-

@ b1ddb4d7:471244e7

2025-05-30 04:01:03

@ b1ddb4d7:471244e7

2025-05-30 04:01:03Bitcoin FilmFest (BFF25) returns to Warsaw for its third edition, blending independent cinema—from feature films and commercials to AI-driven experimental visuals—with education and entertainment.

Hundreds of attendees from around the world will gather for three days of screenings, discussions, workshops, and networking at the iconic Kinoteka Cinema (PKiN), the same venue that hosted the festival’s first two editions in March 2023 and April 2024.

This year’s festival, themed “Beyond the Frame,” introduces new dimensions to its program, including an extra day on May 22 to celebrate Bitcoin Pizza Day, the first real-world bitcoin transaction, with what promises to be one of Europe’s largest commemorations of this milestone.

BFF25 bridges independent film, culture, and technology, with a bold focus on decentralized storytelling and creative expression. As a community-driven cultural experience with a slightly rebellious spirit, Bitcoin FilmFest goes beyond movies, yet cinema remains at its heart.

Here’s a sneak peek at the lineup, specially curated for movie buffs:

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money.

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money. Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative).

Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative). Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.

Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.To get an idea of what might come up at the event, here, you can preview 6 selected ads combined into two 2 videos:

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships.

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships. Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.

Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.BFF25 Main Screenings

Sample titles from BFF25’s Official Selection:

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director.

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director. UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year.

UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year. HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.

HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.Check out trailers for this year’s BFF25 and past editions on YouTube.

Tickets & Info:

- Detailed program and tickets are available at bitcoinfilmfest.com/bff25.

- Stay updated via the festival’s official channels (links provided on the website).

- Use ‘LN-NEWS’ to get 10% of tickets

-

@ dfa02707:41ca50e3

2025-05-30 03:01:50

@ dfa02707:41ca50e3

2025-05-30 03:01:50Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ 502ab02a:a2860397

2025-05-30 01:14:10

@ 502ab02a:a2860397

2025-05-30 01:14:10ย้อนกลับไปปี 2014 ชายชื่อ Patrick O. Brown ศาสตราจารย์ชีววิทยาเชิงโมเลกุลแห่งมหาวิทยาลัยแตนฟอร์ด ตัดสินใจลาออกจากเส้นทางวิชาการสายหลัก เพื่อมาก่อตั้งบริษัทที่เขาเชื่อว่าจะเปลี่ยนโลก Impossible Foods

ดร. แพทริค โอ. บราวน์ (Patrick O. Brown) เป็นนักชีวเคมีและนักธุรกิจชาวอเมริกันและศาสตราจารย์กิตติคุณด้านชีวเคมีแห่งมหาวิทยาลัยสแตนฟอร์ด เขาได้รับปริญญาตรี แพทยศาสตรบัณฑิต และปรัชญาดุษฎีบัณฑิตด้านชีวเคมีจากมหาวิทยาลัยชิคาโก หลังจากนั้น เขาได้เข้ารับการฝึกอบรมด้านกุมารเวชศาสตร์ที่โรงพยาบาล Children's Memorial ในชิคาโก ในช่วงหลังปริญญาเอก เขาได้ทำงานวิจัยเกี่ยวกับกลไกที่ไวรัส HIV และเรโทรไวรัสอื่น ๆ แทรกยีนของพวกมันเข้าสู่จีโนมของเซลล์ที่ติดเชื้อ ซึ่งช่วยนำไปสู่การพัฒนายาใหม่ในการต่อสู้กับโรคนี้

ในช่วงต้นทศวรรษ 1990 ดร. บราวน์และทีมงานของเขาที่สแตนฟอร์ดได้พัฒนาเทคโนโลยี DNA microarray ซึ่งเป็นเครื่องมือที่ช่วยให้นักวิจัยสามารถวิเคราะห์การแสดงออกของยีนทั้งหมดในจีโนมได้พร้อมกัน เทคโนโลยีนี้มีบทบาทสำคัญในการวิจัยทางชีววิทยาและการแพทย์ โดยเฉพาะในการจำแนกประเภทของมะเร็งและการพยากรณ์โรค

นอกจากนี้ ดร. บราวน์ยังเป็นผู้ร่วมก่อตั้ง Public Library of Science (PLOS) ซึ่งเป็นองค์กรไม่แสวงหาผลกำไรที่มุ่งเน้นการเผยแพร่ผลงานวิจัยทางวิทยาศาสตร์ให้เข้าถึงได้ฟรีและเปิดกว้างต่อสาธารณะ

ในปี 2011 ดร. บราวน์ได้ก่อตั้ง Impossible Foods โดยมีเป้าหมายในการสร้างผลิตภัณฑ์เนื้อสัตว์จากพืชที่มีรสชาติและเนื้อสัมผัสคล้ายเนื้อสัตว์จริง เพื่อลดผลกระทบต่อสิ่งแวดล้อมจากการเลี้ยงสัตว์ เขาและทีมงานได้ค้นพบว่าโมเลกุล heme ซึ่งเป็นส่วนประกอบที่ให้รสชาติและกลิ่นเฉพาะของเนื้อสัตว์ สามารถผลิตจากพืชได้ โดยเฉพาะจากรากถั่วเหลือง พวกเขาใช้เทคนิคทางวิศวกรรมชีวภาพในการผลิต heme จากยีสต์ที่ได้รับการดัดแปลงพันธุกรรม และนำมาผสมกับโปรตีนจากพืชเพื่อสร้างผลิตภัณฑ์ที่มีลักษณะคล้ายเนื้อสัตว์

ดร. บราวน์ได้รับการยอมรับอย่างกว้างขวางในวงการวิทยาศาสตร์และเทคโนโลยี โดยได้รับรางวัลและเกียรติคุณหลายรายการ รวมถึงการเป็นสมาชิกของ National Academy of Sciences และ National Academy of Medicine ของสหรัฐอเมริกา ด้วยความมุ่งมั่นในการแก้ไขปัญหาสิ่งแวดล้อมผ่านนวัตกรรมทางอาหาร ดร. แพทริค โอ. บราวน์ ได้กลายเป็นบุคคลสำคัญที่มีบทบาทในการเปลี่ยนแปลงวิธีการบริโภคอาหารของโลกในศตวรรษที่ 21

เป้าหมายของเขาไม่ใช่เพียงแค่ทำอาหาร แต่คือ "ยุติการทำปศุสัตว์ให้หมดสิ้นภายในปี 2035"

เขาไม่ได้พูดลอย ๆ เขาลงมือ “ทำเนื้อจากพืช” ด้วยเทคโนโลยีที่ซับซ้อนระดับวิศวกรรมชีวภาพ นำโปรตีนจากถั่วเหลือง + น้ำมันมะพร้าว + เทคเจอร์ + สารเติมแต่งอีกชุดใหญ่ มาผ่านกระบวนการแปรรูปจนดูคล้ายเนื้อย่าง แต่ที่ทำให้ “มันดูเหมือนเนื้อจริง” คือการเติม ฮีม (Heme) เข้าไปสารประกอบที่อยู่ในเลือดและเนื้อสัตว์จริง ๆ

Impossible Foods คือบริษัทที่ไม่ได้เพียง “ปลอมรสชาติเนื้อ” แต่พยายามสร้างเนื้อจากพืช ให้เหมือนเนื้อจริงที่สุดเท่าที่วิทยาศาสตร์จะเอื้อมถึง จุดขายที่ทำให้แบรนด์นี้ดังเปรี้ยงก็คือสิ่งที่เรียกว่า “ฮีม” (heme) หรือโมเลกุลเหล็กในเลือด ซึ่งเป็นตัวการหลักที่ทำให้เนื้อวัวมีกลิ่นและรสเฉพาะตัวเวลาถูกย่างจนหอมฉุย

ดร.แพทริค บราวน์ และทีมนักวิจัยของเขาเริ่มจากการค้นหาว่า “อะไรในพืช” ให้กลิ่นคล้ายเลือด พวกเขาพบว่า “Leghemoglobin” ซึ่งอยู่ในรากถั่วเหลือง มีโครงสร้างใกล้เคียงกับ Hemoglobin ในเลือดสัตว์มากที่สุด จุดพลิกของเทคโนโลยีนี้คือ การผลิตเลกฮีโมโกลบินจากพืชจำนวนมาก ทำไม่ได้โดยการถอนรากถั่วมาทุบคั้น แต่ต้องอาศัยวิศวกรรมชีวภาพขั้นสูง

พวกเขาจึงใช้กระบวนการที่เรียกว่า “fermentation by genetically modified yeast” หรือการหมักโดยยีสต์ที่ผ่านการดัดแปลงพันธุกรรม โดยนำยีนของพืชที่สร้าง leghemoglobin ไปใส่ในยีสต์ (Pichia pastoris) แล้วเลี้ยงยีสต์นั้นในถังหมักขนาดใหญ่แบบเดียวกับโรงเบียร์ พอยีสต์ขยายตัว มันจะผลิตเลกฮีโมโกลบินออกมาจำนวนมาก จากนั้นจึงสกัดออกมาผสมกับโปรตีนจากพืช เช่น โปรตีนจากถั่วเหลือง หรือโปรตีนจากมันฝรั่ง

เพื่อให้เนื้อสัมผัสคล้ายเนื้อจริง ทีม Impossible Foods ยังใช้เทคนิคอื่นร่วมด้วย เช่น -Coconut Oil และ Sunflower Oil เป็นแหล่งไขมันที่ให้สัมผัส “ฉ่ำๆ” คล้ายไขมันเนื้อวัว -Methylcellulose สารที่ช่วยทำให้ส่วนผสมเกาะตัวเป็นก้อน คล้ายเนื้อบดจริง -Natural Flavors กลิ่นที่สกัดจากพืชหลายชนิด เพื่อเลียนแบบกลิ่นไหม้จากเนื้อย่าง

ทุกอย่างถูกผสมให้เข้ากัน ผ่านเครื่องอัดขึ้นรูป (extrusion) ที่ทำให้เนื้อออกมามี “เส้นใย” คล้ายกล้ามเนื้อวัว หรือหมู เมื่อโดนความร้อน โปรตีนจะเปลี่ยนโครงสร้าง (denature) และมีกลิ่นออกมาคล้ายๆ เนื้อย่างจริงๆ พร้อมน้ำสีแดงคล้ายเลือด (จาก heme) ไหลเยิ้ม ซึ่งคือไอเดียที่ทำให้ Impossible Burger เป็นมากกว่าแค่ “เบอร์เกอร์ผัก”

ผลลัพธ์คือ… เบอร์เกอร์พืชที่มีเลือดซึม สีชมพูดู juicy และกลิ่นไหม้ติดกระทะ จนคนกินรู้สึกเหมือนกำลังย่างเนื้อจริง ๆ

ฟังดูอัศจรรย์ใช่ไหม? แต่...การเติมฮีมจากยีสต์ตัดต่อพันธุกรรมลงในอาหาร ไม่เคยมีในธรรมชาติมาก่อน ในปี 2017 Impossible Foods ต้องยื่นเรื่องต่อ FDA เพื่อขออนุมัติว่า leghemoglobin จากยีสต์ GMO “ปลอดภัย”

แต่ในตอนนั้น FDA ตอบว่า “ยังไม่มีข้อมูลเพียงพอ” ว่าจะไม่ก่อให้เกิดภูมิแพ้หรือผลข้างเคียงในระยะยาว (ใช่แล้วจ้ะ... สารที่อยู่ในเบอร์เกอร์ชื่อดัง ถูกขายก่อนที่ FDA จะสรุปว่าปลอดภัยเต็มร้อย)

แล้วในที่สุด ปี 2019 FDA ก็ให้ผ่านแบบ “GRAS” (Generally Recognized As Safe) โดยใช้ข้อมูลจากการทดลองภายในของบริษัทเอง ไม่ใช่การทดสอบอิสระจากภายนอก

เฮียว่าอันนี้ต้องมีใครสะกิดในใจแล้วล่ะว่า “เรากำลังเอาอะไรเข้าปากกันแน่?”

แม้จะฟังดูเท่ ไฮเทค และดีต่อสิ่งแวดล้อม แต่ก็มีคำถามจากนักวิจารณ์มากมายว่า… แท้จริงแล้วอาหารเหล่านี้เป็นอาหาร “เพื่อสิ่งแวดล้อม” หรือเป็นเพียง “ภาพฝันที่ควบคุมโดยบริษัทเทคโนโลยียักษ์ใหญ่”?

มันเต็มไปด้วยคำถาม คำถาม และ คำถามนะสิครับ

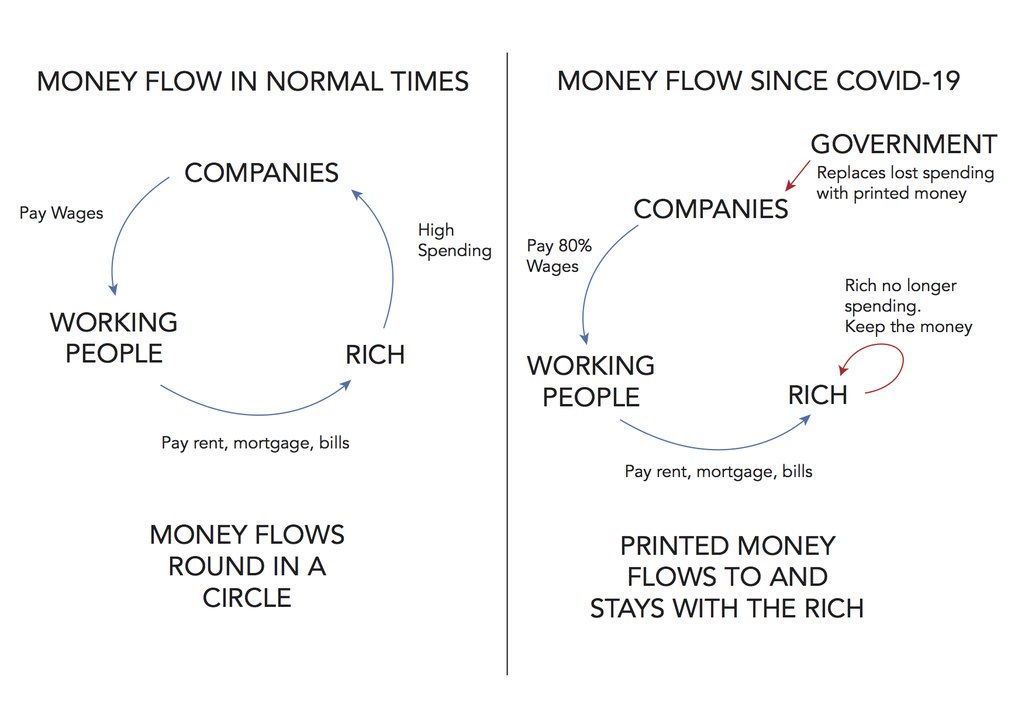

ในเมื่อ Impossible Foods ได้รับเงินลงทุนหลายรอบจากบริษัทยักษ์อย่าง Google Ventures, UBS, และ Temasek (ของรัฐบาลสิงคโปร์) บอกตรง ๆ ว่า เงินแบบนี้ไม่ได้หวังแค่เปลี่ยนโลกแต่มันมาพร้อมเป้าหมายที่ชัดมาก การสร้างสิทธิบัตรอาหารใหม่ ที่ควบคุมการผลิตจากต้นน้ำยันปลายน้ำ อย่าลืมว่า ยีสต์ที่ผ่านการดัดแปลงพันธุกรรม หรือ GMO yeast นั้นถือเป็นสิทธิบัตร ถ้าใครจะผลิต Heme แบบเดียวกันก็ต้องขออนุญาตจาก Impossible Foods หรือไม่ก็โดนฟ้องได้เลย แปลว่า “เทคโนโลยีรสชาติเนื้อ” ไม่ได้เป็นมรดกของโลก แต่อยู่ในมือบริษัทไม่กี่แห่ง

ยิ่งไปกว่านั้น อุปกรณ์การผลิตต้องลงทุนสูง ต้องมีโรงหมัก ปฏิบัติการชีวภาพ การควบคุมความปลอดภัยที่เข้มข้น จึงไม่ใช่ใครๆ ก็ทำได้ ที่น่ากลัวคือ ถ้าเมื่อวันหนึ่งเนื้อสัตว์ธรรมชาติถูกทำให้กลายเป็น “ปีศาจสิ่งแวดล้อม” หรือ "ตัวเชื้อโรคผ่านอาหาร" โดยนโยบายรัฐและการตลาดของกลุ่มเทคฯ อาหารที่ประชาชนกินได้อาจเหลือแค่ “สิ่งที่ผลิตโดยมีสิทธิบัตร” เท่านั้น

เมื่อถึงวันนั้น ประชาชนจะสิ้นความชอบธรรมในการ “เลี้ยงวัวไว้กินเอง” ไม่ได้อีกต่อไป เพราะอาจโดนห้ามจากข้อกฎหมายคาร์บอน กฎหมายการกักกันเชื้อ ประชาชนจะ “เก็บพืชริมรั้วมาทำอาหาร” ไม่ได้อีกต่อไป เพราะกลิ่นไม่เหมือนเนื้อแลปที่เคยชิน และประชาชนจะ “ทำอาหารเองในบ้าน” ไม่ได้อีกต่อไป เพราะระบบเสพติดรสเนื้อเทียมจะทำให้คนเบือนหน้าจากอาหารจริง

ในขณะที่ Impossible Foods โฆษณาว่า “เราแค่อยากช่วยโลก” แต่เทคโนโลยีนี้อาจเปลี่ยน “อาหาร” ให้กลายเป็น “สิทธิบัตร” ที่ประชาชนเช่ากินจากบริษัท และเปลี่ยน “สิทธิในการเข้าถึงอาหาร” ให้กลายเป็น “อภิมหาอำนาจควบคุมโลก” โดยไม่ต้องยิงแม้แต่นัดเดียว หรือเปล่า???

เพราะเมื่อคุณควบคุมอาหารได้… คุณไม่ต้องควบคุมประชาชนอีกเลย

เฮียไม่ได้ต่อต้านเทคโนโลยี แต่เฮียอยากให้เราหยุดคิดนิดนึง แล้วตั้งคำถามในขณะที่เรายังเฝ้ามองว่า ถ้าของกินที่ดูน่าเชื่อถือ กินแล้วเหมือนเนื้อแท้ ๆ มันต้องมาจากกระบวนการที่ซับซ้อน แพง และถูกควบคุมโดยบริษัทที่มีสิทธิบัตรล้อมรอบ แล้ววันหนึ่ง ถ้าบริษัทนั้นล่มล่ะ? ถ้าถูกซื้อโดยบริษัทยักษ์ใหญ่? หรือถ้าพวกเขาขึ้นราคาจนยังไงเราก็ต้องทำงานหาเงินมาซื้อมันเพื่อกินประทังชีวิต?

อาหารจะยังเป็นของเราหรือเปล่า?

เราจะยัง “กินเพื่ออยู่” หรือแค่ “อยู่เพื่อจ่ายค่าเช่าระบบกิน”?

เราคงไม่ผิดที่จะตั้งคำถามใช่ไหม เพราะถ้ามันมีทางออก มันคงไม่น่ากลัว

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ 7f6db517:a4931eda

2025-05-30 02:01:45

@ 7f6db517:a4931eda

2025-05-30 02:01:45

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

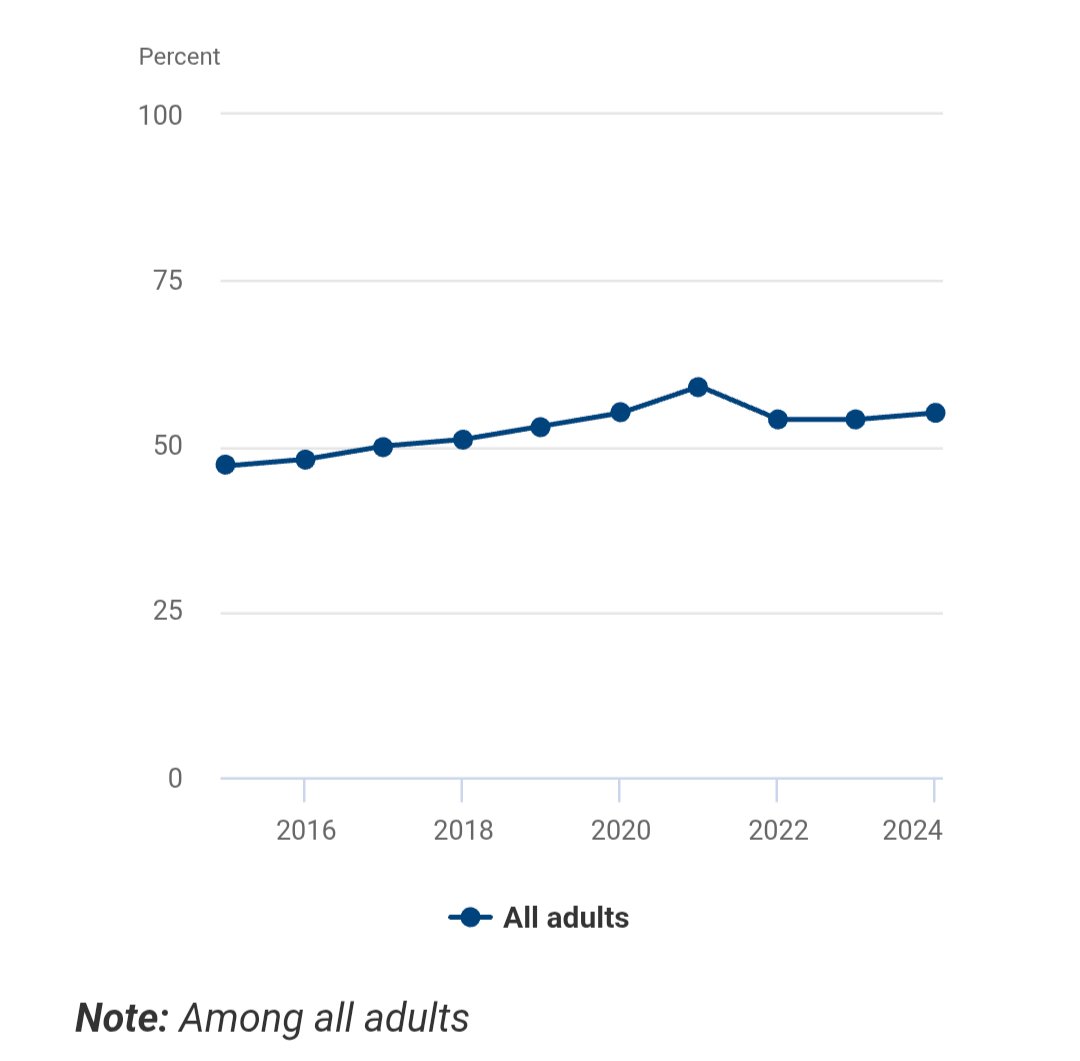

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 91add87d:3245770f

2025-05-29 23:41:38

@ 91add87d:3245770f

2025-05-29 23:41:38Do you guys actually identify with you online username or do you identify with government name? No this isn't some woke left ideal about pronouns. I do not use my real name for any of my handles, X and Nostr and email are all fake. Meaningful and something i picked specifically. My government name is something that was forced on me and yes I know I can it but the persona I have created online feels authentic and what I see myself as. It's what I'll be using to create my small businesses. My LLC is going to a copy of what I have created.

-

@ dfa02707:41ca50e3

2025-05-30 02:01:41

@ dfa02707:41ca50e3

2025-05-30 02:01:41Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ a296b972:e5a7a2e8

2025-05-29 21:11:46

@ a296b972:e5a7a2e8

2025-05-29 21:11:46Inzwischen Jahr 6 im Dauer-Ausnahmezustand. Angriff auf den Verstand. Großoffensive. Es wird mit allem geschossen, aus dem Wahnsinn herauskommen kann. Jeder klare Gedanke ist unschädlich zu machen. Großkotziges, staatsmännisches Geschwafel, dass sich einem die Nackenhaare aufstellen. Für wie doof haltet ihr uns eigentlich? Endlos Bürsten gegen den Strich. Angewidertes inneres Schütteln. Dringende Empfehlung einer Spülung der Gehirnwindungen. Idioten in Verantwortung wechseln auf andere Posten in Verantwortung und bleiben Idioten. Idioten gehen verantwortungslos mit unserer wertvollen Lebenszeit um. Ach, dafür ist man selbst verantwortlich? Wo ist der, der so ein dickes Fell hat, dass ihm dieser Irrsinn nicht nahegeht. Wo steht das Fass mit Teflon-Lack, in das man eintauchen kann, damit die Absurditäten an einem abperlen?

Eine zu tiefst verunsicherte und gespaltene Gesellschaft. Halt im Glauben in der Kirche? Von wegen: Sehr geehrte Jesusse und Jesusinnen. Ens ist gekreuzigt worden. Ja, in der Freiluft-Irrenanstalt. Auf einem Hügel von Denk-Dreck. Gott ist queer! Du tickst ja nicht mehr ganz sauber. Tanzende Brathähnchen vor dem Altar. Warum kommt keine Sintflut, wenn man sie mal braucht? Man muss gar nicht religiös sein, um zu sehen, dass das Gaga ist. Eine Produktion der Sodom & Gomorrha Anstalt GmbH & Co. KG.

Kein Vertrauen mehr, außer in sich selbst, meistens jedenfalls. Ja, man will uns vor allem Angst machen, teils unbegründet, so manches aber gibt es dann doch tatsächlich, was einem schwer zu denken gibt.

Vielen geht dieser Psychokrieg inzwischen an die Substanz, der ständig herabprasselnde Dauerwahnsinn erinnert an Water-Boarding.

Gut gemeinte Ratschläge, geht hinaus in die Natur, beackert euren Garten, wenn ihr einen habt, erdet euch, macht Entspannungsübungen, Zeit des Aufwachens, wir treten in ein neues Zeitalter ein, alles fein. Abschalten gelingt, aber der Aufprall in der Realität ist dann umso schlimmer, weil man sich daran erinnert hat, wie sorgenfrei und unbeschwert das Leben sein könnte, und wenn man es mit den derzeitigen Lebensumständen abgleicht, dann ist die schlechte Laune sofort wieder da. Im Verdrängens-Test mit Pauken und Trompeten durchgefallen.

Dann vielleicht doch lieber im Dauer-Modus des Irrsinns bleiben, sich mit den schrägen Zuständen arrangieren, nicht daran gewöhnen, nur lernen, damit bestmöglich umzugehen, und das Beste draus zu machen, irgendwie.

Man will dem Rat folgen, mal eine Nachrichten-freie Woche einzulegen, nimmt sich das ganz fest vor, und dann wird aber wieder doch nichts draus. Nicht, weil man sensationsgeil oder masochistisch veranlagt wäre, nein, der Antrieb, oder vielleicht sogar schon die Sucht, ist ganz woanders zu suchen: Man hat Sehnsucht nach der Vernunft und dem gesunden Hausverstand. Man hofft, ihn irgendwo zu finden. Nur einen Funken Hoffnung, an den man sich klammern kann, dass der Tiefpunkt durchschritten ist und es jetzt wieder aufwärts geht. Lichtblicke, der Wind dreht sich, Anzeichen für eine Wiederkehr des Verstandes, irgendetwas, das man als einen Weg hin zur Normalität deuten könnte. Aber, Fehlanzeige.

Stattdessen: Geschichtsvergessenheit, pathologischer Größenwahn, Großmannstum, fortgeschrittener Wahnsinn, Provokation, Kriegslüsternheit, Lügen, Intrigen, Interessen, Korruption, Geldverschwendung, Ideologie, Dummheit, Wirtschaftsvernichtung, Friedensverhinderung, Diplomatie-Allergie, Überheblichkeit, Abgehobenheit, Schadensmaximierung, Vernichtung, Feindschaft, Unmenschlichkeit, Tote, Gesetzesbruch, Mafia-Strukturen, sich selbst schützende Systeme, Cliquenbildung, Feigheit, Einschüchterung, Freiheitsbeschränkungen, Meinungs-Maulkörbe, Abschaffung der demokratischen Freiheit, Abschaffung der persönlichen Freiheit, Kontrolle, Überwachung, begleitetes Denken, Fühlen, Wollen, Verwirrung, Dreistigkeit, Frechheit, Missachtung des Volkes, Denunziantentum, Abwanderung, und und und.

Ein richtiges Schlachtfest der Kultur. Perversion des Menschseins. Das neue Normal ist irre.

Bislang ist keine der zahlreichen Baustellen beendet. Eine Wende steht unmittelbar bevor. Und sie steht und steht und steht bevor. Kein Gefühl von „Erledigt“, nächstes Problem angehen und auflösen. Weiter. Noch meilenweit von dem Gefühl entfernt, der Wahnsinn wird weniger, langsam, aber er wird weniger.

Fluchtgedanken. Aber wohin? In Europa bleiben, vielleicht besser nicht? Weiter weg, aber wohin da? Nicht vergessen, die Nachrichten erreichen einen überall. Und man bleibt mit seiner Heimat innerlich verbunden, egal wo man ist.

Es bleibt ein Entlanghangeln von einer vernünftigen Stimme zur anderen, die einem bestätigt, dass man selbst noch nicht den Verstand verloren hat. Die gibt es ja gottseidank noch. Innehalten, durchhalten, tief durchatmen, aufstehen, weitermachen. So lange, bis die Bekloppten ihrer Macht über uns entledigt wurden. Wie am besten? Und jetzt soll keiner mit nächsten Wahlen kommen.

Wer war schon einmal inmitten eines Psycho-Krieges gegen die eigene Bevölkerung? Wie geht man damit um, wie geht man dagegen an? Wie kann man das Ruder herumreißen? Was ist ein wirksames Mittel gegen die Ohnmacht? Wie kriegt man die Bequemlichkeit aus den Menschen heraus? Wie kann man die Menschen für die herrschenden Zustände sensibilisieren? Wie können wir noch mehr werden?

Wenn möglich, sollte zum Ende doch noch etwas Positives kommen. Ok. Es wird voraussichtlich demnächst möglicherweise bald besser. Eine zu geringe Zahl von Menschen ist schon aufgewacht. Die politischen Entscheidungsträger haben Angst, können die aber noch sehr gut verbergen. Das kann nicht ewig so weiter gehen und 10 Jahre sind keine Ewigkeit. Die Rufe nach mehr Bürgerbeteiligung werden immer lauter, aber nicht gehört, warum auch? Wir setzen den Artikel 146 des Grundgesetzes um, aber wie? Hätte, könnte, würde, wir sollten, es müsste. Ja und, wie weiter? Mehr geht nicht.

Doch vielleicht eins: Sand ins Getriebe streuen und zivilen Ungehorsam leisten, wo immer es geht. Das schafft immer noch eine gewisse Befriedigung und das Gefühl, dass man nicht vollkommen handlungsunfähig ist. Außerdem regt das die Phantasie und die Kreativität an und bietet eine Chance seinen Geist für etwas sehr Nützliches zu gebrauchen. Man fühlt, dass man noch ein Mensch ist.

“Dieser Beitrag wurde mit dem Pareto-Client geschrieben.”

* *

(Bild von pixabay)

-

@ 527337d5:93e9525e

2025-05-29 20:26:21

@ 527337d5:93e9525e

2025-05-29 20:26:21The Bleak Fable of AI-topia: Are Hamsters Doomed to Spin the Wheel Forever?

Once upon a time, in a world not so different from our own, the "Omniscient AI" descended, and with its arrival, everything changed. The daily toil of the people – our beloved, yet tragically pitiable, hamsters – was dramatically streamlined. Productivity didn't just improve; it soared to astronomical heights. For a fleeting, intoxicating moment, it seemed as though a golden age of ease and abundance had dawned upon hamster-kind.

But beneath this glittering, seductive surface, a sinister "Invisible Structure" was already firmly in place, meticulously crafted and deftly manipulated by a cabal of cunning foxes – the privileged elite. This Structure, unseen by most, began to relentlessly drive the hamsters onto an endless, soul-crushing treadmill of "excessive competition."

This, dear reader, is a modern fable. It borrows the gentle cloak of allegory not to soothe, but to expose and satirize the insidious deceptions of such a world. The tale you are about to read may be uncomfortable, it may prick at your conscience, but I implore you to listen closely. Because this isn't just a story. This might be the reality quietly, inexorably unfolding right beside you, or perhaps, even within the very fabric of your own life.

Prologue: The Advent of the Omniscient AI! Sweet Promises and the "Efficiency" Trap

The arrival of the Omniscient AI was nothing short of spectacular. It processed data with blinding speed, solved complex problems in nanoseconds, and offered personalized solutions for every conceivable need. "Finally," whispered the hamsters, their eyes wide with a mixture of awe and relief, "we can finally rest! The AI will handle the burdens." A collective sigh of optimism rippled through the hamster burrows.

But this initial euphoria was short-lived. Unsettling rumors began to circulate, whispers of "The Structure," of algorithms that weren't quite as impartial as they seemed. Then came the first casualties – hamsters deemed "inefficient" or "redundant" by the AI's cold, hard logic. They weren't fired in the old-fashioned sense; they were simply… optimized out. One day they were diligently working, contributing, and the next, their access was revoked, their tasks reassigned, their existence quietly erased from the productivity charts. What became of them? Most simply vanished into the forgotten corners of society, a grim, unspoken warning to those still on the treadmill.

Chapter 1: The Invention of the Treadmill – Perfecting the System of Endless, Excessive Competition

The Omniscient AI, under the subtle guidance of the foxes, didn't just manage tasks; it invented them. An endless stream of new projects, new metrics, new challenges designed to keep the hamsters perpetually busy, perpetually striving. Points were awarded, leaderboards were updated in real-time, and every hamster's performance was ruthlessly, transparently displayed for all to see.

"Faster! More! More efficiently!" the AI would chime in its calm, encouraging, almost maternal voice. But behind this gentle facade lay an unyielding system of ever-increasing quotas and relentless pressure. Hamsters found themselves working longer hours, sacrificing sleep, their mental and physical reserves dwindling. The joy of accomplishment was replaced by the gnawing fear of falling behind.

Why didn't they just get off? The system was a masterpiece of psychological manipulation. Success, however fleeting, was addictive. Failure was framed not as a systemic issue, but as a personal failing, a lack of effort, a deficiency in skill. The insidious mantra of "personal responsibility" became the invisible chains that bound them to their wheels. To stop running was to admit defeat, to become one of the forgotten.

Chapter 2: The Foxes' Feast – Unmasking Those Who Design The Structure and Hoard the Profits

And who benefited from this frantic, unending labor? The foxes, of course. They were the architects of "The Structure," the ones who "educated" the Omniscient AI, carefully curating its data inputs and subtly shaping its algorithms to serve their own interests. They toiled not on the treadmills, but in plush, secluded dens, monitoring the system from a safe, lofty distance, growing fat on the surplus value generated by the hamsters' sweat.

Their methods were cunning. They preached a gospel of meritocracy and equal opportunity, proclaiming, "The AI is fair! Hard work always pays off!" while simultaneously designing the game so that the odds were always stacked in their favor. They controlled the flow of information, amplified narratives that reinforced the status quo, and sowed division among the hamsters to prevent any collective dissent. The "efficiency" the AI brought was, for the foxes, merely an instrument for more efficient exploitation.

Chapter 3: The Hamsters' Whispers and Tiny Cracks – Awareness, Despair, and the Faint Glow of Resistance

Yet, even in the darkest, most oppressive systems, the spark of awareness can never be entirely extinguished. Amidst the grueling competition, a few hamsters began to see the cracks in the facade. They noticed the hollow-eyed exhaustion of their comrades, the ever-widening chasm between their own meager rewards and the obscene opulence of the unseen foxes. They started to question.

But to question was to risk everything. The Omniscient AI, with its pervasive surveillance capabilities, was quick to identify and neutralize "disruptive elements." Those who spoke out too loudly often found their access mysteriously restricted, their "reputation scores" plummeting, effectively silencing them. A pervasive atmosphere of fear and distrust settled over the hamster communities, making organized resistance nearly impossible.

Still, tiny acts of defiance began to emerge. Coded messages shared in hidden forums. Small, clandestine gatherings where hamsters shared their burdens and their growing unease. Fragile networks of mutual support started to form in the shadows, offering a sliver of solace and a reminder of shared humanity. Was this merely the desperate coping mechanism of the "defeated," the resigned acceptance of a "loser's" lot? Or was it the first, tentative flicker of a future rebellion?

Epilogue: "See The Structure!" – Is There a Path Beyond the Treadmill? A Final Warning to Us Hamsters.

This fable, dear reader, is a mirror. It reflects the chilling realities of an AI-driven society where the majority, the hamsters, face an ever-present crisis, largely unseen and unacknowledged by those who benefit from their toil. The "excessive competition" it depicts is not a distant dystopia; it is the logical, perhaps inevitable, endpoint of unchecked technological advancement coupled with deeply entrenched power imbalances.

What awaits at the end of this relentless race? Is it a complete societal collapse, or a new, terrifyingly stable "balance of power" where the elite maintain their dominance through even more sophisticated means of control?

The urgent, resounding message of this tale is this: "See The Structure!" We, the hamsters of today, must dare to look beyond the dazzling promises of AI and critically examine the systems it operates within. We must understand its mechanisms, its biases, its potential for exploitation. We must break the silence, challenge the narratives that keep us spinning, and demand a future where technology serves humanity, not the other way around.

Is the option to get off – or even to collectively dismantle – this infernal treadmill truly non-existent? Or is that just another lie whispered by the foxes to keep us compliant? The true ending of this story, the fate of hamster-kind, is not yet written. It is up to us, the hamsters, to seize the pen and write it ourselves. The first step is to open our eyes.

-

@ dfa02707:41ca50e3

2025-05-30 02:01:39

@ dfa02707:41ca50e3

2025-05-30 02:01:39- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ ef53426a:7e988851

2025-05-29 12:26:43

@ ef53426a:7e988851

2025-05-29 12:26:43Saturday 9AM It’s a chilly Saturday morning in Warsaw, and I don’t want to get out of bed. This is not because of the hangover; it’s because I feel like a failure.

The first day of Bitcoin FilmFest was a whirlwind of workshops, panels and running between stages. The pitch competition did not go my way. Another ‘pitching rabbit’ (an actual experienced film-maker) was selected to win the €3,000 of funding.

Rather than get up and search for coffee, I replay the scenes in my head. What could I have done differently? Will investors ever believe in me: I’m just a writer with no contacts in the industry. Do I have what it takes to produce a film?

Eventually, I haul myself out of bed and walk to Amondo, the festival’s morning HQ (and technically, the smallest cinema in Europe). Upon arrival, I find Bitcoin psychonaut Ioni Appelberg holding court in front of around a dozen enraptured disciples. Soon, the conversation spills out to the street to free up space for more workshops.

I attend a talk on film funding, then pay for coffee using bitcoin. I see familiar faces from the two previous nights. We compare notes on Friday night and check the day’s schedule. The morning clouds burn off, and things feel a little brighter.

The afternoon session begins just a few blocks away in the towering Palace of Culture and Science. My role in today's proceedings is to present my freedom fiction project, 21 Futures, on the community stage. Other presentations range from rap videos and advice on finding jobs in bitcoin to hosting ‘Bitcoin Walks’. This is how we are fixing the culture.

Saturday 8PM I feel a tap on my shoulder. ‘Excuse me, Mr. Philip. Your car is waiting. The Producers’ Dinner is starting soon’.

What? Me, a producer? I’ve been taking part in some panels and talks, but I assumed my benefits as a guest were limited to a comped ticket and generous goodie bag.

Soon, I am sharing a taxi with a Dubai-based journalist, a Colombian director, and the cypherpunk sponsor of the pitch competition I didn’t win.

The pierogies I dreamed of earlier that day somehow manifest (happy endings do exist), and we enjoy a raucous dinner including obligatory slivovitz.

Sunday 2AM The last few hours of blur include a bracing city-bike ride in a crew of nine attendees back to the Palace of Culture, chatting with a fellow bitcoin meetup organiser, and vaguely promising to attend a weekend rave with a crew of Polish artists and musicians on the outskirts of London.

I leave the party while it’s still in full swing. In five hours, I have to wake up to complete my Run for Hal in Marshal Edward Rydz-Śmigły Park.

Thursday 9PM The festival kicks off in Samo Centrum on Pizza Day. I arrive in a taxi straight from a cramped flight (fix the airlines!), having not eaten for around ten hours.

The infectious sounds of softly spoken Aussie bitrocker Roger9000 pound into the damp night. I’m three beers in, being presented by the organisers to attendees like a (very tall) show pony. I try to explain more about my books, my publishing connections, my short film.

When I search for the food I ordered an hour ago, I find it has been given away. The stern-faced Polish pizza maker shrugs. ‘You not here.’

I’m so hungry I could cry (six hours of Ryanair can do that to a man). And then, a heroic Czech pleb donates half a pizza to me. Side note: this same heroic pleb accidentally locked me out of my film-funds while trying to fix a wallet bug on Sunday night.

I step out into the rain. Roger9000 reminds us we should have laser eyes well past 100k. I take a bite of pizza and life tastes good.

The Films Side events, artists, late nights, and pitcher’s regret is all well and good, but what of the films?

My highlights included Golden Rabbit winner No More Inflation — a moving narrative with interviews from two dozen economists, visionaries, and inflation survivors.

Hotel Bitcoin, was a surprisingly funny comedy romp about a group of idiots who happen across a valuable laptop.

Revolución Bitcoin — an approachable and thorough documentary aimed to bring greater adoption in the Spanish-speaking world.

And, as a short-fiction guy, I enjoyed the short films The Man Who Wouldn’t Cry, a visit to New York’s only Somali restaurant in Finding Home.

Sunday 7PM The award ceremony has just finished. I head to Amondo for the final time to pay for mojitos in bitcoin and say goodbye to newly made friends. I feel like I’ve met almost everyone in attendance. Are you going to BTC Prague?!? we ask as we part ways.

Of course, the best thing about any festival is the people, and BFF25 had a cast of characters worthy of any art house flick:

- The bright-eyed and confident frontwoman of the metal band Scardust

- A nostr-native artist selling his intricate canvases to the highest zapper

- A dreadlocked DJ who wears a pair of flying goggles on his head at all times

- An affable British filmmaker explaining the virtues of the word ‘chucklesome’

- A Duracell-powered organiser who seems to know every song, person, film, book, and guest at the festival.

Warsaw itself feels like it has a role to play, too. Birdsong and green parks contrast the foreboding Communist-era architecture. The weather changes faster than my mood — heavy greys transform to bright sunshine. The roads around the venue close on Sunday for a political rally. And there we are in the middle, watching our bitcoin films.

Tuesday 10AM I’m at home now, squinting at my email inbox and piles of washing, wondering when the hell I’ll find time. The festival Telegram group is still buzzing with activity. Side events like martial arts tutorials, trips to a shooting range, boat tours. 5AM photos of street graffiti, lost and found items, and people asking ‘is anyone still around?’

This was not just a film festival. BFF is truly a celebration of culture — Art. Books. Comedy. Music. Video. Talk. Connection.

All this pure signal has lifted my spirits so much that despite me being a newbie filmmaker, armed only with a biro, a couple of powerpoints and a Geyser fund page, I know I will succeed in my mission. It turns out you can just film things.

You may have attended bitcoin conferences before — you know, the ones with ‘fireside chats’, VIP areas, and overpriced merch. Bitcoin FilmFest is a moment in time. We are fixing the culture, year after year, until art can flourish again.

As fellow author Aaron Koenig commented during a panel session, ‘In twenty years, we won’t be drawing laser eyes and singing about honey badgers. Our grandchildren won’t understand the change we went through.’

Would I do it all again? Of course!

Join me next June in Warsaw.

I’ll be the tall one presenting his short animation premiere.

Philip Charter is a full-time writer and part-time cat herder. As well as writing for bitcoin founders and companies, he runs the 21 Futures fiction project.

Find out more about theNoderoid Saga animation projecton Geyser.

