-

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06Star Wars is often viewed as a myth of rebellion, freedom, and resistance to tyranny. The iconography—scrappy rebels, totalitarian stormtroopers, lone smugglers—suggests a deep anti-authoritarian ethos. Yet, beneath the surface, the narrative arc of Star Wars consistently affirms the necessity, even sanctity, of central authority. This blog entry introduces the question: Is Star Wars fundamentally a celebration of statism?

Rebellion as Restoration, Not Revolution

The Rebel Alliance’s mission is not to dismantle centralized power, but to restore the Galactic Republic—a bureaucratic, centrally governed institution. Characters like Mon Mothma and Bail Organa are high-ranking senators, not populist revolutionaries. The goal is to remove the corrupt Empire and reinstall a previous central authority, presumed to be just.

- Rebels are loyalists to a prior state structure.

- Power is not questioned, only who wields it.

Jedi as Centralized Moral Elites

The Jedi, often idealized as protectors of peace, are unelected, extra-legal enforcers of moral and military order. Their authority stems from esoteric metaphysical abilities rather than democratic legitimacy.

- They answer only to their internal Council.

- They are deployed by the Senate, but act independently of civil law.

- Their collapse is depicted as tragic not because they were unaccountable, but because they were betrayed.

This positions them as a theocratic elite, not spiritual anarchists.

Chaos and the Frontier: The Case of the Cantina

The Mos Eisley cantina, often viewed as a symbol of frontier freedom, reveals something darker. It is: - Lawless - Violent - Culturally fragmented

Conflict resolution occurs through murder, not mediation. Obi-Wan slices off a limb; Han shoots first—both without legal consequence. There is no evidence of property rights, dispute resolution, or voluntary order.

This is not libertarian pluralism—it’s moral entropy. The message: without centralized governance, barbarism reigns.

The Mythic Arc: Restoration of the Just State

Every trilogy in the saga returns to a single theme: the fall and redemption of legitimate authority.

- Prequels: Republic collapses into tyranny.

- Originals: Rebels fight to restore legitimate order.

- Sequels: Weak governance leads to resurgence of authoritarianism; heroes must reestablish moral centralism.

The story is not anti-state—it’s anti-bad state. The solution is never decentralization; it’s the return of the right ruler or order.

Conclusion: The Hidden Statism of a Rebel Myth

Star Wars wears the costume of rebellion, but tells the story of centralized salvation. It: - Validates elite moral authority (Jedi) - Romanticizes restoration of fallen governments (Republic) - Portrays decentralized zones as corrupt and savage (outer rim worlds)

It is not an anarchist parable, nor a libertarian fable. It is a statist mythology, clothed in the spectacle of rebellion. Its core message is not that power should be abolished, but that power belongs to the virtuous few.

Question to Consider:

If the Star Wars universe consistently affirms the need for centralized moral and political authority, should we continue to see it as a myth of freedom? Or is it time to recognize it as a narrative of benevolent empire? -

@ e844b39d:adafb6a2

2025-05-27 14:31:02

@ e844b39d:adafb6a2

2025-05-27 14:31:02This was not planned, but last evening I realized that I should at least test the Sony A900 and Minolta gear that I had, which was bought for real estate photography around a decade ago.

Look at everything out here!

Look at everything out here!Our two white kittens are almost identical, but they come from two different mothers, Charcoal and Tiger!

I sometimes wonder if they have realized that they look the same, they tend to stick together most of the day.

I know you're there!

I know you're there!This ended up being perfect scenes for the 20/2.8 wide open!

Outside the gate

Outside the gateSeveral of our cats have been digging a hole outside, sniffing for something, we have no idea what that is all about...

Playing around

Playing aroundThey often stay in the slot for the gate, I guess its a little less hot there.

Happy cat?

Happy cat?This sort of scene is perfect for the Beercan, Minolta 70-210/4, its a legendary piece of optics for sure. One of the reasons I got into the system back then.

Scouting

ScoutingThey spent some time hunting each others in the "jungle" of course!

Hunting mode!

Hunting mode!They were moving too rapidly for any gear really, so the slow AF was not a real hindrance.

I look good, yes?

I look good, yes?Sometimes when I process images of them the fur gets messy and kinda dirty looking, but this went the opposite way!

It was a good day in the garden, and a very useful test.

That's it for today!

-

@ 43baaf0c:d193e34c

2025-05-27 14:08:02

@ 43baaf0c:d193e34c

2025-05-27 14:08:02During the incredible Bitcoin Filmfest, I attended a community session where a discussion emerged about zapping and why I believe zaps are important. The person leading the Nostr session who is also developing an app that’s partially connected to Nostr mentioned they wouldn’t be implementing the zap mechanism directly. This sparked a brief but meaningful debate, which is why I’d like to share my perspective as an artist and content creator on why zaps truly matter.

Let me start by saying that I see everything from the perspective of an artist and creator, not so much from a developer’s point of view. In 2023, I started using Nostr after spending a few years exploring the world of ‘shitcoins’ and NFTs, beginning in 2018. Even though I became a Bitcoin maximalist around 2023, those earlier years taught me an important lesson: it is possible to earn money with my art.

Whether you love or hate them, NFTs opened my eyes to the idea that I could finally take my art to the next level. Before that, for over 15 years, I ran a travel stock video content company called @traveltelly. You can read the full story about my journey in travel and content here: https://yakihonne.com/article/traveltelly@primal.net/vZc1c8aXrc-3hniN6IMdK

When I truly understood what Bitcoin meant to me, I left all other coins behind. Some would call that becoming a Bitcoin maximalist.

The first time I used Nostr, I discovered the magic of zapping. It amazed me that someone who appreciates your art or content could reward you—not just with a like, but with real value: Bitcoin, the hardest money on earth. Zaps are small amounts of Bitcoin sent as a sign of support or appreciation. (Each Bitcoin is divisible into 100 million units called Satoshis, or Sats for short—making a Satoshi the smallest unit of Bitcoin recorded on the blockchain.)

The Energy of Zaps

The Energy of ZapsIf you’re building an app on Nostr—or even just connecting to it—but choose not to include zaps, why should artists and content creators share their work there? Why would they leave platforms like Instagram or Facebook, which already benefit from massive network effects?

Yes, the ability to own your own data is one of Nostr’s greatest strengths. That alone is a powerful reason to embrace the protocol. No one can ban you. You control your content. And the ability to post once and have it appear across multiple Nostr clients is an amazing feature.

But for creators, energy matters. Engagement isn’t just about numbers—it’s about value. Zaps create a feedback loop powered by real appreciation and real value, in the form of Bitcoin. They’re a signal that your content matters. And that energy is what makes creating on Nostr so special.

But beyond those key elements, I also look at this from a commercial perspective. The truth is, we still can’t pay for groceries with kisses :)—we still need money as a medium of exchange. Being financially rewarded for sharing your content gives creators a real incentive to keep creating and sharing. That’s where zaps come in—they add economic value to engagement.

A Protocol for Emerging Artists and Creators

I believe Nostr offers a great starting point for emerging artists and content creators. If you’re just beginning and don’t already have a large following on traditional social media platforms, Nostr provides a space where your work can be appreciated and directly supported with Bitcoin, even by a small but engaged community.

On the other hand, creators who already have a big audience and steady income on platforms like Instagram or YouTube may not feel the urgency to switch. This is similar to how wealthier countries are often slower to understand or adopt Bitcoin—because they don’t need it yet. In contrast, people in unbanked regions or countries facing high inflation are more motivated to learn how money really works.

In the same way, emerging creators—those still finding their audience and looking for sustainable ways to grow—are often more open to exploring new ecosystems like Nostr, where innovation and financial empowerment go hand in hand.

The same goes for Nostr. After using it for the past two years, I can honestly say: without Nostr, I wouldn’t be the artist I am today.

Nostr motivates me to create and share every single day. A like is nice but receiving a zap, even just 21 sats, is something entirely different. Once you truly understand that someone is willing to pay you for what you share, it’s no longer about the amount. It’s about the magic behind it. That simple gesture creates a powerful, positive energy that keeps you going.

Even with Nostr’s still relatively small user base, I’ve already been able to create projects that simply wouldn’t have been possible elsewhere.

Zaps do more than just reward—they inspire. They encourage you to keep building your community. That inspiration often leads to new projects. Sometimes, the people who zap you become directly involved in your work, or even ask you to create something specifically for them.

That’s the real value of zaps: not just micro-payments, but micro-connections sparks that lead to creativity, collaboration, and growth.

Proof of Work (PoW)

Over the past two years, I’ve experienced firsthand how small zaps can evolve into full art projects and even lead to real sales. Here are two examples that started with zaps and turned into something much bigger:

Halving 2024 Artwork

When I started the Halving 2024 project, I invited people on Nostr to be part of it. 70 people zapped me 2,100 sats each, and in return, I included their Npubs in the final artwork. That piece was later auctioned and sold to Jurjen de Vries for 225,128 Sats.

Magic Internet Money

For the Magic Internet Money artwork, I again invited people to zap 2,100 sats to be included. Fifty people participated, and their contributions became part of the final art frame. The completed piece was eventually sold to Filip for 480,000 sats.

These examples show the power of zaps: a simple, small act of appreciation can turn into larger engagement, deeper connection, and even the sale of original art. Zaps aren’t just tips—they’re a form of collaboration and support that fuel creative energy.

I hope this article gives developers a glimpse into the perspective of an artist using Nostr. Of course, this is just one artist’s view, and it doesn’t claim to speak for everyone. But I felt it was important to share my Proof of Work and perspective.

For me, Zaps matter.

Thank you to all the developers who are building these amazing apps on Nostr. Your work empowers artists like me to share, grow, and be supported through the value-for-value model.

