-

@ 8bad92c3:ca714aa5

2025-05-24 18:01:02

@ 8bad92c3:ca714aa5

2025-05-24 18:01:02Key Takeaways

Lyn Alden unpacks the complex interplay of global trade imbalances, the dollar’s entrenched reserve currency status, and America’s eroded industrial base, arguing that aggressive tariffs under Trump have backfired by hurting U.S. businesses without reversing decades of offshoring. She illustrates how China has rapidly ascended the value chain, dominating key industries and making it nearly impossible for the U.S. to build a trade coalition against them. Despite the U.S.’s massive debt and persistent global demand for dollars, cracks are forming in the system as nations explore alternative payment systems and neutral reserve assets like gold and Bitcoin. Lyn emphasizes that Bitcoin’s most effective path to integration is through grassroots and corporate adoption, not government-led initiatives, and warns that unless the U.S. urgently scales its energy and industrial capacity, it risks falling further behind China’s unmatched pace of growth and infrastructure dominance.

Best Quotes

- "The trade deficit is often described as us sending out pieces of paper and getting goods and services, which sounds like a really good deal."

- "It's better to correct these imbalances from a position of strength, not weakness."

- "All that debt creates inflexible demand for dollars. There’s literally way more demand than dollars in the system."

- "China became the largest auto exporter in the world in just four years."

- "Bitcoin isn’t changing to fit into the global financial system. The global financial system is changing to fit Bitcoin."

- "Individuals, small businesses, corporations—these are the real drivers of Bitcoin adoption. Not governments."

Conclusion

This episode offers a sobering look at America’s trade and currency dilemmas, with Lyn Alden explaining why quick policy fixes like tariffs can’t reverse decades of deindustrialization tied to the dollar’s reserve status. She highlights the rise of neutral reserve assets like gold and Bitcoin as important hedges, stressing that grassroots and corporate adoption will be more effective than government-led efforts. Lyn also warns that without a major push to expand energy production, the U.S. risks falling behind in an AI-driven, hardware-centric world, urging strategic humility and innovation to navigate the shifting global order.

Timestamps

0:00 - Intro

0:31 - Triffin's dilemma

8:10 - Debt leverage

11:04 - Fold & Bitkey

12:41 - Trump's goals and tariff policy

19:54 - Unchained

20:24 - China is not weak

30:07 - Energy

37:15 - AI/robots

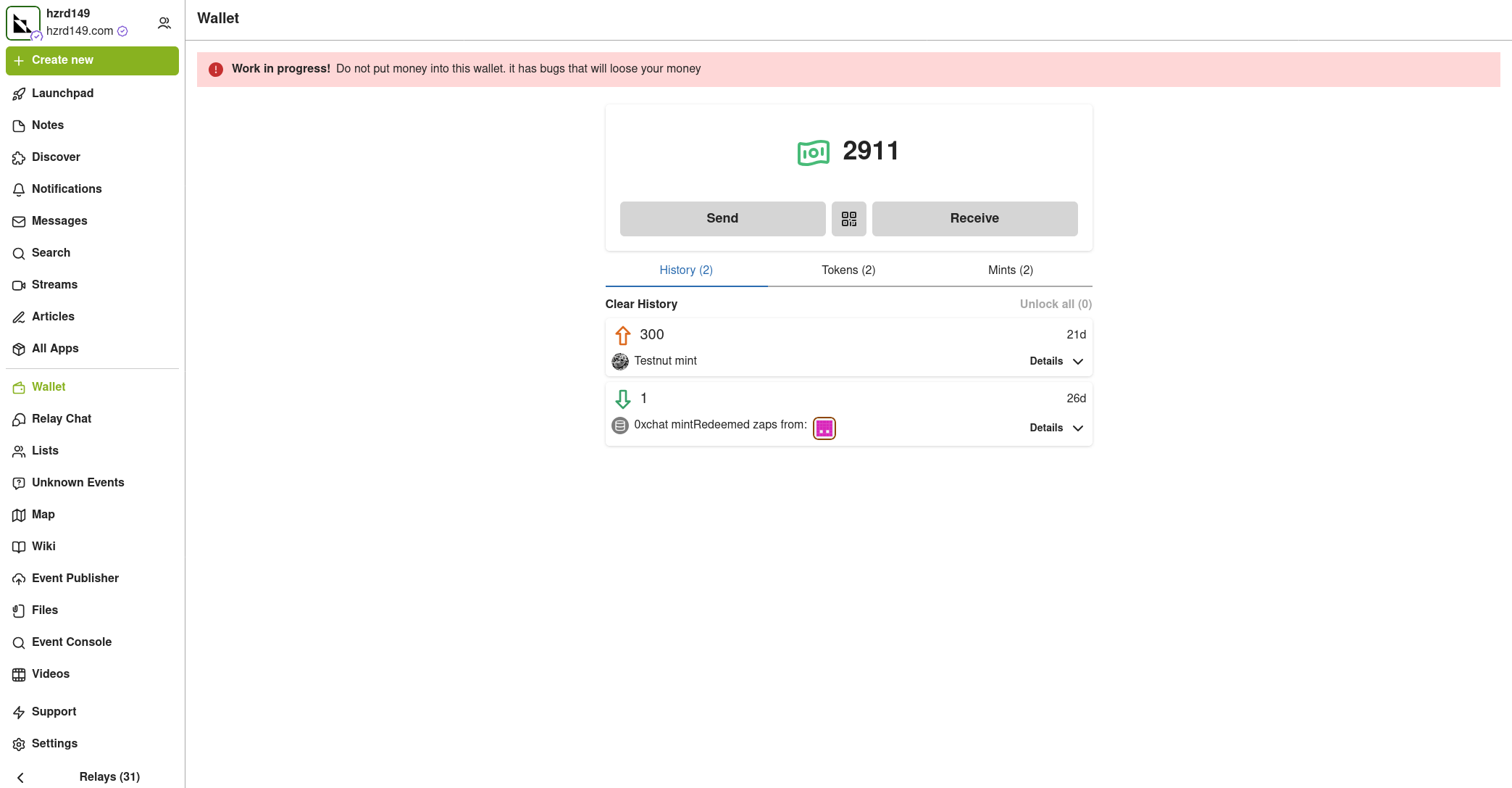

41:11 - SBR

48:47 - Bitcoin credit products

52:40 - Eventful week for bitcoinTranscript

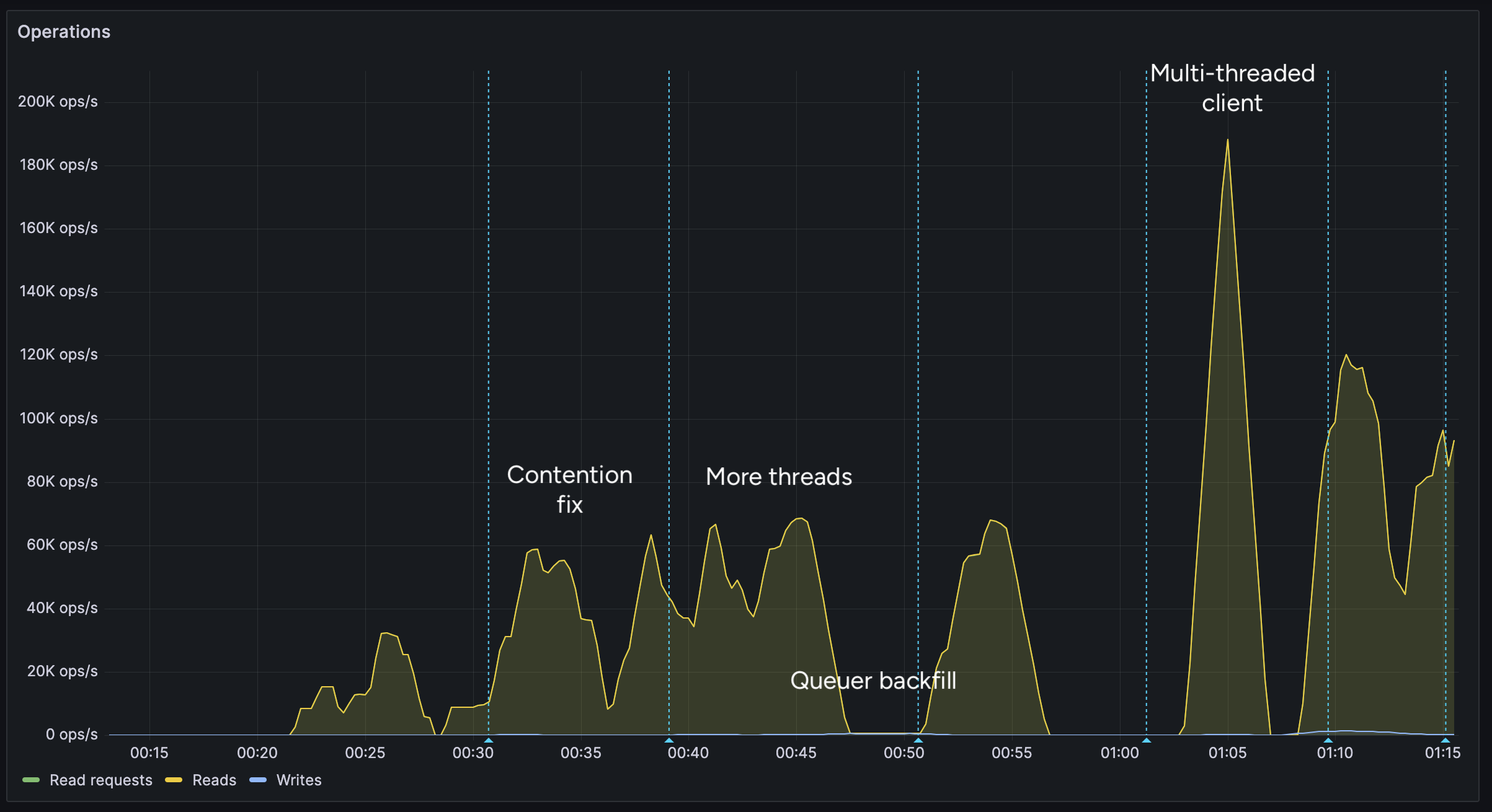

(00:00) They ramped up tariffs super high, super quickly. In many cases, were so high that they hurt us as much as some of our trade adversaries. China has ramped up to like unfathomable degrees. Nuclear, solar, pretty much everything that they can throw money at they're building. The trade is often described as us sending out pieces of paper and getting goods and services, which sounds like a really good deal.

(00:19) They take those slips of paper and then they buy our stocks. They buy our corporate bonds and government bonds. And so they end up owning a larger and larger share of corporate America. got the headphone hair. I'm all out of whack, Lynn. It's been a long week here in Austin. Yeah, I can imagine. It's been a long time since we've talked on the show. It's been two years.

(00:41) I was checking, which is a astonishing to me. But no better time than now. Uh I think quite literally based off of all the conversations we've had uh over the years. I mean, your famous saying, nothing stops this train. I think we're coming to a juncture where that's becoming abundantly clear. and you wrote uh a newsletter earlier this week, I believe you sent it out Sunday, that basically highlighted the crux of the problem, which is the dollar reserve status and the almost impossible task that Trump would like to accomplish, but

(01:21) likely isn't the case, which is sort of solving Triffin's dilemma of reshoring manufacturing while keeping US dollar dominance. So I think diving into this from first principles would be great. Sure. Yeah. And that's that's the um I can imagine the administration's challenge of trying to communicate this because uh the intricacies of how trade deficits and the reserve currency kind of pair together is very wonkish.

(01:46) It it kind of has this like academic quality to it that doesn't go over well uh in kind of political oriented speeches. Um like I would I would be terrible at a political rally for example when I try to explain any of this. Um and so we kind of have this situation where um and this was outlined back during the Breton Wood system by Triffin as you mentioned uh which is that having the reserve currency does come with a bunch of benefits um you know historically called a extraordin uh exorbitant privilege um but then it has certain costs to

(02:15) maintain it and those costs can vary a bit depending on how the system structure. So for example back in the Bretton Woods era the cost was that we kept draining our gold reserves. uh we basically had to kind of keep paying out our go gold gold reserves to maintain that part of the system and in the current formation uh instead we kind of pay for it with our industrial base.

(02:36) We keep kind of sending out little parts of our industrial base over time to maintain the the global reserve currency status. And there's a few reasons for that. One is that um because unlike every other fiat currency, the dollar has all these extra demands for it by countries all around the world. um all these different purposes.

(02:55) um there's this extra demand for dollars which sounds good on the surface and as for Americans for example we have tons of import power when we go on vacations to the rest of the world it's you know we have pretty strong purchasing power compared to when they come to the US um these things seem good on the surface but it also means that it's pretty expensive to manufacture lower margin things here at home uh and so we have this kind of situation where our imports are very strong our exports uh especially lower margin stuff is less uh

(03:22) competitive whereas we can still be competitive competitive on really high margin stuff, you know, technology, finance, healthcare, that kind of thing. Um, and then the other aspect is that even if you could somehow solve that, there's the more fundamental problem, which is that the whole world needs dollars uh for the you know, global reserve currency status to use it for international contract pricing, crossber financing, one side of every trade pair that they do, all these different purposes as a reserve asset. Um uh and

(03:51) when you step back and say, "Well, how do they get all those dollars if they're all using dollars? How did all those dollars get out there?" And the answer is trade deficits. Um basically that overvalued aspect forces open the US trade deficit. And every year we send out hundreds of billions or sometimes a trillion dollars in net outflows.

(04:10) And over years and decades, these have accumulated out there. And so, uh, kind of the way it works is that if you want to fix the trade deficit, which I've been I've been writing about since 2019, I think that's a I think that's a valid mandate to do. Um, unfortunately does come with trade-offs.

(04:26) Uh, some of the some of the benefits that that you know that we enjoy at the cost of the trade deficit. Um, if you do want to kind of fix that imbalance, it comes up, you know, with with basically giving away at least some of those benefits and prioritizing that that industrial base a bit more. And one of the dynamics that you highlighted in your newsletter, which makes sense, but wasn't very clear to me before, is that via these deficits, we flood international markets with dollars because we're sending parts of our industrial base over there. But then

(05:00) it's like cyclical. They take those dollars and then reinvest them in US financial assets. So it has this sort of flow where it goes out but then it comes back in into the financialized economy via equities and real estate and other such assets and that is good for asset owners here in the United States.

(05:19) But again I think that's is part of the bag of mandate is that sort of cycle has led to this large wealth gap in the United States that they're trying to fix. Yeah. Exactly. Um and so basically the opposite side of a current account deficit which is basically so the trade deficit plus things like interest and dividends.

(05:39) Um so we run a structural current account deficit and the opposite side of that is a capital account surplus. Um which is that funds flow in the rest of the world and buy our financial assets. Uh and so it's the the trade deficit is often described as us sending out pieces of paper and getting goods and services which sounds like a really good deal.

(05:57) Um but then the extra step of that that you mentioned is that they take those slips of paper or really those electronic digits that they have and then they buy our stocks, they buy our real estate, they buy our private equity, they they buy our corporate bonds and government bonds and so they end up owning a larger and larger share of corporate America as part of their kind of accumulated uh trade surpluses uh and reserve assets and uh international private assets.

(06:22) Um, and the kind of the consequence of this, if you kind of like view the foreign sector as an intermediary, we're basically constantly kind of taking economic vibrancy out of, you know, Michigan and Ohio and, uh, you know, rural Pennsylvania where the steel m -

@ bf47c19e:c3d2573b

2025-05-24 17:11:28

@ bf47c19e:c3d2573b

2025-05-24 17:11:28Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Odakle Potiče Bitcoin?

- Koje Probleme Rešava Bitcoin?

- Kako se Bitcoin razvijao u poslednjoj deceniji?

Bitcoin je peer to peer elektronski keš, novi oblik digitalnog novca koji se može prenositi između ljudi ili računara, bez potrebe za učestvovanjem pouzdanog posrednika (kao što je banka) i čije izdavanje nije pod kontrolom nijedne stranke.

Zamislite papirni dolar ili metalni novčić. Kad taj novac date drugoj osobi, ona ne mora da zna ko ste vi.

On samo treba da veruju da novac koji dobiju od vas nije falsifikat. Obično, proveravanje falsifikata „fizičkog“ novca, ljudi rade koristeći samo oči i prste ili koristeći specijalnu opremu za testiranje ukoliko se radi o značajnijoj sumi novca.

Većina plaćanja u našem digitalnom društvu vrši se putem Interneta korišćenjem neke posredničke usluge: kompanije za izdavanje kreditnih kartica poput Visa, snabdevača digitalnih plaćanja kao što je PayPal ili Apple Pay ili mrežne platforme poput WeChat u Kini.

Kretanje ka digitalnom plaćanju sa sobom donosi oslanjanje na nekog centralnog aktera koji mora odobriti i verifikovati svaku uplatu.

Priroda novca se promenila od fizičkog predmeta koji možete da nosite, prenesete i autentifikujete do digitalnih bitova koje mora da čuva i verifikuje treća strana koja kontroliše njihov prenos.

Odricanjem od gotovine u korist „udobnih“ digitalnih plaćanja, mi takođe stvaramo sistem u kome dajemo ogromna ovlašćenja onima koji bi poželeli da nas tlače.

Platforme za digitalno plaćanje postale su osnova distopijskih autoritarnih metoda kontrole, poput onih koje kineska vlada koristi za nadgledanje disidenata i sprečava građane, čije ponašanje im se ne svidja, da kupuju robu i plaćaju usluge.

Bitcoin nudi alternativu centralno kontrolisanom digitalnom novcu sa sistemom koji nam vraća prirodu korišćenja keša – čovek čoveku, ali u digitalnom obliku.

Bitcoin je digitalno sredstvo koje se izdaje i prenosi preko mreže međusobno povezanih računara, od koji svaki od njih samostalno potvrđuje da svi ostali igraju po pravilima.

Bitcoin Mreža

Odakle Potiče Bitcoin?

Bitcoin je izumela osoba ili grupa poznata pod pseudonimom Satoshi Nakamoto, oko 2008. godine.

Niko ne zna Satoshijev identitet, a koliko znamo, oni su nestali i o njima se godinama ništa nije čulo.

11.februara 2009. godine, Satoshi je pisao o ranoj verziji Bitcoin-a na mrežnom forumu za cypherpunkere, ljude koji rade na tehnologiji kriptografije i koji su zabrinuti za privatnost i slobodu pojedinca.

Iako ovo nije prvo zvanično objavljivanje Bitcoin-a, sadrži dobar rezime Satoshi-jevih motiva.

Razvio sam novi P2P sistem e-keša otvorenog koda pod nazivom Bitcoin. Potpuno je decentralizovan, bez centralnog servera ili pouzdanih stranki, jer se sve zasniva na kripto dokazima umesto na poverenju. […]

Osnovni problem konvencionalne valute je potpuno poverenje koje je potrebno za njeno funkcionisanje. Centralnoj banci se mora verovati da neće devalvirati valutu, ali istorija tradicionalnih valuta je puna primera kršenja tog poverenja. Bankama se mora verovati da drže naš novac i prenose ga elektronskim putem, ali one ga daju u talasima kreditnih balona sa delićem rezerve. Moramo im verovati sa našom privatnošću, verovati im da neće dozvoliti da kradljivci identiteta pokradu naše račune. Njihovi ogromni režijski troškovi onemogućavaju mikro plaćanja.

Generaciju ranije, višekorisnički time-sharing računarski sistemi imali su sličan problem. Pre pojave jake enkripcije, korisnici su morali da imaju pouzdanje u zaštitu lozinkom kako bi zaštitili svoje fajlove […]

Tada je jaka enkripcija postala dostupna širokim masama i više nije bilo potrebno poverenje. Podaci bi se mogli osigurati na način koji je fizički bio nemoguć za pristup drugima, bez obzira iz kog razloga, bez obzira koliko je dobar izgovor, bez obzira na sve.

Vreme je da imamo istu stvar za novac. Uz e-valutu zasnovanu na kriptografskom dokazu, bez potrebe da verujete posredniku treće strane, novac može biti siguran i transakcije mogu biti izvršene bez napora. […]

Rešenje Bitcoin-a je korišćenje peer-to-peer mreže za proveru dvostruke potrošnje. Ukratko, mreža radi poput distribuiranog servera vremenskih žigova, obeležavajući prvu transakciju koja je potrošila novčić. Potrebna je prednost prirode informacije koju je lako širiti, ali je teško ugušiti. Za detalje o tome kako to funkcioniše, pogledajte članak o dizajnu na bitcoin.org

Satoshi Nakamoto

Koje Probleme Rešava Bitcoin?

Razdvojimo neke od Satoshi-jevih postova kako bismo uvideli razloge njegove motivacije.

„Razvio sam novi P2P sistem e-keša otvorenog koda.“

P2P je skraćenica za peer to peer i ukazuje na sistem u kojem jedna osoba može da komunicira sa drugom bez ikoga u sredini, kao medjusobno jednaki.

Možete se setiti P2P tehnologija za razmenu datoteka poput Napster-a, Kazaa-e i BitTorrrent-a, koje su prve omogućile ljudima da dele muziku i filmove bez posrednika.

Satoshi je dizajnirao Bitcoin kako bi omogućio ljudima da razmenjuju e-keš, elektronski keš, bez prolaska preko posrednika na približno isti način.

Softver je otvorenog koda, što znači da svako može videti kako funkcioniše i doprineti tome.

Ne treba da verujemo ni u šta što je Satoshi napisao u svom postu o tome kako softver radi.

Možemo pogledati kod i sami proveriti kako to funkcioniše. Štaviše, možemo promeniti funkcionalnost sistema promenom koda.

„Potpuno je decentralizovan, bez centralnog servera ili pouzdanih stranki …“

Satoshi napominje da je sistem decentralizovan kako bi se razlikovao od sistema koji imaju centralnu kontrolu.

Prethodne pokušaje stvaranja digitalne gotovine poput DigiCash-a od strane Davida Chaum-a podržavao je centralni server, računar ili skup računara koji je bio odgovoran za izdavanje i verifikaciju plaćanja pod kontrolom jedne korporacije.

Takve, centralno kontrolisane privatne šeme novca, bile su osuđene na propast; ljudi se ne mogu osloniti na novac koji može nestati kada kompanija prestane sa poslovanjem, bude hakovana, pretrpi pad servera ili je zatvori vlada.

Bitcoin održava mreža pojedinaca i kompanija širom sveta.

Da bi se Bitcoin isključio, bilo bi potrebno isključiti desetine do stotine hiljada računara širom sveta u isto vreme, zauvek, od kojih su mnogi na nepoznatim lokacijama.

Bila bi to beznadežna igra, jer bi svaki napad ove prirode jednostavno podstakao stvaranje novih Bitcoin čvorova ili računara na mreži.

„… sve se zasniva na kripto dokazima umesto na poverenju“

Internet, a u stvari i većina savremenih računarskih sistema, izgrađeni su na kriptografiji, metodi prikrivanja informacija, tako da je može dekodirati samo primalac informacije.

Kako se Bitcoin oslobađa potrebe za poverenjem? Umesto da verujemo nekome ko kaže „Ja sam Alisa“ ili „Imam 10 $ na računu“, možemo koristiti kriptografsku matematiku da bismo izneli iste činjenice na način koji je vrlo lako verifikovati od strane primaoca dokaza ali ga je nemoguće falsifikovati.

Bitcoin u svom dizajnu koristi kriptografsku matematiku kako bi učesnicima omogućio da provere ponašanje svih ostalih učesnika, bez poverenja u bilo koju centralnu stranku.

„Moramo im verovati [bankama] sa našom privatnošću, verovati im da neće dozvoliti da kradljivci identiteta pokradu naše račune“

Za razliku od korišćenja vašeg bankovnog računa, sistema digitalnog plaćanja ili kreditne kartice, Bitcoin omogućava dvema stranama da obavljaju transakcije bez davanje bilo kakvih ličnih podataka.

Centralizovana skladišta potrošačkih podataka koji se čuvaju u bankama, kompanijama sa kreditnim karticama, procesorima plaćanja i vladama, predstavljaju pravu poslasticu za hakere.

Kao dokaz Satoshi-jeve poente služi primer iz 2017. godine kada je Equifax masovono kompromitovan, kada su hakeri ukrali identifikacione i finansijske podatke za više od 140 miliona ljudi.

Bitcoin odvaja finansijske transakcije od stvarnih identiteta.

Na kraju krajeva, kada nekome damo fizički novac, on nema potrebu da zna ko smo, niti treba da brinemo da će nakon naše razmene moći da iskoristi neke informacije koje smo mu dali da ukrade još našeg novca.

