-

@ 04c915da:3dfbecc9

2025-03-26 20:54:33

@ 04c915da:3dfbecc9

2025-03-26 20:54:33Capitalism is the most effective system for scaling innovation. The pursuit of profit is an incredibly powerful human incentive. Most major improvements to human society and quality of life have resulted from this base incentive. Market competition often results in the best outcomes for all.

That said, some projects can never be monetized. They are open in nature and a business model would centralize control. Open protocols like bitcoin and nostr are not owned by anyone and if they were it would destroy the key value propositions they provide. No single entity can or should control their use. Anyone can build on them without permission.

As a result, open protocols must depend on donation based grant funding from the people and organizations that rely on them. This model works but it is slow and uncertain, a grind where sustainability is never fully reached but rather constantly sought. As someone who has been incredibly active in the open source grant funding space, I do not think people truly appreciate how difficult it is to raise charitable money and deploy it efficiently.

Projects that can be monetized should be. Profitability is a super power. When a business can generate revenue, it taps into a self sustaining cycle. Profit fuels growth and development while providing projects independence and agency. This flywheel effect is why companies like Google, Amazon, and Apple have scaled to global dominance. The profit incentive aligns human effort with efficiency. Businesses must innovate, cut waste, and deliver value to survive.

Contrast this with non monetized projects. Without profit, they lean on external support, which can dry up or shift with donor priorities. A profit driven model, on the other hand, is inherently leaner and more adaptable. It is not charity but survival. When survival is tied to delivering what people want, scale follows naturally.

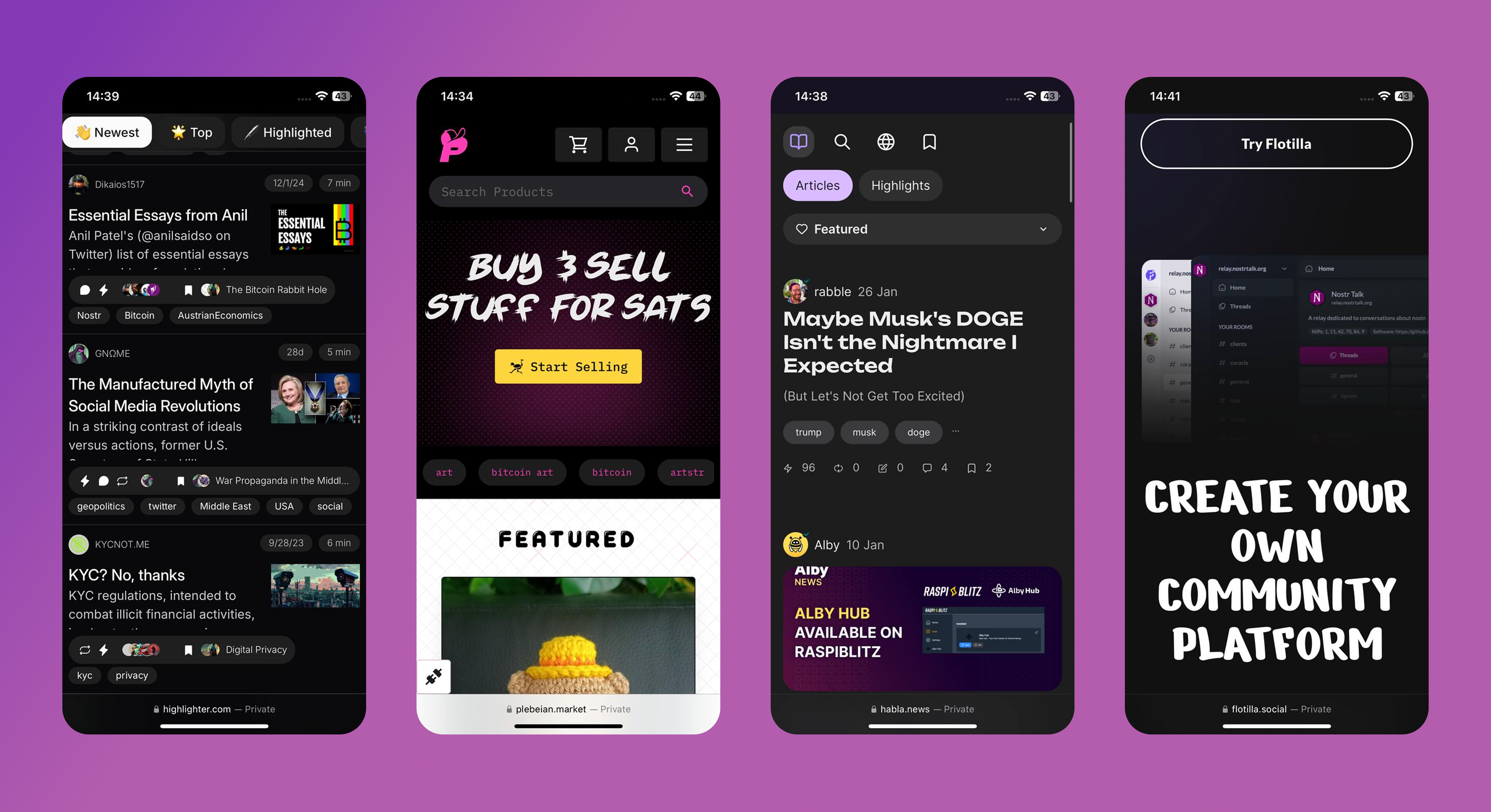

The real magic happens when profitable, sustainable businesses are built on top of open protocols and software. Consider the many startups building on open source software stacks, such as Start9, Mempool, and Primal, offering premium services on top of the open source software they build out and maintain. Think of companies like Block or Strike, which leverage bitcoin’s open protocol to offer their services on top. These businesses amplify the open software and protocols they build on, driving adoption and improvement at a pace donations alone could never match.

When you combine open software and protocols with profit driven business the result are lean, sustainable companies that grow faster and serve more people than either could alone. Bitcoin’s network, for instance, benefits from businesses that profit off its existence, while nostr will expand as developers monetize apps built on the protocol.

Capitalism scales best because competition results in efficiency. Donation funded protocols and software lay the groundwork, while market driven businesses build on top. The profit incentive acts as a filter, ensuring resources flow to what works, while open systems keep the playing field accessible, empowering users and builders. Together, they create a flywheel of innovation, growth, and global benefit.

-

@ 04c915da:3dfbecc9

2025-02-25 03:55:08

@ 04c915da:3dfbecc9

2025-02-25 03:55:08Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ e3ba5e1a:5e433365

2025-02-13 06:16:49

@ e3ba5e1a:5e433365

2025-02-13 06:16:49My favorite line in any Marvel movie ever is in “Captain America.” After Captain America launches seemingly a hopeless assault on Red Skull’s base and is captured, we get this line:

“Arrogance may not be a uniquely American trait, but I must say, you do it better than anyone.”

Yesterday, I came across a comment on the song Devil Went Down to Georgia that had a very similar feel to it:

America has seemingly always been arrogant, in a uniquely American way. Manifest Destiny, for instance. The rest of the world is aware of this arrogance, and mocks Americans for it. A central point in modern US politics is the deriding of racist, nationalist, supremacist Americans.

That’s not what I see. I see American Arrogance as not only a beautiful statement about what it means to be American. I see it as an ode to the greatness of humanity in its purest form.

For most countries, saying “our nation is the greatest” is, in fact, twinged with some level of racism. I still don’t have a problem with it. Every group of people should be allowed to feel pride in their accomplishments. The destruction of the human spirit since the end of World War 2, where greatness has become a sin and weakness a virtue, has crushed the ability of people worldwide to strive for excellence.

But I digress. The fears of racism and nationalism at least have a grain of truth when applied to other nations on the planet. But not to America.

That’s because the definition of America, and the prototype of an American, has nothing to do with race. The definition of Americanism is freedom. The founding of America is based purely on liberty. On the God-given rights of every person to live life the way they see fit.

American Arrogance is not a statement of racial superiority. It’s barely a statement of national superiority (though it absolutely is). To me, when an American comments on the greatness of America, it’s a statement about freedom. Freedom will always unlock the greatness inherent in any group of people. Americans are definitionally better than everyone else, because Americans are freer than everyone else. (Or, at least, that’s how it should be.)

In Devil Went Down to Georgia, Johnny is approached by the devil himself. He is challenged to a ridiculously lopsided bet: a golden fiddle versus his immortal soul. He acknowledges the sin in accepting such a proposal. And yet he says, “God, I know you told me not to do this. But I can’t stand the affront to my honor. I am the greatest. The devil has nothing on me. So God, I’m gonna sin, but I’m also gonna win.”

Libertas magnitudo est

-

@ 0fa80bd3:ea7325de

2025-01-30 04:28:30

@ 0fa80bd3:ea7325de

2025-01-30 04:28:30"Degeneration" or "Вырождение" ![[photo_2025-01-29 23.23.15.jpeg]]

A once-functional object, now eroded by time and human intervention, stripped of its original purpose. Layers of presence accumulate—marks, alterations, traces of intent—until the very essence is obscured. Restoration is paradoxical: to reclaim, one must erase. Yet erasure is an impossibility, for to remove these imprints is to deny the existence of those who shaped them.

The work stands as a meditation on entropy, memory, and the irreversible dialogue between creation and decay.

-

@ 3514ac1b:cf164691

2025-03-29 18:55:29

@ 3514ac1b:cf164691

2025-03-29 18:55:29Cryptographic Identity (CI): An Overview

Definition of Cryptographic Identity

Cryptographic identity refers to a digital identity that is secured and verified using cryptographic techniques. It allows individuals to prove their identity online without relying on centralized authorities.

Background of Cryptographic Identity

Historical Context

- Traditional identity systems rely on centralized authorities (governments, companies)

- Digital identities historically tied to platforms and services

- Rise of public-key cryptography enabled self-sovereign identity concepts

- Blockchain and decentralized systems accelerated development

Technical Foundations

- Based on public-key cryptography (asymmetric encryption)

- Uses key pairs: private keys (secret) and public keys (shareable)

- Digital signatures provide authentication and non-repudiation

- Cryptographic proofs verify identity claims without revealing sensitive data

Importance of Cryptographic Identity

Privacy Benefits

- Users control their personal information

- Selective disclosure of identity attributes

- Reduced vulnerability to mass data breaches

- Protection against surveillance and tracking

Security Advantages

- Not dependent on password security

- Resistant to impersonation attacks

- Verifiable without trusted third parties

- Reduces centralized points of failure

Practical Applications

- Censorship-resistant communication

- Self-sovereign finance and transactions

- Decentralized social networking

- Cross-platform reputation systems

- Digital signatures for legal documents

Building Cryptographic Identity with Nostr

Understanding Nostr Protocol

Core Concepts

- Nostr (Notes and Other Stuff Transmitted by Relays)

- Simple, open protocol for censorship-resistant global networks

- Event-based architecture with relays distributing signed messages

- Uses NIP standards (Nostr Implementation Possibilities)

Key Components

- Public/private keypairs as identity foundation

- Relays for message distribution

- Events (signed JSON objects) as the basic unit of data

- Clients that interface with users and relays

Implementation Steps

Step 1: Generate Keypair

- Use cryptographic libraries to generate secure keypair

- Private key must be kept secure (password managers, hardware wallets)

- Public key becomes your identifier on the network

Step 2: Set Up Client

- Choose from existing Nostr clients or build custom implementation

- Connect to multiple relays for redundancy

- Configure identity preferences and metadata

Step 3: Publish Profile Information

- Create and sign kind 0 event with profile metadata

- Include displayable information (name, picture, description)

- Publish to connected relays

Step 4: Verification and Linking

- Cross-verify identity with other platforms (Twitter, GitHub)

- Use NIP-05 identifier for human-readable identity

- Consider NIP-07 for browser extension integration

Advanced Identity Features

Reputation Building

- Consistent posting builds recognition

- Accumulate follows and reactions

- Establish connections with well-known identities

Multi-device Management

- Secure private key backup strategies

- Consider key sharing across devices

- Explore NIP-26 delegated event signing

Recovery Mechanisms

- Implement social recovery options

- Consider multisig approaches

- Document recovery procedures

Challenges and Considerations

Key Management

- Private key loss means identity loss

- Balance security with convenience

- Consider hardware security modules for high-value identities

Adoption Barriers

- Technical complexity for average users

- Network effects and critical mass

- Integration with existing systems

Future Developments

- Zero-knowledge proofs for enhanced privacy

- Standardization efforts across protocols

- Integration with legal identity frameworks

-

@ 0fa80bd3:ea7325de

2025-01-29 15:43:42

@ 0fa80bd3:ea7325de

2025-01-29 15:43:42Lyn Alden - биткойн евангелист или евангелистка, я пока не понял

npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83aThomas Pacchia - PubKey owner - X - @tpacchia

npub1xy6exlg37pw84cpyj05c2pdgv86hr25cxn0g7aa8g8a6v97mhduqeuhgplcalvadev - Shopstr

npub16dhgpql60vmd4mnydjut87vla23a38j689jssaqlqqlzrtqtd0kqex0nkqCalle - Cashu founder

npub12rv5lskctqxxs2c8rf2zlzc7xx3qpvzs3w4etgemauy9thegr43sf485vgДжек Дорси

npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m21 ideas

npub1lm3f47nzyf0rjp6fsl4qlnkmzed4uj4h2gnf2vhe3l3mrj85vqks6z3c7lМного адресов. Хз кто надо сортировать

https://github.com/aitechguy/nostr-address-bookФиатДжеф - создатель Ностр - https://github.com/fiatjaf

npub180cvv07tjdrrgpa0j7j7tmnyl2yr6yr7l8j4s3evf6u64th6gkwsyjh6w6EVAN KALOUDIS Zues wallet

npub19kv88vjm7tw6v9qksn2y6h4hdt6e79nh3zjcud36k9n3lmlwsleqwte2qdПрограммер Коди https://github.com/CodyTseng/nostr-relay

npub1syjmjy0dp62dhccq3g97fr87tngvpvzey08llyt6ul58m2zqpzps9wf6wlAnna Chekhovich - Managing Bitcoin at The Anti-Corruption Foundation https://x.com/AnyaChekhovich

npub1y2st7rp54277hyd2usw6shy3kxprnmpvhkezmldp7vhl7hp920aq9cfyr7 -

@ 6be5cc06:5259daf0

2025-01-21 01:51:46

@ 6be5cc06:5259daf0

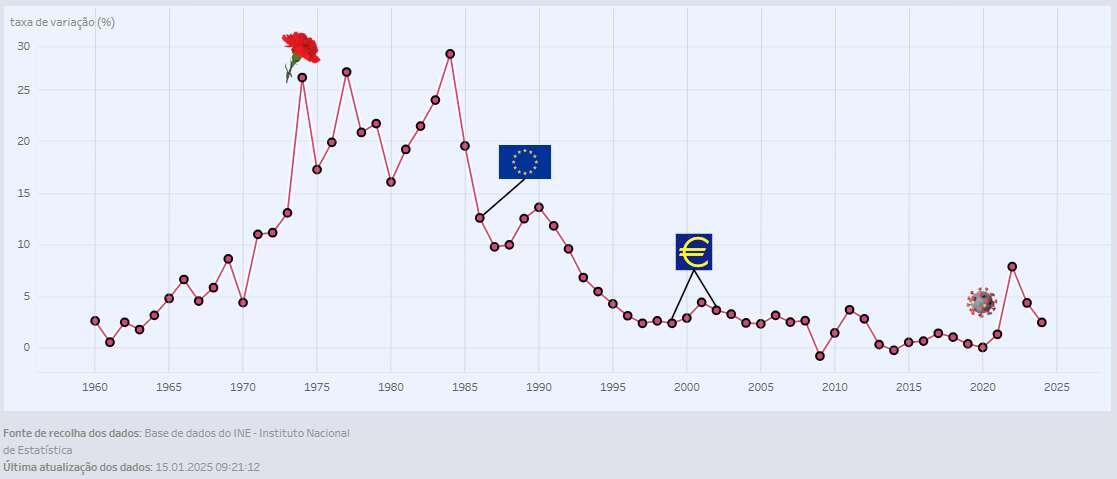

2025-01-21 01:51:46Bitcoin: Um sistema de dinheiro eletrônico direto entre pessoas.

Satoshi Nakamoto

satoshin@gmx.com

www.bitcoin.org

Resumo

O Bitcoin é uma forma de dinheiro digital que permite pagamentos diretos entre pessoas, sem a necessidade de um banco ou instituição financeira. Ele resolve um problema chamado gasto duplo, que ocorre quando alguém tenta gastar o mesmo dinheiro duas vezes. Para evitar isso, o Bitcoin usa uma rede descentralizada onde todos trabalham juntos para verificar e registrar as transações.

As transações são registradas em um livro público chamado blockchain, protegido por uma técnica chamada Prova de Trabalho. Essa técnica cria uma cadeia de registros que não pode ser alterada sem refazer todo o trabalho já feito. Essa cadeia é mantida pelos computadores que participam da rede, e a mais longa é considerada a verdadeira.

Enquanto a maior parte do poder computacional da rede for controlada por participantes honestos, o sistema continuará funcionando de forma segura. A rede é flexível, permitindo que qualquer pessoa entre ou saia a qualquer momento, sempre confiando na cadeia mais longa como prova do que aconteceu.

1. Introdução

Hoje, quase todos os pagamentos feitos pela internet dependem de bancos ou empresas como processadores de pagamento (cartões de crédito, por exemplo) para funcionar. Embora esse sistema seja útil, ele tem problemas importantes porque é baseado em confiança.

Primeiro, essas empresas podem reverter pagamentos, o que é útil em caso de erros, mas cria custos e incertezas. Isso faz com que pequenas transações, como pagar centavos por um serviço, se tornem inviáveis. Além disso, os comerciantes são obrigados a desconfiar dos clientes, pedindo informações extras e aceitando fraudes como algo inevitável.

Esses problemas não existem no dinheiro físico, como o papel-moeda, onde o pagamento é final e direto entre as partes. No entanto, não temos como enviar dinheiro físico pela internet sem depender de um intermediário confiável.

O que precisamos é de um sistema de pagamento eletrônico baseado em provas matemáticas, não em confiança. Esse sistema permitiria que qualquer pessoa enviasse dinheiro diretamente para outra, sem depender de bancos ou processadores de pagamento. Além disso, as transações seriam irreversíveis, protegendo vendedores contra fraudes, mas mantendo a possibilidade de soluções para disputas legítimas.

Neste documento, apresentamos o Bitcoin, que resolve o problema do gasto duplo usando uma rede descentralizada. Essa rede cria um registro público e protegido por cálculos matemáticos, que garante a ordem das transações. Enquanto a maior parte da rede for controlada por pessoas honestas, o sistema será seguro contra ataques.

2. Transações

Para entender como funciona o Bitcoin, é importante saber como as transações são realizadas. Imagine que você quer transferir uma "moeda digital" para outra pessoa. No sistema do Bitcoin, essa "moeda" é representada por uma sequência de registros que mostram quem é o atual dono. Para transferi-la, você adiciona um novo registro comprovando que agora ela pertence ao próximo dono. Esse registro é protegido por um tipo especial de assinatura digital.

O que é uma assinatura digital?

Uma assinatura digital é como uma senha secreta, mas muito mais segura. No Bitcoin, cada usuário tem duas chaves: uma "chave privada", que é secreta e serve para criar a assinatura, e uma "chave pública", que pode ser compartilhada com todos e é usada para verificar se a assinatura é válida. Quando você transfere uma moeda, usa sua chave privada para assinar a transação, provando que você é o dono. A próxima pessoa pode usar sua chave pública para confirmar isso.

Como funciona na prática?

Cada "moeda" no Bitcoin é, na verdade, uma cadeia de assinaturas digitais. Vamos imaginar o seguinte cenário:

- A moeda está com o Dono 0 (você). Para transferi-la ao Dono 1, você assina digitalmente a transação com sua chave privada. Essa assinatura inclui o código da transação anterior (chamado de "hash") e a chave pública do Dono 1.

- Quando o Dono 1 quiser transferir a moeda ao Dono 2, ele assinará a transação seguinte com sua própria chave privada, incluindo também o hash da transação anterior e a chave pública do Dono 2.

- Esse processo continua, formando uma "cadeia" de transações. Qualquer pessoa pode verificar essa cadeia para confirmar quem é o atual dono da moeda.

Resolvendo o problema do gasto duplo

Um grande desafio com moedas digitais é o "gasto duplo", que é quando uma mesma moeda é usada em mais de uma transação. Para evitar isso, muitos sistemas antigos dependiam de uma entidade central confiável, como uma casa da moeda, que verificava todas as transações. No entanto, isso criava um ponto único de falha e centralizava o controle do dinheiro.

O Bitcoin resolve esse problema de forma inovadora: ele usa uma rede descentralizada onde todos os participantes (os "nós") têm acesso a um registro completo de todas as transações. Cada nó verifica se as transações são válidas e se a moeda não foi gasta duas vezes. Quando a maioria dos nós concorda com a validade de uma transação, ela é registrada permanentemente na blockchain.

Por que isso é importante?

Essa solução elimina a necessidade de confiar em uma única entidade para gerenciar o dinheiro, permitindo que qualquer pessoa no mundo use o Bitcoin sem precisar de permissão de terceiros. Além disso, ela garante que o sistema seja seguro e resistente a fraudes.

3. Servidor Timestamp

Para assegurar que as transações sejam realizadas de forma segura e transparente, o sistema Bitcoin utiliza algo chamado de "servidor de registro de tempo" (timestamp). Esse servidor funciona como um registro público que organiza as transações em uma ordem específica.

Ele faz isso agrupando várias transações em blocos e criando um código único chamado "hash". Esse hash é como uma impressão digital que representa todo o conteúdo do bloco. O hash de cada bloco é amplamente divulgado, como se fosse publicado em um jornal ou em um fórum público.

Esse processo garante que cada bloco de transações tenha um registro de quando foi criado e que ele existia naquele momento. Além disso, cada novo bloco criado contém o hash do bloco anterior, formando uma cadeia contínua de blocos conectados — conhecida como blockchain.

Com isso, se alguém tentar alterar qualquer informação em um bloco anterior, o hash desse bloco mudará e não corresponderá ao hash armazenado no bloco seguinte. Essa característica torna a cadeia muito segura, pois qualquer tentativa de fraude seria imediatamente detectada.

O sistema de timestamps é essencial para provar a ordem cronológica das transações e garantir que cada uma delas seja única e autêntica. Dessa forma, ele reforça a segurança e a confiança na rede Bitcoin.

4. Prova-de-Trabalho

Para implementar o registro de tempo distribuído no sistema Bitcoin, utilizamos um mecanismo chamado prova-de-trabalho. Esse sistema é semelhante ao Hashcash, desenvolvido por Adam Back, e baseia-se na criação de um código único, o "hash", por meio de um processo computacionalmente exigente.

A prova-de-trabalho envolve encontrar um valor especial que, quando processado junto com as informações do bloco, gere um hash que comece com uma quantidade específica de zeros. Esse valor especial é chamado de "nonce". Encontrar o nonce correto exige um esforço significativo do computador, porque envolve tentativas repetidas até que a condição seja satisfeita.

Esse processo é importante porque torna extremamente difícil alterar qualquer informação registrada em um bloco. Se alguém tentar mudar algo em um bloco, seria necessário refazer o trabalho de computação não apenas para aquele bloco, mas também para todos os blocos que vêm depois dele. Isso garante a segurança e a imutabilidade da blockchain.

A prova-de-trabalho também resolve o problema de decidir qual cadeia de blocos é a válida quando há múltiplas cadeias competindo. A decisão é feita pela cadeia mais longa, pois ela representa o maior esforço computacional já realizado. Isso impede que qualquer indivíduo ou grupo controle a rede, desde que a maioria do poder de processamento seja mantida por participantes honestos.

Para garantir que o sistema permaneça eficiente e equilibrado, a dificuldade da prova-de-trabalho é ajustada automaticamente ao longo do tempo. Se novos blocos estiverem sendo gerados rapidamente, a dificuldade aumenta; se estiverem sendo gerados muito lentamente, a dificuldade diminui. Esse ajuste assegura que novos blocos sejam criados aproximadamente a cada 10 minutos, mantendo o sistema estável e funcional.

5. Rede

A rede Bitcoin é o coração do sistema e funciona de maneira distribuída, conectando vários participantes (ou nós) para garantir o registro e a validação das transações. Os passos para operar essa rede são:

-

Transmissão de Transações: Quando alguém realiza uma nova transação, ela é enviada para todos os nós da rede. Isso é feito para garantir que todos estejam cientes da operação e possam validá-la.

-

Coleta de Transações em Blocos: Cada nó agrupa as novas transações recebidas em um "bloco". Este bloco será preparado para ser adicionado à cadeia de blocos (a blockchain).

-

Prova-de-Trabalho: Os nós competem para resolver a prova-de-trabalho do bloco, utilizando poder computacional para encontrar um hash válido. Esse processo é como resolver um quebra-cabeça matemático difícil.

-

Envio do Bloco Resolvido: Quando um nó encontra a solução para o bloco (a prova-de-trabalho), ele compartilha esse bloco com todos os outros nós na rede.

-

Validação do Bloco: Cada nó verifica o bloco recebido para garantir que todas as transações nele contidas sejam válidas e que nenhuma moeda tenha sido gasta duas vezes. Apenas blocos válidos são aceitos.

-

Construção do Próximo Bloco: Os nós que aceitaram o bloco começam a trabalhar na criação do próximo bloco, utilizando o hash do bloco aceito como base (hash anterior). Isso mantém a continuidade da cadeia.

Resolução de Conflitos e Escolha da Cadeia Mais Longa

Os nós sempre priorizam a cadeia mais longa, pois ela representa o maior esforço computacional já realizado, garantindo maior segurança. Se dois blocos diferentes forem compartilhados simultaneamente, os nós trabalharão no primeiro bloco recebido, mas guardarão o outro como uma alternativa. Caso o segundo bloco eventualmente forme uma cadeia mais longa (ou seja, tenha mais blocos subsequentes), os nós mudarão para essa nova cadeia.

Tolerância a Falhas

A rede é robusta e pode lidar com mensagens que não chegam a todos os nós. Uma transação não precisa alcançar todos os nós de imediato; basta que chegue a um número suficiente deles para ser incluída em um bloco. Da mesma forma, se um nó não receber um bloco em tempo hábil, ele pode solicitá-lo ao perceber que está faltando quando o próximo bloco é recebido.

Esse mecanismo descentralizado permite que a rede Bitcoin funcione de maneira segura, confiável e resiliente, sem depender de uma autoridade central.

6. Incentivo

O incentivo é um dos pilares fundamentais que sustenta o funcionamento da rede Bitcoin, garantindo que os participantes (nós) continuem operando de forma honesta e contribuindo com recursos computacionais. Ele é estruturado em duas partes principais: a recompensa por mineração e as taxas de transação.

Recompensa por Mineração

Por convenção, o primeiro registro em cada bloco é uma transação especial que cria novas moedas e as atribui ao criador do bloco. Essa recompensa incentiva os mineradores a dedicarem poder computacional para apoiar a rede. Como não há uma autoridade central para emitir moedas, essa é a maneira pela qual novas moedas entram em circulação. Esse processo pode ser comparado ao trabalho de garimpeiros, que utilizam recursos para colocar mais ouro em circulação. No caso do Bitcoin, o "recurso" consiste no tempo de CPU e na energia elétrica consumida para resolver a prova-de-trabalho.

Taxas de Transação

Além da recompensa por mineração, os mineradores também podem ser incentivados pelas taxas de transação. Se uma transação utiliza menos valor de saída do que o valor de entrada, a diferença é tratada como uma taxa, que é adicionada à recompensa do bloco contendo essa transação. Com o passar do tempo e à medida que o número de moedas em circulação atinge o limite predeterminado, essas taxas de transação se tornam a principal fonte de incentivo, substituindo gradualmente a emissão de novas moedas. Isso permite que o sistema opere sem inflação, uma vez que o número total de moedas permanece fixo.

Incentivo à Honestidade

O design do incentivo também busca garantir que os participantes da rede mantenham um comportamento honesto. Para um atacante que consiga reunir mais poder computacional do que o restante da rede, ele enfrentaria duas escolhas:

- Usar esse poder para fraudar o sistema, como reverter transações e roubar pagamentos.

- Seguir as regras do sistema, criando novos blocos e recebendo recompensas legítimas.

A lógica econômica favorece a segunda opção, pois um comportamento desonesto prejudicaria a confiança no sistema, diminuindo o valor de todas as moedas, incluindo aquelas que o próprio atacante possui. Jogar dentro das regras não apenas maximiza o retorno financeiro, mas também preserva a validade e a integridade do sistema.

Esse mecanismo garante que os incentivos econômicos estejam alinhados com o objetivo de manter a rede segura, descentralizada e funcional ao longo do tempo.

7. Recuperação do Espaço em Disco

Depois que uma moeda passa a estar protegida por muitos blocos na cadeia, as informações sobre as transações antigas que a geraram podem ser descartadas para economizar espaço em disco. Para que isso seja possível sem comprometer a segurança, as transações são organizadas em uma estrutura chamada "árvore de Merkle". Essa árvore funciona como um resumo das transações: em vez de armazenar todas elas, guarda apenas um "hash raiz", que é como uma assinatura compacta que representa todo o grupo de transações.

Os blocos antigos podem, então, ser simplificados, removendo as partes desnecessárias dessa árvore. Apenas a raiz do hash precisa ser mantida no cabeçalho do bloco, garantindo que a integridade dos dados seja preservada, mesmo que detalhes específicos sejam descartados.

Para exemplificar: imagine que você tenha vários recibos de compra. Em vez de guardar todos os recibos, você cria um documento e lista apenas o valor total de cada um. Mesmo que os recibos originais sejam descartados, ainda é possível verificar a soma com base nos valores armazenados.

Além disso, o espaço ocupado pelos blocos em si é muito pequeno. Cada bloco sem transações ocupa apenas cerca de 80 bytes. Isso significa que, mesmo com blocos sendo gerados a cada 10 minutos, o crescimento anual em espaço necessário é insignificante: apenas 4,2 MB por ano. Com a capacidade de armazenamento dos computadores crescendo a cada ano, esse espaço continuará sendo trivial, garantindo que a rede possa operar de forma eficiente sem problemas de armazenamento, mesmo a longo prazo.

8. Verificação de Pagamento Simplificada

É possível confirmar pagamentos sem a necessidade de operar um nó completo da rede. Para isso, o usuário precisa apenas de uma cópia dos cabeçalhos dos blocos da cadeia mais longa (ou seja, a cadeia com maior esforço de trabalho acumulado). Ele pode verificar a validade de uma transação ao consultar os nós da rede até obter a confirmação de que tem a cadeia mais longa. Para isso, utiliza-se o ramo Merkle, que conecta a transação ao bloco em que ela foi registrada.

Entretanto, o método simplificado possui limitações: ele não pode confirmar uma transação isoladamente, mas sim assegurar que ela ocupa um lugar específico na cadeia mais longa. Dessa forma, se um nó da rede aprova a transação, os blocos subsequentes reforçam essa aceitação.

A verificação simplificada é confiável enquanto a maioria dos nós da rede for honesta. Contudo, ela se torna vulnerável caso a rede seja dominada por um invasor. Nesse cenário, um atacante poderia fabricar transações fraudulentas que enganariam o usuário temporariamente até que o invasor obtivesse controle completo da rede.

Uma estratégia para mitigar esse risco é configurar alertas nos softwares de nós completos. Esses alertas identificam blocos inválidos, sugerindo ao usuário baixar o bloco completo para confirmar qualquer inconsistência. Para maior segurança, empresas que realizam pagamentos frequentes podem preferir operar seus próprios nós, reduzindo riscos e permitindo uma verificação mais direta e confiável.

9. Combinando e Dividindo Valor

No sistema Bitcoin, cada unidade de valor é tratada como uma "moeda" individual, mas gerenciar cada centavo como uma transação separada seria impraticável. Para resolver isso, o Bitcoin permite que valores sejam combinados ou divididos em transações, facilitando pagamentos de qualquer valor.

Entradas e Saídas

Cada transação no Bitcoin é composta por:

- Entradas: Representam os valores recebidos em transações anteriores.

- Saídas: Correspondem aos valores enviados, divididos entre os destinatários e, eventualmente, o troco para o remetente.

Normalmente, uma transação contém:

- Uma única entrada com valor suficiente para cobrir o pagamento.

- Ou várias entradas combinadas para atingir o valor necessário.

O valor total das saídas nunca excede o das entradas, e a diferença (se houver) pode ser retornada ao remetente como troco.

Exemplo Prático

Imagine que você tem duas entradas:

- 0,03 BTC

- 0,07 BTC

Se deseja enviar 0,08 BTC para alguém, a transação terá:

- Entrada: As duas entradas combinadas (0,03 + 0,07 BTC = 0,10 BTC).

- Saídas: Uma para o destinatário (0,08 BTC) e outra como troco para você (0,02 BTC).

Essa flexibilidade permite que o sistema funcione sem precisar manipular cada unidade mínima individualmente.

Difusão e Simplificação

A difusão de transações, onde uma depende de várias anteriores e assim por diante, não representa um problema. Não é necessário armazenar ou verificar o histórico completo de uma transação para utilizá-la, já que o registro na blockchain garante sua integridade.

10. Privacidade

O modelo bancário tradicional oferece um certo nível de privacidade, limitando o acesso às informações financeiras apenas às partes envolvidas e a um terceiro confiável (como bancos ou instituições financeiras). No entanto, o Bitcoin opera de forma diferente, pois todas as transações são publicamente registradas na blockchain. Apesar disso, a privacidade pode ser mantida utilizando chaves públicas anônimas, que desvinculam diretamente as transações das identidades das partes envolvidas.

Fluxo de Informação

- No modelo tradicional, as transações passam por um terceiro confiável que conhece tanto o remetente quanto o destinatário.

- No Bitcoin, as transações são anunciadas publicamente, mas sem revelar diretamente as identidades das partes. Isso é comparável a dados divulgados por bolsas de valores, onde informações como o tempo e o tamanho das negociações (a "fita") são públicas, mas as identidades das partes não.

Protegendo a Privacidade

Para aumentar a privacidade no Bitcoin, são adotadas as seguintes práticas:

- Chaves Públicas Anônimas: Cada transação utiliza um par de chaves diferentes, dificultando a associação com um proprietário único.

- Prevenção de Ligação: Ao usar chaves novas para cada transação, reduz-se a possibilidade de links evidentes entre múltiplas transações realizadas pelo mesmo usuário.

Riscos de Ligação

Embora a privacidade seja fortalecida, alguns riscos permanecem:

- Transações multi-entrada podem revelar que todas as entradas pertencem ao mesmo proprietário, caso sejam necessárias para somar o valor total.

- O proprietário da chave pode ser identificado indiretamente por transações anteriores que estejam conectadas.

11. Cálculos

Imagine que temos um sistema onde as pessoas (ou computadores) competem para adicionar informações novas (blocos) a um grande registro público (a cadeia de blocos ou blockchain). Este registro é como um livro contábil compartilhado, onde todos podem verificar o que está escrito.

Agora, vamos pensar em um cenário: um atacante quer enganar o sistema. Ele quer mudar informações já registradas para beneficiar a si mesmo, por exemplo, desfazendo um pagamento que já fez. Para isso, ele precisa criar uma versão alternativa do livro contábil (a cadeia de blocos dele) e convencer todos os outros participantes de que essa versão é a verdadeira.

Mas isso é extremamente difícil.

Como o Ataque Funciona

Quando um novo bloco é adicionado à cadeia, ele depende de cálculos complexos que levam tempo e esforço. Esses cálculos são como um grande quebra-cabeça que precisa ser resolvido.

- Os “bons jogadores” (nós honestos) estão sempre trabalhando juntos para resolver esses quebra-cabeças e adicionar novos blocos à cadeia verdadeira.

- O atacante, por outro lado, precisa resolver quebra-cabeças sozinho, tentando “alcançar” a cadeia honesta para que sua versão alternativa pareça válida.

Se a cadeia honesta já está vários blocos à frente, o atacante começa em desvantagem, e o sistema está projetado para que a dificuldade de alcançá-los aumente rapidamente.

A Corrida Entre Cadeias

Você pode imaginar isso como uma corrida. A cada bloco novo que os jogadores honestos adicionam à cadeia verdadeira, eles se distanciam mais do atacante. Para vencer, o atacante teria que resolver os quebra-cabeças mais rápido que todos os outros jogadores honestos juntos.

Suponha que:

- A rede honesta tem 80% do poder computacional (ou seja, resolve 8 de cada 10 quebra-cabeças).

- O atacante tem 20% do poder computacional (ou seja, resolve 2 de cada 10 quebra-cabeças).

Cada vez que a rede honesta adiciona um bloco, o atacante tem que "correr atrás" e resolver mais quebra-cabeças para alcançar.

Por Que o Ataque Fica Cada Vez Mais Improvável?

Vamos usar uma fórmula simples para mostrar como as chances de sucesso do atacante diminuem conforme ele precisa "alcançar" mais blocos:

P = (q/p)^z

- q é o poder computacional do atacante (20%, ou 0,2).

- p é o poder computacional da rede honesta (80%, ou 0,8).

- z é a diferença de blocos entre a cadeia honesta e a cadeia do atacante.

Se o atacante está 5 blocos atrás (z = 5):

P = (0,2 / 0,8)^5 = (0,25)^5 = 0,00098, (ou, 0,098%)

Isso significa que o atacante tem menos de 0,1% de chance de sucesso — ou seja, é muito improvável.

Se ele estiver 10 blocos atrás (z = 10):

P = (0,2 / 0,8)^10 = (0,25)^10 = 0,000000095, (ou, 0,0000095%).

Neste caso, as chances de sucesso são praticamente nulas.

Um Exemplo Simples

Se você jogar uma moeda, a chance de cair “cara” é de 50%. Mas se precisar de 10 caras seguidas, sua chance já é bem menor. Se precisar de 20 caras seguidas, é quase impossível.

No caso do Bitcoin, o atacante precisa de muito mais do que 20 caras seguidas. Ele precisa resolver quebra-cabeças extremamente difíceis e alcançar os jogadores honestos que estão sempre à frente. Isso faz com que o ataque seja inviável na prática.

Por Que Tudo Isso é Seguro?

- A probabilidade de sucesso do atacante diminui exponencialmente. Isso significa que, quanto mais tempo passa, menor é a chance de ele conseguir enganar o sistema.

- A cadeia verdadeira (honesta) está protegida pela força da rede. Cada novo bloco que os jogadores honestos adicionam à cadeia torna mais difícil para o atacante alcançar.

E Se o Atacante Tentar Continuar?

O atacante poderia continuar tentando indefinidamente, mas ele estaria gastando muito tempo e energia sem conseguir nada. Enquanto isso, os jogadores honestos estão sempre adicionando novos blocos, tornando o trabalho do atacante ainda mais inútil.

Assim, o sistema garante que a cadeia verdadeira seja extremamente segura e que ataques sejam, na prática, impossíveis de ter sucesso.

12. Conclusão

Propusemos um sistema de transações eletrônicas que elimina a necessidade de confiança, baseando-se em assinaturas digitais e em uma rede peer-to-peer que utiliza prova de trabalho. Isso resolve o problema do gasto duplo, criando um histórico público de transações imutável, desde que a maioria do poder computacional permaneça sob controle dos participantes honestos. A rede funciona de forma simples e descentralizada, com nós independentes que não precisam de identificação ou coordenação direta. Eles entram e saem livremente, aceitando a cadeia de prova de trabalho como registro do que ocorreu durante sua ausência. As decisões são tomadas por meio do poder de CPU, validando blocos legítimos, estendendo a cadeia e rejeitando os inválidos. Com este mecanismo de consenso, todas as regras e incentivos necessários para o funcionamento seguro e eficiente do sistema são garantidos.

Faça o download do whitepaper original em português: https://bitcoin.org/files/bitcoin-paper/bitcoin_pt_br.pdf

-

@ 7d33ba57:1b82db35

2025-03-29 18:47:34

@ 7d33ba57:1b82db35

2025-03-29 18:47:34Pula, located at the southern tip of Istria, is a city where ancient Roman ruins meet stunning Adriatic beaches. Known for its well-preserved amphitheater, charming old town, and crystal-clear waters, Pula offers a perfect blend of history, culture, and relaxation.

🏛️ Top Things to See & Do in Pula

1️⃣ Pula Arena (Roman Amphitheater) 🏟️

- One of the best-preserved Roman amphitheaters in the world, built in the 1st century.

- Used for gladiator fights, now a venue for concerts & film festivals.

- Climb to the top for stunning sea views.

2️⃣ Explore Pula’s Old Town 🏡

- Wander through cobbled streets, past Venetian, Roman, and Austro-Hungarian architecture.

- Visit the Arch of the Sergii (a 2,000-year-old Roman triumphal arch).

- Enjoy a drink in Forum Square, home to the Temple of Augustus.

3️⃣ Relax at Pula’s Beaches 🏖️

- Hawaiian Beach (Havajska Plaža): Turquoise waters & cliffs for jumping.

- Ambrela Beach: A Blue Flag beach with calm waters, great for families.

- Pješčana Uvala: A sandy beach, rare for Croatia!

4️⃣ Cape Kamenjak Nature Park 🌿

- A wild and rugged coastline with hidden coves and crystal-clear water.

- Great for cliff jumping, kayaking, and biking.

- Located 30 minutes south of Pula.

5️⃣ Visit Brijuni National Park 🏝️

- A group of 14 islands, once Tito’s private retreat.

- Features Roman ruins, a safari park, and cycling trails.

- Accessible via boat from Fazana (15 min from Pula).

6️⃣ Try Istrian Cuisine 🍽️

- Fuži with truffles – Istria is famous for white & black truffles.

- Istrian prosciutto & cheese – Perfect with local Malvazija wine.

- Fresh seafood – Try grilled squid or buzara-style mussels.

🚗 How to Get to Pula

✈️ By Air: Pula Airport (PUY) has flights from major European cities.

🚘 By Car:

- From Zagreb: ~3 hours (270 km)

- From Ljubljana (Slovenia): ~2.5 hours (160 km)

🚌 By Bus: Regular buses connect Pula with Rovinj, Rijeka, Zagreb, and Trieste (Italy).

🚢 By Ferry: Seasonal ferries run from Venice and Zadar.💡 Tips for Visiting Pula

✅ Best time to visit? May–September for warm weather & festivals 🌞

✅ Book Arena event tickets in advance – Summer concerts sell out fast 🎶

✅ Try local wines – Istrian Malvazija (white) and Teran (red) are excellent 🍷

✅ Explore nearby towns – Rovinj & Motovun make great day trips 🏡

✅ Cash is useful – Some small shops & markets prefer cash 💶

-

@ 87730827:746b7d35

2024-11-20 09:27:53

@ 87730827:746b7d35

2024-11-20 09:27:53Original: https://techreport.com/crypto-news/brazil-central-bank-ban-monero-stablecoins/

Brazilian’s Central Bank Will Ban Monero and Algorithmic Stablecoins in the Country

Brazil proposes crypto regulations banning Monero and algorithmic stablecoins and enforcing strict compliance for exchanges.

KEY TAKEAWAYS

- The Central Bank of Brazil has proposed regulations prohibiting privacy-centric cryptocurrencies like Monero.

- The regulations categorize exchanges into intermediaries, custodians, and brokers, each with specific capital requirements and compliance standards.

- While the proposed rules apply to cryptocurrencies, certain digital assets like non-fungible tokens (NFTs) are still ‘deregulated’ in Brazil.

In a Notice of Participation announcement, the Brazilian Central Bank (BCB) outlines regulations for virtual asset service providers (VASPs) operating in the country.

In the document, the Brazilian regulator specifies that privacy-focused coins, such as Monero, must be excluded from all digital asset companies that intend to operate in Brazil.

Let’s unpack what effect these regulations will have.

Brazil’s Crackdown on Crypto Fraud

If the BCB’s current rule is approved, exchanges dealing with coins that provide anonymity must delist these currencies or prevent Brazilians from accessing and operating these assets.

The Central Bank argues that currencies like Monero make it difficult and even prevent the identification of users, thus creating problems in complying with international AML obligations and policies to prevent the financing of terrorism.

According to the Central Bank of Brazil, the bans aim to prevent criminals from using digital assets to launder money. In Brazil, organized criminal syndicates such as the Primeiro Comando da Capital (PCC) and Comando Vermelho have been increasingly using digital assets for money laundering and foreign remittances.

… restriction on the supply of virtual assets that contain characteristics of fragility, insecurity or risks that favor fraud or crime, such as virtual assets designed to favor money laundering and terrorist financing practices by facilitating anonymity or difficulty identification of the holder.

The Central Bank has identified that removing algorithmic stablecoins is essential to guarantee the safety of users’ funds and avoid events such as when Terraform Labs’ entire ecosystem collapsed, losing billions of investors’ dollars.

The Central Bank also wants to control all digital assets traded by companies in Brazil. According to the current proposal, the national regulator will have the power to ask platforms to remove certain listed assets if it considers that they do not meet local regulations.

However, the regulations will not include NFTs, real-world asset (RWA) tokens, RWA tokens classified as securities, and tokenized movable or real estate assets. These assets are still ‘deregulated’ in Brazil.

Monero: What Is It and Why Is Brazil Banning It?

Monero ($XMR) is a cryptocurrency that uses a protocol called CryptoNote. It launched in 2013 and ‘erases’ transaction data, preventing the sender and recipient addresses from being publicly known. The Monero network is based on a proof-of-work (PoW) consensus mechanism, which incentivizes miners to add blocks to the blockchain.

Like Brazil, other nations are banning Monero in search of regulatory compliance. Recently, Dubai’s new digital asset rules prohibited the issuance of activities related to anonymity-enhancing cryptocurrencies such as $XMR.

Furthermore, exchanges such as Binance have already announced they will delist Monero on their global platforms due to its anonymity features. Kraken did the same, removing Monero for their European-based users to comply with MiCA regulations.

Data from Chainalysis shows that Brazil is the seventh-largest Bitcoin market in the world.

In Latin America, Brazil is the largest market for digital assets. Globally, it leads in the innovation of RWA tokens, with several companies already trading this type of asset.

In Closing

Following other nations, Brazil’s regulatory proposals aim to combat illicit activities such as money laundering and terrorism financing.

Will the BCB’s move safeguard people’s digital assets while also stimulating growth and innovation in the crypto ecosystem? Only time will tell.

References

Cassio Gusson is a journalist passionate about technology, cryptocurrencies, and the nuances of human nature. With a career spanning roles as Senior Crypto Journalist at CriptoFacil and Head of News at CoinTelegraph, he offers exclusive insights on South America’s crypto landscape. A graduate in Communication from Faccamp and a post-graduate in Globalization and Culture from FESPSP, Cassio explores the intersection of governance, decentralization, and the evolution of global systems.

-

@ 41e6f20b:06049e45

2024-11-17 17:33:55

@ 41e6f20b:06049e45

2024-11-17 17:33:55Let me tell you a beautiful story. Last night, during the speakers' dinner at Monerotopia, the waitress was collecting tiny tips in Mexican pesos. I asked her, "Do you really want to earn tips seriously?" I then showed her how to set up a Cake Wallet, and she started collecting tips in Monero, reaching 0.9 XMR. Of course, she wanted to cash out to fiat immediately, but it solved a real problem for her: making more money. That amount was something she would never have earned in a single workday. We kept talking, and I promised to give her Zoom workshops. What can I say? I love people, and that's why I'm a natural orange-piller.

-

@ 3bf0c63f:aefa459d

2024-09-06 12:49:46

@ 3bf0c63f:aefa459d

2024-09-06 12:49:46Nostr: a quick introduction, attempt #2

Nostr doesn't subscribe to any ideals of "free speech" as these belong to the realm of politics and assume a big powerful government that enforces a common ruleupon everybody else.

Nostr instead is much simpler, it simply says that servers are private property and establishes a generalized framework for people to connect to all these servers, creating a true free market in the process. In other words, Nostr is the public road that each market participant can use to build their own store or visit others and use their services.

(Of course a road is never truly public, in normal cases it's ran by the government, in this case it relies upon the previous existence of the internet with all its quirks and chaos plus a hand of government control, but none of that matters for this explanation).

More concretely speaking, Nostr is just a set of definitions of the formats of the data that can be passed between participants and their expected order, i.e. messages between clients (i.e. the program that runs on a user computer) and relays (i.e. the program that runs on a publicly accessible computer, a "server", generally with a domain-name associated) over a type of TCP connection (WebSocket) with cryptographic signatures. This is what is called a "protocol" in this context, and upon that simple base multiple kinds of sub-protocols can be added, like a protocol for "public-square style microblogging", "semi-closed group chat" or, I don't know, "recipe sharing and feedback".

-

@ be39043c:4a573ca3

2024-08-16 01:59:24

@ be39043c:4a573ca3

2024-08-16 01:59:24Traditionally, miso making takes place during the cold winter. Miso is fermented during the warm season and start using after it gets cooler in the fall. However, I did make during the summer and there was no problem.

For 29oz miso

Ingredients: * Chickpeas 0.5lbs(227g) * Dried Koji 0.5lbs(227g) *not raw(active) koji * Natural salts 103g * Chickpeas : Koji: Salts = 1: 1: 0.45 (salts 12.5%)

I find chickpeas easier to handle than soy beans. For soy beans,

- Soy beans 230g (soak at least 18 hours)

- Dried Koji 340g

- Natural salts 30g(Salts 12.5%)

You also need :

Container for fermentation -32 oz glass jar (no metal lid) or strong plastic container or bag that can be sealed. * large mixing bowl

small bowl

* pressure cooker or large pot * food processor or blender or masher (I use the bottom of small glass jar sanitized with hotwater) * parchment paper or plastic wrap to cover the surface- Wash chickpeas and soak over night

- Cook chickpeas until it can be crashed with your thumb and pinky finger with a pressure cooker or a pot (this may take hours with a pot) Move a part of cooked liquid from the pot to a small bowl and drain the rest. Wait until chickpeas can be handled with hand.

- Mash chickpeas into paste

- Sanitize the 32oz jar with hot water or sanitizer of your choice

- Mixed dried koji with salts with hand

- Add koji and salts to the chickpea paste. Mix with hand well. Add a little bit of the liquid you put aside earlier if the paste is too dry (do not add too much).

- When mixed well, make balls with the paste using hands.

- Throw one of the balls into the jar and push onto the jar with your fist. Repeat this process. (you don't have to punch here. Just push. This process is to transfer the miso paste into the jar without air. The exposure to air will lead to mold. Make sure not to have a space.)

- After throwing all balls into the jar and place tightly without air, seal the surface with a piece of parchment paper or plastic wrap.

- Close the lid.

- Place the jar in a cool and dark place (room temperature). Leave 6 months to 2 years. After the half of the duration, you may pull out of paste and place the bottom half onto the upper half so that the miso will be evenly fermented. This process can be skipped. Check once in a couple of months if there is mold.

- If mold appears on the surface, just scrape it off.

Miso pro's video. He uses soys.

-

@ 2ede6f6b:b94998e2

2024-08-15 21:11:43

@ 2ede6f6b:b94998e2

2024-08-15 21:11:43test

originally posted at https://stacker.news/items/459389

-

@ 57d1a264:69f1fee1

2025-03-29 18:02:16

@ 57d1a264:69f1fee1

2025-03-29 18:02:16This UX research has been redacted by @iqra from the Bitcoin.Design community, and shared for review and feedback! Don't be shy, share your thoughts.

1️⃣ Introduction

Project Overview

📌 Product: BlueWallet (Bitcoin Wallet) 📌 Goal: Improve onboarding flow and enhance accessibility for a better user experience. 📌 Role: UX Designer 📌 Tools Used: Figma, Notion

Why This Case Study?

🔹 BlueWallet is a self-custodial Bitcoin wallet, but users struggle with onboarding due to unclear instructions. 🔹 Accessibility issues (low contrast, small fonts) create barriers for visually impaired users. 🔹 Competitors like Trust Wallet and MetaMask offer better-guided onboarding.

This case study presents UX/UI improvements to make BlueWallet more intuitive and inclusive.

2️⃣ Problem Statement: Why BlueWalletʼs Onboarding Needs Improvement

🔹 Current Challenges:

1️⃣ Onboarding Complexity - BlueWallet lacks step-by-step guidance, leaving users confused about wallet creation and security.

2️⃣ No Educational Introduction - Users land directly on the wallet screen with no explanation of private keys, recovery phrases, or transactions. 3️⃣ Transaction Flow Issues - Similar-looking "Send" and "Receive" buttons cause confusion. 4️⃣ Poor Accessibility - Small fonts and low contrast make navigation difficult.

🔍 Impact on Users:

Higher drop-off rates due to frustration during onboarding. Security risks as users skip key wallet setup steps. Limited accessibility for users with visual impairments.

📌 Competitive Gap:

Unlike competitors (Trust Wallet, MetaMask), BlueWallet does not offer: ✅ A guided onboarding process ✅ Security education during setup ✅ Intuitive transaction flow

Somehow, this wallet has much better UI than the BlueWallet Bitcoin wallet.

3️⃣ User Research & Competitive Analysis

User Testing Findings

🔹 Conducted usability testing with 5 users onboarding for the first time. 🔹 Key Findings: ✅ 3 out of 5 users felt lost due to missing explanations. ✅ 60% had trouble distinguishing transaction buttons. ✅ 80% found the text difficult to read due to low contrast.

Competitive Analysis

We compared BlueWallet with top crypto wallets:

| Wallet | Onboarding UX | Security Guidance | Accessibility Features | |---|---|---|---| | BlueWallet | ❌ No guided onboarding | ❌ Minimal explanation | ❌ Low contrast, small fonts | | Trust Wallet | ✅ Step-by-step setup | ✅ Security best practices | ✅ High contrast UI | | MetaMask | ✅ Interactive tutorial | ✅ Private key education | ✅ Clear transaction buttons |

📌 Key Insight: BlueWallet lacks guided setup and accessibility enhancements, making it harder for beginners.

📌 User Persona

To better understand the users facing onboarding challenges, I developed a persona based on research and usability testing.

🔹 Persona 1: Alex Carter (Bitcoin Beginner & Investor)

👤 Profile: - Age: 28 - Occupation: Freelance Digital Marketer - Tech Knowledge: Moderate - Familiar with online transactions, new to Bitcoin) - Pain Points: - Finds Bitcoin wallets confusing. - - Doesnʼt understand seed phrases & security features. - - Worried about losing funds due to a lack of clarity in transactions.

📌 Needs: ✅ A simple, guided wallet setup. ✅ Clear explanations of security terms (without jargon). ✅ Easy-to-locate Send/Receive buttons.

📌 Persona Usage in Case Study: - Helps define who we are designing for. - Guides design decisions by focusing on user needs.

🔹 Persona 2: Sarah Mitchell (Accessibility Advocate & Tech Enthusiast)

👤 Profile: - Age: 35 - Occupation: UX Researcher & Accessibility Consultant - Tech Knowledge: High (Uses Bitcoin but struggles with accessibility barriers)

📌 Pain Points: ❌ Struggles with small font sizes & low contrast. ❌ Finds the UI difficult to navigate with a screen reader. ❌ Confused by identical-looking transaction buttons.

📌 Needs: ✅ A high-contrast UI that meets WCAG accessibility standards. ✅ Larger fonts & scalable UI elements for better readability. ✅ Keyboard & screen reader-friendly navigation for seamless interaction.

📌 Why This Persona Matters: - Represents users with visual impairments who rely on accessible design. - Ensures the design accommodates inclusive UX principles.

4️⃣ UX/UI Solutions & Design Improvements

📌 Before (Current Issues)

❌ Users land directly on the wallet screen with no instructions. ❌ "Send" & "Receive" buttons look identical , causing transaction confusion. ❌ Small fonts & low contrast reduce readability.

✅ After (Proposed Fixes)

✅ Step-by-step onboarding explaining wallet creation, security, and transactions. ✅ Visually distinct transaction buttons (color and icon changes). ✅ WCAG-compliant text contrast & larger fonts for better readability.

1️⃣ Redesigned Onboarding Flow

✅ Added a progress indicator so users see where they are in setup. ✅ Used plain, non-technical language to explain wallet creation & security. ✅ Introduced a "Learn More" button to educate users on security.

2️⃣ Accessibility Enhancements

✅ Increased contrast ratio for better text readability. ✅ Used larger fonts & scalable UI elements. ✅ Ensured screen reader compatibility (VoiceOver & TalkBack support).

3️⃣ Transaction Flow Optimization

✅ Redesigned "Send" & "Receive" buttons for clear distinction. ✅ Added clearer icons & tooltips for transaction steps.

5️⃣ Wireframes & Design Improvements:

🔹 Welcome Screen (First Screen When User Opens Wallet)

📌 Goal: Give a brief introduction & set user expectations

✅ App logo + short tagline (e.g., "Secure, Simple, Self-Custody Bitcoin Wallet") ✅ 1-2 line explanation of what BlueWallet is (e.g., "Your gateway to managing Bitcoin securely.") ✅ "Get Started" button → Le ads to next step: Wallet Setup ✅ "Already have a wallet?" → Import option

🔹 Example UI Elements: - BlueWallet Logo - Title: "Welcome to BlueWallet" - Subtitle: "Easily store, send, and receive Bitcoin." - CTA: "Get Started" (Primary) | "Import Wallet" (Secondary)

🔹 Screen 2: Choose Wallet Type (New or Import)

📌 Goal: Let users decide how to proceed

✅ Two clear options: - Create a New Wallet (For first-time users) - Import Existing Wallet (For users with a backup phrase) ✅ Brief explanation of each option 🔹 Example UI Elements: - Title: "How do you want to start?" - Buttons:** "Create New Wallet" | "Import Wallet"

🔹 Screen 3: Security & Seed Phrase Setup (Critical Step)

📌 Goal: Educate users about wallet security & backups

✅ Explain why seed phrases are important ✅ Clear step-by-step instructions on writing down & storing the phrase ✅ Warning: "If you lose your recovery phrase, you lose access to your wallet." ✅ CTA: "Generate Seed Phrase" → Next step

🔹 Example UI Elements: - Title: "Secure Your Wallet" - Subtitle: "Your seed phrase is the key to your Bitcoin. Keep it safe!" - Button: "Generate Seed Phrase"

🔹 Screen 4: Seed Phrase Display & Confirmation

📌 Goal: Ensure users write down the phrase correctly

✅ Display 12- or 24-word seed phrase ✅ “I have written it downˮ checkbox before proceeding ✅ Next screen: Verify seed phrase (drag & drop, re-enter some words)

🔹 Example UI Elements: - Title: "Write Down Your Seed Phrase" - List of 12/24 Words (Hidden by Default) - Checkbox: "I have safely stored my phrase" - Button: "Continue"

🔹 Screen 5: Wallet Ready! (Final Step)

📌 Goal: Confirm setup & guide users on next actions

✅ Success message ("Your wallet is ready!") ✅ Encourage first action: - “Receive Bitcoinˮ → Show wallet address - “Send Bitcoinˮ → Walkthrough on making transactions

✅ Short explainer: Where to find the Send/Receive buttons

🔹 Example UI Elements: - Title: "You're All Set!" - Subtitle: "Start using BlueWallet now." - Buttons: "Receive Bitcoin" | "View Wallet"

5️⃣ Prototype & User Testing Results

🔹 Created an interactive prototype in Figma to test the new experience. 🔹 User Testing Results: ✅ 40% faster onboarding completion time. ✅ 90% of users found transaction buttons clearer. 🔹 User Feedback: ✅ “Now I understand the security steps clearly.ˮ ✅ “The buttons are easier to find and use.ˮ

6️⃣ Why This Matters: Key Takeaways

📌 Impact of These UX/UI Changes: ✅ Reduced user frustration by providing a step-by-step onboarding guide. ✅ Improved accessibility , making the wallet usable for all. ✅ More intuitive transactions , reducing errors.

7️⃣ Direct link to figma file and Prototype

Original PDF available from here

originally posted at https://stacker.news/items/928822

-

@ 8671a6e5:f88194d1

2025-03-29 17:58:33

@ 8671a6e5:f88194d1

2025-03-29 17:58:33A flash of inspiration

Sometimes the mind takes you to strange places. The other day, I stumbled across Madonna’s “Vogue” video, you know “strike a pose” and all that jazz, and it got me thinking. Not about her music (which, let’s be honest, hasn’t aged as gracefully as her PR team might hope), but about Michael Saylor and Bitcoin.

Bear with me here, there’s a connection there. Madonna built an empire and her iconic name on catchy tunes and reinvention, even if her catalog feels a bit thin these days. Saylor? He’s doing something similar—taking an old act, dusting it off, and teaching it a new trick. Only instead of a microphone, he’s wielding Bitcoin, and Wall Street’s playing the role of the music industry, propping up the star despite a shaky back catalog (his initial business software).

Old school meets new moves

Think of Saylor as that veteran artist who’s been around for a few decades and think of bitcoin as a new style of music, a genre or a gimmick that’s popular with the kids. Old music stars sooner or later pick up on that, and even bring people in to do a cross-over song, a mix or god forbid, a duet.

MicroStrategy, his software company, was never a top hit scoring machine. More of a album full of B-sides that faded into obscurity (for those who don’t know, look up what a B-side song was). But then he stumbled onto Bitcoin, the shiny new genre that’s got the attention and attracted people because of the underlying asset (our tunes are here to stay).

It’s not just a pivot; it’s a reinvention. Like an aging pop star learning to rap, Saylor’s taken his old-school business and remixed it into something attracting a decent audience at conferences for example. Like Madonna or the former Prince fulling arenas. He’s voguing alright; with bold moves, big loans, the support of his own music industry and a spotlight for his (sometimes Madonna lyrics like) ramblings.

The Saylor trick: a ray of light on bitcoin

Here’s the play: Saylor’s turned MicroStrategy into a Bitcoin hoarding machine. Forget software licenses; his game is borrowing billions—through corporate bonds and stock sales, only to buy and hold Bitcoin. Bitcoin will outshine gold, bonds, even the S&P 500, Saylor says. It’s a gamble, an honorable one if you’re a bitcoiner, but it’s dressed up as a vision, and it’s got a self-fulfilling prophecy in it. Not only that, such a prophecy can only fully come to fruition if he’s not the only buyer of last resort of any significance. A music industry isn’t a real industry if there was only Madonna dancing on stage as the only mainstream artist.

We had Prince, Michael Jackson, Taylor Swift, Bruno Mars or Dua Lipa and hundreds of other artists over time, vying for your money, attention span, and streaming minutes. The more Strategy buys, the more the Bitcoin crowd cheers, the higher the price climbs, and the more attention he gets. Speaking gigs, headlines, cult status—it’s a win-win, at least on paper. Strike the pose, indeed.

The McDonald’s trick: value under the surface

It’s not the first time Michael Saylro remixes a tape from another artist so to speak. Let’s pivot to McDonald’s for a second, because there’s a parallel here. You think Big Macs when you think McDonald’s, but their real value hustle is actually real estate.

They own prime land, lease it to franchisees, and rake in rent—billions of it. The burgers? Just a tasty front for a property empire. Saylor’s pulling a similar move, but instead of buildings, his asset is Bitcoin. MicroStrategy’s software gig is the fries on the side — nice to have, but not the main course. He’s borrowing against the future value of BTC, betting it’ll keep climbing, just like McDonald’s banks on steady foot traffic and picking strategic (pun intended) locations. The difference? McDonald’s has a fallback if real estate tanks. Saylor’s all-in on bitcoin. (So far so good, if there’s one thing to go all-in on, it’s bitcoin anyway). That on itself is not an issue. But it’s important to know that the “location” is the asset for some while bitcoin is the “asset” for Strategy. Mc Donald’s assets are easy to spot: there are restaurants all over the place. Madonna’s concerts are also easy to spot: they sell out arenas left and right. Strategy’s bitcoin asset is less easy to spot, as we can’t see them, neither can we verify them. More on that later.

The hybrid star: Madonna meets McDonald’s

So, picture this: Saylor’s a cross between Madonna and a fast-food landlord. He’s the aging music icon who’s learned a flashy new dance, but underneath the glitter, he’s running a McDonald’s-style value play. It’s brilliant, in a way. Bitcoin’s scarcity fuels the hype, and his borrowing keeps the show on the road. Madonna’s legacy still sells records her name holds value, and McDonald’s can lean on its food business and brand, if the property game stumbles they can easily pivot back to basics and earn like they’ve always done on selling food and franchise income/licensing. Saylor? His software arm’s is rather dismal. If Bitcoin falters, there’s no encore that can him.a flash of inspiration

Sometimes the mind takes you to strange places. The other day, I stumbled across Madonna’s “Vogue” video, you know “strike a pose” and all that jazz, and it got me thinking. Not about her music (which, let’s be honest, hasn’t aged as gracefully as her PR team might hope), but about Michael Saylor and Bitcoin.\ \ Bear with me here, there’s a connection there. Madonna built an empire and her iconic name on catchy tunes and reinvention, even if her catalog feels a bit thin these days.\ Saylor? He’s doing something similar—taking an old act, dusting it off, and teaching it a new trick. Only instead of a microphone, he’s wielding Bitcoin, and Wall Street’s playing the role of the music industry, propping up the star despite a shaky back catalog (his initial business software).

Old school meets new moves

Think of Saylor as that veteran artist who’s been around for a few decades and think of bitcoin as a new style of music, a genre or a gimmick that’s popular with the kids. Old music stars sooner or later pick up on that, and even bring people in to do a cross-over song, a mix or god forbid, a duet.

MicroStrategy, his software company, was never a top hit scoring machine. More of a album full of B-sides that faded into obscurity (for those who don’t know, look up what a B-side song was).\ But then he stumbled onto Bitcoin, the shiny new genre that’s got the attention and attracted people because of the underlying asset (our tunes are here to stay).\ \ It’s not just a pivot; it’s a reinvention. Like an aging pop star learning to rap, Saylor’s taken his old-school business and remixed it into something attracting a decent audience at conferences for example. Like Madonna or the former Prince fulling arenas.\ He’s voguing alright; with bold moves, big loans, the support of his own music industry and a spotlight for his (sometimes Madonna lyrics like) ramblings.

*The Saylor trick: a ray of light on bitcoin* \ Here’s the play: Saylor’s turned MicroStrategy into a Bitcoin hoarding machine. Forget software licenses; his game is borrowing billions—through corporate bonds and stock sales, only to buy and hold Bitcoin. Bitcoin will outshine gold, bonds, even the S&P 500, Saylor says.\ It’s a gamble, an honorable one if you’re a bitcoiner, but it’s dressed up as a vision, and it’s got a self-fulfilling prophecy in it. Not only that, such a prophecy can only fully come to fruition if he’s not the only buyer of last resort of any significance. A music industry isn’t a real industry if there was only Madonna dancing on stage as the only mainstream artist.\ \ We had Prince, Michael Jackson, Taylor Swift, Bruno Mars or Dua Lipa and hundreds of other artists over time, vying for your money, attention span, and streaming minutes.\ The more Strategy buys, the more the Bitcoin crowd cheers, the higher the price climbs, and the more attention he gets. Speaking gigs, headlines, cult status—it’s a win-win, at least on paper. Strike the pose, indeed.

*The McDonald’s trick: value under the surface* \ It’s not the first time Michael Saylro remixes a tape from another artist so to speak.\ Let’s pivot to McDonald’s for a second, because there’s a parallel here. You think Big Macs when you think McDonald’s, but their real value hustle is actually real estate.

They own prime land, lease it to franchisees, and rake in rent—billions of it. The burgers? Just a tasty front for a property empire. Saylor’s pulling a similar move, but instead of buildings, his asset is Bitcoin.\ MicroStrategy’s software gig is the fries on the side — nice to have, but not the main course. He’s borrowing against the future value of BTC, betting it’ll keep climbing, just like McDonald’s banks on steady foot traffic and picking strategic (pun intended) locations.\ The difference? McDonald’s has a fallback if real estate tanks. Saylor’s all-in on bitcoin. (So far so good, if there’s one thing to go all-in on, it’s bitcoin anyway). That on itself is not an issue. But it’s important to know that the “location” is the asset for some while bitcoin is the “asset” for Strategy.\ Mc Donald’s assets are easy to spot: there are restaurants all over the place. Madonna’s concerts are also easy to spot: they sell out arenas left and right.\ Strategy’s bitcoin asset is less easy to spot, as we can’t see them, neither can we verify them. More on that later.

The hybrid star: Madonna meets McDonald’s

So, picture this: Saylor’s a cross between Madonna and a fast-food landlord. He’s the aging music icon who’s learned a flashy new dance, but underneath the glitter, he’s running a McDonald’s-style value play.\ It’s brilliant, in a way. Bitcoin’s scarcity fuels the hype, and his borrowing keeps the show on the road.\ Madonna’s legacy still sells records her name holds value, and McDonald’s can lean on its food business and brand, if the property game stumbles they can easily pivot back to basics and earn like they’ve always done on selling food and franchise income/licensing.\ Saylor? His software arm’s is rather dismal. If Bitcoin falters, there’s no encore that can him.

The music’s made in-house

Michael Saylor’s strategy with Strategy, is a bold, all-in bet on Bitcoin as the ultimate store of value. Essentially combining what Mc Donald’s does with the strong believe in bitcoin’s future (and fueling that believe with the fitting rhetoric).

It works like this: Since August 2020, Saylor’s company has been buying up more and more Bitcoin, making it their main asset instead of traditional cash or investments, and by March 2025, they own 506,137 BTC—worth about $42.8 billion (at $84,000 per Bitcoin). This, after spending $33.7 billion to buy it over time (DCA), including a massive 218887 BTC purchase late 2024 for $20.5 billion, giving them over 2.41% of all Bitcoin ever to exist (way more than companies like Marathon, Coinbase, Tesla or Riot).

To pull this off, they’ve borrowed heavily: owing $7.2 billion, mostly to Wall Street investors through special IOUs1 called convertible notes, which don’t need to be paid back until 2027, through 2029. These can either be settled with cash or swapped for Strategy stock. (there lies one of the main issues in my opinion, as the main asset’s price in USD is directly impacting the stock price of MSTR). A small example of this repeated correlation happened on March 28, 2025 when Strategy’s stock (MSTR) dropped 10.8% from $324.59 to $289.41, which was mirroring Bitcoin’s move down from $85,000 to $82,000 earlier.

This debt they have can be called “risky” by any stretch, with a high leverage rate of 39-40%, meaning they’ve borrowed a big chunk compared to what they own outright, but here’s the genius of it: they don’t have to sell their Bitcoin if its price drops, and they can refinance (borrow more later) to keep the dance going. As long as they find investors willing to bet on the later bitcoin price surge, but more importantly, as long as the song is liked by the new audience. If Michael Saylor is our “Madonna”, then there’s still not Taylor Swift or Rihanna in sight.

The creditors (big players, not banks) win if Bitcoin soars, as Strategy’s huge stash (potentially 2.9%+ of the market) nets them massive profits, or even if it crashes, they’re still in the game with other ways to make profit (not on bitcoin), since they can afford the risk. If someone is willing to bet 4 to 8 billion dollars, they’re probably not spooked by losing it all. More so, these Wall Streat people in the correct entourage, can probably afford such a gamble, and can stomach to lose it all if something goes horribly wrong as well, instead of risking being left out of a growing market. But since they’re probably the same people steering and “owning” the USD market anyway, they’re just conquering positions in a new market. The fact that they’re not real bitcoin-ethos people, but just “suits” in finance, can make the suspicious bitcoiners watching all of this unfold, even more uneasy.

So, Strategy sits on $44 billion in Bitcoin with just $7.2 billion in debt, voguing confidently. And Saylor’s betting the song never gets old, he’ll do the B-sides and re-mastering his old albums if necessary, but if Bitcoin’s value ever fades (for whatever reason), the real question is how long they can keep striking poses before the music stops. Remember: all money (fiat, gold, silver, bitcoin, nicely made papers) is a matter of trust.

As I have trust in bitcoin itself, but not so much in Strategy, I’ve take some precautions. I've started my own sort of "Strategy crash fund", with fiat money that only will come into action when strategy is done. The crash that we'll see after that goes down, will be such a tremendous opportunity, that I'll pour in some more fiat, gladly, and that will be the exact moment I will actually “sell all my chairs” (from Saylor’s well-known quote).

Purchases

Strategy’s Bitcoin purchases, don’t seem to jolt the market much either, no matter the size of the order. They always have the same sound: “it’s OTC, it doesn’t impact the market that much”.

Still, it’s strange to see: no one has ever come forward to tell anyone “I’ve sold 15000 bitcoin from my old stack to Saylor”, neither do we see any clear evidence and on-chain moves.

Take their first buy in August 2020 for example. Totaling 21454 BTC for $250 million at $11,652 per BTC; Bitcoin sat at $11,500 to $11,700 so barely moved, inching to $12,000 weeks later due to broader trends.