-

@ 5d4b6c8d:8a1c1ee3

2025-05-27 13:34:45

@ 5d4b6c8d:8a1c1ee3

2025-05-27 13:34:45Is the housing market going to crash for real this time?

https://primal.net/e/nevent1qvzqqqqqqypzp6dtxy5uz5yu5vzxdtcv7du9qm9574u5kqcqha58efshkkwz6zmdqqs8dqr35dc0npsc8cuulqm4m7gxrgqq3ytphtja9nx534a592gztzsuzsrja

https://stacker.news/items/990316

-

@ c1e9ab3a:9cb56b43

2025-05-27 13:19:53

@ c1e9ab3a:9cb56b43

2025-05-27 13:19:53I. Introduction: Money as a Function of Efficiency and Preference

Money is not defined by law, but by power over productivity. In any open economy, the most economically efficient actors—those who control the most valuable goods, services, and knowledge—ultimately dictate the medium of exchange. Their preferences signal to the broader market what form of money is required to access the highest-value goods, from durable commodities to intangibles like intellectual property and skilled labor.

Whatever money these actors prefer becomes the de facto unit of account and store of value, regardless of its legal status. This emergent behavior is natural and reflects a hierarchy of monetary utility.

II. Classical Gresham’s Law: A Product of Market Distortion

Gresham’s Law, famously stated as:

"Bad money drives out good"

is only valid under coercive monetary conditions, specifically: - Legal tender laws that force the acceptance of inferior money at par with superior money. - Fixed exchange rates imposed by decree, not market valuation. - Governments or central banks backing elastic fiduciary media with promises of redemption. - Institutional structures that mandate debt and tax payments in the favored currency.

Under these conditions, superior money (hard money) is hoarded, while inferior money (soft, elastic, inflationary) circulates. This is not an expression of free market behavior—it is the result of suppressed price discovery and legal coercion.

Gresham’s Law, therefore, is not a natural law of money, but a law of distortion under forced parity and artificial elasticity.

III. The Collapse of Coercion: Inversion of Gresham’s Law

When coercive structures weaken or are bypassed—through technological exit, jurisdictional arbitrage, monetary breakdown, or political disintegration—Gresham’s Law inverts:

Good money drives out bad.

This occurs because: - Market actors regain the freedom to select money based on utility, scarcity, and credibility. - Legal parity collapses, exposing the true economic hierarchy of monetary forms. - Trustless systems (e.g., Bitcoin) or superior digital instruments (e.g., stablecoins) offer better settlement, security, and durability. - Elastic fiduciary media become undesirable as counterparty risk and inflation rise.

The inversion marks a return to monetary natural selection—not a breakdown of Gresham’s Law, but the collapse of its preconditions.

IV. Elasticity and Control

Elastic fiduciary media (like fiat currency) are not intrinsically evil. They are tools of state finance and debt management, enabling rapid expansion of credit and liquidity. However, when their issuance is unconstrained, and legal tender laws force their use, they become weapons of economic coercion.

Banks issue credit unconstrained by real savings, and governments enforce the use of inflated media through taxation and courts. This distorts capital allocation, devalues productive labor, and ultimately hollows out monetary confidence.

V. Monetary Reversion: The Return of Hard Money

When the coercion ends—whether gradually or suddenly—the monetary system reverts. The preferences of the productive and wealthy reassert themselves:

- Superior money is not just saved—it begins to circulate.

- Weaker currencies are rejected not just for savings, but for daily exchange.

- The hoarded form becomes the traded form, and Gresham’s Law inverts completely.

Bitcoin, gold, and even highly credible stable instruments begin to function as true money, not just stores of value. The natural monetary order returns, and the State becomes a late participant, not the originator of monetary reality.

VI. Conclusion

Gresham’s Law operates only under distortion. Its inversion is not an anomaly—it is a signal of the collapse of coercion. The monetary system then reorganizes around productive preference, technological efficiency, and economic sovereignty.

The most efficient market will always dictate the form of hard money. The State can delay this reckoning through legal force, but it cannot prevent it indefinitely. Once free choice returns, bad money dies, and good money lives again.

-

@ 9cb3545c:2ff47bca

2025-05-27 12:58:56

@ 9cb3545c:2ff47bca

2025-05-27 12:58:56Introduction

Public companies that hold Bitcoin on behalf of investors (often issuing securities backed by those Bitcoin holdings) have faced growing pressure to demonstrate proof of reserves – evidence that they genuinely hold the cryptocurrency they claim. One approach is to publish the company’s Bitcoin wallet addresses so that anyone can verify the balances on the blockchain. This practice gained momentum after high-profile crypto collapses (e.g. FTX in 2022) eroded trust, leading major exchanges and fund issuers like Binance, Kraken, OKX, and Bitwise to publicize wallet addresses as proof of assets . The goal is transparency and reassurance for investors. However, making wallet addresses public comes with significant security and privacy risks. This report examines those risks – from cybersecurity threats and blockchain tracing to regulatory and reputational implications – and weighs them against the transparency benefits of on-chain proof of reserves.

Proof of Reserves via Public Wallet Addresses

In the cryptocurrency ethos of “don’t trust – verify,” on-chain proof of reserves is seen as a powerful tool. By disclosing wallet addresses (or cryptographic attestations of balances), a company lets investors and analysts independently verify that the Bitcoin reserves exist on-chain. For example, some firms have dashboards showing their addresses and balances in real time . In theory, this transparency builds trust by proving assets are not being misreported or misused. Shareholders gain confidence that the company’s Bitcoin holdings are intact, potentially preventing fraud or mismanagement.

Yet this approach essentially sacrifices the pseudonymity of blockchain transactions. Publishing a wallet address ties a large, known institution to specific on-chain funds. While Bitcoin addresses are public by design, most companies treat their specific addresses as sensitive information. Public proof-of-reserve disclosures break that anonymity, raising several concerns as detailed below.

Cybersecurity Threats from Visible Wallet Balances

Revealing a wallet address with a large balance can make a company a prime target for hackers and cybercriminals. Knowing exactly where significant reserves are held gives attackers a clear blueprint. As Bitcoin advocate (and MicroStrategy Executive Chairman) Michael Saylor warned in 2025, “publicly known wallet addresses become prime targets for malicious actors. Knowing where significant reserves are held provides hackers with a clear target, potentially increasing the risk of sophisticated attacks” . In other words, publishing the address increases the attack surface – attackers might intensify phishing campaigns, malware deployment, or insider bribery aimed at obtaining the keys or access to those wallets.

Even if the wallets are secured in cold storage, a public address advertisement may encourage attempts to penetrate the organization’s security. Custodians and partners could also be targeted. Saylor noted that this exposure isn’t just risky for the company holding the Bitcoin; it can indirectly put their custodial providers and related exchanges at risk as well . For instance, if a third-party custodian manages the wallets, hackers might attempt to breach that custodian knowing the reward (the company’s Bitcoin) is great.

Companies themselves have acknowledged these dangers. Grayscale Investments, which runs the large Grayscale Bitcoin Trust (GBTC), pointedly refused to publish its wallet addresses in late 2022, citing “security concerns” and complex custody arrangements that have “kept our investors’ assets safe for years” . Grayscale implied that revealing on-chain addresses could undermine those security measures, and it chose not to “circumvent complex security arrangements” just to appease public demand . This highlights a key point: corporate treasury security protocols often assume wallet details remain confidential. Publicizing them could invalidate certain assumptions (for example, if an address was meant to be operationally secret, it can no longer serve that role once exposed).

Additionally, a publicly known trove of cryptocurrency might invite physical security threats. While not a purely “cyber” issue, if criminals know a particular company or facility controls a wallet with, say, thousands of Bitcoin, it could lead to threats against personnel (extortion or coercion to obtain keys). This is a less common scenario for large institutions (which typically have robust physical security), but smaller companies or key individuals could face elevated personal risk by being associated with huge visible crypto reserves.

In summary, cybersecurity experts consider public proof-of-reserve addresses a double-edged sword: transparency comes at the cost of advertising exactly where a fortune is held. As Saylor bluntly put it, “the conventional way of issuing proof of reserves today is actually insecure… This method undermines the security of the issuer, the custodian, the exchanges and the investors. This is not a good idea”  . From a pure security standpoint, broadcasting your wallets is akin to drawing a bullseye on them.

Privacy Risks: Address Clustering and Blockchain Tracing

Blockchain data is public, so publishing addresses opens the door to unwanted analytics and loss of privacy for the business. Even without knowing the private keys, analysts can scrutinize every transaction in and out of those addresses. This enables address clustering – linking together addresses that interact – and other forms of blockchain forensics that can reveal sensitive information about the company’s activities.

One immediate risk is that observers can track the company’s transaction patterns. For example, if the company moves Bitcoin from its reserve address to an exchange or to another address, that move is visible in real time. Competitors, investors, or even attackers could deduce strategic information: perhaps the company is planning to sell (if coins go to an exchange wallet) or is reallocating funds. A known institution’s on-chain movements can thus “reveal strategic movements or holdings”, eroding the company’s operational privacy . In a volatile market, advance knowledge of a large buy or sell by a major player could even be exploited by others (front-running the market, etc.).

Publishing one or a few static addresses also violates a basic privacy principle of Bitcoin: address reuse. Best practice in Bitcoin is to use a fresh address for each transaction to avoid linking them  . If a company continuously uses the same “proof of reserve” address, all counterparties sending funds to or receiving funds from that address become visible. Observers could map out the company’s business relationships or vendors by analyzing counterparties. A Reddit user commenting on an ETF that published a single address noted that “reusing a single address for this makes me question their risk management… There are much better and more privacy-preserving ways to prove reserves… without throwing everything in a single public address” . In other words, a naive implementation of proof-of-reserve (one big address) maximizes privacy leakage.

Even if multiple addresses are used, if they are all disclosed, one can perform clustering analysis to find connections. This happened in the Grayscale case: although Grayscale would not confirm any addresses, community analysts traced and identified 432 addresses likely belonging to GBTC’s custodial holdings by following on-chain traces from known intermediary accounts . They managed to attribute roughly 317,705 BTC (about half of GBTC’s holdings) to those addresses . This demonstrates that even partial information can enable clustering – and if the company directly published addresses, the task becomes even easier to map the entirety of its on-chain asset base.

