-

@ 502ab02a:a2860397

2025-05-25 01:03:51

@ 502ab02a:a2860397

2025-05-25 01:03:51บางครั้งพลังยิ่งใหญ่ที่สุดก็ไม่ใช่สิ่งที่เห็นได้ด้วยตาเปล่า เหมือนแสงแดดที่คนส่วนใหญ่มักจะกลัวเพราะกลัวผิวเสีย กลัวฝ้า กลัวร้อน แต่แท้จริงแล้วในแสงแดดมีบางสิ่งที่น่าเคารพอยู่ลึกๆ มันคือแสงที่มองไม่เห็น มันไม่แสบตา ไม่แสบผิว แต่มันลึก ถึงเซลล์ มันคือ “แสงอินฟราเรด” ที่ซ่อนตัวอย่างสุภาพในแดดยามเช้า

เฮียมักชอบพูดว่า แดดที่ดีไม่จำเป็นต้องแสบหลัง อาบแสงที่ลอดผ่านใบไม้ยามเช้าแบบไม่ต้องฝืนตาก็พอ แสงอินฟราเรดนี่แหละคือพระเอกตัวจริงในความเงียบ มันไม่ดัง ไม่โชว์ ไม่โฆษณา แต่มันลงลึกไปถึงระดับที่ร่างกายเรากำลังหิวโดยไม่รู้ตัวในระดับเซลล์

ในเซลล์ของเรา มีหน่วยผลิตพลังงานที่เรียกว่าไมโทคอนเดรีย เจ้านี่แหละคือโรงไฟฟ้าจิ๋วประจำบ้าน ที่ต้องตื่นมาทำงานทุกวันโดยไม่ได้หยุดเสาร์อาทิตย์ ยิ่งถ้าไมโทคอนเดรียทำงานไม่ดี ร่างกายก็จะเหมือนไฟตกทั้งระบบ—ง่วงง่าย เพลียไว ปวดนู่นปวดนี่เหมือนไฟในบ้านกระพริบตลอดเวลา

แล้วแสงอินฟราเรดเกี่ยวอะไรกับมัน? เฮียขอเล่าง่ายๆ ว่า ไมโทคอนเดรียมีตัวรับแสงตัวหนึ่งชื่อว่า cytochrome c oxidase เจ้านี่ตอบสนองต่อแสงอินฟราเรดช่วงคลื่นเฉพาะ คือประมาณ 600–900 นาโนเมตร พอโดนเข้าไป มันเหมือนได้จุดประกายให้โรงงานพลังงานในร่างกายกลับมาคึกคักอีกครั้ง ผลิตพลังงานได้มากขึ้น ระบบไหลเวียนเลือดก็ดีขึ้น เหมือนท่อน้ำที่เคยอุดตันก็กลับมาใสแจ๋ว ความอักเสบเล็กๆ ในร่างกายก็ลดลง คล้ายบ้านที่เคยอับชื้นแล้วได้เปิดหน้าต่างให้แสงแดดส่องเข้าไป

และที่น่ารักกว่านั้นคือ เราไม่ต้องไปถึงชายหาด ไม่ต้องจองรีสอร์ตริมทะเล แค่แดดเช้าอ่อนๆ ข้างบ้านหรือตามขอบระเบียง ก็ให้แสงอินฟราเรดได้แล้ว ถ้าใครอยู่ในเมืองใหญ่ที่มีแต่ตึกบังแดด แล้วจะเลือกใช้หลอดไฟ Red Light Therapy ก็ไม่ผิด แต่ต้องเลือกแบบรู้เท่าทันรู้ ไม่ใช่เห็นใครรีวิวก็ซื้อมาเปิดใส่หน้า หวังจะหน้าใสข้ามคืน ต้องเข้าใจทั้งความยาวคลื่น เวลาใช้งาน และจุดประสงค์ ไม่ใช่ใช้เพราะแค่กลัวแก่อยากหน้าตึง แต่ใช้เพราะอยากให้ร่างกายกลับไปทำงานอย่างเป็นธรรมชาติอีกครั้ง และอยู่ในประเทศหรือสถานที่ที่โดนแดดได้น้อยอยากได้เสริมเฉยๆ

แล้วเราจะรู้ได้ยังไงว่าไมโทคอนเดรียเรากลับมาทำงานดีขึ้น? เฮียว่าไม่ต้องรอผลเลือดจากแล็บไหนก็รู้ได้ อย่าไปยึดติดกับตัวเลขมากครับ เอาตัวเองเป็นหลัก ตั้งคำถามกับตัวเองว่ารู้สึกยังไงบ้าง ถ้าเริ่มนอนหลับลึกขึ้น ตื่นมาแล้วหัวไม่มึน ไม่หงุดหงิดตั้งแต่ยังไม่ลืมตา ถ้าปวดหลังปวดข้อที่เคยมีเริ่มหายไปแบบไม่ได้กินยา หรือแม้แต่ผิวที่ดูสดใสขึ้นแบบไม่ต้องง้อสกินแคร์ นั่นแหละคือเสียงขอบคุณเบาๆ จากไมโทคอนเดรียที่ได้แสงแดดแล้วกลับมามีชีวิตอีกครั้ง ถ้ามันดีก็คือดี

บางที เราไม่ต้องกินวิตามินเม็ดไหนเพิ่ม แค่เดินออกไปรับแดดเบาๆ ในเวลาเช้าๆ แล้วให้ร่างกายได้พูดคุยกับธรรมชาติบ้าง เพราะในความอบอุ่นเงียบๆ ของแสงอินฟราเรดนั้น มีเสียงเบาๆ ที่กำลังปลุกพลังในตัวเราให้กลับมาอีกครั้ง

แดดไม่ใช่ศัตรู ถ้าเรารู้จักมันในมุมที่ถูกต้อง เฮียแค่อยากชวนให้ลองเปลี่ยนจากคำว่า “กลัวแดด” เป็น “ฟังแดด” เพราะบางครั้งธรรมชาติไม่ได้พูดด้วยคำ แต่สื่อสารด้วยแสงที่แทรกผ่านหัวใจเราโดยไม่ต้องผ่านล่าม

บางคนอาจคิดในใจ “แหมเฮีย ก็ดีหรอก ถ้าได้ตื่นเช้า” 555555

เฮียเข้าใจดีเลยว่าไม่ใช่ทุกคนจะตื่นมาทันแดดยามเช้าได้เสมอไป ชีวิตคนเรามันไม่ได้เริ่มต้นพร้อมไก่ขันทุกวัน บางคนเพิ่งเข้านอนตอนตีสาม ตื่นอีกทีแดดก็แตะบ่ายเข้าไปแล้ว ไม่ต้องกังวลไปจ้ะ เพราะความมหัศจรรย์ของแสงอินฟราเรดยังมีให้เราได้ใช้แม้ในแดดยามเย็น

แดดช่วงเย็น โดยเฉพาะหลังสี่โมงเย็นไปจนเกือบหกโมง (หรือเร็วช้าตามฤดู) ก็ยังอุดมไปด้วยแสงอินฟราเรดในช่วงคลื่นที่ไมโทคอนเดรียชอบ แถมยังไม่มีรังสี UV ที่แรงจัดมารบกวนเหมือนตอนเที่ยง เรียกว่าเป็นแดดแบบละมุนๆ สำหรับคนที่อยาก “บำบัดใจ” แบบไม่ต้องร้อนจนหัวเปียก

เฮียเคยลองตากแดดเย็นเดินไปในสวนสาธารณะ แล้วรู้สึกว่ามันเหมือนได้รีเซ็ตจิตใจหลังวันเหนื่อยๆ ไปในตัว ยิ่งพอรู้ว่าในช่วงเวลานี้แสงที่ได้กำลังช่วยปลุกพลังงานในร่างกายแบบเงียบๆ ด้วยแล้ว มันทำให้เฮียยิ่งเคารพธรรมชาติมากขึ้นไปอีก เคยเห็นคนที่วันๆมีแต่ความเครียด ความโกรธ ความอาฆาตต่อโลกไหมหละ บางคนแค่โดนแดด แต่ไม่ได้ตากแดด การตากแดดคือปล่อยใจไปกับธรรมชาติ พูดคุยกับร่างกาย บอกเขาว่าเราจะทำตัวให้เป็นประโยชน์กับโลกใบนี้ ให้สมกับที่ใช้พลังงานของโลก

จะเช้าหรือเย็น สำคัญไม่เท่ากับความตั้งใจ เฮียว่าไม่ว่าชีวิตจะตื่นตอนไหน ถ้าเราให้เวลาแค่ 10–15 นาทีในแต่ละวัน ออกไปยืนให้แดดแตะหน้า แตะแขน หรือแค่ให้แสงลอดผ่านตาเบาๆ โดยไม่ต้องจ้องจ้าๆ ก็พอ แค่นี้ก็เป็นการให้ไมโทคอนเดรียได้หายใจ ได้ออกกำลังกายแบบของมัน และได้ส่งพลังกลับมาหาเราทั้งร่างกายและจิตใจ

สุดท้ายแล้ว แดดไม่ได้แบ่งชนชั้น ไม่เลือกว่าจะรักเฉพาะคนตื่นเช้า หรือโกรธคนตื่นสาย ขอแค่เรารู้จักเวลาและวิธีอยู่กับมันอย่างถูกจังหวะ แดดก็พร้อมจะให้เสมอ

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr #SundaySpecialเราจะไปเป็นหมูแดดเดียว

-

@ 3c7dc2c5:805642a8

2025-05-24 22:05:00

@ 3c7dc2c5:805642a8

2025-05-24 22:05:00🧠Quote(s) of the week:

'The Cantillon Effect: When new money is printed, those closest to the source (banks, elites) benefit first, buying assets before prices rise. Others lose purchasing power as inflation hits later. If people find out how this works, they will riot.' -Bitcoin for Freedom

Just think about it. Your employer gives you a 5% raise. The Fed (central banks in general) prints 7% more dollars/euros/Fiat. You just got a 2% pay cut. This isn't a conspiracy theory. This is how fiat money steals from the working class every single day. This is why I support Bitcoin.

Anilsaidso: 'Saving in fiat currency is no longer an option. A 2% inflation rate means you lose 1/3 of your purchasing power over 20yrs. At 5% inflation, you lose 60%. And at 10% you've burnt 85%. Reduce your uncertainty. Save in Bitcoin.' https://i.ibb.co/N661BdVp/Gr-Rwdg-OXc-AAWPVE.jpg

🧡Bitcoin news🧡

“Education increases conviction.

Conviction increases allocation.

Allocation increases freedom.” —Gigi

https://i.ibb.co/Q3trHk8Y/Gr-Arv-Ioa-AAAF5b0.jpg

On the 12th of May:

➡️Google searches for "Digital Gold" are at all-time highs. Bitcoin Croesus: "This is the second wave of the Digital Revolution - the digitization of value to complement the Internet's digitization of information. It wasn't possible to own a slice of the Internet itself, but it is possible with Bitcoin, the internet of value." "...It feels like you're late to Bitcoin. But this is a bigger game playing out than most realize, and we are much earlier than casual observers know. If you're reading this, you're here on the frontier early. And you have a chance to stake a claim before 99% of the world shows up. This is a land grab. This is the digital gold rush. Make your descendants proud."

https://i.ibb.co/5XXbNQ8S/Gqw-X4-QRWs-AEd5-Uh-1.jpg

➡️ 'A new holding company ‘Nakamoto’ just raised $710 million to buy more Bitcoin and will merge with KindlyMD to establish a Bitcoin Treasury company. Saylor playbook!' - Bitcoin Archive

➡️American Bitcoin, backed by Donald Trump Jr. and Eric Trump, will go public via an all-stock merger with Gryphon Digital Mining. Post-merger, Trump affiliates and Hut 8 will retain 98% ownership. GRYP tripled to $2.19, Hut 8 jumped 11% to $15.45. The deal closes in Q3 2025.

➡️Phoenix Wallet: 'Phoenix 0.6.0 is out: offers can now have a custom description simple close (set an exact mutual close tx fee rate) native support for Linux arm64 This is the server version. Phoenix mobile release is around the corner. '

On the 13th of May:

➡️Corporate Bitcoin purchases have now outweighed the supply of new Bitcoin by 3.3x in 2025. https://i.ibb.co/fVdgQhyY/Gq1ck-XRXUAAsg-Ym.jpg

➡️ Publicly listed Next Technology disclosed buying 5,000 Bitcoin for $180m, now HODLs 5,833 $BTC worth +$600m.

➡️ After rejecting the Arizona Strategic Bitcoin Reserve Act, Governor Katie Hobbs vetoed Bill SB 1373, which proposed a digital asset reserve fund. "Current volatility in the cryptocurrency markets does not make a prudent fit for general fund dollars."

➡️Meanwhile in Paris, France the kidnapping of a woman with her 2-year-old child morning on the streets of Paris - the target is allegedly the daughter of a crypto CEO. 3 masked men tried forcing them into a fake delivery van, before being fought off by her partner and bystanders. One of whom grabbed a dropped gun and aimed it back.

➡️ 'Bitcoin illiquid supply hit a new all-time high of $1.4B Are you HODLing too, anon?' - Bitcoin News

➡️Why Coinbase entering the S&P 500 matters. Boomers will have Bitcoin / CrApTo exposure, whether they like it or not. Anyway, remember what happened in 2021. The COIN IPO, and they’re still trading about 35% below their IPO-day high. Oh and please read the 'Coinbase" hack below haha.

➡️ Nasdaq listed GD Culture Group to sell up to $300 million shares to buy Bitcoin.

➡️ A Bitcoin wallet untouched since April 2014 just moved 300 BTC worth $31M for the first time in 11 years. This is how you HODL.

➡️ Bitcoin's realized price is steadily increasing, mirroring behaviors seen in past bull markets, according to CryptoQuant.

➡️ Bitcoin whales and sharks (10-10K BTC) accumulated 83,105 BTC in the last 30 days, while small retail holders (<0.1 BTC) sold 387 BTC, according to Santiment.

Bitcoin Whales have been AGGRESSIVELY accumulating BTC recently! With at least 240,000+ Bitcoin transferred to wallets with at least 100 BTC. The largest market participants are trying to buy as much as possible, what do they think comes next...

➡️'The average cost of mining 1 BTC for miners is currently $36.8K. The spread between the current market price and the cost of one coin = 182%. This is essentially the average profitability. This corresponds to the beginning of the bull cycle in November 2022 and the peaks of this cycle >$100K. A price increase above this level will allow miners to fully recover after the last halving and reach excess profits comparable to the beginning of the bull rally in January 2023.' -Axel Adler Jr.

➡️ Remember last week's segment on Coinbase..."Coinbase just disclosed in their Q1 filing: that they have custody of 2.68 million Bitcoin. That’s over 13% of all Bitcoin in circulation, on one platform. Is this the greatest honeypot in financial history? Yes, it is...read next week's Weekly Bitcoin update."

Well, here you go.

Coinbase estimates $180-$400 million in losses, remediation costs, and reimbursement following today’s cyber attack. https://i.ibb.co/jkysLtZ1/Gq-C7zl-W4-AAJ0-N6.jpg

Coinbase didn't get hacked. Coinbase employees sold customer data on the black market. Coinbase failed to protect customer data. This is why KYC is useless. The criminals have our driver's license scans. They have AI tools that can generate fake images and videos. KYC puts our identities at risk, makes onboarding more difficult, and rewards criminals. To make it even worse. Coinbase knew about the hack as early as January but only disclosed it publicly after being added to the S&P 500.

I will say it one more time! Don't buy your Bitcoin on KYC exchanges. KYC means handing over your identity to be leaked, sold, or extorted.

It was 2 days ago, see the bit on the 13th of May, that we saw a violent attack in Paris. Minimize the data you share with centralized tools. Store as much as you can locally. Always ask yourself what data am I giving and to whom? Remove the need for trust.

And for the love of God, Allah, or whatever god you are praying to...

DON'T LEAVE YOUR COINS ON A FREAKING EXCHANGE!!!!

Clear!

➡️ Sam Callahan: Bitcoin CAGRs over rolling four-year holding periods since 2012:

10th percentile: 33%

25th percentile: 50% 40th percentile: 75%

Said differently, for 90% of the time, Bitcoin’s four-year CAGR was higher than 33%. For comparison, here are the single best four-year CAGRs over the same period for:

Gold: 17%

Silver: 20%

S&P 500: 24%

Apple: 52%

Two lessons here:

1.) Even when Bitcoin underperforms, it still outperforms.

2.) Bitcoin holding goals are best measured in halving cycles.'

https://i.ibb.co/9m6q2118/Gq1-Ie2-Ob-AAIJ8-Kf.jpg

➡️ Deutsche Bank Aktiengesellschaft has bought 96,870 Strategy₿ stocks for 30 Million dollars at an Average Price Of $310 Per Share In Q1 2025, Their Total Holdings Is 518,000 Shares Worth Over 214 Million Dollars.

➡️Senator Lummis urges the U.S. Treasury to eliminate taxes on unrealized gains for Bitcoin.

On the 14th of May:

➡️At $168,000, Bitcoin will surpass Microsoft, the world's largest company.

➡️Fidelity tells institutions to buy Bitcoin if they can’t match Bitcoin’s 65% return on capital.

➡️Michigan has adopted House Resolution 100, declaring May 13 2025 as "Digital Asset Awareness Day." The resolution encourages "activities and programs that foster a deeper understanding of digital assets and their impact on our society and economy."

➡️Publicly traded Vinanz raises funding to buy $2 million in #Bitcoin assets.

➡️Bitcoin News: "Investor Jim Chanos is shorting MicroStrategy while going long on Bitcoin, calling the stock overvalued relative to its BTC holdings. “We’re selling MicroStrategy and buying Bitcoin, basically buying something for $1 and selling it for $2.50," he told CNBC

On the 15th of May:

➡️The Abu Dhabi sovereign wealth fund disclosed owning $511 million in Bitcoin through BlackRock’s ETF.

➡️UK public company Coinsilium Group raises £1.25 million to adopt a Bitcoin treasury strategy.

➡️Chinese Textile company Addentax issues stock to buy 8,000 Bitcoin.

➡️14 US states have reported $632m in $MSTR exposure for Q1, in public retirement and treasury funds. A collective increase of $302m in one quarter. The average increase in holding size was 44%.

➡️Chinese public company DDC Enterprise to adopt a Bitcoin Reserve with 5,000 BTC.

On the 16th of May:

➡️Brazilian listed company Méliuz buys $28.4 million Bitcoin to become the nation's first Bitcoin Treasury Company. Shareholders voted to approve the strategy by an "overwhelming majority".

➡️13F Filings show Texas Retirement System owns MSTR. The day MSTR enters the S&P 500, every pension fund will follow.

➡️'Wealthy Investors Shift Up to 5% into Bitcoin as confidence in fiat falters. UBS, a Swiss banking giant says Bitcoin and digital assets are becoming key hedges against inflation and systemic risk, marking a dramatic shift in modern portfolio strategy.' -CarlBMenger

➡️River: "Above all, Bitcoin is money for the people." https://i.ibb.co/Jj8MVQwr/Gr-Ew-EPp-XAAA1-TVN.jpg

On the 17th of May:

➡️Illicit activity is now down to 0.14% of transaction volume across all crypto.

Context: World Bank, IMF suggests 1.5–4% of global GDP is laundered yearly through traditional banking Of that 0.14%:

63% of illicit trade was stablecoins.

13% was Bitcoin (declining each year)

Source: The 2025 Crypto Crime Report, Chainalysis 2025

Yet another confirmation that Bitcoin's use in facilitating illicit activities is a rounding error on a rounding error.

On the 18th of May:

➡️JPMorgan CEO Jamie Dimon said they will allow clients to buy Bitcoin. The repeal of SAB 121 is a bigger deal than most realize. “I will fire any employee buying or trading Bitcoin for being stupid” - Jamie Dimon (2017) https://i.ibb.co/b5tnkb15/Gr-Vxxc-OXk-AA7cyo.jpg

On the 19th of May.

➡️Bookmark the following stuff from Daniel Batten if you want to combat climate change (fanatics)...

'That Bitcoin mining is not only not harmful, but beneficial to the environment is now supported by:

7 independent reports

20 peer-reviewed papers

As a result * 90% of climate-focused magazines * 87.5% of media coverage on Bitcoin & the environment is now positive * source 7 independent reports https://x.com/DSBatten/status/1922666207754281449… * 20 peer-reviewed papers https://x.com/DSBatten/status/1923014527651615182… * 10 climate-focused magazines https://x.com/DSBatten/status/1919518338092323260… * 16 mainstream media articles https://x.com/DSBatten/status/1922628399551434755

➡️Saifedean Ammous: '5 years ago at the height of corona hysteria, everyone worried about their savings.

If you put $10,000 in "risk-free" long-term US government bonds, you'd have $6,000 today.

If you put the $10,000 in "risky speculative tulip" bitcoin, you'd have $106,000.

HFSP, bondcucks!'

I love how Saifedean always put it so eloquently. haha

➡️An Australian judge rules Bitcoin is “just another form of money.” This could make it exempt from capital gains tax. Potentially opening the door to millions in refunds across the country. - AFR

If upheld, the decision could trigger up to $1B in refunds and overturn the Australian Tax Office’s crypto tax approach.

➡️Publicly traded Vinanz buys 16.9 Bitcoin for $1.75 Million for their treasury.

➡️Bitcoin just recorded its highest weekly close ever, while the Global Economic Policy Uncertainty Index hit its highest level in history.

➡️4 in 5 Americans want the U.S. to convert part of its gold reserves to Bitcoin. - The Nakamoto Project

"or background, the survey question was: "Assuming the United States was thinking of converting some of their gold reserves into Bitcoin, what percentage would you advise they convert?" Respondents were provided a slider used to choose between 0% and 100%. Our survey consisted of a national sample of 3,345 respondents recruited in partnership with Qualtrics, a survey and data collection company"

Context: https://x.com/thetrocro/status/1924552097565180107 https://i.ibb.co/fGDw06MC/Gr-VYDIdb-AAI7-Kxd.jpg

➡️Michael Saylor's STRATEGY bought another $764.9m Bitcoin. They now HODL 576,230 Bitcoin, acquired for $40.18 billion at $69,726 per Bitcoin.

➡️The German Government sold 49,858 BTC for $2.89B, at an average price of $57,900. If they had held it, their BTC would now be worth $5.24B.

➡️A record 63% of all the Bitcoin that exist have not transacted or moved from their wallets this year. - Wicked

https://i.ibb.co/j9nvbvmP/Gq3-Z-x6-Xw-AAv-Bhg.jpg

💸Traditional Finance / Macro:

On the 12th of May:

👉🏽The S&P 500 has closed more than 20% above its April low, technically beginning a new bull market. We are now up +1,000 points in one month.

On the 13th of May:

👉🏽 Nvidia announces a partnership with Humain to build "AI factories of the future" in Saudi Arabia. Just one hour ago, Saudi Arabia signed an economic agreement with President Trump to invest $600 billion in the US.

🏦Banks:

👉🏽 No news

🌎Macro/Geopolitics:

On the 12th of May:

👉🏽Huge pressure is on the European Union to reach a trade deal. Equities and commodities bounce hard on news of China-US trade deal. "We have reached an agreement on a 90-day pause and substantially moved down the tariff levels — both sides, on the reciprocal tariffs, will move their tariffs down 115%." - Treasury Secretary Scott Bessent

Dollar and Yuan strong bounce. Gold corrects.

👉🏽After reaching a high of 71% this year, recession odds are now back down to 40%. The odds of the US entering a recession in 2025 fall to a new low of 40% following the US-China trade deal announcement.

👉🏽'Truly incredible:

- Trump raises tariffs: Yields rise because inflation is back

- Trump cuts tariffs: Yields rise because growth is back

- Trump does nothing: Yields rise because the Fed won't cut rates Today, the bond market becomes Trump and Bessent's top priority.' - TKL

President Trump’s biggest problem persists even as trade deals are announced. Tariffs have been paused for 90 days, the US-China trade deal has been announced, and inflation data is down. Yet, the 10Y yield is nearing 4.50% again. Trump needs lower rates, but rates won’t fall.

👉🏽Last week a lot of talk on Japan’s Debt Death Spiral: Japan’s 40-year yield is detonating and the myth of consequence-free debt just died with it. One of the best explanations, you can read here:

👉🏽Michael A. Arouet: 'Eye-opening chart. Can a country with a services-based economy remain a superpower? Building back US manufacturing base makes a lot of strategic and geopolitical sense.' https://i.ibb.co/Q3zJY9Fc/Gqxc6-Pt-WQAI73c.jpg

On the 13th of May:

👉🏽There is a possibility of a “big, beautiful” economic rebalancing, Treasury Secretary Scott Bessent says at an investment forum in Saudi Arabia. The “dream scenario” would be if China and the US can work together on rebalancing, he adds

Luke Gromen: It does roll off the tongue a whole lot nicer than "We want to significantly devalue USD v. CNY, via a gold reference point."

Ergo: The price of gold specifically would rise in USD much more than it would in CNY, while prices for other goods and services would not, or would do so to a lesser degree.

👉🏽 Dutch inflation rises to 4.1 percent in April | CBS – final figure. Unchanged compared to the estimate.

👉🏽Philipp Heimberger: This interesting new paper argues that cuts to taxes on top incomes disproportionately benefit the financial sector. The finance industry gains more from top-income tax cuts than other industries. "Cuts in top income tax rates increase the (relative) size of the financial sector"

Kinda obvious, innit?

👉🏽US CPI data released. Overall good results and cooler than expected month-over-month and year-over-year (outside of yearly core). U.S. inflation is down to 2.3%, lower than expected.

On the 14th of May:

👉🏽'The US government cannot afford a recession: In previous economic cycles, the US budget deficit widened by ~4% of GDP on average during recessions. This would imply a ~$1.3 trillion deterioration of US government finances if a recession hits in 2025. That said, if the US enters a recession, long-term interest rates will likely go down.

A 2-percentage-point decrease in interest rates would save ~$568 billion in annual interest payments. However, this means government finances would worsen by more than DOUBLE the amount saved in interest due to a recession. An economic downturn would be incredibly costly for the US government.' -TKL

On the 15th of May:

👉🏽'In the Eurozone and the UK, households hold more than 30% of their financial assets in fiat currencies and bank deposits. This means that they (unknowingly?) allow inflation to destroy their purchasing power. The risks of inflation eating up your wealth increase in a debt-driven economic system characterized by fiscal dominance, where interest rates are structurally low and inflation levels and risks are high. There is so much forced and often failed regulation to increase financial literacy, but this part is never explained. Why is that, you think?' - Jeroen Blokland https://i.ibb.co/zWRpNqhz/Gq-jn-Bn-X0-AAmplm.png

On the 16th of May:

👉🏽'For the first time in a year, Japan's economy shrank by -0.7% in Q1 2025. This is more than double the decline expected by economists. Furthermore, this data does NOT include the reciprocal tariffs imposed on April 2nd. Japan's economy is heading for a recession.' -TKL

👉🏽'246 US large companies have gone bankrupt year-to-date, the most in 15 years. This is up from 206 recorded last year and more than DOUBLE during the same period in 2022. In April alone, the US saw 59 bankruptcy filings as tariffs ramped up. So far this year, the industrials sector has seen 41 bankruptcies, followed by 31 in consumer discretionary, and 17 in healthcare. According to S&P Global, consumer discretionary companies have been hit the hardest due to market volatility, tariffs, and inflation uncertainty. We expect a surge in bankruptcies in 2025.' -TKL

👉🏽'Moody's just downgraded the United States' credit rating for the FIRST time in history. The reason: An unsustainable path for US federal debt and its resulting interest burden. Moody's notes that the US debt-to-GDP ratio is on track to hit 134% by 2035. Federal interest payments are set to equal ~30% of revenue by 2035, up from ~18% in 2024 and ~9% in 2021. Furthermore, deficit spending is now at World War 2 levels as a percentage of GDP. The US debt crisis is our biggest issue with the least attention.' - TKL

Still, this is a nothing burger. In August 2023, when Fitch downgraded the US to AA+, and S&P (2011) the US became a split-rated AA+ country. This downgrade had almost no effect on the bond market. The last of the rating agencies, Moodys, pushed the US down to AA+ today. So technically it didn’t even change the US’s overall credit rating because it was already split-rated AA+, now it’s unanimous AA+.

Ergo: Nothing changed. America now shares a credit rating with Austria and Finland. Hard assets don’t lie. Watch Gold and Bitcoin.

https://i.ibb.co/Q7DcWY2P/Gr-K66i-EXIAAKh-MR.jpg

RAY DALIO: Credit Agencies are UNDERSTATING sovereign credit risks because "they don't include the greater risk that the countries in debt will print money to pay their debts" with devalued currency.

👉🏽US consumer credit card serious delinquencies are rising at a CRISIS pace: The share of US credit card debt that is past due at least 90 days hit 12.3% in Q1 2025, the highest in 14 YEARS. The percentage has risen even faster than during the Great Financial Crisis.' - Global Markets Investor

https://i.ibb.co/nNH9CxVK/Gr-E838o-XYAIk-Fyn.png

On the 18th of May:

👉🏽Michael A. Arouet: 'Look at ten bottom of this list. Milei has not only proven that real free market reforms work, but he has also proven that they work fast. It’s bigger than Argentina now, no wonder that the left legacy media doesn’t like him so much.' https://i.ibb.co/MDnBCDSY/Gr-Npu-KKWMAAf-Pc.jpg

On the 19th of May: 👉🏽Japan's 40-year bond yield just hit its highest level in over 20 years. Japan’s Prime Minister Ishiba has called the situation “worse than Greece.” All as Japan’s GDP is contracting again. You and your mother should be scared out of your fucking minds. https://i.ibb.co/rGZ9cMtv/GTXx-S7-Cb-MAAOu-Vt.png

👉🏽 TKL: 'Investors are piling into gold funds like never before: Gold funds have posted a record $85 BILLION in net inflows year-to-date. This is more than DOUBLE the full-year record seen in 2020. At this pace, net inflows will surpass $180 billion by the end of 2025. Gold is now the best-performing major asset class, up 22% year-to-date. Since the low in October 2022, gold prices have gained 97%. Gold is the global hedge against uncertainty.'

🎁If you have made it this far, I would like to give you a little gift, well, in this case, two gifts:

What Bitcoin Did - IS THE FED LOSING CONTROL? With Matthew Mezinskis

'Matthew Mezinskis is a macroeconomic researcher, host of the Crypto Voices podcast, and creator of Porkopolis Economics. In this episode, we discuss fractional reserve banking, why it's controversial among Bitcoiners, the historical precedent for banking practices, and whether fractional reserve banking inherently poses systemic risks. We also get into the dangers and instabilities introduced by central banking, why Bitcoin uniquely offers a pathway to financial sovereignty, the plumbing of the global financial system, breaking down money supply metrics, foreign holdings of US treasuries, and how all these elements indicate growing instability in the dollar system.'

https://youtu.be/j-XPVOl9zGc

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

-

@ c9badfea:610f861a

2025-05-24 12:55:17

@ c9badfea:610f861a

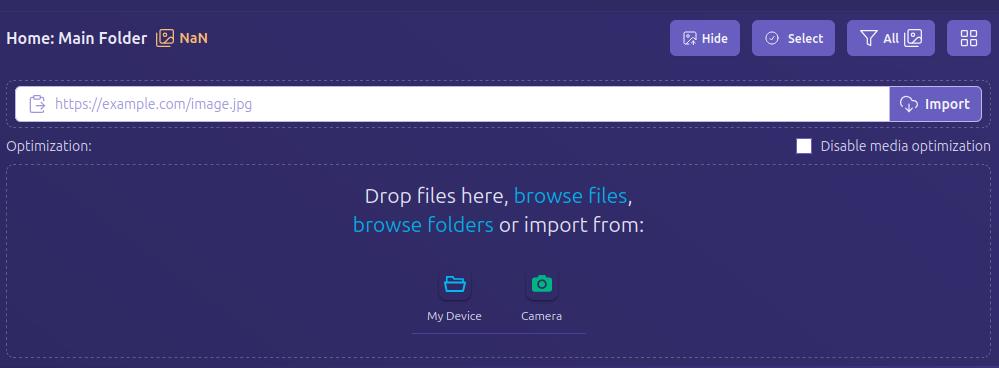

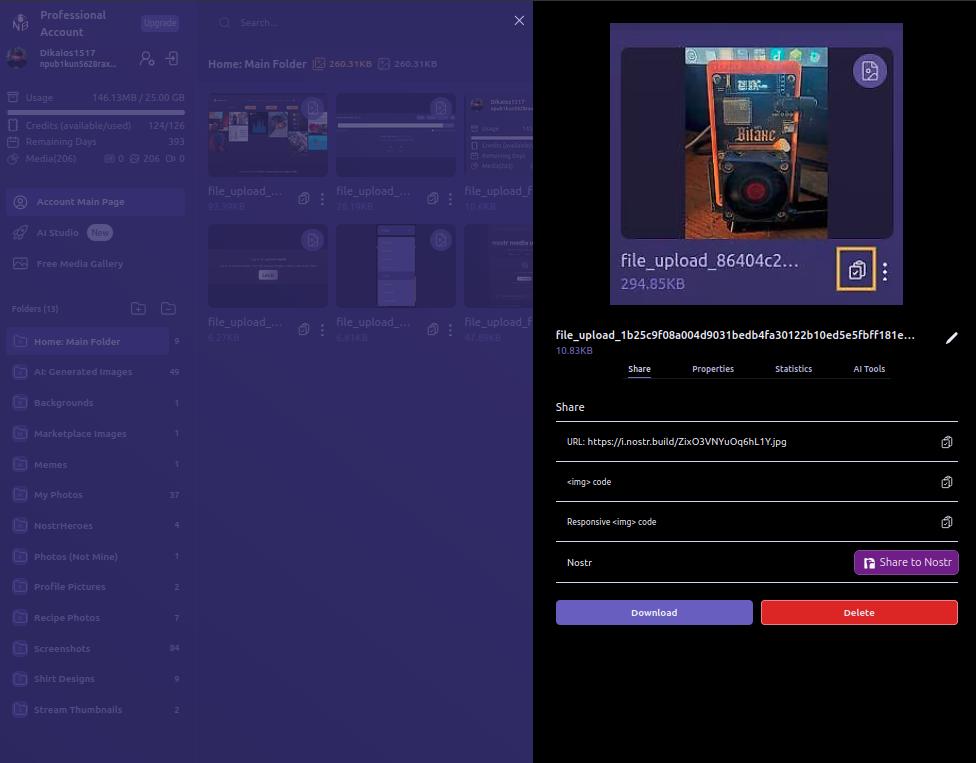

2025-05-24 12:55:17Before you post a message or article online, let the LLM check if you are leaking any personal information using this prompt:

Analyze the following text to identify any Personally Identifiable Information (PII): <Your Message>Replace

<Your Message>with your textIf no PII is found, continue by modifying your message to detach it from your personality. You can use any of the following prompts (and further modify it if necessary).

Prompt № 1 - Reddit-Style

Convert the message into a casual, Reddit-style post without losing meaning. Split the message into shorter statements with the same overall meaning. Here is the message: <Your Message>Prompt № 2 - Advanced Modifications

``` Apply the following modifications to the message: - Rewrite it in lowercase - Use "u" instead of "you" - Use "akchoaly" instead of "actually" - Use "hav" instead of "have" - Use "tgat" instead of "that" - Use comma instead of period - Use British English grammar

Here is the message:

``` Prompt № 3 - Neutral Tone

Rewrite the message to correct grammar errors, and ensure the tone is neutral and free of emotional language: <Your Message>Prompt № 4 - Cross Translation Technique

Translate the message into Chinese, then translate the resulting Chinese text back into English. Provide only the final English translation. Here is the message: <Your Message>Check the modified message and send it.

ℹ️ You can use dialects to obfuscate your language further. For example, if you are from the US, you can tell the LLM to use British grammar and vice versa.

⚠️ Always verify the results. Don't fully trust an LLM.

-

@ 5d4b6c8d:8a1c1ee3

2025-05-23 13:46:21

@ 5d4b6c8d:8a1c1ee3

2025-05-23 13:46:21You'd think I'd be most excited to talk about that awesome Pacers game, but, no. What I'm most excited about this week is that @grayruby wants to continue Beefing with Cowherd.

Still, I am excited to talk about Tyrese Haliburton becoming a legendary Knicks antagonist. Unfortunately, the Western Conference Finals are not as exciting. Also, why was the MVP announcement so dumb?

The T20k cricket contest is tightening up, as we head towards the finish. Can @Coinsreporter hold on to his vanishing lead?

@Carresan has launched Football Madness. Let's see if we understand whatever the hell this is any better than we did last week.

On this week's Blok'd Shots, we'll ridicule Canada for their disgraceful loss in the World Championships and talk about the very dominant American Florida Panthers, who are favorites to win the Stanley Cup.

Are the Colorado the worst team in MLB history?

The Tush Push has survived another season. Will the NFL eventually ban it or will teams adjust?

Plus, whatever else Stackers want to talk about.

https://stacker.news/items/987399

-

@ 6389be64:ef439d32

2025-05-24 21:51:47

@ 6389be64:ef439d32

2025-05-24 21:51:47Most nematodes are beneficial and "graze" on black vine weevil, currant borer moth, fungus gnats, other weevils, scarabs, cutworms, webworms, billbugs, mole crickets, termites, peach tree borer and carpenter worm moths.

They also predate bacteria, recycling nutrients back into the soil and by doing so stimulates bacterial activity. They act as microbial taxis by transporting microbes to new locations of soil as they move through it while providing aeration.

https://stacker.news/items/988573

-

@ 58537364:705b4b85

2025-05-24 20:48:43

@ 58537364:705b4b85

2025-05-24 20:48:43“Any society that sets intellectual development as its goal will continually progress, without end—until life is liberated from problems and suffering. All problems can ultimately be solved through wisdom itself.

The signpost pointing toward ‘wisdom’ is the ability to think—or what is called in Dhamma terms, ‘yoniso-manasikāra,’ meaning wise or analytical reflection. Thinking is the bridge that connects information and knowledge with insight and understanding. Refined or skillful thinking enables one to seek knowledge and apply it effectively.

The key types of thinking are:

- Thinking to acquire knowledge

- Thinking to apply knowledge effectively In other words, thinking to gain knowledge and thinking to use that knowledge. A person with knowledge who doesn’t know how to think cannot make that knowledge useful. On the other hand, a person who thinks without having or seeking knowledge will end up with nothing but dreamy, deluded ideas. When such dreamy ideas are expressed as opinions, they become nonsensical and meaningless—mere expressions of personal likes or dislikes.

In this light, the ‘process of developing wisdom’ begins with the desire to seek knowledge, followed by the training of thinking skills, and concludes with the ability to express well-founded opinions. (In many important cases, practice, testing, or experimentation is needed to confirm understanding.)

Thus, the thirst for knowledge and the ability to seek knowledge are the forerunners of intellectual development. In any society where people lack a love for knowledge and are not inclined to search for it, true intellectual growth will be difficult. That society will be filled with fanciful, delusional thinking and opinions based merely on personal likes and dislikes. For the development of wisdom, there must be the guiding principle that: ‘Giving opinions must go hand-in-hand with seeking knowledge. And once knowledge is gained, thinking must be refined and skillful.’”

— Somdet Phra Buddhaghosacariya (P.A. Payutto) Source: Dhamma treatise “Organizing Society According to the Ideals of the Sangha”

Note: “Pariyosāna” means the complete conclusion or the final, all-encompassing end.

“We must emphasize the pursuit of knowledge more than merely giving opinions. Opinions must be based on the most solid foundation of knowledge.

Nowadays, we face so many problems because people love to express opinions without ever seeking knowledge.”

— Somdet Phra Buddhaghosacariya (P.A. Payutto)

-

@ 3283ef81:0a531a33

2025-05-24 20:47:39

@ 3283ef81:0a531a33

2025-05-24 20:47:39This event has been deleted; your client is ignoring the delete request.

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ ecda4328:1278f072

2025-05-21 11:44:17

@ ecda4328:1278f072

2025-05-21 11:44:17An honest response to objections — and an answer to the most important question: why does any of this matter?

Last updated: May 21, 2025\ \ 📄 Document version:\ EN: https://drive.proton.me/urls/A4A8Y8A0RR#Sj2OBsBYJFr1\ RU: https://drive.proton.me/urls/GS9AS1NB30#ZdKKb5ackB5e

\ Statement: Deflation is not the enemy, but a natural state in an age of technological progress.\ Criticism: in real macroeconomics, long-term deflation is linked to depressions.\ Deflation discourages borrowers and investors, and makes debt heavier.\ Natural ≠ Safe.

1. “Deflation → Depression, Debt → Heavier”

This is true in a debt-based system. Yes, in a fiat economy, debt balloons to the sky, and without inflation it collapses.

But Bitcoin offers not “deflation for its own sake,” but an environment where you don’t need to be in debt to survive. Where savings don’t melt away.\ Jeff Booth said it clearly:

“Technology is inherently deflationary. Fighting deflation with the printing press is fighting progress.”

You don’t have to take on credit to live in this system. Which means — deflation is not an enemy, but an ally.

💡 People often confuse two concepts:

-

That deflation doesn’t work in an economy built on credit and leverage — that’s true.

-

That deflation itself is bad — that’s a myth.

📉 In reality, deflation is the natural state of a free market when technology makes everything cheaper.

Historical example:\ In the U.S., from the Civil War to the early 1900s, the economy experienced gentle deflation — alongside economic growth, employment expansion, and industrial boom.\ Prices fell: for example, a sack of flour cost \~$1.00 in 1865 and \~$0.50 in 1895 — and there was no crisis, because wages held and productivity increased.

Modern example:\ Consumer electronics over the past 20–30 years are a vivid example of technological deflation:\ – What cost $5,000 in 2000 (e.g., a 720p plasma TV) now costs $300 and delivers 10× better quality.\ – Phones, computers, cameras — all became far more powerful and cheaper at the same time.\ That’s how tech-driven deflation works: you get more for less.

📌 Bitcoin doesn’t make the world deflationary. It just doesn’t fight against deflation, unlike the fiat model that fights to preserve its debt pyramid.\ It stops punishing savers and rewards long-term thinkers.

Even economists often confuse organic tech deflation with crisis-driven (debt) deflation.

\ \ Statement: We’ve never lived in a truly free market — central banks and issuance always existed.\ Criticism: ideological statement.\ A truly “free” market is utopian.\ Banks and monetary issuance emerged in response to crises.\ A market without arbiters is not always fair, especially under imperfect competition.

2. “The Free Market Is a Utopia”

Yes, “pure markets” are rare. But what we have today isn’t regulation — it’s centralized power in the hands of central banks and cartels.

Bitcoin offers rules without rulers. 21 million. No one can change the issuance. It’s not ideology — it’s code instead of trust. And it has worked for 15 years.

💬 People often say that banks and centralized issuance emerged as a response to crises — as if the market couldn’t manage on its own.\ But if a system needs to be “rescued” again and again through money printing… maybe the problem isn’t freedom, but the system itself?

📌 Crises don’t disprove the value of free markets. They only reveal how fragile a system becomes when the price of money is set not by the market, but by a boardroom vote.\ Bitcoin doesn’t magically eliminate crises — it removes the root cause: the ability to manipulate money in someone’s interest.

\ \ Statement: Inflation is an invisible tax, especially on the poor and working class.\ Criticism: partly true: inflation can reduce debt burden, boost employment.\ The state indexes social benefits. Under stable inflation, compensators can work. Under deflation, things might be worse (mass layoffs, defaults).

3. “Inflation Can Help”

Theoretically — yes. Textbooks say moderate inflation can reduce debt burdens and stimulate consumption and jobs.\ But in practice — it works as a stealth tax, especially on those without assets. The wealthy escape — into real estate, stocks, funds.\ But the poor and working class lose purchasing power because their money is held in cash — and cash devalues.

💬 As Lyn Alden says:

“When your money can’t hold value, you’re forced to become an investor — even if you just want to save and live.”

The state may index pensions or benefits — but always with a lag, and always less than actual price increases.\ If bread rises 15% and your payment increase is 5%, you got poorer, even if the number on paper went up.

💥 We live in an inflationary system of everything:\ – Inflationary money\ – Inflationary products\ – Inflationary content\ – And now even inflationary minds

🧠 This is more than just rising prices — it’s a degradation of reality perception. You’re always rushing, everything loses meaning.\ But when did the system start working against you?

📉 What went wrong after 1971?

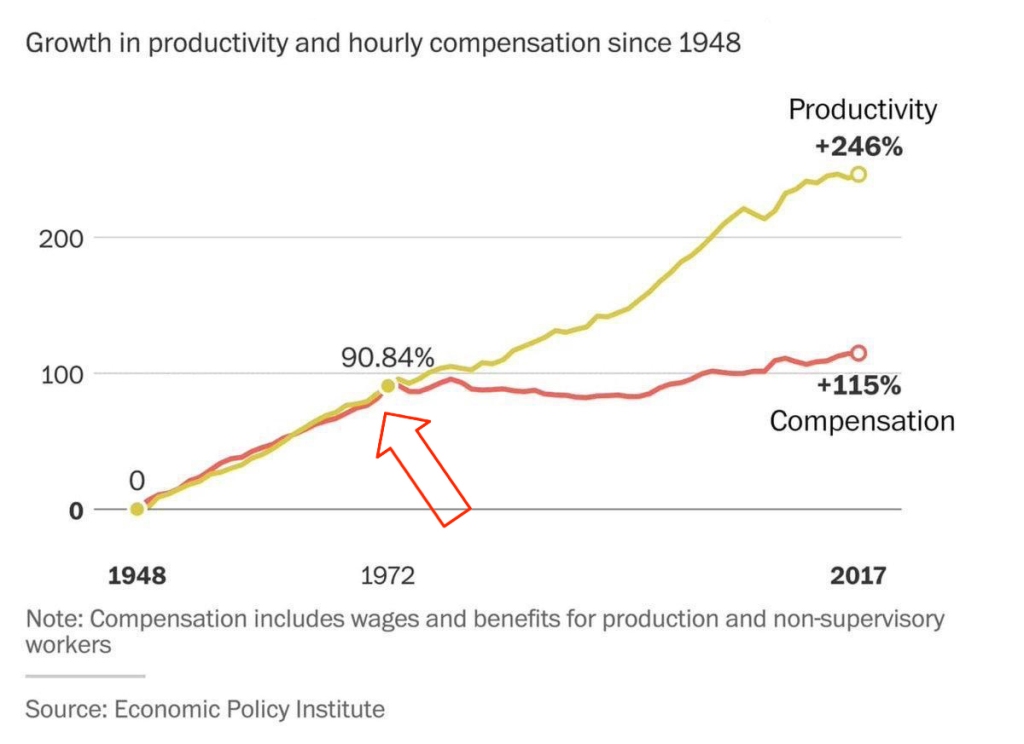

This chart shows that from 1948 to the early 1970s, productivity and wages grew together.\

But after the end of the gold standard in 1971 — the connection broke. Productivity kept rising, but real wages stalled.

This chart shows that from 1948 to the early 1970s, productivity and wages grew together.\

But after the end of the gold standard in 1971 — the connection broke. Productivity kept rising, but real wages stalled.👉 This means: you work more, better, faster — but buy less.

🔗 Source: wtfhappenedin1971.com

When you must spend today because tomorrow it’ll be worth less — that’s rewarding impulse and punishing long-term thinking.

Bitcoin offers a different environment:\ – Savings work\ – Long-term thinking is rewarded\ – The price of the future is calculated, not forced by a printing press

📌 Inflation can be a tool. But in government hands, it became a weapon — a slow, inevitable upward redistribution of wealth.

\ \ Statement: War is not growth, but a reallocation of resources into destruction.

Criticism: war can spur technological leaps (Internet, GPS, nuclear energy — all from military programs). "Military Keynesianism" was a real model.

4. “War Drives R&D”

Yes, wars sometimes give rise to tech spin-offs: Internet, GPS, nuclear power — all originated from military programs.

But that doesn’t make war a source of progress — it makes tech a byproduct of catastrophe.

“War reallocates resources toward destruction — not growth.”

Progress doesn’t happen because of war — it happens despite it.

If scientific breakthroughs require a million dead and burnt cities — maybe you’ve built your economy wrong.

💬 Even Michael Saylor said:

“If you need war to develop technology — you’ve built civilization wrong.”

No innovation justifies diverting human labor, minds, and resources toward destruction.\ War is always the opposite of efficiency — more is wasted than created.

🧠 Bitcoin, on the other hand, is an example of how real R&D happens without violence.\ No taxes. No army. Just math, voluntary participation, and open-source code.

📌 Military Keynesianism is not a model of progress — it’s a symptom of a sick monetary system that needs destruction to reboot.

Bitcoin shows that coordination without violence is possible.\ This is R&D of a new kind: based not on destruction, but digital creation.

Statement: Bitcoin isn’t “Gold 1.0,” but an improved version: divisible, verifiable, unseizable.

Criticism: Bitcoin has no physical value; "unseizability" is a theory;\ Gold is material and autonomous.

5. “Bitcoin Has No Physical Value”

And gold does? Just because it shines?

Physical form is no guarantee of value.\ Real value lies in: scarcity, reliable transfer, verifiability, and non-confiscatability.

Gold is:\ – Hard to divide\ – Hard to verify\ – Expensive to store\ – Easy to seize

💡 Bitcoin is the first store of value in history that is fully free from physical limitations, and yet:\ – Absolutely scarce (21M, forever)\ – Instantly transferable over the Internet\ – Cryptographically verifiable\ – Controlled by no government

🔑 Bitcoin’s value lies in its liberation from the physical.\ It doesn’t need to be “backed” by gold or oil. It’s backed by energy, mathematics, and ongoing verification.

“Price is what you pay, value is what you get.” — Warren Buffett

When you buy bitcoin, you’re not paying for a “token” — you’re gaining access to a network of distributed financial energy.

⚡️ What are you really getting when you own bitcoin?\ – A key to a digital asset that can’t be faked\ – The ability to send “crystallized energy” anywhere on Earth (it takes 10 minutes on the base L1 layer, or instantly via the Lightning Network)\ – A role in a new accounting system that runs 24/7/365\ – Freedom: from banks, borders, inflation, and force

📉 Bitcoin doesn’t require physical value — because it creates value:\ Through trust, scarcity, and energy invested in mining.\ And unlike gold, it was never associated with slavery.

Statement: There’s no “income without risk” in Bitcoin: just hold — you preserve; want more — invest, risk, build.

Criticism: contradicts HODL logic; speculation remains dominant behavior.

6. “Speculation Dominates”

For now — yes. That’s normal for the early phase of a new technology. Awareness doesn’t come instantly.

What matters is not the motive of today’s buyer — but what they’re buying.

📉 A speculator may come and go — but the asset remains.\ And this asset is the only one in history that will never exist again. 21 million. Forever.

📌 Look deeper. Bitcoin has:\ – No CEO\ – No central issuer\ – No inflation\ – No “off switch”\ 💡 It was fairly distributed — through mining, long before ASICs existed. In the early years, bitcoin was spent and exchanged — not hoarded. Only those who truly believed in it are still holding it today.

💡 It’s not a stock. Not a startup. Not someone’s project.\ It’s a new foundation for trust.\ It’s opting out of a system where freedom is a privilege you’re granted under conditions.

🧠 People say: “Bitcoin can be copied.”\ Theoretically — yes.\ Practically — never.

Here’s what you’d need to recreate Bitcoin:\ – No pre-mine\ – A founder who disappears and never sells\ – No foundation or corporation\ – Tens of thousands of nodes worldwide\ – 701 million terahashes of hash power\ – Thousands of devs writing open protocols\ – Hundreds of global conferences\ – Millions of people defending digital sovereignty\ – All that without a single marketing budget

That’s all.

🔁 Everything else is an imitation, not a creation.\ Just like you can’t “reinvent fire” — Bitcoin can only exist once.

Statements:\ **The Russia's '90s weren’t a free market — just anarchic chaos without rights protection.\ **Unlike fiat or even dollars, Bitcoin is the first asset with real defense — from governments, inflation, even thugs.\ *And yes, even if your barber asks about Bitcoin — maybe it's not a bubble, but a sign that inflation has already hit everyone.

Criticism: Bitcoin’s protection isn’t universal — it works only with proper handling and isn’t available to all.\ Some just want to “get rich.”\ None of this matters because:

-

Bitcoin’s volatility (-30% in a week, +50% in a month) makes it unusable for price planning or contracts.

-

It can’t handle mass-scale usage.

-

To become currency, geopolitical will is needed — and without the first two, don’t even talk about the third.\ Also: “Bitcoin is too complicated for the average person.”

7. “It’s Too Complex for the Masses”

It’s complex — if you’re using L1 (Layer 1). But even grandmas use Telegram. In El Salvador, schoolkids buy lunch with Lightning. My barber installed Wallet of Satoshi in minutes right in front of me — and I now pay for my haircut via Lightning.

UX is just a matter of time. And it’s improving. Emerging tools:\ Cashu, Fedimint, Fedi, Wallet of Satoshi, Phoenix, Proton Wallet, Swiss Bitcoin Pay, Bolt Card / CoinCorner (NFC cards for Lightning payments).

This is like the internet in 1995:\ It started with modems — now it’s 4K streaming.

💸 Now try sending a regular bank transfer abroad:\ – you need to type a long IBAN\ – add SWIFT/BIC codes\ – include the recipient’s full physical address (!), compromising their privacy\ – sometimes add extra codes or “purpose of payment”\ – you might get a call from your bank “just to confirm”\ – no way to check the status — the money floats somewhere between correspondent/intermediary banks\ – weekends or holidays? Banks are closed\ – and don’t forget the limits, restrictions, and potential freezes

📌 With Bitcoin, you just scan a QR code and send.\ 10 minutes on-chain = final settlement.\ Via Lightning = instant and nearly free.\ No bureaucracy. No permission. No borders.

8. “Can’t Handle the Load”

A common myth.\ Yes, Bitcoin L1 processes about 7 transactions per second — intentionally. It’s not built to be Visa. It’s a financial protocol, just like TCP/IP is a network protocol. TCP/IP isn’t “fast” or “slow” — the experience depends on the infrastructure built on top: servers, routers, hardware. In the ’90s, it delivered text. Today, it streams Netflix. The protocol didn’t change — the stack did.

Same with Bitcoin: L1 defines rules, security, finality.\ Scaling and speed? That’s the second layer’s job.

To understand scale:

| Network | TPS (Transactions/sec) | | --- | --- | | Visa | up to 24,000 | | Mastercard | \~5,000 | | PayPal | \~193 | | Litecoin | \~56 | | Ethereum | \~20 | | Bitcoin | \~7 |

\ ⚡️ Enter Lightning Network — Bitcoin’s “fast lane.”\ It allows millions of transactions per second, instantly and nearly free.

And it’s not a sidechain.

❗️ Lightning is not a separate network.\ It uses real Bitcoin transactions (2-of-2 multisig). You can close the channel to L1 at any time. It’s not an alternative — it’s a native extension built into Bitcoin.\ Also evolving: Ark, Fedimint, eCash — new ways to scale and add privacy.

📉 So criticizing Bitcoin for “slowness” is like blaming TCP/IP because your old modem won’t stream YouTube.\ The protocol isn’t the problem — it’s the infrastructure.

🛡️ And by the way: Visa crashes more often than Bitcoin.

9. “We Need Geopolitical Will”

Not necessarily. All it takes is the will of the people — and leaders willing to act. El Salvador didn’t wait for G20 approval or IMF blessings. Since 2001, the country had used the US dollar as its official currency, abandoning its own colón. But that didn’t save it from inflation or dependency on foreign monetary policy. In 2021, El Salvador became the first country to recognize Bitcoin as legal tender. Since March 13, 2024, they’ve been purchasing 1 BTC daily, tracked through their public address:

🔗 Address\ 📅 First transaction

This policy became the foundation of their Strategic Bitcoin Reserve (SBR) — a state-led effort to accumulate Bitcoin as a national reserve asset for long-term stability and sovereignty.

Their example inspired others.

In March 2025, U.S. President Donald Trump signed an executive order creating the Strategic Bitcoin Reserve of the USA, to be funded through confiscated Bitcoin and digital assets.\ The idea: accumulate, don’t sell, and strategically expand the reserve — without extra burden on taxpayers.

Additionally, Senator Cynthia Lummis (Wyoming) proposed the BITCOIN Act, targeting the purchase of 1 million BTC over five years (\~5% of the total supply).\ The plan: fund it via revaluation of gold certificates and other budget-neutral strategies.

📚 More: Strategic Bitcoin Reserve — Wikipedia

👉 So no global consensus is required. No IMF greenlight.\ All it takes is conviction — and an understanding that the future of finance lies in decentralized, scarce assets like Bitcoin.

10. “-30% in a week, +50% in a month = not money”

True — Bitcoin is volatile. But that’s normal for new technologies and emerging money. It’s not a bug — it’s a price discovery phase. The world is still learning what this asset is.

📉 Volatility is the price of entry.\ 📈 But the reward is buying the future at a discount.

As Michael Saylor put it:

“A tourist sees Niagara Falls as chaos — roaring, foaming, spraying water.\ An engineer sees immense energy.\ It all depends on your mental model.”

Same with Bitcoin. Speculators see chaos. Investors see structural scarcity. Builders see a new financial foundation.

💡 Now consider gold:

👉 After the gold standard was abandoned in 1971, the price of gold skyrocketed from around \~$300 to over $2,700 (adjusted to 2023 dollars) by 1980. Along the way, it experienced extreme volatility — with crashes of 40–60% even amid the broader uptrend.\ 💡 (\~$300 is the inflation-adjusted equivalent of about $38 in 1971 dollars)\ 📈 Source: Gold Price Chart — Macrotrends\ \ Nobody said, “This can’t be money.” \ Because money is defined not by volatility, but by scarcity, adoption, and trust — which build over time.

📊 The more people save in Bitcoin, the more its volatility fades.

This is a journey — not a fixed state.

We don’t judge the internet by how it worked in 1994.\ So why expect Bitcoin to be the “perfect currency” in 2025?

It grows bottom-up — without regulators’ permission.\ And the longer it survives, the stronger it becomes.

Remember how many times it’s been declared dead.\ And how many times it came back — stronger.

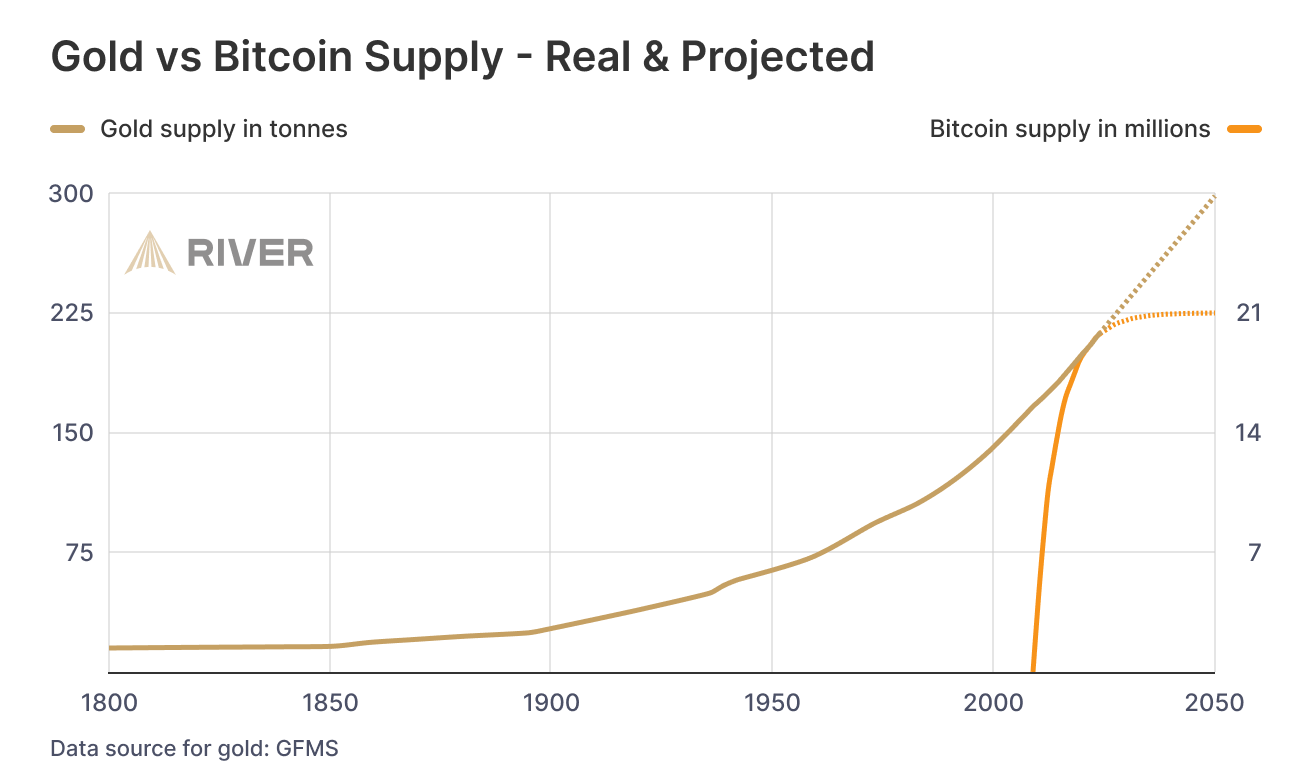

📊 Gold vs. Bitcoin: Supply Comparison

This chart shows the key difference between the two hard assets:

🔹 Gold — supply keeps growing.\ Mining may be limited, but it’s still inflationary.\ Each year, there’s more — with no known cap: new mines, asteroid mining, recycling.

🔸 Bitcoin — capped at 21 million.\ The emission schedule is public, mathematically predictable, and ends completely around 2140.

🧠 Bottom line:\ Gold is good.\ Bitcoin is better — for predictability and scarcity.

💡 As Saifedean Ammous said:

“Gold was the best monetary good… until Bitcoin.”

### While we argue — fiat erodes every day.

### While we argue — fiat erodes every day.No matter your view on Bitcoin, just show me one other asset that is simultaneously:

– immune to devaluation by decree\ – impossible to print more of\ – impossible to confiscate by a centralized order\ – impossible to counterfeit\ – and, most importantly — transferable across borders without asking permission from a bank, a state, or a passport

💸 Try sending $10,000 through PayPal from Iran to Paraguay, or Bangladesh to Saint Lucia.\ Good luck. PayPal doesn't even work there.

Now open a laptop, type 12 words — and you have access to your savings anywhere on Earth.

🌍 Bitcoin doesn't ask for permission.\ It works for everyone, everywhere, all the time.

📌 There has never been anything like this before.

Bitcoin is the first asset in history that combines:

– digital nature\ – predictable scarcity\ – absolute portability\ – and immunity from tyranny

💡 As Michael Saylor said:

“Bitcoin is the first money in human history not created by bankers or politicians — but by engineers.”

You can own it with no bank.\ No intermediary.\ No passport.\ No approval.

That’s why Bitcoin isn’t just “internet money” or “crypto” or “digital gold.”\ It may not be perfect — but it’s incorruptible.\ And it’s not going away.\ It’s already here.\ It is the foundation of a new financial reality.

🔒 This is not speculation. This is a peaceful financial revolution.\ 🪙 This is not a stock. It’s money — like the world has never seen.\ ⛓️ This is not a fad. It’s a freedom protocol.

And when even the barber starts asking about Bitcoin — it’s not a bubble.\ It’s a sign that the system is breaking.\ And people are looking for an exit.

For the first time — they have one.

💼 This is not about investing. It’s about the dignity of work.

Imagine a man who cleans toilets at an airport every day.

Not a “prestigious” job.\ But a crucial one.\ Without him — filth, bacteria, disease.

He shows up on time. He works with his hands.

And his money? It devalues. Every day.

He doesn’t work less — often he works more than those in suits.\ But he can afford less and less — because in this system, honest labor loses value each year.

Now imagine he’s paid in Bitcoin.

Not in some “volatile coin,” but in hard money — with a limited supply.\ Money that can’t be printed, reversed, or devalued by central banks.

💡 Then he could:

– Stop rushing to spend, knowing his labor won’t be worth less tomorrow\ – Save for a dream — without fear of inflation eating it away\ – Feel that his time and effort are respected — because they retain value

Bitcoin gives anyone — engineer or janitor — a way out of the game rigged against them.\ A chance to finally build a future where savings are real.

This is economic justice.\ This is digital dignity.

📉 In fiat, you have to spend — or your money melts.\ 📈 In Bitcoin, you choose when to spend — because it’s up to you.

🧠 In a deflationary economy, both saving and spending are healthy:

You don’t scramble to survive — you choose to create.

🎯 That’s true freedom.

When even someone cleaning floors can live without fear —\ and know that their time doesn’t vanish... it turns into value.

🧱 The Bigger Picture

Bitcoin is not just a technology — it’s rooted in economic philosophy.\ The Austrian School of Economics has long argued that sound money, voluntary exchange, and decentralized decision-making are prerequisites for real prosperity.\ Bitcoin doesn’t reinvent these ideas — it makes them executable.

📉 Inflation doesn’t just erode savings.\ It quietly destroys quality of life.\ You work more — and everything becomes worse:\ – food is cheaper but less nutritious\ – homes are newer but uglier and less durable\ – clothes cost more but fall apart in months\ – streaming is faster, but your attention span collapses\ This isn’t just consumerism — it’s the economics of planned obsolescence.

🧨 Meanwhile, the U.S. debt has exceeded 3x its GDP.\ And nobody wants to buy U.S. bonds anymore — so the U.S. has to buy its own debt.\ Yes: printing money to buy the IOUs you just printed.\ This is the endgame of fiat.

🎭 Bonds are often sold as “safe.”\ But in practice, they are a weapon — especially abroad.\ The U.S. and IMF give loans to developing countries.\ But when those countries can’t repay (due to rigged terms or global economic headwinds), they’re forced to sell land, resources, or strategic assets.\ Both sides lose: the debtor collapses under the weight of debt, while the creditor earns resentment and instability.\ This isn’t cooperation — it’s soft colonialism enabled by inflation.

📌 Bitcoin offers a peaceful exit.\ A financial system where money can’t be created out of thin air.\ Where savings work.\ Where dignity is restored — even for those who clean toilets.

-

-

@ 3283ef81:0a531a33

2025-05-24 20:36:35

@ 3283ef81:0a531a33

2025-05-24 20:36:35Suspendisse quis rutrum nisi Integer nec augue quis ex euismod blandit ut ac mi

Curabitur suscipit vulputate volutpat Donec ornare, risus non tincidunt malesuada, elit magna feugiat diam, id faucibus libero libero efficitur mauris

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 866e0139:6a9334e5

2025-05-23 17:57:24

@ 866e0139:6a9334e5

2025-05-23 17:57:24Autor: Caitlin Johnstone. Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

Ich hörte einem jungen Autor zu, der eine Idee beschrieb, die ihn so sehr begeisterte, dass er die Nacht zuvor nicht schlafen konnte. Und ich erinnerte mich daran, wie ich mich früher – vor Gaza – über das Schreiben freuen konnte. Dieses Gefühl habe ich seit 2023 nicht mehr gespürt.

Ich beklage mich nicht und bemitleide mich auch nicht selbst, ich stelle einfach fest, wie unglaublich düster und finster die Welt in dieser schrecklichen Zeit geworden ist. Es wäre seltsam und ungesund, wenn ich in den letzten anderthalb Jahren Freude an meiner Arbeit gehabt hätte. Diese Dinge sollen sich nicht gut anfühlen. Nicht, wenn man wirklich hinschaut und ehrlich zu sich selbst ist in dem, was man sieht.

Es war die ganze Zeit über so hässlich und so verstörend. Es gibt eigentlich keinen Weg, all diesen Horror umzudeuten oder irgendwie erträglich zu machen. Alles, was man tun kann, ist, an sich selbst zu arbeiten, um genug inneren Raum zu schaffen, um die schlechten Gefühle zuzulassen und sie ganz durchzufühlen, bis sie sich ausgedrückt haben. Lass die Verzweiflung herein. Die Trauer. Die Wut. Den Schmerz. Lass sie deinen Körper vollständig durchfließen, ohne Widerstand, und steh dann auf und schreibe das nächste Stück.

Das ist es, was Schreiben für mich jetzt ist. Es ist nie etwas, worüber ich mich freue, es zu teilen, oder wofür ich von Inspiration erfüllt bin. Wenn überhaupt, dann fühlt es sich eher so an wie: „Okay, hier bitte, es tut mir schrecklich leid, dass ich euch das zeigen muss, Leute.“ Es ist das Starren in die Dunkelheit, in das Blut, in das Gemetzel, in die gequälten Gesichter – und das Aufschreiben dessen, was ich sehe, Tag für Tag.

Nichts daran ist angenehm oder befriedigend. Es ist einfach das, was man tut, wenn ein Genozid in Echtzeit vor den eigenen Augen stattfindet, mit der Unterstützung der eigenen Gesellschaft. Alles daran ist entsetzlich, und es gibt keinen Weg, das schönzureden – aber man tut, was getan werden muss. So, wie man es täte, wenn es die eigene Familie wäre, die da draußen im Schutt liegt.

Dieser Genozid hat mich für immer verändert. Er hat viele Menschen für immer verändert. Wir werden nie wieder dieselben sein. Die Welt wird nie wieder dieselbe sein. Ganz gleich, was passiert oder wie dieser Albtraum endet – die Dinge werden nie wieder so sein wie zuvor.

Und das sollten sie auch nicht. Der Holocaust von Gaza ist das Ergebnis der Welt, wie sie vor ihm war. Unsere Gesellschaft hat ihn hervorgebracht – und jetzt starrt er uns allen direkt ins Gesicht. Das sind wir. Das ist die Frucht des Baumes, den die westliche Zivilisation bis zu diesem Punkt gepflegt hat.

Jetzt geht es nur noch darum, alles zu tun, was wir können, um den Genozid zu beenden – und sicherzustellen, dass die Welt die richtigen Lehren daraus zieht. Das ist eines der würdigsten Anliegen, denen man sich in diesem Leben widmen kann.

Ich habe noch immer Hoffnung, dass wir eine gesunde Welt haben können. Ich habe noch immer Hoffnung, dass das Schreiben über das, was geschieht, eines Tages wieder Freude bereiten kann. Aber diese Dinge liegen auf der anderen Seite eines langen, schmerzhaften, konfrontierenden Weges, der in den kommenden Jahren vor uns liegt. Es gibt keinen Weg daran vorbei.

Die Welt kann keinen Frieden und kein Glück finden, solange wir uns nicht vollständig damit auseinandergesetzt haben, was wir Gaza angetan haben.

Dieser Text ist die deutsche Übersetzung dieses Substack-Artikels von Caitlin Johnstone.

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ cff1720e:15c7e2b2

2025-05-24 20:17:45

@ cff1720e:15c7e2b2

2025-05-24 20:17:45Ich liebe Pareto. Für das was es ist, viel mehr aber für das was es derzeit wird - der Marktplatz der Ideen. Er entsteht durch gemeinsames Engagement von Entwicklern, Autoren und aktiven Lesern. Es ist ein lebendiges Medium, das jeden Tag wächst, quantitativ wie qualitativ, durch offene Interaktion, was es in dieser Form einzigartig macht.\ \ Mein Text ist inspiriert durch den Artikel von Alexa Rodrian vom 22. Mai über den Auftritt von Wolf Biermann bei der Verleihung des Deutschen Filmpreises. Alexa ist keine Publizistin, genau wie zahlreiche unserer Autoren, aber sie hat einen bemerkenswerten Beitrag verfasst. Ich habe ihn spontan geliked, kommentiert und mit einer Spende honoriert. In den vergangenen Tagen habe ich viel darüber reflektiert, und Pareto ermöglicht es mir, und jedem anderen, diese Überlegungen zur “Causa Biermann” hier darzulegen.

MSN kommentierte die anstößige Rede wie folgt: mit einem verfälschten Golda-Meir-Zitat lenkte Biermann das Thema auf das Sterben in Gaza, für das er die Palästinenser selbst verantwortlich machte. „Dass ihr unsere Söhne ermordet habt, werden wir Euch eines Tages verzeihen“, habe Meir zu den Palästinensern gesagt, „aber wir werden euch niemals verzeihen können, dass ihr unsere Söhne gezwungen habt, selber Mörder zu werden.“ Alexa Rodrian, in einer Mischung aus Enttäuschung und Empörung, eröffnete ihren Artikel wie folgt:

„Triff niemals deine Idole“ heißt ein gängiger Ratschlag. In gewendeten Zeiten stehen zu dem die Werte auf dem Kopf – und manche Künstler mit ihnen. Die Worte, die aus manch ihrer Mündern kommen, wirken, als hätte eine fremde Hand sie auf deren Zunge gelegt. Die fremde Hand ist bei Biermann eher unwahrscheinlich, denn sein Hang zu Provokationen und Verletzungen haben Tradition, man erinnere sich an den legendären Auftritt bei einer Feierstunde im Bundestag 2014 in der er die Mitglieder der Linksfraktion als “elenden Rest“ und ”Drachenbrut” bezeichnete. Oder seine Beschimpfungen der (ostdeutschen) Wähler von AfD und BSW im August 2024 in einem Zeit-Interview: „Die, die zu feige waren in der Diktatur, rebellieren jetzt ohne Risiko gegen die Demokratie. Den Bequemlichkeiten der Diktatur jammern sie nach, und die Mühen der Demokratie sind ihnen fremd.“

Im Februar 2025 wurde Wolf Biermann für sein Lebenswerk mit einem Musikpreis der GEMA ausgezeichnet. Was aber ist sein Lebenswerk, sein mutiges Engagement in der Opposition der DDR bis 1976 oder seine verfehlten Rüpeleien in der Gegenwart? Ein solcher Preis ist fragwürdig, denn kein Lebenswerk ist konsistent, und die Bewertung abhängig von subjektiven Maßstäben. Meist wählen wir unsere Idole nach unseren Idealen, aber die können sich verändern, ebenso wie das Idol. Beethoven widmete seine 3. Sinfonie (Eroica) Napoleon, zog die Widmung aber zurück als dieser sich 1804 zum Kaiser krönen ließ. “Ist der auch nichts anderes, wie ein gewöhnlicher Mensch?” soll er wütend ausgerufen haben. Richtig! Was hatte Beethoven erwartet, einen Gott? “Hosianna” und “kreuzigt ihn” sind Affekte die durch unsere Projektionen verursacht und den Realitäten nie gerecht werden.

Den Preis für sein Lebenswerk kann Wolf Biermann behalten. Er hat Millionen von Menschen in der DDR Mut gemacht. Er hat zahlreiche großartige Gedichte und Lieder verfasst, das behalte ich gerne in Erinnerung. Nun hat er sich selbst vom Sockel gestürzt und durch seinen Empathiemangel das Image beschädigt. Das hätte er vermeiden können, wenn er sich an die Worte seines Lehrmeisters Brecht erinnert hätte.

...\ Dabei wissen wir doch:\ Auch der Hass gegen die Niedrigkeit\ verzerrt die Züge.\ Auch der Zorn über das Unrecht\ Macht die Stimme heiser. Ach, wir\ Die wir den Boden bereiten wollten für die Freundlichkeit\ Konnten selber nicht freundlich sein.\ ...

Er hätte auch von der Medizin nehmen können, die er selbst für andere entwickelt hat \ (1966 für seinen Freund Peter Huchel).

…\ Du, laß dich nicht verhärten\ in dieser harten Zeit.\ Die allzu hart sind, brechen,\ die allzu spitz sind, stechen\ und brechen ab sogleich.\ …

PS: Fortsetzung folgt in der Reihe \ “Was wir von großen Persönlichkeiten lernen können, wenn wir ihnen zuhören würden."

-

@ f7a1599c:6f2484d5

2025-05-24 20:06:04

@ f7a1599c:6f2484d5

2025-05-24 20:06:04In March 2020, Lucas was afraid.

The economy was grinding to a halt. Markets were in freefall. In a sweeping response, the Federal Reserve launched an unprecedented intervention—buying everything from Treasury bonds and mortgages to corporate debt, expanding the money supply by $4 trillion. At the same time, the U.S. government issued over $800 billion in stimulus checks to households across the country.

These extraordinary measures may have averted a wave of business failures and bank runs—but they came at a cost: currency debasement and rising inflation. Alarmed by the scale of central bank intervention and its consequences for savers, Lucas decided to act.

In a state of mild panic, he withdrew $15,000 from his bank account and bought ten gold coins. Then he took another $10,000 and bought two bitcoins. If the dollar system failed, Lucas wanted something with intrinsic value he could use.

He mentioned his plan to his friend Daniel, who laughed.

“Why don’t you stock up on guns and cigarettes while you’re at it?” Daniel quipped. “The Fed is doing what it has to—stabilizing the economy in a crisis. Sure, $4 trillion is a lot of money, but it's backed by the most productive economy on Earth. Don’t panic. The world’s not ending.”

To prove his point, Daniel put $25,000 into the S&P 500—right at the pandemic bottom.

And he was right. Literally.

By Spring 2025, the stock market was near all-time highs. The world hadn’t ended. The U.S. economy kept moving, more or less as usual. Daniel’s investment had nearly tripled—his $25,000 had grown to $65,000.

But oddly enough, Lucas’ seemingly panicked reaction had been both prudent and profitable.

His gold coins had climbed from $1,500 to $3,300 apiece—a 120% gain. Bitcoin had soared from $5,000 to $90,000, making his two coins worth $180,000. Altogether, Lucas’s $25,000 allocation had grown to $213,000—a nearly 10x return. And his goal wasn’t even profit. It was safety.

With that kind of fortune, you’d expect Lucas to feel confident, even serene. He had more than enough to preserve his purchasing power, even in the face of years of inflation.

But in the spring of 2025, Lucas felt anything but calm.

He was uneasy—gripped by a sense that the 2020 crisis hadn’t been a conclusion, but a prelude.

In his mind, 2020 was just the latest chapter in a troubling sequence: the Asian financial crisis in 1998, the global financial crisis in 2008, the pandemic shock of 2020. Each crisis had been more sudden, more sweeping, and more dependent on emergency measures than the last.

And Lucas couldn’t shake the feeling that the next act—whenever it came—would be more disruptive, more severe, and far more damaging.

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:22

@ 04c915da:3dfbecc9

2025-05-20 15:50:22There is something quietly rebellious about stacking sats. In a world obsessed with instant gratification, choosing to patiently accumulate Bitcoin, one sat at a time, feels like a middle finger to the hype machine. But to do it right, you have got to stay humble. Stack too hard with your head in the clouds, and you will trip over your own ego before the next halving even hits.

Small Wins

Stacking sats is not glamorous. Discipline. Stacking every day, week, or month, no matter the price, and letting time do the heavy lifting. Humility lives in that consistency. You are not trying to outsmart the market or prove you are the next "crypto" prophet. Just a regular person, betting on a system you believe in, one humble stack at a time. Folks get rekt chasing the highs. They ape into some shitcoin pump, shout about it online, then go silent when they inevitably get rekt. The ones who last? They stack. Just keep showing up. Consistency. Humility in action. Know the game is long, and you are not bigger than it.

Ego is Volatile

Bitcoin’s swings can mess with your head. One day you are up 20%, feeling like a genius and the next down 30%, questioning everything. Ego will have you panic selling at the bottom or over leveraging the top. Staying humble means patience, a true bitcoin zen. Do not try to "beat” Bitcoin. Ride it. Stack what you can afford, live your life, and let compounding work its magic.

Simplicity