-

@ fd06f542:8d6d54cd

2025-03-31 02:07:43

## 什么是nostrbook?

-----

nostrbook 是基于nostr 社区技术存储在 nostr relay server上的长文(30023)文章。

查看浏览,采用的是 [docsify](https://docsify.js.org/#/) 技术。

整个网站技术不会占用部署服务器太多的存储空间,可以实现轻量级部署。

任何人可以部署服务器,或者本地部署 查看本站所有的书籍。

## nostrbook 可以服务哪些人?

-----

* 开发者,如果你想二次开发,看[第一章、开发者指南](/01.md)

* 写书作者,看[第二章、使用教程](/02.md)

* 读者 你就直接点开看。

## nostrbook未来如何发展?

-----

* 可能会增加 blog功能,有些时候你就想随心写点日志,那么用blog功能也可以。

* 点赞互动、留言功能。

-

@ fd06f542:8d6d54cd

2025-03-31 01:55:18

## 什么是nostrbook?

-----

nostrbook 是基于nostr 社区技术存储在 nostr relay server上的长文(30023)文章。

查看浏览,采用的是 [docsify](https://docsify.js.org/#/) 技术。整个网站技术无须部署服务器占用太多的存储空间。

可以实现轻量级部署。

-

@ a012dc82:6458a70d

2025-03-31 01:50:24

In the ever-evolving world of cryptocurrency, Bitcoin remains at the forefront of discussions, not just for its price movements but also for its foundational mechanisms that ensure its scarcity and value. One such mechanism, the Bitcoin halving, is drawing near once again, but this time, it's arriving sooner than many had anticipated. Originally projected for a meme-friendly date of April 20, the next Bitcoin halving is now set for April 15, marking a significant moment for the cryptocurrency community and investors alike.

**Table of Contents**

- Understanding the Bitcoin Halving

- Factors Accelerating the Halving Date

- Implications of an Earlier Halving

- Potential Price Impact

- Miner Revenue and Network Security

- Renewed Interest and Speculation

- The Countdown to April 15

- Conclusion

- FAQs

**Understanding the Bitcoin Halving**

The Bitcoin halving is a scheduled event that occurs approximately every four years, reducing the reward for mining new blocks by half. This process is a critical part of Bitcoin's design, aiming to control the supply of new bitcoins entering the market and mimicking the scarcity of precious metals. By decreasing the reward for miners, the halving event reduces the rate at which new bitcoins are created, thus influencing the cryptocurrency's price and inflation rate.

**Factors Accelerating the Halving Date**

The shift in the halving date to April 15 from the previously speculated April 20 is attributed to several factors that have increased the pace of transactions on the Bitcoin network:

- **Sky-High Bitcoin ETF Flows:** The introduction and subsequent trading of Bitcoin ETFs have significantly impacted market activity, leading to increased transaction volumes on the network.

- **Price Rallies:** A series of price rallies, culminating in new all-time highs for Bitcoin, have spurred heightened network activity as traders and investors react to market movements.

- **Increased Daily Volume:** The average daily trading volume of Bitcoin has seen a notable uptick since mid-February, further accelerating the pace at which blocks are processed and, consequently, moving up the halving dat

**Implications of an Earlier Halving**

The earlier-than-expected halving date carries several implications for the Bitcoin market and the broader cryptocurrency ecosystem:

**Potential Price Impact**

Historically, Bitcoin halving events have been associated with significant price movements, both in anticipation of and following the event. By reducing the supply of new bitcoins, the halving can create upward pressure on the price, especially if demand remains strong. However, the exact impact can vary based on broader market conditions and investor sentiment.

**Miner Revenue and Network Security**

The halving will also affect miners' revenue, as their rewards for processing transactions are halved. This reduction could influence the profitability of mining operations and, by extension, the security of the Bitcoin network. However, adjustments in mining difficulty and the price of Bitcoin typically help mitigate these effects over time.

**Renewed Interest and Speculation**

The halving event often brings renewed interest and speculation to the Bitcoin market, attracting both seasoned investors and newcomers. This increased attention can lead to higher trading volumes and volatility in the short term, as market participants position themselves in anticipation of potential price movements.

**The Countdown to April 15**

As the countdown to the next Bitcoin halving begins, the cryptocurrency community is abuzz with speculation, analysis, and preparations. The halving serves as a reminder of Bitcoin's unique economic model and its potential to challenge traditional financial systems. Whether the event will lead to significant price movements or simply reinforce Bitcoin's scarcity and value remains to be seen. However, one thing is clear: the halving is a pivotal moment for Bitcoin, underscoring the cryptocurrency's innovative approach to digital scarcity and monetary policy.

**Conclusion**

Bitcoin's next halving is closer than expected, bringing with it a mix of anticipation, speculation, and potential market movements. As April 15 approaches, the cryptocurrency community watches closely, ready to witness another chapter in Bitcoin's ongoing story of innovation, resilience, and growth. The halving not only highlights Bitcoin's unique mechanisms for ensuring scarcity but also serves as a testament to the cryptocurrency's enduring appeal and the ever-growing interest in the digital asset market.

**FAQs**

**What is the Bitcoin halving?**

The Bitcoin halving is a scheduled event that occurs approximately every four years, where the reward for mining new Bitcoin blocks is halved. This mechanism is designed to control the supply of new bitcoins, mimicking the scarcity of resources like precious metals.

**When is the next Bitcoin halving happening?**

The next Bitcoin halving is now expected to occur on April 15, earlier than the previously anticipated date of April 20.

**Why has the date of the Bitcoin halving changed?**

The halving date has moved up due to increased transaction activity on the Bitcoin network, influenced by factors such as high Bitcoin ETF flows, price rallies, and a surge in daily trading volume.

**How does the Bitcoin halving affect the price of Bitcoin?**

Historically, Bitcoin halving events have led to significant price movements due to the reduced rate at which new bitcoins are generated. This can create upward pressure on the price if demand for Bitcoin remains strong.

**What impact does the halving have on Bitcoin miners?**

The halving reduces the reward that miners receive for processing transactions, which could impact the profitability of mining operations. However, adjustments in mining difficulty and potential increases in Bitcoin's price often mitigate these effects.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnewsco](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co/](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@thebitcoinlibertarian](https://www.youtube.com/@thebitcoinlibertarian)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

**Get Orange Pill App And Connect With Bitcoiners In Your Area. Stack Friends Who Stack Sats

link: https://signup.theorangepillapp.com/opa/croxroad**

**Buy Bitcoin Books At Konsensus Network Store. 10% Discount With Code “21croxroad”

link: https://bitcoinbook.shop?ref=21croxroad**

*DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.*

-

@ fd06f542:8d6d54cd

2025-03-31 01:45:36

{"coverurl":"https://cdn.nostrcheck.me/fd06f542bc6c06a39881810de917e6c5d277dfb51689a568ad7b7a548d6d54cd/232dd9c092e023beecb5410052bd48add702765258dcc66f176a56f02b09cf6a.webp","title":"NostrBook站点日记","author":"nostrbook"}

-

@ 096ae92f:b8540e0c

2025-03-31 01:09:48

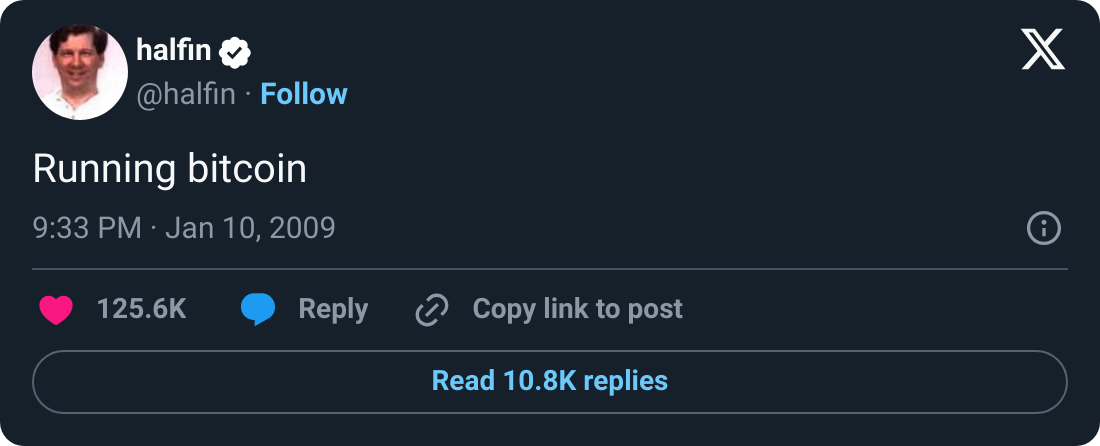

## **Hal Finney’s name is etched in Bitcoin lore.**

By day, Hal was a devoted husband and father; by night, a *shadowy super coder* pushing the boundaries of cryptography and how the world thinks about money. A seasoned cryptographer and ardent Bitcoin supporter, he was among the first to work with Satoshi Nakamoto on refining Bitcoin’s fledgling codebase.

January 2009, the iconic *"Running Bitcoin*" tweet was posted.

Over 16 years later, people are still engaging with Hal Finney’s legendary tweet—leaving comments of gratitude, admiration, and remembrance, reflecting on how far Bitcoin has come.

For many, it marks a key moment in Bitcoin’s early days.

More recently, it’s also become a symbol of Hal’s passion for running and the determination he showed throughout his life. That spirit is now carried forward through the [**Running Bitcoin Challenge**](https://secure.alsnetwork.org/site/TR?fr_id=1510&pg=entry&ref=blog.austinbitcoinclub.com), an ALS fundraiser co-organized by Fran Finney and supported by the Bitcoin community.

## **Shadowy Super Coder**

Long before Bitcoin came along, Hal Finney was already legendary in certain circles. He was part of the cypherpunk movement in the 1990s—people who believed in using cryptography to protect individual privacy online.

> ***"The computer can be used as a tool to liberate and protect people, rather than to control them."\

> -Hal Finney***

Hal contributed to **Pretty Good Privacy (PGP)**, one of the earliest and best-known encryption programs. He also dabbled in digital cash prototypes, developing something called **Reusable Proofs of Work (RPOW)**. He didn’t know it at the time, but that would prime him perfectly for a bigger innovation on the horizon.

## **Bitcoin's Early Days**

When Satoshi Nakamoto released the Bitcoin whitepaper in late 2008, Hal was one of the first to see its promise. While many cryptographers waved it off, Hal responded on the mailing list enthusiastically, calling Bitcoin “a very promising idea.” He soon began corresponding directly with Satoshi. Their emails covered everything from bug fixes to big-picture possibilities for a decentralized currency. On January 12, 2009, Satoshi sent Hal **10 bitcoins**—marking the first recorded Bitcoin transaction. From that day onward, his name was woven into Bitcoin’s origin story.

> ***“When Satoshi announced the first release of the software, I grabbed it right away. I think I was the first person besides Satoshi to run Bitcoin.”\

> -Hal Finney***

Even in Bitcoin’s earliest days—when it had no market value and barely a user base—Hal grasped the scope of what it could become. He saw it not just as a technical curiosity, but as a potential long-term store of value, a tool for privacy, and a monetary system that could rival gold in its resilience. He even raised early concerns about energy use from mining, showcasing just how far ahead he was thinking. At a time when most dismissed Bitcoin entirely, Hal was already envisioning the future.

## **The Bucket List**

By his early fifties, Hal Finney was in the best shape of his life. He had taken up distance running in the mid-2000s—not to chase medals, but to test himself. To stay healthy, to lose some weight, and above all, to do something hard. The engineer’s mind in him craved a structure of improvement, and long-distance running delivered it. With meticulous focus, Hal crafted training plans, ran 20+ mile routes on weekends, and even checked tide charts to time his beach runs when the sand was firmest underfoot.

His ultimate goal: **qualify for the Boston Marathon**.

For most, Boston is a dream. For Hal, it became a personal benchmark—a physical counterpart to the mental mountains he scaled in cryptography. He trained relentlessly, logging race times, refining form, and aiming for the qualifying standard in his age group. Running was more than physical for him. It was meditative. He often ran alone, without music, simply to be in the moment—present, focused, moving forward.

Running was also a shared passion. Fran often ran shorter distances while Hal trained for the longer ones. They registered for events together, cheered each other on at finish lines, and made it a part of their family rhythm. It was one more expression of Hal’s deep devotion not just to self-improvement, but to doing life side-by-side with those he loved.

Hal and Fran competing in the Denver Half-Marathon together

In April 2009, Hal and Fran ran the **Denver Half Marathon together**—a meaningful race and one of the first they completed side by side. At the time, Hal was deep in marathon training and hitting peak form.\

\

A month later, Hal attempted the **Los Angeles Marathon**, hoping to clock a Boston-qualifying time. But something wasn’t right. Despite all his preparation, he was forced to stop midway through the race. His body wasn’t recovering the way it used to. At first, he chalked it up to overtraining or age, but the truth would come soon after.

## **ALS Diagnosis**

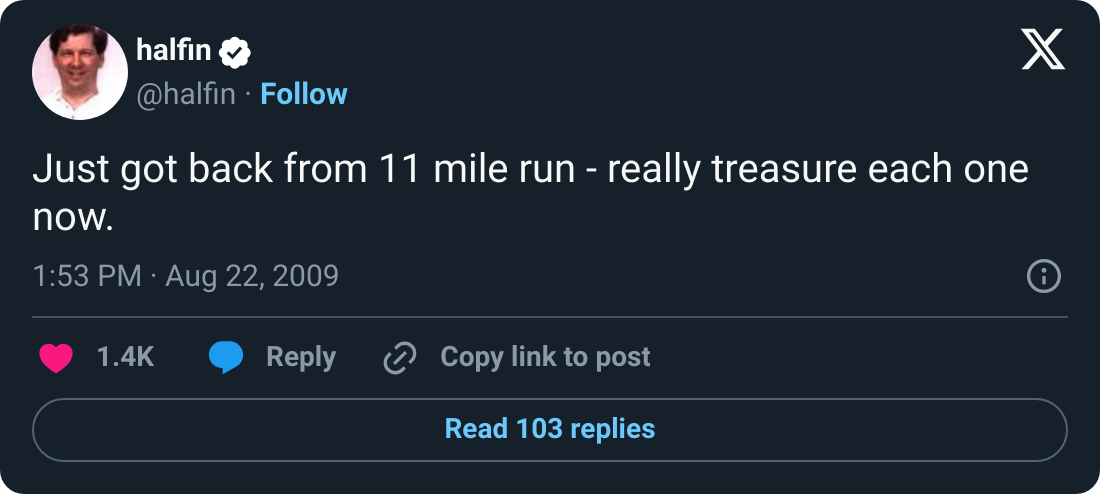

In August 2009, at the height of his physical and intellectual pursuits, Hal received crushing news: a diagnosis of **Amyotrophic Lateral Sclerosis (ALS)**, often referred to as Lou Gehrig’s disease. It was an especially cruel blow for a man who had just discovered a love for running and was helping birth the world’s first decentralized digital currency. ALS gradually robs people of voluntary muscle function. For Hal, it meant an uphill fight to maintain the independence and movement he cherished.

Still, Hal didn’t stop. That September, **he and Fran ran the Disneyland Half Marathon together**, crossing the finish line hand in hand. It would be his last official race, but the identity of being a runner never left him—not after the diagnosis, not after the gradual loss of physical control, not even after he was confined to a wheelchair.

Fran and Hal at the Disney Half Marathon.

By December of that same year, Hal could no longer run. Still, he was determined not to sit on the sidelines. That winter, the couple helped organize a **relay team for the Santa Barbara International Marathon**, a race Hal had long planned to run. Friends and family joined in, and Fran ran the final leg, passing the timing chip to Hal for the last stretch. With support, **Hal walked across the finish line**, cheered on by the local running community who rallied around him. It was a symbolic moment—heartbreaking and inspiring all at once.

Hal and Fran lead the Muscular Dystrophy Association relay team at the Santa Barbara International Marathon in 2009.

Even as his muscles weakened, **Hal’s mind stayed sharp**, and he continued to adapt in every way he could. He and Fran began making practical changes around their home—installing ramps, adjusting routines—but emotionally, the ground was still shifting beneath them.

Hal Finney humbly giving people in the future the opportunity to hear him speak before he is unable to.

Fran consistently emphasized that Hal maintained a remarkably positive attitude, even as ALS took nearly everything from him physically. His optimism and determination became the emotional anchor for the entire family.

> ***“He was the one who kept us all steady. He was never defeated.”\

> -Fran Finney***

## ***Still* Running Bitcoin**

Hal’s response was remarkably consistent with the determination he showed in running and cryptography. Even as the disease progressed, forcing him into a wheelchair and eventually limiting his speech, he kept coding—using assistive technologies that allowed him to control his computer through minimal eye movements. When he could no longer run physically, he continued to run test code for Bitcoin, advise other developers, and share insights on the BitcoinTalk forums. It was perseverance in its purest form. Fran was with him every step of the way.

In October 2009, just months after his diagnosis, Hal published an essay titled [***“Dying Outside”***](https://www.lesswrong.com/posts/bshZiaLefDejvPKuS/dying-outside?ref=blog.austinbitcoinclub.com)—a reflection on the road ahead. In it, he wrote:

> ***“I may even still be able to write code, and my dream is to contribute to open source software projects even from within an immobile body. That will be a life very much worth living."***

And he meant it. Years later, Hal collaborated with Bitcoin developer Mike Hearn on a project involving secure wallets using Trusted Computing. Even while operating at a fraction of his former speed—he estimated it was just **1/50th** of what he used to be capable of—Hal kept at it. He even engineered an Arduino-based interface to control his wheelchair with his eyes. The hacker mindset never left him.

This wasn’t just about legacy. It was about living with purpose, right up to the edge of possibility.

## **Running Bitcoin Challenge**

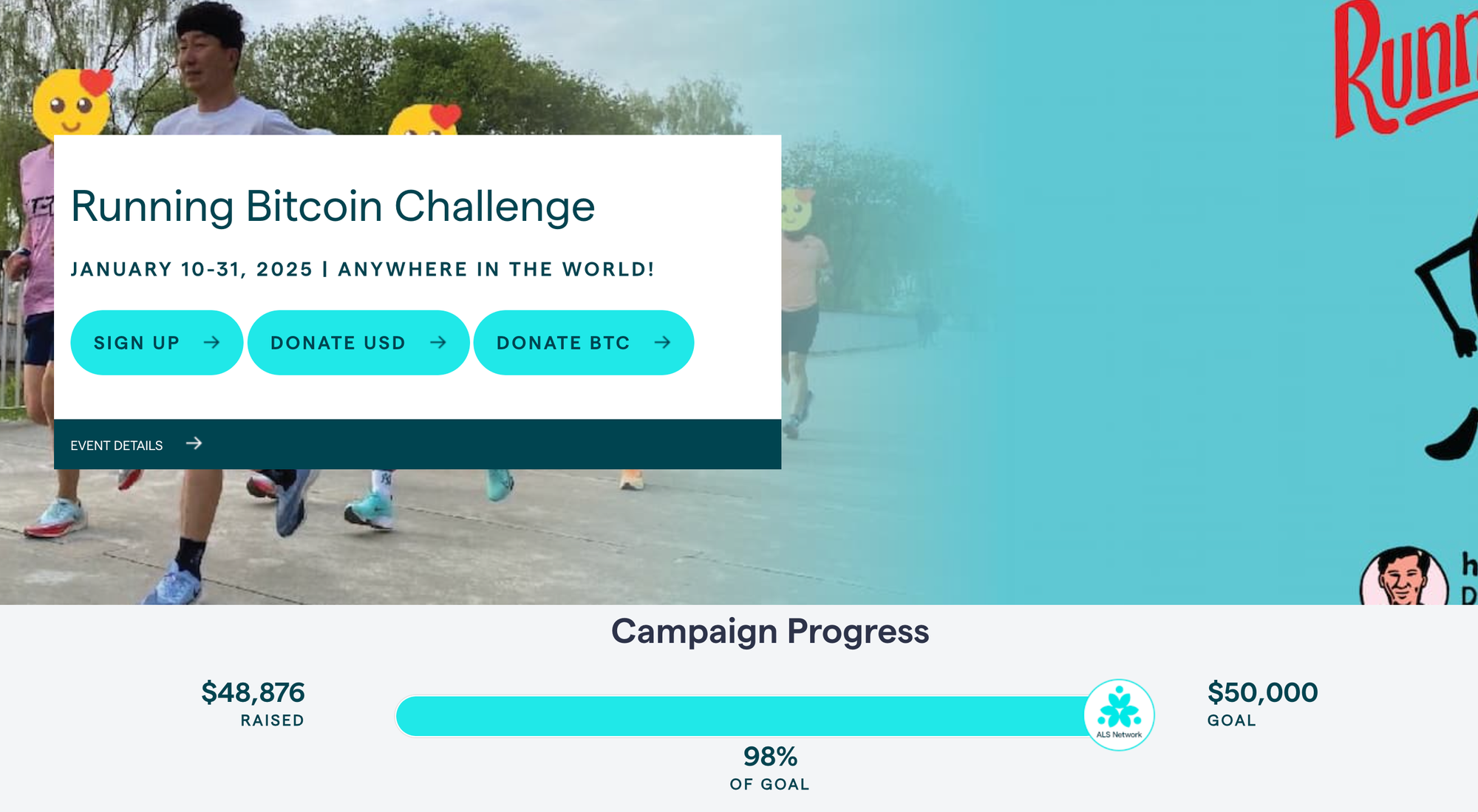

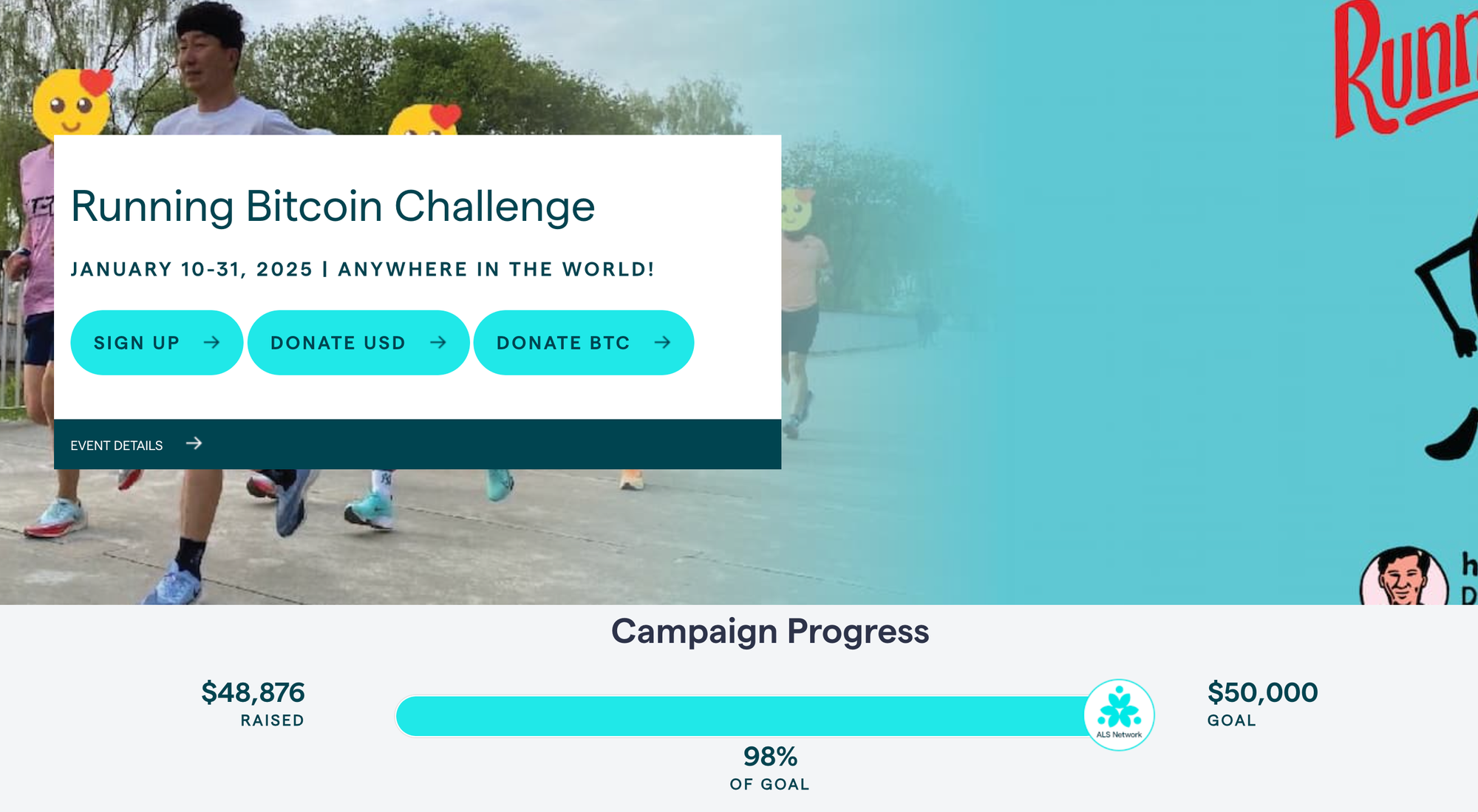

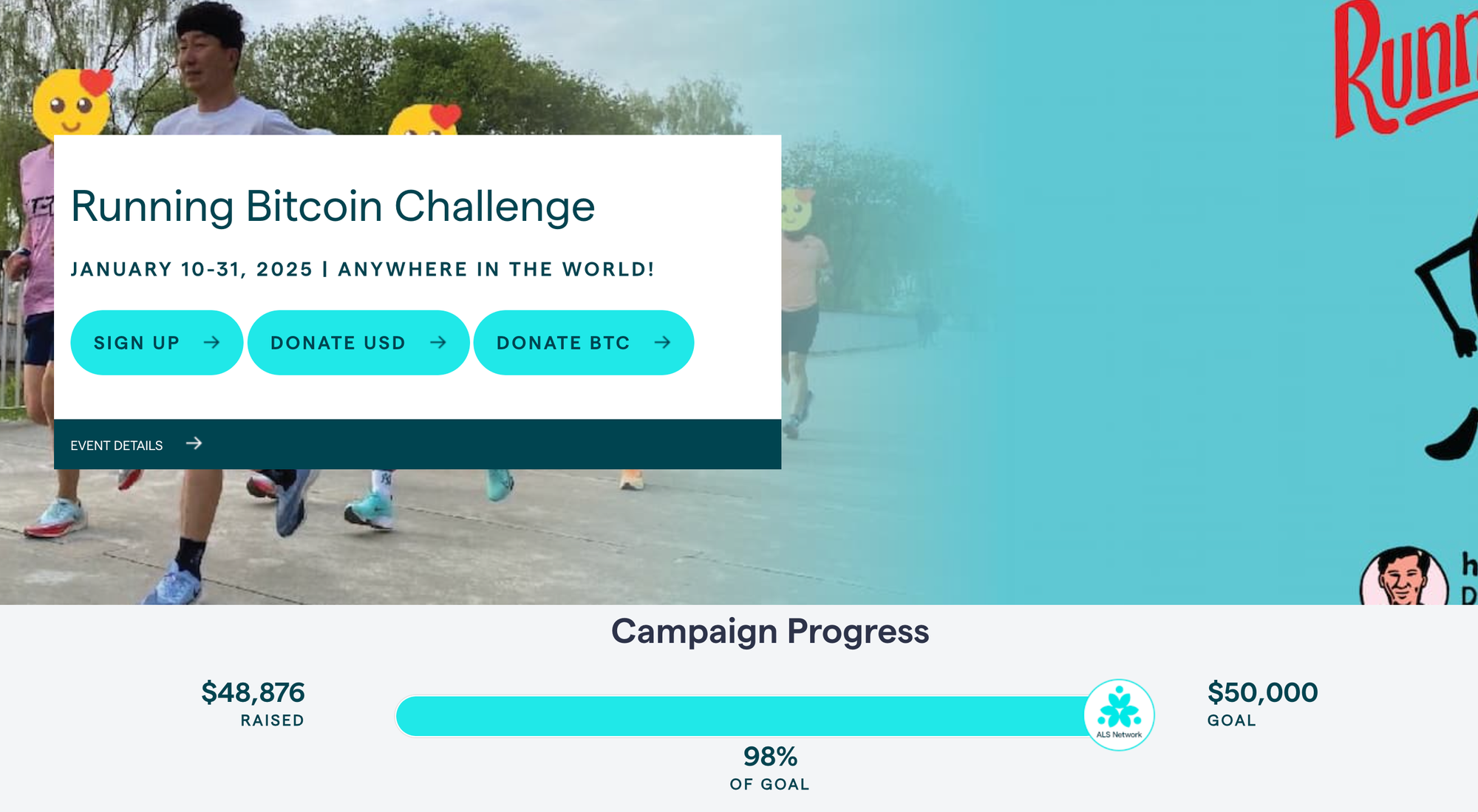

In recent years, Fran Finney—alongside members of the Bitcoin community—launched the [**Running Bitcoin Challenge**](https://secure.alsnetwork.org/site/TR?fr_id=1510&pg=entry&ref=blog.austinbitcoinclub.com), a virtual event that invites people around the world to run or walk **21 kilometers** each January in honor of Hal.

Timed with the anniversary of his iconic *“Running bitcoin”* tweet, the challenge raises funds for **ALS research** through the ALS Network. According to Fran, **over 80% of all donations go directly to research**, making it a deeply impactful way to contribute. **Nearly $50,000 has been raised so far.**

It’s not the next Ice Bucket Challenge—but that’s not the point. This is something more grounded, more personal. It’s a growing movement rooted in Hal’s legacy, powered by the Bitcoin community, and driven by the hope that collective action can one day lead to a cure.

> ***“Since we’re all rich with bitcoins, or we will be once they’re worth a million dollars like everyone expects, we ought to put some of this unearned wealth to good use.”\

> \

> — Hal Finney, January 2011Price of Bitcoin: $0.30***

As Fran has shared, her dream is for the Bitcoin world to take this to heart and truly run with it—**not just in Hal’s memory, but for everyone still fighting ALS today.**

## **Spring Into Bitcoin: Honoring Hal’s Legacy & Building the Bitcoin Community**

**On Saturday, April 12th**, we’re doing something different—and way more based than dumping a bucket of ice water on our heads. [***Spring Into Bitcoin***](https://blog.austinbitcoinclub.com/spring-into-bitcoin/) is a one-day celebration of sound money, health, and legacy. Hosted at [**Hippo Social Club**](https://www.hipposocialclub.com/?ref=blog.austinbitcoinclub.com), the event features a professional [**trail run**](https://www.tejastrails.com/uncommon?ref=blog.austinbitcoinclub.com), a sizzling open-air beef feast, Bitcoin talks, and a wellness zone complete with a **cold plunge challenge** (the ice bucket challenge walked so the cold plunge could run 😏).

[**Purchase Tickets**](https://oshi.link/lVH7Qh?ref=blog.austinbitcoinclub.com) **- General Admission**

*Tickets purchased using this link will get 10% back in Bitcoin rewards compliments of [**Oshi Rewards**](https://oshi.tech/?ref=blog.austinbitcoinclub.com).*

[*Purchase Race Tickets Here*](https://www.tejastrails.com/events/uncommon) *- RACE DISTANCES: Most Miles in 12 Hours, Most Miles in 6 Hours, Most Miles in 1 Hour, 5K, Canine 5K, Youth 1 Mile*

It’s all in honor of Hal Finney, one of Bitcoin’s earliest pioneers and a passionate runner. **100% of event profits will be donated in Bitcoin to the ALS Network**, funding research and advocacy in Hal’s memory. Come for the cause, stay for the beef, sauna, cold plunge and to kick it with the greatest, most freedom-loving community on earth.

[Please consider donating to our Run for Hal Austin team here.](https://secure.alsnetwork.org/site/TR/Endurance/General?team_id=9302&pg=team&fr_id=1510) This race officially kicks off the 2025 Run for Hal World Tour!

Ok, we might be a little biased.

## **The Lasting Impression**

Hal Finney left behind more than code commits and race medals. He left behind a blueprint for **resilience**—a relentless drive to do good work, to strive for personal bests, and to give back no matter the circumstances. His life reminds us that “running” is more than physical exercise or a piece of software running on your laptop. It’s about forward progress. It’s about community. It’s about optimism in the face of challenges.

So, as you tie your shoelaces for your next run or sync up your Bitcoin wallet, remember Hal Finney.

-

@ 1aa9ff07:3cb793b5

2025-03-31 00:44:22

test 2

-

@ f3328521:a00ee32a

2025-03-31 00:25:36

*This paper was originaly writen in early November 2024 as a proposal for an international Muslim entrepreneurial initiative. It was first publish on NOSTR 27 November 2024 as part 1 of a 4 part series of essays. Last updated/revised: 30 March 2025.*

The lament of the Ummah for the past century has been the downfall of the Khalifate. With the genocide in occupied Palestine over the past year and now escalations in Lebanon as well, this concern is at the forefront of a Muslim’s mind. In our tradition, when one part of the Ummah suffers, all believers are affected and share in that suffering. The Ummah today has minimal sovereignty at best. It lacks a Khalifate. It is spiritually weakened due to those not practicing and fulfilling their duties and responsibilities. And, as we will address in this paper, it has no real economic power. In our current monetary system, it is nearly impossible to avoid the malevolence of *riba* (interest) – one of the worst sins. However, with bitcoin there is an opportunity to alleviate this collective suffering and reclaim economic sovereignty.

Since it’s invention 15 years ago, bitcoin has risen to achieve a top 10 market cap ranking as a global asset (currently valued at $1.8 trillion USD). Institutional investors are moving full swing to embrace bitcoin in their portfolios. Recent proposals in Kazan hint that BRICS may even be utilizing bitcoin as part of their new payments system. State actors will be joining soon. With only about 1 million bitcoins left to be mined we need to aim to get as much of those remaining coins as possible into the wallets of Muslims over the next decade. Now is the time to onboard the Ummah. This paper presents Bitcoin as the best option for future economic sovereignty of the Ummah and proposes steps needed to generate a collective *waqf* of an initial 0.1%-0.5% chain dominance to safeguard a revived Khalifate.

Money is the protocol that facilitates economic coordination to help the development and advancement of civilization. Throughout history money has existed as cattle, seashells, salt, beads, stones, precious metals. Money develops naturally and spontaneously; it is not the invention of the state (although it at times is legislated by states). Money exists marginally, not by fiat. During the past few millenniums, gold and silver were optimally used by most advanced civilizations due to strong properties such as divisibility, durability, fungibility, portability, scarcity, and verifiability. Paper money modernized usability through attempts to enhance portability, divisibility, and verifiability. However, all these monetary properties are digitized today. And with the increase of fractional-reserve banking over the past two centuries, *riba* is now the *de facto* foundation of the consensus reserve currency – the USD.

This reserve currency itself is backed by the central banking organ of the treasury bond markets which are essentially government issued debt. Treasurey bonds opperate by manipulating the money supply arbitrarily with the purpose of targeting a set interest rate – injecting or liquidating money into the supply by fiat to control intrest yeilds. At its root, the current global monetary order depends entirely on *riba* to work. One need not list the terrible results of *riba* as Muslims know well its harshness. As Lyn Alden wonderful states in her book, Broken Money, “Everything is a claim of a claim of a claim, reliant on perpetual motion and continual growth to not collapse”. Eventual collapse is inevitable, and Muslims need to be aware and prepared for this reality.

The status quo among Muslims has been to search for “*shariah* compliance”. However, *fatwa* regarding compliance as well as the current Islamic Banking scene still operate under the same fiat protocol which make them involved in the creation of money through *riba*. Obfuscation of this *riba* through *contractum trinius* or "*shariah* compliant" yields (which are benchmarked to interest rates) is simply an attempt to replicate conventional banking, just with a “*halal*” label. Fortunately, with the advent of the digital age we now have other monetary options available.

Experiments and theories with digital money date back to the 1980s. In the 1990s we saw the dot com era with the coming online of the current fiat system, and in 2008 [Satoshi Nakamoto released Bitcoin](https://bitcoin.org/bitcoin.pdf) to the world. We have been in the crypto era ever since. Without diving into the technical aspects of Bitcoin, it is simply a P2P e-cash that is cryptographically stored in digital wallets and secured via a decentralized blockchain ledger. For Muslims, it is essential to grasp that Bitcoin is a new type of money (not just an investment vehicle or payment application) that possesses “anti-*riba*” properties.

Bitcoin has a fixed supply cap of 21 million, meaning there will only ever be 21 million Bitcoin (BTC). Anyone with a cheap laptop or computer with an internet connection can participate on the Bitcoin network to verify this supply cap. This may seem like an inadequate supply for global adoption, but each bitcoin is highly divisible into smaller units (1 btc = 100,000,000 satoshis or sats). Bitcoins are created (or mined) from the processing of transactions on the blockchain which involves expending energy in the real world (via CPU power) and providing proof that this work was done.

In contrast, with the *riba*-based fiat system, central banks need to issue debt instruments, either in the form of buying treasuries or through issuing a bond. Individual banks are supposed to be irresponsibly leveraged and are rewarded for making risky loans. With Bitcoin, there is a hard cap of 21 million, and there is no central authority that can change numbers on a database to create more money or manipulate interest rates. Under a Bitcoin standard, money is verifiably stored on a ledger and is not loaned to create more money with interest. Absolute scarcity drives saving rather than spending, but with increasing purchasing power from the exponentially increasing demand also comes the desire to use that power and increased monetary economization. With bitcoin you are your own bank, and bitcoin becomes for your enemies as much as it is for your friends. Bitcoin ultimately provides a clean foundation for a stable money that can be used by muslims and should be the currency for a future Khalifate.

The 2024 American presidential election has perhaps shown more clearly than ever the lack of politcal power that American Muslims have as well as the dire need for them to attain political influence. Political power comes largely through economic sovereignty, military might, and media distribution. Just a quick gloss of Muslim countries and Turkey & Egypt seem to have decent militaries but failing economies. GCC states have good economies but weak militaries. Iran uniquely has survived sanctions for decades and despite this weakened economic status has still been able to make military gains. Although any success from its path is yet to be seen it is important to note that Iran is the only country that has been able to put up any clear resistance to western powers. This is just a noteworthy observation and as this paper is limited to economic issues, full analysis of media and miliary issues must be left for other writings.

It would also be worthy to note that BDS movements (Boycott, Divest & Sanction) in solidarity with Palestine should continue to be championed. Over the past year they have undoubtedly contributed to PEP stock sinking 2.25% and MCD struggling to break even. SBUX and KO on the other hand, despite active boycott campaigns, remain up 3.5% & 10.6% respectively. But some thought must be put into why the focus of these boycotts has been on snack foods that are a luxury item. Should we not instead be focusing attention on advanced tech weaponry? MSFT is up 9.78%, GOOG up 23.5%, AMZN up 30%, and META up 61%! It has been well documented this past year how most of the major tech companies have contracts with occupying entity and are using the current genocide as a testing ground for AI. There is no justification for AI being a good for humanity when it comes at the expense of the lives of our brothers in Palestine. However, most “*sharia* compliant” investment guides still list these companies among their top recommendations for Muslims to include in their portfolios.

As has already been argued, by investing in fiat-based organization, businesses, ETFs, and mutual funds we are not addressing the root cause of *riba*. We are either not creating truly *halal* capital, are abusing the capital that Allah has entrusted to us or are significantly missing blessings that Allah wants to give us in the capital that we have. If we are following the imperative to attempt to make our wealth as “*riba*-free” as possible, then the first step must be to get off zero bitcoin

Here again, the situation in Palestine becomes a good example. All Palestinians suffer from inflation from using the Israeli Shekel, a fiat currency. Palestinians are limited in ways to receive remittances and are shrouded in sanctions. No CashApp, PayPal, Venmo. Western Union takes huge cuts and sometimes has confiscated funds. Bank wires do this too and here the government sanctions nearly always get in the way. However, Palestinians can use bitcoin which is un-censorable. Israel cannot stop or change the bitcoin protocol. Youssef Mahmoud, a former taxi driver, has been running [Bitcoin For Palestine](http://bitcoinforpalestine.org/) as a way for anyone to make a bitcoin donation in support of children in Gaza. Over 1.6 BTC has been donated so far, an equivalent of about $149,000 USD based on current valuation. This has provided a steady supply of funds for the necessary food, clothing, and medication for those most in need of aid (Note: due to recent updates in Gaza, Bitcoin For Palestine is no longer endorsed by the author of this paper. However, it remains an example of how the Bitcoin network opperates through heavy sanctions and war).

Over in one of the poorest countries in the world, a self-managed orphanage is providing a home to 77 children without the patronage of any charity organization. [Orphans Of Uganda](https://www.orphans-of-uganda.org/) receives significant funding through bitcoin donations. In 2023 and 2024 Muslims ran Ramadan campaigns that saw the equivalent of $14,000 USD flow into the orphanage’s bitcoin wallet. This funding enabled them to purchase food, clothing, medical supplies and treatment, school costs, and other necessities. Many who started donating during the 2023 campaign also have continued providing monthly donations which has been crucial for maintaining the well-being of the children.

According to the [Muslim Philanthropy Initiative](https://scholarworks.indianapolis.iu.edu/items/fd27565f-6738-4d43-a3ad-173a122c617a), Muslim Americans give an estimated $1.8 billion in *zakat* donations every year with the average household donating $2070 anually. Now imagine if international zakat organizations like Launchgood or Islamic Relief enabled the option to donate bitcoin. So much could be saved by using an open, instant, permissionless, and practically feeless way to send *zakat* or *sadaqah* all over the world! Most *zakat* organizations are sleeping on or simply unaware of this revolutionary technology.

Studies by institutions like Fidelity and [Yale](https://www.nber.org/papers/w24877) have shown that adding even a 1% to 5% bitcoin allocation to a traditional 60/40 stock-bond portfolio significantly enhances returns. Over the past decade, a 5% bitcoin allocation in such a portfolio has increased returns by over 3x without a substantial increase in risk or volatility. If American Muslims, who are currently a demographic estimated at 2.5 million, were to only allocate 5% ($270 million) of their annual *zakat* to bitcoin donations, that would eventually become worth $14.8 billion at the end of a decade. Keep in mind this rate being proposed here is gathered from American Muslim *zakat* data (a financially privileged population, but one that only accounts for 0.04% of the Ummah) and that it is well established that Muslims donate in *sadaqa* as well. Even with a more conservative rate of a 1% allocation you would still be looking at nearly $52 million being liquidated out of fiat and into bitcoin annually. However, if the goal is to help Muslims hit at least 0.1% chain dominance in the next decade then a target benchmark of a 3% annual *zakat* allocation will be necessary.

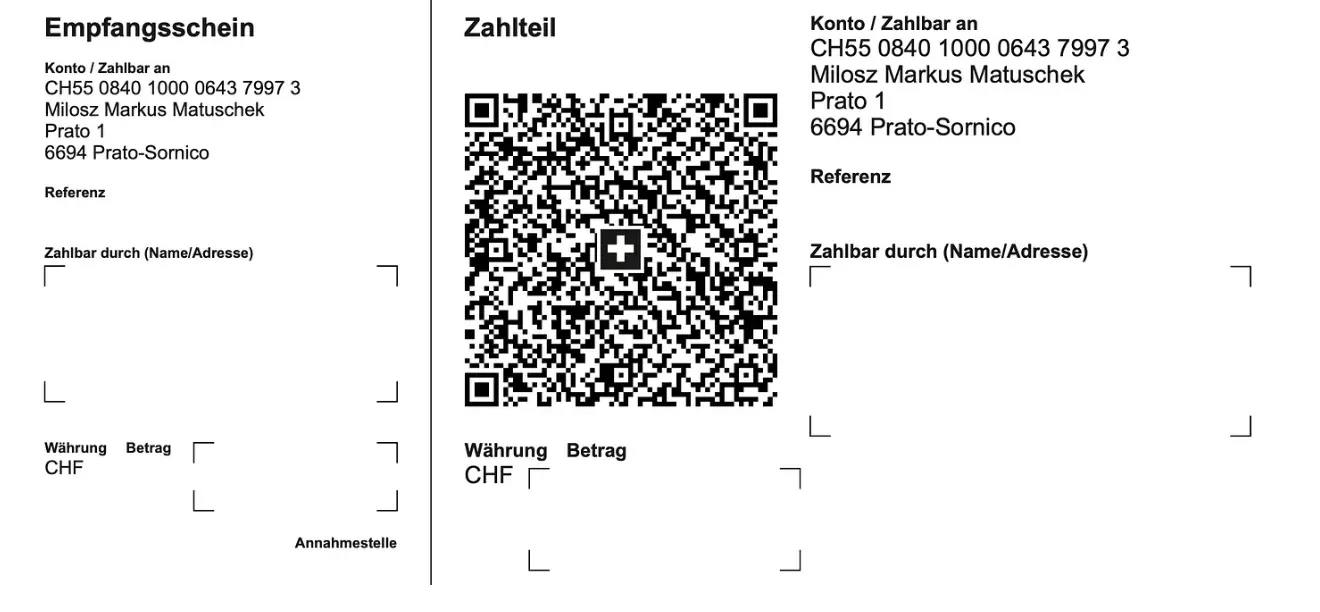

Islamic financial institutions will be late to the game when it comes to bitcoin adoption. They will likely hesitate for another 2-4 years out of abundance of regulatory caution and the persuasion to be reactive rather than proactive. It is up to us on the margin to lead in this regard. Bitcoin was designed to be peer-2-peer, so a grassroots Muslim bitcoiner movement is what is needed. Educational grants through organizations like [Bitcoin Majlis](https://bitcoinmajlis.org/bitcoin-educational-grant-for-muslims/) should be funded with endowments. Local Muslim bitcoin meetups must form around community mosques and Islamic 3rd spaces. Networked together, each community would be like decentralized nodes that could function as a seed-holder for a multi-sig *waqf* that can circulate wealth to those that need it, giving the poorer a real opportunity to level up and contribute to societ and demonstrating why *zakat* is superior to interest.

Organic, marginal organizing must be the foundation to building sovereignty within the Ummah. Sovereignty starts at the individual level and not just for all spiritual devotion, but for economics as well. Physical sovereignty is in the individual human choice and action of the Muslim. It is the direct responsibility placed upon insan when the trust of *khalifa* was placed upon him. Sovereignty is the hallmark of our covenant, we must embrace our right to self-determination and secede from a monetary policy of riba back toward that which is pure.

> "Whatever loans you give, seeking interest at the expense of people’s wealth will not increase with Allah. But whatever charity you give, seeking the pleasure of Allah—it is they whose reward will be multiplied." ([Quran 30:39](https://quran.com/30/39?ref=blog.zoya.finance))

## FAQ

**Why does bitcoin have any value?**

Unlike stocks, bonds, real-estate or even commodities such as oil and wheat, bitcoins cannot be valued using standard discounted cash-flow analysis or by demand for their use in the production of higher order goods. Bitcoins fall into an entirely different category of goods, known as monetary goods, whose value is set game-theoretically. I.e., each market participant values the good based on their appraisal of whether and how much other participants will value it. The truth is that the notions of “cheap” and “expensive” are essentially meaningless in reference to monetary goods. The price of a monetary good is not a reflection of its cash flow or how useful it is but, rather, is a measure of how widely adopted it has become for the various roles of money.

**Is crypto-currency halal?**

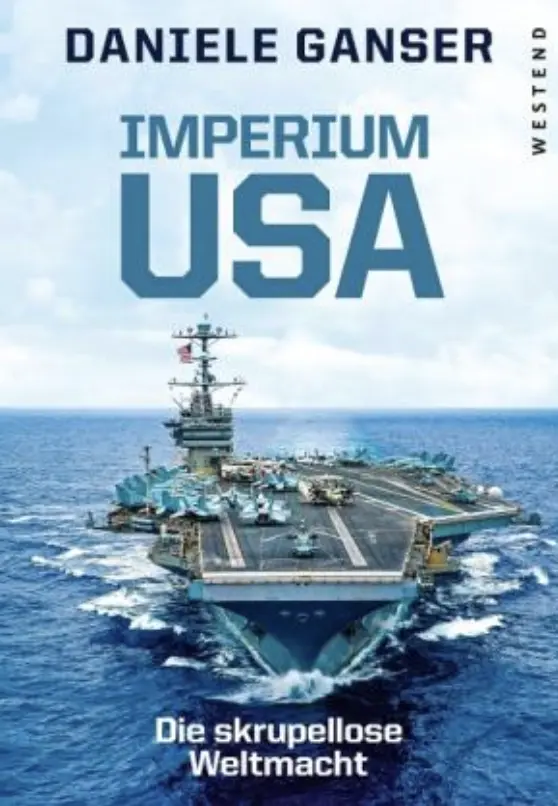

It is important to note that this paper argues in favor of Bitcoin, not “Crypto” because all other crypto coins are simply attempts a re-introducing fiat money-creation in digital space. Since they fail to address the root cause error of *riba* they will ultimately be either destroyed by governments or governments will evolve to embrace them in attempts to modernize their current fiat system. To highlight this, one can call it “bit-power” rather than “bit-coin” and see that there is more at play here with bitcoin than current systems contain. [Mufti Faraz Adam’s *fatwa*](https://darulfiqh.com/is-it-permissible-to-invest-in-cryptocurrencies-2/) from 2017 regarding cryptocurrency adaqately addresses general permissibility. However, bitcoin has evolved much since then and is on track to achieve global recognition as money in the next few years. It is also vital to note that monetary policy is understood by governments as a vehicle for sanctions and a tool in a political war-chest. Bitcoin evolves beyond this as at its backing is literal energy from CPU mining that goes beyond kinetic power projection limitations into cyberspace. For more on theories of bitcoin’s potential as a novel weapons technology see Jason Lowery’s book [Softwar](https://dspace.mit.edu/bitstream/handle/1721.1/153030/lowery-jplowery-sm-sdm-2023-thesis.pdf).

**What about market volatility?**

Since the inception of the first exchange traded price in 2010, the bitcoin market has witnessed five major Gartner hype cycles. It is worth observing that the rise in bitcoin’s price during hype cycles is largely correlated with an increase in liquidity and the ease with which investors could purchase bitcoins. Although it is impossible to predict the exact magnitude of the current hype cycle, it would be reasonable to conjecture that the current cycle reaches its zenith in the range of $115,000 to $170,000. Bitcoin’s final Gartner hype cycle will begin when nation-states start accumulating it as a part of their foreign currency reserves. As private sector interest increases the capitalization of Bitcoin has exceeded 1 trillion dollars which is generally considered the threshold at which an assest becomes liquid enough for most states to enter the market. In fact, El Salvador is already on board.

-

@ 5d4b6c8d:8a1c1ee3

2025-03-31 00:02:14

In my [monthly check-in](https://stacker.news/items/929731/r/Undisciplined), I described my vision for our regularly occurring awards:

- 1 top post for the year, receiving 1/3 of the total prize pool

- 4 top quarter posts, each receiving 1/12 of the total prize pool

- 12 top monthly posts, each receiving 1/36 of the total prize pool

Eventually, I'll want to finance these with some fraction of territory profits. However, when I took over the territory from @jeff, I [pledged](https://stacker.news/items/89179/r/Undisciplined?commentId=826287) to first use any profits to make whole our early donors, in some fashion.

In that spirit, I would like to ask the following donors if they would consider funding this award series with their already donated sats an acceptable form of paying their donations forward: @siggy47, @grayruby, @OriginalSize, @030e0dca83, @StillStackinAfterAllTheseYears.

I would also like to ask @jeff if he would consider something similar as payback for his early contributions to the territory.

Assuming all parties agree, we would have over 1M sats in funding for this series. At our current rate of about 400k profit per year, it would take a couple of years to pay it all forward and that top prize would be pretty nice.

Thanks,

Undisciplined

originally posted at https://stacker.news/items/929828

-

@ 8d34bd24:414be32b

2025-03-30 23:16:09

When it comes to speaking the truth, obeying God, or living a godly life, the average or the compromise is not necessarily correct, but frequently we do err to one extreme or the other.

## Mercy or Wrath?

One area of controversy is whether we serve a God of love & mercy or a God of holiness & wrath. The truth is that the God of the Bible is both love and holiness and he acts in mercy and in wrath.

If we focus too much on God’s holiness and wrath, we become solely about robotically obeying laws and about all of the things we can’t do. We will fail to show love and mercy as Jesus showed those lost in sin. We will fail to show the mercy and love He showed to us. We become much like the Pharisees, whom Jesus called “*whitewashed tombs*.”

> Instead, speaking the truth in love, we will grow to become in every respect the mature body of him who is the head, that is, Christ. (Ephesians 4:15)

We need to always speak the truth, but in a loving and merciful way.

> Grace, mercy and peace from God the Father and from Jesus Christ, the Father’s Son, will be with us in truth and love. (2 John 1:3)

If we focus too much on God’s love and mercy, we can forget that the God of the Bible is holy and righteous and can’t stand to be in the presence of sinfulness. We can begin to soften God’s holy word to be little more than suggestions. Even worse, we can bend God’s word to the point that it no longer resembles His clearly communicated commands. Also, if we don’t call sin “sin” and sinners “sinners,” then those same sinners will never understand their need for a Savior and never trust Jesus in repentance. If God isn’t holy and we aren’t sinners, then why would anyone need a Savior?

> But just as he who called you is holy, so be holy in all you do; (1 Peter 1:15)

We need to treat God and His word as holy, while showing love to His creation.

> If I speak in the tongues of men or of angels, but do not have love, I am only a resounding gong or a clanging cymbal. (1 Corinthians 13:1)

God/Jesus/Holy Spirit are holy and loving. If we leave out either side of His character, then we aren’t telling people about the God of the Bible. We have made a God in the image we desire, rather than who He is. If we go to either extreme, we lose who God really is and it will affect both our relationship with God and our relationship with others detrimentally.

## Faith or Works?

Another area of contention is relating to faith and works. What is more important — faith or works? Are they not both important?

Many believers focus on faith. Sola Fide (faith alone).

> For it is by grace you have been saved, through faith—and this is not from yourselves, it is the gift of God— not by works, so that no one can boast. (Ephesians 2:8-9)

This is a true statement that Salvation comes solely through faith in what Jesus did for us. We don’t get any credit for our own works. All that is good and righteous in us is from the covering of the blood of Jesus and His good works and His power.

But since many people focus on faith alone, they can come to believe that they can live any way that pleases them.

> What shall we say, then? **Shall we go on sinning so that grace may increase? By no means! We are those who have died to sin; how can we live in it any longer**? Or don’t you know that all of us who were baptized into Christ Jesus were baptized into his death? We were therefore buried with him through baptism into death in order that, just as Christ was raised from the dead through the glory of the Father, we too may live a new life. (Romans 6:1-4) {emphasis mine}

By focusing solely on faith, we can be tempted to live life however we please instead of living a life in submission to Our God and Savior. Our lives can be worthless instead of us acting as good servants.

> If any man’s work is burned up, he will suffer loss; but he himself will be saved, yet so as through fire. (1 Corinthians 3:15)

At the same time, there are many who are so focused on good works that they leave faith out of it — either a lack of faith themselves or a failure to communicate the need for faith when sharing the gospel. They try to earn their way to heaven. They try to impress those around them by their works.

> But they do all their deeds to be noticed by men; for they broaden their phylacteries and lengthen the tassels of their garments. They love the place of honor at banquets and the chief seats in the synagogues, and respectful greetings in the market places, and being called Rabbi by men. (Matthew 25:5-7)

I think James best communicates the balance between faith and works.

> What use is it, my brethren, **if someone says he has faith but he has no works? Can *that* faith save him**? If a brother or sister is without clothing and in need of daily food, and one of you says to them, “Go in peace, be warmed and be filled,” and yet you do not give them what is necessary for their body, what use is that? **Even so faith, if it has no works, is dead, being *by itself***.

>

> But someone may well say, “You have faith and I have works; show me your faith without the works, and **I will show you my faith by my works**.” You believe that God is one. You do well; the demons also believe, and shudder. But are you willing to recognize, you foolish fellow, that faith without works is useless? Was not Abraham our father justified by works when he offered up Isaac his son on the altar? You see that faith was working with his works, and as a result of the works, faith was perfected; and the Scripture was fulfilled which says, “And Abraham believed God, and it was reckoned to him as righteousness,” and he was called the friend of God. You see that a man is justified by works and not by faith alone. (James 2:14-24) {emphasis mine}

Let’s look at some of the details here to find the truth. “*if someone says he has faith but he has no works? Can **that** faith save him*?” Can the kind of faith that has no works, that has no evidence, save a person? If a person truly has saving faith, there will be evidence in their world view and the way they live their life. “*Even so faith, if it has no works, is dead, being **by itself***.” We are saved by faith alone, but if we are saved we will have works. Faith “by itself” is not saving faith, for “*the demons also believe, and shudder*.” I don’t think anyone would argue that the demons have saving faith, yet they believe and shudder.

Works are the evidence of true faith leading to salvation, but it is only faith that saves.

## Speak the Truth or Love?

Whether we stand firmly and always loudly speak the truth or whether we show love and mercy is related to how we view God (as loving or as holy), but I thought how we respond was worth its own discussion.

Sometimes people are so worried about love and unity that they compromise the truth. They may actively compromise the truth by claiming the Bible says something other than what it says, i.e.. old earth vs young earth, or marriage is about two people who love each other vs marriage being defined by God as one woman and one man. Sometimes this compromise is just avoiding talking about uncomfortable subjects completely so that no one is made to feel bad. This is a problem because God said what He said and means what He said.

> but speaking the truth in love, we are to grow up in all aspects into Him who is the head, even Christ, (Ephesians 4:15)

Avoiding speaking the whole truth is effectively lying about what God’s word said (see my previous post on [“The Truth, The Whole Truth, and Nothing But the Truth](https://trustjesus.substack.com/p/c7cdf433-9e7d-427e-9db0-e7bbd609661b)”). We are not doing anyone a favor making them feel good about their sin. A person has to admit they have a problem before they will act to fix the problem. A person who doesn’t understand their sin will never submit to a Savior. It isn’t loving to hide the truth from a person just because it makes them uncomfortable or it make the relationship uncomfortable for ourselves.

> Jesus said to him, “I am the way, and the truth, and the life; no one comes to the Father but through Me. (John 14:6)

At the same time, sometimes people seem to beat others over the head with God’s truth. They share the truth in the most unloving and unmerciful way. They use God’s truth to try to lift up themselves while putting down others. This is just as bad.

> Now we pray to God that you do no wrong; **not that we ourselves may appear approved, but that you may do what is right**, even though we may appear unapproved. For we can do nothing against the truth, but only for the truth. (2 Corinthians 13:7-8) {emphasis mine}

Some Christians spend so much time nit picking tiny discrepancies in theology that they miss the whole point of the Gospel.

> “Woe to you, scribes and Pharisees, hypocrites! For you tithe mint and dill and cumin, and have neglected the weightier provisions of the law: justice and mercy and faithfulness; but these are the things you should have done without neglecting the others. (Matthew 23:23)

Some Christians use theological purity as a means to lift themselves up while knocking others down.

> “Two men went up into the temple to pray, one a Pharisee and the other a tax collector. The Pharisee stood and was praying this to himself: ‘God, I thank You that I am not like other people: swindlers, unjust, adulterers, or even like this tax collector. I fast twice a week; I pay tithes of all that I get.’ 13But the tax collector, standing some distance away, was even unwilling to lift up his eyes to heaven, but was beating his breast, saying, ‘God, be merciful to me, the sinner!’ I tell you, this man went to his house justified rather than the other; for everyone who exalts himself will be humbled, but he who humbles himself will be exalted.” (Luke 18:10-14)

We need to stand firmly on the truth, but not to be so focused on truth that we fight with fellow believers over the smallest differences, especially when these differences are among the areas that are not spoken of as clearly (like end times eschatology).

## Rejoice or Fear God?

Tonight I read [Psalm 2](https://www.bible.com/bible/100/PSA.2.NASB1995) which brought to mind another seemingly contradictory way we are to interact with God. Do we fear God or do we rejoice in Him?

There are many verses telling us to fear God or fear the Lord. They are given as a command, as a way to knowledge, as a way to life, etc.

> Honor all people, love the brotherhood, **fear God**, honor the king. (1 Peter 2:17) {emphasis mine}

and

> The f**ear of the Lord is the beginning of knowledge**; Fools despise wisdom and instruction. (Proverbs 1:7) {emphasis mine}

and

> The **fear of the Lord leads to life**, So that one may sleep satisfied, untouched by evil. (Proverbs 19:23) {emphasis mine}

At the same time we are told to rejoice in the Lord.

> Rejoice in the Lord always; again I will say, rejoice! (Philippians 4:4)

and

> Then I will go to the altar of God, To God my exceeding joy; And upon the lyre I shall praise You, O God, my God. (Psalm 43:4)

How often do we rejoice in the thing that makes us tremble in fear? I’d guess, *not very often* or even *never*. A right view of God, however, causes us to “*rejoice with trembling*.”

> Worship the Lord with reverence\

> And **rejoice with trembling**.\

> Do homage to the Son, that He not become angry, and you perish in the way,\

> For His wrath may soon be kindled.\

> How **blessed are all who take refuge in Him**! (Psalm 2:11-12) {emphasis mine}

That phrase, “*rejoice with trembling*” seems to perfectly encapsulate the balance between fear of an awesome, omnipotent, holy God and rejoicing in a loving, merciful God who came to earth, lived the perfect life that we cannot, and died to pay the penalty for our sins.

“*How blessed are all who take refuge in Him*!”

## No Real Contradictions

I think these examples do a good example of demonstrating wisdom regarding God’s word and the importance of balance in our Christian lives. Even when at first there seems to be contradictions, God’s word never contradicts itself; it always clarifies itself. Also, when we see a theological or implementation error to one extreme, we need to make sure we are not driven to an error in the other extreme. We also need to make sure, when debating with fellow believers, that we do not argue against one extreme so strongly that we miscommunicate the truth.

May God in heaven guide you as you study His word and seek to submit to His commands. May He help you to see the truth, the whole truth, and nothing but the truth. May He guide the church to unity in His truth.

Trust Jesus

-

@ 21c9f12c:75695e59

2025-03-30 22:42:19

This guy was in my dad's building. A reminder of the importance of balance in our lives. We all have good and bad experiences in life. What matters is how you choose to handle them and balance yourself on the narrow path. Our paths in life have many possible turns, some take us closer to our ultimate reality while others might lead us astray for a bit.

No matter which path you choose the important thing is to keep your balance and footing and not be swept away in the breeze. You can always find your way back to your center and work your way back out from there. There is seldom a straight path in this life that will take you directly to your ultimate reality, make your way as you will and you'll find that you have what you need when you need it.

Ultimately we are all connected in ways we may never understand. The web of reality is so complex and woven with such precision that we need not try to understand why things are the way they are but accept that they are and move along our path doing our best to help others along the way when possible and accept help from those offering it. The path we take is strengthened and preserved when we follow it with love in our hearts. In this way we can leave a beacon to guide others on their way.

My dad left a lot of love on his path. He has guided so many people whether he realized it or not. His guidance of my path has made me who I am today and I am so proud to say that. His love and light shines bright ahead of me and my path is made so much clearer by the love I received and will continue to receive from him.

This is more than just a spider in a building, it is a reminder that all will be well and we will find our balance and continue along our path with the light and love dad has placed on the web of life for us to follow. Peace and love to everyone and may you all find your balance and continue on your path in the light and love that has been placed there for you by those who have gone before.

-

@ 1aa9ff07:3cb793b5

2025-03-30 21:45:10

test

-

@ 5d4b6c8d:8a1c1ee3

2025-03-30 21:31:02

Revenue rebounded in a major way this month. Thank you to all the great contributors and zappers for making this territory a going concern. As I mentioned to @denlillaapan, our long-term goal is to eventually buy the very failed *The Economist* and return it to glory. So, let's keep the success rolling.

# Some stats:

- ~econ was 2nd to ~bitcoin in revenue this month (and they only beat us by a paltry half million sats)

- We were 5th in posts (296) and 4th in comments (1564)

- 132k sats were stacked in ~econ (4th place)

# Some graphs (thanks to @SimpleStacker):

# Posting fee optimization

The next stop on our search for the optimal post fee is 94 sats.

# Contest update:

I'll probably make a dedicated post for the 1st quarter awards late today, but I made a couple of decisions recently about how I want to do this.

Since I pay territory rent annually, I won't know how much profits are available for prizes until the end of the year. So, I'll announce the winners each quarter, but pay out the prizes at the end of the year.

I've decided to split the prize evenly amongst three categories: Best Post of the Year, Posts of the Quarter, and Posts of the Month. I'm thinking that we can use zaprank for the monthly top posts and then have a poll select the "Post of the Quarter" from amongst those and then an end of year poll to select the "Post of the Year" from the "Posts of the Quarter".

originally posted at https://stacker.news/items/929731

-

@ 6d3df767:363347f6

2025-03-30 21:02:27

asdf

originally posted at https://stacker.news/items/459388

-

@ 878dff7c:037d18bc

2025-03-30 20:46:24

## Business Leaders Warn of Economic Risks from Potential Minority Government

### Summary:

Australian business leaders are expressing deep concerns about the possibility of a minority government influenced by the Greens or independent "teal" candidates after the upcoming May federal election. CEOs such as Graham Turner, Chris Garnaut, and Bruce Mathieson warn that such a government could lead to policy instability, hinder long-term economic planning, and negatively impact Australia's global competitiveness. Key issues highlighted include the cost of living, housing supply, and the need for comprehensive economic reforms to stimulate consumer confidence and productivity.

Sources: <a href="https://www.theaustralian.com.au/business/business-leaders-fret-about-minority-government-deals-as-an-economic-disaster-in-the-making/news-story/a6273a5dcdf2c1eb3fa5a2a766066cd0" target="_blank">The Australian - March 31, 2025</a>

## Forecasted Decline in Australia's Resource and Energy Export Earnings

### Summary:

The Australian government projects a 6% decrease in mining and energy export earnings for the financial year ending in June, attributing the decline to lower U.S. dollar prices for these exports. Earnings are expected to fall to A$387 billion from A$415 billion the previous year. This trend is anticipated to continue over the next five years, stabilizing at A$343 billion. Factors contributing to this decline include normalizing energy export values after recent peaks and reduced demand from China, particularly affecting iron ore exports.

Sources: <a href="https://www.reuters.com/markets/australia-forecasts-hit-resource-energy-export-earnings-lower-us-dollar-2025-03-30/" target="_blank">Reuters - March 31, 2025</a>

## Devastating Queensland Floods Expected to Persist for Weeks

### Summary:

Queensland is experiencing severe flooding due to record-breaking rains exceeding 650mm, submerging entire communities like Adavale and Jundah. Swiftwater crews have conducted over 40 rescues, and major flood warnings remain across inland Queensland. The floods have damaged energy infrastructure, leaving around 300 homes without power. Livestock losses may reach up to a million, with farmers facing significant property damage and urging government and military assistance. Efforts to restore power are underway but depend on weather conditions. Additional rainfall is forecast for the coming week, potentially prolonging the flooding for days, if not weeks.

Sources: <a href="https://www.couriermail.com.au/news/queensland/weather/qld-weather-outback-flooding-to-persist-for-days-if-not-weeks/news-story/2efc920a2a222f2c3156a9c3612e9b2a" target="_blank">The Courier-Mail - 31 March 2025</a>

## Western NSW Towns Brace for Six Weeks of Isolation Due to Floods

### Summary:

A dynamic weather system has caused significant rainfall and flooding along the Paroo and Warrego Rivers, isolating communities in western NSW. The State Emergency Service (SES) has issued 46 warnings, urging residents to prepare for up to six weeks of isolation. Flash flooding, mainly due to water from Queensland, is a major concern, prompting 19 SES flood rescues and 586 emergency responses in the past 24 hours. In Taree, 22 people are surrounded by floodwater and are being rescued. An elderly man is missing after being washed away in floodwaters. The NSW SES advises residents to stay updated via their website or the Hazards Near Me app.

Sources: <a href="https://www.news.com.au/technology/environment/a-low-pressure-system-and-extc-whip-up-storms-and-wild-weather-across-australia/news-story/febbde20ce68b0e5bb6e15dd3de8f6a1" target="_blank">News.com.au - 31 March 2025</a>

## Albanese Abandons Energy Bill Reduction Modelling

### Summary:

Prime Minister Anthony Albanese has distanced himself from earlier modelling that supported the promise to cut power bills by $378 by 2030 and reduce emissions by 43%. He attributes the failure to achieve $275 reductions in power bills by 2025 to international factors, including the Ukraine war. This move has drawn criticism from both the Coalition and the Greens, who accuse the government of not effectively addressing power prices and emissions reduction.

Sources: <a href="https://www.theaustralian.com.au/nation/politics/anthony-albanese-abandons-modelling-underpinning-labors-energy-and-climate-agenda/news-story/2b75da5a71e8ddff7c393ae56db08cfe" target="_blank">The Australian - March 31, 2025</a>

## Albanese Seeks Direct Talks with Trump on Tariffs

### Summary:

Prime Minister Anthony Albanese anticipates a direct discussion with U.S. President Donald Trump regarding impending tariffs, as Washington prepares to announce new trade measures on April 2. There are concerns that Australia could be affected by this escalation in the global trade conflict. Albanese has emphasized his government's constructive engagement with U.S. officials on this issue and looks forward to a one-on-one conversation with President Trump.

Sources: <a href="https://www.reuters.com/world/australias-albanese-expects-one-on-one-discussion-with-trump-tariffs-2025-03-30/" target="_blank">Reuters - March 31, 2025</a>

## Queensland Government Expands 'Adult Time, Adult Crime' Laws

### Summary:

The Queensland state government plans to introduce at least a dozen new offenses to the Making Queensland Safer Laws, including rape, aggravated attempted robbery, attempted murder, arson, and torture. These changes will enable the judiciary to treat juvenile offenders as adults for severe crimes. Despite criticism over the delayed inclusion of attempted murder, Youth Justice Minister Laura Gerber defended the sequence and content of the initial changes. The full list of offenses will be unveiled later this week.

Sources: <a href="https://www.couriermail.com.au/news/queensland/secrecy-shrouds-new-additions-to-adult-time-adult-crime-laws/news-story/cca5b2f49a5a645bdaae882187fc79da" target="_blank">The Courier-Mail - March 30, 2025</a>

## Labor Government Proposes Ban on Supermarket Price Gouging

### Summary:

Prime Minister Anthony Albanese announced that a re-elected Labor government would introduce legislation to outlaw supermarket price gouging by the end of the year. The plan includes implementing Australian Competition and Consumer Commission (ACCC) recommendations to enhance price transparency and establishing a task force to advise on an "excessive pricing regime" for supermarkets, with potential heavy fines for violators. Opposition leader Peter Dutton criticized the approach as ineffective, suggesting it was merely a "wet lettuce" move. Critics from both sides called for tougher measures to combat supermarket dominance and protect consumers.

Sources: <a href="https://www.theguardian.com/australia-news/2025/mar/29/labor-promises-price-gouging-crack-down-on-supermarkets" target="_blank">The Guardian - March 29, 2025</a>, <a href="https://www.news.com.au/national/federal-election/anthony-albanese-declares-war-on-supermarket-pricegouging-promising-to-make-it-illegal/news-story/626425388f45ec44059ecc8854734ab5" target="_blank">News.com.au - March 30, 2025</a>

## Coles Expands Recall on Spinach Products Due to Contamination

### Summary:

Coles has extended its recall of various spinach products across multiple regions, including New South Wales and Victoria, due to potential microbial contamination. Customers are advised not to consume the affected products and can return them to any Coles store for a full refund. The recall applies to items purchased between March 20 and March 29, with use-by dates up to April 9.

Sources: <a href="https://www.news.com.au/lifestyle/food/food-warnings/salad-leaf-recall-extended-to-products-across-australia-as-coles-pulls-products-from-shelves/news-story/cbb2ef70f2452f4446eb5a9899113369" target="_blank">News.com.au - March 31, 2025</a>

## 66-Year-Old Man Rescued After Five Days Stranded in Australian Outback

### Summary:

Tony Woolford, a 66-year-old Australian man, was rescued after being stranded for five days in the flood-hit Munga-Thirri Simpson Desert. Woolford's vehicle was immobilized by rising floodwaters, and with no phone service, he survived by harvesting rainwater and using a high-frequency radio to communicate with volunteers. Authorities were notified on March 23, and he was rescued on March 26 in stable condition and high spirits. Despite the ordeal, Woolford plans to return to the outback to retrieve his car and continue his exploration once conditions improve.

Sources: <a href="https://people.com/man-saved-rising-flood-water-alone-australian-outback-11704149" target="_blank">People - March 28, 2025</a>

## US Tariffs and Australia's Response

### Summary:

Former US trade negotiator Ralph Ives asserts that the US-Australia Free-Trade Agreement has ensured fair reciprocity for two decades, suggesting that President Donald Trump should not impose reciprocal tariffs on Australia. Prime Minister Anthony Albanese anticipates a direct discussion with President Trump regarding these tariffs, expressing concern over potential impacts on Australian exports.

Sources: <a href="https://www.theaustralian.com.au/nation/lead-us-fta-negotiators-oppose-reciprocal-tariffs-on-australia/news-story/e0857b7d3a5354c6368da5930581be1e" target="_blank">The Australian - March 31, 2025</a>, <a href="https://www.reuters.com/world/australias-albanese-expects-one-on-one-discussion-with-trump-tariffs-2025-03-30/" target="_blank">Reuters - March 31, 2025</a>

## Controversial Genetically Modified Mosquito Plan Monitored Amid Backlash

### Summary:

The Queensland government is set to monitor a proposal by Oxitec Australia to release genetically modified mosquitoes aimed at reducing disease transmission. Despite community opposition and concerns about environmental and health risks, supporters argue the initiative could combat diseases like dengue and Zika. Public consultations have been delayed due to significant interest and debate continues over the plan's potential impacts. Sources: <a href="https://www.couriermail.com.au/lifestyle/pets-and-wildlife/qld-government-to-monitor-oxitecs-gm-mozzies-plan-after-community-backlash/news-story/04c5586ea500db3634ff79524fd923c7" target="_blank">The Courier-Mail - March 26, 2025</a>

## Dr. Patrick Soon-Shiong: You're Being Lied to About Cancer, How It's Caused, and How to Stop It

### Summary:

In this episode of The Tucker Carlson Show, Dr. Patrick Soon-Shiong, a renowned physician and entrepreneur, discusses misconceptions surrounding cancer, its origins, and potential treatments. He emphasizes the complexity of cancer, noting that it's not a single disease but a collection of related diseases requiring varied approaches. Dr. Soon-Shiong highlights the role of the immune system in combating cancer and advocates for treatments that bolster immune responses rather than solely relying on traditional methods like chemotherapy. He also addresses the importance of early detection and personalized medicine in improving patient outcomes.

Sources: <a href="https://open.spotify.com/episode/1R8wy3BlEYXcQbNEO5EhVI" target="_blank">The Tucker Carlson Show - March 31, 2025</a>

-

@ 22001a51:7dc020ce

2025-03-30 19:46:55

Adding more bag in $KFR

Is the next big thing in this Easter season on Solana blockchain

-

@ 7d33ba57:1b82db35

2025-03-30 19:16:14

Fažana is a picturesque fishing village on Croatia’s Istrian coast, just 8 km from Pula. Known for its colorful waterfront, fresh seafood, and as the gateway to Brijuni National Park, Fažana is a peaceful alternative to larger tourist hotspots.

## **🌊 Top Things to See & Do in Fažana**

### **1️⃣ Stroll the Fažana Waterfront & Old Town 🎨**

- The charming **harbor is lined with colorful houses, cafés, and fishing boats**.

- Visit **St. Cosmas and Damian Church**, a small yet beautiful historical site.

- Enjoy a **relaxed Mediterranean atmosphere** with fewer crowds than Pula.

### **2️⃣ Take a Boat Trip to Brijuni National Park 🏝️**

- **Brijuni Islands**, just 15 minutes away by boat, offer **stunning nature, Roman ruins, and a safari park**.

- Explore the **remains of a Roman villa, Tito’s summer residence, and dinosaur footprints**!

- Rent a **bike or golf cart** to explore the islands at your own pace.

### **3️⃣ Enjoy the Beaches 🏖️**

- **Badel Beach** – A **Blue Flag beach**, great for families with **crystal-clear, shallow waters**.

- **Pineta Beach** – A **peaceful, pine-shaded spot** with a mix of sand and pebbles.

- **San Lorenzo Beach** – A scenic spot **perfect for sunset views over Brijuni**.

### **4️⃣ Try the Local Seafood 🍽️**

- Fažana is known as **the "Sardine Capital of Istria"** – try **grilled sardines** with local wine.

- Visit **Konoba Feral** or **Stara Konoba** for authentic Istrian seafood.

- Pair your meal with **Istrian Malvazija wine**.

### **5️⃣ Visit the Sardine Park 🐟**

- A **unique outdoor exhibition** dedicated to Fažana’s fishing traditions.

- Learn about **the history of sardine fishing and processing** in Istria.

### **6️⃣ Take a Day Trip to Pula 🏛️**

- Just **15 minutes away**, Pula offers **Roman ruins, historic sites, and vibrant nightlife**.

- Don’t miss the **Pula Arena, Temple of Augustus, and the lively Old Town**.

## **🚗 How to Get to Fažana**

✈️ **By Air:** Pula Airport (PUY) is just **15 minutes away**.

🚘 **By Car:**

- **From Pula:** ~15 min (8 km)

- **From Rovinj:** ~35 min (30 km)

- **From Zagreb:** ~3.5 hours (270 km)

🚌 **By Bus:** Regular buses run between **Pula and Fažana**.

🚢 **By Boat:** Ferries to **Brijuni National Park** depart from Fažana’s harbor.

---

## **💡 Tips for Visiting Fažana**

✅ **Best time to visit?** **May–September** for beach weather & Brijuni trips ☀️

✅ **Try local olive oil** – Istria produces some of the **best olive oils in the world** 🫒

✅ **Visit early for boat tickets to Brijuni** – They can sell out quickly in summer ⏳

✅ **Perfect for a relaxing stay** – Less crowded than Pula but close to major attractions 🌊

-

@ 83e26223:2ba007a6

2025-03-30 15:58:07

Bitcoin's potential to reach $100,000 is gaining traction among experts and analysts. Several factors contribute to this...

- Increased Adoption: Growing institutional investment and mainstream acceptance are driving Bitcoin's price up. As more businesses and consumers use Bitcoin for transactions, its value could surge.

- Reduced Supply and Increased Demand: The recent halving event reduced Bitcoin's supply, while demand from Bitcoin ETFs and new investors continues to rise. This imbalance could push prices higher.

- Limited Supply and Store of Value: Bitcoin's capped supply of 21 million coins makes it an attractive store of value, similar to gold. As inflation concerns grow, investors may turn to Bitcoin as a hedge.

- Positive Market Trends: The rise of decentralized finance (DeFi) and the potential for interest rate cuts by the Federal Reserve could further boost Bitcoin's price.

- Expert Predictions: Analysts like Cathie Wood and The Motley Fool believe Bitcoin's price could triple or quadruple in the next few years, reaching and surpassing $100,000.

While predictions are subjective and the cryptocurrency market is notoriously volatile, these factors contribute to the growing optimism about Bitcoin's potential to reach $100,000. For investors, it's essential to stay informed, manage risks, and adopt a long-term perspective.

-

@ 0f9da413:01bd07d7

2025-03-30 15:37:53

ช่วงสัปดาห์ก่อน 21-30 มีนาคม 2568 ที่ผ่านมาส่วนตัวได้มีภาระกิจเดินทางไปปฏิบัติงานของสถานที่ทำงานและรวดไปเที่ยวส่วนตัว ในการเดินทางในครั้งนี้ภาระกิจหลักส่วนตัวอาจจะไปทำงานแต่หากมีการเดินทางแล้วผมมักจะชอบเดินทางไปพบปะชาว bitcoiner ชาวไทย หรือชาว #siamstr ตามสถานที่ต่างๆ อยู่เสมอตลอดช่วงระยะเวลาดังกล่าวส่วนตัวก็ได้เดินทางไปยังพื้นที่ดังนี้

- ชลบุรี (พัทยา)

- เกาะช้าง (ตราด)

- หาดใหญ่ (สงขลา)

- เชียงใหม่

ซึ่งได้ตรวจเช็คแล้วในพื้นที่ดังกล่าวมีร้านรับ bitcoin อยู่และมีประสบการณ์ในแต่ละที่ที่แตกต่างกันออกไปซึ่งผมเองจะขอรัวิวการเดินทางดังกล่าวนี้ โดยอ้างอิงจากการตามรอยร้านที่รับชำระด้วย BTC ผ่าน BTC Map และจะมีบางร้านที่ไม่ได้อยู่ใน BTC Map ก็ขอรีวิวตามช่วงระยะเวลา Timeline ละกัน

---

### **Seeva Cafe Pattya**

ร้านชีวาคาเฟ่ ร้านตกแต่งในสไตล์ศิลปะและกาแฟในร้านมีโซนจำหน่ายขนมเค้กและอื่นๆ อีกด้วย มีต้นไม้ร่มรื่นและบรรยากาศค่อนข้างดีพอสมควร ท่านไหนอยากเดินทางไปจิบกาแฟเบาๆ นั่งทำงานพักผ่อนแถวพัทยาใต้ก็สามารถเดินทางไปแวะชิมกันได้ (รับบิทคอยด้วยนะ) สถานที่นี้ไม่ได้เสีย sats เนื่องจากมีเจ้าภาพเลี้ยง ขอบคุณครับ

**Google Map**: https://maps.app.goo.gl/ZJNUGYiCgp1VTzGJ9

**BTC-Map:** None

[image](https://yakihonne.s3.ap-east-1.amazonaws.com/0f9da41389e1239d267c43105ecfc92273079e80c2d4b09e1d1e172701bd07d7/files/1743345791736-YAKIHONNES3.JPG)

---

### **Piya Silapakan Museum of Art Pattaya**

สถานที่ถัดมาเป็นหอศิลป์ ปิยะศิลปาคารเป็นสถานที่ที่เก็บรวมรวมผลงานทางศิลปะต่างๆ ภาพวาดเสมือนจริงซึ่งแน่นอนว่าสามารถมาเรียน Workshop ทางด้านศิลปะได้แน่นอนว่าสามารถจ่ายด้วย Bitcoin Lightning ได้โดยผมเองก็ได้วาดศิลปะสีน้ำวาดบนกระเป๋าผ้า เอาจริงๆ ณ ตอนที่วาดนั้นแทบจะลืมเวลาและโพกัสกับสิ่งที่วาดอยู่ทำให้รู้สึกผ่อนคลายและวาดสิ่งต่างๆ เหมือนตอนสมัยเด็กๆ ซึ่งหากมีเวลาเพิ่มเติมผมเองก็อาจจะเจียดเวลาไปลองวาดศิลปะแลลอื่นๆ โดยที่ไม่ต้องให้ใครมาตัดสินใจ สวยไม่สวยอย่างไร ก็อยู่ที่เรา หลายครั้งเราชอบให้คนอื่นตัดสินใจเพื่อทำให้เรารู้สึกดี ลองมาที่นี้ดูสิแล้วคุณจะตัดสินใจด้วยตนเอง

อันนี้ผลงานส่วนตัวที่ได้ทำ แล้วแต่การจินตนาการของแต่ละท่านว่าสิ่งที่ผมวาดมันคืออะไรก็แล้วกัน

งานนี้หมดไปแล้ว 13,173 sats แวะมาเยี่ยมชมกันได้ที่พัทยา ชลบุรี :)

**Google map**: https://maps.app.goo.gl/mjMCdxEe36ra1jDF6

**BTC-Map:** None

---

### **Toffee Cake Pattaya**

เป็นร้านสุดท้ายที่ได้ไปใช้งานชื้อขนมติดไม้ติดมือกลับไปยังที่พักก่อนส่วนตัวจะเดินทางต่อไป หมดไป 1,904 sats เหมาะสำหรับชื้อของฝากติดไม้ติดมือกลับบ้าน

**Google map**: https://maps.app.goo.gl/jqRyHTFzXVe6qYSv9

**BTC-Map:** https://btcmap.org/map?lat=12.9509827&long=100.8974009

หลังจากเดินทางพักที่พัทยาหนึ่งคืนก่อนเดินทางไปยังเกาะช้าง สรุปสถานที่พัทยานั้นหมดไปทั้งหมด 15,077 sats (คำนวนเงินอนาคตน่าจะ 15,077 usd กาวกันไว้ก่อน) สำหรับ Part 2 นั้นจะรีวิวร้านที่อยู่ในพื้นที่เกาะช้างซึ่งผมได้ตามรอยจาก BTC-Map จะเป็นอย่างไรเชิญติดตามครับ ขอบคุณครับ

-

@ 3514ac1b:cf164691

2025-03-30 15:16:56

hi , My name is Erna and i hope this articles find you well.

hmm what i like to talked about today is how i dislike my my black coffee getting cold .

it is happened almost everyday .

here is my morning flow :

wake up

brush teeth and make my self ready

make coffee ( boiled water ) in meantime

switch on my computer

reading news , things ( water allready boiled )

get my coffee and put my coffee on the side of my computer

keep reading and social media

1 hour later

coffee get cold

meeeh i need to drink this everyday .

so which of thos work flow is wrong ? am i doing it wrong ?

suggested me a good morning routine so my coffee still hot when i drink it .

-

@ bcb80417:14548905

2025-03-30 14:40:40

President Donald Trump's recent policy initiatives have significantly impacted the cryptocurrency landscape, reflecting his administration's commitment to fostering innovation and positioning the United States as a global leader in digital assets.

A cornerstone of this approach is the aggressive deregulation agenda aimed at reversing many policies from the previous administration. Key areas of focus include slashing environmental regulations, easing bank oversight, and removing barriers to cryptocurrencies. The Environmental Protection Agency, for instance, announced 31 deregulatory actions in a single day, underscoring the breadth of these efforts. This push has led to rapid growth in the crypto industry, with increased investment and activity following the administration's moves to ease restrictions. citeturn0news10

In line with this deregulatory stance, the U.S. Securities and Exchange Commission (SEC) recently hosted its inaugural public meeting of the crypto task force. Led by Republican SEC Commissioner Hester Peirce, the task force is exploring the applicability of securities laws to digital assets and considering whether new regulatory frameworks are necessary. This initiative reflects a shift in regulatory approach under President Trump, who has pledged to reverse the previous administration's crackdown on crypto firms. citeturn0news11

Further demonstrating his support for the crypto industry, President Trump announced the inclusion of five cryptocurrencies—Bitcoin, Ethereum, Ripple (XRP), Solana (SOL), and Cardano (ADA)—into a proposed "crypto strategic reserve." This move led to significant price surges for these assets, highlighting the market's responsiveness to policy decisions. citeturn0search0

The administration's commitment extends to the development of stablecoins. World Liberty Financial, a cryptocurrency venture established by Donald Trump and his sons, plans to launch a stablecoin called USD1. This stablecoin will be entirely backed by U.S. treasuries, dollars, and cash equivalents, aiming to provide a reliable medium for cross-border transactions by sovereign investors and major institutions. The USD1 token will be issued on the Ethereum network and a blockchain developed by Binance. citeturn0news13

In the financial sector, Trump Media & Technology Group Corp. is collaborating with Crypto.com to introduce "Made in America" exchange-traded funds (ETFs) focusing on digital assets and securities. This initiative aligns with President Trump's pro-cryptocurrency stance and his ambition to make the U.S. a global crypto hub. The ETFs, supported by Crypto.com, will feature a combination of cryptocurrencies such as Bitcoin and are slated to launch later this year. citeturn0news12