Zašto ne bismo očekivali isto, ili čak i bolje, od digitalnog novca?

„Centralnoj banci se mora verovati da neće devalvirati valutu, ali istorija tradicionalnih valuta je puna primera kršenja tog poverenja.“

Pojam tradicionalna valuta, odnosi se na valutu izdatu od strane vlade i centralne banke, koju vlada proglašava zakonskim sredstvom plaćanja.

Istorijski, novac je nastao od stvari koje je bilo teško proizvesti, koje su bile lake za proveravanje i transport, poput školjki, staklenih perli, srebra i zlata.

Kad god bi se nešto koristilo kao novac, postojalo je iskušenje da se stvori više toga.

Ako bi neko pronašao vrhunsku tehnologiju za brzo stvaranje velike količine nečega, ta stvar bi izgubila vrednost.

Evropski naseljenici uspeli su da liše afrički kontinent bogatstva trgujući staklenim perlicama koje su se lako proizvodile za ljudske robove.

Isto se dogodilo sa američkim indijancima, kada su kolonisti otkrili način brze proizvodnje vampum školjki, koje su starosedeoci smatrali retkim.

Vremenom, širom sveta ljudi su shvatili da je samo zlato dovoljno retko da deluje kao novac, bez straha da bi neko drugi mogao da ga stvori u velikim količinama.

Polako smo prešli sa svetske ekonomije koja je koristila zlato kao novac na onu gde su banke izdavale papirne sertifikate kao dokaz posedovanja tog zlata.

Nixon je okončao međunarodnu konvertibilnost američkog dolara u zlato 1971. godine, privremenim rešenjem, koje je ubrzo postalo trajno.

Kraj zlatnog standarda omogućio je vladama i centralnim bankama da imaju punu dozvolu da povećavaju novčanu masu po svojoj volji, razredjujući vrednost svake novčanice u opticaju, poznatije kao umanjenje vrednosti.

Iako je izdata od strane vlade, suštinska tradicionalna valuta je novac koji svi znamo i svakodnevno koristimo, ipak je relativno novo iskustvo u opsegu svetske istorije.

Moramo verovati našim vladama da ne zloupotrebljavaju njegovo štamparije, i ne treba nam puno muke da nadjemo primere kršenja tog poverenja.

U autokratskim i centralno planiranim režimima gde vlada ima prst direktno na mašini za novac, kao što je Venecuela, valuta je postala gotovo bezvredna.

Venecuelanski Bolivar prešao je sa 2 bolivara za 1 američki dolar, koliko je vredeo 2009. godine, na 250.000 bolivara za 1 američki dolar 2019. godine.

Pogledajte koliko novčanica je bilo potrebno za kupovinu piletine u Venecueli posle hiperinflacije.

Satoshi je želeo da ponudi alternativu tradicionalnoj valuti čija se ponuda uvek nepredvidivo širi.

Da bi sprečilo umanjenje vrednosti, Satoshi je dizajnirao novčani sistem gde je zaliha bila fiksna i izdavana po predvidljivoj i nepromenjivoj stopi.

Postojaće samo 21 milion Bitcoin-a.

Međutim, svaki Bitcoin se može podeliti na 100 miliona jedinica koje se sada nazivaju satoshis (sats-ovi), što će činiti ukupno 2,1 kvadriliona satoshi-a u opticaju oko 2140. godine.

Pre Bitcoin-a nije bilo moguće sprečiti beskrajnu reprodukciju digitalnih sredstava.

Kopirati digitalnu knjigu, audio datoteku ili video zapis i poslati ga prijatelju, je jeftino i lako.

Jedini izuzeci od toga su digitalna sredstva koja kontrolišu posrednici.

Na primer, kada iznajmite film sa iTunes-a, možete ga gledati na vašem uređaju samo zato što iTunes kontroliše distribuciju tog filma i može ga zaustaviti nakon perioda njegovog iznajmljivanja.

Slično tome, vaša banka kontroliše vaš digitalni novac. Zadatak banke je da vodi evidenciju koliko novca imate.

Ako ga prenesete nekom drugom, oni će odobriti ili odbiti takav prenos.

Bitcoin je prvi digitalni sistem koji sprovodi oskudicu bez posrednika i prvo je sredstvo poznato čovečanstvu čija je nepromenljiva ponuda i raspored izdavanja poznat unapred.

Ni plemeniti metali poput zlata nemaju ovo svojstvo, jer uvek možemo iskopati sve više i više zlata ukoliko je to isplativo.

Zamislite da otkrijemo asteroid koji sadrži deset puta više zlata nego što ga imamo na zemlji.

Šta bi se dogodilo sa cenom zlata uzimajući u obzir tako obilnu ponudu? Bitcoin je imun na takva otkrića i manipulisanje nabavkom.

Jednostavno je nemoguće proizvesti više od toga (21 miliona).

„Podaci bi se mogli osigurati na način koji je fizički bio nemoguć za pristup drugima, bez obzira iz kog razloga, bez obzira koliko je dobar izgovor, bez obzira na sve. […] Vreme je da imamo istu stvar za novac “

Naše trenutne metode obezbeđivanja novca, poput stavljanja u banku, oslanjaju se na poverenje nekome drugom da će obaviti taj posao.

Poverenje u takvog posrednika ne zahteva samo sigurnost da on neće učiniti nešto zlonamerno ili glupo, već i da vlada neće zapleniti ili zamrznuti vaša sredstva vršeći pritisak na ovog posrednika.

Međutim, videli smo bezbroj puta da vlade mogu, i zaista uskraćuju pristup novcu kada se osećaju ugroženo.

Nekom ko živi u Sjedinjenim Državama ili nekoj drugoj visoko regulisanoj ekonomiji možda zvuči glupo da razmišlja da se probudi sa oduzetim novcem, ali to se događa stalno.

PayPal mi je zamrzao sredstva jednostavno zato par meseci nisam koristio svoj račun.

Trebalo mi je više od nedelju dana da vratim pristup „svom“ novcu.

Srećan sam što živim u Europi, gde bih se bar mogao nadati da ću potražiti neko pravno rešenje ako mi PayPal zamrzne sredstva i gde imam osnovno poverenje da moja vlada i banka neće ukrasti moj novac.

Mnogo gore stvari su se dogodile, i trenutno se dešavaju, u zemljama sa manje slobode.

Banke su se zatvorile tokom kolapsa valuta u Grčkoj.

Banke na Kipru su koristile kaucije da konfiskuju sredstva od svojih klijenata.

Indijska vlada je proglasila određene novčanice bezvrednim.

Bivši SSSR, u kojem sam odrastao, imao je ekonomiju pod kontrolom vlade što je dovelo do ogromnih nestašica robe.

Bilo je nezakonito posedovati strane valute kao što je američki dolar.

Kada smo poželeli da odemo, mojoj porodici je bilo dozvoljeno da zameni samo ograničenu količinu novca po osobi za američke dolare po zvaničnom kursu koji je bio u velikoj meri različit od pravog kursa slobodnog tržišta.

U stvari, vlada nam je oduzela ono malo bogatstva koje smo imali koristeći gvozdeni stisak na ekonomiji i kretanju kapitala.

Autokratske zemlje imaju tendenciju da sprovode strogu ekonomsku kontrolu, sprečavajući ljude da na slobodnom tržištu povuku svoj novac iz banaka, iznesu ga iz zemlje ili da ga razmene u ne još uvek bezvredne valute poput američkog dolara.

To omogućava vladinoj slobodnoj vladavini da primeni sulude ekonomske eksperimente poput socijalističkog sistema SSSR-a.

Bitcoin se ne oslanja na poverenje u treću stranu da bi osigurao vaš novac.

Umesto toga, Bitcoin onemogućava drugima pristup vašim novčićima bez jedinstvenog ključa koji imate samo vi, bez obzira iz kog razloga, bez obzira koliko je dobar izgovor, bez obzira na sve.

Držeći Bitcoin, držite ključeve sopstvene finansijske slobode. Bitcoin razdvaja novac i državu

„Rešenje Bitcoin-a je korišćenje peer-to-peer mreže za proveru dvostruke potrošnje […] poput distribuiranog servera vremenskih žigova, obeležavajući prvu transakciju koja je potrošila novčić“

Mreža se odnosi na ideju da je gomila računara povezana i da mogu međusobno slati poruke.

Reč distribuirano znači da ne postoji centralna stranka koja kontroliše, već da svi učesnici koordiniraju medjusobno kako bi mreža bila uspešna.

U sistemu bez centralne kontrole, bitno je znati da niko ne vara. Ideja dvostruke potrošnje odnosi se na mogućnost trošenja istog novca dva puta.

Fizički novac odlazi iz vaše ruke kad ga potrošite. Međutim, digitalne transakcije se mogu kopirati baš kao muzika ili filmovi.

Kada novac šaljete preko banke, oni se pobrinu da isti novac ne možete da prebacujete dva puta.

U sistemu bez centralne kontrole potreban nam je način da sprečimo ovu vrstu dvostruke potrošnje, koja je u suštini ista kao i falsifikovanje novca.

Satoshi opisuje da učesnici u Bitcoin mreži rade zajedno kako bi vremenski označili (doveli u red) transakcije kako bismo znali šta je bilo prvo.

Zbog toga možemo odbiti sve buduće pokušaje trošenja istog novca.

Satoshi se uhvatio u koštac sa nekoliko zanimljivih tehničkih problema kako bi rešio probleme privatnosti, uništavanja vrednosti i centralne kontrole u trenutnim monetarnim sistemima.

Na kraju je stvorio peer to peer mrežu kojoj se svako mogao pridružiti bez otkrivanja svog identiteta ili potrebe da veruje bilo kom drugom učesniku.

Kako se Bitcoin razvijao u poslednjoj deceniji?

Doprinosi izvornom kodu Bitcoina

Kada je Bitcoin pokrenut, samo nekolicina ljudi ga je koristila i pokrenula Bitcoin softver na svojim računarima za napajanje Bitcoin mreže.

Većina ljudi u to vreme mislila je da je to šala ili da će se otkriti ozbiljni nedostaci u dizajnu sistema koji će ga učiniti neizvodljivim.

Vremenom se mreži pridružilo sve više ljudi koji su pomoću svojih računara dodali sigurnost mreži.

Ljudi su počeli da menjaju Bitcoin-e za robu i usluge, dajući mu stvarnu vrednost. Pojavile su se menjačnice valuta koje su menjale Bitcoin-e za gotovo sve tradicionalne valute na svetu.

Deset godina nakon izuma, Bitcoin koriste milioni ljudi sa desetinama do stotinama hiljada čvorova koji pokreću besplatni Bitcoin softver, koji se razvija od strane stotina dobrovoljaca i kompanija širom sveta.

Bitcoin mreža je porasla kako bi obezbedila vrednost veću od stotine biliona dolara.

Računari koji učestvuju u zaštiti Bitcoin mreže poznati su kao rudari/majneri.

Oni rade u industrijskim operacijama širom sveta, ulažući milione dolara u specijalni rudarski hardver koji radi samo jedno: pobrinuti se da je Bitcoin najsigurnija mreža na planeti.

Rudari troše električnu energiju kako bi transakcije Bitcoin-a učinile sigurnim od modifikacija. Budući da se rudari međusobno takmiče za oskudan broj Bitcoin-a proizvedenih dnevno, oni uvek moraju da pronalaze najjeftinije izvore energije na planeti da bi ostali profitabilni.

Rudari rade na različitim mestima, od hidroelektrana u dalekim krajevima Kine do vetroparkova u Teksasu, do kanadskih naftnih polja koja proizvode gas koji bi u suprotnom bio odzračen ili spaljen u atmosferi.

Iako je Bitcoin popularna tema i o njemu se često raspravlja u medijima, procenjujemo da je samo nekoliko miliona ljudi na svetu počelo da redovno štedi Bitcoin.

Za mnoge ljude, posebno za one koji nikada nisu živeli pod represivnim režimima, ovaj izum novog oblika digitalnog novca izvan kontrole vlade može biti veoma izazovan za razumevanje i prihvatanje.

Zato sam ja ovde. Želim da vam pomognem da razumete Bitcoin i budete gospodar svoje budućnosti!

