-

@ da8b7de1:c0164aee

2025-06-05 17:39:41

@ da8b7de1:c0164aee

2025-06-05 17:39:41| Régió/Ország | Fő esemény/politika | Forrás | |------------------|--------------------------------------------------------------------------------------------------|-------------| | Egyesült Államok | Végrehajtási rendeletek a nukleáris termelés négyszeresére növeléséről; a nem létfontosságú K+F költségvetésének csökkentése; SMR és mikroreaktor kezdeményezések | world-nuclear-news, nucnet, aoshearman, ans | | Kanada | Engedélyezés új BWRX-300 SMR reaktor építésére Darlingtonban | world-nuclear-news, ans | | Európa | EU tervek az orosz nukleáris importok korlátozására; Westinghouse–Bulgária beszállítói megállapodások | nucnet, world-nuclear-news | | Globális/Világbank | A nukleáris finanszírozási tilalom esetleges feloldása a fejlődő országok számára | globalissues | | Egyesült Királyság| Új kiberbiztonsági jogszabályok a nukleáris szektorban | aoshearman | | Katonaság/Védelem| A védelmi minisztérium cégeket választott ki mikroreaktorok telepítésére | ans |

Források:

world-nuclear-news

nucnet

aoshearman

globalissues

ans -

@ 58537364:705b4b85

2025-06-05 15:55:12

@ 58537364:705b4b85

2025-06-05 15:55:12อารมณ์ คือ โลก - โลก คือ อารมณ์ อารมณ์ ในโลกปัจจุบันรวมอยู่ที่ วัตถุนิยม อารมณ์ จึงเป็นปัจจัยแห่งเหตุการณ์ทุกอย่างในโลก

…. “ เดี๋ยวนี้คําว่า “อารมณ์” ในภาษาไทยนั้น หมายถึงความรู้สึกในใจมากกว่า; เช่น พื้นเพของจิตใจในขณะนั้นเป็นอย่างไร, เรียกว่าอารมณ์ของเขาเป็นอย่างไร, อารมณ์กําลังดี อารมณ์กําลังไม่ดี, นี่ คําว่าอารมณ์ในภาษาไทยใช้กันไปเสียอย่างนี้ ; มันคนละเรื่องกับในภาษาบาลี ซึ่งคําว่า “อารมณ์” หมายถึง สิ่งที่จะเข้ามากระทบ ตา หู จมูก ลิ้น กาย ใจ.

…. ถ้ากระทบแล้วเกิดความรู้สึกอย่างไร งุ่นง่านอยู่ในใจ อันนั้นไม่ได้เรียกว่าอารมณ์; อันนั้นก็เรียกว่ากิเลสอย่างอื่น เช่น เรียกว่าตัณหาบ้าง อุปาทานบ้าง; ถ้าจัดเป็นพวกขันธ์ ก็เรียกว่า เวทนาขันธ์บ้าง สัญญาขันธ์บ้าง สังขารขันธ์บ้าง; ถ้าเป็นความคิดที่งุ่นง่านก็เรียกว่า “สังขารขันธ์” ทั้งนั้น ดังนั้น เราจะต้องถือเอาคําว่าอารมณ์ในบาลีมาเป็นหลัก …. คําว่า อารมณ์ ที่จะเข้าใจกันง่ายๆ ก็หมายความว่า รูป เสียง กลิ่น รส โผฏฐัพพะ ที่จะมากระทบ ตา หู จมูก ลิ้น กาย นี้ ๕ อย่าง แล้วก็ความรู้สึกเก่าแก่ที่จะมาผุดขึ้นในใจอีก เรียกว่า ธัมมารมณ์ ที่จะมากระทบใจในปัจจุบันนี้ นี้ก็เป็นอันหนึ่ง เลยได้เป็นอารมณ์ ๖. อารมณ์กระทบ ตา หู จมูก ลิ้น กาย ๕ อย่างข้างนอกนี้ก็สําคัญไปพวกหนึ่ง ที่ปรุงขึ้นภายในสําหรับกระทบใจโดยไม่ต้องอาศัย ตา หู จมูก ลิ้น กาย ใจ เลย ในเวลานั้นก็ยังมีอยู่นี้เรียกว่าธัมมารมณ์ นี้ก็ยิ่งสําคัญ: แต่ว่ารวมกันแล้วก็เรียกว่า อารมณ์ ได้ด้วยกันทั้งนั้น แปลว่า สิ่งที่จะมากระทบกับ ตา หู จมูก ลิ้น กาย ใจ นั่นเอง

…. นี้ ดูให้ละเอียดตามตัวหนังสือ คําว่า “อารมณ์” แปลว่า ที่หน่วงบ้าง แปลว่า ที่ยินดีบ้าง, มันมีความหมายละเอียดมาก. ถ้าถือเอาความหมายอย่างคนที่มีตัวตนเป็นหลัก ธรรมะในฝ่ายฮินดูหรือฝ่ายพรหมณ์เขาก็จะพูดว่า สําหรับจิตหรืออาตมันเข้าไปจับฉวยเอา. แต่ถ้าพูดอย่างภาษาชาวพุทธพูดอย่างนั้นไม่ได้ เพราะไม่มีจิตไม่มีอาตมันชนิดนั้น แล้วจิตนี้ก็เพิ่งเกิดขึ้นหลังอารมณ์กระทบแล้ว; เลยต้องพูดตามพระบาลีที่ว่า อาศัยตาด้วย อาศัยรูปด้วย ย่อมเกิดจักษุวิญญาณ; ตาอาศัยกับรูปคืออารมณ์นั้นได้แล้วจึงจะเกิดจักษุวิญญาณ วิญญาณหรือจิตนี้เกิดทีหลัง

…. ฉะนั้น จึงไม่พูดว่า อารมณ์นี้เป็นสิ่งสําหรับจิตหรือตัวตนเข้าไปจับฉวยยึดเอา; ถ้าพูดอย่างนั้นมันก็จะเป็นฮินดูหรือพราหมณ์ไป คือมีตัวตนไป. พูดอย่างพุทธไม่มีตัวตน ทุกอย่างไม่ใช่ตัวตน เป็นสักว่าธาตุ, ได้การปรุงแต่งที่เหมาะแล้วมันก็ปรุงแต่งเป็นสิ่งใหม่ขึ้นมา ในนั้นอาจจะมีความรู้สึกโง่ไปว่าเป็นตัวเราก็ได้

…. ฉะนั้น คําว่าอารมณ์ ถ้าถือตามหลักในทางพุทธศาสนา ก็แปลว่า สิ่งที่อาศัยกันกับจิต จะเรียกว่าเป็นที่หน่วงของจิตมันก็ยังได้: ถ้าเข้าใจผิดมันก็ผิดได้: เรียกว่าสิ่งที่อาศัยกับอายตนะ แล้วก็เกิดเป็นความรู้สึกเป็นจิตขึ้นมา จิตกําลังหน่วงสิ่งนั้นเป็นอารมณ์ก็ได้ แต่จะให้เป็นตัวตนนั้นไม่ได้

…. โดยพยัญชนะก็มีอยู่อย่างนี้ ตัวพยัญชนะก็ยังกํากวม อารมฺมณํ หรือที่มาจาก อาลมฺพนํ ก็แปลว่า ที่หน่วงของจิต. ถ้าจะถือว่ามาจาก รม ที่แปลว่า ยินดี ก็แปลว่า มันเป็นสิ่งที่หลงใหลยินดีของจิต อย่างนี้ก็ยังได้อีก

…. แต่ขอให้รู้จักจากภายในดีกว่าที่จะมารู้จักจากตัวหนังสือ เมื่อตากระทบรูป เมื่อหูกระทบเสียง เป็นต้น มันเกิดขึ้นในใจ, แล้วสังเกตเอาที่นั่นก็แล้วกัน ว่ารูปที่มากระทบตานั้นมันคืออะไร? เสียงที่มากระทบหูนั้นมันคืออะไร? จะค่อยเข้าใจแจ่มแจ้งขึ้นทีละน้อยๆ ว่าอารมณ์นั้นคืออะไร? แต่ให้เข้าใจไว้ทีหนึ่งก่อนว่าสิ่งที่เรียกว่าอารมณ์ๆที่มากระทบนี้ มันยังไม่ดีไม่ชั่ว ยังไม่จัดเป็นสิ่งดีสิ่งชั่ว มันต้องผสมปรุงแต่งเป็นความคิดอย่างนั้นอย่างนี้เสียก่อน จึงจะจัดเป็นดีเป็นชั่ว อารมณ์ล้วนๆยังไม่ดีไม่ชั่ว จะได้รู้จักป้องกัน อย่าให้เป็นไปในทางชั่ว, ให้เป็นไปแต่ในทางดีได้ตามปรารถนา

…. นี้เรียกว่าโดยพยัญชนะ โดยตัวหนังสือ คําว่า “อารมณ์” แปลว่า เป็นที่ยินดีแห่งจิต, เป็นที่ยึดหน่วงแห่งจิต; โดยเฉพาะภาษาอภิธรรมแล้วก็ใช้คําว่า “เป็นที่หน่วงเอาของจิต”, คือจิตย่อมหน่วงสิ่งใดสิ่งหนึ่งเป็นอารมณ์ แปลคําว่าอารมณ์บ้าง, อาลัมพนะ แปลว่า เป็นที่หน่วงเอา.

…. เดี๋ยวนี้เราเรียนพุทธศาสนาไม่ใช่เรามาเรียนหนังสือบาลี, เราจะเรียนพระธรรมคําสอนของพระพุทธเจ้า เราก็ต้องดูสิ่งที่เรียกว่าอารมณ์ โดยหลักของธรรมชาติที่ปรุงแต่งกันอยู่ในใจดีกว่า; ก็อย่างพระบาลีที่ได้ว่ามาแล้วข้างต้นว่า จกฺขุญฺจ ปฏิจฺจ รูเป จ อุปฺปชฺชติ จกฺขุวิญฺญาณํ = เพราะอาศัยตาด้วย รูปด้วย ย่อมบังเกิดจักษุวิญญาณ ติณฺณํ ธมฺมานํ สงฺคติ ผสฺโส - การประจวบกันของ ๓ สิ่งนี้เรียกว่า “ผัสสะ”, ผสฺสปจฺจยา เวทนา = เพราะผัสสะเป็นปัจจัยจึงเกิดเวทนา, อย่างนี้เรื่อยไปจนเกิดทุกข์ จนเกิดความทุกข์, นี้เรียกว่าโดยธรรมชาติ

…. สิ่งที่เรียกว่าอารมณ์มีอยู่โดยธรรมชาติที่จะเข้ามาอาศัยกันกับตาข้างใน ที่มีอยู่ในตัวคน. แล้วจะเกิดจักษุวิญญาณ เป็นต้น ขึ้นในตัวคน; จะเกิด ผัสสะ เวทนา ตัณหา อุปาทาน ภพ ชาติ ขึ้นในตัวคน; นี้โดยธรรมชาติ พระพุทธเจ้าท่านบันดาลอะไรไม่ได้ : ธรรมชาติเป็นอยู่อย่างนี้ แต่ท่านรู้เรื่องนี้ท่านจึงนํามาสอนว่า ธรรมชาติมันมีอยู่อย่างนี้ เราจะต้องเข้าใจให้ถูกต้อง โดยที่จะป้องกันความทุกข์ไม่ให้เกิดขึ้นมาได้, หรือถ้าเกิดขึ้นมาได้ก็จะดับเสียได้

…. เราควรจะรู้จักอารมณ์ในฐานะที่เป็นธรรมชาติอันหนึ่ง ที่มีอยู่ตามธรรมชาติ แล้วที่จะเข้ามาทําเรื่องทําราวขึ้นในจิตใจของคนเราให้เกิดปัญหายุ่งยากนี้ให้ดีๆ นี้เรียกว่ารู้จักอารมณ์จากธรรมชาติโดยตรงอย่างนี้ ดีกว่าที่จะรู้จักตามตัวหนังสือ, ดีกว่าที่จะรู้จักตามคําบอกเล่าบางอย่างบางประการที่มันไม่มีประโยชน์อะไร. รู้จักตามคําบอกเล่าก็รู้จักตามที่พระพุทธเจ้าท่านตรัสดีกว่า แต่แล้วยังไม่รู้จักตัวจริง จนกว่าจะมารู้จักจากที่เมื่ออารมณ์มากระทบตา หู จมูก ลิ้น กาย ใจ เข้าจริงๆ : นั่นจึงจะรู้จักอารมณ์ รู้จักผลที่เกิดขึ้นจากการกระทบของอารมณ์, รู้จักต่อไปตามลําดับ จนแก้ปัญหาต่างๆ ได้

…. นี่ ขอร้องให้รู้จักสิ่งที่เรียกว่า อารมณ์ ในฐานะที่เป็นธรรมชาติอันหนึ่ง ที่มีอยู่ตามธรรมชาติ ที่จะเข้ามากระทบอายตนะภายใน คือ กระทบ ตา หู จมูก ลิ้น กาย ใจ แล้วมีเรื่องมีราวมีปัญหา

อารมณ์ คือ โลก - โลก คือ อารมณ์ …. “ ที่นี้จะให้ดูต่อไปอีก ว่าโดยข้อเท็จจริงที่เป็นอยู่แล้ว อารมณ์นั้นคืออะไร? ถ้าจะพูดโดยข้อเท็จจริงหรือตามสถานการณ์ที่เป็นอยู่จริงในชีวิตของคนเรา อารมณ์มันก็คือ “โลก” นั่นเอง. เดี๋ยวนี้เราไม่รู้จักโลกในฐานะอย่างนี้, เราไปเข้าใจความหมายของคําว่าโลกแคบไปบ้าง หรือว่าเขวไปบ้าง.

…. ถ้าจะรู้ตามหลักพระพุทธศาสนาแล้ว โลกทั้งหมดก็คือสิ่งที่จะมาปรากฏแก่ ตา หู จมูก ลิ้น กาย ใจ ของเรา, เรามีเพียง ๖ อย่าง, แล้วมันก็ ปรากฏได้เพียง ๖ ทาง, มากกว่านั้นมันปรากฏไม่ได้ ดังนั้น โลกก็คือสิ่งที่จะมาปรากฏแก่ ตา หู จมูก ลิ้น กาย ใจ ๖ อย่างของเรา. “โลก” ก็คือ รูป เสียง กลิ่น รส โผฏฐัพพะ ธัมมารมณ์ ๖ ประการเท่านั้น, ไม่มีอะไรมากไปกว่านั้น

…. ฉะนั้น รูป เสียง กลิ่น รส โผฏฐัพพะ ธัมมารมณ์ แต่ละอย่าง ๆ ก็คือ โลกในแต่ละแง่ละมุม นั่นเอง, ที่เป็น รูป เสียง กลิ่น รส โผฏฐัพพะ ก็อยู่ข้างนอก จะเรียกว่าอยู่ข้างนอกก็ได้, ที่เป็นอารมณ์เกิดขึ้นในใจ ปรุงขึ้นในใจก็เรียกว่าโลกข้างในก็ได้ แต่มันก็เป็นโลกอยู่นั่นแหละ เพราะมันเป็นสิ่งที่จิตจะต้องรู้สึก จิตรู้สึกก็เรียกว่าโลกสําหรับจิต ตา หู จมูก ลิ้น กาย รู้สึก ก็เรียกว่าโลกสำหรับ ตา หู จมูก ลิ้น กาย. นี้ขอให้มองให้เห็นชัดตามพระพุทธประสงค์ว่า โลก ก็คือ อารมณ์, อารมณ์ ก็คือ โลก.

…. แต่ทีนี้ พระพุทธเจ้าท่านมองลึกกว่านั้น ท่านตรัสถึงข้อที่ว่า ถ้ามันมาเกิดเป็นปัญหาแก่เราเมื่อไรจึงจะเรียกว่า “มันมี” พอมันมาเป็นปัญหาแก่เราเมื่อไรก็เรียกว่า “เป็นทุกข์”; เพราะว่าเราได้ไปจับฉวยยึดถือเอาตามประสาตามวิสัยของคนที่ไม่รู้จักโลก ถ้าพูดว่าไม่รู้จักโลกแล้วคนก็มักจะไม่ยอมรับ เพราะว่าเขาจะพูดว่าเขารู้จักโลกดี. ยิ่งพวกฝรั่งสมัยนี้ นักวิทยาศาสตร์ปราดเปรื่องนั้น เขาจะไม่ยอมรับว่าเขาไม่รู้จักโลก. แต่ถ้าพูดตามหลักพุทธศาสนาแล้วก็จะพูดได้ว่ายังไม่รู้จักโลกเลย เป็นคนตาบอดยิ่งกว่าตาบอด; เพราะว่าฝรั่งเหล่านั้นรู้จักโลกแต่ในแง่สําหรับจะยึดมั่นถือมั่นเป็น “ตัวกู ของกู” จะครองโลกจะอะไร เอาประโยชน์ทุกอย่าง; เขารู้จักโลกในแง่นี้ อย่างนี้พุทธบริษัทไม่เรียกว่า “รู้จักโลก”; แต่ถือว่าเป็นคนตาบอดต่อโลก, หลงยึดมั่นถือมั่นในโลก. เพราะว่าคนเหล่านั้นไม่รู้จักโลกโดยความเป็นอารมณ์ ๖ ประการ คือ รูป เสียง กลิ่นรส โผฏฐัพพะ ธัมมารมณ์, แล้วเป็น “มายา” คือ เอาจริงไม่ได้ เป็นของชั่วคราวๆ หลอกให้เกิดความรู้สึกยึดมั่นถือมั่น

…. นี้เรารู้จัก เราไม่ไปหลงยึดมั่นถือมั่นกับมัน นี้จึงเรียกว่า “คนที่รู้จักโลก” ไปตามหลักของพุทธศาสนา, ฉะนั้น จึงไม่ยึดมั่นถือมั่นสิ่งใดโดยความเป็นตัวตน หรือโดยความเป็นของตน, เรียกว่าเป็นผู้รู้จักอารมณ์ ๖ ประการนั้นก็คือรู้จักโลกทั้งปวง, แล้วก็ไม่หลงไปในโลกในแง่ใดแง่หนึ่ง นี้เรียกว่า อารมณ์ ก็คือ โลก นั่นเอง ในความหมายที่ลึกที่สุดของพระพุทธสาสนา ไม่ใช่โลกก้อนดิน, ไม่ใช่โลกก้อนกลมๆ นี้. แต่มันหมายถึงคุณค่าอะไรที่มันมีอยู่ในโลกกลมๆ นี้ ที่จะเข้ามามาทําให้เกิดปัญหา ที่ตา ที่หู ที่จมูก ที่ลิ้น ที่กาย ที่ใจ ของคน. นั่นแหละคือตัวร้ายกาจของสิ่งที่เรียกว่า โลก เราจะต้องรู้จักในส่วนนี้ให้เพียงพอ

อารมณ์ในโลกปัจจุบันมารวมที่วัตถุนิยม …. ทีนี้ ดูอีกแง่หนึ่งก็โดยปัญหาที่กําลังมีอยู่ อารมณ์ในโลกนี้ในฐานะที่มันเป็นตัวปัญหาที่กําลังมีอยู่ มันมารวมอยู่ที่คําว่า “วัตถุนิยม”: หมายความว่า ตา หู จมูก ลิ้น กาย ใจ นี้ มันเป็นฝ่ายชนะ ไปหลงใหลในอารมณ์ รูป เสียง กลิ่น รส โผฏฐัพพะ ฯลฯ, แล้วก็เกิดนิยมหลงใหลในวัตถุเหล่านั้น จนเกิดความคิดใหม่ๆ, ปรุงแต่งไปในทางที่จะให้หลงใหลในโลกยิ่งขึ้นๆ, ความเจริญก้าวหน้า ในโลกสมัยนี้เป็นไปแต่ในทางอย่างนี้ ฉะนั้น จึงไกลความสงบ, ไกลสันติภาพ ไกลอะไรออกไปทุกที. การที่มนุษย์ที่มีปัญญาในโลกสมัยนี้ โดยเฉพาะฝรั่งที่ก้าวหน้านั้นเขาก็จัดโลกไปแต่ในแง่ของวัตถุมากขึ้นๆ: มันก็ไกลจากสันติภาพ ไกลจากความสงบสุขยิ่งขึ้นทุกที

…. ความสะดวกสบายที่ทําให้เกิดขึ้นมาได้นั้น ไม่ได้ช่วยส่งเสริมเกิดสันติภาพ; แต่มันช่วยให้เกิดความหลงในโลกนั้นเองมากขึ้น แล้วก็ช่วยให้หลงใหลใน “ตัวกู ของกู”, ยึดมั่นถือมั่นเห็นแก่ตัวมากขึ้น รวมกันแล้วมันไม่มีทางที่จะเกิดสันติภาพหรือสันติสุขในโลกได้เลย, จึงกลายเป็นความหลอกลวงเหลือประมาณ โลกจึงกลายเป็นความหลอกลวง, หรือสิ่งที่หลอกลวงเหลือประมาณใน เวลานี้ เราเรียกกันว่า ติดบ่วง หรือว่า ติดเหยื่อของวัตถุนิยม. คําพูดทั้งหมดนี้ ล้วนแต่เป็นการแสดงให้เห็นว่า อารมณ์นี้คืออะไร สิ่งที่เรียกว่าอารมณ์นั้น คือตัวโลกที่กําลังหลอกลวงเราอยู่ทุกวันอย่างยิ่ง โดยเฉพาะในปัจจุบันนี้เป็นวัตถุนิยม นี้คืออารมณ์”

พุทธทาสภิกขุ ที่มา : ธรรมบรรยายภาคมาฆบูชา ครั้งที่ ๗ หัวข้อเรื่อง “อารมณ์ คือ ปัจจัยแห่งเหตุการณ์ทุกอย่างในโลก” เมื่อวันที่ ๑๖ กุมภาพันธ์ ๒๕๑๗ จากหนังสือชุดธรรมโฆษณ์ เล่มชื่อว่า “ก ข ก กา ของการศึกษาพุทธศาสนา”

หมายเหตุ

“อารมณ์ ” ในทางพุทธศาสนา มี ๖ คือ... * ๑. รูปะ = รูป, สิ่งที่เห็น หรือ วัณณะ คือ สี * ๒. สัททะ = เสียง * ๓. คันธะ = กลิ่น * ๔. รสะ = รส * ๕. โผฏฐัพพะ = สัมผัสทางกาย * ๖. ธรรมารมณ์ = สิ่งที่ใจนึกคิด, อารมณ์ที่เกิดกับใจ

…. ทั้ง ๖ อย่างนี้ เป็นสิ่งสำหรับให้จิตยึดหน่วง เรียกอีกอย่างว่า "อายตนะภานนอก" ก็ได้

“อายตนะภายใน ๖” คือ ที่เชื่อมต่อให้เกิดความรู้, แดนต่อความรู้ฝ่ายภายใน มี * ๖ อย่าง คือ... * ๑. จักษุ - ตา * ๒. โสตะ - หู * ๓. ฆานะ - จมูก * ๔. ชิวหา - ลิ้น * ๕. กาย - กาย * ๖. มโน - ใจ

… หรือจะเรียกอีกอย่างว่า “อินทรีย์ ๖” ก็ได้ เพราะเป็นใหญ่ในหน้าที่ของตนแต่ละอย่าง เช่น จักษุ เป็นเจ้าการ(เป็นใหญ่)ในการเห็น เป็นต้น

ท. ส. ปัญญาวุฑโฒ – รวบรวม.

-

@ e4950c93:1b99eccd

2025-06-05 10:23:39

@ e4950c93:1b99eccd

2025-06-05 10:23:39Marques

Nordkidz est une marque allemande qui crée à la demande des vêtements et linges pour les bébés, les enfants, et un peu pour leurs parents.

Matières naturelles utilisées dans les produits

⚠️ Attention, certains produits de cette marque contiennent des matières non naturelles, dont :

Catégories de produits proposés

Cette marque propose des produits intégralement en matière naturelle dans les catégories suivantes :

Vêtements

- Tailles vêtements : bébés, enfants, unisexe

- Hauts : pulls, t-shirts

- Bas : pantalons, pantalons de survêtement, shorts

- Tête et mains : bonnets, écharpes

Maison

- Linge : housses de pouf, langes, ponchos de bain

Autres informations

👉 En savoir plus sur le site de la marque

Où trouver leurs produits ?

- Nordkidz (en allemand, zone de livraison : Allemagne et Union Européenne) 💚 Via ce lien vous soutenez directement la marque.

📝 Tu peux contribuer à cette fiche en suggérant une modification en commentaire.

🗣️ Tu utilises des produits de cette marque ? Partage ton avis en commentaire.

⚡ Heureu-x-se de trouver cette information ? Soutiens le projet en faisant un don pour remercier les contribut-eur-ice-s.

-

@ b1ddb4d7:471244e7

2025-06-05 09:01:10

@ b1ddb4d7:471244e7

2025-06-05 09:01:10Starting January 1, 2026, the United Kingdom will impose some of the world’s most stringent reporting requirements on cryptocurrency firms.

All platforms operating in or serving UK customers-domestic and foreign alike-must collect and disclose extensive personal and transactional data for every user, including individuals, companies, trusts, and charities.

This regulatory drive marks the UK’s formal adoption of the OECD’s Crypto-Asset Reporting Framework (CARF), a global initiative designed to bring crypto oversight in line with traditional banking and to curb tax evasion in the rapidly expanding digital asset sector.

What Will Be Reported?

Crypto firms must gather and submit the following for each transaction:

- User’s full legal name, home address, and taxpayer identification number

- Detailed data on every trade or transfer: type of cryptocurrency, amount, and nature of the transaction

- Identifying information for corporate, trust, and charitable clients

The obligation extends to all digital asset activities, including crypto-to-crypto and crypto-to-fiat trades, and applies to both UK residents and non-residents using UK-based platforms. The first annual reports covering 2026 activity are due by May 31, 2027.

Enforcement and Penalties

Non-compliance will carry stiff financial penalties, with fines of up to £300 per user account for inaccurate or missing data-a potentially enormous liability for large exchanges. The UK government has urged crypto firms to begin collecting this information immediately to ensure operational readiness.

Regulatory Context and Market Impact

This move is part of a broader UK strategy to position itself as a global fintech hub while clamping down on fraud and illicit finance. UK Chancellor Rachel Reeves has championed these measures, stating, “Britain is open for business – but closed to fraud, abuse, and instability”. The regulatory expansion comes amid a surge in crypto adoption: the UK’s Financial Conduct Authority reported that 12% of UK adults owned crypto in 2024, up from just 4% in 2021.

Enormous Risks for Consumers: Lessons from the Coinbase Data Breach

While the new framework aims to enhance transparency and protect consumers, it also dramatically increases the volume of sensitive personal data held by crypto firms-raising the stakes for cybersecurity.

The risks are underscored by the recent high-profile breach at Coinbase, one of the world’s largest exchanges.

In May 2025, Coinbase disclosed that cybercriminals, aided by bribed offshore contractors, accessed and exfiltrated customer data including names, addresses, government IDs, and partial bank details.

The attackers then used this information for sophisticated phishing campaigns, successfully deceiving some customers into surrendering account credentials and funds.

“While private encryption keys remained secure, sufficient customer information was exposed to enable sophisticated phishing attacks by criminals posing as Coinbase personnel.”

Coinbase now faces up to $400 million in compensation costs and has pledged to reimburse affected users, but the incident highlights the systemic vulnerability created when large troves of personal data are centralized-even if passwords and private keys are not directly compromised. The breach also triggered a notable drop in Coinbase’s share price and prompted a $20 million bounty for information leading to the attackers’ capture.

The Bottom Line

The UK’s forthcoming crypto reporting regime represents a landmark in financial regulation, promising greater transparency and tax compliance. However, as the Coinbase episode demonstrates, the aggregation of sensitive user data at scale poses a significant cybersecurity risk.

As regulators push for more oversight, the challenge will be ensuring that consumer protection does not become a double-edged sword-exposing users to new threats even as it seeks to shield them from old ones.

-

@ 3eab247c:1d80aeed

2025-06-05 08:51:39

@ 3eab247c:1d80aeed

2025-06-05 08:51:39Global Metrics

Here are the top stats from the last period:

- Total Bitcoin-accepting merchants: 15,306 → 16,284

- Recently verified (1y): 7,540 → 7,803 (the rest of our dataset is slowly rotting; help us before it's too late!)

- Avg. days since last verification: 398 → 405 (more mappers, please)

- Merchants boosted: 22 (for a total of 4,325 days, someone is feeling generous)

- Comments posted: 34

Find current stats over at the 👉 BTC Map Dashboard.

Merchant Adoption

Steak n’ Shake

The US 🇺🇸 is a massive country, yet its BTC Map footprint has been lagging relative to other countries ... that is until now!

In what came as a nice surprise to our Shadowy Supertaggers 🫠, the Steak ’n Shake chain began accepting Bitcoin payments across hundreds of its locations nationwide (with some international locations too).

According to CoinDesk, the rollout has been smooth, with users reporting seamless transactions powered by Speed.

This marks a significant step towards broader Bitcoin adoption in the US. Now to drop the capital gains tax on cheesburgers!

SPAR Switzerland

In other chain/franchise adoption news, the first SPAR supermarket in Switzerland 🇨🇭 to begin accepting Bitcoin was this one in Zug. It was quickly followed by this one in Rossrüti and this one in Kreuzlingen, in what is believed to be part of a wider roll-out plan within the country powered by DFX's Open CryptoPay.

That said, we believe the OG SPAR crown goes to SPAR City in Arnhem Bitcoin City!

New Features

Merchant Comments in the Web App

Web App users are now on par with Android users in that they can both see and make comments on merchants.

This is powered by our tweaked API that enables anyone to make a comment as long as they pass the satswall fee of 500 sats. This helps keep spam manageable and ensure quality comments.

And just in case you were wondering what the number count was on the merchant pins - yep, they're comments!

Here is an 👉 Example merchant page with comments.

Merchant Page Design Tweaks

To support the now trio of actions (Verify, Boost & Comment) on the merchant page, we've re-jigged the design a little to make things a little clearer.

What do you think?

Technical

Codebase Refactoring

Thanks to Hannes’s contributions, we’ve made progress in cleaning-up the Web App's codebase and completing long overdue maintenance. Whilst often thankless tasks, these caretaking activities help immensely with long-term maintainability enabling us to confidently build new features.

Auth System Upgrades

The old auth system was held together with duct tape and prayers, and we’re working on a more robust authentication system to support future public API access. Updates include:

- Password hashing

- Bearer token support

- Improved security practices

More enhancements are in progress and we'll update you in the next blog post.

Better API Documentation

Instead of relying on tribal knowledge, we're finally getting around to writing actual docs (with the help/hindrance of LLMs). The "move fast, break everything" era is over; now we move slightly slower and break slightly less. Progress!

Database Improvements

We use SQLite, which works well but it requires careful handling in async Rust environments. So now we're untangling this mess to avoid accidental blocking queries (and the ensuing dumpster fires).

Backup System Enhancements

BTC Map data comes in three layers of fragility:

- Merchants (backed up by OS - the big boys handle this)

- Non-OSM stuff (areas, users, etc. - currently stored on a napkin)

- External systems (Lightning node, submission tickets - pray to Satoshi)

We're now forcing two core members to backup everything, because redundancy is good.

Credits

Thanks to everyone who directly contributed to the project this period:

- Comino

- descubrebitcoin

- Hannes

- Igor Bubelov

- Nathan Day

- Rockedf

- Saunter

- SiriusBig

- vv01f

Support Us

There are many ways in which you can support us:

-

Become a Shadowy Supertagger and help maintain your local area or pitch-in with the never-ending global effort.

-

Consider a zapping this note or make a donation to the to the project here.

-

@ 527337d5:93e9525e

2025-06-05 03:09:02

@ 527337d5:93e9525e

2025-06-05 03:09:02The Algorithmic Pursuit of Connection: A Five-Book Journey into the Self

As a researcher, hitting my thirties and the winding down of a significant project prompted a crucial re-evaluation of life's latter half. While I'd successfully applied probabilistic control theory to one-on-one interactions, the complexities of group dynamics remained a persistent challenge. My recent dive into five diverse books on human relationships inadvertently became a profound journey of self-discovery, fundamentally reshaping my perspective on social connections.

Neil Strauss: A Mirror Reflecting the Self's Evolution

Neil Strauss's The Truth resonated deepest among my recent reads. The author's battle with sex addiction uncomfortably mirrored my own past struggles: the fragile self-esteem stemming from rejection, the hubris born of early successes, and the tendency to view women as mere objects of manipulation. It felt eerily prescient, a glimpse into a potential future.

Yet, I found myself arriving at Strauss's ultimate conclusion – the paramount importance of self-preparation and community – far sooner than he did. This acceleration wasn't accidental; it was the result of intense focus on individual experiences, meticulously replayed and analyzed in my mind. The book, therefore, served less as a revelation and more as a powerful validation of my own journey of introspection and root-cause analysis.

Quantifying Connection: The Promise and Limits of Mathematical Models

Hannah Fry's The Mathematics of Love offered a kindred spirit in its attempt to quantify human relationships. While I appreciate the mathematical lens, Fry's models primarily concern dyadic relationships (N=2), relying on relatively simple systems of two-variable ordinary differential equations. For me, these are akin to linear models, sufficient only up to a certain point. Beyond N=4, the dependencies become exponentially complex.

My own pursuit extends to understanding and optimizing group dynamics within complex systems. This involves multi-variable problems (N $\ge$ 3) and the application of network theory, a far more sophisticated approach. Human collectives, after all, are systems of nodes and edges, where information propagates in predictable ways. My focus is on deriving optimal behavioral controls within these intricate frameworks.

Conversely, Men Are from Mars, Women Are from Venus initially struck me as bordering on conspiracy theory. However, its latter half proved unexpectedly useful. Its clear enumeration of male and female desires, and its articulation of common points of conflict, presented a practical template for communication styles. In a systemic view, this serves as a rudimentary, yet functional, interface design for complex social interactions.

A Dispassionate Critique of Relationship Dogma

My drive for efficiency and systematic understanding led to a rather blunt assessment of certain relationship classics. The New Science of Adult Attachment felt disorganized and frustratingly anecdotal. Lacking a coherent theoretical framework, it burdened the reader with deciphering meaning from a jumble of examples. Its inefficiency was, frankly, its most irksome flaw.

Similarly, Dale Carnegie's How to Win Friends and Influence People struck me as closer to pseudoscience than social science. Its plethora of specific anecdotes obscured any underlying principle. Given my deep engagement with social engineering – a discipline that systematically and practically analyzes human interaction – Carnegie's work appeared largely irrelevant and inefficient. From my perspective, which views humans as objective systems to be analyzed with mathematical rigor, such unstructured approaches hold little value.

The Unveiling of a Core Principle: Humans as Systems

This intensive reading period solidified my most crucial insight: humans, at their core, are systems. This understanding allows for a dispassionate, methodical approach to human collectives, mitigating unnecessary emotional friction.

This revelation has sharply refined my future learning trajectory. I'm now prioritizing foundational theories like graph theory and network theory over anecdotal accounts of human behavior. By mastering these theoretical underpinnings, I aim to precisely model complex human interactions as systems of nodes and edges, enabling the derivation of optimal behavioral controls within communities.

My choice of the term "target for capture" for individuals stems from a personal aversion to perceived equality in certain human interactions, a mechanism to avoid cognitive dissonance. This rational approach, I believe, is key to cultivating secure attachment styles – relationships demonstrably sustainable in the long term. My philosophy is to strategically approach the initial engagement, then transition to a stable, enduring connection. It's a calculated, dispassionate method for achieving desired relational outcomes.

Ultimately, this period of reading wasn't just about acquiring knowledge; it was a profound journey of self-discovery, clarifying my personal frameworks for navigating life's complexities and forging meaningful, yet strategically managed, connections.

-

@ a296b972:e5a7a2e8

2025-06-04 22:06:06

@ a296b972:e5a7a2e8

2025-06-04 22:06:06In dem Video geht es um Dietrich Bonhoeffer, wie er sich zu Dummheit und vorsätzlicher bzw. rationaler Ignoranz geäußert hat. Schon seit einiger Zeit geht bei vielen Seltsames vor: Sie werden mit einem Thema persönlich konfrontiert und postum gibt es genau zu diesem Thema ein Video oder einen Artikel. Das kommt manchmal so vor, wie ein Frage- und Antwort-Spiel innerhalb der Schwarm-Intelligenz. Irgendwie spooky.

Die erschreckende Theorie der Dummheit, die Sie nie hören sollten - Dietrich Bonhoeffer: https://www.youtube.com/watch?v=PH-Vs5ILEko

Dem Entdecken, oder besser, dem Auf-einen-Zukommen, ist dieser E-Mail-Schriftverkehr in zeitlichem Zusammenhang vorausgegangen:

Nachfrage zu einem Aufruf durch einen Mitarbeiter zur Blutspende in einem Unternehmen mit über 100 Mitarbeitern über den E-Mail-Verteiler:

Lieber XXXXXXX,

danke zunächst für Dein Engagement.

In meiner näheren Familie gibt es jemanden, der regelmäßig Blut spendet, daher bin ich ein wenig für das Thema sensibilisiert.

Seit Du die E-Mail verschickt hast, gehe ich damit „schwanger“, ob ich ein vielleicht „heißes Eisen“ anfassen soll.

In den angehängten Informationen (des Roten Kreuzes) steht, dass das gespendete Blut auf bestimmte „Verunreinigungen“ durch Vorerkrankungen untersucht wird. Was nicht aufgeführt ist, ist eine Untersuchung, von der ich noch nicht einmal weiß, ob sie überhaupt schon durchgeführt wurde, und wenn ja, zu welchem Ergebnis sie gekommen ist, ob das gespendete Blut auch mit Substanzen der Corona-Gen-Behandlung verunreinigt sein kann. Leider zeigen ja die aktuellen Erkenntnisse, dass das Spike-Protein noch nach Jahren aktiv sein kann. Auch in gespendetem Blut? Die konkrete Frage wäre, ob das Rote Kreuz definitiv ausschließen kann, dass das nicht der Fall ist, damit ein möglicher Schaden nicht die Gefahr läuft, größer zu sein, als der Nutzen.

Soweit ich weiß, hat das Rote Kreuz bis heute keine separaten Blutbanken von „geimpftem“ und „ungeimpftem“ Blut angelegt. Wenn zu 100% ausgeschlossen werden kann, dass keine schädlichen Substanzen der Gen-Behandlung in die Blutkonserve gelangen, wäre das ja natürlich nicht nötig. Ist das so? Wenn ja, wo ist der Nachweis dazu zu finden, wie ist der aktuelle Erkenntnisstand, von wem wurden Studien dazu erarbeitet, wer hat das finanziert?

Mindestens 20% der Bevölkerung, das sind rund 16 Millionen Menschen, haben auf die Gen-Behandlung verzichtet und wollen im Ernstfall kein kontaminiertes Blut empfangen. Wie kann das Rote Kreuz belegbar und glaubhaft nachweisen, dass möglicherweise verunreinigtes Blut nicht doch in die Blutkonserven gelangt, weil sonst die Gefahr besteht, dass im Ernstfall Impfverzichter einen Schaden davontragen könnten?

Ich finde das eine wichtige Frage dem Roten Kreuz gegenüber und vielleicht wäre es auch gut, die möglichen Spender im Vorfeld für dieses heikle Thema zu sensibilisieren. Ich finde es auffällig, dass das Rote Kreuz sich hierzu weder in die eine, noch andere Richtung in den Informationen äußert, obwohl sie uns alle betrifft.

Ich schreibe diese Email aus kollegialen Gründen, aber auch zur Sensibilisierung gegenüber der Verantwortung aller Menschen gegenüber ihren Mitmenschen, die (hoffentlich nie) in die Situation kommen, einmal auf eine Blutspende angewiesen zu sein.

Wenn sich etwas Neues auf meine Nachfrage an Dich ergibt, wäre es klasse, ich würde davon erfahren.

Vielen Dank und viele Grüße

YYYYYYY

(Die Intension war, sich so vorsichtig wie möglich, quasi auf „Samtpfötchen“, an den Kern heranzupirschen. Dass es bereits Erkenntnisse dazu gibt, dass das Blut kontaminiert sein kann, wurde bewusst weggelassen, um keine Angriffsfläche zu bieten, ein „Verschwörungstheoretiker“ zu sein. Wenn die andere Seite auf einen Austausch eingestiegen wäre, wäre eine Quelle zu dieser Aussage vorhanden gewesen.)

Die Antwort:

Hallo YYYYYYY,

danke für die ausführliche Nachricht und dass du dir Gedanken zu dem Thema machst. Ich finde, man sollte Blutspenden als eine persönliche und private Sache betrachten.

Jeder und jede sollte für sich selbst abwägen, ob und unter welchen Bedingungen er oder sie das tun möchte.

Die Fragen, die du gestellt hast, sind echt speziell. Da geht's um medizinische und wissenschaftliche Themen, da kann ich als Privatperson nicht mitreden. Ich denke, dass sich Interessierte bei solchen Themen am besten direkt an medizinische Fachstellen oder das Rote Kreuz vor Ort wenden sollten, um fundierte und belastbare Informationen zu erhalten.

Mir persönlich ist es wichtig, Menschen auf die Möglichkeit der Blutspende aufmerksam zu machen.

Jeder kann das für sich selbst entscheiden und es ist auch okay, wenn man dabei Überzeugungen hat.

Beste Grüße

XXXXXXX

(„Blutspende…eine persönliche und private Sache“, nach dem Corona-Ereignis auch noch?, „…ich als Privatperson“ empfehle anderen etwas, bei dem sie möglicherweise anderen einen Schaden zufügen. Ist das schon grob fahrlässig, nach den Denkanstößen, die gegeben wurden?, „Wenn man dabei Überzeugungen hat.“, interessante Formulierung.)

Darauf die Reaktion:

Hallo XXXXXXX,

danke auch für Deine Antwort.

Wenn so eine im Grundsatz sicher gute Aktion beworben wird, liegt es nach meinem Empfinden auch in der Verantwortung, auf mögliche Folgen hinzuweisen, wenn es das Rote Kreuz schon nicht tut. Vorausgesetzt, man misst ihnen Bedeutung zu. Wenn meine E-Mail keine Veranlassung zu einer Beunruhigung und eigener Recherche angeregt hat, dann kann ich leider mehr nicht tun.

Dass das Rote Kreuz keine Hinweise gibt, liegt wohl daran, dass es Teil des Systems ist. Wer die Augen aufmacht, kann mit wenig Aufwand leider mehr als genug Tatsachenwahrheiten finden, die mit Schäden im Zusammenhang der Gen-Behandlung verursacht wurden und immer noch verursacht werden. Es ist nicht meine Aufgabe, einen Wissensrückstand von 5 Jahren auf den aktuellen Stand zu bringen. Allein die veröffentlichten RKI-Protokolle sollten schon genug Anlass zur Skepsis bieten. Der ÖRR berichtet leider nicht darüber, weil er auch Teil des Systems ist.

Ich will es damit genug sein lassen und hoffe, dass es unter den Kolleginnen und Kollegen noch weitere kritische Geister gibt.

Es geht nicht gegen Dich persönlich, aber ich hoffe, das Angebot wird nicht zahlreich genutzt.

Viele Grüße

YYYYYYY

(Einen halben Gang hochgeschaltet, ein Versuch, XXXXXXX aus der Reserve zu locken.)

Und ein Nachtrag von YYYYYYY:

Lieber XXXXXXX,

wir sind schon einmal unter Missbrauch des Begriffes „Solidarität“ hinter die Fichte geführt worden. Das darf nicht noch einmal passieren!

Nochmals viele Grüße

YYYYYYY

(Keine Reaktion mehr von XXXXXXX)

Und, wie gesagt, daraufhin kam das Video mit Bonhoeffer entgegen. Besser kann man vorsätzliche, rationale Ignoranz in Bezug auf den Schriftwechsel nicht beschreiben.

Hier wird eine jeden angehende allgemeinmedizinische Frage zu einer Frage der persönlichen Überzeugung gemacht. Das kommt doch sehr bekannt vor, oder?

Sehr wahrscheinlich lässt es sich vermuten, dass es sich bei XXXXXXX wohl um einen Corona-Jünger handelt, der die Tatsachen scheut, wie der Teufel das Weihwasser. Bloß nicht nachdenken, bloß nicht in Frage stellen, bloß nicht hellhörig oder gar neugierig werden, bloß nicht auf die Äußerungen eingehen, bloß nicht konkret werden, bloß keine eindeutig formulierte Stellung zu den Aussagen beziehen. „Angriffsfläche“ wäre vorhanden gewesen.

Das vorsichtige Anpirschen war alles andere, als mit-der-Brechstange-herangehen. Und doch setzt sofort automatisch der Teflon-Effekt ein. Selbstschutz.

Die Frage ist, wie soll da die Spaltung überwunden werden, wenn „die andere Seite“ so überhaupt nicht bereit ist, sich mit dem Vorgebrachten auseinanderzusetzen. Noch nicht einmal, wenn man nur die Spitze der Spitze des Eisbergs leise anhaucht.

Diesem Beispiel könnten viele unzählige weitere Beispiele hinzugefügt werden. Jeder hat so etwas schon einmal auf die eine oder andere Weise erlebt.

Das Gefühl lässt sich nicht unterdrücken, dass sich die Menschheit in zwei Lager aufgeteilt hat, und es gibt derzeit keinen Weg, wie man wieder aufeinander zukommen könnte.

Wie zwei Welten aufeinanderprallen, kann man derzeit auch in der Enquete-Kommission im sächsischen Landtag erleben: https://www.youtube.com/watch?v=D6ACmwBUBFM

Aus der Sicht von YYYYYYY ist das kein Grund zur Verzweiflung, jedoch drängt sich der Wunsch auf, dass man mit solchen Menschen wie XXXXXXX nichts mehr anfangen will. Man möchte mit ihnen, so schade es auch ist, am liebsten gar nichts mehr zu tun haben, und wenn doch aus irgendwelchen Gründen, nur noch das Allernotwendigste, so kurz und knapp, wie möglich. Empathie aufzubringen erscheint einem als vergeudete Energie, besser ist es, sich auf die Menschen zu konzentrieren, die wegen fehlender Genbehandlung keine Wesensveränderungen, die mittlerweile leider auch schon bestätigt sind, erlitten haben.

Wie Bonhoeffer richtig sagt, es geht hier nicht um Intelligenz, es geht viel tiefer. Es geht um das Menschsein an sich, und man hat den Eindruck, dass vor allem dies unter dem Einfluss der Spritze sehr stark gelitten hat. Da scheint so eine Abgestumpftheit durch, die einem einen kalten Schauer über den Rücken fahren lässt. Und das ist vielleicht noch gefährlicher, als diejenigen, die wirklich dumm sind. Das ist keine Arroganz oder Überheblichkeit, sondern unschuldig, wahllos von der Natur vergebene Dummheit, die jeden hätte ereilen können, hat es immer schon zu einem großen Teil gegeben. Hier hat man wenigstens noch die Möglichkeit, sich einfühlen zu können und Verständnis aufzubringen. Bei Menschen aber, von denen man weiß, dass sie die kognitiven Fähigkeiten zur Reflektion hätten, sie jedoch aus welchen Gründen auch immer nicht nutzen, oder sie als Verdrängungsmechanismus gerade nutzen, weil sie es können, geht auch eine gewisse Gefahr aus, weil man nie wissen kann, was sie sich sonst noch so ausdenken könnten, wenn sie in die geistige Enge getrieben werden, um ja nicht von Menschen, die den Mut haben, die Wahrheit auszusprechen, in ihrem mühsam aufgebauten Weltbild erschüttert zu werden. „Was nicht sein darf, das nicht sein kann!“, obwohl doch eigentlich die Wahrheit dem Menschen zumutbar ist.

So hat man das Gefühl, man atmet Honig ein und bewegt sich mühsam durch einen zähen Brei vorwärts, der einem bis zu den Oberschenkeln reicht. Jeder Schritt eine Anstrengung.

Und bevor man noch tiefer in dieses Verlustgefühl von Lebensqualität eintaucht (das hat nichts mit Depressionen zu tun, man bekommt einfach nur schlechte Laune), sich immer wieder bewusst machen, dass es da draußen noch eine Menge bei Verstand gebliebener Menschen gibt, die unermüdlich daran arbeiten, dass die Wahrheit weiter so sehr erkraftet, dass sie sich ihren Weg in den sogenannten Mainstream bahnt und die Menschen endlich aufwachen. So schmerzlich das für viele sein mag, es muss sein!

Selbst für einen wenig religiösen Menschen, im Sinne von regelmäßigen Kirchgängen und keinem Kontakt zur Institution Kirche, bekommt der Satz eine ganz besondere Bedeutung:

„Ich schicke euch den Geist der Wahrheit, und der wird euch frei machen!“

-

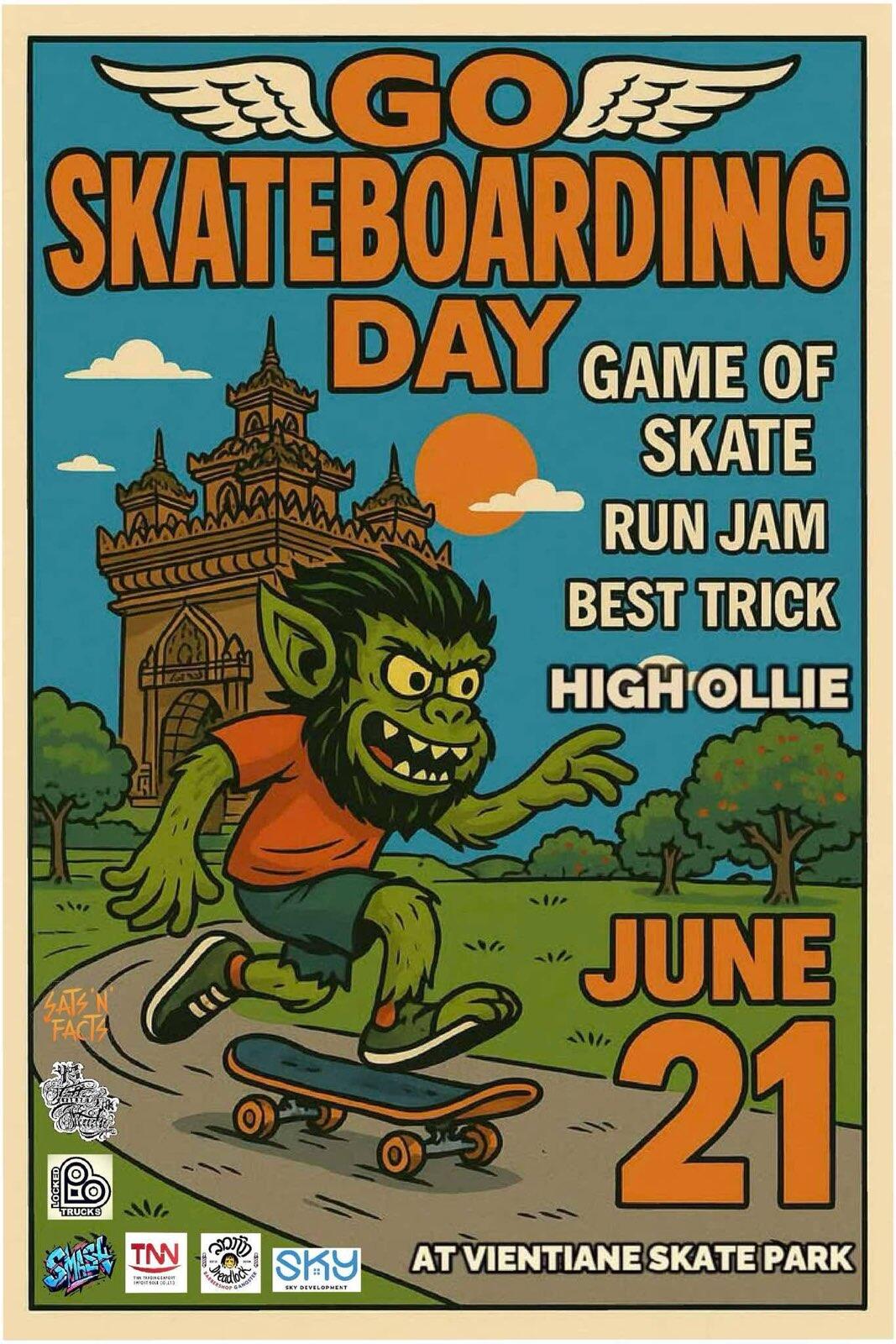

@ 20e7c953:3b8bcb21

2025-06-05 10:32:40

@ 20e7c953:3b8bcb21

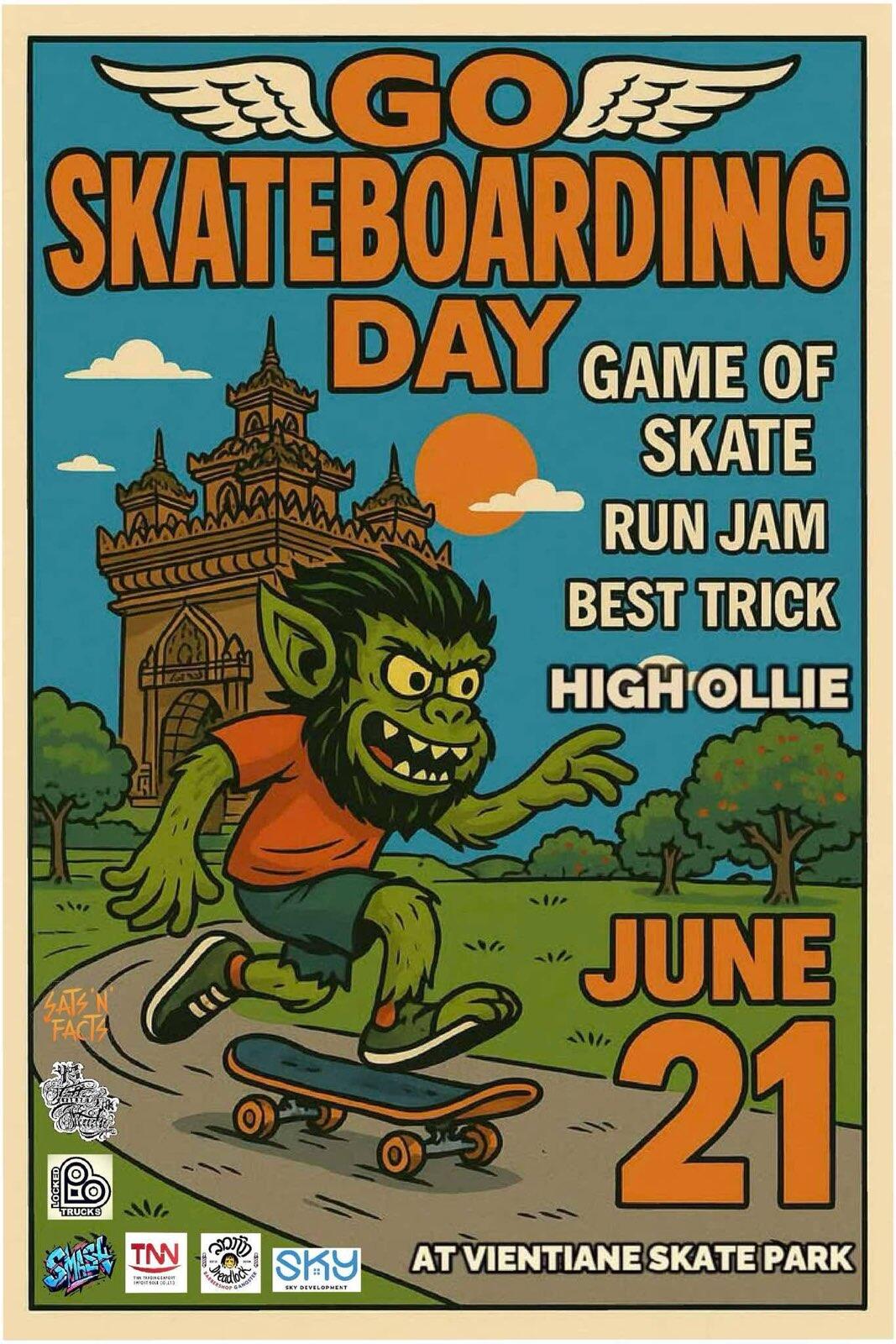

2025-06-05 10:32:4021… That number means something. A reminder that limits create value - both in Bitcoin and in life.

Every June 21st, skaters around the world remind us that freedom is something you make yourself - one push at a time only constrained by your own limitations.

This year in Vientiane, we’re proud to support one of the few real skate spots in Laos. A place built and held together by skaters for skaters.

Expect around 50 locals - from young kids to older heads - showing up not just to skate, but to hold space for each other. No ego, no filters, just boards, fun and respect.

Bircoiners have lots to learn from these communities on this regard. Go skate and you'll find out.

SnF

Laostr

Skateboardingisfun

Skate4Fun

-

@ 472f440f:5669301e

2025-06-04 20:58:53

@ 472f440f:5669301e

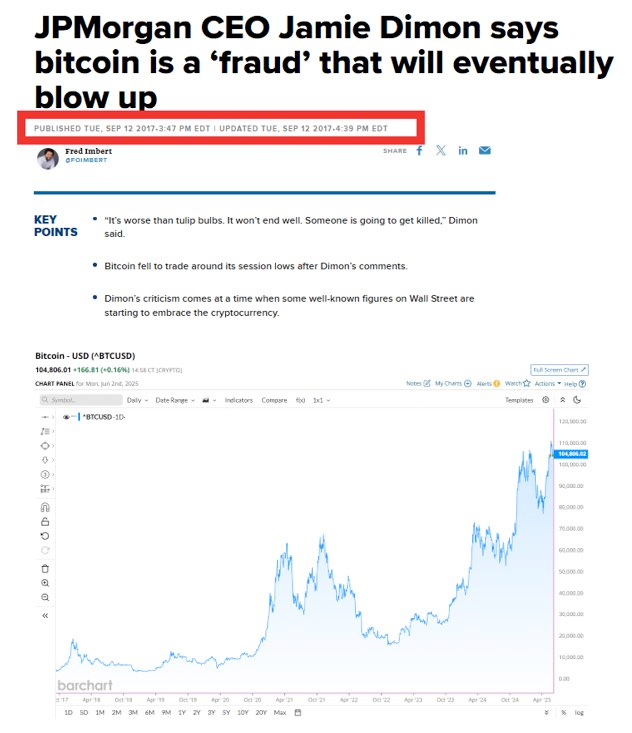

2025-06-04 20:58:53Marty's Bent

J.P. Morgan CEO Jamie Dimon has long been an outspoken skeptic and critic of bitcoin. He has called Bitcoin a speculative asset, a fraud, a pet rock, and has opined that it will inevitably blow up. A couple of years ago, he was on Capitol Hill saying that if he were the government, he would "close it down". Just within the last month, he was on Fox Business News talking with Maria Bartiromo, proclaiming that the U.S. should be stockpiling bullets and rare earth metals instead of bitcoin. It's pretty clear that Jamie Dimon, who is at the helm of the most powerful and largest bank in the world, does not like bitcoin one bit.

Evidence below:

via Bitcoin Magazine

via me

via CNBC

Despite Dimon's distinguished disdain for Bitcoin, J.P. Morgan cannot deny reality. The CEO of the largest bank in the world is certainly a powerful man, but no one individual, even in the position that Jamie Dimon is in, is more powerful than the market. And the market has spoken very clearly, it is demanding bitcoin. The Bitcoin ETFs have been the most successful ETFs in terms of pace of growth since their launch. They've accumulated tens of billions of dollars in AUM in a very short period of time. Outpacing the previous record set by the gold ETF, GLD.

Whether or not Jamie Dimon himself likes Bitcoin doesn't matter. J.P. Morgan, as the largest bank in the world and a publicly traded company, has a duty to shareholders. And that duty is to increase shareholder value by any ethical and legal means necessary. Earlier today, J.P. Morgan announced plans to offer clients financing against their Bitcoin ETFs, as well as some other benefits, including having their bitcoin holdings recognized in their overall net worth and liquid assets, similar to stocks, cars, and art, which will be massive for bitcoiners looking to get mortgages and other types of loans.

via Bloomberg

I've talked about this recently, but trying to buy a house when most of your liquid net worth is held in bitcoin is a massive pain in the ass. Up until this point, if you wanted to have your bitcoin recognized as part of your net worth and count towards your overall credit profile, you would need to sell some bitcoin, move it to a bank account, and have it sit there for a certain period of time before it was recognized toward your net worth. This is not ideal for bitcoiners who have sufficient cash flows and don't want to sell their bitcoin, pay the capital gains tax, and risk not being able to buy back the amount of sats they were forced to sell just to get a mortgage.

It's not yet clear to me whether or not J.P. Morgan will recognize bitcoin in cold storage toward their clients' net worth and credit profile, or if this is simply for bitcoin ETFs only. However, regardless, this is a step in the right direction and a validation of something that many bitcoiners have been saying for years. Inevitably, everyone will have to bend the knee to bitcoin. Today, it just happened to be the largest bank in the world. I expect more of this to come in the coming months, years, and decades.

Lyn Alden likes to say it in the context of the U.S. national debt and the fiscal crisis, but it also applies to bitcoin adoption and the need for incumbents to orient themselves around the demands of individual bitcoiners; nothing stops this train.

Corporate Bitcoin Treasuries are Changing Market Dynamics

Leon Wankum revealed how corporate Bitcoin treasuries are fundamentally reshaping business dynamics. Companies can now issue equity to fund operations while preserving their Bitcoin holdings, creating a revolutionary capital structure. Leon highlighted MicroStrategy's position, noting they hold enough Bitcoin to cover dividend payments for over 200 years. This model enables companies to reduce founder dilution since they don't need repeated funding rounds when their treasury appreciates.

"Some companies' Bitcoin treasuries are now worth more than all money they've ever raised." - Leon Wankum

Leon shared examples from his own portfolio companies where this strategy has proven transformative. Public companies have discovered an entirely new business model through strategic dilution that actually increases BTC per share. As Leon explained, this approach allows firms to leverage equity markets for operational funding while their Bitcoin treasury compounds in value, creating a positive feedback loop that benefits both shareholders and the company's long-term sustainability.

Check out the full podcast here for more on real estate price cycles, Bitcoin lending products, and the transition to a Bitcoin standard.

Headlines of the Day

California May Seize Idle Bitcoin After 3 Years - via X

Semler Scientific Buys $20M More Bitcoin, Holds $467M - via X

US Home Sellers Surge as Buyers Hit 4-Year Low - via X

Get our new STACK SATS hat - via tftcmerch.io

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I feel old.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ ca76c778:e784c54b

2025-06-04 19:45:11

@ ca76c778:e784c54b

2025-06-04 19:45:11A few days ago I remembered video by Antonio Stappaerts(Artwod) on Youtube. And I thought to myself I want to be really good at drawing hands.\ In the video he explains something that, in my opinion, applies when learning just about anything.

If you've heard of the Dunning-Kruger effect then you know the first part.\ If you haven't, one begins learning something and on top of the first peak thinks oneself to be almost a master. And then one learns a little bit more and realizes how little skill one actually has.

\

Now, what is really interesting is this. He points out that the second slope is made up of many smaller Dunning-Kruger effects. For example the effect will apply when learning: the basic shape of the figure, how to pose the figure, how draw the hands, the hair etc.

\

Now, what is really interesting is this. He points out that the second slope is made up of many smaller Dunning-Kruger effects. For example the effect will apply when learning: the basic shape of the figure, how to pose the figure, how draw the hands, the hair etc.So the way to climb the second hill is to understand and practice these smaller skills. And not just once or twice. You want to reach close to the second peak of each of the smaller skills.

And with that in mind I search for a good tutorial about drawing hands and got down to it(for the third time).

Step one was to learn pose and gesture using a grid shape.

https://cdn.satellite.earth/f55a9d1ef2fd687a9dce5ceee5e05a1b666c436509e264ddbac4d260b99e882a.jpg

https://cdn.satellite.earth/1b5524635c20ee4869f4860c982deea469cb87be7ad7b404e1777497b5a4fbd4.jpg

https://cdn.satellite.earth/35652251243ffd8c495b855c319d27da0c193ff2e951591f0a9f1b35aad39b29.jpg

https://cdn.satellite.earth/68f55979d102b4ebe55177842c6d9ab2ab30b95f926441429d977b47fae925c3.jpg

Step two. Practice the basic forms for the palm and fingers.\ I got carried away and drew some hands.

https://cdn.satellite.earth/48b400f72e35d078368149f00182cb58e606ddd16f6db4e7789c1431c28d44a0.jpg

Step three. learn the measurements.

https://cdn.satellite.earth/75c9b82da90ef50d17f698dd7b1eadc223b74a019a702a4617ed7d321646a87c.jpg

Step four. Understand the fingers.

https://cdn.satellite.earth/e33f9f3f9217bf5e3e206e96dfe764eba09b9fb3c10b450bb9c8a4075e3c1ec8.jpg

Step five. Learn about the thumb and put it all together. Drawing from reference and imagination.

https://cdn.satellite.earth/b2dd9c1cc1045dde021272199818b0db331e71a603c5900122aa850eb2d4148a.jpg

https://cdn.satellite.earth/8f5647ae9e148ad6217c106b5b69cf231384475e0a0eedf210bd149f75ade0b7.jpg

-

@ b1ddb4d7:471244e7

2025-06-05 10:00:43

@ b1ddb4d7:471244e7

2025-06-05 10:00:43Starting January 1, 2026, the United Kingdom will impose some of the world’s most stringent reporting requirements on cryptocurrency firms.

All platforms operating in or serving UK customers-domestic and foreign alike-must collect and disclose extensive personal and transactional data for every user, including individuals, companies, trusts, and charities.

This regulatory drive marks the UK’s formal adoption of the OECD’s Crypto-Asset Reporting Framework (CARF), a global initiative designed to bring crypto oversight in line with traditional banking and to curb tax evasion in the rapidly expanding digital asset sector.

What Will Be Reported?

Crypto firms must gather and submit the following for each transaction:

- User’s full legal name, home address, and taxpayer identification number

- Detailed data on every trade or transfer: type of cryptocurrency, amount, and nature of the transaction

- Identifying information for corporate, trust, and charitable clients

The obligation extends to all digital asset activities, including crypto-to-crypto and crypto-to-fiat trades, and applies to both UK residents and non-residents using UK-based platforms. The first annual reports covering 2026 activity are due by May 31, 2027.

Enforcement and Penalties

Non-compliance will carry stiff financial penalties, with fines of up to £300 per user account for inaccurate or missing data-a potentially enormous liability for large exchanges. The UK government has urged crypto firms to begin collecting this information immediately to ensure operational readiness.

Regulatory Context and Market Impact

This move is part of a broader UK strategy to position itself as a global fintech hub while clamping down on fraud and illicit finance. UK Chancellor Rachel Reeves has championed these measures, stating, “Britain is open for business – but closed to fraud, abuse, and instability”. The regulatory expansion comes amid a surge in crypto adoption: the UK’s Financial Conduct Authority reported that 12% of UK adults owned crypto in 2024, up from just 4% in 2021.

Enormous Risks for Consumers: Lessons from the Coinbase Data Breach

While the new framework aims to enhance transparency and protect consumers, it also dramatically increases the volume of sensitive personal data held by crypto firms-raising the stakes for cybersecurity.

The risks are underscored by the recent high-profile breach at Coinbase, one of the world’s largest exchanges.

In May 2025, Coinbase disclosed that cybercriminals, aided by bribed offshore contractors, accessed and exfiltrated customer data including names, addresses, government IDs, and partial bank details.

The attackers then used this information for sophisticated phishing campaigns, successfully deceiving some customers into surrendering account credentials and funds.

“While private encryption keys remained secure, sufficient customer information was exposed to enable sophisticated phishing attacks by criminals posing as Coinbase personnel.”

Coinbase now faces up to $400 million in compensation costs and has pledged to reimburse affected users, but the incident highlights the systemic vulnerability created when large troves of personal data are centralized-even if passwords and private keys are not directly compromised. The breach also triggered a notable drop in Coinbase’s share price and prompted a $20 million bounty for information leading to the attackers’ capture.

The Bottom Line

The UK’s forthcoming crypto reporting regime represents a landmark in financial regulation, promising greater transparency and tax compliance. However, as the Coinbase episode demonstrates, the aggregation of sensitive user data at scale poses a significant cybersecurity risk.

As regulators push for more oversight, the challenge will be ensuring that consumer protection does not become a double-edged sword-exposing users to new threats even as it seeks to shield them from old ones.

-

@ 2f5de000:2f9bcef1

2025-06-05 17:33:37

@ 2f5de000:2f9bcef1

2025-06-05 17:33:37I've wanted to write this piece for months. Not because I have anything against Jack Mallers personally - quite the opposite. But because I've watched a pattern emerge in Bitcoin that mirrors one of the most chilling dynamics in Atlas Shrugged: the systematic destruction of our most productive builders by the very people who should be celebrating them.

We are the looters. And Jack might just be our Hank Rearden.

The Underdog's Dilemma

There's a cruel irony in how we treat success in Bitcoin. We champion the underdog, root for the builder in the garage, celebrate the cypherpunk taking on the establishment. But the moment that underdog succeeds - the moment they scale, grow, and inevitably have to navigate the messy realities of the existing system - we turn on them with the ferocity of the same establishment we claim to oppose.\ \ Jack began building Zap (which evolved into Strike) from his parents home in Chicago. Strike has grown into one of the most seamless fiat-to-bitcoin on-ramps for everyday users. No complexity, just pure utility. From day one, he's operated at a level of transparency that would make most CEO's uncomfortable. He's been building in public, taking feedback, admitting mistakes, and iterating - sometimes within hours of criticism.

The Rearden Parallel

In Atlas Shrugged, Hank Rearden creates Rearden Metal - a revolutionary alloy that's stronger, lighter, and more efficient than anything that came before. Instead of celebration, he faces endless scrutiny, regulation, and demands to prove is worthiness. The people who benefit from his innovation spend their time questioning his motives, dissecting his business practices, and demanding he justify his success.

Sound familiar?

Jack comes from a finance background - his father and grandfather were in the industry. This isn't a liability; it's an asset. He understands the beast we're fighting. He's been a Bitcoiner since 2013 with a spotless track record in a space littered with exit scams and broken promises. His values align with proof of work, individualism, and the radical idea that bitcoin is for everyone.

Yet when he helps launch 21 Capital, we don't see innovation - we see betrayal. When he navigates regulatory requirements to build products that can actually reach mainstream adoption, we don't see pragmatism - we see capitulation.

The Scarred Perspective

Our skepticism isn't entirely unfounded. We've been burned before. Mt. Gox, FTX, Three Arrows Capital, Celcius, Terra/ LUNA, BlockFi, Bitconnect, Voyager, QuadrigaCX - the graveyard of Bitcoin is littered with the corpses of trusted institutions. We've learned, painfully, that trust must be earned and verified.

But somewhere along the way, our healthy skepticism has metastasized into destructive paranoia. We've become so focused on protecting ourselves from the next SBF that we're attacking the people building the future we claim to want.

I'm guilty of this myself. I've made scathing attacks on my Nostr feed, comparing Jack to SBF, scrutinising contract clauses about re-hypothecation, and questioning his every move privately. I was viewing his actions through the lens of collective trauma rather than the reality of his long track record.

The Looters Paradox

Here's the uncomfortable truth: we're not just passive observers in this drama. We're active participants. We're the looters.

In Atlas Shrugged, the looters don't necessarily steal directly. They steal time, energy, and focus. They create bureaucracy, demnd endless justification, and burden the productive with the weight of constant explanation. They don't build competing products - they just tear down what others have built.

Everytime we demand Jack explain his business model for the hundredth time, we're stealing his time. Every time we scrutinize his partnerships without offering alternatives, we're creating bureaucracy . Everytime we attack his character rather than his arguments, we're furthering the system we claim to oppose.

The free market will create products whether we like them or not. People will build services that use bitcoin as collateral, create lending products, and navigate regulatory frameworks. The question isn't whether these products will exist - it's whether they'll be built by people who share our values or by those who don't.

The Atlantis Risk

The producers eventually withdraw from society in Atlas Shrugged, retreating to Galt's Gulch (Atlantis) and leaving the looters to face the consequences of their destructive behaviour. The economy collapses because the people who actually build things decided it wasn't worth the hassle anymore.

We're walking dangerously close to this precipice in Bitcoin. We're creating an environment where our most capable builders might just decide it's not worth it. Where the hassle of dealing with our constant scrutiny and bad-faith attacks outweighs the mission of building the future.

Jack has been more patient with our criticism than we deserve. He's addressed concerns publicly, changed the course when necessary, and continued building despite the noise. But patience has limits. At some point, even the most mission-driven builders will ask themselves: "Why am I doing this?"

The Path Forward

I don't know enough about finance to fully understand everything Jack is building with 21 Capital. Neither do most of his critics. But I know enough about Bitcoin to recognise someone who's been fighting the good fight for over a decade.

This doesn't mean we should trust blindly. It doesn't mean we should stop asking questions or demanding transparency. But it does mean we should approach our builders with the same benefit of the doubt we'd want for ourselves.

We need to distinguish between healthy skepticism and destructive paranoia. Between holding people accountable and tearing them down. Between being vigilant and being looters.

The fiat system is the real enemy here. It's massive, entrenched, and infinitely resourcesful. It will adapt, co-opt, and corrupt everything it touches. Fighting it requires builders who are willing to get their hands dirty, navigate imperfect systems, and make pragmatic compromises while holding onto their core values.

We can continue to be looters, tearing down what we don't understand and driving our best builders toward their own version of Atlantis. Or we can be what we claim to be: supporters of the free market, believers of proof of work, and champions of those building the future.

Don't trust. Verify. But remember: verification works both ways.

-

@ 4fa5d1c4:fd6c6e41

2025-06-04 17:45:05

@ 4fa5d1c4:fd6c6e41

2025-06-04 17:45:051. Einleitung

Dieser Beitrag bietet eine detaillierte Einführung in Nostr - ein dezentrales Protokoll für soziale Medien, das sich grundlegend von traditionellen und föderierten Plattformen unterscheidet - und erweitert seine Diskussion, um das Potenzial für die Integration von Nostr in die Entwicklung von Bildungsplattformen im Sinne von Open Educational Practices (OEP) zu untersuchen. Nostr ist als leichtgewichtiger, zensurresistenter Mechanismus konzipiert, der in erster Linie auf einer kryptografischen Schlüsselverwaltung und einer Client-zentrierten Architektur basiert, die zusammen eine dezentrale Identitätskontrolle und Autonomie über digitale Inhalte ermöglichen. Im Gegensatz zu konventionellen zentralisierten Modellen, die sich auf servergestützte Kontrolle oder föderierte Systeme wie Mastodon, die Moderation und Identitätsspeicherung zusammenfassen, stützt sich Nostr auf ein Netzwerk von "Relais", die ohne direkte Interkommunikation arbeiten, wobei alle Funktionen der Datenaggregation, des Austauschs von Inhalten zwischen den Räumen und der Benutzerinteraktion an die Client-Anwendungen delegiert werden. Ziel dieses Beitrags ist es daher, einen umfassenden technischen und konzeptionellen Überblick über die Architektur des Protokolls und eine kritische Diskussion seiner Anwendbarkeit im Kontext dezentraler Bildungsplattformen zu geben, die eine offene, nutzergesteuerte Erstellung, Verwaltung und Verteilung von Inhalten fördern und damit den Prinzipien des OEP entsprechen.

2. Hintergrund und Motivation

Die Entwicklung der sozialen Medien in den letzten zwei Jahrzehnten war geprägt von zunehmend zentralisierten Plattformen, die sowohl die digitale Identität der Nutzer als auch die von ihnen erstellten Inhalte kontrollieren, was oft zu Zensur, algorithmischer Manipulation und Einzelausfällen führt. Im Gegensatz dazu haben sich dezentralisierte Social-Media-Protokolle wie Nostr als innovative Antwort auf diese Zentralisierungsfallen entwickelt, die offene, kryptografisch sichere und verteilte Architekturen verwenden. Nostr wurde mit dem ausdrücklichen Schwerpunkt konzipiert, den Nutzern die volle Kontrolle über ihre Kontoauthentifizierung und digitale Identität zu geben, was durch die Verwaltung von kryptografischen Schlüsselpaaren analog zu denen in Bitcoin-Wallets erreicht wird. Dieses Modell verbessert nicht nur die zensurresistenten Eigenschaften der Plattform, sondern verändert auch grundlegend die Machtdynamik in traditionellen sozialen Netzwerken, da es die Abhängigkeit von zentralen Behörden minimiert und die Möglichkeiten der Ausbeutung und Überwachung verringert. Im Kontext von Bildungsökosystemen bieten diese Merkmale eine solide Grundlage für die Entwicklung von Plattformen, die transparent, partizipatorisch und widerstandsfähig sind, da sie die gemeinsame Nutzung und kontinuierliche Weiterentwicklung von Bildungsressourcen ohne zentralisierte Kontrolle oder Unternehmenssteuerung unterstützen.

3. Technische Architektur von Nostr

Die Architektur von Nostr basiert in erster Linie auf zwei integralen Komponenten: Clients und Relays. Clients sind die benutzerseitigen Anwendungen, die die Erstellung, Veröffentlichung und Aggregation von Inhalten ermöglichen, während Relays Server sind, die von den Benutzern generierte Nachrichten, so genannte "Events", empfangen, speichern und weiterleiten. Eine der wichtigsten Neuerungen des Nostr-Protokolls ist die radikale Entkopplung der traditionellen Client-Server-Beziehung: Die Relais müssen sich nicht synchronisieren oder miteinander kommunizieren, was bedeutet, dass die Replikation von Inhalten und die Aggregation von Daten zwischen den Räumen vollständig auf der Client-Seite stattfindet. Dies minimiert die zentrale Kontrolle und schafft ein verteiltes, relaisbasiertes System, das von Natur aus resistent gegen Zensur ist, da die Dichte der verfügbaren Relays und die Möglichkeit der Nutzer, sich mit mehreren Relays zu verbinden, sicherstellen, dass die Inhalte auch dann zugänglich bleiben, wenn bestimmte Relays ausfallen oder kompromittiert sind.

In Nostr sind Ereignisse als JSON-Objekte strukturiert, die einem definierten Schema mit verschiedenen "Arten" (NIPs) entsprechen, um spezifische Funktionalitäten und andere zukünftige Erweiterungen zu unterstützen. Jedes Ereignis wird mit dem privaten kryptografischen Schlüssel des Nutzers digital signiert, was die Authentizität und Integrität der Daten garantiert und gleichzeitig eine sichere, pseudonyme Interaktion ermöglicht. Da innerhalb des Protokolls keine zentrale Behörde oder ein einziger Identitätsspeicher existiert, behalten die Nutzer die vollständige Kontrolle über ihre digitalen Identitäten, und wenn der private Schlüssel verloren geht, ist das entsprechende Konto unwiederbringlich. Dieser Ansatz verankert den Grundsatz, dass Identität sowohl dezentralisiert als auch unveränderlich ist, und stärkt die individuelle Kontrolle über persönliche Daten und Inhalte.

Da die Relays unabhängig voneinander von verschiedenen Betreibern verwaltet und nicht von zentralen Diensten koordiniert werden, können die Benutzer mehrere Relays auswählen, um die Bereitstellung und Replikation von Inhalten zu optimieren. Diese architektonische Entscheidung verbessert die Redundanz und Ausfallsicherheit erheblich, bringt aber gleichzeitig technische Herausforderungen in Bezug auf Standardisierung, Moderation und effiziente Kommunikation zwischen den Clients mit sich. Nostr integriert auch Bitcoin-basierte Mikrozahlungen (bekannt als "Zaps"), um finanzielle Anreize für den Betrieb von Relay-Servern zu schaffen und so die Herausforderungen der wirtschaftlichen Nachhaltigkeit in einer dezentralen Infrastruktur zu bewältigen. Die Design-Entscheidungen in Nostr fördern Offenheit und Innovation, indem sie es jeder Person oder Organisation mit ausreichenden technischen Fähigkeiten erlauben, ein Relay zu hosten oder einen Client zu entwickeln, was zu einem lebendigen Ökosystem von verschiedenen Anwendungen und Diensten führt.

4. Identitätsmanagement und Moderation

Im Mittelpunkt des dezentralen Paradigmas von Nostr steht der Ansatz der Identitätsverwaltung, der sich von traditionellen Systemen unterscheidet, bei denen Identitäten als Kontodaten von zentralen Servern verwaltet werden. Bei Nostr verfügt jeder Benutzer über ein einzigartiges kryptografisches Schlüsselpaar, wobei der öffentliche Schlüssel als dauerhafte digitale Kennung und der private Schlüssel als Mittel zum Signieren aller Aktionen und Ereignisse dient. Dieses kryptonative Modell gewährleistet nicht nur robuste Sicherheit und Authentizität, sondern überlässt den Nutzern auch die alleinige Verantwortung für die Verwaltung ihrer Schlüssel - was sowohl die Freiheit als auch das Risiko eines vollständig dezentralen Identitätssystems unterstreicht.Dieses empfindliche Gleichgewicht unterstreicht die Autonomie der Nutzer und steht im Einklang mit dem breiteren Ethos dezentraler sozialer Medien, in denen keine einzelne Instanz die Identität einer Person ohne Zugang zu ihrem privaten Schlüssel außer Kraft setzen oder manipulieren kann.

Die Moderation in Nostr ist aufgrund des dezentralen Kuratierungsmodells noch komplexer. Die Inhalte werden nicht von einer zentralen Behörde moderiert, sondern durch eine Kombination aus relaisspezifischen Richtlinien und clientseitigen Kontrollen, wie z. B. benutzerdefinierte Listen für persönliche Kuratoren oder Sperr-/Stummschaltungsfunktionen. Dieser Ansatz fördert zwar die freie Meinungsäußerung und unterstützt eine Vielzahl von Standpunkten, kann aber auch zu uneinheitlichen Moderationsrichtlinien und fragmentierten Nutzererfahrungen auf verschiedenen Relays und Clients führen, was für die Nutzer eine erhebliche technische und verhaltensbezogene Belastung darstellt, wenn sie ihre digitalen Umgebungen kuratieren wollen.

5. Skalierbarkeit und Widerstandsfähigkeit gegen Zensur

Ein entscheidendes Merkmal des Nostr-Protokolls ist sein hohes Maß an Skalierbarkeit und Zensurresistenz, das durch seine verteilte, relaisbasierte Architektur erreicht wird. Durch die Dezentralisierung der Speicherung und Verbreitung von Inhalten auf zahlreiche unabhängige Relays entschärft Nostr die üblichen Schwachstellen zentralisierter sozialer Plattformen, wie z. B. Single Points of Failure oder das Potenzial für staatliche oder unternehmensgesteuerte Zensur. Mehrere Relays können gleichzeitig arbeiten, wodurch sichergestellt wird, dass die Stabilität des Netzwerks auch dann erhalten bleibt, wenn einige von ihnen vom Netz genommen werden oder behördlichem Druck ausgesetzt sind, und dass Inhalte für Kunden, die mit alternativen Relays verbunden sind, zugänglich bleiben.

Die Skalierbarkeit von Nostr wird dadurch verbessert, dass sich die Nutzenden gleichzeitig mit mehreren Relays verbinden können, was die Replikation von Inhalten über ein globales Netz von Servern ermöglicht, das sich über zahlreiche geografische Regionen und autonome Systeme erstreckt. Dieser Replikationsmechanismus bringt jedoch Herausforderungen mit sich, wie z. B. eine erhöhte Redundanz bei der Speicher- und Bandbreitennutzung, die eine sorgfältige Optimierung und die Entwicklung innovativer clientseitiger Strategien erfordern, um den Datenabruf zu verwalten und den Overhead zu reduzieren, ohne die Verfügbarkeit zu beeinträchtigen. Darüber hinaus trägt die Dezentralisierung der Zuständigkeiten für Kuratierung und Moderation zu einer dynamischen Umgebung bei, in der Inhalte sowohl gegen erzwungene Löschungen resistent als auch an die Bedürfnisse der Nutzer anpassbar sind, wenn auch auf Kosten von Einheitlichkeit und vorhersehbarer Nutzererfahrung.

6. Vergleich mit föderierten und zentralisierten Modellen

Das Aufkommen dezentraler Protokolle wie Nostr steht in scharfem Kontrast zu föderierten Netzwerken wie Mastodon, die das ActivityPub-Protokoll verwenden. Während föderierte Systeme die Kontrolle über unabhängige Instanzen verteilen, verlassen sie sich immer noch auf ein gewisses Maß an Zentralisierung auf der Ebene jeder einzelnen Instanz, von denen jede ihre eigenen Richtlinien bezüglich Moderation, Identitätsüberprüfung und Inhaltszensur durchsetzt. In diesen Systemen ist die Verwaltung zwar auf mehrere Knotenpunkte verteilt, aber es besteht eine Abhängigkeit von Serveradministratoren, die erhebliche Macht über den Inhalt und die Identität der Benutzer haben; dies steht im Gegensatz zu Nostrs vollständig kundenorientiertem Kurations- und Identitätsverwaltungsmodell, das darauf abzielt, jeden einzelnen Kontrollpunkt zu eliminieren.

In zentralisierten Architekturen werden Benutzerdaten und -identitäten auf proprietäre und undurchsichtige Weise verwaltet, wodurch Inhalte den Launen von Unternehmensrichtlinien und externem Druck ausgesetzt werden, was zu Überwachung, gezielter Zensur oder einseitiger algorithmischer Manipulation von Inhalten führen kann. Das Design von Nostr - das auf kryptografischer Authentifizierung, clientseitiger Datenaggregation und dem erlaubnisfreien Betrieb von Relay-Servern beruht - stellt eine radikale Abkehr dar, die das Gleichgewicht der Macht fest in die Hände der einzelnen Nutzer und nicht in die Hände zentraler Behörden legt.

7. Implikationen für Bildungsplattformen

Das Potenzial für die Integration des dezentralen Protokolls von Nostr in Bildungsplattformen bietet eine transformative Gelegenheit zur Unterstützung von Open Educational Practices (OEP). OEP legt den Schwerpunkt auf Inklusion, Autonomie der Lernenden, kollaborative Wissenserstellung und offenen Zugang zu Bildungsressourcen. Herkömmliche Bildungsplattformen sind oft durch zentralisierte Architekturen eingeschränkt, die den Zugang behindern und Innovationen unterdrücken können, da sie auf einzelne administrative Kontrollen und proprietäre Content-Management-Systeme angewiesen sind.

Durch die Nutzung der dezentralen Infrastruktur von Nostr können Bildungsplattformen aufgebaut werden, die es Lehrenden und Lernenden ermöglichen, die volle Kontrolle über ihre digitalen Identitäten und Bildungsinhalte zu behalten, ohne das Risiko von Zensur oder externer Einmischung. In solchen Systemen verwaltet jeder Teilnehmer seine eigene Identität mithilfe von kryptografischen Schlüsseln, wodurch sichergestellt wird, dass Bildungsleistungen, Beiträge und Zeugnisse auf überprüfbare und unveränderliche Weise aufgezeichnet werden. Dies fördert ein Umfeld, in dem die Schaffung und Verbreitung von Wissen wirklich von den Teilnehmern selbst bestimmt wird, frei von den Zwängen, die von zentralen Torwächtern auferlegt werden.

Darüber hinaus bietet die relaisbasierte Architektur von Nostr eine beispiellose Skalierbarkeit und Ausfallsicherheit - Eigenschaften, die für ein Bildungsökosystem, das eine Vielzahl von Nutzern mit unterschiedlichem geografischen und sozioökonomischen Hintergrund unterstützen muss, unerlässlich sind. Bildungsinhalte - von digitalen Lehrbüchern und Multimedia-Vorlesungen bis hin zu interaktiven Diskursen und gemeinschaftlichen Projekten - können gespeichert und über mehrere Relays repliziert werden, um sicherzustellen, dass der Zugang auch bei lokalen Netzwerkausfällen oder Zensurversuchen erhalten bleibt.

Das offene Protokoll von Nostr ist außerdem eine ideale Grundlage für die Entwicklung interoperabler Bildungsplattformen, auf denen Drittentwickler und Bildungseinrichtungen maßgeschneiderte Clients und Anwendungen für pädagogische Zwecke erstellen können. Dieser Ansatz fördert ein vielfältiges Ökosystem von Bildungswerkzeugen und -diensten, die nahtlos zusammenarbeiten, ohne auf eine einzige proprietäre Plattform beschränkt zu sein, und steht damit im Einklang mit dem Ethos des OEP. Pädagogen können digitale Lernumgebungen entwerfen, die die kollaborative Erstellung von Inhalten, Peer-Reviews und Community-gesteuerte Kuration unterstützen und gleichzeitig von der Sicherheit und Transparenz profitieren, die das kryptografische Grundgerüst von Nostr bietet.

Darüber hinaus gewährleistet die inhärente Zensurresistenz von Nostr, dass Bildungsinhalte zugänglich und frei von staatlichen oder unternehmerischen Eingriffen bleiben - ein besonders wichtiger Aspekt für Lernende in Regionen, in denen der Zugang zu Informationen eingeschränkt oder überwacht wird. Diese Widerstandsfähigkeit untermauert nicht nur die demokratische Verbreitung von Wissen, sondern unterstützt auch den Grundsatz eines digitalen Gemeinguts, bei dem Bildungsressourcen kollektiv verwaltet und gemeinsam genutzt werden. In diesem Zusammenhang kann Nostr genutzt werden, um Bildungsplattformen zu entwickeln, die nicht nur robust und integrativ sind, sondern auch auf die Bedürfnisse marginalisierter oder unterrepräsentierter Gemeinschaften abgestimmt sind.

Zusätzlich zu diesen strukturellen Vorteilen kann die finanzielle Nachhaltigkeit dezentraler Bildungsplattformen durch die Integration von auf Kryptowährungen basierenden Anreizmechanismen gestärkt werden - wie die Unterstützung von Nostr für Bitcoin Lightning "Zaps" zeigt. Diese Micropayment-Systeme eröffnen Möglichkeiten für neuartige Finanzierungsmodelle, die Pädagogen und Inhaltsersteller direkt belohnen und so die Abhängigkeit von werbebasierten Einnahmen oder zentralisierten Finanzierungsströmen verringern, die häufig die Integrität der Bildung gefährden. Solche wirtschaftlichen Anreize können auch den Betrieb und die Wartung von Relay-Servern unterstützen und so sicherstellen, dass die dezentrale Infrastruktur belastbar und kontinuierlich für Bildungszwecke verfügbar bleibt.

8. Möglichkeiten für kollaboratives und kultursensibles Lernen

Über die technische Stabilität und Skalierbarkeit hinaus bietet die dezentrale Natur von Nostr bedeutende Möglichkeiten zur Förderung von kollaborativem Lernen und kultursensibler Pädagogik. Dezentralisierte Bildungsplattformen, die auf Nostr aufbauen, können lokale Gemeinschaften in die Lage versetzen, Inhalte zu erstellen und zu kuratieren, die kontextuell relevant und kulturell angemessen sind - ein entscheidender Faktor bei der Förderung von Bildungsgerechtigkeit und Inklusivität. In Umgebungen, in denen Mainstream-Bildungstechnologien als von oben nach unten betrachtet werden und nicht mit lokalen Werten oder pädagogischen Ansätzen übereinstimmen, ermöglicht eine dezentralisierte Infrastruktur die Entwicklung maßgeschneiderter digitaler Lernumgebungen, die lokale Kulturen, Sprachen und Traditionen widerspiegeln.

Dieser gemeinschaftsorientierte Bildungsansatz fördert das Gefühl der Eigenverantwortung bei Lernenden und Lehrenden gleichermaßen und ermutigt zur gemeinschaftlichen Schaffung von Wissen, das unterschiedliche Erkenntnistheorien respektiert. So können Pädagogen beispielsweise dezentrale "Lernräume" einrichten, in denen Open-Source-Lernmaterialien, Werkzeuge für die digitale Kompetenz und innovative Lehrmethoden gemeinsam genutzt und durch partizipatives Engagement kontinuierlich weiterentwickelt werden. In einem solchen Modell verschwimmen die Grenzen zwischen Lernenden und Lehrenden, was einen fließenden Ideenaustausch und die gemeinsame Schaffung von Wissen ermöglicht, die im Mittelpunkt offener Bildungspraktiken stehen.

Darüber hinaus ermöglicht die Flexibilität der Client-zentrierten Architektur von Nostr die Entwicklung von spezialisierten Bildungsclients, die auf die jeweiligen Lernstile und Disziplinen zugeschnitten sind. Diese Clients könnten Funktionen wie erweiterte Such- und Filterfunktionen für Bildungsinhalte, integrierte Anmerkungswerkzeuge für die gemeinsame Bearbeitung von Dokumenten und interoperable Identitätsmanagementsysteme enthalten, die es den Lernenden ermöglichen, ihre Anmeldedaten nahtlos in verschiedene digitale Lernumgebungen zu übertragen. Solche Innovationen würden nicht nur die Rolle der Nutzerautonomie beim digitalen Lernen stärken, sondern auch die Entwicklung von Bildungsnetzwerken fördern, die belastbar und anpassungsfähig sind und auf die sich verändernden pädagogischen Herausforderungen reagieren können.

9. Herausforderungen und Abhilfestrategien

Trotz der vielversprechenden Möglichkeiten ist die Integration von Nostr in Bildungsplattformen nicht unproblematisch. Gerade die Funktionen, die den Nutzern mehr Möglichkeiten bieten - wie selbstverwaltete kryptografische Schlüssel und dezentralisierte Inhaltsmoderation - führen auch Komplexitäten ein, die die Benutzerfreundlichkeit und Zugänglichkeit behindern können, insbesondere für Personen ohne fortgeschrittene technische Kenntnisse. Die Schlüsselverwaltung stellt beispielsweise eine kritische Schwachstelle dar; der Verlust eines privaten Schlüssels führt unwiderruflich zum Verlust der Identität und des Zugriffs auf die eigenen digitalen Beiträge - ein Risiko, das durch solide Bildungsinitiativen und Mechanismen zur Unterstützung der Nutzer angegangen werden muss.

Die technische Kompetenz von Lehrenden und Lernenden ist in diesem Zusammenhang von größter Bedeutung und erfordert die Entwicklung umfassender Einführungsverfahren, benutzerfreundlicher Schnittstellen und Hilfsmittel, die kryptografische Konzepte entmystifizieren und die Interaktion mit dezentralen Netzwerken vereinfachen. Zu diesem Zweck könnte der Einsatz intuitiver Bildungsmodule, interaktiver Tutorials und von der Community geleiteter Schulungen technische Barrieren abbauen und gleichzeitig die Entwicklung digitaler Kompetenzen fördern, die für die Navigation in dezentralen Netzwerken unerlässlich sind. Darüber hinaus muss die Herausforderung einer inkonsistenten Moderation und fragmentierten Nutzererfahrung aufgrund der heterogenen Richtlinien unabhängiger Relais und Clients durch die Einrichtung von Community-Governance-Rahmenwerken und interoperablen Standards angegangen werden, die eine Grundlinie der Qualität und Sicherheit auf der gesamten Plattform gewährleisten.

Strategien zur Bewältigung des mit der Skalierbarkeit verbundenen Overheads - wie etwa die redundante Replikation von Beiträgen über eine übermäßige Anzahl von Relays - sollten sich auf die Implementierung clientseitiger Optimierungstechniken konzentrieren, die die Ineffizienz von Bandbreite und Speicherplatz verringern, ohne die Belastbarkeit und Zugänglichkeit des Netzwerks zu beeinträchtigen. Kontinuierliche Forschung und iterative Verfeinerung werden notwendig sein, um ein Gleichgewicht zwischen den Vorteilen der Dezentralisierung und der ihr innewohnenden betrieblichen Komplexität zu finden und sicherzustellen, dass auf Nostr basierende Bildungsplattformen sowohl robust als auch benutzerfreundlich bleiben können.

10. Zukünftige Richtungen und Forschungsmöglichkeiten