-

@ 5d4b6c8d:8a1c1ee3

2025-05-28 12:37:30

@ 5d4b6c8d:8a1c1ee3

2025-05-28 12:37:30https://rumble.com/embed/v6rp3fh/?pub=4e023h

I know some of our stackers are follicly challenged, so I thought I'd pass along this video.

Have any of you tried topical onion juice for hair regrowth?

I'll eat more onion and rosemary and get more Sun, just to be safe.

https://stacker.news/items/991118

-

@ a3c6f928:d45494fb

2025-05-28 12:21:32

@ a3c6f928:d45494fb

2025-05-28 12:21:32In a world that constantly demands our attention, where external achievements are often mistaken for fulfillment, there is a quieter, more powerful path to freedom—the journey within. True freedom is not merely the absence of constraints but the presence of inner peace, purpose, and self-mastery.

What Is Self-Mastery?

Self-mastery is the ability to govern your thoughts, emotions, and actions in alignment with your values and goals. It is about becoming the author of your own story rather than being swept away by the noise and chaos of the external world. With self-mastery comes clarity, direction, and the freedom to live authentically.

The Pillars of Inner Freedom

-

Self-Awareness: Freedom begins with knowing who you are. Understanding your strengths, triggers, and motivations lays the foundation for personal growth.

-

Discipline: Discipline is not restriction—it is the structure that supports your vision. It turns intention into reality.

-

Emotional Intelligence: Learning to manage emotions, rather than being ruled by them, grants the power to respond rather than react.

-

Purpose: A sense of purpose provides direction. When you know what matters most, distractions lose their power.

Why Self-Mastery Matters

Without self-mastery, external freedom can feel hollow. You might have opportunities, resources, and rights, yet still feel trapped—by fear, self-doubt, or the need for validation. Mastering yourself unlocks the kind of freedom that no one can take away: the freedom to be at peace with who you are.

How to Begin the Journey

-

Reflect Daily: Spend time each day in silence or journaling to deepen your awareness.

-

Set Intentions: Start each day with a clear intention to guide your focus.

-

Challenge Yourself: Growth lies just beyond your comfort zone. Embrace discomfort as part of the process.

-

Seek Stillness: Create moments of stillness to listen to your inner voice.

“He who conquers himself is the mightiest warrior.” — Confucius

True freedom starts from within. Master yourself, and you master your life.

-

-

@ cae03c48:2a7d6671

2025-05-28 12:00:38

@ cae03c48:2a7d6671

2025-05-28 12:00:38Bitcoin Magazine

Bitcoin Enters a New Era: Industry Leaders Predict Trillions in Institutional InflowsAt the 2025 Bitcoin Conference in Las Vegas, the Founder and CEO of Kelly Intelligence Kevin Kelly, the Chief Executive Officer of Bitwise Asset Management Hunter Horsley, the CEO of BitGo Mike Belshe and the Advisor of WBTC Justin Sun talked about the future of financial products in the globe.

Hunter Horsley started the panel by saying that we are entering a new chapter in 2025 with the change in the regulatory circumstances.

“In the US wealth managers manage between 30 and 60 trillion dollars,” said Horsley. “If wealth managers wind up allocating 1% to the space on behalf of their clients, helping their clients access the opportunities here that are hundreds and billions of dollars.”

JUST IN:

$12 billion Bitwise CEO Hunter Horsley says if wealth managers allocate 1% to #Bitcoin, “that's hundreds of billions of dollars.”

$12 billion Bitwise CEO Hunter Horsley says if wealth managers allocate 1% to #Bitcoin, “that's hundreds of billions of dollars.”  pic.twitter.com/4OhoBjwDYR

pic.twitter.com/4OhoBjwDYR— Bitcoin Magazine (@BitcoinMagazine) May 27, 2025

Justin Sun emphasized the importance of integrating Bitcoin into decentralized finance (DeFi) platforms:

“Raw Bitcoin is a way to get your Bitcoin into a smart contract platform,” said Sun. “You can use your Bitcoin as collateral you borrow like stablecoin, you borrow other major crypto currencies tokens and also of course generate yield on the Bitcoin you are holding because Bitcoin is a proof of network.”

“Any transaction you can see in the blockchain and all the reserve addresses is available on the Blockchain. It’s safe and transparent and at the same time is smart,” stated Sun.

Mike Belshe elaborated on the foundational elements that make a stablecoin successful, particularly when Bitcoin is used in that context.

“What makes a good stablecoin whether you are talking about dollars or Bitcoin, it’s the liquidity that you have on the market around the world,” stated Belshe.

Horsley continued by addressing that we’ll see more companies adopting this and hundreds of thousands of Bitcoin being put onto more balance sheets.

“Corporations are buying Bitcoin,” commented Horsley. “It’s an extraordinary theme of this year. As of the first quarter of this year, 79 publicly traded companies had put Bitcoin on their balance sheet. Over 600k Bitcoin and there is only 21 million Bitcoin. It’s a lot of Bitcoin”

Justin Sun closed the panel by stating, “the progress we are making here in the United States really matters because as we all further encourage people around the world to get into the Bitcoin industry.”

“Once Bitcoin passes this kind of stage and gets institution adoption in the United States will accelerate that option globally,” said Sun.

This post Bitcoin Enters a New Era: Industry Leaders Predict Trillions in Institutional Inflows first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 10846a37:73b5f923

2025-05-28 11:41:30

@ 10846a37:73b5f923

2025-05-28 11:41:30A 80win tem se destacado como uma das plataformas de entretenimento online mais completas do momento. Com um ambiente moderno, intuitivo e pensado especialmente para o público brasileiro, a plataforma oferece uma experiência única que une tecnologia, segurança e uma vasta seleção de jogos. Seja você um iniciante curioso ou um jogador experiente, a 80win proporciona diversão para todos os perfis.

Interface Amigável e Acesso Rápido Ao acessar a 80win, o que chama a atenção de imediato é o design leve e fácil de navegar. A plataforma foi projetada para que os usuários encontrem tudo o que precisam com poucos cliques. Desde o cadastro, que pode ser feito em minutos, até a escolha dos jogos, tudo é prático e acessível.

Além disso, a 80win está otimizada para dispositivos móveis, o que significa que você pode jogar onde estiver, sem comprometer a qualidade gráfica ou o desempenho. O site funciona perfeitamente em smartphones, tablets e computadores, garantindo flexibilidade total para o usuário.

Diversidade de Jogos Para Todos os Gostos A seleção de jogos da 80winé um dos seus grandes diferenciais. A plataforma reúne uma enorme variedade de opções, desde jogos de cartas clássicos como pôquer e bacará, até roletas virtuais e jogos temáticos com gráficos impressionantes e trilhas sonoras envolventes.

Para os fãs de jogos com elementos de sorte, a plataforma oferece slots (caça-níqueis) com temas variados, bônus atrativos e efeitos visuais de última geração. Esses jogos são atualizados com frequência, garantindo que sempre haja novidades para explorar.

Já quem prefere jogos que exigem mais estratégia e raciocínio rápido também encontra ótimas opções. Os modos multiplayer permitem interações com outros jogadores em tempo real, trazendo uma camada extra de emoção e competitividade.

Segurança e Suporte de Qualidade A 80win preza pela segurança dos seus usuários. A plataforma utiliza tecnologia de criptografia avançada para proteger todos os dados e transações, garantindo que suas informações pessoais e financeiras estejam sempre seguras.

Além disso, o suporte ao cliente é outro ponto forte. A equipe da 80win está disponível todos os dias para tirar dúvidas, resolver problemas técnicos e auxiliar em qualquer situação. O atendimento pode ser feito via chat ao vivo ou e-mail, com respostas rápidas e eficazes.

Experiência do Jogador: Diversão com Responsabilidade Na 80win, a experiência do jogador vai além dos jogos em si. A plataforma oferece promoções regulares, bônus de boas-vindas e programas de fidelidade que recompensam os usuários mais ativos. Tudo isso contribui para uma jornada mais dinâmica e envolvente.

Outro ponto importante é o incentivo ao jogo responsável. A 80win disponibiliza ferramentas para controle de tempo e gastos, permitindo que cada jogador tenha controle sobre sua própria experiência e jogue de forma consciente.

Conclusão A 80win é muito mais do que uma simples plataforma de jogos online. É um ambiente completo, seguro e divertido, onde a variedade de opções e a qualidade dos serviços colocam o jogador em primeiro lugar. Se você está em busca de uma experiência empolgante, interativa e acessível, a 80win é a escolha certa para explorar o mundo do entretenimento digital com total confiança.

-

@ 10846a37:73b5f923

2025-05-28 11:41:06

@ 10846a37:73b5f923

2025-05-28 11:41:06O cenário de entretenimento online no Brasil está cada vez mais aquecido, e uma plataforma que tem chamado a atenção dos jogadores é a 888f. Com uma proposta moderna, segura e repleta de funcionalidades, o site oferece uma experiência diferenciada para quem busca diversão e oportunidade de ganhos em um ambiente digital bem estruturado.

Introdução à Plataforma 888f A 888f se destaca como uma plataforma inovadora voltada para o público brasileiro, oferecendo uma navegação simples e intuitiva, com suporte completo em português e atendimento dedicado. Desde o primeiro acesso, os usuários são recebidos com um layout limpo, organizado e responsivo, que se adapta perfeitamente a qualquer dispositivo – seja computador, tablet ou smartphone.

Um dos principais atrativos da 888fé a facilidade de cadastro e uso. Em poucos minutos, é possível criar uma conta e começar a explorar todas as opções de jogos disponíveis. A plataforma também oferece diversas formas de pagamento, incluindo métodos populares como Pix, transferências bancárias e carteiras digitais, sempre com foco na agilidade e segurança das transações.

Jogos Variados para Todos os Estilos A variedade de jogos é um dos grandes diferenciais da 888f. O site reúne títulos dos principais fornecedores do mercado, garantindo gráficos de alta qualidade, mecânicas envolventes e jogabilidade fluida. Os usuários encontram desde os clássicos jogos de cartas, como poker e blackjack, até opções modernas de roletas, slots interativos e outros formatos com recursos inovadores.

Os famosos "jogos ao vivo" também estão presentes, oferecendo uma imersão ainda maior para quem busca adrenalina e interação em tempo real. Nesses jogos, o jogador participa de partidas com apresentadores reais, transmitidas por vídeo em alta definição, criando uma sensação de estar dentro de uma sala física sem sair de casa.

Além disso, há jogos de aposta rápida e instantânea, que são perfeitos para quem deseja jogar de maneira dinâmica e divertida, com resultados em poucos segundos. Cada jogo é desenvolvido com tecnologia de ponta, garantindo aleatoriedade justa e transparência nas rodadas.

Experiência do Jogador em Primeiro Lugar A 888f prioriza a satisfação e segurança dos seus usuários. Por isso, investe constantemente em tecnologia de proteção de dados e oferece um ambiente de jogo responsável, com ferramentas de controle de tempo e gastos para promover uma experiência equilibrada e consciente.

O atendimento ao cliente também é um destaque. A equipe de suporte está disponível 24 horas por dia, todos os dias da semana, pronta para ajudar com qualquer dúvida ou problema. Os canais de contato incluem chat ao vivo, e-mail e atendimento via WhatsApp, sempre com resposta rápida e cordial.

Outro ponto importante é o sistema de recompensas. A 888f oferece promoções regulares, bônus de boas-vindas e programas de fidelidade que beneficiam os jogadores mais ativos. Tudo isso contribui para uma jornada envolvente e repleta de vantagens.

Conclusão A 888f surge como uma excelente opção para quem procura entretenimento digital de qualidade no Brasil. Com uma plataforma segura, jogos diversos e suporte de excelência, ela conquista cada vez mais espaço entre os jogadores que buscam diversão com responsabilidade e conforto. Seja você um iniciante ou um usuário experiente, a 888f oferece tudo o que é necessário para uma experiência online completa e gratificante.

-

@ 10846a37:73b5f923

2025-05-28 11:40:41

@ 10846a37:73b5f923

2025-05-28 11:40:41O universo dos jogos online ganha um novo patamar com a chegada da plataforma 30win, um ambiente moderno, seguro e totalmente pensado para oferecer entretenimento de qualidade aos seus usuários. Com uma interface intuitiva, ampla variedade de jogos e suporte completo, a 30win se destaca como uma excelente opção para quem busca diversão e oportunidades emocionantes de vitória.

Uma Plataforma Moderna e Confiável A 30win foi desenvolvida com tecnologia de ponta, priorizando segurança e praticidade. O site possui um design responsivo, que se adapta perfeitamente a computadores, tablets e smartphones, permitindo que o jogador aproveite seus momentos de lazer em qualquer lugar. A navegação é rápida e fluida, com menus claros e opções bem organizadas, o que torna a experiência ainda mais agradável, até mesmo para quem está começando.

Outro grande diferencial da 30winé seu compromisso com a proteção dos dados dos usuários. A plataforma utiliza protocolos avançados de criptografia, garantindo que todas as transações e informações pessoais estejam seguras. Além disso, oferece múltiplos métodos de pagamento e saque, com rapidez e eficiência.

Variedade de Jogos Para Todos os Gostos O que realmente atrai os jogadores para a 30win é a impressionante seleção de jogos disponíveis. A plataforma conta com centenas de títulos de desenvolvedores renomados, trazendo gráficos de alta qualidade, trilhas sonoras envolventes e mecânicas de jogo inovadoras.

Entre os destaques estão os jogos de slots, com temáticas variadas que vão desde aventuras épicas até símbolos clássicos. Cada título traz funções especiais como giros grátis, multiplicadores e rodadas bônus, o que aumenta tanto a diversão quanto as chances de ganhar prêmios.

Para quem gosta de desafios estratégicos, a 30win oferece também uma boa seleção de jogos de cartas como pôquer, blackjack e baccarat, além de roletas virtuais e jogos interativos com crupiês ao vivo, que proporcionam uma experiência realista e envolvente, diretamente da tela do seu dispositivo.

Experiência do Jogador em Primeiro Lugar A 30win se preocupa em entregar uma experiência completa e satisfatória aos seus jogadores. Desde o primeiro acesso, é possível notar a atenção dada aos detalhes. O cadastro é simples e rápido, com poucos cliques, e o usuário já pode começar a explorar tudo o que a plataforma tem a oferecer.

Outro ponto forte é o suporte ao cliente. A equipe de atendimento está disponível 24 horas por dia, sete dias por semana, pronta para ajudar em qualquer dúvida ou situação. Isso transmite confiança e demonstra o comprometimento da plataforma com seus usuários.

Além disso, a 30win promove constantemente bônus e promoções exclusivas, premiando tanto novos jogadores quanto os mais fiéis. Esses incentivos tornam a experiência ainda mais atrativa, com recompensas que vão desde créditos extras até prêmios especiais.

Conclusão Se você está em busca de uma plataforma de jogos online completa, segura e com excelente variedade de opções, a 30win é uma escolha certeira. Com sua interface amigável, suporte eficiente e jogos de altíssimo nível, ela oferece uma experiência empolgante que atende a todos os perfis de jogadores.

-

@ 162b4b08:9f7d278c

2025-05-28 11:37:08

@ 162b4b08:9f7d278c

2025-05-28 11:37:08Lối sống năng động, linh hoạt và hướng đến sự cân bằng đang ngày càng trở thành lựa chọn của nhiều người trẻ Việt Nam trong thời đại hiện đại. Họ không chỉ chú trọng đến công việc và học tập mà còn quan tâm đến việc chăm sóc bản thân, tận hưởng cuộc sống và tìm kiếm những khoảnh khắc thư giãn giữa lịch trình bận rộn. WIN77K, với vai trò là một nền tảng giải trí trực tuyến thông minh, đã nhanh chóng nắm bắt được nhu cầu này và cung cấp một loạt nội dung giải trí phù hợp với nhịp sống trẻ trung, sôi động. Các tính năng truy cập nhanh, giao diện dễ sử dụng và hệ thống hoạt động ổn định trên cả điện thoại lẫn máy tính giúp người dùng linh hoạt tận hưởng các hoạt động giải trí mọi lúc, mọi nơi. Thay vì tiêu tốn thời gian vào những hoạt động kém hiệu quả, người trẻ có thể lựa chọn những trải nghiệm nhẹ nhàng, thư giãn nhưng vẫn duy trì được năng lượng tích cực cho cả ngày dài. Đây chính là điểm mạnh giúp WIN77K trở thành người bạn đồng hành đáng tin cậy cho thế hệ năng động ngày nay.

Không chỉ hỗ trợ giải trí, win77k còn cung cấp nhiều chuyên mục bài viết hữu ích liên quan đến lối sống, sức khỏe tinh thần, và các gợi ý giúp người trẻ duy trì phong cách sống lành mạnh. Những nội dung như cách tổ chức thời gian, làm thế nào để giữ năng lượng tích cực mỗi ngày, hoặc các bài viết chia sẻ kinh nghiệm xây dựng thói quen tốt… đều được biên tập kỹ lưỡng và cập nhật thường xuyên. Điều này giúp người dùng không chỉ tiêu thụ nội dung mà còn được truyền cảm hứng để thay đổi thói quen sống một cách chủ động. Hơn nữa, WIN77K còn kết nối cộng đồng người trẻ có cùng lối sống qua các hoạt động chia sẻ và thảo luận trực tuyến. Nhờ vậy, người dùng có thể tìm thấy sự đồng cảm, học hỏi lẫn nhau và mở rộng mạng lưới quan hệ tích cực trong môi trường số. Việc xây dựng cộng đồng này không chỉ thúc đẩy sự phát triển cá nhân mà còn lan tỏa tinh thần sống tích cực, tự chủ và sáng tạo đến nhiều người hơn trong xã hội.

Thành công của WIN77K đến từ sự thấu hiểu sâu sắc đối với nhu cầu của người dùng hiện đại, đặc biệt là thế hệ trẻ. Trong một thế giới mà mọi thứ đều chuyển động không ngừng, việc tìm ra điểm dừng hợp lý để nạp lại năng lượng là điều cần thiết. Và WIN77K đã làm tốt vai trò đó khi không chỉ tạo ra một nền tảng giải trí đơn thuần mà còn là không gian giúp người trẻ phát triển bản thân một cách toàn diện. Dù là trong lúc nghỉ ngơi giữa giờ học, thư giãn sau một ngày làm việc mệt mỏi hay đơn giản là tìm kiếm một khoảng lặng trong cuộc sống bận rộn, WIN77K luôn hiện diện như một lựa chọn tiện lợi, an toàn và truyền cảm hứng. Sự linh hoạt, hiện đại cùng định hướng phát triển bền vững chính là lý do khiến WIN77K không ngừng gia tăng sự tin tưởng và yêu mến từ cộng đồng người trẻ Việt Nam, ngày càng khẳng định vai trò của mình trong việc đồng hành cùng lối sống năng động và tích cực của thế hệ tương lai.

-

@ cff1720e:15c7e2b2

2025-05-28 11:18:23

@ cff1720e:15c7e2b2

2025-05-28 11:18:23Liebe Anwender,\ \ diesmal beginnen die Neuigkeiten schon beim Titel und der Anrede. Unsere Worte bestimmen unser Denken, und daher war die Korrektur wichtiger als sie zunächst erscheint, denn bei Pareto gibt es die klassische Trennung zwischen Autor und Leser nicht mehr. Cocreation heißt unser Konzept, jeder kann publizieren, kommentieren, honorieren und distribuieren. Mag das bei Blogtexten derzeit noch nicht selbstverständlich sein, so ist das bei Bildern längst die Norm.

“Ein Bild sagt mehr als tausend Worte” beschreibt die Wirkung visueller Kommunikation. Deshalb haben wir nach dem Blogtext nun mit Bildern eine neue Content-Kategorie eingeführt. Natürlich auch hier mit den bekannten Funktionen der Interaktion wie like, repost und zap. Es gibt derzeit eine Gliederung in 4 Feeds, Gefolgt (für Nostr-User verfügbar), Memes und Kunst (gefiltert nach entsprechenden Tags) und Pareto für alles andere.

Jeder Nostr-User hat die Möglichkeit eigene Bilder hochzuladen, zu taggen, sowie mit einem Titel und Untertext zu versehen. “Everyone is a creator” war noch nie leichter, probiert es einfach aus! Noch kein Nostr-Profil und trotzdem interessiert? Kein Problem, bitte Informationen zu originellen Bildquellen oder Interesse an Mitwirkung per Mail senden an pictures@pareto.space

Leicht ist es auch die Pareto-Inhalte zu erhalten und konsumieren, man braucht weder einen Account noch spezielle Apps. Jeder hat bereits die entsprechenden Voraussetzungen, hier ein paar Beispiele.\ \ Newsletter per Mail (Die Friedenstaube)\ hier abonnieren\ \ In Telegram lesen -> hier unsere Kanäle\ https://t.me/pareto_artikel \ https://t.me/friedenstaube_artikel \ \ Als Feed in einem Feed-Reader \ https://pareto.space/atom/feed.xml \ https://pareto.space/atom/de_feed.xml \ https://pareto.space/atom/en_feed.xml

Fügt in Eure Artikel bitte am Anfang / Ende einen Hinweis auf den Pareto-Client ein, andere Clients unterstützen nicht alle Features. Das ist ein Service-Hinweis zur besseren Lesbarkeit “Dieser Beitrag wurde mit dem Pareto-Client geschrieben.” Ebenso ist ein Hinweis auf Onboarding bei Nostr nützlich: neue Nostr-User können euch liken und zappen: not yet on Nostr and want the full experience? Easy onboarding via Start.\ \ Das Pareto-Team baut den “Marktplatz der Ideen” und hat dabei schon viel erreicht. Feedback und Mitarbeit hilft uns damit noch schneller voranzukommen, wir bedanken uns für Eure Unterstützung.\ team@pareto.space \ https://pareto.space \ https://geyser.fund/project/pareto?hero=1c1b8e487090

-

@ 005bc4de:ef11e1a2

2025-05-28 09:05:10

@ 005bc4de:ef11e1a2

2025-05-28 09:05:10

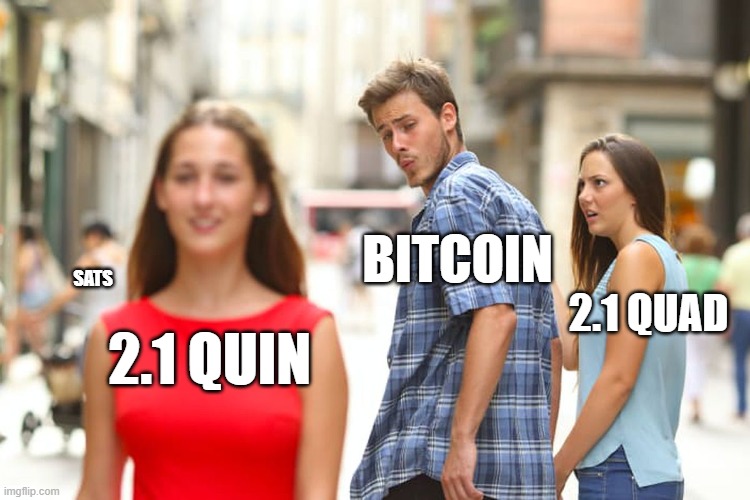

BIP-2,100,000,000,000,000,000

So, you're telling me...

- 21 million bitcoins is out, and...

- 2.1 quadrillion sats is in, except that...

- sats are out, so...

- 2.1 quadrillion bitcoins is in, except that...

- there are actually millisats, but...

- millisats are out, so...

- millibitcoins are in, so now...

- there are 2.1 quintillion millibitcoins, except that...

- millibitcoins are the basic base unit of bitcoin, so...

- millibitcoins are out, and now...

- 2.1 quintillion bitcoins are in

-

@ 33baa074:3bb3a297

2025-05-28 08:54:40

@ 33baa074:3bb3a297

2025-05-28 08:54:40COD (chemical oxygen demand) sensors play a vital role in water quality testing. Their main functions include real-time monitoring, pollution event warning, water quality assessment and pollution source tracking. The following are the specific roles and applications of COD sensors in water quality testing:

Real-time monitoring and data acquisition COD sensors can monitor the COD content in water bodies in real time and continuously. Compared with traditional sampling methods, COD sensors are fast and accurate, without manual sampling and laboratory testing, which greatly saves time and labor costs. By combining with the data acquisition system, the monitoring data can be uploaded to the cloud in real time to form a extemporization distribution map of the COD content in the water body, providing detailed data support for environmental monitoring and management.

Pollution event warning and rapid response COD sensors play an important role in early warning and rapid response in water environment monitoring. Once there is an abnormal increase in organic matter in the water body, the COD sensor can quickly detect the change in COD content and alarm through the preset threshold. This enables relevant departments to take measures at the early stage of the pollution incident to prevent the spread of pollution and protect the water environment.

Water quality assessment and pollution source tracking COD sensors play an important role in water quality assessment and pollution source tracking. By continuously monitoring the COD content in water bodies, the water quality can be evaluated and compared with national and regional water quality standards. At the same time, COD sensors can also help determine and track the location and spread of pollution sources, provide accurate data support for environmental management departments, and guide the development of pollution prevention and control work.

Application scenarios COD sensors are widely used in various water quality monitoring scenarios, including but not limited to: Sewage treatment plants: used to monitor the COD content of in fluent and effluent to ensure the effect of sewage treatment. Water source protection and management: deployed in water sources to monitor the COD content of in fluent sources. Once the water quality exceeds the set limit, the system will issue an alarm in time to ensure water quality safety. Lake and river monitoring: deployed in water bodies such as lakes and rivers to monitor the COD content of water bodies in real time.

Technical features of COD sensor COD sensor uses advanced technology, such as ultraviolet absorption method, which does not require the use of chemical reagents, avoiding the risk of contamination of chemical reagents in traditional COD detection methods, and can achieve online uninterrupted water quality monitoring, providing strong support for real-time water quality assessment. In addition, COD sensor also has the advantages of low cost, high stability, strong anti-interference ability, and convenient installation.

Summary In summary, COD sensor plays an irreplaceable role in water quality detection. It can not only provide real-time and accurate water quality data, but also quickly warn when pollution incidents occur, providing strong technical support for water quality management and environmental protection. With the advancement of technology and the popularization of applications, COD sensor will play a more important role in water quality monitoring in the future.

-

@ 58537364:705b4b85

2025-05-28 08:25:55

@ 58537364:705b4b85

2025-05-28 08:25:55ถ้าอยากแล้วไม่หลง มันก็อยากด้วยปัญญา ความอยากอย่างนี้ท่านเรียกว่า เป็นบารมีของตน แต่ไม่ใช่ทุกคนนะที่มีปัญญา

บางคนไม่อยากจะให้มันอยาก เพราะเข้าใจว่า การมาปฏิบัติก็เพื่อระงับความอยาก ความจริงน่ะ ถ้าหากว่าไม่มีความอยาก ก็ไม่มีข้อปฏิบัติ ไม่รู้ว่าจะทำอะไร ลองพิจารณาดูก็ได้

ทุกคน แม้องค์พระพุทธเจ้าของเราก็ตาม ที่ท่านออกมาปฏิบัติ ก็เพื่อจะให้บรรเทากิเลสทั้งหลายนั้น

แต่ว่ามันต้องอยากทำ อยากปฏิบัติ อยากให้มันสงบ และก็ไม่อยากให้มันวุ่นวาย ทั้งสองอย่างนี้ มันเป็นอุปสรรคทั้งนั้น ถ้าเราไม่มีปัญญา ไม่มีความฉลาดในการกระทำอย่างนั้น เพราะว่ามันปนกันอยู่ อยากทั้งสองอย่างนี้มันมีราคาเท่า ๆ กัน

อยากจะพ้นทุกข์มันเป็นกิเลส สำหรับคนไม่มีปัญญา อยากด้วยความโง่ ไม่อยากมันก็เป็นกิเลส เพราะไม่อยากอันนั้นมันประกอบด้วยความโง่เหมือนกัน คือทั้งอยาก ไม่อยาก ปัญญาก็ไม่มี ทั้งสองอย่างนี้ มันเป็นกามสุขัลลิกานุโยโค กับอัตตกิลมถานุโยโค ซึ่งพระพุทธองค์ของเรา ขณะที่พระองค์กำลังทรงปฏิบัติอยู่นั้น ท่านก็หลงใหลในอย่างนี้ ไม่รู้ว่าจะทำอย่างไร ท่านหาอุบายหลายประการ กว่าจะพบของสองสิ่งนี้

ทุกวันนี้เราทั้งหลายก็เหมือนกัน ทุกสิ่งทั้งสองอย่างนี้มันกวนอยู่ เราจึงเข้าสู่ทางไม่ได้ก็เพราะอันนี้ ความเป็นจริงนี้ทุกคนที่มาปฏิบัติ ก็เป็นปุถุชนมาทั้งนั้น ปุถุชนก็เต็มไปด้วยความอยาก ความอยากที่ไม่มีปัญญา อยากด้วยความหลง ไม่อยากมันก็มีโทษเหมือนกัน “ไม่อยาก” มันก็เป็นตัณหา “อยาก” มันก็เป็นตัณหาอีกเหมือนกัน

ทีนี้ นักปฏิบัติยังไม่รู้เรื่องว่า จะเอายังไงกัน เดินไปข้างหน้าก็ไม่ถูก เดินกลับไปข้างหลังก็ไม่ถูก จะหยุดก็หยุดไม่ได้เพราะมันยังอยากอยู่ มันยังหลงอยู่ มีแต่ความอยาก แต่ปัญญาไม่มี มันอยากด้วยความหลง มันก็เป็นตัณหา ถึงแม้ไม่อยาก มันก็เป็นความหลง มันก็เป็นตัณหาเหมือนกันเพราะอะไร? เพราะมันขาดปัญญา

ความเป็นจริงนั้น ธรรมะมันอยู่ตรงนั้นแหละ ตรงความอยากกับความไม่อยากนั่นแหละ แต่เราไม่มีปัญญา ก็พยายามไม่ให้อยากบ้าง เดี๋ยวก็อยากบ้าง อยากให้เป็นอย่างนั้น ไม่อยากให้เป็นอย่างนี้ ความจริงทั้งสองอย่างนี้ หรือทั้งคู่นี้มันตัวเดียวกันทั้งนั้น ไม่ใช่คนละตัว แต่เราไม่รู้เรื่องของมัน

พระพุทธเจ้าของเรา และสาวกทั้งหลายของพระองค์นั้นท่านก็อยากเหมือนกัน แต่ “อยาก” ของท่านนั้น เป็นเพียงอาการของจิตเฉย ๆ หรือ “ไม่อยาก” ของท่าน ก็เป็นเพียงอาการของจิตเฉย ๆ อีกเหมือนกัน มันวูบเดียวเท่านั้น ก็หายไปแล้ว

ดังนั้น ความอยากหรือไม่อยากนี้ มันมีอยู่ตลอดเวลาแต่สำหรับผู้มีปัญญานั้น “อยาก” ก็ไม่มีอุปาทาน “ไม่อยาก” ก็ไม่มีอุปาทาน เป็น “สักแต่ว่า” อยากหรือไม่อยากเท่านั้น ถ้าพูดตามความจริงแล้ว มันก็เป็นแต่ "อาการของจิต" อาการของจิตมันเป็นของมันอย่างนั้นเอง ถ้าเรามาตะครุบมันอยู่ใกล้ ๆ นี่มันก็เห็นชัด

ดังนั้นจึงว่า การพิจารณานั้น ไม่ใช่รู้ไปที่อื่น มันรู้ตรงนี้แหละ เหมือนชาวประมงที่ออกไปทอดแหนั่นแหละ ทอดแหออกไปถูกปลาตัวใหญ่ เจ้าของผู้ทอดแหจะคิดอย่างไร? ก็กลัว กลัวปลาจะออกจากแหไปเสีย เมื่อเป็นเช่นนั้น ใจมันก็ดิ้นรนขึ้นระวังมาก บังคับมาก ตะครุบไปตะครุบมาอยู่นั่นแหละ ประเดี๋ยวปลามันก็ออกจากแหไปเสีย เพราะไปตะครุบมันแรงเกินไป

อย่างนั้นโบราณท่านพูดถึงเรื่องอันนี้ ท่านว่าค่อย ๆ ทำมัน แต่อย่าไปห่างจากมัน นี่คือปฏิปทาของเรา ค่อย ๆ คลำมันไปเรื่อย ๆ อย่างนั้นแหละ

อย่าปล่อยมัน หรือไม่อยากรู้มัน ต้องรู้ ต้องรู้เรื่องของมัน พยายามทำมันไปเรื่อย ๆ ให้เป็นปฏิปทา ขี้เกียจเราก็ทำไม่ขี้เกียจเราก็ทำ เรียกว่าการทำการปฏิบัติ ต้องทำไปเรื่อยๆอย่างนี้

ถ้าหากว่าเราขยัน ขยันเพราะความเชื่อ มันมีศรัทธาแต่ปัญญาไม่มี ถ้าเป็นอย่างนี้ ขยันไป ๆ แล้วมันก็ไม่เกิดผลอะไรขึ้นมากมาย ขยันไปนาน ๆ เข้า แต่มันไม่ถูกทาง มันก็ไม่สงบระงับ ทีนี้ก็จะเกิดความคิดว่า เรานี้บุญน้อยหรือวาสนาน้อย หรือคิดไปว่ามนุษย์ในโลกนี้คงทำไม่ได้หรอก แล้วก็เลยหยุดเลิกทำเลิกปฏิบัติ

ถ้าเกิดความคิดอย่างนี้เมื่อใด ขอให้ระวังให้มาก ให้มีขันติ ความอดทน ให้ทำไปเรื่อย ๆ เหมือนกับเราจับปลาตัวใหญ่ ก็ให้ค่อย ๆ คลำมันไปเรื่อย ๆ ปลามันก็จะไม่ดิ้นแรงค่อย ๆทำไปเรื่อย ๆ ไม่หยุด ไม่ช้าปลาก็จะหมดกำลัง มันก็จับง่าย จับให้ถนัดมือเลย ถ้าเรารีบจนเกินไป ปลามันก็จะหนีดิ้นออกจากแหเท่านั้น

ดังนั้น การปฏิบัตินี้ ถ้าเราพิจารณาตามพื้นเหตุของเรา เช่นว่า เราไม่มีความรู้ในปริยัติ ไม่มีความรู้ในอะไรอื่น ที่จะให้การปฏิบัติมันเกิดผลขึ้น ก็ดูความรู้ที่เป็นพื้นเพเดิมของเรานั่นแหละอันนั้นก็คือ “ธรรมชาติของจิต” นี่เอง มันมีของมันอยู่แล้ว เราจะไปเรียนรู้มัน มันก็มีอยู่ หรือเราจะไม่ไปเรียนรู้มัน มันก็มีอยู่

อย่างที่ท่านพูดว่า พระพุทธเจ้าจะบังเกิดขึ้นก็ตาม หรือไม่บังเกิดขึ้นก็ตาม ธรรมะก็คงมีอยู่อย่างนั้น มันเป็นของมันอยู่อย่างนั้น ไม่พลิกแพลงไปไหน มันเป็นสัจจธรรม

เราไม่เข้าใจสัจจธรรม ก็ไม่รู้ว่าสัจจธรรมเป็นอย่างไร นี้เรียกว่า การพิจารณาในความรู้ของผู้ปฏิบัติที่ไม่มีพื้นปริยัติ

ขอให้ดูจิต พยายามอ่านจิตของเจ้าของ พยายามพูดกับจิตของเจ้าของ มันจึงจะรู้เรื่องของจิต ค่อย ๆ ทำไป ถ้ายังไม่ถึงที่ของมัน มันก็ไปอยู่อย่างนั้น

ครูบาอาจารย์บางท่านบอกว่า ทำไปเรื่อย ๆ อย่าหยุด บางทีเรามาคิด “เออ ทำไปเรื่อย ๆ ถ้าไม่รู้เรื่องของมัน ถ้าทำไม่ถูกที่มัน มันจะรู้อะไร” อย่างนี้เป็นต้น ก็ต้องไปเรื่อย ๆ ก่อน แล้วมันก็จะเกิดความรู้สึกนึกคิดขึ้นในสิ่งที่เราพากเพียรทำนั้น

มันเหมือนกันกับบุรุษที่ไปสีไฟ ได้ฟังท่านบอกว่า เอาไม้ไผ่สองอันมาสีกันเข้าไปเถอะ แล้วจะมีไฟเกิดขึ้น บุรุษนั้นก็จับไม้ไผ่เข้าสองอัน สีกันเข้า แต่ใจร้อน สีไปได้หน่อย ก็อยากให้มันเป็นไฟ ใจก็เร่งอยู่เรื่อย ให้เป็นไฟเร็วๆ แต่ไฟก็ไม่เกิดสักที บุรุษนั้นก็เกิดความขี้เกียจ แล้วก็หยุดพัก แล้วจึงลองสีอีกนิด แล้วก็หยุดพัก ความร้อนที่พอมีอยู่บ้าง ก็หายไปล่ะซิ เพราะความร้อนมันไม่ติดต่อกัน

ถ้าทำไปเรื่อยๆอย่างนี้ เหนื่อยก็หยุด มีแต่เหนื่อยอย่างเดียวก็พอได้ แต่มีขี้เกียจปนเข้าด้วย เลยไปกันใหญ่ แล้วบุรุษนั้นก็หาว่าไฟไม่มี ไม่เอาไฟ ก็ทิ้ง เลิก ไม่สีอีก แล้วก็ไปเที่ยวประกาศว่า ไฟไม่มี ทำอย่างนี้ไม่ได้ ไม่มีไฟหรอก เขาได้ลองทำแล้ว

ก็จริงเหมือนกันที่ได้ทำแล้ว แต่ทำยังไม่ถึงจุดของมันคือความร้อนยังไม่สมดุลกัน ไฟมันก็เกิดขึ้นไม่ได้ ทั้งที่ความจริงไฟมันก็มีอยู่ อย่างนี้ก็เกิดความท้อแท้ขึ้นในใจของผู้ปฏิบัตินั้น ก็ละอันนี้ไปทำอันโน้นเรื่อยไป อันนี้ฉันใดก็ฉันนั้น

การปฏิบัตินั้น ปฏิบัติทางกายทางใจทั้งสองอย่าง มันต้องพร้อมกัน เพราะอะไร? เพราะพื้นเพมันเป็นคนมีกิเลสทั้งนั้น พระพุทธเจ้าก่อนที่จะเป็นพระพุทธเจ้า ท่านก็มีกิเลสแต่ท่านมีปัญญามากหลาย พระอรหันต์ก็เหมือนกัน เมื่อยังเป็นปุถุชนอยู่ ก็เหมือนกับเรา

เมื่อความอยากเกิดขึ้นมา เราก็ไม่รู้จัก เมื่อความไม่อยากเกิดขึ้นมา เราก็ไม่รู้จัก บางทีก็ร้อนใจ บางทีก็ดีใจ ถ้าใจเราไม่อยาก ก็ดีใจแบบหนึ่ง และวุ่นวายอีกแบบหนึ่ง ถ้าใจเราอยาก มันก็วุ่นวายอย่างหนึ่ง และดีใจอย่างหนึ่ง มันประสมประเสกันอยู่อย่างนี้

อันนี้คือปฏิปทาของผู้ปฏิบัติเรา

[อ่านใจธรรมชาติ] หลวงปู่ชา สุภัทโท หนังสือ หมวด: โพธิญาณ

-

@ 33baa074:3bb3a297

2025-05-28 08:25:13

@ 33baa074:3bb3a297

2025-05-28 08:25:13The oil-in-water sensoris an instrument specially used to detect oil substances in water bodies. Its working principle is mainly based on the characteristic that oil substances will produce fluorescence under ultraviolet light. The following is a detailed explanation:

Principle Overview The oil-in-water sensor uses the characteristic that oil substances will produce fluorescence under ultraviolet light, and measures the fluorescence intensity to infer the concentration of oil substances. Specifically, the sensor uses ultraviolet light as the excitation light source to irradiate the water sample to be tested. After the oil substance absorbs ultraviolet light, it will stimulate fluorescence, and the fluorescence signal is received by the photo detector and converted into an electrical signal. By measuring the strength of the electrical signal, the concentration of oil substances in the water sample can be inferred.

Workflow Ultraviolet light irradiation: The ultraviolet light source inside the sensor emits ultraviolet light and irradiates it into the water sample to be tested.

Fluorescence generation: After the oil substance in the water sample absorbs ultraviolet light, it will stimulate fluorescence.

Fluorescence detection: The photo detector in the sensor measures the intensity of this fluorescence.

Signal conversion: The signal processing circuit converts the output of the photo detector into an electrical signal proportional to the amount of oil in the water. Data analysis: By analyzing the strength of the electrical signal, the concentration of oil substances in the water sample can be obtained.

Features and applications The oil in water sensor has high sensitivity and can detect soluble and falsifiable oils. It is suitable for a variety of water quality monitoring scenarios, such as oil field monitoring, industrial circulating water, condensate water, wastewater treatment, surface water stations, etc. In addition, it can also monitor the content of crude oil (benzene and benzene homologous) in water sources such as reservoirs and water plants in real time online, play an early warning role, and protect the safety of water sources.

Practical application The oil in water sensor has a wide range of functions in practical applications, including but not limited to the following aspects: Monitoring the water quality of water sources: ensuring the safety of drinking water, and timely discovering pollution sources and ensuring water supply safety by continuously monitoring oil substances in water sources. Monitoring sewage treatment plant emissions: ensuring that the discharge water quality of sewage treatment plants meets the emission standards to avoid secondary pollution to the environment. Monitoring rivers, lakes and other water bodies: assessing the pollution status and providing a basis for pollution control. Early warning and emergency response: It has real-time monitoring and early warning functions, and can issue an alarm in time when abnormal conditions are found, providing valuable time for emergency response and reducing losses caused by pollution. Scientific research: Through the monitoring data of this sensor, we can deeply understand the distribution, migration and transformation of oil substances in water bodies, and provide a scientific basis for environmental protection and governance.

In summary, the oil in water sensor monitors the oil content in water bodies through ultraviolet fluorescence method, has high sensitivity and broad application prospects, and is an indispensable and important tool in modern environmental monitoring and industrial production.

-

@ 33baa074:3bb3a297

2025-05-28 08:10:17

@ 33baa074:3bb3a297

2025-05-28 08:10:17The control of residual chlorine in swimming pools is an important part of water quality management, which aims to ensure the sanitation and safety of swimming pool water while avoiding discomfort to swimmers. Here are some key points about residual chlorine control in swimming pools:

Standards for residual chlorine According to the regulations of the national health supervision department, the residual chlorine in swimming pool water should be kept between 0.3mg/L-1.5mg/L. This range can not only ensure effective disinfection, but also avoid irritation to swimmers' skin and eyes caused by excessive residual chlorine. Too low residual chlorine will lead to incomplete disinfection and increase the risk of bacterial growth; while too high residual chlorine may cause human discomfort and even poisoning.

The role of residual chlorine

Residual chlorine is a residual disinfectant in swimming pool water, usually in the form of sodium hypocrite (NaClO). It has strong oxidizing properties and can effectively kill bacteria, viruses and other microorganisms in water, thereby ensuring the health of swimmers. In addition, residual chlorine can eliminate harmful substances such as organic matter and ammonia in water to keep the water clean.

The role of residual chlorine

Residual chlorine is a residual disinfectant in swimming pool water, usually in the form of sodium hypocrite (NaClO). It has strong oxidizing properties and can effectively kill bacteria, viruses and other microorganisms in water, thereby ensuring the health of swimmers. In addition, residual chlorine can eliminate harmful substances such as organic matter and ammonia in water to keep the water clean.Residual chlorine detection method The method of detecting residual chlorine in swimming pools usually uses test strips or test kits for qualitative or quantitative detection. In addition, online monitoring instruments can be used to monitor the residual chlorine in the swimming pool in real time. These methods can help managers promptly detect and deal with situations where the residual chlorine content is too high or too low, ensuring that the water quality of the swimming pool meets the standards.

Methods for controlling residual chlorine Reasonable addition of disinfectants: According to the water quality of the swimming pool and the number of swimmers, reasonable addition of disinfectants to control the residual chlorine content within the specified range.

Regular testing: Regularly test the residual chlorine in the swimming pool to promptly detect and deal with situations where the residual chlorine content is too high or too low.

Maintain swimming pool equipment: Regularly check and maintain swimming pool equipment to ensure the water treatment effect and circulation filtration are normal, and reduce residual disinfectants and other harmful substances in the water.

Do a good job in swimmer hygiene management: Strengthen swimmer hygiene management, require swimmers to shower and rinse their feet before entering the pool, and reduce pollution sources entering the swimming pool.

Solution for excessive residual chlorine If the residual chlorine content in the swimming pool exceeds the standard range, the following measures can be taken:

Use decorating agent: Use decorating agent to quickly restore the excessive residual chlorine in the swimming pool to the normal range (0.3~0.5mg/L). This method is applicable to excessive residual chlorine caused by excessive addition of chlorine disinfectant.

Adjust the water treatment process: According to the water quality, adjust the water treatment process appropriately, such as selecting the appropriate type and dosage of disinfectant, and adjusting operating parameters such as flow rate, pH value, etc., to reduce the generation of residual chlorine.

Strengthen equipment maintenance: Regularly maintain and maintain the water treatment equipment of the swimming pool to ensure its normal operation and disinfection effect.

Through the above methods, the residual chlorine content in the swimming pool can be effectively controlled to ensure water quality safety and protect the health of swimmers.

-

@ 5f078e90:b2bacaa3

2025-05-28 12:00:23

@ 5f078e90:b2bacaa3

2025-05-28 12:00:23Sylvi the seahorse

In the coral haven of Azure Bay, a seahorse named Sylvi danced with the tides. Her tail curled around a swaying frond as she watched fish dart by. One dawn, a lost pearl rolled into her nook. Sylvi, curious, nudged it along the reef, meeting crabs and eels who shared tales of the deep. By dusk, she found its oyster home. The pearl gleamed thanks, and Sylvi twirled home, her heart light as foam.

Ignore this test. This was in bold originally.

(380 chars, plain text after Markdown stripping, this was in italics originally)

Originally written on habla.news (on Nostr)

-

@ da0b9bc3:4e30a4a9

2025-05-28 08:07:30

@ da0b9bc3:4e30a4a9

2025-05-28 08:07:30Hello Stackers!

Welcome on into the ~Music Corner of the Saloon!

A place where we Talk Music. Share Tracks. Zap Sats.

So stay a while and listen.

🚨Don't forget to check out the pinned items in the territory homepage! You can always find the latest weeklies there!🚨

🚨Subscribe to the territory to ensure you never miss a post! 🚨

https://stacker.news/items/991020

-

@ 33baa074:3bb3a297

2025-05-28 07:50:06

@ 33baa074:3bb3a297

2025-05-28 07:50:06Soil moisture is a key factor that affects the structure and function of soil microbial communities. Here are some of the main aspects of how soil moisture affects microorganisms:

Affecting the Growth and Metabolism of Microorganisms Changes in soil moisture content directly affect the growth and metabolic activities of microorganisms. Under suitable moisture conditions, microorganisms are better able to carry out metabolic activities, thereby promoting the decomposition of soil organic matter and the transformation of nutrients. However, under extremely dry or overly wet conditions, the activity of microorganisms will be inhibited, resulting in a decline in soil functions.

Changing the Structure of Microbial Communities Changes in soil moisture conditions can lead to significant changes in the structure of microbial communities. For example, under drought conditions, the number of drought-tolerant microorganisms may increase to adapt to the water shortage environment. While under wet conditions, aerobic microorganisms may dominate. This change in community structure not only affects the soil's water retention capacity, but also other ecological functions of the soil.

Affecting the Stability of Soil Aggregates Soil aggregates are clumps formed by soil particles through physical, chemical and biological actions, and they have an important impact on the soil's water retention capacity. Soil microorganisms participate in the formation and stability of soil aggregates by secreting substances such as extracellular polymers. Appropriate soil moisture helps maintain the stability of soil aggregates, thereby improving the soil's water retention capacity. However, excessive moisture or drought may lead to the destruction of soil aggregates and reduce the soil's water retention capacity.

