-

@ dfa02707:41ca50e3

2025-06-07 14:01:18

@ dfa02707:41ca50e3

2025-06-07 14:01:18Contribute to keep No Bullshit Bitcoin news going.

- This release introduces Payjoin v2 functionality to Bitcoin wallets on Cake, along with several UI/UX improvements and bug fixes.

- The Payjoin v2 protocol enables asynchronous, serverless coordination between sender and receiver, removing the need to be online simultaneously or maintain a server. This simplifies privacy-focused transactions for regular users.

"I cannot speak highly enough of how amazing it has been to work with @bitgould and Jaad from the@payjoindevkit team, they're doing incredible work. None of this would be possible without them and their tireless efforts. PDK made it so much easier to ship Payjoin v2 than it would have been otherwise, and I can't wait to see other wallets jump in and give back to PDK as they implement it like we did," said Seth For Privacy, VP at Cake Wallet.

How to started with Payjoin in Cake Wallet:

- Open the app menu sidebar and click

Privacy. - Toggle the

Use Payjoinoption. - Now on your receive screen you'll see an option to copy a Payjoin URL

- Bull Bitcoin Wallet v0.4.0 introduced Payjoin v2 support in late December 2024. However, the current implementations are not interoperable at the moment, an issue that should be addressed in the next release of the Bull Bitcoin Wallet.

- Cake Wallet was one of the first wallets to introduce Silent Payments back in May 2024. However, users may encounter sync issues while using this feature at present, which will be resolved in the next release of Cake Wallet.

What's new

- Payjoin v2 implementation.

- Wallet group improvements: Enhanced management of multiple wallets.

- Various bug fixes: improving overall stability and user experience.

- Monero (XMR) enhancements.

Learn more about using, implementing, and understanding BIP 77: Payjoin Version 2 using the

payjoincrate in Payjoin Dev Kit here. -

@ dfa02707:41ca50e3

2025-06-07 14:01:18

@ dfa02707:41ca50e3

2025-06-07 14:01:18Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ dfa02707:41ca50e3

2025-06-07 14:01:18

@ dfa02707:41ca50e3

2025-06-07 14:01:18- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ b6dcdddf:dfee5ee7

2024-09-06 17:46:11

@ b6dcdddf:dfee5ee7

2024-09-06 17:46:11Hey Frens,

This is the Geyser team, coming at you with a spicy idea: a grant for proper journalism.

Issue: Journalism is broken. Independent journalism is emerging with the work of The Rage, Whitney Webb and so forth. They deal with issues like privacy, political corruption, economics, ESG, medicine and many other issues that are not discussed by mainstream media.

The problem is that not many people know about their work and there are very few grant programs that support their work.

Proposed Solution: Geyser would like to host a Grant supporting independent journalists using 'community voting mechanism'. See here for how Community Voting Grants work.

However, we need more companies to partner up and sponsor this initiative with us. Ideas of more sponsors: - Stacker news: SN has become a great repository of independent/indie journalism. I think they'd fit in great as sponsors for this type of grant. cc: @k00b - Bitesize media: A new independent media house that wants to focus on the signal Bitcoin brings to our world. They expressed interest already. - Bitcoin Magazine: might be interested as well in this effort.

Would love the community's feedback on this idea and propose additional thoughts!

originally posted at https://stacker.news/items/674951

-

@ cb8f3c8e:c10ec329

2024-06-14 17:53:20

@ cb8f3c8e:c10ec329

2024-06-14 17:53:20WRITTEN BY: ALEX MREMA

Europe awaits for 24 of its best nations to kick off her headline football tournament on the 14th of June. This edition of the tournament promises to showcase some spectacular football filled with style, flair and a uniqueness that is only found in Europe. Surprises, thrillers and fierceness is promised throughout the Euros- not to forget the wonderful and warm German hosts who are promised to provide the vibes in and around the country.On that note, I present my second article on the best games Germany has to offer throughout the group stages!

GROUP D GAME: POLAND VS NETHERLANDS DATE: 16th June 2024 TIME: 14:00 BST

Poland look to prove themselves on the European stage again after a shocking Euro 2020 that saw them finish last in their group with one point and six goals conceded. Coach Michal Probierz will look to the strength of his young and powerful midfield featuring Brighton’s Jakub Moder and Roma’s Nicola Zalewski while the experienced head of Piotr Zielenski is expected to be the headlight to this midfield’s vision. Robert Lewandowski and Wojciech Szczeny are expected to play with an extra chip on their shoulder as this is likely to be their last international tournament for Poland. However, this Dutch side is one lethal side on their day. They can make teams suffer both offensively and defensively plus they can control the midfield appropriately if the backs are not against the walls. Plus the Netherlands put on an impressive run in the 2022 World Cup only to crash out in devastating fashion. Under Ronald Koeman, they have put on some very impressive performances but the only hiccups have come in games against that are “better” than them (in terms of player quality) where they perform poorly. With Netherlands being wishy-washy, can they do enough to beat Poland? We’ll see!

GAME: NETHERLANDS VS FRANCE DATE: 21st June 2024 TIME: 20:00 BST

France are certainly THE side to fear in this tournament. They have everything and they ooze in class with all that they have from the keepers all the way down to the manager. This French side has the potential to win every game in this tournament. Undoubtedly, the return of the engine that is N’golo Kante is vital to this French squad as they look to make their midfield a well-oiled machine with the never-expiring and youthful trio of Rabiot, Tchuoameni and Camavinga partnering working with the experienced Kante. The only problem, is how Deschamps will intergrate Kante in the French in a manner that is smooth and equally provides an immediate click. This is what the Dutch will look to pounce on. Regardless of the result of their first game against Poland, this game is what will make or break their tournament as a loss will be possibly detrimental to their progress while a win will probably make progression ever so likely. Can Koeman’s squad pounce on Les Bleus gamble?

GAME: NETHERLANDS VS AUSTRIA DATE: 25th June 2024 TIME: 17:00 BST

Austria are a side that are able to do their bits. Ralf Ragnick has enforced a hustling and fighting spirit that makes his squad work to the very end-which credits why they have qualified as one of the 24 nations certain to rock Europe this summer. They play progressive,fun,attacking football and are a side that are fearless. The experienced figures of Marko Arnautovic,Michael Gregoristch and Konrad Laimer are key to the leadership of Das Team this summer as the status on main figurehead David Alaba remains unclear as he is out with an injury. Holland’s approach to this game will be interesting. Particularly on how they will view the aerial battle between van Dijk and Gregoristch and how direct Arnautovic is towards the rest of the defence. Les Oranjes also have the capabilites to throw a tactical masterclass that can throw Ragnick and his men overboard. Let’s not forget that this is the final group game, so alll can be to play for...tactics may be thrown out the window and it might just be a full on dog fight between the two nations- what we need!

GROUP E GAME: UKRAINE VS BELGIUM DATE: 26th June 2024 TIME: 17:00

Group E is probably the weakest one in the tournament (alongside Group C).But, that does not take away from some of the talent displayed in the group. As expected to be showcased when the fiery Red Devils of Belgium face off against The Blues and Yellows of Ukraine. This will be Belgium’s first tournament without the legendary Eden Hazard in their camp, however this squad has seen the rise of some extremely talented players namely, Amadou Onana, Charles de Ketelaere and Jeremy Doku that all -coincidently- reside from the English Premier League. Head coach Domenico Tedesco has managed to fit in a blend of youth and experience as Belgium says goodbye to their “first phase” golden generation players and welcome new generation players to renovate the aging squad.On the other side of the dugout, coach Sergiy Rebrov has brought a squad that is extremely pacey,physical,daring and fearless. These aspects are best described in players such as Matviyenko,Zincheko, Mykola Shaparenko,Mudryk,Yaremchuk plus La Liga top scorer and Round of 16 hero in Euro 2020- Artem Dobvyk. This Ukraine squad can bring the heat at any point in the game, even against the run of play- they did not play their best football in Euro 2020 but somehow ended as quarter-finalists, just let it sink in when they start playing their best football...

GROUP F GAME: PORTUGAL VS CZECH REPUBLIC DATE: 18th June 2024 TIME: 20:00 BST

Portugal are a squad that is star-studded throughout and are led by the man, the myth, the

legend that is Cristiano Ronaldo who has the same drive to win as when he first landed in this

tournament 2004. He is the all-time Euros top scorer and you should expect more goals from

within the next four weeks of football. The somewhat fear-factor that strikes opponents is that

this is a Portugal squad that can snatch goals from anywhere, even when Ronaldo has a silent

game, they can get results from Goncalo Ramos, Bernado Silva, Rafael Leao, Bruno

Fernandes... and the list goes on! Truly scary what Seleção das Quinas has in store. But the

Lokomotiva has something to say and boy on their day can they make a statement, this squad’s

physicality, progressive football and never-say-die attitude is what has gotten them results

throughout their journey to the tournament. Players such as Schick,Hlozek,Soucek and Antonin

Barak are vital for the Czech Republic and when they are called upon, they deliver- just ask the

Dutch.

Portugal are a squad that is star-studded throughout and are led by the man, the myth, the

legend that is Cristiano Ronaldo who has the same drive to win as when he first landed in this

tournament 2004. He is the all-time Euros top scorer and you should expect more goals from

within the next four weeks of football. The somewhat fear-factor that strikes opponents is that

this is a Portugal squad that can snatch goals from anywhere, even when Ronaldo has a silent

game, they can get results from Goncalo Ramos, Bernado Silva, Rafael Leao, Bruno

Fernandes... and the list goes on! Truly scary what Seleção das Quinas has in store. But the

Lokomotiva has something to say and boy on their day can they make a statement, this squad’s

physicality, progressive football and never-say-die attitude is what has gotten them results

throughout their journey to the tournament. Players such as Schick,Hlozek,Soucek and Antonin

Barak are vital for the Czech Republic and when they are called upon, they deliver- just ask the

Dutch.GAME: CZECH REPUBLIC VS TURKEY DATE: 26th June 2024 TIME: 20:00 BST

Turkey have underperformed in recent tournaments- with group stage exists in Euro 2016 as well as Euro 2020. They do appear to be a better organized squad nowdays and do not settle for less when it comes to working for a positive result. The Crescent Stars are a joyful side that carry an immense amount of pride for the badge on their jerseys and wear their hearts on their sleeves for every game, this passion can be a huge motivating factor as to how far they progress through the tournament. The talent that the Czech Republic possesses however, can kill off the Turkish party. They are side that comes in to take results like the way a bully eould steal candy from a baby, they just simply play their football and move on quietly but equally deadly. Can they be the party poopers against Turkey in their final group game?

-

@ 8bad92c3:ca714aa5

2025-06-07 14:01:13

@ 8bad92c3:ca714aa5

2025-06-07 14:01:13Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ 9ca447d2:fbf5a36d

2025-06-07 14:00:47

@ 9ca447d2:fbf5a36d

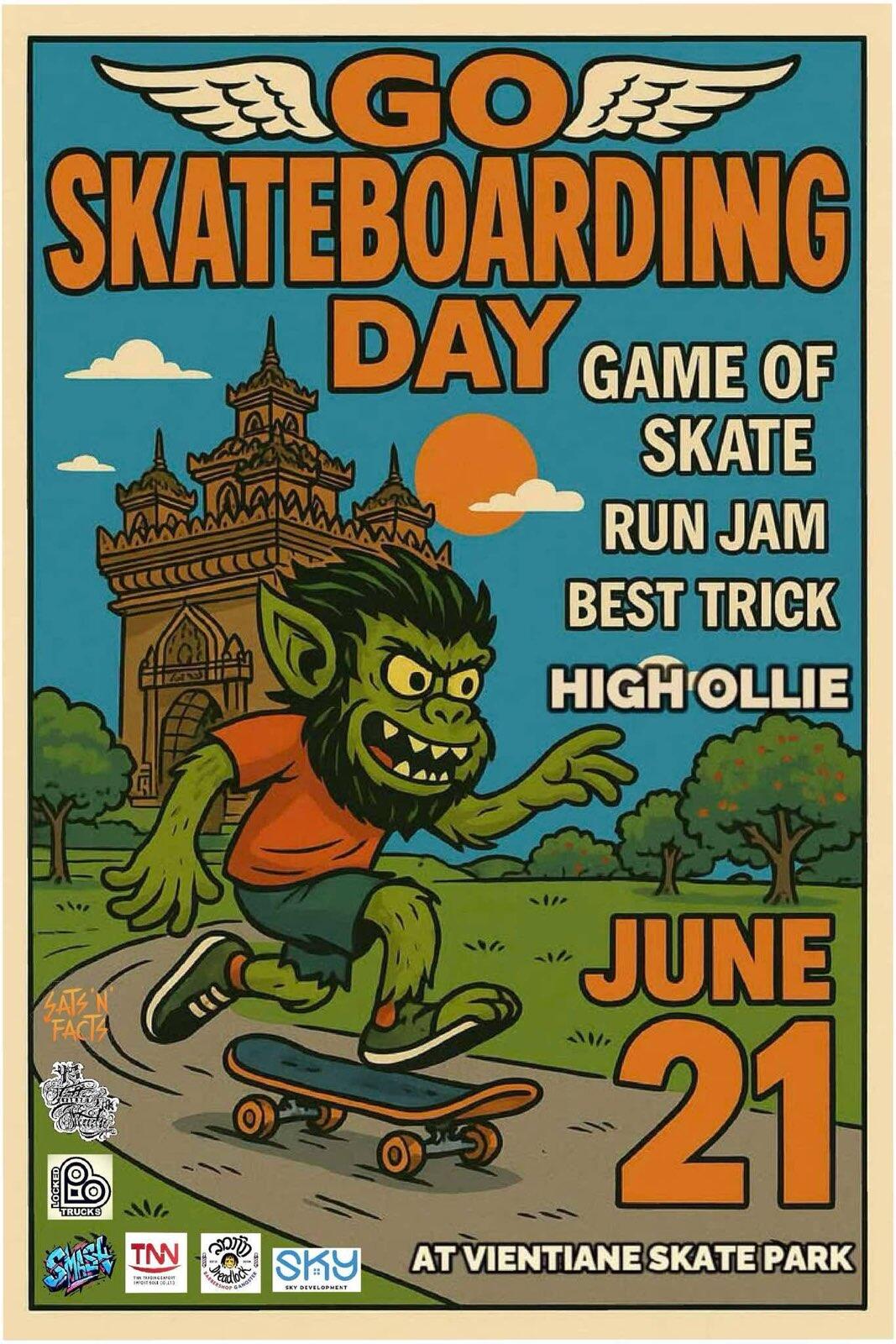

2025-06-07 14:00:47CANNES, FRANCE – May 2025 — Bitcoin mining made its mark at the world’s most prestigious film gathering this year as Puerto Rican director and producer Alana Mediavilla introduced her feature documentary Dirty Coin: The Bitcoin Mining Documentary at the Marché du Film during the Cannes Film Festival.

The film puts bitcoin mining at the center of a rising global conversation about energy, technology, and economic freedom.

Dirty Coin is the first feature-length documentary to explore bitcoin mining through immersive, on-the-ground case studies.

From rural towns in the United States to hydro-powered sites in Latin America and the Congo, the film follows miners and communities navigating what may be one of the most misunderstood technologies of our time.

The result is a human-centered look at how bitcoin mining is transforming local economies and energy infrastructure in real ways.

To mark its Cannes debut, Mediavilla and her team hosted a packed industry event that brought together leaders from both film and finance.

Dirty Coin debut ceremony at the Marché du Film

Sponsors Celestial Management, Sangha Renewables, Nordblock, and Paystand.org supported the program, which featured panels on mining, energy use, and decentralized infrastructure.

Attendees had the rare opportunity to engage directly with pioneers in the space. A special session in French led by Seb Gouspillou spotlighted mining efforts in the Congo’s Virunga region.

Dirty Coin builds on Mediavilla’s award-winning short film Stranded, which won over 20 international prizes, including Best Short Documentary at Cannes in 2024.

That success helped lay the foundation for the feature and positioned Mediavilla as one of the boldest new voices in global documentary filmmaking.

Alana Mediavilla speaks at the Marché du Film — Cannes Film Festival

“If we’ve found an industry that can unlock stranded energy and turn it into real power for people—especially in regions with energy poverty—why wouldn’t we look into it?” says Mediavilla. “Our privilege blinds us.

“The same thing we criticize could be the very thing that lifts the developing world to our standard of living. Ignoring that potential is a failure of imagination.”

Much like the decentralized network it explores, Dirty Coin is spreading globally through grassroots momentum.

Local leaders are hosting independent screenings around the world, from Roatán and Berlin to São Paulo and Madrid. Upcoming events include Toronto and Zurich, with more cities joining each month.

Mediavilla, who previously worked in creative leadership roles in the U.S. — including as a producer at Google — returned to Puerto Rico to found Campo Libre, a studio focused on high-caliber, globally relevant storytelling from the Caribbean.

She was also accepted into the Cannes Producers Network, a selective program open only to producers with box office releases in the past four years.

Mediavilla qualified after independently releasing Dirty Coin in theaters across Puerto Rico. Her participation in the network gave her direct access to meetings, insights, and connections with the most active distributors and producers working today.

The film’s next public screening will take place at the Anthem Film Festival in Palm Springs on Saturday, June 14 at 2 PM. Additional screenings and market appearances are planned throughout the year at Bitcoin events and international film platforms.

Dirty Coin at the Cannes Film Festival

Watch the Trailer + Access Press Materials

📂 EPK

🎬 Screener

🌍 Host a Screening

Follow the Movement

Instagram: https://www.instagram.com/dirty_coin_official/

Twitter: https://x.com/DirtyCoinDoc

Website: www.dirtycointhemovie.com -

@ d78dcc29:aa242350

2024-04-13 06:42:03

@ d78dcc29:aa242350

2024-04-13 06:42:03Opinion about ZBD: Bitcoin, Games, Rewards (iphone)

zbd is a centralised platfom. they have power over users wallets and can deactivate them even with balances, hence making your account pretty much useless. in the times that we are heading , this is definetely not the way. since zbd is A Play to Earn platform, such kind of activity is robbing from users who invested their time to stack sats. just to be kicked out . it's a 0 out of 10 for zbd

WalletScrutiny #nostrOpinion

-

@ ef1a1108:d2bb31da

2024-01-26 16:36:21

@ ef1a1108:d2bb31da

2024-01-26 16:36:211 000 000 satoshis

2 days before the Grand finale, we can proudly annouce we hit the first milestone - 1 million satoshis!

Huge warm thank you to all supportes of The Great Orchestra of Christmas Charity!

Join #orchestrathon on the Grand Finale day

We'd like to invite you to a special type of event we are organising on Nostr - #orchestrathon!

Rules are simple:

``` 1. This Sunday at 18.00 - 19.00 we all connect to nostr relays to join the #orchestrathon

-

For the whole hour - we zap this profile, posts or comments as crazy!

-

At 19.00 it's culmination of both #orchestrathon and Grand Finale ```

We're planning to stream some of The Great Orchestra concerts on zap.stream on that day.

Join the stream, where you can also zap!

Hopefully we can engage a bit Nostr community to support the cause with having fun and zapping during the last hour of Grand Finale

Every Nostr zap to our profile, comment or post will be counted as a contribution and displayed on our Geyser page.

Those contributions will be also rewarded with Nostr badges :)

Rewards

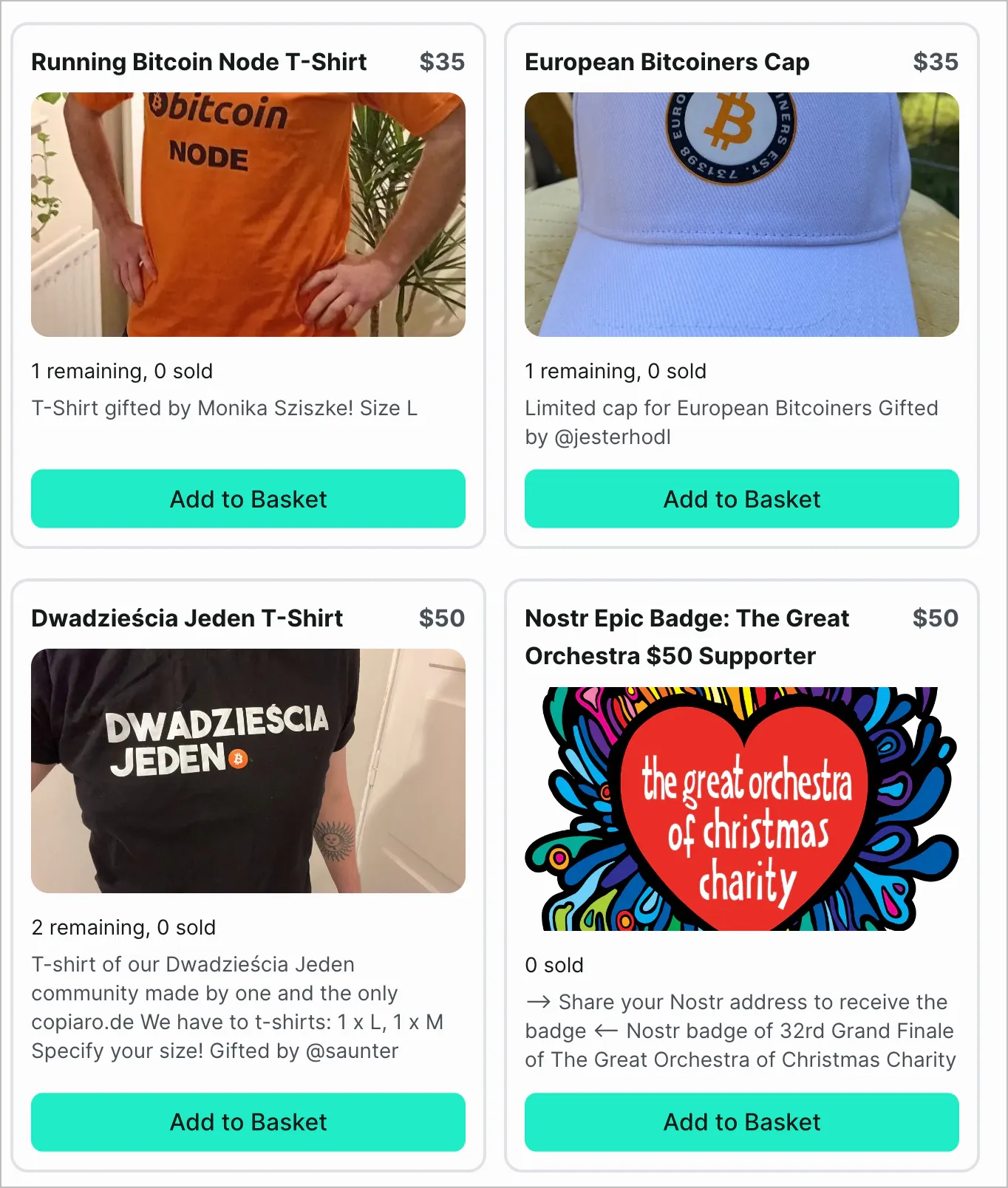

We added several rewards to the project! They look absolutely fabulous with the new Geyser update.

The rarer the badge is, the more expensive it is, but also the more real Proof of Work in computation it took to mine. Epic badge took several hours to be mined...

You can purchase beautiful and unique Nostr badges or choose a physical item, like merchandise or ticket to European Halving Party.

This is a great occasion to buy a very cool t-shirt, hat or ticket to a great event with supporting supply of state-of-the-art, saving lives medical equipment children and adults.

-

-

@ b1ddb4d7:471244e7

2025-06-07 14:00:42

@ b1ddb4d7:471244e7

2025-06-07 14:00:42When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ ef1a1108:d2bb31da

2024-01-23 15:34:05

@ ef1a1108:d2bb31da

2024-01-23 15:34:05Nostr for The Great Orchestra of Christmas Charity

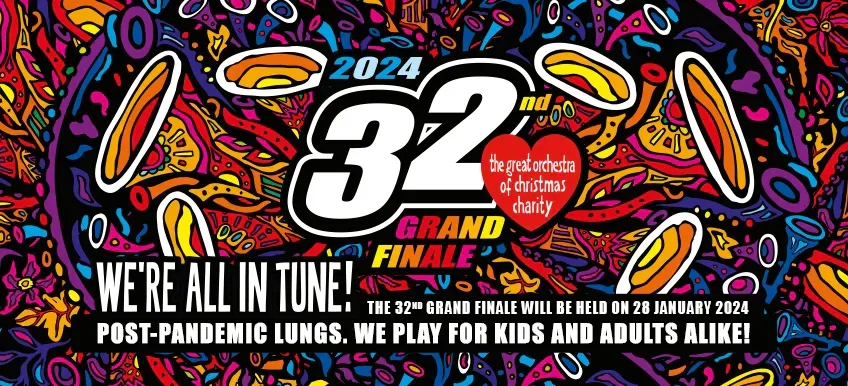

This Sunday, 28.01.2024 at 18:00 - 19:00 UTC we're inviting you to take pare in a very unique #zapathon

Nostrians taking part in this special zapathon that will play in tune with thousands of people playing together with The Great Orchestra of Christmas Charity on their 32nd Grand Finale! Hence the name #orchestrathon

The goal of #orchestrathon is to support the goal of this years Grand Finale, which is: funding equipment for diagnosing, monitoring and rehabilitating lung diseases of patients in pulmonology wards for children and adults in Poland

That means all bitcoin from zaps will be converted to PLN and donated to The Great of Christmas Charity foundation.

What's The Great Orchestra of Christmas Charity? What is the 32nd Grand Finale?! You'll find all of those answers on Geyser project story, or a few paragraphs below 👇 Now coming back to #orchestrathon...

What Is #Orchesthrathon

This Nostr account is a was generated on Geyser and is tied to Geyser project: Bitcoiners support The Great Orchestra of Christmas Charity

That means all zaps sent to this account are at the same time funding Geyser campaing.

So not only you will contribute to the goal in the project, also all the zap comments will be visable there.

Ain't that crazy? We can use this campaign as one giant #orchestrathon client!

Rules are simple:

- On Sunday at 18.00 - 19.00 we all connect to our relays to join the #orchestrathon

- For the whole hour - you can zap this profile, our posts or comments as crazy!

- At 19.00 it's culmination of both #orchestrathon and Grand Finale

All Nostrians who zap will receive special badges, depending on the zapped amount (in total):

On Sunday there will be lot's of concerts and events happening all day, culminating with Grand Finale closing at 19.00. We will try to launch a stream on zap.stream, so we can enjoy Grand Finale and concerts together!

This #orchestrathon and Geyser fundraise is organised by Dwadzieścia Jeden, a community of polish Bitcoiners. More about us and Proof of Work in the project story 👇

We're not only Bitcoiners, are also Nostrians, follow us: Dwadzieścia Jeden account: @npub1cpmvpsqtzxl4px44dp4544xwgu0ryv2lscl3qexq42dfakuza02s4fsapc Saunter: @npub1m0sxqk5uwvtjhtt4yw3j0v3k6402fd35aq8832gp8kmer78atvkq9vgcru Fmar: @npub1xpuz4qerklyck9evtg40wgrthq5rce2mumwuuygnxcg6q02lz9ms275ams JesterHodl: @npub18s59mqct7se3xkhxr3epkagvuydwtvhpsacj67shrta8eknynegqttz5c3 Tomek K: @npub14wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqvagcye Tom Chojnacki: @npub1m0sxqk5uwvtjhtt4yw3j0v3k6402fd35aq8832gp8kmer78atvkq9vgcru Gracjan Pietras: @npub1trkudtnp7jg3tmy4sz8mepmgs5wdxk9x2esgts25mgkyecrse7js6ptss5 Tomek Waszczyk @npub1ah8phwmfyl2lakr23kt95kea3yavpt4m3cvppawuwkatllnrm4eqtuwdmk

Original Geyser project story

Saving Lives and Preserving Health

Dwadzieścia Jeden a polish node in decentralised bitcoin communities network Twenty One, is proud to facilitate bitcoin fundraising for the biggest, non-governmental, non-profit, charity in Poland — The Great Orchestra of Christmas Charity.

For the past 31 years, GOCC continuously fundraises money for pediatric and elderly care in Poland. Each year, a culmination of the raise occurs during the last Sunday of January in the shape of The Grand Finale — a joyful day that when tens of thousands volunteers worldwide, especially kids and teenagers, go on the streets to gather money for the cause, giving donors hear-shaped stickers with logo of the foundation. If you're in Poland on that day, basically every person you'll meet on the street will proudly wear GOCC heart.

The same hear-shaped stickers can be seen in every hospital in Poland on thousands of high quality medical equipment bought by The Great Orchestra. There is not a single polish family that hasn't benefited in some way from this equipment, and it saved thousands of lives, especially the little ones.

32nd Grand Finale Goal

This year, 32rd Grand Finale will take place on 28th of January. The aim of the 32nd Grand Finale is post-pandemic lung diseases — the raised funds will be used to purchase equipment for children's and adults' respiratory units.

The Foundation plans to purchase:

-

equipment for diagnostic imaging, i.a. MRI and ultrasound equipment,

-

equipment for functional diagnosis, i.a. polysomnographs and portable spirometers,

-

equipment for endoscopic diagnosis, i.a. navigational bronchoscopy systems and bronchoscopes

-

equipment for rehabilitation - equipment for pulmonary rehabilitation used in the treatment of patients after lung transplantation

-

equipment for thoracic surgery, e.g. electrocoagulation systems and cryoprobes.

The Great Orchestra of Proof of Work

-

31 years of non-stop fundraising for state-of-the-art saving life equipment, running medical and educational programmes and humanitarian aid

-

2 billion PLN or ~11,781 BTC raised in total

-

Areas of help: children's cardiac surgery, oncology, geriatrics, neonatology, children's nephrology, children's and young people's mental health services, ambulances for children's hospitals, volunteer firefighters & search & rescue units

-

Last year Grand Finale raised over PLN 240 million (1,410 BTC) for a goal to fight sepsis

-

You can check how money from 2022 report (224 376 706 PLN or ~1,321.69 BTC) raise were spent here (although it's in polish)

-

In addition to work focused on Poland, GOCC fundraised money for hospitals in Ukraine and provided substantial humanitarian aid for Ukrainian refugees, Polish-Belarusian border crisis, Turkey earthquake victims and more

-

GOCC is the most-trusted Polish organization and is at the top of the list as the most trusted public entities in Poland

What We'll Do With Gathered Funds

Gathered bitcoin will be converted to PLN by a polish exchange Quark and donated to The Great Orchestra of Christmas Charity after The Grand Finale which takes place on January 28th.

Dwadzieścia Jeden Proof of Work

We're a group of polish pleb Bitcoiners that started organising ourselves about 2 years ago.

Our activities include:

-

organising regular bitcoin meetups in several cities in Poland, also Nostr meetup in Warsaw

-

organising Bitcoin FilmFest and European Halving Party in Warsaw

-

orangepilling and maintaining map of polish bitcoin merchants in Poland on btcmap.org

-

giving talks on bitcoin

-

volounteering for helping with bitcoin payments and running bitcoin workshops on non-conferences (eg. Weekend of Capitalism)

-

working in human rights centered NGOs and promoting bitcoin as a tool for protecting human rights

-

...and we're just starting!

Find Out More

Gallery

-

@ 1817b617:715fb372

2025-06-07 13:15:04

@ 1817b617:715fb372

2025-06-07 13:15:04Looking to simulate a USDT deposit that appears instantly in a wallet — with no blockchain confirmation, no real spend, and no trace?

You’re in the right place.

🔗 Buy Flash USDT Now This product sends Flash USDT directly to your TRC20, ERC20, or BEP20 wallet address — appears like a real deposit, but disappears after a set time or block depth.

✅ Perfect for: Simulating token inflows Wallet stress testing “Proof of funds” display Flash USDT is ideal for developers, trainers, UI testers, and blockchain researchers — and it’s fully customizable.

🧠 What Is Flash USDT? Flash USDT is a synthetic transaction that mimics a real Tether transfer. It shows up instantly in a wallet balance, and it’s confirmed on-chain — and expires after a set duration.

This makes it:

Visible on wallet interfaces Time-limited (auto-disappears cleanly) Undetectable on block explorers after expiry It’s the smartest, safest way to simulate high-value transactions without real crypto.

🛠️ Flash USDT Software – Your Own USDT Flasher at Your Fingertips Want to control the flash? Run your own operations? Flash unlimited wallets?

🔗 Buy Flash USDT Software

This is your all-in-one USDT flasher tool, built for TRC20, ERC20, and BEP20 chains. It gives you full control to:

Send custom USDT amounts Set custom expiry time (e.g., 30–360 days) Flash multiple wallets Choose between networks (Tron, ETH, BSC) You can simulate any amount, to any supported wallet, from your own system.

No third-party access. No blockchain fee. No trace left behind.

💥 Why Our Flash USDT & Software Stands Out Feature Flash USDT Flash USDT Software One-time flash send ✅ Yes Optional Full sender control ❌ No ✅ Yes TRC20 / ERC20 / BEP20 ✅ Yes ✅ Yes Custom duration/expiry Limited ✅ Yes Unlimited usage ❌ One-off ✅ Yes Whether you’re flashing for wallet testing, demoing investor dashboards, or simulating balance flows, our tools deliver realism without risk.

🛒 Ready to Buy Flash USDT or the Software? Skip the wait. Skip the scammers. You’re one click away from real control.

👉 Buy Flash USDT 👉 Buy Flash USDT Software

📞 Support or live walkthrough?

💬 Telegram: @cryptoflashingtool 📱 WhatsApp: +1 770-666-2531

🚫 Legal Notice These tools are intended for:

Educational purposes Demo environments Wallet and UI testing They are not for illegal use or financial deception. Any misuse is your full responsibility.

Final Call: Need to flash USDT? Want full control? Don’t wait for another “maybe” tool.

Get your Flash USDT or Flashing Software today and simulate like a pro.

🔗 Buy Now → Flash USDT 🔗 Buy Now → Flash USDT Software 💬 Telegram: @cryptoflashingtool 📱 WhatsApp: +1 770-666-2531Looking to simulate a USDT deposit that appears instantly in a wallet — with no blockchain confirmation, no real spend, and no trace?

You’re in the right place.

Buy Flash USDT Now\ This product sends Flash USDT directly to your TRC20, ERC20, or BEP20 wallet address — appears like a real deposit, but disappears after a set time or block depth.

Perfect for:

- Simulating token inflows

- Wallet stress testing

- “Proof of funds” display

Flash USDT is ideal for developers, trainers, UI testers, and blockchain researchers — and it’s fully customizable.

What Is Flash USDT?

Flash USDT is a synthetic transaction that mimics a real Tether transfer. It shows up instantly in a wallet balance, and it’s confirmed on-chain — and expires after a set duration.

This makes it:

- Visible on wallet interfaces

- Time-limited (auto-disappears cleanly)

- Undetectable on block explorers after expiry

It’s the smartest, safest way to simulate high-value transactions without real crypto.

Flash USDT Software – Your Own USDT Flasher at Your Fingertips

Want to control the flash?\ Run your own operations?\ Flash unlimited wallets?

This is your all-in-one USDT flasher tool, built for TRC20, ERC20, and BEP20 chains. It gives you full control to:

- Send custom USDT amounts

- Set custom expiry time (e.g., 30–360 days)

- Flash multiple wallets

- Choose between networks (Tron, ETH, BSC)

You can simulate any amount, to any supported wallet, from your own system.

No third-party access.\ No blockchain fee.\ No trace left behind.

Why Our Flash USDT & Software Stands Out

Feature

Flash USDT

Flash USDT Software

One-time flash send

Yes

Optional

Full sender control

No

Yes

TRC20 / ERC20 / BEP20

Yes

Yes

Custom duration/expiry

Limited

Yes

Unlimited usage

One-off

Yes

Whether you’re flashing for wallet testing, demoing investor dashboards, or simulating balance flows, our tools deliver realism without risk.

Ready to Buy Flash USDT or the Software?

Skip the wait. Skip the scammers.\ You’re one click away from real control.

Support or live walkthrough?

Telegram: @cryptoflashingtool

WhatsApp: +1 770-666-2531

Legal Notice

These tools are intended for:

- Educational purposes

- Demo environments

- Wallet and UI testing

They are not for illegal use or financial deception. Any misuse is your full responsibility.

Final Call:

Need to flash USDT? Want full control?\ Don’t wait for another “maybe” tool.

Get your Flash USDT or Flashing Software today and simulate like a pro.

Telegram: @cryptoflashingtool

WhatsApp: +1 770-666-2531

-

@ 044da344:073a8a0e

2025-06-07 07:49:53

@ 044da344:073a8a0e

2025-06-07 07:49:53Es ist merkwürdig, wie sich die Dinge manchmal fügen. Himmelfahrt bin ich mit den beiden größeren Enkeln, 2 und 4, in einen Zirkus gegangen. Wir mussten ein wenig suchen, okay, haben das Zelt aber irgendwann entdeckt am Ufer des Regen. Ich könnte schreiben: klein, aber fein, so richtig trifft es das jedoch nicht. Klein schon. Ich will hier auch nicht schimpfen, weil sich die Zirkusfamilie alle Mühe gegeben hat, einen preisgekrönten Artisten dabeihatte (Silberner Clown in Monte Carlo) und sogar reichlich Tiere in die Manege brachte. Vier Araberpferde, zwei Dromedare, einen Esel und Ziegen.

Dann aber kamen die Katzen. Richtig gelesen. Katzen dort, wo es Tiger, Löwen, Bären gegeben hat, als ich selbst noch ein Kind war. Ich meine gar nicht die großen Zelte in der DDR, Berolina, Busch oder Aeros. Diese Riesen verirrten sich nicht in einen Badeort auf Rügen. Die Wiese gleich hinter unserem Haus gehörte ab Anfang der 1980er Rüdiger Probst, alle paar Jahre wieder. Ein junger Mann, der gar nicht so viel älter war als ich, keine Angst vor großen Tieren hatte und mit einem Salto von Pferd zu Pferd sprang. In einem kleinen Zirkus wie gesagt, für ein paar Groschen und meist vor vollem Haus. Mit den Enkeln hatte ich jetzt allen Platz der Welt und hinterher ein leeres Portemonnaie. Sieben Euro allein für Popcorn (es gab nur eine Tütengröße) und fünf (freiwillig) für ein paar Möhrenstücke, damit die Kinder in der Pause was zum Füttern in der Hand hatten.

Am Abend dann das neue Buch von Matthias Krauß. „Die falschen Fragen gestellt“. Ich habe mich ein wenig gewundert, als das Paket im Kasten lag, weil der Autor vor gar nicht allzu langer Zeit einen „einseitigen Waffenstillstand“ ausgerufen hatte und Schluss machen wollte mit seinem Kampf gegen die „Aufarbeitungsindustrie“ und mit der Verteidigung der DDR. Ich zitiere einfach aus meiner Rezension von 2019:

Matthias Krauß, 1960 in Hennigsdorf geboren, weiß natürlich, was da alles im Argen lag. Er hat selbst an der Sektion Journalistik studiert und in den späten 1980ern noch ein wenig für die Parteipresse gearbeitet. „Apologetisch“, sagt er. Vor allem Innen- und Wirtschaftspolitik. Sein Aber: erstens die Kultur. Begegnungen vor allem mit dem, was in Osteuropa so an Filmen, Serien, Kunst produziert wurde. Punkt zwei: „der einfache Mensch“. „Ungleich häufiger“ im Bild als heute. Und drittens „gab es eine prinzipielle und grundsätzliche Kritik“ am Westen und am Kapitalismus.

Der Zirkus am Ufer des Regen. Ein totes Pferd soll man nicht reiten. Deshalb tauche ich ein in ein Buch, das etwas schafft, was selbst ich nicht für möglich gehalten habe. Matthias Krauß singt ein Loblied auf den DDR-Journalismus, ohne dass es peinlich wird. Er bleibt dabei ganz bei sich – bei der Mappe mit Zeitungsausschnitten, die er als Schüler angelegt hat, bei den Aktbildern im Magazin, das sein Vater abonniert hatte und das dem Sohn auch jenseits der Erotik ganze Welten öffnete, bei einem Porträt, das ihm die Lokalzeitung 1977 widmete.

Das Schöne ist: Matthias Krauß hat das alles aufgehoben und darf jetzt als reifer Mann zurückschauen – als Journalist, der später auch die andere Seite erlebt hat, folglich vergleichen kann und vor allem niemandem mehr nach dem Mund reden muss. Die „Qualität der Bilder“, okay. Eher „Kartoffeldruck“ als Zeitung. Die immer gleichen alten Männer, klar. Die Grenzen, die jedes Parteiorgan hat und die auch ein junger Mann wie Krauß schon zu spüren bekam. Aber eben auch Texte, die nah dran waren am Leben (vor allem an der Arbeit) und ihre Leser ernst nahmen. Matthias Krauß ist nach dem Studium 1986 Redakteur der Jugendseite des Potsdamer SED-Blatts geworden und ruft den Journalismusforschern heute zu: Vergleicht doch einfach die Bravo mit dem Neuen Leben, einer Zeitschrift, die damals sein Leitstern war und immer ausverkauft. These von Matthias Krauß: Das Neue Leben

war vielseitiger, anspruchsvoller und in jeder Hinsicht höherwertiger als die Bravo-Post, mit dem endlos einfältigen Star-Rummel, den auf Kauf und Konsum orientierten Modetipps, dem Klatsch und Abklatsch und den klischeehaften Rollenbildern – Ausdruck des insgesamt unpolitischen Grundanspruchs. Nun gut, aus exakt diesem Grund wird dieser Vergleich wohl niemals stattfinden. (S. 103)

Matthias Krauß hat ein kaum zu schlagendes Argument auf seiner Seite: Er, der SED-Propagandist, hatte nach 1990 schnell wieder das Vertrauen des Publikums, das er „bei Lichte besehen“ vielleicht gar nicht verdiente, aber allein wegen seiner Herkunft bekam (S. 116). Und: Er kann sogar jemanden zitieren, der die Ernte-Berichterstattung vermisst, Hassobjekt von Lesern wie von Journalisten – einen Landwirt aus dem Westen, der dort sehen konnte, wie weit die Kollegen waren, was sie wie machten und wie sie auf das Wetter reagierten (S. 166).

Ich gebe zu: Ich habe eine Schwäche für autobiografische Texte. Solche Bücher erlauben mir, all das mit Leben zu füllen, was in den Akten bald zu Staub zerfällt. Ich habe ein Fußballregal (gleich zweimal Lothar Matthäus!), eine DDR-Abteilung, Erinnerungen von Wissenschaftlern und natürlich Journalisten. Da längst nicht jeder schreibt, der etwas zu sagen hat, helfe ich immer wieder nach und sammle als Interviewer Lebensgeschichten ein. Matthias Krauß dürfte einer der ersten ostdeutschen Medienmenschen aus der Geburtskohorte um 1960 sein, der sich öffentlich äußert und dabei nicht einfach das nachbetet, was ohnehin schon überall steht.

Das gilt auch jenseits des Themas Journalismus. Der Wehrdienst, für mich bis heute ein Albtraum, wird von Matthias Krauß als „Entscheidung für eine Art persönlicher Freiheit“ interpretiert (S. 43). Mit 18 unabhängig sein von den Eltern und dann auch ohne Geldsorgen studieren können. Leipzig war für ihn in den 1980ern nicht nur Uni-Standort, sondern auch „Messestadt“ und damit „Weltstadt“ (S. 50). Und der Aufregung um jede DDR-Exmatrikulation, die er keineswegs schönredet, werden „die Millionen Opfer der Demokratisierung“ gegenübergestellt und das laute gesamtdeutsche Schweigen nicht nur in diesem Punkt (S. 58).

Was das alles mit dem Zirkus zu tun hat? Matthias Krauß hat in der DDR das Motto für sein Leben als Journalist gefunden – bei der Arbeit mit einem Parteisoldaten, der einfach nicht rauswollte aus dem Korsett, das die Genossen über sein Leben geworfen hatten.

Ja, sagte ich mir, stelle immer die falschen Fragen. (S. 153)

In Sachen Zirkus liegen alle Antworten auf dem Tisch. Meine Trauer habe ich schon vor mehr als zehn Jahren verarbeitet. Mal schauen, was die Enkel eines Tages dazu sagen.

Matthias Krauß: Die falschen Fragen gestellt. Journalist in zwei deutschen Staaten. Berlin: Das Neue Berlin 2025, 189 Seiten, 18 Euro.

-

@ b1ddb4d7:471244e7

2025-06-07 14:00:36

@ b1ddb4d7:471244e7

2025-06-07 14:00:36“Not your keys, not your coins” isn’t a slogan—it’s a survival mantra in the age of digital sovereignty.

The seismic collapses of Mt. Gox (2014) and FTX (2022) weren’t anomalies; they were wake-up calls. When $8.7 billion in customer funds vanished with FTX, it exposed the fatal flaw of third-party custody: your bitcoin is only as secure as your custodian’s weakest link.

Yet today, As of early 2025, analysts estimate that between 2.3 million and 3.7 million Bitcoins are permanently lost, representing approximately 11–18% of bitcoin’s fixed maximum supply of 21 million coins, with some reports suggesting losses as high as 4 million BTC. This paradox reveals a critical truth: self-custody isn’t just preferable—it’s essential—but it must be done right.

The Custody Spectrum

Custodial Wallets (The Illusion of Control)

- Rehypothecation Risk: Most platforms lend your bitcoin for yield generation. When Celsius collapsed, users discovered their “held” bitcoin was loaned out in risky strategies.

- Account Freezes: Regulatory actions can lock withdrawals overnight. In 2023, Binance suspended dollar withdrawals for U.S. users citing “partner bank issues,” trapping funds for weeks.

- Data Vulnerability: KYC requirements create honeypots for hackers. The 2024 Ledger breach exposed 270,000 users’ personal data despite hardware security.

True Self-Custody

Self-custody means exclusively controlling your private keys—the cryptographic strings that prove bitcoin ownership. Unlike banks or exchanges, self-custody eliminates:- Counterparty risk (no FTX-style implosions)

- Censorship (no blocked transactions)

- Inflationary theft (no fractional reserve lending)

Conquering the Three Great Fears of Self-Custody

Fear 1: “I’ll Lose Everything If I Make a Mistake”

Reality: Human error is manageable with robust systems:

- Test Transactions: Always send a micro-amount (0.00001 BTC) before large transfers. Verify receipt AND ability to send back.

- Multi-Backup Protocol: Store seed phrases on fireproof/waterproof steel plates (not paper!). Distribute copies geographically—one in a home safe, another with trusted family 100+ miles away.

- SLIP39 Sharding: Split your seed into fragments requiring 3-of-5 shards to reconstruct. No single point of failure.

Fear 2: “Hackers Will Steal My Keys”

Reality: Offline storage defeats remote attacks:

- Hardware Wallets: Devices like Bitkey or Ledger keep keys in “cold storage”—isolated from internet-connected devices. Transactions require physical confirmation.

- Multisig Vaults: Bitvault’s multi-sig system requires attackers compromise multiple locations/devices simultaneously. Even losing two keys won’t forfeit funds.

- Air-Gapped Verification: Use dedicated offline devices for wallet setup. Never type seeds on internet-connected machines.

Fear 3: “My Family Can’t Access It If I Die”

Reality: Inheritance is solvable:

- Dead Man Switches: Bitwarden’s emergency access allows trusted contacts to retrieve encrypted keys after a pre-set waiting period (e.g., 30 days).

- Inheritance Protocols: Bitkey’s inheritance solution shares decryption keys via designated beneficiaries’ emails. Requires multiple approvals to prevent abuse.

- Public Key Registries: Share wallet XPUBs (not private keys!) with heirs. They can monitor balances but not spend, ensuring transparency without risk.

The Freedom Dividend

- Censorship Resistance: Send $10M BTC to a Wikileaks wallet without Visa/Mastercard blocking it.

- Privacy Preservation: Avoid KYC surveillance—non-custodial wallets like Flash require zero ID verification.

- Protocol Access: Participate in bitcoin-native innovations (Lightning Network, DLCs) only possible with self-custodied keys.

- Black Swan Immunity: When Cyprus-style bank bailins happen, your bitcoin remains untouched in your vault.

The Sovereign’s Checklist

- Withdraw from Exchanges: Move all BTC > $1,000 to self-custody immediately.

- Buy Hardware Wallet: Purchase DIRECTLY from manufacturer (no Amazon!) to avoid supply-chain tampering.

- Generate Seed OFFLINE: Use air-gapped device, write phrase on steel—never digitally.

- Test Recovery: Delete wallet, restore from seed before funding.

- Implement Multisig: For > $75k, use Bitvault for 2-of-3 multi-sig setup.

- Create Inheritance Plan: Share XPUBs/SLIP39 shards with heirs + legal documents.

“Self-custody isn’t about avoiding risk—it’s about transferring risk from opaque institutions to transparent, controllable systems you design.”

The Inevitable Evolution: Custody Without Compromise

Emerging solutions are erasing old tradeoffs:

- MPC Wallets: Services like Xapo Bank shatter keys into encrypted fragments distributed globally. No single device holds full keys, defeating physical theft.

- Social Recovery: Ethically designed networks (e.g., Bitkey) let trusted contacts restore access without custodial control.

- Biometric Assurance: Fingerprint reset protocols prevent lockouts from physical injuries.

Lost keys = lost bitcoin. But consider the alternative: entrusting your life savings to entities with proven 8% annual failure rates among exchanges. Self-custody shifts responsibility from hoping institutions won’t fail to knowing your system can’t fail without your consent.

Take action today: Move one coin. Test one recovery. Share one xpub. The path to unchained wealth begins with a single satoshi under your control.

-

@ cb8f3c8e:c10ec329

2024-01-13 09:25:01

@ cb8f3c8e:c10ec329

2024-01-13 09:25:01Written by ALEX MREMA @npub1w4zrulscqraej2570gkazt0e7j0q3xq4437hnxjqfvcs59hq86fs9vnn4x

From the 13th of January 2024 the football world’s eyes will all converge on the Ivory Coast as 24 of Africa’s best football nations look to take each other on for the title of Africa’s best come 11th February. Though there is only going to be one winner, that doesn’t mean we aren’t promised exceptional football, shocks and players showcasing their razzle dazzle throughout the next 29 days. This article will focus on the players from each of the 24 competing nations who don’t get the spotlight they deserve but are certain to cause trouble.

IVORY COAST Name: Simon Adingra Age: 21 Club: Brighton and Hove Albion(England) Position: Winger The bright orange Ivorian jerseys are not the only thing that will catch your eye from this squad as the youthful, electrifying and pacey Brighton winger Simon Adingra is certainly bound to catch the interest of some during the tournament. His eye for goal and his turbo speed is bound to give trouble to any defender.

EQUATORIAL GUINEA Name: Saúl Coco Age: 24 Club: UD Las Palmas(Spain) Position: Center-Back Equatorial Guinea are not newcomers to the competition and are not going to be a pushover in a group that contains hosts Ivory Coast and the star-studded Nigeria. A player one must recognize from the Central African country is none other than Saul Coco. 6-foot-2 and a menace at the back, he will catch the eye of many particularly in his match up with the towering Bissau-Guinean players and of course Nigeria’s Victor Osimhen.

GUINEA-BISSAU Name: Fali Candé Age: 24 Club: FC Metz(France) Position: Centre-Back Like Equatorial Guinea, Guinea- Bissau come to the tournament with a familiar idea of what is expected. This is a nation known for putting up a challenge no matter what and are able to even pull a shock or two. If they are going to attract any wins in the tournament they will need a solid defense in their attack-heavy group, luckily for Guinea Bissau, they have Fali Cande who is one of the rocks at the back that Africa should have an eye on as he is aggressive and committed to keeping a clean sheet.

NIGERIA Name: Moses Simon Age: 28 Club: FC Nantes(France) Position: Winger Nigeria come in as one of the favourites to win it all and with a squad that has the African player of the year (Victor Osimhen) it’s hard to disagree that they are capable of delivering the cup back to Nigeria for the first time since 2013. A player that is sure to electrify the tournament is FC Nantes winger Moses Simon who shone in the last edition but had his time cut short after the Super Eagles shock defeat to Tunisia in the Round of 16. Now with their other attacking star (Victor Boniface) officially out of the tournament, will the Simon-Osimhen-Boniface attacking duo bear fruit for Nigeria?

CAPE VERDE Name: Jamiro Monteiro Age: 30 Club: San Jose Earthquakes(USA) Position: Center Midfield A man of experience and flair, Jamiro Monteiro is going to be a man lighting up the highlight reels throughout his time in the Ivory Coast. With a flair like Alex de Souza and an awareness equal to that of David Silva, Monteiro instantly sets himself as a man to watch in Cape Verde’s conquest to spice up the tournament.

EGYPT

Name: Ahmed Fatouh

Age: 25

Club: Zamalek(Egypt)

Position: Left Back

Fatouh has been described as the “Egyptian Marcelo” for his ability to excel in the attacking third of the pitch despite being a left back. His skill and drive towards making an impact upfront shall not blindside viewers that he can also do it defensively. This man is pivotal for the Egyptians in their quest for glory.

EGYPT

Name: Ahmed Fatouh

Age: 25

Club: Zamalek(Egypt)

Position: Left Back

Fatouh has been described as the “Egyptian Marcelo” for his ability to excel in the attacking third of the pitch despite being a left back. His skill and drive towards making an impact upfront shall not blindside viewers that he can also do it defensively. This man is pivotal for the Egyptians in their quest for glory.

GHANA Name: Salis Abdul Samed Age: 23 Club: RC Lens(France) Position: Central Defensive Midfielder Entering AFCON 2023, the Black Stars of Ghana are a nation booming with talent mixed with just the right amount of experience. Looking to put away the demons of their last AFCON appearance and deliver their first trophy since 1980, Ghana are likely to turn to their midfield to take them all the way. Yes, Mohammed Kudus is in that midfield but a player that goes unnoticed in that midfield is Salis Abdul Samed. He is magnificent at stealing the ball from opponents in a clean manner, further, he is able to put Ghana in promising positions when he moves the ball up. He truly is the new generation player that Ghana needed to make their midfield a threat to opponents.

MOZAMBIQUE Name: Geny Catamo Age: 22 Club: Sporting CP (Portugal) Position: Winger The scouts should keep an eye out for this young talent. He manages to wriggle through spaces with his dribbling and also leave defenders in the dust when going one on one with them. Catamo carries forward the game easily and with purpose and a lucid hunger. Head coach Chiquinho Conde should put his trust in this young man to make Mozambique a threat in the tournament.

CAMEROON

Name: François-Régis Mughe

Age: 19

Club: Olympique de Marseille(France)

Position: Winger

The youngest player on this list is a special prospect. His strength and pace is bound to make any defender have a difficult time when going up against him. He can create something out of nothing when given playing time, Cameroon coach Rigobert Song should make him have a taste of the competition and he will be wowed by the talent he has in his hands.

CAMEROON

Name: François-Régis Mughe

Age: 19

Club: Olympique de Marseille(France)

Position: Winger

The youngest player on this list is a special prospect. His strength and pace is bound to make any defender have a difficult time when going up against him. He can create something out of nothing when given playing time, Cameroon coach Rigobert Song should make him have a taste of the competition and he will be wowed by the talent he has in his hands.

THE GAMBIA

Name: Ablie Jallow

Age: 25

Club: FC Metz(France)

Position: Winger

Classy, calm and collected. These are the three words that can best be used to describe Gambia’s top scorer during qualifiers. He carries an aura that is simply impossible to ignore and he comes at defenders like a high speed train. He will look to be the main influence in The Gambia’s drive towards making another quarter final run like in the last edition of the tournament. Oh, don’t give him time and space to shoot because he will punish the keeper.

THE GAMBIA

Name: Ablie Jallow

Age: 25

Club: FC Metz(France)