Another threat vector is “dusting” attacks, which become more feasible when an address is publicly known. In a dusting attack, an adversary sends a tiny amount of cryptocurrency (dust) to a target address. The dust itself is harmless, but if the target address ever spends that dust together with other funds, it can cryptographically link the target address to other addresses in the same wallet. Blockchain security researchers note that “with UTXO-based assets, an attacker could distribute dust to an address to reveal the owner’s other addresses by tracking the dust’s movement… If the owner unknowingly combines this dust with their funds in a transaction, the attacker can… link multiple addresses to a single owner”, compromising privacy . A company that publishes a list of reserve addresses could be systematically dusted by malicious actors attempting to map out all addresses under the company’s control. This could unmask cold wallet addresses that the company never intended to publicize, further eroding its privacy and security.

Investor confidentiality is another subtle concern. If the business model involves individual investor accounts or contributions (for instance, a trust where investors can deposit or withdraw Bitcoin), public addresses might expose those movements. An outside observer might not know which investor corresponds to a transaction, but unusual inflows/outflows could signal actions by big clients. In extreme cases, if an investor’s own wallet is known (say a large investor announces their involvement), one might link that to transactions in the company’s reserve addresses. This could inadvertently reveal an investor’s activities or holdings, breaching expectations of confidentiality. Even absent direct identification, some investors might simply be uncomfortable with their transactions being part of a publicly traceable ledger tied to the company.

In summary, publishing reserve addresses facilitates blockchain tracing that can pierce the veil of business privacy. It hands analysts the keys to observe how funds move, potentially exposing operational strategies, counterparties, and internal processes. As one industry publication noted, linking a large known institution to specific addresses can compromise privacy and reveal more than intended . Companies must consider whether they are ready for that level of transparency into their every on-chain move.

Regulatory and Compliance Implications

From a regulatory perspective, wallet address disclosure lies in uncharted territory, but it raises several flags. First and foremost is the issue of incomplete information: A wallet address only shows assets, not the company’s liabilities or other obligations. Regulators worry that touting on-chain holdings could give a false sense of security. The U.S. Securities and Exchange Commission (SEC) has cautioned investors to “not place too much confidence in the mere fact a company says it’s got a proof-of-reserves”, noting that such reports “lack sufficient information” for stakeholders to ascertain if liabilities can be met . In other words, a public company might show a big Bitcoin address balance, but if it has debts or customer liabilities of equal or greater value, the proof-of-reserve alone is “not necessarily an indicator that the company is in a good financial position” .

This regulatory stance implies that address disclosure, if done, must be paired with proper context. A public company would likely need to clarify in its financial statements or investor communications that on-chain reserves are unencumbered (not pledged as loan collateral, not already sold forward, etc.) and that total liabilities are accounted for. Otherwise, there’s a risk of misleading investors, which could have legal consequences. For example, if investors interpret the on-chain balance as proof of solvency but the company actually had leveraged those bitcoins for loans, lawsuits or regulatory enforcement could follow for misrepresentation.

There’s also a compliance burden associated with revealing addresses. Once an address is known to be the company’s, that company effectively must monitor all transactions related to it. If someone sends funds to that address (even without permission), the company might receive tainted coins (from hacked sources or sanctioned entities). This could trigger anti-money laundering (AML) red flags. Normally, compliance teams can ignore random deposits to unknown wallets, but they cannot ignore something sent into their publicly identified corporate wallet. Even a tiny dust amount sent from a blacklisted address could complicate compliance – for instance, the company would need to prove it has no relation to the sender and perhaps even avoid moving those tainted outputs. Being in the open increases such exposure. Threat actors might even exploit this by “poisoning” a company’s address with unwanted transactions, just to create regulatory headaches or reputational smears.

Another consideration is that custodial agreements and internal risk controls might forbid public disclosure of addresses. Many public companies use third-party custodians for their Bitcoin (for example, Coinbase Custody, BitGo, etc.). These custodians often treat wallet details as confidential for security. Grayscale noted that its Bitcoin are custodied on Coinbase and implied that revealing on-chain info would interfere with security arrangements  . It’s possible that some custodians would object to their clients broadcasting addresses, or might require additional assurances. A company going against such advice might be seen as negligent if something went wrong.

Regulators have so far not mandated on-chain proofs for public companies – in fact, recent laws have exempted public companies from proof-of-reserve mandates on the assumption they are already subject to rigorous SEC reporting. For example, a Texas bill in 2023 required crypto exchanges and custodians to provide quarterly proof-of-reserves to the state, but it “specifically carved out public reporting companies” since they already file audited financials with the SEC . The rationale was that between SEC filings and audits, public companies have oversight that private crypto firms lack . However, this also highlights a gap: even audited financials might not verify 100% of crypto assets (auditors often sample balances). Some observers noted that standard audits “may not ever include the 100% custodial asset testing contemplated by proof of reserves”, especially since quarterly SEC filings (10-Q) are often not audited . This puts public companies in a nuanced position – they are trusted to use traditional audits and internal controls, but the onus is on them if they choose to add extra transparency like on-chain proofs.

Finally, securities regulators focus on fair disclosure and accuracy. If a company publicly posts addresses, those essentially become investor disclosures subject to anti-fraud rules. The firm must keep them up to date and accurate. Any mistake (such as publishing a wrong address or failing to mention that some coins are locked up or lent out) could attract regulatory scrutiny for being misleading. In contrast, a formal audit or certification from a third-party comes with standards and disclaimers that are better understood by regulators. A self-published wallet list is an unprecedented form of disclosure that regulators haven’t fully vetted – meaning the company bears the risk if something is misinterpreted.

In summary, wallet address disclosure as proof-of-reserve must be handled very carefully to avoid regulatory pitfalls. The SEC and others have warned that on-chain assets alone don’t tell the whole story . Public companies would need to integrate such proofs with their official reporting in a responsible way – otherwise they risk confusion or even regulatory backlash for giving a false sense of security.

Reputational and Operational Risks

While transparency is meant to enhance reputation, in practice public wallet disclosures can create new reputational vulnerabilities. Once an address is public, a company’s every on-chain action is under the microscope of the crypto community and media. Any anomaly or perceived misstep can snowball into public relations problems.

One vivid example occurred with Crypto.com in late 2022. After the exchange published its cold wallet addresses to prove reserves (a move prompted by the FTX collapse), on-chain analysts quickly noticed a “suspicious transfer of 320,000 ETH” – about 82% of Crypto.com’s Ether reserves – moving from their cold wallet to another exchange (Gate.io)  . This large, unexpected transfer sparked immediate panic and FUD (fear, uncertainty, and doubt) on social media. Observers speculated that Crypto.com might be insolvent or was manipulating snapshots of reserves by borrowing funds. The CEO had to publicly respond, admitting it was an operational error – the ETH was supposed to go to a new cold storage address but ended up at a whitelisted external address by mistake . The funds were eventually returned, but not before reputational damage was done: the incident made headlines about mishandled funds and rattled user confidence  . This case illustrates how full public visibility can turn an internal slip-up into a highly public crisis. If the addresses had not been public, the mistake might have been quietly corrected; with on-chain transparency, there was nowhere to hide and no way to control the narrative before the public drew worst-case conclusions.

Even routine operations can be misinterpreted. Blockchain data lacks context – analysts may jump to conclusions that hurt a company’s reputation even if nothing is actually wrong. For instance, Binance (the world’s largest crypto exchange) encountered scrutiny when on-chain observers noted that one of its reserve wallets (labeled “Binance 8”) contained far more assets than it should have. This wallet was meant to hold collateral for Binance’s issued tokens, but held an excess balance, suggesting possible commingling of customer funds with collateral  . Bloomberg and others reported a ~$12.7 billion discrepancy visible on-chain . Binance had to acknowledge the issue as a “clerical error” and quickly separate the funds, all under the glare of public attention  . While Binance maintained that user assets were fully backed and the mistake was purely operational, the episode raised public concern over Binance’s practices, feeding a narrative that even the largest exchange had internal control lapses. The key point is that public proof-of-reserves made the lapse obvious to everyone, forcing a reactive explanation. The reputational hit (even if temporary) was an operational risk of being so transparent.

Additionally, strategic confidentiality is lost. If a company holding Bitcoin as a reserve asset decides to make a major move (say, reallocating to a different wallet, or using some Bitcoin for a strategic investment or loan), doing so with known addresses broadcasts that strategy. Competitors or market analysts can infer things like “Company X is moving 10% of its BTC — why? Are they selling? Hedging? Using it as collateral?” This can erode any competitive advantage of keeping financial strategies discreet. It might even affect the company’s stock price if investors interpret moves negatively. For example, if a blockchain analysis shows the company’s reserves dropping, shareholders might fear the company sold Bitcoin (perhaps due to financial distress), even if the reality is benign (like moving funds to a new custodian). The company would be forced into continuous public explanation of on-chain actions to prevent misunderstanding.

There’s also a risk of exposing business partnerships. Suppose the company uses certain exchanges or OTC desks to rebalance its holdings – transactions with those service providers will be visible and could link the company to them. If one of those partners has issues (say a hacked exchange or a sanctioned entity inadvertently), the company could be reputationally contaminated by association through the blockchain trail.

Finally, not all publicity is good publicity in the crypto world. A public proof-of-reserve might invite armchair auditors to scrutinize and criticize every aspect of the company’s crypto management. Minor issues could be blown out of proportion. On the flip side, if a company chooses not to publish addresses, it could face reputational risk from a different angle: skeptics might question why it isn’t being transparent. (Indeed, Grayscale’s refusal to disclose wallet addresses led to social media chatter about whether they truly held all the Bitcoin they claimed, contributing to investor nervousness and a steep discount on GBTC shares .) Thus, companies are in a delicate spot: share too much and every move invites scrutiny; share too little and you breed distrust.

Balancing Transparency Benefits vs. Risks

The central question is whether the benefit of proving reserve holdings to investors outweighs these security and privacy risks. It’s a classic risk-reward calculation, and opinions in the industry are divided.

On the side of transparency, many argue that the credibility and trust gained by proof-of-reserves is invaluable. Advocates note that Bitcoin was designed for open verification – “on-chain auditability and permissionless transparency” are core features . By embracing this, companies demonstrate they are good stewards of a “trustless” asset. In fact, some believe public companies have a duty to be extra transparent. A recent Nasdaq report contended that “when a publicly traded company holds Bitcoin but offers no visibility into how that Bitcoin is held or verified, it exposes itself to multiple levels of risk: legal, reputational, operational, and strategic”, undermining trust . In that view, opacity is riskier in the long run – a lack of proof could weaken investor confidence or invite regulatory suspicion. Shareholders and analysts may actually penalize a company that refuses to provide verifiable proof of its crypto assets .

Transparency done right can also differentiate a firm as a leader in governance. Publishing reserve data (whether via addresses or through third-party attestations) can be seen as a commitment to high standards. For example, Metaplanet, an investment firm, publicly discloses its BTC reserve addresses and even provides a live dashboard for anyone to verify balances . This proactive openness signals confidence and has been touted as an industry best practice in some quarters. By proving its reserves, a company can potentially avoid the fate of those that lost public trust (as happened with opaque crypto firms in 2022). It’s also a means to preempt false rumors – if data is out in the open, misinformation has less room to grow.

However, the pro-transparency camp increasingly acknowledges that there are smarter ways to achieve trust without courting all the risks. One compromise is using cryptographic proofs or audits instead of plain address dumps. For instance, exchanges like Kraken have implemented Merkle tree proof-of-reserves: an independent auditor verifies all customer balances on-chain and provides a cryptographic report, and customers can individually verify their account is included without the exchange revealing every address publicly. This method proves solvency to those who need to know without handing over a complete roadmap to attackers. Another emerging solution is zero-knowledge proofs, where a company can prove knowledge or ownership of certain assets without revealing the addresses or amounts to the public. These technologies are still maturing, but they aim to deliver the best of both worlds: transparency and privacy.

On the side of caution, many experts believe the risks of full public disclosure outweigh the incremental gain in transparency, especially for regulated public companies. Michael Saylor encapsulates this viewpoint: he calls on-chain proof-of-reserve “a bad idea” for institutions, arguing that it “offers one-way transparency” (assets only) and “leaves organizations open to cyberattacks” . He stresses that no serious security expert would advise a Fortune 500 company to list all its wallet addresses, as it essentially compromises corporate security over time . Saylor and others also point out the pointlessness of an assets-only proof: unless you also prove liabilities, showing off reserves might even be dangerous because it could lull investors into a false sense of security .

Regulators and traditional auditors echo this: proof-of-reserves, while a useful tool, “is not enough by itself” to guarantee financial health . They advocate for holistic transparency – audits that consider internal controls, liabilities, and legal obligations, not just a snapshot of a blockchain address  . From this perspective, a public company can satisfy transparency demands through rigorous third-party audits and disclosures rather than raw on-chain data. Indeed, public companies are legally bound to extensive reporting; adding public crypto addresses on top may be seen as redundant and risky.

There is also an implicit cost-benefit analysis: A successful attack resulting from over-sharing could be catastrophic (loss of funds, legal liability, reputational ruin), whereas the benefit of public proof is somewhat intangible (improved investor sentiment, which might be achieved via other assurance methods anyway). Given that trade-off, many firms err on the side of caution. As evidence, few if any U.S.-listed companies that hold Bitcoin have published their wallet addresses. Instead, they reference independent custodians and audits for assurance. Even crypto-native companies have pulled back on full transparency after realizing the downsides – for example, some auditing firms halted issuing proof-of-reserves reports due to concerns about how they were interpreted and the liability involved  .

Industry best practices are still evolving. A prudent approach gaining favor is to prove reserves without leaking sensitive details. This can involve disclosing total balances and having an auditor or blockchain oracle confirm the assets exist, but without listing every address publicly. Companies are also encouraged to disclose encumbrances (whether any of the reserves are collateralized or lent out) in tandem, to address the liabilities issue . By doing so, they aim to achieve transparency and maintain security.

In evaluating whether to publish wallet addresses, a company must ask: Will this level of openness meaningfully increase stakeholder trust, or would a more controlled disclosure achieve the same goal with less risk? For many public companies, the answer has been to avoid public addresses. The risks – from attracting hackers to revealing strategic moves – tend to outweigh the marginal transparency benefit in their judgment. The collapse of unregulated exchanges has certainly proven the value of reserve verification, but public companies operate in a different context with audits and legal accountability. Thus, the optimal solution may be a middle ground: proving reserves through vetted processes (auditor attestations, cryptographic proofs) that satisfy investor needs without blatantly exposing the company’s financial backend to the world.

Conclusion

Publishing Bitcoin wallet addresses as proof of reserves is a bold transparency measure – one that speaks to crypto’s ideals of open verification – but it comes with a laundry list of security considerations. Public companies weighing this approach must contend with the heightened cybersecurity threat of advertising their treasure troves to hackers, the loss of privacy and confidentiality as on-chain sleuths dissect their every transaction, and potential regulatory complications if such disclosures are misunderstood or incomplete. Real-world incidents illustrate the downsides: firms that revealed addresses have seen how quickly online communities flag (and sometimes misinterpret) their blockchain moves, causing reputational turbulence and forcing rapid damage control  .

On the other hand, proving reserves to investors is important – it can prevent fraud and bolster trust. The question is how to achieve it without incurring unacceptable risk. Many experts and industry leaders lean towards the view that simply publishing wallet addresses is too risky a method, especially for public companies with much to lose  . The risks often do outweigh the direct benefits in such cases. Transparency remains crucial, but it can be provided in safer ways – through regular audits, cryptographic proofs that don’t expose all wallet details, and comprehensive disclosures that include liabilities and controls.

In conclusion, while on-chain proof of reserves via public addresses offers a tantalizing level of openness, it must be approached with extreme caution. For most public companies, the smart strategy is to balance transparency with security: verify and show investors that assets exist and are sufficient, but do so in a controlled manner that doesn’t compromise the very assets you’re trying to protect. As the industry matures, we can expect more refined proof-of-reserve practices that satisfy the demand for honesty and solvency verification without unduly endangering the enterprise. Until then, companies will continue to tread carefully, mindful that transparency is only truly valuable when it doesn’t come at the price of security and trust.

Sources:

• Grayscale statement on refusal to share on-chain proof-of-reserves  • Community analysis identifying Grayscale’s wallet addresses  • Cointelegraph – Crypto.com’s mistaken 320k ETH transfer spotted via on-chain proof-of-reserves   • Axios – Binance wallet “commingling” error observed on-chain   • Michael Saylor’s remarks on security risks of publishing wallet addresses    • SEC Acting Chief Accountant on limitations of proof-of-reserves reports  • Nasdaq (Bitcoin for Corporations) – argument for corporate transparency & proof-of-reserves    • 1inch Security Blog – explanation of dusting attacks and privacy loss via address linking  -

@ e844b39d:adafb6a2

2025-05-27 12:30:49

@ e844b39d:adafb6a2

2025-05-27 12:30:49I've been going so deep into black & white for a longer period now that I've totally forgotten about colours!

Actually that is how I felt when I started editing these, it was kinda too much haha

Grasshopper on our banana flower

Grasshopper on our banana flowerThis was to test my old Minolta 70-210/4 Beercan, even though the AF is slow it still locked in time to get this grasshopper!

I'm contemplating bringing this gear on the long trip instead of the old Nikon stuff, so gotta know it will do almost all sorts of jobs...

Random flower

Random flowerI know that the pastel colours that I found using auto levels is in there, in the combination of the Sony A900 and the Beercan, which is one of the main reasons that I got it all around a decade ago.

Twig

TwigMaybe too much? But still, these colours are in there, just gotta whack the files hard in post hehe

Sharpness is no problem

Sharpness is no problemAll of these are at f4, its sharp enough to tackle anything really.

Spider web

Spider webOf course this could be better technically, but it will do for almost anything I'll get across. Also this was manual focus, I didn't think the matte screen and viewfinder would make it possible to focus like this, never really tried before!

Amulet and my Nikon gear

Amulet and my Nikon gearI found a tiny amulet on the floor, of course its the cats that are responsible for that...

Zelda is happy

Zelda is happyThe A900 has built in stabilization, so any old lenses will get that by default! Which makes it far easier to get things like this right a around 1/4th of a second, even with that mirror clacking...

This one is with the Minolta 20/2.8, which is a lens I should really explore more. I got that and a 24/2.8 for a very low price, never had the time to use them much, and now I realize that they both can focus all the way down to 25 centimeters!

Now that is something I can use creatively, and on the road with ease...

I think this might end with me selling (dumping, really) my Nikon gear instead of this!

We'll find out soon 😁

-

@ b7274d28:c99628cb

2025-05-27 07:07:33

@ b7274d28:c99628cb

2025-05-27 07:07:33A few months ago, a nostrich was switching from iOS to Android and asked for suggestions for #Nostr apps to try out. nostr:npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424 offered the following as his response:

nostr:nevent1qvzqqqqqqypzq0mhp4ja8fmy48zuk5p6uy37vtk8tx9dqdwcxm32sy8nsaa8gkeyqydhwumn8ghj7un9d3shjtnwdaehgunsd3jkyuewvdhk6tcpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhszythwden5te0dehhxarj9emkjmn99uqzpwwts6n28eyvjpcwvu5akkwu85eg92dpvgw7cgmpe4czdadqvnv984rl0z

Yes. #Android users are fortunate to have some powerful Nostr apps and tools at our disposal that simply have no comparison over on the iOS side. However, a tool is only as good as the knowledge of the user, who must have an understanding of how best to wield it for maximum effect. This fact was immediately evidenced by replies to Derek asking, "What is the use case for Citrine?" and "This is the first time I'm hearing about Citrine and Pokey. Can you give me links for those?"

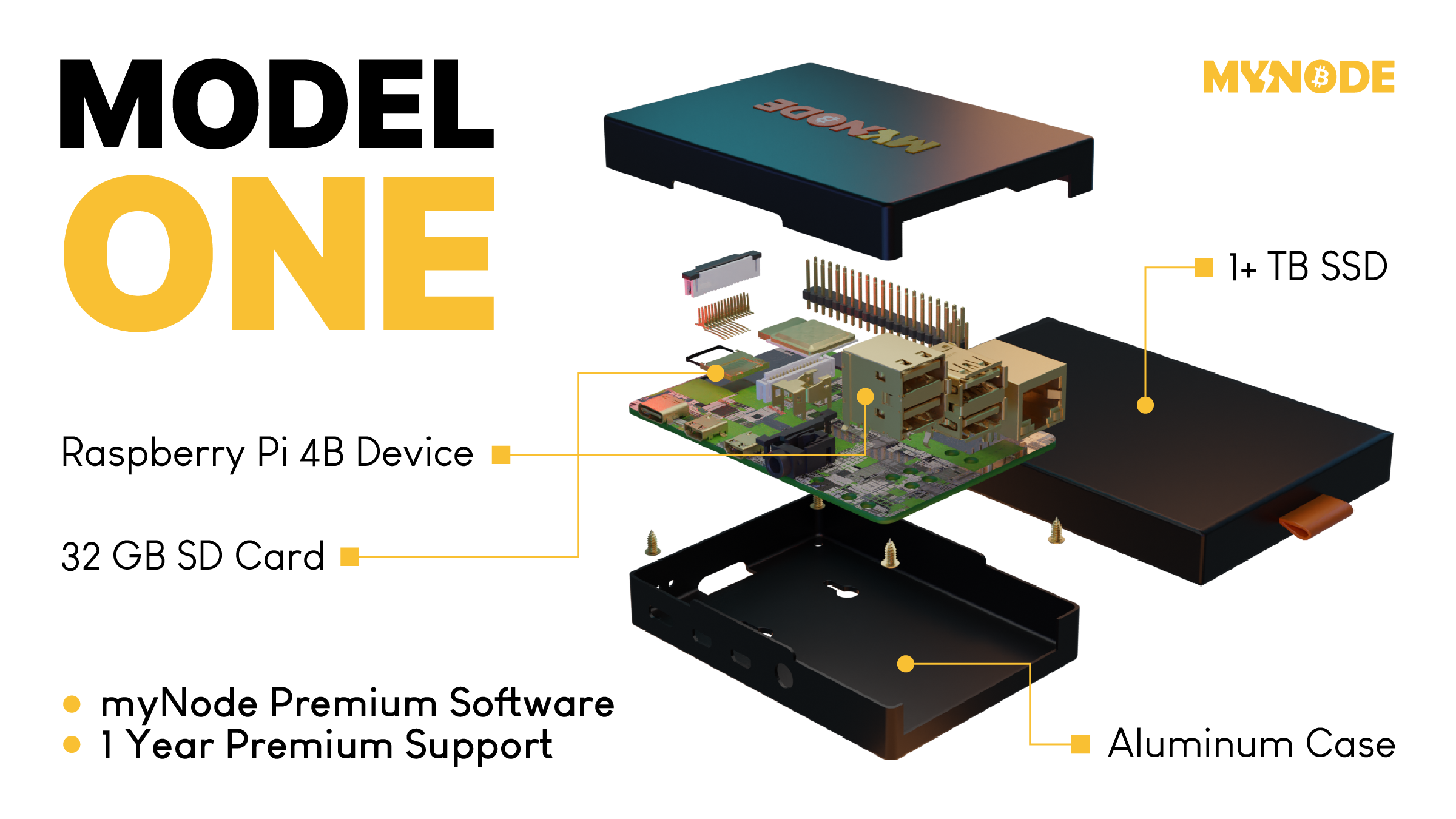

Well, consider this tutorial your Nostr starter-kit for Android. We'll go over installing and setting up Amber, Amethyst, Citrine, and Pokey, and as a bonus we'll be throwing in the Zapstore and Coinos to boot. We will assume no previous experience with any of the above, so if you already know all about one or more of these apps, you can feel free to skip that tutorial.

So many apps...

You may be wondering, "Why do I need so many apps to use Nostr?" That's perfectly valid, and the honest answer is, you don't. You can absolutely just install a Nostr client from the Play Store, have it generate your Nostr identity for you, and stick with the default relays already set up in that app. You don't even need to connect a wallet, if you don't want to. However, you won't experience all that Nostr has to offer if that is as far as you go, any more than you would experience all that Italian cuisine has to offer if you only ever try spaghetti.

Nostr is not just one app that does one thing, like Facebook, Twitter, or TikTok. It is an entire ecosystem of applications that are all built on top of a protocol that allows them to be interoperable. This set of tools will help you make the most out of that interoperability, which you will never get from any of the big-tech social platforms. It will provide a solid foundation for you to build upon as you explore more and more of what Nostr has to offer.

So what do these apps do?

Fundamental to everything you do on Nostr is the need to cryptographically sign with your private key. If you aren't sure what that means, just imagine that you had to enter your password every time you hit the "like" button on Facebook, or every time you commented on the latest dank meme. That would get old really fast, right? That's effectively what Nostr requires, but on steroids.

To keep this from being something you manually have to do every 5 seconds when you post a note, react to someone else's note, or add a comment, Nostr apps can store your private key and use it to sign behind the scenes for you. This is very convenient, but it means you are trusting that app to not do anything with your private key that you don't want it to. You are also trusting it to not leak your private key, because anyone who gets their hands on it will be able to post as you, see your private messages, and effectively be you on Nostr. The more apps you give your private key to, the greater your risk that it will eventually be compromised.

Enter #Amber, an application that will store your private key in only one app, and all other compatible Nostr apps can communicate with it to request a signature, without giving any of those other apps access to your private key.

Most Nostr apps for Android now support logging in and signing with Amber, and you can even use it to log into apps on other devices, such as some of the web apps you use on your PC. It's an incredible tool given to us by nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, and only available for Android users. Those on iPhone are incredibly jealous that they don't have anything comparable, yet.

Speaking of nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, the next app is also one of his making.

All Nostr data is stored on relays, which are very simple servers that Nostr apps read notes from and write notes to. In most forms of social media, it can be a pain to get your own data out to keep a backup. That's not the case on Nostr. Anyone can run their own relay, either for the sake of backing up their personal notes, or for others to post their notes to, as well.

Since Nostr notes take up very little space, you can actually run a relay on your phone. I have been on Nostr for almost 2 and a half years, and I have 25,000+ notes of various kinds on my relay, and a backup of that full database is just 24MB on my phone's storage.

Having that backup can save your bacon if you try out a new Nostr client and it doesn't find your existing follow list for some reason, so it writes a new one and you suddenly lose all of the people you were following. Just pop into your #Citrine relay, confirm it still has your correct follow list or import it from a recent backup, then have Citrine restore it. Done.

Additionally, there are things you may want to only save to a relay you control, such as draft messages that you aren't ready to post publicly, or eCash tokens, which can actually be saved to Nostr relays now. Citrine can also be used with Amber for signing into certain Nostr applications that use a relay to communicate with Amber.

If you are really adventurous, you can also expose Citrine over Tor to be used as an outbox relay, or used for peer-to-peer private messaging, but that is far more involved than the scope of this tutorial series.

You can't get far in Nostr without a solid and reliable client to interact with. #Amethyst is the client we will be using for this tutorial because there simply isn't another Android client that comes close, so far. Moreover, it can be a great client for new users to get started on, and yet it has a ton of features for power-users to take advantage of as well.

There are plenty of other good clients to check out over time, such as Coracle, YakiHonne, Voyage, Olas, Flotilla and others, but I keep coming back to Amethyst, and by the time you finish this tutorial, I think you'll see why. nostr:npub1gcxzte5zlkncx26j68ez60fzkvtkm9e0vrwdcvsjakxf9mu9qewqlfnj5z and others who have contributed to Amethyst have really built something special in this client, and it just keeps improving with every update that's shipped.

Most social media apps have some form of push notifications, and some Nostr apps do, too. Where the issue comes in is that Nostr apps are all interoperable. If you have more than one application, you're going to have both of them notifying you. Nostr users are known for having five or more Nostr apps that they use regularly. If all of them had notifications turned on, it would be a nightmare. So maybe you limit it to only one of your Nostr apps having notifications turned on, but then you are pretty well locked-in to opening that particular app when you tap on the notification.

Pokey, by nostr:npub1v3tgrwwsv7c6xckyhm5dmluc05jxd4yeqhpxew87chn0kua0tjzqc6yvjh, solves this issue, allowing you to turn notifications off for all of your Nostr apps, and have Pokey handle them all for you. Then, when you tap on a Pokey notification, you can choose which Nostr app to open it in.

Pokey also gives you control over the types of things you want to be notified about. Maybe you don't care about reactions, and you just want to know about zaps, comments, and direct messages. Pokey has you covered. It even supports multiple accounts, so you can get notifications for all the npubs you control.

One of the most unique and incredibly fun aspects of Nostr is the ability to send and receive #zaps. Instead of merely giving someone a 👍️ when you like something they said, you can actually send them real value in the form of sats, small portions of a Bitcoin. There is nothing quite like the experience of receiving your first zap and realizing that someone valued what you said enough to send you a small amount (and sometimes not so small) of #Bitcoin, the best money mankind has ever known.

To be able to have that experience, though, you are going to need a wallet that can send and receive zaps, and preferably one that is easy to connect to Nostr applications. My current preference for that is Alby Hub, but not everyone wants to deal with all that comes along with running a #Lightning node. That being the case, I have opted to use nostr:npub1h2qfjpnxau9k7ja9qkf50043xfpfy8j5v60xsqryef64y44puwnq28w8ch for this tutorial, because they offer one of the easiest wallets to set up, and it connects to most Nostr apps by just copy/pasting a connection string from the settings in the wallet into the settings in your Nostr app of choice.

Additionally, even though #Coinos is a custodial wallet, you can have it automatically transfer any #sats over a specified threshold to a separate wallet, allowing you to mitigate the custodial risk without needing to keep an eye on your balance and make the transfer manually.

Most of us on Android are used to getting all of our mobile apps from one souce: the Google Play Store. That's not possible for this tutorial series. Only one of the apps mentioned above is available in Google's permissioned playground. However, on Android we have the advantage of being able to install whatever we want on our device, just by popping into our settings and flipping a toggle. Indeed, thumbing our noses at big-tech is at the heart of the Nostr ethos, so why would we make ourselves beholden to Google for installing Nostr apps?

The nostr:npub10r8xl2njyepcw2zwv3a6dyufj4e4ajx86hz6v4ehu4gnpupxxp7stjt2p8 is an alternative app store made by nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9 as a resource for all sorts of open-source apps, but especially Nostr apps. What is more, you can log in with Amber, connect a wallet like Coinos, and support the developers of your favorite Nostr apps directly within the #Zapstore by zapping their app releases.

One of the biggest features of the Zapstore is the fact that developers can cryptographically sign their app releases using their Nostr keys, so you know that the app you are downloading is the one they actually released and hasn't been altered in any way. The Zapstore will warn you and won't let you install the app if the signature is invalid.

Getting Started

Since the Zapstore will be the source we use for installing most of the other apps mentioned, we will start with installing the Zapstore.

We will then use the Zapstore to install Amber and set it up with our Nostr account, either by creating a new private key, or by importing one we already have. We'll also use it to log into the Zapstore.

Next, we will install Amethyst from the Zapstore and log into it via Amber.

After this, we will install Citrine from the Zapstore and add it as a local relay on Amethyst.

Because we want to be able to send and receive zaps, we will set up a wallet with CoinOS and connect it to Amethyst and the Zapstore using Nostr Wallet Connect.

Finally, we will install Pokey using the Zapstore, log into it using Amber, and set up the notifications we want to receive.

By the time you are done with this series, you will have a great head-start on your Nostr journey compared to muddling through it all on your own. Moreover, you will have developed a familiarity with how things generally work on Nostr that can be applied to other apps you try out in the future.

Continue to Part 2: The Zapstore. Nostr Link: nostr:naddr1qvzqqqr4gupzpde8f55w86vrhaeqmd955y4rraw8aunzxgxstsj7eyzgntyev2xtqydhwumn8ghj7un9d3shjtnzwf5kw6r5vfhkcapwdejhgtcqp5cnwdphxv6rwwp3xvmnzvqgty5au

-

@ c631e267:c2b78d3e

2025-05-16 18:40:18

@ c631e267:c2b78d3e

2025-05-16 18:40:18Die zwei mächtigsten Krieger sind Geduld und Zeit. \ Leo Tolstoi

Zum Wohle unserer Gesundheit, unserer Leistungsfähigkeit und letztlich unseres Glücks ist es wichtig, die eigene Energie bewusst zu pflegen. Das gilt umso mehr für an gesellschaftlichen Themen interessierte, selbstbewusste und kritisch denkende Menschen. Denn für deren Wahrnehmung und Wohlbefinden waren und sind die rasanten, krisen- und propagandagefüllten letzten Jahre in Absurdistan eine harte Probe.

Nur wer regelmäßig Kraft tankt und Wege findet, mit den Herausforderungen umzugehen, kann eine solche Tortur überstehen, emotionale Erschöpfung vermeiden und trotz allem zufrieden sein. Dazu müssen wir erkunden, was uns Energie gibt und was sie uns raubt. Durch Selbstreflexion und Achtsamkeit finden wir sicher Dinge, die uns erfreuen und inspirieren, und andere, die uns eher stressen und belasten.

Die eigene Energie ist eng mit unserer körperlichen und mentalen Gesundheit verbunden. Methoden zur Förderung der körperlichen Gesundheit sind gut bekannt: eine ausgewogene Ernährung, regelmäßige Bewegung sowie ausreichend Schlaf und Erholung. Bei der nicht minder wichtigen emotionalen Balance wird es schon etwas komplizierter. Stress abzubauen, die eigenen Grenzen zu kennen oder solche zum Schutz zu setzen sowie die Konzentration auf Positives und Sinnvolles wären Ansätze.

Der emotionale ist auch der Bereich, über den «Energie-Räuber» bevorzugt attackieren. Das sind zum Beispiel Dinge wie Überforderung, Perfektionismus oder mangelhafte Kommunikation. Social Media gehören ganz sicher auch dazu. Sie stehlen uns nicht nur Zeit, sondern sind höchst manipulativ und erhöhen laut einer aktuellen Studie das Risiko für psychische Probleme wie Angstzustände und Depressionen.

Geben wir negativen oder gar bösen Menschen keine Macht über uns. Das Dauerfeuer der letzten Jahre mit Krisen, Konflikten und Gefahren sollte man zwar kennen, darf sich aber davon nicht runterziehen lassen. Das Ziel derartiger konzertierter Aktionen ist vor allem, unsere innere Stabilität zu zerstören, denn dann sind wir leichter zu steuern. Aber Geduld: Selbst vermeintliche «Sonnenköniginnen» wie EU-Kommissionspräsidentin von der Leyen fallen, wenn die Zeit reif ist.

Es ist wichtig, dass wir unsere ganz eigenen Bedürfnisse und Werte erkennen. Unsere Energiequellen müssen wir identifizieren und aktiv nutzen. Dazu gehören soziale Kontakte genauso wie zum Beispiel Hobbys und Leidenschaften. Umgeben wir uns mit Sinnhaftigkeit und lassen wir uns nicht die Energie rauben!

Mein Wahlspruch ist schon lange: «Was die Menschen wirklich bewegt, ist die Kultur.» Jetzt im Frühjahr beginnt hier in Andalusien die Zeit der «Ferias», jener traditionellen Volksfeste, die vor Lebensfreude sprudeln. Konzentrieren wir uns auf die schönen Dinge und auf unsere eigenen Talente – soziale Verbundenheit wird helfen, unsere innere Kraft zu stärken und zu bewahren.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ c631e267:c2b78d3e

2025-05-10 09:50:45

@ c631e267:c2b78d3e

2025-05-10 09:50:45Information ohne Reflexion ist geistiger Flugsand. \ Ernst Reinhardt

Der lateinische Ausdruck «Quo vadis» als Frage nach einer Entwicklung oder Ausrichtung hat biblische Wurzeln. Er wird aber auch in unserer Alltagssprache verwendet, laut Duden meist als Ausdruck von Besorgnis oder Skepsis im Sinne von: «Wohin wird das führen?»

Der Sinn und Zweck von so mancher politischen Entscheidung erschließt sich heutzutage nicht mehr so leicht, und viele Trends können uns Sorge bereiten. Das sind einerseits sehr konkrete Themen wie die zunehmende Militarisierung und die geschichtsvergessene Kriegstreiberei in Europa, deren Feindbildpflege aktuell beim Gedenken an das Ende des Zweiten Weltkriegs beschämende Formen annimmt.

Auch das hohe Gut der Schweizer Neutralität scheint immer mehr in Gefahr. Die schleichende Bewegung der Eidgenossenschaft in Richtung NATO und damit weg von einer Vermittlerposition erhält auch durch den neuen Verteidigungsminister Anschub. Martin Pfister möchte eine stärkere Einbindung in die europäische Verteidigungsarchitektur, verwechselt bei der Argumentation jedoch Ursache und Wirkung.

Das Thema Gesundheit ist als Zugpferd für Geschäfte und Kontrolle offenbar schon zuverlässig etabliert. Die hauptsächlich privat finanzierte Weltgesundheitsorganisation (WHO) ist dabei durch ein Netzwerk von sogenannten «Collaborating Centres» sogar so weit in nationale Einrichtungen eingedrungen, dass man sich fragen kann, ob diese nicht von Genf aus gesteuert werden.

Das Schweizer Bundesamt für Gesundheit (BAG) übernimmt in dieser Funktion ebenso von der WHO definierte Aufgaben und Pflichten wie das deutsche Robert Koch-Institut (RKI). Gegen die Covid-«Impfung» für Schwangere, die das BAG empfiehlt, obwohl es fehlende wissenschaftliche Belege für deren Schutzwirkung einräumt, formiert sich im Tessin gerade Widerstand.

Unter dem Stichwort «Gesundheitssicherheit» werden uns die Bestrebungen verkauft, essenzielle Dienste mit einer biometrischen digitalen ID zu verknüpfen. Das dient dem Profit mit unseren Daten und führt im Ergebnis zum Verlust unserer demokratischen Freiheiten. Die deutsche elektronische Patientenakte (ePA) ist ein Element mit solchem Potenzial. Die Schweizer Bürger haben gerade ein Referendum gegen das revidierte E-ID-Gesetz erzwungen. In Thailand ist seit Anfang Mai für die Einreise eine «Digital Arrival Card» notwendig, die mit ihrer Gesundheitserklärung einen Impfpass «durch die Hintertür» befürchten lässt.

Der massive Blackout auf der iberischen Halbinsel hat vermehrt Fragen dazu aufgeworfen, wohin uns Klimawandel-Hysterie und «grüne» Energiepolitik führen werden. Meine Kollegin Wiltrud Schwetje ist dem nachgegangen und hat in mehreren Beiträgen darüber berichtet. Wenig überraschend führen interessante Spuren mal wieder zu internationalen Großbanken, Globalisten und zur EU-Kommission.

Zunehmend bedenklich ist aber ganz allgemein auch die manifestierte Spaltung unserer Gesellschaften. Angesichts der tiefen und sorgsam gepflegten Gräben fällt es inzwischen schwer, eine zukunftsfähige Perspektive zu erkennen. Umso begrüßenswerter sind Initiativen wie die Kölner Veranstaltungsreihe «Neue Visionen für die Zukunft». Diese möchte die Diskussionskultur reanimieren und dazu beitragen, dass Menschen wieder ohne Angst und ergebnisoffen über kontroverse Themen der Zeit sprechen.

Quo vadis – Wohin gehen wir also? Die Suche nach Orientierung in diesem vermeintlichen Chaos führt auch zur Reflexion über den eigenen Lebensweg. Das ist positiv insofern, als wir daraus Kraft schöpfen können. Ob derweil der neue Papst, dessen «Vorgänger» Petrus unsere Ausgangsfrage durch die christliche Legende zugeschrieben wird, dabei eine Rolle spielt, muss jede/r selbst wissen. Mir persönlich ist allein schon ein Führungsanspruch wie der des Petrusprimats der römisch-katholischen Kirche eher suspekt.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ 1d7ff02a:d042b5be

2025-05-27 02:56:33

@ 1d7ff02a:d042b5be

2025-05-27 02:56:33ສຳລັບໃຜທີ່ຍັງບໍ່ເຂົ້າໃຈ Bitcoin ຢ່າງແທ້ຈິງ, ຫມາຍຄວາມວ່າເຈົ້າຍັງບໍ່ທັນເຂົ້າໃຈວ່າເງິນແມ່ນຫຍັງ, ໃຜເປັນຜູ້ສ້າງມັນ, ແລະເປັນຫຍັງມະນຸດຈຶ່ງຕ້ອງການເງິນ. ມັນເປັນເລື່ອງ scam ທີ່ລະບົບການສຶກສາບໍ່ໄດ້ສອນເລື່ອງສຳຄັນນີ້, ໃນຂະນະທີ່ພວກເຮົາໃຊ້ເວລາເກືອບທັງຊີວິດເພື່ອຫາເງິນ. ດັ່ງນັ້ນ, ຂໍແນະນຳໃຫ້ follow the money ແລະ ສຶກສາ Bitcoin ຢ່າງຈິງຈັງ.

Why Bitcoin Matters

Saving is the greatest discovery in human history

ກ່ອນທີ່ມະນຸດຈະຮຽນຮູ້ການເກັບອອມ, ພວກເຮົາເປັນພຽງແຕ່ສັດທີ່ມີຊີວິດຢູ່ແບບວັນຕໍ່ວັນ. ການປະຢັດແມ່ນສິ່ງທີ່ເຮັດໃຫ້ມະນຸດແຕກຕ່າງຈາກສັດອື່ນ — ຄວາມສາມາດໃນການຄິດກ່ຽວກັບອະນາຄົດ ແລະ ເກັບໄວ້ສຳລັບມື້ຫຼັງ.

Saving created civilization itself

ບໍ່ມີການເກັບອອມ, ບໍ່ມີການສ້າງເມືອງ, ບໍ່ມີວິທະຍາສາດ, ບໍ່ມີສິລະປະ. ທຸກສິ່ງທີ່ເຮົາເອີ້ນວ່າ "ຄວາມກ້າວໜ້າ" ແມ່ນມາຈາກຄວາມສາມາດໃນການຮູ້ຈັກເກັບອອມ.

Money is the greatest creation in human history

ມັນເປັນເຄື່ອງມືທີ່ເຮັດໃຫ້ອາລະຍະທຳມະນຸດກ້າວໜ້າມາເຖິງທຸກມື້ນີ້ ເງິນ ເປັນເຄື່ອງມືທີ່ດີທີ່ສຸດທີ່ມະນຸດໃຊ້ໃນການເກັບອອມ.

Bitcoin is the best money ever created

ມັນແມ່ນເງິນທີ່ສົມບູນແບບທີ່ສຸດທີ່ມະນຸດເຄີຍສ້າງຂຶ້ນມາ. ບໍ່ມີໃຜສາມາດ ຄວບຄຸມ, ຈັດການ, ທຳລາຍ ແລະ ມີຈຳກັດຢ່າງແທ້ຈິງ ຄືກັບເວລາໃນຊີວິດ.

Bitcoin ຄືກັບ black hole

ທີ່ຈະດູດເອົາມູນຄ່າທັງໝົດຈາກລະບົບການເງິນທີ່ເສຍຫາຍມັນຈະດູດເອົາຄວາມໝັ້ນຄົງແລະມູນຄ່າມາສູ່ຕົວມັນເອງ. ທຸກສິ່ງທີ່ມີມູນຄ່າຈະໄຫຼເຂົ້າສູ່ Bitcoin ໃນທີ່ສຸດ.

Bitcoin ຄືກັບສາດສະໜາພຸດທີ່ຄົ້ນພົບຄວາມຈິງ

ມັນເຮັດໃຫ້ເຂົ້າໃຈຕົ້ນຕໍບັນຫາຂອງລະບົບການເງິນປະຈຸບັນ ແລະ ເກີດເປັນບັນຫາຫລາຍໆຢ່າງໃນສັງຄົມ ດັ່ງກັບພະພຸດທະເຈົ້າທີ່ເຂົ້າໃຈທຸກ ແລະ ເຫດຂອງການເກີດທຸກ.

Bitcoin ຄືອິດສະຫຼະພາບ

ເງິນຄືອຳນາດ, ເງິນຄືສິ່ງຄວບຄຸມພຶດຕິກຳຂອງມະນຸດ ເມື່ອເຮົາມີເງິນທີ່ຮັກສາມູນຄ່າໄດ້ ແລະ ຄວບຄຸມບໍ່ໄດ້ ຈຶ່ງຈະມີຄວາມອິດສະຫຼະທາງຄວາມຄິດ, ການສະແດງອອກ, ແລະ ອຳນາດໃນການເລືອກ.

ຫນີ້ສິນທີ່ມະນຸດສ້າງຂຶ້ນໃນປະຈຸບັນນີ້ ໃຊ້ເວລາອີກພັນປີກໍ່ໄຊ້ຫນີ້ບໍ່ໝົດ

ມັນບໍ່ມີທາງອອກ ແລະ ກຳລັງມຸ່ງໜ້າສູ່ການລົ່ມສະລາຍຢ່າງຮ້າຍແຮງ. Bitcoin ຄືແສງສະຫວ່າງທີ່ຈະຊ່ວຍປ້ອງກັນບໍ່ໃຫ້ມະນຸດເຂົ້າສູ່ຍຸກມືດມົວອີກຄັ້ງ.

Bitcoin cannot steal your time

ມັນບໍ່ສາມາດຖືກສ້າງຂຶ້ນຈາກຄວາມຫວ່າງເປົ່າ. ທຸກ Bitcoin ຕ້ອງໃຊ້ພະລັງງານແລະເວລາທີ່ແທ້ຈິງໃນການສ້າງ.

Bitcoin ຄືປະກັນໄພທີ່ປ້ອງກັນການບໍລິຫານທີ່ຜິດພາດ

ມັນຊ່ວຍປ້ອງກັນຄວາມເສື່ອມໂຊມຂອງເງິນຕາ, ເສດຖະກິດທີ່ຕົກຕ່ຳ ແລະ ນະໂຍບາຍທີ່ຜິດພາດ, Bitcoin ຈະປົກປ້ອງຄຸນຄ່າຂອງເຈົ້າ.

Bitcoin is going to absorb the world's value

ໃນທີ່ສຸດ, Bitcoin ຈະກາຍເປັນທີ່ເກັບຮັກສາມູນຄ່າຂອງໂລກທັງໝົດ. ມັນຈະດູດເອົາຄວາມມັ່ງຄັ່ງຈາກທຸກຊັບສິນ, ທຸກລາຄາ, ແລະທຸກການລົງທຶນ.

Exit The Matrix

ພວກເຮົາອາໄສຢູ່ໃນ Matrix ທາງດ້ານການເງິນ. ທຸກໆມື້ພວກເຮົາຕື່ນຂຶ້ນມາແລະໄປເຮັດວຽກ, ຄິດວ່າເຮົາກຳລັງສ້າງອະນາຄົດໃຫ້ຕົວເອງ. ແຕ່ຄວາມຈິງແລ້ວ, ພວກເຮົາພຽງແຕ່ກຳລັງໃຫ້ພະລັງງານແກ່ລະບົບທີ່ຂູດເອົາຄຸນຄ່າຈາກພວກເຮົາທຸກວິນາທີ. Bitcoin is the red pill — ມັນຈະເປີດຕາໃຫ້ເຈົ້າເຫັນຄວາມຈິງຂອງໂລກການເງິນ. Central banks are the architects of this Matrix — ພວກເຂົາສ້າງເງິນຈາກຄວາມຫວ່າງເປົ່າ, ແລະພວກເຮົາຕ້ອງເຮັດວຽກໜັກເພື່ອໄດ້ມັນມາ.

ລະບົບການສຶກສາໄດ້ຫຼອກລວງເຮົາຢ່າງໃຫຍ່ຫຼວງ. ພວກເຂົາສອນໃຫ້ເຮົາເຮັດວຽກເພື່ອຫາເງິນ, ແຕ່ບໍ່ເຄີຍສອນວ່າເງິນແມ່ນຫຍັງ. ເຮົາໃຊ້ເວລາ 12-16 ປີໃນໂຮງຮຽນ, ຫຼັງຈາກນັ້ນໃຊ້ເວລາທັງຊີວິດເພື່ອຫາເງິນ, ແຕ່ບໍ່ເຄີຍຮູ້ຈັກວ່າມັນແມ່ນຫຍັງ, ໃຜສ້າງ, ແລະເປັນຫຍັງມັນມີຄຸນຄ່າ.This is the biggest scam in human history ພວກເຮົາຖືກສອນໃຫ້ເປັນທາດຂອງລະບົບ, ແຕ່ບໍ່ໄດ້ຮັບການສອນໃຫ້ເຂົ້າໃຈລະບົບ.

The Bitcoin standard will end war

ເມື່ອບໍ່ສາມາດພິມເງິນເພື່ອສົງຄາມແລ້ວ, ສົງຄາມຈະກາຍເປັນສິ່ງທີ່ແພງເກີນໄປ.

ພວກເຮົາກຳລັງເຂົ້າສູ່ຍຸກ Bitcoin Renaissance

ຍຸກແຫ່ງການຟື້ນຟູທາງດ້ານການເງິນແລະປັນຍາ. Bitcoin is creating a new class of humans ຄົນທີ່ເຂົ້າໃຈ ແລະ ຖື Bitcoin ຈະກາຍເປັນຊົນຊັ້ນໃໝ່ທີ່ມີອິດສະຫຼະພາບຢ່າງແທ້ຈິງ.

The Path to Financial Truth

Follow the money trail ແລະເຈົ້າຈະເຫັນຄວາມຈິງ:

- ໃຜຄວບຄຸມການພິມເງິນ?

- ເປັນຫຍັງລາຄາສິນຄ້າຂຶ້ນສູງຂຶ້ນເລື້ອຍໆ?

- ເປັນຫຍັງຄົນທຸກທຸກກວ່າເກົ່າ ແລະຄົນຮັ່ງມີຮັ່ງມີກວ່າເກົ່າ?

ຄຳຕອບທັງໝົດແມ່ນຢູ່ໃນການທຳຄວາມເຂົ້າໃຈເລື່ອງເງິນ ແລະ Bitcoin.

ການສຶກສາ Bitcoin ບໍ່ແມ່ນພຽງແຕ່ການລົງທຶນ — ມັນແມ່ນການເຂົ້າໃຈອະນາຄົດຂອງເງິນຕາ ແລະ ສັງຄົມມະນຸດ.

Don't just work for money. Understand money. Study Bitcoin.

ຖ້າເຈົ້າບໍ່ເຂົ້າໃຈເງິນ, ເຈົ້າຈະເປັນທາດຂອງລະບົບຕະຫຼອດໄປ. ຖ້າເຈົ້າເຂົ້າໃຈ Bitcoin, ເຈົ້າຈະໄດ້ຮັບອິດສະຫຼະພາບ.

-

@ c631e267:c2b78d3e

2025-05-02 20:05:22

@ c631e267:c2b78d3e

2025-05-02 20:05:22Du bist recht appetitlich oben anzuschauen, \ doch unten hin die Bestie macht mir Grauen. \ Johann Wolfgang von Goethe

Wie wenig bekömmlich sogenannte «Ultra-Processed Foods» wie Fertiggerichte, abgepackte Snacks oder Softdrinks sind, hat kürzlich eine neue Studie untersucht. Derweil kann Fleisch auch wegen des Einsatzes antimikrobieller Mittel in der Massentierhaltung ein Problem darstellen. Internationale Bemühungen, diesen Gebrauch zu reduzieren, um die Antibiotikaresistenz bei Menschen einzudämmen, sind nun möglicherweise gefährdet.

Leider ist Politik oft mindestens genauso unappetitlich und ungesund wie diverse Lebensmittel. Die «Corona-Zeit» und ihre Auswirkungen sind ein beredtes Beispiel. Der Thüringer Landtag diskutiert gerade den Entwurf eines «Coronamaßnahmen-Unrechtsbereinigungsgesetzes» und das kanadische Gesundheitsministerium versucht, tausende Entschädigungsanträge wegen Impfnebenwirkungen mit dem Budget von 75 Millionen Dollar unter einen Hut zu bekommen. In den USA soll die Zulassung von Covid-«Impfstoffen» überdacht werden, während man sich mit China um die Herkunft des Virus streitet.

Wo Corona-Verbrecher von Medien und Justiz gedeckt werden, verfolgt man Aufklärer und Aufdecker mit aller Härte. Der Anwalt und Mitbegründer des Corona-Ausschusses Reiner Fuellmich, der seit Oktober 2023 in Untersuchungshaft sitzt, wurde letzte Woche zu drei Jahren und neun Monaten verurteilt – wegen Veruntreuung. Am Mittwoch teilte der von vielen Impfschadensprozessen bekannte Anwalt Tobias Ulbrich mit, dass er vom Staatsschutz verfolgt wird und sich daher künftig nicht mehr öffentlich äußern werde.

Von der kommenden deutschen Bundesregierung aus Wählerbetrügern, Transatlantikern, Corona-Hardlinern und Russenhassern kann unmöglich eine Verbesserung erwartet werden. Nina Warken beispielsweise, die das Ressort Gesundheit übernehmen soll, diffamierte Maßnahmenkritiker als «Coronaleugner» und forderte eine Impfpflicht, da die wundersamen Injektionen angeblich «nachweislich helfen». Laut dem designierten Außenminister Johann Wadephul wird Russland «für uns immer der Feind» bleiben. Deswegen will er die Ukraine «nicht verlieren lassen» und sieht die Bevölkerung hinter sich, solange nicht deutsche Soldaten dort sterben könnten.

Eine wichtige Personalie ist auch die des künftigen Regierungssprechers. Wenngleich Hebestreit an Arroganz schwer zu überbieten sein wird, dürfte sich die Art der Kommunikation mit Stefan Kornelius in der Sache kaum ändern. Der Politikchef der Süddeutschen Zeitung «prägte den Meinungsjournalismus der SZ» und schrieb «in dieser Rolle auch für die Titel der Tamedia». Allerdings ist, anders als noch vor zehn Jahren, die Einbindung von Journalisten in Thinktanks wie die Deutsche Atlantische Gesellschaft (DAG) ja heute eher eine Empfehlung als ein Problem.

Ungesund ist definitiv auch die totale Digitalisierung, nicht nur im Gesundheitswesen. Lauterbachs Abschiedsgeschenk, die «abgesicherte» elektronische Patientenakte (ePA) ist völlig überraschenderweise direkt nach dem Bundesstart erneut gehackt worden. Norbert Häring kommentiert angesichts der Datenlecks, wer die ePA nicht abwähle, könne seine Gesundheitsdaten ebensogut auf Facebook posten.

Dass die staatlichen Kontrolleure so wenig auf freie Software und dezentrale Lösungen setzen, verdeutlicht die eigentlichen Intentionen hinter der Digitalisierungswut. Um Sicherheit und Souveränität geht es ihnen jedenfalls nicht – sonst gäbe es zum Beispiel mehr Unterstützung für Bitcoin und für Initiativen wie die der Spar-Supermärkte in der Schweiz.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ 6be5cc06:5259daf0

2025-05-27 20:37:22

@ 6be5cc06:5259daf0

2025-05-27 20:37:22At

até uma ferramenta de agendamento de tarefas em Linux usada para executar comandos únicos em um horário e data específicos. Diferente docron, que serve para tarefas recorrentes, oatexecuta uma única vez.Como usar o

at1. Verifique se o

atestá instaladobash which atSe não estiver instalado:

bash sudo apt install atE inicie o serviço (caso necessário):

bash sudo systemctl enable --now atd2. Agendar um comando

bash at 10:00 AM tomorrowVocê será levado a um prompt interativo. Digite o comando desejado e finalize com

Ctrl + D.Exemplo 1:

bash at 09:00 AM next Monday(Entrada do usuário no prompt do

at)echo "Relatório pronto" >> ~/relatorio.txt Ctrl + DResultado: O trecho "relatório pronto" será incluído no documento relatorio.txt.

Exemplo 2:

bash at 21:00 Apr 15Entrada no prompt:

notify-send "Hora de fazer backup!" Ctrl + DResultado: Às 21h do dia 15 de abril, o sistema exibirá uma notificação.

Formatos de Data e Hora Válidos

-

now + 1 minute -

midnight -

tomorrow -

5pm -

08:30 -

7:00am next friday -

noon + 2 days

Visualizar tarefas agendadas

bash atqRemover uma tarefa agendada

bash atrm <número_da_tarefa>Você encontra o número da tarefa com

atq.

cron

O

croné um utilitário de agendamento de tarefas baseado no tempo. Permite executar comandos ou scripts automaticamente em horários específicos. Ele depende do daemoncrond, que deve estar ativo e em execução contínua no sistema.Arquivo de configuração:

-

Cada usuário pode editar seu próprio agendador com:

bash crontab -e -

O formato padrão de uma linha no crontab:

m h dom mon dow comando

|Campo|Descrição|Valores possíveis| |---|---|---| |m|Minuto|0–59| |h|Hora|0–23| |dom|Dia do mês|1–31| |mon|Mês|1–12| |dow|Dia da semana|0–6 (0 = Domingo)| |comando|Comando a executar|Qualquer comando shell válido|

Exemplos:

-

Executar um script a cada minuto:

bash * * * * * /usr/local/bin/execute/this/script.sh -

Fazer backup no dia 10 de junho às 08:30:

bash 30 08 10 06 * /home/sysadmin/full-backup -

Backup todo domingo às 5h da manhã:

bash 0 5 * * 0 tar -zcf /var/backups/home.tgz /home/

Limitações:

Tarefas agendadas com

cronnão são executadas se o computador estiver desligado ou suspenso no horário programado. O comando é simplesmente ignorado. Usecronpara tarefas com data/hora exatas.

anacron

O

anacroné uma alternativa aocronvoltada para sistemas que não ficam ligados o tempo todo, como notebooks e desktops. Ele garante a execução de tarefas periódicas (diárias, semanais, mensais) assim que possível após o sistema ser ligado, caso tenham sido perdidas. Useanacronpara tarefas periódicas tolerantes a atrasos.Verificação da instalação: