-

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50

@ 6ad3e2a3:c90b7740

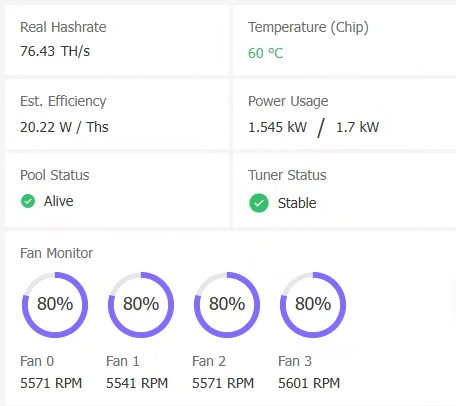

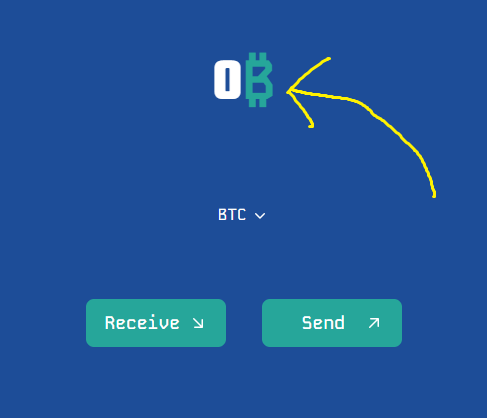

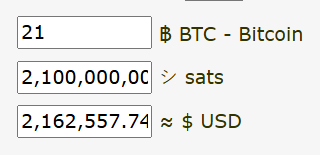

2025-05-20 13:49:50I’ve written about MSTR twice already, https://www.chrisliss.com/p/mstr and https://www.chrisliss.com/p/mstr-part-2, but I want to focus on legendary short seller James Chanos’ current trade wherein he buys bitcoin (via ETF) and shorts MSTR, in essence to “be like Mike” Saylor who sells MSTR shares at the market and uses them to add bitcoin to the company’s balance sheet. After all, if it’s good enough for Saylor, why shouldn’t everyone be doing it — shorting a company whose stock price is more than 2x its bitcoin holdings and using the proceeds to buy the bitcoin itself?

Saylor himself has said selling shares at 2x NAV (net asset value) to buy bitcoin is like selling dollars for two dollars each, and Chanos has apparently decided to get in while the getting (market cap more than 2x net asset value) is good. If the price of bitcoin moons, sending MSTR’s shares up, you are more than hedged in that event, too. At least that’s the theory.

The problem with this bet against MSTR’s mNAV, i.e., you are betting MSTR’s market cap will converge 1:1 toward its NAV in the short and medium term is this trade does not exist in a vacuum. Saylor has described how his ATM’s (at the market) sales of shares are accretive in BTC per share because of this very premium they carry. Yes, we’ll dilute your shares of the company, but because we’re getting you 2x the bitcoin per share, you are getting an ever smaller slice of an ever bigger overall pie, and the pie is growing 2x faster than your slice is reducing. (I https://www.chrisliss.com/p/mstr how this works in my first post.)

But for this accretion to continue, there must be a constant supply of “greater fools” to pony up for the infinitely printable shares which contain only half their value in underlying bitcoin. Yes, those shares will continue to accrete more BTC per share, but only if there are more fools willing to make this trade in the future. So will there be a constant supply of such “fools” to keep fueling MSTR’s mNAV multiple indefinitely?

Yes, there will be in my opinion because you have to look at the trade from the prospective fools’ perspective. Those “fools” are not trading bitcoin for MSTR, they are trading their dollars, selling other equities to raise them maybe, but in the end it’s a dollars for shares trade. They are not selling bitcoin for them.

You might object that those same dollars could buy bitcoin instead, so they are surely trading the opportunity cost of buying bitcoin for them, but if only 5-10 percent of the market (or less) is buying bitcoin itself, the bucket in which which those “fools” reside is the entire non-bitcoin-buying equity market. (And this is not considering the even larger debt market which Saylor has yet to tap in earnest.)

So for those 90-95 percent who do not and are not presently planning to own bitcoin itself, is buying MSTR a fool’s errand, so to speak? Not remotely. If MSTR shares are infinitely printable ATM, they are still less so than the dollar and other fiat currencies. And MSTR shares are backed 2:1 by bitcoin itself, while the fiat currencies are backed by absolutely nothing. So if you hold dollars or euros, trading them for MSTR shares is an errand more sage than foolish.

That’s why this trade (buying BTC and shorting MSTR) is so dangerous. Not only are there many people who won’t buy BTC buying MSTR, there are many funds and other investment entities who are only able to buy MSTR.

Do you want to get BTC at 1:1 with the 5-10 percent or MSTR backed 2:1 with the 90-95 percent. This is a bit like medical tests that have a 95 percent accuracy rate for an asymptomatic disease that only one percent of the population has. If someone tests positive, it’s more likely to be a false one than an indication he has the disease*. The accuracy rate, even at 19:1, is subservient to the size of the respective populations.

At some point this will no longer be the case, but so long as the understanding of bitcoin is not widespread, so long as the dollar is still the unit of account, the “greater fools” buying MSTR are still miles ahead of the greatest fools buying neither, and the stock price and mNAV should only increase.

. . .

One other thought: it’s more work to play defense than offense because the person on offense knows where he’s going, and the defender can only react to him once he moves. Similarly, Saylor by virtue of being the issuer of the shares knows when more will come online while Chanos and other short sellers are borrowing them to sell in reaction to Saylor’s strategy. At any given moment, Saylor can pause anytime, choosing to issue convertible debt or preferred shares with which to buy more bitcoin, and the shorts will not be given advance notice.

If the price runs, and there is no ATM that week because Saylor has stopped on a dime, so to speak, the shorts will be left having to scramble to change directions and buy the shares back to cover. Their momentum might be in the wrong direction, though, and like Allen Iverson breaking ankles with a crossover, Saylor might trigger a massive short squeeze, rocketing the share price ever higher. That’s why he actually welcomes Chanos et al trying this copycat strategy — it becomes the fuel for outsized gains.

For that reason, news that Chanos is shorting MSTR has not shaken my conviction, though there are other more pertinent https://www.chrisliss.com/p/mstr-part-2 with MSTR, of which one should be aware. And as always, do your own due diligence before investing in anything.

* To understand this, consider a population of 100,000, with one percent having a disease. That means 1,000 have it, 99,000 do not. If the test is 95 percent accurate, and everyone is tested, 950 of the 1,000 will test positive (true positives), 50 who have it will test negative (false negatives.) Of the positives, 95 percent of 99,000 (94,050) will test negative (true negatives) and five percent (4,950) will test positive (false positives). That means 4,950 out of 5,900 positives (84%) will be false.

-

@ 30b99916:3cc6e3fe

2025-05-20 23:00:17

@ 30b99916:3cc6e3fe

2025-05-20 23:00:17For all you COVID COWARDS out there perhaps you can redeem yourself by supporting America's Frontline Docters

History will show that the defeat of COVID tyranny wasn’t granted – it was won, case by case, voice by voice – and your support for America’s Frontline Doctors played an important role in this fight.

America 2020 – our nation faced a moment of truth.

Public health soldiers working for deep-state globalists unleashed tyranny in response to a virus - to terrorize us and dismantle our Constitution.

When I look back on the forces arrayed against us, I’m amazed more people did NOT stand up for their rights:

_Government agencies...hospitals...universities...corporations..._

...the state acting as our “savior” ...

...and Big Tech as the enforcer...

All joined forces to impose sweeping authoritarian mandates under the banners of public health and settled science.

_They declared freedom and liberty non-essential._

_They silenced, fired, shamed, and canceled ANYONE who dared question them._

ANYONE who resisted the masking, the lockdowns, the forced mRNA injections, are HEROS.

It angers me just thinking about what happened next.

Everyday Americans lost their livelihoods.

Parents watched as their children deteriorated after being locked out of their schools.

Doctors – some of the best in the country – were hunted down by their own licensing boards for practicing ACTUAL medicine instead of government-approved pseudoscience.

I hate to admit it, but tyranny triumphed.

The people had surrendered so much liberty that I didn’t recognize the nation our founders had forged.

I’m sure you didn’t either.

But while we can’t undo the past, we can make sure we don’t repeat it.

That is why America’s Frontline Doctors and I – with you alongside us – have been fighting back.

And together, we’ve been doing it case by case, supporting legal challenges against these unconstitutional, totalitarian mandates.

-

@ 2b998b04:86727e47

2025-05-20 22:15:45

@ 2b998b04:86727e47

2025-05-20 22:15:45I didn’t take a course on “prompt engineering.” I didn’t memorize secret formulas or chase viral hacks.

What I did do was treat it like a system.

Just like in software:

Write → Compile → Test → Debug → Repeat

With AI, the loop feels just as familiar:

Prompt → Output → Edit → Re-prompt

That’s not magic. That’s engineering.

When someone asked me, “How can you trust AI for anything serious?”\ I told them: “Same way we trust the internet — not because the network’s reliable, but because the protocol is.”

AI is no different. The key is building systems around it:

-

Multiple models if needed

-

Human-in-the-loop verification

-

Layered editing and real discernment

It’s Not That Different From Other Engineering

Once you stop treating AI like a black box and start treating it like a tool, the whole experience changes.

The prompt isn’t a spell. It’s a spec.\ The response isn’t a prophecy. It’s a build.\ And your discernment? That’s your QA layer.

What I Actually Use It For

-

Brainstorming titles and refining headlines

-

Drafting posts that I shape and filter

-

Running content through for edge cases

-

Exploring theological or philosophical questions

And yes — I want it to be useful. I am building to make a living, not just to make noise. But I don’t lead with monetization. I lead with clarity — and build toward sustainability.

Final Thought

If you’re waiting for a course to teach you how to “do AI,” maybe just start by building something real. Test it. Edit it. Use it again. That’s engineering.

Shoutout to Dr. C (ChatGPT) for helping me articulate this.

If this post sparked anything for you, zap a few sats ⚡ — every bit helps me keep building with conviction.

-

-

@ 3f770d65:7a745b24

2025-05-20 21:14:28

@ 3f770d65:7a745b24

2025-05-20 21:14:28I’m Derek Ross, and I’m all-in on Nostr.

I started the Grow Nostr Initiative to help more people discover what makes Nostr so powerful: ✅ You own your identity ✅ You choose your social graph and algorithms ✅ You aren't locked into any single app or platform ✅ You can post, stream, chat, and build, all without gatekeepers

What we’re doing with Grow Nostr Initiative: 🌱 Hosting local meetups and mini-conferences to onboard people face-to-face 📚 Creating educational materials and guides to demystify how Nostr works 🧩 Helping businesses and creators understand how they can plug into Nostr (running media servers, relays, and using key management tools)

I believe Nostr is the foundation of a more open internet. It’s still early, but we’re already seeing incredible apps for social, blogging, podcasting, livestreaming, and more. And the best part is that they're all interoperable, censorship-resistant, and built on open standards. Nostr is the world's largest bitcoin economy by transaction volume and I truly believe that the purple pill helps the orange pill go down. Meaning, growing Nostr will also grow Bitcoin adoption.

If you’ve been curious about Nostr or are building something on it, or let’s talk. Whether you're just getting started or you're already deep in the ecosystem, I'm here to answer questions, share what I’ve learned, and hear your ideas. Check out https://nostrapps.com to find your next social decentralized experience.

Ask Me Anything about GNI, Nostr, Bitcoin, the upcoming #NosVegas event at the Bitcoin Conference next week, etc.!

– Derek Ross 🌐 https://grownostr.org npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424

https://stacker.news/items/984689

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ ece127e2:745bab9c

2025-05-20 18:59:11

@ ece127e2:745bab9c

2025-05-20 18:59:11vamos a ver que tal

-

@ 57c631a3:07529a8e

2025-05-20 15:40:04

@ 57c631a3:07529a8e

2025-05-20 15:40:04The Video: The World's Biggest Toddler

https://connect-test.layer3.press/articles/3f9d28a4-0876-4ee8-bdac-d1a56fa9cd02

-

@ 662f9bff:8960f6b2

2025-05-20 18:52:01

@ 662f9bff:8960f6b2

2025-05-20 18:52:01April already and we are still refugees from the madness in HK. During March I had quite a few family matters that took priority and I also needed to work for two weeks. April is a similar schedule but we flew to Madeira for a change of scene and so that I could have a full 2-weeks off - my first real holiday in quite a few years!

We are staying in an airBnB in Funchal - an experience that I can totally recommend - video below! Nice to have an apartment that is fully equipped in a central location and no hassle for a few weeks. While here we are making the most of the great location and all the local possibiliites.

Elsewhere in the world

Things are clearly not going great around the world. If you are still confused as to why these things are happening, do go back and read the previous Letter from HK section "Why? How did we get here?"

You should be in no doubt that the "Great Reset" with its supporting "Great Narrative" is in full swing.. This is it - it is not a drill. For additional insights the following are recommended.

-

Jeff Booth discusses clearly and unemotionally with Pomp - Inflation is theft from humanity by the world governments

-

James' summary of Day 2 of the Miami conference - Peter Thiel (wow) and a fantastic explainer from Saifedean on the costs of the current corrupt financial system

-

James' summary of Day 3 of the Miami conference - listen in particular to the words of wisdom from Michael Saylor and Lyn Alden

-

Layered Money - The corruption of the system will blow your mind once you understand it…

-

This is BIG: Strike Is Bringing Freedom To Retail Merchants

-

Mark summarises Ray's book: Things will go faster and slower than you want!

-

Thoughtful words from George - evil is at work - be in no doubt..

-

Wow - My mind is blown. Must listen to John Carvalho - what clear ambition and answers to every question!

-

Related to the John Carvalho discussion. Likely these two options will end up complementing each other

On the personal and inspirational side

Advantage of time off work is that I have more time to read, listen and watch things that interest me. It really is a privilege that so much high quality material is so readily available. Do not let it go to waste. A few fabulous finds (and some re-finds) from this past week:

-

Ali Abdaal's bookshelf review just blew my mind! For the full list of books with links see the text under his video. So many inspirations and his delivery is perfect.

-

Gotta recommend Ali's 21 Life Lessons. I have been following him since he was student in Cambridge five years ago - his personal and professional growth and what he achieves (now with his team) is truely staggering.

-

Also his 15 books to read in 2022 - especially this one!

-

I also keep going back to Steve Jobs giving the 2005 Stanford Commencement address Three stories from his life - listen and be inspired - especially story #3

You will know that I am a fan of Audio Books and also Kindle - recently I am starting to use Whispersync where you get the Kindle- and Audio-books together for a nice price. This makes it easier to take notes (using Mac or iPad Kindle reader) while getting the benefit of having the book read to you by a professional reader.

I have also been inspired by a few people pushing themselves to do more reading - like this girl and Ali himself with his tips. Above all: just do it and do not get stuck on something that does not work for you!

Books that I am reading - Audio and Kindle!

-

The Final Empire: Mistborn, Book 1 - this is a new genre for me - I rather feel that it might be a bit too complicated for my engineering mind - let's see

-

Die with Zero: Getting All You Can from Your Money and Your Life - certainly provocative and obvious if you think about it but 99% do the opposite!

-

Chariots of the Gods - a classic by Erich von Daniken (written in 1968) - I have been inspired by his recent YT video appearances. Thought provoking and leads you to many possibilities.

So what's it like in Funchal, Madeira?

Do check out HitTheRoadMadeira's walking tour around Funchal

My first impressions of Funchal

and see my day out on Thursday!

Saturday - Funchal and Camar de Lobos

That's it!

No one can be told what The Matrix is.\ You have to see it for yourself.**

Do share this newsletter with any of your friends and family who might be interested.

You can also email me at: LetterFrom@rogerprice.me

💡Enjoy the newsletters in your own language : Dutch, French, German, Serbian, Chinese Traditional & Simplified, Thai and Burmese.

-

-

@ ecda4328:1278f072

2025-05-19 14:41:48

@ ecda4328:1278f072

2025-05-19 14:41:48An honest response to objections — and an answer to the most important question: why does any of this matter?

\ Statement: Deflation is not the enemy, but a natural state in an age of technological progress.\ Criticism: in real macroeconomics, long-term deflation is linked to depressions.\ Deflation discourages borrowers and investors, and makes debt heavier.\ Natural ≠ Safe.

1. “Deflation → Depression, Debt → Heavier”

This is true in a debt-based system. Yes, in a fiat economy, debt balloons to the sky, and without inflation it collapses.

But Bitcoin offers not “deflation for its own sake,” but an environment where you don’t need to be in debt to survive. Where savings don’t melt away.\ Jeff Booth said it clearly:

“Technology is inherently deflationary. Fighting deflation with the printing press is fighting progress.”

You don’t have to take on credit to live in this system. Which means — deflation is not an enemy, but an ally.

💡 People often confuse two concepts:

-

That deflation doesn’t work in an economy built on credit and leverage — that’s true.

-

That deflation itself is bad — that’s a myth.

📉 In reality, deflation is the natural state of a free market when technology makes everything cheaper.

Historical example:\ In the U.S., from the Civil War to the early 1900s, the economy experienced gentle deflation — alongside economic growth, employment expansion, and industrial boom.\ Prices fell: for example, a sack of flour cost \~$1.00 in 1865 and \~$0.50 in 1895 — and there was no crisis, because wages held and productivity increased.

Modern example:\ Consumer electronics over the past 20–30 years are a vivid example of technological deflation:\ – What cost $5,000 in 2000 (e.g., a 720p plasma TV) now costs $300 and delivers 10× better quality.\ – Phones, computers, cameras — all became far more powerful and cheaper at the same time.\ That’s how tech-driven deflation works: you get more for less.

📌 Bitcoin doesn’t make the world deflationary. It just doesn’t fight against deflation, unlike the fiat model that fights to preserve its debt pyramid.\ It stops punishing savers and rewards long-term thinkers.

Even economists often confuse organic tech deflation with crisis-driven (debt) deflation.

\ \ Statement: We’ve never lived in a truly free market — central banks and issuance always existed.\ Criticism: ideological statement.\ A truly “free” market is utopian.\ Banks and monetary issuance emerged in response to crises.\ A market without arbiters is not always fair, especially under imperfect competition.

2. “The Free Market Is a Utopia”

Yes, “pure markets” are rare. But what we have today isn’t regulation — it’s centralized power in the hands of central banks and cartels.

Bitcoin offers rules without rulers. 21 million. No one can change the issuance. It’s not ideology — it’s code instead of trust. And it has worked for 15 years.

\ \ Statement: Inflation is an invisible tax, especially on the poor and working class.\ Criticism: partly true: inflation can reduce debt burden, boost employment.\ The state indexes social benefits. Under stable inflation, compensators can work. Under deflation, things might be worse (mass layoffs, defaults).

3. “Inflation Can Help”

Theoretically — yes. Textbooks say moderate inflation can reduce debt burdens and stimulate consumption and jobs.\ But in practice — it works as a stealth tax, especially on those without assets. The wealthy escape — into real estate, stocks, funds.\ But the poor and working class lose purchasing power because their money is held in cash — and cash devalues.

💬 As Lyn Alden says:

“When your money can’t hold value, you’re forced to become an investor — even if you just want to save and live.”

The state may index pensions or benefits — but always with a lag, and always less than actual price increases.\ If bread rises 15% and your payment increase is 5%, you got poorer, even if the number on paper went up.

💥 We live in an inflationary system of everything:\ – Inflationary money\ – Inflationary products\ – Inflationary content\ – And now even inflationary minds

🧠 This is more than just rising prices — it’s a degradation of reality perception. You’re always rushing, everything loses meaning.\ But when did the system start working against you?

📉 What went wrong after 1971?

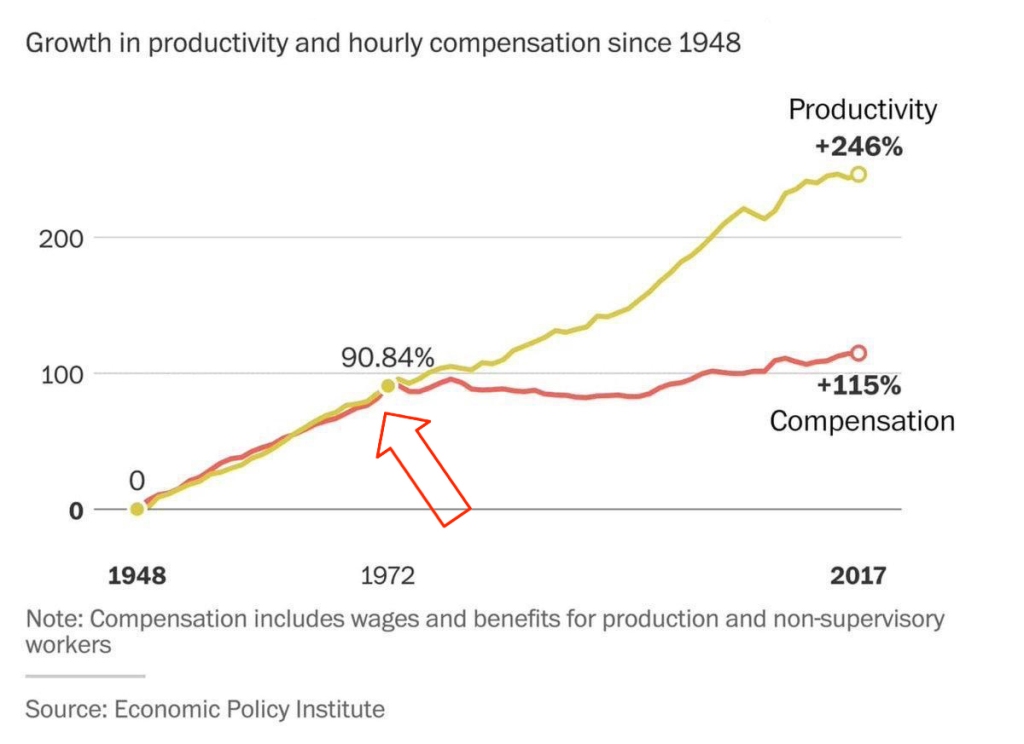

This chart shows that from 1948 to the early 1970s, productivity and wages grew together.\

But after the end of the gold standard in 1971 — the connection broke. Productivity kept rising, but real wages stalled.

This chart shows that from 1948 to the early 1970s, productivity and wages grew together.\

But after the end of the gold standard in 1971 — the connection broke. Productivity kept rising, but real wages stalled.👉 This means: you work more, better, faster — but buy less.

🔗 Source: wtfhappenedin1971.com

When you must spend today because tomorrow it’ll be worth less — that’s rewarding impulse and punishing long-term thinking.

Bitcoin offers a different environment:\ – Savings work\ – Long-term thinking is rewarded\ – The price of the future is calculated, not forced by a printing press

📌 Inflation can be a tool. But in government hands, it became a weapon — a slow, inevitable upward redistribution of wealth.

Indexing is weak compensation if bread is up 15% and your “increase” is only 5%.

\ \ Statement: War is not growth, but a reallocation of resources into destruction.

Criticism: war can spur technological leaps (Internet, GPS, nuclear energy — all from military programs). "Military Keynesianism" was a real model.

4. “War Drives R&D”

Yes, wars sometimes give rise to tech spin-offs: Internet, GPS, nuclear power — all originated from military programs.

But that doesn’t make war a source of progress — it makes tech a byproduct of catastrophe.

“War reallocates resources toward destruction — not growth.”

Progress doesn’t happen because of war — it happens despite it.

If scientific breakthroughs require a million dead and burnt cities — maybe you’ve built your economy wrong.

💬 Even Michael Saylor said:

“If you need war to develop technology — you’ve built civilization wrong.”

No innovation justifies diverting human labor, minds, and resources toward destruction.\ War is always the opposite of efficiency — more is wasted than created.

🧠 Bitcoin, on the other hand, is an example of how real R&D happens without violence.\ No taxes. No army. Just math, voluntary participation, and open-source code.

📌 Military Keynesianism is not a model of progress — it’s a symptom of a sick monetary system that needs destruction to reboot.

Bitcoin shows that coordination without violence is possible.\ This is R&D of a new kind: based not on destruction, but digital creation.

Statement: Bitcoin isn’t “Gold 1.0,” but an improved version: divisible, verifiable, unseizable.

Criticism: Bitcoin has no physical value; "unseizability" is a theory;\ Gold is material and autonomous.

5. “Bitcoin Has No Physical Value”

And gold does? Just because it shines?

Physical form is no guarantee of value.\ Real value lies in: scarcity, reliable transfer, verifiability, and non-confiscatability.

Gold is:\ – Hard to divide\ – Hard to verify\ – Expensive to store\ – Easy to seize

💡 Bitcoin is the first store of value in history that is fully free from physical limitations, and yet:\ – Absolutely scarce (21M, forever)\ – Instantly transferable over the Internet\ – Cryptographically verifiable\ – Controlled by no government

🔑 Bitcoin’s value lies in its liberation from the physical.\ It doesn’t need to be “backed” by gold or oil. It’s backed by energy, mathematics, and ongoing verification.

“Price is what you pay, value is what you get.” — Warren Buffett

When you buy bitcoin, you’re not paying for a “token” — you’re gaining access to a network of distributed financial energy.

⚡️ What are you really getting when you own bitcoin?\ – A key to a digital asset that can’t be faked\ – The ability to send “crystallized energy” anywhere on Earth\ – A role in a new accounting system that runs 24/7/365\ – Freedom: from banks, borders, inflation, and force

📉 Bitcoin doesn’t require physical value — because it creates value:\ Through trust, scarcity, and energy invested in mining.\ And unlike gold, it was never associated with slavery.

Statement: There’s no “income without risk” in Bitcoin: just hold — you preserve; want more — invest, risk, build.

Criticism: contradicts HODL logic; speculation remains dominant behavior.

6. “Speculation Dominates”

For now — yes. That’s normal for the early phase of a new technology. Awareness doesn’t come instantly.

What matters is not the motive of today’s buyer — but what they’re buying.

📉 A speculator may come and go — but the asset remains.\ And this asset is the only one in history that will never exist again. 21 million. Forever.

📌 Look deeper. Bitcoin has:\ – No CEO\ – No central issuer\ – No inflation\ – No “off switch”

💡 It’s not a stock. Not a startup. Not someone’s project.\ It’s a new foundation for trust.\ It’s opting out of a system where freedom is a privilege you’re granted under conditions.

🧠 People say: “Bitcoin can be copied.”\ Theoretically — yes.\ Practically — never.

Here’s what you’d need to recreate Bitcoin:\ – No pre-mine\ – A founder who disappears and never sells\ – No foundation or corporation\ – Tens of thousands of nodes worldwide\ – 701 million terahashes of hash power\ – Thousands of devs writing open protocols\ – Hundreds of global conferences\ – Millions of people defending digital sovereignty\ – All that without a single marketing budget

That’s all.

🔁 Everything else is an imitation, not a creation.\ Just like you can’t “reinvent fire” — Bitcoin can only exist once.

Statements:\ The Russia's '90s weren’t a free market — just anarchic chaos without rights protection.*\ Unlike fiat or even dollars, Bitcoin is the first asset with real defense — from governments, inflation, even thugs.\ And yes, even if your barber asks about Bitcoin — maybe it's not a bubble, but a sign that inflation has already hit everyone.

Criticism: Bitcoin’s protection isn’t universal — it works only with proper handling and isn’t available to all.\ Some just want to “get rich.”\ None of this matters because:

-

Bitcoin’s volatility (-30% in a week, +50% in a month) makes it unusable for price planning or contracts.

-

It can’t handle mass-scale usage.

-

To become currency, geopolitical will is needed — and without the first two, don’t even talk about the third.\ Also: “Bitcoin is too complicated for the average person.”

7. “It’s Too Complex for the Masses”

It’s complex — if you’re using L1 (Layer 1). But even grandmas use Telegram. In El Salvador, schoolkids buy lunch with Lightning. My barber installed Wallet of Satoshi in minutes right in front of me — and I now pay for my haircut via Lightning.

UX is just a matter of time. And it’s improving. Emerging tools:\ Cashu, Fedimint, Fedi, Wallet of Satoshi, Phoenix, Proton Wallet, Swiss Bitcoin Pay, Bolt Card / CoinCorner (NFC cards for Lightning payments).

This is like the internet in 1995:\ It started with modems — now it’s 4K streaming.

8. “Can’t Handle the Load”

A common myth.\ Yes, Bitcoin L1 processes about 7 transactions per second — intentionally. It’s not built to be Visa. It’s a financial protocol, just like TCP/IP is a network protocol. TCP/IP isn’t “fast” or “slow” — the experience depends on the infrastructure built on top: servers, routers, hardware. In the ’90s, it delivered text. Today, it streams Netflix. The protocol didn’t change — the stack did.

Same with Bitcoin: L1 defines rules, security, finality.\ Scaling and speed? That’s the second layer’s job.

To understand scale:

| Network | TPS (Transactions/sec) | | --- | --- | | Visa | up to 24,000 | | Mastercard | \~5,000 | | PayPal | \~193 | | Litecoin | \~56 | | Ethereum | \~20 | | Bitcoin | \~7 |

\ ⚡️ Enter Lightning Network — Bitcoin’s “fast lane.”\ It allows millions of transactions per second, instantly and nearly free.

And it’s not a sidechain.

❗️ Lightning is not a separate network.\ It uses real Bitcoin transactions (2-of-2 multisig). You can close the channel to L1 at any time. It’s not an alternative — it’s a native extension built into Bitcoin.\ Also evolving: Ark, Fedimint, eCash — new ways to scale and add privacy.

📉 So criticizing Bitcoin for “slowness” is like blaming TCP/IP because your old modem won’t stream YouTube.\ The protocol isn’t the problem — it’s the infrastructure.

🛡️ And by the way: Visa crashes more often than Bitcoin.

9. “We Need Geopolitical Will”

Not necessarily. All it takes is the will of the people — and leaders willing to act. El Salvador didn’t wait for G20 approval or IMF blessings. Since 2001, the country had used the US dollar as its official currency, abandoning its own colón. But that didn’t save it from inflation or dependency on foreign monetary policy. In 2021, El Salvador became the first country to recognize Bitcoin as legal tender. Since March 13, 2024, they’ve been purchasing 1 BTC daily, tracked through their public address:

🔗 Address\ 📅 First transaction

This policy became the foundation of their Strategic Bitcoin Reserve (SBR) — a state-led effort to accumulate Bitcoin as a national reserve asset for long-term stability and sovereignty.

Their example inspired others.

In March 2025, U.S. President Donald Trump signed an executive order creating the Strategic Bitcoin Reserve of the USA, to be funded through confiscated Bitcoin and digital assets.\ The idea: accumulate, don’t sell, and strategically expand the reserve — without extra burden on taxpayers.

Additionally, Senator Cynthia Lummis (Wyoming) proposed the BITCOIN Act, targeting the purchase of 1 million BTC over five years (\~5% of the total supply).\ The plan: fund it via revaluation of gold certificates and other budget-neutral strategies.

📚 More: Strategic Bitcoin Reserve — Wikipedia

👉 So no global consensus is required. No IMF greenlight.\ All it takes is conviction — and an understanding that the future of finance lies in decentralized, scarce assets like Bitcoin.

10. “-30% in a week, +50% in a month = not money”

True — Bitcoin is volatile. But that’s normal for new technologies and emerging money. It’s not a bug — it’s a price discovery phase. The world is still learning what this asset is.

📉 Volatility is the price of entry.\ 📈 But the reward is buying the future at a discount.

As Michael Saylor put it:

“A tourist sees Niagara Falls as chaos — roaring, foaming, spraying water.\ An engineer sees immense energy.\ It all depends on your mental model.”

Same with Bitcoin. Speculators see chaos. Investors see structural scarcity. Builders see a new financial foundation.

💡 Now consider gold:

👉 After the U.S. abandoned the gold standard in 1971, gold surged from \~$35 to over $800 in a decade — while suffering wild -40% to -60% crashes along the way.\ \ 📈 Gold Price Chart — Macrotrends\ \ Nobody said, “This can’t be money.” \ Because money is defined not by volatility, but by scarcity, adoption, and trust — which build over time.

📊 The more people save in Bitcoin, the more its volatility fades.

This is a journey — not a fixed state.

We don’t judge the internet by how it worked in 1994.\ So why expect Bitcoin to be the “perfect currency” in 2025?

It grows bottom-up — without regulators’ permission.\ And the longer it survives, the stronger it becomes.

Remember how many times it’s been declared dead.\ And how many times it came back — stronger.

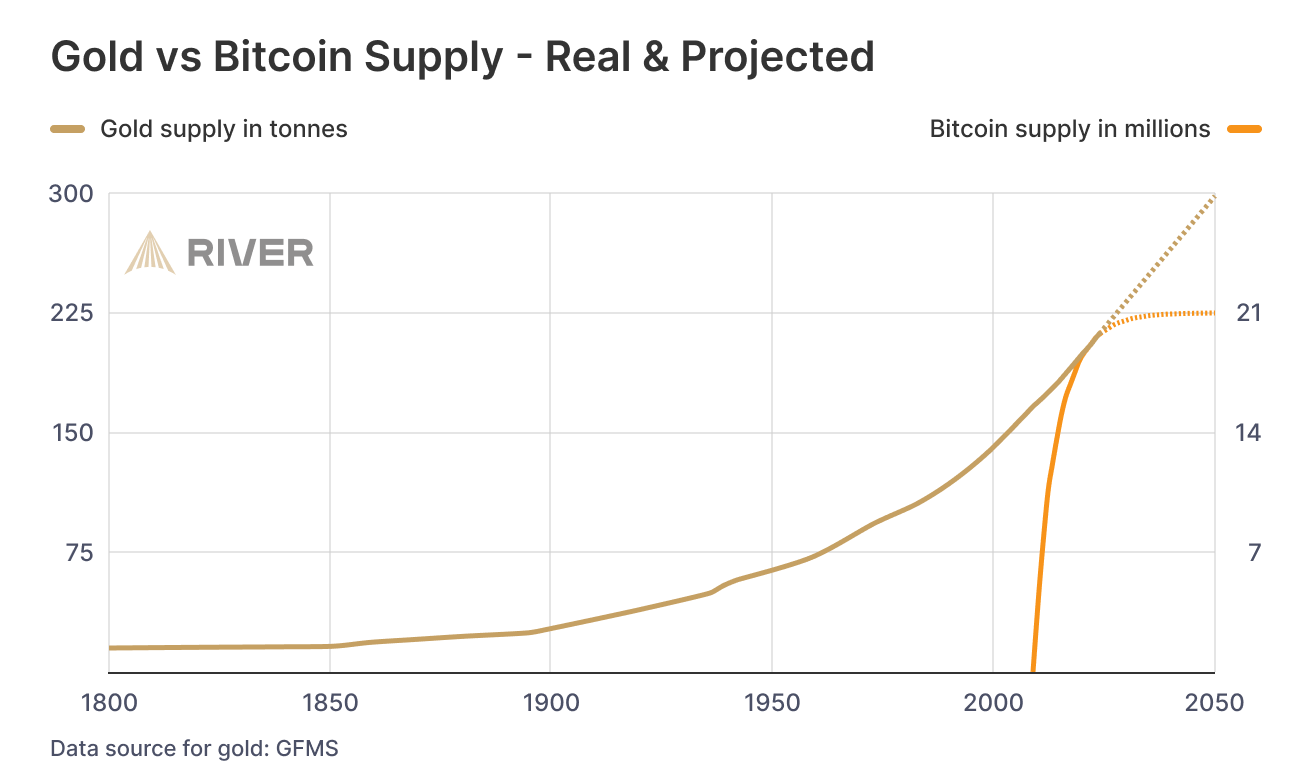

📊 Gold vs. Bitcoin: Supply Comparison

This chart shows the key difference between the two hard assets:

🔹 Gold — supply keeps growing.\ Mining may be limited, but it’s still inflationary.\ Each year, there’s more — with no known cap: new mines, asteroid mining, recycling.

🔸 Bitcoin — capped at 21 million.\ The emission schedule is public, mathematically predictable, and ends completely around 2140.

🧠 Bottom line:\ Gold is good.\ Bitcoin is better — for predictability and scarcity.

💡 As Saifedean Ammous said:

“Gold was the best monetary good… until Bitcoin.”

While we argue — fiat erodes every day.

No matter your view on Bitcoin, just show me one other asset that is simultaneously:

– immune to devaluation by decree\ – impossible to print more of\ – impossible to confiscate by a centralized order\ – impossible to counterfeit\ – and, most importantly — transferable across borders without asking permission from a bank, a state, or a passport

💸 Try sending $10,000 through PayPal from Iran to Paraguay, or Bangladesh to Saint Lucia.\ Good luck. PayPal doesn't even work there.

Now open a laptop, type 12 words — and you have access to your savings anywhere on Earth.

🌍 Bitcoin doesn't ask for permission.\ It works for everyone, everywhere, all the time.

📌 There has never been anything like this before.

Bitcoin is the first asset in history that combines:

– digital nature\ – predictable scarcity\ – absolute portability\ – and immunity from tyranny

💡 As Michael Saylor said:

“Bitcoin is the first money in human history not created by bankers or politicians — but by engineers.”

You can own it with no bank.\ No intermediary.\ No passport.\ No approval.

That’s why Bitcoin isn’t just “internet money” or “crypto” or “digital gold.”\ It may not be perfect — but it’s incorruptible.\ And it’s not going away.\ It’s already here.\ It is the foundation of a new financial reality.

🔒 This is not speculation. This is a peaceful financial revolution.\ 🪙 This is not a stock. It’s money — like the world has never seen.\ ⛓️ This is not a fad. It’s a freedom protocol.

And when even the barber starts asking about Bitcoin — it’s not a bubble.\ It’s a sign that the system is breaking.\ And people are looking for an exit.

For the first time — they have one.

💼 This is not about investing. It’s about the dignity of work.

Imagine a man who cleans toilets at an airport every day.

Not a “prestigious” job.\ But a crucial one.\ Without him — filth, bacteria, disease.

He shows up on time. He works with his hands.

And his money? It devalues. Every day.

He doesn’t work less — often he works more than those in suits.\ But he can afford less and less — because in this system, honest labor loses value each year.

Now imagine he’s paid in Bitcoin.

Not in some “volatile coin,” but in hard money — with a limited supply.\ Money that can’t be printed, reversed, or devalued by central banks.

💡 Then he could:

– Stop rushing to spend, knowing his labor won’t be worth less tomorrow\ – Save for a dream — without fear of inflation eating it away\ – Feel that his time and effort are respected — because they retain value

Bitcoin gives anyone — engineer or janitor — a way out of the game rigged against them.\ A chance to finally build a future where savings are real.

This is economic justice.\ This is digital dignity.

📉 In fiat, you have to spend — or your money melts.\ 📈 In Bitcoin, you choose when to spend — because it’s up to you.

🧠 In a deflationary economy, both saving and spending are healthy:

You don’t scramble to survive — you choose to create.

🎯 That’s true freedom.

When even someone cleaning floors can live without fear —\ and know that their time doesn’t vanish... it turns into value.

-

-

@ c9badfea:610f861a

2025-05-20 17:05:41

@ c9badfea:610f861a

2025-05-20 17:05:41- Install YTDLnis (it's free and open source)

- Launch the app and allow notifications and storage access if prompted

- Go to any supported website or use the YouTube, Instagram, X, or Facebook app

- Tap Share on the post or website URL and select YTDLnis as the sharing destination

- Adjust the settings if desired and tap Download

- You'll be notified when the download finishes

- Enjoy uninterrupted watching!

ℹ️ This app uses

yt-dlpinternally and it's also available as a standalone CLI tool -

@ 472f440f:5669301e

2025-05-20 13:01:09

@ 472f440f:5669301e

2025-05-20 13:01:09Marty's Bent

via me

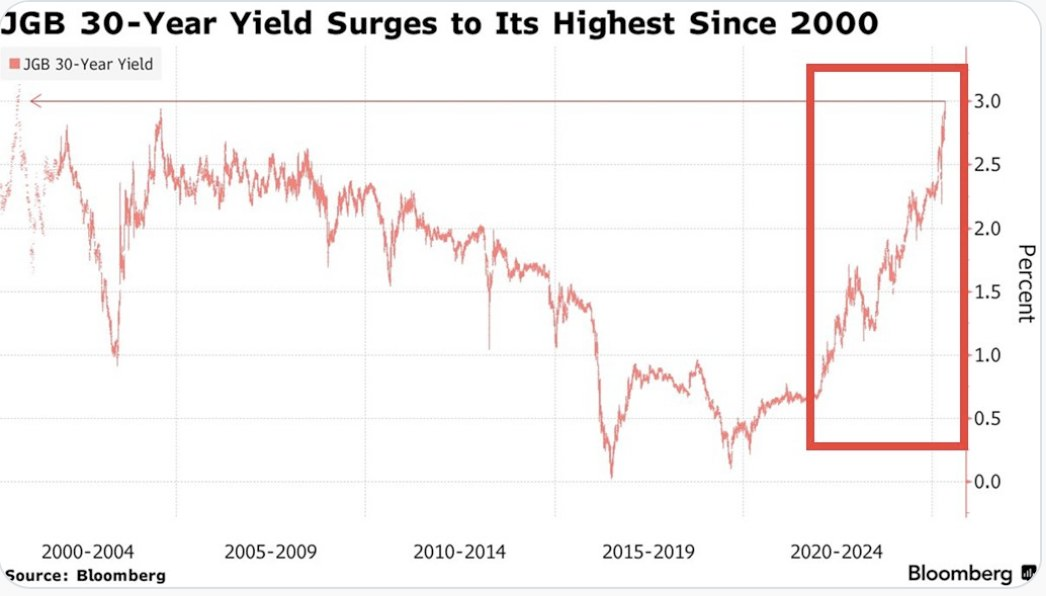

Don't sleep on what's happening in Japan right now. We've been covering the country and the fact that they've lost control of their yield curve since late last year. After many years of making it a top priority from a monetary policy perspective, last year the Bank of Japan decided to give up on yield curve control in an attempt to reel inflation. This has sent yields for the 30-year and 40-year Japanese government bonds to levels not seen since the early 2000s in the case of the 30-year and levels never before seen for the 40-year, which was launched in 2007. With a debt to GDP ratio that has surpassed 250% and a population that is aging out with an insufficient amount of births to replace the aging workforce, it's hard to see how Japan can get out of this conundrum without some sort of economic collapse.

This puts the United States in a tough position considering the fact that Japan is one of the largest holders of U.S. Treasury bonds with more than 1,135 sats | $1.20 trillion in exposure. If things get too out of control in Japan and the yield curve continues to drift higher and inflation continues to creep higher Japan can find itself in a situation where it's a forced seller of US Treasuries as they attempt to strengthen the yen. Another aspect to consider is the fact that investors may see the higher yields on Japanese government bonds and decide to purchase them instead of US Treasuries. This is something to keep an eye on in the weeks to come. Particularly if higher rates drive a higher cost of capital, which leads to even more inflation. As producers are forced to increase their prices to ensure that they can manage their debt repayments.

It's never a good sign when the Japanese Prime Minister is coming out to proclaim that his country's financial situation is worse than Greece's, which has been a laughing stock of Europe for the better part of three decades. Japan is a very proud nation, and the fact that its Prime Minister made a statement like this should not be underappreciated.

As we noted last week, the 10-year and 30-year U.S. Treasury bonds are drifting higher as well. Earlier today, the 30-year bond yield surpassed 5%, which has been a psychological level that many have been pointed to as a critical tipping point. When you take a step back and look around the world it seems pretty clear that bond markets are sending a very strong signal. And that signal is that something is not well in the back end of the financial system.

This is even made clear when you look at the private sector, particularly at consumer debt. In late March, we warned of the growing trend of buy now, pay later schemes drifting down market as major credit card companies released charge-off data which showed charge-off rates reaching levels not seen since the 2008 great financial crisis. At the time, we could only surmise that Klarna was experiencing similar charge-off rates on the bigger-ticket items they financed and started doing deals with companies like DoorDash to finance burrito deliveries in an attempt to move down market to finance smaller ticket items with a higher potential of getting paid back. It seems like that inclination was correct as Klarna released data earlier today showing more losses on their book as consumers find it extremely hard to pay back their debts.

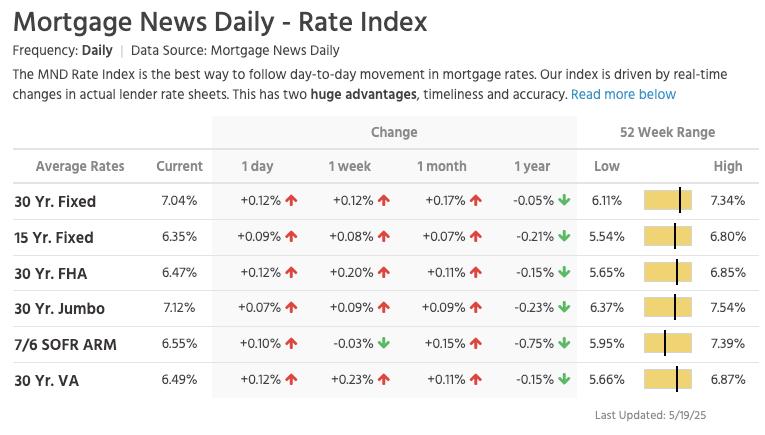

via NewsWire

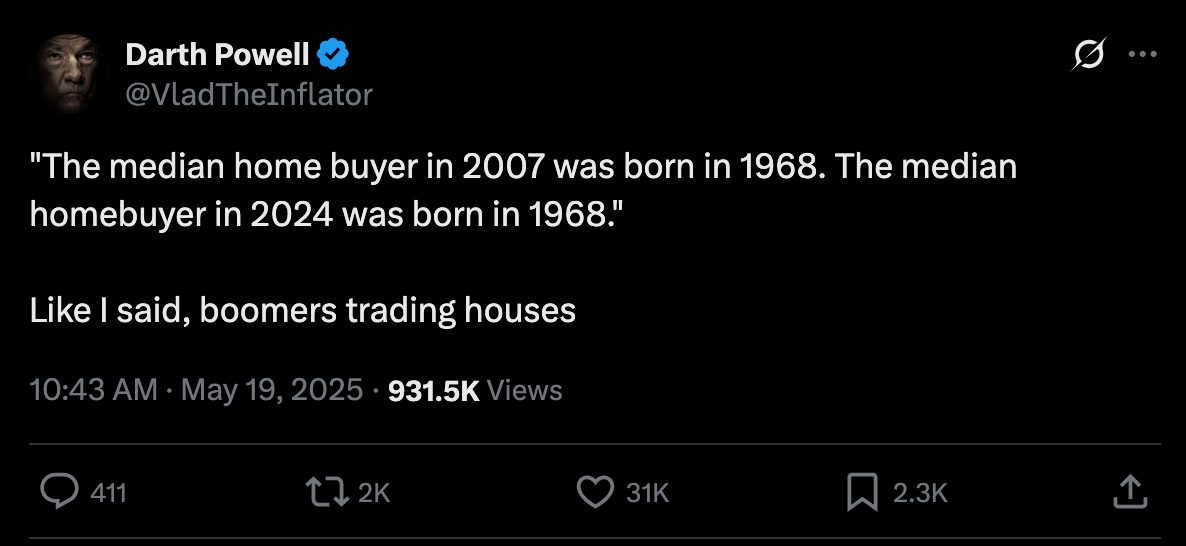

This news hit the markets on the same day as the average rate of the 30-year mortgage in the United States rose to 7.04%. I'm not sure if you've checked lately, but real estate prices are still relatively elevated outside of a few big cities who expanded supply significantly during the COVID era as people flooded out of blue states towards red states. It's hard to imagine that many people can afford a house based off of sticker price alone, but with a 7% 30-year mortgage rate it's becoming clear that the ability of the Common Man to buy a house is simply becoming impossible.

via Lance Lambert

The mortgage rate data is not the only thing you need to look at to understand that it's becoming impossible for the Common Man of working age to buy a house. New data has recently been released that highlights That the median home buyer in 2007 was born in 1968, and the median home buyer in 2024 was born in 1968. Truly wild when you think of it. As our friend Darth Powell cheekily highlights below, we find ourselves in a situation where boomers are simply trading houses and the younger generations are becoming indentured slaves. Forever destined to rent because of the complete inability to afford to buy a house.

via Darth Powell

via Yahoo Finance

Meanwhile, Bitcoin re-approached all-time highs late this evening and looks primed for another breakout to the upside. This makes sense if you're paying attention. The high-velocity trash economy running on an obscene amount of debt in both the public and private sectors seems to be breaking at the seams. All the alarm bells are signaling that another big print is coming. And if you hope to preserve your purchasing power or, ideally, increase it as the big print approaches, the only thing that makes sense is to funnel your money into the hardest asset in the world, which is Bitcoin.

via Bitbo

Buckle up, freaks. It's gonna be a bumpy ride. Stay humble, Stack Sats.

Trump's Middle East Peace Strategy: Redefining U.S. Foreign Policy

In his recent Middle East tour, President Trump signaled what our guest Dr. Anas Alhajji calls "a major change in US policy." Trump explicitly rejected the nation-building strategies of his predecessors, contrasting the devastation in Afghanistan and Iraq with the prosperity of countries like Saudi Arabia and UAE. This marks a profound shift from both Republican and Democratic foreign policy orthodoxy. As Alhajji noted, Trump's willingness to meet with Syrian President Assad follows a historical pattern where former adversaries eventually become diplomatic partners.

"This is really one of the most important shifts in US foreign policy to say, look, sorry, we destroyed those countries because we tried to rebuild them and it was a big mistake." - Dr. Anas Alhajji

The administration's new approach emphasizes negotiation over intervention. Rather than military solutions, Trump is engaging with groups previously considered off-limits, including the Houthis, Hamas, and Iran. This pragmatic stance prioritizes economic cooperation and regional stability over ideological confrontation. The focus on trade deals and investment rather than regime change represents a fundamental reimagining of America's role in the Middle East.

Check out the full podcast here for more on the Iran nuclear situation, energy market predictions, and why AI development could create power grid challenges. Only on TFTC Studio.

Headlines of the Day

Bitcoin Soars to 100,217 sats | $106.00K While Bonds Lose 40% Since 2020 - via X

US Senate Advances Stablecoin Bill As America Embraces Bitcoin - via X

Get our new STACK SATS hat - via tftcmerch.io

Texas House Debates Bill For State-Run Bitcoin Reserve - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Don't let the noise consume you. Focus on making your life 1% better every day.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ e4950c93:1b99eccd

2025-05-20 11:06:09

@ e4950c93:1b99eccd

2025-05-20 11:06:09Contenu à venir.

-

@ b83a28b7:35919450

2025-05-16 19:26:56

@ b83a28b7:35919450

2025-05-16 19:26:56This article was originally part of the sermon of Plebchain Radio Episode 111 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ 0b118e40:4edc09cb

2025-05-15 15:40:21

@ 0b118e40:4edc09cb

2025-05-15 15:40:21My week started off with a lovely message from a friend : “I often think about you. Especially during times when it requires me to be more resilient and have faith in myself. I always carry your note in the book you gave me, “what the dog saw” And it always gives me courage and I send a little prayer your way”.

This friend of mine was dealing with the undercurrent of discrimination in my alma mater when we first met, and I helped out. It's something anybody would have done, but surprisingly, nobody else showed up. We’ve stayed in touch over the years, and my friend went on to help a lot of other people along the way.

I don’t remember what I wrote in that note. It’s something I tend to do (write notes, give books, write notes in books). But the message boomeranged back to me at a time when I needed to hold the line. To keep the faith.

Most of us don’t talk about our struggles. And sometimes the smallest act, which could just be a kind word or a reminder of the person you are, can carry farther than we imagine.

On the act of giving

There’s a book called Give and Take by Adam Grant. I picked it up hoping to learn how to take, because it’s always been easier to give and harder to accept help. But what I learned was something else entirely.

Grant studied over 30,000 people across different companies and grouped them into three types: * Givers * Matchers * Takers

Based on his studies, givers often finish last... They struggle the most. They burn out. They get overlooked. They’re too trusting.

But oddly, they also rise to the very top.

Matchers are the scorekeepers, the “I’ll help you if you help me” kind. They make up most of the population. The fascinating thing about tit-for-tat is that if someone’s kind, they reciprocate. But if someone acts like a jerk, they return the energy, and over time, it becomes a pool of spoiled milk. Matchers are a lukewarm, forgettable kind of network.

Takers are the ones chasing attention, always aligning themselves with whoever looks powerful. They tend to float toward status and soak up what they can. But they often portray themselves as kind and giving.

One example Grant shared was Enron's Kenneth Lay, who was at the center of one of the biggest corporate scandals in U.S. history. He hung around wherever he’d get seen or validated. He funded both Bush and Clinton, hedging his bets on who might win by securing proximity. Sadly, when Enron crumbled, he died of a heart attack before his prison sentencing.

Most people steer clear from takers because they are just exhausting. And takers often collapse under the weight of their own games.

But takers aren’t the lowest performers. That spot belongs to a certain kind of giver—the self-neglecting kind. The ones with no boundaries, no clarity, and no self-awareness. They give in to avoid conflict, to feel worthy, or because they don’t know how to say no. And when life breaks them, they point fingers.

Then there’s the other kind of giver. The ones who build trust and build people up without asking for a receipt.

These givers: 1. Give without expectation, from a place of purpose 2. Build and uplift others without seeking credit 3. Set boundaries and walk away when giving turns into draining

This group of givers rarely talk much about what they do for others. But when you hear about it or see it, it stays with you. It makes you want to show up a little better.

Why open source environments feels like home

The more I thought about it, the more I saw how deeply open source reflects that kind of giving that ends up right at the top.

In open source, you don’t last if it’s just about ego. You can’t fake it. There are no titles, no awards. You either show up to build and help, or you don’t.

People who give without needing to be seen are the ones the community leans on. You can tell when someone’s pretending to care. It’s in their tone, their urgency and their sense of transaction. The genuine ones don’t need to brand themselves as generous. They just are.

Open source works because giving is the default setting. The work speaks volumes and generosity compounds. The system filters for people who show up with purpose and stay consistent.

It’s also why the ones who whine, posture, or manipulate rarely last. They might call themselves givers, but they’re not fooling anyone who’s actually doing the work.

Adam Grant found that for giver cultures to thrive, takers have to be removed. They need to be pruned. Because takers poison the well. They drain givers, shift the culture from contribution to calculation, and unravel the trust that holds open systems together.

When hope boomerangs

That note is something I don’t remember writing. But it found its way back to me, and it was a good reminder to take my own advice and keep the faith.

And maybe that’s the point.

You do a small thing. And years later, it circles back when it matters most. Not because you expected it. But because you mattered.

According to Grant, givers do best when they combine generosity with grit and strategy. They create networks built on goodwill, which eventually open doors others don’t even know exist.

So if you’re wondering where I’m going with this, do something genuinely kind for someone today. Even if it’s as simple as sending a kind note. Not for you to be seen or heard. And not for you to keep scores.

But, just because.

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 39cc53c9:27168656

2025-05-20 10:45:15

@ 39cc53c9:27168656

2025-05-20 10:45:15After almost 3 months of work, we've completed the redesign of kycnot.me. More modern and with many new features.

Privacy remains the foundation - everything still works with JavaScript disabled. If you enable JS, you will get some nice-to-have features like lazy loading and smoother page transitions, but nothing essential requires it.

User Accounts

We've introduced user accounts that require zero personal information:

- Secret user tokens - no email, no phone number, no personal data

- Randomly generated usernames for default privacy and fairness

- Karma system that rewards contributions and unlocks features: custom display names, profile pictures, and more.

Reviews and Community Discussions

On the previous sites, I was using third party open source tools for the comments and discussions. This time, I've built my own from scratch, fully integrated into the site, without JavaScript requirements.

Everyone can share their experiences and help others make informed decisions:

- Ratings: Comments can have a 1-5 star rating attached. You can have one rating per service and it will affect the overall user score.

- Discussions: These are normal comments, you can add them on any listed service.

Comment Moderation

I was strugling to keep up with moderation on the old site. For this, we've implemented an AI-powered moderation system that:

- Auto-approves legitimate comments instantly

- Flags suspicious content for human review

- Keeps discussions valuable by minimizing spam

The AI still can mark comments for human review, but most comments will get approved automatically by this system. The AI also makes summaries of the comments to help you understand the overall sentiment of the community.

Powerful Search & Filtering

Finding exactly what you need is now easier:

- Advanced filtering system with many parameters. You can even filter by attributes to pinpoint services with specific features.

The results are dynamic and shuffle services with identical scores for fairness.

See all listings

Listings are now added as 'Community Contributed' by default. This means that you can still find them in the search results, but they will be clearly marked as such.

Updated Scoring System

New dual-score approach provides more nuanced service evaluations:

- Privacy Score: Measures how well a service protects your personal information and data

-

Trust Score: Assesses reliability, security, and overall reputation

-

Combined into a weighted Overall Score for quick comparisons

- Completely transparent and open source calculation algorithm. No manual tweaking or hidden factors.

AI-Powered Terms of Service Analysis

Basically, a TLDR summary for Terms of Service:

- Automated system extracts the most important points from complex ToS documents

- Clear summaries

- Updated monthly to catch any changes

The ToS document is hashed and only will be updated if there are any changes.

Service Events and Timelines

Track the complete history of any service, on each service page you can see the timeline of events. There are two types of events:

- Automatic events: Created by the system whenever something about a service changes, like its description, supported currencies, attributes, verification status…

- Manual events: Added by admins when there’s important news, such as a service going offline, being hacked, acquired, shut down, or other major updates.

There is also a global timeline view available at /events

Notification System

Since we now have user accounts, we built a notifiaction system so you can stay informed about anything:

- Notifications for comment replies and status changes

- Watch any comment to get notified for new replies.

- Subscribe to services to monitor events and updates

- Notification customization.

Coming soon: Third-party privacy-preserving notifications integration with Telegram, Ntfy.sh, webhooks...

Service Suggestions

Anyone with an account can suggest a new service via the suggestion form. After submitting, you'll receive a tracking page where you can follow the status of your suggestion and communicate directly with admins.

All new suggestions start as "unlisted" — they won't appear in search results until reviewed. Our team checks each submission to ensure it's not spam or inappropriate. If similar services already exist, you'll be shown possible duplicates and can choose to submit your suggestion as an edit instead.

You can always check the progress of your suggestion, respond to moderator questions, and see when it goes live, everything will also be notified to your account. This process ensures high-quality listings and a collaborative approach to building the directory.

These are some of the main features we already have, but there are many more small changes and improvements that you will find when using the site.

What's Next?

This is just the beginning. We will be constantly working to improve KYCnot.me and add more features that help you preserve your privacy.

Remember: True financial freedom requires the right to privacy. Stay KYC-free!

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:48

@ 04c915da:3dfbecc9

2025-05-20 15:50:48For years American bitcoin miners have argued for more efficient and free energy markets. It benefits everyone if our energy infrastructure is as efficient and robust as possible. Unfortunately, broken incentives have led to increased regulation throughout the sector, incentivizing less efficient energy sources such as solar and wind at the detriment of more efficient alternatives.

The result has been less reliable energy infrastructure for all Americans and increased energy costs across the board. This naturally has a direct impact on bitcoin miners: increased energy costs make them less competitive globally.

Bitcoin mining represents a global energy market that does not require permission to participate. Anyone can plug a mining computer into power and internet to get paid the current dynamic market price for their work in bitcoin. Using cellphone or satellite internet, these mines can be located anywhere in the world, sourcing the cheapest power available.

Absent of regulation, bitcoin mining naturally incentivizes the build out of highly efficient and robust energy infrastructure. Unfortunately that world does not exist and burdensome regulations remain the biggest threat for US based mining businesses. Jurisdictional arbitrage gives miners the option of moving to a friendlier country but that naturally comes with its own costs.

Enter AI. With the rapid development and release of AI tools comes the requirement of running massive datacenters for their models. Major tech companies are scrambling to secure machines, rack space, and cheap energy to run full suites of AI enabled tools and services. The most valuable and powerful tech companies in America have stumbled into an accidental alliance with bitcoin miners: THE NEED FOR CHEAP AND RELIABLE ENERGY.

Our government is corrupt. Money talks. These companies will push for energy freedom and it will greatly benefit us all.

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:22

@ 04c915da:3dfbecc9

2025-05-20 15:50:22There is something quietly rebellious about stacking sats. In a world obsessed with instant gratification, choosing to patiently accumulate Bitcoin, one sat at a time, feels like a middle finger to the hype machine. But to do it right, you have got to stay humble. Stack too hard with your head in the clouds, and you will trip over your own ego before the next halving even hits.

Small Wins

Stacking sats is not glamorous. Discipline. Stacking every day, week, or month, no matter the price, and letting time do the heavy lifting. Humility lives in that consistency. You are not trying to outsmart the market or prove you are the next "crypto" prophet. Just a regular person, betting on a system you believe in, one humble stack at a time. Folks get rekt chasing the highs. They ape into some shitcoin pump, shout about it online, then go silent when they inevitably get rekt. The ones who last? They stack. Just keep showing up. Consistency. Humility in action. Know the game is long, and you are not bigger than it.

Ego is Volatile

Bitcoin’s swings can mess with your head. One day you are up 20%, feeling like a genius and the next down 30%, questioning everything. Ego will have you panic selling at the bottom or over leveraging the top. Staying humble means patience, a true bitcoin zen. Do not try to "beat” Bitcoin. Ride it. Stack what you can afford, live your life, and let compounding work its magic.

Simplicity

There is a beauty in how stacking sats forces you to rethink value. A sat is worth less than a penny today, but every time you grab a few thousand, you plant a seed. It is not about flaunting wealth but rather building it, quietly, without fanfare. That mindset spills over. Cut out the noise: the overpriced coffee, fancy watches, the status games that drain your wallet. Humility is good for your soul and your stack. I have a buddy who has been stacking since 2015. Never talks about it unless you ask. Lives in a decent place, drives an old truck, and just keeps stacking. He is not chasing clout, he is chasing freedom. That is the vibe: less ego, more sats, all grounded in life.

The Big Picture

Stack those sats. Do it quietly, do it consistently, and do not let the green days puff you up or the red days break you down. Humility is the secret sauce, it keeps you grounded while the world spins wild. In a decade, when you look back and smile, it will not be because you shouted the loudest. It will be because you stayed the course, one sat at a time. \ \ Stay Humble and Stack Sats. 🫡

-

@ 0971cd37:53c969f4

2025-05-20 17:00:53

@ 0971cd37:53c969f4

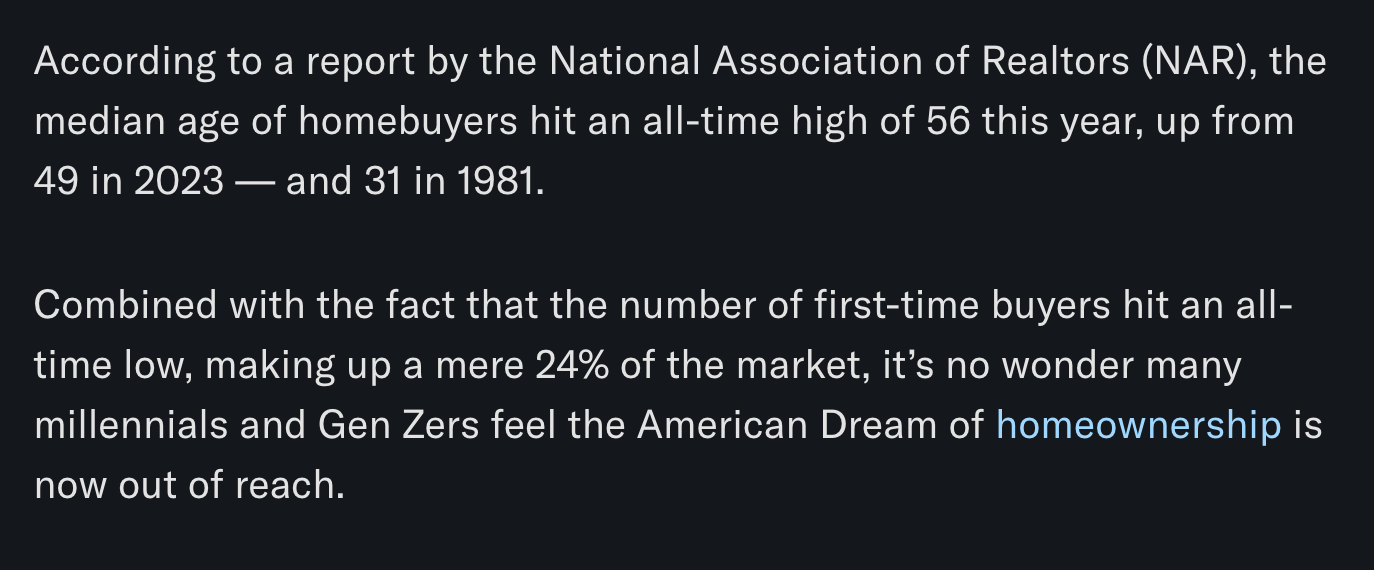

2025-05-20 17:00:53ลดต้นทุนค่าไฟ เพิ่มความคุ้มค่าให้การขุด Bitcoin ที่บ้าน ในยุคที่ต้นทุนพลังงานสูงขึ้นอย่างต่อเนื่อง นักขุด Bitcoin ที่บ้าน หรือ Home Miner ต้องคิดให้รอบคอบก่อนเลือกเครื่องขุด เพราะ “แรงขุดสูงสุด” ไม่ได้แปลว่า “กำไรดีที่สุด” อีกต่อไป การเลือกเครื่องขุดไม่ใช่แค่ดูแค่แรงขุด (Hashrate) สูงสุดเท่านั้น แต่ต้องพิจารณาเรื่อง "การกินไฟ" และ "ความคุ้มค่าในการใช้งานระยะยาว" ด้วย ซึ่งสายหนึ่งที่ได้รับความนิยมมากขึ้นเรื่อย ๆ ก็คือ สาย Tuning Power หรือการจูนเครื่องขุดเพื่อให้ได้อัตราส่วน Hashrate/Watt ที่ดีที่สุด

เทรนด์ใหม่ของวงการขุดคือสาย Tuning Power หรือการปรับแต่งพลังงานของเครื่องขุด Bitcoin (ASIC) ให้ได้ ประสิทธิภาพ Hashrate ต่อการใช้พลังงาน (Efficiency) สูงที่สุด ซึ่งเหมาะอย่างยิ่งสำหรับการขุดในบ้านที่มีข้อจำกัดด้านค่าไฟ ความร้อน และ เสียงรบกวน

Tuning Power คืออะไร? Tuning Power คือการปรับลดแรงขุดของเครื่อง ASIC ลงเล็กน้อย เพื่อให้กินไฟน้อยลงแบบชัดเจน

ตัวอย่างเช่น Custom Firmware Braiins OS ใช้กับ Antminer S19jpro จากเดิมแรงขุด 104 TH/s กินไฟ 3,500W เมื่อปรับแต่งในส่วน Power Target จูนเหลือ 75 TH/s อาจกินไฟแค่ 1,600W-1,800W หลังจาก Tuning ค่าประสิทธิภาพ(Efficiency)ดีขึ้น เช่น จาก 32 J/TH เหลือเพียง 22–20 J/TH

หมายเหตุ: ค่า Efficiency ยิ่งต่ำ ยิ่งดี แปลว่าใช้พลังงานน้อยต่อ 1 TH

หมายเหตุ: ค่า Efficiency ยิ่งต่ำ ยิ่งดี แปลว่าใช้พลังงานน้อยต่อ 1 THทำไมต้อง Tuning Power? การจูนพลังงาน (Tuning Power) คือการปรับแต่งเครื่องขุด เช่น ASIC ให้ทำงานที่แรงขุดไม่เต็ม 100% แต่กินไฟน้อยลงอย่างชัดเจน ส่งผลให้:

- ประหยัดค่าไฟ โดยเฉพาะถ้าขุดในพื้นที่ต้นทุนพลังงานค่าไฟสูงหรือไม่มี TOU (Time of Use) และ เหมาะสำหรับผู้ใช้ไฟแบบ TOU ที่ค่าไฟกลางวัน ON-Peak แพง ต้องการขุดเลือกช่วงกลางคืนและวันหยุดเสาร์-อาทิตย์ และ วันหยุดราชการตามปกติ Off-Peak , ที่ใช้ระบบ Solar หรือมีระบบ Battery ต้องการประหยัดไฟ

- ลดความร้อนของเครื่อง ทำให้ยืดอายุการใช้งานและลดค่าใช้จ่ายด้าน ซำบำรุง ระบบระบายความร้อน

- เพิ่มความคุ้มค่า ในช่วงตลาดหมี ที่กำไรจากการขุดต่ำ การลดต้นทุนไฟฟ้าคือทางรอดหลัก

เครื่องขุด Bitcoin (ASIC) รุ่นไหน ที่เหมาะกับสาย Tuning Power

-

Antminer รองรับ Custom Firmware เช่น Braiins OS ที่เป็นยอดนิยมในการ Tuning Power

-

WhatsMiner M30-M60s Series ขึ้นไป ใช้โปรแกรม WhatsMinerTool เพื่อทำการ Tuning Power ได้โดยตรงไม่จำเป็นต้อง Custom Firmware

สรุป การเป็น Home Miner ที่ยั่งยืนไม่ได้ขึ้นกับว่าเครื่องขุดแรงแค่ไหน แต่ขึ้นกับว่า “จ่ายค่าไฟแล้วเหลือกำไรหรือไม่ หรือ จ่ายค่าไฟแล้วคุ้มค้ารายได้ Bitcoin จากการขุดจำนวนที่ได้รับมากขึ้นหรือไม่” การเลือกเครื่องขุดสำหรับสาย Tuning Power จึงเป็นทางเลือกที่ตอบโจทย์ผู้ที่ต้องการประสิทธิภาพสูงในต้นทุนที่ควบคุมได้โดยเฉพาะในยุคที่ตลาดผันผวน และ ค่าไฟฟ้าคือศัตรูตัวจริงของนักขุด

-

@ d360efec:14907b5f

2025-05-13 00:39:56

@ d360efec:14907b5f

2025-05-13 00:39:56🚀📉 #BTC วิเคราะห์ H2! พุ่งชน 105K แล้วเจอแรงขาย... จับตา FVG 100.5K เป็นจุดวัดใจ! 👀📊

จากากรวิเคราะห์ทางเทคนิคสำหรับ #Bitcoin ในกรอบเวลา H2:

สัปดาห์ที่แล้ว #BTC ได้เบรคและพุ่งขึ้นอย่างแข็งแกร่งค่ะ 📈⚡ แต่เมื่อวันจันทร์ที่ผ่านมา ราคาได้ขึ้นไปชนแนวต้านบริเวณ 105,000 ดอลลาร์ แล้วเจอแรงขายย่อตัวลงมาตลอดทั้งวันค่ะ 🧱📉

ตอนนี้ ระดับที่น่าจับตาอย่างยิ่งคือโซน H4 FVG (Fair Value Gap ในกราฟ 4 ชั่วโมง) ที่ 100,500 ดอลลาร์ ค่ะ 🎯 (FVG คือโซนที่ราคาวิ่งผ่านไปเร็วๆ และมักเป็นบริเวณที่ราคามีโอกาสกลับมาทดสอบ/เติมเต็ม)

👇 โซน FVG ที่ 100.5K นี้ ยังคงเป็น Area of Interest ที่น่าสนใจสำหรับมองหาจังหวะ Long เพื่อลุ้นการขึ้นในคลื่นลูกถัดไปค่ะ!

🤔💡 อย่างไรก็ตาม การตัดสินใจเข้า Long หรือเทรดที่บริเวณนี้ ขึ้นอยู่กับว่าราคา แสดงปฏิกิริยาอย่างไรเมื่อมาถึงโซน 100.5K นี้ เพื่อยืนยันสัญญาณสำหรับการเคลื่อนไหวที่จะขึ้นสูงกว่าเดิมค่ะ!

เฝ้าดู Price Action ที่ระดับนี้อย่างใกล้ชิดนะคะ! 📍

BTC #Bitcoin #Crypto #คริปโต #TechnicalAnalysis #Trading #FVG #FairValueGap #PriceAction #MarketAnalysis #ลงทุนคริปโต #วิเคราะห์กราฟ #TradeSetup #ข่าวคริปโต #ตลาดคริปโต

-

@ d360efec:14907b5f

2025-05-12 04:01:23

@ d360efec:14907b5f

2025-05-12 04:01:23 -

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ d360efec:14907b5f

2025-05-12 01:34:24

@ d360efec:14907b5f

2025-05-12 01:34:24สวัสดีค่ะเพื่อนๆ นักเทรดที่น่ารักทุกคน! 💕 Lina Engword กลับมาพร้อมกับการวิเคราะห์ BTCUSDT.P แบบเจาะลึกเพื่อเตรียมพร้อมสำหรับเทรดวันนี้ค่ะ! 🚀

วันนี้ 12 พฤษภาคม 2568 เวลา 08.15น. ราคา BTCUSDT.P อยู่ที่ 104,642.8 USDT ค่ะ โดยมี Previous Weekly High (PWH) อยู่ที่ 104,967.8 Previous Weekly Low (PWL) ที่ 93,338 ค่ะ

✨ ภาพรวมตลาดวันนี้ ✨

จากการวิเคราะห์ด้วยเครื่องมือคู่ใจของเรา ทั้ง SMC/ICT (Demand/Supply Zone, Order Block, Liquidity), EMA 50/200, Trend Strength, Money Flow, Chart/Price Pattern, Premium/Discount Zone, Trend line, Fibonacci, Elliott Wave และ Dow Theory ใน Timeframe ตั้งแต่ 15m ไปจนถึง Week! 📊 เราพบว่าภาพใหญ่ของ BTCUSDT.P ยังคงอยู่ในแนวโน้มขาขึ้นที่แข็งแกร่งมากๆ ค่ะ 👍 โดยเฉพาะใน Timeframe Day และ Week ที่สัญญาณทุกอย่างสนับสนุนทิศทางขาขึ้นอย่างชัดเจน Money Flow ยังไหลเข้าอย่างต่อเนื่อง และเราเห็นโครงสร้างตลาดแบบ Dow Theory ที่ยก High ยก Low ขึ้นไปเรื่อยๆ ค่ะ

อย่างไรก็ตาม... ใน Timeframe สั้นๆ อย่าง 15m และ 1H เริ่มเห็นสัญญาณของการชะลอตัวและการพักฐานบ้างแล้วค่ะ 📉 อาจมีการสร้าง Buyside และ Sellside Liquidity รอให้ราคาไปกวาดก่อนที่จะเลือกทางใดทางหนึ่ง ซึ่งเป็นเรื่องปกติของการเดินทางของ Smart Money ค่ะ

⚡ เปรียบเทียบแนวโน้มแต่ละ Timeframe ⚡

🪙 แนวโน้มตรงกัน Timeframe 4H, Day, Week ส่วนใหญ่ชี้ไปทาง "ขาขึ้น" ค่ะ ทุกเครื่องมือสนับสนุนแนวโน้มนี้อย่างแข็งแกร่ง 💪 เป้าหมายต่อไปคือการไปทดสอบ PWH และ High เดิม เพื่อสร้าง All-Time High ใหม่ค่ะ! 🪙 แนวโน้มต่างกัน Timeframe 15m, 1H ยังค่อนข้าง "Sideways" หรือ "Sideways Down เล็กน้อย" ค่ะ มีการบีบตัวของราคาและอาจมีการพักฐานสั้นๆ ซึ่งเป็นโอกาสในการหาจังหวะเข้า Long ที่ราคาดีขึ้นค่ะ

💡 วิธีคิดแบบ Market Slayer 💡

เมื่อแนวโน้มใหญ่เป็นขาขึ้นที่แข็งแกร่ง เราจะเน้นหาจังหวะเข้า Long เป็นหลักค่ะ การย่อตัวลงมาในระยะสั้นคือโอกาสของเราในการเก็บของ! 🛍️ เราจะใช้หลักการ SMC/ICT หาโซน Demand หรือ Order Block ที่ Smart Money อาจจะเข้ามาดันราคาขึ้น และรอสัญญาณ Price Action ยืนยันการกลับตัวค่ะ

สรุปแนวโน้มวันนี้: