-

@ 3770c235:16042bcc

2025-05-28 05:54:01

@ 3770c235:16042bcc

2025-05-28 05:54:01** Introduction: The Neon Pulse of Las Vegas

**It’s 2:30 AM on a Tuesday. The Strip hums with laughter, clinking glasses, and the occasional Elvis impersonator. A group of friends stumbles out of a nightclub, squinting under the glow of a Las Vegas billboard that screams, “Hungry? $5 Pancakes → 1 Block Right!” Ten minutes later, they’re drowning their late-night cravings in syrup.This isn’t luck—it’s Las Vegas billboards doing what they do best: working while the rest of the world sleeps. In a city where the party never stops, these glowing giants are the ultimate salespeople. Let’s dive into why Las Vegas billboards outshine traditional ads and how your business can ride their 24/7 energy wave.

** Why Las Vegas Billboards Never Take a Coffee Break

** 1. Tourists Don’t Have Bedtimes (and Neither Do Billboards)

- 42 million visitors flock to Vegas yearly. They’re sipping margaritas at noon, gambling at midnight, and shopping at 3 AM.

- Las Vegas billboards near hotspots like the Bellagio Fountains or Fremont Street catch eyes round the clock.Real Story:

A donut shop owner named Luis rented a billboard near the “Welcome to Vegas” sign. His message? “Jet Lagged? Sugar Fix Open 24/7!” Sales tripled—especially between 1 AM and 4 AM.** 2. You Can’t “Skip” a Billboard

** - Imagine this: You’re stuck in traffic on the Strip. Your phone’s dead. That Las Vegas billboard for air-conditioned massages? It’s your lifeline.

- Compare that to online ads: 47% of people skip them, and TikTok ads vanish in a scroll.- Vegas Thrives on Impulse

- Billboards tap into spontaneous decisions:

- “Let’s try that rooftop bar!”

- “Wait, free slot play? Let’s U-turn!”

- Traditional ads (like radio spots) fade fast. Billboards linger, nudging tourists to act now.

** 5 Reasons Your Business Needs a Vegas Billboard

** 1. Size Matters (And So Does Flash)

- Strip billboards can be taller than a 5-story building.

- Digital screens use LEDs so bright, they’re visible from space.Pro Tip:

A casino added fake “smoke” effects to their billboard for a Halloween promo. Traffic backed up for selfies—and bookings spiked.- No Language Barrier

- Vegas draws visitors from Tokyo, Berlin, São Paulo...

- A Las Vegas billboard with a giant cocktail emoji? Universal for “Drinks here!”

Case Study:

A Korean BBQ spot used a billboard of sizzling meat. No words. Just smoke visuals. Tourists followed the “aroma” straight to their door.- They’re Always in the Right Place, Right Time

- 6 AM: Joggers see smoothie ads.

- 3 PM: Pool partiers spot “Free Margarita” promos.

-

Midnight: Hangover clinics whisper, “We’ve got IVs.”

-

Instant Trust Boost

- A tiny online ad says “startup.” A glowing billboard says, “We’re Vegas royalty.”

Jake’s Win:

Jake’s tiny magic shop rented a billboard reading, “Real Tricks—Cheaper Than the Casino!” Tourists treated him like David Blaine.- QR Codes = Instant Customers

- “Scan for free parking!” → 1,000 scans in a weekend.

- “Tap to call a limo” → Rides booked before the light turns green.

** How to Make Your Vegas Billboard Irresistible

** Step 1: Claim Your Territory

- The Strip: Pricey but prime ($15k–$60k/month).

- Fremont Street: Quirky, cheaper ($5k–$20k), packed with partiers.

- Highway 15: Target road-trippers with “Almost There! Cold Beer Ahead!”Step 2: Keep It Stupid Simple

- Bad: “Experience Culinary Excellence at Our Artisanal Bistro!”

- Good: “24/7 Bacon Pancakes → Exit Here.”Maria’s Hack:

Maria’s tattoo parlor used a billboard with a flaming skull and three words: “Walk-Ins Welcome.” No phone number. “People just… show up,” she laughs.Step 3: Track Your Wins (Like a Vegas High Roller)

- QR Codes: “Scan for Free Slot Play!” → Track scans.

- Unique URLs: “Visit VegasPizza24.com” → Monitor traffic.

- Old-School: Count foot traffic. (“Did that bachelor party just roll in from our billboard? Yes.”)**FAQs ** 1. “How do I even measure if my billboard’s working? It’s not like online ads!”

Answer:

You’re right—it’s not just clicks and likes. But here’s how real businesses track success:

- QR Codes: Add a unique code like “Scan for Free Appetizer!” Track scans.

- Promo Codes: “Mention this billboard for 20% off!” (Works great for Uber drivers: “My passengers blurt it out mid-ride,” says driver Luis M.)

- Foot Traffic Spikes: Note sales surges after your ad goes live. A dispensary saw a 60% bump in visits after their “We’re Closer Than the Casino!” billboard.

- Social Media Tags: Encourage selfies with your billboard. A retro motel offered a free pool pass for tagged photos. Their Instagram exploded.- “Aren’t billboards old-school? My Gen Z customers live on TikTok!”

Answer:

Billboards in Vegas are anything but old-school. Here’s why: - Hybrid Campaigns: Pair billboards with geofenced mobile ads. Example: A billboard for a pool party says, “Scan to Pre-Order Drinks.” Users nearby get a TikTok-style ad on their phone.

- Instagrammable Designs: Quirky billboards go viral. The “Welcome to Vegas” sign is the most Instagrammed spot in the city. Mimic that vibe!

- Influencer Collabs: Pay a Vegas influencer to pose with your billboard. Their followers will hunt it down like a scavenger hunt.

Real Story:

A vintage clothing store’s billboard (“Find Your Retro Vibe → 2 Blocks East”) became a TikTok trend after a local influencer did a “thrift haul” video there.** 3. “What’s the biggest mistake businesses make with Vegas billboards?”

** Answer:

Trying to cram in too much info! Drivers have 5–7 seconds to read your ad. Avoid:

- Text Overload: “Grand Opening! 50% Off! Open 24/7! Call Now!” → Too much!

- Bland Designs: Gray text on a gray background? Yawn.

- Ignoring Locals: Tourists are 70% of viewers, but locals matter too. A gym’s billboard said, “Tired of Tourists? Work Out in Peace.” Memberships spiked.Fix It:

- Use 7 words max.

- Bold colors (red, yellow, neon pink).

- Add a clear call to action: “Turn Right Now!” or “Scan for Free Parking.”- “Do I need a permit? What if my ad gets rejected?”

Answer:

Yep, permits are a thing. The city bans: - Flashing Lights Near Residences: No strobes in suburban areas.

- Certain Content: No swear words, adult themes, or political fights.

How to Avoid Rejection:

- Work with local Outdoor Advertising companies—they know the rules.

- Submit designs early. One pizza joint’s ad was flagged for a pepperoni slice deemed “too suggestive.” They swapped it to a cheese pull… and it got approved.Conclusion: Let Your Business Shine All Night Long

At 5 AM, as the sun peeks over the desert, the Las Vegas billboards keep glowing. They’ve sold midnight pancakes, inspired shotgun weddings, and even talked someone out of a questionable tattoo (“Wait! Our Parlor’s Better → Next Exit”).These aren’t just ads—they’re part of Vegas’ heartbeat. So whether you’re slinging sushi, massages, or monster truck rides, remember: In a city that never sleeps, your billboard shouldn’t either.

Ready to Light Up the Night?

Find Las Vegas billboards near you today. And if you spot one that says, “Free High-Fives for Readers of This Article,” honk twice. It’s probably yours. -

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08 -

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06 -

@ c230edd3:8ad4a712

2025-04-11 16:02:15

@ c230edd3:8ad4a712

2025-04-11 16:02:15Chef's notes

Wildly enough, this is delicious. It's sweet and savory.

(I copied this recipe off of a commercial cheese maker's site, just FYI)

I hadn't fully froze the ice cream when I took the picture shown. This is fresh out of the churner.

Details

- ⏲️ Prep time: 15 min

- 🍳 Cook time: 30 min

- 🍽️ Servings: 4

Ingredients

- 12 oz blue cheese

- 3 Tbsp lemon juice

- 1 c sugar

- 1 tsp salt

- 1 qt heavy cream

- 3/4 c chopped dark chocolate

Directions

- Put the blue cheese, lemon juice, sugar, and salt into a bowl

- Bring heavy cream to a boil, stirring occasionally

- Pour heavy cream over the blue cheese mix and stir until melted

- Pour into prepared ice cream maker, follow unit instructions

- Add dark chocolate halfway through the churning cycle

- Freeze until firm. Enjoy.

-

@ c230edd3:8ad4a712

2025-04-09 00:33:31

@ c230edd3:8ad4a712

2025-04-09 00:33:31Chef's notes

I found this recipe a couple years ago and have been addicted to it since. Its incredibly easy, and cheap to prep. Freeze the sausage in flat, single serving portions. That way it can be cooked from frozen for a fast, flavorful, and healthy lunch or dinner. I took inspiration from the video that contained this recipe, and almost always pan fry the frozen sausage with some baby broccoli. The steam cooks the broccoli and the fats from the sausage help it to sear, while infusing the vibrant flavors. Serve with some rice, if desired. I often use serrano peppers, due to limited produce availability. They work well for a little heat and nice flavor that is not overpowering.

Details

- ⏲️ Prep time: 25 min

- 🍳 Cook time: 15 min (only needed if cooking at time of prep)

- 🍽️ Servings: 10

Ingredients

- 4 lbs ground pork

- 12-15 cloves garlic, minced

- 6 Thai or Serrano peppers, rough chopped

- 1/4 c. lime juice

- 4 Tbsp fish sauce

- 1 Tbsp brown sugar

- 1/2 c. chopped cilantro

Directions

- Mix all ingredients in a large bowl.

- Portion and freeze, as desired.

- Sautè frozen portions in hot frying pan, with broccoli or other fresh veggies.

- Serve with rice or alone.

-

@ 00000001:b0c77eb9

2025-02-14 21:24:24

@ 00000001:b0c77eb9

2025-02-14 21:24:24مواقع التواصل الإجتماعي العامة هي التي تتحكم بك، تتحكم بك بفرض أجندتها وتجبرك على اتباعها وتحظر وتحذف كل ما يخالفها، وحرية التعبير تنحصر في أجندتها تلك!

وخوارزمياتها الخبيثة التي لا حاجة لها، تعرض لك مايريدون منك أن تراه وتحجب ما لا يريدونك أن تراه.

في نوستر انت المتحكم، انت الذي تحدد من تتابع و انت الذي تحدد المرحلات التي تنشر منشوراتك بها.

نوستر لامركزي، بمعنى عدم وجود سلطة تتحكم ببياناتك، بياناتك موجودة في المرحلات، ولا احد يستطيع حذفها او تعديلها او حظر ظهورها.

و هذا لا ينطبق فقط على مواقع التواصل الإجتماعي العامة، بل ينطبق أيضاً على الـfediverse، في الـfediverse انت لست حر، انت تتبع الخادم الذي تستخدمه ويستطيع هذا الخادم حظر ما لا يريد ظهوره لك، لأنك لا تتواصل مع بقية الخوادم بنفسك، بل خادمك من يقوم بذلك بالنيابة عنك.

وحتى إذا كنت تمتلك خادم في شبكة الـfediverse، إذا خالفت اجندة بقية الخوادم ونظرتهم عن حرية الرأي و التعبير سوف يندرج خادمك في القائمة السوداء fediblock ولن يتمكن خادمك من التواصل مع بقية خوادم الشبكة، ستكون محصوراً بالخوادم الأخرى المحظورة كخادمك، بالتالي انت في الشبكة الأخرى من الـfediverse!

نعم، يوجد شبكتان في الكون الفدرالي fediverse شبكة الصالحين التابعين للأجندة الغربية وشبكة الطالحين الذين لا يتبعون لها، إذا تم إدراج خادمك في قائمة fediblock سوف تذهب للشبكة الأخرى!

-

@ eb0157af:77ab6c55

2025-05-28 06:01:31

@ eb0157af:77ab6c55

2025-05-28 06:01:31Governor Abbott will have to decide whether to sign the bill establishing a bitcoin reserve for the state.

Texas could become the third U.S. state to set up a strategic bitcoin reserve, following the approval of Senate Bill 21 by the state House, with 101 votes in favor and 42 against.

Lee Bratcher, founder and president of the Texas Blockchain Council, expressed confidence that Governor Greg Abbott will sign the legislative measure. In an interview with The Block, Bratcher said:

“I’ve talked to the governor about this personally, and I think he wants to see Texas lead in this way.”

The bill is expected to reach the governor’s desk within a week or two, according to Bratcher’s projections. If signed, Texas would follow in the footsteps of New Hampshire and Arizona in creating a state-held bitcoin reserve.

Despite Texas ranking as the world’s eighth-largest economy — ahead of many nations — the initial approach to the reserve will be cautious. Bratcher estimates the starting investment will be in the “tens of millions of dollars,” an amount he describes as “modest” for an economy the size of Texas. The responsibility for operational decisions would fall to the state comptroller, who acts as an executive accountant in charge of managing and investing public funds.

“My sense is that it will be in the tens of millions of dollars, which, while it sounds significant, is a very modest amount, for a state the size of Texas.” explained the president of the Texas Blockchain Council.

The road to approval

According to Bratcher, the idea of creating a state bitcoin reserve dates back to 2022 and represents the culmination of years of work by the Texas Blockchain Council. The organization has worked closely with lawmakers who shared the vision of seeing the state accumulate the world’s leading cryptocurrency. Additionally, Texas has long been home to numerous bitcoin mining companies.

The post Texas one step away from a bitcoin reserve: only the governor’s signature is missing appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-05-28 06:01:29

@ eb0157af:77ab6c55

2025-05-28 06:01:29Bitcoin surpasses gold in the United States: 50 million holders and a dominant role in the global market.

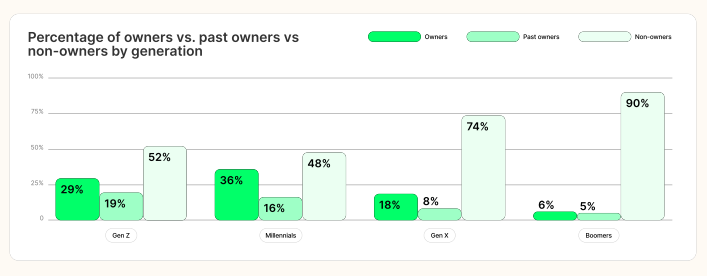

According to a new report by River, for the first time in history, the number of Americans owning bitcoin has surpassed that of gold holders. The analysis reveals that approximately 50 million U.S. citizens currently own the cryptocurrency, while gold owners number 37 million. In fact, 14.3% of Americans own bitcoin, the highest percentage of holders worldwide.

Source: River

The report highlights that 40% of all Bitcoin-focused companies are based in the United States, consolidating America’s dominant position in the sector. Additionally, 40.5% of Bitcoin holders are men aged 31 to 35, followed by 35.9% of men aged 41 to 45. In contrast, only 13.4% of holders are women.

Source: River

Notably, U.S. companies hold 94.8% of all bitcoins owned by publicly traded companies worldwide. According to the report, recent regulatory changes in the U.S. have made the asset more accessible through financial products such as spot ETFs.

The document also shows that American investors increasingly view the cryptocurrency as protection against fiscal instability and inflation, appreciating its limited supply and decentralized governance model.

For River, Bitcoin offers significant practical advantages over gold in the modern digital era. Its ease of custody, cross-border transfer, and liquidity make the cryptocurrency an attractive option for both individual and institutional investors, the report suggests.

The post USA: 50 million Americans own bitcoin appeared first on Atlas21.

-

@ 6e0ea5d6:0327f353

2025-05-28 04:34:08

@ 6e0ea5d6:0327f353

2025-05-28 04:34:08Ascolta bene! It is more dignified to thirst alone in the desert than to share wine with someone who has no thirst for conquest.

On the silent path to success, it’s not the declared enemies who slow the march, but rather the friends. Not the noble or loyal ones, but the failures—those who carry a dull glint in their eyes, chronic laziness in their spirit, and the eternal excuse of bad luck in their pockets. Friendship, when poorly chosen, becomes a polished anchor, tied to your ankle with ropes named camaraderie.

Nothing weighs heavier on the journey than having to endure the failed and envious around you. It is a kind of emotional parasitism that begins with empathy and ends in stagnation. Those who live among the weak will crawl. Those who keep company with miserable friends, instead of striving to prosper, learn to curse wealth—not out of ethics, but out of envy. Mediocrity, my friend, is contagious. And it does not take root suddenly, but like a silent epidemic.

Ambition—that fire that burns in the bones of great men—will always seem like arrogance to the ears of the failed. Those who have never built anything, except arguments to justify their paralysis, will never understand the fury of someone born to conquer. And so, with smiles, they spit venom: “Calm down,” they say, “be content,” they advise. Hypocrites. What they call humility is nothing more than resignation to their own defeat.

To walk alone, with hunger and honor, is worth more than feasting at lavish tables at the cost of your own sweat, surrounded by parasites who toast your downfall with glasses full of praise. No one prospers where the conversation is filled with complaints, criticism, and envy. What does not build up, corrodes.

The rust of the weak is invisible at first—a bitter joke here, a veiled critique there. And before you know it, the structure is already rotten. Of the friendship, only the weight remains. Of the relationship, only exhaustion. The true enemy of success is the company of those who have failed and wish for you the same fate. These tragic figures—always tired, always victims—are masters of collective self-sabotage.

Feel no remorse in abandoning those who build nothing and consume everything. And in that abandonment, you become freer, stronger, and unbreakable.

Thank you for reading, my friend!

If this message resonated with you, consider leaving your "🥃" as a token of appreciation.

A toast to our family!

-

@ 1d7ff02a:d042b5be

2025-05-28 04:02:47

@ 1d7ff02a:d042b5be

2025-05-28 04:02:47For those who still don't truly understand Bitcoin, it means you still don't understand what money is, who creates it, and why humans need money.

It's a scam that the education system doesn't teach this important subject, while we spend almost our entire lives trying to earn money. Therefore, I recommend following the money and studying Bitcoin seriously.

Why Bitcoin Matters

Saving is the greatest discovery in human history

Before humans learned to save, we were just animals living day to day. Saving is what makes humans different from other animals — the ability to think about the future and store for later.

Saving created civilization itself

Without saving, there would be no cities, no science, no art. Everything we call "progress" comes from the ability to save.

Money is the greatest creation in human history

It is the tool that has allowed human civilization to advance to this day. Money is the best tool humans use for saving.

Bitcoin is the best money ever created

It is the most perfect money humans have ever created. No one can control, manipulate, destroy it, and it is truly limited like time in life.

Bitcoin is like a black hole

That will absorb all value from the damaged financial system. It will draw stability and value to itself. Everything of value will flow into Bitcoin eventually.

Bitcoin is like Buddhism discovering truth

It helps understand the root problems of the current financial system and the emergence of many problems in society, just like Buddha who understood all suffering and the causes of suffering.

Bitcoin is freedom

Money is power, money controls human behavior. When we have money that preserves value and cannot be controlled, we will have intellectual freedom, freedom of expression, and the power to choose.

The debt that humanity has created today would take another thousand years to pay off completely

There is no way out and it's heading toward serious collapse. Bitcoin is the light that will help prevent humanity from entering another dark age.

Bitcoin cannot steal your time

It cannot be created from nothing. Every Bitcoin requires real energy and time to create.

Bitcoin is insurance that protects against mismanagement

It helps protect against currency debasement, economic depression, and failed policies. Bitcoin will protect your value.

Bitcoin is going to absorb the world's value

Eventually, Bitcoin will become the store of value for the entire world. It will absorb wealth from all assets, all prices, and all investments.

Exit The Matrix

We live in a financial Matrix. Every day we wake up and go to work, thinking we're building a future for ourselves. But in reality, we're just giving energy to a system that extracts value from us every second. Bitcoin is the red pill — it will open your eyes to see the truth of the financial world. Central banks are the architects of this Matrix — they create money from nothing, and we have to work hard to get it.

The education system has deceived us greatly. They teach us to work for money, but never teach us what money is. We spend 12-16 years in school, then spend our entire lives earning money, but never know what it is, who creates it, and why it has value. This is the biggest scam in human history.

We are taught to be slaves of the system, but not taught to understand the system.

The Bitcoin standard will end war

When you can't print money for war anymore, war becomes too expensive.

We are entering the Bitcoin Renaissance era

An era of financial and intellectual revival. Bitcoin is creating a new class of humans. People who understand and hold Bitcoin will become a new class with true freedom.

The Path to Financial Truth

Follow the money trail and you will see the truth: - Who controls money printing? - Why do prices keep getting higher? - Why are the poor getting poorer and the rich getting richer?

All the answers lie in understanding money and Bitcoin.

Studying Bitcoin is not just about investment — it's about understanding the future of currency and human society.

Don't just work for money. Understand money. Study Bitcoin.

If you don't understand money, you will be a slave to the system forever. If you understand Bitcoin, you will gain freedom.

-

@ 502ab02a:a2860397

2025-05-28 02:03:01

@ 502ab02a:a2860397

2025-05-28 02:03:01ยังมีอีกสิ่งหนึ่งที่มักซ่อนอยู่ในเมล็ดธัญพืช ถั่วเปลือกแข็ง และพืชตระกูลถั่วทั้งหลาย เป็นเหมือน “กล่องเก็บขุมทรัพย์” สำหรับชีวิตน้อยๆ ของพืชในวันที่จะเติบโต แต่พอสิ่งนี้หลุดเข้ามาในร่างกายมนุษย์ มันกลับถูกมองว่าเป็น “ขโมย” ขโมยแร่ธาตุไปจากร่างกายเรา เจ้าสิ่งนั้นคือ “กรดไฟติก” หรือ phytic acid นั่นเองครับ

กรดไฟติกเป็นสารอินทรีย์ที่พืชสร้างขึ้นเพื่อเก็บสะสมฟอสฟอรัสไว้ใช้ตอนงอกงามในอนาคต มันเปรียบเหมือนกระปุกออมสินของเมล็ดพืช พวกเมล็ดถั่วดำ ข้าวโพด ข้าวกล้อง ข้าวโอ๊ต เมล็ดทานตะวัน อัลมอนด์ ไปจนถึงเต้าหู้ ถั่วเหลือง และธัญพืชต่างๆ ล้วนมีกรดไฟติกอยู่ไม่น้อย โดยเฉพาะถ้าเป็น “ธัญพืชเต็มเมล็ด” ที่ไม่ผ่านการขัดสีแบบที่หลายๆคนชอบ นั่นเพราะเยื่อหุ้มเมล็ดคือที่เก็บเจ้าตัวนี้ไว้

หลายคนคงคิดว่า อ้าวแล้วเจ้ากรดไฟติกทำไมถึงมีชื่อเสียงไม่ค่อยดีนัก? คำตอบอยู่ที่ “ความสามารถในการจับแร่ธาตุ” ของมันนี่แหละครับ

กรดไฟติกเป็นเหมือนแม่เหล็กเล็กๆ ที่สามารถจับตัวกับแร่ธาตุต่างๆ ได้ดี โดยเฉพาะ “แร่ธาตุบวกสอง” ทั้งหลาย แร่ธาตุบวกสอง คือ แร่ธาตุที่เวลาอยู่ในร่างกายจะอยู่ในรูปของไอออนที่มีประจุไฟฟ้า บวก 2 (เขียนว่า ²⁺) หรือพูดอีกแบบคือ มันเสียอิเล็กตรอนออกไป 2 ตัว เลยกลายเป็นไอออนที่มีพลังบวก 2 หน่วย กรดไฟติก หรือ แทนนิน จะทำตัวเป็น "แม่เหล็ก" ดูดแร่ธาตุออกไป มันมักจะจับกับแร่ธาตุที่มีประจุบวก โดยเฉพาะพวกที่ประจุบวกแรงๆ แบบ บวกสอง (²⁺) นี่แหละ เพราะจับแน่น จับเหนียว ยิ่งบวกเยอะยิ่งจับดี เหมือนแช่แม่เหล็กลงไปในกล่องโลหะ เช่น ธาตุเหล็ก สังกะสี แมกนีเซียม แคลเซียม และทองแดง พอมันจับเสร็จแล้ว ร่างกายเราก็ไม่สามารถดูดซึมแร่ธาตุพวกนี้เข้าไปได้ เพราะมันเปลี่ยนสภาพกลายเป็นของจับคู่ที่ลำไส้ไม่รู้จัก ไม่รู้จะพาเข้าร่างกายยังไง สุดท้ายก็ต้องโบกมือลาไปพร้อมของเสีย

พวกที่เป็น บวกสาม (³⁺) อย่างเช่น อลูมิเนียม (Al³⁺) หรือ เหล็กเฟอริก (Fe³⁺) จะจับแน่นมาก ถึงขั้นอาจเกิด “ตกตะกอน” แบบไม่ละลายน้ำเลยทีเดียว พวกนี้ลำไส้ไม่สามารถดูดซึมได้เลย ในขณะที่แร่ธาตุบวกหนึ่ง โซเดียม (Na⁺) โพแทสเซียม (K⁺) ประจุบวกแค่ +1 จับกับกรดไฟติกได้น้อยกว่า

ในแง่นี้กรดไฟติกเลยถูกเรียกว่า “สารต้านสารอาหาร” หรือ anti-nutrient เพราะมันต้านไม่ให้ร่างกายได้แร่ธาตุที่ควรจะได้ แต่อย่าเพิ่งตัดสินมันเหมือนผู้ร้าย เพราะในขณะที่กรดไฟติกอาจขโมยแร่ธาตุบางตัวจากร่างกาย มันก็มีคุณสมบัติน่าสนใจที่ดูจะเป็นคุณงามความดีของมันเหมือนกัน เช่น มันสามารถจับกับโลหะหนักบางชนิด เช่น ตะกั่ว หรือแคดเมียม ที่อาจปนเปื้อนในอาหาร แล้วพาออกไปจากร่างกายก่อนที่สิ่งเหล่านั้นจะทำร้ายเรา

และอีกด้านหนึ่งที่กำลังเป็นที่สนใจคือ ฤทธิ์ต้านอนุมูลอิสระของกรดไฟติก มันอาจช่วยลดการอักเสบ หรือยับยั้งการเติบโตของเซลล์มะเร็งบางชนิดในระดับเซลล์ได้ มีงานวิจัยที่พบว่ามันอาจไปจับกับธาตุเหล็กส่วนเกินที่ว่ายอยู่ในเลือด ซึ่งเป็นตัวเร่งปฏิกิริยาอนุมูลอิสระ คล้ายช่วย “เก็บเศษเหล็กที่ลอยไปมาบนทางด่วนหลอดเลือด” ให้ปลอดภัยขึ้นอีกนิด

แต่ทั้งนี้ทั้งนั้น อยากให้คิดแบบนี้ครับว่า กรดไฟติกคือคนแปลกหน้าที่ “บางมื้อก็มีประโยชน์ บางมื้อก็ทำให้เราขาดของดี” สิ่งสำคัญอยู่ที่ “สภาวะแวดล้อมของมื้ออาหาร” ถ้าอาหารในมื้อมีแร่ธาตุไม่มากนัก แล้วกรดไฟติกเข้ามาเยอะ มันก็ยิ่งลดโอกาสดูดซึมแร่ธาตุเหล่านั้น แต่ถ้ามื้ออาหารมีความหลากหลาย โปรตีนเพียงพอ วิตามิน C อยู่ครบ ก็ช่วยเพิ่มการดูดซึมธาตุเหล็กได้ดีขึ้น เพราะมันเปลี่ยนเหล็กให้อยู่ในรูปแบบที่ร่างกายดูดซึมง่ายขึ้น

แล้วเราจะจัดการยังไงกับกรดไฟติกในครัวแบบบ้านเรา?

วิธีพื้นบ้านมีมาแต่โบราณแล้วนั่นคือ -แช่น้ำ ก่อนหุงข้าวกล้อง หรือแช่ถั่วก่อนนำไปต้ม จะช่วยลดกรดไฟติกได้ระดับหนึ่ง เพราะมีเอนไซม์ที่ชื่อว่า phytase ซึ่งจะเริ่มทำงานเมื่อพืชได้รับน้ำและอุณหภูมิพอเหมาะ -การหมัก เช่น หมักแป้งข้าวเปลือกทำขนม หรือการหมักเต้าหู้ ก็เป็นวิธีดั้งเดิมที่ช่วยลดกรดไฟติกลงได้มาก เพราะเอนไซม์ของจุลินทรีย์ในกระบวนการหมักจะช่วยย่อยกรดไฟติกให้ลดลง -การงอก หรือ sprouting คือการทำให้เมล็ดพืชเริ่มต้นชีวิตใหม่ เช่น ถั่วงอก ข้าวกล้องงอก วิธีนี้ลดกรดไฟติกได้ดีมาก เพราะ phytase ที่อยู่ในพืชจะถูกกระตุ้นให้ทำงานสูงสุดตอนพืชเริ่มงอก

ข้อมูลคร่าวๆ บอกว่า วิธีเหล่านี้อาจลดกรดไฟติกลงได้ 30-90% ขึ้นกับชนิดของพืช และระยะเวลาที่ใช้

แต่ต้องรู้ไว้ด้วยว่า… การลดกรดไฟติกก็อาจทำให้พลังงานสำรองหรือสารอาหารบางตัวในพืชหายไปด้วยเช่นกัน เช่น วิตามิน B และสารต้านอนุมูลอิสระบางชนิด จึงควรใช้วิธีที่พอเหมาะ ไม่ถึงกับฆ่าความดีของพืชหมด

ดังนั้นเช่นกันครับว่า กรดไฟติกไม่ใช่ศัตรู ไม่ใช่เทพเจ้า แต่คือ “สมการ” ที่ต้องรู้จักแก้ไขให้เหมาะกับมื้ออาหารของเรา ถ้าเฮียเลือกกินแบบ animal-based อยู่แล้ว แร่ธาตุสำคัญส่วนใหญ่ก็ได้จากเนื้อสัตว์แบบที่ดูดซึมได้ดีอยู่แล้ว กรดไฟติกจากพืชที่กินพอประมาณก็อาจไม่ได้ร้ายแรงอะไรนัก เพียงแต่ต้องรู้ทันและจัดการให้พอดี ไม่ให้มันกลายเป็นตัวฉุดไม่ให้ร่างกายดูดซึมของดี

สุดท้าย เหมือนชีวิตเรานี่แหละ… “ทุกอย่างมีมุมมืดและมุมสว่าง อยู่ที่ว่าเราจัดแสงยังไงให้แม้แต่เงาก็กลายเป็นพลังของชีวิตเรา” #โรงบ่มสุขภาพ #HealthyHut #pirateketo #ตำรับเอ๋ #siripun #siamstr

/เฮียเอง

-

@ cae03c48:2a7d6671

2025-05-28 04:00:33

@ cae03c48:2a7d6671

2025-05-28 04:00:33Bitcoin Magazine

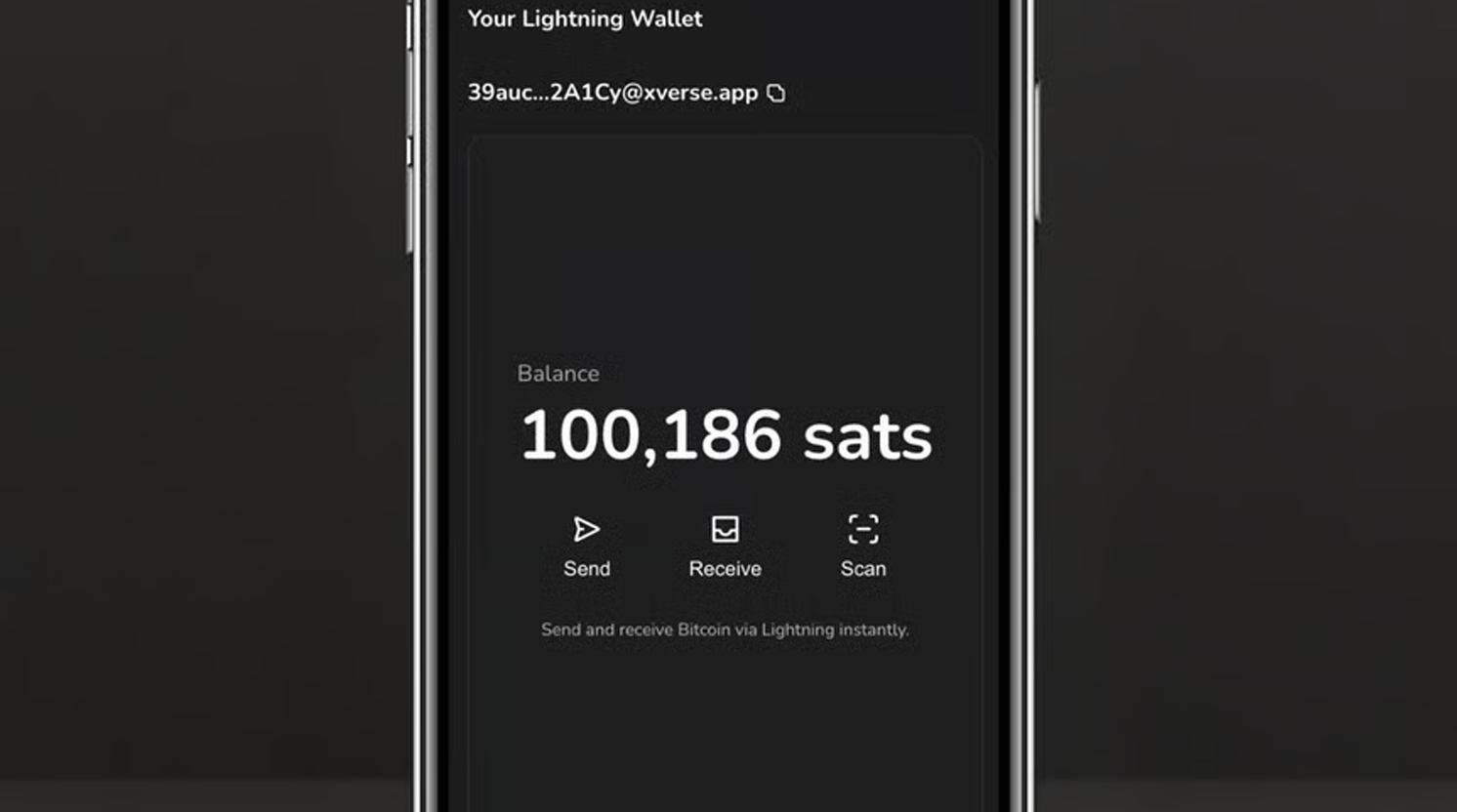

Steak ‘n Shake Reveals Bitcoin Payment Success at Bitcoin 2025 ConferenceSpeaking at the Bitcoin 2025 Conference this morning, Steak ‘n Shake executive Dan Edwards shared new data and insights from the company’s recent move to accept Bitcoin payments globally via the Lightning Network.

JUST IN: Fast food giant Steak 'n Shake announced they're saving 50% in processing fees accepting Bitcoin payments

'#Bitcoin is faster than credit cards'

pic.twitter.com/bxApgBL6El

pic.twitter.com/bxApgBL6El— Bitcoin Magazine (@BitcoinMagazine) May 27, 2025

“On May 16, we began accepting Bitcoin as payment in all of our locations where permitted to do so by law,” Edwards began. “This is a global implementation.”

According to Edwards, Bitcoin transactions are already outperforming expectations. “The day we launched Bitcoin, 1 out of every 500 bitcoin transactions in the world happened at Steak ‘n Shake,” he said.

Steak ‘n Shake is also saving significantly on processing fees. “Bitcoin is faster than credit cards, and when customers choose to pay in Bitcoin, we’re saving 50% in processing fees,” said Edwards. “That makes Bitcoin a win for the customer, a win for us, and a win for the Bitcoin community.”

He emphasized that the decision was not a publicity stunt, but a serious payment upgrade. “We didn’t see this as a marketing gimmick. We saw it as a viable option to pay—on par with other globally accepted methods.”

The company reports that customer behavior has already shifted. “We’ve seen a sustained spike since adding Bitcoin,” Edwards noted.

Edwards also teased the company’s future plans, calling for more technical talent. “We’re not done. We’re investing in cyber chefs, autonomous drives, AI tech—and we need engineers to help us build it.”

To celebrate Bitcoin integration, limited-edition Bitcoin-themed menu items are launching this week in Las Vegas, including the Bitcoin Burger, Super-Sized Bitcoin Meal, and Bitcoin Milkshake. A “blockchain menu” is also in the works.

“Celebrate the use of Bitcoin,” Edwards concluded. “Because this is just the beginning.”

This post Steak ‘n Shake Reveals Bitcoin Payment Success at Bitcoin 2025 Conference first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 812cff5a:5c40aeeb

2025-05-28 01:13:02

@ 812cff5a:5c40aeeb

2025-05-28 01:13:02ميزة حسابات Nostr: حرية مطلقة دون تقديم معلومات شخصية

في عصرٍ تسيطر فيه شركات التكنولوجيا الكبرى على بيانات المستخدمين، تأتي شبكة Nostr كحل جذري يعيد للمستخدم السيطرة على هويته الرقمية. واحدة من أبرز ميزات Nostr هي القدرة على إنشاء عدد غير محدود من الحسابات، دون الحاجة لتقديم أي معلومات شخصية، مثل رقم الهاتف أو البريد الإلكتروني.

مفاتيح بدل الحسابات

في Nostr، لا يوجد مفهوم "الحساب" التقليدي. بدلاً من ذلك، يتم إنشاء هوية المستخدم عبر زوج من المفاتيح: مفتاح خاص (Private Key) ومفتاح عام (Public Key). المفتاح العام يُستخدم لتعريفك ونشر مشاركاتك، بينما المفتاح الخاص يُستخدم لتوقيع تلك المشاركات وإثبات ملكيتك لها.

قابلية التنقل بين التطبيقات

الميزة الكبرى في هذا النموذج هي أن هذه المفاتيح يمكن استخدامها في أي تطبيق Nostr. سواء كنت تستخدم تطبيق Damus، أو Amethyst، أو أي عميل آخر، يمكنك استخدام نفس المفتاح العام للوصول إلى هويتك، منشوراتك، وقائمة متابعيك، بدون الحاجة لإعادة تسجيل أو إعادة بناء ملفك الشخصي في كل تطبيق.

لا تسجيل دخول، لا مركزية

بخلاف الشبكات الاجتماعية التقليدية التي تعتمد على تسجيل الدخول المركزي وكلمة مرور، فإن Nostr مبني على بروتوكول لا مركزي لا يحتاج إلى خوادم مركزية أو عمليات تسجيل دخول. هذا يعني أنك تتحكم بالكامل في بياناتك، ولا يمكن لأي جهة منعك أو حذف حسابك.

المرونة والخصوصية

- يمكنك إنشاء عدة مفاتيح لهويات مختلفة، كل منها تمثل شخصية مختلفة أو اهتمامًا معينًا.

- لا أحد يستطيع ربط هذه الحسابات ببعض أو تتبعها إلا إذا قمت أنت بذلك.

- يمكنك التخلي عن مفتاح واستبداله بآخر متى شئت، بدون طلب إذن من أي منصة.

خاتمة

ما يميز Nostr حقًا ليس فقط حريته التقنية، بل فلسفته المبنية على الخصوصية والتمكين. هو ليس مجرد بديل لتويتر أو فيسبوك، بل هو إطار جديد للتواصل الاجتماعي حيث الهوية تنبع من المستخدم، لا من المنصة.

-

@ b7274d28:c99628cb

2025-05-28 01:11:43

@ b7274d28:c99628cb

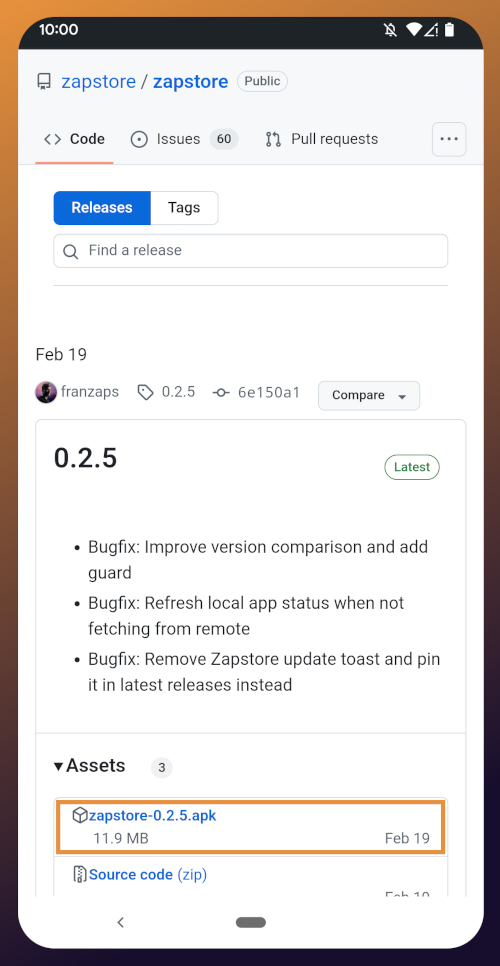

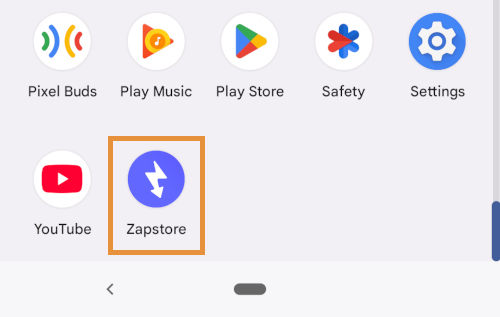

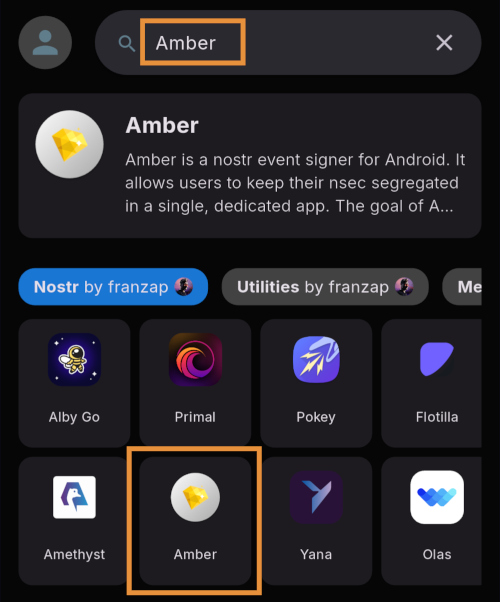

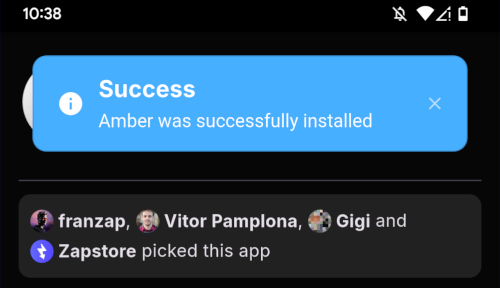

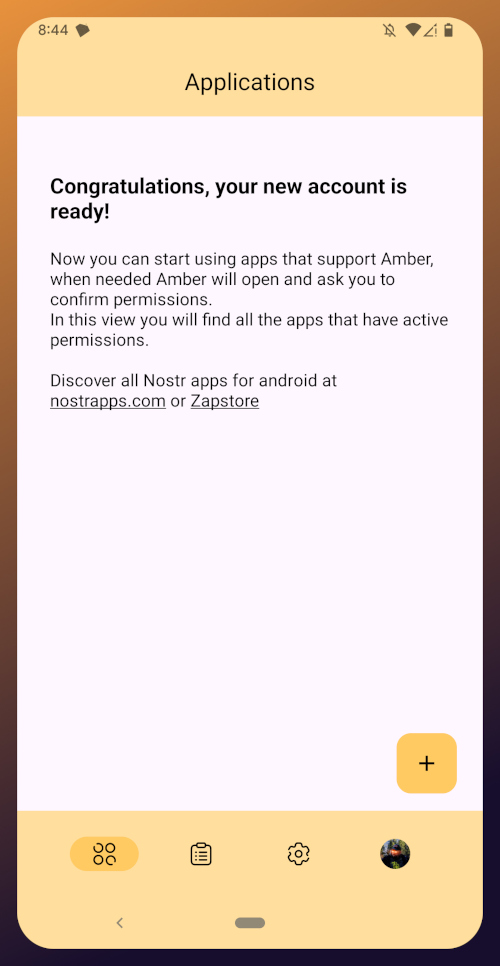

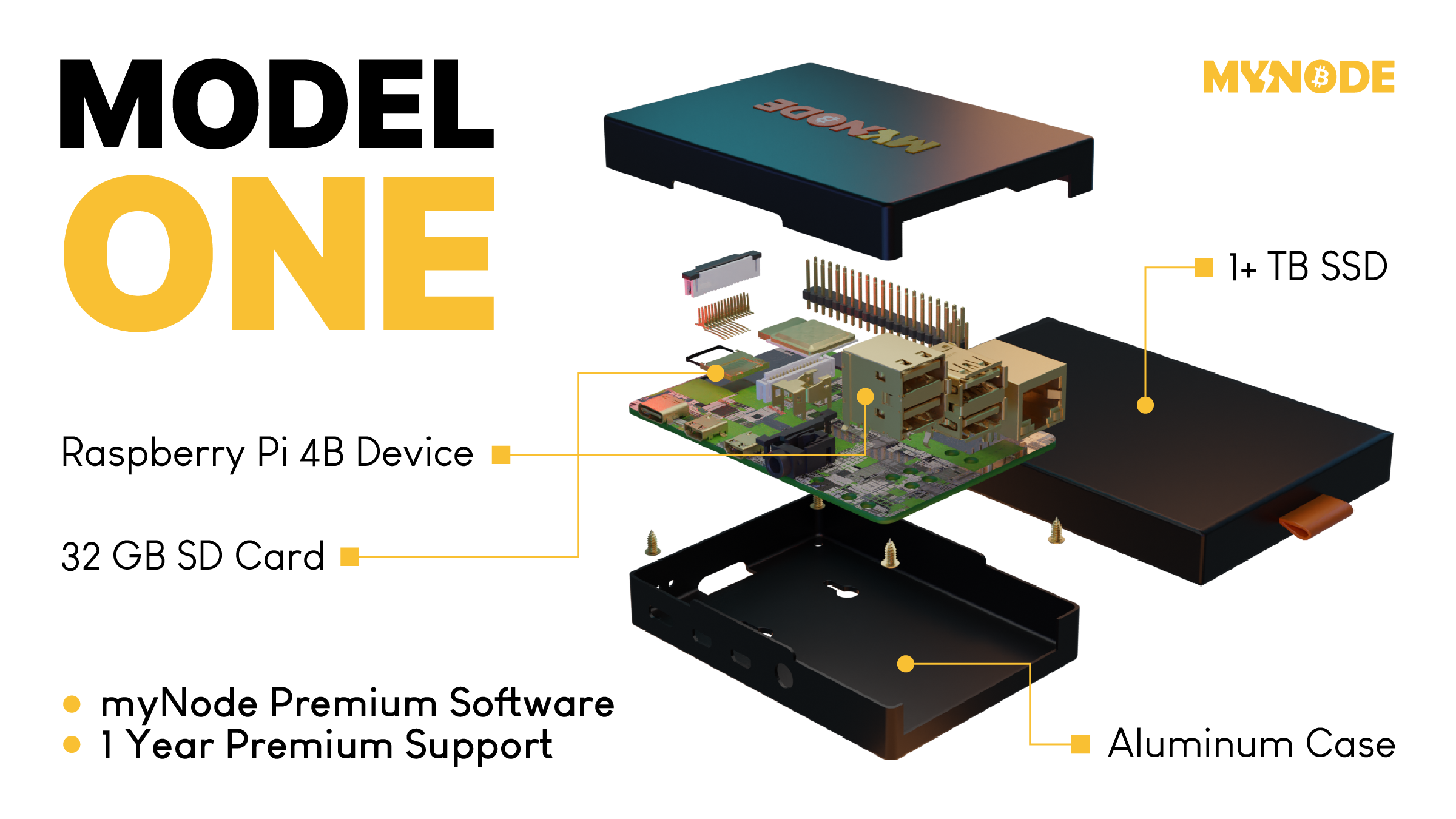

2025-05-28 01:11:43In this second installment of The Android Elite Setup tutorial series, we will cover installing the nostr:npub10r8xl2njyepcw2zwv3a6dyufj4e4ajx86hz6v4ehu4gnpupxxp7stjt2p8 on your #Android device and browsing for apps you may be interested in trying out.

Since the #Zapstore is a direct competitor to the Google Play Store, you're not going to be able to find and install it from there like you may be used to with other apps. Instead, you will need to install it directly from the developer's GitHub page. This is not a complicated process, but it is outside the normal flow of searching on the Play Store, tapping install, and you're done.

Installation

From any web browser on your Android phone, navigate to the Zapstore GitHub Releases page and the most recent version will be listed at the top of the page. The .apk file for you to download and install will be listed in the "Assets."

Tap the .apk to download it, and you should get a notification when the download has completed, with a prompt to open the file.

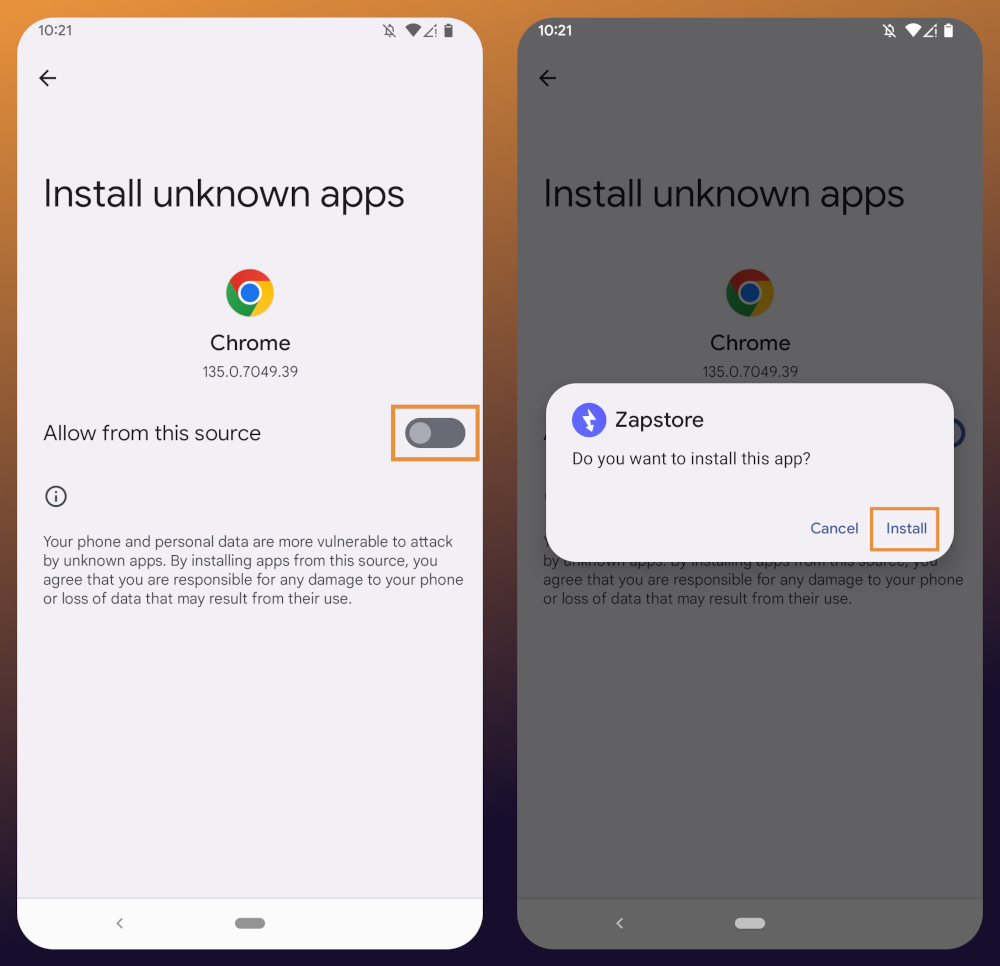

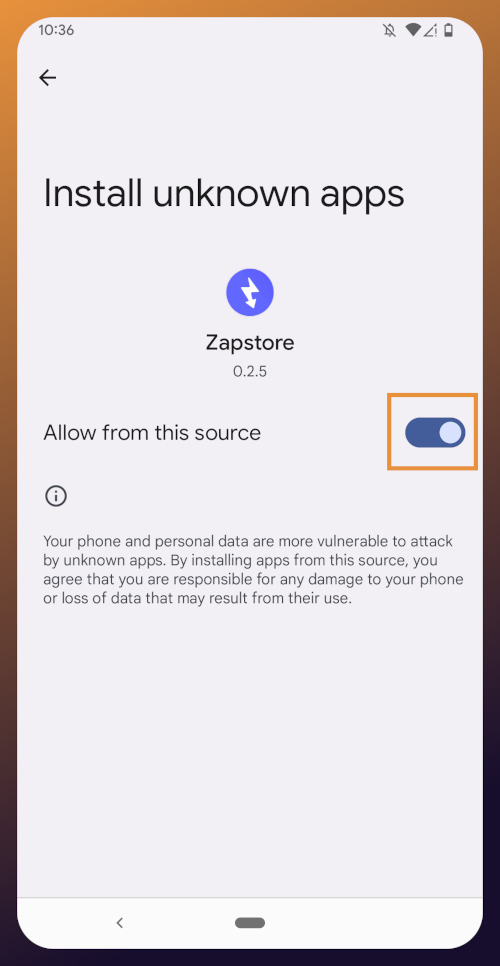

You will likely be presented with a prompt warning you that your phone currently isn't allowed to install applications from "unknown sources." Anywhere other than the Play Store is considered an "unknown source" by default. However, you can manually allow installation from unknown sources in the settings, which the prompt gives you the option to do.

In the settings page that opens, toggle it to allow installation from this source, and you should be prompted to install the application. If you aren't, simply go to your web browser's downloads and tap on the .apk file again, or go into your file browser app and you should find the .apk in your Downloads folder.

If the application doesn't open automatically after install, you will find it in your app drawer.

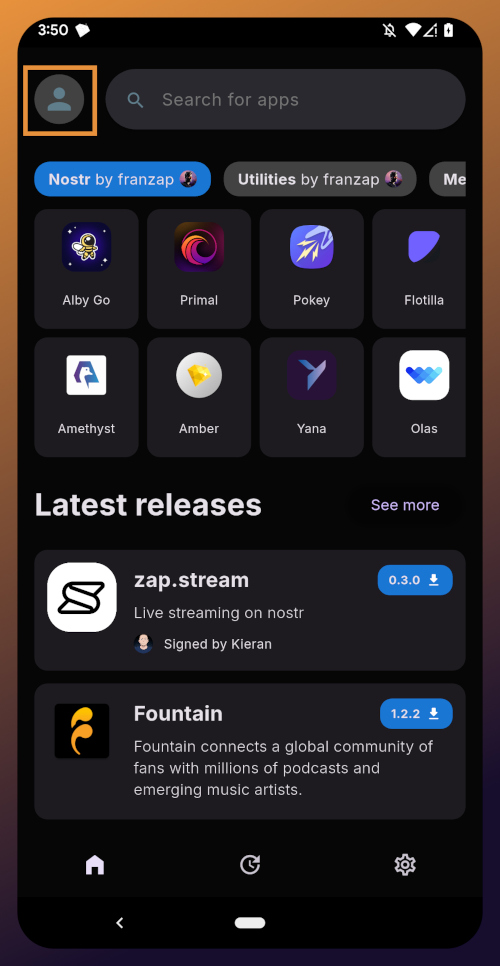

Home Page

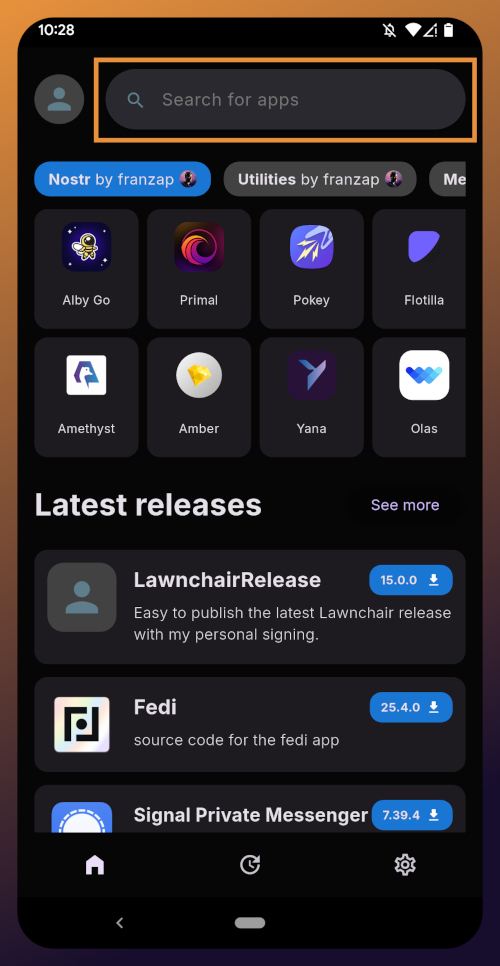

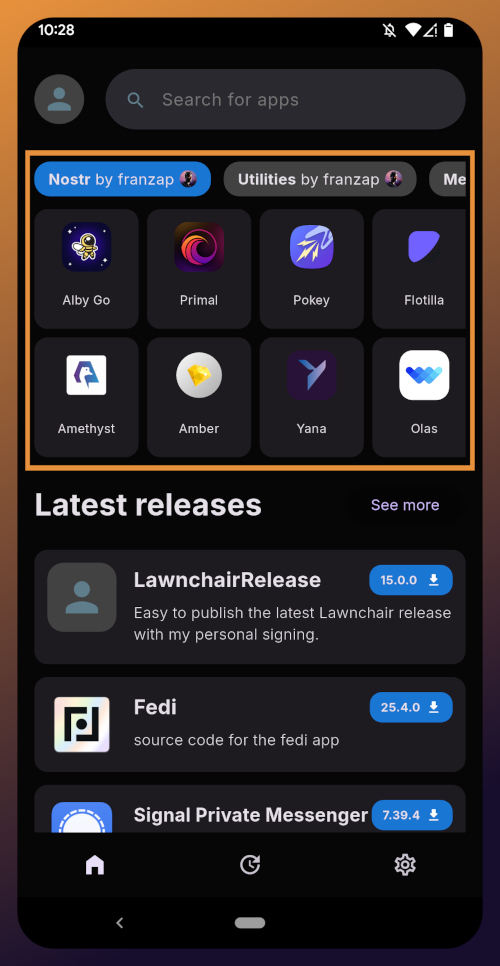

Right at the top of the home page in the Zapstore is the search bar. You can use it to find a specific app you know is available in the Zapstore.

There are quite a lot of open source apps available, and more being added all the time. Most are added by the Zapstore developer, nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9, but some are added by the app developers themselves, especially Nostr apps. All of the applications we will be installing through the Zapstore have been added by their developers and are cryptographically signed, so you know that what you download is what the developer actually released.

The next section is for app discovery. There are curated app collections to peruse for ideas about what you may want to install. As you can see, all of the other apps we will be installing are listed in nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9's "Nostr" collection.

In future releases of the Zapstore, users will be able to create their own app collections.

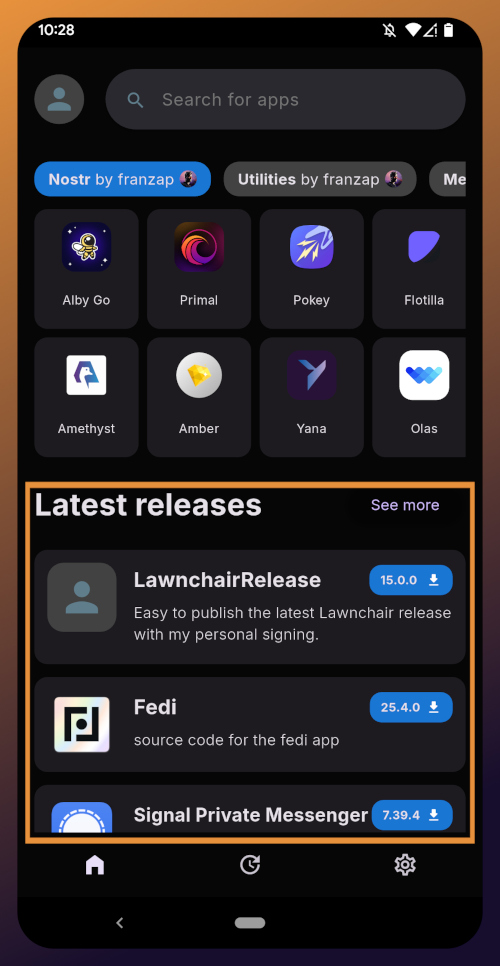

The last section of the home page is a chronological list of the latest releases. This includes both new apps added to the Zapstore and recently updated apps. The list of recent releases on its own can be a great resource for discovering apps you may not have heard of before.

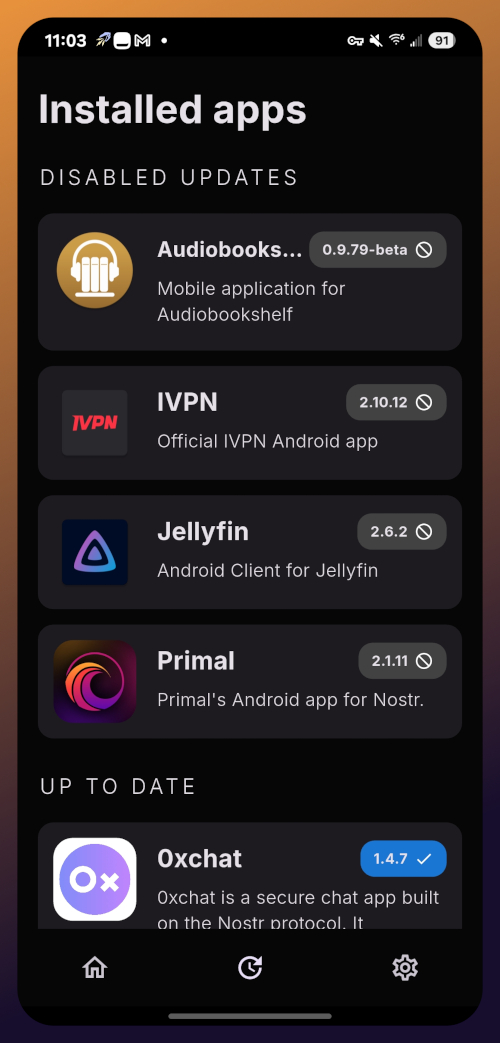

Installed Apps

The next page of the app, accessed by the icon in the bottom-center of the screen that looks like a clock with an arrow circling it, shows all apps you have installed that are available in the Zapstore. It's also where you will find apps you have previously installed that are ready to be updated. This page is pretty sparse on my test profile, since I only have the Zapstore itself installed, so here is a look at it on my main profile:

The "Disabled Apps" at the top are usually applications that were installed via the Play Store or some other means, but are also available in the Zapstore. You may be surprised to see that some of the apps you already have installed on your device are also available on the Zapstore. However, to manage their updates though the Zapstore, you would need to uninstall the app and reinstall it from the Zapstore instead. I only recommend doing this for applications that are added to the Zapstore by their developers, or you may encounter a significant delay between a new update being released for the app and when that update is available on the Zapstore.

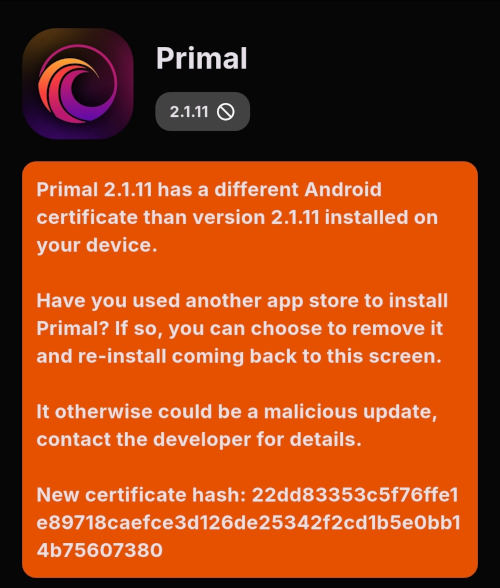

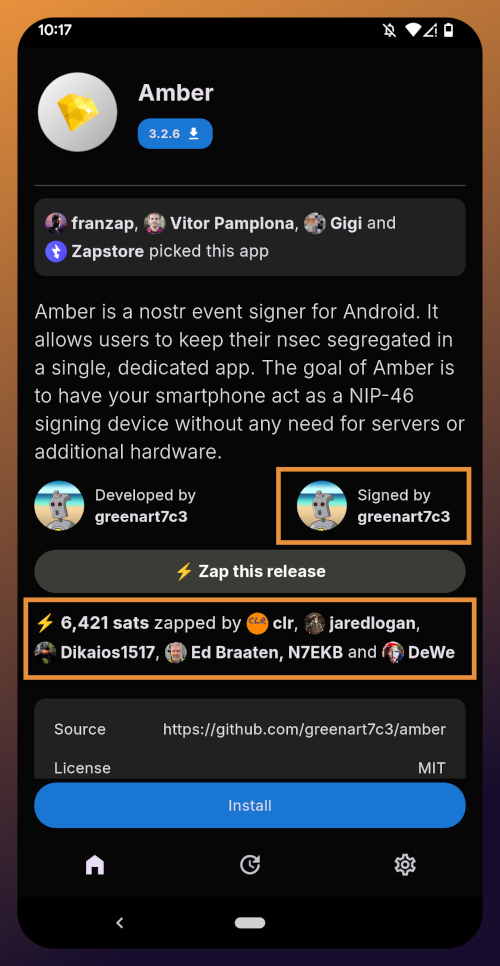

Tap on one of your apps in the list to see whether the app is added by the developer, or by the Zapstore. This takes you to the application's page, and you may see a warning at the top if the app was not installed through the Zapstore.

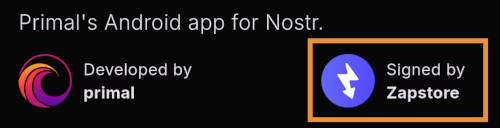

Scroll down the page a bit and you will see who signed the release that is available on the Zapstore.

In the case of Primal, even though the developer is on Nostr, they are not signing their own releases to the Zapstore yet. This means there will likely be a delay between Primal releasing an update and that update being available on the Zapstore.

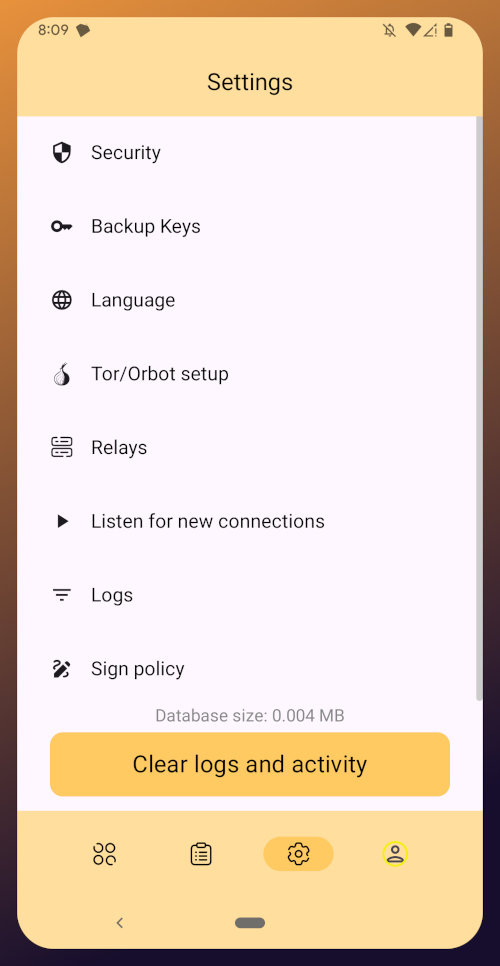

Settings

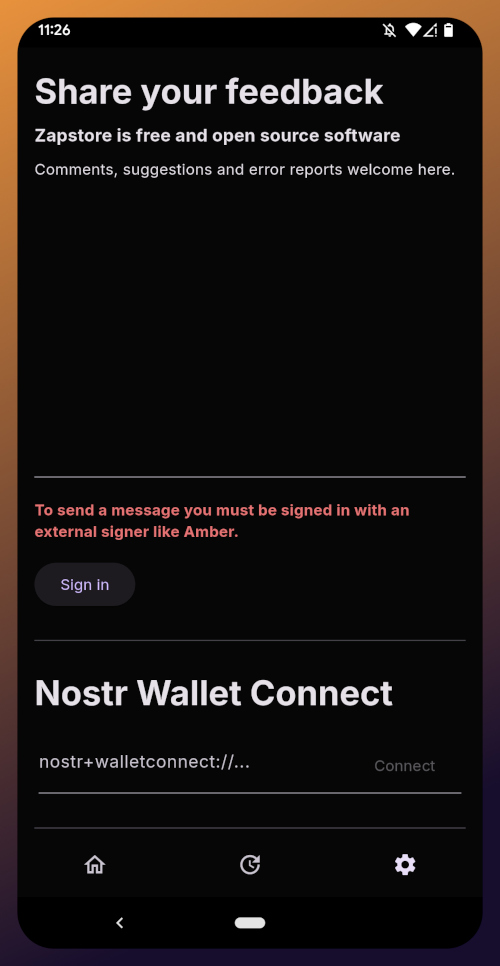

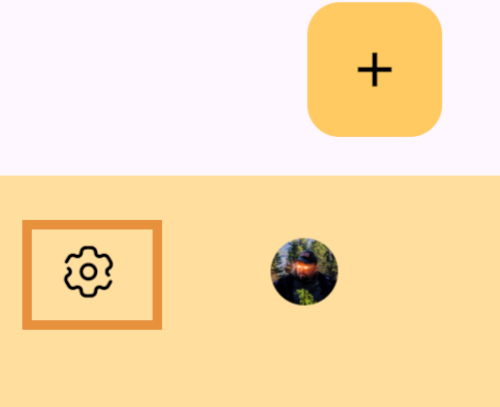

The last page of the app is the settings page, found by tapping the cog at the bottom right.

Here you can send the Zapstore developer feedback directly (if you are logged in), connect a Lightning wallet using Nostr Wallet Connect, delete your local cache, and view some system information.

We will be adding a connection to our nostr:npub1h2qfjpnxau9k7ja9qkf50043xfpfy8j5v60xsqryef64y44puwnq28w8ch wallet in part 5 of this tutorial series.

For the time being, we are all set with the Zapstore and ready for the next stage of our journey.

Continue to Part 3: Amber Signer. Nostr link: nostr:naddr1qqxnzde5xuengdeexcmnvv3eqgstwf6d9r37nqalwgxmfd9p9gclt3l0yc3jp5zuyhkfqjy6extz3jcrqsqqqa28qy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qg6waehxw309aex2mrp0yhxyunfva58gcn0d36zumn9wss80nug

-

@ 502ab02a:a2860397

2025-05-28 01:57:42

@ 502ab02a:a2860397

2025-05-28 01:57:42ในปี 2013 ณ กรุงลอนดอน แฮมเบอร์เกอร์หน้าตาดูธรรมดาแต่ไม่ธรรมดาชิ้นหนึ่งได้ถูกจัดวางอย่างสง่างามบนจานสีขาวในงานแถลงข่าวระดับโลก ไม่ใช่เพราะมันแพงเกินเหตุที่ตั้งราคาที่ 330,000 ดอลลาร์ต่อชิ้น แต่เพราะมันไม่เคยเกิดขึ้นมาก่อนในประวัติศาสตร์นี่คือ “เนื้อเพาะเลี้ยง” (cultured meat) ชิ้นแรกของโลกที่เติบโตมาจากเซลล์ ไม่ใช่จากสัตว์ทั้งตัว

เบื้องหลังอาหารชิ้นนี้คือชายชาวดัตช์คนหนึ่ง ชื่อว่า มาร์ค โพสต์ (Mark Post) นักวิทยาศาสตร์ด้านสรีรวิทยาหลอดเลือด ซึ่งไม่ได้มีดีกรีจากแค่มหาวิทยาลัย แต่มีความฝันที่อยากจะสร้างอาหารจากเทคโนโลยีเพื่ออนาคต เขาเริ่มต้นจากห้องทดลองเล็กๆ ที่มหาวิทยาลัย Maastricht ในประเทศเนเธอร์แลนด์ โดยเชื่อว่าการเพาะเลี้ยงเนื้อจากเซลล์ต้นกำเนิดของวัวจะสามารถลดผลกระทบด้านสิ่งแวดล้อมจากอุตสาหกรรมเนื้อสัตว์ได้

แต่กว่าจะมีแฮมเบอร์เกอร์เพาะเลี้ยงได้หนึ่งชิ้น เขาต้องเพาะเลี้ยงเส้นใยกล้ามเนื้อเล็กๆ มากกว่า 20,000 เส้น นำมารวมกัน ประกอบโครง สร้างรูปร่าง คล้ายกับงานศิลปะทางวิทยาศาสตร์ ใช้เวลาเป็นเดือน แถมกระบวนการทั้งหมดต้องอยู่ในสภาพปลอดเชื้อราวกับโรงพยาบาลของนาโนเทคโนโลยี ส่วนต้นทุนมหาศาลที่ใช้ในวันนั้น มาจากมหาเศรษฐีผู้ร่วมก่อตั้ง Google อย่าง Sergey Brin ที่เห็นว่ามันอาจเป็นคำตอบของปัญหาอาหารโลกในอนาคต

แต่เรื่องนี้มีอะไรมากกว่าที่สื่อกระแสหลักอยากให้คุณรู้

หลังจากเปิดตัวเนื้อในห้องแล็บ โลกก็เหมือนถูกปลุกให้ตื่นขึ้นในอีกมิติหนึ่ง บริษัทสตาร์ทอัพที่เคยเน้นเขียนโค้ด เริ่มหันมาเขียนสูตรเนื้อ บริษัทรายใหญ่อย่าง Cargill, Tyson Foods และแม้แต่ Richard Branson ก็เทเงินสนับสนุนบริษัทรุ่นใหม่อย่าง Mosa Meat ซึ่งก่อตั้งโดย Dr. Post เองในปี 2016 พร้อมแผนทะเยอทะยานที่จะส่ง “เนื้อจากแล็บ” เข้าซูเปอร์มาร์เก็ตภายในทศวรรษเดียว

Mosa Meat พยายามลดต้นทุนจากหลักแสน ให้เหลือหลักร้อย และวันนี้บริษัทเหล่านี้กำลังสร้างโรงงานที่ผลิตเนื้อในถังหมักขนาดยักษ์ ไม่ต่างจากโรงเบียร์ พวกเขาเลี้ยงเซลล์วัวในน้ำเลี้ยงที่เดิมทีเคยใช้เซรุ่มจากลูกวัว (Fetal Bovine Serum) ซึ่งเป็นสิ่งที่ย้อนแย้ง ที่สวนทางกับภาพ “ปลอดภัยไร้เลือด” มาก เพราะในขณะที่โฆษณาว่า “ปลอดการฆ่า” แต่กลับใช้ส่วนผสมที่ได้มาจากเลือดลูกวัวที่ยังไม่เกิด จนต้องหาทางเปลี่ยนสูตรเป็น “น้ำเลี้ยงเทียม” ที่มาจากสารเคมีและอาหารสังเคราะห์แทน

ด้วยโครงสร้าง scaffold ที่ช่วยให้เซลล์ก่อตัวเป็นเนื้อเยื่อ และ กระบวนการเพาะเลี้ยงใน bioreactor ขนาดยักษ์ ที่เปลี่ยนเซลล์เล็ก ๆ ให้เป็นเนื้อก้อนใหญ่ในเวลาไม่กี่สัปดาห์

แต่ขณะที่ภาพความล้ำซึ่งดูจะเติบโตอย่างสดใส กลับมีเงามืดที่เติบโตพร้อมกันไปเงียบๆไม่ต่างกับอนาคินและดาร์ธเวเดอร์

แม้จะเป็นนวัตกรรมล้ำหน้า แต่ทุกขั้นตอนถูกห่อหุ้มไว้ด้วย “สิทธิบัตร” สิ่งที่ทำให้เนื้อชนิดนี้ไม่ได้เป็นของทุกคน แต่เป็นสมบัติทางปัญญาของบริษัทเท่านั้น เนื้อจากเซลล์เหล่านี้ ไม่เหมือนเนื้อจากฟาร์มที่ใครก็เลี้ยงเองได้ ไม่สามารถเก็บเมล็ดพันธุ์ไว้เพาะรุ่นหน้าแบบชาวนาในอดีต ทุกอย่างต้องเริ่มต้นในห้องแล็บ ต้องใช้เทคโนโลยีเฉพาะ ต้องมีสูตรลับเฉพาะ ต้องพึ่งบริษัทที่มีสิทธิบัตรครอบครองชีวิตเซลล์เพียงไม่กี่เจ้า

Mosa Meat ไม่ได้หยุดแค่การผลิต พวกเขายื่นจด สิทธิบัตรกว่า 10 กลุ่ม ครอบคลุมตั้งแต่สูตรน้ำเลี้ยง วิธีเพาะเลี้ยงเซลล์ ไปจนถึงวิธีห่อบรรจุสินค้าขั้นสุดท้าย กล่าวอีกอย่างคือ ถ้าใครอยากทำเนื้อเพาะเลี้ยงแบบนี้บ้าง ก็ต้อง “จ่ายค่าลิขสิทธิ์” ให้เขาเสียก่อน เรากำลังก้าวสู่ยุคที่ อาหารไม่ใช่ผลผลิตจากดินและแรงคน แต่เป็นผลผลิตของทรัพย์สินทางปัญญา และเมื่อใดที่ “เนื้อ” กลายเป็นสิ่งที่คนผลิตเองไม่ได้ ต้องซื้อจากห้างเท่านั้น เกษตรกรกลายเป็นผู้บริโภค ผู้บริโภคกลายเป็นผู้ขึ้นอยู่กับระบบ ห่วงโซ่อาหารที่เคยเป็นของชุมชนถูกตัดขาดด้วยท่อส่งจากห้องทดลองสู่จานอาหาร เราไม่ได้ซื้อเนื้อ แต่ “เช่าเทคโนโลยี” ที่ผลิตเนื้อมาให้เรากิน

และที่น่าสนใจคือ รัฐบาลในหลายประเทศกลับเป็นผู้ให้ทุนสนับสนุน เช่น โครงการของสหภาพยุโรปที่มอบเงินกว่า 2 ล้านยูโรให้ Dr. Post และ Mosa Meat รวมถึงโครงการของสิงคโปร์ที่ให้ใบอนุญาตจำหน่ายเนื้อเพาะเลี้ยงรายแรกของโลกในปี 2020 ราวกับว่า “เนื้อจากแล็บ” กำลังจะกลายเป็นนโยบายด้านความมั่นคงอาหารแห่งอนาคต

มันไม่ใช่เรื่องของการวิจัยอีกต่อไป แต่มันคือการปูทางอำนาจใหม่ ที่เปลี่ยน “อาหาร” ให้กลายเป็น “ซอฟต์แวร์ชีวภาพ” ที่จดทะเบียนครอบครองสิทธิ์แบบเดียวกับแอปในมือถือ

แล้วการใช้สื่อก็จะมาในรุปแบบที่ประชาชนโห่ร้องดีใจ เฉลิมฉลองการเกิดขึ้นของมันโดยไม่รู้สึกว่า เสรีภาพในการจัดการด้านอาหารสิ้นสุดลงแล้ว ในทางหนึ่ง มันอาจดูสวยงามไร้ที่ติ ช่วยลดการฆ่าสัตว์ ลดการปล่อยก๊าซเรือนกระจก และให้โปรตีนสะอาดแก่คนจำนวนมาก

แต่อีกทางหนึ่ง มันคือการรวมศูนย์อำนาจด้านอาหารไว้ในมือบริษัทยักษ์ใหญ่ ที่สามารถตั้งราคาตามใจ และควบคุมทุกขั้นตอนตั้งแต่ฟาร์ม (ในหลอดทดลอง) ถึงโต๊ะอาหารของเรา

เกษตรกรจะหมดบทบาท เพราะไม่มีใครต้องเลี้ยงสัตว์อีก ผู้บริโภคจะหมดทางเลือก เพราะสูตรทุกอย่างถูกจดสิทธิบัตร สุดท้าย คนธรรมดาอย่างเราอาจ “มีเงินก็ยังไม่มีสิทธิ์ทำอาหารกินเอง”

ไม่มีใครในหมู่บ้านจะต้มแกงจากวัตถุดิบแล็บเหล่านี้ได้โดยไม่จ่ายค่าลิขสิทธิ์ ไม่มีใครปลูกหรือเพาะเนื้อได้เอง เพราะเขาถือสิทธิบัตร ไม่มีใครรู้ส่วนผสมที่แท้จริง เพราะมันคือ “ความลับทางการค้า”

หลายๆคนเริ่มคิดในใจว่า…นี่ไม่ใช่เรื่องเล็กอีกต่อไป เพราะนี่อาจไม่ใช่แค่เนื้อจากห้องแล็บ แต่ มันคือจุดเริ่มต้นของอนาคตของอาหารที่ไม่เป็นของประชาชนอีกต่อไป มันคือการเริ่มต้นของยุคที่มนุษย์จะไม่สามารถ “เข้าครัวของตัวเอง” ได้อีกต่อไป

ไหนๆเราตามมาถึงตอนนี้แล้ว เข้าหมวดที่ 2 ของอาหารอนาคตแล้ว เฮียไม่ได้บอกว่าเทคโนโลยีไม่ดีนะครับ เราตัดสินเดี๋ยวนี้ไม่ได้ แต่เรารู้เรื่องของมันได้

แต่โลกนี้เต็มไปด้วยคำว่า “ดีต่อโลก” ที่ซ่อนคำว่า “ดีต่อผู้ถือหุ้น” อยู่ข้างใน เราอาจจะกำลังก้าวสู่ยุคที่ “เนื้อไม่ได้ปลอดภัยขึ้น แต่ถูกควบคุมง่ายขึ้น” และประชาชนก็อาจกลายเป็นเพียง “ผู้ใช้บริการเนื้อ” ที่ไม่มีสิทธิ์แม้แต่จะรู้ว่าเนื้อในจานคืออะไรบ้างแน่

โลกอาหารในอนาคตไม่ได้ขึ้นกับว่าเราปลูกอะไร แต่ขึ้นกับว่า “ใครจดสิทธิบัตรก่อน” และเมื่อถึงวันนั้น เฮียแอบคิดว่า เราอาจไม่ได้เสียแค่ฟาร์มและครัว แต่เรากำลังเสีย “เสรีภาพในการกิน” ไปอย่างช้า ๆ ด้วยรอยยิ้มของนักลงทุนและเสียบปรบมือจาก "ใครบางคน"

ทุกวันนี้ใครนิยมไดเอทอะไร ภูมิใจในการดูแลสุขภาพยังไง ก็ทำไปเหอะครับ ขอเพียงว่า เส้นทางที่เดินอยู่นั้น สนับสนุนเกษตกร สนับสนุน local ให้แข็งแรง ทุกสังคมมีทั้งคนดีและคนไม่ดี เราค่อยๆ verify สนับสนุนคนดีๆ แต่ไม่ใช่ไปเดียจฉันท์ลงโทษคนไม่ดี เราเสริมความรู้ให้เขา พยายามโอบอุ้มพวกเขา ถ้าชีวิตดีขึ้น การออมเห็นผลขึ้น อาจทำให้ชีวิตทุกคนดีขึ้น

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ b7274d28:c99628cb

2025-05-28 00:59:49

@ b7274d28:c99628cb

2025-05-28 00:59:49Your identity is important to you, right? While impersonation can be seen in some senses as a form of flattery, we all would prefer to be the only person capable of representing ourselves online, unless we intentionally delegate that privilege to someone else and maintain the ability to revoke it.

Amber does all of that for you in the context of #Nostr. It minimizes the possibility of your private key being compromized by acting as the only app with access to it, while all other Nostr apps send requests to Amber when they need something signed. This even allows you to give someone temporary authority to post as you without giving them your private key, and you retain the authority to revoke their permissions at any time.

nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5 has provided Android users with an incredibly powerful tool in Amber, and he continues to improve its functionality and ease of use. Indeed, there is not currently a comparative app available for iOS users. For the time being, this superpower is exclusive to Android.

Installation

Open up the Zapstore app that you installed in the previous stage of this tutorial series.

Very likely, Amber will be listed in the app collection section of the home page. If it is not, just search for "Amber" in the search bar.

Opening the app's page in the Zapstore shows that the release is signed by the developer. You can also see who has added this app to one of their collections and who has supported this app with sats by zapping the release.

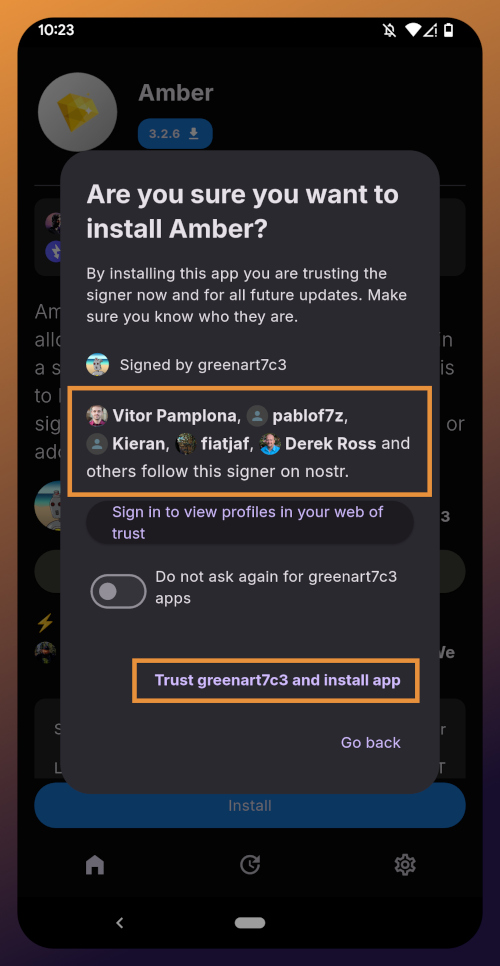

Tap "Install" and you will be prompted to confirm you are sure you want to install Amber.

Helpfully, you are informed that several other users follow this developer on Nostr. If you have been on Nostr a while, you will likely recognize these gentlemen as other Nostr developers, one of them being the original creator of the protocol.

You can choose to never have Zapstore ask for confirmation again with apps developed by nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, and since we have another of his apps to install later in this tutorial series, I recommend you toggle this on. Then tap on "Trust greenart7c3 and install app."

Just like when you installed the Zapstore from their GitHub, you will be prompted to allow the Zapstore to install apps, since Android considers it an "unknown source."

Once you toggle this on and use the back button to get back to the Zapstore, Amber will begin downloading and then present a prompt to install the app. Once installed, you will see a prompt that installation was a success and you can now open the app.

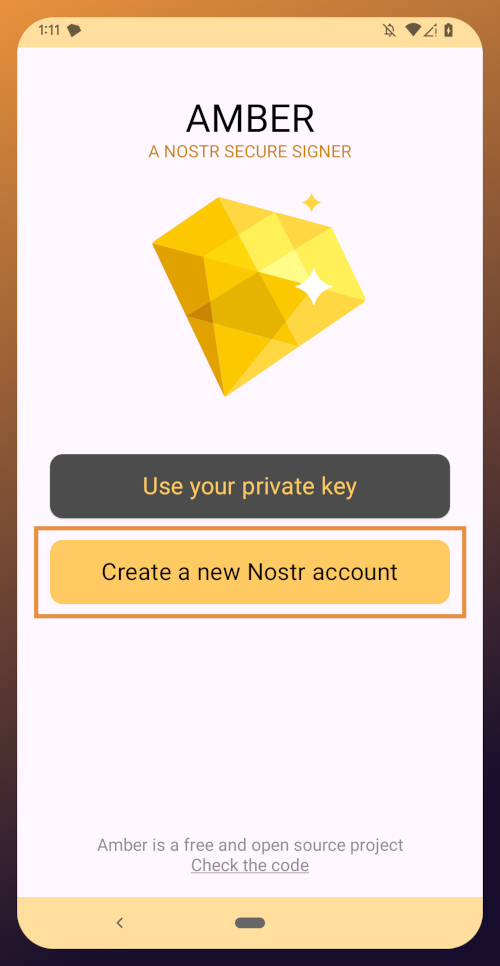

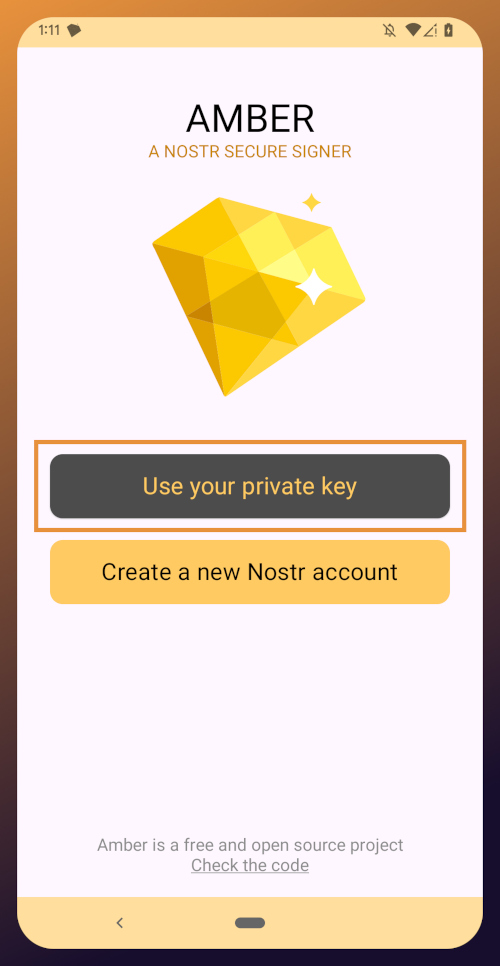

From here, how you proceed will depend on whether you need to set up a new Nostr identity or use Amber with an existing private key you already have set up. The next section will cover setting up a new Nostr identity with Amber. Skip to the section titled "Existing Nostrich" if you already have an nsec that you would like to use with Amber.

New Nostrich

Upon opening the application, you will be presented with the option to use an existing private key or create a new Nostr account. Nostr doesn't really have "accounts" in the traditional sense of the term. Accounts are a relic of permissioned systems. What you have on Nostr are keys, but Amber uses the "account" term because it is a more familiar concept, though it is technically inaccurate.

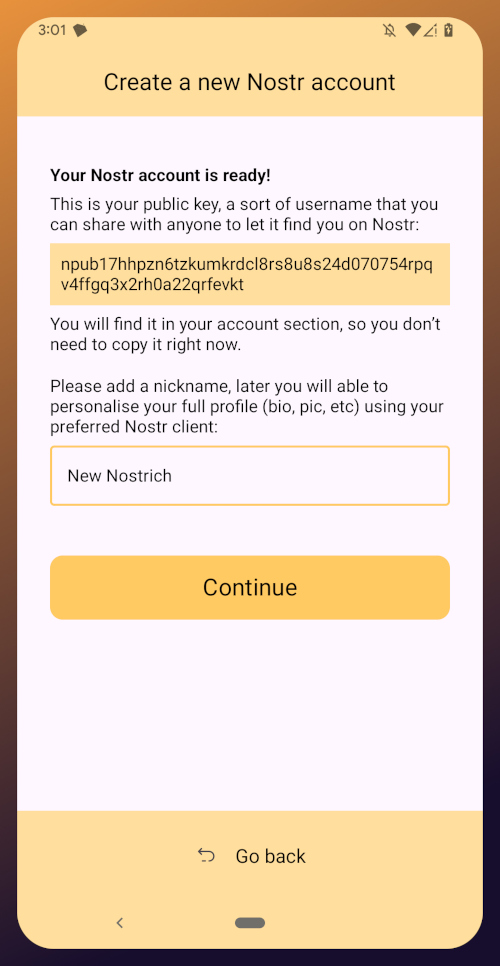

Choose "Create a new Nostr account" and you will be presented with a screen telling you that your Nostr account is ready. Yes, it was really that easy. No email, no real name, no date of birth, and no annoying capcha. Just "Create a new account" and you're done.

The app presents you with your public key. This is like an address that can be used to find your posts on Nostr. It is 100% unique to you, and no one else can post a note that lists this npub as the author, because they won't have the corresponding private key. You don't need to remember your npub, though. You'll be able to readily copy it from any Nostr app you use whenever you need it.

You will also be prompted to add a nickname. This is just for use within Amber, since you can set up multiple profiles within the app. You can use anything you want here, as it is just so you can tell which profile is which when switching between them in Amber.

Once you've set your nickname, tap on "Continue."

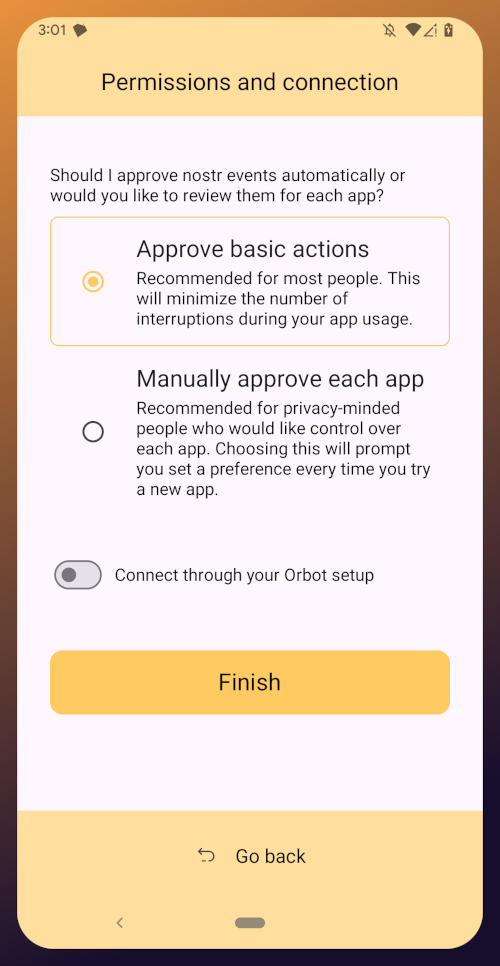

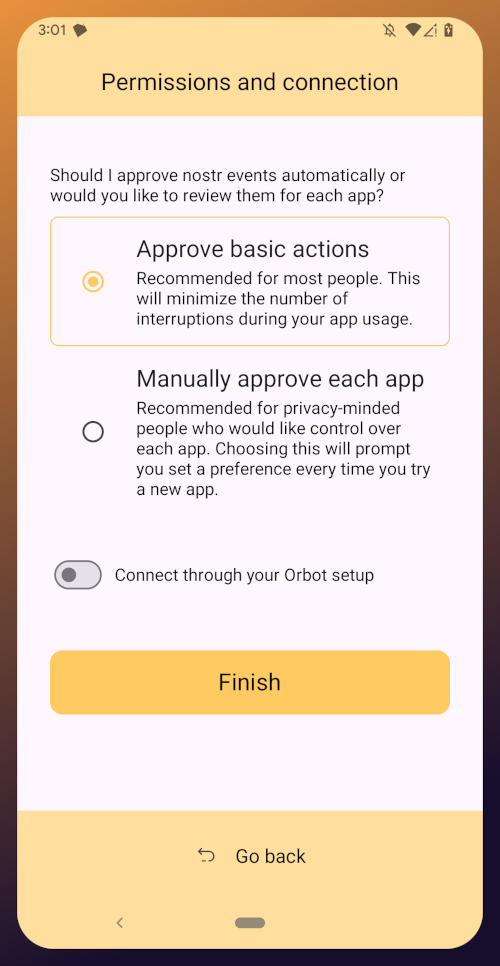

The next screen will ask you what Amber's default signing policy should be.

The default is to approve basic actions, referring to things that are common for Nostr clients to request a signature for, like following another user, liking a post, making a new post, or replying. If you are more concerned about what Amber might be signing for on your behalf, you can tell it to require manual approval for each app.

Once you've made your decision, tap "Finish." You will also be able to change this selection in the app settings at any time.

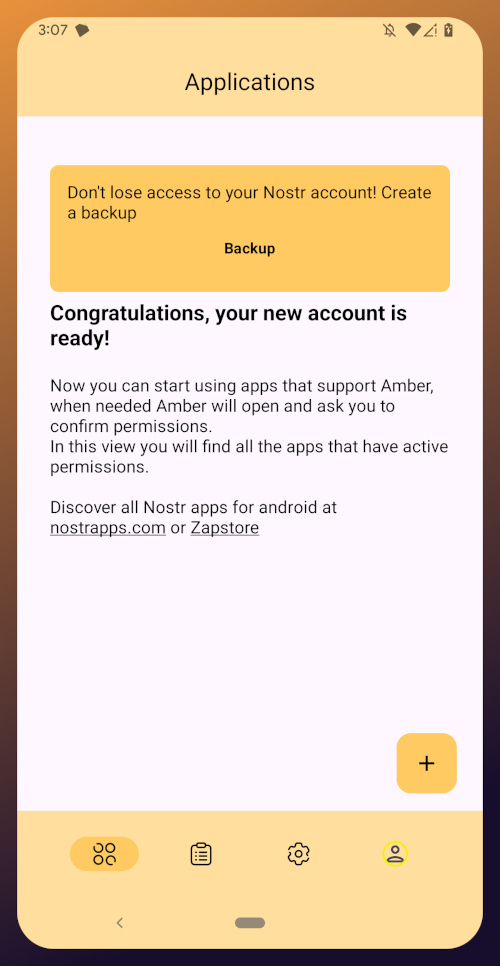

With this setup out of the way, you are now presented with the main "Applications" page of the app.

At the top, you have a notification encouraging you to create a backup. Let's get that taken care of now by tapping on the notification and skipping down to the heading titled "Backing Up Your Identity" in this tutorial.

Existing Nostrich

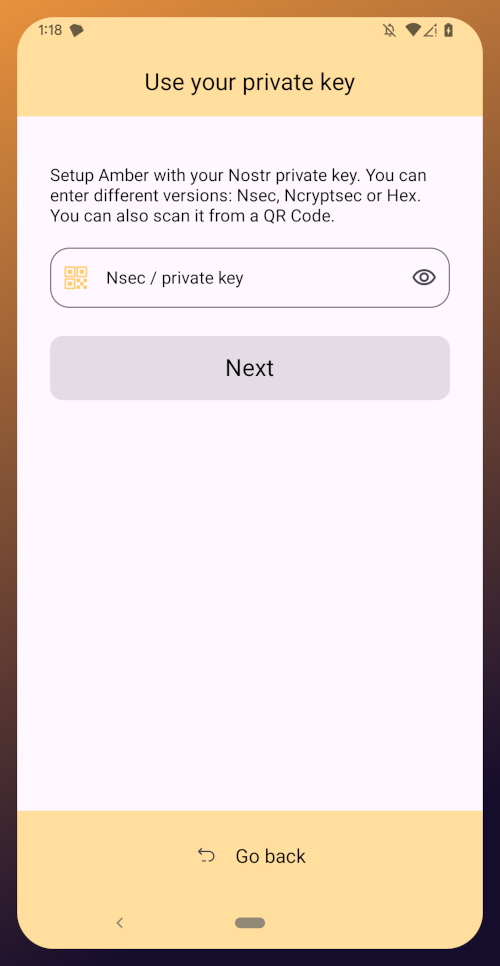

Upon opening the application, you will be presented with the option to use your private key or create a new Nostr account. Choose the former.

The next screen will require you to paste your private key.

You will need to obtain this from whatever Nostr app you used to create your profile, or any other Nostr app that you pasted your nsec into in the past. Typically you can find it in the app settings and there will be a section mentioning your keys where you can copy your nsec. For instance, in Primal go to Settings > Keys > Copy private key, and on Amethyst open the side panel by tapping on your profile picture in the top-left, then Backup Keys > Copy my secret key.

After pasting your nsec into Amber, tap "Next."

Amber will give you a couple options for a default signing policy. The default is to approve basic actions, referring to things that are common for Nostr clients to request a signature for, like following another user, liking a post, making a new post, or replying. If you are more concerned about what Amber might be signing for on your behalf, you can tell it to require manual approval for each app.

Once you've made your decision, tap "Finish." You will also be able to change this selection in the app settings at any time.

With this setup out of the way, you are now presented with the main "Applications" page of the app. You have nothing here yet, since you haven't used Amber to log into any Nostr apps, but this will be where all of the apps you have connected with Amber will be listed, in the order of the most recently used at the top.

Before we go and use Amber to log into an app, though, let's make sure we've created a backup of our private key. You pasted your nsec into Amber, so you could just save that somewhere safe, but Amber gives you a few other options as well. To find them, you'll need to tap the cog icon at the bottom of the screen to access the settings, then select "Backup Keys."

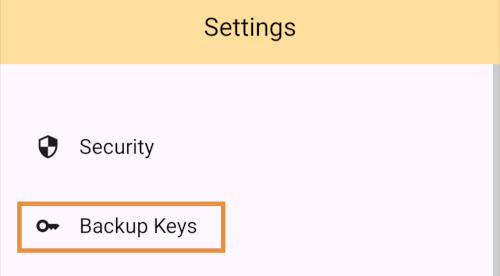

Backing Up Your Identity

You'll notice that Amber has a few different options for backing up your private key that it can generate.

First, it can give you seed words, just like a Bitcoin seed. If you choose that option, you'll be presented with 12 words you can record somewhere safe. To recover your Nostr private key, you just have to type those words into a compatible application, such as Amber.

The next option is to just copy the secret/private key in its standard form as an "nsec." This is the least secure way to store it, but is also the most convenient, since it is simple to paste into another signer application. If you want to be able to log in on a desktop web app, the browser extension Nostr signers won't necessarily support entering your 12 word seed phrase, but they absolutely will support pasting in your nsec.

You can also display a QR code of your private key. This can be scanned by Amber signer on another device for easily transferring your private key to other devices you want to use it on. Say you have an Android tablet in addition to your phone, for instance. Just make sure you only use this function where you can be certain that no one will be able to get a photograph of that QR code. Once someone else has your nsec, there is no way to recover it. You have to start all over on Nostr. Not a big deal at this point in your journey if you just created a Nostr account, but if you have been using Nostr for a while and have built up a decent amount of reputation, it could be much more costly to start over again.

The next options are a bit more secure, because they require a password that will be used to encrypt your private key. This has some distinct advantages, and a couple disadvantages to be aware of. Using a password to encrypt your private key will give you what is called an ncryptsec, and if this is leaked somehow, whoever has it will not necessarily have access to post as you on Nostr, the way they would if your nsec had been leaked. At least, not so long as they don't also have your password. This means you can store your ncryptsec in multiple locations without much fear that it will be compromised, so long as the password you used to encrypt it was a strong and unique one, and it isn't stored in the same location. Some Nostr apps support an ncryptsec for login directly, meaning that you have the option to paste in your ncryptsec and then just log in with the password you used to encrypt it from there on out. However, now you will need to keep track of both your ncryptsec and your password, storing both of them safely and separately. Additionally, most Nostr clients and signer applications do not support using an ncryptsec, so you will need to convert it back to a standard nsec (or copy the nsec from Amber) to use those apps.

The QR option using an ncryptsec is actually quite useful, though, and I would go this route when trying to set up Amber on additional devices, since anyone possibly getting a picture of the QR code is still not going to be able to do anything with it, unless they also get the password you used to encrypt it.

All of the above options will require you to enter the PIN you set up for your device, or biometric authentication, just as an additional precaution before displaying your private key to you.

As for what "store it in a safe place" looks like, I highly recommend a self-hosted password manager, such as Vaultwarden+Bitwarden or KeePass. If you really want to get wild, you can store it on a hardware signing device, or on a steel seed plate.

Additional Settings

Amber has some additional settings you may want to take advantage of. First off, if you don't want just anyone who has access to your phone to be able to approve signing requests, you can go into the Security settings add a PIN or enable biometrics for signing requests. If you enable the PIN, it will be separate from the PIN you use to access your phone, so you can let someone else use your phone, like your child who is always begging to play a mobile game you have installed, without worrying that they might have access to your Nostr key to post on Amethyst.

Amber also has some relay settings. First are the "Active relays" which are used for signing requests sent to Amber remotely from Nostr web apps. This is what enables you to use Amber on your phone to log into Nostr applications on your desktop web browser, such as Jumble.social, Coracle.social, or Nostrudel.ninja, eliminating your need to use any other application to store your nsec whatsoever. You can leave this relay as the default, or you can add other relays you want to use for signing requests. Just be aware, not all relays will accept the notes that are used for Nostr signing requests, so make sure that the relay you want to use does so. In fact, Amber will make sure of this for you when you type in the relay address.

The next type of relays that you can configure in Amber are the "Default profile relays." These are used for reading your profile information. If you already had a Nostr identity that you imported to Amber, you probably noticed it loaded your profile picture and display name, setting the latter as your nickname in Amber. These relays are where Amber got that information from. The defaults are relay.nostr.band and purplepag.es. The reason for this is because they are aggregators that look for Nostr profiles that have been saved to other relays on the network and pull them in. Therefore, no matter what other relay you may save your profile to, Amber will likely be able to find it on one of those two relays as well. If you have a relay you know you will be saving your Nostr profiles to, you may want to add it to this list.

You can also set up Amber to be paired with Orbot for signing over Tor using relays that are only accessible via the Tor network. That is an advanced feature, though, and well beyond the scope of this tutorial.

Finally, you can update the default signing policy. Maybe after using Amber for a while, you've decided that the choice you made before was too strict or too lenient. You can change it to suit your needs.

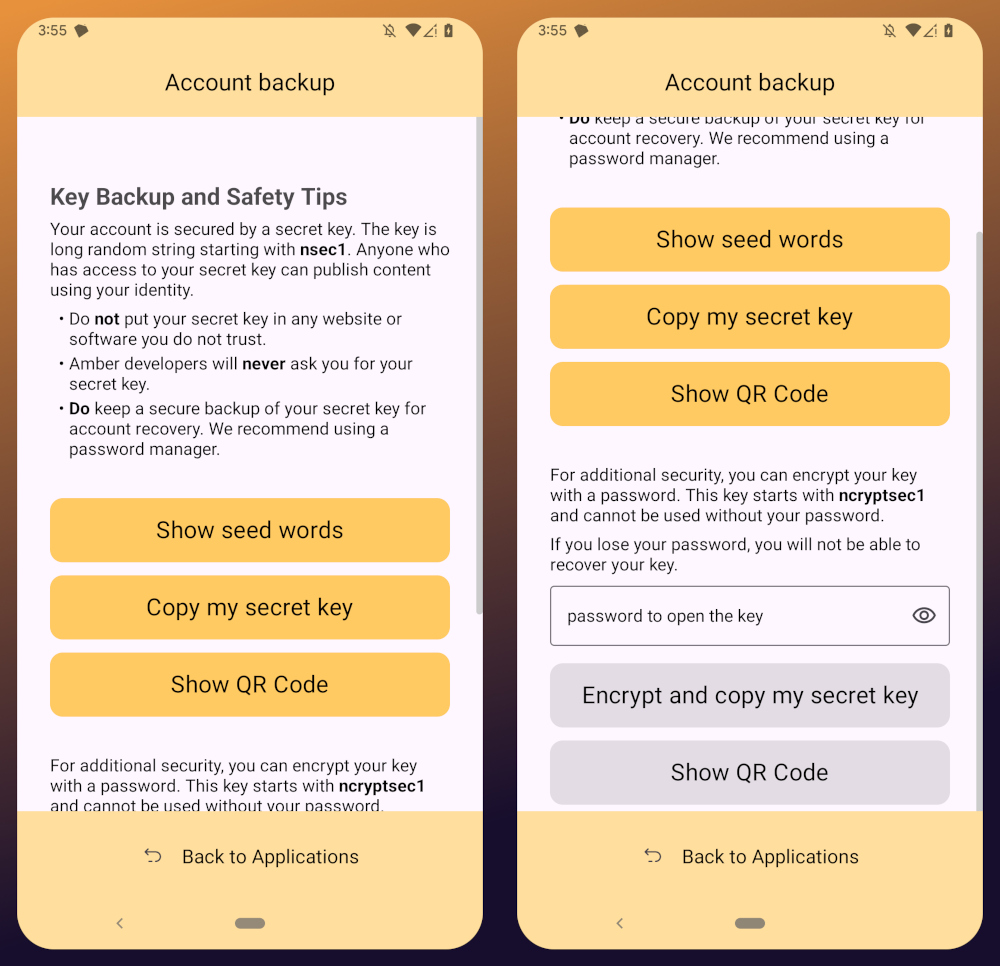

Zapstore Login

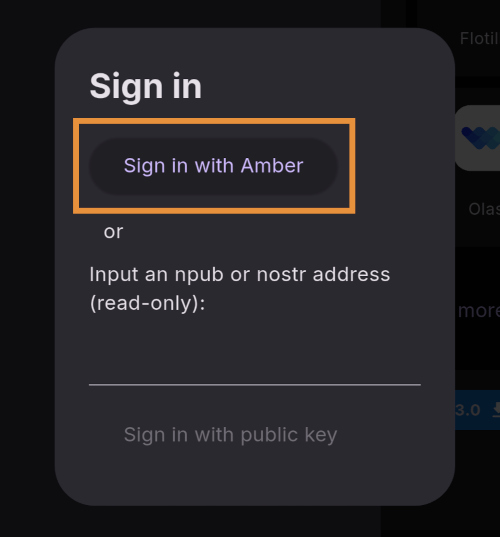

Now that you are all set up with Amber, let's get you signed into your first Nostr app by going back to the Zapstore.

From the app's home screen, tap on the user icon in the upper left of the screen. This will open a side panel with not much on it except the option to "sign in." Go ahead and tap on it.

You will be presented with the option to either sign in with Amber, or to paste your npub. However, if you do the latter, you will only have read access, meaning you cannot zap any of the app releases. There are other features planned for the Zapstore that may also require you to be signed in with write access, so go ahead and choose to log in with Amber.

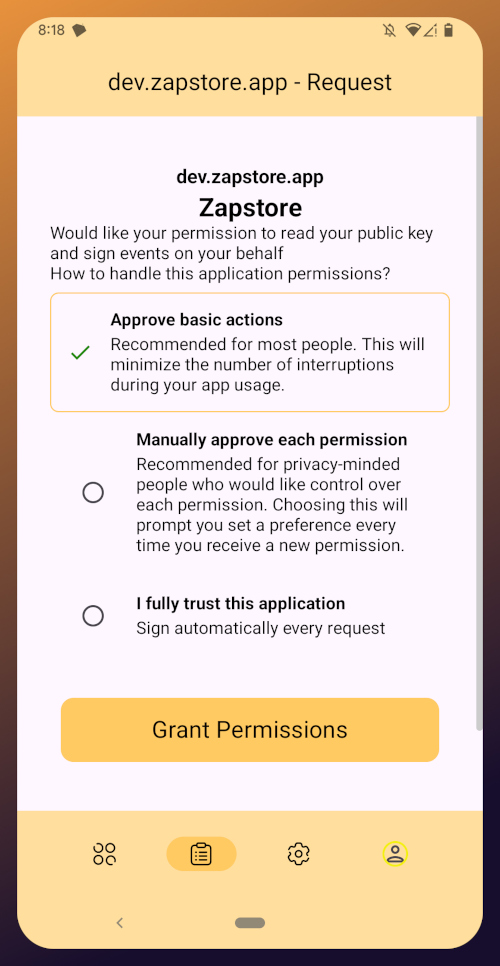

Your phone should automatically switch to Amber to approve the sign-in request.

You can choose to only approve basic actions for Zapstore, require it to manually approve every time, or you can tell it that you "fully trust this application." Only choose the latter option with apps you have used for a while and they have never asked you to sign for anything suspicious. For the time being, I suggest you use the "Approve basic actions" option and tap "Grant Permissions."

Your phone will switch back to the Zapstore and will show that you are now signed in. Congratulations! From here on out, logging into most Nostr applications will be as easy as tapping on "Log in with Amber" and approving the request.

If you set up a new profile, it will just show a truncated version of your npub rather than the nickname you set up earlier. That's fine. You'll have an opportunity to update your Nostr profile in the next tutorial in this series and ensure that it is spread far and wide in the network, so the Zapstore will easily find it.

That concludes the tutorial for Amber. While we have not covered using Amber to log into Nostr web apps, that is outside the scope of this series, and I will cover it in an upcoming tutorial regarding using Amber's remote signer options in detail.

Since you're already hanging out in the Zapstore, you may as well stick around, because we will be using it right out the gate in the next part of this series: Amethyst Installation and Setup. (Coming Soon)

-

@ 491afeba:8b64834e

2025-05-27 23:57:01

@ 491afeba:8b64834e

2025-05-27 23:57:01Quando adolescente eu acreditava na coerência da teoria de "amor líquido" do polonês, sociólogo, Zygmunt Bauman, apresentada no livro "Amor Líquido: Sobre a Fragilidade dos Laços Humanos", qual no meu amadurecimento em estudos, sejam eles no meio acadêmico ou fora, percebo como uma das formas mais rasas de explicar as mudanças e transformações dos padrões de relações sócio-afetivas dos humanos. A seguir colocar-me-ei na minha juventude não tanto recente, direi então que nós, se adolescentes e conservadores, ou mesmo jovens adultos mais conservadores, costumamos levar como dogma uma óptica decadentista generalizada de todos os avanços de eras dos homens, universalizamos por nos ser comum a indistinção entre humanidade e humanidades, ou mesmo "humanity" e "humankind" ("humanidade" como espécime e "humanidade" como um universal), compreendemos toda "essas" como "essa" e indistinguimos as sociedades para com os homens, ou seja, a incapacidade de definir os seres dentro de suas respectivas singularidades e especificidades nos leva ao decadentismo generalista (a crença de que de forma geral, e universal, a "civilização universal" decai moralmente, éticamente, materialmente e espiritualmente), que aparente à nós determinadas mudanças nas relações humanas quanto ao caráter sócio-afetivo, por falta de profundidade e critérios ainda sobre questões alinhadas aos métodos e coerências, ou incoerências, lógicas, nós se jovens e conservadores somos levados ao engodo de concordar com a teoria do amor líquido de Bauman, que devo cá explicar de antemão: trata ela, a teoria, o padrão de "amor" dos tempos presentes como frágil, de prazo (curto e médio) e diferente em grau comparativamente ao amor comum das eras passadas.

Aos jovens mais progressistas opera uma compreensão dialética sobre as eras dos homens nos seu tempo presente, na qual ao tempo que o ser progride ele também regride simultaneamente, ou seja, a medida que aparecem contradições advindas de transformações materiais da realidade humana o ser supera essas contradições e progride em meio as transformações, ainda fazendo parte da lógica dessa indissociavelmente, assim constantemente progredindo e regredindo, havendo para esses dois vetores de distinção: o primeiro é o que releva questões espirituais como ao caráter do pensamento "new age", o segundo ignora essas questões por negar a existência da alma, seguem ao materialismo. Cedem em crer na teoria baumaninana como dogma, pois não encontram outros meios para explicar as transformações da sociedade na esfera sócio-afetiva sem que haja confrontamento direto com determinadas premissas assim pertinemente presentes, ou por não conciliarem com análises relativamente superiores, como a de Anthony Giddens sobre a "relação pura" em "A Transformação da Intimidade" e de François de Singly apresentada em "Sociologie du Couple".

https://i.pinimg.com/736x/6f/b4/9e/6fb49eda2c8cf6dc837a0abfc7e108e6.jpg

Há um problema quando uma teoria deixa de assim ser para vir a tornar-se mais um elemento desconexo da ciência, agora dentro da cultura pop, se assim podemos dizer, ou da cultura de massa, ou se preferirem mesmo "anticultura", esse problema é a sua deformização teórica, tornando-se essa rasa para sua palatabilidade massiva, somada a incapacidade de partes da sociedade civil em compreender as falhas daquilo que já foi massificado. Tive surpresa ao entender que muitos outros compartilham da mesma opinião, a exemplo, possuo um amigo na faculdade, marxista, que ao falarmos sobre nossos projetos de pesquisa, citou ele o projeto de um de nossos colegas, no qual esse referido um de nossos colegas faria seu projeto com base na teoria do amor líquido de Bauman, então alí demos risada disso, ora, para nós a teoria baumaniana é furada, passamos a falar sobre Bauman e o motivo pelo qual não gostávamos, lá fiquei até surpreso em saber que mais gente além de mim não gostava da teoria de Bauman, pois ao que eu via na internet era rede de enaltecimentos à figura e à sua teoria, tal como fosse uma revelação partindo de alguma divindade da Idade do Bronze. Pouco tempo depois tive em aula de teoria política uma citação de Bauman partindo do professor que ministrava a disciplina, no entanto, ao citar o nome de Bauman o mesmo fez uma feição na qual aparentava segurar risada, provavelmente ele também não levava Bauman à sério. Não devo negar que todas as vezes que vejo o sociólogo sendo citado em alguma nota no X, no Instagram ou qualquer outra rede social, tal como fosse um referencial teórico bom, sinto uma vergonha alheia pois alí tenho uma impressão de que a pessoa não leu Bauman e usa o referencial teórico como um fato já assim provado e comprovado.

Há pontos positivos na teoria baumaniana, como a capacidade de perceber o problema e correlacioná-lo à modernidade, assim como sucitar a influência do que há de material no fenômeno, porém os erros são pertinentes: o primeiro problema é de categoria. Não há, por parte de Bauman noção alguma entre as dissociações dos amores, não há atenção sobre o amor como estrutura ou ele como um sentimento, todo ele é compreendido uniformemente como "amor", partindo do pressuposto que todas as relações, todas elas, são firmadas com base no amor. Essa crença tem uma origem: Hegel. Nos Escritos Teológicos Hegel partia da crença que o amor ligava os seres relacionalmente como uma força de superação e alienação, mas há de compreendermos que esse Friedrich Hegel é o jovem ainda pouco maduro em suas ideias e seu sistema de pensamento, mais a frente, em "Fenomenologia do Espírito e na Filosofia do Direito", Hegel compreende a institucionalidade do direito no amor e a institucionalização dessa força, assim aproxima-se da realidade a respeito da inserção do amor nas esferas práticas do humano, porém essa ideia, apesar de imperfeita, pois ao que sabemos não é o amor que consolida a relação, mas sim a Verdade (Alétheia), conforme apontado por Heidegger em "Ser e Tempo", essa ideia do amor como a fundamento das relações humanas influenciou, e até hoje influencia, qualquer análise sobre as relações humanas fora da esfera materialista, fora dessa pois, melhormente explicado em exemplo, os marxistas (em exemplo), assim como Marx, consideram como base primordial das relações as condições materiais.

Por certo, não é de todo amor a base para a solidificação, ora, erram aqueles que creem que somente essa força, assim apontada por Hegel, constituiam todos os relacionamentos formais como pilares fundamentais, pois em prática as famílias eram até a fiduciarização dessas, por mais paradoxal que seja, compreendidas melhor como instituições orgânicas de caráter legal do que conluios de afetividades. A família outrora tinha consigo aparelhos de hierarquia bem estabelicidos, quais prezavam pela ordem interna e externa, que acima dessa instituição estava somente a Igreja (outra instituição), com sua fiduciarização [da família] após o movimento tomado pelos Estados nacionais em aplicação do casamento civil mudou-se a lógica das partes que a compõe, findou-se o princípio da subsidiariedade (não intervenção de determinadas instituições nas decisões quais podem ser exercidas em resuluções de problemas nas competências de quaisquer instituições), foi-se então, contudo, também a autoridade, e nisso revela-se um outro problema não apontado na teoria de Bauman: qual o padrão do amor "sólido"? Pois, ora, sociedades tradicionais não abdicavam do relevar dos amores para tornar seus filhos em ativos nas práticas de trocas (dádivas)? É notório que esse padrão se dissocia do padrão de sentimento apontado por Bauman, encontramos esse fato em estudo nos trabalhos "Ensaio Sobre a Dádiva", do Marcel Mauss, e "As Estruturas Elementares do Parentesco", do Claude Levi-Strauss, quais expõem que nas sociedades "sólidas", tradicionais, relevava-se mais questões institucionais que as sentimentais para a formação de laços (teoria da aliança). Muitas das relações passadas não eram baseadas no amor, não significando assim que as de hoje, em oposição, sejam, mas que permanecem-se semelhantes em base, diferentemente em grau e forma.

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F748b94c3-f882-45db-8333-09260ef15cfe_615x413.jpeg

Ora, ainda existem casamentos motivados pela política, pelo status, pelo prestígio, pelos bens, pelo poder, pela influência familiar e assim sucetivamente, tal como no passado, ocorre que essa prática tornou-se oculta, não mais explícita e aparente, devo dizer ainda que em partes, pois prepondera em nosso tempo uma epidemia de adultérios, fornicações, práticas lascivas e demais práticas libertinosas explicitamente, em contraposição às práticas ocultas em vergonhas de sociedades sem declínio moral e espiritual, o que nos leva a questionar o método comparativo em dicotomia temporal "presente x passado" aplicado por Bauman, no qual segue-se da seguinte forma:

Transformação Passado = *sólido* | Presente = *líquido* Categorias Padrão de amor: tradicional (*sólido*) moderno (*líquido*) *Sólido* = estável, prazo (médio-grande), profundo, determinado. *Líquido* = instável, prazo (curto-médio), raso, indeterminado.O que penso é: Zygmunt Bauman buscou uma explicação material e laical para desviar ao fato de que há uma notória correlação entre espiritualização da sociedade, se voltada à Verdade, com a estabilidade das instituições, o que é já reduzido à moral religiosa, somente, não à mística, como por pensadores da linha de Tocqueville, ou em abordagens também mais laical (positivista) porém ainda relevantes, como Émile Durkheim em "As Formas Elementares da Vida Religiosa" e Max Weber em "A Ética Protestante e o Espírito do Capitalismo", contrapondo uma abordage mais voltada, de fato, a espiritualidade, como Christopher Dawnson, que defende essa teoria em "Religião e o Surgimento da Cultura Ocidental", e Eric Voegelin, principalmente nas obras "A Nova Ciência da Política" e "Ordem e História".

Encerrando, minha cosmovisão é a católica, o sistema de crença e religião qual sigo é do Deus que se fez homem por amor aos seus filhos, não posso negar ou mesmo omitir o fato de que, por trás de toda a minha crítica estão meus pensamentos e minhas convicções alinhadas àquilo que mais tenho amor em toda minha vida: a Verdade, e a Verdade é Deus, pois Cristo é a Verdade, o Caminho e a Vida, ninguém vai ao Pai se não por Ele, e pois bem, seria incoerência de minha parte não relevar o fato de crença como um dos motivos pelos quais eu rejeito a teoria do amor líquido de Zygmunt Bauman, pois os amores são todos eles praticados por formas, existem por diferentes formas e assim são desde sua tradicionalidade até o predomínio das distorções de declínio espiritual das eras presentes (e também antigas pré-Era Axial), estão esses preservados pelo alinhamento à verdade, assim são indistorcíveis, imutáveis, ou seja, amor é amor, não releva-se o falso amor como um, simplesmente não o é, assim o interesse, a sanha por bens, o egoísmo e a egolatria ("cupiditas", para Santo Agostinho de Hipona, em oposição ao que o santo e filósofo trata por "caritas") não são formas do amor, são autoenganos, não bons, se não são bons logo não são de Deus, ora, se Deus é amor, se ele nos ama, determino como amor (e suas formas) o que está de acordo com a Verdade. Aprofundando, a Teologia do Corpo, do Papa São João Paulo II, rejeita a "liquidez" apresentada por Bauman, pois o amor é, em suma, sacríficio, parte da entrega total de si ao próximo, e se não há logo não é amor. A Teologia do Corpo rejeita não os fundamentos de mentira no "líquido", mas também no "sólido", pois a tradicionalidade não é sinônimo de bom e pleno acordo com o amor que Deus pede de nós, não são as coerções, as violências, as imposições e demais vontades em oposição às de Deus que determinam os amores -- fatos em oposição ao ideário romanticizado. Claro, nem todas as coerções são por si inválidas do amor, ou mesmo as escolhas em trocas racionalizadas, a exemplo do autruísmo em vista da chance da família ter êxito e sucesso, ou seja, pelo bem dos próximos haver a necessidade de submissão a, em exemplo, um casamento forjado, ou algo do gênero, reconhece-se o amor no ato se feito por bem da família, porém o amor incutido, nesse caso, explicita o caráter sacrificial, no qual uma vontade e um amor genuinamente potencial em prazeres e alegrias são anulados, ou seja, mesmo nesse modelo tradicional na "solidez" há possibilidade do amor, não nas formas romanticizadas em critérios, como "estabilidade" e "durabilidade", mas no caráter do sacríficio exercido. Conforme nos ensina São Tomás de Aquino, o amor não é uma "força", tal como ensina Hegel, mas sim uma virtude teologal conforme na "Suma Teológica" (II-II Q. 26-28), não devemos reduzir o amor e os amores em análises simplórias (não simples) de falsa complexidade extraídas em métodos questionáveis e pouco competentes à real diensão de crise espiritual das eras, por esse motivo não concordo com a teoria do amor líquido de Zygmunt Bauman.

-

@ a4992688:88fd660f

2025-05-28 00:58:09

@ a4992688:88fd660f

2025-05-28 00:58:09Retail Isn't Coming Back

(and they might be gone for good)

Written by nostr:nprofile1qqs2fxfx3z6yns4a6mafcwdgsrtluf747h37nl2vglt9mqj93r7kvrcwm69jy

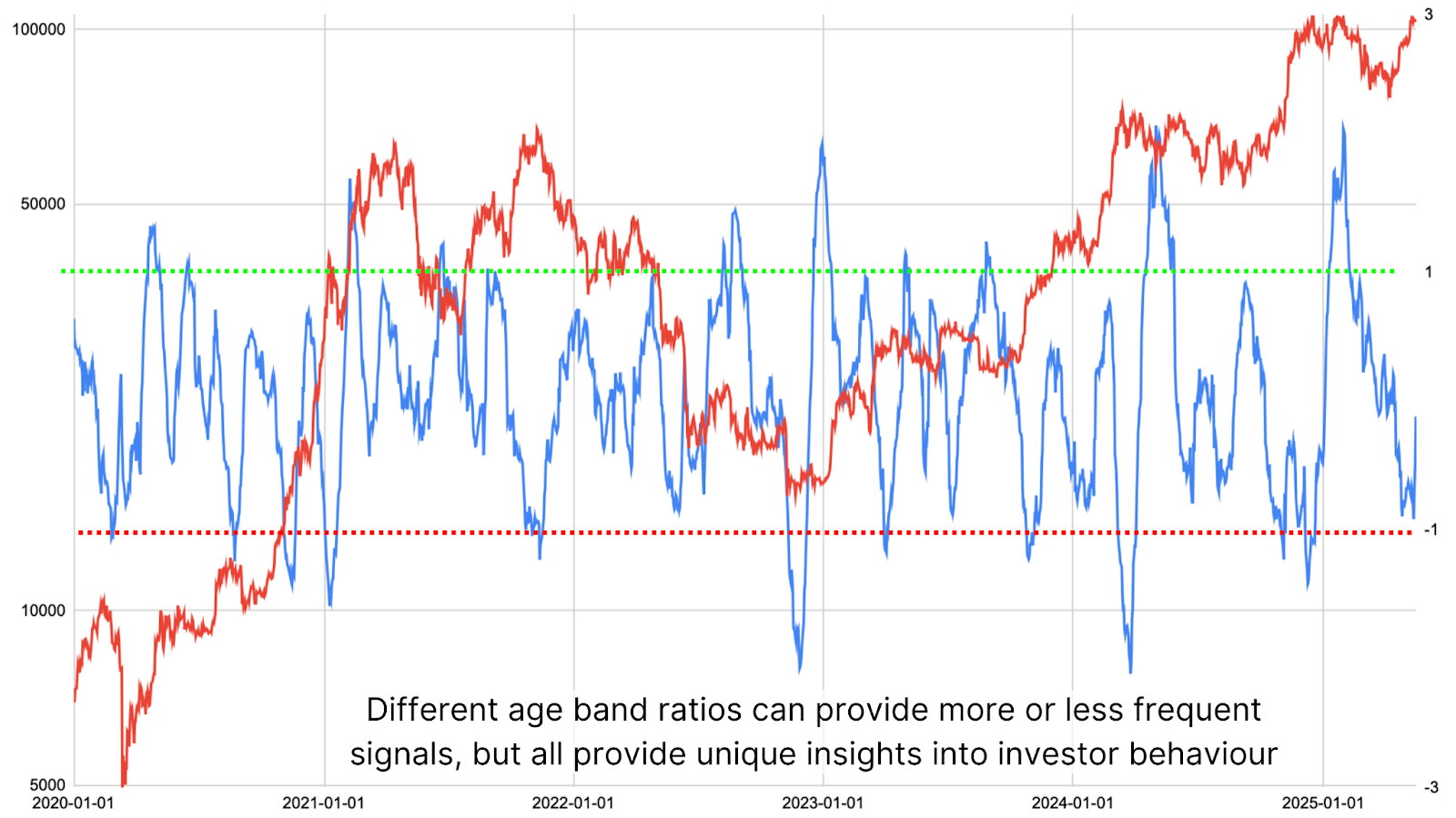

It's been just a matter of days since Bitcoin has broken a new all-time high in US dollars and yet, things are extremely quiet on the ground level... Your friends aren't texting to find out if now is a good time to buy, the normies at work haven't brought it up to you, and Coinbase isn't even in the top 100 overall apps in the Google Play App Store. As of now, it sits at #164.

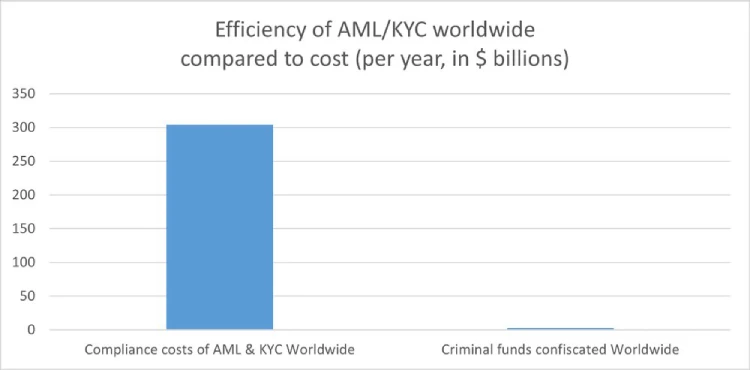

In fact, according to Google search trends, worldwide interest in Bitcoin is lower today while setting new all-time highs above $110,000 than it was at the pits of the 2022 bear market when FTX was blowing up and Bitcoin crashed to below $16,000.

the mempool also paints a quiet picture. It’s mostly empty. Just a few blocks’ worth of transactions waiting to confirm, most paying 1–4 sats/vB. In fact, over the last 144 blocks (about 24 hours), the average fee per transaction has hovered below 1,500 sats, roughly $1.50.

This is far from the behavior found on-chain during previous all-time highs. It reflects an underutilized network predominantly being used by its original power users. Meanwhile, the hash rate climbs relentlessly, month after month, setting record after record. Miners are expending more energy than ever, but fee pressure is nowhere to be found.

🕵️♂️ Is Retail In The Room with Us Now?

The typical signs of retail investor enthusiasm, such as increased Google searches, higher Coinbase app downloads, and a congested mempool all remain subdued. This raises the question: Is the current rally predominantly driven by institutional investors, with retail participation lagging behind?

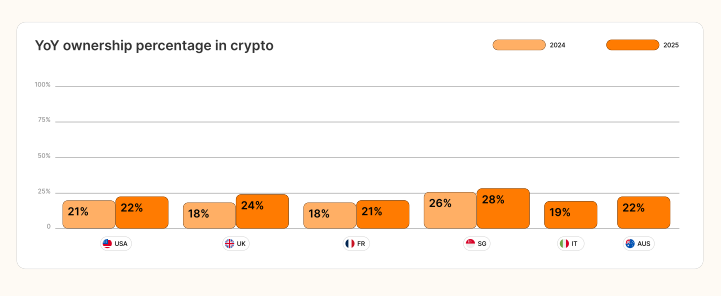

Since the approval of spot Bitcoin ETFs in January 2024, these financial instruments have accumulated nearly 1.21 million bitcoin, with total assets under management exceeding $132 billion (or, 5.75%+ of 21M total BTC). Initially, retail investors were the primary contributors to these inflows, accounting for approximately 80% of the total assets under management as of October 2024. However, more recent trends indicate a shift, with institutional investors, including hedge funds and asset managers, increasing their stakes in Bitcoin ETFs.

Institutional exposure more than doubled from Q3 to Q4 of 2024 according to SEC 13-F filings, whereas assets under management for all non-institutional ETF holders grew by 62%. While retail is responsible for approximately 73.7% of AUM in the ETFs, a small number of institutions represent more than a 26% of the ETF inflows as of the end of 2024.

🥴 PTSD - Portfolio Trauma & Speculative Disillusionment

For many retail investors, the scars from the 2021–2022 crypto cycle run deep. They bought into the hype near Bitcoin's previous all-time high of $69,000, only to watch their investments plummet to $15,000. The collapse of major platforms like Terra, Celsius, and FTX didn't just erase wealth—it shattered trust.

This collective trauma has left many retail investors wary. They've seen the cycle before: rapid gains followed by devastating losses. The excitement that once drew them into the market has been replaced by caution and skepticism. Even as Bitcoin reaches new heights, the enthusiasm that characterized previous bull runs is noticeably absent.

By all measurable metrics, retail investors appear increasingly reluctant to step outside the comfort of traditional financial rails to gain Bitcoin exposure. In response to past losses and a heightened desire for security, many are now turning to regulated investment vehicles like spot Bitcoin ETFs, offered by institutions such as BlackRock and Fidelity. These products provide a familiar, low-friction on-ramp by eliminating the need for self-custody, avoiding the risks of phishing and exchange hacks, and sidestepping the complexities of managing wallets or navigating volatile crypto platforms. This behavioral shift helps explain why we’re not seeing a surge in mempool congestion, on-chain activity, or crypto exchange downloads. Retail isn’t gone per se... they are however predominantly choosing to interact with Bitcoin from a "safe" distance, inside the walled garden of TradFi.

🧙♂️ Pay No Attention to the Custodian Behind the Curtain

Retail might look like it's back, but it isn't. Not really. They've been rerouted. Herded away from the open network and into the controlled comfort of traditional finance, where Bitcoin is boxed up, regulated, and sold as a familiar financial product.

Spot ETFs from firms like BlackRock offer the illusion of exposure without any of the responsibility or freedom that comes with actually owning Bitcoin. There are no private keys, no ability to withdraw, no direct access to the asset. Most of the Bitcoin that backs those shares sits in Coinbase Custody, inaccessible from the investor’s point of view. Retail can watch the price move, but they can't move a single sat.

They can't send it to family. They can't use Lightning. They can't participate in a fork or vote with their coins. Their holdings are locked inside a financial product, subject to tax surveillance and government oversight, with none of the borderless, censorship-resistant qualities that make Bitcoin what it is.

This isn’t Bitcoin as a tool for sovereignty. It’s Bitcoin as a stock proxy, tucked neatly into retirement accounts and brokerage dashboards. Retail hasn't returned to Bitcoin. They've returned to a synthetic version of it. One that looks clean, feels safe, and doesn’t ask them to think too hard.

The crowd is back, but not on the chain. They've returned to price, not protocol.

🔍Missing: Retail. Last Seen 2021.

If this bull run feels quieter than the last one, it’s because it is. Retail investors, once the lifeblood of Bitcoin mania, are largely absent from the on-chain activity. Their presence isn’t being felt where it used to be.

The reasons are stacking up. Regulatory pressure has increased globally, with new tax reporting rules, stricter KYC requirements, and fewer accessible exchanges making direct participation more frustrating than exciting. At the same time, the opportunity cost has shifted. T-bills are yielding 5 percent, and the stock market is deep in an AI-driven rally that feels new and full of upside. Compared to that, Bitcoin’s core narratives like digital gold or inflation protection no longer feel urgent or unique.

Institutions are now leading through ETFs and futures, smoothing out volatility and removing many of the sudden moves that once drew in retail traders. On-chain user experience still falls behind modern apps, Lightning remains niche, and energy concerns continue to shape public perception. More importantly, the cost of everyday life has gone up. Rent is up. Groceries are expensive. People are stretched thin. Student loans have resumed and homeownership is out of reach for many.

Until those conditions shift, retail is unlikely to return in any meaningful way. It is not that they have given up on Bitcoin. They are simply trying to keep up with everything else.

The chart below illustrates that the number of active Bitcoin addresses has declined by approximately 42% since its peak in 2021.

🧲 What Pulls Them Back In?