-

@ 0e9491aa:ef2adadf

2025-05-24 17:01:16

@ 0e9491aa:ef2adadf

2025-05-24 17:01:16

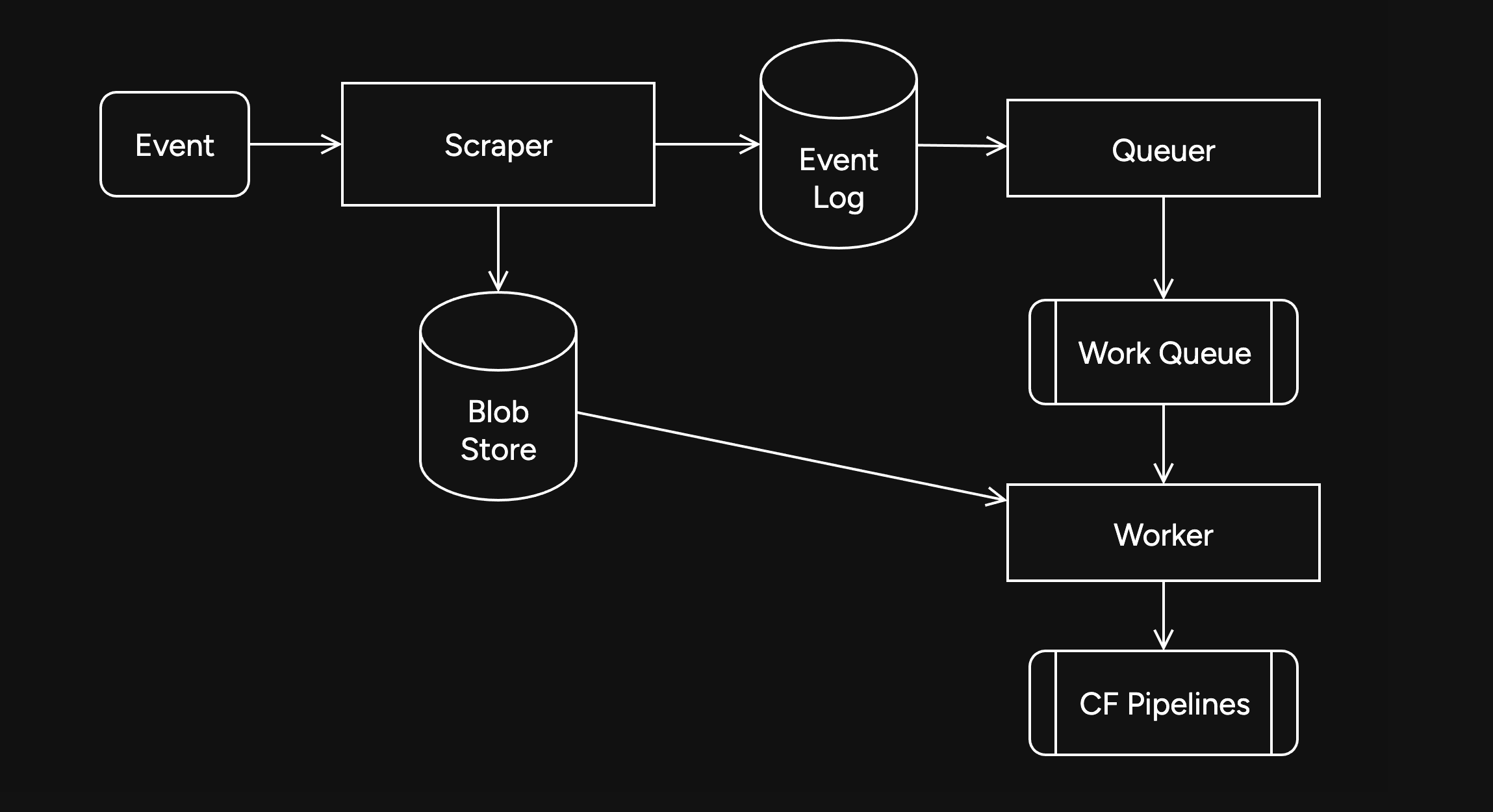

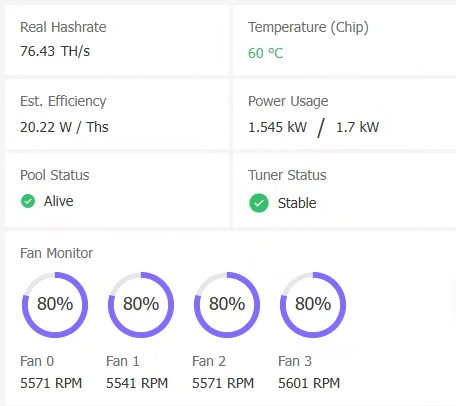

For years American bitcoin miners have argued for more efficient and free energy markets. It benefits everyone if our energy infrastructure is as efficient and robust as possible. Unfortunately, broken incentives have led to increased regulation throughout the sector, incentivizing less efficient energy sources such as solar and wind at the detriment of more efficient alternatives.

The result has been less reliable energy infrastructure for all Americans and increased energy costs across the board. This naturally has a direct impact on bitcoin miners: increased energy costs make them less competitive globally.

Bitcoin mining represents a global energy market that does not require permission to participate. Anyone can plug a mining computer into power and internet to get paid the current dynamic market price for their work in bitcoin. Using cellphone or satellite internet, these mines can be located anywhere in the world, sourcing the cheapest power available.

Absent of regulation, bitcoin mining naturally incentivizes the build out of highly efficient and robust energy infrastructure. Unfortunately that world does not exist and burdensome regulations remain the biggest threat for US based mining businesses. Jurisdictional arbitrage gives miners the option of moving to a friendlier country but that naturally comes with its own costs.

Enter AI. With the rapid development and release of AI tools comes the requirement of running massive datacenters for their models. Major tech companies are scrambling to secure machines, rack space, and cheap energy to run full suites of AI enabled tools and services. The most valuable and powerful tech companies in America have stumbled into an accidental alliance with bitcoin miners: THE NEED FOR CHEAP AND RELIABLE ENERGY.

Our government is corrupt. Money talks. These companies will push for energy freedom and it will greatly benefit us all.

Microsoft Cloud hiring to "implement global small modular reactor and microreactor" strategy to power data centers: https://www.datacenterdynamics.com/en/news/microsoft-cloud-hiring-to-implement-global-small-modular-reactor-and-microreactor-strategy-to-power-data-centers/

If you found this post helpful support my work with bitcoin.

-

@ bf47c19e:c3d2573b

2025-05-24 16:13:51

@ bf47c19e:c3d2573b

2025-05-24 16:13:51Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Definisanje novca

- Šta je sredstvo razmene?

- Šta je obračunska jedinica?

- Šta je zaliha vrednosti?

- Zašto su važne funkcije novca?

- Novac Gubi Funkciju: Alhemičar iz Njutonije

- Eksploatacija pomoću Novca: Agri Perle

- Novac Gubi Funkciju 2. Deo: Kejnslandski Bankar

- Da li nas novac danas eksploatiše?

- Šta je novac, i zašto trebate da brinete?

- Efikasnija Ušteda Novca

- Zasluge

- Molim vas da šerujete!

Google izveštava o stalnom povećanju interesa u svetu za pitanje „Šta je novac?“ koji se postavlja iz godine u godinu, od 2004. do 2021., a sa naglim porastom nakon finansijske krize 2008. godine.

I izgleda se da niko nema dobar odgovor za to.

Godišnji proseci mesečnih interesa za pretragu. 100 predstavlja najveći interes za pretragu tokom čitavog perioda, koji se dogodio u decembru 2019. Podaci sa Google Trends-a.

Godišnji proseci mesečnih interesa za pretragu. 100 predstavlja najveći interes za pretragu tokom čitavog perioda, koji se dogodio u decembru 2019. Podaci sa Google Trends-a.Međutim, odgovaranje na ovo naizgled jednostavno pitanje pomoći će vam da razjasnite ulogu novca u vašem životu. Jednom kada shvatite kako novac funkcioniše, tačno ćete videti i zašto svet danas ludi – i šta učiniti povodom toga. Zato hajde da se udubimo u to.

Na pitanje šta je novac, većina ljudi otvori svoje novčanike i pokaže nekoliko novčanica – “evo, ovo je novac!”

Ali po čemu se ove novčanice razlikuju od stranica vaše omiljene knjige? Pa, naravno, zavod za izradu novčanica te zemlje je odštampao te novčanice iz vašeg novčanika kako bi se oduprla falsifikovanju, i svi ih koriste da bi kupili odredjene stvari.

Međutim, Nemačka Marka imala je sva ova svojstva u prošlosti – ali preduzeća danas ne prihvataju te novčanice. Zapravo, građani Nemačke su početkom dvadesetih godina prošlog veka spaljivali papirne Marke kako bi grejali svoje domove. Marka je imala veću vrednost kao papir za potpalu nego kao novac!

1923. nemačka valuta poznata kao Marka bila je jeftinija od uglja i drveta!

Pa šta to čini novac, novcem?

Ispostavilo se da ovo nije pitanje na koje je lako dati odgovor.

Definisanje novca

Novac nije fizička stvar poput novčanice dolara. Novac je društveni sistem koji koristimo da bismo olakšali trgovinu robom i uslugama. Međutim, tokom istorije fizička monetarna dobra igrala su ključnu ulogu u društvenom sistemu novca, često kao znakovi koji predstavljaju vrednost u monetarnom sistemu. Ovaj sistem ima tri funkcije: 1) Sredstvo Razmene, 2) Obračunsku Jedinicu i 3) Zalihu Vrednosti.

Odakle dolaze ove funkcije, i zašto su one vredne?

Šta je sredstvo razmene?

Sredstvo razmene je neko dobro koje se obično razmenjuje za drugo dobro. Najčešće objašnjenje za to kako su se pojavila sredstva razmene glasi otprilike ovako: Boris ima ječam i želeo bi da kupi ovcu od Marka. Marko ima ovce, ali želi samo piliće. Ana ima piliće, ali ona ne želi ječam ili ovce.

To se naziva problem sticaja potreba: dve strane moraju da žele ono što druga ima da bi mogle da trguju. Ako se želje dve osobe ne podudaraju, oni moraju da pronađu druge ljude sa kojima će trgovati dok svi ne pronađu dobro koje žele.

Ljudi koji trguju robom i uslugama moraju da imaju potrebe koje se podudaraju.

Ljudi koji trguju robom i uslugama moraju da imaju potrebe koje se podudaraju.Vremenom, veoma je verovatno da će se određena vrsta robe, poput pšenice, pojaviti kao sredstvo razmene jer su je mnogi ljudi želeli. Uzimajući pšenicu kao primer: pšenica je rešila “sticaje potreba” u mnogim zanatima, jer čak i ako onaj koji prima pšenicu a nije želeo da je koristi za sebe, znao je da će je neko drugi želeti.

Ovo nazivamo prodajnost imovine.

Pšenica je dobar primer dobra za prodaju jer svi moraju da jedu, a od pšenice se pravi hleb. Pšenica ima vrednost kao sastojak hleba i kao dobro koje olakšava trgovinu rešavanjem problema „sticaja potreba“.

Razmislite o svojoj želji da dobijete više novčanica u eurima ili drugoj valuti. Ne možete da jedete novčanice da biste preživeli, a i ne bi vam bile od velike koristi ako poželite da ih koristite kao građevinski materijal za vašu kuću. Međutim, znate da sa tim novčanicama možete da kupite hranu i kuću.

Stvarne fizičke novčanice su beskorisne za vas. Novčanice su vam dragocene samo zato što će ih drugi prihvatiti za stvari koje su vama korisne.

Tokom dugog perioda istorije, novac je evoluirao do te mere da monetarno dobro može imati vrednost, a da to dobro ne služi za bilo koju drugu ‘suštinsku’ upotrebu, poput hrane ili energije. Umesto toga, njegova upotreba je zaliha vrednosti i jednostavna zamena za drugu robu u bilo kom trenutku koji poželite.

Šta jedno dobro čini poželjnijim i prodajnijim od drugog dobra?

Deljivost

Definicija: Sposobnost podele dobra na manje količine.

Loš Primer: Dijamante je teško podeliti na manje komade. Za zajednicu od hiljada ljudi koji dnevno izvrše milione transakcija, dijamanti čine loše sredstvo razmene. Previše su retki i nedeljivi da bi se koristili za mnoge transakcije.

Ujednačenost

Definicija: Sličnost pojedinačnih jedinica odredjenog dobra.