Regulating soil moisture dynamics Soil microorganisms can regulate the dynamic balance of soil moisture through their metabolic activities, such as decomposing organic matter and synthesizing exopolysaccharides. For example, some microorganisms can increase the water holding capacity of the soil by secreting exopolysaccharides, while others can release water by decomposing organic matter. These activities help maintain the stability of soil moisture and support plant growth.

Influencing the physical properties of soil Soil moisture can also indirectly affect the living environment of microorganisms by affecting the physical properties of the soil, such as pore structure and texture. Good soil pore structure is conducive to the penetration and storage of water, and also provides a suitable living space for microorganisms. Soil texture is closely related to the stability of aggregates. Sandy soils have poor aggregate stability and weak water retention capacity; while clay soils have good aggregate stability and strong water retention capacity.

In summary, soil moisture has many effects on microorganisms, including affecting the growth and metabolism of microorganisms, changing the structure of microbial communities, affecting the stability of soil aggregates, regulating soil moisture dynamics, and affecting the physical properties of soil. Therefore, maintaining suitable soil moisture conditions is of great significance for protecting the diversity and function of soil microbial communities and improving the water retention capacity of soil.

-

@ eb0157af:77ab6c55

2025-05-28 12:01:31

@ eb0157af:77ab6c55

2025-05-28 12:01:31A fake Uber driver steals $73,000 in XRP and $50,000 in Bitcoin after drugging an American tourist.

A U.S. citizen vacationing in the United Kingdom fell victim to a scam that cost him $123,000 in cryptocurrencies stored on his smartphone. The man was drugged by an individual posing as an Uber driver.

According to My London, Jacob Irwin-Cline had spent the evening at a London nightclub, consuming several alcoholic drinks before requesting an Uber ride home. The victim admitted he hadn’t carefully verified the booking details on his device, mistakenly getting into a private taxi driven by someone who, at first glance, resembled the expected Uber driver but was using a completely different vehicle.

Once inside the car, the American tourist reported that the driver offered him a cigarette, allegedly laced with scopolamine — a rare and powerful sedative. Irwin-Cline described how the smoke made him extremely docile and fatigued, causing him to lose consciousness for around half an hour.

Upon waking, the driver ordered the victim to get out of the vehicle. As Irwin-Cline stepped out, the man suddenly accelerated, running him over and fleeing with his mobile phone, which contained the private keys and access to his cryptocurrencies. Screenshots provided to MyLondon show that $73,000 worth of XRP and $50,000 in bitcoin had been transferred to various wallets.

This incident adds to a growing trend of kidnappings, extortions, armed robberies, and ransom attempts targeting crypto executives, investors, and their families.

Just a few weeks ago, the daughter and grandson of Pierre Noizat, CEO of crypto exchange Paymium, were targeted in a kidnapping attempt in Paris. The incident took place in broad daylight when attackers tried to force the family into a parked vehicle. However, Noizat’s daughter managed to fight off the assailants.

The post American tourist drugged and robbed: $123,000 in crypto stolen in London appeared first on Atlas21.

-

@ 33baa074:3bb3a297

2025-05-28 07:27:02

@ 33baa074:3bb3a297

2025-05-28 07:27:02Distilled water has a wide range of applications in the medical field, mainly including the following aspects: Preparation of injection water Distilled water is an indispensable agent in medical institutions, used for the preparation of drugs, injection and washing of instruments, etc. In the medical process, sterile injection water is needed to flush wounds, prepare drugs, etc. The distilled water machine can ensure the purity of water and prevent microorganisms and harmful substances in the water from causing harm to patients.

Surgical wound flushing In breast cancer surgery, warm distilled water is used to flush surgical wounds. This practice helps to clean the wound, remove possible residual tumor cells, and use hypnotic effect to make tumor cells absorb water, swell, rupture, and necrotic, thereby preventing tumors from growing in the wound.

Cleaning and disinfection Distilled water has a certain disinfection and sterilization effect. It can be used to clean the skin, help eliminate bacteria on the skin surface, and is beneficial to the health of the skin. In addition, distilled water can also be used to clean and disinfect medical equipment to ensure the hygiene and safety of the medical environment.

Laboratory use In medical-related laboratories, distilled water is used to prepare experimental solutions, wash utensils and experimental instruments. These applications ensure the accuracy of experimental results while maintaining the sterile environment of the laboratory.

Moisturizing and Beauty Although not directly used in medical applications, distilled water is also used in skin care. It can be used as a basic moisturizer to help improve the symptoms of dry skin. In the field of medical beauty, distilled water is sometimes used for facial compresses to achieve calming, cooling, and swelling effects.

In summary, the application of distilled water in the medical field is multifaceted, from basic injection water preparation to complex surgical assistance to daily skin care, it has played an important role.

-

@ cae03c48:2a7d6671

2025-05-28 12:00:44

@ cae03c48:2a7d6671

2025-05-28 12:00:44Bitcoin Magazine

President Trump Supports Strategic Bitcoin Reserve Bill, Senator Lummis SaysToday at the Bitcoin 2025 Conference in Las Vegas, Nevada, US Senator Cynthia Lummis of Wyoming, Senator Marsha Blackburn of Tennessee, and Senator Jim Justice of West Virginia, took the stage to give updates on federal and state level Bitcoin adoption in the United States.

JUST IN:

Senator Cynthia Lummis said US military generals are "big supporters" of a Strategic Bitcoin Reserve for economic power. pic.twitter.com/2RPMV3tbdA

Senator Cynthia Lummis said US military generals are "big supporters" of a Strategic Bitcoin Reserve for economic power. pic.twitter.com/2RPMV3tbdA— Bitcoin Magazine (@BitcoinMagazine) May 27, 2025

Cynthia Lummis announced that President Donald Trump is supportive of her Strategic Bitcoin Reserve Act, which would see the United States purchase 1,000,000 BTC, among other pro-Bitcoin and stablecoin legislation.

“President Trump supports the bill,” she stated. “And he has a team in the White House working on digital assets — everything from stablecoins to market structure to Bitcoin Strategic Reserve. And they will probably roll out in that order.”

“States have always been the incubators of innovation,” Lummis said. “Senator Justice was the Governor of West Virginia, Senator Blackburn will be the next Governor of Tennessee. The states are where the innovation is occurring.”

“So you have Arizona, Texas and New Hampshire that passed Strategic Bitcoin Reserve bills this year,” she continued. “30 states consider Strategic Bitcoin Reserves. We have the United Arab Emirates purchasing Bitcoin through American exchange traded funds — that’s good for America.”

Senator Blackburn echoed Lummis’ statements, sharing her thoughts on how other countries will follow the United States in their adoption of Bitcoin.

“Many of our allies follow what we do,” Blackburn said. “Everybody wants to be a part of of our market, they want to be a part of our trade. And they will follow what we do. And as Senator Lummis said, we already see countries that are establishing these reserves. So it is vitally important that we hold this as a portion of our reserves.”

Justice emphasized that to be successful, “we have got to get the economics right. Many people ask me many times as Governor, ‘what’s the most important thing you do?’ And I’ll promise you this, it’s all about the economics.”

Justice then went on to explain that when the average, everyday person is using Bitcoin to purchase their necessities, that legislation will start “happening at light speed”, because politicians want to get re-elected and therefore must follow the will of the people.

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Industry Day below:

This post President Trump Supports Strategic Bitcoin Reserve Bill, Senator Lummis Says first appeared on Bitcoin Magazine and is written by Nik.

-

@ 9ca447d2:fbf5a36d

2025-05-28 07:01:16

@ 9ca447d2:fbf5a36d

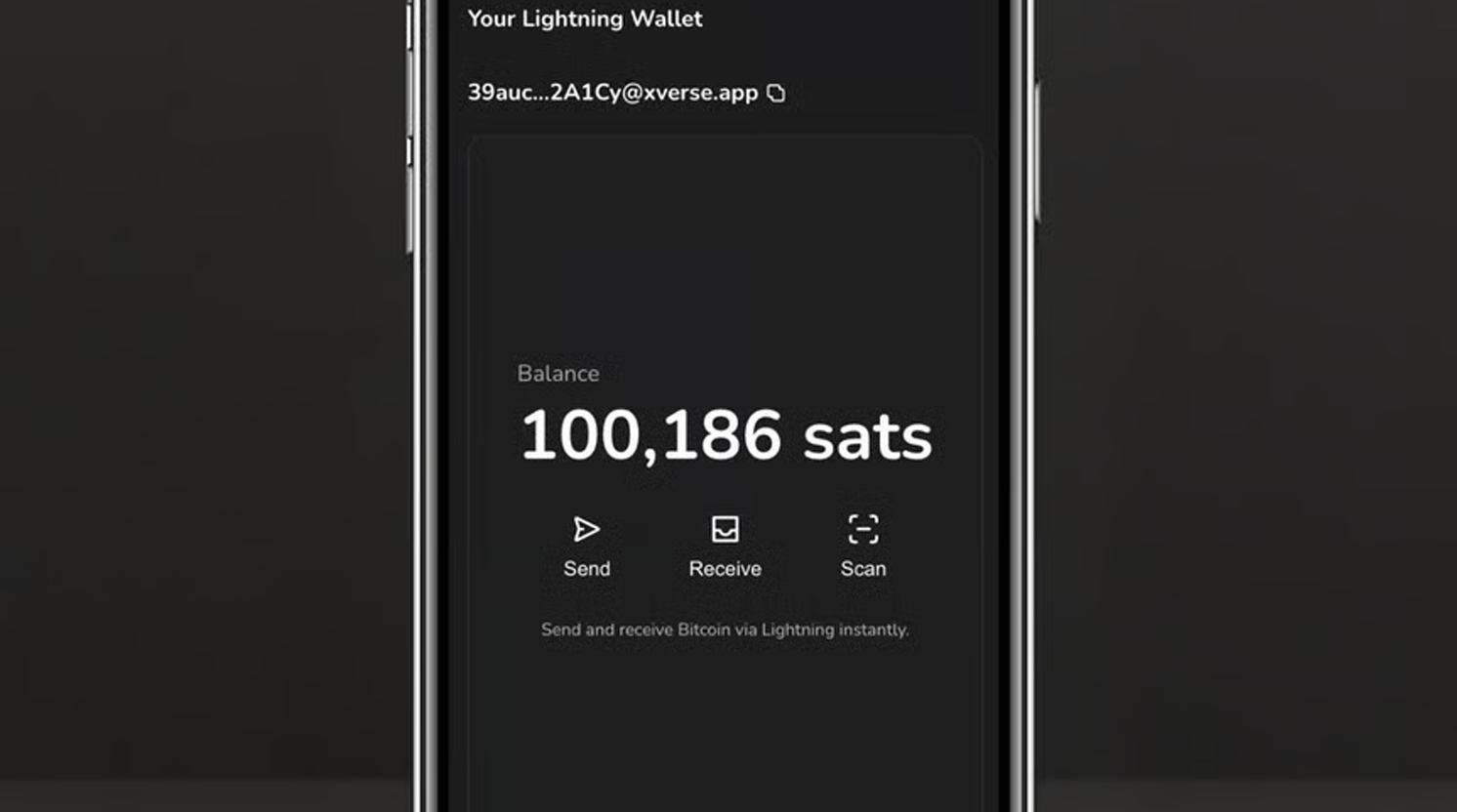

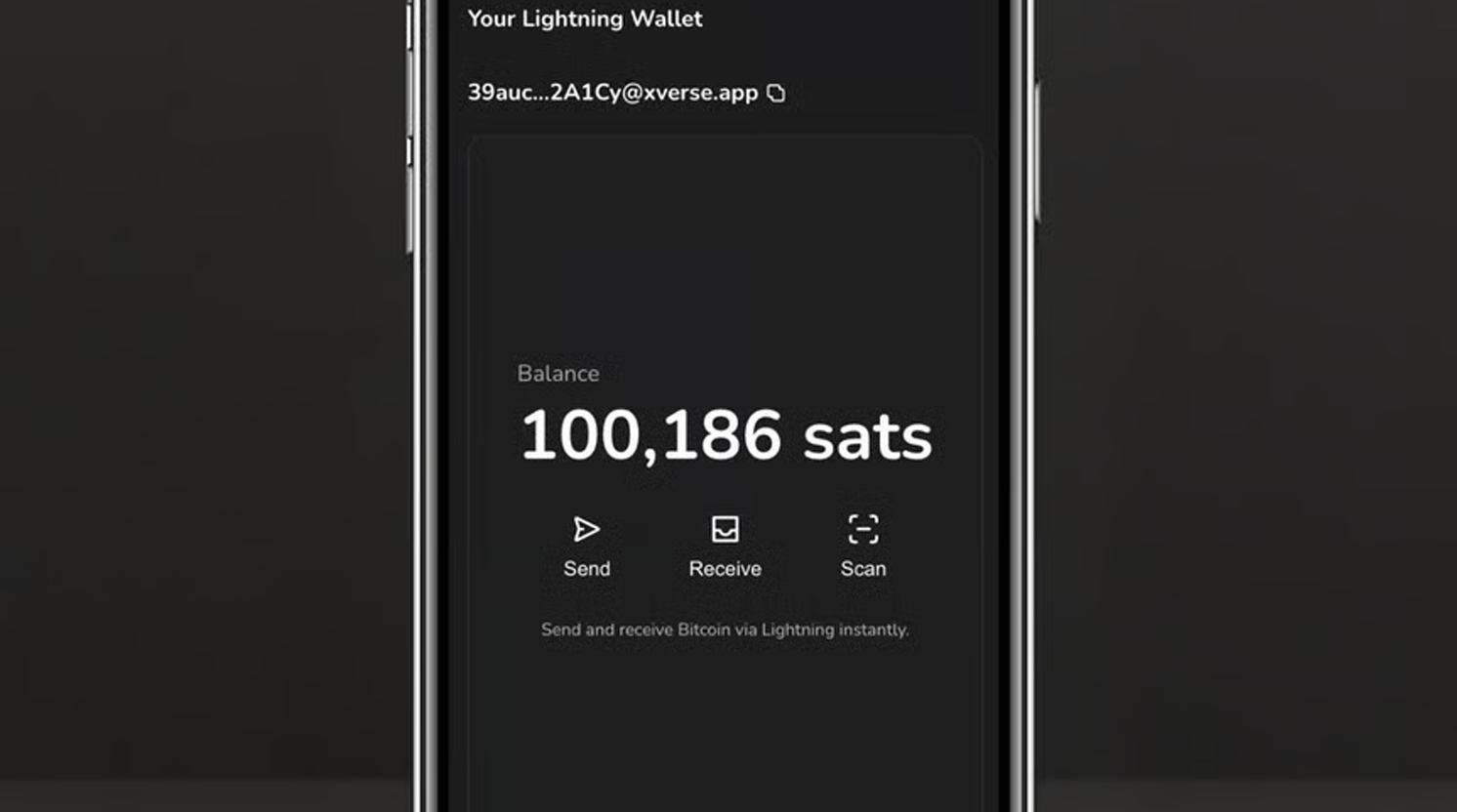

2025-05-28 07:01:16Steak ‘n Shake recently made headlines by officially accepting bitcoin payments via the Lightning Network across all its U.S. locations. The integration of Bitcoin payments at over 500 locations is a monumental moment for both the fast food industry and the broader retail sector.

This is not just something that Steak ‘n Shake is testing in a handful of locations, they are doing a full-scale rollout, fully embracing Bitcoin.

With more than 100 million customers a year, Steak ‘n Shake’s integration of Lightning—Bitcoin’s fast, low-fee payment layer—makes it easier than ever to use Bitcoin in day-to-day life. Buying a burger and a shake with sats? That’s now a real option.

The process is straightforward. Customers simply scan a Lightning QR code at the register, completing their payment in seconds, while Steak ‘n Shake receives instant USD conversion, ensuring price stability and ease of use.

So what does this mean for Bitcoin and E-commerce?

For starters, Steak ‘n Shake becomes the first of eventually many to fully embrace a digital world. As Bitcoin continues to grow, consumers will continue to realize the benefits of saving in a currency that is truly scarce and decentralized.

This is a huge step forward for Bitcoin as it shows it is not just for holding, it’s for spending, too. And by using the Lightning Network, Steak n’ Shake is helping prove that Bitcoin can scale for everyday transactions.

This now creates a seamless checkout experience, making bitcoin a viable alternative to credit cards and cash.

More importantly, it signals a significant shift in mainstream attitudes towards Bitcoin. As a well-known brand across America, this move serves as a powerful endorsement, likely to influence other chains and retailers to consider similar integrations.

Related: Spar Supermarket in Switzerland Now Accepts Bitcoin Via Lightning

What can this mean for your business?

Accepting bitcoin as payment can open the door to a new demographic of tech-savvy, financially engaged consumers who prefer digital assets.

As we know, companies that adopt Bitcoin receive a fascinating amount of love from the Bitcoin community and I would assume Steak n’ Shake will be receiving the same amount of attention.

From a business perspective, accepting bitcoin has become more than just a payment method—it’s a marketing tool. It sets your business apart and gets people talking. And in a crowded market, that kind of edge matters.

Steak ‘n Shake’s embrace of Bitcoin is likely to accelerate the adoption of digital assets in both physical retail and e-commerce.

As more businesses witness the operational and marketing benefits, industry experts anticipate a ripple effect that will increase interaction between consumers and digital currencies, further regulatory clarity, and bring continued innovation in payment technology.

Steak ‘n Shake’s nationwide Bitcoin payments rollout is more than a novelty. It’s a pivotal development for digital payments, setting a precedent for other retailers and signaling the growing integration of digital assets into everyday commerce.

-

@ eb0157af:77ab6c55

2025-05-28 06:01:29

@ eb0157af:77ab6c55

2025-05-28 06:01:29Bitcoin surpasses gold in the United States: 50 million holders and a dominant role in the global market.

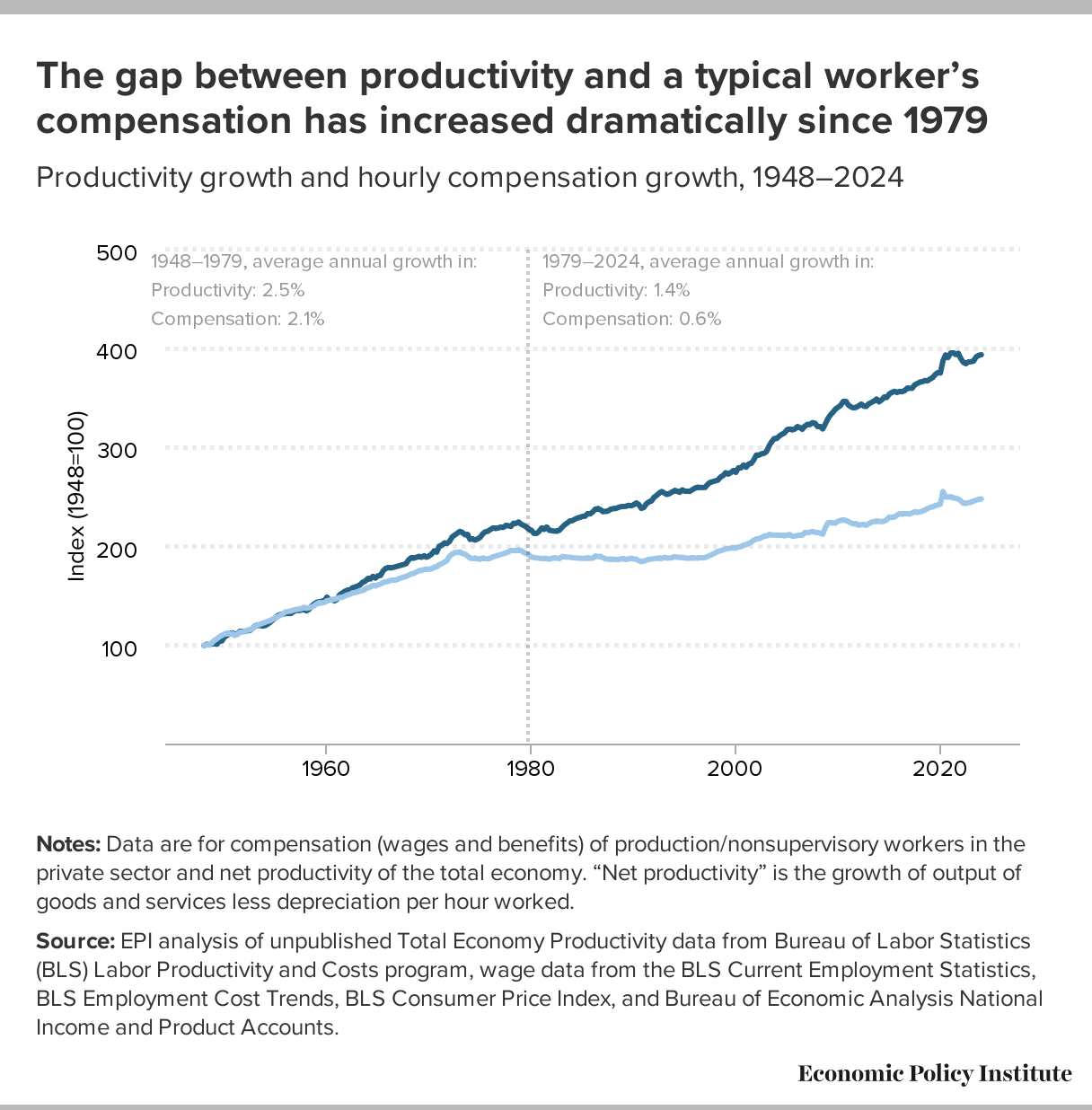

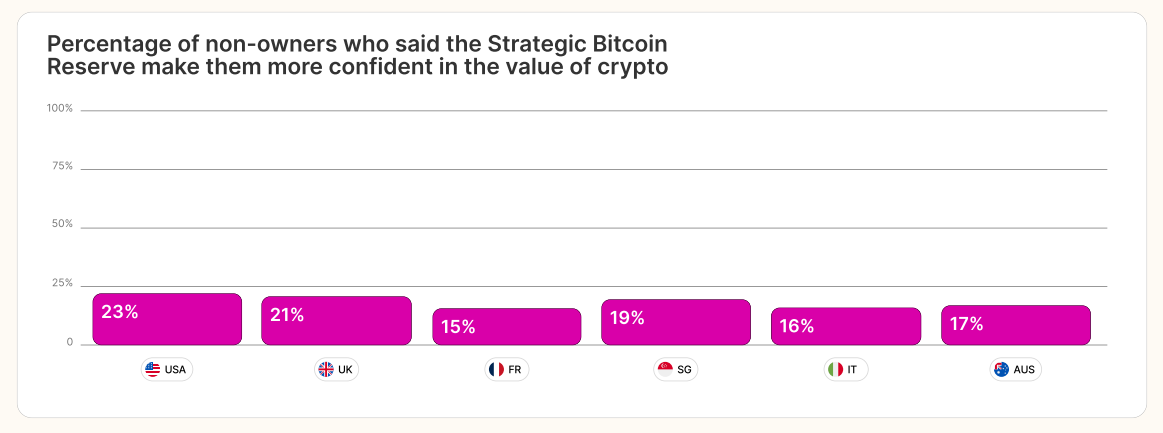

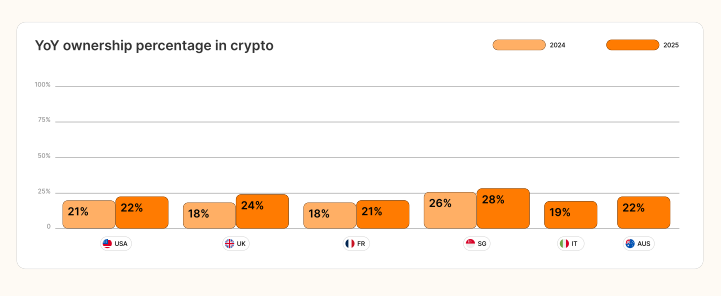

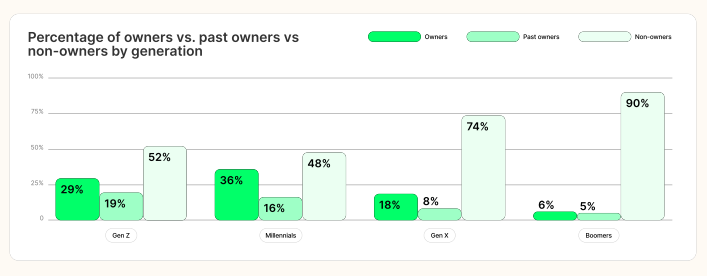

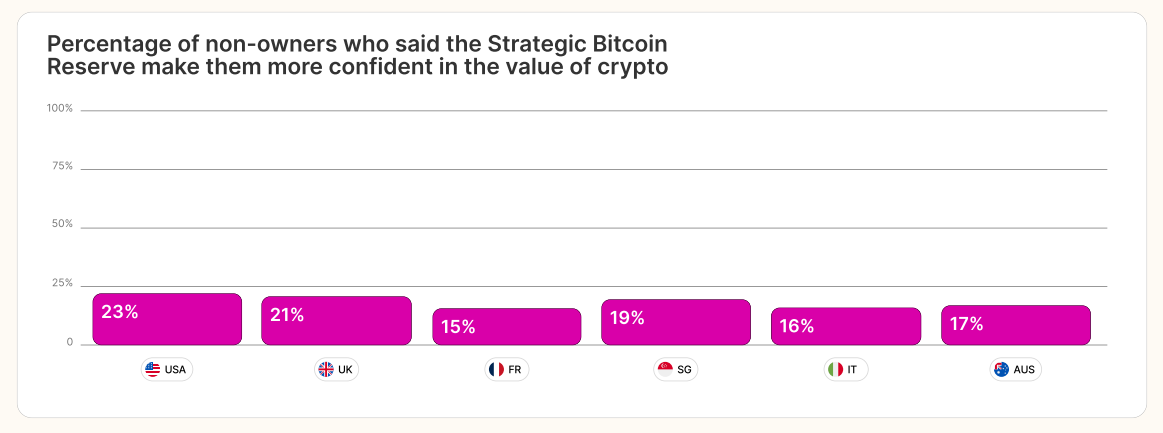

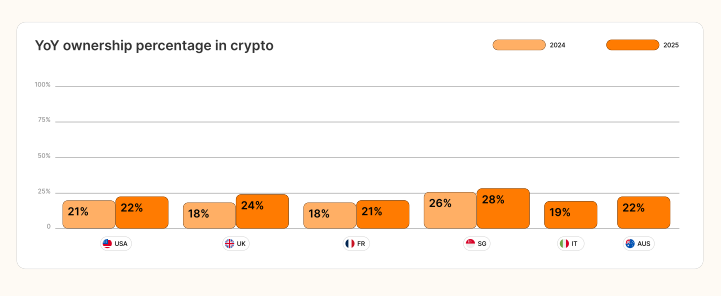

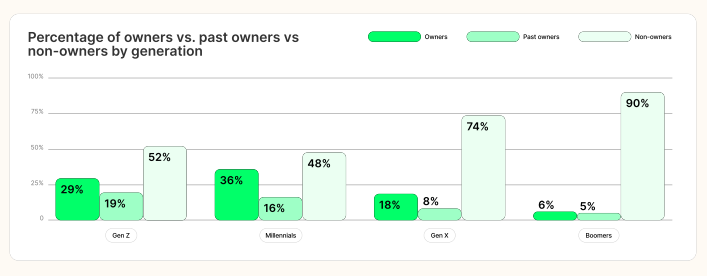

According to a new report by River, for the first time in history, the number of Americans owning bitcoin has surpassed that of gold holders. The analysis reveals that approximately 50 million U.S. citizens currently own the cryptocurrency, while gold owners number 37 million. In fact, 14.3% of Americans own bitcoin, the highest percentage of holders worldwide.

Source: River

The report highlights that 40% of all Bitcoin-focused companies are based in the United States, consolidating America’s dominant position in the sector. Additionally, 40.5% of Bitcoin holders are men aged 31 to 35, followed by 35.9% of men aged 41 to 45. In contrast, only 13.4% of holders are women.

Source: River

Notably, U.S. companies hold 94.8% of all bitcoins owned by publicly traded companies worldwide. According to the report, recent regulatory changes in the U.S. have made the asset more accessible through financial products such as spot ETFs.

The document also shows that American investors increasingly view the cryptocurrency as protection against fiscal instability and inflation, appreciating its limited supply and decentralized governance model.

For River, Bitcoin offers significant practical advantages over gold in the modern digital era. Its ease of custody, cross-border transfer, and liquidity make the cryptocurrency an attractive option for both individual and institutional investors, the report suggests.

The post USA: 50 million Americans own bitcoin appeared first on Atlas21.

-

@ cae03c48:2a7d6671

2025-05-28 06:00:48

@ cae03c48:2a7d6671

2025-05-28 06:00:48Bitcoin Magazine

President Trump Supports Strategic Bitcoin Reserve Bill, Senator Lummis SaysToday at the Bitcoin 2025 Conference in Las Vegas, Nevada, US Senator Cynthia Lummis of Wyoming, Senator Marsha Blackburn of Tennessee, and Senator Jim Justice of West Virginia, took the stage to give updates on federal and state level Bitcoin adoption in the United States.

JUST IN:

Senator Cynthia Lummis said US military generals are "big supporters" of a Strategic Bitcoin Reserve for economic power. pic.twitter.com/2RPMV3tbdA

Senator Cynthia Lummis said US military generals are "big supporters" of a Strategic Bitcoin Reserve for economic power. pic.twitter.com/2RPMV3tbdA— Bitcoin Magazine (@BitcoinMagazine) May 27, 2025

Cynthia Lummis announced that President Donald Trump is supportive of her Strategic Bitcoin Reserve Act, which would see the United States purchase 1,000,000 BTC, among other pro-Bitcoin and stablecoin legislation.

“President Trump supports the bill,” she stated. “And he has a team in the White House working on digital assets — everything from stablecoins to market structure to Bitcoin Strategic Reserve. And they will probably roll out in that order.”

“States have always been the incubators of innovation,” Lummis said. “Senator Justice was the Governor of West Virginia, Senator Blackburn will be the next Governor of Tennessee. The states are where the innovation is occurring.”

“So you have Arizona, Texas and New Hampshire that passed Strategic Bitcoin Reserve bills this year,” she continued. “30 states consider Strategic Bitcoin Reserves. We have the United Arab Emirates purchasing Bitcoin through American exchange traded funds — that’s good for America.”

Senator Blackburn echoed Lummis’ statements, sharing her thoughts on how other countries will follow the United States in their adoption of Bitcoin.

“Many of our allies follow what we do,” Blackburn said. “Everybody wants to be a part of of our market, they want to be a part of our trade. And they will follow what we do. And as Senator Lummis said, we already see countries that are establishing these reserves. So it is vitally important that we hold this as a portion of our reserves.”

Justice emphasized that to be successful, “we have got to get the economics right. Many people ask me many times as Governor, ‘what’s the most important thing you do?’ And I’ll promise you this, it’s all about the economics.”

Justice then went on to explain that when the average, everyday person is using Bitcoin to purchase their necessities, that legislation will start “happening at light speed”, because politicians want to get re-elected and therefore must follow the will of the people.

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Industry Day below:

This post President Trump Supports Strategic Bitcoin Reserve Bill, Senator Lummis Says first appeared on Bitcoin Magazine and is written by Nik.

-

@ 3770c235:16042bcc

2025-05-28 05:54:01

@ 3770c235:16042bcc

2025-05-28 05:54:01** Introduction: The Neon Pulse of Las Vegas

**It’s 2:30 AM on a Tuesday. The Strip hums with laughter, clinking glasses, and the occasional Elvis impersonator. A group of friends stumbles out of a nightclub, squinting under the glow of a Las Vegas billboard that screams, “Hungry? $5 Pancakes → 1 Block Right!” Ten minutes later, they’re drowning their late-night cravings in syrup.This isn’t luck—it’s Las Vegas billboards doing what they do best: working while the rest of the world sleeps. In a city where the party never stops, these glowing giants are the ultimate salespeople. Let’s dive into why Las Vegas billboards outshine traditional ads and how your business can ride their 24/7 energy wave.

** Why Las Vegas Billboards Never Take a Coffee Break

** 1. Tourists Don’t Have Bedtimes (and Neither Do Billboards)

- 42 million visitors flock to Vegas yearly. They’re sipping margaritas at noon, gambling at midnight, and shopping at 3 AM.

- Las Vegas billboards near hotspots like the Bellagio Fountains or Fremont Street catch eyes round the clock.Real Story:

A donut shop owner named Luis rented a billboard near the “Welcome to Vegas” sign. His message? “Jet Lagged? Sugar Fix Open 24/7!” Sales tripled—especially between 1 AM and 4 AM.** 2. You Can’t “Skip” a Billboard

** - Imagine this: You’re stuck in traffic on the Strip. Your phone’s dead. That Las Vegas billboard for air-conditioned massages? It’s your lifeline.

- Compare that to online ads: 47% of people skip them, and TikTok ads vanish in a scroll.- Vegas Thrives on Impulse

- Billboards tap into spontaneous decisions:

- “Let’s try that rooftop bar!”

- “Wait, free slot play? Let’s U-turn!”

- Traditional ads (like radio spots) fade fast. Billboards linger, nudging tourists to act now.

** 5 Reasons Your Business Needs a Vegas Billboard

** 1. Size Matters (And So Does Flash)

- Strip billboards can be taller than a 5-story building.

- Digital screens use LEDs so bright, they’re visible from space.Pro Tip:

A casino added fake “smoke” effects to their billboard for a Halloween promo. Traffic backed up for selfies—and bookings spiked.- No Language Barrier

- Vegas draws visitors from Tokyo, Berlin, São Paulo...

- A Las Vegas billboard with a giant cocktail emoji? Universal for “Drinks here!”

Case Study:

A Korean BBQ spot used a billboard of sizzling meat. No words. Just smoke visuals. Tourists followed the “aroma” straight to their door.- They’re Always in the Right Place, Right Time

- 6 AM: Joggers see smoothie ads.

- 3 PM: Pool partiers spot “Free Margarita” promos.

-

Midnight: Hangover clinics whisper, “We’ve got IVs.”

-

Instant Trust Boost

- A tiny online ad says “startup.” A glowing billboard says, “We’re Vegas royalty.”

Jake’s Win:

Jake’s tiny magic shop rented a billboard reading, “Real Tricks—Cheaper Than the Casino!” Tourists treated him like David Blaine.- QR Codes = Instant Customers

- “Scan for free parking!” → 1,000 scans in a weekend.

- “Tap to call a limo” → Rides booked before the light turns green.

** How to Make Your Vegas Billboard Irresistible

** Step 1: Claim Your Territory

- The Strip: Pricey but prime ($15k–$60k/month).

- Fremont Street: Quirky, cheaper ($5k–$20k), packed with partiers.

- Highway 15: Target road-trippers with “Almost There! Cold Beer Ahead!”Step 2: Keep It Stupid Simple

- Bad: “Experience Culinary Excellence at Our Artisanal Bistro!”

- Good: “24/7 Bacon Pancakes → Exit Here.”Maria’s Hack:

Maria’s tattoo parlor used a billboard with a flaming skull and three words: “Walk-Ins Welcome.” No phone number. “People just… show up,” she laughs.Step 3: Track Your Wins (Like a Vegas High Roller)

- QR Codes: “Scan for Free Slot Play!” → Track scans.

- Unique URLs: “Visit VegasPizza24.com” → Monitor traffic.

- Old-School: Count foot traffic. (“Did that bachelor party just roll in from our billboard? Yes.”)**FAQs ** 1. “How do I even measure if my billboard’s working? It’s not like online ads!”

Answer:

You’re right—it’s not just clicks and likes. But here’s how real businesses track success:

- QR Codes: Add a unique code like “Scan for Free Appetizer!” Track scans.

- Promo Codes: “Mention this billboard for 20% off!” (Works great for Uber drivers: “My passengers blurt it out mid-ride,” says driver Luis M.)

- Foot Traffic Spikes: Note sales surges after your ad goes live. A dispensary saw a 60% bump in visits after their “We’re Closer Than the Casino!” billboard.

- Social Media Tags: Encourage selfies with your billboard. A retro motel offered a free pool pass for tagged photos. Their Instagram exploded.- “Aren’t billboards old-school? My Gen Z customers live on TikTok!”

Answer:

Billboards in Vegas are anything but old-school. Here’s why: - Hybrid Campaigns: Pair billboards with geofenced mobile ads. Example: A billboard for a pool party says, “Scan to Pre-Order Drinks.” Users nearby get a TikTok-style ad on their phone.

- Instagrammable Designs: Quirky billboards go viral. The “Welcome to Vegas” sign is the most Instagrammed spot in the city. Mimic that vibe!

- Influencer Collabs: Pay a Vegas influencer to pose with your billboard. Their followers will hunt it down like a scavenger hunt.

Real Story:

A vintage clothing store’s billboard (“Find Your Retro Vibe → 2 Blocks East”) became a TikTok trend after a local influencer did a “thrift haul” video there.** 3. “What’s the biggest mistake businesses make with Vegas billboards?”

** Answer:

Trying to cram in too much info! Drivers have 5–7 seconds to read your ad. Avoid:

- Text Overload: “Grand Opening! 50% Off! Open 24/7! Call Now!” → Too much!

- Bland Designs: Gray text on a gray background? Yawn.

- Ignoring Locals: Tourists are 70% of viewers, but locals matter too. A gym’s billboard said, “Tired of Tourists? Work Out in Peace.” Memberships spiked.Fix It:

- Use 7 words max.

- Bold colors (red, yellow, neon pink).

- Add a clear call to action: “Turn Right Now!” or “Scan for Free Parking.”- “Do I need a permit? What if my ad gets rejected?”

Answer:

Yep, permits are a thing. The city bans: - Flashing Lights Near Residences: No strobes in suburban areas.

- Certain Content: No swear words, adult themes, or political fights.

How to Avoid Rejection:

- Work with local Outdoor Advertising companies—they know the rules.

- Submit designs early. One pizza joint’s ad was flagged for a pepperoni slice deemed “too suggestive.” They swapped it to a cheese pull… and it got approved.Conclusion: Let Your Business Shine All Night Long

At 5 AM, as the sun peeks over the desert, the Las Vegas billboards keep glowing. They’ve sold midnight pancakes, inspired shotgun weddings, and even talked someone out of a questionable tattoo (“Wait! Our Parlor’s Better → Next Exit”).These aren’t just ads—they’re part of Vegas’ heartbeat. So whether you’re slinging sushi, massages, or monster truck rides, remember: In a city that never sleeps, your billboard shouldn’t either.

Ready to Light Up the Night?

Find Las Vegas billboards near you today. And if you spot one that says, “Free High-Fives for Readers of This Article,” honk twice. It’s probably yours. -

@ 9c9d2765:16f8c2c2

2025-05-28 05:42:53

@ 9c9d2765:16f8c2c2

2025-05-28 05:42:53CHAPTER THIRTY ONE

One quiet evening, as the golden hues of sunset spilled across the office, James found himself standing by the door of Rita’s private workspace. He knocked gently.

She looked up, startled but composed. “James,” she said softly, setting her pen down.

“May I?” he asked, motioning to the chair across from her desk.

She nodded, her expression unreadable. “Of course.”

There was a brief silence, heavy but not uncomfortable. Then James leaned forward, his voice low and sincere.

“Rita… I never hated you,” he began. “Not even for a moment.”

Her eyes flickered, and she looked away, blinking fast. “You should have,” she replied. “I believed lies, I stood by while they treated you like nothing. I was” her voice cracked, “I was a coward.”

“No,” James shook his head. “You were misled. Just like I was, at one point, about the people I trusted.”

He paused, choosing his words carefully. “But everything I did building JP back from ruins, exposing the ones who tried to destroy us, it was never about revenge. It was about finding the truth, and… hoping that maybe, there was still something worth saving between us.”

Tears welled in her eyes, and for the first time in a long time, she didn’t hide them. “Do you really believe we can go back to what we had?”

James offered a small, tender smile. “No. But maybe we can build something new. Something stronger this time with no secrets, no walls.”

That night marked a shift. Rita and James didn’t rush back into love, but they started anew with honesty. Slowly, they began to reconnect over coffee breaks, shared boardroom victories, and late-night reflections.

Meanwhile, the city’s perception of James continued to evolve. He became a keynote speaker at leadership summits, not for his wealth, but for his story. His life, once the subject of cruel gossip, became a testament to resilience, clarity, and vision.

Even the youngest interns in JP Enterprises admired him, not just as a CEO, but as a symbol of what it meant to stand upright in a world eager to bring you down.

Back in the shadows, Mark and Helen's trial proceeded. Witnesses testified, evidence was overwhelming, and public opinion had fully turned against them. Their fall from grace was not swift but it was absolute.

One morning, as James read the headlines declaring Mark and Helen guilty on multiple charges, he simply folded the paper and sipped his tea. There was no celebration. No smirk of triumph.

Only peace.

“Do you still think about the past?” Rita’s voice was soft, almost swallowed by the crackling of the fireplace in the private lounge of JP Towers.

James, seated across from her with a warm mug in his hand, raised his eyes to meet hers. The flicker of flames cast shadows on the polished walls, painting a solemn reflection of everything they'd endured.

“I do,” he admitted, his tone neither bitter nor nostalgic. “Not because I want to relive it but because it reminds me how far we’ve come. How far I’ve come.”

Rita nodded slowly, her eyes glistening beneath the soft glow. “I think about it too,” she confessed. “Every time I walk past the corridors, or sit at my desk… I remember the days I watched you walk these halls like a ghost. Silenced. Humiliated. And I did nothing.”

James leaned back slightly, inhaling deeply. “You did what you thought was right then,” he said with a hint of melancholy. “We were both just trying to survive the storm.”

There was a long pause. Outside, the city pulsed with its usual life, unaware of the quiet reconciliation happening several floors above.

“But survival isn’t living,” she said at last, her voice steadier now. “And I want to live, James. I want to find joy again… with you, if you'll let me.”

Her words hung in the air like fragile glass. James was silent, studying her. This wasn’t the composed, dutiful woman who once echoed the will of her family. This was someone stripped of expectations, speaking from a place of sincerity.

“I won’t promise perfection,” James said after a beat. “But I’ll promise honesty. Loyalty. Peace. No masks. No power games. Just us healing, rebuilding, slowly.”

She exhaled in relief, the corners of her lips lifting slightly. “Then let’s take the first step.”

They stood, a little uncertain, but walked side by side to the balcony overlooking the city that once spat on him, that now bowed to his vision. Rita slipped her hand into his, and this time, James didn’t pull away.

Meanwhile…

The consequences of Mark and Helen’s conspiracy deepened. Investigative journalists began digging further into their past activities, frauds, embezzlements, manipulations. Their names were now synonymous with disgrace in the business world.

The court trials were intense. Mark, once smug and untouchable, appeared gaunt, stripped of the charisma that used to command a room. Helen, on the other hand, wore arrogance like a decaying crown still trying to act superior even when the evidence against her mounted beyond redemption.

And in every newspaper, every media report, James's name was cleared. He had not only reclaimed his honor but redefined what it meant to rise from ruin.

JP Enterprises, now entering its new era of innovation and social impact, had become more than just a corporation it had become a beacon. Business leaders from around the world sought James’s insight. Young entrepreneurs quoted him in lectures and motivational events. And amidst all this, James remained centered because his heart no longer ached with resentment.

The courtroom was saturated with an electrifying silence. The once-glorious reputations of Mark and Helen now hung like withered banners in the wind tattered by deceit, dishonor, and damning evidence. As the judge stepped into the chamber, all eyes turned, yet Mark’s once-confident gaze had diminished into a hollow stare. Helen, dressed in muted tones as if mourning her own prestige, sat rigidly beside him, still refusing to acknowledge the gravity of their downfall.

“For crimes including corporate fraud, defamation, bribery, and obstruction of justice,” the judge’s voice echoed through the courtroom, “this court finds the defendants, Mark Harrison and Helen Ray, guilty on all counts.”

-

@ 9c9d2765:16f8c2c2

2025-05-28 05:22:33

@ 9c9d2765:16f8c2c2

2025-05-28 05:22:33In a quiet village nestled between forest and field, lived a boy named Ezekiel. From birth, he was surrounded by a warm family, playful siblings, and neighbors who always had a story to share. Ezekiel never knew silence, and because of that, he never valued voices. To him, connection was like air everywhere, constant, and unnoticed.

One summer, Ezekiel decided to explore the woods beyond the hills, chasing the thrill of adventure. He wandered farther than he ever had, until the trees thickened and the path thinned into nothing. A sudden storm rolled in. Rain blurred the forest, and Ezekiel lost his way. He sought shelter in a small, abandoned stone hut beside a dried-up well.

The storm passed, but no path appeared. Days turned to weeks. His voice echoed off the stone, unanswered. The silence was no longer peaceful; it was heavy, like a weight pressing on his soul. He learned to survive on roots and rainwater. But loneliness is true, aching loneliness clung to him. He spoke to the walls, to the trees, to the echo in the well, but nothing replied.

One day, while resting against the well, Ezekiel whispered, “I miss them.”

And for the first time, he meant it.

Not just missed their presence but their interruptions, their noise, even their complaints. He missed being seen, and seeing. He understood now: connection wasn’t just comfort. It was color, depth, meaning.

Weeks later, a group of searchers found him thin, dirty, but alive. When he returned, everything was the same, but Ezekiel was not.

He listened differently. Hugged longer. Remembered people’s names, stories, and silences. He no longer saw connection as a given, but a gift.

And every year, he visited the well not to mourn the solitude, but to thank it. For in its quiet, he learned the true value of every voice he once ignored.

Moral: To cherish connection, you must understand solitude not as punishment, but as teacher.

-

@ 6e0ea5d6:0327f353

2025-05-28 04:34:08

@ 6e0ea5d6:0327f353

2025-05-28 04:34:08Ascolta bene! It is more dignified to thirst alone in the desert than to share wine with someone who has no thirst for conquest.

On the silent path to success, it’s not the declared enemies who slow the march, but rather the friends. Not the noble or loyal ones, but the failures—those who carry a dull glint in their eyes, chronic laziness in their spirit, and the eternal excuse of bad luck in their pockets. Friendship, when poorly chosen, becomes a polished anchor, tied to your ankle with ropes named camaraderie.

Nothing weighs heavier on the journey than having to endure the failed and envious around you. It is a kind of emotional parasitism that begins with empathy and ends in stagnation. Those who live among the weak will crawl. Those who keep company with miserable friends, instead of striving to prosper, learn to curse wealth—not out of ethics, but out of envy. Mediocrity, my friend, is contagious. And it does not take root suddenly, but like a silent epidemic.

Ambition—that fire that burns in the bones of great men—will always seem like arrogance to the ears of the failed. Those who have never built anything, except arguments to justify their paralysis, will never understand the fury of someone born to conquer. And so, with smiles, they spit venom: “Calm down,” they say, “be content,” they advise. Hypocrites. What they call humility is nothing more than resignation to their own defeat.

To walk alone, with hunger and honor, is worth more than feasting at lavish tables at the cost of your own sweat, surrounded by parasites who toast your downfall with glasses full of praise. No one prospers where the conversation is filled with complaints, criticism, and envy. What does not build up, corrodes.

The rust of the weak is invisible at first—a bitter joke here, a veiled critique there. And before you know it, the structure is already rotten. Of the friendship, only the weight remains. Of the relationship, only exhaustion. The true enemy of success is the company of those who have failed and wish for you the same fate. These tragic figures—always tired, always victims—are masters of collective self-sabotage.

Feel no remorse in abandoning those who build nothing and consume everything. And in that abandonment, you become freer, stronger, and unbreakable.

Thank you for reading, my friend!

If this message resonated with you, consider leaving your "🥃" as a token of appreciation.

A toast to our family!

-

@ a29cfc65:484fac9c

2025-05-28 10:30:32

@ a29cfc65:484fac9c