-

@ eaccf0cb:23be2b8f

2025-05-13 05:02:24

@ eaccf0cb:23be2b8f

2025-05-13 05:02:24Trong thời đại công nghệ phát triển nhanh chóng, việc tìm kiếm một nền tảng số toàn diện, thân thiện và ổn định đã trở thành nhu cầu thiết yếu đối với người dùng. LU8 chính là câu trả lời cho nhu cầu đó, khi mang đến một hệ sinh thái tích hợp với giao diện thông minh, cấu trúc hợp lý và tốc độ xử lý vượt trội. Mọi thao tác trên LU8 đều được thiết kế để tối giản hóa quá trình sử dụng, từ việc đăng ký, truy cập đến thao tác các tiện ích bên trong. Tính năng tương thích đa nền tảng là một trong những điểm mạnh nổi bật, cho phép người dùng sử dụng LU8 linh hoạt trên điện thoại, máy tính bảng hoặc máy tính cá nhân mà không gặp bất kỳ rào cản nào về kỹ thuật hay hiệu suất. Ngoài ra, LU8 thường xuyên cập nhật các xu hướng công nghệ mới, giúp hệ thống luôn vận hành trơn tru và đáp ứng kịp thời những thay đổi trong hành vi người dùng. Việc áp dụng các thuật toán tối ưu hóa hiệu suất cũng giúp thời gian phản hồi của hệ thống nhanh hơn, mang lại trải nghiệm liền mạch cho người dùng ở mọi hoàn cảnh.

Không chỉ dừng lại ở khả năng vận hành mượt mà, LU8 còn đặc biệt chú trọng đến yếu tố bảo mật và sự an toàn thông tin cá nhân cho người sử dụng. Hệ thống được xây dựng trên nền tảng mã hóa hiện đại, sử dụng nhiều lớp xác thực và kiểm tra chéo để ngăn chặn các rủi ro đến từ bên ngoài. Việc này không chỉ giúp bảo vệ dữ liệu một cách toàn diện mà còn tăng cường mức độ tin cậy từ phía người dùng, đặc biệt là trong những hoạt động yêu cầu tính riêng tư cao. LU8 còn cung cấp các tùy chọn bảo mật nâng cao như xác minh qua email, mã OTP và các công cụ nhận diện thiết bị truy cập để hỗ trợ người dùng quản lý tài khoản một cách hiệu quả nhất. Ngoài ra, quá trình sao lưu dữ liệu được thực hiện định kỳ, đảm bảo không có sự cố mất mát nào ảnh hưởng đến trải nghiệm tổng thể. Đội ngũ kỹ thuật đứng sau LU8 luôn theo dõi hệ thống liên tục, nhằm phát hiện và khắc phục mọi sự cố có thể xảy ra trong thời gian ngắn nhất. Những yếu tố này cho thấy LU8 không chỉ là một nền tảng công nghệ hiện đại, mà còn là một hệ thống được đầu tư bài bản với mục tiêu dài hạn.

Bên cạnh sự mạnh mẽ về công nghệ và bảo mật, LU8 còn tạo nên khác biệt thông qua chất lượng chăm sóc khách hàng vượt trội. Với hệ thống hỗ trợ trực tuyến hoạt động liên tục 24/7, người dùng luôn nhận được sự hỗ trợ tận tình, nhanh chóng và chính xác từ đội ngũ chuyên viên. Mọi thắc mắc, từ đơn giản đến phức tạp, đều được giải đáp cặn kẽ, giúp người dùng an tâm hơn khi tương tác với nền tảng. LU8 cũng duy trì một kênh phản hồi mở, nơi người dùng có thể gửi góp ý để cải thiện chất lượng dịch vụ. Các ý kiến này không bị bỏ qua mà luôn được phân tích và áp dụng vào quá trình nâng cấp hệ thống nhằm phục vụ người dùng tốt hơn mỗi ngày. Ngoài ra, LU8 thường xuyên triển khai các chương trình tri ân khách hàng, khuyến khích sự gắn bó lâu dài và xây dựng cộng đồng người dùng tích cực. Trong tương lai, LU8 đặt mục tiêu mở rộng hơn nữa phạm vi ứng dụng và tích hợp thêm nhiều tiện ích mới, tạo nên một nền tảng số toàn diện, đáp ứng đa dạng nhu cầu của người dùng hiện đại và không ngừng thích ứng với xu hướng công nghệ toàn cầu.

-

@ 75869cfa:76819987

2025-05-13 03:26:29

@ 75869cfa:76819987

2025-05-13 03:26:29GM, Nostriches!

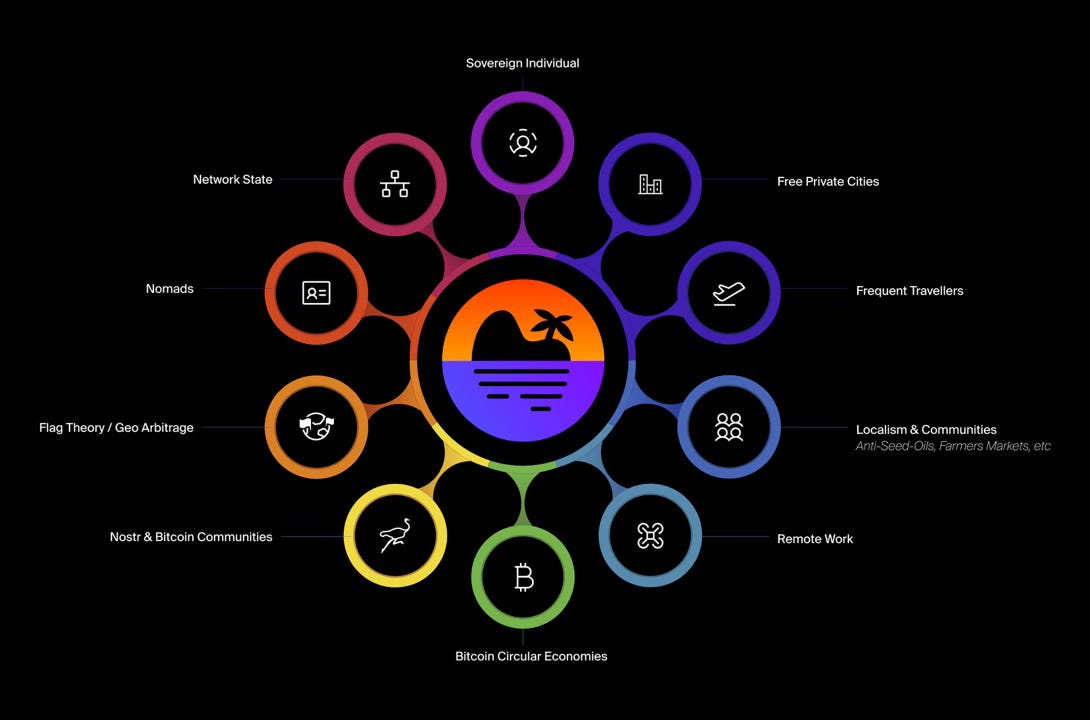

The Nostr Review is a biweekly newsletter focused on Nostr statistics, protocol updates, exciting programs, the long-form content ecosystem, and key events happening in the Nostr-verse. If you’re interested, join me in covering updates from the Nostr ecosystem!

Quick review:

In the past two weeks, Nostr statistics indicate over 211,000 daily trusted pubkey events. The number of new users has seen a notable decrease, Profiles with contact lists were representing a 50% decline. More than 5 million events have been published, reflecting a 34% decrease. Total Zap activity stands at approximately 14 million, marking a 12% increase.

Additionally, 25 pull requests were submitted to the Nostr protocol, with 8 merged. A total of 60 Nostr projects were tracked, with 18 releasing product updates, and over 356 long-form articles were published, 36% focusing on Bitcoin and Nostr. During this period, 5 notable events took place, and 2 significant events are upcoming.

Nostr Statistics

Based on user activity, the total daily trusted pubkeys writing events is about 211,000, representing a slight 2.7 % decrease compared to the previous period. Daily activity peaked at 17027 events, with a low of approximately 15340.

The number of new users has decreased significantly.Profiles with contact lists were 12961, representing a decline of approximately 50% compared to the previous period. The number of profiles with bios and pubkey-written events remained stable.

The total number of note events published is around 5 million, reflecting a 34% decrease.Posts remain the most dominant category by volume, representing a 9% decrease compared to the previous period.

For zap activity, the total zap amount is about 14 million, showing an decrease of over 12% compared to the previous period.

Data source: https://stats.nostr.band/

NIPs

Introduce NIP-PNS: Private Note Storage #1893

nostr:npub1xtscya34g58tk0z605fvr788k263gsu6cy9x0mhnm87echrgufzsevkk5s is proposing PNS that empowers Nostr users with a secure and seamless way to store personal notes—like diaries, drafts, or private application settings—across devices while keeping them completely private. Built on client-side encryption, PNS ensures that only the user can read or manage their notes, even as they sync effortlessly via Nostr relays. Unlike traditional local storage or cumbersome encrypted file solutions, PNS offers privacy without sacrificing convenience, using deterministic keys tied to each user or device. It integrates directly with Nostr’s open infrastructure, enabling private data to coexist with public events—secure, synchronized, and under your control.

Create 97.md: Ring Signatures #1894

nostr:npub1u5njm6g5h5cpw4wy8xugu62e5s7f6fnysv0sj0z3a8rengt2zqhsxrldq3 is proposing a PR that ring signatures can be synergistic with other web of trust related tools.

Introduce NIP: Relay metadata propagation #1900

nostr:npub1txukm7xckhnxkwu450sm59vh2znwm45mewaps4awkef2tvsgh4vsf7phrl is proposing a simple propagation mechanism for kind:0 (user metadata) and kind:10002 (relay list metadata) events between relays. Relays are allowed to forward such events to their peers, improving client synchronization.

nostr:npub1gzuushllat7pet0ccv9yuhygvc8ldeyhrgxuwg744dn5khnpk3gs3ea5ds defines a standardized interaction pattern for Nostr Data Vending Machines (DVMs). It focuses on how clients discover DVM capabilities, request jobs, and receive results. This NIP decouples the core DVM interaction from specific job-type implementations, which should be defined in separate documents.

NIP-47 Add Hold Invoice Support #1913

frnandu is proposing PR that introduces support for hold invoices in the Nostr Wallet Connect (NIP-47) protocol.Hold invoices enable more advanced payment workflows where the receiver must explicitly settle or cancel the invoice using the preimage. This allows for enhanced control and coordination in payment flows, such as conditional payments or escrow-like behavior.

Add A Generic Raitng/Review NIP #1914

nostr:npub1cgd35mxmy37vhkfcmjckk9dylguz6q8l67cj6h9m45tj5rx569cql9kfex is proposing generic nip that meant to handle all categories of things via namespaced Ids.

Notable Projects

Coracle 0.6.15 nostr:npub13myx4j0pp9uenpjjq68wdvqzywuwxfj64welu28mdvaku222mjtqzqv3qk

New version of Coracle is out: 0.6.15 — this one is just more QoL improvements and bugfixes — the big one this time is better blossom support (and dropping nip 96!). * Fix safe areas more * Improve remote signing * Drop nip 96 support * Use user blossom servers * Improve profile edit page * Avoid duplicate notes in feeds

Flotilla nostr:npub1jlrs53pkdfjnts29kveljul2sm0actt6n8dxrrzqcersttvcuv3qdjynqn

New version of Flotilla is out as well — 1.0.2 is mostly cleanup from the 1.0 release earlier this week. * Fix add relay button * Fix safe inset areas * Better rendering for errors from relays * Improve remote signer login

Damus Notedeck Beta nostr:npub18m76awca3y37hkvuneavuw6pjj4525fw90necxmadrvjg0sdy6qsngq955

New in Notedeck Beta: * Dave nostr ai assistant app * GIFs! * Fulltext note search * Add full screen images, add zoom & pan * Zaps! NWC/ Wallet ui * Introduce last note per pubkey feed (experimental) * Allow multiple media uploads per selection * Major Android improvements (still wip) * Added notedeck app sidebar * User Tagging * Note truncation * Local network note broadcast, broadcast notes to other notedeck notes while you're offline * Mute list support (reading) * Relay list support * Ctrl-enter to send notes * Added relay indexing (relay columns soon) * Click hashtags to open hashtag timeline

Primal V2.2 nostr:npub12vkcxr0luzwp8e673v29eqjhrr7p9vqq8asav85swaepclllj09sylpugg

Version 2.2 is now live, bringing long-awaited features like Amber signing support and much more. Here’s what’s new: * Blossom media * Push notifications * Notifications overhaul * External signer support * Feed: image gallery revamp * Muted words, hashtags, & threads * Request delete for notes and articles * System photos: share via Primal

Nostur nostr:npub1n0stur7q092gyverzc2wfc00e8egkrdnnqq3alhv7p072u89m5es5mk6h0

New in this version: * Add blossom media server support * Support multiple blossom servers as mirror * Fixed feed position reset on audio bar toggle * Fixed post screenshot broken for quoted posts

Fountain 1.2 nostr:npub1v5ufyh4lkeslgxxcclg8f0hzazhaw7rsrhvfquxzm2fk64c72hps45n0v5

Fountain 1.2 is live on iOS and Android This massive update brings significant design and UX improvements across the app along with new episode summaries features. Here's what's new: * Library Design Update: Fountain has made it much easier to navigate between podcasts and music in the library with the addition of new content-type filters. The Recently Played view allows users to quickly jump back into what they were listening to before, and the design of the content cards has also been refreshed. * Content Pages Design Update: All content pages—including shows, episodes, artists, albums, tracks, clips, and playlists—have undergone an extensive redesign. The previous tab layout has been replaced with scrollable pages, show notes formatting has been improved, and features like chapters and transcripts have been revamped. * Episode Summaries: Each episode page now features a Summary button above the show notes. Users can pay 500 sats to unlock a summary or upgrade to Fountain Premium for $2.99/month to enjoy unlimited summaries. Summaries and transcripts are now bundled together, and they’re faster, cheaper, and more accurate than ever before. * Playback Improvements: The audio engine has been completely rebuilt from the ground up. Playback is now more robust and reliable—especially for music. Tracks now play instantly when tapped, and users can skip seamlessly between tracks in albums and playlists. The player interface has also been updated for easier access to show notes, comments, transcripts, and chapters, with the addition of a smart resume feature for podcasts.

DEG Mods nostr:npub17jl3ldd6305rnacvwvchx03snauqsg4nz8mruq0emj9thdpglr2sst825x

- New Events Aggregator Server, a type of aggregate/caching server that helps collect and organize mod and blog posts from the (nostr) network and presents them to the user, providing more (immensely more) reliability in discovering and presenting mods and blog posts.

- Adjusted how the mods and blogs are fetched and presented in various pages (there's now pagination for each of their pages, making navigation easier than before).

- Minor adjustment to the design of the gallery of mod posts.

- Images in a social post (in /feed) are now clustered depending on if they're next to each other.

- Quote-repost chain won't render its preview with the second quote-repost (under the posts tab in the feed page).

- Added media upload to the edit profile page.

- The games page now has a filter to switch between popular ones (shows the most popular games first based on mods published to it) or latest ones (shows games based on the latest published mods).

- Mods that are blocked by the user are now swapped with a box telling the user this is a blocked mod by them, with an option to see what that mod is.

- Mods can now be properly discovered, as soon as they're discovered, and presented (Because of that aggregate server implementation).

- A lot more games, with better search term prioritization, are now properly showing when searching in the mod submission page

- Visiting a social post directly is now visible without needing to login

RUNSTR nostr:npub1vygzr642y6f8gxcjx6auaf2vd25lyzarpjkwx9kr4y752zy6058s8jvy4e

- Record your cardio and post to nostr

- Save your stats to nostr

- Listen to your nostr:npub1yfg0d955c2jrj2080ew7pa4xrtj7x7s7umt28wh0zurwmxgpyj9shwv6vg playlists and zap your favorite artists

- Interact with the Kind1 RUNSTR Feed

- Interact with NIP29 run clubs

nostr:npub17h9fn2ny0lycg7kmvxmw6gqdnv2epya9h9excnjw9wvml87nyw8sqy3hpu Now it's possible to keep playing your text while voca is in the background.

Wasabi Wallet v2.6.0 nostr:npub1jw7scmeuewhywwytqxkxec9jcqf3znw2fsyddcn3948lw9q950ps9y35fg

- Support for Standard BIP 158 Block Filters

- Full Node Integration Rework

- Create & Recover SLIP 39 Shares

- Nostr Update Manager

Futr nostr nostr:npub18wxf0t5jsmcpy57ylzx595twskx8eyj382lj7wp9rtlhzdg5hnnqvt4xra

- Solved memory leak in Qt5

- Fixed recursive re-rendering bug in Qt5

- Enable QML debugger through Haskell binding

- Improve event handling and Qt5 signal triggering

ZEUS v0.11.0 nostr:npub1xnf02f60r9v0e5kty33a404dm79zr7z2eepyrk5gsq3m7pwvsz2sazlpr5

ZEUS v0.11.0-alpha3 with Cashu support is now available for testing: * Fix: addresses issues with sweeping Cashu tokens to self-custody with remote connections * Feat: Core Lightning: Taproot address support * Misc: UX enhancements * Cashu wallets are tied to Embedded LND wallets. Enable under Settings > Ecash * Other wallet types can still sweep funds from Cashu tokens * ZEUS Pay now supports Cashu address types. You can switch between Zaplocker, Cashu, and NWC mode but can only use one at a time.

Oracolo nostr:npub10000003zmk89narqpczy4ff6rnuht2wu05na7kpnh3mak7z2tqzsv8vwqk

Now the short notes block has two new styles: "Board" and "Full content"; the former shows notes in a pinterest-like fashion on two columns, while the latter shows full notes in full screen.

Umbrel 1.4.1 nostr:npub1aghreq2dpz3h3799hrawev5gf5zc2kt4ch9ykhp9utt0jd3gdu2qtlmhct

- Search files anywhere with ⌘/Ctrl + K

- New Favorites & Recents widgets

- Real-time transfer speed + ETA

- Snappier performance

- Several other enhancements & fixes

Shopstr v0.4.2 nostr:npub15dc33fyg3cpd9r58vlqge2hh8dy6hkkrjxkhluv2xpyfreqkmsesesyv6e

This update brings the following improvements and fixes: * Added Blossom media support for image uploads with metadata stripping * Added a terms of service and privacy policy * Added pagination for product viewing * Fixed relay list duplication bug * Removed excessive bottom margin on marketplace page

nostr.build nostr:npub1nxy4qpqnld6kmpphjykvx2lqwvxmuxluddwjamm4nc29ds3elyzsm5avr7

The latest free features are: * 100MB upload size * Blossom support * David Lynch tribute page

openvibe nostr:npub1plstrz6dhu8q4fq0e4rjpxe2fxe5x87y2w6xpm70gh9qh5tt66kqkgkx8j

- Share Even Further : Crosspost from one network to another, or take posts beyond the open social web. Share anything, anywhere — effortlessly from

Ditto.13 nostr:npub10qdp2fc9ta6vraczxrcs8prqnv69fru2k6s2dj48gqjcylulmtjsg9arpj

Ditto 1.3 is all about discovery. From improved search and event fetching to a brand-new Explore tab, this release makes it easier than ever to find people, posts, and conversations across the #Nostr network. We've also rolled out streaks, media improvements, translation upgrades, and key admin tools.

Long-Form Content Eco

In the past two weeks, more than 356 long-form articles have been published, including over 90 articles on Bitcoin and more than 37 related to Nostr, accounting for 36% of the total content.

These articles about Nostr mainly explore the ongoing evolution and challenges of the decentralized protocol, including relay scalability, spam mitigation, signer tools, and publishing workflows. They highlight the network’s technical progress as it handles increasing data loads and infrastructure demands, while also addressing issues like spam and search limitations. Many articles focus on content creation and distribution, showcasing tools for decentralized publishing and media hosting. Others introduce practical guides for secure identity management and signer usage. The ecosystem’s economic potential is also discussed, with suggestions for monetization and community growth. Personal reflections and critiques further illustrate the culture and complexity of Nostr as it expands.

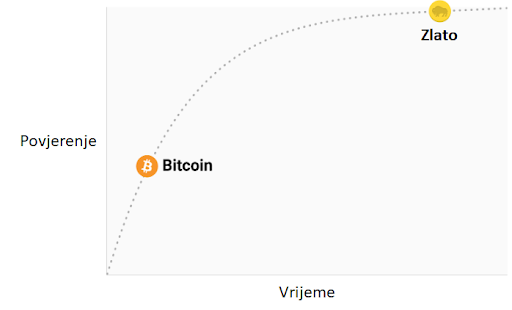

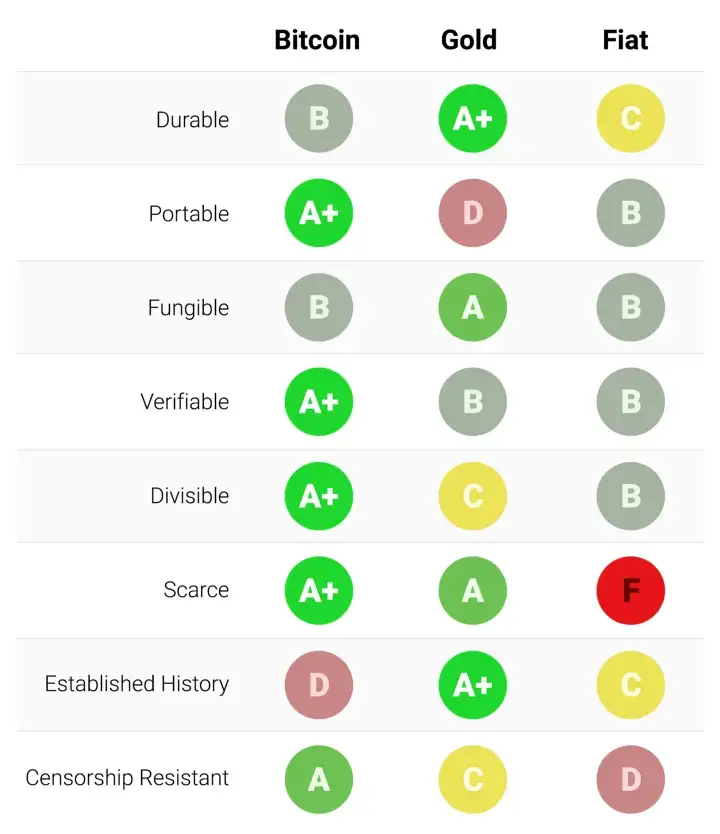

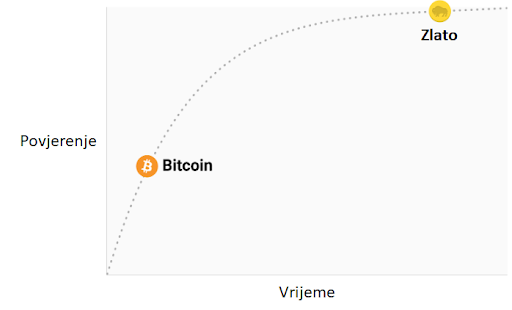

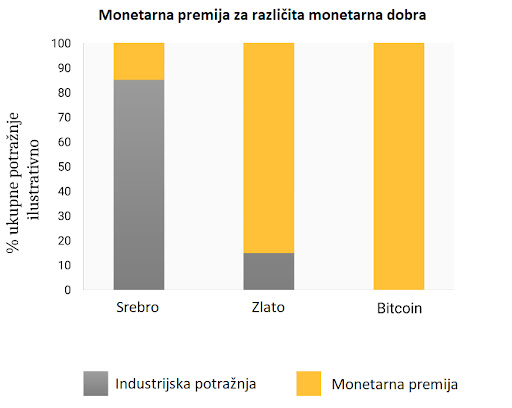

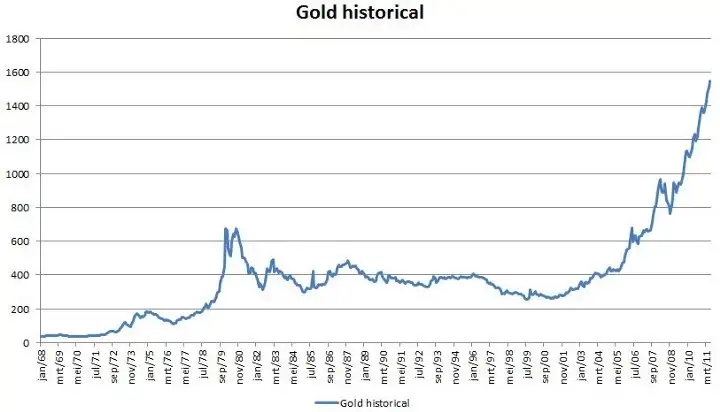

These articles about Bitcoin cover a broad spectrum of topics, highlighting its evolving role in technology, culture, and the global economy. They discuss core concepts such as decentralization, financial sovereignty, and Bitcoin as digital gold, while also addressing current issues like OP_RETURN restrictions, mining centralization, and environmental concerns. Real-world use cases—such as remittances, merchant adoption, and Bitcoin's growth in emerging markets like Africa and South America—are frequently explored. Many articles focus on user education, including wallet security, key management, and node operation. Others provide commentary through book reviews, political reflections, and personal narratives, illustrating how Bitcoin is shaping both individual behavior and institutional thinking.

Thank you, nostr:npub186a9aaqmyp436j0gkxl8yswhat2ampahxunpmfjv80qwyaglywhqswhd06 nostr:npub1xncam2l8u5chg6w096v89f2q2l0lz4jz4n7q7tdjsu6y5t9qea7q2cmrua nostr:npub10m6lrv2kaf08a8um0plhj5dj6yqlw7qxzeag6393z352zrs0e5nsr2tff3 nostr:npub15hhygatg5gmjyfkkguqn54f9r6k8m5m6ksyqffgjrf3uut982sqsffn4vc nostr:npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424 nostr:npub1rsv7kx5avkmq74p85v878e9d5g3w626343xhyg76z5ctfc30kz7q9u4dke nostr:npub1jp3776ujdul56rfkkrv8rxxgrslqr07rz83xpmz3ndl74lg7ngys320eg2 nostr:npub1dk8z5f8pkrn2746xuhfk347a0g6fsxh20wk492fh9h8lkha2efxqgeq55a nostr:npub18sufer6dgm9gzvt8gw37x08dk8gxr8u80rh8f4rjv4m4u73wlalsygnz5q nostr:npub1qpdufhjpel94srm3ett2azgf49m9dp3n5nm2j0rt0l2mlmc3ux3qza082j nostr:npub1th6p84x9u5p4lagglkvm8zepa2dq4s9eanp57vcj4w5652kafads7m930q nostr:npub1xx8t4wk2cvnz5ez7sxkvx40phgqa05a8qas4mcss0fjcdx3x96hq7jdm20 npub1qn4ylq6s79tz4gwkphq8q4sltwurs6s36xsq2u8aw3qd5ggwzuf, nostr:npub1jrr9dlerex7tg8njvc88c60asxnf5dp8hgcerh0q8w3gdyurl48q6s5nwv nostr:npub1harur8s4wmwzgrugwdmrd9gcv6zzfkzfmp36xu4tel0ces7j2uas3gcqdy and others, for your work. Enriching Nostr’s long-form content ecosystem is crucial.Nostriches Global Meet Ups

Recently, several Nostr events have been hosted in different countries. * Recently, YakiHonne collaborated with the University of Jos and Ipaybtc community to successfully host two Nostr Workshops, attracting over 50 enthusiastic participants. The events not only provided a comprehensive introduction to the Nostr ecosystem and Bitcoin payments but also offered hands-on experiences with decentralized technologies through the YakiHonne platform.

The Nostr & Poker Night* was held on April 30 at the Bitcoin Embassy in El Salvador.The event featured an engaging Nostr-themed presentation by nostr:npub1dmnzphvk097ahcpecwfeml08xw8sg2cj4vux55m5xalqtzz9t78q6k3kv6 followed by a relaxed and enjoyable poker night. Notably, 25% of the poker tournament prize was donated to support MyFirstBitcoin and its mission to provide Bitcoin education. * A free webinar on venture capital, Bitcoin, and cryptocurrencies was held online on May 6 at 12:00 PM (ARG time). Organized in collaboration with Draper Cygnus, the event introduced the fundamentals of venture capital, showcased the projects of ONG Bitcoin Argentina Academy, and provided attendees with the opportunity to interact with the guest speakers. * Bitcoin Unveiled: Demystifying Freedom Money was held on May 10, 2025, at Almara Hub. The event explored Bitcoin’s transformative potential, helping participants understand its purpose, learn how to get started, build a career in the Bitcoin space, and begin their Bitcoin savings journey. Featured speakers included nostr:npub1sn0q3zptdcm8qh8ktyhwtrnr9htwpykav8qnryhusr9mcr9ustxqe4tr2x Theophilus Isah, nostr:npub1s7xkezkzlfvya6ce6cuhzwswtxqm787pwddk2395pt9va4ulzjjszuz67p and Megasley.

Here is the upcoming Nostr event that you might want to check out. * The Bitcoin 2025 conference was held from May 26 to 29 at the Venetian Convention Center in Las Vegas, with the Nostr community hosting a series of vibrant activities. While the Nostr Lounge served as a central hub for socializing and technical exchange, featuring app demos, lightning talks, and limited-edition merchandise. Nostr also delivered two key presentations during the conference, focusing on multisig key management and the future of decentralized social media. * BTC Prague 2025 is the largest and most influential Bitcoin-only conference in Europe. It will take place from June 19 to 21, 2025, at PVA Expo Praha in Prague, Czech Republic. The event is expected to attract over 10,000 attendees from around the world, including entrepreneurs, developers, investors, and educators.

The conference will feature more than 200 speakers from various sectors of the global Bitcoin ecosystem, nostr:npub14gm6rq7rkw56cd08aa4k5tvjnepqnxm4xvc535wj0wyjxlgrfa8sqdgv87 nostr:npub1dg6es53r3hys9tk3n7aldgz4lx4ly8qu4zg468zwyl6smuhjjrvsnhsguz nostr:npub1ymgefd46k55yfwph8tdlxur573puastaqdmxff4vj20xj0uh3p2s06k8d5 nostr:npub1jt97tpsul3fp8hvf7zn0vzzysmu9umcrel4hpgflg4vnsytyxwuqt8la9y nostr:npub1dtgg8yk3h23ldlm6jsy79tz723p4sun9mz62tqwxqe7c363szkzqm8up6m nostr:npub1g53mukxnjkcmr94fhryzkqutdz2ukq4ks0gvy5af25rgmwsl4ngq43drvk nostr:npub16c0nh3dnadzqpm76uctf5hqhe2lny344zsmpm6feee9p5rdxaa9q586nvr

and more. In addition to the main program, several side events will be held, such as Developer Hack Days, Cypherpunk gatherings, and Women in Bitcoin initiatives.

Additionally, We warmly invite event organizers who have held recent activities to reach out to us so we can work together to promote the prosperity and development of the Nostr ecosystem.

Thanks for reading! If there’s anything I missed, feel free to reach out and help improve the completeness and accuracy of my coverage.

-

@ 502ab02a:a2860397

2025-05-13 01:07:59

@ 502ab02a:a2860397

2025-05-13 01:07:59มีคนเคยพูดเล่นว่า “ถ้าคุณอยากเปลี่ยนโลก ไม่ต้องปฏิวัติ แค่เปลี่ยนอาหารคนซะ" บรรดาเจ้าพ่อเทคโนโลยีชีวภาพก็เลยเริ่มจับมือกับกลุ่มทุนระดับโลก สร้าง “อาหารแห่งอนาคต” ที่แม้จะไม่งอกจากธรรมชาติ แต่งอกมาจากถังหมักในโรงงานได้แทน

หลังจากที่เราเริ่มมองเห็นแล้วว่า ช่องทางแทรกซึมเข้าสู่อาหารโลกอนาคตนั้น ตั้งอยู่บนพื้นฐาน "โปรตีน" ซึ่งถ้าใครตามซีรีส์นี้กันมาตลอด คงจำโพสเรื่อง "เรากินนมเพราะความกลัว?" กันได้ดีนะครับ ไวรัล และ ตีความหลุด theme กันกระจาย ซึ่งเป็นธรรมดาของ social media ที่มันจะโผล่ไปหาขาจรแค่ครั้งเดียว ดังนั้น ก้าวข้ามมันไปครับ

สิ่งที่ปูทางไว้แล้วก่อนจะแบไต๋ว่า เป้าหลักของโลกคือ โปรตีน นั่นคือ นมทางเลือก มาสู่การยึดพื้นที่นมโรงเรียน การเข้าตลาดของ Perfect Day โปรตีนนมที่อยู่ในทั้งนม ขนม ไอศกรีม แล้วทั้งหมดจะถูกปรับภาพล้างไพ่ใหม่ ในนามของ milk 2.0 ครับ เรามาต่อซีรีส์ของเราด้วยการทำความรู้จัก ผู้เล่น กันทีละตัวนะครับ หลังจากเราได้ เวย์นมตั้งบนชั้นบนเชลฟ์กันไปแล้ว

New Culture เป็นบริษัทสตาร์ทอัปจากซานลีอันโดร รัฐแคลิฟอร์เนีย ที่ก่อตั้งขึ้นในปี 2018 โดย Matt Gibson และ Inja Radman โดยมีเป้าหมายในการผลิตโปรตีนเคซีน (casein) ซึ่งเป็นโปรตีนหลักในนมวัว โดยไม่ใช้สัตว์ ผ่านกระบวนการ precision fermentation หรือการหมักด้วยจุลินทรีย์ที่ได้รับการดัดแปลงพันธุกรรม โดยการฝึกจุลินทรีย์ให้ผลิตโปรตีนเคซีนในห้องปฏิบัติการ เพื่อสร้างผลิตภัณฑ์ชีสที่ปราศจากสัตว์ ซึ่งโปรตีนนี้สามารถนำมาใช้ในการผลิตชีสที่มีคุณสมบัติใกล้เคียงกับชีสจากนมวัว แต่ยังคงคุณสมบัติของชีสแท้ๆ เช่น การยืดหยุ่น การละลาย และรสชาติที่คุ้นเคย เปลี่ยนนิยามของคำว่า “ชีส” ให้กลายเป็นโปรตีนเคซีนจากจุลินทรีย์ ไม่ใช่จากน้ำนมวัวอีกต่อไป

Matt Gibson ชายชาวนิวซีแลนด์ ผู้ก่อตั้ง New Culture ไม่ใช่นักวิทยาศาสตร์ แต่เป็นคนหัวธุรกิจที่มีปมบางอย่างกับการกินชีสแบบดั้งเดิม เขาร่วมมือกับ Dr. Inja Radman นักชีววิทยา แล้วตั้งเป้าผลิต “เคซีน” โปรตีนหลักในนมโดยไม่ใช้สัตว์เลยสักตัว

การที่เขาเลือกใช้ precision fermentation หรือการหมักจุลินทรีย์ที่ตัดต่อพันธุกรรม ให้ผลิตเคซีนออกมาจากถังหมัก ซึ่งไม่ใช่เทคโนโลยีใหม่ในโลกแล้ว (แม้บ้านเราหลายคนจะเพิ่งเคยได้ยิน และ ตกใจกันอยู่) บริษัทคู่แข่งอย่าง Perfect Day ก็ใช้แนวทางเดียวกัน ผลิต “เวย์โปรตีนไร้สัตว์” ไปก่อนแล้ว และตอนนี้ มหาเศรษฐีสายลงทุนยั่งยืนก็กำลังรุมแห่ใส่เงินสนับสนุนแขนงนี้เหมือนเห็นโอกาสใหม่ในโลก Fiat ทำให้ New Culture ปรับทิศไปที่ "ชีส"

ผลิตภัณฑ์หลักของ New Culture คือ มอสซาเรลล่าปราศจากสัตว์ ที่มีคุณสมบัติใกล้เคียงกับมอสซาเรลล่าจากนมวัว โดยสามารถละลายและยืดหยุ่นได้เหมือนชีสแท้ๆ และยังมีปริมาณโปรตีนเคซีนเพียง 50% ของชีสทั่วไป ซึ่ง "ช่วยลดต้นทุนการผลิตและผลกระทบต่อสิ่งแวดล้อม"

New Culture ได้รับการสนับสนุนทางการเงินจากนักลงทุนรายใหญ่ เช่น Kraft Heinz, ADM, CJ CheilJedang, และ Dr. Oetker โดยในปี 2021 บริษัทได้ระดมทุนรอบ Series A จำนวน 25 ล้านดอลลาร์สหรัฐ เพื่อขยายการผลิตและนำผลิตภัณฑ์ออกสู่ตลาด นอกจากนี้ New Culture ยังได้ร่วมมือกับ CJ CheilJedang บริษัทผู้ผลิตผลิตภัณฑ์จากการหมักที่ใหญ่ที่สุดในโลก เพื่อเข้าถึงโรงงานการหมักที่ทันสมัยและลดต้นทุนการผลิตโปรตีนเคซีน

และแน่นอนเลยครับว่า ผลิตภัณฑ์ของ New Culture ต้องมาพร้อมกับการโหมประกาศว่า ปราศจากแลคโตส คอเลสเตอรอล ฮอร์โมน และยาปฏิชีวนะที่พบในนมวัว นอกจากนี้ การผลิตโปรตีนเคซีนผ่านการหมักยังช่วยลดการปล่อยก๊าซเรือนกระจกและการใช้ทรัพยากรน้ำและที่ดินเมื่อเทียบกับการผลิตนมวัวแบบดั้งเดิม เพื่อรับความดีงามจากประชากรโลกไปตามระเบียบ

มาดูรอบการระดมทุนกันครับ ยอดเงินทุนรวมที่ได้รับ จนถึงเดือนมีนาคม 2025 New Culture ได้รับเงินทุนรวมประมาณ $35 ล้านดอลลาร์สหรัฐ จากการระดมทุนทั้งหมด 8 รอบ ที่น่าจับตามองคือ Series A ในเดือนพฤศจิกายน 2021 บริษัทได้รับเงินทุน $25 ล้านดอลลาร์สหรัฐ จากนักลงทุนรวมถึง ADM Ventures และ Evolv Ventures ซึ่งเป็นหน่วยงานร่วมลงทุนของ Kraft Heinz

นอกจาก Evolv Ventures จาก Kraft Heinz แล้ว อย่าคิดว่ามันไกลเกินนะครับ CJ CheilJedang บริษัทจากเกาหลีใต้ที่เป็นผู้นำด้านเทคโนโลยีการหมัก ได้เข้าร่วมลงทุนในรอบ Series A เมื่อเดือนพฤศจิกายน 2022 แล้วเจ้านี้นี่บอกได้เลยครับ บิ๊กเนม CJ CheilJedang เป็นผู้นำด้านเทคโนโลยีการหมักและมีส่วนแบ่งตลาด 25% ในตลาดพิซซ่าแช่แข็งของสหรัฐฯ เป้าหมายการเข้าร่วมลงทุนใน New Culture ก็เพื่อสนับสนุนการพัฒนาผลิตภัณฑ์และการขยายกำลังการผลิตของชีสปราศจากสัตว์ของบริษัท

New Culture ยังได้ร่วมมือกับเชฟชื่อดัง Nancy Silverton เพื่อเปิดตัวผลิตภัณฑ์ชีสในร้านอาหารระดับเชฟชื่อดังในสหรัฐฯ กลางปี 2025 โดยเริ่มที่ร้าน Pizzeria Mozza ในลอสแอนเจลิส ซึ่งถือเป็นการเปิดตัวผลิตภัณฑ์สู่ตลาดผู้บริโภคครั้งแรกของบริษัท

การเข้ามาลงทุนของ Evolv Ventures กองทุนร่วมลงทุนของ Kraft Heinz ทำให้เจ้าพ่อชีสโปรเซสในตำนาน มีโอกาสเข้ามาร่วมมือเปิดร้านอาหารนำร่องกับ New Culture

น่าสนใจไหม เงินทุนใหญ่ๆมาจากหน่วยลงทุนที่มีผลิตภัณฑ์เป็น พิซซ่า #pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ d360efec:14907b5f

2025-05-13 00:39:56

@ d360efec:14907b5f

2025-05-13 00:39:56🚀📉 #BTC วิเคราะห์ H2! พุ่งชน 105K แล้วเจอแรงขาย... จับตา FVG 100.5K เป็นจุดวัดใจ! 👀📊

จากากรวิเคราะห์ทางเทคนิคสำหรับ #Bitcoin ในกรอบเวลา H2:

สัปดาห์ที่แล้ว #BTC ได้เบรคและพุ่งขึ้นอย่างแข็งแกร่งค่ะ 📈⚡ แต่เมื่อวันจันทร์ที่ผ่านมา ราคาได้ขึ้นไปชนแนวต้านบริเวณ 105,000 ดอลลาร์ แล้วเจอแรงขายย่อตัวลงมาตลอดทั้งวันค่ะ 🧱📉

ตอนนี้ ระดับที่น่าจับตาอย่างยิ่งคือโซน H4 FVG (Fair Value Gap ในกราฟ 4 ชั่วโมง) ที่ 100,500 ดอลลาร์ ค่ะ 🎯 (FVG คือโซนที่ราคาวิ่งผ่านไปเร็วๆ และมักเป็นบริเวณที่ราคามีโอกาสกลับมาทดสอบ/เติมเต็ม)

👇 โซน FVG ที่ 100.5K นี้ ยังคงเป็น Area of Interest ที่น่าสนใจสำหรับมองหาจังหวะ Long เพื่อลุ้นการขึ้นในคลื่นลูกถัดไปค่ะ!

🤔💡 อย่างไรก็ตาม การตัดสินใจเข้า Long หรือเทรดที่บริเวณนี้ ขึ้นอยู่กับว่าราคา แสดงปฏิกิริยาอย่างไรเมื่อมาถึงโซน 100.5K นี้ เพื่อยืนยันสัญญาณสำหรับการเคลื่อนไหวที่จะขึ้นสูงกว่าเดิมค่ะ!

เฝ้าดู Price Action ที่ระดับนี้อย่างใกล้ชิดนะคะ! 📍

BTC #Bitcoin #Crypto #คริปโต #TechnicalAnalysis #Trading #FVG #FairValueGap #PriceAction #MarketAnalysis #ลงทุนคริปโต #วิเคราะห์กราฟ #TradeSetup #ข่าวคริปโต #ตลาดคริปโต

-

@ 68768a6c:0eaf07e9

2025-05-12 23:58:56

@ 68768a6c:0eaf07e9

2025-05-12 23:58:56What Is Bitcoin? Bitcoin is the world’s first decentralized digital currency—created in 2009 by an anonymous person (or group) under the name Satoshi Nakamoto. Unlike regular money, it’s not printed or controlled by any government or bank. Instead, it runs on a global network of computers using a technology called blockchain. Why Is Bitcoin Valuable? Bitcoin is often called “digital gold” because it’s limited in supply—only 21 million bitcoins will ever exist. This scarcity, combined with increasing demand and global adoption, makes it valuable. Many people invest in Bitcoin as a hedge against inflation or unstable currencies. How Can You Use Bitcoin? Today, Bitcoin can be used for: Online shopping (some stores accept it) Transferring money across borders Investing for long-term growth You can store it in a digital wallet and send it anywhere in the world in minutes—with low fees. The Risks and Rewards Bitcoin prices can go up or down quickly—it’s very volatile. But many investors believe it will grow in value as the world becomes more digital. Tip for Beginners: Never invest more than you can afford to lose. Start small, learn as you go, and stay updated. Final Thoughts Bitcoin is more than just internet money—it’s a revolution in how we think about value, privacy, and freedom. Whether you’re a curious beginner or a savvy investor, understanding Bitcoin could be your first step toward financial innovation.

-

@ 9c9d2765:16f8c2c2

2025-05-12 23:52:29

@ 9c9d2765:16f8c2c2

2025-05-12 23:52:29CHAPTER SEVENTEEN

"I don't get it... How is James still in charge?" Tracy murmured, her brows furrowed as she stared at her screen. She sat in her office, fingers nervously drumming against her desk.

Across from her, Mark stood with arms folded, pacing slowly. "You mean after all that evidence? After the blacklist, the embezzlement records nothing happened?"

Tracy shook her head. "Nothing. I checked again this morning. He’s still listed as President of JP Enterprises. It’s like the files we found didn’t even exist."

Helen, who had been silent until now, hissed through clenched teeth. "This is ridiculous. Are you sure the information got to the right hands?"

"It did," Tracy insisted. "I sent it directly to the Prime Minister's inbox using a confidential channel. I even received a delivery confirmation. Someone higher up must’ve swept it under the rug or maybe James covered his tracks faster than we imagined."

Mark slumped into the chair, clearly defeated. "He’s not just lucky he’s smart. Smarter than we gave him credit for."

For the first time since they began scheming, their confidence had begun to falter. They had dug into James’s past, unearthed the most damning of records, and yet… nothing. He remained untouched. Unshaken.

James continued to lead JP Enterprises with iron resolve, his status not just preserved, but strengthened. Whatever scandal they tried to ignite had fizzled out before it could burn.

The silence from JP's top board members was loud. No statements. No investigations. Not even a whisper of an internal review. To the outside world, James remained the unshakable President who had pulled a crumbling empire back from the edge.

Mark clenched his jaw. "He must have allies who are protecting him."

Helen nodded slowly. "We underestimated him. That was our biggest mistake."

Tracy remained quiet, her eyes still fixed on the screen as if trying to decipher what had gone wrong. She had risked everything, accessed confidential files, and violated protocols, expecting James to crumble.

Instead, he was thriving.

"Have you heard?" Robert leaned over his desk, eyes wide with interest. "JP Enterprises is about to celebrate their sixteenth anniversary. It’s going to be the biggest corporate event of the year."

Christopher looked up from the documents he was reviewing. "I heard. Mr. and Mrs. JP are returning for it. The entire business world is going to be there including us."

Robert nodded. "Every major company in and out of the city has received an invitation. It’s not just a celebration, it's a power show. A way for JP Enterprises to remind everyone who’s at the top."

Indeed, the buzz around the sixteenth anniversary of JP Enterprises was like nothing the city had seen in years. Massive banners were already being hoisted across the city skyline. High-end hotels were fully booked. Fashion designers, chefs, tech specialists, and media crews from around the world were preparing for the grand occasion. It was more than a business event, it was a spectacle.

At the heart of the preparations was James, the young and surprisingly unshakable President of JP Enterprises. Under his leadership, the company had grown in power and reach, and the anniversary was both a celebration of its legacy and a testament to its transformation.

Meanwhile, at Ray Enterprises, tension brewed behind the scenes. Though they were invited, the Ray family carried mixed feelings about attending the event. Memories of humiliation and disbelief still lingered the day James had revealed himself as the President was still fresh in their minds.

"We have no choice but to attend," Helen muttered in frustration during a board meeting. "If we stay away, we’ll seem petty and afraid. But going there means bowing our heads to him again."

Sarah, the secretary, tried to mask her discomfort. "It’s a corporate event, ma’am. It might be best to appear neutral… diplomatic."

Rita, now reinstated as General Manager, remained quiet but observant. She knew better than anyone how unpredictable James could be when it came to public appearances. She had no idea what to expect from him at the anniversary.

Back at JP Enterprises, preparations continued in full force. The guest list included billionaires, global CEOs, high-ranking politicians, and the most influential figures across industries. Red carpets would roll out, cameras would flash, and speeches would echo through the grand hall like music from an orchestra.

The city, already buzzing with excitement, awaited the grand event.

"I can’t believe it," the young woman muttered as she stared at her phone, her hands trembling with excitement. "James… the same James who used to sleep in front of Mr. Kola’s grocery store? He’s the President of JP Enterprises now?"

Her name was Evelyn. Sharp-tongued, impatient, and fueled by bitter memories, she had known James during his hardest days on the streets, days when survival meant fighting for leftovers and sleeping on cold sidewalks. To her, his rise wasn’t a success story to be admired. It was a jackpot she felt entitled to.

Storming into the JP Enterprises headquarters during working hours, Evelyn ignored the receptionist's polite inquiries and pushed her way toward the executive wing.

"I want to see James!" she shouted, causing heads to turn in the busy lobby. "I know he’s here. Tell him Evelyn from the street is here!"

Security was alerted immediately, but by then, Evelyn had already reached the waiting area outside the President’s office.

James, who was in a brief meeting with department heads, heard the commotion and stepped out with a composed expression. As soon as his eyes met Evelyn’s, something shifted. He recognized her instantly.

"Evelyn?" he said, frowning slightly. "What are you doing here?"

"Don’t act like you don’t know me, James," she snapped, crossing her arms. "You owe me. We suffered together. I was there when you were nothing. Now you’re swimming in wealth and you think you can forget the people who once mattered!"

James’s expression hardened.

"This is not the place for this kind of talk. You’re disrupting my company’s operations. If you need help, there are proper channels"

"To hell with proper channels!" she yelled. "I came to get what’s mine!"

That was enough. James turned to the nearby security officer. "Escort her out. And make sure she doesn’t return without a valid appointment."

The security guards moved quickly, but Evelyn didn’t go quietly. She shouted all the way to the exit, throwing insults, struggling, and drawing even more attention.

Among those who witnessed the scene was Tracy. At first, she thought it was just a random case of disturbance by some unruly visitor trying to make trouble. But as she watched James’s calm yet stern expression, and the woman’s emotional outburst, something clicked in her cunning mind.

This is gold, she thought, quickly pulling out her phone and snapping a series of pictures from the hallway James arguing with a ragged woman, the woman being dragged out, and James watching in silence. What a perfect way to ruin his reputation.

Tracy, ever the opportunist, reviewed the photos and smirked.

This is it… this will shake him up.

Without hesitation, she sent the pictures to Helen and Mark, attaching a voice note.

-

@ 58d88196:bec81862

2025-05-12 19:14:54

@ 58d88196:bec81862

2025-05-12 19:14:54Where We Are Now: AI is already a big part of our lives, even if we don’t always notice it. Think about the last time you used GPS to avoid traffic—that’s AI at work, quietly making your day easier. Companies like NVIDIA,are behind a lot of this magic. They make the tech that powers everything from self-driving cars to massive data centers. In factories, companies like Siemens are using something called "digital twins"—basically virtual copies of their machines—to keep things running smoothly. It’s like having a crystal ball that tells you when a machine might break down before it actually does. Even cities are getting in on the action—Singapore, for example, has a project called Virtual Singapore, which is like a digital version of the city to help with planning things like new roads or buildings. And for us regular folks? If you’ve got a smartwatch tracking your steps or heart rate, you’re already creating a tiny digital version of yourself without even realizing it.

What’s Coming in the near future:Fast forward five or ten years, and this idea of digital twins is going to be everywhere. Picture a factory that never stops because its digital twin catches problems before they happen—no more delays, no more wasted time. Cities will get smarter, too. Imagine a scorching summer day during a heatwave, and instead of a blackout, the city’s AI system automatically shifts energy to where it’s needed most, keeping your AC running. For you and me, digital twins could become a game-changer in healthcare. Your doctor might have a digital version of you—built from your DNA, lifestyle, and even the air quality in your neighborhood—that’s constantly updated. It could warn you about a health issue before you even feel sick, or help your doctor figure out the best treatment just for you. And it doesn’t stop there. You might even have a virtual version of yourself that can attend boring work meetings for you, acting and talking just like you do, while you’re off grabbing a coffee or playing with your kids.

The Big Picture—and the Big Worries: This AI-powered future sounds amazing, but it’s not all smooth sailing. One big concern is privacy. To make these digital twins, companies need a ton of data about us—what we do, where we go, even how our bodies work. That can feel a little creepy, right? What if someone hacks into a city’s digital twin and messes with its power grid or traffic lights? That’s a real risk we’ll need to tackle. Plus, there’s the worry that only the big players—rich companies or cities—will be able to afford this tech, leaving smaller places or communities behind. It’s something we’ll need to figure out so everyone can benefit from what AI has to offer.

-

@ 09d5c0a0:2ebbe260

2025-05-12 17:08:20

@ 09d5c0a0:2ebbe260

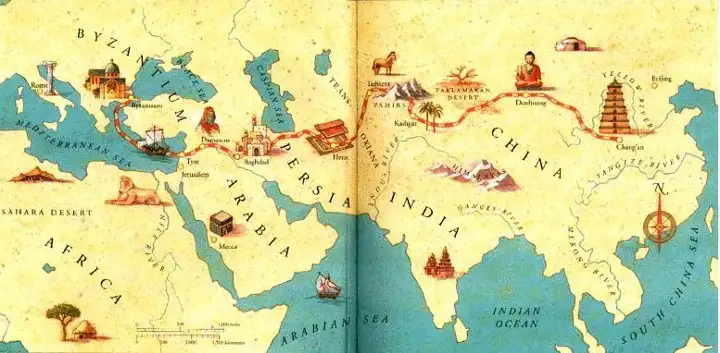

2025-05-12 17:08:20*For some people, Bitcoin is about saving for retirement. For others, it’s about eating tomorrow. __I first shared the idea of a “Bitcoin Privilege Curve” at the Plan B Forum 2025 in El Salvador. And it still guides how I see Bitcoin today—especially here in Uganda. __Bitcoin shows up differently depending on where you are in life. What it gives you depends on what you need most. __In Uganda, Bitcoin shows up as survival and uphill battle towards financial empowerment to the largely financially illiterate community. __Sometimes it’s food. Sometimes it’s school fees. Or even a skill. We receive Bitcoin donations that allow us to feed orphans, support teachers, and build small projects that teach these children how to farm, save, and think differently about money, __They’re learning how to live better. A child who knows how to grow food and save in sats is building wealth from the ground up. That’s what the lower end of the curve looks like: *Cheap transactions: Many of the people we work with don’t have bank accounts and the cost of accessing, setting up and maintaining a bank account is just unnecessary. Bitcoin lets them send and receive money within themselves almost at no fees, a better option than the exploitative fee structure by mobile money service providers and most banks. Cross-border remittances: We’ve seen Bitcoin move across borders in minutes with no forms, no gatekeepers. I can instantly and cheaply pay for a friend's grocery shopping in Kenya by sending Kenyan shillings into a Grocery Vendor's Mpesa straight from my Bitcoin wallet via Tando. Wealth multiplication: Even saving one sat creates a shift. It teaches patience. It grows over time. Bitcoin is a wealth multiplier for most underprivileged or privileged people, we taught Bitcoin and its principles to former students at Makerere University that have now entered the job market, from testimonials Bitcoin is helping them achieve their savings goals faster than their colleagues.

__Now go higher up the curve, and Bitcoin looks different. ****Wealth preservation: For someone with savings, Bitcoin protects that value over time, especially in regions with unstable currencies, the Argentina, Zimbabwe and Venezuala currency devaluation scandals always remind me that, you can do everything right and still end up losing all your hard earned value to mediocre goverment policies. Inflation hedge: Where governments keep printing money, Bitcoin holds its ground. It offers a stable alternative. The fallacy that inflation is a necessary evil no longer holds water, having a currency with a 21 Million coin hard cap enforceable by millions of Bitcoin network participants across the world guarantees no governement intervention. Censorship resistance: No one can freeze, reject or interfere with your Bitcoin and respective transactions. It's easy to assume because its a public ledger, you sacrifice privacy hence transaction integrity but this is far from the case, Bitcoin gives people freedom to transact without interference privately. Choice: Bitcoin doesn’t lock you into one system. You can move in and out of, save, or spend it however you see fit as long as your transactions obey the globally agreed upon, never changing network rules since 2009.

__So no, it’s not fair to compare someone struggling for a meal to someone saving for their retirement. But that’s the point. Bitcoin doesn’t need to be the same thing for everyone.

__With Gorilla Sats , our tourism project, we’re linking both ends of the curve. Bitcoiners from around the world visit our communities and spend their Bitcoin with local vendors. It’s not charity—it’s a circular economy. The people higher up the curve get meaningful experiences. Locals get income, exposure, and proof that their sats are valuable.

__In traditional finance, someone without a Visa machine can’t do business with someone carrying a card. The tourist who can't easily use mobile money and is hesistant because of exchange rates will spend comparably less but with Bitcoin, all you need is a phone even a basic button one because with now Machankura 8333, Bitcoin moves via USSD.

__Bitcoin offers privilege—but not the kind that excludes. It offers access, ownership, and freedom based on where you are in life. So no, it’s not fair to compare someone struggling for a meal with someone protecting their portfolio. But that’s the point.

__And if we build for everyone on the curve, we all move forward.

__If you’re building for Bitcoin adoption, think about the full curve. What’s it solving where you live? And who still needs a way in?

-

@ bbef5093:71228592

2025-05-13 04:18:45

@ bbef5093:71228592

2025-05-13 04:18:45Nukleáris politika – 2025. május 12. | Szerző: David Dalton

Lengyelország és Franciaország nukleáris szerződést ír alá, Macron új építési szerződéseket céloz

Lengyelország és Franciaország olyan szerződést kötött, amely együttműködést irányoz elő a polgári nukleáris energia szektorban, miközben Párizs reménykedik abban, hogy Varsótól jövedelmező új atomerőmű-építési szerződéseket nyer el.

A szerződés közös tevékenységeket tartalmaz, amelyek célja a nukleáris energia előnyeinek kihasználása az európai ipar dekarbonizációja érdekében.

A két ország együtt kíván működni a nukleáris fűtőanyag-ellátás biztonságának megerősítésében is.

Európa szeretné kizárni Oroszországot a nukleáris fűtőanyag-piacáról, de az Euratom Ellátási Ügynökség (ESA) legfrissebb éves jelentése szerint 2023-ban nőtt az Oroszországból származó természetes urán szállítása, mivel az uniós szolgáltatók készleteket halmoztak fel az orosz tervezésű VVER atomerőművekhez.

Az ESA, amely az európai nukleáris anyagok rendszeres és méltányos ellátásáért felelős, közölte, hogy az uniós szolgáltatók tovább diverzifikálják nukleáris fűtőanyag-beszerzéseiket, különösen a VVER reaktorokhoz, hogy csökkentsék a „egy forrásból származó vagy magas kockázatú” ellátásoktól való függést.

„Majdnem minden olyan ország, amely orosz tervezésű reaktorokat üzemeltet, halad az alternatív fűtőanyagok engedélyeztetésében, és ígéretes fejlemények várhatók a közeljövőben” – közölte az ESA.

Az EU-ban jelenleg 19 VVER reaktor működik, köztük négy 1000 MW-os Bulgáriában és Csehországban, valamint tizenöt 440 MW-os Csehországban, Finnországban, Magyarországon és Szlovákiában.

A jelentések szerint a francia–lengyel nukleáris szerződés különösen fontos a francia állami EDF energetikai vállalat számára, amely még mindig reménykedik abban, hogy részt vehet Lengyelország ambiciózus atomerőmű-építési programjában, annak ellenére, hogy az első új építésű projekt tenderét az amerikai Westinghouse nyerte el Pomeránia északi tartományában.

Franciaország ambiciózus reaktorépítési tervei

Franciaország maga is nagyszabású nukleáris fejlesztési terveket dédelget: a kormány nemrégiben felkérte az EDF-et, hogy gyorsítsa fel a hat új generációs EPR2 atomerőmű megépítésének előkészítését.

Az EDF kezdetben három EPR2 párost tervez: az elsőt Penlyben, majd egyet-egyet a Gravelines-i atomerőmű telephelyén (Calais közelében), illetve vagy Bugey-ben (Lyon keleti részén), vagy Tricastinban (Lyon és Avignon közelében).

A nukleáris szerződés aláírását megelőzte egy másik szerződés is, amely a két szövetséges közötti kapcsolatok elmélyítését, valamint kölcsönös biztonsági garanciákat is tartalmaz háború esetére.

Donald Tusk lengyel miniszterelnök, aki Emmanuel Macron francia elnökkel együtt írta alá a biztonsági dokumentumot, „áttörésnek” nevezte a szerződést, kiemelve, hogy csak Németországnak van hasonló biztonsági paktuma Franciaországgal, és ez Lengyelországot „egyenrangú partnerként” helyezi nyugati szövetségesei közé.

Macron eközben úgy fogalmazott, hogy a szerződés „új korszakot nyit” nemcsak Lengyelország és Franciaország, hanem egész Európa számára. „Bresttől Krakkóig Európa együtt áll ki” – mondta a francia elnök.

Nukleáris politika – 2025. május 12. | Szerző: David Dalton

Trump csapata a nukleáris erőművek építésének felgyorsítását tervezi

A Trump-adminisztráció tisztviselői végrehajtási rendeleteket készítenek elő, amelyek célja az atomerőművek jóváhagyásának és építésének felgyorsítása az Egyesült Államokban – számolt be róla a sajtó.

Az erőfeszítés, amelyet egy kormányzati tisztviselő és más, az egyeztetéseket ismerő személyek írtak le, még folyamatban van. Az elnök még nem hagyta jóvá a tervezetet – mondta az egyik forrás, aki névtelenséget kért, mivel hivatalos bejelentés még nem történt. Az amerikai Axios hírportál és a New York Times is beszámolt az egyeztetésekről.

Trump és kormányának tisztviselői többször hangsúlyozták a bőséges, olcsó villamos energia fontosságát az energiaigényes mesterséges intelligencia ipar számára, amely segítheti az Egyesült Államokat abban, hogy megnyerje a feltörekvő technológia globális versenyét.

„Meg kell nyernünk az MI-versenyt, és ebben vezetnünk kell – ehhez pedig sokkal több energiára lesz szükség” – mondta Chris Wright energiaügyi miniszter múlt hónapban egy kabinetülésen Trump társaságában.

Az elnök már hivatalosan is energia-vészhelyzetet hirdetett, nemzeti és gazdasági biztonsági szempontokra hivatkozva annak érdekében, hogy gyorsítsa az erőművek, csővezetékek és elektromos távvezetékek építését az országban.

A szóban forgó tervezetek célokat tűznének ki az atomerőművek gyors országos építésére, illetve az amerikai nukleáris ipar vezető szerepének visszaállítására.

Legalább az egyik intézkedés a Nukleáris Szabályozási Bizottságnál (NRC) vezetne be változtatásokat, amelyek gyorsíthatják az erőműtervek, köztük az új kis moduláris reaktorok (SMR-ek) engedélyezését.

Wright nemrégiben úgy nyilatkozott, hogy az új reaktorblokkok építésének legnagyobb akadálya az Egyesült Államokban a szabályozás volt.

Az elképzelés részeként akár katonai létesítményekre is telepíthetnek majd atomerőműveket, valószínűleg mikroreaktorok vagy SMR-ek formájában.

Jelenleg az Egyesült Államokban nincs kereskedelmi atomerőmű építés alatt. Az utolsó két üzembe helyezett blokk a georgiai Vogtle-3 és Vogtle-4 volt, 2023-ban és 2024-ben.

Előrehaladott tervek vannak a michigani Palisades atomerőmű újraindítására. Ha megvalósul, ez lenne az első olyan, korábban leállított amerikai atomerőmű, amely ismét működésbe lép.

Új építések – 2025. május 12. | Szerző: David Dalton

Vietnam és Oroszország tárgyalásokat kezd atomerőmű-építésről

Vietnam és Oroszország megállapodott abban, hogy tárgyalásokat folytatnak és szerződéseket írnak alá kereskedelmi atomerőművek építéséről Vietnamban – közölték a két ország egy közös nyilatkozatban.

„Az erőművek fejlesztése korszerű technológiával szigorúan megfelel majd a nukleáris és sugárbiztonsági előírásoknak, és a társadalmi-gazdasági fejlődést szolgálja” – áll a közleményben, amely a vietnami vezető, To Lam moszkvai látogatása után jelent meg.

Az orosz állami atomenergetikai vállalat, a Roszatom szerint a látogatás „az együttműködés új szakaszát” jelenti – egy nagy atomerőmű építését Délkelet-Ázsiában.

A Roszatom felajánlotta Vietnámnak a VVER-1200 nyomottvizes reaktor technológiáját, amelyből kettő már működik az oroszországi Novovoronyezs 2 atomerőműben, és kettő Fehéroroszországban.

A Roszatom közölte, hogy további tárgyalásokra van szükség a vietnami atomerőmű műszaki és pénzügyi feltételeinek tisztázásához, de hozzátette: „ezek a tárgyalások ma [május 10-én] megkezdődtek”.

A Roszatom arról is beszámolt, hogy Alekszej Lihacsov vezérigazgató és Nguyen Manh Hung vietnami tudományos és technológiai miniszter aláírt egy nukleáris energia ütemtervet.

Az ütemterv tartalmazza egy nukleáris tudományos és technológiai központ lehetséges megépítését, fűtőanyag-szállítást a dél-vietnami Dalat kutatóreaktorhoz, Vietnam részvételét Oroszország IV. generációs MBIR többcélú gyorsneutronos kutatóreaktor projektjében, valamint vietnami szakemberek képzését.

Vietnamnak jelenleg egy kutatóreaktora van Dalatban, és egy másik is tervben van. A Roszatom nem közölte, melyikre gondolt.

A múlt hónapban Vietnam elfogadta a nemzeti energiastratégia módosított változatát, amely 2030-ig 136 milliárd dollárt irányoz elő az energiaellátás hosszú távú biztonságának megerősítésére, és először szerepel benne az atomenergia.

Vietnam azt szeretné, ha első atomerőművei 2030 és 2035 között lépnének üzembe. A beépített nukleáris kapacitás várhatóan 4–6,4 GW lesz, ami körülbelül 4–6 nagy atomerőműnek felel meg.

A kormány szerint további 8 GW nukleáris kapacitás kerül majd a mixbe az évszázad közepéig.

Vietnam már 2009-ben is tervezett két atomerőművet, de a Nemzetgyűlés 2016-ban költségvetési okokból elutasította a javaslatot.

Új építések – 2025. május 12. | Szerző: David Dalton

Az NRC engedélyt adott az „energia-sziget” munkálatokra a TerraPower wyomingi atomerőművénél

Az Egyesült Államok Nukleáris Szabályozási Bizottsága (NRC) mentességet adott a TerraPower Natrium demonstrációs atomerőművének wyomingi Kemmererben, lehetővé téve a vállalat számára bizonyos „energia-sziget” tevékenységek folytatását, miközben a hatóságok tovább vizsgálják az építési engedély iránti kérelmet.

Az energia-sziget a tervezett Natrium atomerőműben a felesleges hő tárolására szolgál majd, hogy csúcsterhelés idején növelje az áramtermelést.

Az NRC szerint az energia-szigethez kapcsolódó bizonyos tevékenységek engedélyezése nem jelent indokolatlan kockázatot a közegészségre és biztonságra, és „különleges körülmények” állnak fenn.

A mentesség a létesítmények, rendszerek és komponensek korlátozott részére vonatkozik, lehetővé téve például cölöpverést, alapozást, vagy bizonyos szerkezetek, rendszerek és komponensek összeszerelését, gyártását, tesztelését korlátozott munkavégzési engedély nélkül.

Az NRC szerint a mentesség nem befolyásolja a reaktor építési engedélyéről szóló végső döntést. „Az NRC folytatja az építési engedély iránti kérelem vizsgálatát az egész projektre vonatkozóan” – áll a közleményben.

A Bill Gates által alapított TerraPower üdvözölte a döntést, hozzátéve, hogy a nukleáris reaktor és az energiatermelő létesítmények szétválasztása rövidebb építési időt és alacsonyabb anyagköltségeket tesz lehetővé.

Februárban az amerikai energiaügyi minisztérium befejezte a projekt előzetes tevékenységeire vonatkozó végső környezeti értékelést.

A TerraPower, amelyet Gates 2008-ban alapított, 2024 júniusában kezdte meg első kereskedelmi Natrium atomerőművének építését Kemmererben, ahol egy széntüzelésű erőmű zár be.

A Natrium demonstrációs projekt három különálló részből áll: egy nátrium teszt- és feltöltő létesítményből, az energiatermelő vagy energia-szigetből, valamint a nukleáris szigetből magával a reaktorral.

A kezdeti építkezés a teszt- és feltöltő létesítményre összpontosít, amely egy különálló, nem nukleáris épület, és a reaktor nátrium hűtőrendszerének tesztelésére szolgál. Itt történik a folyékony nátrium fogadása, mintavételezése, feldolgozása és tárolása, mielőtt a Natrium reaktorhoz kerülne.

Egyéb hírek

A lengyel atomerőmű-projekt biztosítási szerződéseket kötött

A lengyel Polskie Elektrownie Jądrowe (PEJ) atomerőmű-projekt vállalat négy biztosítási bróker céggel kötött keretmegállapodást. Az Aon Polska, GrECo Polska, Marsh és Smartt Re cégek támogatják a PEJ-t Lengyelország első kereskedelmi atomerőművének biztosítási szerződéseinek megkötésében, valamint a napi működéshez szükséges biztosítások beszerzésében. A PEJ minden brókerrel keretmegállapodást írt alá, amelyek alapján egyes biztosítási feladatokra kiválasztja a megfelelő brókert.

Az Aecon cég nyerte az ontariói SMR építési szerződését

A kanadai Aecon Kiewit Nuclear Partners nyerte el az Ontario Power Generation (OPG) által Darlingtonban építendő első kis moduláris reaktor (SMR) kivitelezési szerződését. A szerződés értéke 1,3 milliárd kanadai dollár (934 millió USD, 841 millió euró), amely projektmenedzsmentet, kivitelezési tervezést és végrehajtást foglal magában, a befejezést és a kereskedelmi üzemet 2030-ra tervezik. Ontario tartomány és az OPG múlt héten hagyta jóvá a négy SMR első darabjának 20,9 milliárd CAD értékű tervét Darlingtonban.

26 000 dolgozó a Hinkley Point C projekten a csúcskivitelezés idején

Az Egyesült Királyságban mintegy 26 000 dolgozó vesz részt a Hinkley Point C atomerőmű építésében, amely jelenleg csúcskivitelezési szakaszban van – derül ki az EDF Energy jelentéséből. Közvetlenül a projekten 18 000-en dolgoznak, ebből 12 000-en a helyszínen, további 3 000 fővel bővülhet a létszám a következő 12 hónapban. További 8 000-en a beszállítói láncban dolgoznak. A jelentés szerint a Hinkley Point C építése fontos katalizátor a gazdasági növekedésben, jelenleg 13,3 milliárd fonttal (15,7 milliárd euró, 17,5 milliárd dollár) járul hozzá a gazdasághoz. Ebből 5 milliárd fontot már a délnyugati régió beszállítóinál költöttek el – jóval meghaladva az 1,5 milliárd fontos célt. A Hinkley Point C két francia EPR reaktort kap.

Az Ansaldo Nucleare nukleáris mesterszakot indít Olaszországban

Az olasz Ansaldo Nucleare és a Politecnico di Milano vállalati mesterszakot indít, amely a nukleáris energia és kapcsolódó technológiák új szakértő generációját képzi. A képzés októberben indul, egy évig tart, 1500 órás, mérnöki, fizikai és kémiai diplomásoknak szól. Húsz résztvevőt választanak ki a következő hónapokban, akiket az Ansaldo Nucleare azonnal, határozatlan időre alkalmaz, és október elején kezdik meg a képzést.

-

@ a3c6f928:d45494fb

2025-05-12 15:30:48

@ a3c6f928:d45494fb

2025-05-12 15:30:48Financial freedom is a powerful concept—one that goes beyond simply having money in the bank. It is the ability to live the life you desire, free from the constraints of financial worry. Achieving financial freedom requires planning, discipline, and a clear understanding of your financial goals.

What Is Financial Freedom?

Financial freedom means having enough income, savings, and investments to support the lifestyle you want for yourself and your family. It is about being in control of your finances, instead of your finances controlling you. When you are financially free, you have choices—you can travel, start a business, or retire comfortably without constant stress about money.

Steps to Achieving Financial Freedom

-

Set Clear Financial Goals: Understand what financial freedom means to you and set measurable goals to achieve it.

-

Create a Budget and Stick to It: Track your income and expenses to identify areas where you can save more.

-

Invest Wisely: Grow your wealth by investing in assets like stocks, real estate, or mutual funds.

-

Build an Emergency Fund: Save at least 3-6 months’ worth of living expenses to protect against unexpected events.

-

Eliminate Debt: High-interest debt can be a major barrier to financial freedom. Prioritize paying it off.

Why Financial Freedom Matters

Financial freedom gives you the power to make decisions without being bound by financial constraints. It allows for greater life flexibility, reduces stress, and opens up opportunities that would otherwise be unreachable. Most importantly, it provides peace of mind and the ability to focus on what truly matters.

Start Your Journey Today

The path to financial freedom is not a quick fix—it is a lifelong commitment to smart financial choices. But with perseverance and planning, it is achievable. Begin today, and take control of your financial future.

“Financial freedom is available to those who learn about it and work for it.” — Robert Kiyosaki

Plan wisely. Invest smartly. Live freely.

-

-

@ 5383d895:7b141166

2025-05-12 13:02:58

@ 5383d895:7b141166

2025-05-12 13:02:58LOVE678 là một nền tảng giải trí trực tuyến hiện đại, được thiết kế để mang đến cho người dùng những trải nghiệm thú vị, an toàn và dễ dàng tiếp cận. Giao diện của nền tảng này rất thân thiện với người dùng, giúp mọi người có thể dễ dàng tìm kiếm các dịch vụ mà mình cần một cách nhanh chóng và thuận tiện. Từ việc truy cập vào các tính năng giải trí cho đến việc quản lý tài khoản, mọi thao tác trên LOVE678 đều được tối ưu hóa để đảm bảo người dùng không gặp phải bất kỳ sự phức tạp nào. Bên cạnh đó, LOVE678 cũng cung cấp tốc độ truy cập nhanh chóng, ổn định trên nhiều thiết bị, từ máy tính để bàn đến điện thoại di động, giúp người dùng có thể tận hưởng dịch vụ mọi lúc, mọi nơi mà không gặp phải sự gián đoạn. Nền tảng này đặc biệt chú trọng đến bảo mật thông tin, với các công nghệ mã hóa tiên tiến giúp bảo vệ dữ liệu người dùng một cách tối ưu. Chính nhờ vào những tính năng vượt trội này, LOVE678 đã và đang trở thành lựa chọn ưu tiên của nhiều người dùng hiện đại.

Không chỉ chú trọng đến sự tiện lợi và bảo mật, LOVE678 còn đặc biệt quan tâm đến việc nâng cao trải nghiệm người dùng thông qua việc cung cấp dịch vụ khách hàng chất lượng cao. Đội ngũ hỗ trợ khách hàng của LOVE678 luôn túc trực 24/7, sẵn sàng giải đáp mọi thắc mắc và xử lý các vấn đề mà người dùng gặp phải trong suốt quá trình sử dụng nền tảng. Người dùng có thể dễ dàng liên hệ với đội ngũ hỗ trợ qua các kênh chat trực tuyến, email hay điện thoại để được giúp đỡ kịp thời. Điều này không chỉ giúp người dùng cảm thấy yên tâm mà còn tạo ra một mối liên kết bền chặt giữa LOVE678 và cộng đồng người sử dụng. Bên cạnh đó, LOVE678 cũng thường xuyên tổ chức các chương trình khuyến mãi, sự kiện và hoạt động giao lưu cộng đồng, tạo cơ hội để người dùng trải nghiệm thêm nhiều dịch vụ hấp dẫn và thú vị. Từ đó, nền tảng này không chỉ là một công cụ giải trí mà còn là một không gian kết nối, giúp người dùng giao lưu, học hỏi và chia sẻ những giá trị hữu ích.

Để đáp ứng nhu cầu ngày càng cao của người dùng, LOVE678 luôn cải tiến và phát triển các tính năng mới, đồng thời không ngừng nâng cấp hệ thống để duy trì sự ổn định và hiệu suất hoạt động. Nền tảng này luôn đặt mục tiêu tạo ra một môi trường trực tuyến an toàn, thú vị và chất lượng, nhằm mang đến những trải nghiệm giải trí tuyệt vời nhất cho người sử dụng. Các tính năng của LOVE678 được thiết kế không chỉ để đáp ứng nhu cầu giải trí mà còn nhằm cung cấp những công cụ tiện ích, giúp người dùng có thể dễ dàng quản lý tài khoản và tối ưu hóa quá trình sử dụng. Với sự cam kết không ngừng phát triển và nâng cao chất lượng dịch vụ, LOVE678 đang từng bước khẳng định vị thế của mình trong ngành giải trí trực tuyến, đồng thời tiếp tục xây dựng niềm tin vững chắc trong lòng người dùng. Nền tảng này không chỉ là nơi để thư giãn, mà còn là nơi để kết nối và phát triển, giúp mọi người trải nghiệm những phút giây giải trí đích thực trong một không gian trực tuyến an toàn và tiện lợi.

-

@ 9c9d2765:16f8c2c2

2025-05-12 05:15:47

@ 9c9d2765:16f8c2c2

2025-05-12 05:15:47CHAPTER SIXTEEN

Mr. JP sat up abruptly as his phone buzzed. It was an anonymous message. He opened it slowly, his eyes scanning the contents with growing disbelief.

"James has returned to JP Enterprises. Charles reinstated him. He’s now President of your company."

His blood ran cold.

Mrs. JP saw the tension in his expression. "What’s wrong?"

"He’s back," Mr. JP said grimly. "Our son. James. He's taken over the company."

He stared into space, his mind reeling. "And Charles helped him..."

They had spent years trying to distance themselves from the disgrace of James’s past only to now be faced with the reality that he had clawed his way back into the empire they built.

The anonymous message was, of course, sent by Mark and Helen, each relishing in the chaos they had ignited. With the scandalous file now in their hands and James’s own family unknowingly brought into the picture, they believed the final blow was in place.

Mark leaned back in his chair and smiled as he read the forwarded documents.

"Let’s see how your so-called empire stands after this, James," he said quietly.

Helen, standing beside him, added coldly, "This time, he won’t survive it."

"How could he do this?" Mr. JP muttered under his breath, clutching his phone tightly. "How could Charles go behind my back and reinstall him? My own brother..."

The news that James had returned to JP Enterprises and not just as a member, but as its President had shaken him to the core. But what stung more was the betrayal he felt from Charles, who had once promised never to interfere in the matter again.

Fuming with rage and disbelief, Mr. JP boarded the next flight back home. Upon arrival, he didn’t even stop by the family estate. Instead, he went straight to the Regency Grand, the city’s most luxurious hotel, the same place he used to spend time with his family during better days. He booked the presidential suite and immediately dialed Charles' number.

"Meet me. Now. At the hotel," he barked before ending the call without waiting for a response.

Within the hour, Charles walked in, calm but aware of the storm brewing.

"You defied me, Charles," Mr. JP said, his voice icy. "You brought back the one person I had removed. The one person I swore would never set foot in the company again."

"Because you were wrong," Charles replied firmly. "You made a decision based on lies."

Mr. JP’s glare deepened.

"Lies? The records were clear embezzlement. Theft. He disgraced this family, Charles!"

Charles stood his ground. "Those records were manipulated. You never gave James a chance to explain himself."

He stepped closer. "The funds he was accused of stealing? He used them to invest in a struggling tech start-up that exploded in value two years later. That investment saved JP Enterprises during the economic downturn. The company is standing today because of James’s vision and sacrifice."

Silence filled the room.

Mr. JP felt his heart sink as the weight of Charles’s words settled in. He turned away, walking slowly to the window, staring out at the city skyline.

"All this time... I condemned my own son... exiled him... because I trusted false reports?"

Charles nodded. "Yes. And despite it all, he returned not for revenge, but to help us."

Tears welled up in Mr. JP’s eyes. His pride, once like stone, was now crumbling.

Without hesitation, he picked up his phone and dialed James’s number. The phone rang twice before James answered.

"Hello?" came the familiar voice, calm and distant.

"James... it’s your father." His voice trembled. "I... I’m sorry. I was wrong. Gravely wrong. Everything I believed about you was a lie. I let you down, son."

There was silence on the other end.

"I just found out the truth," Mr. JP continued. "And I’m proud of what you’ve done for the company, for our name. I want you to know... you are reinstated as the rightful heir to JP Enterprises. I want you back not just as President, but as my son."

James took a long pause before answering.

"It took you long enough," he said softly. "But... thank you."

Though James had once sworn not to seek his parents' approval, deep down, those words still mattered. And hearing them from the father who had disowned him brought a quiet sense of closure.

The rift that had torn them apart for years was beginning to heal.

"Dad, who told you I was the President of JP Enterprises?" James asked, his tone calm but firm as he stood before his father in the grand office of the family estate.

Mr. JP, still adjusting to the emotional weight of his recent apology, furrowed his brow. "It was anonymous, son. I received a message with no name, no clue. Just the information."

James narrowed his eyes. "Can you forward the message to me?"

"Of course," his father replied, pulling out his phone. Within seconds, the message was in James’s inbox.

Later that evening, James sat in his private office, staring at the message on his screen. Something about it felt off too calculated, too timely. He forwarded it to his personal cybersecurity team with one instruction: “Trace the source. I want to know everything about who sent it, how, and if they’re working with someone.”

Meanwhile, Ray Enterprises was thriving again under James’s investment. With the influx of capital and revitalized operations, profits were skyrocketing. However, while the company’s success looked promising on the surface, the Ray family was barely reaping the rewards.

James’s 85% share ensured he collected the lion’s portion of every deal. Robert, despite being the figurehead chairman, found himself managing a flourishing empire but receiving only crumbs in return.

Frustrated and desperate, Robert scheduled a private meeting with James.

"James, please... eighty-five percent is bleeding us dry. We’re grateful for what you’ve done truly but surely we can renegotiate?"

James leaned back in his chair, expression unreadable. "You signed the agreement, Robert. You knew the terms. And frankly, I'm not in the mood to revisit old conversations."

"We just want fairness," Robert pleaded. "A little breathing space"

"If this discussion continues," James interrupted coldly, "I’ll pull out my funds. And when I do, I promise Ray Enterprises will go down faster than it rose. Do I make myself clear?"

Robert’s face fell. He had no choice but to nod and walk away, defeated.

Two weeks later, James’s cybersecurity team sent their report. The source of the anonymous message had been traced and the result was both surprising and telling.

Tracy.

James sat silently as he read the details. Tracy, his own subordinate, had accessed restricted files from the company’s internal network. It wasn’t just a case of whistleblowing it was deliberate sabotage. But what intrigued him more was the fact that she had gone to great lengths to cover her tracks.

No one takes that risk alone, he thought.

Despite having the evidence in hand, James chose silence. Not out of mercy but strategy. He needed to know who she was working with. Who else had a vested interest in his downfall?

-

@ d7955b22:025a3ba9

2025-05-12 04:31:36

@ d7955b22:025a3ba9

2025-05-12 04:31:36O mundo dos jogos online tem se expandido rapidamente, oferecendo uma infinidade de opções para os jogadores. Entre as diversas plataformas disponíveis, o 99bra se destaca por sua variedade de opções e a experiência de usuário única que proporciona. Este artigo oferece uma visão detalhada sobre o que o 99bra tem a oferecer, desde suas características gerais até a experiência de jogo que promete satisfazer todos os tipos de jogadores.

Introdução à Plataforma 99bra 99bra é uma plataforma de entretenimento digital voltada para os entusiastas de jogos online. Com um design intuitivo e uma interface amigável, a plataforma foi criada para oferecer uma experiência de navegação fluida, seja em desktop ou dispositivos móveis. A plataforma se destaca pela sua confiabilidade e pela qualidade dos jogos oferecidos, sempre priorizando a segurança e a proteção dos dados de seus usuários.

Ao se cadastrar no 99bra, os jogadores têm acesso a uma ampla gama de opções de jogos, desde clássicos até lançamentos inovadores. O site se adapta às necessidades dos usuários, com suporte em português e atendimento ao cliente de excelência, tornando a plataforma acessível a jogadores de todas as idades e níveis de experiência. O processo de inscrição é rápido e simples, permitindo que os novos usuários comecem a se divertir em poucos minutos.

A Variedade de Jogos no 99bra O que realmente chama a atenção no 99bra é a diversidade de jogos oferecidos. A plataforma conta com uma vasta seleção de títulos, abrangendo uma ampla gama de gêneros. Seja você um fã de jogos de mesa, slots ou apostas esportivas, o 99bra tem algo para todos. Cada categoria de jogo é desenvolvida para garantir jogabilidade envolvente, gráficos impressionantes e uma experiência imersiva.

Jogos de Mesa Os jogos de mesa são um dos maiores atrativos da plataforma, com várias opções que incluem clássicos como blackjack, roleta e baccarat. Estes jogos oferecem uma experiência realista e dinâmica, com a possibilidade de interagir com outros jogadores. A interface é cuidadosamente projetada para garantir que cada clique e movimento se sinta natural, criando uma atmosfera que lembra a de um ambiente de jogo físico.

Slots e Máquinas de Vídeo Para os amantes das máquinas de vídeo, o 99bra oferece uma impressionante coleção de slots. Os jogadores podem explorar uma variedade de temas, desde aventuras épicas até histórias de fantasia, com gráficos vibrantes e animações cativantes. As funções de bônus, rodadas grátis e jackpots progressivos tornam os jogos ainda mais emocionantes, com a possibilidade de grandes vitórias a cada giro.

Apostas Esportivas Outro ponto forte da plataforma são as apostas esportivas. O 99bra oferece uma extensa seleção de esportes para os fãs de esportes ao vivo. Seja futebol, basquete, tênis ou eSports, a plataforma proporciona odds competitivas e a chance de apostar em eventos de todo o mundo, com atualizações em tempo real para garantir que o jogador esteja sempre informado.

A Experiência do Jogador A experiência do jogador é o aspecto que diferencia o 99bra de outras plataformas. Desde o momento do cadastro até as interações durante os jogos, a plataforma é projetada para oferecer facilidade, conforto e diversão sem interrupções. O 99bra é otimizado para fornecer uma navegação rápida e sem erros, com um layout que garante que o jogador possa acessar todos os jogos e funcionalidades de forma simples.

Além disso, a plataforma oferece recursos adicionais para tornar a experiência ainda mais envolvente. Os jogadores podem configurar preferências de jogo, participar de promoções exclusivas e interagir com outros jogadores, criando uma verdadeira comunidade. A segurança também é uma prioridade, com criptografia de dados avançada e processos de verificação para garantir que todas as transações e informações pessoais estejam protegidas.

Suporte ao Cliente O suporte ao cliente do 99bra é excepcional. A plataforma oferece múltiplos canais de atendimento, incluindo chat ao vivo, e-mail e telefone, para que os jogadores possam obter assistência rápida sempre que necessário. A equipe de suporte é altamente treinada e pronta para resolver qualquer dúvida ou problema de forma eficiente, garantindo que a experiência do jogador nunca seja comprometida.

Conclusão O 99bra é uma plataforma completa que atende aos mais altos padrões de qualidade e segurança no universo dos jogos online. Com uma vasta seleção de jogos, suporte ao cliente de excelência e uma experiência de usuário impecável, o 99bra se consolida como uma das opções mais atrativas para quem busca diversão e entretenimento. Se você está procurando uma plataforma que combine inovação, variedade e uma jogabilidade envolvente, o 99bra certamente é uma excelente escolha.

-

@ d7955b22:025a3ba9

2025-05-12 04:31:00

@ d7955b22:025a3ba9

2025-05-12 04:31:00A plataforma 53a é uma das mais novas e emocionantes opções para quem busca uma experiência completa de entretenimento digital. Com uma ampla gama de jogos e funcionalidades voltadas para o prazer e a diversão dos jogadores, a 53a se destaca por sua interface intuitiva, seu foco na segurança e uma vasta gama de opções para todos os gostos. Se você ainda não conhece essa plataforma inovadora, continue lendo e descubra tudo o que ela tem a oferecer!

Introdução à Plataforma 53a A 53a é uma plataforma de entretenimento online que se destaca pelo seu compromisso em oferecer uma experiência única aos jogadores. Com um design moderno e acessível, a plataforma foi criada para atender a um público que busca algo mais do que simples joguinhos – ela oferece uma verdadeira imersão em um universo de possibilidades.

Ao acessar a 53a , os usuários são rapidamente apresentados a um painel de controle simplificado, onde podem facilmente navegar por diferentes categorias de jogos, conferir promoções e acessar uma série de recursos exclusivos. Além disso, a plataforma está disponível em diversos dispositivos, incluindo desktop, smartphones e tablets, permitindo que o jogador tenha acesso à diversão em qualquer lugar e a qualquer momento.

Jogos Empolgantes para Todos os Gostos A 53a não se limita a um único tipo de jogo. Em vez disso, oferece uma vasta gama de opções, com títulos que atendem a diferentes preferências e estilos de jogo. Desde jogos de habilidade, como jogos de mesa e jogos de cartas, até opções mais interativas e imersivas, como máquinas de diversão, a plataforma tem algo para todos os jogadores.

Jogos de Mesa e Cartas: Para os que apreciam uma experiência mais estratégica, a 53a oferece uma seleção diversificada de jogos de mesa, incluindo opções clássicas como o blackjack, pôquer e roleta. Cada jogo é projetado para proporcionar uma experiência desafiadora e envolvente, com gráficos impressionantes e uma jogabilidade fluida.

Máquinas de Diversão: Para quem busca uma experiência mais dinâmica e de fácil acesso, as máquinas de diversão são a escolha perfeita. Com uma vasta gama de temas e estilos, essas máquinas são ideais para momentos de descontração, com rodadas rápidas e prêmios atrativos. Cada jogo tem sua própria atmosfera única, com sons e animações que mantêm o jogador imerso por horas.

Jogos ao Vivo: Uma das grandes atrações da 53a são os jogos ao vivo, onde os jogadores podem interagir em tempo real com dealers e outros participantes. Esses jogos trazem a emoção de uma experiência presencial, mas com a conveniência de estar em casa ou onde preferir.

A Experiência do Jogador na 53a A experiência do jogador na plataforma 53a é pensada para ser fluida, segura e divertida. Com uma interface simples, os jogadores podem facilmente acessar seus jogos favoritos e navegar por outras funcionalidades da plataforma.

Interface Intuitiva: Desde o momento em que você entra na 53a, perceberá como a plataforma foi projetada com o usuário em mente. O layout claro e as opções bem definidas tornam a navegação fácil, mesmo para aqueles que não são tão familiarizados com plataformas digitais.

Segurança e Privacidade: A plataforma 53a adota as melhores práticas de segurança para garantir que todas as informações dos jogadores sejam protegidas. Desde transações financeiras até dados pessoais, a 53a utiliza tecnologias avançadas de criptografia para garantir que seus dados estejam sempre seguros.