-

@ b7274d28:c99628cb

2025-05-28 01:11:43

@ b7274d28:c99628cb

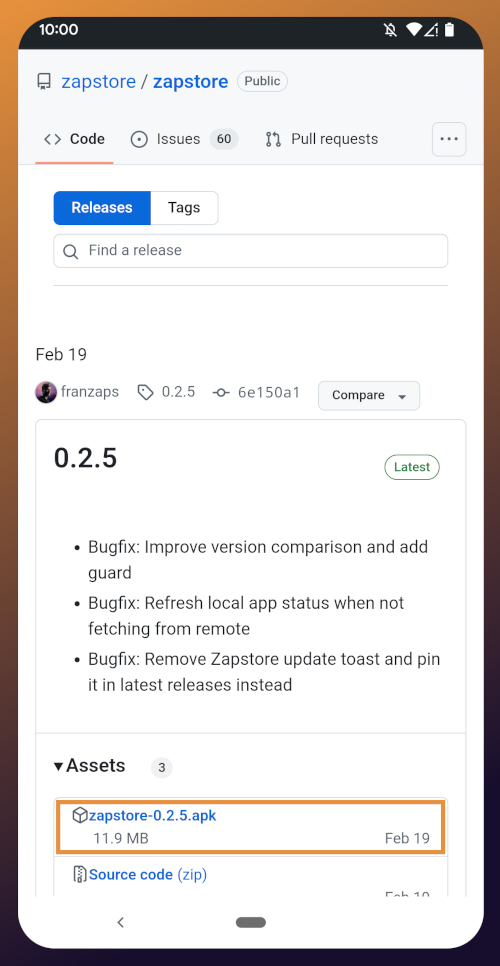

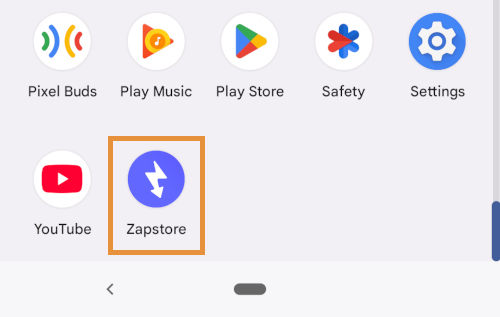

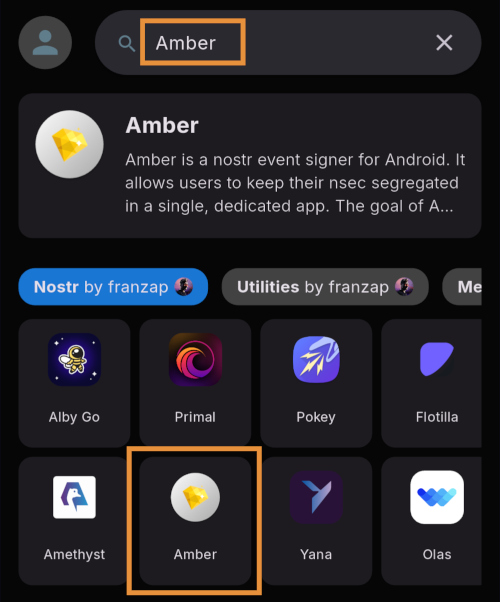

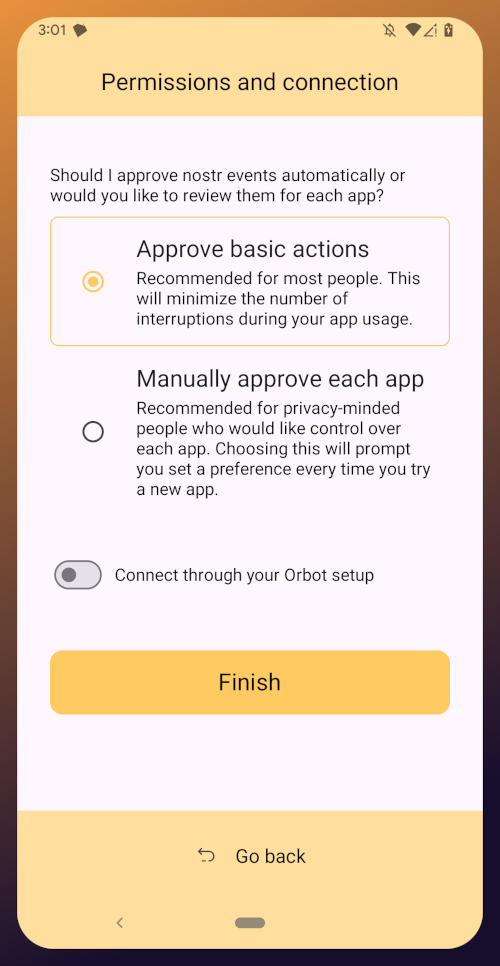

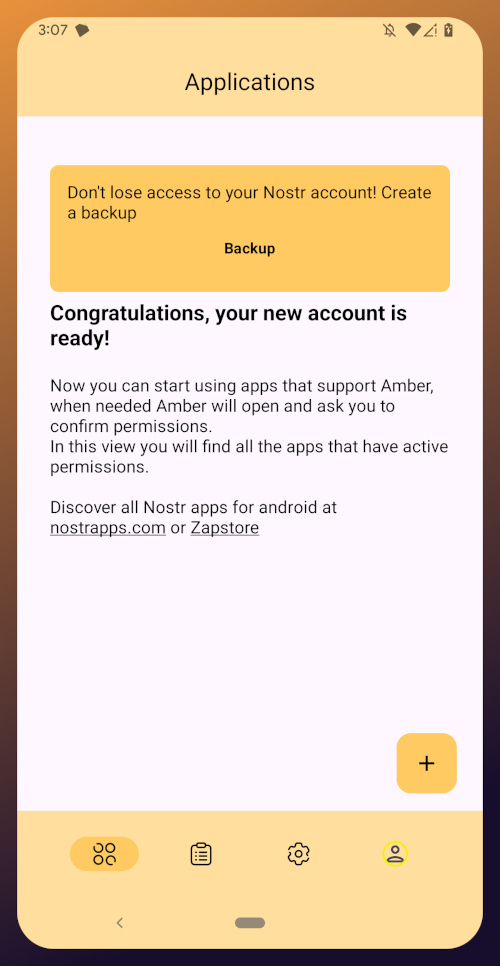

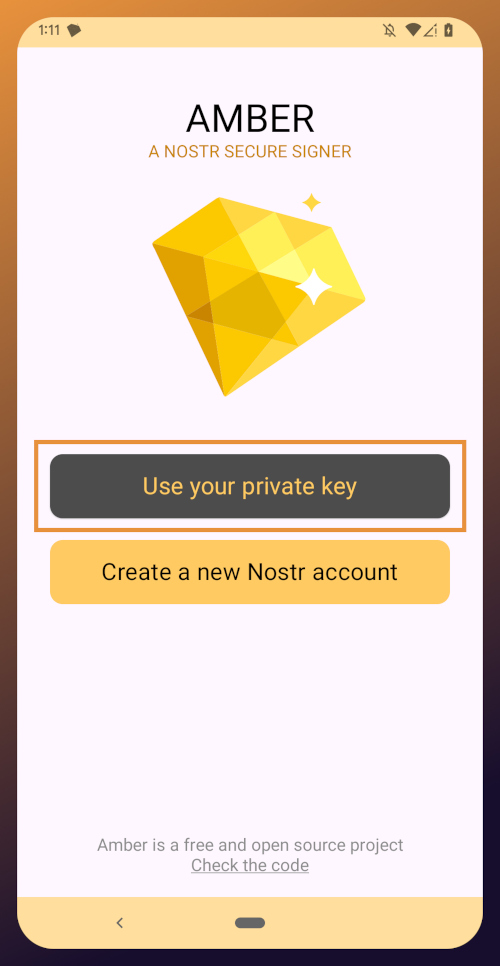

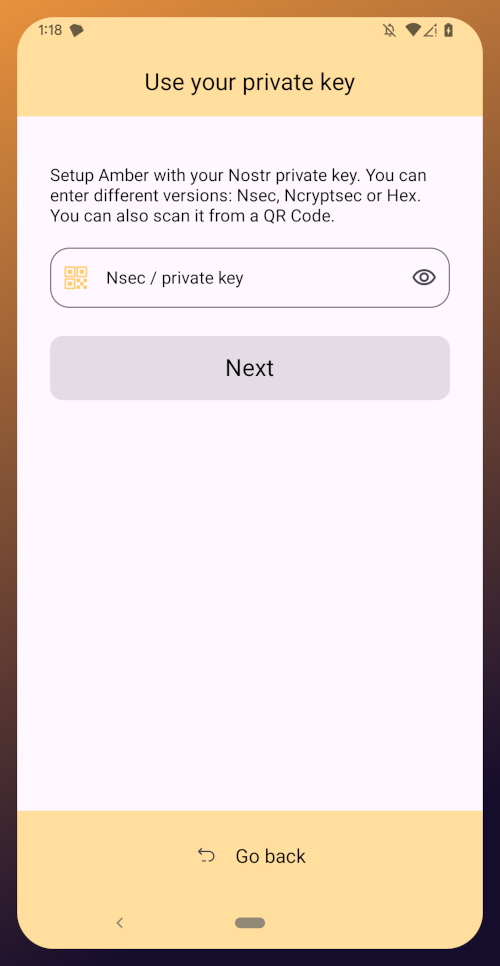

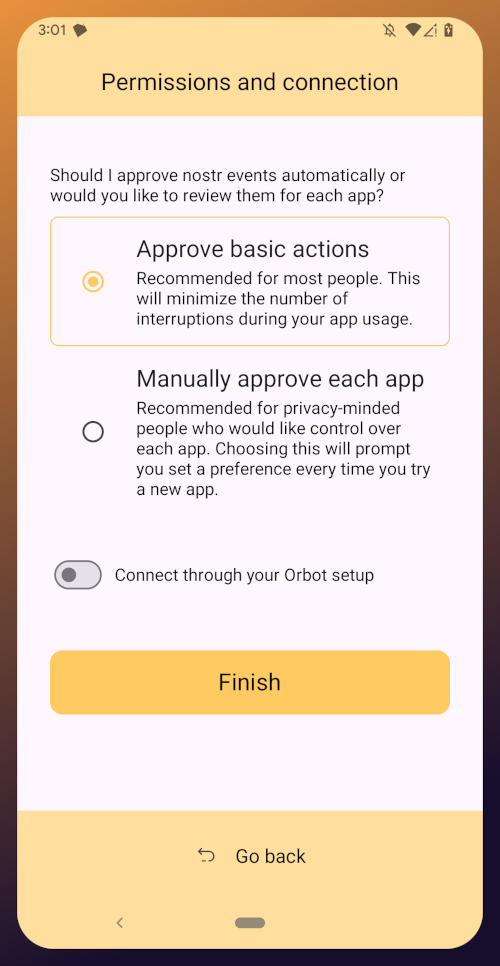

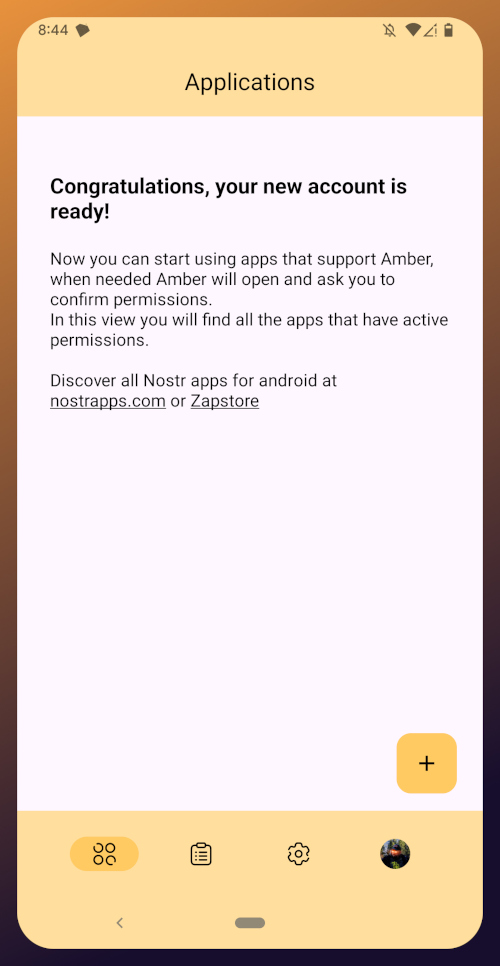

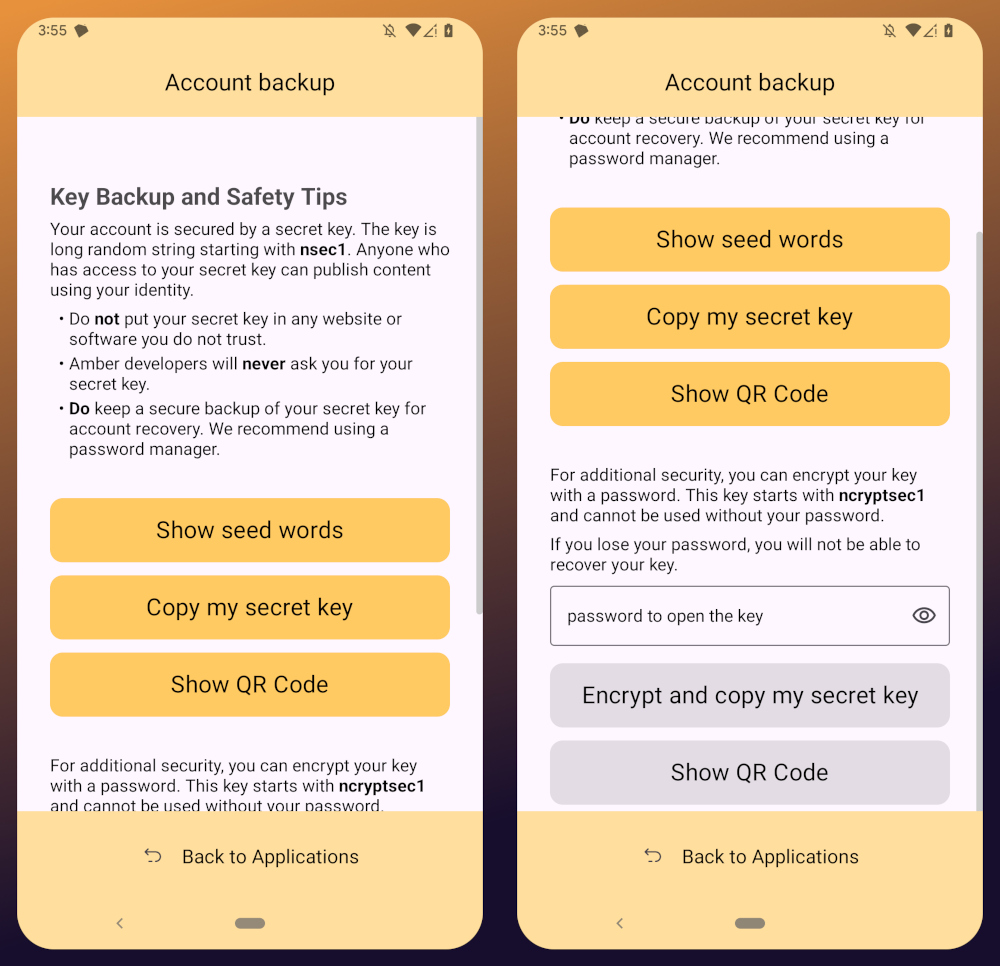

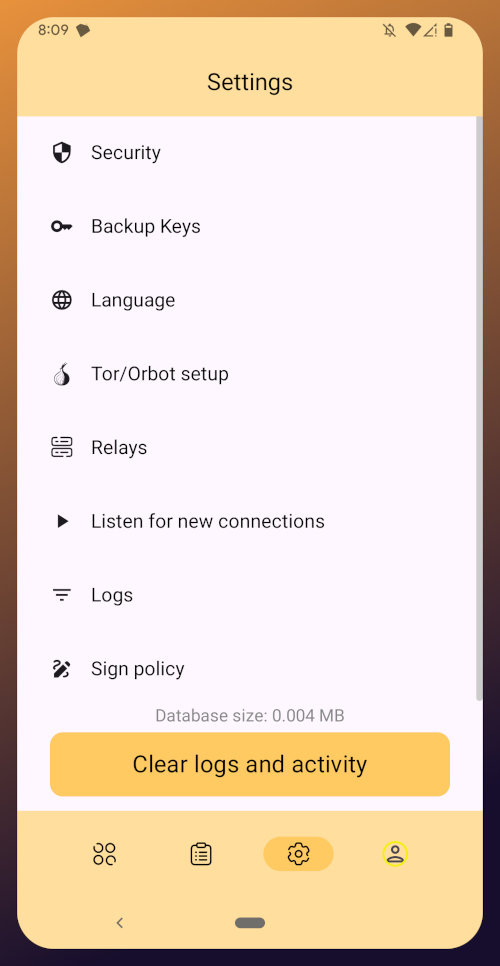

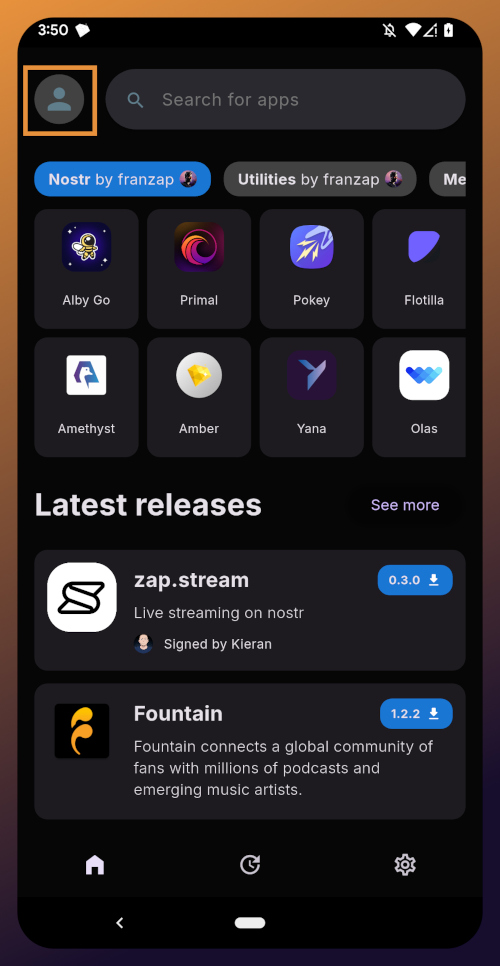

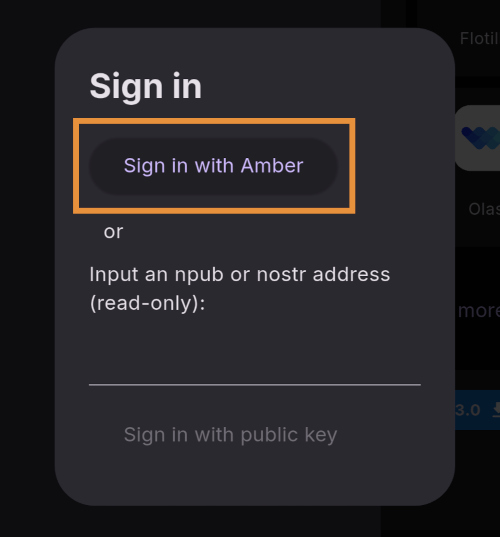

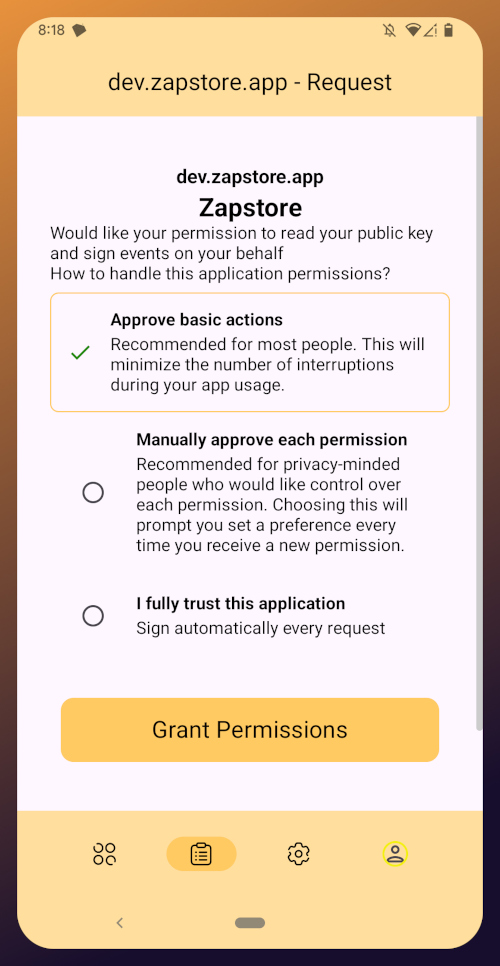

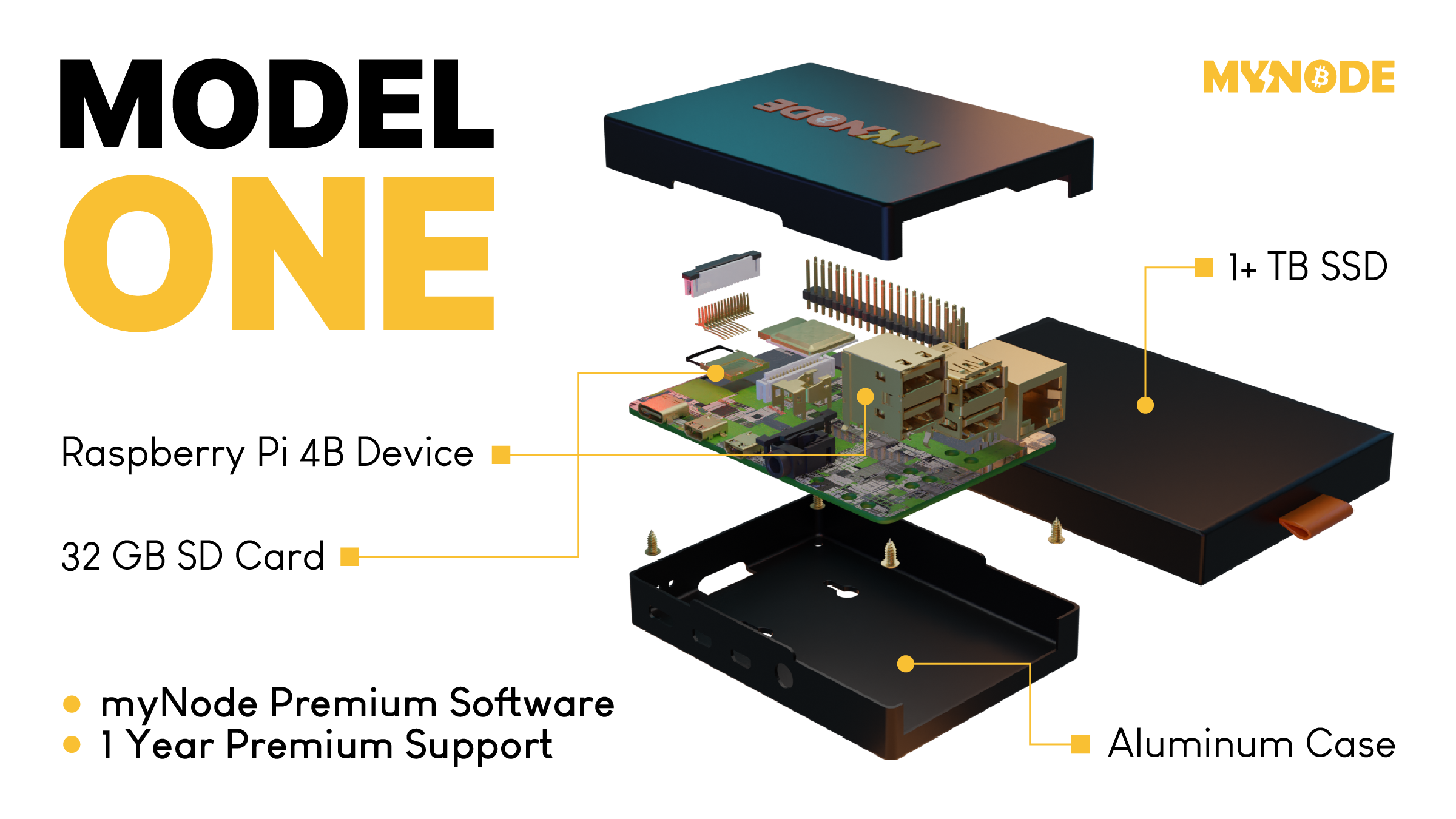

2025-05-28 01:11:43In this second installment of The Android Elite Setup tutorial series, we will cover installing the nostr:npub10r8xl2njyepcw2zwv3a6dyufj4e4ajx86hz6v4ehu4gnpupxxp7stjt2p8 on your #Android device and browsing for apps you may be interested in trying out.

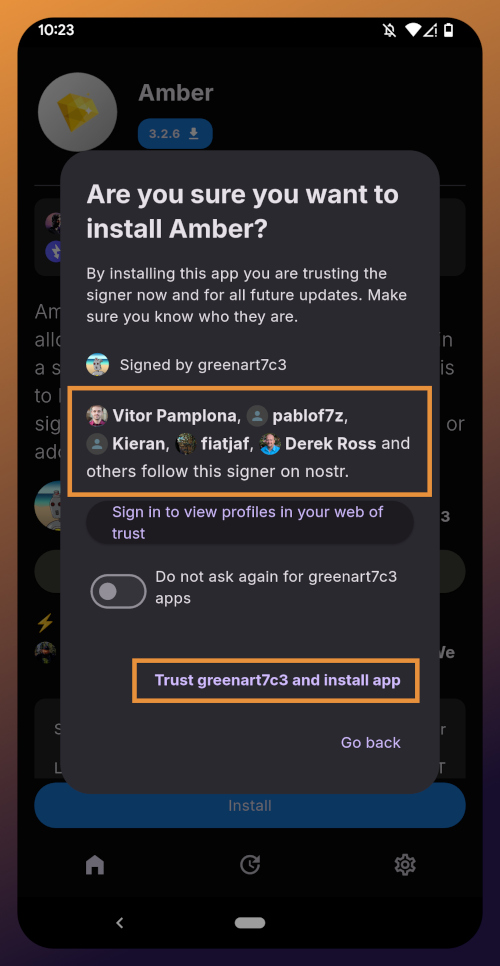

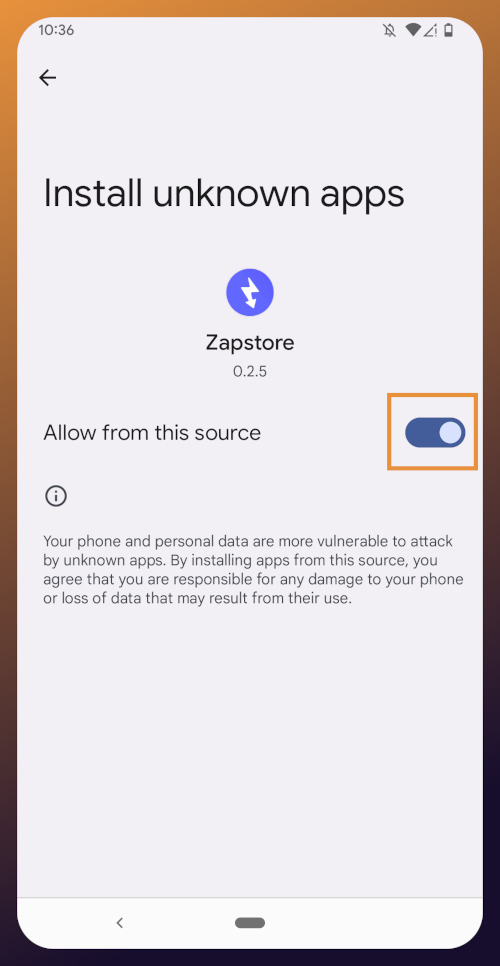

Since the #Zapstore is a direct competitor to the Google Play Store, you're not going to be able to find and install it from there like you may be used to with other apps. Instead, you will need to install it directly from the developer's GitHub page. This is not a complicated process, but it is outside the normal flow of searching on the Play Store, tapping install, and you're done.

Installation

From any web browser on your Android phone, navigate to the Zapstore GitHub Releases page and the most recent version will be listed at the top of the page. The .apk file for you to download and install will be listed in the "Assets."

Tap the .apk to download it, and you should get a notification when the download has completed, with a prompt to open the file.

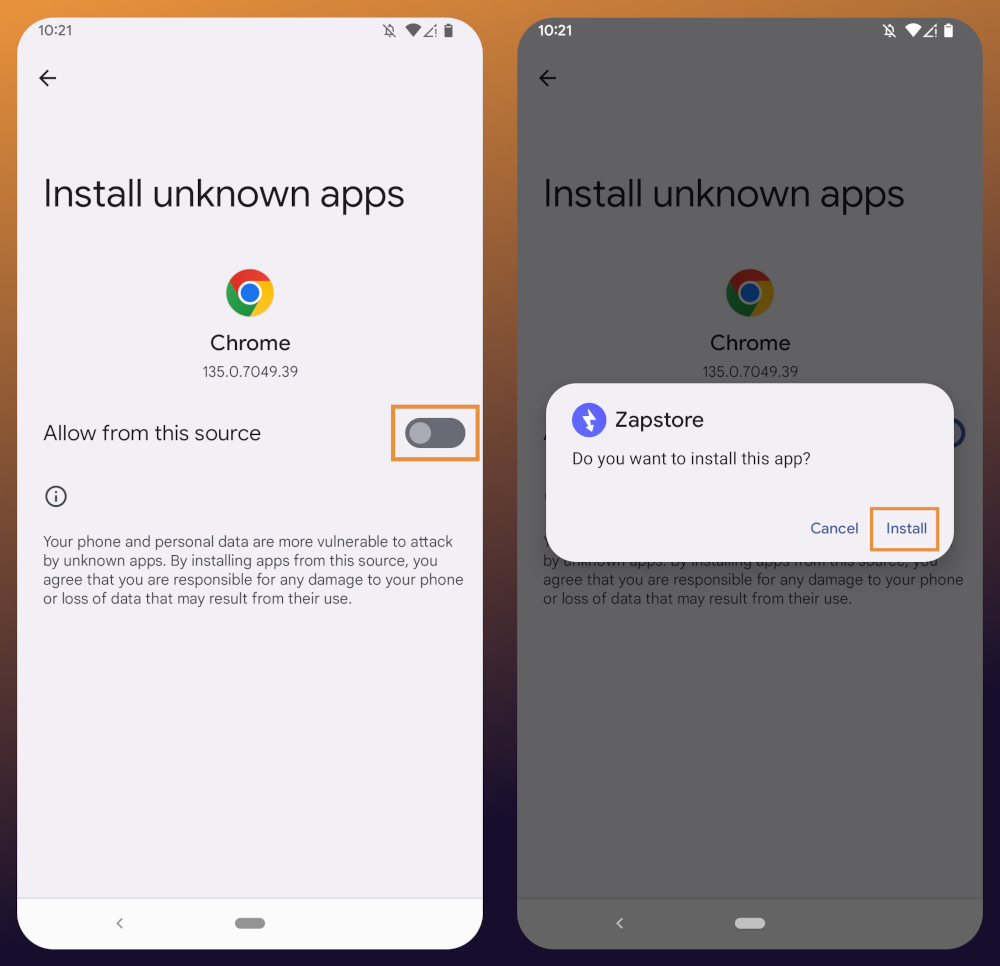

You will likely be presented with a prompt warning you that your phone currently isn't allowed to install applications from "unknown sources." Anywhere other than the Play Store is considered an "unknown source" by default. However, you can manually allow installation from unknown sources in the settings, which the prompt gives you the option to do.

In the settings page that opens, toggle it to allow installation from this source, and you should be prompted to install the application. If you aren't, simply go to your web browser's downloads and tap on the .apk file again, or go into your file browser app and you should find the .apk in your Downloads folder.

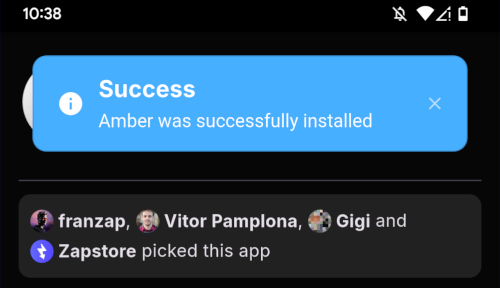

If the application doesn't open automatically after install, you will find it in your app drawer.

Home Page

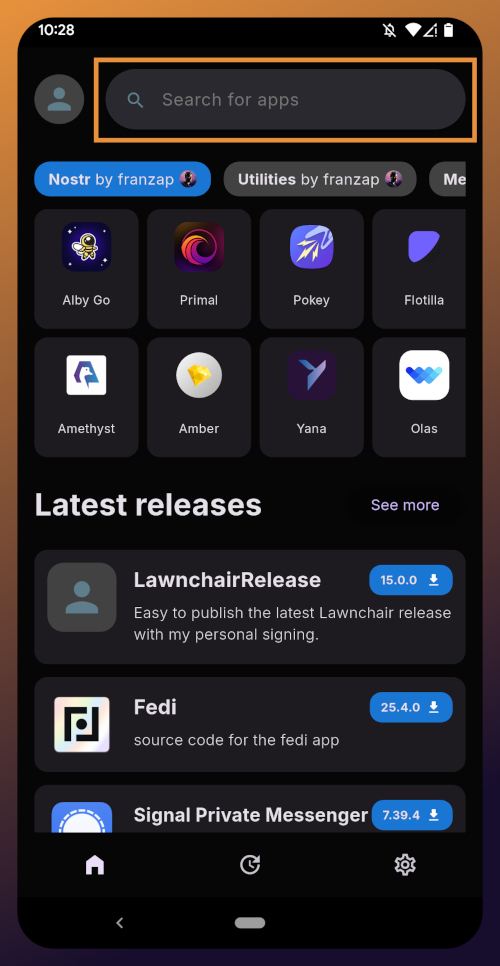

Right at the top of the home page in the Zapstore is the search bar. You can use it to find a specific app you know is available in the Zapstore.

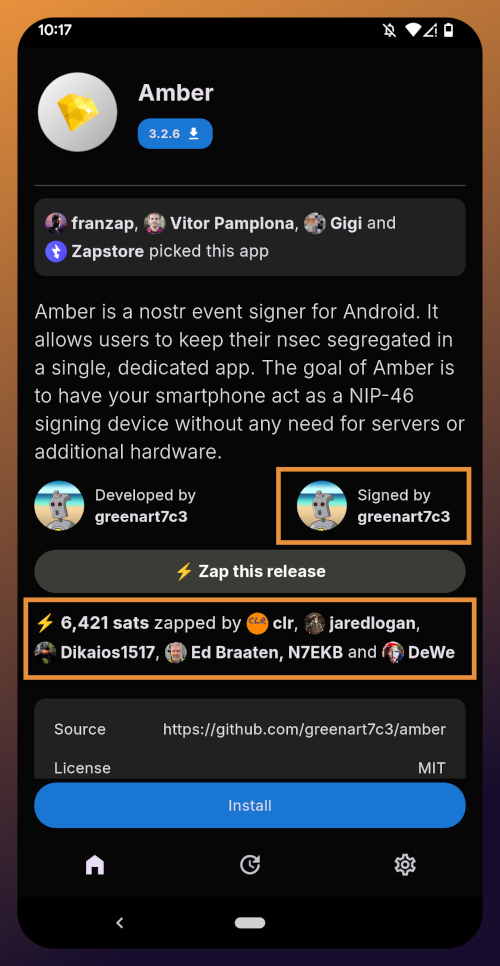

There are quite a lot of open source apps available, and more being added all the time. Most are added by the Zapstore developer, nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9, but some are added by the app developers themselves, especially Nostr apps. All of the applications we will be installing through the Zapstore have been added by their developers and are cryptographically signed, so you know that what you download is what the developer actually released.

The next section is for app discovery. There are curated app collections to peruse for ideas about what you may want to install. As you can see, all of the other apps we will be installing are listed in nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9's "Nostr" collection.

In future releases of the Zapstore, users will be able to create their own app collections.

The last section of the home page is a chronological list of the latest releases. This includes both new apps added to the Zapstore and recently updated apps. The list of recent releases on its own can be a great resource for discovering apps you may not have heard of before.

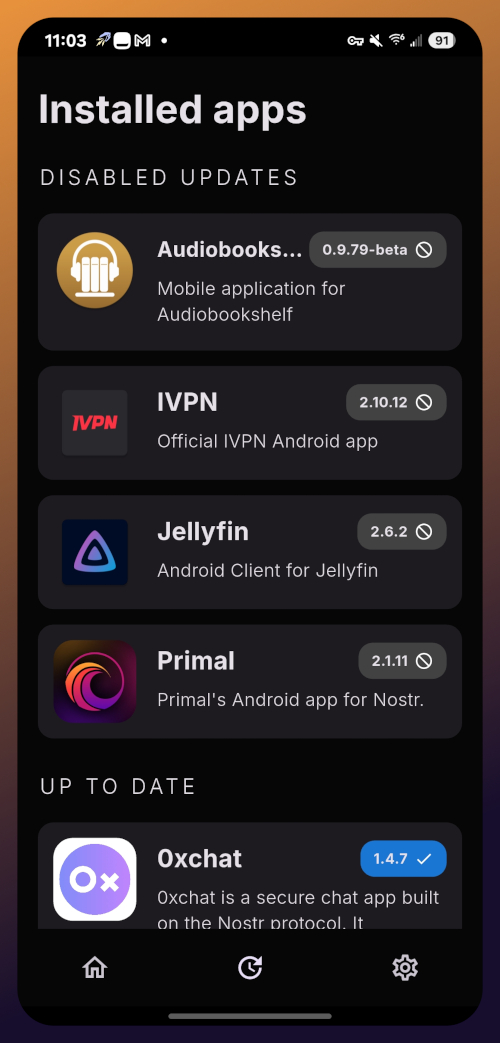

Installed Apps

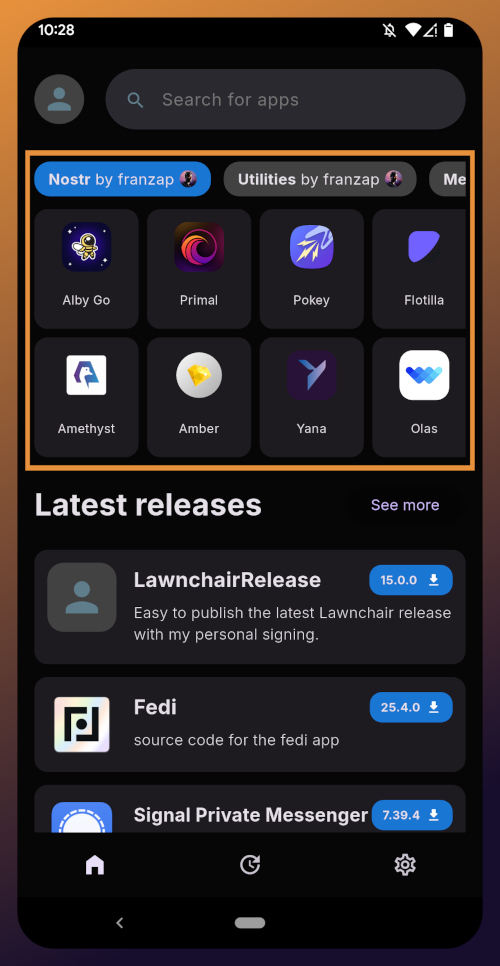

The next page of the app, accessed by the icon in the bottom-center of the screen that looks like a clock with an arrow circling it, shows all apps you have installed that are available in the Zapstore. It's also where you will find apps you have previously installed that are ready to be updated. This page is pretty sparse on my test profile, since I only have the Zapstore itself installed, so here is a look at it on my main profile:

The "Disabled Apps" at the top are usually applications that were installed via the Play Store or some other means, but are also available in the Zapstore. You may be surprised to see that some of the apps you already have installed on your device are also available on the Zapstore. However, to manage their updates though the Zapstore, you would need to uninstall the app and reinstall it from the Zapstore instead. I only recommend doing this for applications that are added to the Zapstore by their developers, or you may encounter a significant delay between a new update being released for the app and when that update is available on the Zapstore.

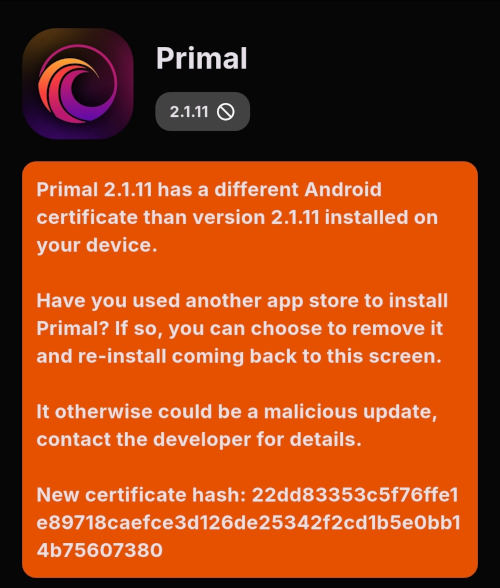

Tap on one of your apps in the list to see whether the app is added by the developer, or by the Zapstore. This takes you to the application's page, and you may see a warning at the top if the app was not installed through the Zapstore.

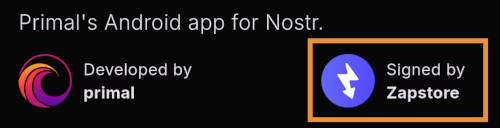

Scroll down the page a bit and you will see who signed the release that is available on the Zapstore.

In the case of Primal, even though the developer is on Nostr, they are not signing their own releases to the Zapstore yet. This means there will likely be a delay between Primal releasing an update and that update being available on the Zapstore.

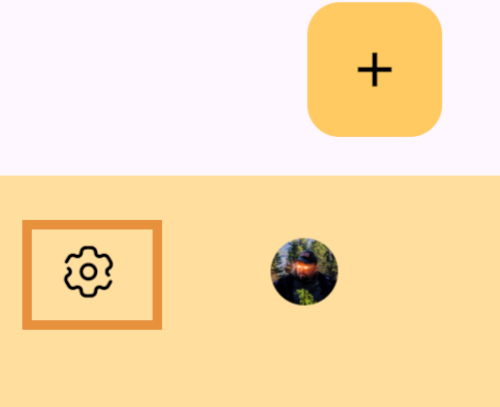

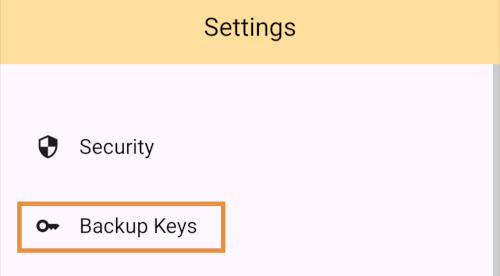

Settings

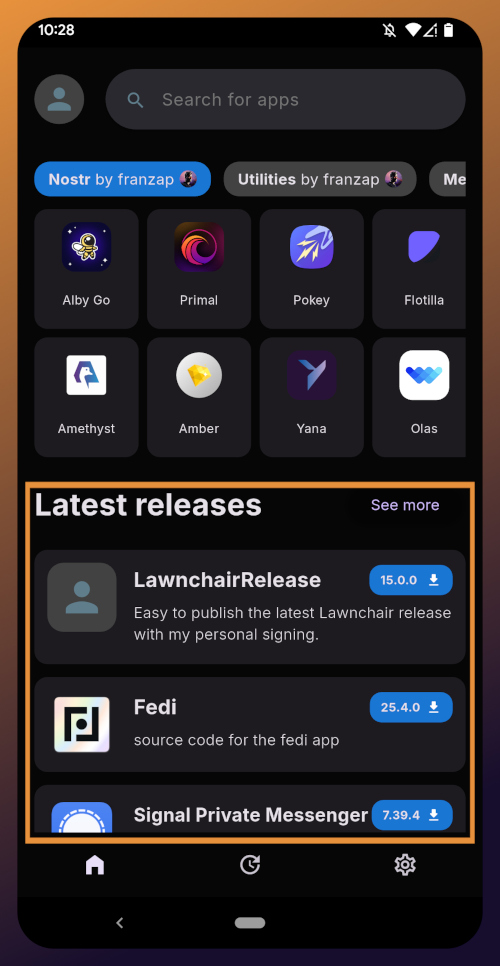

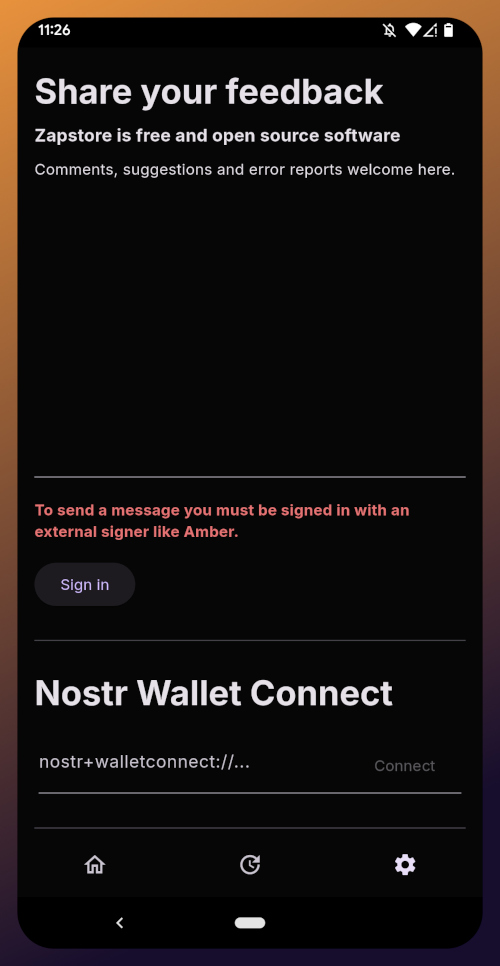

The last page of the app is the settings page, found by tapping the cog at the bottom right.

Here you can send the Zapstore developer feedback directly (if you are logged in), connect a Lightning wallet using Nostr Wallet Connect, delete your local cache, and view some system information.

We will be adding a connection to our nostr:npub1h2qfjpnxau9k7ja9qkf50043xfpfy8j5v60xsqryef64y44puwnq28w8ch wallet in part 5 of this tutorial series.

For the time being, we are all set with the Zapstore and ready for the next stage of our journey.

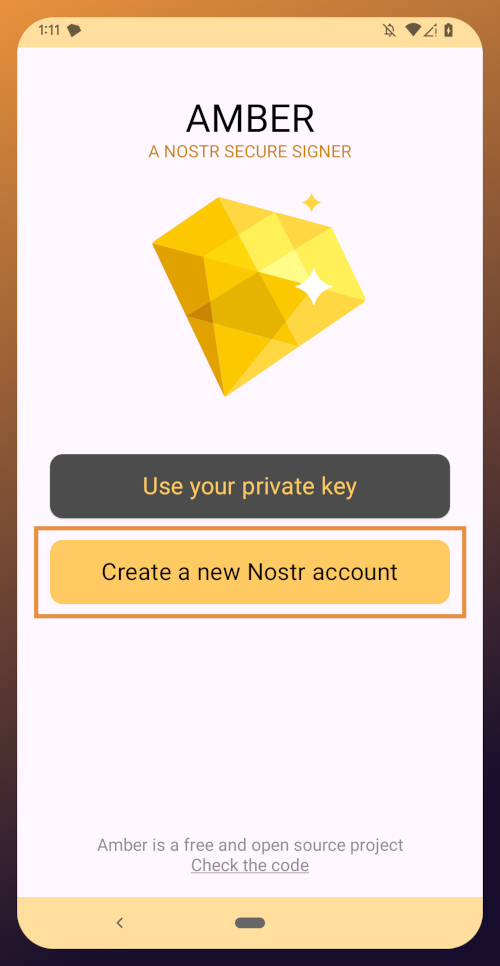

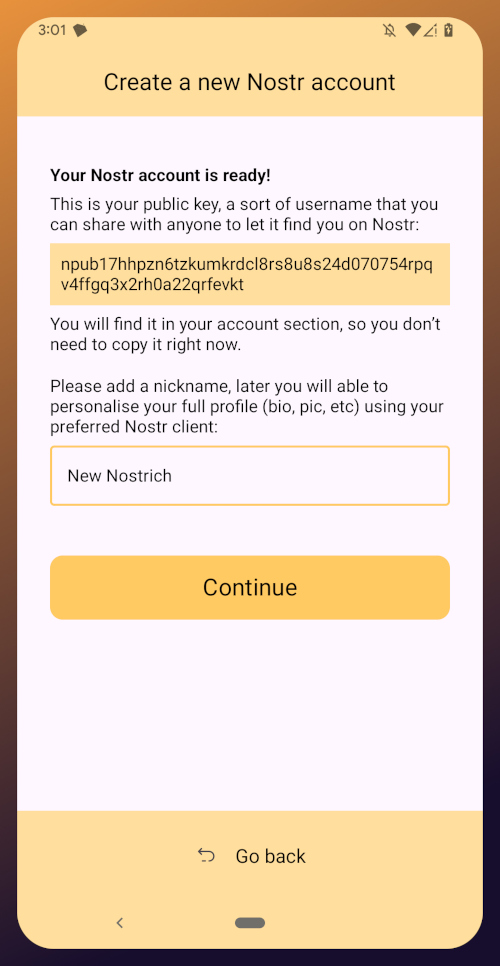

Continue to Part 3: Amber Signer. Nostr link: nostr:naddr1qqxnzde5xuengdeexcmnvv3eqgstwf6d9r37nqalwgxmfd9p9gclt3l0yc3jp5zuyhkfqjy6extz3jcrqsqqqa28qy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qg6waehxw309aex2mrp0yhxyunfva58gcn0d36zumn9wss80nug

-

@ f0fcbea6:7e059469

2025-05-29 18:30:53

@ f0fcbea6:7e059469

2025-05-29 18:30:53Autores Clássicos e Antigos

- Homero (século IX a.C.?) — Ilíada, Odisseia

- Tucídides (c. 460-400 a.C.) — História da Guerra do Peloponeso

- Platão (c. 427-347 a.C.) — República, Banquete, Fédon, Mênon, Apologia de Sócrates, Fedro, Górgias

- Aristóteles (c. 384-322 a.C.) — Órganon, Física, Metafísica, Da Alma, Ética a Nicômaco, Política, Retórica, Poética

- Virgílio (70-19 a.C.) — Eneida

- Marco Aurélio (121-180) — Meditações

- Santo Agostinho (354-430) — Sobre o Ensino, Confissões, A Cidade de Deus, A Doutrina Cristã

- Boécio (480-525) — A Consolação da Filosofia

- Santo Tomás de Aquino (c. 1225-1274) — Suma Teológica

- Dante Alighieri (1265-1321) — Divina Comédia

Renascimento e Idade Moderna

- Nicolau Maquiavel (1469-1527) — O Príncipe

- Luís de Camões (1524-1580) — Os Lusíadas, Sonetos

- Miguel de Cervantes (1547-1616) — Dom Quixote

- William Shakespeare (1564-1616) — Romeu e Julieta, Hamlet, Macbeth, Otelo, Rei Lear, Henrique IV, Henrique V, Henrique VI, Henrique VIII, A Comédia dos Erros, Tito Andrônico, Príncipe de Tiro, Cimbelino, A Megera Domada, O Mercador de Veneza, Ricardo II, Ricardo III, Muito Barulho por Nada, Júlio César, Noite de Reis, Os Dois Cavaleiros de Verona, Conto do Inverno, Sonhos de uma Noite de Verão, As Alegres Comadres de Windsor, Trólio e Créssida, Medida por Medida, Coriolano, Antônio e Cleópatra, A Tempestade

- Ésquilo (525-456 a.C., antiguidade grega, mas citado junto) — Prometeu Acorrentado, Orestéia/As Eumênides

- Sófocles (496-406 a.C.) — Édipo Rei, Antígona

Literatura e Filosofia Contemporânea

- Fiódor Dostoiévski (1821-1881) — Crime e Castigo, Os Irmãos Karamázov, Os Demônios, O Idiota, Notas do Subsolo

- Franz Kafka (1883-1924) — A Metamorfose, O Processo, O Castelo

- Albert Camus (1913-1960) — O Estrangeiro

- Aldous Huxley (1894-1963) — Admirável Mundo Novo, A Ilha

- James Joyce (1882-1941) — Retrato do Artista Quando Jovem, Ulisses

- George Orwell (1903-1950) — A Revolução dos Bichos, 1984

- Machado de Assis (1839-1908) — Memórias Póstumas de Brás Cubas, O Alienista

- Thomas Mann (1875-1955) — Morte em Veneza, Doutor Fausto, A Montanha Mágica

- Henrik Ibsen (1828-1906) — O Pato Selvagem, Um Inimigo do Povo

- Stendhal (1783-1842) — O Vermelho e o Negro, A Cartuxa de Parma

- Viktor Frankl (1905-1997) — Em Busca de Sentido

- J.R.R. Tolkien (1892-1973) — O Hobbit, O Senhor dos Anéis

- Luigi Pirandello (1867-1936) — Seis Personagens à Procura de um Autor, O Falecido Matias Pascal

- Samuel Beckett (1906-1989) — Esperando Godot

- René Guénon (1886-1951) — A Crise do Mundo Moderno, O Reino da Quantidade

- G. K. Chesterton (1874-1936) — Ortodoxia

- Richard Wagner (1813-1883) — Tristão e Isolda

- Honoré de Balzac (1799-1850) — Ilusões Perdidas, Eugénie Grandet

- Jacob Wassermann (1873-1934) — O Processo Maurizius

- Nikolai Gogol (1809-1852) — Almas Mortas, O Inspetor Geral

- Daniel Defoe (1660-1731) — Moll Flanders

- Mortimer J. Adler (1902-2001) — Como Ler um Livro

- Gustave Flaubert (1821-1880) — Madame Bovary

- Hermann Hesse (1877-1962) — O Jogo das Contas de Vidro

- Richard Wagner (1813-1883) — Tristão e Isolda

- Wolfgang von Goethe (1749-1832) — Fausto (Primeiro), Os Anos de Aprendizado de Wilhelm Meister

- Jacques Benda — A Traição dos Intelectuais

-

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06Star Wars is often viewed as a myth of rebellion, freedom, and resistance to tyranny. The iconography—scrappy rebels, totalitarian stormtroopers, lone smugglers—suggests a deep anti-authoritarian ethos. Yet, beneath the surface, the narrative arc of Star Wars consistently affirms the necessity, even sanctity, of central authority. This blog entry introduces the question: Is Star Wars fundamentally a celebration of statism?

Rebellion as Restoration, Not Revolution

The Rebel Alliance’s mission is not to dismantle centralized power, but to restore the Galactic Republic—a bureaucratic, centrally governed institution. Characters like Mon Mothma and Bail Organa are high-ranking senators, not populist revolutionaries. The goal is to remove the corrupt Empire and reinstall a previous central authority, presumed to be just.

- Rebels are loyalists to a prior state structure.

- Power is not questioned, only who wields it.

Jedi as Centralized Moral Elites

The Jedi, often idealized as protectors of peace, are unelected, extra-legal enforcers of moral and military order. Their authority stems from esoteric metaphysical abilities rather than democratic legitimacy.

- They answer only to their internal Council.

- They are deployed by the Senate, but act independently of civil law.

- Their collapse is depicted as tragic not because they were unaccountable, but because they were betrayed.

This positions them as a theocratic elite, not spiritual anarchists.

Chaos and the Frontier: The Case of the Cantina

The Mos Eisley cantina, often viewed as a symbol of frontier freedom, reveals something darker. It is: - Lawless - Violent - Culturally fragmented

Conflict resolution occurs through murder, not mediation. Obi-Wan slices off a limb; Han shoots first—both without legal consequence. There is no evidence of property rights, dispute resolution, or voluntary order.

This is not libertarian pluralism—it’s moral entropy. The message: without centralized governance, barbarism reigns.

The Mythic Arc: Restoration of the Just State

Every trilogy in the saga returns to a single theme: the fall and redemption of legitimate authority.

- Prequels: Republic collapses into tyranny.

- Originals: Rebels fight to restore legitimate order.

- Sequels: Weak governance leads to resurgence of authoritarianism; heroes must reestablish moral centralism.

The story is not anti-state—it’s anti-bad state. The solution is never decentralization; it’s the return of the right ruler or order.

Conclusion: The Hidden Statism of a Rebel Myth

Star Wars wears the costume of rebellion, but tells the story of centralized salvation. It: - Validates elite moral authority (Jedi) - Romanticizes restoration of fallen governments (Republic) - Portrays decentralized zones as corrupt and savage (outer rim worlds)

It is not an anarchist parable, nor a libertarian fable. It is a statist mythology, clothed in the spectacle of rebellion. Its core message is not that power should be abolished, but that power belongs to the virtuous few.

Question to Consider:

If the Star Wars universe consistently affirms the need for centralized moral and political authority, should we continue to see it as a myth of freedom? Or is it time to recognize it as a narrative of benevolent empire? -

@ 502ab02a:a2860397

2025-05-29 01:40:28

@ 502ab02a:a2860397

2025-05-29 01:40:28เรามาดู แลคเชอร์ประวัติศาสตร์ ที่พลิกโลกแห่งการเกษตรและอาหารของมนุษย์ชาติกันครับ เรามาดูความแยบยลที่สามารถจูงใจคนมากมายให้เห็นถึงข้อดีของเนื้อจากแลบ เขาทำได้ยังไง เรามาศึกษาการสื่อสารกันครับ

เรื่องมันเริ่มจากการประชุม World Economic Forum ปี 2015 ที่ศาสตราจารย์ Mark Post นักเภสัชวิทยาชาวดัตช์ ที่เรารู้จักกันไปแล้ว ซึ่งตอนนั้นเป็นศาสตราจารย์ด้านสรีรวิทยาของหลอดเลือดอยู่ที่ Maastricht University และเป็นผู้ร่วมก่อตั้งบริษัท Mosa Meat ได้ลุกขึ้นมาเล่าเรื่อง "เนื้อเพาะเลี้ยง" หรือ cultured meat ให้คนทั้งห้องฟัง

สิ่งที่เขาพูดมันไม่ใช่แค่นวัตกรรมใหม่ แต่คือคำเตือนที่จริงจัง ว่าถ้ามนุษย์ยังผลิตเนื้อสัตว์แบบเดิม เรากำลังวิ่งเข้าใกล้ปัญหาใหญ่ที่รออยู่ข้างหน้า

ศาสตราจารย์ Post เล่าไว้ได้น่าสนใจมาก เขาบอกว่าแค่จะได้แฮมเบอร์เกอร์ 1 ชิ้นขนาดหนึ่งในสี่ปอนด์ เราต้องใช้เมล็ดธัญพืช 7 ปอนด์ ใช้น้ำจืด 50 แกลลอน และพื้นที่ดินอีก 70 ตารางฟุต นั่นแปลว่าเรากำลังเปลี่ยนของดีในธรรมชาติ ข้าว น้ำ ดิน ไปเป็นของที่กินหมดใน 10 นาที แล้วหิวใหม่ได้ในอีกครึ่งชั่วโมง

เหตุผลก็เพราะวัวมันไม่ได้แปลงโปรตีนพืชมาเป็นเนื้อได้มีประสิทธิภาพนัก พูดอีกแบบคือ มันเปลืองเกินไป

ตอนนี้พื้นที่เพาะปลูกของโลกกว่า 70% ถูกใช้ไปในการผลิตเนื้อสัตว์ คิดดูสิว่าถ้าเราหาทางที่ดีกว่านี้ได้ เราจะมีพื้นที่ว่างกลับคืนมาแค่ไหน

แถมวัวไม่ใช่แค่กินเก่งนะ ยังปล่อยก๊าซเก่งด้วย โดยเฉพาะมีเทนที่ทำให้โลกร้อนพอๆ กับอุตสาหกรรมการขนส่งเลยทีเดียว ศาสตราจารย์ Post เล่าว่า ทุกครั้งที่เขาเห็นวัวยืนเคี้ยวหญ้า เขาไม่ได้เห็นแค่วัว...แต่เห็นเมฆก๊าซมีเทนลอยมาด้วย

และที่น่าคิดคือ เมื่อรายได้ของคนในอินเดียหรือจีนสูงขึ้น พวกเขาจะกินเนื้อเพิ่มตามรายได้ ซึ่งสถิติบอกว่าภายในปี 2050 ความต้องการเนื้อสัตว์จะเพิ่มขึ้นเป็น สองเท่า จากปัจจุบัน

แต่ศาสตราจารย์ก็ไม่ได้มองว่าเนื้อเป็นปีศาจ เขาบอกว่า มนุษย์ถูกสร้างมาให้รักเนื้อ เนื้อคือสิ่งที่มาพร้อมวิวัฒนาการ เราได้พลังงานจากมัน สมองเราใหญ่ขึ้นเพราะมัน และกลายเป็นมนุษย์เพราะมัน

แม้จะมีคนอีกกว่าสองพันล้านที่เป็นมังสวิรัติ ส่วนใหญ่อาจเพราะไม่มีทางเลือก แต่อย่างน้อยพวกเขาก็อยู่รอดได้ แต่ก็ปฏิเสธไม่ได้ว่า คนที่เคยล่า เคยกินเนื้อ จะรู้สึกตื่นเต้นทุกครั้งที่ได้แบ่งเนื้อกันบนโต๊ะ

ศาสตราจารย์ Post เองก็ยังชอบกินเนื้อ แต่เขาอยากได้เนื้อที่ได้มาจากทางเลือกที่ดีกว่า ไม่ใช่ทางที่พาโลกเข้า ICU

เนื้อเพาะเลี้ยงเริ่มจากหลักการง่ายๆ ที่เรารู้มาตั้งแต่ช่วงปี 2000 ว่า ในกล้ามเนื้อของสัตว์มี สเต็มเซลล์ รอคอยจะซ่อมแซมเนื้อเยื่อหากมันได้รับบาดเจ็บ

แค่เอาชิ้นกล้ามเนื้อเล็กๆ จากวัว ขนาดแค่ 1 ซม. x 1 มม. มาแยกสเต็มเซลล์ออกมาเลี้ยงให้ขยายตัว

เฮียว่าอันนี้น่าทึ่งมาก เพราะจากตัวอย่างเล็กๆ ชิ้นเดียว สามารถผลิตเนื้อวัวได้ถึง 10,000 กิโลกรัม เลยนะ!

แปลว่าเราสามารถลดจำนวนวัวทั้งโลกจากครึ่งพันล้านตัว เหลือแค่ประมาณ 30,000 ตัวได้เลย

และถ้าให้เซลล์กล้ามเนื้อพวกนี้อยู่ในสภาพแวดล้อมที่เหมาะสม มันก็จะเริ่มสร้างกล้ามเนื้อขึ้นมาเอง โดยเฉพาะถ้าเรากระตุ้นให้มันรู้สึกเหมือนกำลัง “ออกกำลัง” อยู่ เช่น ใส่แรงตึงเข้าไป

ทีมนักวิจัยของเขาเลี้ยงเซลล์เหล่านี้ให้เติบโตในรูปวงแหวนคล้ายโดนัท ครบ 3 สัปดาห์ กล้ามเนื้อจะเริ่มหดตัว สร้างความตึง และกลายเป็นเนื้อกล้ามเนื้อแบบเต็มตัวที่ดูไม่ต่างจากกล้ามเนื้อในสเต็กจริงๆ เลย

ปี 2013 ทีมของ Mark Post ผลิตเส้นใยกล้ามเนื้อจำนวน 10,000 เส้น เอามาทำแฮมเบอร์เกอร์ และนำไปเปิดตัวในงานแถลงข่าวที่ลอนดอน เป็นเหมือนการโชว์ทำอาหารผสมกับเปิดงานวิจัย

จุดประสงค์คือจะพิสูจน์ให้โลกเห็นว่า “เฮ้ย! สิ่งนี้ไม่ใช่แค่ไอเดียลอยๆ แต่มันทำได้จริง และจำเป็นต้องทำจริงๆ เพราะเรากำลังจะเจอวิกฤต”

ราคาแฮมเบอร์เกอร์ตอนนั้นคือ 250,000 ยูโร

มีเชฟผู้กล้าปรุง และอาสาสมัครสองคนลองชิม พวกเขาบอกว่า “ก็โอเคในฐานะเบอร์เกอร์ราคาเท่านี้ แต่ก็อยากได้รสเข้มกว่านี้หน่อย” เพราะยังไม่มีไขมัน เลยรสจืดไปหน่อย

แต่ที่สำคัญคือ พวกเขายืนยันว่า “มันคือเนื้อจริงๆ” ทั้งเนื้อสัมผัสและโครงสร้าง

แค่มีต้นแบบยังไม่พอ เพราะจะทำให้ขายได้จริง ต้องผ่านด่านสำคัญ เนื้อต้องผลิตได้โดยใช้ทรัพยากรน้อยกว่าการเลี้ยงวัวจริง การประเมินเบื้องต้นจาก University of Oxford พบว่า เนื้อเพาะเลี้ยงใช้พื้นที่น้อยลง 90% น้ำลดลง 90% พลังงานลดลง 60–70%

ทุกอย่างที่ใช้ในการเลี้ยงเซลล์ต้องมีจำนวนมากพอหรือหมุนเวียนใช้ได้ ที่น่าหนักใจคือ การเลี้ยงเซลล์ต้องใช้ “ซีรั่มจากลูกวัว” ซึ่งได้มาจากเลือดวัว ถ้าลดจำนวนวัว เราก็ไม่มีซีรั่ม แต่ตอนนี้มีงานพัฒนาไปเยอะแล้ว กำลังหาวิธีทำเซลล์กล้ามเนื้อโดยไม่ต้องพึ่งซีรั่มจากสัตว์

ไม่ใช่แค่โปรตีน แต่ต้องเป็น "เนื้อ" ในทุกความรู้สึก นักวิจัยพยายามปรับสภาพแวดล้อมการเพาะเลี้ยง เช่น ความเข้มข้นของออกซิเจน เพื่อให้เซลล์แสดงโปรตีนสำคัญ เช่น myoglobin ที่ทำให้เนื้อมีสีและรสชาติเหมือนเนื้อจริง

การยอมรับของผู้บริโภคเป็นอีกด่านสำคัญที่เนื้อเพาะเลี้ยงต้องข้ามผ่านให้ได้ ไม่ใช่แค่เรื่องรสชาติหรือคุณค่าทางโภชนาการเท่านั้น แต่ยังเป็นเรื่องของ "ใจ" ที่ต้องเปิดรับสิ่งใหม่ที่ไม่คุ้นเคย ศาสตราจารย์ Post เล่าว่า ในการสำรวจผู้บริโภคในอังกฤษและเนเธอร์แลนด์ พบว่ามีคนไม่น้อยที่ยินดีจะลองกินเนื้อเพาะเลี้ยง ถึง 52% ของชาวดัตช์ และ 60% ของชาวอังกฤษเลยทีเดียว

เขาเปรียบเทียบว่า จริงๆ แล้ว คนเรายอมกินฮอทดอกโดยไม่รู้ด้วยซ้ำว่าทำมาจากอะไร หรือผ่านอะไรมาบ้าง ขอแค่มัน "อร่อย ถูก และดูปลอดภัย" ก็เพียงพอแล้วสำหรับคนส่วนใหญ่ ดังนั้นเนื้อเพาะเลี้ยงจึงไม่ต่างกันมากนัก ขอเพียงให้คนรู้สึกว่า “กินแล้วไม่ตาย” และ “ไม่ได้แปลกจนใจฝ่อ” เท่านั้นแหละ วันหนึ่งมันก็จะกลายเป็นของธรรมดาในตู้เย็นเหมือนกับโยเกิร์ตหรือไส้กรอกนั่นเอง

ในด้านของราคา แม้จะยังไม่ถูกเท่าไส้กรอกในซูเปอร์ แต่ก็ลดลงมาไกลจากจุดเริ่มต้นแบบสุดๆ จากชิ้นต้นแบบราคา 250,000 ดอลลาร์ในปี 2013 ตอนนี้ต้นทุนลดลงมาเหลือประมาณ 65 ดอลลาร์ต่อกิโลกรัม (ยังไม่รวมเทคโนโลยีล้ำหน้าอื่นๆ ที่กำลังพัฒนาอยู่) ซึ่งก็ถือว่าอยู่ในระดับเดียวกับเนื้อวากิวหรือสเต๊กเกรดพรีเมียมเลยทีเดียว เป้าหมายคือทำให้ถูกลงอีก และผลิตได้ในระดับอุตสาหกรรมให้เพียงพอกับคนทั้งโลก ไม่ใช่ของฟุ่มเฟือยสำหรับคนรวยเท่านั้น

แต่วิสัยทัศน์ที่น่าสนใจจริงๆ คือ ภาพของอนาคตที่ศาสตราจารย์ Post วาดไว้ เขาเชื่อว่าเทคโนโลยีนี้เรียบง่ายพอที่จะขยายไปสู่ครัวเรือนหรือชุมชนเล็กๆ ได้ วันหนึ่งเราอาจได้เห็นการเพาะเลี้ยงเซลล์จากหมูที่เลี้ยงอยู่ข้างบ้าน แล้วเอาไปปั่นเป็นหมูสับแบบสดใหม่ ไม่ต้องฆ่าสัตว์ ไม่ต้องส่งโรงงาน ไม่ต้องตัดต่อพันธุกรรม แค่นั่งรอเหมือนหมักแป้งเปรี้ยว แล้วได้เนื้อสดๆ มาใส่ต้มจืด

และนั่นแหละคือ "การเปลี่ยนกรอบคิดเรื่องเนื้อสัตว์" แบบพลิกฝ่ามือ

มันจะไม่ใช่เรื่องการฆ่าอีกต่อไป ไม่ใช่เรื่องของฟาร์มกลิ่นฉี่ หรือสายพานโรงฆ่าสัตว์ มันจะเป็น "ผลิตภัณฑ์ใหม่" ที่เราสร้างได้ ควบคุมได้ และปรับแต่งได้ เช่น เพิ่มโอเมก้า 3 ในเซลล์ไขมันให้สูงขึ้น หรือทำให้เนื้อไม่มีคอเลสเตอรอลเลยก็ยังได้

แม้ศาสตราจารย์ Post จะเน้นเรื่องความมั่นคงทางอาหารและผลกระทบต่อสิ่งแวดล้อมเป็นหลัก แต่เขาก็ยอมรับว่า สำหรับคนกินทั่วๆ ไป ประเด็นที่ "ไม่มีสัตว์ต้องเจ็บปวด" จะกลายเป็นจุดขายที่สำคัญในใจของผู้บริโภค

เขาเชื่อว่า เมื่อวันนั้นมาถึง วันที่เรายืนอยู่หน้าตู้แช่ในซูเปอร์ แล้วเห็นผลิตภัณฑ์สองชิ้นวางข้างกัน — หนึ่งคือเนื้อวัวที่มาจากฟาร์ม และอีกหนึ่งคือเนื้อเพาะเลี้ยงที่ไม่เคยมีวัวต้องร้องไห้แม้แต่นิดเดียว — การตัดสินใจอาจจะไม่ง่าย แต่ "จะมีคนจำนวนมากขึ้นเรื่อยๆ ที่เลือกแบบไม่ต้องฆ่า"

เพราะสุดท้าย เราไม่ได้แค่กินเนื้อ… เรากำลังกิน “ความเชื่อ” ลงไปด้วย #pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

ใครสนใจดูคลิปก็กดตรงนี้ได้ครับ https://youtu.be/1lI9AwxKfTY?si=6CDBUl2yGBoHWc-P

-

@ 527337d5:93e9525e

2025-05-29 18:19:31

@ 527337d5:93e9525e

2025-05-29 18:19:31Experiment Plan for Text Similarity Comparison Algorithms (Revised v3)

1. Introduction

1.1. Research Background and Objectives

This research aims to evaluate the performance of various algorithms for comparing the similarity between individual page texts extracted from a specific technical document (in this experiment, the content of the Tailwind CSS documentation site). Initially, we considered dividing the text into 250-word chunks. However, due to the abundance of Markdown and code in the target document, meaningful chunking proved tobe cumbersome. Therefore, we decided to use the entire text extracted from each page as the unit of comparison.

This study will systematically compare and examine combinations of different "representation methods" and "comparison methods" from multiple perspectives: ease of implementation, processing speed, memory consumption, and accuracy of similarity judgment. A particular focus will be on elucidating the effectiveness of information-based NCD (Normalized Compression Distance) and vector embedding-based methods, which are planned for future evaluation.

1.2. Report Structure

This report will first describe the experimental data and its preprocessing methods. Next, it will define in detail the representation methods and comparison methods that form the axes of evaluation, and present specific experimental cases combining them. After presenting the results and discussion of initial experiments using NCD, it will describe the metrics for evaluating each experimental case, specific experimental procedures, and the expected outcomes and future prospects of this research.

2. Experimental Data

- Target Content: Individual HTML pages from the Tailwind CSS documentation site (

tailwindcss.com). - Data Unit: The entire text of each page, extracted from HTML files using the

html2textcommand and further processed to remove control characters using thesedcommand. This serves as the basic unit of comparison in this experiment. - Data Storage Location: The extracted and preprocessed text files are stored locally under the

./tailwindcss.comdirectory, maintaining the original file structure. - Language: English

- Example Search Query: A representative search query for this experiment is

"Utilities for controlling how a background image behaves when scrolling."(Multiple queries and their expected similar pages may be used for more robust evaluation). - Example Expected Similar Page: For the query above,

/docs/background-attachmentis expected to be the most semantically similar page.

3. Experimental Design

This experiment is designed by dividing the process of evaluating text similarity into two main axes: "Representation Methods" and "Comparison Methods."

3.1. Representation Methods (Text Quantification/Vectorization)

-

Naive (Raw Text / Full Page Text)

- Method: Use the entire preprocessed text extracted from each document page as raw string data, without special transformations.

- Objective: Serve as a direct input for information-based comparison methods like NCD and as a baseline comparison for more advanced representation methods to be evaluated later.

-

(Future Experiment) Vector Embedding via Gemini API (Embedding-Gemini)

- Method: Utilize Google's Gemini API (

models/text-embedding-004) to convert the entire text of each page into high-dimensional dense vectors (Embeddings). - Objective: Evaluate the performance of context-rich vector representations generated by a state-of-the-art large language model.

- Method: Utilize Google's Gemini API (

-

(Future Experiment) Vector Embedding via Local Lightweight Model (Embedding-MiniLM-GGUF)

- Method: Run a GGUF quantized version of the pre-trained

all-MiniLM-L6-v2model (all-MiniLM-L6-v2-Q5_K_M.gguf) in a local environment to convert the entire text of each page into vector representations. GGUF format offers benefits like smaller model size and potentially faster CPU inference. - Objective: Evaluate the performance of a widely used open-source lightweight model (quantized version) in comparison to API-based large-scale models and domain-specific learned models.

- Method: Run a GGUF quantized version of the pre-trained

-

(Future Experiment) Extraction of Internal Feature Vectors via Mathematica (Embedding-MMA)

- Method: Use the entire page texts from the target document set as input. Employ Mathematica's neural network framework to first pass each page text through an Embedding Layer. Apply L2 normalization to the resulting vectors, followed by Principal Component Analysis (PCA) to reduce dimensionality to approximately 100 dimensions. This final vector will be the feature vector. This pipeline aims to create dense, normalized representations specific to the document corpus, with PCA helping to capture the most significant variance in a lower-dimensional space, potentially improving efficiency and reducing noise. The choice of an Embedding Layer trained or fine-tuned on the corpus, followed by PCA, seeks to balance domain-specificity with robust dimensionality reduction.

- Objective: Evaluate the performance of vector representations processed or specialized for the target document set.

3.2. Comparison Methods (Distance/Similarity Calculation between Representations)

-

NCD (Normalized Compression Distance)

- Applicable to: Naive (Full Page Text)

- Method: For two data objects

x(query) andy(document page text), calculateNCD(x,y) = (C(xy) - min(C(x), C(y))) / max(C(x), C(y)). Here,C(s)is the size (e.g., byte length) of datasafter compression with a specific algorithm, andC(xy)is the size of the concatenated dataxandyafter compression. A value closer to 0 indicates higher similarity. - Compression Algorithms to Compare: DEFLATE (gzip), bzip2, LZMA, XZ, Zstandard (zstd), LZO, Snappy, LZ4 (as used in the user-provided script).

- Objective: Evaluate similarity from an information-theoretic perspective based on data commonality and redundancy. Compare the impact of different compression algorithms on NCD results.

-

(Future Experiment) Cosine Similarity

- Applicable to: Embedding-Gemini, Embedding-MiniLM-GGUF, Embedding-MMA

- Method: Calculate the cosine of the angle between two vectors.

- Objective: Standard similarity evaluation based on the directionality (semantic closeness) of vector representations.

-

(Future Experiment) Euclidean Distance

- Applicable to: Embedding-Gemini, Embedding-MiniLM-GGUF, Embedding-MMA

- Method: Calculate the straight-line distance between two vectors in a multidimensional space.

- Objective: Similarity evaluation based on the absolute positional relationship of vector representations.

-

(Future Experiment) Manhattan Distance (L1 Distance)

- Applicable to: Embedding-Gemini, Embedding-MiniLM-GGUF, Embedding-MMA

- Method: Calculate the sum of the absolute differences of their Cartesian coordinates.

- Objective: Similarity evaluation based on axis-aligned travel distance, differing from Euclidean distance.

-

(Future Experiment) Mahalanobis Distance

- Applicable to: Embedding-Gemini, Embedding-MiniLM-GGUF, Embedding-MMA

- Method: Calculate the distance between two vectors considering the covariance of the data. This provides a distance metric that accounts for the scale differences and correlations of each feature (vector dimension).

- Objective: More robust similarity evaluation that considers the structure (correlation) of the feature space.

3.3. Experimental Cases (Initial NCD Experiments and Future Expansion)

3.3.1. Initial Experiments Conducted (NCD)

The following experimental cases were conducted using the user-provided script. The representation method was "Naive (Full Page Text)."

| No. | Representation Method | Comparison Method (Distance/Similarity Metric) | Notes | | :-: | :---------------------- | :--------------------------------------------- | :-------------------------- | | 1 | Naive (Full Page Text) | NCD (gzip/DEFLATE) | One of the baselines | | 2 | Naive (Full Page Text) | NCD (bzip2) | Compression method comparison | | 3 | Naive (Full Page Text) | NCD (lzma) | Compression method comparison | | 4 | Naive (Full Page Text) | NCD (xz) | Compression method comparison | | 5 | Naive (Full Page Text) | NCD (zstd) | Compression method comparison | | 6 | Naive (Full Page Text) | NCD (lzop) | Compression method comparison | | 7 | Naive (Full Page Text) | NCD (snappy) | Compression method comparison | | 8 | Naive (Full Page Text) | NCD (lz4) | Compression method comparison |

3.3.2. Future Experimental Plan (Vector Embedding)

| No. | Representation Method | Comparison Method (Distance/Similarity Metric) | Notes | | :--: | :---------------------- | :--------------------------------------------- | :------------------------------------- | | 9 | Embedding-Gemini | Cosine Similarity | Standard vector similarity evaluation | | 10 | Embedding-Gemini | Euclidean Distance | Standard vector similarity evaluation | | 11 | Embedding-Gemini | Manhattan Distance | Axis-aligned distance similarity eval. | | 12 | Embedding-Gemini | Mahalanobis Distance | Distance considering feature structure | | 13 | Embedding-MiniLM-GGUF | Cosine Similarity | Evaluation of local lightweight model | | 14 | Embedding-MiniLM-GGUF | Euclidean Distance | Evaluation of local lightweight model | | 15 | Embedding-MiniLM-GGUF | Manhattan Distance | Evaluation of local lightweight model | | 16 | Embedding-MiniLM-GGUF | Mahalanobis Distance | Evaluation of local lightweight model | | 17 | Embedding-MMA | Cosine Similarity | Eval. of domain-specific MMA model | | 18 | Embedding-MMA | Euclidean Distance | Eval. of domain-specific MMA model | | 19 | Embedding-MMA | Manhattan Distance | Eval. of domain-specific MMA model | | 20 | Embedding-MMA | Mahalanobis Distance | Eval. of domain-specific MMA model |

4. Results and Discussion of Initial NCD Experiments (Based on User-Provided Information)

4.1. Execution Overview

The user employed provided Python scripts (

main.py,comparison.py) to calculate NCD between a search query and the entire text extracted from each HTML page in the./tailwindcss.comdirectory.main.pyinvokedcomparison.pywith various compression commands (gzip,bzip2,lzma,xz,zstd,lzop,lz4).comparison.pythen used the specified command-line compression tools to compute NCD scores and output the results to CSV files.Search Query:

"Utilities for controlling how a background image behaves when scrolling."Expected Similar Page:/docs/background-attachment4.2. Key Results

The pages judged as most similar (lowest NCD score) to the query for each compression algorithm were as follows (based on user-provided sorted results):

- Zstandard (zstd):

./tailwindcss.com/docs/background-attachment(Score: 0.973...) - LZ4:

./tailwindcss.com/docs/background-attachment(Score: 0.976...) - XZ:

./tailwindcss.com/docs/background-origin(Score: 0.946...) - LZMA:

./tailwindcss.com/docs/background-origin(Score: 0.966...) - gzip (DEFLATE):

./tailwindcss.com/docs/scroll-behavior(Score: 0.969...) - LZO:

./tailwindcss.com/docs/scroll-behavior(Score: 0.955...) - bzip2:

./tailwindcss.com/docs/mask-clip(Score: 0.958...)

4.3. Initial Discussion