-

@ f96073dc:5951c7c2

2025-01-08 16:54:42

@ f96073dc:5951c7c2

2025-01-08 16:54:42Introduction

The food we consume plays an obvious yet undervalued role in not just sustaining us, but also in shaping who we become.

The phrase "You are what you eat" transcends cliché to embody a profound truth: our diet directly influences our life experience.

Debates continue about the optimal food sources for human health and longevity.

These discussions often involve emotionally charged arguments influenced by faith, traditions, economic interests, and political opinions concerning the global climate crisis and sustainability.

My goal isn’t to delve into the weeds of this emotional & political debate, but instead to strip things back and provide a birds eye view on nutrition, whilst offering alternative lenses through which we can view food.

## Understanding Food as Information

## Understanding Food as Information More than mere fuel, food serves as crucial information for our bodies.

This concept may sound strange, as much of our nutritional understanding has been dumbed down to ‘energy in, energy out’, or ‘calories in, calories out’.

This perspective bypasses the importance of micro nutrients—the vitamins & minerals our bodies interrelate with, or don’t.

Food information determines how our cells function and regenerate, impacting everything from energy levels to cognitive ability.

The challenge lies in deciphering what constitutes "good information."

For centuries, nature provided a simple guide.

Our ancestors thrived on a diet of organ meats, plants, seafood, fruit, muscle meats, bones, and eggs—foods naturally rich in nutrients and absent of modern chemicals.

The question remains: If our forebears thrived on these natural foods, why have we deviated so drastically?

## The Shift in Food Paradigms

## The Shift in Food Paradigms The introduction of heavily processed "Frankenfoods" laden with chemicals represents a stark departure from the diets of our grandparents and great-grandparents.

They consumed what we now coin "organic" food out of necessity rather than choice.

Food is pleasure, but it’s also a tool for a healthy self.

This ratio has been disproportionally thrown out of alignment.

The modern supermarket, with its aisles dominated by hyper palatable and processed products, reflects a concerning shift in our eating habits.

On the periphery of supermarkets lie fruits, vegetables, dairy, and animal based products, many of which have been sprayed with chemicals like glyphosate, or raised under inhumane conditions.

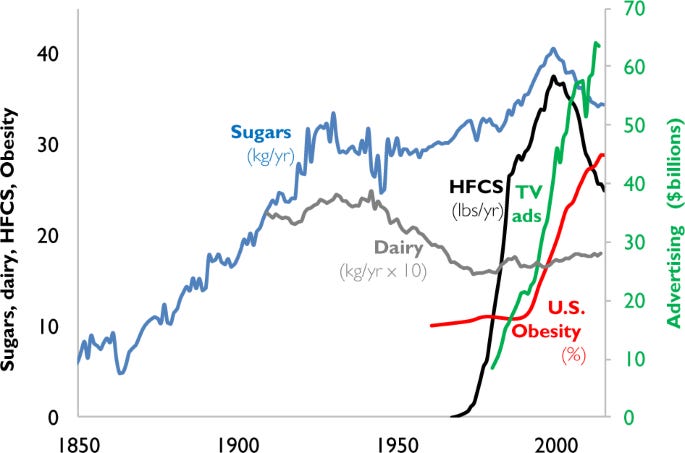

This brings us to the troubling paradox: while some parts of the world suffer from over-consumption and associated health issues like obesity and metabolic diseases, others face malnutrition and starvation due to food scarcity. (See red line below)

*HFCS: High fructose corn syrup

*HFCS: High fructose corn syrupQuestioning Current Food Paradigms

Our current food systems are broken.

A hard truth and pill to swallow, but if you look around, people have never been this unwell and overweight.

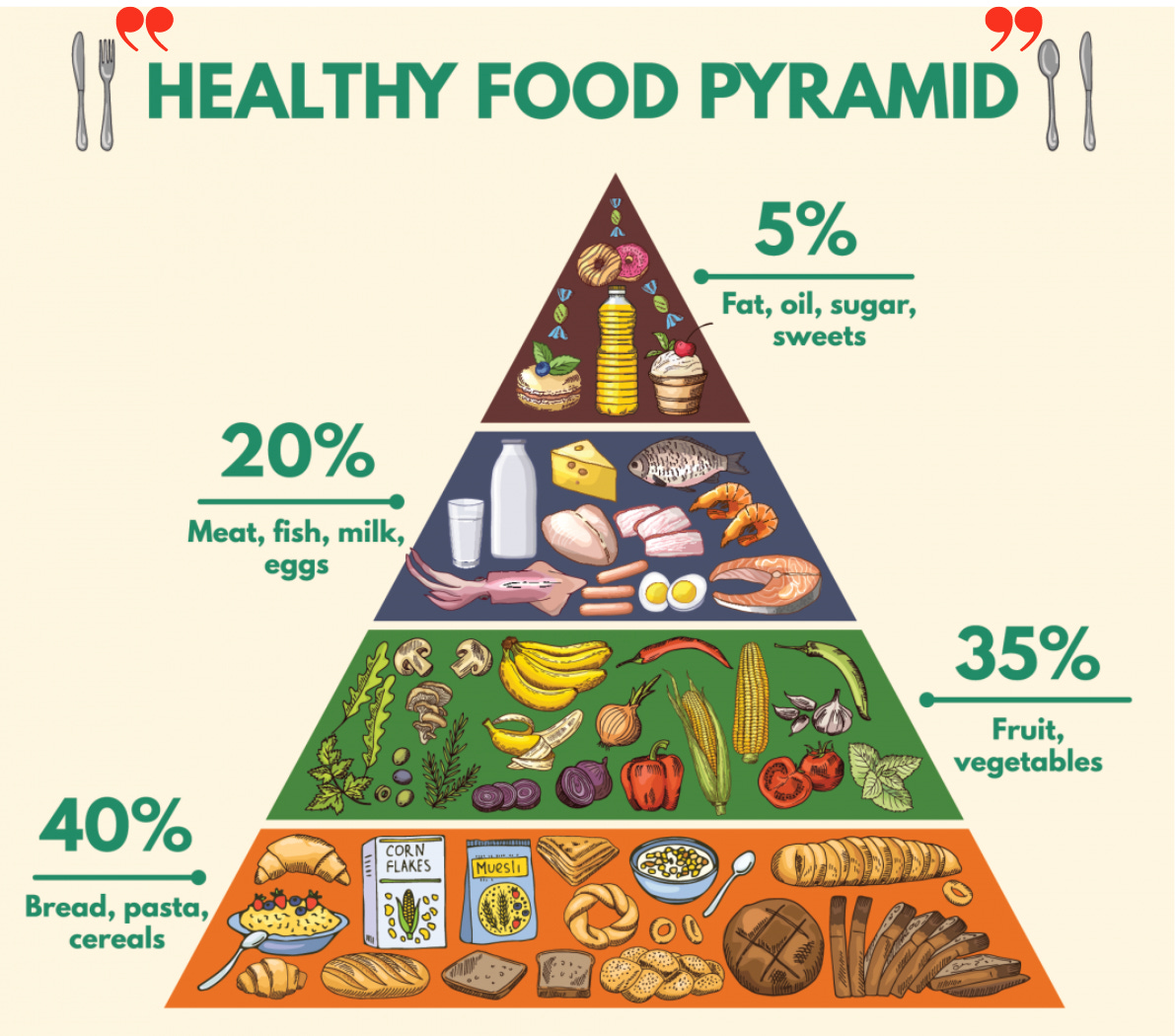

Misleading ‘Health Star Ratings’ and a flawed food pyramid, reflect a deeper societal malaise.

These systems often promote products that are not conducive to health, with processed carbohydrate forms serving as our staple, while nutrient and caloric dense foods like meat, fish, dairy, and natural fats have been marginalised.

## Whole Foods and Balanced Nutrients

## Whole Foods and Balanced Nutrients So, what’s the ideal diet?

There is no universal diet that fits everybody.

The journey to finding the right diet involves personal experimentation.

However, a diet emphasising whole foods, which humans have consumed for millennia, remains a sound choice.

Eating natural foods avoids the pitfalls of ultra-processed foods and provides a balanced array of nutrients.

Side note: historically, meat was always the prized resource.

## Beyond Pesticides

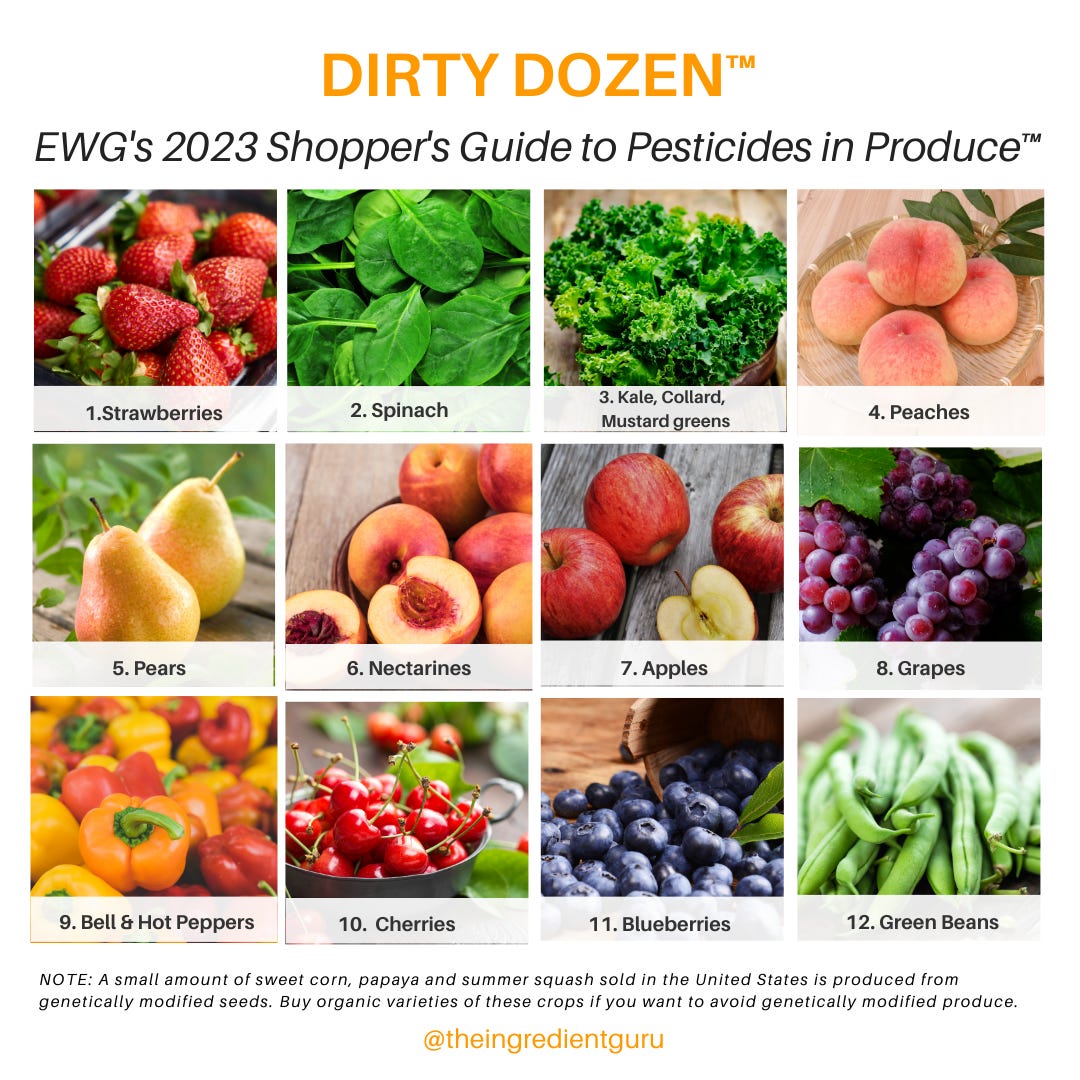

## Beyond Pesticides Every year, the Environmental Working Group (EWG) puts together a list of 15 foods with the lowest amounts of pesticide residues, and conversely, 12 of the most contaminated foods with pesticides.

This is known as the ‘Clean Fifteen’ and ‘Dirty Dozen’.

When financially feasible, it’s advised to consume organic and pasture raised products.

If buying organic isn’t possible, one strategy to reduce pesticides is to soak the produce in water and a teaspoon of baking soda or a splash of apple cider vinegar for a few minutes.

## Nutritional Strategies for Specific Needs

## Nutritional Strategies for Specific Needs Strategies like the elimination diet can help individuals identify how specific foods affect their bodies, allowing them to make informed choices that resonate with their unique physiological needs.

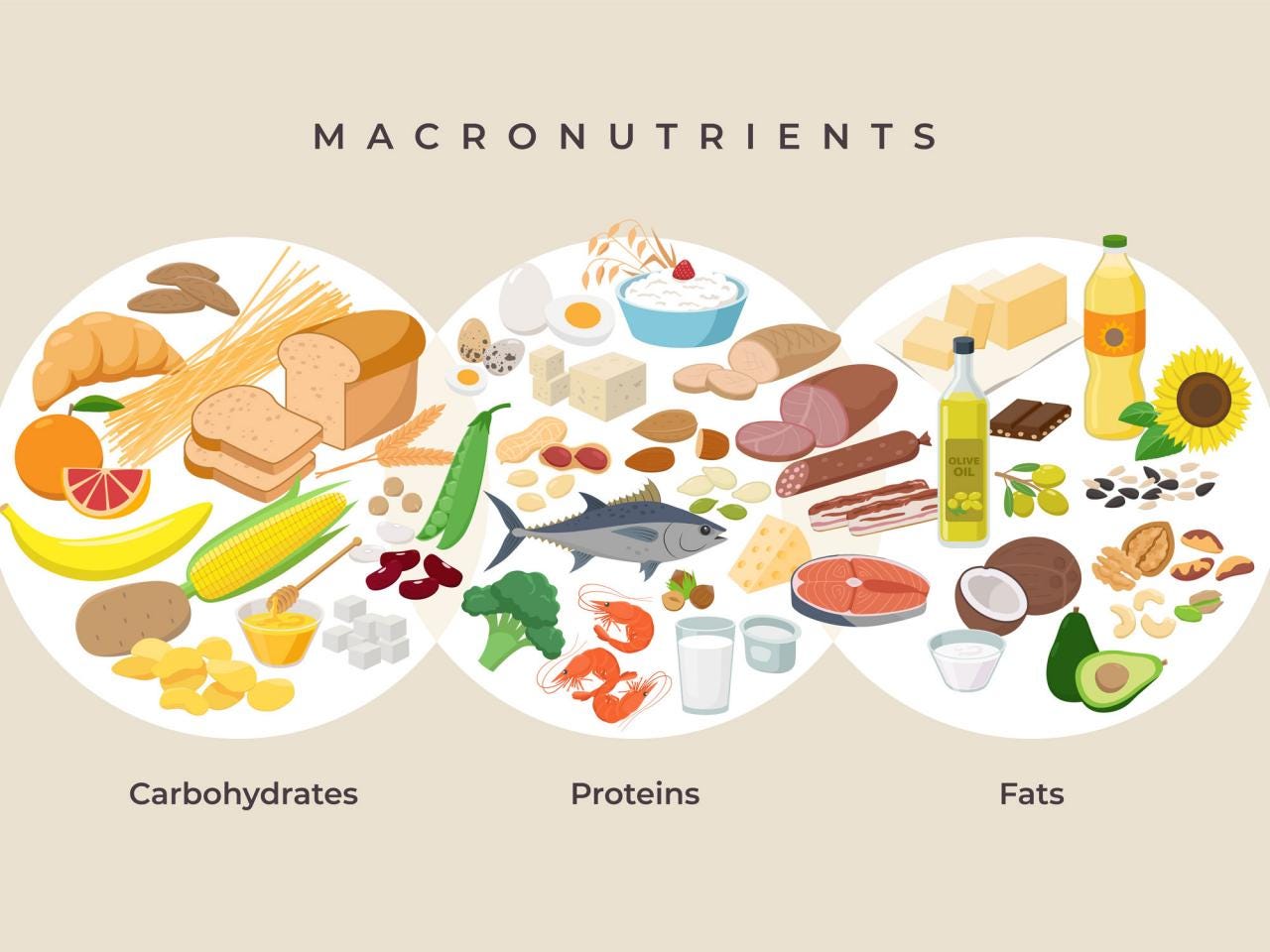

Tracking macronutrients and particularly protein intake can be crucial for specific health goals like muscle growth or weight loss.

Gaining a baseline understanding of the macros in your food can be an important piece of the puzzle, but should not become an obsessive practice.

Many diets serve a purpose, and depending on your goals as well as physiology, can be leveraged for great benefit.

This broad concept has been developed into a growing area of research called Nutrigenomics, defined as the study of how different foods may interact with specific genes to modify the risk of common chronic diseases, such as heart disease, stroke, and certain cancers.

For example, a ketogenic diet can help those with neurological disorders such as epilepsy or Alzheimer's disease, intermittent fasting can facilitate weight loss, and a carnivore diet can heal chronic skin or gut issues.

## Conclusion

## ConclusionIn an era where diet-related health issues are rampant, returning to a more natural, informed way of eating is not just beneficial; it is necessary.

The prevalence of heavily processed "Frankenfoods" deviates from the nutrient-rich diets of our ancestors, contributing to a paradox of overconsumption and malnutrition.

Challenging current food paradigms is necessary to address misleading nutritional guidelines and flawed food systems.

Empower yourself to explore food in a deeper fashion, seeking a diet that not only nourishes your body but also aligns with your lifestyle goals and fosters a sense of vitality and well-being.

Eating well is a form of a self respect, and while we get the chance to inhabit this physical form, it should be our duty to make the most of this life and embody our fullest potential.

-

@ bf47c19e:c3d2573b

2025-01-08 16:43:01

@ bf47c19e:c3d2573b

2025-01-08 16:43:01Originalni tekst na danas.rs

11.01.2021 / Autor: Aleksandar Milošević

Ima više od osam godina otkako sam prvi put čuo za to nešto što se zvalo bitkoin.

Libertarijanski san: „Decentralizovana“ valuta koju ne kontroliše nijedna država; na koju nijedna centralna banka ne može da utiče; koju je zahvaljujući „blokčejn“ tehnologiji nemoguće falsifikovati i koja nudi anonimnost kakvu poznaje samo keš.

Valuta čija je ukupna količina unapred fiksirana pa joj je rast vrednosti usađen u DNK.

I to još valuta koju je moguće dobiti besplatno, ali po zasluzi, jer bitkoini nastaju tako što vaš kompjuter reši komplikovani matematički zadatak iza kojeg se „krije“ jedan od ovih magičnih novčića.

To što je čitav sistem osmislio misteriozni matematički genije poznat kao Satoši Nakamoto, koji možda postoji, a možda i ne postoji i što se ceo finansijski establišment obrušio na čitavu bitkoin-maniju kombinacijom podsmeha i represivnih pretnji, moglo je samo da ubrza moju tadašnju odluku da kupim XFX ATI RADEON HD 5870 grafičku karticu za nekih 200 evra (maksimum koji sam od skromne novinarske plate mogao sebi da oprostim) i priključim se drugoj velikoj zlatnoj groznici, nekih 150 godina nakon one originalne, kalifornijske.

Ipak, kao što se da pretpostaviti iz činjenice da danas pišem ovaj tekst umesto da na nekom tropskom ostrvu vežbam skokove u vodu, sudbina nije htela da se obogatim rudareći bitkoine.

Ispostavilo se, naime, da moja moćna grafička karta ne odgovara mojoj dosta nesposobnoj matičnoj ploči, pa sam uz pomoć najgore „cost-benefit“ analize u istoriji biznisa zaključio da je bolje da prodam grafičku sa 20 evra gubitka i zaboravim na sve, nego da zarad svoje igrarije menjam čitav kompjuter.

Ta greška koštala me je nekih 700.000 dolara.

Toliko bih, žalosno je, danas imao da sam propalu investiciju u pogrešan hardver pretvorio u novotariju zvanu kriptovaluta, po tadašnjem kursu od 10 dolara za novčić, umesto što sam „zaboravio na sve“.

Bitkoin je, ispostavilo se, postao prilično velika stvar.

S kursom od 40.000 dolara za jedan bitkoin, s međunarodnim bankama koje spekulišu ovom valutom, s nuklearnim naučnicima hapšenim jer su ruski državni superkompjuter upregli da za njih rudari bitkoin, sa novinskim izveštajima o ljudima koji idu u zemlje s jeftinom strujom da u njima instaliraju čitava skladišta puna računara za traženje bitkoina, pa čak i sa poslednjim pričama koje krive upravo bitkoin za to što je u Pakistanu pao napon struje za 200 miliona ljudi i što je 500 miliona Evropljana zamalo ostalo bez svetla, nema nikakve sumnje da je bitkoin nešto veliko.

A opet, to nešto veliko i dalje uporno ostaje – ništa.

Ma koliko neverovatna cena od 40.000 dolara delovala zavodljivo, bitkoin entuzijasti su već jednom, pre tačno dve godine, sve to već doživeli, kada je ova valuta prvi put u meteorskom usponu za samo par nedelja dostigla 20.000 dolara, da bi se onda jednako naglo i jednako neobjašnjivo survala nazad, ostavljajući mnoge sa velikom i nimalo virtuelnom rupom u džepu.

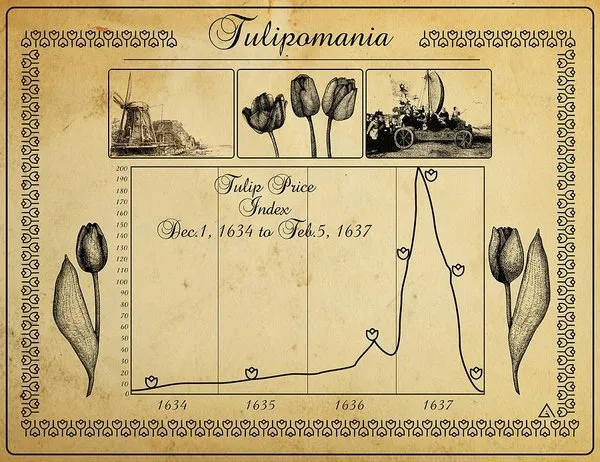

Osnovni problem bitkoina, uzrok njegove karakteristične nestabilnosti – ogromnih skokova i jednako spektakularnih padova – jeste to što niko ne zna za šta je on koristan.

Ma kako uzbudljivo delovala čitava priča o novcu koji je van kontrole vlade, koji nudi anonimnost transakcija i koji je navodno nemoguće falsifikovati, činjenica je da prosečnoj osobi ništa od toga nije potrebno.

Tačnije, bitkoin – sem u uskom krugu slučajeva – ne nudi ništa što već ne možete da dobijete sa svojom valutom, a da vam je potrebno.

Za anonimnost je većini dovoljan keš, rizik od falsifikata je dovoljno mali da je zanemarljiv, a kontrola države i nezavisnost od monetarnih vlasti su priče koje su ljudima eventualno intelektualno zanimljive, ali nikog neće naterati da u praksi krene da koristi neku virtuelnu valutu.

Zato je bitkoin ostao novac ponajviše upotrebljavan za nezakonite transakcije – otkup podataka od hakera, prodaju droge i tome slično – gde su anonimnost i elektronski transfer novca bitniji od svega.

Zašto onda raste cena bitkoinu?

Zato što svi kupuju bitkoine nadajući se da će im cena skočiti i da će zaraditi.

Kako raste tražnja tako raste cena i očekivanje se ispunjava.

Onda kad tražnja nestane, a to će se desiti kad svi koji su upravo sad čuli za bitkoin pokupuju virtuelne novčiće videvši koliki je rast cene u poslednjim danima, cena će krenuti da pada.

Jer – bitkoini nikom nisu potrebni i niko ne želi da ih zadrži. Sve što svi žele je da ih kupe, da im cena „iz nekog razloga skoči“ i da ih onda zamene za „pravi novac“.

U toj igri, koja se stalno ponavlja kako naiđe novi talas publiciteta, neko naravno mora i da izgubi.

Bitkoin neće postići stabilnost i neće uspeti da iskaže svoju „deflatornu“ prirodu u koju se svi uzdaju da im trajno podiže vrednost novčića koje poseduju, sve dok se ne bude pronašla njegova svrha kao valute.

Dok dovoljno veliki broj ljudi ne bude hteo da drži i koristi bitkoine za ono za šta je svaka valuta namenjena – za kupovinu roba i usluga.

Droga, oružje, ucene i ostale oblasti kriminalne ekonomije nisu dovoljni da bi se takva stabilnost postigla.

Glavni problem bitkoina je zato njegova praznina.

Bitkoin nije zlato našeg doba. Pre je blato.

-

@ 00cfe60d:2819cc65

2025-01-08 16:36:40

@ 00cfe60d:2819cc65

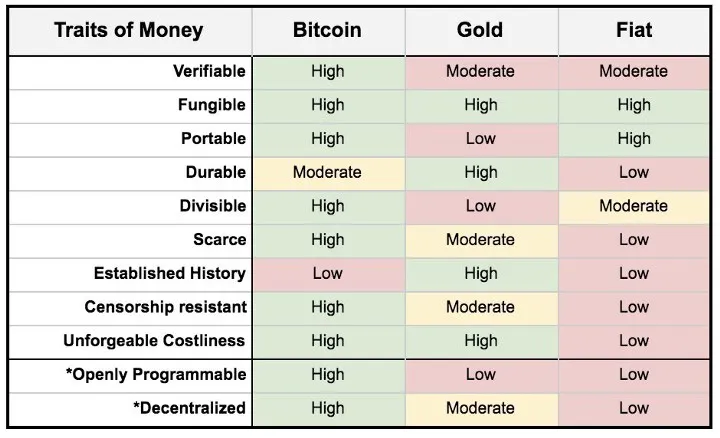

2025-01-08 16:36:40Lets start with the money talk, at its core, a good form of money is created from two key ingredients: time and energy.

**Money = Time + Energy ** This simple idea explains why money has value. Time is something we can never get back, and energy is what powers everything we do, both mentally and physically. Together, they create value.

Why Energy is So Important Energy is what keeps life going. It’s essential for everything we use and do every day. For example:

- Food without energy to cook is raw and not very tasty.

- A car without energy doesn’t go anywhere.

- A person without energy feels tired and can’t work or play.

- Your work without energy gets nothing done.

- Football without energy means no running, no cheering, and no fun.

- A phone without energy is just a useless object.

- A house without energy is cold, dark, and uncomfortable.

- Transportation without energy means no moving buses, trains, or planes.

- The internet without energy means no websites, no games, and no communication.

- Nature without energy means plants don’t grow and animals can’t survive.

And what about money without energy? ** We often hear that “time is money” but if money is created without any time or energy, it becomes worthless. That’s why energy is so important in giving money its value.

Why Bitcoin is Different

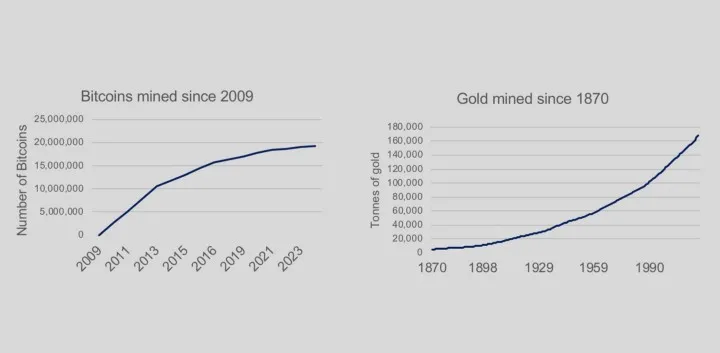

Bitcoin is special because it follows the equation of money perfectly. It’s the best kind of money because it requires both time and energy to exist. Here’s how:

-

Time: Bitcoin’s network is designed to create new bitcoins at regular intervals, so time is built into the system.

-

Energy: Bitcoin is made using a process called Proof-of-Work, which uses real-world energy to produce and secure it. This ties its value to effort and cost.

Thanks to this process, Bitcoin is:

-

Scarce: There will only ever be 21 million bitcoins. It can’t be copied or faked.

-

Reliable: Its value is tied to real-world energy, making it solid and trustworthy.

-

Effort-Based: No one can create bitcoins out of thin air. It takes real work.

This makes Bitcoin an honest form of money, free from manipulation or shortcuts. It connects the digital and physical worlds through energy, just like gold was in the past, requiring time and energy to extract and maintain its value.

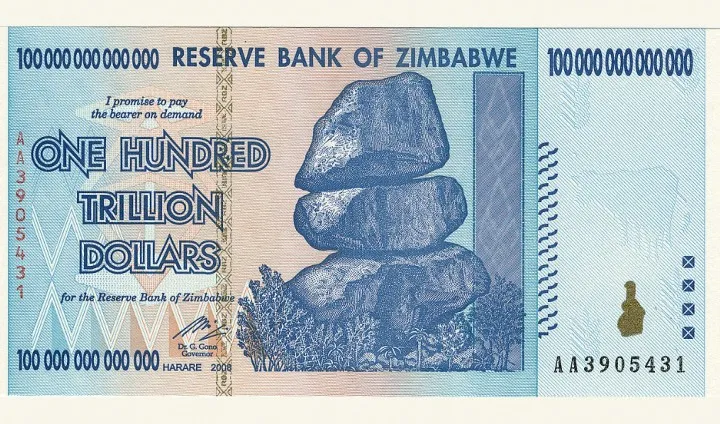

The Problem with Regular Money (Fiat Money)

On the other hand, fiat money, the kind printed by governments, doesn’t follow the same rules. It’s made without effort, just by pressing a button. This leads to big problems:

-

Inflation: More money is printed, making the money you already have worth less.

-

Manipulation: Governments and banks can change the rules whenever they want.

-

Unfairness: People closest to the money printers benefit the most, while everyone else pays the price.

-

Fiat money breaks the rule of time and energy. It’s just a symbol, not a true store of value.

**Henry Ford’s Energy Currency Idea ** Over 100 years ago, Henry Ford had a bold idea: What if money was based on energy? He believed energy was the ultimate resource because it’s measurable and valuable to everyone.

Bitcoin brings Ford’s vision to life. Its Proof-of-Work system ties money directly to energy. Bitcoin acts as a global, incorruptible energy currency that rewards effort and aligns money with real-world value.

Why Energy-Based Money Matters

Money that’s rooted in time and energy isn’t just an idea, it’s a principle we live by every day. To truly understand the value of energy and effort, let me share a personal story.

Every single day of the week, I train. I pour my energy and effort into CrossFit, pushing my body and mind to their limits. Last year, during a competition, I achieved something I’d never done before: 12 ring muscle-ups. Before that, my maximum was just three. Through consistent training, spending my time and energy at the gym, I earned that reward. It wasn’t easy, but it was worth it.

This is Proof-of-Work in action. Just like my training required time and energy to achieve results, Bitcoin requires time and energy to exist. Its

Proof-of-Work mechanism ensures:

- It can’t be faked or inflated.

- It rewards hard work and energy, not shortcuts or manipulation.

- It restores trust by linking value to real-world effort.

In a world where fiat money can be printed without effort, Bitcoin shines as a clear and honest form of money. Like the work I put into my training, Bitcoin ties time and energy to value, creating a system that’s fair, transparent, and built to last.

-

@ bf47c19e:c3d2573b

2025-01-08 16:26:02

@ bf47c19e:c3d2573b

2025-01-08 16:26:02Originalni tekst na politika.rs

13.09.2021 / Autor: Aleksandar Apostolovski

Za svet virtuelne banalnosti u koji smo umarširali potrebna je i njegova moneta. Kakav svet takvo i sredstvo plaćanja.

Ni četnički jataci nisu kao što su nekada bili. Ne skrivaju se u zemunicama, ne spremaju masnu gibanicu – prste da poližeš – ne čekaju zapadne saveznike da se iskrcaju na Jadranu. Verovatno nemaju ni brade modne linije starog američkog benda „Zi Zi Top”.

Nepoznata sajber ilegalna grupa upala je u podrum kuće čiča Draže u Ivanjici. Zaista, prvorazredna vest. Instalirali su snažne procesore i mašine za rudarenje bitkoinima i daljinskim sistemom. Ko zna odakle. Možda sa Kariba, možda iz Kosjerića, možda iz Jajca – ako su ipak partizani. Trgovali su kriptovalutama. Umalo da tako rasture uličnu rasvetu tokom „Nušićijade”, pa su čelnici opštine sproveli internu istragu, tražeći ilegalce koji vrše diverziju nad elektroenergetskim sistemom grada i festivalom satire.

Upali su u Dražin dom, sišli u podrum i zatekli sofisticiranu opremu, snažne procesore i nekakve mašine za rudarenje po internetu. Kompjuterski komandosi, naravno, nisu bili prisutni. Sada ih juri policija. Potrošili su oko 55.000 kilovat-sati struje. Verovatno se skrivaju pod stripovskim kodnim imenima, poput hakera iz Niša koji su ojadili Teksašane, pa im je doakao FBI, jer Ameri možda trpe svoje prevarante koji muzu kockare na globalnom groblju kriptovaluta, ali ne dozvoljavaju da se u međunarodnu spekulativnu igru ubace mozgovi sa južne pruge, gde je dozvoljeno da se prži paprika, pravi ajvar i sluša melanholični džez na „Nišvilu”.

Jedan od članova niške hakerske grupe je Antonije Stojiljković, koji se krio iza lažnih imena „Toni Rivas” i „Džejkob Gold”, a u slobodno vreme bio je reper poznatiji kao „Zli Toni”. Stojiljković je izručen Americi zbog računarskih prevara. Dobrovoljno se prijavio kako bi se sklonio u Ameriku.

Ti momci su nudili bitkoin upola cene i stvorili takvu virtuelnu međunarodnu mrežu lažnih kompanija, menadžera, uz organizaciju video-konferencija, da su omađijali dobar deo internet investitora iz Teksasa, te je Federalni istražni biro morao da spasava čast kauboja koje su izradile Nišlije. Njihov vođa, izvesni Kristijan Krstić, prestao je da se javlja policiji, nestao je sa suprugom i ortakom Markom Pavlovićem bez traga, iako su pod istragom, što može da poremeti i diplomatske odnose između Srbije i SAD.

Taj Kristijan, ne onaj Kristijan koji se seli iz rijalitija u rijaliti, koristio je nadimke poput „Feliksa Logana” ili „Maršala Grahama” i na internet prevarama zaradio je više desetina miliona evra. Priča nije nimalo bezazlena. Veze „Zlog Tonija” dosežu, bar po dosadašnjem toku istrage, sve do klana Belivuka.

Ali, to će rešavati sudovi i policija, mada i podaci koji su procurili otkrivaju suštinu fame bitkoin i na hiljade kriptovaluta koje može stvoriti bilo koji maher, avanturista, šaljivdžija, klinac, multimilioner, tajne službe, trgovci oružjem, narko-bosovi, plaćene ubice ili Del Bojevi koji će iduće godine postati milioneri.

Virtuelni svet ne može postojati bez virtuelnih valuta, s tim što one nisu opipljive, iza njih ne stoje centralne banke i vlade. Dakle, nemate pojma ko ih je stvorio, nemate pojma s kime trgujete i ko su brokeri.

Vidim da na „Jutjubu”, u motelu „Stari Hrast” na Koridoru 10, neki momci plaćaju prebranac i vešalice bitkoinima, preko mobilnih telefona. U kafani primaju i etereume, digitalni novčić u usponu, odmah iza bitkoina. I za to čudo je potreban digitalni novčanik... Ovde ću se zaustaviti jer je za svet banalnosti u koji smo umarširali potrebna i njegova moneta. Kakav svet takvo i sredstvo plaćanja.

Kako su kompjuterski podaci svih vrsta, od pretraživača, društvenih mreža, aplikacija, do podataka kompanija, državnih i međunarodnih organizacija, i onih ličnih, koje upravo vi posedujete, postali nezamislivo ogromna baza koju je nemoguće uskladištiti, otvorena je berza za internet magacionere koji će, rudareći na internetu, postati kandidati za potencijalne šefove skladišta. Teoretski, možete izrudariti deo arhive CIA. Preporuka – ako saznate ko je ukokao Kenedija, ćutite ko zaliveni!

(Dragan Stojanović)

Da je Alija Sirotanović kojim slučajem rudario kao specijalci iz Dražinog podruma, postao bi Bil Gejts. Alija je znao da nema ’leba bez motike, odnosno krampa. Zato je ostao Sirotanović. Ovo je novo doba. Mašina krampuje u simuliranoj stvarnosti, a virtuelni homo sapijens upravlja procesorima. Bitkoin vrti gde burgija neće! Stvar ipak nije tako idilična. Te skalamerije troše ogromne količine električne energije i strahovito zagrevaju prostorije, pa je u Dražinom podrumu bilo nešto vrelije nego u sauni. Priča se da su najveći mešetari otperjali na Island da se prirodno rashlade. Sledeće stanište im je Grenland.

Kome god je stalo do računarskog kriptovalutnog avanturizma može da formira svoj mali rudnik, gde nema zlata ni dijamanata, ali ima koina, odnosno stotog dela bitkoina. Jedan trenutno vredi 50.000 dolara. Pitam se, ovako zastareo, gde su banke i menjačnice?

Sa ono malo informatičkog znanja – valjda ću uspeti nekako imejlom da pošaljem ovaj tekst – saznao sam da vrednost bitkoina vrtoglavo skače i pada na dnevnom nivou, a kako je njegov broj ograničen na globalnom nivou, a neformalni šef Federalnih rezervi bitkoina je donedavno bio jedan od najbogatijih ljudi sveta Ilon Mask, koji je na svom tviter nalogu svakodnevno formirao grafikon rasta i pada svojim opaskama, tu već naslućujem elemente bondovskog zapleta. Harizmatični superbogataš koji leti u svemir, poseduje kompaniju električnih automobila „Tesla”, upravljao je donedavno imaginarnom berzom i valutom, ali je nedavno odustao. Možda zato emigrira u kosmos?

Stvar zaista može izmaći kontroli ili će, možda, bitkoin postati naša sudbina, a mi rudari iz sauna? Salvador je pre nekoliko dana postao prva zemlja na svetu koja je usvojila bitkoin kao zakonsko sredstvo plaćanja, uz američki dolar, s planovima korišćenja vulkanske geotermalne energije za napajanje rudarenja digitalne valute. Postavili su i bankomate. Tamošnjem narodu, kao i meni, ništa nije jasno.

Međutim, broj bitkoina je ograničen i zato pomalo podseća na zlato. Ali kod zlata ipak ponešto razumem. Recimo, ako imam zlatnu polugu i neko me napadne, mogu da je koristim u samoodbrani, a onda je sklonim u trezor banke.

Mogu da učinim i nešto drugo, jednako glupo. Da stvorim sopstvenu kriptovalutu. Nazvaću je „Ser Oliver koin”. Cijena će joj, logično, biti prava sitnica. Trebaju mi saradnici. Kruži fama da se popriličan broj klinaca, mahom dvadesetogodišnjaka, pridružio kultu bitkoina. Tokom korone izgubili su poverenje u sve, naročito u nas matore. Optužuju nas za izdaju i predviđaju propast država i zvaničnih valuta, uz uspon dvoglave aždaje – saveza bogataša i političara.

Delimično su u pravu, ali nisu ukapirali ključnu stvar. Aždaja raste, a oni rudare. Na kraju će završiti još gore nego Alija Sirotanović. Likovi im neće biti na novčanicama, a kablovima će biti priključeni za superkompjuter. Njihov novi vlasnik, s kodnim imenom „Procesor”, plaćaće ih idiot-koinima. Tražili smo, gledaćemo.

-

@ bf47c19e:c3d2573b

2025-01-08 16:03:01

@ bf47c19e:c3d2573b

2025-01-08 16:03:01Originalni tekst na trzisnoresenje.blogspot.com

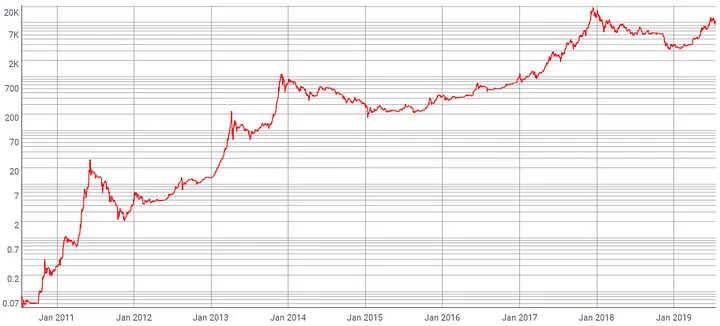

22.12.2017 / Autor: Slaviša Tasić

Ovoliki uspon Bitcoina neobjašnjiv je za ekonomiste. Ne znam da li je to problem za bitcoin ili za ekonomiste, ali činjenica je da se uspeh bitcoina ne uklapa u postojeće ekonomske koncepte bar kada se radi o njemu kao valuti (blockchain kao tehnološka podloga je druga stvar). Možda su tinejdžeri koji su kupovali bitcoin 2010. i sada postali milioneri ispali pametniji od ekonomista, ali ja i dalje ne vidim odgovor bitcoina na neka standardna konceptualna pitanja. Postoji apokrifna izjava pripisana nekom profesoru ekonomije: "OK, vidim da to radi u praksi -- ali čik da vidim da li radi u teoriji?" Ovo je nešto tog tipa.

O poreklu novca, od Aristotela nasuprot Platonu pa sve do danas, postoje dve teorije. Jedna je teorija robnog novca i po njoj je novac nastao kada su neke vredne stvari počele da se češće koriste u razmeni. Plemeniti metali, naročito srebro i zlato, najpogodniji za čuvanje, oblikovanje i seckanje tako su postali novac. Kada se kasnije pojavio papirni novac on je sve do prvih decenija 20. veka bio samo hartija od vrednosti koja donosiocu daje pravo na propisanu količinu zlata.

Druga teorija je kartalizam, po kojoj neku robu novcem ne čini njena unutrašnja vrednost ili robna podloga, već država onda kada odluči da tu robu prihvata za naplatu poreza. Zbog toga je prelaz na papirni novac tokom 20. veka bio tako bezbolan i papirne valute se danas bez problema prihvataju. Današnji papirni novac nije više sertifikat koji vam daje pravo na zlato, ali vrednost ima jer u krajnjoj liniji znate da njime uvek možete platiti državi za porez ili usluge.

Bitcoin se ne uklapa ni u jednu od ovih teorija. On nema imanentnu vrednost kao robni novac, niti se može koristiti za plaćanje državi. Jedini način za bitcoin da ima neku vrednost je da ga prihvataju druge privatne strane u transakcijama. To je potpuni novitet u istoriji novca, jer se po prvi put radi o privatnom dekretnom (proklamovanom ili fiat) novcu. Postojao je privatni novac sa robnom podlogom; postoji državni dekretni novac; ali nikad privatni dekretni novac.

Najveći problem sa bitcoinom kao valutom je nestabilnost. To što njegova vrednost vrtoglavo raste nikako nije argument u prilog njemu jer nestabilnost valute isključuje mogućnost smislenog ugovaranja u njoj. Pristalice bitcoina dobro znaju da je njegova ponuda automatski ograničena i to je čest argument u odbranu bitcoina kao valute i navodno u prilog njegove stabilnosti. Ja nisam siguran da ograničenost ponude igra tako veliku ulogu.

Prvo, iako je količina bitcoina ograničena, može se napraviti neograničeno mnogo kopija bitcoina ili boljih kripto valuta. Već sada postoji na hiljade njih. Šta ograničenost ponude bitcoina uopšte znači kada ima neograničeno mnogo alternativa?

Drugo, iako je ponuda ograničena, cenu novca, kao i svega drugog, određuju ponuda i tražnja. A tražnja je kao što vidimo veoma varijabilna. Tako na jednoj strani imamo kvaziograničenost ponude a na drugoj veliku neizvesnost tražnje. To sve ukazuje na ogromnu nestabilnost.

Kod klasičnih valuta, poput evra ili dinara, ponuda je ograničena politikom centralne banke. Mnogi će reći da to nije nikakva garancija, ali zapadne valute već 30 godina nemaju nikakvu inflaciju, a u proteklih desetak godina veći problem bila je deflacija. Tražnja - želja za držanjem novca - je kod državnih valuta takođe varijabilna, ali mnogo manje jer monopolski karakter ovih valuta i naplata poreza u njima garantuju njihovu upotrebu. I kod tradicionalnih valuta ne samo da je tražnja novca relativno stabilna, već u situacijama kada tražnja novca bude nestabilna, fleksibilnost njegove ponude postaje prednost a ne mana. Na primer, tražnja za švajcarskim francima je negde oko 2009. naglo porasla. Švajcarska centralna banka je na to reagovala ogromnim povećanjem ponude, tako da je franak sačuvao bazičnu stabilnost. Jeste ojačao ali u razumnoj meri - ne desetostruko ili stostruko kao što rade kriptovalute.

Zato ne vidim kako se oscilacije bitcoina mogu zaustaviti. Jasno je da kriptovalute imaju neku korisnost u transakcijama, makar to bilo i za ilegalne aktivnosti, ali kada je ponuda neograničena a tražnja neizvesna onda nema nikakvih smernica buduće vrednosti. Ne znam koliko se to čak i može nazvati balonom jer se uopšte nemamo na šta osloniti u proceni nekakve prave vrednosti -- nema nikakvog fundamentalnog razloga ni da cena bitcoina poraste na $19,000 niti da danas padne na $12,500. Jedina vrednost koja u teoriji ima smisla je nula ili vrlo blizu nule.

-

@ bf47c19e:c3d2573b

2025-01-08 16:01:15

@ bf47c19e:c3d2573b

2025-01-08 16:01:15Originalni tekst na trzisnoresenje.blogspot.com

06.10.2014 / Autor: Slaviša Tasić

Od kako je bitcoin postao popularan vodi se rasprava među zagovornicima slobodnog tržišta oko njegovo gpravog statusa: da li je to budući novac, efikasan sistem zaobilaženja državne kontrole i garant slobode pojedinca, ili pak fikcija i pomodarstvo iza koje nema ničeg stvarnog?

Teorijski centar debate je pitanje da li je bitcoin "zapravo" novac ili ne. Jedna grupa tvrdi da jeste, pozivajući se na to da je nastao hiljadama dobrovoljnih akata potrošača na tržištu i time uspostavljen kao konvencija. Ko ste vi, teoretičari iz fotelje, da u ime naroda koji prihvata bitcoin definišete šte je "pravi" novac a šta nije? Druga škola tvrdi da je to irelevantno, da je takozvana vrednost bitcoina fiktivna i naduvana, i da će uskoro pući, jer nema nikakve realne pozadine: svaki novac kroz istoriju je uvek morao da ima podlogu nećeg realnog, najčešće plemenitog metala neke vrste, novac nikad ne nastaje nečijom naredbom ili proizvoljnom odlukom.

Vrlo često se u ovom kontekstu pominje Misesova čuena "teorema regresije". Ona kaže da je novac univerzalno razmensko sredstvo koje svoju vrednost crpe iz prethodne upotrebne vrednosti materijala od kojeg je sačinjeno. Recimo, zlato i srebro imaju vrednost kao nakit i luksuzna roba koju ljudi traže iz ne-monetarnih razloga, a njihova vrednost kao novca se onda izvodi iz te prethodne evaluacije njegove ne monetarne upotrebne "vrednosti". Tehnički rečeno, tražnja za zlatom kao monetarnim dobrom izvedena je iz tražnje za zlatom kao nemonetarnim dobrom.

Problem sa bitcoinom je što na prvi pogled on nema nikakvu ne-monetarnu vrednost. Nije zasnovan ni na kakvom fizičkom materijalu ili robi, već predstavlja kompjuterski algoritam. Bitcoin je beskoristan za bilo šta drugo osim kao sredstvo plaćanja. Ako je tome tako, onda postoje samo dve mogućnosti: ili bitcoin ne može da bude novac, ili je teorija o realnoj, nemonetarnoj osnovi novca netačna.

Izgleda da ni jedno ni drugo nije slučaj. Bitcoin jeste sredstvo razmene, iako još uvek nije novac, budući da nije univerzalno prihvaćen (što ne znači da ne može ili da neće biti prihvaćen), ali bitcoin istovremeno JESTE zasnovan na nečem realnom, tj ima vrednost i mimo svoje uloge kao novca. Ta prethodna vrednost bitcoina je njegova uloga kao efikasnog sistema plaćanja. Kao što Jeffrey Tucker naglašava u svom novom tekstu, Bitcoin je 2008 uveden kao sistem plaćanja koji bi omogućio efikasni transfer resursa između pojedinaca u raznim delovima sveta uz potpuno zaobilaženje zvaničnog finansijskog sistema. Programski dokument osnivača Bitcoina nije uopšte spominjao novac nego samo sistem plaćanja koji omogućava pouzdanost, anonimonst i operisanje izvan zvaničnih finansijkih tokova. Tehnički detalji su ovde.

Bitcoin kao sistem je lansiran 9 januara 2009, ali u tom trenutku njegova vrednost je bila nula! Sve do oktobra 2009 potenicjalni klijenti su mogli da dobiju besplatno koliko god hoće bitcoina da eksperimentišu. Ljudi su vršili prve transakcije, proveravali da li je sistem pouzdan, da li radi onako kako je obećano itd. Taj proces eksperminetisanja je trajao oko deset meseci. U tom periodu Bitcoin kao novac nije imao nikakvu tržišnu vrednost. Pre tačno pet godina, 5 oktobra 2009 postavljena je prva tržišna cena. Ona je bila 1390 bitcoina za jedan američki dolar, odnosno jedan bitcoin je vredeo manje od desetog dela penija. U tom trenutku publika je bila još uvek skeptična, što se pokazalo u vrlo niskoj ceni, ali kako je vreme prolazilo cena je rasla jer je evaluacija sistema, sa protokom vremena i daljim potvrđivanjem njegove vrednosti i pouzdanosti, kao i ulaskom mnogo šireg kurga ljudi u igru, postajala sve viša. Međutim, to je sve sa teorijske tačke gledišta irelevantno; ključna stvar je da je početna evaluacija bitcoina, prva tržišna cena objavljena 5 oktobra 2009 bila zapravo izraz evaluacije sistema plaćanja koja je vršena mesecima nezavisno od samog novca (tj njegove potencijalne vrednosti). Bitcoin kao novac "regresira" u mizesovskom smislu na bitcoin kao sistem plaćanja.

Dakle, bitcoin nije fiat novac. On predstavlja potencijalnu valutu koja je izvedena iz tržišne vrednosti specifičnog sistema plaćanja koji klijentima omogućava značajne prednosti koje drugi sistemi ne pružaju. I stoga oza njega stoji "realna vrednost" u istom smislu u kome nešto "realno" stoji iza zlata i srebra kao novca, ili iza modernih fiat valuta izvedenih iz zlata i srebra. Ja ne verujem da bi bitcoin imao velike šanse protiv zlata i srebra na slobodnom tržištu valuta, ali u ovom trenutku ne postoji slobodno tržište valuta, tj onaj ko pokuša da trguje u zlatu završiće u zatvoru. U takvim okolnostima, virtuelnost bitcoina predstavlja komparativnu prednost u odnosu na svaku vrstu robnog novca uključujući i zlato: vlasnik ne poseduje nikakvu fizičku supstancu koju vlada može da mu konfiskuje. Naravno, to bi moglo da se promeni ukoliko vlade ocene da je bitcoin značajna opasnost i krene u tehnološki rat protiv njega. U tom slučaju bi i cena verovatno pala.

-

@ bf47c19e:c3d2573b

2025-01-08 15:51:21

@ bf47c19e:c3d2573b

2025-01-08 15:51:21Originalni tekst na trzisnoresenje.blogspot.com

15.12.2023 / Autor: Slaviša Tasić

Ovako sam pisao u aprilu kad je Bitcoin vredeo $50-100 dolara:

"Koja je budućnost Bitcoina? Većina mu predviđa propast, ali već smo videli da ima neprijatelje sa obeju strana i obe imaju svoje razloge. ... Ali ekonomski gledano, sada kad je Bitcoin došao dovde, meni se čini da može još mnogo rasti."

...

"Zato mislim da ekonomski Bitcoin više nema problem. Sa ovako ograničenom ponudom, a uz održanje sadašnje tražnje ili njen rast, njegove vrednost može i još mnogo da poraste."

U međuvremenu je otišao na preko $1,000. Ali mislite da sam kupio neki Bitcoin? Nisam, teško je baviti se takvim sitnicama kad morate da pišete blog.

Evo šta sada mislim o Bitcoinu.

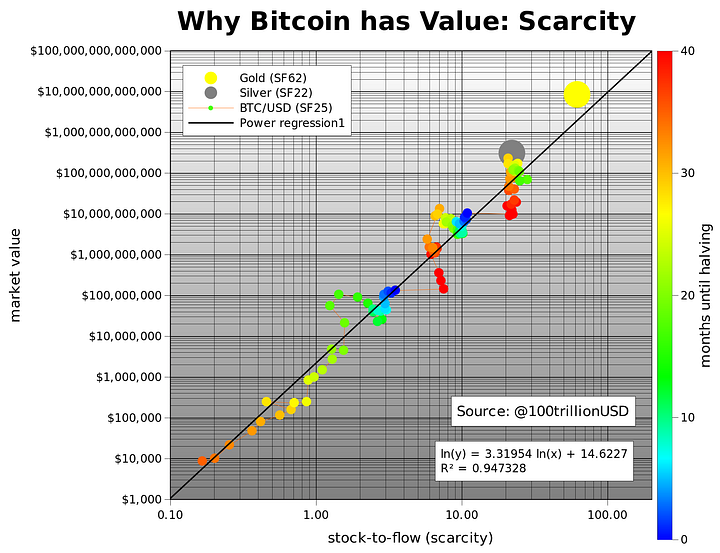

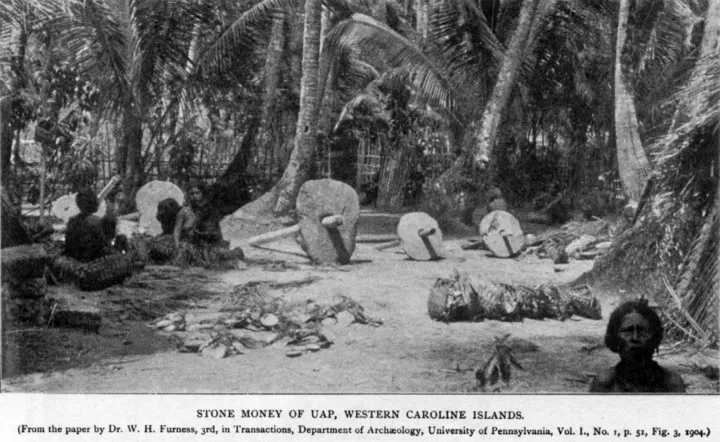

Najvažnije je razumeti zašto Bitcoin uopšte ima vrednost. To što ima neku vrednost i nije tako iznenađujuće. Valute su istorijski spontano nastajale najčešće od nečega što ima istinsku vrednost, bronze, srebra ili zlata. Ali nije neviđeno ni da novac bez intristične vrednosti bude široko prihvaćen. Poznat je slučaj ostrva kamenog novca, gde je novac bilo kamenje, neka vrsta krečnjaka (vidi sliku ispod). Stanovnici jednog polinezijskog ostrva su koristili ovaj kamen kao novac zbog samo jedne osobine -- zato što nije postojao na ostrvu. Da biste nabavili takvo kamenje morali ste ići na drugo ostrvo, što je bilo skupo i naporno. I to je jedina osobina koja je krečnjak činila novcem, nisu ga koristili ni za šta drugo.

Štaviše, da ne bi kotrljali kamenje pri svakoj kupovini, trgovali su samo pravima na odrđeni kamen, a da se kamen uopšte nije morao pomeriti s mesta. To je suštinski isto kao današnje elektronsko bankarstvo, ali to je druga priča.

Bitcoin je nešto najbliže tome. Kad se uspostavi konvencija, onda novac ne mora imati imanentnu vrednost. Konvencija je, iz garantovanu retkost dovoljan uslov da nešto uspe kao novac. Kao i krečnjak na tom ostrvu, Bitcoin je suštinski bezvredan, ali 1) ne može se naći lako (ima retkost) i 2) postoji konvencija da se prihvata kao novac -- prihvatate ga jer znate da će ga i drugi prihvatiti.

Ali koliko je Bitcoin zaista redak? Sam Bitcoin jeste, jer mu je ponuda programski ograničena. Ali sada vidimo uspon drugih kripto valuta -- Litecoin, Peercoin, i drugi. Bitcoin je redak, ali svako može da napravi nešto jako slično bitcoinu i zvati ga drugačije. To se uveliko i dešava, za sada bez efekta na vrednost Bitcoina.

Za sada Bitcoin ima rastuću snagu konvencije, ili ekonomskim rečnikom, za njega radi efekat mreže. Efekat mreže postoji kada svaki dodatni korisnik povećava vrednost dobra -- vi koristite tastaturu sa početnim slovima QWERTY zato što svi drugi koriste istu tastaturu pa je glupo da počinjete nešto drugo; otvorili ste Facebook nalog ne zato što je Facebook tehnološki najbolje urađen nego zato što svi drugi imaju Facebook pa se tako nalkaše povezujete; nemate Google Plus jer niko drugi nema Google Plus što ga čini beskorisnim, i tako dalje. Uspostavljene mreže je jako teško srušiti, one se perpetuiraju i rastu na principu začaranog kruga.

Kad se jednom uspostave, mreže kao Facebook ili Bitcoin imaju ugrađenu prednost i teško ih je srušiti. Ali znate li ko je još imao efekat mreže u svoju korist? Imao je Windows i imao je MySpace. Windows se još drži ali nije ni blizu moći od pre desetak godina, a MySpace je potpuno propao -- a ljudi su 2008. MySpaceu predviđali večni monopol zbog efekta mreže. Poenta je, efekat mreže je prednost ali nikome ne garantuje monopol, pa čak ni opstanak.

Situacija sa Bitcoinom je ovakva. Sa pojavom drugih valuta retkost je izgubio. Nije bitno što nema Bitcoina, Bitcoin je samo ime. Ima ili može biti neograničeno mnogo kriptovaluta istog tipa i to je ono što je važno. Konvenciju odnosno efekat mreže Bitcoin još uvek ima, štaviše tu je i dalje u usponu. Ali to mu ne garantuje dugoročni uspeh. Kad se ta dva saberu, mislim da Bitcoin nema dobrih dugoročnih izgleda. Da sam onda u aprilu kupio Bitcoine, sada bih prodao.

-

@ bf47c19e:c3d2573b

2025-01-08 15:23:03

@ bf47c19e:c3d2573b

2025-01-08 15:23:03Originalni tekst na trzisnoresenje.blogspot.com

03.04.2013 / Autor: Slaviša Tasić

Posle kiparske epizode naglo je došlo do rasta njegove vrednosti. Bitcoin je virtuelna valuta koju ne kontroliše niko. Umesto toga, emitovanje Bitcoina ograničeno je komplikovanim programom. Kao i kod zlata, svako može da iskopa novčiće, ali kopanje je naporno i neizvesno -- jedina je razlika što se posao ne obavlja fizički već kompjuterski. Program je postavljen tako da količina iskopanih Bitcoina raste po stalno opadajućoj stopi, dok se na kraju, za nekih stotinak godina, asimptotski ne približi konačnom nivou.

Za bliže objašnjenje Bitcoina i više o tekućim dešavanima pročešljajte Nedeljni komentar, a meni ceo fenomen postaje vrlo interesantan iz nekoliko razloga.

Prvo, Bitcoin ima mnogo neprijatelja. Neprijatelji su pristalice državnog novca, jer je ovo privatni, decentralizovani novac, čije štampanje ne kontrolišu stručnjaci za monetarnu politiku već se obavlja po automatskom programu. Tokovi novca se teško kontrolišu i neke centralne banke su već "izrazile zabrinutost" zbog rastuće uloge ove valute.

Ali, neprijatelji su i libertarijanski ekonomisti kojima je bliži zlatni standard. U njihovu viziju se ne uklapa to što Bitcoin očigledno nema pravu materijalnu vrednost. Bitcoin je nešto kao privatni fiat novac -- dosada neviđeni fenomen. Po njima tako nešto ne može da postoji i zato mu od samog početka predviđaju propast, ali ih bar za ovih par godina njegovog postojanja stvarnost demantuje.

Dalje, nastanak i dosadašnji uspeh Bitcoina se kosi sa bilo kojom postojećom teorijom i štaviše, za njegov uspeh gotovo da uopšte nema racionalnog objašnjenja. Najveća tajna slobodne razmene, bilo da je to tržište ili drugi oblici slobodne i dobrovoljne saradnje, je to što iz neorganizovane akcije slobodnih pojedinaca može doći do ishoda kojima se ne možemo unapred nadati, koji prevazilaze našu moć imaginacije i koje čak i ex post teško možemo racionalno objasniti. (To je Hayekova najvažnija ideja, a ne njegov libertarijanizam po sebi).

Bitcoin je izgledao a i dalje većini ekonomista i medija izgleda nemoguće, jer iako je njegova ponuda ograničena programom, tražnja za njim je stvar pukog verovanja. Kod zlata i srebra, tražnja postoji jer ti metali imaju i stvarnu vrednost. Kod državnog novca, tražnja postoji jer vam država kaže da morate da koristite taj novac, ali i svojim autoritetom garantuje da će svi ostali prihvatati taj novac. Kod Bitcoina vam niko ne garantuje ništa. Kako je to počelo da se koristi, kako su ljudi, posebno oni u početku, prihvatali da prodaju stvari za Bitcoine, ili da razmenjuju svoje evre i dolare za Bitcoine, meni uopšte nije jasno. Sada je lakše, valuta je donekle uspostavljena, više je prodavaca koji je prihvataju, znate da ima dovoljno onih koji je koriste i zato ima nekih osnova za verovanje da će se to nastaviti. Ali da je tako nešto moglo da počne, da nastane ni iz čega, je gotovo neshvatljivo.

Koja je budućnost Bitcoina? Većina mu predviđa propast, ali već smo videli da ima neprijatelje sa obeju strana i obe imaju svoje razloge. Propast je pre svega moguća usled državne intervencije. Možda će tako nešto jednostavno biti zabranjeno i proganjano. Kad je američka Komisija za hartije od vrednosti mogla da ugasi jako korisnu onlajn kladionicu Intrade (čije smo kvote na razne događaje u svetu ovde često linkovali), navodno iz razloga finansijske sigurnosti, onda je vrlo moguće da i Bitcoin dođe na red.

Ali ekonomski gledano, sada kad je Bitcoin došao dovde, meni se čini da može još mnogo rasti. Tačno je da tražnja za njim počiva na cikličnom verovanju, na verovanju svakog korisnika da će svi drugi nastaviti da primaju Bitcoin, ali: prvo, već nas je jednom iznanadilo da je Bitcoin samo na osnovu tog verovanja došao od nule do današnjih preko 100$ za Bitcoin. Drugo, ne zaboravite da ni ostale valute nisu baš toliko drugačije. Tražnja za državnim novcen se, bez obzira na državne garancije, dobrim delom zasniva na istoj slobodnoj veri da će i drugi prihvatati taj novac. Zlato ima materijalnu vrednost, ali ta vrednost, za industrijsku upotrebu ili nakit, je obično dosta manja od njegove sadašnje cene. Nisu se u poslenjih nekoliko godina industrijska upotreba i atraktivnost zlatnog nakita promenili, već su se promenila očekivanja vrednosti zlata, koja takođe zavise od vaše pretpostavke da će i ostali nastaviti da kupuju i drže zlato.

Zato mislim da ekonomski Bitcoin više nema problem. Sa ovako ograničenom ponudom, a uz održanje sadašnje tražnje ili njen rast, njegove vrednost može i još mnogo da poraste. Mnogo realniji scenario raspada je panika posle najave država da će zabraniti njegovu upotrebu uz neki izgovor kao što su finansijska stabilnost ili sprečavanje pranja novca. Ali čak i ako se to dogodi ostaće fascinantno da je ovakva inicijativa uopšte uspela -- protivno zakonima slabašne ljudske logike.

-

@ 2f4550b0:95f20096

2025-01-08 15:11:46

@ 2f4550b0:95f20096

2025-01-08 15:11:46Leadership is rarely a smooth ride. For every moment of success, there are setbacks and challenges that test even the most seasoned leaders. The key to sustained success isn’t avoiding difficulties but rather how effectively one can navigate through them. Resilience, the ability to bounce back from adversity, is not just a personal asset; it’s a leadership imperative.

I remember an experience earlier in my career that underscored the power of resilience in leadership. I was leading a team on a high-stakes project. We had invested countless hours, fine-tuned every detail, and had finally reached the presentation phase. Then, disaster struck: the technology we relied on for the demo failed at the last minute. The team’s morale plummeted. I saw the disappointment in their faces, and I could feel the weight of their expectations on me.

At that moment, I had a choice: I could either give in to frustration and let the team spiral, or I could model resilience and lead them through the crisis. I took a deep breath and reminded myself that setbacks are temporary and often lead to growth. We brainstormed solutions on the spot, restructured our approach, and within hours had a makeshift presentation that was just as impactful as our original plan. In the end, we delivered it successfully—and I learned one of the most valuable lessons in leadership: resilience doesn’t mean avoiding failure, but rather how we respond when things don’t go as planned.

This experience taught me that resilient leadership hinges on a few essential principles:

- Maintain a Positive Outlook: As a leader, your mindset directly influences your team. When faced with setbacks, staying calm and optimistic can help anchor the group. A positive perspective allows you to focus on solutions instead of dwelling on problems.

- Adapt and Problem-Solve: Resilience is about adaptability. Things don’t always go according to plan, and being able to quickly pivot and think creatively in the face of adversity is crucial. Resilient leaders encourage their teams to embrace change, adapt, and find alternative solutions.

- Support Your Team: Leaders cannot be resilient alone. Resilience thrives in a supportive environment. Offer your team encouragement, communicate openly, and make sure they know they have your support. By fostering a culture of mutual trust, you’ll enable everyone to recover and grow stronger together.

- Learn from Setbacks: Every challenge presents an opportunity to learn. Resilient leaders view failures as stepping stones to improvement. Reflecting on what went wrong and why, allows leaders and teams to strengthen their strategies moving forward.

In leadership, setbacks are inevitable. What sets great leaders apart is their ability to bounce back. With resilience, you can navigate through challenges with confidence and lead your team toward continued success.

-

@ 8d34bd24:414be32b

2025-01-08 14:34:15

@ 8d34bd24:414be32b

2025-01-08 14:34:15I’ve known that there are references to Jesus in the Old Testament. They just don’t use the name Jesus.

Then God said, “Let Us make man in Our image, according to Our likeness; and let them rule over the fish of the sea and over the birds of the sky and over the cattle and over all the earth, and over every creeping thing that creeps on the earth.” (Genesis 1:26) {emphasis mine}

Notice the references to God in the plural. These are clues to the trinitarian (3 persons in one God) nature of God.

There are also examples of theophanies (preincarnate Jesus) in the Old Testament. These theophanies are frequently referred to as “the angel of the Lord” or “the angel of God.”

But the angel of the Lord called to him from heaven and said, “Abraham, Abraham!” And he said, “Here I am.” He said, “Do not stretch out your hand against the lad, and do nothing to him; for now I know that you fear God, since you have not withheld your son, your only son, from Me.” (Genesis 22:11-12) {emphasis mine}

In this case we know that the “angel of the Lord” is not just an angel because he says, “I know that you fear God, since you have not withheld your son, your only son, from Me,” equating Himself, “Me,” with God. In most cases when an angel appears, the people drop face down in worship, but the angel corrects them and tells them not to worship. When the angel is Jesus, He accepts the worship and in many cases sacrifices as well.

The angel of the Lord appeared to him and said to him, “The Lord is with you, O valiant warrior.” Then Gideon said to him, “O my lord, if the Lord is with us, why then has all this happened to us? … So Gideon said to Him, “If now I have found favor in Your sight, then show me a sign that it is You who speak with me. Please do not depart from here, until I come back to You, and bring out my offering and lay it before You.” And He said, “I will remain until you return.”

Then Gideon went in and prepared a young goat and unleavened bread from an ephah of flour; he put the meat in a basket and the broth in a pot, and brought them out to him under the oak and presented them. The angel of God said to him, “Take the meat and the unleavened bread and lay them on this rock, and pour out the broth.” And he did so. Then the angel of the Lord put out the end of the staff that was in his hand and touched the meat and the unleavened bread; and fire sprang up from the rock and consumed the meat and the unleavened bread. Then the angel of the Lord vanished from his sight. When Gideon saw that he was the angel of the Lord, he said, “Alas, O Lord God! For now I have seen the angel of the Lord face to face.” (Judges 6:12=13a, 17-22) {emphasis mine}

As you can see, Gideon offered an offering. An offering to anyone other than God would be idolatry. Gideon offers a “a young goat and unleavened bread from an ephah of flour,” which is a proper sin offering to God. The angel did not eat the offering, but told Gideon to “Take the meat and the unleavened bread and lay them on this rock … Then the angel of the Lord put out the end of the staff that was in his hand and touched the meat and the unleavened bread; and fire sprang up from the rock and consumed the meat and the unleavened bread. Then the angel of the Lord vanished from his sight.” Gideon’s offering was taken as a burnt offering to God and to angel of the Lord, who is Jesus.

With all of this, look at the verse I read last night:

Who has ascended into heaven and descended?\ Who has gathered the wind in His fists?\ Who has wrapped the waters in His garment?\ Who has established all the ends of the earth?\ What is His name or His son’s name?\ Surely you know! (Proverbs 30:4) {emphasis mine}

Surely this is a passage about Jesus.

This verse says, “Who has ascended into heaven and descended?” The New Testament says about Jesus, “No one has ascended into heaven, but He who descended from heaven: the Son of Man.” (John 3:13)

This verse says, “Who has gathered the wind in His fists?” The New Testament says about Jesus,

And there arose a fierce gale of wind, and the waves were breaking over the boat so much that the boat was already filling up. Jesus Himself was in the stern, asleep on the cushion; and they woke Him and said to Him, “Teacher, do You not care that we are perishing?” And He got up and rebuked the wind and said to the sea, “Hush, be still.” And the wind died down and it became perfectly calm. (Mark 4:37-39) {emphasis mine}

This verse says, “Who has wrapped the waters in His garment?” The New Testament says about Jesus,

And in the fourth watch of the night He came to them, walking on the sea. When the disciples saw Him walking on the sea, they were terrified, and said, “It is a ghost!” And they cried out in fear. But immediately Jesus spoke to them, saying, “Take courage, it is I; do not be afraid.”

Peter said to Him, “Lord, if it is You, command me to come to You on the water.” And He said, “Come!” And Peter got out of the boat, and walked on the water and came toward Jesus. (Matthew 14:25-29) {emphasis mine}

This verse says, “Who has established all the ends of the earth?” The New Testament says about Jesus,

In the beginning was the Word, and the Word was with God, and the Word was God. He was in the beginning with God. All things came into being through Him, and apart from Him nothing came into being that has come into being. (John 1:1-3) {emphasis mine}

This verse says, “What is His name or His son’s name?” The New Testament says about Jesus,

After being baptized, Jesus came up immediately from the water; and behold, the heavens were opened, and he saw the Spirit of God descending as a dove and lighting on Him, and behold, a voice out of the heavens said, “This is My beloved Son, in whom I am well-pleased. (Matthew 3:16-17) {emphasis mine}

This verse says, “Surely you know!” As New Testament believers we know the Son of God, Jesus Christ. The Bible was pointing to the Son of God long before He came to earth as a baby.

Who has ascended into heaven and descended?\ Who has gathered the wind in His fists?\ Who has wrapped the waters in His garment?\ Who has established all the ends of the earth?\ What is His name or His son’s name?\ Surely you know! (Proverbs 30:4) {emphasis mine}

It doesn’t matter how many times we have already read the Bible. Every time we read it, we can discover new insight and knowledge of God, His eternal plans, and His commands for our lives. God is good.

Trust Jesus.

-

@ 2063cd79:57bd1320

2025-01-08 14:26:43

@ 2063cd79:57bd1320

2025-01-08 14:26:43Unit-Bias

Bitcoin hat in der öffentlichen Wahrnehmung und bei Menschen, die sich weniger mit dem Thema befassen, einen sogenannten Unit-Bias, also eine durch Unwissenheit hervorgerufene Voreingenommenheit gegenüber der Einheit "Bitcoin". Das bedeutet, dass viele unerfahrene Anleger//innen und Nutzer//innen der Meinung sind, dass der Besitz eines ganzen bitcoins psychologisch wichtig oder überhaupt nur als solcher möglich ist. Anders ausgedrückt, glauben viele Menschen, sie müssen Bitcoin als Ganzes kaufen, also einen ganzen "physischen" bitcoin, statt kleinerer Bruchstücke. Das lässt den Vermögenswert für die meisten zu teuer aussehen.

Dies ist für Bitcoin insofern ein Problem, als dass viele Menschen sich durch ihre Voreingenommenheit gar nicht mit Bitcoin beschäftigen ("kann ich mir nicht leisten") oder das Gefühl haben, Bitcoin sei zu teuer und deshalb gibt es kein Wertsteigerungspotential mehr ("der Zug ist abgefahren, ich hätte vor sechs Jahren investieren sollen"). Schlimmer noch, als sich nicht mit Bitcoin zu beschäftigen, ist sich dann stattdessen alternativen, "erschwinglicheren" Kryptowährungen zuzuwenden. Dieser Unit-Bias ist allerdings nichts anderes als ein Marketing-, bzw. ein Bildungsproblem. Denn wie wir wissen kann man Bitcoin in 100 Millionen Untereinheiten brechen und in kleinsten Mengen erwerben, verschicken und verkaufen. Doch haben Außenstehende von Begriffen wie Lightning oder Sats meistens noch nie gehört.

Dies ist für Bitcoin insofern ein Problem, als dass viele Menschen sich durch ihre Voreingenommenheit gar nicht mit Bitcoin beschäftigen ("kann ich mir nicht leisten") oder das Gefühl haben, Bitcoin sei zu teuer und deshalb gibt es kein Wertsteigerungspotential mehr ("der Zug ist abgefahren, ich hätte vor sechs Jahren investieren sollen"). Schlimmer noch, als sich nicht mit Bitcoin zu beschäftigen, ist sich dann stattdessen alternativen, "erschwinglicheren" Kryptowährungen zuzuwenden. Dieser Unit-Bias ist allerdings nichts anderes als ein Marketing-, bzw. ein Bildungsproblem. Denn wie wir wissen kann man Bitcoin in 100 Millionen Untereinheiten brechen und in kleinsten Mengen erwerben, verschicken und verkaufen. Doch haben Außenstehende von Begriffen wie Lightning oder Sats meistens noch nie gehört.Untereinheiten

Doch auch innerhalb der Bitcoin-Szene ist die Unterteilung von Bitcoin in Untereinheiten nicht ganz unumstritten. Denn viele Nutzer//innen sind sich uneinig darüber, was der beste Weg ist, Bitcoins Untereinheiten zu bezeichnen und sogar darzustellen. Dies zeigt sich z.B. darin, dass Apps oft entweder Bitcoin oder Fiat anzeigen, manche Apps aber auch Beträge in Sats darstellen. Dies verlangt aber oft eigene Einstellungen innerhalb der App oder viele Klicks, die die Bedienung und Darstellung eher unhandlich gestalten.

Es gibt verschiedene Lösungsansätze, die dem/der Nutzer//in die ungewohnte Rechnung mit acht Nachkommastellen erleichtern sollen. Denn viele Anwender//innen denken beim Blick in ihre Wallets oft noch in lokalen Fiat-Werten, also in ganzen Einheiten (z.B. Euro oder Dollar) und Hundertsteln (z.B. Cents).

Es gibt verschiedene Lösungsansätze, die dem/der Nutzer//in die ungewohnte Rechnung mit acht Nachkommastellen erleichtern sollen. Denn viele Anwender//innen denken beim Blick in ihre Wallets oft noch in lokalen Fiat-Werten, also in ganzen Einheiten (z.B. Euro oder Dollar) und Hundertsteln (z.B. Cents). Einige Wallets versuchen diesen Spagat komplett zu umgehen, indem sie vermeiden, Beträge in Fiat darzustellen. Doch auch hier bleibt immer noch das Problem der unhandlichen Darstellung von acht Nachkommastellen, weshalb einige Anbieter einfach zwei Eingabemöglichkeiten bieten und den Betrag in Bitcoin oder Sats automatisch umrechnen.

Einige Wallets versuchen diesen Spagat komplett zu umgehen, indem sie vermeiden, Beträge in Fiat darzustellen. Doch auch hier bleibt immer noch das Problem der unhandlichen Darstellung von acht Nachkommastellen, weshalb einige Anbieter einfach zwei Eingabemöglichkeiten bieten und den Betrag in Bitcoin oder Sats automatisch umrechnen. Doch selbst das Zeichen für Sats ist nicht final geklärt. Es gibt viele verschiedene Vorschläge und Meinungen dazu, welches Symbol genutzt werden sollte. Die meisten Apps, Rechnungen und Sticker schreiben einfach das Wort "Sats" oder "sats" aus. Allerdings ist dies ein Problem, da außerhalb der Bitcoin-Szene niemand weiß, was ein Sat ist. Die meisten Menschen werden mittlerweile von Bitcoin gehört haben, auch wenn sie nicht wissen, wie es funktioniert, was es bedeutet, oder wie man damit umgeht. Doch auch das B Logo mit den Dollarstrichen (₿) werden die meisten Menschen zuordnen können.

Doch selbst das Zeichen für Sats ist nicht final geklärt. Es gibt viele verschiedene Vorschläge und Meinungen dazu, welches Symbol genutzt werden sollte. Die meisten Apps, Rechnungen und Sticker schreiben einfach das Wort "Sats" oder "sats" aus. Allerdings ist dies ein Problem, da außerhalb der Bitcoin-Szene niemand weiß, was ein Sat ist. Die meisten Menschen werden mittlerweile von Bitcoin gehört haben, auch wenn sie nicht wissen, wie es funktioniert, was es bedeutet, oder wie man damit umgeht. Doch auch das B Logo mit den Dollarstrichen (₿) werden die meisten Menschen zuordnen können.Sats hingegen ist ein sehr nischiger Begriff und seine Verwendung noch unbekannter. Oft wird das Blitzsymbol (3 auf der unteren Grafik) verwendet, um Lightning darzustellen und auch das Symbol mit den drei horizontalen Strichen und zwei vertikalen Punkten (4 auf der unteren Grafik), das entfernt an das Dollar-Zeichen erinnern soll ($), erfreut sich immer größerer Beliebtheit. Das Problem dabei ist nur, dass es sich in geschriebener Form nicht, oder nur unzulänglich darstellen lässt: 丰 🤡

Es war lange logisch und notwendig, ganze Bitcoins zur Aufzählung und Bezahlung zu verwenden, da bei der Einführung von Bitcoin sein Geldwert sehr gering war. Es bestand also absolut keine Notwendigkeit dazu, in kleineren Einheiten als Bitcoin zu denken. Einfaches Beispiel: letzte Woche, am 22. Mai, jährte sich der Bitcoin-Pizza-Day zum 13. Mal, also jener Tag an dem Laszlo Hanyecz für zwei Pizza 10.000 bitcoins bezahlte und damit die erste offline Transaktion mit Bitcoin tätigte. 10.000 bitcoins entsprachen zu diesem Zeitpunkt also knapp $40, oder andersrum $1 entsprach 250 bitcoins Es gab also immer noch keine Notwendigkeit, kleinere Einheiten von Bitcoin zu verwenden. Diese Notwendigkeit ergab sich erst, als der Bitcoin und der Dollar Parität erlangten (1 Bitcoin = $1) und spätestens, als Bitcoin die Marke von $100 durchbrach, wurde rechnen in Bitcoin schwieriger.

Es war lange logisch und notwendig, ganze Bitcoins zur Aufzählung und Bezahlung zu verwenden, da bei der Einführung von Bitcoin sein Geldwert sehr gering war. Es bestand also absolut keine Notwendigkeit dazu, in kleineren Einheiten als Bitcoin zu denken. Einfaches Beispiel: letzte Woche, am 22. Mai, jährte sich der Bitcoin-Pizza-Day zum 13. Mal, also jener Tag an dem Laszlo Hanyecz für zwei Pizza 10.000 bitcoins bezahlte und damit die erste offline Transaktion mit Bitcoin tätigte. 10.000 bitcoins entsprachen zu diesem Zeitpunkt also knapp $40, oder andersrum $1 entsprach 250 bitcoins Es gab also immer noch keine Notwendigkeit, kleinere Einheiten von Bitcoin zu verwenden. Diese Notwendigkeit ergab sich erst, als der Bitcoin und der Dollar Parität erlangten (1 Bitcoin = $1) und spätestens, als Bitcoin die Marke von $100 durchbrach, wurde rechnen in Bitcoin schwieriger.Fortan überlegte man sich, Bitcoin in kleineren Einheiten darzustellen. Die zwei Möglichkeiten sind der Bit und der Sat. Ein einzelner bitcoin kann in 1.000.000 Bits oder bis zu 100.000.000 Sats unterteilt werden, also 100 Sats = 1 Bit = 0,000001 Bitcoin.

Ein weiterer Grund, weshalb eine Stückelung in bitcoin (der Begriff für einen ganzen physischen bitcoin) schwierig und verwirrend ist, und deshalb viele nach einer alternativen Bezeichnung für Untereinheiten suchten, ist dass darüber hinaus "Bitcoin" zur Beschreibung von zwei Dingen verwendet werden kann: dem monetären Netzwerk (Bitcoin - großes B) und dem monetären Vermögenswert (bitcoin - kleines B).

Ein weiterer Grund, weshalb eine Stückelung in bitcoin (der Begriff für einen ganzen physischen bitcoin) schwierig und verwirrend ist, und deshalb viele nach einer alternativen Bezeichnung für Untereinheiten suchten, ist dass darüber hinaus "Bitcoin" zur Beschreibung von zwei Dingen verwendet werden kann: dem monetären Netzwerk (Bitcoin - großes B) und dem monetären Vermögenswert (bitcoin - kleines B). Bitcoin, der Vermögenswert, ist für diejenigen, die noch nichts damit zu tun hatten, sowohl verwirrend als auch fremd. Denn wie bereits erwähnt, führt der Unit-Bias dazu, dass viele Menschen denken, dass sie es sich nicht leisten können, Bitcoin zu kaufen, oder dass sie den Anschluss verpasst haben. Die Verwendung einer Bepreisung in Bruchteilen würde die Verwirrung über die Benennung des Netzwerks und des Vermögenswerts verringern, aber auch die psychologische Hürde für den Einstieg in Bitcoin senken. Vorausgesetzt, die Benennung ist logisch und intuitiv.

Bitcoin, der Vermögenswert, ist für diejenigen, die noch nichts damit zu tun hatten, sowohl verwirrend als auch fremd. Denn wie bereits erwähnt, führt der Unit-Bias dazu, dass viele Menschen denken, dass sie es sich nicht leisten können, Bitcoin zu kaufen, oder dass sie den Anschluss verpasst haben. Die Verwendung einer Bepreisung in Bruchteilen würde die Verwirrung über die Benennung des Netzwerks und des Vermögenswerts verringern, aber auch die psychologische Hürde für den Einstieg in Bitcoin senken. Vorausgesetzt, die Benennung ist logisch und intuitiv.Bits vs. Sats

Wie schon erwähnt, gibt es zwei gängige Untereinheiten von Bitcoin, 1 Bit (= 0,000001 Bitcoin) und 1 Sat (0,00000001 Bitcoin). Seit jeher gibt es Diskussionen darüber, welche der beiden Einheiten für den täglichen Gebrauch die vernünftigere und intuitivere ist.

Die Verwendung von Bits zur Aufzählung von Bitcoin hat einige Vorteile. Ein Bit stellt ein „Bit“ eines Bitcoins dar, also der grundlegendsten und kleinsten Informationseinheit in der Informatik. Den meisten Menschen fällt es einfacher, das Wort „Bit“ mit Bitcoin zu assoziieren und daher verstehen sie eher, dass ein Bit ein Teil eines Bitcoins ist. Ein „Sat“ bedeutet für den Durchschnittsmenschen, wie oben beschrieben, nichts.

Adam Back (CEO von Blockstream und Bitcoin-Legende) ist wahrscheinlich der bekannteste Befürworter von Bits > Sats. Er argumentiert von verschiedenen Richtungen, dass z.B. Bits eine rechnerisch einfachere Variante ist, Untereinheiten von Bitcoin darzustellen, als Sats.

Adam Back (CEO von Blockstream und Bitcoin-Legende) ist wahrscheinlich der bekannteste Befürworter von Bits > Sats. Er argumentiert von verschiedenen Richtungen, dass z.B. Bits eine rechnerisch einfachere Variante ist, Untereinheiten von Bitcoin darzustellen, als Sats. Weiter argumentiert er mit der historischen Entwicklung von Bitcoin, dem Protokoll und seiner Referenz-Implementierung. In den Anfangsjahren wurde in der Bitcoin Core Wallet mit Bits gearbeitet. Außerdem argumentiert er, dass die Verbindung zwischen Bitcoin der Haupteinheit und Bits oder Sats als Untereinheit zumindest semantisch gebrochen werden sollte. Da Bitcoin (im Fall eines weiter steigenden Kurses) als Recheneinheit immer unpraktischer wird, sollte man als mentales Modell auf das Rechenpaar Bits und Sats zurückgreifen - analog zur Darstellung von Dollars und Cents oder Euros und Cents. Dabei stellen die zwei Nachkommastellen eines in Bits angegebenen Preises die Sats dar.

Weiter argumentiert er mit der historischen Entwicklung von Bitcoin, dem Protokoll und seiner Referenz-Implementierung. In den Anfangsjahren wurde in der Bitcoin Core Wallet mit Bits gearbeitet. Außerdem argumentiert er, dass die Verbindung zwischen Bitcoin der Haupteinheit und Bits oder Sats als Untereinheit zumindest semantisch gebrochen werden sollte. Da Bitcoin (im Fall eines weiter steigenden Kurses) als Recheneinheit immer unpraktischer wird, sollte man als mentales Modell auf das Rechenpaar Bits und Sats zurückgreifen - analog zur Darstellung von Dollars und Cents oder Euros und Cents. Dabei stellen die zwei Nachkommastellen eines in Bits angegebenen Preises die Sats dar. Ganz einfaches Beispiel: Ein Kasten Bier kostet heute etwas 20€, also 0,00079758 Bitcoin. Einfacher dargestellt: 797,58 Bits, also 797 Bits und 58 Sats. “Ein Bitcoin ist zu teuer, aber Sats sind zu viele, klingen billig und verwirrend.” Es ist schwer in Sats zu denken und selbst wenn der Preis von Bitcoin 1 M US Dollar erreicht, ist ein Bit immer noch eine greifbare und günstige Einheit: 1 Bit = 1 US Dollar.

Ganz einfaches Beispiel: Ein Kasten Bier kostet heute etwas 20€, also 0,00079758 Bitcoin. Einfacher dargestellt: 797,58 Bits, also 797 Bits und 58 Sats. “Ein Bitcoin ist zu teuer, aber Sats sind zu viele, klingen billig und verwirrend.” Es ist schwer in Sats zu denken und selbst wenn der Preis von Bitcoin 1 M US Dollar erreicht, ist ein Bit immer noch eine greifbare und günstige Einheit: 1 Bit = 1 US Dollar. Eines von Adams Hauptargumenten ist, dass Sat als Untereinheit nicht funktioniert, weil es Dust gibt. Das Problem mit Dust besteht darin, dass es nicht möglich ist, Bitcoin unter einem bestimmten Schwellenwert auszugeben. Sein Argument ist, dass der Nutzen einer Einheit abhanden kommt, wenn diese Einheit als kleinste Recheneinheit nicht ausgegeben werden kann. Zugegeben, niemand kann mehr etwas für einen Cent kaufen, aber zumindest ist es technisch nicht unmöglich. Allerdings ist es unmöglich, 1 oder sogar 10 Sats über das Bitcoin-Netzwerk zu senden, ohne Layer-2-Skalierungstechnologien zu verwenden.

Eines von Adams Hauptargumenten ist, dass Sat als Untereinheit nicht funktioniert, weil es Dust gibt. Das Problem mit Dust besteht darin, dass es nicht möglich ist, Bitcoin unter einem bestimmten Schwellenwert auszugeben. Sein Argument ist, dass der Nutzen einer Einheit abhanden kommt, wenn diese Einheit als kleinste Recheneinheit nicht ausgegeben werden kann. Zugegeben, niemand kann mehr etwas für einen Cent kaufen, aber zumindest ist es technisch nicht unmöglich. Allerdings ist es unmöglich, 1 oder sogar 10 Sats über das Bitcoin-Netzwerk zu senden, ohne Layer-2-Skalierungstechnologien zu verwenden.Dust

Unter Bitcoin-Dust versteht man eine sehr kleine Menge Bitcoin, typischerweise in kleinen ein- bis zweistelligen Sats-Beträgen, doch auch kommen immer öfter dreistellige Beträge vor. Sie werden Dust oder „Staub“ genannt, weil diese Beträge so gering sind, dass sie oft als unbedeutend und unpraktisch für die Verwendung bei regulären Transaktionen angesehen werden.

Es gibt keine offizielle Definition dafür wie groß/klein ein Betrag sein muss, um als Dust zu gelten, da jede Softwareimplementierung (Client, Wallet, etc.) einen anderen Schwellenwert annehmen kann. Die Bitcoin Core Referenzimplementierung definiert Dust als jede Transaktionsausgabe, die niedriger ist als die aktuellen Transaktionsgebühren.

Es gibt keine offizielle Definition dafür wie groß/klein ein Betrag sein muss, um als Dust zu gelten, da jede Softwareimplementierung (Client, Wallet, etc.) einen anderen Schwellenwert annehmen kann. Die Bitcoin Core Referenzimplementierung definiert Dust als jede Transaktionsausgabe, die niedriger ist als die aktuellen Transaktionsgebühren.Dust entsteht meist unbeabsichtigt bei Bitcoin-Transaktionen. Denn wenn Bitcoin von einer Adresse an eine andere gesendet wird, fällt oft eine Transaktionsgebühr an. Um Spam zu verhindern und die Sicherheit des Netzwerks zu gewährleisten, gibt es bei Bitcoin eine Mindestgröße für jede Transaktion. Dieses Limit ist der Mindestbetrag an Bitcoin, der als Ausgabe in eine Transaktion einbezogen werden kann. Der Rest ist Dust.

Oder einfacher ausgedrückt, wenn die Mindestgröße für eine Bitcoin-On-Chain-Transaktion 500 Sats (5 Bits) beträgt und ich noch 800 Sats (8 Bits) in meiner Wallet habe, kann ich nach dem Versenden von 600 Sats (6 Bits) die übrigen 200 Sats (2 Bits) nicht mehr ausgeben. Diese verbleibenden 2 Bits sind Dust.

Dust stellt aus mehreren Gründen eine Herausforderung für das Bitcoin-Netzwerk und seine Benutzer//innen dar:

Dust stellt aus mehreren Gründen eine Herausforderung für das Bitcoin-Netzwerk und seine Benutzer//innen dar:UTXO-Bloat: Bei jeder Transaktion werden nicht ausgegebene Transaktionsausgaben (UTXOs) erstellt, und Dust erhöht die Anzahl der UTXOs im System. Dies kann zu einer aufgeblähten Blockchain führen und sich negativ auf die Leistung und Skalierbarkeit des Netzwerks auswirken.

Wallet-Management: Im Laufe der Zeit kann sich in Wallets viel Dust ansammeln, und die Verwaltung solch kleiner Beträge kann für Benutzer//innen unpraktisch sein. Bei vielen Wallets ist ein Mindestguthaben erforderlich, und die Dust-Mengen sind möglicherweise zu gering, um diese Anforderung zu erfüllen. Viele Nutzer//innen wechseln häufig zwischen Wallets und transferirien ihre Vermögen vorher auf die neuen Wallets, bei solchen Wechseln bleiben Dust-Beträge zurück und gelten langfristig als verloren.

Ein weiteres Problem besteht darin, dass Dust nicht genau definiert werden kann. Die Transaktionsgebühren hängen wesentlich von zwei Faktoren ab: Den Gebühren in sat/vB, welche von der Auslastung des Mempools abhängen und zu Zeiten von hoher Auslastung dementsprechend hoch sind, und zum anderen vom UTXO-Set des/der jeweiligen Nutzer//in. Denn wie wir wissen, werden Transaktionen aus einer oder mehreren UTXOs zusammengesetzt, je mehr UTXOs dabei benötigt werden, um den gewünschten Betrag zu versenden, desto höher sind die Kosten für diese Transaktion, da sich das Gewicht (in vBytes) erhöht. Diese beiden Faktoren können die Gebühren in Einzelfällen so strukturieren, dass größere Mengen Dust anfallen, als in anderen Fällen.

Datenschutzbedenken: Da jede Transaktion in der Blockchain gespeichert wird, können selbst winzige Mengen Dust mit der Identität oder dem Transaktionsverlauf einer Person verknüpft werden, was die Privatsphäre gefährdet. Diese Funktion wird von Angreifern in sogenannten Dust-Attacks ausgenutzt. Denn böswillige Angreifer haben schnell erkannt, dass Nutzer//innen die winzigen Dust-Beträge, die in ihren Wallet-Adressen angezeigt werden, nicht viel Aufmerksamkeit schenken oder gar bemerken. Angreifer schicken also Kleinstbeträge an eine große Anzahl von Adressen, um dann im nächsten Schritt in einer kombinierten Analyse dieser Adressen und der Beträge, versuchen herauszufinden, welche Adressen zur gleichen Wallet gehören. Dabei ist es das Ziel, diese so identifizierbaren Adressen und Wallets schließlich den jeweiligen Eigentümer//innen zuzuordnen, um diese dann durch ausgefeilte Phishing-Angriffe oder Cyber-Erpressungen zu attackieren.

Um diese Probleme zu lösen, können Nutzer//innen Dust konsolidieren, indem sie mehrere Dust-UTXOs in einer einzigen Transaktion mit einem höheren Wert kombinieren. Einige Wallets und Dienste bieten Funktionen an, mit denen Benutzer//innen ihren Dust effektiv verwalten und konsolidieren können.

Abschließende Gedanken

Der Unit-Bias ist absolut vorhanden. Ich persönlich begegne ihm immer wieder in Gesprächen mit Bitcoin-Interessierten, die sich mit der Materie noch nicht lange auseinandergesetzt haben. Die Verwunderung ist oft sehr groß, dass bitcoins nicht als Ganzes gekauft werden müssen. Die Verwendung einer Untereinheit sowohl in Wallets, als auch bei der Bepreisung kann dabei helfen.

An die Verwendung von Sats als die kleinste Einheit von Bitcoin habe ich mich gewöhnt, allerdings tendiere ich mittlerweile persönlich zum Gebrauch von Bits. Die hervorgebrachten Argumente leuchten mir ein und ich bin überzeugt, dass Bits eine größere Akzeptanz außerhalb des Bitcoin-Inner-Circles hervorrufen können, als Sats. Darüber hinaus ist das Sats-Zeichen wirklich unpraktisch.

Ich befürworte hier einige Ideen, die das Paragrafzeichen zum Symbol für Sats erheben wollen.

🫳🎤

🫳🎤

In diesem Sinne, 2... 1... Risiko!

-

@ ed84ce10:cccf4c2a

2025-01-08 12:33:06

@ ed84ce10:cccf4c2a

2025-01-08 12:33:06Hackathon Summary

The YQuantum 2024 Hackathon concluded with significant participation and numerous project submissions, establishing itself as a vibrant platform for innovation. Out of 300 registrants, the on-site participants formed teams and worked on developing 28 BUIDLs, engaging in challenges across diverse tracks sponsored by prominent quantum computing organizations, such as QuEra Computing, IBM Quantum, Classiq, DoraHacks, SandboxAQ, and Capgemini/The Hartford/Quantinuum.

Participants developed groundbreaking solutions in quantum computing, driven by prize incentives, including quantum cloud credits, internships, networking opportunities, and potential speaking engagements. The grand prizes recognized exceptional projects, with the first place receiving $2000, presentation opportunities before Yale researchers, and participation in the Yale Innovation Summit.

The hackathon successfully fostered a collaborative environment that encouraged the exploration of cutting-edge technologies and ideas, advancing the quantum computing field. YQuantum 2024 underscored the potential of quantum technologies and promoted knowledge exchange among participants and sponsors.

Hackathon Winners

Held on April 13, 2024, YQuantum's inaugural event attracted 300 participants from 10 countries, featuring six industry-sponsored challenges that culminated in a series of prestigious awards.

Institute Grand Prizes Winners

-

1st Place: Quantum Consortium: Case-Duke-Lehigh-Vandy Nexus This project employs adiabatic methods to prepare antiferromagnetic energy eigenstates, with a focus on quantum many-body scarring and enhancing error correction in computing.

-

2nd Place: Sparse Quantum State Preparation The team developed efficient algorithms using Classiq APIs for sparse quantum state preparation, optimizing execution for scalability and efficiency in managing quantum data.

-

3rd Place: QuBruin This project optimizes algorithms using dynamic quantum circuits and enhances error correction. The team improved user accessibility through Qiskit-based models for better circuit performance under noise conditions.

IBM Quantum Prize Winners

- Modified IBM Challenge

This project delves into foundational linear algebra concepts, emphasizing core principles and mastery.

QuEra Computing Prize Winners

- 3D Quantum Scars on 2D Tweezer Arrays

The team investigates quantum scar states on a 3D lattice projected into 2D, using Julia and QuEra's Bloqade to simulate quantum dynamics.

Classiq Technologies Prize Winners

- YQuantum2024 Classiq Team 34 Wavefunction Wizards

Focusing on optimizing sparse quantum state preparation, this project enhances algorithmic efficiency in quantum data processing.

DoraHacks Prize Winners

- Spooner_QRNG_Classifier

The project employs Python scripts and a gradient booster classifier to predict quantum device origins of random binary data, surpassing baseline prediction accuracy.

Capgemini // Quantinuum // The Hartford Prize Winners

-

Skittlez

This partnership addresses quantum computing challenges through interdisciplinary expertise, designing innovative quantum solutions. -

Honorable Mention: BB24 - Yale Quantum Monte Carlo The project enhances Quantum Monte Carlo techniques via novel sampling and encoding schemes, improving parallel processing and computational efficiency.

SandboxAQ Prize Winners

-

QuantumQuails

This project improves solar cell efficiency through quantum chemistry, utilizing VQE to model solar energy absorption for enhanced conversion effectiveness. -

Honorable Mention: mRNA Sequence Design via Quantum Approximate Optimization Algorithm This project optimizes mRNA sequence design using QAOA, enhancing protein expression and structural stability through codon and nucleotide parameters.

Explore all projects at DoraHacks.

About the Organizer:

YQuantum

YQuantum is a prominent entity within the technology and blockchain sectors, recognized for its innovative approach and strategic initiatives. Specializing in utilizing quantum computing capabilities, YQuantum is committed to advancing the technological frontier. Though specific projects are not highlighted, YQuantum's role in shaping industry standards positions it as a leader in the field. Through dedication to cutting-edge research and development, YQuantum continues to drive progress in quantum technologies, aligning with its mission to propel scientific and technological advancements globally.

-

-

@ c5fede3d:16e03f7b

2025-01-08 11:41:16

@ c5fede3d:16e03f7b

2025-01-08 11:41:16Hay quien dice el famoso dicho de «año nuevo, vida nueva». En este caso, iniciamos el año con el mismo propósito, seguir aprendiendo para que no nos pille el toro. En esta ocasión, toca tratar la entrada de capital a tu wallet. Sin embargo, hay que saber donde meterse sin que las arenas movedizas te engullan. ¿Preparado para comprar la hucha del cerdito?

Esta es la segunda entrega de Semanario Crypto, una serie de artículos dedicados para aquellos que desconocen los conceptos básicos del mundo de las criptomonedas. La semana pasada hicimos un barrido sin adentrarnos en territorio comanche. Si aún no tienes claro qué es una wallet o cuál es el propósito de una frase semilla, ve al punto de partida y vuelve a leerte Semanario Crypto #1 | Un nuevo paradigma, porque es el ticket de entrada para este mundillo y no lo puedes perder.

EL LÍO DEL MONTEPÍO💱

Si has llegado hasta aquí, he de felicitarte. Has dado dos grandes pasos. El primero, tener la mente abierta y querer aprender. El segundo, disponer de una wallet y tener guardada a buen recaudo la frase semilla. Ahora es el momento de la verdad, operar, no sin antes tener claro un par de conceptos más.

¿Qué son los exchanges?