-

@ eac63075:b4988b48

2025-01-04 19:41:34

@ eac63075:b4988b48

2025-01-04 19:41:34Since its creation in 2009, Bitcoin has symbolized innovation and resilience. However, from time to time, alarmist narratives arise about emerging technologies that could "break" its security. Among these, quantum computing stands out as one of the most recurrent. But does quantum computing truly threaten Bitcoin? And more importantly, what is the community doing to ensure the protocol remains invulnerable?

The answer, contrary to sensationalist headlines, is reassuring: Bitcoin is secure, and the community is already preparing for a future where quantum computing becomes a practical reality. Let’s dive into this topic to understand why the concerns are exaggerated and how the development of BIP-360 demonstrates that Bitcoin is one step ahead.

What Is Quantum Computing, and Why Is Bitcoin Not Threatened?

Quantum computing leverages principles of quantum mechanics to perform calculations that, in theory, could exponentially surpass classical computers—and it has nothing to do with what so-called “quantum coaches” teach to scam the uninformed. One of the concerns is that this technology could compromise two key aspects of Bitcoin’s security:

- Wallets: These use elliptic curve algorithms (ECDSA) to protect private keys. A sufficiently powerful quantum computer could deduce a private key from its public key.

- Mining: This is based on the SHA-256 algorithm, which secures the consensus process. A quantum attack could, in theory, compromise the proof-of-work mechanism.

Understanding Quantum Computing’s Attack Priorities

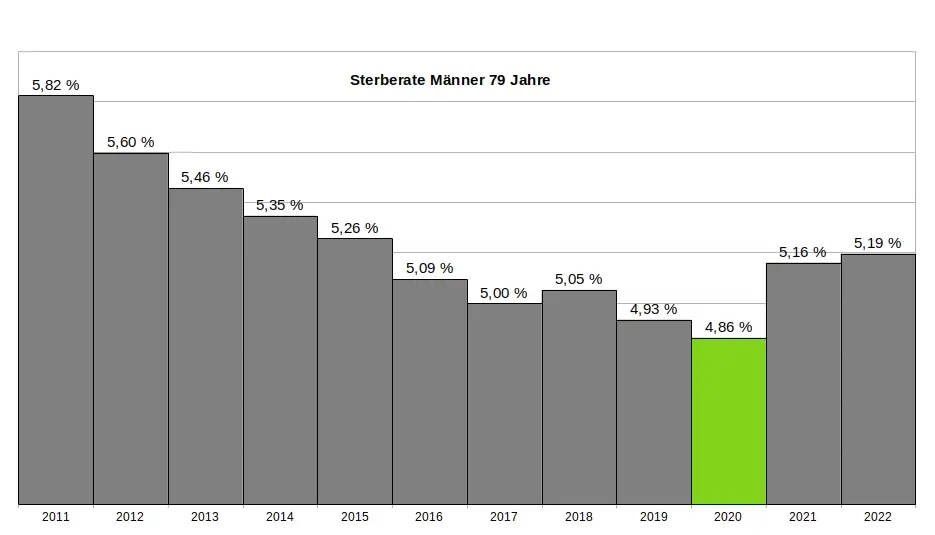

While quantum computing is often presented as a threat to Bitcoin, not all parts of the network are equally vulnerable. Theoretical attacks would be prioritized based on two main factors: ease of execution and potential reward. This creates two categories of attacks:

1. Attacks on Wallets

Bitcoin wallets, secured by elliptic curve algorithms, would be the initial targets due to the relative vulnerability of their public keys, especially those already exposed on the blockchain. Two attack scenarios stand out:

-

Short-term attacks: These occur during the interval between sending a transaction and its inclusion in a block (approximately 10 minutes). A quantum computer could intercept the exposed public key and derive the corresponding private key to redirect funds by creating a transaction with higher fees.

-

Long-term attacks: These focus on old wallets whose public keys are permanently exposed. Wallets associated with Satoshi Nakamoto, for example, are especially vulnerable because they were created before the practice of using hashes to mask public keys.

We can infer a priority order for how such attacks might occur based on urgency and importance.

Bitcoin Quantum Attack: Prioritization Matrix (Urgency vs. Importance)

Bitcoin Quantum Attack: Prioritization Matrix (Urgency vs. Importance)2. Attacks on Mining

Targeting the SHA-256 algorithm, which secures the mining process, would be the next objective. However, this is far more complex and requires a level of quantum computational power that is currently non-existent and far from realization. A successful attack would allow for the recalculation of all possible hashes to dominate the consensus process and potentially "mine" it instantly.

Satoshi Nakamoto in 2010 on Quantum Computing and Bitcoin Attacks

Satoshi Nakamoto in 2010 on Quantum Computing and Bitcoin AttacksRecently, Narcelio asked me about a statement I made on Tubacast:

https://x.com/eddieoz/status/1868371296683511969

If an attack became a reality before Bitcoin was prepared, it would be necessary to define the last block prior to the attack and proceed from there using a new hashing algorithm. The solution would resemble the response to the infamous 2013 bug. It’s a fact that this would cause market panic, and Bitcoin's price would drop significantly, creating a potential opportunity for the well-informed.

Preferably, if developers could anticipate the threat and had time to work on a solution and build consensus before an attack, they would simply decide on a future block for the fork, which would then adopt the new algorithm. It might even rehash previous blocks (reaching consensus on them) to avoid potential reorganization through the re-mining of blocks using the old hash. (I often use the term "shielding" old transactions).

How Can Users Protect Themselves?

While quantum computing is still far from being a practical threat, some simple measures can already protect users against hypothetical scenarios:

- Avoid using exposed public keys: Ensure funds sent to old wallets are transferred to new ones that use public key hashes. This reduces the risk of long-term attacks.

- Use modern wallets: Opt for wallets compatible with SegWit or Taproot, which implement better security practices.

- Monitor security updates: Stay informed about updates from the Bitcoin community, such as the implementation of BIP-360, which will introduce quantum-resistant addresses.

- Do not reuse addresses: Every transaction should be associated with a new address to minimize the risk of repeated exposure of the same public key.

- Adopt secure backup practices: Create offline backups of private keys and seeds in secure locations, protected from unauthorized access.

BIP-360 and Bitcoin’s Preparation for the Future

Even though quantum computing is still beyond practical reach, the Bitcoin community is not standing still. A concrete example is BIP-360, a proposal that establishes the technical framework to make wallets resistant to quantum attacks.

BIP-360 addresses three main pillars:

- Introduction of quantum-resistant addresses: A new address format starting with "BC1R" will be used. These addresses will be compatible with post-quantum algorithms, ensuring that stored funds are protected from future attacks.

- Compatibility with the current ecosystem: The proposal allows users to transfer funds from old addresses to new ones without requiring drastic changes to the network infrastructure.

- Flexibility for future updates: BIP-360 does not limit the choice of specific algorithms. Instead, it serves as a foundation for implementing new post-quantum algorithms as technology evolves.

This proposal demonstrates how Bitcoin can adapt to emerging threats without compromising its decentralized structure.

Post-Quantum Algorithms: The Future of Bitcoin Cryptography

The community is exploring various algorithms to protect Bitcoin from quantum attacks. Among the most discussed are:

- Falcon: A solution combining smaller public keys with compact digital signatures. Although it has been tested in limited scenarios, it still faces scalability and performance challenges.

- Sphincs: Hash-based, this algorithm is renowned for its resilience, but its signatures can be extremely large, making it less efficient for networks like Bitcoin’s blockchain.

- Lamport: Created in 1977, it’s considered one of the earliest post-quantum security solutions. Despite its reliability, its gigantic public keys (16,000 bytes) make it impractical and costly for Bitcoin.

Two technologies show great promise and are well-regarded by the community:

- Lattice-Based Cryptography: Considered one of the most promising, it uses complex mathematical structures to create systems nearly immune to quantum computing. Its implementation is still in its early stages, but the community is optimistic.

- Supersingular Elliptic Curve Isogeny: These are very recent digital signature algorithms and require extensive study and testing before being ready for practical market use.

The final choice of algorithm will depend on factors such as efficiency, cost, and integration capability with the current system. Additionally, it is preferable that these algorithms are standardized before implementation, a process that may take up to 10 years.

Why Quantum Computing Is Far from Being a Threat

The alarmist narrative about quantum computing overlooks the technical and practical challenges that still need to be overcome. Among them:

- Insufficient number of qubits: Current quantum computers have only a few hundred qubits, whereas successful attacks would require millions.

- High error rate: Quantum stability remains a barrier to reliable large-scale operations.

- High costs: Building and operating large-scale quantum computers requires massive investments, limiting their use to scientific or specific applications.

Moreover, even if quantum computers make significant advancements, Bitcoin is already adapting to ensure its infrastructure is prepared to respond.

Conclusion: Bitcoin’s Secure Future

Despite advancements in quantum computing, the reality is that Bitcoin is far from being threatened. Its security is ensured not only by its robust architecture but also by the community’s constant efforts to anticipate and mitigate challenges.

The implementation of BIP-360 and the pursuit of post-quantum algorithms demonstrate that Bitcoin is not only resilient but also proactive. By adopting practical measures, such as using modern wallets and migrating to quantum-resistant addresses, users can further protect themselves against potential threats.

Bitcoin’s future is not at risk—it is being carefully shaped to withstand any emerging technology, including quantum computing.

-

@ eac63075:b4988b48

2024-11-09 17:57:27

@ eac63075:b4988b48

2024-11-09 17:57:27Based on a recent paper that included collaboration from renowned experts such as Lynn Alden, Steve Lee, and Ren Crypto Fish, we discuss in depth how Bitcoin's consensus is built, the main risks, and the complex dynamics of protocol upgrades.

Podcast https://www.fountain.fm/episode/wbjD6ntQuvX5u2G5BccC

Presentation https://gamma.app/docs/Analyzing-Bitcoin-Consensus-Risks-in-Protocol-Upgrades-p66axxjwaa37ksn

1. Introduction to Consensus in Bitcoin

Consensus in Bitcoin is the foundation that keeps the network secure and functional, allowing users worldwide to perform transactions in a decentralized manner without the need for intermediaries. Since its launch in 2009, Bitcoin is often described as an "immutable" system designed to resist changes, and it is precisely this resistance that ensures its security and stability.

The central idea behind consensus in Bitcoin is to create a set of acceptance rules for blocks and transactions, ensuring that all network participants agree on the transaction history. This prevents "double-spending," where the same bitcoin could be used in two simultaneous transactions, something that would compromise trust in the network.

Evolution of Consensus in Bitcoin

Over the years, consensus in Bitcoin has undergone several adaptations, and the way participants agree on changes remains a delicate process. Unlike traditional systems, where changes can be imposed from the top down, Bitcoin operates in a decentralized model where any significant change needs the support of various groups of stakeholders, including miners, developers, users, and large node operators.

Moreover, the update process is extremely cautious, as hasty changes can compromise the network's security. As a result, the philosophy of "don't fix what isn't broken" prevails, with improvements happening incrementally and only after broad consensus among those involved. This model can make progress seem slow but ensures that Bitcoin remains faithful to the principles of security and decentralization.

2. Technical Components of Consensus

Bitcoin's consensus is supported by a set of technical rules that determine what is considered a valid transaction and a valid block on the network. These technical aspects ensure that all nodes—the computers that participate in the Bitcoin network—agree on the current state of the blockchain. Below are the main technical components that form the basis of the consensus.

Validation of Blocks and Transactions

The validation of blocks and transactions is the central point of consensus in Bitcoin. A block is only considered valid if it meets certain criteria, such as maximum size, transaction structure, and the solving of the "Proof of Work" problem. The proof of work, required for a block to be included in the blockchain, is a computational process that ensures the block contains significant computational effort—protecting the network against manipulation attempts.

Transactions, in turn, need to follow specific input and output rules. Each transaction includes cryptographic signatures that prove the ownership of the bitcoins sent, as well as validation scripts that verify if the transaction conditions are met. This validation system is essential for network nodes to autonomously confirm that each transaction follows the rules.

Chain Selection

Another fundamental technical issue for Bitcoin's consensus is chain selection, which becomes especially important in cases where multiple versions of the blockchain coexist, such as after a network split (fork). To decide which chain is the "true" one and should be followed, the network adopts the criterion of the highest accumulated proof of work. In other words, the chain with the highest number of valid blocks, built with the greatest computational effort, is chosen by the network as the official one.

This criterion avoids permanent splits because it encourages all nodes to follow the same main chain, reinforcing consensus.

Soft Forks vs. Hard Forks

In the consensus process, protocol changes can happen in two ways: through soft forks or hard forks. These variations affect not only the protocol update but also the implications for network users:

-

Soft Forks: These are changes that are backward compatible. Only nodes that adopt the new update will follow the new rules, but old nodes will still recognize the blocks produced with these rules as valid. This compatibility makes soft forks a safer option for updates, as it minimizes the risk of network division.

-

Hard Forks: These are updates that are not backward compatible, requiring all nodes to update to the new version or risk being separated from the main chain. Hard forks can result in the creation of a new coin, as occurred with the split between Bitcoin and Bitcoin Cash in 2017. While hard forks allow for deeper changes, they also bring significant risks of network fragmentation.

These technical components form the base of Bitcoin's security and resilience, allowing the system to remain functional and immutable without losing the necessary flexibility to evolve over time.

3. Stakeholders in Bitcoin's Consensus

Consensus in Bitcoin is not decided centrally. On the contrary, it depends on the interaction between different groups of stakeholders, each with their motivations, interests, and levels of influence. These groups play fundamental roles in how changes are implemented or rejected on the network. Below, we explore the six main stakeholders in Bitcoin's consensus.

1. Economic Nodes

Economic nodes, usually operated by exchanges, custody providers, and large companies that accept Bitcoin, exert significant influence over consensus. Because they handle large volumes of transactions and act as a connection point between the Bitcoin ecosystem and the traditional financial system, these nodes have the power to validate or reject blocks and to define which version of the software to follow in case of a fork.

Their influence is proportional to the volume of transactions they handle, and they can directly affect which chain will be seen as the main one. Their incentive is to maintain the network's stability and security to preserve its functionality and meet regulatory requirements.

2. Investors

Investors, including large institutional funds and individual Bitcoin holders, influence consensus indirectly through their impact on the asset's price. Their buying and selling actions can affect Bitcoin's value, which in turn influences the motivation of miners and other stakeholders to continue investing in the network's security and development.

Some institutional investors have agreements with custodians that may limit their ability to act in network split situations. Thus, the impact of each investor on consensus can vary based on their ownership structure and how quickly they can react to a network change.

3. Media Influencers

Media influencers, including journalists, analysts, and popular personalities on social media, have a powerful role in shaping public opinion about Bitcoin and possible updates. These influencers can help educate the public, promote debates, and bring transparency to the consensus process.

On the other hand, the impact of influencers can be double-edged: while they can clarify complex topics, they can also distort perceptions by amplifying or minimizing change proposals. This makes them a force both of support and resistance to consensus.

4. Miners

Miners are responsible for validating transactions and including blocks in the blockchain. Through computational power (hashrate), they also exert significant influence over consensus decisions. In update processes, miners often signal their support for a proposal, indicating that the new version is safe to use. However, this signaling is not always definitive, and miners can change their position if they deem it necessary.

Their incentive is to maximize returns from block rewards and transaction fees, as well as to maintain the value of investments in their specialized equipment, which are only profitable if the network remains stable.

5. Protocol Developers

Protocol developers, often called "Core Developers," are responsible for writing and maintaining Bitcoin's code. Although they do not have direct power over consensus, they possess an informal veto power since they decide which changes are included in the main client (Bitcoin Core). This group also serves as an important source of technical knowledge, helping guide decisions and inform other stakeholders.

Their incentive lies in the continuous improvement of the network, ensuring security and decentralization. Many developers are funded by grants and sponsorships, but their motivations generally include a strong ideological commitment to Bitcoin's principles.

6. Users and Application Developers

This group includes people who use Bitcoin in their daily transactions and developers who build solutions based on the network, such as wallets, exchanges, and payment platforms. Although their power in consensus is less than that of miners or economic nodes, they play an important role because they are responsible for popularizing Bitcoin's use and expanding the ecosystem.

If application developers decide not to adopt an update, this can affect compatibility and widespread acceptance. Thus, they indirectly influence consensus by deciding which version of the protocol to follow in their applications.

These stakeholders are vital to the consensus process, and each group exerts influence according to their involvement, incentives, and ability to act in situations of change. Understanding the role of each makes it clearer how consensus is formed and why it is so difficult to make significant changes to Bitcoin.

4. Mechanisms for Activating Updates in Bitcoin

For Bitcoin to evolve without compromising security and consensus, different mechanisms for activating updates have been developed over the years. These mechanisms help coordinate changes among network nodes to minimize the risk of fragmentation and ensure that updates are implemented in an orderly manner. Here, we explore some of the main methods used in Bitcoin, their advantages and disadvantages, as well as historical examples of significant updates.

Flag Day

The Flag Day mechanism is one of the simplest forms of activating changes. In it, a specific date or block is determined as the activation moment, and all nodes must be updated by that point. This method does not involve prior signaling; participants simply need to update to the new software version by the established day or block.

-

Advantages: Simplicity and predictability are the main benefits of Flag Day, as everyone knows the exact activation date.

-

Disadvantages: Inflexibility can be a problem because there is no way to adjust the schedule if a significant part of the network has not updated. This can result in network splits if a significant number of nodes are not ready for the update.

An example of Flag Day was the Pay to Script Hash (P2SH) update in 2012, which required all nodes to adopt the change to avoid compatibility issues.

BIP34 and BIP9

BIP34 introduced a more dynamic process, in which miners increase the version number in block headers to signal the update. When a predetermined percentage of the last blocks is mined with this new version, the update is automatically activated. This model later evolved with BIP9, which allowed multiple updates to be signaled simultaneously through "version bits," each corresponding to a specific change.

-

Advantages: Allows the network to activate updates gradually, giving more time for participants to adapt.

-

Disadvantages: These methods rely heavily on miner support, which means that if a sufficient number of miners do not signal the update, it can be delayed or not implemented.

BIP9 was used in the activation of SegWit (BIP141) but faced challenges because some miners did not signal their intent to activate, leading to the development of new mechanisms.

User Activated Soft Forks (UASF) and User Resisted Soft Forks (URSF)

To increase the decision-making power of ordinary users, the concept of User Activated Soft Fork (UASF) was introduced, allowing node operators, not just miners, to determine consensus for a change. In this model, nodes set a date to start rejecting blocks that are not in compliance with the new update, forcing miners to adapt or risk having their blocks rejected by the network.

URSF, in turn, is a model where nodes reject blocks that attempt to adopt a specific update, functioning as resistance against proposed changes.

-

Advantages: UASF returns decision-making power to node operators, ensuring that changes do not depend solely on miners.

-

Disadvantages: Both UASF and URSF can generate network splits, especially in cases of strong opposition among different stakeholders.

An example of UASF was the activation of SegWit in 2017, where users supported activation independently of miner signaling, which ended up forcing its adoption.

BIP8 (LOT=True)

BIP8 is an evolution of BIP9, designed to prevent miners from indefinitely blocking a change desired by the majority of users and developers. BIP8 allows setting a parameter called "lockinontimeout" (LOT) as true, which means that if the update has not been fully signaled by a certain point, it is automatically activated.

-

Advantages: Ensures that changes with broad support among users are not blocked by miners who wish to maintain the status quo.

-

Disadvantages: Can lead to network splits if miners or other important stakeholders do not support the update.

Although BIP8 with LOT=True has not yet been used in Bitcoin, it is a proposal that can be applied in future updates if necessary.

These activation mechanisms have been essential for Bitcoin's development, allowing updates that keep the network secure and functional. Each method brings its own advantages and challenges, but all share the goal of preserving consensus and network cohesion.

5. Risks and Considerations in Consensus Updates

Consensus updates in Bitcoin are complex processes that involve not only technical aspects but also political, economic, and social considerations. Due to the network's decentralized nature, each change brings with it a set of risks that need to be carefully assessed. Below, we explore some of the main challenges and future scenarios, as well as the possible impacts on stakeholders.

Network Fragility with Alternative Implementations

One of the main risks associated with consensus updates is the possibility of network fragmentation when there are alternative software implementations. If an update is implemented by a significant group of nodes but rejected by others, a network split (fork) can occur. This creates two competing chains, each with a different version of the transaction history, leading to unpredictable consequences for users and investors.

Such fragmentation weakens Bitcoin because, by dividing hashing power (computing) and coin value, it reduces network security and investor confidence. A notable example of this risk was the fork that gave rise to Bitcoin Cash in 2017 when disagreements over block size resulted in a new chain and a new asset.

Chain Splits and Impact on Stakeholders

Chain splits are a significant risk in update processes, especially in hard forks. During a hard fork, the network is split into two separate chains, each with its own set of rules. This results in the creation of a new coin and leaves users with duplicated assets on both chains. While this may seem advantageous, in the long run, these splits weaken the network and create uncertainties for investors.

Each group of stakeholders reacts differently to a chain split:

-

Institutional Investors and ETFs: Face regulatory and compliance challenges because many of these assets are managed under strict regulations. The creation of a new coin requires decisions to be made quickly to avoid potential losses, which may be hampered by regulatory constraints.

-

Miners: May be incentivized to shift their computing power to the chain that offers higher profitability, which can weaken one of the networks.

-

Economic Nodes: Such as major exchanges and custody providers, have to quickly choose which chain to support, influencing the perceived value of each network.

Such divisions can generate uncertainties and loss of value, especially for institutional investors and those who use Bitcoin as a store of value.

Regulatory Impacts and Institutional Investors

With the growing presence of institutional investors in Bitcoin, consensus changes face new compliance challenges. Bitcoin ETFs, for example, are required to follow strict rules about which assets they can include and how chain split events should be handled. The creation of a new asset or migration to a new chain can complicate these processes, creating pressure for large financial players to quickly choose a chain, affecting the stability of consensus.

Moreover, decisions regarding forks can influence the Bitcoin futures and derivatives market, affecting perception and adoption by new investors. Therefore, the need to avoid splits and maintain cohesion is crucial to attract and preserve the confidence of these investors.

Security Considerations in Soft Forks and Hard Forks

While soft forks are generally preferred in Bitcoin for their backward compatibility, they are not without risks. Soft forks can create different classes of nodes on the network (updated and non-updated), which increases operational complexity and can ultimately weaken consensus cohesion. In a network scenario with fragmentation of node classes, Bitcoin's security can be affected, as some nodes may lose part of the visibility over updated transactions or rules.

In hard forks, the security risk is even more evident because all nodes need to adopt the new update to avoid network division. Experience shows that abrupt changes can create temporary vulnerabilities, in which malicious agents try to exploit the transition to attack the network.

Bounty Claim Risks and Attack Scenarios

Another risk in consensus updates are so-called "bounty claims"—accumulated rewards that can be obtained if an attacker manages to split or deceive a part of the network. In a conflict scenario, a group of miners or nodes could be incentivized to support a new update or create an alternative version of the software to benefit from these rewards.

These risks require stakeholders to carefully assess each update and the potential vulnerabilities it may introduce. The possibility of "bounty claims" adds a layer of complexity to consensus because each interest group may see a financial opportunity in a change that, in the long term, may harm network stability.

The risks discussed above show the complexity of consensus in Bitcoin and the importance of approaching it gradually and deliberately. Updates need to consider not only technical aspects but also economic and social implications, in order to preserve Bitcoin's integrity and maintain trust among stakeholders.

6. Recommendations for the Consensus Process in Bitcoin

To ensure that protocol changes in Bitcoin are implemented safely and with broad support, it is essential that all stakeholders adopt a careful and coordinated approach. Here are strategic recommendations for evaluating, supporting, or rejecting consensus updates, considering the risks and challenges discussed earlier, along with best practices for successful implementation.

1. Careful Evaluation of Proposal Maturity

Stakeholders should rigorously assess the maturity level of a proposal before supporting its implementation. Updates that are still experimental or lack a robust technical foundation can expose the network to unnecessary risks. Ideally, change proposals should go through an extensive testing phase, have security audits, and receive review and feedback from various developers and experts.

2. Extensive Testing in Secure and Compatible Networks

Before an update is activated on the mainnet, it is essential to test it on networks like testnet and signet, and whenever possible, on other compatible networks that offer a safe and controlled environment to identify potential issues. Testing on networks like Litecoin was fundamental for the safe launch of innovations like SegWit and the Lightning Network, allowing functionalities to be validated on a lower-impact network before being implemented on Bitcoin.

The Liquid Network, developed by Blockstream, also plays an important role as an experimental network for new proposals, such as OP_CAT. By adopting these testing environments, stakeholders can mitigate risks and ensure that the update is reliable and secure before being adopted by the main network.

3. Importance of Stakeholder Engagement

The success of a consensus update strongly depends on the active participation of all stakeholders. This includes economic nodes, miners, protocol developers, investors, and end users. Lack of participation can lead to inadequate decisions or even future network splits, which would compromise Bitcoin's security and stability.

4. Key Questions for Evaluating Consensus Proposals

To assist in decision-making, each group of stakeholders should consider some key questions before supporting a consensus change:

- Does the proposal offer tangible benefits for Bitcoin's security, scalability, or usability?

- Does it maintain backward compatibility or introduce the risk of network split?

- Are the implementation requirements clear and feasible for each group involved?

- Are there clear and aligned incentives for all stakeholder groups to accept the change?

5. Coordination and Timing in Implementations

Timing is crucial. Updates with short activation windows can force a split because not all nodes and miners can update simultaneously. Changes should be planned with ample deadlines to allow all stakeholders to adjust their systems, avoiding surprises that could lead to fragmentation.

Mechanisms like soft forks are generally preferable to hard forks because they allow a smoother transition. Opting for backward-compatible updates when possible facilitates the process and ensures that nodes and miners can adapt without pressure.

6. Continuous Monitoring and Re-evaluation

After an update, it's essential to monitor the network to identify problems or side effects. This continuous process helps ensure cohesion and trust among all participants, keeping Bitcoin as a secure and robust network.

These recommendations, including the use of secure networks for extensive testing, promote a collaborative and secure environment for Bitcoin's consensus process. By adopting a deliberate and strategic approach, stakeholders can preserve Bitcoin's value as a decentralized and censorship-resistant network.

7. Conclusion

Consensus in Bitcoin is more than a set of rules; it's the foundation that sustains the network as a decentralized, secure, and reliable system. Unlike centralized systems, where decisions can be made quickly, Bitcoin requires a much more deliberate and cooperative approach, where the interests of miners, economic nodes, developers, investors, and users must be considered and harmonized. This governance model may seem slow, but it is fundamental to preserving the resilience and trust that make Bitcoin a global store of value and censorship-resistant.

Consensus updates in Bitcoin must balance the need for innovation with the preservation of the network's core principles. The development process of a proposal needs to be detailed and rigorous, going through several testing stages, such as in testnet, signet, and compatible networks like Litecoin and Liquid Network. These networks offer safe environments for proposals to be analyzed and improved before being launched on the main network.

Each proposed change must be carefully evaluated regarding its maturity, impact, backward compatibility, and support among stakeholders. The recommended key questions and appropriate timing are critical to ensure that an update is adopted without compromising network cohesion. It's also essential that the implementation process is continuously monitored and re-evaluated, allowing adjustments as necessary and minimizing the risk of instability.

By following these guidelines, Bitcoin's stakeholders can ensure that the network continues to evolve safely and robustly, maintaining user trust and further solidifying its role as one of the most resilient and innovative digital assets in the world. Ultimately, consensus in Bitcoin is not just a technical issue but a reflection of its community and the values it represents: security, decentralization, and resilience.

8. Links

Whitepaper: https://github.com/bitcoin-cap/bcap

Youtube (pt-br): https://www.youtube.com/watch?v=rARycAibl9o&list=PL-qnhF0qlSPkfhorqsREuIu4UTbF0h4zb

-

-

@ eac63075:b4988b48

2024-10-26 22:14:19

@ eac63075:b4988b48

2024-10-26 22:14:19The future of physical money is at stake, and the discussion about DREX, the new digital currency planned by the Central Bank of Brazil, is gaining momentum. In a candid and intense conversation, Federal Deputy Julia Zanatta (PL/SC) discussed the challenges and risks of this digital transition, also addressing her Bill No. 3,341/2024, which aims to prevent the extinction of physical currency. This bill emerges as a direct response to legislative initiatives seeking to replace physical money with digital alternatives, limiting citizens' options and potentially compromising individual freedom. Let's delve into the main points of this conversation.

https://www.fountain.fm/episode/i5YGJ9Ors3PkqAIMvNQ0

What is a CBDC?

Before discussing the specifics of DREX, it’s important to understand what a CBDC (Central Bank Digital Currency) is. CBDCs are digital currencies issued by central banks, similar to a digital version of physical money. Unlike cryptocurrencies such as Bitcoin, which operate in a decentralized manner, CBDCs are centralized and regulated by the government. In other words, they are digital currencies created and controlled by the Central Bank, intended to replace physical currency.

A prominent feature of CBDCs is their programmability. This means that the government can theoretically set rules about how, where, and for what this currency can be used. This aspect enables a level of control over citizens' finances that is impossible with physical money. By programming the currency, the government could limit transactions by setting geographical or usage restrictions. In practice, money within a CBDC could be restricted to specific spending or authorized for use in a defined geographical area.

In countries like China, where citizen actions and attitudes are also monitored, a person considered to have a "low score" due to a moral or ideological violation may have their transactions limited to essential purchases, restricting their digital currency use to non-essential activities. This financial control is strengthened because, unlike physical money, digital currency cannot be exchanged anonymously.

Practical Example: The Case of DREX During the Pandemic

To illustrate how DREX could be used, an example was given by Eric Altafim, director of Banco Itaú. He suggested that, if DREX had existed during the COVID-19 pandemic, the government could have restricted the currency’s use to a 5-kilometer radius around a person’s residence, limiting their economic mobility. Another proposed use by the executive related to the Bolsa Família welfare program: the government could set up programming that only allows this benefit to be used exclusively for food purchases. Although these examples are presented as control measures for safety or organization, they demonstrate how much a CBDC could restrict citizens' freedom of choice.

To illustrate the potential for state control through a Central Bank Digital Currency (CBDC), such as DREX, it is helpful to look at the example of China. In China, the implementation of a CBDC coincides with the country’s Social Credit System, a governmental surveillance tool that assesses citizens' and companies' behavior. Together, these technologies allow the Chinese government to monitor, reward, and, above all, punish behavior deemed inappropriate or threatening to the government.

How Does China's Social Credit System Work?

Implemented in 2014, China's Social Credit System assigns every citizen and company a "score" based on various factors, including financial behavior, criminal record, social interactions, and even online activities. This score determines the benefits or penalties each individual receives and can affect everything from public transport access to obtaining loans and enrolling in elite schools for their children. Citizens with low scores may face various sanctions, including travel restrictions, fines, and difficulty in securing loans.

With the adoption of the CBDC — or “digital yuan” — the Chinese government now has a new tool to closely monitor citizens' financial transactions, facilitating the application of Social Credit System penalties. China’s CBDC is a programmable digital currency, which means that the government can restrict how, when, and where the money can be spent. Through this level of control, digital currency becomes a powerful mechanism for influencing citizens' behavior.

Imagine, for instance, a citizen who repeatedly posts critical remarks about the government on social media or participates in protests. If the Social Credit System assigns this citizen a low score, the Chinese government could, through the CBDC, restrict their money usage in certain areas or sectors. For example, they could be prevented from buying tickets to travel to other regions, prohibited from purchasing certain consumer goods, or even restricted to making transactions only at stores near their home.

Another example of how the government can use the CBDC to enforce the Social Credit System is by monitoring purchases of products such as alcohol or luxury items. If a citizen uses the CBDC to spend more than the government deems reasonable on such products, this could negatively impact their social score, resulting in additional penalties such as future purchase restrictions or a lowered rating that impacts their personal and professional lives.

In China, this kind of control has already been demonstrated in several cases. Citizens added to Social Credit System “blacklists” have seen their spending and investment capacity severely limited. The combination of digital currency and social scores thus creates a sophisticated and invasive surveillance system, through which the Chinese government controls important aspects of citizens’ financial lives and individual freedoms.

Deputy Julia Zanatta views these examples with great concern. She argues that if the state has full control over digital money, citizens will be exposed to a level of economic control and surveillance never seen before. In a democracy, this control poses a risk, but in an authoritarian regime, it could be used as a powerful tool of repression.

DREX and Bill No. 3,341/2024

Julia Zanatta became aware of a bill by a Workers' Party (PT) deputy (Bill 4068/2020 by Deputy Reginaldo Lopes - PT/MG) that proposes the extinction of physical money within five years, aiming for a complete transition to DREX, the digital currency developed by the Central Bank of Brazil. Concerned about the impact of this measure, Julia drafted her bill, PL No. 3,341/2024, which prohibits the elimination of physical money, ensuring citizens the right to choose physical currency.

“The more I read about DREX, the less I want its implementation,” says the deputy. DREX is a Central Bank Digital Currency (CBDC), similar to other state digital currencies worldwide, but which, according to Julia, carries extreme control risks. She points out that with DREX, the State could closely monitor each citizen’s transactions, eliminating anonymity and potentially restricting freedom of choice. This control would lie in the hands of the Central Bank, which could, in a crisis or government change, “freeze balances or even delete funds directly from user accounts.”

Risks and Individual Freedom

Julia raises concerns about potential abuses of power that complete digitalization could allow. In a democracy, state control over personal finances raises serious questions, and EddieOz warns of an even more problematic future. “Today we are in a democracy, but tomorrow, with a government transition, we don't know if this kind of power will be used properly or abused,” he states. In other words, DREX gives the State the ability to restrict or condition the use of money, opening the door to unprecedented financial surveillance.

EddieOz cites Nigeria as an example, where a CBDC was implemented, and the government imposed severe restrictions on the use of physical money to encourage the use of digital currency, leading to protests and clashes in the country. In practice, the poorest and unbanked — those without regular access to banking services — were harshly affected, as without physical money, many cannot conduct basic transactions. Julia highlights that in Brazil, this situation would be even more severe, given the large number of unbanked individuals and the extent of rural areas where access to technology is limited.

The Relationship Between DREX and Pix

The digital transition has already begun with Pix, which revolutionized instant transfers and payments in Brazil. However, Julia points out that Pix, though popular, is a citizen’s choice, while DREX tends to eliminate that choice. The deputy expresses concern about new rules suggested for Pix, such as daily transaction limits of a thousand reais, justified as anti-fraud measures but which, in her view, represent additional control and a profit opportunity for banks. “How many more rules will banks create to profit from us?” asks Julia, noting that DREX could further enhance control over personal finances.

International Precedents and Resistance to CBDC

The deputy also cites examples from other countries resisting the idea of a centralized digital currency. In the United States, states like New Hampshire have passed laws to prevent the advance of CBDCs, and leaders such as Donald Trump have opposed creating a national digital currency. Trump, addressing the topic, uses a justification similar to Julia’s: in a digitalized system, “with one click, your money could disappear.” She agrees with the warning, emphasizing the control risk that a CBDC represents, especially for countries with disadvantaged populations.

Besides the United States, Canada, Colombia, and Australia have also suspended studies on digital currencies, citing the need for further discussions on population impacts. However, in Brazil, the debate on DREX is still limited, with few parliamentarians and political leaders openly discussing the topic. According to Julia, only she and one or two deputies are truly trying to bring this discussion to the Chamber, making DREX’s advance even more concerning.

Bill No. 3,341/2024 and Popular Pressure

For Julia, her bill is a first step. Although she acknowledges that ideally, it would prevent DREX's implementation entirely, PL 3341/2024 is a measure to ensure citizens' choice to use physical money, preserving a form of individual freedom. “If the future means control, I prefer to live in the past,” Julia asserts, reinforcing that the fight for freedom is at the heart of her bill.

However, the deputy emphasizes that none of this will be possible without popular mobilization. According to her, popular pressure is crucial for other deputies to take notice and support PL 3341. “I am only one deputy, and we need the public’s support to raise the project’s visibility,” she explains, encouraging the public to press other parliamentarians and ask them to “pay attention to PL 3341 and the project that prohibits the end of physical money.” The deputy believes that with a strong awareness and pressure movement, it is possible to advance the debate and ensure Brazilians’ financial freedom.

What’s at Stake?

Julia Zanatta leaves no doubt: DREX represents a profound shift in how money will be used and controlled in Brazil. More than a simple modernization of the financial system, the Central Bank’s CBDC sets precedents for an unprecedented level of citizen surveillance and control in the country. For the deputy, this transition needs to be debated broadly and transparently, and it’s up to the Brazilian people to defend their rights and demand that the National Congress discuss these changes responsibly.

The deputy also emphasizes that, regardless of political or partisan views, this issue affects all Brazilians. “This agenda is something that will affect everyone. We need to be united to ensure people understand the gravity of what could happen.” Julia believes that by sharing information and generating open debate, it is possible to prevent Brazil from following the path of countries that have already implemented a digital currency in an authoritarian way.

A Call to Action

The future of physical money in Brazil is at risk. For those who share Deputy Julia Zanatta’s concerns, the time to act is now. Mobilize, get informed, and press your representatives. PL 3341/2024 is an opportunity to ensure that Brazilian citizens have a choice in how to use their money, without excessive state interference or surveillance.

In the end, as the deputy puts it, the central issue is freedom. “My fear is that this project will pass, and people won’t even understand what is happening.” Therefore, may every citizen at least have the chance to understand what’s at stake and make their voice heard in defense of a Brazil where individual freedom and privacy are respected values.

-

@ 8fb140b4:f948000c

2023-11-21 21:37:48

@ 8fb140b4:f948000c

2023-11-21 21:37:48Embarking on the journey of operating your own Lightning node on the Bitcoin Layer 2 network is more than just a tech-savvy endeavor; it's a step into a realm of financial autonomy and cutting-edge innovation. By running a node, you become a vital part of a revolutionary movement that's reshaping how we think about money and digital transactions. This role not only offers a unique perspective on blockchain technology but also places you at the heart of a community dedicated to decentralization and network resilience. Beyond the technicalities, it's about embracing a new era of digital finance, where you contribute directly to the network's security, efficiency, and growth, all while gaining personal satisfaction and potentially lucrative rewards.

In essence, running your own Lightning node is a powerful way to engage with the forefront of blockchain technology, assert financial independence, and contribute to a more decentralized and efficient Bitcoin network. It's an adventure that offers both personal and communal benefits, from gaining in-depth tech knowledge to earning a place in the evolving landscape of cryptocurrency.

Running your own Lightning node for the Bitcoin Layer 2 network can be an empowering and beneficial endeavor. Here are 10 reasons why you might consider taking on this task:

-

Direct Contribution to Decentralization: Operating a node is a direct action towards decentralizing the Bitcoin network, crucial for its security and resistance to control or censorship by any single entity.

-

Financial Autonomy: Owning a node gives you complete control over your financial transactions on the network, free from reliance on third-party services, which can be subject to fees, restrictions, or outages.

-

Advanced Network Participation: As a node operator, you're not just a passive participant but an active player in shaping the network, influencing its efficiency and scalability through direct involvement.

-

Potential for Higher Revenue: With strategic management and optimal channel funding, your node can become a preferred route for transactions, potentially increasing the routing fees you can earn.

-

Cutting-Edge Technological Engagement: Running a node puts you at the forefront of blockchain and bitcoin technology, offering insights into future developments and innovations.

-

Strengthened Network Security: Each new node adds to the robustness of the Bitcoin network, making it more resilient against attacks and failures, thus contributing to the overall security of the ecosystem.

-

Personalized Fee Structures: You have the flexibility to set your own fee policies, which can balance earning potential with the service you provide to the network.

-

Empowerment Through Knowledge: The process of setting up and managing a node provides deep learning opportunities, empowering you with knowledge that can be applied in various areas of blockchain and fintech.

-

Boosting Transaction Capacity: By running a node, you help to increase the overall capacity of the Lightning Network, enabling more transactions to be processed quickly and at lower costs.

-

Community Leadership and Reputation: As an active node operator, you gain recognition within the Bitcoin community, which can lead to collaborative opportunities and a position of thought leadership in the space.

These reasons demonstrate the impactful and transformative nature of running a Lightning node, appealing to those who are deeply invested in the principles of bitcoin and wish to actively shape its future. Jump aboard, and embrace the journey toward full independence. 🐶🐾🫡🚀🚀🚀

-

-

@ 8fb140b4:f948000c

2023-11-18 23:28:31

@ 8fb140b4:f948000c

2023-11-18 23:28:31Chef's notes

Serving these two dishes together will create a delightful centerpiece for your Thanksgiving meal, offering a perfect blend of traditional flavors with a homemade touch.

Details

- ⏲️ Prep time: 30 min

- 🍳 Cook time: 1 - 2 hours

- 🍽️ Servings: 4-6

Ingredients

- 1 whole turkey (about 12-14 lbs), thawed and ready to cook

- 1 cup unsalted butter, softened

- 2 tablespoons fresh thyme, chopped

- 2 tablespoons fresh rosemary, chopped

- 2 tablespoons fresh sage, chopped

- Salt and freshly ground black pepper

- 1 onion, quartered

- 1 lemon, halved

- 2-3 cloves of garlic

- Apple and Sage Stuffing

- 1 loaf of crusty bread, cut into cubes

- 2 apples, cored and chopped

- 1 onion, diced

- 2 stalks celery, diced

- 3 cloves garlic, minced

- 1/4 cup fresh sage, chopped

- 1/2 cup unsalted butter

- 2 cups chicken broth

- Salt and pepper, to taste

Directions

- Preheat the Oven: Set your oven to 325°F (165°C).

- Prepare the Herb Butter: Mix the softened butter with the chopped thyme, rosemary, and sage. Season with salt and pepper.

- Prepare the Turkey: Remove any giblets from the turkey and pat it dry. Loosen the skin and spread a generous amount of herb butter under and over the skin.

- Add Aromatics: Inside the turkey cavity, place the quartered onion, lemon halves, and garlic cloves.

- Roast: Place the turkey in a roasting pan. Tent with aluminum foil and roast. A general guideline is about 15 minutes per pound, or until the internal temperature reaches 165°F (74°C) at the thickest part of the thigh.

- Rest and Serve: Let the turkey rest for at least 20 minutes before carving.

- Next: Apple and Sage Stuffing

- Dry the Bread: Spread the bread cubes on a baking sheet and let them dry overnight, or toast them in the oven.

- Cook the Vegetables: In a large skillet, melt the butter and cook the onion, celery, and garlic until soft.

- Combine Ingredients: Add the apples, sage, and bread cubes to the skillet. Stir in the chicken broth until the mixture is moist. Season with salt and pepper.

- Bake: Transfer the stuffing to a baking dish and bake at 350°F (175°C) for about 30-40 minutes, until golden brown on top.

-

@ 8fb140b4:f948000c

2023-11-02 01:13:01

@ 8fb140b4:f948000c

2023-11-02 01:13:01Testing a brand new YakiHonne native client for iOS. Smooth as butter (not penis butter 🤣🍆🧈) with great visual experience and intuitive navigation. Amazing work by the team behind it! * lists * work

Bold text work!

Images could have used nostr.build instead of raw S3 from us-east-1 region.

Very impressive! You can even save the draft and continue later, before posting the long-form note!

🐶🐾🤯🤯🤯🫂💜

-

@ 8fb140b4:f948000c

2023-08-22 12:14:34

@ 8fb140b4:f948000c

2023-08-22 12:14:34As the title states, scratch behind my ear and you get it. 🐶🐾🫡

-

@ 8fb140b4:f948000c

2023-07-30 00:35:01

@ 8fb140b4:f948000c

2023-07-30 00:35:01Test Bounty Note

-

@ 8fb140b4:f948000c

2023-07-22 09:39:48

@ 8fb140b4:f948000c

2023-07-22 09:39:48Intro

This short tutorial will help you set up your own Nostr Wallet Connect (NWC) on your own LND Node that is not using Umbrel. If you are a user of Umbrel, you should use their version of NWC.

Requirements

You need to have a working installation of LND with established channels and connectivity to the internet. NWC in itself is fairly light and will not consume a lot of resources. You will also want to ensure that you have a working installation of Docker, since we will use a docker image to run NWC.

- Working installation of LND (and all of its required components)

- Docker (with Docker compose)

Installation

For the purpose of this tutorial, we will assume that you have your lnd/bitcoind running under user bitcoin with home directory /home/bitcoin. We will also assume that you already have a running installation of Docker (or docker.io).

Prepare and verify

git version - we will need git to get the latest version of NWC. docker version - should execute successfully and show the currently installed version of Docker. docker compose version - same as before, but the version will be different. ss -tupln | grep 10009- should produce the following output: tcp LISTEN 0 4096 0.0.0.0:10009 0.0.0.0: tcp LISTEN 0 4096 [::]:10009 [::]:**

For things to work correctly, your Docker should be version 20.10.0 or later. If you have an older version, consider installing a new one using instructions here: https://docs.docker.com/engine/install/

Create folders & download NWC

In the home directory of your LND/bitcoind user, create a new folder, e.g., "nwc" mkdir /home/bitcoin/nwc. Change to that directory cd /home/bitcoin/nwc and clone the NWC repository: git clone https://github.com/getAlby/nostr-wallet-connect.git

Creating the Docker image

In this step, we will create a Docker image that you will use to run NWC.

- Change directory to

nostr-wallet-connect:cd nostr-wallet-connect - Run command to build Docker image:

docker build -t nwc:$(date +'%Y%m%d%H%M') -t nwc:latest .(there is a dot at the end) - The last line of the output (after a few minutes) should look like

=> => naming to docker.io/library/nwc:latest nwc:latestis the name of the Docker image with a tag which you should note for use later.

Creating docker-compose.yml and necessary data directories

- Let's create a directory that will hold your non-volatile data (DB):

mkdir data - In

docker-compose.ymlfile, there are fields that you want to replace (<> comments) and port “4321” that you want to make sure is open (check withss -tupln | grep 4321which should return nothing). - Create

docker-compose.ymlfile with the following content, and make sure to update fields that have <> comment:

version: "3.8" services: nwc: image: nwc:latest volumes: - ./data:/data - ~/.lnd:/lnd:ro ports: - "4321:8080" extra_hosts: - "localhost:host-gateway" environment: NOSTR_PRIVKEY: <use "openssl rand -hex 32" to generate a fresh key and place it inside ""> LN_BACKEND_TYPE: "LND" LND_ADDRESS: localhost:10009 LND_CERT_FILE: "/lnd/tls.cert" LND_MACAROON_FILE: "/lnd/data/chain/bitcoin/mainnet/admin.macaroon" DATABASE_URI: "/data/nostr-wallet-connect.db" COOKIE_SECRET: <use "openssl rand -hex 32" to generate fresh secret and place it inside ""> PORT: 8080 restart: always stop_grace_period: 1mStarting and testing

Now that you have everything ready, it is time to start the container and test.

- While you are in the

nwcdirectory (important), execute the following command and check the log output,docker compose up - You should see container logs while it is starting, and it should not exit if everything went well.

- At this point, you should be able to go to

http://<ip of the host where nwc is running>:4321and get to the interface of NWC - To stop the test run of NWC, simply press

Ctrl-C, and it will shut the container down. - To start NWC permanently, you should execute

docker compose up -d, “-d” tells Docker to detach from the session. - To check currently running NWC logs, execute

docker compose logsto run it in tail mode add-fto the end. - To stop the container, execute

docker compose down

That's all, just follow the instructions in the web interface to get started.

Updating

As with any software, you should expect fixes and updates that you would need to perform periodically. You could automate this, but it falls outside of the scope of this tutorial. Since we already have all of the necessary configuration in place, the update execution is fairly simple.

- Change directory to the clone of the git repository,

cd /home/bitcoin/nwc/nostr-wallet-connect - Run command to build Docker image:

docker build -t nwc:$(date +'%Y%m%d%H%M') -t nwc:latest .(there is a dot at the end) - Change directory back one level

cd .. - Restart (stop and start) the docker compose config

docker compose down && docker compose up -d - Done! Optionally you may want to check the logs:

docker compose logs

-

@ dfc7c785:4c3c6174

2025-01-07 15:28:43

@ dfc7c785:4c3c6174

2025-01-07 15:28:43For many years I’ve been researching my family tree. I’ve always been intrigued by my middle name of Brewster which many of you (perhaps) might associate with William Brewster of the pilgrim fathers who settled in America some 400 years ago, after a treacherous journey across the Atlantic that lasted weeks; scary to think I crossed it in just 10 hours not so long ago much like tens of thousands do year upon year.

My grandmother was convinced he was a direct ancestor of ours. My Grandad disagreed on the basis that they set sail childless, their first born entering the world once they had settled on American shores. So how could it be possible that we were descendants?

Anyway I inherited my middle name from hers and was thus christened Nicholas Euan Brewster in 1972.

During my school years other kids found it amusing and being a bespectacled nerd, they teased me no end. I instead learnt to love it because for me, as I’ve learnt over the years, it represents bravery, ingenuity, leadership and a general resilience to the world around me. Surviving against all the odds.

I’ve never been able to draw a direct connection between myself and William, other than to learn about a city of the same name on Cape Cod, that I flew over recently on that same flight but still have never visited to this day. Not far from there in the American version of Plymouth they came ashore, some distance from their intended destination of Virginia. Weather prevented them from making their way down the coast, so Massachusetts became their new settlement point.

Many years ago I was researching the Brewsters and spoke to a fellow Brewster in the USA via Compuserve, who sent me a massive box of DVDs with genealogical data on them; holy Moses, I was overwhelmed and came to realise there were perhaps zillions of us. The information was interesting but I had no real way of making that link, even if there ever was one to be found.

In the end I turned back to reading the bundle of notes my late grandmother had left us, including a family tree and some papers on another man who became just as interesting to me. His name was Alfred Berry Brewster born of Victorian London.

The following was sourced from - https://www.soldiersofthequeen.com/softheq-nile-valley

Egypt, the Nile Valley & Sudan

In Khedival Service

What was the [[Khedival Service]]?

Alfred Berry Brewster was born in London, England on 7 November 1856.

Whereabouts in London was he born?

Brewster Bey entered Egyptian Service in 1877 (aged 21) in the Customs Administration and Coastguard Service. In 1879 he was appointed to the position of Director of Customs at [[Suakin]] by [[General Gordon]]. He served in the Commissariat staff during the Egyptian Campaign and was awarded the Egypt Medal w/Clasp as well as the Khedive's Star. He returned to Suakin and in 1883 did duty in Valentine Baker Pasha's Intelligence Department (1884).

In 1885 he served under General Graham at Suakin as Chief Interpreter and Secretary to the Intelligence Department.

He took part in several engagements and received a Mention in Despatches from General Graham (30 May 1885). Most notably Brewster entered the Dervish camp alone before a planned attack on Saukin and convinced a large number of the enemy to come over to the British side. These same men later served in the capture of Tamai.

Brewster remained Director of Customs for Saukin until 1890 when he transferred to the Coastguard Service as Secretary and Controller. He was chosen as Private Secretary by both Khedive Mohammed Tewfik and Abbas II.

![[Pasted image 20241229083331.png]] Further reading

https://www.britishmuseum.org/collection/term/BIOG121543

https://www.soldiersofthequeen.com/alfredberrybrewsterbey

https://www.soldiersofthequeen.com/alfredberrybrewsterbey

-

@ d5c3d063:4d1159b3

2025-01-07 11:02:03

@ d5c3d063:4d1159b3

2025-01-07 11:02:03โพสที่อาจารย์พิริยะ บอกว่า “If you are angry at something... maybe it's just you.”

เป็นคำกล่าวที่เตือนให้เรามองกลับเข้ามาในตัวเองว่า "ความโกรธ" มีต้นกำเนิดจากจิตใจของเราเอง การใช้สติและการตระหนักถึงความคาดหวังที่เรามีต่อผู้อื่นจะช่วยให้เราสามารถจัดการกับความโกรธได้อย่างสร้างสรรค์และมีเหตุผล แนวคิดของอริยสัจ ๔ ช่วยให้เราเข้าใจถึงต้นเหตุและวิธีการดับทุกข์ และผมนำแนวคิดอิสรนิยมมาช่วยเสริมให้เราได้ตระหนักถึงความรับผิดชอบในชีวิตของตนเองและการเคารพเสรีภาพของผู้อื่นในการนำไปใช้ทางโลกได้จริง

เมื่อเราฝึกเดินด้วยเมตตา ปล่อยวางโทสะ และไม่หลงด้วยโมหะ เราจะสามารถสร้างความสงบสุขในจิตใจและในความสัมพันธ์กับผู้อื่นได้อย่างแท้จริง ทั้งหมดนี้นำไปสู่ชีวิตที่มีความสุขและเสรีภาพอย่างสมดุลในทุกมิติของการดำรงอยู่

เริ่มจาก...อริยสัจ ๔ คือการค้นหาต้นเหตุแห่งทุกข์ในจิตใจ

พระพุทธศาสนาสอนว่าความโกรธไม่ได้เกิดจากสิ่งภายนอกโดยตรง แต่มีรากฐานมาจาก สมุทัยหรือ "เหตุแห่งทุกข์" ที่เกิดจากภายในจิตใจของเราเอง เช่น - ตัณหา (ความยึดมั่นถือมั่น) ที่ทำให้เราคาดหวังว่าสิ่งต่าง ๆ จะต้องเป็นไปตามใจเรา - อวิชชา (ความไม่รู้) ทำให้เรามองไม่เห็นว่าความโกรธไม่ได้ทำให้ปัญหาแก้ไขได้ แต่กลับเผาผลาญจิตใจเราเอง การดับความโกรธ (นิโรธ) จึงเริ่มต้นจากการมีสติรู้ตัวและปล่อยวางความยึดมั่น โดยการฝึกสมาธิและการเจริญเมตตาเป็นเครื่องมือสำคัญที่ช่วยให้เรามองเห็นความเป็นจริงและลดทอนพลังทำลายของความโกรธ

...ต่อมาคือแนวคิดอิสรนิยม ที่เน้นถึงการรับผิดชอบต่อตนเองและเสรีภาพในการเลือก ปัจเจกบุคคลต้องรับผิดชอบต่อชีวิตของตนเองและไม่พึ่งพิงปัจจัยภายนอกเกินไป ความโกรธในมุมมองนี้สามารถมองได้ว่าเป็นผลลัพธ์ของการละเลยความรับผิดชอบต่ออารมณ์ของตัวเองและการพึ่งพิงสิ่งภายนอกเกินไป เช่น การโกรธที่ผู้อื่นไม่ทำตามที่เราต้องการ สะท้อนถึงการพยายามควบคุมสิ่งที่อยู่นอกเหนืออำนาจของเรา ซึ่งขัดกับหลักการเสรีภาพส่วนบุคคลของอิสรนิยม หลักการสำคัญของอิสรนิยมคือ Non-Aggression Principle (หลักการไม่รุกราน) ที่สอนว่าความรุนแรงและการบีบบังคับผู้อื่นเป็นสิ่งที่ควรหลีกเลี่ยง ความโกรธจึงถือเป็นการรุกรานจิตใจของเราเองก่อน เพราะเป็นการสร้างภาระให้กับจิตใจโดยไม่จำเป็น

แนวทางการปฏิบัติที่อาจารย์ได้ใส่ # ไว้ 1. #เดินด้วยเมตตา - มุมมองจากอริยสัจ ๔ #เมตตา คือการยอมรับและปรารถนาดีต่อทั้งตัวเองและผู้อื่น การให้ความรักและความปรารถนาดีจะช่วยลดพลังของโทสะในจิตใจ ทำให้เรามีมุมมองที่เปิดกว้างและมีความสุขที่แท้จริง - การเชื่อมโยงในอิสรนิยม เสรีภาพของแต่ละบุคคลรวมถึงการเคารพเสรีภาพของผู้อื่น เมตตาได้ช่วยส่งเสริมการอยู่ร่วมกันในสังคมโดยไม่ก้าวก่ายสิทธิและเสรีภาพของกันและกัน เมตตาในแง่นี้จึงเป็นการสร้างสมดุลระหว่างเสรีภาพของเราและของผู้อื่น เช่น การเคารพในความคิดหรือการกระทำของผู้อื่น แม้จะเขาจะเห็นต่างจากเรา 2. #อย่าเดินด้วยโทสะ - มุมมองจากอริยสัจ ๔ #โทสะ เป็นเหมือนยาพิษที่เราดื่มเองและทำให้เราเป็นทุกข์ ความโกรธไม่ได้ทำร้ายผู้อื่นเท่าที่มันทำลายจิตใจและร่างกายของเราเอง การฝึกเจริญสติช่วยให้เราเห็นถึงอารมณ์โกรธตั้งแต่เริ่มต้น และตัดวงจรของความคิดและการกระทำที่เป็นพิษ - การเชื่อมโยงในอิสรนิยม ความโกรธหรือการใช้อารมณ์ ไม่ควรเป็นเหตุผลในการละเมิดสิทธิหรือเสรีภาพของผู้อื่น หลักการ Non-Aggression Principle (NAP) ของอิสรนิยมเตือนเราว่าการใช้อารมณ์รุนแรงหรือโทสะมักนำไปสู่การบีบบังคับหรือทำร้ายผู้อื่น ซึ่งเป็นสิ่งที่ขัดแย้งกับความเคารพในเสรีภาพของทุกคน การไม่เดินด้วยโทสะจึงเป็นการเคารพในเสรีภาพของทั้งตัวเราและผู้อื่น 3. #อย่าหลงด้วยโมหะ - มุมมองจากอริยสัจ ๔ #โมหะ หรือความหลง ทำให้เรามองสิ่งต่าง ๆ อย่างผิดเพี้ยนและติดอยู่ในภาพลวงตา เช่น การโทษผู้อื่นว่าเป็นต้นเหตุของความทุกข์ทั้งหมด ทั้งที่แท้จริงแล้วความทุกข์มักเกิดจากจิตใจและความคาดหวังของเราเอง - การเชื่อมโยงกับอิสรนิยม สอนว่าความสุขและความสงบในชีวิต ไม่ได้ขึ้นอยู่กับสิ่งภายนอก แต่ขึ้นอยู่กับเสรีภาพในการเลือกและการรับผิดชอบชีวิตของตนเอง การหลุดพ้นจากโมหะเป็นการยอมรับว่าเราไม่สามารถควบคุมผู้อื่นหรือโลกภายนอกได้ แต่สามารถควบคุมปฏิกิริยาและการตอบสนองของเราได้ การไม่หลงด้วยโมหะจึงช่วยให้เราเป็นอิสระจากความยึดมั่นในสิ่งที่อยู่นอกเหนือการควบคุม

ทีนี้มาลองดูตัวอย่างในชีวิตประจำวันกันดูบ้าง

-

เดินด้วยเมตตา หากเราพยายามอธิบายเรื่องบิตคอยน์ให้คนอื่นเข้าใจ แต่เขายังเชื่อมั่นในระบบการเงินของรัฐ การใช้เมตตาจะช่วยให้เราเข้าใจว่าการเปลี่ยนแปลงความคิดต้องใช้เวลาและกระบวนการขั้นตอน ไม่ใช่ทุกคนจะพร้อมเปิดรับแนวคิดใหม่ในทันที การพูดคุยด้วยความรักและปรารถนาดีแทนการตำหนิ จะช่วยสร้างบทสนทนาที่สร้างสรรค์

-

อย่าเดินด้วยโทสะ หากเรารู้สึกโกรธเมื่อคนอื่นยังคงเชื่อในระบบเศรษฐกิจแบบเคนส์หรือสังคมนิยม อาจใช้โอกาสนี้แหละ ในการฝึกเจริญสติและตระหนักว่าเราควบคุมความเชื่อของผู้อื่นไม่ได้ แต่สามารถเลือกอธิบายด้วยเหตุผลและความเคารพ หรือเลือกที่จะปล่อยวางเมื่อสถานการณ์ไม่เอื้ออำนวย

-

อย่าหลงด้วยโมหะ หากเราหงุดหงิดที่ผู้อื่นไม่ยอมรับแนวคิดของบิตคอยน์ การตระหนักว่าความคาดหวังของเราที่ต้องการให้ผู้อื่นเข้าใจในทันทีนั้นเป็นภาพลวงตา มันก็จะช่วยให้เรามองเห็นความจริงที่ว่า การเปลี่ยนแปลงทางความคิด เป็นกระบวนการที่ต้องใช้เวลาและเกิดจากเสรีภาพในการตัดสินใจของแต่ละบุคคล

……..……..……..

ความโกรธ เป็นหนึ่งในอารมณ์พื้นฐานที่มนุษย์ทุกคนต้องเผชิญในชีวิต แต่การจัดการความโกรธนั้นไม่ใช่เพียงเรื่องของการควบคุมอารมณ์ หากยังสะท้อนถึงการทำความเข้าใจตัวตนและธรรมชาติของสิ่งต่าง ๆ รอบตัวเรา ประโยคที่อาจารย์พิริยะบอกว่า “If you are angry at something... maybe it's just you.” ไม่ได้เป็นเพียงคำกล่าวเตือนใจ แต่ยังเป็นการเชื้อเชิญให้เราไตร่ตรองถึงรากฐานของความโกรธ ซึ่งซุปขอเชื่อมโยงเข้ากับหลักอริยสัจ ๔ ในพระพุทธศาสนาและแนวคิดอิสรนิยม (#Libertarianism) ที่เน้นความรับผิดชอบส่วนบุคคลและเสรีภาพในชีวิต

Siamstr

-

-

@ 2355757c:5ad3e04d

2025-01-07 15:16:37

@ 2355757c:5ad3e04d

2025-01-07 15:16:37Grounding or Earthing, names for getting your good ole bare feet on the surface of the earth. Sounds simple because it is simple, but are the benefits really that profound? Short answer: YES

Grounding is really only so a modern health hack because we are so disconnected. Until the invention of modern footwear with insulated rubber/plastic soles, we were connected to the surface of the earth pretty much 24/7. Why does this matter? The Earth’s surface is a POOL of free electrons waiting for us to tap into. Electrons? Why do those matter. Electrons are the true currency of energy and the input to our energy production system (Electron Transport Chain) that produces ATP. The human body, like all other living things is electromagnetic. We use electrical signaling to operate our biology. Without a sufficient amount of electrons and sufficient voltage potential, our body will not function properly. However, it is not so simple to say more electrons = more health. If that were the case then we’d all be hooked up to copper wires absorbing current to level up our biology.

TOO MUCH of anything is bad. Our skin has resistance to protect us from shocks and lightning strikes (absorbing too much electrical current at once). However, our hands and feet (with thousands of nerve endings) have lower skin resistance. Lower resistance = better ability to conduct electricity. That is not a mistake. Through contact of our feet or hands on the ground, we are able to sustain a voltage differential up to a few hundred millivolts (depending on the surface). These electrons on the surface of the earth are willing to move to a less negatively charge area (us), and thus we are able to absorb a small amount of free flowing electrons into our body through our semi-conductive tissue on our hands and feet. Sounds cool, right? Now what are the actual benefits?

-

Managing Reactive Oxygen Species (ROS) and/or free radicals

-

Maintaining Proper Blood Flow & Pressure

-

Regulating Cortisol & Circadian Rhythm

Oxidative stress. Anti-oxidants. Free radicals. These are all terms you MAY be familiar with, but what do they actually mean? If you read my newsletter from last week on Travel, you will know a bit more about oxidative stress and the function of anti-oxidants (if not, I will link it HERE). The TLDR is that our energy production process in our mitochondria, otherwise known as the Electron Transport Chain (ETC), is not perfect. As a result of this, free radicals are generated. Free radicals are typically oxygen molecules or molecules that contain oxygen (aka reactive oxygen species) that have an unpaired electron in their valence shell. O2 is supposed to be converted into metabolic water (H2O), but as mentioned the efficiency is not 100%. Therefore you get molecules like superoxide (O2-) or hydroxyl radical (OH) that are hungry to fill the unpaired electron and go back to stability. “Anti-oxidants” combat these radicals by attempting to supply an electron before they steal one from elsewhere in the cell and cause damage. Enter in newly absorbed electrons from grounding. These free electrons absorbed from the earth can help combat the free radicals/ROS by acting as an anti-oxidant. This will in turn help your body get back to redox homeostasis and not suffer cellular damage from oxidative stress. Grounding, in turn “reduces inflammation”. The thermal images often touted alongside grounding (before/after) show a positive response (thermal imaging can be a bit dodgy in accuracy but it captures some essence of effectiveness).

Maintaining proper blood flow and blood pressure. Perhaps the most interesting and fundamentally undebatable benefit of grounding. As stated above we are electromagnetic beings, and our blood flow exemplifies that. Both the lining of the blood vessel and surface of our red blood cells have a negative charge. This negative charge is imperative because it prevents rouleaux and coagulation, or the stacking of blood cells. If you blood cells stack, they are far easier to clump/clot and cause a blockage. Like charges repel, so having a sufficient “zeta potential” or negative charge on our RBCs will keep the blood flowing smoothly. Grounding helps maintain that. A study linked HERE showed how Earthing/Grounding reduces blood viscosity.

“Grounding increases the surface charge on RBCs and thereby reduces blood viscosity and clumping. Grounding appears to be one of the simplest and yet most profound interventions for helping reduce cardiovascular risk and cardiovascular events.”

Regulating our circadian rhythm. A lesser touted benefit to grounding is its ability to influence our circadian rhythm or our “body clock”.

I am under the belief now that our circadian health is THE MOST IMPORTANT ASPECT of HEALTH. Why? Because literally all of our downstream biological functions are dictated by our circadian rhythm. This is why light, meal/exercise timing, sleep, connection to nature are all so important & interconnected.

The main input might be light, but that doesn’t mean there aren’t more inputs to the complex system that is our body. Connection to the earth is another. How do we know? Grounding has been proven to regulate cortisol rhythms. One of the biggest signs of a irregular circadian rhythm is cortisol and melatonin cycles that are out of whack. When you are grounded you are connected to the earth in the position of your geographical location. This is not proven, but its quite logical that the reason grounding helps regulate circadian rhythm is because along with those electrons you are getting a signal sent to your brain about the location/time/season it is where you are in that moment. It is the only logical explanation and it is one of the reasons I am such a big fan of grounding as MUCH as possible, especially after travel.

I recently released my first health optimization guide that includes all the travel hacks I use (including grounding) to completely avoid jet lag on long haul flights: AVOIDING JET LAG-An In Depth Guide to Hacking the Stressors of Travel.

This guide is extremely comprehensive, and application specific. It is a 30 page PDF that goes into WHY travel is so bad for us, and what you can do pre/during/post travel to avoid jet lag completely. If you travel often, this is worth checking out…but I warn you it is dense and only worth purchasing if you are willing to learn.

Grounding PROTOCOLS:

-

Just do it-bare feet on the ground

-

Length? 1 min is better than 0…5 min even better…2 hours even better still. There is no threshold dose.

-

Surfaces? Dirt/Grass/Rocks/Sand/Ocean all great. If it is wet and post thunderstorm, even better. Concrete works but asphalt is not the best.

-

Grounding shoes? Not comparable to barefoot but still better than rubber/plastic soled shoes. I will write more about this in the near future as I am conducting experiments with different shoes on different surfaces.

-

IT IS LITERALLY FREE

Big Grounding did not pay me to write this, even though I am an electrical engineer. Seriously, grounding is a no brainer. You may not “feel” anything, but the more you do it and the more disconnected you are to start…the better you will feel I can guarantee that. We are electromagnetic creates of Earth, it is about damn time we get back to connecting with our natural input signals.

Stay Sovereign,

-Tristan

Originally written July 25th, 2023

-

-

@ dd81a8ba:3eb298a5

2025-01-07 15:02:49

@ dd81a8ba:3eb298a5

2025-01-07 15:02:49it's better to read 100 books 10 times than 1,000 books once

I don't know who originated this concept. I've heard it said by Naval. the idea is to go deep on a narrower slice of possible books than to be spread so thin. this isn't so much an algorithm as a heuristic, a tactic for filtering the kinds of books you read, and also a way to measure your own growth over time. I've had the experience of getting something different from reading the same book at different points in my life. deliberately checking in with different books regularly over time is a good way to get an informative but different perspective on your own mentality.

this is my list. I'll be short of 100 for a while, the point is to make a tangible artifact out of it, and update it over time. let me know if you have or make a similar list and I'll add a link to your list here.

update 2/24

since I created the 100 books page and started shaping my reading around it, I have reached 100 books, and now in order to add one to the list I must first evict one already on the list.

I have also encountered a different way to refer to this project, and a sharper take on what I’m doing. it comes from an author with one book on my list already and more to come, Italo Calvino. the introduction to his book “Why Read the Classics?” is a quick read, and well worth it.

A classic is a book that has never finished saying what it has to say.

first, he defines “classic” to mean any book that once read, you return to again and again, and continue finding new takes, new value, fresh perspectives on. actually he lists many criteria, but that’s roughly what it boils down to, books that have meaning to you, which you read repeatedly at different stages in your life, a through-line to return to.