-

@ ed22fab2:422b9051

2025-05-08 04:32:01

@ ed22fab2:422b9051

2025-05-08 04:32:01A plataforma BRL987 tem se consolidado como uma das principais opções para quem busca entretenimento online com qualidade, segurança e uma ampla gama de jogos. Com uma proposta moderna e acessível, a BRL987 oferece aos usuários uma experiência completa, unindo tecnologia, suporte eficiente e uma interface amigável que atende tanto os iniciantes quanto os mais experientes.

Introdução à Plataforma BRL987 O BRL987 foi criado com o objetivo de proporcionar diversão de forma segura e confiável. Desde o primeiro acesso, os usuários percebem o cuidado com a usabilidade do site. O design intuitivo facilita a navegação e permite que qualquer jogador encontre rapidamente seus jogos preferidos, promoções ativas e métodos de pagamento.

A segurança também é um pilar da plataforma. Todos os dados dos usuários são protegidos por tecnologia de criptografia de ponta, garantindo total confidencialidade em cada transação realizada. Além disso, o BRL987 opera com total transparência e é reconhecido por sua reputação positiva entre os jogadores brasileiros.

Variedade de Jogos para Todos os Estilos Um dos grandes destaques da BRL987 é sua impressionante diversidade de jogos. A plataforma abriga títulos de fornecedores renomados internacionalmente, oferecendo gráficos de alta qualidade, jogabilidade fluida e mecânicas inovadoras.

Entre os jogos mais populares estão as máquinas de giros, que conquistam os jogadores com temas variados e bônus surpreendentes. Também há opções de jogos de mesa, como roleta e blackjack virtual, para quem prefere desafios estratégicos. Para os amantes de interatividade, há jogos ao vivo com crupiês reais, proporcionando uma experiência imersiva e próxima da realidade.

Outro diferencial são os torneios e competições periódicas promovidas pela plataforma. Essas disputas aumentam ainda mais o nível de diversão e premiam os participantes com bônus generosos e brindes exclusivos.

Experiência do Jogador: Simples, Rápida e Gratificante A experiência do jogador na BRL987 é pensada para ser fluida e satisfatória desde o cadastro até o saque dos ganhos. O processo de registro é simples, exigindo poucos passos e informações básicas. Após o cadastro, o usuário já pode aproveitar bônus de boas-vindas, que dão aquele incentivo inicial para explorar os jogos disponíveis.

Os métodos de pagamento incluem as principais opções do mercado brasileiro, como PIX, boleto bancário e transferências. Os depósitos são processados rapidamente e os saques são feitos com eficiência, muitas vezes sendo liberados no mesmo dia.

Outro ponto que merece destaque é o suporte ao cliente. O BRL987 oferece atendimento 24 horas por dia, 7 dias por semana, através de chat ao vivo e e-mail. A equipe de suporte é treinada para resolver dúvidas e problemas com agilidade e cordialidade.

Conclusão A BRL987 se destaca como uma plataforma completa de entretenimento online, ideal para quem busca qualidade, segurança e diversão em um só lugar. Com uma seleção de jogos variada, suporte eficiente e pagamentos rápidos, ela conquista cada vez mais usuários em todo o Brasil. Seja para quem está começando ou para quem já tem experiência, o BRL987 é o destino certo para momentos de lazer com emoção e confiança.

-

@ 681ec9c0:fe78b4e7

2024-07-22 12:09:04

@ 681ec9c0:fe78b4e7

2024-07-22 12:09:04A refugee from Twitter said they lost 10,000 followers

My first thought was, did they die?

If they didn't follow you here then they weren't your followers

But on that platform did you manage to talk with anyone

Did you get an impression of them as a living feeling human being

Did you connect with them

And if you did will they find you here or will they be a fleeting moment

Life is like that sometimes

Pay no heed to the slot machine numbers

Cherish the fleeting moments

-

@ ed22fab2:422b9051

2025-05-08 04:31:25

@ ed22fab2:422b9051

2025-05-08 04:31:25A plataforma Pix177 chegou para redefinir a forma como os brasileiros aproveitam o entretenimento digital. Com uma proposta moderna, segura e recheada de opções emocionantes, o Pix177 tem conquistado milhares de usuários por todo o país, oferecendo uma experiência completa e personalizada desde o primeiro acesso. Se você busca diversão, praticidade e oportunidades de ganhos reais, o Pix177 pode ser o lugar ideal para você.

O grande diferencial do Pix177 está na sua interface amigável e acessível. Logo ao entrar na plataforma, o usuário percebe a fluidez e organização do site. Cada seção é pensada para facilitar a navegação, seja no computador ou pelo celular. Outro ponto de destaque é o sistema de pagamentos: o Pix177 conta com suporte total ao método Pix, permitindo transações instantâneas e seguras, tanto para depósitos quanto para saques. Isso significa menos tempo esperando e mais tempo jogando.

A equipe responsável pela plataforma se preocupa com a segurança e a privacidade dos usuários, implementando tecnologia de criptografia de ponta e protocolos rigorosos de proteção de dados. Assim, os jogadores podem se concentrar apenas no que realmente importa: a diversão e a emoção dos jogos.

Variedade de jogos para todos os gostos

O Pix177 oferece uma seleção extensa de jogos que atendem a todos os perfis de jogadores. Desde opções clássicas e populares até lançamentos mais recentes, há algo para cada tipo de gosto. Os amantes das cartas encontram mesas de poker, blackjack e baccarat com diferentes níveis de apostas. Para quem prefere jogos de giro, há uma vasta biblioteca de slots online com gráficos vibrantes, trilhas sonoras envolventes e recursos especiais como rodadas grátis e multiplicadores.

Jogos ao vivo também fazem parte do catálogo da plataforma, permitindo que os usuários participem de partidas em tempo real com crupiês reais e interajam com outros jogadores. A imersão é total, com transmissão de alta qualidade e ambiente virtual que simula uma sala de jogos tradicional — tudo sem sair de casa.

Além disso, o Pix177 frequentemente atualiza seu portfólio com novidades de provedores renomados do mercado, garantindo sempre conteúdo fresco e inovador.

Uma experiência pensada para o jogador brasileiro

O Pix177 entende as preferências e necessidades do público nacional. Por isso, oferece suporte em português, atendimento ao cliente via chat ao vivo e promoções personalizadas com foco nos usuários brasileiros. O processo de cadastro é simples e rápido, permitindo que novos jogadores comecem sua jornada em poucos minutos.

Os bônus de boas-vindas e promoções semanais são outros atrativos que mantêm os jogadores engajados. Programas de fidelidade e desafios especiais aumentam ainda mais as chances de recompensas, tornando a experiência mais empolgante e dinâmica.

Conclusão

O Pix177 é mais do que uma simples plataforma de jogos online: é um verdadeiro universo de entretenimento digital, feito sob medida para o público brasileiro. Com seu sistema de pagamentos ágil, interface intuitiva, suporte completo e uma biblioteca de jogos impressionante, o Pix177 se posiciona como uma das melhores opções para quem quer unir diversão e praticidade em um só lugar.

Se você ainda não conhece o Pix177, essa é a hora de explorar tudo o que a plataforma tem a oferecer. Prepare-se para uma jornada cheia de emoção, desafios e recompensas!

-

@ 5d4b6c8d:8a1c1ee3

2025-05-08 01:22:05

@ 5d4b6c8d:8a1c1ee3

2025-05-08 01:22:05I've been thinking about how Predyx and other lightning based prediction markets might finance their operations, without undermining their core function of eliciting information from people.

The standard approach, of offering less-than-fair odds, guarantees long-run profitability (as long as you have enough customers), but it also creates a friction for participants that reduces the information value of their transactions. So, what are some less frictiony options for generating revenue?

Low hanging fruit

- Close markets in real-time: Rather than prespecifying a closing time for some markets, like sports, it's better to close the market at the moment the outcome is realized. This both prevents post hoc transactions and enables late stage transactions. This should be easily automatable (I say as someone with no idea how to do that), with the right resolution criteria.

- Round off shares: Shares and sats are discrete, so just make sure any necessary rounding is always in the house's favor.

- Set initial probabilities well: Use whatever external information is available to open markets as near to the "right" value as possible.

- Arbitrage: whenever markets are related to each other, make sure to resolve any illogical odds automatically

The point of these four is to avoid giving away free sats. None of them reduce productive use of the market. Keeping markets open up until the outcome is realized will probably greatly increase the number of transactions, since that's usually when the most information is coming in.

Third party support

- Ads are the most obvious form of third party revenue

- Sponsorships are the more interesting one: Allow sponsors to boost a market's visibility. This is similar to advertising, but it also capitalizes on the possibility of a market being of particular interest to someone.

- Charge for market creation: users should be able to create new markets (this will also enhance trade quantity and site traffic), but it should be costly to create a market. If prediction markets really provide higher quality information, then it's reasonable to charge for it.

- Arbitrage: Monitor external odds and whenever a gain can be locked in, place the bets (buy the shares) that guarantee a gain.

Bitcoin stuff

- Routing fees: The volume of sats moving into, out of, and being held in these markets will require a fairly large lightning node. Following some helpful tips to optimize fee revenue will generate some sats for logistical stuff that had to be done anyway.

- Treasury strategy: Take out loans against the revenue generated from all of the above and buy bitcoin: NGU -> repay with a fraction of the bitcoin, NGD -> repay with site revenue.

Bitcoin and Lightning Competitive Advantages

These aren't revenue ideas. They're just a couple of advantages lightning and bitcoin provide over fiat that should allow charging lower spreads than a traditional prediction market or sportsbook.

Traditional betting or prediction platforms are earning depreciating fiat, while a bitcoin based platform earns appreciating bitcoin. Traditional spreads must therefor be larger, in order to pull in the same real return. This also means the users' odds are worse on fiat platforms (again in real terms), even if the listed odds are the same, because their winnings will have depreciated by the time they receive them. Technically, this opens an opportunity to charge even higher spreads, but as mentioned in the intro, that would be bad for the information purposes of the market.

Lightning has much lower transactions costs than fiat transactions. So, even with tighter spreads, a lightning platform can net a better (nominal) return per transaction.

@mega_dreamer, I imagine most of those ideas were already on y'all's radar, and obviously you're already doing some, but I wanted to get them out of my head and onto digital paper. Hopefully, some of this will provide some useful food for thought.

originally posted at https://stacker.news/items/974372

-

@ 681ec9c0:fe78b4e7

2024-07-20 17:09:50

@ 681ec9c0:fe78b4e7

2024-07-20 17:09:50I was puzzled when Mike Masnick claimed that Bluesky is everything Jack wished for in a decentralized social network, being as it is highly centralized

I think the discrepancy comes down to different views of the role of decentralization encapsulated in this term, enshittification

"Even if most of the users of a decentralized system don’t know or care about the fact that it’s decentralized, the fact that the underlying protocol is that way and is set up such that others can build and provide services (algorithms, moderation services, interfaces, etc.) means that Bluesky itself has strong, built-in incentives to not enshittify the service.

In some ways, Bluesky is building in the natural antidote to the activist investors that so vexed Jack at Twitter. Bluesky can simply point out that going down the enshittification path of greater and greater user extraction/worsening service just opens up someone else to step in and provide a better competing service on the same protocol. Having it be on the same protocol removes the switching costs that centralized enshittified services rely on to keep users from leaving, allowing them to enshittify. The underlying protocol that Bluesky is built on is a kind of commitment device. The company (and, in large part, its CEO Jay) is going to face tremendous pressures to make Bluesky worse.

But by committing to an open protocol they’re building, it creates a world that makes it much harder to force the company down that path. That doesn’t mean there won’t still be difficult to impossible choices to make. Because there will be. But the protocol is still there."

https://www.techdirt.com/2024/05/13/bluesky-is-building-the-decentralized-social-media-jack-dorsey-wants-even-if-he-doesnt-realize-it/

And echoed by Bluesky CEO Jay Graber

"There will always be free options, and we can't enshittify the network with ads. This is where federation comes in. The fact that anyone can self-host and anyone can build on the software means that we'll never be able to degrade the user experience in a way where people want to leave."

https://web.archive.org/web/20240209161307/https://www.wired.com/story/bluesky-ceo-jay-graber-wont-enshittify-ads/

It all comes down to this

"the protocol is still there"

In this view of decentralization, being there is sufficient

Decentralization is this thing that can happen if needed

It's a safety valve operated by market forces

And where I think Jack and most of nostr would disagree is that market forces do not cater to the rights of individuals

Because one person being deplatformed is not a market demand

Especially for ATProto where decentralization is relatively expensive

To service deplatformed users would require building four servers, each one capable of ingesting the entire network: a Relay, a Labeller, an AppView and a Feed Generator

Decentralization by default is necessary for censorship resistance

Jack talked about censorship in the interview that formed the basis for Mike's article

"I know it's early, and Nostr is weird and hard to use, but if you truly believe in censorship resistance and free speech, you have to use the technologies that actually enable that, and defend your rights."

https://www.piratewires.com/p/interview-with-jack-dorsey-mike-solana

Mike's concerns over enshittification are highly valid

I would like to see Mike address Jack's concern for censorship resistance

I think that would help understanding

-

@ 21335073:a244b1ad

2025-05-01 01:51:10

@ 21335073:a244b1ad

2025-05-01 01:51:10Please respect Virginia Giuffre’s memory by refraining from asking about the circumstances or theories surrounding her passing.

Since Virginia Giuffre’s death, I’ve reflected on what she would want me to say or do. This piece is my attempt to honor her legacy.

When I first spoke with Virginia, I was struck by her unshakable hope. I had grown cynical after years in the anti-human trafficking movement, worn down by a broken system and a government that often seemed complicit. But Virginia’s passion, creativity, and belief that survivors could be heard reignited something in me. She reminded me of my younger, more hopeful self. Instead of warning her about the challenges ahead, I let her dream big, unburdened by my own disillusionment. That conversation changed me for the better, and following her lead led to meaningful progress.

Virginia was one of the bravest people I’ve ever known. As a survivor of Epstein, Maxwell, and their co-conspirators, she risked everything to speak out, taking on some of the world’s most powerful figures.

She loved when I said, “Epstein isn’t the only Epstein.” This wasn’t just about one man—it was a call to hold all abusers accountable and to ensure survivors find hope and healing.

The Epstein case often gets reduced to sensational details about the elite, but that misses the bigger picture. Yes, we should be holding all of the co-conspirators accountable, we must listen to the survivors’ stories. Their experiences reveal how predators exploit vulnerabilities, offering lessons to prevent future victims.

You’re not powerless in this fight. Educate yourself about trafficking and abuse—online and offline—and take steps to protect those around you. Supporting survivors starts with small, meaningful actions. Free online resources can guide you in being a safe, supportive presence.

When high-profile accusations arise, resist snap judgments. Instead of dismissing survivors as “crazy,” pause to consider the trauma they may be navigating. Speaking out or coping with abuse is never easy. You don’t have to believe every claim, but you can refrain from attacking accusers online.

Society also fails at providing aftercare for survivors. The government, often part of the problem, won’t solve this. It’s up to us. Prevention is critical, but when abuse occurs, step up for your loved ones and community. Protect the vulnerable. it’s a challenging but a rewarding journey.

If you’re contributing to Nostr, you’re helping build a censorship resistant platform where survivors can share their stories freely, no matter how powerful their abusers are. Their voices can endure here, offering strength and hope to others. This gives me great hope for the future.

Virginia Giuffre’s courage was a gift to the world. It was an honor to know and serve her. She will be deeply missed. My hope is that her story inspires others to take on the powerful.

-

@ 681ec9c0:fe78b4e7

2024-07-05 06:32:39

@ 681ec9c0:fe78b4e7

2024-07-05 06:32:39"I work for a Government I despise for ends I think criminal"

John Maynard Keynes

Politicians are assholes

That hasn't changed in 5,000 years

It's objectively true that Julian Assange was persecuted by multiple democratic governments

https://thedissenter.org/inside-the-assange-plea-deal-why-the-us-government-abruptly-ended-the-case/

The difference between democracy and not democracy is tens of thousands of Julian Assanges (Iran) and hundreds of thousands of Julian Assanges (Syria, North Korea)

The difference is a full stop

nostr:nevent1qqs857j7ge4daqk4frsy5md3l0e7qnxlx3fu2zld2gxacs999fp5tkspz9mhxue69uhkummnw3ezuamfdejj7q3qcpazafytvafazxkjn43zjfwtfzatfz508r54f6z6a3rf2ws8223qxpqqqqqqzxsdxpy

Someone challenged a human rights activist and former Venezuelan political prisoner to support freedom over shilling for democracy

Placing democracy and freedom in opposition can make perfect sense to someone who is living in a liberal democracy

It does not make any sense for someone who is living in Iran, Venezuela or North Korea

At this moment in time there are several hundred thousand people being forced to work in online scam centres generating tens of $ billions of revenue for organized crime

To gain freedom they must risk their lives to escape or their families pay a ransom

They are tortured if they don't meet targets

These centres are mainly located in Cambodia and Myanmar

They are in Cambodia because Cambodia is a one-party state

The Cambodian police, judiciary and government have been bought

And they are in Myanmar where regional military fiefdoms are financed by organized crime

https://bangkok.ohchr.org/wp-content/uploads/2023/08/ONLINE-SCAM-OPERATIONS-2582023.pdf

https://www.nytimes.com/interactive/2023/12/17/world/asia/myanmar-cyber-scam.html

Spreading liberal democracy reduces human trafficking

Spreading liberal democracy increases freedom of speech

In as far as human rights activists work with objective facts and the most oppressed peoples in the world, they will work to spread democracy

Expecting anything else is unrealistic

Presenting it as a choice will only go one way

But it needn't be a choice as we're all on the same side

It's in the interest of governments to split people into sides and get them to fight on Twitter

The self-sovereign tech movement is interesting as it cuts across all political contexts

It helps people in the most oppressed parts of the world as well as the freest

It's an escape hatch and a home for some of the nicest people on the planet

It has the shape of the future

But it didn't free Julian Assange

And it doesn't solve the problem of the thousands of Julian Assanges in Iran

It didn't transition Taiwan from the white terror to an open society

nostr:nevent1qqsqfc8qgsqd7gxcmw5zw3udg56utkcj0qnp9jxemj6eht9p4e2z8vgpz4mhxue69uhhyetvv9ujumn0wd68ytnzvuhsygqn3qlypmqmr9q2v406wa4dt5ehv44xsanedpvc8zq53wthu4j4pupsgqqqqqqsffxa78

Although it may help in all those things

Human progress toward freedom is slow and faltering

It is also inexorable

That is our history

The tide will wash away the "Supreme Leaders" and the slavers and their mad dreams

And ultimately all governments

"Many forms of Government have been tried, and will be tried in this world of sin and woe. No one pretends that democracy is perfect or all-wise. Indeed it has been said that democracy is the worst form of Government except for all those other forms that have been tried from time to time..."

Winston Churchill

-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ 502ab02a:a2860397

2025-05-08 01:18:46

@ 502ab02a:a2860397

2025-05-08 01:18:46เฮียไม่แน่ใจว่าโลกยุคนี้มันเปลี่ยนไป หรือแค่เล่ห์กลมันแนบเนียนขึ้น แต่ที่แน่ ๆ คือ “อาหารไม่ใช่อาหารอีกต่อไป” มันกลายเป็นสินค้าในพอร์ตการลงทุน มันกลายเป็นเครื่องมือสร้างภาพลักษณ์ และในบางมุมที่คนไม่อยากมอง...มันคือเครื่องมือควบคุมมวลชน

ทุกอย่างเริ่มจากแนวคิดที่ดูดี “เราต้องผลิตอาหารให้พอเลี้ยงคน 8,000 ล้านคน” จากนั้นบริษัทเทคโนโลยีเริ่มกระโดดเข้ามา แทนที่จะให้เกษตรกรปลูกผักเลี้ยงวัว เรากลับได้เห็นบริษัทวิเคราะห์ดีเอ็นเอของจุลินทรีย์ แล้วขายโปรตีนจากถังหมัก แทนที่จะสนับสนุนอาหารพื้นบ้าน กลับอัดเงินให้สตาร์ทอัพทำเบอร์เกอร์ที่ไม่มีเนื้อจริงแม้แต่เส้นใยเดียว

เบื้องหลังมันมี “ทุน” และทุนเหล่านี้ไม่ใช่แค่ผู้ผลิตอาหาร แต่พ่วงไปถึงบริษัทยา บริษัทวัคซีน บริษัทเทคโนโลยี บางเจ้ามีทั้งบริษัทยา + ธุรกิจฟาร์มแมลง + บริษัทลงทุนในบริษัทวิจัยพันธุกรรม แปลว่า...คนที่ขายยาให้เฮียเวลาเฮียป่วย อาจเป็นคนเดียวกับที่ขาย "อาหารที่ทำให้เฮียป่วย" ตั้งแต่แรก ตลกร้ายไหมหล่ะ หึหึหึ

เคยมีใครสังเกตไหม ว่าองค์การระดับโลกบางองค์กรที่ส่งเสริม "เนื้อทางเลือก" และ "อาหารยั่งยืน" ได้รับเงินบริจาคหรืออยู่ภายใต้บอร์ดของบริษัทผลิตอาหารอุตสาหกรรมเจ้าใหญ่ไหมนะ แล้วคำว่า “วิทยาศาสตร์รองรับ” ที่ติดบนฉลากสวย ๆ เฮียไม่รู้หรอกว่าใครเป็นคนตีความ แต่ที่รู้แน่ ๆ คือ บทวิจัยจำนวนไม่น้อย มาจากทุนวิจัยที่สนับสนุนโดยอุตสาหกรรมอาหารเอง ดั่งเช่นที่เราเรียนรู้กันมาจากประวัติศาสตร์แล้ว

มีคนเคยพูดไว้ว่า “เราควบคุมคนด้วยอาหารง่ายกว่าด้วยอาวุธ” และเฮียเริ่มเชื่อขึ้นเรื่อย ๆ เพราะถ้าบริษัทใดบริษัทหนึ่ง ควบคุมได้ทั้งอาหาร ยา ข้อมูลสุขภาพ และการวิจัย นั่นหมายความว่า เขาไม่ได้ขายของให้เฮีย แต่เขากำหนดว่าเฮียควร “อยากกินอะไร” และ “รู้สึกผิดกับอะไร”

เหมือนที่ให้ลองจินตนาการเล่น ๆ เมื่อวาน สมมติเฮียไปร้านข้าวมันไก่ปากซอยแบบดั้งเดิม สั่งไก่ต้มไม่เอาข้าวมากิน แล้วแอปสุขภาพขึ้นข้อความเตือนว่า “ไขมันสูง ส่งผลต่อคะแนนสุขภาพคุณ” แต่ถ้าเฮียสั่งข้าวกล่องสำเร็จรูปอัจฉริยะจากโปรตีนที่หมักจากจุลินทรีย์ GMO ระบบจะบอกว่า “คุณกำลังช่วยลดโลกร้อน” แล้วเพิ่มคะแนนสุขภาพให้เราไปเป็นส่วนลดครั้งต่อไป

ใครนิยามคำว่า “ดี” ให้เฮีย?

เบื้องหลังอาหารจึงไม่ใช่แค่โรงงาน แต่มันคือโครงข่ายที่พัวพันตั้งแต่ห้องแล็บ ห้องบอร์ด ไปจนถึงห้องครัวในบ้านเรา แล้วถ้าเราไม่ตั้งคำถาม เฮียกลัวว่าเราจะไม่ได้กินในสิ่งที่ร่างกายต้องการ แต่กินในสิ่งที่ “ระบบ” ต้องการให้เรากิน

ขอบคุณล่วงหน้าที่มองว่าสิ่งนี้คือการ แพนิคไปเอง ขอให้มีสุขสวัสดิ์

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ bf47c19e:c3d2573b

2025-05-07 21:59:42

@ bf47c19e:c3d2573b

2025-05-07 21:59:42"Misterija Satoši - Poreklo bitkoina" je francuski dokumentarno-animirani serijal koji dešifruje unutrašnje funkcionisanje bitkoin revolucije, dok istražuje identitet njenog tvorca.

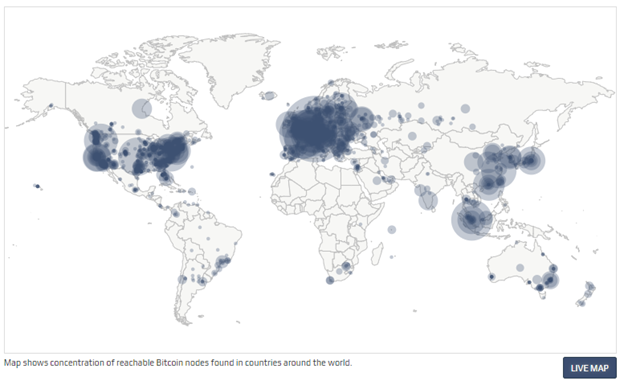

Prvu decentralizovanu i pouzdanu kriptovalutu – bitkoin, osnovao je Satoši Nakamoto 3. januara 2009. godine. On je nestao 2011. i od tada ostaje anoniman, a njegov identitet je predmet svakakvih spekulacija. Tokom poslednjih 12 godina, vrednost bitkoina je porasla sa 0,001 na 69.000 dolara. Svi, od vlada do velikih korporacija, zainteresovali su se za Satošijev izum. Ko je Satoši Nakamoto? Kako je njegov izum postao toliko popularan? Šta nam bitkoin govori o svetu u kome živimo?

Ovaj serijal se prikazivao na Radio-televiziji Srbije (RTS 3) u sklopu novogodišnjeg muzičkog i filmskog programa 2022/2023. godine.

Naslov originala: "Le Mystère Satoshi"

Copyright: , ARTE.TV

-

@ 91bea5cd:1df4451c

2025-04-26 10:16:21

@ 91bea5cd:1df4451c

2025-04-26 10:16:21O Contexto Legal Brasileiro e o Consentimento

No ordenamento jurídico brasileiro, o consentimento do ofendido pode, em certas circunstâncias, afastar a ilicitude de um ato que, sem ele, configuraria crime (como lesão corporal leve, prevista no Art. 129 do Código Penal). Contudo, o consentimento tem limites claros: não é válido para bens jurídicos indisponíveis, como a vida, e sua eficácia é questionável em casos de lesões corporais graves ou gravíssimas.

A prática de BDSM consensual situa-se em uma zona complexa. Em tese, se ambos os parceiros são adultos, capazes, e consentiram livre e informadamente nos atos praticados, sem que resultem em lesões graves permanentes ou risco de morte não consentido, não haveria crime. O desafio reside na comprovação desse consentimento, especialmente se uma das partes, posteriormente, o negar ou alegar coação.

A Lei Maria da Penha (Lei nº 11.340/2006)

A Lei Maria da Penha é um marco fundamental na proteção da mulher contra a violência doméstica e familiar. Ela estabelece mecanismos para coibir e prevenir tal violência, definindo suas formas (física, psicológica, sexual, patrimonial e moral) e prevendo medidas protetivas de urgência.

Embora essencial, a aplicação da lei em contextos de BDSM pode ser delicada. Uma alegação de violência por parte da mulher, mesmo que as lesões ou situações decorram de práticas consensuais, tende a receber atenção prioritária das autoridades, dada a presunção de vulnerabilidade estabelecida pela lei. Isso pode criar um cenário onde o parceiro masculino enfrenta dificuldades significativas em demonstrar a natureza consensual dos atos, especialmente se não houver provas robustas pré-constituídas.

Outros riscos:

Lesão corporal grave ou gravíssima (art. 129, §§ 1º e 2º, CP), não pode ser justificada pelo consentimento, podendo ensejar persecução penal.

Crimes contra a dignidade sexual (arts. 213 e seguintes do CP) são de ação pública incondicionada e independem de representação da vítima para a investigação e denúncia.

Riscos de Falsas Acusações e Alegação de Coação Futura

Os riscos para os praticantes de BDSM, especialmente para o parceiro que assume o papel dominante ou que inflige dor/restrição (frequentemente, mas não exclusivamente, o homem), podem surgir de diversas frentes:

- Acusações Externas: Vizinhos, familiares ou amigos que desconhecem a natureza consensual do relacionamento podem interpretar sons, marcas ou comportamentos como sinais de abuso e denunciar às autoridades.

- Alegações Futuras da Parceira: Em caso de término conturbado, vingança, arrependimento ou mudança de perspectiva, a parceira pode reinterpretar as práticas passadas como abuso e buscar reparação ou retaliação através de uma denúncia. A alegação pode ser de que o consentimento nunca existiu ou foi viciado.

- Alegação de Coação: Uma das formas mais complexas de refutar é a alegação de que o consentimento foi obtido mediante coação (física, moral, psicológica ou econômica). A parceira pode alegar, por exemplo, que se sentia pressionada, intimidada ou dependente, e que seu "sim" não era genuíno. Provar a ausência de coação a posteriori é extremamente difícil.

- Ingenuidade e Vulnerabilidade Masculina: Muitos homens, confiando na dinâmica consensual e na parceira, podem negligenciar a necessidade de precauções. A crença de que "isso nunca aconteceria comigo" ou a falta de conhecimento sobre as implicações legais e o peso processual de uma acusação no âmbito da Lei Maria da Penha podem deixá-los vulneráveis. A presença de marcas físicas, mesmo que consentidas, pode ser usada como evidência de agressão, invertendo o ônus da prova na prática, ainda que não na teoria jurídica.

Estratégias de Prevenção e Mitigação

Não existe um método infalível para evitar completamente o risco de uma falsa acusação, mas diversas medidas podem ser adotadas para construir um histórico de consentimento e reduzir vulnerabilidades:

- Comunicação Explícita e Contínua: A base de qualquer prática BDSM segura é a comunicação constante. Negociar limites, desejos, palavras de segurança ("safewords") e expectativas antes, durante e depois das cenas é crucial. Manter registros dessas negociações (e-mails, mensagens, diários compartilhados) pode ser útil.

-

Documentação do Consentimento:

-

Contratos de Relacionamento/Cena: Embora a validade jurídica de "contratos BDSM" seja discutível no Brasil (não podem afastar normas de ordem pública), eles servem como forte evidência da intenção das partes, da negociação detalhada de limites e do consentimento informado. Devem ser claros, datados, assinados e, idealmente, reconhecidos em cartório (para prova de data e autenticidade das assinaturas).

-

Registros Audiovisuais: Gravar (com consentimento explícito para a gravação) discussões sobre consentimento e limites antes das cenas pode ser uma prova poderosa. Gravar as próprias cenas é mais complexo devido a questões de privacidade e potencial uso indevido, mas pode ser considerado em casos específicos, sempre com consentimento mútuo documentado para a gravação.

Importante: a gravação deve ser com ciência da outra parte, para não configurar violação da intimidade (art. 5º, X, da Constituição Federal e art. 20 do Código Civil).

-

-

Testemunhas: Em alguns contextos de comunidade BDSM, a presença de terceiros de confiança durante negociações ou mesmo cenas pode servir como testemunho, embora isso possa alterar a dinâmica íntima do casal.

- Estabelecimento Claro de Limites e Palavras de Segurança: Definir e respeitar rigorosamente os limites (o que é permitido, o que é proibido) e as palavras de segurança é fundamental. O desrespeito a uma palavra de segurança encerra o consentimento para aquele ato.

- Avaliação Contínua do Consentimento: O consentimento não é um cheque em branco; ele deve ser entusiástico, contínuo e revogável a qualquer momento. Verificar o bem-estar do parceiro durante a cena ("check-ins") é essencial.

- Discrição e Cuidado com Evidências Físicas: Ser discreto sobre a natureza do relacionamento pode evitar mal-entendidos externos. Após cenas que deixem marcas, é prudente que ambos os parceiros estejam cientes e de acordo, talvez documentando por fotos (com data) e uma nota sobre a consensualidade da prática que as gerou.

- Aconselhamento Jurídico Preventivo: Consultar um advogado especializado em direito de família e criminal, com sensibilidade para dinâmicas de relacionamento alternativas, pode fornecer orientação personalizada sobre as melhores formas de documentar o consentimento e entender os riscos legais específicos.

Observações Importantes

- Nenhuma documentação substitui a necessidade de consentimento real, livre, informado e contínuo.

- A lei brasileira protege a "integridade física" e a "dignidade humana". Práticas que resultem em lesões graves ou que violem a dignidade de forma não consentida (ou com consentimento viciado) serão ilegais, independentemente de qualquer acordo prévio.

- Em caso de acusação, a existência de documentação robusta de consentimento não garante a absolvição, mas fortalece significativamente a defesa, ajudando a demonstrar a natureza consensual da relação e das práticas.

-

A alegação de coação futura é particularmente difícil de prevenir apenas com documentos. Um histórico consistente de comunicação aberta (whatsapp/telegram/e-mails), respeito mútuo e ausência de dependência ou controle excessivo na relação pode ajudar a contextualizar a dinâmica como não coercitiva.

-

Cuidado com Marcas Visíveis e Lesões Graves Práticas que resultam em hematomas severos ou lesões podem ser interpretadas como agressão, mesmo que consentidas. Evitar excessos protege não apenas a integridade física, mas também evita questionamentos legais futuros.

O que vem a ser consentimento viciado

No Direito, consentimento viciado é quando a pessoa concorda com algo, mas a vontade dela não é livre ou plena — ou seja, o consentimento existe formalmente, mas é defeituoso por alguma razão.

O Código Civil brasileiro (art. 138 a 165) define várias formas de vício de consentimento. As principais são:

Erro: A pessoa se engana sobre o que está consentindo. (Ex.: A pessoa acredita que vai participar de um jogo leve, mas na verdade é exposta a práticas pesadas.)

Dolo: A pessoa é enganada propositalmente para aceitar algo. (Ex.: Alguém mente sobre o que vai acontecer durante a prática.)

Coação: A pessoa é forçada ou ameaçada a consentir. (Ex.: "Se você não aceitar, eu termino com você" — pressão emocional forte pode ser vista como coação.)

Estado de perigo ou lesão: A pessoa aceita algo em situação de necessidade extrema ou abuso de sua vulnerabilidade. (Ex.: Alguém em situação emocional muito fragilizada é induzida a aceitar práticas que normalmente recusaria.)

No contexto de BDSM, isso é ainda mais delicado: Mesmo que a pessoa tenha "assinado" um contrato ou dito "sim", se depois ela alegar que seu consentimento foi dado sob medo, engano ou pressão psicológica, o consentimento pode ser considerado viciado — e, portanto, juridicamente inválido.

Isso tem duas implicações sérias:

-

O crime não se descaracteriza: Se houver vício, o consentimento é ignorado e a prática pode ser tratada como crime normal (lesão corporal, estupro, tortura, etc.).

-

A prova do consentimento precisa ser sólida: Mostrando que a pessoa estava informada, lúcida, livre e sem qualquer tipo de coação.

Consentimento viciado é quando a pessoa concorda formalmente, mas de maneira enganada, forçada ou pressionada, tornando o consentimento inútil para efeitos jurídicos.

Conclusão

Casais que praticam BDSM consensual no Brasil navegam em um terreno que exige não apenas confiança mútua e comunicação excepcional, mas também uma consciência aguçada das complexidades legais e dos riscos de interpretações equivocadas ou acusações mal-intencionadas. Embora o BDSM seja uma expressão legítima da sexualidade humana, sua prática no Brasil exige responsabilidade redobrada. Ter provas claras de consentimento, manter a comunicação aberta e agir com prudência são formas eficazes de se proteger de falsas alegações e preservar a liberdade e a segurança de todos os envolvidos. Embora leis controversas como a Maria da Penha sejam "vitais" para a proteção contra a violência real, os praticantes de BDSM, e em particular os homens nesse contexto, devem adotar uma postura proativa e prudente para mitigar os riscos inerentes à potencial má interpretação ou instrumentalização dessas práticas e leis, garantindo que a expressão de sua consensualidade esteja resguardada na medida do possível.

Importante: No Brasil, mesmo com tudo isso, o Ministério Público pode denunciar por crime como lesão corporal grave, estupro ou tortura, independente de consentimento. Então a prudência nas práticas é fundamental.

Aviso Legal: Este artigo tem caráter meramente informativo e não constitui aconselhamento jurídico. As leis e interpretações podem mudar, e cada situação é única. Recomenda-se buscar orientação de um advogado qualificado para discutir casos específicos.

Se curtiu este artigo faça uma contribuição, se tiver algum ponto relevante para o artigo deixe seu comentário.

-

@ e3ba5e1a:5e433365

2025-04-15 11:03:15

@ e3ba5e1a:5e433365

2025-04-15 11:03:15Prelude

I wrote this post differently than any of my others. It started with a discussion with AI on an OPSec-inspired review of separation of powers, and evolved into quite an exciting debate! I asked Grok to write up a summary in my overall writing style, which it got pretty well. I've decided to post it exactly as-is. Ultimately, I think there are two solid ideas driving my stance here:

- Perfect is the enemy of the good

- Failure is the crucible of success

Beyond that, just some hard-core belief in freedom, separation of powers, and operating from self-interest.

Intro

Alright, buckle up. I’ve been chewing on this idea for a while, and it’s time to spit it out. Let’s look at the U.S. government like I’d look at a codebase under a cybersecurity audit—OPSEC style, no fluff. Forget the endless debates about what politicians should do. That’s noise. I want to talk about what they can do, the raw powers baked into the system, and why we should stop pretending those powers are sacred. If there’s a hole, either patch it or exploit it. No half-measures. And yeah, I’m okay if the whole thing crashes a bit—failure’s a feature, not a bug.

The Filibuster: A Security Rule with No Teeth

You ever see a firewall rule that’s more theater than protection? That’s the Senate filibuster. Everyone acts like it’s this untouchable guardian of democracy, but here’s the deal: a simple majority can torch it any day. It’s not a law; it’s a Senate preference, like choosing tabs over spaces. When people call killing it the “nuclear option,” I roll my eyes. Nuclear? It’s a button labeled “press me.” If a party wants it gone, they’ll do it. So why the dance?

I say stop playing games. Get rid of the filibuster. If you’re one of those folks who thinks it’s the only thing saving us from tyranny, fine—push for a constitutional amendment to lock it in. That’s a real patch, not a Post-it note. Until then, it’s just a vulnerability begging to be exploited. Every time a party threatens to nuke it, they’re admitting it’s not essential. So let’s stop pretending and move on.

Supreme Court Packing: Because Nine’s Just a Number

Here’s another fun one: the Supreme Court. Nine justices, right? Sounds official. Except it’s not. The Constitution doesn’t say nine—it’s silent on the number. Congress could pass a law tomorrow to make it 15, 20, or 42 (hitchhiker’s reference, anyone?). Packing the court is always on the table, and both sides know it. It’s like a root exploit just sitting there, waiting for someone to log in.

So why not call the bluff? If you’re in power—say, Trump’s back in the game—say, “I’m packing the court unless we amend the Constitution to fix it at nine.” Force the issue. No more shadowboxing. And honestly? The court’s got way too much power anyway. It’s not supposed to be a super-legislature, but here we are, with justices’ ideologies driving the bus. That’s a bug, not a feature. If the court weren’t such a kingmaker, packing it wouldn’t even matter. Maybe we should be talking about clipping its wings instead of just its size.

The Executive Should Go Full Klingon

Let’s talk presidents. I’m not saying they should wear Klingon armor and start shouting “Qapla’!”—though, let’s be real, that’d be awesome. I’m saying the executive should use every scrap of power the Constitution hands them. Enforce the laws you agree with, sideline the ones you don’t. If Congress doesn’t like it, they’ve got tools: pass new laws, override vetoes, or—here’s the big one—cut the budget. That’s not chaos; that’s the system working as designed.

Right now, the real problem isn’t the president overreaching; it’s the bureaucracy. It’s like a daemon running in the background, eating CPU and ignoring the user. The president’s supposed to be the one steering, but the administrative state’s got its own agenda. Let the executive flex, push the limits, and force Congress to check it. Norms? Pfft. The Constitution’s the spec sheet—stick to it.

Let the System Crash

Here’s where I get a little spicy: I’m totally fine if the government grinds to a halt. Deadlock isn’t a disaster; it’s a feature. If the branches can’t agree, let the president veto, let Congress starve the budget, let enforcement stall. Don’t tell me about “essential services.” Nothing’s so critical it can’t take a breather. Shutdowns force everyone to the table—debate, compromise, or expose who’s dropping the ball. If the public loses trust? Good. They’ll vote out the clowns or live with the circus they elected.

Think of it like a server crash. Sometimes you need a hard reboot to clear the cruft. If voters keep picking the same bad admins, well, the country gets what it deserves. Failure’s the best teacher—way better than limping along on autopilot.

States Are the Real MVPs

If the feds fumble, states step up. Right now, states act like junior devs waiting for the lead engineer to sign off. Why? Federal money. It’s a leash, and it’s tight. Cut that cash, and states will remember they’re autonomous. Some will shine, others will tank—looking at you, California. And I’m okay with that. Let people flee to better-run states. No bailouts, no excuses. States are like competing startups: the good ones thrive, the bad ones pivot or die.

Could it get uneven? Sure. Some states might turn into sci-fi utopias while others look like a post-apocalyptic vidya game. That’s the point—competition sorts it out. Citizens can move, markets adjust, and failure’s a signal to fix your act.

Chaos Isn’t the Enemy

Yeah, this sounds messy. States ignoring federal law, external threats poking at our seams, maybe even a constitutional crisis. I’m not scared. The Supreme Court’s there to referee interstate fights, and Congress sets the rules for state-to-state play. But if it all falls apart? Still cool. States can sort it without a babysitter—it’ll be ugly, but freedom’s worth it. External enemies? They’ll either unify us or break us. If we can’t rally, we don’t deserve the win.

Centralizing power to avoid this is like rewriting your app in a single thread to prevent race conditions—sure, it’s simpler, but you’re begging for a deadlock. Decentralized chaos lets states experiment, lets people escape, lets markets breathe. States competing to cut regulations to attract businesses? That’s a race to the bottom for red tape, but a race to the top for innovation—workers might gripe, but they’ll push back, and the tension’s healthy. Bring it—let the cage match play out. The Constitution’s checks are enough if we stop coddling the system.

Why This Matters

I’m not pitching a utopia. I’m pitching a stress test. The U.S. isn’t a fragile porcelain doll; it’s a rugged piece of hardware built to take some hits. Let it fail a little—filibuster, court, feds, whatever. Patch the holes with amendments if you want, or lean into the grind. Either way, stop fearing the crash. It’s how we debug the republic.

So, what’s your take? Ready to let the system rumble, or got a better way to secure the code? Hit me up—I’m all ears.

-

@ 57d1a264:69f1fee1

2025-05-07 06:56:25

@ 57d1a264:69f1fee1

2025-05-07 06:56:25Wild parrots tend to fly in flocks, but when kept as single pets, they may become lonely and bored https://www.youtube.com/watch?v=OHcAOlamgDc

Source: https://www.smithsonianmag.com/smart-news/scientists-taught-pet-parrots-to-video-call-each-other-and-the-birds-loved-it-180982041/

originally posted at https://stacker.news/items/973639

-

@ c230edd3:8ad4a712

2025-04-11 16:02:15

@ c230edd3:8ad4a712

2025-04-11 16:02:15Chef's notes

Wildly enough, this is delicious. It's sweet and savory.

(I copied this recipe off of a commercial cheese maker's site, just FYI)

I hadn't fully froze the ice cream when I took the picture shown. This is fresh out of the churner.

Details

- ⏲️ Prep time: 15 min

- 🍳 Cook time: 30 min

- 🍽️ Servings: 4

Ingredients

- 12 oz blue cheese

- 3 Tbsp lemon juice

- 1 c sugar

- 1 tsp salt

- 1 qt heavy cream

- 3/4 c chopped dark chocolate

Directions

- Put the blue cheese, lemon juice, sugar, and salt into a bowl

- Bring heavy cream to a boil, stirring occasionally

- Pour heavy cream over the blue cheese mix and stir until melted

- Pour into prepared ice cream maker, follow unit instructions

- Add dark chocolate halfway through the churning cycle

- Freeze until firm. Enjoy.

-

@ 9063ef6b:fd1e9a09

2025-05-07 19:12:36

@ 9063ef6b:fd1e9a09

2025-05-07 19:12:36✅ Requirements

- GitHub account

- Own domain (e.g.,

yourdomain.com) - Public Nostr key in hex format (not

npub!) - Basic DNS configuration knowledge

🛒 1. Register a Domain

Register a domain from a provider like orangewebsite, njal.la, or similar.

🌐 2. Configure DNS Records for GitHub Pages

Set the following A records for your domain (via your DNS provider):

| Type | Host | Value | TTL | Priority | |------|--------------|-------------------|-----|----------| | A | @ (or blank) | 185.199.108.153 | 300 | | | A | @ (or blank) | 185.199.109.153 | 300 | | | A | @ (or blank) | 185.199.110.153 | 300 | | | A | @ (or blank) | 185.199.111.153 | 300 | |

Optional:

Add aCNAMErecord forwww→yourusername.github.io

📁 3. Create a GitHub Repository

- Go to https://github.com/new

- Repository name: e.g.,

nip5 - Check "Add a README"

- Click "Create repository"

🏗️ 4. Create Directory & File

a)

.well-known/nostr.jsonPath:

.well-known/nostr.json

Example content:json { "names": { "nostrName": "ldajflasjföldsjflj..." } }IMPORTANT: Use your hex-encoded Nostr public key, not the

npub1...format.b)

_config.ymlin RootCreate a file named

_config.ymlwith this content:yml include: [".well-known"]This ensures GitHub includes the

.well-knownfolder in the build output.

⚙️ 5. Configure GitHub Pages

- Go to Settings > Pages inside your repository

- Under "Build and Deployment":

- Choose:

Deploy from branch - Branch:

mainormaster - Under Custom domain:

- Enter

yourdomain.com - Ignore any warning

- Enable ✅ Enforce HTTPS

It may take a few minutes for the certificate to be issued.

🔍 6. Configure Nostr Client

Open your Nostr client and set the NIP-05 identifier as:

nostrName@yourdomain.com e.g. meier@meier.techSave – done!

✅ Test

In your browser or via

curl:bash curl https://yourdomain.com/.well-known/nostr.json?name=avrenExpected output:

json { "names": { "Nostr Benutzer": "elkajdlkajslfkjaödlkfjs..." } }

🛡️ Privacy Tips

| Item | Recommendation | |-----------------------------------|----------------------------------| | Public key is visible | Use pseudonyms only | | Register a KYC-free domain | e.g., orangewebsite, njal.la | | Use KYC-free email for GitHub | e.g., ProtonMail | | GitHub repository visibility | Must be public for GitHub Pages | | Commit metadata | Use a separate pseudonymous user | | Avoid tracking | Don’t include analytics scripts |

-

@ 57d1a264:69f1fee1

2025-05-07 06:29:52

@ 57d1a264:69f1fee1

2025-05-07 06:29:52Your device, your data. TRMNL's architecture prevents outsiders (including us) from accessing your local network. TRMNAL achieve this through 1 way communication between client and server, versus the other way around. Learn more.

Learn more at https://usetrmnl.com/

originally posted at https://stacker.news/items/973632

-

@ c230edd3:8ad4a712

2025-04-09 00:33:31

@ c230edd3:8ad4a712

2025-04-09 00:33:31Chef's notes

I found this recipe a couple years ago and have been addicted to it since. Its incredibly easy, and cheap to prep. Freeze the sausage in flat, single serving portions. That way it can be cooked from frozen for a fast, flavorful, and healthy lunch or dinner. I took inspiration from the video that contained this recipe, and almost always pan fry the frozen sausage with some baby broccoli. The steam cooks the broccoli and the fats from the sausage help it to sear, while infusing the vibrant flavors. Serve with some rice, if desired. I often use serrano peppers, due to limited produce availability. They work well for a little heat and nice flavor that is not overpowering.

Details

- ⏲️ Prep time: 25 min

- 🍳 Cook time: 15 min (only needed if cooking at time of prep)

- 🍽️ Servings: 10

Ingredients

- 4 lbs ground pork

- 12-15 cloves garlic, minced

- 6 Thai or Serrano peppers, rough chopped

- 1/4 c. lime juice

- 4 Tbsp fish sauce

- 1 Tbsp brown sugar

- 1/2 c. chopped cilantro

Directions

- Mix all ingredients in a large bowl.

- Portion and freeze, as desired.

- Sautè frozen portions in hot frying pan, with broccoli or other fresh veggies.

- Serve with rice or alone.

-

@ 9223d2fa:b57e3de7

2025-04-15 02:54:00

@ 9223d2fa:b57e3de7

2025-04-15 02:54:0012,600 steps

-

@ bf47c19e:c3d2573b

2025-05-07 21:58:37

@ bf47c19e:c3d2573b

2025-05-07 21:58:37Originalni tekst na dvadesetjedan.com

Autor: Vijay Boyapati / Prevod na hrvatski: Matija

Sa zadnjim cijenama koje je bitcoin dosegao 2017., optimističan scenarij za ulagače se možda čini toliko očitim da ga nije potrebno niti spominjati. Alternativno, možda se nekome čini glupo ulagati u digitalnu vrijednost koja ne počiva na nijednom fizičkom dobru ili vladi i čiji porast cijene su neki usporedili sa manijom tulipana ili dot-com balonom. Nijedno nije točno; optimističan scenarij za Bitcoin je uvjerljiv, ali ne i očit. Postoje značajni rizici kod ulaganja u Bitcoin, no, kao što planiram pokazati, postoji i ogromna prilika.

Geneza

Nikad u povijesti svijeta nije bilo moguće napraviti transfer vrijednosti među fizički udaljenim ljudima bez posrednika, poput banke ili vlade. 2008. godine, anonimni Satoshi Nakamoto je objavio 8 stranica rješenja na dugo nerješivi računalski problem poznat kao “Problem Bizantskog Generala.” Njegovo rješenje i sustav koji je izgradio - Bitcoin - dozvolio je, prvi put ikad, da se vrijednost prenosi brzo i daleko, bez ikakvih posrednika ili povjerenja. Implikacije kreacije Bitcoina su toliko duboke, ekonomski i računalski, da bi Nakamoto trebao biti prva osoba nominirana za Nobelovu nagradu za ekonomiju i Turingovu nagradu.

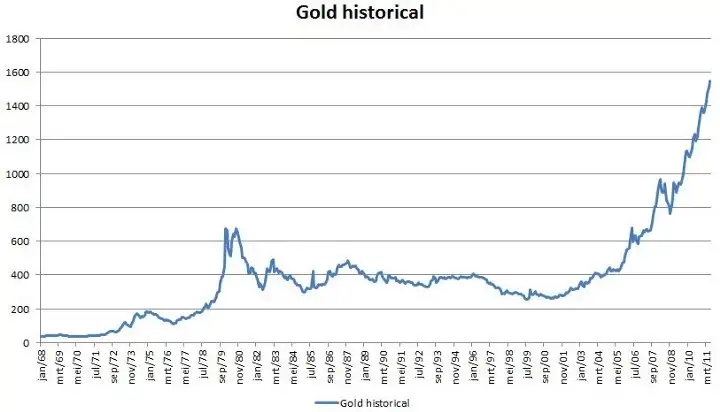

Za ulagače, važna činjenica izuma Bitcoina (mreže i protokola) je stvaranje novog oskudnog digitalnog dobra - bitcoina (monetarne jedinice). Bitcoini su prenosivi digitalni “novčići” (tokeni), proizvedeni na Bitcoin mreži kroz proces nazvan “rudarenje” (mining). Rudarenje Bitcoina je ugrubo usporedivo sa rudarenjem zlata, uz bitnu razliku da proizvodnja bitcoina prati unaprijed osmišljeni i predvidivi raspored. Samo 21 milijun bitcoina će ikad postojati, i većina (2017., kada je ovaj tekst napisan) su već izrudareni. Svake četiri godine, količina rudarenih bitcoina se prepolovi. Produkcija novih bitcoina će potpuno prestati 2140. godine.

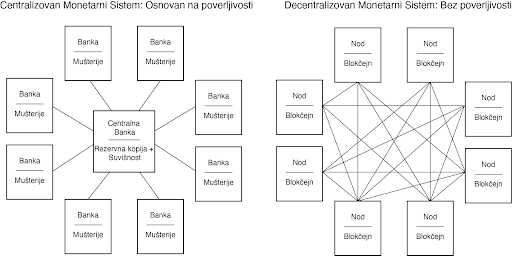

Stopa inflacije —— Monetarna baza

Stopa inflacije —— Monetarna bazaBitcoine ne podržava nikakva roba ili dobra, niti ih garantira ikakva vlada ili firma, što postavlja očito pitanje za svakog novog bitcoin ulagača: zašto imaju uopće ikakvu vrijednost? Za razliku od dionica, obveznica, nekretnina ili robe poput nafte i žita, bitcoine nije moguće vrednovati koristeći standardne ekonomske analize ili korisnost u proizvodnji drugih dobara. Bitcoini pripadaju sasvim drugoj kategoriji dobara - monetarnih dobara, čija se vrijednost definira kroz tzv. teoriju igara; svaki sudionik na tržištu vrednuje neko dobro, onoliko koliko procjenjuje da će ga drugi sudionici vrednovati. Kako bismo bolje razumjeli ovo svojstvo monetarnih dobara, trebamo istražiti podrijetlo novca.

Podrijetlo novca

U prvim ljudskim društvima, trgovina među grupama se vršila kroz robnu razmjenu. Velika neefikasnost prisutna u robnoj razmjeni je drastično ograničavala količinu i geografski prostor na kojem je bila moguća. Jedan od najvećih problema sa robnom razmjenom je problem dvostruke podudarnosti potražnje. Uzgajivač jabuka možda želi trgovati sa ribarom, ali ako ribar ne želi jabuke u istom trenutku, razmjena se neće dogoditi. Kroz vrijeme, ljudi su razvili želju za čuvanjem određenih predmeta zbog njihove rijetkosti i simbolične vrijednosti (npr. školjke, životinjski zube, kremen). Zaista, kako i Nick Szabo govori u svojem izvrsnom eseju o podrijetlu novca, ljudska želja za sakupljanjem predmeta pružila je izraženu evolucijsku prednost ranom čovjeku nad njegovim najbližim biološkim rivalom, neandertalcem - Homo neanderthalensis.

"Primarna i najbitnija evolucijska funkcija sakupljanja bila je osigurati medij za čuvanje i prenošenje vrijednosti".

Predmeti koje su ljudi sakupljali služili su kao svojevrsni “proto-novac,” tako što su omogućavale trgovinu među antagonističkim plemenima i dozvoljavale bogatsvu da se prenosi na sljedeću generaciju. Trgovina i transfer takvih predmeta bile su rijetke u paleolitskim društvima, te su oni služili više kao “spremište vrijednosti” (store of value) nego kao “medij razmjene” (medium of exchange), što je uloga koju danas igra moderni novac. Szabo objašnjava:

"U usporedbi sa modernim novcem, primitivan novac je imao jako malo “brzinu” - mogao je promijeniti ruke samo nekoliko puta u životu prosječnog čovjeka. Svejedno, trajni i čvrsti sakupljački predmet, što bismo danas nazvali “nasljeđe,” mogao je opstati mnogo generacija, dodajući znatnu vrijednost pri svakom transferu - i zapravo omogućiti transfer uopće".

Rani čovjek suočio se sa bitnom dilemom u teoriji igara, kada je odlučivao koje predmete sakupljati: koje od njih će drugi ljudi željeti? Onaj koji bi to točno predvidio imao bi ogromnu prednost u mogućnosti trgovine i akvizicije bogatsva. Neka američka indijanska plemena, npr. Naraganseti, specijalizirala su se u proizvodnji sakupljačkih dobara koja nisu imala drugu svrhu osim trgovine. Valja spomenuti da što je ranije predviđanje da će neko dobro imati takvu vrijednost, veća je prednost koju će imati onaj koji je posjeduje, zato što ju je moguće nabaviti jeftinije, prije nego postane vrlo tražena roba i njezona vrijednost naraste zajedno sa populacijom. Nadalje, nabava nekog dobra u nadi da će u budućnosti biti korišteno kao spremište vrijednosti, ubrzava upravo tu primjenu. Ova cirkularnost je zapravo povratna veza (feedback loop) koja potiče društva da se rapidno slože oko jednog spremišta vrijednosti. U terminima teorije igara, ovo je znano kao “Nashov ekvilibrij.” Postizanje Nashovog ekvilibrija za neko spremište vrijednosti je veliko postignuće za društvo, pošto ono znatno olakšava trgovinu i podjelu rada, i time omogućava napredak civilizacije.

Tisućljećima, kako su ljudska društva rasla i otvarala trgovinske puteve, različite aplikacije spremišta vrijednosti u individualnim društvima počele su se natjecati međusobno. Trgovci su imali izbor: čuvati svoju zaradu u spremištu vrijednosti vlastite kulture, ili one kulture sa kojom su trgovali, ili mješavini oboje. Benefit štednje u stranom spremištu vrijednosti bila je uvećana sposobnost trgovanja u povezanom stranom društvu. Trgovci koji su štedili u stranom spremištu vrijednosti su također imali dobrih razloga da potiču svoje društvo da ga prihvati, jer bi tako uvećali vrijednost vlastite ušteđevine. Prednosti “uvezene” tehnologije spremanja vrijednosti bile su prisutne ne samo za trgovce, nego i za sama društva. Kada bi se dvije grupe konvergirale u jedinstvenom spremištu vrijednosti, to bi značajno smanjilo cijenu troškova trgovine jednog s drugim, i samim time povećanje bogatstva kroz trgovinu. I zaista, 19. stoljeće bilo je prvi put da je najveći dio svijeta prihvatio jedinstveno spremište vrijednosti - zlato - i u tom periodu vidio najveću eksploziju trgovine u povijesti svijeta. O ovom mirnom periodu, pisao je John Maynard Keynes:

"Kakva nevjerojatna epizoda u ekonomskom napretku čovjeka… za svakog čovjeka iole iznadprosječnog, iz srednje ili više klase, život je nudio obilje, ugodu i mogućnosti, po niskoj cijeni i bez puno problema, više nego monarsima iz prethodnih perioda. Stanovnik Londona mogao je, ispijajući jutarnji čaj iz kreveta, telefonski naručiti razne proizvode iz cijele Zemlje, u količinama koje je želio, i sa dobrim razlogom očekivati njihovu dostavu na svoj kućni prag."

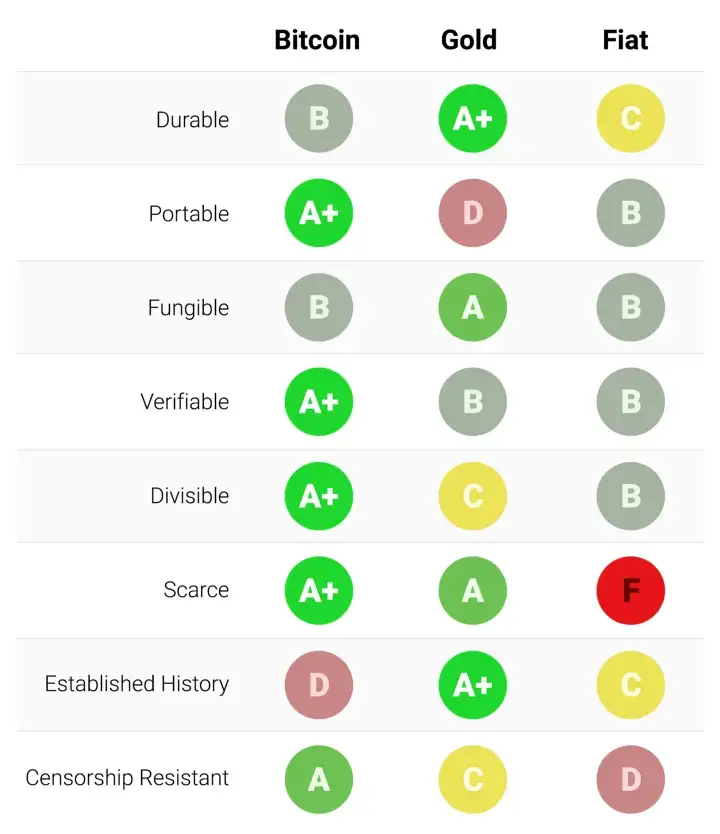

Svojstva dobrog spremišta vrijednosti

Kada se spremišta vrijednosti natječu jedno s drugim, specifična svojstva rade razliku koja daje jednom prednost nad drugim. Premda su mnoga dobra u prošlosti korištena kao spremišta vrijednosti ili kao “proto-novac,” određena svojstva su se pokazala kao posebno važna, i omogućila dobrima sa njima da pobijede. Idealno spremište vrijednosti biti će:

- Trajno: dobro ne smije biti kvarljivo ili lako uništeno. Tako naprimjer, žito nije idealno spremište vrijednosti.

- Prenosivo: dobro mora biti lako transportirati i čuvati, što omogućuje osiguranje protiv gubitka ili krađe i dopušta trgovinu na velike udaljenosti. Tako, krava je lošije spremište vrijednosti od zlatne narukvice.

- Zamjenjivo: jedna jedinica dobra treba biti zamjenjiva sa drugom. Bez zamjenjivosti, problem podudarnosti želja ostaje nerješiv. Time, zlato je bolje od dijamanata, jer su oni nepravilni u obliku i kvaliteti.

- Provjerljivo: dobro mora biti lako i brzo identificirano i testirano za autentičnost. Laka provjera povećava povjerenje u trgovini i vjerojatnost da će razmjena biti dovršena.

- Djeljivo: dobro mora biti lako djeljivo na manje dijelove. Premda je ovo svojstvo bilo manje važno u ranim društvima gdje je trgovina bila rijetka, postalo je važnije sa procvatom trgovine. Količine koje su se mijenjale postale su manje i preciznije.

- Oskudno: Monetarno dobro mora imati “cijenu nemoguću za lažirati,” kao što je rekao Nick Szabo. Drugim riječima, dobro ne smije biti obilno ili lako dostupno kroz proizvodnju. Oskudnost je možda i najvažnije svojstvo spremišta vrijednosti, pošto se izravno vezuje na ljudsku želju da sakupljamo ono što je rijetko. Ona je izvor vrijednosti u spremištu vrijednosti.

- Duge povijesti: što je dulje neko dobro vrijedno za društvo, veća je vjerojatnost da će biti prihvaćeno kao spremište vrijednosti. Dugo postojeće spremište vrijednosti biti će jako teško uklonjeno od strane došljaka, osim u slučaju sile (ratno osvajanje) ili ako je nova tehnologija znatno bolja u ostalim svojstvima.

- Otporno na cenzuru: novije svojstvo, sve više važno u modernom digitalnom svijetu sa sveprisutnim nadzorom, je otpornost na cenzuru. Drugim riječima, koliko je teško da vanjski agent, kao korporacija ili država, spriječi vlasnika dobra da ga čuva i koristi. Dobra koja su otporna na cenzuru su idealna za ljude koji žive u režimima koji prisilno nadziru kapital ili čine neke oblike mirne trgovine protuzakonitima.

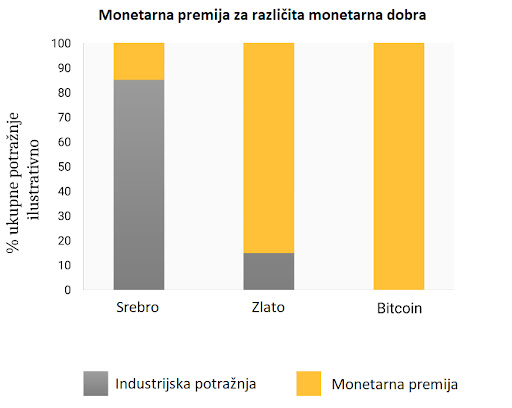

Ova tablica ocjenjuje Bitcoin, zlato (gold) i fiat novac (kao što je euro ili dolar) po svojstvima izlistanim gore. Objašnjenje svake ocjene slijedi nakon tablice.

Trajnost:

Zlato je neosporeni kralj trajnosti. Velika većina zlata pronađenog kroz povijest, uključujući ono egipatskih faraona, opstaje i danas i vjerojatno će postojati i za tisuću godina. Zlatnici korišteni u antičko doba imaju značajnu vrijednost i danas. Fiat valute i bitcoini su digitalni zapisi koji ponekad imaju fizički oblik (npr. novčanice). Dakle, njihovu trajnost ne određuju njihova fizička svojstva (moguće je zamijeniti staru i oštećenu novčanicu za novu), nego institucije koje stoje iza njih. U slučaju fiat valuta, mnoge države su nastale i nestale kroz stoljeća, i valute su nestale s njima. Marke iz Weimarske republike danas nemaju vrijednost zato što institucija koja ih je izdavala više ne postoji. Ako je povijest ikakav pokazatelj, ne bi bilo mudro smatrati fiat valute trajnima dugoročno; američki dolar i britanska funta su relativne anomalije u ovom pogledu. Bitcoini, zato što nemaju instituciju koja ih održava, mogu se smatrati trajnima dok god mreža koja ih osigurava postoji. Obzirom da je Bitcoin još uvijek mlada valuta, prerano je za čvrste zaključke o njegovoj trajnosti. No, postoje ohrabrujući znakovi - prominente države su ga pokušavale regulirati, hakeri ga napadali - usprkos tome, mreža nastavlja funkcionirati, pokazujući visok stupanj antifragilnosti.

Prenosivost:

Bitcoini su najprenosivije spremište vrijednosti ikad. Privatni ključevi koji predstavljaju stotine milijuna dolara mogu se spremiti na USB drive i lako ponijeti bilo gdje. Nadalje, jednako velike sume mogu se poslati na drugi kraj svijeta skoro instantno. Fiat valute, zbog svojeg temeljno digitalnog oblika, su također lako prenosive. Ali, regulacije i kontrola kapitala od strane države mogu ugroziti velike prijenose vrijednosti, ili ih usporiti danima. Gotovina se može koristiti kako bi se izbjegle kontrole kapitala, ali onda rastu rizik čuvanja i cijena transporta. Zlato, zbog svojeg fizičkog oblika i velike gustoće, je najmanje prenosivo. Nije čudo da većina zlatnika i poluga nikad ne napuste sefove. Kada se radi prijenos zlata između prodavača i kupca, uglavnom se prenosi samo ugovor o vlasništvu, ne samo fizičko zlato. Prijenos fizičkog zlata na velike udaljenosti je skupo, riskantno i sporo.

Zamjenjivost:

Zlato nam daje standard za zamjenjivost. Kada je rastopljeno, gram zlata je praktički nemoguće razlikovati od bilo kojeg drugog grama, i zlato je oduvijek bilo takvo. S druge strane, fiat valute, su zamjenjive samo onoliko koliko njihova institucija želi da budu. Iako je uglavnom slučaj da je novčanica zamjenjiva za drugu istog iznosa, postoje situacije u kojima su velike novčanice tretirane drukčije od malih. Naprimjer, vlada Indije je, u pokušaju da uništi neoporezivo sivo tržište, potpuno oduzela vrijednost novčanicama od 500 i 1000 rupija. To je uzrokovalo da ljudi manje vrednuju te novčanice u trgovini, što je značilo da više nisu bile zaista zamjenjive za manje novčanice. Bitcoini su zamjenjivi na razini mreže; svaki bitcoin je pri prijenosu tretiran kao svaki drugi. No, zato što je moguće pratiti individualne bitcoine na blockchainu, određeni bitcoin može, u teoriji, postati “prljav” zbog korštenja u ilegalnoj trgovini, te ga trgovci ili mjenjačnice možda neće htjeti prihvatiti. Bez dodatnih poboljšanja oko privatnosti i anonimnosti na razini mrežnog protokola, bitcoine ne možemo smatrati jednako zamjenjivim kao zlato.

Mogućnost provjere:

Praktično gledajući, autentičnost fiat valuta i zlata je prilično lako provjeriti. Svejedno, i usprkos pokušajima da spriječe krivotvorenje novčanica, i dalje postoji potencijal prevare za vlade i njihove građane. Zlato također nije imuno na krivotvorenje. Sofisticirani kriminalci su koristili pozlaćeni tungsten kako bi prevarili kupce zlata. Bitcoine je moguće provjeriti sa matematičkom sigurnošću. Korištenjem kriptografskih potpisa, vlasnik bitcoina može javno demonstrirati da posjeduje bitcoine koje tvrdi da posjeduje.

Djeljivost:

Bitcoine je moguće podijeliti u stotinu milijuna manjih jedinica (zvanih satoshi), i prenositi takve (no, valja uzeti u obzir ekonomičnost prijenosa malih iznosa, zbog cijene osiguravanja mreže - “network fee”). Fiat valute su tipično dovoljno djeljive na jedinice sa vrlo niskom kupovnom moći. Zlato, iako fizički i teoretski djeljivo, postaje teško za korištenje kada se podijeli na dovoljno male količine da bi se moglo koristiti u svakodnevnoj trgovini.

Oskudnost:

Svojstvo koje najjasnije razlikuje Bitcoin od fiat valuta i zlata je njegova unaprijed definirana oskudnost. Od početka, konačna količina bitcoina nikad neće biti veća od 21 milijun. To daje vlasnicima bitcoina jasan i znan uvid u postotak ukupnog vlasništva. Naprimjer, vlasnik 10 bitcoina bi znao da najviše 2,1 milijuna ljudi (manje od 0.03% populacije) može ikad imati isto bitcoina kao i on. Premda je kroz povijest uvijek bilo oskudno, zlato nije imuno na povećanje ukupne količine. Ako se ikad izumi nova, ekonomičnija metoda rudarenja ili proizvodnje zlata, ukupna količina zlata bi se mogla dramatično povećati (npr. rudarenje morskog dna ili asteroida). Na kraju, fiat valute, relativno nov izum u povijesti, pokazale su se sklonima konstantnim povećanjima u količini. Države su pokazale stalnu sklonost inflaciji monetarne kvantitete kako bi rješavale kratkoročne političke probleme. Inflacijske tendencije vlada diljem svijeta čine fiat valute gotovo sigurnim da će gubiti vrijednost kroz vrijeme.

Etablirana povijest:

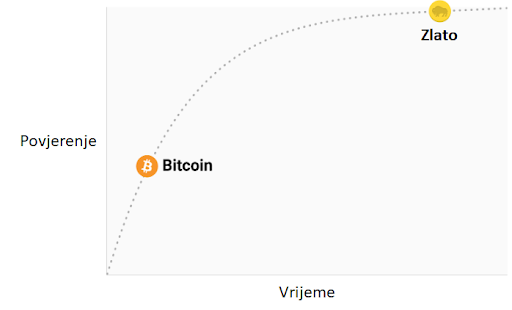

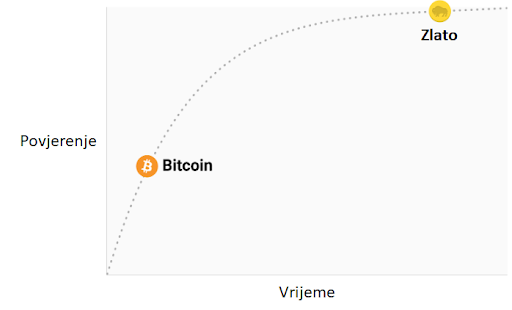

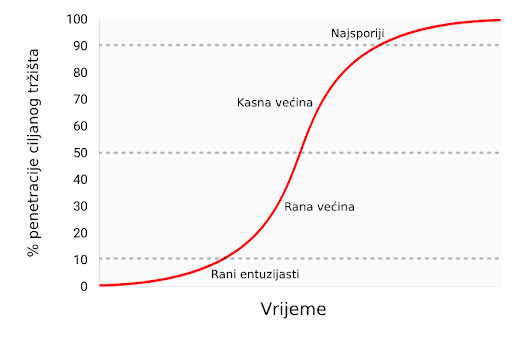

Nijedno monetarno dobro nema povijest kao zlato, koje je imalo vrijednost za cijelog trajanja ljudske civilizacije. Kovanice izrađene u antičko doba i danas imaju značajnu vrijednost. Ne može se isto reći za fiat valute, koje su same relativno nova povijesna anomalija. Od njihovog početka, fiat valute su imale gotovo univerzalni smjer prema bezvrijednosti. Korištenje inflacije kao podmuklog načina za nevidljivo oporezivanje građana je vječita kušnja kojoj se skoro nijedna država u povijesti nije mogla oduprijeti. Ako je 20. stoljeće, u kojem je fiat novac dominirao globalni monetarni poredak, demonstriralo neku ekonomsku istinu, to je onda bila ta da ne možemo računati na fiat novac da održi vrijednost u dužem ili srednjem vremenskom periodu. Bitcoin, usprkos svojoj novosti, je preživio dovoljno testova tržišta da postoji velika vjerojatnost da neće nestati kao vrijedno dobro. Nadalje, Lindy efekt govori da što duže Bitcoin bude korišten, to će veća biti vjera u njega i njegovu sposobnost da nastavi postojati dugo u budućnost. Drugim riječima, društvena vjera u monetarno dobro je asimptotička, kao u grafu ispod:

Ako Bitcoin preživi prvih 20 godina, imat će gotovo sveopće povjerenje da će trajati zauvijek, kao što ljudi vjeruju da je internet trajna stvar u modernom svijetu.

Otpor na cenzuru

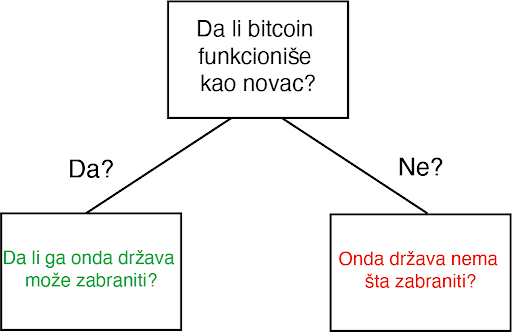

Jedan od najbitnijih izvora za ranu potražnju bitcoina bila je njegova upotreba u ilegalnoj kupovini i prodaji droge. Mnogi su zato pogrešno zaključili da je primarna potražnja za bitcoinima utemeljena u njihovoj prividnoj anonimnosti. Međutim, Bitcoin nije anonimna valuta; svaka transakcija na mreži je zauvijek zapisana na javnom blockchainu. Povijesni zapis transakcija dozvoljava forenzičkoj analizi da identificira izvore i tijek sredstava. Takva analiza dovela je do uhićenja počinitelja zloglasne MtGox pljačke. Premda je istina da dovoljno oprezna i pedantna osoba može sakriti svoj identitet koristeći Bitcoin, to nije razlog zašto je Bitcoin bio toliko popularan u trgovini drogom.

Ključno svojstvo koje čini Bitcoin najboljim za takve aktivnosti je njegova agnostičnost i nepotrebnost za dozvolom (“premissionlessness”) na mrežnoj razini. Kada se bitcoini prenose na Bitcoin mreži, ne postoji nitko tko dopušta transakcije. Bitcoin je distribuirana peer-to-peer (korisnik-korisniku) mreža, i samim time dizajnirana da bude otporna na cenzuru. Ovo je u velikom kontrastu sa fiat bankarskim sustavom, u kojem države reguliraju banke i ostale institucije prijenosa novca, kako bi one prijavljivale i sprječavale protuzakonito korištenje monetarnih dobara. Klasičan primjer regulacije novca su kontrole kapitala. Npr., bogati milijunaš će vrlo teško prenijeti svoje bogatstvo u novu zemlju, kada bježi iz opresivnog režima. Premda zlato nije izdano i proizvedeno od države, njegova fizička priroda ga čini teško prenosivim kroz prostor, i samim time ga je daleko lakše regulirati nego Bitcoin. Indijski Akt kontrole zlata je primjer takve regulacije.

Bitcoin je odličan u većini gore navedenih svojstava, što mu omogućava da bude marginalno bolji od modernih i drevnih monetarnih dobara, te da pruži poticaje za svoje rastuće društveno usvajanje. Specifično, moćna kombinacija otpornosti na cenzuru i apsolutne oskudnosti bila je velika motivacija za bogate ulagače koji su uložili dio svojeg bogatstva u Bitcoin.

Evolucija novca

U modernoj monetarnoj ekonomiji postoji opsesija sa ulogom novca kao medija razmjene. U 20. stoljeću, države su monopolizirale izdavanje i kontrolu novca i kontinuirano potkopavale njegovo svojstvo spremišta vrijednosti, stvarajući lažno uvjerenje da je primarna svrha novca biti medij razmjene. Mnogi su kritizirali Bitcoin, govoreći da je neprikladan da bude novac zato što mu je cijena bila previše volatilna za medij razmjene. No, novac je uvijek evoluirao kroz etape; uloga spremišta vrijednosti je dolazila prije medija razmjene. Jedan od očeva marginalističke ekonomije, William Stanley Jevons, objašnjava:

"Povijesno govoreći… čini se da je zlato prvo služilo kao luksuzni metal za ukras; drugo, kao sačuvana vrijednost; treće, kao medij razmjene; i konačno, kao mjerilo vrijednosti."

U modernoj terminologiji, novac uvijek evoluira kroz četiri stadija:

- Kolekcionarstvo: U prvoj fazi svoje evolucije, novac je tražen samo zbog svojih posebnih svojstava, uglavnom zbog želja onog koji ga posjeduje. Školjke, perlice i zlato su bili sakupljani prije nego su poprimili poznatije uloge novca.

- Spremište vrijednosti: Jednom kada je novac tražen od dovoljnog broja ljudi, biti će prepoznat kao način za čuvanje i spremanje vrijednosti kroz vrijeme. Kada neko dobro postane široko korišteno kao spremište vrijednosti, njegova kupovna moć raste sa povećanom potražnjom za tu svrhu. Kupovna moć spremišta vrijednosti će u jednom trenutku doći do vrhunca, kada je dovolno rašireno i broj novih ljudi koji ga potražuju splasne.

- Sredstvo razmjene: Kada je novac potpuno etabliran kao spremište vrijednosti, njegova kupovna moć se stabilizira. Nakon toga, postane prikladno sredstvo razmjene zbog stabilnosti svoje cijene. U najranijim danima Bitcoina, mnogi ljudi nisu shvaćali koju buduću cijenu plaćaju koristeći bitcoine kao sredstvo razmjene, umjesto kao novonastalo spremište vrijednosti. Poznata priča o čovjeku koji je za 10,000 bitcoina (vrijednih oko 94 milijuna dolara kada je ovaj članak napisan) za dvije pizze ilustrira ovaj problem.

- Jedinica računanja vrijednosti: Jednom kada je novac široko korišten kao sredstvo razmjene, dobra će biti vrednovana u njemu, tj. većina cijena će biti izražena u njemu. Uobičajena zabluda je da je većinu dobara moguće zamijeniti za bitcoine danas. Npr., premda je možda moguće kupiti šalicu kave za bitcoine, izlistana cijena nije prava bitcoin cijena; zapravo se radi o cijeni u državnoj valuti koju želi trgovac, preračunatu u bitcoin po trenutnoj tržišnoj cijeni. Kad bi cijena bitcoina pala u odnosu na valutu, vrijednost šalice izražena u bitcoinima bi se povećala. Od trenutka kada trgovci budu voljni prihvaćani bitcoine kao platežno sredstvo, bez obraćanja pažnje na vrijednost bitcoina u državnoj fiat valuti, moći ćemo reći da je Bitcoin zaista postao jedinica računanja vrijednosti.

Monetarna dobra koja još nisu jedinice računanja vrijednosti možemo smatrati “djelomično monetiziranima.” Danas zlato ima takvu ulogu, jer je spremište vrijednosti, ali su mu uloge sredstva razmjene i računanja vrijednosti oduzete intervencijama država. Moguće je također da se jedno dobro koristi kao sredstvo razmjene, dok druga ispunjavaju ostale uloge. To je tipično u zemljama gdje je država disfunkcionalna, npr. Argentina ili Zimbabwe. U svojoj knjizi, Digitalno zlato, Nathaniel Popper piše:

"U Americi, dolar služi trima funkcijama novca: nudi sredstvo razmjene, jedinicu za mjerenje vrijednosti dobara, i mjesto gdje se može čuvati vrijednosti. S druge strane, argentinski peso je korišten kao sredstvo razmjene (za svakodnevne potrebe), ali ga nitko nije koristio kao spremište vrijednosti. Štednja u pesosima bila je ekvivalent bacanja novca. Zato su ljudi svu svoju štednju imali u dolarima, jer je dolar bolje čuvao vrijednost. Zbog volatilnosti pesosa, ljudi su računali cijene u dolarima, što im je pružalo pouzdaniju jedinicu mjerenja kroz vrijeme."

Bitcoin je trenutno u fazi tranzicije iz prvog stadija monetizacije u drugi. Vjerojatno će proći nekoliko godina prije nego Bitcoin pređe iz začetaka spremišta vrijednosti u istinski medij razmjene, i put do tog trenutka je još uvijek pun rizika i nesigurnosti. Važno je napomenuti da je ista tranzicija trajala mnogo stoljeća za zlato. Nitko danas živ nije doživio monetizaciju dobra u realnom vremenu (kroz koju Bitcoin prolazi), tako da nemamo puno iskustva govoriti o putu i načinu na koji će se monetizacija dogoditi.

Put monetizacije

Kroz proces monetizacije, monetarno dobro će naglo porasti u kupovnoj moći. Mnogi su tako komentirali da je uvećanje kupovne moći Bitcoina izgledalo kao “balon” (bubble). Premda je ovaj termin često korišten kako bi ukazao na pretjeranu vrijednosti Bitcoina, sasvim slučajno je prikladan. Svojstvo koje je uobičajeno za sva monetarna dobra jest da je njihova kupovna moć viša nego što se može opravdati samo kroz njihovu uporabnu vrijednost. Zaista, mnogi povijesni novci nisu imali uporabnu vrijednost. Razliku između kupovne moći i vrijednosti razmjene koju bi novac mogao imati za svoju inherentnu korisnost, možemo razmatrati kao “monetarnu premiju.” Kako monetarno dobro prolazi kroz stadije monetizacije (navedene gore), monetarna premija raste. No, ta premija ne raste u ravnoj i predvidivoj liniji. Dobro X, koje je bilo u procesu monetizacije, može izgubiti u usporedbi sa dobrom Y koje ima više svojstava novca, te monetarna premija dobra X drastično padne ili potpuno nestane. Monetarna premija srebra je skoro potpuno nestala u kasnom 19. stoljeću, kada su ga vlade diljem svijeta zamijenile zlatom kao novcem.

Čak i u odsustvu vanjskih faktora, kao što su intervencije vlade ili druga monetarna dobra, monetarna premija novog novca neće ići predvidivim putem. Ekonomist Larry White primijetio je:

"problem sa pričom “balona,” naravno, je da je ona konzistentna sa svakim putem cijene, i time ne daje ikakvo objašnjenje za specifičan put cijene"

Proces monetizacije opisuje teorija igara; svaki akter na tržištu pokušava predvidjeti agregiranu potražnju ostalih aktera, i time buduću monetarnu premiju. Zato što je monetarna premija nevezana za inherentnu korisnost, tržišni akteri se uglavnom vode za prošlim cijenama da bi odredili je li neko dobro jeftino ili skupo, i žele li ga kupiti ili prodati. Veza trenutne potražnje sa prošlim cijenama naziva se “ovisnost o putu” (path dependence); ona je možda najveći izvor konfuzije u shvaćanju kretanja cijena monetarnih dobara.

Kada kupovna moć monetarnog dobra naraste zbog većeg i šireg korištenja, očekivanja tržišta o definicijama “jeftinog” i “skupog” se mijenjaju u skladu s time. Slično tome, kada cijena monetarnog dobra padne, očekivanja tržišta mogu se promijeniti u opće vjerovanje da su prethodne cijene bile “iracionalne” ili prenapuhane. Ovisnost o putu novca ilustrirana je riječima poznatog upravitelja fondova s Wall Streeta, Josha Browna: