-

@ 83279ad2:bd49240d

2025-05-14 03:58:40

@ 83279ad2:bd49240d

2025-05-14 03:58:40test nostr:nevent1qvzqqqqqqypzpqe8ntfgamz8sh3p88w99x5k2r7mksjrvm2xghju9qj00j75jfqdqyxhwumn8ghj77tpvf6jumt9qyghwumn8ghj7u3wddhk56tjvyhxjmcpr3mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmqpzemhxue69uhhyetvv9ujumn0wvh8xmmrd9skcqg5waehxw309aex2mrp0yhxgctdw4eju6t0qy28wumn8ghj7mn0wd68ytn00p68ytnyv4mqzrmhwden5te0dehhxarj9ekk7mgpp4mhxue69uhkummn9ekx7mqqyqknwtnxd4422ya9nh0qrcwfy6q3hhruyqaukvh2fpcu94es3tvu20tf7nt nostr:nevent1qvzqqqqqqypzpqe8ntfgamz8sh3p88w99x5k2r7mksjrvm2xghju9qj00j75jfqdqyxhwumn8ghj77tpvf6jumt9qyghwumn8ghj7u3wddhk56tjvyhxjmcpr3mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmqpzemhxue69uhhyetvv9ujumn0wvh8xmmrd9skcqg5waehxw309aex2mrp0yhxgctdw4eju6t0qy28wumn8ghj7mn0wd68ytn00p68ytnyv4mqzrmhwden5te0dehhxarj9ekk7mgpp4mhxue69uhkummn9ekx7mqqyqknwtnxd4422ya9nh0qrcwfy6q3hhruyqaukvh2fpcu94es3tvu20tf7nt

-

@ af92154b:b59d671f

2025-05-14 03:19:09

@ af92154b:b59d671f

2025-05-14 03:19:09Since World War II, America has doubled down on the Car and the Jetplane as the primary mode of short- and long-range transportation respectively. The construction of the interstate highway system in the 1950's was ostensibly for civil and economic purposes, however the military applications of being able to move large numbers of soldiers and war material across the vast distance of the US mainland were not lost on the planners of the system. The development of civilian air travel industry followed a similar rationale, to promote a viable industrial base of aerospace manufacturers who could be easily re-tasked for war should the need arise.

Now in the 21st century we frequently forget these facts and provide convenient ex-post-facto justifications for why we drive and fly everywhere. "It's just more convenient... It must be that the market naturally arrived at this solution!"

Not quite. As a vast array of literature from academics like the late Donald Shoup has shown in works like The High Cost of Free Parking, American cities and suburbs were designed (in many cases, top-down, by fiat) around cars. And in turn, most Americans have designed their lives around cars, in such a way that they couldn't imagine living without their own personal 2-ton transportation machine in their garage.

But here I wanted to ask: What form of transportation actually aligns with the core values expressed in Bitcoin? What is most anonymous, permission-less, and decentralized form of mobility technology?

Breakdown of Mobility Modes

Here I will argue, perhaps counter-intuitively, that it's not the car. The following table is an entirely subjective, but I believe nonetheless reasonable, breakdown of 7 of the most commonly used modes of mobility in the developed world across three core values that I believe are expressed in Bitcoin culture:

| Mode | Range | Scheduled? | Anonymous? | Permission Level | | --- | --- | --- | --- | --- | | Walking | ~1 mi | No ✅| Yes ✅| None ✅| | Cycling | ~5 mi | No ✅| Yes ✅| None ✅| | E-Mobility | ~15 mi | No ✅| Yes ✅| None ✅| | Local Transit | ~25 mi | Maybe 🚧| Yes ✅| Low 🚧| | Driving | ~300 mi | No ✅| No 🛑| High 🛑| | Intercity Rail | ~1000 mi | Yes 🛑| Yes ✅| Low 🚧| | Passenger Jet | ~8000 mi | Yes 🛑| No 🛑| High 🛑|

My explanations for each category are below:

Scheduling: Go Anytime

To many, this is a core component of what they think of as "freedom" in mobility. This is the attraction to many of the car: go anytime.

However, it's important to note that this attribute is shared with walking, biking, and e-mobility. And, it should be mentioned, better public transit systems that have low headways (i.e. time between trains and buses) approach "go anytime" methods of travel. If you're only waiting ~5-10 minutes for the next bus or train, this becomes functionally equivalent to the "go anytime" convenience of cars, especially if one factors in traffic, parking, & etc.

Longer-distance travel, planes and trains, will obviously require some aspect of scheduling in advance.

Anonymity

What forms of transportation allow you to travel anonymously? Well, we can clearly strike cars and planes off that list. Car travel requires both you and your vehicle to be registered with the state. You literally carry a visible ID (license plate) with you every time you leave the house. Can you imagine having to strap a number to your back every time you walk out of the house? And things only get more stringent when stepping on a plane, especially with the implementation of RealID nationwide.

In contrast, police overreach notwithstanding, nobody is asking for your ID for simply walking on the sidewalk, biking or e-mobility. Neither do bikes or e-scooter devices generally need to be registered (although it's a good idea to use private registries for your bike in case it gets stolen).

Even intra- and inter-city rail systems generally allow for payments in cash, thus allowing for anonymous travel using these means. They certainly aren't checking ID's by default.

So we see that on anonymity, any means of transport other than cars or planes are superior.

Permissioned vs Permissionless Movement

Here again, Cars and Planes are clearly inferior to all other forms described. As we're all told in high school Driver's Ed, "driving is a privilege, not a right." The nature of car and plane travel is inherently subsidized, regulated, monitored, and most importantly permissioned by the State.

It's almost sad from a libertarian perspective to see how much "faux-individuality" is expressed by American car culture. We deck out our cars with custom decals, detail the interiors, and see them as some expression of our individuality and personal freedom. Meanwhile, practically every aspect of car travel, from the size and shape of the vehicles, the size and markings of roads, the guarantee (or at least reasonable expectation) that there will be available parking at both points of your journey... it's all a product of decades of subsidies, regulation, and Technocracy.

But I digress. No permission is needed to walk or ride a bike. And, assuming you pay your fare and are not violating the code of conduct, your permission to use public transit is assumed by default, rather than you needing to prove it, as is the case for both driving and flying.

Conclusion

Here I'm attempting to take stock of values that are important to many bitcoiners, as I perceive them (us?) as a group: Freedom, anonymity, and permissionless action. I've argued here that, applying these values to the mobility space, bitcoiners should focus on a combination of walking, biking, e-mobility, public transit, and trains over cars and air travel, as the former methods maximize these values over the latter.

I expect (if anyone's even reading this) there to be some cultural shock; the "modal" bitcoiner as I perceive them, much like the average libertarian, skews to the Right culturally (if not politically). And that might mean you're thinking "you'll pry my cold dead fingers off my F-150's steering wheel!" Or, maybe you're making (entirely reasonable) complaints: "But (bus system in my area) is non-existent or underfunded! But (street network in my area) doesn't even have sidewalks!"

All I'm saying is: convenience comes with a cost. You know what's convenient? The fiat system. Paying with your credit card. Driving everywhere. Freedom, like Bitcoin (heck like Nostr) is, at least for now, inconvenient. It takes effort to unlearn what you've learned, as Yoda put it. But the reward is a more free life.

-

@ 9223d2fa:b57e3de7

2025-05-13 23:12:18

@ 9223d2fa:b57e3de7

2025-05-13 23:12:1811,375 steps

-

@ ee6ea13a:959b6e74

2025-05-13 21:29:02

@ ee6ea13a:959b6e74

2025-05-13 21:29:02Reposted without permission from Business Insider.

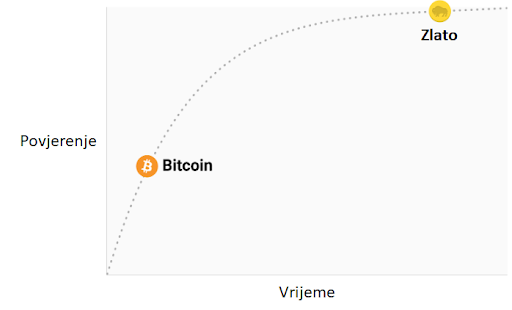

Bitcoin Is A Joke

Joe Weisenthal Nov 6, 2013, 10:42 PM UTC

REUTERS/Eliana Aponte

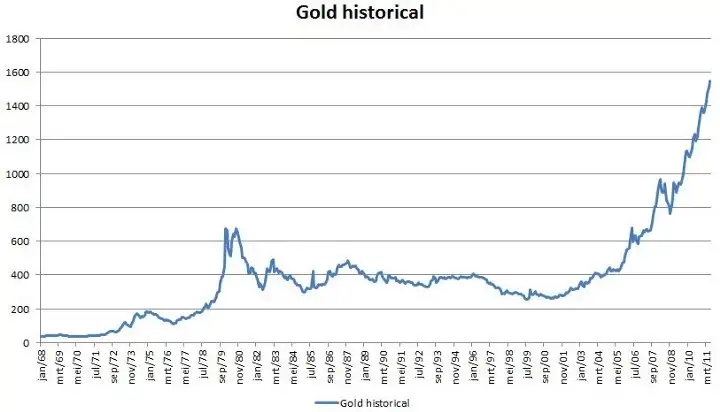

Bitcoin is back in the news, as the digital currency has surged to new all-time highs in recent weeks.

A few weeks ago, it was just above $100. Today it's over $260.

This surge has prompted Timothy B Lee at The Washington Post to ask whether those who have called it a bubble in the past should retract and admit that they were wrong.

Well I'm not totally sure if I've called it a bubble, but I have spoken negatively of it, and I'll say that I still think it's a joke, and probably in a bubble.

Now first of all, I find the premise of Lee's post to be hilarious. The currency has been surging several percent every day lately, and that's evidence that it's not in a bubble?

Before going on, I want to be clear that saying something is a bubble is not saying it will go down. It could go to $500 or $1000 or $10,000. That's the nature of manias.

But make no mistake, Bitcoin is not the currency of the future. It has no intrinsic value.

Now this idea of "intrinsic value" when it comes to currency bothers people, and Bitcoin Bugs will immediately ask why the U.S. dollar has intrinsic value. There's an answer to that. The U.S. Dollar has intrinsic value because the U.S. government which sets the laws of doing business in the United States says it has intrinsic value. If you want to conduct commerce in the United States you have to pay taxes, and there's only one currency you're allowed to pay taxes in: U.S. dollars. There's no getting around this fact. Furthermore, if you want to use the banking system at all, there's no choice but to use U.S. dollars, because that's the currency of the Fed which is behind the whole thing.

On top of all these laws requiring the U.S. dollar to be used, the United States has a gigantic military that can force people around the world to use dollars (if it came to that) so yes, there's a lot of real-world value behind greenbacks.

Bitcoin? Nada. There's nothing keeping it being a thing. If people lose faith in it, it's over. Bitcoin is fiat currency in the most literal sense of the word.

But it gets worse. Bitcoin is mostly just a speculative vehicle. Yes, there are PR stunts about bars and other shops accepting bitcoins. And there is a Bitcoin ATM for some reason. But mostly Bitcoin is a speculative vehicle. And really, you'd be insane to actually conduct a sizable amount of commerce in bitcoins. That's because the price swings so wildly, that the next day, there's a good chance that one of the parties will have gotten royally screwed. Either the purchaser of the good will have ended up totally blowing a huge opportunity (by not holding longer) or the seller will be totally screwed (if Bitcoin instantly plunges). The very volatility that excited people to want to play the Bitcoin game is death when it comes to real transactions in the real world.

Again, Bitcoin might go up a lot more before it ultimately ends. That's the nature of bubbles. The dotcom bubble crashed a bunch of times on its way up. Then one day it ended. The same will happen with this.

In the meantime, have fun speculating!

-

@ 472f440f:5669301e

2025-05-14 13:17:04

@ 472f440f:5669301e

2025-05-14 13:17:04Marty's Bent

via me

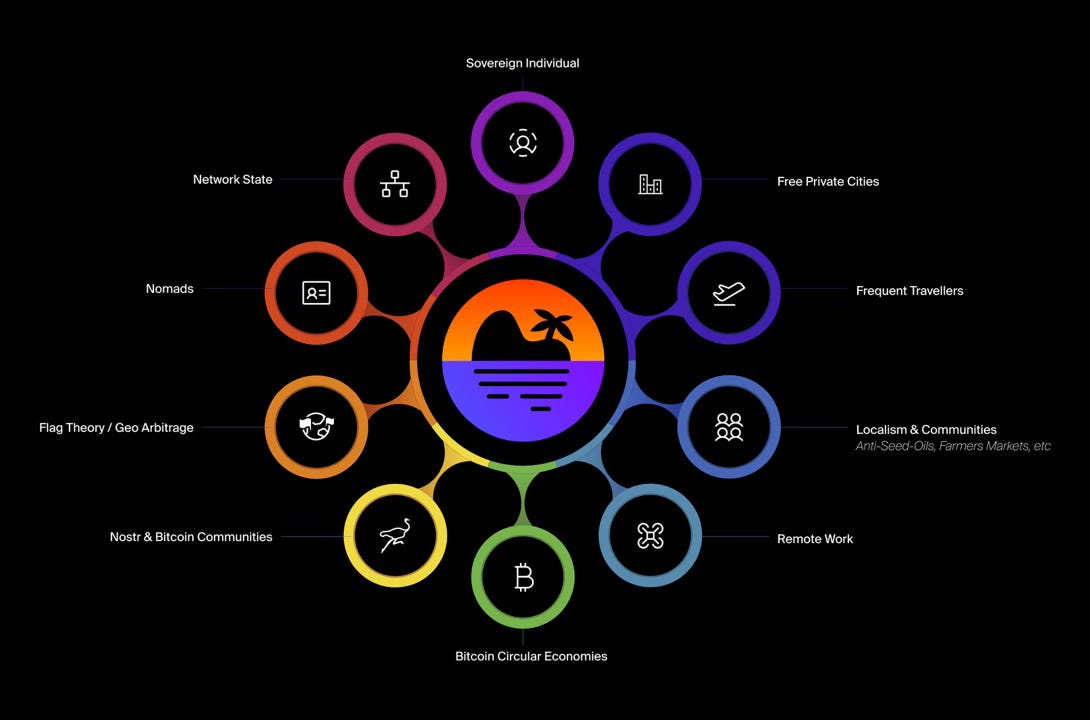

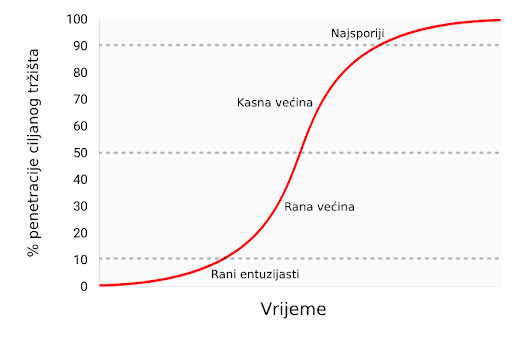

It seems like every other day there's another company announced that is going public with the intent of competing with Strategy by leveraging capital markets to create financial instruments to acquire Bitcoin in a way that is accretive for shareholders. This is certainly a very interesting trend, very bullish for bitcoin in the short-term, and undoubtedly making it so bitcoin is top of mind in the mainstream. I won't pretend to know whether or not these strategies will ultimately be successful or fail in the short, medium or long term. However, one thing I do know is that the themes that interest me, both here at TFTC and in my role as Managing Partner at Ten31, are companies that are building good businesses that are efficient, have product-market-fit, generate revenues and profits and roll those profits into bitcoin.

While it seems pretty clear that Strategy has tapped into an arbitrage that exists in capital markets, it's not really that exciting. From a business perspective, it's actually pretty straightforward and simple; find where potential arbitrage opportunities exists between pools of capital looking for exposure to spot bitcoin or bitcoin's volatility but can't buy the actual asset, and provide them with products that give them access to exposure while simultaneously creating a cult-like retail following. Rinse and repeat. To the extent that this strategy is repeatable is yet to be seen. I imagine it can expand pretty rapidly. Particularly if we have a speculative fervor around companies that do this. But in the long run, I think the signal is falling back to first principles, looking for businesses that are actually providing goods and services to the broader economy - not focused on the hyper-financialized part of the economy - to provide value and create efficiencies that enable higher margins and profitability.

With this in mind, I think it's important to highlight the combined leverage that entrepreneurs have by utilizing bitcoin treasuries and AI tools that are emerging and becoming more advanced by the week. As I said in the tweet above, there's never been a better time to start a business that finds product-market fit and cash flows quickly with a team of two to three people. If you've been reading this rag over the last few weeks, you know that I've been experimenting with these AI tools and using them to make our business processes more efficient here at TFTC. I've also been using them at Ten31 to do deep research and analysis.

It has become abundantly clear to me that any founder or entrepreneur that is not utilizing the AI tools that are emerging is going to get left behind. As it stands today, all anyone has to do to get an idea from a thought in your head to the prototype stage to a minimum viable product is to hop into something like Claude or ChatGPT, have a brief conversation with an AI model that can do deep research about a particular niche that you want to provide a good service to and begin building.

Later this week, I will launch an app called Opportunity Cost in the Chrome and Firefox stores. It took me a few hours of work over the span of a week to ideate and iterate on the concept to the point where I had a working prototype that I handed off to a developer who is solving the last mile problem I have as an "idea guy" of getting the product to market. Only six months ago, accomplishing something like this would have been impossible for me. I've never written a line of code that's actually worked outside of the modded MySpace page I made back in middle school. I've always had a lot of ideas but have never been able to effectively communicate them to developers who can actually build them. With a combination of ChatGPT-03 and Replit, I was able to build an actual product that works. I'm using it in my browser today. It's pretty insane.

There are thousands of people coming to the same realization at the same time right now and going out there and building niche products very cheaply, with small teams, they are getting to market very quickly, and are amassing five figures, six figures, sometimes seven figures of MRR with extremely high profit margins. What most of these entrepreneurs have not really caught on to yet is that they should be cycling a portion - in my opinion, a large portion - of those profits into bitcoin. The combination of building a company utilizing these AI tools, getting it to market, getting revenue and profits, and turning those profits into bitcoin cannot be understated. You're going to begin seeing teams of one to ten people building businesses worth billions of dollars and they're going to need to store the value they create, any money that cannot be debased.

nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpz4mhxue69uhk2er9dchxummnw3ezumrpdejqqgy8fkmd9kmm8yp4lea2cx0g8fyz27g4ud7572j4edx2v6lz6aa23qmp5dth , one of the co-founders of Ten31, wrote about this in early 2024, bitcoin being the fourth lever of equity value growth for companies.

Bitcoin Treasury - The Fourth Lever to Equity Value Growth

We already see this theme playing out at Ten31 with some of our portfolio companies, most notably nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpqex7mdykw786qxvmtuls208uyxmn0hse95rfwsarvfde5yg6wy7jqjrm2qp , which recently released some of their financials, highlighting the fact that they're extremely profitable with high margins and a relatively small team (\~75). This is extremely impressive, especially when you consider the fact that they're a global company competing with the likes of Coinbase and Block, which have each thousands of employees.

Even those who are paying attention to the developments in the AI space and how the tools can enable entrepreneurs to build faster aren't really grasping the gravity of what's at play here. Many are simply thinking of consumer apps that can be built and distributed quickly to market, but the ways in which AI can be implemented extend far beyond the digital world. Here's a great example of a company a fellow freak is building with the mindset of keeping the team small, utilizing AI tools to automate processes and quickly push profits into bitcoin.

via Cormac

Again, this is where the exciting things are happening in my mind. People leveraging new tools to solve real problems to drive real value that ultimately produce profits for entrepreneurs. The entrepreneurs who decide to save those profits in bitcoin will find that the equity value growth of their companies accelerates exponentially as they provide more value, gain more traction, and increase their profits while also riding the bitcoin as it continues on its monetization phase. The compounded leverage of building a company that leverages AI tools and sweeps profits into bitcoin is going to be one of the biggest asymmetric plays of the next decade. Personally, I also see it as something that's much more fulfilling than the pure play bitcoin treasury companies that are coming to market because consumers and entrepreneurs are able to recive and provide a ton of value in the real economy.

If you're looking to stay on top of the developments in the AI space and how you can apply the tools to help build your business or create a new business, I highly recommend you follow somebody like Greg Isenberg, whose Startup Ideas Podcast has been incredibly valuable for me as I attempt to get a lay of the land of how to implement AI into my businesses.

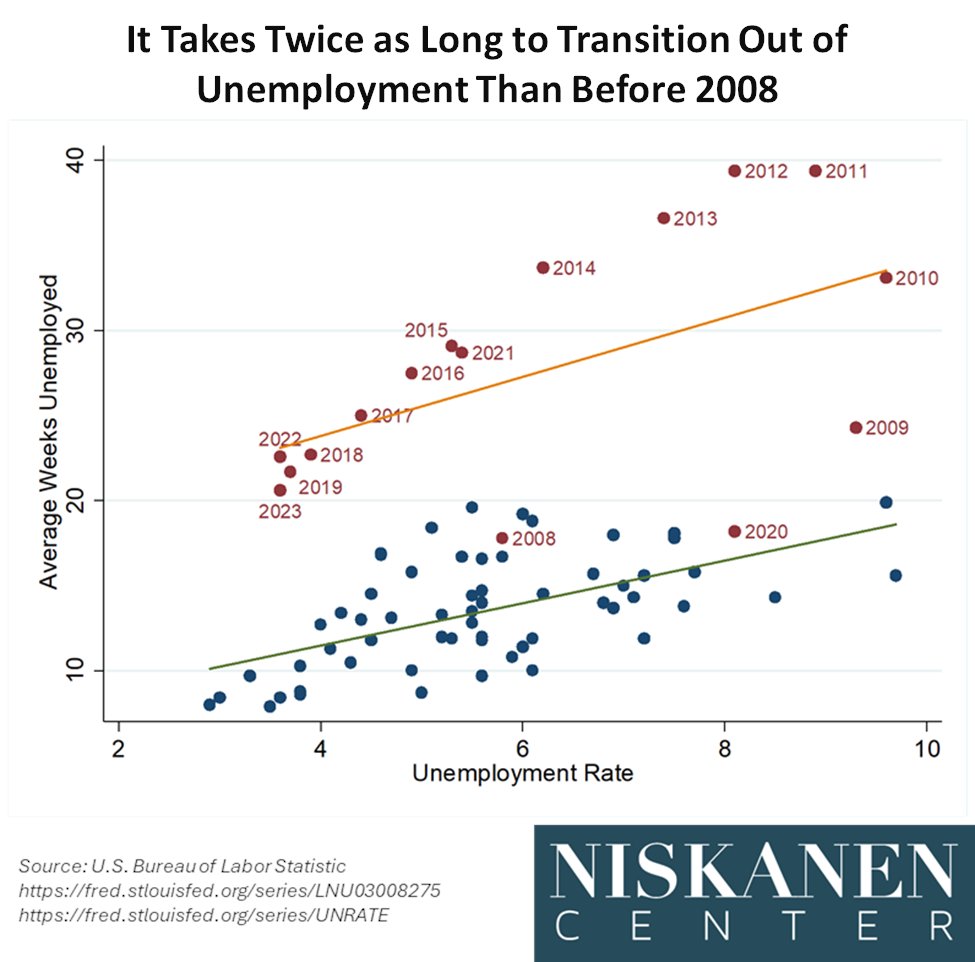

America's Two Economies

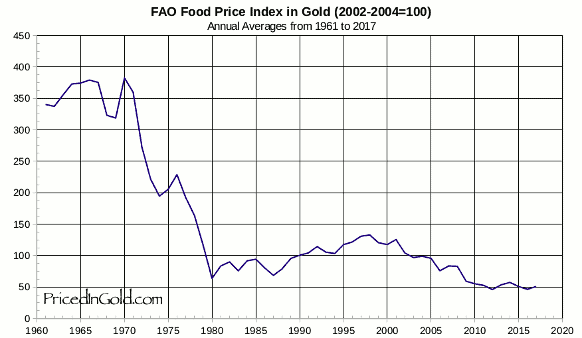

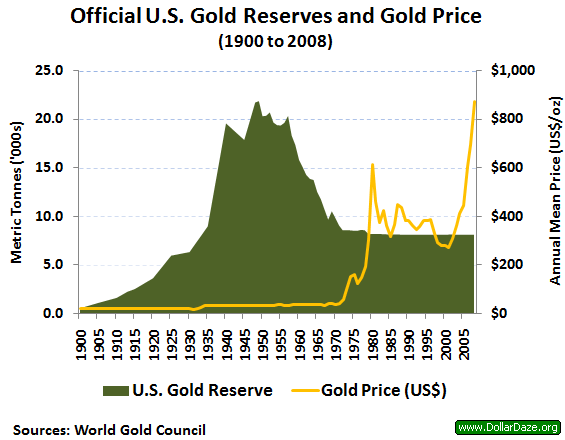

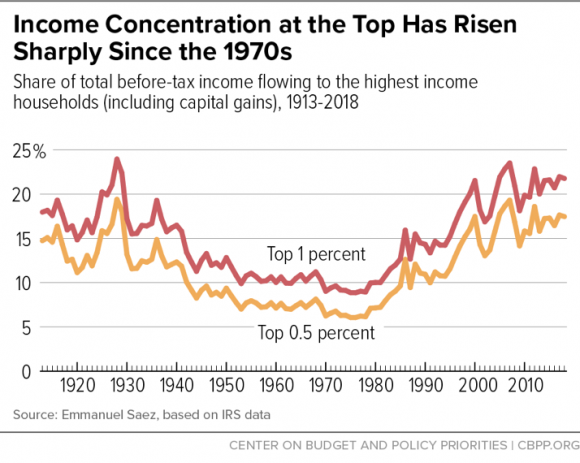

In my recent podcast with Lyn Alden, she outlined how our trade deficits create a cycle that's reshaping America's economic geography. As Alden explained, US trade deficits pump dollars into international markets, but these dollars don't disappear - they return as investments in US financial assets. This cycle gradually depletes industrial heartlands while enriching financial centers on the coasts, creating what amounts to two separate American economies.

"We're basically constantly taking economic vibrancy out of Michigan and Ohio and rural Pennsylvania where the steel mills were... and stuffing it back into financial assets in New York and Silicon Valley." - nostr:nprofile1qy2hwumn8ghj7mn0wd68ytndv9kxjm3wdahxcqg5waehxw309ahx7um5wfekzarkvyhxuet5qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncdhu7e3

This pattern has persisted for over four decades, accelerating significantly since the early 1980s. Alden emphasized that while economists may argue there's still room before reaching a crisis point, the political consequences are already here. The growing divide between these two Americas has fueled populist sentiment as voters who feel left behind seek economic rebalancing, even if they can't articulate the exact mechanisms causing their hardship.

Check out the full podcast here for more on China's manufacturing dominance, Trump's tariff strategy, and the future of Bitcoin as a global reserve asset. All discussed in under 60 minutes.

Headlines of the Day

Trump's Saudi Summit: Peace and Economic Ties - via X

MSTR Edges Closer To S\&P 500 With Just 89 Trading Days Left - via X

Get our new STACK SATS hat - via tftcmerch.io

Individuals Shed 247K Bitcoin As Businesses Gain 157K - via X

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

Ten31, the largest bitcoin-focused investor, has deployed 144,229 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

My boys have started a game in the car where we count how many Waymos we see on the road while driving around town. Pretty crazy how innately stoked they are about that particular car.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ e516ecb8:1be0b167

2025-05-13 18:58:24

@ e516ecb8:1be0b167

2025-05-13 18:58:24El mundo está al borde del abismo. La Guerra Fría amenaza con volverse nuclear, las superpotencias se miran con desconfianza, y la humanidad parece tener un pie en la tumba. Entra Adrian Veidt, alias Ozymandias, el hombre más listo del planeta, con un plan tan genial como perturbador: matar a millones para salvar a miles de millones. ¿Un villano sacado de un cómic? No exactamente. En Watchmen de Alan Moore y Dave Gibbons, Ozymandias es un utilitarista radical que cree que el fin justifica los medios. Pero, ¿y si su plan suena sospechosamente parecido a las ideas de Lenin, quien justificó la muerte de millones por un supuesto "bien mayor"? Prepárate para un viaje que conecta el calamar gigante de Watchmen con las ríadas de prisioneros hacia los gulags, con un toque de historia y filosofía para mantenerte pegado a la pantalla.

Ozymandias: El arquitecto del apocalipsis controlado Adrian Veidt, alias Ozymandias, no es un héroe común. Es un multimillonario, un estratega brillante y un admirador de Alejandro Magno que lleva el utilitarismo a extremos aterradores. Su plan en Watchmen es una obra maestra de manipulación: crea una criatura interdimensional falsa que mata a millones en Nueva York, haciendo que las naciones, presas del pánico ante una amenaza "alienígena", dejen sus rencillas y se unan. ¿El resultado? La Guerra Fría se desvanece, los misiles se guardan, y el mundo respira… por ahora.

Ozymandias no es un psicópata que disfruta el caos. Está atormentado, pero convencido de que sacrificar a millones es la única forma de evitar la extinción. Su lógica es fría, calculadora y, curiosamente, tiene un eco inquietante en los escritos de Lenin y el marxismo-leninismo, donde la violencia y la muerte se justificaban como un precio "razonable" por la revolución.

Lenin: La revolución vale unos cuantos millones Vladímir Lenin, el cerebro detrás de la Revolución Bolchevique, no era de los que se andaban con rodeos. En sus escritos, como El Estado y la Revolución (1917) y ¿Qué hacer? (1902), defendía que la revolución socialista requería una ruptura violenta con el viejo orden. Para Lenin, la burguesía, los kulaks (campesinos propietarios) y los "contrarrevolucionarios" eran obstáculos que debían ser eliminados, incluso si eso significaba sangre. En una carta de 1918, Lenin instó a "aplastar sin piedad" a los enemigos de la revolución, y en otro escrito de ese año, justificó el "terror rojo" diciendo que "unas decenas o cientos de miles de víctimas" eran un costo insignificante comparado con el triunfo del socialismo. Para él, estas muertes eran un mal necesario para construir un mundo sin clases.

Pero no todo quedó en teoría. Durante la Guerra Civil Rusa (1917-1922), la Cheka, la policía secreta de Lenin, ejecutó a decenas de miles y envió a otros tantos a campos de trabajo que, como señala Aleksandr Solzhenitsyn en Archipiélago Gulag, fueron el germen de las "ríadas" de prisioneros que caracterizarían el sistema de gulags. Antes de que Stalin elevara el horror a niveles industriales, Lenin ya había sentado las bases de un sistema donde el sacrificio humano era moneda corriente. Solzhenitsyn describe cómo, desde 1918, los campos se llenaban de "enemigos del pueblo" —desde nobles hasta campesinos que se resistían a la colectivización—, todo en nombre de un futuro utópico que nunca llegó.

Marxismo-Leninismo: Una utopía empapada en sangre El marxismo-leninismo prometía un paraíso sin clases, pero el camino hacia él estaba pavimentado con cadáveres. Bajo Lenin, y más tarde Stalin, millones murieron en purgas, hambrunas como el Holodomor en Ucrania (1932-1933), y en los gulags. La lógica era utilitarista, como la de Ozymandias: sacrificar a una generación por un "bien mayor". Pero, a diferencia del plan de Veidt, el proyecto marxista-leninista nunca llegó a puerto. La Unión Soviética se industrializó, sí, pero a un costo humano atroz, y el sueño socialista se desmoronó en 1991, dejando un legado de desigualdad, burocracia corrupta y memoriales a las víctimas.

¿Por qué Ozymandias “gana” y Lenin fracasa? Aquí está la gran diferencia. En Watchmen, el plan de Ozymandias funciona, al menos por un tiempo. Las naciones se unen, la guerra nuclear se evita, y la paz parece posible. ¿Por qué? Porque Ozymandias es un genio que controla cada detalle: la ciencia, la narrativa, el momento exacto del "ataque". Su plan es una coreografía perfecta, sin espacio para el caos humano. En cambio, Lenin y sus sucesores lidiaron con economías complejas, sociedades rebeldes y errores garrafales. La colectivización forzada provocó hambrunas, las purgas alienaron a aliados, y la burocracia soviética se volvió un monstruo inmanejable. El marxismo-leninismo nunca pudo ser tan "limpio" como el calamar de Ozymandias.

Pero hay un detalle crucial: el plan de Ozymandias depende del secreto. Si el mundo descubriera que el ataque fue un montaje, la paz se derrumbaría. Y aquí entra Rorschach, el vigilante que no transige con la moral. Su diario, que revela la verdad, queda en manos de un periódico al final del cómic. Si se publica, adiós al sueño de Veidt. En la vida real, el marxismo-leninismo no tuvo un "diario de Rorschach" que expusiera un engaño específico, pero sus fracasos —hambrunas, gulags, estancamiento— fueron prueba suficiente de que la utopía era una quimera.

El dilema: ¿Justifica el fin los medios? Tanto Ozymandias como Lenin nos enfrentan a una pregunta espinosa: ¿está bien matar a millones por un supuesto bien mayor? En Watchmen, Moore no da respuestas fáciles. Ozymandias es un héroe y un monstruo al mismo tiempo, y su éxito pende de un hilo. En la vida real, las justificaciones de Lenin y sus seguidores se desmoronan ante el peso de las tragedias. Los gulags, las hambrunas y las purgas no llevaron al paraíso prometido, sino a un callejón sin salida.

Lo que hace a Watchmen tan brillante es su capacidad para hacernos pensar sin predicarnos. Ozymandias cree que está salvando al mundo, pero su paz es tan frágil como un castillo de naipes. Lenin, por su parte, soñó con una revolución que cambiaría la historia, pero dejó un legado de sufrimiento que Solzhenitsyn no nos deja olvidar.

Conclusión: Un cómic que refleja nuestras paradojas Watchmen no es solo un cómic; es un espejo de nuestras ambiciones y fracasos. Ozymandias, con su plan para la paz, nos recuerda a Lenin y su fe ciega en un futuro mejor, aun a costa de millones de vidas. En el cómic, la utopía de Veidt funciona… hasta que Rorschach amenaza con exponerla. En la vida real, el marxismo-leninismo nunca llegó tan lejos, y las "ríadas" hacia los gulags son un recordatorio de lo que pasa cuando los sueños utópicos se encuentran con la realidad.

¿Qué piensas? ¿Es Ozymandias un visionario o un tirano? ¿Y qué tan lejos estamos de justificar horrores por un “bien mayor”? ¿Crees que un plan así funcionaría pero solamente si lo ejecuta la persona “correcta”?

-

@ 58537364:705b4b85

2025-05-13 18:05:03

@ 58537364:705b4b85

2025-05-13 18:05:03A man once went to a temple to listen to a Dhamma talk. But in his heart, he kept judging and condemning another person who was fishing by the pond nearby — mentally accusing him of being sinful and unafraid of karma — while believing that he himself was making merit by listening to the sermon.

However, the one who was fishing silently rejoiced in the merit of those listening to the Dhamma. He asked forgiveness from the fish and made a heartfelt wish to have the opportunity to do good in his next life, since in this life, he had responsibilities caring for his sick parents and no chance to go to the temple like others.

This story teaches us that merit or sin is not defined by outer actions, but by intention and the true state of the heart.

Some people chant prayers but still gossip. Some give alms but still take advantage of others. Some have knowledge but look down on others. Some keep their bodies clean, but their hearts remain impure.

Do not be deceived by appearances of goodness. Instead, look inward — examine your own heart.

A small act of kindness we offer to a fellow human being may be a greater merit than traveling far to make merit.

It is compassion that sustains the world — not judging others as good or bad.

Read the full TH version at: https://w3.do/kFkeHGZ6

-

@ 3f68dede:779bb81d

2025-05-14 11:25:17

@ 3f68dede:779bb81d

2025-05-14 11:25:17sdsdsdsd

-

@ 58537364:705b4b85

2025-05-13 17:52:51

@ 58537364:705b4b85

2025-05-13 17:52:51ธรรมะที่ดับทุกข์ได้จริงต้องเป็นวิทยาศาสตร์ ถ้าเป็นปรัชญามันจะได้แต่ ประมาณ คะเน คำนวณ ไม่มีของจริง มีแต่สมมติฐาน

สมมติฐานว่า เราเป็นทุกข์ ว่าเราคงจะเป็นทุกข์ หรือว่าอย่างนี้ต้องเรียกว่า เราเป็นทุกข์ มันมีสมมติฐานอย่างนี้

ถ้าตั้งต้นอย่างนี้แล้วหาทางคำนวณต่อไปว่า คงจะดับมันได้อย่างไร อย่างนั้นเป็นปรัชญาหมดแหละ ไม่เป็นพุทธศาสนา และจะไม่มีประโยชน์อะไรด้วย เอาไปทำเป็นปรัชญาเสีย

ดังนั้น ความทุกข์ของเราต้องไม่ใช่สมมติฐาน ไม่ใช่ที่เรียกว่า hypothesis ไม่ใช่ไอ้อันนั้น มันต้องมี ความทุกข์ที่ปรากฏอยู่กับเรา แผดเผาเราอยู่จริงๆ

ตั้งแต่เราเล็กๆ มา เราไม่ค่อยรู้จักมัน แต่เรารู้สึกได้ว่ามันมี มันเคยมี และมันได้มีเรื่อยๆ มา จนกระทั่งวันนี้ มันมีความทุกข์อยู่จริง ไอ้ความรู้สึกที่เป็นทุกข์อยู่จริงนี่ไม่ใช่สมมติ มันไม่ต้องสมมติ มันสมมติไม่ได้เพราะมันเป็นทุกข์อยู่จริงนี่เอาตัวจริง เอาเข้ามาวางลงแล้ว ก็ดู ดู ดู ไม่ต้องคำนวณ ไม่ต้องคำนวณ ดู ดูด้วยปัญญา ดูด้วยตาสำหรับดู เห็นเหตุมันอย่างนั้น เห็นทางดับมันอย่างนั้น แล้วก็ปฏิบัติดับได้จริง นี่เลยเป็นวิทยาศาสตร์

พุทธทาสภิกขุ

ธรรมะทำไม? #หน้า_๑๕-๑๖

🌿🌼🌿 ๒,๕๐๐ กว่าปีแล้ว นักวิทยาศาสตร์ยังยืนยันว่า พุทธศาสนา สอนอย่างมีหลักการ ที่เป็นจริงที่สุด "...ปัญญาของพระพุทธองค์“ อาตมาเห็นว่าเรื่อง ปัญญา นี้ เราไม่จำเป็นต้องไปเอาของฝรั่ง ซึ่งก็มีดีบ้าง เสียบ้าง แต่จะบอกว่า ระบบต่างๆ ปรัชญาต่างๆ ทั้งหมดของตะวันตก

ขอให้จำไว้ให้ดีว่า เป็นปรัชญาแนวความคิดของ “ปุถุชน” ไม่ใช่ปัญญาที่เกิดขึ้นกับ “พระพุทธเจ้า” คือ “ผู้ที่รู้โลกและชีวิตตามความเป็นจริง”

จะเห็นว่า..ระบบความคิดที่ถือว่าเฉียบแหลมที่สุดของฝรั่ง อย่างเช่น คาร์ลมาร์ค (Larl Marx) ของ ฟรอยด์ (Sigmund Freud) เป็นต้น ไม่กี่สิบปีก็ทิ้งทั้งหมด

แต่ของพระพุทธองค์เกือบทั้ง ๒,๕๐๐ กว่าปี ยังไม่มีนักวิทยาศาสตร์ที่ไหนที่สามารถพิสูจน์ได้ว่า คำสอนของพระพุทธเจ้าผิดพลาดคลาดเคลื่อนไปจากความเป็นจริงแม้แต่ข้อเดียว ๘,๔๐๐๐ พระธรรมขันธ์ มีข้อไหนที่ผิด ? ถ้าเราเทียบกับนักปราชญ์คนอื่น หรือศาสดาคนอื่น จะเห็นความแตกต่างอย่างชัดเจน

ในสมัยโบราณนั้น นักปราชญ์ที่มีชื่อเสียงมากที่สุดของโลกตะวันตกคงจะเป็นอริสโตเติ้ล ที่จริงหลักปรัชญาของอริสโตเติ้ลในระดับศีลธรรมหรือจริยธรรมก็น่าศึกษา เพราะมีบางสิ่งบางอย่าง หลายสิ่งหลายอย่างที่คล้ายกับคำสอนของพระพุทธเจ้า

แต่ถ้าเราอ่านปรัชญาของอริสโตเติ้ลทั้งหมด ก็คงจะเกิดความรู้สึกว่า หลายอย่างที่ว่าไม่ใช่ หรือว่ามีหลายอย่างที่คนปัจจุบันเชื่อไม่ได้(ไม่เข้ากับยุคสมัย) ยกตัวอย่าง ในการเขียนเรื่องหลักการเมือง ปรัชญาการเมือง อริสโตเติ้ลบอกว่า คนที่เกิดในโลกนี้มีสองอย่าง หรือว่าสองประเภท ประเภทหนึ่งคือ เจ้านาย เกิดแล้วพร้อมที่เป็นเจ้านาย อีกประเภทหนึ่งก็คือคนรับใช้ คือมีธรรมชาติอยู่แล้วว่าเกิดแล้วต้องเป็นคนรับใช้ ดังนั้น สังคมของเรามีคนรับใช้ไม่ใช่สิ่งผิดเลย มันเป็นสิ่งที่ถูกต้องอยู่แล้ว เพราะพวกนี้เกิดขึ้นเพื่อเป็นคนรับใช้ของเจ้านายทั้งหลาย **นี่คือความคิดของนักปราชญ์ที่เก่งที่สุดในโลกตะวันตก

อีกคนหนึ่ง เวลาต่อมาหลายร้อยปี คือ เดคาร์ด ซึ่งมีผลต่อสังคมตะวันตกมาก เดคาร์ต ถือว่า สัตว์ทั้งหลายไม่มีความน่าสงสาร ไม่มีความรู้สึก ถ้าสัตว์ร้องก็ไม่มีความหมาย

ตัวอย่างมีมากกว่านี้ แต่ถ้าเปรียบเทียบกับคำสอนของพระพุทธองค์ ในความรู้สึกของอาตมา ไม่มีที่ไหนที่เราจะบอกได้ว่า คำสอนนี้ล้าสมัยแล้ว แต่บางคนก็ยังถืออย่างนั้นอยู่เหมือนกัน (เช่น)ถือว่า คำสอนของพระพุทธเจ้าเกี่ยวกับเรื่องการเวียนว่ายตายเกิด เป็นเรื่องความเชื่อถือของคนในสมัยก่อน..."

🌸🌿 พระอาจารย์ชยสาโร 🌷 ที่มา :: คุยธรรมะกับพระฝรั่ง https://youtu.be/uAO7-2VUZXU

สันทิฏฐิโกตัวกู_แก้ได้ด้วยสันทิฏฐิโกจริง

ตั้งแต่ครั้งพุทธกาลหรือก่อนพุทธกาล ก็มีคนถือว่ามันมีตัวกู - มีของกู,

ปรัชญาของพวกฝรั่ง ก็มีอยู่แขนงหนึ่ง หรือว่าพวกหนึ่ง ที่ถือเรื่องมีตัวกู ที่ว่าฉันคิด แล้วก็ฉะนั้นฉันมีอยู่, สูตรของเขาว่าอย่างนี้ คอกิโต, เออโกซุม, เป็นภาษาลาติน ออกเสียงอย่างไรก็ไม่รู้ อ่านตรง ๆอย่างภาษาอังกฤษเป็นอย่างนี้, cogito, ergo sum นั่นแหละ I think, therefore I exist. เพราะฉันคิดได้ ฉันจึงมีอยู่,นี้เขาก็พูดดีที่สุดแล้วว่า, ก็เราคิดนึกได้ เรารู้สึกคิดนึกอยู่ตลอดเวลา การที่คิดนึกได้นั้นมันต้องมี, มีเหตุผลหรือมีอะไรพอที่จะเป็นตัวฉัน, ฉันคิด ฉันมีอยู่ มีเท่านี้, มันมีสั้น ๆเท่านี้ เขาเรียกว่าปรัชญาของเดสคารด์, แล้วมันก็ไม่ใช่ของเดสคารด์ มันของคนทั้งโลก, กระทั่งในเมืองไทย กระทั่งพุทธบริษัท ในประเทศไทย ก็มีหลักอย่างนี้ : ฉันคิดได้ ฉันรู้สึกอยู่ว่าอย่างนั้น อย่างนี้ มันก็ต้องเป็นตัวฉัน มีตัวฉัน, มันช่วยไม่ได้

คนที่มีปัญญา มีอำนาจ มีเสรีภาพ จะต้องคิดอย่างนี้ทั้งนั้น, จะต้องถามอย่างนี้ทั้งนั้น

แล้วผมก็เคยประสบมามาก คนใหญ่คนโต เขาไม่อาจจะอ่านบทความของเราเข้าใจได้ ที่ว่าไม่มีตัวตน, เพราะรู้สึกแต่ว่า มีตัวตนอยู่ทุกทีไปตลอดเวลาด้วย นี้มันเป็นตัวอย่างที่ทำให้เห็นว่า… สันทิฏฐิโกของแต่ะละคนล้วนแต่เป็นตัวกู ทั้งนั้นแหละ, ถึงคนที่กำลังพูด เรื่องอนัตตาเรื่องอะไรอยู่ ก็มีสันทิฏฐิโกเป็นตัวกูทั้งนั้นแหละ, แล้วปากมันก็พูดเรื่องไม่ใช่ตัวกูหรือไม่มีตัวกูฉะนั้น จึงถือว่าเป็นเรื่องที่ยากลำบากที่สุดกว่าเรื่องใดหมด ในบรรดาเรื่องที่เกี่ยวกับอนัตตา ไม่ใช่ตน, หรือว่า หลักของพุทธศาสนา ก็แปลว่า คำสอนของพระพุทธเจ้าเรื่องนี้ ประสบปัญหาหนัก เพราะทุกคนรู้สึกเป็นตัวตนอยู่เรื่อย, เป็นสันทิฏฐิโกของตัวตนอยู่เรื่อยไปไม่ว่าที่ไหน

ทีนี้จะมาสอนกันอย่างไร ให้เกิดความรู้สึกกลับตรงกันข้าม ว่าไม่ใช่ตัวตน มันต้องเป็นเรื่องเฉพาะคนเฉพาะกรณีมากกว่า, จะพูดทีเดียวสำหรับทุกคนนี้ เข้าใจว่ามันเป็นไปไม่ได้, เราจะเทศน์ทีเดียวฟังกันทั้งหมด ทั้งหมู่ ทั้งประเทศนี้ มันแทบจะไม่มีประโยชน์อะไรเลย, มันเป็นเรื่องเฉพาะคน คนหนึ่ง ๆ เคยมีประสบการณ์อะไรมาแล้ว เคยคิดอะไรมาแล้ว ค้นอะไรมามากแล้ว ก็มาพูดกันให้เหมาะแก่ เรื่องของบุคคลนั้น ก็พอจะเห็น แต่ทีนี้มันมีเทคนิคหรือมันมีอุบายของธรรมชาติอยู่อันหนึ่ง ซึ่งจะเป็นหนทางออก อย่าลืมผมเคยบอกคุณที่เพิ่งบวชใหม่นี้ว่า ธรรมะทุกระบบเป็นอุบายทั้งนั้น

อย่าไปพูดว่าจริง หรือไม่จริง ไม่อะไรอย่าไปพูด, รู้จักมันแต่ว่ามันเป็นอุบายก็แล้วกัน ถ้ามันมีประโยชน์ก็ใช้ได้ แล้วแต่ละอุบายมันก็เป็นเทคนิคของธรรมชาติ, ไม่ใช่มนุษย์บัญญัติ คือว่าต้องเป็นอย่างนั้นลงไปก่อน ผลมันจึงจะเกิดขึ้นมาอย่างนี้, เรียกว่าเทคนิคของธรรมชาติดีกว่า ทีนี้มนุษย์ก็ไม่รู้อะไรมากไปกว่าแต่เพียงว่าเอ้อ, อันนี้มัน อาจจะเอามาใช้เป็นอุบายแก้ปัญหานี้ได้ ทีนี้อุบายหรือธรรมะที่เป็นนอุบายนี้ ที่จะมาแก้สันทิฏฐิโกของตัวกูนี้ มันก็มีอยู่, ไม่ใช่ไม่มี คุณฟังดูให้ดี ว่าทุกคนมันรู้สึก รู้สึกอยู่ในใจเอง แจ่มแจ้งว่า มีตัวกู มีของกู จะไปเปลี่ยนของเขาไม่ได้, จะไปจับเปลี่ยนอย่างไรได้ จะไปพูดอย่างอธิบายว่า โอ๊ย บังคับไม่ได้ เหมือนกับความฝันหรืออะไรต่าง ๆ นี้ มันก็พูดกันมาแล้ว แม้ในสูตร ในพระบาลีที่เป็นสูตร ก็พูดทำนองนี้ว่า

ถ้าเป็นตัวตน ตัวกู มันก็ต้องบังคับได้ตามต้องการซิ, เดี๋ยวนี้มันบังคับไม่ได้, เช่นจะบังคับรูป ว่ารูปจงเป็นอย่างนี้, เวทนาจงเป็นอย่างนี้, สัญญาจงเป็นอย่างนี้, อย่าเป็นอย่างอื่น นี้มันก็บังคับไม่ได้เพราะฉะนั้น จึงถือว่าไม่ใช่ตัวกู แล้วมันก็เคยทำให้มีผู้บรรลุมรรคผลมาแล้ว เพราะคำพูดเพียงเท่านี้, แต่อย่าลืมว่า นั้นมันเฉพาะหมู่นั้นกรณีนั้นเท่านั้น กรณีอื่นมันเป็นไปไม่ได้ เห็นไหม ? ทีนี้มันมีอุบายอะไร ที่จะใช้ได้แก่ทุกคน ที่จะไปแก้สิ่งที่เหนียวแน่นที่สุด คือสันทิฏฐิโกแห่งตัวกูนี้ มันจะต้องอุบายทำนองว่า เผชิญกันจริง ๆ ให้มันเป็นสันทิฏฐิโก เข้าไปอีกอย่างหนึ่ง อีกเรื่องหนึ่ง คือว่ามีความรู้สึกเป็นตัวกูทีไรก็มีความทุกข์ทุกที, เราไม่พูดกันแล้วว่า เหตุไรจึงถือว่าเป็นอนัตตา จะไม่พูด, แต่ให้มาตั้งข้อสังเกต หรือว่าเผชิญกันเข้าไปจริง ๆ กับความรู้สึกว่า ถ้าความรู้สึกว่าตัวกูเกิดขึ้นมาทีไรแล้วก็เป็นทุกข์ทุกที

เอ้า, ใครกล้าดีลองดู ลองปล่อยให้ความคิด ที่เป็นตัวกู - ของกูเกิด มันเป็นทุกข์ทุกที

แล้วนี่คืออุบาย, ลองสร้างความคิดที่เป็นตัวกู - ของกูขึ้นมา หรือปล่อยให้ความคิดที่เป็นตัวกู - ของกูเกิดขึ้นมา มันเป็นความทุกข์ทุกที, มันเผาลนทุกที

เมื่อทำอยู่อย่างนี้มันเข็ด, มันรู้จักเข็ด, หรือมันเริ่มเข็ด เริ่มเอือม เริ่มระอา, นั่นแหละจึงจะรู้สึกว่า โอ๊ะ ไม่เอาแล้วโว้ย เรื่องตัวกู -ของกูนี้ไม่ไหว, เป็นเรื่องไม่ไหวขึ้นมานี้เราเอาสันทิฏฐิโกจริง ๆ ไปแก้สันทิฏฐิโกเท็จ ๆ, เอาสันทิฏฐิโกจริง ๆไปแก้สันทิฏฐิโกหลอกลวง

สันทิฏฐิโกแห่งตัวกูนั้น มันจริงสำหรับคนโง่ ที่ยังโง่อยู่ ยังไม่มีความเป็นพระอริยะสักนิดเดียว มันสันทิฏฐิโกว่าตัวกู, ตัวกูเรื่อย ทีนี้มันแก้ไม่ได้ดอก ถ้าไม่มีอะไรที่มันมีน้ำหนักเท่ากัน มีกำลังเท่ากัน มันแก้ไม่ได้ จะไปบิดกลับเหมือนกับพลิกหน้ามือเป็นหลังมือนี่ มันก็ทำไม่ได้, ไม่มีใครทำได้โดยวิธีพูด หรือโดยวิธีอะไร ต้องสร้างสันทิฏฐิโกเกี่ยวกับความทุกข์ขึ้นมา, สันฏฐิโกในความทุกข์ให้รู้รสของความทุกข์จริง ๆ แล้วก็ทุกครั้งที่มีตัวกู - ของกูเกิดขึ้นในใจ, โดยอาศัยหลักที่ว่า…การเกิดทุกคราวเป็นทุกข์ทุกที การเกิดทุกคราวเป็นทุกข์ทุกที

การเกิดนี้หมายถึงเกิดขึ้นแห่งตัวกู ถ้าไม่มีตัวกูก็ไม่ถือว่าเป็นการเกิด, จะเป็นตัวกูชนิดไหนก็ตาม ถ้ามีขึ้นมาแล้วเรียกว่าเป็นการเกิด เกิดแห่งตัวเรา, นี้ก็รู้ผล รู้สึกในผลของการเกิดนี้ เกิดทุกทีเป็นทุกข์ทุกที : ตัวกูใหญ่ก็ทุกข์มาก, ตัวกูเล็กก็ทุกข์น้อย, ตัวกูยาวก็ทุกข์ยาว,เป็นต้น

ฉะนั้น วิธีปฏิบัติจึงได้แก่การทำความซึมซาบ realize อยู่กับเรื่องความทุกข์ ที่เกิดจากตัวกูนี้ตลอดเวลา, ที่เราเรียกว่า… ทำวิปัสสนา

พุทธทาสภิกขุ

ธรรมปาฏิโมกข์_เล่ม_๒ #หน้า_๔๗๓-๔๗๖

truthbetold #pyschology #mindset #science #siamstr

-

@ 3f68dede:779bb81d

2025-05-14 11:25:15

@ 3f68dede:779bb81d

2025-05-14 11:25:15 -

@ 57d1a264:69f1fee1

2025-05-14 09:48:43

@ 57d1a264:69f1fee1

2025-05-14 09:48:43Just another Ecash nutsnote design is a ew template for brrr.gandlaf.com cashu tocken printing machine and honoring Ecash ideator David Lee Chaum. Despite the turn the initial project took, we would not have Ecash today without his pioneering approach in cryptography and privacy-preserving technologies.

A simple KISS (Keep It Super Simple) Ecash nutsnote delivered as SVG, nothing fancy, designed in PenPot, an open source design tool, for slides, presentations, mockups and interactive prototypes.

Here Just another Nutsnote's current state, together with some snapshots along the process. Your feedback is more than welcome.

https://design.penpot.app/#/view?file-id=749aaa04-8836-81c6-8006-0b29916ec156&page-id=749aaa04-8836-81c6-8006-0b29916ec157§ion=interactions&index=0&share-id=addba4d5-28a4-8022-8006-2ecc4316ebb2

originally posted at https://stacker.news/items/979728

-

@ 58537364:705b4b85

2025-05-13 17:51:02

@ 58537364:705b4b85

2025-05-13 17:51:02เสียงตะโกนของ “อิทัปปัจจยตา”

ทุกอย่างตะโกนคำว่า “อิทัปปัจจยตา” อยู่ตลอดเวลา

“ท่านทั้งหลายนั่งอยู่ที่นี่ แต่ไม่ได้ยินเสียงตะโกนที่ดังลั่นไปหมดของธรรมชาติว่า ‘อิทัปปัจจยตา’ เสียงตะโกนของอิทัปปัจจยตา คือการร้องบอกร้องตะโกนว่า ‘เพราะมีสิ่งนี้เป็นปัจจัย สิ่งนี้จึงเกิดขึ้น’ หมายความว่า ท่านต้องดูลงไปที่ทุกสิ่งที่อยู่รอบตัวเราในเวลานี้ว่า ทุกสิ่งกำลังเป็นอิทัปปัจจยตา หรือเป็นไปตาม ‘กฎอิทัปปัจจยตา’”

ต้นไม้ต้นนี้มีความเป็นไปตามกฎอิทัปปัจจยตา ไม่มีอะไรมาต้านทานได้ ถ้าเราเข้าใจข้อเท็จจริงที่กำลังเป็นอยู่กับต้นไม้ เราจะเหมือนได้ยินมันตะโกนบอกว่า “อิทัปปัจจยตา” ไม่มีอะไรมากไปกว่านั้น มันเพียงบอกว่า “เมื่อมีสิ่งนี้เป็นปัจจัย สิ่งนี้จึงเกิดขึ้น”

ต้นไม้ไม่ได้หยุดเพียงเท่านั้น มันมีการเปลี่ยนแปลงเกิดขึ้นเรื่อยๆ ใบไม้ทุกใบก็บอกอย่างนั้น คงเป็นเสียงที่ดังเหลือประมาณว่า ใบไม้ทุกใบร้องตะโกนว่า “อิทัปปัจจยตา”

ผู้มีปัญญาและเข้าใจหัวใจของพระพุทธศาสนา จะไปนั่งอยู่ที่ไหนก็ได้ยินเสียงตะโกนว่า “อิทัปปัจจยตา” สนั่นหวั่นไหวไปหมด นี่พูดถึงแค่ต้นไม้ต้นเดียว ถ้าเป็นต้นไม้จำนวนมากก็เป็นเช่นเดียวกัน

เมื่อมองไปที่ก้อนหิน ก้อนหินก็เป็นเช่นเดียวกัน อนุภาคของมันเปลี่ยนแปลงอยู่ตลอดเวลา ก้อนหินที่เราเห็นอาจเกิดขึ้นมาเมื่อหลายพันล้านปีมาแล้ว จนมันแตกสลายและถูกทำให้มาอยู่ตรงนี้ มันจึงกล่าวว่า “อิทัปปัจจยตา” เพราะมีสิ่งนี้เป็นปัจจัย ฉันจึงมานั่งอยู่ที่นี่

ทุกอย่างตะโกนคำว่า “อิทัปปัจจยตา” ตลอดเวลา

- ต้นไม้ เม็ดกรวด เม็ดทราย มด แมลง สัตว์ต่างๆ รวมถึงมนุษย์เอง

- แม้แต่ร่างกายของเราเองก็ตะโกนบอกถึงอิทัปปัจจยตา

แม้เราจะเคยได้ยินคำว่า “อนิจจัง ทุกขัง อนัตตา” อาการของสิ่งเหล่านี้ยิ่งสะท้อนถึงอิทัปปัจจยตาอย่างชัดเจน

ดังนั้น เราต้องทำความเข้าใจจนซึมซาบอยู่ในใจ จนรู้สึกว่าไม่ว่าเราจะมองไปทางไหน ก็เห็นถึงภาวะของ อิทัปปัจจยตา ได้ยินเสียงของมัน หรือแม้แต่สัมผัสผ่านการดมกลิ่นและลิ้มรส

เมื่อเข้าใจสิ่งนี้ จะสามารถเรียกผู้นั้นว่า ‘เป็นพุทธบริษัทผู้เห็นธรรม’

สามารถเห็นกิเลสและทุกข์ แล้วป้องกันหรือกำจัดกิเลสและทุกข์ให้น้อยลงไปได้มากทีเดียว— พุทธทาสภิกขุ

(จากหนังสือธรรมบรรยาย “อิทัปปัจจยตา” หน้า 131–133)

อิทัปปัจจยตา: กฎอันเฉียบขาดตลอดจักรวาล

“อิทัปปัจจยตา” เป็นกฎของธรรมชาติที่ไม่อาจเปลี่ยนแปลง

คำว่า “อิทัปปัจจยตา” อาจเป็นคำที่ไม่คุ้นหู แต่ขอให้สนใจ เพราะมันเป็นกฎของธรรมชาติที่แน่นอนตลอดจักรวาลและอนันตกาล

- สิ่งนี้เกิดขึ้น เพราะมีเหตุปัจจัยนี้

- สิ่งนี้มี เพราะสิ่งนี้มี

- ดวงอาทิตย์ ดวงจันทร์ ดวงดาว ทุกอย่างล้วนเกิดขึ้นตามกฎของ “อิทัปปัจจยตา”

เมื่อทำสิ่งนี้ มันต้องเกิดสิ่งนั้นขึ้น

เมื่อทำสิ่งนี้ มันต้องเกิดทุกข์ขึ้น

เมื่อทำสิ่งนี้ มันต้องเกิดความดับทุกข์ขึ้นนี่คือปรมัตถธรรมอันสูงสุด ไม่มีสัตว์ ไม่มีบุคคล ไม่มีพระเจ้าที่เป็นตัวตน

มีเพียง กฎอิทัปปัจจยตา ที่เป็นกฎของธรรมชาติอันเฉียบขาดพระพุทธเจ้าตรัสรู้ ก็คือ ตรัสรู้เรื่อง “อิทัปปัจจยตา”

เรามักเรียกกันว่า “ปฏิจจสมุปบาท” ซึ่งหมายถึงเฉพาะเรื่องทุกข์ของสิ่งมีชีวิต แต่ “อิทัปปัจจยตา” กว้างขวางกว่านั้น ทุกสิ่งไม่ว่าจะมีชีวิตหรือไม่มีชีวิตล้วนตกอยู่ใต้อำนาจของกฎนี้

กฎของอิทัปปัจจยตาไม่ใช่ฝ่ายบวกหรือฝ่ายลบ

- ไม่ใช่ Positive

- ไม่ใช่ Negative

- เป็น “สายกลาง” ของมันเองคนเราต่างหากที่ไปบัญญัติว่า “นี่คือสุข นี่คือทุกข์ นี่คือแพ้ นี่คือชนะ”

แต่แท้จริงแล้ว ทุกอย่างเป็นไปตามอิทัปปัจจยตาความเข้าใจในปรมัตถธรรมต้องไปให้ถึงจุดนี้

- จนไม่มีสัตว์ ไม่มีบุคคล

- ไม่ใช่สัตว์ ไม่ใช่บุคคล

- แต่ก็ไม่ใช่ว่าไม่มีอะไรเลย และก็ไม่ได้มีสิ่งใดที่ตายตัว

ทุกอย่างเป็นเพียง กระแสของการเปลี่ยนแปลงและปรุงแต่ง

เมื่อเข้าใจถึงจุดนี้ จึงจะรู้อย่างที่พระพุทธเจ้าท่านรู้ และดับทุกข์ได้

นี่คือสิ่งสูงสุดที่ต้องเคารพ คือ กฎของ “อิทัปปัจจยตา”— พุทธทาสภิกขุ

(จากธรรมบรรยายประจำวันเสาร์ ภาคอาสาฬหบูชา ชุด “ฟ้าสางระหว่าง 50 ปีที่มีสวนโมกข์” ครั้งที่ 19 เมื่อวันที่ 13 สิงหาคม 2526 ณ ศาลามหานาวา สวนโมกขพลาราม จากหนังสือ “ธรรมานุภาพ”) -

@ 58537364:705b4b85

2025-05-13 17:44:48

@ 58537364:705b4b85

2025-05-13 17:44:48The Dhamma of the Buddha is not merely a concept or philosophical hypothesis. It is the direct seeing of the truth — that suffering truly exists within us, and that it can genuinely be ended — through observing, with wisdom, not by calculation or blind belief.

Suffering is not an abstract idea; it is a real experience we can feel. When we truly understand suffering by facing it directly — not running from it or deceiving ourselves — we will see that the sense of “self” is the root of suffering. Every time the feeling of “this is me, this is mine” arises — suffering follows.

The solution is not in argument or debate, but in taking action to see and know this truth for ourselves.

Thus, Dhamma is the science of the mind — not just a philosophy. And this is why the Buddha’s teachings have never become outdated, even after more than 2,500 years.

Read the TH full version at: https://w3.do/okHFEDy-

-

@ 91bea5cd:1df4451c

2025-05-14 10:47:44

@ 91bea5cd:1df4451c

2025-05-14 10:47:44A origem do Dia das Mães

Anna Jarvis (1864-1948 Virgínia Ocidental), uma ativista americana, fundou o Dia das Mães nos Estados Unidos há mais de um século, escolhendo o segundo domingo de maio para tal celebração; mesma data que é comemorada até hoje em muitos países do mundo.

Ela nasceu durante a Guerra Civil, e viu sua mãe, Ann Reeves Jarvis, trabalhar na organização de Clubes de Trabalho Materno para cuidar de soldados de ambos os lados da guerra, a fim de diminuir as diferenças entre as mães do Norte e do Sul.

Em 1910, o Dia das Mães tornou-se feriado estadual na Virgínia Ocidental (EUA) e, em 1914, foi declarado feriado nacional pelo presidente Woodrow Wilson.

Segundo historiadores, Anna imaginava o feriado como um retorno ao lar, um dia para homenagear a sua mãe, a única mulher que dedicou sua vida à Anna. Ela escolheu o segundo domingo de maio porque seria sempre próximo de 9 de maio, o dia da morte de sua mãe, que faleceu em 1905.

E por que Anna Jarvis passou a odiar a data?

Acontece que a data começou a ter um apelo comercial, e Anna nunca quis que o dia se tornasse comercial, mas sim, só uma celebração às figuras maternas. Então ela acabou se opondo à comercialização e popularização do feriado.

Com o feriado, as indústrias floral, de cartões comemorativos e de doces começaram a ficar gananciosas para vender os seus produtos e subiram os preços nesta data, a fim de lucrarem mais.

Para Anna, "estavam comercializando o seu Dia das Mães". Para um jornal da época, ela comentou: "O que vocês farão para afugentar charlatões, bandidos, piratas, mafiosos, sequestradores e outros cupins que, com sua ganância, minam um dos movimentos e celebrações mais nobres e verdadeiros?".

Ela se irritava com qualquer organização que usasse seu dia para qualquer coisa que não fosse seu propósito original e sentimental, dizem historiadores. Em 1920, ela já incentivava as pessoas a não comprarem flores, por exemplo.

Além disso, instituições de caridade usavam o feriado para arrecadar fundos com a intenção de ajudar mães pobres; porém, como contam, elas não estavam usando o dinheiro para mães pobres, como alegavam.

Anna reivindicou os direitos autorais da frase "Segundo domingo de maio, Dia das Mães" ("Second Sunday in May, Mother's Day") e passou a vida lutando contra a comercialização da data. Um dos seus últimos atos foi ir de porta em porta na Filadélfia (EUA) pedindo assinaturas para apoiar a revogação do Dia das Mães.

Anna Jarvis nunca se casou e nem teve filhos, dedicando sua vida principalmente à causa do Dia das Mães. Ela faleceu em West Chester, na Pensilvânia (EUA), no dia 24 de novembro de 1948, aos 84 anos, devido a uma insuficiência cardíaca.

Fontes

- https://www.bbc.com/news/stories-52589173

- https://aventurasnahistoria.com.br/noticias/historia-hoje/dia-das-maes-por-que-mulher-que-criou-o-feriado-passou-odiar-data.phtml

- https://www.tempo.com/noticias/actualidade/dia-das-maes-por-que-a-mulher-que-inventou-a-data-se-arrependeu-de-te-la-criado.html

-

@ 000002de:c05780a7

2025-05-13 17:03:45

@ 000002de:c05780a7

2025-05-13 17:03:45Hopefully this is the beginning of a trend. I don't have any near me but I will try it out the first chance I get.

Steak n Shake is owned by Biglari Holdings Inc. a publicly traded holding company based in Texas. Do any stackers have any background info on this move or the companies involved?

Not the first to mention this.

More info on Bitcoin Mag

originally posted at https://stacker.news/items/979201

-

@ 57d1a264:69f1fee1

2025-05-14 06:48:45

@ 57d1a264:69f1fee1

2025-05-14 06:48:45Has the architect Greg Chasen considered it when rebuilding the house just one year before the catastrophe? Apparently not! Another of his projects was featured on the Value of Architecture as properties with design integrity.

This is a super interesting subject. The historic character, livability, and modern disaster-resistance is a triangle where you often have to pick just one or two, which leads to some tough decisions that have major impacts on families and communities. Like one of the things he mentions is that the architect completely eliminated plants from the property. That's great for fire resistance, but not so great for other things if the entire town decides to go the same route (which he does bring up later in the video). I don't think there's any objectively right answer, but definitely lots of good (and important) discussion points to be had.

https://www.youtube.com/watch?v=cbl_1qfsFXk

originally posted at https://stacker.news/items/979653

-

@ d61f3bc5:0da6ef4a

2025-05-13 16:03:48

@ d61f3bc5:0da6ef4a

2025-05-13 16:03:48What happens when you integrate a Nostr client with a bitcoin lightning wallet? They both get massively better! Social interactions benefit from seamless micropayments, while the wallet is able to tap into the massive address book represented by the Nostr social graph. This makes it possible to interact with people around the world in totally new ways. For example, Markus from Germany can zap a note posted by Isabella in Costa Rica, who can then buy a coffee with those sats, all from the same app.

At Primal, our goal is to deliver products that have mass appeal; products that can be easily used by anyone. Our latest iOS release represents our best take on how to build on open protocols and balance the tradeoffs between user sovereignty, user experience and ease of use. We believe that Nostr and Bitcoin will grow to billions of users, and we are building the technology that will help onboard and delight everyone.

Nostr Onboarding

Our goal is to achieve the highest level of user experience on a decentralized network, without sacrificing user sovereignty over their account, connections, and content. Therefore the onboarding process needs to be smooth and resemble what users are used to on legacy platforms, while providing access to their Nostr keys:

The user is able to sign up and start using Nostr quickly and without friction. Their key is available in the Account Settings, providing complete control over their Nostr account. In addition, the user can specify the set of Nostr relays they wish to publish to. The Primal iOS app signs all content with the user’s key and publishes it directly to the specified set of relays. This achieves full user control over their Nostr account, social connections, and the content they publish.

Performance & UX

In order to compete with the centralized legacy platforms, we must match and exceed their level of user experience. Interfaces must load quickly and completely, otherwise people will lose interest and Nostr will see a high degree of user churn. With this in mind, we built the Nostr caching service, and open sourced it so that other Nostr developers can leverage it as well. This enables us to provide the types of user experiences that are expected by most people today:

For details about our caching approach please refer to my Nostrasia presentation.

Primal Wallet

We are psyched to introduce Primal Wallet, an insanely easy-to-use transactional wallet, ideal for holding small amounts of bitcoin and making payments on the lightning network.

Strike is providing custody, fiat conversions, and lightning network connectivity to Primal users. By integrating with Strike, we are able to provide uninterrupted service to U.S. and international customers.

Smooth onboarding and wallet operation are essential for our use case. Given that we are dealing with very small amounts, we decided to take the custodial approach. This sacrifices direct user custody over the funds, but makes the overall UX seamless and reliable. New users are able to send and receive sats as soon as they download the app.

Here are a few additional points to keep in mind:

-

\In-App Purchases\: Once the wallet is activated, it is fully-operational and able to receive sats. If the user doesn’t own any sats, they are able to buy small amounts via an in-app purchase, in $5 increments. Note that these purchases are subject to “Apple tax” (15% in U.S. and Canada, 30% elsewhere, for customers with iOS devices), plus 1% Strike margin. Primal does not make any revenue on these purchases. Users can always buy sats through a different method and send them to their Primal Wallet. The in-app purchase is merely a convenient way for new users to get started with small amounts.

-

\Maximum Wallet Balance\: Primal Wallet is designed for holding and transacting with small amounts of bitcoin. Larger amounts should be kept in self custody, preferably on a hardware wallet. To encourage self custody for larger amounts, we are enforcing a maximum wallet balance of 1,000,000 sats (approximately USD $400 at the time of this writing).

We believe that Primal Wallet offers the best tradeoff balance for our use case, including social media zaps, and small purchases: coffee, beer, lunch, etc. We are planning to expand the feature set of the wallet in the upcoming releases, based on the feedback from our users.

Open Networks Win

Nostr is an open network, not controlled by any person, company, nor organization. Anyone can join without asking for permission, and any developer is free to build on it. In a short amount of time, hundreds of projects have sprouted building on Nostr, including: Damus, Amethyst, Snort, Highlighter, Alby, Nos, Mutiny, Coracle, ZBD, Fountain, Habla.news, Plebstr, Spring, Iris, Nostrgram, Current, Blogstack, Zap.stream, Listr, Nostr.band, Nostr.build, Flycat, Nosta.me, NoStrudel, Nostur, Nostore, Zaplife, Wavlake, and many more.

Your Nostr keys work with Primal, as well as every other app in the Nostr ecosystem. You can seamlessly use your Nostr identity in social media apps, blog/news sites, marketplaces, etc. Every Nostr product brings more users and more gravity to the entire network. This is why we believe that Nostr will eventually connect everybody.

If you are not satisfied with the status quo dictated by the legacy media complex, if you think that the global town square should not be owned by anyone, if you feel that people should be in control over their online identity, social connections, and the content they publish - you do have a choice. Join us on Nostr. 🤙💜

-

-

@ 961e8955:d7fa53e4

2025-05-14 08:52:07

@ 961e8955:d7fa53e4

2025-05-14 08:52:07 Cryptocurrencies have become increasingly popular in recent years, and their impact on the world economy is a topic of much discussion. While there are many potential benefits to using cryptocurrencies, such as greater privacy and security, there are also several ways in which they may impact the global economy.

Cryptocurrencies have become increasingly popular in recent years, and their impact on the world economy is a topic of much discussion. While there are many potential benefits to using cryptocurrencies, such as greater privacy and security, there are also several ways in which they may impact the global economy.One potential impact of cryptocurrencies on the world economy is their ability to disrupt traditional financial systems. By enabling peer-to-peer transactions without the need for intermediaries such as banks or financial institutions, cryptocurrencies have the potential to lower transaction costs and increase efficiency. This could have a significant impact on industries such as remittances, where people send money across borders to their families.

However, the rise of cryptocurrencies has also brought concerns around their potential impact on monetary policy. Because cryptocurrencies are decentralized and not subject to government control, some fear that they could lead to increased volatility and instability in financial markets. Additionally, the use of cryptocurrencies could make it more difficult for central banks to control inflation and regulate the money supply.

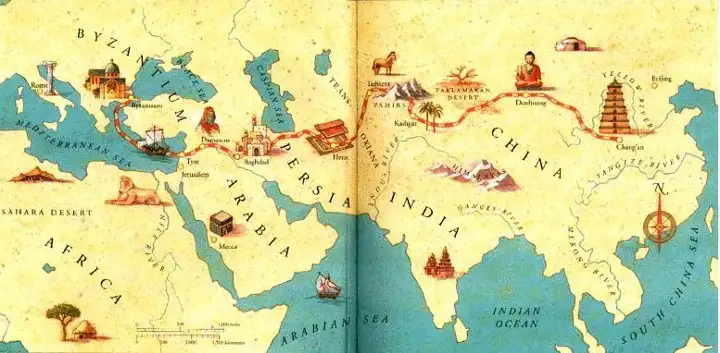

Another potential impact of cryptocurrencies on the global economy is their ability to facilitate international trade. With the use of blockchain technology, cryptocurrencies could provide a secure and transparent means of conducting cross-border transactions. This could reduce the costs and time associated with traditional international payments, which could have a positive impact on global trade.

Finally, the growth of cryptocurrencies could also have an impact on wealth distribution. Because cryptocurrencies are accessible to anyone with an internet connection, they could provide new opportunities for people who have been excluded from traditional financial systems. However, there are also concerns that the concentration of wealth in the hands of early adopters and large cryptocurrency holders could exacerbate existing inequalities.

In conclusion, the impact of cryptocurrencies on the world economy is complex and multifaceted. While they have the potential to disrupt traditional financial systems and facilitate international trade, they also raise concerns around monetary policy and wealth distribution. As the use of cryptocurrencies continues to grow, it will be important to carefully monitor their impact on the global economy and take steps to address any potential risks.

-

@ 961e8955:d7fa53e4

2025-05-14 07:02:41

@ 961e8955:d7fa53e4

2025-05-14 07:02:41Medical billing and coding play a crucial role in the healthcare industry. Healthcare facilities and insurance companies rely on skilled professionals to accurately code medical procedures and submit claims for reimbursement.

If you're interested in pursuing a career in medical billing and coding, online schools offer a convenient and flexible option to learn the necessary skills. Here is a detailed list of some of the top online schools for medical billing and coding:

Penn Foster College: Penn Foster College offers an online associate degree program in medical billing and coding that covers topics such as anatomy and physiology, medical terminology, and healthcare law and ethics. The program is self-paced, allowing students to complete it at their own pace.

Ultimate Medical Academy: Ultimate Medical Academy offers an online diploma program in medical billing and coding that can be completed in as little as 10 months. The program covers topics such as medical office management, medical coding, and healthcare reimbursement.

Herzing University: Herzing University offers an online associate degree program in medical billing and insurance coding that can be completed in as little as 20 months. The program covers topics such as medical billing, medical coding, and healthcare reimbursement.

Ashworth College: Ashworth College offers an online diploma program in medical billing and coding that can be completed in as little as four months. The program covers topics such as medical terminology, medical coding, and healthcare law and ethics.

Career Step: Career Step offers an online certificate program in medical billing and coding that can be completed in as little as four months. The program covers topics such as medical terminology, anatomy and physiology, and medical coding.

These online schools offer a range of programs to meet the needs of aspiring medical billing and coding professionals. With the flexibility and convenience of online learning, you can gain the skills and knowledge you need to start a rewarding career in this growing field.

Average Salaries for Medical Billing and Coding Professionals in the United States Medical billing and coding salaries can vary depending on several factors such as location, experience, and certification. Here is a general list of average salaries for medical billing and coding professionals in the United States:

Medical billing and coding specialist: $42,640 per year Medical records technician: $44,020 per year Medical coder: $49,780 per year Medical billing specialist: $41,750 per year Certified coding specialist: $61,620 per year It's important to note that these are average salaries and may vary based on individual circumstances. Additionally, pursuing advanced certification and further education can lead to higher salaries and opportunities for career advancement.

The Future of Medical Billing and Coding Careers: Job Outlook and Growth Potential The demand for skilled medical billing and coding professionals is expected to grow in the coming years. According to the Bureau of Labor Statistics, employment of health information technicians (which includes medical billing and coding professionals) is projected to grow 8 percent from 2019 to 2029, much faster than the average for all occupations.

Medical billing and coding professionals can work in a variety of settings, including hospitals, clinics, physician's offices, and insurance companies. They play a critical role in ensuring accurate documentation and reimbursement for medical services.

In addition to traditional employment opportunities, medical billing and coding professionals can also work as freelancers or start their own businesses. With the rise of telemedicine and remote work, there may be even more opportunities for individuals to work from home in this field.

Overall, the job outlook for medical billing and coding professionals is promising, with a variety of employment opportunities available in the healthcare industry.

Where Can You Work with a Medical Billing and Coding Certification? Medical billing and coding professionals can work in various healthcare settings, such as:

Hospitals Clinics and outpatient centers Physician's offices Insurance companies Government agencies Nursing homes and long-term care facilities Home healthcare agencies Medical billing and coding companies Telemedicine companies Additionally, with the rise of remote work and telemedicine, medical billing and coding professionals may have the opportunity to work from home or as freelancers. This flexibility allows for a more diverse range of employment options and can provide greater work-life balance.

-

@ 57d1a264:69f1fee1

2025-05-14 06:12:19

@ 57d1a264:69f1fee1

2025-05-14 06:12:19We asked members of the design community to choose an artifact that embodies craft—something that speaks to their understanding of what it means to make with intention. Here’s what they shared.

A vintage puzzle box, a perfectly tuned guitar, an AI-powered poetry camera. A daiquiri mixed with precision. A spreadsheet that still haunts muscle memory. Each artifact tells a story: not just about the thing itself, but about the choices of the creator behind it. What to refine, what to leave raw. When to push forward, when to let go. Whether built to last for generations or designed to delight in a fleeting moment, the common thread is that great craft doesn’t happen by accident. It’s made.

On the application of craft

Even the most experienced makers can benefit from building structure and intention into their practice. From sharpening your storytelling to designing quality products, these pieces offer practical ways to uplevel your craft.

Read more at https://www.figma.com/blog/craft-artifacts/

originally posted at https://stacker.news/items/979644

-

@ b80cc5f2:966b8353

2025-05-13 16:02:17

@ b80cc5f2:966b8353

2025-05-13 16:02:17Originally posted on 11/12/2024 @ https://music.2140art.com/could-bitcoin-solve-the-music-industrys-legal-chaos-a-new-music-economy-in-action/

The first part of our exploration into the “New Music Economy” focused on Bitcoin’s potential to redefine how artists and fans exchange value. In this follow-up, we dive into the current state of the music industry—an ecosystem riddled with legal battles, power struggles, and technological disruptions.

From lawsuits involving AI-generated music to accusations of collusion between major labels and streaming platforms, these challenges highlight the flaws of the traditional system. A Bitcoin-powered New Music Economy doesn’t just offer an alternative—it may eventually be the solution the industry desperately needs.

The Legal Challenges Shaking the Music Industry

The music industry is no stranger to legal disputes, but recent cases reveal deeper systemic issues, highlighting the need for a foundational rethink of its economic and operational models. Let’s break down some of the most significant battles:

- Drake vs. Universal Music Group and Spotify In late 2024, Drake filed lawsuits against Universal Music Group (UMG) and Spotify, alleging they artificially inflated the streams of Kendrick Lamar’s diss track Not Like Us. He accused UMG of using bots and engaging in pay-to-play schemes, distorting the competitive landscape and causing him financial harm.

- Record Labels vs. AI Music Companies Major labels such as Sony Music, UMG, and Warner Records have launched lawsuits against AI startups like Suno and Udio. These companies allegedly trained their AI models using copyrighted songs without permission, generating content that is directly competing with human artists.

- Artists’ Lawsuit Over Streaming Revenue Transparency In an ongoing class-action lawsuit, artists are demanding greater transparency from streaming platforms like Spotify, accusing them of underreporting streams and withholding royalties.

- The Copyright Battle Over AI-Generated Drake and The Weeknd Song Earlier in 2024, an AI-generated song mimicking Drake and The Weeknd went viral. Universal Music Group sought to have it removed from platforms, citing copyright infringement, but the case has sparked debate about whether AI-generated works fall under current copyright laws.

- Streaming Payout Inequities for Independent Artists Independent musicians continue to push back against low streaming payouts. Platforms like Spotify pay fractions of a penny per stream, leading to widespread frustration and calls for systemic reform.

Copyright Challenges in Blockchain-Based Platforms

While blockchain offers revolutionary benefits for transparency and fair royalties, it also introduces copyright challenges. A prominent example is Audius, a decentralised music streaming platform aiming to empower artists by removing intermediaries. Despite its innovative approach, Audius has faced significant copyright infringement issues.

Key Copyright Challenges:

Irremovability of Content: Once data is recorded on a blockchain, it becomes difficult to alter or remove, which complicates the elimination of infringing material.

Decentralised Control: With no central authority,enforcing copyright compliance is challenging, as responsibilities are distributed across the network.

Addressing Copyright in Blockchain Music:

Advanced Content Identification Systems: Integrating tools that detect and block unauthorised uploads can prevent copyright violations proactively.

Collaborative Efforts with Rights Holders: Engaging directly with artists and labels fosters trust and reduces disputes.

Robust Copyright Policies: Clear rules and enforcement mechanisms ensure compliance while promoting innovation.

Distribution Challenges and Niche Crowds

One of the most pressing concerns for Bitcoin-powered music platforms is their niche audience. Compared to major platforms like Spotify or Apple Music, Bitcoin-based platforms often attract smaller, more targeted communities. This can create challenges in distribution and reach, as artists may find it difficult to achieve visibility or access millions of listeners.

Why the Niche Approach Works

-

Dedicated Fans: Smaller, focused communities often have higher engagement rates. Fans on Bitcoin-powered platforms actively choose to support artists rather than passively streaming.

-

Revenue Transparency: With Bitcoin, artists retain control over their earnings, avoiding the opaque systems of major platforms.

-

Early Adoption Opportunities: As Bitcoin-powered platforms grow, early adopters gain a competitive edge, establishing themselves within a loyal community.

How Bitcoin Addresses Industry Issues

A Bitcoin-powered New Music Economy offers solutions to these systemic problems:

-

Transparent and Automated Royalties With Bitcoin smart contracts, royalty payments can be automated, transparent, and instant.

-

Immutable Ownership Records Blockchain can securely record ownership and licensing information, reducing disputes over intellectual property and providing clear attribution, even for AI-generated content.

-

Global Accessibility and Fair Compensation Bitcoin’s decentralised nature enables artists worldwide to receive payments directly from fans, bypassing traditional financial barriers.

-

Decentralised Platforms Building music distribution platforms on the blockchain can eliminate centralised control, reducing the risk of manipulation and ensuring artists maintain ownership of their content and revenue streams.

-

Equitable AI Content Compensation When AI tools use songs for training, those works can be identified through their blockchain registrations. Bitcoin smart contracts could automatically pay royalties to original creators whenever their work contributes to an AI-generated song.

To demonstrate just a fraction of the possibilities, platforms like Audionals.com, founded by Jim Crane, are actively developing ways to use Bitcoin’s blockchain to decentralise music creation, rights management, and distribution. By exploring how detailed metadata and audio data can be inscribed onto Bitcoin, Audionals is working toward solutions that allow for precise and transparent ownership and royalty tracking. While still in progress, it highlights how blockchain technology could enable a more efficient and artist-focused music economy.

For further insights on how Audionals works, check out this interview with Jim Crane.

A Real Economy, Not Just an Ecosystem

The current wave of lawsuits, technological disruption, and artist frustration shows that the music industry is ripe for change. Bitcoin offers more than just a payment system—it provides a decentralised, censorship-resistant infrastructure capable of fostering true ownership, transparency, and equitable participation in the music economy.

By addressing both the promises and challenges of blockchain, platforms like Audius highlight the complexities of this shift. From royalty transparency to AI copyright disputes, Bitcoin isn’t just a tool; it’s a blueprint for the real New Music Economy. The question now is whether the industry is ready to embrace it, or whether independent artists and fans will lead the way.

-

@ 57d1a264:69f1fee1

2025-05-14 05:56:15

@ 57d1a264:69f1fee1

2025-05-14 05:56:15Shanghai: Bus Stops Here

A new crowd-sourced transit platform allows riders to propose, vote on, and activate new bus lines in as little as three days.

From early-morning school drop-offs to seniors booking rides to the hospital, from suburban commuters seeking a faster link to the metro to families visiting ancestral graves, Shanghai is rolling out a new kind of public bus — one that’s designed by commuters, and launched only when enough riders request it.

Branded “DZ” for dingzhi, or “customized,” the system invites residents to submit proposed routes through a city-run platform. Others with similar travel needs can opt in or vote, and if demand meets the threshold — typically 15 to 20 passengers per trip — the route goes live.

More than 220 DZ routes have already launched across all 16 city districts. Through an online platform opened May 8, users enter start and end points, preferred times, and trip frequency. If approved, routes can begin running in as little as three days.

Continue reading at https://www.sixthtone.com/news/1017072

originally posted at https://stacker.news/items/979637

-

@ 502ab02a:a2860397

2025-05-14 06:36:13

@ 502ab02a:a2860397

2025-05-14 06:36:13ย้อนกลับไปในยุคโบราณ ไม่ว่าชนเผ่าชาวทุ่งหญ้าในยูเรเชีย ชาวอินเดียตอนเหนือ หรือเผ่าทะเลทรายแถบตะวันออกกลาง ล้วนมีวัฒนธรรมที่เกี่ยวข้องกับนมวัว นมจามรี นมแพะ และทุกชนิดก็ลงเอยที่การเอานมไปแปรรูปเป็น “เนย” ทั้งเนยแบบสด เนยหมัก

เนยที่เก่าแก่ที่สุดเท่าที่มีบันทึก คือ “Bog Butter” จากไอร์แลนด์ ไม่ใช่ blockbuster นะ ฮาๆๆๆ “Bog Butter” เป็นเนยที่ถูกฝังไว้ในบึงพรุ (bog) ของไอร์แลนด์และสก็อตแลนด์ มาหลายร้อยถึงหลายพันปี โดยไม่มีการเน่าเสีย! เพราะบึงพรุมีสภาพแวดล้อมที่เป็นกรด ไม่มีออกซิเจน และเย็น จึงเป็นสภาวะที่เหมาะกับการถนอมอาหารแบบธรรมชาติสุด ๆ

มีหลักฐานการค้นพบ Bog Butter อายุราว 3,000 ปี (ยุคเหล็กตอนต้น) ในหลายพื้นที่ของไอร์แลนด์ เช่น County Offaly, County Cavan และ County Fermanagh ลักษณะของ Bog Butter ที่ขุดพบ บางก้อนยังอยู่ในสภาพดี มีสีเหลืองทอง เนื้อเนียน และยังมีกลิ่นคล้ายชีสที่สุกมาก ๆ ภาชนะที่ใช้ใส่เนยมักเป็นถังไม้ กล่องไม้โอ๊ค หรือแม้แต่หนังสัตว์ผูกไว้แน่น ๆ

นักโบราณคดีเชื่อว่า Bog Butter คือเนยจากนมสัตว์ (นมวัวหรือนมแพะ) ที่อาจผ่านการหมักหรือเคี่ยวแล้วก่อนนำไปฝัง เพื่อถนอมไว้กินในฤดูหนาวหรือในปีที่น้ำนมขาดแคลน บางทฤษฎีก็เสนอว่ามีการฝังเนยเพื่อเหตุผลทางพิธีกรรม หรือใช้เป็น “ทรัพย์สิน” ที่ฝากไว้กับแผ่นดินเพื่อแสดงความมั่งคั่ง

ที่น่าทึ่งก็คือนี่เป็นการถนอมเนยที่ไม่ใช้ความร้อน ไม่ใช้เกลือ และไม่ใช้น้ำแข็ง แต่กลับอยู่ได้นานเป็นพันปี เพราะอาศัยสภาพแวดล้อมที่เข้าใจธรรมชาติสุด ๆ มีข้อมูลว่าเขามีการชิม Bog Butter ที่ขุดขึ้นมาด้วยนะ มีคำบรรยายไว้ว่า “มันมีกลิ่นชีสเข้มข้น กลิ่นดินและควันบาง ๆ เหมือนกินประวัติศาสตร์” 5555

เนยแท้ (butter) ก็คือน้ำนมที่ถูกแยกเอาไขมันออกมาด้วยการตี (churning) โดยอาศัยแรงมือหรือแรงกล เครื่องตีจะรวมเม็ดไขมันเล็ก ๆ จากครีมนมให้จับตัวกันกลายเป็นก้อนเนย แล้วแยกเอาน้ำบัตเตอร์มิลค์ออกไป คงเหลือไว้แค่ไขมันเนยที่หอม มัน และอุดมไปด้วยวิตามิน A, D, E, K ในรูปที่ดูดซึมง่าย เพราะละลายในไขมัน

องค์ประกอบหลักที่อยู่ในเนยจะมี 3 ส่วนใหญ่ๆเรียกแบบเหมารวมคือ

1 ไขมันนม/ไขมันเนย หรือ butter oil 2 เนื้อนม หรือ solid milk 3 ส่วนที่เป็นของเหลวต่างๆ หรือ moisture คือมันไม่เจาะจงว่าน้ำนึกออกไหมครับ นมมาจากธรรมชาติไม่ได้มาจากการผสมสัดส่วน ดังนั้นการจะมุ่งว่าเป็นน้ำเลยจึงไม่ใช่เสียทีเดียว ภาษาไทยเราจึงมักแปลไว้ว่าส่วนที่เป็นความชื้น *ตรงนี้มีหมายเหตุไว้นิดหน่อยครับว่า เจ้าไขมันเนยนี่ เราอาจะเจอภาษาอังกฤษหลายคำนะครับ เช่น butterfat, butter oil, fat milk ตรงนี้ให้เข้าไจไว้ว่ามันหมายถึงสิ่งเดียวกันนั่นหละครับ

สิ่งสำคัญในการทำเนยคือ ไขมันจากนมนั่นเอง นมส่วนที่ไขมันสูงนั้นเราเรียกว่า ครีม นึกภาพเป็นการ์ตูนง่ายๆได้ว่า เราช้อนเเอาเฉพาะส่วนที่เป็นครีมนั่นแหละ แล้วเอามาทำมาทำเป็นเนย ปล่อยทิ้งส่วนของนมที่ไม่มีไขมันเอาไว้ทำอย่างอื่น (มันคือนมพร่องมันเนย คุ้นมะ แต่จริงๆเค้าไม่ได้เอาส่วนนี้มาขายเป็นนมให้เราหรอกนะครับ โรงงานแต่ละโรงจะตั้งไลน์ผลิตเพื่อสินค้าที่ดีที่สุดของตัวเอิง จะไม่จับฉ่ายเอาเศษเดนมาทำของขายให้เรา)

การเตรียมครีมก่อนจะเข้าสู่การผลิตเนยก็จะมีหลากหลายรูปแบบยกตัวอย่างเช่น

-Sour cream butter หรือ Cultured butter เป็นเนยทำจากครีมที่ผ่านการพาสเจอไรส์(ฆ่าเชื้อ) แล้วหมักด้วยจุลินทรีย์แลคติกหรือไม่ก็แลคโตบาซิลัส ทำให้มีกลิ่นและรสที่ดี -Neutralized sour cream butter เป็นเนยที่ได้จากครีมที่หมักด้วยจุลินทรีย์แล้วเอาไปทำเป็นกลางด้วย โซเดียมไบคาบอเนต โซเดียมคาร์บอเนต แคลเซียมไฮดรอกไซด์ รวมกับ แมกนีเซียมออกไซด์ หรือ แมกนีเซียมไฮดรอกไซด์ -Sweet cream butter เป็นเนยที่ทำจากครีมที่ผ่านการพาสเจอไรส์(ฆ่าเชื้อ) แต่ไม่มีการหมักบ่ม คือนำไปปั่นทำเนยเลย เนยชนิดนี้จะมีกลิ่นคล้ายครีมถ้ายี่ห้อนั้นๆไม่ได้เติมกลิ่นลงไปเพิ่มนะครับ รสชาติจะออกไปทางหวานนิดๆ เพราะมีน้ำตาลธรรมชาติในนมอยู่เนื่องจากไม่ได้ผ่านการหมัก แต่ไม่ต้องกังวลเพราะไม่ถึงกับหวานเวอร์ มันจะแค่หวานกว่าเนยชนิด Cultured butter แค่นั้น -Semi-culture butter หรือ European-style butter หรือ Fresh cream butter เป็นเนยที่ได้จากครีมที่ไม่ได้ผ่านการหมัก คือทำแบบเดียวกับ Sweet cream butter แต่ขั้นตอนสุดท้ายมีการเติมกลิ่นรสและกรดแลคติก ที่ได้จากนมหมักจุลินทรีย์แล้วเอาไปผ่านกระบวนการ อัลตร้าฟิลเทรชัน (Ultrafiltration) เพื่อให้เข้มข้นขึ้น -Raw butter cream เป็นเนยที่ผลิตจากน้ำนมดิบ ไม่ผ่านการพาสเจอไรส์(ฆ่าเชื้อ) คือจัดไปดิบๆเลย นมดิบสดๆมาแยกครีมแล้วปั่นทำเนยเลยไม่มีการเติมอะไรทั้งสิ้น คุณภาพของเนยชนิดนี้จะแปรผันตามคุณภาพของน้ำนมดิบและความเชี่ยวชาญของผู้ที่ผลิตเนย อายุของเนยชนิดนี้จะสั้นแค่ประมาณ 7-10วันเท่านั้นเพราะทุกอย่างมันสดจริงๆ

เห็นไหมครับว่า เนยแต่ละยี่ห้อเขาก็จะมีกรรมวิธีผลิตเนยในรูปแบบที่ต่างกันไป เนยบ่มก็จะมีกลิ่นหอมรสที่หนักแน่นปริมาณไขมันเนยและความชื้นน้อยกว่าเนยแบบ sweet cream ส่วนเจ้าเนย sweet cream เองก็เน้นที่ความสดความเฟรช กลิ่นเบาๆครีมๆมีความหวานหลงเหลืออยู่และมีราคาถูกกว่า ส่วนตัว raw butter ก็จะออกไปทางงานคราฟท์ คลาสสิค

เนย Home made ทำยังไง เนยแบบที่เราทำกินเองได้ในบ้านก็เป็นแบบ sweet cream butter หรือ เนยที่ได้จากครีมสดไม่ผ่านการหมักอะไรเลย เว้นแต่เติมเกลือเพื่อให้เป็นเนยเค็ม (จริงๆเติมเกลือเพื่อช่วยยืดอายุเนยได้อีกระยะหนึ่งด้วยนะ เป็นแทคติก) ปกติวิธีการทำเนย เขาจะเอาครีมเข้าถังปั่น เพื่อให้ครีมเกิดการแยกก้อนเนยเป็น grain (เขาเรียกว่า butter granule/butter curds) กับ หางเนย (butter milk) ซึ่งเป็นของเหลวที่ประกอบไปด้วยเนื้อนมไม่รวมมันเนยแล้วก็น้ำ แล้วเขาก็จะเอาก้อนเนยนี่แหละไปล้างน้ำเย็นเอากลิ่นหืนๆและรสประหลาดๆออกไป กำจัดความชื้นแล้วจบกระบวนการตีๆตบๆขึ้นรูปเนยก้อนต่อไป

ตรงนี้ถ้าจะให้เห็นภาพขึ้น ใครทำขนมเองคงรู้ดี เวลาที่เราตีวิปครีมมากเกินไป มันจะจับก้อนและแยกชั้น เป็นก้อนๆกับเหลวๆ ก้อนๆก็คือเนื้อเนย ไอ้เหลวๆก็คือ butter milk

การทำ เนยสด homemade fresh butter กินเองที่บ้านเราก็ทำได้ด้วยการจำลองถังปั่นด้วยเครื่องตีขนม จะเป็นแบบตีมือหรือแบบเครื่องก็ได้ครับ หรืออยากจะแอดวานซ์เอาใส่ขวดน้ำแล้วเขย่าก็ได้เหมือนกันนะครับ เมื่อถึงระยะเวลานึงครีมก็จะแยกตัวเป็นเนย กับ butter milk

ลองดูที่ผมเคยทำไว้ในคลิปนี้ได้ครับ https://youtu.be/bzo7V9n2cxc?si=0ZvcAT1H-6h1ZmUh

ไขมันในเนยมีองค์ประกอบพิเศษที่ไม่ค่อยถูกพูดถึงเท่าไรนัก นั่นคือกรดไขมันสายสั้นอย่าง butyric acid ซึ่งมีชื่อมาจากคำว่า “butter” เลย เพราะมันมีบทบาทในลำไส้ โดยเฉพาะการเป็นอาหารของเซลล์เยื่อบุลำไส้ใหญ่ ช่วยลดอาการอักเสบในระบบทางเดินอาหาร

สัดส่วนไขมันในเนยส่วนใหญ่จะเป็น ไขมันอิ่มตัว (SFA) ราว 50-65%, ไขมันไม่อิ่มตัวเชิงเดี่ยว (MUFA) ประมาณ 25-30% และไขมันไม่อิ่มตัวเชิงซ้อน (PUFA) ราว 2-5% เท่านั้น แต่ในส่วนของ PUFA นั้นมีความพิเศษเล็กน้อย ที่จะคุยในน้ำมันตัวต่อไปครับ

ในโลกตะวันตกโดยเฉพาะฝรั่งเศส อิตาลี และยุโรปตอนเหนือ เนยคือพระเอกประจำห้องครัว ใช้ผัด ใช้อบ ใช้ทาขนมปัง เป็นของคู่กับวัฒนธรรมการกินแบบ traditional food ซึ่งแตกต่างจากยุคอุตสาหกรรมที่ผลักให้เนยแท้หลบมุม แล้วเอา margarine หรือ shortening ซึ่งเต็มไปด้วยไขมันแปรรูปมาแทน ด้วยการโฆษณาแบบ fiat food คล้ายกับเรื่องที่เฮียเคยพูดบ่อย ๆ นั่นแหละ

ในประเทศไทยเราเองก็มีเนยวัวใช้ในอาหารบางชนิด โดยเฉพาะขนมอบ ขนมฝรั่งโบราณ หรือขนมเนยสดสไตล์ยุโรปที่เข้ามาสมัยรัชกาลที่ 5 แต่โดยรวมคนไทยไม่คุ้นเคยกับเนยในครัวร้อนมากนัก เพราะวัฒนธรรมอาหารเรามักใช้ไขมันจากสัตว์ท้องถิ่นมากกว่า เช่น น้ำมันหมู ไขมันวัว หรือน้ำมันจากไก่และเป็ด