-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ 1d7ff02a:d042b5be

2025-05-24 10:15:40

@ 1d7ff02a:d042b5be

2025-05-24 10:15:40ຄົນສ່ວນຫຼາຍມັກຈະມອງເຫັນ Bitcoin ເປັນສິນຊັບທີ່ມີຄວາມສ່ຽງສູງ ເນື່ອງຈາກມີອັດຕາການປ່ຽນແປງລາຄາທີ່ຮຸນແຮງແລະກວ້າງຂວາງໃນໄລຍະສັ້ນໆ. ແຕ່ຄວາມຈິງແລ້ວ ຄວາມຜັນຜວນຂອງ Bitcoin ແມ່ນຄຸນລັກສະນະພິເສດທີ່ສຳຄັນຂອງມັນ ບໍ່ແມ່ນຂໍ້ບົກພ່ອງ.

ລາຄາແມ່ນຫຍັງ?

ເພື່ອເຂົ້າໃຈເລື້ອງນີ້ດີຂຶ້ນ ເຮົາຕ້ອງເຂົ້າໃຈກ່ອນວ່າລາຄາໝາຍເຖິງຫຍັງ. ລາຄາແມ່ນການສະທ້ອນຄວາມຄິດເຫັນແລະການປະເມີນມູນຄ່າຂອງຜູ້ຊື້ແລະຜູ້ຂາຍໃນເວລາໃດໜຶ່ງ. ການຕັດສິນໃຈຊື້ຫຼືຂາຍໃນລາຄາໃດໜຶ່ງ ກໍແມ່ນການສື່ສານກັບຕະຫຼາດ ແລະກົນໄກຂອງຕະຫຼາດຈະຄ້ົນຫາແລະກໍານົດລາຄາທີ່ແທ້ຈິງຂອງສິນຊັບນັ້ນ.

ເປັນຫຍັງ Bitcoin ຈຶ່ງຜັນຜວນ?

Bitcoin ຖືກສ້າງຂຶ້ນບົນພື້ນຖານອິນເຕີເນັດ ເຮັດໃຫ້ການສື່ສານຄວາມຄິດເຫັນຂອງຜູ້ຄົນສາມາດເຮັດໄດ້ຢ່າງໄວວາ. ຍິ່ງໄປກວ່ານັ້ນ Bitcoin ມີລັກສະນະກະຈາຍສູນ (decentralized) ແລະບໍ່ມີຜູ້ຄວບຄຸມສູນກາງ ຈຶ່ງເຮັດໃຫ້ຄົນສາມາດຕັດສິນໃຈຊື້ຂາຍໄດ້ຢ່າງໄວວາ.

ສິ່ງນີ້ເຮັດໃຫ້ລາຄາຂອງ Bitcoin ສາມາດສະທ້ອນຄວາມຄິດເຫັນຂອງຄົນໄດ້ແບບເວລາຈິງ (real-time). ແລະເນື່ອງຈາກມະນຸດເຮົາມີຄວາມຄິດທີ່ບໍ່ແນ່ນອນ ມີການປ່ຽນແປງ ລາຄາຂອງ Bitcoin ຈຶ່ງປ່ຽນແປງໄປຕາມຄວາມຄິດເຫັນລວມຂອງຜູ້ຄົນແບບທັນທີ.

ປັດໄຈທີ່ເພີ່ມຄວາມຜັນຜວນ:

ຂະໜາດຕະຫຼາດທີ່ຍັງນ້ອຍ: ເມື່ອປຽບທຽບກັບຕະຫຼາດການເງິນແບບດັ້ງເດີມ ຕະຫຼາດ Bitcoin ຍັງມີຂະໜາດນ້ອຍ ເຮັດໃຫ້ການຊື້ຂາຍຈຳນວນໃຫຍ່ສາມາດສົ່ງຜົນກະທົບຕໍ່ລາຄາໄດ້ຫຼາຍ.

ການຄ້າຂາຍຕະຫຼອດ 24/7: ບໍ່ເຫມືອນກັບຕະຫຼາດຫຼັກຊັບທີ່ມີເວລາເປີດປິດ Bitcoin ສາມາດຊື້ຂາຍໄດ້ຕະຫຼອດເວລາ ເຮັດໃຫ້ການປ່ຽນແປງລາຄາສາມາດເກີດຂຶ້ນໄດ້ທຸກເວລາ.

ການປຽບທຽບກັບສິນຊັບອື່ນ

ເມື່ອປຽບທຽບກັບສິນຊັບອື່ນທີ່ມີການຄວບຄຸມ ເຊັ່ນ ສະກຸນເງິນທ້ອງຖິ່ນຫຼືທອງຄຳ ທີ່ເບິ່ງຄືວ່າມີຄວາມຜັນຜວນໜ້ອຍກວ່າ Bitcoin ນັ້ນ ບໍ່ແມ່ນຫມາຍຄວາມວ່າພວກມັນບໍ່ມີຄວາມຜັນຜວນ. ແຕ່ເປັນເພາະມີການຄວບຄຸມຈາກອົງການສູນກາງ ເຮັດໃຫ້ການສື່ສານຄວາມຄິດເຫັນຂອງຄົນໄປຮອດຕະຫຼາດບໍ່ແບບເວລາຈິງ.

ດັ່ງນັ້ນ ສິ່ງທີ່ເຮົາເຫັນແມ່ນການຊັກຊ້າ (delay) ໃນການສະແດງຄວາມຄິດເຫັນທີ່ແທ້ຈິງອອກມາເທົ່ານັ້ນ ບໍ່ແມ່ນຄວາມໝັ້ນຄົງຂອງມູນຄ່າ.

ກົນໄກການຄວບຄຸມແລະຜົນກະທົບ:

ສະກຸນເງິນ: ທະນາຄານກາງສາມາດພິມເງິນ ປັບອັດຕາດອກເບີ້ຍ ແລະແຊກແຊງຕະຫຼາດ ເຮັດໃຫ້ລາຄາບໍ່ສະທ້ອນມູນຄ່າທີ່ແທ້ຈິງໃນທັນທີ.

ຫຼັກຊັບ: ມີລະບຽບການຫຼາຍຢ່າງ ເຊັ່ນ ການຢຸດການຊື້ຂາຍເມື່ອລາຄາປ່ຽນແປງຫຼາຍເກີນໄປ (circuit breakers) ທີ່ຂັດຂວາງການສະແດງຄວາມຄິດເຫັນທີ່ແທ້ຈິງ.

ທອງຄຳ: ຖຶງແມ່ນຈະເປັນສິນຊັບທີ່ບໍ່ມີການຄວບຄຸມ ແຕ່ຕະຫຼາດທອງຄຳມີຂະໜາດໃຫຍ່ກວ່າ Bitcoin ຫຼາຍ ແລະມີການຄ້າແບບດັ້ງເດີມທີ່ຊ້າກວ່າ.

ບົດສະຫຼຸບ

ການປຽບທຽບຄວາມຜັນຜວນລະຫວ່າງ Bitcoin ແລະສິນຊັບອື່ນໆ ໂດຍໃຊ້ໄລຍະເວລາສັ້ນນັ້ນ ບໍ່ມີຄວາມສົມເຫດສົມຜົນປານໃດ ເພາະວ່າປັດໄຈເລື້ອງການຊັກຊ້າໃນການສະແດງຄວາມຄິດເຫັນນີ້ແມ່ນສິ່ງສຳຄັນທີ່ສົ່ງຜົນຕໍ່ລາຄາທີ່ແທ້ຈິງ.

ສິ່ງທີ່ຄວນເຮັດແທ້ໆແມ່ນການນຳເອົາກອບເວລາທີ່ກວ້າງຂວາງກວ່າມາວິເຄາະ ເຊັ່ນ ເປັນປີຫຼືຫຼາຍປີ ແລ້ວຈຶ່ງປຽບທຽບ. ດ້ວຍວິທີນີ້ ເຮົາຈຶ່ງຈະເຫັນປະສິດທິຜົນແລະການດຳເນີນງານທີ່ແທ້ຈິງຂອງ Bitcoin ໄດ້ຢ່າງຈະແຈ້ງ

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ 91bea5cd:1df4451c

2025-05-23 17:04:49

@ 91bea5cd:1df4451c

2025-05-23 17:04:49Em nota, a prefeitura justificou que essas alterações visam ampliar a segurança das praias, conforto e organização, para os frequentadores e trabalhadores dos locais. No entanto, Orla Rio, concessionária responsável pelos espaços, e o SindRio, sindicato de bares e restaurantes, ficou insatisfeita com as medidas e reforçou que a música ao vivo aumenta em mais de 10% o ticket médio dos estabelecimentos e contribui para manter os empregos, especialmente na baixa temporada.

De acordo com Paes, as medidas visam impedir práticas ilegais para que a orla carioca continue sendo um espaço ativo econômico da cidade: “Certas práticas são inaceitáveis, especialmente por quem tem autorização municipal. Vamos ser mais restritivos e duros. A orla é de todos”.

Saiba quais serão as 16 proibições nas praias do Rio de Janeiro

- Utilização de caixas de som, instrumentos musicais, grupos ou qualquer equipamento sonoro, em qualquer horário. Apenas eventos autorizados terão permissão.

- Venda ou distribuição de bebidas em garrafas de vidro em qualquer ponto da areia ou do calçadão.

- Estruturas comerciais ambulantes sem autorização, como carrocinhas, trailers, food trucks e barracas.

- Comércio ambulante sem permissão, incluindo alimentos em palitos, churrasqueiras, isopores ou bandejas térmicas improvisadas.

- Circulação de ciclomotores e patinetes motorizados no calçadão.

- Escolinhas de esportes ou recreações não autorizadas pelo poder público municipal.

- Ocupação de área pública com estruturas fixas ou móveis de grandes proporções sem autorização.

- Instalação de acampamentos improvisados em qualquer trecho da orla.

- Práticas de comércio abusivo ou enganosas, incluindo abordagens insistentes. Quiosques e barracas devem exibir cardápio, preços e taxas de forma clara.

- Uso de animais para entretenimento, transporte ou comércio.

- Hasteamento ou exibição de bandeiras em mastros ou suportes.

- Fixação de objetos ou amarras em árvores ou vegetação.

- Cercadinhos feitos por ambulantes ou quiosques, que impeçam a livre circulação de pessoas.

- Permanência de carrinhos de transporte de mercadorias ou equipamentos fora dos momentos de carga e descarga.

- Armazenamento de produtos, barracas ou equipamentos enterrados na areia ou depositados na vegetação de restinga.

- Uso de nomes, marcas, logotipos ou slogans em barracas. Apenas a numeração sequencial da prefeitura será permitida.

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 502ab02a:a2860397

2025-05-25 01:03:51

@ 502ab02a:a2860397

2025-05-25 01:03:51บางครั้งพลังยิ่งใหญ่ที่สุดก็ไม่ใช่สิ่งที่เห็นได้ด้วยตาเปล่า เหมือนแสงแดดที่คนส่วนใหญ่มักจะกลัวเพราะกลัวผิวเสีย กลัวฝ้า กลัวร้อน แต่แท้จริงแล้วในแสงแดดมีบางสิ่งที่น่าเคารพอยู่ลึกๆ มันคือแสงที่มองไม่เห็น มันไม่แสบตา ไม่แสบผิว แต่มันลึก ถึงเซลล์ มันคือ “แสงอินฟราเรด” ที่ซ่อนตัวอย่างสุภาพในแดดยามเช้า

เฮียมักชอบพูดว่า แดดที่ดีไม่จำเป็นต้องแสบหลัง อาบแสงที่ลอดผ่านใบไม้ยามเช้าแบบไม่ต้องฝืนตาก็พอ แสงอินฟราเรดนี่แหละคือพระเอกตัวจริงในความเงียบ มันไม่ดัง ไม่โชว์ ไม่โฆษณา แต่มันลงลึกไปถึงระดับที่ร่างกายเรากำลังหิวโดยไม่รู้ตัวในระดับเซลล์

ในเซลล์ของเรา มีหน่วยผลิตพลังงานที่เรียกว่าไมโทคอนเดรีย เจ้านี่แหละคือโรงไฟฟ้าจิ๋วประจำบ้าน ที่ต้องตื่นมาทำงานทุกวันโดยไม่ได้หยุดเสาร์อาทิตย์ ยิ่งถ้าไมโทคอนเดรียทำงานไม่ดี ร่างกายก็จะเหมือนไฟตกทั้งระบบ—ง่วงง่าย เพลียไว ปวดนู่นปวดนี่เหมือนไฟในบ้านกระพริบตลอดเวลา

แล้วแสงอินฟราเรดเกี่ยวอะไรกับมัน? เฮียขอเล่าง่ายๆ ว่า ไมโทคอนเดรียมีตัวรับแสงตัวหนึ่งชื่อว่า cytochrome c oxidase เจ้านี่ตอบสนองต่อแสงอินฟราเรดช่วงคลื่นเฉพาะ คือประมาณ 600–900 นาโนเมตร พอโดนเข้าไป มันเหมือนได้จุดประกายให้โรงงานพลังงานในร่างกายกลับมาคึกคักอีกครั้ง ผลิตพลังงานได้มากขึ้น ระบบไหลเวียนเลือดก็ดีขึ้น เหมือนท่อน้ำที่เคยอุดตันก็กลับมาใสแจ๋ว ความอักเสบเล็กๆ ในร่างกายก็ลดลง คล้ายบ้านที่เคยอับชื้นแล้วได้เปิดหน้าต่างให้แสงแดดส่องเข้าไป

และที่น่ารักกว่านั้นคือ เราไม่ต้องไปถึงชายหาด ไม่ต้องจองรีสอร์ตริมทะเล แค่แดดเช้าอ่อนๆ ข้างบ้านหรือตามขอบระเบียง ก็ให้แสงอินฟราเรดได้แล้ว ถ้าใครอยู่ในเมืองใหญ่ที่มีแต่ตึกบังแดด แล้วจะเลือกใช้หลอดไฟ Red Light Therapy ก็ไม่ผิด แต่ต้องเลือกแบบรู้เท่าทันรู้ ไม่ใช่เห็นใครรีวิวก็ซื้อมาเปิดใส่หน้า หวังจะหน้าใสข้ามคืน ต้องเข้าใจทั้งความยาวคลื่น เวลาใช้งาน และจุดประสงค์ ไม่ใช่ใช้เพราะแค่กลัวแก่อยากหน้าตึง แต่ใช้เพราะอยากให้ร่างกายกลับไปทำงานอย่างเป็นธรรมชาติอีกครั้ง และอยู่ในประเทศหรือสถานที่ที่โดนแดดได้น้อยอยากได้เสริมเฉยๆ

แล้วเราจะรู้ได้ยังไงว่าไมโทคอนเดรียเรากลับมาทำงานดีขึ้น? เฮียว่าไม่ต้องรอผลเลือดจากแล็บไหนก็รู้ได้ อย่าไปยึดติดกับตัวเลขมากครับ เอาตัวเองเป็นหลัก ตั้งคำถามกับตัวเองว่ารู้สึกยังไงบ้าง ถ้าเริ่มนอนหลับลึกขึ้น ตื่นมาแล้วหัวไม่มึน ไม่หงุดหงิดตั้งแต่ยังไม่ลืมตา ถ้าปวดหลังปวดข้อที่เคยมีเริ่มหายไปแบบไม่ได้กินยา หรือแม้แต่ผิวที่ดูสดใสขึ้นแบบไม่ต้องง้อสกินแคร์ นั่นแหละคือเสียงขอบคุณเบาๆ จากไมโทคอนเดรียที่ได้แสงแดดแล้วกลับมามีชีวิตอีกครั้ง ถ้ามันดีก็คือดี

บางที เราไม่ต้องกินวิตามินเม็ดไหนเพิ่ม แค่เดินออกไปรับแดดเบาๆ ในเวลาเช้าๆ แล้วให้ร่างกายได้พูดคุยกับธรรมชาติบ้าง เพราะในความอบอุ่นเงียบๆ ของแสงอินฟราเรดนั้น มีเสียงเบาๆ ที่กำลังปลุกพลังในตัวเราให้กลับมาอีกครั้ง

แดดไม่ใช่ศัตรู ถ้าเรารู้จักมันในมุมที่ถูกต้อง เฮียแค่อยากชวนให้ลองเปลี่ยนจากคำว่า “กลัวแดด” เป็น “ฟังแดด” เพราะบางครั้งธรรมชาติไม่ได้พูดด้วยคำ แต่สื่อสารด้วยแสงที่แทรกผ่านหัวใจเราโดยไม่ต้องผ่านล่าม

บางคนอาจคิดในใจ “แหมเฮีย ก็ดีหรอก ถ้าได้ตื่นเช้า” 555555

เฮียเข้าใจดีเลยว่าไม่ใช่ทุกคนจะตื่นมาทันแดดยามเช้าได้เสมอไป ชีวิตคนเรามันไม่ได้เริ่มต้นพร้อมไก่ขันทุกวัน บางคนเพิ่งเข้านอนตอนตีสาม ตื่นอีกทีแดดก็แตะบ่ายเข้าไปแล้ว ไม่ต้องกังวลไปจ้ะ เพราะความมหัศจรรย์ของแสงอินฟราเรดยังมีให้เราได้ใช้แม้ในแดดยามเย็น

แดดช่วงเย็น โดยเฉพาะหลังสี่โมงเย็นไปจนเกือบหกโมง (หรือเร็วช้าตามฤดู) ก็ยังอุดมไปด้วยแสงอินฟราเรดในช่วงคลื่นที่ไมโทคอนเดรียชอบ แถมยังไม่มีรังสี UV ที่แรงจัดมารบกวนเหมือนตอนเที่ยง เรียกว่าเป็นแดดแบบละมุนๆ สำหรับคนที่อยาก “บำบัดใจ” แบบไม่ต้องร้อนจนหัวเปียก

เฮียเคยลองตากแดดเย็นเดินไปในสวนสาธารณะ แล้วรู้สึกว่ามันเหมือนได้รีเซ็ตจิตใจหลังวันเหนื่อยๆ ไปในตัว ยิ่งพอรู้ว่าในช่วงเวลานี้แสงที่ได้กำลังช่วยปลุกพลังงานในร่างกายแบบเงียบๆ ด้วยแล้ว มันทำให้เฮียยิ่งเคารพธรรมชาติมากขึ้นไปอีก เคยเห็นคนที่วันๆมีแต่ความเครียด ความโกรธ ความอาฆาตต่อโลกไหมหละ บางคนแค่โดนแดด แต่ไม่ได้ตากแดด การตากแดดคือปล่อยใจไปกับธรรมชาติ พูดคุยกับร่างกาย บอกเขาว่าเราจะทำตัวให้เป็นประโยชน์กับโลกใบนี้ ให้สมกับที่ใช้พลังงานของโลก

จะเช้าหรือเย็น สำคัญไม่เท่ากับความตั้งใจ เฮียว่าไม่ว่าชีวิตจะตื่นตอนไหน ถ้าเราให้เวลาแค่ 10–15 นาทีในแต่ละวัน ออกไปยืนให้แดดแตะหน้า แตะแขน หรือแค่ให้แสงลอดผ่านตาเบาๆ โดยไม่ต้องจ้องจ้าๆ ก็พอ แค่นี้ก็เป็นการให้ไมโทคอนเดรียได้หายใจ ได้ออกกำลังกายแบบของมัน และได้ส่งพลังกลับมาหาเราทั้งร่างกายและจิตใจ

สุดท้ายแล้ว แดดไม่ได้แบ่งชนชั้น ไม่เลือกว่าจะรักเฉพาะคนตื่นเช้า หรือโกรธคนตื่นสาย ขอแค่เรารู้จักเวลาและวิธีอยู่กับมันอย่างถูกจังหวะ แดดก็พร้อมจะให้เสมอ

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr #SundaySpecialเราจะไปเป็นหมูแดดเดียว

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:22

@ 04c915da:3dfbecc9

2025-05-20 15:50:22There is something quietly rebellious about stacking sats. In a world obsessed with instant gratification, choosing to patiently accumulate Bitcoin, one sat at a time, feels like a middle finger to the hype machine. But to do it right, you have got to stay humble. Stack too hard with your head in the clouds, and you will trip over your own ego before the next halving even hits.

Small Wins

Stacking sats is not glamorous. Discipline. Stacking every day, week, or month, no matter the price, and letting time do the heavy lifting. Humility lives in that consistency. You are not trying to outsmart the market or prove you are the next "crypto" prophet. Just a regular person, betting on a system you believe in, one humble stack at a time. Folks get rekt chasing the highs. They ape into some shitcoin pump, shout about it online, then go silent when they inevitably get rekt. The ones who last? They stack. Just keep showing up. Consistency. Humility in action. Know the game is long, and you are not bigger than it.

Ego is Volatile

Bitcoin’s swings can mess with your head. One day you are up 20%, feeling like a genius and the next down 30%, questioning everything. Ego will have you panic selling at the bottom or over leveraging the top. Staying humble means patience, a true bitcoin zen. Do not try to "beat” Bitcoin. Ride it. Stack what you can afford, live your life, and let compounding work its magic.

Simplicity

There is a beauty in how stacking sats forces you to rethink value. A sat is worth less than a penny today, but every time you grab a few thousand, you plant a seed. It is not about flaunting wealth but rather building it, quietly, without fanfare. That mindset spills over. Cut out the noise: the overpriced coffee, fancy watches, the status games that drain your wallet. Humility is good for your soul and your stack. I have a buddy who has been stacking since 2015. Never talks about it unless you ask. Lives in a decent place, drives an old truck, and just keeps stacking. He is not chasing clout, he is chasing freedom. That is the vibe: less ego, more sats, all grounded in life.

The Big Picture

Stack those sats. Do it quietly, do it consistently, and do not let the green days puff you up or the red days break you down. Humility is the secret sauce, it keeps you grounded while the world spins wild. In a decade, when you look back and smile, it will not be because you shouted the loudest. It will be because you stayed the course, one sat at a time. \ \ Stay Humble and Stack Sats. 🫡

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ bf47c19e:c3d2573b

2025-05-24 23:02:05

@ bf47c19e:c3d2573b

2025-05-24 23:02:05Da li ste znali da se već danas u Srbiji možete kompletno obući i svoj dom u potpunosti opremiti tehnikom i za sve to platiti Bitkoinom? Sve ovo je moguće zahvaljujući kompaniji Bitrefill!

Bitrefill je vodeća platforma koja omogućava kupovinu poklon-kartica putem Bitkoina i drugih kriptovaluta.

Od poklon-kartica koje je moguće kupiti na Bitrefillu, u Srbiji je najpopularnija, najraznovrsnija i najpraktičnija za korišćenje digitalna Giftoncard Multibrand poklon-kartica koju je moguće koristiti u više desetina šoping centara širom Srbije! Moguće je iskoristiti u više od 150 naznačenih brendova i radnji raznovrsnog tipa i zato kao takva predstavlja pravi spoj zabave, mode, sporta, tehnike... Od najpoznatijih prodavnica izdvajaju se Gigatron, Tehnomanija, Tehnomedija, Puma, Adidas, Sport Vision, Univerexport...

GiftOnCard poklon kartica je savršen način da ispoštujete ukus baš svakoga i rešite problem promašenog poklona!

Neki od tržnih centara u kojima se mogu koristiti poklon-kartice: Delta City, TC Ušće, Ada Mall, Galerija Beograd, TC Stadion, Merkator Centar Beograd/Novi Sad, Roda Mega Shopping Centar, Big Kruševac, Big Nova Pazova, Aviv Park Zvezdara, Stop Shop Borča, Forum Park, Big Shopping Centar Novi Sad, TC Promenada Novi Sad, TC Forum Niš, Delta Planet Niš, Capitol Park Šabac...

Giftoncard Multibrand poklon-karticu je na Bitrefillu moguće kupiti kako on-chain Bitkoinom, tako i putem Bitkoin Lightning mreže. U ponudi su kartice sa sredstvima u iznosu od 3000 i 6000 dinara.

Pored Multibrand kartice, na sajtu Bitrefill su dostupne i poklon-kartice Tehnomanije i Sport Visiona, s tim što je Sport Vision karticu moguće iskoristiti i onlajn na njihovom sajtu (ovo važi i za Multibrand karticu).

Kako do Giftoncard Multibrand poklon-kartice?

Proces plaćanja Bitkoin (Lightning-om) je veoma jednostavan.

- Izaberite vašu poklon-karticu zajedno sa željenom vrednošću.

- Popunite potrebna polja da biste nastavili sa plaćanjem.

- Izaberite željenu kriptovalutu i pošaljite odgovarajući iznos na dostavljenu adresu ili skenirajte QR kod putem vašeg mobilnog novčanika.

- Kada plaćanje bude izvršeno, digitalna poklon-kartica će vam biti dostavljena za nekoliko trenutaka, a takođe ćete dobiti i kopiju putem imejla.

Kako iskoristiti poklon-karticu?

- Možete iskoristiti poklon-karticu za plaćanje proizvoda i usluga na više od 300 lokacija širom Srbije sve do visine sredstava koja se nalaze na kartici.

- Niste u obavezi da iskoristite ceo iznos sa kartice odjednom; kartica se može koristiti više puta za više proizvoda i usluga sve dok ne potrošite čitav iznos.

- Možete proveravati stanje na kartici i sve transakcije registracijom na sajtu giftoncard.eu.

- Moguće je iskoristiti više poklon-kartica za jednu kupovinu.

- Kartica se ne može koristiti za povlačenje gotovine

- Kartica ne može biti poništena ili ponovo dopunjena.

Obradujte svoje najmilije i sebe poklonima, proizvodima i uslugama kupljenim za Bitkoin!

-

@ 39cc53c9:27168656

2025-05-20 10:45:31

@ 39cc53c9:27168656

2025-05-20 10:45:31The new website is finally live! I put in a lot of hard work over the past months on it. I'm proud to say that it's out now and it looks pretty cool, at least to me!

Why rewrite it all?

The old kycnot.me site was built using Python with Flask about two years ago. Since then, I've gained a lot more experience with Golang and coding in general. Trying to update that old codebase, which had a lot of design flaws, would have been a bad idea. It would have been like building on an unstable foundation.

That's why I made the decision to rewrite the entire application. Initially, I chose to use SvelteKit with JavaScript. I did manage to create a stable site that looked similar to the new one, but it required Jav aScript to work. As I kept coding, I started feeling like I was repeating "the Python mistake". I was writing the app in a language I wasn't very familiar with (just like when I was learning Python at that mom ent), and I wasn't happy with the code. It felt like spaghetti code all the time.

So, I made a complete U-turn and started over, this time using Golang. While I'm not as proficient in Golang as I am in Python now, I find it to be a very enjoyable language to code with. Most aof my recent pr ojects have been written in Golang, and I'm getting the hang of it. I tried to make the best decisions I could and structure the code as well as possible. Of course, there's still room for improvement, which I'll address in future updates.

Now I have a more maintainable website that can scale much better. It uses a real database instead of a JSON file like the old site, and I can add many more features. Since I chose to go with Golang, I mad e the "tradeoff" of not using JavaScript at all, so all the rendering load falls on the server. But I believe it's a tradeoff that's worth it.

What's new

- UI/UX - I've designed a new logo and color palette for kycnot.me. I think it looks pretty cool and cypherpunk. I am not a graphic designer, but I think I did a decent work and I put a lot of thinking on it to make it pleasant!

- Point system - The new point system provides more detailed information about the listings, and can be expanded to cover additional features across all services. Anyone can request a new point!

- ToS Scrapper: I've implemented a powerful automated terms-of-service scrapper that collects all the ToS pages from the listings. It saves you from the hassle of reading the ToS by listing the lines that are suspiciously related to KYC/AML practices. This is still in development and it will improve for sure, but it works pretty fine right now!

- Search bar - The new search bar allows you to easily filter services. It performs a full-text search on the Title, Description, Category, and Tags of all the services. Looking for VPN services? Just search for "vpn"!

- Transparency - To be more transparent, all discussions about services now take place publicly on GitLab. I won't be answering any e-mails (an auto-reply will prompt to write to the corresponding Gitlab issue). This ensures that all service-related matters are publicly accessible and recorded. Additionally, there's a real-time audits page that displays database changes.

- Listing Requests - I have upgraded the request system. The new form allows you to directly request services or points without any extra steps. In the future, I plan to enable requests for specific changes to parts of the website.

- Lightweight and fast - The new site is lighter and faster than its predecessor!

- Tor and I2P - At last! kycnot.me is now officially on Tor and I2P!

How?

This rewrite has been a labor of love, in the end, I've been working on this for more than 3 months now. I don't have a team, so I work by myself on my free time, but I find great joy in helping people on their private journey with cryptocurrencies. Making it easier for individuals to use cryptocurrencies without KYC is a goal I am proud of!

If you appreciate my work, you can support me through the methods listed here. Alternatively, feel free to send me an email with a kind message!

Technical details

All the code is written in Golang, the website makes use of the chi router for the routing part. I also make use of BigCache for caching database requests. There is 0 JavaScript, so all the rendering load falls on the server, this means it needed to be efficient enough to not drawn with a few users since the old site was reporting about 2M requests per month on average (note that this are not unique users).

The database is running with mariadb, using gorm as the ORM. This is more than enough for this project. I started working with an

sqlitedatabase, but I ended up migrating to mariadb since it works better with JSON.The scraper is using chromedp combined with a series of keywords, regex and other logic. It runs every 24h and scraps all the services. You can find the scraper code here.

The frontend is written using Golang Templates for the HTML, and TailwindCSS plus DaisyUI for the CSS classes framework. I also use some plain CSS, but it's minimal.

The requests forms is the only part of the project that requires JavaScript to be enabled. It is needed for parsing some from fields that are a bit complex and for the "captcha", which is a simple Proof of Work that runs on your browser, destinated to avoid spam. For this, I use mCaptcha.

-

@ b83a28b7:35919450

2025-05-16 19:26:56

@ b83a28b7:35919450

2025-05-16 19:26:56This article was originally part of the sermon of Plebchain Radio Episode 111 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ 04c915da:3dfbecc9

2025-05-16 18:06:46

@ 04c915da:3dfbecc9

2025-05-16 18:06:46Bitcoin has always been rooted in freedom and resistance to authority. I get that many of you are conflicted about the US Government stacking but by design we cannot stop anyone from using bitcoin. Many have asked me for my thoughts on the matter, so let’s rip it.

Concern

One of the most glaring issues with the strategic bitcoin reserve is its foundation, built on stolen bitcoin. For those of us who value private property this is an obvious betrayal of our core principles. Rather than proof of work, the bitcoin that seeds this reserve has been taken by force. The US Government should return the bitcoin stolen from Bitfinex and the Silk Road.

Using stolen bitcoin for the reserve creates a perverse incentive. If governments see bitcoin as a valuable asset, they will ramp up efforts to confiscate more bitcoin. The precedent is a major concern, and I stand strongly against it, but it should be also noted that governments were already seizing coin before the reserve so this is not really a change in policy.

Ideally all seized bitcoin should be burned, by law. This would align incentives properly and make it less likely for the government to actively increase coin seizures. Due to the truly scarce properties of bitcoin, all burned bitcoin helps existing holders through increased purchasing power regardless. This change would be unlikely but those of us in policy circles should push for it regardless. It would be best case scenario for American bitcoiners and would create a strong foundation for the next century of American leadership.

Optimism

The entire point of bitcoin is that we can spend or save it without permission. That said, it is a massive benefit to not have one of the strongest governments in human history actively trying to ruin our lives.

Since the beginning, bitcoiners have faced horrible regulatory trends. KYC, surveillance, and legal cases have made using bitcoin and building bitcoin businesses incredibly difficult. It is incredibly important to note that over the past year that trend has reversed for the first time in a decade. A strategic bitcoin reserve is a key driver of this shift. By holding bitcoin, the strongest government in the world has signaled that it is not just a fringe technology but rather truly valuable, legitimate, and worth stacking.

This alignment of incentives changes everything. The US Government stacking proves bitcoin’s worth. The resulting purchasing power appreciation helps all of us who are holding coin and as bitcoin succeeds our government receives direct benefit. A beautiful positive feedback loop.

Realism

We are trending in the right direction. A strategic bitcoin reserve is a sign that the state sees bitcoin as an asset worth embracing rather than destroying. That said, there is a lot of work left to be done. We cannot be lulled into complacency, the time to push forward is now, and we cannot take our foot off the gas. We have a seat at the table for the first time ever. Let's make it worth it.

We must protect the right to free usage of bitcoin and other digital technologies. Freedom in the digital age must be taken and defended, through both technical and political avenues. Multiple privacy focused developers are facing long jail sentences for building tools that protect our freedom. These cases are not just legal battles. They are attacks on the soul of bitcoin. We need to rally behind them, fight for their freedom, and ensure the ethos of bitcoin survives this new era of government interest. The strategic reserve is a step in the right direction, but it is up to us to hold the line and shape the future.

-

@ 662f9bff:8960f6b2

2025-05-23 07:38:51

@ 662f9bff:8960f6b2

2025-05-23 07:38:51I have been really busy this week with work - albeit back in Madeira - so I had little time to read or do much other than work. In the coming weeks I should have more time - I am taking a few weeks off work and have quite a list of things to do.

First thing is to relax a bit and enjoy the pleasant weather here in Funchal for a few days. With 1st May tomorrow it does seem that there will be quite a bit to do..

Some food for thought for you. Who takes and makes your decisions? Do you make them yourself based on information that you have and know to be true or do you allow other people to take and make decisions for you? For example - do you allow governments or unaccountable beaureaucrats and others to decide for you and even to compell you?

In theory Governments should respect Consent of the Governed and the 1948 Universal Declaration of Human Rights states that "The will of the people shall be the basis of the authority of government". For you to decide if and to what extent governments today are acting in line with these principles. If not, what can you do about it? I dive into this below and do refer back to letter 9 - section: So What can you do about it.

First, a few things to read, watch and listen to

-

I Finance the Current Thing by Allen Farrington - when money is political, everything is political...

-

Prediction for 2030 (the Great Reset). Sorelle explains things pretty clearly if you care to watch and listen...

-

The Global Pandemic Treaty: What You Need to Know . James Corbett is pretty clear too... is this being done with your support? Did you miss something?

-

Why the Past 10 Years of American Life Have Been Uniquely Stupid - fascinating thinking on how quite a few recent things came about...

And a few classics - you ought to know these already and the important messages in them should be much more obvious now...

-

1984 by George Orwell - look for the perpetual war & conflict, ubiquitous surveillance and censorship not to mention Room 101

-

Animal farm - also by George Orwell - note how the pigs end up living in the farmhouse exceeding all the worst behaviour of the farmer and how the constitution on the wall changes. Things did not end well for loyal Boxer.

-

Brave New World by Aldous Huxley- A World State, inhabited by genetically modified citizens and an intelligence-based social hierarchy - the novel anticipates large scale psychological manipulation and classical conditioning that are combined to make a dystopian society which is challenged by only a single individual who does not take the Soma.

For more - refer to the References and Reading List

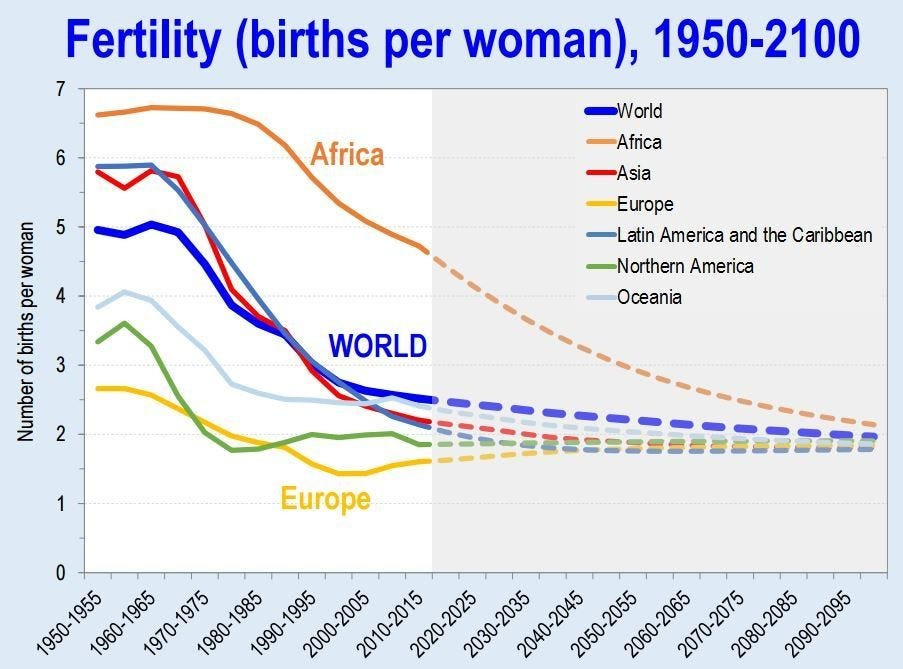

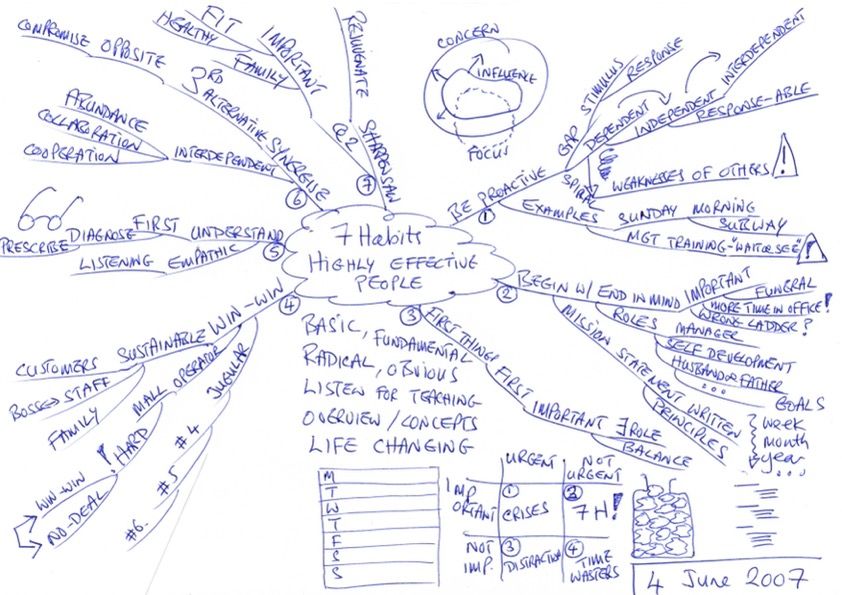

The 7 Habits of Highly Effective People

One of the most transformative books that I ever read was 7 Habits of Highly Effective People by Steven Covey. Over many years and from researching hstorical literature he found seven traits that successful people typically display. By default everyone does the opposite of each of these! Check how you do - be honest...

-

Habits 1-3 are habits of Self - they determine how you behave and feel

-

Habits 4-6 are habits of interpersonal behaviour - they determine how you deal with and interact with others

-

Habit 7 is about regeneration and self care - foundation for happy and healthy life and success

One: Be proactive

Choose your responses to all situations and provocations - your reaction to a situation determines how you feel about it.

By default people will be reactive and this controls their emotions

Two: Begin with the end in mind

When you start to work on something, have a clear view of the goal to be achieved; it should be something substantial that you need and will value.

By default people will begin with what is in front of them or work on details that they can do or progress without having a clear view on the end result to be achieved

Three: Put First things First

Be clear on, and begin with, the Big Rocks- the most important things. If you do not put the Big Rocks into your planning daily activities, your days will be full of sand and gravel! All things can be categorised as Urgent or Not-Urgent and Important or Not-Important.

By Default people will focus on Urgent regardless of importance - all of the results come from focusing on Important Non-Urgent things. All of the 7 Habits are in this category!

Four: Seek Win-Win in all dealings with people and in all negotiations

This is the only sustainable outcome; if you cannot achieve Win-Win then no-deal is the sustainable alternative.

By default people will seek Win-Loose - this leads to failed relationships

Five: Seek first to understand - only then to be understood.

Once you visibly understand the needs and expectations of your counterpart they will be open to listening to your point of view and suggestions/requests - not before!

By default people will expound their point of view or desired result causing their counterpart to want to do the same - this ends in "the dialogue of the deaf"

Six: Synergise - Seek the 3rd alternative in all problems and challenges

Work together to find a proposal that is better than what each of you had in mind

By default people will focus on their own desired results and items, regardless of what the other party could bring to help/facilitate or make available

Seven: Sharpen the saw

Take time to re-invigorate and to be healthy - do nothing to excess. Do not be the forrester who persists in cutting the tree with a blunt saw bcause sharpening it is inconvenient or would "take too much time"!

By default people tend to persist on activities and avoid taking time to reflect, prepare and recover

Mindaps - a technique by Tony Buzan

Many years ago I summarised this in a Mind Map (another technique that was transformative for me - a topic for another Letter from around the world!) see below. Let me know if this interests you - happy to do an explainer video on this!

That's it!

No one can be told what The Matrix is.\ You have to see it for yourself.**

Do share this newsletter with any of your friends and family who might be interested.

You can also email me at: LetterFrom@rogerprice.me

💡Enjoy the newsletters in your own language : Dutch, French, German, Serbian, Chinese Traditional & Simplified, Thai and Burmese.

-

-

@ 662f9bff:8960f6b2

2025-05-22 07:36:58

@ 662f9bff:8960f6b2

2025-05-22 07:36:58This past week I have been very busy in Holywood - just outside Belfast, Northern Ireland with a lot to do on top of my day-job! It was an unplanned trip but mission accomplished and we are off on the road again. I am writing this on my 3h30 Ryanair flight - so even in weeks like this you can find time to reflect quietly and think clearly if you look for it and seize the opportunity.

You might have noticed that I have "rebranded" the website and newsletter as "Letter From ...around the world". This reflects the reality that Hong Kong is not currently the "Asia World City" and I am not there. Whether it will ever reclaim that title again and when, or even if I can return remains to be seen. I am deeply saddened that after living 10 fabulous years in HK we had to abandon everything that Saturday night at the end of February.

This is the third time in my life that I have chosen Exit from "Loyalty, Voice or Exit" - (recall issue 09 - On Location).... Expect both Voice and Exit to become increasingly difficult or even unavailable in many jurisdictions. It is time to wake up. Talk to me if you are awake or curious!

One thing I learned back in 2004 on my first businss trip to New York is that "The way you react to a situation determines how you feel about it". This is one of so many insights that I learned from "The 7 Habits of Highly Effective People" by Steven Covey. I found the book at 4pm in the afternoon walking around outside my hotel trying to stay up to overcome jet-lag. I got back to the hotel and proceeded to devour the entire book overnight. I had never done that with any book before and I do not think I have done it since. Look out for a full review in an upcoming newsletter.

Thanks to Ali Abdaal for his passionate and insightful review of "Show Your Work" by Austin Kleon - clearly this is something that he has internalised and he does practice what he preaches. Indeed this is a short and easy read with many pictures and simple suggestions - recommended! I did read it on my Kindle and I am enjoying how the highlights automagically sync into Obsidian (see last week's find).

I was also inspired by Ali's How to Start a Youtube Channel explainer. I have been following Ali for about 5 years since he was a student doing these videos in his student room on his iPhone while studying Medicine in Cambridge. His passion for sharing his insights on how to study effectively as well as facilitating the learning that medical students needed to do enabled him to set up his own businesss. This set him on the road to his current 3 million subscribers and a business employing over a dozen people inspiring and helping others to acquire skills that are increasingly valuable in the the world today and going forward.

Over the coming months I will be experimenting with different channels and different media not only to discover new insights for myself but also to share things that I distill and find interesting. Also somewhat loosely inspired by "How to Get What you want and Want What You Have" by Jon Gray, I do recognize that I am now in the latter of the "Ten Time Periods" - if I had to pick one, I would say number 8 - at least that is how I feel!

So do subscribe to the newsletter and do follow along on Youtube. I'm obviously still in stage 1 of Ali's 3-stage process - so be patient and do give feedback, questions and suggestions!

Another day - another Airport...

That's it!

No one can be told what The Matrix is.\ You have to see it for yourself.**

Do share this newsletter with any of your friends and family who might be interested.

You can also email me at: LetterFrom@rogerprice.me

💡Enjoy the newsletters in your own language : Dutch, French, German, Serbian, Chinese Traditional & Simplified, Thai and Burmese.

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ 04c915da:3dfbecc9

2025-05-16 17:51:54

@ 04c915da:3dfbecc9

2025-05-16 17:51:54In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ 04c915da:3dfbecc9

2025-05-16 17:12:05

@ 04c915da:3dfbecc9

2025-05-16 17:12:05One of the most common criticisms leveled against nostr is the perceived lack of assurance when it comes to data storage. Critics argue that without a centralized authority guaranteeing that all data is preserved, important information will be lost. They also claim that running a relay will become prohibitively expensive. While there is truth to these concerns, they miss the mark. The genius of nostr lies in its flexibility, resilience, and the way it harnesses human incentives to ensure data availability in practice.

A nostr relay is simply a server that holds cryptographically verifiable signed data and makes it available to others. Relays are simple, flexible, open, and require no permission to run. Critics are right that operating a relay attempting to store all nostr data will be costly. What they miss is that most will not run all encompassing archive relays. Nostr does not rely on massive archive relays. Instead, anyone can run a relay and choose to store whatever subset of data they want. This keeps costs low and operations flexible, making relay operation accessible to all sorts of individuals and entities with varying use cases.

Critics are correct that there is no ironclad guarantee that every piece of data will always be available. Unlike bitcoin where data permanence is baked into the system at a steep cost, nostr does not promise that every random note or meme will be preserved forever. That said, in practice, any data perceived as valuable by someone will likely be stored and distributed by multiple entities. If something matters to someone, they will keep a signed copy.

Nostr is the Streisand Effect in protocol form. The Streisand effect is when an attempt to suppress information backfires, causing it to spread even further. With nostr, anyone can broadcast signed data, anyone can store it, and anyone can distribute it. Try to censor something important? Good luck. The moment it catches attention, it will be stored on relays across the globe, copied, and shared by those who find it worth keeping. Data deemed important will be replicated across servers by individuals acting in their own interest.

Nostr’s distributed nature ensures that the system does not rely on a single point of failure or a corporate overlord. Instead, it leans on the collective will of its users. The result is a network where costs stay manageable, participation is open to all, and valuable verifiable data is stored and distributed forever.

-

@ 3c7dc2c5:805642a8

2025-05-24 22:05:00

@ 3c7dc2c5:805642a8

2025-05-24 22:05:00🧠Quote(s) of the week:

'The Cantillon Effect: When new money is printed, those closest to the source (banks, elites) benefit first, buying assets before prices rise. Others lose purchasing power as inflation hits later. If people find out how this works, they will riot.' -Bitcoin for Freedom

Just think about it. Your employer gives you a 5% raise. The Fed (central banks in general) prints 7% more dollars/euros/Fiat. You just got a 2% pay cut. This isn't a conspiracy theory. This is how fiat money steals from the working class every single day. This is why I support Bitcoin.

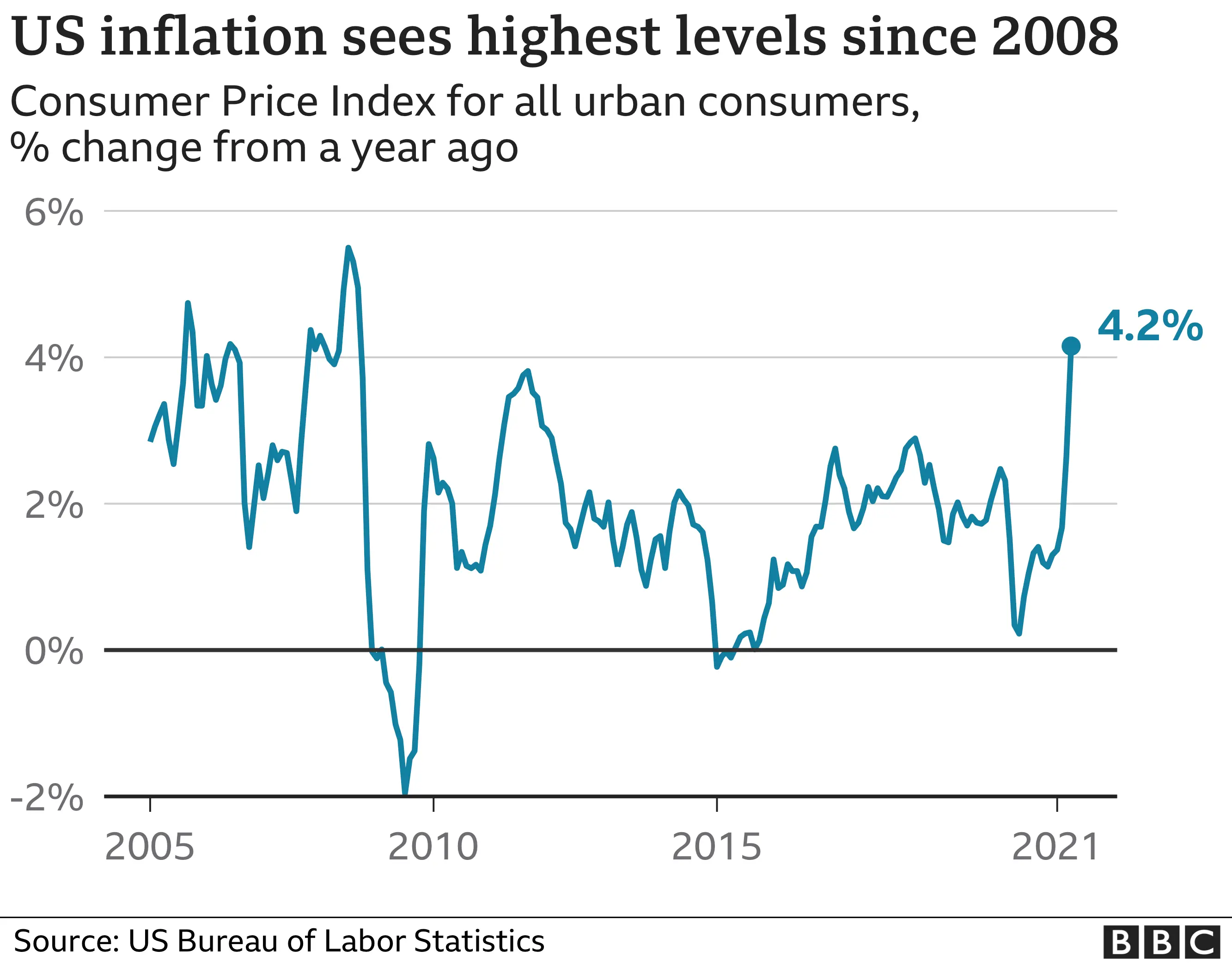

Anilsaidso: 'Saving in fiat currency is no longer an option. A 2% inflation rate means you lose 1/3 of your purchasing power over 20yrs. At 5% inflation, you lose 60%. And at 10% you've burnt 85%. Reduce your uncertainty. Save in Bitcoin.' https://i.ibb.co/N661BdVp/Gr-Rwdg-OXc-AAWPVE.jpg

🧡Bitcoin news🧡

“Education increases conviction.

Conviction increases allocation.

Allocation increases freedom.” —Gigi

https://i.ibb.co/Q3trHk8Y/Gr-Arv-Ioa-AAAF5b0.jpg

On the 12th of May:

➡️Google searches for "Digital Gold" are at all-time highs. Bitcoin Croesus: "This is the second wave of the Digital Revolution - the digitization of value to complement the Internet's digitization of information. It wasn't possible to own a slice of the Internet itself, but it is possible with Bitcoin, the internet of value." "...It feels like you're late to Bitcoin. But this is a bigger game playing out than most realize, and we are much earlier than casual observers know. If you're reading this, you're here on the frontier early. And you have a chance to stake a claim before 99% of the world shows up. This is a land grab. This is the digital gold rush. Make your descendants proud."

https://i.ibb.co/5XXbNQ8S/Gqw-X4-QRWs-AEd5-Uh-1.jpg

➡️ 'A new holding company ‘Nakamoto’ just raised $710 million to buy more Bitcoin and will merge with KindlyMD to establish a Bitcoin Treasury company. Saylor playbook!' - Bitcoin Archive

➡️American Bitcoin, backed by Donald Trump Jr. and Eric Trump, will go public via an all-stock merger with Gryphon Digital Mining. Post-merger, Trump affiliates and Hut 8 will retain 98% ownership. GRYP tripled to $2.19, Hut 8 jumped 11% to $15.45. The deal closes in Q3 2025.

➡️Phoenix Wallet: 'Phoenix 0.6.0 is out: offers can now have a custom description simple close (set an exact mutual close tx fee rate) native support for Linux arm64 This is the server version. Phoenix mobile release is around the corner. '

On the 13th of May:

➡️Corporate Bitcoin purchases have now outweighed the supply of new Bitcoin by 3.3x in 2025. https://i.ibb.co/fVdgQhyY/Gq1ck-XRXUAAsg-Ym.jpg

➡️ Publicly listed Next Technology disclosed buying 5,000 Bitcoin for $180m, now HODLs 5,833 $BTC worth +$600m.

➡️ After rejecting the Arizona Strategic Bitcoin Reserve Act, Governor Katie Hobbs vetoed Bill SB 1373, which proposed a digital asset reserve fund. "Current volatility in the cryptocurrency markets does not make a prudent fit for general fund dollars."

➡️Meanwhile in Paris, France the kidnapping of a woman with her 2-year-old child morning on the streets of Paris - the target is allegedly the daughter of a crypto CEO. 3 masked men tried forcing them into a fake delivery van, before being fought off by her partner and bystanders. One of whom grabbed a dropped gun and aimed it back.

➡️ 'Bitcoin illiquid supply hit a new all-time high of $1.4B Are you HODLing too, anon?' - Bitcoin News

➡️Why Coinbase entering the S&P 500 matters. Boomers will have Bitcoin / CrApTo exposure, whether they like it or not. Anyway, remember what happened in 2021. The COIN IPO, and they’re still trading about 35% below their IPO-day high. Oh and please read the 'Coinbase" hack below haha.

➡️ Nasdaq listed GD Culture Group to sell up to $300 million shares to buy Bitcoin.

➡️ A Bitcoin wallet untouched since April 2014 just moved 300 BTC worth $31M for the first time in 11 years. This is how you HODL.

➡️ Bitcoin's realized price is steadily increasing, mirroring behaviors seen in past bull markets, according to CryptoQuant.

➡️ Bitcoin whales and sharks (10-10K BTC) accumulated 83,105 BTC in the last 30 days, while small retail holders (<0.1 BTC) sold 387 BTC, according to Santiment.

Bitcoin Whales have been AGGRESSIVELY accumulating BTC recently! With at least 240,000+ Bitcoin transferred to wallets with at least 100 BTC. The largest market participants are trying to buy as much as possible, what do they think comes next...

➡️'The average cost of mining 1 BTC for miners is currently $36.8K. The spread between the current market price and the cost of one coin = 182%. This is essentially the average profitability. This corresponds to the beginning of the bull cycle in November 2022 and the peaks of this cycle >$100K. A price increase above this level will allow miners to fully recover after the last halving and reach excess profits comparable to the beginning of the bull rally in January 2023.' -Axel Adler Jr.

➡️ Remember last week's segment on Coinbase..."Coinbase just disclosed in their Q1 filing: that they have custody of 2.68 million Bitcoin. That’s over 13% of all Bitcoin in circulation, on one platform. Is this the greatest honeypot in financial history? Yes, it is...read next week's Weekly Bitcoin update."

Well, here you go.

Coinbase estimates $180-$400 million in losses, remediation costs, and reimbursement following today’s cyber attack. https://i.ibb.co/jkysLtZ1/Gq-C7zl-W4-AAJ0-N6.jpg

Coinbase didn't get hacked. Coinbase employees sold customer data on the black market. Coinbase failed to protect customer data. This is why KYC is useless. The criminals have our driver's license scans. They have AI tools that can generate fake images and videos. KYC puts our identities at risk, makes onboarding more difficult, and rewards criminals. To make it even worse. Coinbase knew about the hack as early as January but only disclosed it publicly after being added to the S&P 500.

I will say it one more time! Don't buy your Bitcoin on KYC exchanges. KYC means handing over your identity to be leaked, sold, or extorted.

It was 2 days ago, see the bit on the 13th of May, that we saw a violent attack in Paris. Minimize the data you share with centralized tools. Store as much as you can locally. Always ask yourself what data am I giving and to whom? Remove the need for trust.

And for the love of God, Allah, or whatever god you are praying to...

DON'T LEAVE YOUR COINS ON A FREAKING EXCHANGE!!!!

Clear!

➡️ Sam Callahan: Bitcoin CAGRs over rolling four-year holding periods since 2012:

10th percentile: 33%

25th percentile: 50% 40th percentile: 75%

Said differently, for 90% of the time, Bitcoin’s four-year CAGR was higher than 33%. For comparison, here are the single best four-year CAGRs over the same period for:

Gold: 17%

Silver: 20%

S&P 500: 24%

Apple: 52%

Two lessons here:

1.) Even when Bitcoin underperforms, it still outperforms.

2.) Bitcoin holding goals are best measured in halving cycles.'

https://i.ibb.co/9m6q2118/Gq1-Ie2-Ob-AAIJ8-Kf.jpg

➡️ Deutsche Bank Aktiengesellschaft has bought 96,870 Strategy₿ stocks for 30 Million dollars at an Average Price Of $310 Per Share In Q1 2025, Their Total Holdings Is 518,000 Shares Worth Over 214 Million Dollars.

➡️Senator Lummis urges the U.S. Treasury to eliminate taxes on unrealized gains for Bitcoin.

On the 14th of May:

➡️At $168,000, Bitcoin will surpass Microsoft, the world's largest company.

➡️Fidelity tells institutions to buy Bitcoin if they can’t match Bitcoin’s 65% return on capital.

➡️Michigan has adopted House Resolution 100, declaring May 13 2025 as "Digital Asset Awareness Day." The resolution encourages "activities and programs that foster a deeper understanding of digital assets and their impact on our society and economy."

➡️Publicly traded Vinanz raises funding to buy $2 million in #Bitcoin assets.

➡️Bitcoin News: "Investor Jim Chanos is shorting MicroStrategy while going long on Bitcoin, calling the stock overvalued relative to its BTC holdings. “We’re selling MicroStrategy and buying Bitcoin, basically buying something for $1 and selling it for $2.50," he told CNBC

On the 15th of May:

➡️The Abu Dhabi sovereign wealth fund disclosed owning $511 million in Bitcoin through BlackRock’s ETF.

➡️UK public company Coinsilium Group raises £1.25 million to adopt a Bitcoin treasury strategy.

➡️Chinese Textile company Addentax issues stock to buy 8,000 Bitcoin.

➡️14 US states have reported $632m in $MSTR exposure for Q1, in public retirement and treasury funds. A collective increase of $302m in one quarter. The average increase in holding size was 44%.

➡️Chinese public company DDC Enterprise to adopt a Bitcoin Reserve with 5,000 BTC.

On the 16th of May:

➡️Brazilian listed company Méliuz buys $28.4 million Bitcoin to become the nation's first Bitcoin Treasury Company. Shareholders voted to approve the strategy by an "overwhelming majority".

➡️13F Filings show Texas Retirement System owns MSTR. The day MSTR enters the S&P 500, every pension fund will follow.

➡️'Wealthy Investors Shift Up to 5% into Bitcoin as confidence in fiat falters. UBS, a Swiss banking giant says Bitcoin and digital assets are becoming key hedges against inflation and systemic risk, marking a dramatic shift in modern portfolio strategy.' -CarlBMenger

➡️River: "Above all, Bitcoin is money for the people." https://i.ibb.co/Jj8MVQwr/Gr-Ew-EPp-XAAA1-TVN.jpg

On the 17th of May:

➡️Illicit activity is now down to 0.14% of transaction volume across all crypto.

Context: World Bank, IMF suggests 1.5–4% of global GDP is laundered yearly through traditional banking Of that 0.14%:

63% of illicit trade was stablecoins.

13% was Bitcoin (declining each year)

Source: The 2025 Crypto Crime Report, Chainalysis 2025

Yet another confirmation that Bitcoin's use in facilitating illicit activities is a rounding error on a rounding error.

On the 18th of May:

➡️JPMorgan CEO Jamie Dimon said they will allow clients to buy Bitcoin. The repeal of SAB 121 is a bigger deal than most realize. “I will fire any employee buying or trading Bitcoin for being stupid” - Jamie Dimon (2017) https://i.ibb.co/b5tnkb15/Gr-Vxxc-OXk-AA7cyo.jpg

On the 19th of May.

➡️Bookmark the following stuff from Daniel Batten if you want to combat climate change (fanatics)...

'That Bitcoin mining is not only not harmful, but beneficial to the environment is now supported by:

7 independent reports

20 peer-reviewed papers

As a result * 90% of climate-focused magazines * 87.5% of media coverage on Bitcoin & the environment is now positive * source 7 independent reports https://x.com/DSBatten/status/1922666207754281449… * 20 peer-reviewed papers https://x.com/DSBatten/status/1923014527651615182… * 10 climate-focused magazines https://x.com/DSBatten/status/1919518338092323260… * 16 mainstream media articles https://x.com/DSBatten/status/1922628399551434755

➡️Saifedean Ammous: '5 years ago at the height of corona hysteria, everyone worried about their savings.

If you put $10,000 in "risk-free" long-term US government bonds, you'd have $6,000 today.

If you put the $10,000 in "risky speculative tulip" bitcoin, you'd have $106,000.

HFSP, bondcucks!'

I love how Saifedean always put it so eloquently. haha

➡️An Australian judge rules Bitcoin is “just another form of money.” This could make it exempt from capital gains tax. Potentially opening the door to millions in refunds across the country. - AFR

If upheld, the decision could trigger up to $1B in refunds and overturn the Australian Tax Office’s crypto tax approach.

➡️Publicly traded Vinanz buys 16.9 Bitcoin for $1.75 Million for their treasury.

➡️Bitcoin just recorded its highest weekly close ever, while the Global Economic Policy Uncertainty Index hit its highest level in history.

➡️4 in 5 Americans want the U.S. to convert part of its gold reserves to Bitcoin. - The Nakamoto Project

"or background, the survey question was: "Assuming the United States was thinking of converting some of their gold reserves into Bitcoin, what percentage would you advise they convert?" Respondents were provided a slider used to choose between 0% and 100%. Our survey consisted of a national sample of 3,345 respondents recruited in partnership with Qualtrics, a survey and data collection company"

Context: https://x.com/thetrocro/status/1924552097565180107 https://i.ibb.co/fGDw06MC/Gr-VYDIdb-AAI7-Kxd.jpg

➡️Michael Saylor's STRATEGY bought another $764.9m Bitcoin. They now HODL 576,230 Bitcoin, acquired for $40.18 billion at $69,726 per Bitcoin.

➡️The German Government sold 49,858 BTC for $2.89B, at an average price of $57,900. If they had held it, their BTC would now be worth $5.24B.

➡️A record 63% of all the Bitcoin that exist have not transacted or moved from their wallets this year. - Wicked

https://i.ibb.co/j9nvbvmP/Gq3-Z-x6-Xw-AAv-Bhg.jpg

💸Traditional Finance / Macro:

On the 12th of May:

👉🏽The S&P 500 has closed more than 20% above its April low, technically beginning a new bull market. We are now up +1,000 points in one month.

On the 13th of May:

👉🏽 Nvidia announces a partnership with Humain to build "AI factories of the future" in Saudi Arabia. Just one hour ago, Saudi Arabia signed an economic agreement with President Trump to invest $600 billion in the US.

🏦Banks:

👉🏽 No news

🌎Macro/Geopolitics:

On the 12th of May:

👉🏽Huge pressure is on the European Union to reach a trade deal. Equities and commodities bounce hard on news of China-US trade deal. "We have reached an agreement on a 90-day pause and substantially moved down the tariff levels — both sides, on the reciprocal tariffs, will move their tariffs down 115%." - Treasury Secretary Scott Bessent

Dollar and Yuan strong bounce. Gold corrects.

👉🏽After reaching a high of 71% this year, recession odds are now back down to 40%. The odds of the US entering a recession in 2025 fall to a new low of 40% following the US-China trade deal announcement.

👉🏽'Truly incredible:

- Trump raises tariffs: Yields rise because inflation is back

- Trump cuts tariffs: Yields rise because growth is back

- Trump does nothing: Yields rise because the Fed won't cut rates Today, the bond market becomes Trump and Bessent's top priority.' - TKL

President Trump’s biggest problem persists even as trade deals are announced. Tariffs have been paused for 90 days, the US-China trade deal has been announced, and inflation data is down. Yet, the 10Y yield is nearing 4.50% again. Trump needs lower rates, but rates won’t fall.

👉🏽Last week a lot of talk on Japan’s Debt Death Spiral: Japan’s 40-year yield is detonating and the myth of consequence-free debt just died with it. One of the best explanations, you can read here:

👉🏽Michael A. Arouet: 'Eye-opening chart. Can a country with a services-based economy remain a superpower? Building back US manufacturing base makes a lot of strategic and geopolitical sense.' https://i.ibb.co/Q3zJY9Fc/Gqxc6-Pt-WQAI73c.jpg

On the 13th of May:

👉🏽There is a possibility of a “big, beautiful” economic rebalancing, Treasury Secretary Scott Bessent says at an investment forum in Saudi Arabia. The “dream scenario” would be if China and the US can work together on rebalancing, he adds

Luke Gromen: It does roll off the tongue a whole lot nicer than "We want to significantly devalue USD v. CNY, via a gold reference point."

Ergo: The price of gold specifically would rise in USD much more than it would in CNY, while prices for other goods and services would not, or would do so to a lesser degree.

👉🏽 Dutch inflation rises to 4.1 percent in April | CBS – final figure. Unchanged compared to the estimate.

👉🏽Philipp Heimberger: This interesting new paper argues that cuts to taxes on top incomes disproportionately benefit the financial sector. The finance industry gains more from top-income tax cuts than other industries. "Cuts in top income tax rates increase the (relative) size of the financial sector"

Kinda obvious, innit?

👉🏽US CPI data released. Overall good results and cooler than expected month-over-month and year-over-year (outside of yearly core). U.S. inflation is down to 2.3%, lower than expected.

On the 14th of May:

👉🏽'The US government cannot afford a recession: In previous economic cycles, the US budget deficit widened by ~4% of GDP on average during recessions. This would imply a ~$1.3 trillion deterioration of US government finances if a recession hits in 2025. That said, if the US enters a recession, long-term interest rates will likely go down.