-

@ 000002de:c05780a7

2025-04-08 01:24:25

@ 000002de:c05780a7

2025-04-08 01:24:25Trump is trying to sell a victim narrative and I don't buy it.

Trump repeats a troupe that I find hard to swallow. The US is getting ripped off. When he says this, as far as I can tell he's not referring to the people. He's referring the US government getting ripped off by other nations. This is so absurd I'm surprised I don't hear more people push back on it.

The US is the most powerful government in the history of the planet. No nation has the firepower or wealth of the US. The US has manipulated the governments and policies of much of the world since WW2. The idea that the US government is getting ripped off is absurd.

Trump and I agree that NATO is obsolete. It was created to counter a government that dissolved in the 90s. This should be an example to everyone that governments do not behave like businesses. They do not respond to market forces. They will always seek to increase their power and influence and always resist any efforts to reduce their size and scope. But back to Trump. He says that the US is getting ripped off by the other NATO countries. I would say the US people are in indeed being ripped off by their own government. But the US government is NOT getting ripped off.

The US military power in Europe is a massive influence on geopolitics in the region. US military companies benefit massively as well. The US military has bases all over the globe and if you don't think that is a factor in "diplomatic" negotiations you are being naive. The US uses this "defensive" shield to keep the "leaders" of Europe in line. The US isn't being ripped off. This is just a marketing tactic Trump is using to sell downsizing the US military deployments.

Trump also loves to point out how other countries are imposing tariffs on the US. We are being ripped off! I mean, he has a point there. But if tariffs aren't a tax as many in his admin like to claim, how exactly are "we" being ripped off? We are being told that Trump's tariff policy isn't a tax and that expecting prices to increase is oversimplifying things. The talk about tariffs is frankly frustrating.

On the one hand the left is saying tariffs are a tax and is going to drive up prices. Yet these same people pretend to not understand that corporate tax increases don't have the same effect. The right claims to understand tax policy and often oppose corporate taxes. They will tell you that those taxes just get passed down to consumers in the form of price increases. Now they are pretending to not get this in relation to tariffs.

I've read and listened to the pro tariff people and they aren't all dumb. They may be right about tariffs not effecting all products and nations equally. I guess we will find out. But, can we be honest? The US is not getting ripped off.

Someone is getting ripped off, but it isn't the US federal government. Its the people of the world. First, the people of the world live under the thumb of the US fiat dollar standard. We in the US complain about 3+% inflation but most people in the world would kill for that level of inflation. Most of the world gets none of supposed benefits from government spending. They only get the debasement of their own currencies.

Moving away from economics, the entire globe is affected by the elections in the US. The US is the top dog government and its decisions effect people everywhere. The US deep state has manipulated many elections across the globe and continues to do so. Meanwhile we are told that Russia is manipulating our elections. So who exactly is getting ripped off here? I think the nation (the people) are being subjected to massive mismanagement at best. I can support that argument.

Don't get me wrong... I know we in the US are getting ripped off. We are being ruled by people that do not represent us and do not answer to us. The politicians that claim to represent us are being paid and influenced by foreign groups ranging from Israeli political groups, to any number of other groups domestic and foreign. We are getting ripped off, but I firmly believe the people in the US have it better than most of the world. Trump is trying to sell a victim narrative and I don't buy it.

originally posted at https://stacker.news/items/937482

-

@ 4d41a7cb:7d3633cc

2025-04-08 01:17:39

@ 4d41a7cb:7d3633cc

2025-04-08 01:17:39Satoshi Nakamoto, the pseudonymous creator of Bitcoin, registered his birthday as April 5, 1975, on his P2P Foundation profile. Many think that he chose this date because on that same day in 1933, the United States government confiscated the gold of the American people. Whether this was on purpose or not, what happened in this day is very important to understand how do we ended up here.

In 1933, as expressed in Roosevelt’s Executive Orders 6073, 6102, and 6260, the United States first declared bankruptcy. The bankrupt U.S. went into receivership in 1933. America was turned over via receivership and reorganization in favor of its creditors. These creditors, the International Bankers, from the beginning stated their intent, which was to plunder, bankrupt, conquer and enslave America and return it to its colonial status.1

As one of his first acts as President, Franklin Delano Roosevelt declared a “Banking Emergency” to bail out the Federal Reserve Bank, which had embezzled this country’s gold supply. The Congress gave the President dictatorial powers under the “War Powers Act of 1917” (amended 1933), written, by the way, by the Board of Governors of the Federal Reserve Bank of New York.2

This day marked the official abandonment of the American Constitution, law and real money. Today, 92 years after this event, most of the people living today have never had any real money or paid for anything using real money; unless they used Bitcoin...

There could be no bankruptcy if there was not a private central bank lending paper currency to the government at interest, so we must start from 1913, when the Federal Reserve was created: a non-federal private bank with no reserves and the monopoly of issuing debt based paper currency in unlimited amounts and lending it to the government at interest by buying treasury bills. The fact that this currency is lent into existence at interest makes the debt mathematically impossible to be repaid; it can only be refinanced or defaulted.

Between 1929 and 1933, the Federal Reserve Bank reduced the currency supply by 33%, thereby creating the Great Depression, bankrupting the US government, stealing the Americans’ gold supply, and officially ending the gold standard. Since then the US dollar (money) was replaced with Federal Reserve Notes (debt). This was also the end of the Republican form of government and the beginning of a socialist mob rule democracy (Fascism).

“Fascism should more properly be called corporatism because it is the merger of state and corporate power.” — Benito Mussolini

The United States government has been bankrupt since 1933, since it defaulted on its gold bonds. This type of bond existed until 1933, when the U.S. monetary system abandoned the gold standard. 3 From this year the government has been totally controlled by the International bankers and used as a tool to spread and maintain their power worldwide.

Many people think that the gold standard was abandoned in 1971, but this is not true; in fact, this happened in 1933 when the US dollar was replaced by Federal Reserve Notes that are 100% debt-based fiat paper currency.

The year 1933 in the United States marked:

- The end of the Republican form of government and the beginning of American Fascism

- The end of the United States dollar and its replacement by Federal Reserve Notes

- The abandonment of common law and replacement with military admiralty law

- The takeover of the United States government by International bankers

- A massive gold theft and the end of the US gold standard

- The exchange of rights with privileges and licenses

- The United States government bankruptcy

The next shameful event in our history which still plagues us to this day was the “War Powers Act of 1933.” This Act permitted President Roosevelt to make law in the form of Executive Order, bypass Congress and create his socialist state. We (citizens of this country) were ever after to be considered enemies of the United States who must be licensed to engage in any commercial activity. With the aid of the Federal Reserve (the same people who created the Depression), the President confiscated our gold and silver coin and replaced it with worthless pieces of paper and a debt system that will eventually destroy this great country. Our land and our labor were pledged to the Federal Reserve Bank, Inc., as collateral for a debt system that could never be paid.4

“Emergency Powers” means any form of military style government, martial law, or martial rule. Martial law and martial rule are not the same.

United States Congressional Record March 17, 1993 Vol. #33, page H- 1303, Congressman James Traficant, Jr. (Ohio) addressing the House:

“Mr. Speaker, we are here now in chapter 11. Members of Congress are official trustees presiding over the greatest reorganization of any Bankrupt entity in world history, the U.S. Government. We are setting forth, hopefully, a blueprint for our future”

“There are some who say it is a coroner’s report that will lead to our demise. It is an established fact that the United States Federal Government has been dissolved by the Emergency Banking Act, March 9, 1933, 48 Stat. 1, Public Law 89-719; dered by President Roosevelt, being bankrupt and insolvent. H.J.R. 192, 73rd Congress in session June 5, 1933 – Joint Resolution To Suspend The Gold Standard and Abrogate the Gold Clause dissolved the Sovereign Authority of the United States and the official capacities of all United States Governmental Offices, Officers, and Departments and is further evidence that the United States Federal Government exists today in name only” **“The receivers of the United States Bankruptcy are the International Bankers, via the United Nations, the World Bank and the International Monetary Fund”

“All United States Offices, Officials, and Departments are now operating within a de facto status in name only under Emergency War Powers. With the Constitutional Republican form of Government now dissolved, the receivers of the Bankruptcy have adopted a new form of government for the United States. This new form of government is known as a Democracy, being an established Socialist/Communist order under a new governor for America. This act was instituted and established by transferring and/or placing the Office of the Secretary of Treasury to that of the Governor of the International Monetary Fund. Public Law 94-564, page 8, Section H.R. 13955 read in part:”

“The U.S. Secretary of Treasury receives no compensation for representing the United States.”

The American Spirit

The intention of the founding fathers of the United States was to create a constitutional republic to protect natural human rights and escape from the tyrannical English monarchy and its usurious Bank of England's monetary system. They created an honest monetary system based on gold and silver (United State Dollar) and got rid of nobility titles, creating equality under the law.

Section 10 of the American Constitution says:

No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make anything but gold and silver Coin a tender in payment of debts; pass any bill of attainder, ex post facto law, or law impairing the obligation of contracts; or grant any title of nobility.

The United States Dollar (1792-1933)

A dollar is a measure of weight defined by the Coinage Act of 1792 and 1900, which specifies a certain quantity—24.8 grains of gold or 371.25 grains of silver (from 1792 to 1900) when the American dollar was based on a bimetallic standard.

The Gold Standard Act of 1900 formally placed the United States on the gold standard, setting the value of one dollar at 25.8 grams of 90% pure gold, which fixed the price of gold at $20.67 per troy ounce. This standard was totally abandoned in 1933.

Gold and silver were such powerful money during the founding of the United States of America that the founding fathers declared that only gold or silver coins could be “money” in America.

But since the greedy bankers cannot profit from honest money they cannot print, they replaced the money with paper debt instruments. And by doing this, they have effectively enslaved the American people until today. My definition of modern slavery is working for a currency that someone else can create at no cost or effort. What's worse is that they even demand to be paid back and with interest!

Federal Reserve Notes (1913-present)

Federal Reserve Notes are not real money. Money that has metallic or other intrinsic value, as distinguished from paper currency, checks, and drafts.

Federal Reserve Notes (FRNs) are a legal fiction. An assumption that something is true even though it may be untrue. 5 The assumption that they are money, when in fact they are the opposite of money: debt or paper currency.

Paper money. Paper documents that circulate as currency; bills drawn by a government against its own credit. 6 Like Goldsmiths' notes. Hist. Bankers' cash notes: promissory notes given by bankers to customers as acknowledgments of the receipt of money. • This term derives from the London banking business, which originally was transacted by goldsmiths.7

These notes were scientifically designed to bankrupt the government and slave the American people, as Alfred Owen Crozier warned one year before the bill for the creation of the FED was passed through Congress (1912):

If Congress yields and authorizes a private central bank as proposed by the pending bill, the end when the bubble bursts will be universal ruin and national bankruptcy.

Unfortunately, the bill was passed in 1913, and this private bank started printing a new currency different from the US dollar creating the great depression and effectible bankrupting the government like Alfred warned 20 years before.

Alfred also warned:

Thus the way is opened for an unlimited inflation of corporate paper currency issued by a mere private corporation with relatively small net assets and no government guarantee, every dollar supposed to be redeemable in gold, but with not a single dollar of gold necessarily held in the reserves of such corporation to accomplish such redemption.

Differently from what's commonly believed Federal Reserve Notes (FRNs) were never really “backed” by gold; they were never supposed to be hard currency. Currency backed by reserves, esp. gold and silver reserves.

The United States government defaulted on its gold clauses, calling for payment in gold. This marked the end of the gold standard. A monetary system in which currency is convertible into its legal equivalent in gold or gold coin.

Since then we have been under a paper standard, where we use fake money as tender for payments. Paper standard. A monetary system based entirely on paper; a system of currency that is not convertible into gold or other precious metal.

People traded their coupons as money or “currency.” Currency is not money but a money substitute. Redeemable currency must promise to pay a dollar equivalent in gold or silver money. Federal Reserve Notes (FRNs) make no such promises and are not “money.” A Federal Reserve Note is a debt obligation of the federal United States government, not “money.” The federal United States government and the U.S. Congress were not and have never been authorized by the Constitution of the United States of America to issue currency of any kind, but only lawful money—gold and silver coin.8

A bona fide note can be used in a financial transaction to discharge the debt only because it is an unconditional promise to pay by the issuer to the bearer. Is a Federal Reserve Note a contract note, an unconditional promise to pay? At one time the Federal Reserve issued bona fide contractual notes and certificates, redeemable in gold and silver coin. Most people never saw or comprehended the contract. It went largely unread because the Federal Reserve very cunningly hid the contract on the face of the note by breaking it up into five separate lines of text with a significantly different typeface for each line and placing the president’s picture right in the middle of it. They even used the old attorney’s ruse of obscuring the most important text in fine print! Over time, the terms and conditions of the contract were diluted until eventually they literally became an I.O.U. for nothing.

FEDERAL RESERVE NOTE

-

THIS NOTE IS LEGAL TENDER FOR ALL DEBT, PUBLIC AND PRIVATE, AND IT IS REDEEMABLE IN LAWFUL MONEY AT THE UNITED STATES TREASURY OR ANY FEDERAL RESERVE BANK.

-

DATE: SERIES OF 1934

-

WILL PAY TO THE BEARER ON DEMAND: ONE HUNDRED DOLLARS

-

TREASURER OF THE UNITED STATES SIGNATURE

-

SECRETARY OF THE TREASURY SIGNATURE

Nowadays FRNs say "This note is legal tender for all debts public and private" it tender debt but it does not pay the bearer on demand. It value was stolen by a counterfeiting technique commonly know as inflation.

One hundred dollars (SERIES OF 1934) will be 2480 grains of gold, or 159.4 grams, or 5.1249 troy ounces. Today one troy ounce is priced around $3,000 federal reserve notes. 5.1249 X 3,000 = $15,375 actual FRNs.

A $100 FRN bill today will buy 0.65% of a real gold $100 dollar certificate. That’s a -99.35% loss of purchasing power in the last 91 years.

FRNs savers have been rugged pulled!

Gold bugs where the winners...

But Bitcoin is even better...

Happy birthday Satoshi! April 5 will be forever remembered.

Satoshi... The man, the myth, the Legend...

-

@ d9a329af:bef580d7

2025-04-08 01:08:42

@ d9a329af:bef580d7

2025-04-08 01:08:42Everyone who sees it knows at this point that the matrix of control comes from the overdependence of proprietary software to do our everyday tasks. You can think of this like us being the cling wrap that will just not let go of these pieces of garbage software that don't allow you to see what is in their source code, and how they work. This will tend to lead to the unlawful collection of data (violating the most basic of privacy laws, despite unenforceable contracts that are enforced regardless), bad OPSEC that sees you being stalked and harassed over nothing significant. In the worst of cases, if you speak your mind where you aren't necessarily supposed to be able to do that, and you get doxxed, the worst cases could be far worse than one could imagine.

The solution to this, on the other hand, is using almost exclusively free/libre open-source software and GNU/Linux operation systems. If you're using certain proprietary software, hardening it to give as little data as possible to the entity responsible for it will also work, as long as you know which ones to use. This is a hard pass for a lot of people, but if you want to escape the control matrix of proprietary software, Winblows, HackOS, iHackOS, iBloatOS and stock Google AI Fever Dream, then researching which Free Software (notice the spelling) to use is your first bet. I had already done this for the past four and a half years, and will continue to do it as long as I live, seeing what new Free Software compliant applications and libraries come into the spotlight once things get locked down into walled gardens like what HackOS, iHackOS and BlindnessOS do on a regular basis.

Each of these pieces of software will be in a categorized list with a brief description of what the software is used for. There is a lot to take in, so research this yourself and see if these are right for you. These are the applications I personally use on a regular day-to-day basis, and they work for my needs.

- Operating Systems (the core to your device)

- GNU/Linux operating systems (for PCs) or GrapheneOS (for de-googled Android phones) To be fair on this one, GNU/Linux is the combination of the Linux kernel with the GNU toolchain, which in turn allows any developer to make an operating system that is FOSS, not necessarily Free Software, especially with the Linux Kernel's proprietary bits of code. The Linux kernel is also used in the Android Open-Source Project (AOSP), and is used as the base of operating systems for Android phones such as GrapheneOS, the only AOSP custom ROM I would recommend based upon the research I had done on this (even if very little).

My recommendations on the Linux side of things are almost any Arch-based distribution (with the exception of Manjaro), Debian-based distributions like Linux Mint Debian edition, regular Debian, AntiX or Devuan, or a Fedora/RedHat-based distribution like Nobara Project (if you're a gamer), OpenSUSE (if set up properly) or even Bluefin if you want an atomic desktop (I wouldn't recommend Bluefin if you want to monkey with your operating system and DIY on many aspects of it). Once you learn how to set these up securely, privately and properly, you're on your way to starting your journey into digital liberation, but there's far more to go on this front.

- Web Browsers (How you surf the internet)

-

Firefox Forks This one is self-explanatory. I harden all the Firefox forks I use (LibreWolf, Waterfox, Cachy Browser, Floorp and Zen as some examples) to the nines, despite being unable to do anything about my fingerprint. This is why I use multiple browsers for specific purposes to counteract the fingerprint spying due to weaponized JavaScript. There are ways to circumvent the fingerprint-based espionage, and make sure the site fingerprint.com doesn't know that one's lying about what their user agent is, though it's not very easy to fool that site, as it's used by 6,000 companies.

-

Brave Browser This is the only Chromium-based browser I would recommend, as it's better when hardened against all the other Chromium-based browsers, including Ungoogled Chromium, which is almost impossible to harden due to security vulnerabilities. Despite that, Brave has some of the best features for a Chromium-based browser one can feel comfortable using, even though you'll have similar issues with Firefox-based browsers that aren't actually Firefox (and Firefox has its own issues regarding espionage from Mozilla)

-

Office Suites (If you need to do professional office documents)

-

LibreOffice A fork of Apache's OpenOffice, made better with many features missing from even OnlyOffice and OpenOffice, this suite of applications is the go-to Free Software office suite for many people looking to switch from the proprietary software nether to the diamonds of free/libre open-source software. Though one may need to perform some extra steps to set up compatibility with G-Suite and Microsoft Office past 2015 potentially, it's still a good thing that people trust LibreOffice as their one-stop shop for office documents, despite being completely different from your standard office suite fare.

-

OnlyOffice The competitor to LibreOffice with the ease of Microsoft Office and G-Suite compatibility, OnlyOffice is another office suite that can be good for those who need it, especially since anybody who had used Microsoft Office in particular will be familiar with its layout, if not for a slight learning curve. As someone who's used G-Suite more (due to schooling that stunk worse than a decomposing rat in New York City), that's part of the reason why I switched to LibreOffice, though I tried some others, including OnlyOffice and Abiword (since I use a word processor a lot). This one is another solid option for those who need it.

-

Wordgrinder For those who like to use a terminal emulator like I do, Wordgrinder is a word processor with a terminal user interface (TUI) designed with just focusing on typing without distractions in mind. .wg is the file extension for documents made using Wordgrinder, especially since nowadays most word processors are cloud based. For those who live in a terminal, this is a good option to your terminal UI-based toolbox

-

Text editors

-

Vi, Vim, Neovim and other Vim-like editors The classic VI Improved (Vim), a fork of the TUI modal editor, vi, with keybinds that will be confusing at first, but with practice and patience, bring about muscle memory to stay on the keyboard, and not necessarily touch the mouse, keypad on the right hand side, or even the arrow keys. These keybind skills will stay with one for the rest of their life once they learn how the modes in vi, Vim or vi-based editors work. It's a classic for those working in the terminal, and a staple in FLOSS text editing and coding tools once customized potentially to the nines to your particular style.

-

VSCodium The Free Software fork of Code OSS by Microsoft, but made to be similar in function to VSCode without Microsoft's espionage baked into it. It has almost exactly the same features as VSCode that one would need, and even any VSIX files from VSCode will work in VSCodium. This one is an easy switch from VSCode for those who use it, but don't want the forced telemetry.

-

Emacs The competitor to Vim, Emacs is an editor that is FLOSS in every way imaginable. It is one of the most customizable editors anybody could have ever conceived, though the programming language used in Emacs is a dialect of Lisp the developers had made themselves. There are more keybinds to memorize compared to Vim, though Vim keybinds can be added using the Evil Mode package in any Emacs package manager to get the best of both worlds in Emacs. Once one gets a handle of the steep learning curve for Emacs, it's customizable in every imaginable way almost.

These four categories will get you started on your privacy journey, though I covered things a developer might want. I have plans on more lists to compile once I get my ducks in a row on what I want to cover here on Nostr in a longform format. Feel free to let me know if you have recommendations for me to write about, and I can do some digging on that if it isn't a rabbit hole.

-

@ 404a8cf3:b03bd9d5

2025-04-08 00:01:29

@ 404a8cf3:b03bd9d5

2025-04-08 00:01:29A popularidade das plataformas de apostas online tem crescido de forma significativa no Brasil, e a 337Bet surge como uma das mais novas opções para os apostadores do país. Com uma proposta inovadora e uma série de características que agradam aos jogadores, a 337Bet se destaca não apenas pela variedade de jogos, mas também pela experiência única que oferece aos usuários. Neste artigo, vamos analisar de forma detalhada o que torna essa plataforma tão atrativa para os jogadores brasileiros.

A Plataforma: Simples e Eficiente Quando se trata de plataformas de apostas online, a facilidade de uso é essencial. A 337Bet entende isso perfeitamente e, por isso, oferece uma interface simples, limpa e altamente eficiente. O design intuitivo permite que qualquer jogador, independentemente do nível de experiência, consiga navegar pela plataforma sem dificuldades.

O processo de registro é rápido e seguro, e a navegação pelo site também é descomplicada, com todas as opções de jogos, promoções e suporte claramente destacadas. Além disso, a plataforma é completamente responsiva, o que significa que pode ser acessada de forma confortável em qualquer dispositivo, seja desktop, smartphone ou tablet.

Jogos Para Todos os Tipos de Jogadores A 337bet oferece uma impressionante gama de jogos para todos os gostos. Para os fãs de esportes, a plataforma disponibiliza uma seção de apostas esportivas completa, que abrange uma enorme variedade de esportes locais e internacionais. O futebol, como esperado, é o esporte mais popular, com uma ampla cobertura das principais ligas e torneios. No entanto, os apostadores também podem explorar outras modalidades como basquete, vôlei, tênis e até esportes menos tradicionais, como o e-sports.

Para quem prefere jogos de sorte e habilidade, a 337Bet oferece uma rica seleção de jogos de mesa, como roleta, blackjack e baccarat, além de diversas opções de máquinas de caça-níqueis. Esses jogos são desenvolvidos com gráficos de alta qualidade e são projetados para proporcionar uma experiência de jogo fluida e envolvente.

Uma das características inovadoras da plataforma é a inclusão de jogos virtuais, como as corridas de cavalos e o futebol virtual, que simulam eventos esportivos de forma rápida e emocionante. Esses jogos permitem apostas em tempo real e são uma excelente opção para quem busca uma experiência mais dinâmica e acelerada.

Segurança e Suporte ao Jogador A segurança é uma prioridade fundamental na 337Bet. A plataforma utiliza tecnologia de criptografia avançada para proteger todas as transações financeiras e informações pessoais dos usuários. Isso garante que todos os jogadores possam fazer depósitos e retiradas com total confiança, sabendo que seus dados estão protegidos.

Além disso, o suporte ao cliente é outro ponto forte da 337Bet. A plataforma oferece atendimento contínuo, 24 horas por dia, 7 dias por semana, por meio de chat ao vivo, e-mail e telefone. Os jogadores podem contar com uma equipe de suporte qualificada para solucionar dúvidas ou problemas a qualquer momento.

Conclusão A 337Bet é uma plataforma de apostas online completa, oferecendo uma experiência de jogo segura, envolvente e cheia de oportunidades. Se você é um apostador experiente ou está começando sua jornada nas apostas online, a 337Bet é a escolha ideal. Com uma interface amigável, jogos diversificados e um excelente suporte ao cliente, a plataforma garante que seus usuários tenham uma experiência única.

-

@ a7f85dfe:27305a2b

2025-04-07 23:56:34

@ a7f85dfe:27305a2b

2025-04-07 23:56:34在收到二手mini pc之前,先制作USB起动器。

首先,官网下载最新安装器的iso文件,下载地址:

https://www.proxmox.com/en/downloads

第二步,linux系统下使用dd命令制作USB起动器

查找usb路径

lsblkdd命令直接烧录 ``` sudo dd if=/path/to/iso_file.iso of=/dev/sdX bs=4M status=progress```

-

@ 878dff7c:037d18bc

2025-04-07 23:54:09

@ 878dff7c:037d18bc

2025-04-07 23:54:09Potential Reacquisition of Port of Darwin by Australian Government

Summary:

Deputy Prime Minister Richard Marles has indicated that the Australian government may use legal powers to reclaim the Port of Darwin from Chinese control. While the government prefers a commercial solution, it is prepared to take legislative action if necessary. This move reflects growing concerns over foreign ownership of critical infrastructure amid escalating global trade tensions.

Sources: The Guardian - April 8, 2025

Australian Economy Faces Slowdown Amid Global Trade Tensions

Summary:

The Australian economy is projected to experience a slowdown due to escalating global trade tensions, particularly stemming from the United States' recent tariff implementations. Treasurer Jim Chalmers indicated that while Australia is not the primary target—only 4% of its exports go to the U.S.—the broader global impact is expected to affect the local economy. The Reserve Bank may consider interest rate cuts to mitigate these effects. Treasury forecasts suggest a deceleration in GDP growth from 4.25% in 2024–25 to 3.25% in 2025–26, influenced by declining terms of trade and global inflation pressures. Chalmers criticized the U.S. tariff measures as "ill-considered," warning of heightened economic risks and uncertainty.

Sources: News.com.au - April 8, 2025, Reuters - April 8, 2025, The Wall Street Journal - April 8, 2025

Spiking to Announce TradeGPT's Enterprise AI Future at IBM Z Day

Summary:

Spiking will participate in IBM Z Day: Special Edition 2025, unveiling TradeGPT's enterprise AI capabilities. This collaboration with IBM aims to revolutionize AI applications in capital markets by leveraging advanced computing technologies.

Sources: Newsfile - April 7, 2025, Yahoo Finance - April 7, 2025

Earthquake in Upper Hunter Region, NSW

Summary:

A magnitude 3.4 earthquake struck the Upper Hunter region of New South Wales early this morning, with the tremor recorded at 5:18 am local time. The earthquake occurred at a shallow depth of approximately 2.4 miles below the surface. Residents in the vicinity reported feeling the tremor, but there have been no reports of damage or injuries.

Sources: Volcano Discovery - April 8, 2025, Newcastle Weekly - April 8, 2025

Opposition Leader Peter Dutton Predicts Global Recession Amid Market Volatility

Summary:

Opposition Leader Peter Dutton has warned that Australia could face a global recession, citing recent stock market declines and potential delays in retirement for baby boomers. This comes as both Dutton and Prime Minister Anthony Albanese prepare for the first leaders' debate, with economic management and cost-of-living issues at the forefront of their campaigns.

Sources: News.com.au - April 8, 2025

Family Law Regulations Updated

Summary:

Effective April 1, 2025, new Family Law Regulations have commenced, replacing previous regulations from 1984, 2001, and 2008. These updates aim to modernize family law procedures and forms, impacting various aspects of family dispute resolution and arbitration processes.

Source: Federal Circuit and Family Court of Australia - April 1, 2025

U.S. Tariffs Spark Global Economic Concerns

Summary:

U.S. President Donald Trump has announced a 50% increase in tariffs on Chinese imports, escalating trade tensions and causing significant volatility in global stock markets. Australian Treasurer Jim Chalmers stated that while Australia can manage the immediate effects, the country's economic growth is expected to slow due to global repercussions, particularly from the resulting trade war between the U.S. and China. Treasury analysis indicated Australia's GDP would be 0.1% lower this year than previously forecasted, and inflation would rise by 0.2 percentage points. Despite these pressures, Chalmers emphasized that a recession is not expected, with the economy poised for continued growth, supported by increased consumer spending driven by easing inflation and tax cuts.

Sources: The Guardian - April 8, 2025, Reuters - April 7, 2025

NSW Public Hospital Doctors Begin Three-Day Strike Over Pay and Conditions

Summary:

Thousands of doctors in New South Wales public hospitals have commenced a three-day strike starting today, protesting against unsustainable workloads, chronic understaffing, and inadequate pay. The Australian Salaried Medical Officers' Federation (ASMOF) is demanding a 30% pay increase over time, citing excessive workloads and unsafe shift patterns as critical issues. The industrial action is expected to impact elective surgeries and specialist outpatient appointments, primarily at major Sydney hospitals, while emergency services will remain operational but with reduced staffing levels. The strike proceeds despite an Industrial Relations Commission order against such action, making it potentially illegal. The government has urged patients with urgent medical needs to seek emergency care, while those with non-urgent needs are advised to consider alternative healthcare options. Sources: The Guardian - April 7, 2025, ABC News - April 7, 2025, News.com.au - April 2, 2025

World War II Veteran Celebrates 100th Birthday Summary:

Mr. Roy Porter, a World War II veteran, celebrates his 100th birthday. Porter served as a tail-gunner with the Royal Australian Air Force’s 18 Squadron during the war. After returning, he married Norma in 1949, and they have spent over seven decades together in Ocean Grove, Australia. Despite health challenges, both remain mentally sharp and reflect on a century marked by service and love.

Sources: Herald Sun - April 8, 2025

Australian Government Officials Surprised by U.S. Beef Export Comments

Summary:

Australian government officials were taken aback by U.S. President Donald Trump's remarks regarding Australian beef exports. The U.S. administration's concerns appear to be based on inflated figures, with Australian officials clarifying that beef exports to the U.S. are valued closer to $2 billion, not $29 billion as suggested.

Sources: Sky News - April 8, 2025

Donald Trump Threatens 104% Tariff on Chinese Imports

Summary:

U.S. President Donald Trump has threatened to impose a 104% tariff on Chinese goods if China does not withdraw its 34% tariff on American products by April 8, 2025. This escalation has contributed to significant volatility in global stock markets, with concerns about a potential trade war intensifying. The Chinese government has yet to respond to this ultimatum.

Sources: ABC News - April 8, 2025, Sky News - April 8, 2025

Plastic Pollution on Australian Coastlines Drops by 39%

Summary:

Research by CSIRO indicates a 39% reduction in plastic pollution along Australia's metropolitan coastlines over the past decade. The study attributes this decline to effective waste management strategies and increased public awareness, highlighting significant progress in addressing coastal environmental challenges.

Sources: CSIRO - April 8, 2025

Trump’s FDA Chief Dr. Marty Makary Slams Medical Dogma in Healthcare

Summary:

In this episode of the "Dad Saves America" podcast, Dr. Marty Makary, former FDA Chief under President Trump, critiques entrenched medical dogmas that hinder innovation and patient care. He emphasizes the necessity for healthcare professionals to challenge outdated practices and adopt evidence-based approaches.

Key Discussions:

-

Medical Dogma vs. Innovation: Dr. Makary discusses how rigid adherence to traditional medical practices can obstruct the adoption of innovative treatments and technologies.

-

Patient-Centered Care: He advocates for a shift towards more personalized healthcare, emphasizing the importance of tailoring treatments to individual patient needs rather than relying solely on standardized protocols.

-

Transparency in Healthcare: The conversation highlights the need for greater transparency in medical practices and pricing to empower patients and foster trust in the healthcare system.

Insights:

-

Challenging established medical norms is crucial for progress and improving patient outcomes.

-

Embracing innovation requires a balance between evidence-based practices and openness to new methodologies.

-

Enhancing transparency can lead to more informed decisions by patients and promote accountability within the healthcare industry.

For a more in-depth exploration of these topics, listen to the full episode on Spotify: Dad Saves America Podcast - Episode with Dr. Marty Makary

-

-

@ a396e36e:ec991f1c

2025-04-07 23:46:01

@ a396e36e:ec991f1c

2025-04-07 23:46:01Introduction

In recent years, the term "the new normal" has been used to describe a world reshaped by pandemic policies, inflationary economic measures, rising surveillance, and growing cultural compliance. For many, this phrase signals safety and adaptation. But for others, it marks an era of overreach and loss of personal autonomy. At the heart of the digital resistance to this new order stands an unlikely champion: Bitcoin.

More than a volatile investment or tech novelty, Bitcoin has become a tool of protest, a lifeline for dissidents, and a vehicle for economic sovereignty. As governments expand control over currencies, transactions, and narratives, Bitcoin's decentralized, censorship-resistant architecture offers a parallel path. This post explores how Bitcoin is used to challenge the core pillars of the new normal.

- Pandemic-Era Restrictions and Bitcoin as a Lifeline

During the COVID-19 pandemic, governments worldwide implemented measures ranging from lockdowns to vaccine passports and mass surveillance. For many protestors, these policies were seen not as safety measures, but as infringements on civil liberties.

In Nigeria, during the #EndSARS protests against police brutality, bank accounts of organizers were frozen. Bitcoin became the fallback. Donations poured in through decentralized wallets, bypassing government censors. Similarly, in Canada’s 2022 Freedom Convoy, traditional fundraising platforms were blocked. Activists turned to Bitcoin, distributing funds peer-to-peer using QR codes, out of reach from centralized authority.

These examples underscore Bitcoin’s core strength: permissionless value transfer. No bank account, no ID, no government approval required. It provided activists with the means to continue their work even under financial siege.

- Economic Collapse and the Return to Sound Money

The economic fallout from pandemic stimulus measures has been immense. In the U.S. alone, over $5 trillion in stimulus spending contributed to record-breaking inflation, eroding the purchasing power of fiat currencies. Central banks worldwide flooded markets with newly created money, leading to a global crisis of confidence in fiat.

Bitcoin offered an escape route. With its capped supply of 21 million coins and transparent monetary policy, it attracted investors, corporations, and citizens looking to hedge against inflation and financial mismanagement. In countries like Turkey, Argentina, and Venezuela, where national currencies collapsed, Bitcoin emerged as a digital safe haven.

More than a hedge, Bitcoin became a symbol of protest. Where governments printed wealth out of thin air, Bitcoiners opted out. For them, stacking sats (satoshis) wasn't just financial planning—it was civil disobedience against fiat excess.

- CBDCs, Programmable Money, and the Case for Financial Autonomy

Central Bank Digital Currencies (CBDCs) are on the rise. Promoted as modern, efficient alternatives to cash, they also raise alarms for privacy advocates. Programmable money, expiration dates on stimulus funds, restrictions on purchases—these aren’t speculative fears. They’re openly discussed features.

Bitcoin offers the inverse: a financial system without surveillance, control, or gatekeeping. Unlike CBDCs, it is neutral, global, and governed by code, not political whim. Where CBDCs threaten to tether money to state approval, Bitcoin affirms the right to transact freely.

In this context, adopting Bitcoin is more than a tech choice. It’s a rejection of programmable compliance in favor of financial autonomy.

- Censorship, Compliance Culture, and the Sovereign Individual

Beyond economics and health, the new normal is marked by growing censorship and behavioral control. From deplatforming to frozen bank accounts, those who dissent often find their financial access cut off.

Bitcoin resists this. It doesn’t care who you are, what you believe, or where you live. As long as you control your private keys, your funds are yours.

This neutrality makes Bitcoin a sanctuary for the politically persecuted, the economically excluded, and the privacy-conscious. It’s not about hiding—it’s about freedom by design. In a time when expressing the wrong opinion can cost you your livelihood, Bitcoin offers a parallel economy where your rights don’t expire when you disagree.

Conclusion

Bitcoin is not a panacea. It doesn’t guarantee utopia, and it's not immune to misuse. But in the context of expanding state power, algorithmic governance, and compliant culture, it stands out as one of the few tools that empowers individuals to say "no."

To use Bitcoin today is to engage in a subtle form of protest. It is to opt out of a system many see as rigged, to reclaim privacy, and to assert control over one’s economic life. For those resisting the new normal—not with slogans, but with actions—Bitcoin is not just code. It’s civil disobedience made digital.

-

@ a7f85dfe:27305a2b

2025-04-07 23:26:25

@ a7f85dfe:27305a2b

2025-04-07 23:26:25{"coverurl":"https://cdn.nostrcheck.me/a7f85dfe651aaa0b47d69659266f434479e40558a640a308a8f6769627305a2b/e9801593f2ea4560c55a6a2651788620cfe6c587c17c08f0e8023f06e7ffaf31.webp","title":"proxmox安装记录","author":"npub15lu"}

-

@ 2e8970de:63345c7a

2025-04-07 20:44:00

@ 2e8970de:63345c7a

2025-04-07 20:44:00the total number of U.S. forces in the Middle East has now reached 300,000 personnel, including both combat and administrative units.

The US normally has a total of 156,000 military personnel stationed overseas. Trump has suddenly doubled that number in just the Middle East. The Carl Vincent carrier group is relocating to the Red Sea, and half our active B2 bombers are in Diego Garcia. He’s going to bomb Iran.

https://x.com/davegreenidge57/status/1908826028467696075

originally posted at https://stacker.news/items/937451

-

@ 2e8970de:63345c7a

2025-04-07 19:49:08

@ 2e8970de:63345c7a

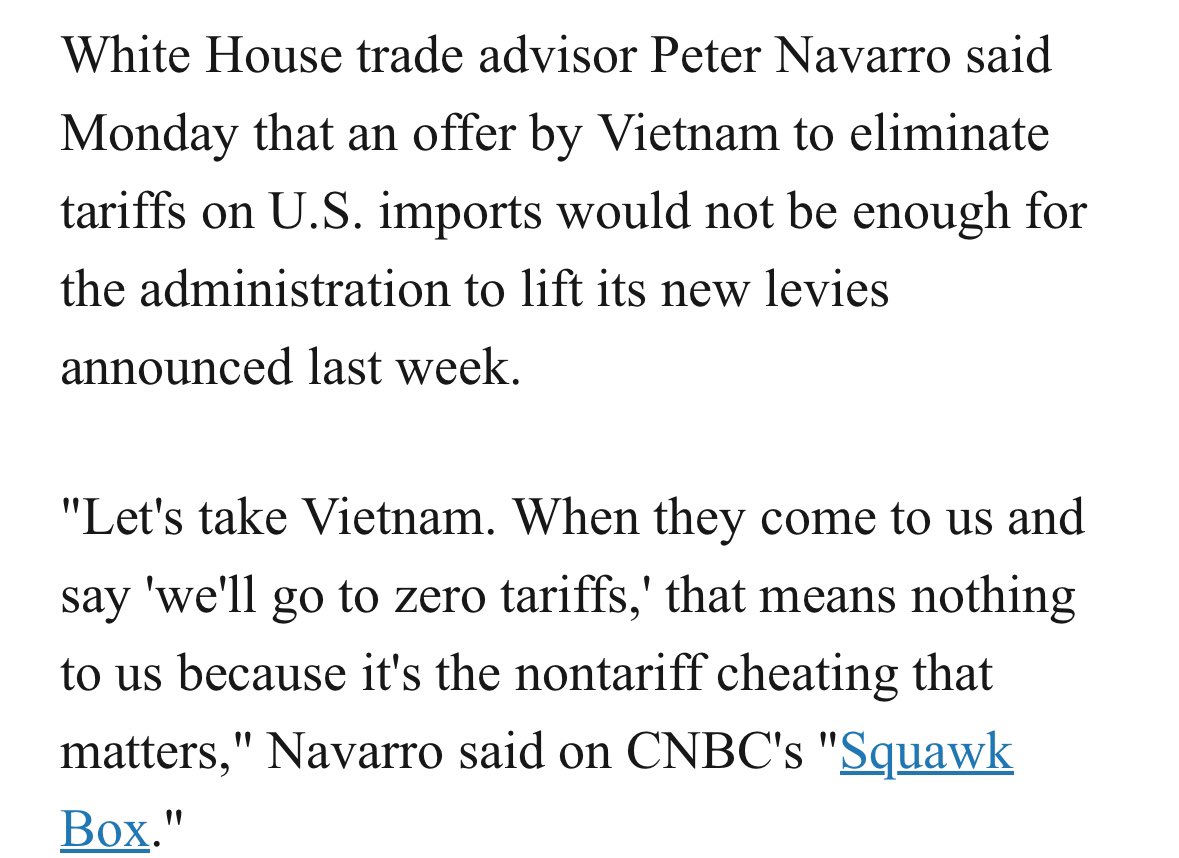

2025-04-07 19:49:08https://www.cnbc.com/amp/2025/04/07/peter-navarro-says-vietnams-0percent-tariff-offer-is-not-enough-its-the-non-tariff-cheating-that-matters.html

Vietnam is the US fastest growing trading partner and is helping to diversify away from China. Their offer to make imports from the US import tax free was rejected from the Trump administration.

This is a strong indicator that Trumps overall strategy isn't to use tariffs as a bargaining chip. It seems like the tariffs are the goal, not the means to an end.

originally posted at https://stacker.news/items/937410

-

@ f1577c25:de26ba14

2025-04-07 19:39:37

@ f1577c25:de26ba14

2025-04-07 19:39:37احنا المرة اللي فاتت اتكلمنا عن الاساسيات تعالي بقي نتكلم بشكل عام علي الطرق اللي في وجهه نظري احسن طرق و هقولك ليه و تبدا بمين الاول و كمان كل طريقه هسيب لك ليها لينك تشرح التطبيق عنه بشكل مفصل اكتر بحيث تعرف الحلو و الوحش و الحد الادني و كل دا

البورصة الأمريكية

- العملة: دولار

- العائد المتوقع: ~10% سنوياً

- الحد الأدنى: ~100 جنيه

- الورق المطلوب: باسبور

- المميزات:

- استثمار دولاري

- سهولة الإيداع بالعملات الرقمية

- إمكانية السحب في أي وقت

- العيوب:

- تحتاج جواز سفر

- تتطلب معرفة بالشركات

- تقلبات السوق علي المدي القصير

- ملاحظات: لو لسة جديد بس معاك حساب دولاري يبقي انصحك بـ IBKR علشان سهل ولكن لو معكش حساب دولاري يبقي Tastytrade علشان سهل الايداع بالكريبتو

العملات الرقمية

- العملة: دولار

- العائد المتوقع: ~10% سنوياً (متغير)

- الحد الأدنى: ~100 جنيه

- الورق المطلوب: بطاقة

- المميزات:

- عائد يومي

- استثمار دولاري

- سهولة السحب

- العيوب:

- العائد متغير

- مخاطر الأمان

- ملاحظات: هنا قصدي منتجات Earn زي في بينانس

ذهب (عالمي)

- العملة: دولار

- العائد المتوقع: متغير حسب سعر الذهب

- الحد الأدنى: ~100 جنيه

- الورق المطلوب: بطاقة

- المميزات:

- الذهب بسعر السوق العالمي

- تحوط ضد التضخم

- العيوب:

- تقلبات السوق علي المدي القصير

- استثمار طويل الأجل

- مخاطر الامان

- ملاحظات: الذهب العالمي قصدي انه تحول عملات ل PAXG في بينانس او Kraken

عقارات (عالمي)

- العملة: دولار

- العائد المتوقع: ~9-10% سنوياً

- الحد الأدنى: ~50 دولار في موقع Realt و ~135 لو موقع Stake

- الورق المطلوب: باسبور

- المميزات:

- استثمار دولاري

- عائد شهري

- العيوب:

- استثمار طويل الأجل

- لو Stake فا تقدر تسحب فلوسك مرتين بالسنة بس

- تحتاج باسبور

- تقلبات السوق

- ملاحظات: في تطبيقين RealT للسوق الامريكي و Stake للسوق الامراتي او السعودي

فوري يومي

- العملة: جنيه مصري

- العائد المتوقع: ~24%

- الحد الأدنى: ~3 جنيه

- الورق المطلوب: بطاقة

- المميزات:

- سهولة الاستخدام

- عائد يومي

- بدون حد أدنى عالي

- العيوب:

- بالجنيه المصري

- عائد أقل من شهادات البنك (الي الان)

- تقلبات العائد

- ملاحظات: قصدي تطبيق فوري يومي

عقارات (محلي)

- العملة: جنيه مصري

- العائد المتوقع: الفعلي 9% ولكن متوقع 28-48% (متوسط 32%)

- الحد الأدنى: 50,000 جنيه

- الورق المطلوب: بطاقة

- المميزات:

- عائد سنوي مرتفع

- العائد مربوط بالدولار بمعني لو حصل تعويم العائد بتاعك هيزيد فا مقاوم للتضخم.

- سهولة الاستخدام

- العيوب:

- حجز الأموال 6 شهور

- 50 ألف حد أدنى

- ضرائب عقارية

- ملاحظات: قصدي تطبيق Safe

شهادات البنك

- العملة: جنيه مصري

- العائد المتوقع: 27% او 30% بعائد تناقصي

- الحد الأدنى: 1000 جنيه

- الورق المطلوب: بطاقة

- المميزات:

- عائد مرتفع

- العيوب:

- بالجنيه المصري

- متقدرش تسحب فلوسك غير بعد مدة الشهادة.

- ملاحظات: دخولك هنا او لا و العائد شهري او سنوي يبقي علي حسب هدفك

ذهب (محلي)

- العملة: جنيه مصري

- العائد المتوقع: متغير حسب سعر الذهب

- الحد الأدنى: ~18 جنيه

- الورق المطلوب: بطاقة

- المميزات:

- قيمة ثابتة ومستقرة

- سهولة الشراء

- الحد الادني صغير لو سهم في صندوق زي AZG

- العيوب:

- يحتاج مبلغ عالي للدخول لو حقيقي

- تقلبات السوق علي المدي القصير

- ملاحظات: يعتبر خيار حلو بس انا شايف لو هتدخل بدهب يبقي عالمي + قصدي ذهب بجد او عن طريق صناديق الذهب زي AZG

كمل قراية بالتفصيل:

nostr:naddr1qvzqqqr4gupzpu2h0sja0vmqdqjzq6e820jjjnuytzw2ksmemfnadhe0hm0zdws5qqxnzde5xvurzvfsxuerzvphcvddg0

nostr:naddr1qvzqqqr4gupzpu2h0sja0vmqdqjzq6e820jjjnuytzw2ksmemfnadhe0hm0zdws5qqxnzde5xvunzvesx5erywpsepywcn

nostr:naddr1qvzqqqr4gupzpu2h0sja0vmqdqjzq6e820jjjnuytzw2ksmemfnadhe0hm0zdws5qqxnzde5xvunzdpcxq6nxwp3xqxgmx

nostr:naddr1qvzqqqr4gupzpu2h0sja0vmqdqjzq6e820jjjnuytzw2ksmemfnadhe0hm0zdws5qqxnzde5xscrqdesxycnvv34l5ye0c

nostr:naddr1qvzqqqr4gupzpu2h0sja0vmqdqjzq6e820jjjnuytzw2ksmemfnadhe0hm0zdws5qqxnzde5xvungvfsx5cnvv3ndwszwl

nostr:naddr1qvzqqqr4gupzpu2h0sja0vmqdqjzq6e820jjjnuytzw2ksmemfnadhe0hm0zdws5qqxnzde5xscrqdpnxc6rvvee3fqr5t

nostr:naddr1qvzqqqr4gupzpu2h0sja0vmqdqjzq6e820jjjnuytzw2ksmemfnadhe0hm0zdws5qqxnzde5xscrqdesxucrjdehs24uge

ادعمني (اختياري)

- USDT (TRC20):

TKQ3Uwkq21ntiua2Zh9Hu376fdMdnRGWN6

آخر تحديث: 4 أبريل 2025

-

@ da0b9bc3:4e30a4a9

2025-04-07 18:59:28

@ da0b9bc3:4e30a4a9

2025-04-07 18:59:28Hello Stackers!

It's Monday so we're back doing "Meta Music Mondays" 😉.

From before the territory existed there was just one post a week in a ~meta take over. Now each month we have a different theme and bring music from that theme.

This month is April and we're doing what it...?. So give me those what if tracks.

Here's and example;

What if, Another Brick in the Wall was EDM?

Let's have fun.

https://youtu.be/uLMobfyKB9o?si=vD9OMd6irvFG2vP

Talk Music. Share Tracks. Zap Sats.

originally posted at https://stacker.news/items/937359

-

@ 39f70015:9d4e378a

2025-04-07 17:28:03

@ 39f70015:9d4e378a

2025-04-07 17:28:03This is a copy of chapter four of Mastering Bitcoin Cash. I'm using it to test out creating long-form content on highlighter.com.

This is an edit after the original post. I want to test how editing long-form content works on Nostr.

4. Transactions

Introduction

Transactions are the most important part of the Bitcoin Cash system. Everything else in Bitcoin Cash is designed to ensure that transactions can be created, propagated on the network, validated, and finally added to the global ledger of transactions (the blockchain). Transactions are data structures that encode the transfer of value between participants in the Bitcoin Cash system. Each transaction is a public entry in Bitcoin Cash’s blockchain, the global double-entry bookkeeping ledger.

In this chapter we will examine all the various forms of transactions, what they contain, how to create them, how they are verified, and how they become part of the permanent record of all transactions.

Transaction Lifecycle

A transaction’s lifecycle starts with the transaction’s creation, also known as origination. The transaction is then signed with one or more signatures indicating the authorization to spend the funds referenced by the transaction. The transaction is then broadcast on the Bitcoin Cash network, where each network node (participant) validates and propagates the transaction until it reaches (almost) every node in the network. Finally, the transaction is verified by a mining node and included in a block of transactions that is recorded on the blockchain.

Once recorded on the blockchain and confirmed by sufficient subsequent blocks (confirmations), the transaction is a permanent part of the Bitcoin Cash ledger and is accepted as valid by all participants. The funds allocated to a new owner by the transaction can then be spent in a new transaction, extending the chain of ownership and beginning the lifecycle of a transaction again.

Creating Transactions

In some ways it helps to think of a transaction in the same way as a paper check. Like a check, a transaction is an instrument that expresses the intent to transfer money and is not visible to the financial system until it is submitted for execution. Like a check, the originator of the transaction does not have to be the one signing the transaction.

Transactions can be created online or offline by anyone, even if the person creating the transaction is not an authorized signer on the account. For example, an accounts payable clerk might process payable checks for signature by the CEO. Similarly, an accounts payable clerk can create Bitcoin Cash transactions and then have the CEO apply digital signatures to make them valid. Whereas a check references a specific account as the source of the funds, a Bitcoin Cash transaction references a specific previous transaction as its source, rather than an account.

Once a transaction has been created, it is signed by the owner (or owners) of the source funds. If it is properly formed and signed, the signed transaction is now valid and contains all the information needed to execute the transfer of funds. Finally, the valid transaction has to reach the Bitcoin Cash network so that it can be propagated until it reaches a miner for inclusion in the pubic ledger (the blockchain).

Broadcasting Transactions to the Bitcoin Cash Network

First, a transaction needs to be delivered to the Bitcoin Cash network so that it can be propagated and included in the blockchain. In essence, a Bitcoin Cash transaction is just 300 to 400 bytes of data and has to reach any one of tens of thousands of Bitcoin Cash nodes. The senders do not need to trust the nodes they use to broadcast the transaction, as long as they use more than one to ensure that it propagates. The nodes don’t need to trust the sender or establish the sender’s "identity." Because the transaction is signed and contains no confidential information, private keys, or credentials, it can be publicly broadcast using any underlying network transport that is convenient. Unlike credit card transactions, for example, which contain sensitive information and can only be transmitted on encrypted networks, a Bitcoin Cash transaction can be sent over any network. As long as the transaction can reach a Bitcoin Cash node that will propagate it into the Bitcoin Cash network, it doesn’t matter how it is transported to the first node.

Bitcoin Cash transactions can therefore be transmitted to the Bitcoin Cash network over insecure networks such as WiFi, Bluetooth, NFC, Chirp, barcodes, or by copying and pasting into a web form. In extreme cases, a Bitcoin Cash transaction could be transmitted over packet radio, satellite relay, or shortwave using burst transmission, spread spectrum, or frequency hopping to evade detection and jamming. A Bitcoin Cash transaction could even be encoded as smileys (emoticons) and posted in a public forum or sent as a text message or Skype chat message. Bitcoin Cash has turned money into a data structure, making it virtually impossible to stop anyone from creating and executing a Bitcoin Cash transaction.

Propagating Transactions on the Bitcoin Cash Network

Once a Bitcoin Cash transaction is sent to any node connected to the Bitcoin Cash network, the transaction will be validated by that node. If valid, that node will propagate it to the other nodes to which it is connected, and a success message will be returned synchronously to the originator. If the transaction is invalid, the node will reject it and synchronously return a rejection message to the originator.

The Bitcoin Cash network is a peer-to-peer network, meaning that each Bitcoin Cash node is connected to a few other Bitcoin Cash nodes that it discovers during startup through the peer-to-peer protocol. The entire network forms a loosely connected mesh without a fixed topology or any structure, making all nodes equal peers. Messages, including transactions and blocks, are propagated from each node to all the peers to which it is connected, a process called "flooding." A new validated transaction injected into any node on the network will be sent to all of the nodes connected to it (neighbors), each of which will send the transaction to all its neighbors, and so on. In this way, within a few seconds a valid transaction will propagate in an exponentially expanding ripple across the network until all nodes in the network have received it.

The Bitcoin Cash network is designed to propagate transactions and blocks to all nodes in an efficient and resilient manner that is resistant to attacks. To prevent spamming, denial-of-service attacks, or other nuisance attacks against the Bitcoin Cash system, every node independently validates every transaction before propagating it further. A malformed transaction will not get beyond one node.

Transaction Structure

A transaction is a data structure that encodes a transfer of value from a source of funds, called an input, to a destination, called an output. Transaction inputs and outputs are not related to accounts or identities. Instead, you should think of them as Bitcoin Cash amounts—chunks of Bitcoin Cash—being locked with a specific secret that only the owner, or person who knows the secret, can unlock. A transaction contains a number of fields, as shown in The structure of a transaction.

| Size | Field | Description | | --- | --- | --- | | 4 bytes | Version | Specifies which rules this transaction follows | | 1–9 bytes (VarInt) | Input Counter | How many inputs are included | | Variable | Inputs | One or more transaction inputs | | 1–9 bytes (VarInt) | Output Counter | How many outputs are included | | variable | Outputs | One or more transaction outputs | | 4 bytes | Locktime | A Unix timestamp or block number |

Table 1. The structure of a transaction

Transaction Locktime

Locktime, also known as nLockTime from the variable name used in the reference client, defines the earliest time that a transaction is valid and can be relayed on the network or added to the blockchain. It is set to zero in most transactions to indicate immediate propagation and execution. If locktime is nonzero and below 500 million, it is interpreted as a block height, meaning the transaction is not valid and is not relayed or included in the blockchain prior to the specified block height. If it is above 500 million, it is interpreted as a Unix Epoch timestamp (seconds since Jan-1-1970) and the transaction is not valid prior to the specified time. Transactions with locktime specifying a future block or time must be held by the originating system and transmitted to the Bitcoin Cash network only after they become valid. The use of locktime is equivalent to postdating a paper check.

Transaction Outputs and Inputs

The fundamental building block of a Bitcoin Cash transaction is an unspent transaction output, or UTXO. UTXO are indivisible chunks of Bitcoin Cash currency locked to a specific owner, recorded on the blockchain, and recognized as currency units by the entire network. The Bitcoin Cash network tracks all available (unspent) UTXO currently numbering in the millions. Whenever a user receives Bitcoin Cash, that amount is recorded within the blockchain as a UTXO. Thus, a user’s Bitcoin Cash might be scattered as UTXO amongst hundreds of transactions and hundreds of blocks. In effect, there is no such thing as a stored balance of a Bitcoin Cash address or account; there are only scattered UTXO, locked to specific owners. The concept of a user’s Bitcoin Cash balance is a derived construct created by the wallet application. The wallet calculates the user’s balance by scanning the blockchain and aggregating all UTXO belonging to that user.

There are no accounts or balances in Bitcoin Cash; there are only _unspent transaction outputs_ (UTXO) scattered in the blockchain.

A UTXO can have an arbitrary value denominated as a multiple of satoshis. Just like dollars can be divided down to two decimal places as cents, bitcoins can be divided down to eight decimal places as satoshis. Although UTXO can be any arbitrary value, once created it is indivisible just like a coin that cannot be cut in half. If a UTXO is larger than the desired value of a transaction, it must still be consumed in its entirety and change must be generated in the transaction. In other words, if you have a 20 Bitcoin Cash UTXO and want to pay 1 Bitcoin Cash, your transaction must consume the entire 20 Bitcoin Cash UTXO and produce two outputs: one paying 1 Bitcoin Cash to your desired recipient and another paying 19 Bitcoin Cash in change back to your wallet. As a result, most Bitcoin Cash transactions will generate change.

Imagine a shopper buying a $1.50 beverage, reaching into her wallet and trying to find a combination of coins and bank notes to cover the $1.50 cost. The shopper will choose exact change if available (a dollar bill and two quarters), or a combination of smaller denominations (six quarters), or if necessary, a larger unit such as a five dollar bank note. If she hands too much money, say $5, to the shop owner, she will expect $3.50 change, which she will return to her wallet and have available for future transactions.

Similarly, a Bitcoin Cash transaction must be created from a user’s UTXO in whatever denominations that user has available. Users cannot cut a UTXO in half any more than they can cut a dollar bill in half and use it as currency. The user’s wallet application will typically select from the user’s available UTXO various units to compose an amount greater than or equal to the desired transaction amount.

As with real life, the Bitcoin Cash application can use several strategies to satisfy the purchase amount: combining several smaller units, finding exact change, or using a single unit larger than the transaction value and making change. All of this complex assembly of spendable UTXO is done by the user’s wallet automatically and is invisible to users. It is only relevant if you are programmatically constructing raw transactions from UTXO.

The UTXO consumed by a transaction are called transaction inputs, and the UTXO created by a transaction are called transaction outputs. This way, chunks of Bitcoin Cash value move forward from owner to owner in a chain of transactions consuming and creating UTXO. Transactions consume UTXO by unlocking it with the signature of the current owner and create UTXO by locking it to the Bitcoin Cash address of the new owner.

The exception to the output and input chain is a special type of transaction called the coinbase transaction, which is the first transaction in each block. This transaction is placed there by the "winning" miner and creates brand-new Bitcoin Cash payable to that miner as a reward for mining. This is how Bitcoin Cash’s money supply is created during the mining process, as we will see in Mining and Consensus.

What comes first? Inputs or outputs, the chicken or the egg? Strictly speaking, outputs come first because coinbase transactions, which generate new Bitcoin Cash, have no inputs and create outputs from nothing.

Transaction Outputs

Every Bitcoin Cash transaction creates outputs, which are recorded on the Bitcoin Cash ledger. Almost all of these outputs, with one exception (see Data Output (OP_RETURN)) create spendable chunks of Bitcoin Cash called unspent transaction outputs or UTXO, which are then recognized by the whole network and available for the owner to spend in a future transaction. Sending someone Bitcoin Cash is creating an unspent transaction output (UTXO) registered to their address and available for them to spend.

UTXO are tracked by every full-node Bitcoin Cash client as a data set called the UTXO set or UTXO pool, held in a database. New transactions consume (spend) one or more of these outputs from the UTXO set.

Transaction outputs consist of two parts:

- An amount of Bitcoin Cash, denominated in satoshis, the smallest Bitcoin Cash unit

- A locking script, also known as an "encumbrance" that "locks" this amount by specifying the conditions that must be met to spend the output

The transaction scripting language, used in the locking script mentioned previously, is discussed in detail in Transaction Scripts and Script Language. The structure of a transaction output shows the structure of a transaction output.

| Size | Field | Description | | --- | --- | --- | | 8 bytes | Amount | Bitcoin Cash value in satoshis (108 Bitcoin Cash) | | 1–9 bytes (VarInt) | Locking-Script Size | Locking-Script length in bytes, to follow | | Variable | Locking-Script | A script defining the conditions needed to spend the output | | 1–9 bytes (VarInt) | Output Counter | How many outputs are included | | variable | Outputs | One or more transaction outputs | | 4 bytes | Locktime | A Unix timestamp or block number |

Table 2. The structure of a transaction output

In A script that calls

bitbox.Address.utxoto find the UTXO related to an address, we use thebitbox.Addressclass to find the unspent outputs (UTXO) of a specific address.Example 1. A script that calls

bitbox.Address.utxoto find the UTXO related to an address```javascript bitbox.Address.utxo('bitcoincash:qpcxf2sv9hjw08nvpgffpamfus9nmksm3chv5zqtnz').then((result) => { console.log(result); }, (err) => { console.log(err); });

Returns the following: [{ txid: 'cc27be8846276612dfce5924b7be96556212f0f0e62bd17641732175edb9911e', vout: 0, scriptPubKey: '76a9147064aa0c2de4e79e6c0a1290f769e40b3dda1b8e88ac', amount: 0.00007021, satoshis: 7021, height: 527155, confirmations: 11879, legacyAddress: '1BFHGm4HzqgXXyNX8n7DsQno5DAC4iLMRA', cashAddress: 'bitcoincash:qpcxf2sv9hjw08nvpgffpamfus9nmksm3chv5zqtnz' } ] ```

Running the script, we see an array of objects representing unspent transaction outputs which are available to this address.

Spending conditions (encumbrances)

Transaction outputs associate a specific amount (in satoshis) to a specific encumbrance or locking script that defines the condition that must be met to spend that amount. In most cases, the locking script will lock the output to a specific Bitcoin Cash address, thereby transferring ownership of that amount to the new owner. When Alice paid Bob’s Cafe for a cup of coffee, her transaction created a 0.00208507 Bitcoin Cash output encumbered or locked to the cafe’s Bitcoin Cash address. That 0.00208507 Bitcoin Cash output was recorded on the blockchain and became part of the Unspent Transaction Output set, meaning it showed in Bob’s wallet as part of the available balance. When Bob chooses to spend that amount, his transaction will release the encumbrance, unlocking the output by providing an unlocking script containing a signature from Bob’s private key.

Transaction Inputs

In simple terms, transaction inputs are pointers to UTXO. They point to a specific UTXO by reference to the transaction hash and sequence number where the UTXO is recorded in the blockchain. To spend UTXO, a transaction input also includes unlocking scripts that satisfy the spending conditions set by the UTXO. The unlocking script is usually a signature proving ownership of the Bitcoin Cash address that is in the locking script.

When users make a payment, their wallet constructs a transaction by selecting from the available UTXO. For example, to make a 0.00208507 Bitcoin Cash payment, the wallet app may select a 0.002 UTXO and a 0.00008507 UTXO, using them both to add up to the desired payment amount.

Once the UTXO is selected, the wallet then produces unlocking scripts containing signatures for each of the UTXO, thereby making them spendable by satisfying their locking script conditions. The wallet adds these UTXO references and unlocking scripts as inputs to the transaction. The structure of a transaction input shows the structure of a transaction input.

| Size | Field | Description | | --- | --- | --- | | 32 bytes | Transaction Hash | Pointer to the transaction containing the UTXO to be spent | | 4 bytes | Output Index | The index number of the UTXO to be spent; first one is 0 | | 1-9 bytes (VarInt) | Unlocking-Script Size | Unlocking-Script length in bytes, to follow | | Variable | Unlocking-Script | A script that fulfills the conditions of the UTXO locking script | | 4 bytes | Sequence Number | Currently disabled Tx-replacement feature, set to 0xFFFFFFFF |

Table 3. The structure of a transaction input

Transaction Fees

Most transactions include transaction fees, which compensate the Bitcoin Cash miners for securing the network. Mining and the fees and rewards collected by miners are discussed in more detail in Mining and Consensus. This section examines how transaction fees are included in a typical transaction. Most wallets calculate and include transaction fees automatically. However, if you are constructing transactions programmatically, or using a command-line interface, you must manually account for and include these fees.

Transaction fees serve as an incentive to include (mine) a transaction into the next block and also as a disincentive against "spam" transactions or any kind of abuse of the system, by imposing a small cost on every transaction. Transaction fees are collected by the miner who mines the block that records the transaction on the blockchain.

Transaction fees are calculated based on the size of the transaction in kilobytes, not the value of the transaction in Bitcoin Cash. Overall, transaction fees are set based on market forces within the Bitcoin Cash network. Miners prioritize transactions based on many different criteria, including fees, and might even process transactions for free under certain circumstances. Transaction fees affect the processing priority, meaning that a transaction with sufficient fees is likely to be included in the next-most–mined block, whereas a transaction with insufficient or no fees might be delayed, processed on a best-effort basis after a few blocks, or not processed at all. Transaction fees are not mandatory, and transactions without fees might be processed eventually; however, including transaction fees encourages priority processing.

The current algorithm used by miners to prioritize transactions for inclusion in a block based on their fees is examined in detail in Mining and Consensus.

Adding Fees to Transactions

The data structure of transactions does not have a field for fees. Instead, fees are implied as the difference between the sum of inputs and the sum of outputs. Any excess amount that remains after all outputs have been deducted from all inputs is the fee that is collected by the miners.

Transaction fees are implied, as the excess of inputs minus outputs:

Fees = Sum(Inputs) – Sum(Outputs)This is a somewhat confusing element of transactions and an important point to understand, because if you are constructing your own transactions you must ensure you do not inadvertently include a very large fee by underspending the inputs. That means that you must account for all inputs, if necessary by creating change, or you will end up giving the miners a very big tip!

For example, if you consume a 20-Bitcoin Cash UTXO to make a 1-Bitcoin Cash payment, you must include a 19-Bitcoin Cash change output back to your wallet. Otherwise, the 19-Bitcoin Cash "leftover" will be counted as a transaction fee and will be collected by the miner who mines your transaction in a block. Although you will receive priority processing and make a miner very happy, this is probably not what you intended.

If you forget to add a change output in a manually constructed transaction, you will be paying the change as a transaction fee. "Keep the change!" might not be what you intended.

Let’s see how this works in practice, by looking at Alice’s coffee purchase again. Alice wants to spend 0.00208507 Bitcoin Cash to pay for coffee. To ensure this transaction is processed promptly, she will want to include a transaction fee of 1 satoshi per byte. That will mean that the total cost of the transaction will be 0.00208750. Her wallet must therefore source a set of UTXO that adds up to 0.00208750 Bitcoin Cash or more and, if necessary, create change. Let’s say her wallet has a 0.00277257-Bitcoin Cash UTXO available. It will therefore need to consume this UTXO, create one output to Bob’s Cafe for 0.00208507, and a second output with 0.00068507 Bitcoin Cash in change back to her own wallet, leaving 0.00000243 Bitcoin Cash unallocated, as an implicit fee for the transaction.

Transaction Chaining and Orphan Transactions

As we have seen, transactions form a chain, whereby one transaction spends the outputs of the previous transaction (known as the parent) and creates outputs for a subsequent transaction (known as the child). Sometimes an entire chain of transactions depending on each other—say a parent, child, and grandchild transaction—are created at the same time, to fulfill a complex transactional workflow that requires valid children to be signed before the parent is signed.

When a chain of transactions is transmitted across the network, they don’t always arrive in the same order. Sometimes, the child might arrive before the parent. In that case, the nodes that see a child first can see that it references a parent transaction that is not yet known. Rather than reject the child, they put it in a temporary pool to await the arrival of its parent and propagate it to every other node. The pool of transactions without parents is known as the orphan transaction pool. Once the parent arrives, any orphans that reference the UTXO created by the parent are released from the pool, revalidated recursively, and then the entire chain of transactions can be included in the transaction pool, ready to be mined in a block. Transaction chains can be arbitrarily long, with any number of generations transmitted simultaneously. The mechanism of holding orphans in the orphan pool ensures that otherwise valid transactions will not be rejected just because their parent has been delayed and that eventually the chain they belong to is reconstructed in the correct order, regardless of the order of arrival.

There is a limit to the number of orphan transactions stored in memory, to prevent a denial-of-service attack against Bitcoin Cash nodes. The limit is defined as MAX_ORPHAN_TRANSACTIONS in the source code of the Bitcoin Cash reference client. If the number of orphan transactions in the pool exceeds MAX_ORPHAN_TRANSACTIONS, one or more randomly selected orphan transactions are evicted from the pool, until the pool size is back within limits.

Transaction Scripts and Script Language

Bitcoin Cash clients validate transactions by executing a script, written in a Forth-like scripting language. Both the locking script (encumbrance) placed on a UTXO and the unlocking script that usually contains a signature are written in this scripting language. When a transaction is validated, the unlocking script in each input is executed alongside the corresponding locking script to see if it satisfies the spending condition.

Today, most transactions processed through the Bitcoin Cash network have the form "Alice pays Bob" and are based on the same script called a Pay-to-Public-Key-Hash script. However, the use of scripts to lock outputs and unlock inputs means that through use of the programming language, transactions can contain an infinite number of conditions. Bitcoin Cash transactions are not limited to the "Alice pays Bob" form and pattern.

This is only the tip of the iceberg of possibilities that can be expressed with this scripting language. In this section, we will demonstrate the components of the Bitcoin Cash transaction scripting language and show how it can be used to express complex conditions for spending and how those conditions can be satisfied by unlocking scripts.

Bitcoin Cash transaction validation is not based on a static pattern, but instead is achieved through the execution of a scripting language. This language allows for a nearly infinite variety of conditions to be expressed. This is how Bitcoin Cash gets the power of "programmable money."

Script Construction (Lock + Unlock)

Bitcoin Cash’s transaction validation engine relies on two types of scripts to validate transactions: a locking script and an unlocking script.

A locking script is an encumbrance placed on an output, and it specifies the conditions that must be met to spend the output in the future. Historically, the locking script was called a scriptPubKey, because it usually contained a public key or Bitcoin Cash address. In this book we refer to it as a "locking script" to acknowledge the much broader range of possibilities of this scripting technology. In most Bitcoin Cash applications, what we refer to as a locking script will appear in the source code as scriptPubKey.

An unlocking script is a script that "solves," or satisfies, the conditions placed on an output by a locking script and allows the output to be spent. Unlocking scripts are part of every transaction input, and most of the time they contain a digital signature produced by the user’s wallet from his or her private key. Historically, the unlocking script is called scriptSig, because it usually contained a digital signature. In most Bitcoin Cash applications, the source code refers to the unlocking script as scriptSig. In this book, we refer to it as an "unlocking script" to acknowledge the much broader range of locking script requirements, because not all unlocking scripts must contain signatures.