Loš Primer: Krave nisu ujednačene – neke su veće, neke manje, neke bolesne, neke zdrave. Sa druge strane, unca čistog zlata je jednolična – jedna unca je potpuno ista kao sledeća. Ovo svojstvo se takođe često naziva zamenljivost.

Prenosivost

Definicija: Lakoća transporta dobra.

Loš Primer: Krava nije baš prenosiva. Zlatnici su prilično prenosivi. Papirne novčanice su još prenošljivije. Knjiga u kojoj se jednostavno beleži vlasništvo nad tim vrednostima (poput Rai kamenog sistema ili digitalnog bankovnog računa) je neverovatno prenosiva, jer nema fizičkog dobra koje treba nositi sa sobom za kupovinu. Postoji samo sistem za evidentiranje vlasništva nad tim vrednostima u nematerijalnom obliku.

Kako dobro postaje sredstvo razmene?

Dobra postaju, i ostaju sredstva razmene zbog svoje univerzalne potražnje, takođe poznate kao njihova prodajnost, čemu pomažu svojstva koja su gore nabrojana.

Mnogo različitih dobara mogu u različitoj meri delovati kao sredstva razmene u ekonomiji. Danas, naša globalna ekonomija koristi valute koje izdaju države, zlato, pa čak i robu poput nafte kao sredstvo razmene.

Šta je obračunska jedinica?

Stvari se komplikuju kada u ekonomiji postoji mnogo robe koja se prodaje. Čak i sa samo 5 dobara, postoji 10 “kurseva razmene” između svake robe kojih svi u ekonomiji moraju da se sete: 1 svinja se menja za 15 pilića, 1 pile se menja za 15 litara mleka, desetak jaja se menja za 15 litara mleka, i tako dalje. Ako ekonomija ima 50 dobara, među njima postoji 1.225 “kurseva razmene”!

Sredstvo za merenje vrednosti

Zamislite obračunsku jedinicu kao sredstvo za merenje vrednosti. Umesto da se sećamo vrednosti svakog dobra u poredjenju sa drugim dobrima, mi samo treba da se setimo vrednosti svakog dobra u poredjenju sa jednim dobrom – obračunskom jedinicom.

Umesto da se setimo 1.225 kurseva razmene kada imamo 50 proizvoda na tržištu, mi treba da zapamtimo samo 50 cena.

Na primer, ne treba da se sećamo da litar mleka vredi 1/15 piletine ili desetak jaja, možemo da se samo setimo da litar mleka košta 1USD.

Poređenje dobara je lakše sa obračunskom jedinicom

Obračunska jedinica takođe olakšava upoređivanje vrednosti i donošenje odluka. Zamislite da pokušavate da kupite par Nike Air Jordan patika kada ih jedan prodavac prodaje za jedno pile, a drugi za 50 klipova kukuruza.

Šta je zaliha vrednosti?

Do sada smo gledali samo primere transakcija koje se odvijaju u određenom trenutku u vremenu.

Međutim, ljudi vrše transakcije tokom vremena – oni štede novac i troše ga kasnije. Da bi odredjeno dobro moglo da funkcioniše pravilno kao monetarno dobro, ono treba da održi vrednost tokom vremena.

Novac koji vremenom dobro drži vrednost daje njegovom imaocu više izbora kada će taj novac da potroši.

To znači da prodajnost dobra uključuje njegovu sposobnost da održi vrednost tokom vremena.

Šta jedno dobro čini boljom zalihom vrednosti od drugog dobra?

Trajnost

Definicija: Sposobnost dobra da vremenom zadrži svoj oblik.

Loš Primer: Jagode čine lošu zalihu vrednosti jer se lako oštete i brzo trunu.

Odluka je daleko lakša ako jedan prodavac naplaćuje 150 USD, a drugi 200 USD – odmah je očigledno koja je bolja ponuda jer su vrednosti izražene u istoj jedinici.

Teške za Proizvodnju

Definicija: Teškoće koje ljudi imaju u proizvodnji veće količine dobra.

Loš Primer: Papirne novčanice predstavljaju lošu zalihu vrednosti jer banke i vlade mogu jeftino da ih naprave.

Sa zlatom je suprotno – u ponudi se nalazi ograničena količina uprkos velikoj potražnji za njim, jednostavno zato što ga je vrlo teško iskopati iz zemlje. Ova ograničena ponuda osigurava da svaka jedinica zlata održi vrednost tokom vremena.

Kako dobra postaju zalihe vrednosti?

Dobro postaje zaliha vrednosti ako se vremenom pokaže trajnim i teškim za proizvodnju.

Samo će vreme pokazati da li je neko dobro zaista trajno i da li ga je teško proizvesti. Zbog toga neki oblici novca su postojali vekovima pre nego što je neko otkrio način da ih proizvede više, i na kraju se to dobro više nije koristilo kao novac.

Ovo je priča o školjkama, Rai kamenju i mnogim drugim oblicima novca tokom istorije.

Zlato je primer dobra koje je hiljadama godina služilo kao dobra zaliha vrednosti. Zlato se ne razgrađuje tokom vremena i još uvek ga je teško proizvesti. Hiljadama godina alhemičari su bezuspešno pokušavali da sintetišu zlato iz jeftinih materijala.

Čak i sa današnjim naprednim rudarskim tehnikama, svake godine svi svetski rudnici zlata zajedno mogu da proizvedu samo 2% od ukupne ponude zlata u prometu.

Teškoće u proizvodnji zlata daju izuzetno visok odnos “zaliha i protoka”: zaliha je broj postojećih jedinica, a protok su nove jedinice stvorene tokom određenog vremenskog perioda. Svake godine se stvori vrlo malo novih jedinica zlata, iako je potražnja za zlatom obično vrlo velika.

Kombinujući ovo sa deljivošću, ujednačenošću i prenosivošću zlata, nije ni čudo što je zlato čovečanstvu služilo kao monetarno dobro tokom poslednjih 5.000 godina. Pošto je zlato teško proizvesti, možemo ga nazvati teškim novcem (hard money).

Kao rezultat toga, svoju vrednost je u velikoj meri zadržao kroz milenijume. Cena većine dobara i usluga u pogledu zlata zapravo se vremenom smanjivala kao rezultat tehnoloških inovacija, koje sve proizvode čine jeftinijim.

Uzmimo na primer cene hrane prema praćenju Kancelarije za hranu i poljoprivredu UN-a: sa obzirom na skokove u poljoprivrednoj tehnologiji tokom poslednjih 60 godina, cene hrane drastično su pale kada se procenjuju u zlatu. To čak i važi uprkos činjenici da obični ljudi retko koriste zlato za kupovinu stvari.

Cene hrane su padale u pogledu zlata tokom proteklih 60 godina, i mnogo pre toga (FAO Indeks Cena Hrane u Zlatu)

Cene hrane su padale u pogledu zlata tokom proteklih 60 godina, i mnogo pre toga (FAO Indeks Cena Hrane u Zlatu)Zaliha vrednosti omogućava ljudima da uštede novac kako bi mogli da ga ulažu u pokretanje preduzeća i obrazovanje, povećavajući produktivnost društva.

Monetarna dobra koja dobro čuvaju vrednost takođe podstiču dugoročniji pogled na život, ili kratke vremenske preference. Pojedinac može da radi 10 godina, uštedi odredjeno monetarno dobro koje je dobra zaliha vrednosti, i nema potrebe da se plaši da će njegova ušteđevina biti izbrisana krahom tržišta ili povećanjem ponude tog dobra.

Zašto su važne funkcije novca?

Kada neki oblik novca izgubi bilo koju od svojih važnih funkcija kao što su sredstvo razmene, obračunska jedinica i zaliha vrednosti, celokupna ekonomija i društvo mogu da se rastrgnu.

Tokom istorije često vidimo grupe ljudi koje eksploatišu druge iskorišćavajući nesporazume o novcu i važnosti njegovih funkcija.

Sledeće, proći ću kroz istoriju novca, prvo hipotetički da bih ilustrovao poentu, a zatim ću preći na stvarne istorijske primere. Kroz ove primere videćemo štetne efekte na društva u slučajevima kada se izgubi samo jedna od tih ključnih funkcija novca.

Novac Gubi Funkciju: Alhemičar iz Njutonije

Kroz istoriju, mnoga dobra su dolazila i odlazila kao oblici novca. Na žalost, kada se neki oblik novca ukine, ponekad postoji grupa ljudi koja eksploatiše drugi oblik manipulišući tim novcem.

Hajde da pogledamo hipotetičko selo zvano Njutonija da bismo razumeli kako dolazi do ove eksploatacije.

Zelene perle postaju Novac

Tokom stotina godina ribolova u obližnjoj reci, stanovnici Njutonije sakupljali su zelene perle iz vode. Zrnca su mala, lagana, izdržljiva, jednolična i retko se pojavljuju u reci. Ljudi prvo priželjkuju perle zbog svoje lepote. Na kraju, seljani shvataju da svi drugi žele perle – one se vrlo lako mogu prodati. Zrnca uskoro postaju sredstvo razmene i obračunska jedinica u selu: pile je 5 zrna, vreća jabuka 2 zrna, krava 80 zrna.

Ukupna ponuda perli je prilično konstantna i cene se vremenom ne menjaju mnogo. Seoski starešina je uveren da može da se opustiti u poslednjim danima živeći od svoje velike zalihe perli.

Alhemičar stvara više perli

Seoski alhemičar je poželeo da bude bogat čovek, ali nije voleo da vredno radi na tome. Umesto da traži perle u reci ili da prodaje vrednu robu drugim seljanima, on sedeo je u svojoj laboratoriji. Na kraju je otkrio kako da lako stvori stotine perli sa malo peska i vatre.

Seljani koji su tragali za perlama u reci bili su srećni ako bi svaki dan pronašli po 1 zrno. Alhemičar je mogao da proizvede stotine uz malo napora.

Alhemičar troši svoje perle

Budući da je bio prilično zao, alhemičar nije svoj metod pravljenja zrna delio ni sa kim drugim. Stvorio je sebi još više perli i počeo da ih troši za dobra na tržištu u Njutoniji. Tokom sledećih meseci, alhemičar je kupio farmu pilića, nekoliko krava, finu svilu, posteljine i ogromno imanje. On je imao priliku da kupi ova dobra po normalnim cenama na tržištu.

Alhemičarevo trošenje ostavljalo je seljanima mnogo perli, ali malo njihove vredne robe.

Svi seljani su se osećali bogatima – imali su tone perli! Međutim, polako su primetili da i svi ostali takodje imaju tone.

Cene počinju da rastu

Uzgajivač pilića primetio je da sva roba koju je trebalo da kupi na pijaci poskupela. Džak jabuka sada se prodaje za 100 perli – 50 puta više od njihove cene pre nekoliko meseci!

Iako je sada imao hiljade perli, uskoro bi mogao da ostane bez njih zbog ovih cena. Pitao se – da li zaista može sebi da priušti da prodaje svoje piliće za samo 5 perli po komadu? Morao je i on da podigne svoje cene.

Jednostavno rečeno, kao rezultat alhemičarevog trošenja njegovih novostvorenih perli, bilo je previše perli koje su jurile premalo dobara – pa su cene porasle.

Kupci robe bili su spremni da potroše više perli da bi kupili potrebna dobra. Prodavci robe su trebali da naplate više da bi bili sigurni da su zaradili dovoljno da kupe potrebna dobra za sebe.

Budući da su cene svih dobara porasle, možemo reći da se vrednost svake perle smanjila.

Nejednakost bogatstva raste

Seoski starešina, koji je vredno radio da sačuva hiljade perli, sada se našao osiromašenim i gladnim. U međuvremenu, alhemičar je udobno sedeo na svom velikom imanju sa kravama, pilićima i slugama koji su se brinuli za svaki njegov hir.

Alhemičar je efikasno ukrao bogatstvo celog sela, tako što je jeftino proizvodio perle i koristio ih za kupovinu vredne robe.

Ono što je najvažnije, kupio je robu pre nego što je tržište shvatilo da je više perli u opticaju i da ima manje robe, što je dovelo do rasta cena. Ova dodatna proizvodnja perli nije dodala korisnu robu ili usluge selu.

Eksploatacija pomoću Novca: Agri Perle

Nažalost, priča o alhemičaru iz Njutonije nije u potpunosti hipotetička. Ovaj prenos bogatstva kroz stvaranje novca ima istorijske i moderne presedane.

Na primer, afrička plemena su nekada koristila staklene perle, poznate kao “agri perle”, kao sredstvo razmene. U to vreme plemenskim ljudima je bilo veoma teško da prave staklene perle, i one su predstavljale težak novac unutar njihovog plemenskog društva.

Niko nije mogao jeftino da proizvede perle i koristiti ih za kupovinu skupe, vredne robe poput kuća, hrane i odeće.

Sve se promenilo kada su stigli Evropljani, i primetili upotrebu staklenih perli kao novca.

U to vreme, Evropljani su mogli jeftino da stvaraju staklo u velikim količinama. Kao rezultat toga, Evropljani su počeli tajno da uvoze perle i koriste ih za kupovinu dobara, usluga i robova od Afrikanaca.

Vremenom se iz Afrike izvlačila vredna roba i ljudi, dok je plemenima ostajalo mnogo perli i malo robe.

Perle su izgubile veći deo vrednosti zbog inflacije uzrokovane snabdevanjem od strane Evropljana.

Rezultat je bio osiromašenje afričkih plemena i bogaćenje Evropljana, kako to ovde objašnjava monetarni istoričar Bezant Denier.

Dragocena roba je kupljena jeftino proizvedenim monetarnim dobrom.

Profitiranje na proizvodnji novca: Emisiona dobit

Ova priča ilustruje kako se bogatstvo prenosi kada jedna grupa može jeftino da proizvodi monetarno dobro.

Razlika između troškova proizvodnje monetarnog dobra i vrednosti tog monetarnog dobra poznata je kao emisiona dobit, eng. seignorage.

Kada je monetarno dobro mnogo vrednije od troškova proizvodnje, ljudi će proizvesti više od monetarnog dobra da bi uhvatili profit od emisione dobiti.

Na kraju će ova povećana ponuda dovesti do pada vrednosti monetarnog dobra. To je zbog zakona ponude i potražnje: kada se ponuda povećava, cena (poznata i kao vrednost) dobra opada.

Novac Gubi Funkciju 2. Deo: Kejnslandski Bankar

U priči o Njutoniji, alhemičar je otkrio način da se od malo peska jeftino stvori više zelenih perli. To se u stvarnosti odigralo kroz trgovinu između Evropljana i Afrikanaca, pričom o agri perlama. Međutim, ove priče su pomalo zastarele – mi više ne trgujemo robom za perle.

Da bismo nas doveli do modernog doba, hajde da promenimo neka imena u našoj priči:

- Selo Njutonija postaje država koja se zove Kejnsland

- Alhemičar postaje bankar

- Seoski starešina postaje penzioner

- Zelene perle postaju zlato, koje niko ne može jeftinije da stvori – čak ni bankar.

Bankar Menja Papirne Novčanice za Zlato

Kao i u stvarnosti, bankar u ovoj priči nema formulu ili trik da stvori više zlata. Međutim, bankar bezbedno čuva zlato u vlasništvu svakog građanina Kejnslanda. Bankar daje svakom građaninu po jednu potvrdu za svaku uncu zlata koje ima u svom trezoru.

Te potvrde se mogu iskoristiti u bilo koje vreme za stvarno zlato. Papirne potvrde ili novčanice su mnogo pogodnije za plaćanje nego nošenje zlata kroz supermarket.

Građani su srećni – oni imaju prikladno sredstvo plaćanja u vidu bankarevih novčanica, i znaju da niko ne može da ukrade njihovo bogatstvo falsifikujući više zlata.

Građani na kraju počinju da plaćaju u potpunosti papirnim novčanicama, ne trudeći se nikad da zamene svoje novčanice za zlato. Na kraju, novčanice postaju “dobre kao i zlato” – svaka predstavlja fiksnu količinu zlata u bankarevom trezoru.

Ukupno kruži 1.000.000 novčanica, od kojih je svaka otkupljiva za jednu uncu zlata. 1.000.000 unci zlata sedi u bankarevom trezoru. Svaka novčanica je u potpunosti podržana u zlatu.

Starešina koji je sačuvao sve svoje perle u priči o Njutoniji sada je penzioner u Kejnslandu, koji svoje zlato drži u banci i planira da ugodno živi od novčanica koje je dobio zauzvrat.

Hajde da u ovu priču dodamo i novi lik: premijera Kejnslanda. Premijer naplaćuje porez od građana i koristi ga za plaćanje javnih usluga poput policije i vojske. Premijer takođe drži vladino zlato kod bankara.

Bankar Menja Papirne Novčanice za Dug

Premijer želi da osigura da nacionalno zlato ostane na sigurnom, pa banku štiti policijom. Bankar i premijer se zbog toga zbližavaju, pa premijer traži uslugu. Traži od bankara da kreira 200.000 novčanica za premijera, uz obećanje da će mu premijer vratiti za pet godina. Premijeru su novčanice potrebne za finansiranje rata. Građani Kejnslanda borili su se protiv većih poreza zbog finansiranja rata, pa je morao da se obrati bankaru.

Bankar se slaže da izradi novčanice, ali pod jednim uslovom: bankar uzima deo od 10.000 novčanica za sebe. Premijer prihvata posao kojim bankar ’kupuje državni dug’. Sada je u opticaju 1.200.000 novčanica, potpomognutih kombinacijom 1.000.000 unci zlata i ugovorom o dugu sa vladom za 200.000 novčanica.

Premijer troši svoje nove novčanice na bombe kupujući ih od dobavljača iz domaće vojne industrije, a bankar sebi kupuje veliki luksuzni stan.

Dobavljač iz vojne industrije koristi sve nove novčanice koje je dobio od premijera da kupi amonijum nitrat (đubrivo koje se koristi u bombama) za proizvodnju bombi. Sve njegove kupovine povećavaju cenu đubriva za uzgajivače pšenice u Kejnslandu, pa oni podižu cenu pšenice.

Kao uzrok toga, pekar koji kupuje pšenicu treba da podigne cenu svog hleba da bi ostao u poslu. Na taj način cene u Kejnslandu počinju da rastu, baš kao što su to činile u Njutoniji kada su nove perle ušle u opticaj.

Papirne Novčanice Više Ne Predstavljaju Zlato

Penzioner nailazi na finansijski časopis u kojem se pominje premijerov dogovor da se zaduži za finansiranje rata. Obzirom da je mudar, on zna da bombe loše vraćaju ulaganje i sumnja da će premijer ikada da vrati svoj dug.

Ako on ‘podmiri’ svoj dug, to bi ostavilo 1.200.000 novčanica u opticaju sa samo 1.000.000 unci zlata da bi ih podržalo, obezvređujući njegovu ušteđevinu. Već oseća stisak u džepu zbog porasta cena, i on odlučuje da se uputi u lokalnu banku i preda svoje novčanice i zameni ih za zlato, koje niko ne može da napravi u većoj količini.

Kada penzioner stigne u banku, on zatiče i mnoge druge okupljene oko banke. Svi oni se nadaju da će uzeti zlato koje predstavljaju njihove novčanice. Građani Kejnslanda sa pravom se plaše da njihove novčanice gube na vrednosti – oni to već osećaju zbog porasta cena.

Vrata su zaključana, sa obaveštenjem bankara na njima:

Po nalogu premijera, onom koji se plaši za stabilnost ove bankarske institucije, ova banka više neće podržavati konvertibilnost papirnih novčanica u zlato. Hvala vam!

Gomila se razilazi, ostavljena sa jednim izborom: da zadrže svoje novčanice, koje sada vrede manje od 1 unce zlata. Građani sa dovoljno finansijske stabilnosti odlučuju da ulože svoje novčanice u kupovinu akcija banke i kompanija vojne industrije, koje dobro posluju jer mogu da kupuju stvari pre nego što se povećaju tržišne cene.

Mnogi ljudi nisu u mogućnosti da investiraju – oni moraju da gledaju kako njihove zarade stagniraju i kako njihova ušteđevina polako ali sigurno gubi vrednost.

Penzioner, koji se nadao da će živeti od novčanica koje je zaradio tokom svojih 40 radnih godina, sada 40 sati nedeljno provodi iza kase u lokalnoj prodavnici, pitajući se gde je sve pošlo po zlu.

Dug Nikada Nije Otplaćen

Prošlo je nekoliko godina, a premijerov dug prema banci dolazi na naplatu. Budući da je potrošio svih 200.000 novčanica na bombe, koje nemaju baš dobar povraćaj ulaganja, on nema novčanice koje može da vrati banci. Plus, premijer želi da kupi još bombi za svoj rat.

Bankar uverava premijera da je sve u redu. Bankar će napraviti novi ugovor o dugu za 600.000 novčanica, koji bi trebao da stigne na naplatu u narednih 5 godina. Premijer može da iskoristi 200.000 od tih novih 600.000 novčanica da vrati svoj prvobitni dug prema banci, zadrži još 300.000 da kupi još bombi i da 100.000 bankaru da bi mu platio njegove usluge.

To nastavlja da se dešava – svaki put kada dug dospeva na naplatu, bankar stvara više novčanica za vraćanje starijih dugova i daje premijeru još više novca za trošenje. Ovaj ciklus se nastavlja.

Šta se dešava u Kejnslandu?

- Oni koji prvi dobiju nove novčanice, gledaju kako se njihovo bogatstvo povećava

- To uključuje bankara, premijera, vladu i sve one koji mogu da pristupe mogućnostima za investiranje u preduzeća koja prva dobiju nove novčanice (finansijske, vojne itd.).

- Cene roba rastu

- Cene se ne povećavaju ravnomerno – one se povećavaju gde god nove novčanice prvo uđu u ekonomiju i od tog trenutka imaju efekat talasa na tržišta. U našem primeru prvo raste cena amonijum nitrata, zatim cena pšenice, pa cena hleba. A tek na kraju zarade običnih ljudi.

- Štednja i životni standard opšte populacije se smanjuju

- Najviše pate oni koji žive od plate do plate i ne mogu da ulažu. Čak i oni koji su u mogućnosti da investiraju podložni su hirovima tržišta. Mnogi su prisiljeni da prodaju svoje investicije po niskim cenama tokom pada tržišta samo da bi platili svoje dnevne potrebe.

- Razlika u prihodima i bogatstvu između bogatih i siromašnih se povećava

- Bogatstvo opšte populacije se smanjuje, dok se bogatstvo onih koji su blizu mesta gde se troše nove novčanice povećava. Rezultat je disparitet koji se vremenom samo proširuje.

Da li nas novac danas eksploatiše?

Priča o Njutoniji i stvarna priča o agri perlama u Africi deluju pomalo zastarelo. Priča o Kejnslandu, međutim, deluje neobično poznato. U našem svetu cene robe uvek rastu, i vidimo rekordne nivoe nejednakosti u bogatstvu.

U poslednjem odeljku ovog našeg članka Šta je novac, proći ću kroz nastanak bankarstva i korake koji su bili potrebni da se dođe do današnjeg sistema, gde banke i vlade sarađuju u kontroli ekonomije i samog novca.

Šta su banke, i odakle su one došle?

Pojava bankarstva verovatno se dogodila da bi olakšala poljoprivrednu trgovinu i da bi povećala pogodnosti. Iako su se mnoga društva na kraju konvergirala ka upotrebi zlata i srebra kao novca, ovi metali su bili teški i opasni za nošenje kao tovar. Međutim, u mnogim slučajevima ih nije ni trebalo prevoziti. Uzmite ovaj primer:

Grad treba da plati poljoprivrednicima na selu za žito, a poljoprivrednici gradskoj vojsci za zaštitu od varvara. U ovom dogovoru zlato se kreće u oba smera: prema poljoprivrednicima u selu kako bi im se platilo žito, i nazad u grad da bi se platila vojska. Da bi olakšali ove transakcije, preduzetnici su stvorili koncept banke. Banka je zlato čuvala u sigurnom trezoru i izdavala novčanice od papira. Svaka priznanica je predstavljala potvrdu da njen imaoc poseduje određenu količinu zlata u banci. Imaoc novčanice je u svako doba mogao da uzme svoje zlato nazad vraćanjem te novčanice banci.

Korisnici banke mogli su lakše da trguju sa novčanicama od papira, i onaj koji poseduje novčanice mogao je da preuzme njihovo fizičko zlato u bilo kom trenutku. To je te novčanice učinilo “dobrim kao i zlato”.

Banke su izdržavale svoje poslovanje naplaćujući od kupaca naknadu za skladištenje zlata ili pozajmljivanjem dela zlata i zaračunavanjem kamata na njega. Trgovina na ovaj način je mogla da se odvija sa laganim novčanicama od papira umesto sa teškim vrećama zlatnika.

Ovakva praksa sa transakcijama, korišćenjem papirne valute potpomognute monetarnim dobrima, verovatno je započela u Kini u 7. veku.

Na kraju se proširila Evropom 1600-ih, a svoj zalet dobila je u Holandiji sa bankama poput Amsterdamske Wisselbanke. Novčanice Wisselbank-e često su vredele više od zlata koje ih je podržavalo, zbog dodane vrednosti njihovih pogodnosti.

Uspon nacionalnih ‘centralnih banaka’

Tokom vekova, zlato je počelo da se sakuplja u trezorima banaka, jer su ljudi više voleli pogodnosti transakcija sa novčanicama.

Na kraju, nacionalne banke u vlasništvu vlada preuzele su ulogu čuvanja zlata od privatnih banaka koje su započeli preduzetnici.

Nacionalne papirne valute potpomognute zlatnim rezervama u nacionalnim bankama zamenile su novčanice iz privatnih banaka. Sve nacionalne valute bile su jednostavno potvrde za zlato koje se nalazilo u trezoru nacionalne banke.

Ovaj sistem je poznat kao zlatni standard – sve valute su jednostavno predstavljale različite težine zlata.

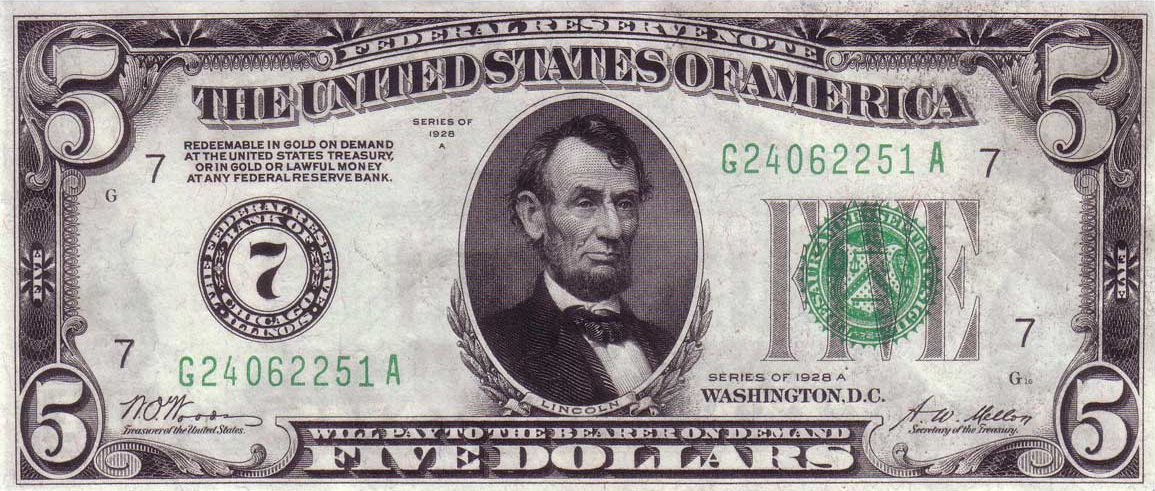

U gornjem levom uglu novčanice možete videti da piše da je novčanica “zamenljiva za zlato”. Savremeni dolari nemaju ovaj natpis, ali inače izgledaju vrlo slično. Izvor

U gornjem levom uglu novčanice možete videti da piše da je novčanica “zamenljiva za zlato”. Savremeni dolari nemaju ovaj natpis, ali inače izgledaju vrlo slično. IzvorZlatni sistem je postojao veći deo vremena, sve do Prvog svetskog rata. Vladama je bilo teško da prikupe novac za ovaj rat putem poreza, pa su morale da budu kreativne.

Kada vlade troše više nego što zarađuju na porezima, to se naziva deficitna potrošnja.

Kako vlade mogu ovo da urade? Vlade to rade tako što pozajmljuju novac prodavajući svoj dug.

Tokom Prvog svetskog rata, vlade su građanima i preduzećima prodavale vrstu duga koja se naziva ratna obveznica. Kada građanin kupi ratnu obveznicu, on preda svoj novac vladi i dobije papir u kojem je stajalo vladino obećanje da će vlasniku obveznice vratiti novac, plus kamate, za nekoliko godina.

Plakat koji obaveštava građane, tražeći od njih da kupe ratne obveznice – što predstavlja zajam vladi. Izvor

Centralne banke ‘monetizuju’ državni dug

Međutim, građani i preduzeća nisu bili voljni da kupe dovoljno ratnih obveznica za finansiranje Prvog svetskog rata.

Vlade se nisu predale – pa su zatražile od svojih nacionalnih ‘centralnih banaka’ da one kupe ove obveznice. Centralne banke su otkupile obveznice, ali ih nisu platile valutom potpomognutom postojećim zlatnim rezervama, kao što su to činili građani i banke prilikom kupovine obveznica.

Centralne banke su umesto toga davale vladi novu, sveže štampanu papirnu valutu potpomognutu samo obveznicom. Ovu valutu podržalo je samo obećanje da će im vlada vratiti dugove. Ovo je poznato kao monetizacija duga.

Budući da su ratne obveznice i valuta samo komadi papira, one su lake i jeftine za proizvodnju i mogu se napraviti u ogromnim količinama. Ono što ograničava proizvodnju i jednog i drugog je poverenje.

Ima smisla da se neko rastane od svog teško stečenog novca da kupi državnu obveznicu, samo ako veruje da će vlada da vrati svoj dug, plus kamate. Centralna banka je “krajnji kupac”, što znači da će ona da kupi državne obveznice kada to niko drugi neće da uradi.

Zapamtite, centralnu banku gotovo da ništa ne košta da kupi državne obveznice, jer oni sami štampaju valutu da bi ih kupili.

Zamislite da pridjete najskupljem automobilu u autosalonu – koji košta 100.000 USD. Mislite da je automobil lep, ali taj novac biste radije potrošili na lepši stan – tako da ste spremni da platite samo 40.000 USD za taj auto.

Sada, hajde da zamislimo da imate štampač za novac i da vas košta samo 50 USD za mastilo i papir da bi ištampali 1.000.000 USD. Vi biste odmah kupili auto, čak i ako biste morali da se cenkate sa drugim čovekom, i da ga na kraju platite 150.000 USD!

Ista stvar se dešava kada centralna banka kupuje obveznice (dugove) od vlade. Centralna banka može da stvori valutu toliko jeftino, da su spremni da plate i više nego što bi drugi platili ove obveznice i nastaviće da ih kupuju čak i kada niko drugi ne bude želeo.

Monetizacija duga uzrokuje inflaciju

Kada centralne banke monetizuju državni dug, funkcija novca kao zalihe vrednosti počinje da se nagriza. Vlada troši novi novac koji je dobila od svoje centralne banke na ratnu robu, obroke i još mnogo toga.

Cene roba rastu od ove novoštampane valute koja kruži kroz ekonomiju. Kada se cene povećavaju, to znači da se vrednost svake jedinice valute smanjuje. Svi koji drže valutu sada imaju manje vrednosti. Danas to nazivamo sporim gubitkom funkcije zalihe vrednosti u novčanoj inflaciji.

Za Nemačku nakon Prvog svetskog rata monetizacija duga izazvala je totalni slom Nemačke ekonomije i stvorila uslove za rast fašizma.

Kao deo sporazuma o prekidu vatre koji je okončao Prvi svetski rat, Nemačka je pobednicima morala da plati ogroman novac. Nemačkoj vladi je bio preko potreban novac, pa su prodale obveznice (dug) Rajhsbanci, nemačkoj centralnoj banci.

Ovaj postupak doveo je do toga da je vlada štampala toliko maraka (tadašnja nemačka valuta) da je tempo inflacije u Nemačkoj ubrzan u hiperinflaciju početkom 1920-ih. Cena vekne hleba za samo 4 godine popela se sa 1,2 marke na 428 biliona maraka.

Tokom i posle Prvog svetskog rata, SAD, Britanija, Francuska i mnoge druge vlade pratile su Nemačku u štampanju valute potpomognute državnim dugom.

To je dovelo do toga da su građani želeli da svoju papirnu valutu zamene za zlato, baš kao i penzioner iz priče o Kejnslandu.

Međutim, mnoge vlade su suspendovale konvertibilnost svojih valuta u zlato. Ovim potezom vlade su primorale svoje građane da drže nacionalnu papirnu valutu i gledaju kako se njihova ušteda smanjuje u vrednosti.

Da bi mogle da nastave da štampaju novac i da bi ga trošile na nepopularne programe za koje nisu mogle da skupljaju poreze za finansiranje – poput ratova.

Bretton Woods: Novi monetarni sistem

Nakon razaranja koja su donela dva svetska rata, vlade su uspostavile novi globalni monetarni sistem prema Bretton Woods-ovom sporazumu iz 1944. godine.

Prema ovom sporazumu, valuta svake države konvertovala se po fiksnom kursu sa američkim dolarom. Američki dolar je zauzvrat predstavljao zlato po stopi od 35 USD za jednu trojsku uncu zlata*.

Sve globalne valute su stoga još uvek bile jednostavna reprezentacija zlata, putem američkih dolara kao posrednika. Redovni građani više nisu mogli da otkupljuju svoje valute za zlato iz Sjedinjenih Država. Međutim, strane centralne banke mogle bi da dođu u Sjedinjene Države da bi zamenile dolare za zlato po stopi od 35 USD za jednu uncu zlata.

Međutim, vlada Sjedinjenih Država nije uvek držala dovoljno zlata da podrži sve dolare u opticaju. Američka vlada nastavila je da finansira proširene socijalne i vojne programe prodajom državnog duga svojoj centralnoj banci, Federalnim rezervama, koja je povećala ponudu dolara bez povećanja ponude zlata koja podupire te dolare.

*Trojna unca je standardna mera čistog zlata i ima malo veću težinu od normalne unce.

Propast Bretton Woods-a

Tokom 1970-ih, sve veći troškovi rata u Vijetnamu i stranih vlada koje su otkupljivale svoje dolare za zlato, stvorili su pritisak na Trezor Sjedinjenih Država.

Ponuda dolara je porasla, dok je zlato u posedu Sjedinjenih Država opalo. Od 1950. pa do početka 1970-ih, rezerve zlata koje je držala vlada Sjedinjenih Država smanjile su se za više od 50%, sa 20 metričkih tona na samo 8 metričkih tona.

Godine 1970. država je imala zlata u vrednosti od samo 12 biliona dolara po zvaničnom kursu od 35 dolara za trojsku uncu zlata. Tokom ovog istog vremenskog perioda, ukupna ponuda američkih dolara otišla je sa oko 32 biliona USD na skoro 70 biliona USD.

Zvanične rezerve zlata u SAD-u su naglo padale od 1950. do 1970. godine, dok su se dolari u opticaju povećavali. Izvor: Wikipedia, DollarDaze.org

Američka vlada nije bila u stanju da potkrepi dolare zlatom od 35 dolara po trojnoj unci, što dovelo do rizika za čitav globalni monetarni sistem.

Početkom sedamdesetih godina, trojna unca zlata trebala je da vredi 200 USD da bi u potpunosti podržala sve američke dolare u opticaju. Rečeno na drugi način, Sjedinjene Države su pokušavale da kažu svetu da jedan dolar vredi 1/35 trojne unce zlata, ali u stvarnosti dolar je vredeo samo 1/200 trojne unce.

Kad su strane vlade trebale da pribave dolare za međunarodnu trgovinu i rezerve, bile su opelješene. Francuska vlada je to shvatila šezdesetih godina prošlog veka i počela je da prodaje svoje američke dolare za zlato po zvaničnom kursu od 35 dolara za trojsku uncu zlata.

Zemlje su počinjale da se bude iz šeme američke vlade. SAD su krale bogatstvo putem emisione dobiti, prodajući dolare za 1/35 trojne unce zlata, kada su vredeli samo 1/200 trojske unce.

Nixonov Šok ulazi u ’tradicionalni’ novac

Da bi kuća od karata mogla da ostane na mestu, predsednik Nixon je 1971. najavio da će američka vlada privremeno da obustavi konvertibilnost dolara u zlato.

Strane vlade više nisu mogle da polažu pravo na zlato svojim papirnim dolarima, a dolar više nije bio “poduprt” zlatom. Nixon je tvrdio da će ovo stabilizovati dolar.

50 godina kasnije, kristalno je jasno da je ovo samo pomoglo dolaru da izgubi vrednost i da ovaj “privremeni” program još uvek traje.

Pre 1971. godine, sve globalne valute bile su vezane za američki dolar putem Bretton Woods-ovog sporazuma. Kada je Nixon promenio američki dolar iz dolara podržanog u zlatu u dolar podržan dugom, ovim je promenio i svaku drugu valutu na Zemlji.

Sam je učinio da se celokupna svetska ekonomija zasniva na dugovima. Valute više nisu predstavljale zlato, već su predstavljale vrednost državnog duga.

Zlatni Standard se nikada nije vratio

Konvertibilnost američkih dolara u zlato – zlatni standard – nikada se nije vratio.

Od 1971. godine, čitav globalni monetarni sistem pokreće se tradicionalnim “fiat” valutama: poverenjem u vladine institucije da održavaju valutni sistem.

Većina valuta podržana je kombinacijom duga njihove vlade i drugih tradicionalnih valuta poput dolara i evra. Papirne valute više nisu podržane zlatom, imovinom koja je više od 5000 godina služila kao težak novac.

Danas vas vlade prisiljavaju da plaćate porez u njihovoj valuti i manipulišu saznanjima oko novca kako bi osigurale da potražnja za njihovom valutom ostane velika.

To im omogućava da neprestano štampaju više valuta, da bi je potrošili na vladine projekte, uzrokujući inflaciju cena koja jede i smanjuje bogatstvo i plate.

Američka vlada sada prodaje državne obveznice (dugove), poznate kao obveznice Trezora SAD, eng. US Treasuries, komercijalnim bankama u zamenu za američke dolare.

Vlada koristi te dolare za finansiranje svog budžetskog deficita. Komercijalne banke prodaju mnoge obveznice Trezora SAD, koje su kupile, američkoj centralnoj banci, Federalnim Rezervama.

Federalne rezerve plaćaju komercijalnim bankama sveže štampanim novcem “pomoću računara i upisivanjem količine na račun”, kako je rekao bivši predsednik Fed-a Ben Bernanke.

Ove komercijalne banke često zarađuju samo kupujući obveznice Trezora SAD od države i prodajući ih centralnoj banci. Kupujte nisko, prodajte visoko.

Centralne banke ovaj proces kupovine državnog duga – odnosno pozajmljivanja novca državi – nazivaju operacijama otvorenog tržišta.

Kada centralna banka odjednom kupi velike iznose duga, oni to nazivaju kvantitativnim ublažavanjem. Centralne banke javno najavljuju kupovinu državnog duga, ali vrlo malo ljudi razume šta to zapravo znači.

Euro, jen i svaka druga valuta koja se danas koristi funkcionišu slično kao američki dolar.

Da li će SAD ikada vratiti svoj nacionalni dug? Neobična stvar u vezi sa državnim dugom SAD-a je ta što vlada poseduje štampariju potrebnu za njegovu otplatu.

Kao rezultat toga, kada vlada duguje novac, oni samo pozajme još više novca da bi otplatile taj dug, povećavajući nacionalni dug.

Ako vam ovo zvuči kao Ponzijeva piramidalna šema, to je zato što ona to i jeste – najveća Ponzijeva šema u istoriji. Kao i svaka Ponzijeva šema, nastaviće se sve dok su ljudi koji kupuju Ponzijevu šemu budu uvereni da će im biti plaćeno nazad.

Ako ljudi i nacije prestanu da se zadužuju i koriste američke dolare jer nemaju poverenja u američku vladu ili vide da cena robe raste (tj. dolar postaje sve manje vredan), potražnja za dolarom će opadati, što će izazvati začaranu spiralu.

Ova spirala često završi u hiperinflaciji, kao što smo videli u novijoj istoriji sa Jugoslavijom, Venecuelom, Argentinom, Zimbabveom i mnogim drugim državama.

Ovo je način kako funkcioniše novac na vašem bankovnom računu. Novac svake nacije na svetu pati od istih problema kao i perle i novčanice u pričama o Njutoniji i Kejnslandu.

Kako banke i vlade kradu tvoj novac?

Tokom vekova, stigli smo do monetarnog sistema u kojem banke i vlade mogu da štampaju novu valutu za finansiranje svojih operacija i svojih prijatelja u zločinu, dok kradu bogatstvo svojih građana.

Šta će se desiti sa svetom kada novac bude mogao da štampa svaki narod na planeti?

- Bogatstvo onih koji su blizu pravljenja nove valute se povećava

- Vlada i politički povlašćena klasa ljudi, imaju pristup novoštampanom novcu pre svih ostalih, pa mogu da ga potroše pre nego što cene porastu. Na ovaj efekat pokazao je ekonomista Richard Cantillon sredinom 1700-ih i poznat je kao Cantillonov Efekat.

- Cena robe raste (poznato kao inflacija

- Ne raste sve roba istovremeno u ceni. Roba blizu mesta gde se proizvodi nova valuta – finansijski sektor i vlada – prva raste, i odatle uzrokuje efekt talasa na cene.

- Inflacija se često predstavlja kao promena cene potrošačke korpe, poznata kao Indeks Potrošačkih Cena, eng. Consumer Price Index (CPI). Vlada ima alate za manipulisanje ovim brojem kako bi osigurala da se ona čini niskom i stabilnom, kao što je objašnjeno u našem članku o inflaciji.

- Finansijska imovina često primećuje ogromnu inflaciju, ali bankari to ne nazivaju inflacijom – oni kažu da naša ekonomija cveta! Nakon što su američke Federalne rezerve učetvorostručile ponudu američkih dolara u šest godina nakon finansijske krize 2008. godine, banke koje su dobile te nove dolare, kupile su akcije i obveznice, stvarajući ogroman balon u cenama ove imovine.

- Štednja i životni standard stanovništva se smanjuju

- Plate su jedna od poslednjih “cena” u ekonomiji koja se prilagođava, jer se često povećavaju samo jednom godišnje. U međuvremenu, cene dnevnih potrepština te osobe koja zaradjuje platu neprestano rastu kako novi novac kruži ekonomijom.

- Najviše su pogođeni oni koji žive od plate do plate – a to je 70% Amerikanaca.

- Razlike u prihodima između bogatih i siromašnih se povećavaju, kao što se vidi na grafikonu ispod.

*Koncentracija dohotka na vrhu naglo je porasla od 1970-ih

Zašto i dalje imamo isti monetarni sistem?

Ako ovaj sistem bogate još više obogaćuje, a siromašne još više osiromašuje, dovodeći do političke nestabilnosti, zašto ga onda ne bismo promenili?

Najveći razlog zašto se ništa ne menja je verovatno to što puno toga ne znamo o samom sistemu. Svi svakodnevno koristimo valute svojih vlada, ali većina nas ne razume kako sistem funkcioniše i šta on čini našim društvima.

Obrazovni sistem, mediji i finansijski stručnjaci neprestano nam govore da je monetarni sistem previše komplikovan da bi ga normalni ljudi razumeli. Mnogi od nas se zato i ne trude da pokušaju.

Još nekoliko razloga zašto ovaj sistem nastavlja da opstaje:

- Mnogo je ljudi koji imaju direktnu korist od štampanja novog novca.

- Ti ljudi ne žele nikakve promene i bore se da zadrže tu moć.

- Nacionalne valute su često pogodne

- Kreditne kartice, online bankarstvo i još mnogo toga čine upravljanje nacionalnim valutama i njihovo trošenje lakim i jednostavnim.

- Građani moraju da plaćaju porez u svojoj nacionalnoj valuti

- To stvara potražnju za tom valutom od svih građana, povećavajući njenu vrednost.

- Glavna međunarodna tržišta, poput nafte, denominirana su u dolarima.

- Nafta je potrebna svakoj zemlji na planeti, ali pošto mnogi ne mogu da je proizvode, moraju da je kupuju na međunarodnim berzama. Od 1970-ih na ovim berzama gotovo sva nafta se prodaje za dolare, što stvara potražnju za dolarima. Da bi se odmaknule od ovog sistema, zemlje bi trebale da pronađu novu valutu ili robu za trgovinu naftom, što zahteva vreme i rizike.

- Nije postojala dobra alternativa

- Uz globalnu ekonomiju u realnom vremenu, naš sistem digitalnog bankarstva koji koristi nacionalne valute je pogodan. Transakcija u tvrdom novcu poput zlata bila bi previše nezgrapna za današnji svet. Digitalna valuta pod nazivom Bitcoin, predstavljena 2009. godine, je rastuća alternativa koja nudi čvrst novac koji se kreće brzinom interneta.

Šta je novac, i zašto trebate da brinete?

Novac je alat koji olakšava razmenu dobara. Kao i svako drugo dobro, novac se pridržava zakona ponude i potražnje – povećanje potražnje povećaće njegovu vrednost, a povećanje ponude smanjiće njegovu vrednost.

Na ovaj način novac se ne razlikuje od kuće ili piletine. Međutim, velika prodajnost novca znači da je potražnja za njim uvek velika. Kao rezultat, novac mora biti težak za proizvodnju (a samim tim i ograničen u ponudi) ili će ga onaj ko ga može napraviti, stvoriti toliko, da vremenom više neće služiti kao zaliha vrednosti. Uskoro će izgubiti svoje funkcije kao sredstvo razmene i obračunske jedinice.

Najbolji novac u datoj ekonomiji je onaj koji se najslobodnije kreće – svi ga žele, lako je obaviti transakcije sa njim i koji sa vremenom dobro drži svoju vrednost. Nijedan novac nije savršen u svemu ovome, a neki ističu jednu funkciju novca na štetu drugih.

Iako se istorija ne ponavlja, ona se rimuje, a usponi i padovi monetarnih sistema imaju jasne ritmove. Uspon i pad monetarnog sistema često sledi opšti obrazac koji smo videli u pričama o agri perlama i Kejnslandu: pojavljuje se odredjenji oblik novca koji pomaže ljudima da efikasnije trguju i štede, ali na kraju gubi na vrednosti kada neko shvati kako da ga jeftino stvori u velikoj količini. Međutim, tokom dugog perioda vremena, monetarni sistemi su se poboljšali u sve tri funkcije novca.

Na primer, zlato je tokom vremena dobro služilo kao zaliha vrednosti. Međutim, naša međusobno povezana ekonomija ne bi mogla efikasno da funkcioniše ako bi trebalo da fizičko zlato zamenimo robom i uslugama. Mnogo je lakše kretati se na papirnom i digitalnom novcu, ali istorija nam govori da su vlade i bankari iskoristili ove oblike novca za krađu bogatstva putem inflacije.

Današnji globalni monetarni sistem je vrlo zgodan, a digitalna plaćanja i kreditne kartice olakšavaju trošenje novca. Ovo skriva stalnu inflaciju koja nagriza vrednost svake jedinice novca i dovodi do sve većeg jaza u bogatstvu.

Nadam se da je ovaj članak proširio vaše razumevanje novca i njegove uloge u društvu. Ovo je samo početak svega što treba istražiti o novcu: za kasnije su sačuvane teme o inflaciji, kamatnim stopama, pozajmljivanju, poslovnim ciklusima i još mnogo toga.

Efikasnija Ušteda Novca

Možda se pitate kako zaštititi svoju štednju kada svaki oblik često korišćenog novca i investicija pati od inflacije ponude – koja umanjuje vrednost i prenosi bogatstvo onima koji mogu da stvore novac ili investiciju. Možda se čini da se ništa na planeti danas ne može kvalifikovati kao ‘težak’ novac, ali dve stvari ipak ostaju: zlato i njegov noviji rođak Bitcoin. Obe ove stvari je neverovatno teško proizvesti, a jedna od njih se kreće brzinom interneta i može se čuvati u vašem mozgu.

Ako želite da saznate više o Bitcoin-u kao sredstvu za zaštitu vaše ušteđevine, pročitajte ovde. Ako ste već spremni za kupovinu Bitcoin-a, pogledajte moj vodič za kupovinu Bitcoin-a. Možete početi sa investiranjem sa samo 5 ili 10 €.

Zasluge