protokol otvorenog koda koji upravlja Bitcoin sistemom ograničava broj novih bitcoin-a koji se mogu stvoriti tokom vremena, sa ograničenjem od ukupno 21.000.000 bitcoin-a. S druge strane, valute koje danas koristimo imaju neograničenu ponudu. Istorija i sadašnje odluke centralnih banaka govore nam da će vlade uvek štampati sve više i više valuta, sve dok valuta ne bude bezvredna. Sve ovo štampanje uzrokuje inflaciju, što pravi štetu običnim radnim ljudima i štedišama.

Tradicionalne valute su dizajnirane tako da opadaju vremenom. Svaki put kada centralna banka kaže da cilja određenu stopu inflacije, oni ustvari kažu da žele da vaš novac svake godine izgubi određeni procenat svoje vrednosti.

Bitcoin-ova ograničena ponuda znači da je on tako dizajniran da raste vremenom kako se potražnja za njim povećava.

Bitcoin putuje oko sveta za nekoliko minuta.

Svako može da pošalje bitcoin-e za nekoliko minuta širom sveta, bez obzira na granice, banke i vlade. Potrebno je manje od minuta da se transakcija pojavi na novčaniku primaoca i oko 60 minuta da se transakcija u potpunosti „obračuna“, tako da primaoc može da bude siguran da su primljeni bitcoin-i sada njegovi (6 konfirmacija bloka). Slanje drugih valuta širom sveta traje danima ili čak mesecima ako se šalju milionski iznosi, a podrazumeva i visoke naknade.

Neke vlade i novinari tvrde da ova sloboda putovanja koju pruža Bitcoin pomaže kriminalcima i teroristima. Međutim, transakciju Bitcoin-a je lakše pratiti nego većinu transakcija u dolarima ili eurima.

Bitcoin se može čuvati na “USB-u”.

Dizajn Bitcoin-a je takav da vam treba samo da čuvate privatni ključ do svojih ‘bitcoin’ adresa (poput lozinke do bankovnih računa) da biste pristupili svojim bitcoin-ima odakle god poželite. Ovaj privatni ključ možete da sačuvate na disku ili na papiru u obliku 12 ili 24 reči na engleskom jeziku. Kao rezultat toga, možete da držite Bitcoin-e vredne milione dolara u svojoj šaci.

Sve ostale valute danas možete ili da strpate u svoj dušek ili da ih poverite banci na čuvanje. Za većinu ljudi koji žive u razvijenom svetu, i koji ne osporavaju autoritet i poverenje u banku, ovo deluje sasvim dobro. Međutim, oni kojima je potrebno da pobegnu od ugnjetavačke vlade ili koji naljute pogrešne ljude, ne mogu verovati bankama. Za njih je sposobnost da nose svoju ušteđevinu bez potrebe za ogromnim koferom neprocenjiva. Čak i ako ne živite na mestu poput ovog, cena Bitcoin-a se i dalje povećava kada ih neko kome oni trebaju kupi.

Kako Bitcoin spašava svet?

Bitcoin, kao ultimativni način štednje, je cakum pakum, ali da li on pomaže u poboljšanju sveta u celini?

Kao što ćete početi da shvatate, ulazeći sve dublje i u druge sadržaje na ovoj stranici, mnogi temeljni delovi našeg današnjeg monetarnog sistema i ekonomije su duboko slomljeni. Međutim, oni koji upravljaju imaju korist od ovakvih sistema, pa se on verovatno neće promeniti bez revolucije ili mirnog svrgavanja od strane naroda. Bitcoin predstavlja novi sistem, sa nekoliko glavnih prednosti:

- Bitcoin popravlja novac, koji je milenijumima služio kao važan alat za rast i poboljšanje društva.

- Bitcoin vraća zdrav razum pozajmljivanju, uklanjanjem apsurdnih situacija poput negativnih kamatnih stopa (gde zajmitelj plaća da bi se zadužio).

- Bitcoin pokreće ulaganja u obnovljive izvore energije i poboljšava energetsku efikasnost u mreži, služeći kao „krajnji kupac“ za sve vrste energije.

Kako mogu da saznam više o Bitcoin-u?

Ovaj članak vam je dao osnovno razumevanje zašto biste trebali razmišljati o Bitcoin-u. Ako želite da saznate više, preporučujem ove resurse:

- Film Bitcoin: Kraj Novca Kakav Poznajemo

- Još uvek je rano za Bitcoin

- Zasto baš Bitcoin?

- Šta je to Bitcoin?

- The Bitcoin Whitepaper ← objavljen 2008. godine, ovo je izložio dizajn za Bitcoin.

-