-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

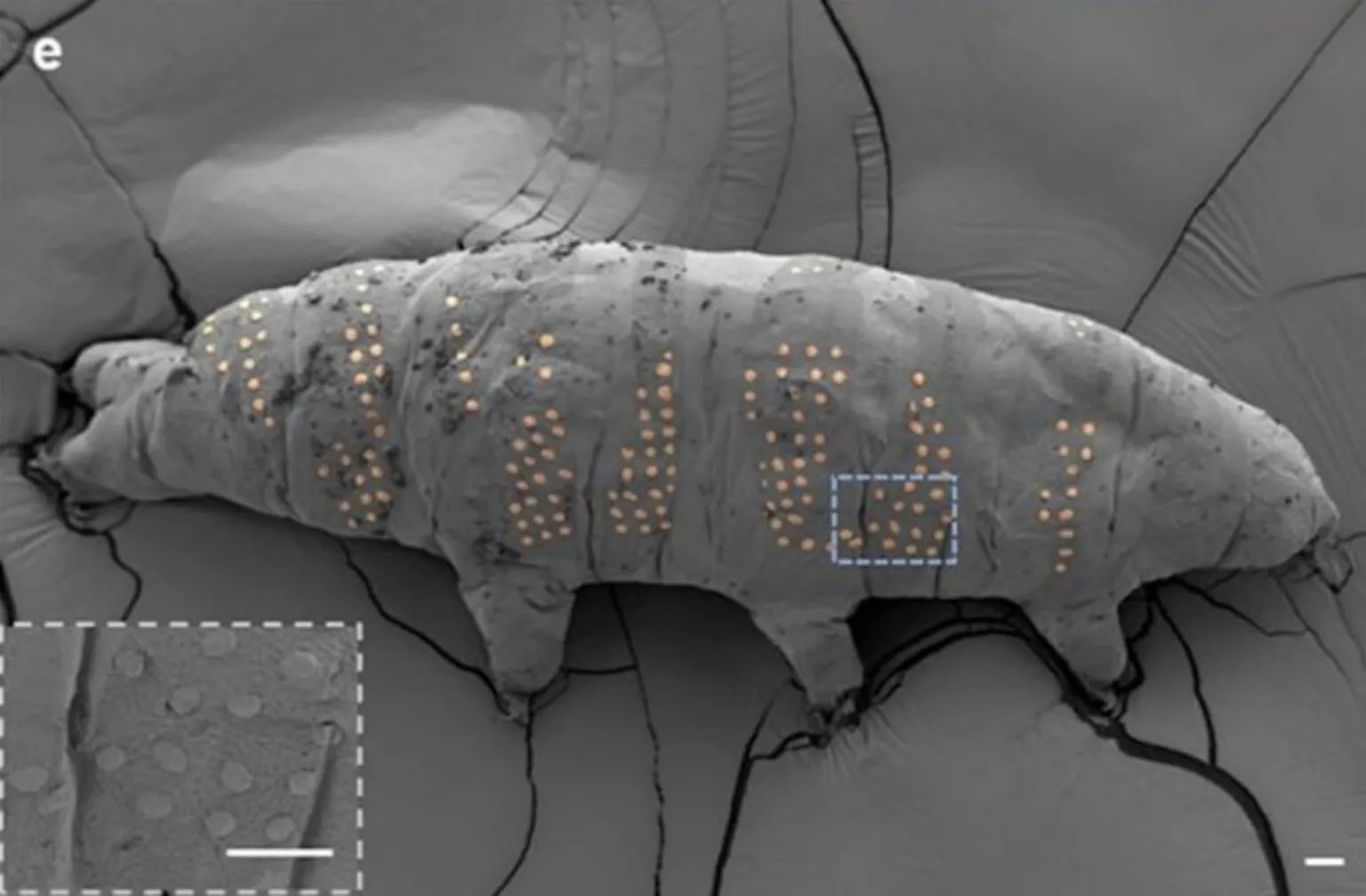

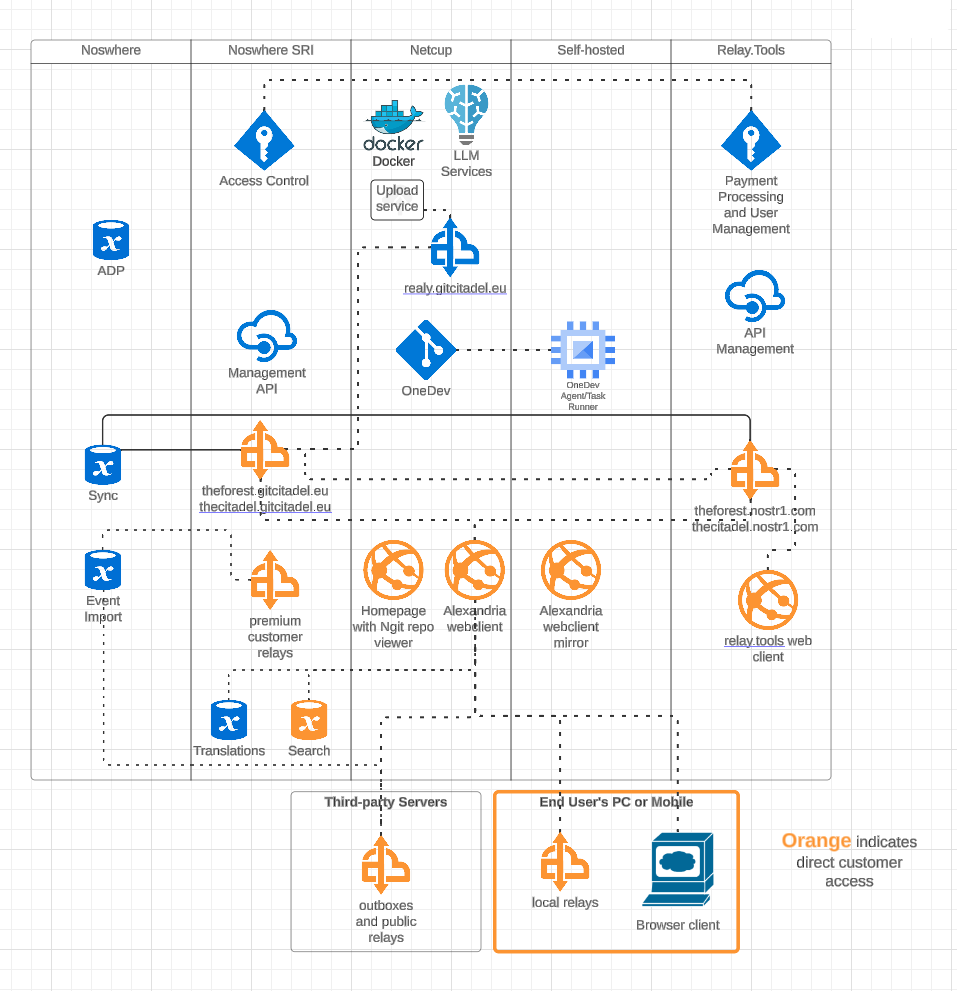

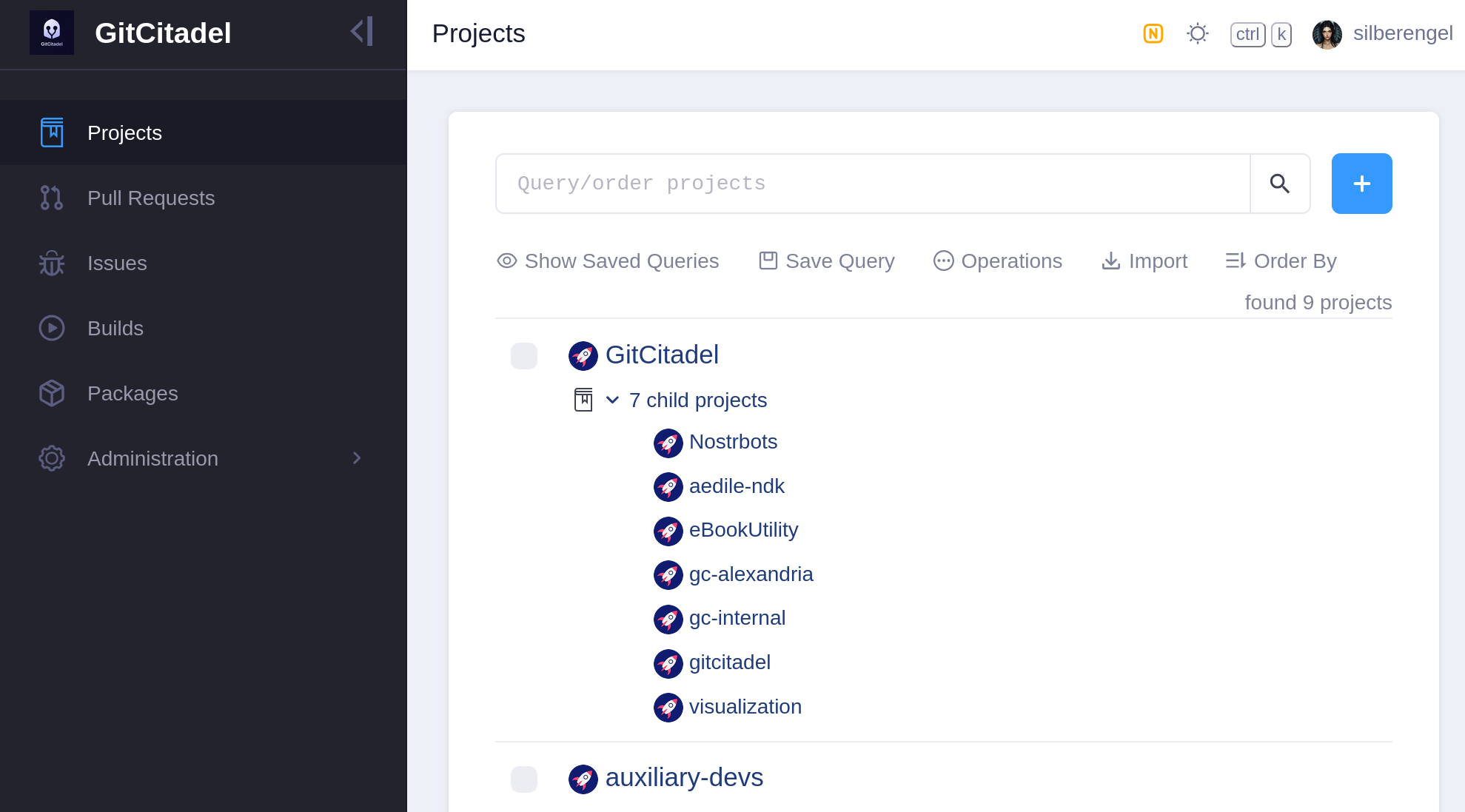

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ 40b9c85f:5e61b451

2025-04-24 15:27:02

@ 40b9c85f:5e61b451

2025-04-24 15:27:02Introduction

Data Vending Machines (DVMs) have emerged as a crucial component of the Nostr ecosystem, offering specialized computational services to clients across the network. As defined in NIP-90, DVMs operate on an apparently simple principle: "data in, data out." They provide a marketplace for data processing where users request specific jobs (like text translation, content recommendation, or AI text generation)

While DVMs have gained significant traction, the current specification faces challenges that hinder widespread adoption and consistent implementation. This article explores some ideas on how we can apply the reflection pattern, a well established approach in RPC systems, to address these challenges and improve the DVM ecosystem's clarity, consistency, and usability.

The Current State of DVMs: Challenges and Limitations

The NIP-90 specification provides a broad framework for DVMs, but this flexibility has led to several issues:

1. Inconsistent Implementation

As noted by hzrd149 in "DVMs were a mistake" every DVM implementation tends to expect inputs in slightly different formats, even while ostensibly following the same specification. For example, a translation request DVM might expect an event ID in one particular format, while an LLM service could expect a "prompt" input that's not even specified in NIP-90.

2. Fragmented Specifications

The DVM specification reserves a range of event kinds (5000-6000), each meant for different types of computational jobs. While creating sub-specifications for each job type is being explored as a possible solution for clarity, in a decentralized and permissionless landscape like Nostr, relying solely on specification enforcement won't be effective for creating a healthy ecosystem. A more comprehensible approach is needed that works with, rather than against, the open nature of the protocol.

3. Ambiguous API Interfaces

There's no standardized way for clients to discover what parameters a specific DVM accepts, which are required versus optional, or what output format to expect. This creates uncertainty and forces developers to rely on documentation outside the protocol itself, if such documentation exists at all.

The Reflection Pattern: A Solution from RPC Systems

The reflection pattern in RPC systems offers a compelling solution to many of these challenges. At its core, reflection enables servers to provide metadata about their available services, methods, and data types at runtime, allowing clients to dynamically discover and interact with the server's API.

In established RPC frameworks like gRPC, reflection serves as a self-describing mechanism where services expose their interface definitions and requirements. In MCP reflection is used to expose the capabilities of the server, such as tools, resources, and prompts. Clients can learn about available capabilities without prior knowledge, and systems can adapt to changes without requiring rebuilds or redeployments. This standardized introspection creates a unified way to query service metadata, making tools like

grpcurlpossible without requiring precompiled stubs.How Reflection Could Transform the DVM Specification

By incorporating reflection principles into the DVM specification, we could create a more coherent and predictable ecosystem. DVMs already implement some sort of reflection through the use of 'nip90params', which allow clients to discover some parameters, constraints, and features of the DVMs, such as whether they accept encryption, nutzaps, etc. However, this approach could be expanded to provide more comprehensive self-description capabilities.

1. Defined Lifecycle Phases

Similar to the Model Context Protocol (MCP), DVMs could benefit from a clear lifecycle consisting of an initialization phase and an operation phase. During initialization, the client and DVM would negotiate capabilities and exchange metadata, with the DVM providing a JSON schema containing its input requirements. nip-89 (or other) announcements can be used to bootstrap the discovery and negotiation process by providing the input schema directly. Then, during the operation phase, the client would interact with the DVM according to the negotiated schema and parameters.

2. Schema-Based Interactions

Rather than relying on rigid specifications for each job type, DVMs could self-advertise their schemas. This would allow clients to understand which parameters are required versus optional, what type validation should occur for inputs, what output formats to expect, and what payment flows are supported. By internalizing the input schema of the DVMs they wish to consume, clients gain clarity on how to interact effectively.

3. Capability Negotiation

Capability negotiation would enable DVMs to advertise their supported features, such as encryption methods, payment options, or specialized functionalities. This would allow clients to adjust their interaction approach based on the specific capabilities of each DVM they encounter.

Implementation Approach

While building DVMCP, I realized that the RPC reflection pattern used there could be beneficial for constructing DVMs in general. Since DVMs already follow an RPC style for their operation, and reflection is a natural extension of this approach, it could significantly enhance and clarify the DVM specification.

A reflection enhanced DVM protocol could work as follows: 1. Discovery: Clients discover DVMs through existing NIP-89 application handlers, input schemas could also be advertised in nip-89 announcements, making the second step unnecessary. 2. Schema Request: Clients request the DVM's input schema for the specific job type they're interested in 3. Validation: Clients validate their request against the provided schema before submission 4. Operation: The job proceeds through the standard NIP-90 flow, but with clearer expectations on both sides

Parallels with Other Protocols

This approach has proven successful in other contexts. The Model Context Protocol (MCP) implements a similar lifecycle with capability negotiation during initialization, allowing any client to communicate with any server as long as they adhere to the base protocol. MCP and DVM protocols share fundamental similarities, both aim to expose and consume computational resources through a JSON-RPC-like interface, albeit with specific differences.

gRPC's reflection service similarly allows clients to discover service definitions at runtime, enabling generic tools to work with any gRPC service without prior knowledge. In the REST API world, OpenAPI/Swagger specifications document interfaces in a way that makes them discoverable and testable.

DVMs would benefit from adopting these patterns while maintaining the decentralized, permissionless nature of Nostr.

Conclusion

I am not attempting to rewrite the DVM specification; rather, explore some ideas that could help the ecosystem improve incrementally, reducing fragmentation and making the ecosystem more comprehensible. By allowing DVMs to self describe their interfaces, we could maintain the flexibility that makes Nostr powerful while providing the structure needed for interoperability.

For developers building DVM clients or libraries, this approach would simplify consumption by providing clear expectations about inputs and outputs. For DVM operators, it would establish a standard way to communicate their service's requirements without relying on external documentation.

I am currently developing DVMCP following these patterns. Of course, DVMs and MCP servers have different details; MCP includes capabilities such as tools, resources, and prompts on the server side, as well as 'roots' and 'sampling' on the client side, creating a bidirectional way to consume capabilities. In contrast, DVMs typically function similarly to MCP tools, where you call a DVM with an input and receive an output, with each job type representing a different categorization of the work performed.

Without further ado, I hope this article has provided some insight into the potential benefits of applying the reflection pattern to the DVM specification.

-

@ 8cda1daa:e9e5bdd8

2025-04-24 10:20:13

@ 8cda1daa:e9e5bdd8

2025-04-24 10:20:13Bitcoin cracked the code for money. Now it's time to rebuild everything else.

What about identity, trust, and collaboration? What about the systems that define how we live, create, and connect?

Bitcoin gave us a blueprint to separate money from the state. But the state still owns most of your digital life. It's time for something more radical.

Welcome to the Atomic Economy - not just a technology stack, but a civil engineering project for the digital age. A complete re-architecture of society, from the individual outward.

The Problem: We Live in Digital Captivity

Let's be blunt: the modern internet is hostile to human freedom.

You don't own your identity. You don't control your data. You don't decide what you see.

Big Tech and state institutions dominate your digital life with one goal: control.

- Poisoned algorithms dictate your emotions and behavior.

- Censorship hides truth and silences dissent.

- Walled gardens lock you into systems you can't escape.

- Extractive platforms monetize your attention and creativity - without your consent.

This isn't innovation. It's digital colonization.

A Vision for Sovereign Society

The Atomic Economy proposes a new design for society - one where: - Individuals own their identity, data, and value. - Trust is contextual, not imposed. - Communities are voluntary, not manufactured by feeds. - Markets are free, not fenced. - Collaboration is peer-to-peer, not platform-mediated.

It's not a political revolution. It's a technological and social reset based on first principles: self-sovereignty, mutualism, and credible exit.

So, What Is the Atomic Economy?

The Atomic Economy is a decentralized digital society where people - not platforms - coordinate identity, trust, and value.

It's built on open protocols, real software, and the ethos of Bitcoin. It's not about abstraction - it's about architecture.

Core Principles: - Self-Sovereignty: Your keys. Your data. Your rules. - Mutual Consensus: Interactions are voluntary and trust-based. - Credible Exit: Leave any system, with your data and identity intact. - Programmable Trust: Trust is explicit, contextual, and revocable. - Circular Economies: Value flows directly between individuals - no middlemen.

The Tech Stack Behind the Vision

The Atomic Economy isn't just theory. It's a layered system with real tools:

1. Payments & Settlement

- Bitcoin & Lightning: The foundation - sound, censorship-resistant money.

- Paykit: Modular payments and settlement flows.

- Atomicity: A peer-to-peer mutual credit protocol for programmable trust and IOUs.

2. Discovery & Matching

- Pubky Core: Decentralized identity and discovery using PKARR and the DHT.

- Pubky Nexus: Indexing for a user-controlled internet.

- Semantic Social Graph: Discovery through social tagging - you are the algorithm.

3. Application Layer

- Bitkit: A self-custodial Bitcoin and Lightning wallet.

- Pubky App: Tag, publish, trade, and interact - on your terms.

- Blocktank: Liquidity services for Lightning and circular economies.

- Pubky Ring: Key-based access control and identity syncing.

These tools don't just integrate - they stack. You build trust, exchange value, and form communities with no centralized gatekeepers.

The Human Impact

This isn't about software. It's about freedom.

- Empowered Individuals: Control your own narrative, value, and destiny.

- Voluntary Communities: Build trust on shared values, not enforced norms.

- Economic Freedom: Trade without permission, borders, or middlemen.

- Creative Renaissance: Innovation and art flourish in open, censorship-resistant systems.

The Atomic Economy doesn't just fix the web. It frees the web.

Why Bitcoiners Should Care

If you believe in Bitcoin, you already believe in the Atomic Economy - you just haven't seen the full map yet.

- It extends Bitcoin's principles beyond money: into identity, trust, coordination.

- It defends freedom where Bitcoin leaves off: in content, community, and commerce.

- It offers a credible exit from every centralized system you still rely on.

- It's how we win - not just economically, but culturally and socially.

This isn't "web3." This isn't another layer of grift. It's the Bitcoin future - fully realized.

Join the Atomic Revolution

- If you're a builder: fork the code, remix the ideas, expand the protocols.

- If you're a user: adopt Bitkit, use Pubky, exit the digital plantation.

- If you're an advocate: share the vision. Help people imagine a free society again.

Bitcoin promised a revolution. The Atomic Economy delivers it.

Let's reclaim society, one key at a time.

Learn more and build with us at Synonym.to.

-

@ c4b5369a:b812dbd6

2025-04-15 07:26:16

@ c4b5369a:b812dbd6

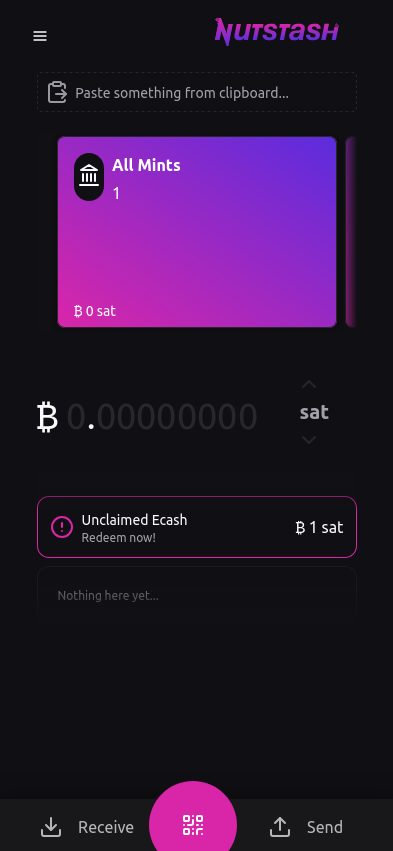

2025-04-15 07:26:16Offline transactions with Cashu

Over the past few weeks, I've been busy implementing offline capabilities into nutstash. I think this is one of the key value propositions of ecash, beinga a bearer instrument that can be used without internet access.

It does however come with limitations, which can lead to a bit of confusion. I hope this article will clear some of these questions up for you!

It does however come with limitations, which can lead to a bit of confusion. I hope this article will clear some of these questions up for you!What is ecash/Cashu?

Ecash is the first cryptocurrency ever invented. It was created by David Chaum in 1983. It uses a blind signature scheme, which allows users to prove ownership of a token without revealing a link to its origin. These tokens are what we call ecash. They are bearer instruments, meaning that anyone who possesses a copy of them, is considered the owner.

Cashu is an implementation of ecash, built to tightly interact with Bitcoin, more specifically the Bitcoin lightning network. In the Cashu ecosystem,

Mintsare the gateway to the lightning network. They provide the infrastructure to access the lightning network, pay invoices and receive payments. Instead of relying on a traditional ledger scheme like other custodians do, the mint issues ecash tokens, to represent the value held by the users.How do normal Cashu transactions work?

A Cashu transaction happens when the sender gives a copy of his ecash token to the receiver. This can happen by any means imaginable. You could send the token through email, messenger, or even by pidgeon. One of the common ways to transfer ecash is via QR code.

The transaction is however not finalized just yet! In order to make sure the sender cannot double-spend their copy of the token, the receiver must do what we call a

swap. A swap is essentially exchanging an ecash token for a new one at the mint, invalidating the old token in the process. This ensures that the sender can no longer use the same token to spend elsewhere, and the value has been transferred to the receiver.

What about offline transactions?

Sending offline

Sending offline is very simple. The ecash tokens are stored on your device. Thus, no internet connection is required to access them. You can litteraly just take them, and give them to someone. The most convenient way is usually through a local transmission protocol, like NFC, QR code, Bluetooth, etc.

The one thing to consider when sending offline is that ecash tokens come in form of "coins" or "notes". The technical term we use in Cashu is

Proof. It "proofs" to the mint that you own a certain amount of value. Since these proofs have a fixed value attached to them, much like UTXOs in Bitcoin do, you would need proofs with a value that matches what you want to send. You can mix and match multiple proofs together to create a token that matches the amount you want to send. But, if you don't have proofs that match the amount, you would need to go online and swap for the needed proofs at the mint.Another limitation is, that you cannot create custom proofs offline. For example, if you would want to lock the ecash to a certain pubkey, or add a timelock to the proof, you would need to go online and create a new custom proof at the mint.

Receiving offline

You might think: well, if I trust the sender, I don't need to be swapping the token right away!

You're absolutely correct. If you trust the sender, you can simply accept their ecash token without needing to swap it immediately.

This is already really useful, since it gives you a way to receive a payment from a friend or close aquaintance without having to worry about connectivity. It's almost just like physical cash!

It does however not work if the sender is untrusted. We have to use a different scheme to be able to receive payments from someone we don't trust.

Receiving offline from an untrusted sender

To be able to receive payments from an untrusted sender, we need the sender to create a custom proof for us. As we've seen before, this requires the sender to go online.

The sender needs to create a token that has the following properties, so that the receciver can verify it offline:

- It must be locked to ONLY the receiver's public key

- It must include an

offline signature proof(DLEQ proof) - If it contains a timelock & refund clause, it must be set to a time in the future that is acceptable for the receiver

- It cannot contain duplicate proofs (double-spend)

- It cannot contain proofs that the receiver has already received before (double-spend)

If all of these conditions are met, then the receiver can verify the proof offline and accept the payment. This allows us to receive payments from anyone, even if we don't trust them.

At first glance, this scheme seems kinda useless. It requires the sender to go online, which defeats the purpose of having an offline payment system.

I beleive there are a couple of ways this scheme might be useful nonetheless:

-

Offline vending machines: Imagine you have an offline vending machine that accepts payments from anyone. The vending machine could use this scheme to verify payments without needing to go online itself. We can assume that the sender is able to go online and create a valid token, but the receiver doesn't need to be online to verify it.

-

Offline marketplaces: Imagine you have an offline marketplace where buyers and sellers can trade goods and services. Before going to the marketplace the sender already knows where he will be spending the money. The sender could create a valid token before going to the marketplace, using the merchants public key as a lock, and adding a refund clause to redeem any unspent ecash after it expires. In this case, neither the sender nor the receiver needs to go online to complete the transaction.

How to use this

Pretty much all cashu wallets allow you to send tokens offline. This is because all that the wallet needs to do is to look if it can create the desired amount from the proofs stored locally. If yes, it will automatically create the token offline.

Receiving offline tokens is currently only supported by nutstash (experimental).

To create an offline receivable token, the sender needs to lock it to the receiver's public key. Currently there is no refund clause! So be careful that you don't get accidentally locked out of your funds!

The receiver can then inspect the token and decide if it is safe to accept without a swap. If all checks are green, they can accept the token offline without trusting the sender.

The receiver will see the unswapped tokens on the wallet homescreen. They will need to manually swap them later when they are online again.

Later when the receiver is online again, they can swap the token for a fresh one.

Later when the receiver is online again, they can swap the token for a fresh one.

Summary

We learned that offline transactions are possible with ecash, but there are some limitations. It either requires trusting the sender, or relying on either the sender or receiver to be online to verify the tokens, or create tokens that can be verified offline by the receiver.

I hope this short article was helpful in understanding how ecash works and its potential for offline transactions.

Cheers,

Gandlaf

-

@ 20986fb8:cdac21b3

2025-05-02 14:08:55

@ 20986fb8:cdac21b3

2025-05-02 14:08:55传统黑客松:闪耀火花中的局限

过去几十年里,黑客松一直是技术文化的培养皿——24小时或48小时的狂热编程马拉松,在披萨、咖啡因和几近不可能的乐观情绪中推进。

自1999年Sun Microsystems首次举办黑客松,要求Java开发者在Palm V掌上电脑上完成一日编程,到创业公司和大学里通宵达旦的“黑客日”[1],这些活动始终在庆祝黑客精神。它们为我们带来了Facebook的“点赞”按钮和聊天功能——这些标志性的创新[1],皆诞生于一夜之间的即兴狂想。

它们也催生了如GroupMe这样的公司——这个应用仅用了几个深夜时段就完成开发,一年后就被Skype以8000万美元收购[2]。

黑客松逐渐成为技术界的传说,成为“无拘束创造力”的代名词。然而,尽管充满激情和炒作,传统黑客松却存在着严重的局限:它们是偶发、线下的活动——更像是“蓝月亮”才出现一次的肾上腺素爆发,而不是一种可持续的创新流程。

一次黑客松也许能在周末召集100名程序员共聚一室,但活动结束后便销声匿迹,直到下一年。

频率低、规模小、触达有限。只有能亲临现场的人(往往是硅谷或精英高校)才有机会参与。哪怕你是来自拉各斯或圣保罗的天才黑客,只要身处远方,你的绝妙创意也注定被忽视。

这类冲刺式活动的成果也极为受限。

当然,团队可能构建出炫酷的演示项目,并赢得一时风头。但大多数情况下,这些项目只是一次性原型——“玩具”应用,最终并未发展为真正的产品或公司。有研究表明,只有约5%的黑客松项目在活动结束几个月后还有任何生命迹象[3]。

其余95%则如烟云般消散——在“黑客松宿醉”中夭折:人们回到“正职”,而演示代码也蒙尘。

批评者甚至给黑客松取了个贬义的别名:“周末虚耗松”(weekend wastedathons),抨击其成果如同短命的“蒸汽软件”(vaporware)[3]。

想想看:一阵创造力的爆发,数十个点子竞相绽放……然后呢?

你能说出几个真正从黑客松走出的成功企业名字?对于每一个如Carousell或EasyTaxi那样从黑客松中诞生、后来成功融资数千万美元的项目,就有几百个聪明的创意组合永远不见天日[2]。

传统黑客松模式,尽管令人兴奋,却极少能转化为持续的创新。

它更像是被时间、地域和后续缺失所束缚的孤岛式创新。黑客松是事件,不是流程;它是烟花,不是日出。

此外,黑客松在历史上一直颇为封闭。

直到近年,它们主要由技术圈内人士自办自娱。大型科技公司会举办内部黑客松,以激发员工创造力(Facebook每几周举办一次通宵活动,最终诞生了时间线和标记功能,影响了十亿用户 [1]);NASA和世界银行也曾尝试用黑客松推进公民科技。但这些都是例外,印证了一个普遍规律:黑客松从来不是常规工作流程,而是特例事件。

在科技巨头之外,鲜有组织具备资源或经验能频繁举办黑客松。

除非你是Google、Microsoft,或资金雄厚的创业孵化器,否则黑客松只是一场偶尔奢侈的尝试。事实上,当今世界上最大的黑客松是微软的内部全球黑客松——有多达70,000名员工跨越75个国家同时参与,这是壮观的成就,但唯有企业巨头才能负担得起[4]。

而中小型玩家只能仰望、惊叹。

限制显而易见:黑客松太少见、太封闭,无法真正激活全球人才库;周期太短,难以构建成熟产品;过于孤立,无法真正撼动行业。

没错,它们确实产生过惊艳的灵感时刻——创新的闪光灯。

但若视其为持续进步的机制,传统黑客松则显得捉襟见肘。作为投资者或科技领袖,你或许会为创造力鼓掌,但仍会追问:真正的长期影响在哪里?有谁搭建了把这些火花转化为持续光束的基础设施?

正如克莱顿·克里斯滕森的《创新者的窘境》所言,传统巨头往往将黑客松项目视作“玩具”——有趣但不切实际。

而事实上,“每一个未来的大事物,起初总是被当作玩具”。黑客松的确催生了不少“玩具”,却极少能拥有支持系统去把它们变为下一个伟大的事物。

这个模式,是时候被重新发明了。

为何到了2020年代,我们还在用1990年代的创新方式?为何将突破性的想法限制在一个周末或一个地点?为何允许95%的早期创新无声凋谢?

这些问题,悬而未解,等待着回答。

Hackathons 2.0 ——DoraHacks与黑客松的第一次进化(2020–2024)

DoraHacks登场。

在2020年代初,DoraHacks如同一台“心脏除颤器”,令黑客松这种形式重获新生。DoraHacks 1.0(大致始于2020年、延续至2024年)并非对黑客松的微调,而是对其彻底的重塑:将传统黑客松从1.0升级到2.0。它汲取原有理念,加速、扩展并升级至全维度,全方位放大其影响力。结果是一场全球黑客运动的兴起,一个将黑客松从“一锤子买卖”变为持续技术创新引擎的平台。

DoraHacks如何革命性地重构黑客松?请看以下几个维度:

从24小时到24天(甚至24周)——时间轴的重构

DoraHacks拉长了黑客松的时间框架,解锁了远超以往的创新潜能。

相比于传统那种紧张焦躁的24小时冲刺,DoraHacks支持的黑客松往往持续数周甚至数月——这是一场范式转变。

团队终于有了足够时间去打磨原型、迭代优化、反复精炼。更长的周期意味着项目能从粗糙演示走向成熟MVP。黑客们终于可以“偶尔睡觉”,引入用户反馈,将灵感的火花铸造成实用的成果。

时间的延展模糊了黑客松与加速器之间的界限,但保留了黑客松自由、开放的精神。例如,DoraHacks为区块链初创团队组织的黑客松通常持续6到8周,最终成果往往能吸引真实用户与投资人。

延长的时间,把“玩具”变成了产品。就像黑客松终于“长大成人”:Less Hack, More BUIDL(少些临时拼凑,多些踏实构建)。打破24小时范式之后,黑客松真正变得更高效、更深远、更具生产力。

从街角咖啡馆到全球虚拟竞技场——地理限制的打破

DoraHacks将黑客松从线下搬到云端,释放出全球参与的可能性。

2020年之前,黑客松意味着必须到现场——可能是旧金山某仓库,或是大学实验室,与本地队友并肩作战。而DoraHacks颠覆了这一格局:任何人、任何地方,只要连上网络,就可以参与。

一位尼日利亚的开发者、乌克兰的设计师、巴西的产品经理,如今可以在同一场线上黑客松中协作创新。地理边界不复存在。

当DoraHacks举办面向非洲区块链开发者的Naija HackAtom时,吸引了来自尼日利亚科技社群的500多名参与者(包括160多位开发者,odaily.news)。在另一场活动中,来自数十个国家的黑客同时在线参与、构思、竞争 [6]。

这种全球性拓展不仅增加了参与人数,更引入了多样的视角和本地问题。一个金融科技黑客松中,可能有拉美开发者解决汇款问题;一个AI黑客松中,亚洲或非洲开发者将机器学习应用于本地医疗。

线上化,让黑客松变得真正普惠。DoraHacks有效地民主化了创新的入场门槛——你只需要一根网线和一颗创作的心。

结果是:创意的数量与质量实现量子飞跃。 黑客松不再是精英小圈子的游戏,而是一场面向全人类的全球创新嘉年华。

从几十人到数万人——规模的跃迁

DoraHacks推动的另一项革命,就是规模的扩展。传统黑客松人少而亲密(几十人,顶多几百)。DoraHacks则催生了成千上万人参与、数百万美元奖金池的大型活动。

例如,在2021年的一场线上黑客松中,近7000名参与者提交了550个项目,争夺500万美元奖金。这是2010年代初期根本无法想象的规模[7]。

DoraHacks本身也成为这些“超级黑客松”的中枢。平台在Web3领域所举办的黑客松常常吸引数百支队伍参赛,奖金高达数百万美元。

这不只是好看的数据,而是更广泛的全球人才投入,也带来了更高概率的真正突破性成果。

以BNB Chain支持的黑客松系列为例,在DoraHacks推动下,有216支开发团队获得了超过1000万美元的资金支持[8]——是的,真金白银的种子投资。这哪是黑客松?简直就是一个小型经济体。

奖池也从“披萨钱”膨胀成“起步资本”,吸引那些有抱负、懂商业的创业者参与。越来越多的项目不再只是周末练习,而是具备融资能力的初创企业。黑客松,也由“科技科学展”升格为“全球创业发射台”。

从玩具项目到真公司(甚至独角兽)——成果的飞跃

最令人振奋的一点是:DoraHacks所孵化的项目,不只是应用,更是真正的公司。其中一些甚至成长为独角兽(估值超过10亿美元的公司)。

我们之前提到过2020年之前为数不多的成功案例,比如Carousell(一个在2012年黑客松上诞生的小点子,如今已成为估值11亿美元的二手市场[2]),或EasyTaxi(始于黑客松,后融资7500万美元、覆盖30个国家[2])。

DoraHacks让这种奇迹频繁上演。通过更长的周期、更多的支持、更好的资金接力,黑客松逐渐成为真正的“创新孵化器”。

以1inch Network为例——它是一家去中心化金融聚合平台,起初就是在2019年一个黑客松中诞生的。创始人Sergej Kunz和Anton Bukov在社区支持下完成了最初的原型,随后持续迭代。

如今,1inch的累计交易额已超4000亿美元,成为DeFi领域的头部平台之一 [9]。

再看DoraHacks Web3黑客松中的优胜者,许多项目已经完成了数百万美元的融资,获得顶级VC支持。

黑客松成为了“创业世界的前门”,创始人往往在此首次亮相。比如Solana Season Hackathons中的热门项目STEPN —— 一个“边走边赚”应用,于2021年赢得黑客松奖项,不久后就成长为拥有数十亿美元代币经济的现象级产品[10]。

这不是孤立事件,而是DoraHacks设定的系统性趋势。它的黑客松正在源源不断地产出可投、可用、可落地的创业项目。

某种意义上,DoraHacks模糊了黑客松与早期孵化器的界限。玩乐的黑客精神依然在,但结果已不只是炫耀——而是真实存在的公司,有用户,有营收,有估值。

借用投资人Chris Dixon的话说:DoraHacks把那些“玩具”,扶育成了下一个伟大的事物[5]。

DoraHacks不仅优化了旧模式,它创造了一个全新的创新生态

DoraHacks主导的第一次黑客松进化,不只是“修补优化”,而是打造了一个全新的创新系统。

黑客松变得高频、全球化、具决定性影响。

它不再是短暂的周末狂欢,而是持续的创新供给链。

DoraHacks平台每年孵化出上百个可行项目,其中很多都获得后续融资。它不仅提供活动本身,更提供“术后护理”:社区支持、导师指导、连接投资人与资助渠道(如DoraHacks的资助计划和二次方资助机制)。 到2024年,成果不言自明。DoraHacks已成长为全球最重要的黑客松平台——一个贯通区块链、AI乃至更多前沿科技的黑客运动中枢。

数据不会说谎。

9年间,DoraHacks帮助4000多个项目获得超过3000万美元资金(coindesk.com)[11];到2025年,这一数字飙升,DoraHacks支持的黑客松和资助总计为超过21000个初创团队提供了逾8000万美元资金(linkedin.com)[12]。

这不是夸张宣传——而是写入技术史的事实。CoinDesk评价道:“DoraHacks已成为全球最活跃的多链Web3开发平台与黑客松组织者之一。”(coindesk.com)[13]

主流技术生态纷纷注意到这一趋势。

超过40个公链(包括L1与L2)——从Solana到Polygon再到Avalanche——皆与DoraHacks合作,组织黑客松与开放创新计划(blockworks.co)[13]。

Blockworks 报道称,DoraHacks已成为数十个Web3生态系统的“核心合作伙伴”,帮助他们连接全球开发者资源(blockworks.co)[11]。

在投资人眼中,DoraHacks本身就是关键基础设施:“DoraHacks对Web3基础设施建设至关重要。”一位支持平台的VC如此指出(blockworks.co)[13]。

简而言之:到2024年,DoraHacks已将黑客松从一个小众事件变为全球创新引擎。

它证明:只要规模足够、流程健全,黑客松可以持续地产出真实、可投、可商业化的创新。

它连接开发者与资源,把“孤岛式创新”变成一场全球开发者的常青运动。

这就是Hackathons 2.0:更大、更久、更无界,也远比以往更具颠覆性。

也许你会问:还能比这更好吗?

DoraHacks似乎已经破解了“如何让黑客创造力产生持久影响”的密码。

但这并不是终点。事实上,DoraHacks团队即将揭示的,是一场更加激进的革命。

如果说DoraHacks 1.0是“进化”,那接下来将是一次范式转移的“革命”。

Agentic Hackathon:BUIDL AI与第二次黑客松革命

2024年,DoraHacks推出了BUIDL AI,并由此提出了“Agentic Hackathon(自主智能黑客松)”的概念。

如果说最初的黑客松像是模拟电话,DoraHacks 1.0则使其进化为智能手机,那么BUIDL AI的出现,就像为黑客松安装上了AI副驾驶——进入自动驾驶模式。

这不仅是渐进式的提升,而是一场彻底的第二次革命。

BUIDL AI为黑客松注入了人工智能、自动化与“智能代理”能力(Agentic),根本性地改变了黑客松的组织方式与体验路径。

我们正迈入“自主智能创新时代(Age of Agentic Innovation)”,在这个时代中,借助AI代理运行的黑客松可以以前所未有的频率、高效与智慧展开。

那么,究竟什么是Agentic Hackathon?

它是一种由AI代理全面增强的黑客松,从策划、评审到参与者支持都涵盖在内,使得创新的速度与规模达到前所未有的高度。

在Agentic Hackathon中,AI是那位永不疲倦的共同组织者,与人类并肩工作。 过去那些压垮组织者的繁琐流程,如今交由智能算法完成。你可以想象——黑客松几乎在自动运行,如同一场永不停歇的“点子锦标赛”。

借助BUIDL AI,DoraHacks实现了“自驾黑客松”:自主、高效、全天候运行,且可在多个领域同时并行。 这并非科幻小说,而是正在发生的现实。我们来看BUIDL AI是如何运作的,以及它如何将黑客松效率提升十倍以上:

AI驱动的评审与项目筛选:效率提升10倍以上

大型黑客松中最耗时的环节之一就是评审数百个项目提交。传统做法常常需要组织者耗费数周精力,才能从中筛选出有潜力的项目。

BUIDL AI彻底改变了这一切。

它配备了BUIDL Review模块——一个AI驱动的评审系统,能够从多个维度(项目完整性、创意性、主题契合度等)智能分析项目,并自动剔除质量较低的提交[14]。

就像配备了一支随叫随到的专家评审军团。

效果如何?原本需要几百人小时完成的工作,如今几分钟即可完成。

DoraHacks报告称,AI辅助评审已将组织效率提高超过10倍[14]。

想象一下:一项原本需要一个月枯燥工作完成的任务,如今在几天之内搞定,而且评分更一致、公正、透明。 组织者不再淹没在文书工作中,参与者也能更快获得反馈。

当然,AI并不完全取代人工评委——最终决策仍需专家参与,但AI承担了繁重的初审环节。这也意味着:黑客松可放心接纳更多项目提交,因为AI会帮你完成筛选。

不再因为“人手不足”而限制报名人数。

在Agentic Hackathon中,再也没有优秀项目被埋没的遗憾,因为AI确保它们都能被看到。

自动化市场营销与内容讲述:让每场黑客松都自带扩散力

赢得一场黑客松固然令人激动,但如果无人知晓,影响力也就大打折扣。

过去,黑客松结束后,组织者通常需要手动撰写总结、撰文致谢、更新结果——虽然重要,却常常被推迟。

BUIDL AI改变了这一点。

它配备了自动化营销模块,可一键生成黑客松的总结报告与传播内容[14]。

想象这样一个AI,它完整“观察”了整场黑客松(包括提交项目、获奖名单、技术趋势),然后自动撰写出一份专业报道:突出最佳创意、介绍获胜团队、提炼洞察(比如“本次黑客松中60%的项目应用AI于医疗场景”)。

BUIDL AI正是这么做的:自动生成“高光集锦”与总结报告[14]。

这不仅节省了组织者的写作工作,还极大提升了黑客松的传播力。

活动结束数小时内,一份内容丰富的总结即可全球发布,展示创新成果,吸引关注。

赞助方与合作伙伴对此尤为青睐,因为他们的投资能被迅速宣传;参与者也很喜欢,因为自己的项目立刻获得庆祝与曝光。

本质上,每一场黑客松都在讲述一个故事,而BUIDL AI确保这个故事被迅速、广泛地传播。

这种自动化叙事机制,使得黑客松不再是孤立事件,而是持续内容的源泉,为下一场活动积蓄动能。

这是一个良性循环:黑客松产出创新,AI包装传播,传播吸引更多创新者。

一键发起,多黑客松并行:组织者的自由释放

BUIDL AI最具解放性的功能之一,是一键启动黑客松、支持多场并行管理。

过去,发起一场黑客松本身就是一项大型项目:报名系统、评委协调、奖金设计、沟通流程……一切都需人工配置。

DoraHacks的BUIDL AI引入了“一键发起黑客松”工具 [14] 。

组织者只需输入基本信息(主题、奖池、时间、评审规则),平台即自动生成活动页面、提交入口、评审流程等,就像发一篇博客一样简单。

这极大降低了社区与公司举办黑客松的门槛。

如今,即使是一个初创公司或大学社团,也可以轻松举办全球级黑客松,无需专职活动团队。

此外,BUIDL AI还支持多场黑客松的并行管理[14]。

过去,即使是科技巨头也难以同步组织多场黑客松——资源消耗太大。如今,一个生态系统可以同时运行DeFi、AI、 IoT等主题黑客松,背后由AI自动调度。

自BUIDL AI发布以来,组织12场/年,甚至同时运行数场黑客松,从“不可能”变成常规操作[14]。

平台还自动管理参与者接入、发送提醒、通过聊天机器人回答常见问题,确保流程顺畅。

简而言之,BUIDL AI让黑客松主办方像使用云服务器一样“按需发起”创新活动。

这是一场结构性转变:黑客松不再是“偶尔有空才办”的事件,而是“需要时就能发”的常态流程。 我们正在见证永续黑客松文化的诞生——不再是偶尔的火花,而是持续的火焰,始终燃烧,永不熄灭。

实时AI导师与智能助手:人人皆可成为“Agentic Hacker”

Agentic Hackathon的“智能代理”不仅体现在后台,也贯穿了参与者的体验。

借助AI集成,开发者得到了更智能的工具与支持。

例如,BUIDL AI可以配备AI助手,在活动中实时回答开发者问题(如“这个API怎么用?”、“有没有这个算法的代码示 例?”),就像随叫随到的技术导师。

它还可以推荐协作伙伴、推送参考资料。

本质上,每位参与者都像身边多了一个AI队友——全能、勤奋、永不疲倦。

一些本需数小时调试的bug,借助AI助手几分钟即可解决。

这意味着:项目质量提升,参与者学习效率大幅提高。

正如followin.io所言,这种“agentic协助”体现了“人人皆可成为黑客”的愿景[14]。

AI自动化了大量重复性工作,放大了小团队的能力边界[14]。

在Agentic Hackathon中,两个人加AI助手,就能完成过去五人团队数周才能达成的任务[14]。

这既降低了门槛,也拉高了上限——创新的天花板不再遥不可及。

总结:从黑客松2.0跃迁至3.0,进入智能化持续创新的新时代

所有这些变革,指向同一个事实:黑客松已从偶发的灵感爆发,演化为持续、高频、AI优化的创新流程。

我们正从黑客松2.0走向黑客松3.0——一个自主、常驻、智能的新时代。

这是一场范式转移。

黑客松不再是你参加的一场活动,而是你生活的一个创新环境。

借助BUIDL AI,DoraHacks描绘出这样的世界:“黑客松将进入一个前所未有的自动化与智能化时代,使全球更多黑客、开发者与开源社区能够轻松发起与参与。”

创新将随时随地发生,因为支持它的基础设施正由AI驱动、全天候运转于云端。

黑客松已成为一个智能平台,随时准备将创意转化为现实。

更关键的是,这一切并不局限于区块链。

BUIDL AI是通用平台——无论是AI、气候科技、医疗、教育等领域,都可接入Agentic Hackathon平台,享受更高频、更高效的创新节奏。

这预示着一个未来:黑客松将成为默认的解决问题方式。

公司与社区不再靠封闭的委员会与研发部门推进创新,而是将问题投入黑客松竞技场——一个始终活跃的解决问题引擎。

形象地说:

**DoraHacks 1.0 让黑客松拥有了高速引擎;

DoraHacks 2.0 加上 BUIDL AI,则让它变成一辆自动驾驶的赛车——油门踩到底。**

成本、复杂度、时间的阻碍——都不复存在。

如今,任何组织都能毫无阻力地驶入创新高速公路,从0加速到60。

黑客松频率如博客更新,融入日常运营,如同敏捷开发的冲刺演示。

按需创新,规模扩张——这就是Agentic Hackathon的力量。

随需创新:Agentic Hackathon 如何惠及所有人

Agentic Hackathon(自主智能黑客松)的诞生,并非只是技术社区的一款“新奇玩具”,而是一种变革性的工具,可服务于企业、开发者,乃至整个行业。

我们正步入一个全新时代:任何拥有愿景的人都能将“黑客松即服务”转化为推动创新的引擎。以下是不同参与者如何从这场革命中受益:

AI公司 —— 加速生态成长的发动机

对于专注于人工智能的公司(如 OpenAI、Google、Microsoft、Stability AI 等),黑客松是一座座发掘其技术创意用途的金矿。

如今借助 Agentic Hackathon,这些公司几乎可以为自己的平台持续举办一场“永不落幕”的开发者大会。

比如,OpenAI 可以为 GPT-4 或 DALL·E 启动全年在线的黑客松,鼓励全球开发者持续实验、展示这些AI的应用场景——本质上,以众包方式为AI平台孵化创新与杀手级应用。

收益何在?生态系统和用户基数的指数级扩展。

新的用例往往来自公司内部未曾设想的角落。 (最早展示 GPT-3 能撰写法律合同、生成游戏关卡的,不是大公司,而是独立黑客——他们在黑客松和社区挑战中发现了这些潜力。)

有了 BUIDL AI,AI 公司可以一键启动月度黑客松,每月聚焦不同方向(比如本月自然语言处理,下月机器人控制)。 这是市场营销与产品研发的倍增器。

无需再组织昂贵的开发者布道之旅,AI 将成为全球开发者互动的主力军。产品在推广的同时也在优化。 本质上,每家AI公司都可以开启自己的“黑客松联赛”,推动API或模型的普及与应用。

Coinbase最近首次举办AI主题黑客松,尝试连接加密与AI领域——他们很清楚,要播下新范式的种子,黑客松是最佳路径[15] 。

未来,我们将看到所有AI平台效仿:持续通过黑客松教育开发者、生成内容(演示、教程),并发掘可投资/可招聘的杰出人才。这将是社区建设的超级助推器。

L1/L2与技术平台 —— 发现下一只独角兽

对于区块链的一层/二层网络(Layer1/Layer2),以及任何技术平台(如云服务、VR平台等)来说,黑客松已成为新的“Deal Flow”(项目源)。

在 Web3 世界里,许多顶级项目与协议都诞生于黑客松,这一点早已被广泛认同。

我们看到,1inch 就是始于黑客松,后来成长为 DeFi 独角兽(cointelegraph.com)[9]。

Polygon 积极举办黑客松以寻找其生态的新型dApps;Filecoin 借助黑客松发掘分布式存储应用。

借助 DoraHacks 和 BUIDL AI,这些平台现在可以高频率地组织黑客松,持续输出创新成果。

不再是一年一两次大型活动,而是一个滚动进行的计划——比如每季度一场,甚至同时多地开展全球挑战,保持开发者“常态建设”。

回报率巨大:即使设有可观奖金,黑客松的举办成本也远低于收购一个蓬勃发展的初创公司或协议所需投入。 黑客松本质上是将早期研发外包给充满热情的社区成员,最好的创意自然浮现。

Solana 的黑客松就促成了 Phantom、Solend 等明星项目的落地。Facebook 的内部黑客松也曾带来推动平台主导地位的功能创新[1]。

现在,任何平台都可以将黑客松“外部化”:作为发现人才与创新的“雷达”。借助 BUIDL AI,哪怕一个 L2 区块链的核心团队人手有限,也能并行运行多场黑客松与赏金任务——一场关注 DeFi,一场关注 NFT,一场关注游戏等等。

AI 负责初审项目与管理社区问答,让平台的 DevRel 团队不至于“过劳”。结果是,一条源源不断的创新供给链,不断喂养平台增长。下一个独角兽、下一个杀手级应用,将被提前识别并扶持成长。

黑客松已成为 VC 和技术生态的新型创业漏斗(Startup Funnel)。

未来,投资人将活跃于 Agentic Hackathon 中——因为那里正是“未来车库”的所在:黑客们聚集在云端黑客室中重塑世界。

正如 Paul Graham 所言:“黑客与画家,皆为创造者”,他们将在黑客松平台的画布上,描绘未来科技的蓝图。

所有公司与社区 —— 创新成为一种持续流程

或许 BUIDL AI 最深远的影响是:让所有组织都能举办黑客松,不再局限于科技公司。

任何希望推动创新的机构——银行探索金融科技、医院网络寻找医疗科技方案、政府寻找公民科技创意——都可以利用 Agentic Hackathon。

创新不再是巨头的特权,它成为一项“云服务”,人人可用。

比如,一个城市政府可以举办全年黑客松,征集“智慧城市”解决方案,让本地开发者持续提出、建设项目以改善城市生活。

BUIDL AI 平台可以设置不同“赛道”:交通、能源、安全,每月评选最佳创意并给予奖励。

这比传统招标流程更加灵活,能更高效地激发社区活力与项目孵化。

同样地,任何担心被颠覆的财富500强公司(其实谁不担心?)都可以主动“自我颠覆”——通过黑客松邀请员工和外部创新者挑战企业自身难题。

在 agentic 模式下,即使是非技术型公司也能轻松参与;AI 会引导流程,保障运行顺畅。试想:黑客松成为每一家企业战略部门的“标配工具”,不断原型化未来。

正如 Marc Andreessen 所说,“软件正在吞噬整个世界”——而现在,每家公司都可以通过举办黑客松,参与“软件化”自身问题的过程。

这将推动跨行业的创新民主化。

尝试大胆创意的门槛大幅降低(周末黑客松 vs. 数月企业流程),更多潜在颠覆性创意将在企业内部浮现。

有了 DoraHacks 的全球影响力,企业也能轻松吸引外部创新者参与。

零售公司为何不能从全球黑客那里众包 AR 购物创意?

制药公司为何不办场生物信息学黑客松以探索数据分析新方法?

答案只有一个:没有理由不做。Agentic Hackathon 让一切变得可行、值得。

黑客松即服务(Hackathon-as-a-Service)将成为下一代的创新部门——要么使用它,要么被使用它的人超越。

结语:从偶发事件到创新基础设施的演进

所有上述变革,归结为一个深刻转变:黑客松正从一次性的活动,演变为创新生态系统中的常驻组成部分。

它们正成为像云计算、宽带网络一样的基础资源:随时可用,规模无限。

想获得新点子或原型?办场黑客松,让全球开发者接招。

想激活开发者社群?发布主题黑客松,提供舞台。

想试验10种解决方案?来一场比赛,看看谁跑出来。

我们正在见证所谓“创新公地(Innovation Commons)”的诞生:一个持续匹配问题与创意、迅速迭代解决方案的协 作空间。

AI是这片公地的维护者,保证运行高效、协作持久,不再需要消耗人为组织者的精力。

这也正好回应了人们对黑客松的批评:缺乏可持续性与后续跟进。

而在Agentic模型中,黑客松不再是孤岛——它们可以彼此衔接:上届的优胜团队可以直接晋级加速器,或参与下月的 新主题挑战。

BUIDL AI 甚至可以追踪团队进展,推荐资助机会、合作方、甚至下一步要申请的Grant,彻底解决过去“项目周末之后无人接手”的痛点。

好项目不会在周日夜晚“死掉”,而是被自动引导进入下一阶段的旅程。

我们还应认识到一种更深层的哲学意义:

创新文化,变得更具实验性、更重才智、更具节奏感。

在Agentic Hackathon的世界中,座右铭是:“为啥不原型一下?为啥不现在就试?”

因为启动一场实验的门槛如此之低,创新思维将像空气般流入每一个组织、每一个社区。

失败的成本极低(只需几周),成功的可能却极高(也许就是下一个突破)。

这是一块供“颠覆性想法”安全试验的沙盒,也正是解决《创新者的窘境》的现实路径:

结构性地为那些被视为“玩具”的想法,保留生长空间[5]。

企业无需在“核心业务”与“实验创新”之间二选一——他们可以为后者开设一条常驻黑客松轨道。

本质上,DoraHacks 与 BUIDL AI 打造了一座“创新工厂”——任何有远见的组织都可以“租用”一周末,甚至一年。

从 Like 按钮到点火升空:黑客松是创新的摇篮

要真正理解这个新时代的分量,我们不妨回顾一下——多少改变世界的创新,其实起源于黑客松项目或类似黑客松的实验,即使当时还受限于旧有模式。而现在,随着这些限制被移除,我们能期待的,将远远不止于此。 历史本身,就是黑客松创新模式的最佳佐证:

Facebook 的基因,由黑客松塑造

马克·扎克伯格本人曾表示,Facebook 的许多关键功能都来自公司内部的黑客松:“点赞”按钮、Facebook Chat、时间线功能,无一不是工程师们在通宵达旦的黑客松中迸发出的创意[1]。

一位实习生在黑客松中构建的“评论区标记好友”原型,在短短两周后就上线,触达了十亿用户[1]。Facebook 的核心理念“Move fast and break things(快速行动,大胆试错)”,几乎就是黑客松精神的官方化表达。

可以毫不夸张地说,Facebook 能在2000年代超越 MySpace,正是得益于其由黑客松推动的快速创新文化[1]。

如果黑客松能在一家公司的内部产生如此颠覆性作用,想象一下——当它成为全球网络时,创新的速度将怎样改变整个世界?

Google 的“20% 时间”项目:制度化的黑客精神

Google 长期鼓励员工将20%的时间投入到自由探索的副项目中,这本质上是黑客松理念的延伸:结构外的探索实验。 Gmail 和 Google News 就是这样诞生的。

此外,Google 也曾围绕其 API 举办公开黑客松(如 Android 黑客松),催生了无数应用。

换句话说,Google 将黑客式实验制度化,获得了巨大的创新红利。

如今借助 Agentic Hackathon,即便没有 Google 资源的公司,也能制度化实验文化。

世界各地的开发者,都可以把每个周末当作自己的“20%时间”,借由这些平台启动属于自己的探索。

开源运动的推进器:Hackathons + Open Source = 强生态

开源软件世界也从“代码冲刺”(黑客松形式)中受益匪浅。

例如整个 OpenBSD 操作系统的开发就离不开其定期举办的黑客松[3]。

近年来,Node.js 与 TensorFlow 等项目也都通过黑客松来构建工具与生态组件。

其结果是:更强壮的技术生态,更活跃的贡献者社群。

DoraHacks 也在延续这种传统,并将自己定位为“全球领先的黑客松社区与开源开发者激励平台”[17]。

开源与黑客松的结合——都去中心化、社群驱动、基于 meritocracy(才智主义)——本身就是创新引擎。

我们可以预见,未来开源项目将借助 BUIDL AI 启动“永不停歇的黑客松”:持续修复 bug、加入新功能、奖励优秀贡献者。

这将为开源世界注入新生命——不仅通过奖金提供激励,还能以系统化的方式提供认可与传播。

初创世界:黑客松造就新公司

众多初创企业的起点,都是黑客松。 我们已提到的 Carousell(起于Startup Weekend,估值超10亿美元[2])、EasyTaxi(同样出自Startup Weekend,融资7500万美元[2])。 再加上:

- Zapier(集成工具平台,灵感来自黑客松)

- GroupMe(如前所述,被Skype收购)

- Instacart(传说在Y Combinator Demo Day 黑客松中以早期版本夺得优胜)

- 以及无数加密初创项目(包括 Ethereum 创始人们的相识与合作也源于早期黑客松与比特币线下聚会)

如今,当 Coinbase 想寻找链上 AI 的下一个机会时,他们办一场黑客松[15]。

Stripe 想推动支付平台上的应用数量,也选择了办黑客松并发放 Bounty。

这种模式行之有效:找到充满热情的构建者,为他们提供跳板。

有了 Agentic Hackathon,这个跳板不再只是弹射一次,而是始终在线,能接住更多人。

这个“创业漏斗”变宽了,我们将看到更多初创企业诞生于黑客松。

完全可以想象:

2030年代最伟大的公司,不会诞生于车库,而是源自一场在线黑客松,由几个在 Discord 上认识的开发者,在 AI 导师协助下完成原型,并在 DoraHacks 平台数周内获得融资。

换句话说,“车库神话”已进化为全球、云端、AI驱动的创业现实。

黑客与画家:创造者的共鸣

Paul Graham 在《Hackers & Painters》中曾将“黑客”比作“画家”——两者皆为纯粹的创作者[16]。

而黑客松,正是这种创造能量最集中、最爆发的场域。

许多伟大程序员都会告诉你,他们最具灵感的作品,正是在黑客松或秘密小项目中完成的——在没有官僚主义的束缚 下,沉浸于“心流”中完成的创作。

扩大黑客松的规模与频率,本质上就是扩大人类的创造力边界。

我们或许会想起文艺复兴时期——艺术家与发明家聚集在赞助人举办的工坊中自由创作;而如今,黑客松就是现代文艺复兴的“创客工坊”。

它融合了艺术、科学与企业家精神。

若达·芬奇活在今天,他一定会如鱼得水地出现在黑客松中——他以疯狂原型迭代著称。

更重要的是:黑客松完美解决了《创新者的窘境》中的核心问题:鼓励人们去做那些 incumbent(巨头)不屑一顾、看似“小而无用”的项目——而那恰恰往往是颠覆性创新的藏身之处 [5]。

DoraHacks 正是通过制度化黑客松,制度化了颠覆本身——确保下一个 Netflix、Airbnb,不会因为“听起来像个玩具”而被错过。

黑客松已成为全球创新基础设施的一部分

我们已从“黑客松罕见且本地化”的时代,走到了“黑客松持续且全球化”的今天。

这不仅是节奏上的转变,更是全球创新基础设施的关键转折点。

19世纪,我们修建了铁路与电报,催化了工业革命,连接了市场与思想;

20世纪,我们构建了互联网与万维网,引爆了信息革命;

而今,21世纪,DoraHacks 与 BUIDL AI 正在搭建“创新高速公路”:一个持续运行、AI驱动的网络,

在全球范围内,实时连接解决者与问题、人才与机会、资本与创意。

这是为 创新本身修建的基础设施。

伟大的愿景:全球创新的新基础设施

我们正站在一个历史拐点上。

有了 DoraHacks 和 Agentic Hackathon(自主智能黑客松)的出现,创新不再局限于象牙塔、硅谷办公室,或一年一度的大会。

它正成为一项持续的全球性活动——一个随时随地聚集最聪明头脑与最大胆创意的竞技场。

这是一个未来:创新将像 Wi-Fi 一样无处不在,像摩尔定律一样不断加速。

这是 DoraHacks 正在主动构建的未来,而它所带来的影响将是深远的。

想象几年之后的世界:DoraHacks + BUIDL AI 成为跨行业创新项目的默认基础设施。

这个平台7×24不间断运转,承载着从 AI 医疗、气候变化应对,到艺术娱乐前沿的各类黑客松。

而且它不仅仅属于程序员——设计师、创业者、科学家,任何有创造力冲动的人,都能接入这张全球创新网络。

一个伦敦的创业者凌晨2点冒出商业点子;2点15分,她就在 DoraHacks 上发起一场48小时黑客松,AI 自动为她召集来自四大洲的协作者。

听起来疯狂?但未来这将成为常态。

亚洲某国突发环境危机,政府通过 BUIDL AI 紧急发起黑客松,数日内即收到来自全球的数十个可执行科技方案。 纽约某家风投基金希望发现新项目,不再只是等着 PPT 投递——他们直接赞助一场开放黑客松,要求提交原型,而非空谈构想。

这就是 Agentic 创新正在发生的方式:快速、无边界、智能协作。 在这个即将到来的时代,DoraHacks 将如同 GitHub 之于代码、AWS 之于初创企业一般,成为全球创新的基础平台。

你甚至可以称它为创新的 GitHub——不是一个存储代码的工具,而是项目诞生的土壤[17]。 DoraHacks 自称是“全球黑客运动的引擎”;而有了 BUIDL AI,它更成为这场运动的自动驾驶系统。

我们应将其视为全球公共创新基础设施的一部分:

正如高速公路运输货物、互联网传递信息,DoraHacks 传递的是创新本身——

从创意萌芽到落地实施,以惊人的速度。

当历史回顾2020年代,持续性、AI驱动的黑客松的诞生,将被视为人类创新模式变革的重要篇章。

这是一幅宏大但真实可触的愿景:

创新,将变成一场永恒的黑客松。

设想一下:

黑客精神深入社会每个角落,成为对现状的持续挑战,时刻发出这样的提问:

“我们如何改进这件事?”、“我们如何重新发明那件事?”

然后立刻号召人才,迅速投入行动。

这不是混乱,而是一种全新的、有组织、去中心化的研发模式。

一个大胆问题——“我们能治愈这种疾病吗?”、“我们能否让儿童教育更高效?”、“我们能不能让城市真正可持续?”—— 不再需要靠闭门造车的委员会来思考十年,而是一场全球黑客松,就可能在几天或几周内产生答案。 这将是一个创新不再稀缺、不再由少数人垄断,而是成为一项公共物品的世界。

一场开放的、胜者为王的比赛,不管解决方案来自斯坦福博士,还是拉各斯的自学黑客,只要够好,就能脱颖而出。 如果你觉得这听起来太理想,请看看我们已经走了多远:

黑客松从一个名不见经传的程序员聚会,变成了支撑十亿美元企业和全球关键技术的创新机制。 (别忘了,比特币本身就是黑客文化的产物!)

随着 DoraHacks 的壮大和 BUIDL AI 的腾飞,黑客松正朝着持续化与无处不在的方向稳步推进。 技术已经准备就绪,模式已经跑通,现在的关键是执行与普及。

而趋势已然明朗:

- 越来越多公司拥抱开放创新;

- 越来越多开发者远程工作、参与在线社区;

- AI 正快速成为每个创造过程的副驾驶。

DoraHacks 正站在这场转型的核心。

它拥有先发优势、全球社区、明确愿景。

他们的理念非常清晰:“为黑客运动提供永恒燃料”是他们的口号之一[18]。

在他们眼中,黑客松不仅是活动,更是一场必须永续进行的思维革命。 而 BUIDL AI,正是支撑这场永续革命的引擎。

这预示着一个未来:

DoraHacks + BUIDL AI,将成为全球创新关键基础设施的一部分,就像公共事业一样。

这是一张“创新电网”;一旦接入它,奇迹发生。

Marc Andreessen 常在文章中以“建造更好的未来”为信条,热情洋溢地谈论人类的进步。

如果秉持这一精神,我们可以大胆断言:

Agentic Hackathon 将重塑我们的未来——更快、更好。

它们将加速人类解决最难问题的速度,

动员更广泛的人才库,

以史无前例的节奏不断迭代方案。

它们将赋能每一个人——让地球上任何拥有创造力的人,立即就能获得工具、社群和机会,产生真正的影响,而不是“未来某天”。

这是一种深层次的民主化。

它呼应了早期互联网的精神:不需许可的创新(Permissionless Innovation)。

而 DoraHacks 正在将这一精神引入结构化的创新事件中,并将其延展为一种持久的创新模式。

总结:我们正目睹一场范式的彻底转变:黑客松被重塑,创新被解放。

旧模型的限制已被打破,

新范式的核心是:

高频黑客松、AI增强、结果导向。

DoraHacks 在 2020–2024 年引领了这场变革,

而随着 BUIDL AI 的登场,它即将开启下一个篇章——Agentic Innovation 的时代。

对投资者与有远见的领袖而言,这是一场集结号。

我们常说要“投资基础设施”,

那么现在,就是投资“创新本身的基础设施”。

支持 DoraHacks 和它的使命,

就像支持跨洲铁路或洲际高速的建造者,

只不过这次运载的是创意与突破。

网络效应巨大:每一场新增的黑客松、每一位新增的参与者,

都以复利效应提升整个生态系统的价值。

这是一场正和博弈(Positive-Sum Game),

DoraHacks 将是那个创造并捕捉全球价值的平台与社区。

DoraHacks 重新定义了黑客松:

它将黑客松从偶发行为变成了持续创新的系统方法。

在这个过程中,它敞开了创新之门,

引领我们进入一个全新的时代:

一个创新可以自主驱动、自组织、永不停歇的时代。

我们正站在这个新时代的黎明。

这是一个真正意义上:

拥有开发者,拥有世界的时代[14] 。

DoraHacks 正在确保:

无论你身在何处,只要你是开发者、黑客、梦想家,

你都能为这个世界的未来贡献力量。

前方的远景令人震撼——一个由全球黑客思维构成的智能蜂巢,

不断发明、持续发现,

由 AI 指引航向,

由 DoraHacks 与 BUIDL AI 领航。

这不仅仅是一个平台,

它是一项革命性的基础设施——创新的铁路,创意的高速。

请系好安全带:

DoraHacks 已经启程,

Agentic Innovation 的时代已经到来,

未来正以黑客松的速度,向我们疾驰而来。

这场黑客松,永不停歇。

而这,正是我们构建更美好世界的方式。

参考文献:

[1] Vocoli. (2015). Facebook’s Secret Sauce: The Hackathon . https://www.vocoli.com/blog/june-2015/facebook-s-secret-sauce-the-hackathon/

[2] Analytics India Magazine. (2023). Borne Out Of Hackathons . https://analyticsindiamag.com/ai-trends/borne-out-of-hackathons/

[3] Wikipedia. (n.d.). Hackathon: Origin and History . https://en.wikipedia.org/wiki/Hackathon#Origin_and_history

[4] LinkedIn. (2024). This year marked my third annual participation in Microsoft’s Global… . https://www.linkedin.com/posts/clare-ashforth_this-year-marked-my-third-annual-participation-activity-7247636808119775233-yev-

[5] Glasp. (n.d.). Chris Dixon’s Quotes . https://glasp.co/quotes/chris-dixon

[6] ODaily. (2024). Naija HackAtom Hackathon Recap . https://www.odaily.news/en/post/5203212

[7] Solana. (2021). Meet the winners of the Riptide hackathon - Solana . https://solana.com/news/riptide-hackathon-winners-solana

[8] DoraHacks. (n.d.). BNB Grant DAO - DoraHacks . https://dorahacks.io/bnb

[9] Cointelegraph. (2021). From Hackathon Project to DeFi Powerhouse: AMA with 1inch Network . https://cointelegraph.com/news/from-hackathon-project-to-defi-powerhouse-ama-with-1inch-network

[10] Gemini. (2022). How Does STEPN Work? GST and GMT Token Rewards . https://www.gemini.com/cryptopedia/stepn-nft-sneakers-gmt-token-gst-crypto-move-to-earn-m2e

[11] CoinDesk. (2022). Inside DoraHacks: The Open Source Bazaar Empowering Web3 Innovations . https://www.coindesk.com/sponsored-content/inside-dorahacks-the-open-source-bazaar-empowering-web3-innovations

[12] LinkedIn. (n.d.). DoraHacks . https://www.linkedin.com/company/dorahacks

[13] Blockworks. (2022). Web3 Hackathon Incubator DoraHacks Nabs $20M From FTX, Liberty City . https://blockworks.co/news/web3-hackathon-incubator-dorahacks-nabs-20m-from-ftx-liberty-city

[14] Followin. (2024). BUIDL AI: The future of Hackathon, a new engine for global open source technology . https://followin.io/en/feed/16892627

[15] Coinbase. (2024). Coinbase Hosts Its First AI Hackathon: Bringing the San Francisco Developer Community Onchain . https://www.coinbase.com/developer-platform/discover/launches/Coinbase-AI-hackathon

[16] Graham, P. (2004). Hackers & Painters . https://ics.uci.edu/~pattis/common/handouts/hackerspainters.pdf

[17] Himalayas. (n.d.). DoraHacks hiring Research Engineer – BUIDL AI . https://himalayas.app/companies/dorahacks/jobs/research-engineer-buidl-ai

[18] X. (n.d.). DoraHacks . https://x.com/dorahacks?lang=en

-

@ 826e9f89:ffc5c759

2025-04-12 21:34:24

@ 826e9f89:ffc5c759

2025-04-12 21:34:24What follows began as snippets of conversations I have been having for years, on and off, here and there. It will likely eventually be collated into a piece I have been meaning to write on “payments” as a whole. I foolishly started writing this piece years ago, not realizing that the topic is gargantuan and for every week I spend writing it I have to add two weeks to my plan. That may or may not ever come to fruition, but in the meantime, Tether announced it was issuing on Taproot Assets and suddenly everybody is interested again. This is as good a catalyst as any to carve out my “stablecoin thesis”, such as it exists, from “payments”, and put it out there for comment and feedback.

In contrast to the “Bitcoiner take” I will shortly revert to, I invite the reader to keep the following potential counterargument in mind, which might variously be termed the “shitcoiner”, “realist”, or “cynical” take, depending on your perspective: that stablecoins have clear product-market-fit. Now, as a venture capitalist and professional thinkboi focusing on companies building on Bitcoin, I obviously think that not only is Bitcoin the best money ever invented and its monetization is pretty much inevitable, but that, furthermore, there is enormous, era-defining long-term potential for a range of industries in which Bitcoin is emerging as superior technology, even aside from its role as money. But in the interest not just of steelmanning but frankly just of honesty, I would grudgingly agree with the following assessment as of the time of writing: the applications of crypto (inclusive of Bitcoin but deliberately wider) that have found product-market-fit today, and that are not speculative bets on future development and adoption, are: Bitcoin as savings technology, mining as a means of monetizing energy production, and stablecoins.

I think there are two typical Bitcoiner objections to stablecoins of significantly greater importance than all others: that you shouldn’t be supporting dollar hegemony, and that you don’t need a blockchain. I will elaborate on each of these, and for the remainder of the post will aim to produce a synthesis of three superficially contrasting (or at least not obviously related) sources of inspiration: these objections, the realisation above that stablecoins just are useful, and some commentary on technical developments in Bitcoin and the broader space that I think inform where things are likely to go. As will become clear as the argument progresses, I actually think the outcome to which I am building up is where things have to go. I think the technical and economic incentives at play make this an inevitability rather than a “choice”, per se. Given my conclusion, which I will hold back for the time being, this is a fantastically good thing, hence I am motivated to write this post at all!

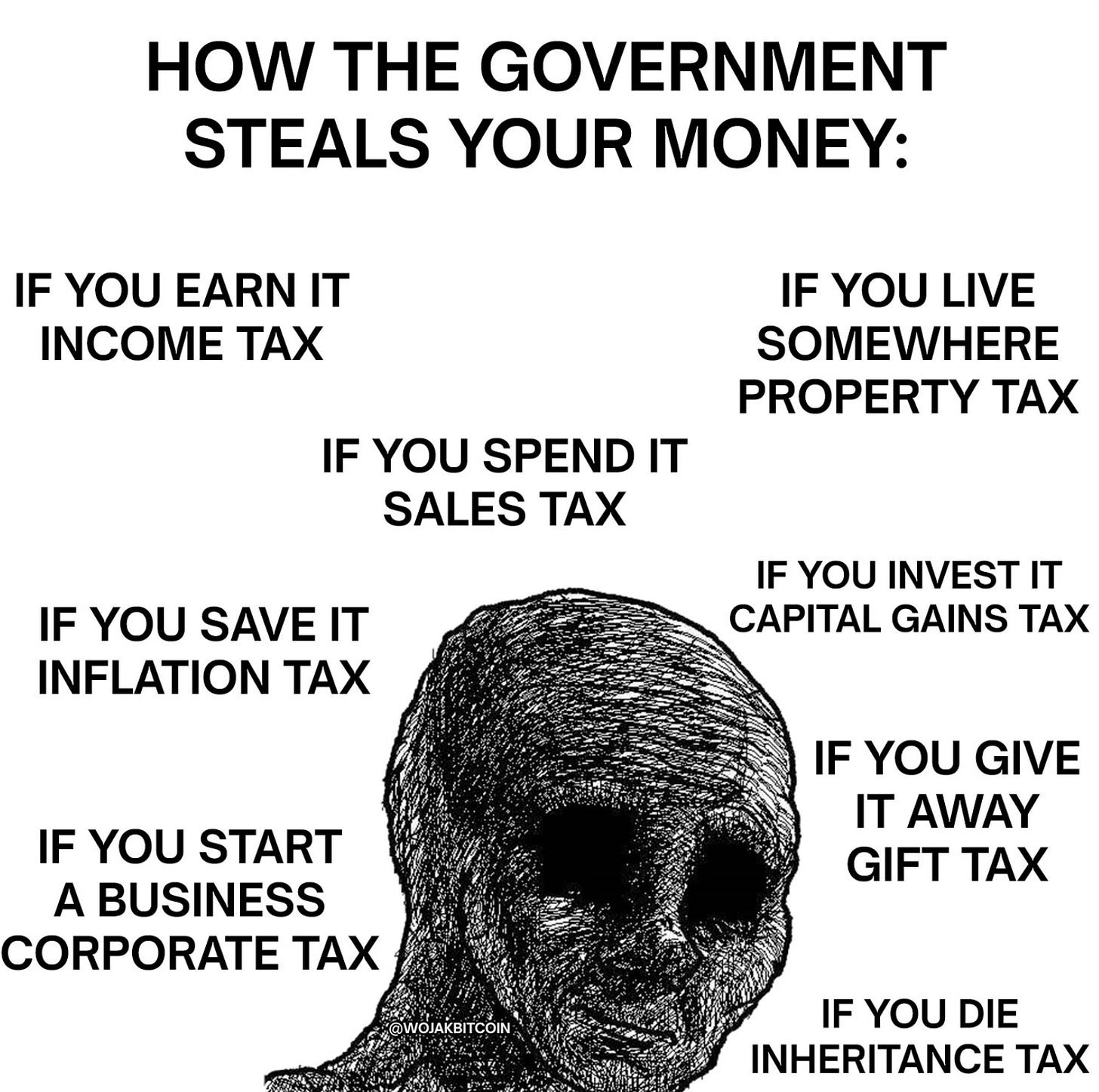

Objection 1: Dollar Hegemony

I list this objection first because there isn’t a huge amount to say about it. It is clearly a normative position, and while I more or less support it personally, I don’t think that it is material to the argument I am going on to make, so I don’t want to force it on the reader. While the case for this objection is probably obvious to this audience (isn’t the point of Bitcoin to destroy central banks, not further empower them?) I should at least offer the steelman that there is a link between this and the realist observation that stablecoins are useful. The reason they are useful is because people prefer the dollar to even shitter local fiat currencies. I don’t think it is particularly fruitful to say that they shouldn’t. They do. Facts don’t care about your feelings. There is a softer bridging argument to be made here too, to the effect that stablecoins warm up their users to the concept of digital bearer (ish) assets, even though these particular assets are significantly scammier than Bitcoin. Again, I am just floating this, not telling the reader they should or shouldn’t buy into it.

All that said, there is one argument I do want to put my own weight behind, rather than just float: stablecoin issuance is a speculative attack on the institution of fractional reserve banking. A “dollar” Alice moves from JPMorgan to Tether embodies two trade-offs from Alice’s perspective: i) a somewhat opaque profile on the credit risk of the asset: the likelihood of JPMorgan ever really defaulting on deposits vs the operator risk of Tether losing full backing and/or being wrench attacked by the Federal Government and rugging its users. These risks are real but are almost entirely political. I’m skeptical it is meaningful to quantify them, but even if it is, I am not the person to try to do it. Also, more transparently to Alice, ii) far superior payment rails (for now, more on this to follow).

However, from the perspective of the fiat banking cartel, fractional reserve leverage has been squeezed. There are just as many notional dollars in circulation, but there the backing has been shifted from levered to unlevered issuers. There are gradations of relevant objections to this: while one might say, Tether’s backing comes from Treasuries, so you are directly funding US debt issuance!, this is a bit silly in the context of what other dollars one might hold. It’s not like JPMorgan is really competing with the Treasury to sell credit into the open market. Optically they are, but this is the core of the fiat scam. Via the guarantees of the Federal Reserve System, JPMorgan can sell as much unbacked credit as it wants knowing full well the difference will be printed whenever this blows up. Short-term Treasuries are also JPMorgan’s most pristine asset safeguarding its equity, so the only real difference is that Tether only holds Treasuries without wishing more leverage into existence. The realization this all builds up to is that, by necessity,

Tether is a fully reserved bank issuing fiduciary media against the only dollar-denominated asset in existence whose value (in dollar terms) can be guaranteed. Furthermore, this media arguably has superior “moneyness” to the obvious competition in the form of US commercial bank deposits by virtue of its payment rails.

That sounds pretty great when you put it that way! Of course, the second sentence immediately leads to the second objection, and lets the argument start to pick up steam …

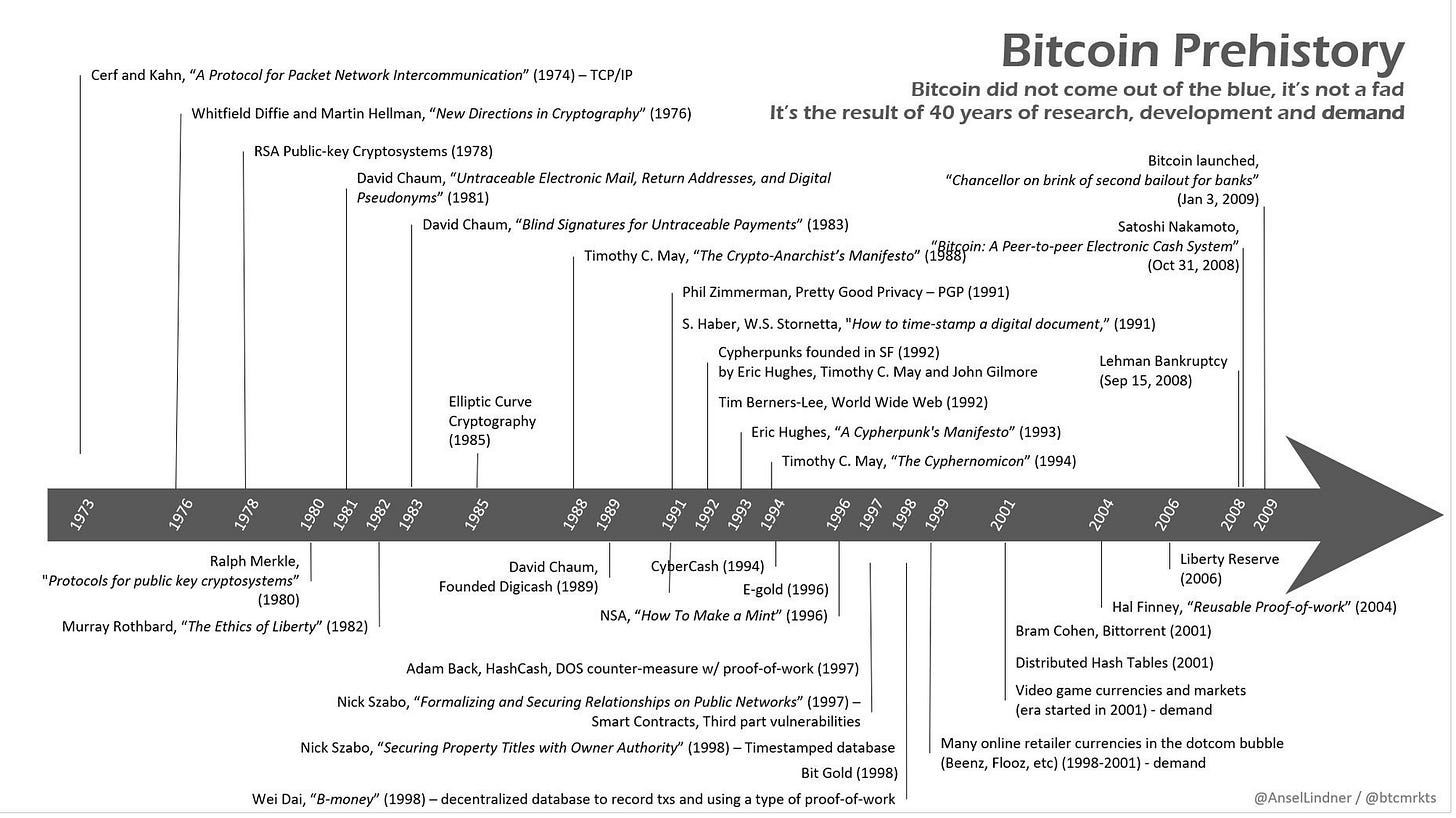

Objection 2: You Don’t Need a Blockchain

I don’t need to explain this to this audience but to recap as briefly as I can manage: Bitcoin’s value is entirely endogenous. Every aspect of “a blockchain” that, out of context, would be an insanely inefficient or redundant modification of a “database”, in context is geared towards the sole end of enabling the stability of this endogenous value. Historically, there have been two variations of stupidity that follow a failure to grok this: i) “utility tokens”, or blockchains with native tokens for something other than money. I would recommend anybody wanting a deeper dive on the inherent nonsense of a utility token to read Only The Strong Survive, in particular Chapter 2, Crypto Is Not Decentralized, and the subsection, Everything Fights For Liquidity, and/or Green Eggs And Ham, in particular Part II, Decentralized Finance, Technically. ii) “real world assets” or, creating tokens within a blockchain’s data structure that are not intended to have endogenous value but to act as digital quasi-bearer certificates to some or other asset of value exogenous to this system. Stablecoins are in this second category.

RWA tokens definitionally have to have issuers, meaning some entity that, in the real world, custodies or physically manages both the asset and the record-keeping scheme for the asset. “The blockchain” is at best a secondary ledger to outsource ledger updates to public infrastructure such that the issuer itself doesn’t need to bother and can just “check the ledger” whenever operationally relevant. But clearly ownership cannot be enforced in an analogous way to Bitcoin, under both technical and social considerations. Technically, Bitcoin’s endogenous value means that whoever holds the keys to some or other UTXOs functionally is the owner. Somebody else claiming to be the owner is yelling at clouds. Whereas, socially, RWA issuers enter a contract with holders (whether legally or just in terms of a common-sense interpretation of the transaction) such that ownership of the asset issued against is entirely open to dispute. That somebody can point to “ownership” of the token may or may not mean anything substantive with respect to the physical reality of control of the asset, and how the issuer feels about it all.

And so, one wonders, why use a blockchain at all? Why doesn’t the issuer just run its own database (for the sake of argument with some or other signature scheme for verifying and auditing transactions) given it has the final say over issuance and redemption anyway? I hinted at an answer above: issuing on a blockchain outsources this task to public infrastructure. This is where things get interesting. While it is technically true, given the above few paragraphs, that, you don’t need a blockchain for that, you also don’t need to not use a blockchain for that. If you want to, you can.

This is clearly the case given stablecoins exist at all and have gone this route. If one gets too angry about not needing a blockchain for that, one equally risks yelling at clouds! And, in fact, one can make an even stronger argument, more so from the end users’ perspective. These products do not exist in a vacuum but rather compete with alternatives. In the case of stablecoins, the alternative is traditional fiat money, which, as stupid as RWAs on a blockchain are, is even dumber. It actually is just a database, except it’s a database that is extremely annoying to use, basically for political reasons because the industry managing these private databases form a cartel that never needs to innovate or really give a shit about its customers at all. In many, many cases, stablecoins on blockchains are dumb in the abstract, but superior to the alternative methods of holding and transacting in dollars existing in other forms. And note, this is only from Alice’s perspective of wanting to send and receive, not a rehashing of the fractional reserve argument given above. This is the essence of their product-market-fit. Yell at clouds all you like: they just are useful given the alternative usually is not Bitcoin, it’s JPMorgan’s KYC’d-up-the-wazoo 90s-era website, more than likely from an even less solvent bank.

So where does this get us? It might seem like we are back to “product-market-fit, sorry about that” with Bitcoiners yelling about feelings while everybody else makes do with their facts. However, I think we have introduced enough material to move the argument forward by incrementally incorporating the following observations, all of which I will shortly go into in more detail: i) as a consequence of making no technical sense with respect to what blockchains are for, today’s approach won’t scale; ii) as a consequence of short-termist tradeoffs around socializing costs, today’s approach creates an extremely unhealthy and arguably unnatural market dynamic in the issuer space; iii) Taproot Assets now exist and handily address both points i) and ii), and; iv) eCash is making strides that I believe will eventually replace even Taproot Assets.

To tease where all this is going, and to get the reader excited before we dive into much more detail: just as Bitcoin will eat all monetary premia, Lightning will likely eat all settlement, meaning all payments will gravitate towards routing over Lightning regardless of the denomination of the currency at the edges. Fiat payments will gravitate to stablecoins to take advantage of this; stablecoins will gravitate to TA and then to eCash, and all of this will accelerate hyperbitcoinization by “bitcoinizing” payment rails such that an eventual full transition becomes as simple as flicking a switch as to what denomination you want to receive.

I will make two important caveats before diving in that are more easily understood in light of having laid this groundwork: I am open to the idea that it won’t be just Lightning or just Taproot Assets playing the above roles. Without veering into forecasting the entire future development of Bitcoin tech, I will highlight that all that really matters here are, respectively: a true layer 2 with native hashlocks, and a token issuance scheme that enables atomic routing over such a layer 2 (or combination of such). For the sake of argument, the reader is welcome to swap in “Ark” and “RGB” for “Lightning” and “TA” both above and in all that follows. As far as I can tell, this makes no difference to the argument and is even exciting in its own right. However, for the sake of simplicity in presentation, I will stick to “Lightning” and “TA” hereafter.

1) Today’s Approach to Stablecoins Won’t Scale

This is the easiest to tick off and again doesn’t require much explanation to this audience. Blockchains fundamentally don’t scale, which is why Bitcoin’s UTXO scheme is a far better design than ex-Bitcoin Crypto’s’ account-based models, even entirely out of context of all the above criticisms. This is because Bitcoin transactions can be batched across time and across users with combinations of modes of spending restrictions that provide strong economic guarantees of correct eventual net settlement, if not perpetual deferral. One could argue this is a decent (if abstrusely technical) definition of “scaling” that is almost entirely lacking in Crypto.

What we see in ex-Bitcoin crypto is so-called “layer 2s” that are nothing of the sort, forcing stablecoin schemes in these environments into one of two equally poor design choices if usage is ever to increase: fees go higher and higher, to the point of economic unviability (and well past it) as blocks fill up, or move to much more centralized environments that increasingly are just databases, and hence which lose the benefits of openness thought to be gleaned by outsourcing settlement to public infrastructure. This could be in the form of punting issuance to a bullshit “layer 2” that is a really a multisig “backing” a private execution environment (to be decentralized any daw now) or an entirely different blockchain that is just pretending even less not to be a database to begin with. In a nutshell, this is a decent bottom-up explanation as to why Tron has the highest settlement of Tether.

This also gives rise to the weirdness of “gas tokens” - assets whose utility as money is and only is in the form of a transaction fee to transact a different kind of money. These are not quite as stupid as a “utility token,” given at least they are clearly fulfilling a monetary role and hence their artificial scarcity can be justified. But they are frustrating from Bitcoiners’ and users’ perspectives alike: users would prefer to pay transaction fees on dollars in dollars, but they can’t because the value of Ether, Sol, Tron, or whatever, is the string and bubblegum that hold their boondoggles together. And Bitcoiners wish this stuff would just go away and stop distracting people, whereas this string and bubblegum is proving transiently useful.

All in all, today’s approach is fine so long as it isn’t being used much. It has product-market fit, sure, but in the unenviable circumstance that, if it really starts to take off, it will break, and even the original users will find it unusable.

2) Today’s Approach to Stablecoins Creates an Untenable Market Dynamic

Reviving the ethos of you don’t need a blockchain for that, notice the following subtlety: while the tokens representing stablecoins have value to users, that value is not native to the blockchain on which they are issued. Tether can (and routinely does) burn tokens on Ethereum and mint them on Tron, then burn on Tron and mint on Solana, and so on. So-called blockchains “go down” and nobody really cares. This makes no difference whatsoever to Tether’s own accounting, and arguably a positive difference to users given these actions track market demand. But it is detrimental to the blockchain being switched away from by stripping it of “TVL” that, it turns out, was only using it as rails: entirely exogenous value that leaves as quickly as it arrived.

One underdiscussed and underappreciated implication of the fact that no value is natively running through the blockchain itself is that, in the current scheme, both the sender and receiver of a stablecoin have to trust the same issuer. This creates an extremely powerful network effect that, in theory, makes the first-to-market likely to dominate and in practice has played out exactly as this theory would suggest: Tether has roughly 80% of the issuance, while roughly 19% goes to the political carve-out of USDC that wouldn’t exist at all were it not for government interference. Everybody else combined makes up the final 1%.

So, Tether is a full reserve bank but also has to be everybody’s bank. This is the source of a lot of the discomfort with Tether, and which feeds into the original objection around dollar hegemony, that there is an ill-defined but nonetheless uneasy feeling that Tether is slowly morphing into a CBDC. I would argue this really has nothing to do with Tether’s own behavior but rather is a consequence of the market dynamic inevitably created by the current stablecoin scheme. There is no reason to trust any other bank because nobody really wants a bank, they just want the rails. They want something that will retain a nominal dollar value long enough to spend it again. They don’t care what tech it runs on and they don’t even really care about the issuer except insofar as having some sense they won’t get rugged.

Notice this is not how fiat works. Banks can, of course, settle between each other, thus enabling their users to send money to customers of other banks. This settlement function is actually the entire point of central banks, less the money printing and general corruption enabled (we might say, this was the historical point of central banks, which have since become irredeemably corrupted by this power). This process is clunkier than stablecoins, as covered above, but the very possibility of settlement means there is no gigantic network effect to being the first commercial issuer of dollar balances. If it isn’t too triggering to this audience, one might suggest that the money printer also removes the residual concern that your balances might get rugged! (or, we might again say, you guarantee you don’t get rugged in the short term by guaranteeing you do get rugged in the long term).

This is a good point at which to introduce the unsettling observation that broader fintech is catching on to the benefits of stablecoins without any awareness whatsoever of all the limitations I am outlining here. With the likes of Stripe, Wise, Robinhood, and, post-Trump, even many US megabanks supposedly contemplating issuing stablecoins (obviously within the current scheme, not the scheme I am building up to proposing), we are forced to boggle our minds considering how on earth settlement is going to work. Are they going to settle through Ether? Well, no, because i) Ether isn’t money, it’s … to be honest, I don’t think anybody really knows what it is supposed to be, or if they once did they aren’t pretending anymore, but anyway, Stripe certainly hasn’t figured that out yet so, ii) it won’t be possible to issue them on layer 1s as soon as there is any meaningful volume, meaning they will have to route through “bullshit layer 2 wrapped Ether token that is really already a kind of stablecoin for Ether.”

The way they are going to try to fix this (anybody wanna bet?) is routing through DEXes, which is so painfully dumb you should be laughing and, if you aren’t, I would humbly suggest you don’t get just how dumb it is. What this amounts to is plugging the gap of Ether’s lack of moneyness (and wrapped Ether’s hilarious lack of moneyness) with … drum roll … unknowable technical and counterparty risk and unpredictable cost on top of reverting to just being a database. So, in other words, all of the costs of using a blockchain when you don’t strictly need to, and none of the benefits. Stripe is going to waste billions of dollars getting sandwich attacked out of some utterly vanilla FX settlement it is facilitating for clients who have even less of an idea what is going on and why North Korea now has all their money, and will eventually realize they should have skipped their shitcoin phase and gone straight to understanding Bitcoin instead …

3) Bitcoin (and Taproot Assets) Fixes This

To tie together a few loose ends, I only threw in the hilariously stupid suggestion of settling through wrapped Ether on Ether on Ether in order to tee up the entirely sensible suggestion of settling through Lightning. Again, not that this will be new to this audience, but while issuance schemes have been around on Bitcoin for a long time, the breakthrough of Taproot Assets is essentially the ability to atomically route through Lightning.

I will admit upfront that this presents a massive bootstrapping challenge relative to the ex-Bitcoin Crypto approach, and it’s not obvious to me if or how this will be overcome. I include this caveat to make it clear I am not suggesting this is a given. It may not be, it’s just beyond the scope of this post (or frankly my ability) to predict. This is a problem for Lightning Labs, Tether, and whoever else decides to step up to issue. But even highlighting this as an obvious and major concern invites us to consider an intriguing contrast: scaling TA stablecoins is hardest at the start and gets easier and easier thereafter. The more edge liquidity there is in TA stables, the less of a risk it is for incremental issuance; the more TA activity, the more attractive deploying liquidity is into Lightning proper, and vice versa. With apologies if this metaphor is even more confusing than it is helpful, one might conceive of the situation as being that there is massive inertia to bootstrap, but equally there could be positive feedback in driving the inertia to scale. Again, I have no idea, and it hasn’t happened yet in practice, but in theory it’s fun.

More importantly to this conversation, however, this is almost exactly the opposite dynamic to the current scheme on other blockchains, which is basically free to start, but gets more and more expensive the more people try to use it. One might say it antiscales (I don’t think that’s a real word, but if Taleb can do it, then I can do it too!).

Furthermore, the entire concept of “settling in Bitcoin” makes perfect sense both economically and technically: economically because Bitcoin is money, and technically because it can be locked in an HTLC and hence can enable atomic routing (i.e. because Lightning is a thing). This is clearly better than wrapped Eth on Eth on Eth or whatever, but, tantalisingly, is better than fiat too! The core message of the payments tome I may or may not one day write is (or will be) that fiat payments, while superficially efficient on the basis of centralized and hence costless ledger amendments, actually have a hidden cost in the form of interbank credit. Many readers will likely have heard me say this multiple times and in multiple settings but, contrary to popular belief, there is no such thing as a fiat debit. Even if styled as a debit, all fiat payments are credits and all have credit risk baked into their cost, even if that is obscured and pushed to the absolute foundational level of money printing to keep banks solvent and hence keep payment channels open.

Furthermore! this enables us to strip away the untenable market dynamic from the point above. The underappreciated and underdiscussed flip side of the drawback of the current dynamic that is effectively fixed by Taproot Assets is that there is no longer a mammoth network effect to a single issuer. Senders and receivers can trust different issuers (i.e. their own banks) because those banks can atomically settle a single payment over Lightning. This does not involve credit. It is arguably the only true debit in the world across both the relevant economic and technical criteria: it routes through money with no innate credit risk, and it does so atomically due to that money’s native properties.

Savvy readers may have picked up on a seed I planted a while back and which can now delightfully blossom:

This is what Visa was supposed to be!

Crucially, this is not what Visa is now. Visa today is pretty much the bank that is everybody’s counterparty, takes a small credit risk for the privilege, and oozes free cash flow bottlenecking global consumer payments.

But if you read both One From Many by Dee Hock (for a first person but pretty wild and extravagant take) and Electronic Value Exchange by David Stearns (for a third person, drier, but more analytical and historically contextualized take) or if you are just intimately familiar with the modern history of payments for whatever other reason, you will see that the role I just described for Lightning in an environment of unboundedly many banks issuing fiduciary media in the form of stablecoins is exactly what Dee Hock wanted to create when he envisioned Visa:

A neutral and open layer of value settlement enabling banks to create digital, interbank payment schemes for their customers at very low cost.

As it turns out, his vision was technically impossible with fiat, hence Visa, which started as a cooperative amongst member banks, was corrupted into a duopolistic for-profit rent seeker in curious parallel to the historical path of central banks …

4) eCash

To now push the argument to what I think is its inevitable conclusion, it’s worth being even more vigilant on the front of you don’t need a blockchain for that. I have argued that there is a role for a blockchain in providing a neutral settlement layer to enable true debits of stablecoins. But note this is just a fancy and/or stupid way of saying that Bitcoin is both the best money and is programmable, which we all knew anyway. The final step is realizing that, while TA is nice in terms of providing a kind of “on ramp” for global payments infrastructure as a whole to reorient around Lightning, there is some path dependence here in assuming (almost certainly correctly) that the familiarity of stablecoins as “RWA tokens on a blockchain” will be an important part of the lure.

But once that transition is complete, or is well on its way to being irreversible, we may as well come full circle and cut out tokens altogether. Again, you really don’t need a blockchain for that, and the residual appeal of better rails has been taken care of with the above massive detour through what I deem to be the inevitability of Lightning as a settlement layer. Just as USDT on Tron arguably has better moneyness than a JPMorgan balance, so a “stablecoin” as eCash has better moneyness than as a TA given it is cheaper, more private, and has more relevantly bearer properties (in other words, because it is cash). The technical detail that it can be hashlocked is really all you need to tie this all together. That means it can be atomically locked into a Lightning routed debit to the recipient of a different issuer (or “mint” in eCash lingo, but note this means the same thing as what we have been calling fully reserved banks). And the economic incentive is pretty compelling too because, for all their benefits, there is still a cost to TAs given they are issued onchain and they require asset-specific liquidity to route on Lightning. Once the rest of the tech is in place, why bother? Keep your Lightning connectivity and just become a mint.

What you get at that point is dramatically superior private database to JPMorgan with the dramatically superior public rails of Lightning. There is nothing left to desire from “a blockchain” besides what Bitcoin is fundamentally for in the first place: counterparty-risk-free value settlement.

And as a final point with a curious and pleasing echo to Dee Hock at Visa, Calle has made the point repeatedly that David Chaum’s vision for eCash, while deeply philosophical besides the technical details, was actually pretty much impossible to operate on fiat. From an eCash perspective, fiat stablecoins within the above infrastructure setup are a dramatic improvement on anything previously possible. But, of course, they are a slippery slope to Bitcoin regardless …

Objections Revisited

As a cherry on top, I think the objections I highlighted at the outset are now readily addressed – to the extent the reader believes what I am suggesting is more or less a technical and economic inevitability, that is. While, sure, I’m not particularly keen on giving the Treasury more avenues to sell its welfare-warfare shitcoin, on balance the likely development I’ve outlined is an enormous net positive: it’s going to sell these anyway so I prefer a strong economic incentive to steadily transition not only to Lightning as payment rails but eCash as fiduciary media, and to use “fintech” as a carrot to induce a slow motion bank run.

As alluded to above, once all this is in place, the final step to a Bitcoin standard becomes as simple as an individual’s decision to want Bitcoin instead of fiat. On reflection, this is arguably the easiest part! It's setting up all the tech that puts people off, so trojan-horsing them with “faster, cheaper payment rails” seems like a genius long-term strategy.

And as to “needing a blockchain” (or not), I hope that is entirely wrapped up at this point. The only blockchain you need is Bitcoin, but to the extent people are still confused by this (which I think will take decades more to fully unwind), we may as well lean into dazzling them with whatever innovation buzzwords and decentralization theatre they were going to fall for anyway before realizing they wanted Bitcoin all along.

Conclusion

Stablecoins are useful whether you like it or not. They are stupid in the abstract but it turns out fiat is even stupider, on inspection. But you don’t need a blockchain, and using one as decentralization theatre creates technical debt that is insurmountable in the long run. Blockchain-based stablecoins are doomed to a utility inversely proportional to their usage, and just to rub it in, their ill-conceived design practically creates a commercial dynamic that mandates there only ever be a single issuer.

Given they are useful, it seems natural that this tension is going to blow up at some point. It also seems worthwhile observing that Taproot Asset stablecoins have almost the inverse problem and opposite commercial dynamic: they will be most expensive to use at the outset but get cheaper and cheaper as their usage grows. Also, there is no incentive towards a monopoly issuer but rather towards as many as are willing to try to operate well and provide value to their users.

As such, we can expect any sizable growth in stablecoins to migrate to TA out of technical and economic necessity. Once this has happened - or possibly while it is happening but is clearly not going to stop - we may as well strip out the TA component and just use eCash because you really don’t need a blockchain for that at all. And once all the money is on eCash, deciding you want to denominate it in Bitcoin is the simplest on-ramp to hyperbitcoinization you can possibly imagine, given we’ve spent the previous decade or two rebuilding all payments tech around Lightning.

Or: Bitcoin fixes this. The End.

- Allen, #892,125

thanks to Marco Argentieri, Lyn Alden, and Calle for comments and feedback

-

@ 4ba8e86d:89d32de4

2025-05-02 13:51:37

@ 4ba8e86d:89d32de4

2025-05-02 13:51:37Tutorial OpenKeychain

- Baixar no F-droid https://f-droid.org/app/org.sufficientlysecure.keychain

Ao abrir o OpenKeychain pela primeira vez, você verá uma tela inicial indicando que ainda não há chaves configuradas. Nesse ponto, você terá três opções:

-

Criar uma nova chave PGP diretamente no OpenKeychain: Ideal para quem está começando e precisa de uma solução simples para criptografia em comunicações diárias.

-

Usar um token de segurança (como Fidesmo, Yubikey, NEO, ou Sigilance) Se você busca uma segurança ainda maior, pode optar por armazenar sua chave privada em um token de segurança. Com essa configuração, a chave privada nunca é salva no dispositivo móvel. O celular atua apenas como uma interface de comunicação, enquanto a chave permanece protegida no token, fora do alcance de possíveis invasores remotos. Isso garante que somente quem possui o token fisicamente possa usar a chave, elevando significativamente o nível de segurança e controle sobre seus dados.

-